Exhibit 99.1

The following is certain information about The Reader’s Digest Association, Inc. (“RDA”) being made available to potential lenders in connection with the bank financing required by RDA Holdings Co. (formerly Doctor Acquisition Holding Co.) (“Holdings”) to complete the acquisition of RDA pursuant to the Agreement and Plan of Merger, dated as of November 16, 2006, by and among Holdings, Doctor Acquisition Co. and RDA.

* * * * *

Summary historical financial information

The following table sets forth certain historical financial results for RDA.

| | Fiscal year ended June 30, | | | |

| | 2004 | | 2005 | | 2006 | | LTM* 12/31/06 | |

Total operating profit (loss) | | $ | 112 | | $ | (34 | ) | $ | (45 | ) | $ | 121 | |

Add back adjustments1 | | 36 | | 192 | | 207 | | 38 | |

Adjusted operating profit (loss) | | $ | 148 | | $ | 158 | | $ | 162 | | $ | 160 | |

Depreciation & amortization | | 63 | | 57 | | 37 | | 35 | |

Adjusted EBITDA | | 212 | | 215 | | 199 | | 195 | |

Stock-based compensation | | 10 | | 11 | | 14 | | 11 | |

Adjusted EBITDA (excluding stock based compensation) | | $ | 222 | | $ | 227 | | $ | 213 | | $ | 206 | |

Note: Amounts may not sum due to rounding.

* The twelve-month period ended December 31, 2006 (LTM) represents the sum of amounts set forth in the consolidated statement of operations for the fiscal year ended June 30, 2006 and the amounts set forth in the consolidated statement of operations for the six-month period ended December 31, 2006 less the amounts set forth in the consolidated statement of operations for the six-month period ended December 31, 2005.

1 Includes the following addback adjustments:

| | Fiscal year ended June 30, | | | |

| | 2004 | | 2005 | | 2006 | | LTM* 12/31/06 | |

| | | | | | | | | |

Previously deferred magazine promotion | | $ | 27.2 | | $ | 77.1 | | — | | — | |

Gain on asset sales | | (6.2 | ) | (14.1 | ) | (3.4 | ) | (0.1 | ) |

Goodwill charge | | — | | 129.0 | | 187.8 | | — | |

WFC chocolate contract charge | | — | | — | | 5.6 | | 5.6 | |

Books are Fun (BAF) charges | | — | | — | | 15.4 | | 19.6 | |

Restructuring charges (excluding BAF) | | 16.7 | | 3.6 | | 5.1 | | 5.1 | |

Loss on sale of American Woodworker | | — | | — | | — | | 6.2 | |

Merger-related stock based compensation | | — | | — | | — | | 2.0 | |

Retention grants | | — | | — | | — | | 0.6 | |

Reserve reversals and other | | (1.7 | ) | (3.6) | | (3.4 | ) | (0.8 | ) |

Total | | $ | 36.0 | | $ | 192.0 | | $ | 207.1 | | $ | 38.2 | |

| | | | | | | | | | | | | |

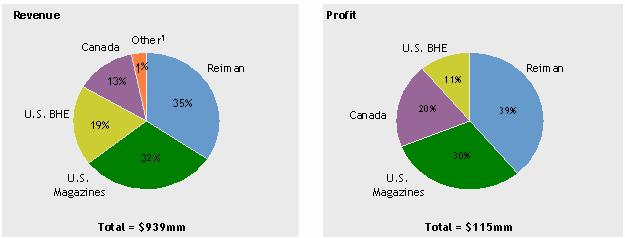

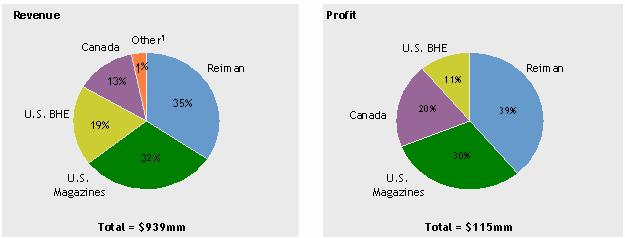

RDA’s geographic diversity (% of total 2006 revenue)

Source: Management.

Source: Management.

Note: June 30 fiscal year end.

1 Includes Every Day with Rachael Ray, Taste of Home Entertaining and Allrecipes.com.

2

Non-GAAP Financial Measures

RDA publicly reports its financial information in accordance with United States generally accepted accounting principles (GAAP). To facilitate internal managerial and external analysis of RDA’s operating performance, RDA also presents financial information that may be considered “non-GAAP financial measures” under Regulation G and related reporting requirements promulgated by the Securities and Exchange Commission. Non-GAAP financial measures should be evaluated in conjunction with, and are not a substitute for, GAAP financial measures. The following non-GAAP financial measures included in this Exhibit 99.1 are used by RDA in its internal analysis of the business.

Adjusted operating profit (loss) is defined as operating profit (loss) excluding sales of certain non-strategic assets, significant non-cash charges and certain non-recurring items. RDA considers Adjusted operating profit (loss) to be a profitability measure that facilitates forecasting of RDA’s operating results for future periods and allows for the comparison of RDA’s operating results to historical periods. A limitation of these measures is that they do not include all items that affect operating profit (loss) during the period and may not be comparable to other companies’ definitions of such measures. The table under the heading “Summary historical financial information” above presents a reconciliation of Total operating profit (loss) to Adjusted operating profit (loss).

In addition to using Adjusted operating profit (loss), RDA uses Adjusted operating profit (loss) before depreciation and amortization (“Adjusted EBITDA”), a non-GAAP financial measure, to evaluate the performance of its businesses. Adjusted EBITDA additionally adds back certain expenses that RDA believes are not representative of future performance. Adjusted EBITDA is used by management in evaluating RDA’s cash generating abilities. Adjusted EBITDA is used in addition to and in conjunction with results presented in accordance with GAAP.

A limitation of these measures is that they do not include all items that affect operating profit (loss) and EBITDA. RDA’s non-GAAP results may differ from similar measures used by other companies, even if similar terms are used to identify such measures. Adjusted EBITDA should be considered in addition to, and not as a substitute for, net income (loss) or other measures of financial performance reported in accordance with GAAP.

The table under the heading “Summary historical financial information” above presents a reconciliation of (i) Total operating profit (loss) to Adjusted operating profit (loss) and (ii) Adjusted operating profit (loss) to Adjusted EBITDA.

3