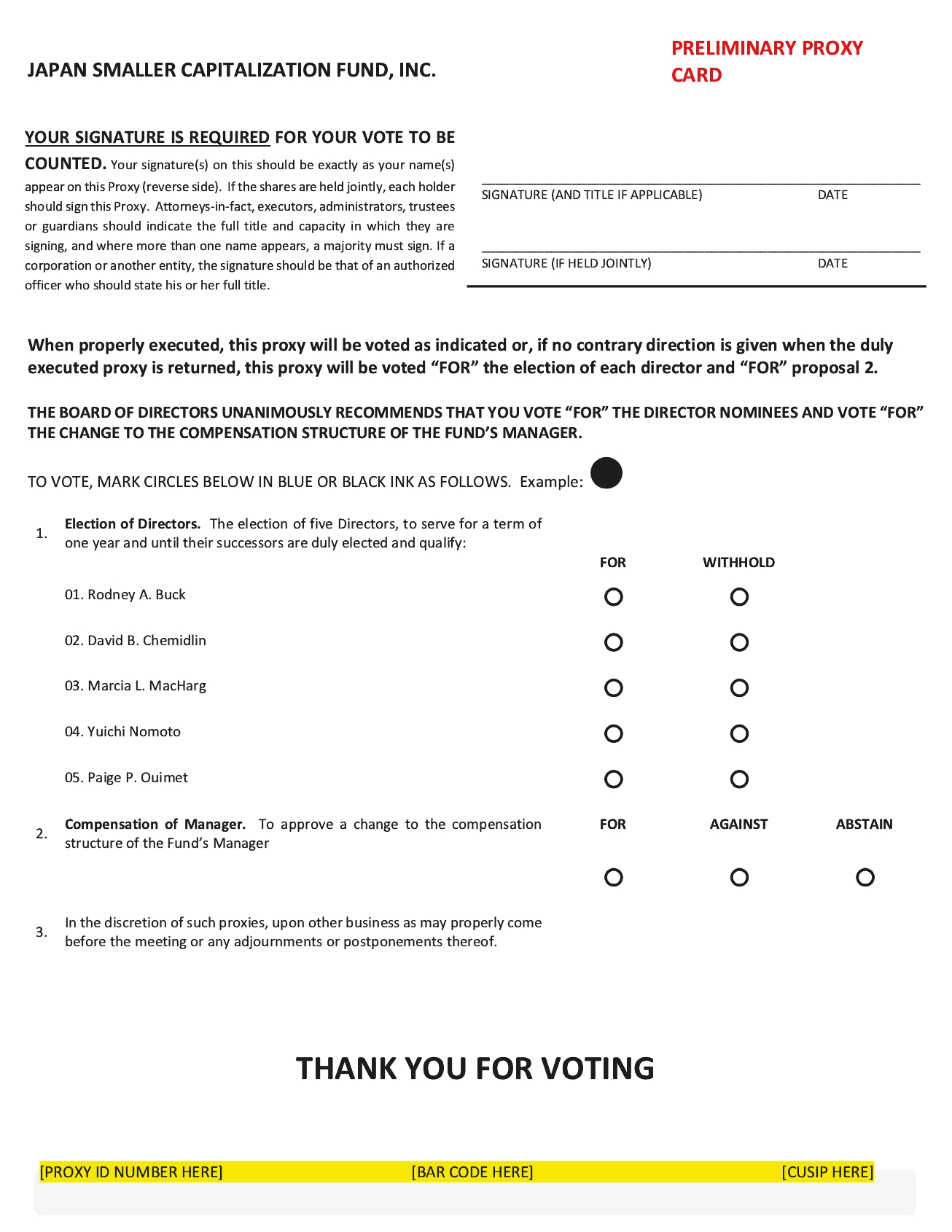

PROPOSAL 2: CHANGE TO THE COMPENSATION STRUCTURE OF THE FUND’S MANAGER

NAM-U.S.A. acts as the manager of the Fund pursuant to a management agreement (the “Management Agreement”). Under the Management Agreement, NAM-U.S.A. provides all office space, facilities and personnel necessary to perform its duties. Pursuant to such Management Agreement, NAM-U.S.A. has retained its parent company, NAM, as investment adviser to the Fund pursuant to an investment advisory agreement (the “Investment Advisory Agreement”). The Management Agreement was approved by the Board of the Fund on November 8, 2006 and became effective in its current form on January 1, 2007.

