SECURITIES AND EXCHANGE COMMISSION

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

SMALLCAP World Fund, Inc.

(Exact name of registrant as specified in charter)

6455 Irvine Center Drive

Irvine, California 92618

(Address of principal executive offices)

6455 Irvine Center Drive

Irvine, California 92618

(Name and address of agent for service)

Registrant's telephone number, including area code:

Date of reporting period:

ITEM 1 - Reports to Stockholders

ANNUAL SHAREHOLDER REPORT

Class A | SMCWX

for the year ended September 30, 2024

This annual shareholder report contains important information about SMALLCAP World Fund (the "fund")

for the period from October 1, 2023 to September 30, 2024. You can find additional information about the fund at

capitalgroup.com/mutual-fund-literature-A

. You can also request this information by contacting us at (800) 421-4225.

What were the fund costs for the last year?

(based on a hypothetical $10,000 inves

tm

ent)

| Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $ 115 | 1.04 % |

Management's discussion of fund performance

The fund’s Class A shares gained 21.01% for the year ended September 30, 2024. That result compares with a 24.62% gain for the MSCI All Country World Small Cap Index. For information on returns for additional periods, including the fund lifetime, please refer to

capitalgroup.com/mutual-fund-returns-A

.

What factors influenced results

Global equity markets saw a strong rally over the course of the fund’s fiscal year, with easing inflation and rate cuts by the Federal Reserve restoring confidence in stocks, particularly in the United States. The market strength was particularly concentrated in mega-cap US stocks, with small-cap stocks lagging the overall market.

Portfolio holdings in industrials, financials, and consumer discretionary had better returns relative to the overall portfolio. In industrials, companies that indirectly benefit from the build out in AI data centers such as Comfort Systems, as well as the reshoring trend in the US, positively contributed to results. Companies in consumer discretionary, such as Cava, TopBuild and MakeMyTrip, were additive to results as well. On the other hand, Staples and Energy shares lagged the overall portfolio.

Geographically – US companies, where the fund had the largest exposure, saw returns above those of the overall portfolio. Some select emerging markets were also additive, such as India, Philippines and Turkey, while China lagged the fund. Shares domiciled in the Eurozone, the UK and Japan saw returns below that of the overall portfolio.

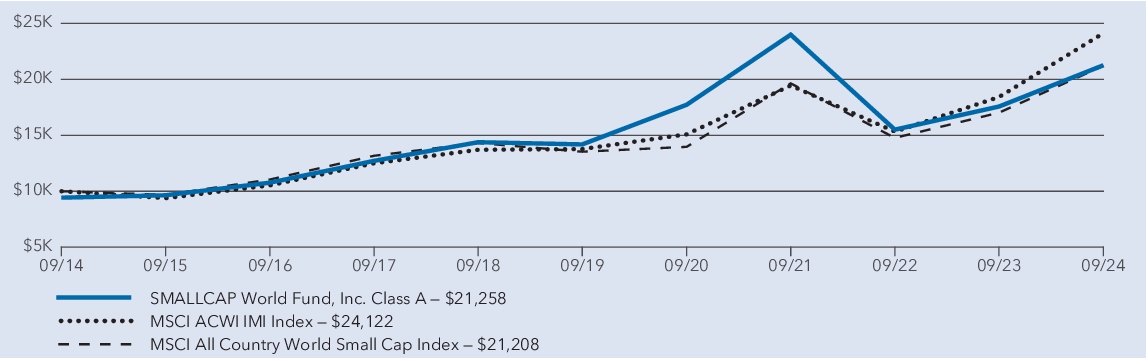

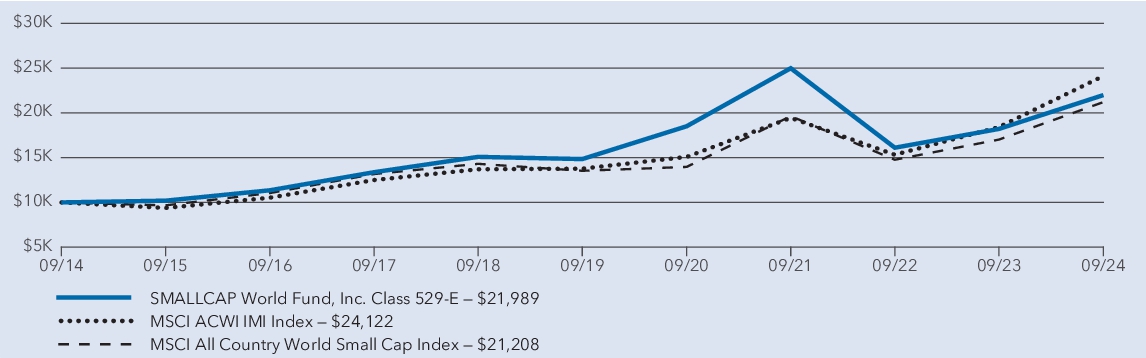

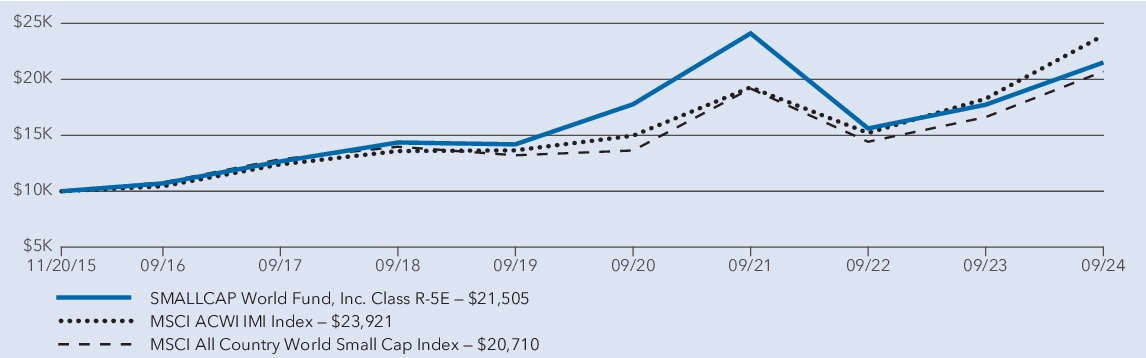

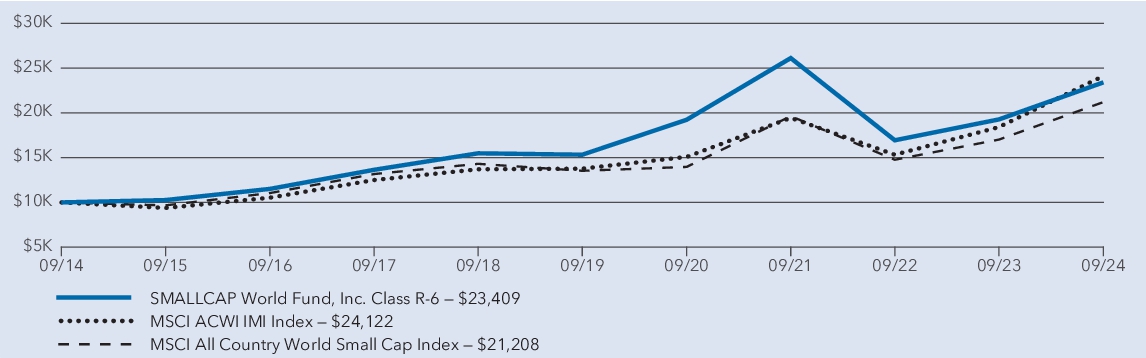

How a hypothetical $10,000 investment has grown

Figures reflect deduction of the maximum sales charge and assume reinvestment of divi

de

nds and capital g

ai

ns.

Average annual total returns

| 1 year | 5 years | 10 years |

SMALLCAP World Fund — Class A (with sales charge)* | 14.06 % | 7.15 % | 7.83 % |

| SMALLCAP World Fund — Class A (without sales charge) * | 21.01 % | 8.43 % | 8.47 % |

| MSCI ACWI IMI Index † | 30.96 % | 11.87 % | 9.20 % |

| MSCI All Country World Small Cap Index † | 24.62 % | 9.40 % | 7.81 % |

Effective July 24, 2024, the fund's primary benchmark changed from the MSCI All Country World Small Cap Index (the "Previous Primary Benchmark") to the MSCI ACWI IMI Index, a broad-based index that represents the overall applicable securities market, as required by the SEC. The Previous Primary Benchmark provides a means to compare the fund's results to a benchmark that the investment adviser believes is more representative of the fund's investment universe. There is no change in the fund's investment strategies as a result of the benchmark change.

*

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower.

†

Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI.

The fund’s past performance is not a predictor of its future performance.

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund net assets (in millions) | $ 77,077 |

| Total number of portfolio holdings | 866 |

| Total advisory fees paid (in millions) | $ 428 |

| Portfolio turnover rate | 32 % |

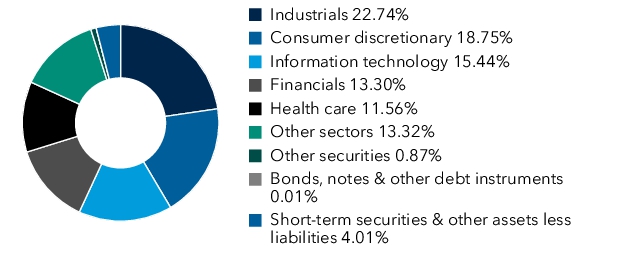

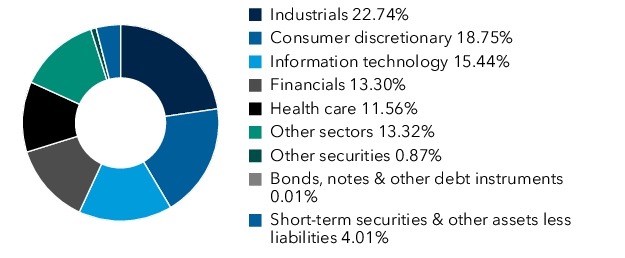

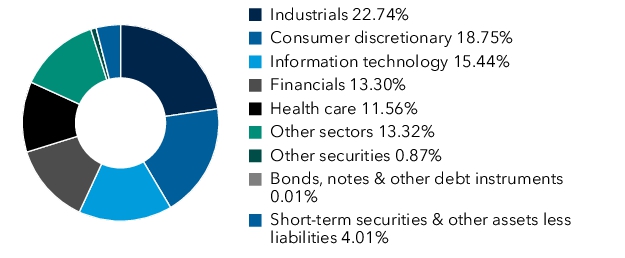

Portfolio holdings by sector

(percent of

n

et

assets

)

Availability of additional inform

ati

on

Scan the QR code to view additional information about the fund, including its prospectus, financial information, holdings and information on proxy voting. Or refer to the web address included at the beginning of this report.

To reduce fund expenses, only one copy of most shareholder documents will be mailed to shareholders with multiple accounts at the same address (householding). If you would prefer that your documents not be householded, please contact Capital Group at

(800) 421-4225

, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Capital Group or your financial intermediary.

Lit. No. MFAAARX-035-1124 © 2024 Capital Group. All rights reserved.

ANNUAL SHAREHOLDER REPORT

for the year ended September 30, 2024

This annual shareholder report contains important information about SMALLCAP World Fund (the "fund")

for the period from October 1, 2023 to September 30, 2024. You can find additional information about the fund at

capitalgroup.com/mutual-fund-literature-C

. You can also request this information by contacting us at (800) 421-4225.

What were the fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $ 196 | 1.78 % |

Management's discussion of fund performance

The fund’s Class C shares gained 20.11% for the year ended September 30, 2024. That result compares with a 24.62% gain for the MSCI All Country World Small Cap Index. For information on returns for additional periods, including the fund lifetime, please refer to

capitalgroup.com/mutual-fund-returns-C

.

What factors influenced results

Global equity markets saw a strong rally over the course of the fund’s fiscal year, with easing inflation and rate cuts by the Federal Reserve restoring confidence in stocks, particularly in the United States. The market strength was particularly concentrated in mega-cap US stocks, with small-cap stocks lagging the overall market.

