Institutional Shareholder Services

July 11, 2006

Forward-Looking Statement

The following presentation includes certain forward-looking statements.

These forward-looking statements are estimates and are subject to

various risks and uncertainties, including market conditions, customer

demand and the economy, which could cause actual results to differ

materially from those stated or implied by such statements. The forward-

looking statements contained in this presentation are subject to change

or amendment without notice, and we assume no obligation to revise

such statements to reflect any future events or circumstances.

2

Participants

Russell Independent Directors

Herschel M. Bloom: Director

Ronald G. Bruno: Director

Russell Management

Bob Koney: Senior Vice President and Chief Financial Officer

Floyd Hoffman: Senior Vice President, General Counsel and Secretary

Roger Holliday: Vice President, Investor Relations

Financial Advisor

Jim Katzman: Managing Director, Goldman, Sachs & Co.

Proxy Solicitors

Alan Miller: Innisfree M&A Incorporated

Jennifer Shotwell: Innisfree M&A Incorporated

3

Agenda

Transaction Overview

Russell Stock Price Performance

Board Process Designed to Deliver Shareholder Value

Financial Analysis

Conclusion

General Discussion and Q&A

4

Transaction Overview

5

Overview of Transaction

Rigorous, deliberative Board process designed to ensure shareholders

receive maximum value for their investment

Considered all reasonable alternatives to deliver full value to shareholders

Leading law firm advised on fiduciary responsibilities and structure of contract

Advised by internationally recognized financial firm

Fair value of $18.00 cash per share

Significant premium to pre-announcement share price (35.3% premium)

Valuation supported by publicly traded companies analysis, present value of

future stock price analysis, DCF analysis, sale in pieces analysis, selected

transactions analysis and LBO analysis

Optimal structure and certainty of terms

100% cash with no financing issues / condition

Customary “no shop” provision that allows Russell to consider and accept better

offers - none received to date

6

Overview of Transaction

Transaction Terms

Berkshire Hathaway acquires Russell for $18.00 cash per share

Sale of 100% of the stock of Russell

One-step merger

No financing issues / condition

Customary break-up fee of $22 million (negotiated down from $25 million)

2.2% of enterprise value vs. 3.2% median for 2000-2006 YTD transactions

3.6% of equity value vs. 3.3% median for 2000-2006 YTD transactions

Customary “no shop” provision that allows Russell to consider and

accept better offers

HSR antitrust review waiting period terminated on May 30, 2006

Russell shareholder vote scheduled for August 1, 2006

7

Overview of Transaction

$18.00 per share offers attractive valuation for shareholders

15.8x 2006E IBES median EPS estimate vs. 12.1x Russell’s 3-year average

7.2x LTM (2005A) EV/EBITDA vs. 6.4x Russell’s 3-year average

Certainty of price and financing

Limited due diligence

Speed of execution

Transaction timing designed to allow higher offers to emerge

Significant challenges / risks to remaining independent

Board carefully considered other strategic alternatives as sources of

shareholder value, but deemed them to have greater risk and lower

probability of a higher valuation now or in the future

Post-signing market check process

No other bids have emerged

No requests for due diligence have been made

Transaction Rationale

8

Premium Analysis

Overview of Transaction

Value ($)

Premium (%)

Offer Price Per Share

$

18.00

Stock Price (17-Apr-06)

$

13.30

35.3

%

1-week prior (10-Apr-06)

$

13.44

33.9

%

4-weeks prior (20-Mar-06)

$

14.14

27.3

%

Equity Value @ $18.00 per share

$

612.9

Less Existing Cash (as of 31-Dec-2005)

(42.8)

Total Debt and Minority Interest (as of 31-Dec-2005)

418.8

Enterprise Value

$

988.9

9

Overview of Transaction

Valuation Metrics

Enterprise Value/Sales

2005A

$1,435

0.7

x

2006E

$1,482

0.7

x

Enterprise Value/EBITDA

2005A

$137

7.2

x

2006E

$151

6.6

x

Offer Price/EPS (Mgmt.)

