UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant Filed by the Registrant

|  Filed by a Party other than the Registrant Filed by a Party other than the Registrant

|

Check the appropriate box: |

| Preliminary Proxy Statement |

| CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to § 240.14a-12 |

THE RYLAND GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): |

| No fee required. |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) Title of each class of securities to which transaction applies: |

(2) Aggregate number of securities to which transaction applies: |

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction: |

(5) Total fee paid: |

| The Ryland Group | |

| | |

| | Notice of 2014

Annual Meeting of

Stockholders |

Dear Fellow Stockholders

As demonstrated at last year’s Annual Meeting of Stockholders by the strong support of 98% of our stockholders in favor of our 2013 Say-on-Pay proposal, Ryland maintains executive compensation programs that emphasize our commitment to matching executive compensation with our financial and operational performance. I am pleased to report that in 2013 Ryland improved its performance with significant growth in pretax income and revenues as well as home sales and closings and our executive compensation more than favorably aligned with this performance. Reflecting our commitment to best practices in executive compensation, Ryland previously eliminated all tax gross-ups for Executive Officers and maintains a representative compensation peer group for benchmarking executive compensation that is broader than the peer groups utilized by other large public homebuilders. In aligning our pay to performance, we use performance metrics based on adjusted consolidated pretax earnings for our short-term incentive bonus program and relative total shareholder return and revenue growth over a three-year period for our long-term incentive plan. These performance metrics align with our strategic objectives to maintain profitability, maximize Ryland’s growth and increase the value of our Common Stock to benefit our stockholders.

In the area of corporate governance, we are proud of Ryland’s commitment to utilizing best practices. This commitment was demonstrated in 2013 when we amended our Bylaws to provide that all Directors are elected annually by a majority vote of stockholders. Consistent with our focus, we maintain a Board of Directors that, except for Mr. Nicholson, Ryland’s CEO, is composed entirely of “independent directors” and I serve as your independent Chairman of the Board. Additionally, both the Board of Directors and Executive Officers are subject to stock ownership requirements that align us with our stockholders. Demonstrating the level of corporate governance at which we operate, we maintain a comprehensive set of policies that govern the conduct of the Board of Directors. Many of these policies are contained within our “Guidelines on Significant Corporate Governance Issues.” You can review these Guidelines atwww.ryland.com/home/investors.htmlunder the Corporate Governance heading.

In closing, I hope that this Proxy Statement provides the information you seek in an easy to read format. On behalf of your Board of Directors, I request your support for the proposals presented herein for action by you at the 2014 Annual Meeting of Stockholders.

With Best Regards,

William L. Jews

Chair of the Board of Directors

| RYLAND GROUP - 2014 Proxy Statement | 3 |

| RYLAND GROUP - 2014 Proxy Statement | 4 |

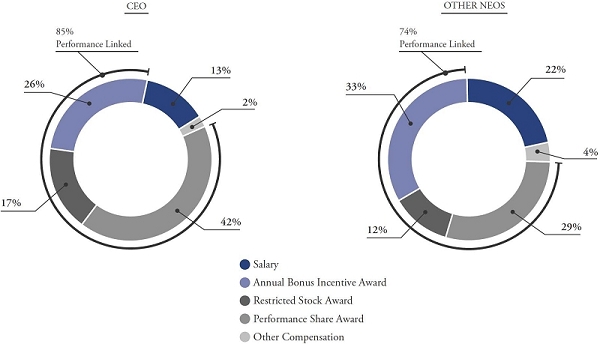

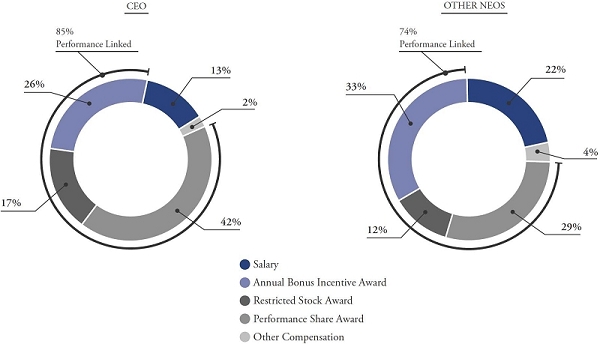

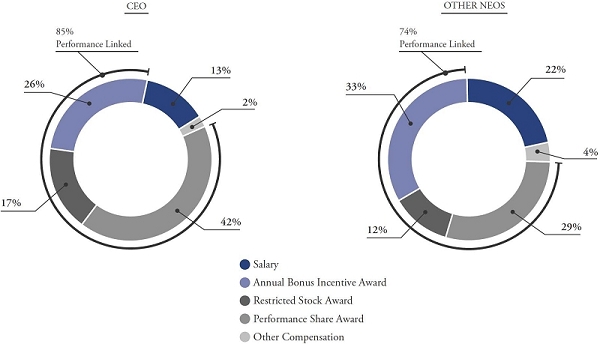

Pay for Performance Compensation Mix

The charts below show the 2013 percentage of performance-linked compensation for our CEO and our other Named Executive Officers (NEOs). These charts identify that 85% of our CEO’s and 74% of our NEOs’ compensation is dependent on and determined by the success of Ryland’s financial, operational and/or stock performance.

2013 TOTAL COMPENSATION EXCLUDING “CHANGE IN PENSION VALUE”

FROM THE SUMMARY COMPENSATION TABLE - PAGE 34

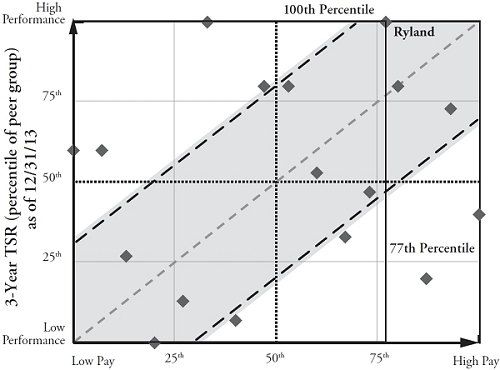

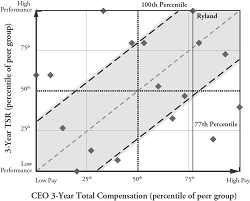

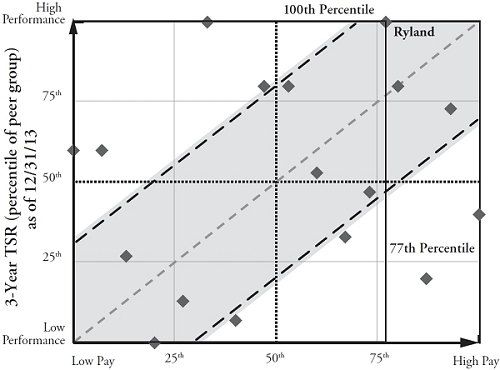

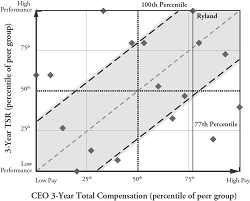

Relative Alignment of CEO Pay

The table below demonstrates the alignment as of February 11, 2014 of our CEO’s three-year total compensation and our three-year total shareholder return (TSR) relative to the companies included in our Compensation Peer Group.

PAY AND PERFORMANCE RELATIVE TO OUR COMPENSATION PEER GROUP

CEO 3-Year Total Compensation (percentile of peer group)

We believe that companies that fall within the shaded area, like Ryland, exhibit a substantial degree of alignment between CEO compensation and total shareholder return. As illustrated above, Ryland’s CEO three-year total compensation was at the 77thpercentile of our peer group while total shareholder return (TSR) ranked at the 100thpercentile. This shows that our CEO pay is aligned with Ryland’s performance relative to our Compensation Peer Group and that our pay-for-performance compensation programs are working as intended.

| RYLAND GROUP - 2014 Proxy Statement | 5 |

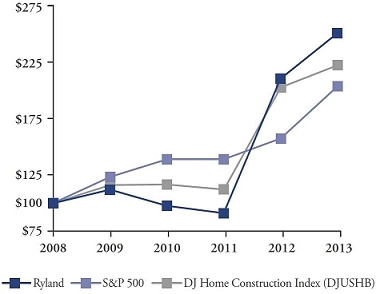

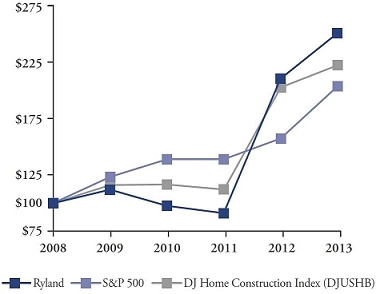

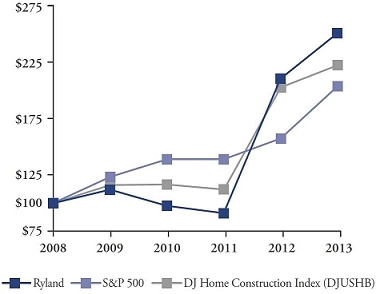

Five-Year Total Shareholder Return

The following chart shows how a $100 investment in Ryland Common Stock on December 31, 2008 would have grown to $252.32 on December 31, 2013, with dividends reinvested quarterly. This compares to a $100 investment in the S&P 500 over the same period that would have increased to $204.63 on December 31, 2013, with dividends reinvested quarterly. A $100 investment in the DJ Home Construction Index over the same five-year period would have increased to $223.53 on December 31, 2013, with dividends reinvested quarterly. As you can see, a $100 investment in Ryland Common Stock has outperformed the S&P 500 and DJ Home Construction Index over this five-year period.

