Exhibit 99.1

Exhibit 99.1

EQUIPPED TO WIN

Russell Corporation Analyst Day

May 12, 2005

Forward Looking Statement

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

The information presented involving the use of forward-looking statements are estimates. These forward-looking statements are subject to various risks and uncertainties, including market conditions, customer demand and the economy, which could cause actual results to differ materially from those, stated or implied by such statements. In addition, risk factors change from quarter to quarter. The information contained in this presentation is subject to change, completion, or amendment without notice.

The financial information contained in this presentation is qualified in its entirety by the audited financial statements (including the financial notes), which were filed with the SEC in our Annual Report on Form 10-K, for the year ended January 1, 2005 and the financial information included in our Quarterly Reports on Form 10-Q filed with the SEC since that date.

Agenda

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Introductory Comments Roger Holliday

Russell Corporation Strategic Overview Jack Ward

Russell Corporation Initiatives Jon Letzler

Spalding Group Overview Scott Creelman

Russell Athletic Group Overview Calvin Johnston

Brooks Overview Jim Weber

Agenda

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Mossy Oak Overview Mark Tate

Activewear Group Overview Julio Barea

Capital Structure Review Martie Zakas

Financial Objectives Bob Koney

Panel Q&A All

Conclusions Jack Ward

EQUIPPED TO WIN

Russell Corporation OVERVIEW & STRATEGY

Jack Ward Chairman and CEO

EQUIPPED TO WIN

Russell is an international $1.5 Billion leading authentic athletic and sporting goods company with over a century of success.

A Brief History of Russell

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

1902 – 1997

Primarily domestically focused Excellent products, great reputation Vertically integrated Sourced 5% of goods sold Limited marketing

An authentic heritage based on quality and performance.

A Brief History of Russell (continued)

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Corporate Repositioning (1998 – 2001)

Moved 99% of sewing offshore

100% of yarn requirements sourced from Joint Venture or outside Exited $150 million of unprofitable businesses Reduced costs by over $150 million Substantially increased investment in consumer research and marketing

Russell is more Global & Cost Competitive.

A Brief History of Russell (continued)

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

2002 – Present

Implemented strategic direction to become a broader sports company Established new capital structure Acquired six strategic businesses Increased focus on marketing and product innovation

Diversifying Russell for more predictable long-term growth.

New Segment Reporting

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Sporting Goods

Activewear

Other

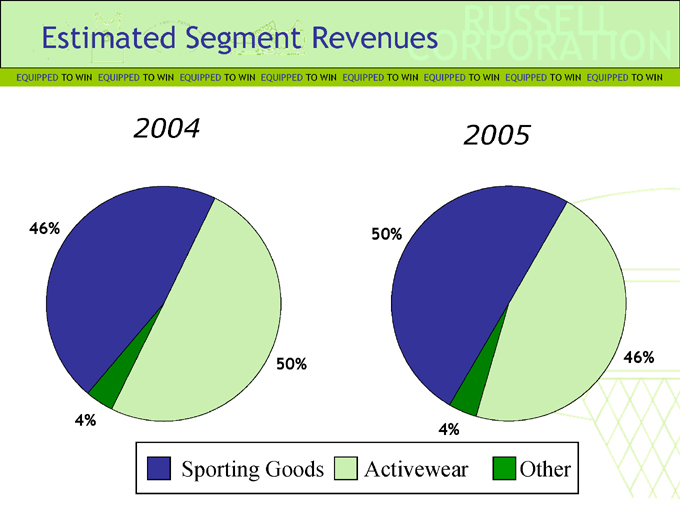

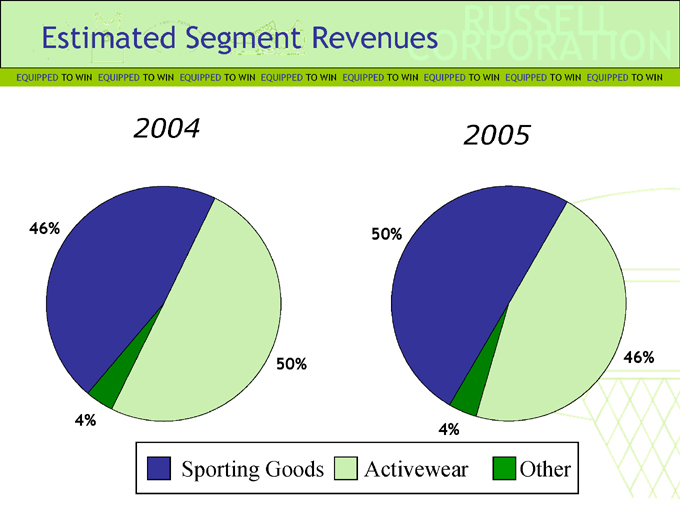

Estimated Segment Revenues

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

2004 2005

46%

4%

50%

50%

4%

46%

Sporting Goods

Activewear

Other

EQUIPPED TO WIN

Supply Chain Strategy

Source or produce ourselves, choosing the lowest cost model to deliver product to the local market.

Supply Chain Today RUSSELL CORPORATION EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Sporting Goods Sourced Internal

Equipment 60% 40%

Footwear 100% -

Apparel 40% 60%

Activewear

Apparel 30% 70%

EQUIPPED TO WIN

MARKET OVERVIEW

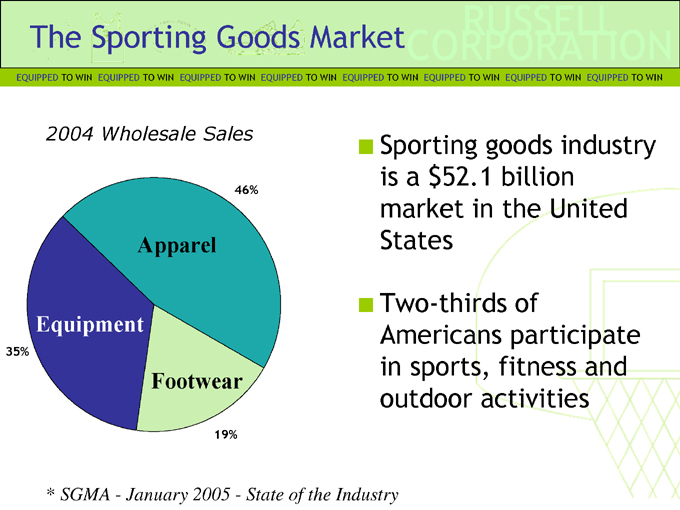

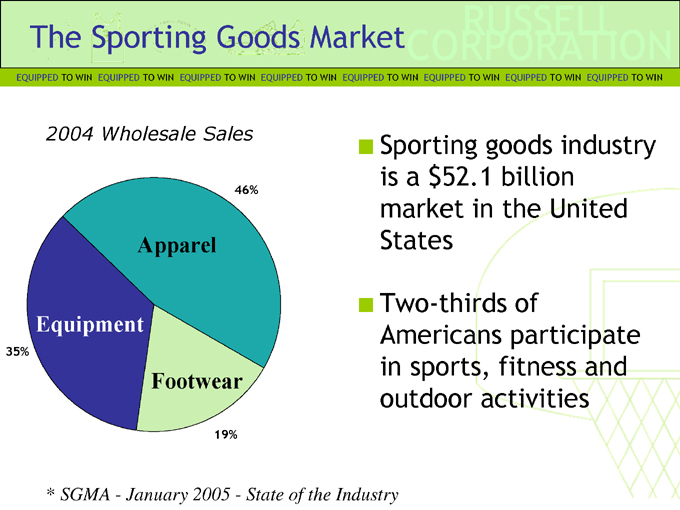

The Sporting Goods Market

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

2004 Wholesale Sales

46%

Apparel

Equipment

35%

Footwear

19%

Sporting goods industry is a $52.1 billion market in the United States

Two-thirds of

Americans participate in sports, fitness and outdoor activities

* SGMA—January 2005—State of the Industry

The Sporting Goods Market

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Overall market grew 4% to $52.1 Billion Sports Apparel increased 5.5% to $24.1 Billion Sports Equipment increased 2.8% to $18.0 Billion Athletic Footwear increased 2.6% to $10.0 Billion

* SGMA - January 2005 - State of the Industry

EQUIPPED TO WIN

DIRECTION BEYOND 2005

EQUIPPED TO WIN

RUSSELL CORPORATION VISION

“To be the world’s most respected athletic company.”

Strategic Direction

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Continue to build Russell into a world-class athletic and sporting goods company

Leverage our brands, category expertise, organization and strong customer relationships Continue to leverage synergies and aggressively reduce supply chain costs Broaden internationally by growing self-owned operations, licensees and distributors Manage in a highly ethical, credible and conservative manner

Key Strategies

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Build Spalding into a one-billion dollar global sporting goods mega-brand (equipment, apparel, shoes)

Aggressively develop Spalding internationally, including acquisitions and joint ventures, as appropriate Market Spalding apparel ourselves in the U.S. Develop a premium basketball footwear line, using Brooks’ expertise Spalding will be our largest international brand

Key Strategies

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Continue to build Jerzees as a low-cost provider of basic activewear

Introduce performance athleticwear products Invest in off-shore facilities and equipment to remain competitive Aggressively lower costs in all areas of the business

Key Strategies

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Expand performance athletic positioning for Russell Athletic

Grow sales of performance athletic products at retail Continue to build the college bookstore and team businesses, concentrating on outstanding customer service

Key Strategies

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Double sales and profits of Brooks over the next 4-5 years

Expand further into sporting good chains that sell technical running shoes Use Brooks’ expertise to develop products for other brands

Key Strategies

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Expand Moving Comfort as a high-end Women’s performance athletic brand

Build Bike as Authentic Athletic Protection

Expand Mossy Oak from a premier hunting brand to a premier outdoor brand

Key Strategies

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Pursue acquisitions where they can accelerate the growth of these key strategies

EQUIPPED TO WIN

Russell Corporation INITIATIVES

Jon Letzler President & COO

Brands

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Strong Customer Relationships

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Key Initiatives

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Focus on our brands Focus on our customers Focus on our operations

Focus on Brands

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Three major brands

Focus on Brands

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Multiple targeted brands

Highly relevant

More narrowly focused brands

Brand Framework

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Investment strategy based on long term potential

Channel/category conflicts being resolved

Remaining brands used for trade/channel differentiation

Focus on Brands

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Team, Sporting Goods

Focus on Brands

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Sports Specialty

Focus on Brands

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Mass Retail

Focus on Brands

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Wholesale

Focus on Customers

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Simplify customer contact/ consolidate sales

Consolidate selected marketing and merchandising programs Provide improved customer service, simplification, lower costs

Focus on Operations

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Accelerate synergistic opportunities

Transportation Procurement Sourcing offices Innovation Distribution Customer Service

Focus on Operations

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

In 2003, began $30 million project to improve all systems By completion, expect significant improvement

Customer service Inventory turns Reduced cost Improved responsiveness

Expected Results

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Improved customer service Greater innovation Improved efficiencies Increased asset utilization Improved profitability Accelerated growth

The Spalding Group

Scott Creelman CEO

Spalding Group Today $400MM in worldwide direct and licensed sales #4 highest sports brand awareness in U.S.

50% brand sales in US; 50% brand sales in international 80 country specific distributors worldwide 70 licensees with specific category expertise

Spalding Group Today

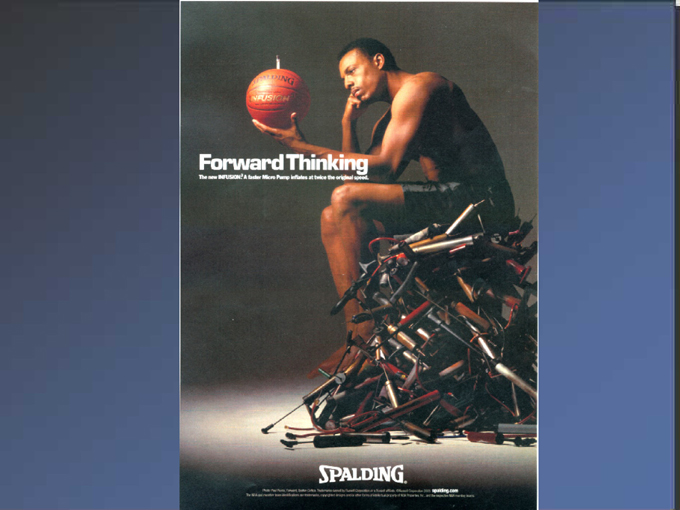

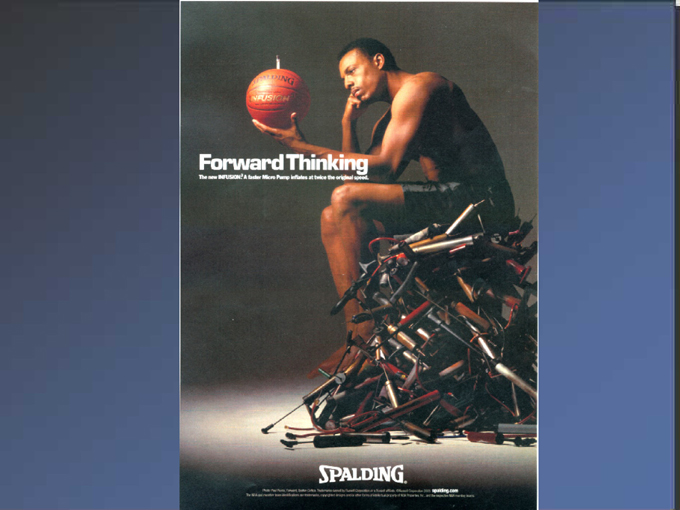

World’s largest basketball equipment supplier Extensive “consumer equity”

Innovative product history -Infusion Important endorsements -NBA, WNBA, AFL, Leagues Worldwide acceptance

