- CTRA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Coterra Energy (CTRA) DEF 14ADefinitive proxy

Filed: 18 Mar 22, 8:15am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

COTERRA ENERGY INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | ||

| No fee required. | |

| Fee paid previously with preliminary materials. | |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

MESSAGE FROM

THE EXECUTIVE CHAIRMAN

OF THE BOARD AND THE CHIEF

EXECUTIVE OFFICER

March 18, 2022

Dear Coterra Energy Shareholders,

This past year marked a significant step forward for the two legacy companies that combined to form Coterra Energy Inc., one of the premier oil and gas companies in North America. Thank you for your support of this transformative merger with your overwhelmingly strong vote in favor of the merger and for your trust in our team. Our Company stands at the top of the upstream exploration and production segment with two “core” basins and one of the best balance sheets in our industry. This blueprint affords us significant financial sustainability across commodity price cycles with the ability to return higher levels of capital to you – our shareholders.

Operationally, by placing a best-in-class oil asset with a best-in-class natural gas asset, we created a diversified portfolio for our capital investments, which allows us to pivot between commodities to maximize returns during commodity price cycles. This optionality benefits all Coterra stakeholders and creates a strong financial position for the organization.

We are now over six months into the integration of the two legacy companies into one Coterra. Our team is collaborating and working well together. And in the waning stages of the ongoing pandemic, our employees continue to safely conduct our field operations and lead our company-wide integration efforts. Their dedication and commitment are very much recognized and appreciated. From these efforts we are beginning to experience the initial cost synergies that were introduced in our merger announcement.

From the ever important Environmental, Social and Governance (ESG) lens, we took the best policies from each legacy company as our starting point and are building on that platform. We are committed to environmental stewardship & sustainability reporting, including currently reporting in line with SASB standards, adding TCFD-based disclosures in the future and reducing GHG emissions across our portfolio. To further bolster our commitment to sustainability, executive compensation will include metrics related to emissions reductions.

We take our social responsibilities seriously and are committed to supporting the communities in which we operate, funding education, healthcare and, when they arise, emergency needs of those communities. We fully support diversity among our employees and management, including among our Board members, and we strive for top-tier benefits for our employees and their families delivered at nominal cost to them to minimize the financial burden of health care and to increase wellness.

In terms of governance, we believe in a strong, independent Board of Directors, evidenced by our Board’s composition and tenure; transparency in our activities that may impact shareholders, including our corporate political contributions, which are fully disclosed on our website; and rigorous shareholder rights, such as proxy access and the ability to act by written consent. These governance principles, while present to some extent in both legacy companies, have been solidified and strengthened in Coterra.

As the two leaders of the talented, diverse group of independent directors and the dedicated and accomplished management team of Coterra, we are exceptionally proud of the company that was created this past year and the opportunities ahead for our fellow shareholders. Thank you, again, for your trust and your investment in this future.

|  | ||

| Dan O. Dinges | Thomas E. Jorden | ||

| Executive Chairman | Chief Executive Officer and President |

April 29, 2022

8:00 a.m., Central Time

Hotel ZaZa Memorial City

9787 Katy Freeway

Houston TX, 77024

And

Virtually at www.virtualshareholdermeeting.com/CTRA2022

PURPOSE OF THE MEETING: | |

| 1. | To elect each of the ten persons named in the attached Proxy Statement to the Board of Directors of the Company for a one-year term. |

| 2. | To ratify the appointment of the firm PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Company for its 2022 fiscal year. |

| 3. | To approve, by non-binding advisory vote, the compensation of our named executive officers. |

| 4. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Each of these items is fully described in the attached Proxy Statement, which is made a part of this Notice.

March 18, 2022

By Order of the Board of Directors,

Deidre L. Shearer

Vice President and Corporate Secretary | |

NOTICE

of Annual Meeting of Shareholders

RECORD DATE

Only holders of record of our common stock on March 8, 2022 will be entitled to notice of and to vote at the Annual Meeting.

IF YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON:

| • | Registered stockholders will be asked to present a valid government-issued photo identification. If your shares are held in the name of your broker, bank or other nominee, you must bring to the meeting a valid government-issued photo identification and an account statement or letter (and a legal proxy if you wish to vote your shares) from the nominee indicating that you beneficially owned the shares on the record date for voting. |

| • | We ask that you follow recommended guidance, mandates and applicable executive orders from federal and state authorities regarding COVID-19. We will require all attendees to comply with the Company’s policies in place at the time of the meeting, which may include a temperature check, completing a health check questionnaire, wearing a mask and maintaining six-foot social distance. If you are not feeling well, have had close contact (defined as being within six feet for 15 minutes or more without facial covering) with someone who has tested positive for COVID-19, or think you may have been exposed to COVID-19, we ask that you vote by proxy for the meeting. |

IF YOU PLAN TO ATTEND THE ANNUAL MEETING VIRTUALLY:

| • | You must visit www.virtualshareholdermeeting.com/CTRA2022. You will need the 16-digit control number included on your Notice of Internal Availability of Proxy Materials, your proxy card or the instructions that accompanied your proxy materials. If you do not have your 16-digit control number and attend the meeting online, you will be able to listen to the meeting only - you will not be able to vote or submit questions during the meeting. |

| VOTING PROCEDURES: |  |  |  |  |

| Please vote your shares as promptly as possible, even if you plan to attend the Annual Meeting, by one of the following methods: | INTERNET Use the instructions on the proxy card or voting instruction form | BY TELEPHONE Use the instructions on the proxy card or voting instruction form | BY MAIL Complete and return the enclosed proxy card or voting instruction form in the postage-paid envelope provided | BY ATTENDING IN PERSON OR VIRTUALLY You may also vote at the Annual Meeting by attending in person or virtually |

| TABLE OF CONTENTS |

| COTERRA • 2022 PROXY STATEMENT | 4 |

PROXY SUMMARY | ||

This summary highlights information described in other parts of this Proxy Statement and does not contain all of the information you should consider in voting. Please read the entire Proxy Statement before voting. For more complete information regarding our 2021 financial and operating performance, please review our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, which accompanies this Proxy Statement.

|  |  |  |

| DATE AND TIME | PLACE | RECORD DATE | VOTING |

| April 29, 2022 8:00 a.m. Central Time | Hotel ZaZa Memorial City 9787 Katy Freeway Houston, Texas 77024 Virtually at www.virtualshareholdermeeting.com/CTRA2022 | March 8, 2022 Shares Outstanding: 810,978,794 | Only holders of record of our common stock will be entitled to notice of and to vote at the Annual Meeting. |

| METHOD | INSTRUCTION | ||

| IN PERSON OR VIRTUALLY | you may attend the Annual Meeting and vote in person or, during the meeting, go to www.virtualshareholdermeeting.com/CTRA2022 to vote; | |

| BY INTERNET | log onto www.proxyvote.com and use the instructions on the proxy card or voting instruction form received from your broker or bank; | |

| BY TELEPHONE | dial 1.800.690.6903 and use the instructions on the proxy card or voting instruction form received from your broker or bank (if available); or | |

| BY MAIL | complete and return the enclosed proxy card or voting instruction form in the postage-paid envelope provided (for stockholders receiving paper copies only). |

| PROPOSAL | MATTER | BOARD VOTE RECOMMENDATION | PAGE REFERENCE |

| 1. | The election of the ten director candidates named herein. | FOR | 9 |

| 2. | Ratification of the appointment of the firm PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Company for its 2022 fiscal year. | FOR | 65 |

| 3. | The approval on an advisory basis of executive compensation. | FOR | 67 |

| COTERRA • 2022 PROXY STATEMENT | 5 |

| BOARD HIGHLIGHTS |

|  |  |  |  |

DAN O. DINGES

Executive Chairman of Coterra Energy Age 68 Years Served 20 Other public company boards: 1 • None | THOMAS E. JORDEN

Chief Executive Officer and President of Coterra Age 65 Years Served <1 Other public company boards: None | LISA A. STEWART

Lead Director Executive Chairman of Sheridan Production Partners Age 64 Years Served <1 Other public company boards: 2 • Western Midstream Partners LP • Jadestone Energy | DOROTHY M. ABLES

Former Chief Administrative Officer of Spectra Energy Corp Age 64 Years Served 6 Other public company boards: 1 • Martin Marietta Materials Inc. | ROBERT S. BOSWELL

Chairman and CEO of Laramie Energy, LLC Age 72 Years Served 6 Other public company boards: 1 • Enerflex Ltd. (Canadian) |

|  |  |  |  |

AMANDA M. BROCK

CEO Aris Water Age 61 Years Served 4 Other public company boards: 1 • Macquarie Infrastructure Corporation • Aris Water | PAUL N. ECKLEY