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL SHAREHOLDER RETURN

Voting Matters

| | | | | More | | Board | | Broker Non-Votes | | Votes required |

| | | | | information | | recommendation | | and Abstentions | | for approval |

| PROPOSAL 1 | | Election of Directors | | page 10 | | FOReach nominee | | | | |

| PROPOSAL 2 | | Advisory Vote to Approve Executive Compensation | | page 49 | | FOR | | Do not

count | | Majority of

shares cast |

| PROPOSAL 3 | | Ratification of Auditors | | page 50 | | FOR | | | | |

| RYLAND GROUP - 2014 Proxy Statement | 6 |

Notice of Annual Meeting

of Stockholders |

To the Stockholders:

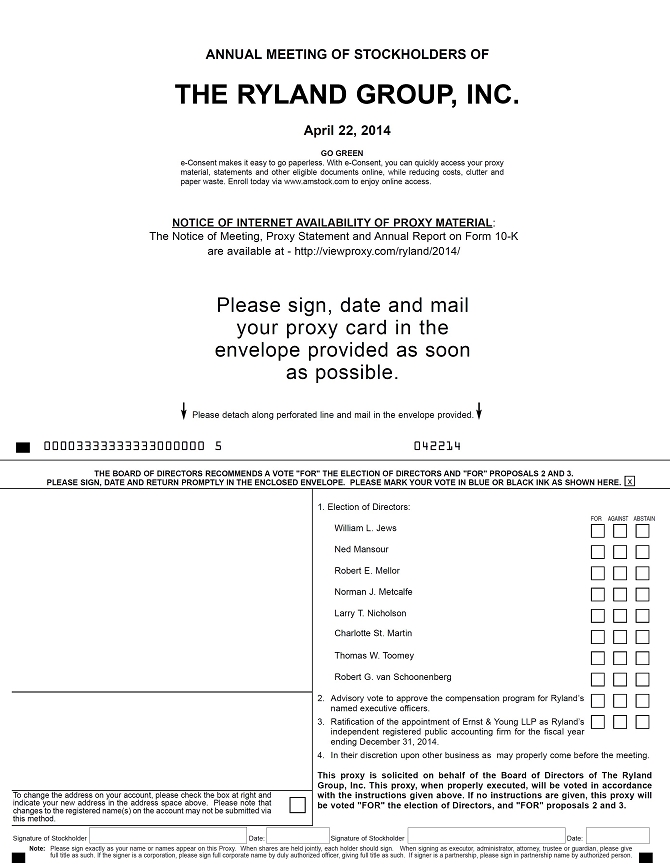

Notice is given that the Annual Meeting of Stockholders of The Ryland Group, Inc. (“Ryland”) will be held at The Ritz-Carlton, 4375 Admiralty Way, Marina del Rey, California, on April 22, 2014, at 5:00 p.m., local time, for the following purposes:

| 1. | To elect eight Directors named in the Proxy Statement to serve until the next Annual Meeting of Stockholders or until their successors are elected and shall qualify. |

| | | |

| 2. | To approve the compensation program for Ryland’s Named Executive Officers with an advisory vote. |

| | | |

| 3. | To ratify the appointment of Ernst & Young LLP as Ryland’s independent registered public accounting firm for the fiscal year ending December 31, 2014. |

| | | |

| 4. | To act upon other business properly brought before the meeting. |

Stockholders of record at the close of business on February 11, 2014 are entitled to vote at the meeting or any adjournment thereof. Please date and sign the enclosed proxy and return it in the accompanying postage-paid return envelope. You may revoke your proxy at any time prior to its exercise by filing with the Secretary of Ryland a notice of revocation or a duly executed proxy bearing a later date. Your proxy may also be revoked by attending the meeting and voting in person.

By Order of the Board of Directors

Timothy J. Geckle

Secretary

March 10, 2014

Table of Contents

Welcome to the 2014 Annual Meeting of Stockholders

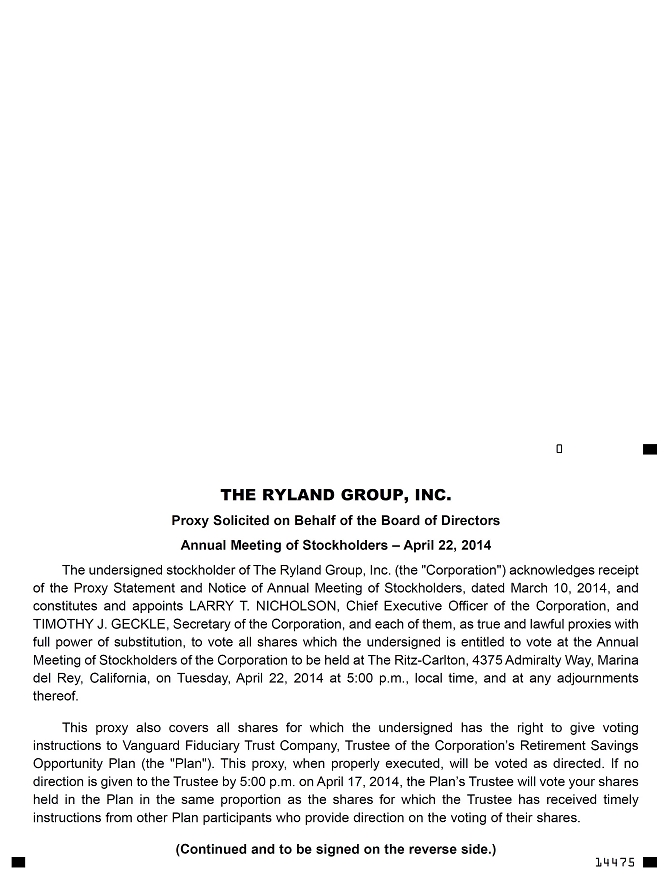

The enclosed proxy is being solicited by The Ryland Group, Inc. (“Ryland”) for use at the Annual Meeting of Stockholders on April 22, 2014. This Proxy Statement and proxy are first being distributed to stockholders on approximately March 10, 2014. Ryland’s Annual Report on Form 10-K for the year ended December 31, 2013 is enclosed with this Proxy Statement. If a proxy is properly executed and received by Ryland prior to voting at the meeting, the shares represented by the proxy will be voted in accordance with the instructions contained on the proxy. In the absence of instructions, the shares will be voted FOR the election of each Director, the approval of the compensation program for Ryland’s Named Executive Officers, and the appointment of Ernst & Young LLP as Ryland’s accounting firm for 2014. A proxy may be revoked by a stockholder at any time prior to its exercise by filing with the Secretary of Ryland a notice of revocation or a duly executed proxy bearing a later date. It may also be revoked by attendance at the meeting and election to vote in person.

The election of each of the Directors requires the affirmative vote of a majority of the votes cast in person or by proxy for the election of each particular Director with a quorum present. As a result, the number of shares voted “for” a Director must exceed the number of shares voted “against” that Director. For the election of Directors, abstentions and broker non-votes are not considered votes cast for the foregoing purpose, and will have no effect on the vote.

The votes that stockholders cast “for” must exceed the votes stockholders cast “against” to approve the compensation program for Ryland’s Named Executive Officers with an advisory vote. Because this vote is advisory, it is not binding on the Board of Directors or Ryland. However, the Board will review the voting results and take them into consideration when making future decisions regarding executive compensation. Abstentions and broker non-votes are not considered votes cast for the foregoing purpose, and will have no effect on the vote.

The ratification of Ernst & Young LLP as Ryland’s independent registered public accounting firm for the fiscal year ending December 31, 2014 requires the affirmative vote of a majority of the votes cast in person or by proxy with a quorum present. Abstentions and broker non-votes are not considered votes cast for the foregoing purpose, and will have no effect on the vote.

Brokers may not vote shares unless they receive voting instructions from stockholders, with the exception of the ratification of Ernst & Young LLP as Ryland’s independent registered public accounting firm for the fiscal year ending December 31, 2014.

Ryland will utilize the services of Alliance Advisors in the solicitation of proxies for this Annual Meeting of Stockholders for a fee of $15,000, plus expenses. Ryland may also solicit proxies by mail, personal interview or telephone by officers and other management employees of Ryland, who will receive no additional compensation for their services. The cost of solicitation of proxies is borne by Ryland. Arrangements will be made by Ryland for the forwarding to beneficial owners, at Ryland’s expense, of soliciting materials by brokerage firms and others.

Only stockholders of record at the close of business on February 11, 2014 are entitled to vote at the meeting or any adjournment thereof. The only outstanding securities of Ryland entitled to vote at the meeting are shares of Common Stock. There were 46,559,600 shares of Common Stock outstanding as of the close of business on February 11, 2014. Ryland’s Common Stock does not have cumulative voting rights. Holders of Common Stock are entitled to one vote per share on all matters. The representation in person or by proxy of at least a majority of the outstanding shares entitled to vote is necessary to provide a quorum at the meeting.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on April 22, 2014:

This Proxy Statement and the Annual Report on Form 10-K for the year ended December 31, 2013, are available athttp://viewproxy.com/ryland/2014/

Stockholders may, upon written request, obtain without charge a copy of the Annual Report on Form 10-K for the year ended December 31, 2013 by contacting the Corporate Secretary, Timothy J. Geckle, at 3011 Townsgate Road, Suite 200, Westlake Village, California 91361.

| RYLAND GROUP -2014 Proxy Statement | 9 |

| PROPOSAL NO. 1 | ELECTION OF DIRECTORS |

The Directors listed below (eight in number) are nominated for election to hold office until the next Annual Meeting of Stockholders or until the election and qualification of their successors. Management has no reason to believe that any nominee is unable or unwilling to serve as a Director; but if that should occur for any reason, the proxy holders reserve the right to vote for another person of their choice. The proxies solicited, unless directed to the contrary, will be voted FOR the eight Directors named below.