2006E

$1.20

15.0

x

2007E

$1.60

11.3

x

Offer Price/EPS (IBES)

2006E

$1.14

15.8

x

2007E

$1.35

13.3

x

10

Russell Stock Price Performance

11

Historical Stock Price Performance (10 years)

$10

$15

$20

$25

$30

$35

$40

Apr-1996

Oct-1998

Apr-2001

Oct-2003

Apr-2006

Daily from 17-Apr-1996 to 17-Apr-2006

Russell Corp.

01-Apr-1998

Jack Ward appointed

CEO of Russell Corp

22-Jul-1998

Russell announced 7-pt

restructuring plan involving

closing of 25 high-cost facilities,

expansion in Mexico and the

Honduras, and establishment

of dual headquarters in Atlanta

and Alexander City

15-Oct-1999

Russell Europe announced it planned to

close two plants in Scotland with the loss of

more than 300 jobs and transfer the

European headquarters to the Hague

30-Oct-2000

Additional $25mm

charge for European

restructuring plan

announced, including

phase-out of Russell

Athletic brand in

Europe

01-Feb-2000

Russell announced

additional restructuring

including 5,000 job cuts,

supply chain

improvements and

movement of 90% of

apparel operations

offshore

26-Jul-2001

Russell announced the

expansion of its restructuring

plans with a 5% cut in global

workforce and $70mm -

$80mm related restructuring

charges

30-Oct-2003

Russell announces Operational

Improvement Plan involving

realignment of operations based on

product segments and plans for new

textile facility in the Honduras for the

Activewear Group

$13.30

20-Jan-2006

Company announces

restructuring plan involving

offshore apparel

operations, reorganization

of sales & marketing and

reduction in overhead

12

20-Jan-2006

Company announces restructuring plan involving

offshoring apparel operations, reorganization of

sales & marketing and reduction in overhead

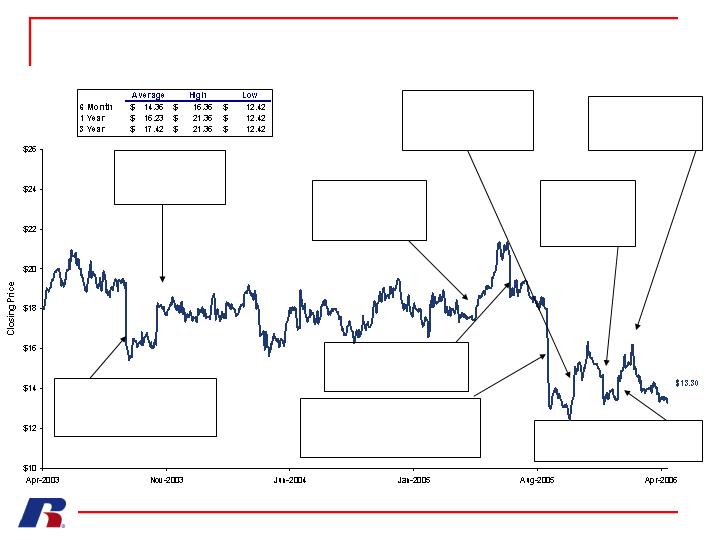

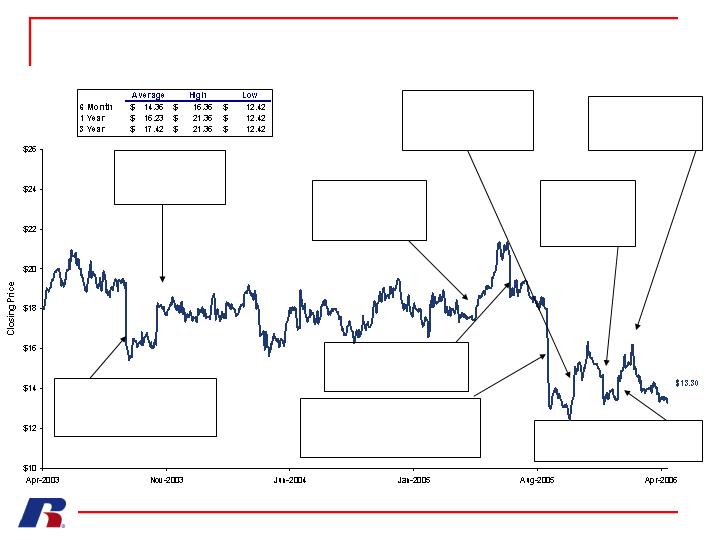

Historical Stock Price Performance (3 years)

13

30-Oct-2003

Q3 EPS drop of 21% is better

than analyst expectations;

Company raises full year

guidance to $1.31 - $1.39

16-May-2005

Company outlines new long-

term strategy at an investor

conference. Announces a

Spalding agreement that

includes products and retail

stores in China

22-Dec-2005

Company announces it

will miss 2005 guidance.

