UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

TRANSCEND SERVICES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

TRANSCEND SERVICES, INC.

945 East Paces Ferry Road, Suite 1475

Atlanta, Georgia 30326

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 17, 2006

To the Stockholders:

The annual meeting of stockholders (the “Annual Meeting”) of Transcend Services, Inc. (the “Company”) will be held on May 17, 2006 at the offices of Smith, Gambrell & Russell, LLP, Suite 3100, Promenade II, 1230 Peachtree Street, N.E., Atlanta, Georgia 30309-3592 at 1:00 p.m. local time for the following purposes:

| 1. | To elect a Board of Directors consisting of five members to hold office until the next annual meeting of stockholders or until their successors are elected and qualified. |

| 2. | To ratify the appointment of Miller Ray Houser & Stewart LLP as independent public accountants to audit the accounts of the Company for the year ending December 31, 2006. |

| 3. | To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. |

Only stockholders of record at the close of business on March 27, 2006 shall be entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof.

A Proxy Statement and a proxy solicited by the Board of Directors are enclosed herewith. You are cordially invited to attend the Annual Meeting. Whether or not you plan to attend the Annual Meeting, please complete, sign, date and mail the enclosed proxy card promptly in the enclosed postage-paid envelope. If you attend the meeting, you may, if you wish, withdraw your proxy and vote in person.

By order of the Board of Directors, |

| /s/ Lance Cornell |

LANCE CORNELL |

Secretary |

Atlanta, Georgia

March 29, 2006

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, YOU ARE URGED TO COMPLETE, SIGN, DATE AND PROMPTLY MAIL THE ENCLOSED PROXY IN THE ACCOMPANYING POSTAGE PAID ENVELOPE. IF YOU ATTEND THE MEETING, YOU MAY REVOKE THE PROXY AND VOTE YOUR SHARES IN PERSON.

TRANSCEND SERVICES, INC.

945 East Paces Ferry Road, Suite 1475

Atlanta, Georgia 30326

PROXY STATEMENT

For Annual Meeting Of Stockholders To Be Held On May 17, 2006

GENERAL

This Proxy Statement and the accompanying form of Proxy are being furnished to the stockholders of Transcend Services, Inc. (the “Company” or “Transcend”) on or about March 29, 2006 in connection with the solicitation of proxies by the Board of Directors of the Company for use at the Annual Meeting of Stockholders to be held on May 17, 2006 at the offices of Smith, Gambrell & Russell, LLP, Suite 3100, Promenade II, 1230 Peachtree Street, N.E., Atlanta, Georgia 30309-3592 at 1:00 p.m. local time and any postponement or adjournment thereof. Any stockholder who executes and delivers a proxy may revoke it at any time prior to its use by (i) giving written notice of revocation to the Secretary of the Company; (ii) executing a proxy bearing a later date; or (iii) appearing at the meeting and voting in person. The address of the principal executive offices of the Company is 945 East Paces Ferry Road, Suite 1475, Atlanta, Georgia 30326 and the Company’s telephone number is (404) 364-8000.

Unless otherwise specified, all shares represented by effective proxies will be voted in favor of (i) election of the five nominees as Directors; (ii) the ratification of the selection of Miller Ray Houser & Stewart LLP to serve as the independent public accountants for the Company for the year ending December 31, 2006; and (iii) the transaction of such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. The Board of Directors does not know of any other business to be brought before the meeting, but as to any such other business, proxies will be voted upon any such matters in accordance with the best judgment of the person or persons acting thereunder as to what is in the best interests of the Company.

The cost of soliciting proxies will be borne by the Company. In addition to use of the mails, proxies may be solicited in person or by telephone or telegram by Directors and Officers of the Company who will not receive additional compensation for such services. Brokerage houses, nominees, custodians and fiduciaries will be requested to forward soliciting material to beneficial owners of stock held of record by them, and the Company will reimburse such persons for their reasonable expenses in doing so.

Holders of record of outstanding shares of the Common Stock of the Company, at the close of business on March 27, 2006, are entitled to notice of and to vote at the meeting. As of March 27, 2006, there were approximately 296 holders of record of the Company’s Common Stock and 7,908,613 shares of Common Stock outstanding. Each share of outstanding Common Stock is entitled to one vote. A majority of the shares entitled to vote, whether present in person or by proxy, shall constitute a quorum.

When a quorum is present at the meeting, the affirmative vote of the holders of a majority of the shares having voting power present in person or by proxy shall decide the action proposed in each matter listed in the accompanying Notice of Annual Meeting of Stockholders, except for the election of Directors. The Directors are elected by a plurality of the votes of the shares present in person or by proxy and entitled to vote. Abstentions and broker “non-votes” will be counted as present in determining whether the quorum requirement is satisfied. A “non-vote” occurs when a nominee holding shares for a beneficial owner votes on one proposal pursuant to discretionary authority or instructions from the beneficial owner, but does not vote on another proposal because the nominee has not received instructions from the beneficial owner, and does not have discretionary power. An abstention from voting by a stockholder on proposals other than the election of directors and ratification of accountants will have the same effect as a vote against such proposal. Broker “non-votes” are not counted for purposes of determining whether proposals other than the election of directors and ratification of accountants have been approved, which will also have the same effect as a vote against such proposals.

1

AGENDA ITEM ONE

ELECTION OF DIRECTORS

The Bylaws of Transcend currently provide that the Board of Directors shall consist of not less than one Director, subject to increase or decrease in such number within legal limits by action of the Board of Directors or stockholders. There are presently five Directors.

The Nominating and Corporate Governance Committee evaluates the size and composition of the Board of Directors on at least an annual basis. The Nominating and Corporate Governance Committee has nominated and recommends for election as Directors the five nominees set forth below. Each nominee presently serves as a Director of the Company. Directors shall be elected to serve until the next annual meeting of stockholders or until their successors are elected and qualified. If all of the nominees are elected, the Company’s Board of Directors will have five members.

Each of the five nominees has consented to being named in this Proxy Statement and to serve as a Director of the Company if elected. In the event that any nominee withdraws, or for any reason is unable to serve as a Director, the proxies will be voted for such other person as may be designated by the Nominating and Corporate Governance Committee as substitute nominee, but in no event will proxies be voted for more than five nominees. The Nominating and Corporate Governance Committee has no reason to believe that any nominee will not continue to be a candidate or will not serve if elected.

