INVESTOR/ANALYST DAY AUGUST 9, 2018

Safe Harbor This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder, that involve inherent risks and uncertainties. Any statements about our plans, objectives, expectations, strategies, beliefs, or future performance or events constitute forward- looking statements. Forward-looking statements are neither historical facts nor assurances about future performance, and involve known and unknown risks, uncertainties, assumptions, estimates and other important factors that could cause actual results to differ materially from any results, performance or events expressed or implied by such forward-looking statements. Such forward-looking statements include but are not limited to statements about revenues, income, net interest margin, quarterly provisions for loan losses, non-interest expense, loan growth, non-performing assets and net charge-off of loans and other statements that are not historical facts. These forward-looking statements are subject to risks and uncertainties that are difficult to predict and may be outside our control including, but not limited to, the risks and uncertainties described under sections such as those entitled “Risk Factors” in our Form 10-K and subsequent filings with the Securities and Exchange Commission (“SEC”) including, but not limited to, our Form 10-Q for the quarter ended June 30, 2018. The risk factors described in the Form 10-K and the Form 10-Q are not necessarily all of the important factors that could cause our actual results, performance or achievements to differ materially from those expressed in or implied by any of the forward-looking statement contained in this presentation. Other unknown or unpredictable factors also could affect our results. Therefore, you should not rely on any of these forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above. Forward-looking statements speak only to the information currently available to us and only as of the date they are made and we do not undertake or assume any obligation to update publicly any of these statements, whether written or oral, to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. Page 2

Important Additional Information This presentation is being made in respect of the proposed merger between First Interstate and Northwest Bancorporation. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed transaction, First Interstate filed a registration statement on Form S-4 on June 8, 2018 with the SEC, which included a proxy statement of Northwest Bancorporation and a prospectus of First Interstate. First Interstate amended the registration statement with its filing on Form S-4/A on July 2, 2018 and it became effective on July 3, 2018. First Interstate also filed a prospectus pursuant to Rule 424(b)(3) on July 9, 2018. First Interstate and Northwest Bancorporation will file other documents regarding the proposed transaction with the SEC as needed. Before making any voting or investment decision, investors and security holders of Northwest Bancorporation are urged to carefully read the entire registration statement and proxy statement/prospectus, when they become available, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. The documents filed by First Interstate with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. Other important business and financial information about First Interstate may be found in our other filings with the SEC.In addition, the documents filed by First Interstate may be obtained free of charge at its website at www.fibk.com or by contacting First Interstate BancSystem, Inc., 401 North 31st Street, Billings, Montana 59116, Attention: Marcy Mutch, Chief Financial Officer, telephone (406) 255-5312. First Interstate and Northwest Bancorporation and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies of Northwest Bancorporation’s shareholders in connection with the proposed transaction. Information about the directors and executive officers of First Interstate and their ownership of First Interstate common stock is set forth in the proxy statement for First Interstate’s 2018 Annual Meeting of Shareholders, as filed with the SEC on Schedule 14A on March 16, 2018. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the proxy statement/prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. Page 3

Agenda Timing Topic Management 7:30 a.m. – 9:30 a.m. A quick peek of Billings Trolley Tour | departing from downtown 9:30 a.m. – 9:35 a.m. Welcome & Introductions Kevin Riley, President and Chief Executive Officer 9:35 a.m. – 9:50 a.m. Our History and Culture Jim Scott, Chairman of the Board 9:50 a.m. – 10:05 a.m. Board Governance David L. Jahnke, Independent Director 10:05 a.m. – 10:35 a. m. People, Process, Technology Kevin Riley, President and Chief Executive Officer 10:35 a.m. – 11:00 a.m. Community Bank Strategy Renee Newman, Chief Banking Officer 11:00 a.m. – 11:15 a.m. Break 11:15 a.m. – 12:00 p.m. Banking across our Footprint Bill Gottwals, Director of Banking 12:00 p.m. – 1:00 pm Lunch Economic Update & Balance Sheet 1:00 p.m. – 1:45 p.m. Larry Johns, Treasurer Management 1:45 p.m. – 2:15 p.m. Enterprise Risk Management Phil Gaglia, Chief Risk Officer 2:15 p.m. – 2:30 p.m. Break Financial Performance and Acquisition 2:30 p.m. – 3:00 p.m. Marcy Mutch, Chief Financial Officer Strategy 3:00 p.m. – 3:30 p.m. Current Strategic Initiatives Kevin Riley, Chief Executive Officer 3:30 p.m. – 4:00 p.m. Q & A Kevin Riley, Marcy Mutch 4:00 p.m. Closing Remarks Kevin Riley & Jim Scott Page 4

Our History and Culture JAMES R SCOTT, CHAIRMAN OF THE BOARD

We are … our Vision, Mission & Values Our Vision To be the premier financial service provider in the communities we serve. To continuously strengthen our relationships with employees, clients, Our Mission and communities while driving long-term shareholder value. Our Strategic Objectives Best in Class Employer of Relationship Operational Financial Choice Management Excellence Excellence We are Our Values We put We strive for We act with We embrace committed We celebrate people first excellence integrity change to our success communities Page 6

Board Governance DAVID JAHNKE, BOARD MEMBER AND AUDIT COMMITTEE CHAIR

Board Governance o Our corporate governance program is structured to build long-term financial performance and value for all of First Interstate’s shareholders. o The Board’s responsibilities include: • Identifying organizational values and vision; Committed to • Together with management setting strategic direction; Building Long- • Evaluating executive management and ensuring management succession plans are in place; Term Value • Monitoring company performance against established criteria; • Ensuring adherence to ethical practices; • Ensuring full and fair disclosure is provided to shareholders, regulators, and other constituents and • Overseeing risk management. o We are a controlled company under the NASDAQ Marketplace Rules, based on the voting rights of Controlled members of the Scott family. Company Status o As a controlled company, we are not required to have a majority independent board. o As a controlled company, we are allowed to have non-independent members on the Compensation and Governance and Nominating committees. Page 8

Board of Directors o Although First Interstate is a controlled company, its governance guidelines stipulate that the majority of its board is constituted of independent directors. o Independent directors must fulfill standards under the NASDAQ Marketplace Rules Independent Directors Non-Independent Directors • Teresa A. Taylor – Lead Independent Director, Chair of • James R. Scott – Chair of the Board, Chair of Executive Compensation Committee Committee • Steven J. Corning • Kevin P. Riley – President and Chief Executive Officer • Dana L. Crandall – Chair of Technology Committee • John M. Heyneman, Jr. • William B. Ebzery • James R. Scott, Jr. • Charles E. Hart, M.D. – Chair of Governance & • Jonathan R. Scott Nominations Committee • David L. Jahnke – Chair of Audit Committee • Dennis L. Johnson • Ross E. Leckie – Chair of Risk Committee • Patricia L. Moss • Peter I. Wold Page 9

Corporate Governance o Appointment of a lead independent director o Separation of the Chair of the Board and CEO roles Structure reflects o 5 of 6 committees chaired by independent directors commitment to o Regular executive sessions of independent directors good corporate o Annual board and committee self-evaluations governance o Stock ownership guidelines for directors and executive officers o Cash and equity awards with clawback provisions o Directors are actively involved in strategy and oversight to benefit First Interstate and all of its stockholders. Board operates o Each director exercises his or her own independent business judgment, on an informed basis, and in good consistently with faith on board matters to benefit First Interstate and all of its stockholders. company values and strategic vision Page 10

Our Future: People, Process, Technology KEVIN RILEY, PRESIDENT AND CEO

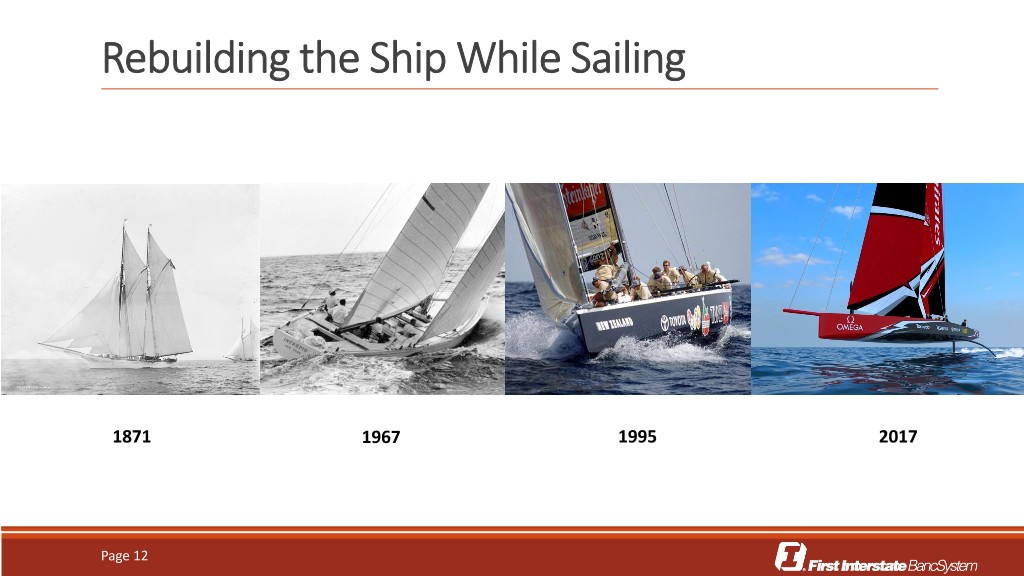

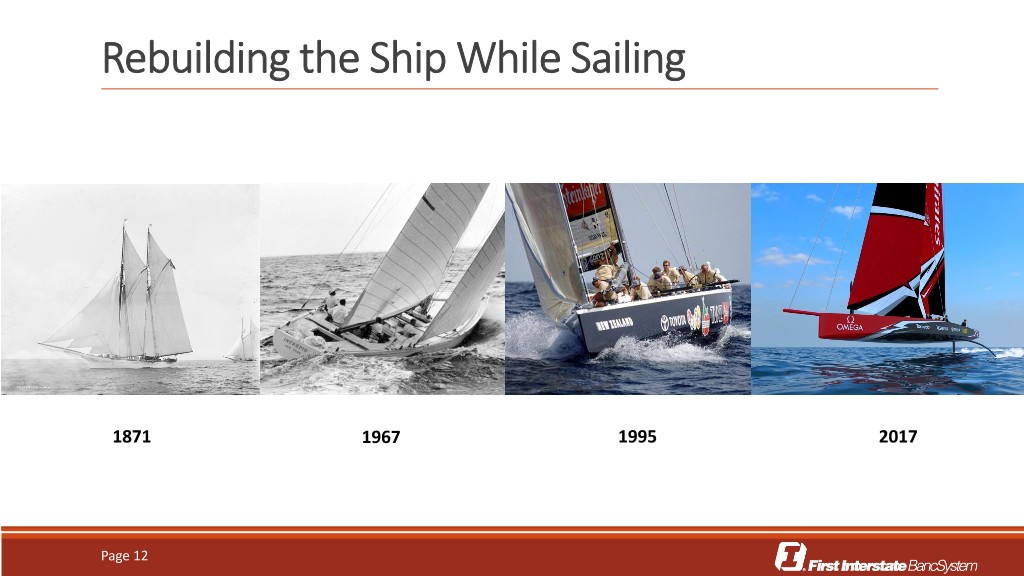

Rebuilding the Ship While Sailing 1871 1967 1995 2017 Page 12

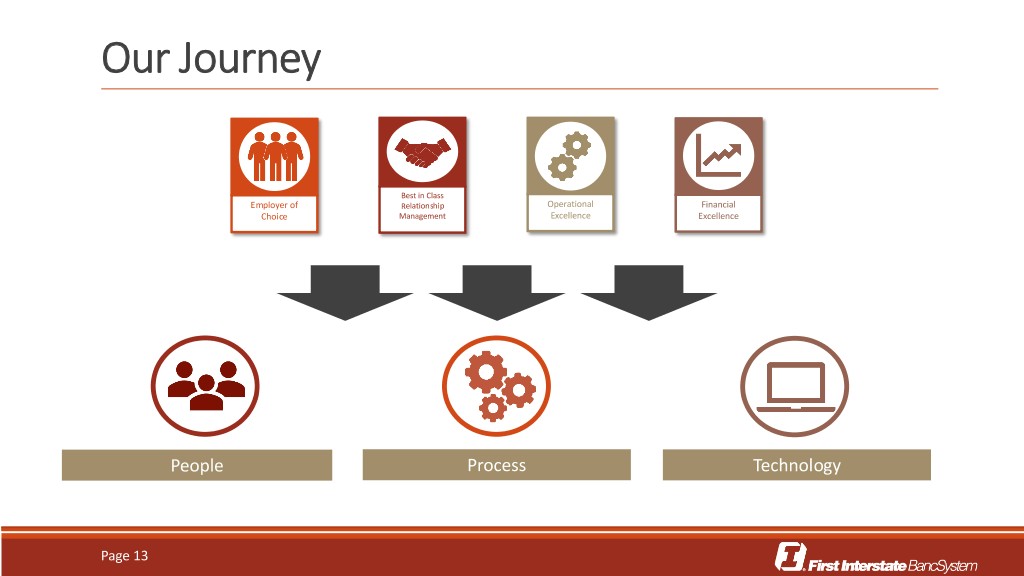

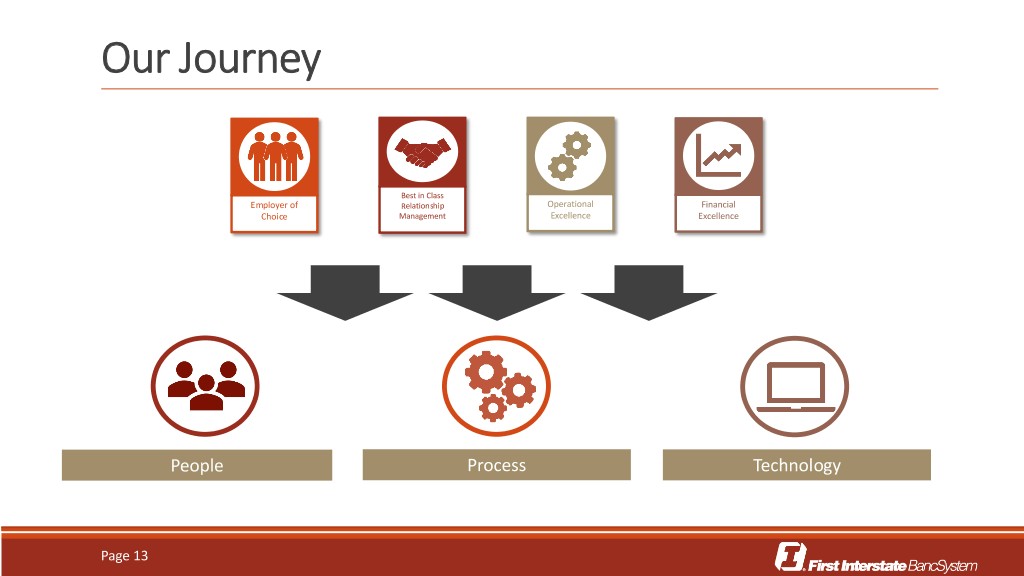

Our Journey Best in Class Employer of Relationship Operational Financial Choice Management Excellence Excellence People Process Technology Page 13

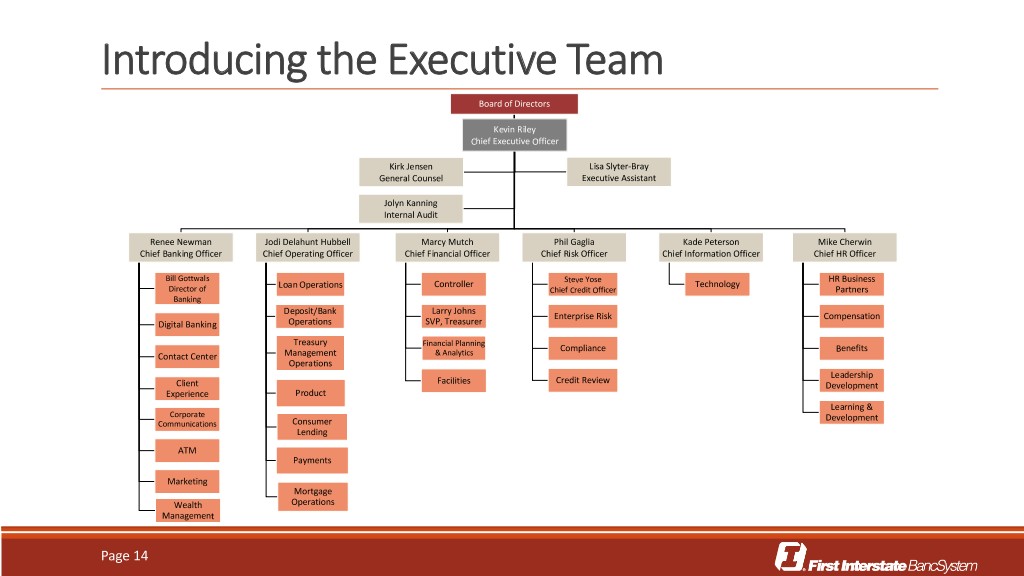

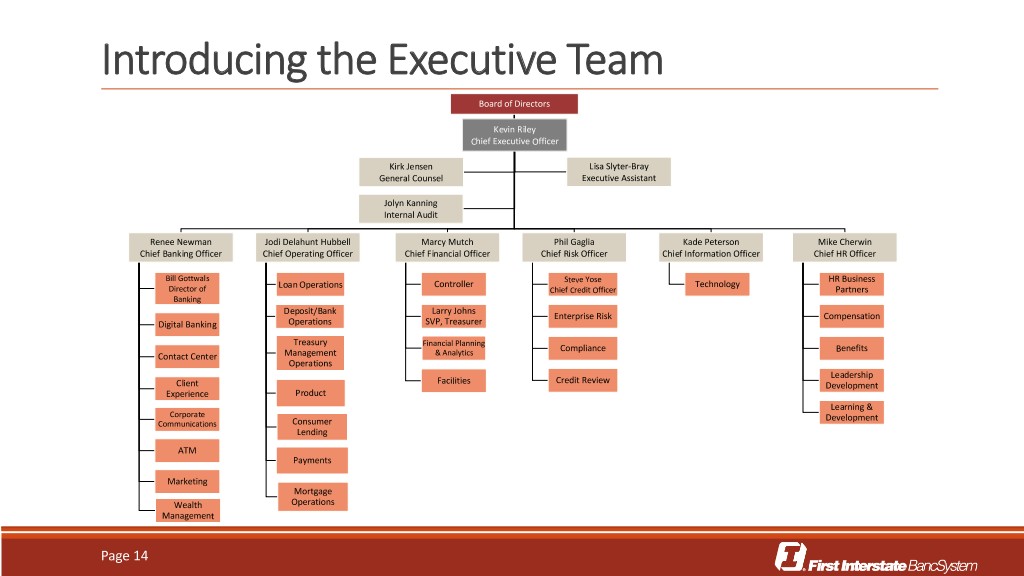

Introducing the Executive Team Board of Directors Kevin Riley Chief Executive Officer Kirk Jensen Lisa Slyter-Bray General Counsel Executive Assistant Jolyn Kanning Internal Audit Renee Newman Jodi Delahunt Hubbell Marcy Mutch Phil Gaglia Kade Peterson Mike Cherwin Chief Banking Officer Chief Operating Officer Chief Financial Officer Chief Risk Officer Chief Information Officer Chief HR Officer Bill Gottwals Steve Yose HR Business Loan Operations Controller Technology Director of Chief Credit Officer Partners Banking Deposit/Bank Larry Johns Enterprise Risk Compensation Digital Banking Operations SVP, Treasurer Treasury Financial Planning Compliance Benefits Contact Center Management & Analytics Operations Leadership Facilities Credit Review Client Development Experience Product Learning & Corporate Development Communications Consumer Lending ATM Payments Marketing Mortgage Wealth Operations Management Page 14

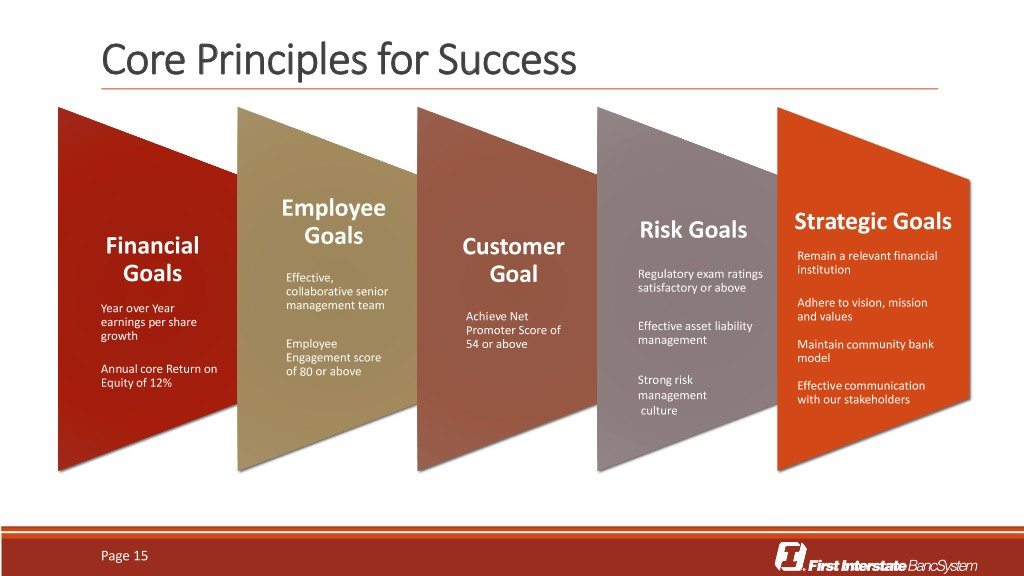

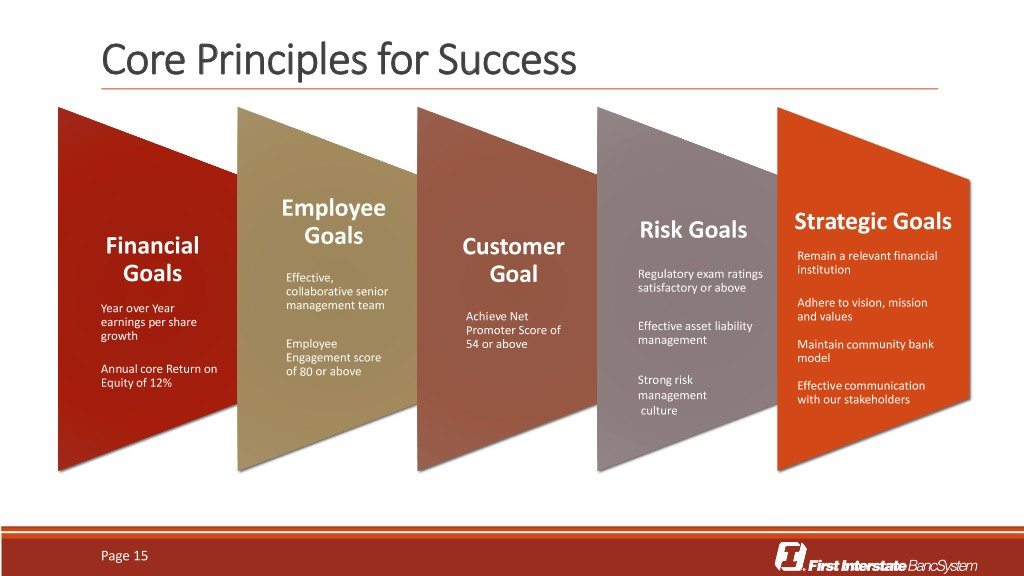

Core Principles for Success Employee Strategic Goals Goals Risk Goals Financial Customer Remain a relevant financial institution Goals Effective, Goal Regulatory exam ratings collaborative senior satisfactory or above Year over Year management team Adhere to vision, mission Achieve Net and values earnings per share Effective asset liability growth Promoter Score of Employee 54 or above management Maintain community bank Engagement score model Annual core Return on of 80 or above Equity of 12% Strong risk Effective communication management with our stakeholders culture Page 15

Community Bank Strategy RENEE NEWMAN, CHIEF BANKING OFFICER

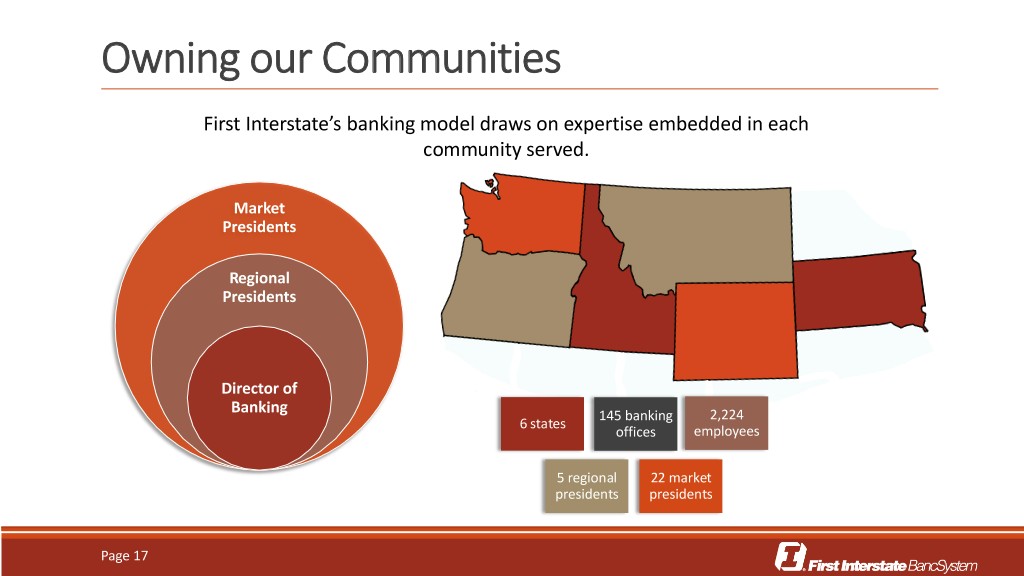

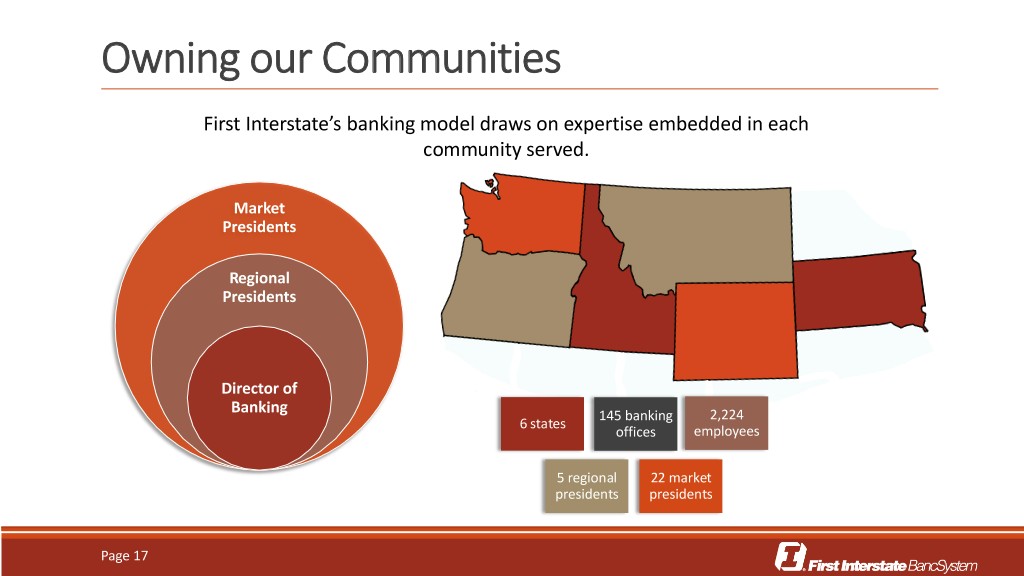

Owning our Communities First Interstate’s banking model draws on expertise embedded in each community served. Market Presidents Regional Presidents Director of Banking 145 banking 2,224 6 states offices employees 5 regional 22 market presidents presidents Page 17

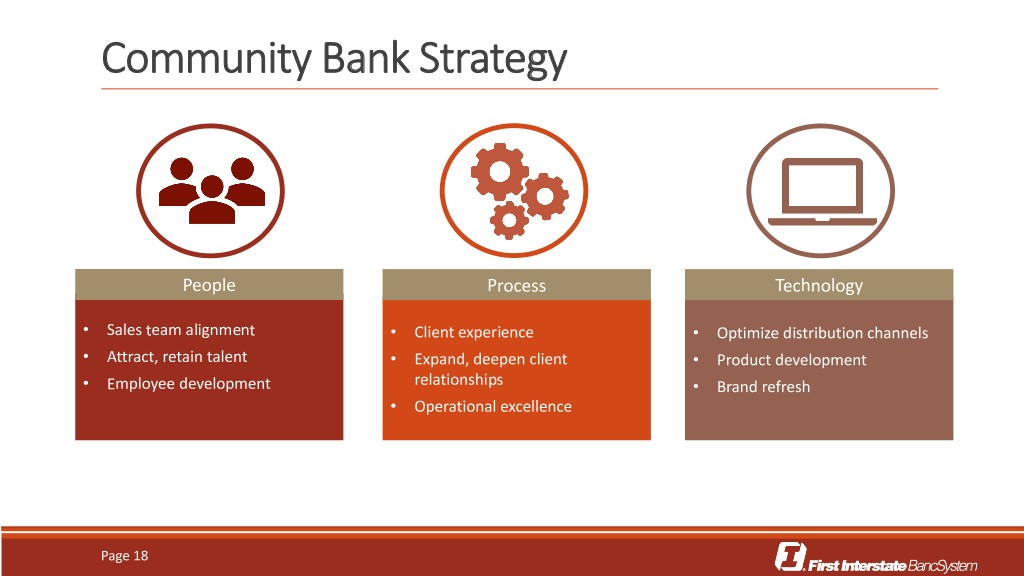

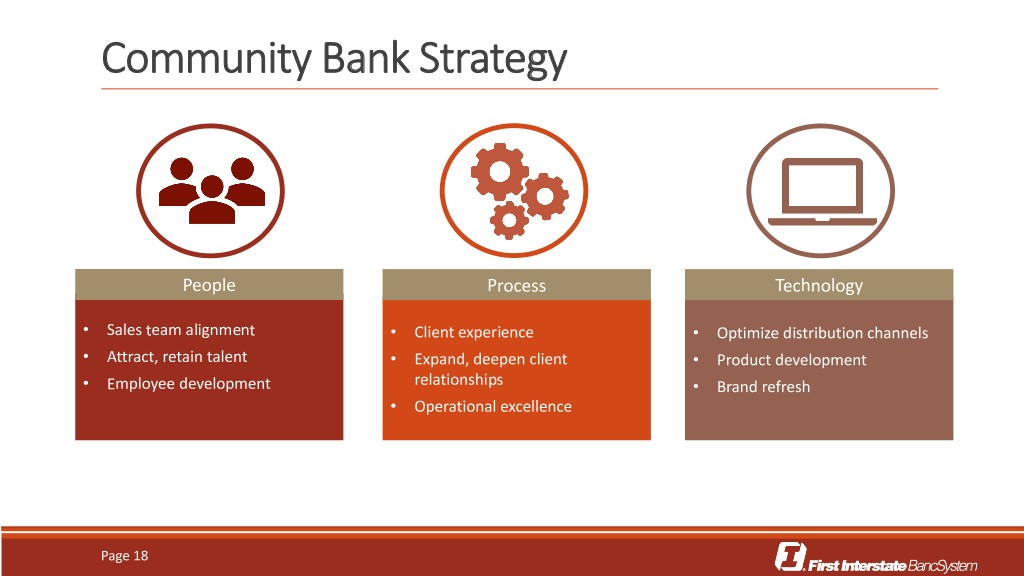

Community Bank Strategy People Process Technology • Sales team alignment • Client experience • Optimize distribution channels • Attract, retain talent • Expand, deepen client • Product development • Employee development relationships • Brand refresh • Operational excellence Page 18

Banking Across our Footprint BILL GOTTWALS, DIRECTOR OF BANKING

Banking Across our Footprint – Past and Present People Process Technology • • • Staffing model project Enhanced credit culture Optimize current technology • Renewed focus on business • Expansion of digital banking • Leadership development development Page 20

Banking Across our Footprint Payments Treasury New leadership New sales leadership role Opportunities in our new and existing Adapting to changing client behaviors markets Page 21

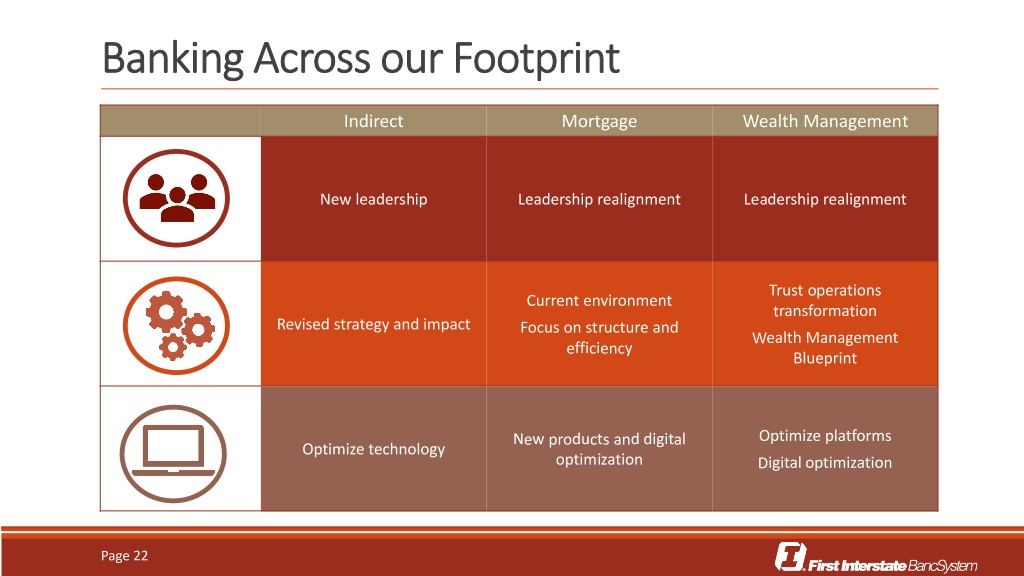

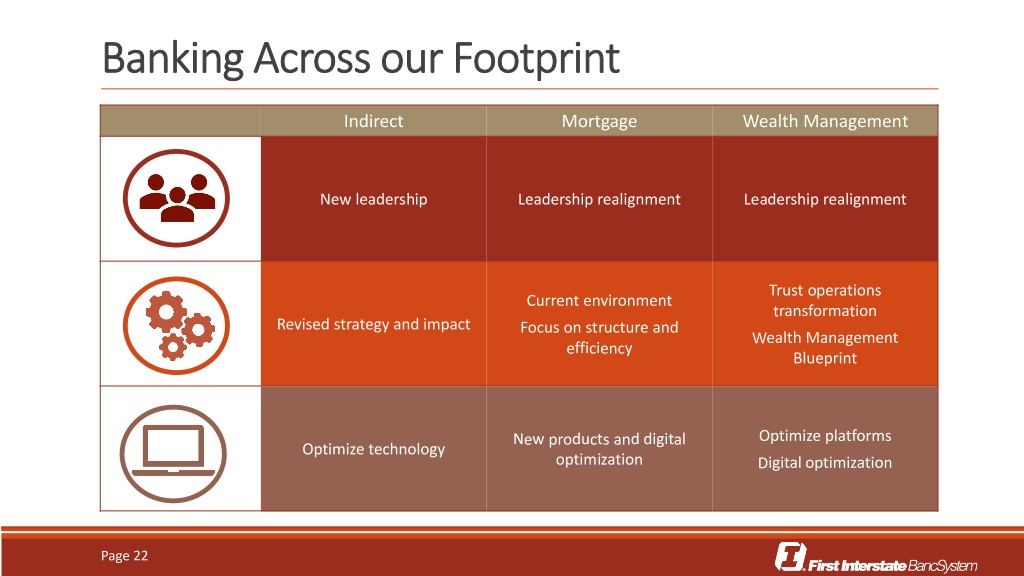

Banking Across our Footprint Indirect Mortgage Wealth Management New leadership Leadership realignment Leadership realignment Trust operations Current environment transformation Revised strategy and impact Focus on structure and Wealth Management efficiency Blueprint New products and digital Optimize platforms Optimize technology optimization Digital optimization Page 22

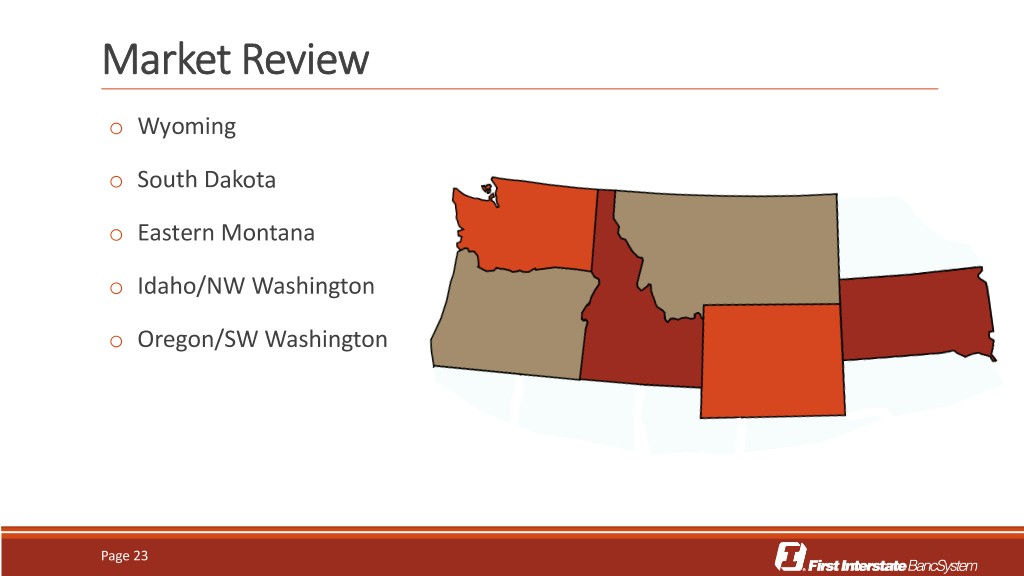

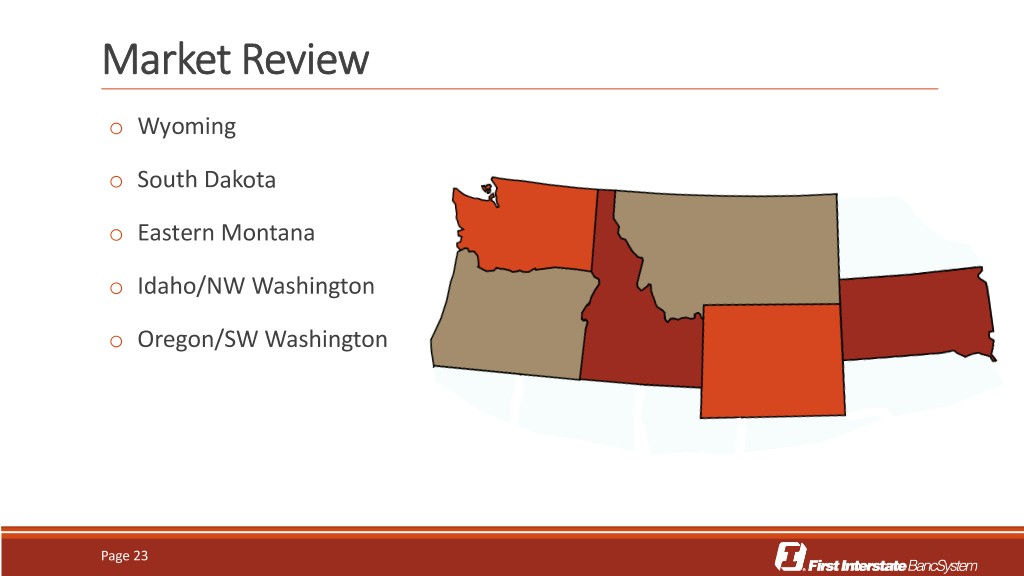

Market Review o Wyoming o South Dakota o Eastern Montana o Idaho/NW Washington o Oregon/SW Washington Page 23

Regional Economic Update LARRY JOHNS, TREASURER

GDP Composition Page 25

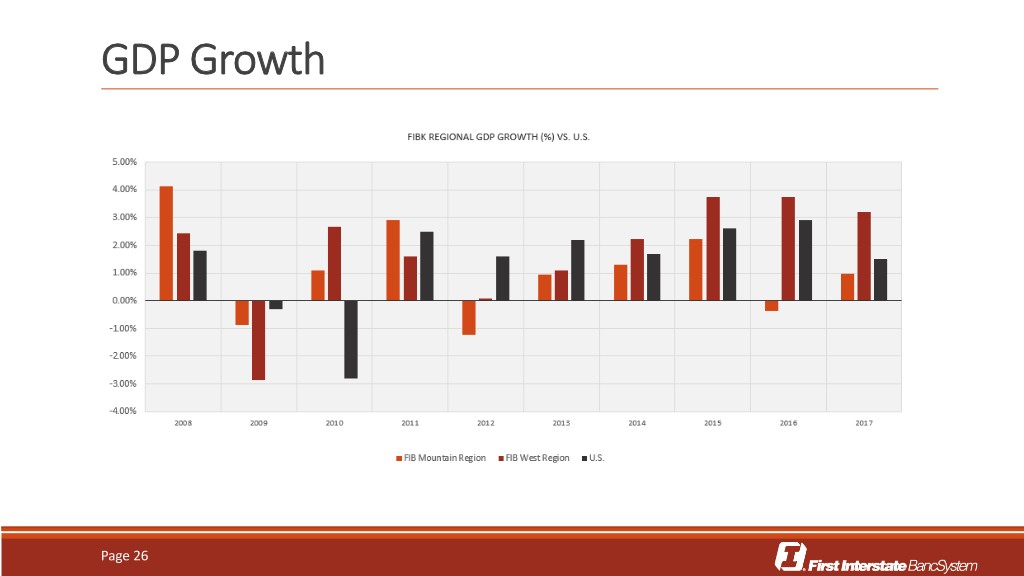

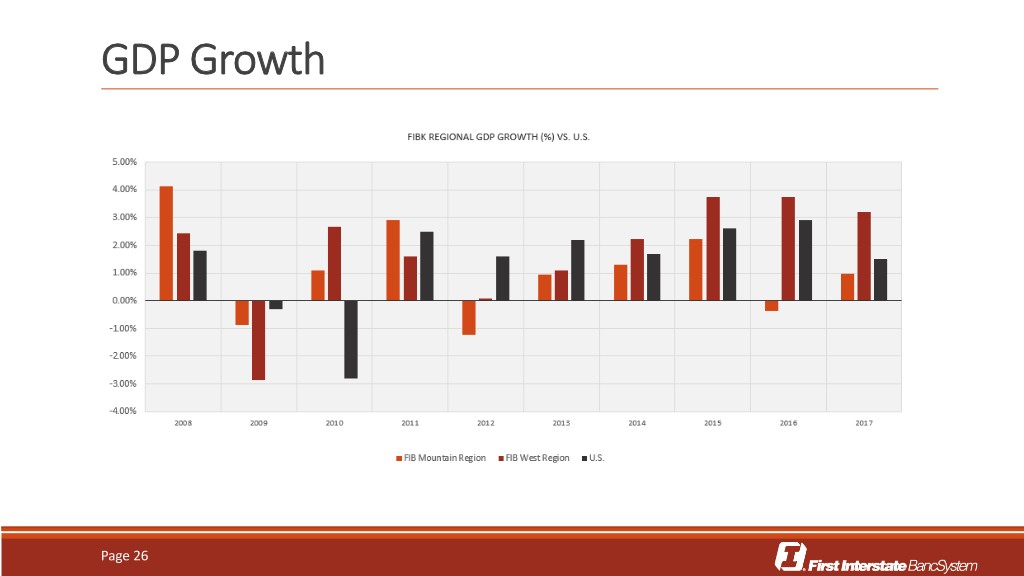

GDP Growth Page 26

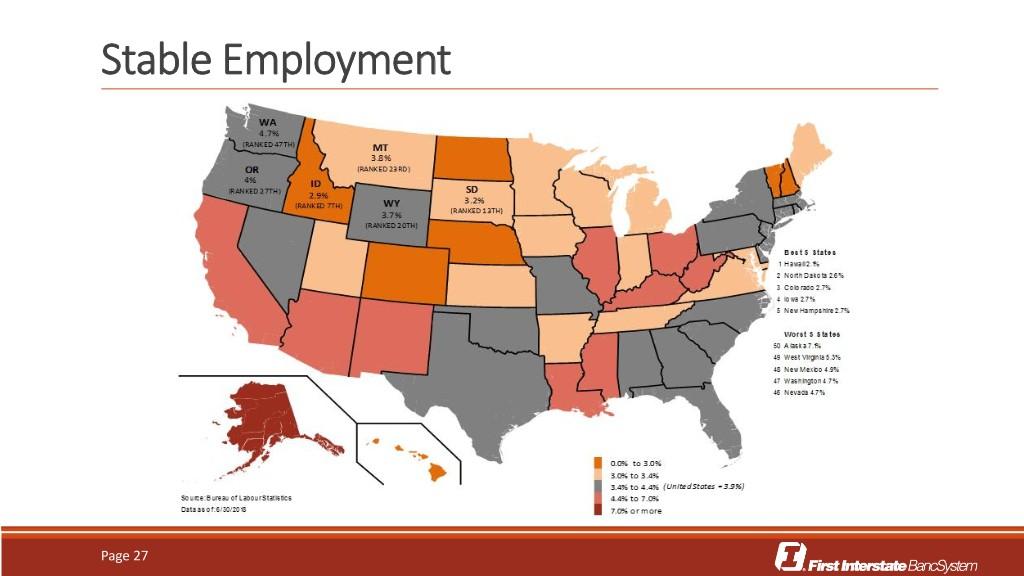

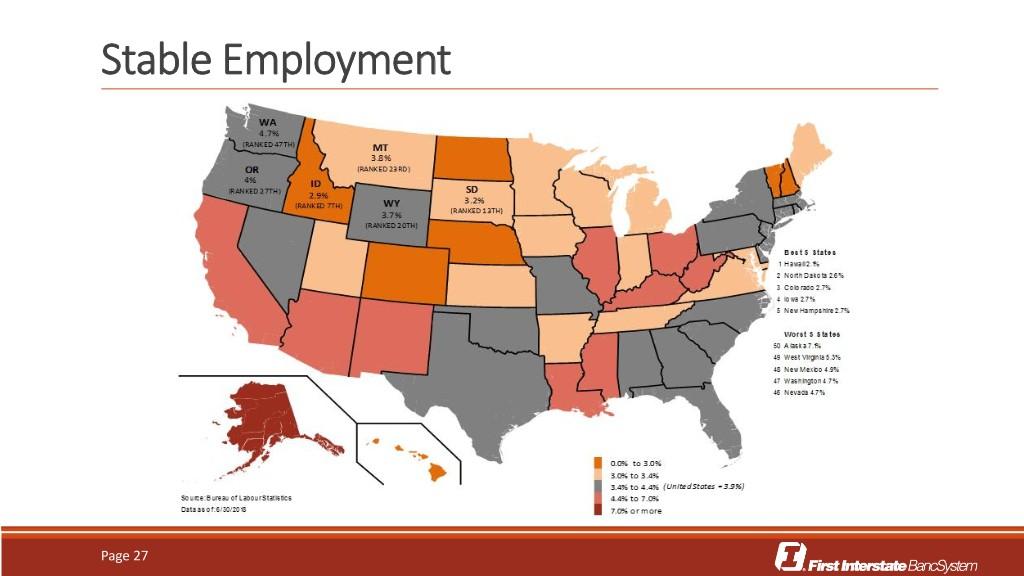

Stable Employment Page 27

Home Prices Page 28

Balance Sheet Management LARRY JOHNS, TREASURER

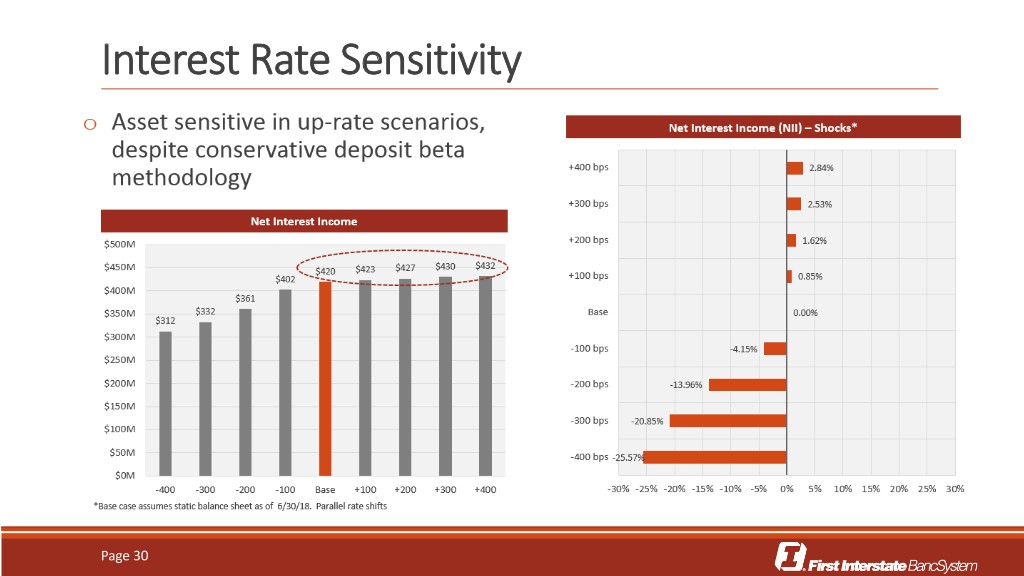

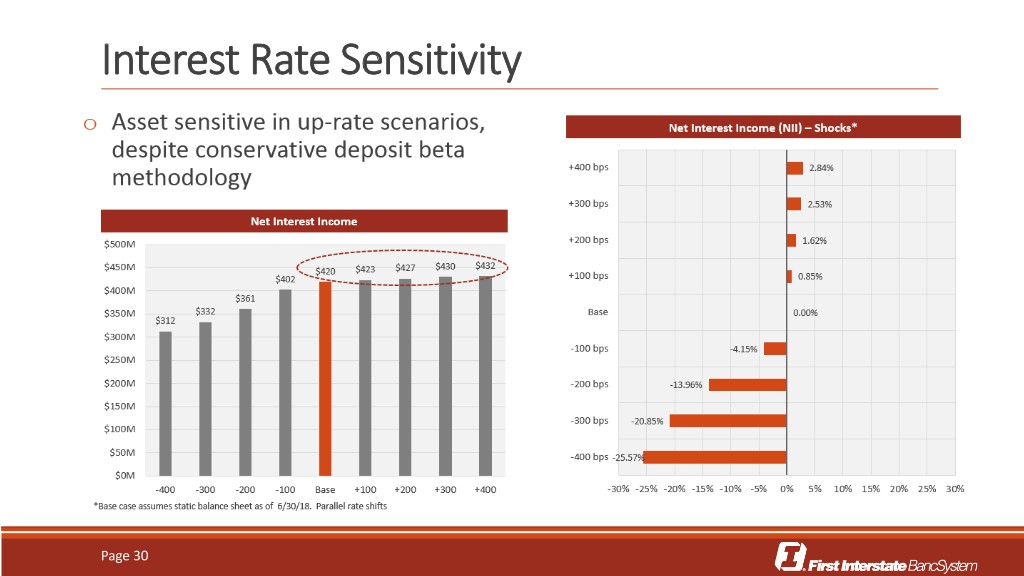

Interest Rate Sensitivity Page 30

Impact Of Rising Rates On The Loan Portfolio Page 31

Enterprise Risk Management PHIL GAGLIA, CHIEF RISK OFFICER

Risk Management Enhancements People Process Technology • Risk Committee of Board • Governance and risk appetite • Optimize Archer • Strong executive team • Compliance restructure • Upgrade to Verafin • Risk leadership team • Credit risk process enhancement Page 33

Financial Performance and Acquisition Strategy MARCY MUTCH, CHIEF FINANCIAL OFFICER

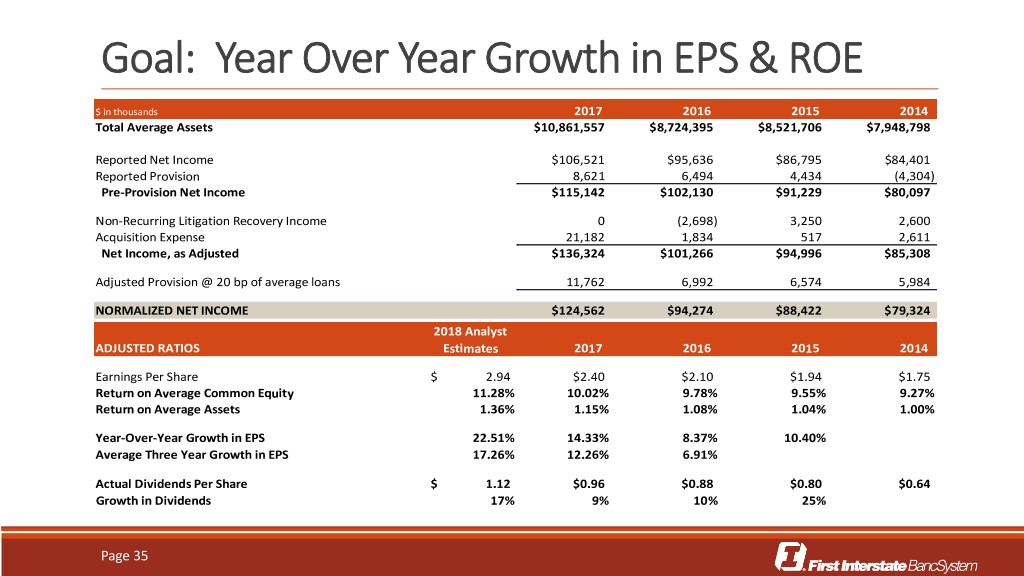

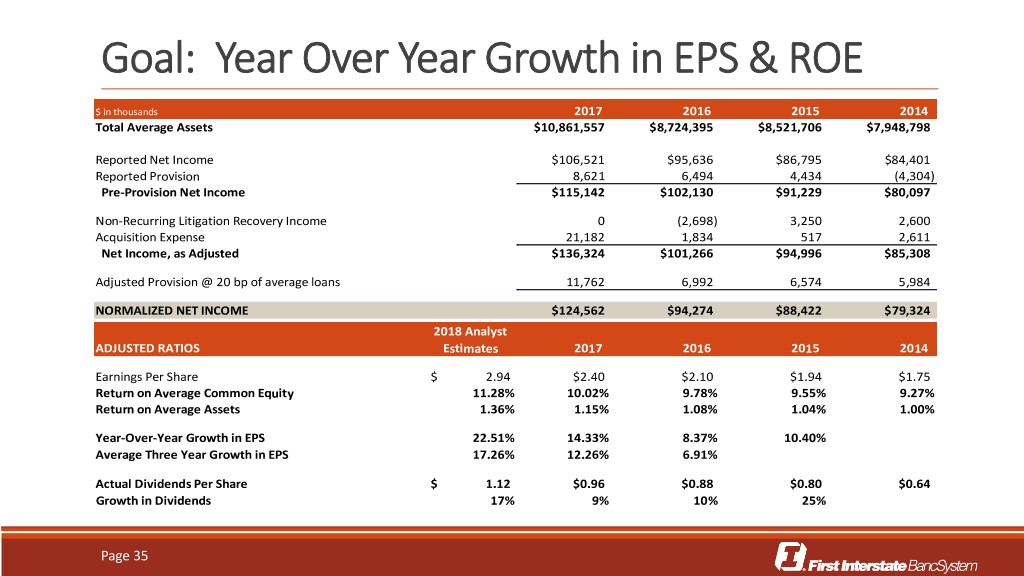

Goal: Year Over Year Growth in EPS & ROE $ in thousands 2017 2016 2015 2014 Total Average Assets $10,861,557 $8,724,395 $8,521,706 $7,948,798 Reported Net Income $106,521 $95,636 $86,795 $84,401 Reported Provision 8,621 6,494 4,434 (4,304) Pre-Provision Net Income $115,142 $102,130 $91,229 $80,097 Non-Recurring Litigation Recovery Income 0 (2,698) 3,250 2,600 Acquisition Expense 21,182 1,834 517 2,611 Net Income, as Adjusted $136,324 $101,266 $94,996 $85,308 Adjusted Provision @ 20 bp of average loans 11,762 6,992 6,574 5,984 NORMALIZED NET INCOME $124,562 $94,274 $88,422 $79,324 2018 Analyst ADJUSTED RATIOS Estimates 2017 2016 2015 2014 Earnings Per Share $ 2.94 $2.40 $2.10 $1.94 $1.75 Return on Average Common Equity 11.28% 10.02% 9.78% 9.55% 9.27% Return on Average Assets 1.36% 1.15% 1.08% 1.04% 1.00% Year-Over-Year Growth in EPS 22.51% 14.33% 8.37% 10.40% Average Three Year Growth in EPS 17.26% 12.26% 6.91% Actual Dividends Per Share $ 1.12 $0.96 $0.88 $0.80 $0.64 Growth in Dividends 17% 9% 10% 25% Page 35

Our Motto “Bigger’s not Better, Better’s Better” Kevin Riley, CEO Page 36

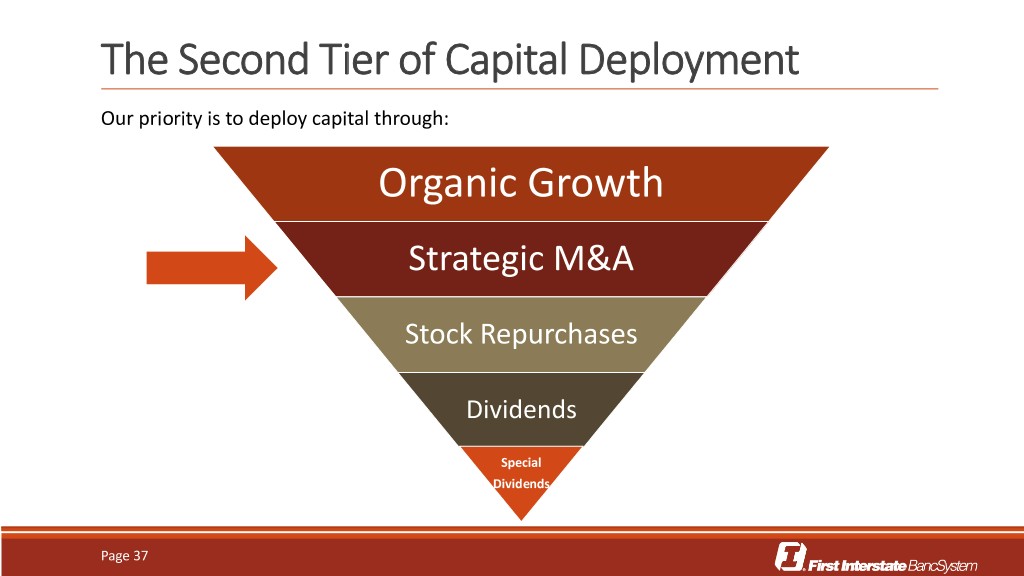

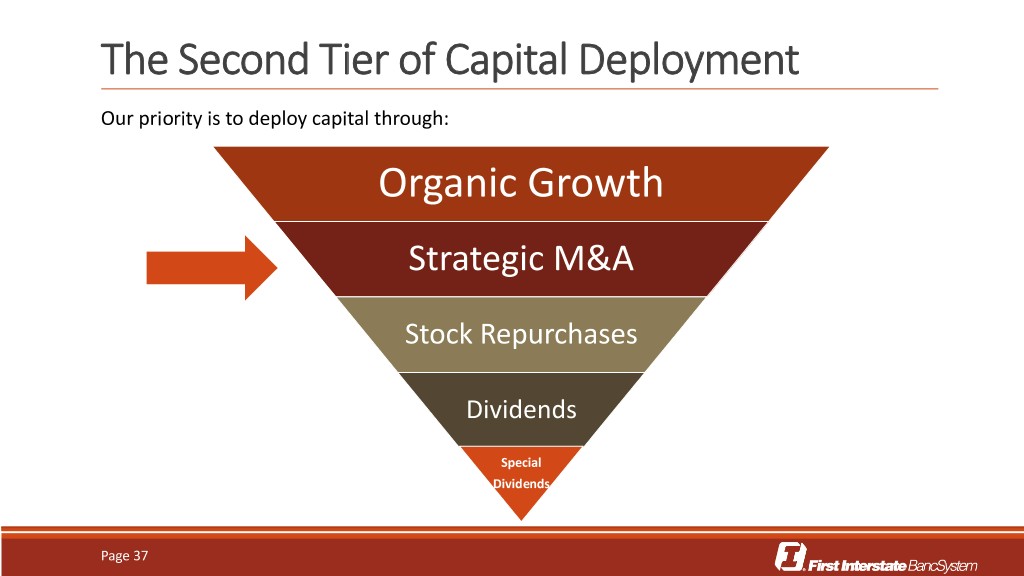

The Second Tier of Capital Deployment Our priority is to deploy capital through: Organic Growth Strategic M&A Stock Repurchases Dividends Special Dividends Page 37

Merger and Acquisition Criteria Considered Financial Considerations Growth Potential Geographic Proximity Risk Page 38

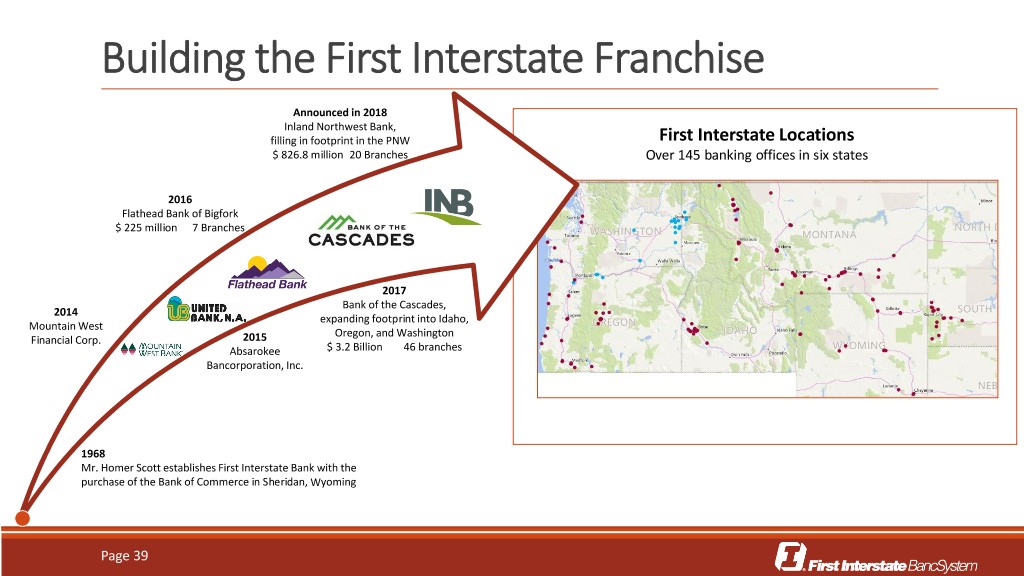

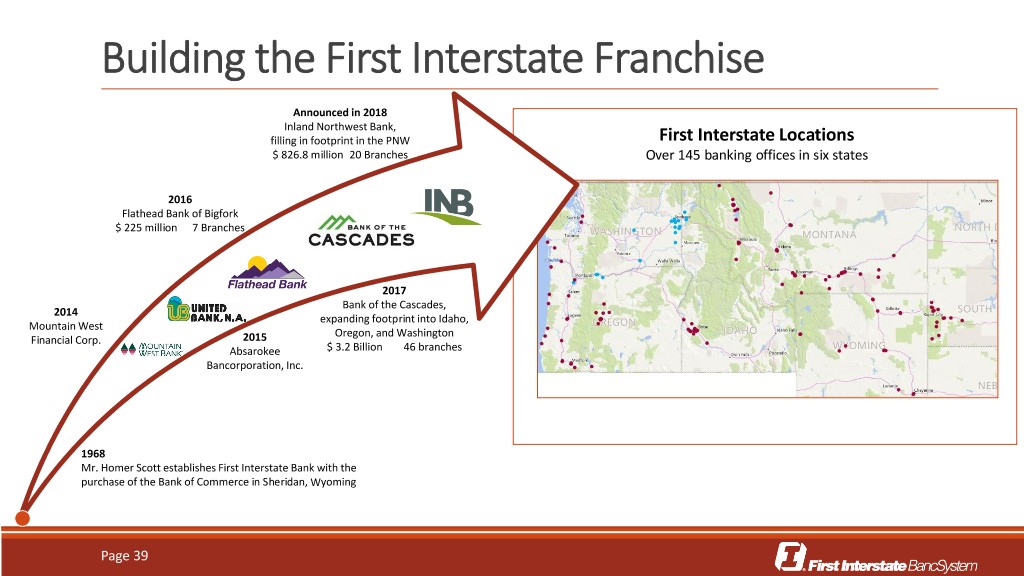

Building the First Interstate Franchise Announced in 2018 Inland Northwest Bank, filling in footprint in the PNW First Interstate Locations $ 826.8 million 20 Branches Over 145 banking offices in six states 2016 Flathead Bank of Bigfork $ 225 million 7 Branches 2017 Bank of the Cascades, 2014 expanding footprint into Idaho, Mountain West Oregon, and Washington Financial Corp. 2015 Absarokee $ 3.2 Billion 46 branches Bancorporation, Inc. 1968 Mr. Homer Scott establishes First Interstate Bank with the purchase of the Bank of Commerce in Sheridan, Wyoming Page 39

Inland Northwest Fits the Model o Financially attractive transaction with conservative assumptions Financial • 3%+ EPS accretion in 2019 and beyond Considerations • Tangible Book Value per share earnback of <2.0 years using both crossover and simple methods • 20+% IRR • Increased efficiencies as a result of 30% cost savings and continued positive operating leverage Geographic o Continued geographic diversification into attractive, high deposit growth markets in Pacific Northwest; Proximity and Strong presence in Spokane, Washington and Coeur d’Alene, Idaho Growth Potential o Complements First Interstate’s existing footprint between the Mountain West and Pacific Northwest o Expanded lending base and product offerings for INB clients o Strong understanding of markets, diversified lending products and approach to relationship banking o Similar credit cultures focused on conservative underwriting with high quality, low risk portfolio Risk o Comprehensive due diligence process completed o Retention of key Northwest Bancorporation personnel o All regulatory approvals have been obtained; Regulatory o Pending INB shareholder vote scheduled for August 14, 2018 Approvals Page 40

Strategic Initiatives KEVIN RILEY, CHIEF EXECUTIVE OFFICER

Our 2018 Strategic Initiatives Best in Class Employer of Relationship Operational Financial Choice Management Excellence Excellence • Transform core • Executive team • Enhancements to our • Comprehensive stress systems structure digital channels testing • Commercial & • Total Rewards strategy • Private Banking • Improved budgeting Consumer loan • FIB University • Treasury Management and forecasting processes • Talent management • Enhance client • Implementation of ERP • Disciplined product • Employee engagement experience • M&A management • CECL • Project governance oversight Page 42

Questions Page 43

Page 44

Appendix

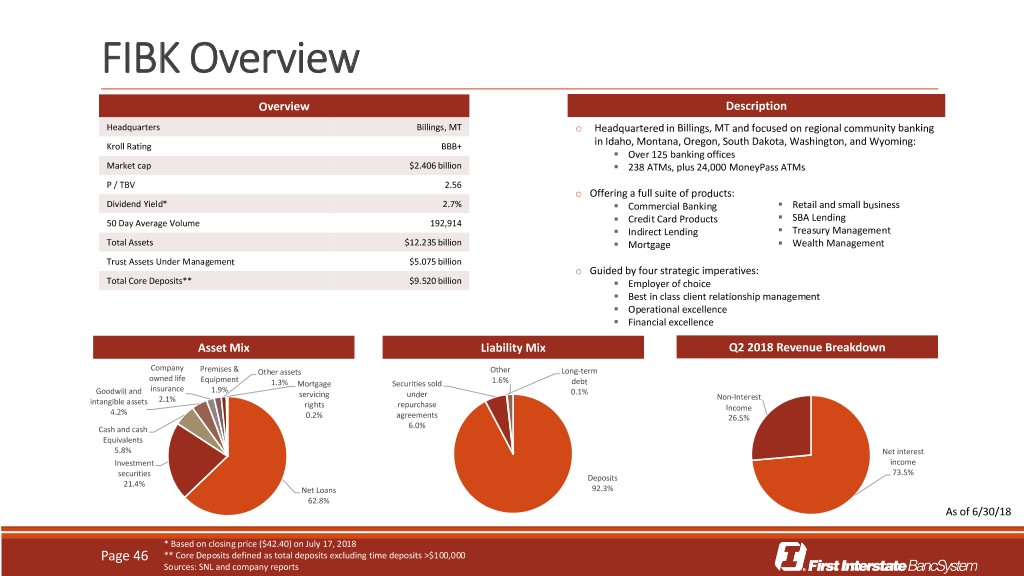

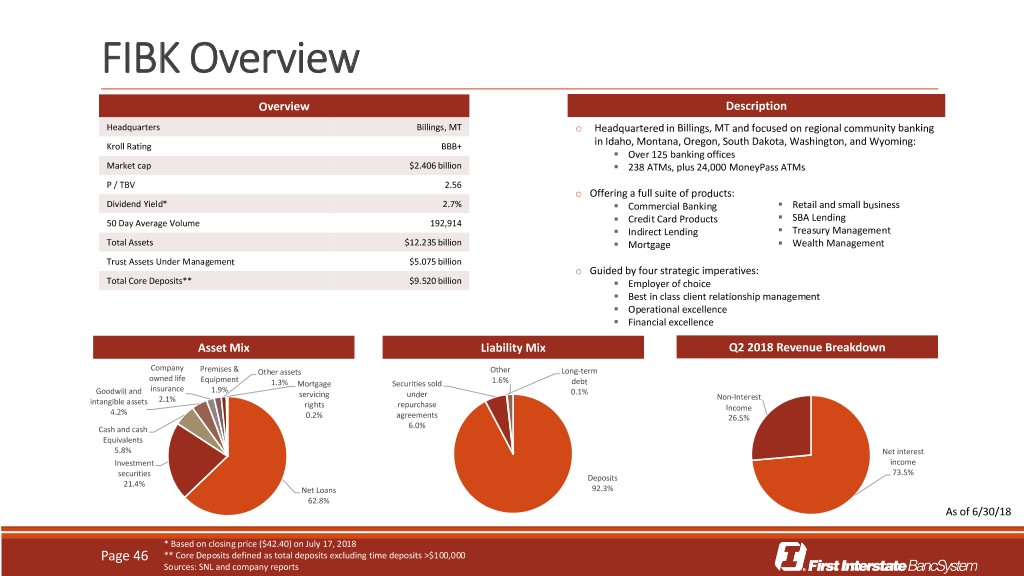

FIBK Overview Overview Description Headquarters Billings, MT o Headquartered in Billings, MT and focused on regional community banking Kroll Rating BBB+ in Idaho, Montana, Oregon, South Dakota, Washington, and Wyoming: . Over 125 banking offices Market cap $2.406 billion . 238 ATMs, plus 24,000 MoneyPass ATMs P / TBV 2.56 o Offering a full suite of products: . Dividend Yield* 2.7% . Commercial Banking Retail and small business . . Credit Card Products SBA Lending 50 Day Average Volume 192,914 . . Indirect Lending Treasury Management . Total Assets $12.235 billion . Mortgage Wealth Management Trust Assets Under Management $5.075 billion o Guided by four strategic imperatives: Total Core Deposits** $9.520 billion . Employer of choice . Best in class client relationship management . Operational excellence . Financial excellence Asset Mix Liability Mix Q2 2018 Revenue Breakdown Company Premises & Other assets Other Long-term owned life Equipment 1.3% Mortgage Securities sold 1.6% debt Goodwill and insurance 1.9% 0.1% servicing under Non-Interest intangible assets 2.1% rights repurchase Income 4.2% 0.2% agreements 26.5% Cash and cash 6.0% Equivalents 5.8% Net interest Investment income securities 73.5% Deposits 21.4% Net Loans 92.3% 62.8% As of 6/30/18 * Based on closing price ($42.40) on July 17, 2018 Page 46 ** Core Deposits defined as total deposits excluding time deposits >$100,000 Sources: SNL and company reports

Bank of the Cascades Acquisition

Bank of the Cascades: Conversion Statistics o Transitioned over 500 employees, 115,000 clients, and 137,000 accounts o Added 82,200 debit cards o Replaced 444 signs o The Contact Center handled 25,000 client calls during the first week o Provided comprehensive banker support, including 77 ambassadors and 70 Hotline/Chat volunteers who handled 1,000 employee inquiries per day o Resolved 1,798 technical issues during the first week o Mailed over 60 unique letters to clients and over 70 messages to employees o Reviewed and decisioned over 240 vendor contracts o Completed approximately 3,500 trackable tasks, with 500 occurring over conversion weekend Page 48

Bank of the Cascades: Integration Efforts o Comprehensive approach to branding and branch refresh o Investment in role-based training o Employee visits focused on Vision, Mission, Values o Grand opening and community celebrations o Video from the CEO: https://www.youtube.com/watch?v=JlwX2z_Rtjo Page 49

Inland Northwest Announcement

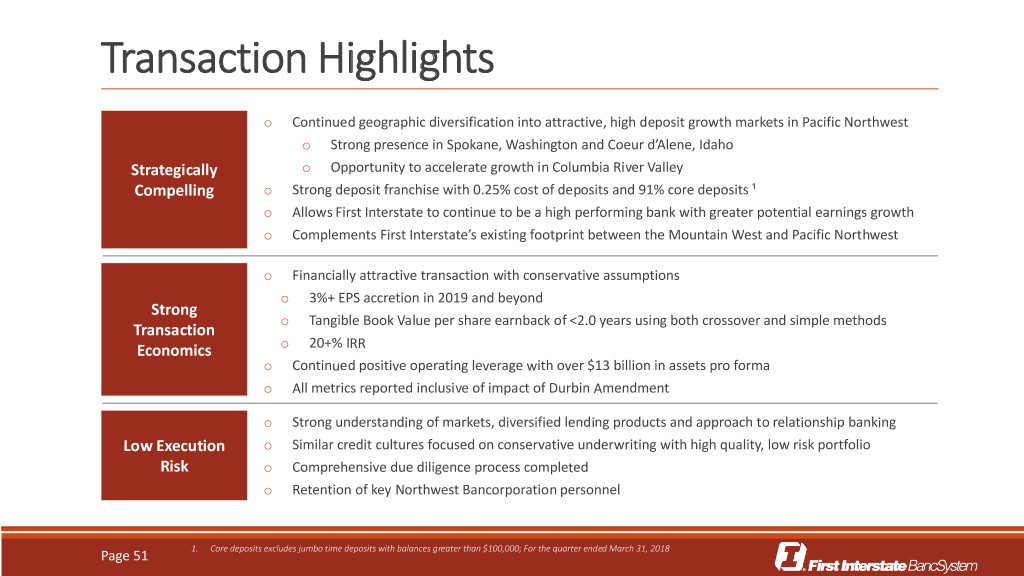

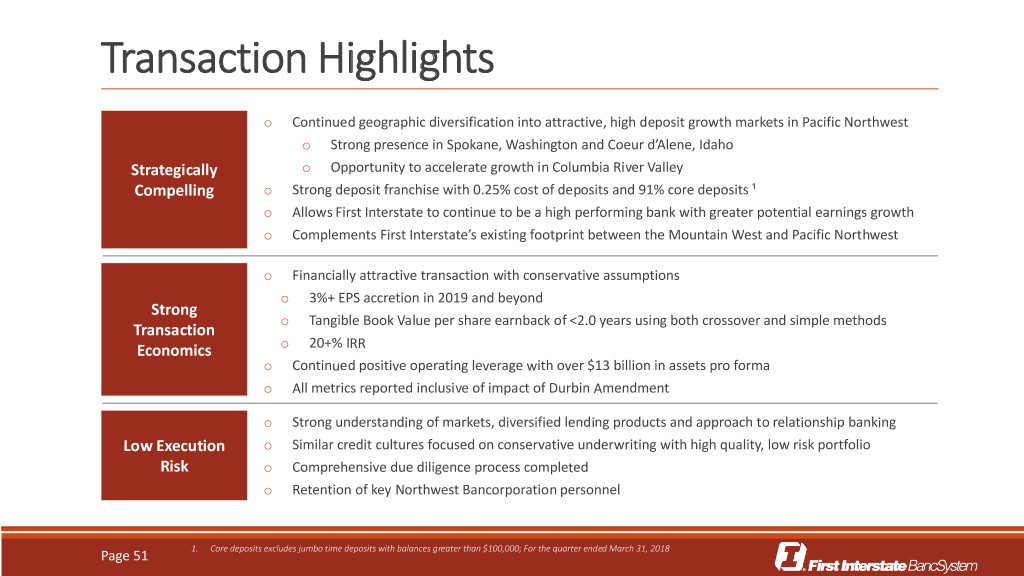

Transaction Highlights o Continued geographic diversification into attractive, high deposit growth markets in Pacific Northwest o Strong presence in Spokane, Washington and Coeur d’Alene, Idaho Strategically o Opportunity to accelerate growth in Columbia River Valley Compelling o Strong deposit franchise with 0.25% cost of deposits and 91% core deposits ¹ o Allows First Interstate to continue to be a high performing bank with greater potential earnings growth o Complements First Interstate’s existing footprint between the Mountain West and Pacific Northwest o Financially attractive transaction with conservative assumptions o 3%+ EPS accretion in 2019 and beyond Strong o Tangible Book Value per share earnback of <2.0 years using both crossover and simple methods Transaction o Economics 20+% IRR o Continued positive operating leverage with over $13 billion in assets pro forma o All metrics reported inclusive of impact of Durbin Amendment o Strong understanding of markets, diversified lending products and approach to relationship banking Low Execution o Similar credit cultures focused on conservative underwriting with high quality, low risk portfolio Risk o Comprehensive due diligence process completed o Retention of key Northwest Bancorporation personnel 1. Core deposits excludes jumbo time deposits with balances greater than $100,000; For the quarter ended March 31, 2018 Page 51

Overview of Northwest Bancorporation, Inc. Highlights Northwest Bancorporation Overview o Northwest Bancorporation, Inc. is the bank holding Headquarters Spokane, Washington company of Inland Northwest Bank, a state-chartered community bank which currently operates 20 offices across Footprint 20 branches / 3 states Washington, Idaho and Oregon Assets $827 million o Leading community bank in Columbia River Gorge and Gross Loans $670 million Eastern Washington; growth opportunity in Portland Deposits $721 million o Consistent and growing, low-cost deposit base Total Equity $82 million o Diverse loan portfolio with expertise in business banking and agricultural lending Dominant Community Bank in Strong Economies Bank Regulatory Loan and Deposit Composition Portland Metro and Hood River, OR Other 1-4 Family Transaction 2% 10% CDs o Portland-Vancouver-Hillsboro MSA is largest MSA in Oregon ¹ Farm / Ag 11% 18% Multifamily 15% o Portland economy ranks 20th largest in country by GDP ² 3% Consumer o Hood River’s population expected to grow 5.6% in next 5 years ¹ 1% Eastern Washington C&D 11% o Diverse economic region including strong corporate and CRE Savings & government employers, top universities and robust agriculture C&I 42% 13% MMDA o Spokane Region is the 5th largest aerospace cluster in the U.S. ³ 74% Loans: $670mm Deposits: $721mm o Whitman County is the #1 wheat producing county in the U.S Yield on Loans: 5.29% Cost of Deposits: 0.25% As of 6/30/18 and #2 for barley production ³ Non-int. Bearing Deposits: 33% 1. S&P Global Market Intelligence Page 52 2. Bureau of Economic Analysis 3. Greater Spokane Incorporated

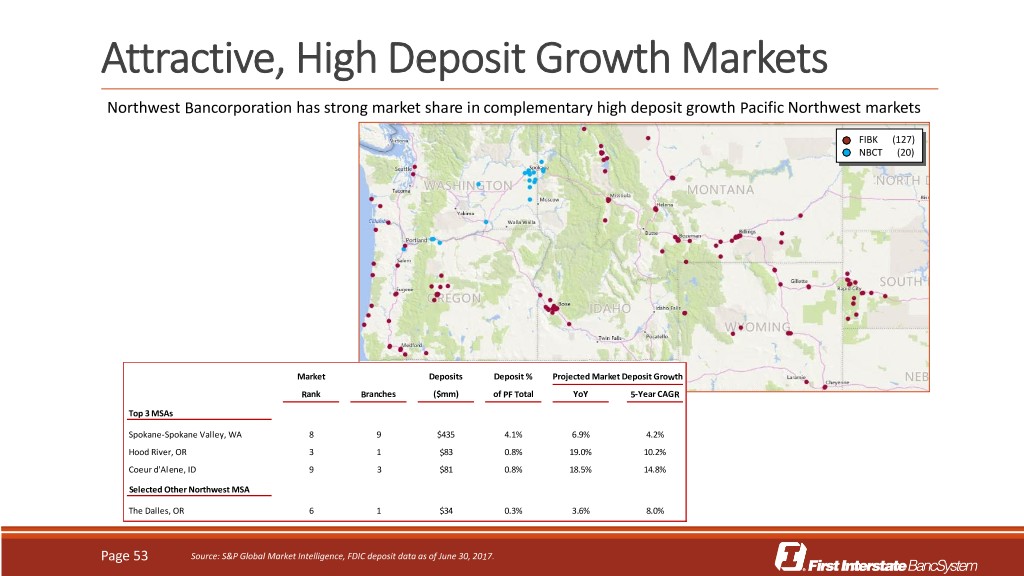

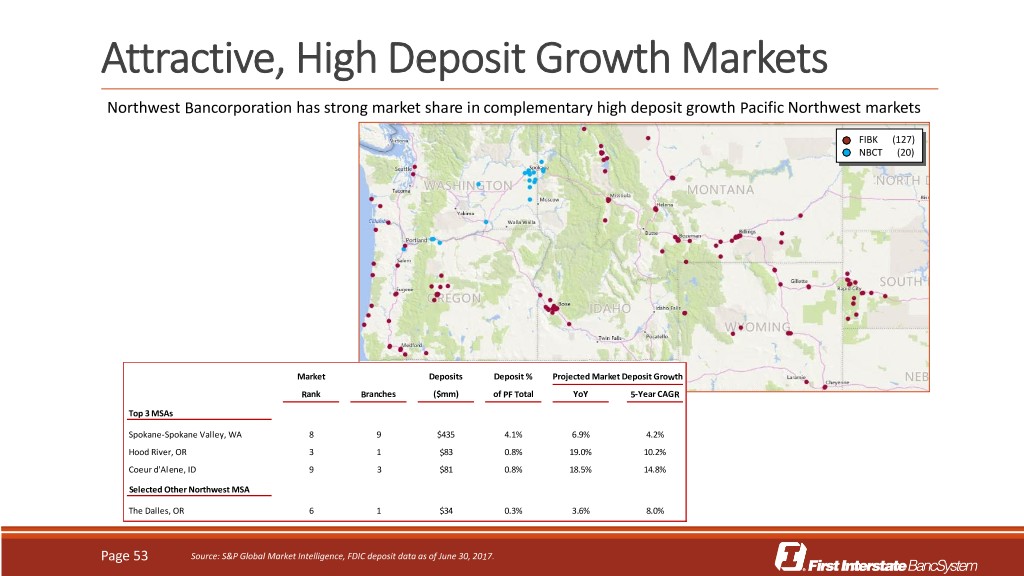

Attractive, High Deposit Growth Markets Northwest Bancorporation has strong market share in complementary high deposit growth Pacific Northwest markets FIBK (127) NBCT (20) Market Deposits Deposit % Projected Market Deposit Growth Rank Branches ($mm) of PF Total YoY 5-Year CAGR Top 3 MSAs Spokane-Spokane Valley, WA 8 9 $435 4.1% 6.9% 4.2% Hood River, OR 3 1 $83 0.8% 19.0% 10.2% Coeur d'Alene, ID 9 3 $81 0.8% 18.5% 14.8% Selected Other Northwest MSA The Dalles, OR 6 1 $34 0.3% 3.6% 8.0% Page 53 Source: S&P Global Market Intelligence, FDIC deposit data as of June 30, 2017.

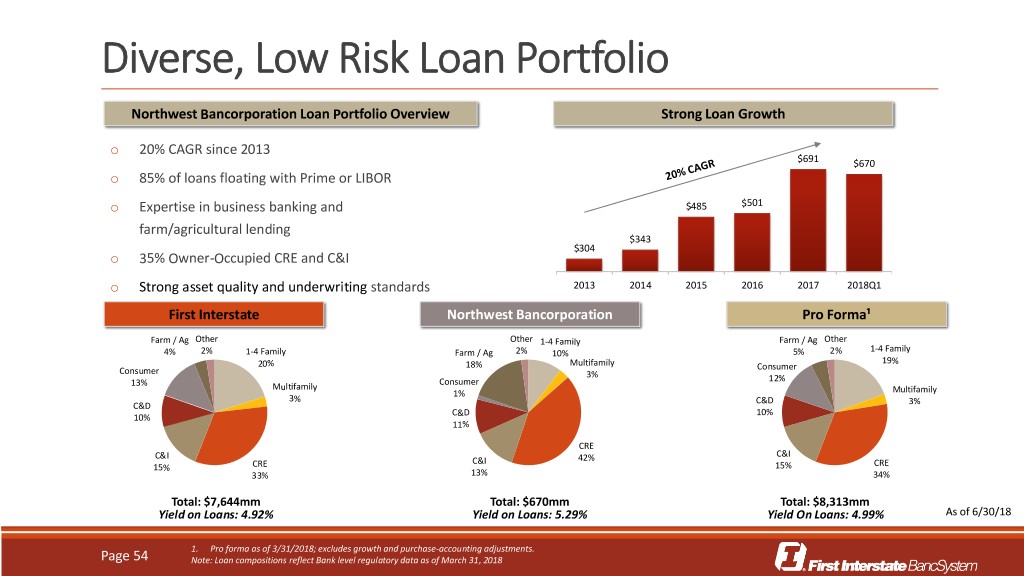

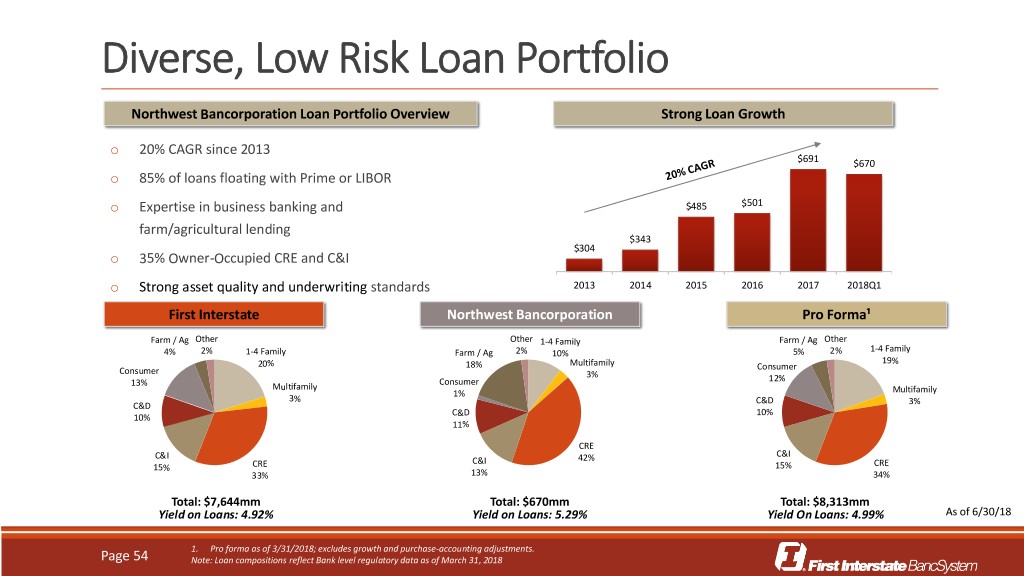

Diverse, Low Risk Loan Portfolio Northwest Bancorporation Loan Portfolio Overview Strong Loan Growth o 20% CAGR since 2013 $691 $670 o 85% of loans floating with Prime or LIBOR o Expertise in business banking and $485 $501 farm/agricultural lending $343 $304 o 35% Owner-Occupied CRE and C&I o Strong asset quality and underwriting standards 2013 2014 2015 2016 2017 2018Q1 First Interstate Northwest Bancorporation Pro Forma¹ Farm / Ag Other Other 1-4 Family Farm / Ag Other 1-4 Family 4% 2% 1-4 Family Farm / Ag 2% 10% 5% 2% 19% 20% 18% Multifamily Consumer Consumer 3% Consumer 12% 13% Multifamily 1% Multifamily 3% C&D C&D 3% C&D 10% 10% 11% CRE C&I C&I C&I 42% 15% CRE 15% CRE 33% 13% 34% Total: $7,644mm Total: $670mm Total: $8,313mm Yield on Loans: 4.92% Yield on Loans: 5.29% Yield On Loans: 4.99% As of 6/30/18 1. Pro forma as of 3/31/2018; excludes growth and purchase-accounting adjustments. Page 54 Note: Loan compositions reflect Bank level regulatory data as of March 31, 2018

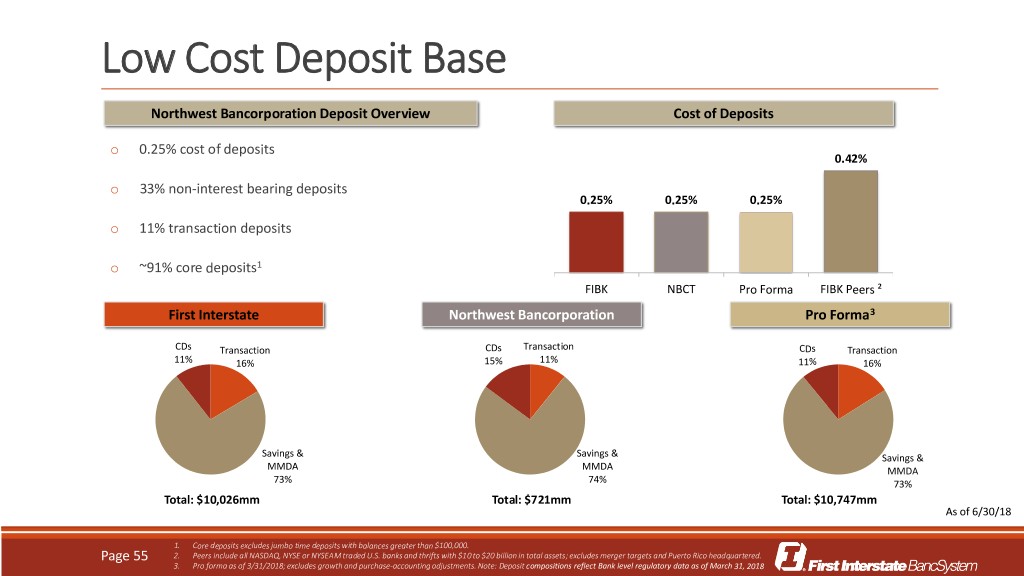

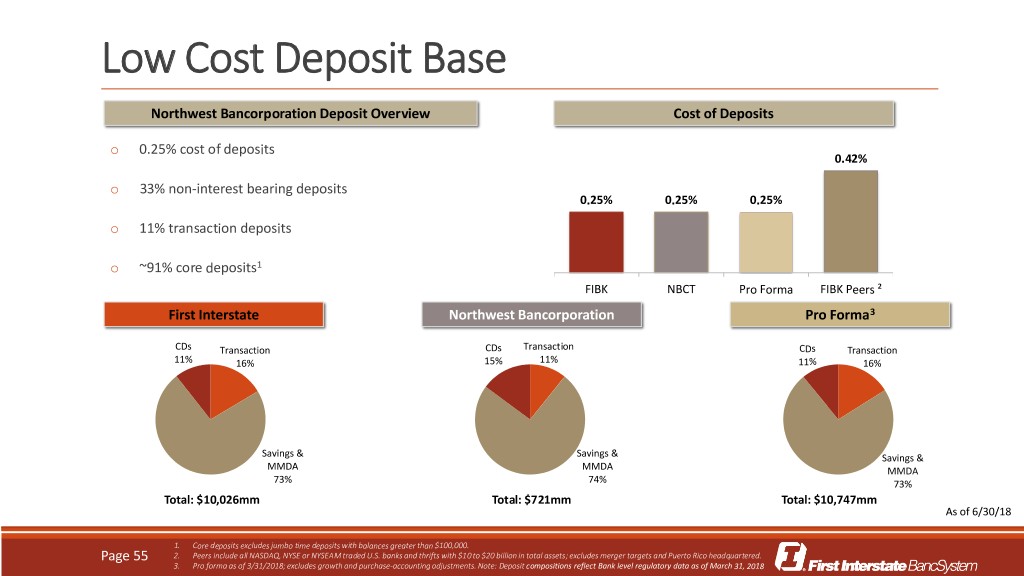

Low Cost Deposit Base Northwest Bancorporation Deposit Overview Cost of Deposits o 0.25% cost of deposits 0.42% o 33% non-interest bearing deposits 0.25% 0.25% 0.25% o 11% transaction deposits o ~91% core deposits1 FIBK NBCT Pro Forma FIBK Peers ² First Interstate Northwest Bancorporation Pro Forma3 CDs Transaction CDs Transaction CDs Transaction 11% 16% 15% 11% 11% 16% Savings & Savings & Savings & MMDA MMDA MMDA 73% 74% 73% Total: $10,026mm Total: $721mm Total: $10,747mm As of 6/30/18 1. Core deposits excludes jumbo time deposits with balances greater than $100,000. Page 55 2. Peers include all NASDAQ, NYSE or NYSEAM traded U.S. banks and thrifts with $10 to $20 billion in total assets; excludes merger targets and Puerto Rico headquartered. 3. Pro forma as of 3/31/2018; excludes growth and purchase-accounting adjustments. Note: Deposit compositions reflect Bank level regulatory data as of March 31, 2018

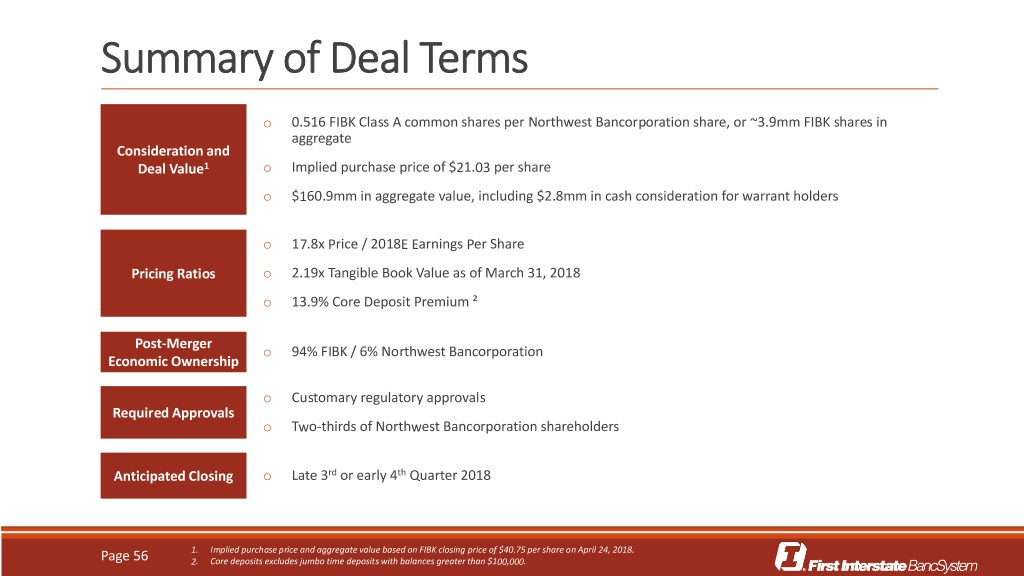

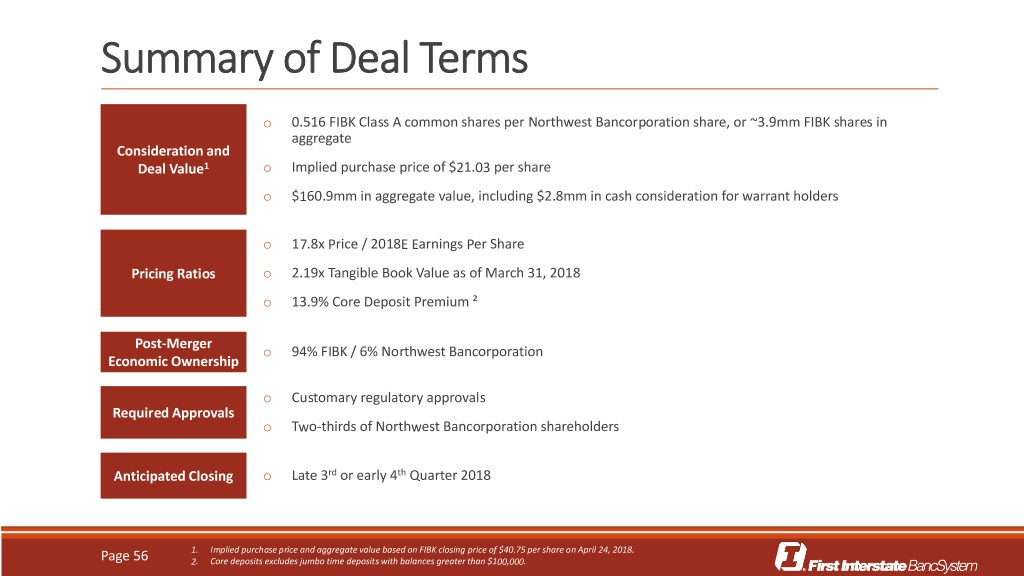

Summary of Deal Terms o 0.516 FIBK Class A common shares per Northwest Bancorporation share, or ~3.9mm FIBK shares in aggregate Consideration and Deal Value1 o Implied purchase price of $21.03 per share o $160.9mm in aggregate value, including $2.8mm in cash consideration for warrant holders o 17.8x Price / 2018E Earnings Per Share Pricing Ratios o 2.19x Tangible Book Value as of March 31, 2018 o 13.9% Core Deposit Premium ² Post-Merger o 94% FIBK / 6% Northwest Bancorporation Economic Ownership o Customary regulatory approvals Required Approvals o Two-thirds of Northwest Bancorporation shareholders Anticipated Closing o Late 3rd or early 4th Quarter 2018 1. Implied purchase price and aggregate value based on FIBK closing price of $40.75 per share on April 24, 2018. Page 56 2. Core deposits excludes jumbo time deposits with balances greater than $100,000.

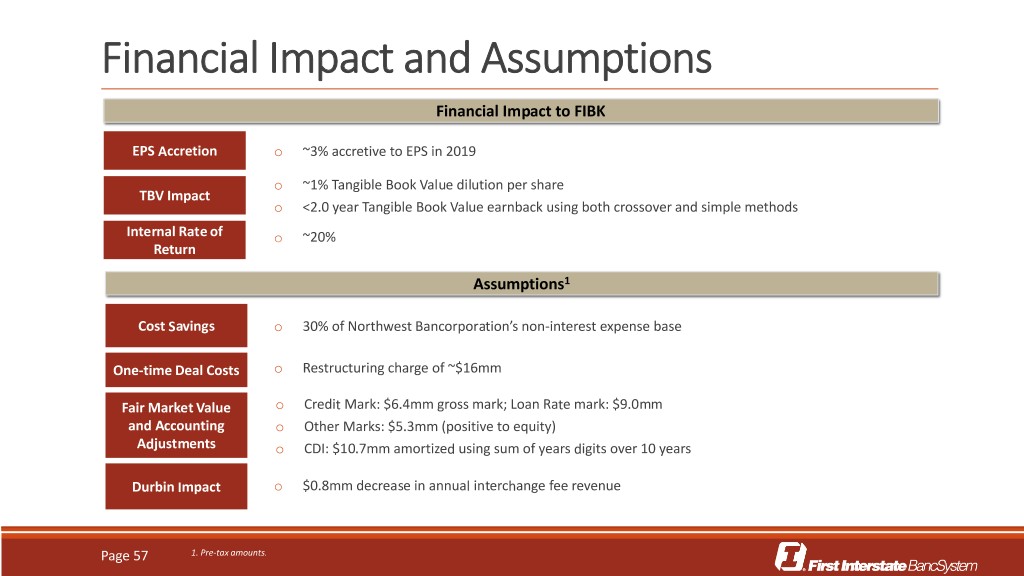

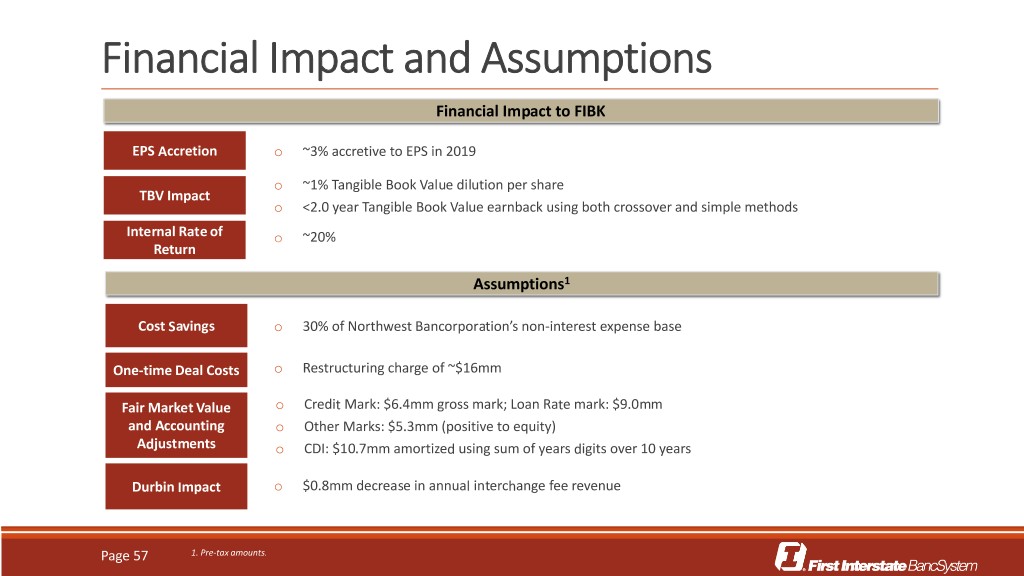

Financial Impact and Assumptions Financial Impact to FIBK EPS Accretion o ~3% accretive to EPS in 2019 o ~1% Tangible Book Value dilution per share TBV Impact o <2.0 year Tangible Book Value earnback using both crossover and simple methods Internal Rate of o ~20% Return Assumptions1 Cost Savings o 30% of Northwest Bancorporation’s non-interest expense base One-time Deal Costs o Restructuring charge of ~$16mm Fair Market Value o Credit Mark: $6.4mm gross mark; Loan Rate mark: $9.0mm and Accounting o Other Marks: $5.3mm (positive to equity) Adjustments o CDI: $10.7mm amortized using sum of years digits over 10 years Durbin Impact o $0.8mm decrease in annual interchange fee revenue Page 57 1. Pre-tax amounts.

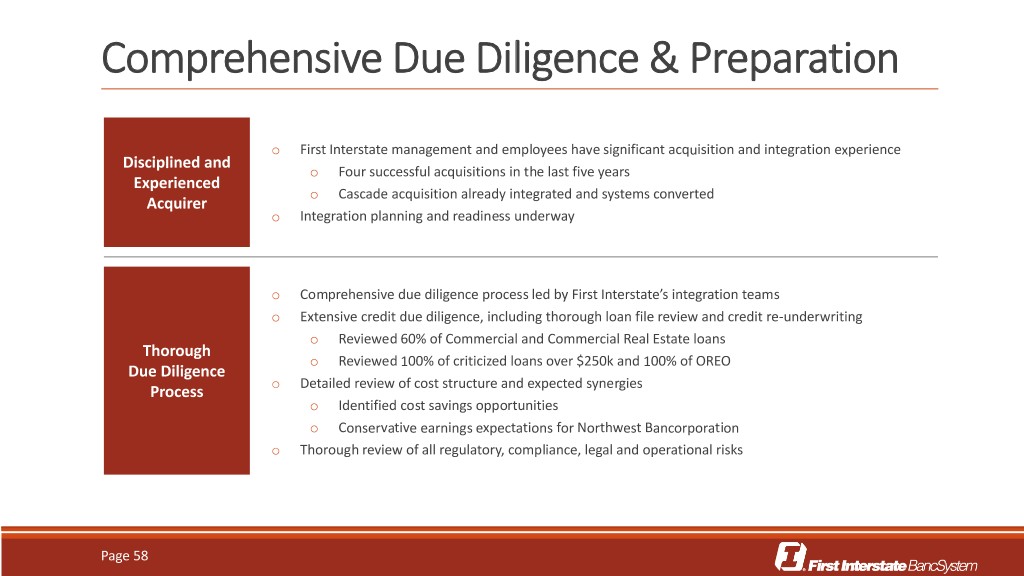

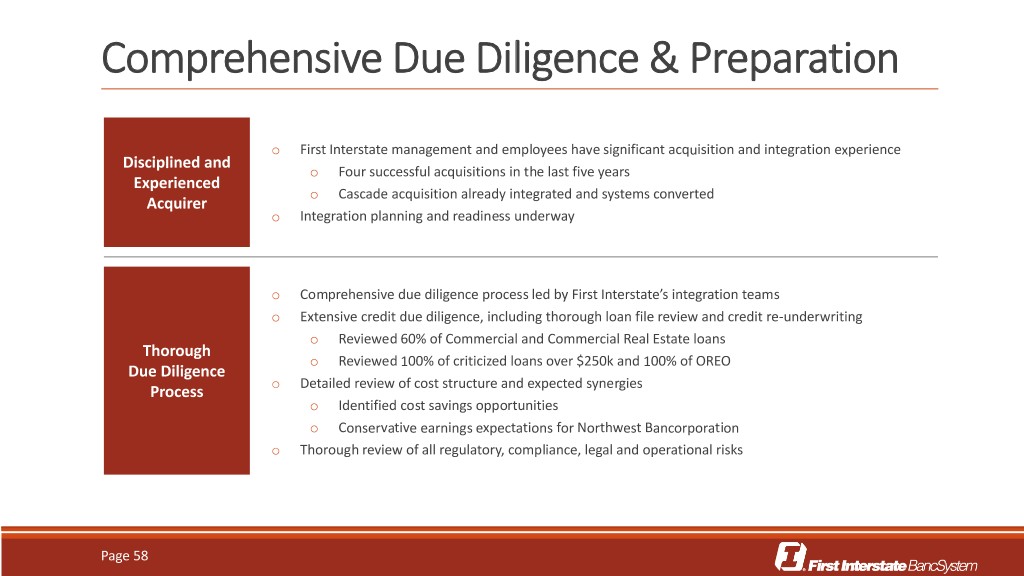

Comprehensive Due Diligence & Preparation o First Interstate management and employees have significant acquisition and integration experience Disciplined and o Four successful acquisitions in the last five years Experienced o Cascade acquisition already integrated and systems converted Acquirer o Integration planning and readiness underway o Comprehensive due diligence process led by First Interstate’s integration teams o Extensive credit due diligence, including thorough loan file review and credit re-underwriting o Reviewed 60% of Commercial and Commercial Real Estate loans Thorough o Reviewed 100% of criticized loans over $250k and 100% of OREO Due Diligence o Detailed review of cost structure and expected synergies Process o Identified cost savings opportunities o Conservative earnings expectations for Northwest Bancorporation o Thorough review of all regulatory, compliance, legal and operational risks Page 58

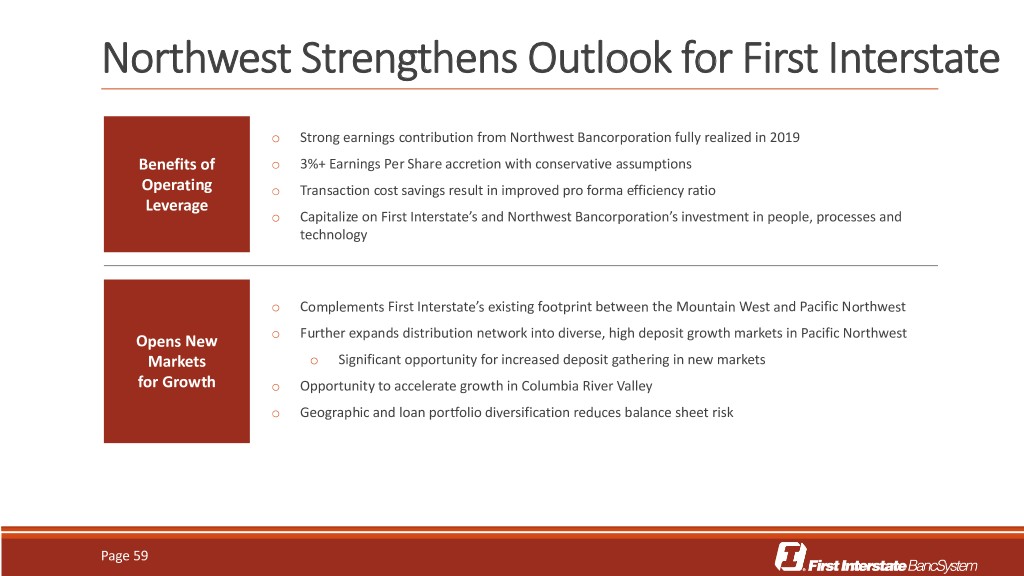

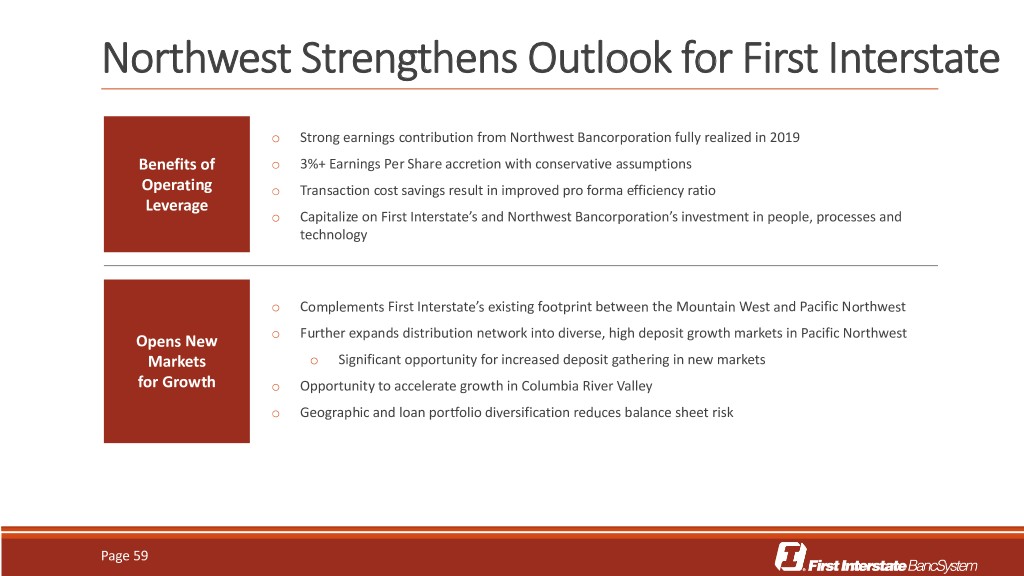

Northwest Strengthens Outlook for First Interstate o Strong earnings contribution from Northwest Bancorporation fully realized in 2019 Benefits of o 3%+ Earnings Per Share accretion with conservative assumptions Operating o Transaction cost savings result in improved pro forma efficiency ratio Leverage o Capitalize on First Interstate’s and Northwest Bancorporation’s investment in people, processes and technology o Complements First Interstate’s existing footprint between the Mountain West and Pacific Northwest o Opens New Further expands distribution network into diverse, high deposit growth markets in Pacific Northwest Markets o Significant opportunity for increased deposit gathering in new markets for Growth o Opportunity to accelerate growth in Columbia River Valley o Geographic and loan portfolio diversification reduces balance sheet risk Page 59

Regional Overview

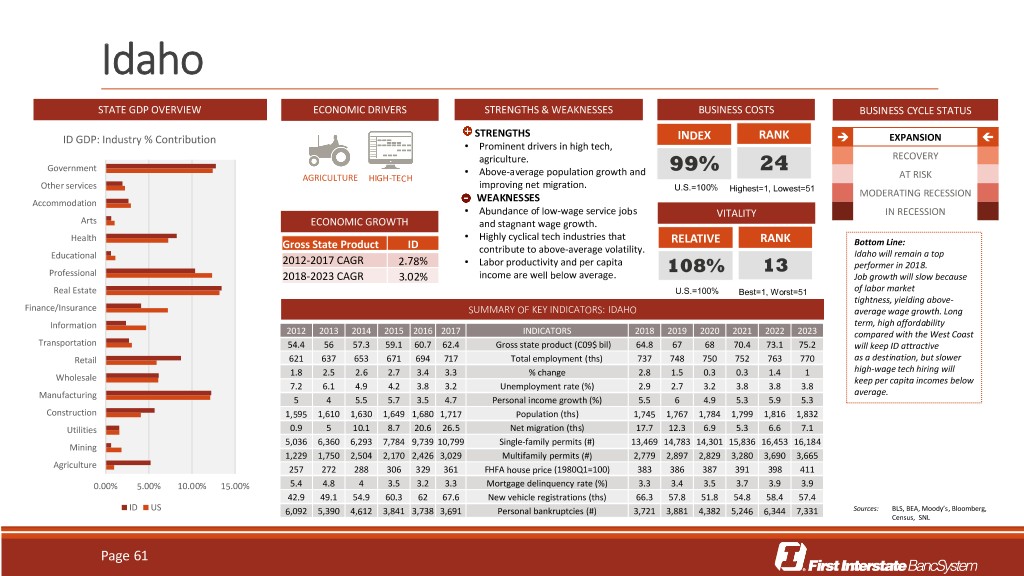

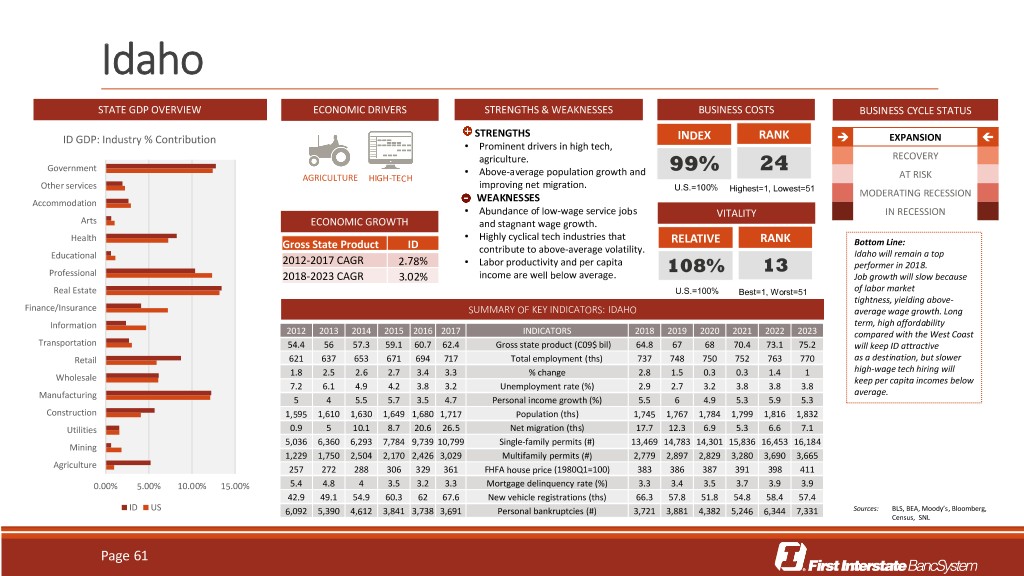

Idaho STATE GDP OVERVIEW ECONOMIC DRIVERS STRENGTHS & WEAKNESSES BUSINESS COSTS BUSINESS CYCLE STATUS STRENGTHS ID GDP: Industry % Contribution INDEX RANK EXPANSION • Prominent drivers in high tech, agriculture. RECOVERY Government • Above-average population growth and 99% 24 AGRICULTURE HIGH-TECH AT RISK Other services improving net migration. U.S.=100% Highest=1, Lowest=51 MODERATING RECESSION Accommodation WEAKNESSES • Abundance of low-wage service jobs VITALITY IN RECESSION Arts ECONOMIC GROWTH and stagnant wage growth. • Highly cyclical tech industries that Health RELATIVE RANK Bottom Line: Gross State Product ID contribute to above-average volatility. Educational Idaho will remain a top 2012-2017 CAGR 2.78% • Labor productivity and per capita 108% 13 performer in 2018. Professional 2018-2023 CAGR 3.02% income are well below average. Job growth will slow because Real Estate U.S.=100% Best=1, Worst=51 of labor market tightness, yielding above- Finance/Insurance SUMMARY OF KEY INDICATORS: IDAHO average wage growth. Long Information term, high affordability 2012 2013 2014 2015 2016 2017 INDICATORS 2018 2019 2020 2021 2022 2023 compared with the West Coast Transportation 54.4 56 57.3 59.1 60.7 62.4 Gross state product (C09$ bil) 64.8 67 68 70.4 73.1 75.2 will keep ID attractive Retail 621 637 653 671 694 717 Total employment (ths) 737 748 750 752 763 770 as a destination, but slower 1.8 2.5 2.6 2.7 3.4 3.3 % change 2.8 1.5 0.3 0.3 1.4 1 high-wage tech hiring will Wholesale keep per capita incomes below 7.2 6.1 4.9 4.2 3.8 3.2 Unemployment rate (%) 2.9 2.7 3.2 3.8 3.8 3.8 Manufacturing average. 5 4 5.5 5.7 3.5 4.7 Personal income growth (%) 5.5 6 4.9 5.3 5.9 5.3 Construction 1,595 1,610 1,630 1,649 1,680 1,717 Population (ths) 1,745 1,767 1,784 1,799 1,816 1,832 Utilities 0.9 5 10.1 8.7 20.6 26.5 Net migration (ths) 17.7 12.3 6.9 5.3 6.6 7.1 5,036 6,360 6,293 7,784 9,739 10,799 Single-family permits (#) 13,469 14,783 14,301 15,836 16,453 16,184 Mining 1,229 1,750 2,504 2,170 2,426 3,029 Multifamily permits (#) 2,779 2,897 2,829 3,280 3,690 3,665 Agriculture 257 272 288 306 329 361 FHFA house price (1980Q1=100) 383 386 387 391 398 411 0.00% 5.00% 10.00% 15.00% 5.4 4.8 4 3.5 3.2 3.3 Mortgage delinquency rate (%) 3.3 3.4 3.5 3.7 3.9 3.9 42.9 49.1 54.9 60.3 62 67.6 New vehicle registrations (ths) 66.3 57.8 51.8 54.8 58.4 57.4 ID US 6,092 5,390 4,612 3,841 3,738 3,691 Personal bankruptcies (#) 3,721 3,881 4,382 5,246 6,344 7,331 Sources: BLS, BEA, Moody’s, Bloomberg, Census, SNL Page 61

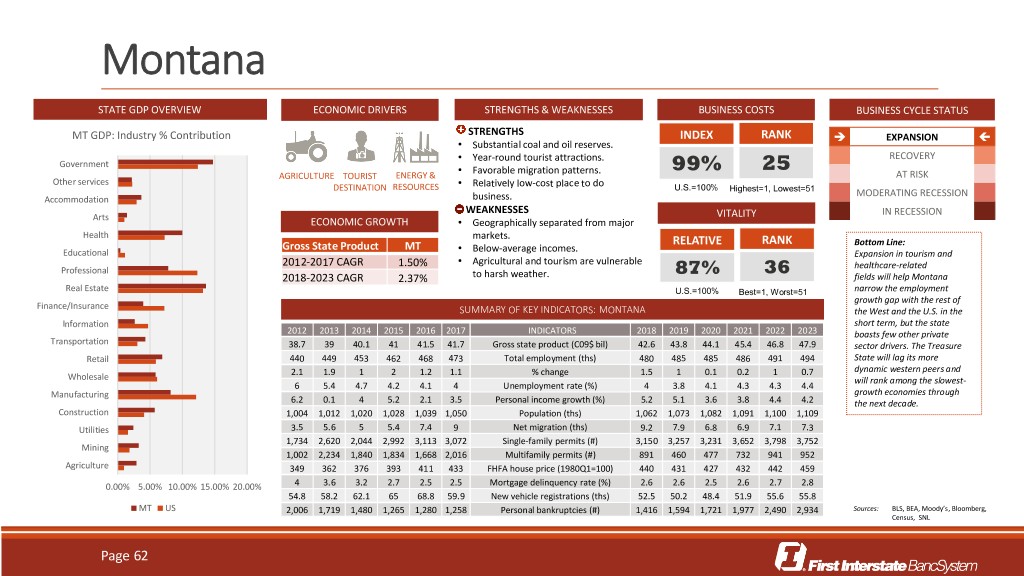

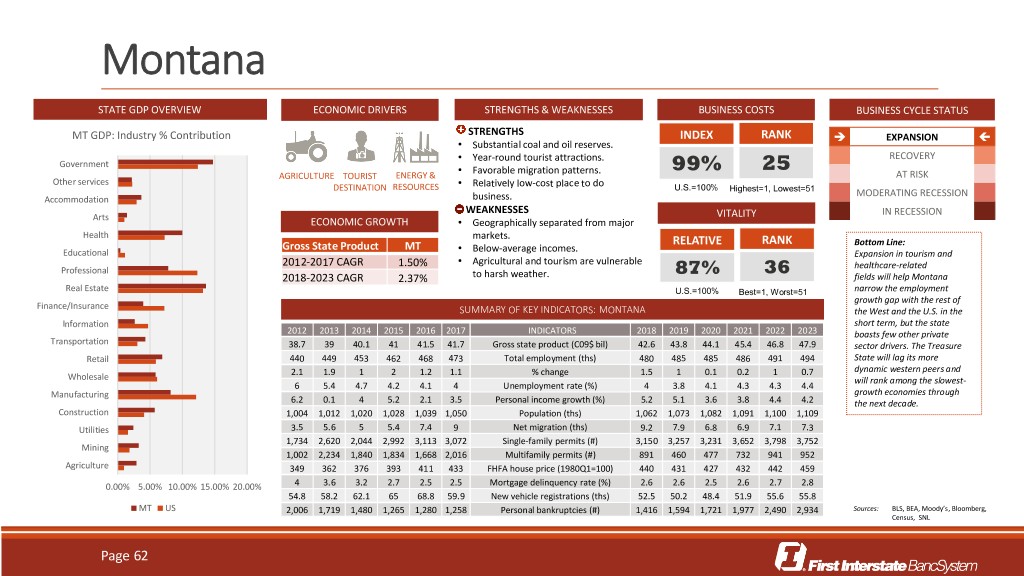

Montana STATE GDP OVERVIEW ECONOMIC DRIVERS STRENGTHS & WEAKNESSES BUSINESS COSTS BUSINESS CYCLE STATUS STRENGTHS MT GDP: Industry % Contribution INDEX RANK EXPANSION • Substantial coal and oil reserves. • Year-round tourist attractions. RECOVERY Government • Favorable migration patterns. 99% 25 AGRICULTURE TOURIST ENERGY & AT RISK Other services DESTINATION RESOURCES • Relatively low-cost place to do U.S.=100% Highest=1, Lowest=51 MODERATING RECESSION Accommodation business. WEAKNESSES IN RECESSION Arts VITALITY ECONOMIC GROWTH • Geographically separated from major Health markets. RELATIVE RANK Bottom Line: Gross State Product MT • Below-average incomes. Educational Expansion in tourism and 2012-2017 CAGR 1.50% • Agricultural and tourism are vulnerable healthcare-related Professional 87% 36 2018-2023 CAGR 2.37% to harsh weather. fields will help Montana Real Estate U.S.=100% Best=1, Worst=51 narrow the employment growth gap with the rest of Finance/Insurance SUMMARY OF KEY INDICATORS: MONTANA the West and the U.S. in the Information short term, but the state 2012 2013 2014 2015 2016 2017 INDICATORS 2018 2019 2020 2021 2022 2023 boasts few other private Transportation 38.7 39 40.1 41 41.5 41.7 Gross state product (C09$ bil) 42.6 43.8 44.1 45.4 46.8 47.9 sector drivers. The Treasure Retail 440 449 453 462 468 473 Total employment (ths) 480 485 485 486 491 494 State will lag its more 2.1 1.9 1 2 1.2 1.1 % change 1.5 1 0.1 0.2 1 0.7 dynamic western peers and Wholesale will rank among the slowest- 6 5.4 4.7 4.2 4.1 4 Unemployment rate (%) 4 3.8 4.1 4.3 4.3 4.4 Manufacturing growth economies through 6.2 0.1 4 5.2 2.1 3.5 Personal income growth (%) 5.2 5.1 3.6 3.8 4.4 4.2 the next decade. Construction 1,004 1,012 1,020 1,028 1,039 1,050 Population (ths) 1,062 1,073 1,082 1,091 1,100 1,109 Utilities 3.5 5.6 5 5.4 7.4 9 Net migration (ths) 9.2 7.9 6.8 6.9 7.1 7.3 1,734 2,620 2,044 2,992 3,113 3,072 Single-family permits (#) 3,150 3,257 3,231 3,652 3,798 3,752 Mining 1,002 2,234 1,840 1,834 1,668 2,016 Multifamily permits (#) 891 460 477 732 941 952 Agriculture 349 362 376 393 411 433 FHFA house price (1980Q1=100) 440 431 427 432 442 459 0.00% 5.00% 10.00% 15.00% 20.00% 4 3.6 3.2 2.7 2.5 2.5 Mortgage delinquency rate (%) 2.6 2.6 2.5 2.6 2.7 2.8 54.8 58.2 62.1 65 68.8 59.9 New vehicle registrations (ths) 52.5 50.2 48.4 51.9 55.6 55.8 MT US 2,006 1,719 1,480 1,265 1,280 1,258 Personal bankruptcies (#) 1,416 1,594 1,721 1,977 2,490 2,934 Sources: BLS, BEA, Moody’s, Bloomberg, Census, SNL Page 62

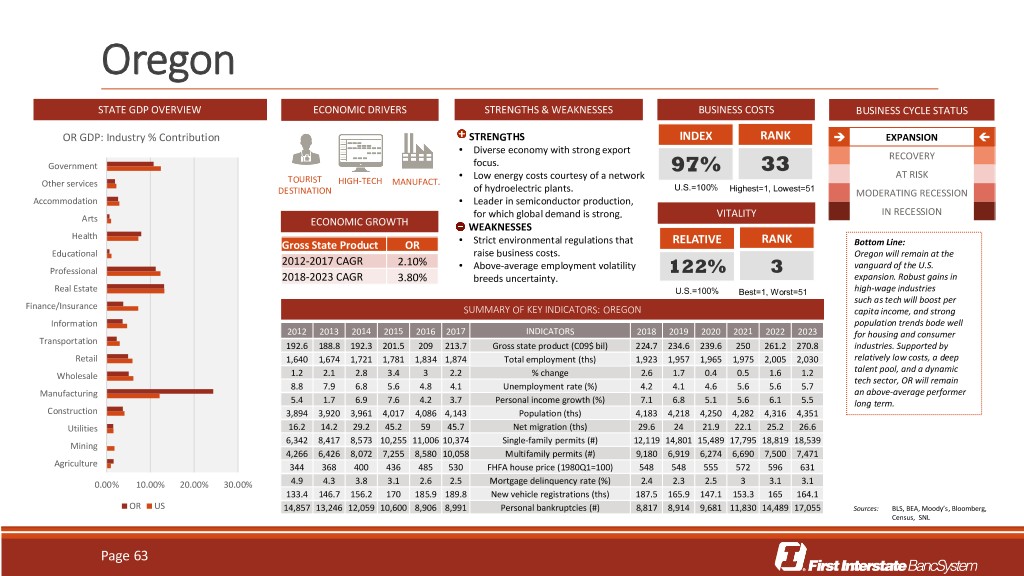

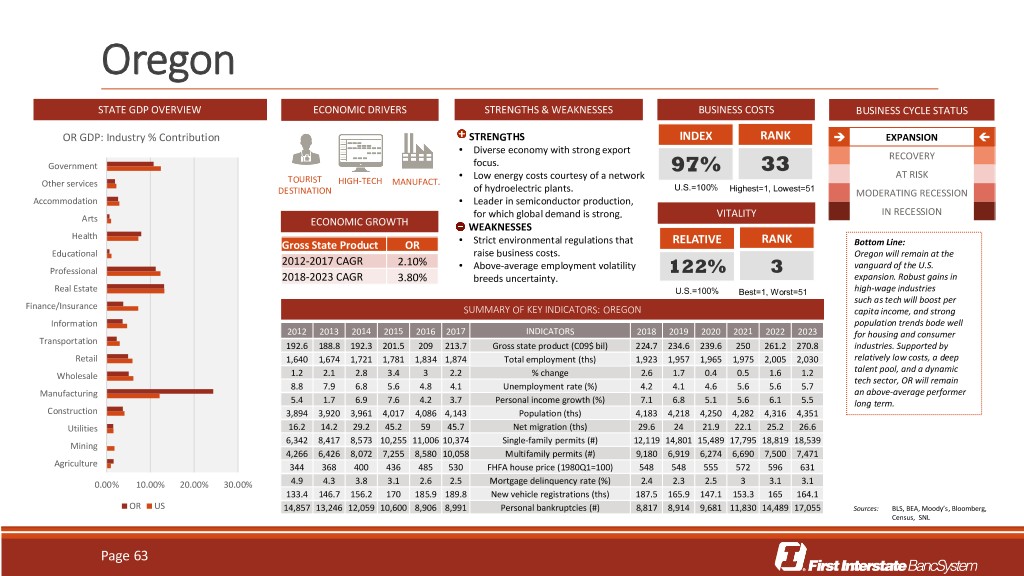

Oregon STATE GDP OVERVIEW ECONOMIC DRIVERS STRENGTHS & WEAKNESSES BUSINESS COSTS BUSINESS CYCLE STATUS OR GDP: Industry % Contribution STRENGTHS INDEX RANK EXPANSION • Diverse economy with strong export RECOVERY Government focus. 97% 33 • Low energy costs courtesy of a network AT RISK TOURIST HIGH-TECH MANUFACT. Other services U.S.=100% DESTINATION of hydroelectric plants. Highest=1, Lowest=51 MODERATING RECESSION Accommodation • Leader in semiconductor production, IN RECESSION Arts for which global demand is strong. VITALITY ECONOMIC GROWTH WEAKNESSES Health Gross State Product OR • Strict environmental regulations that RELATIVE RANK Bottom Line: Educational raise business costs. Oregon will remain at the 2012-2017 CAGR 2.10% • Above-average employment volatility vanguard of the U.S. Professional 122% 3 2018-2023 CAGR 3.80% breeds uncertainty. expansion. Robust gains in Real Estate U.S.=100% Best=1, Worst=51 high-wage industries such as tech will boost per Finance/Insurance SUMMARY OF KEY INDICATORS: OREGON capita income, and strong Information population trends bode well 2012 2013 2014 2015 2016 2017 INDICATORS 2018 2019 2020 2021 2022 2023 for housing and consumer Transportation 192.6 188.8 192.3 201.5 209 213.7 Gross state product (C09$ bil) 224.7 234.6 239.6 250 261.2 270.8 industries. Supported by Retail 1,640 1,674 1,721 1,781 1,834 1,874 Total employment (ths) 1,923 1,957 1,965 1,975 2,005 2,030 relatively low costs, a deep 1.2 2.1 2.8 3.4 3 2.2 % change 2.6 1.7 0.4 0.5 1.6 1.2 talent pool, and a dynamic Wholesale tech sector, OR will remain 8.8 7.9 6.8 5.6 4.8 4.1 Unemployment rate (%) 4.2 4.1 4.6 5.6 5.6 5.7 Manufacturing an above-average performer 5.4 1.7 6.9 7.6 4.2 3.7 Personal income growth (%) 7.1 6.8 5.1 5.6 6.1 5.5 long term. Construction 3,894 3,920 3,961 4,017 4,086 4,143 Population (ths) 4,183 4,218 4,250 4,282 4,316 4,351 Utilities 16.2 14.2 29.2 45.2 59 45.7 Net migration (ths) 29.6 24 21.9 22.1 25.2 26.6 6,342 8,417 8,573 10,255 11,006 10,374 Single-family permits (#) 12,119 14,801 15,489 17,795 18,819 18,539 Mining 4,266 6,426 8,072 7,255 8,580 10,058 Multifamily permits (#) 9,180 6,919 6,274 6,690 7,500 7,471 Agriculture 344 368 400 436 485 530 FHFA house price (1980Q1=100) 548 548 555 572 596 631 0.00% 10.00% 20.00% 30.00% 4.9 4.3 3.8 3.1 2.6 2.5 Mortgage delinquency rate (%) 2.4 2.3 2.5 3 3.1 3.1 133.4 146.7 156.2 170 185.9 189.8 New vehicle registrations (ths) 187.5 165.9 147.1 153.3 165 164.1 OR US 14,857 13,246 12,059 10,600 8,906 8,991 Personal bankruptcies (#) 8,817 8,914 9,681 11,830 14,489 17,055 Sources: BLS, BEA, Moody’s, Bloomberg, Census, SNL Page 63

South Dakota STATE GDP OVERVIEW ECONOMIC DRIVERS STRENGTHS & WEAKNESSES BUSINESS COSTS BUSINESS CYCLE STATUS SD GDP: Industry % Contribution STRENGTHS INDEX RANK EXPANSION • Some of the lowest costs of doing RECOVERY Government business in the nation. 85% 50 TOURIST MEDICAL FINANCIAL • High housing affordability. AT RISK Other services CENTER CENTER U.S.=100% DESTINATION • Low volatility relative to the U.S. Highest=1, Lowest=51 MODERATING RECESSION Accommodation WEAKNESSES • Few high-paying growth industries. VITALITY IN RECESSION Arts ECONOMIC GROWTH • High dependence on agriculture and Health Gross State Product SD exposure to fluctuating commodity RELATIVE RANK Bottom Line: Educational prices. South Dakota’s economy will 2012-2017 CAGR 1.24% strengthen in the near term, Professional • Weak and worsening migration 90% 29 2018-2023 CAGR 2.54% patterns. led by consumer industries Real Estate U.S.=100% Best=1, Worst=51 and construction. In the long term, healthy population Finance/Insurance SUMMARY OF KEY INDICATORS: SOUTH DAKOTA growth and low business costs Information will help SD outshine the 2012 2013 2014 2015 2016 2017 INDICATORS 2018 2019 2020 2021 2022 2023 Midwest and keep Transportation 39.2 39.6 40 41 41.6 41.7 Gross state product (C09$ bil) 42.6 43.8 44.3 45.6 47.1 48.3 pace with the U.S. Retail 414 418 424 429 432 435 Total employment (ths) 442 447 448 448 452 456 Wholesale 1.6 0.9 1.4 1.1 0.9 0.6 % change 1.6 1.2 0.2 0.1 0.9 0.8 Manufacturing 4.3 3.8 3.4 3.1 3 3.3 Unemployment rate (%) 3.1 2.5 2.6 3 3.1 3.1 2.2 0.3 3.8 4.4 1.2 1.4 Personal income growth (%) 2.9 4.8 3.3 3.4 4 3.7 Construction 833 843 849 854 862 870 Population (ths) 875 881 886 891 896 901 Utilities 4.7 5.1 1.6 0.1 2.6 3.2 Net migration (ths) 1 0.7 0.5 0.5 1.1 1.4 Mining 2,788 3,193 2,798 2,868 3,195 3,484 Single-family permits (#) 3,022 3,954 4,160 4,607 4,777 4,727 Agriculture 1,390 2,289 1,924 1,614 2,491 2,009 Multifamily permits (#) 2,682 2,529 2,302 2,401 2,552 2,512 296 307 316 330 346 366 FHFA house price (1980Q1=100) 377 374 377 385 395 409 0.00% 5.00% 10.00% 15.00% 3.5 3.3 3 2.8 2.6 2.6 Mortgage delinquency rate (%) 2.4 2.4 2.4 2.7 2.8 2.8 SD US 37.2 38.8 39.4 39.7 37.7 40.6 New vehicle registrations (ths) 40.1 37.5 33.1 34.9 37.7 37.4 1,496 1,249 1,150 1,051 1,055 1,003 Personal bankruptcies (#) 1,102 1,190 1,331 1,562 1,869 2,163 Sources: BLS, BEA, Moody’s, Bloomberg, Census, SNL Page 64

Washington STATE GDP OVERVIEW ECONOMIC DRIVERS STRENGTHS & WEAKNESSES BUSINESS COSTS BUSINESS CYCLE STATUS WA GDP: Industry % Contribution STRENGTHS INDEX RANK EXPANSION • High-value-added commercial aircraft RECOVERY Government manufacturing. 98% 30 • Fast-growing information technology AT RISK Other services HIGH-TECH MANUFACT. DEFENSE industry. U.S.=100% Highest=1, Lowest=51 MODERATING RECESSION Accommodation • Above-average per capita income and household wealth. VITALITY IN RECESSION Arts ECONOMIC GROWTH WEAKNESSES Health Gross State Product WA • Relatively high unit labor costs. RELATIVE RANK Bottom Line: Educational • Large agriculture industry exposed to Washington will extend its 2012-2017 CAGR 3.55% low and volatile commodity prices. 116% 5 reign as one of the most Professional 2018-2023 CAGR 3.27% dynamic economies in the Real Estate U.S.=100% Best=1, Worst=51 West as the global migration to cloud services bolsters Finance/Insurance SUMMARY OF KEY INDICATORS: WASHINGTON core software and IT Information industries. Longer term, 2012 2013 2014 2015 2016 2017 INDICATORS 2018 2019 2020 2021 2022 2023 aerospace manufacturing will Transportation 368.5 377.4 389.4 403.9 420.7 438.8 Gross state product (C09$ bil) 459.1 472.7 479.9 497.3 515.6 530.8 lend stability, but WA’s Retail 2,919 2,984 3,058 3,147 3,241 3,325 Total employment (ths) 3,409 3,458 3,479 3,499 3,547 3,581 competitive edge in high-tech 1.6 2.2 2.5 2.9 3 2.6 % change 2.5 1.4 0.6 0.6 1.4 1 services will secure its position Wholesale at the helm of the West and 8.1 7 6.1 5.6 5.3 4.8 Unemployment rate (%) 4.3 4 4.7 5.5 5.5 5.5 Manufacturing U.S. expansions. 8.2 2.1 7.7 5.8 4.7 4.7 Personal income growth (%) 5.8 5.5 4.7 5.3 5.4 4.9 Construction 6,891 6,963 7,047 7,153 7,281 7,406 Population (ths) 7,506 7,599 7,689 7,776 7,867 7,960 Utilities 34.7 36.6 47.6 70.7 94.1 90.6 Net migration (ths) 65.8 59.8 56.9 54.9 59.4 61.4 16,508 18,396 17,905 19,797 22,463 23,385 Single-family permits (#) 28,129 33,538 33,236 37,555 39,415 38,855 Mining 11,610 14,566 15,993 20,577 21,614 23,175 Multifamily permits (#) 26,452 21,408 14,554 14,969 16,423 16,284 Agriculture 381 401 429 464 514 573 FHFA house price (1980Q1=100) 612 624 639 657 680 712 0.00% 5.00% 10.00% 15.00% 6.8 5.1 4.1 3.2 2.7 2.5 Mortgage delinquency rate (%) 2.5 2.6 2.8 3.2 3.3 3.3 228.1 251.2 264.2 285.9 303.1 309.3 New vehicle registrations (ths) 298.6 290.2 275 287.9 308.1 307.1 WA US 26,984 24,171 20,814 17,973 15,961 14,355 Personal bankruptcies (#) 13,964 14,472 16,086 18,855 22,959 26,885 Sources: BLS, BEA, Moody’s, Bloomberg, Census, SNL Page 65

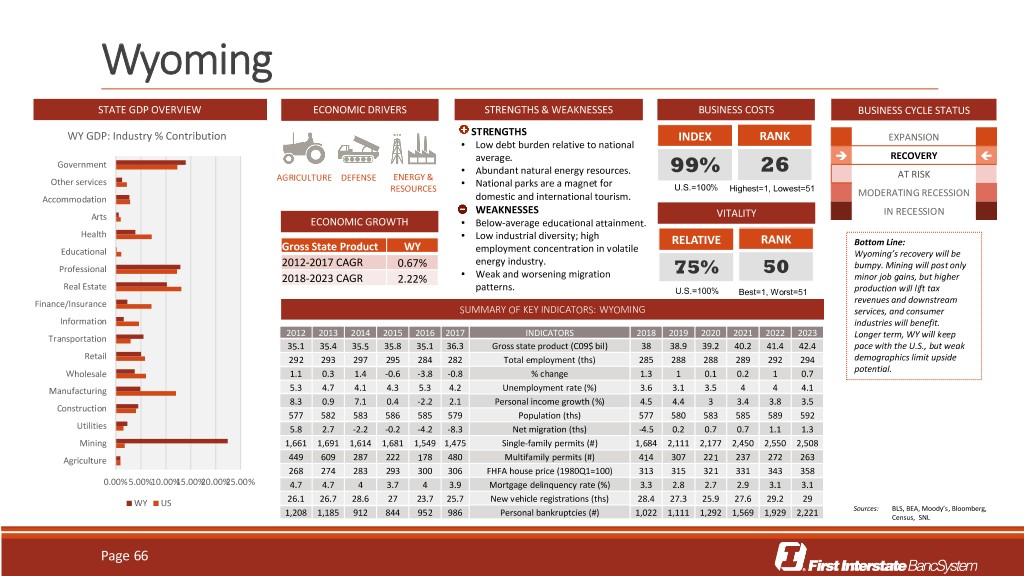

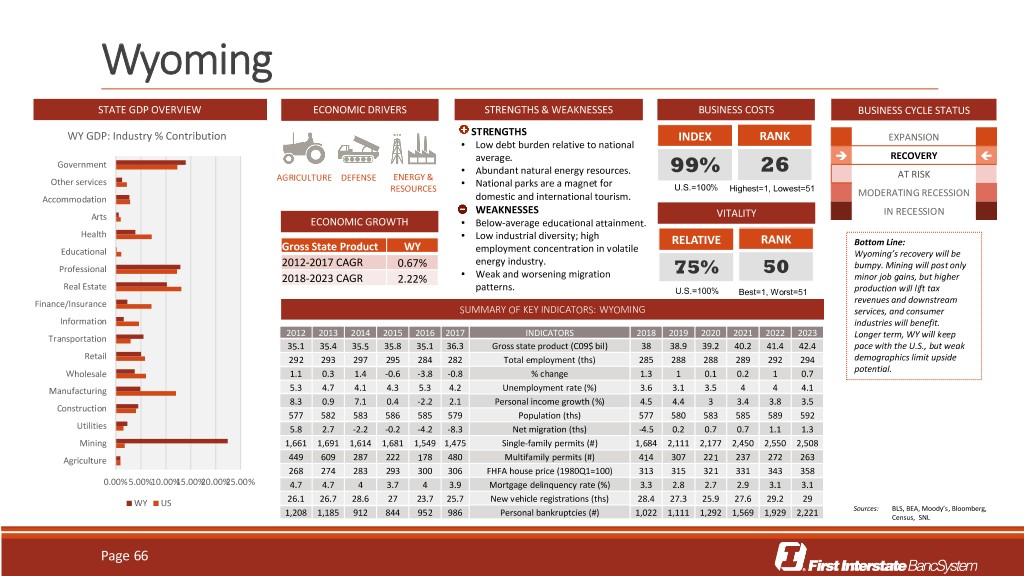

Wyoming STATE GDP OVERVIEW ECONOMIC DRIVERS STRENGTHS & WEAKNESSES BUSINESS COSTS BUSINESS CYCLE STATUS STRENGTHS WY GDP: Industry % Contribution INDEX RANK EXPANSION • Low debt burden relative to national average. RECOVERY Government • Abundant natural energy resources. 99% 26 ENERGY & AT RISK Other services AGRICULTURE DEFENSE • National parks are a magnet for U.S.=100% RESOURCES Highest=1, Lowest=51 MODERATING RECESSION Accommodation domestic and international tourism. WEAKNESSES IN RECESSION Arts VITALITY ECONOMIC GROWTH • Below-average educational attainment. Health • Low industrial diversity; high RELATIVE RANK Gross State Product WY Bottom Line: Educational employment concentration in volatile Wyoming’s recovery will be 2012-2017 CAGR 0.67% energy industry. Professional 75% 50 bumpy. Mining will post only 2018-2023 CAGR 2.22% • Weak and worsening migration minor job gains, but higher Real Estate patterns. U.S.=100% Best=1, Worst=51 production will lift tax Finance/Insurance revenues and downstream SUMMARY OF KEY INDICATORS: WYOMING services, and consumer Information industries will benefit. 2012 2013 2014 2015 2016 2017 INDICATORS 2018 2019 2020 2021 2022 2023 Transportation Longer term, WY will keep 35.1 35.4 35.5 35.8 35.1 36.3 Gross state product (C09$ bil) 38 38.9 39.2 40.2 41.4 42.4 pace with the U.S., but weak Retail 292 293 297 295 284 282 Total employment (ths) 285 288 288 289 292 294 demographics limit upside potential. Wholesale 1.1 0.3 1.4 -0.6 -3.8 -0.8 % change 1.3 1 0.1 0.2 1 0.7 Manufacturing 5.3 4.7 4.1 4.3 5.3 4.2 Unemployment rate (%) 3.6 3.1 3.5 4 4 4.1 8.3 0.9 7.1 0.4 -2.2 2.1 Personal income growth (%) 4.5 4.4 3 3.4 3.8 3.5 Construction 577 582 583 586 585 579 Population (ths) 577 580 583 585 589 592 Utilities 5.8 2.7 -2.2 -0.2 -4.2 -8.3 Net migration (ths) -4.5 0.2 0.7 0.7 1.1 1.3 Mining 1,661 1,691 1,614 1,681 1,549 1,475 Single-family permits (#) 1,684 2,111 2,177 2,450 2,550 2,508 Agriculture 449 609 287 222 178 480 Multifamily permits (#) 414 307 221 237 272 263 268 274 283 293 300 306 FHFA house price (1980Q1=100) 313 315 321 331 343 358 0.00%5.00%10.00%15.00%20.00%25.00% 4.7 4.7 4 3.7 4 3.9 Mortgage delinquency rate (%) 3.3 2.8 2.7 2.9 3.1 3.1 WY US 26.1 26.7 28.6 27 23.7 25.7 New vehicle registrations (ths) 28.4 27.3 25.9 27.6 29.2 29 Sources: BLS, BEA, Moody’s, Bloomberg, 1,208 1,185 912 844 952 986 Personal bankruptcies (#) 1,022 1,111 1,292 1,569 1,929 2,221 Census, SNL Page 66

Financial Overview

Diversified Loan Portfolio by Industry Loan Mix Commercial Retail Trade 9% Health Care & Social Assistance All Other 9% $7.76 Billion in Loans 39% Agriculture RE Construction Commercial 2.26% 8% 16.32% Transportation & Warehousing Agriculture Finance & Insurance 7% 4% Manufacturing 1.95% 5% Real Estate & Rental & Leasing Other Public Administration 4% 0.04% Commercial RE 5% 36.78% Accommodation & Food Services Professional, Scientific, 5% & Technical Services… Consumer Commercial Real Estate & Construction 13.60% Commercial Construction Residential Construction 4% 6% Land Acquisition & Development 10% Owner Occupied 39% Construction RE 9.25% Commercial Purpose - Secured by 1-4 Family Residence Loans Held for 8% Sale Residential RE 0.65% 19.16% Non-Owner Occupied 33% As of 6/30/18 Page 68

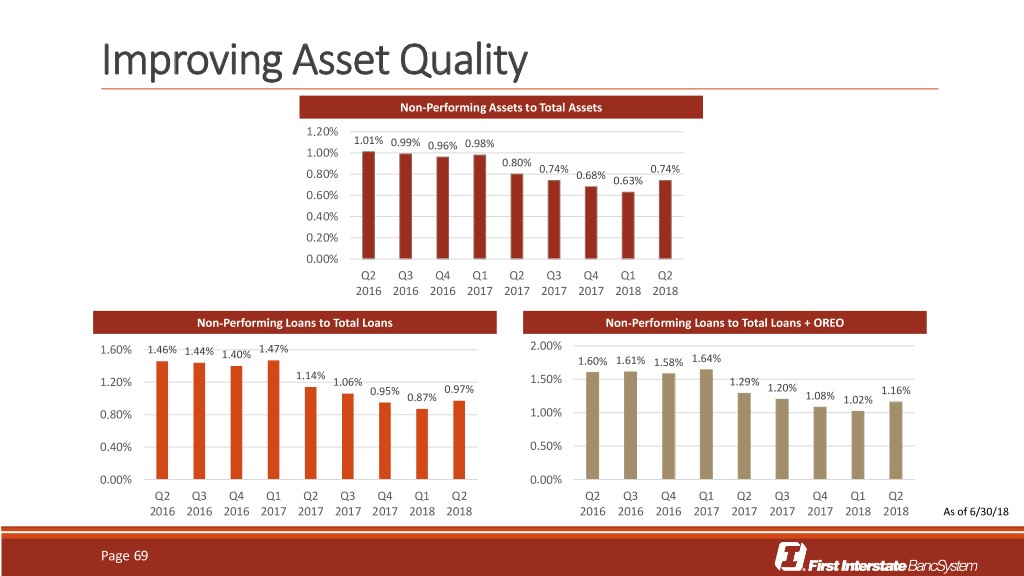

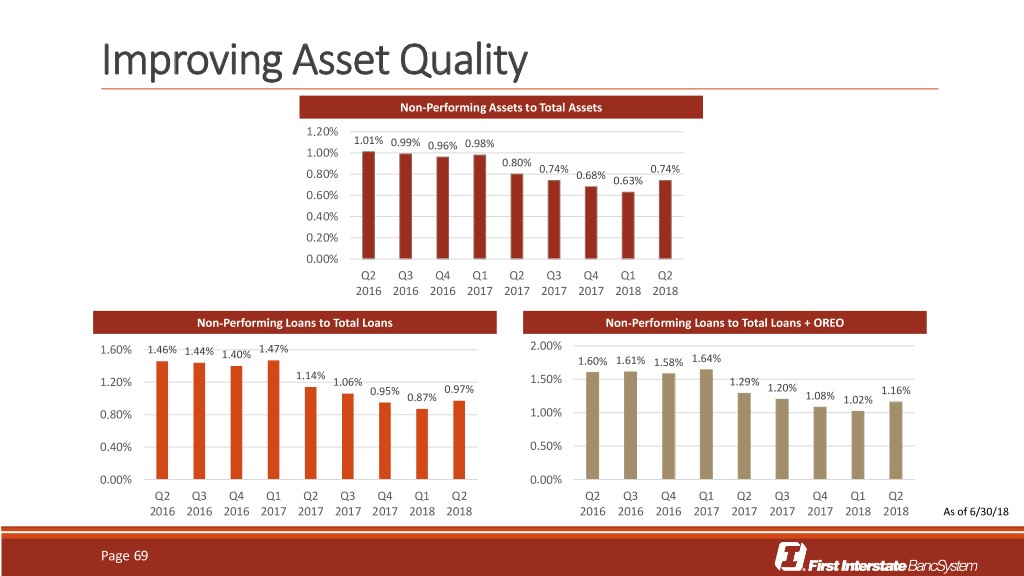

Improving Asset Quality Non-Performing Assets to Total Assets 1.20% 1.01% 0.99% 0.96% 0.98% 1.00% 0.80% 0.80% 0.74% 0.74% 0.68% 0.63% 0.60% 0.40% 0.20% 0.00% Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 2016 2016 2016 2017 2017 2017 2017 2018 2018 Non-Performing Loans to Total Loans Non-Performing Loans to Total Loans + OREO 2.00% 1.60% 1.46% 1.44% 1.40% 1.47% 1.60% 1.61% 1.58% 1.64% 1.14% 1.20% 1.06% 1.50% 1.29% 0.95% 0.97% 1.20% 1.16% 0.87% 1.08% 1.02% 0.80% 1.00% 0.40% 0.50% 0.00% 0.00% Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 2016 2016 2016 2017 2017 2017 2017 2018 2018 2016 2016 2016 2017 2017 2017 2017 2018 2018 As of 6/30/18 Page 69

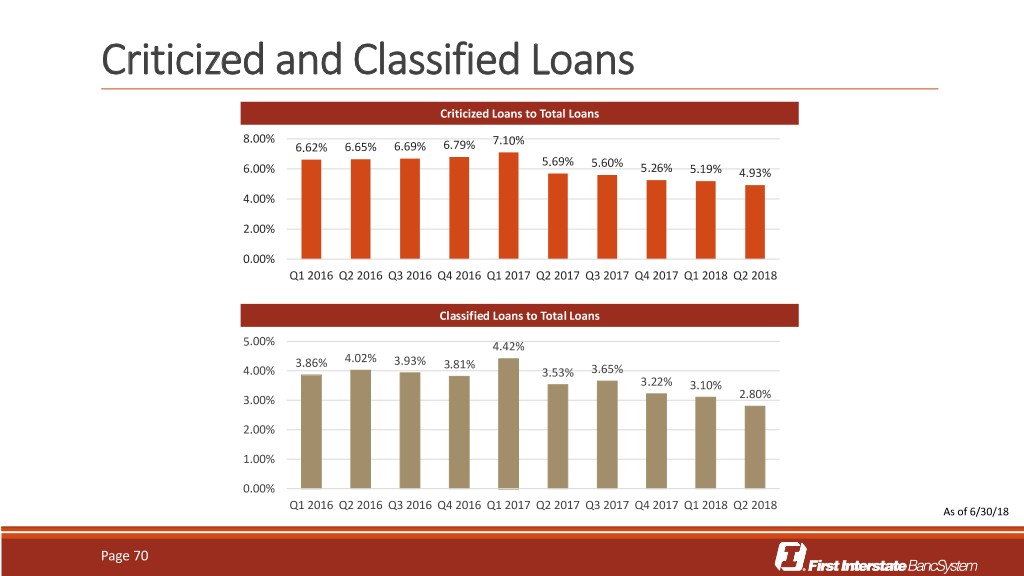

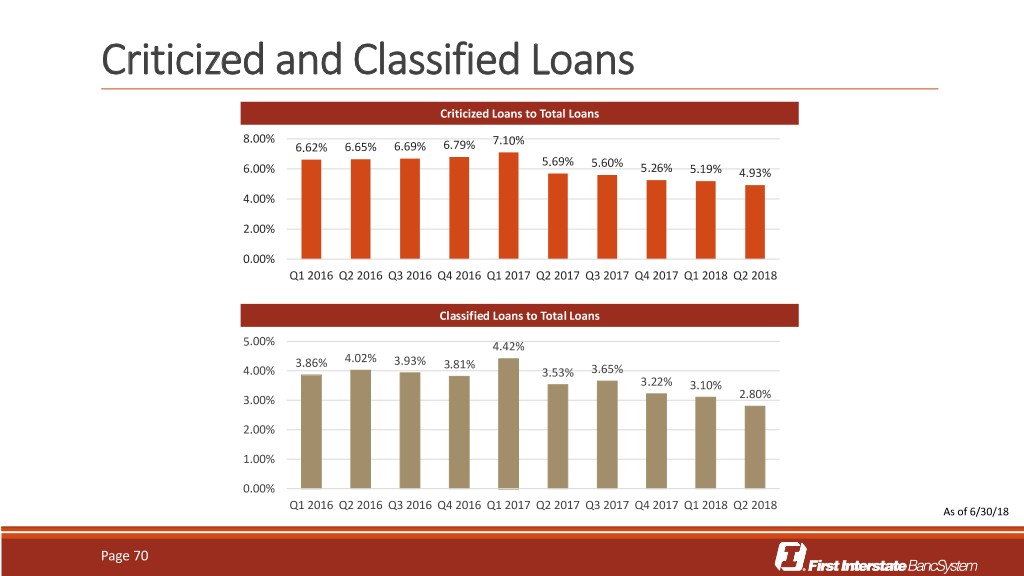

Criticized and Classified Loans CRITICIZEDCriticized Loans LOANS to Total TOLoans TOTAL LOANS 8.00% 7.10% 6.62% 6.65% 6.69% 6.79% 5.69% 5.60% 6.00% 5.26% 5.19% 4.93% 4.00% 2.00% 0.00% Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 CLASSIFIEDClassified LOANSLoans TO to Total TOTAL Loans LOANS 5.00% 4.42% 3.86% 4.02% 3.93% 3.81% 4.00% 3.53% 3.65% 3.22% 3.10% 3.00% 2.80% 2.00% 1.00% 0.00% Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 As of 6/30/18 Page 70

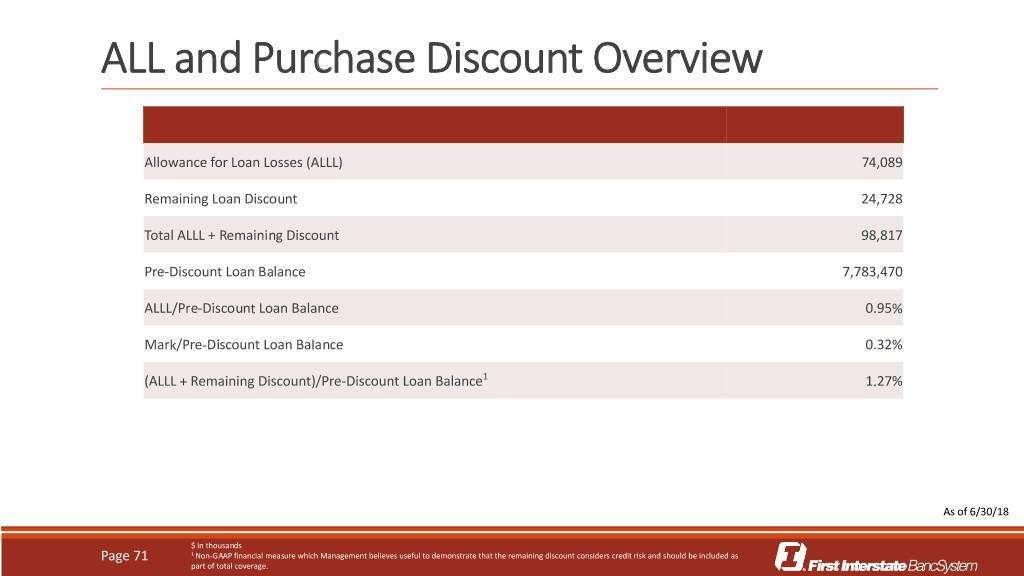

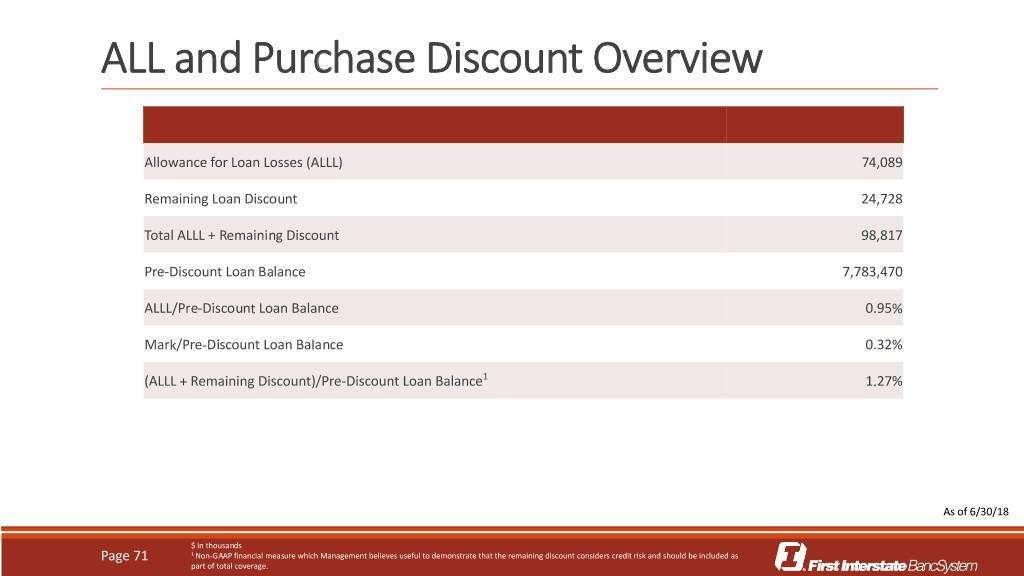

ALL and Purchase Discount Overview Allowance for Loan Losses (ALLL) 74,089 Remaining Loan Discount 24,728 Total ALLL + Remaining Discount 98,817 Pre-Discount Loan Balance 7,783,470 ALLL/Pre-Discount Loan Balance 0.95% Mark/Pre-Discount Loan Balance 0.32% (ALLL + Remaining Discount)/Pre-Discount Loan Balance1 1.27% As of 6/30/18 $ in thousands Page 71 1 Non-GAAP financial measure which Management believes useful to demonstrate that the remaining discount considers credit risk and should be included as part of total coverage.

Strong Deposit Base $9.945 Billion in Deposits CDs > $100k 4% Time Other 7% Demand Non- Interest Bearing 29% Savings 31% Demand Interest Bearing 29% Low Cost of Funds: 34 basis points As of 6/30/18 Page 72

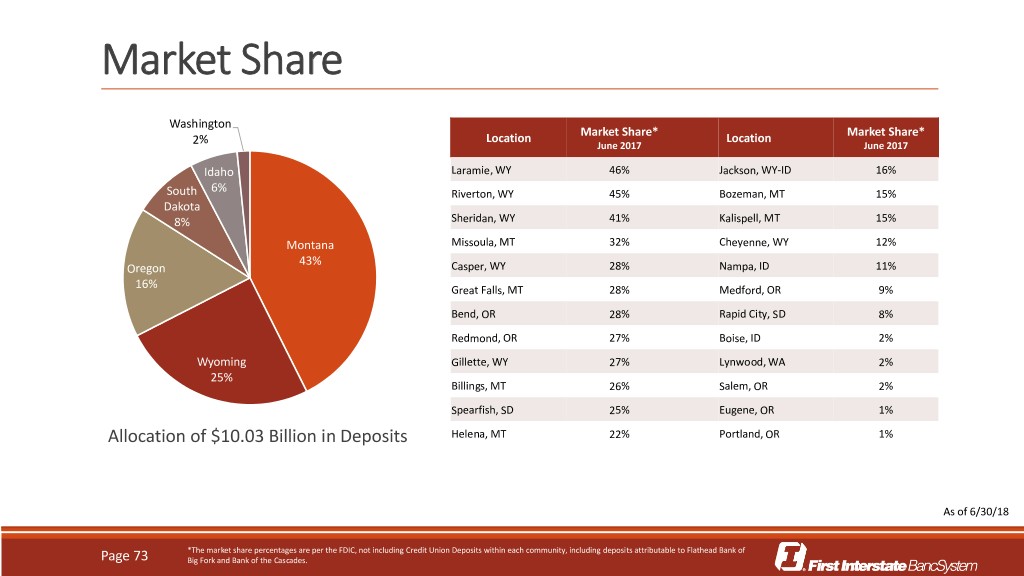

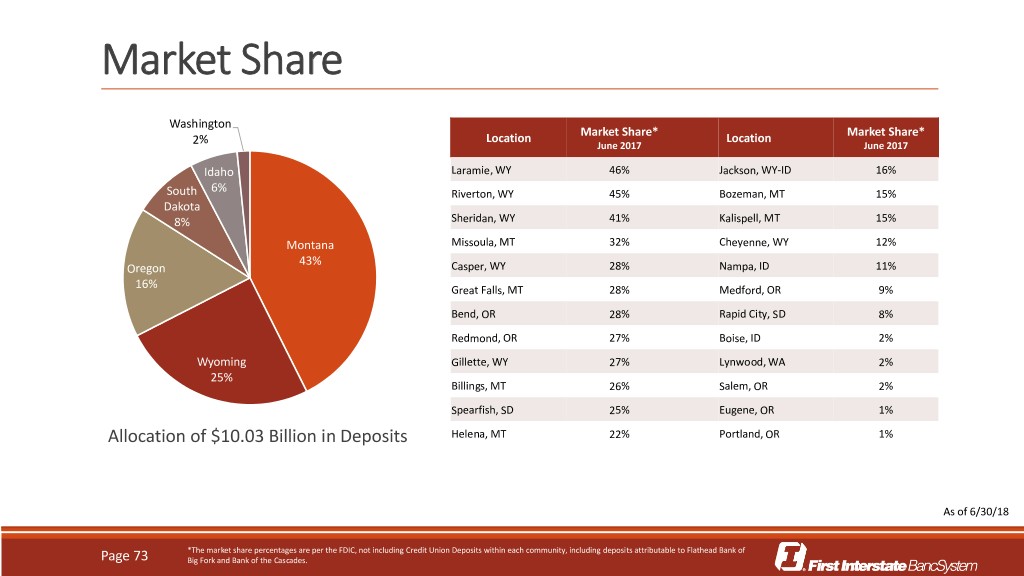

Market Share Washington Location Market Share* Location Market Share* 2% June 2017 June 2017 Idaho Laramie, WY 46% Jackson, WY-ID 16% South 6% Riverton, WY 45% Bozeman, MT 15% Dakota 8% Sheridan, WY 41% Kalispell, MT 15% Montana Missoula, MT 32% Cheyenne, WY 12% 43% Oregon Casper, WY 28% Nampa, ID 11% 16% Great Falls, MT 28% Medford, OR 9% Bend, OR 28% Rapid City, SD 8% Redmond, OR 27% Boise, ID 2% Wyoming Gillette, WY 27% Lynwood, WA 2% 25% Billings, MT 26% Salem, OR 2% Spearfish, SD 25% Eugene, OR 1% Allocation of $10.03 Billion in Deposits Helena, MT 22% Portland, OR 1% As of 6/30/18 *The market share percentages are per the FDIC, not including Credit Union Deposits within each community, including deposits attributable to Flathead Bank of Page 73 Big Fork and Bank of the Cascades.

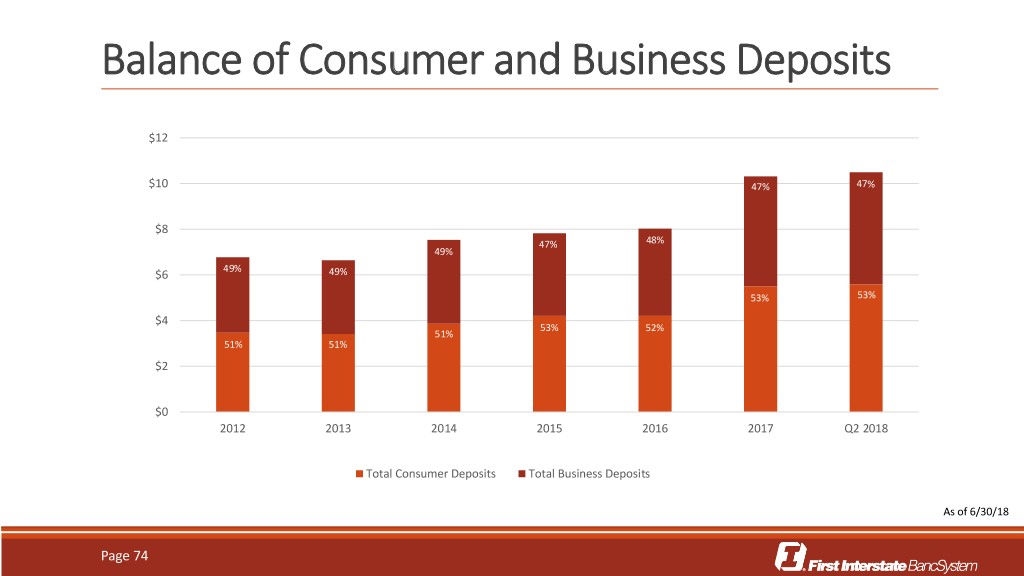

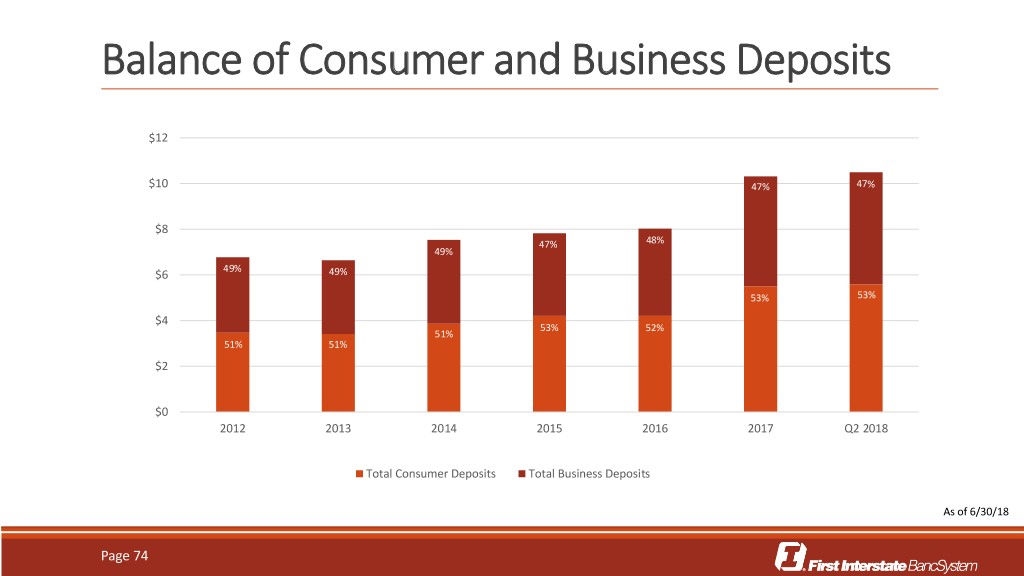

Balance of Consumer and Business Deposits $12 $10 47% 47% $8 47% 48% 49% $6 49% 49% 53% 53% $4 53% 52% 51% 51% 51% $2 $0 2012 2013 2014 2015 2016 2017 Q2 2018 Total Consumer Deposits Total Business Deposits As of 6/30/18 Page 74

Investment Portfolio Portfolio % Portfolio % Portfolio % Book Value Book Value Book Value Market Value Market Value Market Value 12/31/17 3/31/18 6/30/18 12/30/17 3/31/18 6/30/18 12/31/17 3/31/18 6/30/18 Treasury/Agency 21.8% 21.0% 21.7% $592,499,339 $585,805,107 $578,755,308 $584,249,305 $572,441,597 $564,620,057 Fixed MBS 32.3% 36.5% 35.9% $877,792,814 $1,017,889,644 $957,651,901 $872,410,017 $999,656,521 $937,223,807 Floating MBS 4.1% 3.7% 3.7% $111,142,066 $103,018,312 $99,175,906 $111,991,590 $103,221,752 $99,164,929 CMO 18.1% 16.6% 16.8% $492,493,869 $464,078,968 $447,818,551 $482,981,902 $449,404,862 $432,071,761 CMO Floating 5.0% 4.6% 4.6% $136,708,652 $128,590,648 $122,318,032 $136,139,053 $127,254,686 $120,847,191 Municipal 6.3% 6.0% 6.1% $172,400,013 $168,250,298 $162,077,389 $174,385,811 $168,758,065 $162,456,270 CMBS 6.6% 6.0% 5.7% $179,699,144 $168,172,528 $153,065,563 $177,573,421 $164,318,865 $149,184,875 Corporate 5.5% 5.4% 5.4% $149,608,233 $149,541,783 $144,382,482 $149,306,473 $148,099,024 $142,907,947 CD’s 0.1% 0.1% 0.1% $2,951,000 $2,951,000 $2,461,000 $2,953,478 $2,945,547 $2,451,643 TOTAL 100% 100% 100% $2,715,295,132 $2,788,298,287 $2,667,706,133 $2,691,991,050 $2,736,100,918 $2,610,928,481 Duration of Q2 2018 Purchases T/E Yield of Q2 2018 Purchases Q2 2018 Par Purchases Agencies $ 5,000,000 Muni 7.67 Muni 3.67% MBS $ $12,308,666 CMO 3.86 CMO 3.25% Muni’s $ 300,000 Grand Total $ $17,608,667 Agencies 4.23 Agencies 3.25% 0.00 2.00 4.00 6.00 8.00 3.00% 3.10% 3.20% 3.30% 3.40% 3.50% 3.60% 3.70% 3.80% As of 6/30/18 Page 75

Interest Rate Sensitivity o Asset sensitive in up-rate scenarios, Net Interest Income (NII) – Shocks* despite conservative deposit beta methodology +400 bps 2.84% +300 bps 2.53% Net Interest Income $500M +200 bps 1.62% $430 $432 $450M $420 $423 $427 $402 +100 bps 0.85% $400M $361 $350M $332 Base 0.00% $312 $300M -100 bps -4.15% $250M $200M -200 bps -13.96% $150M -300 bps -20.85% $100M $50M -400 bps -25.57% $0M -400 -300 -200 -100 Base +100 +200 +300 +400 -30% -25% -20% -15% -10% -5% 0% 5% 10% 15% 20% 25% 30% *Base case assumes static balance sheet as of 6/30/18. Parallel rate shifts Page 76

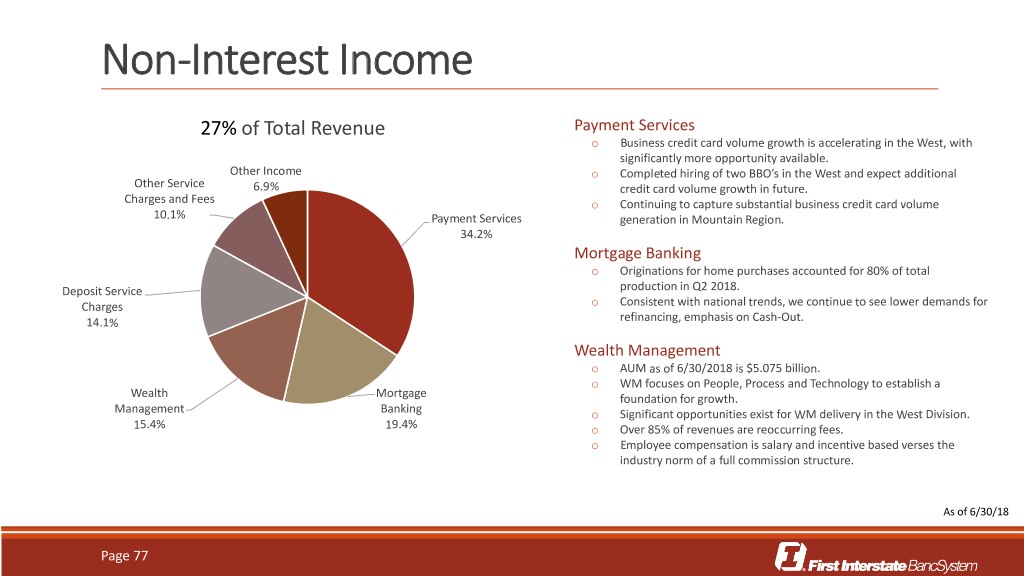

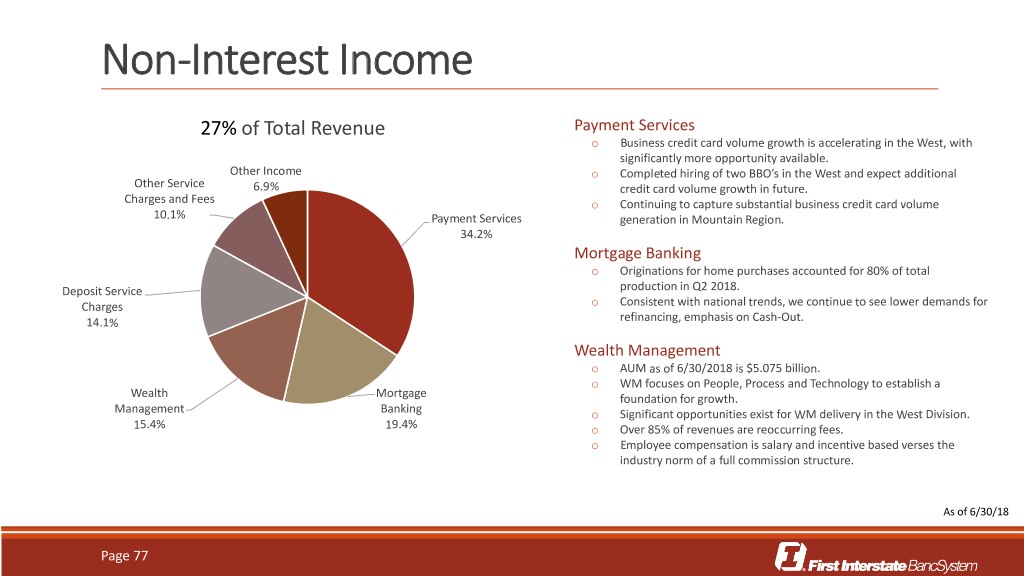

Non-Interest Income 27% of Total Revenue Payment Services o Business credit card volume growth is accelerating in the West, with significantly more opportunity available. Other Income o Completed hiring of two BBO’s in the West and expect additional Other Service 6.9% credit card volume growth in future. Charges and Fees o Continuing to capture substantial business credit card volume 10.1% Payment Services generation in Mountain Region. 34.2% Mortgage Banking o Originations for home purchases accounted for 80% of total Deposit Service production in Q2 2018. Charges o Consistent with national trends, we continue to see lower demands for 14.1% refinancing, emphasis on Cash-Out. Wealth Management o AUM as of 6/30/2018 is $5.075 billion. o WM focuses on People, Process and Technology to establish a Wealth Mortgage foundation for growth. Management Banking o Significant opportunities exist for WM delivery in the West Division. 15.4% 19.4% o Over 85% of revenues are reoccurring fees. o Employee compensation is salary and incentive based verses the industry norm of a full commission structure. As of 6/30/18 Page 77

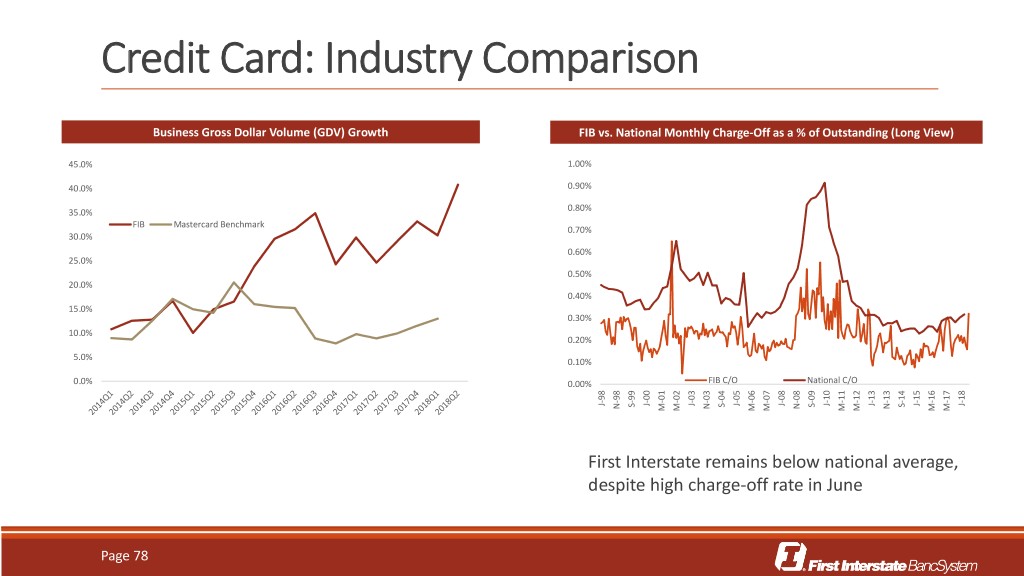

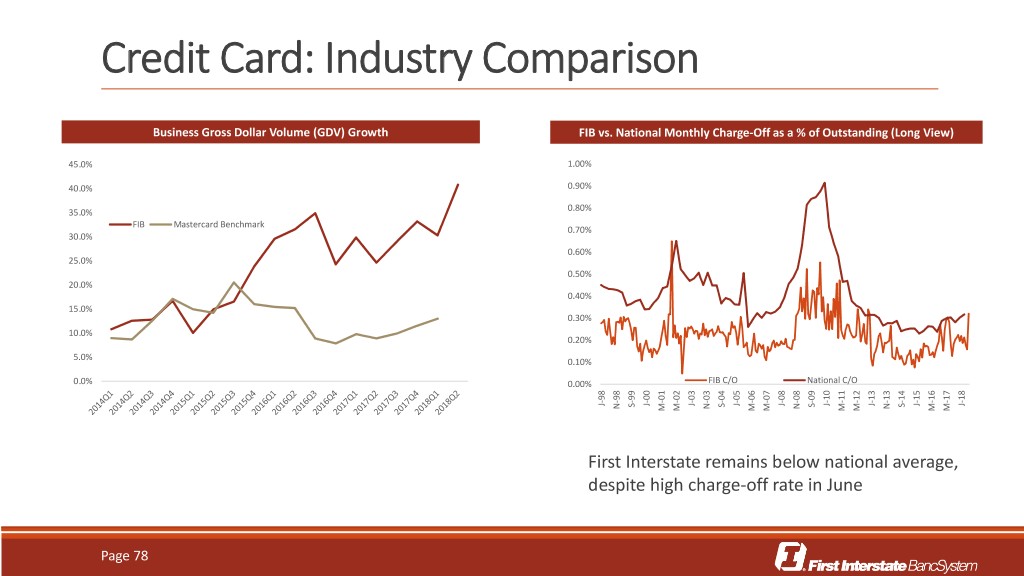

Credit Card: Industry Comparison Business Gross Dollar Volume (GDV) Growth FIB vs. National Monthly Charge-Off as a % of Outstanding (Long View) 45.0% 1.00% 40.0% 0.90% 35.0% 0.80% FIB Mastercard Benchmark 0.70% 30.0% 0.60% 25.0% 0.50% 20.0% 0.40% 15.0% 0.30% 10.0% 0.20% 5.0% 0.10% 0.0% 0.00% FIB C/O National C/O J-98 J-00 J-03 J-05 J-08 J-10 J-13 J-15 J-18 S-99 S-04 S-09 S-14 N-98 N-03 N-08 N-13 M-01 M-02 M-06 M-07 M-11 M-12 M-16 M-17 First Interstate remains below national average, despite high charge-off rate in June Page 78

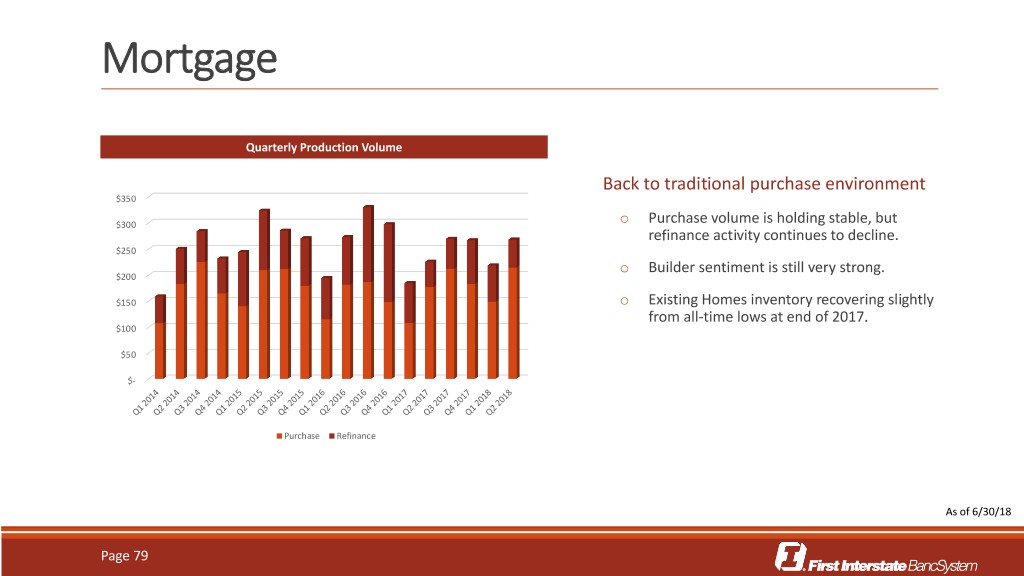

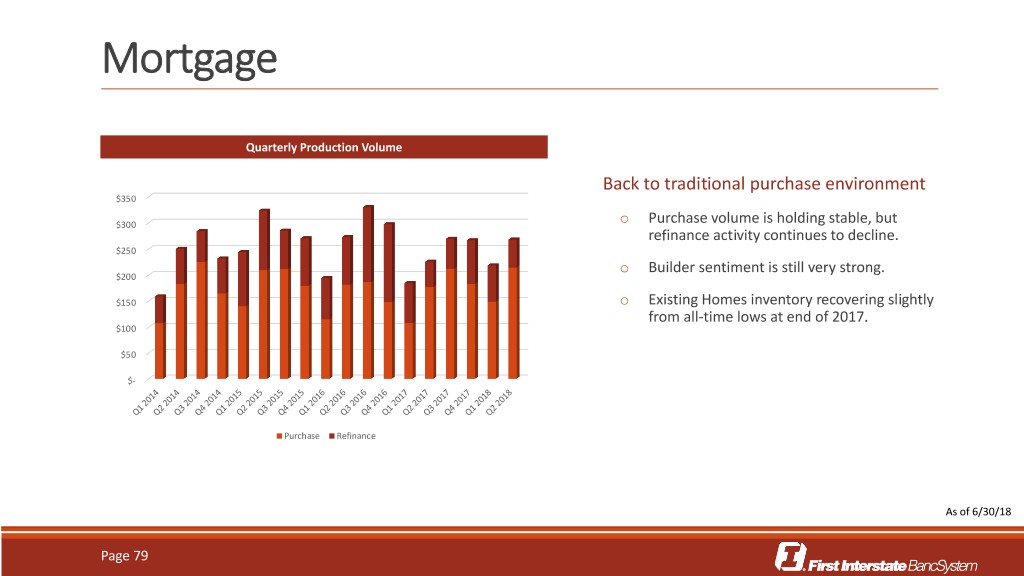

Mortgage Quarterly Production Volume Back to traditional purchase environment $350 $300 o Purchase volume is holding stable, but refinance activity continues to decline. $250 o Builder sentiment is still very strong. $200 $150 o Existing Homes inventory recovering slightly from all-time lows at end of 2017. $100 $50 $- Purchase Refinance As of 6/30/18 Page 79

Growth Strategies and Capital Allocation

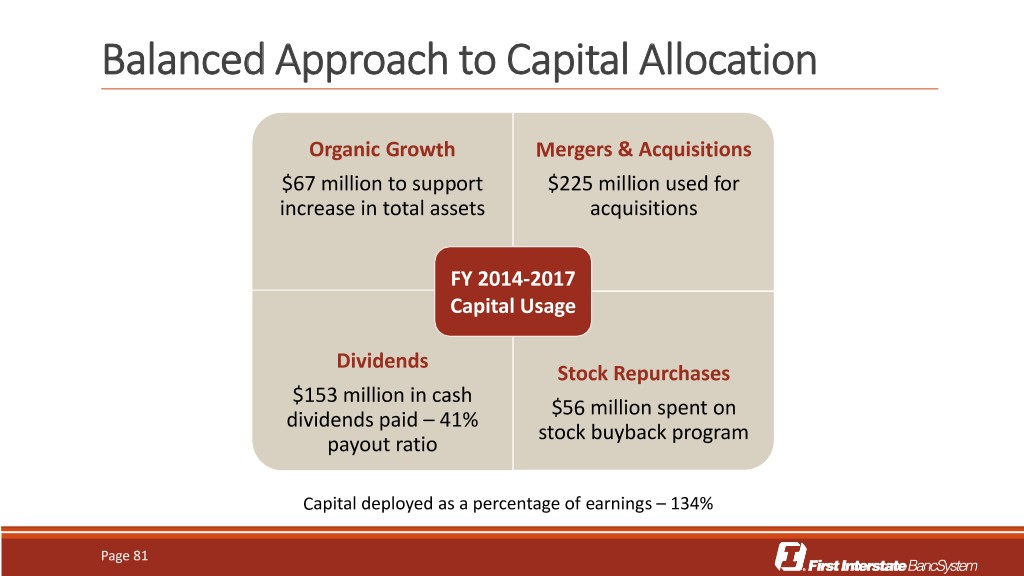

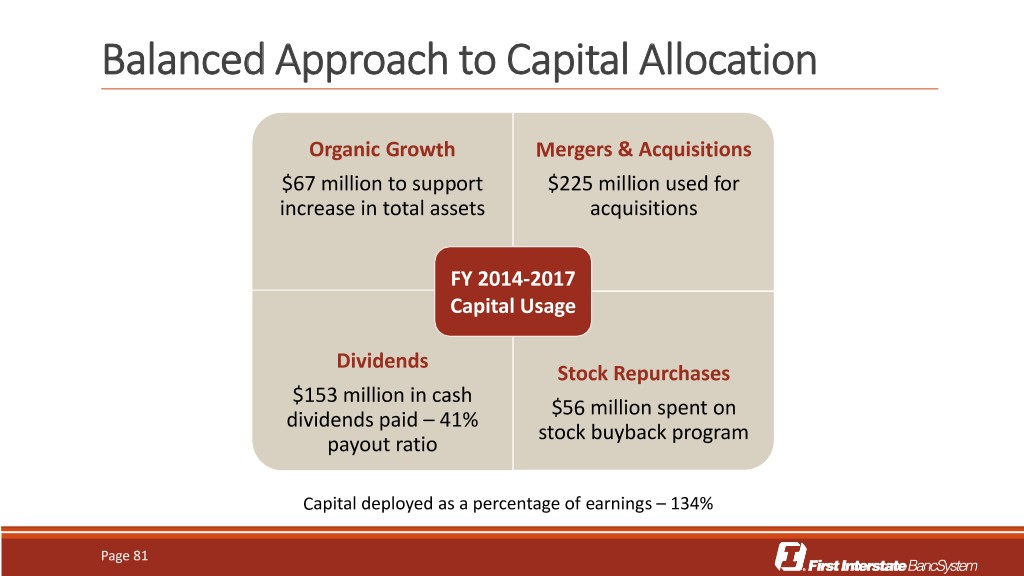

Balanced Approach to Capital Allocation Organic Growth Mergers & Acquisitions $67 million to support $225 million used for increase in total assets acquisitions FY 2014-2017 Capital Usage Dividends Stock Repurchases $153 million in cash $56 million spent on dividends paid – 41% stock buyback program payout ratio Capital deployed as a percentage of earnings – 134% Page 81

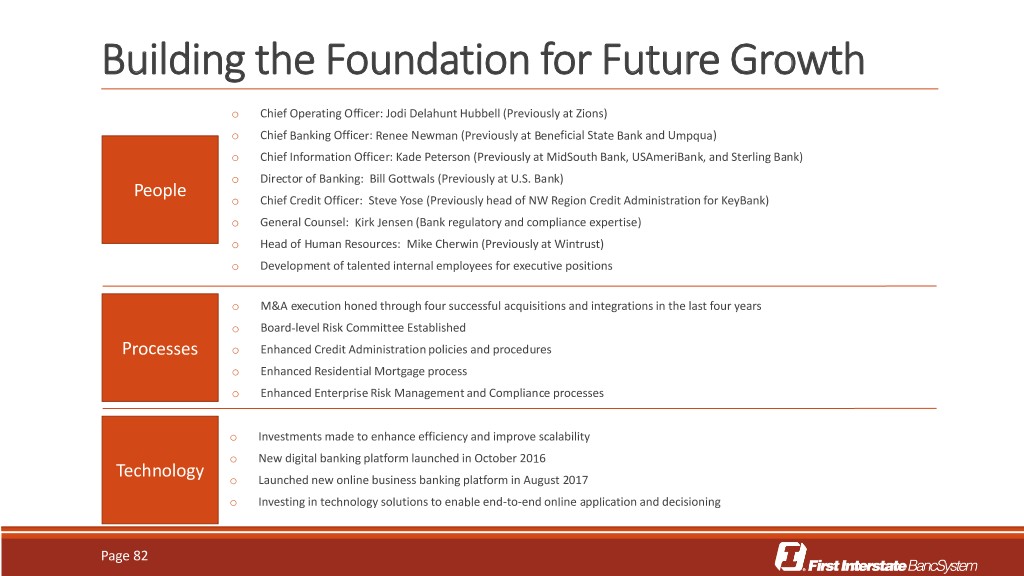

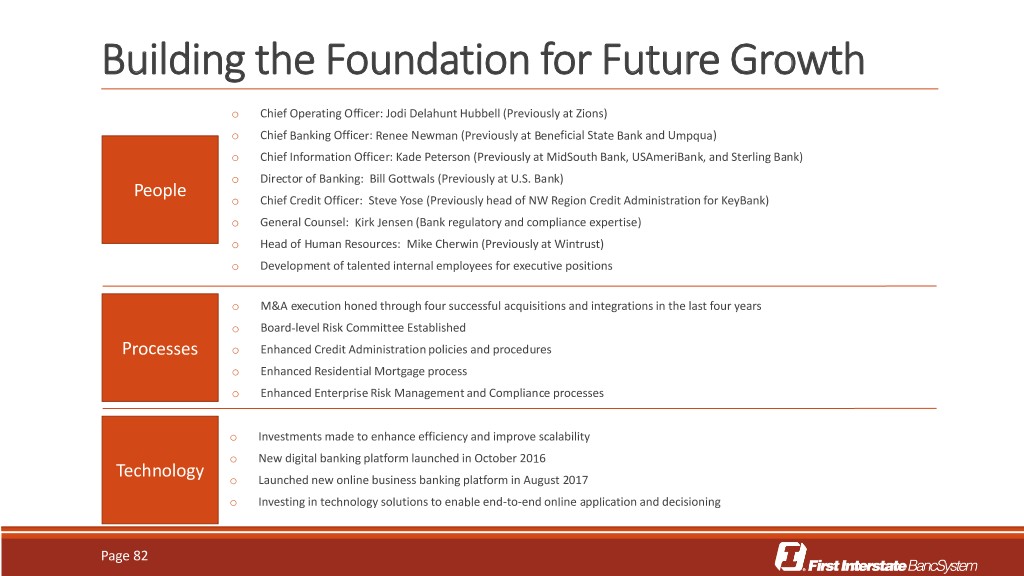

Building the Foundation for Future Growth o Chief Operating Officer: Jodi Delahunt Hubbell (Previously at Zions) o Chief Banking Officer: Renee Newman (Previously at Beneficial State Bank and Umpqua) o Chief Information Officer: Kade Peterson (Previously at MidSouth Bank, USAmeriBank, and Sterling Bank) o Director of Banking: Bill Gottwals (Previously at U.S. Bank) People o Chief Credit Officer: Steve Yose (Previously head of NW Region Credit Administration for KeyBank) o General Counsel: Kirk Jensen (Bank regulatory and compliance expertise) o Head of Human Resources: Mike Cherwin (Previously at Wintrust) o Development of talented internal employees for executive positions o M&A execution honed through four successful acquisitions and integrations in the last four years o Board-level Risk Committee Established Processes o Enhanced Credit Administration policies and procedures o Enhanced Residential Mortgage process o Enhanced Enterprise Risk Management and Compliance processes o Investments made to enhance efficiency and improve scalability o New digital banking platform launched in October 2016 Technology o Launched new online business banking platform in August 2017 o Investing in technology solutions to enable end-to-end online application and decisioning Page 82

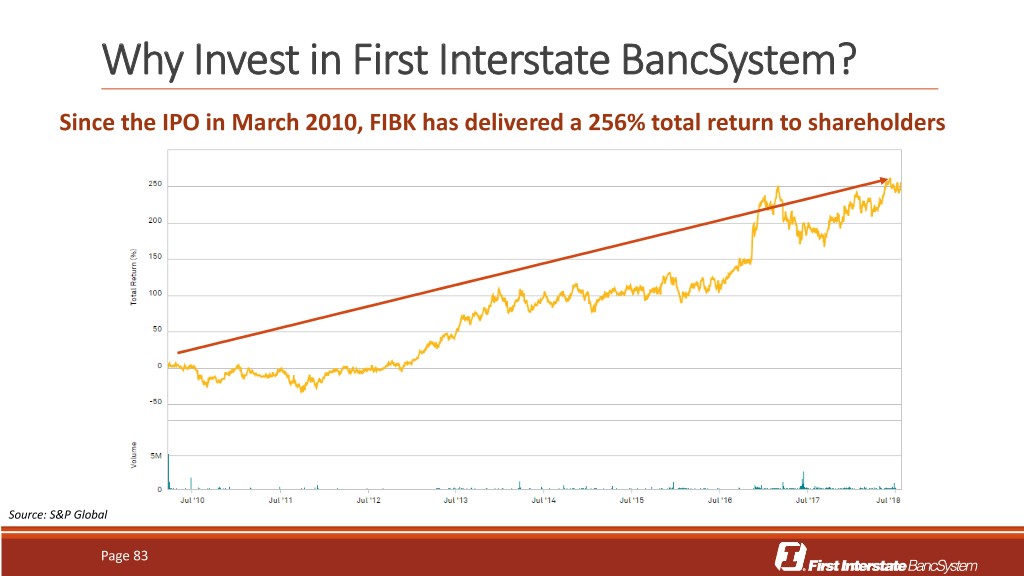

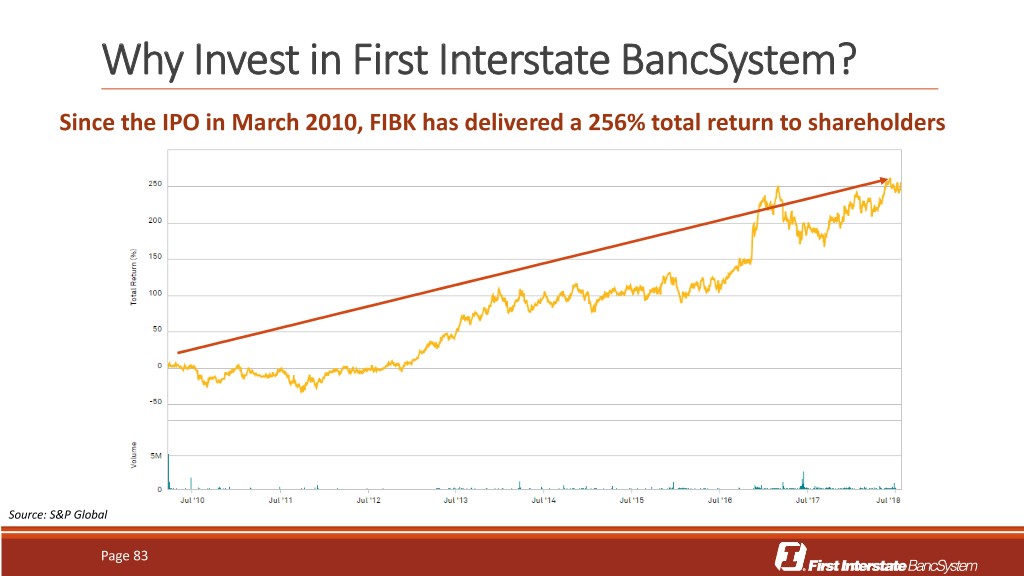

Why Invest in First Interstate BancSystem? Since the IPO in March 2010, FIBK has delivered a 256% total return to shareholders Source: S&P Global Page 83

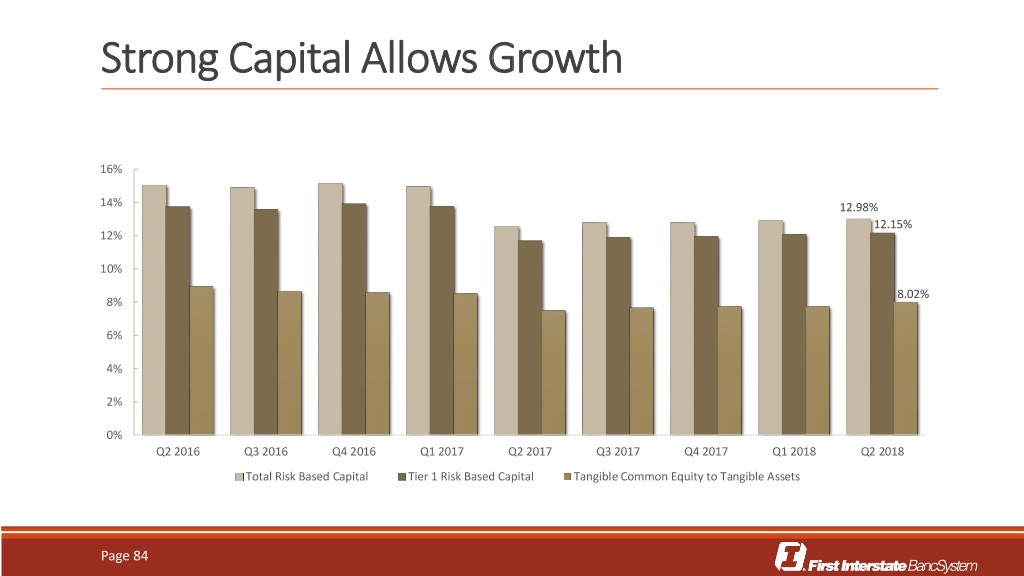

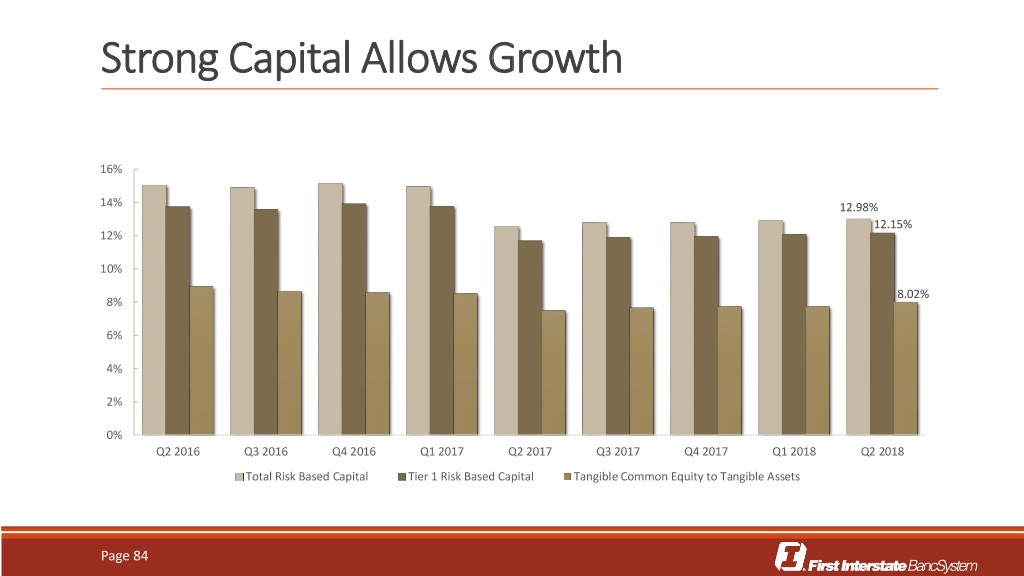

Strong Capital Allows Growth 16% 14% 12.98% 12.15% 12% 10% 8.02% 8% 6% 4% 2% 0% Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Total Risk Based Capital Tier 1 Risk Based Capital Tangible Common Equity to Tangible Assets Page 84

BOTC Purchase Accounting Adjustments Removing Purchase 5/30/2017 Prior BOTC Accounting Pro Forma $ in thousands Balance Mark Adjustments Balance Valuation Source ASSETS Cash & Cash Equivalents 246,804 246,804 Investment Securities 476,733 4,876 481,609 Stiefel Loans held for Investment 2,108,014 4,063 (32,741) 2,079,336 Primatics Mortgage Loans Held for Sale 10,253 10,253 Allowance for Loan Loss (23,974) 23,974 - Premises and Equipment 46,554 178 46,732 Appraisal and BOV OREO 1,192 1,192 Goodwill 85,829 (85,829) 232,783 232,783 Core Deposit Intangible 11,693 (11,693) 47,968 47,968 CroweHorwath Other Assets 146,223 (18,772) 127,451 Level1 (MSR 1,111), and Crowe (DTA -22,400) Total Assets $3,109,322 ($69,486) $234,292 $3,274,128 Deposits 2,669,910 (933) 2,668,976 Accts Pay and Accrued Exp 62,150 2,006 64,156 Total Liabilities $2,732,060 $0 $1,073 $2,733,132 Stockholders Equity 377,262 (377,262) 540,996 540,996 Total Liabilities and Stockholders Equity $3,109,322 ($377,262) $542,069 $3,274,128 Page 85

Indirect Auto: Lending Consumer Indirect Auto Loan Portfolio $400 Other 8.6% 6.4% New $350 6.26% 28.9% 6.2% RV 21.7% $300 5.93% 6.0% $250 5.77% 5.8% $200 5.6% $150 Used 40.8% $99.2 $97.7 5.4% $100 $81.0 $50 5.2% o Total Portfolio Yield: 5.19% $0 5.0% 2Q17 1Q18 2Q18 o Average Life of RV: 47 months New Quarterly Production Production Yield o Average Life of Auto: 31 months As of 6/30/18 Page 86

Indirect Auto: Delinquency and Charge-Off Originations from a credit quality perspective remain unchanged o ~50% of our originations are above a 760 FICO score o ~72% of our originations are above a 720 FICO score o Not participating in the subprime space, less than 1.5% of the portfolio has a score below 620 As a result, our credit metrics remain healthy and below peer 30-Day Delinquency 1.50% 1.30% Delinquency and C/O are both stable YOY 1.10% o Delinquency Q2 at .88% (1.08% in 2017, Peer = 1.50%) 0.90% 0.70% o 2018 net C/O = $1.2mm, 0.30% (0.30% in 2018) 0.50% As of 6/30/18 Page 87

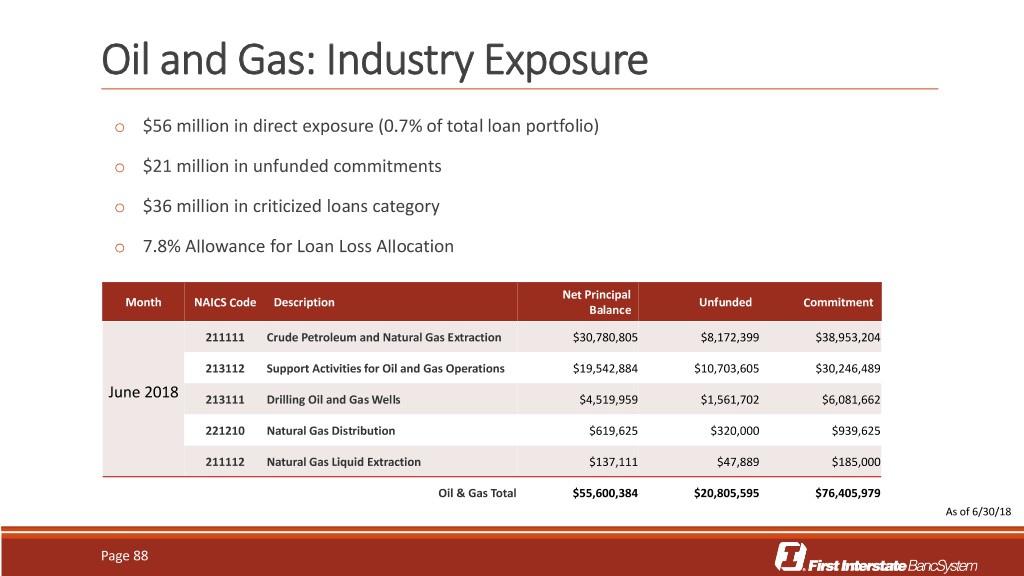

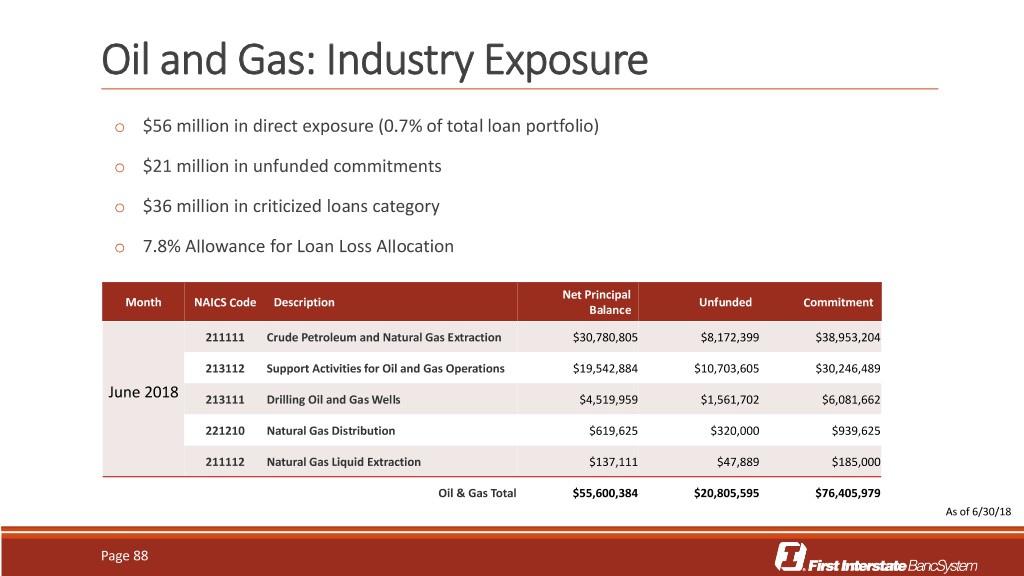

Oil and Gas: Industry Exposure o $56 million in direct exposure (0.7% of total loan portfolio) o $21 million in unfunded commitments o $36 million in criticized loans category o 7.8% Allowance for Loan Loss Allocation Net Principal Month NAICS Code Description Unfunded Commitment Balance 211111 Crude Petroleum and Natural Gas Extraction $30,780,805 $8,172,399 $38,953,204 213112 Support Activities for Oil and Gas Operations $19,542,884 $10,703,605 $30,246,489 June 2018 213111 Drilling Oil and Gas Wells $4,519,959 $1,561,702 $6,081,662 221210 Natural Gas Distribution $619,625 $320,000 $939,625 211112 Natural Gas Liquid Extraction $137,111 $47,889 $185,000 Oil & Gas Total $55,600,384 $20,805,595 $76,405,979 As of 6/30/18 Page 88

Oil and Gas: Industry Performance Metrics o $13 million in impaired loan categories o 7.8% allowance allocation o $2.7 million in potential loss exposure Description Criticized % Criticized Classified % Classified Impaired % Impaired Crude Petroleum and Natural Gas Extraction $26,197,236 85.1% $26,197,236 85.1% $12,859,477 41.8% Support Activities for Oil and Gas Operations $8,567,446 43.8% $566,426 2.9% $0 0.0% Drilling Oil and Gas Wells $1,197,272 26.5% $70,999 1.6% $0 0.0% Natural Gas Distribution $0 0.0% $0 0.0% $0 0.0% Natural Gas Liquid Extraction $0 0.0% $0 0.0% $0 0.0% Oil & Gas Total $35,961,953 64.7% $26,834,661 48.3% $12,859,477 23.1% As of 6/30/18 Page 89

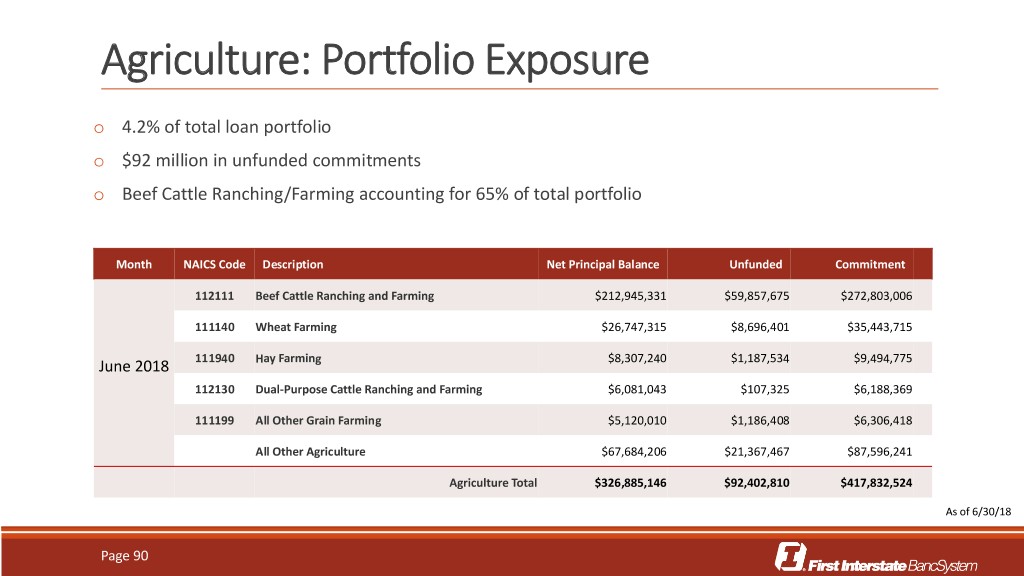

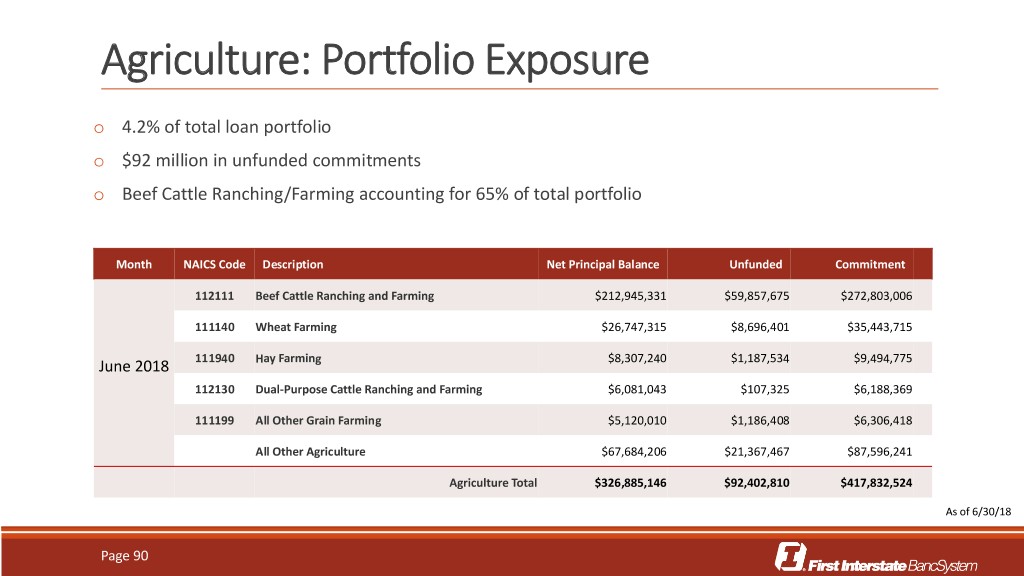

Agriculture: Portfolio Exposure o 4.2% of total loan portfolio o $92 million in unfunded commitments o Beef Cattle Ranching/Farming accounting for 65% of total portfolio Month NAICS Code Description Net Principal Balance Unfunded Commitment 112111 Beef Cattle Ranching and Farming $212,945,331 $59,857,675 $272,803,006 111140 Wheat Farming $26,747,315 $8,696,401 $35,443,715 June 2018 111940 Hay Farming $8,307,240 $1,187,534 $9,494,775 112130 Dual-Purpose Cattle Ranching and Farming $6,081,043 $107,325 $6,188,369 111199 All Other Grain Farming $5,120,010 $1,186,408 $6,306,418 All Other Agriculture $67,684,206 $21,367,467 $87,596,241 Agriculture Total $326,885,146 $92,402,810 $417,832,524 As of 6/30/18 Page 90

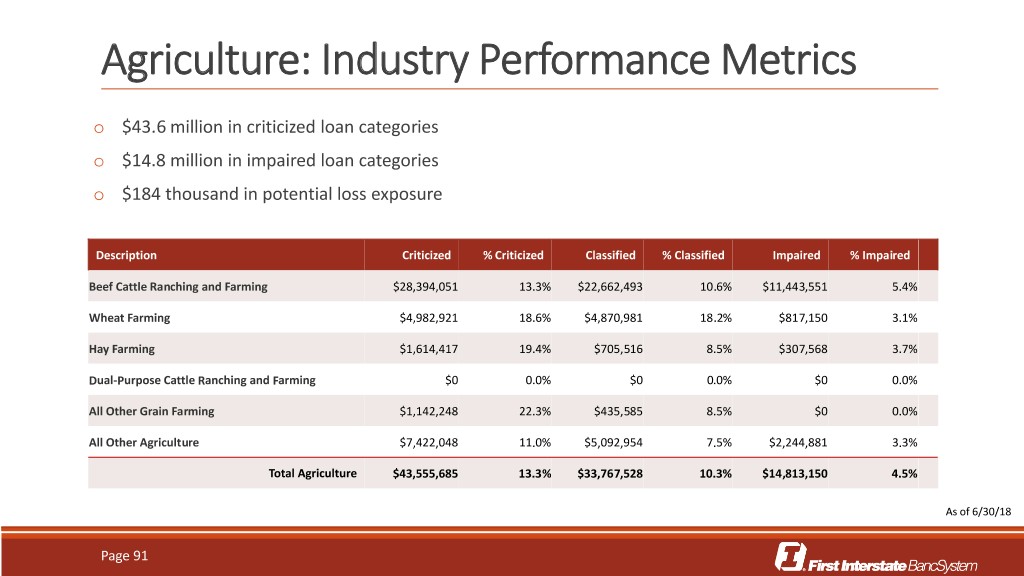

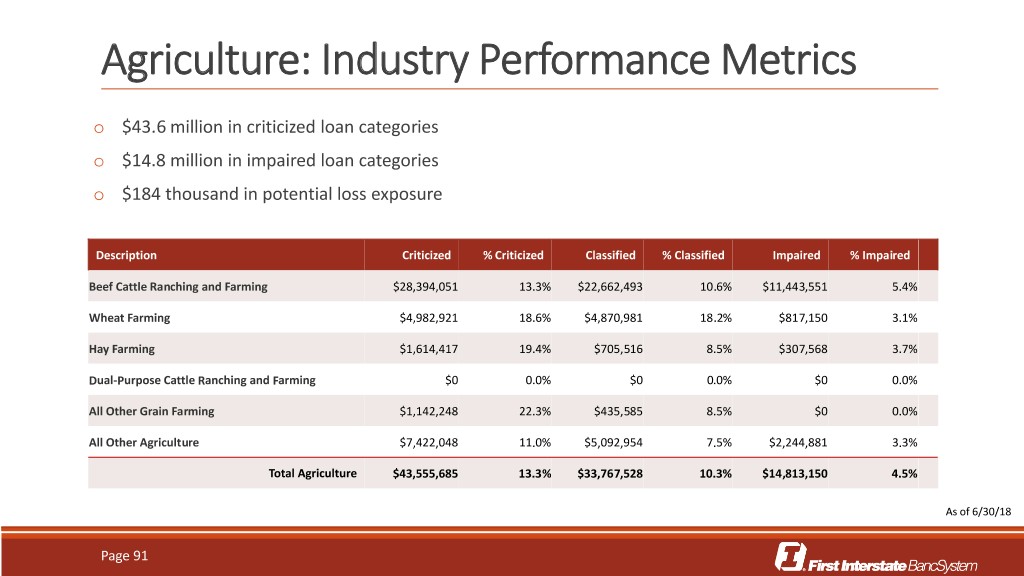

Agriculture: Industry Performance Metrics o $43.6 million in criticized loan categories o $14.8 million in impaired loan categories o $184 thousand in potential loss exposure Description Criticized % Criticized Classified % Classified Impaired % Impaired Beef Cattle Ranching and Farming $28,394,051 13.3% $22,662,493 10.6% $11,443,551 5.4% Wheat Farming $4,982,921 18.6% $4,870,981 18.2% $817,150 3.1% Hay Farming $1,614,417 19.4% $705,516 8.5% $307,568 3.7% Dual-Purpose Cattle Ranching and Farming $0 0.0% $0 0.0% $0 0.0% All Other Grain Farming $1,142,248 22.3% $435,585 8.5% $0 0.0% All Other Agriculture $7,422,048 11.0% $5,092,954 7.5% $2,244,881 3.3% Total Agriculture $43,555,685 13.3% $33,767,528 10.3% $14,813,150 4.5% As of 6/30/18 Page 91

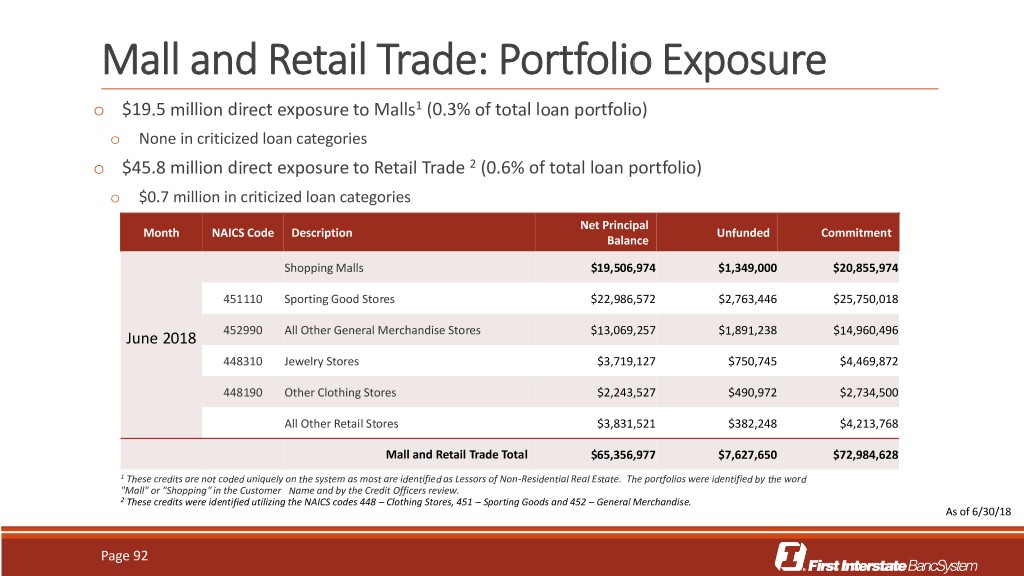

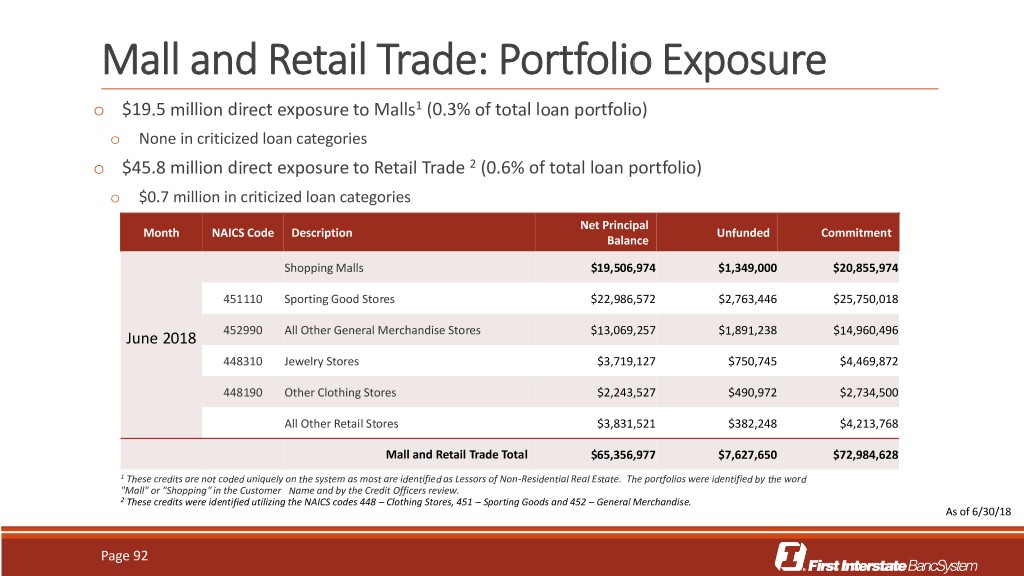

Mall and Retail Trade: Portfolio Exposure o $19.5 million direct exposure to Malls1 (0.3% of total loan portfolio) o None in criticized loan categories o $45.8 million direct exposure to Retail Trade 2 (0.6% of total loan portfolio) o $0.7 million in criticized loan categories Net Principal Month NAICS Code Description Unfunded Commitment Balance Shopping Malls $19,506,974 $1,349,000 $20,855,974 451110 Sporting Good Stores $22,986,572 $2,763,446 $25,750,018 June 2018 452990 All Other General Merchandise Stores $13,069,257 $1,891,238 $14,960,496 448310 Jewelry Stores $3,719,127 $750,745 $4,469,872 448190 Other Clothing Stores $2,243,527 $490,972 $2,734,500 All Other Retail Stores $3,831,521 $382,248 $4,213,768 Mall and Retail Trade Total $65,356,977 $7,627,650 $72,984,628 1 These credits are not coded uniquely on the system as most are identified as Lessors of Non-Residential Real Estate. The portfolios were identified by the word "Mall" or "Shopping" in the Customer Name and by the Credit Officers review. 2 These credits were identified utilizing the NAICS codes 448 – Clothing Stores, 451 – Sporting Goods and 452 – General Merchandise. As of 6/30/18 Page 92