QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

BIOSOURCE INTERNATIONAL, INC. |

(Name of Registrant as Specified in Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No Fee Required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid with preliminary materials: |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

|

|

(1) |

|

Amount previously paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing party:

|

| | | (4) | | Date filed:

|

[LOGO]

542 Flynn Road

Camarillo, California 93012

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on July 27, 2004

The Annual Meeting of Stockholders of BioSource International, Inc. (the "Company") will be held on Tuesday, July 27, 2004, at 10:00 a.m. local time, at the Westlake Village Inn Hotel, 31943 Agoura Road, Westlake Village, California 91361, for the following purposes:

- 1.

- To elect six directors to hold office for a period of one year or until their respective successors have been duly elected and qualified;

- 2.

- To ratify the appointment of KPMG LLP as independent accountants of the Company for the fiscal year ending December 31, 2004;

- 3.

- To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. The Board of Directors has fixed the close of business on May 31, 2004 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and at any adjournment or postponement thereof.

Your vote is important regardless of the number of shares you own. Whether or not you plan to attend the Annual Meeting, please complete, date, sign and return the enclosed proxy card as soon as possible. Your prompt response is necessary to assure that your shares are represented at the Annual Meeting.

|

|

By Order Of The Board Of Directors |

| | |

Alan I. Edrick

Executive Vice President and

Chief Financial Officer |

Camarillo, California

June 7, 2004

| | |

BioSource International, Inc.

542 Flynn Road

Camarillo, California 93012

(805) 987-0086

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

General

The enclosed Proxy is solicited on behalf of the Board of Directors of BioSource International, Inc., a Delaware corporation ("BioSource," the "Company", "we", or "us"), for use at the Annual Meeting of Stockholders to be held on Tuesday, July 27, 2004, at 10:00 a.m. local time, or at any adjournments or postponements. The meeting will be held at the Westlake Village Inn Hotel, 31943 Agoura Road, Westlake Village, California, 91361.

It is anticipated that this Proxy Statement and the accompanying proxy card will be mailed to stockholders on or about June 11, 2004.

Who can Vote

Holders of our common stock at the close of business on May 31, 2004 are entitled to receive this notice and to vote their shares at the Annual Meeting. Common stock is our only outstanding class of securities that is entitled to vote at the Annual Meeting. As of May 31, 2004, there were 9,440,968 shares of common stock outstanding.

Proxies

Your vote is important. If your shares are registered in your name, you are a stockholder of record. If your shares are in the name of your broker or bank, your shares are held in street name. We encourage you to vote by Proxy so that your shares will be represented and voted at the meeting even if you cannot attend. All stockholders can vote by written Proxy card. Your submission of the enclosed Proxy will not limit your right to vote at the Annual Meeting if you later decide to attend in person.If your shares are held in street name, you must obtain a Proxy, executed in your favor, from the holder of record in order to be able to vote at the meeting. If you are a stockholder of record, you may revoke your Proxy at any time before the meeting either by filing with our Secretary, at our principal executive offices, a written notice of revocation or a duly executed Proxy bearing a later date, or by attending the Annual Meeting and expressing a desire to vote your shares in person. All shares entitled to vote and represented by properly executed Proxies received prior to the Annual Meeting, and not revoked, will be voted at the Annual Meeting in accordance with the instructions indicated on those Proxies. If no instructions are indicated on a properly executed Proxy, the shares represented by that Proxy will be voted as recommended by the Board of Directors.

Quorum

The presence, in person or by Proxy, of a majority of the votes entitled to be cast by the stockholders entitled to vote at the Annual Meeting is necessary to constitute a quorum. Abstentions and broker non-votes will be included in the number of shares present at the Annual Meeting for

1

determining the presence of a quorum. Broker non-votes occur when a broker holding customer securities in street name has not received voting instructions from the customer on certain non-routine matters and, therefore, is barred by the rules of the applicable securities exchange from exercising discretionary authority to vote those securities.

Voting

Each share of our common stock is entitled to one vote on each matter properly brought before the meeting. Abstentions will be counted toward the tabulation of votes cast on proposals submitted to stockholders and will have the same effect as negative votes, while broker non-votes will not be counted as votes cast for or against such matters.

The proposals to be voted on have different vote requirements. Directors will be elected by a plurality of the votes cast by the shareholders, which means that the six nominees receiving the most votes will be elected. In an uncontested election of directors, the plurality requirement is not a factor. Abstentions, broker non-votes and instructions on proxy cards to withhold authority to vote for one or more of the nominees will result in those nominees receiving fewer votes. If any nominee is unable or unwilling to serve as a director at the time of the Annual Meeting, the Proxies will be voted for such other nominee(s) as shall be designated by the current Board of Directors to fill any vacancy. We have no reason to believe that any nominee will be unable or unwilling to serve if elected as a director.

The proposal to ratify the appointment of the independent public accountants will be approved if we receive the affirmative vote of a majority of the shares of common stock present or represented and entitled to vote at the Annual Meeting. Abstentions and broker non-votes will not be counted for or against the proposal.

Other Matters

At the date this Proxy Statement went to press, we do not know of any other matter to be raised at the Annual Meeting.

In the event a stockholder proposal was not submitted to us prior to April 21, 2004, the enclosed Proxy will confer authority on the Proxyholders to vote the shares in accordance with their best judgment and discretion if the proposal is presented at the Annual Meeting. As of the date hereof, no stockholder proposal has been submitted to us, and management is not aware of any other matters to be presented for action at the Annual Meeting. However, if any other matters properly come before the Annual Meeting, the Proxies solicited hereby will be voted by the Proxyholders in accordance with the recommendations of the Board of Directors. Such authorization includes authority to appoint a substitute nominee for any Board of Directors' nominee identified herein where death, illness or other circumstance arises which prevents such nominee from serving in such position and to vote such Proxy for such substitute nominee.

2

PROPOSAL NO. 1: ELECTION OF DIRECTORS

Proposal No. 1 is the election of six directors to hold office for a period of one year or until their respective successors have been duly elected and qualified. Our Bylaws provide that the number of directors on our Board of Directors shall be fixed from time to time exclusively by the Board of Directors, but shall not be less than three or more than nine. The Board of Directors has fixed the number of directors at six.

Unless otherwise instructed, the Proxy holders will vote the Proxies received by them for the nominees named below. If any nominee is unwilling to serve as a director at the time of the Annual Meeting, the Proxies will be voted for such other nominee(s) as shall be designated by the then current Board of Directors to fill any vacancy. We have no reason to believe that any nominee will be unable or unwilling to serve if elected as a director.

The Board of Directors proposes the election of the following nominees as directors:

Name

| | Age

| | Position

|

|---|

| Terrance J. Bieker | | 58 | | President and Chief Executive Officer, Director |

| Jean-Pierre L. Conte(1) | | 40 | | Chairman of the Board of Directors, Director |

| David J. Moffa, Ph.D.(1)(2) | | 61 | | Director |

| John R. Overturf, Jr.(2) | | 43 | | Director |

| Robert J. Weltman | | 39 | | Director |

| John L. Zabriskie, Ph.D.(1)(2) | | 64 | | Director |

- (1)

- Member of the Compensation Committee.

- (2)

- Member of the Audit Committee.

Terrance J. Bieker, has served as a director, and our President and Chief Executive Officer, since November 1, 2003. From April 2003 to October 2003, Mr. Bieker served as Chief Executive Officer of Axya Medical, Inc. a medical device company engaged in the sales of orthopedic surgical devices. From 2000 through 2002, Mr. Bieker served as President and Chief Executive Officer of MedSafe, Inc. a medical regulatory consulting company. Mr. Bieker was President and CEO of Transfusion Technologies Corporation, a medical device company from 1999 to 2000. From 1997 to 1999, Mr. Bieker served as Executive Vice President and Chief Operating Officer of Safeskin Corporation, a manufacturer of disposable gloveware. From 1989 to 1997, Mr. Bieker served as Chairman, CEO and President of Sanofi Diagnostics Pasteur, Inc., a clinical diagnostic division of Sanofi, SA, a French pharmaceutical and healthcare company. Prior to these appointments, Mr. Bieker served as General Manager of Genetic Systems Corporation. His early career was with various divisions of American Hospital Supply Corporation. Mr. Bieker holds a B.S. degree in Economics from the University of Minnesota.

