UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

Investment Company Act file number | 811-6041 |

The Central Europe & Russia Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154

(Address of principal executive offices) (Zip code)

Registrant’s Telephone Number, including Area Code: (212) 454-7190

Paul Schubert

345 Park Avenue

New York, NY 10154

(Name and Address of Agent for Service)

Date of fiscal year end: | 10/31 |

Date of reporting period: | 10/31/06 |

ITEM 1. REPORT TO STOCKHOLDERS

The Central Europe and Russia Fund, Inc.

LETTER TO THE SHAREHOLDERS

Dear Shareholders,

We are pleased to report that for the fiscal year ended October 31, 2006, The Central Europe and Russia Fund's total return based on share price was 19.25% while its total return based on net asset value per share was 48.55%. The Fund's blended benchmark returned 45.00% during the same period.1 (Past performance is no guarantee of future results. Please see page 5 for more complete performance information.)

During the first quarter, the Fund completed a rights offering. Shareholders were issued one transferable right for each share owned. The rights entitled the shareholders to purchase one new share of common stock for every three rights held at a subscription price of $40.19. The net asset value per share of the Fund's common shareholders was reduced by approximately $3.25 per share as a result of the share issuance. Net proceeds were approximately $132 million after deduction of fees and expenses.

In the fund's fiscal Q4 2006, emerging European equity markets rebounded from the sharp downturns seen earlier in the year. Among Czech stocks, most of the blue chips generate substantial amounts of cash and should be able to post good earnings growth over the next 12 months, though Czech stocks continue to trade at the highest P/E (price-to-earnings) ratio (based on estimated 2007 earnings) of the fund's five core markets. However, the potential for double-digit total returns over the next year combined with their defensive qualities make a few Czech stocks worthwhile investments on a risk adjusted basis. Ceske Energeticke Zavody (CEZ), the electric utility, remains a modest overweight relative to the fund's benchmark and was the second best performing company in our Czech benchmark over the past year.2 Erste Bank and Komercni Banka, the other Czech holdings in the fund, are weighted slightly below their benchmark weights. On fundamental grounds, Hungarian blue chips are reasonably valued, with some moderate upside potential seen from both company-specific factors and sector trends. However, due to their tenuous economic foundation we maintain smaller weightings in Hungarian stocks than we would based on sheer company fundamentals. In Poland, the economy may slow somewhat in 2007, but growth should still be sufficient to underpin good profit performances for listed companies next year. We continue to like construction, construction materials, and real estate: fund holdings Cersanit and Echo Investments each had triple-digit returns over the past year. Telecoms on the other hand seem to be entering a more difficult regulatory environment.

After a tough second quarter, Turkish shares and the currency rebounded over the summer, but volatility is likely to remain an issue over the near-term. We remain cautiously optimistic about the Turkish market with our positive bias tied to the apparently quite resilient economic expansion, above-average earnings growth and attractive valuations. The fund's weighting in Turkish equities is just above that of its benchmark (11.5%) with an effectively neutral position in the banking sector as slight overweight positions in Akbank and Isbank offset the underweight positions in Finansbank and Garanti Bank. The balance of the fund's Turkish portfolio consists of construction and consumer-oriented names such as food retailer BIM Birlesik and construction company Enka, both of which contributed to the fund's outperformance for the year.

We continue to maintain an overweight position in Russian equities relative to the benchmark, with an increasingly pronounced bias towards domestically oriented stocks. Within the energy segment, we continue to prefer the shares of natural gas companies over those of oil companies. Gas prices on the export markets tend to lag the oil price by six months, so this past summer's high oil prices should be realized in the gas market during the peak demand winter months. In addition, domestic gas prices are expected to rise by 10-15% a year over the next three years. The fund's overweight positions in Gazprom and independent

1

LETTER TO THE SHAREHOLDERS (continued)

gas producer Novatek helped fund performance, as Gazprom posted above-benchmark returns for the period and Novatek was the best-performing stock in the fund's Russian benchmark, posting triple-digit gains. We also believe that conditions are favorable for Russian metals companies, given the environment of short supply and rising demand, and Russian consumer stocks, which benefit from rising income levels and the introduction of consumer credit products. The fund's position in Sberbank contributed positively to performance, as the shares posted triple-digit gains for the period.

The Central Europe and Russia Fund's discount to net asset value averaged 6.8% during the fiscal year ended October 31, 2006, compared with 7.5% for the same period last year.

Sincerely,

|  |  | |||||||||

| Christian Strenger Chairman | Ralf Oberbannscheidt Lead Portfolio Manager | Michael G. Clark President and Chief Executive Officer | |||||||||

The views expressed in this report reflect those of the named individuals only through the end of the period of the report as stated on the cover. This information is subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance does not guarantee future results.

1 A custom blend of 45% in Central Europe (CECE-Index), 45% Russia (RTX-Index) and 10% in Turkey (ISE National 30).The CECE is a regional capitalization-weighted index, including stocks from the Czech Republic, Hungary, Poland and Slovakia and is published daily by the Vienna Stock Exchange. The RTX is a capitalization-weighted index of Russian blue chip stocks and published daily by the Vienna Stock Exchange. The ISE National 30 is a capitalization-weighted index composed of National Market companies except investment trusts and will also be used for trading in the Derivatives Market. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly in an index.

2 "Overweight" means the fund holds a higher weighting in a given sector or security than the benchmark. "Underweight" means the fund holds a lower weighting.

For additional information about the Fund including performance, dividends, presentations, press releases, daily NAV and shareholder reports, please visit www.ceefund.com

2

ECONOMIC OUTLOOK

Czech Republic:

While political instability from the government's lost confidence vote in October has not yet translated into a worsening of output data, soft warning signs can be found in two areas: weak foreign direct investment (FDI) inflows and the state budget balance. The Finance Ministry has warned that the public sector deficit is set to exceed EU convergence criteria in 2006, and the Central Bank expressed its concern over fiscal stimuli emerging in 2007. The combination of a stagnating trade balance and rising profit repatriation of FDI projects has placed the current account deficit on track for returning to 4% of gross domestic product. Tighter monetary policy is likely to persist next year given fast GDP growth propelled by strengthening domestic demand, a decreasing unemployment rate, the likelihood of fiscal stimulus and higher interest rates in the Eurozone.

Hungary:

With the budget deficit at close to 10% of GDP, Hungary's medium-term economic backdrop largely depends on the implementation of Prime Minister Gyurcsany's austerity package, which we expect will be implemented broadly in its original structure (60/40 income-expenditure side elements). We expect CPI to peak at 8% year-over-year (y-o-y) in March 2007.The external deficit is apt to improve to around 5.5% of GDP as slowing investments and domestic demand should be countered by still healthy net export growth in the fourth quarter of 2006. Quicker economic slowdowns in the US and EU represent a meaningful downside risk as Hungary has one of the highest business cycle synchronizations with the EU. With slowing growth and contained domestic demand, we think the Monetary Policy Council (MPC) is close to the end of its tightening cycle, unless the EUR/HUF breaches its all time highs.

Poland:

GDP growth has likely peaked, but a combination of relatively firm domestic demand and a closing output gap means that demand-led risks to inflation continue to increase. Also there is clear evidence that the labor market is getting tighter and we expect demand for labor will remain at an elevated level supported by robust fixed investment spending, which should remain robust on the back of high capacity utilization and still relatively high inflow of foreign direct investment. In addition to the cyclical factors, we expect the labor market will tighten further on the back of emigration of the labor force to other EU countries. This tendency should intensify as Italy and Spain recently opened their labor markets to Poles. Firmer demand increases the risk of cost pressures (particularly on the food side). As such, the time when the MPC starts its tightening cycle is drawing closer.

Russia:

GDP growth will likely reach 6.5% y-o-y, the current account surplus may reach 12% of GDP and the federal budget should close in a surplus of 7.0% of GDP. The year 2006 also marks the first year of net capital inflows since the 1998 crisis. The mix of fiscal surplus, accumulation of the Oil Stabilization Fund1, and gradual ruble appreciation have sterilized a sizable part of the inflows and kept inflation relatively subdued so far, but the key question remains whether signs of overheating and Dutch disease2 begin to more meaningfully drive inflation higher. We expect CPI to remain in a range of 8-9% y-o-y into 2007 with the government likely controlling any meaningful upside deviation with administrative measures. On the back of a healthy current account and improving capital inflows, the Central Bank of Russia increased FX reserves, which – despite the recent drop in oil prices – are likely to reach $290 bi llion by the end of 2006. Russia's debt dynamics look very healthy with external debt now falling below 10% of GDP.

