4Q 2024 Investor Presentation Exhibit 99.2 January 29, 2025

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder, that involve inherent risks and uncertainties. Any statements about our plans, objectives, expectations, strategies, beliefs, or future performance or events constitute forward-looking statements. Such statements are identified by words or phrases such as “believes,” “expects,” “anticipates,” “plans,” “trends,” “objectives,” “continues”, “projected”, or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “may” or similar expressions. Forward- looking statements involve known and unknown risks, uncertainties, assumptions, estimates and other important factors that could cause actual results to differ materially from any results, performance or events expressed or implied by such forward-looking statements. The following factors, among others, may cause actual results to differ materially from current expectations in the forward-looking statements, including those set forth in this presentation: new or changes in existing, governmental regulations or in the way such regulations are interpreted or enforced; negative developments in the banking industry and increased regulatory scrutiny; tax legislative initiatives or assessments; more stringent capital requirements, to the extent they may become applicable to us; changes in accounting standards; any failure to comply with applicable laws and regulations, including, but not limited to, the Community Reinvestment Act and fair lending laws, the USA PATRIOT ACT of 2001, the Office of Foreign Asset Control guidelines and requirements, the Bank Secrecy Act, and the related Financial Crimes Enforcement Network and Federal Financial Institutions Examination Council Guidelines and regulations; federal deposit insurance increases; lending risks and risks associated with loan sector concentrations; a decline in economic conditions that could reduce demand for our products and services and negatively impact the credit quality of loans; loan credit losses exceeding estimates; exposure to losses in collateralized loan obligation securities; changes to United States trade policies, including the imposition of tariffs and retaliatory tariffs; the soundness of other financial institutions; the ability to meet cash flow needs and availability of financing sources for working capital and other needs; a loss of deposits or a change in product mix that increases the Company’s funding costs; inability to access funding or to monetize liquid assets; changes in interest rates; interest rate effect on the value of our investment securities; cybersecurity risks, including denial-of-service attacks, network intrusions, business e-mail compromise, and other malicious behavior that could result in the disclosure of confidential information; privacy, information security, and data protection laws, rules, and regulations that affect or limit how we collect and use personal information or otherwise have an adverse effect on us; the potential impairment of our goodwill and other intangible assets; our reliance on other companies that provide key components of our business infrastructure; events that may tarnish our reputation; mainstream and social media contagion; the loss of the services of key members of our management team and directors; our ability to attract and retain qualified employees to operate our business; costs associated with repossessed properties, including environmental remediation; the effectiveness of our internal control over financial reporting; our ability to implement technology-facilitated products and services or be successful in marketing these products and services to our clients; the development and use of artificial intelligence; risks related to acquisitions, mergers, strategic partnerships and other transactions; competition from new or existing financial institutions and non-banks; investing in technology; incurrence of significant costs related to mergers and related integration activities; the volatility in the price and trading volume of our common stock; “anti-takeover” provisions in our certificate of incorporation and regulations, which may make it more difficult for a third party to acquire control of us even in circumstances that could be deemed beneficial to stockholders; changes in our dividend policy or our ability to pay dividends; our common stock not being an insured deposit; the potential dilutive effect of future equity issuances; the subordination of our common stock to our existing and future indebtedness; the effect of global conditions, earthquakes, volcanoes, tsunamis, floods, fires, drought, and other natural catastrophic events; and the impact of climate change and environmental sustainability matters. The foregoing factors are not necessarily all of the factors that could cause our actual results, performance or achievements to differ materially from those expressed in or implied by any of our forward-looking statements. Other unknown or unpredictable factors also could harm our results. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above and included in our periodic reports filed with the Securities and Exchange Commission, or SEC, under the Securities Exchange Act of 1934, as amended, under the caption “Risk Factors”. Interested parties are urged to read in their entirety such risk factors prior to making any investment decision with respect to the Company. Forward-looking statements speak only as of the date they are made and we do not undertake or assume any obligation to update publicly any of these statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward- looking statements, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. 2

FIRST INTERSTATE BANCSYSTEM, INC. OVERVIEW Premier community banking institution in growing markets throughout the Midwest and Pacific Northwest Financial Highlights Balance Sheet Capital Assets $29.1 Billion Total RBC3** 14.38% LHFI1 $17.8 Billion CET14** 12.16% Deposits $23.0 Billion Leverage** 8.71% ACL2/LHFI 1.14% TCE ratio5 7.55% 1Loans held for investment (LHFI) 3Risk based capital (RBC) 2Allowance for credit losses (ACL) 4Common equity tier-1 (CET1) 5Tangible common equity (TCE) (Non-GAAP) Corporate Overview Headquarters Billings, MT Exchange/Listing NASDAQ: FIBK Market Capitalization* $3.4 Billion Annualized Dividend Yield 5.8% Branch Network 300 banking offices Sub Debt Rating Kroll BBB 3 300 banking offices in 14 states * Calculated using closing stock price of $32.47 as of 12/31/2024 ** Preliminary estimates - may be subject to change

Earnings • Net income of $52.1 million, or $0.50 per share for the fourth quarter of 2024. • Net interest margin (NIM) of 3.18%, an increase of 17 basis points from the third quarter of 2024, NIM on a fully taxable equivalent (“FTE”) basis1, of 3.20%, an increase of 16 basis points from the third quarter of 2024; adjusted FTE NIM1 of 3.08%, an increase of 11 basis points from the third quarter of 2024. • Efficiency ratio2 of 60.2% for the fourth quarter of 2024 Balance Sheet • Loans decreased by $182.2 million, or 4.0% annualized, from the third quarter of 2024, driven by declines in all categories except for Commercial Real Estate and Credit card; the increase in Commercial Real Estate loans was driven by construction loans moving to permanent financing. • Deposits increased by $151.5 million from the third quarter of 2024 driven by increases in interest bearing demand deposits. • The Company’s balance sheet continues to maintain a strong liquidity position, with a loan/deposit ratio of 77.5% as of the fourth quarter of 2024. Short-term borrowings declined $512.5 million as a result of a decrease in investment securities, an increase in deposits, and a decrease in loan balances. Asset Quality • Criticized loans increased $170.0 million, or 28.2%, from the third quarter of 2024, to 4.3% of loans held for investment (LHFI), driven mostly by downgrades of Commercial Real Estate loans. Four relationships represent over 90% of the net increase in criticized loans. The relationships were largely in the eastern part of the footprint and the downgrades were not broadly driven by industry specific challenges. • Non-performing loans of $141.3 million decreased 19.0% from the third quarter of 2024, reflecting 0.79% of LHFI, driven by the charge-off of the previously disclosed non-performing commercial and industrial loan and the payoff of a $22.2 million agricultural credit, offset by normal migration. Non-performing assets of $145.6 million decreased 18.6% from the third quarter of 2024, reflecting the decrease in non-performing loans. • Net charge-offs (NCOs) were $55.2 million, or an annualized 122 basis points of average loans outstanding during the fourth quarter of 2024, driven by a $49.3 million charge-off on the previously disclosed commercial and industrial loan. Excluding this charge-off, NCOs were 13 basis points of average loans outstanding. • Total provision for credit losses was $33.7 million; funded Allowance for Credit Losses coverage of 1.14% of LHFI during the fourth quarter of 2024 compared to 1.25% from the third quarter of 2024, driven by the release of the previously disclosed $26.5 million specific reserve on the commercial and industrial loan that was partially charged-off. Coverage increased 4 basis points absent the impact of the noted specific reserve release. Capital • Quarterly cash dividend of $0.47 per share, for an annualized yield of 5.8% for the fourth quarter of 2024. • CET13 of 12.16% and total RBC3 of 14.38% for the fourth quarter of 2024. • Regulatory capital ratios improved during the quarter; CET1 improved 33 basis points. FOURTH QUARTER 2024 HIGHLIGHTS 4 1 See non-GAAP table in appendix for reconciliation 2 The ratio of bank non-interest expense to revenue (per FDIC definition) 3 Preliminary estimates - may be subject to change