Spalding Key Strategies

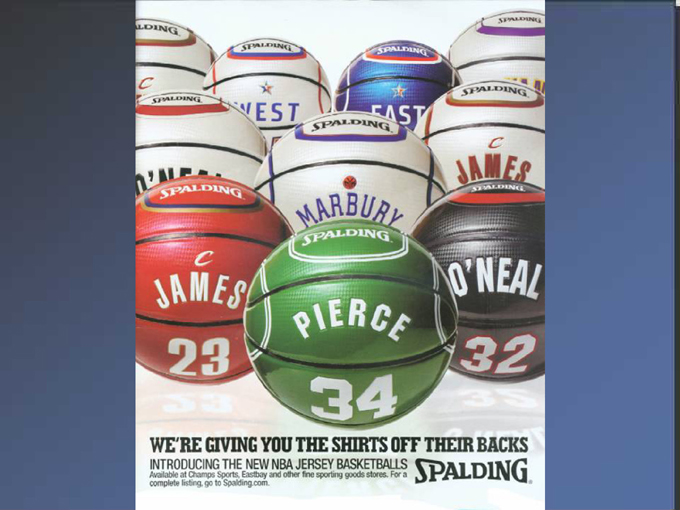

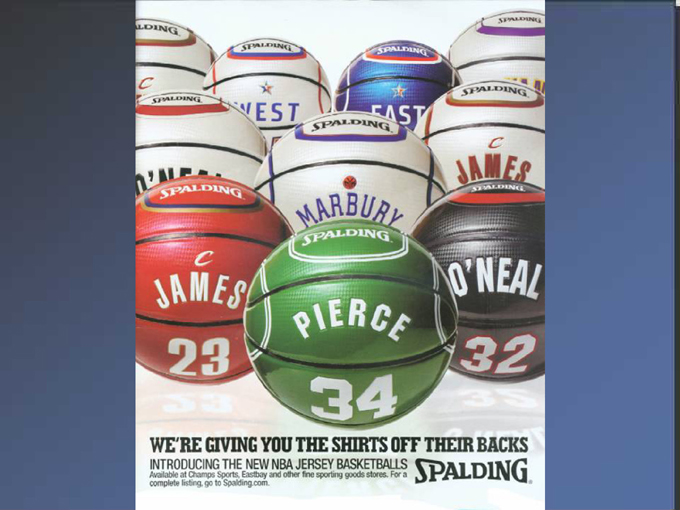

Building brand strength establishing a predominant position in basketball in all relevant product categories

Balls Backboards Accessories

Spalding Key Strategies

Fully integrate AAI and Huffy Sports

Spalding Key Strategies

Building a consumer oriented global brand

Megabrand platform for future products $1 billion potential

Spalding Key Strategies

Introducing consistent and well defined expansion programs

Focusing on integrated product innovation Global distribution strategy New apparel to be marketed directly in-house Brooks technology for future Spalding shoes

Spalding Key Strategies

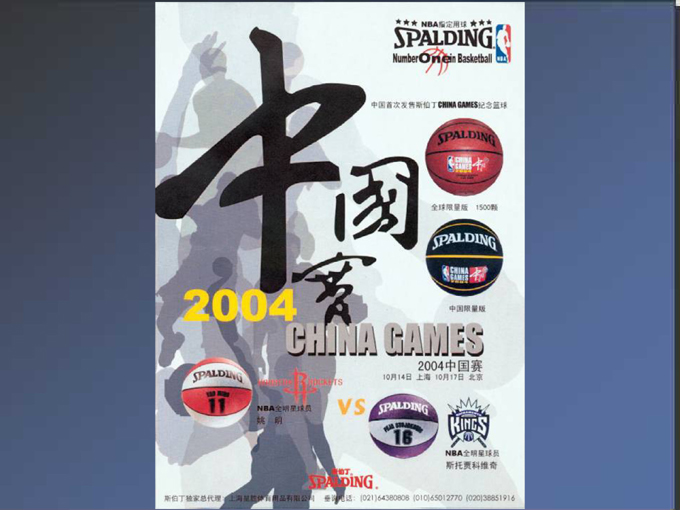

Execute new initiatives for international growth

Capitalize on Spalding’s high global awareness Leveraging positive consumer acceptance

Spalding Key Tactics

A solid basketball foundation worldwide Product innovation and leadership Backboard /accessory acquisition in 2004—AAI, Huffy New NBA long-term exclusive contract—8 years

Spalding Key Tactics

New Spalding basketball branding -balls, backboards 28 high school state adoptions 53 country international pro leagues—new long-term China League Agreements Significant new sporting goods store distribution Worldwide consumer advertising

Spalding Key Tactics

A Comprehensive Global Brand

Rolling out currently

Extensive consumer research Applications

? Worldwide equipment

? Apparel

? Footwear

Executed through products, advertising, web

Video

Spalding Key Tactics

Building Profitability

Huffy is forecast to have at least 10% operating income (as a percent of sales) by 2007 Additional growth opportunities:

Key products - football, volleyball, baseball Spalding apparel (Russell in-house) Spalding footwear (Brooks in-house)

Spalding Key Tactics

Further Product Category Expansion

Utilizing “Path to Excellence” strategy

Spalding Path to Excellence

Performance Footwear

Performance Retail Apparel

Institutional Apparel

Equipment / Accessories Retail

Equipment / Accessories Institutional

Balls – Retail

Balls – Institutional

INDIVIDUAL CATEGORY

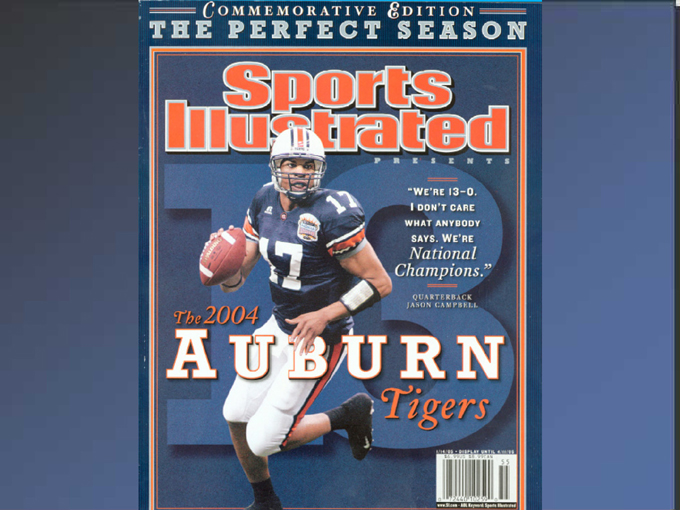

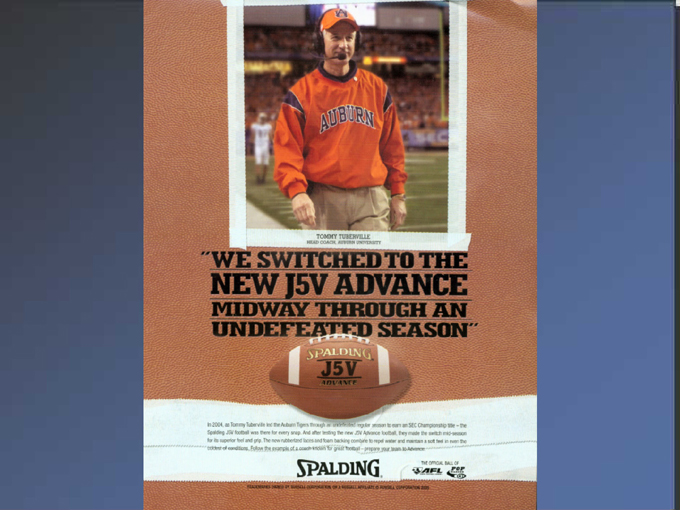

Spalding Key Tactics

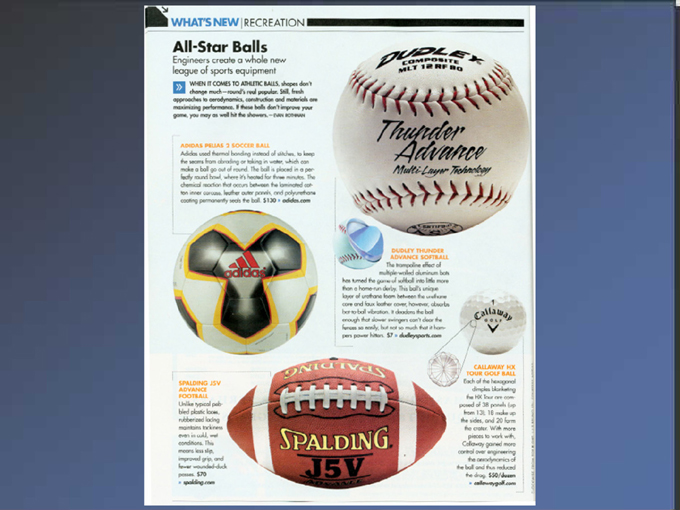

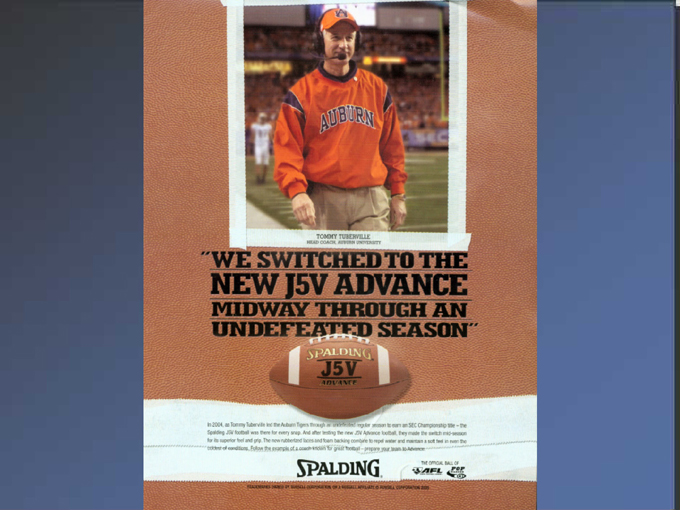

First Step in Football

New J5V Advance -Auburn use AFL ball Pop Warner endorsement

Spalding Key Tactics

First Step in Volleyball

New King of Beach product 20 State adoptions Grass roots marketing

Spalding Key Tactics

First Step in Apparel

Acquired majority of apparel rights back from current licensees Will utilize Russell apparel skill sets—design, production, distribution

Spalding Key Tactics

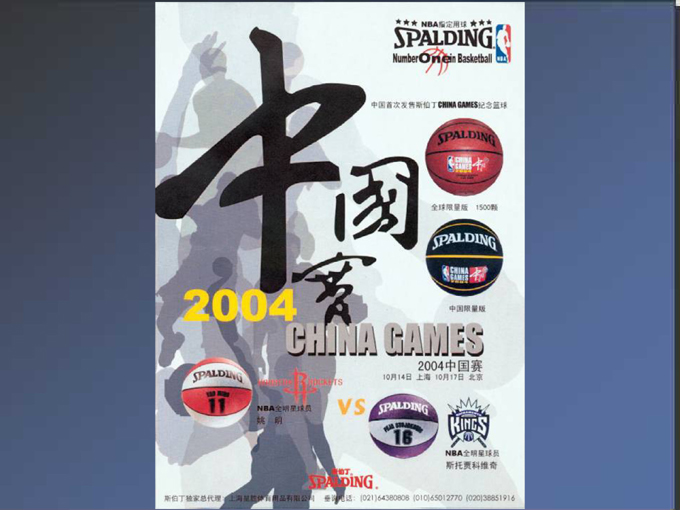

International Growth

Totally integrated all backboard sales with Spalding Restructured distribution key markets -Mexico, Canada, Australia, China, Scandinavia Totally restructured/upgraded $100MM Japan master licensing with Itochu Fashion System

Spalding Key Tactics

International Growth (continued)

China

Launching new footwear, apparel licensee in China Includes 600 Spalding stores and shops by end 2006 Launching new backboard distribution in China

Strategic Growth Overview

Calvin Johnston CEO

To be the preferred performance brand of athletes Everyday!

Russell Athletic Brand History

Russell Athletic owns a unique and solid history as an Authentic Athletic Brand:

Started in the early 1930’s

Today, Russell is the #1 supplier in team uniforms & practice wear:

- Outfit over 500+ Division I Men’s and Women’s Teams

31% of high school athletes wear Russell Athletic

32% market share of baseball uniforms

47% market share of football uniforms

Russell Athletic Team Sports

Offer Key Service Programs:

Supplier of team uniforms and practice wear

Stock Product

Decorated Stock Product

Customized Team Uniforms

Work through dealer network to service high schools, universities and intramural teams

Russell Athletic Team Sports

Key drivers are brand credibility and service Will drive future growth by “Owning the Campus” in apparel and equipment Official sponsor of Little League World Series

Russell Athletic Retail Products

Historically strong in sweats and tees

Durable

Comfort

Value

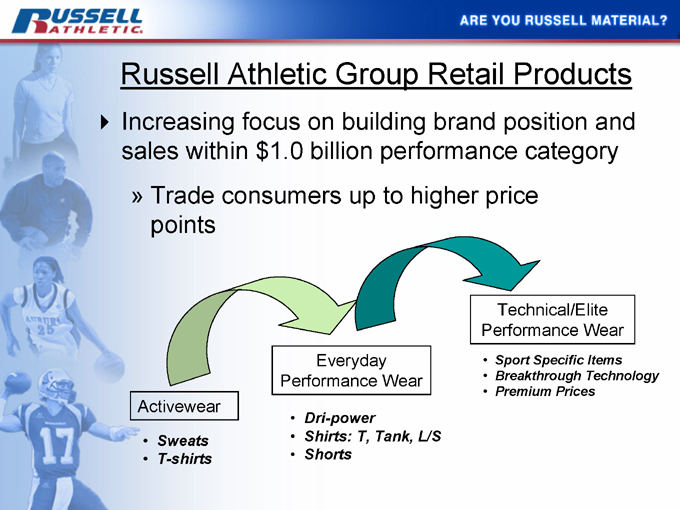

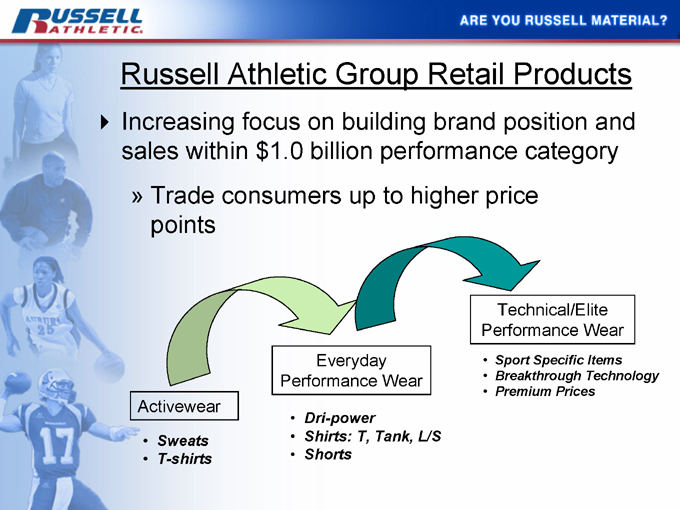

Russell Athletic Group Retail Products

Increasing focus on building brand position and sales within $1.0 billion performance category

