UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05984

The New Ireland Fund, Inc.

(Exact name of registrant as specified in charter)

One Boston Place

201 Washington St. 36th Floor

Boston, MA 02108

(Address of principal executive offices) (Zip code)

KBI Global Investors (North America) Ltd.

One Boston Place

201 Washington St. 36th Floor

Boston, MA 02108

(Name and address of agent for service)

1-800-468-6475

Registrant's telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: April 30, 2022

Item 1. Reports to Stockholders.

Semi-Annual Report

April 30, 2022

Letter to Shareholders

Dear Stockholder,

We are pleased to provide the Semi-Annual Report for The New Ireland Fund, Inc. (the “Fund”) for the six months ended April 30, 2022.

For the period, the Fund’s net asset value (“NAV”) decreased 21.4%, marginally underperforming the Fund’s benchmark, the MSCI All Ireland Capped Index (“MSCI”), which decreased 20.5%. The Fund’s market price decreased 16.4% over the same period.

Over the last six months global stock markets have been dogged with significant negatives such as the reality of higher-than-expected inflation and significantly more hawkish central banks, before reflecting on the tragic war in Ukraine. Despite all this negative news, global equity markets have generally been much more resilient than might have been expected so far during 2022. Towards the end of 2021, signs of a ‘regime change’ were beginning to become evident indicating a period of increasing short-term interest rates and an end to quantitative easing. This has certainly become a reality and has broadened to now also include a challenging new world order when it comes to the outlook for geopolitics, globalization and protectionism. In terms of currencies, they have also been a factor and for the twelve-month period ended April 30, 2022, with the US$ having strengthened by approximately 15% against the Euro, which has not benefitted US investors. The vast bulk of this has occurred in the last 6 months, with the US$ proving to be a safe haven in times of geopolitical uncertainty.

The relative performance of the Irish economy in 2021 was very strong, as it expanded by 13.5%, as measured by GDP, and consumer spending grew by almost 6%. The Central Bank of Ireland is forecasting a GDP growth rate of 4.8% in 2022, a marked slowdown relative to 2021 but still a very strong forecast. With the anticipation of a ‘regime change’ which should drive a different market environment over the coming years, at an aggregate level this should benefit many non-US markets with Ireland being specifically well placed. As outlined previously, the Fund was repositioned during 2021 to be underweight and less defensively positioned, having reduced the allocation of more expensive growth type stocks and re-invested towards cheaper more value-oriented and cyclical names, e.g. the Irish banks and homebuilders. This is consistent with our positive medium-term outlook for the economy and the stock market, as well as reflecting the more attractive fundamentals for such names. With this in mind, the Fund continues to be built in an active balanced way, focusing on the same themes as over the last year.

Our detailed comments regarding the Irish economy, market and Fund performance follows in our Management Discussion and Analysis. Please do not hesitate to let us know if you have questions or concerns. We would encourage you to visit our website at

www.newirelandfund.com for daily price information, fund documents as well as investment updates. We thank you for investing with us and we look forward to our continued relationship.

Sincerely,

|

|

David Dempsey

Chair of the Board

June 10, 2022 | Sean Hawkshaw

Director & President

June 10, 2022 |

1

Important Information Concerning Management’s Discussion of Fund Performance

Except as otherwise specifically stated, all information and investment team commentary, including portfolio security positions, is as of April 30, 2022. The views expressed in the Management Discussion and Analysis section (the “MD&A”) are those of the Fund’s portfolio manager and are subject to change without notice. They do not necessarily represent the views of KBI Global Investors (North America) Ltd. The MD&A contain some forward-looking statements providing current expectations or forecasts of future events; they do not necessarily relate to historical or current facts. There can be no guarantee that any forward-looking statement will be realized. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events, or otherwise. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The Fund may buy, sell, or hold any security discussed herein, on the basis of factors described herein or the basis of other factors or other considerations. Fund holdings will change.

Performance quoted represents past performance and does not guarantee or predict future results.

Management Discussion and Analysis (as of April 30, 2022)

Over the most recent fiscal quarter, the Fund’s net asset value (“NAV”) per share decreased by 16.4% in U.S. Dollar terms1 to $10.04 per share, as compared to the MSCI Ireland All Capped Index (“MSCI”) which decreased by 15.1% over the period. For the 6 months ended April 30, 2022, the Fund’s NAV returned -21.4%, marginally underperforming the comparable MSCI return of -20.5%.

Economic Growth

Growth was very strong in 2021, as measured by GDP, as the economy expanded by 13.5%. GDP is an imperfect measure of economic activity in Ireland however, and alternative measures of activity showed a slower rate of growth, though still strong. Consumer spending grew by almost 6%, for example. The Central Bank of Ireland is forecasting a GDP growth rate of 4.8% in 2022, so a marked slowdown relative to 2021 but still a very strong outcome if the forecast is correct. Consumer spending is expected to grow by 4%-6% in each of 2021, 2022 and 2023.

1 | All returns are in US dollars unless stated otherwise |

2

Coronavirus

Almost all Covid restrictions have been lifted for some time now in Ireland, allowing normal activity to resume in areas including retail, entertainment and travel. There still appears to be a “catch-up” happening in some sectors such as restaurants and overseas travel, as consumers have pent-up demand that is now coming through.

Russia/Ukraine Crisis

Ireland has very low levels of trade with either Russia or Ukraine and so the direct impact on economic activity in Ireland is negligible. However, the invasion of Ukraine has led to a surge in energy prices which has pushed up inflation and reduced incomes in real terms. This has led to modest reductions in forecasts of economic growth for the year, but, as outlined above, growth is nonetheless expected to be quite strong. It is possible that Ireland could face a shortage of natural gas next winter if Russian gas supplies are cut off, but that seems highly unlikely as currently Ireland does not source any gas directly from Russia, instead relying on domestic sources and on gas from the UK and Norway.

Politics

On the political front, Northern Ireland remains noteworthy on two fronts. Firstly, the ongoing ‘war of words’ between the UK government and EU negotiators surrounding the agreed Northern Ireland protocol and the UKs unhappiness with same. Separately, at the recent Northern Ireland Assembly elections there were some notable shifts in the state of the parties. Most notably a material loss of seats for the DUP party, a holding of position for the Nationalist Sinn Fein party and material gains for the more liberal and non-sectarian Alliance party.

Equity Market

To date, 2022 has been dogged with significant negatives such as the reality of higher-than-expected inflation, significantly more hawkish Central banks and before reflecting on the tragic war in the Ukraine. Despite all this negative news, global equity markets have generally been much more resilient than might have been expected so far during 2022.

Towards the end of 2021, signs of a ‘regime change’ were beginning to become evident indicating a period of increasing short-term interest rates and an end to quantitative easing. This has certainly become a reality and has broadened to now also include a challenging new world order when it comes to the outlook for geo-politics, globalization and protectionism.

3

The major market index moves over the last twelve months are highlighted below with the Irish market not performing as well as most of the other indices in relative terms, particularly the UK’s large cap FTSE100 or mid-cap FTSE250 indices against which many Irish companies compete.

In terms of currencies, they have also been a factor and for the twelve-month period ending April 30, 2022, with the US dollar having strengthened by approximately 15% against the Euro which has not benefitted US investors. The vast bulk of this has occurred in the most recent 6 months, with the US$ proving to be a safe haven in times of geopolitical uncertainty.