Former Senior Vice President – Investments of State Farm® Corporate Headquarters Age 67 Years Served <1 Other public company boards: None | HANS HELMERICH

Chairman of the Board of Helmerich & Payne Age 63 Years Served <1 Other public company boards: 1 • Helmerich & Payne, Inc. | FRANCES M. VALLEJO

Former Vice President for Corporate Planning and Development of ConocoPhillips Age 57 Years Served <1 Other public company boards: 1 • Crestwood Energy Partners, LP | MARCUS A. WATTS

President of The Friedkin Group Age 64 Years Served 4 Other public company boards: 1 • Service Corporation International |

| BOARD EXPERIENCE |

|

| COTERRA • 2022 PROXY STATEMENT | 6 |

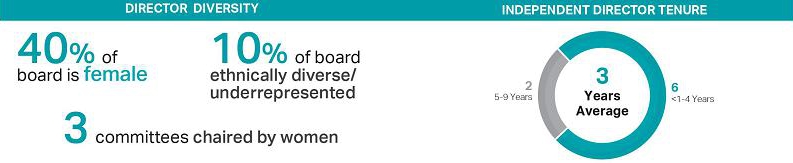

• Women hold 50% of independent Board seats and chair three of our four standing Board committees

• One member of our Board of Directors is member of a historically underrepresented group

• Recent Board refreshment from the merger with average independent director tenure of three years

• Proxy access for stockholders

• Rigorous stock ownership guidelines for all executive officers and directors

• Annual election of directors and majority voting • An independent lead director chairs executive sessions of independent directors at each regular Board meeting

• Board oversight of all political contributions and website disclosures of recipients and amounts contributed

• Separate Board committee devoted entirely to environmental, health and safety and matters

• Annual Board and committee self-assessments

• Stockholders may act by written consent

• Director orientation and continuing education

• No poison pill |

After nearly a decade of rationalizing the Company’s reserve portfolio, eliminating non-strategic and lower-tier assets, the Company was successful in acquiring – through a merger of equals with Cimarex Energy Co. (the “Merger”) – a complimentary strategic set of assets adding a mix of oil, liquids and natural gas to the portfolio, making 2021 a milestone year for the Company. Coincident with the Merger, the industry experienced a strengthening of all commodity prices, creating momentum in the second half of the year that further enhanced results from 2020. Highlights and accomplishments for 2021 include the following:(1)

| • | Free Cash Flow:(2) Generated free cash flow of $1.083 billion on the strength of the acquired assets in the Merger and improved commodity prices. |

| • | Returns to Shareholders: Continuing the legacy of returning at least 50 percent of free cash flow to shareholders, the Company returned 60 percent of 2021’s free cash flow in the form of dividends – including an increased base dividend, supplemented with a variable dividend. |

| • | Reserves: As a result of both the Merger and our capital investment activity in 2021, our absolute reserves grew by 27 percent from the prior year and our reserves as of December 31, 2021 changed from 100 percent natural gas to approximately 86 percent natural gas and 14 percent oil and natural gas liquids. |

| • | Production: As a result of the Merger, absolute production increased 17 percent from 2020 levels to 167.1 MMBOE for the year. |

| • | Debt and Leverage: During the year the Company repaid $188 million in maturing long term debt. With the improvement in pricing, and taking into account the acquired debt from the Merger, the Company still experienced a reduction in our leverage ratio (net debt to EBITDAX)(2) from 1.38x in 2020 to .95x in 2021. |

| • | Sustainability: In 2021 the Company reduced greenhouse gas emissions, methane intensity and high-pressure flaring intensity from previous levels of both companies involved in the Merger, in its ongoing commitment to environmental, social and governance leadership. |

| (1) | These results reflect nine months of Cabot Oil & Gas Corporation results and three months of the combined results following the effective time of the Merger. |

| (2) | Free cash flow and net debt to EBITDAX are not measures calculated in accordance with generally accepted accounting principles (GAAP). See Appendix A for additional information. |

| COTERRA • 2022 PROXY STATEMENT | 7 |

| What we do: | What we don’t do: | |||

| For 2022, added emissions reductions target metric to the short-term incentive program (p.45) |  | No vesting periods of less than three years for equity awards issued in February 2022 | |

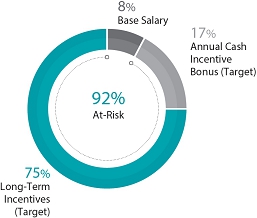

| Emphasis on long-term, performance-based equity compensation (p.30) |  | No hedging or pledging of company stock by executive officers or directors | |

| Short-term incentive compensation based on disclosed performance metrics (with payout caps), including operational, financial and returns metrics (p.40) |  | No excise tax gross-ups for executive officers appointed after 2010 | |

| Substantial stock ownership and retention requirements for executive officers and directors (p.49) |  | No vesting of equity awards after retirement if competing with Company | |

| Provide for “double trigger” cash payouts in change-in-control agreements (p.58) |  | No re-pricing or discounting of options or SARs | |

| Clawback policy (p.46) |  | No performance metrics that would encourage excessive risk-taking | |

| Hold annual advisory “say-on-pay” vote (p.67) | |||

| Only independent directors on Compensation Committee (p.23) | |||

| Use an independent compensation consultant (p.35) | |||

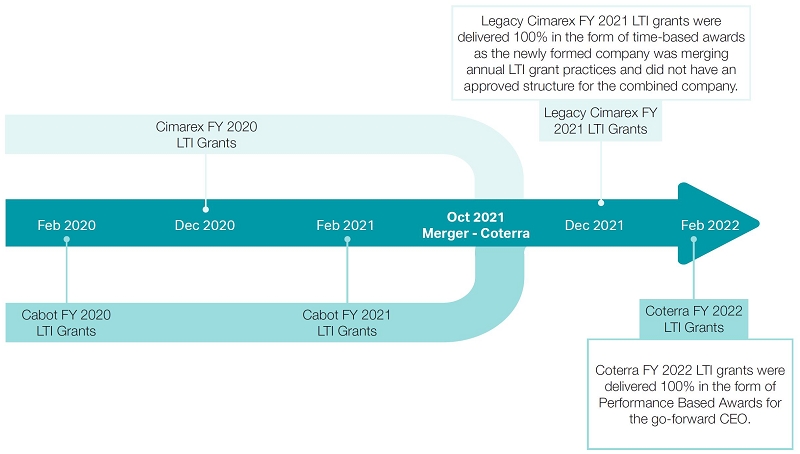

In February and March 2022, the Committee adopted Coterra’s first post-Merger executive compensation program. The 2022 executive compensation program is designed to align with governance best practices, shareholder expectations and Coterra’s business strategy as a combined company. The highlights of the 2022 executive compensation program include the following:

| • | Awarded 100% performance-based long-term incentives to the CEO |

| • | Following Mr. Jorden’s December 2021 grant of time-based restricted stock units representing the legacy Cimarex annual award, the Committee approved 100% performance-based awards in February 2022 so that the average of Mr. Jorden’s 2021 and 2022 annual grants is at least 50% performance-based | |

| • | The Committee expects Mr. Jorden’s annual long-term incentive grants in 2023 and beyond to be consistent with the other NEOs’ 2022 grants, which consisted of 60% performance-based awards |

| • | Added two broad market indices to executives’ long-term performance awards that are based on relative TSR, reflecting Coterra’s willingness to compete with investment dollars across industries |

| • | Capped relative TSR award payout at 100% of target if Coterra’s TSR is negative over the performance period |

| • | 55th percentile relative TSR performance required to receive target payout |

| • | Adopted three-year cliff vest on time-based RSUs, strengthening retention and alignment with shareholders |

| • | Aligned short-term incentive plan metrics with Coterra’s value proposition communicated to shareholders when seeking approval of the Merger |

| • | Focused incentives on return on invested capital, free cash flow, and ESG goals related to emissions reduction targets | |

| • | Reduced the overall maximum plan payout from 250% to 200% of target | |

| • | Removed the conditional multiplier from the short-term incentive calculation |

| • | No salary increases for the CEO and Executive Chairman; market-based adjustments for other NEOs who had not received salary increases since 2019 |

| COTERRA • 2022 PROXY STATEMENT | 8 |

The size of our Board of Directors (the “Board of Directors” or “Board”) is currently set at ten members, each of whose term expires in 2022. Accordingly, the Board of Directors has nominated ten directors to be elected at the 2022 Annual Meeting. Each of the nominees is currently a director and has been nominated to hold office until the expiration of his or her term in 2022 and until his or her successor shall have been elected and shall have qualified. The business experience of each nominee as well as the qualifications that led our Board to select each nominee for election to the Board is discussed below.