Trade consumers up to higher price points

Activewear

Sweats T-shirts

Everyday Performance Wear

Dri-power

Shirts: T, Tank, L/S Shorts

Technical/Elite Performance Wear

Sport Specific Items Breakthrough Technology Premium Prices

Key Action Points

Offer products with improved quality and performance features:

Moisture Management Soft Feel Breathable Non-chafing Style

Dri-Power rated by SGB as the best

performing moisture management product

Drive message home to consumers

Sponsorships

Drive message home to consumers

In-Store

Drive message home to consumers

Media

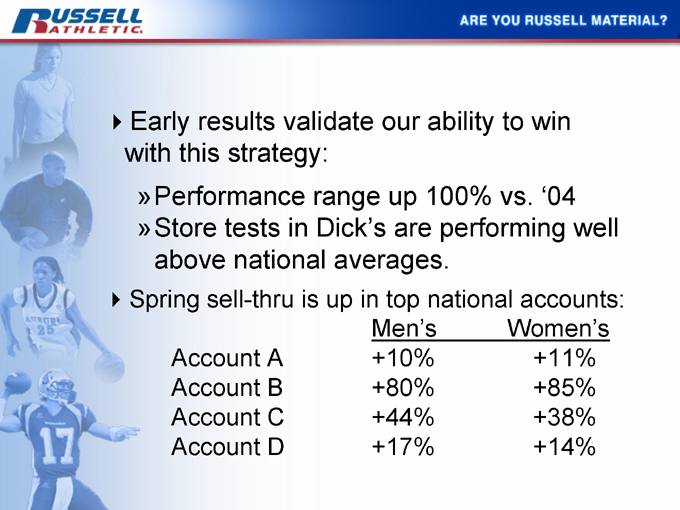

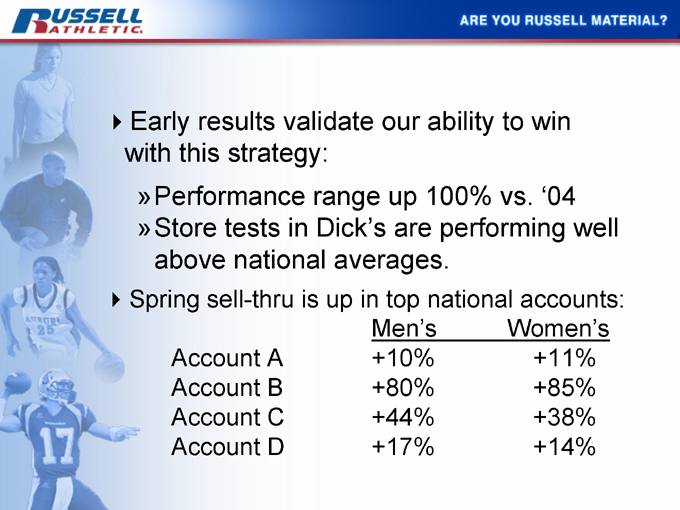

Early results validate our ability to win with this strategy: Performance range up 100% vs. ‘04 Store tests in Dick’s are performing well above national averages.

Spring sell-thru is up in top national accounts:

Men’s Women’s

Account A +10% +11%

Account B +80% +85%

Account C +44% +38%

Account D +17% +14%

Russell Athletic College Bookstore

College Bookstore business continues to perform well

» Strong double digit growth

» Innovative Service Programs

- Sports Track

- Sidelines

“A Fit Woman is a Powerful Woman”

Moving Comfort History

Founded in 1977 by Elizabeth Goeke and Ellen Wessel to meet the particular running apparel needs for women Goal is to free women to pursue their workouts, free of distraction from clothes that don’t enjoy the ride Acquired by Russell in 2002 Strong, loyal following

Product Portfolio

Complete line of premium sports bras and activewear. Focus on:

Fit Support

Comfort

Moisture Management

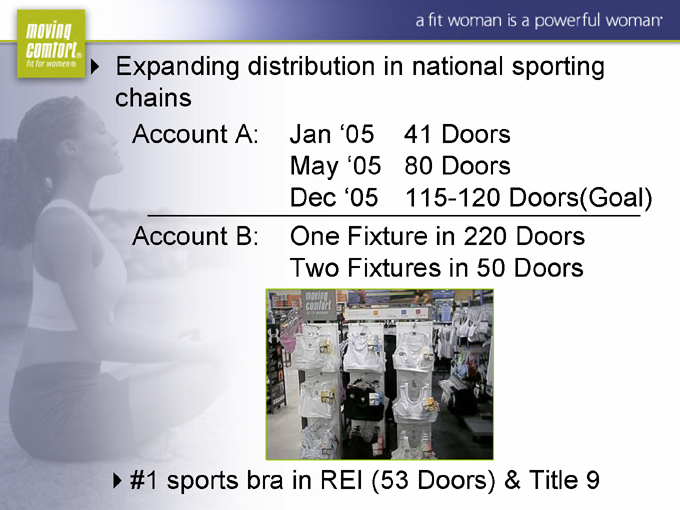

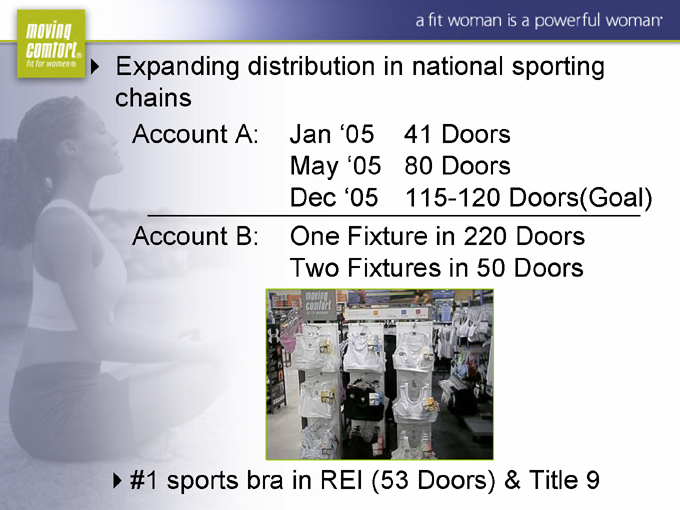

Expanding distribution in national sporting

chains

Account A: Jan ‘05 41 Doors

May ‘05 80 Doors

Dec ‘05 115-120 Doors(Goal)

Account B: One Fixture in 220 Doors

Two Fixtures in 50 Doors

#1 sports bra in REI (53 Doors) & Title 9

Advanced Athletic Protection

Bike History

Founded over 130 years ago

Historically strong in cups, supporters and football protective equipment Acquired by Russell in 2003 Currently developing a more innovative and leadership brand proposition Official protective gear of Pop Warner Football

TO WIN EQUIPPED TO WIN EQUIPPED

WIN EQUIPPED TO WIN

Focus on Athletic Protection and Sports Medicine Incorporate moisture management and compression Enhanced packaging

Strategy Overview

Jim Weber CEO

Brooks Sports was founded in 1914 $170 MM Brand

Licensed 35%

Direct 65%

Int’l. 52%

Domestic 48%

And we are focused on Running…

Uniquely Positioned to Benefit from Surge in Running and Fitness Lifestyle…

Consumer Trends

Obesity/Diabetes Women in sports Baby boomers playing and spending

Running Trends

Women and youth are driving growth Continued proliferation and rising popularity of races Walking/Active lifestyle a driver

* Source: National Health & Nutrition Examination Study 2003.

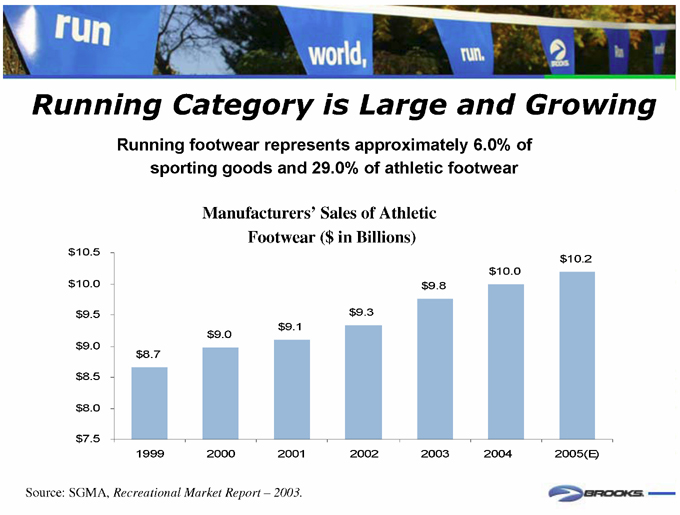

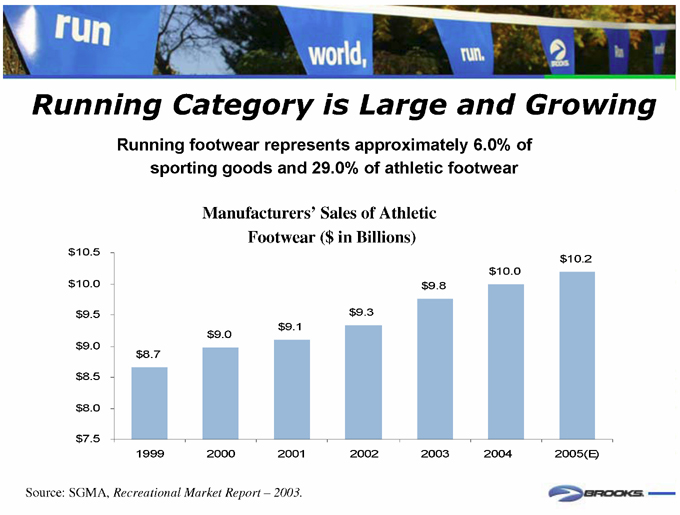

Running Category is Large and Growing

Running footwear represents approximately 6.0% of sporting goods and 29.0% of athletic footwear

Manufacturers’ Sales of Athletic Footwear ($ in Billions) $10.5 $10.0 $9.5 $9.0 $8.5 $8.0 $7.5

1999 2000 2001 2002 2003 2004(E) 2005(E) $8.7 $9.0 $9.1 $9.3 $9.8 $10.0 $10.2

Source: SGMA, Recreational Market Report – 2003.

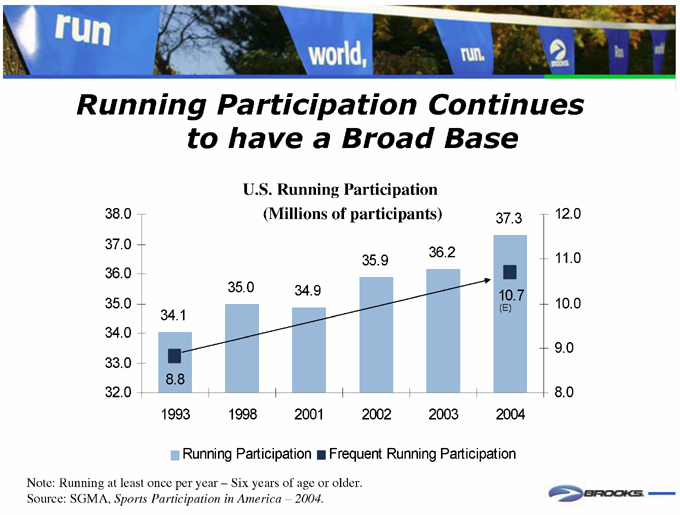

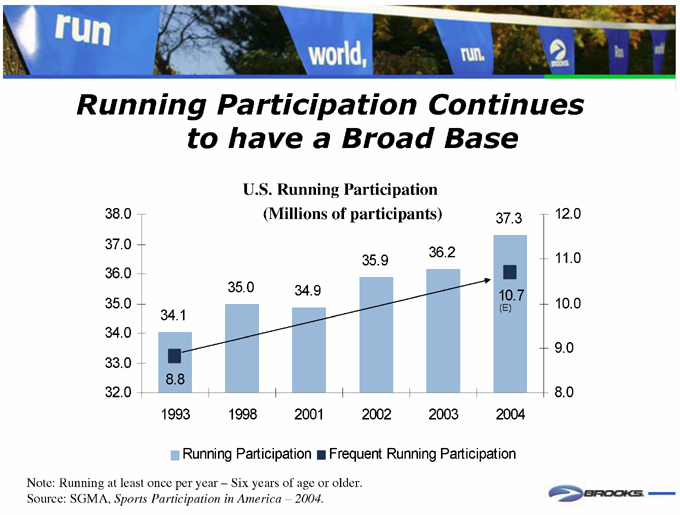

Running Participation Continues to have a Broad Base

U.S. Running Participation (Millions of participants)

38.0 37.0 36.0 35.0 34.0 33.0 32.0

1993 1998 2001 2002 2003 2004

8.8

34.1

35.0

34.9

35.9

36.2

37.3

12.0 11.0 10.0 9.0 8.0

10.7

(E)

Running Participation

Frequent Running Participation

Note: Running at least once per year – Six years of age or older. Source: SGMA, Sports Participation in America – 2004.

