EXHIBIT 13

Annual Report to Stockholders for the fiscal year ended December 31, 2007

Emclaire Financial Corp. (OTCBB: EMCF), a publicly traded Pennsylvania corporation and bank holding company, provides a wide range of retail and commercial financial products and services to customers in Western Pennsylvania through its wholly owned subsidiary bank, the Farmers National Bank of Emlenton.

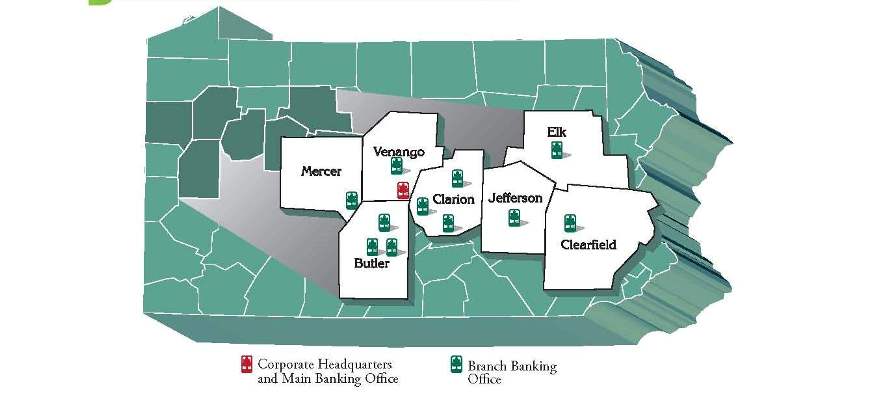

The Farmers National Bank of Emlenton is an FDIC-insured national banking association, which conducts business through twelve offices in Venango, Butler, Clarion, Clearfield, Elk, Jefferson and Mercer counties, Pennsylvania. The Bank also provides retail brokerage and other investment services through its Farmers National Financial Services division. To complement consumer and commercial banking activities conducted through its banking offices, the Corporation also invests in U.S. Government, municipal, mortgage-backed and corporate marketable securities primarily through its subsidiary bank.

Farmers National Bank of Emlenton Market Area

| | | At December 31, | |

| Balance Sheet: | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | | | | | | | | | | | | | | |

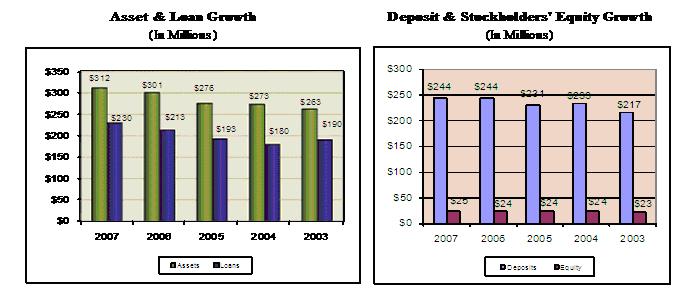

| Total assets | | $ | 311,720 | | | $ | 300,560 | | | $ | 275,517 | | | $ | 273,380 | | | $ | 262,512 | |

| Loans receivable, net | | | 229,819 | | | | 213,344 | | | | 192,526 | | | | 179,575 | | | | 190,482 | |

| Deposits | | | 244,262 | | | | 244,492 | | | | 230,503 | | | | 232,874 | | | | 217,110 | |

| Borrowed funds | | | 40,400 | | | | 30,000 | | | | 19,500 | | | | 15,000 | | | | 20,700 | |

| Stockholders' equity | | | 24,703 | | | | 23,917 | | | | 23,615 | | | | 23,616 | | | | 22,655 | |

| | | | | | | | | | | | | | | | | | | | | |

| Stockholders' equity per common share | | $ | 19.48 | | | $ | 18.86 | | | $ | 18.63 | | | $ | 18.63 | | | $ | 17.87 | |

| Market value per common share | | $ | 25.75 | | | $ | 29.25 | | | $ | 26.60 | | | $ | 26.25 | | | $ | 25.75 | |

| Common shares outstanding | | | 1,267,835 | | | | 1,267,835 | | | | 1,267,835 | | | | 1,267,835 | | | | 1,267,835 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income Statement: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Net interest income | | $ | 9,969 | | | $ | 9,291 | | | $ | 9,304 | | | $ | 8,734 | | | $ | 9,308 | |

| Noninterest income | | | 2,943 | | | | 2,934 | | | | 3,317 | | | | 2,535 | | | | 1,785 | |

| Net income | | | 2,697 | | | | 1,966 | | | | 2,573 | | | | 2,557 | | | | 2,492 | |

| | | | | | | | | | | | | | | | | | | | | |

| Basic and diluted earnings per common share | | $ | 2.13 | | | $ | 1.55 | | | $ | 2.03 | | | $ | 2.02 | | | $ | 1.91 | |

| Cash dividends per common share | | $ | 1.54 | | | $ | 1.10 | | | $ | 1.02 | | | $ | 0.94 | | | $ | 1.11 | |

| | | | | | | | | | | | | | | | | | | | | |

| Key Ratios: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Return on average assets | | | 0.90 | % | | | 0.69 | % | | | 0.94 | % | | | 0.96 | % | | | 0.99 | % |

| Return on average equity | | | 11.13 | % | | | 8.28 | % | | | 10.69 | % | | | 11.08 | % | | | 10.96 | % |

| Net interest margin | | | 3.73 | % | | | 3.68 | % | | | 3.82 | % | | | 3.71 | % | | | 4.18 | % |

| Non-performing assets to total assets | | | 0.35 | % | | | 0.65 | % | | | 0.57 | % | | | 0.33 | % | | | 0.52 | % |

| Efficiency ratio | | | 68.66 | % | | | 74.18 | % | | | 69.72 | % | | | 67.11 | % | | | 64.16 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Dear Fellow Shareholder:

During a period of internal transition and growth and external market turmoil for the financial services industry, Emclaire Financial Corp. and its wholly owned subsidiary bank, the Farmers National Bank of Emlenton, delivered record financial performance in 2007. We continue to prove that an independent community bank headquartered in rural Western Pennsylvania can consistently realize sound returns for shareholders, provide safe and competitive banking services for the customers and communities we serve, and offer promising career opportunities for our employees.

In recent years, your board of directors and management team have set forth certain broad objectives and strategies to continue to move the Corporation forward and enhance financial and operational performance. These broad objectives encompass profitably growing our financial institution while managing risk and holding true to the culture and tradition that has brought us to where we are today and expect to be in the future. Herein we will set forth how we successfully executed these strategies of profitability, growth, quality and culture to achieve our record financial results for 2007 while persisting to build a first-class organization | |

Profitability

The Corporation’s financial success during 2007 and in recent years is reflected in our record earnings and the positive performance of our common stock.

Earnings. The Corporation realized consolidated net income of $2.7 million or $2.13 per share for 2007, versus $2.0 million or $1.55 per share for 2006. The 2007 results reflected a return on average equity of 11.13%. While results for 2006 included certain one-time charges associated with strategic reorganization initiatives undertaken in that year, the Corporation experienced improved core financial performance through increased net interest and noninterest income and by controlling noninterest expenses between 2007 and 2006.

Net interest income increased $678,000 to $10.0 million for 2007 compared to $9.3 million for 2006. This 7.3% increase can be attributed to continued growth in the Bank’s loan portfolios, particularly commercial loans, and disciplined asset liability management practices. These practices included regimented pricing of loan and deposit products and a tactical focus on maintaining core deposit accounts. This growth and these initiatives provided for an increase in the Corporation’s net interest margin to 3.73% for 2007 versus 3.68% for 2006. This improvement occurred during a period when the market interest rate yield curve was relatively flat to negatively inverted, an extremely difficult rate environment in which to manage a financial institution’s margins.

Excluding security sale gains, which we consider non-recurring income, noninterest revenues increased $202,000 or 8.0% between 2007 and the prior year. As we continue to explore ways to diversify our revenue streams and mitigate our reliance on net interest revenues, we have experienced increases in both customer service fees and financial services division commissions.

Excluding consideration of the one-time 2006 reorganization charges, the Corporation experienced only a modest increase in noninterest expenses of $314,000 or 3.5% between 2007 and the prior year. During 2007, we realized some of the ongoing savings as a result of the 2006 reorganization initiatives while focusing on controlling all expenses. Operating expenses increased primarily as a result of the opening of the new Cranberry office in late 2006 and professional fees associated with required Sarbanes-Oxley compliance initiatives pursued during 2007.

Shareholder Letter

continued

We spent much of 2007 focused on increasing core revenues while controlling operating costs. This focus will continue as we seek new opportunities to efficiently deliver new and traditional banking services.