Jean-Pierre L. Conte has served as a director since February 2000 and was appointed as Chairman in May 2001. Mr. Conte is a Managing Director of Genstar Capital LLC, which is the sole general partner of Genstar Capital Partners II, L.P., a private equity limited partnership, and the Chairman and Managing Director of Genstar Capital L.P., which is the sole general partner of Genstar Capital Partners III, L.P. Prior to joining Genstar in 1995, he was a principal for six years at the NTC Group, Inc., a private equity investment firm. He is a director of several private companies. Mr. Conte earned a Masters of Business Administration from the Harvard Business School and a Bachelor of Arts from Colgate University. Mr. Conte has been appointed to the Board of Directors pursuant to an investor rights agreement among us, Genstar, and Stargen II LLC, another investor in us.

David J. Moffa, Ph.D. has been a director since April 1995. Dr. Moffa serves as the Regional Director and as Special Projects Director for Lab Corporation of America, Inc. located in Fairmont, West Virginia, positions he has held since 1982 and 1984, respectively. In addition, Dr. Moffa currently

3

serves as a Director of LabCorp in Pittsburgh, Pennsylvania, a position he has held since 1985 and is Chairman and CEO of ClinServices LLC since 1999. Dr. Moffa also serves as an advisor and consultant to various diagnostic, scientific and health care facilities. Dr. Moffa also serves on a number of committees and boards of directors of various privately held companies and governmental offices. Dr. Moffa has completed a post doctoral fellowship in Clinical Biochemistry at the West Virginia University National Institutes of Health, holds a Ph.D. in Medical Biochemistry from the West Virginia University School of Medicine, a Masters of Science degree in Biochemistry from West Virginia University and a Bachelor of Arts degree in Pre-Medicine from West Virginia University.

John R. Overturf, Jr. has been a director since September 1993. Mr. Overturf serves as the President of R.O.I., Inc., a private investment company, a position he has held since July 1993. He also serves as President of the Combined Penny Stock Fund, Inc., a closed-end stock market fund, a position he has held since August 1996. From September 1993 until September 1996, Mr. Overturf served as Vice President of The Rockies Fund, Inc., a closed-end stock market fund. Mr. Overturf holds a Bachelor of Science degree in Finance from the University of Northern Colorado.

Robert J. Weltman has served as a director of BioSource since February 2000. He is a Managing Director of Genstar Capital, L.P., the sole general partner of Genstar Capital Partners II, L.P., a private equity limited partnership. Mr. Weltman joined Genstar in August 1995. Prior to joining Genstar, from July 1993 to July 1995, Mr. Weltman was an Associate with Robertson, Stephens & Company, an investment banking firm. Mr. Weltman holds an AB degree in Chemistry from Princeton University. Mr. Weltman has been appointed to the Board of Directors pursuant to an investor rights agreement among us, Genstar, and Stargen II LLC, another investor in us.

John L. Zabriskie, Ph.D. has served as a director of BioSource since July 2002. He is Co-founder and has served as Director of Puretech Ventures, a venture creation company since 2001. From 1997 to 2000 Dr. Zabriskie was Chairman and Chief Executive Officer of NEN Life Science Products, Inc., a leading supplier of kits for labeling and detection of DNA. From 1995 to 1997, Dr. Zabriskie was President and Chief Executive Officer of Pharmacia and Upjohn, Inc., a Fortune 500 pharmaceutical company formed by the merger of Pharmacia AB of Sweden and the Upjohn Company of Kalamazoo, Michigan. From 1965 until joining Upjohn in 1994, Dr. Zabriskie was employed by Merck and Co., Inc. He began his career at Merck as a chemist in 1965 and held various positions including President of Merck Sharp & Dohme and Executive Vice President of Merck and Co., Inc. He has served on a number of boards for health care and academic institutions and currently serves on the Board of Directors of Kellogg Co., Cubist Pharmaceutical, Inc., Biomira, Inc., Array BioPharma, and MacroChem Corp. Dr. Zabriskie received his A.B. degree in Chemistry from Dartmouth College (N.H.) and his Ph.D. in Organic Chemistry from the University of Rochester (N.Y.).

If elected, each nominee is expected to serve for a period of one year or until their respective successors have been duly elected and qualified. The six nominees for election as directors at the Annual Meeting who receive the highest number of affirmative votes will be elected.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE ELECTION OF EACH NOMINEE NAMED ABOVE.

Meetings and Committees of the Board of Directors

Meetings and Committees. The Board of Directors held 5 meetings during fiscal 2003. All of the directors who were on the Board during fiscal 2003 attended at least 75% of the total number of meetings of the Board of Directors and committees on which they served. Mr. Bieker was appointed to the Board of Directors on November 1, 2003, and from that point forward attended all meetings of the Board of Directors.

4

The Board of Directors maintains two standing committees: an Audit Committee and a Compensation Committee. Each of these committees has a written charter approved by the Board of Directors. A copy of each charter can be found on our website at www.biosource.com.

Audit Committee. The Audit Committee currently consists of Messrs. Overturf (Chairman), Moffa, and Zabriskie, all of whom are considered "independent" within the meaning of Rule 10A-3 promulgated under the Securities Exchange Act of 1934, as amended, and under Rule 4200(a)(15) of the National Association of Securities Dealers listing standards. Our Board of Directors has determined that each of the members of its separately standing Audit Committee, Messrs. Moffa, Overturf and Zabriskie, are an "audit committee financial expert," as defined in Item 401(h)(2) of Regulation S-K. Dr. Zabriskie was elected to the Audit Committee on April 22, 2003, replacing Robert Weist, who resigned from our Board for personal reasons. The primary purposes of the Audit Committee are (i) to review the scope of the audit and all non-audit services to be performed by our independent accountants and the fees incurred by us in connection therewith, (ii) to review the results of such audit, including the independent accountants' opinion and letter of comment to management and management's response thereto, (iii) to review with our independent accountants our internal accounting principles, policies and practices and financial reporting, (iv) to engage our independent accountants, and (v) to review our quarterly and annual financial statements prior to public issuance. The Audit Committee held 7 meetings during the year ended December 31, 2003.

Compensation Committee. The Compensation Committee currently consists of Messrs. Conte (Chairman), Moffa and Zabriskie, all of whom are considered "independent" under Rule 4200(a)(15) of the National Association of Securities Dealers listing standards. The Compensation Committee is responsible for considering and making recommendations to the Board of Directors regarding executive compensation and is responsible for administering our stock option and management incentive plans. The Compensation Committee held 5 meetings during the year ended December 31, 2003.

Director Nominations. We do not currently have a standing nominating committee. Because the Board of Directors has adopted resolutions requiring that all director nominations be approved or recommended for approval by a majority of the independent directors (as defined by Rule 4200(a)(15) of the National Association of Securities Dealers listing standards), voting in executive session, the Board has determined not to designate a separately standing nominating committee.

The independent members of the Board of Directors ("Independent Board Members") review those Board members who are candidates for re-election to our Board of Directors, and make the determination to nominate a candidate who is a current member of the Board of Directors for re-election. The Independent Board Members also nominate outside candidates for inclusion on the Board of Directors. The Independent Board Members do not consider nominees recommended by stockholders. The Board of Directors has not adopted a charter that governs the nominating responsibilities of the Independent Board Members.

Among other matters, the Independent Board Members:

- •

- Review the desired experience, mix of skills and other qualities to assure appropriate Board composition, taking into account the current Board members and the specific needs of us and the Board;

- •

- Conduct candidate searches, interview prospective candidates and conduct programs to introduce candidates to the Board;

- •

- Recommend to the Board qualified candidates who bring the background, knowledge, experience, independence, skill sets and expertise that would strengthen and increase the diversity of the Board;

- •

- Conduct appropriate inquiries into the background and qualifications of potential nominees; and

5

- •

- Review the suitability for continued service as a director of each Board member when he or she has a significant change in status, such as an employment change, and recommend whether or not such director should be re-nominated.

