- HOLX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

SC TO-C Filing

Hologic (HOLX) SC TO-CInformation about tender offer

Filed: 11 Jun 08, 12:00am

Goldman Sachs Twenty-Ninth Annual Global Healthcare Conference Glenn Muir Executive Vice President & CFO Howard Doran President, Diagnostics Group June 10, 2008 Exhibit 99.1 |

Forward-Looking Statements This presentation contains forward-looking information that involves risks and uncertainties, including statements regarding the Company’s plans, objectives, expectations and intentions. These forward-looking statements are based upon assumptions made by the Company as of the date hereof and are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those anticipated. Factors that could adversely affect the Company’s business and prospects are described in the Company’s filings with the Securities and Exchange Commission. Hologic expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any such statements to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which any such statement is based. |

Information Concerning Forward-Looking Statements Information set forth in this communication contains forward-looking statements, which involve a number of risks and uncertainties. Such forward-looking statements include, but are not limited to, statements about the timing of the completion of the transaction, the anticipated benefits of the acquisition of Third Wave by Hologic, including future financial and operating results, the expected permanent financing for the transaction, Hologic’s and Third Wave’s plans, objectives, expectations and intentions and other statements that are not historical facts. Hologic and Third Wave caution readers that any forward-looking information is not a guarantee of future performance and actual results could differ materially from those contained in the forward-looking information. Risks and uncertainties include, among others: the ability of the parties to obtain regulatory approvals of the transaction on the proposed terms and schedule; the parties may be unable to complete the transaction because conditions to the closing of the transaction may not be satisfied; the risk that the businesses will not be integrated successfully; the transaction may involve unexpected costs or unexpected liabilities; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; competition and its effect on pricing, spending, third-party relationships and revenues; the risk of Third Wave’s products not obtaining regulatory approval or significant delays in obtaining such approval; the need to develop new products and adapt to significant technological change; implementation of strategies for improving internal growth; use and protection of intellectual property; dependence on customers’ capital spending policies and government funding policies, including third-party reimbursement; realization of potential future savings from new productivity initiatives; general worldwide economic conditions and related uncertainties; future legislative, regulatory, or tax changes as well as other economic, business and/or competitive factors; and the effect of exchange rate fluctuations on international operations. In addition, the transaction will require Hologic to increase the financing available to it under its existing credit agreement with Goldman Sachs Credit Partners L.P. While Hologic has obtained a commitment for such increased financing, Hologic’s liquidity and results of operations could be materially adversely affected if such financing is not available on favorable terms. Moreover, the substantial leverage resulting from such financing will subject Hologic’s business to additional risks and uncertainties. The risks included above are not exhaustive. The annual reports on Form 10-K, the quarterly reports on Form 10-Q, current reports on Form 8-K and other documents Hologic and Third Wave have filed with the SEC contain additional factors that could impact Hologic’s business and financial performance. Hologic and Third Wave expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any such statements to reflect any change in the parties expectations or any change in events, conditions or circumstances on which any such statement is based. |

Important Information for Investors and Stockholders This description contained herein is neither an offer to purchase nor solicitation of an offer to sell securities. The tender offer for the outstanding shares of Third Wave’s common stock described herein has not commenced. At the time the Offer is commenced, Hologic and Thunder Tech Corp. (a wholly owned subsidiary of Hologic) will file with the Securities and Exchange Commission (the “SEC”) a tender offer statement on Schedule TO containing an offer to purchase, the form of the letter of transmittal and other documents relating to the tender offer, and Third Wave will file with the SEC a solicitation/recommendation statement on Schedule 14D-9, with respect to the Offer. Hologic, Thunder Tech Corp. and Third Wave intend to mail these documents to the stockholders of Third Wave. The tender offer statement (including an offer to purchase, a related letter of transmittal and other offer documents) and the solicitation/recommendation statement will contain important information about the tender offer, including the terms and conditions of the offer and stockholders of Third Wave are urged to read them carefully when they become available before they make a decision with respect to the Offer. Stockholders of Third Wave will be able to obtain a free copy of these documents (when they become available) at http://www.hologic.com and the website maintained by the SEC at http://www.sec.gov. In addition, stockholders will be able to obtain a free copy of these documents (when they become available) by contacting Hologic or Third Wave. |

