Exhibit 99.1

Exhibit 99.1

The women’s health Company Presentation to Prospective Lenders

HOLOGIC®

July 2012

The women’s health company

Agenda

Executive Summary Transaction Merits Company Overview Key Credit Strengths Historical Financial Review

Appendix A: Non-GAAP Adjustments

Appendix B: Disclaimers

HOLOGIC

The women’s health company

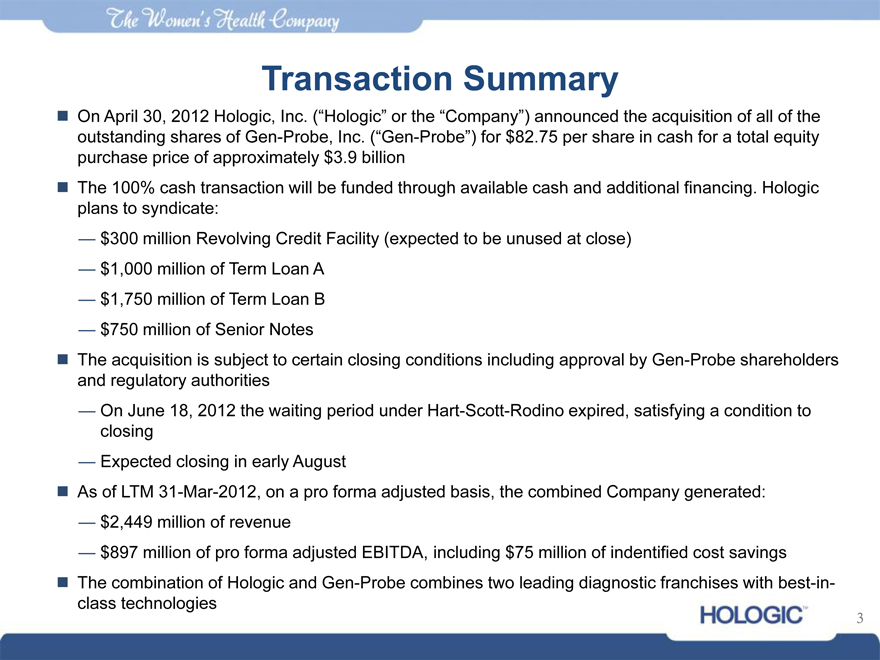

Transaction Summary

On April 30, 2012 Hologic, Inc. (“Hologic” or the “Company”) announced the acquisition of all of the outstanding shares of Gen-Probe, Inc. (“Gen-Probe”) for $82.75 per share in cash for a total equity purchase price of approximately $3.9 billion

The 100% cash transaction will be funded through available cash and additional financing. Hologic plans to syndicate:

— $300 million Revolving Credit Facility (expected to be unused at close)

— $1,000 million of Term Loan A

— $1,750 million of Term Loan B

— $750 million of Senior Notes

The acquisition is subject to certain closing conditions including approval by Gen-Probe shareholders and regulatory authorities

— On June 18, 2012 the waiting period under Hart-Scott-Rodino expired, satisfying a condition to closing

— Expected closing in early August

As of LTM 31-Mar-2012, on a pro forma adjusted basis, the combined Company generated:

— $2,449 million of revenue

— $897 million of pro forma adjusted EBITDA, including $75 million of indentified cost savings

The combination of Hologic and Gen-Probe combines two leading diagnostic franchises with best-in-class technologies

HOLOGIC

The womens health company

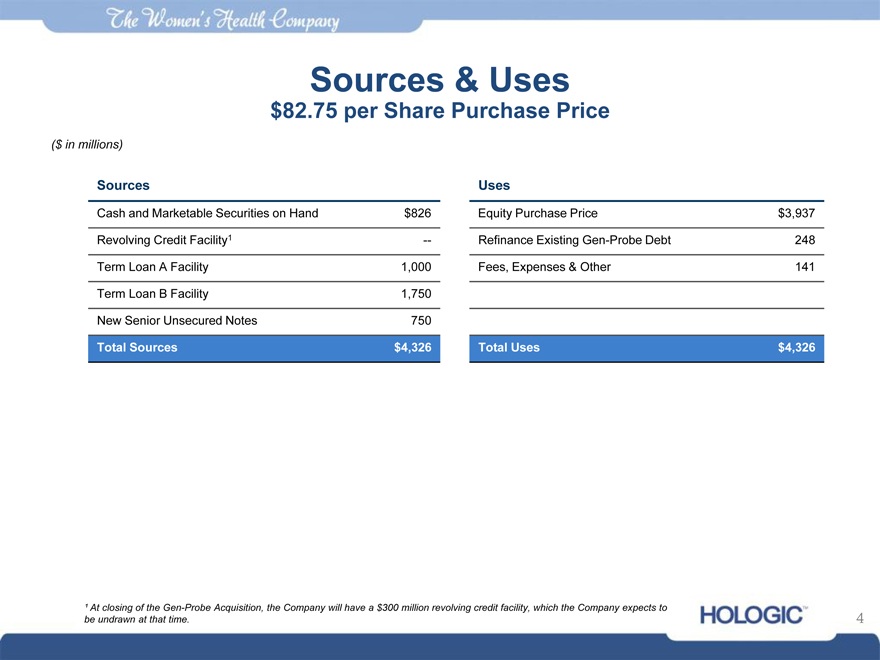

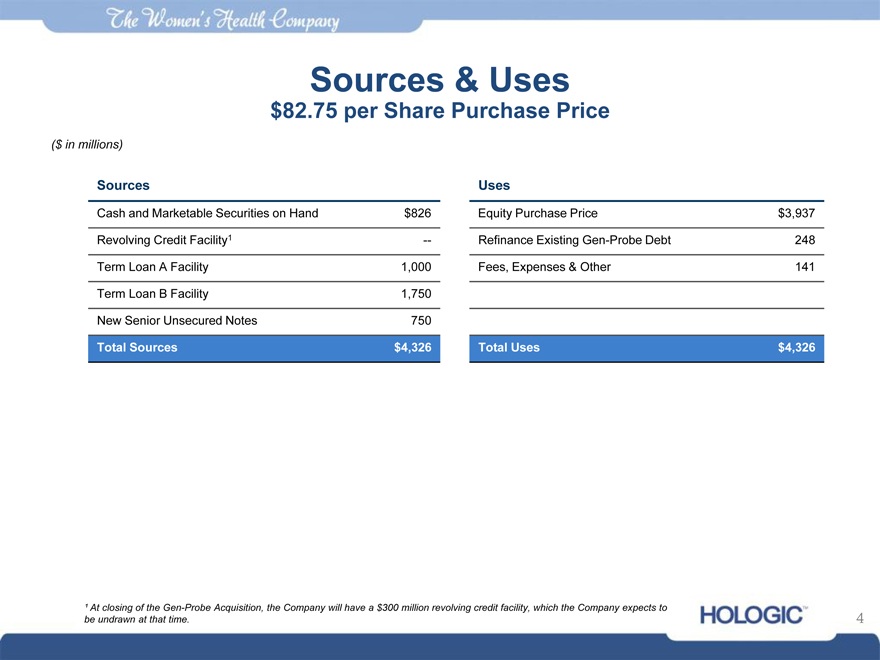

Sources & Uses

$82.75 per Share Purchase Price

($ in millions)

Sources Uses

Cash and Marketable Securities on Hand $826 Equity Purchase Price $3,937

Revolving Credit Facility1 — Refinance Existing Gen-Probe Debt 248

Term Loan A Facility 1,000 Fees, Expenses & Other 141

Term Loan B Facility 1,750

New Senior Unsecured Notes 750

Total Sources $4,326 Total Uses $4,326

¹ At closing of the Gen-Probe Acquisition, the Company will have a $300 million revolving credit facility, which the Company expects to be undrawn at that time.

HOLOGIC

The women’s health company

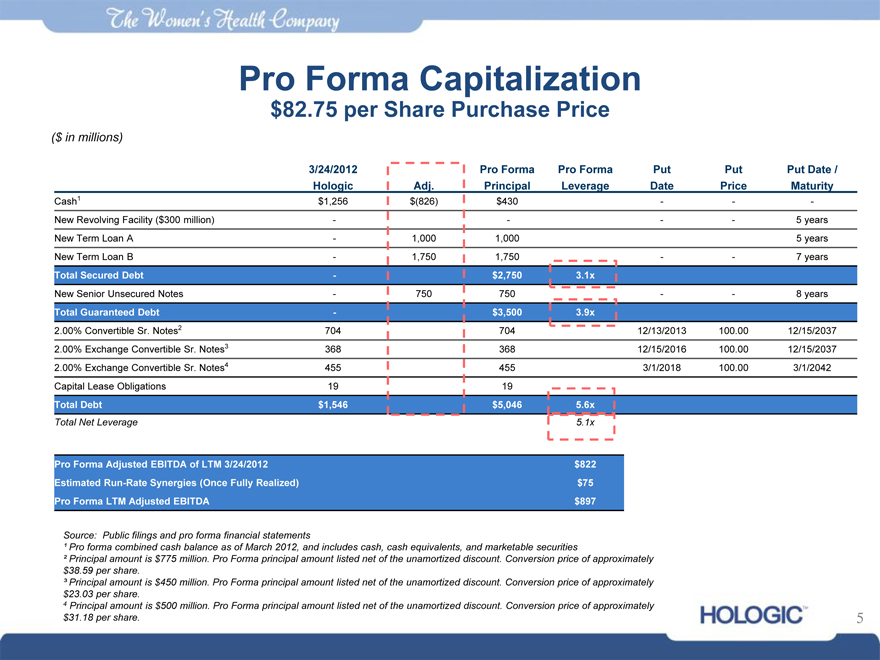

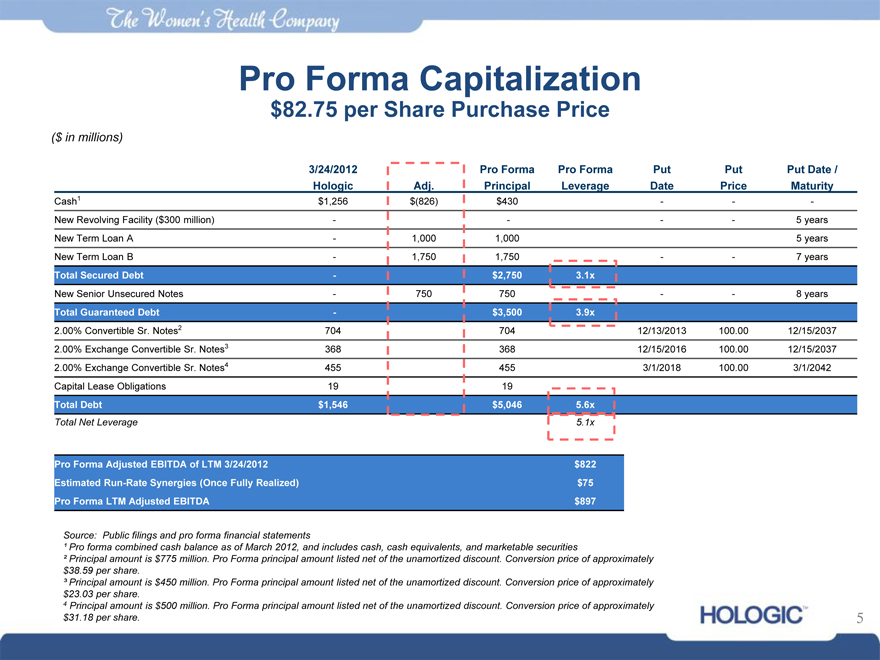

Pro Forma Capitalization

$82.75 per Share Purchase Price

($ in millions)

3/24/2012 Pro Forma Pro Forma Put Put Put Date /

Hologic Adj. Principal Leverage Date Price Maturity

Cash1 $1,256 $(826) $430 — — -

New Revolving Facility ($300 million) — — — — 5 years

New Term Loan A — 1,000 1,000 5 years

New Term Loan B — 1,750 1,750 — — 7 years

Total Secured Debt — $2,750 3.1x

New Senior Unsecured Notes — 750 750 — — 8 years

Total Guaranteed Debt — $3,500 3.9x

2.00% | | Convertible Sr. Notes2 704 704 12/13/2013 100.00 12/15/2037 |

2.00% | | Exchange Convertible Sr. Notes3 368 368 12/15/2016 100.00 12/15/2037 |

2.00% | | Exchange Convertible Sr. Notes4 455 455 3/1/2018 100.00 3/1/2042 |

Capital Lease Obligations 19 19

Total Debt $1,546 $5,046 5.6x

Total Net Leverage 5.1x

Pro Forma Adjusted EBITDA of LTM 3/24/2012 $822

Estimated Run-Rate Synergies (Once Fully Realized) $75

Pro Forma LTM Adjusted EBITDA $897

Source: Public filings and pro forma financial statements

¹ Pro forma combined cash balance as of March 2012, and includes cash, cash equivalents, and marketable securities

² Principal amount is $775 million. Pro Forma principal amount listed net of the unamortized discount. Conversion price of approximately

$38.59 per share.

³ Principal amount is $450 million. Pro Forma principal amount listed net of the unamortized discount. Conversion price of approximately

$23.03 per share.

4 Principal amount is $500 million. Pro Forma principal amount listed net of the unamortized discount. Conversion price of approximately

$31.18 per share.

HOLOGIC

The women’s health company

Agenda

Executive Summary

Transaction Merits Company Overview Key Credit Strengths Historical Financial Review

Appendix A: Non-GAAP Adjustments

Appendix B: Disclaimers

HOLOGIC

The women’s health company

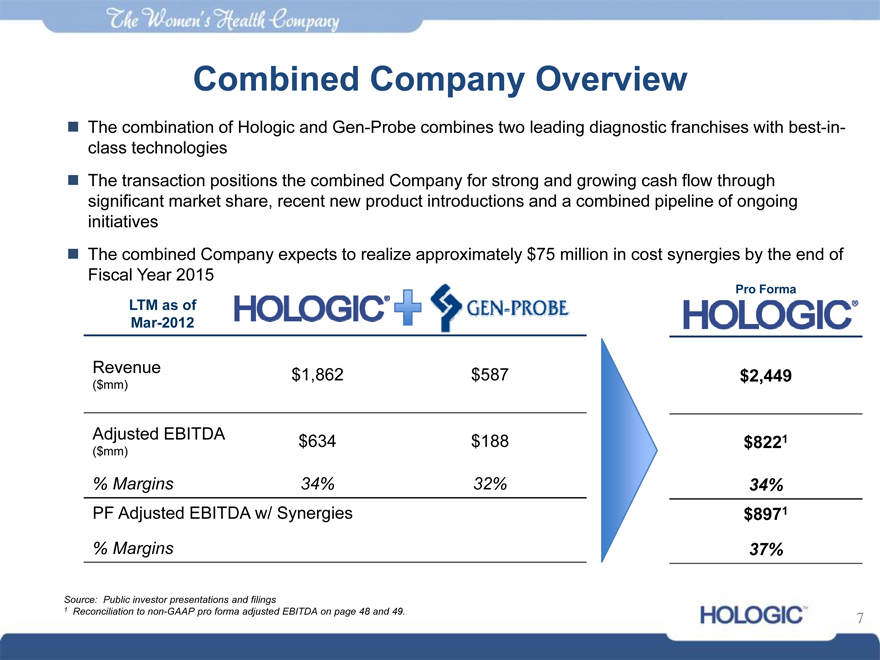

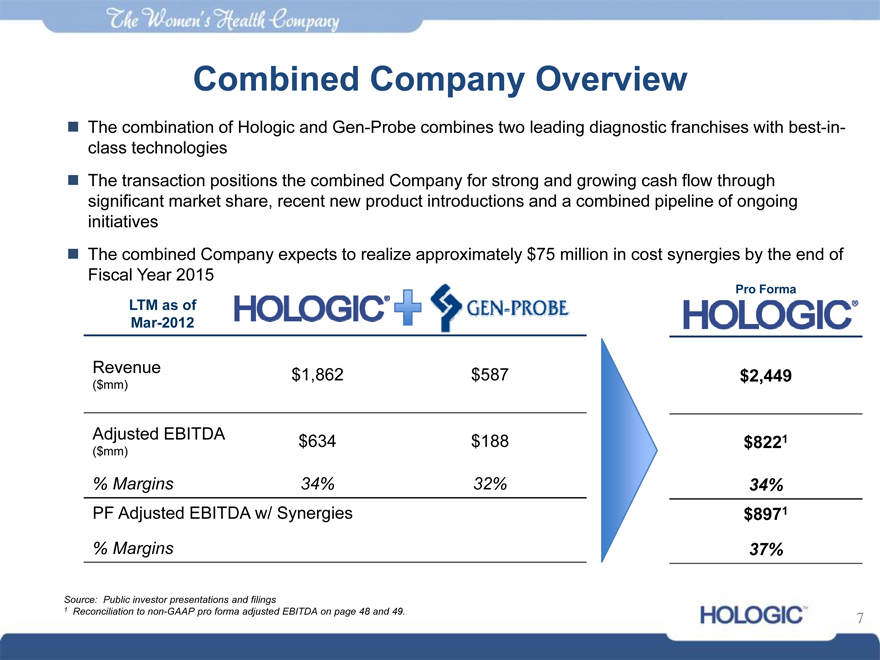

Combined Company Overview

The combination of Hologic and Gen-Probe combines two leading diagnostic franchises with best-in-class technologies

The transaction positions the combined Company for strong and growing cash flow through significant market share, recent new product introductions and a combined pipeline of ongoing initiatives

The combined Company expects to realize approximately $75 million in cost synergies by the end of Fiscal Year 2015