Turkey:

The Central Bank of Turkey (CBT) was forced to hike rates by 425 bps in 2006 due to inflation pressure and negative spillover from abroad. Inflation remains a challenge, with CPI standing at 10% y-o-y in October. The lira recovered to a level below 1.50 as the aggressive CBT rate hikes calmed nerves and stopped cash outflows. The government has already attained the 3% of GDP Maastricht deficit criterion and debt-to-GDP may reach the 60% Maastricht target by the end of 2007. At 7% of GNP, the current account deficit is the main economic risk, given the country imports almost all of its oil needs; every $1 increase in the average yearly price of oil raises the current account deficit by $350 million. Net FDI through August stood at more than $12 billion, more than the total for 2004 and 2005 combined, while FX reserves stand at a supportive $58 billion.

1 The Oil Stabilization Fund was created by the Russian Ministry of Finance on January 1, 2004 and is used to cover the federal budget deficit and reduce inflationary pressure by accumulating revenues when the oil price exceeds a specified cut-off price. Use of accumulated funds is restricted to payment of certain expenses as determined by the Russian government, such as repayment of foreign debt and funding of the pension system.

2 Dutch disease refers to the negative impact on the manufacturing sector of a domestic economy that often accompanies an increase in the export of natural resources from that country.

3

FUND HISTORY AS OF OCTOBER 31, 2006

All performance shown is historical, assumes reinvestment of all dividend and capital gain distributions, and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when sold, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please visit www.ceefund.com for the Fund's most recent performance.

TOTAL RETURNS:

| For the years ended October 31, | |||||||||||||||||||||||||||

| 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | ||||||||||||||||||||||

| Net Asset Value(a) | 48.55 | %(c) | 48.74 | % | 35.20 | %(b) | 44.88 | % | 17.05 | % | (14.31 | )% | |||||||||||||||

| Market Value(a) | 19.25 | % | 80.71 | % | 18.73 | % | 60.38 | % | 23.43 | % | (7.79 | )% | |||||||||||||||

| Benchmark | 45.00 | %(1) | 37.81 | %(1) | 32.73 | %(2) | 40.65 | %(3) | 14.68 | %(4) | (20.40 | )%(5) | |||||||||||||||

(a) Total return based on net asset value reflects changes in the Fund's net asset value during the period. Total return based on market value reflects changes in market value. Each figure includes reinvestments of distributions. These figures will differ depending upon the level of any discount from or premium to net asset value at which the Fund's shares trade during the period.

(b) Return excludes the effect of the $2.15 per share dilution associated with the Fund's rights offering.

(c) Return excludes the effect of the $3.25 per share dilution associated with the Fund's rights offering.

(1) Represents an arithmetic composite consisting of 45% CECE*/45% RTX**/10% ISE National 30***.

(2) Represents an arithmetic composite consisting of 70% CECE/30% RTX for the 5 months ended 3/31/04 and 45% CECE/45% RTX/10% ISE National 30 for the seven months ended 10/31/04. The Fund changed its benchmark from 70% CECE/30% RTX to 45% CECE/45% RTX/10% ISE National 30 on April 1, 2004.

(3) Represents an arithmetic composite consisting of 85% CECE/15% RTX for the 9 months ended 7/31/03 and 70% CECE/30% RTX for the 3 months ended 10/31/03. The Fund changed its benchmark from 85% CECE/15% RTX to 70% CECE/30% RTX on August 1, 2003.

(4) Represents the CECE Index.

(5) Represents an arithmetic composite consisting of a customized MSCI index for the 2 months ended 12/31/00 and the CECE Index for the 10 months ended 10/31/01. The customized MSCI index consists of 35% Germany, 20% Poland, 15% Hungary, 10% Czech Republic, 10% Russia and 10% Austria. The Fund changed its benchmark from a customized MSCI Index to the CECE Index on January 1, 2001.

* The CECE is a regional capitalization-weighted index including stocks from the Czech Republic, Hungary and Poland and is published daily by the Vienna Stock Exchange.

** The RTX is a capitalization-weighted index of Russian blue chip stocks and published daily by the Vienna Stock Exchange.

*** The ISE National 30 is a capitalization-weighted index composed of National Market companies except investment trusts and will also be used for trading in the Derivatives Market.

Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly in an index.

Investments in funds involve risks including the loss of principal.

This Fund is not diversified and may focus its investments in certain geographical regions, thereby increasing its vulnerability to developments in that region. Investing in foreign securities presents certain unique risks not associated with domestic investments, such as currency fluctuation and political and economic changes and market risks. This may result in greater share price volatility.

Shares of closed-end funds frequently trade at a discount from net asset value. The price of the Fund's shares is determined by a number of factors, several of which are beyond the control of the Fund. Therefore, the Fund cannot predict whether its shares will trade at, below or above net asset value. Closed-end funds, unlike open-end funds, are not continuously offered. There is a one-time public offering, and once issued, shares of closed-end funds are sold in the open market through a stock exchange.

The Fund is complying with the German tax transparency rules for the current fiscal year that ends on October 31, 2006 and therefore qualifies as a transparent fund within the meaning of the German fund tax law (InvStG 2004).

4

FUND HISTORY AS OF OCTOBER 31, 2006 (continued)

STATISTICS:

| Net Assets | $ | 772,722,225 | |||||

| Shares Outstanding | 14,002,505 | ||||||

| NAV Per Share | $ | 55.18 | |||||

DIVIDEND AND CAPITAL GAIN DISTRIBUTIONS:

| Record Date | Payable Date | Ordinary Income | ST Capital Gains | LT Capital Gains | Total | ||||||||||||||||||

| 12/20/05 | 12/30/05 | $ | 0.33 | $ | 0.215 | $ | 2.507 | $ | 3.05 | ||||||||||||||

| 12/22/04 | 12/31/04 | $ | 0.17 | $ | — | $ | — | $ | 0.17 | ||||||||||||||

| 12/22/03 | 12/31/03 | $ | 0.22 | $ | — | $ | — | $ | 0.22 | ||||||||||||||

| 11/19/01 | 11/29/01 | $ | 0.10 | $ | 0.13 | $ | — | $ | 0.23 | ||||||||||||||

OTHER INFORMATION:

| NYSE Ticker Symbol | CEE | ||||||

| NASDAQ Symbol | XCEEX | ||||||

| Dividend Reinvestment Plan | Yes | ||||||

| Voluntary Cash Purchase Program | Yes | ||||||

| Annual Expense Ratio (10/31/06)* | 1.09 | % | |||||

* Represents expense ratio before custody credits. Please see "Financial Highlights" section of this report.

Fund statistics and expense ratio are subject to change. Distributions are historical, will fluctuate and are not guaranteed.

5

10 LARGEST EQUITY HOLDINGS AS OF OCTOBER 31, 2006 (As a % of Portfolio's Net Assets)

| 1. | Gazprom | 11.4 | |||||||||

| 2. | Lukoil | 10.1 | |||||||||

| 3. | JSC MMC Norilsk Nickel | 5.4 | |||||||||

| 4. | Surgutneftegaz | 5.3 | |||||||||

| 5. | Unified Energy Systems | 4.9 | |||||||||

| 6. | Ceske Energeticke Zavody | 4.2 | |||||||||

| 7. | Polski Koncern Naftowy | 3.5 | |||||||||

| 8. | KGHM Polska Miedz SA | 3.0 | |||||||||

| 9. | Telekomunikacja Polska | 2.7 | |||||||||

| 10. | Polyus Gold Co. | 2.6 | |||||||||

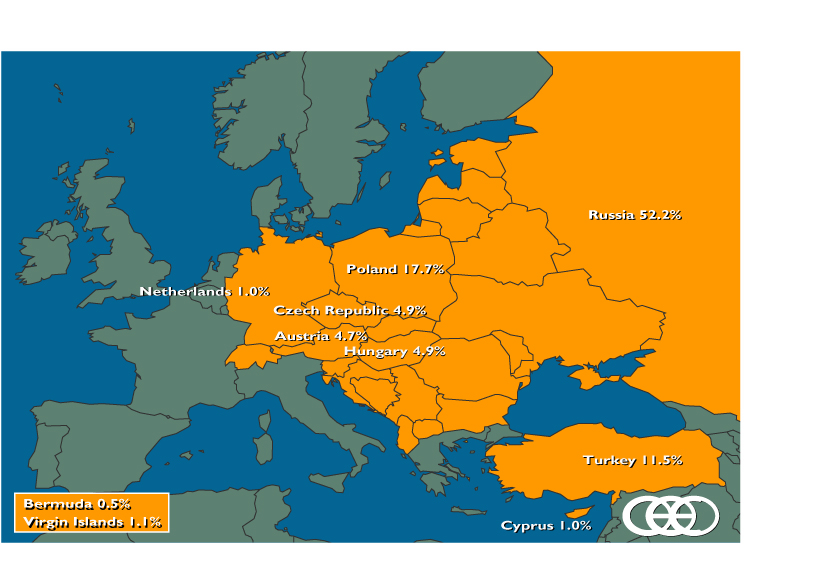

GEOGRAPHICAL REPRESENTATION OF HOLDINGS BY COUNTRY

10 Largest Equity Holdings and Country Breakdown are subject to change and may not be indicative of future portfolio composition.

