UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

RUSSELL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

RUSSELL CORPORATION

To the Stockholders of Russell Corporation:

Notice is hereby given that the annual meeting of the stockholders of Russell Corporation (the “Company”) will be held on Wednesday, April 26, 2006, at 11:30 a.m., Central Daylight Time, at the Company’s office located at 281 Sales Office Drive, Alexander City, Alabama 35011 for the following purposes:

| | (1) | To elect three (3) directors to the Board of Directors for three-year terms ending in 2009; and |

| | (2) | To transact such other business as may properly come before the meeting. |

Holders of the common stock of the Company at the close of business on March 10, 2006, are entitled to notice of, and to vote upon, all matters at the annual meeting.

You are cordially invited to attend the annual meeting so that we may have the opportunity to meet with you and discuss the affairs of the Company. WHETHER OR NOT YOU PLAN TO ATTEND, YOU CAN ENSURE THAT YOUR SHARES ARE REPRESENTED AT THE MEETING BY PROMPTLY VOTING AND SUBMITTING YOUR PROXY BY TELEPHONE OR BY INTERNET, OR BY COMPLETING, SIGNING, DATING AND RETURNING YOUR PROXY IN THE ENCLOSED ENVELOPE.

BY ORDER OF THE BOARD OF DIRECTORS,

FLOYD G. HOFFMAN

Senior Vice President, Corporate Development,

General Counsel and Secretary

RUSSELL CORPORATION

PROXY STATEMENT FOR THE ANNUAL MEETING OF

STOCKHOLDERS TO BE HELD APRIL 26, 2006

This proxy statement is furnished, and the accompanying proxy is solicited, by the Board of Directors of Russell Corporation (the “Company”) for use at its annual meeting of stockholders to be held at the Company’s office located at 281 Sales Office Drive, Alexander City, Alabama 35011, on Wednesday, April 26, 2006, at 11:30 a.m., Central Daylight Time, and at any adjournment thereof. The proxy statement, accompanying proxy and the Company’s annual report to stockholders will be mailed to stockholders on or about March 30, 2006.

The Board of Directors of the Company has fixed the close of business on March 10, 2006, as the record date for determining the holders of the common stock of the Company entitled to notice of, and to vote at, the annual meeting. As of that date, 33,184,790 shares of the Company’s common stock were issued and outstanding, which are the only shares entitled to vote at the annual meeting. Every owner of the Company’s common stock is entitled to one vote for each share owned.

A quorum is necessary to hold a valid meeting of stockholders. A quorum exists if a majority of the shares entitled to vote are represented at the annual meeting, either in person or by proxy. If there is a quorum at the annual meeting, nominees for election as director to serve until the 2009 annual meeting of stockholders will be elected by a plurality of the votes cast. This means that the three director candidates receiving the highest number of votes will be elected. Stockholders may vote in favor of all nominees, withhold votes as to all nominees, or withhold votes as to specific nominees. If you vote and are part of the quorum, your shares will be voted for election of all three of the director nominees unless you give instructions to “withhold” votes. Withhold votes and broker nonvotes will not influence voting results. Abstentions are not recognized as to election of directors.

Under New York Stock Exchange rules, the election of directors is considered a “routine” matter upon which a brokerage firm that holds a stockholder’s shares in its name may vote on the stockholder’s behalf, even if the stockholder has not furnished the brokerage firm voting instructions within a specified period prior to the annual meeting.

All stockholders whose shares are registered in their name (“stockholders of record”) can vote by completing, signing, dating and returning by mail the enclosed proxy card. Stockholders of record also can vote by touchtone telephone, using the toll-free telephone number on the proxy card, or through the Internet, using the procedures and instructions described on the proxy card. If your shares are held in the name of your broker or bank (“street name holders”), you will receive proxy materials from your bank or broker. Street name holders may vote by mail, or by telephone or through the Internet if their bank or broker makes those methods available, in which case the bank or broker will enclose the instructions with the proxy materials. The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to vote their shares, and to confirm that their instructions have been properly recorded.

Shares represented by a properly executed proxy on the accompanying form, and all properly completed proxies submitted by telephone or by the Internet, will be voted at the annual meeting and, when instructions have been given by the stockholder, will be voted in accordance with those instructions. A stockholder who has given a proxy may revoke it at any time prior to its exercise by giving written notice of such revocation to the Secretary of the Company, by delivering to the Company a later dated proxy reflecting contrary instructions, or by appearing at the annual meeting and taking appropriate steps to vote in person.

If you have further questions, you may contact Innisfree M&A Incorporated, our proxy solicitor, toll-free at (888) 750-5834 from the United States and Canada; for other international callers, (412) 232-3651. Banks and brokers may call Innisfree collect at (212) 750-5833.

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF THE NOMINEES FOR DIRECTOR (PROPOSAL NO. 1).

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Directors of the Company are divided into three classes, with approximately one-third of the directors being elected at each annual meeting for three-year terms. The terms of Arnold W. Donald, Rebecca C. Matthias and John F. Ward will expire at the annual meeting, and each of these directors has been nominated for reelection at the annual meeting, to serve until the annual meeting of stockholders in 2009 and until their successors have been duly elected and qualified. Margaret M. Porter, whose term also will expire at the annual meeting, is retiring from the Board of Directors and will not stand for reelection. The Board of Directors is grateful to Mrs. Porter for her nine years of dedicated service.

Proxies cannot be voted for more than three persons, and in the absence of contrary instructions, shares represented by the proxies will be voted FOR the election of all nominees for director of the Company listed below. Should any nominee be unable or unwilling to accept election, it is expected that the proxies will vote for the election of such other person for director as the Board of Directors then recommends. The Board of Directors has no reason to believe that any of the nominees will be unable to serve or will decline to serve if elected.

Each of the nominees to be elected to the Board of Directors must receive a plurality of the votes cast at the annual meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A

VOTE “FOR” THE ELECTION OF ALL THE NOMINEES (PROPOSAL NO. 1).

NOMINEES FOR TERMS EXPIRING IN 2009 (CLASS I):

| | | | |

| | Arnold W. Donald St. Louis, Missouri | | Director since 2004

Age 51 |

| | Mr. Donald is President and Chief Executive Officer of Juvenile Diabetes Research Foundation International, a position he has held since December 2005. He served as Chairman of Merisant Company, a manufacturer and marketer of tabletop sweetener products, from March 2000 until November 2005, and was Merisant’s Chief Executive Officer from March 2000 to June 2003. Mr. Donald is a director of Carnival Corporation, a global cruise vacation and leisure travel accommodations company; Crown Cork & Seal Company, Inc., a packaging products manufacturer; The Laclede Group, a holding company that provides natural gas service in St. Louis and surrounding counties; Oil-Dri Corporation of America, an absorbent products and related services company; and The Scotts Company, a consumer lawn and garden products company. |

| | Mr. Donald is a member of the Management Development and Compensation Committee of the Board of Directors. |

| | |

| | Rebecca C. Matthias Philadelphia, Pennsylvania | | Director since 2004

Age 52 |

| | Ms. Matthias is President, Chief Operating Officer and a director of Mothers Work, Inc., a manufacturer and retailer of maternity apparel, and has held these positions for more than five years. She is a director of CSS Industries, Inc., a designer, manufacturer and seller of seasonal and gift products and educational activity products. Ms. Matthias is a member of the Management Development and Compensation Committee of the Board of Directors. |