Based on the foregoing, upon their own recommendation, the Independent Board Members nominated Terrance J. Bieker, Jean-Pierre L. Conte, David J. Moffa, John R. Overturf, Jr., Robert J. Weltman, and John L. Zabriskie for re-election as directors on the Board of Directors, subject to stockholder approval, for a one-year term ending on or around the date of the 2005 Annual Meeting.

Director Compensation. All Directors are elected annually to serve for a term of one year. Directors who are also employees of us or our subsidiaries receive no separate compensation for serving as Directors. Each non-employee director, except for Dr. Zabriskie, receives a payment of $2,000 for each board meeting attended, and $1,000 per year for service on a board committee. In addition, non-employee directors, except Dr. Zabriskie, receive an annual grant of 4,000 non-statutory stock options at the end of each year, exercisable at the fair market value of our common stock on the date of grant, and which fully vest on the date of grant. Dr. Zabriskie received 55,000 stock options upon his acceptance as a member of our Board of Directors in July 2002. 20,000 of these stock options vested immediately, 17,500 of these stock options vested on July 18, 2003, and 17,500 stock options will vest on the date of the Annual Meeting. Dr. Zabriskie does not receive cash remuneration. Directors may be reimbursed for certain expenses incurred in connection with attending Board meetings.

Compensation Committee Interlocks and Insider Participation. No member of the Compensation Committee served as an officer or employee of the Company at any time during fiscal 2003. Additionally, no current executive officer or Director has served as a member of the board of directors or compensation committee of any entity for which a member of our Board of Directors or Compensation Committee has served as an executive officer.

Executive Officers

The following table sets forth certain information with respect to our executive officers as of May 31, 2004.

Name

| | Age

| | Position

|

|---|

| Terrance J. Bieker | | 58 | | President and Chief Executive Officer |

| Alan I. Edrick | | 36 | | Executive Vice President and Chief Financial Officer |

| Jozef Vangenechten, Ph.D. | | 49 | | Executive Vice President, Commercial Operations |

| Kevin J. Reagan, Ph.D. | | 52 | | Executive Vice President, Technical Operations |

Information with respect to Executive Officers of the Company who are also Directors is set forth under Proposal No. 1

Alan I. Edrick joined us in May 2004 as Executive Vice President and Chief Financial Officer. Prior thereto, from 1998 to February 2004, Mr. Edrick served as Senior Vice President and Chief Financial Officer at North American Scientific, Inc., a leading medical device and specialty pharmaceutical company. From 1989 to 1998, Mr. Edrick worked at Price Waterhouse LLP in various positions, including Senior Manager, Capital Markets. Mr. Edrick received his B.A. degree from UCLA and an M.B.A. from the Anderson School at UCLA.

Jozef Vangenechten, Ph.D. became Executive Vice President of Commercial Operations in April 2004 and was Managing Director of BioSource Europe, S.A., our Belgium subsidiary, from February 1998 through March 2004, through our engagement of Vita B.V.B.A., a consulting firm in which Dr. Vangenechten is a beneficial owner and serves as President. From 1988 to February 1998,

6

Dr. Vangenechten worked for SGS (Societe Generale de Surveillance, Switzerland), an international provider of inspection, verification, testing and certification services, as General Manager and Director of their environmental consultancy operations in Belgium. From 1981 to 1988 Dr. Vangenechten worked as a researcher at the Radiobiology Division of the Belgium Nuclear Energy Research Center. Dr. Vangenechten received both his Masters and Ph.D. degrees in Biology and Physiology from the University of Antwerp in Belgium.

Kevin J. Reagan, Ph.D. became Executive Vice President of Technical Operations in February of 2004 and was Vice President, Immunology from December 1996 through January 2004. From 1991 to December 1996, Dr. Reagan served first as the Director of Development, Laboratories and then Vice President, Laboratory Operations at Specialty Laboratories, Inc., a clinical reference lab. From 1984 to 1991, Dr. Reagan was involved with AIDS/Hepatitis R&D at Ortho Diagnostics, Inc., a Johnson & Johnson Company and E.I. DuPont de Nemours and Co. Dr. Reagan received his Bachelor of Arts in Biological Sciences from the University of Delaware and both his Masters and Ph.D. degrees in Microbiology and Immunology from Hahnemann Medical College. His post-doctoral fellowship was completed at the University of Pennsylvania School of Medicine.

7

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information regarding the beneficial ownership of our common stock, as of May 15, 2004, by (i) each person known by us to be the beneficial owner of more than five percent of the outstanding shares of our common stock, (ii) each of our directors, (iii) each of our executive officers, and (iv) all of our executive officers and directors as a group. Except as may be indicated in the footnotes to the table and subject to applicable community property laws, each such person has the sole voting and investment power with respect to the shares owned. Unless otherwise indicated, the address of each person listed is in care of BioSource International, Inc., 542 Flynn Road, Camarillo, California 93012, and the address of Messrs. Conte, Weltman and Genstar Capital LLC is Four Embarcadero Center, Suite 1900, San Francisco, California 94111.

Name and Address

| | Number of Shares of

Common Stock

Beneficially Owned(1)

| | Approximate

Percent(1,2)

| |

|---|

| Genstar Capital LLC(3) | | 3,452,856 | | 32.2 | % |

| Jean-Pierre L. Conte(4) | | 3,400,189 | | 31.7 | % |

| Kennedy Capital Management, Inc.(5) | | 653,328 | | 6.9 | % |

| Royce & Associates LLC(6) | | 682,600 | | 7.2 | % |

| Westfield Capital Management Co. LLC.(7) | | 559,100 | | 5.9 | % |

| Dimensional Funds Advisors Inc.(8) | | 511,800 | | 5.4 | % |

| Oxford Bioscience Partners IV L.P.(9) | | 470,866 | | 5.0 | % |

| Leonard M. Hendrickson(10) | | 291,831 | | 3.0 | % |

| Charles C. Best(11) | | 104,706 | | 1.1 | % |

| Kevin J. Reagan(12) | | 86,103 | | * | |

| John L. Zabriskie, Ph.D.(13) | | 52,500 | | * | |

| David J. Moffa, Ph.D.(14) | | 47,350 | | * | |

| Jozef Vangenechten(15) | | 36,123 | | * | |

| John R. Overturf, Jr.(16) | | 34,600 | | * | |

| Robert J. Weltman(17) | | 19,333 | | * | |

| Terrance J. Bieker(18) | | — | | * | |

| Alan I. Edrick(19) | | — | | * | |

| All directors and executive officers as a group (ten persons)(20) | | 3,790,904 | | 34.2 | % |

- *

- Less than one percent.

- (1)

- Shares of Common Stock that an individual or group has a right to acquire within 60 days after May 15, 2004 pursuant to the exercise of options, warrants or other rights are deemed to be outstanding for the purpose of computing the percentage ownership of such individual or group, but are not deemed to be outstanding for computing the percentage ownership of any other person or group shown in the table.

- (2)

- Percentage ownership is calculated based on 9,435,138 shares of common stock outstanding as of May 15, 2004.