Also announces intention

to take aggressive action

in early 2006 to improve

ongoing earnings

27-Oct-2005

Company reports third quarter

adjusted earnings of $0.60 at the top

end of latest guidance. Cites lower

than expected costs in Activewear,

strong sales and profit improvements

in international apparel

16-Feb-2006

Reports fourth quarter earnings

of $0.36 per share. Stock price

drops 4.8% on weak sales

forecast and anticipated

restructuring charges

09-Sep-2003

Company revises earnings expectations for Q3

and full year citing difficult conditions in

Artwear. Q3 guidance revised from $0.72 -

$0.85 to $0.47 - $0.53. Full year guidance

revised from $1.60 - - $1.75 to $1.25 - $1.35

14-Jul-2005

Company cuts Q2 guidance from $0.18 -

$0.22 to $0.12 - $0.14; Cites higher costs

and lower than expected sales in certain

divisions

19-Sep-2005

Company announces that it expects Q3 earnings of

$0.50 - $0.60 and full year earnings in the $1.25 to

$1.35 range; below previously issued earnings

guidance of $0.62 - $0.70 for Q3 and $1.40 - - $1.48

for the full year period

Daily From 17-Apr-2003 to 17-Apr-2006

Relative Stock Price Performance

Russell stock declined (24.3)% for the year ended April 17, 2006

Russell stock declined (26.8)% for the 3-years ended April 17, 2006

12.1x Russell’s 3-year average forward P/E ratio

vs. 15.8x 2006E IBES median EPS implied by Berkshire Hathaway offer

6.4x Russell’s 3-year average LTM EV/EBITDA multiple

vs. 7.2x 2005A EV/EBITDA implied by Berkshire Hathaway offer

Offer price is at a 35.3% premium to the April 17, 2006 stock price

14

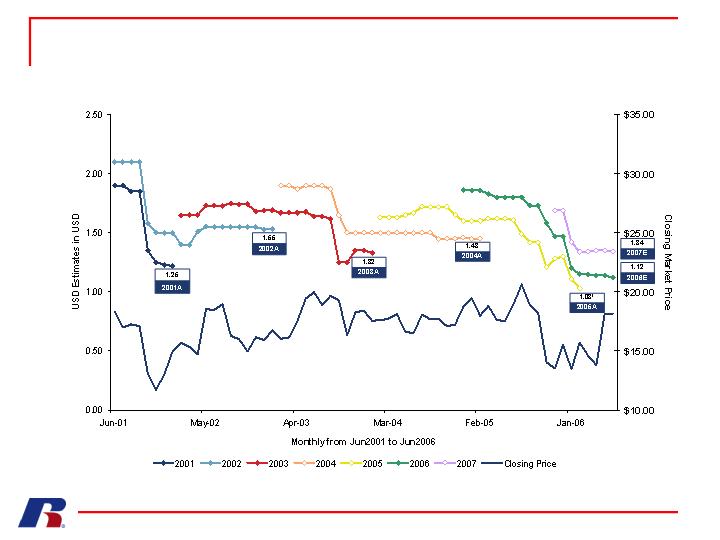

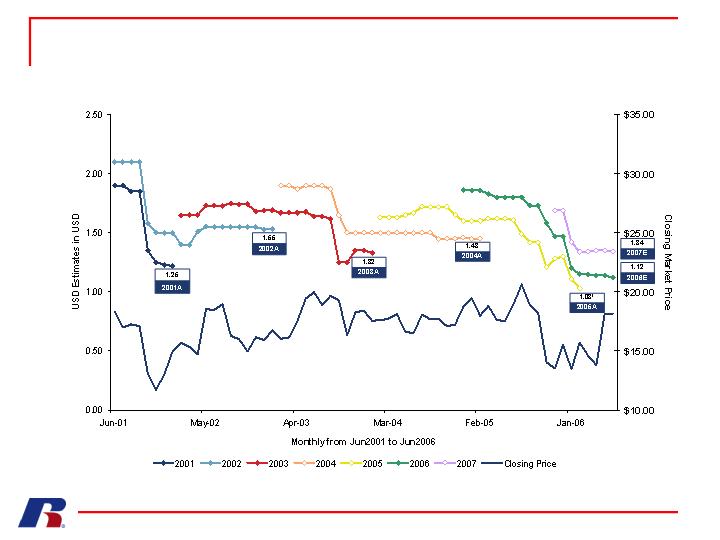

Earnings Track Record vs. Research Analyst

Estimates

¹ To be consistent with IBES estimates, 2005 EPS is not adjusted for one-time charges of COO departure and hurricane related missed sales and losses.

15

Board Process Designed to

Maximize Shareholder Value

16

Board of Directors

Independent, Knowledgeable and Committed to Shareholder Value

7 out of the 10 directors are independent directors

Former President of J.F. Ward Group, Inc.; Chief Executive Officer

of the Hanes Group and Senior Vice President of Sara Lee

Corporation

Chairman and Chief Executive Officer

John F. Ward

Chancellor of the University of Arkansas; Director of Motorola,

Inc., Logility, Inc. and J.B. Hunt Transport Services, Inc.

Director, Independent Outsider

John A. White

Chairman, President, and Chief Executive Officer of Aliant

Financial Corporation; Director of ALFA Corporation