The Board believes that the combination of the various qualifications, skills and experiences of the 2022 director nominees would contribute to an effective and well-functioning Board. Whether nominated by a shareholder or through the activities of the Committee, the Governance and Social Responsibility (“GSR”) Committee seeks to select candidates who have:

| • | personal and professional integrity; |

| • | a record of achievement, and a position of leadership in his/ her field with the interest and intellect to be able to address energy industry challenges and opportunities; |

| • | the ability to think strategically and the insight to assist management in placing the Company in a competitive position within the industry; and |

| • | the time to attend Board meetings and the commitment to devote any reasonable required additional time to deal with Company business. |

The Board and the GSR Committee believe that, individually and as a whole, the Board possesses the necessary qualifications, varied tenure and independence to provide effective oversight of the business and quality advice and counsel to the Company’s management.

The persons named in the enclosed form of proxy intend to vote such proxies FOR the election of each of the nominees for terms of one year. If any one of the nominees is not available at the time of the Annual Meeting to serve, proxies received will be voted for substitute nominees to be designated by the Board of Directors or, in the event no such designation is made by the Board, proxies will be voted for a lesser number of nominees. In no event will the proxies be voted for more than the number of nominees set forth above.

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF EACH OF THE NOMINEES TO THE BOARD OF DIRECTORS. |

Set forth below, as of March 1, 2022, for each nominee for election as a director of the Company, is biographical information and information regarding the business experience, qualifications and skills of each director nominee that led the Board to conclude that the director nominee is qualified to serve on our Board. Mr. Dinges, Executive Chairman, and Mr. Jorden, Chief Executive Officer and President are the only employees or former employees of the Company on the Board of Directors.

| COTERRA • 2022 PROXY STATEMENT | 9 |

Age: 64

Director

Committee Memberships: • Audit (Chair); Governance and Social Responsibility

| DOROTHY M. ABLES |  | |

BUSINESS EXPERIENCE: • Spectra Energy Corp - Chief Administrative Officer – 2008 to 2017 - Vice President, Audit Services and Chief Ethics & Compliance Officer – 2007 to 2008

| • Duke Energy Corporation - Vice President, Audit Services – 2004 to 2006 • Duke Energy Gas Transmission - Senior Vice President and Chief Financial Officer – 1998 to 2004

| ||

OTHER DIRECTORSHIPS: • Martin Marietta Materials Inc. - November 2018 to present

| |||

KEY SKILLS, ATTRIBUTES AND QUALIFICATIONS: Ms. Ables brings a depth of experience in the natural gas transportation and marketing aspects of our industry, having served in positions of leadership with Spectra Energy Corp and its predecessor companies for over 30 years, as well as extensive financial expertise to our Board. The Board considered Ms. Ables’ extensive experience in the pipeline, processing and midstream business as adding value to our stockholders at a time in our business when transportation is crucial to our strategy. Ms. Ables’ financial expertise acquired through serving as Chief Financial Officer of Duke Energy Gas Transmission and later as Vice President of Audit Services of both Spectra Energy Corp and Duke Energy was also a key attribute leading to her appointment and to her February 2019 appointment as the Chair of our Audit Committee. Most recently, Ms. Ables gained executive experience as the Chief Administrative Officer of Spectra Energy Corp, from 2008 until her February 2017 retirement effective upon Spectra’s merger with Enbridge Inc. While serving in that role, Ms. Ables had responsibility for human resources, information technology, community relations and support services. Ms. Ables has prior governance experience gained from prior service on the Board of Directors of BJ Services, Inc. from July 2017 to October 2020 and the Board of Directors of Spectra Energy Corp’s publicly traded master limited partnership, Spectra Energy Partners, LP. Ms. Ables has served on the Board of Directors of Martin Marietta Materials Inc. since November 2018. Ms. Ables is also very active in community and charitable endeavors, including serving on the Board of Directors of the Houston Methodist Hospital Foundation since May 2017 and the Board of Trustees of United Way of Greater Houston from 2008 to April 2016 and was re-appointed to the Board of Trustees in April 2018. This diversity of background and leadership experience make her a valuable contributor to our Board and to the Audit and Governance and Social Responsibility Committees of our Board.

| |||

|  |  |  |  |  |  |  |  |

| PUBLIC COMPANY C-SUITE | PRIVATE COMPANY C-SUITE | EXPLORATION & PRODUCTION | RELATED INDUSTRY EXPERIENCE | OTHER PUBLIC COMPANY BOARDS | FINANCIAL/ ACCOUNTING EXPERTISE | LEGAL | OPERATING/ STRATEGIC RESPONSIBILITY | HSE RESPONSIBILITY |

| COTERRA • 2022 PROXY STATEMENT | 10 |

Age: 72

Director

Committee Memberships: • Environment, Health & Safety; Audit

| ROBERT S. BOSWELL |  | |

BUSINESS EXPERIENCE: • Laramie Energy LLC - Chairman of the Board and Chief Executive Officer – 2007 to present • Laramie Energy I, LLC - Chairman of the Board and Chief Executive Officer – 2004 to 2007

| • Forest Oil Corporation - Chairman of the Board and Chief Executive Officer – 1989 to 2003

| ||

OTHER DIRECTORSHIPS: • Enerflex Ltd. - 2011 to present

| |||

KEY SKILLS, ATTRIBUTES AND QUALIFICATIONS: Mr. Boswell has management and operating experience as an executive in the upstream industry and brings an extensive technical understanding of the development of oil and gas reserves, as well as financial expertise to our Board. Mr. Boswell’s distinguished career includes serving as Chairman and Chief Executive Officer of exploration and production companies for over 30 years, including overseeing the turnaround of Forest Oil Corporation, a mid-sized public exploration and production company, and the sale of Laramie Energy I, a private company which he founded, for over $1 billion. Throughout his career, Mr. Boswell has successfully led a number of upstream companies through the life cycle of capital-raising: growing reserves, production and profitability through both acquisitions and development of existing properties, and sale or merger and acquisition transactions. His most recent success with private companies Laramie Energy I and his current venture, Laramie Energy LLC, operating in the Piceance Basin, has provided him with tremendous experience in unconventional resource plays, which is relevant to the Company’s operations in the Marcellus Shale. He also brings extensive financial expertise gained through both acting as Chief Financial Officer of public and private companies and supervising them as Chief Executive Officer. Mr. Boswell is currently serving as a director of Enerflex Ltd., a Canadian public company that manufactures and sells natural gas transmission and process equipment worldwide. Mr. Boswell’s management, technical and financial expertise are a tremendous asset to our Board and the committees on which he serves, and his operations experience is invaluable to his service on the Environment, Health & Safety Committee.

| |||

|  |  |  |  |  |  |  |  |

| PUBLIC COMPANY C-SUITE | PRIVATE COMPANY C-SUITE | EXPLORATION & PRODUCTION | RELATED INDUSTRY EXPERIENCE | OTHER PUBLIC COMPANY BOARDS | FINANCIAL/ ACCOUNTING EXPERTISE | LEGAL | OPERATING/ STRATEGIC RESPONSIBILITY | HSE RESPONSIBILITY |

| COTERRA • 2022 PROXY STATEMENT | 11 |

Age: 61

Director

Committee Memberships: • Compensation; Environment, Health & Safety

| AMANDA M. BROCK |  | |

BUSINESS EXPERIENCE: • Aris Water Solutions, Inc. - Chief Executive Officer – September 2021 to present - President and Chief Operating Officer – September 2020 to September 2021 - Chief Operating Officer – July 2018 to September 2020

| - Chief Commercial Officer – February 2018 to September 2020 • Water Standard - Chief Executive Officer – 2009 to 2017

| ||

OTHER DIRECTORSHIPS: • Aris Water Solutions, Inc. – September 2021 to present • Macquarie Infrastructure Corporation – August 2018 to present

| |||

KEY SKILLS, ATTRIBUTES AND QUALIFICATIONS: Ms. Brock was appointed in August 2017, adding to our Board her diverse experience and background, which she gained from her distinguished career building and managing global infrastructure businesses in the oil and gas, water and power industries. Ms. Brock is currently Chief Executive Officer of Aris Water Solutions, Inc., a publicly traded growth-oriented environmental infrastructure and solutions company that owns, operates and designs crucial water midstream assets across key unconventional U.S. basins. Ms. Brock joined Aris Water (formerly Solaris Midstream) in 2017 as the Senior Commercial Advisor and assumed the President and Chief Operating Officer positions in September 2020 and July 2018, respectively. Ms. Brock also served as Chief Commercial Officer of Solaris Midstream from February 2018 to September 2020. Prior to that, Ms. Brock served as Chief Executive Officer of Water Standard, a water treatment company focused on water-based enhanced oil recovery, recycling and reuse of water and produced water treatment from 2009. Prior to her appointment at Water Standard, Ms. Brock served as Executive Director and President, Americas, of Azurix, a global water treatment and services company and subsidiary of Enron Corp., from 1999 to 2002, and for Enron Corp. in various other capacities from 1991, including President of a division responsible for the management of power plants, related assets and joint ventures worldwide. Her expertise and depth of knowledge in the water management aspects of the oil and gas industry, as well as her global perspective, executive management and financial expertise, were considered by our Board as key attributes leading to her appointment. Ms. Brock has received numerous professional awards throughout her career, including being named one of the 25 most influential women in Energy by Hart Energy’s Oil and Gas Investor Magazine in 2020, being named one of the top 25 people globally in water and wastewater in 2016 by Water and Wastewater International, being named as a Houston Business Journal honoree for Women in Energy in 2016, and being inducted into the 2017 Greater Houston Women’s Hall of Fame. Ms. Brock also serves as Chair of the Texas Business Hall of Fame. Ms. Brock obtained her law degree from Louisiana State University, where she was a member of the Law Review, after completing her undergraduate studies in South Africa.