-2-

| | | | |

| | John F. Ward Atlanta, Georgia | | Director since 1998

Age 62 |

| | Mr. Ward was elected President and Chief Executive Officer of the Company effective March 31, 1998, and Chairman of the Board of Directors effective April 22, 1998, and presently serves as Chairman of the Board of Directors and Chief Executive Officer. Prior to being elected to such positions, Mr. Ward was President of J. F. Ward Group, Inc., a consulting firm specializing in the domestic and international apparel and textile industries, from 1996 to 1998. Prior to that time, Mr. Ward was Chief Executive Officer of the Hanes Group and Senior Vice President of Sara Lee Corporation. Mr. Ward is a member of the executive committee of the Metro Atlanta Chamber of Commerce and a member of the advisory board of the Robert C. Goizueta Business School at Emory University. |

| | Mr. Ward is a member of the Executive Committee of the Board of Directors. |

Directors Whose Terms Expire in 2007 (Class II):

| | | | |

| | C.V. Nalley III Atlanta, Georgia | | Director since 1989

Age 63 |

| | Mr. Nalley has been Chairman of Nalley Automotive Group, a wholly owned subsidiary of the Asbury Automotive Group, Inc., which consists of automobile and truck sales companies, since 2004. Prior to that time, he served as Chief Executive Officer of Nalley Automotive Group, a position he held for more than five years. |

| | Mr. Nalley is Chairperson of the Corporate Governance Committee of the Board of Directors. |

| | |

| | John R. Thomas Alexander City, Alabama | | Director since 1966

Age 68 |

| | Mr. Thomas is Chairman, President and Chief Executive Officer of Aliant Financial Corporation, a bank holding company, and has held these positions for more than five years. He is a director of Alfa Corporation, a financial services holding company. |

| | Mr. Thomas is a member of the Corporate Responsibility and Management Development and Compensation Committees of the Board of Directors. |

| | |

| | John A. White Fayetteville, Arkansas | | Director since 1992

Age 66 |

| | Dr. White has been Chancellor of the University of Arkansas since July 1997. He served as Dean of Engineering of the Georgia Institute of Technology from 1991 to June 1997. He is a director of Motorola, Inc., an electronics and communications technology company; Logility, Inc., an internet business-to-business service provider; and J.B. Hunt Transport Services, Inc., a transportation and shipping company. He also serves on the boards of the National Science Foundation; Arkansas Science and Technology Authority; Arkansas Bioscience Institute; and Northwest Arkansas Airport Authority. |

| | Dr. White is a member of the Audit and Corporate Governance Committees of the Board of Directors. |

-3-

Directors Whose Terms Expire in 2008 (Class III):

| | | | |

| | Herschel M. Bloom Atlanta, Georgia | | Director since 1986

Age 63 |

| | Mr. Bloom has been a partner in the law firm of King & Spalding for more than five years. He is a director of Post Properties, Inc., an upscale apartment developer. |

| | Mr. Bloom is Chairperson of the Executive Committee of the Board of Directors. Mr. Bloom also serves as the Lead Director. |

| | |

| | Ronald G. Bruno Birmingham, Alabama | | Director since 1992

Age 54 |

| | Mr. Bruno is President of Bruno Capital Management Corporation, an investment company, and Chairman, Bruno Event Team, a sports marketing company, and has held each of these positions for more than five years. He is a director of Books-a-Million, Inc., a retail book sales company. |

| | Mr. Bruno is Chairperson of the Management Development and Compensation Committee and a member of the Audit Committee of the Board of Directors. |

| | |

| | Mary Jane Robertson Morristown, New Jersey | | Director since 2000

Age 52 |

| | Ms. Robertson has been Executive Vice President and Chief Financial Officer for Crum & Forster, a property and casualty insurance group, since 1999. Ms. Robertson is a director of Crum & Forster Holding Inc., and several of its subsidiary companies. She was previously Senior Vice President and Chief Financial Officer of Capsure Holdings Corp., a property and casualty insurance holding company. |

| | Ms. Robertson is the Chairperson of the Audit Committee and a member of the Corporate Governance Committee of the Board of Directors. |

-4-

BENEFICIAL OWNERSHIP

Security Ownership of Executive Officers and Directors

The following table sets forth information regarding beneficial ownership of the Company’s common stock by each director, the executive officers named in the Summary Compensation Table on page 16, and the directors and executive officers of the Company as a group, all as of March 1, 2006:

| | | | | | | | | | | | | |

| | | Amount and Nature of Beneficial Ownership

| | | |

Individual or Group

| | Sole Voting

And

Investment

Power

| | | Options

Exercisable

Within

60 Days

| | Other

Beneficial

Ownership

| | | Total

Beneficial

Ownership

| | Percent

of

Class (6)

| |

John F. Ward | | 228,299 | (1) | | 1,146,212 | | 15,000 | (2) | | 1,389,511 | | 3.9 | % |

Herschel M. Bloom | | 13,094 | | | 16,468 | | 0 | | | 29,562 | | * | |

Ronald G. Bruno | | 23,612 | | | 16,468 | | 0 | | | 40,080 | | * | |

Arnold W. Donald | | 7,756 | | | 0 | | 0 | | | 7,756 | | * | |

Rebecca C. Matthias | | 11,670 | | | 0 | | 0 | | | 11,670 | | * | |

C.V. Nalley III | | 31,349 | | | 24,446 | | 0 | | | 55,795 | | * | |

Margaret M. Porter | | 9,363 | | | 16,468 | | 0 | | | 25,831 | | * | |

Mary Jane Robertson | | 8,807 | | | 30,168 | | 0 | | | 38,975 | | * | |

John R. Thomas | | 105,320 | | | 16,468 | | 649,124 | (3) | | 770,912 | | 2.1 | % |

John A. White | | 15,315 | | | 16,468 | | 2,404 | (4) | | 34,187 | | * | |

Julio A. Barea | | 17,200 | (1) | | 0 | | 0 | | | 17,200 | | * | |

Floyd G. Hoffman | | 17,105 | (1) | | 110,000 | | 600,960 | (5) | | 728,065 | | 2.0 | % |

Robert D. Koney, Jr. | | 25,067 | (1) | | 0 | | 600,960 | (5) | | 626,027 | | 1.7 | % |

Calvin S. Johnston | | 10,370 | (1) | | 0 | | 0 | | | 10,370 | | * | |

All Executive Officers and Directors as a group (18 persons) | | 565,702 | | | 1,397,216 | | 1,267,488 | | | 3,230,406 | | 9.0 | % |

| * | Represents less than one percent (1%). |

| (1) | For Messrs. Ward, Barea, Hoffman, Koney and Johnston, respectively, includes 45,000, 15,000, 6,000, 12,000, and 7,500 shares of time lapse restricted stock granted in 2003 to Mr. Barea and in 2006 to all other named executive officers. Vesting of all shares of restricted stock is contingent upon continued employment until the applicable vesting date. See “Management Development and Compensation Committee Report on Executive Compensation – Long-Term Compensation” on page 12. |

| (2) | Shares owned by Mr. Ward’s spouse. Mr. Ward disclaims beneficial ownership of such shares. |

| (3) | Includes (i) 3,120 shares held by Mr. Thomas as executor of an estate, (ii) 454,248 shares owned indirectly by Mr. Thomas as general and limited partner in two limited partnerships, (iii) 3,500 shares owned by Mr. Thomas’ spouse; (iv) 32,372 shares held by a trust of which Mr. Thomas is one of three trustees; and (v) 155,884 shares held in the John Russell Thomas Children’s Trust, of which Mr. Thomas is the trustee. |

| (4) | Shares held by John and Mary Lib White Revocable Trust, under which Dr. White, as co-trustee, shares voting and investment power. |

| (5) | Shares held by the Company’s pension plan. Mr. Hoffman and Mr. Koney are members of the Administrative Committee for the pension plan, and in that capacity share the right to direct the voting and disposition of such shares. Mr. Hoffman and Mr. Koney disclaim beneficial ownership of such shares. |

| (6) | For purposes of determining Percent of Class, options exercisable within sixty days are added to total shares outstanding. |

-5-

Principal Stockholders

The following table sets forth each person who, to the Company’s knowledge, had sole or shared voting or investment power over more than five percent of the outstanding shares of common stock of the Company as of March 1, 2006:

| | | | | | | | |

Name and Address of Beneficial Owner

| | | | Amount and Nature of Beneficial Ownership

| | | Percent of Class (5)

| |

Dimensional Fund Advisors, Inc. 1299 Ocean Avenue, 11thFloor Santa Monica, CA 90401 | | 2,789,740 | (1) | | 7.8 | % |

| | |

M&G Investment Management Limited Governor’s House Laurence Pountney Hill London, England EC4R 0HH | | 3,335,000 | (2) | | 9.3 | % |

| | |

NFJ Investment Group, L.P. 2100 Ross Avenue, Suite 1840 Dallas, TX 75201 | | 1,945,300 | (3) | | 5.4 | % |

| | |

Franklin Resources, Inc. One Franklin Parkway San Mateo, CA 94403-1906 | | 2,401,488 | (4) | | 6.7 | % |

| (1) | From Schedule 13G filed with the Securities and Exchange Commission on February 6, 2006, which states that Dimensional Fund Advisors, Inc., in its capacity as investment adviser or manager, has sole voting and dispositive power with respect to 2,789,740 shares and shared voting and dispositive power with respect to no shares. |