LTM as of Mar-2012

Pro Forma

Revenue $1,862 $587 $2,449

($mm)

Adjusted EBITDA $634 $188 $8221

($mm)

% Margins 34% 32% 34%

PF Adjusted EBITDA w/ Synergies $8971

% Margins 37%

Source: Public investor presentations and filings

1 | | Reconciliation to non-GAAP pro forma adjusted EBITDA on page 48 and 49. |

HOLOGIC

The women’s health company

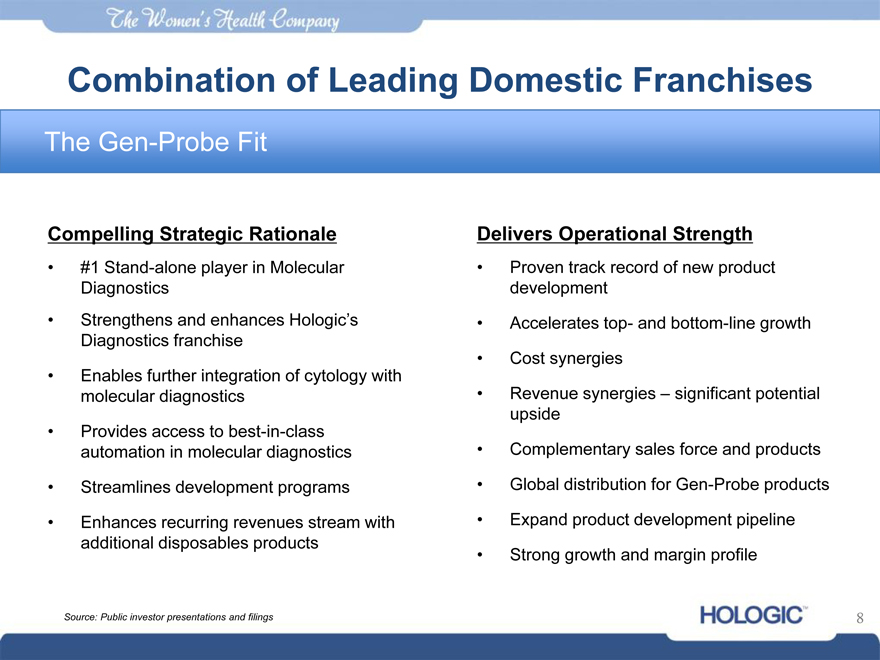

Combination of Leading Domestic Franchises

The Gen-Probe Fit

Compelling Strategic Rationale Delivers Operational Strength

• #1 Stand-alone player in Molecular • Proven track record of new product

Diagnostics development

• Strengthens and enhances Hologic’s • Accelerates top- and bottom-line growth

Diagnostics franchise

• Cost synergies

• Enables further integration of cytology with

molecular diagnostics • Revenue synergies – significant potential

upside

• Provides access to best-in-class

automation in molecular diagnostics • Complementary sales force and products

• Streamlines development programs • Global distribution for Gen-Probe products

• Enhances recurring revenues stream with • Expand product development pipeline

additional disposables products

• Strong growth and margin profile

Source: Public investor presentations and filings

HOLOGIC

The women’s health company

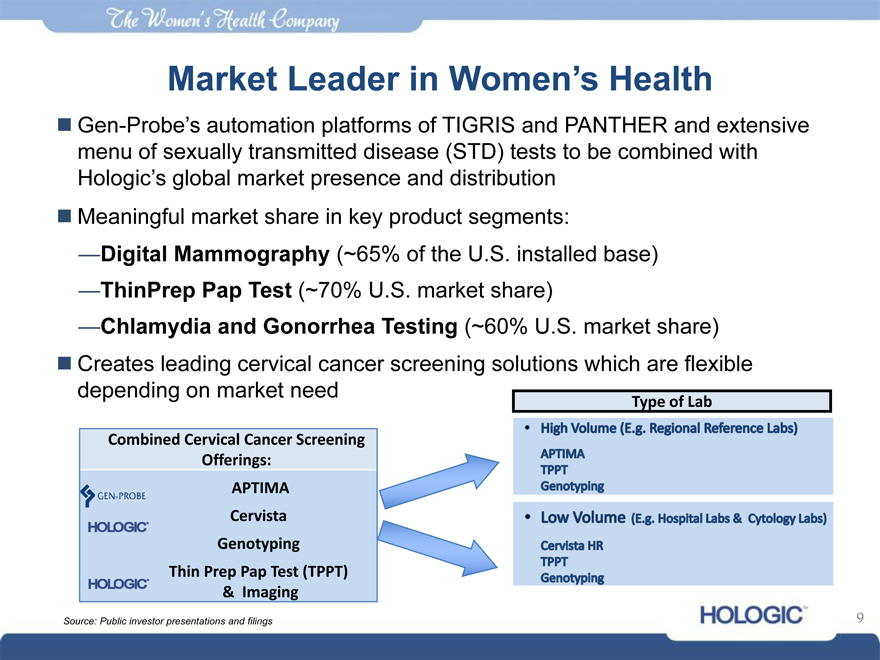

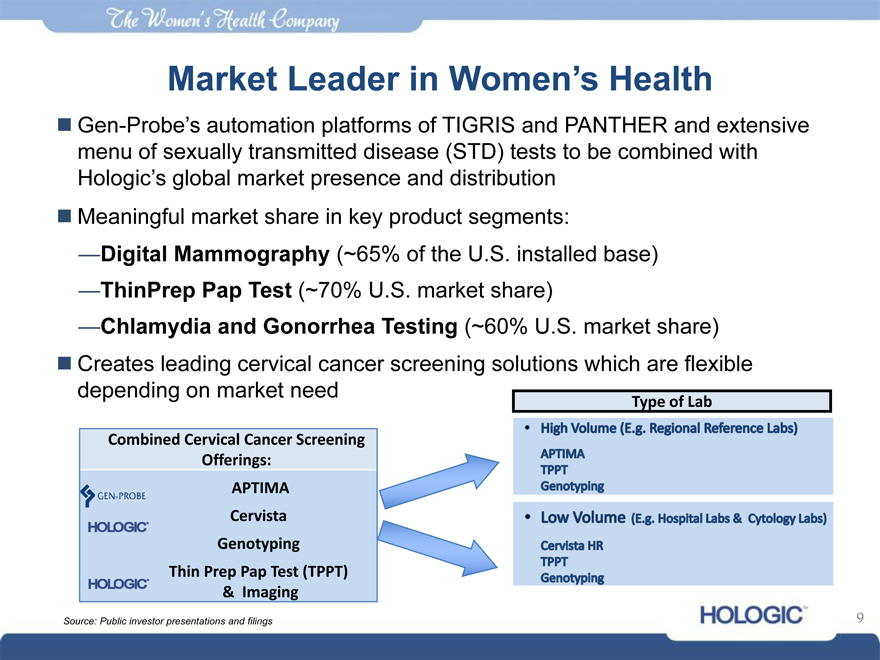

Market Leader in Women’s Health

Gen-Probe’s automation platforms of TIGRIS and PANTHER and extensive menu of sexually transmitted disease (STD) tests to be combined with Hologic’s global market presence and distribution

Meaningful market share in key product segments:

—Digital Mammography (~65% of the U.S. installed base)

—ThinPrep Pap Test (~70% U.S. market share)

—Chlamydia and Gonorrhea Testing (~60% U.S. market share)

Creates leading cervical cancer screening solutions which are flexible depending on market need

Combined Cervical Cancer Screening Offerings: APTIMA

Cervista Genotyping Thin Prep Pap Test (TPPT)

& Imaging

Type of Lab

High volume (E.g. Regional Reference Labs)

APTIM

TPPT

Genotyping

Low Volume (E.g Hospital Labs & Cytology Labs)

Cervista HR

TPPT

Genotyping

Source: Public investor presentations and filings

HOLOGIC

9

The women’s health company

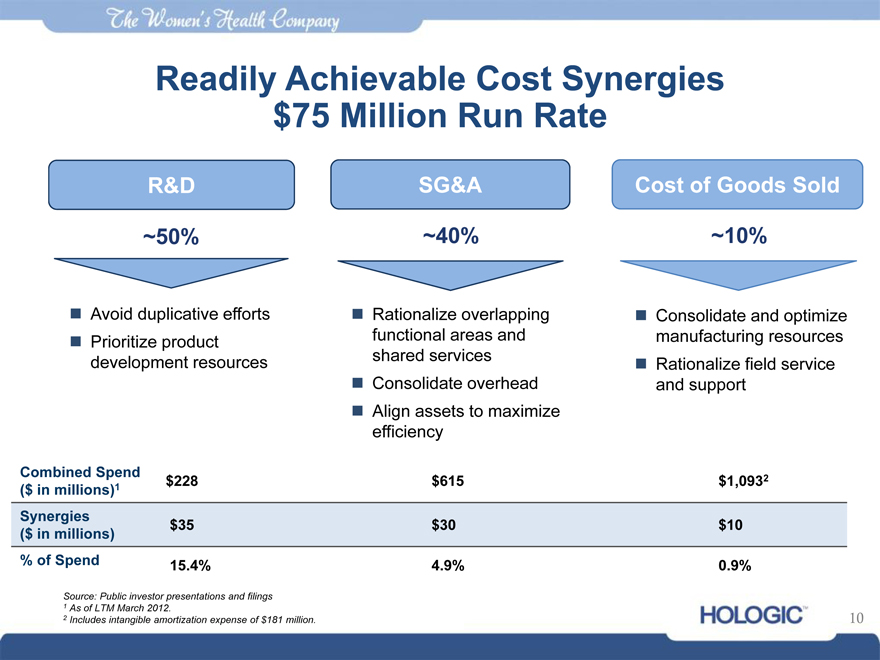

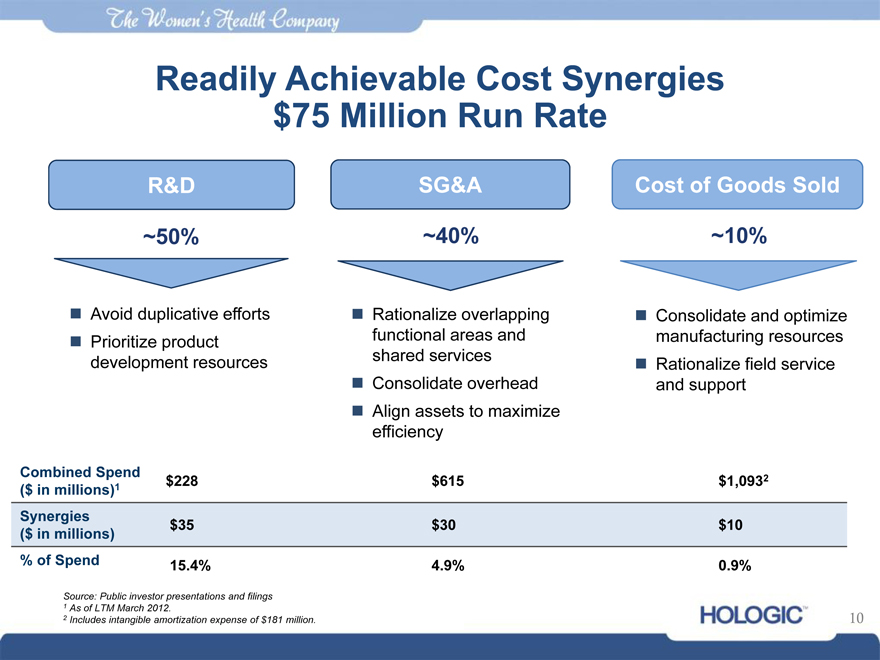

Readily Achievable Cost Synergies

$75 Million Run Rate

R&D SG&A Cost of Goods Sold

~50% ~40% ~10%

Avoid duplicative efforts

Prioritize product development resources

Rationalize overlapping functional areas and shared services

Consolidate overhead

Align assets to maximize efficiency

Consolidate and optimize manufacturing resources

Rationalize field service and support

Combined Spend $228 $615 $1,0932

($ in millions)1

Synergies $35 $30 $10

($ in millions)

% of S 15.4% 4.9% 0.9%

Source: Public investor presentations and filings

2 | | Includes intangible amortization expense of $181 million. |

HOLOGIC

10

The women’s health company

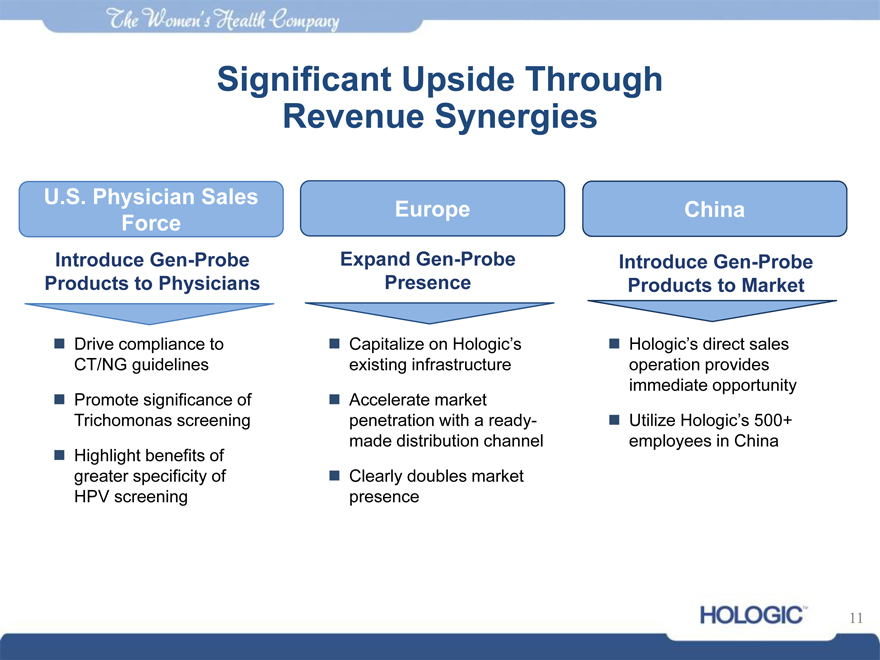

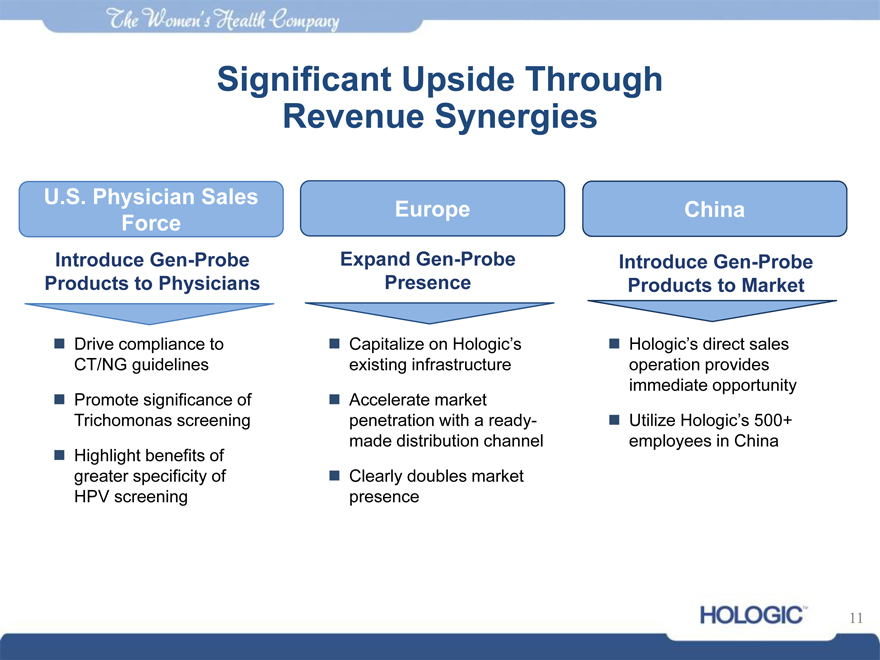

Significant Upside Through Revenue Synergies

U.S. Physician Sales

Europe China Force

Introduce Gen-Probe Expand Gen-Probe Introduce Gen-Probe Products to Physicians Presence Products to Market