Portfolio holdings in industrials, financials, and consumer discretionary had better returns relative to the overall portfolio. In industrials, companies that indirectly benefit from the build out in AI data centers such as Comfort Systems, as well as the reshoring trend in the US, positively contributed to results. Companies in consumer discretionary, such as Cava, TopBuild and MakeMyTrip, were additive to results as well. On the other hand, Staples and Energy shares lagged the overall portfolio.

Geographically – US companies, where the fund had the largest exposure, saw returns above those of the overall portfolio. Some select emerging markets were also additive, such as India, Philippines and Turkey, while China lagged the fund. Shares domiciled in the Eurozone, the UK and Japan saw returns below that of the overall

portfolio

.

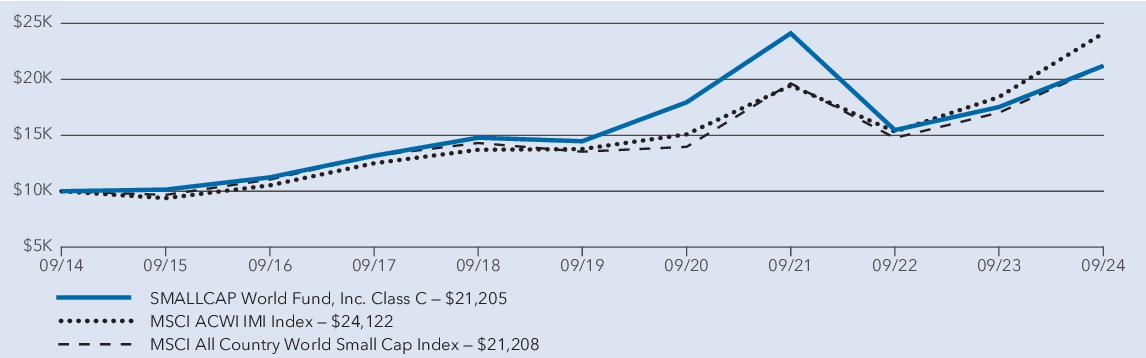

How a hypothetical $10,000 investment has grown

Figures assume reinvestment of dividends and capital gains.

Average annual total returns

| 1 year | 5 years | 10 years |

| SMALLCAP World Fund — Class C (with sales charge) * | 19.11 % | 7.63 % | 7.81 % |

| SMALLCAP World Fund — Class C (without sales charge) * | 20.11 % | 7.63 % | 7.81 % |

| MSCI ACWI IMI Index † | 30.96 % | 11.87 % | 9.20 % |

| MSCI All Country World Small Cap Index † | 24.62 % | 9.40 % | 7.81 % |

Effective July 24, 2024, the fund's primary benchmark changed from the MSCI All Country World Small Cap Index (the "Previous Primary Benchmark")

to

the MSCI ACWI IMI Index, a broad-based index that represents the overall applicable securities market, as required by the SEC. The

Previous

Primary Benchmark provides a means to compare the fund's results to a benchmark that the investment adviser believes is more representative of the fund's investment universe. There is no change in the fund's investment strategies as a result of the benchmark change.

*

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower.

†

Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors

cannot

invest directly in an index. Source(s): MSCI.

The fund’s past performance is not a predictor of its future performance.

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund net assets (in millions) | $ 77,077 |

| Total number of portfolio holdings | 866 |

| Total advisory fees paid (in millions) | $ 428 |

| Portfolio turnover rate | 32 % |

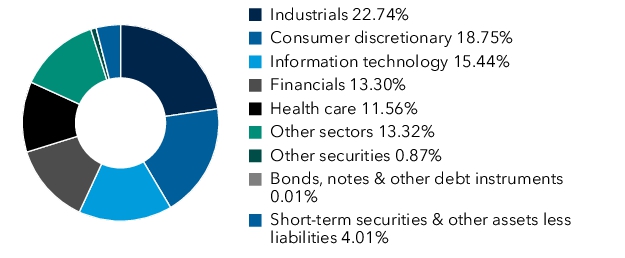

Portfolio holdings by sector

(percent of net

assets

)

Availability of additional information

Scan the QR code to view additional information about the fund, including its prospectus,

financial

information, holdings and information on proxy voting. Or refer to the web address included at the beginning of this report.

To reduce fund expenses, only one copy of most shareholder documents will be mailed to shareholders with multiple accounts at the same address (householding). If you would prefer that your documents not be householded, please contact Capital Group at

(800) 421-4225

, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Capital Group or your financial intermediary.

Lit. No. MFCCARX-035-1124 © 2024 Capital Group. All rights reserved.

ANNUAL SHAREHOLDER REPORT

Class T | TSFFX

for the year ended September 30, 2024

This annual shareholder report contains important information about SMALLCAP World Fund (the "fund")

for the period from October 1, 2023 to September 30, 2024. You can find additional information about the fund at

capitalgroup.com/mutual-fund-literature

. You can also request this information by contacting us at (800) 421-4225.

What were the fund costs for the last year?

(based on a hypothetical $10,000

investment

)

| Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class T | $ 83 | 0.75 % |

Management's discussion of fund performance

The fund’s Class T shares gained 21.35% for the year ended September 30, 2024. That result compares with a 24.62% gain for the MSCI All Country World Small Cap Index.

What factors influenced results

Global equity markets saw a strong rally over the course of the fund’s fiscal year, with easing inflation and rate cuts by the Federal Reserve restoring confidence in stocks, particularly in the United States. The market strength was particularly concentrated in mega-cap US stocks, with small-cap stocks lagging the overall market.

Portfolio holdings in industrials, financials, and consumer discretionary had better returns relative to the overall portfolio. In industrials, companies that indirectly benefit from the build out in AI data centers such as Comfort Systems, as well as the reshoring trend in the US, positively contributed to results. Companies in consumer discretionary, such as Cava, TopBuild and MakeMyTrip, were additive to results as well. On the other hand, Staples and Energy shares lagged the overall portfolio.

Geographically – US companies, where the fund had the largest exposure, saw returns above those of the overall portfolio. Some select emerging markets were also additive, such as India, Philippines and Turkey, while China lagged the fund. Shares domiciled in the Eurozone, the UK and Japan saw returns below that of the overall portfolio.

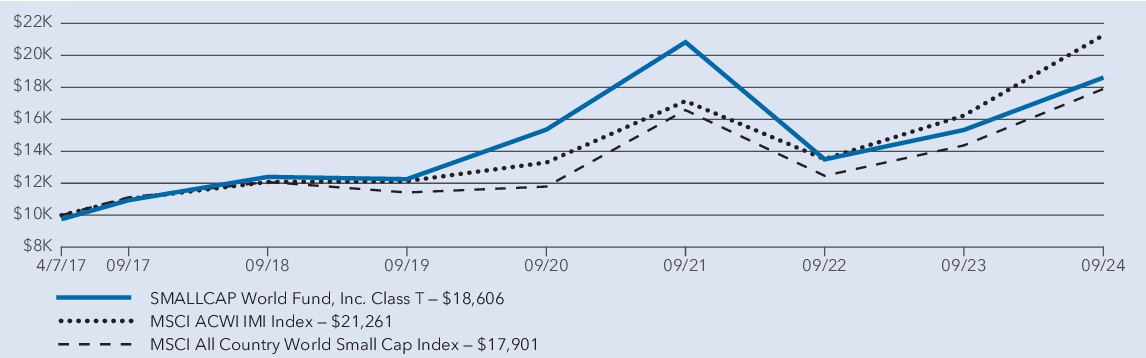

How a hypothetical $10,000 investment has grown

Figures reflect deduction of the maximum sales charge and assume reinvestment of dividends and capital gains.

Average annual total returns

| 1 year | 5 years | |

| SMALLCAP World Fund — Class T (with sales charge) 2 | 18.32 % | 8.16 % | 8.65 % |

| SMALLCAP World Fund — Class T (without sales charge) 2 | 21.35 % | 8.71 % | 9.02 % |

| MSCI ACWI IMI Index 3 | 30.96 % | 11.87 % | 10.61 % |

| MSCI All Country World Small Cap Index 3 | 24.62 % | 9.40 % | 8.09 % |

Effective July 24, 2024, the fund's primary benchmark changed from the MSCI All Country World Small Cap Index (the "Previous Primary Benchmark") to the MSCI ACWI IMI Index, a broad-based index that represents the overall applicable securities market, as required by the SEC. The Previous Primary Benchmark provides a means to compare the fund's results to a benchmark that the investment adviser believes is more representative of the fund's investment universe. There is no change in the fund's investment strategies as a result of the benchmark change.

1

Class T shares were first offered on April 7, 2017.

2

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower.

3

Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI.

The fund’s past performance is not a predictor of its future performance.

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund net assets (in millions) | $ 77,077 |

| Total number of portfolio holdings | 866 |

| Total advisory fees paid (in millions) | $ 428 |

| Portfolio turnover rate | 32 % |

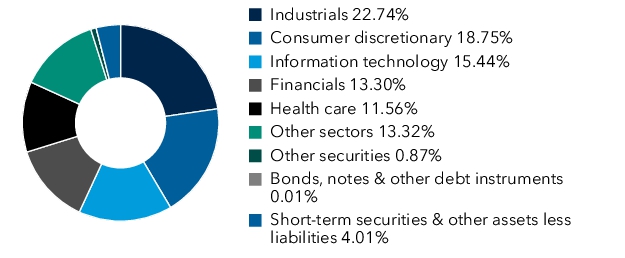

Portfolio holdings by sector

(percent of net assets)

Availability of additional information

Scan the QR code to view additional information about the fund, including its prospectus, financial information, holdings and information on proxy voting. Or refer to the web address included at the beginning of this report.

To reduce fund expenses, only one copy of most

shareholder

documents will be mailed to shareholders with multiple accounts at the same address (householding). If you would prefer that your documents not be householded, please contact Capital Group at

(800) 421-4225

, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Capital Group or your financial intermediary.

Lit. No. MFTTARX-035-1124 © 2024 Capital Group. All rights reserved.

ANNUAL SHAREHOLDER REPORT

Class F-1 | SCWFX

for the year ended September 30, 2024

This annual shareholder report contains important information about SMALLCAP World Fund (the "fund")

for the period from October 1, 2023 to September 30, 2024. You can find additional information about the fund at

capitalgroup.com/mutual-fund-literature-F1

. You can also request this information by contacting us at (800) 421-4225.

What were the fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class F-1 | $ 119 | 1.08 % |

Management's discussion of fund performance

The fund’s Class F-1 shares gained 20.96% for the year ended September 30, 2024. That result compares with a 24.62% gain for the MSCI All Country World Small Cap Index. For information on returns for additional periods, including the fund lifetime, please refer to

capitalgroup.com/mutual-fund-returns-F1

.

What factors influenced results

Global equity markets saw a strong rally over the course of the fund’s fiscal year, with easing inflation and rate cuts by the Federal Reserve restoring confidence in stocks, particularly in the United States.

The

market strength was particularly concentrated in mega-cap US stocks, with small-cap stocks lagging the overall market.

Portfolio holdings in industrials, financials, and consu

m

er discretionary had better returns relative to the o

ve

ra

ll p

ortfolio. In industrials, companies that indirectly benefit from the build out in AI data centers such as Comfort Systems, as well as the reshoring trend in the US, positively contributed to results. Companies in consumer discretionary, such as Cava, TopBuild and MakeMyTrip, were additive to results as well. On the other hand, Staples and Energy shares lagged the overall portfolio.

Geographically – US companies, where the fund had the largest exposure, saw retur

ns

above thos

e of

the overall portfolio. Some select emerging markets were also additive, such as India, Philippines and Turkey, while China lagged the fund. Shares domiciled in the Eurozone, the UK and Japan saw returns below that of the overall portfolio.