| (2) | From Schedule 13G filed with the Securities and Exchange Commission on February 27, 2006, which states that M&G Investment Management Limited, in its capacity as investment adviser or manager, and its investment advisory client M&G Investment Funds 1, each have shared voting and shared dispositive power with respect to 3,335,000 shares and sole voting and dispositive power with respect to no shares. |

| (3) | From Schedule 13G filed with the Securities and Exchange Commission on February 14, 2006, which states that NFJ Investment Group, L.P., in its capacity as investment adviser or manager, has sole voting and dispositive power with respect to 1,945,300 shares and shared voting and dispositive power with respect to no shares. |

| (4) | From Schedule 13G filed with the Securities and Exchange Commission on February 7, 2006, which states that Franklin Advisory Services, LLC (an investment adviser subsidiary of Franklin Resources, Inc.), in its capacity as investment adviser or manager, has sole voting power with respect to 2,397,203 shares, sole dispositive power with respect to 2,401,103 shares and shared voting and dispositive power with respect to no shares. Fiduciary Trust Company, another investment advisory subsidiary of Franklin Resources, Inc., has sole voting and dispositive power with respect to 385 shares. |

| (5) | For purposes of determining Percent of Class, options exercisable within sixty days are added to total shares outstanding. |

-6-

BOARD OF DIRECTORS

Determinations Regarding Director Independence

In February 2004, the Board of Directors adopted the Company’sCorporate Governance Principles and Practices (the “Governance Principles”). TheGovernance Principles can be found on the Investor Relations section of the Company’s website (www.russellcorp.com). A copy also may be obtained by written request submitted to Floyd G. Hoffman, Secretary, Russell Corporation, 3330 Cumberland Boulevard, Suite 800, Atlanta, Georgia 30339.

Pursuant to theGovernance Principles, and in compliance with the corporate governance listing standards of the New York Stock Exchange, the Board of Directors undertook its annual review of director independence in February 2006. During this review, the Board of Directors considered transactions and relationships between each director or any member of his or her immediate family or companies or entities with which the director is affiliated on the one hand, and the Company or any of its subsidiaries or affiliates on the other hand, including those reported under “Transactions with Management and Others and Certain Business Relationships” on page 10 of this proxy statement. The Board of Directors also examined transactions and relationships between directors or their affiliates and members of the Company’s senior management or their affiliates. The purpose of this review was to determine whether any such relationships or transactions were inconsistent with a determination that a director is independent. In the course of its review, the Board of Directors considered the following relationships:

| | • | | the Company paid legal fees to King & Spalding, a law firm in which Mr. Bloom is a partner, of approximately $460,000, $742,000 and $591,000 in 2005, 2004 and 2003, respectively; |

| | • | | the Company paid legal fees to Bradley Arant Rose & White, a law firm in which Ms. Porter’s son-in-law is a partner, of approximately $462,000, $525,000 and $708,000 in 2005, 2004 and 2003, respectively; |

| | • | | in 2005, 2004 and 2003, the Company paid interest and fees to Aliant Bank, a subsidiary of Aliant Financial Corporation for which Mr. Thomas serves as Chairman, President and Chief Executive Officer, of approximately $279,000, $174,000 and $166,000, respectively; |

| | • | | in 2004 and 2003, respectively, the Company paid fees to Adjoined Consulting, Inc., a firm in which Dr. White’s son is a non-executive officer, of approximately $719,000 and $172,000. The projects for which the Company engaged Adjoined Consulting ended in 2004, and the Company no longer has a relationship with that firm; and |

| | • | | Mr. Bruno is Chairman of the Bruno’s Memorial Classic Foundation, a nonprofit organization that holds an annual charity golf tournament. The Company provides uniforms for volunteers and purchases pro am spots to entertain its customers at this event, the value of which was approximately $42,000, $31,000 and $35,000 in 2005, 2004 and 2003, respectively. |

In each case, the Board of Directors considered all of the relevant facts and circumstances, including the nature of the relationship between the director and the organization to which such payments were made, and the dollar amounts involved (both in absolute terms and in relation to the total revenues of the Company and of the organization to which the payments were made). As a result of this review, the Board of Directors affirmatively determined that, other than Mr. Ward, the Company’s Chairman and Chief Executive Officer, none of the directors has a material relationship with the Company or any relationship that would preclude his or her independence under the listing standards of the New York Stock Exchange.

Lead Director

Herschel M. Bloom serves as the Company’s Lead Director and chairs meetings of the non-management directors. To contact Mr. Bloom, or the non-management directors as a group, see “Communicating with Directors” on page 10 of this proxy statement.

-7-

Committees of the Board of Directors; Meetings

The Board of Directors has standing Executive, Management Development and Compensation, Audit, Corporate Governance, and Corporate Responsibility committees. The members of each committee are indicated on pages 2 through 4 of this proxy statement.

The Executive Committee is authorized to act in place of the Board of Directors between meetings of the Board of Directors. The Committee held one meeting during 2005.

The Management Development and Compensation Committee has overall responsibility for designing, approving and evaluating the Company’s executive compensation plans, policies and programs, including determining and approving the compensation of the Company’s Chief Executive Officer. The Committee operates under a written charter adopted by the Company’s Board of Directors, which is available on the Investor Relations section of the Company’s website atwww.russellcorp.com. A copy also may be obtained by written request submitted to Floyd G. Hoffman, Secretary, Russell Corporation, 3330 Cumberland Boulevard, Suite 800, Atlanta, Georgia 30339. The Committee is composed of four directors who are not officers of the Company and who meet the independence requirements of the New York Stock Exchange. The Committee held four meetings during 2005.

The Audit Committee appoints the Company’s independent accountants and reviews the audit plan, annual financial statements and audit results prior to the Company’s release of annual earnings and the filing of its annual report on Form 10-K. The Committee also reviews the interim financial statements with management and independent auditors prior to filings of quarterly reports on Form 10-Q and the release of quarterly earnings. The Committee discusses with the independent auditors their independence from management of the Company and the matters included in the written disclosures required by the Public Company Accounting Oversight Board. The Committee has adopted a formal written charter that specifies the Audit Committee’s responsibilities. A copy of the Charter is available on the Investor Relations section of the Company’s website atwww.russellcorp.com. A copy may also be obtained by written request submitted to Floyd G. Hoffman, Secretary, Russell Corporation, 3330 Cumberland Boulevard, Suite 800, Atlanta, Georgia 30339.

The Audit Committee is composed of three directors, Ms. Robertson, Mr. Bruno and Dr. White, who meet the audit committee independence requirements of the New York Stock Exchange. The Board of Directors has determined that Ms. Robertson, the chair of the Committee, is qualified as an “audit committee financial expert” within the meaning of SEC regulations and that all of the Committee members meet the financial literacy requirements of the New York Stock Exchange. Dr. White currently serves on the audit committees of three other public companies. Under the Audit Committee Charter, a Committee member may not simultaneously serve on the audit committees of more than two other public companies unless the Board affirmatively determines that such simultaneous service does not impair the ability of the member to effectively serve on the Committee. The Board of Directors has determined that Dr. White’s simultaneous service on the three other audit committees does not impair his ability to effectively serve on the Committee. The Committee held ten meetings during 2005.

The Corporate Governance Committee (i) evaluates the composition of the Board of Directors, assists the Board of Directors in identifying qualified candidates for director and recommends candidates for election to the Company’s Board of Directors; (ii) conducts an annual appraisal of the performance of the Board of Directors as a whole and the performance of individual members of the Board of Directors; (iii) recommends director nominees for each of the committees of the Board of Directors; and (iv) develops and implements policies and practices for the Company relating to corporate governance in accordance with applicable law and regulations and the Company’sGovernance Principles. The Committee operates under a written charter adopted by the Company’s Board of Directors. The Charter of the Corporate Governance Committee is available on the Investor Relations section of the Company’s website atwww.russellcorp.com. A copy also may be obtained by written request submitted to Floyd G. Hoffman, Secretary, Russell Corporation, 3330 Cumberland Boulevard, Suite 800, Atlanta, Georgia 30339. The Committee is composed of three directors who are not officers of the Company and who meet the independence requirements of the New York Stock Exchange. The Committee held three meetings during 2005.

-8-

The Corporate Responsibility Committee provides oversight and guidance concerning the Company’s obligations to its employees and the communities in which it operates. The Committee held two meeting in 2005.