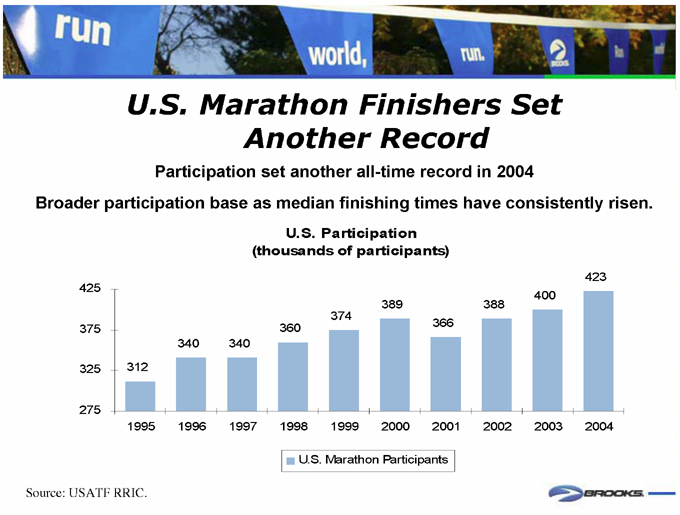

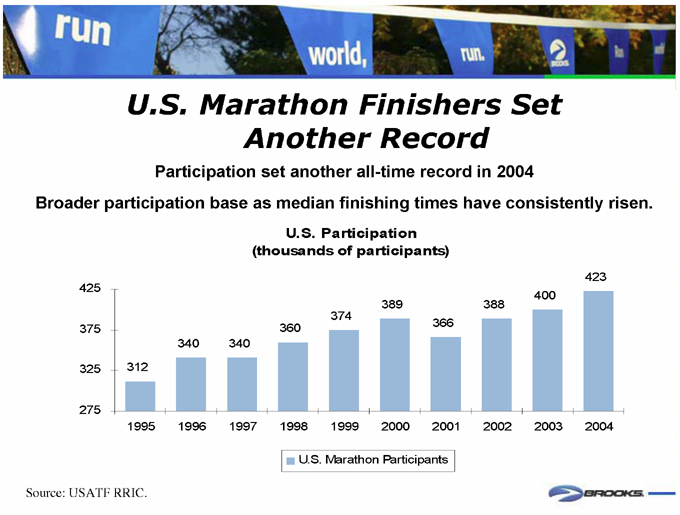

U.S. Marathon Finishers Set Another Record

Participation set another all-time record in 2004

Broader participation base as median finishing times have consistently risen.

U.S. Participation (thousands of participants)

425 375 325 275

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

312

340

340

360

374

389

366

388

400

423

U.S. Marathon Participants

Source: USATF RRIC.

Brooks Strategy Evolution

Different is essential

Customer/consumer relevance

Business model discipline

Brand creation requires vision and passion

Purpose, values, culture, relevance

Team Win

Deliver results, shoot straight, stay connected with reality, be accountable

Building a Brand

People want to be part of something big, important and meaningful.

Inspire people to run and be active.

Building A Brand

Success In Performance Running Requires a Distinctive

Competitive Strategy . . .

Product leadership

Performance function, innovation, style, quality

Best in class customer service

People, on time delivery, cycle management, systems, supply chain

Marketing energy

Momentum, cool factor, grass roots, close to runners

Competing with Product

Every great brand in sporting goods began with innovative, performance product that enthusiasts found (usually in a specialty store), embraced, and told their friends about.

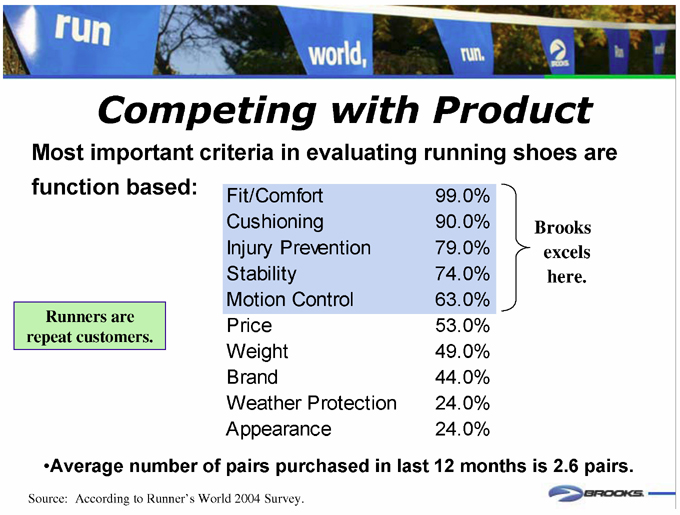

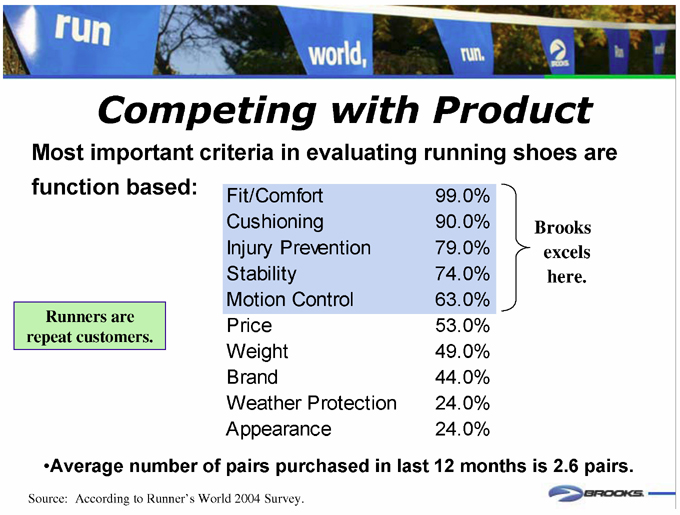

Competing with Product

Most important criteria in evaluating running shoes are function based:

Runners are repeat customers.

Fit/Comfort 99.0%

Cushioning 90.0%

Injury Prevention 79.0%

Stability 74.0%

Motion Control 63.0%

Price 53.0%

Weight 49.0%

Brand 44.0%

Weather Protection 24.0%

Appearance 24.0%

Brooks excels here.

Average number of pairs purchased in last 12 months is 2.6 pairs.

Source: According to Runner’s World 2004 Survey.

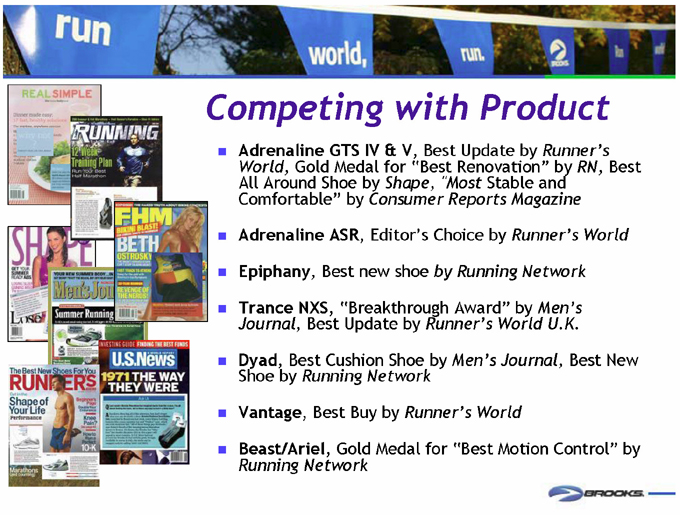

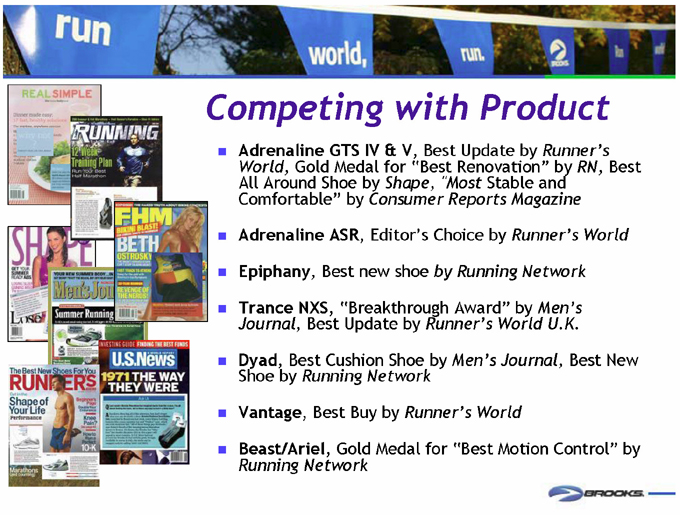

Competing with Product

Adrenaline GTS IV & V, Best Update by Runner’s World, Gold Medal for “Best Renovation” by RN, Best All Around Shoe by Shape, “Most Stable and Comfortable” by Consumer Reports Magazine

Adrenaline ASR, Editor’s Choice by Runner’s World

Epiphany, Best new shoe by Running Network

Trance NXS, “Breakthrough Award” by Men’s Journal, Best Update by Runner’s World U.K.

Dyad, Best Cushion Shoe by Men’s Journal, Best New Shoe by Running Network

Vantage, Best Buy by Runner’s World

Beast/Ariel, Gold Medal for “Best Motion Control” by

Running Network

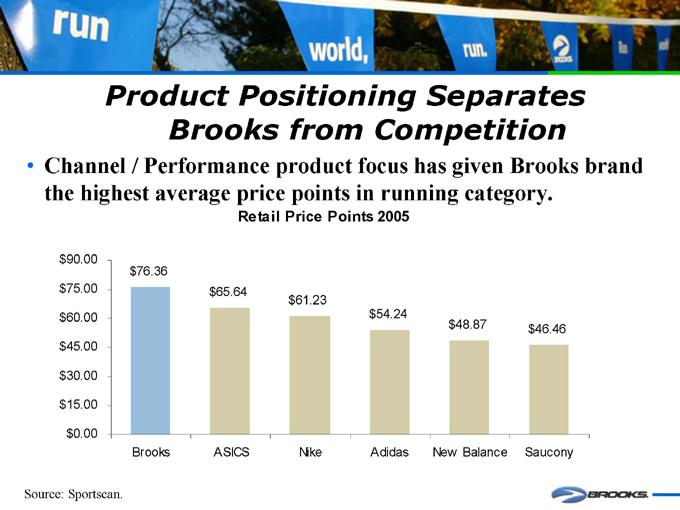

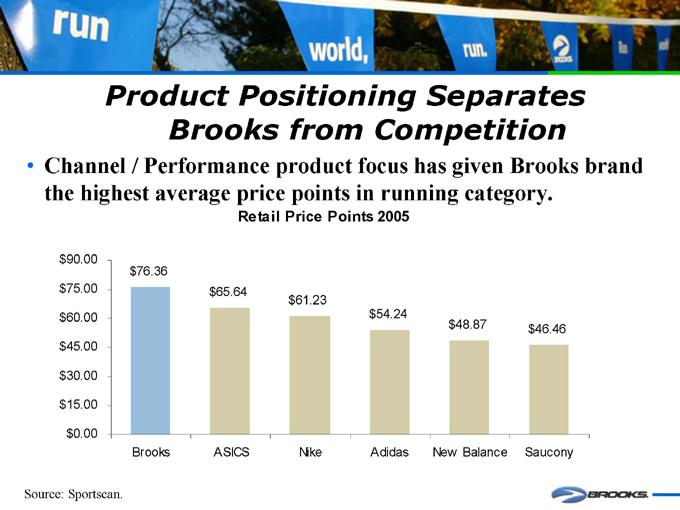

Product Positioning Separates Brooks from Competition

Channel / Performance product focus has given Brooks brand the highest average price points in running category.

Retail Price Points 2005 $90.00 $75.00 $60.00 $45.00 $30.00 $15.00 $0.00

Brooks ASICS Nike Adidas New Balance Saucony $76.36 $65.64 $61.23 $54.24 $48.87 $46.46

Source: Sportscan.

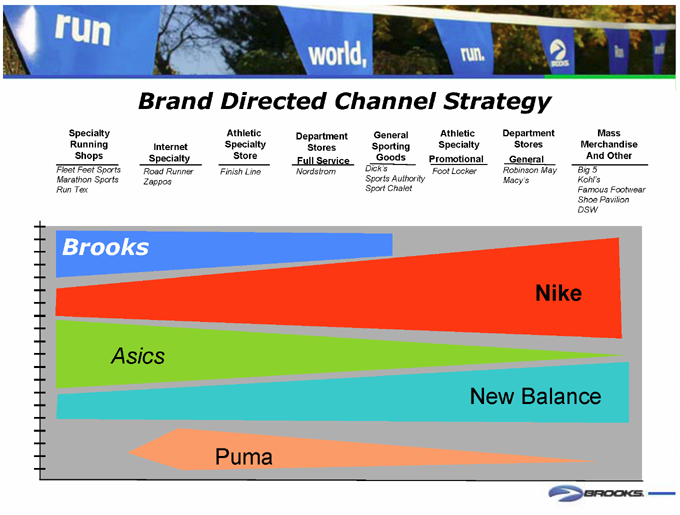

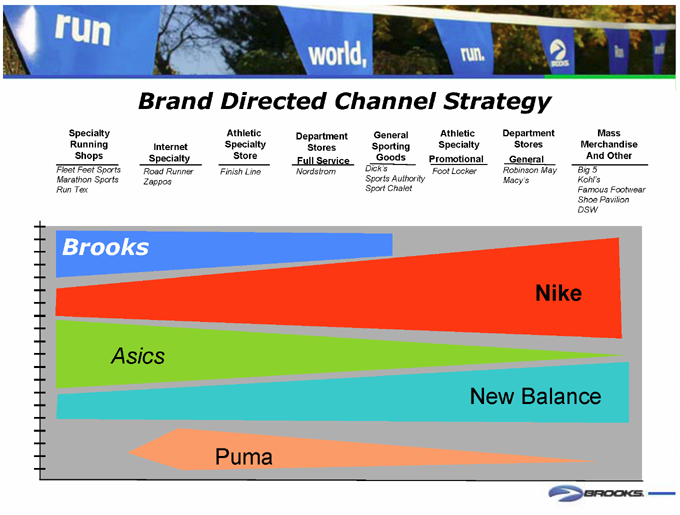

Brand Directed Channel Strategy

Specialty Running Shops Internet Specialty Athletic Specialty Store Department Stores Full Service General Sporting Goods Athletic Specialty Promotional Department Stores General Mass Merchandise And Other