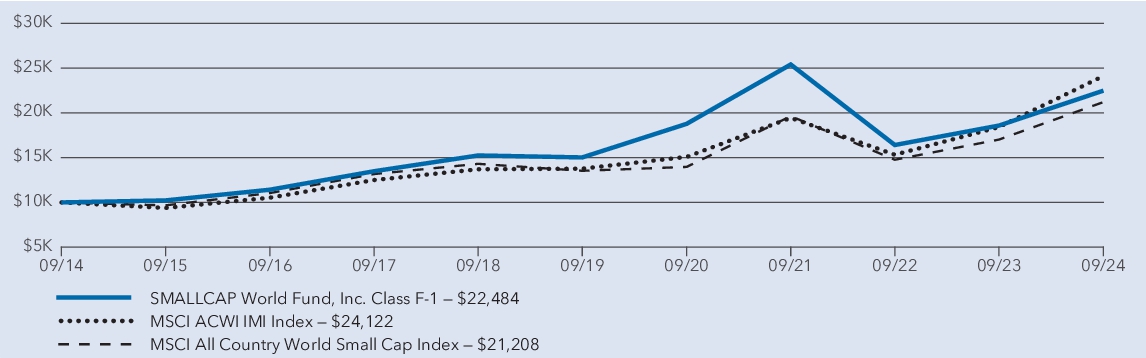

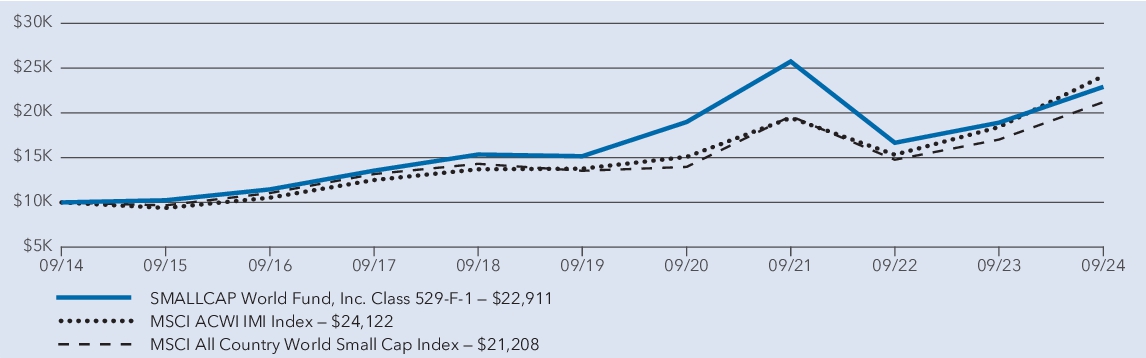

How a hypothetical $10,000 investment has grown

Figures assume reinvestment of dividends and capital gains.

Average annual total returns

| 1 year | 5 years | 10 years |

| SMALLCAP World Fund — Class F-1 * | 20.96 % | 8.39 % | 8.44 % |

| MSCI ACWI IMI Index † | 30.96 % | 11.87 % | 9.20 % |

| MSCI All Country World Small Cap Index † | 24.62 % | 9.40 % | 7.81 % |

Effective July 24, 2024, the fund's primary benchmark changed from the MSCI All Country World Small Cap Index (the "

Previous

Primary Benchmark") to the MSCI ACWI IMI Index, a broad-based index that represents the overall applicable securities market, as required by the SEC. The Previous Primary Benchmark provides a means to compare the fund's results to a benchmark that the investment adviser believes is more representative of the fund's investment universe. There is no change in the fund's investment strategies as a result of the benchmark change.

*

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower.

†

Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI.

The fund’s past performance is not a predictor of its future performance.

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund net assets (in millions) | $ 77,077 |

| Total number of portfolio holdings | 866 |

| Total advisory fees paid (in millions) | $ 428 |

| Portfolio turnover rate | 32 % |

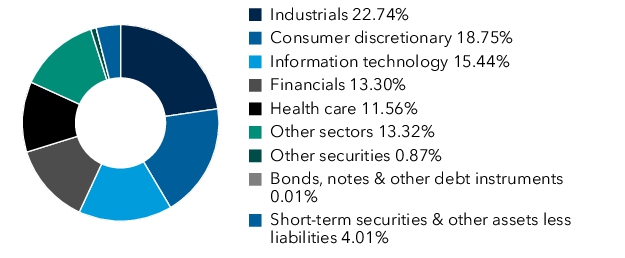

Portfolio holdings by sector

(percent of net assets)

Availability of additional information

Scan the QR code to view additional information about the fund, including its prospectus, financial information, holdings and information on proxy voting. Or refer to the web address included at the beginning of this report.

To reduce fund expenses, only one copy of most shareholder documents will be mailed to shareholders with multiple accounts at the same address (householding). If you would prefer that your documents not be householded, please contact Capital Group at

(800) 421-4225

, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Capital Group or your financial intermediary.

Lit. No. MFF1ARX-035-1124 © 2024 Capital Group. All rights reserved.

ANNUAL SHAREHOLDER REPORT

Class F-2 | SMCFX

for the year ended September 30,

2024

This annual shareholder report contains important information about SMALLCAP World Fund (the "fund")

for the period from October 1, 2023 to September 30, 2024. You can find additional information about the fund at

capitalgroup.com/mutual-fund-literature-F2

. You can also request this information by contacting us at (800) 421-4225.

What were the fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class F-2 | $ 85 | 0.77 % |

Management's discussion of fund performance

The fund’s Class F-2 shares gained 21.32% for the year ended September 30, 2024. That result compares with a 24.62% gain for the MSCI All Country World Small Cap Index. For information on returns for additional periods, including the fund lifetime, please refer to

capitalgroup.com/mutual-fund-returns-F2

.

What factors influenced results

Global equity markets saw a strong rally over the course of the fund’s fiscal year, with easing inflation and rate cuts by the Federal Reserve restoring confidence in stocks, particularly in the United States. The market strength was particularly concentrated in mega-cap US stocks, with small-cap stocks lagging the overall market.

Portfolio holdings in industrials, financials, and consumer discretionary had better returns relative to the overall portfolio. In industrials, companies that indirectly benefit from the build out in AI data centers such as Comfort Systems, as well as the reshoring trend in the US, positively contributed to results. Companies in consumer discretionary, such as Cava, TopBuild and MakeMyTrip, were additive to results as well. On the other hand, Staples and Energy shares lagged the overall portfolio.

Geographically – US companies, where the fund had the largest exposure, saw returns above those of the overall portfolio. Some select emerging markets were also additive, such as India, Philippines and Turkey, while China lagged the fund. Shares domiciled in the Eurozone, the UK and Japan saw returns below that of the overall portfolio.

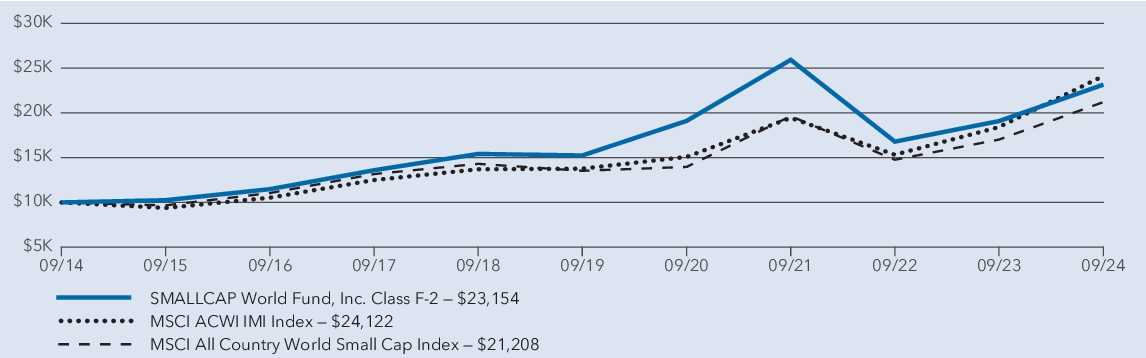

How a hypothetical $10,000 investment has grown

Figures assume reinvestment of dividends and capital gains.

Average annual total returns

| 1 year | 5 years | 10 years |

| SMALLCAP World Fund — Class F-2 * | 21.32 % | 8.71 % | 8.76 % |

| MSCI ACWI IMI Index † | 30.96 % | 11.87 % | 9.20 % |

| MSCI All Country World Small Cap Index † | 24.62 % | 9.40 % | 7.81 % |

Effective July 24, 2024, the fund's primary benchmark changed from the MSCI All Country World Small Cap Index (the "Previous Primary Benchmark") to the MSCI ACWI IMI Index, a broad-based index that represents the overall applicable securities market, as required by the SEC. The Previous Primary Benchmark provides a means to compare the fund's results to a benchmark that the investment adviser believes is more representative of the fund's investment universe. There is no change in the fund's investment strategies as a result of the benchmark change.

*

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower.

†

Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI.

The fund’s past performance is not a predictor of its future performance.

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund net assets (in millions) | $ 77,077 |

| Total number of portfolio holdings | 866 |

| Total advisory fees paid (in millions) | $ 428 |

| Portfolio turnover rate | 32 % |

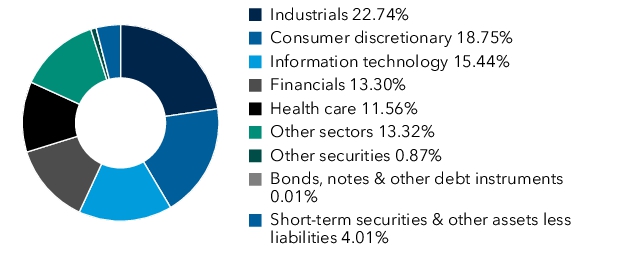

Portfolio holdings by sector

(percent of net assets)

Availability of additional information

Scan the QR code to view additional information about the fund, including its prospectus, financial information, holdings and information on proxy voting. Or refer to the web address included at the beginning of this report.

To reduce fund expenses, only one copy of most shareholder documents will be mailed to shareholders with multiple accounts at the same address (householding). If you would prefer that your documents not be householded, please contact Capital Group at

(800) 421-4225

, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Capital Group or your financial intermediary.

Lit. No. MFF2ARX-035-1124 © 2024 Capital Group. All rights reserved.

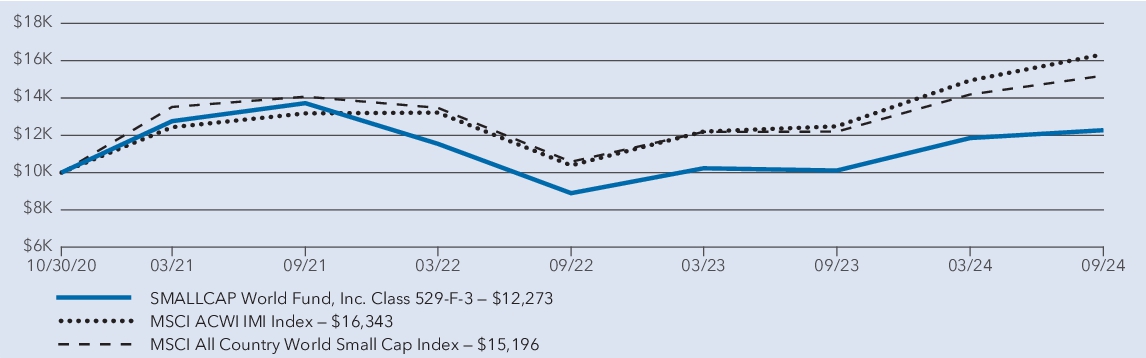

ANNUAL SHAREHOLDER REPORT

Class F-3 | SFCWX

for the year ended September 30,

2024

This annual shareholder report contains important information about SMALLCAP World Fund (the "fund")

for the period from October 1, 2023 to September 30, 2024. You can find additional information about the fund at

capitalgroup.com/mutual-fund-literature-F3

. You can also request this information by contacting us at (800) 421-4225.