- (3)

- Includes (i) 2,032,809 shares of common stock and 1,262,542 shares of common stock issuable upon exercise of immediately exercisable warrants held by Genstar Capital Partners II, L.P., (ii) 34,380 shares of common stock and 24,458 shares of common stock issuable upon exercise of immediately exercisable warrants held by Stargen II LLC, (iii) 30,000 shares of common stock and 16,000 shares subject to outstanding options which are deemed to be beneficially owned, in each case held by Mr. Conte, (iv) 3,333 shares of common stock and 16,000 shares subject to outstanding options which are deemed to be beneficially owned, in each case held by Mr. Weltman, (v) 16,667 shares of common stock held by Richard F. Hoskins, and (vi) 16,667

8

shares of common stock held by Richard D. Paterson. Genstar Capital LLC is the general partner of Genstar Capital Partners II, L.P. Mr. Conte, Mr. Hoskins and Mr. Paterson are the managers and managing directors of Genstar Capital LLC and are members of Stargen, and Mr. Paterson is the Administrative Member of Stargen. In such capacities Messrs. Conte, Hoskins and Paterson may be deemed to beneficially own shares of common stock beneficially held by Genstar Capital Partners and Stargen, but disclaim such beneficial ownership, except to the extent of their economic interest in these shares. Messrs. Conte, Hoskins, Paterson, Genstar Capital LLC, Genstar Capital Partners II, L.P. and Stargen II LLC may be deemed to be acting as a group in relation to their respective holdings in BioSource but do not affirm the existence of any such group.

- (4)

- Includes (i) 30,000 shares of common stock and 16,000 shares subject to outstanding options which are deemed to be beneficially owned, in each case held by Mr. Conte, (ii) 2,032,809 shares of common stock and 1,262,542 shares of common stock issuable upon exercise of immediately exercisable warrants held by Genstar Capital Partners II, L.P., and (ii) 34,380 shares of common stock and 24,458 shares of common stock issuable upon exercise of immediately exercisable warrants held by Stargen II LLC. Genstar Capital LLC is the general partner of Genstar Capital Partners II, L.P. Mr. Conte is a manager and managing director of Genstar Capital LLC and is a member of Stargen. In such capacity, Mr. Conte may be deemed to beneficially own shares of common stock beneficially held by Genstar Capital Partners and Stargen, but he disclaims such beneficial ownership, except to the extent of his economic interest in those shares.

- (5)

- As disclosed on Form 13F-NT, filed with the Securities and Exchange Commission on May 14, 2004 by Kennedy Capital Management, Inc.

- (6)

- As disclosed on Form 13F-HR, filed with the Securities and Exchange Commission on May 12, 2004 by Royce & Associates LLC.

- (7)

- As disclosed on Form 13F-HR, filed with the Securities and Exchange Commission on April 7, 2004 by Westfield Capital Management Co. LLC.

- (8)

- As disclosed on Form 13F-HR, filed with the Securities and Exchange Commission on April 28, 2004 by Dimensional Fund Advisors, Inc.

- (9)

- As disclosed in the Schedule 13G filed with the Securities and Exchange Commission on April 8, 2004 by Oxford Bioscience Partners IV L.P.

- (10)

- Includes 239,831 shares subject to outstanding options which are deemed to be beneficially owned. On December 31, 2003, a "special terminating event," as that term is defined in Mr. Hendrickson's Stock Option Agreements, was deemed to have occurred with respect to all stock options granted to him, and therefore any stock options previously granted to Mr. Hendrickson, to the extent not fully vested on that date, ceased to vest and became exercisable pursuant to their terms for a period of one year, until December 31, 2004. Also includes (i) 48,000 shares of common stock owned; (ii) 4,000 shares of common stock held of record by two of Mr. Hendrickson's minor children.

- (11)

- Consists of 104,706 shares subject to outstanding options which are deemed to be beneficially owned. Mr. Best resigned effective May 14, 2004.

- (12)

- Includes 60,102 shares subject to outstanding options which are deemed to be beneficially owned.

- (13)

- Includes 37,500 shares subject to outstanding options which are deemed to be beneficially owned.

- (14)

- Includes (i) 40,500 shares subject to outstanding options which are deemed to be beneficially owned; (ii) 550 shares of common stock held solely by Dr. Moffa's spouse; (iii) 4,000 shares of common stock held jointly with Dr. Moffa's spouse; and (iv) 2,850 shares of common stock held directly.

9

- (15)

- Consists of 36,123 shares subject to outstanding options which are deemed to be beneficially owned.

- (16)

- Includes 28,000 shares subject to outstanding options which are deemed to be beneficially owned.

- (17)

- Includes (i) 3,333 shares of common stock held directly; (ii) 16,000 shares of common stock reserved for issuance upon exercise of stock options which are deemed to be beneficially owned. Mr. Weltman is also a Principal of Genstar Capital LP and a member, but not a managing member, of Stargen II LLC. Mr. Weltman does not have power to vote or dispose of, or to direct the voting or disposition of, any securities beneficially owned by Genstar Capital LLC or Stargen II LLC. Mr. Weltman disclaims that he beneficially owns any shares of common stock beneficially owned by Genstar Capital LLC or Stargen II LLC, except to the extent of his economic interest in shares owned by Genstar Capital LLC or Stargen II LLC.

- (18)

- Mr. Bieker joined us on November 1, 2003 and was granted 285,000 stock options whose initial vesting occurs one year from the date of grant. Mr. Bieker owns no shares directly.

- (19)

- Mr. Edrick joined us on May 10, 2004 and was granted 100,000 stock options whose initial vesting occurs one year from the date of grant. Mr. Edrick owns no shares directly.

- (20)

- Includes 245,122 shares subject to outstanding options which are deemed exercised and 1,287,000 shares of common stock reserved for issuance upon the exercise of warrants.

Executive Compensation

SUMMARY COMPENSATION TABLE

The following table sets forth, as to the Chief Executive Officer and as to each of the other four most highly compensated executive officers who were serving as executive officers at the end of the fiscal year ended December 31, 2003 and whose compensation exceeded $100,000 during that fiscal year (the "Named Executive Officers"), information concerning all compensation paid to such individuals for each of the three years ended December 31 indicated below.

| |

| |

| |

| |

| | Long Term Compensation

| |

|---|

| |

| | Annual Compensation

| |

|---|

| |

| | Number of Securities Underlying Options

| |

| |

|---|

Name and Principal Position(1)

| | Year

| | Salary

($)

| | Bonus

($)

| | Other Annual Compensation ($)

| | All Other

Compensation

| |

|---|

Terrance J. Bieker

Chief Executive Officer and President | | 2003 | | 40,105 | (2) | 325,000 | (3) | — | | — | | — | |

Leonard M. Hendrickson(4)

Chief Executive Officer and President | | 2003

2002

2001 | | 187,500

250,000

49,000 |

(6) | —

99,650

90,000 | | 52,083

| (5)

| —

—

280,000 | | —

1,548

173 |

(6)

(6) |

Robert Weltman(7)

Interim Chief Executive Officer | | 2003 | | — | | — | | 6,000 | | — | | — | |

Charles C. Best(8)

Chief Financial Officer and Executive Vice President | | 2003

2002

2001 | | 176,800

166,400

160,000 | | —

59,023

23,500 | | | | —

—

87,500 | | 337

324

325 | (6)

(6)

(6) |

- (1)

- For a description of employment agreements between certain executive officers and us, see "Employment Agreements with Executive Officers" below.

- (2)

- Mr. Bieker began his employment with us on November 1, 2003.

- (3)

- Amount consists of a $90,000 signing bonus and a $235,000 bonus as a partial payment for relocation costs.

10

- (4)

- Mr. Hendrickson began his employment with us in October 2001 and resigned on September 29, 2003.

- (5)

- Represents payments made under a separation and release agreement. See "Employment Agreements with Executive Officers" below.

- (6)

- Consists of group life insurance premiums paid by us.

- (7)

- Mr. Weltman served as our Interim Chief Executive Officer from September 30, 2003 through October 31, 2003. Mr. Weltman did not receive any additional compensation for his services as Interim Chief Executive Officer. The compensation identified above was received by Mr. Weltman in his capacity as a member of our Board of Directors.

- (8)

- Mr. Best resigned on May 14, 2004.