Loan Highlights: • Loans decreased $182.2 million during the fourth quarter of 2024 driven by declines in most loan categories. • Commercial real estate loans increased due to inflows from completed construction projects; excluding completed construction projects, commercial real estate loans declined as paydowns exceeded new loan originations. • Commercial real estate balances are 33.0% owner-occupied as-of the fourth quarter of 2024. DIVERSIFIED LOAN PORTFOLIO Loans Held for Investment Commercial RE, 52% Construction RE, 7% Residential RE, 12% Agriculture RE, 4% Consumer, 5%Commercial, 16% Agriculture, 4% Loans by Geography MT, 19% WY, 6% ID, 7% WA, 9% OR, 10%NE, 7% SD, 12% ND, 2% IA, 11% KS, 2% AZ, 6% CO, 7% Other, 2% Revolving Commitments ($B) $3.0 $2.9 $2.7 $2.7 $2.6 38.5% 38.6% 41.3% 40.4% 41.9% Unfunded Funded 4Q23 1Q24 2Q24 3Q24 4Q24 5 $17.8B Balances as of December 31, 2024

COMMERCIAL REAL ESTATE AND CONSTRUCTION PORTFOLIOS Property Type Multifamily, 24% Medical, 12% Retail, 20% Industrial/Warehouse, 18% Office, 10%Hotel, 9% Land & Development, 3% Other CRE, 2% Residential 1-4 Family, 2% Market Type Metro, 5% Mid-Metro, 8% Non-Metro, 87% 6 Highlights: • $10.5 billion portfolio (59% of total loans), well diversified by property type and geography • Non-owner-occupied portfolio of $6.2 billion (35% of total loans) • $58.7 million of non-accrual loans (0.56% of commercial real estate and construction portfolios) • Montana has the largest state concentration representing 17% of portfolio Balances as of December 31, 2024 Highlights: • Metro defined as property located in Portland, Seattle, Denver, Phoenix, Minneapolis / St. Paul, and Kansas City. • Mid-metro defined as Omaha, Des Moines, Tuscon, and Boise. • Non-metro defined as all other areas.

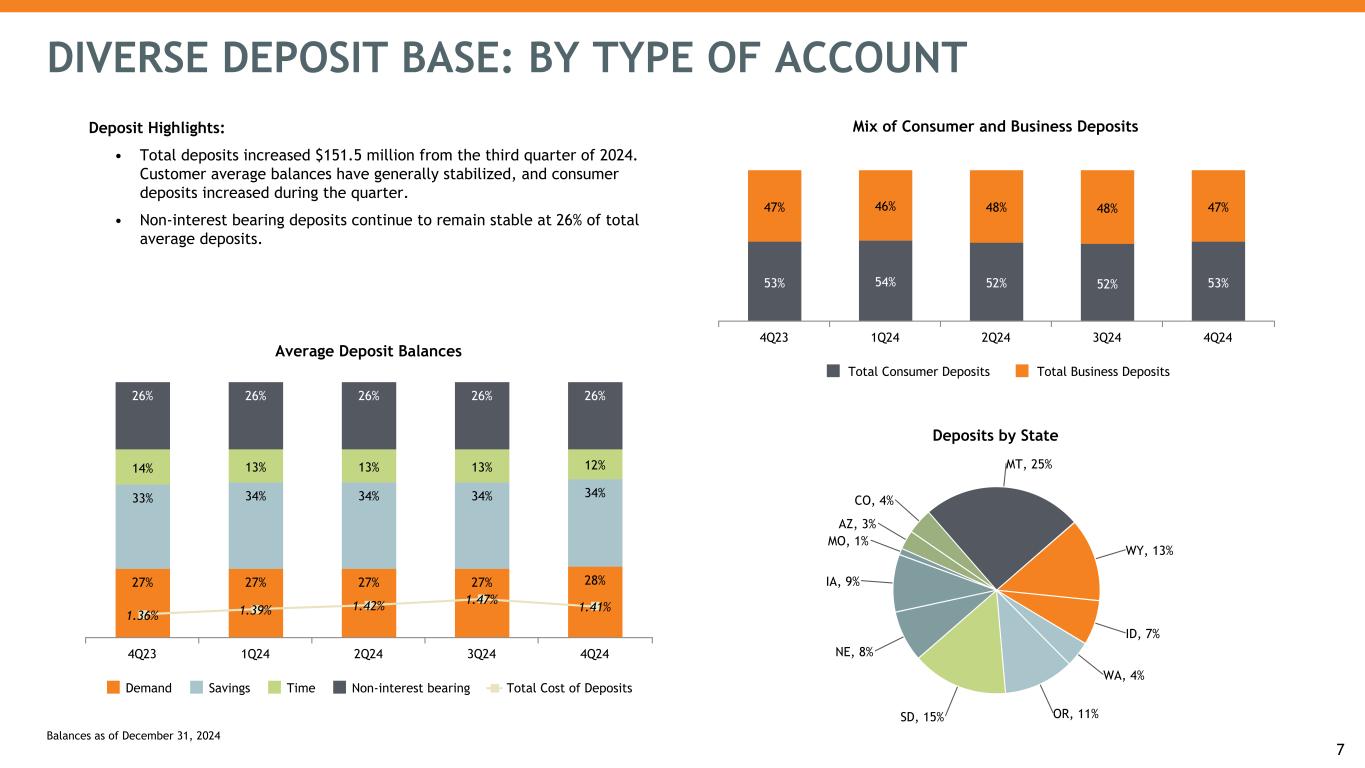

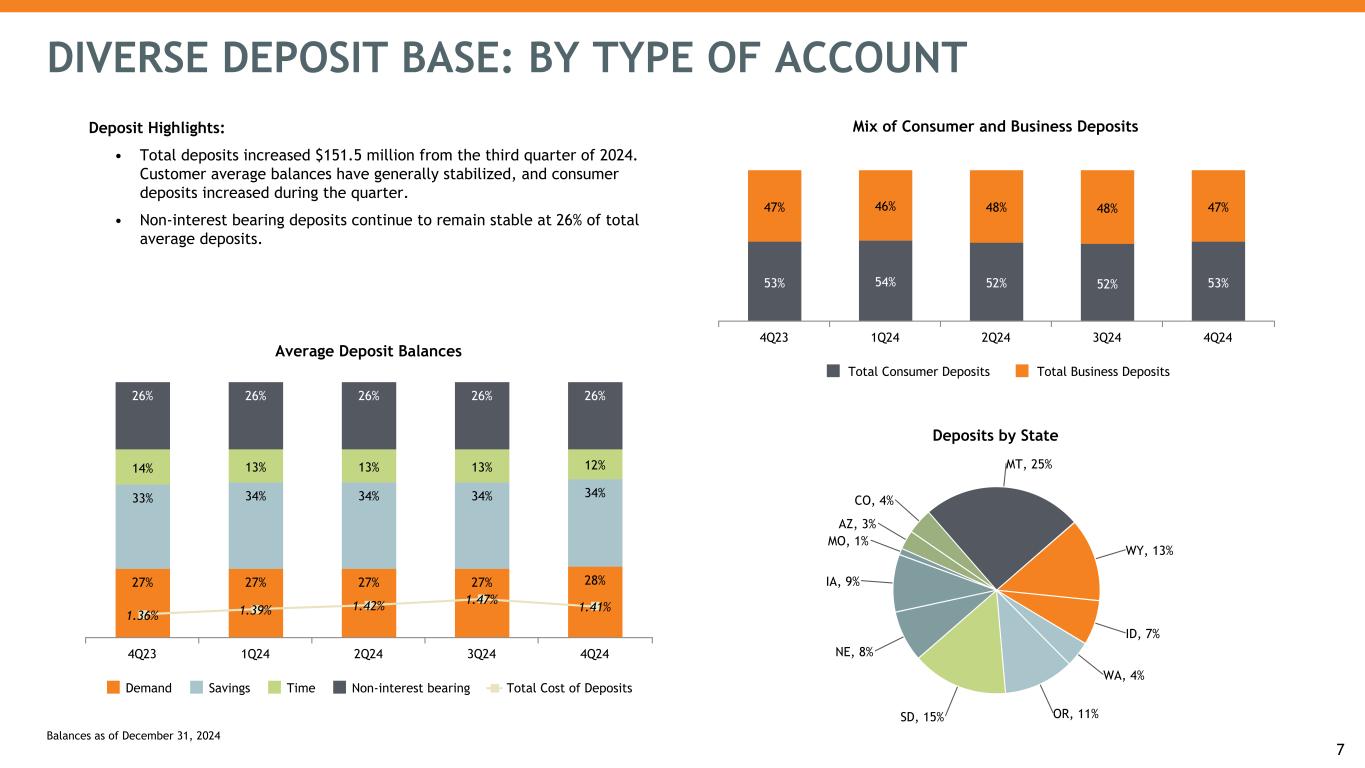

Deposits by State MT, 25% WY, 13% ID, 7% WA, 4% OR, 11%SD, 15% NE, 8% IA, 9% MO, 1% AZ, 3% CO, 4% Mix of Consumer and Business Deposits 53% 54% 52% 52% 53% 47% 46% 48% 48% 47% Total Consumer Deposits Total Business Deposits 4Q23 1Q24 2Q24 3Q24 4Q24 7 Average Deposit Balances 27% 27% 27% 27% 28% 33% 34% 34% 34% 34% 14% 13% 13% 13% 12% 26% 26% 26% 26% 26% 1.36% 1.39% 1.42% 1.47% 1.41% Demand Savings Time Non-interest bearing Total Cost of Deposits 4Q23 1Q24 2Q24 3Q24 4Q24 DIVERSE DEPOSIT BASE: BY TYPE OF ACCOUNT Balances as of December 31, 2024 Deposit Highlights: • Total deposits increased $151.5 million from the third quarter of 2024. Customer average balances have generally stabilized, and consumer deposits increased during the quarter. • Non-interest bearing deposits continue to remain stable at 26% of total average deposits.