What were the fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class F-3 | $ 73 | 0.66 % |

Management's discussion of fund performance

The fund’s Class F-3 shares gained 21.46% for the year ended September 30, 2024. That result compares with a 24.62% gain for the MSCI All Country World Small Cap Index. For information on returns for additional periods, including the fund lifetime, please refer to

capitalgroup.com/mutual-fund-returns-F3

.

What factors influenced results

Global equity markets saw a strong rally over the course of the fund’s fiscal year, with easing inflation and rate cuts by the Federal Reserve restoring confidence in stocks, particularly in the United States. The market strength was particularly concentrated in mega-cap US stocks, with small-cap stocks lagging the overall market.

Portfolio holdings in industrials, financials, and consumer discretionary had better returns relative to the overall portfolio. In industrials, companies that indirectly benefit from the build out in AI data centers such as Comfort Systems, as well as the reshoring trend in the US, positively contributed to results. Companies in consumer discretionary, such as Cava, TopBuild and MakeMyTrip, were additive to results as well. On the other hand, Staples and Energy shares lagged the overall portfolio.

Geographically – US companies, where the fund had the largest exposure, saw returns above those of the overall portfolio. Some select emerging markets were also additive, such as India, Philippines and Turkey, while China lagged the fund. Shares domiciled in the Eurozone, the UK and Japan saw returns below that of the overall portfolio.

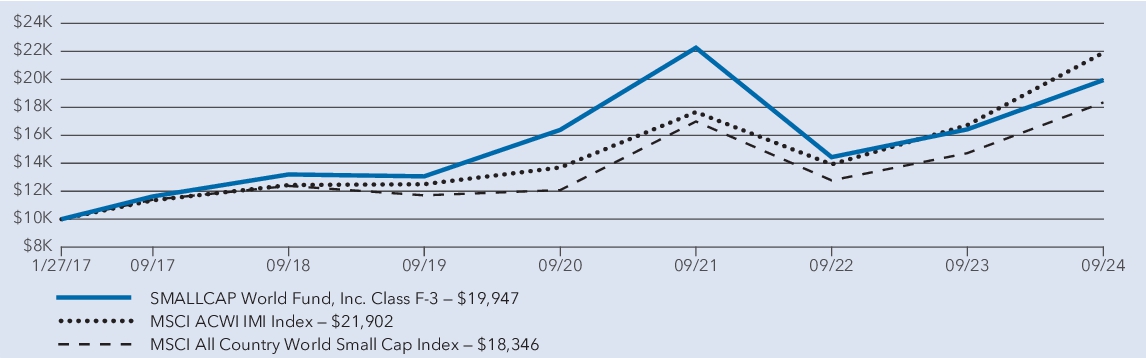

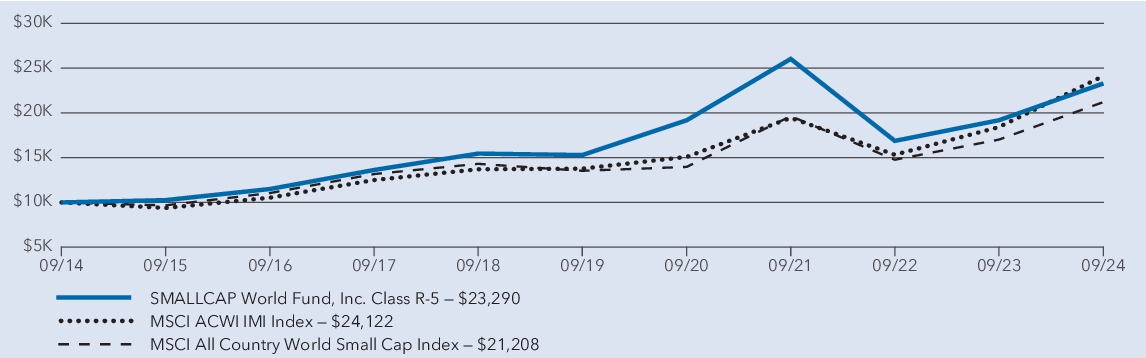

How a hypothetical $10,000 investment has grown

Figures assume reinvestment of dividends and capital gains.

Average annual total returns

| 1 year | 5 years | |

| SMALLCAP World Fund — Class F-3 2 | 21.46 % | 8.83 % | 9.41 % |

| MSCI ACWI IMI Index 3 | 30.96 % | 11.87 % | 10.76 % |

| MSCI All Country World Small Cap Index 3 | 24.62 % | 9.40 % | 8.23 % |

Effective July 24, 2024, the fund's primary benchmark changed from the MSCI All Country World Small Cap Index (the "Previous Primary Benchmark") to the MSCI ACWI IMI Index, a broad-based index that represents the overall applicable securities market, as required by the SEC. The Previous Primary Benchmark provides a means to compare the fund's results to a benchmark that the investment adviser believes is more representative of the fund's investment universe. There is no change in the fund's investment strategies as a result of the benchmark change.

1

Class F-3 shares were first offered on January 27, 2017.

2

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower.

3

Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI.

The fund’s past performance is not a predictor of its future performance.

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund net assets (in millions) | $ 77,077 |

| Total number of portfolio holdings | 866 |

| Total advisory fees paid (in millions) | $ 428 |

| Portfolio turnover rate | 32 % |

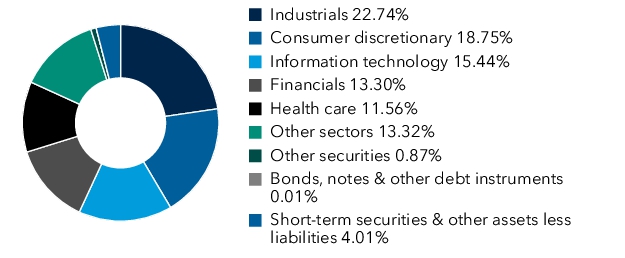

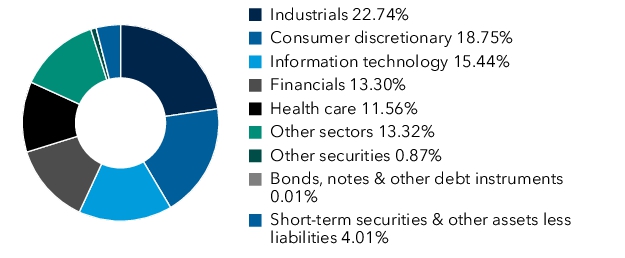

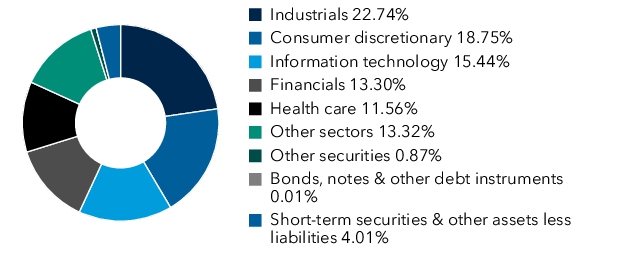

Portfolio holdings by sector

(percent of net assets)

Availability of additional information

Scan the QR code to view additional information about the fund, including its prospectus, financial information, holdings and information on proxy voting. Or refer to the web address included at the beginning of this report.

To reduce fund expenses, only one copy of most shareholder documents will be mailed to shareholders with multiple accounts at the same address (householding). If you would prefer that your documents not be householded, please contact Capital Group at

(800) 421-4225

, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Capital Group or your financial intermediary.

Lit. No. MFF3ARX-035-1124 © 2024 Capital Group. All rights reserved.

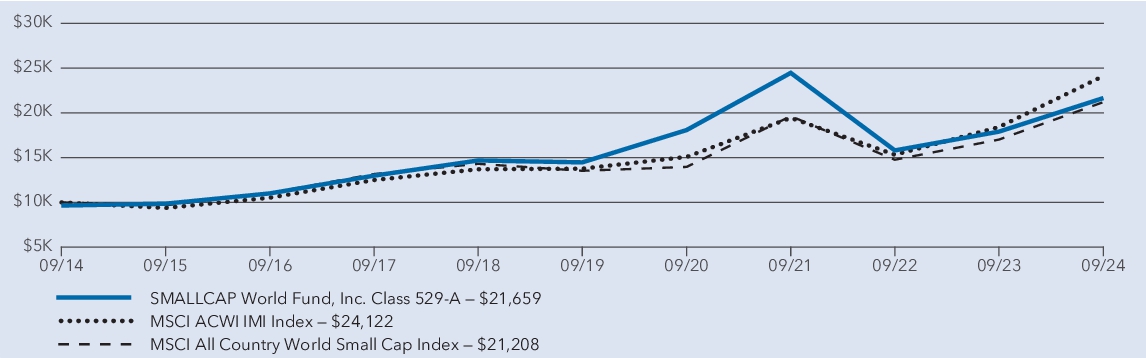

ANNUAL SHAREHOLDER REPORT

Class 529-A | CSPAX

for the year ended September 30, 2024

This annual shareholder report contains important information about SMALLCAP World Fund (the "fund")

for the period from October 1, 2023 to September 30, 2024. You can find additional information about the fund at

capitalgroup.com/mutual-fund-literature-529A

. You can also request this information by contacting us at (800) 421-4225.

What were the fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class 529-A | $ 118 | 1.07 % |

Management's discussion of fund performance

The fund’s Class 529-A shares gained 20.95% for the year ended September 30, 2024. That result compares with a 24.62% gain for the MSCI All Country World Small Cap Index. For information on returns for additional periods, including the fund lifetime, please refer to

capitalgroup.com/mutual-fund-returns-529A

.

What factors influenced results

Global equity markets saw a strong rally over the course of the fund’s fiscal year, with easing inflation and rate cuts by the

Federal

Reserve restoring confidence in stocks, particularly in the United States. The market strength was particularly concentrated in mega-cap US stocks, with small-cap stocks lagging the overall market.

Portfolio holdings in industrials, financials, and consumer discretionary had better returns relative to the overall portfolio. In industrials, companies that indirectly benefit from the build out in AI data centers such as Comfort Systems, as well as the reshoring trend in the US, positively contributed to results. Companies in consumer discretionary, such as Cava, TopBuild and MakeMyTrip, were additive to results as well. On the other hand, Staples and Energy shares lagged the overall portfolio.

Geographically – US companies, where the fund had the largest exposure, saw returns above those of the overall portfolio. Some select emerging markets were also additive, such as India, Philippines and Turkey, while China lagged the fund. Shares domiciled in the Eurozone, the UK and Japan saw returns below that of the overall portfolio.

How a hypothetical $10,000 investment has grown

Figures reflect deduction of the maximum sales charge and assume reinvestment of dividends and capital gains.

Average annual total returns

| 1 year | 5 years | 10 years |

| SMALLCAP World Fund — Class 529-A (with sales charge) * | 16.72 % | 7.62 % | 8.03 % |

| SMALLCAP World Fund — Class 529-A (without sales charge) * | 20.95 % | 8.39 % | 8.42 % |

| MSCI ACWI IMI Index † | 30.96 % | 11.87 % | 9.20 % |

| MSCI All Country World Small Cap Index † | 24.62 % | 9.40 % | 7.81 % |

Effective July 24, 2024, the fund's primary benchmark changed from the

MSCI

All Country World Small Cap Index (the "Previous Primary Benchmark") to the MSCI ACWI IMI Index, a broad-based index that represents the overall applicable securities market, as required by the SEC. The Previous Primary Benchmark provides a means to compare the fund's results to a benchmark that the investment adviser believes is more representative of the fund's investment universe. There is no change in the fund's investment strategies as a result of the benchmark change.

*

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower.

†

Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI.

The fund’s past performance is not a predictor of its future performance.

