Proprietary and Confidential | April 23, 2014 First Quarter 2014 Earnings Conference Call Exhibit 99.2 1

Proprietary and Confidential | 2 Certain statements and information included in this presentation are "forward-looking statements" under the Federal Private Securities Litigation Reform Act of 1995, including our expectations regarding revenue and earnings growth, lease fleet growth, performance in our product lines, including full service lease, supply chain solutions, commercial rental and used vehicle pricing. Accordingly, these forward-looking statements should be evaluated with consideration given to the many risks and uncertainties inherent in our business that could cause actual results and events to differ materially from those in the forward-looking statements. Important factors that could cause such differences include, among others, lower than expected lease sales, decreases in commercial rental demand and pricing, fluctuations in market demand for used vehicles impacting inventory levels, pricing and our anticipated proportion of retail versus wholesale sales, lower than expected benefits from maintenance initiatives and a newer fleet, setbacks in the economic recovery, decreases in freight demand or volumes, our ability to obtain adequate profit margins for our services, our inability to maintain current pricing levels due to soft economic conditions, further decline in economic and market conditions in the U.K., business interruptions or expenditures due to severe weather or natural occurrences, competition from other service providers, customer retention levels, loss of key customers, unexpected bad debt reserves or write-offs, changes in customers’ business environments that will limit their ability to commit to long-term vehicle leases, a decrease in credit ratings, increased debt costs, adequacy of accounting estimates, reserves and accruals particularly with respect to pension, taxes, depreciation, insurance and revenue, sudden or unusual changes in fuel prices, our ability to manage our cost structure, and the risks described in our filings with the Securities and Exchange Commission. The risks included here are not exhaustive. New risks emerge from time to time and it is not possible for management to predict all such risk factors or to assess the impact of such risks on our business. Accordingly, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. This presentation includes certain non-GAAP financial measures as defined under SEC rules, including operating revenue, comparable earnings, comparable earnings forecast, comparable earnings before income tax, comparable tax rate, adjusted return on capital, total cash generated, free cash flow, total obligations and the ratios based on these financial measures. Refer to Appendix – Non-GAAP Financial Measures for more information about the non-GAAP financial measures contained in this presentation. Additional information as required by Regulation G regarding non-GAAP financial measures can be found in our most recent Form 10-K, Form 10-Q and our Form 8-K filed as of the date of this presentation with the SEC, which are available at http://investors.ryder.com. Safe Harbor and Non-GAAP Financial Measures

Proprietary and Confidential | 3 Contents ►First Quarter 2014 Results Overview ►Asset Management Update ►Earnings Forecast ►Q & A

Proprietary and Confidential | 4 1st Quarter Results Overview ► Comparable earnings per share from continuing operations were $0.92 vs. $0.81 in 1Q13 ► Earnings per diluted share from continuing operations were $0.92 in 1Q14 vs. $0.79 in 1Q13 – 1Q14 included non-operating pension costs of $0.03, which were offset by a $0.03 benefit related to a state tax law change – 1Q13 included net expense of $0.02 from non-operating pension costs, partially offset by a foreign currency translation ► Operating revenue increased 4% and total revenue increased 3% vs. prior year reflecting higher revenue in both segments

Proprietary and Confidential | 5 Key Financial Statistics First Quarter ($ Millions, Except Per Share Amounts) Operating Revenue Fuel Services and Subcontracted Transportation Revenue Total Revenue Earnings Per Share from Continuing Operations Comparable Earnings Per Share from Continuing Operations 2014 2013 % B/(W) 1,322.5$ 1,267.5$ 4% 288.3 295.5 (2)% 1,610.7$ 1,563.0$ 3% 0.92$ 0.79$ 16% 0.92$ 0.81$ 14% Memo: Average Shares (Millions) - Diluted Tax Rate from Continuing Operations Comparable Tax Rate from Continuing Operations Adjusted Return on Capital vs. Cost of Capital (Trailing 12 months) 53.1 51.4 34.5% 34.7% 37.2% 36.2% 0.9% 0.9% Note: Amounts throughout presentation may not be additive due to rounding.

