- FIBK Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

First Interstate BancSystem (FIBK) DEF 14ADefinitive proxy

Filed: 11 Apr 24, 4:24pm

☒ | No fee required. | |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

1) Title of each class of securities to which transaction applies: | ||

2) Aggregate number of securities to which transaction applies: | ||

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

4) Proposed maximum aggregate value of transaction: | ||

5) Total fee paid: | ||

☐ | Fee paid previously with preliminary materials. | |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

1) Amount Previously Paid: | ||

2) Form, Schedule or Registration Statement No.: | ||

3) Filing Party: | ||

4) Date Filed: | ||

Date: | Time: | Location: |

May 22, 2024 | 4:00 p.m. MT | First Interstate Great West Center |

1800 6th Avenue North | ||

Billings, Montana |

Kirk D. Jensen | ||

Corporate Secretary |

Table of Contents |

Director Compensation . . . . . . . . . | ||||||

A-1 | ||||||

B-1 | ||||||

Time and Date: | 4:00 p.m., Mountain Time, Wednesday, May 22, 2024 |

Place: | First Interstate Great West Center, 1800 Sixth Avenue North, Billings, Montana 59101 |

Record Date: | Close of business on Friday, March 22, 2024 |

Voting: | Shareholders of record as of the record date are entitled to vote the shares of our common stock that they held as of the record date at the meeting. Each outstanding share of common stock entitles its holder to cast one vote on all matters submitted to a vote of shareholders at the annual meeting. |

Attendance: | If you plan to attend the annual meeting in person, you must bring the Notice of Internet Availability of Proxy Materials. If your shares are not registered in your name, you will need a legal proxy, account statement, or other documentation confirming your First Interstate BancSystem, Inc. holdings from the broker, bank, or other institution that is the record holder of your shares. You will also need a valid, government-issued picture identification that matches your Notice of Internet Availability of Proxy Materials, legal proxy, or other confirming documentation. |

Adjournments: | Any action on the items of business described above may be considered at the annual meeting at the time and on the date specified above or at any time and date to which the annual meeting may be properly adjourned or postponed. |

2023 Proxy Statement | 1 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 2 | First Interstate BancSystem, Inc. |

$257.5 | $2.48 | 8.17% | / | 13.32% | $31.05 | / | $19.41 | |||||||||||

Net Income | Diluted Earnings Per Share | ROAE / ROATCE* | BVPS / TBVPS* | |||||||||||||||

2023 Proxy Statement | 3 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 4 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 5 | First Interstate BancSystem, Inc. |

☑ | All Board Committees are chaired by independent directors; |

☑ | Regular executive sessions of independent directors; |

☑ | Equity ownership guidelines for directors and executive officers; and |

☑ | Cash and equity awards with clawback provisions. |

2023 Proxy Statement | 6 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 7 | First Interstate BancSystem, Inc. |

What We Do... | What We Do Not Do... | |||

☑ | Emphasize pay for performance | ý | Allow for short-selling, hedging, or pledging of Company securities by Company insiders | |

☑ | Use multiple performance measures and caps on potential incentive payments | ý | Allow "single-trigger" accelerated vesting of equity-based awards upon change in control | |

☑ | Engage an independent compensation consultant | ý | Grant excessive perquisites | |

☑ | Require minimum equity ownership for directors and executive officers | ý | Pay excise tax "gross ups" upon change in control | |

☑ | Maintain a clawback policy | ý | Reprice or liberally recycle shares | |

☑ | Discourage excessive risk taking by reserving the right to use discretion in the payout of all incentives | ý | Trade in Company securities during designated black-out periods, except under limited circumstances including valid rule 10b5-1 trading plans | |

2023 Proxy Statement | 8 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 9 | First Interstate BancSystem, Inc. |

1 Pursuant to a stockholder’s agreement the Company entered into in 2021 with members of the Scott Family in connection with the Company’s acquisition of Great Western Bancorp. The stockholder’s agreement is discussed below under the caption “Director Nomination, Selection, and Qualifications”. | |

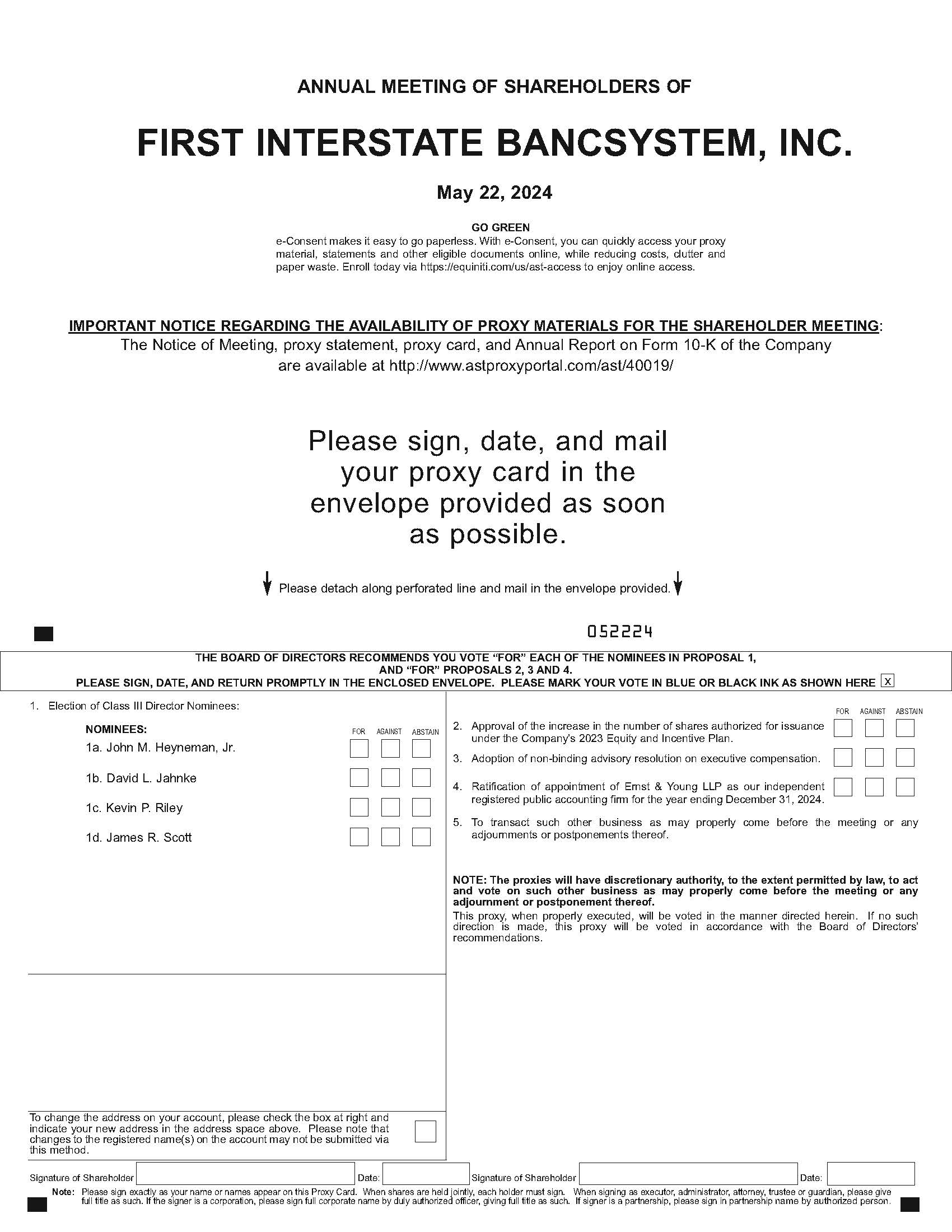

Name and Age | Director Since | Principal Occupation |

John M. Heyneman, Jr., 56 | 2010 | Managing Partner, Awe LLC and Towanda Investments LLC |

David L. Jahnke, 70 | 2011 | Board Chair, First Interstate BancSystem, Inc.; Retired Partner, KPMG |

Kevin P. Riley, 64 | 2015 | President and CEO, First Interstate BancSystem, Inc. |

James R. Scott, 74 | 1971 | Former Board Chair, First Interstate BancSystem, Inc. |

2023 Proxy Statement | 10 | First Interstate BancSystem, Inc. |

Name and Age | Director Since | Class | Term Expires | Principal Occupation | ||||

Stephen B. Bowman, 60 | 2021 | I | 2025 | Retired CFO, The Northern Trust Corporation | ||||

Alice S. Cho, 57 | 2020 | II | 2026 | Senior Advisor, Boston Consulting Group | ||||

Frances P. Grieb, 63 | 2022 | I | 2025 | Retired Partner, Deloitte LLP | ||||

Thomas E. Henning, 71 | 2022 | II | 2026 | Manager, Henning LLC | ||||

Dennis L. Johnson, 69 | 2017 | II | 2026 | Retired President and CEO, United Heritage Mutual Holding Company | ||||

Stephen M. Lacy, 70 | 2022 | I | 2025 | Retired CEO, Meredith Corporation | ||||

Patricia L. Moss, 70 | 2017 | II | 2026 | Retired President and CEO, Cascade Bancorp. | ||||

Joyce A. Phillips, 61 | 2021 | I | 2025 | CEO, EqualFuture Corp. | ||||

Daniel A. Rykhus, 59 | 2022 | II | 2026 | Retired CEO, Raven Industries | ||||

Jonathan R. Scott, 49 | 2020 | I | 2025 | General and Limited Partner, Scott Land & Livestock, LP |