Drive compliance to CT/NG guidelines

Promote significance of Trichomonas screening

Highlight benefits of greater specificity of HPV screening

Capitalize on Hologic’s existing infrastructure

Accelerate market penetration with a ready-made distribution channel

Clearly doubles market presence

Hologic’s direct sales operation provides immediate opportunity

Utilize Hologic’s 500+ employees in China

HOLOGIC

11

The Women’s Health Company

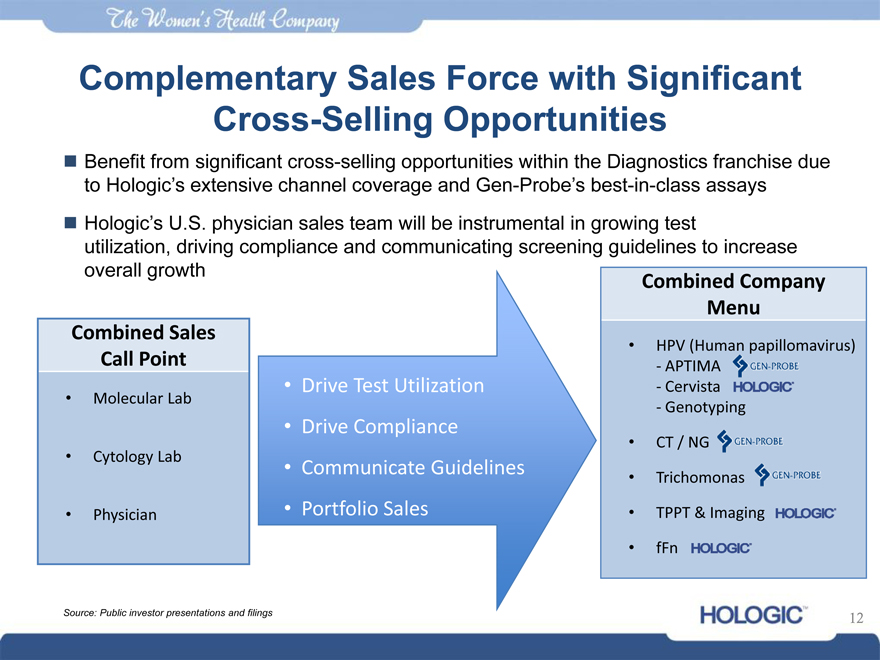

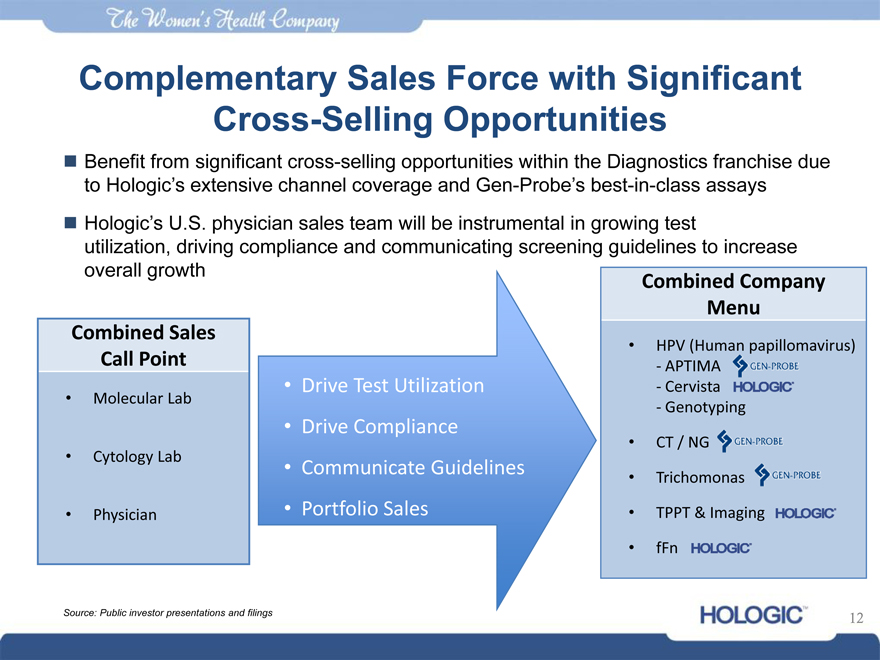

Complementary Sales Force with Significant Cross-Selling Opportunities

Benefit from significant cross-selling opportunities within the Diagnostics franchise due to Hologic’s extensive channel coverage and Gen-Probe’s best-in-class assays

Hologic’s U.S. physician sales team will be instrumental in growing test utilization, driving compliance and communicating screening guidelines to increase overall growth

Combined Sales Call Point

• Molecular Lab

• Cytology Lab

• Physician

• Drive Test Utilization

• Drive Compliance

• Communicate Guidelines

• Portfolio Sales

Menu

Combined Company

• HPV (Human papillomavirus)

- APTIMA

- Cervista

- Genotyping

• CT / NG

• Trichomonas

• TPPT & Imaging • fFn

Source: Public investor presentations and filings

HOLOGIC

12

The Women’ss Health Company

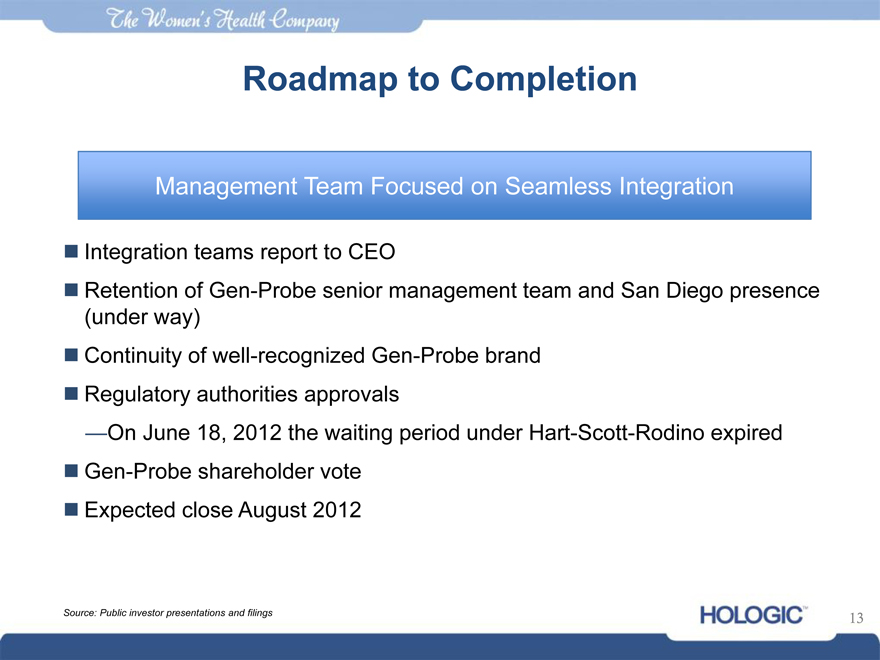

Roadmap to Completion

Management Team Focused on Seamless Integration

Integration teams report to CEO

Retention of Gen-Probe senior management team and San Diego presence (under way)

Continuity of well-recognized Gen-Probe brand

Regulatory authorities approvals

—On June 18, 2012 the waiting period under Hart-Scott-Rodino expired

Gen-Probe shareholder vote

Expected close August 2012

Source: Public investor presentations and filings

HOLOGIC

13

The Women’s Health Company

Agenda Executive Summary Transaction Merits Company Overview Key Credit Strengths Historical Financial Review

Appendix A: Non-GAAP Adjustments

Appendix B: Disclaimers

HOLOGIC

14

The women’s health company

Overview of Hologic Business Description

Hologic is a developer, manufacturer and supplier of premium diagnostics products, medical imaging systems and surgical products dedicated to the healthcare needs of women

The company operates in four main business segments:

—Breast Health: Broad portfolio of breast imaging and related products including digital mammography systems and biopsy devices

—Diagnostics: Product offerings include the ThinPrep system used for cytology applications, Rapid Fetal Fibronectic Test for pre-term birth risk assessment and molecular diagnostic reagents used in DNA and RNA analysis applications

—GYN Surgical: Products include NovaSure system for abnormal uterine bleeding and the MyoSure system for uterine fibroids and polyps

—Skeletal Health: Products include bone densitometers and sonometers used for osteoporosis and imaging instrumentation used by surgeons

March 24, 2012 LTM Revenue and Adjusted EBITDA of $1,862 million and $634 million, respectively

Source: Public investor presentations and filings

HOLOGIC

15

The women’s health company

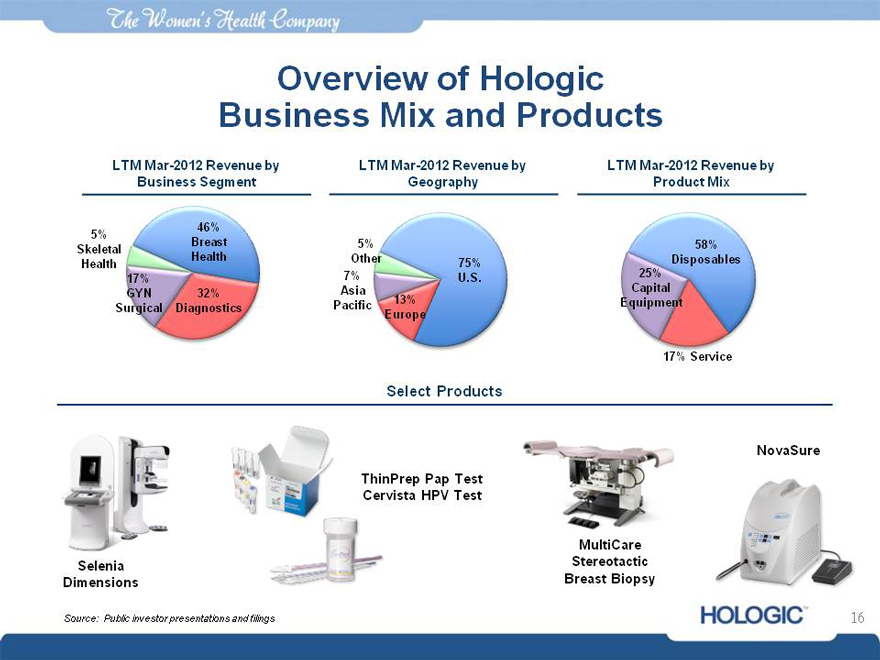

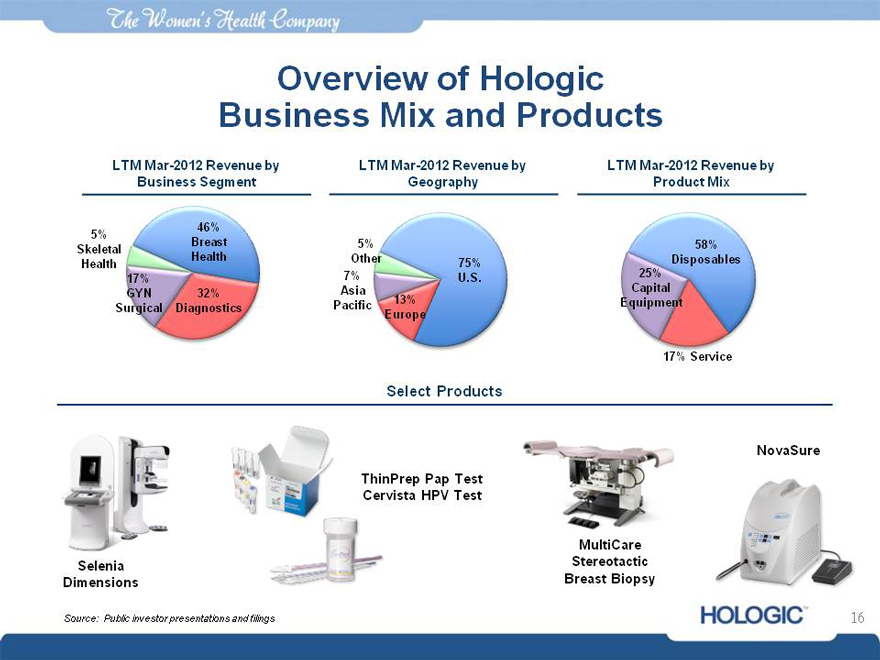

Overview of Hologic Business Mix and Products

LTM Mar-2012 Revenue by LTM Mar-2012 Revenue by LTM Mar-2012 Revenue by Business Segment Geography Product Mix

5% Skeletal Health

46% Breast Health

17% GYN

Surgical

32% Diagnostics

5%

Other 75%

7% U.S.

Asia

Pacific 13% Europe

58% Disposables 25% Capital Equipment

17% Service

Select Products

Selenia Dimensions

ThinPrep Pap Test Cervista HPV Test

MultiCare Stereotactic Breast Biopsy

NovaSure

Source: Public investor presentations and filings

HOLOGIC

16

The womens health company

Breast Health—Mammography

Hologic’s Flagship and Most Significant Near-Term Growth Driver

Leader in Breast Cancer Screening & Diagnosis Digital Mammography Market Size: ~$4 billion U.S. addressable market Market Share: ~65% of U.S. installed base Substantial replacement cycle expected Strong competitive advantages of 3D Dimensions

– Clinical superiority to 2D

– First-to-market with no near-term U.S. competition

Robust Service Offering: Recurring revenue stream driven by system placements

Source: Public investor presentations and filings

HOLOGIC

17

The womens health company

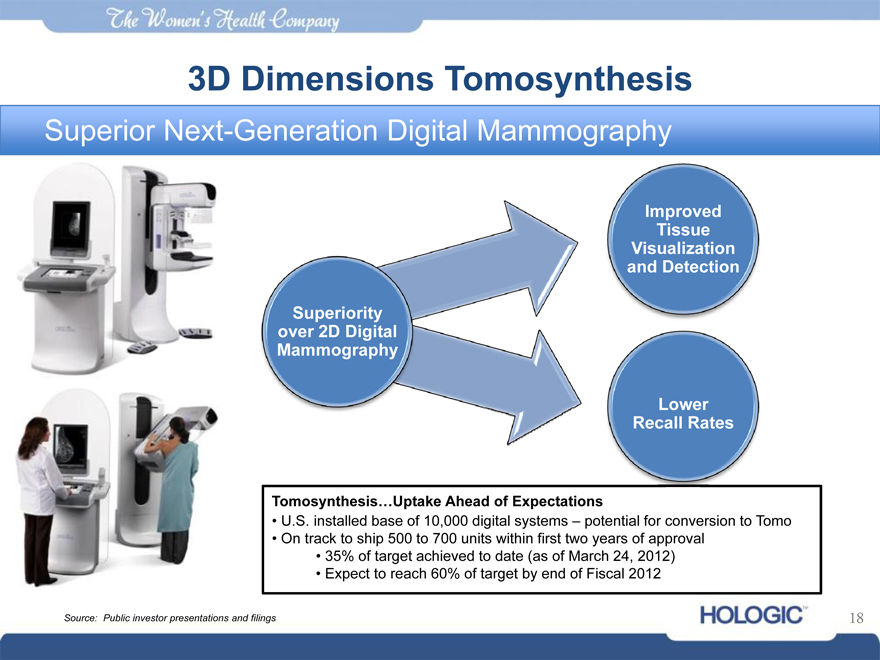

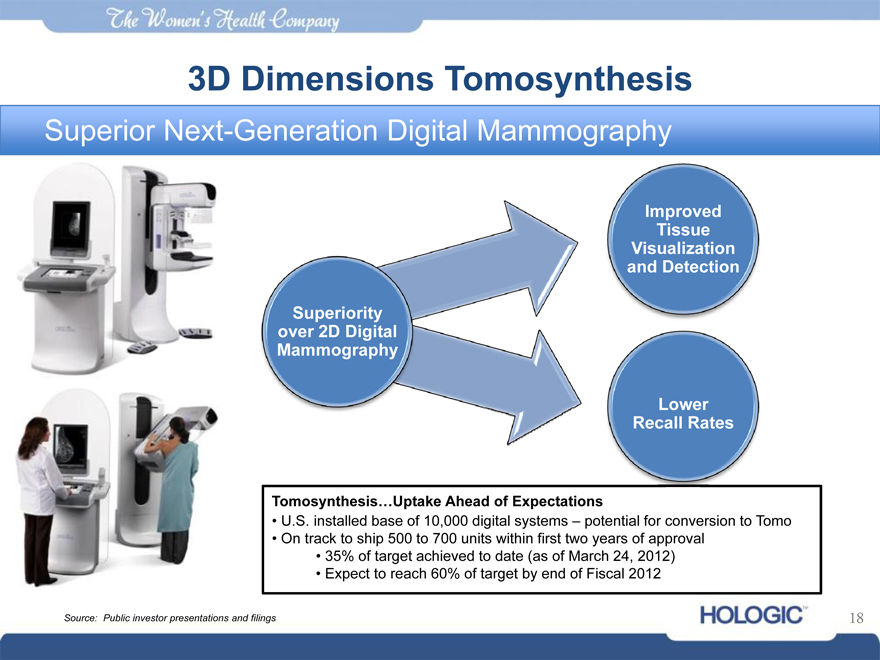

3D Dimensions Tomosynthesis

Superior Next-Generation Digital Mammography

Superiority over 2D Digital Mammography

Improved Tissue Visualization and Detection

Lower Recall Rates

Tomosynthesis…Uptake Ahead of Expectations

• U.S. installed base of 10,000 digital systems – potential for conversion to Tomo

• On track to ship 500 to 700 units within first two years of approval

• 35% of target achieved to date (as of March 24, 2012)

