|

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

FORM 8-K/A |

(Amendment No. 1) |

CURRENT REPORT |

Pursuant to Section 13 or 15(d) |

of the Securities Exchange Act of 1934 |

Date of Report (Date of earliest event reported): December 19, 2007 |

CONTINENTAL FUELS, INC. |

--------------------------------------------------- |

(Exact Name of Registrant as Specified in Charter) |

Nevada | 33-33042 | 22-3161629 |

----------------------- | ------------------ | ------------------------- |

(State of Incorporation) | (Commission File No.) | (I.R.S. Employer |

Identification Number) |

9901 IH 10 West, Suite 800, San Antonio, Texas 78230 |

------------------------------------------------------------ |

(Address of Principal Executive Offices) |

(210) 558-2800 |

------------------------------------------------------------- |

(Registrant's Telephone Number, including area code) |

------------------------------------------------------------------------------ |

(Former Name or Former Address, if changed since last report) |

|

Section 9. Financial Statement and Exhibits.

This Current Report on Form 8-K/A amends the Current Report on Form 8-K filed by Continental Fuels, Inc. (the

"Registrant") with the Securities and Exchange Commission on December 17, 2007 (the "Original Report"), by

which the Registrant reported, amongst other things, the acquisition by the Registrant of all the capital stock of Geer

Tank Trucks, Inc., a privately held Texas corporation, which is defined below as the "Business Acquired".

(a) Financial Statements of the Business Acquired

The following financial statements are filed as part of this amendment:

Index to Financial Statements of Business Acquired | Page | ||

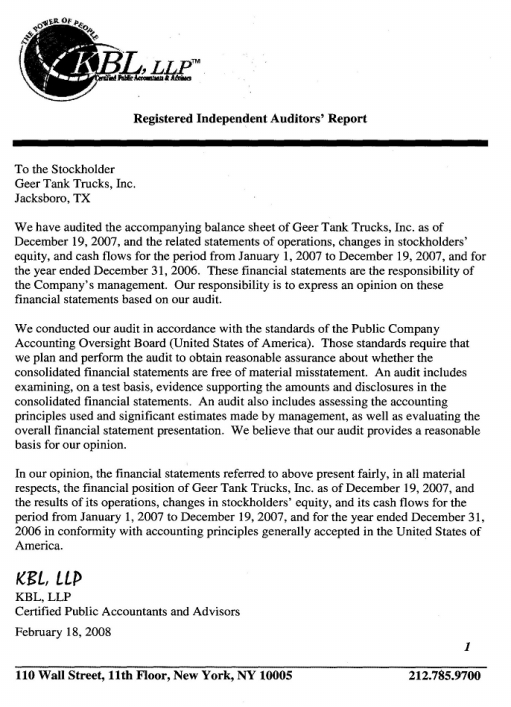

Registered Independent Auditors Report | 4 | ||

Financial Statements | |||

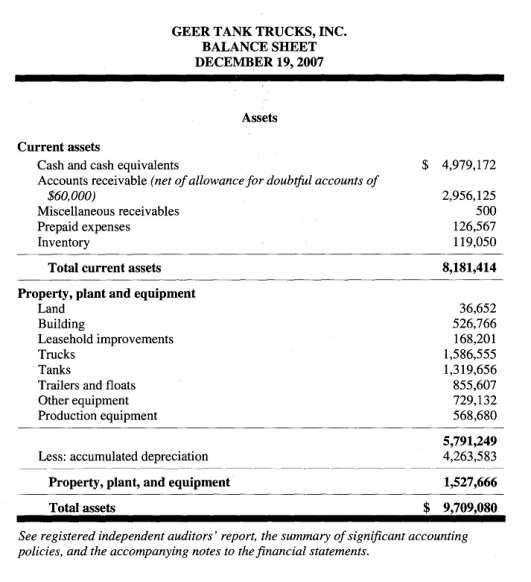

| Balance Sheets | 5-6 | |

| Statements of Operations | 7 | |

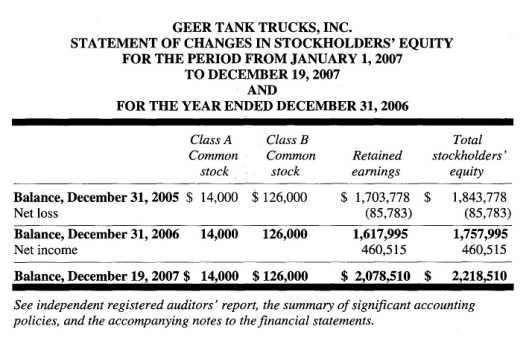

| Statements of Changes in Stockholders' Equity | 8 | |

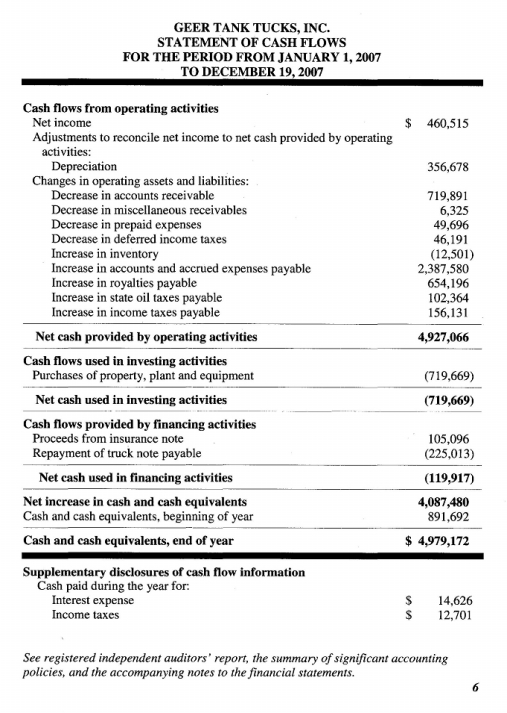

| Statements of Cash Flows | 9-10 | |

Summary of Significant Accounting Policies | 11-12 | ||

Notes to Financial Statements | 13-14 | ||

(b) Pro Forma Financial Information

The following pro forma financial information is filed as part of this amendment:

Index to Unaudited Pro Forma Consolidated Financial Statements | Page | ||

Introduction to Unaudited Pro Forma Consolidated Financial Statements | 15 | ||

Pro Forma Unaudited Consolidated Balance Sheets | 17 | ||

Pro Forma Unaudited Consolidated Income Statements | |||

| for the nine months ended September 30, 2007 | 18 | |

Pro Forma Unaudited Consolidated Income Statements | |||

| for the twelve months ended December 31, 2006 | 19 | |

2 |

SIGNATURES |

Pursuant to the requirements of the Securities Exchange Act of 1934, Continental Fuels, Inc. has duly caused this