MARKET INDEX | 3 Months Perf | | 6 Months Perf | | 12 Months Perf |

Name | Local | USD $ | | Local | USD $ | | Local | USD $ |

IRELAND SE OVERALL (ISEQ) | -9.9% | -15.2% | | -13.4% | -21.0% | | -8.2% | -19.6% |

MSCI ALL IRELAND CAPPED $ | -9.8% | -15.1% | | -12.8% | -20.5% | | -6.1% | -17.7% |

S&P 500 COMPOSITE | -8.2% | -8.2% | | -9.6% | -9.6% | | 0.2% | 0.2% |

NASDAQ COMPOSITE | -13.2% | -13.2% | | -20.2% | -20.2% | | -11.1% | -11.1% |

FTSE 100 | 2.5% | -4.1% | | 6.2% | -2.7% | | 12.3% | 1.9% |

TOPIX | 1.4% | -9.9% | | -3.8% | -15.3% | | 2.4% | -13.6% |

EURO STOXX 50 | -8.2% | -13.6% | | -9.6% | -17.6% | | -1.8% | -14.0% |

DAX 30 PERFORMANCE | -8.9% | -14.2% | | -10.1% | -18.1% | | -6.9% | -18.4% |

FRANCE CAC 40 | -6.0% | -11.5% | | -3.4% | -11.9% | | 7.1% | -6.2% |

AEX INDEX (AEX) | -5.1% | -10.7% | | -11.4% | -19.2% | | 3.0% | -9.8% |

FTSE 250 | -4.8% | -11.0% | | -9.4% | -17.0% | | -5.9% | -14.7% |

Note-Indices are total gross return

* Source: Datastream

Major Fund stock capital moves over the 6 months to April 30, 2022 (in US dollar terms)

Strongest % move | | | Weakest % move | |

Origin Enterprises Plc | +18.9% | | Flutter Entertainment Plc | -46.0% |

Dalata Hotel Group Plc | +7.2% | | Malin Corporation Plc | -36.3% |

Bank Of Ireland Group Plc | +2.6% | | Grafton Group Plc | -31.6% |

Greencoat Renewables Plc | -3.1% | | Costain Group Plc | -31.5% |

Highlights regarding some of the significant contributors to the Fund’s performance over the 6-month period are detailed below:

Origin Enterprises Plc: This was the top performing holding over the period. As a leading provider of agronomy services and products to farmers, the company benefitted from its exposure to agricultural product inflation as a result of the Ukrainian war. The company also delivered solid results compared to market expectations.

4

Bank Of Ireland Plc: The bank performed relatively well given its exposure to the Irish economy and was helped by the prospects of higher interest rates on the horizon. It also delivered an earnings report in line with market expectations as well as providing a confident business outlook.

Dalata Hotel Group Plc: Similar to Bank of Ireland Plc it performed relatively well given its exposure to the Irish economy and in particular to the reopening of the country post Covid. It has also provided a confident business outlook.

Greencoat Renewables Plc: The company performed strongly over the period and announced a number of new bolt on acquisitions which helped drive momentum. Their higher dividend and the more defensive natures of their business has also helped.

Flutter Entertainment Plc: The stock was a material underperformer over the period. As a highly rated growth stock it suffered alongside most other growth stocks in the face of higher inflation and bond yields. Separately the company remains locked in an arbitration dispute with Fox Bet in North America.

Malin Corporation Plc: There was no material news to rationalize it’s performance. The stock had been a top performer over prior periods and given its rather illiquid nature gave up some of the prior outperformance in the period.

Costain Group Plc and Grafton Plc: Both stock prices were weak over the period. In both cases no stock specific reasons to justify the performance and in fact in both cases management continued to provide the market with strong results in line with market expectations as well as providing confident outlooks.

Global Market Outlook

Looking ahead, market consensus calls for the economy slowing through to the end of next year, but not falling into a recession. We don’t disagree with this and remain generally of the view that the global economy is far more resilient than feared and can withstand more interest rate rises than many fear it can. We are not in the camp that argues ‘inverted yield curves’ mean recession. The world economy is at present very strong, as evidenced for example by the employment markets. At the same time, CPI inflation is globally elevated, and showing no signs of subsiding. The Fed is embarking on a tightening cycle as they play catch-up. We expect similar elsewhere.

Against this background. equity markets should struggle to make much meaningful progress from here, but neither do we believe is there a serious bear market ahead. Equities are a real asset and with positive earnings and dividend growth ahead should remain more resilient than some may fear. A growing economy supports real assets. That said we continue to argue that components of global equity markets remain overvalued and certainly those

5

growth sectors that have benefitted valuation-wise from the support of low bond yields. Growth sectors have begun to struggle and should continue as such.

As investors we currently argue for calm rather than panic. We do remain ever vigilant to the many risks and challenges that surround us as already highlighted. We are also mindful that although Covid has generally ceased to be a market factor, that the virus still exists and is dominant in certain parts of the world that remain either partially or fully closed.

Irish Market Outlook

As outlined previously we are of the view that after a decade of central banks flooding the global system with liquidity through various actions to counter deflationary forces, a ‘regime change’ now lies ahead and we should expect and plan for a reversal of such actions and next expect a period of increasing short-term interest rates and ‘tapering’ of their bond purchases. This should meaningfully drive a different market environment over the coming years with new winners and losers across asset classes, equity sectors and equity styles. At an aggregate level, this should benefit many non-US markets with Ireland being specifically well placed.

Corporate activity over the quarter has been relatively quiet and the primary focus will be on the 2022 outlook over coming weeks. We expect these to be solid with an overall confident tone.

The portfolio was repositioned during 2021 to be underweight and less defensively positioned having reduced the allocation of more expensive growth type stocks and re-invested towards cheaper more value-oriented and cyclical names. The Irish banks and homebuilders a prime example of same. Current market concerns aside, this is consistent with our positive medium-term outlook for the economy and stock-market as well as reflecting the more attractive fundamentals for such names. In the short term, some of these positions have been challenged by economic concerns, for example the house building names however we retain this positioning.

Through all the panic and commotion over the last year, we continue to remain steadfast with the investment approach, and build the portfolio in an active and balanced way, currently focusing on many of the same themes as we have over the last year.

Noel O’Halloran,

Chief Investment Officer,

KBI Global Investors (North America) Ltd

June 10, 2022

6

Investment Summary (unaudited)

Average Annual Total Returns

as of April 30, 2022 | Six

Months | One

Year | Three

Year | Five

Year | Ten

Year |

The New Ireland Fund, Inc. - NAV (a)(b) | (21.38)% | (20.49)% | 3.29% | (0.22)% | 7.44% |

The New Ireland Fund, Inc. - Market Price (a)(b) | (16.69)% | (21.98)% | 5.30% | (1.19)% | 8.23% |

Benchmark * | (20.48)% | (17.74)% | 4.46% | 3.76% | 8.78% |

* | The Benchmark is the MSCI All Ireland Capped Index. |

Per Share Information and Returns

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | Six

Months

Ended

April 30,

2022 |

Net Asset Value ($) | 9.59 | 14.24 | 14.17 | 16.31 | 13.04 | 15.56(c) | 11.07 | 11.09 | 10.76 | 15.17 | 10.04 |

Income Dividends ($) | (0.02) | — | (0.07) | — | (0.16) | — | — | (0.10) | — | — | (0.00) |

Capital Gain Distributions ($) | — | — | (0.30) | (1.13) | (2.06) | (1.14) | (1.16) | (0.27) | — | (0.31) | (2.28) |

Return of Capital ($) | — | — | — | — | — | — | — | (0.07) | — | — | — |

Total Return (%) (a) | 13.82 | 48.49 | 2.39 | 25.09 | (5.66) | 30.04 | (21.54) | 5.38 | (2.98) | 44.27 | (21.38)(b) |

Notes

(a) | Total Market Value returns reflect changes in share market prices and assume reinvestment of dividends and capital gain distributions, if any, at the price obtained under the Dividend Reinvestment and Cash Purchase Plan (the “Plan”). Total Net Asset Value returns reflect changes in share net asset value and assume reinvestment of dividends and capital gain distributions, if any, at the price obtained under the Plan. For more information with regard to the plan, see page 2. |

(b) | Periods less than one year are not annualized. |

(c) | In November 2017, the Fund had a rights issue of one new share of common stock for every three rights held i.e. a 1-for-3 offer. The subscription price was $11.54, which was a 20% discount to the NAV of $14.45. Prior to the rights issue, there were 3,736,333 shares in issue. Following the rights issue, there were 1,245,445 additional shares available to be issued resulting in a total of 4,981,778 shares issued. This had a dilutive effect of ($1.09) on the NAV. |

7

Investment Summary (unaudited)

Past results are not necessarily indicative of future performance of the Fund.