The following is a brief description of the background and business experience of each of the nominees for election to the Board of Directors:

| Larry G. Gerdes | Mr. Gerdes (age 57) has served as Chairman of the Board of the Company since May 2000, as a Director of the Company since June 1985, as its Chief Executive Officer since May 1993 and its President since April 1, 2005.; From June 1985 until December 8, 2003, Mr. Gerdes served as President of the Company. From September 16, 2000 through December 31, 2003, Mr. Gerdes served as the Company’s Chief Financial Officer. In addition, Mr. Gerdes served as Secretary of the Company between September 16, 2000 and May 22, 2001. From 1991 to 1993, Mr. Gerdes was a private investor and from May 1992 until January 1995, Mr. Gerdes was the Chairman of the Board of Directors of Bottomley and Associates, which merged with Transcend in 1995. Prior to 1991, Mr. Gerdes held various executive positions with HBO & Company, a healthcare information systems company, including Chief Financial Officer and Executive Vice President. Mr. Gerdes serves as a member of: (i) the Board of Directors, and the Compensation and Nominating Committees of the Chicago Board of Trade (NYSE: BOT), a futures and future-options exchange. Mr. Gerdes also serves as a Director of Alliance Healthcard, Inc., (OTC: ALHC.OB). | |

| Joseph P. Clayton | Mr. Clayton (age 56) has served as a Director of the Company since May 2000. Mr. Clayton has been Chairman of the Board of Directors of Sirius Satellite Radio (“Sirius”), a satellite radio broadcaster, since November 18, 2004 and served as the President and Chief Executive Officer of Sirius between November 2001 and November 17, 2004. Sirius is a publicly traded company which trades under the symbol SIRI. Prior to joining Sirius, Mr. Clayton was President of North American Operations of Global Crossing Ltd. (“Global”), a global provider of integrated Internet, data, voice and conferencing services, from September 1999 to November 2001. On January 28, 2002, Global filed a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the Southern District of New York. From 1997 to 1999, Mr. Clayton was the President and Chief Executive Officer of Frontier Corporation (“Frontier”), a provider of telecommunication services that was purchased by Global in 1999. Prior to joining Frontier, Mr. Clayton served as Executive Vice President of Marketing and Sales for the Americas and Asia for Thomson, a consumer electronics company, from 1992 through 1996. Mr. Clayton serves on the Dean’s Advisory Board of the Indiana University Kelley School of Business, as a Trustee of Bellarmine University, Louisville, Kentucky, and as Trustee of the Rochester Institute of Technology, Rochester, New York. He is also a member of the New York State Office of Science, Technology and Academic Research (NYSTAR) Advisory Council. | |

2

| James D. Edwards | Mr. Edwards (age 62) has served as a Director of the Company since July 2003. Mr. Edwards provided independent contractor and consulting services to a real estate development company in 2002 and 2003 subsequent to his retirement in April 2002 from the position of Managing Partner – Global Market Organization of Arthur Andersen LLC, an international public accounting firm, where he was employed for 38 years. Mr. Edwards serves as a member of: (i) the Board of Directors and the Audit Committee of IMS Health Incorporated (NYSE: RX), a global provider of pharmaceutical market intelligence; (ii) the Board of Directors of Crawford & Company (NYSE: CRDA and CRDB), a global provider of claims management solutions to insurance companies and self-insured entities; and (iii) the Board of Directors of Huron Consulting Group (OTC: HURN), a provider of financial and operational consulting services. Mr. Edwards is a member of the American Institute of Certified Public Accountants. | |

| Walter S. Huff, Jr | Mr. Huff (age 71) has served as a Director of the Company since October 1993. Mr. Huff was the founder of HBO & Company and served as its Chairman from 1974 until 1990 and Chief Executive Officer from 1974 to 1984 and from 1986 until 1989. Since 1990, Mr. Huff has been a private investor. | |

| Charles E. Thoele | Mr. Thoele (age 70) has served as a Director of the Company since October 1993. Mr. Thoele has been a consultant to Sisters of Mercy Health Systems since February 1991. From 1986 to February 1991, he served as a Director and the Chief Operating Officer of Sisters of Mercy Health Systems. Mr. Thoele is currently Chairman of the Board of St. John’s Mercy Healthcare System in St. Louis, Missouri. Mr. Thoele is a past Chairman of the Catholic Hospital Association. | |

No Director or Executive Officer of Transcend is related to any other Director or Executive Officer of Transcend.

The Board of Directors recommends a vote “FOR” each of the above nominees.

AGENDA ITEM TWO

APPOINTMENT OF INDEPENDENT PUBLIC ACCOUNTANTS

Miller Ray Houser & Stewart LLP (“MRH&S”) has served as the independent public accountants for the fiscal years ended December 31, 2001 through 2005, and upon the recommendation of the Audit Committee, the Board of Directors has selected MRH&S as the Company’s independent public accountants for the year ending December 31, 2006. See also the Report of the Audit Committee included in this Proxy Statement.

A representative of Miller Ray Houser & Stewart LLP will be present at the Annual Meeting of Stockholders and shall have the opportunity to make a statement and to respond to appropriate questions.

The Board of Directors recommends a vote “FOR” the ratification of the appointment of Miller Ray Houser & Stewart LLP.

3

ADDITIONAL INFORMATION

MEETINGS OF THE BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD

The Company’s Board of Directors has three standing committees: the Nominating and Corporate Governance Committee, the Audit and Finance Committee and the Stock Option and Compensation Committee.