• Expect to reach 60% of target by end of Fiscal 2012

Source: Public investor presentations and filings

HOLOGIC

18

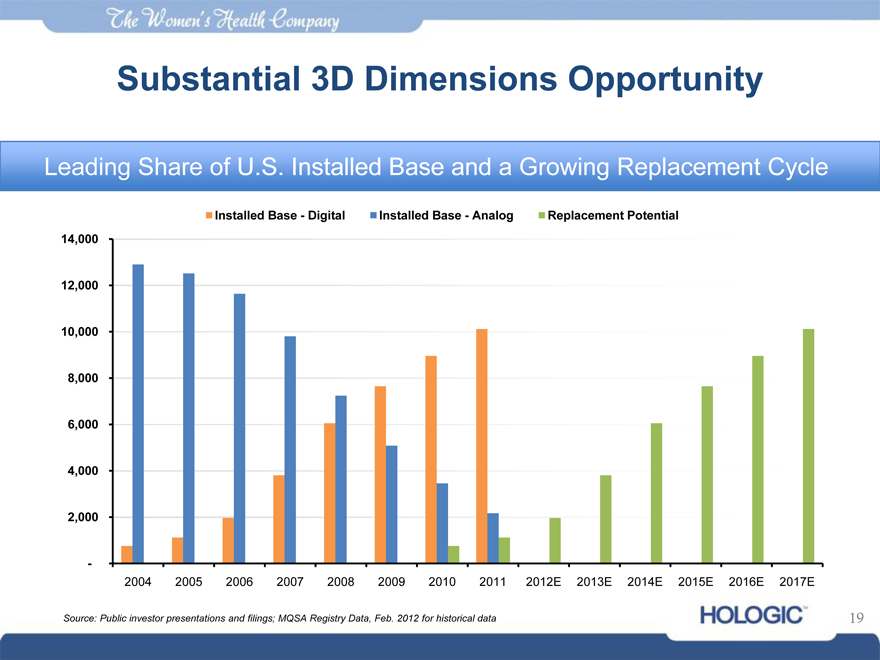

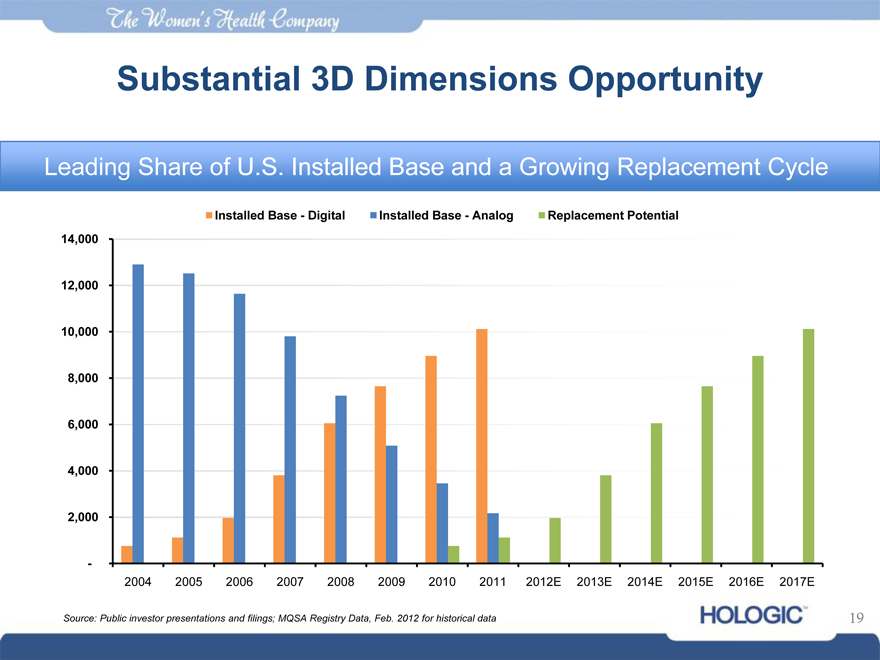

Substantial 3D Dimensions Opportunity

Leading Share of U.S. Installed Base and a Growing Replacement Cycle

Installed Base—Digital Installed Base—Analog Replacement Potential

14,000

12,000

10,000

8,000

6,000

4,000

2,000

-

2004 2005 2006 2007 2008 2009 2010 2011 2012E 2013E 2014E 2015E 2016E 2017E

Source: Public investor presentations and filings; MQSA Registry Data, Feb. 2012 for historical data 19

Fundamental Factors Key to Adoption of

3D Dimensions

#1: Ongoing Clinical Validation of the Technology

Oslo study

– Over 12,000 patients imaged

– Significant increase in cancer detection rates

FDA trial data—submitted for publication by Dr. Betty Rafferty, Mass General Hospital

#2: Competition Among Regional Imaging Providers for

Local Market Share Leadership

#3: Establish Code for 3D Dimensions Reimbursement

Source: Public investor presentations and filings 20

Diagnostics

ThinPrep: Steady US Business with Upside Potential Internationally

Cervical Cancer Screening & Diagnosis

ThinPrep Pap Test & Related Instrumentation

• U.S. market share ~ 70%

• Significant EBITDA contributor

• Growth opportunity OUS, especially in China and other emerging markets

Molecular Diagnostics: Significant Contributor to Global Diagnostics Segment Growth

HPV Screening & Diagnosis

Cervista HPV HR & 16/18 Genotyping

• Utilizes powerful ThinPrep franchise with physician / lab sales infrastructure

HPV Screening & Diagnosis

• Serves mid and low volume lab segments

• Recent approvals in U.S., Europe and China

Source: Public investor presentations and filings 21

GYN Surgical

Addressing Substantial Unmet Medical Needs for Women Globally

Abnormal Uterine Bleeding

NovaSure

• Clear leader with ~ 60-65% current U.S. share of a potential future $1B+ global market opportunity

• Standard of care

Uterine Fibroids and Polyps

MyoSure

• Double-digit annual growth expected to continue

• Minimally-invasive technology

• Maintains uterine form and function

Source: Public investor presentations and filings 22

R&D Investment Drives Innovation

Steady Pace of Recent New Product Approvals

U.S. FDA approvals and clearances

• 3D Dimensions Tomosynthesis (PMA)

• Cervista HPV High-Throughput Automation (PMA)

• Sentinelle Prostate coils (510k)

• Sentinelle 16-channel breast coils (510k)

• Trident Specimen Radiography system (510k)

International approvals and clearances

• Serenity digital mammography system (SFDA – China)

• Cervista HPV HR test (SFDA – China)

• C-View (CE Marking)

• Cervista MTA Medium-Throughput Automation (CE Marking)

Source: Public investor presentations and filings 23

Overview of Gen-Probe Business Description

Gen-Probe is a global leader in blood screening and women’s health through the development, manufacturing and marketing of molecular diagnostic products and services

The company operates in two main business segments:

—Clinical Diagnostics: Market leading position in NAT assays for the detection of chlamydia and gonorrhea (CT/NG). Products include amplified APTIMA products

—Blood Screening: Develops reagents and instrumentation for blood screening applications (PROCLEIX assays). Applications in HIV, WNV, HCA and HBA screening of blood, plasma, organs and tissues

Fully automated TIGRIS and PANTHER systems provide differentiated competitive advantages

Best-in-class assays with leading market shares

March 31, 2012 LTM Revenue and Adjusted EBITDA of $587 million and $188 million, respectively

Source: Public investor presentations and filings 24

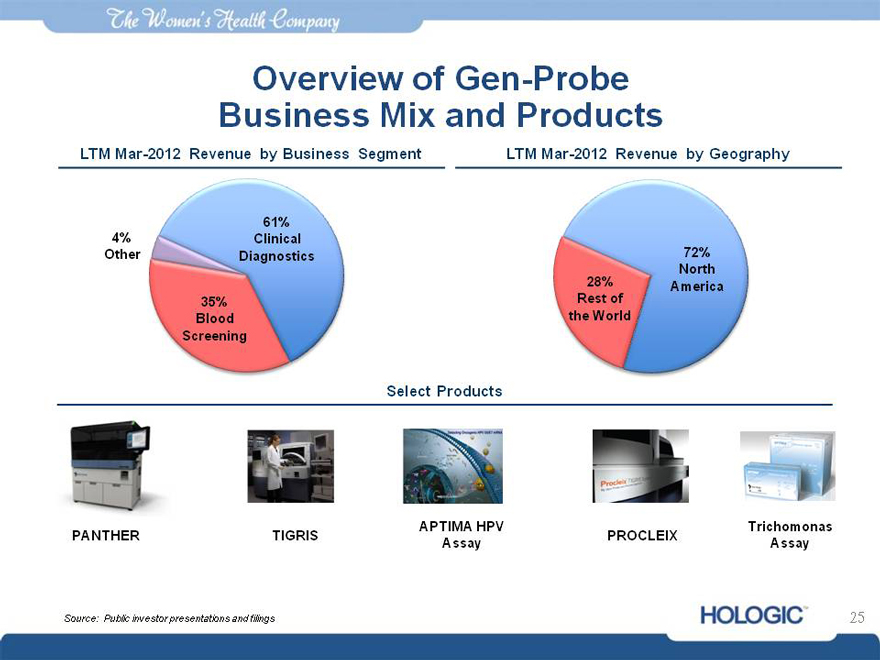

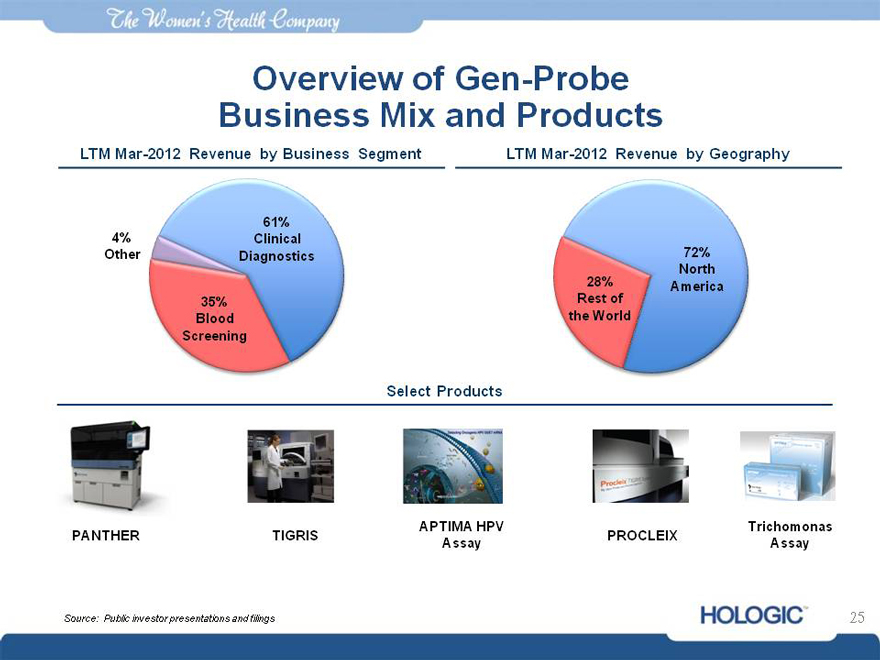

Overview of Gen-Probe Business Mix and Products

LTM Mar-2012 Revenue by Business Segment LTM Mar-2012 Revenue by Geography

61%

4% Clinical

Other Diagnostics 72%

North

28% America

35% Rest of

Blood the World

Screening

Select Products

APTIMA HPV Trichomonas

PANTHER TIGRIS PROCLEIX

Assay Assay

Source: Public investor presentations and filings 25

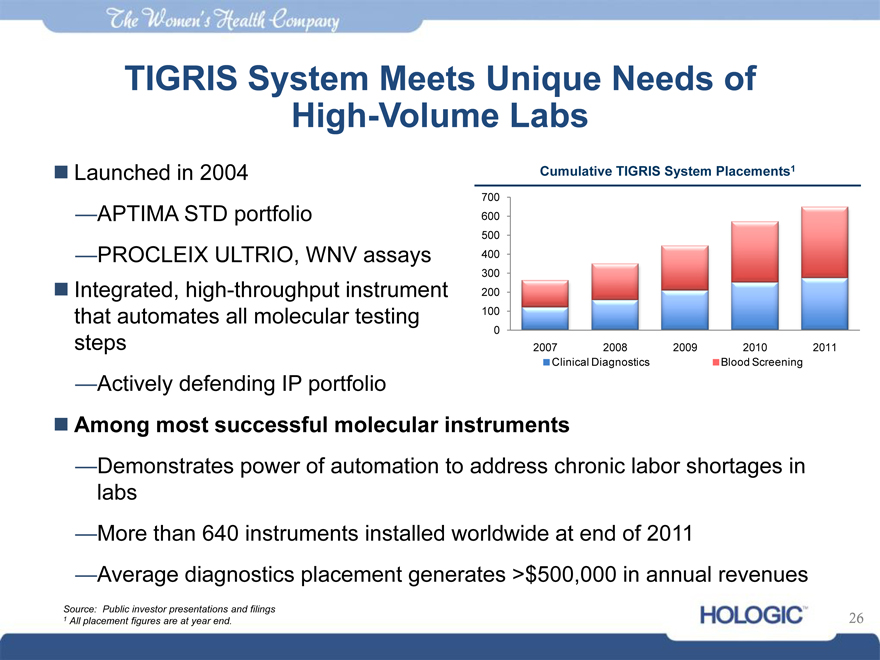

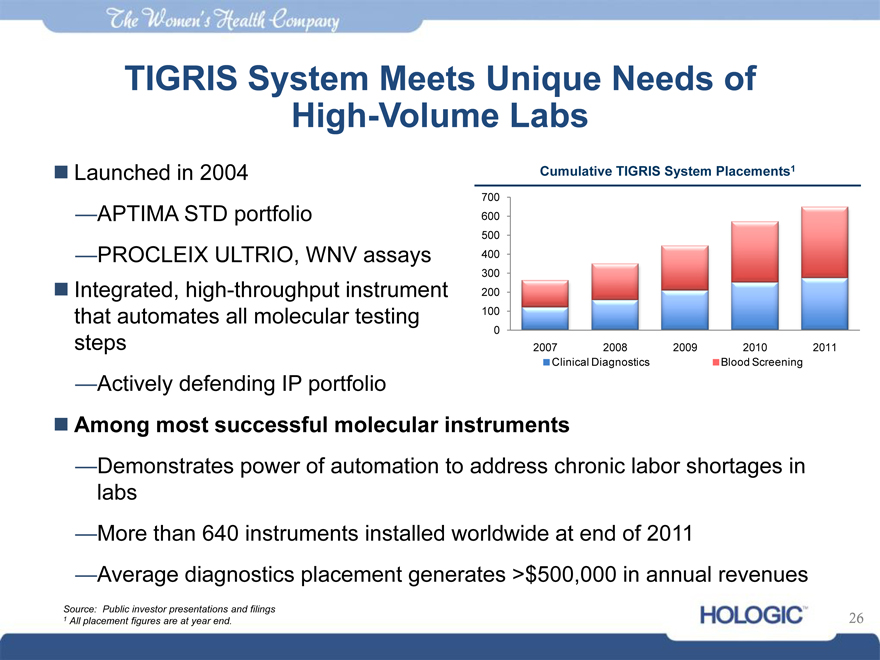

TIGRIS System Meets Unique Needs of

High-Volume Labs

Launched in 2004 Cumulative TIGRIS System Placements1

700

—APTIMA STD portfolio 600

500

—PROCLEIX ULTRIO, WNV assays 400

300

Integrated, high-throughput instrument 200

that automates all molecular testing 100

0

steps 2007 2008 2009 2010 2011

Clinical Diagnostics Blood Screening

—Actively defending IP portfolio

Among most successful molecular instruments

—Demonstrates power of automation to address chronic labor shortages in

labs

—More than 640 instruments installed worldwide at end of 2011

—Average diagnostics placement generates >$500,000 in annual revenues

Source: Public investor presentations and filings

1 All placement figures are at year end. 26

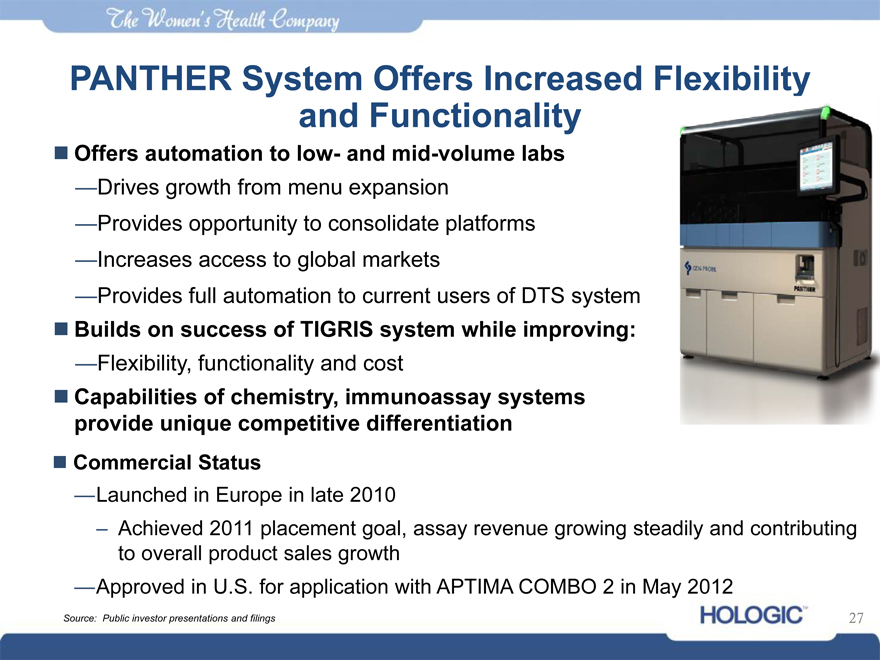

PANTHER System Offers Increased Flexibility and Functionality

Offers automation to low- and mid-volume labs

—Drives growth from menu expansion

—Provides opportunity to consolidate platforms

—Increases access to global markets

—Provides full automation to current users of DTS system

Builds on success of TIGRIS system while improving:

—Flexibility, functionality and cost

Capabilities of chemistry, immunoassay systems provide unique competitive differentiation

Commercial Status

—Launched in Europe in late 2010

– Achieved 2011 placement goal, assay revenue growing steadily and contributing to overall product sales growth

—Approved in U.S. for application with APTIMA COMBO 2 in May 2012

Source: Public investor presentations and filings 27

Gen-Probe STD Franchise Remains Robust

Chlamydia and gonorrhea are most common bacterial STDs

—CDC reported 1.3 million cases of Chlamydia in 2010, most for any condition

—HEDIS data indicates that less than half of sexually active women are tested

$492 million market in 2011

—$344 million in U.S., +3%

—$148 million ex-U.S., +10%

APTIMA COMBO 2 assay, on TIGRIS and PANTHER systems, remains a growth driver

—Sustainable competitive advantage based on best combination of sensitivity, specificity, reproducibility, sample flexibility and scalable automation

—Gen-Probe estimates they have leading global market share in Chlamydia

Source: and Public investor Gonorrhea presentation and filings. testing Data are 2011 with year-end ~60% Gen-Probe of estimates U.S. and ~49% of worldwide markets