The Board of Directors unanimously recommends that the stockholders vote FOR each of the nominees listed below.

Set forth below is information regarding the Directors nominated for election at the Annual Meeting of Stockholders, including background information and information regarding the specific experience, qualifications, attributes and skills that support the conclusion that these nominees should serve as Directors of Ryland.

William L. Jews

Age:62

Year in which First Elected a Director:1995

Committees Served:Chairman of the Board of Directors and a member of the Compensation and Nominating and Governance Committees

Principal Occupation and Other Public Company Directorships for Five Prior Years and Other Information:Chairman of the Board of Directors of Ryland; President and Chief Executive Officer of CareFirst Blue Cross Blue Shield until 2006; and Director of Choice Hotels International, Inc., CACI International Inc., Camden Learning Corporation and KCI Technologies Inc.

Mr. Jews was instrumental in the expansion and growth of CareFirst Blue Cross Blue Shield in the Mid-Atlantic markets that it served which led it to generate over $6 billion in annual revenue. As President and Chief Executive Officer, Mr. Jews led this successful and complex health insurance administrator during a time of numerous business, market and regulatory challenges. He previously served as a Director for a nationally recognized leader in credit related services, MBNA Corporation. He has also served on the Boards of Ecolabs Corp. and Bank of America. His experience on several Boards provides him with a broad range of experience and knowledge which is relevant to his current role as Chairman of Ryland’s Board of Directors.

Ned Mansour

Age:65

Year in which First Elected a Director:2000

Committees Served:Chairman of the Nominating and Governance Committee and a member of the Audit Committee

Principal Occupation and Other Public Company Directorships for Five Prior Years and Other Information:President of Mattel, Inc. until 2000

Mr. Mansour served as President of Mattel, Inc., a worldwide leader in the design, manufacture and marketing of family products, until his retirement in March 2000. He joined Mattel in 1978 as an attorney and held numerous positions before becoming President, including President of Corporate Operations, President of Mattel USA, Chief Administrative Officer, and Executive Vice President and General Counsel. Mr. Mansour previously served as a member of the Board of Directors of Mattel, Inc., Big Lots, Inc., a national retailer, and Blue Nile, Inc., a leading online retailer of diamonds and fine jewelry. With his legal, operational and managerial experience, Mr. Mansour brings an informed insight and understanding to Ryland’s Board and the work of its various committees.

| RYLAND GROUP -2014 Proxy Statement | 10 |

Robert E. Mellor

Age:70

Year in which First Elected a Director:1999

Committees Served:Chairman of the Compensation Committee and a member of the Audit Committee

Principal Occupation and Other Public Company Directorships for Five Prior Years and Other Information:Chairman of the Board of Directors and Chief Executive Officer of Building Materials Holding Corporation until 2010; Chairman of the Board of Directors of Coeur Mining, Inc., Director of Stock Building Supply, Inc. and Lead Director of Monro Muffler Brake, Inc.

As Chairman and CEO of Building Materials Holding Corporation, Mr. Mellor headed a corporation that was a key supplier of labor and materials to the homebuilding industry. As a result, Mr. Mellor has a significant knowledge of Ryland’s core homebuilding business and the challenges we face in the markets that drive our business results. As a result of the downturn in the building materials industry, Building Materials Holding Corporation went through a Chapter 11 restructuring in 2009 and emerged from the restructuring in January 2010. Mr. Mellor is no longer an officer or director of Building Materials Holding Corporation. Mr. Mellor previously was of counsel with the leading national law firm of Gibson, Dunn & Crutcher, LLP and, therefore, has a valuable knowledge and understanding of the legal issues and regulatory complexities that Ryland must address as a publicly traded homebuilder. As the Chairman of the Board and Lead Director of two well recognized companies, he provides expertise to our Board in the ever-changing landscape of corporate governance and strategic planning.

Norman J. Metcalfe

Age:71

Year in which First Elected a Director:2000

Committees Served:Chairman of the Audit Committee and a member of the Compensation Committee

Principal Occupation and Other Public Company Directorships for Five Prior Years and Other Information:Director of The Tejon Ranch Company (real estate development).

Mr. Metcalfe has an extensive history and background in real estate development and homebuilding. He is a Director of The Tejon Ranch Company, a diversified real estate development and agribusiness company located in Southern California. He previously was Vice Chairman and Chief Financial Officer of The Irvine Company, one of the nation’s largest real estate and community development companies. Prior to The Irvine Company, Mr. Metcalfe spent over 20 years in various real estate, corporate finance and investment positions with the Kaufman and Broad/ SunAmerica family of companies. These positions included President and Chief Investment Officer of SunAmerica Investments and member of the Board of Directors and Chief Financial Officer of Kaufman and Broad Home Corporation (currently known as KB Home). Given his experience in finance and real estate, Mr. Metcalfe brings a wealth of knowledge and expertise to Ryland’s core business of homebuilding and the financial challenges we face in maintaining a strong balance sheet.

Larry T. Nicholson

Age:56

Year in which First Elected a Director:2009

Principal Occupation and Other Public Company Directorships for Five Prior Years and Other Information:President and Chief Executive Officer of Ryland; Executive Vice President and Chief Operating Officer until 2008; President of the Southeast Region of Ryland Homes until 2007; President of the Orlando Division of Ryland Homes until 2005.

Mr. Nicholson was promoted in June 2009 to the position of Chief Executive Officer of Ryland. Mr. Nicholson has been with Ryland since 1996 when he joined as a Division President in the South Region. Throughout his working career, Mr. Nicholson has held a wide variety of positions within the homebuilding industry. Given his expertise as a senior manager at all key levels within our organization and his extensive knowledge about the homebuilding business, Mr. Nicholson now leads our organization with all the critical skills necessary to continue Ryland’s role as a leading public homebuilder. His role on the Board is essential to linking the operational and strategic decisions necessary to continue Ryland’s success.

| RYLAND GROUP -2014 Proxy Statement | 11 |

Charlotte St. Martin

Age:68

Year in which First Elected a Director:1996

Committees Served:Compensation and Nominating and Governance Committees

Principal Occupation for Five Prior Years and Other Information:Executive Director of the Broadway League (a national association for the Broadway Theatre Industry) since 2006; and Executive Vice President of Loews Hotels until 2005.

Ms. St. Martin brings valuable insight and knowledge from her prior experience managing the operations of Loews Hotels, a national hotel brand that operates in similar markets to Ryland. As an executive with Loews Hotels, she was involved with the critical elements necessary for the operational success of Loews’ principal resort properties and hotels. Prior to her position as a senior executive, Ms. St. Martin directed a major business operation as the President and Chief Executive Officer of a 1,600 room Loews Hotel which employed 2,000 people. Ms. St. Martin has served on the Boards of Gibson Greetings, Inc. and Metropolitan Bank. Given her executive managerial experience and knowledge of the markets in which we operate, Ms. St. Martin provides valuable input into the deliberations and decisions of Ryland’s Board of Directors.

Thomas W. Toomey

Age:53

Year in which First Elected a Director:2013

Committees Served:Audit Committee

Principal Occupation for Five Prior Years and Other Information:Chief Executive Officer, President and Director of UDR, Inc., a leading multifamily real estate investment trust and an S&P 400 company. Mr. Toomey joined UDR, Inc. in 2001.

As Chief Executive Officer, President and Director of UDR, Inc., Mr. Toomey manages a national multifamily real estate investment trust that owns or has an ownership interest in over 54,739 apartment homes that are spread across the U.S. Prior to joining UDR, Inc., Mr. Toomey held various senior executive positions, including Chief Operating Officer and Chief Financial Officer of Apartment Investment and Management Company (AIMCO). During his tenure at AIMCO, Mr. Toomey was instrumental in the growth of AIMCO’s portfolio ten-fold from 34,000 apartment homes to 360,000 apartment homes. As a leader in the real estate industry, Mr. Toomey currently serves on the Board of the National Association of Real Estate Investment Trusts as well as the National Multi Housing Council. As an executive with over 20 years of experience in the real estate industry, Mr. Toomey brings a wealth of real estate related expertise and knowledge of the financial and operational challenges of operating a real estate focused business.

Robert G. van Schoonenberg

Age:67

Year in which First Elected a Director:2009

Committees Served:Nominating and Governance and Audit Committees

Principal Occupation for Five Prior Years and Other Information:Chairman and Chief Executive Officer of BayPoint Capital Partners, LLC; Co-Managing Partner of AmeriCap Partners, LLC; Executive Vice President and General Counsel of Avery Dennison Corporation until 2009; and Director of Guidance Software, Inc.

Mr. van Schoonenberg leads BayPoint Capital Partners, a private equity/ advisory firm, and is Co-Managing Partner at AmeriCap Partners, a growth capital investment firm. He previously was an executive with Avery Dennison Corporation, a highly diversified international corporation. Avery Dennison operates in the core businesses of pressure-sensitive labeling and materials, retail information services and office and consumer products. As an Executive Officer of Avery Dennison, Mr. van Schoonenberg was involved in the key decisions related to its businesses as well as the challenges of operating a highly diversified organization facing a wide range of complex legal and regulatory issues. In his current roles with two investment firms, Mr. van Schoonenberg is critically involved in the development and growth of various emerging businesses. With his background and experience, Mr. van Schoonenberg brings a broad range of talents, knowledge and expertise to Ryland’s Board.