Use of Non-GAAP Financial Measures In addition to the financial measures prepared in accordance with generally accepted accounting principles (GAAP), we use the non-GAAP financial measures "adjusted EPS" and “EBITDA”. Adjusted EPS excludes the write-off and amortization of acquisition-related intangible assets, and tax provisions/benefits related thereto. EBITDA is defined as net earnings (loss) before interest, taxes, depreciation and amortization expense. Neither adjusted EPS nor EBITDA is a measure of operating performance under GAAP. We believe that the use of these non-GAAP measures helps investors to gain a better understanding of our core operating results and future prospects, consistent with how management measures and forecasts our performance, especially when comparing such results to previous periods or forecasts. When analyzing our operating performance, investors should not consider these non-GAAP measures as a substitute for net income prepared in accordance with GAAP. |

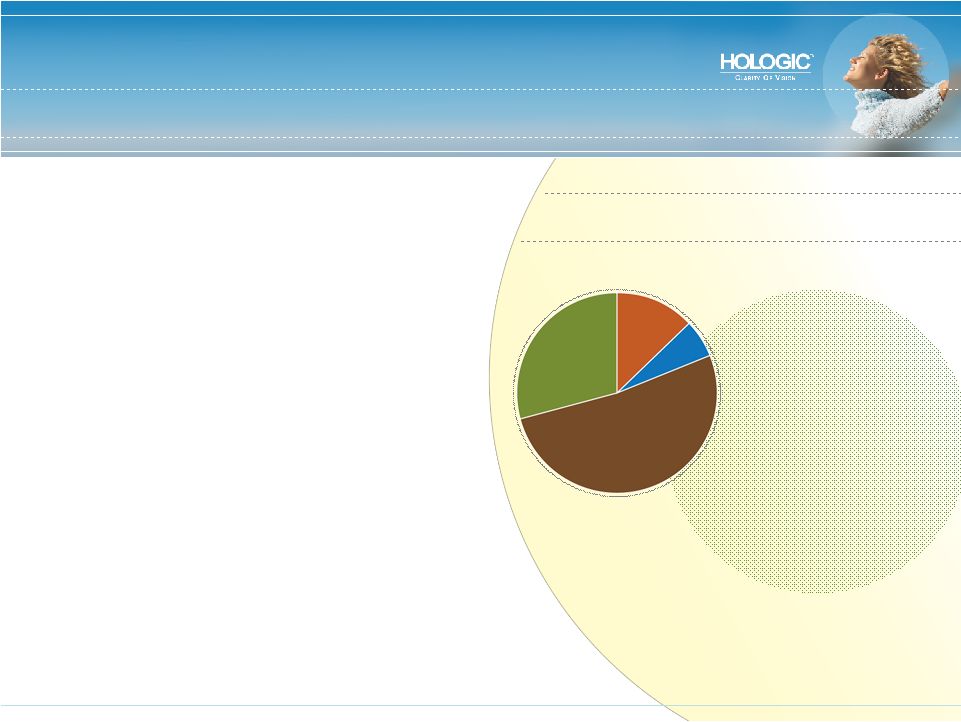

World’s Largest Pure Play in Women’s Healthcare • Our mission: To be the gold standard of care in the markets we serve • Nine Hologic products with #1 share in major women’s healthcare markets: • Breast cancer • Cervical cancer • Abnormal uterine bleeding • Osteoporosis • Pre-term labor • Permanent contraception • Focused on earlier detection, improved diagnosis and less invasive therapy FY 2008 Revenue Forecast: $1.7 Billion Breast Health 52% Diagnostics 28% Gyn Surgical 13% Skeletal Health 7% |

Targeting Key Segments in U.S. Women’s Healthcare Market Market Drivers: • Aging population • Global economic growth • Advanced screening improves outcomes • Push for less invasive, less costly therapies Total Market 2007: $2.75 Billion (16% CAGR) Hologic Covered Market: $2.13 billion Breast Health $906 million (20% CAGR*) Cervical Cancer $592 million (17% CAGR) Gynecological Health $392 million (25% CAGR) Incontinence $340 million (9% CAGR) Aesthetics $282 million (15% CAGR) Pre-natal Health $141 million (17% CAGR) Osteoporosis $110 million (0% CAGR) * CAGRs represent historical market growth from 2003-2006 |

Defining the Standard of Care in Women’s Health • Technology – R&D leadership and Innovation products • 293 patents issued,184 pending • Distribution – largest dedicated sales/service force in U.S. • > 20 years • 440 sales / 250 service team in U.S. • Expansion – Going Global, Leverage Distribution, Cross-Sell |

Best-In-Class Products • Screening • Diagnosis • Therapy Early Detection… Saves Lives ThinPrep Pap Test Cervical Cancer Screening ThinPrep Imaging System Cervical Cancer Screening FullTerm - Adeza Preterm Labor NovaSure Endometrial Ablation Adiana Contraception MammoSite Radiation Therapy Discovery Osteoporosis Screening Suros Biopsy Systems MultiCare Stereotactic Biopsy Selenia Breast Cancer Screening Comprehensive Women’s Health Platform |

Transaction Overview $600 million term loan under existing secured credit facility Financing: 100% cash in two-step cash merger through tender offer Transaction Structure: Fourth Quarter of Fiscal 2008 Timing to Close: Customary closing conditions, including HSR Customary Approvals: $11.25 for each Third Wave share for approximate total consideration of $580 million in cash Purchase Consideration: Third Wave – June 9, 2008 Announcement |

Acquisition of Third Wave Technologies • Platform for entry into the U.S. Molecular Diagnostics Market ($2.1B) and growing rapidly • Access to the U.S. HPV Testing Market ($200M) • Utilizes Hologic’s existing Laboratory & GYN sales force calling on the same customer base • Promising Technology and Strong Product Differentiators • Clinical data supports test results are better • Improved lab productivity • Entry to Sizeable OUS Market Opportunity which will provide revenue growth opportunity for many years Strategic Rationale |

Human Papillomavirus (HPV) Testing • Cervical Cancer is caused by HPV infections • Most infections are cleared by the immune system • Persistent HPV infections can lead to cervical cancer • HPV Testing and Pap Testing are Complementary • Pap tests detect presence of disease • Clinical guidelines recommend HPV for: • Triaging ambiguous Pap test results • HPV with Pap, for women over 30, to identify women at-risk for developing cancer • Adoption of HPV with pap testing for women over 30 will expand the HPV market • Large and Growing Potential Market • $400M U.S., 50% penetrated • $400M OUS, 10% penetrated A Complementary Growth Driver |

Roadmap to the Future … Tomosynthesis 3D Mammography Image Fusion w/3D Functional Imaging NexGen Biopsy Guidance More Comfort, Better Accuracy Eviva Hand Piece Improved Geometry, Broader Utilization Mammosite II Better Dosimetry, Expanded Patient Base FA Percutaneous Extraction Device FullTerm to “AT RISK” T5000, Better Thru Put, Improved Reliability Integrated Imager, Improved WF, Lower Cost Adiana To Market SuperNova, Better Comfort, Ease of Use, Reliability Adiana II, Improved Efficiency, Ease of Use AAC, Expanded Market Body Composition Fracture Risk, Improved Predictability Breast Health Diagnostic GYN Surgical Skeletal Health HPV Testing |