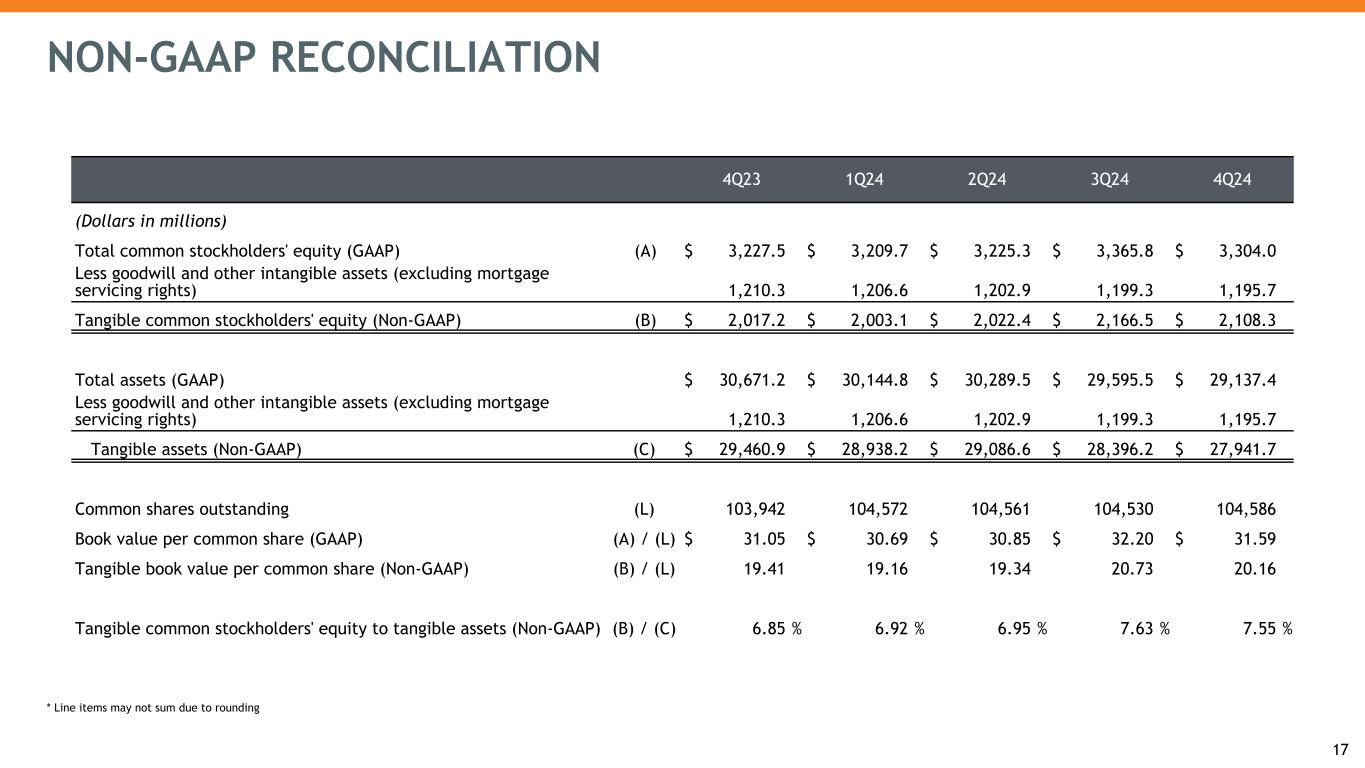

Total Risk-Based Capital Ratios 13.28% 13.64% 13.80% 14.11% 14.38% 11.08% 11.37% 11.53% 11.83% 12.16% 2.20% 2.27% 2.27% 2.28% 2.23% CET1 Total RBC 4Q23 1Q24 2Q24 3Q24 4Q24² CAPITAL AND LIQUIDITY Liquid and flexible balance sheet with strong capital position Common Equity (CE) and Tangible Common Equity (TCE)¹ $31.05 $30.69 $30.85 $32.20 $31.59 $19.41 $19.16 $19.34 $20.73 $20.16 6.85% 6.92% 6.95% 7.63% 7.55% 10.52% 10.65% 10.65% 11.37% 11.34% TBVPS BVPS TCE Ratio CE Ratio 4Q23 1Q24 2Q24 3Q24 4Q24 8 LHFI to Deposit Ratio 78.4% 79.8% 79.7% 78.8% 77.5% 4Q23 1Q24 2Q24 3Q24 4Q24 1 See Non-GAAP table in appendix for reconciliation 2 Preliminary estimates - may be subject to change Capital and Liquidity Highlights: • Annualized dividend yield of 5.8% based on an average share price of $32.53 for the fourth quarter of 2024. • Capital ratios increased for the eighth consecutive quarter. • Tangible book value per share (TBVPS)1 decreased during the fourth quarter, driven by an increase in the accumulated other comprehensive income (AOCI) position of $67.0 million. For the fourth quarter of 2024, the AOCI mark is equal to $3.08 of book value per share (BVPS).

ALLOWANCE FOR CREDIT LOSSES (ACL) ACL ($MM) and Funded ACL/LHFI Ratio $246.1 $243.1 $238.6 $231.0 $209.3$227.7 $227.7 $232.8 $225.4 $204.1 $18.4 $15.4 $5.8 $5.6 $5.2 1.25% 1.25% 1.28% 1.25% 1.14% Funded ACL Unfunded ACL Funded ACL % of LHFI 4Q23 1Q24 2Q24 3Q24 4Q24 9 ACL Roll-forward ($MM) Funded Unfunded Investments Total ACL 9/30/24 $225.4 $5.6 $0.7 $231.7 ACL Provision (Reversal) 33.9 (0.4) 0.2 33.7 Net Charge-offs 55.2 — — 55.2 ACL 12/31/24 $204.1 $5.2 $0.9 $210.2 * Line items may not sum due to rounding ACL Highlights: • Funded ACL decreased to 1.14% of loans from 1.25% in the prior quarter, driven by the release of the previously disclosed $26.5 million specific reserve on the C&I loan that was partially charged-off. • Coverage increased 4 basis points absent the impact of the noted specific reserve release. • Charge-offs were driven by a $49.3 million charge-off on the previously disclosed C&I loan. Excluding this charge-off, NCOs were 13 basis points of average loans outstanding.