The Nominating and Corporate Governance Committee of the Board of Directors (the “Nominating and Governance Committee”), which is comprised of Messrs. Clayton (Chairman), Edwards and Thoele, was established on May 6, 2004 for the purposes of (i) assisting the Board in identifying qualified individuals to become members of the Board of Directors; (ii) determining the composition of the Board of Directors and its committees; (iii) monitoring the process to assess the effectiveness of the Board of Directors; and (iv) developing and implementing the Company’s corporate governance guidelines. Each of Messrs. Edwards, Clayton and Thoele is “independent” as defined in and required by Rules 4200(a)(14) and 4350(d)(2)(A) of The Nasdaq Stock Market’s listing standards and Section 301 of the Sarbanes-Oxley Act of 2002. The Nominating and Governance Committee (i) leads the search for individuals qualified to become members of the Board of Directors and selects director nominees to be presented for approval by the stockholders of the Company; (ii) reviews the Board of Director’s committee structure and recommends to the Board of Directors for its approval directors to serve as members of each committee; (iii) develops and recommends to the Board of Directors for its approval a set of corporate governance guidelines; (iv) reviews all related party transactions and all potential conflicts of interest involving members of the Board or management and recommends appropriate action on each such matter to the Board; (v) monitors compliance with the Company’s existing Code of Business Conduct and Ethics Policy and considers any waiver of the provisions of said Code; (vi) develops and recommends to the Board of Directors for its approval an annual self-evaluation process of the Board and its committees; and (vii) reviews on an annual basis compensation for directors serving on the Board of Directors and its committees. The Nominating and Governance Committee will consider a candidate for director proposed by a stockholder. A candidate must be highly qualified and be both willing and expressly interested in serving on the Board of Directors. A stockholder wishing to propose a candidate for the Nominating and Governance Committee’s consideration should forward the candidate’s name and information about the candidate’s qualifications to Transcend Services, Inc., 945 East Paces Ferry Road, Suite 1475, Atlanta, Georgia, 30326, Attention: Corporate Secretary not later than January 1, 2007. The Nominating and Governance Committee shall select individuals, including candidates proposed by stockholders, as director nominees who shall have the highest personal and professional integrity, who shall have demonstrated exceptional ability and judgment, and who shall be most effective, in conjunction with the other nominees to the Board of Directors, in collectively serving the long-term interests of the stockholders. Additional information regarding the Nominating and Governance Committee is included in the Nominating and Corporate Governance Committee Charter which was filed as an exhibit to the Definitive Proxy Statement for the 2005 Annual Meeting of Stockholders held May 4, 2005. The Nominating and Governance Committee held four (4) meetings during the year ended December 31, 2005.

The Audit and Finance Committee (the “Audit Committee”) of the Board of Directors, which is comprised of Messrs. Edwards (Chairman), Clayton and Thoele, oversees the accounting and reporting processes of Transcend and the audits of the financial statements of Transcend. Each of Messrs. Edwards, Clayton and Thoele is “independent” as defined in and required by Rules 4200(a)(14) and 4350(d)(2)(A) of The Nasdaq Stock Market’s listing standards and Section 301 of the Sarbanes-Oxley Act of 2002. The Board of Directors has determined that Mr. Edwards is an audit committee financial expert as defined in Item 401(h)(2) of Regulation S-K. The Report of the Audit Committee appears below. The Audit Committee held seven (7) meetings during the year ended December 31, 2005.

The Stock Option and Compensation Committee (the “Compensation Committee”), comprised during 2005 of Messrs. Thoele (Chairman), Clayton and Huff, acts as administrator of Transcend’s stock option, stock incentive and stock purchase plans and makes recommendations concerning the establishment of additional employee benefit plans for the Company and compensation for Transcend’s executive officers and Directors. Effective February 20, 2006 Mr. Huff is no longer a member of the Stock Option and Compensation Committee and Mr. Edwards has joined the Committee. Each member of the Compensation Committee is “independent” as defined in and required by Rules 4200(a)(14) and 4350(d)(2)(A) of The Nasdaq Stock Market’s listing standards and Section 301 of the Sarbanes-Oxley Act of 2002. The Compensation Committee held four (4) meetings during the year ended December 31, 2005.

The Board of Directors held seven (7) meetings during the year ended December 31, 2005. During the year ended December 31, 2005, each Director attended more than 75% of the total number of meetings of the Board of Directors and committees on which he served. The independent members of the Board of Directors met in executive session at

4

each meeting of the Board of Directors held during the year ended December 31, 2005. Although the Company does not have a formal policy regarding the Directors’ attendance at annual meetings, all of the Company’s Directors attended the last annual meeting of stockholders that was held on May 4, 2005.

COMPENSATION OF DIRECTORS

At the recommendation of the Compensation Committee, the Board approved the compensation of Directors presented herein. The Board grants an immediately exercisable option to purchase 10,000 shares of the Company’s Common Stock at a per share exercise price equal to the fair market value per share on the date of grant to a Director elected by the stockholders for his first term of service. The Board also grants immediately exercisable options to purchase 5,000 shares of the Company’s Common Stock at a per share exercise price equal to the fair market value per share on the date of grant to each non-management Director upon reelection to the Board. As such, on May 4, 2005, Messrs. Clayton, Edwards, Huff and Thoele were each granted a ten-year option to purchase 5,000 shares of the Company’s Common Stock at an exercise price of $2.45 per share. In addition, until December 21, 2005, each non-management Director received (i) a cash retainer of $3,500 per quarter with the exception of the Chairman of the Audit Committee whose cash retainer was $4,500 per quarter; (ii) a $500 fee for participating in each meeting of the Board, other than telephonic meetings for which the fee was $250 per meeting; and (iii) a $250 fee for participating in each meeting of a Committee of the Board. Effective December 21, 2005 the Board suspended cash compensation for Directors until further notice. No fees are paid to Mr. Gerdes, the Chairman of the Board, who is also an Executive Officer of the Company. See “Executive Compensation.”

COMMUNICATIONS WITH THE BOARD

While the Board of Directors does not have a formal process for stockholders to send communications to the Board of Directors, each member of the Board of Directors is receptive to receiving such communications from stockholders. Stockholders may send communications to the attention of any Director at the Company’s office address.

CODE OF BUSINESS CONDUCT AND ETHICS POLICY

The Company’s Board of Directors adopted a Code of Business Conduct and Ethics Policy (the “Code of Ethics”) on February 10, 2003. The Code of Ethics applies to all Directors, officers and employees of the Company and must be acknowledged in writing by the Company’s Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer. The Code of Ethics was filed as an exhibit to the Company’s Annual Report on Form 10-K for the year ended December 31, 2003.