Director, Independent Outsider

John R. Thomas

Executive Vice President and Chief Financial Officer for Crum &

Forster

Director, Independent Outsider

Mary Jane Robertson

Former Mayor of Mountain Brook, Alabama; Director of National

Association of Children’s Hospitals and Related Institutions and

the Eyesight Foundation of Alabama

Director, Affiliated Outsider

Margaret M. Porter

Chairman of Nalley Automotive Group

Director, Independent Outsider

C.V. Nalley, III

President, Chief Operating Officer and Director of Mothers Work,

Inc.; Director of CSS Industries

Director, Independent Outsider

Rebecca C. Matthias

President and CEO of Juvenile Diabetes Research Foundation;

Former Chairman of Merisant Company; Director of Carnival

Corporation

Director, Independent Outsider

Arnold W. Donald

President of Bruno Capital Management Corporation; Director of

Books-a-Million, Inc.

Director, Independent Outsider

Ronald G. Bruno

Partner at King & Spalding; Director of Post Properties, Inc.

Director, Affiliated Outsider

Herschel M. Bloom

Description/Biography

Position

Name

17

Transaction Background and Key Dates

18

September 2005

J. Holland (CEO of Fruit of the Loom) contacted J. Ward (CEO)

December 7, 2005

Russell Board meeting

- Review of market environment

- Decision to engage investment bank to assist in evaluation of strategic options

January 2006

Formally engaged Goldman Sachs

February 2006

Two unsolicited general indications of interest – neither pursued a

transaction

February 15, 2006

Board Meeting

- Discussed and decided not to pursue other strategic alternatives at the time in

favor of pursuing a transaction with Berkshire Hathaway

- Authorized approach to Berkshire Hathaway proposing $20.00/share

March 6, 2006

Goldman Sachs contacted Berkshire Hathaway

March 16, 2006

Management to management meeting with Fruit of the Loom

March 25, 2006

Berkshire Hathaway offered $18.00 per share with a break-up fee of $25 million,

subsequently negotiated down to $22 million

April 2, 2006

Board Meeting

- Reviewed legal duties of Board of Directors

- Reviewed Proposal

- Ward provided his new financial projection (“upside case projection”)

- Koney provided financial performance update for Q1 2006

April 17, 2006

Board Meeting – adopted Merger Agreement

Approval of All 9 Outside Directors

In the course of reaching its decision, over a period of several months,

the Board consulted members of senior management, financial and legal

counsel and considered a number of factors:

None of the possible alternatives to the merger were reasonably likely to present

superior opportunities for Russell or create greater shareholder value

Likelihood of achieving the “updated base case projection”

Russell’s financial condition and prospects in light of multiple missed earnings

projections in 2005

The likelihood that Q1 2006 would not meet Russell’s Q1 operating budget,

according to the CFO and based on preliminary results

Mr. Ward’s was the sole dissenting vote

Mr. Ward cited his belief that timing was inappropriate, and that an improvement

in business practices, reduction in tax rate, and implementation of CAFTA, which

would result in lower cost of goods, would enable Russell to achieve internal

projections that were significantly higher than Wall Street estimates

19

Approval of All 9 Outside Directors

The Board vigorously discussed all financial projections with the

Company’s advisors, CFO and general counsel

The Board concluded that the “base financial plan,” the “updated base

case projection” and the “upside case projection” were subject to

significant risk and based on Russell’s prior performance and industry

conditions, were unlikely to be achieved

Subsequently, the Board determined, based on these considerations

and discussions and the Company’s failure to meet its earnings

projections in 2005, to pursue the proposed transaction with Berkshire

Hathaway

20

Board Delivered Value for Shareholders

Board process designed to ensure shareholders receive full value for

their investment

Considered all reasonable alternatives to deliver full value to shareholders

Leading law firm advised on fiduciary responsibilities and structure of contract

Advised by internationally recognized financial firm

Fair value of $18.00 cash per share

Significant premium of 35.3% over the April 17, 2006 stock price

Valuation supported by publicly traded companies analyses, present value of

future stock price analyses, DCF analyses, sale in pieces analyses, selected

transactions analyses and LBO analyses

Optimal structure and certainty of terms

100% cash with no financing issues / condition

Customary “no shop” provision that allows Russell to consider and accept better

offers - none received to date

21

Research Analyst Commentary Post-Signing

“The deal should be viewed favorably by RML shareholders, receiving a 35% premium to the April

17 closing price, given the difficulties the company has experienced over the last year. We believe

this is a good fit with Berkshire”

BB&T

Capital

Markets

18 Apr 2006

“The $18 deal price represents a 35% premium over Monday’s closing price of $13.30. Since

Russell’s business segments have been under considerable operational and competitive pressures

for the last few years with declining organic sales and EBITDA, this acquisition “bails out”

shareholders from an uncertain future”

CL King &

Associates

18 Apr 2006

“We believe such a deal would make strategic sense for both parties. Berkshire Hathaway owns

and operates competitor Fruit of the Loom after acquiring the company out of bankruptcy in 2002.

The longer-term consolidation of operations for Russell’s Activewear business (47.0% of RML FY05

sales) and Fruit of the Loom should generate much needed scale (we estimate >40-50% share in

Russell’s “Activewear” sub-categories) and improved operating efficiencies to help contend with

competitors that possess more favorable cost structures (e.g. Gildan Activewear)”

“We view the 35% premium to the stock's current value as a clear positive for shareholders,

particularly as the market has given management little credit for the restructuring initiatives it

announced earlier this year”

JPMorgan

17 Apr 2006

Comments

Broker

22

Research Analyst Commentary Post-Signing

“RML’s Activewear (47% of revenue) and Sporting Goods (43%) segments will fit well with Berkshire's

existing holdings, Fruit of the Loom, Fechhemer (activewear), and H.H. Brown Shoe. We doubt any

potential suitor wants to get in a bidding war with Berkshire. We therefore expect the transaction to

close as planned in 3Q06, and expect the stock to remain in the $18 trading range until the deal

closes”

SunTrust

Robinson

Humphrey

26 Apr 2006

“We believe Berkshire Hathaway is at an advantage to other potential buyers and that the stock, at it

recent share price of $18.17, is fully valued”

“There has been speculation that Berkshire Hathaway’s offer for Russell of $18 per share is too low

and rival bids will soon appear. However, we believe it is more likely that Berkshire Hathaway will

prevail”

“Although the multiples at the acquisition price are lower than the industry average, we believe the

company’s lower-than-average operating margins (5.9% vs. 9.5%), ROE (6% vs. 16.4%); and sales

growth (10.5% vs. 16.4%) justify the valuation”