2023 Proxy Statement | 11 | First Interstate BancSystem, Inc. |

Name | Age | Position |

David L. Jahnke | 70 | Chair of the Board |

Kevin P. Riley | 64 | President, Chief Executive Officer, and Director |

Stephen B. Bowman | 60 | Director |

Alice S. Cho | 57 | Director |

Frances P. Grieb | 63 | Director |

Thomas E. Henning | 71 | Director |

John M. Heyneman, Jr. | 56 | Director |

Dennis L. Johnson | 69 | Director |

Stephen M. Lacy | 70 | Director |

Patricia L. Moss | 70 | Director |

Joyce A. Phillips | 61 | Director |

Daniel A. Rykhus | 59 | Director |

James R. Scott | 74 | Director |

Jonathan R. Scott | 49 | Director |

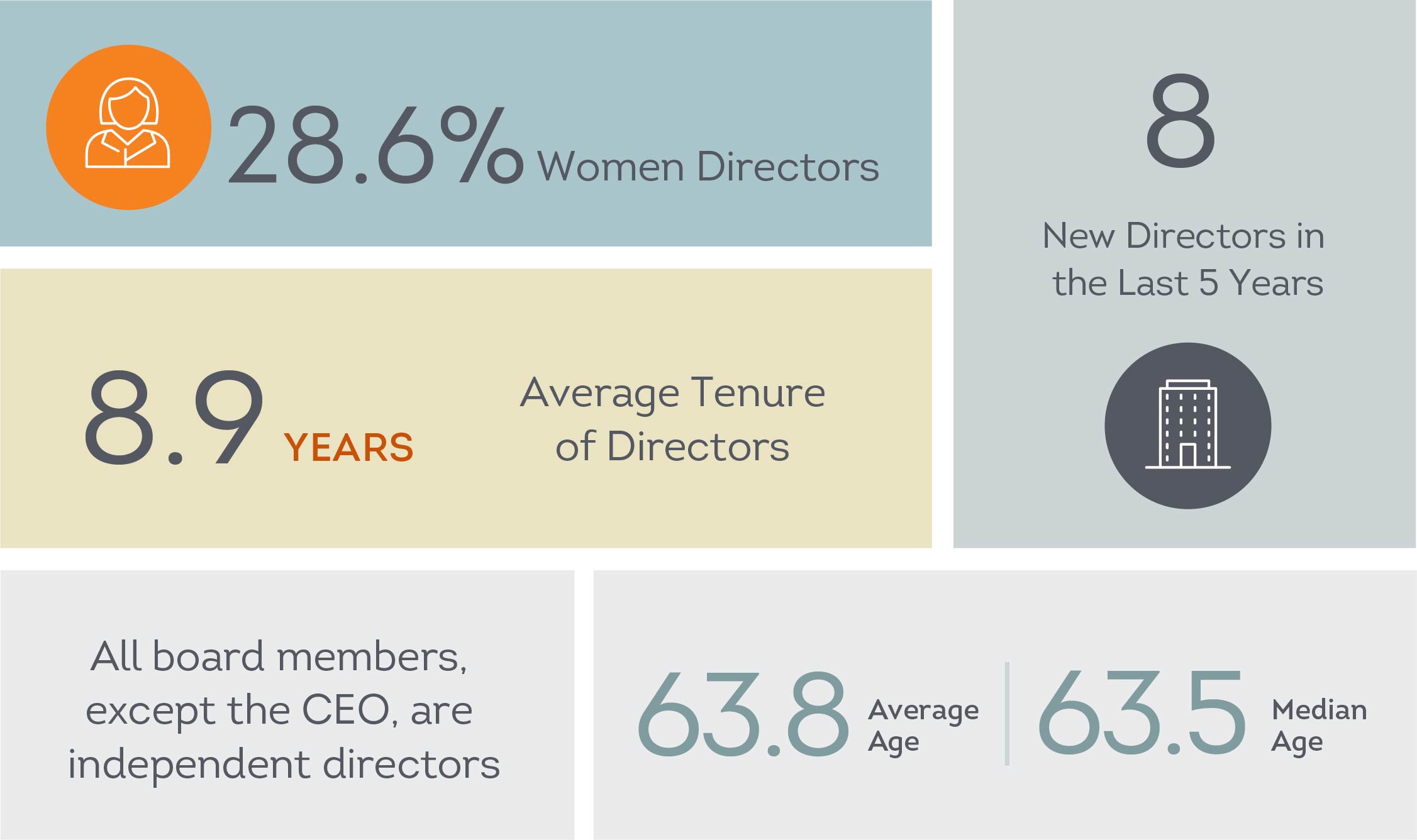

Board Diversity Matrix (As of March 22, 2024)* | |||

Female | Male | ||

Total Number of Directors | 15 | ||

Part I: Gender Identity | |||

Directors | 4 | 11 | |

Part II: Demographic Background | |||

Asian | 1 | 0 | |

White | 3 | 11 | |

2023 Proxy Statement | 12 | First Interstate BancSystem, Inc. |

Qualifications | Committee Memberships | Additional Current Public Company Board Memberships |

•Significant experience in the accounting, auditing, and financial service industries, both nationally and internationally •Extensive knowledge in key issues, dynamics, and trends affecting the Company, its business, and banking industry in general •Extensive knowledge regarding fiduciary obligations, insurance, and other legal requirements and duties of a public company. | ▪Governance and Nominating Committee | •Swiss Re America Holding Corporation (Audit Committee Chair) •Radius Recycling, Inc. (Lead Independent Director, Audit Committee and Compensation and Human Resources Committee Member) |

Qualifications | Committee Memberships | Additional Current Public Company Board Memberships |

•Extensive knowledge of key issues, dynamics, and trends affecting the Company, its business, and the banking industry in general. •Strategic insight and direction to the Company. | •None | •None |

2023 Proxy Statement | 13 | First Interstate BancSystem, Inc. |

Qualifications | Committee Memberships | Additional Current Public Company Board Memberships |

•Significant knowledge in the financial services industry, executive management, and legal requirements and duties of public companies | •Audit Committee (Financial Expert) •Compensation and Human Capital Committee (Chair) | •Voya Financial, Inc. (Audit, Risk, and Technology Committee member) |

Qualifications | Committee Memberships | Additional Current Public Company Board Memberships |

•Significant knowledge in risk management and regulatory compliance issues •Knowledge in strategic initiatives and technology innovation, including digitization, in the financial services industry | •Audit Committee (Financial Expert) •Risk Committee (Risk Management Expert) •Technology, Innovation and Operations Committee | •Globe Life, Inc. (Audit Committee Member) |

2023 Proxy Statement | 14 | First Interstate BancSystem, Inc. |

Qualifications | Committee Memberships | Additional Current Public Company Board Memberships |

•Extensive experience with corporate governance and regulatory matters •Significant relevant public company and board experience in the financial services industry, including banking, insurance, broker-dealer, investment company and real estate audit and consulting •Significant experience with public company financial reporting and internal control matters | •Audit Committee (Chair, Financial Expert) •Risk Committee (Risk Management Expert) | •None |

2023 Proxy Statement | 15 | First Interstate BancSystem, Inc. |

Qualifications | Committee Memberships | Additional Current Public Company Board Memberships |

•Over 32 years of relevant business experience in banking and financial services industry •Significant management and leadership experience •Chartered Financial Analyst with substantial financial expertise | •Risk Committee (Risk Management Expert) •Technology, Innovation and Operations Committee | •Nelnet, Inc. (Audit Committee Chair, Executive Committee Member, and Risk and Finance Committee Member) |

2023 Proxy Statement | 16 | First Interstate BancSystem, Inc. |

Qualifications | Committee Memberships | Additional Current Public Company Board Memberships |

•Executive management and business experience in the agriculture industry •Understanding of the regional economies and communities the Company serves •Knowledge of the Company’s unique challenges, regulatory environment, and history as a result of his years of service to the Company | •Governance and Nominating Committee (Chair) | •None |

2023 Proxy Statement | 17 | First Interstate BancSystem, Inc. |

Qualifications | Committee Memberships | Additional Current Public Company Board Memberships |

•Significant experience in the insurance industry and risk management issues. | •Risk Committee (Chair, Risk Management Expert) •Audit Committee (Financial Expert) •Technology, Innovation and Operations Committee | •IDACORP, Inc. (Corporate Governance & Nominating Committee Chair, Executive Committee Member) |

Qualifications | Committee Memberships | Additional Current Public Company Board Memberships |

•Significant public company management experience and public company board experience •Public company corporate governance experience | •Compensation and Human Capital Committee •Governance and Nominating Committee | •Hormel Foods Corporation (Compensation Committee Chair, Audit Committee) |

2023 Proxy Statement | 18 | First Interstate BancSystem, Inc. |

Qualifications | Committee Memberships | Additional Current Public Company Board Memberships |

•Significant banking experience as previous CEO of the Bank of the Cascades and Cascade Bancorp •Significant public company management experience and public company board experience •Knowledge of the unique history of the company prior to and after merging with First Interstate BancSystem, Inc. | •Compensation and Human Capital Committee •Governance and Nominating Committee | •Knife River Corporation (Audit Committee Chair and Compensation Committee member) |

Qualifications | Committee Memberships | Additional Current Public Company Board Memberships |

•Significant experience in financial services and FinTech industries •Knowledge of the regulatory environment | •Technology, Innovation and Operations Committee (Chair) •Risk Committee | •Katapult Holdings, Inc. (Nominating and Corporate Governance Committee member and Audit Committee Chair) |

2023 Proxy Statement | 19 | First Interstate BancSystem, Inc. |

Qualifications | Committee Memberships | Additional Current Public Company Board Memberships |

•31 years of leadership experience •Experience as a director and past audit committee member of Great Western Bancorp •Public company corporate governance experience | •Compensation & Human Capital Committee •Governance and Nominating Committee | •None |

2023 Proxy Statement | 20 | First Interstate BancSystem, Inc. |

Qualifications | Committee Memberships | Additional Current Public Company Board Memberships |

•Significant executive management, business, and corporate governance experience as a result of his years of service to the Company and other family-related businesses •Extensive knowledge of key issues, dynamics, and trends affecting the Company, its business, and the banking industry in general •Extensive knowledge of the Company’s unique challenges, regulatory environment, and history | •Compensation & Human Capital Committee | •None |

2023 Proxy Statement | 21 | First Interstate BancSystem, Inc. |

Qualifications | Committee Memberships | Additional Current Public Company Board Memberships |

•History of achievement in management positions as a result of his years of service to the Company •Extensive knowledge of the Company’s unique challenges, regulatory environment, and history | •Risk Committee •Technology, Innovation and Operations Committee | •None |

2023 Proxy Statement | 22 | First Interstate BancSystem, Inc. |

Key Corporate Governance Documents | |

Please visit our website at www.FIBK.com for our corporate governance documents. Shareholders may also request a copy of any corporate governance documents by contacting our Corporate Secretary at: P.O. Box 30918, Billings, MT 59116 | ▪Corporate Governance Guidelines |

▪Charters for each of the Company’s standing Board committees | |

▪Code of Conduct | |

▪Insider Trading Policy | |

•Code of Ethics for Chief Executive Officer and Senior Financial Officers | |

☑ | Overseeing our mission, vision, and values; |

☑ | Hiring and evaluating our Chief Executive Officer; |

☑ | Providing oversight of management regarding strategic direction; |

☑ | Ensuring management succession; |

☑ | Monitoring our performance against established criteria; |

☑ | Overseeing adherence to ethical practices; |

☑ | Overseeing compliance with applicable federal and state law; |

☑ | Ensuring that full and fair disclosure is provided to shareholders, regulators, and other constituents; |

☑ | Overseeing risk management; and |

☑ | Approving certain policies for Company operations. |

2023 Proxy Statement | 22 | First Interstate BancSystem, Inc. |

Tenure on Board | Number of Directors |

More than 10 years | 3 |

6-10 years | 3 |

5 years or less | 8 |

2023 Proxy Statement | 23 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 24 | First Interstate BancSystem, Inc. |

Current Committee Assignments | |||||

FIBK Board | Audit | Compensation & Human Capital | Governance & Nominating | Risk | Technology, Innovation & Operations |

David L. Jahnke, Chair | X | ||||

Kevin P. Riley | |||||

Stephen B. Bowman | Financial Expert | Chair | |||

James P. Brannen1 | X | X | |||

Alice S. Cho | Financial Expert | Risk Mgmt Expert | X | ||

Frances P. Grieb | Chair Financial Expert | Risk Mgmt Expert | |||

Thomas E. Henning | Risk Mgmt Expert | X | |||

John M. Heyneman, Jr. | Chair | ||||

Dennis L. Johnson | Financial Expert | Chair Risk Mgmt Expert | X | ||

Stephen M. Lacy | X | X | |||

Patricia L. Moss | X | X | |||

Joyce A. Phillips | X | Chair | |||

Daniel A. Rykhus | X | X | |||

James R. Scott | X | ||||

Jonathan R. Scott | X | X | |||

2023 Proxy Statement | 25 | First Interstate BancSystem, Inc. |

Audit Committee | ||

Meetings Held in 2023: 11 | Additional Members: Stephen B. Bowman, James P. Brannen*, Alice S. Cho, and Dennis L. Johnson | Independence: Each member of the Audit Committee is independent under applicable law and NASDAQ Marketplace Rules |

Key Committee Responsibilities: | ||

•Represents and assists our Board in its oversight responsibility relating to the quality and integrity of the Company’s financial statements and related internal controls; internal and external audit independence, qualifications, and performance; and the processes for monitoring compliance with laws and regulations. | ||

•Oversees the appointment, compensation, and retention of our independent, registered public accounting firm, including the performance of permissible audit, audit-related, and non-audit services, and the associated fees. | ||

•Establishes procedures for the confidential, anonymous submission by employees of concerns regarding questionable accounting, reporting, internal control, or auditing matters as well as monitoring our compliance with ethics programs. | ||

•Our Board has determined that Frances P. Grieb, Stephen B. Bowman, Alice S. Cho, and Dennis L. Johnson qualify as “audit committee financial experts” as that term is defined in applicable law and each of the Audit Committee members have the requisite financial literacy and accounting or related financial-management expertise required generally of an Audit Committee member under the applicable standards of the SEC and NASDAQ. *Mr. Brannen will leave the Committee when his current Board term ends at the annual meeting. | ||

2023 Proxy Statement | 26 | First Interstate BancSystem, Inc. |

Compensation and Human Capital Committee | ||

Meetings Held in 2023: 6 | Additional Members: Stephen M. Lacy, Patricia L. Moss, Daniel A. Rykhus, and James R. Scott | Independence: Each member of this committee is independent under applicable NASDAQ Marketplace Rules |

Key Committee Responsibilities: | ||

•Reviews and approves goals relevant to compensation for executive officers and evaluates the effectiveness of our compensation practices in achieving Company objectives, encouraging behaviors consistent with our values, and aligning performance objectives. | ||

•Reviews and approves the compensation of our non-CEO Named Executive Officers (“NEOs”), recommends for Board approval of CEO compensation, and oversees succession planning for all executive officers. In addition, the Committee recommends compensation for Board members. | ||

•Oversees the Company’s equity and incentive compensation plans and operation of compensation programs affecting the Company’s employees generally. Approves equity awards granted to the non- CEO NEOs and recommends Board approval of CEO equity awards. The Compensation and Human Capital Committee has delegated authority to our CEO to make awards to employees who are not NEOs. | ||

•Provides oversight of the Company’s talent management, development, and related programs, including diversity, equity and inclusion. | ||

•Oversees the Company’s CEO and executive succession planning. | ||

Compensation Consultant. The Compensation and Human Capital Committee has retained the services of Pearl Meyer & Partners (“Pearl Meyer”), a compensation consulting firm, to assist with its executive compensation review and to provide competitive market data. A consultant from Pearl Meyer generally attends the Compensation and Human Capital Committee meetings at which executive officer compensation is discussed and provides information, research, and analysis pertaining to executive compensation and updates on market trends as requested by the Compensation and Human Capital Committee. In connection with its engagement of Pearl Meyer, the Compensation and Human Capital Committee considered various factors bearing upon Pearl Meyer’s independence including, but not limited to, the amount of fees received by Pearl Meyer from the Company, Pearl Meyer’s policies and procedures designed to prevent conflicts of interest, and the existence of any business or personal relationship that could impact Pearl Meyer’s independence. After reviewing these and other factors, the Compensation and Human Capital Committee determined that Pearl Meyer was independent and that its engagement did not present any conflicts of interest. Pearl Meyer does not provide executive compensation services to the Company. The Compensation and Human Capital Committee sets compensation levels based on the skills, experience, and achievements of each executive officer, considering market analysis and input provided by Pearl Meyer and the compensation recommendations of our Chief Executive Officer, except with respect to his own position. The Compensation and Human Capital Committee believes that input from both Pearl Meyer and our Chief Executive Officer provides useful information and perspective to assist the Compensation and Human Capital Committee in determining the appropriate compensation. | ||

2023 Proxy Statement | 27 | First Interstate BancSystem, Inc. |

Compensation and Human Capital Committee Interlocks and Insider Participation: | ||

•No members of the Compensation and Human Capital Committee who served during 2023 were officers or employees of the Company during the year, or were former officers of the Company, or had any relationship requiring disclosure under the caption "Certain Relationships and Related Party Transactions" included below in this proxy statement other than James R. Scott, who served as Chair of the Board from 2016 to 2020 and as Vice Chair in prior periods. | ||

•No executive officer of the Company served on the compensation committee or board of directors of another company that had an executive officer who served on the Company's Compensation and Human Capital Committee or Board. | ||

Governance and Nominating Committee | ||

Meetings Held in 2023: 6 | Additional Members: David L. Jahnke, Patricia L. Moss, Stephen M. Lacy, and Daniel A. Rykhus | Independence: Each member of this committee is independent under applicable NASDAQ Marketplace Rules |

Key Committee Responsibilities: | ||

•Oversees the Company’s corporate governance needs and assists the Board with the process of identifying, evaluating, and nominating candidates for membership to our Board. | ||

•Evaluates the performance of our Chair and oversees the functions and needs of the Board and its committees, including overseeing the orientation and development of Board members, evaluating the effectiveness of the Board, each committee, and the respective performance of each Board member; and evaluating services provided to and communications with shareholders. | ||

•Reviews and approves related party transactions. | ||

•Assists the Board in providing primary Board oversight of the Company’s Environmental, Social, and Governance (ESG) program. | ||

•Reviews each committee’s annual priorities during a meeting of the Chair of the Board and the committee chairs to increase the efficiency of the work of the Board and the committees. | ||

2023 Proxy Statement | 28 | First Interstate BancSystem, Inc. |

Risk Committee | ||

Meetings Held in 2023: 4 | Additional Members: Alice S. Cho, Frances P. Grieb, Thomas E. Henning, Joyce A. Phillips, and Jonathan R. Scott | Independence: Each member of this committee is independent under applicable NASDAQ Marketplace Rules |

Key Committee Responsibilities: | ||

•Oversees the Company’s enterprise-wide risk management program and corporate risk function, which include the strategies, policies, and systems established by senior management to identify, assess, measure, monitor, and manage the Company’s significant risks, including cybersecurity risk. | ||

•Assesses whether management’s implementation of the program is capable of managing those risks consistent with the Company’s risk appetite. | ||

•Monitors whether the Company’s most significant enterprise-wide risk exposures are in alignment with the Company’s appetite for risk. | ||

•Coordinates with and serves as a resource to the Board of Directors and other Board committees through facilitation of the understanding of enterprise-wide risk management processes and effectiveness. | ||

2023 Proxy Statement | 29 | First Interstate BancSystem, Inc. |

Technology, Innovation and Operations Committee | ||

Meetings Held in 2023: 5 | Additional Members: James P. Brannen*, Alice S. Cho, Thomas E. Henning, Dennis L. Johnson, and Jonathan R. Scott | Independence: Each member of this committee is independent under applicable NASDAQ Marketplace Rules |

Key Committee Responsibilities: | ||

•Reviews Company management’s proposals regarding significant investments in support of the Company’s technology, operations and innovation strategies. | ||

•Reviews the Company’s budget relative to technology, operations, and innovation and ensures projects are appropriately aligned with and adequately support the Company’s strategic priorities, including periodically reviewing technology spending compared to peers. | ||

•Monitors the Company’s oversight of information technology, operations, and operational effectiveness and innovation strategies. | ||

•Provides oversight of Management’s monitoring of existing and future trends in technology, operations, and innovation. *Mr. Brannen will leave the Committee when his current Board term ends at the annual meeting. | ||

2023 Proxy Statement | 30 | First Interstate BancSystem, Inc. |

Board Role in Risk Oversight | |||||

Audit | Risk | Technology, Innovation & Operations | Governance & Nominating | Compensation & Human Capital | FIBK Board |

•Internal & External Fraud Risk •Internal & External Audit Risk •Ethical Risk •Regulatory Compliance Risk •Financial Reporting Risk •Operational Risk | •Enterprise Risk Management Policy Review •ERM Efficacy Review •Emerging & Newly Identified Risk Review | •Technology Efficacy Review •Technology & Innovation Investment •Technology and Innovation Trends & Practices Oversight | •Board Membership Criteria •Board Candidate Review •Board Committee Review & Referral •Board NASDAQ Marketplace Rules Compliance •Board Member Responsibility Scope •Corporate Governance •ESG Oversight •Board Performance & Activity Oversight | •Board Compensation •CEO Compensation •Executive Officer Compensation •Clawback Policy •Say on Pay •Talent Retention & Development Risk | •Lending Activity Risk •Liquidity & Capital Position Risk •Asset Quality Risk •Interest Rate Risk •Investment strategy Risk •Investor Risk •Reputational Risk •Emerging Risk •All Other Risk as Appropriate |

2023 Proxy Statement | 31 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 32 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 33 | First Interstate BancSystem, Inc. |

Committee | Chair Retainer(1) | Member Retainer |

Audit | $27,500 | $10,000 |

Compensation and Human Capital | 20,000 | 10,000 |

Executive(2) | — | 7,500 |

Governance and Nominating | 19,000 | 7,500 |

Risk | 22,500 | 10,000 |

Technology | 19,000 | 7,500 |

2023 Proxy Statement | 34 | First Interstate BancSystem, Inc. |

Name | Fees Earned or Paid In Cash(1) | Stock Awards (2) | All Other Compensation(3) | Total |