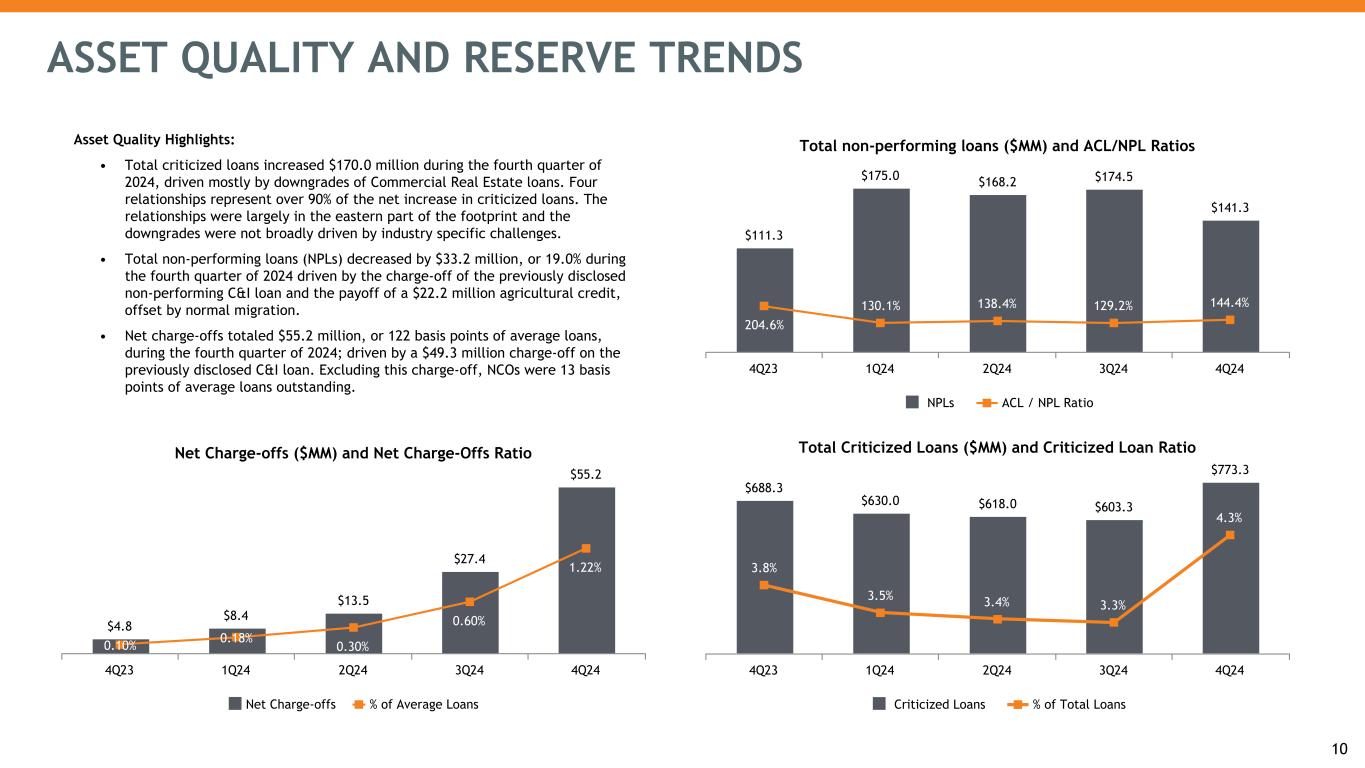

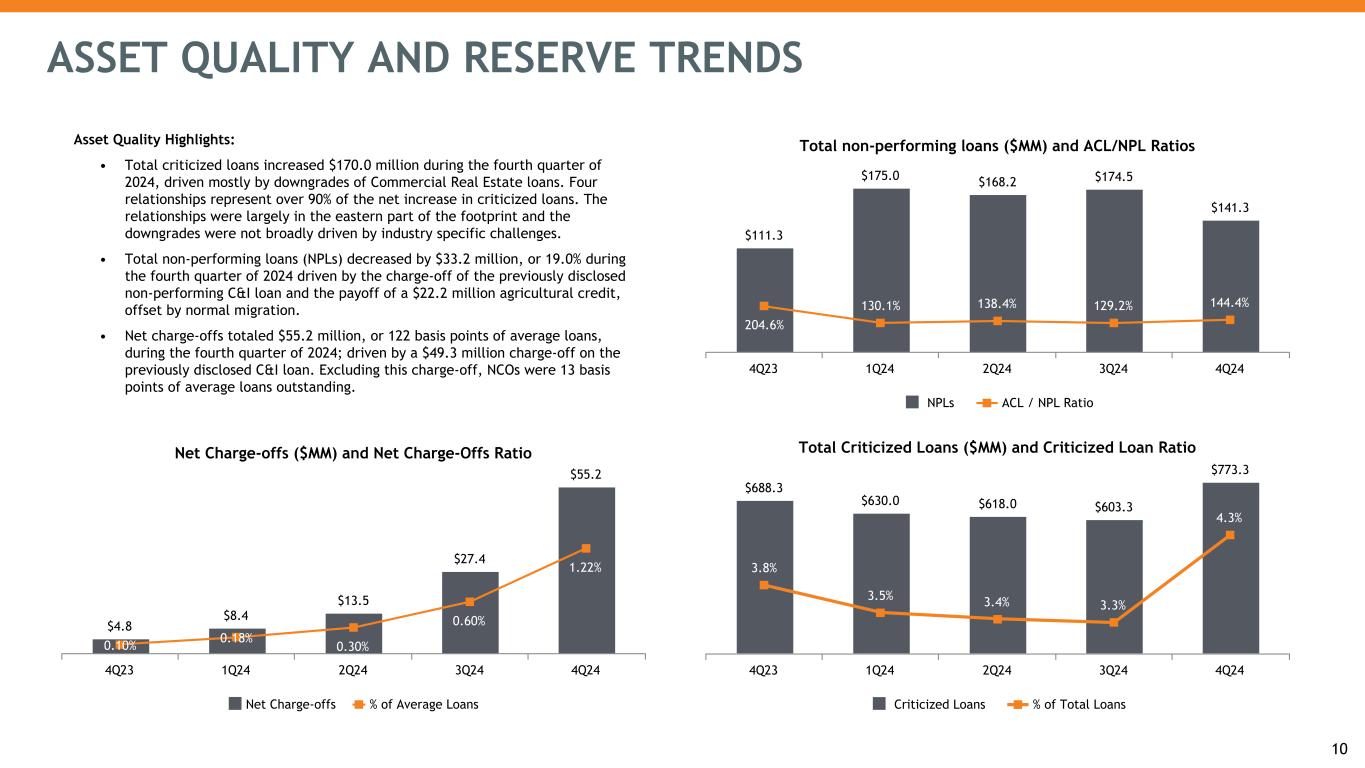

Asset Quality Highlights: • Total criticized loans increased $170.0 million during the fourth quarter of 2024, driven mostly by downgrades of Commercial Real Estate loans. Four relationships represent over 90% of the net increase in criticized loans. The relationships were largely in the eastern part of the footprint and the downgrades were not broadly driven by industry specific challenges. • Total non-performing loans (NPLs) decreased by $33.2 million, or 19.0% during the fourth quarter of 2024 driven by the charge-off of the previously disclosed non-performing C&I loan and the payoff of a $22.2 million agricultural credit, offset by normal migration. • Net charge-offs totaled $55.2 million, or 122 basis points of average loans, during the fourth quarter of 2024; driven by a $49.3 million charge-off on the previously disclosed C&I loan. Excluding this charge-off, NCOs were 13 basis points of average loans outstanding. ASSET QUALITY AND RESERVE TRENDS Net Charge-offs ($MM) and Net Charge-Offs Ratio $4.8 $8.4 $13.5 $27.4 $55.2 0.10% 0.18% 0.30% 0.60% 1.22% Net Charge-offs % of Average Loans 4Q23 1Q24 2Q24 3Q24 4Q24 Total non-performing loans ($MM) and ACL/NPL Ratios $111.3 $175.0 $168.2 $174.5 $141.3 204.6% 130.1% 138.4% 129.2% 144.4% NPLs ACL / NPL Ratio 4Q23 1Q24 2Q24 3Q24 4Q24 Total Criticized Loans ($MM) and Criticized Loan Ratio $688.3 $630.0 $618.0 $603.3 $773.3 3.8% 3.5% 3.4% 3.3% 4.3% Criticized Loans % of Total Loans 4Q23 1Q24 2Q24 3Q24 4Q24 10