During the year ended December 31, 2005, the Board of Directors held five regular and one special meeting. Each member of the Board of Directors attended at least 75% of the meetings of the Board of Directors and the committees of which he/she is a member, except for Dr. White, who attended 74% of such meetings. It is traditional that the Company holds a Board of Directors meeting immediately prior to the annual meeting of stockholders, and all directors are invited and encouraged to attend the annual meeting of stockholders. All members of the Board of Directors attended the Company’s 2005 annual meeting.

Process for Selecting Nominees for the Board of Directors

The Corporate Governance Committee of the Board of Directors makes director recommendations to the full Board of Directors for appointments to fill vacancies in any unexpired term on the Board of Directors and to recommend nominees for submission to stockholders for approval at the time of the annual meeting. When formulating its director recommendations, the Corporate Governance Committee may consider advice and recommendations from others, including Company stockholders, as it deems appropriate. The Corporate Governance Committee has the responsibility to extend any offer to a new director candidate to serve on the Board of Directors.

The Company does not set specific criteria for directors but believes that candidates should show evidence of leadership in their particular field, have broad business experience and the ability to exercise sound business judgment. In selecting directors, the Board of Directors generally seeks a combination of active or former Chief Executive Officers or senior officers of major businesses. The Board of Directors also considers, among other factors, a nominee’s reputation for integrity and ethical dealings and a willingness to devote adequate time and effort to the responsibilities of the Board of Directors.

The Corporate Governance Committee identifies potential nominees by asking current directors and executive officers to notify the Committee if such directors and officers become aware of persons who meet the criteria described above. The Committee also, from time to time, may engage firms that specialize in identifying director candidates. As described below, the Committee will also consider candidates recommended by stockholders.

Once a potential candidate has been identified by the Corporate Governance Committee, the Committee collects and reviews publicly available information regarding the person to assess whether the person should be considered further. If the Committee determines that the candidate warrants further consideration, the Chairperson or another member of the Committee contacts the person. Generally, if the person expresses a willingness to be considered and to serve on the Board of Directors, the Committee would request information from the candidate, review factors bearing on the person’s independence from the Company, review the person’s accomplishments and qualifications relative to the accomplishments and qualifications of any other candidates that the Committee might be considering, and conduct one or more interviews with the candidate. In certain instances, members of the Committee may contact references provided by the candidate, other members of the business community or other persons that may have greater first-hand knowledge of the candidate’s accomplishments. The Committee would employ the same evaluation process if a candidate was to be recommended by a stockholder.

Stockholders who submit to the Company evidence of their share ownership may recommend candidates for the Board of Directors. Recommendations of candidates for the Board of Directors submitted by stockholders will be considered by the Corporate Governance Committee if the Company receives such recommendations not less than 120 days prior to the anniversary date of the Company’s most recent annual meeting. The names of such candidates, along with biographical information, should be submitted to Floyd G. Hoffman, Secretary, Russell Corporation, 3330 Cumberland Boulevard, Suite 800, Atlanta, Georgia 30339.

-9-

Compensation of Directors

Under the Russell Corporation 2000 Non-Employee Directors’ Compensation Plan, as amended (the “2000 Directors’ Plan”), each non-employee director receives a quarterly retainer of $8,750. A stock retainer deferral account (a “deferral account”) also is established for each non-employee director. Immediately following each annual meeting each non-employee director’s deferral account is credited with shares of common stock having a market value of $25,000. In addition, on each dividend payment date with respect to the common stock, each deferral account is credited with additional shares of common stock equal to the number of shares of common stock which could be acquired with the dividends paid on the shares of common stock in the deferral account based on the market value of such shares on that date. The shares in a deferral account will be paid to a non-employee director on the earlier of (i) the first anniversary of the date the director leaves the Board or (ii) the day after the director leaves the Board, if the director has reached age 70. Non-employee directors serving in the following capacities receive the following additional annual cash retainers: Chairperson of the Audit Committee — $10,000; members of the Audit Committee — $5,000; and Lead Director — $5,000. The 2000 Directors’ Plan allows a non-employee director to elect to receive the cash retainer fees payable to such director in (i) shares of common stock or (ii) shares of common stock deposited to a deferral account. 302,130 shares of common stock are presently authorized to be issued under the 2000 Directors’ Plan, including those shares of common stock remaining under a predecessor plan.

Section 16(a) Beneficial Ownership Reporting Compliance

Based solely on a review of Forms 3, 4 and 5 and amendments thereto related to the Company’s most recent fiscal year, and written representations from certain reporting persons that no Form 5 was required, the Company believes that all Forms 3, 4 and 5 were timely filed during fiscal year 2005, except as follows: for Mr. Ed Flowers, Senior Vice President – Human Resources of the Company, two required Form 4’s, each reporting one transaction exempt under the short-swing liability provisions of Section 16(b) of the Securities Exchange Act, were filed, but not on a timely basis.

Transactions with Management and Others and Certain Business Relationships

Herschel Bloom, a director of the Company, is a partner in the law firm of King & Spalding. During 2005 the Company paid approximately $460,000 to King & Spalding for legal services.

Margaret Porter’s son-in-law is a partner in the law firm of Bradley Arant Rose & White. During 2005 the Company paid approximately $462,000 to Bradley Arant Rose & White for legal services.

Conduct Guidelines and Code of Conduct

The Company hasBusiness Conduct Guidelines, which are applicable to all employees and executive officers of the Company, including the Company’s Chief Executive Officer, Chief Financial Officer and Controller. The Board of Directors has a separateDirectors’ Code of Conduct that contains provisions specifically applicable to the directors. Both theBusiness Conduct Guidelines and theDirectors’ Code of Conduct are available on the Investor Relations section of the Company’s website atwww.russellcorp.com, or copies may be obtained by written request submitted to Floyd G. Hoffman, Secretary, Russell Corporation, 3330 Cumberland Boulevard, Suite 800, Atlanta, Georgia 30339.

The Company intends to satisfy any disclosure requirements regarding amendments to, or waivers from, any provision of theBusiness Conduct Guidelines or theDirectors’ Code of Conduct by posting such information on the Investor Relations section of the Company’s website atwww.russellcorp.com.

Communicating with Directors

Stockholders and other interested parties may communicate directly with the Lead Director and with the non-management directors as a group by writing to Herschel M. Bloom, Esq., Russell Corporation Lead Director, at King & Spalding, 1180 Peachtree St., N.E., Atlanta, GA 30309-3521, or by calling the Company’s reporting hotline toll-free at 1-877-774-3367.

-10-

MANAGEMENT DEVELOPMENT AND COMPENSATION COMMITTEE

REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee

The Management Development and Compensation Committee of the Board of Directors (the “Compensation Committee”) is responsible for establishing the compensation policy and administering the compensation programs for the Company’s executive officers and other key employees. The Compensation Committee is comprised of the four individuals listed below, all of whom, in the opinion of the Board of Directors, meet the independence requirements of the New York Stock Exchange, are “non-employee directors” pursuant to SEC Rule 16b-3, and are “outside directors” for purposes of Section 162(m) of the Internal Revenue Code. All of the members of the Compensation Committee served throughout fiscal year 2005, except that Rebecca C. Matthias has served as a member of the Compensation Committee since February 2005. In fiscal year 2005, the Board did not modify or reject in any material way any recommendation or action of the Compensation Committee.

Compensation Philosophy

The compensation program for executive officers is designed to attract, motivate and retain talented executives who will strive to attain the Company’s strategic and financial objectives and thereby increase stockholder value. The main elements of the program are:

| | • | | annual compensation (base salary and annual bonus) and |

| | • | | long-term incentives (performance shares and other stock-based incentives). |

The Compensation Committee’s philosophy is to provide total compensation at a level that is consistent with the Company’s size and performance relative to other leading branded athletic and activewear companies. The Compensation Committee periodically reviews the reasonableness of total compensation levels using public information from comparable company proxy statements and annual reports as well as survey information from third-party industry surveys and independent executive compensation consulting firms.

The Compensation Committee believes that the Company’s overall financial performance should be an important factor in the total compensation of the Company’s executive officers. At the executive officer level, the Compensation Committee has a policy that a significant portion of the total compensation should consist of variable, performance-based components, such as performance share awards and annual incentive bonuses, which can increase or decrease to reflect changes in corporate and individual performances. These incentive compensation programs are intended to reinforce management’s commitment to the enhancement of profitability and stockholder value.