David L. Jahnke | $90,000 | $124,979 | $— | $214,979 |

Kevin P. Riley (4) | — | — | — | — |

Stephen B. Bowman(5) | 62,500 | 99,975 | — | 162,475 |

James P. Brannen | 70,625 | 74,992 | — | 145,617 |

Alice S. Cho | 77,500 | 74,992 | — | 152,492 |

Frances P. Grieb | 92,083 | 74,992 | 2,299 | 169,374 |

Thomas E. Henning | 67,500 | 74,992 | — | 142,492 |

John M. Heyneman, Jr. | 74,250 | 74,992 | — | 149,242 |

Dennis L. Johnson | 89,375 | 74,992 | — | 164,367 |

Stephen M. Lacy | 67,500 | 74,992 | — | 142,492 |

Patricia L. Moss | 71,875 | 74,992 | — | 146,867 |

Joyce A. Phillips | 78,625 | 74,992 | — | 153,617 |

Daniel A. Rykhus | 67,500 | 74,992 | — | 142,492 |

James R. Scott(5) | 28,125 | 124,979 | — | 153,104 |

Jonathan R. Scott(5) | 48,750 | 99,975 | — | 148,725 |

2023 Proxy Statement | 35 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 36 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 37 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 38 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 39 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 40 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 41 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 42 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 43 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 44 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 45 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 46 | First Interstate BancSystem, Inc. |

2023 | 2022 | ||||||

Audit fees (1) | $ | 1,911,000 | $ | 1,805,000 | |||

Audit-related fees (2) | 15,000 | 19,300 | |||||

Tax fees | — | — | |||||

All other fees | — | — | |||||

(1) | Audit fees consist of fees for the audit of the financial statements included in our Annual Report, reviews of the Quarterly Reports on Form 10-Q, including procedures related to acquisitions, $490,000 related to internal control matters and related services, and $50,000 in fees for EY workpaper access in 2023. | ||||

(2) | Audit-related fees for 2023 and 2022 consists of fees associated with the acquisition of Great Western Bank and our registration statement on Form S-3 filed with the SEC on May 26, 2023. | ||||

2023 Proxy Statement | 47 | First Interstate BancSystem, Inc. |

Frances P. Grieb (Chair) | Stephen B. Bowman | James P. Brannen | Alice S. Cho | Dennis L. Johnson | ||||||||||

2023 Proxy Statement | 48 | First Interstate BancSystem, Inc. |

Beneficial Ownership Table | ||||

Common Stock Beneficially Owned | ||||

Name of Beneficial Owner | Number of Shares | Percent of Class | ||

Directors and nominees for director | ||||

David L. Jahnke | 19,873 | * | ||

Kevin P. Riley | 170,979 | * | ||

Stephen B. Bowman | 3,579 | * | ||

James P. Brannen | 8,385 | * | ||

Alice S. Cho | 4,184 | * | ||

Frances P. Grieb | 20,883 | * | ||

Thomas E. Henning | 20,651 | * | ||

John M. Heyneman, Jr.(1) | 1,506,311 | 1.5% | ||

Dennis L. Johnson | 7,847 | * | ||

Stephen M. Lacy | 13,473 | * | ||

Patricia L. Moss | 17,219 | * | ||

Joyce A. Phillips | 2,991 | * | ||

Daniel A. Rykhus | 18,645 | * | ||

James R. Scott (2) | 4,358,315 | 4.2% | ||

Jonathan R. Scott (3) | 831,551 | * | ||

Named Executive Officers who are not directors | ||||

Lorrie F. Asker | 6,639 | * | ||

Kirk D. Jensen | 22,573 | * | ||

Marcy D. Mutch | 55,230 | * | ||

Kristina R. Robbins | 8,631 | * | ||

Other Executive Officers who are not directors | ||||

Karlyn M. Knieriem | 21,070 | * | ||

Lori A. Meyer | 8,962 | * | ||

All executive officers and directors as a group (21 persons) | 7,127,991 | 6.9% | ||

5% or greater security holders | ||||

Scott Family FIBK Shareholder Group (4) | 18,514,564 | 17.9% | ||

The Vanguard Group (5) | 9,180,537 | 8.9% | ||

BlackRock, Inc. (6) | 8,267,067 | 8.0% | ||

FMR LLC (7) | 6,605,392 | 6.4% | ||

Franklin Mutual Advisers, LLC (8) | 5,384,069 | 5.2% | ||

* Less than 1% of the class of common stock outstanding. | ||||

2023 Proxy Statement | 49 | First Interstate BancSystem, Inc. |

(1) | Includes 257,508 shares over which Mr. Heyneman reports shared voting and shared dispositive power. Mr. Heyneman disclaims beneficial ownership, except to the extent of his pecuniary interest therein, over 1,343,300 of the shares reported as beneficially owned indirectly by Mr. Heyneman, which shares are reported as indirectly beneficially owned, in the aggregate, through a limited partnership and several family trusts. |

(2) | Includes 385,935 shares over which Mr. Scott reports shared voting and shared dispositive power. Mr. Scott has caused a trust through which he reports indirect beneficial ownership in the shares to pledge as collateral security for a loan from Western Security Bank 395,000 shares of common stock. |

(3) | Mr. Scott has caused a trust through which he reports indirect beneficial ownership in the shares to pledge as collateral security for a loan from Western Security Bank 380,000 shares of common stock. |

(4) | Based on an amendment to Schedule 13D filed with the SEC on December 21, 2023 (the “Schedule 13D”) by James R. Scott, as well as reports filed pursuant to Section 16 of the Exchange Act. As disclosed in the Schedule 13D, the Scott Family FIBK Shareholder Group is composed of John M. Heyneman, Jr., Susan Heyneman, Julie Scott Rose, Homer Scott, Jr., James R. Scott, James R. Scott, Jr., Jeremy P. Scott, Jonathan R. Scott, Risa K. Scott, and several trusts, foundations, entities and other shareholders of the Company affiliated with such Scott family members which are identified in the Schedule 13D and which signed with such family members a Stockholders’ Agreement with the Company dated September 15, 2021. The foregoing family members report sole or shared voting and dispositive power over all of such shares. |

(5) | Based solely on an amendment to Schedule 13G filed with the SEC on February 13, 2024 (the “Schedule 13G/ A”) by The Vanguard Group. As disclosed in the Schedule 13G/A, this includes 0 shares over which The Vanguard Group has sole voting power, 64,867 shares over which The Vanguard Group has shared voting power, 9,026,392 shares over which The Vanguard Group has sole dispositive power, and 154,145 shares over which The Vanguard Group has shared dispositive power. The address for The Vanguard Group is 100 Vanguard Blvd., Malvern, PA 19355. |

(6) | Based solely on an amendment to Schedule 13G filed with the SEC on January 26, 2024 (the “Schedule 13G/ A”) by BlackRock, Inc (“BlackRock”). As disclosed in the Schedule 13G/A, this includes 7,856,561 shares over which BlackRock has sole voting power and 8,267,067 shares over which BlackRock has sole dispositive power. The address for BlackRock is 50 Hudson Yards, New York, New York 10001. |

(7) | Based solely on a Schedule 13G filed with the SEC on February 9, 2024 (the “Schedule 13G”) by FMR LLC (“FMR”) and Abigail P. Johnson, who is a Director, the Chairman and the Chief Executive Officer of FMR. As disclosed in the Schedule 13G, this includes 6,600,686 shares over which FMR has sole voting power and 6,605,392 shares over which FMR has sole dispositive power. Ms. Johnson and members of the Johnson family control 49% of FMR, and Ms. Johnson reported sole dispositive power of 6,605,392 shares. The address for FMR is 245 Summer Street, Boston, Massachusetts 02210. |

(8) | Based solely on a Schedule 13G filed with the SEC on January 30, 2024 (the “Schedule 13G”) by Franklin Mutual Advisers, LLC. As disclosed in the Schedule 13G, this includes 5,088,349 shares over which Franklin Mutual Advisers, LLC, has sole voting power, 0 shares over which Franklin Mutual Advisers, LLC, has shared voting power, 5,384,069 shares over which Franklin Mutual Advisers, LLC, has sole dispositive power, and 0 shares over which Franklin Mutual Advisers, LLC, has shared dispositive power. The address for Franklin Mutual Advisers, LLC, is 101 John F. Kennedy Parkway, Short Hills, New Jersey 07078‑2789. |

2023 Proxy Statement | 50 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 51 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 52 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 53 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 54 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 55 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 56 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 57 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 58 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 59 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 60 | First Interstate BancSystem, Inc. |

What We Do... | What We Do Not Do... | |||

☑ | Emphasize pay for performance | ý | Allow for short-selling, hedging, or pledging of Company securities | |

☑ | Use multiple performance measures and caps on potential incentive payments | ý | Allow "single-trigger" accelerated vesting of equity-based awards upon change in control | |

☑ | Engage an independent compensation consultant | ý | Grant excessive perquisites | |

☑ | Require minimum equity ownership for directors and executive officers | ý | Pay excise tax "gross ups" upon change in control | |

☑ | Maintain a clawback policy | ý | Reprice or liberally recycle shares | |

☑ | Discourage excessive risk taking by reserving the right to use discretion in the payout of all incentives | ý | Trade in Company securities during designated black-out periods, except under limited circumstances including valid rule 10b5-1 trading plans | |

2023 Proxy Statement | 61 | First Interstate BancSystem, Inc. |

Pay Element | Payment Form | Description/Objectives |

Base Salary | Cash | •Competitive fixed rate of pay to attract and retain talent •Considers market data and individual factors such as performance, scope of responsibility, experience, and strategic impact •Used as a foundation for determining incentive opportunities |

Short-Term Incentive (STI) | Cash | •Target is reflective of a percentage of base salary; varies by role at the Company •Awarded based on individual and Company performance •Awards are not guaranteed •Awards aligned with Company financial and strategic growth objectives •Awards established at threshold, target, and maximum values |

Long-Term Incentive (LTI) | Equity | •Target is reflective of a percentage of base salary; varies by role at the Company •Emphasis on long-term Company performance compared to peers (60% performance restricted stock units/40% time-based restricted stock units) •Objective is to retain top talent and align interests of management and our shareholders |

2023 Proxy Statement | 62 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 63 | First Interstate BancSystem, Inc. |

Ameris Bancorp | Pacific Premier Bancorp, Inc. | |

Associated Banc-Corp | PacWest Bancorp | |

BankUnited, Inc. | Pinnacle Financial Partners, Inc. | |

Cadence Bank | Prosperity Bancshares, Inc. | |

Commerce Bancshares, Inc. | Simmons First National Corporation | |

F.N.B Corporation | SouthState Corporation | |

Fulton Financial Corporation | UMB Financial Corporation | |

Glacier Bancorp, Inc. | Umpqua Holdings Corporation | |

Hancock Whitney Corporation | United Bankshares, Inc. | |

Old National Bancorp, Inc. | Valley National Bancorp |

Officer | 2022 Base Salary ($) | 2023 Base Salary ($) | Increase (%) |

Kevin P. Riley | 931,943 | 978,540 | 5% |

Marcy D. Mutch | 499,958 | 539,954 | 8% |

Kirk D. Jensen | 381,854 | 412,402 | 8% |

Lorrie F. Asker(1) | — | 440,000 | —% |

Kristina R. Robbins | 325,000 | 351,000 | 8% |

Ashley Hayslip | 450,000 | 450,000 | —% |

Scott E. Erkonen | 270,250 | 310,788 | 15% |

2023 Proxy Statement | 64 | First Interstate BancSystem, Inc. |

Metric | Weight | Description |

Adjusted Pre-Provision Net Revenue (PPNR) per Share | 50% | Adjusted for securities gains or losses and litigation expenses. (“Adjusted PPNR”) |

Adjusted Efficiency Ratio | 25% | Adjusted for securities gains or losses and litigation expenses and excluding OREO-related expense/income and amortization expense related to intangibles. |

Total Criticized Loan Ratio | 25% | Based on criticized loans divided by tier 1 capital, or the Total Criticized Loan Ratio percentile ranking relative to peer performance. The peer group is composed of those companies included in the KBW Regional Banking Index (KRX) that continue to trade on a major exchange throughout the entire performance period. |

2023 Proxy Statement | 65 | First Interstate BancSystem, Inc. |

Performance Measure | Weight | Minimum Performance | Target Performance | Maximum Performance | Performance Result | Weighted Payout % |

Adjusted PPNR per Share | 50% | $4.37 | $5.15 | $5.92 | $3.80 | —% |

Adjusted Efficiency Ratio | 25% | 56.04% | 54.00% | 52.04% | 61.00% | — |

Relative Total Criticized Loan Ratio | 25% | 45th percentile | 60th percentile | 75th percentile | 16th percentile | — |

STI Funding Results | 0% | 100% | 200% | — |

Target Payout Opportunity | Actual Payouts | ||||

Officer | 12/31/2023 Base Salary ($) | Target (%) | Target Amount ($) | Payout (%)(3) | Payout Amount ($) |

Kevin P. Riley | 978,540 | 110 | 1,076,394 | 20 | 215,279 |

Marcy D. Mutch | 539,954 | 70 | 377,968 | 20 | 75,594 |

Kirk D. Jensen | 412,402 | 60 | 247,441 | 20 | 49,488 |

Lorrie F. Asker | 440,000 | 70 | 308,000 | 20 | 61,600 |

Kristina R. Robbins | 351,000 | 60 | 210,600 | 20 | 42,120 |

Ashley Hayslip(1) | 450,000 | 70 | 315,000 | — | — |

Scott E. Erkonen(2) | 310,788 | 60 | 186,473 | — | — |

2023 Proxy Statement | 66 | First Interstate BancSystem, Inc. |

Type | Weight | Description |

Performance Restricted Stock Units | 60% | •Relative Performance: Based on peers in the KBW Regional Banking Index •Performance Metrics: ◦50% Adjusted Return on Average Equity ◦50% Total Shareholder Return •Performance Measurement Period: 3 years (1/1/2023-12/31/2025) •Vesting: 3 years after grant date, subject to performance criteria •Payout range: of 0-200% |

Restricted Stock Units | 40% | •Vesting: Time-based vesting 1/3 each year for 3 years |

Performance Level | Percentile Ranking | Payout Range |

- | Below 35th percentile | 0% |

Threshold | 35th percentile | 50% |

Target | 50th percentile | 100% |

Maximum | 90th percentile | 200% |

2023 Proxy Statement | 67 | First Interstate BancSystem, Inc. |

Target Award | Shares Awarded | |||||

Officer | Base Salary at Grant Date ($) | Target (%) | Target LTI ($) | Actual LTI ($) | PRSUs (#)(1) | RSUs (#)(1) |

Kevin P. Riley | 978,540 | 240 | 2,348,496 | 2,348,496 | 45,206 | 30,137 |

Marcy D. Mutch | 539,954 | 100 | 539,954 | 539,954 | 10,393 | 6,929 |

Kirk D. Jensen | 412,402 | 70 | 288,681 | 288,681 | 5,556 | 3,704 |

Lorrie F. Asker(2) | 360,000 | 100 | 360,000 | 200,000 | 3,849 | 2,566 |

Kristina R. Robbins | 351,000 | 70 | 245,700 | 245,700 | 4,729 | 3,153 |

Ashley Hayslip | 450,000 | 100 | 450,000 | — | — | — |

Scott E. Erkonen | 310,788 | 70 | 217,552 | 217,552 | 4,187 | 2,791 |

Performance Metric | Percentile Rank | Unweighted % of Target Award | Goal Weight | Vesting % |

Adjusted Return on Average Equity | 32.00% | —% | 50% | —% |

Total Shareholder Return | 3.00% | —% | 50% | —% |

Total | 100% | —% |

2023 Proxy Statement | 68 | First Interstate BancSystem, Inc. |

Officer | 2021 Performance Shares Granted (#) | 2021 Performance Shares Vested (#) |

Kevin P. Riley | 17,392 | — |

Marcy D. Mutch | 4,413 | — |

Kirk D. Jensen | 2,049 | — |

Lorrie F. Asker | 1,438 | — |

Kristina R. Robbins | 1,475 | — |

Equity Ownership Guidelines | |

Chief Executive Officer | Five (5) times base salary |

Chief Financial Officer and Chief Banking Officer | Three (3) times base salary |

All other Executive Officers | Two (2) times base salary |

2023 Proxy Statement | 69 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 70 | First Interstate BancSystem, Inc. |

☑ | Use of multiple metrics in short and long-term incentive plans for executive officers; | |

☑ | Application of caps on incentives; | |

☑ | Providing time-based share awards that vest ratably over three years and performance-based awards that cliff vest after a three year performance period; | |

☑ | Emphasizing long-term and performance-based compensation; | |

☑ | Instituting formal clawback policies applicable to both cash and equity performance-based compensation; and | |

☑ | Aligning interests of our executive officers with the long-term interests of our shareholders through equity ownership guidelines. |

Stephen B. Bowman, Chair | Patricia L. Moss | Stephen M. Lacy | Daniel A. Rykhus | James R. Scott |

2023 Proxy Statement | 71 | First Interstate BancSystem, Inc. |

Name and Position | Year | Salary ($) | Bonus ($) | Stock Awards ($)(1) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(2) | All Other Compensation ($)(3) | Total ($) |

(a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | (j) |

Kevin P. Riley | 2023 | 971,372 | — | 1,890,589 | 215,279 | — | 307,656 | 3,384,896 | |

President & Chief | 2022 | 922,564 | — | 1,856,680 | 1,537,706 | — | 300,134 | 4,617,084 | |

Executive Officer | 2021 | 864,594 | — | 1,442,198 | 649,817 | — | 244,634 | 3,201,243 | |

Marcy D. Mutch | 2023 | 533,801 | — | 482,881 | 75,594 | — | 37,480 | 1,129,756 | |

Exec. Vice President & | 2022 | 494,926 | — | 448,174 | 610,000 | — | 37,822 | 1,590,922 | |

Chief Financial Officer | 2021 | 463,827 | — | 365,948 | 261,454 | — | 33,069 | 1,124,298 | |

Kirk D. Jensen | 2023 | 407,703 | — | 251,430 | 49,488 | — | 33,292 | 741,913 | |

Exec. Vice President & | 2022 | 376,514 | — | 228,166 | 378,035 | 18 | 29,670 | 1,012,403 | |

General Counsel | 2021 | 346,042 | — | 169,913 | 161,871 | — | 29,123 | 706,949 | |

Lorrie F. Asker | 2023 | 377,885 | — | 268,317 | 61,600 | — | 22,690 | 730,492 | |

Exec. Vice President & | 2022 | ||||||||

Chief Banking Officer | 2021 | ||||||||

Kristina R. Robbins | 2023 | 347,000 | — | 207,518 | 42,120 | — | 34,395 | 631,033 | |

Exec. Vice President & | 2022 | ||||||||

Chief Operations Officer | 2021 | ||||||||

Ashley Hayslip (4) | 2023 | 58,846 | — | — | — | — | 825,148 | 883,994 | |

Former EVP & Chief | 2022 | ||||||||

Banking Officer | 2021 | ||||||||

Scott E. Erkonen (5) | 2023 | 152,743 | — | 147,235 | — | — | 598,828 | 898,806 | |

Former EVP & | 2022 | 243,225 | 75,000 | 261,495 | 267,548 | — | 16,520 | 863,788 | |

Chief Information Officer | 2021 |

2023 Proxy Statement | 72 | First Interstate BancSystem, Inc. |

Name | 401K Match ($) | Personal Use of Company Vehicle/ Aircraft ($) | SERP Contribution ($) | Dividends on Unvested Stock ($) | Social Club Dues ($) | Other ($) | Total ($) |

(a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) |

Kevin P. Riley | 18,725 | 35,741 | 195,708 | 51,662 | 5,820 | — | 307,656 |

Marcy D. Mutch | 19,800 | — | — | 14,908 | 2,772 | — | 37,480 |

Kirk D. Jensen | 19,800 | — | — | 7,294 | 6,198 | — | 33,292 |

Lorrie F. Asker | 14,550 | — | — | 8,140 | — | — | 22,690 |

Kristina R. Robbins | 16,770 | — | — | 9,195 | 8,430 | — | 34,395 |

Ashley Hayslip(1) | 2,077 | — | — | 2,109 | 100 | 820,862 | 825,148 |

Scott E. Erkonen(2) | 8,629 | — | — | 3,405 | — | 586,794 | 598,828 |

Name | Time-Based Vesting Restricted Equity Awards (#) | Performance-Based Restricted Equity Awards (#)(1) | |||

Kevin P. Riley | 2023 | 39,789 | 45,206 | ||

2022 | 19,116 | 28,675 | |||

2021 | 11,594 | 17,392 | |||

Marcy D. Mutch | 2023 | 10,695 | 10,393 | ||

2022 | 4,614 | 6,922 | |||

2021 | 2,942 | 4,413 | |||

Kirk D. Jensen | 2023 | 5,502 | 5,556 | ||

2022 | 2,349 | 3,524 | |||

2021 | 1,366 | 2,049 | |||

Lorrie F. Asker | 2023 | 6,367 | 3,849 | ||

Kristina R. Robbins | 2023 | 4,475 | 4,729 | ||

Ashley Hayslip | 2023 | — | — | ||

Scott E. Erkonen | 2023 | 2,791 | 4,187 | ||

2022 | 4,346 | 2,494 | |||

2023 Proxy Statement | 73 | First Interstate BancSystem, Inc. |

☑ | The maximum number of shares of our common stock reserved for issuance under the 2023 Plan was 2,000,000 (not including the additional shares that will be reserved if Proposal Two is approved), which was approximately 1.9% of our previously existing Common Stock outstanding at the time of shareholder approval. |

☑ | The 2023 Plan prohibits the repricing of awards without shareholder approval. |

☑ | The 2023 Plan prohibits the liberal recycling of shares. |

☑ | Awards under the 2023 Plan are subject to broad discretion by the Compensation and Human Capital Committee administering the plan. |

☑ | The determination of fair market value of all awards under the 2023 Plan is based on the closing price of the underlying common stock as quoted on NASDAQ Stock Market for the last market trading day prior to the date of the award. |

2023 Proxy Statement | 74 | First Interstate BancSystem, Inc. |

All Other Awards | ||||||||||||

Estimated Future Payouts Under Non-Equity Incentive Plan Awards (1) | Estimated Future Payouts Under Equity Incentive Plan Awards | Stock Awards: Number of Shares or Units (#) | Grant Date Fair Value of Stock Awards ($) | |||||||||

Name | Grant Date(6) | Approval Date(7) | Threshold ($) | Target ($) | Max ($) | Threshold (#) | Target (#) | Max (#) | ||||

Kevin P. Riley | STI | — | 1,076,394 | 2,152,788 | — | — | — | — | — | |||

RSA | 3/15/2023(2) | 3/15/2023 | — | — | — | — | — | — | 9,652 | 300,853 | ||

RSU | 5/24/2023(3) | 3/15/2023 | — | — | — | — | — | — | 30,137 | 724,493 | ||

PRSU | 5/24/2023(4) | 3/15/2023 | — | — | — | 22,603 | 45,206 | 90,412 | — | 865,243 | ||

Marcy D. Mutch | STI | — | 377,968 | 755,936 | — | — | — | — | — | |||

RSA | 3/15/2023(2) | 3/15/2023 | — | — | — | — | — | — | 3,766 | 117,386 | ||

RSU | 5/24/2023(3) | 3/15/2023 | — | — | — | — | — | — | 6,929 | 166,573 | ||

PRSU | 5/24/2023(4) | 3/15/2023 | — | — | — | 5,197 | 10,393 | 20,786 | — | 198,922 | ||

Kirk D. Jensen | STI | — | 247,441 | 494,882 | — | — | — | — | — | |||

RSA | 3/15/2023(2) | 3/15/2023 | — | — | — | — | — | — | 1,798 | 56,044 | ||

RSU | 5/24/2023(3) | 3/15/2023 | — | — | — | — | — | — | 3,704 | 89,044 | ||

PRSU | 5/24/2023(4) | 3/15/2023 | — | — | — | 2,778 | 5,556 | 11,112 | — | 106,342 | ||

Lorrie F. Asker | STI | — | 308,000 | 616,000 | — | — | — | — | — | |||

RSA | 2/9/2023(5) | 2/9/2023 | — | — | — | — | — | — | 2,743 | 99,982 | ||

RSA | 3/15/2023(2) | 3/15/2023 | — | — | — | — | — | — | 1,058 | 32,978 | ||

RSU | 5/24/2023(3) | 3/15/2023 | — | — | — | — | — | — | 2,566 | 61,687 | ||

PRSU | 5/24/2023(4) | 3/15/2023 | — | — | — | 1,925 | 3,849 | 7,698 | 73,670 | |||

Kristina R. Robbins | STI | — | 210,600 | 421,200 | — | — | — | — | — | |||

RSA | 3/15/2023(2) | 3/15/2023 | — | — | — | — | — | — | 1,322 | 41,207 | ||

RSU | 5/24/2023(3) | 3/15/2023 | — | — | — | — | — | — | 3,153 | 75,798 | ||

PRSU | 5/24/2023(4) | 3/15/2023 | — | — | — | 2,365 | 4,729 | 9,458 | 90,513 | |||

Ashley Hayslip | STI | — | 315,000 | 630,000 | — | — | — | — | — | |||

RSU | — | — | — | — | — | — | — | — | ||||

PRSU | — | — | — | — | — | — | — | — | ||||

Scott E. Erkonen | STI | — | 186,473 | 372,945 | — | — | — | — | — | |||

RSU | 5/24/2023(3) | 3/15/2023 | — | — | — | — | — | — | 2,791 | 67,096 | ||

PRSU | 5/24/2023(4) | 3/15/2023 | — | — | — | 2,094 | 4,187 | 8,374 | — | 80,139 | ||

2023 Proxy Statement | 75 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 76 | First Interstate BancSystem, Inc. |

Stock Awards | |||||

Restricted Stock | Performance Stock | ||||

Name | Number of Shares or Units of Stock That Have Not Vested (#)(1) | Market Value of Shares or Units of Stock That Have Not Vested ($)(3) | Equity incentive Plan awards: Number of Unearned Shares, Units, or Other Rights That Have Not Vested (#)(2) | Equity incentive plan awards: Market Value of Payout Value of Unearned Shares, Units, or Other Rights That Have Not Vested ($)(3) | |

Kevin P. Riley | 56,398 | 1,734,239 | 91,273 | 2,806,645 | |

Marcy D. Mutch | 14,752 | 453,624 | 21,728 | 668,136 | |

Kirk D. Jensen | 7,524 | 231,363 | 11,129 | 342,217 | |

Lorrie F. Asker | 7,542 | 231,917 | 7,210 | 221,708 | |

Kristina R. Robbins | 7,580 | 233,085 | 8,511 | 261,713 | |

Ashley Hayslip | — | — | — | — | |

Scott E. Erkonen | — | — | — | — | |

2023 Proxy Statement | 77 | First Interstate BancSystem, Inc. |

Stock Awards | |||

Name | Number of Shares Acquired on Vesting (#)(1) | Value Realized on Vesting ($)(2) | |

Kevin P. Riley | 21,080 | 687,098 | |

Marcy D. Mutch | 6,749 | 221,761 | |

Kirk D. Jensen | 3,257 | 106,967 | |

Lorrie F. Asker | 1,934 | 63,491 | |

Kristina R. Robbins | 3,200 | 96,649 | |

Ashley Hayslip | — | — | |

Scott E. Erkonen | 1,448 | 50,745 | |

Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants, and Rights (#) | Weighted Average Exercise Price of Outstanding Options, Warrants, and Rights ($) | Number of Securities Remaining Available For Future Issuance Under Equity Compensation Plan (#) |

Equity compensation plans approved by shareholders(1) | — | — | 1,389,724 |

Equity compensation plans not approved by shareholders | N/A | N/A | N/A |

Total | — | — | 1,389,724 |

(1) Includes only remaining shares available for future issuance under the 2023 Equity and Incentive Plan. As of May 24, 2023, no additional awards can be issued under the 2015 Equity and Incentive Plan. |

2023 Proxy Statement | 78 | First Interstate BancSystem, Inc. |

Name | Executive Contributions in Last Fiscal Year ($)(1) | Registrant Contributions in Last Fiscal Year ($)(2) | Aggregate Earnings in Last Fiscal Year ($)(3) | Aggregate Withdrawals/ Distributions ($) | Aggregate Balance at Last Fiscal Year End ($) |

(a) | (b) | (c) | (d) | (e) | (f) |

Kevin P. Riley | — | 208,755 | 599,124 | — | 4,277,281 |

Marcy D. Mutch | 183,000 | — | 57,830 | — | 561,682 |

Kirk D. Jensen | — | — | 58 | — | 1,225 |

Lorrie F. Asker | — | — | 6,647 | — | 49,171 |

Kristina R. Robbins | — | — | — | — | — |

Ashley Hayslip | — | — | — | — | — |

Scott E. Erkonen | — | — | — | — | — |

2023 Proxy Statement | 79 | First Interstate BancSystem, Inc. |

Median Employee Total Annual Compensation | PEO Total Annual Compensation | Ratio of PEO to Median Employee Total Annual Compensation | ||

$61,326 | $3,384,896 | 55 to 1 |

2023 Proxy Statement | 80 | First Interstate BancSystem, Inc. |

Year | Summary Compensation Table Total for PEO ($)(1) | Compensation Actually Paid to PEO ($)(1)(3) | Average Summary Compensation Table Total for non-PEO NEOs ($)(2) | Average Summary Compensation Actually Paid to non-PEO NEOs ($)(2)(3) | Value of Initial Fixed $100 Investment Based On: | Net Income (in $M) ($) | Compensation Adjusted ROAE ($)(4) | |

Company Total Shareholder Return ($) | KBW Regional Banking Index Total Shareholder Return ($) | |||||||

(a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) |

2023 | 3,384,896 | 1,951,042 | 835,999 | 550,266 | 90.37 | 115.64 | 257.5 | 11.68 |

2022 | 4,617,084 | 4,215,324 | 1,482,037 | 1,343,374 | 106.06 | 116.11 | 202.2 | 11.75 |

2021 | 3,201,243 | 2,342,207 | 928,135 | 733,189 | 106.90 | 124.75 | 192.1 | 13.19 |

2020 | 2,939,173 | 3,641,663 | 1,260,013 | 1,454,331 | 103.20 | 91.29 | 161.2 | 10.65 |

PEO | Average Other NEOs | |||

2023 ($) | 2023 ($) | |||

Summary Compensation Total | 3,384,896 | 835,999 | ||

- Grant Date Fair Value of Option Awards and Stock Awards Granted in Fiscal Year | (1,890,589) | (226,230) | ||

+ Fair Value at Fiscal Year-End of Outstanding and Unvested Option Awards and Stock Awards Granted in Fiscal Year | 2,147,660 | 223,423 | ||

+ Change in Fair Value of Outstanding and Unvested Option Awards and Stock Awards Granted in Prior Fiscal Years | (1,539,137) | (176,369) | ||

+ Fair Value at Vesting of Option Awards and Stock Awards Granted in Fiscal Year That Vested During Fiscal Year | — | — | ||

+ Change in Fair Value as of Vesting Date of Option Awards and Stock Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year | (151,788) | (40,412) | ||

- Fair Value as of Prior Fiscal Year-End of Option Awards and Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year | — | (66,145) | ||

+ Value of Dividends or other Earnings Paid on Stock or Option Awards not Otherwise Reflected in Fair Value or Total Compensation | — | — | ||

Compensation Actually Paid | 1,951,042 | 550,266 |

2023 Proxy Statement | 81 | First Interstate BancSystem, Inc. |

•Total Shareholder Return |

•Compensation Adjusted Return on Average Common Stockholders’ Equity |

•Adjusted PPNR per Share |

•Adjusted Efficiency Ratio |

•Non-Performing Assets |

•Criticized Assets |

•CAP and the Company’s & Peer Group’s cumulative TSR; |

•CAP and the Company’s Net Income; and |

•CAP and the Company’s Compensation Adjusted ROAE |

2023 Proxy Statement | 82 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 83 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 84 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 85 | First Interstate BancSystem, Inc. |

Involuntary | Change in Control | ||||||||

Executive Payments and | Involuntary | Termination Without | With Termination | ||||||

Benefits upon Termination | Voluntary | Termination | Cause / Termination | for Good Reason | |||||

or Change in Control | Termination | for Cause | for Good Reason | or Without Cause | Death | Disability | |||

Compensation: | |||||||||

Severance | $— | $— | $3,948,787 | (a) | $6,164,805 | (b) | $— | $— | |

Pro-rata Bonus | — | — | — | 1,076,394 | (c) | — | — | ||

Long-term Incentives | |||||||||

- Time-Restricted Awards (d) | — | — | — | 1,762,567 | 1,762,567 | 1,762,567 | |||

- Performance Awards (e) | — | — | — | 3,023,694 | 3,023,694 | 3,023,694 | |||

Supplemental Retirement (f) | — | — | — | 244,720 | 244,720 | 244,720 | |||

Benefits & Perquisites: | |||||||||

Survivor Income Benefits (g) | — | — | — | — | 150,000 | — | |||

Health Benefits (h) | — | — | 37,176 | 37,176 | — | — | |||

Total | $— | $— | $3,985,963 | $12,309,356 | $5,180,981 | $5,030,981 | |||

(a) | Severance is equal to two times the sum of: Mr. Riley's current base salary, plus his average annual incentive compensation paid during the three years prior to termination (for performance in FYE 2020, 2021 and 2022), when the termination event is not in connection with a change-in-control or following an acquisition of an entity. Severance would increase to $5,923,181 (three times the compensation described herein) if the termination event followed an acquisition of an entity not constituting a change-in-control. Benefits are payable over 18 months. |

(b) | Severance is equal to three times the sum of Mr. Riley's current base salary, plus his 2023 target annual cash incentive, payable over 18 months. |

(c) | Reflects Mr. Riley's target annual cash incentive award pro-rated for the portion of the year prior to termination. Because termination is assumed to occur on December 31, 2023, the amount reflects the full target cash award that would be payable in lieu of his 2023 annual incentive award. |

(d) | Reflects full vesting of time-based restricted stock/unit awards (including dividends accrued through December 31, 2023) upon a qualifying termination during the 24 month period following a change-in-control, and in the event of death, or disability. Awards are valued using the December 29, 2023 closing price of $30.75. |

(e) | Reflects vesting of performance-based restricted stock units (including dividends accrued through December 31, 2023) upon a qualifying termination during the 24 month period following a change-in-control, and in the event of death or disability, payable at target levels. Awards are valued using the December 29, 2023 closing price of $30.75. |

(f) | Reflects full vesting of Mr. Riley's unvested nonqualified defined contribution supplemental executive retirement plan balance upon a qualifying termination in connection with a change-in-control, and in the event of death, or disability. Amounts include annual and performance contingent contributions earned for service Mr. Riley has provided through December 31, 2023. |

(g) | Reflects $150,000 of survivor income benefits payable to Mr. Riley's beneficiaries through a company owned life insurance policy covering the life of Mr. Riley. Mr. Riley's beneficiaries would also be entitled to receive $300,000 of life insurance benefits under our group life insurance plan. |

(h) | Estimates the cost of continuing medical, dental, and vision benefits, using 2023 COBRA rates. Assumes 24 months of continued coverage for qualifying terminations not in connection with a change-in-control as well as in connection with a change-in-control If the termination event followed an acquisition of an entity not constituting a change-in-control, costs are estimated as $55,764 as benefits would continue for 36 months. |

2023 Proxy Statement | 86 | First Interstate BancSystem, Inc. |

Involuntary | Change in Control | ||||||||

Executive Payments and | Involuntary | Termination Without | With Termination | ||||||

Benefits upon Termination | Voluntary | Termination | Cause / Termination | for Good Reason | |||||

or Change in Control | Termination | for Cause | for Good Reason | or Without Cause | Death | Disability | |||

Compensation: | |||||||||

Severance | $— | $— | $942,106 | (a) | $1,835,844 | (b) | $— | $— | |

Pro-rata Bonus | — | — | — | 377,968 | (c) | — | — | ||

Long-term Incentives | |||||||||

- Time-Restricted Awards (d) | — | — | — | 460,137 | 460,137 | 460,137 | |||

- Performance Awards (e) | — | — | — | 721,075 | 721,075 | 721,075 | |||

Benefits & Perquisites: | |||||||||

Survivor Income Benefits (f) | — | — | 150,000 | — | |||||

Health Benefits (g) | — | — | 18,728 | 37,456 | — | — | |||

Total | $— | $— | $960,834 | $3,432,480 | $1,331,212 | $1,181,212 | |||

(a) | Severance is equal to one times the sum of: Ms. Mutch's current base salary, plus her average annual incentive compensation paid during the three years prior to termination (for performance in FYE 2020, 2021 and 2022), when the termination event is not in connection with a change-in-control or following an acquisition of an entity. Severance would increase to $1,884,211 (two times the compensation described herein) if the termination event followed an acquisition of an entity not constituting a change-in-control. Benefits are payable over 12 months. |

(b) | Severance is equal to two times the sum of: Ms. Mutch's current base salary, plus her 2023 target annual cash incentive, payable over 12 months. |

(c) | Reflects Ms. Mutch's target annual cash incentive award pro-rated for the portion of the year prior to termination. Because termination is assumed to occur on December 31, 2023, the amount reflects the full target cash award that would be payable in lieu of her 2023 annual incentive award. |

(d) | Reflects full vesting of time-based restricted stock/unit awards (including dividends accrued through December 31, 2023) upon a qualifying termination during the 24 month period following a change-in-control, and in the event of death, or disability. Awards are valued using the December 29, 2023 closing price of $30.75. |

(e) | Reflects vesting of performance-based restricted stock awards (including dividends accrued through December 31, 2023) upon a qualifying termination during the 24 month period following a change-in-control, and in the event of death or disability, payable at target levels. Awards are valued using the December 29, 2023 closing price of $30.75. |

(f) | Reflects $150,000 of survivor income benefits payable to Ms. Mutch's beneficiaries through a company owned life insurance policy covering the life of Ms. Mutch. Ms. Mutch's beneficiaries would also be entitled to receive $300,000 of life insurance benefits under our group life insurance plan. |

(g) | Estimates the cost of continuing medical, dental, and vision benefits, using 2023 COBRA rates. Assumes 12 months of continued coverage for a qualifying termination not in connection with a change-in-control and 24 months of continued coverage for a termination in connection with a change-in-control. If the termination event followed an acquisition of an entity not constituting a change-in-control, costs are estimated to be $28,092, as benefits would continue for 18 months. |

2023 Proxy Statement | 87 | First Interstate BancSystem, Inc. |

Involuntary | Change in Control | ||||||||

Executive Payments and | Involuntary | Termination Without | With Termination | ||||||

Benefits upon Termination | Voluntary | Termination | Cause / Termination | for Good Reason | |||||

or Change in Control | Termination | for Cause | for Good Reason | or Without Cause | Death | Disability | |||

Compensation: | |||||||||

Severance | $— | $— | $640,704 | (a) | $1,319,687 | (b) | $— | $— | |

Pro-rata Bonus | — | — | — | 247,441 | (c) | — | — | ||

Long-term Incentives | |||||||||

- Time-Restricted Awards (d) | — | — | — | 234,845 | 234,845 | 234,845 | |||

- Performance Awards (e) | — | — | — | 368,466 | 368,466 | 368,466 | |||

Benefits & Perquisites: | |||||||||

Survivor Income Benefits (f) | — | — | — | — | 150,000 | — | |||

Health Benefits (g) | — | — | 24,361 | 48,722 | — | — | |||

Total | $— | $— | $665,065 | $2,219,161 | $753,311 | $603,311 | |||

(a) | Severance is equal to one times the sum of: Mr. Jensen's current base salary, plus his average annual incentive compensation paid during the three years prior to termination (for performance in FYE 2020, 2021, and 2022), when the termination event is not in connection with a change-in-control or following an acquisition of an entity. Severance would increase to $1,281,409 (two times the compensation described herein) if the termination event followed an acquisition of an entity not constituting a change-in-control. Benefits are payable over 12 months. |

(b) | Severance is equal to two times the sum of Mr. Jensen's current base salary, plus his 2023 target annual cash incentive, payable over 12 months. |

(c) | Reflects Mr. Jensen's target annual cash incentive award pro-rated for the portion of the year prior to termination. Because termination is assumed to occur on December 31, 2023, the amount reflects the full target cash award that would be payable in lieu of his 2023 annual incentive award. |

(d) | Reflects full vesting of time-based restricted stock/unit awards (including dividends accrued through December 31, 2023) upon a qualifying termination during the 24 month period following a change-in-control, and in the event of death, or disability. Awards are valued using the December 29, 2023 closing price of $30.75. |

(e) | Reflects vesting of performance-based restricted stock awards (including dividends accrued through December 31, 2023) upon a qualifying termination during the 24 month period following a change-in-control, and in the event of death or disability, payable at target levels. Awards are valued using the December 29, 2023 closing price of $30.75. |

(f) | Reflects $150,000 of survivor income benefits payable to Mr. Jensen's beneficiaries through a company owned life insurance policy covering the life of Mr. Jensen. Mr. Jensen's beneficiaries would also be entitled to receive $300,000 of life insurance benefits under our group life insurance plan. |

(g) | Estimates the cost of continuing medical, dental, and vision benefits, using 2023 COBRA rates. Assumes 12 months of continued coverage for a qualifying termination not in connection with a change-in-control and 24 months of continued coverage for a termination in connection with a change-in-control. If the termination event followed an acquisition of an entity not constituting a change-in-control, costs are estimated to be $36,542, as benefits would continue for 18 months. |

2023 Proxy Statement | 88 | First Interstate BancSystem, Inc. |

Involuntary | Change in Control | ||||||||

Executive Payments and | Involuntary | Termination Without | With Termination | ||||||