report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: March 3, 2008

CONTINENTAL FUELS, INC. | ||

By: /s/ | Timothy Brink | |

| Timothy Brink | |

| CEO, President, Treasurer | |

3 |

4 |

5 |

6 |

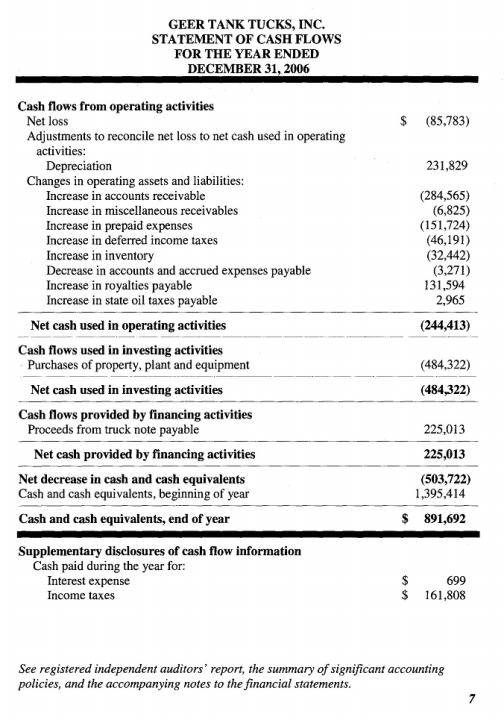

7 |

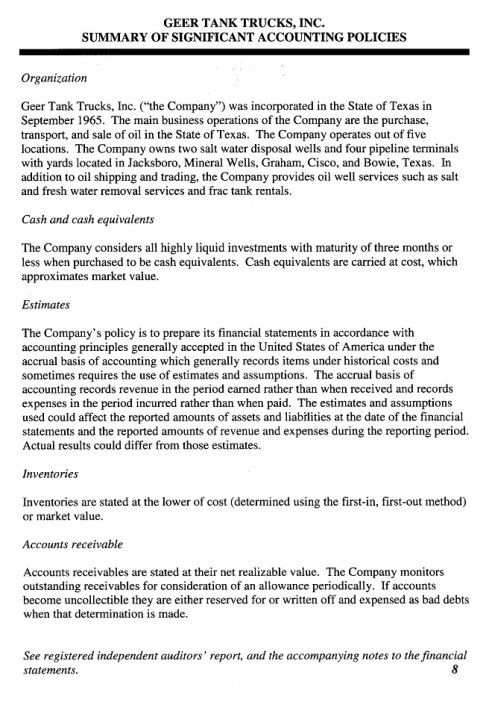

8 |

9 |

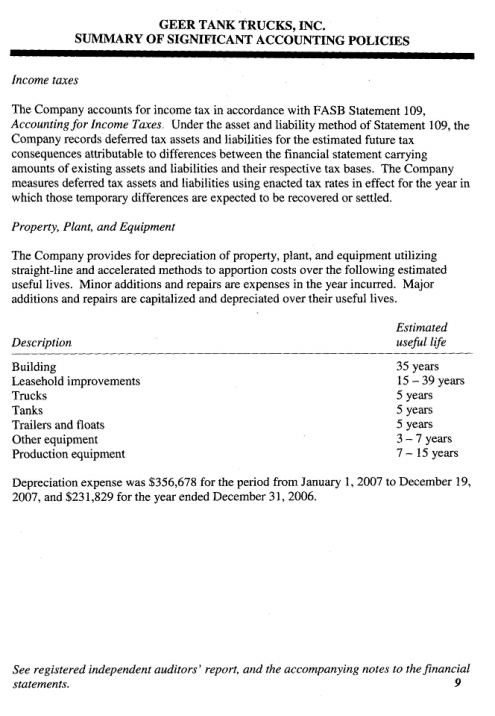

10 |

11 |

12 |

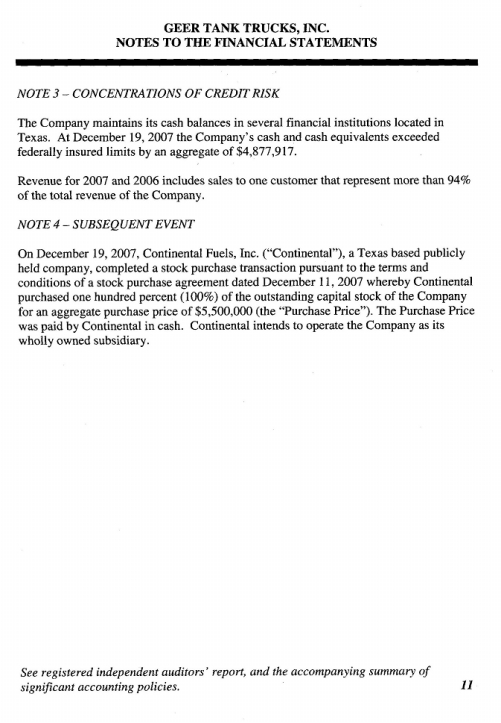

13 |

14 |

UNAUDITED PRO FORMA |

CONSOLIDATED CONDENSED FINANCIAL STATEMENTS |

Acquisition of the Capital Stock of Geer Tank Trucks, Inc.

On December 19, 2007, Continental Fuels, Inc. (the "Company" or "Continental") completed its previously

announced acquisition of Geer Tank Trucks, Inc. ("Geer"), a privately held Texas corporation, pursuant to the terms

and conditions of the Stock Purchase Agreement, dated as of December 11, 2007 (the "SPA"), whereby Continental

purchased one hundred percent (100%) of the outstanding capital stock of Geer, for an aggregate purchase price of

$5,500,000. The purchase price was paid by Continental in cash. Continental financed the acquisition with the

proceeds of a Term Loan from Sheridan.