28

New APTIMA Assays

APTIMA HPV Assay

—HPV causes cervical cancer

—~$275 million U.S. market with growth opportunities in U.S. & Europe

—Assay targets disease progression markers

—Runs on TIGRIS system (FDA approved in October 2011) and PANTHER system (in Europe)

—HPV testing is highly concentrated, providing opportunities for Gen-Probe automation

APTIMA Trichomonas Assay

—Trichomonas vaginalis is a common and curable STD

– If untreated can cause significant complications including premature births and low birth weights

– Studies indicate it potentially increases HIV susceptibility and risk for transmission

—Assay FDA cleared in April 2011 for use on TIGRIS system (launched on both TIGRIS and PANTHER systems in Europe)

Source: Public investor presentations and filings. Data are 2011 year-end Gen-Probe estimates 29

Blood Screening

Portfolio of Best-in-Class Products

Franchise enhancing segment with a diversifying revenue stream and complimentary product set to other core assets

—Approximately 35% of product sales, strong margins and cash flow

—Leading global market share in dollars

—Underlying donation volumes essentially flat, with a few percent variation in either direction

Key PROCLEIX products detect HIV, HCV, HBV and WNV

—More than 370 TIGRIS systems at blood banks worldwide

Partnership with Novartis provides improving economics over time

Over time, growth opportunities from PANTHER system, new markets and geographies, emerging pathogens

Source: Public investor presentations and filings 30

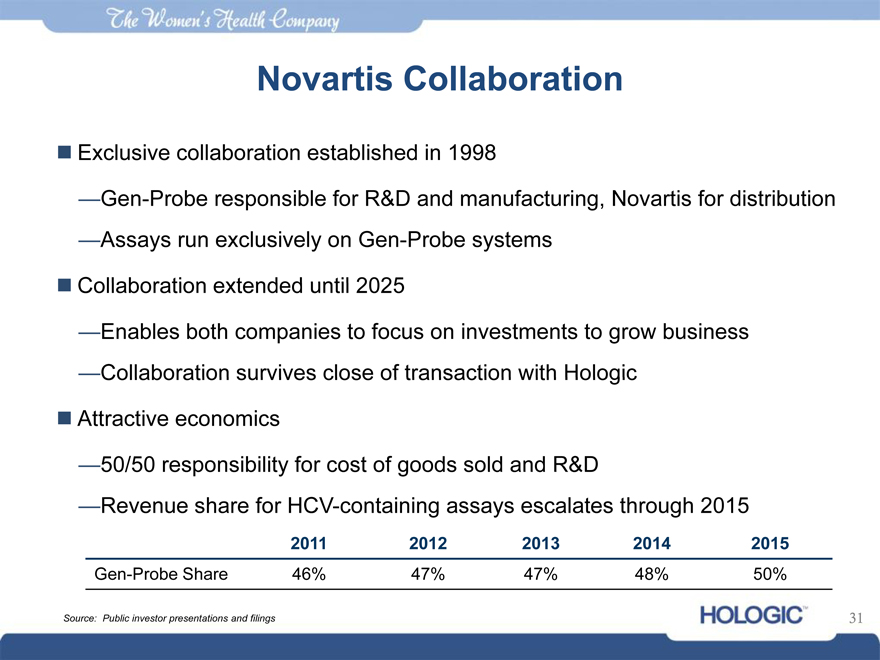

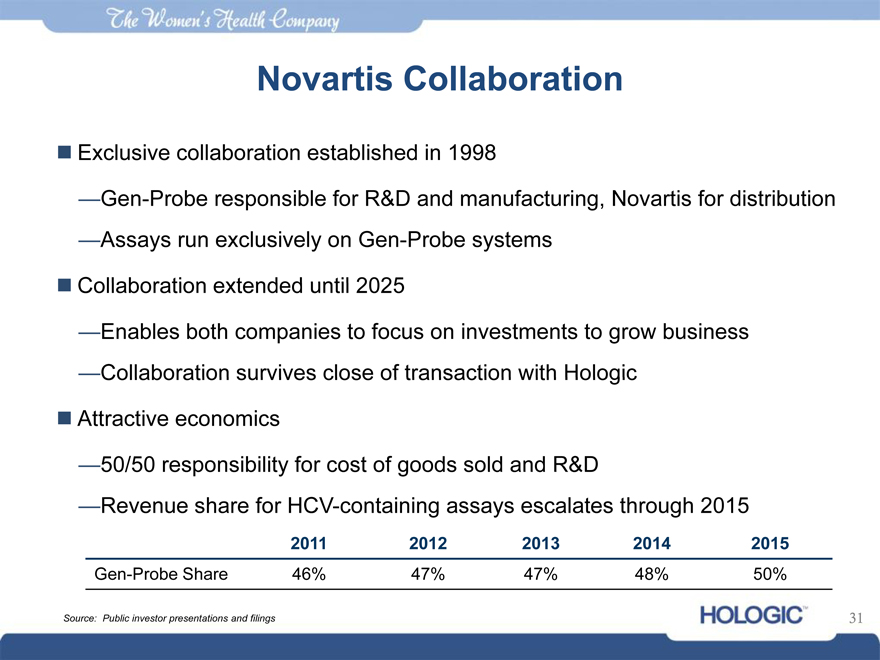

Novartis Collaboration

Exclusive collaboration established in 1998

—Gen-Probe responsible for R&D and manufacturing, Novartis for distribution

—Assays run exclusively on Gen-Probe systems

Collaboration extended until 2025

—Enables both companies to focus on investments to grow business

—Collaboration survives close of transaction with Hologic

Attractive economics

—50/50 responsibility for cost of goods sold and R&D

—Revenue share for HCV-containing assays escalates through 2015

2011 2012 2013 2014 2015

Gen-Probe Share 46% 47% 47% 48% 50%

Source: Public investor presentations and filings 31

Agenda

Executive Summary Transaction Merits Company Overview Key Credit Strengths Historical Financial Review

Appendix A: Non-GAAP Adjustments

Appendix B: Disclaimers 32

Key Credit Strengths

Market Leader in Key Products Diversified and Balanced Revenue Mix Best-in-Class Technologies Broad International Presence Experienced and Proven Management Team

Significant Free Cash Flow Generation Drives Expected Deleveraging

Attractive Credit Profile with Meaningful Equity Value

33

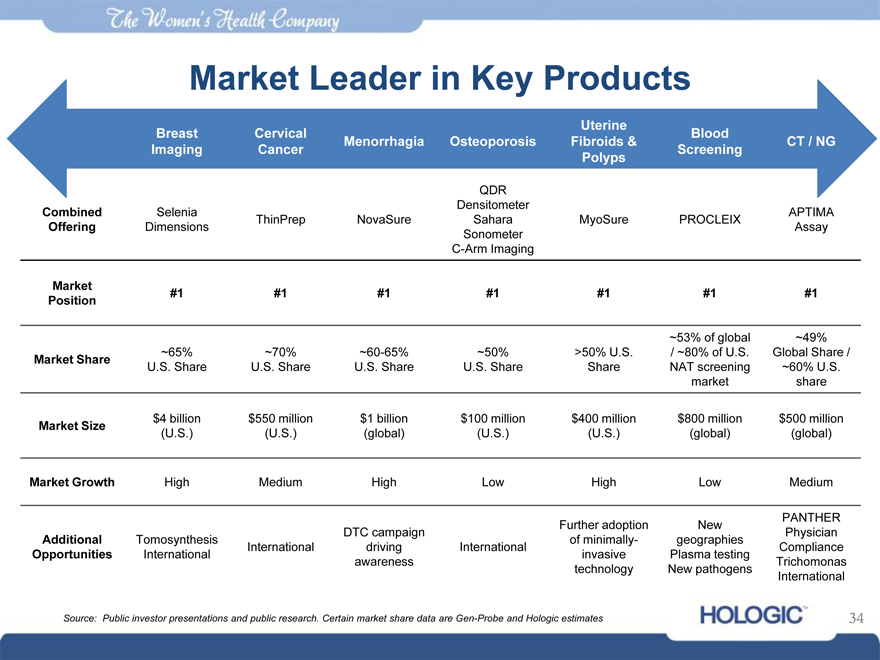

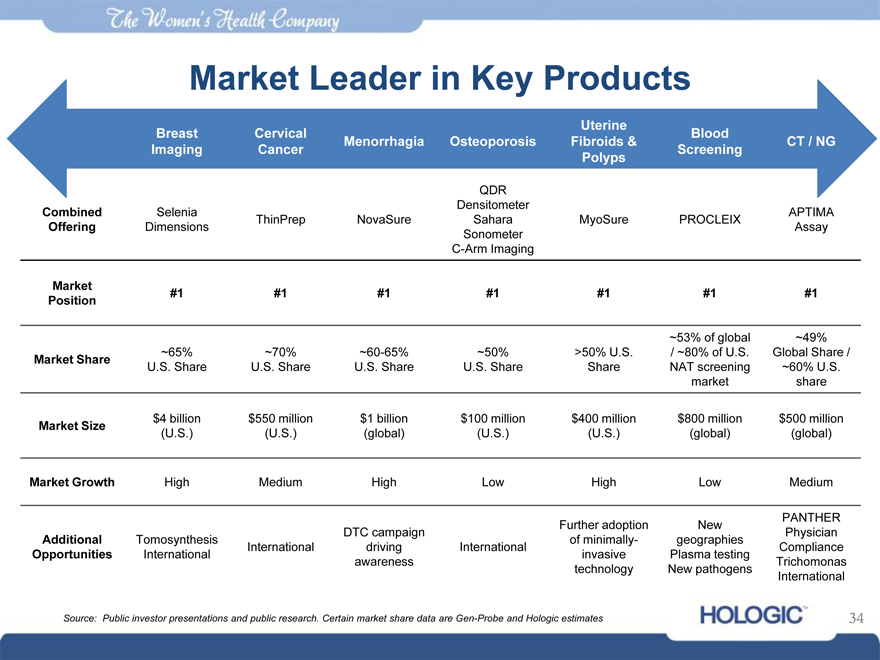

Market Leader in Key Products

Uterine

Breast Cervical Blood

Menorrhagia Osteoporosis Fibroids & CT / NG

Imaging Cancer Screening

Polyps

QDR

Densitometer

Combined Selenia APTIMA

ThinPrep NovaSure Sahara MyoSure PROCLEIX

Offering Dimensions Assay

Sonometer

C-Arm Imaging

Market #1 #1 #1 #1 #1 #1 #1

Position

~53% of global ~49%

~65% ~70% ~60-65% ~50% >50% U.S. / ~80% of U.S. Global Share /

Market Share U.S. Share U.S. Share U.S. Share U.S. Share Share NAT screening ~60% U.S.

market share

Market Size $4 billion $550 million $1 billion $100 million $400 million $800 million $500 million

(U.S.) (U.S.) (global) (U.S.) (U.S.) (global) (global)

Market Growth High Medium High Low High Low Medium

Further adoption New PANTHER

DTC campaign Physician

Additional Tomosynthesis of minimally- geographies

International driving International Compliance

Opportunities International invasive Plasma testing

awareness Trichomonas

technology New pathogens International

Source: Public investor presentations and public research. Certain market share data are Gen-Probe and Hologic estimates

34

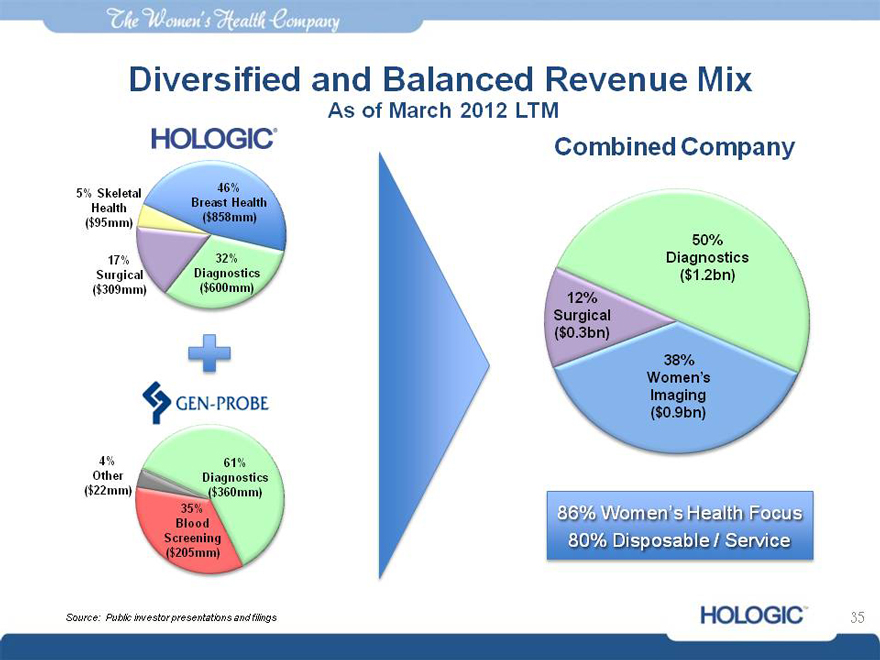

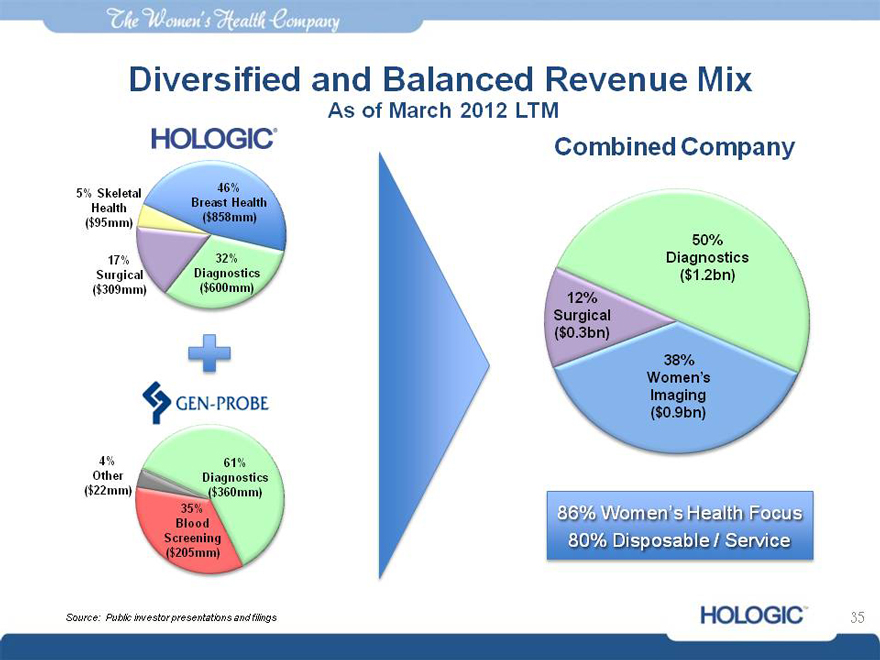

Diversified and Balanced Revenue Mix

As of March 2012 LTM

Combined Company

5% Skeletal 46%

Health Breast Health

($95mm) ($858mm)

17% 32%

Surgical Diagnostics

($309mm) ($600mm)

4% 61%

Other Diagnostics

($22mm) ($360mm)

35%

Blood

Screening

($205mm)

Source: Public investor presentations and filings

50% Diagnostics

( $1.2bn) 12% Surgical

($0.3bn)

38% Women’ s Imaging

($0.9bn)

86% Women’s Health Focus 80% Disposable / Service

35

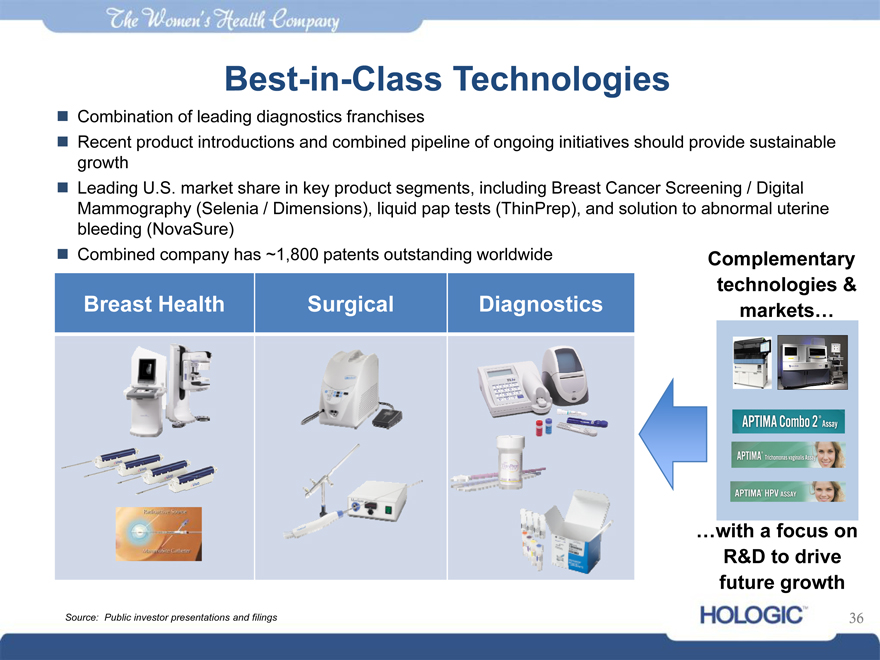

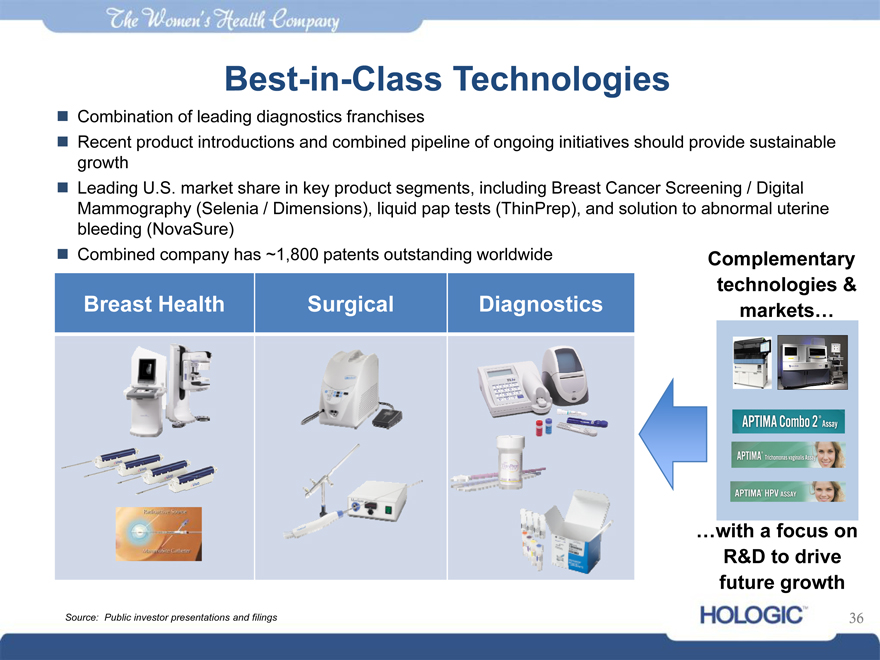

Best-in-Class Technolo iesg

Combination of leading diagnostics franchises

Recent product introductions and combined pipeline of ongoing initiatives should provide sustainable

growth

Leading U.S. market share in key product segments, including Breast Cancer Screening / Digital