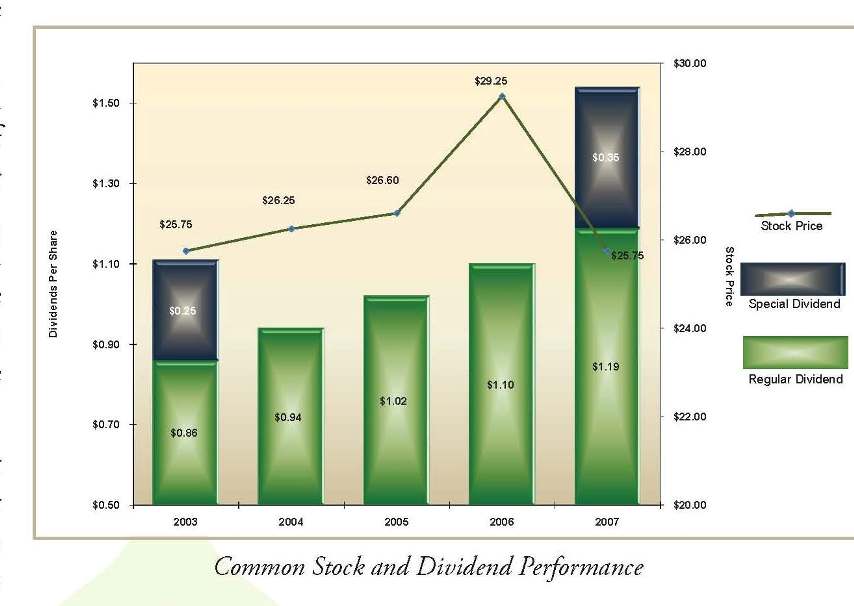

Stock Performance. One of the Corporation’s cornerstone goals is to be a profitable and growth-oriented entity that is committed to quality and building value for our stockholders. As an example, if you invested $1,000 in the Corporation’s common stock five years ago, at year end 2002, and reinvested cash dividends, the value of your original investment would have increased more than 46% to $1,462 by December 31, 2007. This represents a 9.2% average annual return over that period.

While 2007’s turbulent financial markets saw declines in the values of stock prices of banks and other financial institutions in excess of 30%, the Corporation’s common stock did not see this significant drop in value and ended the year at a modest 12% decline from the closing price at the end of 2006.

Since 2002, we have increased our regular annual cash dividend on our common stock by more than 38% to $1.19 per share for 2007 compared to $0.86 per common share in 2002. Regular cash dividends increased 8% between 2007 and 2006. In connection with our record financial performance in 2007 and our ongoing capital management initiatives, during the fourth quarter we declared and paid a special cash dividend of $0.35 per common share. This is the third special cash dividend that we have paid since 2001; in addition to the 2007 special dividend, we paid a special cash dividend of $0.25 per share in 2002 and again in 2003.

We are proud of our overall stock performance and our favorable dividend policy resulting from our solid core earnings. While we build value, we intend to pursue controlled growth and prudent business practices to continue to provide a safe investment alternative with positive market returns.

Growth

We have and will continue to pursue growth on all fronts, not only internally through organic balance sheet growth in loans and deposits, but through expanding our branch network. The Corporation continues to explore expansion of our core banking business through the acquisition of branches and smaller institutions, expanding our financial services division and investigating other financial services delivery channels and businesses.

Shareholder Letter

continued

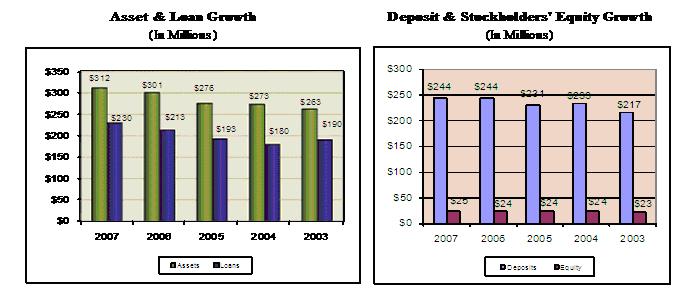

Balance Sheet Growth. For the year ended December 31, 2007, we experienced modest asset growth with total assets reaching $311.7 million at year end. The $11.2 million or 3.7% increase in assets was principally driven by loan growth funded by borrowed funds and, to a lesser extent, the employment of cash.

Customer deposits remained relatively flat during 2007 ending the year at $244.3 million as we sought to eliminate higher priced less profitable certificate of deposit accounts and replace these with core demand deposit accounts. The decline in certificate accounts of $10.0 million during the year was offset by increases in noninterest bearing and interest bearing demand deposits of $3.0 million and $6.7 million, respectively. During the year, we sought to expand existing customer balances through cross-selling and negotiated pricing on relationship accounts. We experienced demand deposit customer growth in existing branches and in our new Cranberry office where we cultivated new deposits of $3.1 million. This new office has grown to $6.3 million in deposits since opening in the fourth quarter of 2006.

We remain successful at lending within the markets we serve and during 2007 expanded all loan portfolios. During the year, all classes of loans grew as we continued our shift to more profitable commercial lending. The Corporation’s total loans ended the year at $229.8 million versus $213.3 million at year end 2006.

Our corporate banking group increased commercial real estate loans $10.5 million or 17.1% to $71.6 million at December 31, 2007. Commercial business loans ended the year at $35.6 million up $978,000 from $34.6 million at year end 2006. This growth was the result of focused in-market relationship lending efforts by our commercial lending and branch banking teams. At December 31, 2007, commercial loans comprised 47% of the Bank’s total loan portfolios compared to 29% at December 31, 2001. This successful shift has been a direct result of our strategies to identify and expand key business relationships in all of our markets. While we still consider consumer lending through our branch network as one key to growth, our accomplishments in business lending have proven more profitable.

Our consumer loan portfolios reached record levels as well in 2007, as residential first mortgage, home equity and installment loans ended the year at $65.7 million, $49.4 million and $9.7 million, respectively, up 1.6%, 4.4% and 26.2%, respectively. This excludes $13.0 million of off-balance sheet loans that we have originated and service at December 31, 2007. We experienced nice growth in our installment loan portfolio given a successful automobile loan promotion during the third and fourth quarters of 2007.

New Branch Offices. In November 2006, we opened our eleventh branch office in the Township of Cranberry, Pennsylvania. Since inception, this office has generated new consumer loans of $3.1 million and deposits of $6.3 million. This office has provided us with additional market coverage in our home county, Venango County, and has provided a platform for further commercial business development. During 2007, our corporate banking division originated $2.1 million in commercial loans through this office.

In April 2008, we will open our twelfth office in Grove City, Pennsylvania with high expectations. Strategically expanding to the Grove City area makes sense in a number of regards. This market is contiguous to the Bank’s existing markets, there is an opportunity to penetrate current banking market share, particularly with deposits, as the need for a community bank presence exists and this expansion moves us closer to other growing communities in Western Pennsylvania.

Shareholder Letter

continued

It is important to note that we continue to improve core profitability and operating efficiencies while expanding and investing in de novo branch offices. There are fundamental startup operating costs associated with the opening of each new office. Some of these costs are one-time, but ongoing period costs remain, and we estimate that it takes three to five years for a new office to break even in the markets that we operate. It takes this time to generate loans and deposits to levels that cover basic office working expenses. It is important to note that we are improving overall consolidated profitability while covering these startup costs and investing in advantageous expansion.

Quality

While continually looking towards profitable growth, we remain grounded by maintaining a culture of sound policies, procedures and systems to promote the highest in asset quality, internal controls and integrity.

We remained insulated from the well-chronicled national market conditions that impacted the overall financial services industry during 2007. The Bank has never provided sub-prime mortgage products and for the most part rural and Western Pennsylvania did not experience the sub-prime or real estate crises experienced in other parts of the country.

Asset Quality. Not only did we continue to realize stable growth in all loan portfolios, the credit quality of these portfolios remained strong as measured by any industry standards. The ratio of non-performing assets to total assets was a mere 0.35%, and the allowance for loan losses to non-performing loans provided coverage of 227%, at December 31, 2007. We view the quality of our loan portfolio, including the systems surrounding the loan origination and monitoring processes, as one of the true ideals of the Corporation. Our credit culture and corresponding training are diligently pursued and part of the way we lend.

Compliance. During the year, we complied with the early requirements of Sarbanes-Oxley section 404 for non-accelerated filers. We also significantly enhanced our compliance function by establishing an internal compliance council whereby all internal functional areas are represented to address compliance requirements for corresponding banking disciplines. We made advances in core business processes by improving how we utilize our information technology systems. These initiatives will continue in 2008 and beyond as we seek to better serve our customers and support deposit and lending delivery channels.

Integrity. We have consistently conducted our business with honor and integrity and do not assume unreasonable risks, regardless of the possible rewards. Integrity and attention to quality through sound systems, controls and asset quality management are the Corporation’s foundation for current and future success.

Shareholder Letter

continued

Culture

Much of our effort in 2007 was focused on proactive succession planning, building an experienced management team, marketing initiatives, staff development and community involvement activities.