COMMITTEE MEMBERSHIPS

| Name | | Audit | | Compensation | | Nominating

&Governance | |

| William L. Jews | | | |  | |  | |

| Ned Mansour | |  | | | |  | |

| Robert E. Mellor | |  | |  | | | |

| Norman J. Metcalfe | |  | |  | | | |

| Charlotte St. Martin | | | |  | |  | |

| Thomas W. Toomey | |  | | | | | |

| Robert G. van Schoonenberg | |  | | | |  | |

| Member of Committee |

| | |

| Chairperson of Committee |

| RYLAND GROUP -2014 Proxy Statement | 12 |

INFORMATION CONCERNING THE BOARD OF DIRECTORS

During 2013, the Board of Directors held four meetings. All incumbent Directors attended at least 75% of the meetings of the Board of Directors and of the Committees of the Board of Directors on which they served during 2013. Directors are expected to attend the 2014 Annual Meeting of Stockholders and all Directors were present at last year’s meeting. The Board of Directors of Ryland has Audit, Compensation and Nominating and Governance Committees. Each of the Committees has adopted a Charter, all of which are available for viewing on Ryland’s Web Site atwww.ryland.com/home/investors.htmlunder the Corporate Governance heading.

Board Committees

The Audit Committee of the Board of Directors for 2013 was composed of Directors Mansour, Mellor, Metcalfe, Toomey and van Schoonenberg. The Audit Committee oversees the integrity of our financial statements, the audit services provided by our independent auditors, the performance of our internal audit function and our risk assessment and risk management processes. Additionally, the Audit Committee reviews and monitors the financial plans and capital structure of Ryland. The Audit Committee prepares the Audit Committee Report that is required by SEC rules and included on page 51 of this Proxy Statement. The Audit Committee is composed entirely of Directors who satisfy the NYSE director independence standards. The Board has determined that each Audit Committee member is an “audit committee financial expert” as defined by SEC rules. The Audit Committee maintains a subcommittee that is focused on mortgage underwriting quality assurance. This subcommittee is composed of the same members as the Audit Committee and meets in conjunction with each Audit Committee meeting. During 2013, four meetings of the Audit Committee were held.

The Compensation Committee of the Board of Directors determines and approves Ryland’s compensation plans and the amount and form of compensation awarded and paid to Executive Officers of Ryland, including awards and distributions under Ryland’s compensation plans. Directors Jews, Mellor, Metcalfe and St. Martin served as Compensation Committee members during 2013, all of whom are considered “independent directors” under the New York Stock Exchange corporate governance standards and “outside directors” under Section 162(m) of the Internal Revenue Code (“Code”). The Compensation Committee members do not have interlocking relationships with compensation committees of other companies. During 2013, the Compensation Committee held three meetings.

The Nominating and Governance Committee recommends to the Board of Directors candidates to fill vacancies on the Board, makes recommendations about the composition of the Board’s Committees, monitors the role and effectiveness of the Board and oversees the corporate governance process. Directors Jews, Mansour, St. Martin and van Schoonenberg were the members of the Nominating and Governance Committee, which held two meetings during 2013. The Nominating and Governance Committee will consider nominees proposed by stockholders for election to the Board of Directors. Recommendations by stockholders should be forwarded to the Secretary of Ryland, and should identify the nominee by name and provide information about the nominee’s background and experience.

The Nominating and Governance Committee evaluates potential nominees for election to the Board of Directors based on a wide variety of factors. These factors include the candidate’s background and qualifications, diversity and business experience, including experience related to Ryland’s homebuilding and mortgage finance businesses, as well as the appropriate fit and interrelationship with the other Board members. Potential Board candidates meet with current Board members as part of the selection process. The Nominating and Governance Committee determines the need to add Board members based on a periodic assessment of the appropriate size of Ryland’s Board and the effectiveness of the Board’s communications and decision-making given the number and composition of the Board. The Nominating and Governance Committee seeks to maintain a diverse membership on Ryland’s Board and does not have a formal policy regarding diversity in identifying nominees for a Directorship but rather considers diversity among the various factors relevant to any particular nominee.

Nomination Process

The nomination process for Directors is supervised by Ryland’s Nominating and Governance Committee. The Committee seeks out appropriate candidates to serve as Directors of Ryland, and the Committee interviews and examines Director candidates and makes recommendations to the Board regarding candidate selection. Once the Committee has selected appropriate candidates for election as a Director, it presents the candidates to the full Board of Directors for election if the selection occurs during the course of the year, or for nomination if the Director is elected by the stockholders.

| RYLAND GROUP -2014 Proxy Statement | 13 |

Ryland’s Bylaws provide the procedure for stockholders to make Director nominations. A nominating stockholder must give appropriate notice to Ryland of the nomination not less than 75 days prior to the date of the Annual Meeting of Stockholders. If less than 100 days’ notice of the date of the Annual Meeting of Stockholders is given by Ryland, then Ryland must receive notice of the nomination not later than the close of business on the 10thday following the date Ryland first mailed the notice or made public disclosure of the meeting. In this regard, notice is given that the 2014 Annual Meeting of Stockholders is expected to be held on the third Wednesday of April 2015, or on or before the 30thday thereafter, as determined by the Board of Directors in accordance with Ryland’s Bylaws. The stockholders’ notice shall set forth, as to

| (a) | each person whom the stockholder proposes to nominate for election as a Director: |

| | |

| | • | name, age, business address and residence address of the person. |

| | | |

| | • | the principal occupation or employment of the person. |

| | | |

| | • | the number of shares of Ryland stock which are beneficially owned, if any, by the person. |

| | | |

| | • | any other information relating to the person which is required to be disclosed in solicitations for proxies for the election of Directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (“Exchange Act”), or any successor act or regulation. |

| | | |

| (b) | the stockholder giving the notice: |

| | |

| • | the name and record address of the stockholder. |

| | | |

| • | the number of shares of Ryland stock which are beneficially owned by the stockholder. |

Ryland may require any proposed nominee to furnish such other information as may be reasonably required by Ryland to determine the qualifications of such proposed nominee to serve as a Director of Ryland.

Majority Voting in Director Elections

Ryland��s Bylaws provide that at all meetings of stockholders for the election of Directors at which a quorum is present, each Director shall be elected by the vote of the majority of the votes cast. Any Director not elected by a majority vote will tender their resignation and the Nominating and Governance Committee will recommend to the Board of Directors whether to accept or reject the resignation offer. If the Board of Directors accepts a Director’s resignation offer, the Nominating and Governance Committee will determine whether to fill this vacancy or reduce the size of the Board.

Leadership Structure

As required by the rules of the New York Stock Exchange, the Board of Directors has held, and will continue to hold, regularly scheduled executive sessions of the nonmanagement Directors including only independent Directors at least once a year. The independent Chairman of the Board is Mr. Jews, who presides at these executive sessions. The Board of Directors does not have a fixed policy as to whether the role of the Chief Executive Officer and the Chairman of the Board of Directors should be separate. When the two positions are combined or there is not an independent Board Chair, the Board of Directors will designate a Lead Director from among its nonmanagement independent Directors. The Lead Director will then have responsibility for various matters including chairing executive sessions of the Board of Directors and acting as a liaison between nonmanagement Directors and the management of the Company.

OUR BOARD LEADERSHIP

| • | William Jews is our Independent Chairman |

| | |

| • | Larry Nicholson is our President and CEO |

| | |

| • | 7 of our 8 Directors are independent |

The Board of Directors has determined that it is appropriate at this time for the positions of Chief Executive Officer and Board Chair to be separated. The Chief Executive Officer is responsible for setting the strategic direction for the Company and the day-to-day leadership and performance of the Company, while the Chairman of the Board of Directors provides guidance to the Chief Executive Officer and sets the agenda for meetings of the Board of Directors and presides over meetings of the Board of Directors and executive sessions of the Board of Directors.

| RYLAND GROUP -2014 Proxy Statement | 14 |

Our Chief Executive Officer serves on our Board of Directors and is a bridge between management and the Board of Directors ensuring that both groups act with a common purpose. The Chief Executive Officer’s membership on the Board of Directors enhances his ability to provide insight and direction on important strategic initiatives to both management and the independent Directors.

Independence of the Board of Directors

Under the Guidelines on Significant Corporate Governance Issues, the Board of Directors is required to be composed predominately of independent Directors. An “independent director” is a person who is not a member of management and is free from any relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment. Additionally, Section 303A of the NYSE Listed Company Manual states that in order for a Director to be “independent,” the Board of Directors must affirmatively determine that a Director does not have a “material relationship” with the Company either directly or through a company in which the Director is a partner, shareholder or officer. In accordance with the Guidelines and the NYSE Corporate Governance Standards, the Board of Directors, at its meeting held on February 26, 2014, determined that all Directors, except Mr. Nicholson, are “independent.”

The NYSE rules require that certain Committees of the Board of Directors be composed of independent Directors. In excess of this requirement, the membership of all of Ryland’s Board Committees is composed entirely of independent Directors.

Risk Oversight

As a general matter, the Board of Directors has oversight responsibility with respect to risk management and is not responsible for the day-to-day management of risk issues, which is the responsibility of senior management. With respect to this oversight responsibility, the Board of Directors has delegated primary responsibility for risk oversight and the monitoring of Ryland’s significant areas of risk to the Audit Committee. Specifically, the Audit Committee has prepared and uses a Risk Control Matrix which identifies in detail the various risk review factors that the Audit Committee reviews, monitors and manages. Additionally, the Audit Committee works with the management of Ryland to identify key areas of risk in Ryland’s business operations and corporate functions for further review and analysis. The Audit Committee focuses on and discusses key areas of risk at its meetings. Areas of risk that are periodically reviewed, in some cases in conjunction with other Committees of the Board, include liability and litigation management, land and inventory valuation, land acquisition review and approval process, mortgage finance markets and indemnities, warranty reserves, public reporting disclosure, legal compliance and regulatory matters.