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund net assets (in millions) | $ 77,077 |

| Total number of portfolio holdings | 866 |

| Total advisory fees paid (in millions) | $ 428 |

| Portfolio turnover rate | 32 % |

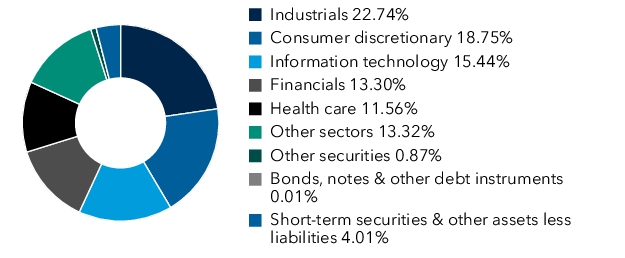

Portfolio holdings by sector

(percent of net assets)

Availability of additional information

Scan the QR code to view additional information about the fund, including its prospectus, financial information,

holdings

and information on proxy voting. Or refer to the web address included at the beginning of this report.

To reduce fund expenses, only one copy of most shareholder documents will be mailed to shareholders with multiple accounts at the same address (householding). If you would prefer that your documents not be householded, please contact Capital Group at

(800) 421-4225

, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Capital Group or your financial intermediary.

Lit. No. MF5AARX-035-1124 © 2024 Capital Group. All rights reserved.

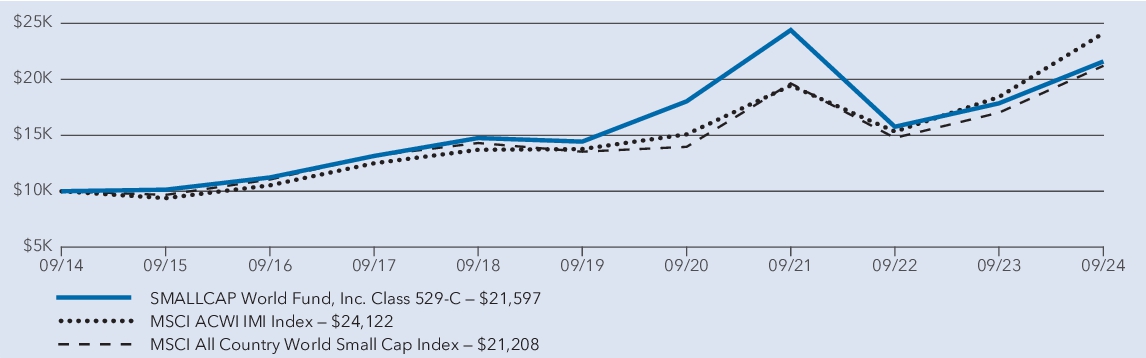

ANNUAL SHAREHOLDER REPORT

Class 529-C | CSPCX

for the year ended September 30, 2024

This annual shareholder report contains important information about SMALLCAP World Fund (the "fund")

for the period from October 1, 2023 to September 30, 2024. You can find additional information about the fund at

capitalgroup.com/mutual-fund-literature-529C

. You can also request this information by contacting us at (800) 421-4225.

What were the fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class 529-C | $ 199 | 1.81 % |

Management's discussion of fund performance

The fund’s Class 529-C shares gained 20.08% for the year ended September 30, 2024. That result compares with a 24.62% gain for the MSCI All Country World Small Cap Index. For information on returns for additional periods, including the fund lifetime, please refer to

capitalgroup.com/mutual-fund-returns-529C

.

What factors influenced results

Global equity markets saw a strong rally over the course of the fund’s fiscal year, with easing inflation and rate cuts by the Federal Reserve restoring confidence in stocks, particularly in the United States. The market strength was particularly concentrated in mega-cap US stocks, with small-cap stocks lagging the overall market.

Portfolio holdings in industrials, financials, and consumer discretionary had better returns relative to the overall portfolio. In industrials, companies that indirectly benefit from the build out in AI data centers such as Comfort Systems, as well as the reshoring trend in the US, positively contributed to results. Companies in consumer discretionary, such as Cava, TopBuild and MakeMyTrip, were additive to results as well. On the other hand, Staples and Energy shares lagged the overall portfolio.

Geographically – US companies, where the fund had the largest exposure, saw returns above those of the overall portfolio. Some select emerging markets were also additive, such as India, Philippines and Turkey, while China lagged the fund. Shares domiciled in the Eurozone, the UK and Japan saw returns below that of the overall portfolio.

How a hypothetical $10,000 investment has grown

Figures assume reinvestment of dividends and capital gains.

Average annual total returns

| 1 year | 5 years | 10 years |

| SMALLCAP World Fund — Class 529-C (with sales charge) * | 19.08 % | 7.58 % | 8.00 % |

| SMALLCAP World Fund — Class 529-C (without sales charge) * | 20.08 % | 7.58 % | 8.00 % |

| MSCI ACWI IMI Index † | 30.96 % | 11.87 % | 9.20 % |

| MSCI All Country World Small Cap Index † | 24.62 % | 9.40 % | 7.81 % |

Effective July 24, 2024, the fund's primary benchmark changed from the MSCI All Country World Small Cap Index (the "Previous Primary Benchmark") to the MSCI ACWI IMI Index, a broad-based index that represents the overall applicable securities market, as required by the SEC. The Previous Primary Benchmark provides a means to compare the fund's results to a benchmark that the investment adviser believes is more representative of the fund's investment universe. There is no change in the fund's investment strategies as a result of the benchmark change.

*

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower.

†

Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI.

The fund’s past performance is not a predictor of its future performance.

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund net assets (in millions) | $ 77,077 |

| Total number of portfolio holdings | 866 |

| Total advisory fees paid (in millions) | $ 428 |

| Portfolio turnover rate | 32 % |

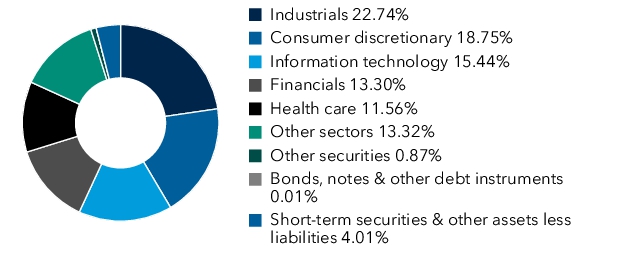

Portfolio holdings by sector

(percent of net assets)

Availability of additional information

Scan the QR code to view additional information about the fund, including its prospectus, financial information, holdings and information on proxy voting. Or refer to the web address included at the beginning of this report.

To reduce fund expenses, only one copy of most shareholder documents will be mailed to shareholders with multiple

accounts

at the same address (householding). If you would prefer that your documents not be householded, please contact Capital Group at

(800) 421-4225

, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Capital Group or your financial intermediary.

Lit. No. MF5CARX-035-1124 © 2024 Capital Group. All rights reserved.

ANNUAL SHAREHOLDER REPORT

Class 529-E | CSPEX

for the year ended September 30, 2024

This annual shareholder report contains important information about SMALLCAP World Fund (the "fund")

for the period from October 1, 2023 to September 30, 2024. You can find additional information about the fund at

capitalgroup.com/mutual-fund-literature-529E

. You can also request this information by contacting us at (800) 421-4225.

What were the fund costs for the last year?

(based on a hypothetical $

10,000

investment

)

| Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class 529-E | $ 139 | 1.26 % |

Management's discussion of fund performance

The fund’s Class 529-E shares gained 20.73% for the year ended September 30, 2024. That result compares with a 24.62% gain for the MSCI All Country World Small Cap Index. For information on returns for additional periods, including the fund lifetime, please refer to

capitalgroup.com/mutual-fund-returns-529E

.

What factors influenced results

Global equity markets saw a strong rally over the course of the fund’s fiscal year, with easing inflation and rate cuts by the Federal Reserve restoring confidence in stocks, particularly in the United States. The market strength was particularly concentrated in mega-cap US stocks, with small-cap stocks lagging the overall market.

Portfolio holdings in industrials, financials, and consumer discretionary had better returns relative to the overall portfolio. In industrials, companies that indirectly benefit from the build out in AI data centers such as Comfort Systems, as well as the reshoring trend in the US, positively contributed to results. Companies in consumer discretionary, such as Cava, TopBuild and MakeMyTrip, were additive to results as well. On the other hand, Staples and Energy shares lagged the overall portfolio.

Geographically – US companies, where the fund had the largest exposure, saw returns above those of the overall portfolio. Some select emerging markets were also additive, such as India, Philippines and Turkey, while China lagged the fund. Shares domiciled in the Eurozone, the UK and Japan saw returns below that of the overall portfolio.

How a hypothetical $10,000 investment has grown

Figures assume reinvestment of dividends and capital gains.

Average annual total returns

| 1 year | 5 years | 10 years |

| SMALLCAP World Fund — Class 529-E * | 20.73 % | 8.18 % | 8.20 % |

| MSCI ACWI IMI Index † | 30.96 % | 11.87 % | 9.20 % |

| MSCI All Country World Small Cap Index † | 24.62 % | 9.40 % | 7.81 % |

Effective July 24, 2024, the fund's primary benchmark changed from the MSCI All Country World Small Cap Index (the "Previous Primary Benchmark") to the MSCI ACWI IMI Index, a broad-based index that represents the overall applicable securities market, as required by the SEC. The Previous Primary Benchmark provides a means to compare the fund's results to a benchmark that the investment adviser believes is more representative of the fund's investment universe. There is no change in the fund's investment strategies as a result of the benchmark change.

*

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower.

†

Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI.

The fund’s past performance is not a predictor of its future performance.

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund net assets (in millions) | $ 77,077 |

| Total number of portfolio holdings | 866 |

| Total advisory fees paid (in millions) | $ 428 |

| Portfolio turnover rate | 32 % |

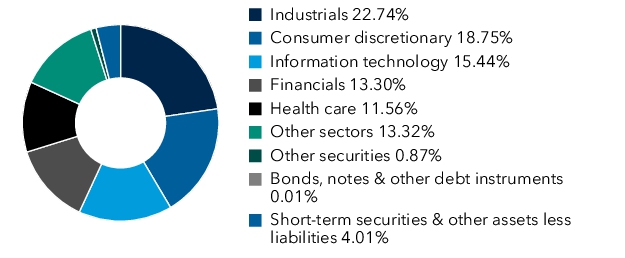

Portfolio holdings by sector

(percent of net assets)

Availability of additional information

Scan the QR code to view additional information about the fund, including its prospectus, financial information, holdings and information on proxy voting. Or refer to the web address included at the beginning of this report.

To reduce fund expenses, only one copy of most shareholder documents will be mailed to shareholders with multiple accounts at the same address (householding). If you would prefer that your documents not be householded, please contact Capital Group at

(800) 421-4225

, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Capital Group or your financial intermediary.

Lit. No. MF5EARX-035-1124 © 2024 Capital Group. All rights reserved.

ANNUAL SHAREHOLDER REPORT

Class 529-T | TWSFX

for the year ended September 30, 2024

This annual shareholder report contains important information about SMALLCAP World Fund (the "fund")

for the period from October 1, 2023 to September 30, 2024. You can find additional information about the fund at

capitalgroup.com/mutual-fund-literature

. You can also request this information by contacting us at (800) 421-4225.

What were the fund costs for the last year?

(based on a hypothetical $10,000

investment

)

| Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class 529-T | $ 92 | 0.83 % |

Management's discussion of fund performance

The fund’s Class 529-T shares gained 21.26% for the year ended September 30, 2024. That result compares with a 24.62% gain for the MSCI All Country World Small Cap Index.

What factors influenced results

Global equity markets saw a strong rally over the course of the fund’s fiscal year, with easing inflation and rate cuts by the Federal Reserve restoring confidence in stocks, particularly in the United States. The market strength was particularly concentrated in mega-cap US stocks, with small-cap stocks lagging the overall market.

Portfolio holdings in industrials, financials, and consumer discretionary had better returns relative to the overall portfolio. In industrials, companies that indirectly benefit from the build out in AI data centers such as Comfort Systems, as well as the reshoring trend in the US, positively contributed to results. Companies in consumer discretionary, such as Cava, TopBuild and MakeMyTrip, were additive to results as well. On the other hand, Staples and Energy shares lagged the overall portfolio.

Geographically – US companies, where the fund had the largest exposure, saw returns above those of the overall portfolio. Some select emerging markets were also additive, such as India, Philippines and Turkey, while China lagged the fund. Shares domiciled in the Eurozone, the UK and Japan saw returns below that of the overall portfolio.

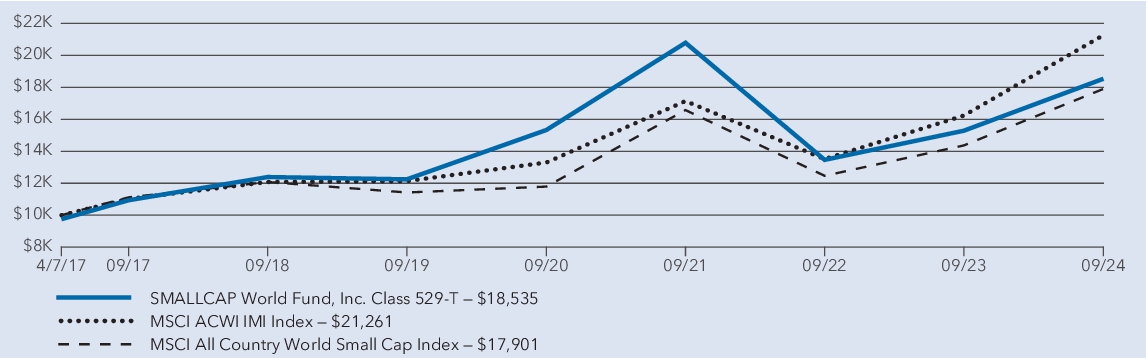

How a hypothetical $10,000 investment has grown

Figures reflect deduction of the maximum sales charge and assume reinvestment of dividends and capital gains.

Average annual total returns

| 1 year | 5 years | |

| SMALLCAP World Fund — Class 529-T (with sales charge) 2 | 18.22 % | 8.10 % | 8.60 % |

| SMALLCAP World Fund — Class 529-T (without sales charge) 2 | 21.26 % | 8.65 % | 8.96 % |

| MSCI ACWI IMI Index 3 | 30.96 % | 11.87 % | 10.61 % |

| MSCI All Country World Small Cap Index 3 | 24.62 % | 9.40 % | 8.09 % |

Effective July 24, 2024, the fund's primary benchmark changed from the MSCI All Country World Small Cap Index (the "Previous Primary Benchmark") to the MSCI ACWI IMI Index, a broad-based index that represents the overall applicable securities market, as required by the SEC. The Previous Primary Benchmark provides a means to compare the fund's results to a benchmark that the investment adviser believes is more representative of the fund's investment universe. There is no change in the fund's investment strategies as a result of the benchmark change.

1

Class 529-T shares were first offered on April 7, 2017.

2

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower.

3

Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI.

The fund’s past performance is not a predictor of its future performance.

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund net assets (in millions) | $ 77,077 |

| Total number of portfolio holdings | 866 |

| Total advisory fees paid (in millions) | $ 428 |

| Portfolio turnover rate | 32 % |

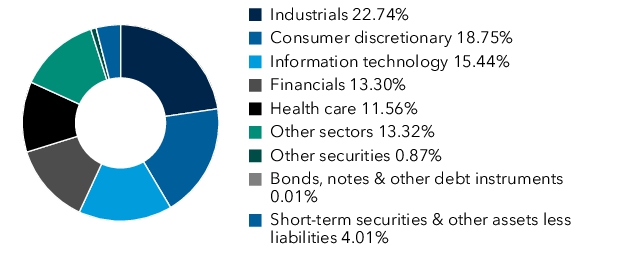

Portfolio holdings by sector

(percent of

net

assets)

Availability of additional information

Scan the QR code to view additional information about the fund, including its prospectus, financial information, holdings and information on proxy voting. Or refer to the web address included at the beginning of this report.

To reduce fund expenses, only one copy of most shareholder documents will be mailed to shareholders with multiple accounts at the same address (householding). If you would prefer that your documents not be householded, please contact Capital Group at

(800) 421-4225

, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Capital Group or your financial intermediary.

Lit. No. MF5TARX-035-1124 © 2024 Capital Group. All rights reserved.

ANNUAL SHAREHOLDER REPORT

Class 529-F-1 | CSPFX

for the year ended September 30, 2024

This annual shareholder report contains important information about SMALLCAP World Fund (the "fund")

for the period from October 1, 2023 to September 30, 2024. You can find additional information about the fund at

capitalgroup.com/mutual-fund-literature-529F1

. You can also request this information by contacting us at (800) 421-4225.

What were the fund costs for the last year?

(based on a hypothetical $

10,000

investment

)

| Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class 529-F-1 | $ 100 | 0.90 % |

Management's discussion of fund performance

The fund’s Class 529-F-1 shares gained 21.17% for the year ended September 30, 2024. That result compares with a 24.62% gain for the MSCI All Country World Small Cap Index. For information on returns for additional periods, including the fund lifetime, please refer to

capitalgroup.com/mutual-fund-returns-529F1

.

What factors influenced results

Global equity markets saw a strong rally over the course of the fund’s fiscal year, with easing inflation and rate cuts by the Federal Reserve restoring confidence in stocks, particularly in the United States. The market strength was particularly concentrated in mega-cap US stocks, with small-cap stocks lagging the overall market.

Portfolio holdings in industrials, financials, and consumer discretionary had better returns relative to the overall portfolio. In industrials, companies that indirectly benefit from the build out in AI data centers such as Comfort Systems, as well as the reshoring trend in the US, positively contributed to results. Companies in consumer discretionary, such as Cava, TopBuild and MakeMyTrip, were additive to results as well. On the other hand, Staples and Energy shares lagged the overall portfolio.

Geographically – US companies, where the fund had the largest exposure, saw returns above those of the overall portfolio. Some select emerging markets were also additive, such as India, Philippines and Turkey, while China lagged the fund. Shares domiciled in the Eurozone, the UK and Japan saw returns below that of the overall portfolio.

How a hypothetical $10,000 investment has grown

Figures assume reinvestment of dividends and capital gains.

Average annual total returns

| 1 year | 5 years | 10 years |

| SMALLCAP World Fund — Class 529-F-1 * | 21.17 % | 8.60 % | 8.64 % |

| MSCI ACWI IMI Index † | 30.96 % | 11.87 % | 9.20 % |

| MSCI All Country World Small Cap Index † | 24.62 % | 9.40 % | 7.81 % |

Effective July 24, 2024, the fund's primary benchmark changed from the MSCI All Country World Small Cap Index (the "Previous Primary Benchmark") to the MSCI ACWI IMI Index, a broad-based index that represents the overall applicable securities market, as required by the SEC. The Previous Primary Benchmark provides a means to compare the fund's results to a benchmark that the investment adviser believes is more representative of the fund's investment universe. There is no change in the fund's investment strategies as a result of the benchmark change.

*

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower.

†

Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI.

The fund’s past performance is not a predictor of its future performance.

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund net assets (in millions) | $ 77,077 |

| Total number of portfolio holdings | 866 |

| Total advisory fees paid (in millions) | $ 428 |

| Portfolio turnover rate | 32 % |

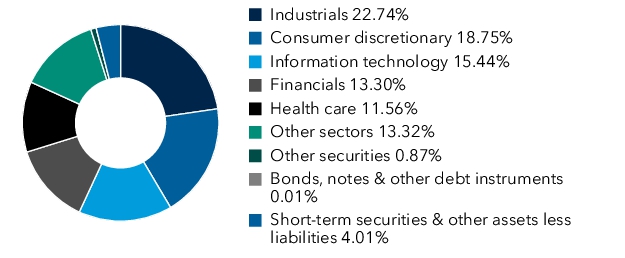

Portfolio holdings by sector

(percent of net assets)

Availability of additional information

Scan the QR code to view additional information about the fund, including its prospectus, financial information, holdings and information on proxy voting. Or refer to the web address included at the beginning of this report.

To reduce fund expenses, only one copy of most shareholder documents will be mailed to shareholders with multiple accounts at the same address (householding). If you would prefer that your documents not be householded, please contact Capital Group at

(800) 421-4225

, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Capital Group or your financial intermediary.

Lit. No. MF5FARX-035-1124 © 2024 Capital Group. All rights reserved.

ANNUAL SHAREHOLDER REPORT

Class 529-F-2 | FSWFX

for the year ended September 30, 2024

This annual shareholder report contains important information about SMALLCAP World Fund (the "fund")

for the period from October 1, 2023 to September 30, 2024. You can find additional information about the fund at

capitalgroup.com/mutual-fund-literature-529F2

. You can also request this information by contacting us at (800) 421-4225.

What were the fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class 529-F-2 | $ 85 | 0.77 % |

Management's discussion of fund performance

The fund’s Class 529-F-2 shares gained 21.32% for the year ended September 30, 2024. That result compares with a 24.62% gain for the MSCI All Country World Small Cap Index. For information on returns for additional periods, including the fund lifetime, please refer to

capitalgroup.com/mutual-fund-returns-529F2

.

What factors influenced results

Global equity markets saw a strong rally over the course of the fund’s fiscal year, with easing inflation and rate cuts by the Federal Reserve restoring confidence in stocks, particularly in the United States. The market strength was particularly concentrated in mega-cap US stocks, with small-cap stocks lagging the overall market.

Portfolio holdings in industrials, financials, and consumer discretionary had better returns relative to the overall portfolio. In industrials, companies that indirectly benefit from the build out in AI data centers such as Comfort Systems, as well as the reshoring trend in the US, positively contributed to results. Companies in consumer discretionary, such as Cava, TopBuild and MakeMyTrip, were additive to results as well. On the other hand, Staples and Energy shares lagged the overall portfolio.

Geographically – US companies, where the fund had the largest exposure, saw returns above those of the overall portfolio. Some select emerging markets were also additive, such as India, Philippines and Turkey, while China lagged the fund. Shares domiciled in the Eurozone, the UK and Japan saw returns below that of the overall

portfolio

.

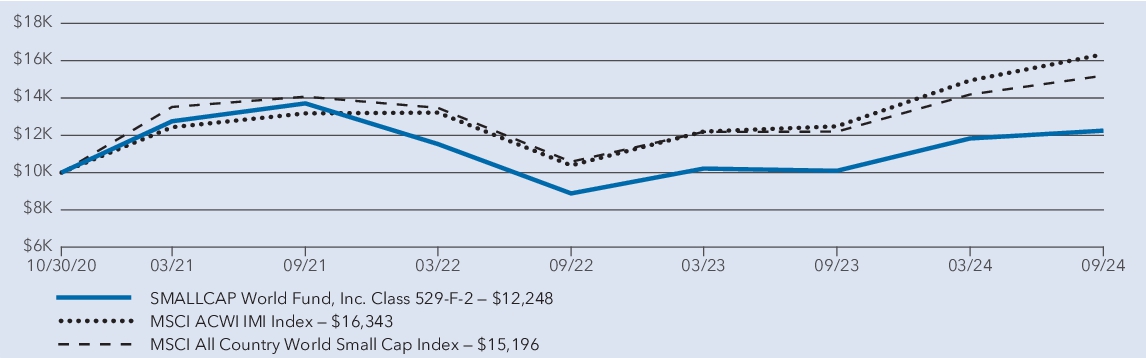

How a hypothetical $10,000 investment has grown

Figures assume reinvestment of dividends and capital gains.

Average annual total

returns

| 1 year | |

| SMALLCAP World Fund — Class 529-F-2 2 | 21.32 % | 5.31 % |

| MSCI ACWI IMI Index 3 | 30.96 % | 13.36 % |

| MSCI All Country World Small Cap Index 3 | 24.62 % | 11.27 % |

Effective July 24, 2024, the fund's primary benchmark changed from the MSCI All Country World Small Cap Index (the "Previous Primary Benchmark") to the MSCI ACWI IMI Index, a broad-based index that represents the overall applicable securities market, as required by the SEC. The Previous Primary Benchmark provides a means to compare the fund's results to a benchmark that the investment adviser believes is more representative of the fund's investment universe. There is no change in the fund's investment strategies as a result of the benchmark change.

1

Class 529-F-2 shares were first offered on October 30, 2020.

2

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower.

3

Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI.

The fund’s past performance is not a predictor of its future performance.

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund net assets (in millions) | $ 77,077 |

| Total number of portfolio holdings | 866 |

Total advisory fees paid (in millions) | $ 428 |

| Portfolio turnover rate | 32 % |

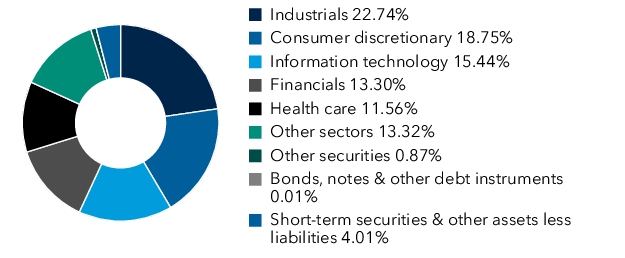

Portfolio holdings by sector

(percent of net assets)

Availability of additional information

Scan the QR code to view additional information about the fund, including its prospectus, financial information, holdings and information on proxy voting. Or refer to the web address included at the beginning of this report.

To reduce fund expenses, only one copy of most shareholder documents will be mailed to shareholders with multiple accounts at the same address (householding). If you would prefer that your documents not be householded, please contact Capital Group at

(800) 421-4225

, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Capital Group or your financial intermediary.

Lit. No. MF5XARX-035-1124 © 2024 Capital Group. All rights reserved.

ANNUAL SHAREHOLDER REPORT

Class 529-F-3 | FSFWX

for the year ended September 30, 2024

This annual shareholder report contains important information about SMALLCAP World Fund (the "fund")

for the period from October 1, 2023 to September 30, 2024. You can find additional information about the fund at

capitalgroup.com/mutual-fund-literature-529F3

. You can also request this information by contacting us at (800) 421-4225.

What were the fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class 529-F-3 | $ 79 | 0.71 % |

Management's discussion of fund performance

The fund’s Class 529-F-3 shares gained 21.40% for the year ended September 30, 2024. That result compares with a 24.62% gain for the MSCI All Country World Small Cap Index. For information on returns for additional periods, including the fund lifetime, please refer to

capitalgroup.com/mutual-fund-returns-529F3

.

What factors influenced results

Global equity markets saw a strong rally over the course of the fund’s fiscal year, with easing inflation and rate cuts by the Federal Reserve restoring confidence in stocks, particularly in the United States. The market strength was particularly concentrated in mega-cap US stocks, with small-cap stocks lagging the overall market.

Portfolio holdings in industrials, financials, and consumer discretionary had better returns relative to the overall portfolio. In industrials, companies that indirectly benefit from the build out in AI data centers such as Comfort Systems, as well as the reshoring trend in the US, positively contributed to results. Companies in consumer discretionary, such as Cava, TopBuild and MakeMyTrip, were additive to results as well. On the other hand, Staples and Energy shares lagged the overall portfolio.

Geographically – US companies, where the fund had the largest exposure, saw returns above those of the overall portfolio. Some select emerging markets were also additive, such as India, Philippines and Turkey, while China lagged the fund. Shares domiciled in the Eurozone, the UK and Japan saw returns below that of the overall portfolio.

How a hypothetical $10,000 investment has grown

Figures assume reinvestment of dividends and capital gains.

Average annual total

returns

| 1 year | |

| SMALLCAP World Fund — Class 529-F-3 2 | 21.40 % | 5.37 % |

| MSCI ACWI IMI Index 3 | 30.96 % | 13.36 % |

| MSCI All Country World Small Cap Index 3 | 24.62 % | 11.27 % |

Effective July 24, 2024, the fund's primary benchmark changed from the MSCI All Country World Small Cap Index (the "Previous Primary Benchmark") to the MSCI ACWI IMI Index, a broad-based index that represents the overall applicable securities market, as required by the SEC. The Previous Primary Benchmark provides a means to compare the fund's results to a benchmark that the investment adviser believes is more representative of the fund's investment universe. There is no change in the fund's investment strategies as a result of the benchmark change.

1

Class 529-F-3 shares were first offered on October 30, 2020.

2

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower.

3

Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI.

The fund’s past performance is not a predictor of its future performance.

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund net assets (in millions) | $ 77,077 |

| Total number of portfolio holdings | 866 |

| Total advisory fees paid (in millions) | $ 428 |

| Portfolio turnover rate | 32 % |

Portfolio holdings by sector

(percent of net assets)

Availability of additional information

Scan the QR code to view additional information about the fund, including its prospectus, financial information, holdings and information on proxy voting. Or refer to the web address included at the beginning of this report.

To reduce fund expenses, only one copy of most shareholder documents will be mailed to shareholders with multiple accounts at the same address (householding). If you would prefer that your documents not be householded, please contact Capital Group at

(800) 421-4225

, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Capital Group or your financial intermediary.

Lit. No. MF5YARX-035-1124 © 2024 Capital Group. All rights reserved.

ANNUAL SHAREHOLDER REPORT

for the year ended September 30, 2024

This annual shareholder report contains important information about SMALLCAP World Fund (the "fund")

for the period from October 1, 2023 to September 30, 2024. You can find additional information about the fund at

capitalgroup.com/mutual-fund-literature-R1

. You can also request this information by contacting us at (800) 421-4225.

What were the fund costs for the last year?

(based on a hypothetical $10,000 in

ves

tment)

| Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R-1 | $ 193 | 1.75 % |

Management's discussion of fund performance

The fund’s Class R-1 shares gained 20.15% for the year ended September 30, 2024. That result compares with a 24.62% gain for the MSCI All Country World Small Cap Index. For information on returns for additional periods, including the fund lifetime, please refer to

capitalgroup.com/mutual-fund-returns-R1

.

What factors influenced results

Global equity markets saw a strong rally over the course of the fund’s fiscal year, with easing inflation and rate cuts by the Federal Reserve restoring confidence in stocks, particularly in the United States. The market strength was particularly concentrated in mega-cap US stocks, with small-cap stocks lagging the overall market.

Portfolio holdings in industrials, financials, and consumer discretionary had better returns relative to the overall portfolio. In industrials, companies that indirectly benefit from the build out in AI data centers such as Comfort Systems, as well as the reshoring trend in the US, positively contributed to results. Companies in consumer discretionary, such as Cava, TopBuild and MakeMyTrip, were additive to results as well. On the other hand, Staples and Energy shares lagged the overall portfolio.

Geographically – US companies, where the fund had the largest exposure, saw returns above those of the overall portfolio. Some select emerging markets were also additive, such as India, Philippines and Turkey, while China lagged the fund. Shares domiciled in the Eurozone, the UK and Japan saw returns below that of the overall portfolio.

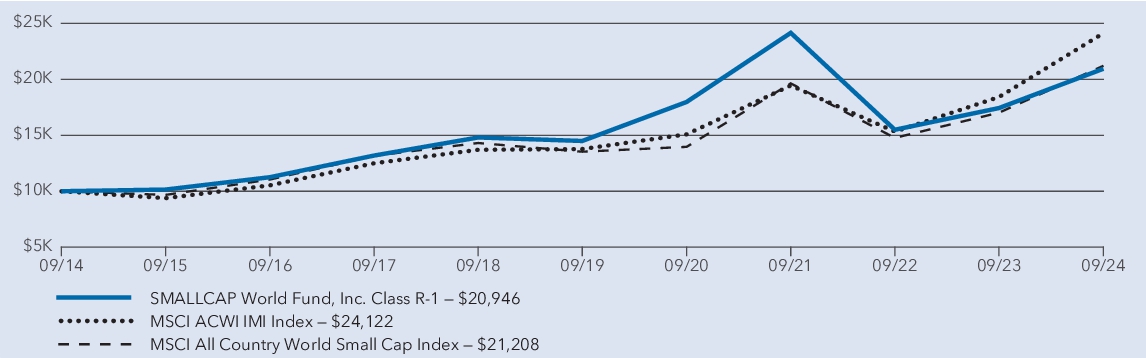

How a hypothetical $10,000 investment has grown

Figures assume reinvestment of dividends and capital gains.

Average annual total return

s

| 1 year | 5 years | 10 years |

SMALLCAP World Fund — Class R-1 * | 20.15 % | 7.65 % | 7.67 % |

| MSCI ACWI IMI Index † | 30.96 % | 11.87 % | 9.20 % |

| MSCI All Country World Small Cap Index † | 24.62 % | 9.40 % | 7.81 % |

Effective July 24, 2024, the fund's primary benchmark changed from the MSCI All Country World

Small

Cap

Index (the "Previous Primary Benchmark") to the MSCI ACWI IMI Index, a broad-based index that represents the overall applicable securities market, as required by the SEC. The Previous Primary Benchmark provides a means to compare the fund's results to a benchmark that the investment adviser believes is more representative of the fund's investment universe. There is no change in the fund's investment strategies as a result of the benchmark change.

*

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower.

†

Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI.

The fund’s past performance is not a predictor of its future performance.

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund net assets (in millions) | $ 77,077 |

| Total number of portfolio holdings | 866 |

| Total advisory fees paid (in millions) | $ 428 |

| Portfolio turnover rate | 32 % |

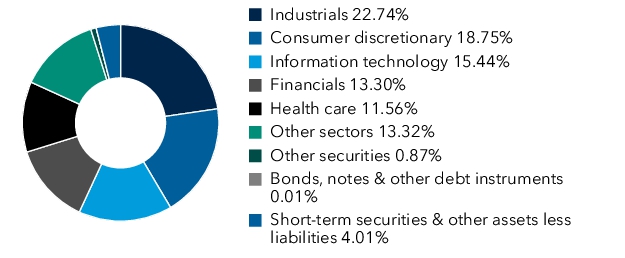

Portfolio holdings by sector

(perce

n

t of net assets)

Availability of additional information

Scan the QR code to view additional information about the fund, including its prospectus, financial information, holdings and information on proxy voting. Or refer to the web address included at the beginning of this report.

To reduce fund expenses, only one copy of most shareholder documents will be mailed to shareholders with multiple accounts at the same address (householding). If you would prefer that your documents not be householded, please contact Capital Group at

(800) 421-4225

, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Capital Group or your financial intermediary.

Lit. No. MFR1ARX-035-1124 © 2024 Capital Group. All rights reserved.

ANNUAL SHAREHOLDER REPORT

Class R-2 | RSLBX

for the year ended September 30, 2024

This annual shareholder report contains important information about SMALLCAP World Fund (the "fund")

for the period from October 1, 2023 to September 30, 2024. You can find additional information about the fund at

capitalgroup.com/mutual-fund-literature-R2

. You can also request this information by contacting us at (800) 421-4225.

What were the fund costs for the last year?

(based on a hypothetical $10,000

investment

)

| Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R-2 | $ 193 | 1.75 % |

Management's discussion of fund performance

The fund’s Class R-2 shares gained 20.15% for the year ended September 30, 2024. That result compares with a 24.62% gain for the MSCI All Country World Small Cap Index. For information on returns for additional periods, including the fund lifetime, please refer to

capitalgroup.com/mutual-fund-returns-R2

.

What factors influenced results

Global equity markets saw a strong rally over the course of the fund’s fiscal year, with easing inflation and rate cuts by the Federal Reserve restoring confidence in stocks, particularly in the United States. The market strength was particularly concentrated in mega-cap US stocks, with small-cap stocks lagging the overall market.

Portfolio holdings in industrials, financials, and consumer discretionary had better returns relative to the overall portfolio. In industrials, companies that indirectly benefit from the build out in AI data centers such as Comfort Systems, as well as the reshoring trend in the US, positively contributed to results. Companies in consumer discretionary, such as Cava, TopBuild and MakeMyTrip, were additive to results as well. On the other hand, Staples and Energy shares lagged the overall portfolio.