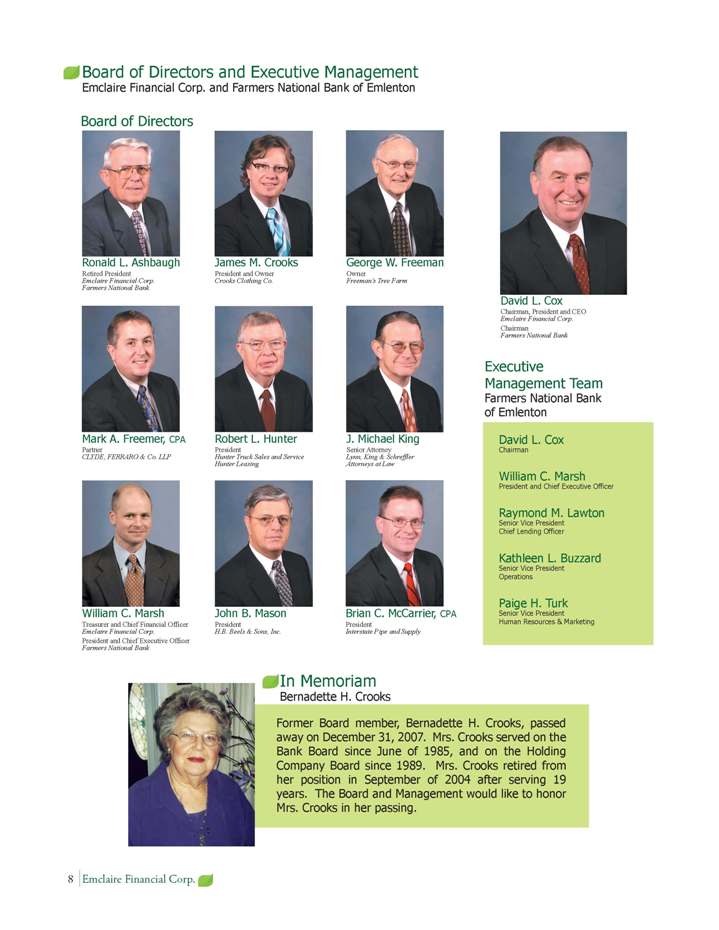

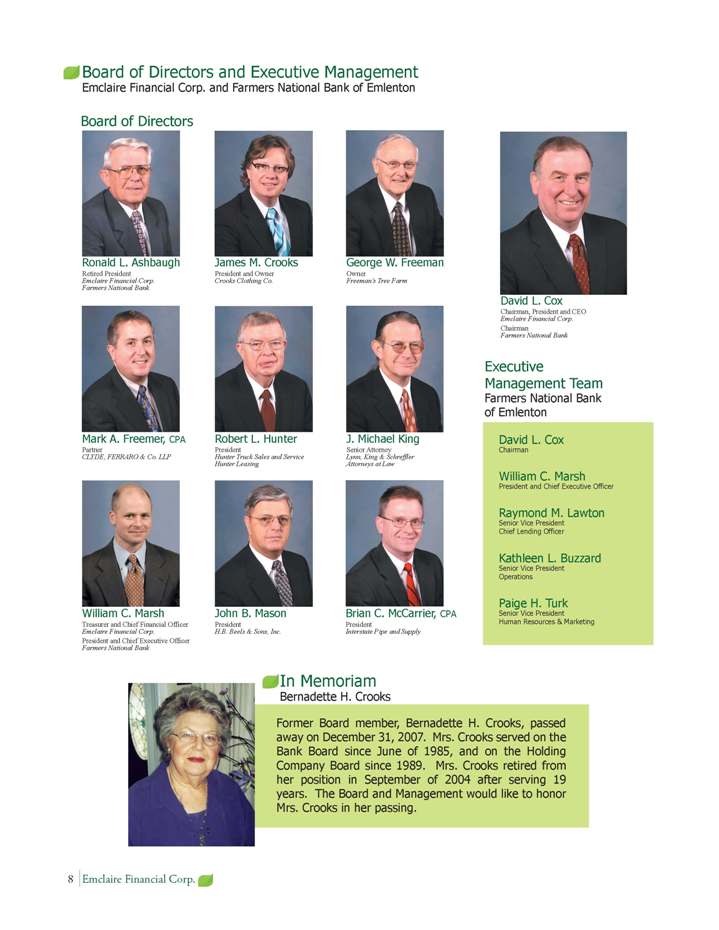

Succession. In June 2007, the Corporation announced a management transition whereby William C. Marsh was named President and Chief Executive Officer of the Bank. Mr. Marsh will remain as Treasurer and Chief Financial Officer of the Corporation and David L. Cox will serve as Chairman of the Board of the Bank and continue in his role with the Corporation. Mr. Marsh’s promotion from within will facilitate the Corporation’s long term expansion plan by sharing executive responsibilities and permitting the team to focus on growth and strategic initiatives as well as management of the daily operations of the Bank.

Management Team. We have assembled an experienced executive management team capable of responding to daily challenges while focusing on strategic initiatives. Senior Vice President, Chief Lending Officer, Raymond M. Lawton, continues to successfully manage the delicate balance between loan growth and asset quality. He has created a credit culture that has positioned the Bank to navigate safely through a turbulent mortgage market. Senior Vice President, Operations, Kathleen L. Buzzard, transitioned from Retail Banking to Operations mid-year in 2007. Her extensive knowledge of branch banking, deposit products, and technology has proved valuable in not only improving operating efficiencies, but also in team building between the Operations Center and Branch Banking. Paige H. Turk was recently promoted to Senior Vice President, Director of Human Resources and Marketing. Her ability to communicate clearly and consistently to employees and customers has positioned the human resources and marketing functions to perform at a highly integrated level resulting in enhanced customer relationship management.

Marketing. Our definition and story - our brand, will also significantly impact the management of customer relationships. Our brand speaks to our purpose and is communicated in a way that will connect with consumer’s standards so they value their affiliation with the Bank. Our marketing plan is to keep our brand fresh and compelling in a competitive market. That, combined with a customer service standard that is rooted in professional competence, strong product knowledge, and a commitment to engage customers in enduring relationships, has resulted in a consistent, credible and exemplary brand statement. Our look may be fresh and updated, but our roots run deep and will remain firmly planted in integrity and trust.

Staff Development/Training. We continue to invest in employee development and training at all levels of the organization. Service Training and Leadership Development are key initiatives to support the continuation of accountability and excellent performance. We successfully enhanced the performance planning and review process for all employees during 2007 to include higher levels of performance feedback, coaching, communication of standards and ongoing position documentation. Our goal is to sustain a culture where communication and motivation drive accountability and excellence in performance.

Shareholder Letter

continued

Community Involvement. We believe that our responsibility to train individuals and provide meaningful information carries over into our communities as well. We are proud to provide community education programs on Fraud Prevention, Get Smart about Credit, Teaching Children to Save, and Tips for First-Time Home Buyers. We will continue to research and present relevant educational programs to assist our customers, neighbors and communities. Our responsibility to support the communities we serve is also reflected in a host of community involvement activities ranging from food bank collections to raising money for families or individuals in need. We are successful not only because our financial statements reflect stability and continued profitability, but also because we have helped to make the communities we call home responsive, stable and strong.

In late 2007, the Bank lost a valuable advocate and supporter when Bernadette Crooks passed away on New Year’s Eve. Bernadette served on the board of the Corporation and the Bank for almost twenty years before retiring in 2004. She will clearly remain part of the Bank’s rich history. We will miss Bernadette’s dedication, attention to detail and interest in all things Farmers. With respect, we express our deepest condolences to her family and closest friends.

We strive to provide and enhance shareholder value and believe strongly that there is a place for an independent community bank with long-term shareholder growth prospects. We will never waiver from our commitment to providing the very best in community banking. On behalf of your management team, the staff and Board of Directors, we thank you for your ongoing investment and support.

Very truly yours,

|  |

| David L. Cox | William C. Marsh |

| | |

| Emclaire Financial Corp | Emclaire Financial Corp |

| Chairman of the Board, President and | Treasurer and |

| Chief Executive Officer | Chief Financial Officer |

| | |

| Farmers National Bank of Emlenton | Farmers National Bank of Emlenton |

| Chairman of the Board | President and |

| Chief Executive Officer | |

February 27, 2008

| |

| (Dollar amounts in thousands, except share data) | |

| | | | | | | | | | | | | | | | |

| | | As of December 31, | |

| Financial Condition Data | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | | | | | | | | | | | | | | |

| Total assets | | $ | 311,720 | | | $ | 300,560 | | | $ | 275,517 | | | $ | 273,380 | | | $ | 262,512 | |

| Securities | | | 51,919 | | | | 51,774 | | | | 56,304 | | | | 63,362 | | | | 49,162 | |

| Loans receivable, net | | | 229,819 | | | | 213,344 | | | | 192,526 | | | | 179,575 | | | | 190,482 | |

| Deposits | | | 244,262 | | | | 244,492 | | | | 230,503 | | | | 232,874 | | | | 217,110 | |

| Borrowed funds | | | 40,400 | | | | 30,000 | | | | 19,500 | | | | 15,000 | | | | 20,700 | |

| Stockholders' equity | | | 24,703 | | | | 23,917 | | | | 23,615 | | | | 23,616 | | | | 22,655 | |

| Stockholders' equity per common share | | $ | 19.48 | | | $ | 18.86 | | | $ | 18.63 | | | $ | 18.63 | | | $ | 17.87 | |

| Tangible stockholders' equity per common share | | $ | 18.36 | | | $ | 17.74 | | | $ | 17.50 | | | $ | 17.48 | | | $ | 16.70 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| Operations Data | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | | | | | | | | | | | | | | | | | | | |

| Interest income | | $ | 17,855 | | | $ | 16,259 | | | $ | 14,877 | | | $ | 13,953 | | | $ | 14,209 | |