REPORT OF THE AUDIT COMMITTEE

February 20, 2005

We have reviewed and discussed with management the Company’s audited financial statements as of and for the year ended December 31, 2005 to be included in the Company’s Annual Report on Form 10-K.

We have discussed with Miller Ray Houser & Stewart LLP the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees, as amended. In addition, we have received and reviewed the written disclosures and the letter from Miller Ray Houser & Stewart LLP required by Independence Standards Board, Standard No. 1,Independence Discussions with Audit Committees, and have discussed with Miller Ray Houser & Stewart LLP the accountants’ independence.

Based on the reviews and discussions referred to above, we recommended to the Board of Directors that the financial statements referred to above be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005 for filing with the Securities and Exchange Commission.

We have recommended that the stockholders of the Company ratify the appointment of Miller Ray Houser & Stewart LLP as its independent public accountants to audit the accounts of the Company for the year ending December 31, 2006. Miller Ray Houser & Stewart LLP served as the independent public accountants that audited the accounts of the Company and its subsidiaries for each year since the year ended December 31, 2001.

5

Prior to the start of each annual audit in 2005 and 2004, the Audit Committee reviewed and pre-approved the fee estimates of Miller Ray Houser & Stewart LLP for providing the audit, audit-related, tax and all other services described below. In addition, the Audit Committee reviewed and pre-approved Management’s budget for audit, audit-related, tax and all other fees related to Miller Ray Houser & Stewart LLP in conjunction with its review of the Company’s business plan and related operating budgets for the years ended December 31, 2005 and 2004. In addition to the review and pre-approval processes described above, in 2005 and beyond, as provided for in the Audit Committee Charter referred to below, the Committee pre-approved and intends to continue pre-approving all audit and non-audit services to be provided by the independent auditors by delegating to the Chairman of the Audit Committee the authority to pre-approve any audit or non-audit services to be performed by the independent auditors, provided that any such approvals are presented to the Audit Committee at its next scheduled meeting.

The Audit Committee has considered whether the provision of the services described under the captions “Audit-Related Fees,” “Tax Fees,” and “All Other Fees” by Miller Ray Houser & Stewart LLP are compatible with maintaining the principal accountant’s independence and determined that the independence of Miller Ray Houser & Stewart LLP was not and is not impaired by the provision of said services.

Audit Fees

The aggregate fees billed by Miller Ray Houser & Stewart LLP for professional services rendered for the audit of the Company’s annual financial statements for the years ended December 31, 2005 and 2004 and the reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q for those years were $79,325 and $51,500, respectively. No person or firm other than Miller Ray Houser & Stewart LLP performed audit services for the Company in either 2005 or 2004.

Audit-Related Fees

The aggregate fees billed by Miller Ray Houser & Stewart LLP for professional services rendered in conjunction with accounting and financial reporting issues during 2005 and 2004 and the Company’s Registration Statements on Forms S-8 in 2004 totaled $759 and $4,259, respectively.

Tax Fees

The aggregate fees billed by Miller Ray Houser & Stewart LLP for professional services rendered in conjunction with federal, state and local income tax return preparation and signature; payroll tax consulting; and sales and use tax consulting totaled $33,277 and $46,789 in the years ended December 31, 2005 and 2004, respectively.

All Other Fees

The aggregate fees billed by Miller Ray Houser & Stewart LLP for the audit of the Company’s 401(K) plan and related review of the Company’s Form 5500 for said plan totaled $6,840 and $6,150 in the years ended December 31, 2005 and 2004, respectively.

A representative of Miller Ray Houser & Stewart LLP will be present at the Annual Meeting of Stockholders and shall have the opportunity to make a statement and to respond to appropriate questions.

Audit Committee Charter

The Audit Committee operates pursuant to a written charter adopted by the Board of Directors that was included as an exhibit to the Proxy Statement for the 2004 Annual Meeting of Stockholders held on May 6, 2004. The Audit Committee reviews and reassesses the adequacy of its charter on an annual basis

The foregoing report has been furnished by the Audit Committee of the Board of Directors of Transcend Services, Inc.

James D. Edwards, Chairman

Joseph P. Clayton

Charles E. Thoele

The foregoing report of the Audit Committee shall not be deemed to be incorporated by reference in any previous or future documents filed by the Company with the Securities and Exchange Commission under the Securities Act of 1933

6

or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates the report by reference in any such document.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of February 15, 2006, certain information with respect to all stockholders known to Transcend to beneficially own more than five percent of the Company’s Common Stock, and information with respect to Transcend Common Stock beneficially owned by each Director of Transcend, each nominee for election as Director, the Executive Officers included in the Summary Compensation Table set forth under the caption “Executive Compensation,” and all Directors and Executive Officers of Transcend as a group. Unless otherwise indicated, the address of each beneficial owner is c/o Transcend Services, Inc., 945 East Paces Ferry Road, Suite 1475, Atlanta, GA 30326. Except as otherwise indicated, the stockholders listed in the table have sole voting and investment powers with respect to the Common Stock owned by them.

Beneficial Owner | Amount and of Beneficial Ownership/(1)/ | Percentage Beneficially Owned | ||||

Larry G. Gerdes | 1,081,795 | /(2)/ | 13.55 | % | ||

Joseph P. Clayton | 40,375 | /(3)/ | * | |||

James D. Edwards | 25,000 | /(4)/ | * | |||

Walter S. Huff, Jr. | 1,005,979 | /(5)/ | 12.70 | % | ||

Charles E. Thoele | 55,580 | /(6)/ | * | |||

Robert Alexander | 53,500 | * | ||||

Juan A. Muñoz | 41,499 | /(8)/ | * | |||

Laumar Investors Limited Partnership | 531,000 | /(9)/ | 6.71 | % | ||

3500 Parklane | ||||||

Suite 720 | ||||||

Norcross, GA 30092 | ||||||

All Directors and Executive Officers as a group (9 persons) | 2,328,895 | /(10)/ | 28.65 | % |