Growth of an Assumed $10,000 Investment

8

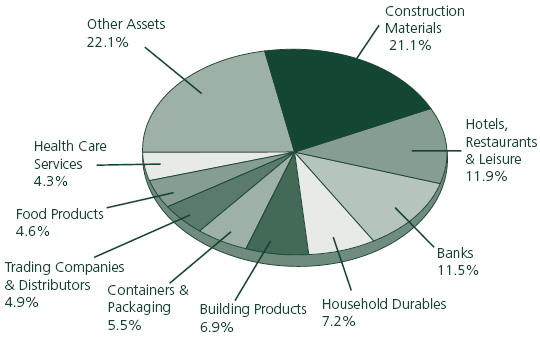

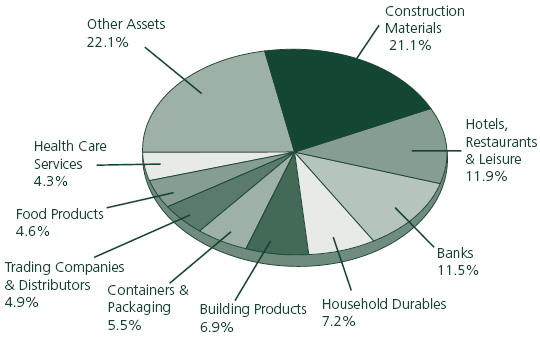

Portfolio by Market Sector as of April 30, 2022

(Percentage of Net Assets) (unaudited)

Top 10 Holdings by Issuer as of April 30, 2022 (unaudited)

Holding | Sector | % of Net Assets |

CRH Plc | Construction Materials | 21.14% |

Flutter Entertainment Plc | Hotels, Restaurants & Leisure | 8.24% |

Bank of Ireland Group Plc | Banks | 6.31% |

Kingspan Group Plc | Building Products | 5.50% |

Smurfit Kappa Group Plc | Containers & Packaging | 5.47% |

AIB Group Plc | Banks | 5.17% |

Grafton Group Plc | Trading Companies & Distributors | 4.87% |

Uniphar Plc | Health Care Services | 4.30% |

Kerry Group Plc, Series A | Food Products | 4.16% |

Ryanair Holdings Plc * | Airlines | 3.98% |

9

The New Ireland Fund, Inc.

Portfolio Holdings (unaudited)

April 30, 2022 | | Shares | | | Value (U.S.)

(Note A) | |

COMMON STOCKS (98.55%) (a) |

COMMON STOCKS OF IRISH COMPANIES (92.29%) |

Airlines (3.98%) |

Ryanair Holdings Plc * | | | 39,801 | | | $ | 613,447 | |

Ryanair Holdings Plc - Sponsored ADR* | | | 9,587 | | | | 837,137 | |

| | | | | | | | 1,450,584 | |

Banks (11.48%) |

AIB Group Plc | | | 857,594 | | | | 1,883,629 | |

Bank of Ireland Group Plc | | | 375,654 | | | | 2,298,523 | |

| | | | | | | | 4,182,152 | |

Beverages (3.94%) |

C&C Group Plc * | | | 545,836 | | | | 1,434,496 | |

Building Products (5.50%) |

Kingspan Group Plc | | | 21,336 | | | | 2,004,604 | |

Construction Materials (21.14%) |

CRH Plc | | | 191,190 | | | | 7,700,767 | |

Containers & Packaging (5.47%) |

Smurfit Kappa Group Plc | | | 46,404 | | | | 1,991,449 | |

Food Products (4.55%) |

Glanbia Plc | | | 7,206 | | | | 86,511 | |

Kerry Group Plc, Series A | | | 13,695 | | | | 1,516,995 | |

Origin Enterprises Plc | | | 11,575 | | | | 52,202 | |

| | | | | | | | 1,655,708 | |

Health Care Services (4.30%) |

Uniphar Plc | | | 379,093 | | | | 1,567,706 | |

Hotels, Restaurants & Leisure (11.93%) |

Dalata Hotel Group Plc * | | | 293,259 | | | | 1,345,778 | |

Flutter Entertainment Plc * | | | 29,446 | | | | 3,000,174 | |

| | | | | | | | 4,345,952 | |

Household Durables (7.21%) |

Cairn Homes Plc | | | 1,121,791 | | | | 1,360,952 | |

Glenveagh Properties Plc * | | | 1,044,081 | | | | 1,264,471 | |

| | | | | | | | 2,625,423 | |

Industrial Conglomerates (0.74%) |

DCC Plc | | | 3,507 | | | | 268,032 | |

Life Sciences Tools & Services (2.25%) |

Malin Corp. Plc* | | | 167,443 | | | | 821,397 | |

See Notes to Financial Statements.

10

The New Ireland Fund, Inc.

Portfolio Holdings (unaudited) (continued)

April 30, 2022 | | Shares | | | Value (U.S.)

(Note A) | |

COMMON STOCKS (continued) |

Machinery (1.95%) |

Mincon Group Plc | | | 538,834 | | | $ | 710,555 | |

Marine (2.06%) |

Irish Continental Group Plc - UTS | | | 184,720 | | | | 750,253 | |

Multi-Utilities (0.92%) |

Greencoat Renewables Plc | | | 269,988 | | | | 334,669 | |

Pharmaceuticals (0.00%) | | | | | | | | |

Amryt Pharma Plc * | | | 4 | | | | — | |

Trading Companies & Distributors (4.87%) |

Grafton Group Plc | | | 143,912 | | | | 1,773,068 | |

TOTAL COMMON STOCKS OF IRISH COMPANIES |

(Cost $23,648,157) | | | | | | | 33,616,815 | |

| | | | | | | | | |

COMMON STOCKS OF FRENCH COMPANIES (3.08%) |

Building Products (1.40%) |

Cie de St-Gobain | | | 8,597 | | | | 510,881 | |

Multi-Utilities (1.68%) |

Veolia Environnement SA | | | 20,799 | | | | 612,180 | |

TOTAL COMMON STOCKS OF FRENCH COMPANIES |

(Cost $712,489) | | | | | | | 1,123,061 | |

| | | | | | | | | |

COMMON STOCKS OF ITALIAN COMPANIES (1.68%) |

Electric Utilities (1.68%) |

Enel SpA | | | 93,004 | | | | 610,078 | |

TOTAL COMMON STOCKS OF ITALIAN COMPANIES |

(Cost $644,684) | | | | | | | 610,078 | |

| | | | | | | | | |

COMMON STOCKS OF UNITED KINGDOM COMPANIES (1.50%) |

Construction & Engineering (1.50%) |

Costain Group Plc * | | | 1,086,927 | | | | 546,703 | |

TOTAL COMMON STOCKS OF UNITED KINGDOM COMPANIES |

(Cost $810,959) | | | | | | | 546,703 | |

| | | | | | | | | |

TOTAL COMMON STOCKS | | | | | | | | |

(Cost $25,816,289) | | | | | | $ | 35,896,657 | |

See Notes to Financial Statements.

11

The New Ireland Fund, Inc.

Portfolio Holdings (unaudited) (continued)

April 30, 2022 | | Shares | | | Value (U.S.)

(Note A) | |

RIGHTS —% |

AMRYT EMA CVR (b) | | | 300,819 | | | $ | — | |

AMRYT FDA CVR (b) | | | 300,819 | | | | — | |

AMRYT REVENUE CVR (b) | | | 300,819 | | | | — | |

| | | | | | | | — | |

TOTAL RIGHTS |

(Cost $0) | | | | | | | — | |

| | | | | | | | | |

TOTAL INVESTMENTS (98.55%) |

(Cost $25,816,289) | | | | | | | 35,896,657 | |

OTHER ASSETS AND LIABILITIES (1.45%) | | | 527,247 | |

NET ASSETS (100.00%) | | $ | 36,423,904 | |

* | Non-income producing security. |

ADR | – American Depositary Receipt traded in U.S. dollars. |

CVR | – Contingent Value Rights |

(a) | The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Administrator, U.S. Bancorp Fund Services, LLC. |

(b) | Value determined using significant unobservable inputs. |

See Notes to Financial Statements.

12

The New Ireland Fund, Inc.

