Investor Presentation February | March 2019

Safe Harbor This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about (1) the benefits of the mergers between First Interstate BancSystem, Inc. (“First Interstate”) and Idaho Independent Bank (“IIBK”) and Community 1st Bank (“CMYF”), including anticipated future results, cost savings and accretion to reported earnings that may be realized from the mergers; (2) First Interstate, IIBK’s and CMYF’s plans, objectives, expectations and intentions and other statements contained in this presentation that are not historical facts (including statements about revenues, income, net interest margin, the provision for loan losses, non- interest expense, loan growth and non-performing loans and assets); and (3) other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” or words of similar meaning. Forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from those in such statements. The following factors, among others, could cause actual results to differ materially from the anticipated results expressed in the forward-looking statements: the businesses of First Interstate, IIBK and CMYF may not be combined successfully, or such combination may take longer than expected; the cost savings from the mergers may not be fully realized or may take longer than expected; operating costs, customer loss and business disruption following the mergers may be greater than expected; governmental approvals of the mergers may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the mergers or otherwise; the stockholders of IIBK and CMYF may fail to approve the merger; credit and interest rate risks associated with First Interstate’s, IIBK’s and CMYF’s respective businesses; and difficulties associated with achieving expected future financial results. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in First Interstate’s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the SEC and available at the SEC’s Internet website (www.sec.gov). All subsequent written and oral forward-looking statements concerning the proposed transactions or other matters attributable to First Interstate, IIBK or CMYF or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Except as required by law, First Interstate, IIBK and CMYF do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statement is made. Page 2

Important Additional Information This presentation is being made in respect of the proposed mergers between First Interstate and IIBK and First Interstate and CMYF. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed transaction, First Interstate has filed a registration statements on Form S-4 on November 28, 2018 with the SEC, which included a proxy statement for each IIBK and CMYF, and a prospectus of First Interstate. First Interstate amended the registration statements with the S-4/A filings on January 16, 2019 and the registration statements became effective on February 5, 2019. First Interstate also filed a prospectus for each transaction pursuant to Rule 424(b)(3) on February 7, 2019. First Interstate, IIBK and CMYF will file other documents regarding the proposed transactions with the SEC. Before making any voting or investment decision, investors and security holders of IIBK and CMYF are urged to carefully read the entire registration statement and proxy statement/prospectus, as well as any amendments or supplements to these documents, because they contain important information about the proposed transactions. The documents filed by First Interstate with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by First Interstate may be obtained free of charge at its website at www.fibk.com or by contacting First Interstate BancSystem, Inc., 401 North 31st Street, Billings, Montana 59116, Attention: Marcy D. Mutch, Executive VP & CFO, telephone (406) 255-5390. First Interstate, IIBK and CMYF and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies of IIBK’s and CMYF ’s shareholders in connection with the proposed transactions. Information about the directors and executive officers of First Interstate and their ownership of First Interstate common stock is set forth in the proxy statement for First Interstate’s 2018 Annual Meeting of Shareholders, as filed with the SEC on Schedule 14A on March 16, 2018. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the proxy statement/prospectus regarding the proposed mergers when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. Page 3

Why Invest in First Interstate BancSystem? • Committed to Increasing Shareholder Value • Long Track Record of Profitability • Strong Core Deposit Funding • Conservative Credit Strategy which Limits Exposure to Large Losses • Diversified Client Base Tempers Economic Volatility • Expansion into Northwest Region Strengthens Foundation for Future Growth Page 4

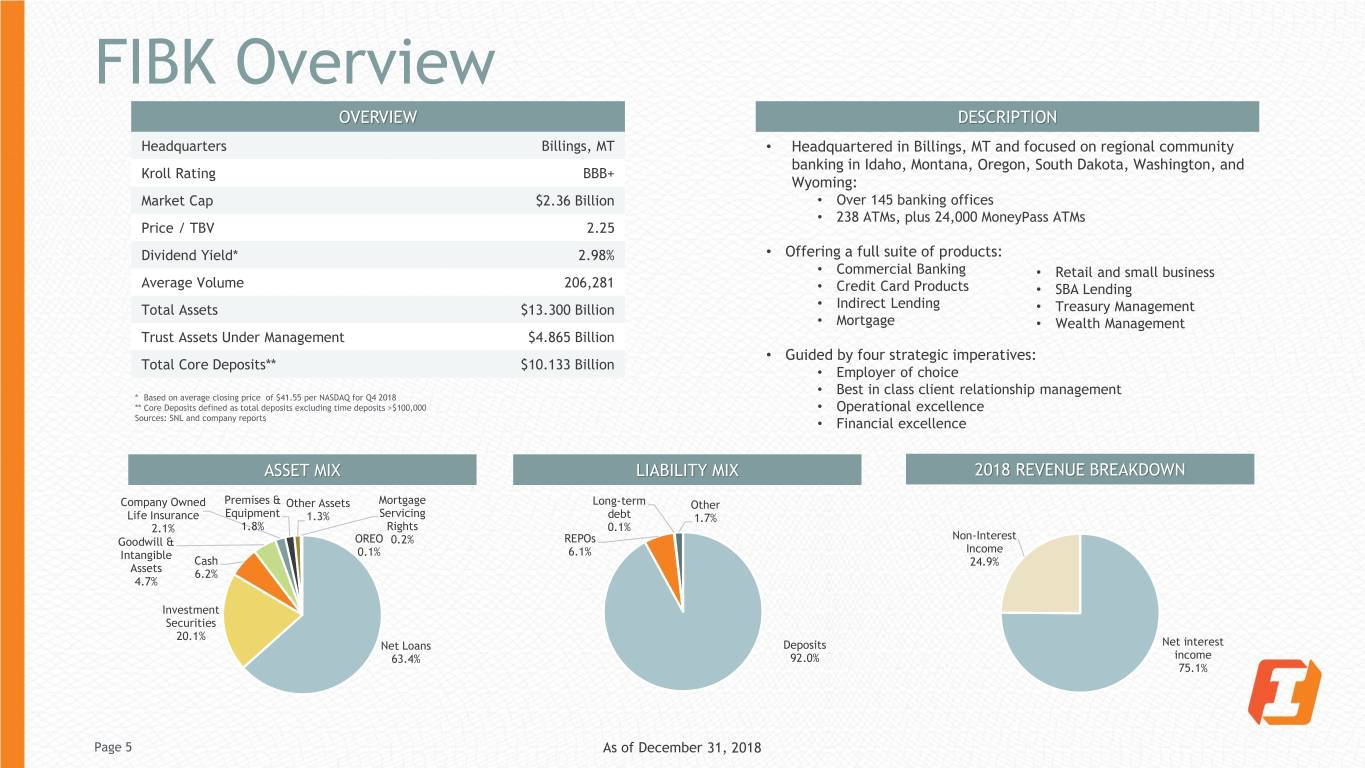

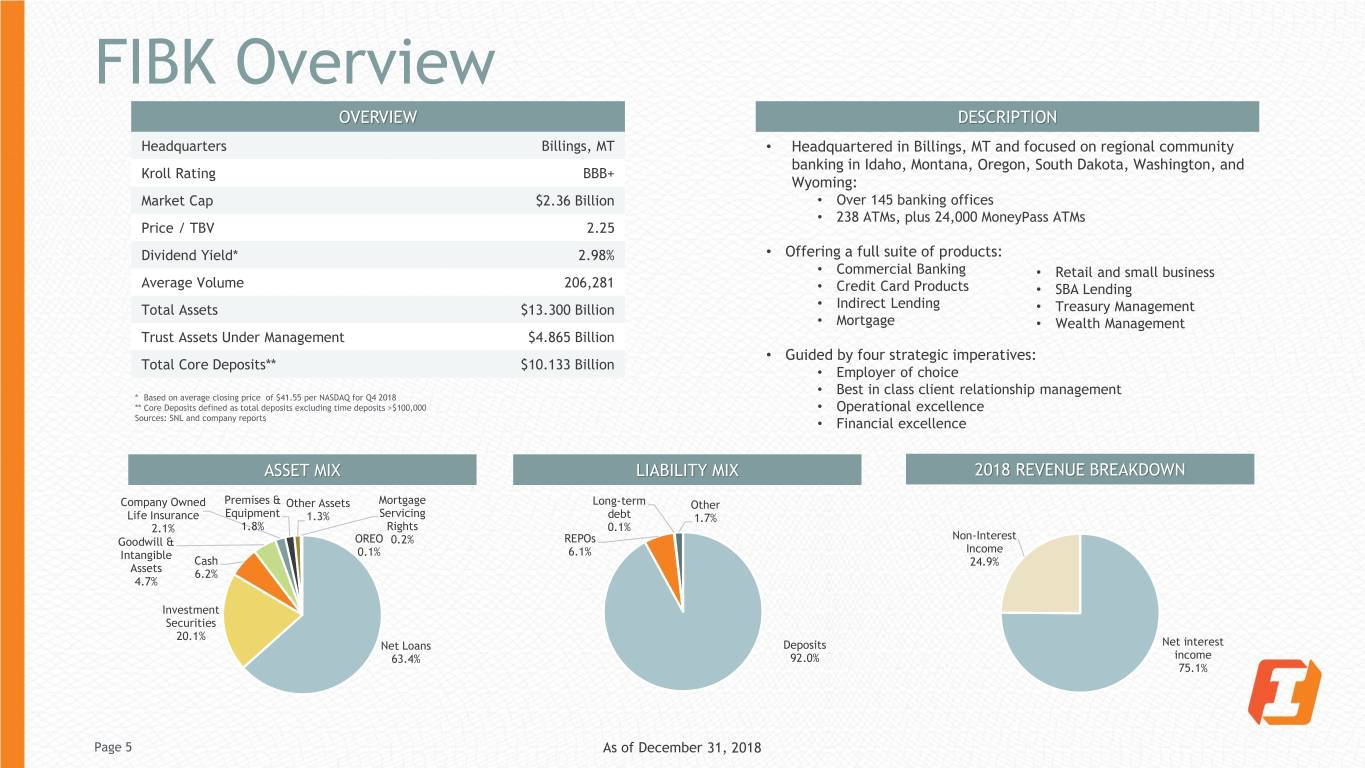

FIBK Overview OVERVIEW DESCRIPTION Headquarters Billings, MT • Headquartered in Billings, MT and focused on regional community banking in Idaho, Montana, Oregon, South Dakota, Washington, and Kroll Rating BBB+ Wyoming: Market Cap $2.36 Billion • Over 145 banking offices • 238 ATMs, plus 24,000 MoneyPass ATMs Price / TBV 2.25 Dividend Yield* 2.98% • Offering a full suite of products: • Commercial Banking • Retail and small business Average Volume 206,281 • Credit Card Products • SBA Lending Total Assets $13.300 Billion • Indirect Lending • Treasury Management • Mortgage • Wealth Management Trust Assets Under Management $4.865 Billion • Guided by four strategic imperatives: Total Core Deposits** $10.133 Billion • Employer of choice • Best in class client relationship management ** Based on average closing price of $41.55 per NASDAQ for Q4 2018 ** Core Deposits defined as total deposits excluding time deposits >$100,000 • Operational excellence Sources: SNL and company reports • Financial excellence ASSET MIX LIABILITY MIX 2018 REVENUE BREAKDOWN Company Owned Premises & Other Assets Mortgage Long-term Other Life Insurance Equipment 1.3% Servicing debt 1.7% 2.1% 1.8% Rights 0.1% Non-Interest Goodwill & OREO 0.2% REPOs Income Intangible 0.1% 6.1% Cash 24.9% Assets 6.2% 4.7% Investment Securities 20.1% Net Loans Deposits Net interest 63.4% 92.0% income 75.1% Page 5 As of December 31, 2018

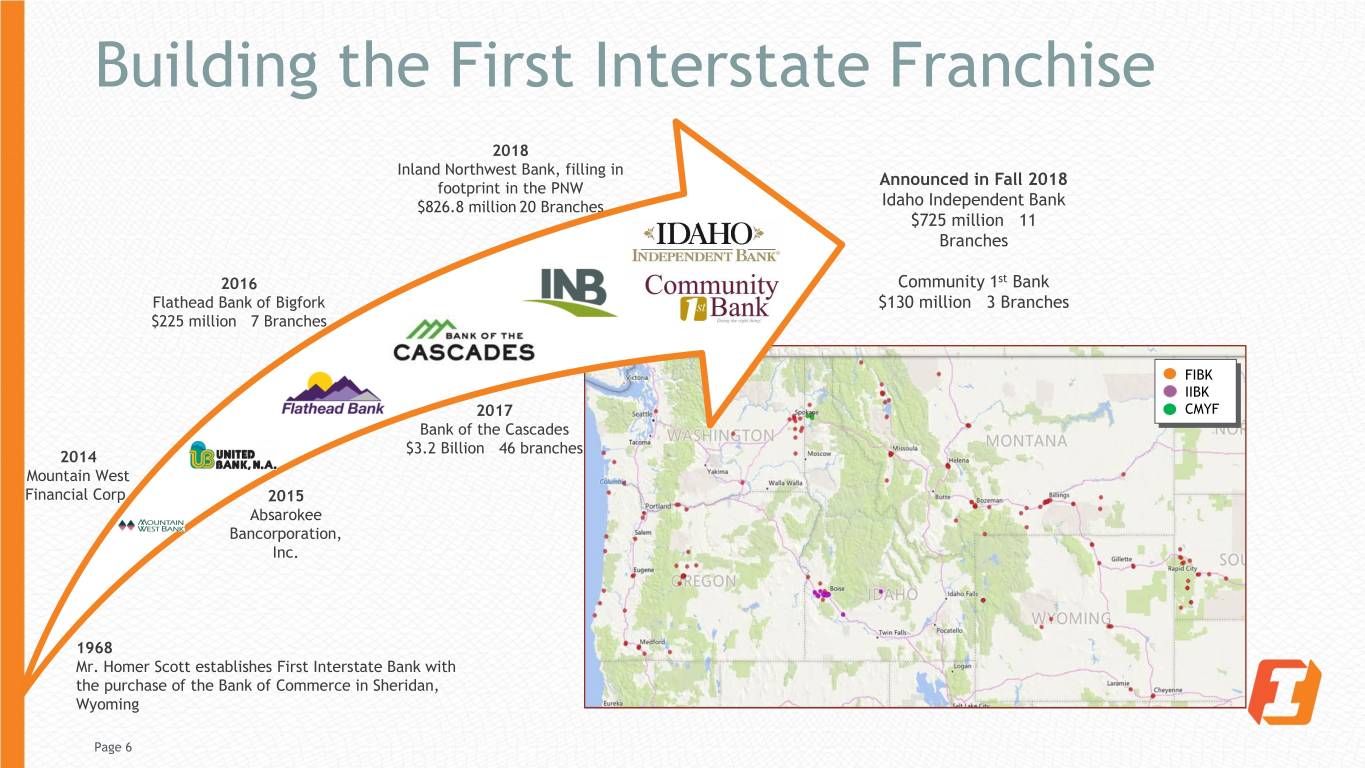

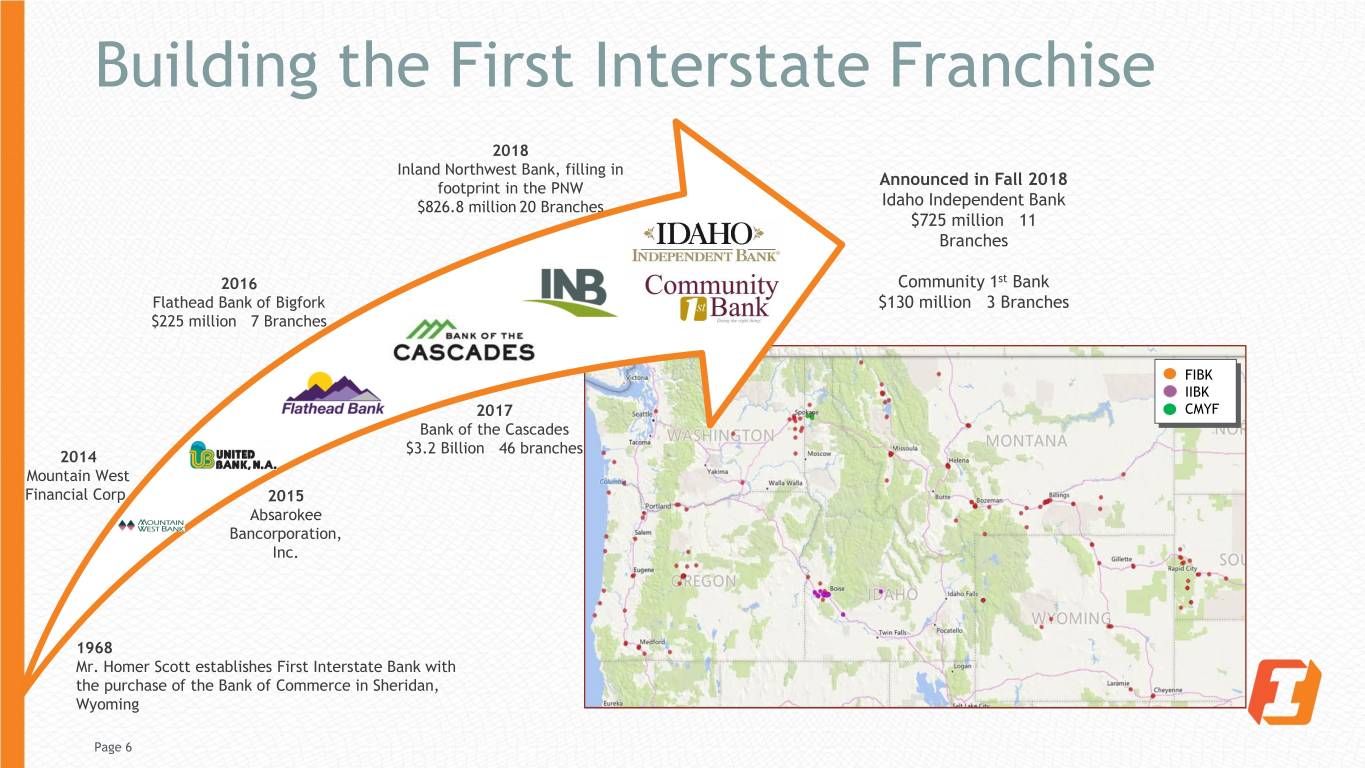

Building the First Interstate Franchise 2018 Inland Northwest Bank, filling in Announced in Fall 2018 footprint in the PNW $826.8 million 20 Branches Idaho Independent Bank $725 million 11 Branches 2016 Community 1st Bank Flathead Bank of Bigfork $130 million 3 Branches $225 million 7 Branches FIBK IIBK 2017 CMYF Bank of the Cascades $3.2 Billion 46 branches 2014 Mountain West Financial Corp. 2015 Absarokee Bancorporation, Inc. 1968 Mr. Homer Scott establishes First Interstate Bank with the purchase of the Bank of Commerce in Sheridan, Wyoming Page 6

Idaho Independent Bank (IIBK) Community 1st Bank (CMYF)

Transaction Highlights • Continued geographic diversification into attractive, high growth markets in Pacific Northwest • Strong Idaho presence in Boise and Coeur d’Alene Strategically • Cohesive set of banking franchises with similar cultures due to the management, market and ownership Compelling • Strong deposit franchises with $725 million of 0.13% cost of deposits and 95% core deposits ¹ • Additional scale and synergies will enhance First Interstate’s earnings power • Increases the percentage of First Interstate’s footprint operating in higher growth markets • Financially attractive transaction on a both a standalone and combined basis • > 3%+ EPS accretion in first full year and beyond Strong • Tangible Book Value per share earnback of <2.0 years using crossover method Transaction • 20%+ IRR Economics • Significant core deposits and excess liquidity • Continued positive operating leverage with over $14 billion in assets pro forma • All metrics reported inclusive of impact of Durbin Amendment • Strong understanding of markets, diversified lending products and approach to relationship banking Low Execution • Similar credit cultures focused on conservative underwriting with high quality portfolios Risk • Comprehensive due diligence process completed • Retention of key personnel 1. Core deposits for IIBK and CMYF excludes jumbo time deposits with balances greater than $100,000; For the quarter ended June 30, 2018. Page 8

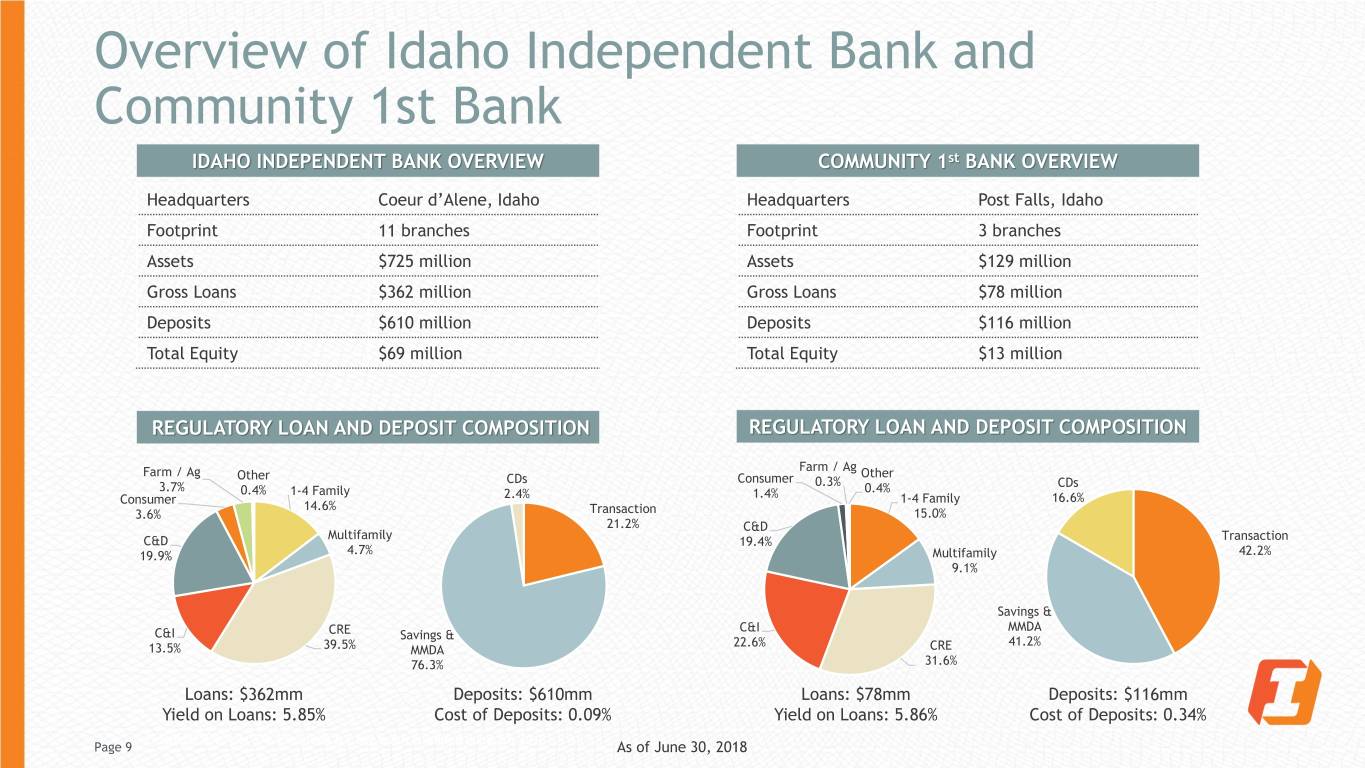

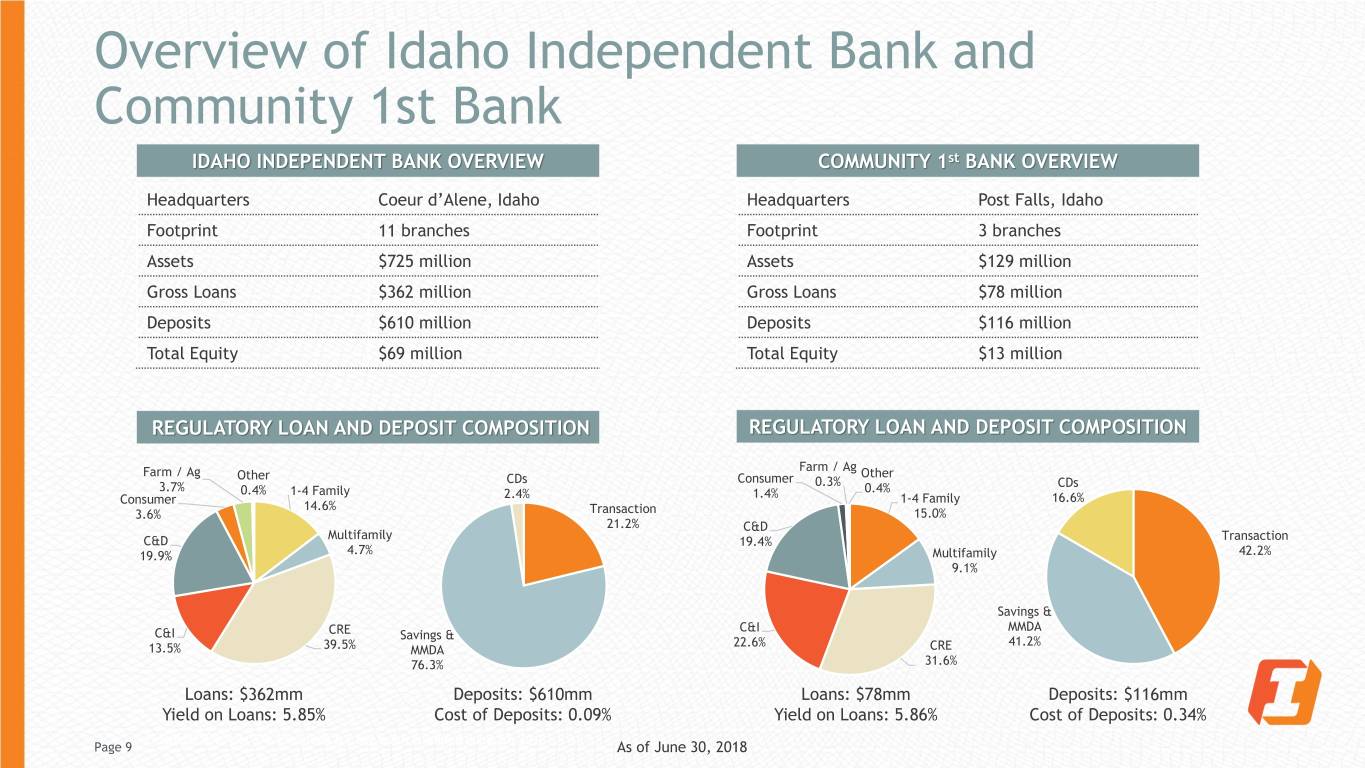

Overview of Idaho Independent Bank and Community 1st Bank IDAHO INDEPENDENT BANK OVERVIEW COMMUNITY 1st BANK OVERVIEW Headquarters Coeur d’Alene, Idaho Headquarters Post Falls, Idaho Footprint 11 branches Footprint 3 branches Assets $725 million Assets $129 million Gross Loans $362 million Gross Loans $78 million Deposits $610 million Deposits $116 million Total Equity $69 million Total Equity $13 million REGULATORY LOAN AND DEPOSIT COMPOSITION REGULATORY LOAN AND DEPOSIT COMPOSITION Farm / Ag Farm / Ag Other Other CDs Consumer 0.3% CDs 3.7% 0.4% 1-4 Family 0.4% 2.4% 1.4% 1-4 Family 16.6% Consumer 14.6% 3.6% Transaction 15.0% 21.2% C&D Multifamily C&D 19.4% Transaction 19.9% 4.7% Multifamily 42.2% 9.1% Savings & C&I MMDA C&I CRE Savings & 22.6% 41.2% 13.5% 39.5% MMDA CRE 76.3% 31.6% Loans: $362mm Deposits: $610mm Loans: $78mm Deposits: $116mm Yield on Loans: 5.85% Cost of Deposits: 0.09% Yield on Loans: 5.86% Cost of Deposits: 0.34% Financial data per SNL Financial for the quarter ended June 30, 2018 Page 9 As of June 30, 2018

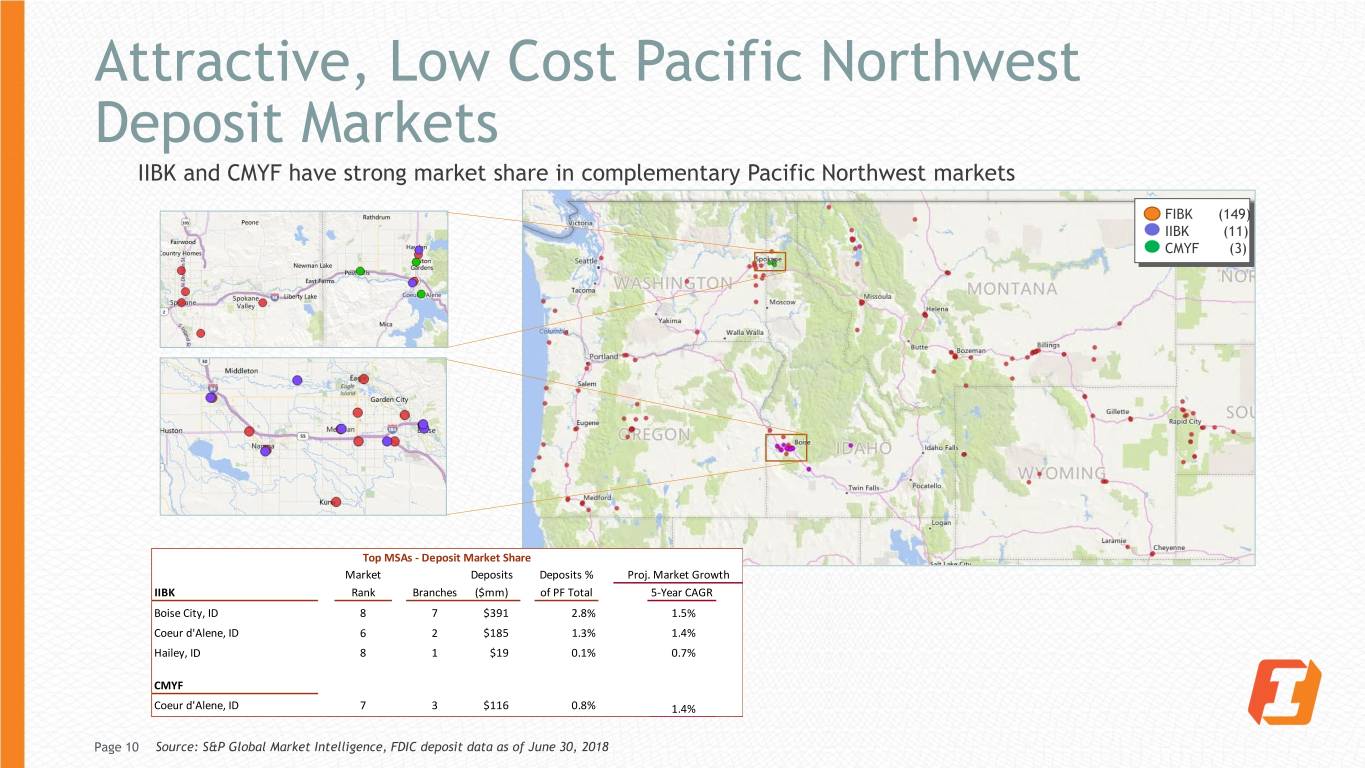

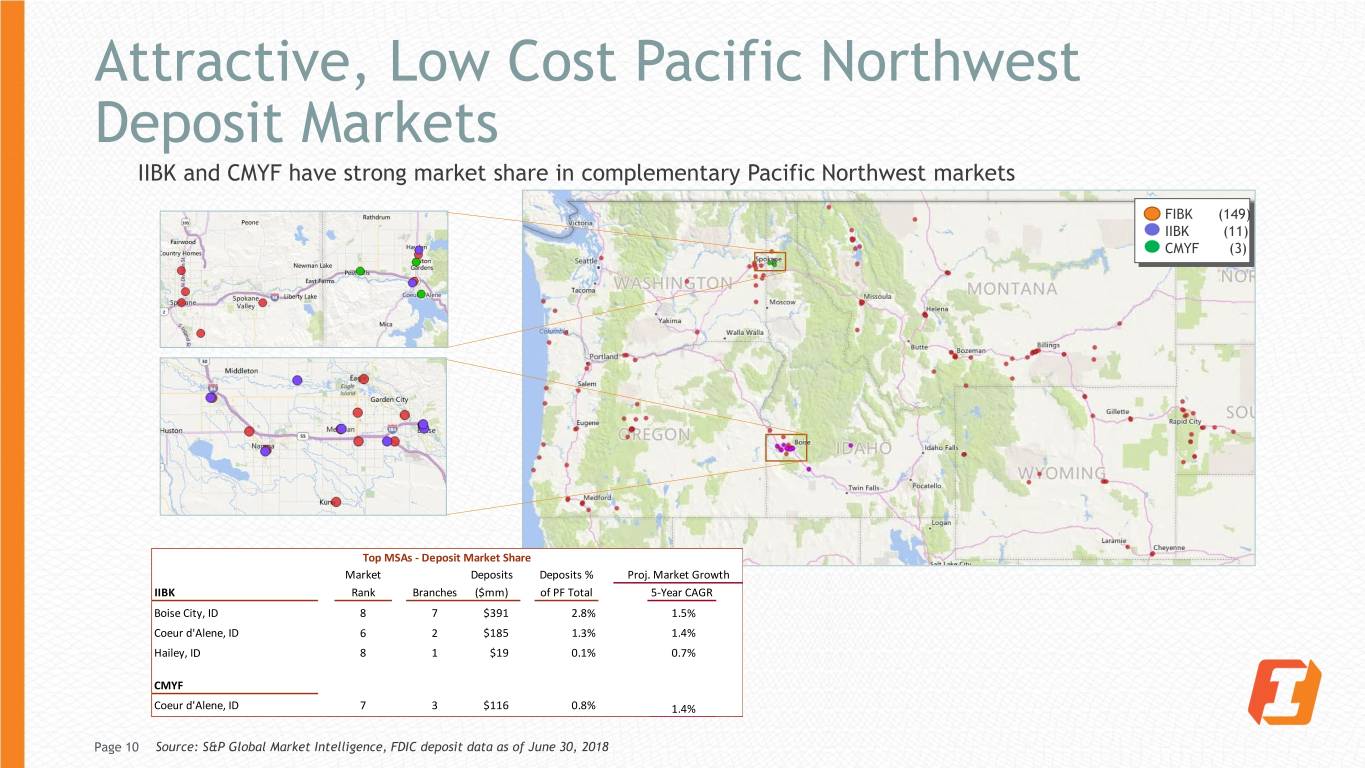

Attractive, Low Cost Pacific Northwest Deposit Markets IIBK and CMYF have strong market share in complementary Pacific Northwest markets FIBK (149) IIBK (11) CMYF (3) Top MSAs - Deposit Market Share Market Deposits Deposits % Proj. Market Growth IIBK Rank Branches ($mm) of PF Total 5-Year CAGR Boise City, ID 8 7 $391 2.8% 1.5% Coeur d'Alene, ID 6 2 $185 1.3% 1.4% Hailey, ID 8 1 $19 0.1% 0.7% CMYF Coeur d'Alene, ID 7 3 $116 0.8% 1.4% Page 10 Source: S&P Global Market Intelligence, FDIC deposit data as of June 30, 2018

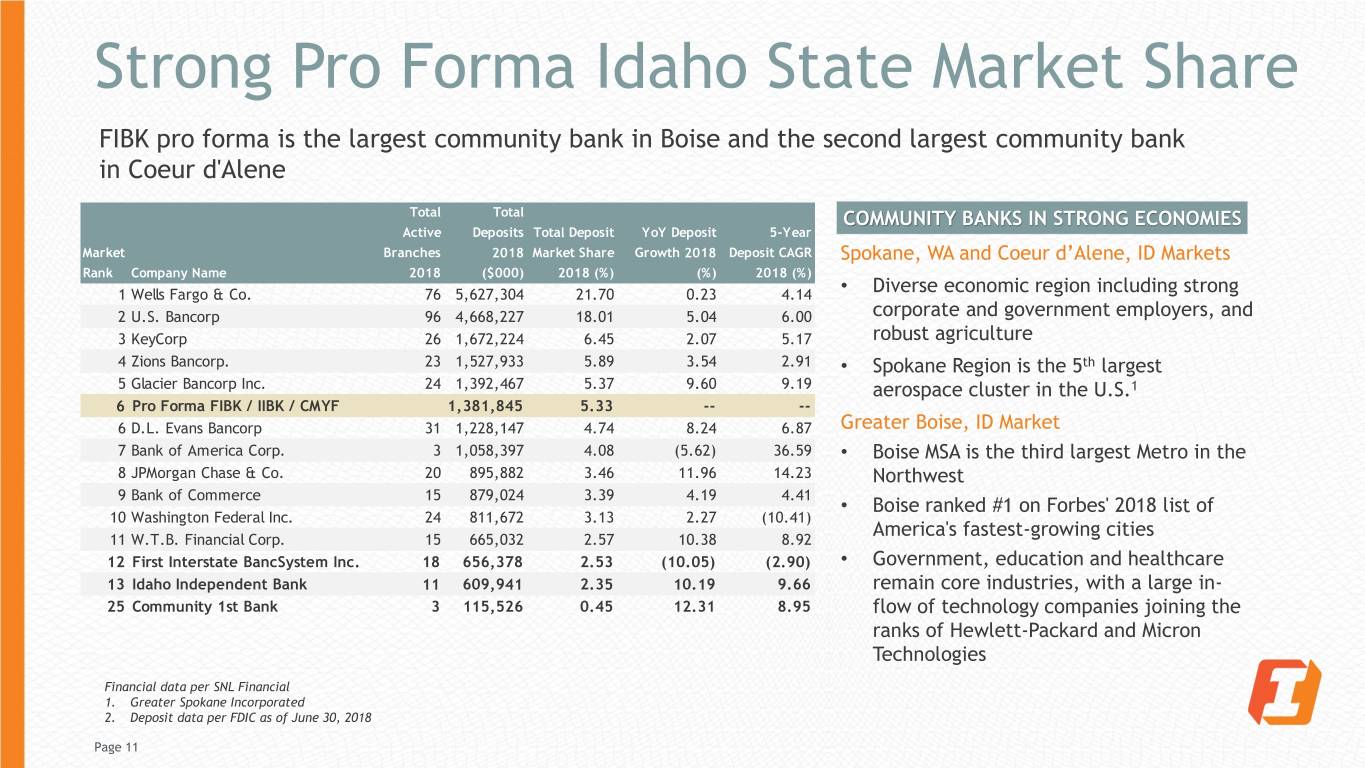

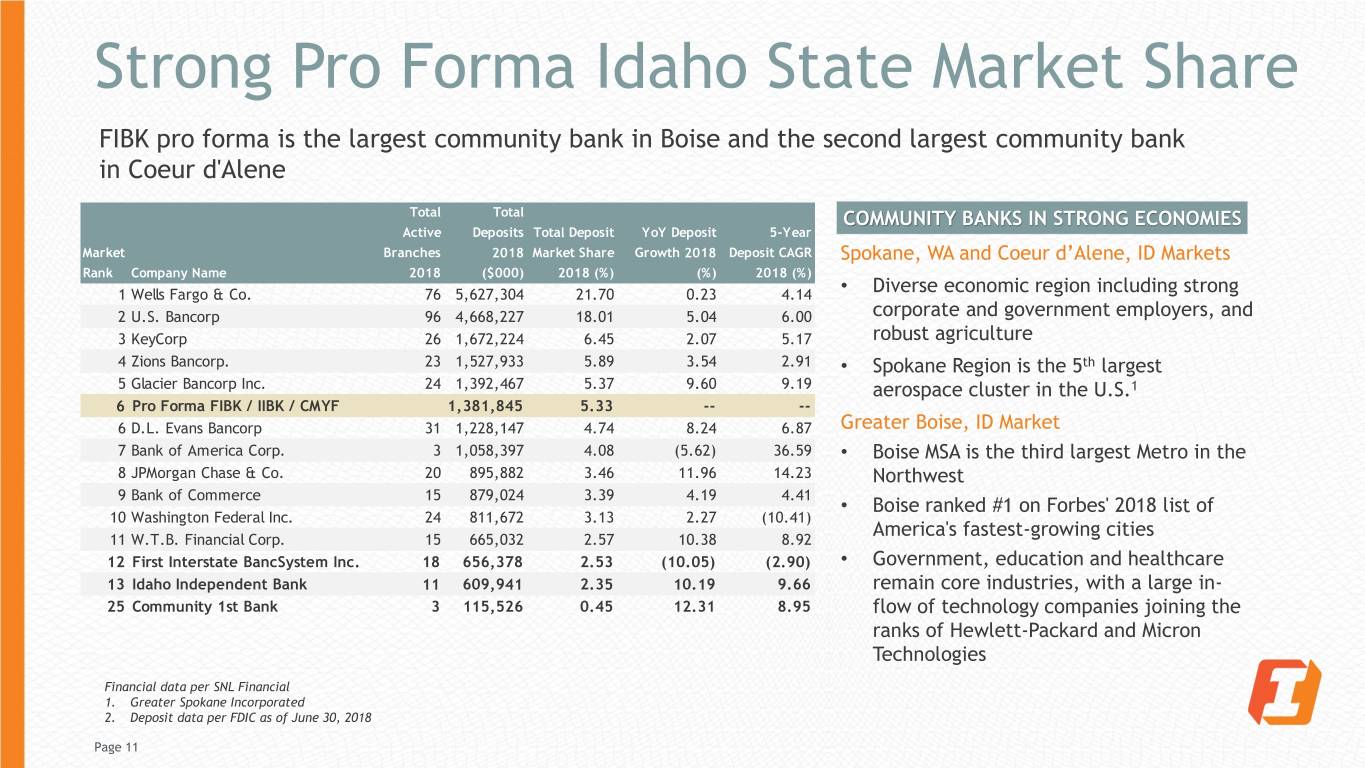

Strong Pro Forma Idaho State Market Share FIBK pro forma is the largest community bank in Boise and the second largest community bank in Coeur d'Alene Total Total COMMUNITY BANKS IN STRONG ECONOMIES Active Deposits Total Deposit YoY Deposit 5-Year Market Branches 2018 Market Share Growth 2018 Deposit CAGR Spokane, WA and Coeur d’Alene, ID Markets Rank Company Name 2018 ($000) 2018 (%) (%) 2018 (%) 1 Wells Fargo & Co. 76 5,627,304 21.70 0.23 4.14 • Diverse economic region including strong 2 U.S. Bancorp 96 4,668,227 18.01 5.04 6.00 corporate and government employers, and 3 KeyCorp 26 1,672,224 6.45 2.07 5.17 robust agriculture 4 Zions Bancorp. 23 1,527,933 5.89 3.54 2.91 • Spokane Region is the 5th largest 5 Glacier Bancorp Inc. 24 1,392,467 5.37 9.60 9.19 aerospace cluster in the U.S.1 6 Pro Forma FIBK / IIBK / CMYF 1,381,845 5.33 -- -- 6 D.L. Evans Bancorp 31 1,228,147 4.74 8.24 6.87 Greater Boise, ID Market 7 Bank of America Corp. 3 1,058,397 4.08 (5.62) 36.59 • Boise MSA is the third largest Metro in the 8 JPMorgan Chase & Co. 20 895,882 3.46 11.96 14.23 Northwest 9 Bank of Commerce 15 879,024 3.39 4.19 4.41 • Boise ranked #1 on Forbes' 2018 list of 10 Washington Federal Inc. 24 811,672 3.13 2.27 (10.41) America's fastest-growing cities 11 W.T.B. Financial Corp. 15 665,032 2.57 10.38 8.92 12 First Interstate BancSystem Inc. 18 656,378 2.53 (10.05) (2.90) • Government, education and healthcare 13 Idaho Independent Bank 11 609,941 2.35 10.19 9.66 remain core industries, with a large in- 25 Community 1st Bank 3 115,526 0.45 12.31 8.95 flow of technology companies joining the ranks of Hewlett-Packard and Micron Technologies Financial data per SNL Financial 1. Greater Spokane Incorporated 2. Deposit data per FDIC as of June 30, 2018 Page 11

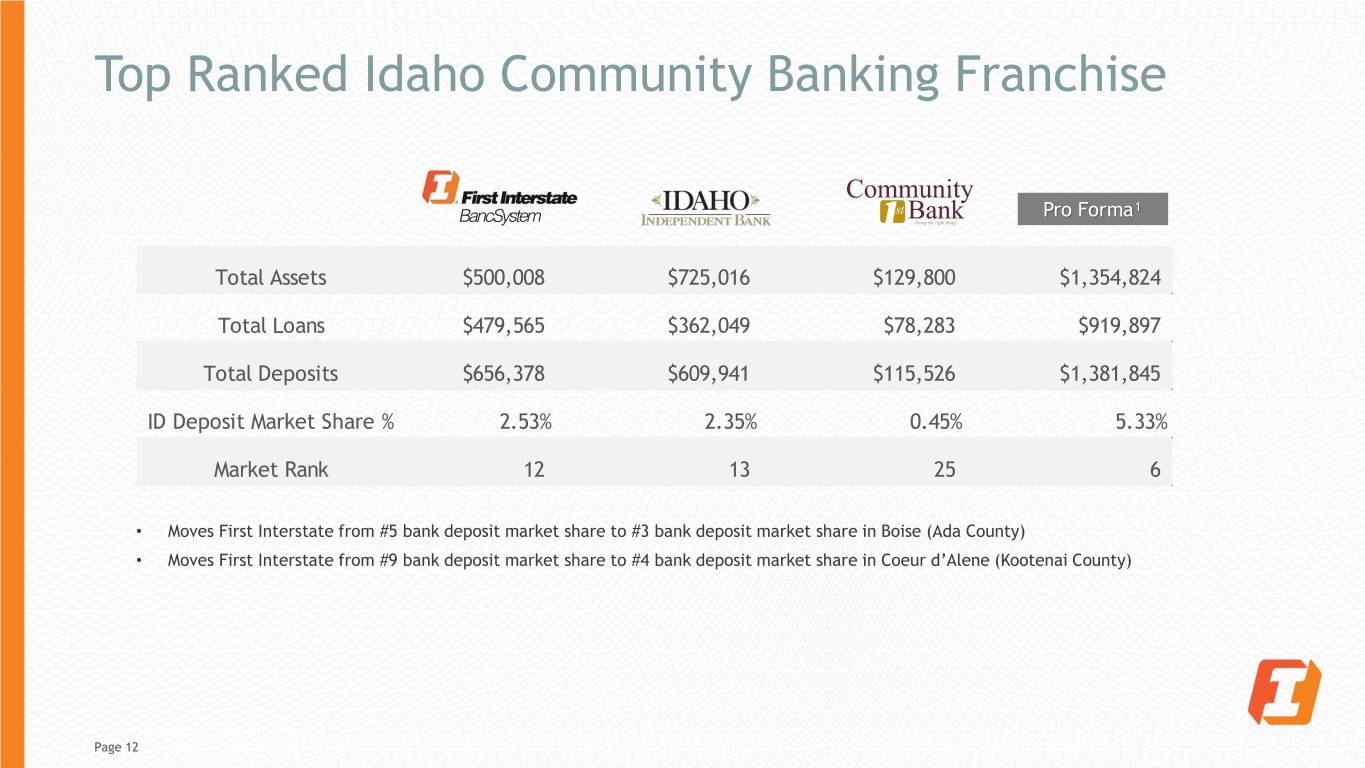

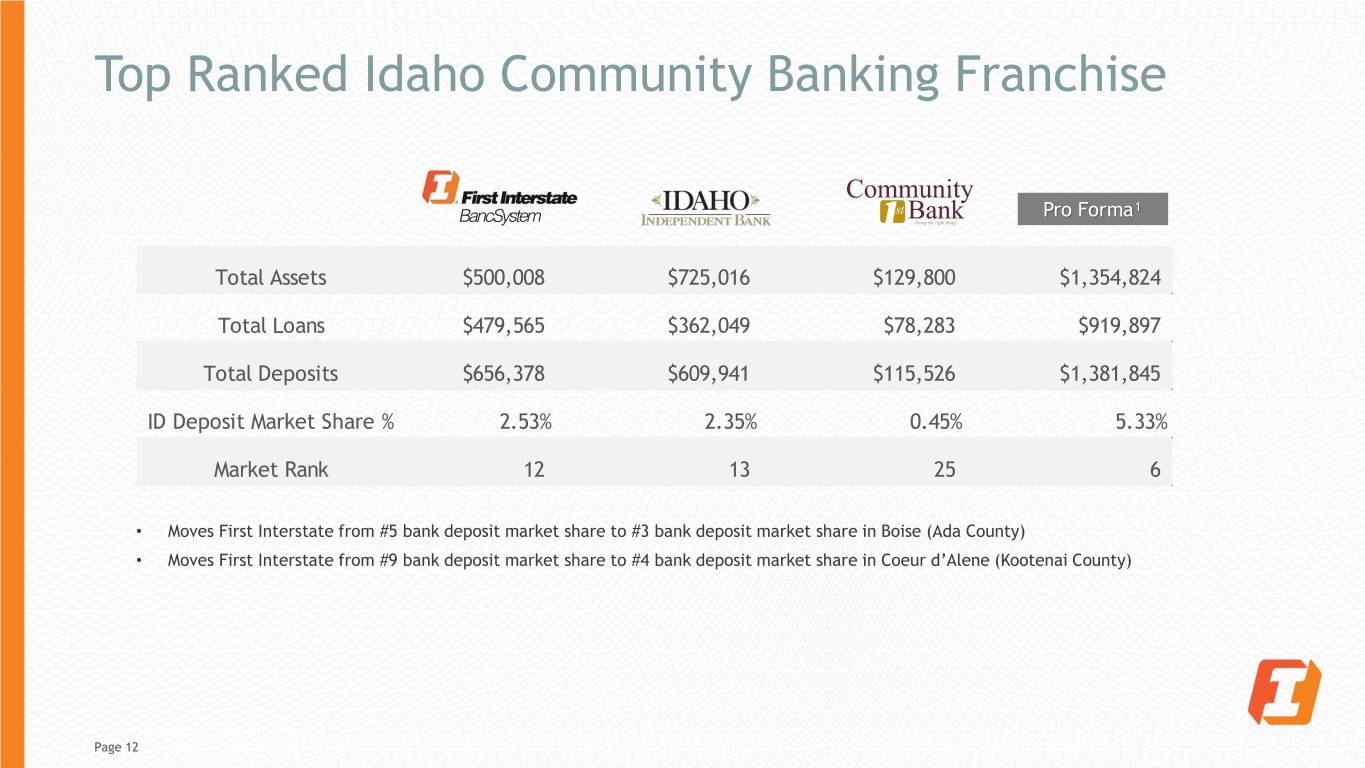

Top Ranked Idaho Community Banking Franchise Pro Forma¹ Total Assets $500,008 $725,016 $129,800 $1,354,824 Total Loans $479,565 $362,049 $78,283 $919,897 Total Deposits $656,378 $609,941 $115,526 $1,381,845 ID Deposit Market Share % 2.53% 2.35% 0.45% 5.33% Market Rank 12 13 25 6 • Moves First Interstate from #5 bank deposit market share to #3 bank deposit market share in Boise (Ada County) • Moves First Interstate from #9 bank deposit market share to #4 bank deposit market share in Coeur d’Alene (Kootenai County) Financial data per SNL Financial Page 121. Financial data as of June 30, 2018 and FIBK pro forma for NBCT acquisition. Combined pro forma column excludes growth and purchase-accounting adjustments.

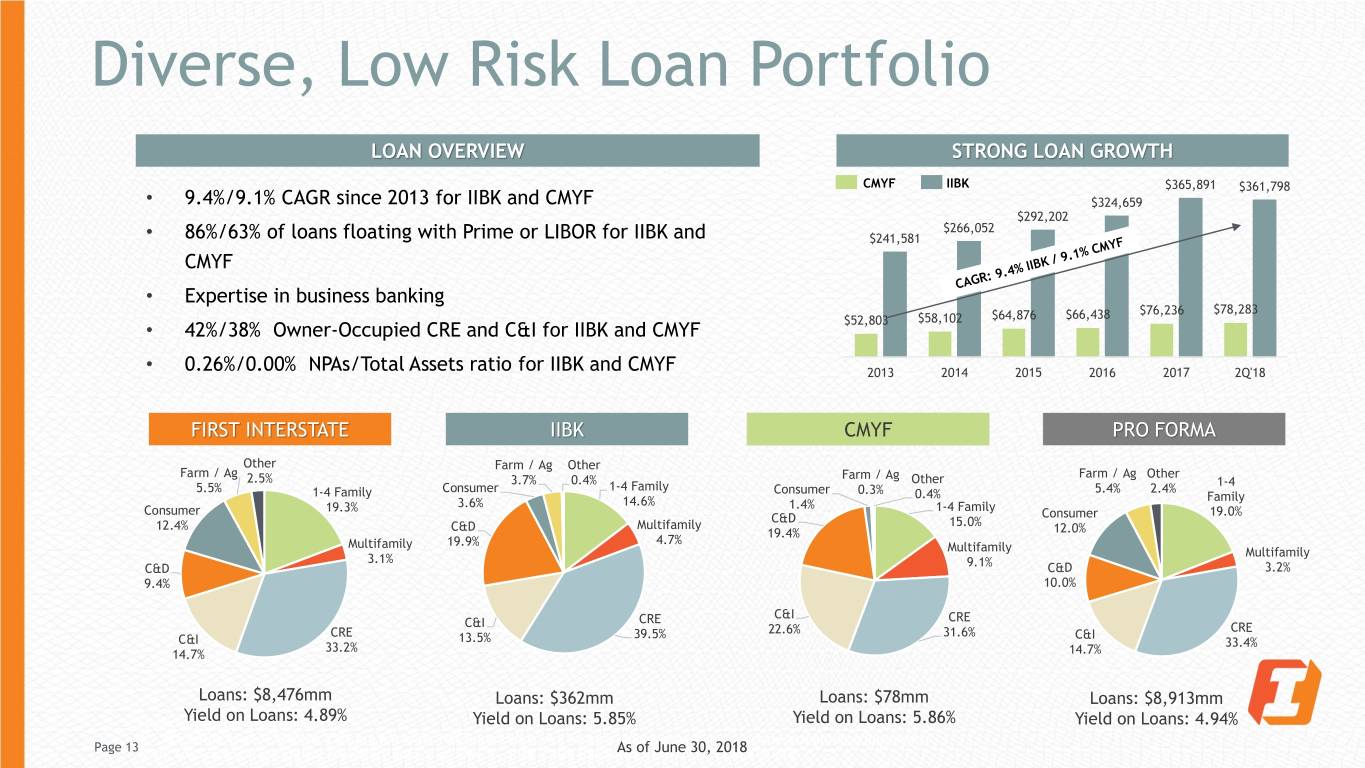

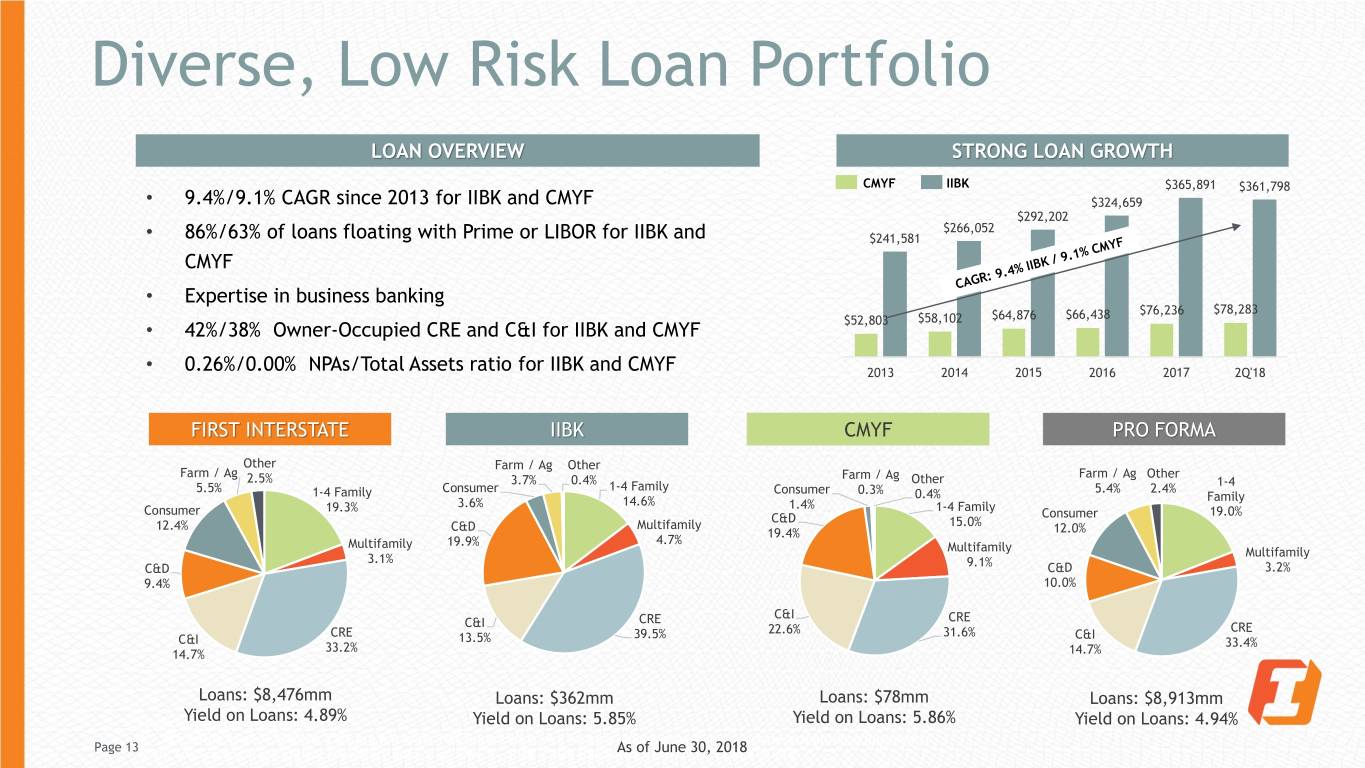

Diverse, Low Risk Loan Portfolio LOAN OVERVIEW STRONG LOAN GROWTH CMYF IIBK $365,891 $361,798 • 9.4%/9.1% CAGR since 2013 for IIBK and CMYF $324,659 $292,202 $266,052 • 86%/63% of loans floating with Prime or LIBOR for IIBK and $241,581 CMYF • Expertise in business banking $76,236 $78,283 $58,102 $64,876 $66,438 • 42%/38% Owner-Occupied CRE and C&I for IIBK and CMYF $52,803 • 0.26%/0.00% NPAs/Total Assets ratio for IIBK and CMYF 2013 2014 2015 2016 2017 2Q'18 FIRST INTERSTATE IIBK CMYF PRO FORMA Other Farm / Ag Other Farm / Ag Farm / Ag Farm / Ag Other 2.5% 3.7% 0.4% Other 1-4 5.5% Consumer 1-4 Family Consumer 0.3% 5.4% 2.4% 1-4 Family 0.4% Family 3.6% 14.6% 1.4% Consumer 19.3% 1-4 Family 19.0% C&D Consumer 12.4% C&D Multifamily 15.0% 19.4% 12.0% Multifamily 19.9% 4.7% Multifamily Multifamily 3.1% 9.1% C&D C&D 3.2% 9.4% 10.0% C&I C&I CRE CRE CRE 22.6% 31.6% CRE C&I 13.5% 39.5% C&I 33.2% 33.4% 14.7% 14.7% Loans: $8,476mm Loans: $362mm Loans: $78mm Loans: $8,913mm FinancialYield data peron SNLLoans: Financial 4.89% Yield on Loans: 5.85% Yield on Loans: 5.86% Yield on Loans: 4.94% 1. Pro forma as of 6/30/2018; FIBK pro forma for NBCT acquisition. Pro Forma excludes growth and purchase-accounting adjustments. Page 13 Note: Loan compositions reflect regulatory data as of June 30, 2018. CAGR calculatedAs of from June 12/31/13 30, 2018 to 6/30/18

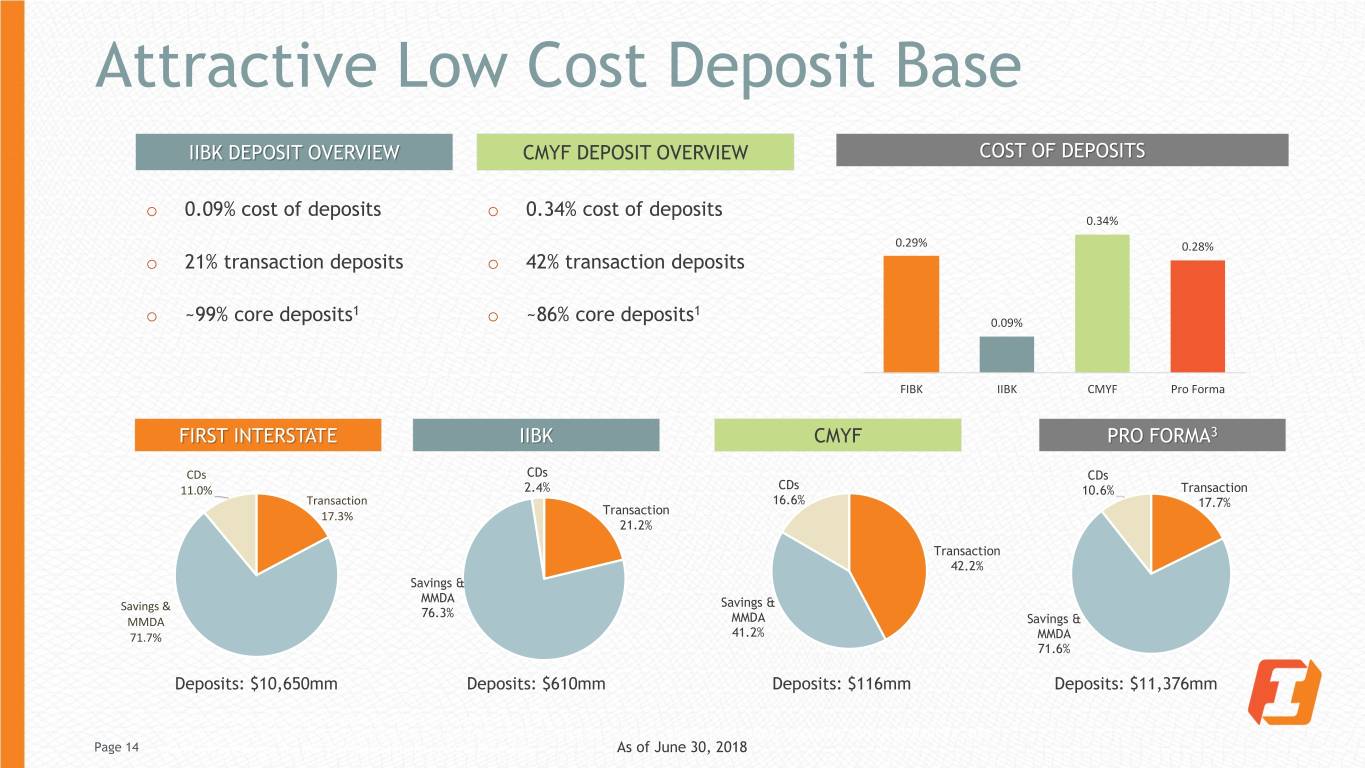

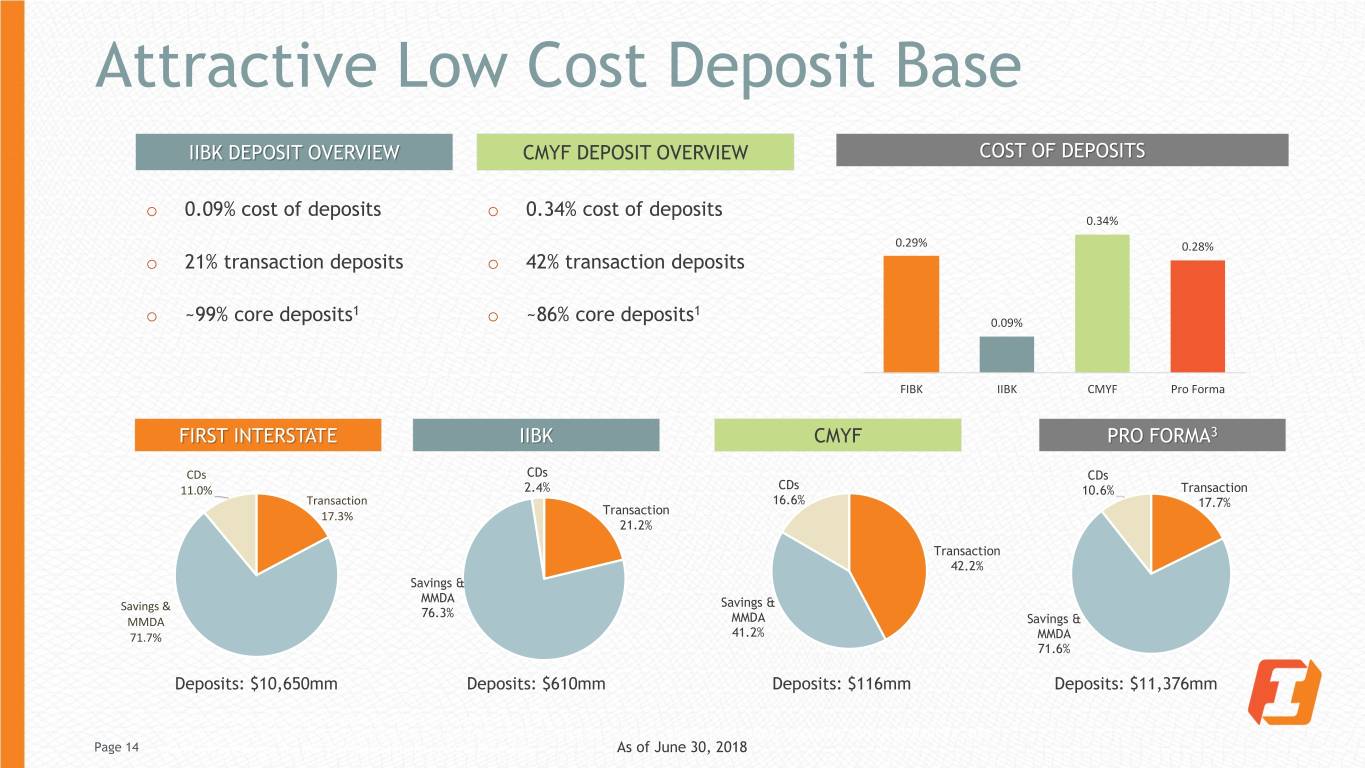

Attractive Low Cost Deposit Base IIBK DEPOSIT OVERVIEW CMYF DEPOSIT OVERVIEW COST OF DEPOSITS o 0.09% cost of deposits o 0.34% cost of deposits 0.34% 0.29% 0.28% o 21% transaction deposits o 42% transaction deposits 1 1 o ~99% core deposits o ~86% core deposits 0.09% FIBK IIBK CMYF Pro Forma FIRST INTERSTATE IIBK CMYF PRO FORMA3 CDs CDs CDs 11.0% 2.4% CDs 10.6% Transaction Transaction 16.6% 17.7% Transaction 17.3% 21.2% Transaction 42.2% Savings & MMDA Savings & Savings & 76.3% MMDA MMDA Savings & 71.7% 41.2% MMDA 71.6% Deposits: $10,650mm Deposits: $610mm Deposits: $116mm Deposits: $11,376mm 1. Core deposits excludes jumbo time deposits with balances greater than $100,000. 2. Pro forma as of 6/31/2018; excludes growth and purchase-accounting adjustments. Note: Deposit compositions reflect regulatory data as of June 30, 2018 Page 14 with FIBK pro forma for NBCT. Financial data per SNL Financial As of June 30, 2018

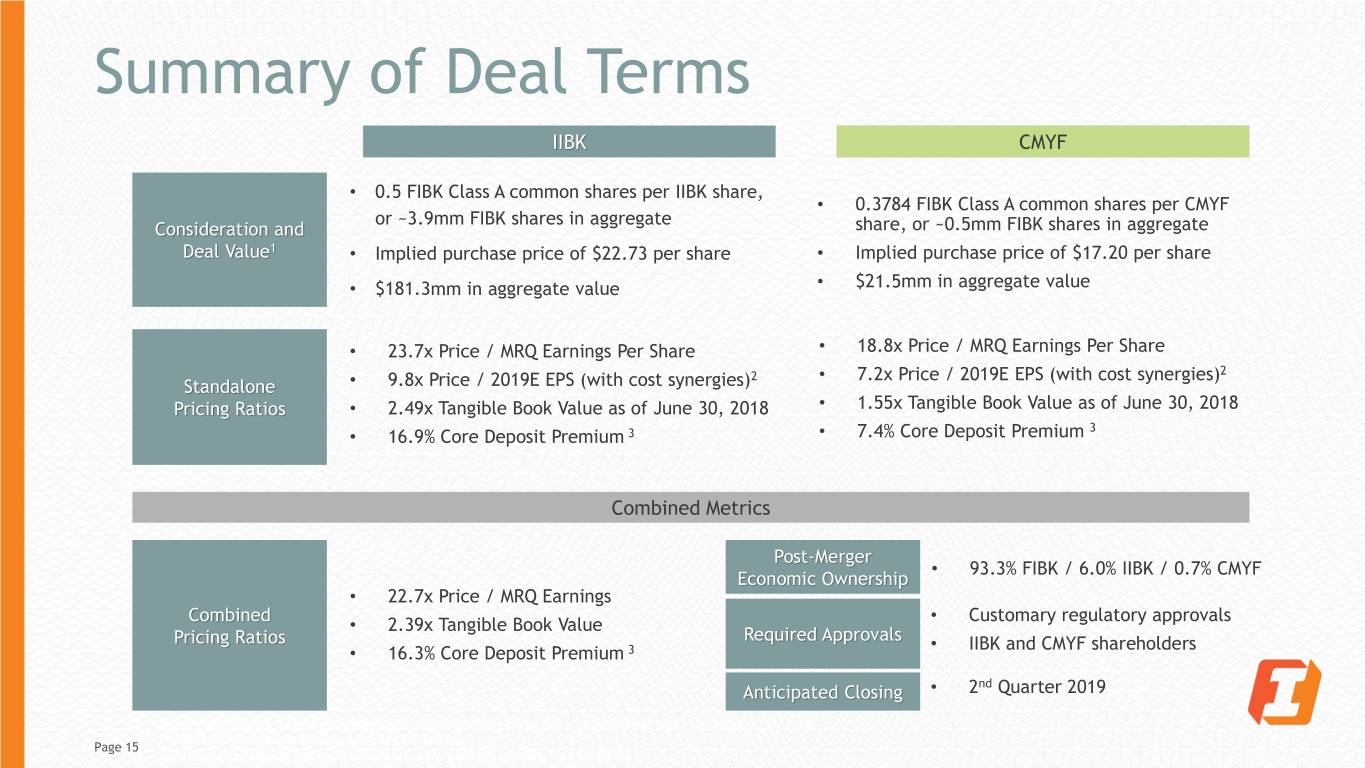

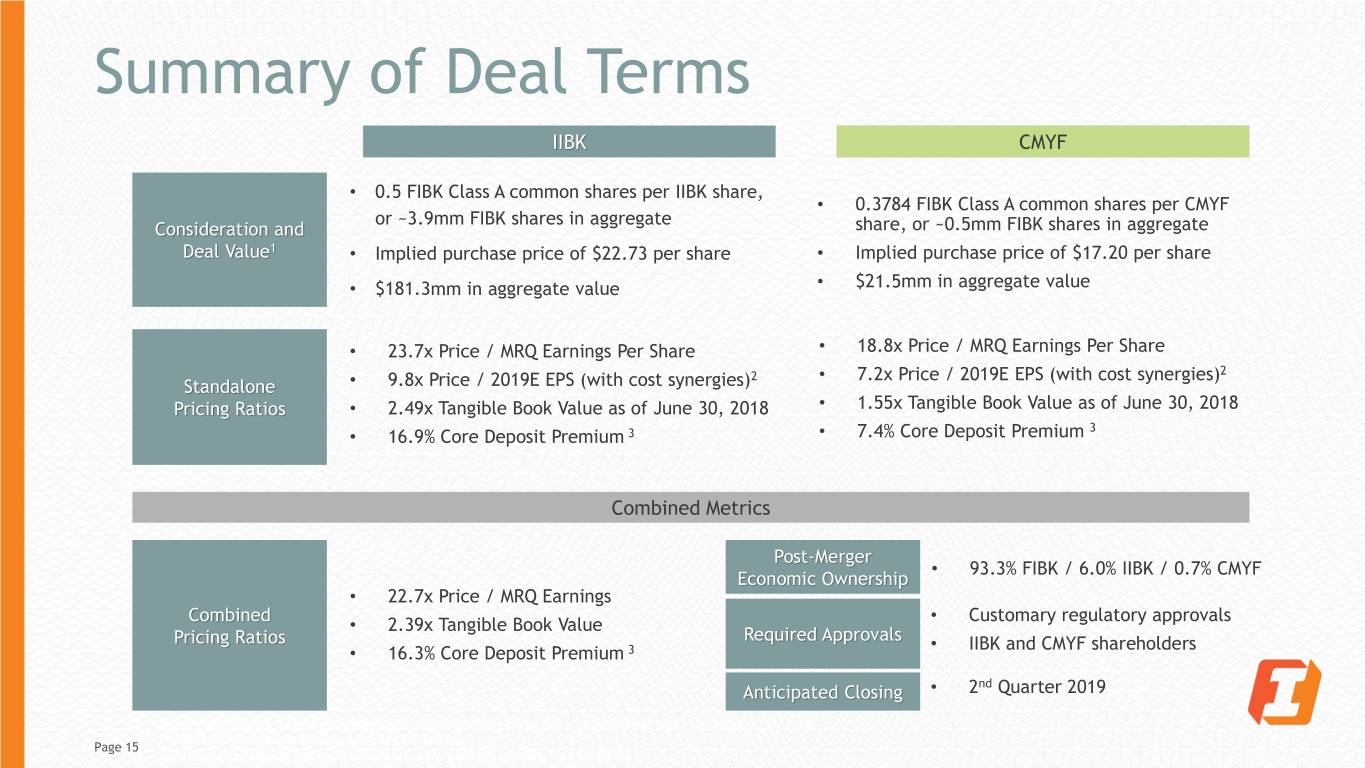

Summary of Deal Terms IIBK CMYF • 0.5 FIBK Class A common shares per IIBK share, • 0.3784 FIBK Class A common shares per CMYF or ~3.9mm FIBK shares in aggregate Consideration and share, or ~0.5mm FIBK shares in aggregate Deal Value1 • Implied purchase price of $22.73 per share • Implied purchase price of $17.20 per share • $181.3mm in aggregate value • $21.5mm in aggregate value • 23.7x Price / MRQ Earnings Per Share • 18.8x Price / MRQ Earnings Per Share 2 • 7.2x Price / 2019E EPS (with cost synergies)2 Standalone • 9.8x Price / 2019E EPS (with cost synergies) Pricing Ratios • 2.49x Tangible Book Value as of June 30, 2018 • 1.55x Tangible Book Value as of June 30, 2018 3 • 16.9% Core Deposit Premium 3 • 7.4% Core Deposit Premium Combined Metrics Post-Merger • 93.3% FIBK / 6.0% IIBK / 0.7% CMYF Economic Ownership • 22.7x Price / MRQ Earnings Combined • Customary regulatory approvals • 2.39x Tangible Book Value Pricing Ratios Required Approvals • IIBK and CMYF shareholders • 16.3% Core Deposit Premium 3 nd Anticipated Closing • 2 Quarter 2019 1. Implied purchase price and aggregate value based on FIBK closing price of $45.45 per share on October [5], 2018. 2. P / 2019E EPS multiples include 100% of Cost Savings Page 15 3. Core deposits excludes jumbo time deposits with balances greater than $100,000.

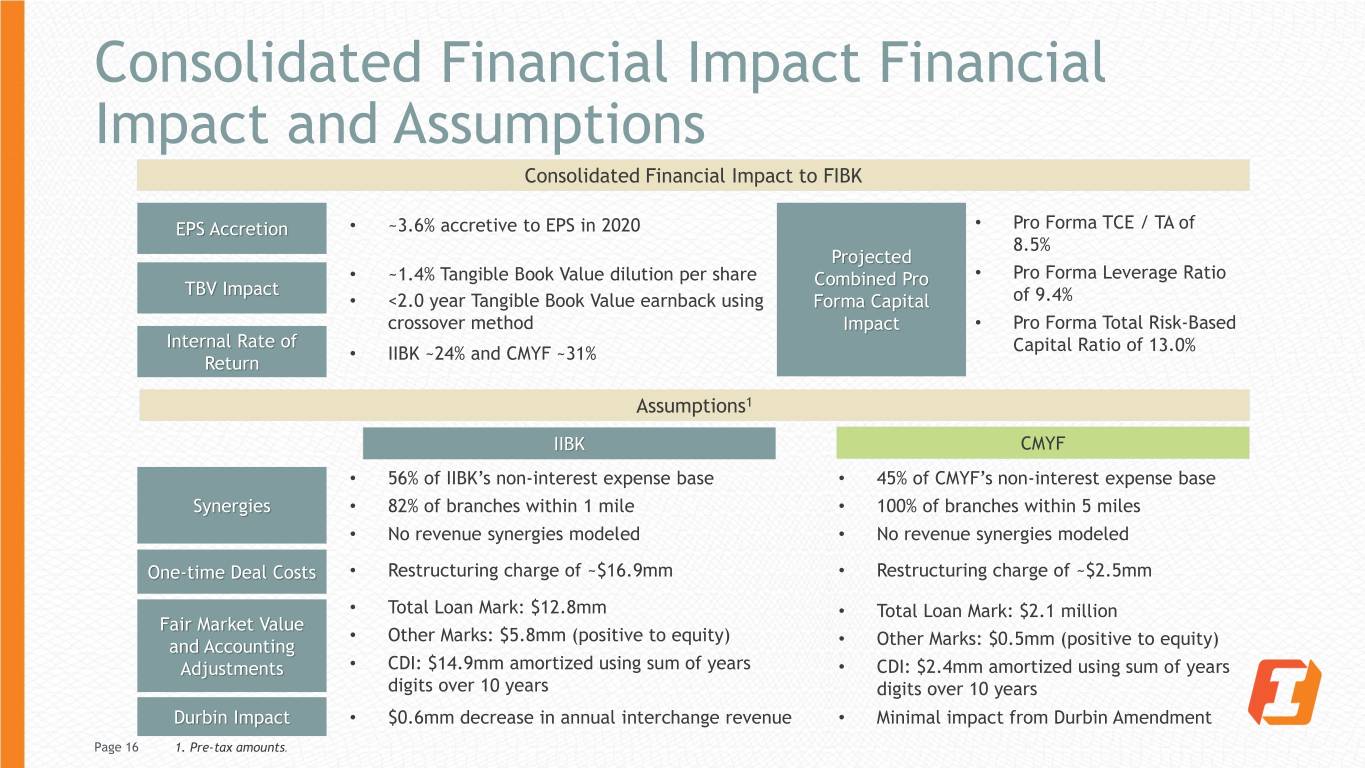

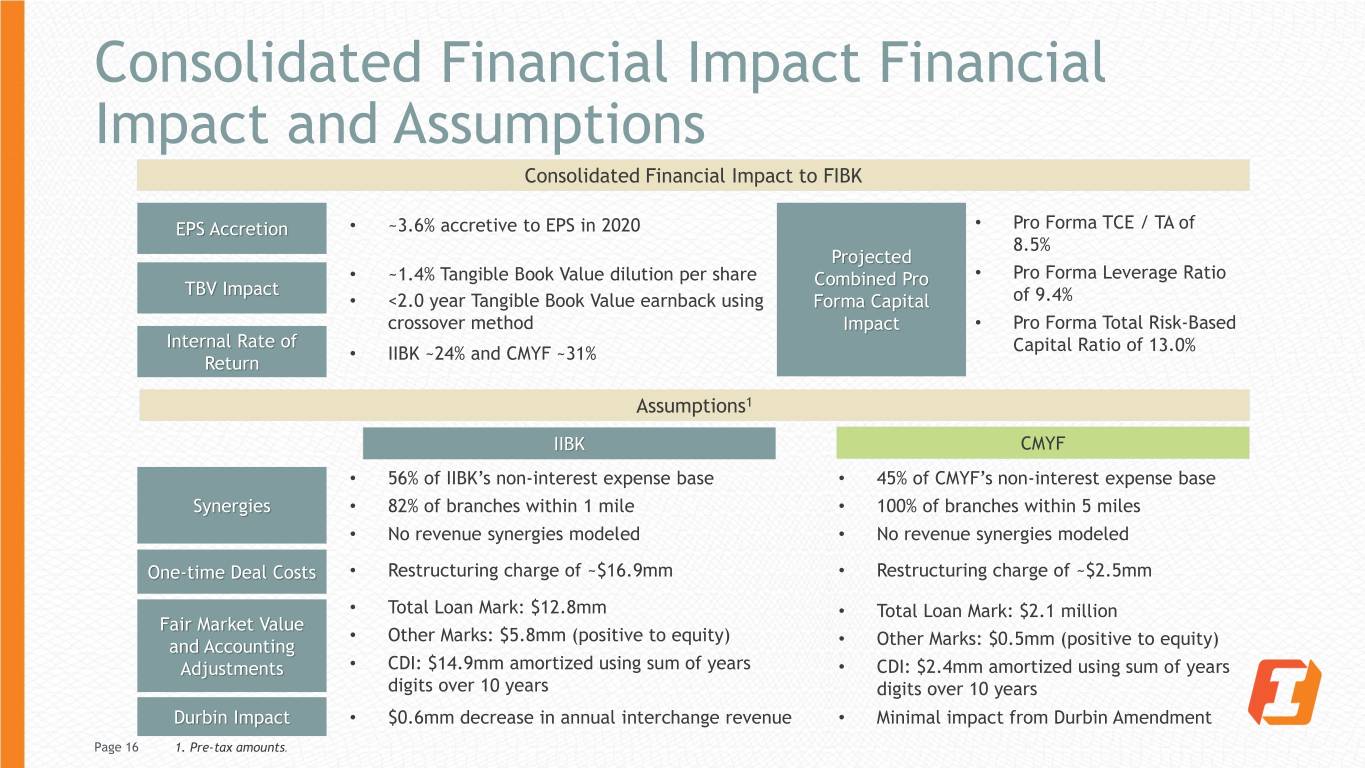

Consolidated Financial Impact Financial Impact and Assumptions Consolidated Financial Impact to FIBK EPS Accretion • ~3.6% accretive to EPS in 2020 • Pro Forma TCE / TA of 8.5% Projected • ~1.4% Tangible Book Value dilution per share Combined Pro • Pro Forma Leverage Ratio TBV Impact • <2.0 year Tangible Book Value earnback using Forma Capital of 9.4% crossover method Impact • Pro Forma Total Risk-Based Internal Rate of • IIBK ~24% and CMYF ~31% Capital Ratio of 13.0% Return Assumptions1 IIBK CMYF • 56% of IIBK’s non-interest expense base • 45% of CMYF’s non-interest expense base Synergies • 82% of branches within 1 mile • 100% of branches within 5 miles • No revenue synergies modeled • No revenue synergies modeled One-time Deal Costs • Restructuring charge of ~$16.9mm • Restructuring charge of ~$2.5mm • Total Loan Mark: $12.8mm • Total Loan Mark: $2.1 million Fair Market Value • Other Marks: $5.8mm (positive to equity) and Accounting • Other Marks: $0.5mm (positive to equity) Adjustments • CDI: $14.9mm amortized using sum of years • CDI: $2.4mm amortized using sum of years digits over 10 years digits over 10 years Durbin Impact • $0.6mm decrease in annual interchange revenue • Minimal impact from Durbin Amendment Page 16 1. Pre-tax amounts.

Comprehensive Due Diligence and Preparation • First Interstate management and employees have significant acquisition and integration Experienced And experience Disciplined • Five successful acquisitions in the last five years Acquisition And • Cascade acquisition already integrated and systems converted, Northwest Integration Bancorporation, Inc. in progress Approach • Integration planning and readiness underway • Comprehensive due diligence process • Extensive credit due diligence, including thorough loan file review and credit re- underwriting, significant local knowledge • Reviewed 69%/62% of Ag, Commercial and Commercial Real Estate loans of IIBK and Thorough CMYF Due Diligence • Reviewed 100% of criticized loans and 100% of OREO Process • Detailed review of cost structure and expected synergies • Identified cost savings opportunities • Conservative earnings expectations • Revenue synergies quantified but not included in model • Thorough review of all regulatory, compliance, legal and operational risks Page 17

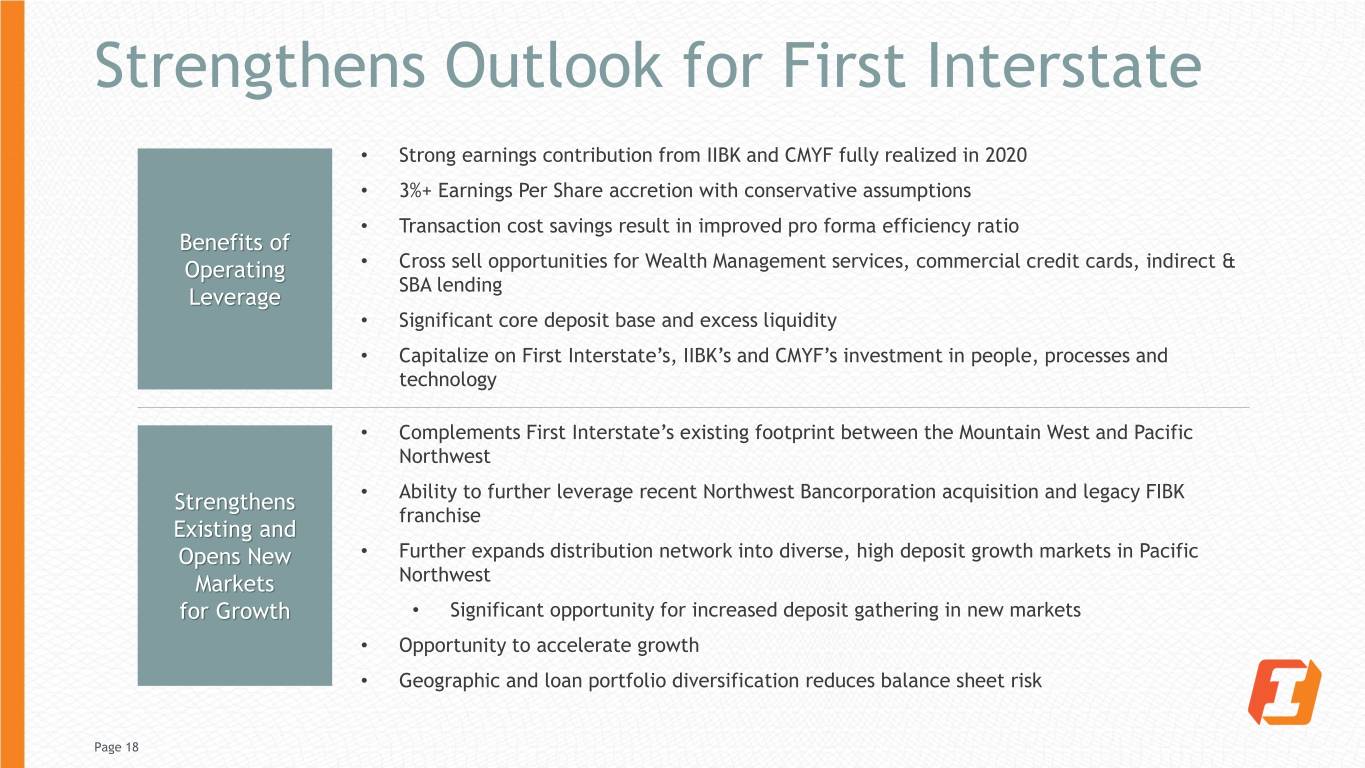

Strengthens Outlook for First Interstate • Strong earnings contribution from IIBK and CMYF fully realized in 2020 • 3%+ Earnings Per Share accretion with conservative assumptions • Transaction cost savings result in improved pro forma efficiency ratio Benefits of Operating • Cross sell opportunities for Wealth Management services, commercial credit cards, indirect & SBA lending Leverage • Significant core deposit base and excess liquidity • Capitalize on First Interstate’s, IIBK’s and CMYF’s investment in people, processes and technology • Complements First Interstate’s existing footprint between the Mountain West and Pacific Northwest Strengthens • Ability to further leverage recent Northwest Bancorporation acquisition and legacy FIBK franchise Existing and Opens New • Further expands distribution network into diverse, high deposit growth markets in Pacific Markets Northwest for Growth • Significant opportunity for increased deposit gathering in new markets • Opportunity to accelerate growth • Geographic and loan portfolio diversification reduces balance sheet risk Page 18

Regional Overview Page 19

Stable Employment WA 4.3% (RANKED 41ST) MT 3.7% OR (RANKED 27TH) 4.1% ID (RANKED 36TH) SD 2.6% 2.9% (RANKED 4TH) WY (RANKED 10TH) 4.1% (RANKED 37TH) B est 5 States 1 Iowa 2.4% 2 Hawaii 2.5% 3 New Hampshire 2.5% 4 Idaho 2.6% 5 North Dakota 2.7% Wo rst 5 States 50 Alaska 6.3% 49 West Virginia 5.1% 48 Louisiana 4.9% 47 Arizona 4.8% 46 New M exico 4.7% 0.0% to 3.0% 3.0% to 3.4% 3.4% to 4.4% (United States = 3.9%) Source: Bureau of Labour Statistics 4.4% to 7.0% Data as of: 12/31/2018 7.0% or more Page 20

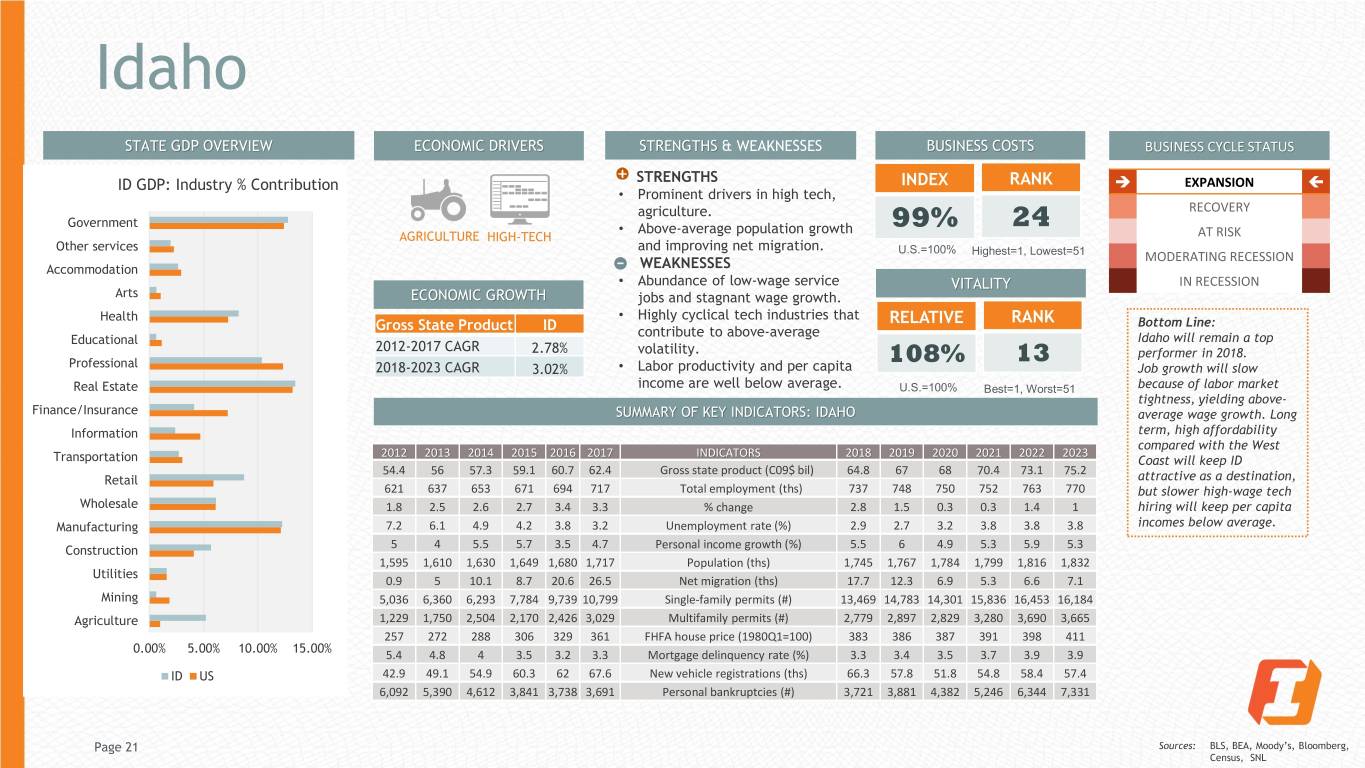

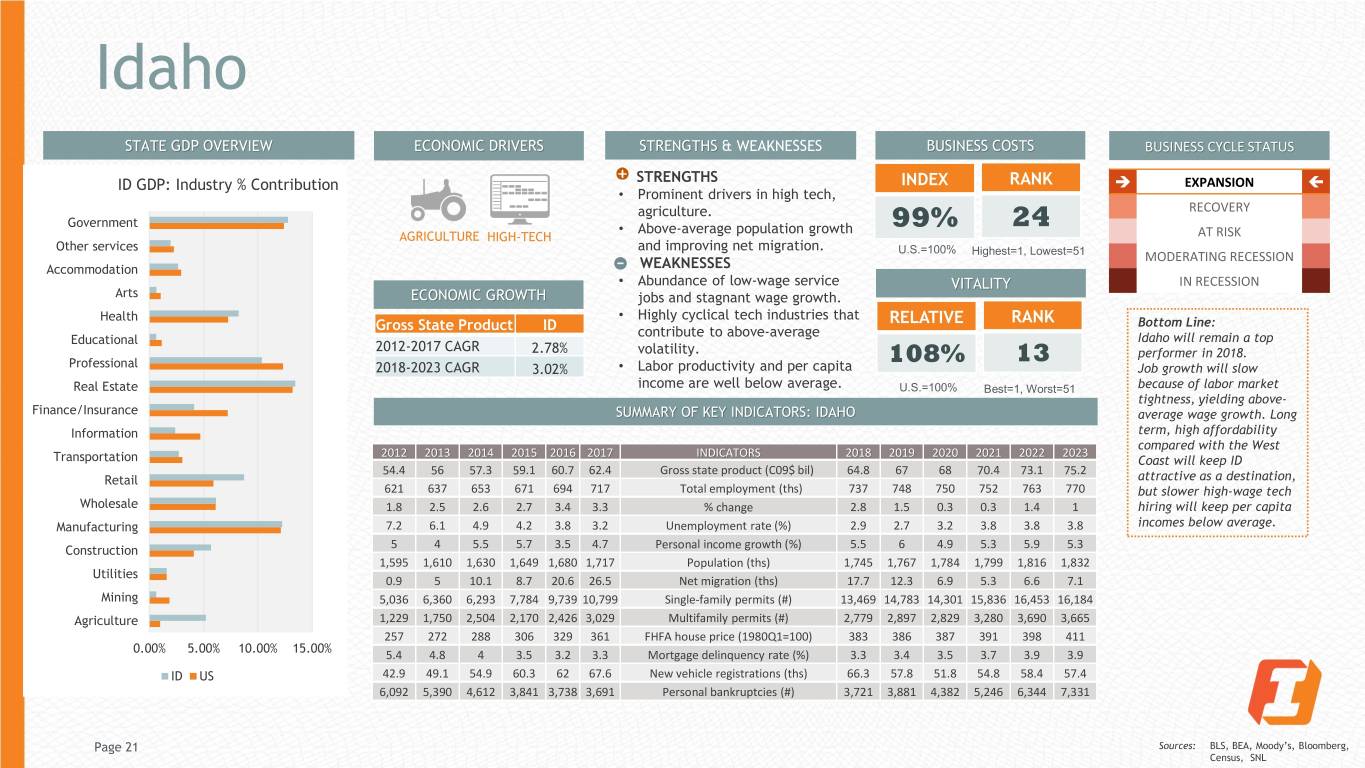

Idaho STATE GDP OVERVIEW ECONOMIC DRIVERS STRENGTHS & WEAKNESSES BUSINESS COSTS BUSINESS CYCLE STATUS ID GDP: Industry % Contribution STRENGTHS INDEX RANK EXPANSION • Prominent drivers in high tech, agriculture. RECOVERY Government • Above-average population growth 99% 24 AGRICULTURE HIGH-TECH AT RISK Other services and improving net migration. U.S.=100% Highest=1, Lowest=51 MODERATING RECESSION Accommodation WEAKNESSES • Abundance of low-wage service VITALITY IN RECESSION Arts ECONOMIC GROWTH jobs and stagnant wage growth. Health • Highly cyclical tech industries that Gross State Product ID RELATIVE RANK Bottom Line: contribute to above-average Idaho will remain a top Educational 2012-2017 CAGR 2.78% volatility. 108% 13 performer in 2018. Professional 2018-2023 CAGR 3.02% • Labor productivity and per capita Job growth will slow Real Estate income are well below average. U.S.=100% Best=1, Worst=51 because of labor market tightness, yielding above- Finance/Insurance SUMMARY OF KEY INDICATORS: IDAHO average wage growth. Long Information term, high affordability compared with the West 2012 2013 2014 2015 2016 2017 INDICATORS 2018 2019 2020 2021 2022 2023 Transportation Coast will keep ID 54.4 56 57.3 59.1 60.7 62.4 Gross state product (C09$ bil) 64.8 67 68 70.4 73.1 75.2 Retail attractive as a destination, 621 637 653 671 694 717 Total employment (ths) 737 748 750 752 763 770 but slower high-wage tech Wholesale 1.8 2.5 2.6 2.7 3.4 3.3 % change 2.8 1.5 0.3 0.3 1.4 1 hiring will keep per capita Manufacturing 7.2 6.1 4.9 4.2 3.8 3.2 Unemployment rate (%) 2.9 2.7 3.2 3.8 3.8 3.8 incomes below average. Construction 5 4 5.5 5.7 3.5 4.7 Personal income growth (%) 5.5 6 4.9 5.3 5.9 5.3 1,595 1,610 1,630 1,649 1,680 1,717 Population (ths) 1,745 1,767 1,784 1,799 1,816 1,832 Utilities 0.9 5 10.1 8.7 20.6 26.5 Net migration (ths) 17.7 12.3 6.9 5.3 6.6 7.1 Mining 5,036 6,360 6,293 7,784 9,739 10,799 Single-family permits (#) 13,469 14,783 14,301 15,836 16,453 16,184 Agriculture 1,229 1,750 2,504 2,170 2,426 3,029 Multifamily permits (#) 2,779 2,897 2,829 3,280 3,690 3,665 257 272 288 306 329 361 FHFA house price (1980Q1=100) 383 386 387 391 398 411 0.00% 5.00% 10.00% 15.00% 5.4 4.8 4 3.5 3.2 3.3 Mortgage delinquency rate (%) 3.3 3.4 3.5 3.7 3.9 3.9 ID US 42.9 49.1 54.9 60.3 62 67.6 New vehicle registrations (ths) 66.3 57.8 51.8 54.8 58.4 57.4 6,092 5,390 4,612 3,841 3,738 3,691 Personal bankruptcies (#) 3,721 3,881 4,382 5,246 6,344 7,331 Page 21 Sources: BLS, BEA, Moody’s, Bloomberg, Census, SNL

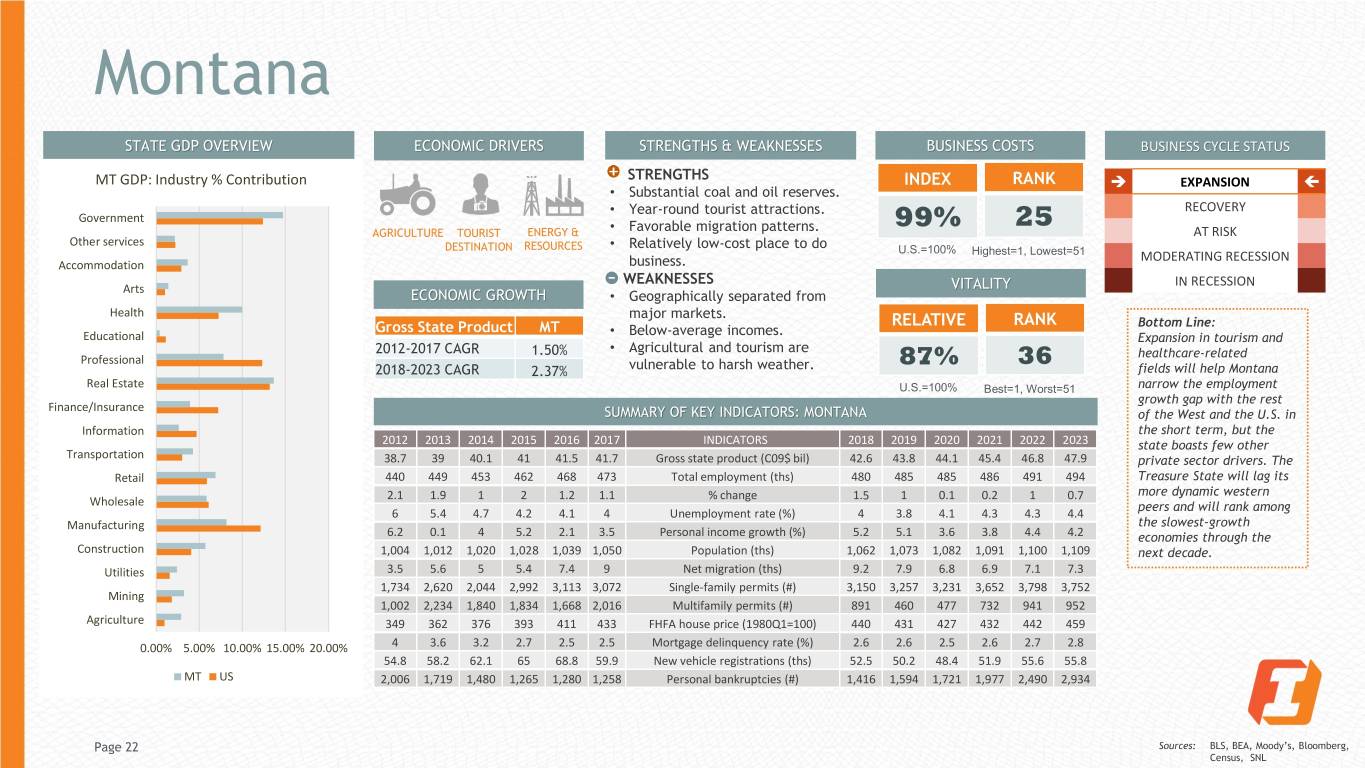

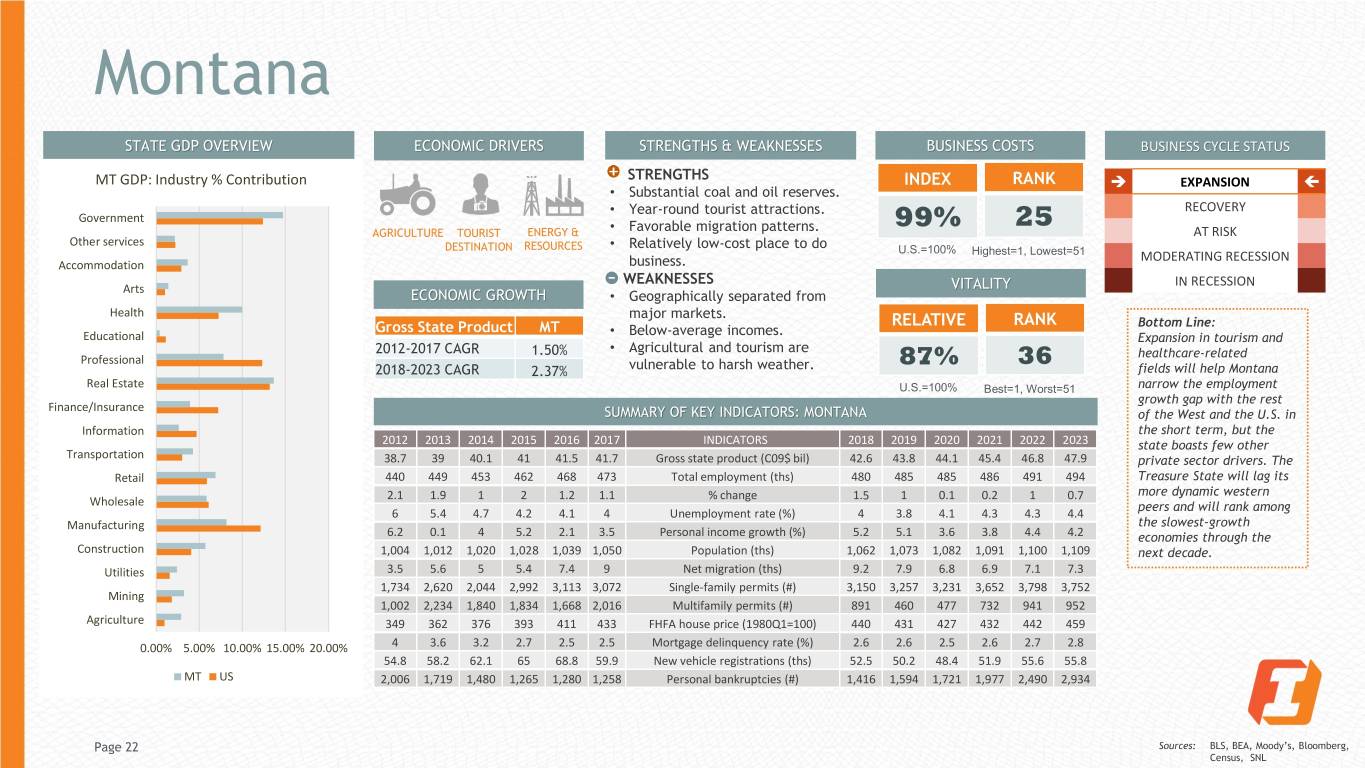

Montana STATE GDP OVERVIEW ECONOMIC DRIVERS STRENGTHS & WEAKNESSES BUSINESS COSTS BUSINESS CYCLE STATUS STRENGTHS MT GDP: Industry % Contribution INDEX RANK EXPANSION • Substantial coal and oil reserves. • Year-round tourist attractions. RECOVERY Government 99% 25 AGRICULTURE TOURIST ENERGY & • Favorable migration patterns. AT RISK Other services DESTINATION RESOURCES • Relatively low-cost place to do U.S.=100% Highest=1, Lowest=51 MODERATING RECESSION Accommodation business. WEAKNESSES IN RECESSION Arts VITALITY ECONOMIC GROWTH • Geographically separated from Health major markets. RELATIVE RANK Bottom Line: Gross State Product MT • Below-average incomes. Educational Expansion in tourism and 2012-2017 CAGR 1.50% • Agricultural and tourism are healthcare-related Professional 87% 36 2018-2023 CAGR 2.37% vulnerable to harsh weather. fields will help Montana Real Estate U.S.=100% Best=1, Worst=51 narrow the employment growth gap with the rest Finance/Insurance SUMMARY OF KEY INDICATORS: MONTANA of the West and the U.S. in Information the short term, but the 2012 2013 2014 2015 2016 2017 INDICATORS 2018 2019 2020 2021 2022 2023 state boasts few other Transportation 38.7 39 40.1 41 41.5 41.7 Gross state product (C09$ bil) 42.6 43.8 44.1 45.4 46.8 47.9 private sector drivers. The Retail 440 449 453 462 468 473 Total employment (ths) 480 485 485 486 491 494 Treasure State will lag its 2.1 1.9 1 2 1.2 1.1 % change 1.5 1 0.1 0.2 1 0.7 more dynamic western Wholesale peers and will rank among 6 5.4 4.7 4.2 4.1 4 Unemployment rate (%) 4 3.8 4.1 4.3 4.3 4.4 Manufacturing the slowest-growth 6.2 0.1 4 5.2 2.1 3.5 Personal income growth (%) 5.2 5.1 3.6 3.8 4.4 4.2 economies through the Construction 1,004 1,012 1,020 1,028 1,039 1,050 Population (ths) 1,062 1,073 1,082 1,091 1,100 1,109 next decade. Utilities 3.5 5.6 5 5.4 7.4 9 Net migration (ths) 9.2 7.9 6.8 6.9 7.1 7.3 1,734 2,620 2,044 2,992 3,113 3,072 Single-family permits (#) 3,150 3,257 3,231 3,652 3,798 3,752 Mining 1,002 2,234 1,840 1,834 1,668 2,016 Multifamily permits (#) 891 460 477 732 941 952 Agriculture 349 362 376 393 411 433 FHFA house price (1980Q1=100) 440 431 427 432 442 459 0.00% 5.00% 10.00% 15.00% 20.00% 4 3.6 3.2 2.7 2.5 2.5 Mortgage delinquency rate (%) 2.6 2.6 2.5 2.6 2.7 2.8 54.8 58.2 62.1 65 68.8 59.9 New vehicle registrations (ths) 52.5 50.2 48.4 51.9 55.6 55.8 MT US 2,006 1,719 1,480 1,265 1,280 1,258 Personal bankruptcies (#) 1,416 1,594 1,721 1,977 2,490 2,934 Page 22 Sources: BLS, BEA, Moody’s, Bloomberg, Census, SNL

Oregon STATE GDP OVERVIEW ECONOMIC DRIVERS STRENGTHS & WEAKNESSES BUSINESS COSTS BUSINESS CYCLE STATUS OR GDP: Industry % Contribution STRENGTHS INDEX RANK EXPANSION • Diverse economy with strong export RECOVERY Government focus. 97% 33 • Low energy costs courtesy of a AT RISK TOURIST HIGH-TECH MANUFACT. Other services U.S.=100% DESTINATION network of hydroelectric plants. Highest=1, Lowest=51 MODERATING RECESSION Accommodation • Leader in semiconductor IN RECESSION Arts production, for which global VITALITY ECONOMIC GROWTH demand is strong. Health Gross State Product OR WEAKNESSES RELATIVE RANK Bottom Line: Educational • Strict environmental regulations Oregon will remain at the 2012-2017 CAGR 2.10% that raise business costs. vanguard of the U.S. Professional 122% 3 2018-2023 CAGR 3.80% • Above-average employment expansion. Robust gains in Real Estate volatility breeds uncertainty. U.S.=100% Best=1, Worst=51 high-wage industries such as tech will boost per Finance/Insurance SUMMARY OF KEY INDICATORS: OREGON capita income, and strong Information population trends bode 2012 2013 2014 2015 2016 2017 INDICATORS 2018 2019 2020 2021 2022 2023 well for housing and Transportation 192.6 188.8 192.3 201.5 209 213.7 Gross state product (C09$ bil) 224.7 234.6 239.6 250 261.2 270.8 consumer industries. Retail 1,640 1,674 1,721 1,781 1,834 1,874 Total employment (ths) 1,923 1,957 1,965 1,975 2,005 2,030 Supported by relatively 1.2 2.1 2.8 3.4 3 2.2 % change 2.6 1.7 0.4 0.5 1.6 1.2 low costs, a deep talent Wholesale pool, and a dynamic tech 8.8 7.9 6.8 5.6 4.8 4.1 Unemployment rate (%) 4.2 4.1 4.6 5.6 5.6 5.7 Manufacturing sector, OR will remain 5.4 1.7 6.9 7.6 4.2 3.7 Personal income growth (%) 7.1 6.8 5.1 5.6 6.1 5.5 an above-average Construction 3,894 3,920 3,961 4,017 4,086 4,143 Population (ths) 4,183 4,218 4,250 4,282 4,316 4,351 performer long term. Utilities 16.2 14.2 29.2 45.2 59 45.7 Net migration (ths) 29.6 24 21.9 22.1 25.2 26.6 6,342 8,417 8,573 10,255 11,006 10,374 Single-family permits (#) 12,119 14,801 15,489 17,795 18,819 18,539 Mining 4,266 6,426 8,072 7,255 8,580 10,058 Multifamily permits (#) 9,180 6,919 6,274 6,690 7,500 7,471 Agriculture 344 368 400 436 485 530 FHFA house price (1980Q1=100) 548 548 555 572 596 631 0.00% 10.00% 20.00% 30.00% 4.9 4.3 3.8 3.1 2.6 2.5 Mortgage delinquency rate (%) 2.4 2.3 2.5 3 3.1 3.1 133.4 146.7 156.2 170 185.9 189.8 New vehicle registrations (ths) 187.5 165.9 147.1 153.3 165 164.1 OR US 14,857 13,246 12,059 10,600 8,906 8,991 Personal bankruptcies (#) 8,817 8,914 9,681 11,830 14,489 17,055 Page 23 Sources: BLS, BEA, Moody’s, Bloomberg, Census, SNL

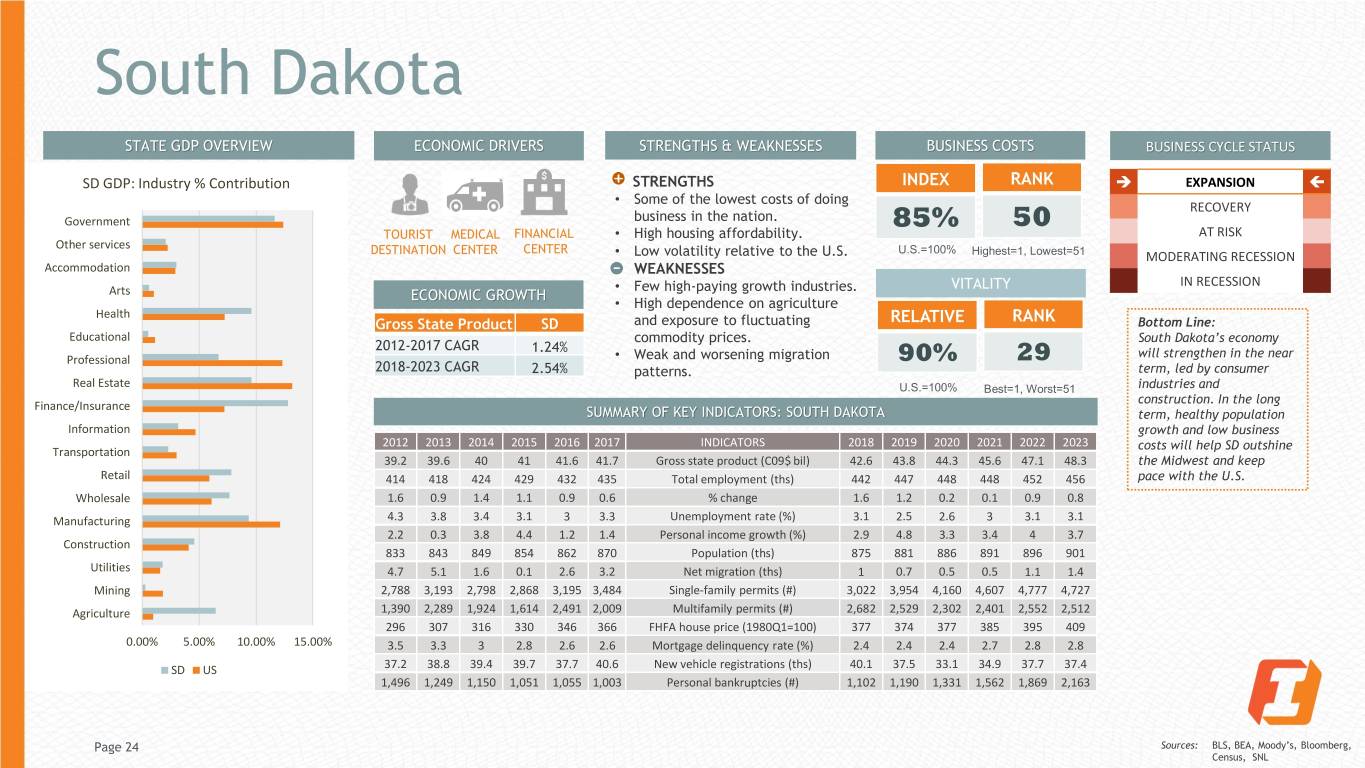

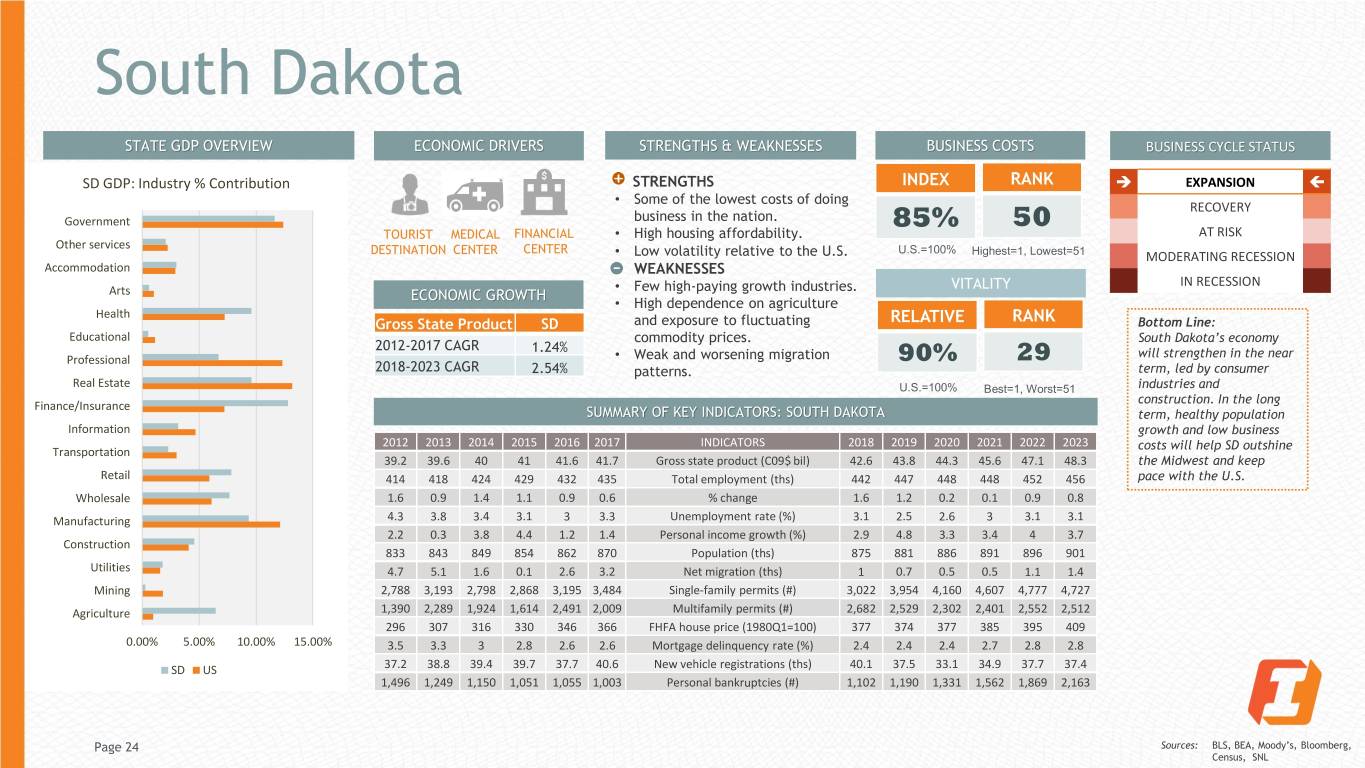

South Dakota STATE GDP OVERVIEW ECONOMIC DRIVERS STRENGTHS & WEAKNESSES BUSINESS COSTS BUSINESS CYCLE STATUS SD GDP: Industry % Contribution STRENGTHS INDEX RANK EXPANSION • Some of the lowest costs of doing RECOVERY Government business in the nation. 85% 50 TOURIST MEDICAL FINANCIAL • High housing affordability. AT RISK Other services DESTINATION CENTER CENTER U.S.=100% • Low volatility relative to the U.S. Highest=1, Lowest=51 MODERATING RECESSION Accommodation WEAKNESSES • Few high-paying growth industries. VITALITY IN RECESSION Arts ECONOMIC GROWTH • High dependence on agriculture Health Gross State Product SD and exposure to fluctuating RELATIVE RANK Bottom Line: Educational commodity prices. South Dakota’s economy 2012-2017 CAGR 1.24% will strengthen in the near Professional • Weak and worsening migration 90% 29 2018-2023 CAGR 2.54% patterns. term, led by consumer Real Estate U.S.=100% Best=1, Worst=51 industries and construction. In the long Finance/Insurance SUMMARY OF KEY INDICATORS: SOUTH DAKOTA term, healthy population Information growth and low business 2012 2013 2014 2015 2016 2017 INDICATORS 2018 2019 2020 2021 2022 2023 costs will help SD outshine Transportation 39.2 39.6 40 41 41.6 41.7 Gross state product (C09$ bil) 42.6 43.8 44.3 45.6 47.1 48.3 the Midwest and keep Retail 414 418 424 429 432 435 Total employment (ths) 442 447 448 448 452 456 pace with the U.S. Wholesale 1.6 0.9 1.4 1.1 0.9 0.6 % change 1.6 1.2 0.2 0.1 0.9 0.8 Manufacturing 4.3 3.8 3.4 3.1 3 3.3 Unemployment rate (%) 3.1 2.5 2.6 3 3.1 3.1 2.2 0.3 3.8 4.4 1.2 1.4 Personal income growth (%) 2.9 4.8 3.3 3.4 4 3.7 Construction 833 843 849 854 862 870 Population (ths) 875 881 886 891 896 901 Utilities 4.7 5.1 1.6 0.1 2.6 3.2 Net migration (ths) 1 0.7 0.5 0.5 1.1 1.4 Mining 2,788 3,193 2,798 2,868 3,195 3,484 Single-family permits (#) 3,022 3,954 4,160 4,607 4,777 4,727 Agriculture 1,390 2,289 1,924 1,614 2,491 2,009 Multifamily permits (#) 2,682 2,529 2,302 2,401 2,552 2,512 296 307 316 330 346 366 FHFA house price (1980Q1=100) 377 374 377 385 395 409 0.00% 5.00% 10.00% 15.00% 3.5 3.3 3 2.8 2.6 2.6 Mortgage delinquency rate (%) 2.4 2.4 2.4 2.7 2.8 2.8 SD US 37.2 38.8 39.4 39.7 37.7 40.6 New vehicle registrations (ths) 40.1 37.5 33.1 34.9 37.7 37.4 1,496 1,249 1,150 1,051 1,055 1,003 Personal bankruptcies (#) 1,102 1,190 1,331 1,562 1,869 2,163 Page 24 Sources: BLS, BEA, Moody’s, Bloomberg, Census, SNL

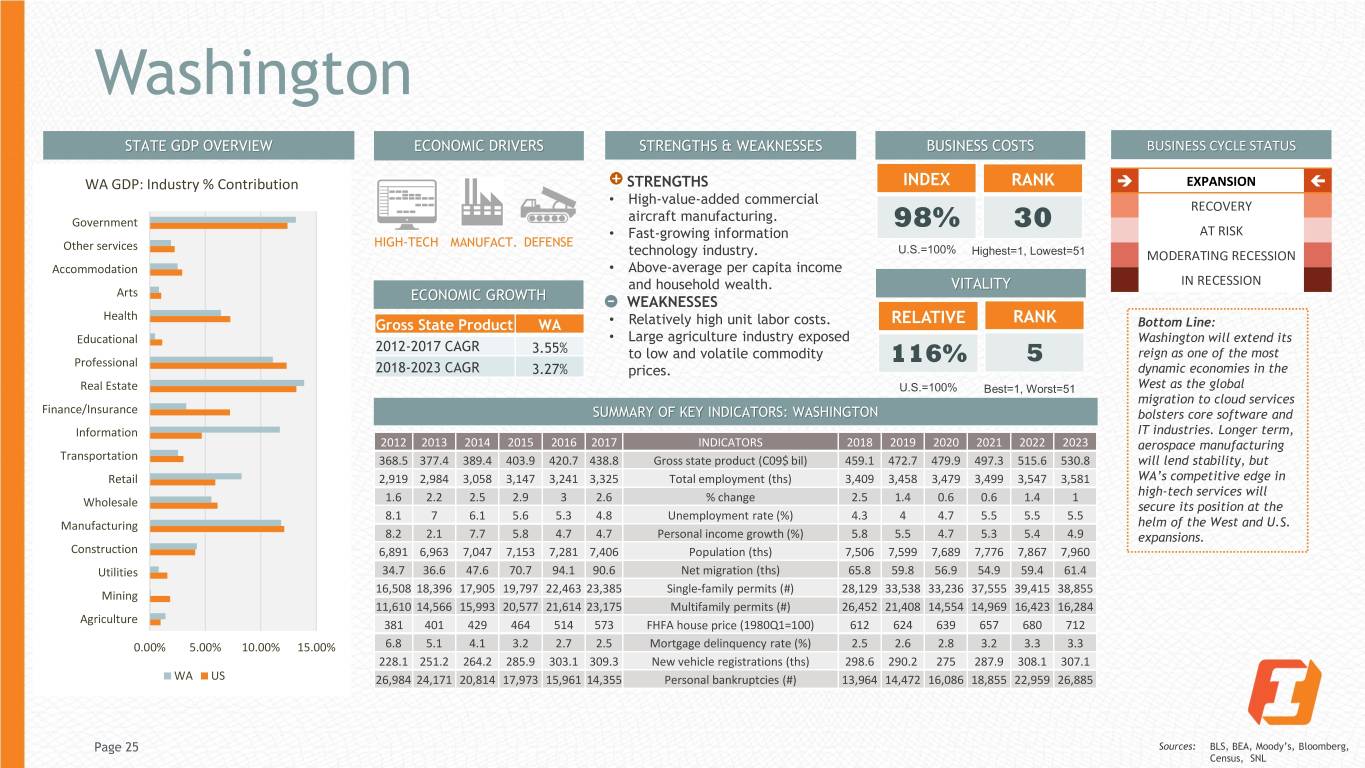

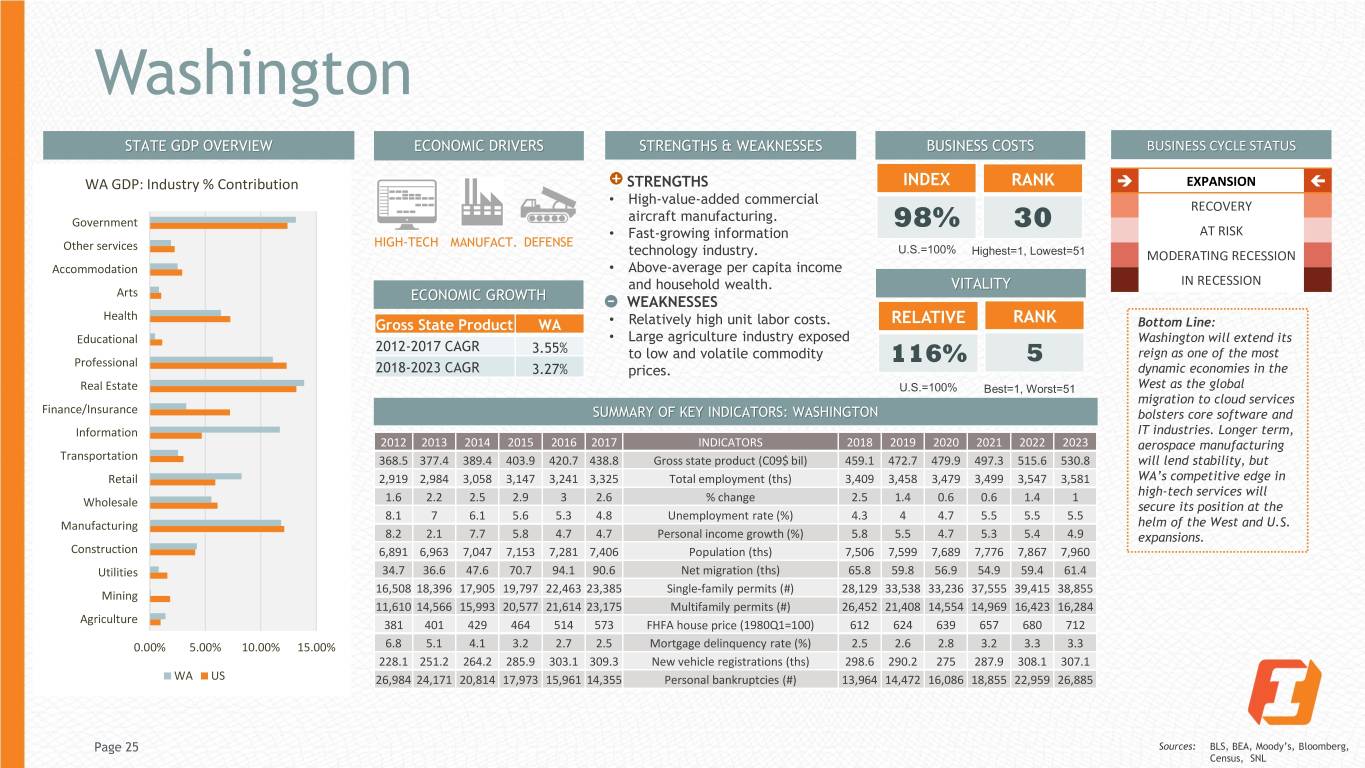

Washington STATE GDP OVERVIEW ECONOMIC DRIVERS STRENGTHS & WEAKNESSES BUSINESS COSTS BUSINESS CYCLE STATUS WA GDP: Industry % Contribution STRENGTHS INDEX RANK EXPANSION • High-value-added commercial RECOVERY aircraft manufacturing. Government 98% 30 • Fast-growing information AT RISK Other services HIGH-TECH MANUFACT. DEFENSE technology industry. U.S.=100% Highest=1, Lowest=51 MODERATING RECESSION Accommodation • Above-average per capita income and household wealth. VITALITY IN RECESSION Arts ECONOMIC GROWTH WEAKNESSES Health Gross State Product WA • Relatively high unit labor costs. RELATIVE RANK Bottom Line: • Large agriculture industry exposed Washington will extend its Educational 2012-2017 CAGR 3.55% to low and volatile commodity reign as one of the most Professional 116% 5 2018-2023 CAGR 3.27% prices. dynamic economies in the Real Estate U.S.=100% Best=1, Worst=51 West as the global migration to cloud services Finance/Insurance SUMMARY OF KEY INDICATORS: WASHINGTON bolsters core software and Information IT industries. Longer term, 2012 2013 2014 2015 2016 2017 INDICATORS 2018 2019 2020 2021 2022 2023 aerospace manufacturing Transportation 368.5 377.4 389.4 403.9 420.7 438.8 Gross state product (C09$ bil) 459.1 472.7 479.9 497.3 515.6 530.8 will lend stability, but Retail 2,919 2,984 3,058 3,147 3,241 3,325 Total employment (ths) 3,409 3,458 3,479 3,499 3,547 3,581 WA’s competitive edge in 1.6 2.2 2.5 2.9 3 2.6 % change 2.5 1.4 0.6 0.6 1.4 1 high-tech services will Wholesale secure its position at the 8.1 7 6.1 5.6 5.3 4.8 Unemployment rate (%) 4.3 4 4.7 5.5 5.5 5.5 Manufacturing helm of the West and U.S. 8.2 2.1 7.7 5.8 4.7 4.7 Personal income growth (%) 5.8 5.5 4.7 5.3 5.4 4.9 expansions. Construction 6,891 6,963 7,047 7,153 7,281 7,406 Population (ths) 7,506 7,599 7,689 7,776 7,867 7,960 Utilities 34.7 36.6 47.6 70.7 94.1 90.6 Net migration (ths) 65.8 59.8 56.9 54.9 59.4 61.4 16,508 18,396 17,905 19,797 22,463 23,385 Single-family permits (#) 28,129 33,538 33,236 37,555 39,415 38,855 Mining 11,610 14,566 15,993 20,577 21,614 23,175 Multifamily permits (#) 26,452 21,408 14,554 14,969 16,423 16,284 Agriculture 381 401 429 464 514 573 FHFA house price (1980Q1=100) 612 624 639 657 680 712 0.00% 5.00% 10.00% 15.00% 6.8 5.1 4.1 3.2 2.7 2.5 Mortgage delinquency rate (%) 2.5 2.6 2.8 3.2 3.3 3.3 228.1 251.2 264.2 285.9 303.1 309.3 New vehicle registrations (ths) 298.6 290.2 275 287.9 308.1 307.1 WA US 26,984 24,171 20,814 17,973 15,961 14,355 Personal bankruptcies (#) 13,964 14,472 16,086 18,855 22,959 26,885 Page 25 Sources: BLS, BEA, Moody’s, Bloomberg, Census, SNL

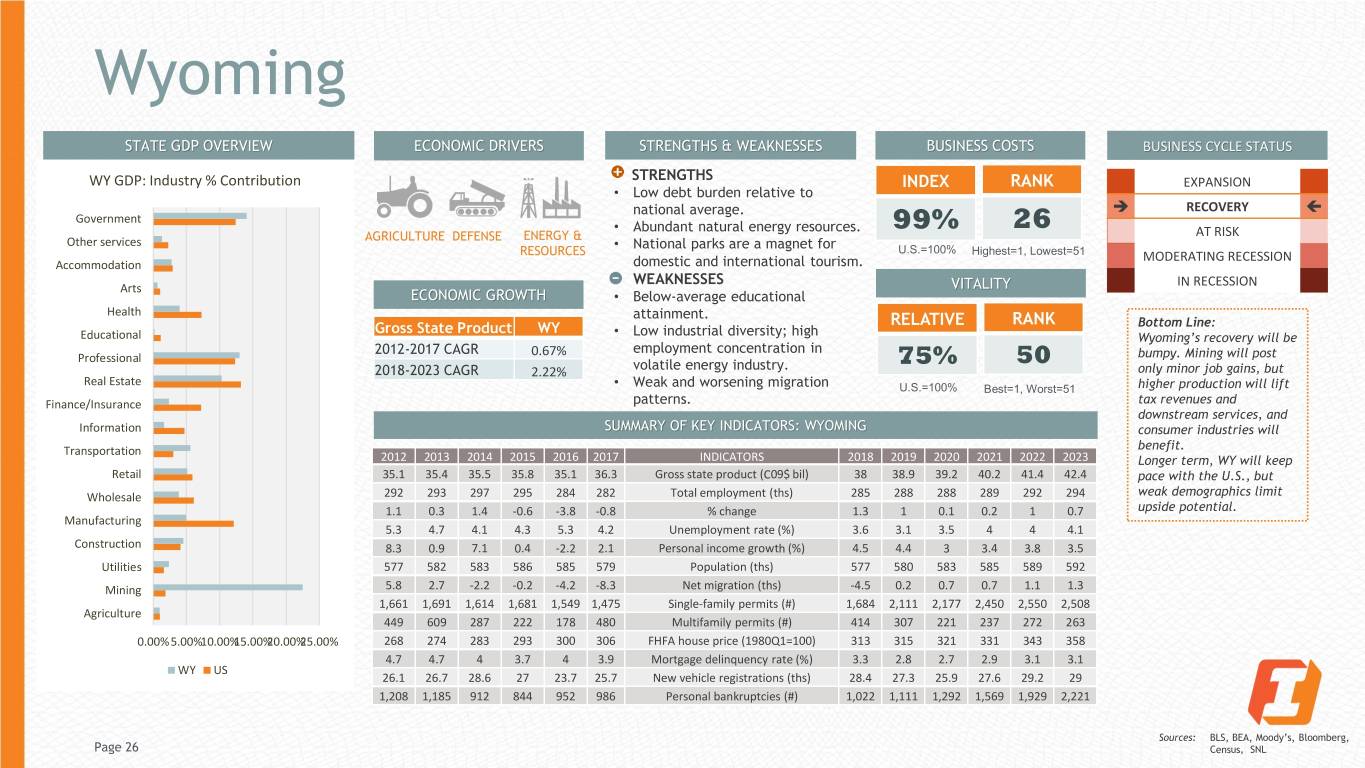

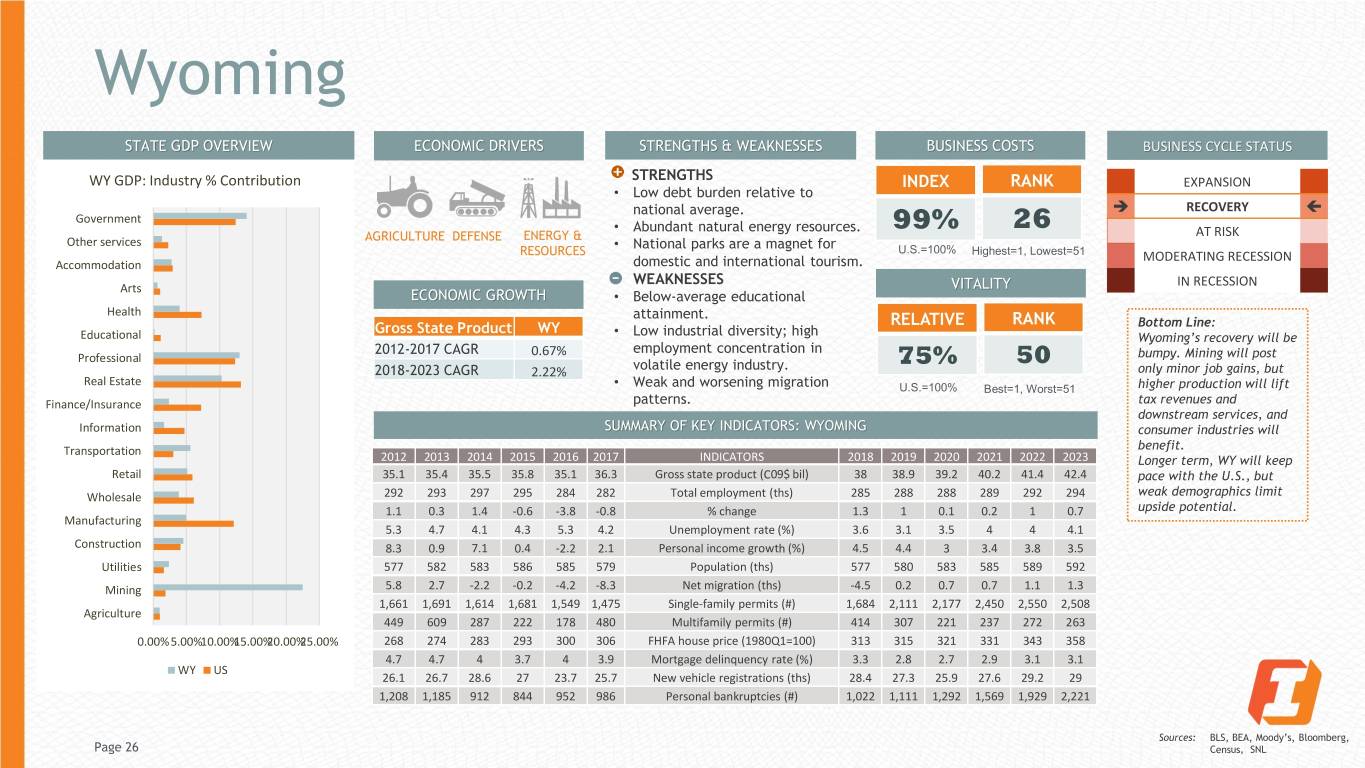

Wyoming STATE GDP OVERVIEW ECONOMIC DRIVERS STRENGTHS & WEAKNESSES BUSINESS COSTS BUSINESS CYCLE STATUS STRENGTHS WY GDP: Industry % Contribution INDEX RANK EXPANSION • Low debt burden relative to national average. RECOVERY Government • Abundant natural energy resources. 99% 26 ENERGY & AT RISK Other services AGRICULTURE DEFENSE • National parks are a magnet for U.S.=100% RESOURCES Highest=1, Lowest=51 MODERATING RECESSION Accommodation domestic and international tourism. WEAKNESSES IN RECESSION Arts VITALITY ECONOMIC GROWTH • Below-average educational Health attainment. RELATIVE RANK Gross State Product WY Bottom Line: Educational • Low industrial diversity; high Wyoming’s recovery will be 2012-2017 CAGR 0.67% employment concentration in bumpy. Mining will post Professional volatile energy industry. 75% 50 2018-2023 CAGR 2.22% only minor job gains, but Real Estate • Weak and worsening migration U.S.=100% Best=1, Worst=51 higher production will lift Finance/Insurance patterns. tax revenues and downstream services, and Information SUMMARY OF KEY INDICATORS: WYOMING consumer industries will Transportation benefit. 2012 2013 2014 2015 2016 2017 INDICATORS 2018 2019 2020 2021 2022 2023 Longer term, WY will keep Retail 35.1 35.4 35.5 35.8 35.1 36.3 Gross state product (C09$ bil) 38 38.9 39.2 40.2 41.4 42.4 pace with the U.S., but Wholesale 292 293 297 295 284 282 Total employment (ths) 285 288 288 289 292 294 weak demographics limit 1.1 0.3 1.4 -0.6 -3.8 -0.8 % change 1.3 1 0.1 0.2 1 0.7 upside potential. Manufacturing 5.3 4.7 4.1 4.3 5.3 4.2 Unemployment rate (%) 3.6 3.1 3.5 4 4 4.1 Construction 8.3 0.9 7.1 0.4 -2.2 2.1 Personal income growth (%) 4.5 4.4 3 3.4 3.8 3.5 Utilities 577 582 583 586 585 579 Population (ths) 577 580 583 585 589 592 Mining 5.8 2.7 -2.2 -0.2 -4.2 -8.3 Net migration (ths) -4.5 0.2 0.7 0.7 1.1 1.3 1,661 1,691 1,614 1,681 1,549 1,475 Single-family permits (#) 1,684 2,111 2,177 2,450 2,550 2,508 Agriculture 449 609 287 222 178 480 Multifamily permits (#) 414 307 221 237 272 263 0.00%5.00%10.00%15.00%20.00%25.00% 268 274 283 293 300 306 FHFA house price (1980Q1=100) 313 315 321 331 343 358 4.7 4.7 4 3.7 4 3.9 Mortgage delinquency rate (%) 3.3 2.8 2.7 2.9 3.1 3.1 WY US 26.1 26.7 28.6 27 23.7 25.7 New vehicle registrations (ths) 28.4 27.3 25.9 27.6 29.2 29 1,208 1,185 912 844 952 986 Personal bankruptcies (#) 1,022 1,111 1,292 1,569 1,929 2,221 Sources: BLS, BEA, Moody’s, Bloomberg, Page 26 Census, SNL

Financial Overview Page 27

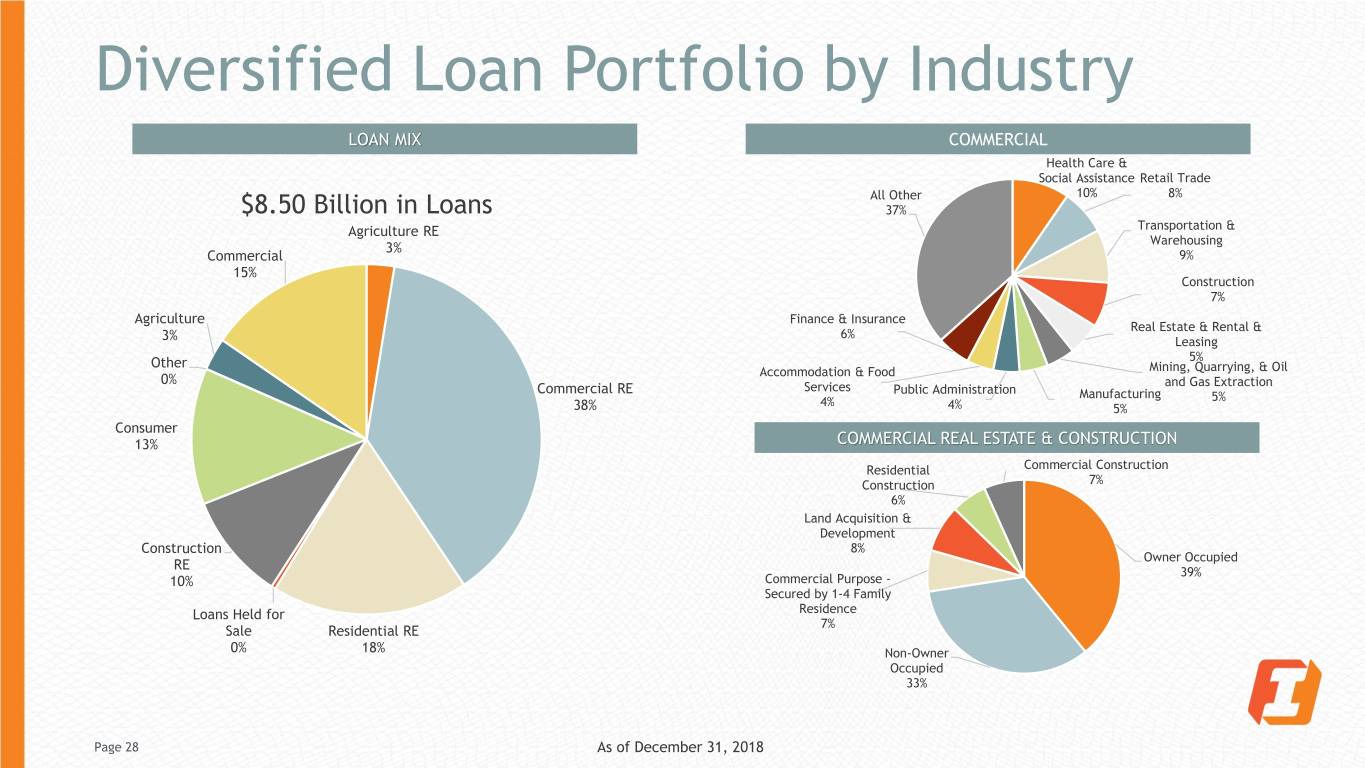

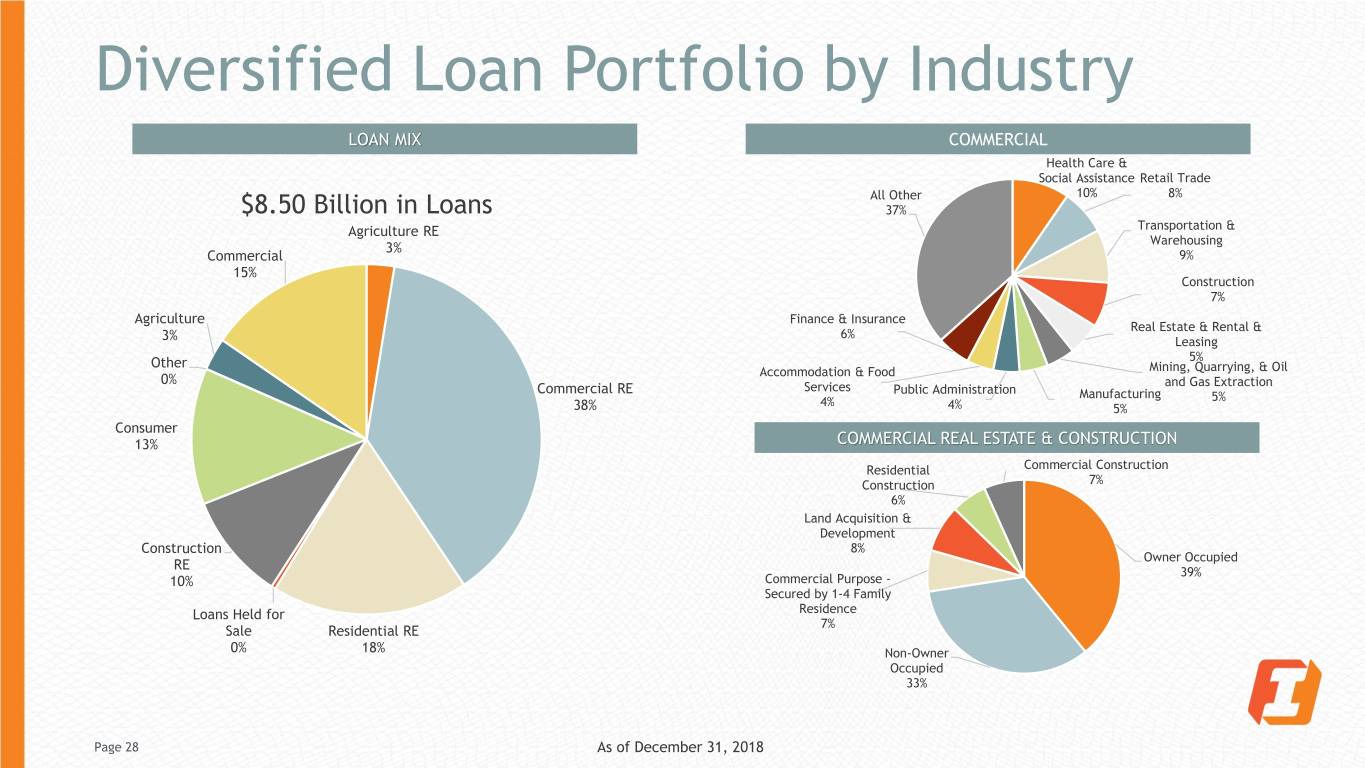

Diversified Loan Portfolio by Industry LOAN MIX COMMERCIAL Health Care & Social Assistance Retail Trade All Other 10% 8% $8.50 Billion in Loans 37% Agriculture RE Transportation & Warehousing 3% Commercial 9% 15% Construction 7% Agriculture Finance & Insurance Real Estate & Rental & 6% 3% Leasing Other 5% Accommodation & Food Mining, Quarrying, & Oil 0% Services and Gas Extraction Commercial RE Public Administration Manufacturing 4% 5% 38% 4% 5% Consumer 13% COMMERCIAL REAL ESTATE & CONSTRUCTION Residential Commercial Construction Construction 7% 6% Land Acquisition & Development Construction 8% Owner Occupied RE 39% 10% Commercial Purpose - Secured by 1-4 Family Loans Held for Residence 7% Sale Residential RE 0% 18% Non-Owner Occupied 33% Page 28 As of December 31, 2018

Improving Asset Quality NON-PERFORMING ASSETS TO TOTAL ASSETS 1.20% 0.96% 0.98% 1.00% 0.80% 0.80% 0.74% 0.74% 0.68% 0.63% 0.63% 0.60% 0.55% 0.40% 0.20% 0.00% Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2016 2017 2017 2017 2017 2018 2018 2018 2018 NON-PERFORMING LOANS TO TOTAL LOANS NON-PERFORMING ASSETS TO TOTAL LOANS + OREO 1.60% 1.47% 2.00% 1.40% 1.58% 1.64% 1.14% 1.20% 1.06% 1.50% 1.29% 0.95% 0.97% 1.20% 1.16% 0.87% 1.08% 0.78% 1.02% 0.98% 0.80% 0.68% 1.00% 0.85% 0.40% 0.50% 0.00% 0.00% Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2016 2017 2017 2017 2017 2018 2018 2018 2018 2016 2017 2017 2017 2017 2018 2018 2018 2018 Page 29 As of December 31, 2018

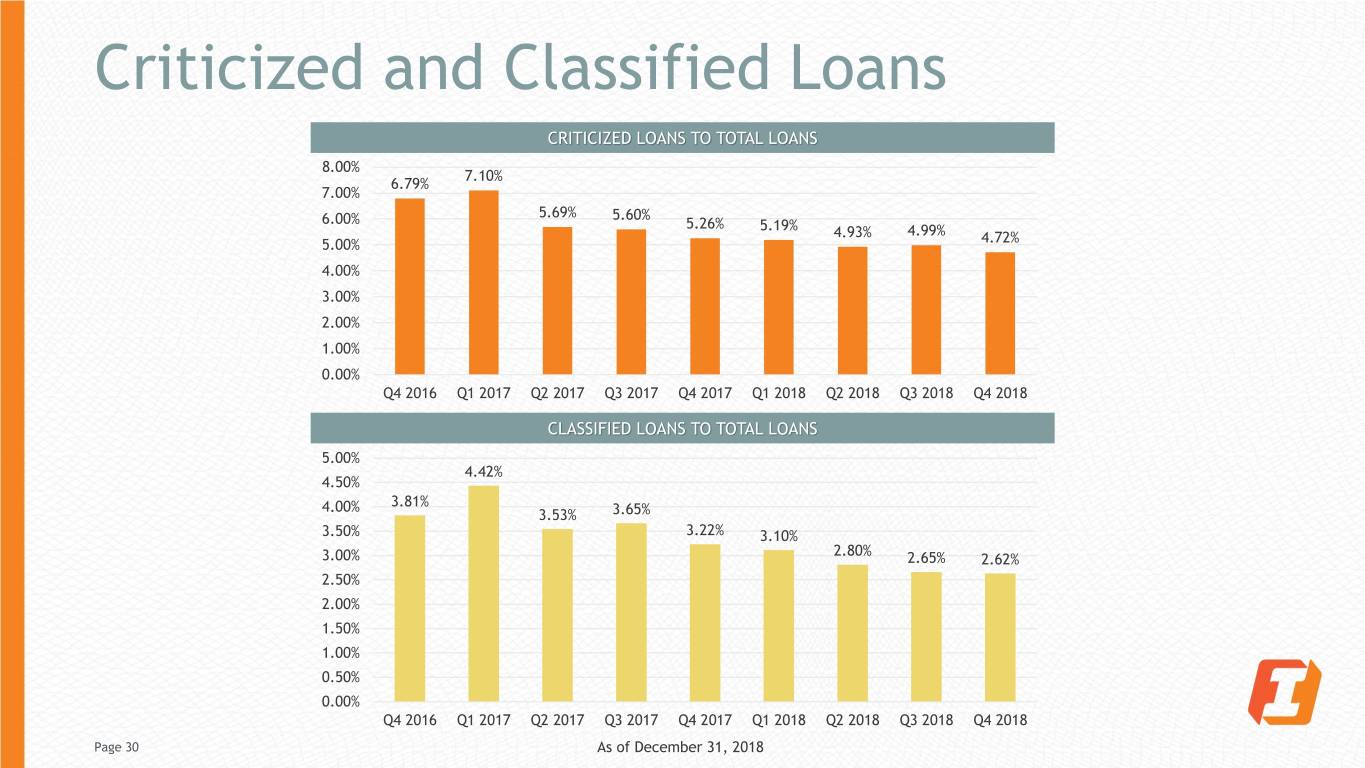

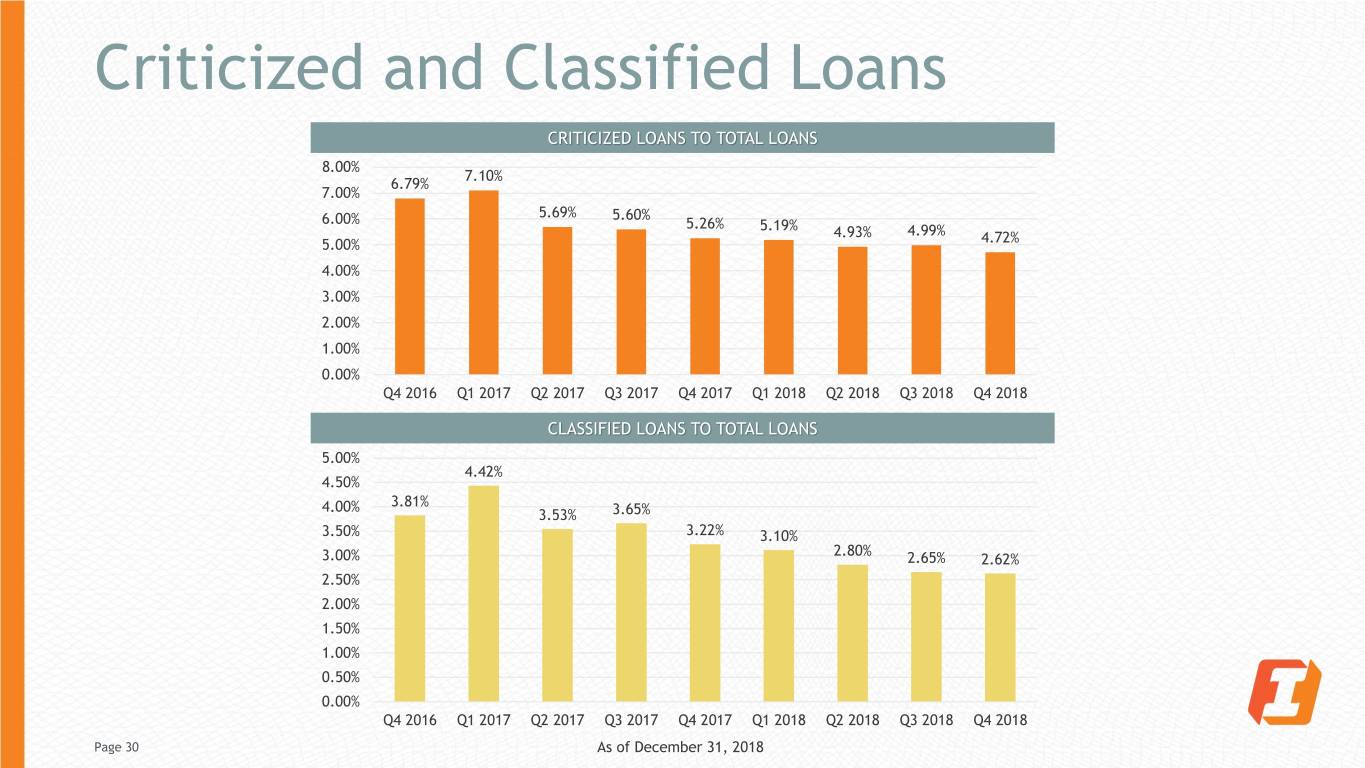

Criticized and Classified Loans CRITICIZED LOANS TO TOTAL LOANS 8.00% 7.10% 6.79% 7.00% 5.69% 5.60% 6.00% 5.26% 5.19% 4.93% 4.99% 5.00% 4.72% 4.00% 3.00% 2.00% 1.00% 0.00% Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 CLASSIFIED LOANS TO TOTAL LOANS 5.00% 4.42% 4.50% 4.00% 3.81% 3.53% 3.65% 3.50% 3.22% 3.10% 2.80% 3.00% 2.65% 2.62% 2.50% 2.00% 1.50% 1.00% 0.50% 0.00% Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Page 30 As of December 31, 2018

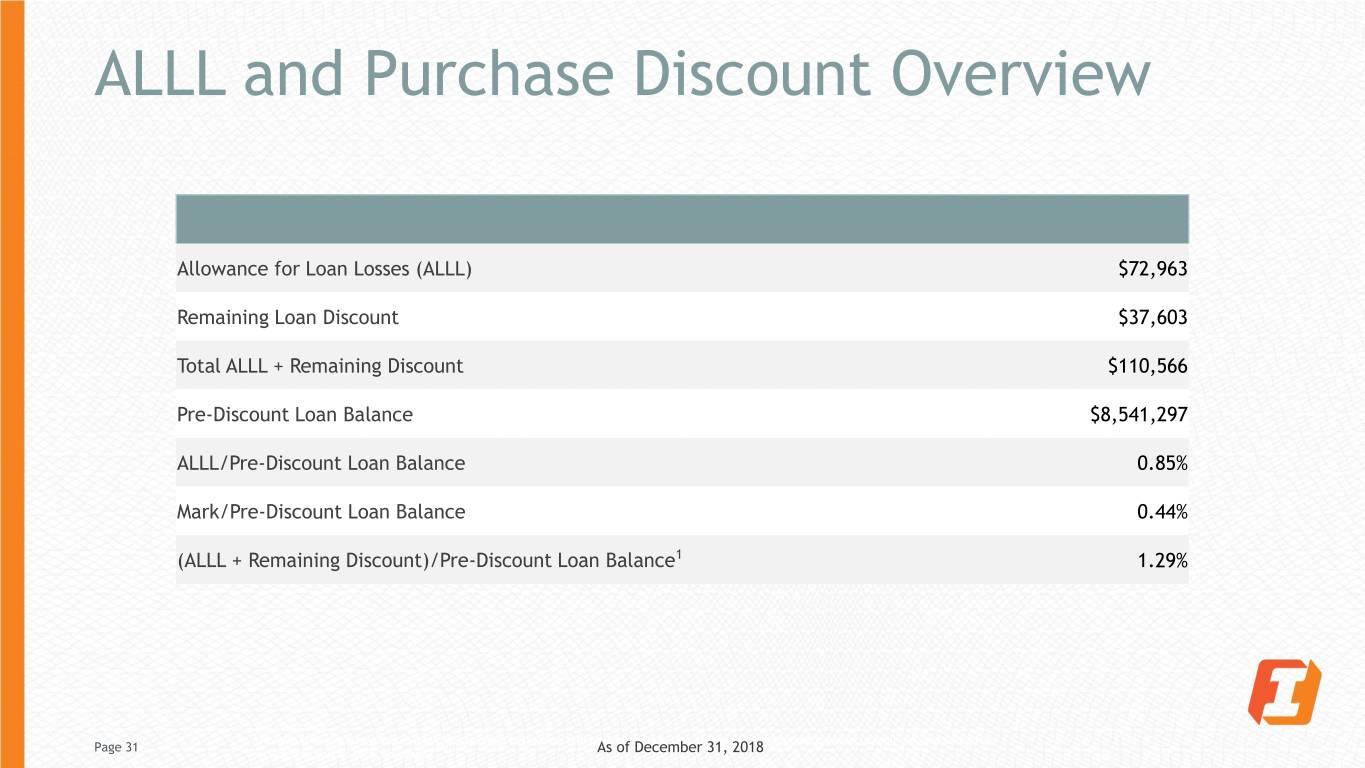

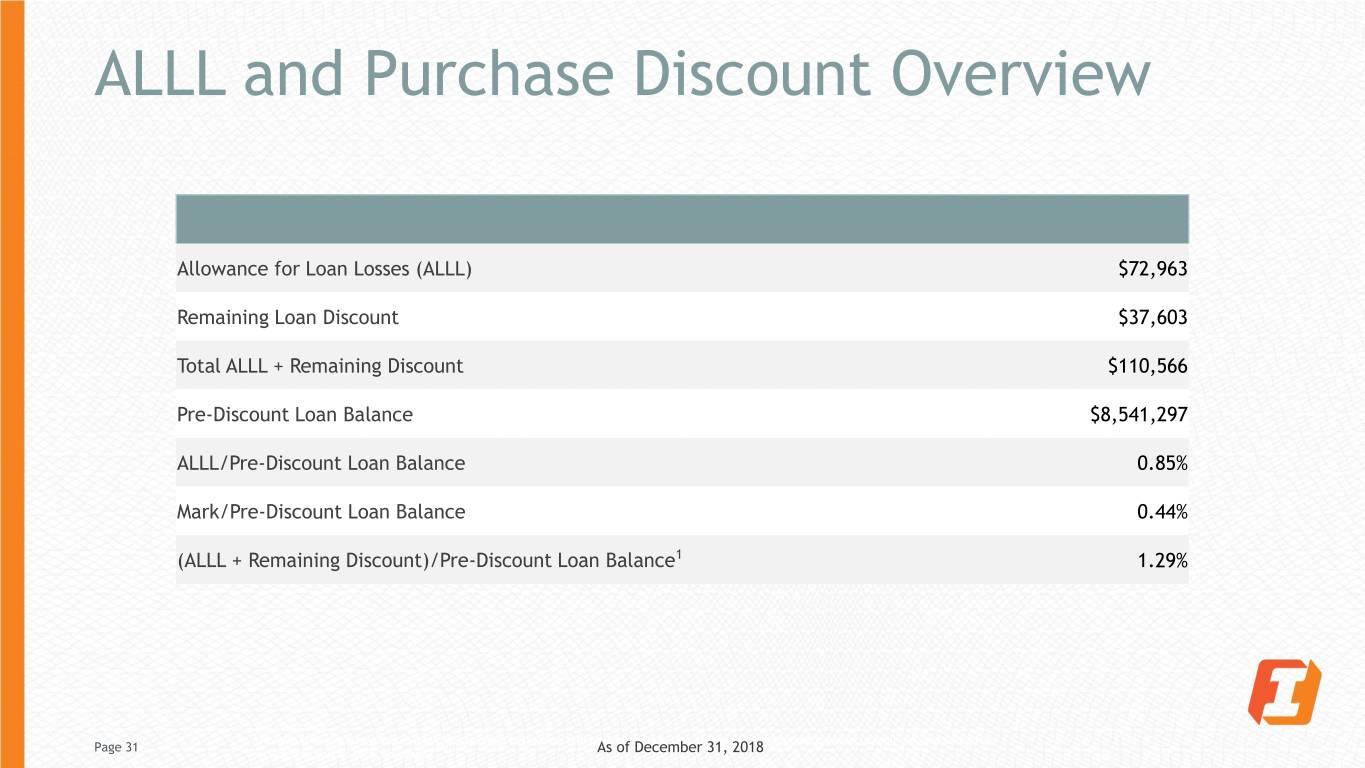

ALLL and Purchase Discount Overview Allowance for Loan Losses (ALLL) $72,963 Remaining Loan Discount $37,603 Total ALLL + Remaining Discount $110,566 Pre-Discount Loan Balance $8,541,297 ALLL/Pre-Discount Loan Balance 0.85% Mark/Pre-Discount Loan Balance 0.44% (ALLL + Remaining Discount)/Pre-Discount Loan Balance1 1.29% $ in thousands 1 Non-GAAP financial measure which Management believes useful to demonstrate that the remaining discount considers credit risk and should be Page 31 included as part of total coverage. As of December 31, 2018

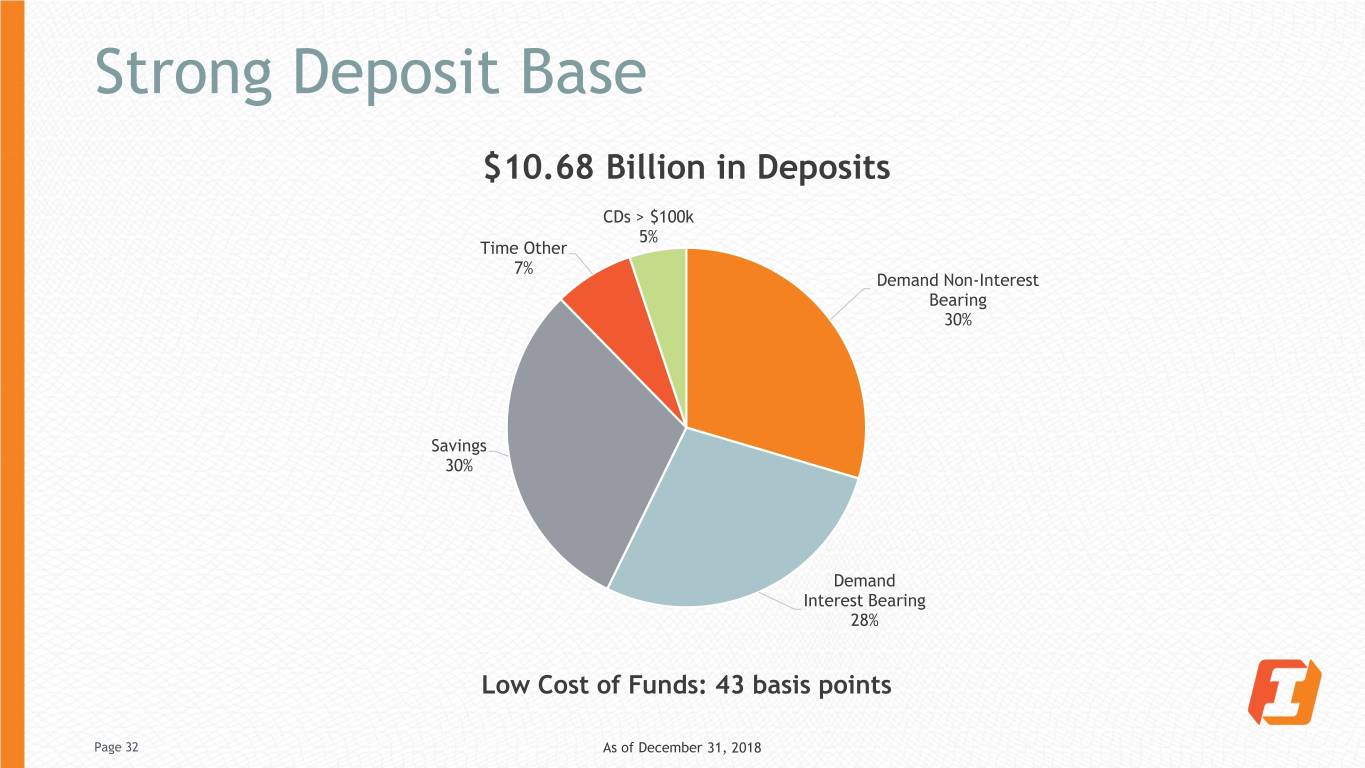

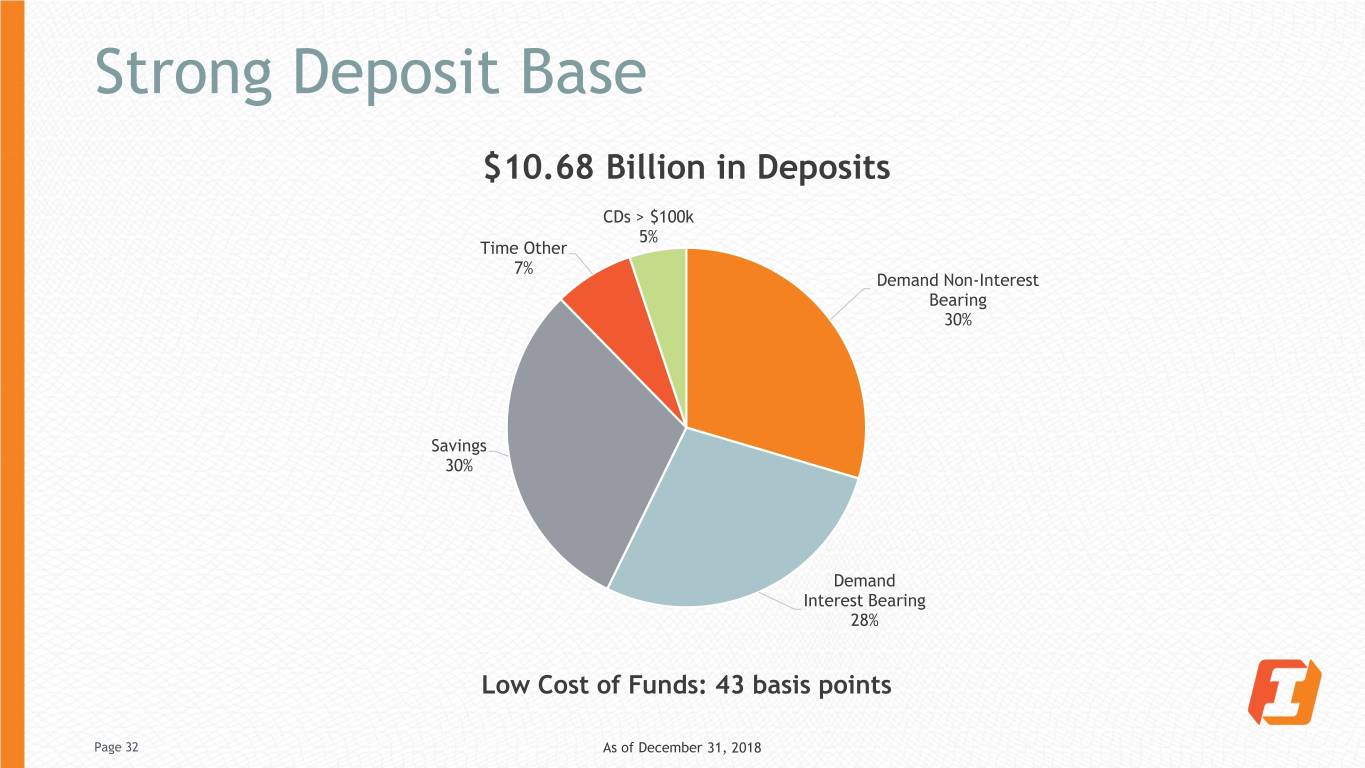

Strong Deposit Base $10.68 Billion in Deposits CDs > $100k 5% Time Other 7% Demand Non-Interest Bearing 30% Savings 30% Demand Interest Bearing 28% Low Cost of Funds: 43 basis points Page 32 As of December 31, 2018

Market Share MARKET MARKET ALLOCATION OF DEPOSITS LOCATION SHARE* LOCATION SHARE* JUNE 2018 JUNE 2018 Laramie, WY 48% Bozeman, MT 16% Washington 5% Riverton, WY 43% Kalispell, MT 15% Idaho 6% Sheridan, WY 40% Jackson, WY 14% South Dakota Missoula, MT 32% Cheyenne, WY 12% 8% Casper, WY 30% Nampa, ID 11% Montana 40% Great Falls, MT 30% Medford, OR 8% Gillette, WY 28% Rapid City, SD 8% Oregon Billings, MT 26% Boise, ID 2% 17% Redmond, OR 26% Lynnwood, WA 2% Spearfish, SD 25% Eugene, OR 2% Bend, OR 24% Salem, OR 1% Wyoming Helena, MT 21% Portland, OR .5% 24% *The market share percentages are per the FDIC, not including Credit Union Deposits within each community. Page 33 As of December 31, 2018

Balance of Consumer and Business Deposits (In billions) $12 47% $10 47% $8 47% 48% 49% $6 49% 49% 53% 53% $4 53% 52% 51% 51% 51% $2 $0 2012 2013 2014 2015 2016 2017 2018 Total Consumer Deposits Total Business Deposits Page 34

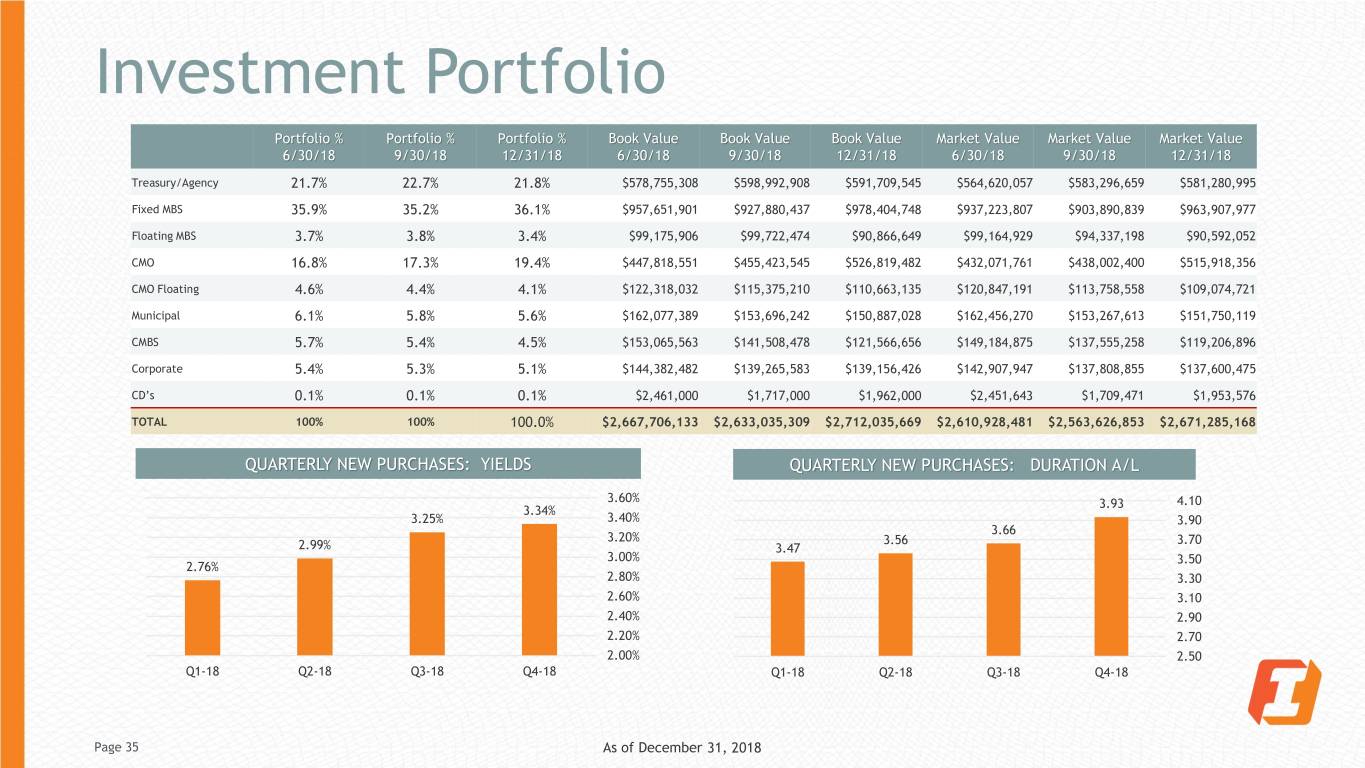

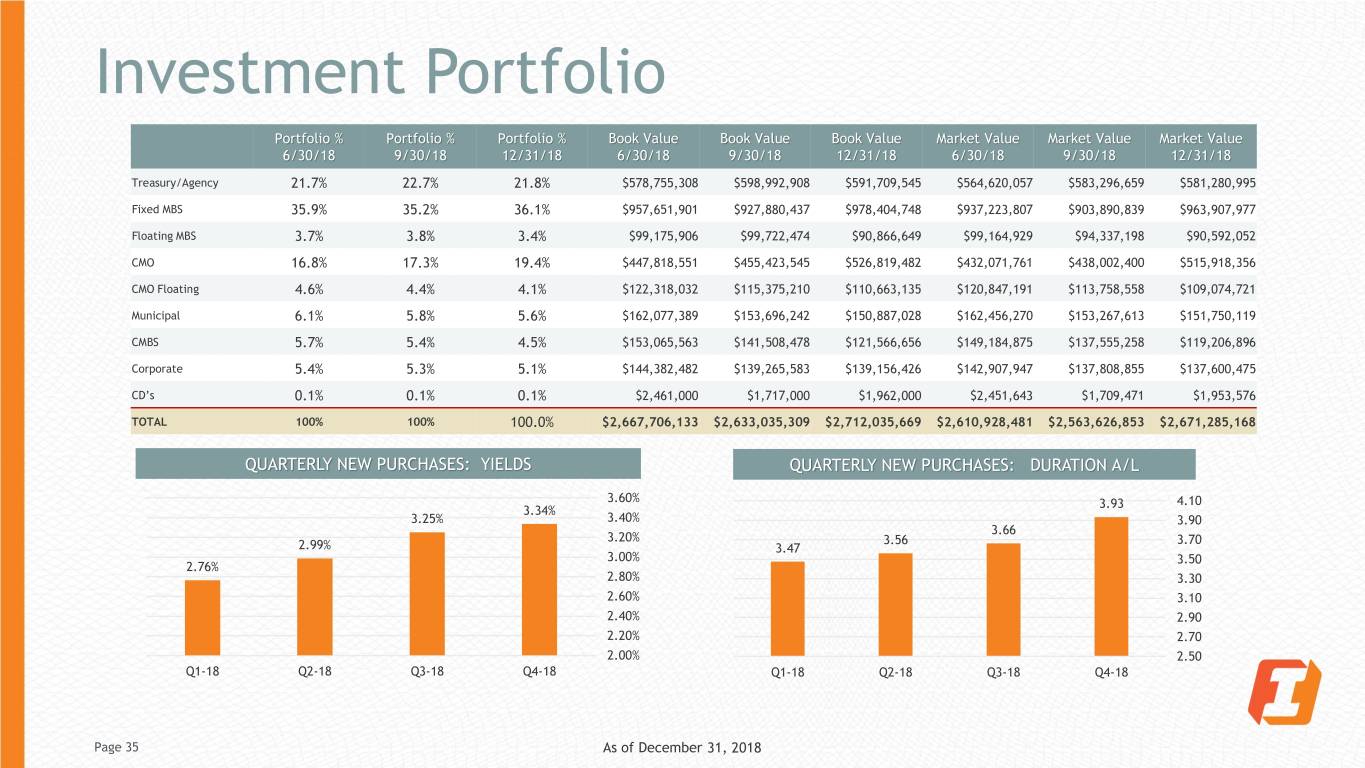

Investment Portfolio Portfolio % Portfolio % Portfolio % Book Value Book Value Book Value Market Value Market Value Market Value 6/30/18 9/30/18 12/31/18 6/30/18 9/30/18 12/31/18 6/30/18 9/30/18 12/31/18 Treasury/Agency 21.7% 22.7% 21.8% $578,755,308 $598,992,908 $591,709,545 $564,620,057 $583,296,659 $581,280,995 Fixed MBS 35.9% 35.2% 36.1% $957,651,901 $927,880,437 $978,404,748 $937,223,807 $903,890,839 $963,907,977 Floating MBS 3.7% 3.8% 3.4% $99,175,906 $99,722,474 $90,866,649 $99,164,929 $94,337,198 $90,592,052 CMO 16.8% 17.3% 19.4% $447,818,551 $455,423,545 $526,819,482 $432,071,761 $438,002,400 $515,918,356 CMO Floating 4.6% 4.4% 4.1% $122,318,032 $115,375,210 $110,663,135 $120,847,191 $113,758,558 $109,074,721 Municipal 6.1% 5.8% 5.6% $162,077,389 $153,696,242 $150,887,028 $162,456,270 $153,267,613 $151,750,119 CMBS 5.7% 5.4% 4.5% $153,065,563 $141,508,478 $121,566,656 $149,184,875 $137,555,258 $119,206,896 Corporate 5.4% 5.3% 5.1% $144,382,482 $139,265,583 $139,156,426 $142,907,947 $137,808,855 $137,600,475 CD’s 0.1% 0.1% 0.1% $2,461,000 $1,717,000 $1,962,000 $2,451,643 $1,709,471 $1,953,576 TOTAL 100% 100% 100.0% $2,667,706,133 $2,633,035,309 $2,712,035,669 $2,610,928,481 $2,563,626,853 $2,671,285,168 QUARTERLY NEW PURCHASES: YIELDS QUARTERLY NEW PURCHASES: DURATION A/L 3.60% 3.93 4.10 3.34% 3.25% 3.40% 3.90 3.66 3.20% 3.56 3.70 2.99% 3.47 3.00% 3.50 2.76% 2.80% 3.30 2.60% 3.10 2.40% 2.90 2.20% 2.70 2.00% 2.50 Q1-18 Q2-18 Q3-18 Q4-18 Q1-18 Q2-18 Q3-18 Q4-18 Page 35 As of December 31, 2018

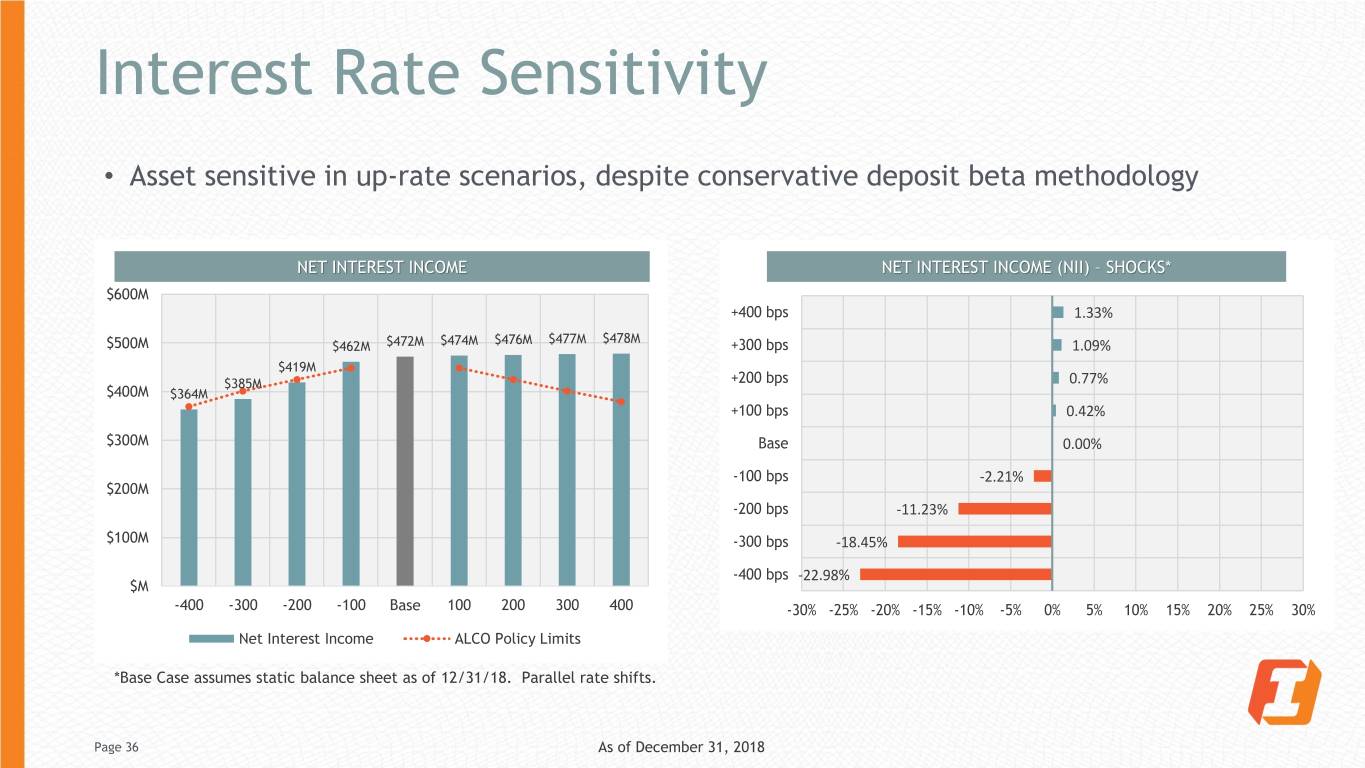

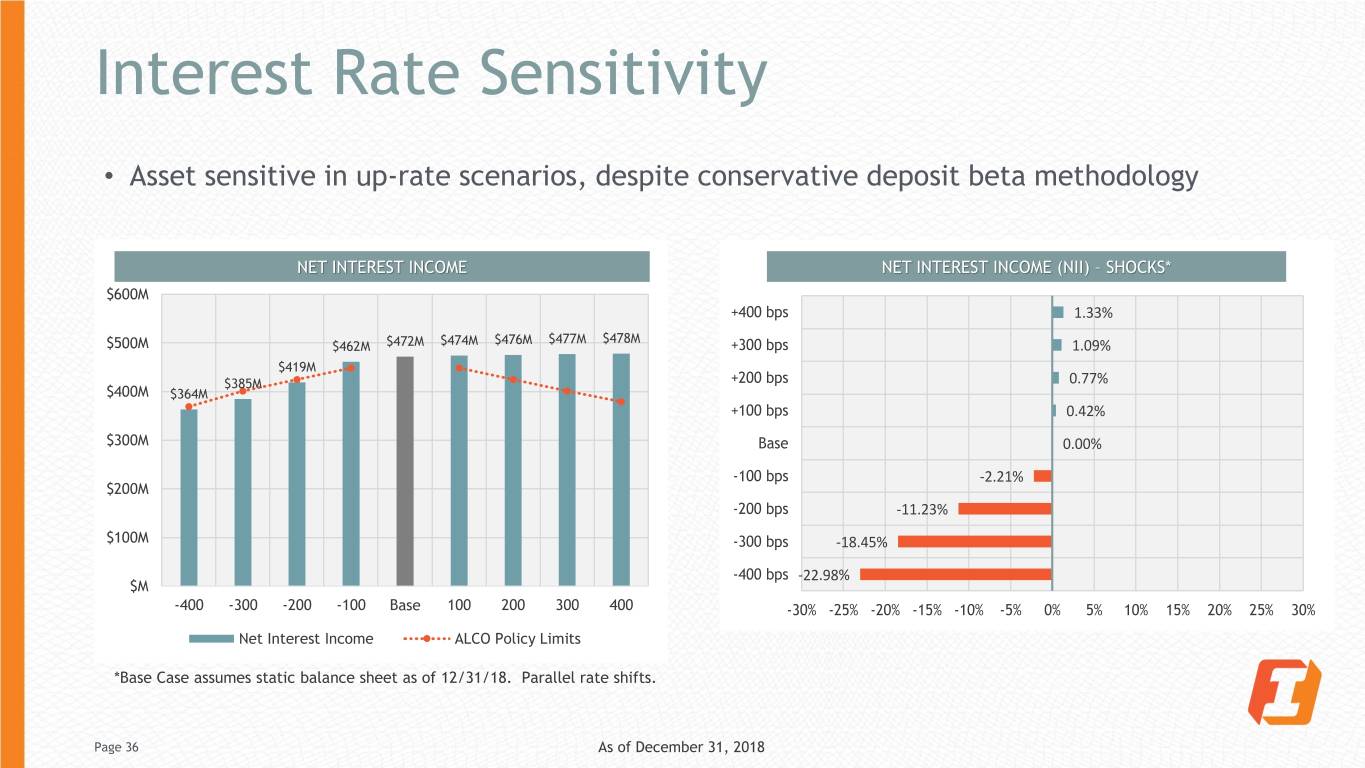

Interest Rate Sensitivity • Asset sensitive in up-rate scenarios, despite conservative deposit beta methodology NETNET INTEREST INTERESTINCOME INCOME NETNET INTEREST INTERESTINCOME INCOME (NII) (NII) – -SHOCKS*Shocks $600M +400 bps 1.33% $476M $477M $478M $500M $462M $472M $474M +300 bps 1.09% $419M $385M +200 bps 0.77% $400M $364M +100 bps 0.42% $300M Base 0.00% -100 bps -2.21% $200M -200 bps -11.23% $100M -300 bps -18.45% -400 bps -22.98% $M -400 -300 -200 -100 Base 100 200 300 400 -30% -25% -20% -15% -10% -5% 0% 5% 10% 15% 20% 25% 30% Net Interest Income ALCO Policy Limits *Base Case assumes static balance sheet as of 12/31/18. Parallel rate shifts. Page 36 As of December 31, 2018

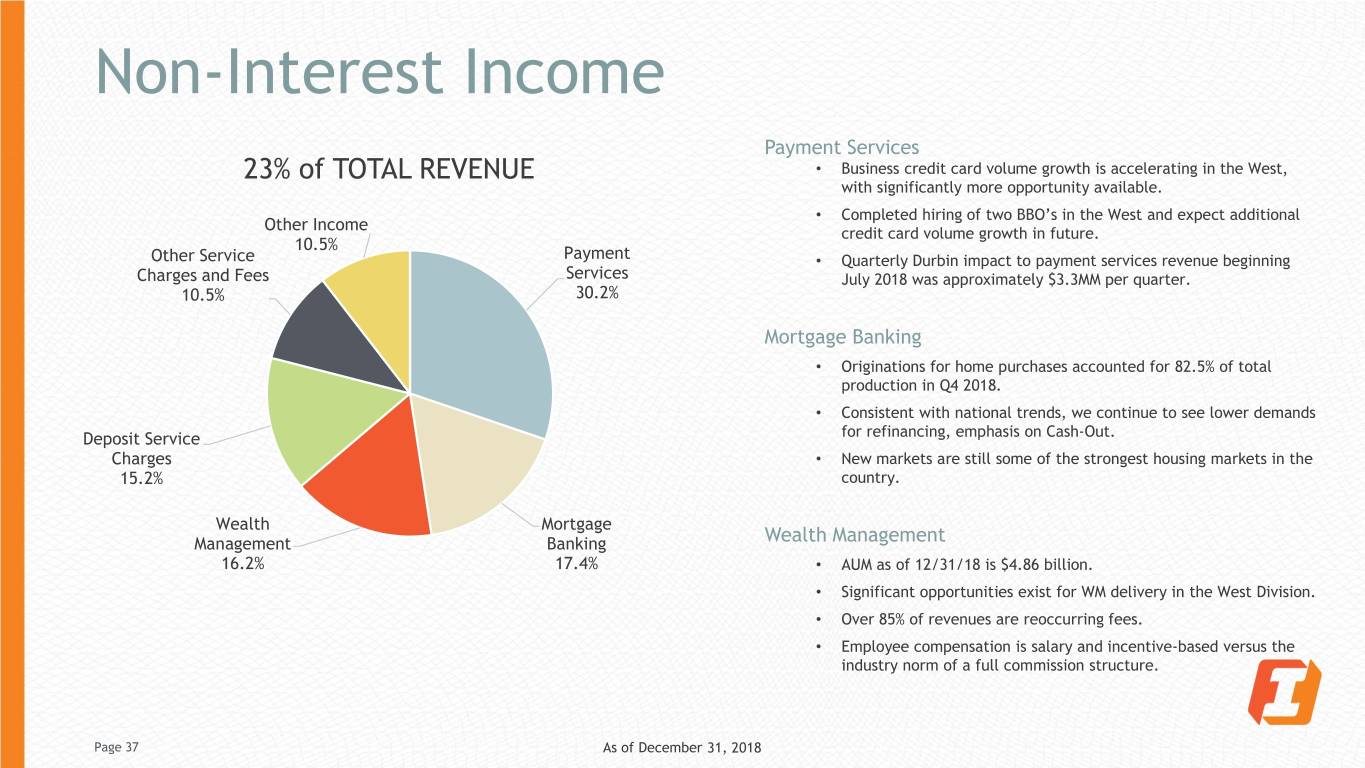

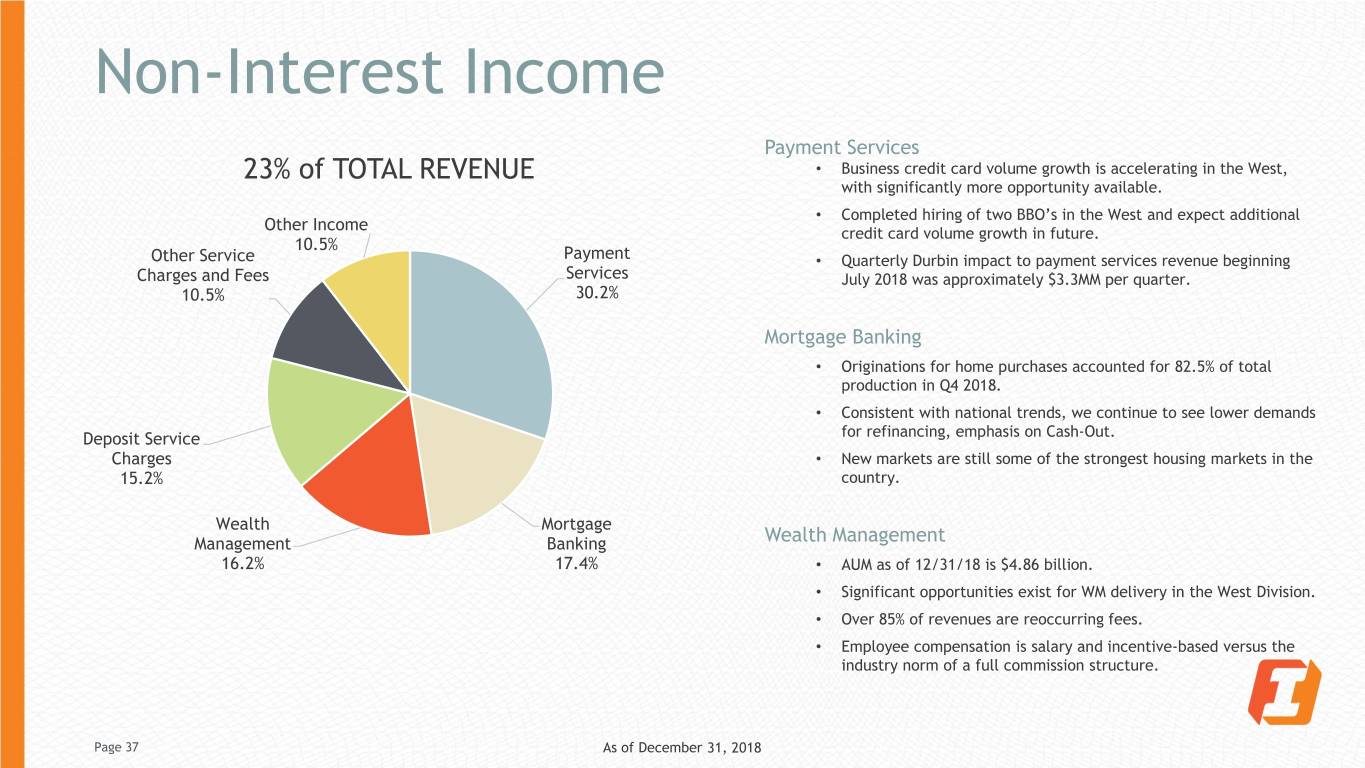

Non-Interest Income Payment Services 23% of TOTAL REVENUE • Business credit card volume growth is accelerating in the West, with significantly more opportunity available. • Completed hiring of two BBO’s in the West and expect additional Other Income credit card volume growth in future. 10.5% Other Service Payment • Quarterly Durbin impact to payment services revenue beginning Charges and Fees Services July 2018 was approximately $3.3MM per quarter. 10.5% 30.2% Mortgage Banking • Originations for home purchases accounted for 82.5% of total production in Q4 2018. • Consistent with national trends, we continue to see lower demands Deposit Service for refinancing, emphasis on Cash-Out. Charges • New markets are still some of the strongest housing markets in the 15.2% country. Wealth Mortgage Management Banking Wealth Management 16.2% 17.4% • AUM as of 12/31/18 is $4.86 billion. • Significant opportunities exist for WM delivery in the West Division. • Over 85% of revenues are reoccurring fees. • Employee compensation is salary and incentive-based versus the industry norm of a full commission structure. Page 37 As of December 31, 2018

Growth Strategies and Capital Allocation Page 38

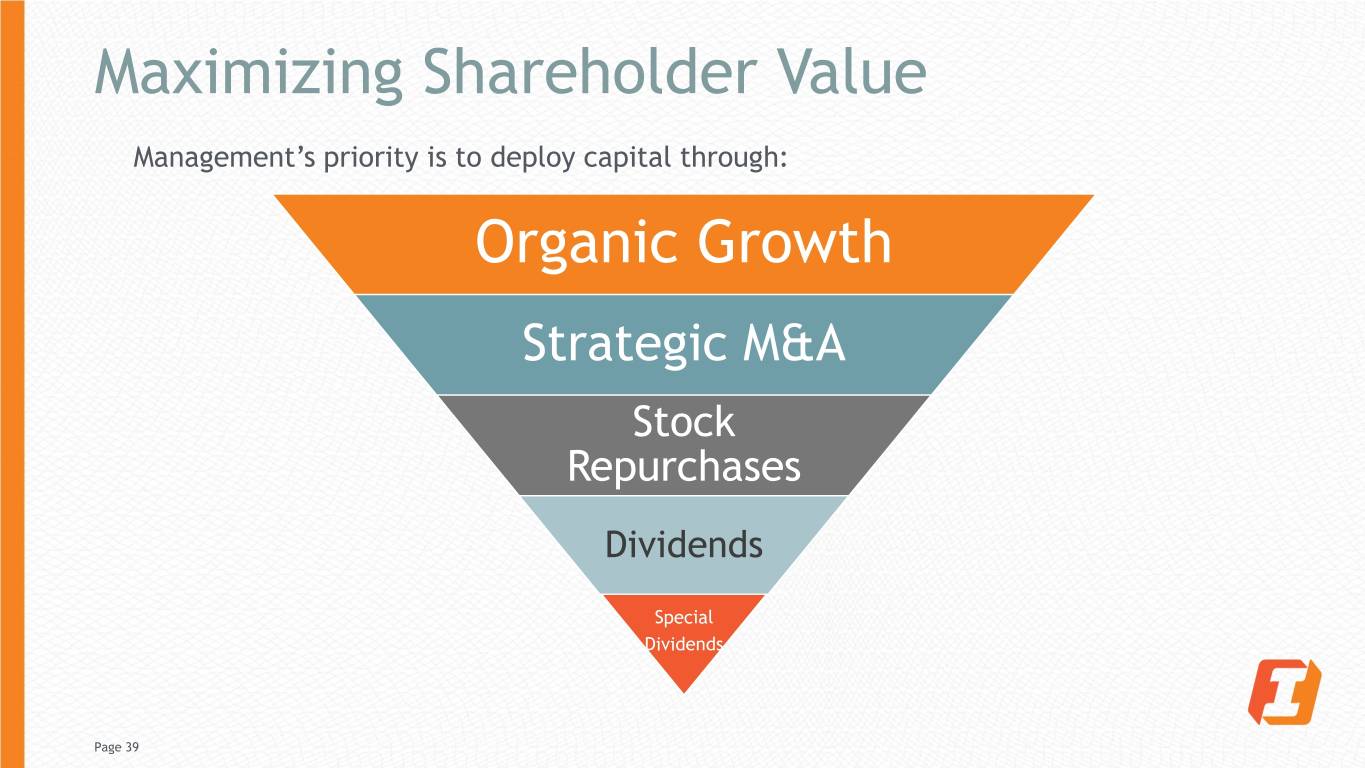

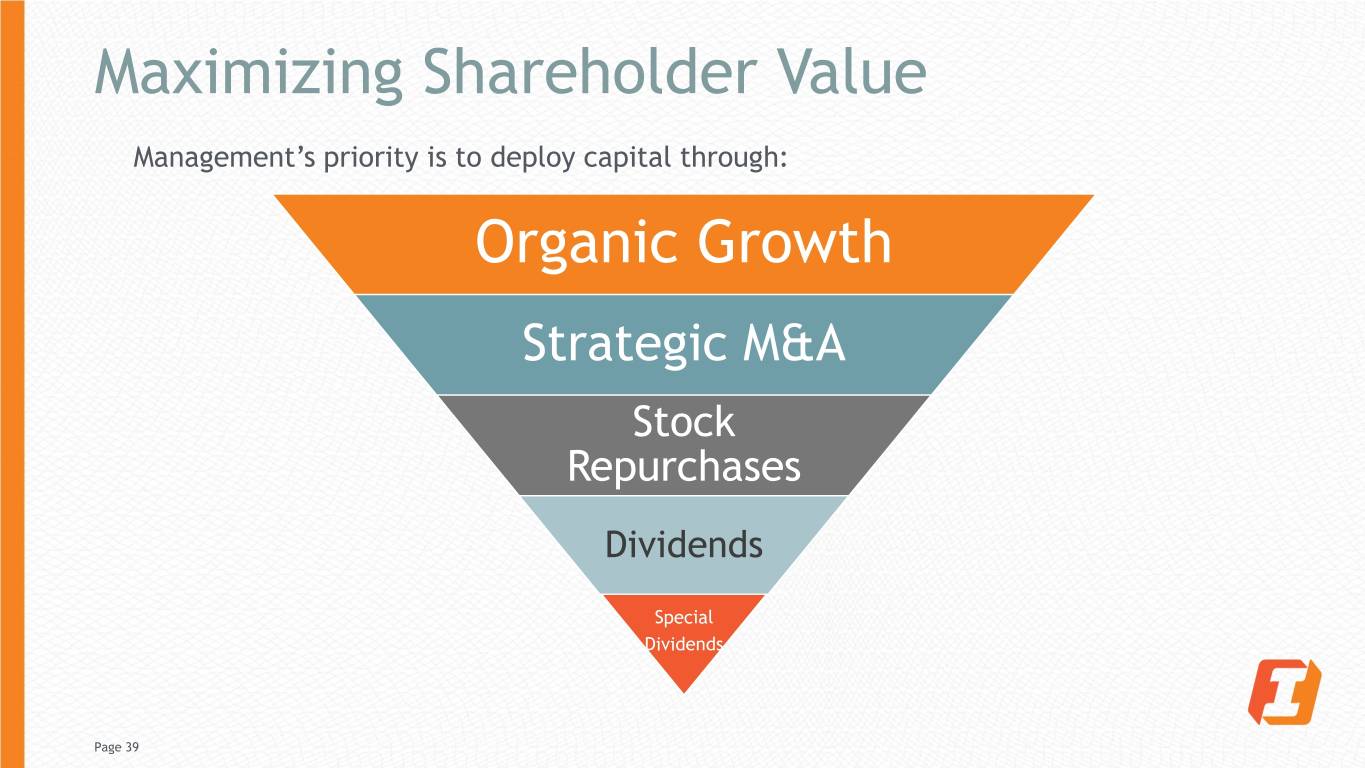

Maximizing Shareholder Value Management’s priority is to deploy capital through: Organic Growth Strategic M&A Stock Repurchases Dividends Special Dividends Page 39

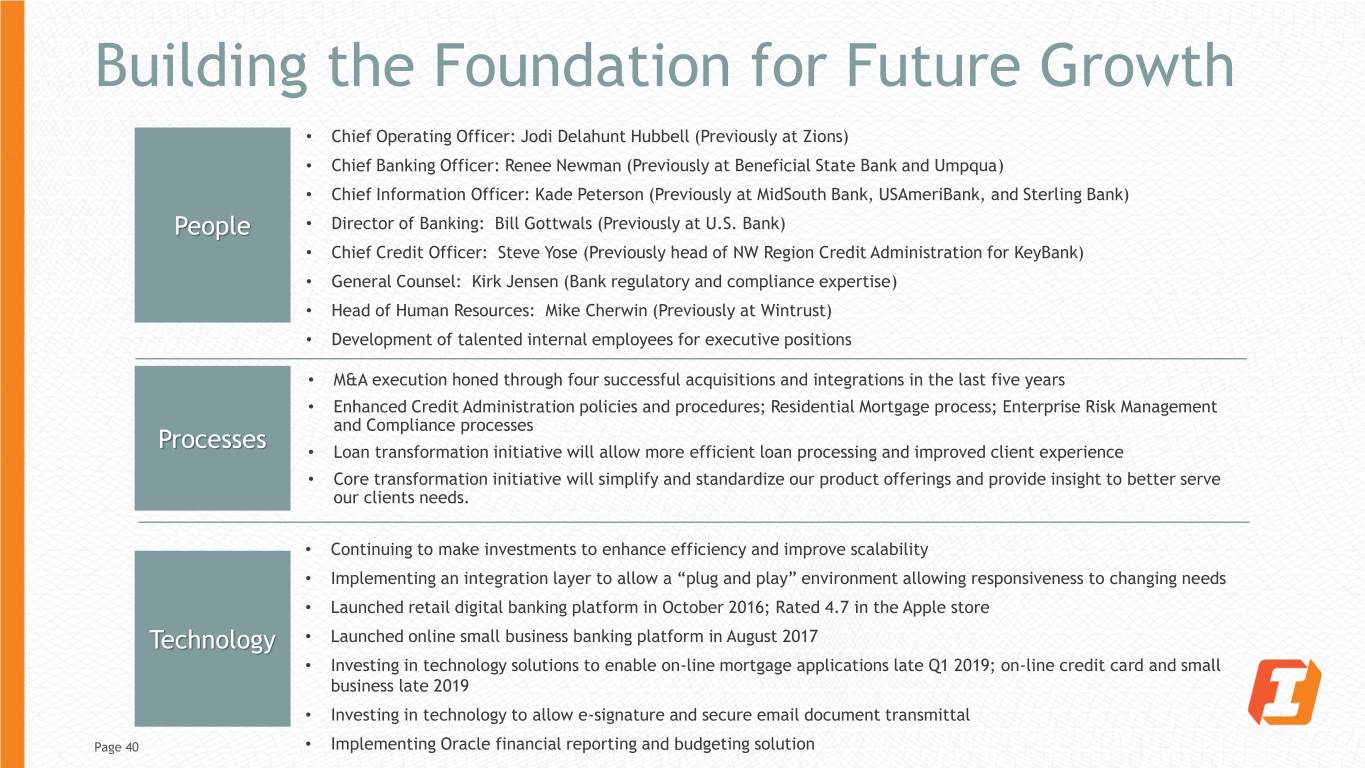

Building the Foundation for Future Growth • Chief Operating Officer: Jodi Delahunt Hubbell (Previously at Zions) • Chief Banking Officer: Renee Newman (Previously at Beneficial State Bank and Umpqua) • Chief Information Officer: Kade Peterson (Previously at MidSouth Bank, USAmeriBank, and Sterling Bank) People • Director of Banking: Bill Gottwals (Previously at U.S. Bank) • Chief Credit Officer: Steve Yose (Previously head of NW Region Credit Administration for KeyBank) • General Counsel: Kirk Jensen (Bank regulatory and compliance expertise) • Head of Human Resources: Mike Cherwin (Previously at Wintrust) • Development of talented internal employees for executive positions • M&A execution honed through four successful acquisitions and integrations in the last five years • Enhanced Credit Administration policies and procedures; Residential Mortgage process; Enterprise Risk Management and Compliance processes Processes • Loan transformation initiative will allow more efficient loan processing and improved client experience • Core transformation initiative will simplify and standardize our product offerings and provide insight to better serve our clients needs. • Continuing to make investments to enhance efficiency and improve scalability • Implementing an integration layer to allow a “plug and play” environment allowing responsiveness to changing needs • Launched retail digital banking platform in October 2016; Rated 4.7 in the Apple store Technology • Launched online small business banking platform in August 2017 • Investing in technology solutions to enable on-line mortgage applications late Q1 2019; on-line credit card and small business late 2019 • Investing in technology to allow e-signature and secure email document transmittal Page 40 • Implementing Oracle financial reporting and budgeting solution

Realignment of the Executive Team BOARD OF DIRECTORS Kevin Riley Chief Executive Officer Kirk Jensen Lisa Slayer-Bray Legal Counsel Executive Assistant Jolyn Kanning Lori Meyer Internal Audit Director of Enterprise Program Mgmt Renee Newman Jodi Delahunt Hubbell Marcy Mutch Phil Gaglia Kade Peterson Mike Cherwin Chief Banking Officer Chief Operating Officer Chief Financial Officer Chief Risk Officer Chief Information Officer Chief HR Officer Banking Network Loan Operations Controller Chief Credit Officer Technology HR Business Partners Deposit/Bank Digital Banking Treasurer Enterprise Risk Compensation Operations Treasury Management Financial Planning & Contact Center Compliance Benefits Operations Analytics Leadership Facilities Credit Review Client Experience Product Development Learning & Corporate Consumer Lending Investor Relations Communications Development ATM Payments Marketing Mortgage Operations Page 41 Wealth Management

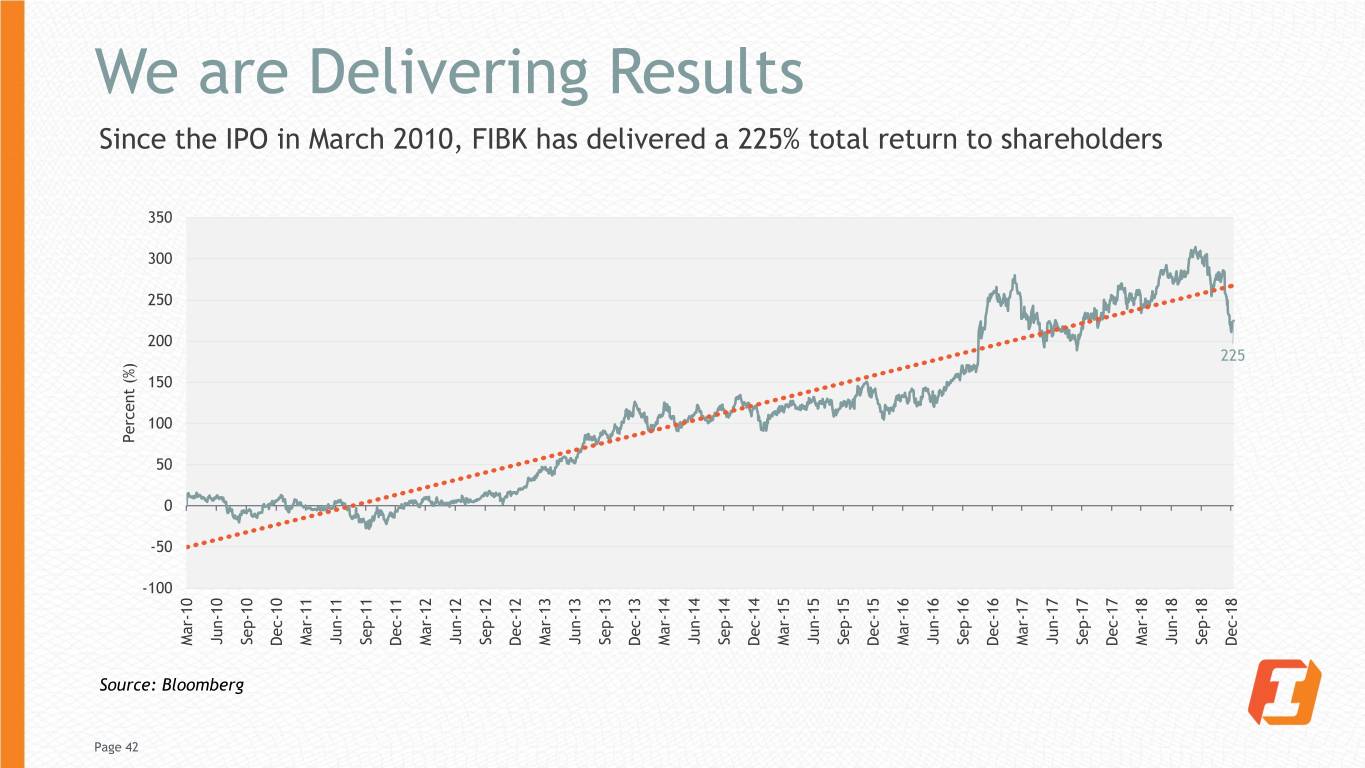

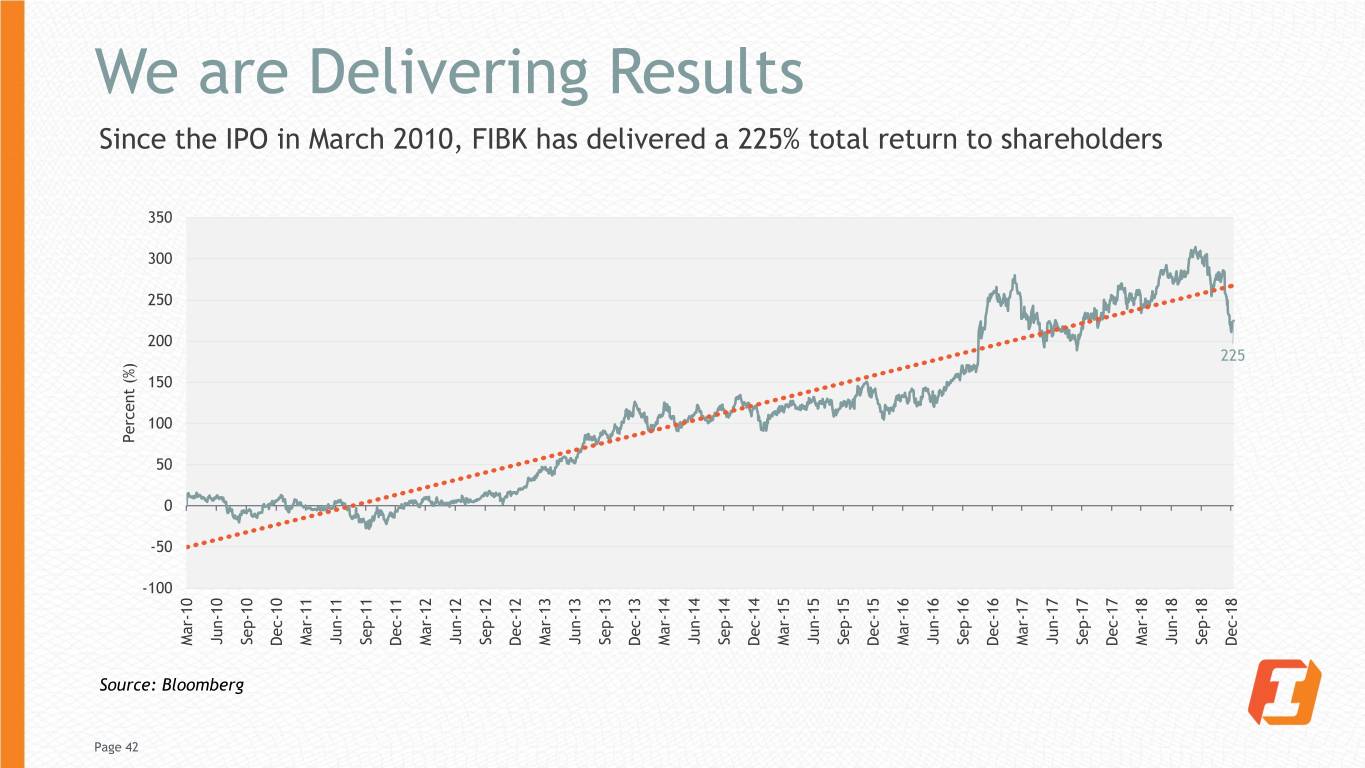

We are Delivering Results Since the IPO in March 2010, FIBK has delivered a 225% total return to shareholders 350 300 250 200 225 150 100 Percent (%) Percent 50 0 -50 -100 Jun-10 Jun-11 Jun-12 Jun-13 Jun-14 Jun-15 Jun-16 Jun-17 Jun-18 Sep-12 Sep-10 Sep-11 Sep-13 Sep-14 Sep-15 Sep-16 Sep-17 Sep-18 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17 Dec-18 Source: Bloomberg Page 42

Appendix Page 43

Strong Capital Allows Growth 16% 14% 12.99% 12.26% 12% 10% 8.39% 8% 6% 4% 2% 0% Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Total Risk Based Capital Tier 1 Risk Based Capital Tangible Common Equity to Tangible Assets Page 44 As of December 31, 2018

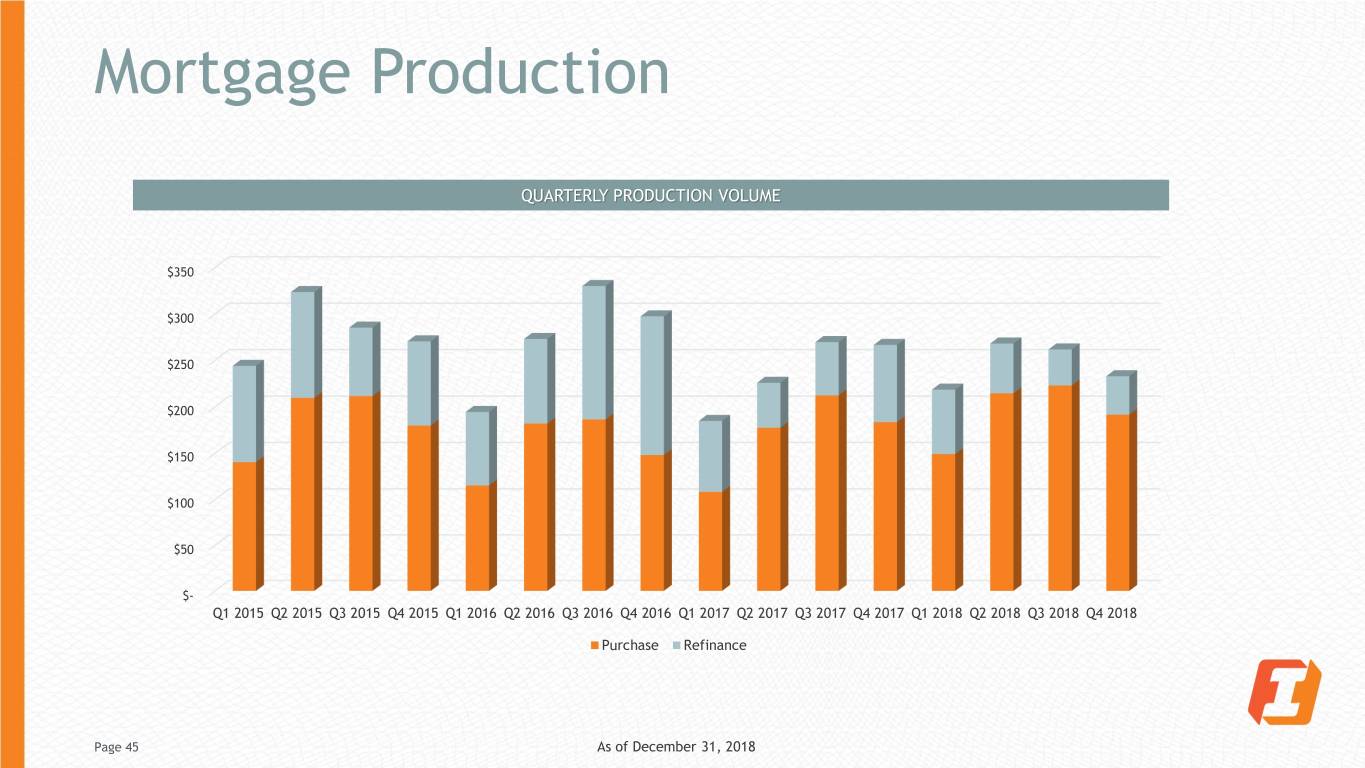

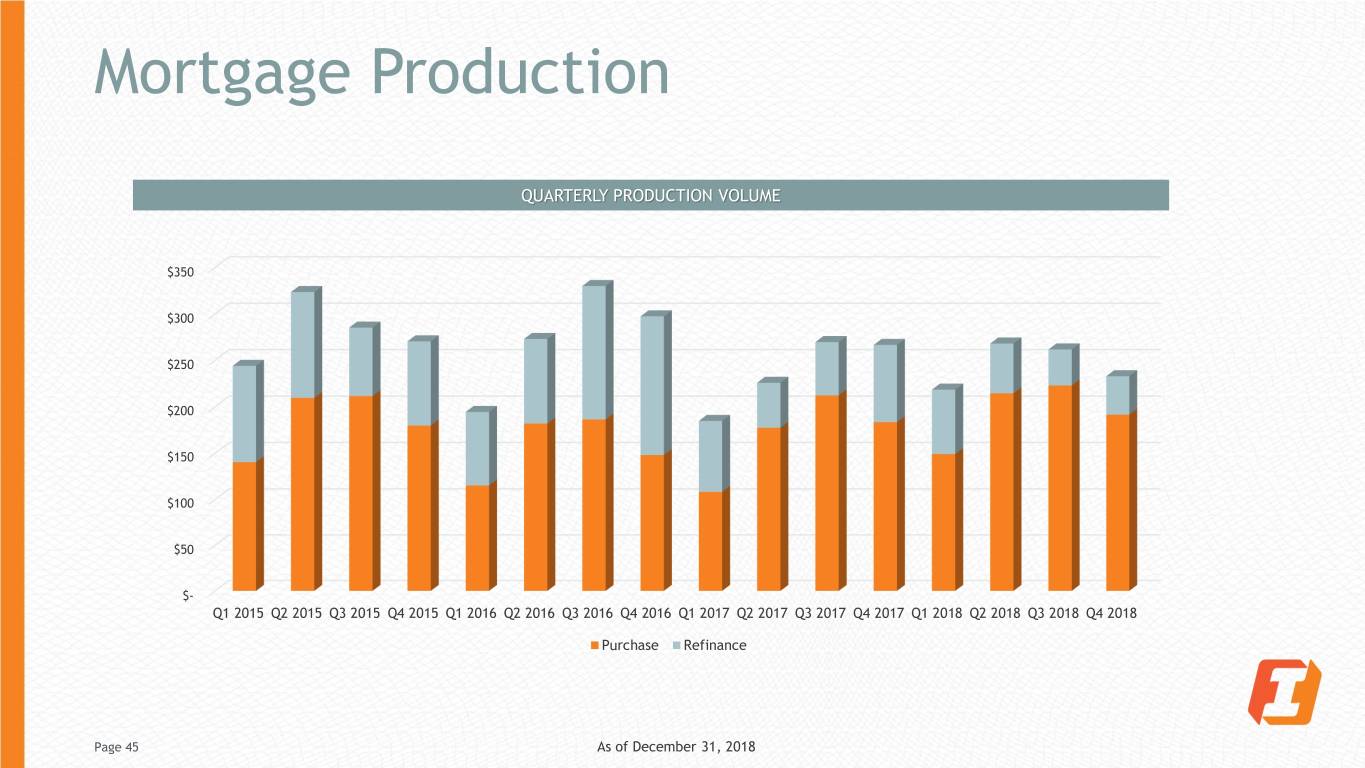

Mortgage Production QUARTERLY PRODUCTION VOLUME $350 $300 $250 $200 $150 $100 $50 $- Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Purchase Refinance Page 45 As of December 31, 2018

Credit Card: Industry Comparison BUSINESS GROSS DOLLAR VOLUME (GDV) GROWTH FIB vs. NATIONAL MONTHLY CHARGE-OFF AS A % of OUTSTANDING (LONG VIEW) 45.0% 1.00% FIB C/O National C/O FIB Mastercard Benchmark 40.0% 0.90% 35.0% 0.80% 30.0% 0.70% 0.60% 25.0% 0.50% 20.0% 0.40% 15.0% 0.30% 10.0% 0.20% 0.10% 5.0% 0.00% 0.0% 2010 2011 2012 2013 2014 2015 2016 2017 2018 *MasterCard updated peer group First Interstate continues to remain below national average Page 46

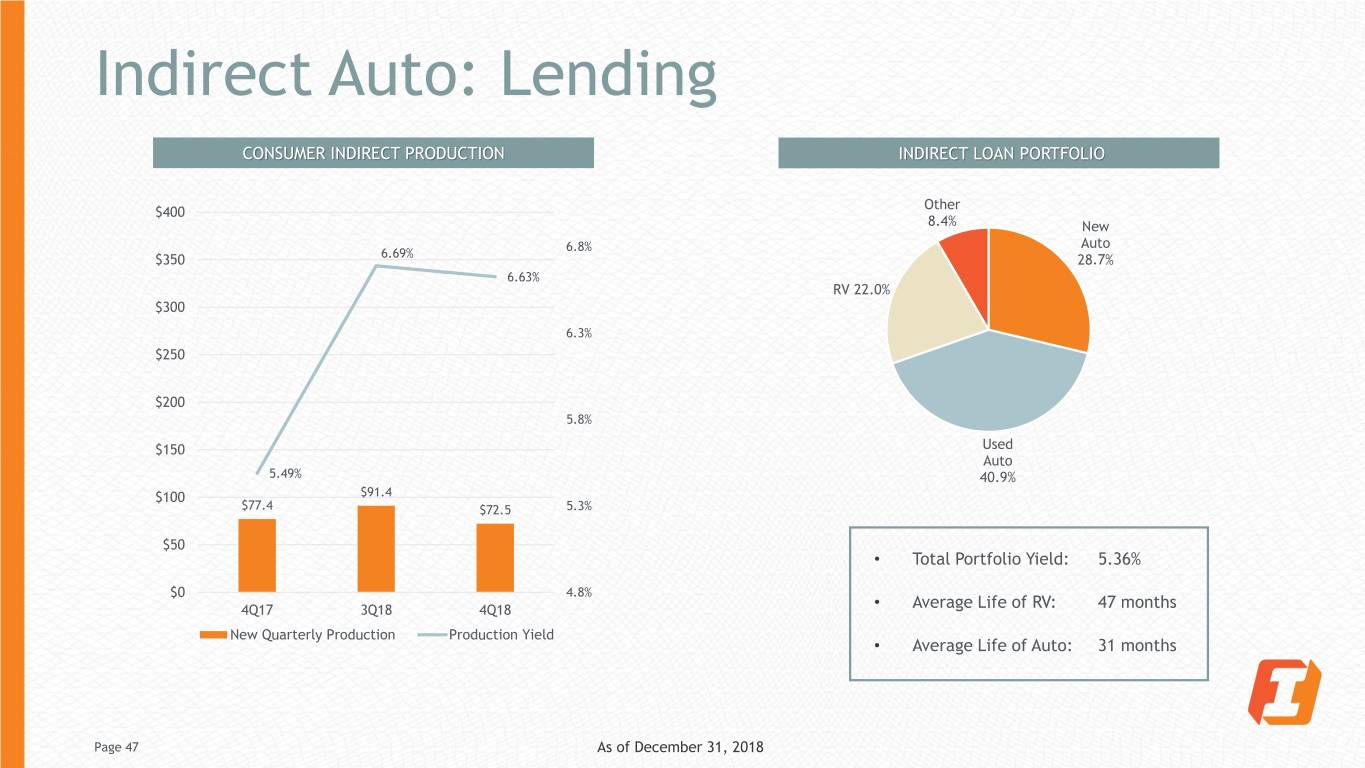

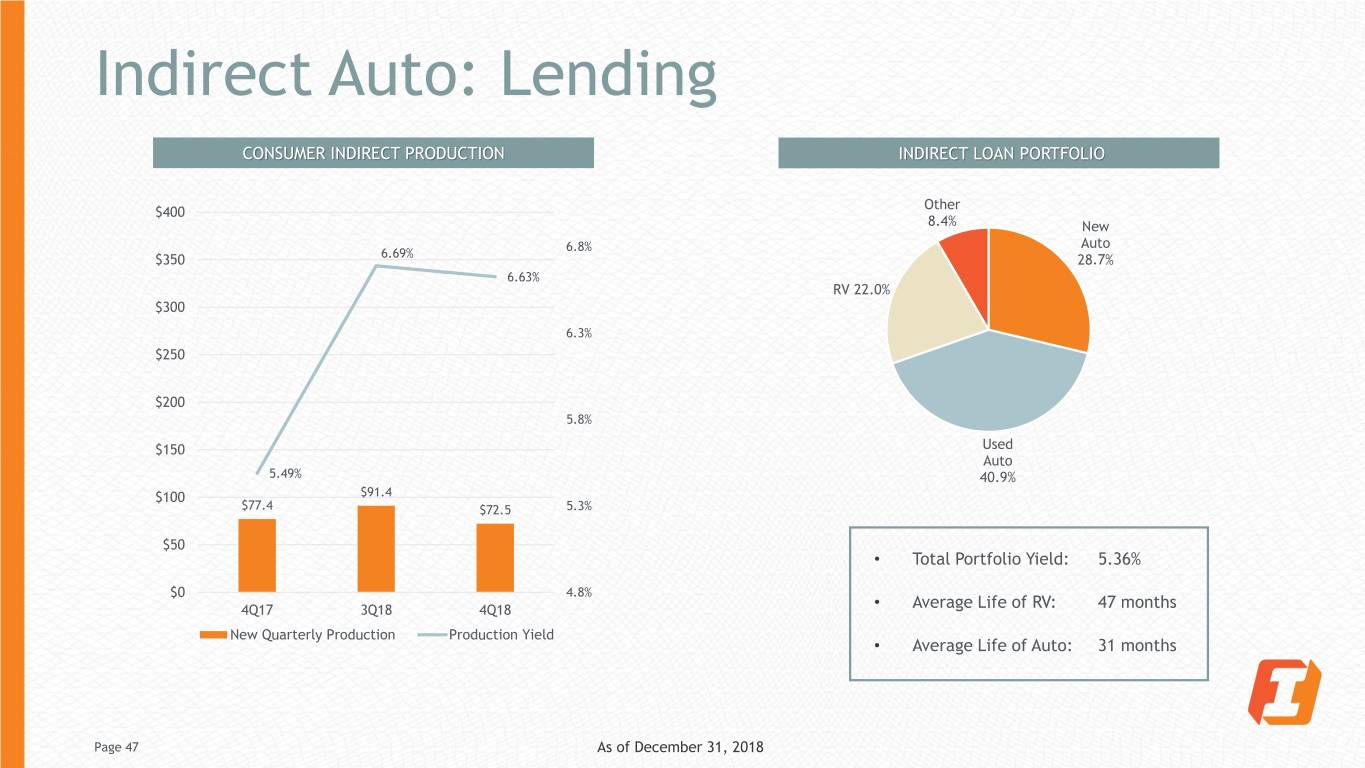

Indirect Auto: Lending CONSUMER INDIRECT PRODUCTION INDIRECT LOAN PORTFOLIO Other $400 8.4% New 6.8% Auto $350 6.69% 28.7% 6.63% RV 22.0% $300 6.3% $250 $200 5.8% $150 Used Auto 5.49% 40.9% $100 $91.4 $77.4 $72.5 5.3% $50 • Total Portfolio Yield: 5.36% $0 4.8% 4Q17 3Q18 4Q18 • Average Life of RV: 47 months New Quarterly Production Production Yield • Average Life of Auto: 31 months Page 47 As of December 31, 2018

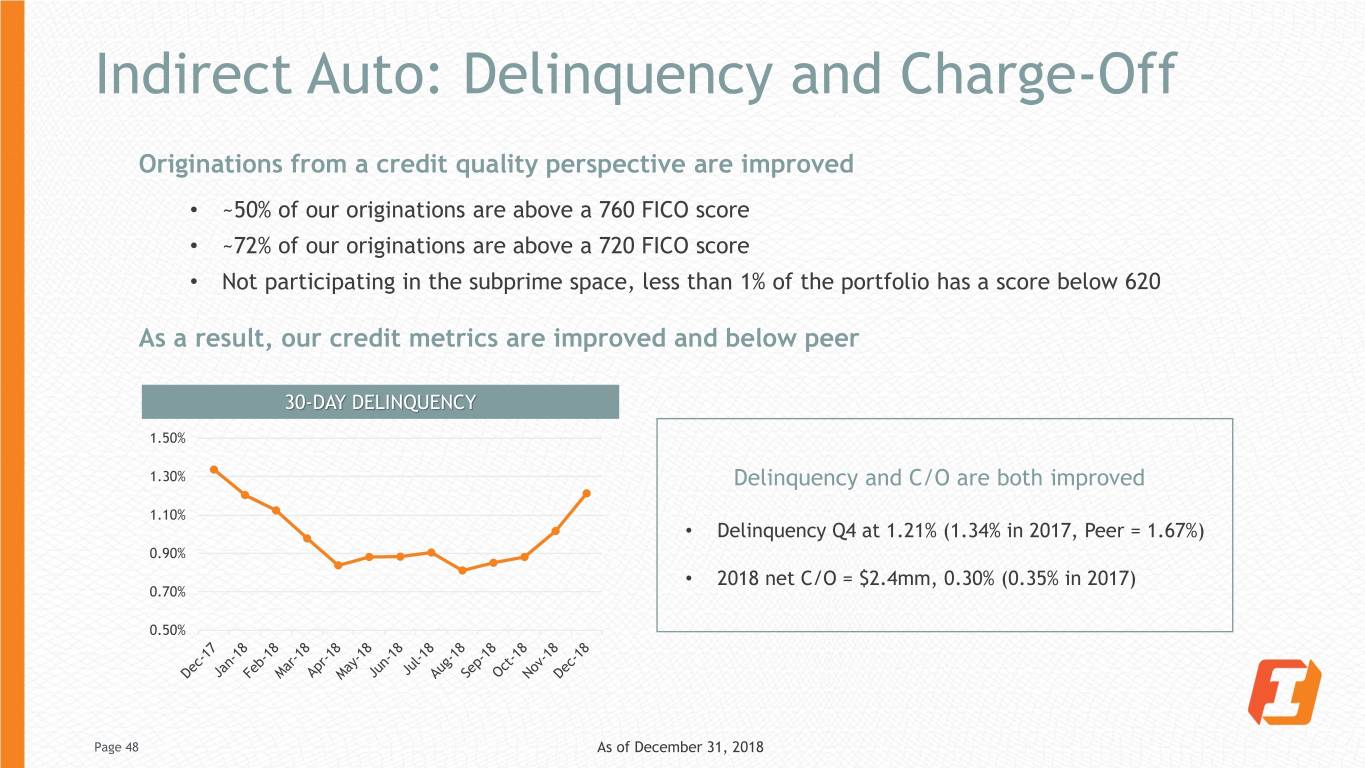

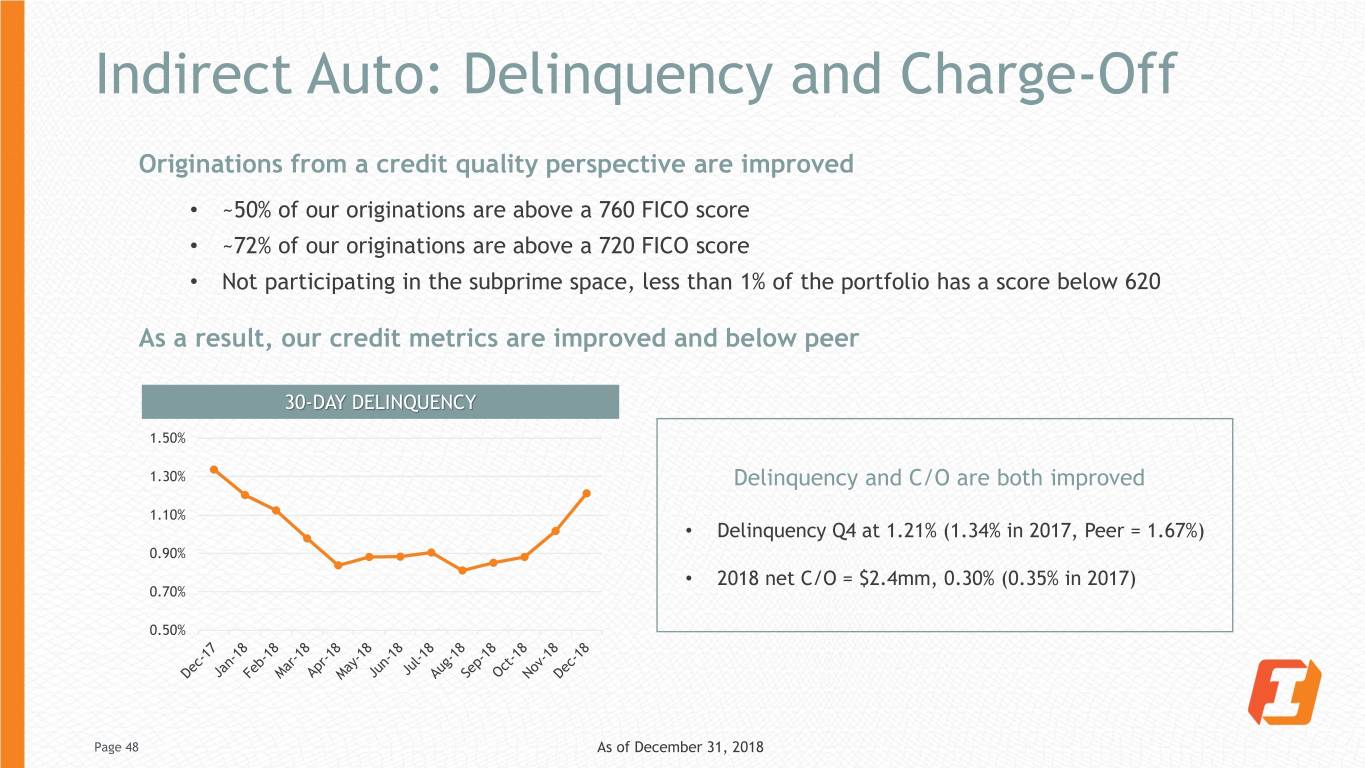

Indirect Auto: Delinquency and Charge-Off Originations from a credit quality perspective are improved • ~50% of our originations are above a 760 FICO score • ~72% of our originations are above a 720 FICO score • Not participating in the subprime space, less than 1% of the portfolio has a score below 620 As a result, our credit metrics are improved and below peer 30-DAY DELINQUENCY 1.50% 1.30% Delinquency and C/O are both improved 1.10% • Delinquency Q4 at 1.21% (1.34% in 2017, Peer = 1.67%) 0.90% • 2018 net C/O = $2.4mm, 0.30% (0.35% in 2017) 0.70% 0.50% Page 48 As of December 31, 2018

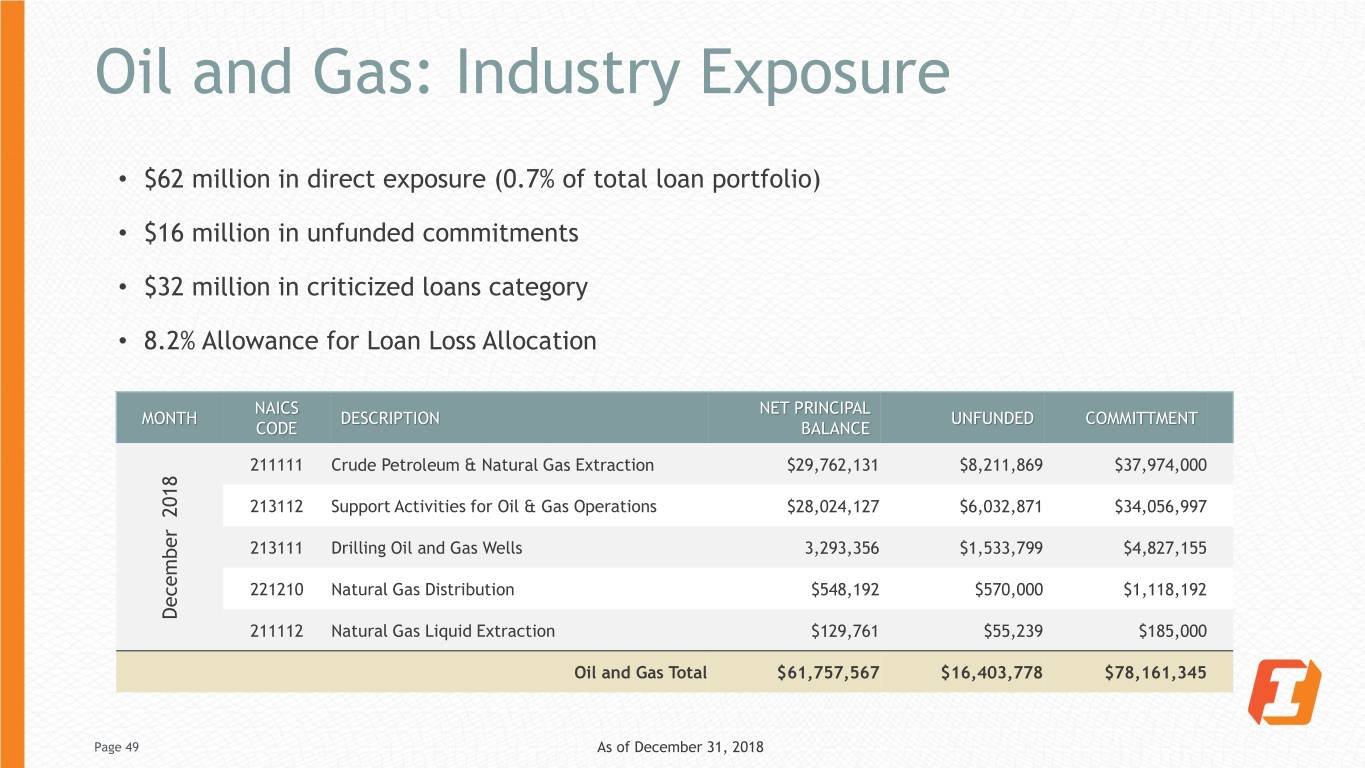

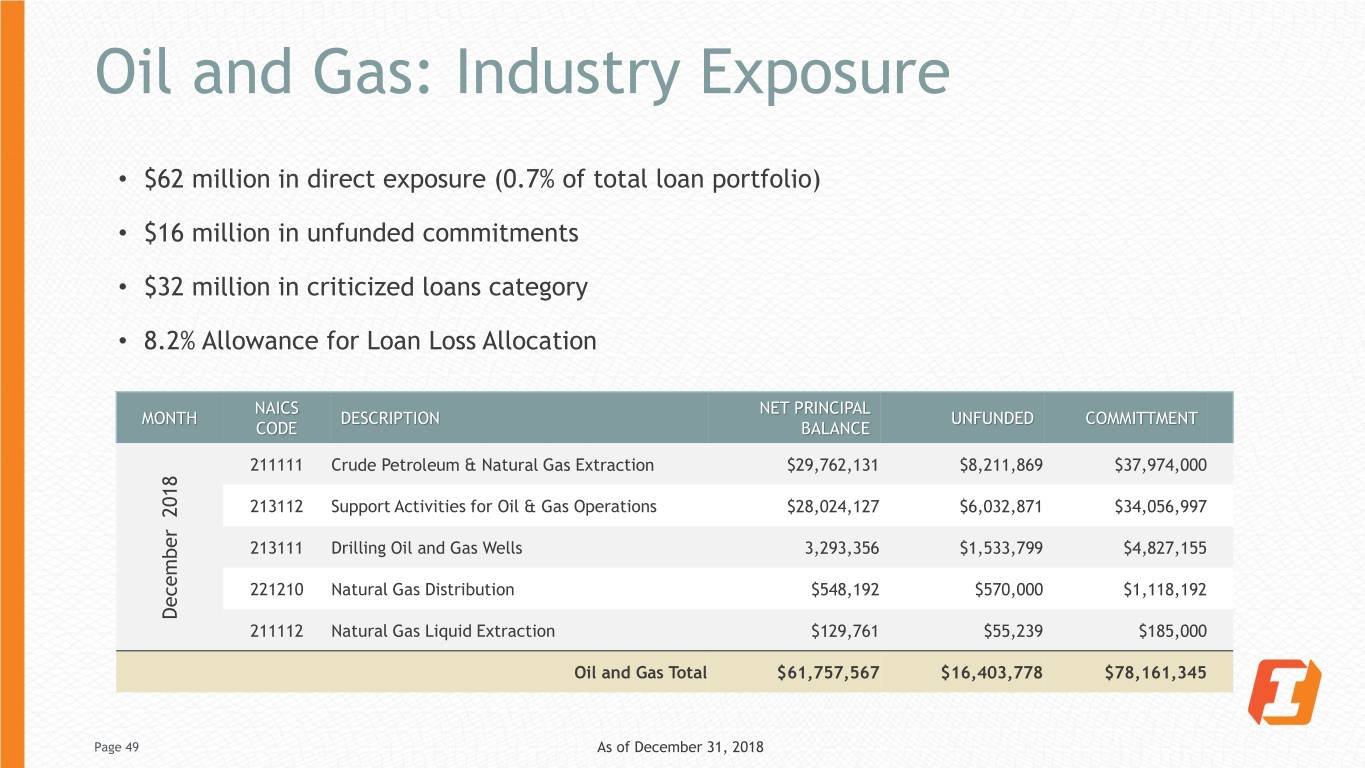

Oil and Gas: Industry Exposure • $62 million in direct exposure (0.7% of total loan portfolio) • $16 million in unfunded commitments • $32 million in criticized loans category • 8.2% Allowance for Loan Loss Allocation NAICS NET PRINCIPAL MONTH DESCRIPTION UNFUNDED COMMITTMENT CODE BALANCE 211111 Crude Petroleum & Natural Gas Extraction $29,762,131 $8,211,869 $37,974,000 213112 Support Activities for Oil & Gas Operations $28,024,127 $6,032,871 $34,056,997 213111 Drilling Oil and Gas Wells 3,293,356 $1,533,799 $4,827,155 221210 Natural Gas Distribution $548,192 $570,000 $1,118,192 December 2018 December 211112 Natural Gas Liquid Extraction $129,761 $55,239 $185,000 Oil and Gas Total $61,757,567 $16,403,778 $78,161,345 Page 49 As of December 31, 2018

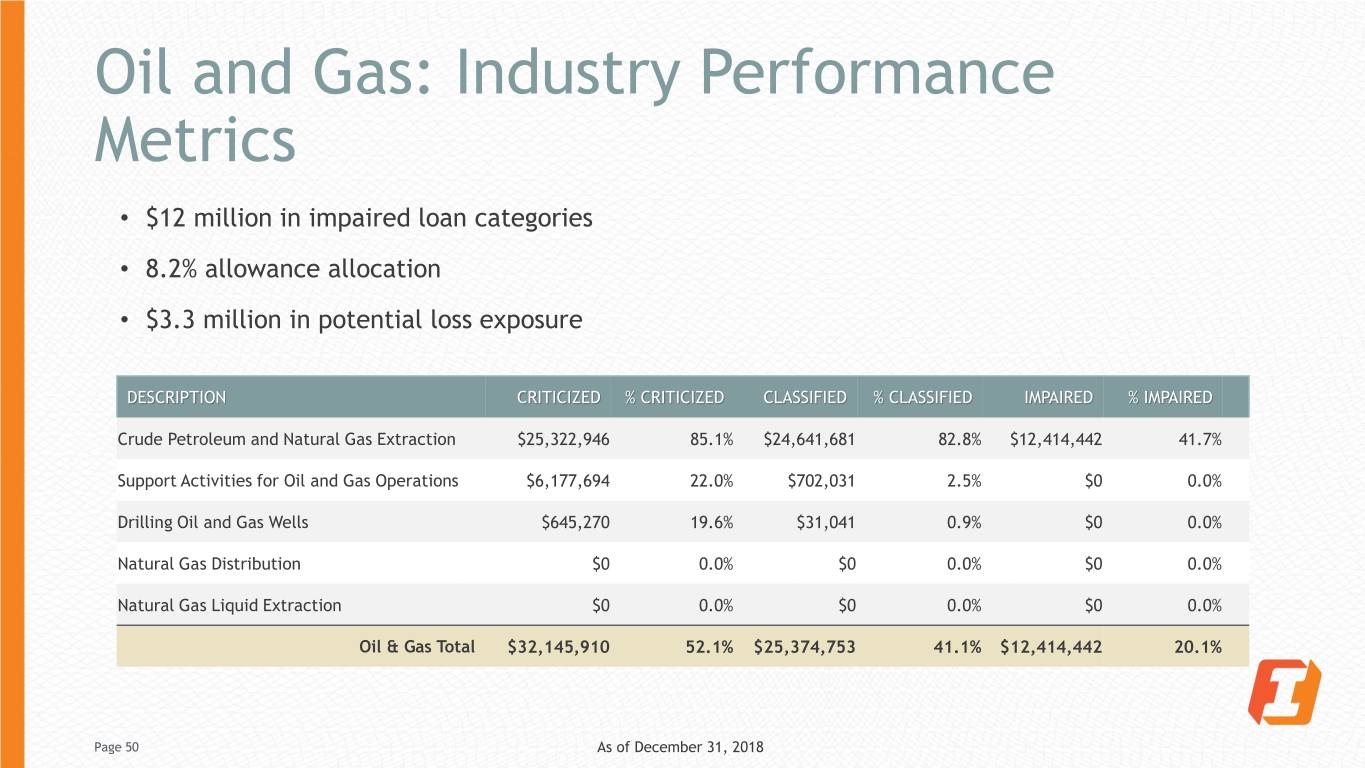

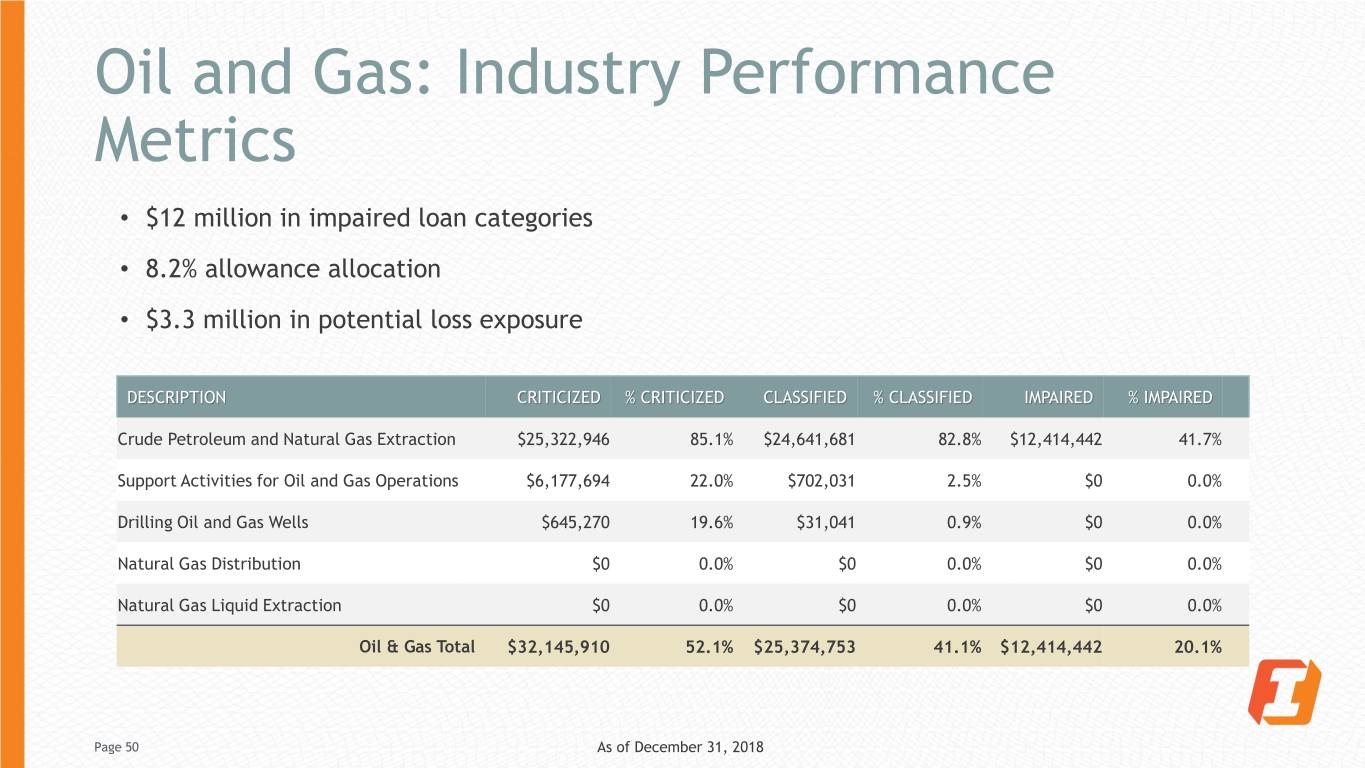

Oil and Gas: Industry Performance Metrics • $12 million in impaired loan categories • 8.2% allowance allocation • $3.3 million in potential loss exposure DESCRIPTION CRITICIZED % CRITICIZED CLASSIFIED % CLASSIFIED IMPAIRED % IMPAIRED Crude Petroleum and Natural Gas Extraction $25,322,946 85.1% $24,641,681 82.8% $12,414,442 41.7% Support Activities for Oil and Gas Operations $6,177,694 22.0% $702,031 2.5% $0 0.0% Drilling Oil and Gas Wells $645,270 19.6% $31,041 0.9% $0 0.0% Natural Gas Distribution $0 0.0% $0 0.0% $0 0.0% Natural Gas Liquid Extraction $0 0.0% $0 0.0% $0 0.0% Oil & Gas Total $32,145,910 52.1% $25,374,753 41.1% $12,414,442 20.1% Page 50 As of December 31, 2018

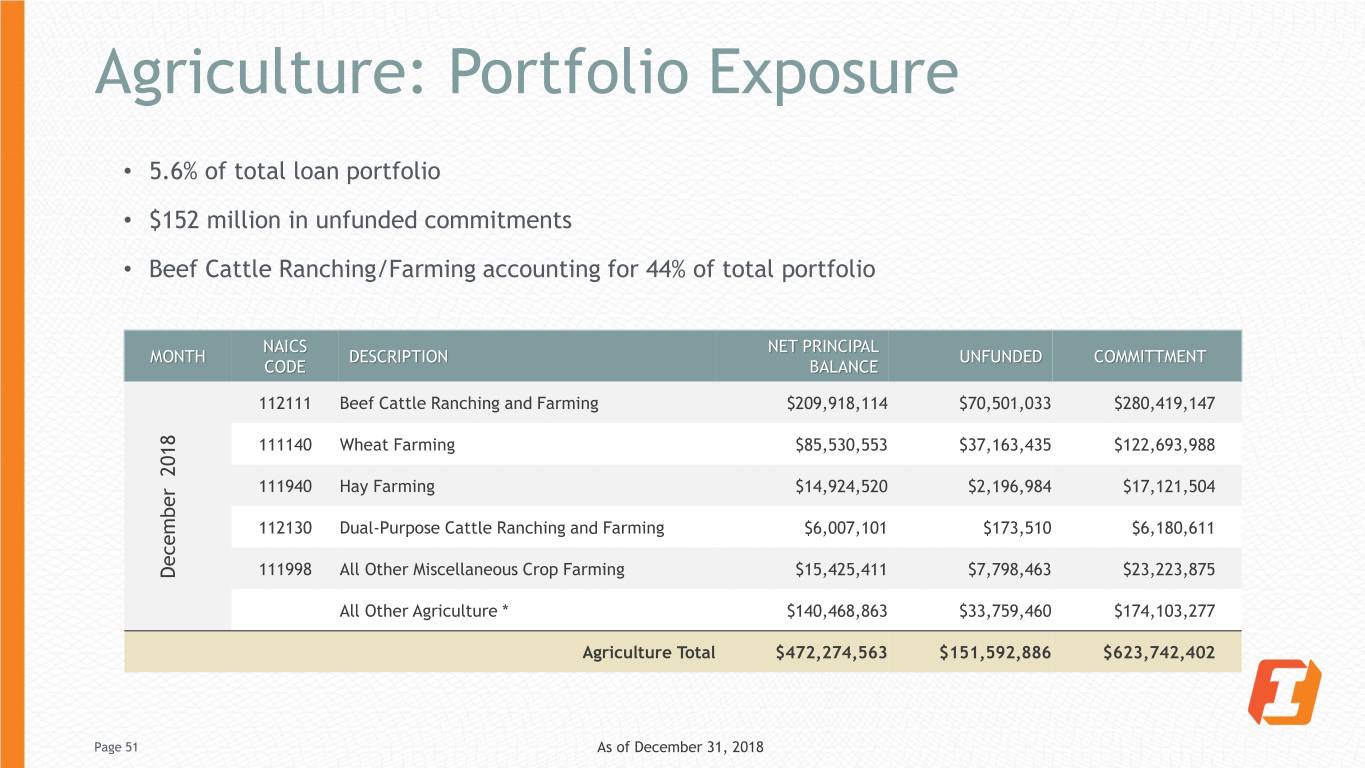

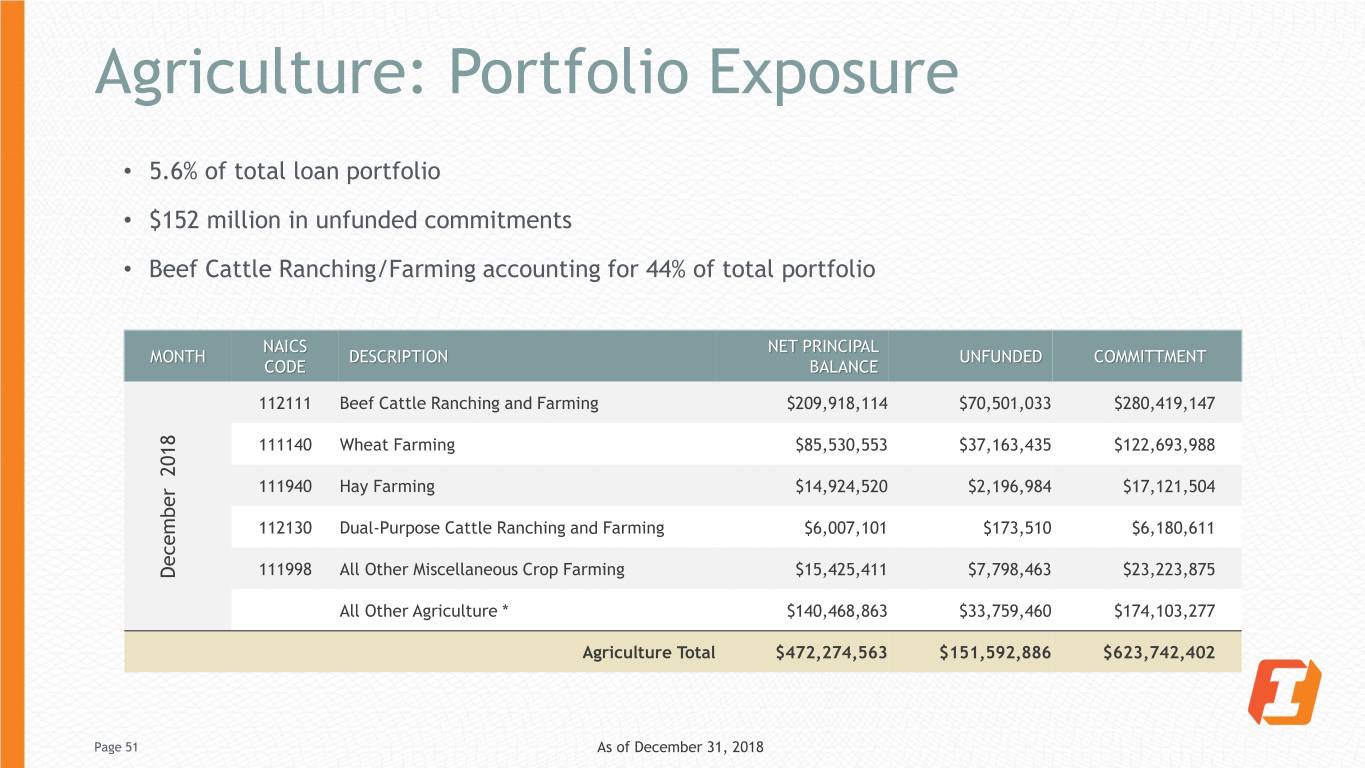

Agriculture: Portfolio Exposure • 5.6% of total loan portfolio • $152 million in unfunded commitments • Beef Cattle Ranching/Farming accounting for 44% of total portfolio NAICS NET PRINCIPAL MONTH DESCRIPTION UNFUNDED COMMITTMENT CODE BALANCE 112111 Beef Cattle Ranching and Farming $209,918,114 $70,501,033 $280,419,147 111140 Wheat Farming $85,530,553 $37,163,435 $122,693,988 111940 Hay Farming $14,924,520 $2,196,984 $17,121,504 112130 Dual-Purpose Cattle Ranching and Farming $6,007,101 $173,510 $6,180,611 December 2018 December 111998 All Other Miscellaneous Crop Farming $15,425,411 $7,798,463 $23,223,875 All Other Agriculture * $140,468,863 $33,759,460 $174,103,277 Agriculture Total $472,274,563 $151,592,886 $623,742,402 Page 51 As of December 31, 2018

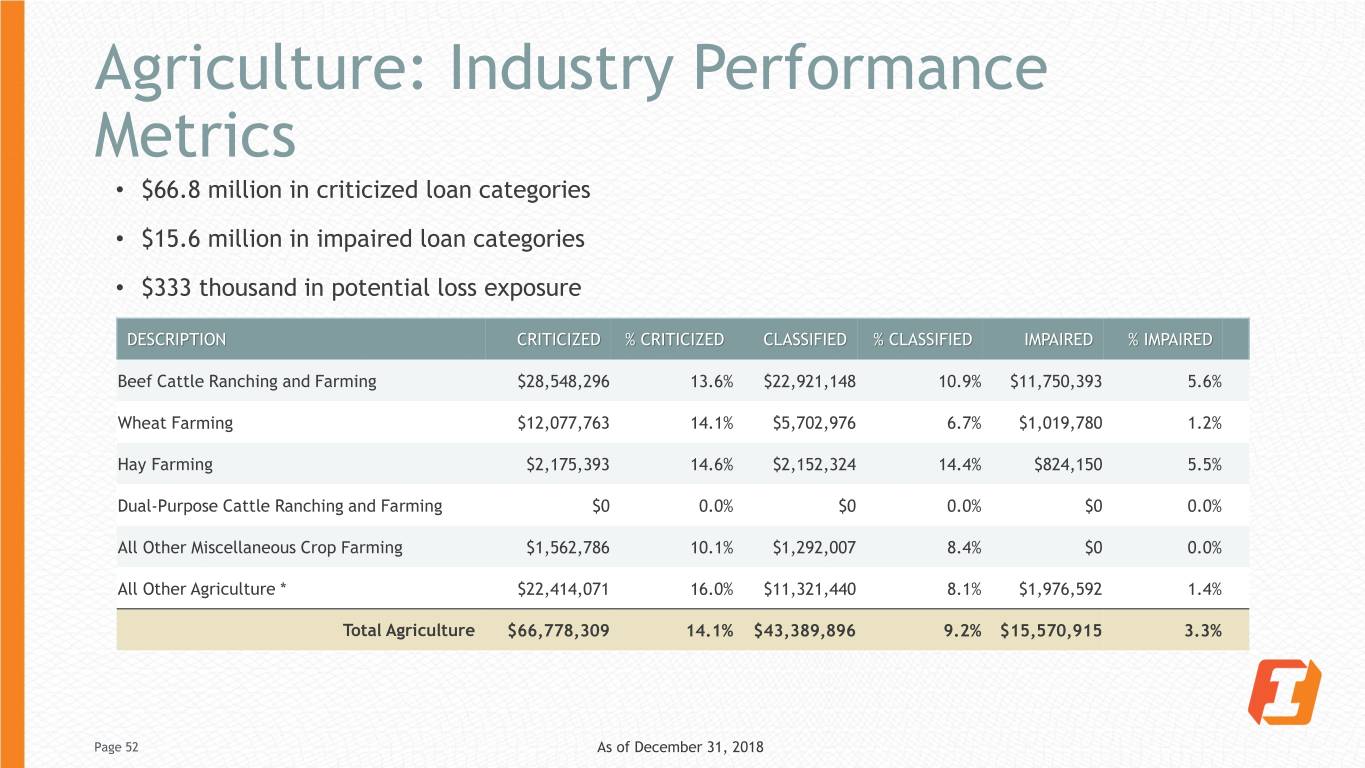

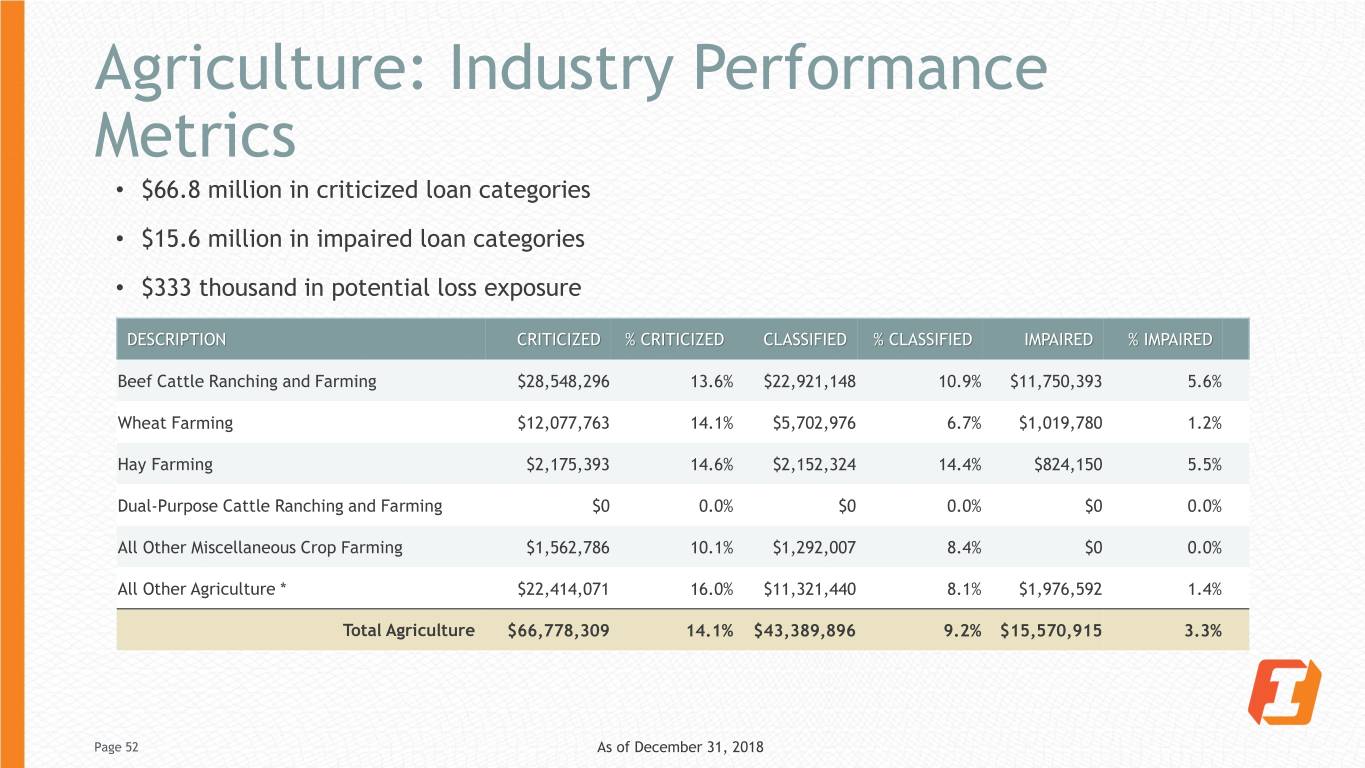

Agriculture: Industry Performance Metrics • $66.8 million in criticized loan categories • $15.6 million in impaired loan categories • $333 thousand in potential loss exposure DESCRIPTION CRITICIZED % CRITICIZED CLASSIFIED % CLASSIFIED IMPAIRED % IMPAIRED Beef Cattle Ranching and Farming $28,548,296 13.6% $22,921,148 10.9% $11,750,393 5.6% Wheat Farming $12,077,763 14.1% $5,702,976 6.7% $1,019,780 1.2% Hay Farming $2,175,393 14.6% $2,152,324 14.4% $824,150 5.5% Dual-Purpose Cattle Ranching and Farming $0 0.0% $0 0.0% $0 0.0% All Other Miscellaneous Crop Farming $1,562,786 10.1% $1,292,007 8.4% $0 0.0% All Other Agriculture * $22,414,071 16.0% $11,321,440 8.1% $1,976,592 1.4% Total Agriculture $66,778,309 14.1% $43,389,896 9.2% $15,570,915 3.3% Page 52 As of December 31, 2018

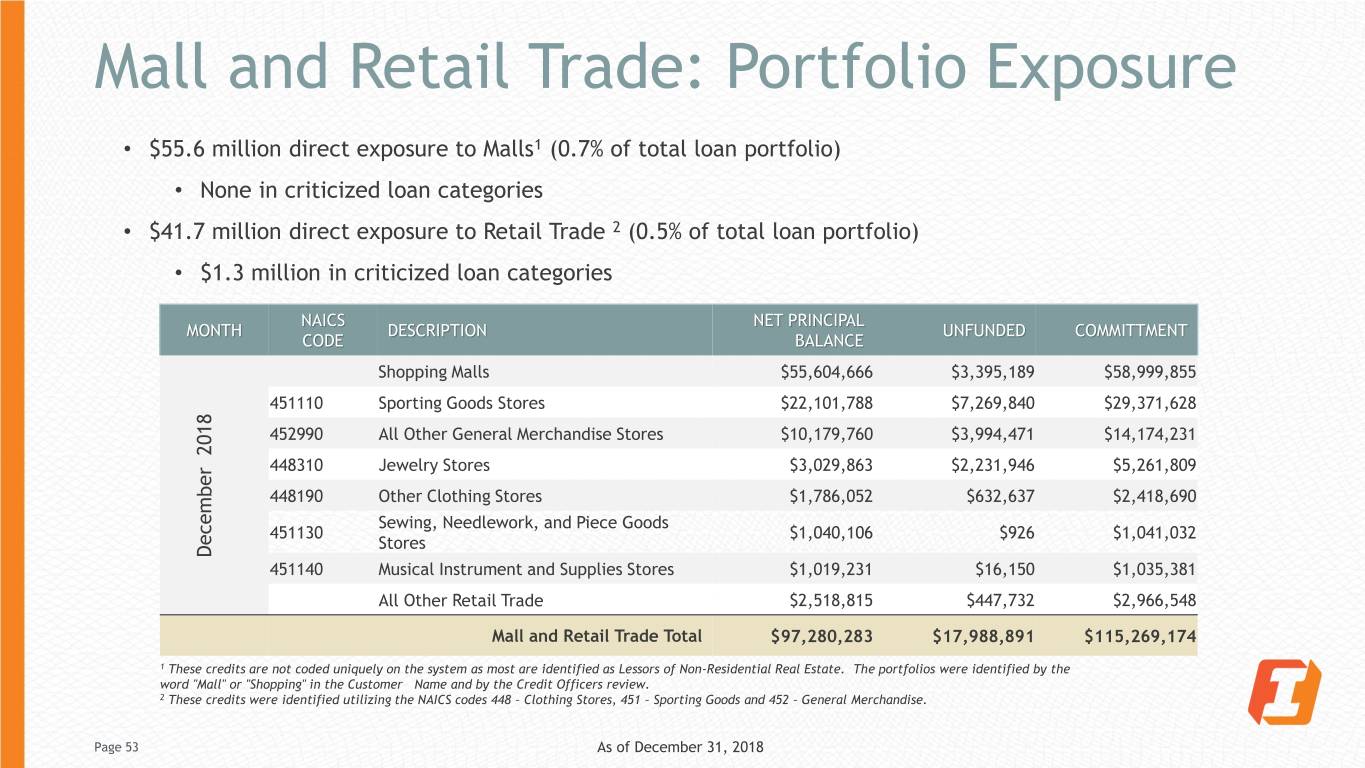

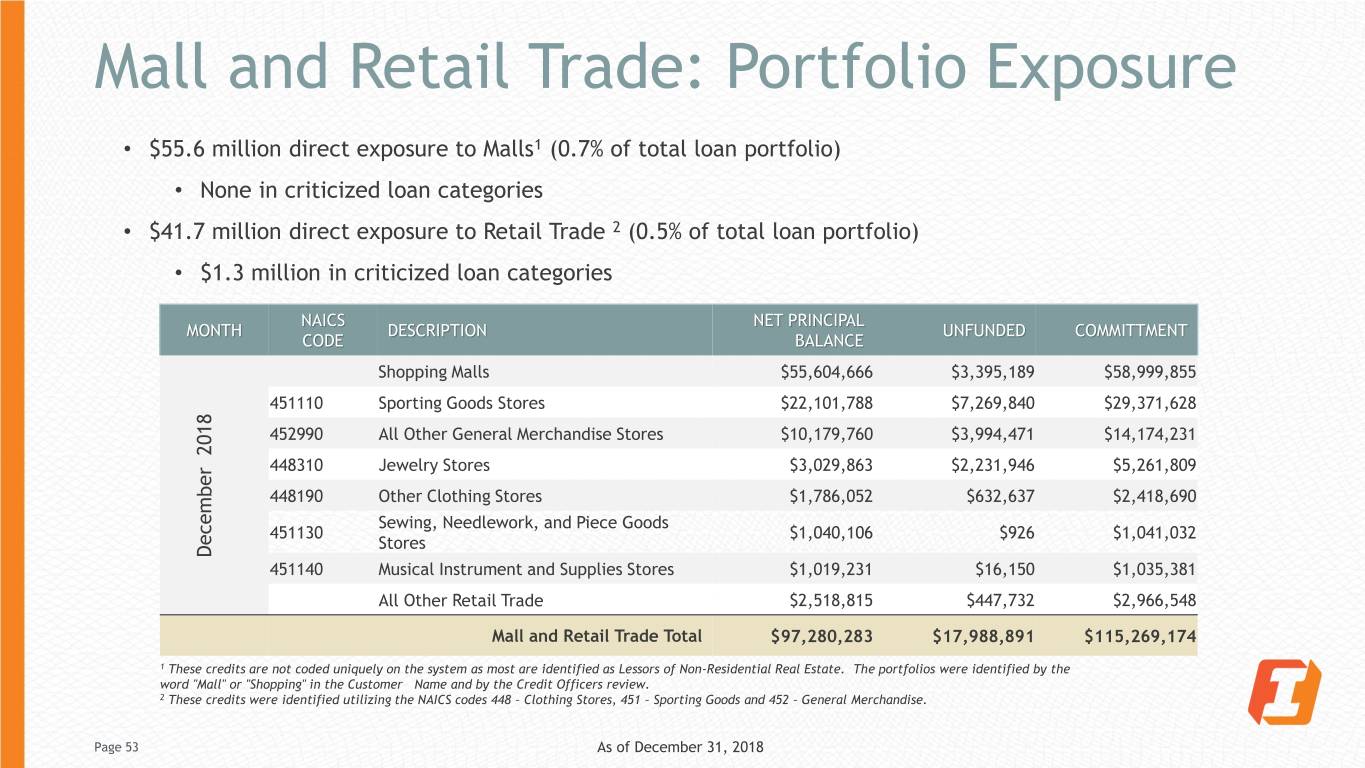

Mall and Retail Trade: Portfolio Exposure • $55.6 million direct exposure to Malls1 (0.7% of total loan portfolio) • None in criticized loan categories • $41.7 million direct exposure to Retail Trade 2 (0.5% of total loan portfolio) • $1.3 million in criticized loan categories NAICS NET PRINCIPAL MONTH DESCRIPTION UNFUNDED COMMITTMENT CODE BALANCE Shopping Malls $55,604,666 $3,395,189 $58,999,855 451110 Sporting Goods Stores $22,101,788 $7,269,840 $29,371,628 452990 All Other General Merchandise Stores $10,179,760 $3,994,471 $14,174,231 448310 Jewelry Stores $3,029,863 $2,231,946 $5,261,809 448190 Other Clothing Stores $1,786,052 $632,637 $2,418,690 Sewing, Needlework, and Piece Goods 451130 $1,040,106 $926 $1,041,032 Stores December 2018 December 451140 Musical Instrument and Supplies Stores $1,019,231 $16,150 $1,035,381 All Other Retail Trade $2,518,815 $447,732 $2,966,548 Mall and Retail Trade Total $97,280,283 $17,988,891 $115,269,174 1 These credits are not coded uniquely on the system as most are identified as Lessors of Non-Residential Real Estate. The portfolios were identified by the word "Mall" or "Shopping" in the Customer Name and by the Credit Officers review. 2 These credits were identified utilizing the NAICS codes 448 – Clothing Stores, 451 – Sporting Goods and 452 – General Merchandise. Page 53 As of December 31, 2018