Guidelines on Significant Corporate Governance Issues

Our Board of Directors operate under the Guidelines on Significant Corporate Governance Issues (the “Guidelines”) which they established and approved. The Guidelines are available for your reference and review on Ryland’s Web Site atwww.ryland.com/home/investors.htmlunder the Corporate Governance heading. The Guidelines provide the Board’s policies and procedures on Board structure and composition, expectations and requirements about Board meetings, assessments of performance, and Committee functions and procedures as well as succession planning and management development matters. The Guidelines are subject to continual review and assessment to assure that they represent current recommended Board governance practices and procedures with the objective of acting in the best interests of Ryland and its stockholders.

Policies of the Board

The Board of Directors has adopted a Code of Ethics which is applicable to the Board of Directors, senior officers (including Ryland’s principal executive, financial and accounting officers) and employees of Ryland. Any waiver of the Code of Ethics for Directors or Executive Officers will be promptly disclosed to stockholders on Ryland’s Web Site. The Board has also adopted a written Policy for the Review of Transactions with Related Persons which governs all transactions with related parties. The Nominating and Governance Committee is responsible for implementing the Policy, and reviews, approves or ratifies all transactions with related persons. The Policy governs any transaction or series of transactions over $120,000 in which Ryland is or would be a participant, and in which any Director, Executive Officer or 5% stockholder of Ryland or members of their immediate families would have a direct or indirect material interest. There were no transactions with related parties involving Ryland or any of its subsidiaries that were covered by this Policy during 2013. The Code of Ethics and Policy for the Review of Transactions with Related Persons are available on Ryland’s Web Site atwww.ryland.com/home/investors.htmlunder the Corporate Governance heading.

| RYLAND GROUP -2014 Proxy Statement | 15 |

Retirement and Tenure Policy

Ryland’s Bylaws provide that no Director shall stand for election upon reaching the age of 72. Additionally, the Guidelines provide that the retirement age for Directors is age 72.

Director Stock Ownership and Retention Requirements

In order to further align the interests of non-management Directors with the long-term interests of our stockholders, the Board believes that Directors should have a significant personal financial stake in our performance. Consequently, in accordance with the “Stock Ownership and Retention Guidelines for Non-Management Directors” in the Guidelines on Significant Corporate Governance Issues, each non-management Director has acquired and holds shares of Ryland’s Common Stock having a value equal to three times the Director’s annual cash retainer. Upon meeting this ownership goal, that number of shares becomes fixed and must be maintained until the end of the Director’s service on the Board. This requirement does not preclude transfers of equity instruments to trusts or similar entities for the benefit of a Director, his or her spouse or family members.

Frequency of the Advisory Vote on Executive Compensation

At the 2011 Annual Meeting of Stockholders, an advisory vote was held on the frequency of the advisory vote on the compensation program for Ryland’s Named Executive Officers. A majority of the votes cast at the Annual Meeting approved holding an advisory vote on the compensation program for Named Executive Officers on an annual basis. In line with this recommendation by our stockholders, the Board of Directors has determined that we will include an advisory stockholder vote regarding Named Executive Officer compensation in our proxy materials annually until the next required advisory vote regarding the frequency of an advisory vote on Named Executive Officer compensation at the Annual Meeting of Stockholders in 2017. As a result, Proposal No. 2 on page 49 of this Proxy Statement presents for consideration by our stockholders an advisory vote to approve the compensation program for Ryland’s Named Executive Officers.

COMMUNICATIONS WITH DIRECTORS

Stockholders and any interested parties may send correspondence, comments, questions and concerns to the Board of Directors or to any individual Director at the following:

| | The Ryland Group, Inc.

c/o Corporate Secretary

3011 Townsgate Road, Suite 200

Westlake Village, California 91361 |

| | | |

| | www.ryland.com/home/investors.html |

If applicable, the communication should indicate that the sender is a stockholder. Based on procedures approved by the Nominating and Governance Committee, the Corporate Secretary will retain and not send to Directors communications that are purely promotional or commercial in nature, or other topics that clearly are unrelated to Director responsibilities. These types of communications will be logged and filed but not circulated to Directors. The Corporate Secretary will review and log all other communications and subsequently deliver them to the specified Directors.

| RYLAND GROUP -2014 Proxy Statement | 16 |

2013 DIRECTOR COMPENSATION

| | | Fees Earned | | | | |

| Name(1) | | or Paid in Cash(4) | | Stock Awards(5) | | Total |

| William L. Jews(2) | | $ | 235,000 | | | $ | 132,270 | | | $ | 367,270 | |

| Ned Mansour | | $ | 125,000 | | | $ | 132,270 | | | $ | 257,270 | |

| Robert E. Mellor | | $ | 125,000 | | | $ | 132,270 | | | $ | 257,270 | |

| Norman J. Metcalfe | | $ | 125,000 | | | $ | 132,270 | | | $ | 257,270 | |

| Charlotte St. Martin | | $ | 120,000 | | | $ | 132,270 | | | $ | 252,270 | |

| Thomas W. Toomey(3) | | $ | 5,992 | | | $ | 44,460 | | | $ | 50,452 | |

| Robert G. van Schoonenberg | | $ | 120,000 | �� | | $ | 132,270 | | | $ | 252,270 | |

| (1) | Mr. Nicholson is a member of the Board of Directors as well as President and Chief Executive Officer of Ryland. His compensation is disclosed in the executive compensation tables. Since he does not receive compensation separately for his duties as a Director, he is not included in the Director Compensation Table. |

| (2) | Mr. Jews serves as Chairman of the Board of Directors. |

| (3) | Mr. Toomey was elected as a Director at the meeting of the Board of Directors held on December 10, 2013. |

| (4) | The annual retainer fee for 2013 was $90,000. Mr. Jews received an additional annual retainer fee of $115,000, which was increased to $125,000 at the December 10, 2013 meeting of the Compensation Committee, to serve as Chairman of the Board of Directors. Half of the annual retainer fee for Directors is paid directly in cash. The other half is used to purchase Ryland’s Common Stock with Ryland instructing a broker to enter an order to purchase shares of Ryland’s Common Stock on the open market so that the purchases occur immediately after the market opens on the date the retainer is paid by Ryland. For 2013, Committee members received an annual fee of $15,000 per committee which was paid in cash. Committee chairpersons received an additional annual fee of $5,000 paid in cash. Directors are able to defer their fees and the stock purchased as part of their annual retainer fee into Ryland’s nonqualified deferred compensation plan, the EDDCP II. Ryland does not match Director contributions into the EDDCP II. |

| (5) | On April 27, 2011, Ryland’s stockholders approved the 2011 Non-Employee Director Stock Plan pursuant to which each non-employee Director receives an automatic grant of 3,000 shares of Common Stock each May 1. On May 1, 2013, six non-employee Directors received 3,000 shares. Pursuant to FASB ASC Topic 718, the aggregate grant date fair value of these stock awards was computed using the closing market price of Ryland’s Common Stock on May 1, 2013 which was $44.09. Upon his election to the Board of Directors, in accordance with the 2011 Non-Employee Director Stock Plan, Mr. Toomey received 1,170 shares of Common Stock on December 11, 2013. Pursuant to FASB ASC Topic 718, the aggregate grant date fair value of this stock award was computed using the closing market price of Ryland’s Common Stock on December 11, 2013 which was $38.00. The Common Stock awards received pursuant to Ryland’s 2011 Non-Employee Director Stock Plan are fully vested and distributed on the date of grant. |

| | Previously, the Directors were granted awards of stock options pursuant to a prior Non-Employee Director Stock Plan. As a result, the Directors have the following aggregate number of stock option awards outstanding as of December 31, 2013: Mr. Jews, 40,000 shares; Mr. Mansour, 40,000 shares; Mr. Mellor, 40,000 shares; Mr. Metcalfe, 40,000 shares; and Ms. St. Martin, 40,000 shares. |

| RYLAND GROUP -2014 Proxy Statement | 17 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

To the knowledge of Ryland, the only beneficial owners of more than 5% of the outstanding shares of Common Stock, as of February 14, 2014, are:

| Name and Address | | Amount and Nature

of Beneficial Ownership | | Percent of Class |

BlackRock, Inc.