Statement of Assets and Liabilities (unaudited)

April 30, 2022 | | | | | | |

| | | | | | | | | |

ASSETS: | | | | | | | | |

Investments at value (Cost $25,816,289) | U.S. | | $ | 35,896,657 | |

See accompanying schedule | | | | | | | | |

Dividends receivable | | | | | | | 479,986 | |

Cash | | | | | | | 201,054 | |

Prepaid expenses | | | | | | | 27,305 | |

Total assets | U.S. | | $ | 36,605,002 | |

| | | | | | | | | |

LIABILITIES: | | | | | | | | |

Directors’ fees and expenses payable | U.S. | | $ | 36,722 | |

Accrued audit fees payable | | | | | | | 21,324 | |

Investment advisory fee payable (Note B) | | | | | | | 19,775 | |

Administration fee payable (Note B) | | | | | | | 18,075 | |

Custody fees payable (Note B) | | | | | | | 8,458 | |

Accrued legal fees payable | | | | | | | 4,693 | |

Accrued expenses and other payables | | | | | | | 72,051 | |

Total liabilities | | | | | | | 181,098 | |

| | | | | | | | | |

NET ASSETS | U.S. | | $ | 36,423,904 | |

| | | | | | | | | |

AT APRIL 30, 2022 NET ASSETS CONSISTED OF: | | | | | | | | |

Common Stock, U.S. $.01 Par Value - Authorized 20,000,000 Shares Issued and Outstanding 3,626,980 | | | | | | $ | 36,270 | |

Additional paid-in capital | | | | | | | 25,661,984 | |

Total distributable earnings | | | | | | | 10,725,650 | |

TOTAL NET ASSETS | | | | | | $ | 36,423,904 | |

| | | | | | | | | |

NET ASSET VALUE PER SHARE | | | | | | | | |

(Applicable to 3,626,980 outstanding shares) | | | | | | | | |

(authorized 20,000,000 shares) | | | | | | | | |

(U.S. $26,426,904 ÷ 3,626,980) | | | | | | $ | 10.04 | |

See Notes to Financial Statements.

13

The New Ireland Fund, Inc.

Statement of Operations

| | | | | | | For the

Six Months Ended

April 30, 2022

(unaudited) | |

| | | | | | | | | | | |

INVESTMENT INCOME | | | | | | | | | | |

Dividends | | | | | | U.S. | | $ | 395,594 | |

Foreign taxes withheld | | | | | | | | | (79,311 | ) |

TOTAL INVESTMENT INCOME | | | | | | | | | 316,283 | |

| | | | | | | | | | | |

EXPENSES | | | | | | | | | | |

Investment advisory fees (Note B) | U.S. | | $ | 142,944 | | | | | | |

Directors’ fees | | | | 89,919 | | | | | | |

Administration fees (Note B) | | | | 58,181 | | | | | | |

Legal fees | | | | 41,983 | | | | | | |

Compliance fees (Note B) | | | | 33,219 | | | | | | |

Insurance premiums | | | | 23,207 | | | | | | |

Transfer agent fees (Note B) | | | | 21,478 | | | | | | |

Audit fees | | | | 21,324 | | | | | | |

Custodian fees (Note B) | | | | 14,866 | | | | | | |

Investor services fees | | | | 12,849 | | | | | | |

Exchange listing fees | | | | 12,415 | | | | | | |

Printing and mailing expenses | | | | 12,224 | | | | | | |

Other expenses | | | | 9,443 | | | | | | |

TOTAL EXPENSES | | | | | | | | | 494,052 | |

NET INVESTMENT LOSS | | | | | | U.S. | | $ | (177,769 | ) |

| | | | | | | | | | | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY | | | | | |

Realized gain/(loss) on: | | | | | | | | | | |

Securities transactions | | | | 1,353,054 | | | | | | |

Foreign currency transactions | | | | 17,437 | | | | | | |

Net realized gain/(loss) on investments and foreign currency during the period | | | | | | | | | 1,370,491 | |

Net change in unrealized appreciation/(depreciation) of: | | | | | | | | | | |

Securities | | | | (11,531,199 | ) | | | | | |

Foreign currency and net other assets | | | | (10,289 | ) | | | | | |

Net unrealized appreciation/(depreciation) of investments and foreign currency during the period | | | | | | | | | (11,541,488 | ) |

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY | | | | (10,170,997 | ) |

| | | | | | | | | | | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | U.S. | | $ | (10,348,766 | ) |

See Notes to Financial Statements.

14

The New Ireland Fund, Inc.

Statements of Changes in Net Assets

| | | Six Months Ended

April 30, 2022

(unaudited) | | | | Year Ended

October 31, 2021 | |

| | | | | | | | | | | |

OPERATIONS: | | | | | | | | | | |

Net investment income/(loss) | U.S. | | $ | (177,769 | ) | U.S. | | $ | (289,944 | ) |

Net realized gain on investments and foreign currency transactions | | | | 1,370,491 | | | | | 8,155,494 | |

Net unrealized appreciation/(depreciation) of investments, foreign currency holdings and net other assets | | | | (11,541,488 | ) | | | | 14,665,566 | |

Net increase/(decrease) in net assets resulting from operations | | | | (10,348,766 | ) | | | | 22,531,116 | |

| | | | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | | | | | | | | |

Distributable earnings | | | | (8,276,406 | ) | | | | (1,496,636 | ) |

Total distributions | | | | (8,276,406 | ) | | | | (1,496,636 | ) |

| | | | | | | | | | | |

CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | |

Costs associated with tender offer (Note E) | | | | — | | | | | (101,098 | ) |

Value of 0 and 1,213,300 shares repurchased, respectively, from shareholders in connection with a tender offer (Note E) | | | | — | | | | | (17,932,574 | ) |

Value of 12,922 and 65,606 shares repurchased, respectively, from shareholders in connection with a share repurchase program (Note F) | | | | (163,608 | ) | | | | (693,584 | ) |

Net increase/(decrease) in net assets resulting from capital share transactions | | | | (163,608 | ) | | | | (18,727,256 | ) |

Total increase/(decrease) in net assets | | | | (18,788,780 | ) | | | | 2,307,224 | |

| | | | | | | | | | | |

NET ASSETS: | | | | | | | | | | |

Beginning of period | | | | 55,212,684 | | | | | 52,905,460 | |

End of period | U.S. | | $ | 36,423,904 | | U.S. | | $ | 55,212,684 | |

See Notes to Financial Statements.

15

The New Ireland Fund, Inc.

Financial Highlights (For a Fund share outstanding throughout each period)

| | | | Six Months

Ended

April 30, 2022 | | | Year Ended October 31, | |

| | | (unaudited) | | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

Operating Performance: | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning of Period | U.S. | | | $15.17 | | | $ | 10.76 | | | $ | 11.09 | | | $ | 11.07 | | | $ | 15.56 | | | $ | 13.04 | |

Net Investment Income/(Loss) | | | | (0.05 | ) | | | (0.09 | ) | | | (0.09 | ) | | | 0.02 | | | | (0.03 | ) | | | (0.15 | ) |

Net Realized and Unrealized Gain/(Loss) on Investments | | | | (2.81 | ) | | | 4.67 | | | | (0.25 | ) | | | 0.42 | | | | (2.21 | ) | | | 3.67 | |

Net Increase/(Decrease) in Net Assets Resulting from Investment Operations | | | | (2.86 | ) | | | 4.58 | | | | (0.34 | ) | | | 0.44 | | | | (2.24 | ) | | | 3.52 | |

Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income | | | | (0.00 | )†† | | | — | | | | — | | | | (0.10 | ) | | | — | | | | — | |

Net Realized Gains | | | | (2.28 | ) | | | (0.31 | ) | | | — | | | | (0.27 | ) | | | (1.16 | ) | | | (1.14 | ) |

Return of Capital | | | | — | | | | — | | | | — | | | | (0.07 | ) | | | — | | | | — | |

Total from Distributions | | | | (2.28 | ) | | | (0.31 | ) | | | — | | | | (0.44 | ) | | | (1.16 | ) | | | (1.14 | ) |

Anti-Dilutive/(Dilutive) Impact of Capital Share Transactions | | | | 0.01 | | | | 0.14 | (a) | | | 0.01 | (b) | | | 0.02 | (b) | | | (1.09 | )(c) | | | 0.14 | (d) |

Net Asset Value, End of Period | U.S. | | | $10.04 | | | $ | 15.17 | | | $ | 10.76 | | | $ | 11.09 | | | $ | 11.07 | | | $ | 15.56 | |

