Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

Item 8. Financial Statements and Supplementary Data

Table of Contents

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. 1)

| | |

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

ý |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

| Southwest Oil & Gas Income Fund X-B, L.P. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

o |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

Units representing limited partnership interests |

| | | (2) | | Aggregate number of securities to which transaction applies:

10,004.67 Units representing limited partnership interests |

|

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

The maximum aggregate value of the transaction was calculated by multiplying the 10,004.67 units representing limited partnership interests held by the investors unaffiliated with Southwest Royalties, Inc. by the merger consideration of $252.08 per unit. The filing fee was determined by multiplying 0.0001146 by the maximum aggregate value of the transaction as determined in accordance with the preceding sentence. |

| | | (4) | | Proposed maximum aggregate value of transaction:

$2,521,977 |

| | | (5) | | Total fee paid:

$292 ($290 was paid on September 9, 2011. The balance of $2 is being offset against the excess fee paid in connection with the filing referenced below.) |

ý |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

$303 |

| | | (2) | | Form, Schedule or Registration Statement No.:

Schedule 14A—Preliminary Proxy Statement |

| | | (3) | | Filing Party:

Southwest Royalties Institutional Income Fund VII-B L.P. |

| | | (4) | | Date Filed:

September 9, 2011 |

Table of Contents

SOUTHWEST OIL & GAS INCOME FUND X-B, L.P.

6 DESTA DRIVE, SUITE 6500, MIDLAND, TEXAS 79705

NOTICE OF SPECIAL MEETING OF LIMITED PARTNERS

TO BE HELD ON , 2011

To the Limited Partners of Southwest Oil & Gas Income Fund X-B, L.P.:

This is notice that a special meeting of the limited partners of Southwest Oil & Gas Income Fund X-B, L.P., which we refer to as the partnership, will be held on , 2011, at , at the ClayDesta Conference Center, Six Desta Drive, Suite 6550, Midland, Texas 79705. The purpose of the special meeting is for you to consider and vote on the following matters:

- •

- A proposal to approve an agreement and plan of merger dated as of October 28, 2011, which we refer to as the merger agreement, by and between Southwest Royalties, Inc., a Delaware corporation and the general partner of the partnership, which we refer to as SWR, and the partnership, pursuant to which the partnership will merge into SWR, with SWR being the surviving entity in the merger. SWR is a wholly owned subsidiary of Clayton Williams Energy, Inc., a Delaware corporation, which we refer to as CWEI. Upon consummation of the merger, all of the partnership's outstanding units representing limited partnership interests, which we refer to as the units, other than those held by SWR, will be converted into the right to receive cash in an amount equal to $252.08 per unit, less the amount of per unit cash distributions made after September 30, 2011, if any. SWR will not receive any cash payment for its partnership interests in the partnership. However, as a result of the merger, SWR will acquire 100% of the assets and liabilities of the partnership.

- •

- Any proposal to adjourn or postpone the special meeting to a later date if necessary or appropriate, including an adjournment or postponement to solicit additional proxies if, at the special meeting, the number of units present or represented by proxy and voting in favor of the approval of the merger proposal is insufficient to approve the merger proposal.

- •

- Other business that properly comes before the special meeting or any adjournments or postponements of the special meeting. We are not aware of any other business for the special meeting.

The accompanying proxy statement contains information about the merger and a description of the merger agreement. The proxy statement also contains a copy of the merger agreement. We urge you to read the proxy statement and the documents included with the proxy statement, including the merger agreement, in their entirety.

SWR has set the close of business on , 2011 as the record date for the limited partners who are entitled to notice of, and to vote at, the special meeting or any adjournments or postponements of the special meeting. During the 10 days before the special meeting, you may examine the list of the limited partners of the partnership at its offices during normal business hours for any purpose relevant to the special meeting.

On October 27, 2011, a committee of the board of directors of SWR, which we refer to as the transaction committee and the board of directors, respectively, by a unanimous vote, (1) considering, among other factors, the written opinion of Energy Capital Solutions, LLC described in the accompanying proxy statement, determined that the consideration to be received by the limited partners of the partnership, other than SWR, which we refer to as the unaffiliated investors, in the merger pursuant to the merger agreement is fair to the unaffiliated investors from a financial point of view, (2) determined that the merger agreement and the merger are advisable and in the best interests of the unaffiliated investors and the partnership and (3) recommended that the board of directors (a) approve the merger agreement, the merger and the other transactions contemplated by the merger agreement and (b) recommend that the unaffiliated investors vote to approve the merger agreement.

On October 27, 2011, the board of directors, relying in part on the recommendation of the transaction committee, unanimously determined that the merger is advisable and substantively and

Table of Contents

procedurally fair to the unaffiliated investors and is in their best interests.The board of directors has approved the merger agreement, the merger and the other transactions contemplated by the merger agreement, and recommends that you vote FOR the merger proposal and FOR any proposal to adjourn or postpone the special meeting to a later date if necessary or appropriate, including an adjournment or postponement to solicit additional proxies if, at the special meeting, the number of units present or represented by proxy and voting in favor of the approval of the merger proposal is insufficient to approve the merger proposal. Although the board of directors believes that it has fulfilled its fiduciary duties to you, the members of the board of directors had conflicting interests in evaluating the merger as described in more detail in the accompanying proxy statement.

The merger will be completed only if (1) the limited partners of the partnership who own more than 50 percent of the units owned by all limited partners approve the merger agreement, the merger and the transactions contemplated by the merger agreement and (2) the unaffiliated investors who own more than 50 percent of the units owned by all unaffiliated investors present in person or by proxy at the special meeting vote their units to approve the merger agreement, the merger and the transactions contemplated by the merger agreement.

Your vote is important regardless of the number of units you own. You are requested to sign, vote and date the enclosed proxy card and return it promptly in the enclosed envelope, even if you expect to be present at the special meeting. You may also vote by telephone or over the Internet by following the instructions provided on the proxy card. If you give a proxy, you can revoke it at any time before the special meeting. If you are present at the special meeting, you may withdraw your proxy and vote in person.

If you have any questions concerning the merger or the accompanying proxy statement, would like additional copies or need help voting, please contact SWR at its principal place of business at 6 Desta Drive, Suite 6500, Midland, Texas 79705, attention McRae M. Biggar, or by telephone at (432) 682-6324.

| | |

| Southwest Oil & Gas Income Fund X-B, L.P. | | |

/s/ MICHAEL L. POLLARD

Michael L. Pollard

Senior Vice President

Southwest Royalties, Inc.

General Partner |

|

|

, 2011 |

|

|

Table of Contents

Preliminary Proxy Statement, Subject to Completion

SOUTHWEST OIL & GAS INCOME FUND X-B, L.P.

6 DESTA DRIVE, SUITE 6500, MIDLAND, TEXAS 79705

, 2011

Dear Limited Partners of Southwest Oil & Gas Income Fund X-B, L.P.:

We invite you to attend a special meeting of the limited partners of Southwest Oil & Gas Income Fund X-B, L.P., which we refer to as the partnership. The special meeting will be held on , 2011, at , at the ClayDesta Conference Center, Six Desta Drive, Suite 6550, Midland, Texas 79705. The purpose of the special meeting is for you to vote on the merger of the partnership that, if completed, will result in you receiving cash for your units representing limited partnership interests of the partnership, which we refer to as the units. Clayton Williams Energy, Inc., a Delaware corporation, which we refer to as CWEI, is the sole stockholder of Southwest Royalties, Inc., a Delaware corporation and the general partner of the partnership, which we refer to as SWR, and is the beneficial owner of the general and limited partnership interests in the partnership that are owned by SWR. CWEI desires to acquire all of the units not held by SWR through the merger of the partnership into SWR. The merger will be completed only if (1) the limited partners of the partnership who own more than 50 percent of the units owned by all limited partners approve the merger agreement, the merger and the transactions contemplated by the merger agreement and (2) the limited partners of the partnership, other than SWR, who we refer to as the unaffiliated investors, who own more than 50 percent of the units owned by all unaffiliated investors present in person or by proxy at the special meeting vote their units to approve the merger agreement, the merger and the transactions contemplated by the merger agreement. Upon completion of the merger, all units, other than those held by SWR, will be converted into the right to receive cash in an amount equal to $252.08 per unit, less the amount of per unit cash distributions made after September 30, 2011, if any. SWR will not receive any cash payment for its partnership interests in the partnership. However, as a result of the merger, SWR will acquire 100% of the assets and liabilities of the partnership.

On October 27, 2011, a committee of the board of directors of SWR, which we refer to as the transaction committee and the board of directors, respectively, by a unanimous vote, (1) considering, among other factors, the written opinion of Energy Capital Solutions, LLC, which we refer to as ECS, described in this proxy statement, determined that the consideration to be received by the unaffiliated investors in the merger pursuant to the merger agreement is fair to the unaffiliated investors from a financial point of view, (2) determined that the merger agreement and the merger are advisable and in the best interests of the unaffiliated investors and the partnership and (3) recommended that the board of directors (a) approve the merger agreement, the merger and the other transactions contemplated by the merger agreement and (b) recommend that the unaffiliated investors vote to approve the merger agreement.

On October 27, 2011, the board of directors, relying in part on the recommendation of the transaction committee, unanimously determined that the merger is advisable and substantively and procedurally fair to the unaffiliated investors and is in their best interests.The board of directors has approved the merger agreement, the merger and the other transactions contemplated by the merger agreement, and recommends that you vote FOR the merger proposal and FOR any proposal to adjourn or postpone the special meeting to a later date if necessary or appropriate, including an adjournment or postponement to solicit additional proxies if, at the special meeting, the number of units present or represented by proxy and voting in favor of the approval of the merger proposal is insufficient to approve the merger proposal. Although the board of directors believes that it has fulfilled its fiduciary duties to you, members of the board of directors had conflicting interests in evaluating the merger as described in more detail in this proxy statement.

The transaction committee retained ECS to issue a fairness opinion in connection with the merger. The ECS opinion is dated as of October 27, 2011 and, subject to the qualifications expressed in such opinion, states that the merger consideration to be paid with respect to the units is fair to the

Table of Contents

unaffiliated investors from a financial point of view. The form of the written opinion of ECS is included with this proxy statement. We urge you to read the opinion of ECS in its entirety.

Your vote is important. Whether or not you plan to attend the special meeting, please take the time to vote by completing and mailing to us the enclosed proxy card. You may also vote by telephone or over the Internet by following the instructions provided on the proxy card. This will not prevent you from revoking your proxy at any time prior to the special meeting or from voting your units in person if you later choose to attend the special meeting.

If the merger is approved, checks will be mailed to the record holders of units, other than SWR, promptly after the effective time of the merger. Checks will be mailed to the same address to which monthly distribution checks are mailed.

| | |

| Sincerely, | | |

/s/ MICHAEL L. POLLARD

Michael L. Pollard

Senior Vice President

Southwest Royalties, Inc.

General Partner |

|

|

YOU SHOULD CAREFULLY CONSIDER THE RISKS RELATING TO THE MERGER DESCRIBED IN "RISK FACTORS" ON PAGE 16. THESE INCLUDE:

- •

- YOU WERE NOT INDEPENDENTLY REPRESENTED IN ESTABLISHING THE TERMS OF THE MERGER.

- •

- THE INTERESTS OF CWEI, SWR AND THEIR OFFICERS AND DIRECTORS MAY DIFFER FROM THE INTERESTS OF THE UNAFFILIATED INVESTORS.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE TRANSACTION, PASSED UPON THE MERITS OR FAIRNESS OF THE TRANSACTION OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This proxy statement is dated , 2011 and is first being mailed to the limited partners on or about , 2011.

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

The partnership files annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission, which we refer to as the SEC, under the Securities Exchange Act of 1934, which we refer to as the Exchange Act. You may read and copy any of this information at the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. The SEC also maintains an Internet website that contains reports, proxy and information statements, and other information regarding issuers, including the partnership, who file electronically with the SEC. The address of that site is www.sec.gov.

The supplement to this proxy statement contains financial and other information for the partnership. The supplement constitutes an integral part of this proxy statement. We urge you to read the supplement in its entirety.

PROXY STATEMENT

TABLE OF CONTENTS

| | | | | |

| | Page | |

|---|

ABOUT THIS PROXY STATEMENT | | | 1 | |

SUMMARY TERM SHEET | | | 2 | |

| | Special Meeting | | | 2 | |

| | Parties to the Merger | | | 2 | |

| | About Clayton Williams Energy, Inc. | | | 3 | |

| | The Merger | | | 3 | |

| | Merger Consideration | | | 3 | |

| | Calculation of Merger Consideration | | | 4 | |

| | Benefits to the Unaffiliated Investors | | | 6 | |

| | Recommendation to Unaffiliated Investors | | | 7 | |

| | Conflicts | | | 8 | |

| | Fairness | | | 9 | |

| | Fairness Opinion of Financial Advisor | | | 9 | |

| | Material U.S. Federal Income Tax Consequences | | | 9 | |

| | Record Date; Voting Power | | | 10 | |

| | Partner Vote Required to Approve the Merger | | | 10 | |

| | Conditions to the Merger | | | 10 | |

| | Termination of the Merger | | | 11 | |

| | Effects of Merger on Limited Partners Who Do Not Vote In Favor of the Merger | | | 11 | |

| | Future of the Partnership If the Merger Is Not Completed | | | 11 | |

| | Expenses and Fees | | | 12 | |

| | Regulatory Requirements | | | 12 | |

| | Similar Transactions | | | 12 | |

| | Third Party Offers | | | 13 | |

QUESTIONS AND ANSWERS ABOUT THE MERGER | | | 14 | |

RISK FACTORS | | | 16 | |

| | The merger consideration involves reserve estimates that may vary materially from the quantities of oil and gas actually recovered, and consequently future net cash flows may be materially different from the estimates used in calculating the merger consideration. | | | 16 | |

| | The merger consideration might not reflect the current market value of the partnership's assets. | | | 17 | |

| | The merger consideration involves estimates that will not be adjusted. | | | 17 | |

| | Unaffiliated investors were not independently represented in establishing the terms of the merger. | | | 17 | |

| | The interests of CWEI, SWR and their officers and directors may differ from the interests of the unaffiliated investors. | | | 18 | |

| | The merger is conditioned on CWEI's acquisition of other limited partnerships. | | | 18 | |

| | The merger consideration may be less than the value potentially attainable in an alternative transaction. | | | 19 | |

| | Third parties may not be willing to make an offer to acquire the partnership if they cannot become operator of the partnership's properties, or a third party may discount its offer to account for the lack of operating control. | | | 19 | |

| | Potential litigation challenging the merger may seek to delay or block the merger. | | | 19 | |

| | Your units could be bound by the merger even if you do not vote in favor of the merger. | | | 19 | |

i

| | | | | |

| | Page | |

|---|

SPECIAL FACTORS | | | 20 | |

| | Background of the Merger | | | 20 | |

| | Reasons for the Merger | | | 29 | |

| | Position of the Partnership Affiliates as to the Fairness of the Merger to the Unaffiliated Investors | | | 31 | |

| | Recommendation of the Board of Directors | | | 35 | |

| | Opinion of the Transaction Committee's Financial Advisor | | | 36 | |

| | Summary Reserve Report | | | 45 | |

| | Alternative Transactions to the Merger | | | 46 | |

| | Third Party Offers | | | 49 | |

| | Effects of the Merger | | | 49 | |

| | Effect on Net Book Value and Net Earnings of CWEI and SWR | | | 49 | |

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING INFORMATION | | | 50 | |

METHOD OF DETERMINING THE MERGER CONSIDERATION AND AMOUNT OF CASH OFFERED | | | 52 | |

| | Calculation of Merger Consideration | | | 52 | |

| | Comparison of Merger Consideration to Historical Cash Distributions | | | 55 | |

| | Allocation of Merger Consideration Among Partners | | | 55 | |

| | Other Methods of Determining Merger Consideration | | | 55 | |

THE MERGER | | | 57 | |

| | General | | | 57 | |

| | Distribution of Cash Payments | | | 57 | |

| | Material U.S. Federal Income Tax Consequences | | | 57 | |

| | Accounting Treatment | | | 58 | |

| | Effect of the Merger on Limited Partners Who Do Not Vote in Favor of the Merger; No Appraisal or Dissenter Rights | | | 58 | |

| | Future of the Partnership if the Merger Is Not Completed | | | 59 | |

| | Termination of Registration and Reporting Requirements | | | 59 | |

| | Source of Funds | | | 59 | |

| | Payment of Expenses and Fees | | | 60 | |

THE MERGER AGREEMENT | | | 61 | |

| | Structure; Effective Time | | | 61 | |

| | Conduct of Business Prior to the Merger | | | 61 | |

| | Other Agreements | | | 61 | |

| | Vote of Units at the Special Meeting | | | 62 | |

| | Representations and Warranties of SWR and the Partnership | | | 62 | |

| | Conditions to the Merger | | | 62 | |

| | Termination of the Merger and the Merger Agreement | | | 63 | |

| | Amendments; Waivers | | | 64 | |

| | Authority of the Transaction Committee | | | 65 | |

| | Withholding | | | 65 | |

THE SPECIAL MEETING | | | 66 | |

| | General Background | | | 66 | |

| | Record Date; Voting Rights and Proxies | | | 66 | |

| | Revocation of Proxies | | | 67 | |

| | Solicitation of Proxies | | | 67 | |

| | Quorum | | | 68 | |

| | Required Vote; Broker Non-Votes | | | 68 | |

| | Participation by Assignees | | | 68 | |

| | Special Requirements for Certain Limited Partners | | | 69 | |

| | Validity of Proxy Cards | | | 69 | |

| | Local Laws | | | 69 | |

ii

| | | | | |

| | Page | |

|---|

INTERESTS OF CWEI, SWR AND THEIR DIRECTORS AND OFFICERS | | | 70 | |

| | Conflicting Duties of SWR, Individually and as General Partner; Financial Interests of Officers and Directors | | | 70 | |

| | Employees of CWEI Provide Services to the Partnership | | | 71 | |

| | Operation of Oil and Gas Properties | | | 71 | |

| | Farm-Out Arrangements with SWR | | | 71 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT OF PARTNERSHIP INTERESTS | | | 72 | |

TRANSACTIONS AMONG THE PARTNERSHIP, CWEI, SWR AND THEIR DIRECTORS AND OFFICERS | | | 73 | |

MANAGEMENT | | | 74 | |

| | Clayton Williams Energy, Inc. | | | 74 | |

| | Southwest Royalties, Inc. | | | 75 | |

INDEPENDENT AUDITORS | | | 77 | |

INDEPENDENT PETROLEUM ENGINEERING CONSULTANTS | | | 77 | |

COMMONLY USED OIL AND GAS TERMS | | | 78 | |

LIST OF APPENDICES

| | | | | | | |

| |

| | Appendix | |

|---|

General Information | | | A-1 | |

| | Table 1 | | Historical Cash Distributions to Limited Partners | | | A-2 | |

| | Table 2 | | Quarterly Repurchase Prices and Aggregate Payments | | | A-3 | |

| | Table 3 | | Production, Average Prices and Production Costs | | | A-4 | |

| | Table 4 | | Proved Reserves Attributable to the General Partner and Limited Partners | | | A-5 | |

| | Table 5 | | Summary Proposals from Prospective Equity Partners | | | A-6 | |

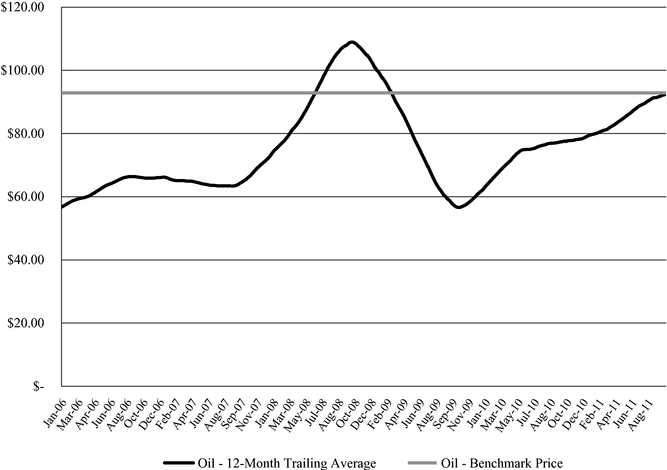

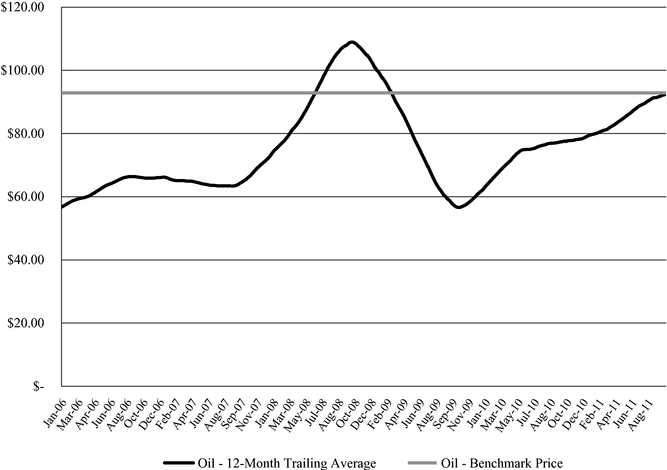

| | Table 6 | | 12-Month Trailing Average of Closing NYMEX Futures Prices for Oil Compared to Benchmark Price of $92.84 per Bbl | | | A-7 | |

Reserve Audit Report of Ryder Scott Company, L.P. for the Partnership as of July 1, 2011 | | | B-1 | |

Summary Reserve Report of Ryder Scott Company, L.P. for the Partnership as of December 31, 2010 | | | C-1 | |

Fairness Opinion of Energy Capital Solutions, LLC | | | D-1 | |

Agreement and Plan of Merger | | | E-1 | |

WE HAVE PREPARED A SUPPLEMENT TO THIS PROXY STATEMENT, WHICH INCLUDES:

- •

- THE PARTNERSHIP'S ANNUAL REPORT ON FORM 10-K, INCLUDING MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS, FOR THE YEAR ENDED DECEMBER 31, 2010.

- •

- THE PARTNERSHIP'S QUARTERLY REPORT ON FORM 10-Q, INCLUDING MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS, FOR THE SIX MONTHS ENDED JUNE 30, 2011.

THE SUPPLEMENT CONSTITUTES AN INTEGRAL PART OF THIS PROXY STATEMENT. WE URGE YOU TO READ THE SUPPLEMENT IN ITS ENTIRETY.

iii

Table of Contents

ABOUT THIS PROXY STATEMENT

The definitions set forth below shall apply to the indicated terms as used in this proxy statement.

"board of directors" means the board of directors of SWR.

"CWEI" means Clayton Williams Energy, Inc., the sole stockholder of SWR.

"ECS" means Energy Capital Solutions, LLC, the independent financial advisory firm engaged by the transaction committee.

"Exchange Act" means the Securities Exchange Act of 1934.

"limited partners" means the limited partners of the partnership.

"merger" means the merger of the partnership into SWR.

"merger agreement" means the merger agreement between SWR and the partnership pursuant to which the merger will occur.

"merger proposal" means the proposal to approve the merger agreement.

"partnership" means Southwest Oil & Gas Income Fund X-B, L.P.

"partnership agreement" means our agreement of limited partnership as amended or modified.

"partnership affiliates" means CWEI and SWR.

"Ryder Scott" means Ryder Scott Company, L.P., independent engineering consulting firm.

"SEC" means the Securities and Exchange Commission.

"stated valuation date" means October 7, 2011, the latest practicable date through which historical oil and gas pricing information was available for calculating the merger consideration.

"SWR," "we," "our" and "us" mean Southwest Royalties, Inc., the general partner of the partnership and a wholly owned subsidiary of CWEI, unless the context otherwise requires.

"SWR partnerships" means the partnership and each of the 23 other oil and gas drilling and income partnerships in which SWR is the general partner.

"transaction committee" means the transaction committee of the board of directors. The members of the transaction committee are Ted Gray, Jr. and Davis L. Ford. Mr. Gray and Dr. Ford are also members of the board of directors of CWEI.

"trading day" means any day on which barrels of oil are traded on the NYMEX.

"unaffiliated investors" means the limited partners of the partnership, other than SWR.

"units" means units representing limited partnership interests in the partnership.

For definitions of oil and gas terms used in this proxy statement, see "Commonly Used Oil and Gas Terms" on page 78.

You should rely only on the information contained in this proxy statement to vote on the merger proposal. We have not authorized anyone to give any information that is different from that contained in this proxy statement. This proxy statement is dated , 2011. You should not assume that the information contained in this proxy statement is accurate as of any date other than that date and the mailing of this proxy statement to you shall not create an implication to the contrary.

1

Table of Contents

SUMMARY TERM SHEET

This summary term sheet highlights selected information from this proxy statement and may not contain all of the information that is important to you. To understand the merger and the merger agreement and to obtain a description of the legal terms and conditions of the merger, you should carefully review this entire proxy statement, including the tables and appendices, which include a copy of the merger agreement and the fairness opinion of the independent financial advisory firm engaged by the transaction committee.

Special Meeting

- •

- The special meeting will be held on , 2011, at , at the ClayDesta Conference Center, Six Desta Drive, Suite 6550, Midland, Texas 79705. The purpose of the special meeting is for you to consider and vote on the following matters:

- •

- A proposal to approve the merger agreement pursuant to which the partnership will merge into SWR, with SWR being the surviving entity in the merger.

- •

- Any proposal to adjourn or postpone the special meeting to a later date if necessary or appropriate, including an adjournment or postponement to solicit additional proxies if, at the special meeting, the number of units present or represented by proxy and voting in favor of the approval of the merger proposal is insufficient to approve the merger proposal.

- •

- Other business that properly comes before the special meeting or any adjournments or postponements of the special meeting. We are not aware of any other business for the special meeting.

- •

- For additional information, see "The Special Meeting" on page 66.

Parties to the Merger

Southwest Royalties, Inc.

- •

- SWR was incorporated under the laws of the state of Delaware in 1983 and is a wholly owned subsidiary of CWEI. SWR is engaged in the exploration for and production of oil and natural gas primarily in Texas and New Mexico. SWR is also the general partner of 24 partnerships, including the partnership, formed to drill, acquire, own and operate oil and natural gas wells. We refer to these 24 partnerships collectively as the SWR partnerships.

- •

- SWR, as the general partner of the partnership, sent you this proxy statement and the enclosed proxy card and is soliciting your proxy pursuant to this proxy statement.

Southwest Oil & Gas Income Fund X-B, L.P.

- •

- The partnership was organized under the laws of the state of Delaware for the purpose of acquiring and owning economic interests in producing oil and gas properties and producing and marketing the associated crude oil and natural gas production from those properties. The partnership's properties consist primarily of working interests in oil and gas properties located in Texas, New Mexico and Arkansas.

- •

- The business objective of the partnership is to optimize the production and related net cash flow from the properties it owns without engaging in the drilling of any development or exploratory wells except through farm-out arrangements. If additional drilling is necessary to fully develop a partnership property, the partnership enters into farm-out agreements with SWR to assign a portion of the partnership's interest in the property to SWR in exchange for retaining an interest in one or more new wells at no cost to the partnership.

2

Table of Contents

- •

- The partnership distributes cash to its limited and general partners from net cash flows generated from its oil and gas operations. These distributions are made quarterly, unless sufficient cash flow is not available.

- •

- The partnership has 10,889 units outstanding. As of the record date, 10,004.67 units (or approximately 91.9%) were owned by 501 unaffiliated investors and 884.33 units (or approximately 8.1%) were owned by SWR. SWR is entitled to vote the units it holds as a limited partner at the special meeting and has agreed in the merger agreement to vote all of its units in favor of the merger proposal.

- •

- As of June 30, 2011, the partnership's book value per unit was $20.61.

The principal place of business for each of the parties to the merger is 6 Desta Drive, Suite 6500, Midland, Texas 79705, and the telephone number is (432) 682-6324. For additional information, see "Interests of CWEI, SWR and Their Directors and Officers" on page 70, "Transactions Among the Partnership, CWEI, SWR, and Their Directors and Officers" on page 73 and "Management" on page 74.

About Clayton Williams Energy, Inc.

- •

- CWEI was incorporated under the laws of the state of Delaware in 1991. CWEI is an independent oil and gas company engaged in the exploration for and production of oil and natural gas primarily in Texas, Louisiana and New Mexico. Its common stock is traded on the Nasdaq National Stock Market, LLC under the symbol "CWEI."

- •

- CWEI files annual, quarterly and special reports, proxy statements and other information with the SEC. Those SEC filings are available to you in the same manner as the partnership's information. For additional information, see "Where You Can Find More Information" on the inside front cover of this proxy statement.

The principal place of business for CWEI is 6 Desta Drive, Suite 6500, Midland, Texas 79705, and the telephone number is (432) 682-6324. For additional information about CWEI, see "Interests of CWEI, SWR and Their Directors and Officers," on page 70, "Transactions Among the Partnership, CWEI, SWR and Their Directors and Officers" on page 73 and "Management" on page 74.

The Merger

- •

- CWEI proposes to acquire all of the units not held by SWR by merging the partnership into SWR. SWR will be the surviving entity in the merger. For additional information, see "The Merger" on page 57.

Merger Consideration

- •

- Upon consummation of the merger, all of the outstanding units, other than those held by SWR, will be converted into the right to receive cash in an amount equal to $252.08 per unit, less the amount of per unit cash distributions made after September 30, 2011, if any. SWR will not receive any cash payment for its partnership interests in the partnership. However, as a result of the merger, SWR will acquire 100% of the assets and liabilities of the partnership. For additional information, see "The Merger" on page 57 and "Method of Determining the Merger Consideration and Amount of Cash Offered" on page 52.

3

Table of Contents

- •

- The table below shows the allocation of merger consideration among the general and limited partnership interests of the partnership, selected data applicable to unaffiliated investors and a summary of cash return per unit based on an initial issue price of $500 per unit.

| | | | | | | | | | |

| | Sharing

Percentage | | Amount | |

|---|

Allocation of Merger Consideration: | | | | | | | |

| | SWR as general partner | | | 10 | % | $ | 304,991 | |

| | All limited partners as a group | | | 90 | % | | 2,744,922 | |

| | | | | | |

| | | Total merger consideration | | | 100 | % | $ | 3,049,913 | |

| | | | | | |

| | Allocation among limited partners: | | | | | | | |

| | | SWR | | | 8.121 | % | $ | 222,924 | |

| | | Unaffiliated investors as a group | | | 91.879 | % | | 2,521,998 | |

| | | | | | |

| | | | Total limited partners as a group | | | 100.000 | % | $ | 2,744,922 | |

| | | | | | |

| | Summary of merger consideration by group: | | | | | | | |

| | | SWR as general and limited partner | | | 17.309 | % | $ | 527,915 | |

| | | Unaffiliated investors as a group | | | 82.691 | % | | 2,521,998 | |

| | | | | | |

| | | | Total merger consideration | | | 100.000 | % | $ | 3,049,913 | |

| | | | | | |

Selected data applicable to unaffiliated investors: | | | | | | | |

| | Total number of limited partnership units | | | | | | 10,889.00 | |

| | Units held by unaffiliated investors as a group | | | | | | 10,004.67 | |

| | Percentage of units held by unaffiliated investors as a group | | | | | | 91.879 | % |

| | Merger consideration allocated to unaffiliated investors as a group | | | | |

$ |

2,521,998 | |

| | Merger consideration per unit | | | | | $ | 252.08 | |

| | Initial investment per unit | | | | | $ | 500.00 | |

Summary of cash return per unit: | | | | | | | |

| | Cumulative cash distributions since inception | | | | | $ | 760.95 | |

| | Merger consideration | | | | | | 252.08 | |

| | | | | | | |

| | | Total cash return, assuming consummation of merger | | | | | $ | 1,013.03 | |

| | | | | | | |

| | | Total cash return as a percentage of initial investment | | | | | | 203 | % |

| | | | | | | |

Calculation of Merger Consideration

- •

- CWEI and SWR established the merger consideration and the transaction committee negotiated the merger agreement and the transactions contemplated by the merger agreement on behalf of the partnership and the unaffiliated investors. The board of directors, relying in part on the recommendation of the transaction committee, unanimously determined that the merger consideration is substantively and procedurally fair to the unaffiliated investors and is in their best interests. Since SWR is a wholly owned subsidiary of, and is controlled by, CWEI, the merger consideration was not determined by arm's-length negotiations. For additional information, see "Risk Factors—Unaffiliated investors were not independently represented in establishing the terms of the merger" on page 17 and "Interests of CWEI, SWR and Their Directors and Officers" on page 70. The calculations made by CWEI and SWR in establishing the merger consideration were based primarily on reserve and production information and other

4

Table of Contents

| | | | | |

Estimated fair value of oil and gas reserves | | $ | 3,127,785 | |

Net working capital | | | 260,567 | |

Net asset retirement obligations | | | (263,439 | ) |

| | | | |

| | Total enterprise value as of June 30, 2011 | | | 3,124,913 | |

Cash distributions after June 30, 2011 | | | (75,000 | ) |

| | | | |

| | Total merger consideration | | $ | 3,049,913 | |

| | | | |

- •

- Estimated Fair Value of Oil and Gas Reserves. SWR estimated the partnership's proved reserves based on production curves used in the December 31, 2010 evaluation made by Ryder Scott Company, L.P., an independent engineering consulting firm, which we refer to as Ryder Scott, with additional adjustments to the production curves made to reflect changes in well performance based on updated production information through March 2011. The recoverable reserves volumes and the related future net cash flows from those reserves were based on benchmark prices of $92.84 per Bbl of oil and NGL and $4.15 per MMBtu of natural gas. These benchmark prices were further adjusted for quality, energy content, transportation fees and other price differentials specific to the partnership's properties, resulting in an average price of $84.88 per Bbl of oil and $5.56 per Mcf of natural gas. Estimated future operating costs were deducted in arriving at the estimated fair value of oil and gas reserves and include direct operating expenses, field overhead costs, and ad valorem taxes. Costs of workovers, well stimulations, and other significant non-recurring maintenance costs are not included in estimated future operating costs. Operating costs were held constant for the life of the properties.

- •

- To determine the estimated fair value of proved oil and gas reserves, CWEI and SWR applied discount rates to the partnership's estimated future net cash flows for each reserve category, as follows:

- •

- 15% to proved developed producing reserves; and

- •

- 40% to proved undeveloped reserves.

- •

- In addition to proved reserves, the partnership had probable reserves included in the December 31, 2010 reserve report prepared by Ryder Scott. These reserves were included in the calculation of the merger consideration based on 50% of the present value of future net cash flows, discounted at 15%, as derived from the Ryder Scott report as of December 31, 2010.

- •

- Net Working Capital Surplus (Deficit). The merger consideration was increased by the amount of the partnership's net working capital surplus or decreased by the amount of the partnership's net working capital deficit. Net working capital was derived from the partnership's unaudited balance sheet at June 30, 2011, a copy of which is included in the partnership's quarterly report on Form 10-Q for the six months ended June 30, 2011.

5

Table of Contents

- •

- Net Asset Retirement Obligations. The partnership is responsible for the cost of plugging and abandoning wells and related production facilities as its wells cease to produce and become inactive. Under generally accepted accounting principles, the partnership is required to recognize a liability on its balance sheet, which we refer to as an asset retirement obligation, for the present value of all legal obligations associated with plugging and abandoning its oil and gas properties. The estimated salvage value of abandoned equipment is expected to be available to partially offset the cost of plugging and abandoning activities, and accordingly has been subtracted from the recorded asset retirement obligation on the partnership's unaudited balance sheet at June 30, 2011, a copy of which is included in the partnership's quarterly report on Form 10-Q for the six months ended June 30, 2011, to determine the net asset retirement obligation component of merger consideration.

- •

- Distributions. The partnership distributes cash to its limited and general partners from net cash flows generated from its oil and gas operations. These distributions are made quarterly, unless sufficient cash flow is not available. The merger consideration was reduced by the aggregate amount of any cash distributions made subsequent to June 30, 2011 and will be further reduced by the sum of per unit cash distributions made after September 30, 2011, if any.

- •

- For additional information, see "Method of Determining the Merger Consideration and Amount of Cash Offered" on page 52.

Benefits to the Unaffiliated Investors

We believe the merger provides the following benefits to the unaffiliated investors:

- •

- Liquidity. None of the units are traded on a national stock exchange or in any active market and it is unlikely that a market will develop. Although units may occasionally be sold in privately negotiated or over-the-counter transactions, we believe the potential buyers in such transactions are few and the prices generally reflect a significant discount for illiquidity. From time to time at the request of an investor, we will agree to repurchase units on terms and conditions established by us in our sole and absolute discretion. Table 2 of Appendix A includes information on the number of units repurchased by us, and the price per unit paid by us, since January 1, 2008. In anticipation of the possibility that CWEI would propose the merger, we determined that it was not practicable to repurchase units in 2011 and therefore notified unaffiliated investors in May 2011 that we had suspended repurchases. If the merger is not completed, we may elect to repurchase units at the request of an investor beginning in 2012. The merger provides liquidity to the unaffiliated investors at a price based on oil and gas reserve values, not on limited market demand for illiquid units. If the merger is approved, unaffiliated investors in the partnership will receive cash for their units promptly after the effective time of the merger.

- •

- Liquidation Value. The merger consideration is based on the estimated fair value of the partnership's underlying oil and gas properties, which we believe is comparable to the value that could be achieved by selling the partnership's properties and liquidating the partnership following the sale. In addition, by approving the merger proposal, unaffiliated investors will avoid bearing an allocable portion of the following costs:

- •

- general and administrative expenses incurred after June 30, 2011 and through the date the merger is completed; and

- •

- asset retirement obligations to the extent that actual costs incurred in the future to plug and abandon inactive wells exceed the present value of such obligations as of June 30, 2011.

- •

- Declining Production and Rising Costs. The partnership was formed in 1990. Many partnership properties are approaching the end of their commercially productive lives, which we refer to as a property's economic limit. As oil and gas properties approach their economic limit, production

6

Table of Contents

levels generally decline and operating costs, particularly repair and maintenance costs, generally increase. To reverse this trend, the partnership would need to acquire additional properties to replace the reserves being produced. However, the partnership is a single purpose entity formed to own and operate certain properties. The partnership agreement does not permit the partnership to borrow money, assess its partners for additional capital contributions or reinvest operating cash flow in new property acquisitions. As a result, the partnership's production is expected to continue to decline. Declining production and increasing costs create adverse pressures on cash flow and make it difficult for the partnership to pay its fixed administrative costs and still be able to accumulate meaningful levels of distributable cash. We believe that unaffiliated investors will benefit by liquidating their holdings in the partnership's assets through the merger.

- •

- Acceleration of Realization of Value. The merger will provide unaffiliated investors with cash earlier than if they remain in the partnership and receive the expected ordinary cash distributions from future oil and gas production over the economic life of the partnership's properties. We believe that the discount rates used in the determination of estimated fair value of oil and gas reserves are fair and provide unaffiliated investors with an opportunity to accelerate the return on their investment in the partnership, while providing us reasonable profit incentive relative to the production, pricing and timing risks associated with the future cash flows from the partnership's assets.

- •

- For additional information, see "Special Factors" on page 20.

Recommendation to Unaffiliated Investors

- •

- Transaction Committee. On October 27, 2011, the transaction committee, by a unanimous vote, (1) considering, among other factors, the written opinion of ECS, determined that the consideration to be received by the unaffiliated investors in the merger pursuant to the merger agreement is fair to the unaffiliated investors from a financial point of view, (2) determined that the merger agreement and the merger are advisable and in the best interests of the unaffiliated investors and the partnership and (3) recommended that the board of directors (a) approve the merger agreement, the merger and the other transactions contemplated by the merger agreement and (b) recommend that the unaffiliated investors vote to approve the merger agreement.

- •

- Board of Directors. On October 27, 2011, the board of directors, relying in part on the recommendation of the transaction committee, unanimously determined that the merger is advisable and substantively and procedurally fair to the unaffiliated investors and is in their best interests.The board of directors approved the merger agreement, the merger and the other transactions contemplated by the merger agreement, and recommends that you vote FOR the merger proposal and FOR any proposal to adjourn or postpone the special meeting to a later date if necessary or appropriate, including an adjournment or postponement to solicit additional proxies if, at the special meeting, the number of units present or represented by proxy and voting in favor of the approval of the merger proposal is insufficient to approve the merger proposal. Although the board of directors believes it has fulfilled its fiduciary duties to you, members of the board of directors had conflicting interest in evaluating the merger.

- •

- For additional information, see "Special Factors—Recommendation of the Board of Directors" on page 35.

7

Table of Contents

Conflicts

- •

- In considering the recommendation of the board of directors, the unaffiliated investors should be aware that we have interests in the merger that are different from, or in addition to, the interests of the unaffiliated investors generally. SWR, as the general partner of the partnership, has a duty to manage the partnership in the best interests of the limited partners. However, SWR also has a duty to operate its business for the benefit of CWEI, its sole stockholder. Consequently, SWR's duties to CWEI may conflict with its duties to the unaffiliated investors.

- •

- Members of the board of directors have a duty to cause SWR to manage the partnership in the best interests of the limited partners. However, members of the board of directors also have a duty to operate SWR's business for the benefit of CWEI, its sole stockholder, and board members who are also officers of SWR have a duty to operate SWR's business in SWR's best interests. Each member of the board of directors is also a member of the board of directors of CWEI. Members of the board of directors of CWEI have a duty to operate CWEI's business for the benefit of its stockholders. Two members of the board of directors are also officers of CWEI, and therefore have a duty to operate CWEI's business in the best interests of CWEI and it stockholders. In addition, one member of the board of directors, Clayton W. Williams, Jr., beneficially owns approximately 26% of the outstanding common stock of CWEI, and a partnership in which his adult children are limited partners owns approximately 25% of the outstanding common stock of CWEI. Members of the board of directors may have an indirect financial interest in the merger, as stockholders of CWEI or as officers of CWEI and SWR, and such interest may conflict with the interests of unaffiliated investors. Consequently, the duties of members of the board of directors to the unaffiliated investors may conflict with the duties of those members to SWR and CWEI. In addition, members of the transaction committee and the board of directors of CWEI are compensated for their services on such committee and board.

- •

- SWR and the board of directors have attempted to formally address the conflicts inherent in the relationships among SWR, CWEI, the partnership and the officers and directors of SWR and CWEI by forming the transaction committee comprising two members of the board of directors who are not officers or employees of SWR or CWEI. The transaction committee was authorized to review, evaluate and negotiate the terms of the merger on behalf of the unaffiliated investors; however, the transaction committee is not authorized to develop, solicit, initiate or pursue any potential alternatives to the merger. Because both members of the transaction committee are also members of the boards of directors of SWR and CWEI, an inherent conflict may continue to exist with respect to each member's duties to the unaffiliated investors in his capacity as a member of the transaction committee, on the one hand, and such member's duties to SWR, CWEI and the stockholders of CWEI in his capacity as a member of the boards of directors of SWR and CWEI, on the other hand. In addition, members of the transaction committee may have an indirect financial interest in the merger, as stockholders of CWEI, and such interest may conflict with the interests of the unaffiliated investors. The board of directors was aware of these interests and considered them in approving the merger proposal. The board of directors believes that any economic benefit that the officers and directors of CWEI and SWR may obtain from the merger will be modest and will not result in a material economic benefit, if any, to such officers and directors individually. The board of directors does not believe that Mr. Williams or any member of his family will obtain any economic benefit from the merger that differs from any economic benefit obtained by the stockholders of CWEI generally.

- •

- For additional information, see "Special Factors" on page 20 and "Interests of CWEI, SWR and their Directors and Officers" on page 70.

8

Table of Contents

Fairness

In deciding to approve the merger, the board of directors determined that the merger is advisable and fair to the unaffiliated investors and is in their best interests based on a variety of factors. These factors include:

- •

- the calculation of the merger consideration is based on the estimated fair value of the partnership's oil and gas reserves using historically favorable benchmark commodity prices of $92.84 per Bbl of oil and $4.15 per MMBtu of natural gas, which were further adjusted for quality, energy content, transportation fees and other price differentials specific to the partnership's properties, resulting in an average price of $84.88 per Bbl of oil and $5.56 per Mcf of natural gas;

- •

- the merger consideration is all cash, which allows the unaffiliated investors to immediately realize monetary value for their units, and equates to 7.8 times the historical per unit cash distributions for the 12-month period ended September 31, 2011;

- •

- the merger consideration has not been reduced for general and administrative expenses of the partnership incurred after June 30, 2011;

- •

- the merger provides liquidity to the unaffiliated investors based on oil and gas reserve data and balance sheet information as of June 30, 2011 and oil and gas pricing information as of the stated valuation date, and not on limited market demand for illiquid units;

- •

- the transaction committee received an opinion from ECS that the merger consideration to be paid with respect to the units is fair to the unaffiliated investors from a financial point of view;

- •

- the elimination after the merger of unaffiliated investors' tax preparation costs relating to partnership tax information; and

- •

- the belief that the merger consideration is a better price than would be obtained if a third party made an offer to acquire the partnership because, since CWEI is not offering to sell or otherwise dispose of its beneficial interests in the partnership or the partnership's properties, a third party may discount any such offer for lack of operational control.

For additional information, see "Special Factors—Position of the Partnership Affiliates as to the Fairness of the Merger to the Unaffiliated Investors" on page 31 and "Special Factors—Recommendation of the Board of Directors" on page 35.

Fairness Opinion of Financial Advisor

- •

- ECS has issued a fairness opinion in connection with the merger. The ECS opinion is dated October 27, 2011 and, subject to the qualifications expressed in the opinion, states that the merger consideration to be paid with respect to the units is fair to the unaffiliated investors from a financial point of view. The full text of the written opinion of ECS is attached to this proxy statement as Appendix D. We urge you to read the fairness opinion in its entirety.The opinion of ECS is directed to the transaction committee. It is not a recommendation to you about how you should vote on matters relating to the merger.

- •

- For additional information, see "Special Factors—Opinion of the Transaction Committee's Financial Advisor" on page 36.

Material U.S. Federal Income Tax Consequences

- •

- You will generally recognize gain or loss equal to the difference between your amount realized in the merger and your adjusted tax basis in your units. Your gain or loss will be capital or

9

Table of Contents

Record Date; Voting Power

- •

- You may vote at the special meeting if you owned units as of the close of business on , 2011, which we refer to as the record date. You may cast one vote for each unit you held of record on the record date.

- •

- Your vote is important. Whether or not you plan to attend the special meeting, please take the time to vote by completing and mailing to us the enclosed proxy card. You may also vote by telephone or over the Internet by following the instructions provided on the proxy card. This will not prevent you from revoking your proxy at any time prior to the special meeting or from voting your units in person if you later choose to attend the special meeting.

- •

- Except as set forth in "Security Ownership of Certain Beneficial Owners and Management of Partnership Interests" on page 72, neither CWEI nor SWR, nor, to our knowledge, any of their directors or executive officers, or any associate or majority owned subsidiary of CWEI, SWR, or any such officer or director beneficially owns any partnership interests in the partnership or has effected any transactions in any partnership interests in the partnership during the past 60 days.

- •

- For additional information, see "The Special Meeting" on page 66.

Partner Vote Required to Approve the Merger

- •

- The merger will be completed only if (1) the limited partners of the partnership who own more than 50 percent of the units owned by all limited partners approve the merger agreement, the merger and the transactions contemplated by the merger agreement and (2) the unaffiliated investors who own more than 50 percent of the units owned by all unaffiliated investors present in person or by proxy at the special meeting vote their units to approve the merger agreement, the merger and the transactions contemplated by the merger agreement. SWR is entitled to vote the units it holds as a limited partner at the special meeting and has agreed in the merger agreement to vote all of its units in favor of the merger proposal.

- •

- For additional information, see "The Merger" on page 57.

Conditions to the Merger

- •

- The merger will be completed only if the conditions of the merger agreement are satisfied or, if permitted, waived. These conditions include:

- •

- the requisite votes of the limited partners and the unaffiliated investors are obtained;

- •

- the written opinion of ECS not having been withdrawn;

- •

- the absence of any law or court order that prohibits the merger;

- •

- the absence of any lawsuit challenging the legality or any aspect of the merger; and

- •

- the fulfillment (or waiver in whole or in part by us in our sole discretion) of each of the conditions to our obligation to effect the mergers of at least a majority of the other SWR

10

Table of Contents

partnerships as described under "—Similar Transactions." If the limited partners of at least a majority of the other SWR partnerships do not approve the merger of their respective partnerships into SWR, or if the mergers of the other SWR partnerships into SWR are not completed for any reason, this condition to the merger will not be satisfied, and SWR may elect to abandon the merger.

- •

- So long as the law allows us to do so, we may choose to complete the merger even though a condition has not been satisfied if the merger proposal has been approved by the limited partners and the unaffiliated investors.

- •

- For more information, see "The Merger Agreement—Conditions to the Merger" on page 62.

Termination of the Merger

- •

- SWR and the partnership may jointly terminate the merger agreement, at any time, even after limited partner approval. Either SWR or the partnership may also terminate the merger agreement under certain additional circumstances, including the following:

- •

- the limited partners or unaffiliated investors fail to approve the merger; or

- •

- if the other party is in material breach of the merger agreement.

- •

- In addition, the partnership may terminate the merger agreement if the partnership determines that termination of the merger agreement is required for the board of directors to comply with its fiduciary duties.

- •

- SWR may terminate the merger agreement in the event there has been a material adverse effect on the partnership's business, operations, properties, condition, results of operations, assets, liabilities or cash flows.

- •

- SWR may also terminate the merger agreement if at any time between the fifth trading day prior to the closing date of the merger and the closing date of the merger the closing NYMEX futures price for oil on any trading day during such period is equal to or less than $79.00 per Bbl.

- •

- For additional information, see "The Merger Agreement—Termination of the Merger and the Merger Agreement" on page 63.

Effects of Merger on Limited Partners Who Do Not Vote In Favor of the Merger

- •

- Your units will be bound by the merger if (1) the limited partners of the partnership who own more than 50 percent of the units owned by all limited partners approve the merger agreement, the merger and the transactions contemplated by the merger agreement and (2) the unaffiliated investors who own more than 50 percent of the units owned by all unaffiliated investors present in person or by proxy at the special meeting vote their units to approve the merger agreement, the merger and the transactions contemplated by the merger agreement, even if you vote against the merger. If the merger is completed, you will be entitled to receive only the per unit cash merger consideration described in this proxy statement. You will not have appraisal, dissenters' or similar rights in connection with the merger, even if you vote against the merger.

- •

- For additional information, see "The Merger" on page 57.

Future of the Partnership If the Merger Is Not Completed

- •

- If the merger is not completed for any reason, the partnership will remain in existence. Some reasons that the merger may not be completed are (1) the requisite votes of the limited partners

11

Table of Contents

Expenses and Fees

- •

- SWR has agreed to pay all expenses and fees incurred in connection with the merger and the mergers of the other SWR partnerships into SWR. These expenses and fees are currently estimated to be approximately $2.4 million in the aggregate. CWEI considered SWR's obligation to pay the total amount of merger expenses and fees regardless of the success of the merger in determining the amount of merger consideration offered. For additional information, see "Method of Determining the Merger Consideration and Amount of Cash Offered" on page 52 and "The Merger—Payment of Expenses and Fees" on page 60.

Regulatory Requirements

- •

- No federal or state regulatory requirements must be satisfied or approvals obtained in connection with the merger, except for the filing of this proxy statement with the SEC and the filing of a certificate of merger with the Secretary of State of the State of Delaware.

Similar Transactions

- •

- CWEI is also proposing to acquire each of the other SWR partnerships. Concurrently with the execution of the merger agreement, SWR and each other SWR partnership entered into a merger agreement pursuant to which such SWR partnership will merge into SWR. The terms and conditions of the other merger agreements are substantially similar to the terms and conditions of the merger agreement (other than financial terms) set forth in this proxy statement for the merger. The merger is conditioned on the fulfillment (or waiver in whole or in part by SWR in its sole discretion) of each of the conditions to SWR's obligation to effect the mergers of at least a majority of the other SWR partnerships.

- •

- For additional information, see "Transactions Among the Partnership, CWEI, SWR and Their Directors and Officers" on page 73.

12

Table of Contents

Third Party Offers

- •

- CWEI is not offering to sell or otherwise dispose of its beneficial interests in the partnership or the partnership's properties.

- •

- As described in more detail under "Special Factors—Background of the Merger," CWEI previously considered the possibility of consolidating the SWR partnerships by merging the SWR partnerships into an acquisition entity to be formed for that purpose. As a result of such merger, the acquisition entity would have acquired for cash all the limited partnership interests of the SWR partnerships, other than those held by SWR. In connection with that possible consolidation transaction, CWEI would contribute SWR's general and limited partnership interests in each of the SWR partnerships to the acquisition entity in exchange for an equity interest in the acquisition entity. CWEI discussed possible equity financing transactions with prospective equity partners pursuant to which an equity partner would contribute cash to the acquisition entity in exchange for the remaining equity interest in the acquisition entity. The proceeds from the equity financing transaction would be utilized by the acquisition entity to fund the consideration payable to the holders of limited partnership interests of the SWR partnerships, other than SWR. CWEI received preliminary, non-binding proposals from prospective equity partners to provide such equity financing. None of these equity financing transactions were consummated, however, and CWEI terminated discussions with each of the prospective equity partners. For more information, see "Special Factors—Background of the Merger" on page 20.

- •

- Although the proposed consolidation transaction described in the preceding paragraph would have resulted in the acquisition by the acquisition entity of all of the units, including those owned by the unaffiliated investors, none of SWR, the board of directors or the transaction committee has received any firm offer from a third party to acquire the partnership or all or substantially all of assets. The transaction committee is authorized to review, evaluate and negotiate the terms of the merger on behalf of the unaffiliated investors; however, the transaction committee is not authorized to develop, solicit, initiate or pursue any potential alternatives to the merger.

- •

- For additional information, see "Special Factors—Third Party Offers" on page 49.

13

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE MERGER

When and where is the special meeting of the limited partners?

The special meeting will be held on , 2011, at , at the ClayDesta Conference Center, Six Desta Drive, Suite 6550, Midland, Texas 79705.

What is the structure of the merger?

CWEI proposes to acquire all of the units not held by SWR by merging the partnership into SWR. SWR will be the surviving entity in the merger.