Fleet Feet Sports Marathon Sports Run Tex Road Runner Zappos Finish Line Nordstrom Dick’s Sports Authority Sport Chalet Foot Locker Robinson May Macy’s Big 5 Kohl’s Famous Footwear Shoe Pavilion DSW

Brooks

Asics

Puma

New Balance

Nike

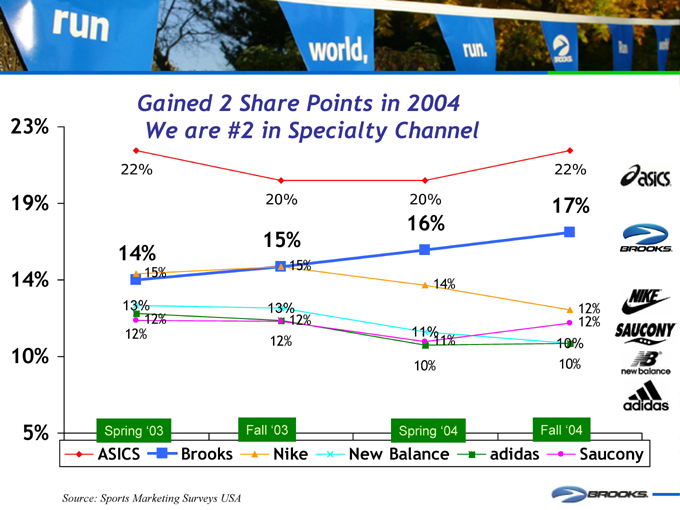

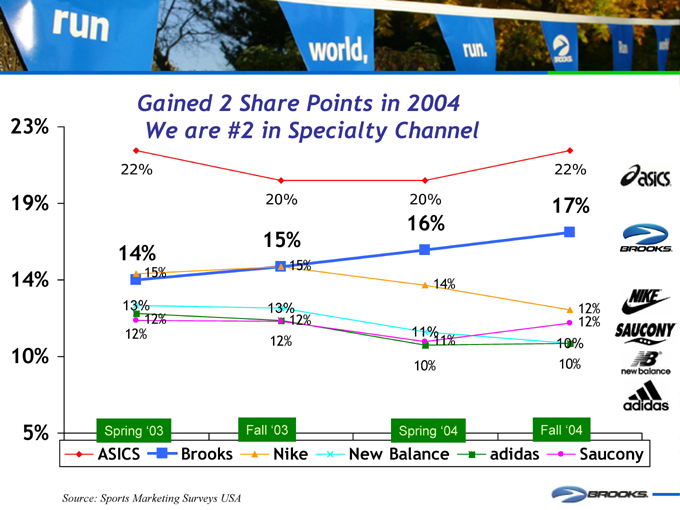

Gained 2 Share Points in 2004 We are #2 in Specialty Channel

23% 19% 14% 10% 5%

ASICS

Brooks

Nike

New Balance adidas

Saucony

22% 20% 20% 22% 14% 15% 16% 17%

15% 15% 14% 12% 12% 10% 10% 11% 11% 10% 13% 12% 12% 13% 12% 12%

Source: Sports Marketing Surveys USA

Spring ‘03

Fall ‘03

Spring ‘04

Fall ‘04

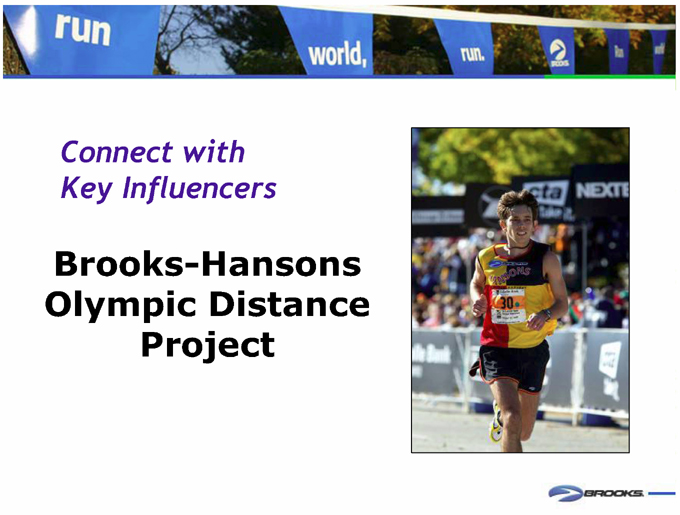

Connect with Key Influencers

Brooks-Hansons Olympic Distance Project

Connect with Key Influencers

Renowned UltraRunner Scott Jurek

Connect with Key Influencers

Professional Purchase Program

Connect with Key Influencers

Field Marketing/Events

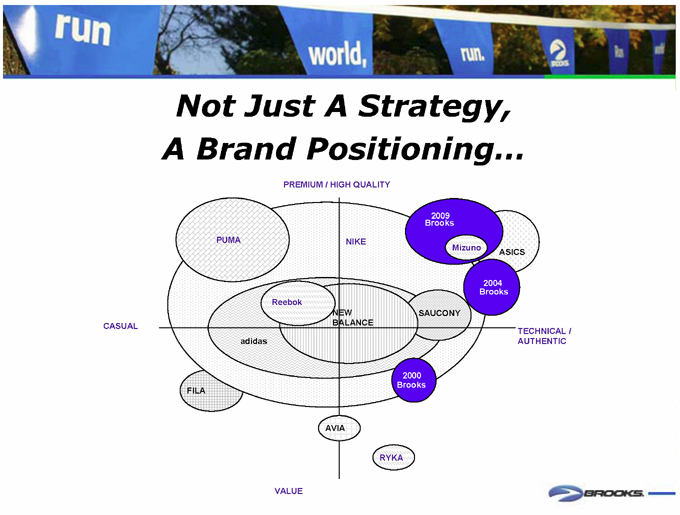

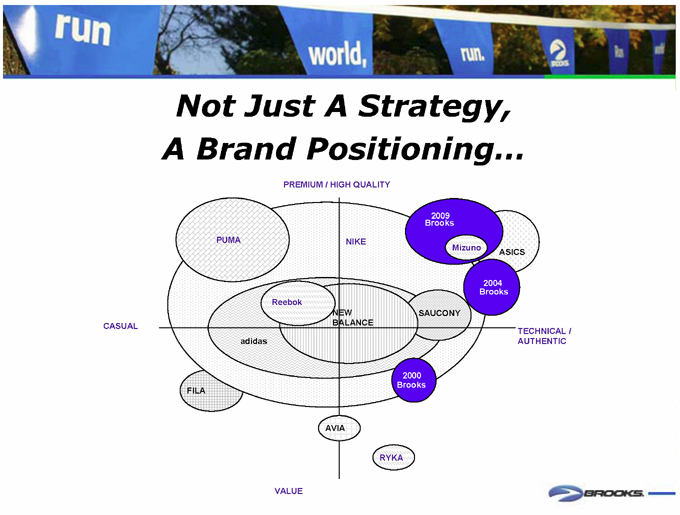

Not Just A Strategy, A Brand Positioning…

PREMIUM / HIGH QUALITY

PUMA

CASUAL

FILA

AVIA

RYKA

VALUE

TECHNICAL / AUTHENTIC

2000 Brooks adidas

Reebok

NEW BALANCE

SAUCONY

NIKE

2009 Brooks

Mizuno

ASICS

2004 Brooks

adidas

Inspire… Run world, run.

New global brand campaign designed to turn some heads and position Brooks uniquely in the running community TV, Print, In-store, Web, Guerilla, PR

12-month campaign; August ‘04 kickoff

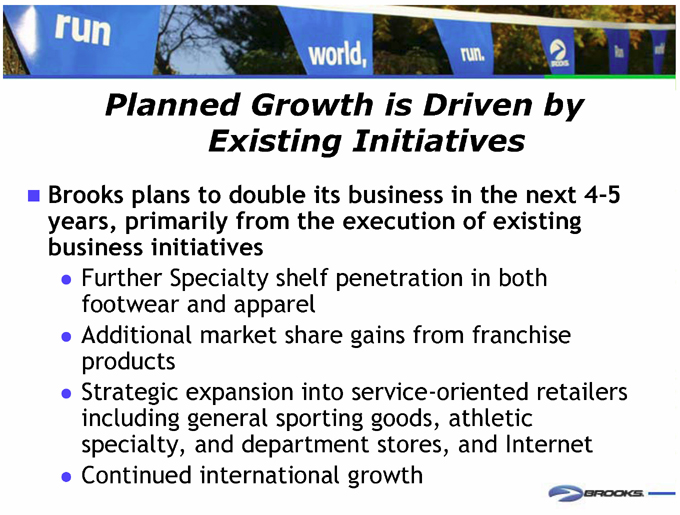

Planned Growth is Driven by Existing Initiatives

Brooks plans to double its business in the next 4-5 years, primarily from the execution of existing business initiatives

Further Specialty shelf penetration in both footwear and apparel Additional market share gains from franchise products Strategic expansion into service-oriented retailers including general sporting goods, athletic specialty, and department stores, and Internet Continued international growth

Brooks Utopia

EPICENTER OF THE RUNNING EXPERIENCE

A COMPANY WITH GOOD PRODUCT & SERVICE

Mark Tate President

A leading brand of hunting apparel

A “passion sports” brand User-experts focused on the outdoor market Products for the specific performance needs of consumers Complete brand/channel portfolio

Vision: We will build and leverage one of the strongest brands in hunting to become the premier marketer of innovative gear for outdoor recreational lifestyles

Mission: Outfitting the Outdoor Obsession

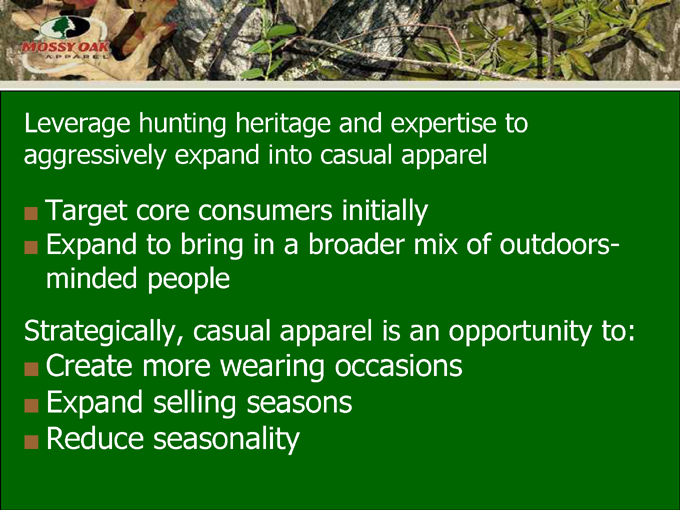

Leverage hunting heritage and expertise to aggressively expand into casual apparel

Target core consumers initially

Expand to bring in a broader mix of outdoors-minded people

Strategically, casual apparel is an opportunity to:

Create more wearing occasions Expand selling seasons Reduce seasonality

Expand distribution of hunting and casual apparel into non-traditional channels of distribution

Reach broad consumer base that identifies with lifestyle Align with key apparel purchase outlets for other outdoor lifestyle apparel

Expand brand awareness

Market highest performance hunting products

Market APX—Advanced Performance for Extremes Use key design functions from Outdoor industry Create “Halo” effect on brand

NRA Golden Bullseye Award Recipient

Additional key strategies

Expand core product offering Develop leadership in Customer Satisfaction Leverage corporate sourcing and product development capabilities

Strategy Overview

Julio Barea CEO

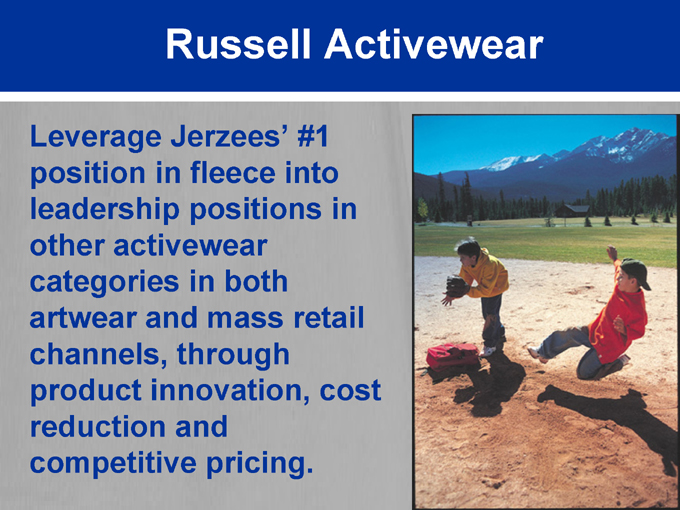

Russell Activewear

Leverage Jerzees’ #1 position in fleece into leadership positions in other activewear categories in both artwear and mass retail channels, through product innovation, cost reduction and competitive pricing.