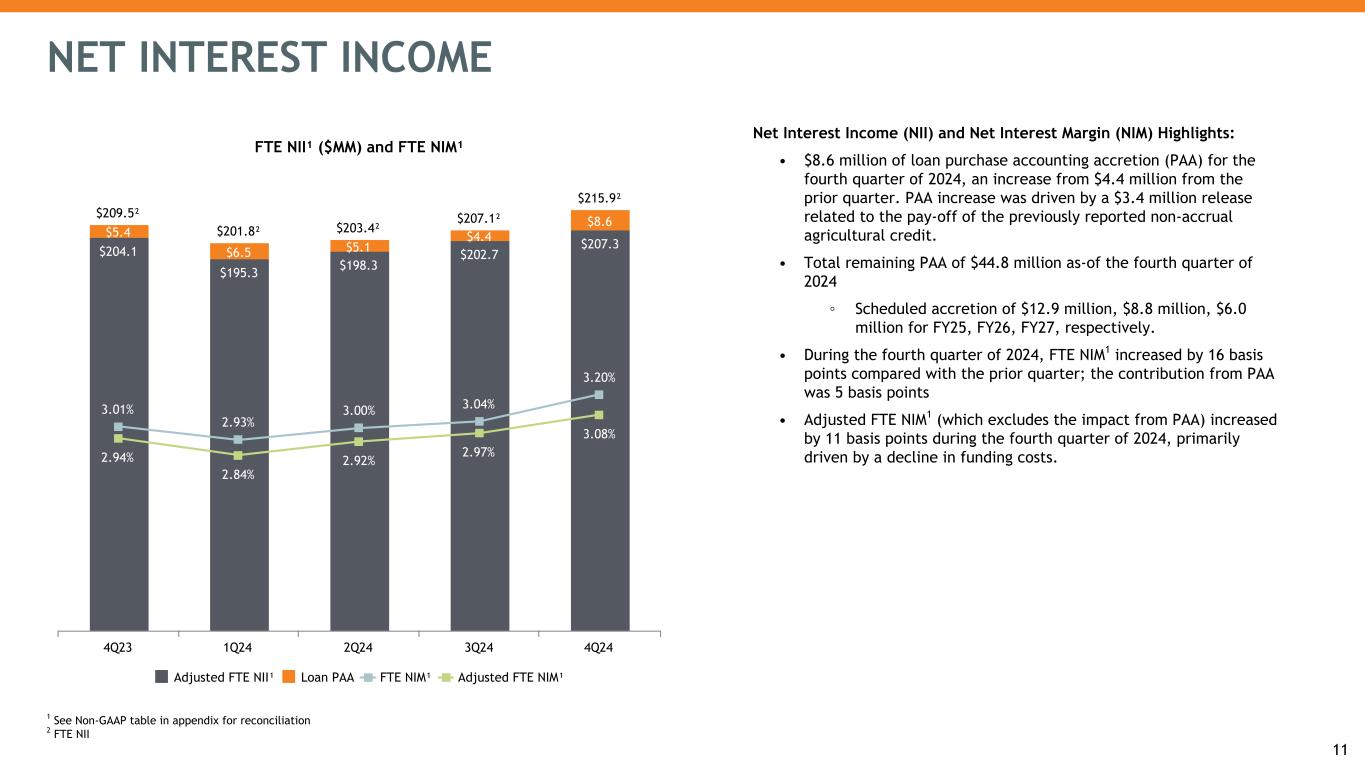

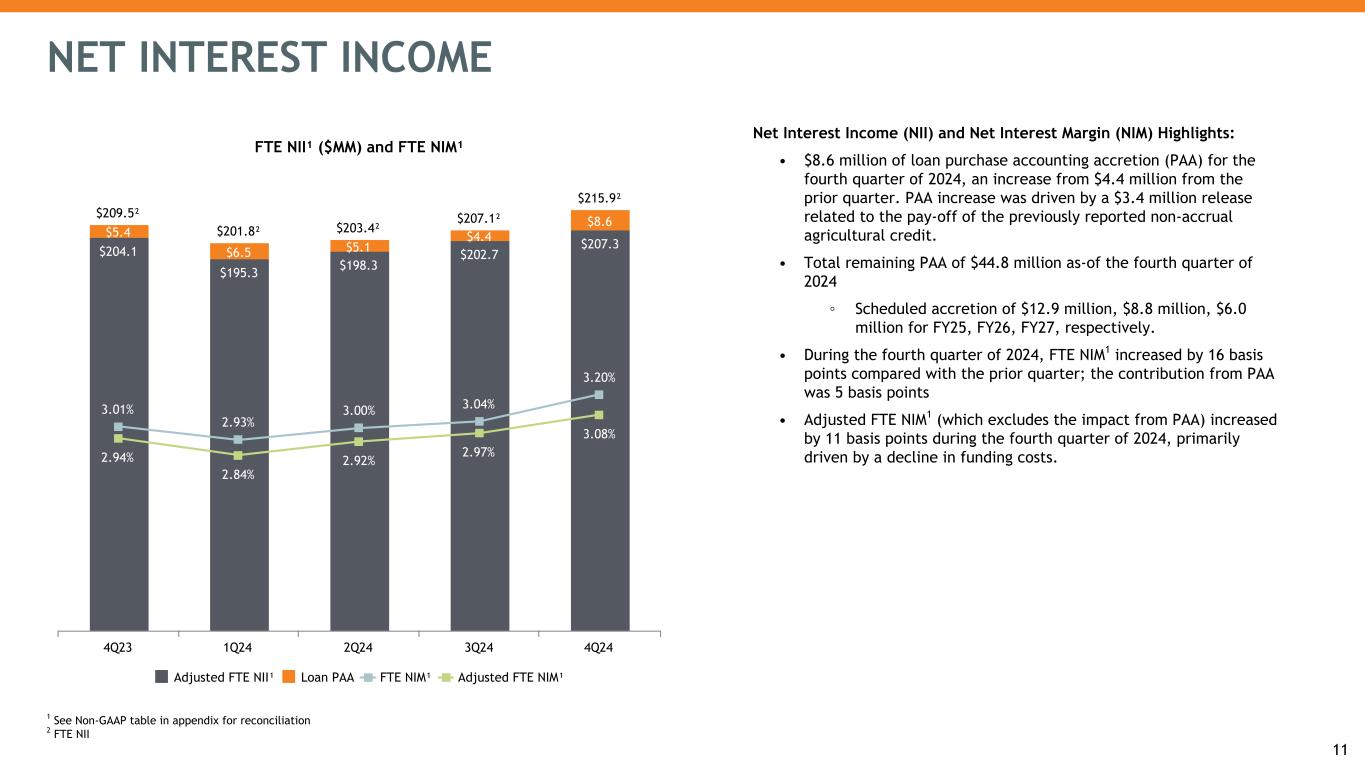

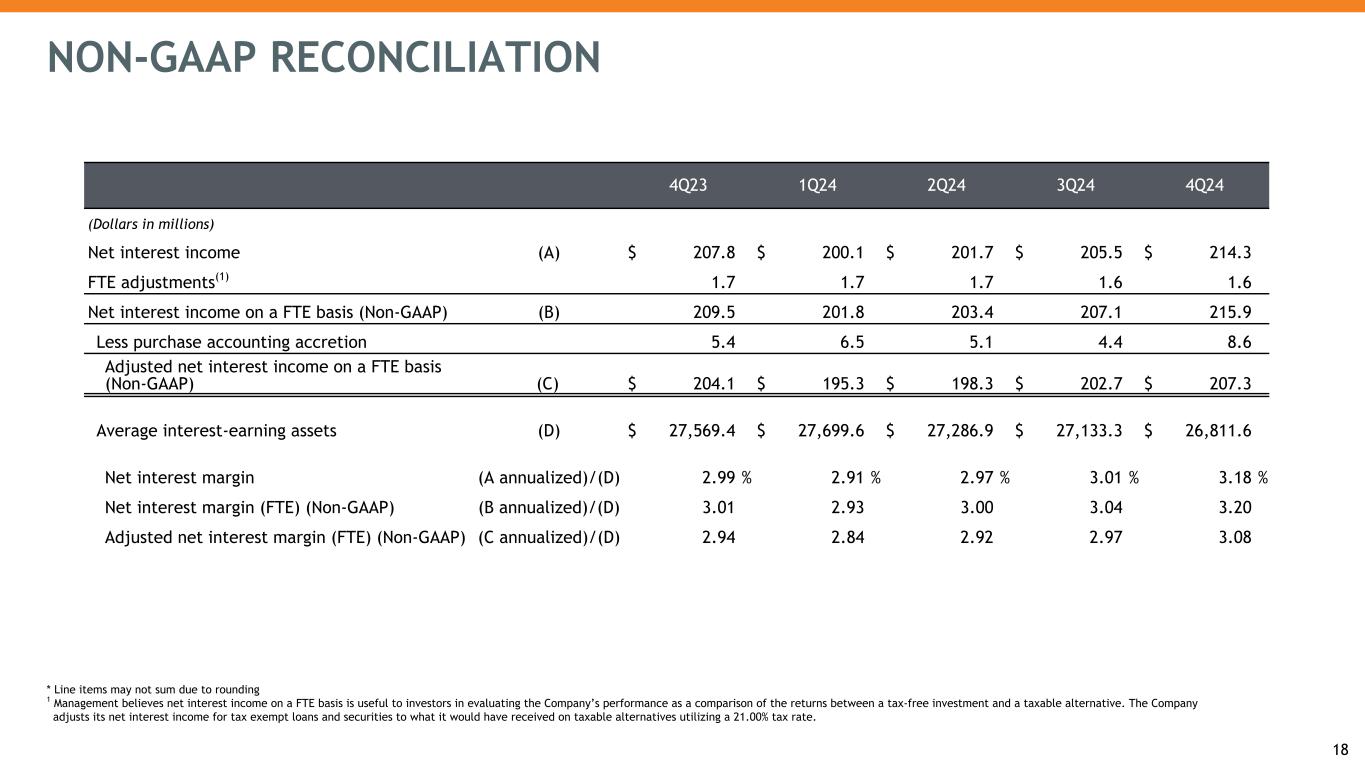

Net Interest Income (NII) and Net Interest Margin (NIM) Highlights: • $8.6 million of loan purchase accounting accretion (PAA) for the fourth quarter of 2024, an increase from $4.4 million from the prior quarter. PAA increase was driven by a $3.4 million release related to the pay-off of the previously reported non-accrual agricultural credit. • Total remaining PAA of $44.8 million as-of the fourth quarter of 2024 ◦ Scheduled accretion of $12.9 million, $8.8 million, $6.0 million for FY25, FY26, FY27, respectively. • During the fourth quarter of 2024, FTE NIM1 increased by 16 basis points compared with the prior quarter; the contribution from PAA was 5 basis points • Adjusted FTE NIM1 (which excludes the impact from PAA) increased by 11 basis points during the fourth quarter of 2024, primarily driven by a decline in funding costs. NET INTEREST INCOME FTE NII¹ ($MM) and FTE NIM¹ $204.1 $195.3 $198.3 $202.7 $207.3 $5.4 $6.5 $5.1 $4.4 $8.6 $209.5² $201.8² $203.4² $207.1² $215.9² 3.01% 2.93% 3.00% 3.04% 3.20% 2.94% 2.84% 2.92% 2.97% 3.08% Adjusted FTE NII¹ Loan PAA FTE NIM¹ Adjusted FTE NIM¹ 4Q23 1Q24 2Q24 3Q24 4Q24 11 1 See Non-GAAP table in appendix for reconciliation 2 FTE NII

INVESTMENT PORTFOLIO 12 Total Portfolio Duration at Quarter-end 3.5 3.6 3.5 3.4 3.7 4Q23 1Q24 2Q24 3Q24 4Q24 (in years) Projected Cash Flow ($MM) and Yield Roll-Off at Quarter-end* $168.6 $198.1 $318.8 $205.7 $196.0 $199.5 2.37% 2.36% 2.73% 2.49% 2.36% 2.39% 1Q25E 2Q25E 3Q25E 4Q25E 1Q26E 2Q26E *Constitute forward-looking statements