| |||

|  |  |  |  |  |  |  |  |

| PUBLIC COMPANY C-SUITE | PRIVATE COMPANY C-SUITE | EXPLORATION & PRODUCTION | RELATED INDUSTRY EXPERIENCE | OTHER PUBLIC COMPANY BOARDS | FINANCIAL/ ACCOUNTING EXPERTISE | LEGAL | OPERATING/ STRATEGIC RESPONSIBILITY | HSE RESPONSIBILITY |

| COTERRA • 2022 PROXY STATEMENT | 12 |

Age: 68

Director

Committee Memberships: • Executive

Position: • Executive Chairman | DAN O. DINGES |  | |

| |||

BUSINESS EXPERIENCE: • Cabot Oil & Gas Corporation - Executive Chairman – October 2021 to present - Chairman, President and Chief Executive Officer – May 2002 to September 2021 OTHER DIRECTORSHIPS: • United States Steel Corporation – 2010 to 2021

KEY SKILLS, ATTRIBUTES AND QUALIFICATIONS:

Mr. Dinges served as our Chief Executive Officer for the last 20 years until the completion of the merger with Cimarex Energy Co. on October 1, 2021, and brings to the Board over 37 years of executive management experience in the oil and gas exploration and production business, a deep knowledge of our business, operations, culture and long-term strategy and goals. Mr. Dinges joined the Company in September 2001, after a successful 20-year career in various management positions with the predecessor to Noble Energy, Inc., and oversaw an era of tremendous growth for the Company. His steadfast leadership as Executive Chairman of the Board provides the Board with extensive institutional knowledge and continuity, as well creating a vital link between management and the Board. Mr. Dinges also possesses a diversity of corporate governance experience gained from service on the Board of United States Steel Corporation and several charitable and industry organizations, including American Petroleum Institute since 2017, American Exploration Production Council since 2002, Spitzer Industries, Inc. (private company) since 2006, and Houston Methodist Hospital Research Institute from 2014 to January 2020.

| |||

Age: 67

Director

Committee Memberships: • Compensation (Chair); Governance and Social Responsibility

| PAUL N. ECKLEY |  | |

| |||

BUSINESS EXPERIENCE: • State Farm - Senior Vice President – 1998 to 2020 - Vice President, Common Stocks – 1995 to 1998 - Investment Officer – 1990 to 1995 - Investment Analyst – 1977 to 1990 OTHER DIRECTORSHIPS: • None

KEY SKILLS, ATTRIBUTES AND QUALIFICATIONS: Mr. Eckley was appointed in October 2021 in connection with the consummation of the Merger. Mr. Eckley has a wealth of experience in investments in public and private companies, including companies in the oil and gas industry, and extensive leadership roles that are key attributes that make him well qualified to serve our Board. He has had a distinguished career of over 43 years and has served in various capacities and most recently served as Senior Vice President – Investments at State Farm® Corporate Headquarters in Bloomington, Illinois until his retirement in 2020. With this experience, Mr. Eckley brings considerable value in his service as Chair of the Compensation Committee. Mr. Eckley also has previously served as Director of the Emerging Markets Growth Fund owned by the Capital Group, which included serving as Chairman of the Board.

| |||

|  |  |  |  |  |  |  |  |

| PUBLIC COMPANY C-SUITE | PRIVATE COMPANY C-SUITE | EXPLORATION & PRODUCTION | RELATED INDUSTRY EXPERIENCE | OTHER PUBLIC COMPANY BOARDS | FINANCIAL/ ACCOUNTING EXPERTISE | LEGAL | OPERATING/ STRATEGIC RESPONSIBILITY | HSE RESPONSIBILITY |

| COTERRA • 2022 PROXY STATEMENT | 13 |

Age: 63

Director

Committee Memberships: • Compensation; Environment, Health and Safety | HANS HELMERICH |  | |

| |||

BUSINESS EXPERIENCE: • Helmerich & Payne, Inc. - Chief Executive Officer – 1989 to 2014 - President – 1989 to 2012 OTHER DIRECTORSHIPS: • Helmerich & Payne, Inc. - 1987 to present • Atwood Oceanics, Inc. - 1989 to 2017

KEY SKILLS, ATTRIBUTES AND QUALIFICATIONS: Mr. Helmerich was appointed in October 2021 in connection with the consummation of the Merger. Mr. Helmerich currently serves as Chairman of Helmerich & Payne, Inc. (“H&P”), a publicly held company primarily engaged in contract drilling services for oil and gas exploration and production companies. H&P uses drilling rigs it designs and builds and is one of the major land and offshore platform drilling companies in the world. Mr. Helmerich has had an extensive career with H&P, which includes serving as Chief Executive Officer and as President. Mr. Helmerich’s background with the drilling sector of the oil and gas business provides the Board with insight into an aspect of Company’s business that represents a significant expenditure in the Company’s capital budget. His over 25 years of executive experience provide a strong background for his service on the Board and on the Compensation Committee. In addition, his service as a Director and Chairman of H&P, and his former service as a Trustee of The Northwestern Mutual Life Insurance Company and Director of Atwood Oceanics, Inc. provides him with additional experience and knowledge invaluable to his service on the Board.

| |||

Age: 65

Director

Committee Memberships: • Executive Position: • Chief Executive Officer and President | THOMAS E. JORDEN |  | |

| |||

BUSINESS EXPERIENCE: • Cimarex Energy Co. - Chief Executive Officer – 2011 to 2021 - Executive Vice President—Exploration – 2003 to 2011 - Vice President—Exploration – 2002 to 2003 OTHER DIRECTORSHIPS: • None

KEY SKILLS, ATTRIBUTES AND QUALIFICATIONS: Mr. Jorden was appointed in October 2021 in connection with the consummation of the Merger. Mr. Jorden is the Chief Executive Officer and President of Coterra, following his tenure at Cimarex. At Cimarex, he began serving as Executive Vice President of Exploration when the company was formed in 2002. In 2011, he became Chief Executive Officer and President of Cimarex and then Chairman of the Board in 2012. Prior to the formation of Cimarex, Mr. Jorden held multiple leadership roles at Key Production Company, Inc. (“Key”), Cimarex’s predecessor. He joined Key in 1993 as Chief Geophysicist and went on to become Executive Vice President of Exploration. Before joining Key, Mr. Jorden was with Union Pacific Resources and Superior Oil Company.