The Compensation Committee takes into account various qualitative and quantitative indicators of Company and individual performance in determining the level and composition of compensation for the chief executive officer and other executive officers. While the Compensation Committee considers such Company performance measures as asset management and earnings per share, the Compensation Committee does not apply any specific quantitative formula in making compensation decisions. However, certain awards, such as performance shares, are based on specific Company performance measures. The Compensation Committee also appreciates the importance of achievements that may be difficult to quantify and, accordingly, recognizes qualitative factors, such as successful completion of major corporate projects, demonstrated leadership ability and management of diversity.

Annual Compensation

Base Salary. The Compensation Committee annually reviews and approves base salaries for the Company’s executive officers, considering the responsibilities of their positions, their individual performance, their competitive position relative to comparable companies, the Company’s financial performance, and industry

-11-

surveys. Salary ranges are targeted at the median of the competitive market place. Salary increases, including increases due to promotions, for the most recent fiscal year are based upon these criteria.

Annual Incentive Bonus. Executive officers are eligible to receive annual cash incentive awards under provisions of the Executive Incentive Plan. Under this Plan, the Compensation Committee established Earnings Per Share Growth, Return on Investment, divisional net income for CEO’s of each division, Leadership and Diversity goals for executive officers. The maximum incentive opportunity is established and communicated to each participant, along with the performance scale under which incentive awards are earned. Threshold performance levels are also established for each goal, below which no incentive award is paid. Individual standards of performance that are agreed upon at the beginning of each year provide each participant the opportunity to earn incentive awards based upon the accomplishment of strategic and tactical objectives.

Long-Term Compensation

The Compensation Committee believes that stock-based incentives are among the most effective ways of linking executives with the interests of the stockholders. Since fiscal 2003, the primary focus of the Company’s long-term compensation program has been performance shares. The Company’s performance share program provides for the earning of shares of common stock if the Company achieves specified performance objectives established at the time of the award during the performance period, and vesting is contingent on continued employment for a specific period.

The Compensation Committee in 2004 approved the grant of long-term incentive awards to certain officers, executives and key managers in the form of (i) performance shares based on the attainment of cumulative earnings per share goals for fiscal years 2004 and 2005 (the “Performance Period”) and (ii) restricted stock, which vests based upon continuing service over the Performance Period. Eighty percent (80%) of the grant was in the form of performance shares and twenty percent (20%) was in the form of restricted stock. The primary purpose of the grant was to further align the interests of these employees with those of our stockholders by basing the number of performance shares earned by these employees on the extent to which the Company’s cumulative earnings per share (as determined in accordance with the performance share award program) over the Performance Period exceeds preset earnings per share goals. Thus, each of these employees would earn a specified number of shares if the Company achieves the earnings per share goals, and the value to the employee of the shares earned is based on the share price at the time the shares are earned.

In determining the size of these grants, the Compensation Committee reviewed individual performance and a competitive analysis of long-term incentive compensation and targeted the grant at the market median.

In addition, the Committee decided to consider granting long-term incentive awards every two years to provide a strong incentive for achieving specific performance goals over a two-year period.

Accordingly, the Compensation Committee in 2006 approved the grant of long-term incentive awards to certain officers, executives and key managers in the form of (i) performance shares based on the attainment of cumulative earnings per share goals over a performance period covering fiscal years 2006 and 2007 and (ii) restricted stock, which vests in three-year installments beginning on the first anniversary of the grant. Seventy percent (70%) of the grant is in the form of performance shares and thirty percent (30%) is in the form of restricted stock. In determining the size of these grants, the Compensation Committee took into account individual performance and the Company’s performance versus its peers and established award opportunities to approximate the market median.

Stock Ownership Guidelines

The Compensation Committee believes that stock ownership by the management team is essential to a strong linkage between management and the stockholders. The Compensation Committee in February 2003

-12-

approved revised Stock Ownership Guidelines that outline the minimum stock ownership expectations for the officer group. Each officer is expected to be in compliance with the guidelines within five years of becoming covered by the guideline. However, corporate officers at the time of the Compensation Committee’s approval of the revised Guidelines have three years to be in compliance.

Chief Executive Officer

As it does each year, the Compensation Committee approved the compensation of John F. Ward, Chairman and Chief Executive Officer. His compensation principally consists of base salary, annual bonus and stock-based incentive awards. The Compensation Committee made the following decisions regarding Mr. Ward’s compensation:

ANNUAL COMPENSATION

| | • | | Base Salary. In February 2005, the Compensation Committee approved an increase of Mr. Ward’s annual salary for 2005 of $24,000 to $850,000, based on an assessment of competitive practices, the Company’s financial performance in 2004 and the assessment by the Compensation Committee of Mr. Ward’s individual performance.As with other executive officers, the salary range for Mr. Ward is targeted at the median of the competitive marketplace. |

| | • | | Annual Incentive. Since the Company’s performance during fiscal year 2005 did not achieve the goals relative to EPS Growth and Return on Investment that were established and approved by the Compensation Committee at the beginning of 2005, Mr. Ward was not awarded any annual incentive payment for 2005. |

LONG-TERM COMPENSATION

| | • | | Performance Shares. In 2004, Mr. Ward was granted the right to earn 80,000 performance shares based on the attainment of the same earnings per share goals as the other participants in the program. None of these shares were earned out, as threshold Company performance goals were not met. In 2006, Mr. Ward was granted the right to earn 180,000 performance shares. For more information regarding the terms of these performance shares, see “Employment Agreements” on pages 19 and 20. |

| | • | | Restricted Stock. In 2004, Mr. Ward was granted 20,000 shares of restricted stock representing 20% of his base long-term incentive award, and 68,000 shares of restricted stock in consideration of his relinquishment of the right to receive reload options that had been included in his outstanding and exercisable options. These shares vested on January 1, 2006. In 2006, Mr. Ward was granted 45,000 shares of restricted stock. For additional information regarding the terms of this restricted stock, see “Employment Agreements” on pages 19 and 20. |

OTHER BENEFITS

| | • | | In addition to participating in the same benefit programs as all other executives of the Company, Mr. Ward participates in a supplemental executive retirement plan (“SERP”) that the Compensation Committee approved in 2000 for senior executives of the Company. Under the SERP, Mr. Ward would be eligible for an annual retirement benefit equal to 4% per year of service of his average annual pay based on the highest 36 consecutive months out of the final 120 months of employment, less any benefits under Russell’s qualified defined benefit and excess plans. |

EMPLOYMENT AGREEMENT

| | • | | In July 2005, the Company renewed Mr. Ward’s employment agreement effective October 18, 2005. The benefits and payments provided by the renewed employment agreement are described on pages 19 and 20. |

-13-

Deductibility of Compensation

Section 162(m) of the Internal Revenue Code denies a publicly-held corporation, such as the Company, a federal income tax deduction for compensation in excess of $1 million in a taxable year paid to each of its chief executive officer and the four other most highly compensated executive officers. Certain “performance based” compensation, such as stock options awarded at fair market value, is not subject to the limitation on deductibility provided that certain stockholder approval and independent director requirements are met.

In carrying out its duties, the Compensation Committee intends to make all reasonable efforts to comply with the requirements to exempt executive compensation from the $1 million deduction limitation under Section 162(m) of the Internal Revenue Code by establishing “performance-based” compensation programs or by otherwise structuring compensation programs to avoid exceeding the $1 million limit. However, the Compensation Committee has reserved the right to grant compensation which is not exempt and not deductible under Section 162(m) of the Internal Revenue Code to the extent it determines providing such compensation is in the best interests of the Company and its stockholders.

Conclusion

The Compensation Committee believes that the executive compensation programs directly link the pay opportunities of the Company’s executives to the financial and stockholder returns of the Company. These programs reinforce the linkage between pay and performance, and between executive compensation and stockholder return, and allow the Company to attract and retain the caliber of executives required in the highly competitive global environment in which executives of the Company must perform.

Management Development and Compensation Committee

Ronald G. Bruno, Chairman

Arnold W. Donald

Rebecca C. Matthias

John R. Thomas

-14-

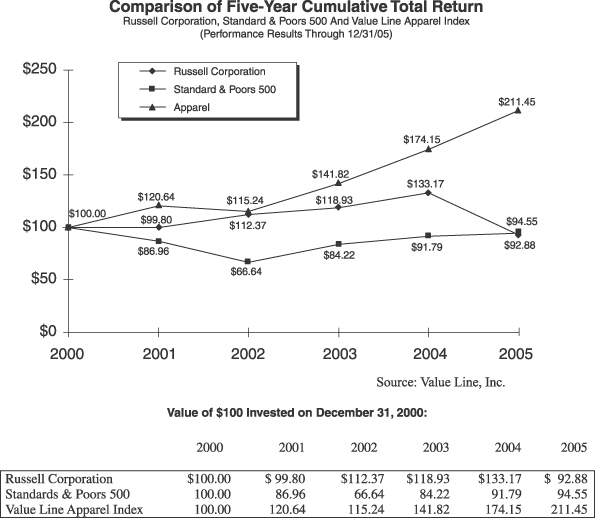

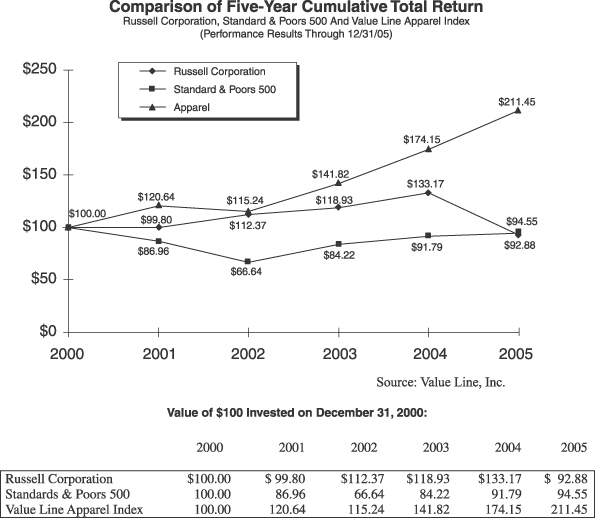

| (1) | Assumes that the value of the investment in the Company’s common stock and in each index was $100 on December 31, 2000 and that all dividends were reinvested. |

| (2) | The Value Line Apparel Index presently includes: Carter’s, Inc.; Columbia Sportswear Company; Guess, Inc.; Jones Apparel Group; Kellwood Company; Liz Claiborne, Inc.; Oxford Industries, Inc.; Phillips-Van Heusen, Inc.; Polo-Ralph Lauren; Tommy Hilfiger Corp.; Unifi, Inc.; VF Corporation; Warnaco Group; and the Company. |

| (3) | The Value Line Apparel Index has undergone several changes since 2000. Warnaco Group, Inc., which filed for bankruptcy, was deleted from the Index in 2001 and added back in 2005. Hartmarx Corporation was deleted from the Index in 2002. Nautica Enterprises, Inc. was deleted from the Index upon its acquisition by VF Corporation in 2003. Unifi, Inc. was added in 2004. In 2005, Carter’s, Inc. was added to the Index and Oshkosh B’Gosh, Inc. was deleted. |

-15-

EXECUTIVE COMPENSATION

Summary Compensation Table

The following information is furnished for the fiscal years ended December 31, 2005, January 1, 2005 and January 3, 2004, with respect to the Company’s named executive officers.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Long Term Compensation

| | | |

| | | | | Annual Compensation

| | | Awards

| | | Payouts

| | | |

Name and Principal Position

| | Fiscal

Year

| | Salary

| | Bonus(3)

| | Other Annual

Compensation

| | | Restricted

Stock

Awards(5)

| | Securities

Underlying

Options/

SARs

| | | LTIP

Payouts

| | | All Other

Compensation(8)

|

John F. Ward Chairman and C.E.O. | | 2005

2004

2003 | | $

| 845,600

823,333

804,167 | |

$

| —

621,775

100,354 | |

$

| —

58,850

51,111 |

(4)

| |

$

| —

1,606,880

— | |

$ | —

—

64,146 |

(6) | |

| —

— ��

— |

| | $

| 22,869

22,635

22,428 |

| | | | | | | | |

Julio A. Barea Sr. V.P./President and C.E.O., Activewear | | 2005

2004

2003 | |

| 343,834

310,000

58,821 | |

| 71,099

155,000

44,563 | |

| —

84,653

28,837 |

(4)

(4) | |

| 17,960

18,260

240,600 | |

| —

—

— |

| |

| —

—

— |

| |

| —

24,074

— |

| | | | | | | | |

Floyd G. Hoffman Sr. V.P., Corporate Development, General Counsel and Secretary | | 2005

2004

2003 | |

| 289,668

275,167

269,167 | |

| 59,199

146,711

23,820 | |

| —

—

— |

| |

| —

91,300

— | |

| —

—

— |

| |

| —

—

— |

| |

| 2,877

2,747

2,466 |

| | | | | | | | |

Robert D. Koney, Jr. Sr. V.P. and C.F.O.(1) | | 2005

2004

2003 | |

| 333,335

96,250 | |

| 44,431

112,500 | |

| 37,792

23,949 | (4)

(4) | |

| —

225,900 | |

| —

— |

| |

| —

— |

| |

| —

— |

| | | | | | | | |

Calvin S. Johnston V.P./C.E.O., Russell Athletic(1) | | 2005

2004

2003 | | | 246,167 | | | 95,490 | | | 76,671 | (4) | | | 10,584 | | | — | | | | — | | | | 2,877 |

| | | | | | | | |

Jonathan R. Letzler Former President and C.O.O.(2) | | 2005

2004

2003 | |

| 309,950

426,667

414,167 | |

| 128,333

247,303

40,317 | |

| —

—

— |

| |

| —

547,800

— | |

| —

—

— |

| | $

| 1,358,000

—

— | (7)

| |

| 1,834,872

—

— |

| (1) | Mr. Koney joined the Company and became an executive officer during 2004. Information is provided for all of 2004 and 2005. Mr. Johnston became an executive officer of the Company in 2005. Information is provided for all of 2005. |

| (2) | Mr. Letzler left the Company effective August 10, 2005. For additional information regarding certain amounts paid to Mr. Letzler in connection with his separation, see note 8 below and “Employment Agreements” on pages 19 to 22. |

| (3) | Bonus payments are reported for the year in which related services were performed. See “Employment Agreements” on pages 19 to 22. |

| (4) | For Mr. Ward in 2004, includes personal use of Company aircraft in the amount of $23,433 and financial planning services valued at $22,584. For Mr. Barea in 2004 and 2003, Mr. Koney in 2005 and 2004 and Mr. Johnston in 2005, consists of moving expenses paid by the Company. |

| (5) | Amounts represent the number of shares of restricted stock awarded multiplied by the closing market price of the Company’s common stock on the respective dates of grant. Dividends are paid on shares of restricted stock awarded during 2003, at the rate paid to holders of the Company’s unrestricted common stock. No dividends are paid on shares of restricted stock awarded in 2004 or 2005. |

In 2004, Messrs. Ward, Barea, Hoffman, Johnston and Letzler were awarded 88,000, 1,000, 5,000, 1,000 and 30,000 restricted shares, respectively. In 2005 Mr. Barea was awarded 1,000 restricted shares and Mr. Johnston was awarded 600 restricted shares. Except with respect to Mr. Letzler’s award, all such shares vested on January 1, 2006. Under the terms of Mr. Letzler’s employment agreement, all of his shares vested upon his separation from the Company.

-16-

Upon joining the Company in 2004, Mr. Koney was awarded 15,000 shares of restricted stock. 5,000 of these shares vested on January 3, 2005, 5,000 shares vested on April 4, 2005, and the remaining 5,000 shares vested on January 1, 2006.

The number and value of the aggregate restricted stock holdings of the named executive officers as of December 31, 2005, is as follows:

| | | | | |

| | | Number of Shares

| | Value at 12/31/05

|

Mr. Ward | | 88,000 | | $ | 1,184,480 |

Mr. Barea | | 17,000 | | | 228,820 |

Mr. Hoffman | | 5,000 | | | 67,300 |

Mr. Koney | | 5,000 | | | 67,300 |

Mr. Johnston | | 1,600 | | | 21,536 |

Mr. Letzler | | 0 | | | 0 |

| (6) | Grant of reload options pursuant to the 2000 Stock Option Plan. |

| (7) | Under the terms of his employment agreement, 70,000 shares of restricted stock awarded to Mr. Letzler in previous years, the vesting of which otherwise was dependent on the Company’s achievement of certain performance goals, automatically vested on the termination of Mr. Letzler’s employment with the Company. Value is based on the closing price of the Company’s common stock on that date. |

| (8) | For Mr. Ward, includes life insurance premiums in the amount of $14,409 in 2005 and $14,415 in each of 2004 and 2003. For Mr. Barea in 2004, represents payment made by the Company to compensate Mr. Barea for income under a consulting arrangement with a third party, which income he forfeited when he joined the Company. |

Under the terms of Mr. Letzler’s separation from the Company, he received in December 2005 a one-time, lump sum payment in lieu of the salary and bonus based severance pay ($1,320,000), additional retirement benefit ($358,000) and group health plan subsidy ($70,000) he would have received under his employment agreement, and the Company also paid for legal services rendered to him ($81,717). See “Employment Agreements” on pages 19 to 22.

All other amounts represent Company matching contributions to the Flexible Deferral Plan account of the named executive officers.

Aggregated Option/SAR Exercises in Fiscal 2005 and Year-End Option/SAR Values

The following table sets forth information concerning the exercise of stock options for the named executive officers for the fiscal year ended December 31, 2005 and the value of options held by such persons at December 31, 2005:

| | | | | | | | | | | | | | | |

| | | Shares

Acquired

on Exercise

| | Value

Realized (1)

| | Number of Securities

Underlying

Unexercised Options/SARs

at December 31, 2005

| | Value of Unexercised

In-the-Money Options/SARs

at December 31, 2005 (2)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

John F. Ward | | — | | $ | — | | 1,146,212 | | — | | $ | — | | $ | — |

Julio A. Barea | | — | | | — | | — | | — | | | — | | | — |

Floyd G. Hoffman | | — | | | — | | 110,000 | | — | | | — | | | — |

Robert D. Koney, Jr. | | — | | | — | | — | | — | | | — | | | — |

Calvin S. Johnston | | 10,000 | | | 52,909 | | — | | — | | | — | | | — |

Jonathan R. Letzler | | — | | | — | | 300,000 | | — | | | — | | | — |

| (1) | This amount represents the aggregate of the market value of the Company’s common stock at the time the option was exercised less the exercise price for such option. |

| (2) | This amount represents the aggregate of the number of options multiplied by the difference between the closing price of the Company’s common stock on the last trading day prior to December 31, 2005 ($13.46), and the exercise price for such option. |

-17-

Long-Term Incentive Plan Awards in Fiscal 2005

There is shown below information concerning grants of Performance Shares made to the named executive officers during 2005.

| | | | | | | | | | |

| | | Number of Shares,

Units or Other

Rights (#)(1)

| | Performance or Other

Period Until Maturation or

Payout

| | Estimated Future Payouts Under Non-Stock

Price-Based Plans

|

Name

| | | | Threshold(#)

| | Target(#)

| | Maximum(#)

|

John F. Ward | | — | | — | | — | | — | | — |

Julio A. Barea | | 4,000 | | 2 years | | 1,333 | | 4,000 | | 6,000 |

Floyd G. Hoffman | | — | | — | | — | | — | | — |

Robert D. Koney, Jr. | | — | | — | | — | | — | | — |

Calvin S. Johnston | | 2,400 | | 2 years | | 800 | | 2,400 | | 3,600 |

Jonathan R. Letzler | | — | | — | | — | | — | | — |

| (1) | Performance Shares granted in 2005 that were eligible to be earned under the Company’s Executive Incentive Plan, based on the Company’s cumulative earnings per share on a fully diluted basis for fiscal years 2004 and 2005, adjusted to exclude extraordinary items and other unusual or nonrecurring items. Threshold performance was not achieved; accordingly, no shares were earned under these grants. |

Pension Plan

Pension Plan Table

| | | | | | | | | | | | | | | |

| | | Years of Credited Service

|

Average Remuneration

| | 5

| | 10

| | 15

| | 20

| | 25

|

$ 350,000 | | $ | 35,000 | | $ | 70,000 | | $ | 105,000 | | $ | 140,000 | | $ | 175,000 |

400,000 | | | 40,000 | | | 80,000 | | | 120,000 | | | 160,000 | | | 200,000 |

450,000 | | | 45,000 | | | 90,000 | | | 135,000 | | | 180,000 | | | 225,000 |

500,000 | | | 50,000 | | | 100,000 | | | 150,000 | | | 200,000 | | | 250,000 |

600,000 | | | 60,000 | | | 120,000 | | | 180,000 | | | 240,000 | | | 300,000 |

700,000 | | | 70,000 | | | 140,000 | | | 210,000 | | | 280,000 | | | 350,000 |

800,000 | | | 80,000 | | | 160,000 | | | 240,000 | | | 320,000 | | | 400,000 |

900,000 | | | 90,000 | | | 180,000 | | | 270,000 | | | 360,000 | | | 450,000 |

1,000,000 | | | 100,000 | | | 200,000 | | | 300,000 | | | 400,000 | | | 500,000 |

1,100,000 | | | 110,000 | | | 220,000 | | | 330,000 | | | 440,000 | | | 550,000 |

1,200,000 | | | 120,000 | | | 240,000 | | | 360,000 | | | 480,000 | | | 600,000 |

1,300,000 | | | 130,000 | | | 260,000 | | | 390,000 | | | 520,000 | | | 650,000 |

The officers of the Company participate in the Russell Corporation Revised Pension Plan (the “Pension Plan”), a defined benefit plan covering certain employees of the Company. Benefits under the Pension Plan are based upon years of credited service at retirement and upon “Final Average Earnings,” which is the average base compensation for the highest 60 consecutive months out of the final 120 months of employment. This compensation consists only of salary and excludes any bonus and any form of contribution to other benefit plans or any other form of compensation. Normal or delayed retirement benefits are payable upon retirement on the first day of any month following attainment of age 65 and continue for the life of the employee (and spouse, if any) or in accordance with other elections permitted by the Pension Plan.

On January 26, 1994, the Board of Directors adopted a supplemental retirement plan (the “Supplemental Plan”) covering any participant’s compensation in excess of the limitation amount specified in Section 401, et seq., of the Internal Revenue Code. This plan is a nonqualified plan, thereby rendering any benefits subject to claims of general creditors and not deductible until paid.

On December 5, 2000, the Board of Directors adopted the SERP, an additional defined benefit plan covering key employees of the Company. Benefits under the SERP are based upon years of credited service at retirement and upon “Final Average Pay,” which is the average compensation for the highest 36 consecutive months out of

-18-

the final 120 months of employment and, unlike the Pension Plan, includes amounts received as bonuses during that period. The SERP is a nonqualified plan, thereby rendering any benefits subject to claims of general creditors. Unless the participant otherwise elects, upon termination of employment, benefits are paid before the participant attains age 62 in the form of a single life annuity, and upon attaining age 62, the remaining benefits are paid in a lump sum.

The table above presents estimated annual benefits payable from the Pension Plan, the SERP and the supplemental retirement plan mentioned above upon normal or delayed retirement to participants in specified remuneration and years-of-credited service classifications. The amounts shown assume the current maximum social security benefit and that the participant has elected for benefits to be payable for a single life only.

Years of service at December 31, 2005 credited under the Pension Plan for individuals shown in the Summary Compensation Table on page 16 are as follows: Mr. Ward, 7 years; Mr. Barea, 2 years; Mr. Hoffman, 6 years; Mr. Koney, 1 year; Mr. Johnston, 1 year; and Mr. Letzler, 7 years. Years of service at December 31, 2005 credited under the SERP for individuals shown in the Summary Compensation Table on page 16 are as follows: Mr. Ward, 16 years (see Employment Agreements on pages 19 to 20); Mr. Barea, 2 years; Mr. Hoffman, 6 years; Mr. Koney, 1 year; Mr. Johnston, 1 year; and Mr. Letzler, 7 years.

Effective at the end of March 2006, the Pension Plan and the Supplemental Plan will be frozen, such that earnings paid and service completed after that time will not be taken into account in determining the amount of any benefits payable under those plans.