As part of the terms of the Stock Purchase, at the closing of the Stock Purchase transaction Messrs. Kamal Abdallah,

Christopher M cCauley and Timothy Brink were each appointed to the board of directors of Geer Tank to fill

vacancies on that board caused by the resignations of previous board members. Mr. Brink is the Company's Chief

Executive Officer and a member of its board of directors, and Messrs. Abdallah and McCauley are each members of

the Company's board of directors.

This unaudited pro forma information should be read in conjunction with the consolidated financial statements of

Continental included in our Annual Report filed on Form 10-KSB/A for the year ended December 31, 2006 filed on

May 18, 2007 and our Quarterly Report filed on Form 10-Q for the nine months ended September 30, 2007 filed on

November 9, 2007. In addition, this pro forma information should be read in conjunction with the financial

statements for Geer for the year ended December 31, 2006 and for the period ended December 19, 2007, included

within this Form 8-K.

The following unaudited pro forma balance sheet has been prepared in accordance with accounting principles

generally accepted in the United States to give effect to the December 19, 2007 acquisition of Geer and the financing

raised in connection with the acquisition as if the acquisition and financing occurred on January 1, 2007. The pro

forma balance sheet combines the consolidated balance sheet of Continental as of September 30, 2007, which is

included on Form 10-Q, with the Geer balance sheet as of December 19, 2007 as a Geer balance sheet as of

September 30, 2007 was not available. We do not believe that the balances as of September 30, 2007 would not have

been materially different.

The following unaudited pro forma statement of operations for the nine months ended September 30, 2007 has been

prepared in accordance with accounting principles generally accepted in the United States to give effect to the

December 19, 2007 acquisition of Geer as if the transaction occurred on January 1, 2007. The pro forma statement of

operations combines the consolidated results of operations of Continental for the nine months ended September 30,

2007 with the results of operations of Geer for September 30, 2007, respectively. Geer's statement of operations for

the nine months ended September 30, 2007 was prorated from Geer's December 19, 2007 statement of operations as

no statement was available for the nine months ended September 30, 2007. Pro forma adjustments include interest on

the Sheridan loan relating to the Geer acquisition, amortization of financing costs and accretion expense relating to

the warrant liability to Sheridan.

The following unaudited pro forma statement of operations for the year ended December 31, 2006 has been prepared

in accordance with accounting principles generally accepted in the United States to give effect to the December 19,

2007 acquisition of Geer as if the transaction occurred on January 1, 2006. The pro forma statement of operations

combines the consolidated results of operations of Continental for the year ended December 31, 2006 with the results

of operations of Geer for the year ended December 31, 2006. Pro forma adjustments include interest on the Sheridan

loan relating to the Geer acquisition, amortization of financing costs and accretion expense relating to the warrant

liability to Sheridan.

15 |

Under the purchase method of accounting, the estimated cost of approximately $5,500,000 to acquire Geer, plus

financing costs, was allocated to Geer's underlying net assets in proportion to their respective fair values. As more

fully described in the notes to the pro forma consolidated financial statements, a preliminary allocation of the excess

of the purchase price over the book value of the net assets acquired has been made to goodwill. At this time, the

work needed to provide the basis for estimating these fair values, and amortization periods, has not been completed.

As a result, the final allocation of the excess of purchase price over the book value of the net assets acquired could

differ materially. Accordingly, a change in the amortization period would impact the amount of annual amortization

expense.

These unaudited pro forma financial statements are prepared for informational purposes only and are not necessarily

indicative of future results or of actual results that would have been achieved had the acquisition of Geer been

consummated as of the dates specified above.