OPTION GRANTS IN FISCAL 2003

The following table sets forth certain information regarding the grant of stock options made during the fiscal year ended December 31, 2003 to the Named Executive Officers.

| | Number of Securities Underlying Options Granted

| | Percent of Total Options Granted to Employees in Fiscal Year(1)

| |

| |

| | Potential Realizable Value

of Assumed Annual Rates of Stock

Price Appreciation for Option Term

|

|---|

Name

| | Exercise Price per Share

($/sh.)

| | Expiration

Date

|

|---|

| | 5%($)

| | 10%($)

|

|---|

| Terrance J. Bieker | | 285,000 | | 94 | % | 7.18 | | 11/1/2013 | | $ | 1,286,907 | | $ | 2,778,768 |

| Leonard M. Hendrickson | | — | | 0 | % | — | | — | | $ | 0 | | $ | 0 |

| Robert Weltman | | — | | 0 | % | — | | — | | $ | 0 | | $ | 0 |

| Charles C. Best | | — | | 0 | % | — | | — | | $ | 0 | | $ | 0 |

- (1)

- Based upon an aggregate of 303,000 options granted during the year ended December 31, 2003.

- (2)

- Calculated on the assumption that the market value of the underlying stock increases at the stated values compounded annually for the ten-year term of the option, and that the option is exercised and sold on the last day of its term for the appreciated stock price. There can be no assurance that the actual stock price appreciation over the ten year option term will be at the assumed 5% and 10% levels or at any other defined level. Unless the market price of the Common Stock appreciates over the option term, no value will be realized from those option grants that were made to the Named Executive Officers with an exercise price equal to the fair market value of the option shares on the grant date.

11

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

The following table sets forth, for the Named Executive Officers, certain information regarding options exercised in fiscal year 2003, the number of shares of common stock underlying stock options held and the value of options held at fiscal year end based upon the last reported sales price of the common stock on the NASDAQ market on December 31, 2003 ($6.77 per share).

| |

| |

| | Number of Securities Underlying Unexercised Options at December 31, 2003

| |

| |

|

|---|

| |

| |

| | Value of Unexercised

In-The-Money Options at December 31, 2003

|

|---|

Name

| | Shares Acquired on Exercise

(#)

| | Value

Realized

($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Terrance J. Bieker | | — | | — | | — | | 285,000 | | $ | 0 | | $ | — |

| Leonard M. Hendrickson | | 12,000 | | 54,720 | | 228,165 | | — | | | 423,531 | | | — |

| Robert Weltman | | — | | — | | 16,000 | | — | | | 4,840 | | | — |

| Charles C. Best | | — | | — | | 102,643 | | 31,357 | | | 88,245 | | | — |

Employment Agreements

We have entered into employment contracts with the following executive officers.

Terrance J. Bieker

We have entered into an executive employment agreement with Terrance J. Bieker to serve as our President and Chief Executive Officer, effective as of November 1, 2003. Pursuant to this agreement, Mr. Bieker receives an annual base salary of $275,000, which the Board may increase at the end of each year of his employment. In addition to the base salary to be paid to Mr. Bieker, we paid Mr. Bieker a one time signing bonus in the amount of $90,000, upon commencement of his employment. In addition, Mr. Bieker received a one time payment of $235,000 the intent of which was to have such amounts applied as partial payment of the costs and expenses incurred by him in connection with his relocation to California. Mr. Bieker is also eligible to receive an annual bonus under our management incentive plan to be agreed upon between Mr. Bieker and the Board on an annual basis. The management incentive plan will provide for the payment of a bonus equal to fifty percent (50%) of Mr. Bieker's then-current base salary upon achieving specified target objectives set forth in the plan. The agreement terminates on December 31, 2007. In the event that Mr. Bieker's employment is terminated without cause during the term of the agreement, we are obligated to continue to pay Mr. Bieker's then-current base salary for a period of 12 months following the effective date of such termination. In connection with his employment, Mr. Bieker received an initial grant of stock options to purchase 285,000 shares of our Common Stock at an exercise price equal to the fair market value of our Common Stock on the date of grant, or $7.18 per share. In certain instances involving a "change of control," as defined in our 2000 Non-Qualified Stock Option Plan, the stock options which have been granted to Mr. Bieker that are unvested at the time of such change of control become immediately vested and exercisable.

Alan I. Edrick

We entered into an executive employment agreement with Alan I. Edrick, effective May 10, 2004, to serve as our Executive Vice President and Chief Financial Officer, effective May 17, 2004. Prior to joining us, Mr. Edrick served as Senior Vice President and Chief Financial Officer at North American Scientific, Inc., a leading medical device and specialty pharmaceutical company. Pursuant to his employment agreement, Mr. Edrick receives an annual base salary of $190,000, which the Chief Executive Officer may increase at the end of each year of Mr. Edrick's employment. In addition to his base salary, Mr. Edrick will receive an additional $72,000 as a signing bonus, which amount will be

12

payable in thirty equal monthly installments of $2,400 each commencing May 10, 2004, and ending on the earlier of November 10, 2006 or the date upon which Mr. Edrick's employment with us terminates for any reason. Mr. Edrick is also eligible to receive an annual bonus under our management incentive plan. The management incentive plan will provide for the payment of a bonus equal to thirty percent (30%) of Mr. Edrick's then-current base salary upon achieving specified target objectives set forth in the plan. The agreement terminates on May 9, 2008. In the event that Mr. Edrick's employment is terminated without cause by us, or for good reason by Mr. Edrick (as defined in the agreement), during the term of the agreement, the agreement provides for a severance equal to nine months of his current base salary. In connection with his employment, Mr. Edrick received an initial grant of stock options to purchase 100,000 shares of our Common Stock at an exercise price equal to the fair market value of our Common Stock on the date of grant, or $7.99 per share. In certain instances involving a "change of control," as defined in our 2000 Non-Qualified Stock Option Plan, the stock options which have been granted to Mr. Edrick that are unvested at the time of such change of control become immediately vested and exercisable.

Jozef Vangenechten

We have entered into an executive employment agreement with Jozef Vangenechten to serve as our Executive Vice President—Commercial Operations, effective as of April 1, 2004. Prior to our employment of Dr. Vangenechten, he served as the Managing Director of our Belgium subsidiary through our engagement of Vita B.V.B.A., a consulting firm in which Dr. Vangenechten is a beneficial owner and serves as President ("VITA"). Pursuant to his employment agreement, Dr. Vangenechten receives an annual base salary of approximately $100,000, which is payable in a combination of both U.S. Dollars and Euros, which the President may increase at the end of each year of Dr. Vangenechten's employment. In addition to the base salary to be paid to Dr. Vangenechten, we will pay various travel and living expenses during the term of his employment in aggregate net amount equal to approximately $41,000 annually. Dr. Vangenechten is also eligible to receive an annual bonus under our management incentive plan. The management incentive plan will provide for the payment of a bonus equal to $62,000 upon achieving specified target objectives set forth in the plan. The agreement terminates on December 31, 2007. In the event that Dr. Vangenechten's employment is terminated without cause during the term of the agreement, we are obligated to continue to pay Dr. Vangenechten a severance amount equal to $22,500 and the US$ equivalent of €119,000 over a period of nine months following the effective date of such termination. In connection with his employment, Dr. Vangenechten was also granted stock options to purchase 50,000 shares of our Common Stock at an exercise price equal to the fair market value of our Common Stock on the date of grant, or $7.00 per share. In certain instances involving a "change of control," as defined in our 2000 Non-Qualified Stock Option Plan, the stock options which have been granted to Dr. Vangenechten that are unvested at the time of such change of control become immediately vested and exercisable.

Concurrent with our execution of the executive employment agreement with Dr. Vangenechten, our Belgium subsidiary executed a new management agreement with VITA pursuant to which VITA was re-engaged to manage, oversee and direct the business and affairs of our Belgium subsidiary, subject to the supervision of the subsidiary's Board of Directors. For its services, VITA will invoice the Belgium subsidiary on a monthly basis but will not be entitled to receive more than €102,700 in any calendar year. The agreement with VITA may be terminated by the Belgium subsidiary at any time upon thirty days notice and without penalty to our subsidiary. However, if the VITA agreement is terminated without cause, Dr. Vangenechten's executive employment agreement will also terminate, and he will be entitled to receive from us the termination payment described above. Notwithstanding this, if we can terminate Dr. Vangenechten's executive employment agreement for cause, or as a result of his death or permanent disability, any termination of the VITA agreement without cause at that time will not entitle him to receive the termination payment.