Proprietary and Confidential | 6 1st Quarter Results Overview – FMS ► Fleet Management Solutions (FMS) operating revenue up 4% and total revenue up 3% vs. prior year – Full service lease revenue up 4% – Contract maintenance revenue down 5% – Contract-related maintenance revenue up 5% – Commercial rental revenue up 10% ► FMS earnings increased due to strong commercial rental performance, better used vehicle sales results and improved full service lease results – Favorable lease results benefited from vehicle residual value benefits and fleet growth ► FMS earnings before tax (EBT) up 27% – FMS EBT percent of operating revenue up 160 basis points to 9.0%

Proprietary and Confidential | 7 1st Quarter Results Overview – SCS ► Supply Chain Solutions (SCS) operating revenue up 5% and total revenue up 4% vs. prior year due to new business and higher volumes – Dedicated operating revenue increased 7% vs. prior year due to new sales ► SCS earnings were lower reflecting weather-related impacts and, to a lesser extent, start-up costs related to a new account ► SCS earnings before tax (EBT) down 11% – SCS EBT percent of operating revenue down 70 basis points to 4.2%

Proprietary and Confidential | 8 Business Segments 2014 2013 Operating Revenue: Fleet Management Solutions 860.0$ 824.0$ Supply Chain Solutions 520.4 494.8 Eliminations (57.9) (51.3) Total 1,322.5$ 1,267.5$ Segment Earnings Before Tax: (1) Fleet Management Solutions 77.0$ 60.7$ Supply Chain Solutions 21.8 24.4 Eliminations (9.6) (8.0) 89.1 77.2 Central Support Services (Unallocated Share) (10.8) (11.4) Non-operating Pension Costs (3.3) (5.2) Restructuring and Other Charges, Net and Other Items - 1.9 Earnings Before Income Taxes 75.0 62.5 Provision for Income Taxes (25.9) (21.7) Earnings from Continuing Operations 49.1$ 40.8$ Comparable Earnings from Continuing Operations 49.2$ 42.0$ % B/(W) 2014 2013 4% 1,135.1$ 1,099.7$ 5% 597.3 576.5 (13)% (121.7) (113.2) 4% 1,610.7$ 1,563.0$ 27% (11)% (21)% 15% 5% 37% NM 20% (19)% 20% 17% Memo: Total Revenue % B/(W) 3% 4% (8)% 3% First Quarter (1) Our primary measure of segment financial performance excludes unallocated CSS, non-operating pension costs, restructuring and other charges, net and other items. ($ Millions)

Proprietary and Confidential | Capital Expenditures Full Service Lease Commercial Rental Operating Property and Equipment Gross Capital Expenditures 2014 $ 2014 2013 O/(U) 2013 446$ 381$ 65$ 125 47 79 24 22 2 596 449 146 Less: Proceeds from Sales (Primarily Revenue Earning Equipment) 128 113 14 Net Capital Expenditures 468$ 336$ 132$ First Quarter ($ Millions) 9

Proprietary and Confidential | Cash Flow from Continuing Operations 2014 2013 Earnings from Continuing Operations 49$ 41$ Depreciation 249 232 Gains on Vehicle Sales, Net (29) (23) Amortization and Other Non-Cash Charges, Net 19 18 Pension Contributions (4) (4) Changes in Working Capital and Deferred Taxes (46) (14) Cash Provided by Operating Activities 238 249 Proceeds from Sales (Primarily Revenue Earning Equipment) 128 113 Collections of Direct Finance Leases 16 27 Other, Net (1) 4 Total Cash Generated 380 393 Capital Expenditures (1) (579) (420) Free Cash Flow (2) (198)$ (27)$ First Quarter ($ Millions) (1) Capital expenditures presented net of changes in accounts payable related to purchases of revenue earning equipment. (2) Free Cash Flow excludes acquisitions and changes in restricted cash. 10

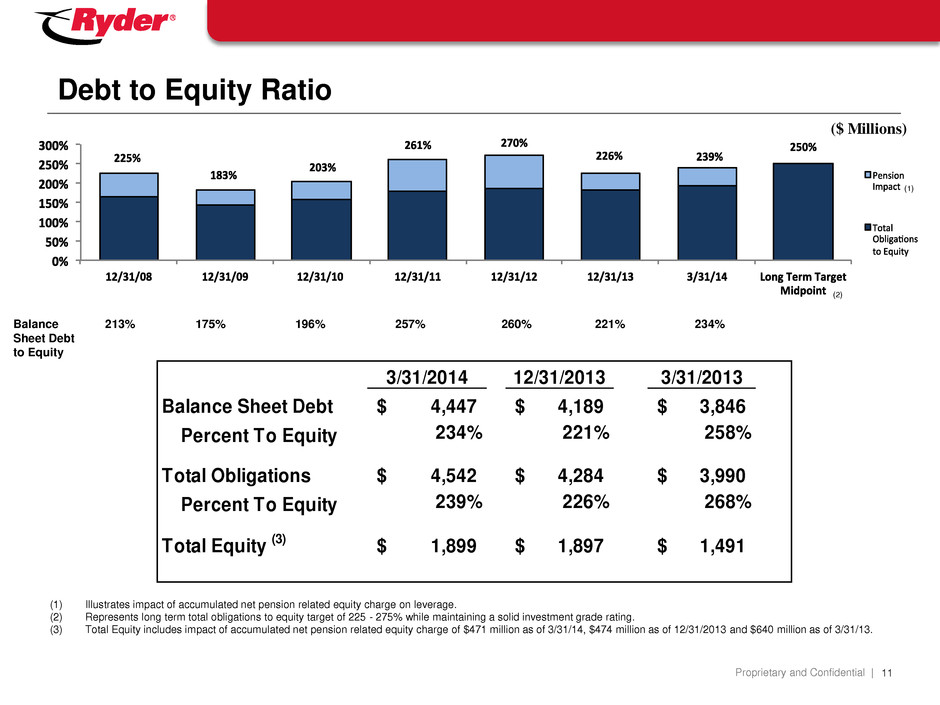

Proprietary and Confidential | Debt to Equity Ratio 3/31/2014 12/31/2013 3/31/2013 Balance Sheet Debt 4,447$ 4,189$ 3,846$ Percent To Equity 234% 221% 258% Total Obligations 4,542$ 4,284$ 3,990$ Percent To Equity 239% 226% 268% Total Equity (3) 1,899$ 1,897$ 1,491$ Balance 213% 175% 196% 257% 260% 221% 234% Sheet Debt to Equity (1) (2) (1) Illustrates impact of accumulated net pension related equity charge on leverage. (2) Represents long term total obligations to equity target of 225 - 275% while maintaining a solid investment grade rating. (3) Total Equity includes impact of accumulated net pension related equity charge of $471 million as of 3/31/14, $474 million as of 12/31/2013 and $640 million as of 3/31/13. 11 ($ Millions)

Proprietary and Confidential | Contents ►First Quarter 2014 Results Overview ►Asset Management Update ►Earnings Forecast ►Q & A 12

Proprietary and Confidential | ► Units held for sale were 7,200 at quarter end, down from 10,000 units held for sale in the prior year ─ Sequentially from the fourth quarter, units held for sale decreased by 700 units ► The number of used vehicles sold in the first quarter was 5,600, down 3% from the prior year ─ Sequentially from the fourth quarter, units sold were down 2% ► Proceeds per unit were up 2% for tractors and up 12% for trucks in the first quarter compared with prior year (excluding the impact of exchange rates) ─ Proceeds per unit were up 4% for tractors and up 16% for trucks vs. the fourth quarter ► Average first quarter total commercial rental fleet was up 3% from the prior year ─ Average commercial rental fleet remained unchanged from the fourth quarter Global Asset Management Update (1) (1) Units rounded to nearest hundred. 13

Proprietary and Confidential | Contents ►First Quarter 2014 Results Overview ►Asset Management Update ►Earnings Forecast ►Q & A 14

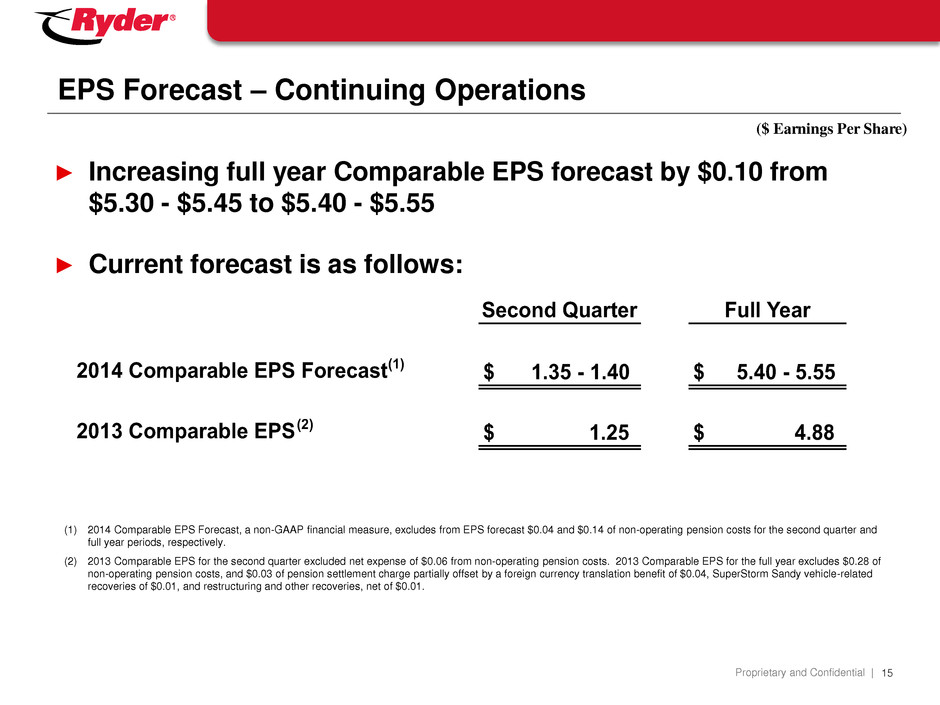

Proprietary and Confidential | EPS Forecast – Continuing Operations Second Quarter Full Year 2014 Comparable EPS Forecast(1) $ 1.35 - 1.40 $ 5.40 - 5.55 2013 Comparable EPS (2) $ 1.25 $ 4.88 ($ Earnings Per Share) (1) 2014 Comparable EPS Forecast, a non-GAAP financial measure, excludes from EPS forecast $0.04 and $0.14 of non-operating pension costs for the second quarter and full year periods, respectively. (2) 2013 Comparable EPS for the second quarter excluded net expense of $0.06 from non-operating pension costs. 2013 Comparable EPS for the full year excludes $0.28 of non-operating pension costs, and $0.03 of pension settlement charge partially offset by a foreign currency translation benefit of $0.04, SuperStorm Sandy vehicle-related recoveries of $0.01, and restructuring and other recoveries, net of $0.01. 15 ► Increasing full year Comparable EPS forecast by $0.10 from $5.30 - $5.45 to $5.40 - $5.55 ► Current forecast is as follows:

Proprietary and Confidential | Q&A 16

Proprietary and Confidential | Appendix Full Service Lease Vehicle Count Business Segment Detail Central Support Services Balance Sheet Financial Indicators Forecast Asset Management Non-GAAP Financial Measures & Reconciliations 17

Proprietary and Confidential | End of Period 1Q13 2Q13 3Q13 4Q13 1Q14 FSL Fleet (as reported) 121,700 120,300 120,800 122,900 123,300 1,600 UK FSL Trailers 6,000 5,400 5,100 5,000 4,800 (1,200) FSL Fleet - excluding UK 115,700 114,900 115,700 117,900 118,500 2,800 Sequential Change 2Q13 O/(U) 1Q13 3Q13 O/(U) 2Q13 4Q13 O/(U) 3Q13 1Q14 O/(U) 4Q13 FSL Fleet (as reported) (1,400) 500 2,100 400 UK FSL Trailers (600) (300) (100) (200) FSL Fleet - excluding UK (800) 800 2,200 600 1Q14 O/(U) 1Q13 18 Note: Represents end of period vehicle count. Full Service Lease (FSL) Fleet Count

Proprietary and Confidential | Fleet Management Solutions (FMS) Full Service Lease Contract Maintenance Contractual Revenue Commercial Rental Contract-related Maintenance Other Operating Revenue Fuel Services Revenue Total Revenue Segment Earnings Before Tax (EBT) Segment EBT as % of Total Revenue Segment EBT as % of Operating Revenue 2014 2013 % B/(W) 552.2$ 533.2$ 4% 43.7 46.1 (5)% 595.9 579.3 3% 190.2 173.1 10% 56.1 53.3 5% 17.7 18.2 (3)% 860.0 824.0 4% 275.2 275.7 - 1,135.1$ 1,099.7$ 3% 77.0$ 60.7$ 27% 6.8% 5.5% 9.0% 7.4% First Quarter ($ Millions) 19

Proprietary and Confidential | Supply Chain Solutions (SCS) 2014 2013 % B/(W) Automotive 144.6$ 148.6$ (3)% High-Tech 81.5 77.8 5% Retail & CPG 183.3 175.8 4% Industrial & Other 111.1 92.6 20% Operating Revenue 520.4 494.8 5% Subcontracted Transportation 76.9 81.6 (6)% Total Revenue 597.3$ 576.5$ 4% Segment Earnings Before Tax (EBT) 21.8$ 24.4$ (11)% Segment EBT as % of Total Revenue 3.6% 4.2% Segment EBT as % of Operating Revenue 4.2% 4.9% Memo: Dedicated Services - Operating Revenue(1) 311.7$ 291.1$ 7%324.8 Dedicated Services - Total Revenue 345.9$ 324.8$ 6% Fuel Costs 70.4$ 68.2$ 3% First Quarter ($ Millions) (1) Excludes $34.1 million and $33.6 million of Dedicated Services Subcontracted Transportation in 2014 and 2013, respectively. 20

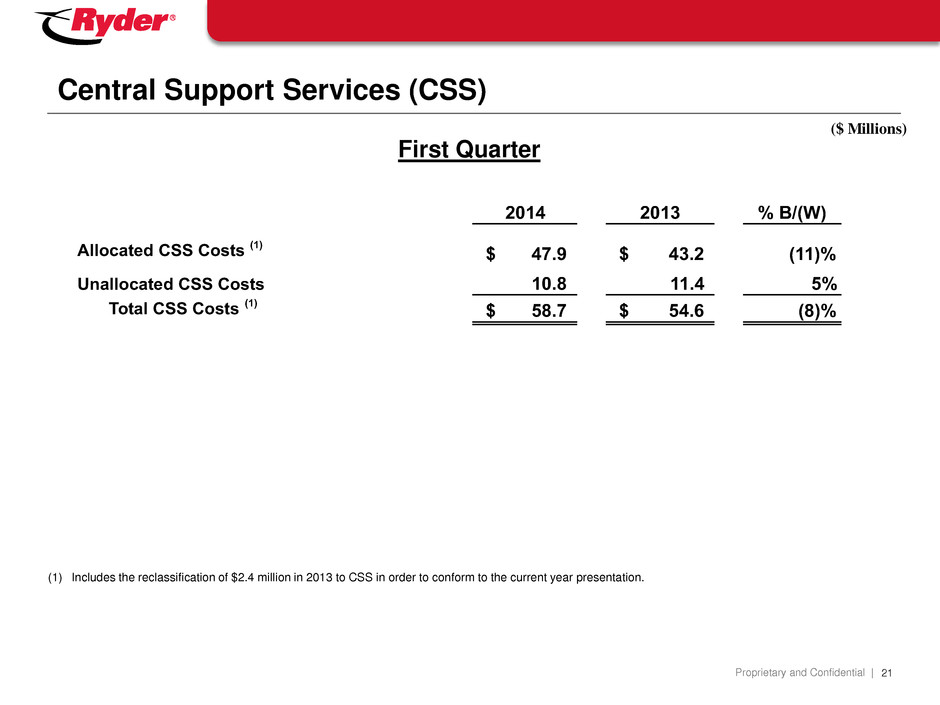

Proprietary and Confidential | Central Support Services (CSS) 2014 2013 % B/(W) Allocated CSS Costs (1) 47.9$ 43.2$ (11)% Unallocated CSS Costs 10.8 11.4 5% Total CSS Costs (1) 58.7$ 54.6$ (8) First Quarter ($ Millions) 21 (1) Includes the reclassification of $2.4 million in 2013 to CSS in order to conform to the current year presentation.

Proprietary and Confidential | Balance Sheet Cash and Cash Equivalents Other Current Assets Revenue Earning Equipment, Net Operating Property and Equipment, Net Other Assets Total Assets Short-Term Debt / Current Portion Long-Term Debt Other Current Liabilities Long-Term Debt Other Non-Current Liabilities (including Deferred Income Taxes) Shareholders' Equity Total Liabilities and Shareholders' Equity March 31, December 31, 2014 2013 73$ 62$ 1,044 1,001 6,688 6,491 637 634 926 916 9,367$ 9,104$ 401$ 259$ 972 972 4,046 3,930 2,051 2,046 1,899 1,897 9,367$ 9,104$ ($ Millions) 22

Proprietary and Confidential | 2008 2009 2010 2011 2012 2013 2013 Forecast Midpoint Long Term Target Midpoint Financial Indicators Forecast (1) (1) Total Obligations to Equity includes acquisitions. Free Cash Flow and Gross Capital Expenditures exclude acquisitions. (2) Illustrates impact of accumulated net pension related equity charge on leverage. (3) Represents long term obligations to equity target of 225-275% while maintaining a solid investment grade credit rating. 2008 2009 2010 2011 2012 2013 2014 Forecast Gross Capital Expenditures Free Cash Flow $1,265 $611 341 614 $1,088 (384) 258 $1,760 Full Service Lease PP&E/Other Commercial Rental $2,161 (257) Total Obligations to Equity Pension Impact (2) 2008 2009 2010 225% 183% 203% 270% Long Term Target Midpoint (3) 2011 261% Forecast 2012 230% 2014 Total Obligations to Equity 226% $2,184 Balance Sheet Debt to Equity 213% 175% 196% 257% 260% 221% (386) $2,160 (300) 2013 250% 23 Forecast 2014 2008 2009 2010 2011 2012 2013 ($ Millions)

Proprietary and Confidential | 1,061 1,210 1,269 896 1,521 1,684 1,485 2,088 1,334 1,147 1,701 889 742 1,855 572 1,001 1,512 787 727 1,384 649 0 500 1,000 1,500 2,000 2,500 Redeployments Extensions Early Terminations N u m b e r o f U n i t s 1Q08 1Q09 1Q10 1Q11 1Q12 1Q13 1Q14 (a) U.S. only (b) Current year statistics may exclude some units due to a lag in reporting (b) Excludes early terminations where customer purchases vehicle (b)(c) Redeployments – Vehicles coming off-lease or in Rental with useful life remaining are redeployed in the Ryder fleet (SCS, or with another Lease customer). Redeployments exclude units transferred into the Rental product line. Extensions – Ryder re-prices lease contract and extends maturity date. Early terminations – Customer elects to terminate lease prior to maturity. Depending on the remaining useful life, the vehicle may be redeployed in the Ryder fleet (Commercial Rental, SCS, other Lease customer) or sold by Ryder. Asset Management Update (a) 24

Proprietary and Confidential | Non-GAAP Financial Measures ► This presentation includes “non-GAAP financial measures” as defined by SEC rules. As required by SEC rules, we provide a reconciliation of each non-GAAP financial measure to the most comparable GAAP measure. Non-GAAP financial measures should be considered in addition to, but not as a substitute for or superior to, other measures of financial performance prepared in accordance with GAAP. ► Specifically, the following non-GAAP financial measures are included in this presentation: Non-GAAP Financial Measure Comparable GAAP Measure Reconciliation & Additional Information Presented on Slide Titled Page Operating Revenue Total Revenue Key Financial Statistics 5 Comparable Earnings / Comparable EPS Earnings / EPS from Continuing Operations Earnings and Tax Rate from Continuing Operations Reconciliation 26 Comparable Earnings Before Income Tax / Comparable Tax Rate Earnings Before Income Tax / Tax Rate Earnings and Tax Rate from Continuing Operations Reconciliation 26 Comparable EPS Forecast EPS Forecast EPS Forecast – Continuing Operations 15 Adjusted Return on Capital Net Earnings / Total Capital Adjusted Return on Capital Reconciliation 27 Total Cash Generated / Free Cash Flow Cash Provided by Operating Activities Cash Flow Reconciliation 29 Total Obligations / Total Obligations to Equity Balance Sheet Debt / Debt to Equity Debt to Equity Reconciliation 28 FMS Operating Revenue / SCS and Dedicated Services Operating Revenue FMS Total Revenue / SCS and Dedicated Services Total Revenue Fleet Management Solutions (FMS) / Supply Chain Solutions (SCS) 19-20 25

Proprietary and Confidential | Earnings and Tax Rate from Continuing Operations Reconciliation ($ Millions or $ Earnings Per Share) (1) The company uses Comparable Earnings, Comparable Earnings per Share (EPS). Comparable Earnings Before Income Tax (EBT) and Comparable Tax Rate, all from Continuing Operations, non-GAAP financial measures, which provide useful information to investors and allow for better year over year comparison of operating performance because they exclude from Earnings, EPS, EBT and Tax Rate from Continuing Operations non-operating pension costs, which we consider to be costs outside of the operational performance of the business and can significantly change from year to year. These non-GAAP financial measures also exclude other significant items that are not representative of our ongoing business operations and allow for better year over year comparison. 26 1Q14 - 1Q14 - 1Q14 - 1Q14 - 1Q14 - Earnings EPS EBT Tax Tax Rate Reported 49.1$ 0.92$ 75.0$ 25.9$ 34.5% Non-Operating Pension Costs 1.9 0.03 3.3 1.4 Tax Law Change Benefit (1.8) (0.03) - 1.8 Comparable (1) 49.2$ 0.92$ 78.3$ 29.1$ 37.2% 1Q13 - 1Q13 - 1Q13 - 1Q13 - 1Q13 - Earnings EPS EBT Tax Tax Rate Reported 40.8$ 0.79$ 62.5$ 21.7$ 34.7% Non-Operating Pension Costs 3.1 0.06 5.2 2.2 Foreign Currency Translation Benefit (1.9) (0.04) (1.9) - Comparable (1) 42.0$ 0.81$ 65.8$ 23.9$ 36.2%

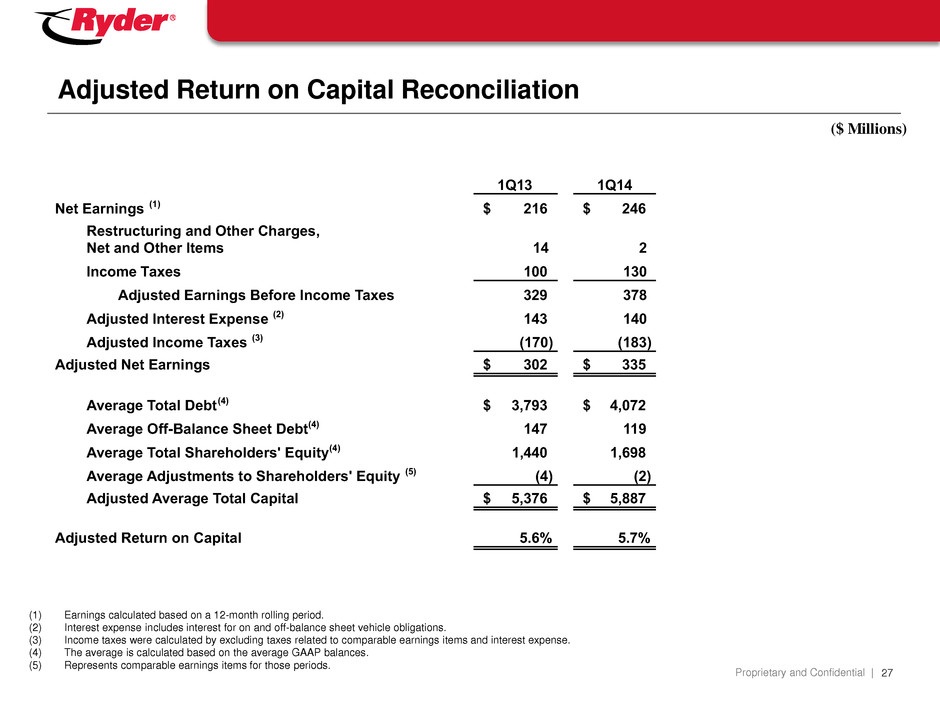

Proprietary and Confidential | ($ Millions) (1) Earnings calculated based on a 12-month rolling period. (2) Interest expense includes interest for on and off-balance sheet vehicle obligations. (3) Income taxes were calculated by excluding taxes related to comparable earnings items and interest expense. (4) The average is calculated based on the average GAAP balances. (5) Represents comparable earnings items for those periods. 27 1Q13 1Q14 Net Earnings (1) 216$ 246$ Restructuring and Other Charges, Net and Other Items 14 2 Income Taxes 100 130 Adjusted Earnings Before Income Taxes 329 378 Adjusted Interest Expense (2) 143 140 Adjusted Income Taxes (3) (170) (183) Adjusted Net Earnings 302$ 335$ Average Total Debt(4) 3,793$ 4,072$ Average Off-Balance Sheet Debt(4) 147 119 Average Total Shareholders' Equity(4) 1,440 1,698 Average Adjustments to Shareholders' Equity (5) (4) (2) Adjusted Average Total Capital 5,376$ 5,887$ Adjusted Return on Capital 5.6% 5.7% Adjusted Return on Capital Reconciliation

Proprietary and Confidential | Debt to Equity Reconciliation ($ Millions) Note: Amounts may not recalculate due to rounding. % to % to % to % to % to % to % to % to 12/31/2008 Equity 12/31/2009 Equity 12/31/2010 Equity 12/31/2011 Equity 12/31/2012 Equity 12/31/2013 Equity 3/31/2014 Equity 3/31/2013 Equity Balance Sheet Debt $2,863 213% $2,498 175% $2,747 196% $3,382 257% $3,821 260% $4,189 221% $4,447 234% $3,846 258% Receivables Sold - - - - - - - - PV of minimum lease payments and guaranteed residual values under operating leases for vehicles 163 119 100 64 148 95 95 144 Total Obligatio s $3,026 225% $2,617 183% $2,847 203% $3,446 261% $3,969 270% $4,284 226% $4,542 239% $3,990 268% 28

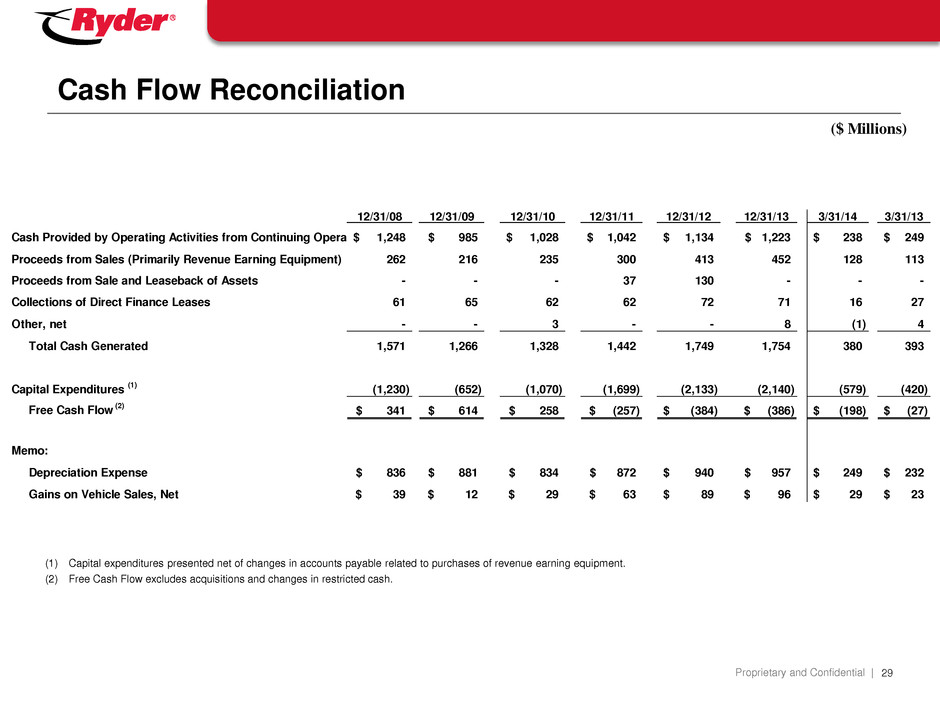

Proprietary and Confidential | Cash Flow Reconciliation ($ Millions) (1) Capital expenditures presented net of changes in accounts payable related to purchases of revenue earning equipment. (2) Free Cash Flow excludes acquisitions and changes in restricted cash. 29 12/31/08 12/31/09 12/31/10 12/31/11 12/31/12 12/31/13 3/31/14 3/31/13 Cash Provided by Operating Activities from Continuing Operations 1,248$ 985$ 1,028$ 1,042$ 1,134$ 1,223$ 238$ 249$ Proceeds from Sales (Primarily Revenue Earning Equipment) 262 216 235 300 413 452 128 113 Proceeds from Sale and Leaseback of Assets - - - 37 130 - - - Collections of Direct Finance Leases 61 65 62 62 72 71 16 27 Other, net - - 3 - - 8 (1) 4 Total Cash Generated 1,571 1,266 1,328 1,442 1,749 1,754 380 393 Capital Expenditures (1) (1,230) (652) (1,070) (1,699) (2,133) (2,140) (579) (420) Free Cash Flow (2) 341$ 614$ 258$ (257)$ (384)$ (386)$ (198)$ (27)$ Memo: Depreciation Expense 836$ 881$ 834$ 872$ 940$ 957$ 249$ 232$ Gains on Vehicle Sales, Net 39$ 12$ 29$ 63$ 89$ 96$ 29$ 23$

Proprietary and Confidential |