| |||

|  |  |  |  |  |  |  |  |

| PUBLIC COMPANY C-SUITE | PRIVATE COMPANY C-SUITE | EXPLORATION & PRODUCTION | RELATED INDUSTRY EXPERIENCE | OTHER PUBLIC COMPANY BOARDS | FINANCIAL/ ACCOUNTING EXPERTISE | LEGAL | OPERATING/ STRATEGIC RESPONSIBILITY | HSE RESPONSIBILITY |

| COTERRA • 2022 PROXY STATEMENT | 14 |

Age: 64

Director

Committee Memberships: • Executive; Audit; Environment, Health & Safety

Position: • Lead Director

| LISA A. STEWART |  | |

BUSINESS EXPERIENCE: • Sheridan Production Partners - Executive Chairman – 2006 to present - President and Chief Executive Officer – 2016 to 2020 - Chief Investment Officer – 2006 to 2020 • El Paso Corporation - Executive Vice President – 2004 to 2006

| • El Paso E&P - President – 2004 to 2006 • Apache Corporation - Executive Vice President and various capacities – 1984 to 2004

| ||

OTHER DIRECTORSHIPS: • Western Midstream Partners, LP - 2020 to present • Jadestone Energy - 2019 to present

| • Talisman Energy, Inc. - 2009 to 2015 | ||

KEY SKILLS, ATTRIBUTES AND QUALIFICATIONS: Ms. Stewart was appointed in October 2021 in connection with the consummation of the Merger. Ms. Stewart has nearly 40 years of experience in the oil and gas industry, including in reservoir engineering, business development, land and environmental, health and safety (EH&S), and extensive leadership roles. Ms. Stewart is the current Executive Chairman of Sheridan Production Partners, a privately-owned oil and gas operating company she founded in 2006. From its founding in until 2020, Ms. Stewart served as Chairman and Chief Investment Officer and for 14 years served as President and Chief Executive Officer. Prior to 2006, Ms. Stewart served as Executive Vice President of El Paso Corporation and President of El Paso E&P and in various capacities of Apache Corporation, including most recently as Executive Vice President, with responsibilities in Apache Corporation’s reservoir engineering, business development, land, EH&S, and corporate purchasing departments. Ms. Stewart currently serves on the Board of Directors of the general partner of Western Midstream Partners, LP, a publicly traded master limited partnership formed to acquire, own, develop and operate midstream energy assets. Ms. Stewart also serves as a Director of Jadestone Energy, an upstream oil and gas company in the Asia Pacific region, which focuses on production and near-term development assets. Jadestone Energy is headquartered in Singapore and is publicly traded on the Alternative Investment Market, a sub-market of the London Stock Exchange. Previously, Ms. Stewart served as a Director on the Board of Talisman Energy, Inc., a Canadian oil and gas exploration and production company traded publicly on the NYSE and the Toronto Stock Exchange until its acquisition in 2015. In 2021, Ms. Stewart received the National Association of Corporate Directors Director Certification, which is the premier director designation available in the United States. This vast array of leadership, roles and duties in the E&P and midstream segments of the oil and gas industry provide instrumental knowledge to our Board and a valuable contributor and member of the Executive and Audit Committees and Chair of the Environment, Health & Safety Committee.

| |||

|  |  |  |  |  |  |  |  |

| PUBLIC COMPANY C-SUITE | PRIVATE COMPANY C-SUITE | EXPLORATION & PRODUCTION | RELATED INDUSTRY EXPERIENCE | OTHER PUBLIC COMPANY BOARDS | FINANCIAL/ ACCOUNTING EXPERTISE | LEGAL | OPERATING/ STRATEGIC RESPONSIBILITY | HSE RESPONSIBILITY |

| COTERRA • 2022 PROXY STATEMENT | 15 |

Age: 57

Director

Committee Memberships: • Audit; Governance and Social Responsibility (Co-Chair) | FRANCES M. VALLEJO |  | |

| |||

BUSINESS EXPERIENCE: • ConocoPhillips - Vice President Corporate Planning and Development – 2015 to 2016 - Vice President and Treasurer – 2008 to 2015 - General Manager-Corporate Planning and Budgets, and other various positions – 1987 to 2008 OTHER DIRECTORSHIPS: • Crestwood Equity Partners LP - 2021 to present

KEY SKILLS, ATTRIBUTES AND QUALIFICATIONS: Ms. Vallejo was appointed in October 2021 in connection with the consummation of the Merger. Ms. Vallejo’s over 30 years of experience in the oil and gas industry and extensive leadership roles in corporate planning, budgeting, and treasury are key attributes that make her well qualified to serve our Board. Ms. Vallejo is a former executive officer of ConocoPhillips, an independent exploration and production company. Beginning in 1987, Ms. Vallejo held various positions with both ConocoPhillips and Phillips Petroleum Company, which merged with Conoco Inc. to form ConocoPhillips in 2002. She served as Vice President Corporate Planning and Development from 2015 until 2016 and as Vice President and Treasurer from 2008 until 2015. Prior to 2008, she served as General Manager—Corporate Planning and Budgets, Vice President Upstream Planning & Portfolio Management, Assistant Treasurer, Manager Strategic Transactions, and in other geophysical, commercial, and finance roles. Since 2021, Ms. Vallejo has served as a director of the general partner of Crestwood Equity Partners LP, a publicly traded master limited partnership that owns and operates oil and gas midstream assets located primarily in the Bakken Shale, Delaware Basin, Powder River Basin, Marcellus Shale and Barnett Shale. In 2021, Ms. Vallejo received the National Association of Corporate Directors Director Certification, which is the premier director designation available in the United States. She also serves on the Executive Committee (fiduciary body) of the Colorado School of Mines Foundation. Ms. Vallejo formerly served until 2016 as a member of the Board of Trustees of Colorado School of Mines and she currently serves or has served on boards of other charitable associations. This vast array of leadership, roles and duties in the E&P and midstream segments of the oil and gas industry offers considerable value to the Board and her service as Co-Chair of the Governance and Social Responsibility Committee and a member of the Audit Committee.

| |||

Age: 64

Director

Committee Memberships: • Governance and Social Responsibility (Co-Chair); Compensation | MARCUS A. WATTS |  | |

| |||

BUSINESS EXPERIENCE: • The Friedkin Group - President – 2011 to present • Locke Lord LLP – 1984 to 2010 - Managing Partner, Houston - Vice-Chairman (Executive Committee) OTHER DIRECTORSHIPS: • Service Corporation International - 2012 to present

KEY SKILLS, ATTRIBUTES AND QUALIFICATIONS: Mr. Watts joined our Board in August 2017, adding a wealth of legal, transactional and management expertise from both the oil and gas industry and other industries to our Board. Mr. Watts has served as President of The Friedkin Group, an umbrella company overseeing various business interests that are principally automotive-related, since 2011, after over 26 years of legal experience with the international law firm of Locke Lord LLP. In his prior experience with Locke Lord LLP, Mr. Watts focused on corporate and securities law, governance and related matters and served as the Managing Partner of the Houston, Texas office and Vice-Chairman of the firm-wide Executive Committee. Mr. Watts’ combination of legal and management talent is unique on our Board and he offers a fresh perspective from an industry other than our own, as well as years of experience representing oil and gas companies in his private law practice. This industry experience, as well as his legal and regulatory background, is particularly valuable to our Governance and Social Responsibility Committee of the Board, which he Co-Chairs. Mr. Watts served as a director of Complete Production Services until its merger with Superior Energy Services in 2012 and currently serves on the Board of Directors of Service Corporation International. He has also served on the boards of the Federal Reserve Bank of Dallas-Houston Branch since 2014 and the Greater Houston Partnership since 2012, and is the former Chairman of both organizations. Mr. Watts holds a law degree from Harvard Law School and a B.S. degree in Mechanical Engineering from Texas A&M University.

| |||

|  |  |  |  |  |  |  |  |

| PUBLIC COMPANY C-SUITE | PRIVATE COMPANY C-SUITE | EXPLORATION & PRODUCTION | RELATED INDUSTRY EXPERIENCE | OTHER PUBLIC COMPANY BOARDS | FINANCIAL/ ACCOUNTING EXPERTISE | LEGAL | OPERATING/ STRATEGIC RESPONSIBILITY | HSE RESPONSIBILITY |

| COTERRA • 2022 PROXY STATEMENT | 16 |

SECURITY OWNERSHIP | ||

The following table reports beneficial ownership of the Company’s common stock (“Common Stock”) by holders of more than five percent of the Company’s Common Stock as of the dates reported by such holders. Unless otherwise noted, all ownership information is based upon filings made by such persons with the Securities and Exchange Commission (“SEC”).