40 East 52ndStreet, New York, NY 10022 | | | 5,552,563 | (1) | | | 11.9 | % |

Odey Asset Management Group LTD

Odey Asset Management LLP

Odey Holdings AG

Crispin Odey

12 Upper Grosvenor Street, London, United Kingdom W1K 2ND | | | 4,430,234 | (2) | | | 9.5 | % |

Marketfield Asset Management LLC

292 Madison Avenue, 14thFloor

New York, NY 10017 | | | 3,490,387 | (3) | | | 7.5 | % |

The Vanguard Group

100 Vanguard Boulevard, Malvern, PA 19355 | | | 2,968,730 | (4) | | | 6.4 | % |

Fisher Investments

5525 NW Fisher Creek Drive, Camas, WA 98607 | | | 2,606,642 | (5) | | | 5.6 | % |

State Street Corporation

One Lincoln Street, Boston, MA 02111 | | | 2,419,988 | (6) | | | 5.2 | % |

| (1) | Based on the information contained in Schedule 13G/A filed with the Securities and Exchange Commission on January 10, 2014, 5,405,409 of these shares are owned with sole voting power and all of these shares are owned with sole dispositive power. |

| (2) | Based on the information contained in Schedule 13G filed with the Securities and Exchange Commission on January 22, 2014, all of these shares are owned with shared voting and shared dispositive power. |

| (3) | Based on the information contained in Schedule 13G filed with the Securities and Exchange Commission on February 14, 2014, 135,423 of these shares are owned with sole voting power and sole dispositive power and 3,354,964 of these shares are owned with shared voting power and shared dispositive power. Marketfield Asset Management LLC does not directly own shares of Ryland’s Common Stock. By virtue of being an investment advisor to The Marketfield Fund Dublin, Marketfield Asset Management LLC may be deemed to indirectly beneficially own 135,423 shares of Common Stock that are beneficially owned by The Marketfield Fund Dublin. By virtue of being a sub-investment advisor to MainStay Marketfield Fund, Marketfield Asset Management LLC may be deemed to indirectly beneficially own 3,298,025 shares of Common Stock that are beneficially owned by MainStay Marketfield Fund. By virtue of being a sub-investment advisor to MainStay VP Marketfield Portfolio which is a part of the MainStay VP Funds Trust, Marketfield Asset Management LLC may be deemed to indirectly beneficially own 56,939 shares of Common Stock that are beneficially owned by the MainStay VP Marketfield Portfolio. |

| (4) | Based on the information contained in Schedule 13G filed with the Securities and Exchange Commission on February 12, 2014, 64,499 of these shares are owned with sole voting power, 61,399 of these shares are owned with shared dispositive power and 2,907,331 of these shares are owned with sole dispositive power. |

| (5) | Based on the information contained in Schedule 13G filed with the Securities and Exchange Commission on January 16, 2014, 1,214,157 of these shares are owned with sole voting power and all of these shares are owned with sole dispositive power. |

| (6) | Based on the information contained in Schedule 13G filed with the Securities and Exchange Commission on February 4, 2014, all of these shares are owned with shared voting and shared dispositive power. |

| RYLAND GROUP -2014 Proxy Statement | 18 |

The following table sets forth, as of February 11, 2014, the number of shares of Ryland’s Common Stock beneficially owned by Ryland’s Directors, each of the Executive Officers named in the Summary Compensation Table, and by the Directors and Executive Officers as a group:

| Name of Beneficial Owner | | Number of Shares Beneficially Owned(1) |

| William L. Jews | | | 77,761 | |

| Ned Mansour | | | 81,250 | |

| Robert E. Mellor | | | 100,982 | (2) |

| Norman J. Metcalfe | | | 105,250 | |

| Charlotte St. Martin | | | 68,706 | |

| Thomas W. Toomey | | | 1,488 | |

| Robert G. van Schoonenberg | | | 23,218 | |

| Larry T. Nicholson | | | 1,038,391 | |

| Gordon A. Milne | | | 333,206 | |

| Peter G. Skelly | | | 179,692 | |

| David L. Fristoe | | | 103,497 | |

| Timothy J. Geckle | | | 187,441 | |

| Directors and Executive Officers as a group (13 persons) | | | 2,446,523 | |

| (1) | The Directors, nominees or Executive Officers do not individually own more than 1% of Ryland’s outstanding Common Stock with the exception of Mr. Nicholson who beneficially owns 2.2% of Ryland’s outstanding Common Stock. Directors, nominees and Executive Officers as a group beneficially own 5.3% of Ryland’s outstanding Common Stock. All of the shares in the table are owned individually with sole voting and dispositive power. |

| | Includes shares subject to stock options which may be exercised within 60 days of February 11, 2014, as follows: Mr. Jews, 40,000 shares; Mr. Mansour, 40,000 shares; Mr. Mellor, 40,000 shares; Mr. Metcalfe, 40,000 shares; Ms. St. Martin, 40,000 shares; Mr. Nicholson, 572,667 shares; Mr. Milne, 133,333 shares; Mr. Skelly, 33,666 shares; Mr. Fristoe, 26,667 shares; Mr. Geckle, 26,667 shares; and Directors and Executive Officers as a group, 1,019,667 shares. |

| | Includes shares represented by unvested restricted stock units as follows: Mr. Nicholson, 167,670 shares; Mr. Milne, 87,899 shares; Mr. Skelly, 73,342 shares; Mr. Fristoe, 44,621 shares; Mr. Geckle, 44,621 shares; and Directors and Executive Officers as a group, 455,224 shares. |

| | Includes shares of Common Stock which have been allocated to participants’ accounts under Ryland’s Retirement Savings Opportunity Plan as follows: Mr. Nicholson, 575 shares; Mr. Fristoe, 1,951 shares; Mr. Geckle, 4,495 shares; and Directors and Executive Officers as a group, 12,770 shares. |

| | Includes shares of Common Stock that have been allocated to the Directors’ deferred compensation plan accounts as follows: Mr. Mansour, 33,786 shares; Mr. Metcalfe, 33,786 shares; Ms. St. Martin, 18,237 shares; and Mr. Toomey, 252 shares. |

| (2) | Does not include 2,000 shares of Common Stock owned by Mr. Mellor’s wife as to which he disclaims beneficial ownership. |

| RYLAND GROUP -2014 Proxy Statement | 19 |

2014 COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

Focus on Pay-for-Performance

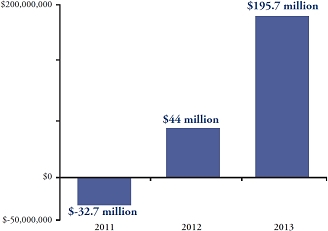

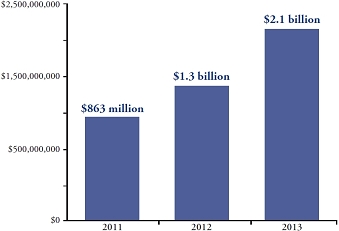

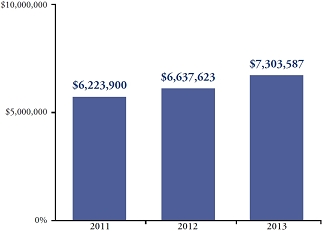

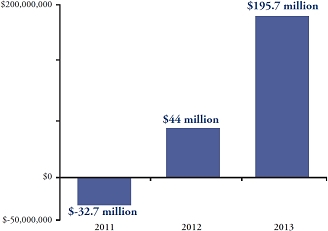

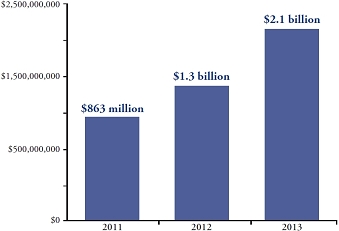

Our executive compensation is designed and driven by a focus on pay-for-performance utilizing performance metrics that are tied to Ryland’s business objectives and strategies. For 2013, short-term incentive annual bonus payments were determined based on Ryland’s profitability. Our 2013 Executive Officer Long-Term Incentive Plan utilizes both our total shareholder return (TSR) together with our revenue growth over a three-year period to determine the payment of awards. These performance metrics align with our strategic objective to maintain profitability, maximize growth and increase the value of our Common Stock to benefit our stockholders. The following graphs illustrate our improvement in performance over the prior three years based on the key metrics of pretax income, new orders / home sales, homebuilding revenues and housing gross profit margins, which we believe drive long-term shareholder value:

PRETAX INCOME FROM

CONTINUING OPERATIONS | | ORDERS / HOMES SALES |

| | | |

| |  |

| | | |

| HOME BUILDING REVENUES | | HOUSING GROSS PROFIT MARGINS

(EXCLUDING IMPAIRMENTS) |

| | | |

| |  |

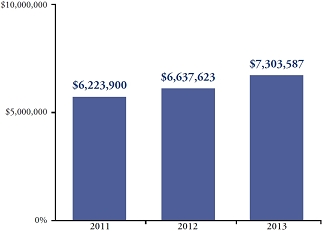

The following graph illustrates the comparative level of total compensation received by Mr. Nicholson, our CEO, over the three-year period of 2011, 2012 and 2013. This graph illustrates that our CEO received total compensation for 2013 that was 10% greater than 2012 and 17% greater than 2011 while Ryland’s financial and operational performance has improved significantly over this three-year period as shown in the graphs above.

CEO TOTAL COMPENSATION

(SUMMARY COMPENSATION TABLE - PAGE 34)

| RYLAND GROUP -2014 Proxy Statement | 20 |

Business Highlights

| • | Ryland achieved pretax income from continuing operations of $195.7 million in 2013 compared to pretax income of $44.0 million in 2012 – an increase of 345% from 2012. |

| • | Homebuilding revenues increased by 64.4% to $2.1 billion for the 12 months of 2013 from $1.3 billion in 2012. |

| • | New home orders rose to 7,262 units for 2013 – an increase of 27.0% from 2012. |

| • | Home closings in 2013 grew to 7,027 units which represents an improvement of 46.1% from 2012. |

| • | Ryland’s housing gross profit margin increased from 20.0% in the fourth quarter of 2012 to 21.9% in the fourth quarter of 2013. |

| • | Selling, general and administrative expense totaled 11.3% of homebuilding revenues for the fourth quarter of 2013, compared to 13.4% for the fourth quarter of 2012. |

Pay for Performance Compensation Mix

The charts below show the 2013 percentage of performance-linked compensation for our CEO and our other Named Executive Officers (NEOs). These charts identify that 85% of our CEO’s and 74% of our NEOs’ compensation is dependent on and determined by the success of Ryland’s financial, operational and/or stock performance. Our Annual Bonus Incentive Award was based on the level of performance of Ryland’s adjusted consolidated pretax earnings for 2013. The Performance Share Award is provided pursuant to Ryland’s 2013 Executive Officer Long-Term Incentive Plan (“LTIP”). Though the actual value of a Performance Share Award pursuant to the LTIP realized upon vesting is not currently determinable, these values are based on the assumptions and calculations explained in Footnote (1) of the Summary Compensation Table. The actual Performance Share Award is based on Ryland’s relative total shareholder return (TSR) and revenue growth over a three-year period that extends from January 1, 2013 to December 31, 2015.