Following the Fund's fiscal first and third quarter-end, a complete portfolio holdings listing is filed with the SEC on Form N-Q. The form will be available on the SEC's Web site at www.sec.gov, and it also may be reviewed and copied at the SEC's Public Reference Room in Washington, D.C. Information on the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

6

INTERVIEW WITH THE LEAD PORTFOLIO MANAGER — Ralf Oberbannscheidt

Question: Given the recent decline in oil prices, is the rise of the Russian equity market over?

Answer: Although oil and materials are certainly critical for the Russian market, they are not the only determinants for many domestic stocks. In fact, the Russian Trading System Index (RTS) gained more than 4% in October despite the fact that oil fell about 6% that month.1 Overall, in 2006, the RTS gained more than 43% through the end of October, while oil prices declined 3% during that same time period. In addition, President Putin has stated that diversification of the economy is a priority, so correlation to the oil price should decrease over time, especially if the IPO boom in Russia continues. The banking and utilities sectors are set to lead the way in 2007, with Sberbank having recently announced plans to raise up to $8.5 billion in the market to further develop and consolidate the Russian banking market. Toward the end of 2007, market mo vement will increasingly depend on the transition of power from President Putin in the 2008 presidential election, with increased volatility likely as the next leader settles into office.

Question: What are the key issues impacting sentiment in the Turkish market as we head into 2007?

Answer: Aside from keeping a watchful eye on currency and interest rate developments following the events of this past year, progress on EU accession talks continues to be a key factor. The opening of ports to (Greek) Cypriot vessels and article 301 of the penal code (which punishes those criticizing "Turkishness") are two issues that have garnered attention recently. The government must also address the issue of Kurdish rebels in northern Iraq, which has recently seen escalation and depends on Iraqi and US action, and continued political noise out of the EU (such as the Armenian genocide bill in France). At the same time, we do not expect EU talks to stop with the half-year presidency handing over to Germany in January 2007. Domestically, all eyes will be on the Spring 2007 presidential election, voted by a required two-thirds of Members of Parliament (MPs ). The Justice and Development Party (AKP) needs the support of 12 MPs outside its own party to support its candidate. It appears that the AKP government will wait until the last minute (i.e., April 2007) to announce its candidate, but many equity market participants do not expect Prime Minister Erdogan to stand as a candidate. Once the presidential elections are over, focus will turn to the December 2007 parliamentary elections.

Question: What are the reasons behind your improving outlook for the Polish market?

Answer: As far as investment opportunities, valuations have come down to more reasonable levels on an absolute basis following the sell-off in stock markets earlier this year. The market is experiencing healthy earnings growth, though valuation still seems rather full when comparing Polish equities with others around the region. However, the booming economy should have a positive impact on corporate earnings, which creates some upside risk to current forecasts. In the near term, domestic politics may prove a distraction for Polish equities as the possible dissolution of the government and early elections could place fiscal plans in some doubt, but the likely change in the government's make-up would be in the direction of more credible economic policies. In an environment of solid growth and benign monetary policy, Polish corporations should fare well, with domestic-oriented companies likely to do better than exporters.

Ralf Oberbannscheidt, Lead Portfolio Manager of The Central Europe and Russia Fund, Inc.

1 The Russian Trading System Index is a capitalization-weighted index comprised of stocks traded on the Russian Trading System and uses free-float adjusted shares.

The views expressed in this report reflect those of the named individuals only through the end of the period of the report as stated on the cover. This information is subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance does not guarantee future results.

7

DIRECTORS OF THE FUND

| Name, Address, Age* | Principal Occupation(s) During Past Five Years | Other Directorships Held by Director | |||||||||

| Detlef Bierbaum, 64(1)(2) Class I | Partner of Sal. Oppenheim Jr. & Cie KGaA (investment management). | Director, The European Equity Fund, Inc. (since 1986). Member, Supervisory Board, Tertia Handelsbeteiligungsgesellschaft mbH (electronic retailor). Member, Supervisory Board, Douglas AG (retailer). Member, Supervisory Board, LVM Landwirtschaftlicher Versicherungsverein (insurance). Member, Supervisory Board, Monega KAG. Member of Supervisory Board, AXA Investment Managers GmbH (Investment Company). Chairman of Supervisory Board, Oppenheim Kapitalanlagegesellsehaft mbH (investment company). Chairman of the Supervisory Board, Oppenheim Real Estate Investment GmbH. Chairman of Administrative Board, Oppenheim Prumerica Asset Management S.a.r.l. (investment company). Member of Supervisory Board, Atradius N.V. (insurance company). Member of the Supervisory Board of DWS Investment GmbH. Member of the Board of Quindee REIT, Toronto. | |||||||||

8

DIRECTORS OF THE FUND (continued)

| Name, Address, Age* | Principal Occupation(s) During Past Five Years | Other Directorships Held by Director | |||||||||

| Dr. Kurt W Bock, 48(1)(4) Class II | Member of the Board of Executive Directors and CFO, BASF Aktiengesellschaft (since 2003); President, Logistics and Information Services, BASF Aktiengesellschaft (2000-2003); Chief Financial Officer, BASF Corporation (1998-2000); Managing Director, Robert Bosch Ltda. (1996-1998); Senior Vice President, Finance and Accounting, Robert Bosch GmbH (1994-1996); Senior Vice President, Finance, Robert Bosch GmbH (1992-1994); Head of Technology, Planning and Controlling, Engineering Plastics division, BASF Aktiengesellschaft (1991-1992); Executive Assistant to BASF's Chief Financial Officer (1987-1991). | Director of The European Equity Fund, Inc. (since 2004). Member ot the Supervisory Boards of Wintershall AG (since 2003), Wintershall Holding AG (since 2006), and BASF Coatings AG (since 2006). Member of the Advisory Boards of Landesbank Baden- Wurttemberg (since 2003), Gebr. Röchling KG (since 2004). Member of the Advisory Forum of Deutsche Bank AG (since 2004). Member of the Boards of BASFIN Corporation (since 2002). Deutsches Rechnungslegungs Standards Committee ("DRSC") (since 2003). | |||||||||

| John Bult, 70(1)(2) Class II | Chairman, PaineWebber International (since 1985) | Director, The European Equity Fund, Inc. (since 1986) and The New Germany Fund, Inc. (since 1990). Director, The Greater China Fund, Inc. (closed end fund). | |||||||||

| Ambassador Richard R. Burt, 59(1) Class I | Chairman, Diligence, Inc. (international information and risk management firm) (since 2002). Chairman, IEP Advisors, LLP (information services firm) (since 1998). Chairman of the Board, Weirton Steel Corp. (1996-2004). Formerly, Partner, McKinsey & Company (consulting firm) (1991-1994). U.S. Ambassador to the Federal Republic of Germany (1985-1989). | Director, The European Equity Fund, Inc. (since 2000) and The New Germany Fund, Inc. (since 2004). Board Member, IGT, Inc. (gaming technology) (since 1995). Board Member, EADS North America (defense and aerospace) (since 2005). Director, UBS family of Mutual Funds (since 1995). | |||||||||

| John H. Cannon, 64(1) Class I | Consultant (since 2002); Vice President and Treasurer Venator Group/Footlocker Inc. (footwear retailer) (until 2001). | Director of The New Germany Fund, Inc. (since 1990) and The European Equity Fund, Inc. (since 2004). | |||||||||