Benefits upon Termination | Voluntary | Termination | Cause / Termination | for Good Reason | |||||

or Change in Control | Termination | for Cause | for Good Reason | or Without Cause | Death | Disability | |||

Compensation: | |||||||||

Severance | $— | $— | $598,083 | (a) | $1,496,000 | (b) | $— | $— | |

Pro-rata Bonus | — | — | — | 308,000 | (c) | — | — | ||

Long-term Incentives | |||||||||

- Time-Restricted Awards (d) | — | — | — | 234,329 | 234,329 | 234,329 | |||

- Performance Awards (e) | — | — | — | 238,338 | 238,338 | 238,338 | |||

Benefits & Perquisites: | |||||||||

Survivor Income Benefits (f) | — | — | — | — | 150,000 | — | |||

Health Benefits (g) | — | — | 17,059 | 34,118 | — | — | |||

Total | $— | $— | $615,142 | $2,310,785 | $622,667 | $472,667 | |||

(a) | Severance is equal to one times the sum of: Ms. Asker's current base salary, plus her average annual incentive compensation paid during the three years prior to termination (for performance in 2020, 2021, and 2022), when the termination event is not in connection with a change-in-control or following an acquisition of an entity. Severance would increase to $1,196,167 (two times the compensation described herein) if the termination event followed an acquisition of an entity not constituting a change-in-control. Benefits are payable over 12 months. |

(b) | Severance is equal to two times the sum of Ms. Asker's current base salary, plus her 2023 target annual cash incentive, payable over 12 months. |

(c) | Reflects Ms. Asker’s target annual cash incentive award pro-rated for the portion of the year prior to termination. Because termination is assumed to occur on December 31, 2023, the amount reflects the full target cash award that would be payable in lieu of her 2023 annual incentive award. |

(d) | Reflects full vesting of time-based restricted stock/unit awards (including dividends accrued through December 31, 2023) upon a qualifying termination during the 24 month period following a change-in-control, and in the event of death, or disability. Awards are valued using the December 29, 2023 closing price of $30.75. |

(e) | Reflects vesting of performance-based restricted stock awards (including dividends accrued through December 31, 2023) upon a qualifying termination during the 24 month period following a change-in-control, and in the event of death or disability, payable at target levels. Awards are valued using the December 29, 2023 closing price of $30.75. |

(f) | Reflects $150,000 of survivor income benefits payable to Ms. Asker’s beneficiaries through a company owned life insurance policy covering the life of Ms. Asker. Ms. Asker's beneficiaries would also be entitled to receive $300,000 of life insurance benefits under our group life insurance plan. |

(g) | Estimates the cost of continuing medical, dental, and vision benefits, using 2023 COBRA rates. Assumes 12 months of continued coverage for a qualifying termination not in connection with a change-in-control and 24 months of continued coverage for a termination in connection with a change-in-control. If the termination event followed an acquisition of an entity not constituting a change-in-control, costs are estimated to be $25,589, as benefits would continue for 18 months. |

2023 Proxy Statement | 89 | First Interstate BancSystem, Inc. |

Involuntary | Change in Control | ||||||||

Executive Payments and | Involuntary | Termination Without | With Termination | ||||||

Benefits upon Termination | Voluntary | Termination | Cause / Termination | for Good Reason | |||||

or Change in Control | Termination | for Cause | for Good Reason | or Without Cause | Death | Disability | |||

Compensation: | |||||||||

Severance | $— | $— | $— | (a) | $1,123,200 | (b) | $— | $— | |

Pro-rata Bonus | — | — | — | 210,600 | (c) | — | — | ||

Long-term Incentives | |||||||||

- Time-Restricted Awards (d) | — | — | — | 236,049 | 236,049 | 236,049 | |||

- Performance Awards (e) | — | — | — | 280,566 | 280,566 | 280,566 | |||

Benefits & Perquisites: | |||||||||

Survivor Income Benefits (f) | — | — | — | — | 150,000 | — | |||

Health Benefits (g) | — | — | — | 54,238 | — | — | |||

Total | $— | $— | $— | $1,904,653 | $666,615 | $516,615 | |||

(a) | Under her Change-in-Control Separation Agreement that was in place as December 31, 2023, Ms. Robbins is not entitled to involuntary termination / good reason severance benefits unless her qualifying termination occurs within 18 months following an acquisition of an entity not constituting a change-in-control. Had a qualifying termination occurred on December 31, 2023, her severance would be $1,102,000 (two times her current base salary, plus her average annual incentive compensation paid during the three years prior to termination (for performance in FYE 2020, 2021, and 2022)). Benefits are payable over 12 months. |

(b) | Severance is equal to two times the sum of Ms. Robbins' current base salary, plus her 2023 target annual cash incentive, payable over 12 months. |

(c) | Reflects Ms. Robbins' target annual cash incentive award pro-rated for the portion of the year prior to termination. Because termination is assumed to occur on December 31, 2023, the amount reflects the full target cash award that would be payable in lieu of her 2023 annual incentive award. |

(d) | Reflects full vesting of time-based restricted stock / unit awards (including dividends accrued through December 31, 2023) upon a qualifying termination during the 24 month period following a change-in-control, and in the event of death, or disability. Awards are valued using the December 29, 2023 closing price of $30.75. |

(e) | Reflects vesting of performance-based restricted stock units (including dividends accrued through December 31, 2023) upon a qualifying termination during the 24 month period following a change-in-control, and in the event of death or disability, payable at target levels. Awards are valued using the December 29, 2023 closing price of $30.75. |

(f) | Reflects $150,000 of survivor income benefits payable to Ms. Robbins' beneficiaries through a company owned life insurance policy covering the life of Ms. Robbins. Ms. Robbins' beneficiaries would be entitled to receive $300,000 of life insurance benefits under our group life insurance plan. |

(g) | Estimates the cost of continuing medical, dental, and vision benefits, using 2023 COBRA rates. Assumes 24 months of continued coverage for a termination in connection with a change-in-control. If the termination event followed an acquisition of an entity not constituting a change-in-control, costs are estimated to be $40,678, as benefits would continue for 18 months. |

2023 Proxy Statement | 90 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 91 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 92 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 93 | First Interstate BancSystem, Inc. |

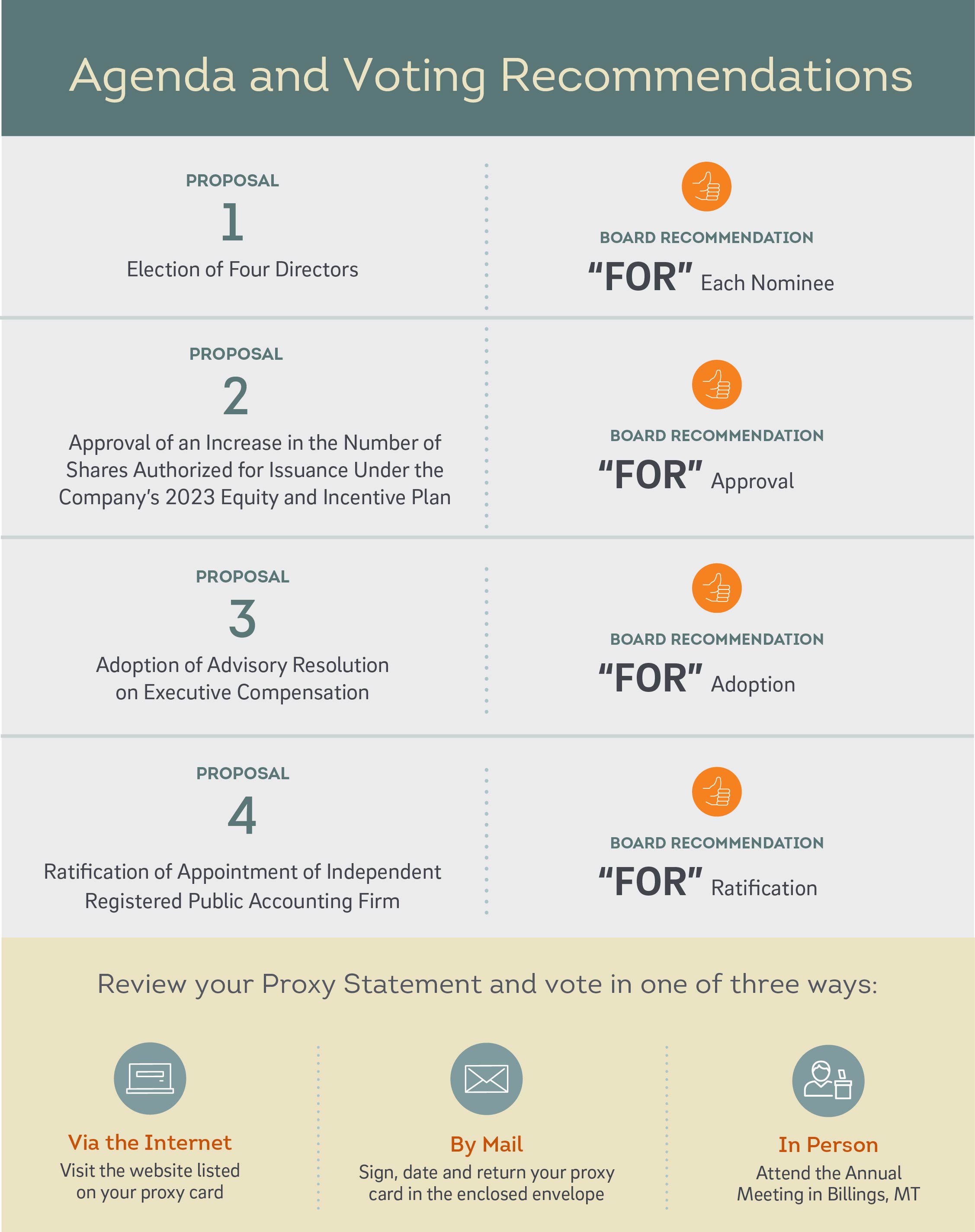

PROPOSAL 1 | The Board recommends you vote your shares FOR the election of each of the four director nominees. |

PROPOSAL 2 | The Board recommends you vote your shares FOR the approval of the increase in the number of shares authorized for issuance under the Company’s 2023 Equity and Incentive Plan. |

PROPOSAL 3 | The Board recommends you vote your shares FOR the adoption of a non-binding advisory resolution on executive compensation. |

PROPOSAL 4 | The Board recommends you vote your shares FOR ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2024. |

2023 Proxy Statement | 94 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 95 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 96 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 97 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 98 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | 99 | First Interstate BancSystem, Inc. |

2023 Proxy Statement | A-1 | First Interstate BancSystem, Inc. |