Share Price, End of Period | U.S. | | | $8.75 | | | $ | 12.55 | | | $ | 7.85 | | | $ | 9.06 | | | $ | 9.18 | | | $ | 13.65 | |

Total NAV Investment Return (e) | | | | (21.38 | )%(f) | | | 44.27 | % | | | (2.98 | )% | | | 5.38 | % | | | (21.54 | )% | | | 30.04 | % |

Total Market Investment Return (g) | | | | (16.69 | )%(f) | | | 64.58 | % | | | (13.36 | )% | | | 3.81 | % | | | (25.83 | )% | | | 27.69 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

RATIOS TO AVERAGE NET ASSETS/SUPPLEMENTAL DATA: |

Net assets, End of Period (000’s) | U.S. | | | $36,424 | | | $55,213 | | | | $ | 52,905 | | | $ | 54,749 | | | $ | 55,157 | | | $ | 58,152 | |

Ratio of Net Investment Income/(Loss) to Average Net Assets | | | | (0.81 | )(h) | | | (0.47 | )% | | | (0.89 | )% | | | 0.20 | % | | | (0.27 | )% | | | (0.76 | )% |

Ratio of Operating Expenses to Average Net Assets | | | | 2.24 | %(h) | | | 1.67 | % | | | 1.96 | % | | | 2.07 | % | | | 1.98 | % | | | 2.19 | % |

Portfolio Turnover Rate | | | | 6 | %(f) | | | 22 | % | | | 21 | % | | | 19 | % | | | 18 | % | | | 14 | % |

†† | Less than one cent per share. |

(a) | Amount represents a $0.04 per share impact related to the Share Repurchase Program and a $0.10 per share impact related to the Tender Offer. |

(b) | Amount represents per share impact related to the Share Repurchase Program. |

(c) | Amount represents per share impact related to a Rights Offering, which was completed in December 2017. |

(d) | Amount represents per share impact related to the Tender Offer, which was completed in May 2017. |

(e) | Based on share net asset value and reinvestment of distributions at the price obtained under the Dividend Reinvestment and Cash Purchase Plan. |

(f) | Period less than one year are not annualized. |

(g) | Based on share market price and reinvestment of distributions at the price obtained under the Dividend Reinvestment and Cash Purchase Plan. |

(h) | Annualized. |

See Notes to Financial Statements.

16

The New Ireland Fund, Inc.

Notes to Financial Statements (unaudited)

The New Ireland Fund, Inc. (the “Fund”) was incorporated under the laws of the State of Maryland on December 14, 1989 and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s investment objective is long-term capital appreciation through investment primarily in equity securities of Irish companies. The Fund is designed for U.S. and other investors who wish to participate in the Irish securities markets. In order to take advantage of significant changes that have occurred in the Irish economy and to advance the Fund’s investment objective, the investment strategy has a bias towards Ireland’s growth companies.

The Fund is an investment company that follows the accounting and reporting guidance of Accounting Standards Codification Amendments to the Scope, Measurements, and Disclosure Requirements applicable to Investment Companies.

A. Significant Accounting Policies:

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

Security Valuation: Securities listed on a stock exchange for which market quotations are readily available are valued at the closing prices on the date of valuation, or if no such closing prices are available, at the last bid price quoted on such day. If there are no such quotations available for the date of valuation, the last available closing price will be used. The value of securities and other assets for which no market quotations are readily available, or whose values have been materially affected by events occurring before the Fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the Board of Directors to represent fair value. Short-term securities that mature in 60 days or less may be valued at amortized cost.

Fair Value Measurements: As described above, the Fund utilizes various methods to measure the fair value of most of its investments on a recurring basis. U.S. Generally Accepted Accounting Principles (“GAAP”) establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

| | Level 1 – | unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| | Level 2 – | observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | Level 3 – | unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

17

The New Ireland Fund, Inc.

Notes to Financial Statements (unaudited) (continued)

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

At the end of each fiscal quarter, management evaluates the Level 2 and Level 3 assets and liabilities, if any, for changes in liquidity, including but not limited to: whether a broker is willing to execute at the quoted price, the depth and consistency of prices from third party services, and the existence of contemporaneous, observable trades in the market. Additionally, management evaluates the Level 1 and Level 2 assets and liabilities on a quarterly basis for changes in listing or delistings on national exchanges.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Transfers in and out of levels are recognized at market value at the end of period. The summary of inputs used to value the Fund’s net assets as of April 30, 2022 is as follows:

| | | Total

Value at

04/30/2022 | | | Level 1

Quoted

Price | | | Level 2

Significant

Observable

Input | | | Level 3

Significant

Unobservable

Input** | |

Investments in Securities | | | | | | | | | | | | | | | | |

Common Stocks* | | $ | 35,896,657 | | | $ | 35,896,657 | | | $ | — | | | $ | — | |

Rights | | | — | | | | — | | | | — | | | | — | |

Total Investments ^ | | $ | 35,896,657 | | | $ | 35,896,657 | | | $ | — | | | $ | — | |

* | See Portfolio Holdings detail for country breakout. |

** | The fair valued securities (Level 3) held in the Fund consisted of Amryt EMA CVR, Amryt FDA CVR and Amryt Revenue CVR. There was no change in value since October 31, 2021, therefore no Level 3 reconciliation table is needed. |

^ | Investments are disclosed individually on the Portfolio Holdings. |

There was no change in Level 3 securities.

Dividends and Distributions to Stockholders: Distributions from net realized gains on investment transactions and net realized foreign exchange gains, if any, are declared and paid annually and are recorded on the ex-dividend date. On December 14, 2021 the Board determined that the Fund was in a position to distribute short-term capital gains, long-term capital gains and income.

18

The New Ireland Fund, Inc.

Notes to Financial Statements (unaudited) (continued)

Distributions are reported on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some point in the future. Differences in classification may also result from the treatment of short-term gain as ordinary income for tax purposes.

U.S. Federal Income Taxes: It is the Fund’s intention to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and distribute all of its taxable income within the prescribed time. It is also the intention of the Fund to make distributions in sufficient amounts to avoid Fund excise tax. Accordingly, no provision for U.S. federal income taxes is required.

Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years (October 31, 2021, 2020, 2019, and 2018), and has concluded that no provision for federal income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax return for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

Currency Translations: The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the spot rate of such currencies against U.S. dollars by obtaining from ICE Data Services each day the current 4:00 pm New York time spot rate and future rate (the future rates are quoted in 30-day increments) on foreign currency contracts. Net realized foreign currency gains and losses resulting from changes in exchange rates include foreign currency gains and losses between trade date and settlement date on investment securities transactions, foreign currency transactions, and the difference between the amounts of interest and dividends recorded on the books of the Fund and the amount actually received. The portion of foreign currency gains and losses related to fluctuation in exchange rates between the initial purchase trade date and subsequent sale trade date is included in realized gains and losses on security transactions.

Securities Transactions and Investment Income: Securities transactions are recorded based on their trade date. Realized gains and losses from securities sold are recorded on the identified cost basis. Dividend income is recorded on the ex-dividend date except that certain dividends from foreign securities are recorded as soon as the Fund is informed of the ex-dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Interest income is recorded on the accrual basis. Withholding tax reclaims are filed in certain countries to recover a portion of the amounts previously withheld. The Fund records a reclaim receivable based on, among other things, a jurisdiction’s legal obligation to pay reclaims as well as payment history and market convention.

Offering Costs: Offering costs are capitalized in conjunction with the shares issued in such offering. Offering costs can also be amortized through the expiration of the offering period depending on the likelihood of the occurrence of the offering.

19

The New Ireland Fund, Inc.

Notes to Financial Statements (unaudited) (continued)

Use of Estimates: The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

B. Management Services:

The Fund has entered into an investment advisory agreement (the “Investment Advisory Agreement”) with KBI Global Investors (North America) Ltd. (“KBIGINA”). Under the Investment Advisory Agreement, the Fund pays a monthly fee at an annualized rate equal to 0.65% of the value of the average daily net assets of the Fund up to the first $50 million, 0.60% of the value of the average daily net assets of the Fund over $50 million and up to and including $100 million and 0.50% of the value of the average daily net assets of the Fund on amounts in excess of $100 million. In addition, KBIGINA provides investor services to existing and potential shareholders. See the effect of expenses on Statement of Operations.