| * | Represents less than 1% |

| (1) | “Beneficial Ownership” includes shares for which an individual, directly or indirectly, has or shares voting or investment power or both and also includes shares of Common Stock underlying options to purchase Common Stock which are exercisable within 60 days of the date hereof. Beneficial ownership as reported in the above table has been determined in accordance with Rule 13d-3 of the Securities Exchange Act of 1934. The percentages are based upon 7,908,613 shares of Common Stock outstanding as of February 15, 2006, except for certain parties who hold presently exercisable options to purchase Common Stock, or options which are exercisable within 60 days of February 15, 2006. The percentages for those parties who hold presently exercisable options to purchase Common Stock, or options which are exercisable within 60 days of February 15, 2006, are based upon the sum of 7,908,613 shares plus the number of shares subject to presently exercisable options to purchase Common Stock, or options which are exercisable within 60 days of February 15, 2006, held by them, as indicated in the following notes. |

| (2) | Includes 28,720 shares held by Mr. Gerdes’ spouse; 10,000 shares held by the Gerdes Family Partnership LP of which Mr. Gerdes is the General Partner; 3,000 shares held by an Investment Partnership for which Mr. Gerdes has a 1/8th interest, exercises investment decision control and shares voting power; and 75,000 shares of Common Stock that may be acquired by Mr. Gerdes upon the exercise of stock options exercisable within 60 days of February 15, 2006. |

7

| (3) | Includes 5,000 shares held by Joseph P. Clayton Revocable Trust; 375 shares held by an Investment Partnership in which Mr. Clayton has a 1/8th interest and shares voting power; and 20,000 shares of Common Stock that may be acquired by Mr. Clayton upon the exercise of stock options exercisable within 60 days of February 15, 2006. |

| (4) | Includes 20,000 shares of Common Stock that may be acquired by Mr. Edwards upon the exercise of stock options exercisable within 60 days of February 15, 2006. |

| (5) | Includes 10,000 shares of Common Stock that may be acquired by Mr. Huff upon the exercise of stock options exercisable within 60 days of February 15, 2006. |

| (6) | Includes 45,580 shares held by C. Thoele Lifetime Trust and 10,000 shares of Common Stock that may be acquired by Mr. Thoele upon the exercise of stock options exercisable within 60 days of February 15, 2006. |

| (7) | Effective December 31, 2005 Mr. Alexander is no longer employed by the Company. |

| (8) | Includes 6,666 shares of Common Stock that may be acquired by Mr. Muñoz upon the exercise of stock options exercisable within 60 days of February 15, 2006. |

| (9) | This amount confirmed by Laumar Investors Limited Partnership. |

| (10) | Includes 218,958 shares of Common Stock that may be acquired upon the exercise of stock options exercisable within 60 days of February 15, 2006. |

8

EXECUTIVE OFFICERS

The executive officers of the Company as of February 28, 2006 are presented below:

NAME | AGE | POSITION WITH THE COMPANY | ||

| Larry G. Gerdes | 57 | Chairman of the Board, Chief Executive Officer and President | ||

| Juan Alejandro Muñoz | 40 | Executive Vice President - Operations | ||

| Lance Cornell | 40 | Chief Financial Officer, Treasurer and Corporate Secretary | ||

| Jeanne N. Bateman | 51 | Controller, Chief Accounting Officer and Assistant Secretary |

Larry G. Gerdes has served as Chairman of the Board of the Company since May 2000, as a Director of the Company since June 1985, as its Chief Executive Officer since May 1993 and its President since April 1, 2005. From June 1985 until December 8, 2003, Mr. Gerdes served as President of the Company. From September 16, 2000 through December 31, 2003, Mr. Gerdes served as the Company’s Chief Financial Officer. In addition, Mr. Gerdes served as Secretary of the Company between September 16, 2000 and May 22, 2001. From 1991 to 1993, Mr. Gerdes was a private investor and from May 1992 until January 1995, Mr. Gerdes was the Chairman of the Board of Directors of Bottomley and Associates, which merged with Transcend in 1995. Prior to 1991, Mr. Gerdes held various executive positions with HBO & Company, a healthcare information systems company, including Chief Financial Officer and Executive Vice President. Mr. Gerdes also serves as a Director of Alliance Healthcard, Inc., (OTC: ALHC.OB) and The Chicago Board of Trade, (NYSE: BOT).

Juan Alejandro (Alex) Muñozhas served as Executive Vice President – Operations for Transcend since June 7, 2005. Prior to joining Transcend, Mr. Muñoz started and solely operated CSR, LLC, a business services consulting firm, commencing in February 2002. From October 2000 to April 2002, Mr. Muñoz served as the Senior Director of the CodeRemote Division of PHNS, Inc., a health information technology and business processing outsourcing service firm. From September 1998 to October 2000, Mr. Muñoz was Vice President of Operations for Transcend Services and developed the CodeRemote operation that was sold by Transcend to PHNS during October 2000.

Lance Cornell has served as Chief Financial Officer, Treasurer and Secretary since November 1, 2005. Prior to joining Transcend, Mr. Cornell served as Chief Financial Officer beginning November 2000 at Facility Resources, Inc., a private consulting firm specializing in facility-related project management, systems implementations and outsourcing for large corporations. Prior to that experience, Mr. Cornell served in chief financial officer and controller positions in two separate publicly traded companies in the healthcare information systems industry. Mr. Cornell is a licensed Certified Public Accountant.

Jeanne N. Batemanhas served as Controller, Chief Accounting Officer and Assistant Secretary since December 1, 2003. During 2002 and 2003, Ms. Bateman provided financial and analytical services on a volunteer basis to several community organizations. From February 2001 until January 2002, Ms. Bateman served as Chief Financial Officer of Surgical Information Systems, LLC, a developer of software for use in hospital surgical suites; from 1999 until 2001, she was Vice President – Chief Financial Officer, Treasurer and Corporate Secretary for MarketRing.com, Inc., a former provider of Web-based portals to facilitate e-commerce; and from 1993 through 1998, she held several financial executive positions with XcelleNet, Inc., a provider of communication software for large, remote and mobile workforces. Ms. Bateman is a licensed Certified Public Accountant.

Executive officers are chosen by and serve at the discretion of the Board of Directors of the Company.