| Interest expense | | | 7,886 | | | | 6,968 | | | | 5,573 | | | | 5,219 | | | | 4,901 | |

| Net interest income | | | 9,969 | | | | 9,291 | | | | 9,304 | | | | 8,734 | | | | 9,308 | |

| Provision for loan losses | | | 256 | | | | 358 | | | | 205 | | | | 290 | | | | 330 | |

| Net interest income after provision for loan losses | | | 9,713 | | | | 8,933 | | | | 9,099 | | | | 8,444 | | | | 8,978 | |

| Noninterest income | | | 2,943 | | | | 2,934 | | | | 3,317 | | | | 2,535 | | | | 1,785 | |

| Noninterest expense | | | 9,164 | | | | 9,409 | | | | 9,146 | | | | 7,909 | | | | 7,522 | |

| Income before income taxes | | | 3,492 | | | | 2,458 | | | | 3,270 | | | | 3,070 | | | | 3,241 | |

| Provision for income taxes | | | 795 | | | | 492 | | | | 697 | | | | 513 | | | | 749 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 2,697 | | | $ | 1,966 | | | $ | 2,573 | | | $ | 2,557 | | | $ | 2,492 | |

| | | | | | | | | | | | | | | | | | | | | |

| Average common shares outstanding | | | 1,267,835 | | | | 1,267,835 | | | | 1,267,835 | | | | 1,267,835 | | | | 1,301,714 | |

| Basic and diluted earnings per share | | $ | 2.13 | | | $ | 1.55 | | | $ | 2.03 | | | $ | 2.02 | | | $ | 1.91 | |

| Dividends per share (1) | | $ | 1.54 | | | $ | 1.10 | | | $ | 1.02 | | | $ | 0.94 | | | $ | 1.11 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | As of or for the year ended December 31, | |

| Other Data | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | | | | | | | | | | | | | | | | | | | |

| Performance Ratios | | | | | | | | | | | | | | | | | | | | |

| Return on average assets | | | 0.90 | % | | | 0.69 | % | | | 0.94 | % | | | 0.96 | % | | | 0.99 | % |

| Return on average equity | | | 11.13 | % | | | 8.28 | % | | | 10.69 | % | | | 11.08 | % | | | 10.96 | % |

| Yield on interest-earning assets (2) | | | 6.55 | % | | | 6.30 | % | | | 6.00 | % | | | 5.81 | % | | | 6.28 | % |

| Cost of interest-bearing liabilities | | | 3.46 | % | | | 3.23 | % | | | 2.70 | % | | | 2.57 | % | | | 2.56 | % |

| Cost of funds | | | 2.89 | % | | | 2.69 | % | | | 2.24 | % | | | 2.15 | % | | | 2.16 | % |

| Interest rate spread (2) | | | 3.09 | % | | | 3.08 | % | | | 3.30 | % | | | 3.24 | % | | | 3.72 | % |

| Net interest margin (2) | | | 3.73 | % | | | 3.68 | % | | | 3.82 | % | | | 3.71 | % | | | 4.18 | % |

| Efficiency ratio (2) (3) | | | 68.66 | % | | | 74.18 | % | | | 69.72 | % | | | 67.11 | % | | | 64.16 | % |

| Noninterest expense to average assets | | | 3.06 | % | | | 3.30 | % | | | 3.33 | % | | | 2.96 | % | | | 2.99 | % |

| Interest-earning assets to average assets | | | 93.13 | % | | | 92.89 | % | | | 92.82 | % | | | 92.86 | % | | | 92.69 | % |

| Loans to deposits | | | 94.09 | % | | | 87.26 | % | | | 83.52 | % | | | 77.11 | % | | | 87.74 | % |

| Dividend payout ratio (1) | | | 72.39 | % | | | 70.93 | % | | | 50.25 | % | | | 46.61 | % | | | 57.98 | % |

| Asset Quality Ratios | | | | | | | | | | | | | | | | | | | | |

| Non-performing loans to total loans | | | 0.41 | % | | | 0.85 | % | | | 0.75 | % | | | 0.46 | % | | | 0.69 | % |

| Non-performing assets to total assets | | | 0.35 | % | | | 0.65 | % | | | 0.57 | % | | | 0.33 | % | | | 0.52 | % |

| Allowance for loan losses to total loans | | | 0.93 | % | | | 0.94 | % | | | 0.96 | % | | | 1.00 | % | | | 0.92 | % |

| Allowance for loan losses to non-performing loans | | | 226.58 | % | | | 110.54 | % | | | 128.72 | % | | | 215.48 | % | | | 133.71 | % |

| Capital Ratios | | | | | | | | | | | | | | | | | | | | |

| Stockholders' equity to assets | | | 7.92 | % | | | 7.96 | % | | | 8.57 | % | | | 8.64 | % | | | 8.63 | % |

| Tangible stockholders' equity to tangible assets | | | 7.50 | % | | | 7.52 | % | | | 8.09 | % | | | 8.15 | % | | | 8.11 | % |

| Average equity to average assets | | | 8.08 | % | | | 8.32 | % | | | 8.75 | % | | | 8.63 | % | | | 9.02 | % |

| | | | | | | | | | | | | | | | | | | | | |

| (1) | Includes special cash dividend or $0.35 per share and $0.25 per share paid in 2007 and 2003, respectively. |

| (2) | Interest income utilized in calculation is on a fully tax equivalent basis. |

| (3) | The efficiency ratio is calculated by dividing noninterest expense (less intangible amortization) by net interest income (on a fully tax equivalent basis) and noninterest income. The efficiency ratio gives a measure of how effectively a financial institution is operating. |

Financial Condition and Results of Operations

The following discussion and analysis represents a review of Emclaire Financial Corp.’s consolidated financial condition and results of operations. This review should be read in conjunction with the consolidated financial statements presented later in this report.

Business Summary

Emclaire Financial Corp. (the Corporation) is a Pennsylvania corporation and bank holding company that provides a full range of retail and commercial financial products and services to customers in Western Pennsylvania through its wholly owned subsidiary bank, the Farmers National Bank of Emlenton (the Bank).

The Bank was organized in 1900 as a national banking association and is a financial intermediary whose principal business consists of attracting deposits from the general public and investing such funds in real estate loans secured by liens on residential and commercial property, consumer loans, commercial business loans, marketable securities and interest-earning deposits. The Bank operates through a network of twelve offices in Venango, Butler, Clarion, Clearfield, Elk, Jefferson and Mercer counties, Pennsylvania. The Corporation and the Bank are headquartered in Emlenton, Pennsylvania. Farmers National Financial Services, formed in 2004, is a division of the Bank that offers retail brokerage and other investment services to customers in the Bank’s market area.

The Bank is subject to examination and comprehensive regulation by the Office of the Comptroller of the Currency (OCC), which is the Bank’s chartering authority, and the Federal Deposit Insurance Corporation (FDIC), which insures customer deposits held by the Bank to the full extent provided by law. The Bank is a member of the Federal Reserve Bank of Cleveland (FRB) and the Federal Home Loan Bank of Pittsburgh (FHLB). The Corporation, as a registered bank holding company, is subject to regulation by the Federal Reserve Board.

Overview

The Corporation reported an increase in income for 2007 as consolidated net income amounted to $2.7 million or $2.13 per share, compared to net income of $2.0 million or $1.55 per share for 2006.

The increase in net income of $731,000 or 37.2% for the year ended December 31, 2007 was primarily due to an increase in net interest income and decreases in the provision for loan losses and noninterest expense, partially offset by an increase in the provision for income taxes. Net interest income increased as a result of growth in the loan portfolio, particularly with respect to commercial loans. Noninterest expense decreased as certain charges associated with strategic reorganization initiatives were experienced in 2006. These 2006 charges included $375,000 in pension expense for employees who took part in an early retirement program as well as $184,000 for severance, other benefits and legal costs associated with the reorganization. Excluding these one-time reorganization charges, noninterest expense increased modestly primarily as a result of the opening of a new banking office in November 2006 and professional fees associated with Sarbanes-Oxley compliance. The provision for income taxes increased due to increased pre-tax income.

During the year ended December 31, 2007, the Corporation experienced asset growth of 3.7% as total assets increased $11.2 million or 3.7% to $311.7 million at year end from $300.6 million at December 31, 2006. This asset growth was driven by total loan portfolio growth of $16.5 million or 7.7% funded by a decrease in cash and equivalents of $6.2 million or 37.3% and an increase in borrowed funds of $10.4 million or 34.7%.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

Changes in Financial Condition

Total assets increased $11.2 million or 3.7% to $311.7 million at December 31, 2007 from $300.6 million at December 31, 2006. This increase was primarily due to increases in loans receivable of $16.5 million, partially offset by a decrease in cash and equivalents of $6.2 million.

The increase in the Corporation’s total assets was primarily funded by increases in total liabilities of $10.4 million or 3.7% and total stockholders’ equity of $786,000 or 3.3%. The increase in total liabilities was primarily due to an increase in borrowed funds of $10.4 million or 34.7%.