2013 TOTAL COMPENSATION EXCLUDING “CHANGE IN PENSION VALUE”

FROM THE SUMMARY COMPENSATION TABLE - PAGE 34

| RYLAND GROUP -2014 Proxy Statement | 21 |

Relative Alignment of CEO Pay

The table below demonstrates the alignment as of February 11, 2014 of our CEO’s three-year total compensation and our three-year total shareholder return (TSR) relative to the companies included in our Compensation Peer Group as identified in “Compensation Peer Group” on page 24 of this Proxy Statement.

PAY AND PERFORMANCE RELATIVE TO OUR COMPENSATION PEER GROUP

We believe that companies that fall within the shaded area, like Ryland, exhibit a substantial degree of alignment between CEO compensation and total shareholder return. As illustrated above, Ryland’s CEO three-year total compensation was at the 77thpercentile of our peer group while total shareholder return (TSR) ranked at the 100thpercentile. This shows that our CEO pay is aligned with Ryland’s performance relative to our Compensation Peer Group and that our pay-for-performance compensation programs are working as intended. The “3-Year TSR” in this table is as of December 31, 2013, and the “CEO 3-Year Total Compensation” is taken from the Summary Compensation Tables of the most recent Proxy Statements as of February 11, 2014.

Ryland’s Compensation Best Practices

| | | |

| WE DO | | WE DO NOT |

| | A significant portion of the total compensation of our Executive Officers is determined based on performance tied to strategic objectives. | |  | | No tax gross-ups for Executive Officers. |

| | Executive Stock Ownership Guidelines as multiple of annualized base salary. | |  | | No repricing or replacement of stock options and other equity awards. |

| | Change-in-control severance agreements contain “double triggers.” | |  | | No hedging policy that prohibits entering into any contract or instrument designed to hedge or offset any decrease in the market value of Ryland’s stock unless written approval is received from Ryland’s General Counsel. |

| | Cash severance under change-in-control agreements is limited to less than three times annual compensation. | |  | | No pledging policy that prohibits Directors and Executive Officers from pledging Ryland stock as collateral for a loan. |

| | Clawback policy that permits the recoupment of excess compensation from a culpable Executive Officer in the event of a restatement of financial results. | |  | | No employment agreements with Executive Officers which guarantee salaries, bonuses or other compensation or benefits. Mr. Nicholson has a CEO severance agreement in the event of a termination of his employment and all Executive Officers have change-in-control severance agreements. |

| | The Compensation Committee is composed entirely of independent Directors and the Committee has retained Exequity as its independent executive compensation consultant. | |  | | No cash dividend equivalent payments are made until the related restricted stock unit grant vests and is payable. |

| RYLAND GROUP -2014 Proxy Statement | 22 |

Total Shareholder Return

The following chart shows how a $100 investment in Ryland Common Stock on December 31, 2008 would have grown to $252.32 on December 31, 2013, with dividends reinvested quarterly. This compares to a $100 investment in the S&P 500 over the same period that would have increased to $204.63 on December 31, 2013, with dividends reinvested quarterly. A $100 investment in the DJ Home Construction Index over the same five-year period would have increased to $223.53 on December 31, 2013, with dividends reinvested quarterly. As you can see, a $100 investment in Ryland Common Stock has outperformed the S&P 500 and DJ Home Construction Index over this five-year period.

COMPARISON OF FIVE–YEAR CUMULATIVE TOTAL SHAREHOLDER RETURN

The following chart shows the performance of Ryland’s TSR over the most recent three-year period in comparison to our Compensation Peer Group and the S&P 500. This data demonstrates that Ryland’s three-year TSR performance ranks in excess of the 75thpercentile when compared to our Compensation Peer Group and well above the performance of the S&P 500.

| | | TSR Ending 12/31/2013(1) |

| | | 3-Year |

| Compensation Peer Group TSR Performance | | |

| 75th percentile | | 21% |

| 50th percentile | | 17% |

| 25th percentile | | 10% |

| Ryland | | 37% |

| S&P 500 | | 16% |

| | (1) | Data per Standard & Poor’s Research Insight and Yahoo! Finance. |

| RYLAND GROUP -2014 Proxy Statement | 23 |

Compensation Peer Group

The Compensation Committee utilizes a broad compensation peer group of 16 comparably-sized companies in the homebuilding, building products and real estate development industries. Comparable companies were deemed to be 0.33 to 2 times Ryland’s revenues and 0.2 to 3 times Ryland’s market capitalization. Based on this analysis and selection process, the Compensation Committee used the following 16 companies to serve as Ryland’s peer group in benchmarking performance and executive compensation. No changes were made to the peer group in fiscal 2013:

| American Woodmark Corporation | | MDC Holdings, Inc. |

| Armstrong World Industries, Inc. | | M/I Homes, Inc. |

| Beazer Homes USA, Inc. | | Meritage Homes Corporation |

| Forest City Enterprises, Inc. | | NVR, Inc. |

| Gibraltar Industries, Inc. | | Quanex Building Products Corporation |

| Hovnanian Enterprises, Inc. | | Standard Pacific Corp. |

| KB Home | | Toll Brothers, Inc. |

| Louisiana-Pacific Corporation | | USG Corporation |

| | | Peer Company Data as of December 31, 2013 |

| (Dollars in Millions) | | Range | | Median | | Ryland | | Ryland’s Ranking |

| Revenues (trailing four quarters) | | $691-$4,221 | | $ 1,701 | | $ 2,141 | | 74th percentile |

| Market Capitalization | | $571-$6,266 | | $ 1,658 | | $ 2,005 | | 56th percentile |

Upcoming Executive Compensation Program for 2014

For our 2014 Executive Compensation Program, we are using performance metrics consistent with 2013 that are based on annual adjusted consolidated pretax earnings for our short-term incentive bonus program and relative total shareholder return (TSR) and revenue growth over a three-year period for our long-term incentive plan. These performance metrics align with our strategic objectives to maintain profitability, maximize growth and increase the value of our Common Stock to benefit our stockholders. Our 2014 Executive Officer Long-Term Incentive Plan will use a three-year long-term performance period (from January 1, 2014 to December 31, 2016) and measure our relative TSR and growth in revenues to determine the amount of performance shares earned at the end of the performance period. One-half of the target amount of performance shares is earned by an Executive Officer if our TSR is at the 50thpercentile of the performance of our compensation peer group as measured over the long-term performance period. If our relative TSR performance exceeds or falls below this target level, one-half of the target amount of performance shares earned by an Executive Officer is calculated such that it is reduced to zero at or below the 30th percentile level or increased to a maximum level of 200% at or above the 90thpercentile level. The other half of the target amount of performance shares is earned if our revenue growth over the long-term performance period is 30%. If our revenue growth exceeds or falls below this target level, one-half of the target amount of performance shares earned by an Executive Officer is calculated such that it is reduced to zero for revenue growth at or below 20% or increased to a maximum level of 200% for revenue growth at or above 40%. There are incremental adjustments for the calculation of earned performance shares between these minimum and maximum levels of performance.

Consideration of 2013 Say-on-Pay Results

At the 2013 Annual Meeting of Stockholders, stockholders expressed strong support for our executive compensation program, with approximately 98% of the votes cast for approval of the “say-on-pay” advisory vote. The Compensation Committee took into consideration the results of the 2013 advisory “say-on-pay” vote and, in light of the approval of the overwhelming majority of our stockholders of the executive compensation program, the Compensation Committee did not make significant changes to the executive compensation program.

| RYLAND GROUP -2014 Proxy Statement | 24 |

The Compensation Committee’s Independent Compensation Consultant

In accordance with its Charter, the Compensation Committee has the sole authority to retain and terminate independent consultants on matters of executive compensation and benefits, including sole authority to approve the consultant’s fees and other retention terms. The Committee also has the authority to obtain advice and assistance from internal and external legal, accounting or other advisors. The Compensation Committee utilizes Exequity LLP (“Exequity”) as its compensation consultant. Exequity reports directly to the Compensation Committee. Exequity was not engaged to perform any additional services beyond their support of the Compensation Committee.

In reviewing conflicts of interest, our Compensation Committee considered the following six factors with respect to Exequity:

| | (i) | the provision of other services to us by Exequity; |

| | | |

| | (ii) | the amount of fees received from us by Exequity as a percentage of their total revenue; |

| | | |

| | (iii) | the policies and procedures of Exequity that are designed to prevent conflicts of interest; |

| | | |

| | (iv) | any business or personal relationship of Exequity with a member of the Compensation Committee; |

| | | |

| | (v) | any of our stock owned by Exequity; and |

| | | |

| | (vi) | any business or personal relationship of Exequity with any of our Executive Officers. |

Upon consideration of these factors, our Compensation Committee concluded that the engagement of Exequity did not present any conflicts of interest.