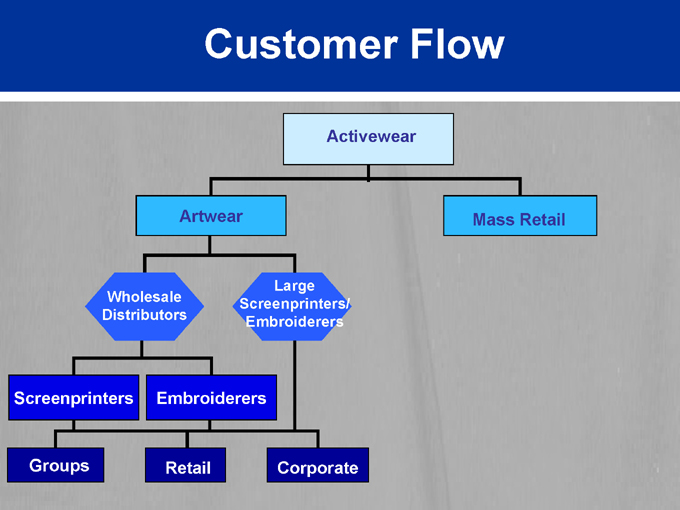

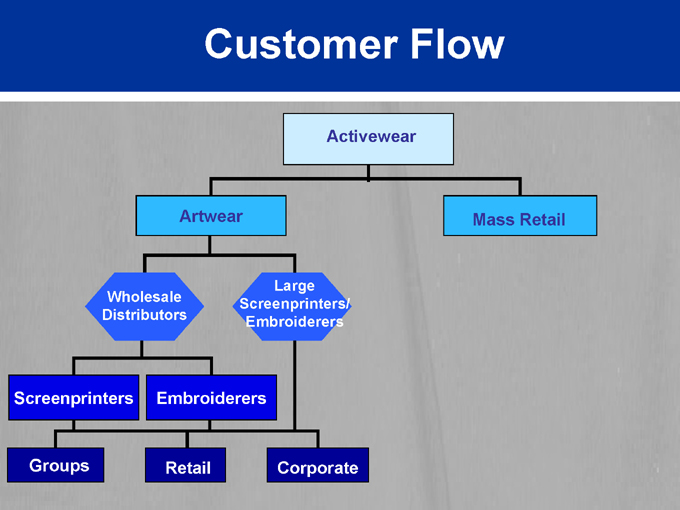

Customer Flow

Activewear

Artwear

Mass Retail

Wholesale Distributors

Large Screenprinters/ Embroiderers

Screenprinters

Embroiderers

Groups

Retail

Corporate

JERZEES - Mass Retail

Awarded Target’s Partner Award of Excellence - recognizing innovative leadership, superior business practice

JERZEES—Mass Retail

Jerzees consumers are trading up Increased new product introduction in ‘04-’05 ?Moisture Control / Antimicrobial socks ?Printed T-shirts ?Brushed lightweight garments #1 in Men’s and Boys’ sweats at mass retail #1 in Athletic socks at WalMart

JERZEES - Artwear

In every major wholesaler in the U.S.

#1 in fleece (2004)

#1 in 50/50 T-shirts (2004) - the fastest growing T-shirt category

JERZEES—Artwear

#2 in Sportshirts (2004)

Improving trends in overall market

Accelerated direct sales

Selectively introduce “other” Russell brands into premium categories

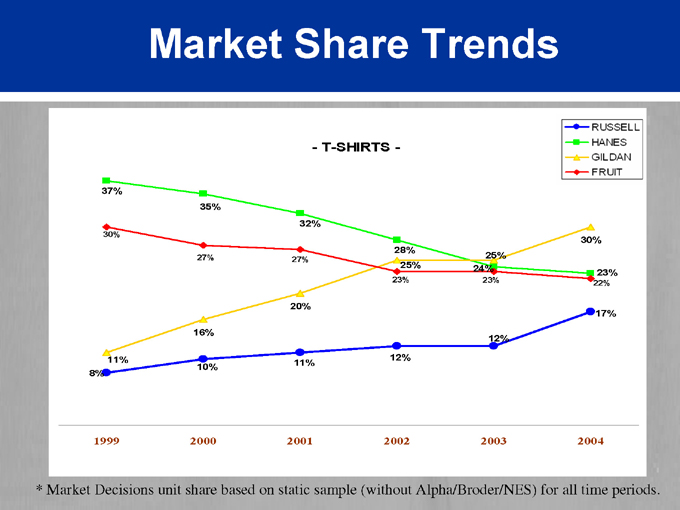

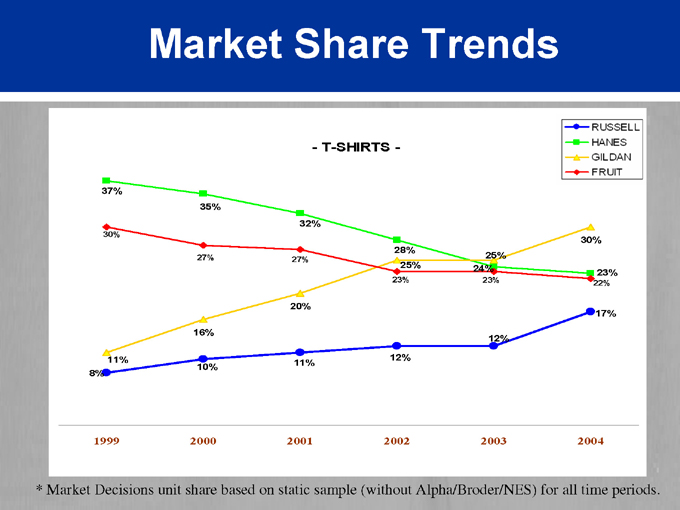

Market Share Trends

RUSSELL

HANES

GILDAN

FRUIT

- T-SHIRTS -

37% 35% 32% 28% 25% 30% 30% 27% 27% 25% 23% 24% 23% 23% 22% 11% 8% 16% 10% 20% 11% 12% 12% 17%

1999 2000 2001 2002 2003 2004

* Market Decisions unit share based on static sample (without Alpha/Broder/NES) for all time periods.

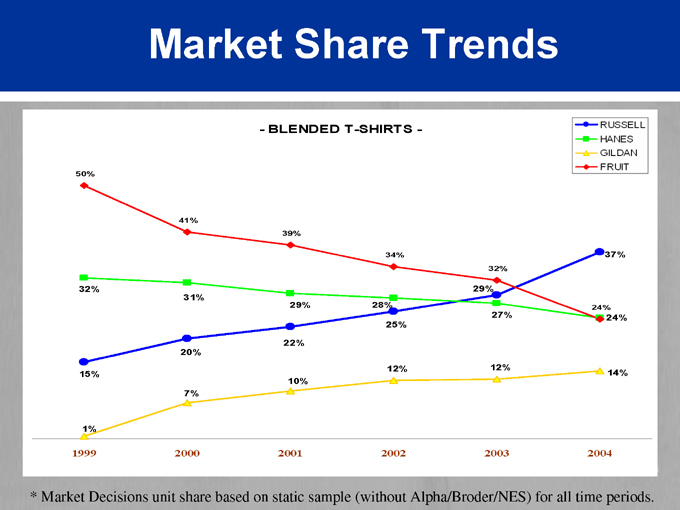

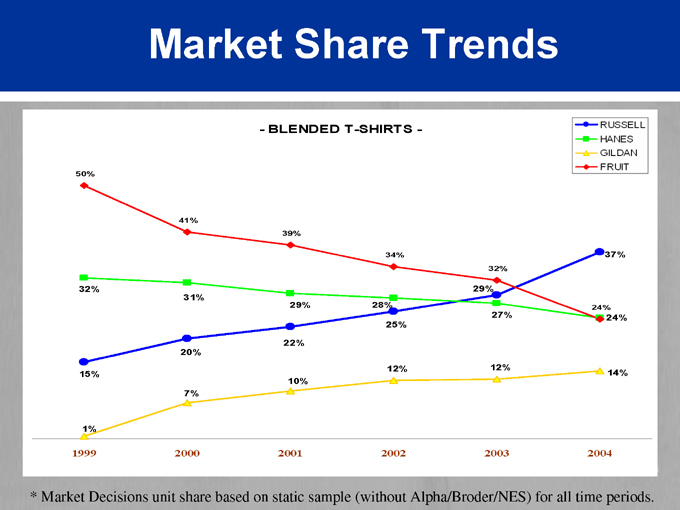

Market Share Trends

RUSSELL

HANES

GILDAN

FRUIT

- BLENDED T-SHIRTS -

50% 41% 39% 34% 32% 37% 32% 31% 29% 28% 29% 24% 15% 20% 22% 25% 27% 24% 1% 7% 10% 12% 12% 14%

1999 2000 2001 2002 2003 2004

* Market Decisions unit share based on static sample (without Alpha/Broder/NES) for all time periods.

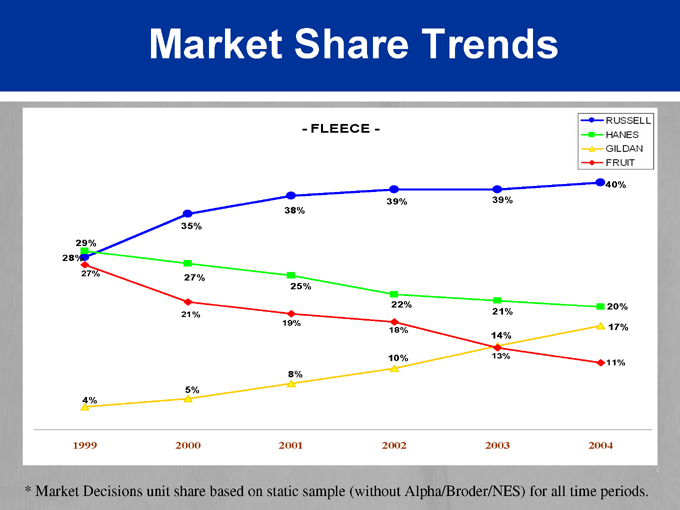

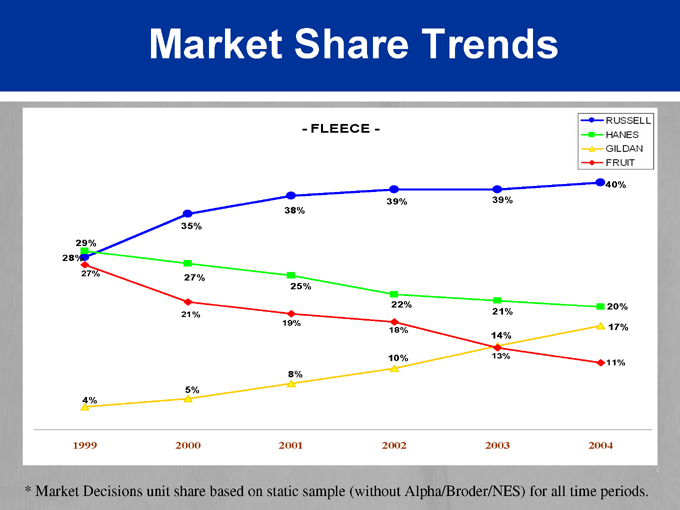

Market Share Trends

RUSSELL

HANES

GILDAN

FRUIT

- FLEECE -

29% 28% 27% 35% 38% 39% 39% 40% 27% 21% 25% 19% 22% 18% 10% 21% 14% 13% 20% 17% 11% 4% 5% 8%

1999 2000 2001 2002 2003 2004

* Market Decisions unit share based on static sample (without Alpha/Broder/NES) for all time periods.

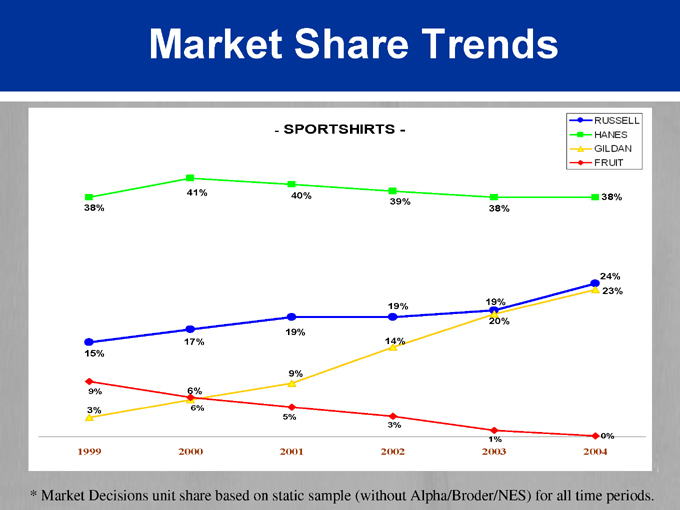

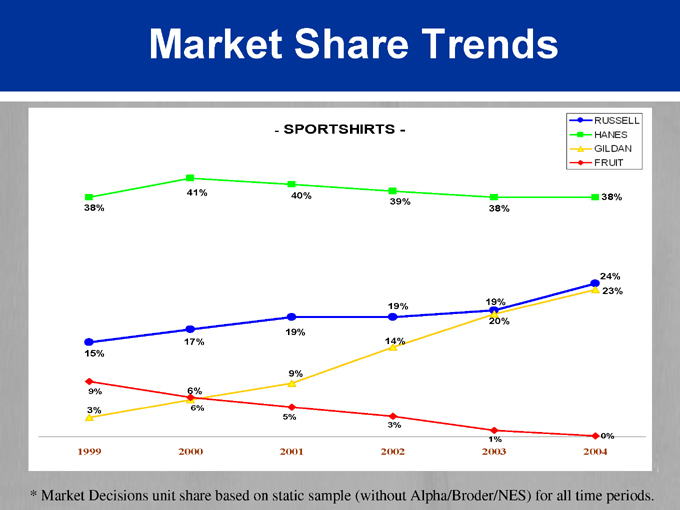

Market Share Trends

RUSSELL

HANES

GILDAN

FRUIT

- SPORTSHIRTS -

38% 41% 40% 39% 38% 38% 15% 17% 19% 19% 19% 20% 24% 23% 9% 3% 6% 6% 9% 14% 5% 3% 1% 0%

1999 2000 2001 2002 2003 2004

* Market Decisions unit share based on static sample (without Alpha/Broder/NES) for all time periods.