13

Kevin Reagan

We have also entered into an executive employment agreement with Kevin Reagan to serve as our Executive Vice President—Technical Operations, effective as of February 15, 2004. Dr. Reagan served as our Vice President, Immunology since December 1996. Pursuant to his employment agreement, Dr. Reagan receives an annual base salary of $190,000, which the President may increase at the end of each year of Dr. Reagan's employment. Dr. Reagan is also eligible to receive an annual bonus under our management incentive plan. The management incentive plan will provide for the payment of a bonus equal to thirty percent (30%) of Dr. Reagan's then-current base salary upon achieving specified target objectives set forth in the management incentive plan. The agreement terminates on December 31, 2007. In the event that Dr. Reagan's employment is terminated without cause, the agreement provides for a severance equal to nine months of his current base salary. In connection with his employment, Dr. Reagan was also granted stock options to purchase 30,000 shares of our Common Stock at an exercise price equal to the fair market value of our Common Stock on the date of grant, or $6.99 per share. In certain instances involving a "change of control," as defined in our 2000 Non-Qualified Stock Option Plan, the stock options which have been granted to Mr. Reagan that are unvested at the time of such change of control become immediately vested and exercisable.

Leonard M. Hendrickson

We entered into an employment agreement with Leonard M. Hendrickson to serve as our President and Chief Executive Officer, effective as of October 15, 2001. Pursuant to that agreement Mr. Hendrickson received an annual base salary of $250,000. In addition to the base salary paid to Mr. Hendrickson, we paid Mr. Hendrickson a one time signing bonus in the amount of $90,000, upon commencement of his employment. In addition, Mr. Hendrickson was eligible to receive annual bonuses under our management incentive plan. The agreement was intended to terminate on December 31, 2004. In connection with Mr. Hendrickson's indefinite medical disability leave of absence in September 2003, we entered into a Separation and Release Agreement with him which is dated as of September 29, 2003 (the "Separation Agreement"). In connection with entering into the Separation Agreement, Mr. Hendrickson resigned his positions as our President and Chief Executive Officer, and as a member of our Board of Directors, and commenced a disability leave of absence effective as of the date of that agreement and continuing through December 31, 2004 (the "Leave Period"). Additionally, pursuant to the terms of that Separation Agreement, in consideration for a full release of any and all claims Mr. Hendrickson may have had against us, from September 29, 2003 through December 31, 2003, we continued to pay or otherwise provide to Mr. Hendrickson (i) the difference between his then current base salary and any amount received by him under our disability insurance plans and pursuant to any governmental disability benefits, and (ii) our portion of the health insurance and life insurance benefits previously provided to him, which we will continue to provide through March 31, 2004. The Separation Agreement also provides that, from January 1, 2004 through December 31, 2004, we will pay or otherwise provide to Mr. Hendrickson (i) the difference between sixty percent (60%) of his then current base salary and any amount received by him under our disability insurance plans and pursuant to any governmental disability benefits, and (ii) various other health and life insurance benefits, including portions of any amounts he is permitted to pay through the provisions of the Consolidated Omnibus Budget Reconciliation Act of 1985 ("COBRA"), provided, however, although he will be entitled to receive these benefits beyond 2004, Mr. Hendrickson will be required to assume the responsibility for portions, or all, of these payments over the course of 2004 and in 2005, respectively. With respect to any stock options previously granted to Mr. Hendrickson, to the extent they were not fully vested on the date of the Separation Agreement, they continued to vest through December 31, 2003. On December 31, 2003, a "special terminating event," as that term is defined in Mr. Hendrickson's Stock Option Agreements, was deemed to have occurred with respect to all stock options granted to him, and therefore any stock options previously granted to

14

Mr. Hendrickson, to the extent not fully vested on that date, stopped vesting and became exercisable pursuant to their terms for a period of one year.

Charles C. Best

Pursuant to the provisions of a Separation Agreement between us and Charles C. Best, our former Chief Financial Officer, dated December 17, 1999, as amended on April 29, 2004, Mr. Best exercised his right of termination of his employment with us effective May 14, 2004. Under the terms of the agreement, Mr. Best will continue to receive his then current base salary for one year and his current medical benefits for up to six months.

Report of the Compensation Committee

Overview & Philosophy

The Compensation Committee of the Board of Directors is composed entirely of Directors who have never served as officers of the Company and who meet the criteria for independence established by applicable law and The Nasdaq Stock Market listing standards. The Compensation Committee is charged with the responsibility of administering all aspects of our executive officer and Board of Directors compensation programs and generally administers our stock option plans for all employees. Following review and approval by the Compensation Committee, determinations pertaining to executive officer compensation are submitted to the full Board of Directors for approval. In connection with its deliberations, the Compensation Committee seeks, and is influenced by, the views of the Chief Executive Officer with respect to appropriate compensation levels of the other executive officers.

It is the philosophy of the Compensation Committee that executive compensation should be structured to provide an appropriate relationship between executive compensation and our financial performance and the share price of our common stock, as well as to attract, motivate and retain executives of outstanding abilities and experience. Since the Company's inception, we have maintained the philosophy that executive compensation should be competitive with that provided by other companies in the biomedical research industry to assist us in attracting and retaining qualified executives critical to our long-term success.

Executive Officer Compensation

Base Salary. Base salaries are negotiated at the commencement of an executive's employment with the Company or upon renewal of his or her employment agreement and are designed to reflect the position, duties and responsibilities of each executive officer, the cost of living in the area in which the officer is located, and the market for base salaries of similarly situated executives at other companies engaged in businesses similar to that of the Company. Base salaries may be annually adjusted at the sole discretion of the Compensation Committee to reflect changes in any of the foregoing factors.

Annual Incentives. The Compensation Committee believes that executive compensation should be determined with specific reference to the Company's overall performance and goals, as well as the performance and goals of the division or function over which each individual executive has primary responsibility. In this regard, the Compensation Committee considers both quantitative and qualitative factors. Quantitative items used by the Compensation Committee in analyzing performance include sales and sales growth, results of operations and an analysis of actual levels of operating results and sales to budgeted amounts. Qualitative factors include the Compensation Committee's assessment of such matters as the enhancement of the Company's image and reputation, expansion into new markets, and the development and success of new products and new marketing programs. To this end, the Company developed, and the Compensation Committee approved, a management incentive plan for executives and senior employees for the year 2003 based on specific goals and criteria.

15

Long-term, Equity Based Incentive Awards. The general purpose of long-term awards, currently in the form of stock options, is to provide each executive officer with a significant incentive to manage from the perspective of an owner with an equity stake in the business. Additionally, long-term awards foster the retention of executive officers and provide executive officers with an incentive to achieve superior performance over time. In approving stock option grants, the Committee bases its decision on each individual's performance and potential to improve stockholder value. The Committee has broad discretion to determine the terms and conditions applicable to each option grant, including the vesting schedule and terms upon which the options may be exercised. Since the exercise price of each stock option must be at least equal to the market price of our Common Stock on the date of grant, the options do not become valuable to the holder unless our shares increase in market value above the price of the Common Stock on the date of grant and the executive officer remains with the Company through the applicable vesting period.

The Compensation Committee attributes various weights to the qualitative factors discussed above based upon their perceived relative importance to BioSource at the time compensation determinations are made. Each executive's performance is evaluated with respect to each of these factors, and compensation levels are determined based on each executive's overall performance.

Determination of Chief Executive Officer's Compensation. Effective November 1, 2003, Terrance J. Bieker became our Chief Executive Officer and President. The terms of the executive employment agreement entered into with Mr. Bieker are identified elsewhere in this Proxy Statement. Mr. Bieker's compensation package was established based upon the principles described above. The package was also based upon the Compensation Committee's comparative analysis of other similarly situated chief executive officers, review of Mr. Bieker's prior experience and expected contributions and consideration of the relative importance of his respective position in terms of achieving our objectives.