Ferris, Baker

Watts,

Incorporated

15 May 2006

“We do view the acquisition as a good fit with Berkshire's existing holdings, which include Fruit of the

Loom, Fechhemer (activewear), and H.H. Brown Shoe. We are uncertain if there will be other

competing bids for this business but believe there is a limited number of companies that would want

both the Activewear (47% of revenue) and Sporting Goods (43%) businesses”

SunTrust

Robinson

Humphrey

17 Apr 2006

Comments

Broker

23

Financial Analysis

24

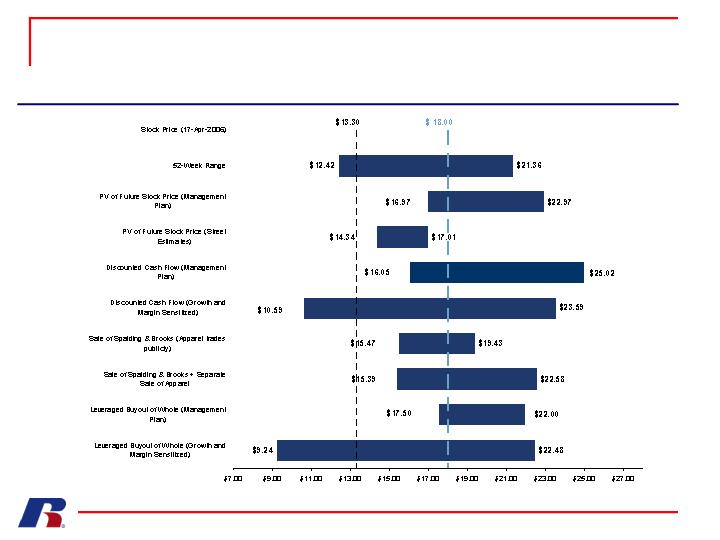

Financial Assumptions

All financial analysis based on financial projections provided by

Russell management and estimates from Wall Street research

Projections provided by management assume “updated base case

projection,” reflecting a lower-than-initially-expected effective tax rate

However, 2006E EPS remained unchanged

Russell management projections were also compared to the available

Wall Street estimates

Significant gap between Wall Street estimates and management projections

25

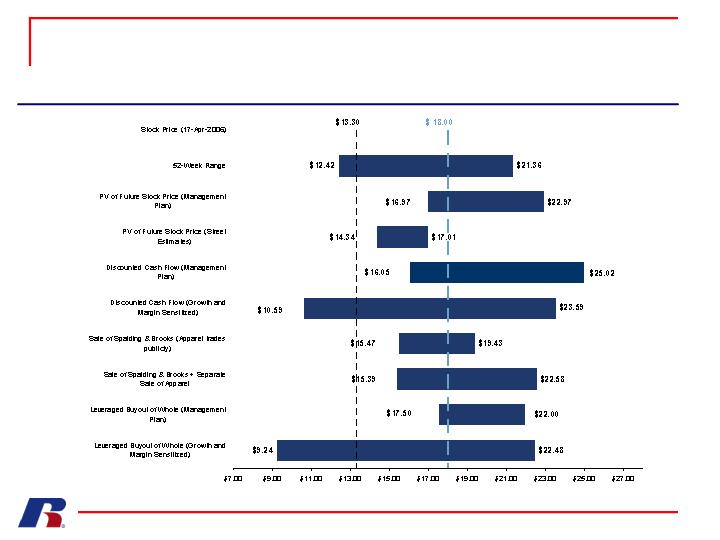

Illustrative Per Share Ranges

Methodology

Summary of Financial Analysis

Note: As of 17-Apr-2006

26

Conclusion

27

Conclusion

Board process designed to ensure shareholders receive full value for

their investment

Considered all reasonable alternatives to deliver full value to shareholders

Fair value of $18.00 cash per share

Fairness of price supported by valuation analysis

Optimal structure and certainty of terms

100% cash with no financing issues / condition

Customary “no shop” provision that allows Russell to consider and

accept better offers

No other offers or requests for due diligence received to date

Russell Board continues to believe the proposed transaction is in the

best interest of shareholders

28

General Discussion

and

Q&A

29