Russell’s Operations

Startup of low-cost Honduras fabric facility on schedule. Inaugurated on April 1, 2005

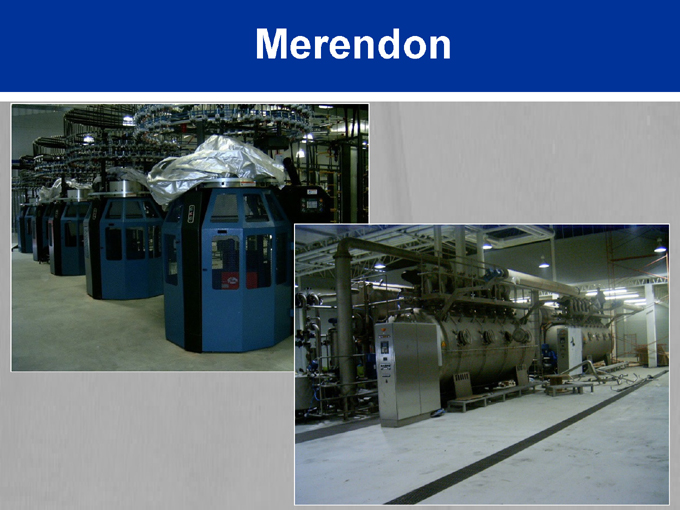

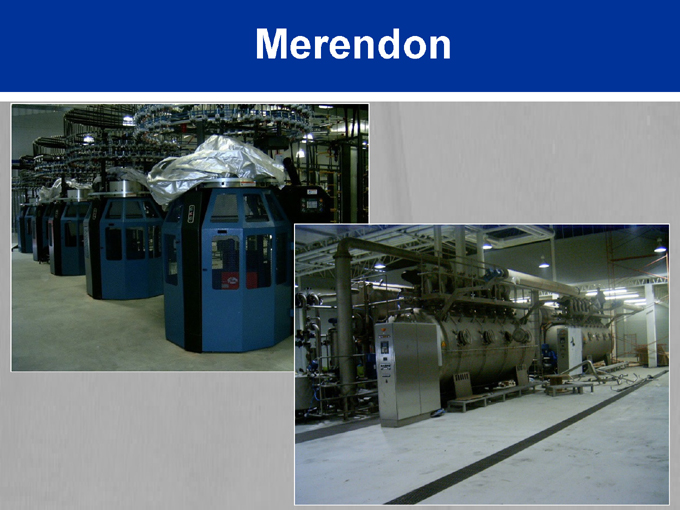

Merendon

Merendon

Russell’s Operations

Startup of low-cost Honduras fabric facility on schedule. Inaugurated on April 1, 2005

$60 Million savings last year

Additional $30 million in 2005

Russell’s Operations

Startup of low-cost Honduras fabric facility on schedule. Inaugurated on April 1, 2005

$60 Million savings last year

Additional $30 million in 2005

Sourcing offices in China and Pakistan (Hong Kong, Shenzhen, Lahore)

EQUIPPED TO WIN

CAPITAL STRUCTURE OVERVIEW

Martie Edmunds Zakas Vice President, Treasurer

Capital Structure

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

$300MM Asset-Based Loan Facility

$250MM 9¼% Senior Unsecured Notes

£17.5MM UK Credit Facility

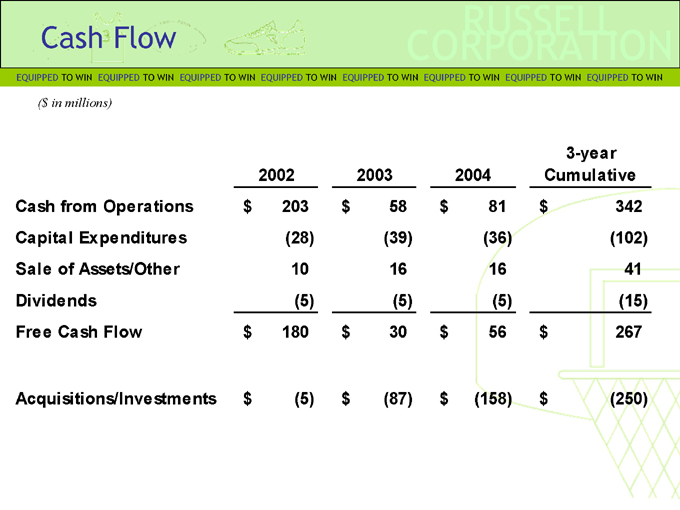

Cash Flow

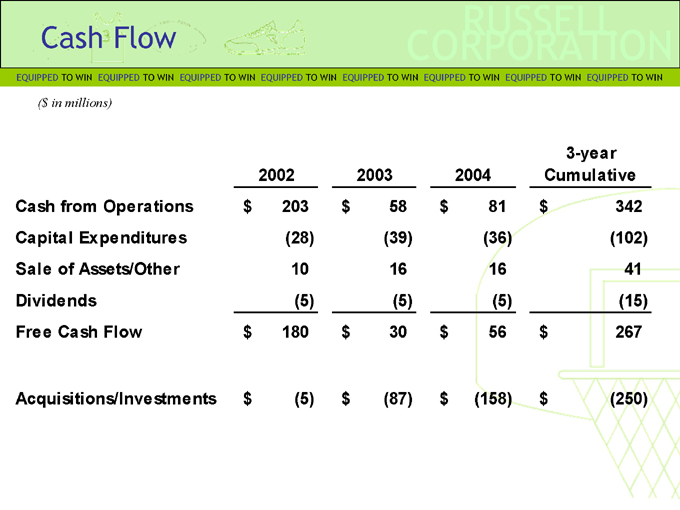

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

($ in millions)

2002 2003 2004 3-year Cumulative

Cash from Operations $203 $58 $81 $342

Capital Expenditures (28) (39) (36) (102)

Sale of Assets/Other 10 16 16 41

Dividends (5) (5) (5) (15)

Free Cash Flow $180 $30 $56 $267

Acquisitions/Investments $(5) $(87) $(158) $(250)

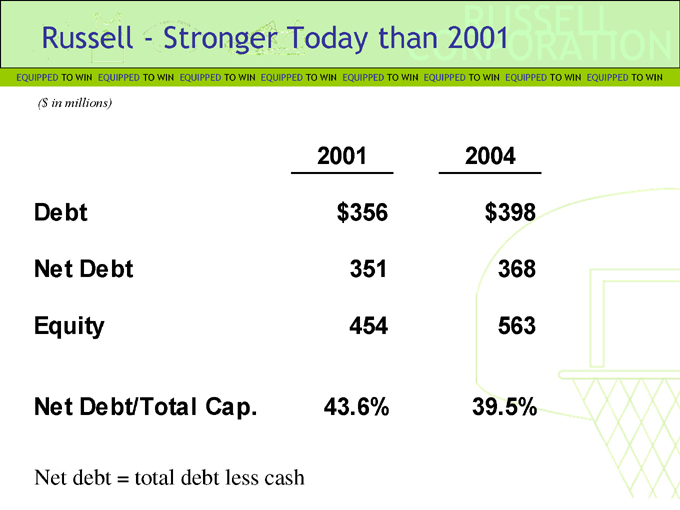

Russell—Stronger Today than 2001

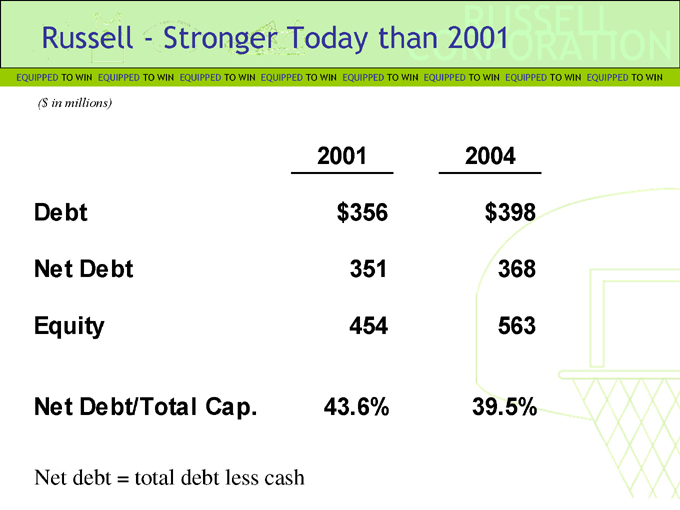

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

($ in millions)

2001 2004

Debt $356 $398

Net Debt 351 368

Equity 454 563

Net Debt/Total Cap. 43.6% 39.5%

Net debt = total debt less cash

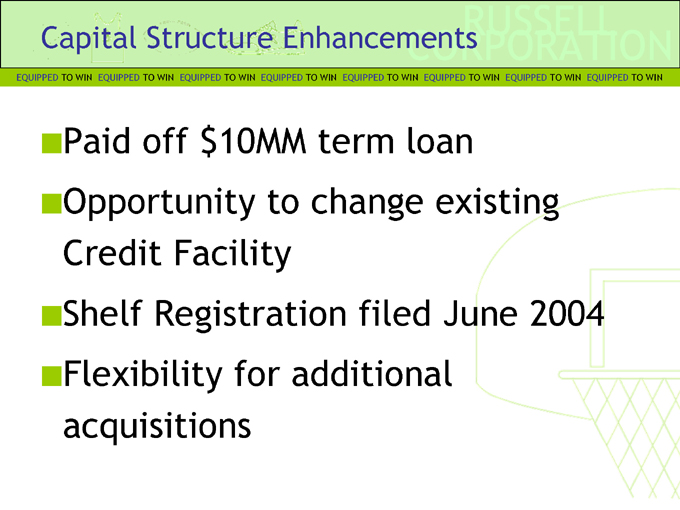

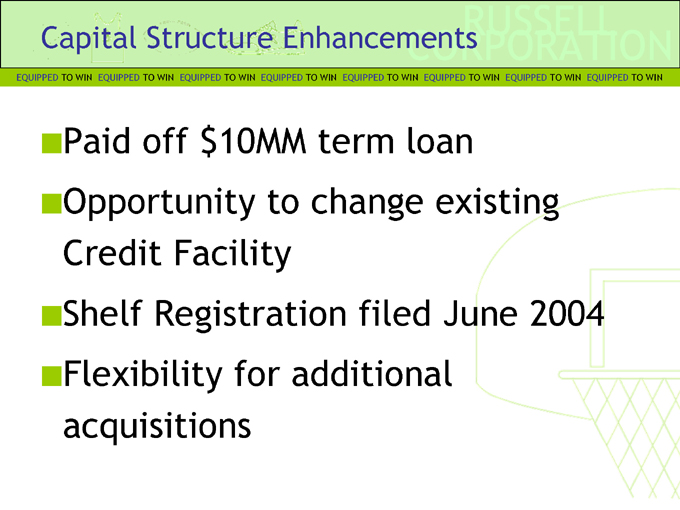

Capital Structure Enhancements

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Paid off $10MM term loan Opportunity to change existing Credit Facility Shelf Registration filed June 2004 Flexibility for additional acquisitions