Mr. Leonard M. Hendrickson served as our Chief Executive Officer and President from October 15, 2001 through September 29, 2003. Mr. Hendrickson resigned from all his positions with BioSource in connection with his indefinite medical leave of absence in September 2003. Mr. Hendrickson's original compensation package was established based upon the Compensation Committee's comparative analysis of other similarly situated chief executive officers, review of Mr. Hendrickson's prior experience and expected contributions and consideration of the relative importance of his respective position in terms of achieving our objectives. Additionally, the Compensation Committee consulted with a professional recruiting firm hired as a consultant to assist in the process of retaining such an executive.

The Compensation Committee intends to continue its policy of linking executive compensation with maximizing stockholder returns and corporate performance to the extent possible through the programs described above.

Tax Considerations

Section 162(m) of the Internal Revenue Code generally limits the tax deductions a public corporation may take for compensation paid to its executive officers named in its summary compensation table to $1 million per executive per year. This limitation applies only to compensation which is not considered to be performance-based. Based on fiscal year 2003 compensation levels, no such limits on the deductibility of compensation applied to any of our executive officers.

| | | Compensation Committee |

|

|

Jean-Pierre L. Conte,Chairman

David J. Moffa, Ph.D.

John L. Zabriskie, Ph.D. |

16

Report of the Audit Committee

The Audit Committee of the Board of Directors, which consists of independent directors (within the meaning of Rule 10A-3 promulgated under the Securities Exchange Act of 1934, as amended, and Rule 4200(a)(15) of the National Association of Securities Dealers' Marketplace Rules), has furnished the following report:

The Audit Committee assists the Board of Directors in overseeing and monitoring the integrity of the Company's financial reporting process, its compliance with legal and regulatory requirements and the quality of its internal and external audit processes. The role and responsibilities of the Audit Committee are set forth in a written Charter adopted by the Board of Directors, which was attached as Appendix "A" to the Company's 2003 Proxy Statement and which can be found on the BioSource website at www.biosource.com. The Audit Committee reviews and reassesses the Charter annually and recommends any changes to the Board of Directors for approval.

In fulfilling its responsibilities for the financial statements for fiscal year 2003, the Audit Committee:

- •

- Reviewed and discussed the audited financial statements for the year ended December 31, 2003 with management and KPMG LLP, the Company's independent auditors ("KPMG");

- •

- Discussed with KPMG the matters required to be discussed by Statement on Auditing Standards No. 61 relating to the conduct of the audit; and

- •

- Received written disclosures and the letter from KPMG regarding its independence as required by Independence Standards Board Standard No. 1. The Audit Committee discussed with KPMG their independence.

The Audit Committee also considered the status of pending litigation and other areas of oversight relating to the financial reporting and audit process that the committee determined appropriate.

Based on the Audit Committee's review of the audited financial statements and discussions with management and the Auditors, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2003 for filing with the SEC.

| | | Audit Committee |

|

|

John R. Overturf, Jr.,Chairman

David J. Moffa, Ph.D.

John L. Zabriskie, Ph.D. |

17

PROPOSAL NO. 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT PUBLIC ACCOUNTANTS

We are asking our stockholders to ratify the Audit Committee's appointment of KPMG LLP ("KPMG") as our independent public accountants for the fiscal year ending December 31, 2004. In the event our stockholders fail to ratify the appointment, the Audit Committee will reconsider this appointment. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent auditing firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of us and out stockholders.

KPMG has served as the principal independent public accounting firm utilized by us since fiscal 1994. We anticipate that a representative of KPMG will be present at the Annual Meeting to respond to appropriate questions and to make statements as they so desire.

The ratification of KPMG as our independent public accountants for the fiscal year ended December 31, 2004 will require the affirmative vote of a majority of the shares of common stock present or represented and entitled to vote at the Annual Meeting. All Proxies will be voted to approve the Proposal unless a contrary vote is indicated on the enclosed Proxy card.

Fees to Independent Public Accountants for Fiscal 2003 and 2002

The following table presents fees for professional services rendered by KPMG for the audit of our annual financial statements for fiscal 2003 and fiscal 2002 and fees billed for audit-related services, tax services and all other services rendered by KPMG for fiscal 2003 and fiscal 2002.

| | Fiscal 2003

| | Fiscal 2002

|

|---|

| | (in thousands)

|

|---|

| Audit fees(1) | | $ | 191 | | $ | 160 |

| Audit-related fees | | | — | | | — |

| Tax fees(2) | | | 97 | | | 109 |

| All other fees | | | — | | | — |

- (1)

- Audit fees consist of fees billed for the audit of our consolidated annual financial statements and the review of our interim quarterly financial statements.

- (2)

- Tax fees consisted of fees for tax compliance, tax advice, and tax planning services.

The Audit Committee is directly responsible for interviewing and retaining our independent public accountants, considering the accounting firm's independence and effectiveness, and pre-approving the engagement fees and other compensation to be paid to, and the services to be conducted by, the independent public accountants.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS OUR INDEPENDENT PUBLIC ACCOUNTANTS FOR FISCAL 2004.

18

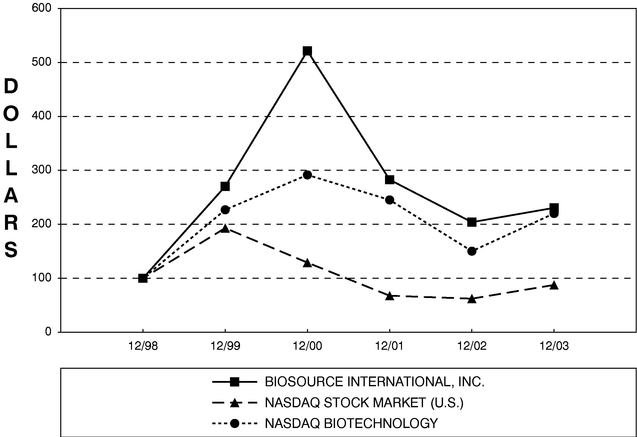

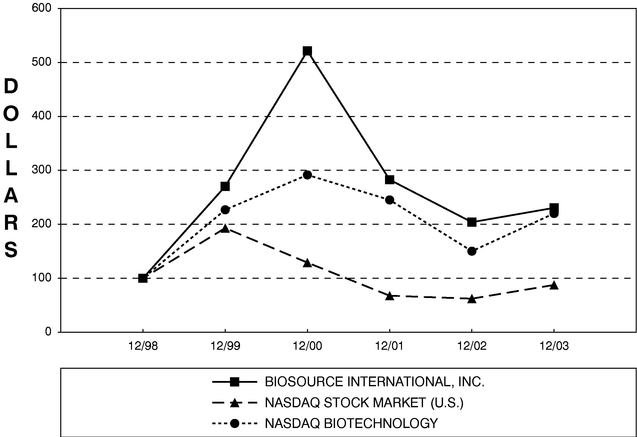

Performance Graph

The graph below shows the five-year cumulative total stockholder's return assuming the investment of $100 on December 31, 1998 (and the reinvestment of dividends thereafter) in each of our Common Stock, the Nasdaq Composite index and the Nasdaq Biotechnology index.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG BIOSOURCE INTERNATIONAL, INC., THE NASDAQ STOCK MARKET (U.S.) INDEX

AND THE NASDAQ BIOTECHNOLOGY INDEX

*$100 invested on 12/31/98 in stock or index-

including reinvestment of dividends.

Fiscal year ending December 31.

Other Matters

Certain Transactions with Directors and Executive Officers

Except as disclosed in this Proxy Statement, neither the nominees for election as directors, our directors or executive officers, nor any stockholder owning more than five percent of our issued shares, nor any of their respective associates or affiliates, had any material interest, direct or indirect, in any material transaction to which we were a party during fiscal 2003, or which is presently proposed.

See "Employment Agreements with Executive Officers" for a summary of employment agreements with certain of our executive officers.