Mammography (Selenia / Dimensions), liquid pap tests (ThinPrep), and solution to abnormal uterine

bleeding (NovaSure)

Combined company has ~1,800 patents outstanding worldwide Complementary

technologies &

Breast Health Surgical Diagnostics markets…

…with a focus on R&D to drive future growth

Source: Public investor presentations and filings

36

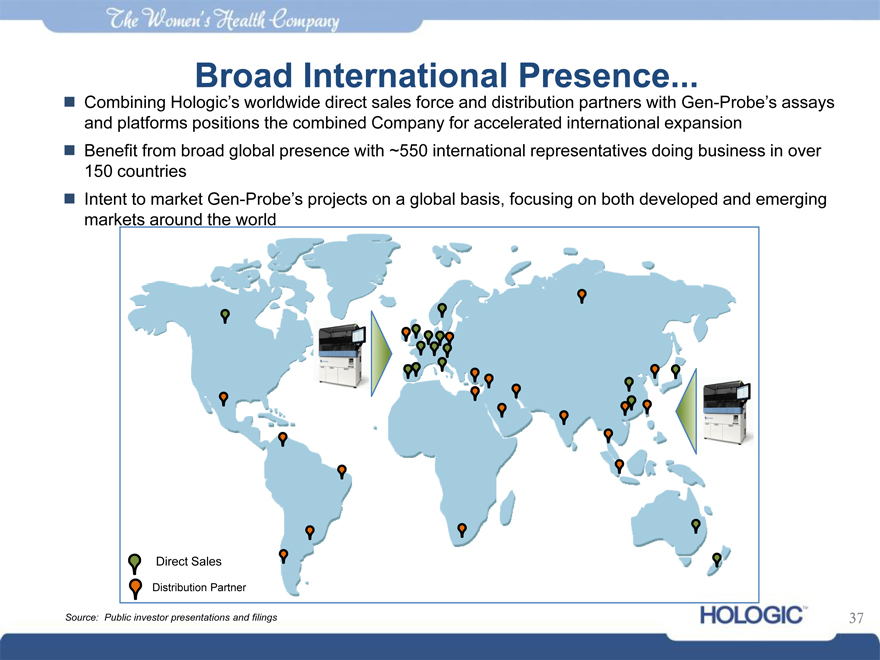

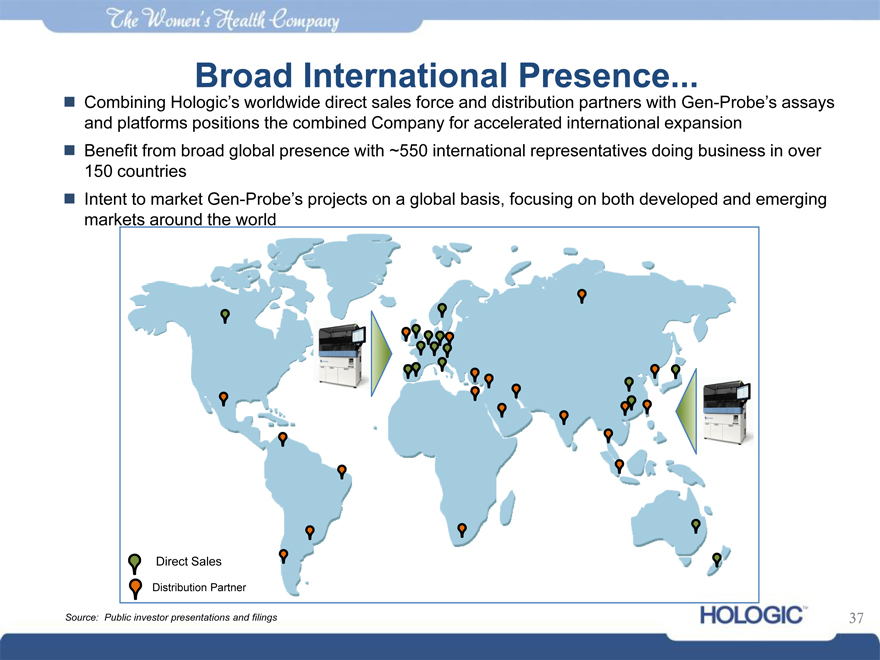

Broad International Presence

Combining Hologic’s worldwide direct sales force and distribution partners with Gen-Probe’s assays and platforms positions the combined Company for accelerated international expansion Benefit from broad global presence with ~550 international representatives doing business in over 150 countries Intent to market Gen-Probe’s projects on a global basis, focusing on both developed and emerging markets around the world

Direct Sales

Distribution Partner

Source: Public investor presentations and filings

37

With Significant Emerging Market Opportunity

2011 Investments and Progress in China

Two recent acquisitions in 2011 increased our footprint in China

TCT Medical – Market leading distributor of ThinPrep

Healthcome – Manufacturer of low-cost mammography systems

China expected to be major growth driver over the next five years

– Improving healthcare standards for the emerging middle class

– Hospital construction fueling demand for capital equipment

Enhancing the infrastructure to sell Hologic’s existing and newly-approved products

ThinPrep (existing)

Cervista HPV HR test, NovaSure and Serenity Digital Mammography system (recently approved)

Utilizing the model to further expand into other emerging markets Introduce Gen-Probe’s products on a global basis, focusing on both developed and emerging markets around the world

Source: Public investor presentations and filings

38

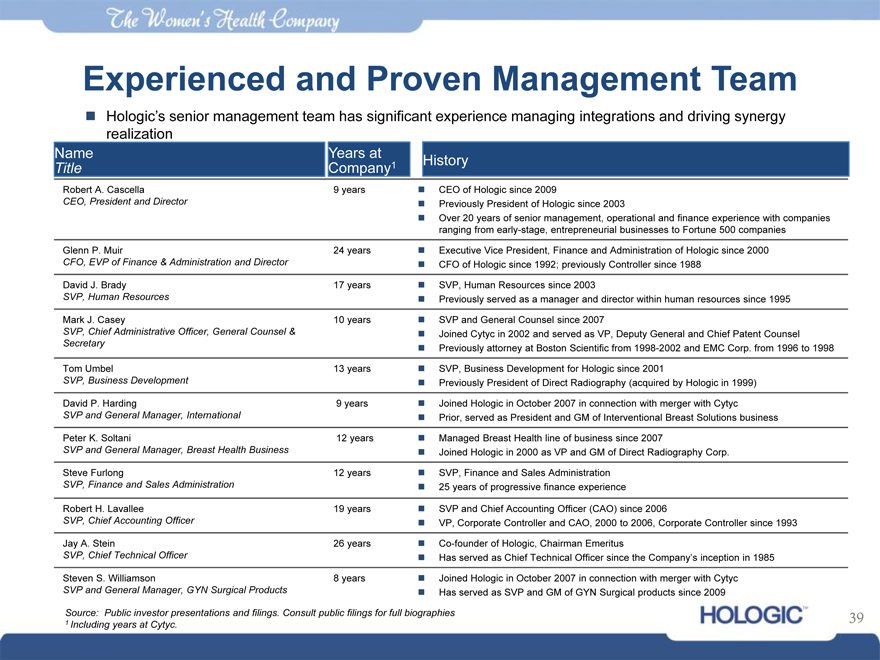

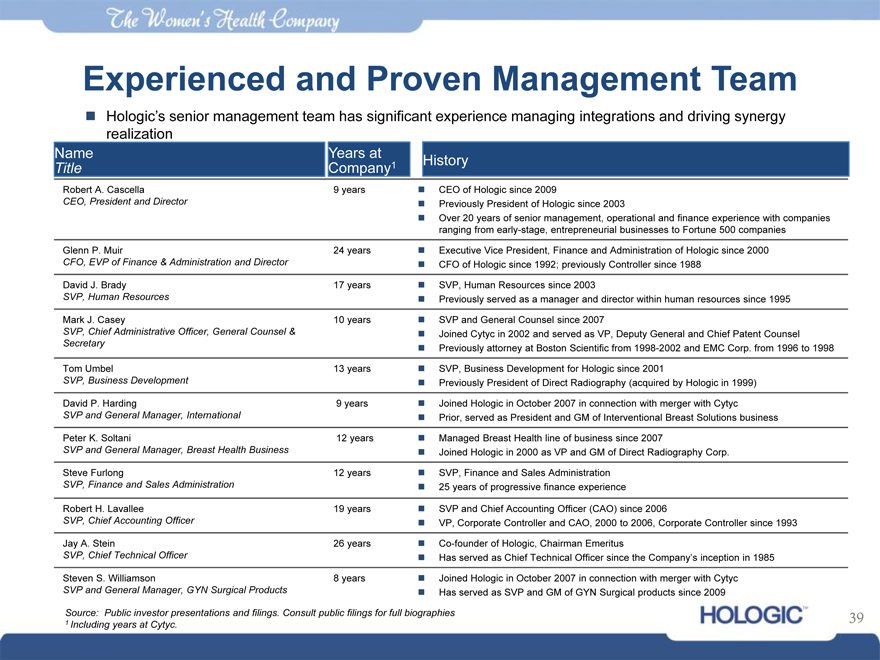

Experienced and Proven Management Team

Hologic’s senior management team has significant experience managing integrations and driving synergy realization

Name Years at

Title Company1

Robert A. Cascella 9 years

CEO, President and Director

Glenn P. Muir 24 years

CFO, EVP of Finance & Administration and Director

David J. Brady 17 years

SVP, Human Resources

Mark J. Casey 10 years

SVP, Chief Administrative Officer, General Counsel &

Secretary

Tom Umbel 13 years

SVP, Business Development

David P. Harding 9 years

SVP and General Manager, International

Peter K. Soltani 12 years

SVP and General Manager, Breast Health Business

Steve Furlong 12 years

SVP, Finance and Sales Administration

Robert H. Lavallee 19 years

SVP, Chief Accounting Officer

Jay A. Stein 26 years

SVP, Chief Technical Officer

Steven S. Williamson 8 years

SVP and General Manager, GYN Surgical Products

History

CEO of Hologic since 2009

Previously President of Hologic since 2003

Over 20 years of senior management, operational and finance experience with companies

ranging from early-stage, entrepreneurial businesses to Fortune 500 companies

Executive Vice President, Finance and Administration of Hologic since 2000

CFO of Hologic since 1992; previously Controller since 1988

SVP, Human Resources since 2003

Previously served as a manager and director within human resources since 1995

SVP and General Counsel since 2007

Joined Cytyc in 2002 and served as VP, Deputy General and Chief Patent Counsel

Previously attorney at Boston Scientific from 1998-2002 and EMC Corp. from 1996 to 1998

SVP, Business Development for Hologic since 2001

Previously President of Direct Radiography (acquired by Hologic in 1999)

Joined Hologic in October 2007 in connection with merger with Cytyc

Prior, served as President and GM of Interventional Breast Solutions business

Managed Breast Health line of business since 2007

Joined Hologic in 2000 as VP and GM of Direct Radiography Corp.

SVP, Finance and Sales Administration

25 years of progressive finance experience

SVP and Chief Accounting Officer (CAO) since 2006

VP, Corporate Controller and CAO, 2000 to 2006, Corporate Controller since 1993

Co-founder of Hologic, Chairman Emeritus

Has served as Chief Technical Officer since the Company’s inception in 1985

Joined Hologic in October 2007 in connection with merger with Cytyc

Has served as SVP and GM of GYN Surgical products since 2009

Source: Public investor presentations and filings. Consult public filings for full biographies

1 | | Including years at Cytyc. |

39

Significant Free Cash Flow Generation Drives Expected Deleveraging

Pro Forma LTM net leverage of 5.4x1, including synergies, expected to decline to below 5.0x by fiscal year-end

Cash flow should allow for rapid deleveraging of acquisition debt, with the goal of returning to pre-transaction leverage ratio within 3 years Hologic has historically maintained a disciplined approach to balance sheet management as demonstrated by significant debt paydown post the Cytyc and Third Wave acquisitions in calendar 2007 and 2008, respectively

Hologic Historical Net Leverage Profile ($ in millions)

4.2x 4.1x

3.6x

2.7x

2.0x

1.7x

6/30/2007 6/30/2008 FY 2008 FY 2009 FY 2010 FY 2011

Total Net Debt $2,220 $2,205 $2,133 $1,636 $1,234 $1,033 EBITDA $531 $536 $600 $603 $605 $611

Mar. 2012 LTM Operating Cash Flow less CapEx ($ in millions)

$390

$126

$516

Combined

Source: Public filings, public investor presentations

Note: September Hologic Fiscal Year End. 6/30/2007 pro forma for Cytyc acquisition. 6/30/2008 pro forma for Third Wave acquisition. Red represents amount of added leverage from the Cytyc acquisition in 2007 (took leverage from ~0.0x to 4.1x). Leverage multiples from 2007 and 2008 public marketing materials for the associated capital raises.

1 | | Calculated using the principal amount of outstanding convertible senior notes rather than book value. |

40

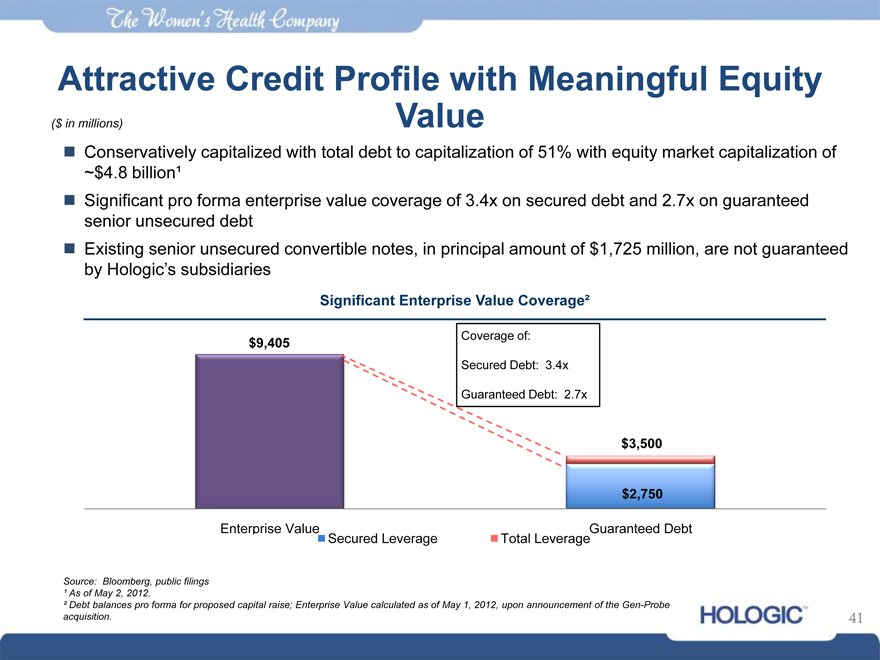

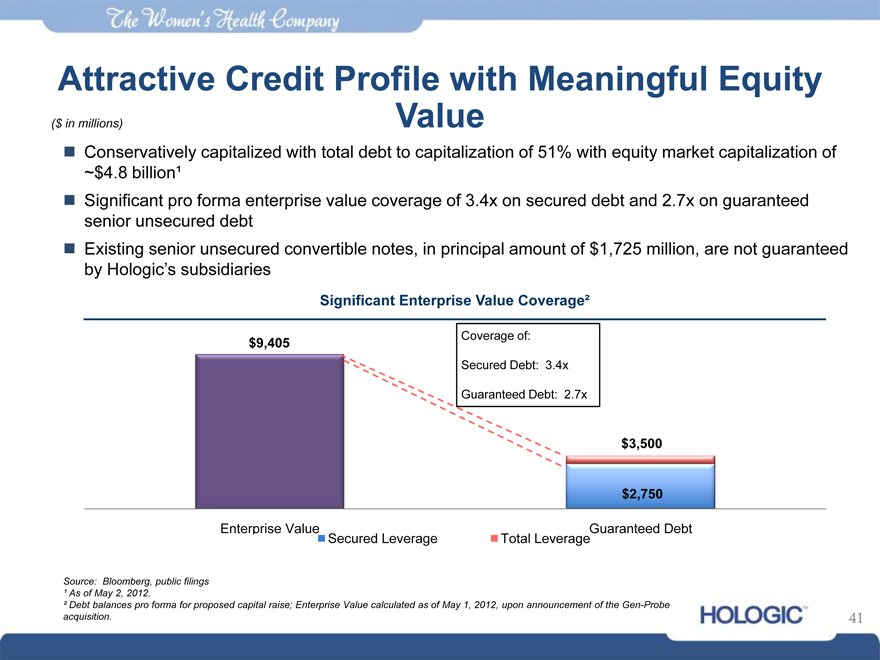

Attractive Credit Profile with Meaningful Equity

($ in millions) Value

Conservatively capitalized with total debt to capitalization of 51% with equity market capitalization of

~$4.8 billion¹

Significant pro forma enterprise value coverage of 3.4x on secured debt and 2.7x on guaranteed senior unsecured debt Existing senior unsecured convertible notes, in principal amount of $1,725 million, are not guaranteed by Hologic’s subsidiaries

Significant Enterprise Value Coverage²

$9,405

Coverage of: Secured Debt: 3.4x Guaranteed Debt: 2.7x

$3,500

Enterprise Value

Secured Leverage

Total Leverage

Guaranteed Debt

Source: Bloomberg, public filings

¹ As of May 2, 2012.