16 |

UNAUDITED CONSOLIDATED BALANCE SHEET | |||||||||||

(A) | (C) | ||||||||||

CFUL | Geer | ||||||||||

As of | As of | ||||||||||

September 30, | December 19, | Proforma | |||||||||

| 2007 | 2007 | (O) | Adjustments | Total | ||||||

| |||||||||||

ASSETS | |||||||||||

Current Assets: | |||||||||||

Cash | $ | 425,566 | $ | 4,979,172 | (1,978,472) | (J) | $ | 3,426,266 | |||

Accounts receivable | 2,351,618 | 2,956,625 | - | 5,308,243 | |||||||

Inventory | 132,497 | 119,050 | - | 251,547 | |||||||

Prepaid expenses | 50,891 | 126,567 | - | 177,458 | |||||||

Goodwill | - | - | 3,281,490 | (F) | 3,281,490 | ||||||

|

|

|

| - | |||||||

Total Current Assets | 2,960,572 | 8,181,414 | 1,303,018 | 12,445,004 | |||||||

Property and equipment, at cost, net of accumulated | |||||||||||

depreciation of $18,755 and $4,263,583, respectively | 1,614,997 | 1,527,666 | - | 3,142,663 | |||||||

| |||||||||||

OTHER ASSETS | |||||||||||

Surety bonds | 48,400 | - | - | 48,400 | |||||||

Deposits towards pending oil distribution acquisition | 100,000 | - | - | 100,000 | |||||||

Rent security deposit | 4,901 | - | - | 4,901 | |||||||

Other deposits | - | - | - | - | |||||||

|

|

|

|

| |||||||

TOTAL ASSETS | $ | 4,728,870 | $ | 9,709,080 | $ | 1,303,018 | $ | 15,740,968 | |||

|

| ||||||||||

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | |||||||||||

Current Liabilities: | |||||||||||

Line of credit payable | $ | 1,800,000 | - | - | $ | 1,800,000 | |||||

Accounts and accrued expenses payable | 1,180,430 | 7,490,570 | - | 8,671,000 | |||||||

Bank overdraft | - | - | - | - | |||||||

Notes and loans payable: |

| ||||||||||

Others | 1,050,000 | - | - | 1,050,000 | |||||||

Related parties: |

| ||||||||||

UPDA and certain of its wholly-owned subsidiaries, net of | |||||||||||

loss on recapitalization of $2,736,541 (reserve for liabilities to UPDA parent | |||||||||||

with payment contingent on future profitability of Continental) | 2,295 | - | - | 2,295 | |||||||

Other relationships | 400,000 | - | - | 400,000 | |||||||

Other liabilities | 33,970 | - | - | 33,970 | |||||||

Total current liabilities | 4,466,695 | 7,490,570 | - | 11,957,265 | |||||||

Long-term Liabilities: | |||||||||||

Loan Payable - Sheridan term loan | - | - | 5,500,000 | (D) | 3,479,988 | ||||||

(961,859) | (K) | ||||||||||

240,465 | (L) | ||||||||||

(1,731,491) | (M) | ||||||||||

|

| 432,873 | (N) |

| |||||||

Total Long-term liabilities | - | - | 3,479,988 | 3,479,988 | |||||||

25% minority interest in Agencia Fiduciaria Aequitas N.V. (Continental A.V.V.) subsidiary | 2,328 | - | - | 2,328 | |||||||

Minority Interest | 2,328 | - | - | 2,328 | |||||||

|

|

|

| ||||||||

TOTAL LIABILITIES | 4,469,023 | 7,490,570 | 3,479,988 | 15,439,581 | |||||||

| |||||||||||

STOCKHOLDERS' EQUITY (DEFICIT) | |||||||||||

Series A convertible preferred stock - $.001 par value; 500,000 shares | |||||||||||

authorized at September 30, 2007 | 48 | - | - | 48 | |||||||

Common stock (1,000,000 shares $1 par value voting Class A authorized) | - | 14,000 | (14,000) | (E) | - | ||||||

Common stock (1,000,000 shares $1 par value non-voting Class B authorized) | - | 126,000 | (126,000) | (E) | - | ||||||

Common stock - $.001 par value; 900,000,000 shares authorized; |

| ||||||||||

80,043,219 issued and outstanding at September 30, 2007 | 80,043 | - | - | 80,043 | |||||||

Common stock to be issued of 21,436,678 shares | 21,437 | - | - | 21,437 | |||||||