| Name and Address of Beneficial Owner | Number of Shares of Common Stock Owned | Percent of Class | ||||||

| The Vanguard Group | 97,354,545 | (1) | 11.97 | % | ||||

| Capital World Investors | 74,260,277 | (2) | 9.10 | % | ||||

| BlackRock, Inc. | 67,851,412 | (3) | 8.30 | % | ||||

| State Street Corporation | 54,572,539 | (4) | 6.71 | % | ||||

| Aristotle Capital Management, LLC | 43,367,076 | (5) | 5.33 | % | ||||

| (1) | According to Amendment No. 12 to Schedule 13G, dated February 9, 2022, filed with the SEC by The Vanguard Group (100 Vanguard Blvd., Malvern, PA 19355), it has shared voting power over 1,260,285 of these shares, sole dispositive power over 94,121,086 of these shares and shared dispositive power over 3,233,459 of these shares. |

| (2) | According to Amendment No. 2 to Schedule 13G, dated February 14, 2022, filed with the SEC by Capital World Investors (333 South Hope Street, 55th Floor, Los Angeles, CA 90071), it has sole voting power over all 74,260,277 shares and sole dispositive power over all 74,260,277 shares. |

| (3) | According to Amendment No. 12 to Schedule 13G, dated February 1, 2022, filed with the SEC by BlackRock, Inc. (55 East 52nd Street, New York, NY 10055), it has sole voting power over 60,399,526 of these shares and sole dispositive power over all 67,851,412 shares. |

| (4) | According to Schedule 13G, dated February 10, 2022, filed with the SEC by State Street Corporation (State Street Financial Center, One Lincoln Street, Boston, MA 02111), it has shared voting power over 51,624,983 and shared dispositive power over 54,566,359 of these shares. |

| (5) | According to Amendment No. 4 to Schedule 13G, dated February 14, 2022, filed with the SEC by Aristotle Capital Management, LLC (11100 Santa Monica Blvd., Suite 1700, Los Angeles, CA 90025), it has sole voting power over 38,893,012 of these shares and sole dispositive power over all 43,367,076 shares. |

| COTERRA • 2022 PROXY STATEMENT | 17 |

The following table reports, as of January 28, 2022, beneficial ownership of Common Stock by each director and nominee for director, by each named executive officer listed in the “Summary Compensation Table” below and by all directors, nominees and executive officers as a group. Unless otherwise indicated, the persons below have sole voting and investment power with respect to the shares of Common Stock showed as beneficially owned by them.

| Name of Beneficial Owner | Number of Shares of Common Stock Owned | Percent of Class | ||||||

| Dorothy M. Ables | 75,732 | (1)(2) | * | |||||

| Robert S. Boswell | 86,478 | (2) | * | |||||

| Amanda M. Brock | 49,344 | (2) | * | |||||

| Paul N. Eckley | 55,084 | * | ||||||

| Hans Helmerich | 1,900,196 | (3) | * | |||||

| Lisa A. Stewart | 87,735 | (4) | * | |||||

| Frances M. Vallejo | 55,084 | * | ||||||

| Marcus A. Watts | 49,344 | (2) | * | |||||

| Dan O. Dinges | 5,180,046 | (5) | * | |||||

| Thomas E. Jorden | 1,172,111 | (6)(7) | * | |||||

| Scott C. Schroeder | 1,972,967 | * | ||||||

| Stephen P. Bell | 336,327 | * | ||||||

| Phillip L. Stalnaker | 425,439 | (7) | * | |||||

| Steven W. Lindeman | 309,327 | (7) | * | |||||

| Jeffrey W. Hutton | 389,149 | (7) | * | |||||

| All Directors, nominees and executive officers as a group (20 individuals) | 12,837,586 | (1)(2)(3)(4)(5)(6)(7) | 1.6 | %(8) | ||||

| * | Represents less than 1% of the outstanding Common Stock. |

| (1) | Includes 5,000 shares held by an immediate family member, with respect to which Ms. Ables has shared voting and investment power. |

| (2) | Includes the following restricted stock units held as of January 28, 2022, as to which the restrictions lapse upon the holders’ retirement from the Board of Directors: Ms. Ables, 70,732; Mr. Boswell, 81,478; Ms. Brock 49,344; and Mr. Watts, 49,344 and all directors, nominees and executive officers as a group, 250,898. No executive officers hold restricted stock units. |

| (3) | Includes 45,968 shares owned by Mr. Helmerich’s wife. Mr. Helmerich disclaims beneficial ownership of the shares held by his wife. Also includes 230,756 shares owned by 1993 Hans Helmerich Trust, of which Mr. Helmerich is the trustee, 44,410 shares owned by Helmerich Grandchildren LLC, of which Mr. Helmerich is the co-manager, 31,575 shares owned by Family Trust, of which Mr. Helmerich is the trustee, 147,396 shares owned by The Helmerich Trust, of which Mr. Helmerich is the co-trustee, 1,304,745 shares held by the Peggy Helmerich QTIP Trust, of which Mr. Helmerich is the trustee, and 40,146 shares held by Saddleridge, LLC, of which Mr. Helmerich owns 99% and his wife owns 1%. |

| (4) | Includes 5,700 shares held in an individual retirement account, with respect to which Ms. Stewart has sole voting and investment power. |

| (5) | Includes 1,261,330 shares held in trust for the benefit of an immediate family member, with respect to which Mr. Dinges has shared voting and investment power. |

| (6) | Includes 1,115,552 shares held in trust for the benefit of an immediate family member, with respect to which Mr. Jorden has shared voting and investment power. |

| (7) | Includes the following shares held in the Company’s Savings Investment Plan as of December 31, 2021, as to which the reporting person shares voting power with the trustee of the plan: Mr. Jorden, 56,559; Mr. Lindeman, 25,482; Mr. Stalnaker, 17,537; Mr. Hutton, 7,211; and all directors, nominees and executive officers as a group, 111,206. |

| (8) | There were 810,658,027 shares outstanding on January 28, 2022. |

Our legal staff is primarily responsible for developing and implementing processes and controls to obtain information regarding our directors, executive officers, and significant stockholders with respect to related party transactions and then determining, based on the facts and circumstances, whether we or a related party has a director indirect interest in these transactions. On a periodic basis, the legal team reviews all transactions involving payments between the Company and any company that has a Coterra executive officer or director as an officer or director. In addition, our directors and executive officers are required to notify us of any potential related party transactions and provide us with the information regarding such transactions.

Our GSR Committee reviews our disclosure of related-party transactions in connection with its annual review of director independence. These procedures are not in writing but are documented through the meeting agendas and minutes of our GSR Committee, in each case with the assistance of our legal staff.

| COTERRA • 2022 PROXY STATEMENT | 18 |

Several of our Board members serve as directors or executive officers of other organizations, including organizations with which the Company has commercial relationships. The Company does not believe that any director had a direct or indirect material interest in any such relationships during 2021 and through the date of this Proxy Statement.

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers and directors to file initial reports of ownership and reports of changes in ownership of Company Common Stock with the SEC and, pursuant to rules promulgated under Section 16(a), such individuals are required to furnish the Company with copies of Section 16(a) reports they file. Based solely on a review of the copies of such reports furnished to the Company, and written representations that those reports accurately reflect all reportable transactions and holdings, all reports required by Section 16(a) were timely filed in 2021, except that a Form 3 and a Form 4 for each of Kevin Smith and Michael DeShazer were filed late due to administrative delays.

CORPORATE GOVERNANCE MATTERS | ||

Our Board of Directors has adopted Governance Guidelines to assist the Board and its committees in performing their duties to oversee the governance of the Company. Our Governance Guidelines outline the functions and responsibilities of the Board, director qualifications, and various processes and procedures designed to ensure effective and responsive governance. The guidelines are reviewed annually and revised as appropriate to reflect changing regulatory requirements and best practices. All of our key corporate governance documents, including the Governance Guidelines, the charters of our Board committees, and our Code of Business Conduct, can be found on the Company’s website at www.coterra.com, under the “Corporate Governance” section of “Investors.” Our commitment to the environment and the communities in which we operate can be found on our website under “A Sustainable Future”.

Nomination Process

Under its charter, the Governance and Social Responsibility (“GSR”) Committee seeks out and evaluates qualified candidates to serve as Board members as necessary to fill vacancies or the additional needs of the Board, and considers candidates recommended by shareholders and management of the Company. The GSR Committee identifies nominees through a number of methods, which may include retention of professional executive search firms, use of publicly available director databases or referral services and recommendations made by incumbent directors. A resume is reviewed and, if merited, an interview follows. Any shareholder desiring to propose a nominee to the Board of Directors should submit such proposed nominee for consideration by the GSR Committee, including the proposed nominee’s qualifications, to: Corporate Secretary, Coterra Energy Inc., 840 Gessner Road, Suite 1400, Houston, Texas 77024. Shareholders who meet certain requirements specified in our bylaws may also nominate candidates for inclusion in our proxy materials for an annual meeting as described in “General Information.” There are no differences in the manner in which the GSR Committee evaluates nominees for director based on whether the nominee is recommended by a shareholder or the incumbent directors.