In connection with their engagement by the Compensation Committee, Exequity has:

| • | Provided information, insights and advice regarding compensation philosophy, objectives and strategy. |

| | |

| • | Recommended peer group selection criteria and identified and recommended potential peer companies. |

| | |

| • | Provided preliminary analysis of competitive compensation practices for Executive Officers. |

| | |

| • | Consulted with the Compensation Committee on long-term incentive and equity plan design. |

| | |

| • | Reviewed and commented on recommendations regarding CEO and NEO compensation. |

| | |

| • | Advised the Compensation Committee on specific issues as they arose. |

The total amount of fees paid to Exequity for 2013 was $86,632.50. In addition, the Committee reimburses Exequity for any reasonable travel and business expenses.

| RYLAND GROUP -2014 Proxy Statement | 25 |

Components of Executive Compensation

Our Named Executive Officers for 2013 include:

| Named Executive Officers | | Position |

| Larry. T. Nicholson | | President and Chief Executive Officer |

| Gordon A. Milne | | Executive Vice President and Chief Financial Officer |

| Peter G. Skelly | | Executive Vice President and Chief Operating Officer |

| David L. Fristoe | | Senior Vice President and Chief Accounting Officer |

| Timothy J. Geckle | | Senior Vice President and General Counsel |

Base Salary

Base salaries are a necessary part of our compensation program and provide Executive Officers with a fixed portion of pay that is not performance-based. Our goal is to provide competitive base pay levels in comparison with our Compensation Peer Group. Since December 2008, the base salaries of Ryland’s Executive Officers have not increased other than as a result of promotions. Mr. Nicholson received an increase of his annual base salary to $900,000 as a result of his promotion to Chief Executive Officer of Ryland on June 1, 2009. Mr. Skelly received an increase of his annual base salary to $500,000 in early 2011 in connection with his additional responsibilities as President of Ryland’s Homebuilding Operation and an increase to $600,000 in June 2013 in connection with his promotion to the position of Chief Operating Officer.

Annual Bonus Incentives

Annual bonus incentives for Executive Officers and managers are intended to reward participants for Ryland’s annual financial performance. In February 2013, the Compensation Committee approved the 2013 annual bonus incentive program for Executive Officers. The Compensation Committee approved a performance target for Executive Officers based on Ryland’s adjusted consolidated pretax earnings for 2013. The Compensation Committee established the performance metric for the annual bonus incentive program so that if Ryland achieved adjusted consolidated pretax earnings of $100 million for 2013, the Executive Officers had the opportunity to receive their targeted 2013 annual bonus incentive payment opportunity. For each $1 million of adjusted consolidated pretax earnings that is above the target amount of $100 million, there is a 2% increase in the amount of the targeted annual bonus incentive payment opportunity earned by an Executive Officer up to a limit of 200% of the target award which is achieved when Ryland’s adjusted consolidated pretax earnings are at or above $150 million. For each $1 million of adjusted consolidated pretax earnings that is below the target amount of $100 million, there is a 4% decrease in the amount of the targeted annual bonus incentive payment opportunity earned by an Executive Officer until adjusted consolidated pretax earnings reaches $75 million. The threshold amount below which a targeted annual bonus incentive payment opportunity is not earned for 2013 is adjusted consolidated pretax earnings of $75 million or less. The targeted annual bonus incentive payment opportunities for Ryland’s Named Executive Officers were as follows:

| | | 2013 Targeted Annual Bonus |

| Name and Position | | Incentive Payment Opportunity |

| Larry T. Nicholson – President and Chief Executive Officer | | $ 900,000 |

| Gordon A. Milne – Executive Vice President and Chief Financial Officer | | $ 420,000 |

| Peter G. Skelly – Executive Vice President and Chief Operating Officer | | $ 500,000 |

| David L. Fristoe – Senior Vice President and Chief Accounting Officer | | $ 275,000 |

| Timothy J. Geckle – Senior Vice President and General Counsel | | $ 275,000 |

For 2013, Ryland’s adjusted consolidated pretax earnings were a profit of $200.5 million. Accordingly, the Executive Officers earned the maximum amount of 200% of their targeted annual bonus incentive payment opportunity described above.

| RYLAND GROUP -2014 Proxy Statement | 26 |

Long-Term Incentives

In 2013, Ryland used two types of long-term incentive compensation for its executive compensation program. The first type of long-term incentive compensation for Executive Officers is the 2013 Executive Officer Long-Term Incentive Plan (“LTIP”). This performance-based long-term incentive plan measures Ryland’s total shareholder return in comparison to the performance of its compensation peer group over a three-year period to determine one-half of the awards. The performance metric that determines the other half of the awards is Ryland’s growth in revenues over a three-year period. The second type of long-term incentive compensation consisted of equity grants of restricted stock units that vest ratably over a three-year period. Of these two types of long-term incentive compensation, the majority of the awards are performance driven awards pursuant to the LTIP.

2013 Executive Officer Long-Term Incentive Awards

At its February 2013 meeting, the Compensation Committee approved Ryland’s 2013 Executive Officer Long-Term Incentive Plan (“LTIP”). Under the terms of the LTIP, the Committee established target amounts of performance shares for each Executive Officer contingent upon the achievement of long-term performance goals. The amount of each performance share award (“Performance Award”) is determined after a three-year performance period ending on December 31, 2015 (“Long-Term Performance Period”), based on Ryland’s Total Shareholder Return (“TSR”) performance over the Long-Term Performance Period in comparison to the TSR performance of a comparative peer group selected by the Compensation Committee (“Industry Peer Group”) and on Ryland’s Revenue Growth over the Long-Term Performance Period. The amount of the Performance Award is determined by the application of a Relative Performance Multiplier (discussed below) in relation to the Target Performance Shares for each Executive Officer.

Relative TSR Performance Metric

At the end of the Long-Term Performance Period, the Relative Performance Multiplier will be determined for calculating one-half of the Performance Award by comparing Ryland’s TSR to the TSR of the companies in the Industry Peer Group over the Long-Term Performance Period (which is the three-year period from January 1, 2013 to December 31, 2015). For purposes of computing TSR, the beginning stock price is the opening stock price on the first trading day following January 1, 2013 and the ending stock price is the closing stock price on the last trading day prior to December 31, 2015. TSR is calculated by measuring the difference between the beginning stock price and the ending stock price plus any dividends paid by a company over the Long-Term Performance Period and dividing that amount by the beginning stock price.

If Ryland’s TSR over the Long-Term Performance Period is at the 50thpercentile when ranked against the TSR over the Long-Term Performance Period of the companies in the Industry Peer Group, the Relative Performance Multiplier for one-half of the Performance Award is 100%. If Ryland’s TSR over the Long-Term Performance Period is between the 50thand 30thpercentiles when ranked against the TSR over the Long-Term Performance Period of the companies in the Industry Peer Group, the Relative Performance Multiplier is determined using straight line interpolation between zero and 100% based on the actual percentile ranking of Ryland relative to the Industry Peer Group, such that for each percentile of the ranking of Ryland’s TSR performance below the 50thpercentile in comparison to the Industry Peer Group performance, there is a reduction of 5% of the Relative Performance Multiplier of 100%. By way of example, a ranking at the 38thpercentile of relative TSR performance would result in a Relative Performance Multiplier of 40%.

If Ryland’s TSR over the Long-Term Performance Period is between 50thand 90thpercentiles when ranked against the TSR over the Long-Term Performance Period of the companies in the Industry Peer group, the Relative Performance Multiplier is determined using straight line interpolation between 100% and 200% based on the actual percentile ranking of Ryland relative to the Industry Peer Group, such that for each percentile of the ranking of Ryland’s TSR performance over the 50thpercentile in comparison to the Industry Peer Group performance, there is an addition of 2.5% of the Relative Performance Multiplier of 100%. By way of example, a ranking at the 73rdpercentile of relative TSR performance would result in a Relative Performance Multiplier of 157.5%.

The following table illustrates how the Relative Performance Multiplier for computing one-half of the Performance Award is calculated based upon Ryland’s relative TSR performance in comparison to the Industry Peer Group:

| Ryland Relative TSR Percentile Ranking | | |

| compared to Industry Peer Group | | Relative Performance Multiplier |

| 90th Percentile or above | | 200% |

| 70th Percentile | | 150% |

| 50th Percentile | | 100% |

| 40th Percentile | | 50% |

| 30th Percentile or below | | 0 |

The Relative Performance Multiplier cannot exceed 200%.

| RYLAND GROUP -2014 Proxy Statement | 27 |

Revenue Growth Performance Metric

At the end of the Long-Term Performance Period, the Relative Performance Multiplier will be determined for calculating one-half of the Performance Award by calculating Ryland’s Revenue Growth over the Long-Term Performance Period (which is the three-year period from January 1, 2013 to December 31, 2015). For purposes of calculating Ryland’s Revenue Growth over the Long-Term Performance Period, the amount of the difference between $1,308,466,000 (the amount of Ryland’s total revenues for the year ended December 31, 2012) and the amount of Ryland’s total revenues for the fiscal year ending December 31, 2015 is divided by $1,308,466,000. If Ryland’s Revenue Growth over the Long-Term Performance Period is 60%, the Relative Performance Multiplier for one-half of the Performance Award is 100%. If Ryland’s Revenue Growth over the Long-Term Performance Period is between 75% and 45%, the Relative Performance Multiplier is determined using straight line interpolation between zero and 200% based on the amount of Revenue Growth achieved by Ryland over the Long-Term Performance Period between 45%, where the Relative Performance Multiplier is zero, and 75%, where the maximum Relative Performance Multiplier is 200%. As a result, for each 0.15% of Revenue Growth over 45%, there is a 1% increase over zero of the Relative Performance Multiplier such that at 48% of Revenue Growth, the Relative Performance Multiplier is 20% and at 69% of Revenue Growth the Relative Performance Multiplier is 160%.

The following table illustrates how the Relative Performance Multiplier for computing one-half of the Performance Award is calculated based upon Revenue Growth over the Long-Term Performance Period: