SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Statement Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

x Definitive Proxy Statement |

|

¨ Definitive Additional Materials |

|

¨ Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

VARCO INTERNATIONAL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | ¨ | | Fee paid previously with preliminary materials. |

| | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

VARCO INTERNATIONAL, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 16, 2002

Our annual meeting of stockholders will be held on Thursday, May 16, 2002, at the Doubletree Hotel, 2001 Post Oak Boulevard, Houston, Texas 77056, starting at 9:00 a.m., local time, for the purposes of:

1. Electing a board of 11 directors to serve until our next annual meeting and until their successors are duly elected and qualified;

2. Ratifying the selection of Ernst & Young LLP as our independent auditors for the fiscal year ending December 31, 2002; and

3. Transacting such other business as may properly come before the meeting or any adjournment or postponement of the meeting.

Our Board of Directors has fixed the close of business on March 22, 2002, as the record date for determining those stockholders who are entitled to notice of, and to vote at our annual meeting and at any adjournment or postponement of the meeting.

It is important that your common shares be represented and voted at the meeting. If you do not plan to attend the meeting and vote your common shares in person, please vote in one of these ways:

| | · | | MARK, SIGN, DATE AND PROMPTLY RETURN your enclosed proxy card in the postage-paid envelope; |

| | · | | USE THE TOLL-FREE TELEPHONE NUMBER shown on your proxy card (this call is free in the U.S. and Canada); or |

| | · | | VISIT THE WEBSITE address shown on your proxy card to vote through the Internet. |

| | By | Order of the Board of Directors, |

| | Vice President, Secretary and General Counsel |

Houston, Texas

April 19, 2002

VARCO INTERNATIONAL, INC.

2000 W. Sam Houston Parkway South Suite 1700 Houston, Texas 77042 | | 743 North Eckhoff Street Orange, California 92668 |

2002 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 16, 2002

PROXY STATEMENT

SOLICITATION OF PROXIES

This proxy statement is being furnished to our stockholders in connection with the solicitation by our Board of Directors of proxies for use at our annual meeting of stockholders to be held on Thursday, May 16, 2002, at The Doubletree Hotel, 2001 Post Oak Boulevard, Houston, Texas 77056, starting at 9:00 a.m. local time, and at any adjournment or postponement of the meeting.

We underwent a significant transformation in May 2000 when Varco International, Inc., a California corporation (“Varco”), merged into Tuboscope Inc., a Delaware corporation (“Tuboscope”). Tuboscope was the surviving corporation and changed its name to Varco International, Inc. Unless otherwise indicated, all references in this proxy statement to “Varco” refer to the disappearing California corporation prior to the merger, and all references to the “Company,” “us,” “we,” and “our” refer to Tuboscope Inc. prior to the merger and to the surviving or combined corporation after the merger.

All shares of our common stock which are entitled to vote and are represented at the annual meeting by properly executed proxies received at or prior to the annual meeting, and not revoked, will be voted at the annual meeting in accordance with the instructions specified on the proxies. If no instructions are specified, the proxies will be voted for the election of the 11 nominees to the Board of Directors named below and for the ratification of the selection of Ernst & Young LLP. as our independent auditors for the fiscal year ending December 31, 2002.

If any other matters are properly presented at the annual meeting for consideration, including, among other things, consideration of a motion to adjourn the annual meeting to another time or place, the persons named in the proxy will have discretion to vote on these matters in accordance with their best judgment.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. Proxies may be revoked by:

| | · | | filing with our Secretary, at or before the voting at the annual meeting, a written notice of revocation bearing a later date than the proxy; or |

| | · | | duly executing a proxy with a later date and delivering it to our Secretary before the voting at the annual meeting; or |

| | · | | attending the annual meeting and voting in person, although attendance at the annual meeting will not by itself constitute a revocation of a proxy. |

Any written notice of revocation or subsequent proxy should be sent to Varco International, Inc., 2000 W. Sam Houston Parkway South, Suite 1700, Houston, Texas 77042, Attention: Secretary, or hand delivered to our Secretary at or before the voting at the annual meeting.

This proxy statement and the accompanying proxy card, together with a copy of our 2001 Annual Report, is being mailed to our stockholders on or about April 19, 2002. You may also obtain an electronic version our annual report on Form 10-K from the Securities and Exchange Commission’s website located at www.sec.gov or from our website located at www.varco.com. All expenses of soliciting proxies, including the cost of mailing this proxy statement to stockholders, will be borne by us. In addition to solicitation by use of the mails, proxies may be solicited by our directors, officers and employees in person or by telephone or other means of communication. These persons will not receive additional compensation, but may be reimbursed for reasonable out-of pocket expenses in connection with this solicitation. In addition, we have retained the services of Morrow & Company to assist in the solicitation of proxies. We will pay $5,000, plus reimbursement of out-of-pocket expenses, to Morrow & Company for its services. We will make arrangements with brokerage houses, custodians, nominees and fiduciaries to forward proxy solicitation materials to beneficial owners of shares held of record by them. We will reimburse these brokerage houses, custodians, nominees and fiduciaries for their reasonable expenses incurred in forwarding the proxy materials.

If you are a stockholder of record, you can elect to receive future annual reports and proxy statements electronically by marking the appropriate box on your proxy card. If you choose this option, when the annual report and proxy materials are mailed to stockholders, you will either receive an electronic version of our annual report and proxy materials or you will receive a notice listing the website where you can view or download the annual report and proxy documents. Your choice to receive annual report and proxy material electronically will remain in effect until you notify us by mail that you wish to resume paper delivery of these documents. If you hold your stock through a bank, broker or another holder of record, refer to the information provided by that entity for instructions on how to elect this option. We encourage stockholders to register to receive future annual reports and proxy materials electronically.

OUTSTANDING SHARES AND VOTING RIGHTS

Our Board of Directors has fixed March 22, 2002, as the record date for determining the stockholders entitled to notice of, and to vote at, the annual meeting. Accordingly, only holders of our common stock of record on the record date will be entitled to notice of, and to vote at, the annual meeting. As of the record date, 96,146,721 shares of our common stock were outstanding and entitled to vote, which shares were held by approximately 1,327 holders of record. Each holder of shares of our common stock on the record date is entitled to one vote per share. Votes may be cast either in person or by a properly executed proxy.

The presence, in person or by properly executed proxy, of the holders of a majority of the outstanding shares of our common stock entitled to vote at the annual meeting is necessary for a quorum. Shares of our common stock represented in person or by proxy will be counted for the purpose of determining whether a quorum is present at the annual meeting. Shares represented by proxies that reflect abstentions or “broker non-votes” (i.e., shares held by a broker or nominee which are represented at the meeting, but with respect to which such broker or nominee is not instructed or authorized to vote on a particular proposal) will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum.

For the election of the nominees to the Board of Directors, the 11 nominees receiving the highest vote totals will be elected. Accordingly, abstentions will not affect the outcome of the election of the nominees to the Board of Directors. The election of directors is a matter on which a broker or other nominee is empowered to vote. Accordingly, no broker non-votes will result from this proposal. Stockholders are not permitted to cumulate their shares for the purpose of electing directors or otherwise.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting is required to ratify the ratification of the selection of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2002. Abstentions will have the same effect as a vote against this proposal. However, the ratification of our Ernst & Young LLP is a matter on which a broker or other nominee is empowered to vote. Accordingly, no broker non-votes will result from this proposal.

2

All other matters to be voted on, if any, will be decided by a majority vote of the shares present or represented by proxy at the meeting and entitled to vote. On any of these matters, an abstention will have the same effect as a negative vote. Because “broker non-votes” represent shares as to which the beneficial owner has not instructed the broker to vote, on any of these matters, these shares are considered not entitled to vote on such matters, and thus broker non-votes on a matter will have no effect on the outcome of the voting on these matters.

The Board of Directors recommends a vote “FOR” each of the 11 nominees to the Board of Directors and “FOR” the ratification of the selection of Ernst & Young LLP as our independent auditors for the fiscal year ending December 31, 2002.

ELECTION OF DIRECTORS

General

Our certificate of incorporation requires that there be a minimum of one and a maximum of 15 directors, as determined by the Board of Directors. The authorized number of directors, as determined by the Board, is currently fixed at 11. Eleven directors are to be elected at the annual meeting. Directors are elected at each annual meeting of our stockholders and hold office until their successors are duly elected and qualified at the next annual meeting.

We do not anticipate that any of the nominees will become unavailable to serve for any reason, but if that should occur before the annual meeting, proxies will be voted for another nominee or nominees selected by the our Board of Directors.

Nominees

Set forth below are the names and descriptions of the backgrounds of the nominees for election as directors. Each of the nominees for election currently serves as a director for us and was elected by the stockholders to his present term of office.

The directors, each of whom is a nominee, are as follows:

Name

| | Age

| | Position with the Company

|

| George Boyadjieff | | 63 | | Chairman of the Board, Chief Executive Officer and Chief Technology Officer |

|

| John F. Lauletta | | 57 | | Director, President and Chief Operating Officer |

|

| George S. Dotson | | 61 | | Director |

|

| Andre R. Horn | | 73 | | Director |

|

| Richard A. Kertson | | 62 | | Director |

|

| Eric L. Mattson | | 50 | | Director |

|

| L.E. Simmons | | 55 | | Director |

|

| Jeffery A. Smisek | | 47 | | Director |

|

| Douglas E. Swanson | | 63 | | Director |

|

| Eugene R. White | | 70 | | Director |

|

| James D. Woods | | 70 | | Director |

3

Set forth below are descriptions of the backgrounds of the nominees and their principal occupations for at least the past five years and their public-company directorship positions as of March 22, 2002.

George Boyadjieff. Mr. Boyadjieff has been our Chairman of the Board and Chief Executive Officer since May 2000 and our Chief Technology Officer since May 2001. He served as a director of Varco from 1976 until May 2000. Mr. Boyadjieff was Chief Executive Officer of Varco from April 1991 and Chairman from May 1998 until May 2000 when he assumed his current positions. He served as President of Varco from 1981 until February 2000 and as Chief Operating Officer from June 1979 until April 1991. Prior to 1981, Mr. Boyadjieff was Senior Vice President-Operations and was first employed by Varco in 1969.

John F. Lauletta. Mr. Lauletta has been our President and served on our Board of Directors since April 1996 and has been our Chief Operating Officer since May 2000. From April 1996 until May 2000, Mr. Lauletta was our Chief Executive Officer. From 1993 until April 1996, Mr. Lauletta was the President and Chief Executive Officer of D.O.S., Ltd. From 1973 until 1993, Mr. Lauletta was with Baker Hughes Incorporated, a provider of products and services to the oil, gas and process industries, holding several executive positions, including President of Exlog/TOTCO, President of Milpark Drilling Fluids and Vice President of Baker Hughes INTEQ.

George S. Dotson. Mr. Dotson served as a director of Varco from February 1997 until May 2000, when he became a member of our Board of Directors. He is a director and Vice President of Helmerich & Payne, Inc. and is President of its subsidiary, Helmerich & Payne International Drilling Co., an owner-operator of drilling rigs, providing drilling services to both the land and offshore oil and gas drilling industry. Mr. Dotson has held these positions since 1977. He is also a director of Atwood Oceanics, Inc., an international off-shore drilling company.

Andre R. Horn. Mr. Horn served as a director of Varco from July 1987 until May 2000, when he became a member of our Board of Directors. He retired from Joy Manufacturing Co. in 1985, where he served as a director and Chairman of the Board. Mr. Horn was Chairman of the Board of Needham & Co., Inc., investment bankers, from 1985 until 1991. He is also a director of REMEC, Inc., a designer and manufacturer of high-frequency subsystems and components used in wireless communications and in defense electronics applications.

Richard A. Kertson. Mr. Kertson has served on our Board of Directors since August 2000. Mr. Kertson was Vice President-Finance and Chief Financial Officer of Varco from May 1984 until his retirement in February 2000. Mr. Kertson had been Controller of Varco Oil Tools from January 1982 until May 1984 and joined Varco in October 1975 as Director of Management Information Services.

Eric L. Mattson. Mr. Mattson has served on our Board of Directors since January 1994. Mr. Mattson has been the Chief Financial Officer of Netrail, Inc., a private Internet backbone and broadband service provider, since September 1999. Netrail filed for Chapter 11 Bankruptcy protection in the Northern Georgia district of the United States Bankruptcy Court in July 2001. Mr. Mattson currently serves as the Chief Financial Officer and the primary representative for Netrail in connection with finalization of Netrail’s bankruptcy proceedings. From July 1993 until May 1999, Mr. Mattson served as Senior Vice President and Chief Financial Officer of Baker Hughes Incorporated. For more than five years prior to 1993, Mr. Mattson was Vice President and Treasurer of Baker Hughes. Baker Hughes is a provider of products and services to the oil, gas and process industries.

L.E. Simmons. Mr. Simmons has served on our Board of Directors since April 1996 and was Chairman of our Board from April 1996 until May 2000. Mr. Simmons has served for more than five years as President and a director of SCF Partners, L.P., which serves as the general partner for various investment limited partnerships. Mr. Simmons is also a director of Zions Bancorporation, a multi-bank holding company, and Chairman of the Board of Oil States International, Inc., a provider of oil and gas drilling services.

Douglas E. Swanson. Mr. Swanson has served on our Board of Directors since October 1997. He has been President, Chief Executive Officer, and a director of Oil States International, Inc., a provider of oil and gas

4

drilling services since January 2000. Mr. Swanson was the President, Chief Executive Officer and Chairman of the Board of Cliffs Drilling Company from 1992 to July 1999. From 1978 to 1992, Mr. Swanson was an Executive Vice President of Cliffs Drilling Company, an international offshore and land contract drilling company.

Jeffery A. Smisek. Mr. Smisek has served on our Board of Directors since February 1998. Mr. Smisek has been Executive Vice President—Corporate of Continental Airlines, Inc. since May 2001 and prior thereto was Executive Vice President, General Counsel and Secretary.

Eugene R. White. Mr. White served as a director of Varco from October 1990 until May 2000, when he became a member of our Board of Directors. He served as the Vice Chairman of Amdahl Corporation, a provider of mainframe computers and storage products, from 1987 to 1992, as Chairman of the Board from 1979 to 1987. Mr. White was Deputy Chairman of the Board, President and Chief Executive Officer of Amdahl Corporation from 1974 to 1979. He is also a director of Needham & Co., investment bankers, and Nextest Systems Corp., which is engaged in the business of automatic test equipment for the semiconductor industry.

James D. Woods. Mr. Woods served as a director of Varco from 1988 until May 2000 when he became a member of our Board of Directors. Mr. Woods is the Chairman Emeritus and retired Chief Executive Officer of Baker Hughes Incorporated. Mr. Woods was Chief Executive Officer of Baker Hughes from April 1987 and Chairman from January 1989, in each case until January 1998. Mr. Woods is also a director of United States Energy Co. (USEC), ESCO Technologies, a supplier of engineered filtration precuts to the process, healthcare and transportation markets, Integrated Electrical Services, a national provider of electrical services, and OMI Corporation, a bulk shipping company providing seaborne transportation services primarily of crude oil and refined petroleum products.

We are not aware of any family relationships between any of the foregoing nominees for director or between any nominee and any executive officer.

Our certificate of incorporation and bylaws contain provisions eliminating or limiting the personal liability of directors for violations of a director’s fiduciary duty to the extent permitted by the General Corporation Law of the State of Delaware. In addition, pursuant to the merger agreement between Varco and us, we agreed to indemnify, to the fullest extent permitted by Delaware law, each director or former director of Varco against all liabilities or expenses in connection with claims relating to matters that occurred prior to the closing of the merger.

Meetings and Committees

Our Board of Directors held four meetings and took action once by written consent during the year ended December 31, 2001. Each director attended at least 75% of the aggregate of the total number of meetings of our Board of Directors held during this period and of the total number of meetings held during such period by all committees of our Board of Directors on which that director served.

We currently have a standing Audit and Compliance Committee and a standing Compensation Committee. We do not have a nominating committee.

For fiscal 2001, the members of the Audit and Compliance Committee were Andre R. Horn (Chairman), Eric L. Mattson and L.E. Simmons. In March 2002, Mr. Mattson resigned from this Committee and Eugene R. White was appointed to this Committee in his place. Each of Messrs. Horn, Mattson, Simmons and White is “independent” as required by the applicable listing standards of the New York Stock Exchange. The Audit and Compliance Committee met three times during the fiscal year ended December 31, 2001.

5

The Audit and Compliance Committee operates pursuant to a written charter adopted by the Board of Directors on November 9, 2000, a copy of which has been filed with the Securities and Exchange Commission. In accordance with its charter, the Committee’s responsibilities include:

| | · | | recommending the selection of our independent auditors to the Board of Directors and approving of their fees and other significant compensation; and |

| | · | | our annual financial statements and quarterly results; |

| | · | | the adequacy and effectiveness of our systems of internal accounting controls; |

| | · | | the independent auditors’ audit plan and engagement letter; |

| | · | | the independence and performance of our independent auditors; |

| | · | | material legal matters and potential conflicts of interest; and |

| | · | | our code of ethical conduct and its enforcement. |

The members of our Compensation Committee are currently James D. Woods (Chairman), George S. Dotson, and Jeffery Smisek. The Compensation Committee met three times during the fiscal year ended December 31, 2001. The Compensation Committee’s responsibilities include reviewing and approving the compensation program for our directors, officers and key employees, administering our executive incentive and stock plans and performing other related functions upon request of the Board of Directors.

Board Compensation and Benefits

Each of our directors who is neither an employee nor otherwise subject to an agreement to provide services to us is entitled to receive $30,000 per year as compensation for service on the Board of Directors, plus $1,500 for each attended regular and special meeting of the Board of Directors. In addition, the Chairman of the Audit and Compliance Committee and the Chairman of the Compensation Committee are each entitled to receive an additional annual retainer in the amount of $4,500, and each member of these Committees, including the Chairman, is entitled to receive an attendance fee of $1,000 for each committee meeting attended in person and $500 for each committee meeting attended telephonically.

Under the terms of our Amended and Restated 1996 Equity Participation Plan, each non-employee director has been automatically granted an initial option to purchase 4,000 shares of our common stock and is automatically granted options to purchase an additional 4,000 shares on the date of each annual meeting of stockholders following the initial grant if he continues as a non-employee director. All options are granted at an exercise price equal to the fair market value of our common stock on the date of grant and vest at the rate of 25% per year beginning on the first anniversary of the date of grant. In accordance with the terms of this plan, options to purchase 4,000 shares of our common stock at an exercise price of $23.95 per share were granted on May 17, 2001 to each of Messrs. Dotson, Horn, Kertson, Mattson, Simmons, Swanson, Smisek, White and Woods, our non-employee directors.

During 2001, Messrs. Dotson, Simmons and Swanson participated in our Non-Qualified Deferred Compensation Plans, defined contribution plans pursuant to which non-employee directors are permitted to defer all or a portion of the compensation they receive from us in directors fees.

Vote and Recommendation

Directors will be elected by a favorable vote of a plurality of the shares of our common stock present or represented by proxy and entitled to vote at the annual meeting. Abstentions as to the election of directors will not be treated as votes cast with respect to such election and, thus, will not affect the election of the nominees

6

receiving the plurality of votes. The election of directors is a matter on which a broker or other nominee is empowered to vote. Accordingly, no broker non-votes will result from this proposal. Unless instructed to the contrary, the shares represented by the proxies will be voted “FOR” the election of the 11 nominees named above as directors. Should any nominee become unavailable to serve, the proxies will be voted for such other person or persons as may be designated by the Board of Directors.

Our Board of Directors recommends that you vote “FOR” the election of each of the nominees named above.

EXECUTIVE OFFICERS

The following persons serve as our executive officers as of March 22, 2002:

Name

| | Age

| | Position

|

| George Boyadjieff | | 63 | | Chairman of the Board, Chief Executive Officer and Chief Technology Officer |

|

| John F. Lauletta | | 57 | | Director, President and Chief Operating Officer |

|

| Joseph C. Winkler | | 50 | | Executive Vice President, Chief Financial Officer, Treasurer and President—Varco Drilling Equipment Group |

|

| James F. Maroney, III | | 50 | | Vice President, Secretary and General Counsel |

|

| Kenneth L. Nibling | | 51 | | Vice President—Human Resources and Administration |

|

| Haynes B. Smith, III | | 50 | | President—Varco Services Group |

|

| Clay C. Williams | | 39 | | Vice President—Corporate Development |

Set forth below are descriptions of the backgrounds of the executive officers and their principal occupations for at least the past five years. For a description of the backgrounds of Messrs. Boyadjieff and Lauletta, see “Election of Directors,” above. Michael W. Sutherlin, our former Group President, Products ceased serving as an executive officer as of February 7, 2002, in connection with his termination of employment to be effective in May 2002.

Joseph C. Winkler. Mr. Winkler has served as our Executive Vice President, Chief Financial Officer and Treasurer since April 1996 and since February 2002 he has served as President-Varco Drilling Equipment Group. From 1993 to April 1996, Mr. Winkler served as the Chief Financial Officer of D.O.S., Ltd. Prior to joining D.O.S., Ltd., he was Chief Financial Officer of Baker Hughes INTEQ and served in a similar role for various companies owned by Baker Hughes Incorporated including Eastman/Teleco and Milpark Drilling Fluids. For ten years prior to joining Baker Hughes, Mr. Winkler held the position of Chief Financial Officer of an independent oil and gas producer.

James F. Maroney, III. Mr. Maroney has served as our Vice President since May 1991, Secretary since January 1991 and General Counsel since November 1989. Mr. Maroney was our Assistant Secretary from December 1989 to January 1991. He was Associate General Counsel and Head of Litigation for TransAmerican Natural Gas Corporation, a gas production company, from 1987 to 1989. From 1985 to 1987, Mr. Maroney was in a private law practice specializing in commercial litigation.

Kenneth L. Nibling. Mr. Nibling has served as our Vice President-Human Resources and Administration since December 1991. From July 1988 to November 1991, Mr. Nibling was Director of Human Resources for Union Texas Petroleum Corp., an international exploration and production company. From January 1984 to July 1988, Mr. Nibling was Manager, Compensation and Employment for Louisiana Land and Exploration Company now a subsidiary of Burlington Resources, a crude oil and natural gas production company.

7

Haynes B. Smith, III. Mr. Smith has served as our President-Varco Services Group since May 2000. From July 1996 to May 2000, Mr. Smith was Vice President-Western Hemisphere Operations. From May 1991 to July 1996, Mr. Smith served as our Vice President and General Manager of Inspection Services. From 1989 to May 1991, Mr. Smith was our Northeast Zone Manager. From June 1972 to 1989, Mr. Smith held various sales and managerial positions with us and AMF Tuboscope Inc.

Clay C. Williams. Mr. Williams has been our Vice President-Corporate Development since February 2001 and from February 1997 until June 2000. From April 1999 to June 2000, he was Vice-President of Pipeline-Services for the Company. From April 1996 to February 1997, Mr. Williams was our Director of Corporate Development. From March 1996 to April 1996, Mr. Williams was Director of Corporate Development of Drexel. Mr. Williams was an associate at SCF Partners, L.P. from December 1993 to March 1996. From July 1992 to December 1993, Mr. Williams was a graduate student at the University of Texas business school. Mr. Williams was an engineer for Shell Oil Company from 1985 to 1992.

We are not aware of any family relationships between any of the foregoing executive officers or between any executive officer and any nominee for election as director.

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 22, 2002, the amount and percentage of the outstanding shares of our common stock which, according to the information furnished to us, are beneficially owned by:

| | · | | each stockholder known by us to beneficially own 5% or more of the outstanding shares of our common stock; |

| | · | | each director (each of whom is a nominee for election at the annual meeting); |

| | · | | our Named Executive Officers as defined on page 11; and |

| | · | | all current executive officers and directors as a group. |

The number and percentage of shares beneficially owned is based on 96,146,721 shares outstanding as of March 22, 2002, our record date. Beneficial ownership includes any shares as to which the stockholder has voting power or investment power and any shares that the stockholder has the right to acquire within 60 days of the record date, through the exercise of any stock option, warrant or other right. Unless otherwise indicated in the table or the footnotes, each stockholder has sole voting and investment power, or shares these powers with his spouse, with respect to the shares shown as beneficially owned.

| | | Shares Beneficially Owned

| |

Beneficial Owner

| | Outstanding Common Stock Shares

| | Outstanding Options Exercisable Within 60 Days

| | Percent of Class

| |

Directors and Named Executive Officers | | | | | | | |

| George Boyadjieff | | 178,818 | | 437,420 | | * | |

| George S. Dotson | | 4,274 | | 31,500 | | * | |

| Andre R. Horn | | 10,000 | | 28,624 | | * | |

| Richard A. Kertson | | 36,495 | | 2,000 | | * | |

| John F. Lauletta | | 62,527 | | 119,333 | | * | |

| Eric L. Mattson | | 4,000 | | 22,000 | | * | |

| L.E. Simmons(1) | | 9,772,386 | | 18,000 | | 10.2 | % |

| Jeffery A. Smisek | | 5,000 | | 14,000 | | * | |

| Haynes B. Smith III | | 55,238 | | 27,993 | | * | |

| Michael W. Sutherlin(2) | | 59,371 | | 81,640 | | * | |

| Douglas E. Swanson | | 1,201 | | 14,000 | | * | |

| Eugene R. White | | 40,062 | | 27,937 | | * | |

| Joseph C. Winkler | | 102,791 | | 187,033 | | * | |

| James D. Woods | | 2,850 | | 27,937 | | * | |

| All current directors and executive officers as a group(16 persons) | | 10,376,811 | | 1,229,432 | | 11.9 | % |

|

5% Beneficial Holders | | | | | | | |

L.E. Simmons & Associates, Incorporated(3) 6600 Chase Tower Houston, Texas 77002 | | 9,710,522 | | 0 | | 10.2 | % |

|

Salomon Smith Barney(4) 399 Park Avenue New York, NY 10013 | | 8,907,169 | | 0 | | 9.3 | % |

|

Franklin Resources, Inc.(5) 777 Mariners Island Boulevard San Mateo, California 94404 | | 6,844,101 | | 0 | | 7.1 | % |

|

FMR Corp.(6) 82 Devonshire Street Boston, Massachusetts 02109 | | 6,542,602 | | 0 | | 6.8 | % |

9

| * | | Less than one percent of the shares of common stock outstanding on the record date. |

| (1) | | Includes 9,710,522 shares beneficially owned by L.E. Simmons & Associates, Incorporated, of which Mr. Simmons is president, a director and sole stockholder. (See footnote 2 below.) Mr. Simmons has shared voting power and shared dispositive power with respect to these shares. Mr. Simmons disclaims beneficial ownership of these shares except to the extent of his pecuniary interest therein. Also includes 61,864 shares owned by Mr. Simmons directly or through the Deferred Compensation Plan, with respect to which he has sole dispositive and voting power. |

| (2) | | Effective as of February 2002, Mr. Sutherlin no longer serves as an executive officer. Mr. Sutherlin’s employment will be terminated effective May 2002. |

| (3) | | Based on information contained in the Schedule 13D/A dated July 2, 2001 filed by SCF Partners. Includes 4,159,457 shares deemed beneficially owned by SCF-III, L.P., 4,043,937 shares deemed beneficially owned by D.O.S. Partners, L.P. and 1,507,128 shares deemed beneficially owned by FGSI Partners, L.P. L.E. Simmons & Associates is the general partner of SCF Partners and SCF II, L.P., SCF II, L.P. is a limited partner and General Partner of SCF-III, L.P., SCF Partners is a limited partnership and general partner of D.O.S. Partners, L.P. and FGSI Partners. |

| (4) | | Based on information contained in the Schedule 13G dated February 6, 2002 filed by Salomon Smith Barney Inc. (“SSB”), Salomon Brothers Holding Company Inc. (“SBHC”), Salomon Smith Barney Holding Inc. (“SSB Holdings”) and Citigroup Inc. (“Citigroup”). Citigroup, the sole stockholder of SSB Holdings, holds 8,907,169 shares of which Citigroup shares voting power on 8,725,141 shares with SSB Holdings. SSB Holdings, the sole stockholder of SBHC, holds 8,725,141 shares of which it shares voting power with SBHC and Citigroup on 6,556,033 shares. SBHC, the sole stockholder of SSB, holds 6,556,033 shares of which it shares voting power with Citigroup, SSB Holdings, and SSB. SSB holds 6,556,033 shares of which it shares voting power with Citigroup, SSB Holdings and SBHC. |

| (5) | | Based on information contained in the Schedule 13G/A dated February 14, 2002 filed by Franklin Resources, Inc., as the parent holding company for investment advisory subsidiaries to closed-end investment companies or other managed accounts, and Charles B. Johnson and Rupert H. Johnson, Jr., principal shareholders of Franklin Resources, are the beneficial owners of 6,844,101 shares. Franklin Advisors, Inc., an investment advisory subsidiary of Franklin Resources, is the beneficial owner of 6,299,143 of such shares with respect to which it has sole voting and dispositive power. Franklin Management, Inc., also an investment advisory subsidiary of Franklin Resources, has sole dispositive power with respect to 544,958 shares. Franklin Small Cap Growth Fund I, a registered investment company, has an interest in more than 5% of our common stock. |

| (6) | | Based on information contained in the Schedule 13G dated February 14, 2002 filed by FMR Corp., who is the beneficial owner of 6,542,602 shares with respect to which it has sole dispositive power and with respect to 1,094,881 shares of which it has sole voting power. All of such shares are also deemed to be beneficially owned by Edward C. Johnson 3d, Chairman of FMR Corp., and Abigail P. Johnson, a director and stockholder of FMR Corp. Fidelity Management & Research Company, a wholly-owned subsidiary of FMR Corp., is the beneficial owner of 5,447,721 shares held by various registered investment companies with respect to which Mr. Johnson and FMR Corp. have sole dispositive power but no voting power. Fidelity Management Trust Company, a wholly-owned subsidiary of FMR Corp. and a bank, is the beneficial owner of 1,002,381 shares over which Mr. Johnson and FMR Corp. have sole dispositive power and sole voting power. |

10

EXECUTIVE COMPENSATION

The following table sets forth certain information regarding the annual and long-term compensation for services in all capacities for the fiscal years indicated for each of the following persons (our “Named Executive Officers”):

| | · | | our chief executive officer; and |

| | · | | the next four of our most highly compensated executive officers whose annual salary and bonus exceeded $100,000. |

| | | Annual Compensation(1)

| | | Long-Term Compensation Awards

| | All Other Annual Compensation(4)

|

| | | | Securities Underlying Options

| |

| | | | |

Name and Principal Position in 2001

| | Year

| | Salary(2)

| | Bonus(3)

| | | |

| George Boyadjieff(5) | | 2001 | | $ | 682,616 | | $ | 761,629 | | | 147,027 | | $ | 38,123 |

| Chairman and Chief Executive | | 2000 | | | 327,928 | | | 359,600 | (3) | | 0 | | | 9,554 |

| Officer | | | | | | | | | | | | | | |

|

| John F. Lauletta | | 2001 | | | 510,000 | | | 571,200 | | | 79,639 | | | 36,608 |

| President and Chief Operating | | 2000 | | | 387,600 | | | 405,200 | | | 0 | | | 12,040 |

| Officer | | 1999 | | | 370,000 | | | 0 | | | 366,942 | | | 11,098 |

|

| Michael W. Sutherlin(6) | | 2001 | | | 356,364 | | | 813,008 | (3) | | 46,906 | | | 17,962 |

| Group President—Products | | 2000 | | | 175,378 | | | 123,600 | (3) | | 0 | | | 9,544 |

|

| Joseph C. Winkler(7) | | 2001 | | | 310,017 | | | 285,200 | | | 40,960 | | | 20,218 |

| Executive Vice President, Chief | | 2000 | | | 222,100 | | | 185,760 | | | 0 | | | 6,593 |

| Financial Officer and Treasurer | | 1999 | | | 212,000 | | | 0 | | | 168,198 | | | 6,360 |

|

| Haynes B. Smith III(8) | | 2001 | | | 260,000 | | | 249,600 | | | 18,738 | | | 15,315 |

| President, Varco Services Group | | | | | | | | | | | | | | |

| (1) | | Perquisites are excluded as their aggregate value did not exceed the lesser of $50,000 or the 10% of total annual salary and bonus for any named executive officer. |

| (2) | | Includes amounts deferred by the named executive officers under our 401(k) Profit Sharing Plan and Non-Qualified Deferred Compensation Plans. |

| (3) | | For Mr. Sutherlin, includes $600,000 retention bonus paid to Mr. Sutherlin in 2001 under his Executive Agreement. As a result of Mr. Sutherlin’s termination of employment to be effective May 2002, this bonus payment will be offset against, and thereby reduce, the severance and other payments otherwise owing to Mr. Sutherlin under his Executive Agreement in connection with such termination. See “Executive Agreements” below. For Messrs. Boyadjieff and Sutherlin, the bonuses for 2000 consisted of cash bonuses and awards of our common stock valued at fair market value on January 29, 2001 . |

| (4) | | For fiscal year 2001, represents matching contributions paid by the Company under its 401(k) Profit Sharing Plan of $8,699, $2,800, $5,950, $1,740 and $5,598, for Messrs. Boyadjieff, Lauletta, Sutherlin, Winkler and Smith, respectively, and matching contributions by the Company under its Non-Qualified Deferred Compensation Plans of $29,423, $33,808, $12,012, $18,478, and $9,717 for Messrs. Boyadjieff, Lauletta, Sutherlin, Winkler and Smith, respectively. |

| (5) | | Mr. Boyadjieff became our Chairman and Chief Executive Officer on May 30, 2000, upon consummation of the merger. Compensation paid by Varco (including stock options) to Mr. Boyadjieff for services rendered to Varco prior to the merger is not included in the table. |

| (6) | | Mr. Sutherlin served as our Group President, Products from May 30, 2000, upon consummation of the merger until February 7, 2002. Compensation paid by Varco (including stock options) to Mr. Sutherlin for services rendered to Varco prior to the merger is not included in the table. Mr. Sutherlin’s employment will be terminated effective May 2002. |

| (7) | | As of February 2002, Mr. Winkler also serves as President-Varco Drilling Equipment Group. |

| (8) | | Mr. Smith was appointed an executive officer as of May 2001; compensation shown is for the full calendar year. |

11

OPTION GRANTS IN LAST FISCAL YEAR

The following table sets forth certain information with respect to option grants made during fiscal 2001 to the Named Executive Officers. No stock appreciation rights were granted during 2001.

| | | Granted Options (Shares)

| | Percentage of Total Options Granted to Employees in Fiscal | | Exercise or Base Price per | | | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(2)

|

| | | | | | Expiration | |

Name

| | | Year

| | Share

| | Date

| | 5%

| | 10%

|

| George F. Boyadjieff | | 147,027 | | 13% | | $ | 20.81 | | 1/31/2011 | | $ | 1,924,186 | | $ | 4,876,265 |

| John F. Lauletta | | 79,639 | | 7% | | $ | 20.81 | | 1/31/2011 | | | 1,042,259 | | | 2,641,290 |

| Michael W. Sutherlin | | 46,906 | | 4% | | $ | 20.81 | | 1/31/2011 | | | 613,873 | | | 1,555,674 |

| Joseph C. Winkler | | 40,960 | | 4% | | $ | 20.81 | | 1/31/2011 | | | 536,056 | | | 1,358,470 |

| Haynes B. Smith III | | 18,738 | | 2% | | $ | 20.81 | | 1/31/2011 | | | 245,230 | | | 621,460 |

| (1) | | These options become exercisable in three annual installments on the anniversary of the grant date, and have a term of ten years, subject to earlier termination in certain events. The exercise price is equal to the closing price of the Common Stock on the New York Stock Exchange on the date of the grant. |

| (2) | | Assumes annual rates of stock price appreciation for illustrative purposes only. Actual stock prices will vary from time to time based upon market factors and the Company’s financial performance. No assurance can be given that such rates will be achieved. |

12

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR END OPTION VALUES

The following table sets forth certain information with respect to options exercised during fiscal 2001 and exercisable and unexercisable options held by the Named Executive Officers as of December 31, 2001.

Name

| | Shares Acquired on Exercise

| | Value Realized(1)

| | Number of Securities Underlying Unexercised Options at Fiscal Year End

| | Value of Unexercised In-The-Money Options at Fiscal Year End(2)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| George Boyadjieff | | 14,250 | | $ | 205,770 | | 347,434 | | 257,157 | | $ | 2,516,080 | | $ | 142,997 |

| John F. Lauletta | | 166,942 | | | 2,744,109 | | 92,787 | | 79,639 | | | 48,125 | | | 0 |

| Michael W. Sutherlin | | 0 | | | 0 | | 54,818 | | 79,126 | | | 306,272 | | | 37,803 |

| Joseph C. Winkler | | 10,000 | | | 202,500 | | 173,380 | | 40,960 | | | 1,046,686 | | | 0 |

| Haynes B. Smith III | | 61,321 | | | 947,998 | | 21,747 | | 18,738 | | | 11,200 | | | 0 |

| (1) | | Determined by calculating the spread between the market value of our common stock on the date of exercise and the exercise price of the options. |

| (2) | | Based on the closing sales price of our common stock ($14.98) on the New York Stock Exchange on December 31, 2001, minus the exercise price of the in-the-money option, multiplied by the number of shares to which the in-the-money option relates. |

Amendment and Restatement of the Supplemental Executive Retirement Plan

We assumed the Varco Supplemental Executive Retirement Plan in connection with the merger of Varco into us in May 2000. In November 2001, based on a review and the recommendations made by Stone Partners, the Compensation Committee amended and restated the then existing plan as to executive officer participants and adopted the Amendment and Restatement of the Supplemental Executive Retirement Plan (the “Amended SERP”). Prior to November 2001, the only named executive officers in this plan were Messrs. Boyadjieff and Sutherlin. Effective as of November 2001, all of our executive officers, including all of our Named Executive Officers, are participants in the Amended SERP. We believe that the Amended SERP aids in our ability to attract, retain, motivate and provide financial security to executive employees who render valuable services to us.

The Amended SERP provides for retirement, death and disability benefits, payable over ten years. The annual benefit amount is generally equal to 50% of the average of a participant’s highest five calendar years of base salary, or if greater, in the case of terminations within two years following a change of control (as defined), the salary in effect prior to the change in control. This annual benefit is subject to a service reduction in the event the participant retires or his employment is terminated prior to reaching age 65 (excluding from this reduction are certain terminations within two years following a change in control). The benefits vest at the rate of 10% per year of service with us, and are fully vested upon a termination due to death or in the event of a change in control.

Based on historical earnings and presuming normal retirement at age 65, Messrs. Boyadjieff, Lauletta, Sutherlin, Winkler and Smith would be entitled to an annual benefit of $312,000, $270,000, $177,500, $177,500 and $150,000, respectively.

Executive Agreements

Severance Plans. We have two severance plans which are intended to provide financial security to our senior management and to match similar plans adopted by competitors in our industry. These plans are designed to retain and to motivate our key employees. One of the severance plans, the “standard severance plan,” pertains to involuntary terminations and the other severance plan, the “change in control severance plan,” pertains to terminations following a change in control. Each of the named executive officers and certain other members of our senior management (currently a total of 16 persons) participate in both the standard and the change in control severance plans.

13

The severance plans are implemented by Executive Agreements with the participants, which were either entered into by us or assumed by us as a result of the merger. Prior to the merger, Varco entered into Executive Agreements with its executive officers which have substantially the same terms as those entered into by us except as noted below.

Standard Severance Plan. The standard severance plan provides participants with severance compensation and benefits following the involuntary termination of their employment with us, other than for cause (as defined), including the benefits set forth below. Those benefits marked with an ** are not provided to former Varco employee participants.

| | · | | Base salary for a period ranging from one to two years, depending upon the particular participant, payable on a regular payroll basis. |

| | · | | A cash bonus ranging from 40% to 60% of the participant’s annual base salary, which is pro-rated to the date of termination for certain participants, payable in installments with base salary. |

| | · | | Full vesting of any restricted stock awards and payment of any awards earned under any intermediate or long-term bonus plan.** |

If a terminated participant is re-employed during the severance payment period at a salary greater than or equal to what the participant received while employed by us, the participant would receive 50% of full severance pay for the remainder of the severance period. If the terminated participant is re-employed during the severance pay-out period at a salary less than what the participant received while employed by us, the participant would receive the difference in actual salary for the remainder of the severance period, plus 50% of the aggregate severance pay remaining that would have been paid throughout the severance period.

Change in Control Severance Plan. The change in control severance plan provides enhanced benefits in the case of a change in control of us (and prior to the merger, Varco) and are available if, within two years of the change in control, the participant is terminated other than for cause or if the participant terminates his employment for good reason (as defined). Upon a qualifying termination following a change in control, the participants are entitled to severance compensation and benefits, including those set forth below. Those benefits marked with an ** are not provided to former Varco employee participants.

| | · | | Base salary for a period ranging from 18 months to three years, depending upon the particular participant, payable on a regular payroll basis. |

| | · | | A cash bonus for the salary payout period ranging from 40% to 60% of base salary, depending upon the particular participant, payable in installments with base salary. |

| | · | | Full vesting of all accrued benefits under our pension, profit sharing, 401(k), SERP, Executive Retiree Medical Plan and similar plans. |

| | · | | Full vesting of any restricted stock awards and payment of awards earned under any intermediate or long-term bonus plan.** |

| | · | | The gross-up of certain payments, subject to excise taxes under the Internal Revenue Code as “parachute payments,” so that the participant receives the same amount he would have received had there been no applicable excise taxes. |

| | · | | An extended option exercise period.** |

In addition to the benefits set forth above, upon any change in control, all of the unvested stock options and restricted stock awards held by a participant become immediately vested, except that the May 2000 merger of Varco into us does not constitute a change in control for purposes of the vesting of stock options held by former Varco employee participants. As a result of the May 2000 merger, the vesting of options and restricted stock units then held by Messrs. Lauletta, Winkler and Smith were accelerated and thus became fully vested as of May 30, 2000.

14

Additional Benefits. Under both the standard severance plan and the change in control severance plans, a participant is entitled to receive upon a qualifying termination, medical, dental and disability benefits (based on the cost sharing arrangement in place on the date of termination) and automobile benefits throughout the payout period, and outplacement services of up to 15% of base salary.

Specific Payout Periods and Bonuses. For each of the named executive officers, the length of their payout period under the Standard Severance Plan, the length of their payout period under the Change in Control Severance Plan and their bonus percentages (which are identical under both plans) are as follows:

Name

| | Standard Severance Payout Period

| | Bonus%

| | Change in Control Payout Period

|

| George Boyadjieff | | 2 years | | 60% | | 3 years |

| John F. Lauletta | | 2 years | | 60% | | 3 years |

| Michael W. Sutherlin | | 2 years | | 60% | | 3 years |

| Joseph C. Winkler | | 18 months | | 50% | | 2 years |

| Haynes B. Smith, III | | 1 year | | 40% | | 18 months |

Mr. Sutherlin’s Termination. The merger of Varco into us in May 2000 constituted a change in control and thus the benefits under the change in control severance plan are available to a participant who terminates his employment for good reason within two years following the merger. Mr. Sutherlin has notified us of his termination of employment under his Executive Agreement for good reason to be effective in May 2002, and thus Mr. Sutherlin will be entitled to all of the benefits enumerated above under the change in control severance plan. The Executive Agreement with Mr. Sutherlin provides for an additional benefit, a retention bonus in the amount of $600,000, payable to Mr. Sutherlin if he does not exercise his right to terminate his employment for good reason for a period of 12 months following the May 2000 merger of Varco into us. This retention bonus was paid in 2001. Since, however, Mr. Sutherlin has notified us of his termination of employment under his Executive Agreement for good reason within the two-year period following the merger, pursuant to the terms of his Executive Agreement this retention bonus will be offset against, and reduce, the severance pay and bonus otherwise payable under the Executive Agreement to Mr. Sutherlin.

15

Notwithstanding anything to the contrary set forth in any of our previous filings under the Securities Act or the Exchange Act that refer to future filings for additional information, including specifically to this proxy statement, in whole or in part, the Compensation Committee Report, the Audit Committee Report and the stock performance graph shall not be considered to be a part of any such filing.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of our Board of Directors is pleased to present its annual report, which is intended to update stockholders on the development of our executive compensation program. This report summarizes the responsibilities of the Compensation Committee, the compensation policy and objectives that guide the development and administration of the executive compensation program, each component of the program, and the basis on which the compensation for the chief executive officer, corporate officers and other key executives was determined for the calendar year ended December 31, 2001.

During the 2001 fiscal year, the members of the Compensation Committee were James D. Woods (Chairman), Jeffery A. Smisek and George S. Dotson. The Compensation Committee’s responsibilities are to oversee the development and administration of the total compensation program for corporate officers and key executives, and administer the executive incentive and stock plans. The Compensation Committee held three meetings during the fiscal year 2001. In January 2001, the Compensation Committee retained Frederic W. Cook & Co., an executive compensation and benefits consulting firm (“Frederic Cook”), to review the competitiveness of the total compensation opportunities offered by us to our senior executives and directors, to review the various compensation programs that were in place at Varco and us prior to the merger and to assist in the development of an integrated compensation philosophy going forward. Frederic Cook compared our compensation practices against an industry peer group. In November 2001, the Compensation Committee also retained Stone Partners, benefits consultants with expertise in the oilfield sector, to review market practices and advise us concerning our retirement plans.

Executive Compensation Philosophy

In designing the Company’s compensation programs, we follow our belief that compensation should reflect the value created for stockholders while supporting our business strategies and long-range plans and the markets we serve. The Compensation Committee reviews and determines the compensation of our executive officers based on a compensation program that reflects the following themes:

| | · | | A compensation program that stresses our annual financial performance and increase in value. |

| | · | | A compensation program that strengthens the relationship between pay and performance by providing variable, at-risk compensation based on predetermined objective performance measures. |

| | · | | A compensation program that will attract, motivate and retain high quality employees who will enable us to achieve our strategic and financial performance goals. |

| | · | | An annual incentive plan that supports a performance-oriented environment with superior performance resulting in total annual compensation above median levels. |

Section 162(m) of the Internal Revenue Code of 1986 currently imposes a $1 million limitation on the deductibility of certain compensation paid to our five highest paid executives. Excluded from the limitation is compensation that is “performance based.” For compensation to be performance based, it must meet certain criteria, including being based on predetermined objective standards approved by stockholders. Although the Compensation Committee takes the requirements of Section 162(m) into account in designing executive compensation, there may be circumstances when it is appropriate to pay compensation to our five highest paid executives that does not qualify as “performance based compensation” and thus is not deductible by us for federal income tax purposes. Any cash compensation payable under our Annual Incentive Compensation Plan currently does not qualify as “performance based compensation” as defined by Section 162(m) of the Internal Revenue Code. Our Amended and Restated 1996 Equity Participation Plan includes provisions establishing the criteria by which awards may be paid to qualify such awards as “performance-based” compensation as defined by Section 162(m) of the Internal Revenue Code. It is the Committee’s intention to have all compensation associated with option grants be made so as to comply with the “performance based” exemption from Section 162(m) of the Internal Revenue Code.

16

Executive Compensation Components

On an annual basis the Compensation Committee, in conjunction with executive management, assesses the effectiveness of the overall program and compares the compensation levels of our executives and our performance to the compensation received by executives and the performance of similar companies. For 2001, the primary market comparisons were made to a broad group of oilfield manufacturing and service companies, adjusted for size and job responsibilities. Data sources include industry survey groups, national survey databases, proxy disclosures and general trend data, which are updated annually. The following is a discussion of the principal components of the executive compensation program for fiscal 2001, each of which is intended to serve our overall compensation philosophy.

Base Salary. The base salary program for our executive officers and senior management team members was established in 2001 on the basis of the median to median plus 10% of base salaries paid by our primary comparison group for such position. Each officer’s salary is reviewed individually on an annual basis. Salary adjustments are based upon the individual’s experience and background, performance during the prior year, the general movement of salaries in the marketplace, and our financial position. Due to these factors, an executive’s base salary may be above or below the targeted points at any time.

Performance Incentive Compensation. The Compensation Committee administers our annual management incentive plan for executive officers and senior operations, sales and staff managers. The goal of the management incentive plan is to reward participants in proportion to our performance and/or our business unit/region for which they have a direct impact.

| | · | | Annual Incentive Compensation Plan. Our Annual Incentive Compensation Plan (which was adopted by the Compensation Committee in 1997) rewards eligible employees for our achievement of objective measurable financial performance, and, in certain circumstances, on a business unit or regional or divisional basis. The Annual Incentive Compensation Plan is available to executive officers and senior management team members. The level of award is based on our targeted performance and/or the targeted performance of one of our businesses or regional units compared to our actual performance or the actual performance of such business or regional unit. The performance target for 2001 was earnings per share for the executive officers, and for all other eligible employees the target also included specific operational objectives, such as operating profits and return on capital requirements. The resulting performance incentive award is a percentage of the participant’s base salary, depending on the level of the employee and the level of actual performance versus targeted performance. For the fiscal year ended December 31, 2001, the Company overachieved its corporate earnings per share performance target and a majority of the regional targets, and bonuses were accordingly paid to the participants of the plan. |

Long-Term Incentive Compensation. The primary purpose of our long- term incentive compensation is to encourage and facilitate personal stock ownership by the executive officers and thus strengthen their personal commitments to us and provide a longer-term perspective in their managerial responsibilities. This component of an executive officer’s compensation directly links the officer’s interests with those of our other stockholders. In addition, long-term incentives encourage management to focus on our long-term development and prosperity in addition to annual operating profits. Our primary form of long-term incentive compensation is through stock option grants, which is complemented by our stock ownership guidelines.

| | · | | Stock Option Awards. The goal of the stock option program is to provide a compensation program that is competitive within the industry while directly linking a significant portion of the executive’s compensation to the enhancement of stockholder value. The ultimate value of any stock option is based solely on the increase in value of the shares of our common stock over the grant price. Accordingly, stock options have value only if the stock price appreciates from the date of grant. This at-risk component of compensation focuses executives on the creation of stockholder value over the long-term and encourages equity ownership in us. We grant stock options to the Company’s key executives based |

17

on competitive multiples of the optionee’s base salary. Senior executives typically receive a higher multiple and, as a result, have a greater portion of their total compensation linked to increases in stockholder value. In determining the appropriate grant multiples, we considered the report of Frederic Cook comparing our grant practices to publicly traded oilfield manufacturing and service companies of comparable size and we set targets awards of total compensation, including cash and equity awards, at between the market median plus 10% to the 75th percentile. Senior executives and managers are eligible to receive stock options annually with other key managers becoming eligible on a discretionary basis. Eligibility for an award does not ensure receipt of a stock option award. Options are granted at the then current market price and generally vest in equal annual installments over a three year period.

| | · | | Stock Ownership Guidelines. The goal of the stock ownership guidelines are to encourage our executives to maintain a meaningful ownership interest in us, directly linking the interests of the executive with the enhancement of stockholder value. Stock ownership guidelines were established in 2001 at one to three times multiple of the executive’s salary, based on his position. |

Amendments to SERP and Executive Retiree Medical Plan. Frederic Cook, in reviewing the total compensation available to our executives and the different plans of Varco and us, and based on industry practices, recommended expanded participation and improved benefits in certain of our retirement plans. In November 2001, based on further review and recommendations made by Stone Partners, the Compensation Committee made certain amendments to the Supplemental Executive Retirement Plan and the Executive Retiree Medical Plan, which plans we assumed from Varco in the merger. See “Amendment and Restatement of the Supplemental Executive Retirement Plan”. Messrs. Boyadjieff and Sutherlin were the only participants in these plans prior to November 2001. All of our executive officers, including all of our Named Executive Officers, became participants in the Amended SERP and the Executive Retiree Medical Plan effective as of November 2001. We believe that these plans aid in our ability to attract, retain, motivate and provide financial security to executive employees who render valuable services to us.

Compensation of the Chief Executive Officer. At the time of the merger in May 2000, Mr. Boyadjieff became our Chief Executive Officer, and we continued Mr. Boyadjieff at the base salary of $580,000 that Varco paid Mr. Boyadjieff. In January 2001, after consideration of the review and recommendations made by Frederic Cook, we set Mr. Boyadjieff’s salary for 2001 at $680,000, representing the median plus 10% of the comparison group for salaries paid to chief executive officers. Based on the Company overachieving its fiscal 2001 earnings per share performance target, Mr. Boyadjieff received an Annual Incentive Compensation Plan award of approximately $761,000. Mr. Boyadjieff was also granted options covering 147,027 shares during 2001, based on a multiple value of his salary.

| | | COMPENSATION COMMITTEE |

|

| | | James D. Woods, Chairman |

| | | George S. Dotson |

| | | Jeffery A. Smisek |

18

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The members of the Compensation Committee are James D. Woods, George S. Dotson and Jeffery A. Smisek. None of such persons is an officer or employee of us or any of our subsidiaries.

During 2001, none of our executive officers served as a director or member of a compensation committee (or other committee serving an equivalent function) of any other entity, whose executive officers served as a director or member of our Compensation Committee.

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, and persons who own more than 10% of a registered class of our equity securities, to file initial reports of ownership and reports of changes in ownership with the SEC and the New York Stock Exchange. These persons are required by regulations promulgated by the SEC to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on its review of copies of such reports received by us or written representations from certain reporting persons that no other reports were required, during the year ended December 31, 2001, all of our directors and executive officers and persons who own more than 10% of the outstanding shares of our common stock have complied with the reporting requirements of Section 16(a), except that (i) L.E. Simmons and L.E. Simmons & Associates, and certain of their affiliated entities, SCF Partners, L.P. SCF II, L.P., SCF III, L.P., D.O.S. Partners, L.P. and FGSI Partners, L.P., were late filing two reports concerning stock sales occurring on eight separate days in March and April 2001; (ii) John F. Lauletta was late in filing one report concerning an option exercise and stock sale in February 2001; (iii) George Boyadjieff was late in filing one report concerning an option exercise and stock sale in January 2001; and (iv) Haynes B. Smith III was late in filing his initial report.

19

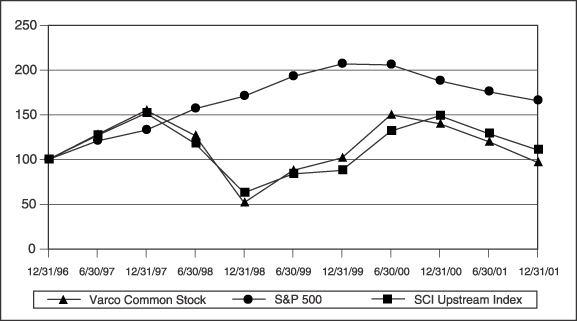

STOCKHOLDER RETURN PERFORMANCE GRAPH

The following line graph compares the yearly percentage change in the cumulative total stockholder return on our common stock against the cumulative total return of a peer index of 75 oil service companies prepared by Simmons & Company International, an independent third party, known as the “SCI Upstream Index,” and the Standard & Poor’s 500 Stock Index, each for the period from December 31, 1996 to December 31, 2001.

The graph assumes $100 invested in our common stock, the SCI Upstream Index and the Standard & Poor’s 500 Stock Index on December 31, 1996 and the reinvestment of all dividends.

20

REPORT OF AUDIT AND COMPLIANCE COMMITTEE

The Audit and Compliance Committee is composed of independent directors and operates under a written charter adopted by the Board of Directors. For fiscal 2001, the members of the Committee were Andre R. Horn (Chairman), Eric L. Mattson and L.E. Simmons. After completion of fiscal 2001 review, Mr. Mattson resigned from the Committee and Eugene R. White was appointed to replace him on the Committee.

Management has the primary responsibility for our financial statements and the reporting process, including the system of internal control. Ernst & Young, LLP, the independent accountants for us, are responsible for performing an independent audit of our consolidated financial statements in accordance with generally accepted auditing standards and to issue a report thereon. The Committee’s responsibility is to monitor these processes.

In this context, the Committee has met and held discussions with management and the independent accountants. Management represented to the Committee that our consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Committee has reviewed and discussed the consolidated financial statements with management and the independent accountants. The Committee’s discussions with the independent accountants included the matters required to be discussed by Statement on Auditing Standards No. 61, “Communication with Audit Committees.”

The independent accountants provided to the Committee the written disclosures and letter required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and the Committee discussed with the independent accountants the accountants’ independence from us and our management.

The Committee discussed with our internal auditors and the independent accountants the overall scope and plans for their audits. The Committee met with the internal auditors and independent accounts, with and without management present, and discussed the results of their examinations, their evaluations of our internal controls, and the overall quality of our financial reporting. The Committee held three meetings during fiscal 2001.

In reliance on the reviews and discussions referred to above, the Committee recommended to the Board of Directors that the audited financial statements be included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2001, for filing with the Securities and Exchange Commission.

| | AU | DIT AND COMPLIANCE COMMITTEE |

21

FEES PAID TO INDEPENDENT PUBLIC ACCOUNTANTS

The fees paid to Ernst & Young, LLP, our independent public accountants, during or with respect to 2001 were as follows:

Audit Fees

The aggregate fees billed for professional services rendered by Ernst & Young LLP for the audit of our annual financial statements for the year ended December 31, 2001 and the reviews of the financial statements included in the our Quarterly Reports on Form 10-Q for that year were approximately $789,000.

Financial Information Systems Design and Implementation Fees

We did not engage Ernst & Young LLP to provide advice to us regarding financial information systems design and implementation during fiscal 2001.

All Other Fees

The aggregate fees billed for services rendered by Ernst & Young LLP, other than fees for the services referenced under the caption “Audit Fees,” during the 2001 fiscal year were approximately $658,000. Of such “All Other Fees,” fees paid for audit related services were as follows: statutory audits, $133,000; acquisition analysis, $57,000; benefit plan analysis, $40,000; debt offering analysis, $56,000 and other audit related analysis, $95,000. Fees paid for certain tax advisory services, including tax compliance and tax consulting, were approximately $277,000.

The Audit and Compliance Committee has reviewed the non-audit services provided by Ernst & Young LLP and determined that the provision of these services during fiscal 2001 is compatible with maintaining Ernst & Young LLP’s independence.

22

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

Ernst & Young LLP has been our independent auditors since 1988, and the Board of Directors desires to continue to engage the services of this firm for the fiscal year ending December 31, 2002. Accordingly, the Board of Directors, upon the recommendation of the Audit and Compliance Committee, has reappointed Ernst & Young LLP to audit our and our subsidiaries’ financial statements for fiscal 2002 and to report on these financial statements. Our stockholders are being asked to vote upon ratification of this selection. If our stockholders do not ratify the selection, the Board of Directors and the Audit and Compliance Committee will reconsider the selection.

Representatives of Ernst & Young LLP are expected to be present at the annual meeting and will have the opportunity to make statements if they so desire and to respond to appropriate questions from our stockholders.

Vote Required for Ratification of the Selection of the Independent Auditors

The affirmative vote of a majority of the shares represented and entitled to vote at the annual meeting is required for ratification of the selection of Ernst & Young LLP as our independent auditors for fiscal 2002. Broker non-votes as to the ratification of the selection of Ernst & Young LLP as our independent auditors will not be treated as shares entitled to vote with respect to ratification and, thus, will not affect the vote on ratification. Abstentions, however, will have the same effect as votes against the proposal. Unless instructed to the contrary, the shares represented by the proxies will be voted “FOR” ratification of the selection of Ernst & Young LLP as our independent auditors.

The Board of Directors recommends a vote “FOR” ratification of the selection of Ernst & Young LLP as our independent auditors for fiscal year ending December 31, 2002.

23

STOCKHOLDER PROPOSALS

It is currently contemplated that our 2003 Annual Meeting of Stockholders will be held on or about May 15, 2003. In the event that a stockholder desires to have a proposal considered for presentation at the 2003 Annual Meeting of Stockholders, and inclusion in the proxy statement and form of proxy used in connection with such meeting, the proposal must be forwarded in writing to our Secretary so that it is received no later than December 20, 2002. Any such proposal must comply with the requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934.

If a stockholder, rather than including a proposal in our proxy statement as discussed above, commences his or her own proxy solicitation for the 2003 Annual Meeting of Stockholders or seeks to nominate a candidate for election or propose business for consideration at such meeting, we must receive notice of such proposal on or before March 5, 2003. If the notice is not received by March 5, 2003 it will be considered untimely under Rule 14a-4(c)(1) of the SEC’s proxy rules, and we will have discretionary voting authority under proxies solicited for the 2003 Annual Meeting of Stockholders with respect to such proposal, if presented at the meeting.

Proposals and notices should be directed to the attention of the Secretary, Varco International, Inc., 2000 W. Sam Houston Parkway South, Suite 1700, Houston, Texas 77042.

OTHER MATTERS

As of the date of this proxy statement, the Board of Directors knows of no other matters that may be presented for consideration at the annual meeting. However, if any other matter is presented properly for consideration and action at the annual meeting, or any adjournment or postponement of the meeting, it is intended that the proxies will be voted on any such matters in accordance with the best judgment and in the discretion of the proxy holders.

| | By | Order of the Board of Directors, |

| | Vice President, Secretary and General Counsel |

April 19, 2002

24

Please mark [X]

your votes as

indicated in

this example

1. ELECTION OF DIRECTORS

FOR ALL WITHHOLD

nominees listed AUTHORITY

below (except to vote for

as marked to all nominees

the contrary) listed below

[_] [_]

Nominees: 01 George Boyadjieff, 02 George S. Dotson, 03 Andre R. Horn,

04 Richard A. Kertson, 05 John F. Lauletta,06 Eric L. Mattson,

07 L. E. Simmons, 08 Jeffery A. Smisek, 09 Douglas E. Swanson,

10 Eugene R. White, 11 James D. Woods

Instruction: To withhold authority for any

nominee, draw a line through

(or otherwise strike out) the nominee's name

in the list above.

2. To ratify the selection of Ernst & Young LLP as Varco's independent

auditors for the fiscal year ending December 31, 2002.

FOR AGAINST ABSTAIN

[_] [_] [_]

FOR AGAINST ABSTAIN

[_] [_] [_]

3. In the discretion of the persons acting as proxies, on such other

matters as may properly come before the annual meeting or any

adjustment(s) thereof.

ELECTION TO RECEIVE PROXY AND ANNUAL

REPORT DOCUMENTS ELECTRONICALLY

By checking this box, I consent to future [_]

delivery of annual reports, proxy statements,

prospectuses and other materials and shareholder

communications electronically via the Internet

at a webpage which will be disclosed to me. I

understand that Varco may no longer distribute

printed materials to me for any future