Board Composition Following the Merger

Pursuant to the Merger Agreement, upon the closing of the Merger on October 1, 2021, the Board consisted of five members selected by Cabot and five members selected by Cimarex. As a result, Mr. Best, Mr. Delaney and Mr. Ralls resigned from the Board and Mr. Eckley, Mr. Jorden, Mr. Helmerich, Ms. Stewart and Ms. Vallejo, who were selected by Cimarex in accordance with the Merger Agreement, were appointed to the Board.

| COTERRA • 2022 PROXY STATEMENT | 19 |

Skills and Qualifications

Whether nominated by a shareholder or through the activities of the Committee, the GSR Committee seeks to select candidates who have personal and professional integrity, who have demonstrated exceptional ability and judgment and who will be most effective, in conjunction with the other nominees and Board members, in collectively serving the long-term interests of the Company and its shareholders. The GSR Committee’s assessment of candidates will include, but not be limited to, considerations of character, judgment, diversity, age, expertise, industry experience, independence, other board commitments and the ability and willingness to devote the time and effort necessary to be an effective board member. The GSR Committee has adopted minimum criteria for Board membership that include (i) a strong commitment to his/her fiduciary responsibilities to the Company’s shareholders, with no actual or perceived conflict of interest that would interfere with his/her responsibilities to or relationships with the Company’s shareholders, employees, suppliers, and customers; (ii) the ability to think strategically and the insight to assist management in placing the Company in a competitive position within the industry; (iii) a record of achievement, and a position of leadership in his/her field, with the interest and intellect to be able to address energy industry challenges and opportunities; and (iv) the time to attend Board meetings and the commitment to devote any reasonable required additional time to deal with Company business.

The Board of Directors encourages a diversity of backgrounds, including with respect to race, gender and ethnic background, among its members. In February 2021, the Board formalized its commitment to diversity among its members by amending the GSR Committee charter to add a commitment to include qualified racially/ethnically and gender diverse candidates in the initial candidate list for all director searches. In this way, the Board has ensured that the nomination process will include diverse candidates for consideration each time it seeks to nominate a new director.

The Board considers candidates with significant direct or indirect energy industry experience that will provide the Board as a whole the talents, skills, diversity and expertise to serve the long-term interests of the Company and its shareholders. Specifically, the following are the key skills and qualifications considered in evaluating the director nominees and the Board composition as a whole:

| DIRECTOR SKILLS | ||||||||||||||||||

|  |  |  |  |  |  |  |  | ||||||||||

| Public Company C-Suite | Private Company C-Suite | Exploration & Production | Related Industry Experience | Other Public Company Boards | Financial/ Accounting Expertise | Legal | Operating/ Strategic Responsibility | HSE Responsibility | ||||||||||

| Ables |  |  |  |  |  | |||||||||||||

| Boswell |  |  |  |  |  |  |  | |||||||||||

| Brock |  |  |  |  |  |  |  | |||||||||||

| Dinges |  |  |  |  | ||||||||||||||

| Eckley |  |  |  |  | ||||||||||||||

| Helmerich |  |  |  |  |  |  |  | |||||||||||

| Jorden |  |  |  |  |  | |||||||||||||

| Stewart |  |  |  |  |  |  |  |  | ||||||||||

| Vallejo |  |  |  |  | ||||||||||||||

| Watts |  |  |  |  | ||||||||||||||

| COTERRA • 2022 PROXY STATEMENT | 20 |

Director Independence

The Company’s Corporate Governance Guidelines require that at least a majority of the Company’s directors be independent under the New York Stock Exchange (“NYSE”) listing standards and all other applicable legal requirements. Additionally, all members of the Audit Committee, Compensation Committee and Governance and Social Responsibility Committee are required to be independent. The NYSE listing standards include objective tests that can disqualify a director from being treated as independent, as well as a subjective element, under which the Board must affirmatively determine that each independent director has no material relationship with the Company or management. In making its independence determinations, the Board considered all material relationships with each director, and all transactions since the start of 2019 between the Company and each director nominee, members of their immediate families or entities associated with them.

The Board of Directors has determined that each director, with the exception of Mr. Dinges, the Executive Chairman, and Mr. Jorden, the Chief Executive Officer and President (“CEO”), is independent. In making its determination that each nonemployee director is independent, the Board reviewed and discussed additional information provided by the directors and the Company with regard to each director’s business and personal activities as they may relate to the Company and the Company’s management. The Board considered the transactions in the context of the NYSE’s objective listing standards, the additional standards established for members of audit committees, and the SEC, U.S. Internal Revenue Service and NYSE standards for compensation committee members. Some members of the Company’s Board also serve as directors of other entities with which the Company does business. Each of these relationships is reviewed by the Board, which examines the amount of business done by the Company and the other entities and the gross revenue for each of the other entities. This review is for each of the last three fiscal years for which financial data is available.

This review applied to Ms. Ables, Ms. Brock, Mr. Helmerich, and Mr. Boswell due to their service on boards of directors or as officers of companies with which we have done business in the last three years. When evaluating the independence of Ms. Ables and Mr. Helmerich, the Board considered that each director served as a director, and not an officer, of the other companies involved in the transactions.

When determining the independence of Ms. Brock, the Board considered that Ms. Brock is the Chief Executive Officer of Aris Water, a publicly-traded growth-oriented environmental infrastructure and solutions company that owns, operates and designs crucial water midstream assets across key unconventional U.S. basins, including the Permian Basin. Cimarex’s payments to Aris Water represented 1.1% of Aris Water’s consolidated gross revenues for 2021. The Board reviewed these transactions and concluded: (i) the transactions are proper and not material when compared to both Cimarex’s total costs and Aris Water’s gross revenues; (ii) the transactions occurred in the ordinary course of business and at arms’ length; (iii) the produced water disposal agreement was entered into before Cabot and Cimarex entered into the Merger Agreement and, as a result, was not reviewed or approved by the Board; and (v) Ms. Brock’s relationship with Aris Water does not interfere with her independent judgment as a director of Coterra.

Mr. Boswell is the Chairman of the Board and Chief Executive Officer of Laramie Energy, LLC (“Laramie”). On January 11, 2022, Cimarex entered into a sub-lease of a portion of its office space in Denver, Colorado with Laramie. This space is no longer needed by Cimarex as it integrates its management team with Coterra at Coterra’s headquarters in Houston, Texas. The sublease is for a term from March 1, 2022 through August 31, 2026, with rental payments to Cimarex of approximately $405,000 per year increasing to approximately $450,000 per year, payable monthly on a pro-rata basis. The Board reviewed this transaction with Laramie and concluded: (i) the transaction is proper and not material when compared to Coterra’s and Laramie’s consolidated gross revenues and anticipated revenues for the relevant periods; (ii) the transaction occurred in the ordinary course of business, at market rates and on arms’ length terms; (iii) the Board does not review or approve office leases or subleases; and (iv) Mr. Boswell’s relationships with Laramie does not interfere with his independent judgment as a director of Coterra.

In each case, the Board made a subjective determination that, because of the nature of the transactions, the director’s relationship with the other entity and/or the amount involved, no relationships exist that, in the opinion of the Board, would impair the director’s independence. Further, the Board of Directors has determined that all members of the Audit Committee, Compensation Committee and Governance and Social Responsibility Committee are independent.

Director Orientation and Continuing Education

Each new director appointed to fill a vacancy or elected at the annual meeting of stockholders undergoes an orientation program immediately upon joining the Board. The program adopted by the Company includes in-person meetings with the Chairman and the CEO and other key officers to discuss Company business and strategy, review of a comprehensive director handbook that encompasses all Board policies and procedures and corporate documents, access to the Board’s portal containing all past board meeting materials and a briefing by the Corporate Secretary as to the legal requirements and obligations of Board membership. New directors will typically attend Board committee meetings for committees on which they do not serve for a period of time to familiarize them with the areas of responsibility of each committee.

| COTERRA • 2022 PROXY STATEMENT | 21 |

All of our directors are encouraged to pursue continuing education opportunities for directors of public companies, generally, and the Company will reimburse directors for reasonable expenses incurred in connection with one such continuing education program each year. Ms. Stewart, our independent Lead Director and Chair of the Environmental, Health & Safety Committee, and Ms. Vallejo, Co-Chair of the GSR Committee, received the National Association of Corporate Directors Director Certification (“NACD.DC”) in 2021. NACD.DC is the premier director designation available in the United States and consists of three components: study and education, an exam and ongoing professional development in the field of corporate governance.

Director Succession

Our GSR Committee engages in regular director succession planning as part of its duty to oversee the composition and effectiveness of the Board and its committees. Regular succession planning allows the GSR Committee to nominate qualified candidates for annual stockholder elections and to fill vacancies created upon the planned or unplanned departure of sitting directors or upon increasing the size of the Board to meet additional needs of the Board. In its succession planning activities, the GSR Committee reviews annual Board and committee self-assessments, reviews a Board skills matrix of identified skills for each director and for the effective functioning of the Board, tracks director tenure and expected director departures and engages in various director recruitment activities. The Board does not have a mandatory retirement policy.