Cash and cash equivalents. These accounts decreased a combined $6.2 million to $10.5 million at December 31, 2007 from $16.7 million at December 31, 2006. These accounts are typically increased by net operating results, deposits by customers into savings and checking accounts, loan and security repayments and proceeds from borrowed funds. Decreases result from customer deposit withdrawals, new loan originations or other loan fundings, security purchases, repayments of borrowed funds and cash dividends to stockholders. The Corporation maintained a lower balance of cash at year end December 31, 2007 than at the prior year end primarily as a result of loan growth experienced during the year and the purchase of commercial paper late in the year.

Securities. Securities increased $145,000 or 0.3% to $51.9 million at December 31, 2007 from $51.8 million at December 31, 2006. The overall increase in securities for the year resulted from the purchase of commercial paper late in the year, partially offset by management deploying funds from security maturities, calls and repayments into loan growth during the year.

Loans receivable. Net loans receivable increased $16.5 million or 7.7% to $229.8 million at December 31, 2007 from $213.3 million at December 31, 2006, resulting from strong loan production of $82.0 million during 2007. This increase can be primarily attributed to growth in the Corporation’s commercial loan portfolios. Commercial real estate loans increased $10.5 million or 17.1% and commercial business loans increased $1.0 million or 2.8%. This growth in commercial loans can be attributed to the production success of the Bank’s Corporate Banking Group established during 2004 and the related continued market penetration in larger communities served by the Bank.

Also contributing to the growth in the loan portfolio was an increase in home equity loans of $2.1 million or 4.4% due primarily to home equity loan campaigns put forth during the year. In addition, consumer loans increased $2.0 million or 26.2% due to an auto loan campaign during the year. Residential first mortgage loans increased $1.0 million or 1.6% during the year, net of $1.7 million of loans sold, due to strong residential mortgage production of $11.6 million.

Non-performing assets. Non-performing assets include non-accrual loans, loans 90 days past due and still accruing, and real estate acquired through foreclosure (REO). Non-performing assets decreased $858,000 to $1.1 million or 0.35% of total assets at December 31, 2007 from $1.9 million or 0.65% of total assets at December 31, 2006 primarily as the result of the full payoff of one larger credit relationship during the year. Non-performing assets consisted of non-performing loans and REO of $1.0 million and $129,000, respectively, at December 31, 2007 and $1.8 million and $98,000, respectively, at December 31, 2006. At December 31, 2007 non-performing assets consisted primarily of residential mortgage loans.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

Federal bank stocks. Federal bank stocks were comprised of FHLB stock and FRB stock of $2.3 million and $333,000, respectively, at December 31, 2007. These stocks are purchased and redeemed at par as directed by the federal banks and levels maintained are based primarily on borrowing and other correspondent relationships between the Corporation and the banks. The increase at December 31, 2007 compared to December 31, 2006 can be attributed to an increase in FHLB borrowings during 2007.

Bank-owned life insurance (BOLI). The Corporation maintains single premium life insurance policies on twenty current and former officers and employees of the Bank. In addition to providing life insurance coverage, whereby the Bank as well as the officers and employees receive life insurance benefits, the appreciation of the cash surrender value of the BOLI will serve to offset and finance existing and future employee benefit costs. Increases in this account during 2007 were associated with the increase in the cash surrender value of the policies, partially offset by certain administrative expenses.

Premises and equipment. Premises and equipment decreased $54,000 to $7.9 million at December 31, 2007 from $8.0 million at December 31, 2006. The overall decrease in premises and equipment during the year was due to the normal depreciation of fixed assets of $663,000, partially offset by capital expenditures of $609,000. Capital expenditures during the year consisted primarily of investments in technology and improvements made at the full service banking facility purchased in December of 2006.

Deposits. Total deposits decreased $230,000 to $244.3 million at December 31, 2007 from $244.5 million at December 31, 2006. While noninterest-bearing deposits increased $3.1 million or 7.0% during the year, interest-bearing deposits decreased by $3.3 million or 1.6%. This change in the deposit composition resulted principally from the Corporation’s focus on maintaining core deposit accounts and establishing strong relationship accounts while allowing certain high rate certificates of deposit to mature. In addition, the Bank opened a new office in November 2006. At December 31, 2007, this office had total deposits of $6.3 million with $3.1 million generated in 2007. Of these deposits, $625,000 is noninterest-bearing and $5.7 million is interest-bearing.

Borrowed funds. Borrowed funds, or advances from the FHLB, increased $10.4 million or 34.7% to $40.4 million at December 31, 2007 from $30.0 million at December 31, 2006. The increase in advances was the result of management matching $5.0 million in long-term borrowed funds with loans originated during the third quarter of 2007. In addition, short-term borrowings of $5.4 million were utilized in funding loan growth and purchasing commercial paper late in the year.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

Changes in Results of Operations

The Corporation reported net income of $2.7 million, $2.0 million and $2.6 million in 2007, 2006 and 2005, respectively. The following “Average Balance Sheet and Yield/Rate Analysis” and “Analysis of Changes in Net Interest Income” tables should be utilized in conjunction with the discussion of the net interest income and interest expense components of net income.

Average Balance Sheet and Yield/Rate Analysis. The following table sets forth, for the periods indicated, information concerning the total dollar amounts of interest income from interest-earning assets and the resulting average yields, the total dollar amounts of interest expense on interest-bearing liabilities and the resulting average costs, net interest income, interest rate spread and the net interest margin earned on average interest-earning assets. For purposes of this table, average loan balances include non-accrual loans and exclude the allowance for loan losses and interest income includes accretion of net deferred loan fees. Interest and yields on tax-exempt loans and securities (tax-exempt for federal income tax purposes) are shown on a fully tax equivalent basis. The information is based on average daily balances during the periods presented.

| | | | | | | | | | | | | | | | | | | | | | | |

| (Dollar amounts in thousands) | | Year ended December 31, | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007 | | | 2006 | | | 2005 | |

| | | Average | | | | Yield / | | | Average | | | | Yield / | | | Average | | | | | Yield / | |

| | | Balance | | Interest | | Rate | | | Balance | | Interest | | Rate | | | Balance | | | Interest | | Rate | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Loans, taxable | | $ | 215,771 | | $ | 15,006 | | | 6.95 | % | | $ | 200,499 | | $ | 13,554 | | | 6.76 | % | | $ | 181,109 | | | $ | 12,011 | | | 6.63 | % |

| Loans, tax-exempt | | | 6,286 | | | 407 | | | 6.47 | % | | | 6,781 | | | 438 | | | 6.46 | % | | | 7,052 | | | | 454 | | | 6.44 | % |

| Total loans receivable | | | 222,057 | | | 15,413 | | | 6.94 | % | | | 207,280 | | | 13,992 | | | 6.75 | % | | | 188,161 | | | | 12,465 | | | 6.62 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Securities, taxable | | | 36,882 | | | 1,571 | | | 4.26 | % | | | 37,944 | | | 1,481 | | | 3.90 | % | | | 47,075 | | | | 1,714 | | | 3.64 | % |

| Securities, tax-exempt | | | 14,750 | | | 996 | | | 6.75 | % | | | 15,250 | | | 1,013 | | | 6.64 | % | | | 15,468 | | | | 1,012 | | | 6.53 | % |

| Total securities | | | 51,632 | | | 2,567 | | | 4.97 | % | | | 53,194 | | | 2,494 | | | 4.69 | % | | | 62,543 | | | | 2,726 | | | 4.36 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-earning deposits with banks | | | 3,209 | | | 166 | | | 5.17 | % | | | 2,608 | | | 129 | | | 4.95 | % | | | 2,978 | | | | 81 | | | 2.72 | % |

| Federal bank stocks | | | 2,315 | | | 144 | | | 6.22 | % | | | 1,945 | | | 94 | | | 4.83 | % | | | 1,633 | | | | 58 | | | 3.55 | % |

| Total interest-earning cash equivalents | | | 5,524 | | | 310 | | | 5.61 | % | | | 4,553 | | | 223 | | | 4.90 | % | | | 4,611 | | | | 139 | | | 3.01 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total interest-earning assets | | | 279,213 | | | 18,290 | | | 6.55 | % | | | 265,027 | | | 16,709 | | | 6.30 | % | | | 255,315 | | | | 15,330 | | | 6.00 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash and due from banks | | | 5,952 | | | | | | | | | | 6,922 | | | | | | | | | | 7,399 | | | | | | | | |

| Other noninterest-earning assets | | | 14,649 | | | | | | | | | | 13,376 | | | | | | | | | | 12,340 | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Assets | | $ | 299,814 | | | | | | | | | $ | 285,325 | | | | | | | | | $ | 275,054 | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing demand deposits | | $ | 73,364 | | | 956 | | | 1.30 | % | | $ | 72,584 | | | 770 | | | 1.06 | % | | $ | 79,063 | | | | 570 | | | 0.72 | % |

| Time deposits | | | 121,889 | | | 5,484 | | | 4.50 | % | | | 120,544 | | | 5,197 | | | 4.31 | % | | | 110,829 | | | | 4,324 | | | 3.90 | % |

| Total interest-bearing deposits | | | 195,253 | | | 6,440 | | | 3.30 | % | | | 193,128 | | | 5,967 | | | 3.09 | % | | | 189,892 | | | | 4,894 | | | 2.58 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Borrowed funds, short-term | | | 1,208 | | | 33 | | | 2.73 | % | | | 1,147 | | | 53 | | | 4.62 | % | | | 1,199 | | | | 50 | | | 4.17 | % |