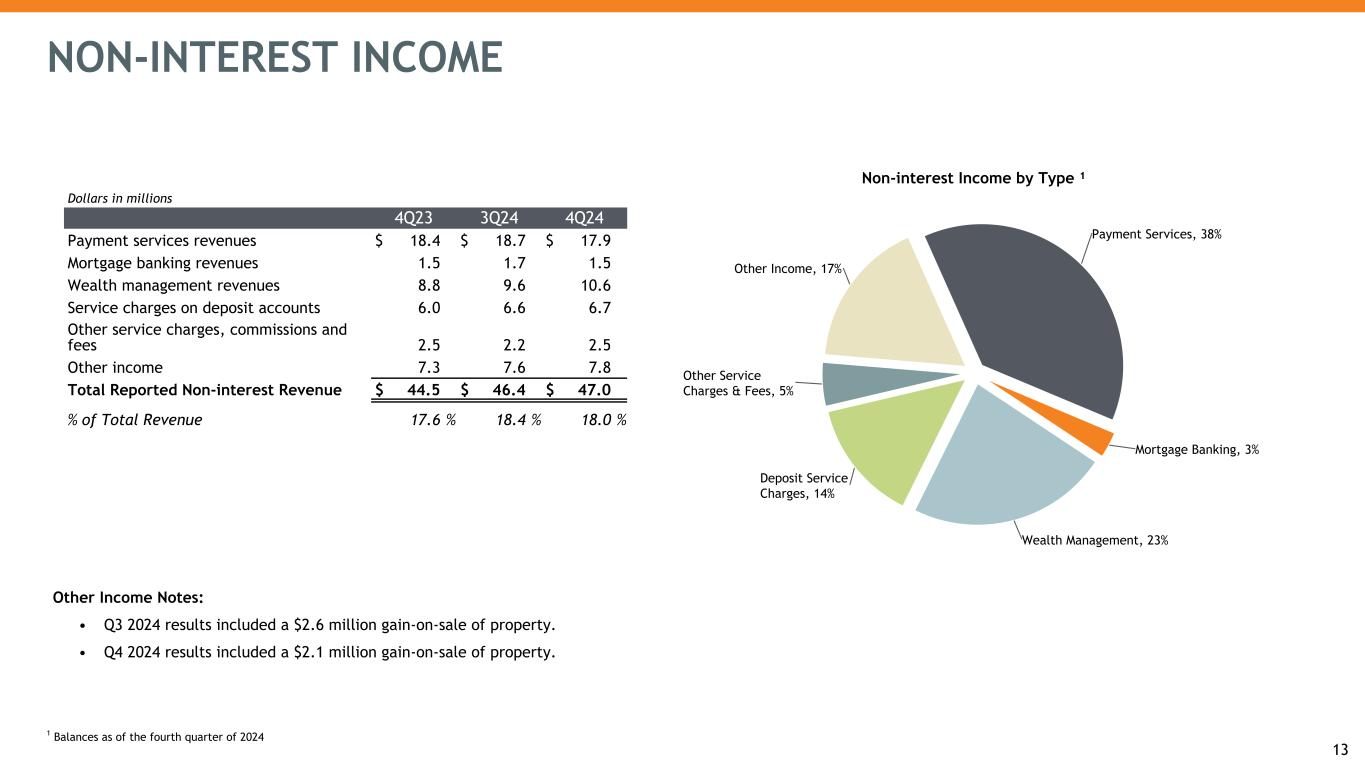

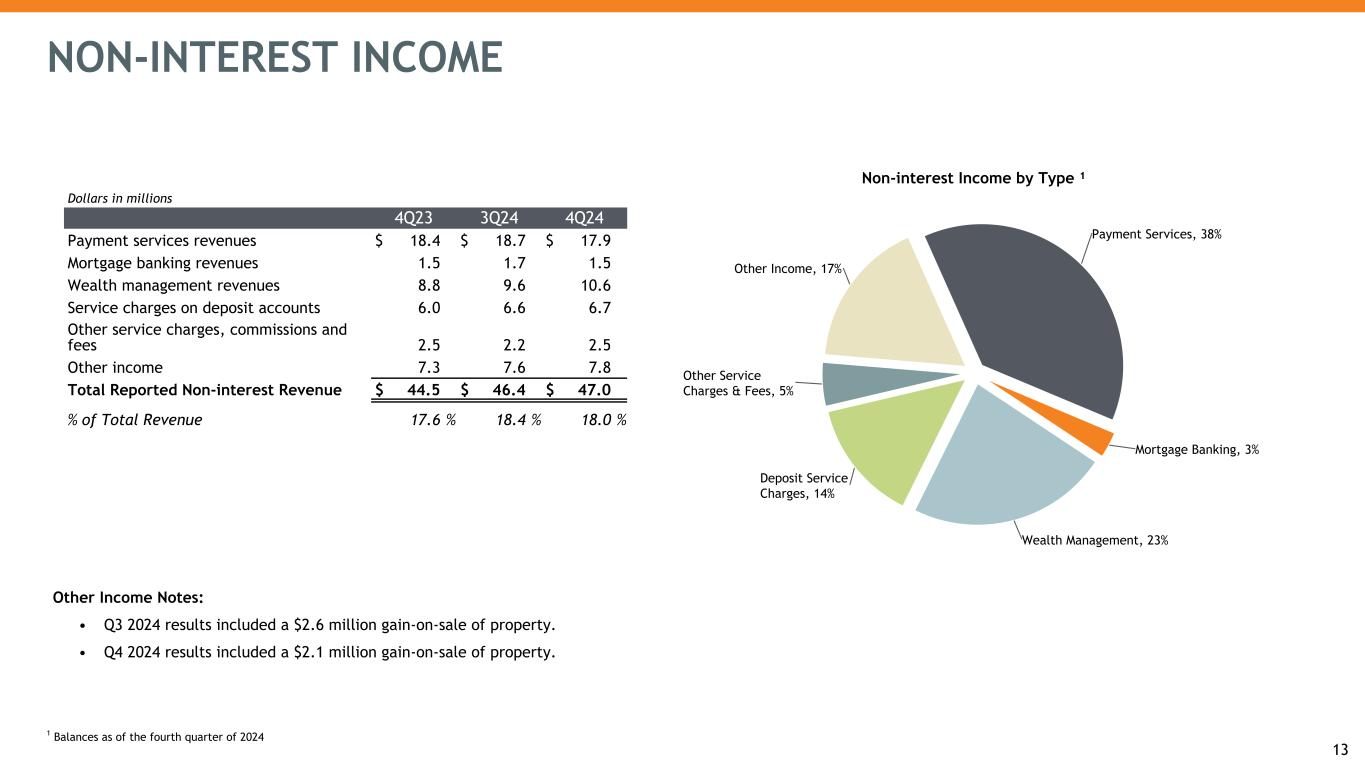

13 Non-interest Income by Type ¹ Payment Services, 38% Mortgage Banking, 3% Wealth Management, 23% Deposit Service Charges, 14% Other Service Charges & Fees, 5% Other Income, 17% Dollars in millions 4Q23 3Q24 4Q24 Payment services revenues $ 18.4 $ 18.7 $ 17.9 Mortgage banking revenues 1.5 1.7 1.5 Wealth management revenues 8.8 9.6 10.6 Service charges on deposit accounts 6.0 6.6 6.7 Other service charges, commissions and fees 2.5 2.2 2.5 Other income 7.3 7.6 7.8 Total Reported Non-interest Revenue $ 44.5 $ 46.4 $ 47.0 % of Total Revenue 17.6 % 18.4 % 18.0 % NON-INTEREST INCOME Other Income Notes: • Q3 2024 results included a $2.6 million gain-on-sale of property. • Q4 2024 results included a $2.1 million gain-on-sale of property. 1 Balances as of the fourth quarter of 2024

NON-INTEREST EXPENSE 14 Dollars in millions 4Q23 3Q24 4Q24 Salaries and wages $ 64.0 $ 70.9 $ 68.5 Employee benefits 13.5 19.7 20.5 Occupancy and equipment 17.4 17.0 18.2 Other intangible amortization 3.9 3.6 3.6 Other expenses 67.0 48.2 50.0 Other real estate owned expense 0.2 — 0.1 Total Reported Non-interest Expense $ 166.0 $ 159.4 $ 160.9 Non-interest Expense ($MM) and Efficiency Ratio 166.0 160.2 156.9 159.4 160.9 64.2% 64.6% 62.7% 61.8% 60.2% Total Non-interest Expenses Efficiency Ratio ¹ 4Q23 1Q24 2Q24 3Q24 4Q24 1 The ratio of the bank’s non-interest expense to revenue (per FDIC definition) Non-interest Expense Notes: • Q1 2024 results include a $1.5 million accrual for a FDIC special assessment • Q3 2024 results included $3.8 million related to former CEO transition related expenses

Loans and Deposits • Anticipate ending deposits to increase low single digits in 2025, with normal seasonality • Discontinuing Indirect Lending originations in the first quarter; portfolio reflects ~4% of loan balances; annual amortization approximating 30-40% of Indirect balances • Excluding Indirect runoff, modest loan growth in 2025, primarily focused in back-half of year. Net Interest Income • Anticipate full-year net interest income to increase 5-7% in 2025 over 2024 • Outlook assumes one 25 basis point rate decrease in second quarter; rate decreases have minimal impact on outlook Non-Interest Income • Excluding the impact of 2024 gains on sale of property, anticipate 2025 non-interest income to be modestly higher compared to 2024; assumption continues to include muted mortgage activity Non-Interest Expense • Anticipate reported 2025 non-interest expense to increase 3-5% over 2024 due to resetting of certain expenses, including advertising and medical insurance Tax Rate • Anticipate effective tax rate to be 23.5%-24.0% for full-year 2025 Credit Quality • Anticipate net charge-offs between 20 and 30 basis points for the full year 2025 GUIDANCE SUMMARY* 15 *Preliminary estimates - may be subject to change *Constititute forward-looking statements

NON-GAAP FINANCIAL MEASURES 16 In addition to results presented in accordance with accounting principles generally accepted in the United States of America, or GAAP, this presentation contains the following non-GAAP financial measures that management uses to evaluate our performance relative to our capital adequacy standards: (i) tangible common stockholders’ equity; (ii) tangible assets; (iii) tangible book value per common share; (iv) tangible common stockholders’ equity to tangible assets;(v) net interest income on a fully taxable equivalent basis; (vi) adjusted net interest income on a fully taxable equivalent basis; (vii) net interest margin on a fully taxable equivalent basis; and (viii) adjusted