² Debt balances pro forma for proposed capital raise; Enterprise Value calculated as of May 1, 2012, upon announcement of the Gen-Probe acquisition.

41

Agenda

Executive Summary Transaction Merits Company Overview Key Credit Strengths

Historical Financial Review

Appendix A: Non-GAAP Adjustments

Appendix B: Disclaimers

42

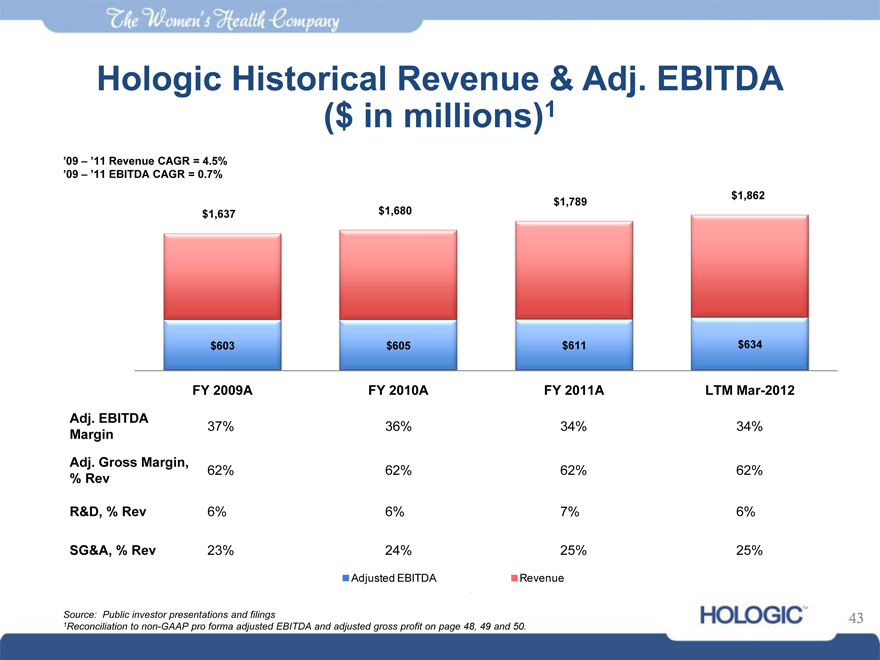

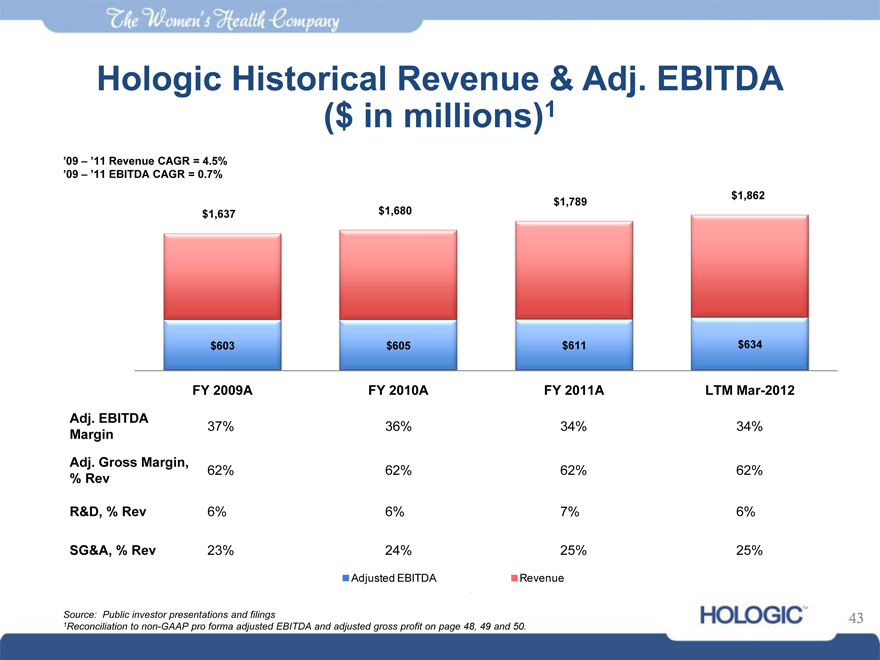

Hologic Historical Revenue & Adj. EBITDA ($ in millions)1

‘09 – ‘11 Revenue CAGR = 4.5% ‘09 – ‘11 EBITDA CAGR = 0.7%

$1,637 $1,680

$1,789

$1,862

$603

$605

$611

$634

FY 2009A FY 2010A FY 2011A LTM Mar-2012

Adj. EBITDA Margin

Adj. Gross Margin,

% Rev R&D, % Rev

SG&A, % Rev

37% 62% 6% 23%

36% 62% 6% 24%

34% 62% 7% 25%

34% 62% 6% 25%

Adjusted EBITDA Revenue

Source: Public investor presentations and filings

1Reconciliation to non-GAAP pro forma adjusted EBITDA and adjusted gross profit on page 48, 49 and 50.

43

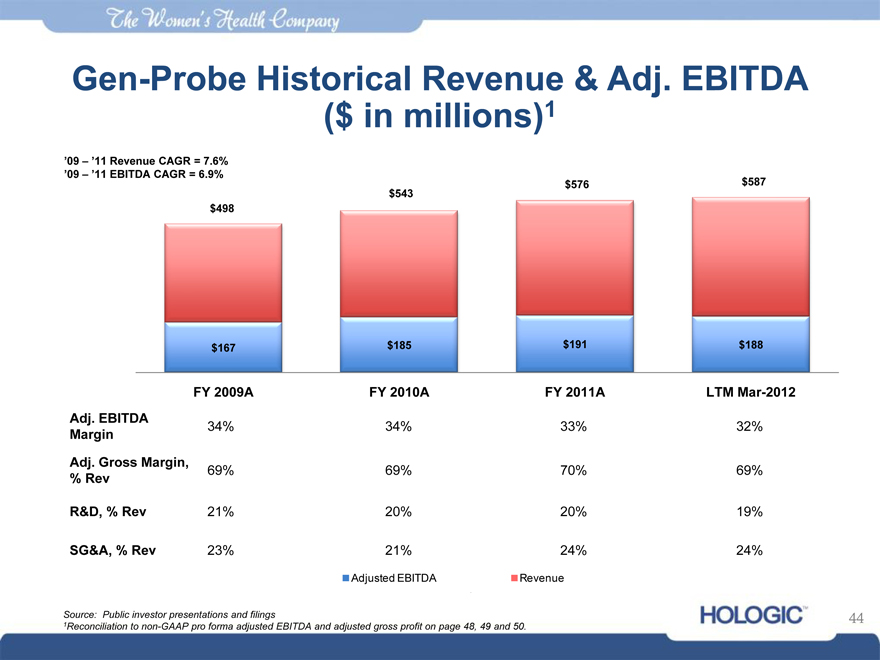

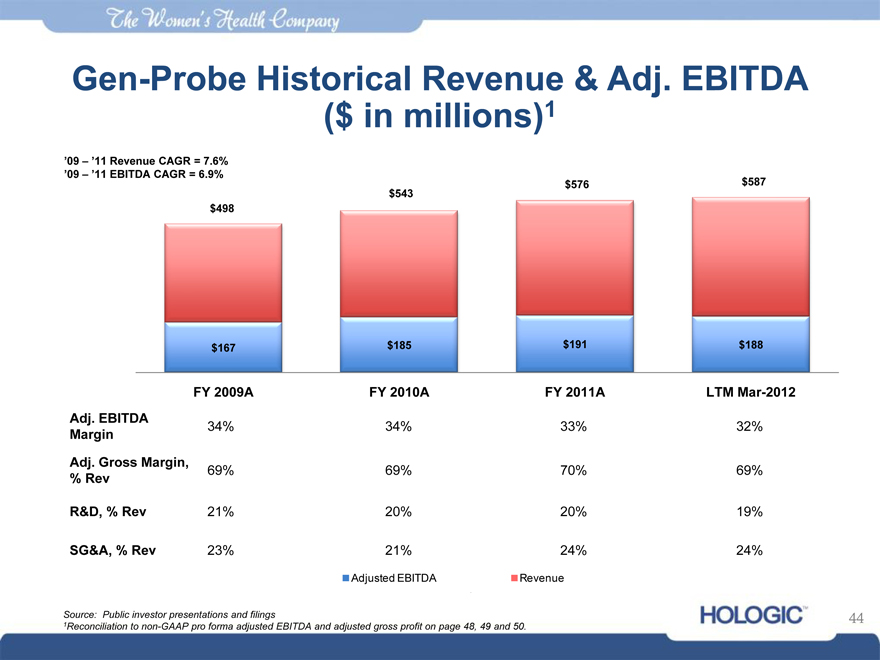

Gen-Probe Historical Revenue & Adj. EBITDA ($ in millions)1

‘09 – ‘11 Revenue CAGR = 7.6% ‘09 – ‘11 EBITDA CAGR = 6.9%

$498

$167

$543

$185

$576

$191

$587

$188

FY 2009A FY 2010A FY 2011A LTM Mar-2012

Adj. EBITDA Margin

Adj. Gross Margin,

% Rev R&D, % Rev

SG&A, % Rev

34% 69% 21% 23%

34% 69% 20% 21%

33% 70% 20% 24%

32% 69% 19% 24%

Revenue

Adjusted EBITDA

Source: Public investor presentations and filings

1Reconciliation to non-GAAP pro forma adjusted EBITDA and adjusted gross profit on page 48, 49 and 50.

44

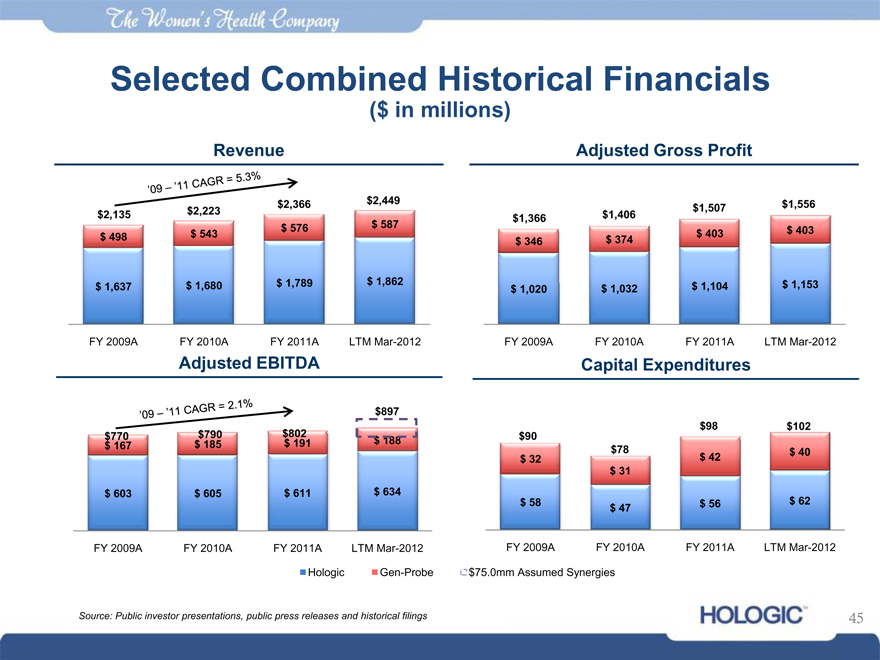

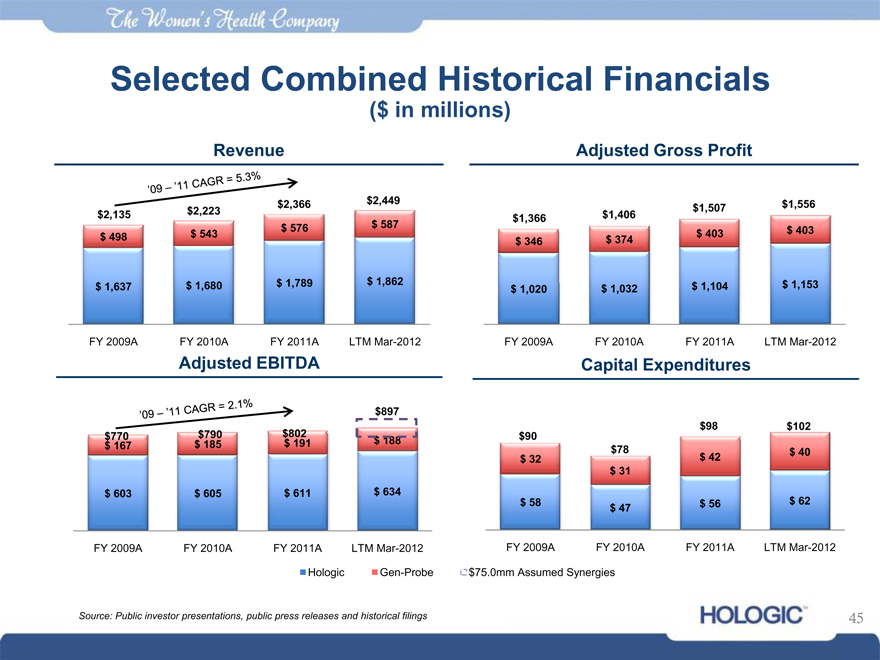

Selected Combined Historical Financials

($ in millions)

Revenue

‘09-’11 CAGR = 5.3%

$2,135 $ 498

$ 1,637

$2,223

$ 543

$ 1,680

$2,366

$ 576

$ 1,789

$2,449

$ 587

$ 1,862

FY 2009A FY 2010A FY 2011A LTM Mar-2012

$1,366

$ 346

$ 1,020

$1,406

$ 374

$ 1,032

$1,507

$ 403

$ 1,104

$1,556

$ 403

$ 1,153

Adjusted Gross Profit

FY 2009A FY 2010A FY 2011A LTM Mar-2012

Adjusted EBITDA

‘09-’11 CAGR = 2.1%

$770 $ 167

$ 603

$790 $ 185

$ 605

$802 $ 191

$ 611

$897

$ 188

$ 634

FY 2009A FY 2010A FY 2011A LTM Mar-2012

Capital Expenditures

$90 $ 32 $ 58

$78 $ 31 $ 47

$98

$ 42

$ 56

$102

$ 40

$ 62

FY 2009A FY 2010A FY 2011A LTM Mar-2012

$75.0mm Assumed Synergies

Gen-Probe

Hologic

Source: Public investor presentations, public press releases and historical filings

45

Agenda

Executive Summary Transaction Merits Company Overview Key Credit Strengths Historical Financial Review Financing Overview Questions & Answers

Appendix A: Non-GAAP Adjustments

Appendix B: Disclaimers

46

Hologic Reconciliation of GAAP Net Income to Non-GAAP Adj. Net Income and Pro Forma EBITDA

($ in millions) Year Ended Twelve Months Twelve Months Pro Forma

September September September Ended Ended

26, 2009 25, 2010 24, 2011 March 24, 2012 March 24, 2012

NET INCOME

GAAP net income($2,216.64)($62.81) $157.15 $44.30($132.79)

Adjustments

Amortization of intangible assets 206.73 226.31 235.79 242.12 425.22

Non-cash interest expense relating to convertible notes 67.67 73.13 72.91 73.60 73.60

Non-cash loss on convertible notes exchange—- 29.89 42.35 42.35

Contingent consideration—- 11.99 91.98 91.98

Adiana closure charges—— 18.28 18.28

Gain on sale of intellectual property, net—-(84.50)(12.42)(12.42)

Acquisition-related costs and other charges—2.23 2.32 2.92 5.12

Restructuring and divestiture charges (benefit) 2.00 1.58(0.07) 0.28 3.27

Litigation settlement charges—11.40 0.77 0.76 0.76

Fair value write up of acquired inventory sold 1.17 0.73 3.30

Goodwill and asset impairment charges 2,344.09 220.19—- 12.75

Other-than-temporary impairment loss on equity investments 2.24 1.10 2.45 0.35 39.48

Acquired in-process research and development—2.00 -

Income tax effect of reconciling items (1) (2)(101.91)(167.17)(96.50)(152.32)(251.41)

Non-GAAP adjusted net income $305.35 $308.68 $335.48 $352.20 $316.19

EBITDA

Non-GAAP adjusted net income $305.35 $308.68 $335.48 $352.20 $316.19

Interest expense, net, not adjusted above 66.12 52.70 39.86 39.37 234.58

Provision for income taxes 164.42 174.99 166.74 175.35 162.89

Depreciation and amortization expense, not adjusted above 67.20 68.46 68.95 67.57 108.62

Cost Reduction Initiatives (3)———75.00

Adjusted EBITDA $603.09 $604.84 $611.03 $634.49 $897.28

Source: Public filings and pro forma financial statements

Note: Column summations may be different due to rounding

1 For Years Ended September 26, 2009, September 25, 2010 and September 24, 2011: To reflect an annual effective tax rate of 35.0%, 36.2% and 33.2%, respectively, on a non-GAAP basis.