Additional paid-in capital | 111,625,080 | - | 1,731,491 | (M) | 113,356,571 | ||||||

Accumulated deficit | (111,466,761) | 2,078,510 | (2,078,510) | (E) | (113,156,712) | ||||||

|

|

| (1,689,951) | (J) |

| ||||||

TOTAL STOCKHOLDERS' EQUITY (DEFICIT) | 259,847 | 2,218,510 | (2,176,970) | 301,387 | |||||||

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 4,728,870 | $ | 9,709,080 | $ | 1,303,018 | $ | 15,740,968 | |||

17 |

UNAUDITED CONSOLIDATED STATEMENT OF OPERATIONS | |||||||||

(A) | (C) | ||||||||

CFUL | Geer | ||||||||

| For the Nine | For the Nine | |||||||

| Months Ended | Months Ended | |||||||

September 30, | September 30, | Proforma | |||||||

| 2007 | 2007 | Adjustments | Total | |||||

| |||||||||

REVENUE | |||||||||

Product revenue | $ | 17,440,493 | $ | 32,612,973 | $ | - | $ | 50,053,466 | |

| |||||||||

COST OF SALES | - | ||||||||

Cost of product revenue | 15,516,847 | 29,827,621 | - | 45,344,468 | |||||

GROSS PROFIT | 1,923,646 | 2,785,352 | - | 4,708,998 | |||||

| |||||||||

General & administrative expenses: | |||||||||

Consulting fees and services | 520,477 | - | - | 520,477 | |||||

Payroll and related benefits | 274,093 | - | - | 274,093 | |||||

Selling and marketing expenses | 525,000 | - | - | 525,000 | |||||

General & administrative expenses | 649,742 | 2,267,594 | - | 2,917,336 | |||||

Total operating expenses | 1,969,312 | 2,267,594 | - | 4,236,906 | |||||

|

| ||||||||

INCOME (LOSS) FROM OPERATIONS | (45,666) | 517,758 | - | 472,092 | |||||

| |||||||||

Other income (expense): | |||||||||

Interest expense, net | (304,547) | 29,708 | 618,750 | (H) | 550,161 | ||||

| 206,250 | (I) | |||||||

Amortization of deferred loan costs | - | - | 240,465 | (L) | 240,465 | ||||

Accretion expense | - | - | 432,873 | (N) | 432,873 | ||||

Debt conversion costs | (91,056,436) | - | - | (91,056,436) | |||||

Gain on sale of Company net assets to a former officer/director | |||||||||

predecessor entity | 114,963 | - | - | 114,963 | |||||

Other expense | (650) | - | - | (650) | |||||

Total other income (expenses) | $ | (91,246,670) | $ | 29,708 | $ | 1,498,338 | $ | (89,718,624) | |

|

| ||||||||

Loss before provision for income taxes | (91,292,337) | 547,466 | 1,498,338 | (89,246,533) | |||||

Provision for income taxes | - | (191,613) | 191,613 | (G) | - | ||||

Net loss | (91,292,337) | 355,853 | 1,689,951 | (89,246,533) | |||||

Add, 25% minority interest in net loss of Agencia Fiduciaria Aequitas |

| ||||||||

N.V. (Continental A.V.V.) subsidiary | (2) | - | - | (2) | |||||

NET INCOME (LOSS) AFTER MINORITY INTEREST | (91,292,339) | 355,853 | 1,689,951 | (89,246,535) | |||||

Basic and diluted net loss per weighted-average shares common stock | $ | (1.12) | $ | (1.09) | |||||

Weighted-average number of shares of common stock outstanding | 81,723,576 | 81,723,576 | |||||||