Stock Option Plans

The Company has adopted the Executive Incentive Plan. The Management Development and Compensation Committee presently administers the plan and has broad discretion to develop the terms and, subject to limitations specified in the plan, the size of awards in order to provide appropriate incentives. Awards may be issued in a variety of forms, including: (a) restricted, deferred and bonus shares; (b) incentive, non-qualified and accelerated stock ownership options (all such options are referred to collectively as “options”); (c) freestanding and tandem stock appreciation rights; and (d) performance shares, performance units and cash-based awards. In addition to conditions and restrictions required under the plan, the Committee may impose additional conditions and restrictions with respect to the exercise or receipt of benefits under any award. The aggregate number of shares of common stock presently authorized for issuance under the Executive Incentive Plan is 2,607,906.Any shares of common stock (whether subject to or received pursuant to an award under any Company plan) withheld or applied to pay the exercise price or related required tax withholding reduce the number of shares treated as issued under the Executive Incentive Plan and thereby increase the aggregate number of shares available for issuance.

The Company has also adopted the Russell Corporation 2000 Stock Option Plan (the “2000 Option Plan”). The 2000 Option Plan is an incentive compensation plan that gives the Committee broad discretion to grant awards, and develop the terms of such awards, to any employee or consultant of the Company. The 2000 Option Plan permits the issuance of awards in a variety of forms, including: (a) incentive stock options; (b) non-qualified stock options; (c) reload stock options; (d) restricted shares; (e) bonus shares; (f) deferred shares; (g) freestanding stock appreciation rights; (h) tandem stock appreciation rights; (i) performance units; and (j) performance shares. The aggregate number of shares of common stock presently authorized for issuance under the 2000 Option Plan is 214,731, subject to appropriate adjustment for dividends, distributions, recapitalizations, stock splits or other similar events.

Employment Agreements

Effective October 18, 2005, the Company and Mr. Ward entered into an amended and restated employment agreement. The agreement, as amended, provides for his continued employment until the later of March 31, 2009

-19-

or the third anniversary of a change of control of the Company, subject to earlier termination in the event of death, disability, or as otherwise provided for in the agreement. Mr. Ward’s annual base salary shall be a minimum of $850,000. The annual base salary is subject to increase(s) in the discretion of the Board of Directors. Mr. Ward is eligible to receive an annual bonus ranging from zero to 200% of his base salary. If he achieves his target performance goals established by the Board of Directors, he shall receive a bonus of 100% of his base salary.

In addition to the base salary and annual bonus, Mr. Ward is entitled to a grant of restricted common stock and performance shares for the award cycle 2006-2008. The restricted shares become fully vested upon the first to occur of (i) the third anniversary of the grant date or (ii) March 31, 2009, except in the event of death, total disability, Mr. Ward’s resignation for “good reason” or if the Company terminates his employment for other than “cause”; in any of which events, the shares shall become immediately vested. The performance shares shall vest based upon the degree to which Mr. Ward achieves threshold, target or outstanding performance goals as determined by the Board of Directors. The employment agreement provides that the grant of restricted stock shall be not less than 45,000 shares and that the grant of performance shares shall be not less than 180,000 shares at target level of performance. The amended agreement also provides that the Company will offer health care and certain other supplemental benefits to Mr. Ward. Additionally, any termination of employment of Mr. Ward shall be treated as retirement for purposes of the Company’s various plans and benefits. Each year of Mr. Ward’s employment, commencing on January 1, 1998, shall be treated as two (2) years of employment for purposes of determining Mr. Ward’s participation in the SERP, subject to the provisions of the SERP.

Mr. Ward’s amended employment agreement provides that if (i) he should resign for “good reason” or (ii) the Company terminates his employment for other than “cause”, he would receive a lump sum amount equal to the discounted present value of three (3) times his then current base salary and three times the higher of (x) the target bonus for the year of his termination or (y) the amount of bonus he would have received if he remained employed by the Company through the end of such year.

Under the terms of Mr. Ward’s amended employment agreement, if, following a change of control (or in certain circumstances during the six months prior to a change of control), Mr. Ward should resign for “good reason,” or the Company terminates his employment for other than “cause” or total disability, he would be entitled to the following: (a) a lump-sum payment equal to three times the sum of (i) his base salary, (ii) target level bonus which cannot be less than 100% of base salary, and (iii) annual employer contributions to defined contribution plans on his behalf; (b) the immediate lapse of all restrictions on restricted shares; (c) the immediate vesting of outstanding performance shares at the maximum performance level; (d) outplacement; (e) continued participation in the Company’s employee benefit plans for a period of three years; (e) payment of amounts intended to compensate for excise taxes that may be imposed as a result of payments under the agreement; and (f) certain other benefits specified in the agreement. Also in the event of a change of control, he would become fully vested in (and would be paid) all benefits previously accrued under the SERP and any other non-qualified deferred compensation plans.

In connection with his employment by the Company in 1998, to compensate Mr. Ward for the forfeiture of certain benefits from his former employer, the Company put into a trust for his benefit approximately $2,467,000. The amount in the trust will be paid to Mr. Ward when his employment by the Company terminates.

Prior to August 10, 2005, the Company and Mr. Letzler were parties to an employment agreement with a continuous two-year term, provided that either the Company or Mr. Letzler could terminate the agreement with at least two years’ notice, and further subject to earlier termination in the event of death, disability, or as otherwise provided for in the agreement. Under the agreement, Mr. Letzler’s salary could be increased annually in the discretion of the Board of Directors, and he was eligible for an annual bonus of up to his base salary, with a midpoint/target bonus of 50% of base salary.

Mr. Letzler’s agreement provided that if he should resign for “good reason” or the Company terminated his employment for other than “cause,” he would be entitled to a prorated portion of the bonus for which he was eligible in the year of termination, at the rate such bonus was earned, but not less than 50% of his salary for such period. For a period of twenty-four months, he also would continue to be paid his final salary, along with a bonus

-20-

at a rate of 50% of salary. In the event Mr. Letzler’s employment was terminated by reason of his death or total disability, by the Company for other than cause or by Mr. Letzler for good reason, any options held by him were to vest and become immediately exercisable and remain exercisable for three years from the termination of employment (but not beyond the normal expiration of such options), all remaining restrictions on any restricted shares were to lapse and any outstanding performance shares were to be deemed fully earned.

Effective August 10, 2005, the employment of Mr. Letzler was terminated as a result of the elimination of his position. On November 10, 2005, Mr. Letzler and the Company entered into a Separation Agreement and General Release (the “Separation Agreement”). The purpose of the Separation Agreement was to bring the separation payments and benefits in compliance with recently enacted provisions of the Internal Revenue Code. Under the Separation Agreement, Mr. Letzler received in December 2005 a one-time, lump sum payment in lieu of the salary and bonus based severance pay, additional retirement benefit and group health plan subsidy that he would have received under his employment agreement.

The Company and Mr. Hoffman are parties to an agreement that provides for a base salary (subject to annual increases in the discretion of the Chief Executive Officer and with the concurrence of the Board of Directors) and an annual maximum potential bonus of 100% of annual base salary. The agreement also provides for certain compensation and benefits (including one year’s salary and target bonus, immediate vesting of all equity awards and one year’s benefit continuation) to be awarded to Mr. Hoffman if his employment is terminated without cause.

The Company and Mr. Barea are parties to an employment agreement that is effective until October 30, 2006 or Mr. Barea’s earlier death or resignation, termination, or disability under the agreement. The agreement provides for a base salary (subject to annual merit increase) and an annual maximum potential bonus of 100% of annual base salary. For 2004, Mr. Barea was guaranteed a bonus equal to 50% of base salary. In addition, in 2003 the Company granted Mr. Barea 15,000 shares of restricted stock (which vests on December 31, 2006) pursuant to the terms of his employment agreement. In the event Mr. Barea’s employment terminates for any reason before the age of retirement under the Company’s benefit plans, Mr. Barea will be considered to have attained the minimum retirement age in those plans, and all vesting periods are waived. The agreement also provides for certain compensation (including base salary for the remaining term of the agreement and immediate vesting of all restricted stock) to be awarded to Mr. Barea if his employment is terminated without cause or by Mr. Barea for good reason.

The Company and Mr. Koney are parties to an agreement dated August 25, 2004 that provides for a base salary (subject to annual merit increases) and an annual maximum potential bonus of 100% of base salary. In addition, Mr. Koney received a grant under the Company’s Executive Incentive Plan for the 2004-2005 performance cycle of 10,000 performance shares and 15,000 time lapse restricted shares. The time lapse restricted shares vested in one-third increments in January 2005, April 2005 and January 2006.