Geographically – US companies, where the fund had the largest exposure, saw returns above those of the overall portfolio. Some select emerging markets were also additive, such as India, Philippines and Turkey, while China lagged the fund. Shares domiciled in the Eurozone, the UK and Japan saw returns below that of the overall portfolio.

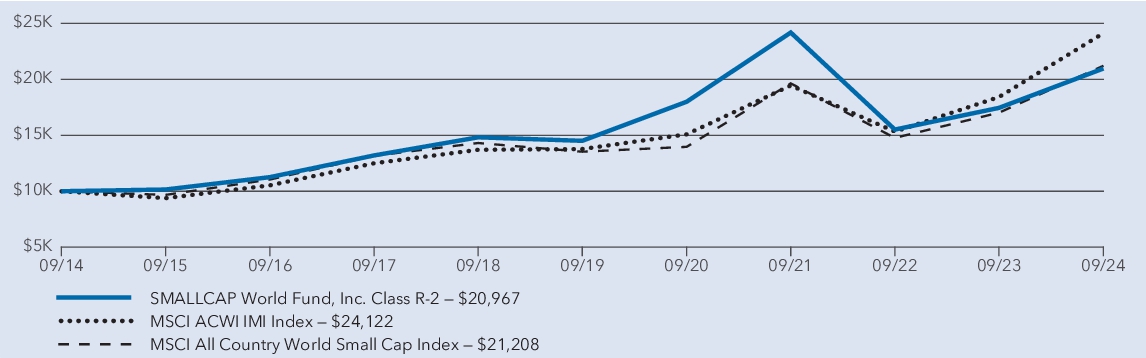

How a hypothetical $10,000 investment has grown

Figures assume reinvestment of dividends and capital gains.

Average annual total returns

| 1 year | 5 years | 10 years |

| SMALLCAP World Fund — Class R-2 * | 20.15 % | 7.65 % | 7.69 % |

| MSCI ACWI IMI Index † | 30.96 % | 11.87 % | 9.20 % |

| MSCI All Country World Small Cap Index † | 24.62 % | 9.40 % | 7.81 % |

Effective July 24, 2024, the fund's primary benchmark changed from the MSCI All Country World Small Cap Index (the "Previous Primary Benchmark") to the MSCI ACWI IMI Index, a broad-based index that represents the overall applicable securities market, as required by the SEC. The Previous Primary Benchmark provides a means to compare the fund's results to a benchmark that the investment adviser believes is more representative of the fund's investment universe. There is no change in the fund's investment strategies as a result of the benchmark change.

*

Investment results assume all distributions are reinvested and reflect applicable fees and expenses.

When

applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower.

†

Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): MSCI.

The fund’s past performance is not a predictor of its future performance.

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund net assets (in millions) | $ 77,077 |

| Total number of portfolio holdings | 866 |

| Total advisory fees paid (in millions) | $ 428 |

| Portfolio turnover rate | 32 % |

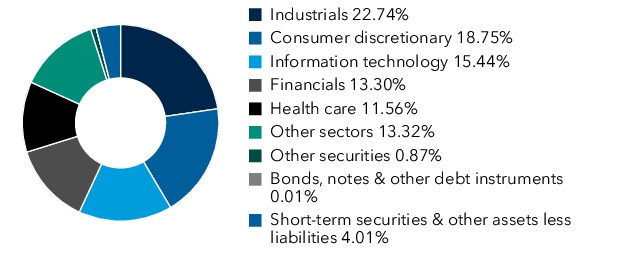

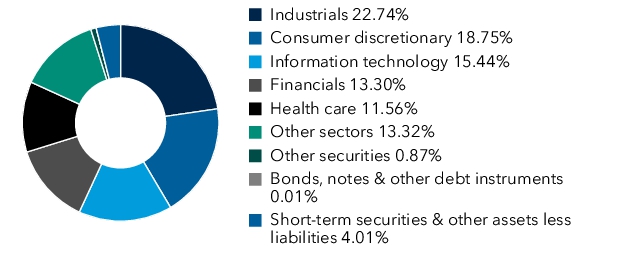

Portfolio holdings by sector

(percent of net assets)

Availability of additional information

Scan the QR code to view additional information about the fund, including its prospectus, financial information, holdings and information on proxy voting. Or refer to the web address included at the beginning of this report.

To reduce fund expenses, only one copy of most shareholder documents will be mailed to shareholders with multiple accounts at

the

same address (householding). If you would prefer that your documents not be householded, please contact Capital Group at

(800) 421-4225

, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Capital Group or your financial intermediary.

Lit. No. MFR2ARX-035-1124 © 2024 Capital Group. All rights reserved.

ANNUAL SHAREHOLDER REPORT

Class R-2E | RSEBX

for the year ended September 30, 2024

This annual shareholder report contains important information about SMALLCAP World Fund (the "fund")

for the period from October 1, 2023 to September 30, 2024. You can find additional information about the fund at

capitalgroup.com/mutual-fund-literature-R2E

. You can also request this information by contacting us at (800) 421-4225.

What were the fund costs for the last year?

(based on a hypothetical $10,000

investment

)

| Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R-2E | $ 161 | 1.46 % |

Management's discussion of fund performance

The fund’s Class R-2E shares gained 20.49% for the year ended September 30, 2024. That result compares with a 24.62% gain for the MSCI All Country World Small Cap Index. For information on returns for additional periods, including the fund lifetime, please refer to

capitalgroup.com/mutual-fund-returns-R2E

.

What factors influenced results

Global equity markets saw a strong rally over the course of the fund’s fiscal year, with easing inflation and rate cuts by the Federal Reserve restoring confidence in stocks, particularly in the United States. The market strength was particularly concentrated in mega-cap US stocks, with small-cap stocks lagging the overall market.

Portfolio holdings in industrials, financials, and consumer discretionary had better returns relative to the overall portfolio. In industrials, companies that indirectly benefit from the build out in AI data centers such as Comfort Systems, as well as the reshoring trend in the US, positively contributed to results. Companies in consumer discretionary, such as Cava, TopBuild and MakeMyTrip, were additive to results as well. On the other hand, Staples and Energy shares lagged the overall portfolio.

Geographically – US companies, where the fund had the largest exposure, saw returns above those of the overall portfolio. Some select emerging markets were also additive, such as India, Philippines and Turkey, while China lagged the fund. Shares domiciled in the Eurozone, the UK and Japan saw returns below that of the overall portfolio.

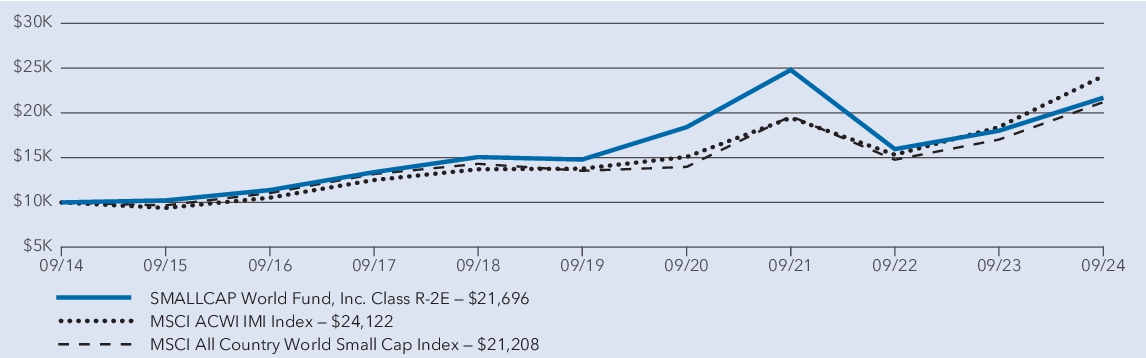

How a hypothetical $10,000 investment has grown

Figures assume reinvestment of dividends and capital gains.

Average annual total returns

| 1 year | 5 years | 10 years |

| SMALLCAP World Fund — Class R-2E * | 20.49 % | 7.96 % | 8.05 % |

| MSCI ACWI IMI Index † | 30.96 % | 11.87 % | 9.20 % |

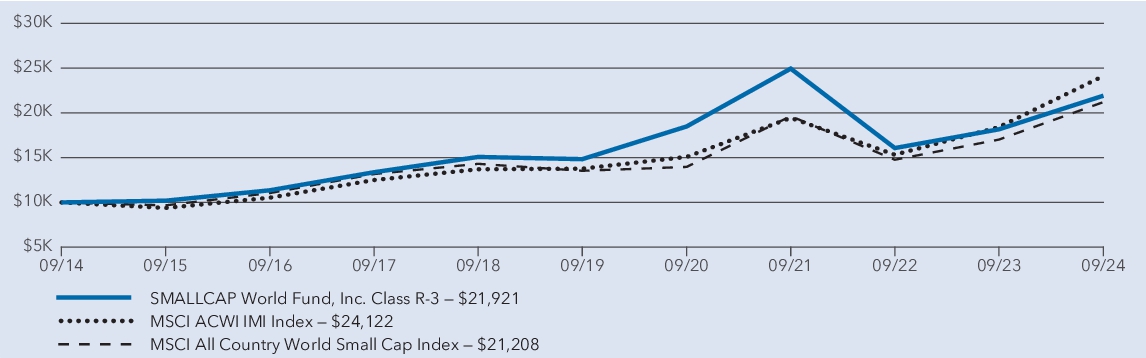

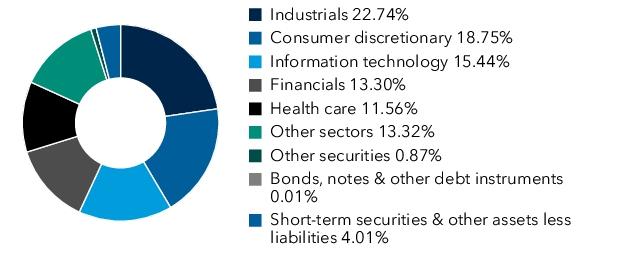

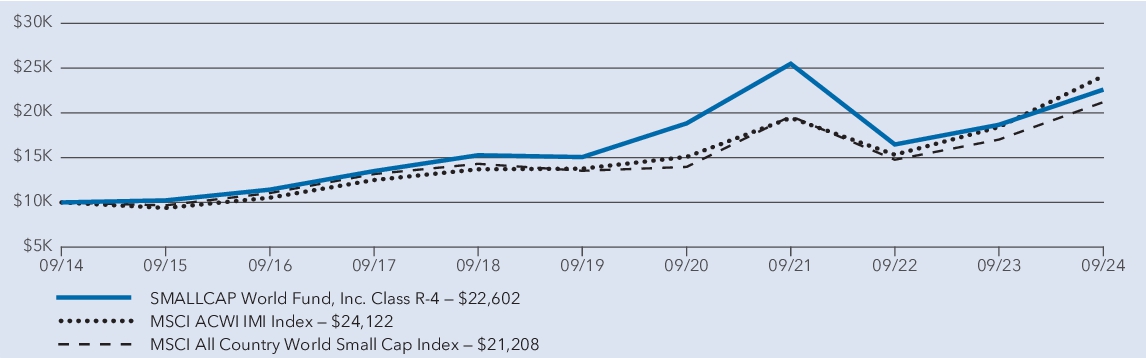

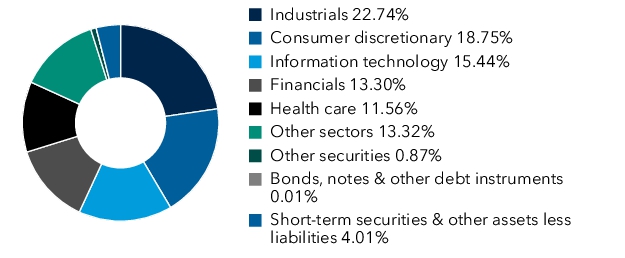

| MSCI All Country World Small Cap Index † | 24.62 % | 9.40 % | 7.81 % |