The Fund has entered into an administration agreement (the “Administration Agreement”) with U.S. Bancorp Fund Services, LLC, d/b/a U.S. Bank Global Fund Services (“Fund Services”). The Fund pays Fund Services an annual fee payable monthly. See the effect of expenses on Statement of Operations.

The Fund has entered into an agreement with U.S. Bank, N.A. to serve as the custodian for the Fund’s assets. See the effect of expenses on Statement of Operations.

The Fund has entered into a transfer agency and registrar services agreement (the “Transfer Agency and Registrar Services Agreement”) with American Stock Transfer & Trust Company, LLC (“AST”) to serve as transfer agent for the Fund. See the effect of expenses on Statement of Operations.

The Fund has entered into an agreement with Vigilant Compliance, LLC for compliance services. See the effect of expenses on Statement of Operations.

C. Purchases and Sales of Securities:

The cost of purchases and proceeds from sales of securities for the six month period ended April 30, 2022, excluding U.S. government and short-term investments, aggregated to U.S. $2,788,896 and U.S. $11,725,327 respectively.

D. Components of Distributable Earnings:

At October 31, 2021, the components of distributable earnings on a tax basis were as follows:

Qualified Late

Year Losses Deferred | Undistributed

Ordinary Income | Undistributed

Long-Term Gains | Net Unrealized

Appreciation |

$— | $920,157 | $7,355,607 | $21,075,058 |

As of October 31, 2021, the Fund had no capital loss carryforwards.

20

The New Ireland Fund, Inc.

Notes to Financial Statements (unaudited) (continued)

Under the Regulated Investment Company Modernization Act of 2010, net capital losses (those earned in taxable years beginning after December 22, 2010) may be carried forward indefinitely and must retain the character of the original loss.

The aggregate cost of investments and the composition of unrealized appreciation and depreciation on investments and appreciation, on assets and liabilities in foreign currencies on a tax basis as of April 30, 2022, were as follows:

Total Cost of

Investments | Gross

Unrealized

Appreciation

on Investments | Gross

Unrealized

Depreciation on

Investments | Net Unrealized

Appreciation

on Investments |

$25,816,281 | $12,685,873 | $2,605,497 | $10,080,376 |

E. Common Stock

For the six months ended April 30, 2022, the Fund did not issue any shares. For the year ended October 31, 2021, the Fund redeemed 1,213,300 shares in connection with a Tender Offer on May 14, 2021.

F. Share Repurchase Program:

In accordance with Section 23(c) of the 1940 Act, the Fund hereby gives notice that it may from time to time repurchase shares of the Fund in the open market at the option of the Board of Directors and upon such terms as the Directors shall determine.

For the six months ended April 30, 2022, the Fund repurchased 12,922 (0.40% of the shares outstanding at April 30, 2022) of its shares for a total cost of $163,608 at an average discount of 10% of net asset value. For the year ended October 31, 2021, the Fund repurchased 65,606 (1.80% of the shares outstanding at October 31, 2021) of its shares for a total cost of $693,584 at an average discount of 20% of net asset value.

G. Market Concentration:

Because the Fund concentrates its investments in securities of Irish Companies, its portfolio may be subject to special risks and considerations typically not associated with investing in a broader range of domestic securities. In addition, the Fund is more susceptible to factors adversely affecting the Irish economy than a comparable fund not concentrated in these issuers to the same extent.

H. Risk Factors:

Investing in the Fund may involve certain risks including, but not limited to, those described below.

The prices of securities held by the Fund may decline in response to certain events, including those directly involving the companies whose securities are owned by the Fund; conditions affecting the general economy; overall market changes; local, regional or

21

The New Ireland Fund, Inc.

Notes to Financial Statements (unaudited) (continued)

global political, social or economic instability; and currency, interest rate and commodity price fluctuations. The growth-oriented, equity-type securities generally purchased by the Fund may involve large price swings and potential for loss.

Investments in securities issued by entities based outside the Unites States may also be affected by currency controls; different accounting, auditing, financial reporting, and legal standards and practices; expropriation; changes in tax policy; greater market volatility; differing securities market structures; higher transactions costs; and various administrative difficulties, such as delays in clearing and settling portfolio transactions or in receiving payment of dividends. These risks may be heightened in connection with investments in developing countries.

The Fund may face risks associated with the potential uncertainty and consequences that may follow Brexit, including with respect to volatility in exchange rates and interest rates.

The COVID-19 pandemic has disrupted economic markets and the prolonged economic impact is uncertain. The operational and financial performance of the issuers of securities in which the Fund invests depends on future developments, including the duration and spread of the outbreak, and such uncertainty may in turn impact the value of the Fund’s investments.

Global tensions, particularly between Russia, the U.S. and a number of European states, have heightened significantly as a result of Russia’s invasion of Ukraine, and the escalation of hostilities between the two countries. The outbreak of hostilities between the two countries could result in more widespread conflict and could have a severe adverse effect on the region and the markets. In addition, sanctions imposed on Russia by the United States and other countries, and any sanctions imposed in the future could have a significant adverse impact on the Russian economy and related markets. The price and liquidity of investments may fluctuate widely as a result of the conflict and related events. How long such conflict and related events will last and whether it will escalate further cannot be predicted, nor its effect on the Fund.

I. Subsequent Event:

Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were issued, and has determined that there were no subsequent events.

22

Additional Information (unaudited)

Dividend Reinvestment and Cash Purchase Plan

Pursuant to the Dividend Reinvestment and Cash Purchase Plan (the “Plan”) approved by the Fund’s Board of Directors (the “Directors”), each shareholder will be deemed to have elected, unless American Stock Transfer & Trust Company LLC (the “Plan Agent”) is instructed otherwise by the shareholder in writing, to have all distributions automatically reinvested by the Plan Agent in Fund shares pursuant to the Plan. Distributions with respect to Fund shares registered in the name of a broker-dealer or other nominee (i.e., in “street name”) will be reinvested by the broker or nominee in additional Fund shares under the Plan, unless the service is not provided by the broker or nominee or the shareholder elects to receive distributions in cash. Investors who own Fund shares registered in street names may not be able to transfer those shares to another broker-dealer and continue to participate in the Plan. These shareholders should consult their broker-dealer for details. Shareholders who do not participate in the Plan will receive all distributions in cash paid by check in U.S. dollars mailed directly to the shareholder by the Plan Agent, as paying agent. Shareholders who do not wish to have distributions automatically reinvested should notify the Fund, in care of the Plan Agent for The New Ireland Fund, Inc.

The Plan Agent will serve as agent for the shareholders in administering the Plan. If the Directors of the Fund declare an income dividend or a capital gains distribution payable either in the Fund’s common stock or in cash, as shareholders may have elected, non-participants in the Plan will receive cash and participants in the Plan will receive common stock to be issued by the Fund. If the market price per share on the valuation date equals or exceeds net asset value per share on that date, the Fund will issue new shares to participants at net asset value or, if the net asset value is less than 95% of the market price on the valuation date, then at 95% of the market price. The valuation date will be the dividend or distribution payment date or, if that date is not a trading day on the New York Stock Exchange, Inc. (“NYSE”), the next preceding trading day. If the net asset value exceeds the market price of Fund shares at such time, participants in the Plan will be deemed to have elected to receive shares of stock from the Fund, valued at market price on the valuation date. If the Fund should declare a dividend or capital gains distribution payable only in cash, the Plan Agent as agent for the participants, will buy Fund shares in the open market, on the NYSE or elsewhere, with the cash in respect of such dividend or distribution, for the participants’ account on, or shortly after, the payment date.

Participants in the Plan have the option of making additional cash payments to the Plan Agent, monthly, in any amount from U.S. $100 to U.S. $3,000, for investment in the Fund’s common stock. The Plan Agent will use all funds received from participants to purchase Fund shares in the open market, at the prevailing market price, on the 15th of each month or the next business day shares are traded if the 15th is a Saturday, Sunday or holiday. Voluntary cash payments must be received by the Plan Agent at least two business days prior to such investment date. To avoid unnecessary cash accumulations and to allow ample time for receipt and processing of voluntary cash payments to the participant’s account, it is suggested that the participants send in voluntary cash payments to be received by the Plan Agent ten days prior to the investment date.