Over a period of several months, the Independent Directors discussed both among themselves and with representatives of NAM-U.S.A. the desirability and feasibility of a simplified management fee structure for the Management Agreement. At a Board meeting held on May 19, 2022 (the “May Meeting”), NAM-U.S.A. proposed for consideration by the Board a change in the management fee structure. The proposed fee structure would replace the multi-tier structure in the current Management Agreement with a two-tier structure calculated at an annual rate of 0.90% of the Fund’s net assets not in excess of $250 million and 0.80% of the Fund’s average weekly net assets in excess of $250 million (the “New Management Fee”). The New Management Fee, at current net asset levels of the Fund, would result in a lower management fee for the Fund. A comparison of the fees calculated under the current Management Agreement and those fees if calculated under the New Management Fee is described below under the section titled “Management Fees Paid for the Fiscal Year Ended February 28, 2022 and for the Semi-Annual for the Six Months Ended August 31, 2022.”

Board Approval and Recommendation for Shareholder Approval

At the May Meeting, the Board, including the Independent Directors, voted unanimously to approve the New Management Fee and to recommend that the shareholders of the Fund approve the New Management Fee and the amended Management Agreement solely to reflect the New Management Fee, as described in more detail below.

Summary of the Management Agreement and the Amended Management Agreement

Other than the New Management Fee, the terms of the amended Management Agreement will be the same as the terms of the current Management Agreement. The form of the amended Management Agreement is attached as Appendix A, and the description of the New Management Fee and the amended Management Agreement is qualified in its entirety by reference to Appendix A.

Management and Advisory Duties. Under both the current Management Agreement and the amended Management Agreement, NAM-U.S.A. shall perform, or supervise the performance of, the management and administrative services necessary for the operation of the Fund including administering shareholder accounts and handling shareholder relations subject to review by the Board. NAM-U.S.A. shall also, on behalf of the Fund, conduct relations with custodians, depositories, transfer agents, dividend disbursing agents, other shareholder servicing agents, accountants, attorneys, underwriters, brokers and dealers, corporate fiduciaries, insurers, banks and such other persons in any such other capacity deemed to be necessary or desirable. Under both the current Management Agreement and the amended Management Agreement, NAM-U.S.A. shall act as investment adviser to the Fund and shall furnish continuously an investment program for the Fund and shall determine from time to time which securities shall be purchased, sold or exchanged and what portion of the assets of the Fund shall be held in the various securities in which the Fund invests.

Allocation of Charges and Expenses. Under both the current Management Agreement and the amended Management Agreement, NAM-U.S.A. shall pay for maintaining the staff and personnel necessary to perform its obligations thereunder and shall, at its own expense, provide the office space, equipment and facilities which it is obligated to provide pursuant thereto, and shall pay all compensation of officers of the Fund and all directors of the Fund who are “affiliated persons” (as defined in the Investment Company Act) of NAM-U.S.A. The Fund assumes and shall pay or cause to be paid all other expenses of the Fund, including, without limitation: organization costs, taxes, expenses for legal and auditing services, costs of printing proxies, stock certificates, shareholder reports, prospectuses, charges of the custodian, any sub-custodian and transfer and dividend disbursing agent, expenses of portfolio transactions, SEC and stock exchange fees, expenses of registering the Fund’s shares under federal, state and foreign laws, expenses of administering any dividend reinvestment plan