2 For Six Months Ended March 26, 2011 and March 24, 2012: To reflect an annual effective tax rate of 34% on a non-GAAP basis.

3 Represents cost-savings Hologic currently expects to achieve as a result of the Gen-Probe Acquisition. The Company estimates that they will realize approximately $75 million of cost savings by the end of fiscal year 2015.

47

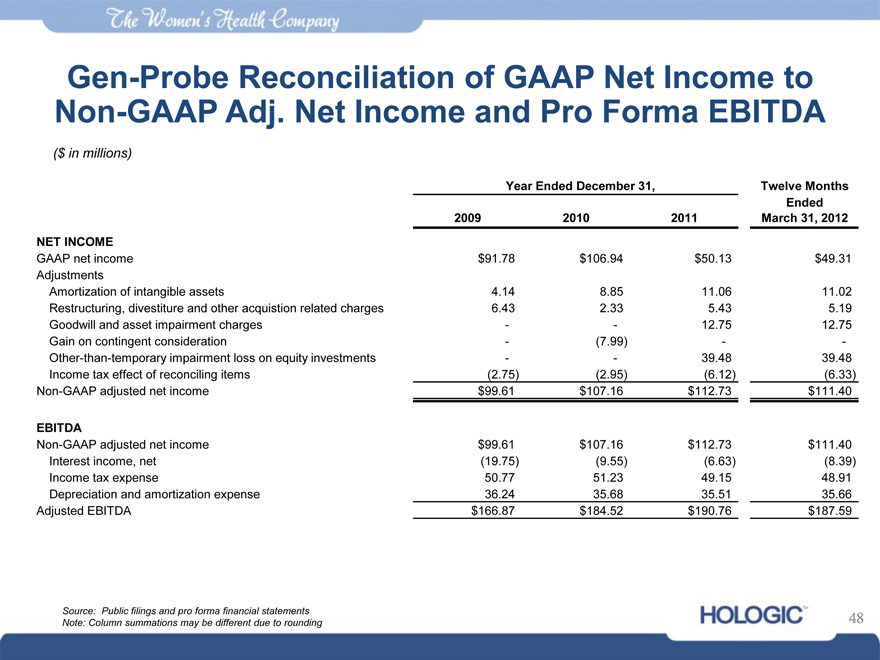

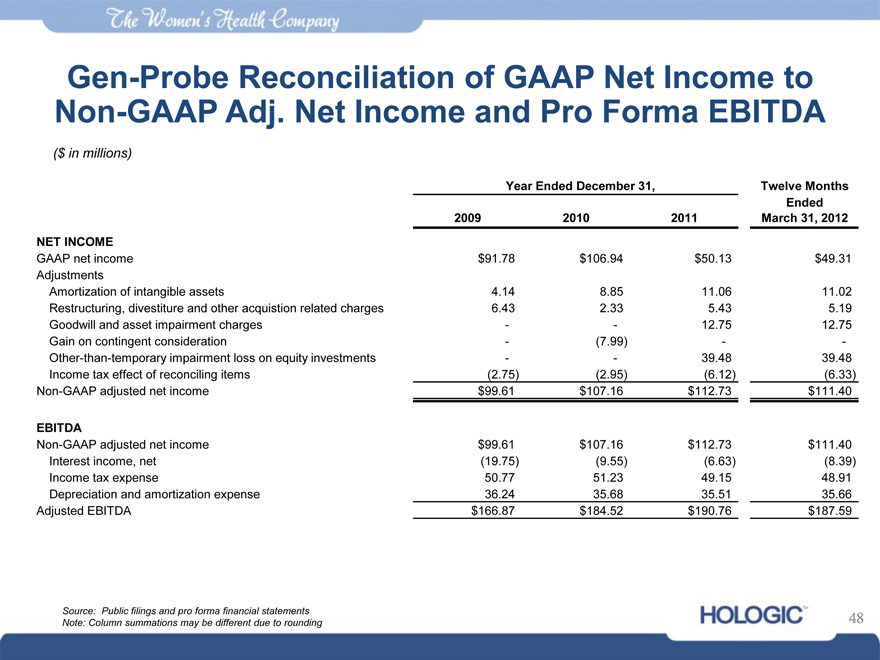

Gen-Probe Reconciliation of GAAP Net Income to Non-GAAP Adj. Net Income and Pro Forma EBITDA

($ in millions)

Year Ended December 31, Twelve Months

Ended

2009 2010 2011 March 31, 2012

NET INCOME

GAAP net income $91.78 $106.94 $50.13 $49.31

Adjustments

Amortization of intangible assets 4.14 8.85 11.06 11.02

Restructuring, divestiture and other acquistion related charges 6.43 2.33 5.43 5.19

Goodwill and asset impairment charges—- 12.75 12.75

Gain on contingent consideration -(7.99)—-

Other-than-temporary impairment loss on equity investments—- 39.48 39.48

Income tax effect of reconciling items(2.75)(2.95)(6.12)(6.33)

Non-GAAP adjusted net income $99.61 $107.16 $112.73 $111.40

EBITDA

Non-GAAP adjusted net income $99.61 $107.16 $112.73 $111.40

Interest income, net(19.75)(9.55)(6.63)(8.39)

Income tax expense 50.77 51.23 49.15 48.91

Depreciation and amortization expense 36.24 35.68 35.51 35.66

Adjusted EBITDA $166.87 $184.52 $190.76 $187.59

Source: Public filings and pro forma financial statements Note: Column summations may be different due to rounding

48

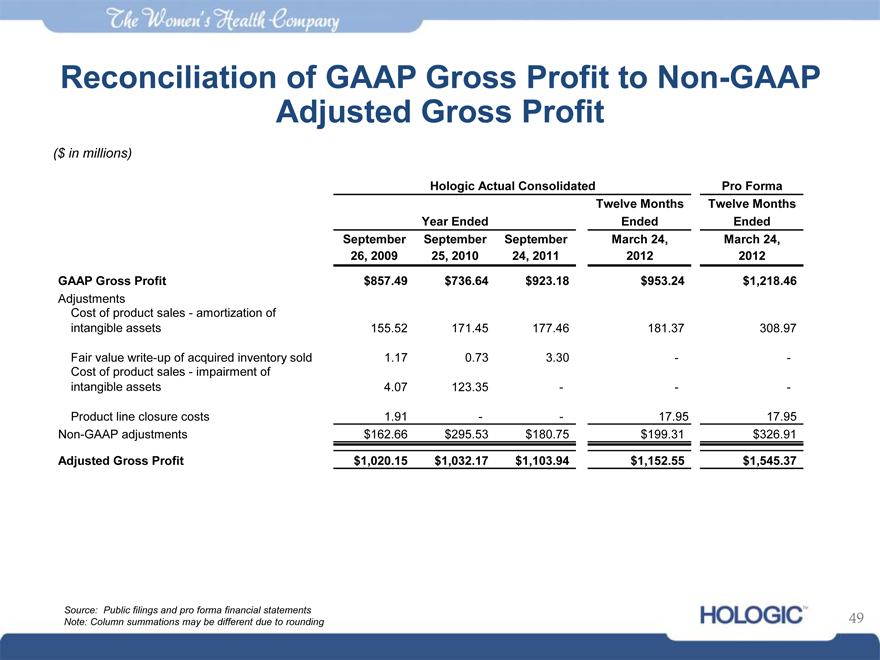

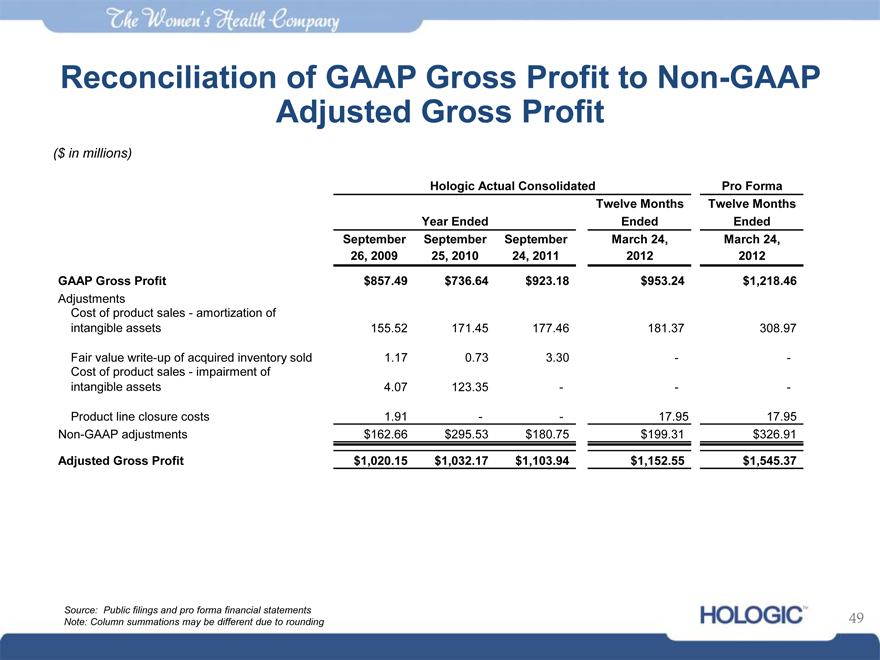

Reconciliation of GAAP Gross Profit to Non-GAAP Adjusted Gross Profit

($ in millions)

Hologic Actual Consolidated Pro Forma

Twelve Months Twelve Months

Year Ended Ended Ended

September September September March 24, March 24,

26, 2009 25, 2010 24, 2011 2012 2012

GAAP Gross Profit $857.49 $736.64 $923.18 $953.24 $1,218.46

Adjustments

Cost of product sales—amortization of

intangible assets 155.52 171.45 177.46 181.37 308.97

Fair value write-up of acquired inventory sold 1.17 0.73 3.30—-

Cost of product sales—impairment of

intangible assets 4.07 123.35——

Product line closure costs 1.91—- 17.95 17.95

Non-GAAP adjustments $162.66 $295.53 $180.75 $199.31 $326.91

Adjusted Gross Profit $1,020.15 $1,032.17 $1,103.94 $1,152.55 $1,545.37

Source: Public filings and pro forma financial statements Note: Column summations may be different due to rounding

49

Agendag

Executive Summary Transaction Overview Company Overview Key Credit Strengths Historical Financial Review

Appendix A: Non-GAAP Adjustments

50

Forward-Looking Statements

This presentation contains forward-looking information that involves risks and uncertainties, including statements about Hologic’s plans, objectives, expectations and intentions. Such statements include, without limitation, statements about the timing of the completion of the transaction, the anticipated benefits thereof, including anticipated future financial and operating results of the combined company, the expected permanent financing for the transaction, other of Hologic’s plans, objectives, expectations and intentions, and other statements that are not historical facts. Forward-looking statements may contain words such as “expect,” “believe,” “may,” “can,” “should,” “will,” “forecast,” “anticipate,” or similar expressions (including their use in the negative), and include assumptions that underlie such statements. These forward-looking statements are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements, including but not limited to: the ability of the parties to consummate the proposed merger in a timely manner or at all; satisfaction of the conditions precedent to consummation of the proposed merger, including the ability to secure regulatory approvals in a timely manner or at all, and approval by Gen-Probe’s stockholders; uncertainties relating to litigation (including pending and future Gen-Probe shareholder lawsuits related to the proposed merger); successful completion of anticipated financing arrangements; Hologic’s ability to successfully and timely integrate Gen-Probe’s operations, product lines, technologies and employees, and realize synergies from the proposed transaction; unknown, underestimated or undisclosed commitments or liabilities; effects of purchase accounting that may be different from expectations; the level of demand for the combined company’s products; the ability of the combined company to develop, deliver and support a broad range of products, develop new products, expand its markets and/or develop new markets; and the ability of the combined company to attract, motivate and retain key employees. Moreover, the combined business may be adversely affected by future legislative, regulatory, or tax changes as well as other economic, business and/or competitive factors. The risks included above are not exhaustive. Other factors that could adversely affect the combined company’s business and prospects are described in Hologic’s and Gen-Probe’s filings with the Securities and Exchange Commission. Hologic expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any such statements presented herein to reflect any change in expectations or any change in events, conditions or circumstances on which any such statements are based.

51

Trademark Notice

Hologic is a trademark of Hologic, Inc. Other trademarks, logos, and slogans registered or used by Hologic and its divisions and Subsidiaries in the United States and other countries include, but are not limited to, the following: Adiana, Aegis, Affirm, ATEC, Aquilex, Celero, Cellient, Cervista, Citra, C-View, Dimensions, DigitalNow, Discovery, Explorer, Eviva, Fluoroscan, Imagechecker, Inplex, Interlace, Invader, MammoPad, MammoSite, MultiCare, MyoSure, NovaSure, PreservCyt, QDR, QCette, Rapid fFN, Sahara, SecurView, SecurMark, SecurXchange, Selenia, Sentinelle, Serenity, Smartvalve, Suresound, StereoLoc, ThinPrep, THS, TCT, TLI IQ, Trident, Trimark, Urocyte.

ACCUPROBE, AMPLIFIED MTD, APTIMA, APTIMA COMBO 2, DKA, DTS, ELUCIGENE, GASDIRECT, GEN-PROBE, GTI DIAGNOSTICS, HPA, LIFECODES, PACE, PANTHER, PROADENO, PRODESSE, PROFAST, PROFLU, PROGASTRO, PROGENSA, TEPNEL, TIGRIS, TMA and Gen- Probe’ s other logos and trademarks are the property of Gen-Probe Incorporated or its subsidiaries. PROCLEIX and ULTRIO are trademarks of Novartis Vaccines & Diagnostics, Inc. XMAP is a trademark of Luminex Corporation.

All other brand names or trademarks appearing in this offering circular are the property of their respective holders. Hologic’s use or display of other parties’ trademarks, trade dress or products in this offering circular does not imply that Hologic or Gen-Probe has a relationship with, or endorsement or sponsorship of, the trademark or trade dress owners.

52

Use of Non-GAAP Financial Measures

Hologic has presented the following non-GAAP financial measures in this presentation: adjusted net income, adjusted gross profit and adjusted EBITDA of each of Hologic and Gen-Probe, and pro forma adjusted net income and adjusted EBITDA of the combined company.

The Company defines its non-GAAP adjusted net income to exclude (i) the amortization of intangible assets, (ii) acquisition-related charges and effects (comprised of (a) adjustments for changes in the fair value of the contingent consideration liabilities initially recorded as part of the purchase price of an acquisition as required by GAAP, and (b) contingent consideration that is tied to continuing employment of the former shareholders and employees which is recorded as compensation expense), transaction costs, charges associated with the write-up of acquired inventory to fair value, and the effects of lost revenue related to the write-up of accounts receivable to fair value, (iii) non-cash interested expense related to amortization of the debt discount for convertible debt securities, (iv) divestiture and restructuring charges, (v) non-cash loss on exchange of convertible notes, (vi) litigation settlement charges (benefits), (vii) other-than-temporary impairment losses on equity investments, (viii) other one-time, nonrecurring, unusual or infrequent charges, expenses or gains that may not be indicative of our core business results, and (ix) income taxes related to such adjustments.

The Company defines adjusted EBITDA as our non-GAAP adjusted net income plus interest expense, net, income taxes, and depreciation expense included in our non-GAAP adjusted net income.

The Company defines adjusted gross profit as consolidated revenues less cost of product sales and cost of services and other revenues, but excludes “cost of product sales-amortization of intangible assets” and “cost of product sales-impairment of intangible assets,” and non-recurring or infrequent items such as the purchase accounting effects resulting from the write-up of accounts receivable and inventory to fair value, other acquisition related charges, and impairment and other charges related to closure of facilities or abandonment of product lines.

The reconciliations of these historical non-GAAP measures to each of Hologic’s and Gen-Probe’s GAAP financial measures for the periods presented, are set forth on slide 48, 49 and 50.

The Company believes the use of non-GAAP adjusted net income and non-GAAP adjusted gross profit are useful to investors by eliminating certain of the more significant effects of its acquisitions and related activities, noncash charges resulting from the application of GAAP to convertible debt instruments with cash settlement features, charges related to debt extinguishment losses, equity investment impairments, litigation settlements, and divestiture and restructuring initiatives. These measures also reflect how the Company manages its businesses internally. In addition to the adjustments set forth in the calculation of the Company’s non-GAAP adjusted net income, its non-GAAP adjusted EBITDA eliminates the effects of financing, income taxes and the accounting effects of capital

spending. As with the items eliminated in its calculation of non-GAAP adjusted net income, these items may vary for different companies for reasons unrelated to the overall operating performance of a company’s business. When analyzing the Hologic’s, Gen-Probe’s and the pro forma combined company’s operating performance, investors should not consider these non-GAAP financial measures as a substitute for net income and gross profit prepared in accordance with GAAP.

53