9

DIRECTORS OF THE FUND (continued)

| Name, Address, Age* | Principal Occupation(s) During Past Five Years | Other Directorships Held by Director | |||||||||

| Christian H. Strenger, 63(1)(2) Class III | Member of Supervisory Board (since 1999) and formerly Managing Director (1991-1999) of DWS Investment GmbH (investment management), a subsidiary of Deutsche Bank AG. | Director of The European Equity Fund, Inc. (formerly The Germany Fund, Inc.) (since 1986) and The New Germany Fund, Inc. (since 1990). (Member, Supervisory Board, Fraport AG (international airport business) and Hermes Focus Asset Management Europe Ltd. (asset management). | |||||||||

| Dr. Frank Trömel, 70(1) Class III | Deputy Chairman of the Supervisory Board of DELTON AG (strategic management holding company operation in the pharmaceutical, household products, logistics and power supply sectors) (since 2000). Member (since 2000) and Vice-President (since 2002) of the German Accounting Standards Board; Chairman of the Board of Managing Directors of DELTON AG (1990-1999); Chairman of the Board of Managing Directors of AL TANA AG (1987-1990) (management holding company for pharmaceutical and chemical operation) and Member of the Board (1977-1987). | Director, The European Equity Fund, Inc (since 2005) and The New Germany Fund, Inc (since 1990). | |||||||||

| Robert H. Wadsworth, 66(1)(3) Class II | President, Robert H. Wadsworth Associates, Inc. (consulting firm) (May 1983-present). Formerly, President and Trustee, Trust for Investment Managers (registered investment companies) (April 1999-June 2002). President, Investment Company Administration, L.L.C. (January 1992(5)-July 2001). President, Treasurer and Director, First Fund Distributors, Inc. (mutual fund distribution) (June 1990-January 2002). Vice President, Professionally Managed Portfolios (May 1991-January 2002) and Advisors Series Trust (registered investment companies) (October 1996-January 2002). | Director, The European Equity Fund, Inc. (since 1986) and The New Germany Fund, Inc. (since 1992) as well as other funds in the Fund Complex as indicated. | |||||||||

10

DIRECTORS OF THE FUND (continued)

| Name, Address, Age* | Principal Occupation(s) During Past Five Years | Other Directorships Held by Director | |||||||||

| Werner Walbröl, 69(1) Class III | President and Chief Executive Officer, The European American Chamber of Commerce, Inc. Formerly, President and Chief Executive Officer, The German American Chamber of Commerce, Inc. (until 2003). | Director of The European Equity Fund, Inc. (since 1986) and The New Germany Fund, Inc. (since 1990). Director, TÜV Rheinland of North America, Inc. (independent testing and assessment services). Director, The German American Chamber of Commerce, Inc. President and Director, German-American Partnership Program (student exchange programs). Director, AXA Art Insurance Corporation (fine art and collectible insurer). | |||||||||

Each has served as a Director of the Fund since the Fund's inception in 1990 except for Ambassador Burt, Dr. Bock, Mr. Cannon, and Dr. Trömel. Ambassador Burt was elected to the Board on June 30, 2000, Dr. Bock was elected to the Board on May 5, 2004, Mr. Cannon was elected to the Board on April 23, 2004, and Dr. Trömel was elected to the Board on July 17, 2005. The term of office for Directors in Class I expires at the 2007 Annual Meeting, Class II expires at the 2008 Annual Meeting and Class III expires at the 2009 Annual Meeting. Each Director also serves as a Director of The European Equity Fund, Inc., one of the two other closed-end registered investment companies for which Deutsche Investment Management Americas Inc. acts as manager.

(1) Indicates that Messrs. Bult, Burt, Cannon, Trömel, Walbröl, Wadsworth and Strenger each also serve as a Director of The European Equity Fund, Inc. and The New Germany Fund, Inc., two other closed-end registered investment companies for which Deutsche Investment Management Americas Inc. acts as manager. Indicates that Messrs. Bierbaum and Bock also serve as a Director of The European Equity Fund, Inc., one of the two other closed-end registered investment companies for which Deutsche Investment Management Americas Inc. acts as manager.

(2) Indicates "interested" Director, as defined in the Investment Company Act of 1940, as amended (the "1940 Act"). Mr. Bierbaum is an "interested" Director because of his affiliation with Sal. Oppenheim Jr. & Cie KGaA, which engages in brokerage with the Fund and other accounts managed by the investment advisor and manager; Mr. Bult is an "interested" Director because of his affiliation with PaineWebber International, an affiliate of UBS Securities Inc., a registered broker-dealer; and Mr. Strenger is an "interested" Director because of his affiliation with DWS-Deutsche Gesellschaft fur Werpapiersparen mbH ("DWS"), a majority-owned subsidiary of Deutsche Bank AG and because of his ownership of Deutsche Bank AG shares.

(3) Indicates that Mr. Wadsworth also serves as Director/Trustee of the following open-end investment companies: DWS Balanced Fund, DWS Blue Chip Fund, DWS Equity Trust, DWS High Income Series, DWS State Tax-Free Income Series, DWS Strategic Income Fund, DWS Target Fund, DWS Technology Fund, DWS U.S. Government Securities Fund, DWS Value Series, Inc., DWS Variable Series II, Cash Account Trust, Investors Cash Trust, Investors Municipal Cash Fund, Tax-Exempt California Money Market Fund and DWS Money Funds. Mr. Wadsworth also serves as Director of Dreman Value Income Edge Fund, Inc., DWS High Income Trust, DWS Multi-Market Income Trust, DWS Municipal Income Trust, DWS Strategic Income Trust, DWS Strategic Municipal Income Trust, closed-end investment companies. These Funds are advised by Deutsche Investment Management Americas Inc., an indirect wholly-owned sub sidiary of Deutsche Bank AG.

(4) Dr. Tessen von Heydebreck, a managing director of Deutsche Bank, is a member of the supervisory board of BASF AG, Dr. Bock's employer.

(5) Inception date of corporation which was predecessor to the LLC.

* The address of each Director is 345 Park Avenue, New York, NY 10154.

11

OFFICERS OF THE FUND

| Name, Age | Principal Occupations During Past Five Years | ||||||

| Michael G. Clark(3,8), 41 President and Chief Executive Officer | Managing Director(7), Deutsche Asset Management (2006-present); President of DWS family of funds; formerly, Director of Fund Board Relations (2004-2006) and Director of Product Development (2000-2004), Merrill Lynch Investment Managers; Senior Vice President Operations, Merrill Lynch Asset Management (1999-2000) | ||||||

| Paul H. Schubert(8), 43 Chief Financial Officer and Treasurer | Managing Director(7), Deutsche Asset Management (since July 2004); formerly, Executive Director, Head of Mutual Fund Services and Treasurer for UBS Family of Funds (1998-2004); Vice President and Director of Mutual Fund Finance at UBS Global Asset Management (1994-1998) | ||||||

| David Goldman(4,8), 32 Secretary | Vice President(7), Deutsche Asset Management | ||||||

| John Millette(5,9), 44 Assistant Secretary | Director(7), Deutsche Asset Management | ||||||

| Scott M. McHugh(4,9), 35 Assistant Treasurer | Director(7), Deutsche Asset Management | ||||||

| Elisa D. Metzger(2,8), 44 Chief Legal Officer | Director(7), Deutsche Asset Management (since September 2005); formerly, Counsel, Morrison and Foerster LLP (1999-2005) | ||||||

| Philip Gallo(6,8), 44 Chief Compliance Officer | Managing Director(7), Deutsche Asset Management (2003-present); formerly, Co-Head of Goldman Sachs Asset Management Legal (1994-2003) | ||||||

Each also serves as an Officer of The European Equity Fund, Inc. and The New Germany Fund, Inc., two other closed-end registered investment companies for which Deutsche Investment Management Americas Inc. acts as manager.

(1) As a result of their respective positions held with the Manager, these individuals are considered "interested persons" of the Manager within the meaning of the 1940 Act. Interested persons receive no compensation from the Fund.

(2) Since January 30, 2006.

(3) Since June 15, 2006.

(4) Since July 14, 2006.

(5) Since July 14, 2006. From January 30, 2006 to July 14, 2006 served as Secretary to the Fund.

(6) Since October 5, 2004.

(7) Executive title, not a board directorship.

(8) Address: 345 Park Avenue, New York, New York 10154.

(9) Address: Two International Place, Boston, Massachusetts 02110.