9

EXECUTIVE COMPENSATION

The following table provides certain summary information for the years ended December 31, 2005, 2004 and 2003 concerning compensation paid or accrued by the Company to or on behalf of the Company’s Chief Executive Officer and the only other executive officers of the Company whose total annual salary and bonus exceeded $100,000 during the year ended December 31, 2005 (the “Named Executive Officers”).

SUMMARY COMPENSATION TABLE

| Annual Compensation | Long-term Compensation | |||||||||

Name and Principal Position | Year | Salary ($) | Bonus ($) | Restricted Stock Awards ($) | Securities Options (#) | |||||

Larry G. Gerdes Chairman of the Board, President and Chief Executive Officer (1) | 2005 2004 2003 | 235,000 235,000 220,000 | — — — | — — — | — — 100,000 | |||||

Robert Alexander (2) | 2005 2004 2003 | 126,485 104,293 137,500 | — — — | — — — | — — 20,000 | |||||

Juan A. Muñoz Executive Vice President – Operations (3) | 2005 | 113,333 | — | 295,000 | 20,000 | |||||

| (1) | Mr. Gerdes served as the Company’s President from June 1985 until December 8, 2003 and also from July 1, 2005 to present. Mr. Gerdes also served as the Company’s Chief Financial Officer and Treasurer from September 16, 2000 through December 31, 2003. |

| (2) | Mr. Alexander served as the Company’s Vice President of Customer Service from January 1, 2003 until March 16, 2004. He then served as Vice President of National Account Sales from March 16, 2004 until March 3, 2005. From March 4, 2005 until December 31, 2005, Mr. Alexander served as the Company’s Vice President of Human Resources. During his tenure with the Company, Mr. Alexander served as an officer from January 1, 2003 until March 5, 2004 and again from March 4, 2005 until December 31, 2005. Mr. Alexander’s employment with Transcend terminated effective December 31, 2005. |

| (3) | Mr. Muñoz was appointed to the position of Executive Vice President – Operations effective June 7, 2005. Mr. Munoz was granted 100,000 shares of restricted stock on June 9, 2005 when the stock price was $2.95 per share. The shares vest one-third on January 1, 2006, one-third on June 7, 2007 and one-third on June 7, 2008. The Company does not currently have any plans to pay dividends. |

STOCK OPTION GRANTS AND RELATED INFORMATION

The following table sets forth information regarding the grant of an option to purchase Transcend Common Stock during the year ended December 31, 2005 to one of the Named Executive Officers in the Summary Compensation Table above. The one indicated grant was made pursuant to the Transcend Services, Inc. 2003 Stock Incentive Plan. In accordance with the rules of the Securities and Exchange Commission, the table sets forth the hypothetical gains or “option spreads” that would exist for the options at the end of their respective ten-year terms based on assumed annualized rates of compound stock price appreciation of 5% and 10% from the dates the options were granted to the end of the respective option terms. Actual gains, if any, on option exercises are dependent on the future performance of Transcend Common Stock and overall market conditions. There can be no assurance that the potential realizable values shown in this table will be achieved.

10

OPTION GRANTS IN LAST FISCAL YEAR

Individual Grants | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (4) | ||||||||||||||||

Name | Number of Securities Underlying Options Granted (#) | % of Total | Exercise or Base Price ($/Sh) (3) | Expiration Date | 5% | 10% | |||||||||||

Juan A. Muñoz | 20,000 | (1) | 6.6 | % | $ | 2.95 | 1/31/2015 | $ | 37,105 | $ | 94,031 | ||||||

| (1) | One-third of these options vested on June 30, 2005. The remaining options vest one-third on June 30, 2006 and the one-third on June 30, 2007. |

| (2) | Transcend granted options to purchase a total of 303,500 to Directors, Officers and employees during the year ended December 31, 2005. |

| (3) | The stock option was granted with an exercise price equal to the fair market value of the Transcend Common Stock on the date of grant. |

| (4) | The 5% and 10% assumed rates of annual compound stock appreciation are mandated by rules of the Securities and Exchange Commission and do not represent Transcend’s estimate of projection of future prices for Transcend Common Stock. |

AGGREGATED OPTION EXERCISES IN FISCAL 2005 AND FISCAL YEAR END OPTION VALUES

There were no options exercised by the Named Executive Officers during fiscal 2005.

The following table provides certain information regarding the aggregate number of shares of Common Stock underlying stock options held by each Named Executive Officer as of December 31, 2005:

| Number of Securities Underlying Unexercised Options at December 31, 2005 (#) | Value of Unexercised In-The-Money Options at December 31, 2005 ($) (1) | ||||||||||

Name | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||

Larry G. Gerdes | 75,000 | 25,000 | $ | 0 | $ | 0 | |||||

Juan A. Muñoz | 6,666 | 13,334 | $ | 0 | $ | 0 | |||||

Robert Alexander | 73,125 | 11,875 | (2) | $ | 45,716 | $ | 2,738 | ||||

| (1) | Represents the excess of the fair market value of the Common Stock of approximately $2.25 per share (the closing price as quoted on the Nasdaq SmallCap Market on December 31, 2005) above the exercise price per share of the options times the applicable number of shares. |

| (2) | These options expired on January 31, 2006, 30 days following the termination of Mr. Alexander’s employment on December 31, 2005. |

11

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION IN

COMPENSATION DECISIONS

The Stock Option and Compensation Committee of the Board of Directors for 2005 was comprised of Messrs. Charles E. Thoele (Chairman), Joseph P. Clayton and Walter S. Huff, Jr. None of the members of the Stock Option and Compensation Committee served as an officer or employee of the Company during the fiscal year ended December 31, 2005. No interlocking relationship exists between members of the Company’s Board of Directors or Compensation Committee and members of the board of directors or compensation committee of any other company.

Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this Proxy Statement, in whole or in part, the following Report of Compensation Committee on Executive Compensation and the Stockholder Return Performance Graph shall not be incorporated by reference into any such filings.