What will approval of the merger mean for me?

Upon consummation of the merger, all of the outstanding units, other than those held by SWR, will be converted into the right to receive cash in an amount equal to $252.08 per unit, less the sum of per unit cash distributions made after September 30, 2011, if any. SWR will not receive any cash payment for its partnership interests in the partnership. However, as a result of the merger, SWR will acquire 100% of the assets and liabilities of the partnership.

How do I vote my units?

You may grant a proxy by dating, signing and mailing your proxy card or by voting by telephone or over the Internet. You may also attend the special meeting and cast your vote in person at the meeting.

- •

- By Mail. To grant your proxy by mail, please complete your proxy card and sign, date and return it in the enclosed envelope. To be valid, a returned proxy card must be signed and dated.

- •

- By Telephone or Over the Internet. Please follow the instructions provided on the proxy card. If you vote by telephone or over the Internet, you do not need to return your proxy card to SWR.

- •

- In Person. If you attend the special meeting in person, you may vote your units by completing a ballot at the meeting. Attendance at the special meeting will not by itself be sufficient to vote your units; you still must complete and submit a ballot at the special meeting to vote your units.

What happens if I do not return a proxy card?

The merger will be completed only if (1) the limited partners of the partnership who own more than 50 percent of the units owned by all limited partners approve the merger agreement, the merger and the transactions contemplated by the merger agreement and (2) the unaffiliated investors who own more than 50 percent of the units owned by all unaffiliated investors present in person or by proxy at the special meeting vote their units to approve the merger agreement, the merger and the transactions contemplated by the merger agreement. For purposes of the limited partner vote described in clause (1) above, the failure to return your proxy card will have the same effect as voting against the merger. If, however, the limited partner vote is obtained, the failure to return your proxy card will not have any effect on the investor vote described in clause (2) above. Only units owned by unaffiliated investors present in person or by proxy at the special meeting will be considered in determining whether the vote of the unaffiliated investors has been obtained. SWR is entitled to vote the units it holds as a limited partner at the special meeting and has agreed in the merger agreement to vote all of its units in favor of the merger proposal.

What does the general partner recommend that I do?

The board of directors, relying in part on the recommendation of the transaction committee, recommends that you voteFOR the merger proposal andFOR any proposal to adjourn or postpone the special meeting to a later date if necessary or appropriate, including an adjournment or

14

Table of Contents

postponement to solicit additional proxies if, at the special meeting, the number of units present or represented by proxy and voting in favor of the approval of the merger proposal is insufficient to approve the merger proposal.

May I change my vote after I have returned my signed proxy?

Yes. You may change your vote at any time before your proxy is voted at the special meeting by following the instructions on page 67. You then may either change your vote by sending in a new proxy card, changing your vote by telephone or over the Internet or by attending the special meeting.

Am I entitled to appraisal or dissenters' rights?

No. You will not have any appraisal, dissenters' or similar rights in connection with the merger.

What happens to my future cash distributions?

You will continue to receive distributions made by the partnership until the merger is completed. The merger consideration will be reduced by the sum of the per unit cash distributions made subsequent to September 30, 2011, if any. If the merger is completed, your units will be cancelled upon completion of the merger, and you will not receive future distributions on those units.

What are the tax implications of the transaction?

You will generally recognize gain or loss equal to the difference between your amount realized in the merger and your adjusted tax basis in your units. Your gain or loss will be capital or ordinary depending on the nature of the assets held by the partnership and the amount of depletion, depreciation and intangible drilling and development costs that is subject to recapture.

What effect will the merger have on my Schedule K-1 tax report?

In 2012, you will receive your 2011 Schedule K-1 tax report reflecting 2011 taxable income. If the merger is approved and completed in 2011, your 2011 Schedule K-1 tax report will be your final Schedule K-1 tax report. After the merger is completed, you will have no continuing interest in the partnership and you will not receive Schedule K-1 tax reports for the partnership for tax years after the year in which the merger occurs. We believe the merger will simplify your individual tax return preparation and reduce your tax preparation costs.

When is the proposed transaction expected to be completed?

We intend to complete the proposed transaction as soon as practicable following limited partner and unaffiliated investor approval. If the merger is approved, we estimate that the closing of the merger will occur on or before , 2011.

Who can help answer my questions?

If you have any questions concerning the merger or this proxy statement, would like additional copies or need help voting, please contact SWR at its principal place of business at 6 Desta Drive, Suite 6500, Midland, Texas 79705, attention McRae M. Biggar, or by telephone at (432) 682-6324.

15

Table of Contents

RISK FACTORS

You should carefully consider the following risk factors in determining whether to vote to approve the merger proposal.

The merger consideration involves reserve estimates that may vary materially from the quantities of oil and gas actually recovered, and consequently future net cash flows may be materially different from the estimates used in calculating the merger consideration.

The calculations of the partnership's estimated reserves of crude oil, natural gas liquids and natural gas and calculations of future net cash flows from those reserves included in this proxy statement are only estimates. The accuracy of any estimate of proved reserves is a function of:

- •

- the quality of available data;

- •

- engineering and geological interpretation and judgment regarding future production levels of oil, natural gas liquids and natural gas;

- •

- assumptions about future quantities of recoverable oil, natural gas liquids and natural gas reserves and operating expenses related thereto;

- •

- the timing of and actual level of success realized in the development of non-producing reserves;

- •

- assumptions about prices for crude oil, natural gas liquids and natural gas; and

- •

- assumptions about costs to extract and process, if necessary, crude oil, natural gas liquids and natural gas and to transport them to their point of sale.

Actual prices, production, operating expenses and quantities of recoverable oil and natural gas reserves may vary from those assumed in the estimates. Any significant variance from the assumptions used could result in the actual quantity of the partnership's reserves and future net cash flows being materially different from the estimates used in the calculation of the merger consideration. If a significant variance occurs, the merger consideration you will receive may not be a reflection of the actual value of the partnership's reserves.

SWR estimated the partnership's proved reserves based on production curves used in the December 31, 2010 evaluation made by Ryder Scott, with additional adjustments to the production curves made to reflect changes in well performance based on updated production information through March 2011. The recoverable reserves volumes and the related future net cash flows from those reserves were based on benchmark prices of $92.84 per Bbl of oil and NGL and $4.15 per MMBtu of natural gas. These benchmark prices, which were computed based on the 12-month historical average of the NYMEX closing prices for oil and gas through the stated valuation date, were further adjusted for quality, energy content, transportation fees and other price differentials specific to the partnership's properties, resulting in an average price of $84.88 per Bbl of oil and $5.56 per Mcf of natural gas. Estimated future operating costs were deducted in arriving at the estimated fair value of oil and gas reserves and include direct operating expenses, field overhead costs, and ad valorem taxes. Costs of workovers, well stimulations, and other significant non-recurring maintenance costs are not included in estimated future operating costs. Operating costs were held constant for the life of the properties.

The discount rates that were applied to the estimated future net cash flows from the partnership's proved reserves to determine the merger consideration were determined by CWEI and SWR. Lower discount rates would result in higher merger consideration and lower potential return to CWEI on its investment in the partnership's underlying assets. Conversely, higher discount rates would result in lower merger consideration and greater potential return on CWEI's investment in those assets. Furthermore, higher discount rates may disfavor longer-lived properties when compared to shorter-lived properties. In establishing these discount rates, CWEI considered various factors, including (1) its

16

Table of Contents

desire and commitment to offer merger consideration that is fair to both the unaffiliated investors and the CWEI stockholders, (2) its cost of capital for the merger and (3) a reasonable profit incentive relative to the production, pricing and timing risks associated with the future cash flows from the partnership's assets. Although CWEI believes these discount rates are within the range of discount rates commonly used in the oil and gas industry in property acquisition transactions, the discount rates applied in the calculation of the merger consideration may not reflect the actual cost of capital in effect from time to time, the specific risks associated with the partnership's properties or the general risks of ownership of oil and gas properties in general.

The merger consideration might not reflect the current market value of the partnership's assets.