12

SHARES REPURCHASED AND ISSUED

The Fund has been purchasing shares of its common stock in the open market. Shares repurchased and shares issued for div idend reinvestment for the past five years are as follows:

| Fiscal year ended October 31, | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | |||||||||||||||||||||

| Shares repurchased | — | — | 97,300 | 237,400 | 201,600 | 686,975 | |||||||||||||||||||||

| Shares issued for dividend reinvestment | 388,226 | — | 37,769 | — | 96,643 | — | |||||||||||||||||||||

| Shares issued in rights offering | 3,417,070 | — | 2,555,677 | — | — | — | |||||||||||||||||||||

PRIVACY POLICY AND PRACTICES

We never sell customer lists or information about individual clients (stockholders). We consider privacy fundamental to our client relationships and adhere to the policies and practices described below to protect current and former clients' information. Internal policies are in place to protect confidentiality, while allowing client needs to be served. Only individuals who need to do so in carrying out their job responsibilities may access client information. We maintain physical, electronic and procedural safeguards that comply with federal and state standards to protect confidentiality. These safeguards extend to all forms of interaction with us, including the Internet.

In the normal course of business, we may obtain information about stockholders whose shares are registered in their names. For purposes of these policies, "clients" means stockholders of the Fund. (We generally do not have knowledge of or collect personal information about stockholders who hold Fund shares in "street" name," such as through brokers or banks.) Examples of the nonpublic personal information collected are name, address, Social Security number and transaction and balance information. To be able to serve our clients, certain of this client information may be shared with affiliated and nonaffiliated third party service providers such as transfer agents, custodians, and broker-dealers to assist us in processing transactions and servicing the client's account with us. The organizations described above that receive client information may only use it for the purpose designated by the Fund.

We may also disclose nonpublic personal information about clients to other parties as required or permitted by law. For example, we are required or we may provide information to government entities or regulatory bodies in response to requests for information or subpoenas, to private litigants in certain circumstances, to law enforcement authorities, or any time we believe it necessary to protect the firm from such activity.

CERTIFICATIONS

The Fund's chief executive officer has certified to the New York Stock Exchange that, as of July 19, 2006, he was not aware of any violation by the Fund of applicable NYSE corporate governance listing standards. The Fund's reports to the Securities and Exchange Commission on Forms N-CSR, N-CSRS and N-Q contain certifications by the Fund's chief executive officer and chief financial officer that relate to the Fund's disclosure in such reports and that are required by rule 30a-2(a) under the Investment Company Act.

PROXY VOTING

A description of the Fund's policies and procedures for voting proxies for portfolio securities and information about how the Fund voted proxies related to its portfolio securities during the 12-month period ended June 30 is available on our Web site — www.ceefund.com or on the SEC's Web site — www.sec.gov. To obtain a written copy of the Fund's policies and procedures without charge, upon request, call us toll free at (800) 437-6269.

13

THE CENTRAL EUROPE AND RUSSIA FUND, INC.

SCHEDULE OF INVESTMENTS — OCTOBER 31, 2006

| Shares | Description | Value | |||||||||

| INVESTMENTS IN RUSSIAN COMMON STOCKS – 52.2% | |||||||||||

| COMMERCIAL BANKS – 1.5% | |||||||||||

| 5,000 | Sberbank | $ | 11,250,000 | ||||||||

| 1,000 | Sberbank RF-(GDR) Reg S | 245,224 | |||||||||

| 11,495,224 | |||||||||||

| DIVERSIFIED TELECOMMUNICATION SERVICES – 2.3% | |||||||||||

| 525,000 | AFK Sistema OAO (GDR) | 13,912,500 | |||||||||

| 117,100 | Rostelecom (ADR)†† | 3,565,695 | |||||||||

| 17,478,195 | |||||||||||

| FOOD PRODUCTS – 1.2% | |||||||||||

| 116,319 | Lebedyansky JSC* | 9,072,882 | |||||||||

| METALS & MINING – 8.4% | |||||||||||

| 281,000 | JSC MMC Norilsk Nickel (ADR) | 41,517,750 | |||||||||

| 416,000 | Polyus Gold Co. (ADR) | 19,809,969 | |||||||||

| 3,500 | Vyksa Metallurgical Plant* | 3,815,000 | |||||||||

| 65,142,719 | |||||||||||

| MULTI-UTILITIES – 4.9% | |||||||||||

| 503,000 | Unified Energy Systems (GDR) | 37,875,900 | |||||||||

| OIL, GAS & CONSUMABLE FUELS – 31.5% | |||||||||||

| 1,400,000 | Gazprom | 14,700,000 | |||||||||

| 968,000 | Lukoil (ADR) | 78,214,400 | |||||||||

| 270,000 | Novatek OAO-Spons (GDR) | 15,714,000 | |||||||||

| 1,725,000 | OAO Gazprom (ADR) | 73,071,000 | |||||||||

| 650,000 | Surgutneftegaz (ADR)†† | 41,145,000 | |||||||||

| 137,000 | Tatneft (ADR) | 12,604,000 | |||||||||

| 153,250 | TMK OAO (GDR) | 3,869,563 | |||||||||

| 1,143,800 | TNK-BP | 2,619,302 | |||||||||

| 500,000 | Ufimskij NPZ-$US Board | 1,117,500 | |||||||||

| 243,054,765 | |||||||||||

| PERSONAL PRODUCTS – 1.0% | |||||||||||

| 181,000 | Kalina | 7,954,950 | |||||||||

| WIRELESS TELECOMMUNICATION SERVICES – 1.4% | |||||||||||

| 140,000 | Mobile Telesystems (GDR) | 5,982,200 | |||||||||

| 50,000 | Mobile Telesystems-SP (ADR) | 2,136,500 | |||||||||

| 45,500 | Vimpel-Communications (ADR)* | 2,950,220 | |||||||||

| 11,068,920 | |||||||||||

| Total Investment in Russian Common Stocks (cost $192,697,195) | 403,143,555 | ||||||||||

| Shares | Description | Value | |||||||||

| INVESTMENTS IN POLISH COMMON STOCKS – 17.7% | |||||||||||

| BUILDING PRODUCTS – 1.1% | |||||||||||

| 650,950 | Cersanit-Krasnystaw SA | $ | 8,635,226 | ||||||||

| COMMERCIAL BANKS – 5.6% | |||||||||||

| 185,000 | Bank Pekao SA | 12,484,326 | |||||||||

| 45,000 | BK Prezemyslowo-Handlowy PBank | 12,889,388 | |||||||||

| 1,450,000 | PKO Bank Polski SA | 18,302,039 | |||||||||

| 43,675,753 | |||||||||||

| CONSTRUCTION & ENGINEERING – 0.1% | |||||||||||

| 40,842 | Budimex* | 985,200 | |||||||||

| DIVERSIFIED TELECOMMUNICATION SERVICES – 2.7% | |||||||||||

| 2,320,207 | Telekomunikacja Polska | 17,073,857 | |||||||||

| 490,000 | Telekomunikacja Polska (GDR)† | 3,626,000 | |||||||||

| 20,699,857 | |||||||||||

| MEDIA – 0.2% | |||||||||||

| 37,700 | TVN SA* | 1,430,669 | |||||||||

| METAL & MINING – 3.0% | |||||||||||

| 650,000 | KGHM Polska Miedz SA | 23,486,998 | |||||||||

| OIL, GAS & CONSUMABLE FUELS – 3.5% | |||||||||||

| 1,036,102 | Polski Koncern Naftowy | 16,411,331 | |||||||||

| 149,500 | Polski Koncern Naftowy (GDR) | 4,784,000 | |||||||||

| 180,000 | Polski Koncern Naftowy (GDR)† | 5,760,000 | |||||||||

| 26,955,331 | |||||||||||

| REAL ESTATE – 1.5% | |||||||||||

| 436,072 | Echo Investment SA* | 11,288,889 | |||||||||

| Total Investments in Polish Common Stocks (cost $83,091,218) | 137,157,923 | ||||||||||

| INVESTMENTS IN HUNGARIAN COMMON STOCKS – 4.9% | |||||||||||

| COMMERCIAL BANKS – 1.8% | |||||||||||

| 387,400 | OTP Bank | 13,655,588 | |||||||||

The accompanying notes are an integral part of the financial statements.

14

THE CENTRAL EUROPE AND RUSSIA FUND, INC.