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

During the fiscal year ended December 31, 2005, the Compensation Committee of the Board of Directors was comprised of three non-employee members of the Board: Charles E. Thoele (Chairman), Joseph P. Clayton and Walter S. Huff, Jr. The Compensation Committee establishes the general compensation policy for all executive officers of the Company and administers the incentive plans, including the 1992 Stock Option Plan, the 2001 Stock Option Plan, the 2003 Stock Incentive Plan, the 2005 Stock Incentive Plan and the cash bonus program for executive officers. The Compensation Committee also is responsible for reviewing executive officer compensation levels and evaluating management performance. The discussion set forth below is a report submitted by the Compensation Committee regarding the Company’s compensation policies and programs for executive officers for 2005.

Stock Option and Compensation Committee Philosophy

The Company’s executive compensation program is designed to reward outstanding performance and results. The Compensation Committee believes that the Company must pay competitively to attract, motivate and retain qualified executives. Moreover, in order to align their interests with the stockholders of the Company and maximize stockholder value, the Compensation Committee also believes that the Chief Executive Officer and the Company’s other executive officers should be significantly motivated by Transcend’s as well as individual performance.

In support of this philosophy, the executive compensation program is designed to reward performance that is directly relevant to the Company’s short-term and long-term success. As such, the Company attempts to provide both short-term and long-term incentive compensation that varies based on corporate and individual performance.

To accomplish these objectives, the Compensation Committee has structured the executive compensation program with three primary underlying components: base salary, performance incentives and long-term incentives (such as stock options). The following sections describe these elements of compensation and discuss how each component relates to the Company’s overall compensation philosophy.

Base Salary Program

The Company’s base salary program is based on a philosophy of providing base pay levels that are competitive with similarly situated companies in the healthcare industry as well as public companies of similar size in other industries. The Compensation Committee periodically reviews its executive pay levels to assure consistency with the external market. At its meeting on December 8, 2004, the Compensation Committee reviewed the historical cash compensation and stock option awards received by the Company’s executives. At its meeting on December 21, 2005, the Compensation Committee performed a comprehensive review of comparative executive compensation information that was prepared by Company Management using criteria for selecting comparable companies that was provided by the Chairman of the Compensation Committee. Annual salary adjustments are based on several factors, including the general level of market salary increases, individual performance and long-term value to the Company, competitive base salary levels and the Company’s overall financial and operating results. Mr. Gerdes, the Company’s Chief Executive Officer, received an increase of 6.8% in base pay from an annual base salary level of $220,000 to $235,000 effective January 1, 2004. Mr. Gerdes did not receive an increase in his annual base salary level for 2005 or 2006. The committee believes that Mr. Gerdes’ base salary is reasonable considering all of the factors discussed herein.

12

Performance Bonuses

Performance bonuses are intended to (i) reward executive officers based on Company and individual performance, (ii) motivate executive officers, and (iii) provide pay-for-performance cash compensation opportunities to executive officers. Accordingly, a portion of the executives’ compensation is contingent upon corporate performance and adjusted where appropriate, based on an executives’ performance against personal performance objectives. No bonuses were paid to executive officers in 2005.

Long-Term Incentives

Long-term incentives are designed to focus the efforts of executive officers on the long-term goals of the Company and to maximize total return to the stockholders of the Company. In the past, the Compensation Committee has relied primarily on stock option awards to provide long-term incentive opportunities. Stock options issued by the Company generally have a ten-year term before expiration, are exercisable over a number of years from the date of grant, and executives must be employed by the Company at the time of vesting in order to exercise the options. During 2005 the Compensation Committee granted restricted stock allowed in the 2005 Stock Incentive Plan. The restricted stock vests over a number of years. The Compensation Committee believes that dependence on stock options and restricted stock for a portion of executives’ compensation more closely aligns such executives’ interests with those of the Company’s stockholders, since the ultimate value of such compensation is linked directly to stock price.

On December 24, 2003, the Compensation Committee granted to Mr. Gerdes a nonqualified stock option to purchase 100,000 shares of the Company’s Common Stock at an exercise price of $4.15 per share, which was the closing price per share of the Company’s Common Stock as reported on the Nasdaq SmallCap Market System on that date. One half of the shares covered by the option granted to Mr. Gerdes vested on the first anniversary of the date of the grant. The remaining 50% of the shares covered by the option vest in two equal annual installments beginning on the second anniversary of the date of grant. Mr. Gerdes did not receive any additional grant of stock options during 2004 or 2005. Mr. Muñoz was the only named executive officer to be granted stock options during 2005 as presented in the “Stock Option Grants and Related Information” section of this Proxy Statement.

Fiscal Year 2005 Actions

The compensation for the Chief Executive Officer for fiscal 2005 was determined in the manner described above and no particular quantitative measures were used by the Compensation Committee in determining his compensation except as so described.

At its meeting on December 21, 2005, the Compensation Committee reviewed and approved the Company’s executive compensation program effective January 1, 2006 in the manner described herein. Said executive compensation program was filed with the Securities and Exchange Commission as an exhibit included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005 that was filed on March 6, 2006.

The Compensation Committee continually evaluates the Company’s compensation policies and procedures with respect to executives. Although the Compensation Committee believes that current compensation policies have been successful in aligning the financial interests of executive officers with those of the Company’s stockholders and with Company performance, it continues to examine what modifications, if any, should be implemented to further link executive compensation with both individual and Company performance.

Charles E. Thoele, Chairman

Joseph P. Clayton

Walter S. Huff, Jr.

13

EQUITY COMPENSATION PLAN INFORMATION

The following table gives information about the Company’s Common Stock that may be issued upon the exercise of stock options under all of the Company’s existing equity compensation plans, including the Company’s 1992 Stock Option Plan, 2001 Stock Option Plan, 2003 Stock Incentive Plan and 2005 Stock Incentive Plan.