23

Additional Information (unaudited) (continued)

Interest will not be paid on any uninvested cash payments. A participant may withdraw a voluntary cash payment by written notice, if the notice is received by the Plan Agent not less than forty-eight hours before such payment is to be invested.

The Plan Agent maintains all shareholder accounts in the Plan and furnishes written confirmations of all transactions in the account, including information needed by shareholders for personal and U.S. federal tax records. Shares in the account of each Plan participant will be held by the Plan Agent in non-certificated form in the name of the participant, and each shareholder’s proxy will include those shares purchased pursuant to the Plan.

In the case of shareholders such as banks, brokers or nominees who hold shares for beneficial owners, the Plan Agent will administer the Plan on the basis of the number of shares certified from time to time by the shareholder as representing the total amount registered in the shareholder’s name and held for the account of beneficial owners who are participating in the Plan.

There is no charge to participants for reinvesting dividends or capital gains distributions. The Plan Agent’s fee for the handling of the reinvestment of dividends and distributions will be paid by the Fund. However, each participant’s account will be charged a pro rata share of brokerage commissions incurred with respect to the Plan Agent’s open market purchases in connection with the reinvestment of dividends or capital gains distributions. A participant will also pay brokerage commissions incurred in purchases in connection with the reinvestment of dividends or capital gains distributions. A participant will also pay brokerage commissions incurred in purchases from voluntary cash payments made by the participant and a transaction fee of $2.50 (which will be deducted from the participant’s voluntary cash payment investment). Brokerage charges for purchasing small amounts of stock of individual accounts through the Plan are expected to be less than the usual brokerage charges for such transactions, because the Plan Agent will be purchasing stock for all participants in blocks and prorating the lower commission thus attainable.

Participants may sell some or all their shares. This can be done either online at www.amstock.com, via telephone, toll free, at 1-800-243-4353 or by submitting the transaction request form at the bottom of the participant’s statement. Requests received either via the Internet or telephone by 4:00 pm, Eastern time, or via the mail by 12:00 pm, Eastern time, will generally be sold the next business day shares are traded. There is a transaction fee of $15 and $0.10 per share commission on sales of shares.

Neither the Fund nor the Plan Agent will provide any advice, make any recommendations, or offer any opinion with respect to whether or not you should purchase or sell shares or otherwise participate under the Plan. You must make independent investment decisions based on your own judgment and research. The shares held in Plan accounts are not subject to protection under the Securities Investor Protection Act of 1970.

Neither the Fund nor the Plan Agent will be liable for any act performed in good faith or for any good faith omission to act or failure to act, including, without limitation, any claim of liability (i) arising out of failure to terminate a participant’s account, sell stock held in the Plan, deposit certificates or direct registration shares, invest voluntary

24

Additional Information (unaudited) (continued)

cash payments or dividends; or (ii) with respect to the prices at which stock is purchased or sold for the participant’s account and the time such purchases or sales are made. Without limiting the foregoing, the Plan Agent will not be liable for any claim made more than 30 days after any instruction to buy or sell stock was given to the Plan Agent.

The automatic reinvestment of dividends and distributions will not relieve participants of any U.S. Federal income tax which may be payable on such dividends or distributions.

Experience under the Plan may indicate that changes are desirable. Accordingly, the Fund reserves the right to amend or terminate the Plan as applied to any voluntary cash payment made and any dividend or distribution paid subsequent to notice of the change sent to all shareholders at least thirty days before the record date for such dividend or distribution. The Plan also may be amended or terminated by the Plan Agent with at least thirty days written notice to all shareholders. All correspondence concerning the Plan should be directed to the Plan Agent for The New Ireland Fund, Inc. in care of American Stock Transfer & Trust Company LLC, P.O. Box 922, Wall Street Station, New York, New York, 10269-0560, telephone number (718) 921-8265.

Fund’s Privacy Policy

The New Ireland Fund, Inc. appreciates the privacy concerns and expectations of its registered shareholders and safeguarding their nonpublic personal information (“Information”) is of great importance to the Fund. The Fund collects Information pertaining to its registered shareholders, including matters such as name, address, phone number, tax I.D. number, Social Security number and instructions regarding the Fund’s Dividend Reinvestment Plan. The Information is collected from the following sources:

| | ● | Directly from the registered shareholder through data provided on applications or other forms and through account inquiries by mail, telephone or e-mail. |

| | ● | From the registered shareholder’s broker as the shares are initially transferred into registered form. |

Fund will not disclose the Information about registered shareholders who are individuals, except as permitted by law and for its everyday business purposes. Such disclosures may be made to the Fund’s affiliates such as its investment manager, and with nonaffiliated third parties to process your transactions, maintain your account(s), respond to court orders and legal investigations. Nonaffiliated third parties the Fund can share with may include its accountants, attorneys, transfer agents, custodians and broker-dealers.

The Fund may also disclose your Information to its affiliates for marketing purposes, such as to offer the Fund’s products and services to you. Further, the Fund may also disclose your Information as described above to nonaffiliated third parties that perform marketing services on the Fund’s behalf. The Fund does not engage in joint marketing.

25

Additional Information (unaudited) (continued)

To protect this Information, the Fund permits access only by authorized employees who need access to that Information in order to perform their jobs. The Fund uses security measures that comply with applicable law. These measures include computer safeguards and secured files and buildings.

The Fund’s privacy policy applies only to its individual registered shareholders. If you are the record holder of shares of the Fund through a third-party broker, bank or other financial institution, that institution’s privacy policies will apply to you and the Fund’s privacy policy will not.

If you have any questions, please call the Fund’s transfer agent at 1-877-295-6932.

Dated June 15, 2021

26

Additional Information (unaudited) (continued)

Portfolio Information

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q or Part F of Form N-PORT. The filings are available (1) by calling 1-800-468-6475 or by emailing investor.query@newirelandfund.com; (2) on the Fund’s website located at http://www.newirelandfund.com; (3) on the SEC’s website at http://www.sec.gov.

Proxy Voting Information

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities held by the Fund is available, without charge and upon request, by calling 1-800-468-6475 or by emailing investor.query@newirelandfund.com. This information is also available from the EDGAR database or the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 is available, without charge and upon request, by calling 1-800-468-6475 or by emailing investor.query@newirelandfund.com, and at http://www.sec.gov.

Advisory Agreement

The Directors, including a majority of the Directors who are not “interested persons” of the Fund under the 1940 Act (the “Independent Directors”), unanimously approved the continuance of the Investment Advisory Agreement (the “Advisory Agreement”) between the Fund and the Adviser for an additional annual period at a meeting held on March 8, 2022.

In considering whether to approve the renewal of the Advisory Agreement, the Directors reviewed a variety of information provided by the Adviser and USBGFS, including comparative performance, fee and expense information and other information regarding the nature, extent and quality of services provided by the Adviser. The materials provided to the Directors included, among other items: (i) information on the investment performance of the Fund and the performance of a peer group of funds and the Fund’s performance benchmark; (ii) information on the Fund’s advisory fees and other expenses, including information comparing the Fund’s expenses to those of a peer group of funds and information about any applicable expense limitations and fee “breakpoints”; (iii) information about the profitability of the Advisory Agreement to the Adviser; (iv) a report prepared by the Adviser in response to a request submitted by the Independent Directors’ independent legal counsel on behalf of such Directors; and (v) a memorandum from the Independent Directors’ independent legal counsel on the responsibilities of the Board in considering for approval the investment advisory arrangement under the 1940 Act and Maryland law. The Directors, including the Independent Directors, also considered other matters such as: (i) the Adviser’s financial results and financial condition; (ii) the Fund’s investment objective and strategies; (iii) the Adviser’s investment personnel and operations; (iv) the procedures employed to determine the value of the Fund’s assets; (v) the allocation of the Fund’s brokerage, if

27

Additional Information (unaudited) (continued)

any, including, if applicable, allocations to brokers affiliated with the Adviser and the lack of use of “soft” commission dollars to pay Fund expenses and to pay for research and other similar services; (vi) the resources devoted to, and the record of compliance with, the Fund’s investment policies and restrictions, policies on personal securities transactions and other compliance policies; and (vii) possible conflicts of interest. Throughout the process, the Board was afforded the opportunity to ask questions of and request additional materials from the Adviser.