Executive Chairman

Mr. Dinges serves as the Executive Chairman of the Board of the Company. He served as Chairman, President and Chief Executive Officer until the merger of Coterra and Cimarex on October 1, 2021.

Mr. Jorden began serving as Chief Executive Officer and President of the Company effective on the closing of the merger with Cimarex on October 1, 2022. In accordance with the Merger Agreement, upon the expiration of Mr. Dinges’ term as Executive Chairman on December 31, 2022, the Board will determine the new Chairperson, who may be Mr. Dinges, or whether another Chairperson or combined Chairperson and CEO is appropriate.

Our Corporate Governance Guidelines contain strong checks and balances regarding the roles, or combined roles, of CEO and Chairperson. Those provisions include the requirement that only nonemployee directors serve on committees of the Board (other than the Executive Committee), and the requirement that a substantial majority of the directors be independent, as discussed above under “Director Independence.” All of our directors, other than Mr. Dinges and Mr. Jorden, are independent.

Independent Lead Director

The Chairman is joined in the leadership of the Board by our Lead Director, who ordinarily is nominated by the GSR Committee and elected by the nonemployee directors. Pursuant to the Merger Agreement, the Company agreed that, until the Company’s 2024 annual meeting of shareholders, the Board of Directors shall have a lead independent director who shall be (i) a continuing Cimarex director at any time when the Chairperson of the Board of Directors is a continuing Cabot director and (ii) a continuing Cabot director at times that the Chairperson of the Board is a continuing Cimarex director. Pursuant to this arrangement, Ms. Stewart has served as the Lead Director since the closing of the merger on October 1, 2021.

The Board of Directors held four regular and eleven special meetings during 2021. All directors attended at least 75% of the meetings of the Board of Directors and of the committees on which they served that were held during the period that the directors served.

The Company’s policy is that it expects all members of the Board of Directors to attend, virtually or in person, the Company’s annual meeting of shareholders. In 2021, all of the continuing members of the Board attended the annual meeting.

| COTERRA • 2022 PROXY STATEMENT | 22 |

Committee Membership

Information on each of the Board’s standing committees as of the date hereof is discussed below. The charters of Board committees can be found on the Company’s website at www.coterra.com, under the “Corporate Governance” section of “Investors.” The following is a summary of the composition of each of the standing committees before and after the completion of the Merger on October 1, 2021:

For the Period May 1, 2021 through September 30, 2021

| Committees | Independent? | 2021 Meetings | Dinges | Ables | Best | Boswell | Brock | Delaney | Ralls | Watts | ||||||||||

| Governance & Social Responsibility | Yes | 3 |  |  |  | |||||||||||||||

| Audit | Yes | 3 |  |  |  |  | ||||||||||||||

| Compensation | Yes | 4 |  |  |  |  | ||||||||||||||

| Environment, Health & Safety | Yes | 3 |  |  |  |  | ||||||||||||||

| Executive | No | 0 |  |  |  |

For the Period October 1, 2021 through December 31, 2021

| Committees | Independent? | 2021 Meetings | Dinges | Jorden | Ables | Boswell | Brock | Eckley | Helmerich | Stewart | Watts | Vallej | ||||||||||||

| Governance & Social Responsibility | Yes | 1 |  |  | - |  |  | |||||||||||||||||

| Audit | Yes | 1 |  |  |  |  | ||||||||||||||||||

| Compensation | Yes | 2 |  |  |  |  | ||||||||||||||||||

| Environment, Health & Safety | Yes | 1 |  |  |  |  | ||||||||||||||||||

| Executive | No | 0 |  |  |  |  |

| COMMITTEE CHAIR OR CO-CHAIR |

| MEMBER OF COMMITTEE |

Committee Responsibilities

Governance and Social Responsibility Committee

The function of the GSR Committee is to assist the Board in fulfilling its responsibility to the stockholders by:

| • | Overseeing, and assisting the Board with, the Company’s efforts for socially responsible operations, programs and initiatives not otherwise delegated to another committee of the Board and the reporting or public disclosure of such efforts by the Company; |

| • | Identifying qualified individuals to become Board members and assisting the Board in determining the composition of the Board and its committees; |

| • | Assessing Board and committee effectiveness; |

| • | Developing and implementing the Company’s corporate governance guidelines; and |

| • | Taking a leadership role in shaping the corporate governance of the Company. |

In accordance with its charter, the GSR Committee has adopted minimum criteria for Board membership, which are discussed in more detail at “Director Nominations and Qualifications” above.

Audit Committee

The function of the Audit Committee is to assist the Board in overseeing:

| • | The integrity of the financial statements of the Company; |

| • | The compliance by the Company with legal and regulatory requirements; |

| COTERRA • 2022 PROXY STATEMENT | 23 |

| • | The independence, qualifications, performance and compensation of the Company’s independent auditors; and |

| • | The performance of the Company’s internal audit function. |

The Audit Committee Charter provides that the Audit Committee shall pre-approve all audit, review or attest engagements and permissible non-audit services, including the fees and terms thereof, to be performed by the independent auditors, subject to, and in compliance with, the de minimis exception for non-audit services described in Section 10A(i)(1)(B) of the Securities Exchange Act of 1934 and the applicable rules and regulations of the SEC. The Audit Committee has delegated to each member of the Audit Committee authority to pre-approve permissible services to be performed by the independent auditors. Decisions of a member to pre-approve permissible services must be reported to the full Audit Committee at its next scheduled meeting.

Each member of the Audit Committee satisfies the financial literacy and independence requirements of the NYSE listing standards. The Board has determined that Ms. Ables meets the requirements of an “audit committee financial expert” as defined by the SEC.

Compensation Committee

The function of the Compensation Committee is to:

| • | Review and approve corporate goals and objectives relevant to the CEO’s compensation, evaluate the CEO’s performance in light of those goals and objectives, and determine, subject to ratification by the Board, the CEO’s compensation level based on this evaluation; |

| • | Provide counsel and oversight of the evaluation and compensation of management of the Company, including base salaries, incentive compensation and equity-based compensation; |

| • | Review and report to the Board on CEO and executive officer succession planning; |

| • | Discharge any duties imposed on the Compensation Committee by the Company’s incentive compensation and equity-based compensation plans, including making grants; |

| • | Evaluate the independence of, and retain or replace any compensation consultant engaged to assist in evaluating the compensation of the Company’s directors, CEO and other officers and to approve such consultant’s fees and other terms of retention; and |

| • | Review the annual compensation of the directors. |

Environment, Health & Safety Committee

The function of the Environment, Health & Safety (“EHS”) Committee is to assist the Board in providing risk oversight and support of the Company’s policies, programs and initiatives on the environment, health and safety. Among other things, the EHS Committee:

| • | Oversees the Company’s climate change and sustainability policies and programs and the reporting and public disclosure thereon; | |

| • | Monitors environmental matters and trends in such matters that affect the Company’s activities and performance; | |

| • | Reviews the Company’s compliance with environmental, health and safety laws and regulations, including: | |

| • | management and responses to environmental releases | |

| • | safety incidents, statistics and outcomes and the Company’s responses | |

| • | the Company’s assessment of and responses to pending legislative and regulatory efforts | |

| • | initiatives and training designed to improve EHS performance | |

| • | Consults with the Board and internal and external advisors regarding the management of the Company’s EHS programs; and | |

| • | Oversees and reviews all external disclosures regarding the Company’s EHS and sustainability data and programs. | |

The EHS Committee also reviews comparisons of our safety performance with established benchmarks, such as the Bureau of Labor Statistics (BLS), American Exploration and Production Council (AXPC) and the Independent Producers EHS Managers Forum. This allows the Board to assess safety performance on a continuous basis and provides the governance structure to ensure our programs are effective for providing a safe working environment for our employees.

Executive Committee

The function of the Executive Committee is to exercise all power and authority of the Board of Directors in the event action is needed between regularly scheduled Board meetings and a meeting of the full Board is deemed unnecessary, except as limited by the Company’s bylaws or applicable law. The Executive Committee did not meet during 2021.

| COTERRA • 2022 PROXY STATEMENT | 24 |

| Board of Directors | |

| • | Responsible for overall risk oversight |

| • | Regularly holds discussions regarding risks faced by the Company throughout the year |

| • | Hears a report from the Audit Committee Chair regarding the activities of the Committee at each regular Board meeting |

| • | Oversees environmental, social and governance risks, policies and practices by hearing reports from the Environment, Health & Safety Committee (which is devoted solely to health, safety and environmental oversight) and the Governance and Social Responsibility Committee at each regular quarterly meeting, and acts collectively as a Board to review risks in these areas |

| Audit Committee | Environment, Health & Safety Committee | Governance and Social Responsibility Committee | ||||