Number of securities (a) | Weighted-average (b) | Number of securities (c) | |||||

Equity compensation plans approved by security holders | 804,575 | $ | 2.69 | 196,425 | |||

Equity compensation plans not approved by security holders | 0 | N/A | 0 | ||||

Total | 804,575 | $ | 2.69 | 196,425 | |||

STOCKHOLDER RETURN PERFORMANCE GRAPH

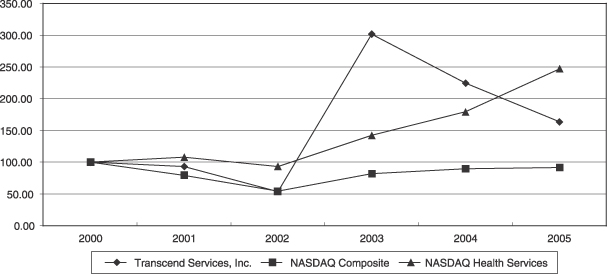

Set forth on the following page is a line graph comparing the percentage change in the cumulative total stockholder return on the Company’s Common Stock against the cumulative total return of the Nasdaq Composite Index and the Nasdaq Health Services Index for the period commencing on December 31, 2000 and ending December 31, 2005. The graph assumes that the value of the investment in the Company’s Common Stock in each index was $100 on December 31, 2000. The Company has not paid any cash dividends on its Common Stock.

Comparison of 5 Year Cumulative Total Returns

Performance Graph for

Transcend Services, Inc.

Produced on 3/10/2006 including date to 12/31/2005

14

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

On December 9, 2005, Larry G. Gerdes loaned the Company $100,000. On December 30, 2005, the Company repaid Mr. Gerdes the $100,000 principal plus interest of $550.

PROPOSALS BY STOCKHOLDERS

Proposals by stockholders intended to be presented at the 2007 Transcend annual meeting (to be held in the Spring of 2007) must be forwarded in writing and received at the principal executive office of Transcend no later than November 17, 2006 directed to the attention of the Secretary, for consideration for inclusion in Transcend’s proxy statement for the annual meeting of stockholders to be held in 2007. Any such proposals must comply in all respects with the rules and regulations of the Securities and Exchange Commission.

In connection with the Company’s Annual Meeting of Stockholders to be held in 2007, if the Company does not receive notice of a matter or proposal to be considered by February 1, 2007; then the persons appointed by the Board of Directors to act as the proxies for such Annual Meeting (named in the form of proxy) will be allowed to use their discretionary voting authority with respect to any such matter or proposal at the Annual Meeting, if such matter or proposal is properly raised at the Annual Meeting and put to a vote.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s Directors, executive officers and persons who own more than 10% of the outstanding Common Stock of the Company to file with the Securities and Exchange Commission reports of changes in ownership of the Common Stock of the Company held by such persons. Officers, Directors and greater than 10% stockholders are also required to furnish the Company with copies of all forms they file under this regulation.

The rules of the Securities and Exchange Commission require us to disclose late filings of stock transaction reports by our executive officers and Directors. During the year ended December 31, 2005, two reports, each covering one transaction, were inadvertently filed late, one by Walter S. Huff, Jr. and one by Joseph Clayton. To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and representations that no other reports were required, all Section 16(a) filing requirements applicable to its Directors, officers and greater than 10% stockholders, with the exception of these two filings, were complied with during the year ended December 31, 2005.

Although it is not the Company’s obligation to make filings pursuant to Section 16 of the Securities Exchange Act of 1934, the Company has adopted a policy requiring all Section 16 reporting persons to report to the Company’s Chief Financial Officer all trading activity in the Company’s Common Stock on the day of said trade(s) to facilitate the timely filing of the reports(s) of such trading activity with the Securities and Exchange Commission.

ANNUAL REPORT ON FORM 10-K

Additional information concerning the Company, including financial statements of the Company, is provided in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005, which accompanies this report. Exhibits filed with the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005, as filed with the Securities and Exchange Commission, are available to stockholders who make written request to the Company’s Secretary, 945 East Paces Ferry Road, Suite 1475, Atlanta, Georgia 30326. These documents may also be accessed from the Company’s Website at www.transcendservices.com.

15

OTHER MATTERS

The Board of Directors is not aware of any other matters to be presented for action at the Annual Meeting. If any other matter should come before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on such matter in accordance with their best judgment of what is in the best interests of the Company.

| By Order of the Board of Directors |

/s/ Larry G. Gerdes |

| LARRY G. GERDES |

| Chairman of the Board |

Atlanta, Georgia

March 29, 2006

16

PROXY SOLICITED BY THE BOARD OF DIRECTORS OF TRANSCEND SERVICES, INC.

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 17, 2006

The undersigned hereby appoints Larry G. Gerdes and Walter S. Huff, Jr., or either or them, with full power of substitution as proxies and attorneys-in-fact, to represent and vote, as designated below, the common stock of the undersigned at the Annual Meeting of Stockholders of Transcend Services Inc., (the “Company”) to be held on May 17, 2006, at the offices of Smith, Gambrell & Russell, LLP, Suite 3100, Promenade II, 1230 Peachtree Street, N.E., Atlanta, Georgia 30309-3592 at 11:00 a.m. local time and at any adjournments or postponements thereof on the matters set forth below:

| 1. | To elect five directors for a term of one year and until their successors are elected and qualified: |

q For all Nominees listed below (except as instructed below).

Joseph P. Clayton, James D. Edwards, Larry G. Gerdes, Walter S. Huff, Jr. and Charles E. Thoele

q WITHHOLD AUTHORITY to vote for those Nominees listed below:

| 2. | To ratify the appointment of Miller Ray Houser & Stewart LLP as independent public accountants for the year ending December 31, 2006. |

q FOR q AGAINST q ABSTAIN

| 3. | In their discretion, upon such other matter or matters as may properly come before the meeting or any adjournments or postponements thereof. |

The Board of Directors recommends a vote “FOR” each of the above proposals.

THE SHARES REPRESENTED BY THIS PROXY CARD WILL BE VOTED AS DIRECTED ON THE REVERSE HEREOF. IF NO DIRECTION IS GIVEN AND THE PROXY CARD IS VALIDLY EXECUTED, THE SHARES WILL BE VOTED FOR ALL LISTED PROPOSALS. IN THEIR DISCRETION, THE PROXIES DESIGNATED HEREIN ARE AUTHORIZED TO VOTE UPON SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE MEETING.

| Signature of Stockholder |

| Signature of Stockholder |

| Dated: |

| Important: Sign exactly as your name appears on this proxy card. Give full title of executor, administrator, trustee, guardian, etc. Joint owners should each sign personally. |