19

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, requires our executive officers, directors, and persons who own more than ten percent of a registered class of our equity securities to file reports of ownership and changes in ownership with the Securities and Exchange Commission (the "SEC"). Executive officers, directors and greater-than-ten percent stockholders are required by SEC regulations to furnish us with all Section 16(a) forms they file. Based solely on our review of the copies of the forms furnished to us and written representations from certain reporting persons that they have complied with the relevant filing requirements, we believe that, during the year ended December 31, 2003, all our executive officers, directors and greater-than-ten percent stockholders complied with all Section 16(a) filing requirements, except for the following; Robert D. Weist filed two late Form 4s, each reporting late one transaction that occurred in November 2002 and December 2002, respectively; and each of John R. Overturf, Jr., David J. Moffa, Jean-Pierre L. Conte, and Robert J. Weltman filed one late Form 4, each reporting late one transaction that occurred for each in December 2002.

Stockholder Proposals

Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended, promulgated by the SEC, any stockholder of record who intends to present a proposal at the next Annual Meeting of Stockholders for inclusion in our Proxy Statement and Proxy form relating to such Annual Meeting must submit such proposal to us at our principal executive offices no later than January 22, 2005. In order for proposals by stockholders not submitted in accordance with Rule 14a-8 to have been timely within the meaning of Rule 14a-4(c) under the Securities Exchange Act of 1934, as amended, that proposal must have been submitted so that it is received no later than April 6, 2005. In addition, in the event a stockholder proposal is not received by us by April 6, 2005, the Proxy to be solicited by the Board of Directors for the next Annual Meeting will confer discretionary authority on the holders of the Proxy to vote the shares if the proposal is presented at the next Annual Meeting without any discussion of the proposal in the Proxy Statement for such meeting.

SEC rules and regulations provide that if the date of our 2005 Annual Meeting is advanced or delayed more than 30 days from the date of the 2004 Annual Meeting, stockholder proposals intended to be included in the proxy materials for the 2005 Annual Meeting must be received by us within a reasonable time before we begin to print and mail the proxy materials for the 2005 Annual Meeting. Upon determination by us that the date of the 2005 Annual Meeting will be advanced or delayed by more than 30 days from the date of the 2004 Annual Meeting, we will disclose such change in the earliest possible Quarterly Report on Form 10-Q.

In addition to the above procedure, additional information regarding stockholder communications with our Board of Directors can be found at our website at www.biosource.com.

Solicitation of Proxies

It is expected that the solicitation of Proxies will be by mail. The cost of solicitation by management will be borne by us. We will reimburse brokerage firms and other persons representing beneficial owners of shares for their reasonable disbursements in forwarding solicitation material to such beneficial owners. Proxies may also be solicited by certain of our directors and officers, without additional compensation, personally or by mail, telephone, telegram or otherwise.

Annual Report on Form 10-K

OUR ANNUAL REPORT ON FORM 10-K, WHICH HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION FOR THE YEAR ENDED DECEMBER 31, 2003, WILL BE MADE AVAILABLE TO STOCKHOLDERS WITHOUT CHARGE UPON WRITTEN REQUEST TO ALAN I. EDRICK, EXECUTIVE VICE PRESIDENT AND CHIEF FINANCIAL

20

OFFICER, BIOSOURCE INTERNATIONAL, INC., 542 FLYNN ROAD, CAMARILLO, CALIFORNIA 93012.

|

|

ON BEHALF OF THE BOARD OF DIRECTORS |

| | |

Alan I. Edrick, Executive Vice President and Chief Financial Officer |

Camarillo, California

June 4, 2004 | | |

21

-Detach Proxy Card Here-

PROXY

BIOSOURCE INTERNATIONAL, INC.

PROXY FOR ANNUAL MEETING OF STOCKHOLDERS

The undersigned, a Stockholder of BIOSOURCE INTERNATIONAL, INC., a Delaware corporation (the "Company"), hereby nominates, constitutes and appoints JEAN-PIERRE L. CONTE, TERRANCE J. BIEKER and ALAN I. EDRICK, or any one of them, as proxy of the undersigned, each with full power of substitution, to attend, vote and act for the undersigned at the Annual Meeting of Stockholders of the Company, to be held on July 27, 2004, and any postponements or adjournments thereof, and in connection therewith, to vote and represent all of the shares of the Company which the undersigned would be entitled to vote, as follows:

(Continued, and to be marked, dated and signed, on the other side)

BIOSOURCE INTERNATIONAL, INC.

DETACH PROXY CARD HERE

A VOTE FOR ALL PROPOSALS IS RECOMMENDED BY THE BOARD OF DIRECTORS:

- 1.

- To elect the Board of Directors' six nominees as directors:

Nominees:01 Terrance J. Bieker, 02 Jean-Pierre L. Conte, 03 David J. Moffa, Ph.D., 04 John R. Overturf, Jr., 05 Robert J. Weltman, 06 John L. Zabriskie, Ph.D.

| o | | FOR ALL NOMINEES LISTED ABOVE (except as marked to the contrary below) | | o | | WITHHELD for all nominees listed above |

(INSTRUCTION: To withhold authority to vote for any individual nominee, write that nominee's name in the space below:)

|

The undersigned hereby confer(s) upon the proxies and each of them discretionary authority with respect to the election of directors in the event that any of the above nominees is unable or unwilling to serve.

- 2.

- To ratify the appointment of KPMG LLP as the Company's independent public accountants for the year ending December 31, 2004.

| o | | FOR | | o | | AGAINST | | o | | ABSTAIN |

The undersigned hereby revokes any other proxy to vote at the Annual Meeting, and hereby ratifies and confirms all that said attorneys and proxies, and each of them, may lawfully do by virtue hereof. With respect to matters not known at the time of the solicitation hereof, said proxies are authorized to vote in accordance with their best judgment.

THIS PROXY WILL BE VOTED IN ACCORDANCE WITH THE INSTRUCTIONS SET FORTH ABOVE OR, TO THE EXTENT NO CONTRARY DIRECTION IS INDICATED, WILL BE TREATED AS A GRANT OF AUTHORITY TO VOTE FOR ALL PROPOSALS. IF ANY OTHER BUSINESS IS PRESENTED AT THE ANNUAL MEETING, THIS PROXY CONFERS AUTHORITY TO AND SHALL BE VOTED IN ACCORDANCE WITH THE RECOMMENDATIONS OF THE PROXIES.

o |

|

Please indicate by checking this box if you anticipate attending the Annual Meeting. |

|

PLEASE MARK SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE |

|

|

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF BIOSOURCE INTERNATIONAL, INC. |

|

The undersigned acknowledges receipt of a copy of the Notice of Annual Meeting and accompanying Proxy Statement dated June 7, 2004, relating to the Annual Meeting. |

|

|

|

|

Dated: |

|

|

|

, 2004 |

|

|

|

|

|

| | | | | Signature |

|

|

|

|

|

| | | | | Signature

Signature(s) of Stockholder(s)

(See Instructions Below) |

|

|

|

|

The Signature(s) hereon should correspond exactly with the name(s) of the Stockholder(s) appearing on the Share Certificate. If stock is held jointly, all joint owners should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If signer is a corporation, please sign the full corporation name, and give title of signing officer.

|

QuickLinks

PROPOSAL NO. 1: ELECTION OF DIRECTORSMeetings and Committees of the Board of DirectorsExecutive OfficersSecurity Ownership of Certain Beneficial Owners and ManagementExecutive Compensation SUMMARY COMPENSATION TABLEOPTION GRANTS IN FISCAL 2003AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR-END OPTION VALUESEmployment AgreementsReport of the Compensation CommitteeReport of the Audit CommitteePROPOSAL NO. 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT PUBLIC ACCOUNTANTSPerformance GraphCOMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN* AMONG BIOSOURCE INTERNATIONAL, INC., THE NASDAQ STOCK MARKET (U.S.) INDEX AND THE NASDAQ BIOTECHNOLOGY INDEXOther Matters Certain Transactions with Directors and Executive OfficersSection 16(a) Beneficial Ownership Reporting ComplianceStockholder ProposalsSolicitation of ProxiesAnnual Report on Form 10-K