18 |

UNAUDITED CONSOLIDATED STATEMENT OF OPERATIONS | |||||||||

(B) | (C) | ||||||||

CFUL | Geer | ||||||||

| For the Twelve | For the Twelve | |||||||

| Months Ended | Months Ended | |||||||

December 31, | December 31, | Proforma | |||||||

| 2006 | 2006 | Adjustments | Total | |||||

| |||||||||

REVENUE | |||||||||

Product revenue | $ | 90,076 | $ | 43,759,162 | $ | - | $ | 43,849,238 | |

|

| ||||||||

COST OF SALES | |||||||||

Cost of product revenue | 58,614 | 41,130,977 | - | 41,189,591 | |||||

GROSS PROFIT | 31,462 | 2,628,185 | - | 2,659,647 | |||||

| |||||||||

General & administrative expenses: | |||||||||

Consulting fees and services | - | - | - | - | |||||

Payroll and related benefits | 1,012,660 | - | - | 1,012,660 | |||||

Selling and marketing expenses | 513,611 | - | - | 513,611 | |||||

General & administrative expenses | 2,385,590 | 2,797,154 | - | 5,182,744 | |||||

Total operating expenses | 3,911,861 | 2,797,154 | - | 6,709,015 | |||||

| |||||||||

INCOME (LOSS) FROM OPERATIONS | (3,880,399) | (168,969) | - | (4,049,368) | |||||

| - | ||||||||

Other income (expense): | - | ||||||||

Interest expense, net | (83,968) | 36,995 | 825,000 | (H) | 1,053,027 | ||||

|

| 275,000 | (I) | ||||||

Amortization of deferred loan costs | - | - | 320,620 | (L) | 320,620 | ||||

Accretion expense | - | - | 577,164 | (N) | 577,164 | ||||

Debt conversion costs | - | - | - | - | |||||

Gain on sale of Company net assets to a former officer/director |

| ||||||||

predecessor entity | - | - | - | - | |||||

Other expense | - | - | - | - | |||||

Total other income (expenses) | $ | (83,968) | $ | 36,995 | $ | 1,997,784 | $ | 1,950,811 | |

|

| ||||||||

Loss before provision for income taxes | (3,964,367) | (131,974) | - | (4,096,341) | |||||

Provision for income taxes | - | 46,191 | (46,191) | (G) | - | ||||

Net loss | (3,964,367) | (85,783) | (46,191) | (4,096,341) | |||||

Add, 25% minority interest in net loss of Agencia Fiduciaria Aequitas | |||||||||

N.V. (Continental A.V.V.) subsidiary | - | - | - | - | |||||

NET LOSS AFTER MINORITY INTEREST | (3,964,367) | (85,783) | (46,191) | (4,096,341) | |||||

Basic and diluted net loss per weighted-average shares common stock | $ | (3.82) | $ | (3.95) | |||||

Weighted-average number of shares of common stock outstanding | 1,036,940 | 1,036,940 | |||||||

| |||||||||

Notes for Pro forma Financial Statements

(A) Information derived from the Company's 9/30/2007 10QSB.

(B) Information derived from the Company's 12/31/2006 10KSB.

(C) Information derived from the 12/19/2007 audited financial statements of Geer.

(D) The long-term loan payable to Sheridan is based on the repayment schedule per the terms of the Sheridan loan entered into by Continental

to acquire Geer.

(E) This adjustment is based on the reversal of Geer's equity after the Geer was purchased by Continental.

(F) Goodwill is based on the liability assumed by Continental less the elimination of Geer's equity and retained earnings.

(G) There is no tax expense as Continental has net operating loss carry forwards.

(H) This interest expense is based on the terms of the Sherida n $5,500,000 loan of 15% per year.

(I) This interest expense is based on the terms of the Sheridan $5,500,000 loan of payment-in-kind interest of 5% per year.

(J) Cash is adjusted for the P&L pro forma adjustments, i.e. for interest expense, less loan origination costs, loan amortization expense and

accretion expense that are recorded in the P&L but do not affect cash.

(K) This adjustment is to record the loan origination costs associated with the Sheridan term loan.

(L) This adjustment is to record amortization of loan origination costs for 1 year.

(M) This adjustment is to record the warrant liability for the value of the warrant to purchase 5,500,000 shares of Continental's common stock

that was issued to Sheridan as consideration for the loan.

(N) This adjustment is to record accretion expense on th e warrant liability in item (M).

(O) The December 19, 2007 Geer balance sheet was used as a September 30, 2007 balance sheet was not available. However, the balances

would not be materially different.

19 |