| Borrowed funds, long-term | | | 31,233 | | | 1,413 | | | 4.52 | % | | | 21,521 | | | 948 | | | 4.40 | % | | | 15,000 | | | | 629 | | | 4.19 | % |

| Total borrowed funds | | | 32,441 | | | 1,446 | | | 4.46 | % | | | 22,668 | | | 1,001 | | | 4.42 | % | | | 16,199 | | | | 679 | | | 4.19 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total interest-bearing liabilities | | | 227,694 | | | 7,886 | | | 3.46 | % | | | 215,796 | | | 6,968 | | | 3.23 | % | | | 206,091 | | | | 5,573 | | | 2.70 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest-bearing demand deposits | | | 45,086 | | | - | | | - | | | | 43,556 | | | - | | | - | | | | 42,450 | | | | - | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Funding and cost of funds | | | 272,780 | | | 7,886 | | | 2.89 | % | | | 259,352 | | | 6,968 | | | 2.69 | % | | | 248,541 | | | | 5,573 | | | 2.24 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other noninterest-bearing liabilities | | | 2,810 | | | | | | | | | | 2,224 | | | | | | | | | | 2,452 | | | | | | | | |

| Total Liabilities | | | 275,590 | | | | | | | | | | 261,576 | | | | | | | | | | 250,993 | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stockholders' Equity | | | 24,224 | | | | | | | | | | 23,749 | | | | | | | | | | 24,061 | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Liabilities and Stockholders' Equity | | $ | 299,814 | | | | | | | | | $ | 285,325 | | | | | | | | | $ | 275,054 | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net interest income | | | | | $ | 10,404 | | | | | | | | | $ | 9,741 | | | | | | | | | | $ | 9,757 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest rate spread (difference between | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| weighted average rate on interest-earning | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| assets and interest-bearing liabilities) | | | | | | 3.09 | % | | | | | | | | | 3.08 | % | | | | | | | | | | 3.30 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest margin (net interest | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| income as a percentage of average | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| interest-earning assets) | | | | | | | | | 3.73 | % | | | | | | | | | 3.68 | % | | | | | | | | | | 3.82 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

Analysis of Changes in Net Interest Income. The following table analyzes the changes in interest income and interest expense in terms of: (1) changes in volume of interest-earning assets and interest-bearing liabilities and (2) changes in yields and rates. The table reflects the extent to which changes in the Corporation’s interest income and interest expense are attributable to changes in rate (change in rate multiplied by prior year volume), changes in volume (changes in volume multiplied by prior year rate) and changes attributable to the combined impact of volume/rate (change in rate multiplied by change in volume). The changes attributable to the combined impact of volume/rate are allocated on a consistent basis between the volume and rate variances. Changes in interest income on loans and securities reflect the changes in interest income on a fully tax equivalent basis.

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| (Dollar amounts in thousands) | | 2007 versus 2006 | | | 2006 versus 2005 | |

| | | | | | | | | | | | | | | | | | | |

| | | Increase (decrease) due to | | | Increase (decrease) due to | |

| | | Volume | | | Rate | | | Total | | | Volume | | | Rate | | | Total | |

| Interest income: | | | | | | | | | | | | | | | | | | |

| Loans | | $ | 1,018 | | | $ | 403 | | | $ | 1,421 | | | $ | 1,287 | | | $ | 240 | | | $ | 1,527 | |

| Securities | | | (75 | ) | | | 148 | | | | 73 | | | | (428 | ) | | | 196 | | | | (232 | ) |

| Interest-earning deposits with banks | | | 31 | | | | 6 | | | | 37 | | | | (11 | ) | | | 59 | | | | 48 | |

| Federal bank stocks | | | 20 | | | | 30 | | | | 50 | | | | 13 | | | | 23 | | | | 36 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total interest-earning assets | | | 994 | | | | 587 | | | | 1,581 | | | | 861 | | | | 518 | | | | 1,379 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest expense: | | | | | | | | | | | | | | | | | | | | | | | | |

| Deposits | | | 66 | | | | 407 | | | | 473 | | | | 85 | | | | 988 | | | | 1,073 | |

| Borrowed funds | | | 436 | | | | 9 | | | | 445 | | | | 284 | | | | 38 | | | | 322 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total interest-bearing liabilities | | | 502 | | | | 416 | | | | 918 | | | | 369 | | | | 1,026 | | | | 1,395 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net interest income | | $ | 492 | | | $ | 171 | | | $ | 663 | | | $ | 492 | | | $ | (508 | ) | | $ | (16 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

2007 Results Compared to 2006 Results

The Corporation reported net income of $2.7 million and $2.0 million for 2007 and 2006, respectively. The $731,000 or 37.2% increase in net income can primarily be attributed to an increase in net interest income of $678,000 and decreases in the provision for loan losses and noninterest expense of $102,000 and $245,000, respectively. Partially offsetting these favorable comparisons, the provision for income taxes increased $303,000.

In addition, 2006 operating results were adversely impacted as the Corporation realized one-time charges associated with strategic reorganization initiatives. Excluding these one-time charges, the Corporation experienced a modest income in noninterest expense for 2007.

Net interest income. The primary source of the Corporation’s revenue is net interest income. Net interest income is the difference between interest income on earning assets such as loans and securities, and interest expense on liabilities, such as deposits and borrowed funds, used to fund the earning assets. Net interest income is impacted by the volume and composition of interest-earning assets and interest-bearing liabilities, and changes in the level of interest rates. Tax equivalent net interest income increased $663,000 to $10.4 million for 2007, compared to $9.7 million for 2006. This increase in net interest income can be attributed to an increase in tax equivalent interest income of $1.6 million partially offset by an increase in interest expense of $918,000.

Interest income. Tax equivalent interest income increased $1.6 million or 9.5% to $18.3 million for 2007, compared to $16.7 million for 2006. This increase can be attributed to an increase in interest earned on loans, securities, interest-earning deposits and federal bank stocks of $1.4 million, $73,000, $37,000 and $50,000, respectively.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

Tax equivalent interest earned on loans receivable increased $1.4 million or 10.2% to $15.4 million for 2007, compared to $14.0 million for 2006. During that time, average loans increased $14.8 million or 7.1%, accounting for $1.0 million in additional loan interest income. The increase in average loans outstanding can be attributed to the aforementioned commercial and home equity loan growth experienced during 2007 as well as the positive impact in 2007 of loan growth in 2006. Additionally, the interest rate earned on loans increased as market interest rates for lending were more favorable in 2007 compared to 2006 and the yield on loans increased 19 basis points to 6.94% for 2007, versus 6.75% for 2006 contributing $403,000 in additional interest income. Contributing to the increase in the yield on loans between the periods was the collection of $125,000 of interest and late fees due associated with the payoff of previously non-performing commercial loans during the year that had been on non-accrual status. In connection with the loan payoffs, the Corporation received all principal and interest due under the contractual terms of the loan agreements and interest collected was recorded as loan interest income during the year. In addition, the Corporation recognized $42,000 in prepayment fees resulting from the early payoff of a large commercial mortgage in the fourth quarter of 2007.

Tax equivalent interest earned on securities increased $73,000 or 2.9% to $2.6 million for 2007, compared to $2.5 million for 2006. The average yield on securities increased by 28 basis points as a result of certain lower yielding securities maturing. Partially offsetting the increase in interest income associated with the yield increase was the decrease in the average volume of these assets of $1.6 million or 2.9% primarily as a result of the utilization of these funds for loan growth.

Interest earned on interest-earning deposit accounts increased $37,000 to $166,000 for 2007, compared to $129,000 for 2006, as a result of a higher yield realized on higher average balances maintained. Interest earned on federal bank stocks increased $50,000 to $144,000 for 2007, compared to $94,000 for 2006 as a result of higher volume and higher yield.

Interest expense. Interest expense increased $918,000 or 13.2% to $7.9 million for 2007, compared to $7.0 million for 2006. This increase in interest expense can be attributed to an increase in interest incurred on deposits and borrowed funds of $473,000 and $445,000, respectively.

Deposit interest expense increased $473,000 or 7.9% to $6.4 million for 2007, compared to $6.0 million for 2006. This increase in deposit interest expense was principally rate driven as the cost of interest-bearing deposits increased 21 basis points to 3.30% for 2007 versus 3.09% for 2006 contributing $407,000 in additional expense. The increase in the interest rate on deposits can be attributed to the Corporation offering certain higher priced certificate products in the fourth quarter of 2006. The average volume of deposits increased by $2.1 million or 1.1% contributing an additional $66,000 in interest expense.

Interest expense on borrowed funds increased $445,000 to $1.5 million for 2007, compared to $1.0 million for 2006 due to $15.0 million of FHLB long term borrowings placed in the second and third quarters of 2006 and $5.0 million of FHLB long term borrowings placed in the fourth quarter of 2007. The Corporation utilized these borrowings primarily to fund loan growth.

Provision for loan losses. The Corporation records provisions for loan losses to maintain a level of total allowance for loan losses that management believes, to the best of its knowledge, covers all known and inherent losses that are both probable and reasonably estimable at each reporting date. Management considers historical loss experience, the present and prospective financial condition of borrowers, current conditions (particularly as they relate to markets where the Corporation originates loans), the status of non-performing assets, the estimated underlying value of the collateral and other factors related to the collectibility of the loan portfolio.