net interest margin on a fully taxable equivalent basis. Tangible common stockholders’ equity is calculated as total common stockholders’ equity less goodwill and other intangible assets (excluding mortgage servicing rights). Tangible assets are calculated as total assets less goodwill and other intangible assets (excluding mortgage servicing rights). Tangible book value per common share is calculated as tangible common stockholders’ equity divided by common shares outstanding. Tangible common stockholders’ equity to tangible assets is calculated as tangible common stockholders’ equity divided by tangible assets. Net interest income on a fully taxable equivalent basis is calculated as net interest income, adjusted to include its fully taxable equivalent interest income. Adjusted net interest income on a fully taxable equivalent basis is calculated as net interest income on a fully taxable equivalent basis less purchase accounting interest accretion on acquired loans. Net interest margin on a fully taxable equivalent basis is calculated as annualized net interest income on a fully taxable equivalent basis divided by average interest-earning assets. Adjusted net interest margin on a fully taxable equivalent basis is calculated as annualized adjusted net interest income on a fully taxable equivalent basis divided by average interest-earning assets. These non-GAAP financial measures are calculated on the reconciliation pages that follow). These non-GAAP financial measures may not be comparable to similarly titled measures reported by other companies because other companies may not calculate these non-GAAP measures in the same manner. They also should not be considered in isolation or as a substitute for measures prepared in accordance with GAAP. The Company adjusts the most directly comparable capital adequacy GAAP financial measures to the non-GAAP financial measures described in subclauses (i) through (iv) above to exclude goodwill and other intangible assets (except mortgage servicing rights), adjusts its GAAP net interest income to include fully taxable equivalent adjustments and further adjusts its net interest income on a fully taxable equivalent basis to exclude purchase accounting interest accretion. Management believes these non-GAAP financial measures, which are intended to complement the capital ratios defined by banking regulators and are intended to present on a consistent basis our and our acquired companies’ organic continuing operations without regard to the acquisition costs and adjustments that we consider to be unpredictable and dependent on a significant number of factors that are outside our control, are useful to investors in evaluating the Company’s performance because, as a general matter, they either do not represent an actual cash expense and are inconsistent in amount and frequency depending upon the timing and size of our acquisitions (including the size, complexity and/or volume of past acquisitions, which may drive the magnitude of acquisition related costs, but may not be indicative of the size, complexity and/or volume of future acquisitions or related costs), or they cannot be anticipated or estimated in a particular period (in particular as it relates to unexpected recovery amounts). This impacts the ratios that are important to analysts and allows investors to compare certain aspects of the Company’s capitalization to other companies. See the Non-GAAP Financial Measures tables included below and the textual discussion for a reconciliation of the above described non-GAAP financial measures to their most directly comparable GAAP financial measures.