EQUIPPED TO WIN

Financial Strategies and Results

Bob Koney

Senior Vice President and CFO

New Segment Reporting

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Sporting Goods

Activewear

Other

Estimated Segment Revenues

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

2004

2005

46%

4%

50%

50%

4%

46%

Sporting Goods

Activewear

Other

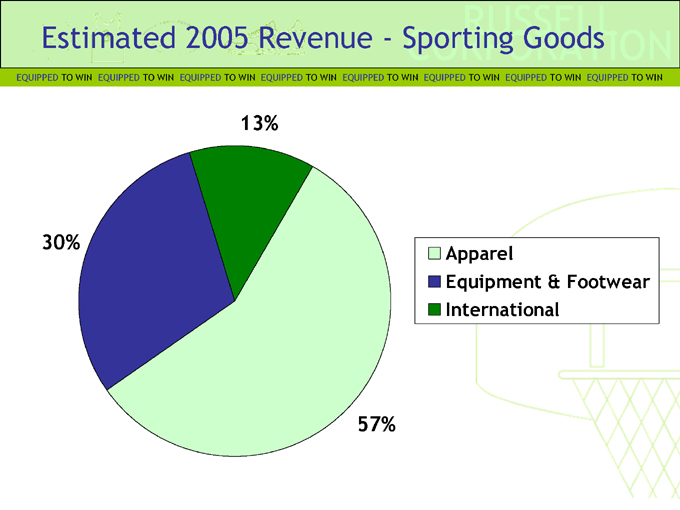

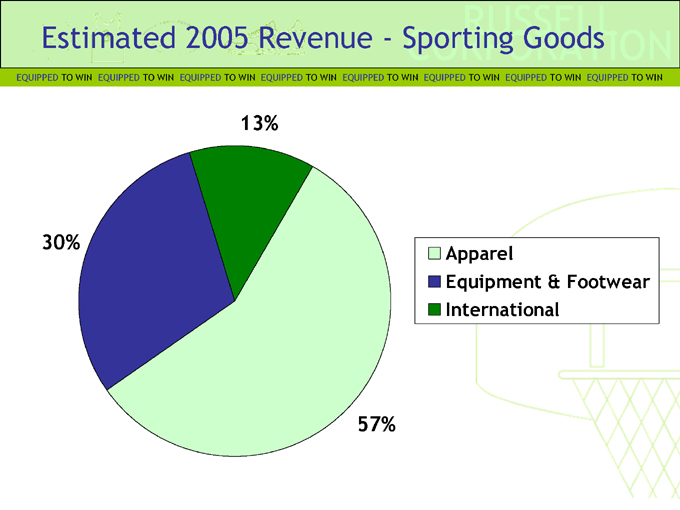

Estimated 2005 Revenue—Sporting Goods RUSSELL CORPORATION

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

13%

30%

57%

Apparel

Equipment & Footwear International

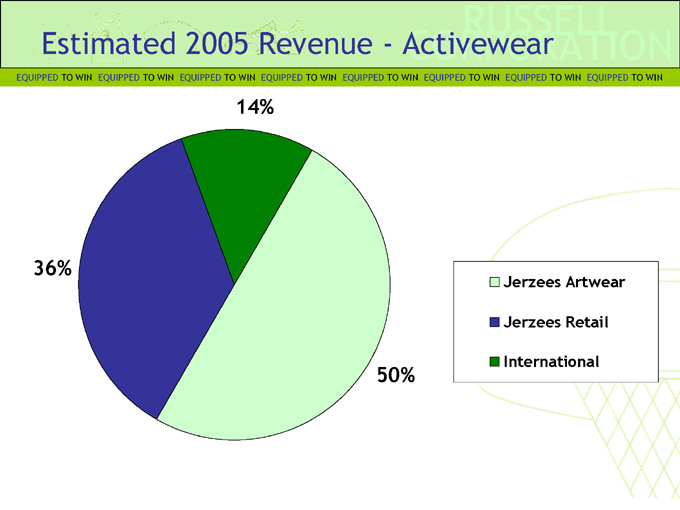

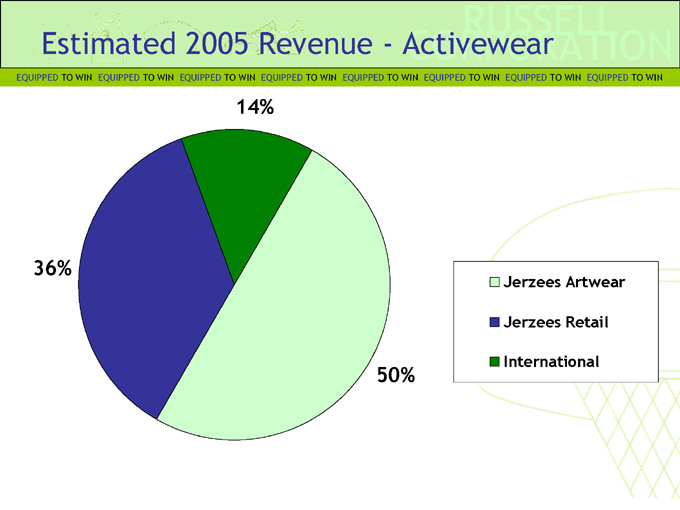

Estimated 2005 Revenue—Activewear

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

14%

36%

50%

Jerzees Artwear Jerzees Retail International

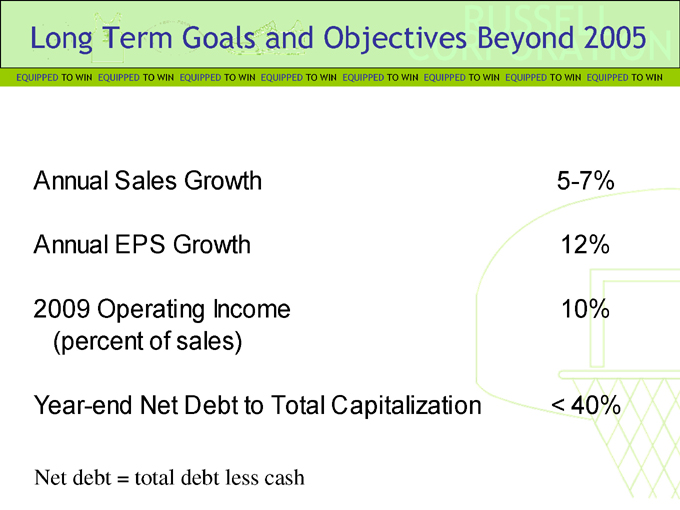

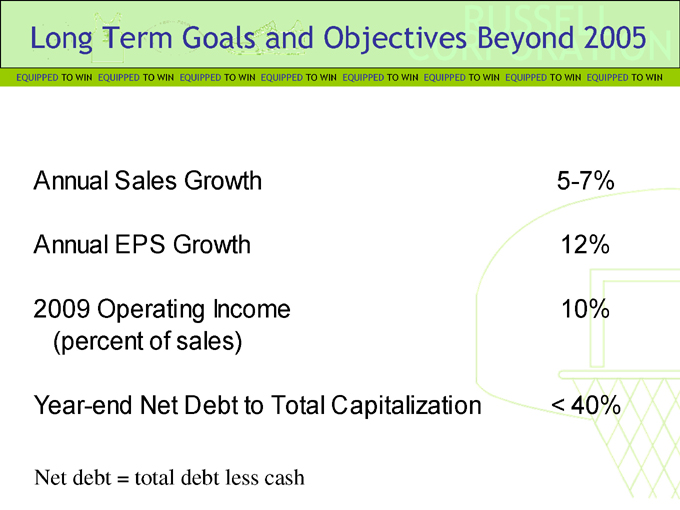

Long Term Goals and Objectives Beyond 2005 RUSSELL CORPORATION

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Annual Sales Growth 5-7%

Annual EPS Growth 12%

2009 Operating Income (percent of sales) 10%

Year-end Net Debt to Total Capitalization < 40%

Net debt = total debt less cash

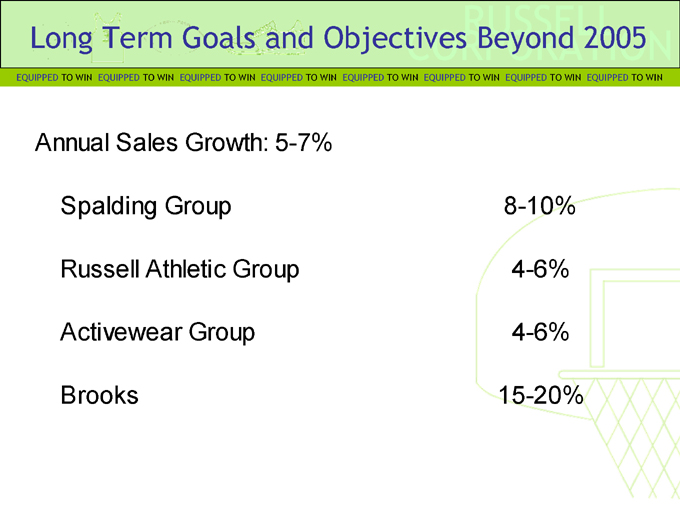

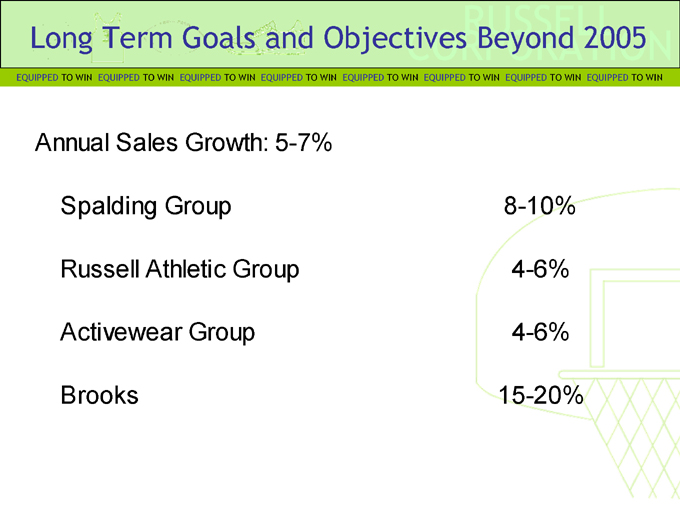

Long Term Goals and Objectives Beyond 2005

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Annual Sales Growth: 5-7%

Spalding Group 8-10%

Russell Athletic Group 4-6%

Activewear Group 4-6%

Brooks 15-20%

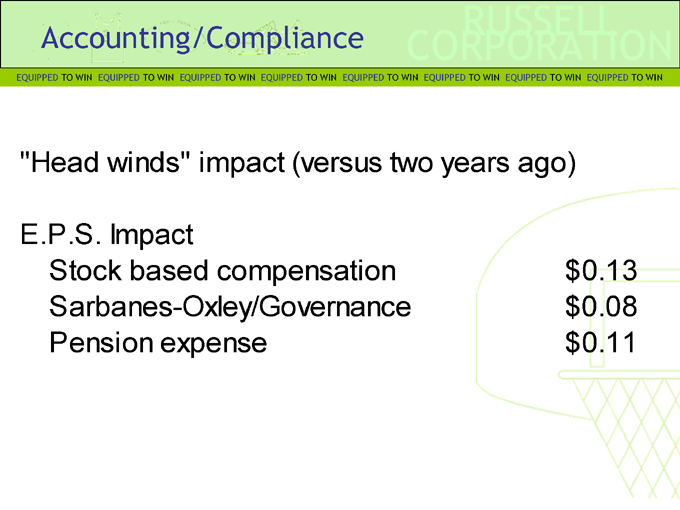

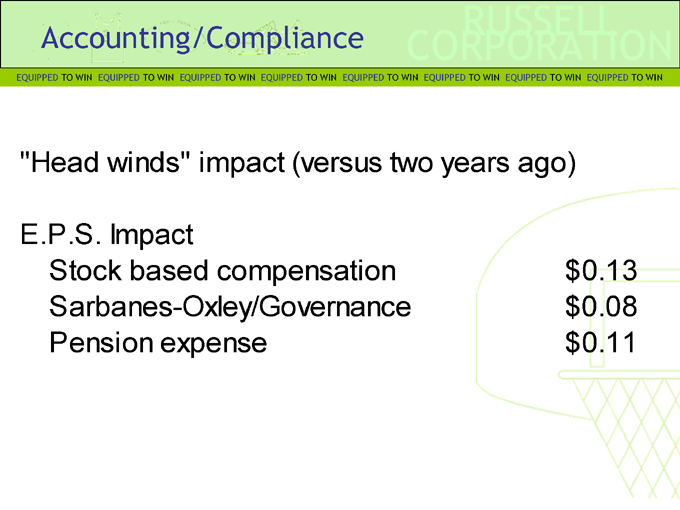

Accounting/Compliance

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

“Head winds” impact (versus two years ago)

E.P.S. Impact

Stock based compensation $0.13

Sarbanes-Oxley/Governance $0.08

Pension expense $0.11

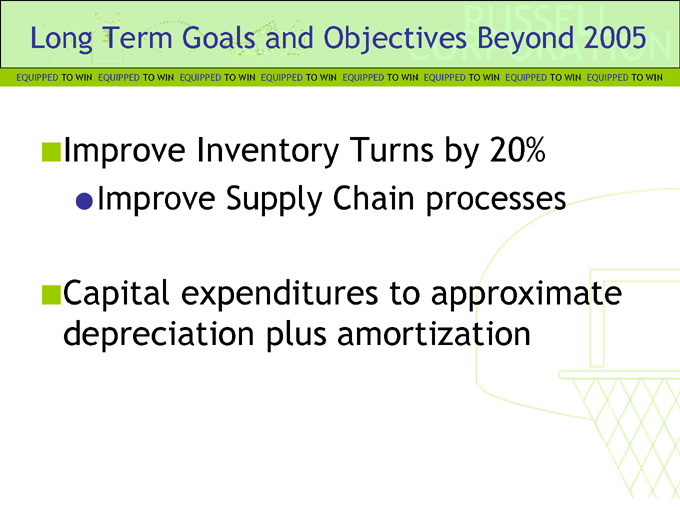

Long Term Goals and Objectives Beyond 2005

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Improve Inventory Turns by 20%

Improve Supply Chain processes

Capital expenditures to approximate depreciation plus amortization

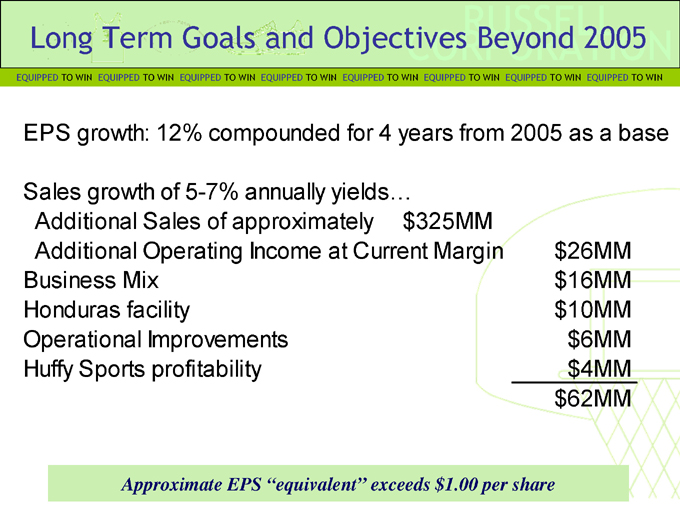

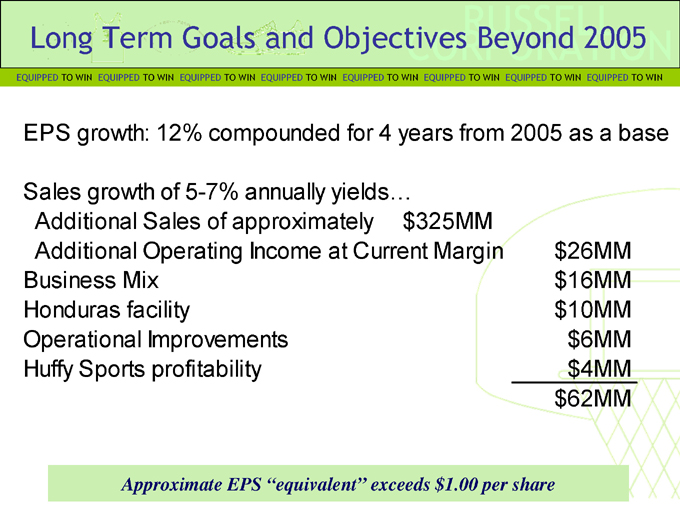

Long Term Goals and Objectives Beyond 2005 RUSSELL CORPORATION

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

EPS growth: 12% compounded for 4 years from 2005 as a base

Sales growth of 5-7% annually yields…

Additional Sales of approximately $325MM

Additional Operating Income at Current Margin $26MM

Business Mix $16MM

Honduras facility $10MM

Operational Improvements $6MM

Huffy Sports profitability $4MM

$62MM

Approximate EPS “equivalent” exceeds $1.00 per share

EQUIPPED TO WIN

GAME PLAN

Major Brand Expansions

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Spalding

Today

High-awareness global brand

Strong in equipment, especially basketball

Broadly licensed (apparel, accessories and footwear)

Direction

A global, tightly-managed, sports mega-brand

Major Brand Expansions

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Russell Athletic

Today

Strong position in team, college, and activewear Expanding position in performance products at retail

Direction

A global, major, sports-performance brand with apparel and accessories

Major Brand Expansions

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Jerzees

Today

A leading provider of Activewear in both the Artwear and Mass Retail channels

Direction

Solidify leading positions in Activewear with further expansions into performance athleticwear and embellished products

Major Brand Expansions

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Brooks

Today

A leading provider of technical performance running footwear

Direction

Further global expansion

Expand other running equipment (apparel and accessories)

Russell Recap

EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN EQUIPPED TO WIN

Leading market positions with diversified brands, products and distribution channels Strong customer base to leverage additional product categories Continued expansion into sports equipment and athletic footwear Commitment to maintain diversified low cost supply chains Successful track record of strategic acquisitions Strong sales and profit growth opportunities in all three sports categories

EQUIPPED TO WIN