In addition to the materials requested by the Directors in connection with their annual consideration of the continuation of the Advisory Agreement, the Directors received materials in advance of each regular quarterly meeting of the Board that provided information relating to the services provided by the Adviser.

The Independent Directors were advised by independent counsel throughout the process. The Independent Directors also discussed the proposed continuance in a private session with counsel at which no representatives of the Adviser were present. In reaching their determinations relating to continuance of the Advisory Agreement in respect of the Fund, the Directors considered all factors they believed relevant, including the following:

| | 1) | the total compensation to be received, directly or indirectly, by the Adviser; |

| | 2) | the expenses incurred by the Adviser in performing services under the Agreement; |

| | 3) | the Fund’s expense ratio; |

| | 4) | the possible reduction in advisory fees to reflect economies of scale; |

| | 5) | competitive prices for comparable services; |

| | 6) | competitive expense ratios; and |

| | 7) | past performance and reliability of the Adviser. |

The Directors did not identify any single factor as determinative. Individual Directors may have evaluated information presented differently from one another, giving different weights to different factors.

Matters considered by the Directors, including the Independent Directors, in connection with their approval of the Advisory Agreement included in the factors listed below.

Nature, Extent and Quality of Services Provided by the Adviser

The Directors considered the nature, extent and quality of services provided by the Adviser under the Advisory Agreement. The Directors considered the Adviser’s investment experience, the quality of the investment research capabilities of the Adviser and the other resources dedicated to performing services for the Fund. The quality of other services, including the Adviser’s assistance in the coordination of the activities of some of the Fund’s other service providers, also were considered. The Directors also noted the Adviser is responsible for maintaining and monitoring its own compliance program and coordinating certain activities with the Fund’s Chief Compliance Officer,

28

Additional Information (unaudited) (continued)

and that such compliance program is routinely refined and enhanced in light of new regulatory requirements and current market conditions. The Directors concluded that, overall, they were satisfied with the nature, extent and quality of services provided to the Fund under the Advisory Agreement.

Costs of Services Provided and Profitability to the Adviser

At the request of the Directors, the Adviser provided information concerning the profitability to the Adviser of the Advisory Agreement. The Directors reviewed with the Adviser assumptions and methods of allocation used by the Adviser in preparing this Fund- specific profitability data. The Directors recognized that it is difficult to make comparisons of profitability from investment advisory contracts. This is because comparative information is not generally publicly available and is affected by numerous factors, including the structure of the particular adviser, the type of clients it advises, its business mix, and numerous assumptions regarding allocations and the adviser’s capital structure and cost of capital. The Directors recognized that the Adviser should, in the abstract, be entitled to earn a reasonable level of profits for the services it provides, to the Fund. Based on their review, they concluded they were satisfied that the Adviser’s level of profitability, from its relationship with the Fund, was not excessive.

Fall-Out Benefits

The Directors also considered so-called “fall-out benefits” to the Adviser and its affiliates, such as reputational and other benefits from the Adviser’s association with the Fund. The Directors considered any possible conflicts of interest associated with these fall-out and other benefits.

Investment Results

The Directors considered the investment results of the Fund as compared to a peer group of single country or regional closed-end equity funds (“Peer Funds”) provided by Broadridge, an independent third-party provider of investment company data, and by reviewing the performance of the Fund’s benchmark. In addition to the information received by the Directors for the Meeting, the Directors receive detailed performance information for the Fund at each regular Board meeting during the year.

The comparative information showed that the Fund’s performance outperformed the median performance of the Peer Funds over the one-, three- and ten-year periods, and underperformed the median performance of the Peer Funds over the five-year period, in each case, ended December 31, 2021. The Directors took into account the impact of the Fund’s rights offering on the Fund’s performance. Based upon this review, the Directors concluded that the Fund’s relative investment performance over time had been satisfactory.

29

Additional Information (unaudited) (continued)

Advisory Fee

The Adviser reviewed with the Directors the major differences in the scope of services it provides to institutional clients and to the Fund. For example, despite not being required under the Advisory Agreement, the Adviser provides, among other things, consultants who serve as officers of the Fund (which officers provide required certifications, with the attendant costs and exposure to liability). The Adviser also assists in coordinating the provision of services to the Fund by certain nonaffiliated service providers. In looking at fee comparisons, the Directors took these aspects into consideration.

The information provided by Broadridge showed that the Fund’s total management fee, which included the advisory fee and administration fee, was a rate of approximately 0.74% (based on net assets at October 31, 2021), which was below the median for the group of Peer Funds. The Directors also considered that the Adviser must pay for research as a result of its compliance with the Markets in Financial Instruments Directive (“MiFID II”).

The Directors recognized the limitations on the usefulness of these comparisons, given the potential varying nature, extent and quality of the services provided by the advisers of other portfolios. Similar limitations are inherent in comparing services being provided by the Adviser to its other clients.

The Directors took into account that, although the Adviser may realize economies of scale in managing the Fund as its assets increase, there are substantial restraints on the growth of Fund assets. These are: (a) a public offering may only reasonably be made in rights offerings, or when the market price of the Fund’s shares exceeds the Fund’s net asset value per share; and (b) stockholders either take dividends or distributions in cash or they reinvest them in secondary market purchases of Fund shares, neither of which serves to increase Fund assets.

The Directors also considered the total expense ratio of the Fund in comparison to the fees and expenses of the Peer Funds. It was noted that the Fund’s total expense ratio of 1.67%was slightly higher than the median expense ratio of the Peer Funds. The Directors considered the factors that impacted the Fund’s expenses.

After considering this information, the Directors concluded that they believed that the Fund’s advisory fee was reasonable, with the breakpoint in the advisory fee being set at a relatively low level of assets. They also concluded that the absolute dollar fees paid to the Adviser were modest in light of the commitment required to advise the Fund, and that they were satisfied with the nature and quality of the services provided.

In addition, the Directors recognized that many industry observers have noted that the level of services required and risks involved in managing registered investment companies are significantly different from those for pension and institutional accounts and that market fees vary accordingly.

Based on their evaluation of all factors that they deemed to be material, including those factors described above, and assisted by the advice of independent counsel, the Directors, including the Independent Directors, concluded that the investment advisory arrangements between the Fund and the Adviser were fair and reasonable and that

30

Additional Information (unaudited) (continued)

the renewal of the Advisory Agreement would be in the best interest of the Fund and its shareholders. Accordingly, the Board, including the Independent Directors voting separately, approved the Advisory Agreement for an additional one-year term.

31

This page intentionally left blank.

This page intentionally left blank.

This page intentionally left blank.

The New Ireland Fund, Inc.

Directors and Officers

| | David Dempsey | – | Director |

| | Sean Hawkshaw | – | Director and President |

| | Michael A. Pignataro | – | Director |

| | Eleanor Hoagland | – | Director |

| | Derval Murray | – | Treasurer, Secretary |

| | Suzanne Hammer | – | Chief Compliance Officer |

Investment Adviser

KBI Global Investors (North America) Ltd

One Boston Place

201 Washington St,

36th Floor

Boston, MA 02108

Administrator

U.S. Bancorp Fund Services, LLC

811 E Wisconsin Ave

Milwaukee, WI 53202

Custodian

U.S. Bank, N.A.

1555 N. Rivercenter Dr., MK-WI-5302

Milwaukee, WI 53212

Shareholder Servicing Agent

American Stock Transfer & Trust Company, LLC

6201 15th Avenue

Brooklyn, NY 11219

Legal Counsel

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New York, NY 10019

Independent Registered Public Accounting Firm

Tait, Weller & Baker LLP

Two Liberty Place

50 South 16th Street, Suite 2900

Philadelphia PA 19102-2529

Correspondence

All correspondence should be addressed to:

The New Ireland Fund, Inc.

c/o KBI Global Investors (North America) Ltd

One Boston Place

201 Washington Street

36th Floor

Boston, MA 02108

Telephone inquiries should be directed to:

1-800-GO-TO-IRL (1-800-468-6475)

Email inquires should be sent to:

investor.query@newirelandfund.com

Website address:

www.newirelandfund.com

IR-SAR 04/22

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable for semi-annual reports.

Item 6. Investments.