SCHEDULE OF INVESTMENTS — OCTOBER 31, 2006 (continued)

| Shares | Description | Value | |||||||||

| OIL, GAS & CONSUMABLE FUELS – 2.2% | |||||||||||

| 110,000 | MOL Magyar Olaj-Es Gazipari | $ | 10,970,278 | ||||||||

| 61,000 | MOL Magyar Olaj-Es Gazipari (GDR) | 6,084,750 | |||||||||

| 17,055,028 | |||||||||||

| PHARMACEUTICALS – 0.9% | |||||||||||

| 30,000 | Gedeon Richter RT | 6,308,032 | |||||||||

| 4,300 | Gedeon Richter (GDR) | 895,475 | |||||||||

| 7,203,507 | |||||||||||

| Total Investments in Hungarian Common Stocks (cost $11,844,068) | 37,914,123 | ||||||||||

| INVESTMENTS IN CZECH REPUBLIC COMMON STOCKS – 4.9% | |||||||||||

| COMMERCIAL BANKS – 0.7% | |||||||||||

| 4,500 | Komercni Banka A.S. | 701,368 | |||||||||

| 89,996 | Komercni Banka A.S. (GDR) | 4,634,794 | |||||||||

| 5,336,162 | |||||||||||

| MULTI-UTILITIES – 4.2% | |||||||||||

| 825,000 | Ceske Energeticke Zavody | 32,727,087 | |||||||||

| Total Investments in Czech Republic Common Stocks (cost $6,770,110) | 38,063,249 | ||||||||||

| INVESTMENTS IN TURKISH COMMON STOCKS – 11.5% | |||||||||||

| AUTOMOBILES – 1.1% | |||||||||||

| 200,000 | Ford Otomotiv Sanayi A.S. | 1,413,864 | |||||||||

| 2,100,000 | Tofas Turk Oromobil Fabrika | 6,947,152 | |||||||||

| 8,361,016 | |||||||||||

| BUILDING PRODUCTS – 0.7% | |||||||||||

| 2,278,517 | Trakya Cam Sanayii A.S. | 6,380,473 | |||||||||

| COMMERCIAL BANKS – 0.7% | |||||||||||

| 750,000 | Turkiye Sinai Kalkinma Bank | 1,616,335 | |||||||||

| 692,850 | Turkiye Vakiflar Bankasi T-D* | 3,637,819 | |||||||||

| 5,254,154 | |||||||||||

| CONSTRUCTION & ENGINEERING – 1.0% | |||||||||||

| 600,000 | Enka Insaat Ve Sanayi As | 5,065,202 | |||||||||

| 250,000 | Izocam Ticaret Ve Sanayi As | 2,762,526 | |||||||||

| 7,827,728 | |||||||||||

| Shares | Description | Value | |||||||||

| CONSTRUCTION MATERIALS – 0.5% | |||||||||||

| 690,000 | Akcansa Cimento | $ | 3,741,249 | ||||||||

| DIVERSIFIED FINANCIAL SERVICES – 4.0% | |||||||||||

| 2,230,549 | Akbank T.A.S. | 12,706,633 | |||||||||

| 1,416,356 | Turkiye Garanti Bankasi | 5,200,758 | |||||||||

| 2,000,000 | Turkiye Is Bankasi | 12,971,860 | |||||||||

| 30,879,251 | |||||||||||

| FOOD & STAPLES RETAILING – 1.2% | |||||||||||

| 203,200 | BIM Birlesik Magazalar A.S.* | 8,995,470 | |||||||||

| HOTELS RESTAURANTS & LEISURE – 0.5% | |||||||||||

| 3,200,000 | Marmaris Marti Otel Isletmel | 3,689,774 | |||||||||

| INSURANCE – 0.7% | |||||||||||

| 1,520,833 | Anadolu Hayat Emeklilik Ord | 5,031,171 | |||||||||

| OIL, GAS & CONSUMABLE FUELS – 0.6% | |||||||||||

| 300,000 | Tupras-Turkiye Petrol Rafinex | 4,982,841 | |||||||||

| WIRELESS TELECOMMUNICATION SERVICES – 0.5% | |||||||||||

| 683,166 | Turkcell Iletisim Hizmet A.S. | 3,680,752 | |||||||||

| Total Investments in Turkish Common Stocks (cost $65,707,492) | 88,823,879 | ||||||||||

| INVESTMENTS IN AUSTRIAN COMMON STOCKS – 4.7% | |||||||||||

| COMMERCIAL BANKS – 2.5% | |||||||||||

| 285,868 | Erste Bank Der Oester Spark | 19,478,651 | |||||||||

| OIL, GAS & CONSUMABLE FUELS – 2.2% | |||||||||||

| 7,750 | Bank Austria Credit Transneft Warrant (expires 4/16/07) | 16,950,839 | |||||||||

| Total Investments In Austrian Common Stocks (cost $28,135,045) | 36,429,490 | ||||||||||

The accompanying notes are an integral part of the financial statements.

15

THE CENTRAL EUROPE AND RUSSIA FUND, INC.

SCHEDULE OF INVESTMENTS — OCTOBER 31, 2006 (continued)

| Shares | Description | Value | |||||||||

| INVESTMENTS IN DUTCH COMMON STOCKS – 1.0% | |||||||||||

| BEVERAGES – 0.4% | |||||||||||

| 93,000 | Efes Breweries International (GDR) | $ | 2,836,500 | ||||||||

| FOOD & STAPLES RETAILING – 0.6% | |||||||||||

| 219,700 | Pyaterochka Holding (GDR) | 4,870,749 | |||||||||

| Total Investments in Dutch Common Stocks (cost $5,871,109) | 7,707,249 | ||||||||||

| INVESTMENTS IN CYPRUS COMMON STOCKS – 1.0% | |||||||||||

| OIL, GAS & CONSUMABLE FUELS – 1.0% | |||||||||||

| 1,050,000 | Urals Energy Public Co. Ltd. (cost $5,541,802) | 7,813,260 | |||||||||

| INVESTMENTS IN BERMUDA COMMON STOCKS – 0.5% | |||||||||||

| OIL, GAS & CONSUMABLE FUELS – 0.4% | |||||||||||

| 52,000 | Vostok Nafta Investment (SDR)* (cost $265,840) | 3,300,535 | |||||||||

| INVESTMENTS IN VIRGIN ISLANDS (BR) COMMON STOCKS – 1.1% | |||||||||||

| MULTI-UTILITIES – 1.1% | |||||||||||

| 4,094,119 | Renshares Utilities-Rengen (cost $6,511,451) | 8,352,003 | |||||||||

| Total Investments in Common Stocks – 99.5% (cost $406,435,330) | 768,705,266 | ||||||||||

| Shares | Description | Value | |||||||||

| SECURITIES LENDING COLLATERAL – 5.2% | |||||||||||

| 40,388,250 | Daily Assets Fund Institutional, 5.27%††† (cost $40,388,250) | $ | 40,388,250 | ||||||||

| Total Investments – 104.7% (cost $446,823,580) | 809,093,516 | ||||||||||

| Liabilities in excess of cash and other assets – (4.7%) | (36,371,291 | ) | |||||||||

| NET ASSETS – 100.0% | $ | 772,722,225 | |||||||||

* Non-income producing security.

† 144A - Restricted to resale to institutional investors only.

†† All or a portion of these securities were on loan. The value of all securities loaned at October 31, 2006 amounted to $39,506,279, which is 5.1% of the net assets.

††† Represents collateral held in connection with securities lending. Daily Assets Fund Institutional, an affiliated fund, is managed by Deutsche Asset Management, Inc. The rate shown is the annualized seven-day yield at period end.

Key

ADR – American Depository Receipt

GDR – Global Depository Receipt

SDR – Swedish Depository Receipt

The accompanying notes are an integral part of the financial statements.

16

THE CENTRAL EUROPE AND RUSSIA FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2006

| ASSETS | |||||||

| Investments, at value, (cost $406,435,330) — including $39,506,279 of securities loaned | $ | 768,705,266 | |||||

| Investment in Daily Assets Fund Institutional (cost $40,388,250)* | 40,388,250 | ||||||

| Cash and foreign currency (cost $4,645,225) | 4,606,621 | ||||||

| Dividend receivable | 3,317,734 | ||||||

| Foreign withholding tax refund receivable | 276,249 | ||||||

| Interest receivable | 24,365 | ||||||

| Total assets | 817,318,485 | ||||||

| LIABILITIES | |||||||

| Payable upon return of securities loaned | 40,388,250 | ||||||

| Payable for investments purchased | 3,310,200 | ||||||

| Management fee payable | 355,392 | ||||||

| Investment advisory fee payable | 170,949 | ||||||

| Payable for Directors' fees and expenses | 36,064 | ||||||

| Accrued expenses and accounts payable | 335,405 | ||||||

| Total liabilities | 44,596,260 | ||||||

| NET ASSETS | $ | 772,722,225 | |||||

| Net assets consist of: | |||||||

| Paid-in capital, $.001 par (Authorized 80,000,000 shares) | $ | 408,102,200 | |||||

| Cost of 5,476,217 shares held in treasury | (70,781,427 | ) | |||||

| Undistributed net investment income | 5,122,133 | ||||||

| Accumulated net realized gain on investments and foreign currency transactions | 67,970,779 | ||||||

| Net unrealized appreciation on investments and foreign currency related transactions | 362,308,540 | ||||||

| Net assets | $ | 772,722,225 | |||||

| Net asset value per share ($772,722,225 ÷ 14,002,505) shares of common stock issued and outstanding) | $ | 55.18 | |||||

*Represents collateral on securities loaned.