The provision for loan losses decreased $102,000 or 28.5% to $256,000 for 2007, compared to $358,000 for 2006. The Corporation’s allowance for loan losses amounted to $2.2 million or 0.93% of the Corporation’s total loan portfolio at December 31, 2007, compared to $2.0 million or 0.94% at December 31, 2006. The allowance for loan losses as a percentage of non-performing loans at December 31, 2007 and 2006 was 226.6% and 110.5%, respectively. The decrease in the provision for loan losses from 2006 to 2007 was primarily due to a lower allowance for loan losses necessary in connection with the aforementioned payoff of previously non-performing large commercial loans during the year.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

Noninterest income. Noninterest income includes revenue that is not related to interest rates, but rather to services rendered and activities conducted in the financial services industry, including fees on depository accounts, general transaction and service fees, commissions on financial services, security and loan gains and losses, and earnings on BOLI. Noninterest income increased a modest $9,000, remaining stable at $2.9 million for 2007 and 2006. This increase can be primarily attributed to increases in fees and service charges, commissions on financial services, earnings on BOLI, and other noninterest income of $65,000, $40,000, $24,000 and $98,000, respectively. Partially offsetting the increase in noninterest income were decreases in gains on loan sales and gains on available for sale securities of $25,000 and $193,000, respectively. This decrease in gains on available for sale securities resulted primarily from the 2006 gains realized of $372,000 as management elected to divest a community bank stock investment. During 2007, the Corporation realized $166,000 in gains from the sale of another community bank stock investment as a result of that banks merger with a larger financial institution.

Noninterest expense. Noninterest expense decreased $245,000 or 2.6% to $9.2 million for 2007, compared to $9.4 million for 2006. This decrease in noninterest expense was comprised of decreases in compensation and employee benefits, premises and equipment and intangible amortization expense of $542,000, $48,000 and $7,000, respectively, partially offset by an increase in other expenses of $352,000.

The largest component of noninterest expense, compensation and employee benefits, decreased $542,000 or 9.6%. This decrease was primarily the result of the Corporation realizing non-recurring charges of $559,000 relating to the aforementioned reorganization during 2006. These charges included $375,000 in pension expense for employees who took part in an early retirement program as well as $184,000 for severance, other benefits and legal costs associated with the reorganization. Excluding these one-time charges, the Corporation realized a slight increase in compensation and employee benefits resulting from normal salary and wage adjustments and increases in 401(k) match expense, training expense, director’s fees, incentive expense and stock option expense. Mitigating these increases was the realization of ongoing savings in salaries and wages and employee benefits resulting from the 2006 reorganization.

Premises and equipment expense decreased $48,000 or 2.9% as the Corporation focused on controlling expenses. This decrease was primarily the result of lower equipment and software depreciation. The decrease in equipment depreciation resulted from the write-off of an asset determined to be obsolete during 2006. Partially offsetting these decreases were increased occupancy costs related to a new branch location opened during the fourth quarter of 2006.

Other expense increased $352,000 or 16.5% primarily due to increases in professional fees, travel, entertainment and conferences and telephone expenses of $174,000, $43,000 and $41,000, respectively. Also contributing to this increase was an increase in other noninterest expense of $70,000 primarily consisting of increases in subscriptions, credit bureau expense, and internet banking expense of $41,000, $25,000 and $26,000, respectively. The increase in professional fees resulted primarily from fees associated with required Sarbanes-Oxley compliance initiatives pursued during 2007.

The provision for income taxes increased $303,000 or 61.6% to $795,000 for 2007, compared to $492,000 for 2006, primarily due to the increase in the Corporation’s pre-tax earnings of $1.0 million. In addition, the Corporation’s effective tax rate was 22.8% for 2007, compared with 20.0% for 2006.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

2006 Results Compared to 2005 Results

The Corporation reported net income of $2.0 million and $2.6 million for 2006 and 2005, respectively. The $607,000 or 23.6% decrease in net income can be attributed to decreases in net interest income and noninterest income of $13,000 and $383,000, respectively, and increases in the provision for loan losses and noninterest expense of $153,000 and $263,000, respectively. Partially offsetting these unfavorable comparisons, the provision for income taxes decreased $205,000.

Net interest income. The primary source of the Corporation’s revenue is net interest income. Net interest income is the difference between interest income on earning assets such as loans and securities, and interest expense on liabilities, such as deposits and borrowed funds, used to fund the earning assets. Net interest income is impacted by the volume and composition of interest-earning assets and interest-bearing liabilities, and changes in the level of interest rates. Tax equivalent net interest income decreased $16,000 to $9.7 million for 2006. This decrease in net interest income can be attributed to an increase in tax equivalent interest income of $1.4 million and a corresponding increase in interest expense.

Interest income. Tax equivalent interest income increased $1.4 million or 9.0% to $16.7 million for 2006, compared to $15.3 million for 2005. This increase can be attributed to an increase in interest earned on loans, interest-earning deposits and federal bank stocks of $1.5 million, $48,000 and $36,000, respectively, partially offset by a $232,000 decrease in interest earned on securities.

Tax equivalent interest earned on loans receivable increased $1.5 million or 12.2% to $14.0 million for 2006, compared to $12.5 million for 2005. During that time, average loans increased $19.1 million or 10.2%, accounting for $1.3 million in additional loan interest income. Additionally, the interest rate earned on loans increased as market interest rates for lending were more favorable in 2006 compared to 2005 and the yield on loans increased 13 basis points to 6.75% for 2006, versus 6.62% for 2005 contributing $240,000 in additional interest income. The increase in average loans outstanding can be attributed to the aforementioned commercial and home equity loan growth experienced during 2006 as well as the positive impact in 2006 of loan growth in 2005.

Tax equivalent interest earned on securities decreased $232,000 or 8.5% to $2.5 million for 2006, compared to $2.7 million for 2005. The average volume of these assets decreased $9.3 million or 14.9% primarily as a result of the utilization of these funds for loan growth. The average yield on securities increased by 33 basis points, as a result of certain lower yielding securities maturing, partially offsetting the decline in interest income associated with the volume decline.

Interest earned on interest-earning deposit accounts increased $48,000 to $129,000 for 2006, compared to $81,000 for 2005, as a result of a higher yield realized partially offset by lower average balances maintained. Interest earned on federal bank stocks increased $36,000 to $94,000 for 2006, compared to $58,000 for 2005 as a result of a higher volume and higher yield.

Interest expense. Interest expense increased $1.4 million or 25.0% to $7.0 million for 2006, compared to $5.6 million for 2005. This increase in interest expense can be attributed to an increase in interest incurred on deposits and borrowed funds of $1.1 million and $322,000, respectively.

Deposit interest expense increased $1.1 million or 21.9% to $6.0 million for 2006, compared to $4.9 million for 2005. This increase in deposit interest expense was principally rate driven as the cost of interest-bearing deposits increased 51 basis points to 3.09% for 2007 versus 2.58% for 2005 contributing $988,000 in additional expense. The average volume of deposits increased modestly by $3.2 million or 1.7% contributing to an additional $85,000 in interest expense. The increase in the interest rate on deposits can be attributed to the increase in short term market interest rates during 2006 and 2005 as well as to the Corporation offering certain higher priced certificate products during 2006.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

Interest expense on borrowed funds increased $322,000 to $1.0 million for 2006, compared to $679,000 for 2005 due to $15.0 million of FHLB long term borrowings placed in the second and third quarters of 2006.

Provision for loan losses. The Corporation records provisions for loan losses to maintain a level of total allowance for loan losses that management believes, to the best of its knowledge, covers all known and inherent losses that are both probable and reasonably estimable at each reporting date. Management considers historical loss experience, the present and prospective financial condition of borrowers, current conditions (particularly as they relate to markets where the Corporation originates loans), the status of non-performing assets, the estimated underlying value of the collateral and other factors related to the collectibility of the loan portfolio.

The provision for loan losses increased $153,000 to $358,000 for 2006, compared to $205,000 for 2005. The Corporation’s allowance for loan losses amounted to $2.0 million or 0.94% of the Corporation’s total loan portfolio at December 31, 2006, compared to $1.9 million or 0.96% at December 31, 2005. The allowance for loan losses as a percentage of non-performing loans at December 31, 2006 and 2005 was 110.5% and 128.7%, respectively. The increase in the provision for loan losses from 2005 to 2006 was primarily due to the aforementioned growth in the loan portfolio.

Noninterest income. Noninterest income includes items that are not related to interest rates, but rather to services rendered and activities conducted in the financial services industry, including fees on depository accounts, general transaction and service fees, commissions on financial services, security and loan gains and losses, and earnings on BOLI. Noninterest income decreased $383,000 or 11.6% to $2.9 million for 2006, compared to $3.3 million for 2005. This decrease can be primarily attributed to a decrease in gains on the sale of securities of $457,000. This decrease resulted primarily from the 2005 gains realized of $628,000 as management elected to divest a community bank stock investment. In 2006, the Corporation realized $372,000 in gains from the sale of this particular investment. Also contributing to the decrease was a 2005 involuntary transaction that resulted from the sale of a community bank which contributed $198,000 to gains on the sale of securities. Partially offsetting the decrease in noninterest income were increases in fee and service income of $64,000 and gains on the sale of loans of $53,000 as management sold $4.0 million of 30-year fixed rate conforming mortgage loans.