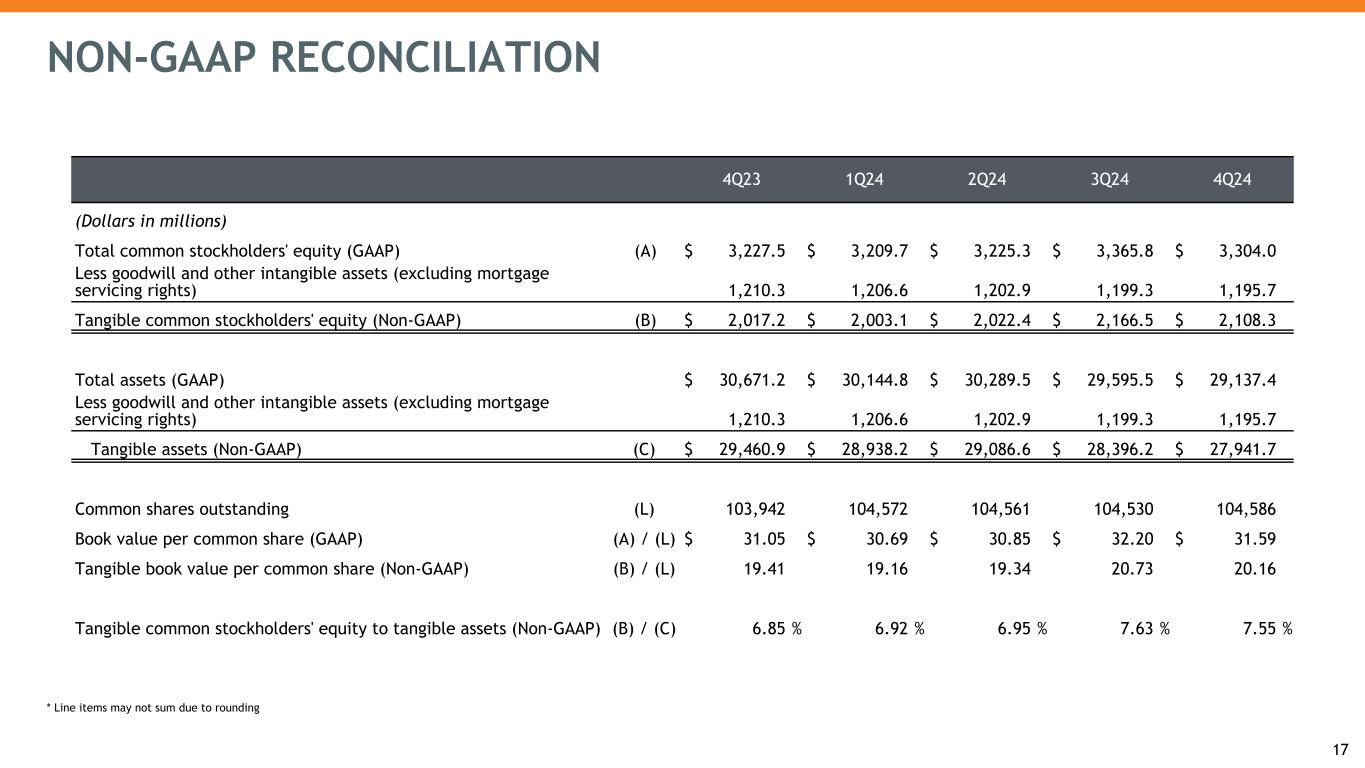

4Q23 1Q24 2Q24 3Q24 4Q24 (Dollars in millions) Total common stockholders' equity (GAAP) (A) $ 3,227.5 $ 3,209.7 $ 3,225.3 $ 3,365.8 $ 3,304.0 Less goodwill and other intangible assets (excluding mortgage servicing rights) 1,210.3 1,206.6 1,202.9 1,199.3 1,195.7 Tangible common stockholders' equity (Non-GAAP) (B) $ 2,017.2 $ 2,003.1 $ 2,022.4 $ 2,166.5 $ 2,108.3 Total assets (GAAP) $ 30,671.2 $ 30,144.8 $ 30,289.5 $ 29,595.5 $ 29,137.4 Less goodwill and other intangible assets (excluding mortgage servicing rights) 1,210.3 1,206.6 1,202.9 1,199.3 1,195.7 Tangible assets (Non-GAAP) (C) $ 29,460.9 $ 28,938.2 $ 29,086.6 $ 28,396.2 $ 27,941.7 Common shares outstanding (L) 103,942 104,572 104,561 104,530 104,586 Book value per common share (GAAP) (A) / (L) $ 31.05 $ 30.69 $ 30.85 $ 32.20 $ 31.59 Tangible book value per common share (Non-GAAP) (B) / (L) 19.41 19.16 19.34 20.73 20.16 Tangible common stockholders' equity to tangible assets (Non-GAAP) (B) / (C) 6.85 % 6.92 % 6.95 % 7.63 % 7.55 % NON-GAAP RECONCILIATION 17 * Line items may not sum due to rounding

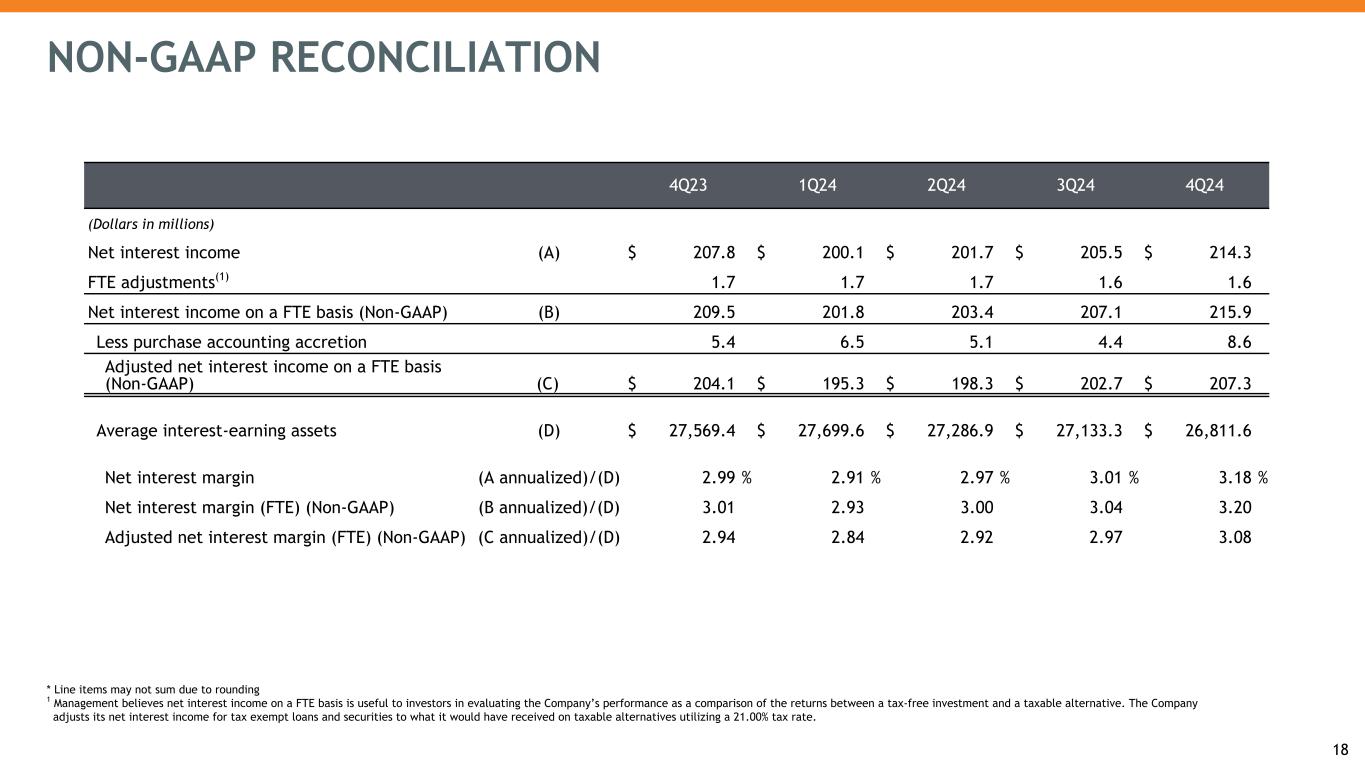

4Q23 1Q24 2Q24 3Q24 4Q24 (Dollars in millions) Net interest income (A) $ 207.8 $ 200.1 $ 201.7 $ 205.5 $ 214.3 FTE adjustments(1) 1.7 1.7 1.7 1.6 1.6 Net interest income on a FTE basis (Non-GAAP) (B) 209.5 201.8 203.4 207.1 215.9 Less purchase accounting accretion 5.4 6.5 5.1 4.4 8.6 Adjusted net interest income on a FTE basis (Non-GAAP) (C) $ 204.1 $ 195.3 $ 198.3 $ 202.7 $ 207.3 Average interest-earning assets (D) $ 27,569.4 $ 27,699.6 $ 27,286.9 $ 27,133.3 $ 26,811.6 Net interest margin (A annualized)/(D) 2.99 % 2.91 % 2.97 % 3.01 % 3.18 % Net interest margin (FTE) (Non-GAAP) (B annualized)/(D) 3.01 2.93 3.00 3.04 3.20 Adjusted net interest margin (FTE) (Non-GAAP) (C annualized)/(D) 2.94 2.84 2.92 2.97 3.08 NON-GAAP RECONCILIATION 18 * Line items may not sum due to rounding 1 Management believes net interest income on a FTE basis is useful to investors in evaluating the Company’s performance as a comparison of the returns between a tax-free investment and a taxable alternative. The Company adjusts its net interest income for tax exempt loans and securities to what it would have received on taxable alternatives utilizing a 21.00% tax rate.