The accompanying notes are an integral part of the financial statements.

17

THE CENTRAL EUROPE AND RUSSIA FUND, INC.

STATEMENT OF OPERATIONS

| For the year ended October 31, 2006 | |||||||

| NET INVESTMENT INCOME | |||||||

| Dividends (net of foreign withholding taxes of $1,272,749) | $ | 13,848,975 | |||||

| Interest | 49,223 | ||||||

| Securities lending, including income from Daily Assets Fund Institutional, net of borrower rebates | 284,902 | ||||||

| Total investment income | 14,183,100 | ||||||

| Expenses: | |||||||

| Management fee | 3,727,058 | ||||||

| Investment advisory fee | 1,769,574 | ||||||

| Custodian and Transfer Agent's fees and expenses | 871,860 | ||||||

| Reports to shareholders | 182,740 | ||||||

| Directors' fees and expenses | 165,490 | ||||||

| Legal fee | 233,172 | ||||||

| Audit fee | 116,494 | ||||||

| NYSE Listing Fee | 42,890 | ||||||

| Insurance | 44,436 | ||||||

| Miscellaneous | 129,320 | ||||||

| Total expenses before custody credits | 7,283,034 | ||||||

| Less: custody credits* | (320,440 | ) | |||||

| Net expenses | 6,962,594 | ||||||

| Net investment income (loss) | 7,220,506 | ||||||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY TRANSACTIONS | |||||||

| Net realized gain (loss) on: | |||||||

| Investments | 68,057,547 | ||||||

| Foreign currency transactions | (515,014 | ) | |||||

| Net unrealized appreciation (depreciation) during the period on: | |||||||

| Investments | 148,847,632 | ||||||

| Translation of other assets and liabilities from foreign currency | 32,546 | ||||||

| Net gain on investments and foreign currency transactions | 216,422,711 | ||||||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 223,643,217 | |||||

*The custody credits are attributable to interest earned on U.S. cash balances held on deposit at custodian.

The accompanying notes are an integral part of the financial statements.

18

THE CENTRAL EUROPE AND RUSSIA FUND, INC.

STATEMENTS OF CHANGES IN NET ASSETS

| For the year ended October 31, 2006 | For the year ended October 31, 2005 | ||||||||||

| INCREASE (DECREASE) IN NET ASSETS | |||||||||||

| Operations: | |||||||||||

| Net investment income (loss) | $ | 7,220,506 | $ | 2,745,756 | |||||||

| Net realized gain (loss) on: | |||||||||||

| Investments | 68,057,547 | 31,314,982 | |||||||||

| Foreign currency transactions | (515,014 | ) | (198,744 | ) | |||||||

| Net unrealized appreciation (depreciation) on: | |||||||||||

| Investment transactions during the period | 148,847,632 | 107,778,042 | |||||||||

| Translation of other assets and liabilities from foreign currency | 32,546 | (9,119 | ) | ||||||||

| Net increase in net assets resulting from operations | 223,643,217 | 141,630,917 | |||||||||

| Distributions to shareholders from: | |||||||||||

| Net investment income | (3,365,079 | ) | (1,733,526 | ) | |||||||

| Net realized gains | (27,756,803 | ) | — | ||||||||

| Capital share transactions: | |||||||||||

| Net proceeds from rights offering of Fund shares (3,417,070 and 0 shares, respectively) | 131,742,212 | — | |||||||||

| Net proceeds from reinvestment of dividends (388,226 and 0 shares, respectively) | 16,484,086 | — | |||||||||

| Net increase (decrease) in net assets from capital share transactions | 148,226,298 | — | |||||||||

| Total increase in net assets | 340,747,633 | 139,897,391 | |||||||||

| NET ASSETS | |||||||||||

| Beginning of year | 431,974,592 | 292,077,201 | |||||||||

| End of year (including undistributed net investment income of $5,122,133 and $1,781,720 as of October 31, 2006 and October 31, 2005, respectively) | $ | 772,722,225 | $ | 431,974,592 | |||||||

The accompanying notes are an integral part of the financial statements.

19

THE CENTRAL EUROPE AND RUSSIA FUND, INC.

NOTES TO FINANCIAL STATEMENTS — OCTOBER 31, 2006

NOTE 1. ACCOUNTING POLICIES

The Central Europe and Russia Fund, Inc. (the "Fund") is a non-diversified, closed-end management investment company incorporated in Maryland. The Fund commenced investment operations on March 6, 1990.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Security Valuation: Investments are stated at value. All securities for which market quotations are readily available are valued at the last sales price on the primary exchange on which they are traded prior to the time of valuation. If no sales price is available at that time, and both bid and ask prices are available, the securities are valued at the mean between the last current bid and ask prices; if no quoted asked prices are available, they are valued at the last quoted bid price. All securities for which market quotations are not readily available will be valued as determined in good faith by the Board of Directors of the Fund. The Fund calculates its net asset value per share at 11:30 A.M., New York time, in order to minimize the possibility that events occurring after the close of the securities exchanges on which the Fund's portfolio securities pr incipally trade would require adjustment to the closing market prices in order to reflect fair value.

In September 2006, FASB released Statement of Financial Accounting Standards No. 157, "Fair Value Measurements" ("FAS 157"). FAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. FAS 157 is effective for fiscal years beginning after November 15, 2007. As of October 31, 2006, management does not believe the adoption of FAS 157 will impact the amounts reported in the financial statements; however, additional disclosures will be required about the inputs used to develop the measurements of fair value and the effect of certain of the measurements reported in the statement of operations for a fiscal period.

Securities Transactions and Investment Income: Securities transactions are recorded on the trade date. Cost of securities sold is calculated using the identified cost method. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Such dividend income is recorded net of unrecoverable foreign withholding tax.

Securities Lending: The Fund may lend securities to financial institutions. The Fund retains beneficial ownership of the securities it has loaned and continues to receive interest and dividends paid by the securities and to participate in any changes in their market value. The Fund requires the borrowers of the securities to maintain collateral with the Fund consisting of liquid, unencumbered assets having a value at least equal to or greater than the "Margin Percentage" of the value of the securities loaned. "Margin Percentage" shall mean (i) for collateral which is denominated in the same currency as the loaned securities, 102%, and (ii) for collateral which is denominated in a currency different from that of the loaned securities, 105%. The Fund may invest the cash collateral into a joint trading account in an affiliated money market fund pursuant to Exe mptive Orders issued by the SEC. Deutsche Asset Management receives a management fee on the cash collateral invested in the affiliated money fund. The Fund receives compensation for lending its securities either in the form of fees or by earning interest on invested cash collateral net of fees paid to a lending agent. Either the Fund or the borrower may terminate the loan. The Fund is subject to all investment risks associated with the value of any cash collateral received, including, but not limited to, interest rate, credit and liquidity risk associated with such investments.

Foreign Currency Translation: The books and records of the Fund are maintained in United States dollars.

Assets and liabilities denominated in euros and other foreign currency are translated into United States dollars at the 11:00 A.M. mid-point of the buying and selling spot rates quoted by the Federal Reserve Bank of New York.

20

THE CENTRAL EUROPE AND RUSSIA FUND, INC.

NOTES TO FINANCIAL STATEMENTS — OCTOBER 31, 2006 (continued)

Purchases and sales of investment securities, income and expenses are reported at the rate of exchange prevailing on the respective dates of such transactions. The resultant gains and losses arising from exchange rate fluctuations are identified separately in the Statement of Operations, except for such amounts attributable to investments, which are included in net realized and unrealized gains and losses on investments.