Noninterest expense. Noninterest expense increased $263,000 or 2.9% to $9.4 million for 2006, compared to $9.1 million for 2005. This increase in noninterest expense is comprised of increases in compensation and employee benefits and premises and equipment of $525,000 and $26,000, respectively, partially offset by reductions in intangible amortization expense and other expenses of $24,000 and $264,000, respectively.

The largest component of noninterest expense is compensation and employee benefits. This expense increased $525,000 or 10.2%. This increase was primarily the result of the Corporation realizing charges relating to the aforementioned reorganization. These charges included $375,000 in pension expense for employees who took part in an early retirement program as well as $184,000 for severance, other benefits and legal costs associated with the reorganization.

Premises and equipment expense increased $26,000 or 1.6% as a result of increased occupancy costs related to a new drive-thru facility as well as a new branch location. Also contributing to the increase was the write-off of an asset determined to be obsolete.

Other expense decreased $264,000 or 11.0% primarily due to a decrease in telephone expenses of $155,000 as the Corporation received credit from its telephone vendor for billing errors. Also contributing to this decrease was a $203,000 write-off of amounts related to a correspondent bank reconciliation in 2005, which resulted from inefficiencies related to consolidation of their offices as well as variances resulting from the Bank’s technology conversions late in 2004.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

The provision for income taxes decreased $205,000 or 29.4% to $492,000 for 2006, compared to $697,000 for 2005, primarily due to the decrease in the Corporation’s pre-tax earnings of $812,000.

Market Risk Management

The primary objective of the Corporation’s asset liability management function is to maximize the Corporation’s net interest income while simultaneously maintaining an acceptable level of interest rate risk given the Corporation’s operating environment, capital and liquidity requirements, balance sheet mix, performance objectives and overall business focus. One of the primary measures of the exposure of the Corporation’s earnings to interest rate risk is the timing difference between the repricing or maturity of interest-earning assets and the repricing or maturity of its interest-bearing liabilities.

The Corporation’s Board of Directors has established a Finance Committee, consisting of four outside directors, the President and Chief Executive Officer and the Chief Financial Officer, to monitor market risk, including primarily interest rate risk. This committee, which meets at least quarterly, generally establishes and monitors the investment, interest rate risk and asset liability management policies established by the Corporation.

In order to minimize the potential for adverse affects of material and prolonged changes in interest rates on the Corporation’s results of operations, the Corporation’s management has implemented and continues to monitor asset liability management policies to better match the maturities and repricing terms of the Corporation’s interest-earning assets and interest-bearing liabilities. Such policies have consisted primarily of (i) originating adjustable-rate mortgage loans; (ii) originating short-term secured commercial loans with the rate on the loan tied to the prime rate or reset features in which the rate changes at determined intervals; (iii) emphasizing investment in shorter-term (15 years or less) investment securities; (iv) selling longer-term (30-year) fixed-rate residential mortgage loans in the secondary market; (v) maintaining a high level of liquid assets (including securities classified as available for sale) that can be readily reinvested in higher yielding investments should interest rates rise; (vi) emphasizing the retention of lower-costing savings accounts and other core deposits; and (vii) lengthening liabilities and locking in lower borrowing rates with longer terms whenever possible.

Interest Rate Sensitivity Gap Analysis

The implementation of asset and liability initiatives and strategies and compliance with related policies, combined with other external factors such as demand for the Corporation’s products and economic and interest rate environments in general, has resulted in the Corporation maintaining a one-year cumulative interest rate sensitivity gap ranging between a positive and negative 20% of total assets. The one-year interest rate sensitivity gap is identified as the difference between the Corporation’s interest-earning assets that are scheduled to mature or reprice within one year and its interest-bearing liabilities that are scheduled to mature or reprice within one year.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

The interest rate sensitivity gap is defined as the difference between the amount of interest-earning assets maturing or repricing within a specific time period and the amount of interest-bearing liabilities maturing or repricing within that time period. A gap is considered positive when the amount of interest rate-sensitive assets exceeds the amount of interest rate-sensitive liabilities, and is considered negative when the amount of interest rate-sensitive liabilities exceeds the amount of interest rate-sensitive assets. Generally, during a period of rising interest rates, a negative gap would adversely affect net interest income while a positive gap would result in an increase in net interest income. Conversely, during a period of falling interest rates, a negative gap would result in an increase in net interest income and a positive gap would adversely affect net interest income. The closer to zero, or more neutral, that gap is maintained, generally, the lesser the impact of market interest rate changes on net interest income.

Based on certain assumptions provided by a federal regulatory agency, which management believes most accurately represents the sensitivity of the Corporation’s assets and liabilities to interest rate changes, at December 31, 2007, the Corporation’s interest-earning assets maturing or repricing within one year totaled $72.7 million while the Corporation’s interest-bearing liabilities maturing or repricing within one-year totaled $93.2 million, providing an excess of interest-bearing liabilities over interest-earning assets of $20.5 million or a negative 6.6% of total assets. At December 31, 2007, the percentage of the Corporation’s assets to liabilities maturing or repricing within one year was 78.1%.

The following table presents the amounts of interest-earning assets and interest-bearing liabilities outstanding as of December 31, 2007 which are expected to mature, prepay or reprice in each of the future time periods presented:

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| (Dollar amounts in thousands) | | Due in | | | Due within | | | Due within | | | Due within | | | Due in | | | | |

| | | six months | | | six months | | | one to | | | three to | | | over | | | | |

| | | or less | | | to one year | | | three years | | | five years | | | five years | | | Total | |

| | | | | | | | | | | | | | | | | | | |

| Total interest-earning assets | | $ | 47,171 | | | $ | 25,554 | | | $ | 74,212 | | | $ | 43,505 | | | $ | 89,942 | | | $ | 280,384 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total interest-bearing liabilities | | | 58,930 | | | | 34,224 | | | | 57,827 | | | | 37,169 | | | | 96,516 | | | | 284,666 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Maturity or repricing gap during the period | | $ | (11,759 | ) | | $ | (8,670 | ) | | $ | 16,385 | | | $ | 6,336 | | | $ | (6,574 | ) | | $ | (4,282 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Cumulative gap | | $ | (11,759 | ) | | $ | (20,429 | ) | | $ | (4,044 | ) | | $ | 2,292 | | | $ | (4,282 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of gap during the period to total assets | | | (3.77% | ) | | | (2.78% | ) | | | 5.26 | % | | | 2.03 | % | | | (2.11% | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of cumulative gap to total assets | | | (3.77% | ) | | | (6.55% | ) | | | (1.30% | ) | | | 0.74 | % | | | (1.37% | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | | | | | | | | | | | | | | | | | | | | | $ | 311,720 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Although certain assets and liabilities may have similar maturities or periods of repricing, they may react in different degrees to changes in market interest rates. The interest rates on certain types of assets and liabilities may fluctuate in advance of changes in market interest rates, while interest rates on other types of assets and liabilities may lag behind changes in market interest rates. In the event of a change in interest rates, prepayment and early withdrawal levels would likely deviate significantly from those assumed in calculating the table. The ability of many borrowers to service their debt may decrease in the event of an interest rate increase.

The one-year interest rate sensitivity gap has been the most common industry standard used to measure an institution’s interest rate risk position regarding maturities, repricing and prepayments. In recent years, in addition to utilizing interest rate sensitivity gap analysis, the Corporation has increased its emphasis on the utilization of interest rate sensitivity simulation analysis to evaluate and manage interest rate risk.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

Interest Rate Sensitivity Simulation Analysis

The Corporation also utilizes income simulation modeling in measuring its interest rate risk and managing its interest rate sensitivity. The Finance Committee of the Corporation believes that simulation modeling enables the Corporation to more accurately evaluate and manage the possible effects on net interest income due to the exposure to changing market interest rates, the slope of the yield curve and different loan and security prepayment and deposit decay assumptions under various interest rate scenarios.

As with gap analysis and earnings simulation modeling, assumptions about the timing and variability of cash flows are critical in net portfolio equity valuation analysis. Particularly important are the assumptions driving mortgage prepayments and the assumptions about expected attrition of the core deposit portfolios. These assumptions are based on the Corporation’s historical experience and industry standards and are applied consistently across the different rate risk measures.

The Corporation has established the following guidelines for assessing interest rate risk:

Net interest income simulation. Given a 200 basis point parallel and gradual increase or decrease in market interest rates, net interest income may not change by more than 25% for a one-year period.

Portfolio equity simulation. Portfolio equity is the net present value of the Corporation’s existing assets and liabilities. Given a 200 basis point immediate and permanent increase or decrease in market interest rates, portfolio equity may not correspondingly decrease or increase by more than 30% of stockholders’ equity.

These guidelines take into consideration the current interest rate environment, the Corporation’s financial asset and financial liability product mix and characteristics and liquidity sources among other factors. Given the current rate environment, a drop in short-term market interest rates of 200 basis points immediately or over a one-year horizon would seem unlikely. This should be considered in evaluating modeling results outlined in the table below.