Contingencies: In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

Taxes: No provision has been made for United States Federal income tax because the Fund intends to meet the requirements of the United States Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income to shareholders.

The cost of investments at October 31, 2006 was $410,487,751 for United States Federal income tax purposes. Accordingly, as of October 31, 2006, net unrealized appreciation of investments aggregated $358,217,515, of which $361,301,554 and $3,084,039 related to unrealized appreciation and depreciation, respectively.

In July 2006, the Financial Accounting Standards Board (FASB) issued Interpretation No. 48, "Accounting for Uncertainty in Income Taxes- an interpretation of FASB Statement No. 109" (the "Interpretation"). The Interpretation establishes for the Fund a minimum threshold for financial statement recognition of the benefit of positions taken in filing tax returns (including whether the Fund is taxable in certain jurisdictions), and requires certain expanded tax disclosures. The Interpretation is effective for fiscal years beginning after December 15, 2006. Management has begun to evaluate the application of the Interpretation to the Fund and is not in a position at this time to estimate the significance of its impact, if any, on the Fund's financial statements.

Dividends and Distributions to Shareholders: The Fund records dividends and distributions to its shareholders on the ex-dividend date. Income and capital gain distributions are determined in accordance with United States Federal income tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences, which could be temporary or permanent in nature, may result in reclassification of distributions; however, net investment income, net realized gains and net assets are not affected.

At October 31, 2006, the Fund's components of distributable earnings (accumulated losses) on a tax-basis were as follows:

| Undistributed ordinary income* | $ | 35,280,078 | |||||

| Undistributed net long-term capital gains | $ | 41,875,821 | |||||

| Net unrealized appreciation | $ | 358,217,515 | |||||

In addition, the tax character of distributions paid to shareholders by the Fund is summarized as follows:

| Years Ended October 31 | |||||||||||

| 2006 | 2005 | ||||||||||

| Distributions from ordinary income* | $ | 5,557,479 | — | ||||||||

| Distributions from long-term capital gains | $ | 25,564,403 | — | ||||||||

*For tax purposes short-term capital gains are considered ordinary income.

During the year ended October 31, 2006, the Fund reclassified permanent book and tax differences as follows:

| Increase (decrease) | |||||||

| Undistributed net investment income | $ | (515,014 | ) | ||||

| Undistributed net realized gain/loss on investments and foreign currency transactions | 515,014 | ||||||

NOTE 2. MANAGEMENT AND INVESTMENT ADVISORY AGREEMENTS

The Fund has a Management Agreement with Deutsche Investment Management Americas Inc. (the "Manager"). The Fund has an Investment Advisory Agreement with Deutsche Asset Management International GmbH (the

21

THE CENTRAL EUROPE AND RUSSIA FUND, INC.

NOTES TO FINANCIAL STATEMENTS — OCTOBER 31, 2006 (continued)

"Investment Adviser.") The Manager and the Investment Adviser are affiliated companies.

The Management Agreement provides the Manager with a fee, computed weekly and payable monthly, at the annual rates of 0.65% of the Fund's average weekly net assets up to $100 million, 0.55% of such assets in excess of $100 million and up to $500 million, and, effective June 1, 2006, 0.50% of such assets in excess of $500 million. The Investment Advisory Agreement provides the Investment Adviser with a fee, computed weekly and payable monthly, at the annual rates of 0.35% of the Fund's average weekly net assets up to $100 million and 0.25% of such assets in excess of $100 million. Accordingly, for the year ended October 31, 2006, the fee pursuant to the Management and Investment Advisory Agreements was equivalent to an annualized effective rate of 0.82% of the Fund's average net assets.

Pursuant to the Management Agreement, the Manager is the corporate manager and administrator of the Fund and, subject to the supervision of the Board of Directors and pursuant to recommendations made by the Fund's Investment Adviser, determines the suitable securities for investment by the Fund. The Manager also provides office facilities and certain administrative, clerical and bookkeeping services for the Fund. Pursuant to the Investment Advisory Agreement, the Investment Adviser, in accordance with the Fund's stated investment objective, policies and restrictions, makes recommendations to the Manager with respect to the Fund's investments and, upon instructions given by the Manager as to suitable securities for investment by the Fund, transmits purchase and sale orders to select brokers and dealers to execute portfolio transactions on behalf of the Fund.

NOTE 3. TRANSACTIONS WITH AFFILIATES

Certain officers of the Fund are also officers of either the Manager or Deutsche Bank AG.

The Fund pays each Director not affiliated with the Manager retainer fees plus specified amounts for attended board and committee meetings.

NOTE 4. PORTFOLIO SECURITIES

Purchases and sales of investment securities, other than short-term investments, for the year ended October 31, 2006 were $331,326,656 and $208,365,879, respectively.

NOTE 5. INVESTING IN FOREIGN MARKETS

Foreign investments may involve certain considerations and risks not typically associated with those of domestic origin as a result of, among others, the possibility of political and economic developments and the level of governmental supervision and regulation of foreign securities markets. In addition, certain foreign markets may be substantially smaller, less developed, less liquid and more volatile than the major markets of the United States.

NOTE 6. CAPITAL AND RIGHTS OFFERING

The Fund had no capital stock repurchase activity for the year ended October 31, 2006. During the year ended October 31, 2006, the Fund reissued 388,226 shares held in treasury as part of the dividend reinvestment plan.

During January 2006, the Fund issued 3,417,070 shares of common stock in connection with a rights offering of the Fund's shares. Shareholders of record on December 22, 2005 were issued one transferable right for each share owned. The rights entitled the shareholders to purchase one new share of common stock for every three rights held. These shares were issued at a subscription price of $40.19. Net proceeds to the Fund were $131,742,212 after deducting the solicitation/dealer manager fees of $5,148,591 and expenses of $400,276. The net asset value per share of the Fund's common shareholders was reduced by approximately $3.25 per share as a result of the share issuance.

22

THE CENTRAL EUROPE AND RUSSIA FUND, INC.

FINANCIAL HIGHLIGHTS

Selected data for a share of common stock outstanding throughout each of the periods indicated:

| For the years ended October 31, | |||||||||||||||||||||||

| 2006 | 2005 | 2004 | 2003 | 2002 | |||||||||||||||||||

| Per share operating performance: | |||||||||||||||||||||||

| Net asset value: | |||||||||||||||||||||||

| Beginning of period | $ | 42.36 | $ | 28.64 | $ | 23.08 | $ | 15.93 | $ | 13.83 | |||||||||||||

| Net investment income (loss) | .55 | .27 | .20 | .21 | (.07 | ) | |||||||||||||||||

| Net realized and unrealized gain (loss) on investments and foreign currency transactions | 18.67 | 13.62 | 7.97 | 6.86 | 2.37 | ||||||||||||||||||

| Increase (decrease) from investment operations | 19.22 | 13.89 | 8.17 | 7.07 | 2.30 | ||||||||||||||||||

| Increase resulting from share repurchases | — | — | .02 | .08 | .06 | ||||||||||||||||||

| Distributions from net investment income | (.33 | ) | (.17 | ) | (.22 | ) | — | (.10 | ) | ||||||||||||||

| Distributions from net realized gains on investment transactions | (2.72 | ) | — | — | — | (.13 | ) | ||||||||||||||||

| Total distributions† | (3.05 | ) | (.17 | ) | (.22 | ) | — | (.23 | ) | ||||||||||||||

| Dilution from rights offering | (2.85 | ) | — | (2.15 | ) | — | — | ||||||||||||||||

| Dealer manager fees and offering costs | (0.40 | ) | — | (0.25 | ) | — | — | ||||||||||||||||

| Dilution in NAV from dividend reinvestment | (0.10 | ) | — | (.01 | ) | — | (.03 | ) | |||||||||||||||

| Net asset value: | |||||||||||||||||||||||

| End of period | $ | 55.18 | $ | 42.36 | $ | 28.64 | $ | 23.08 | $ | 15.93 | |||||||||||||

| Market value: | |||||||||||||||||||||||

| End of period | $ | 49.94 | $ | 44.89 | $ | 24.99 | $ | 21.25 | $ | 13.25 | |||||||||||||

| Total investment return for the period:†† | |||||||||||||||||||||||

| Based upon market value | 19.25 | % | 80.71 | % | 18.73 | % | 60.38 | % | 23.43 | % | |||||||||||||

| Based upon net asset value | 48.55 | %* | 48.74 | % | 35.20 | %* | 44.88 | % | 17.05 | % | |||||||||||||

| Ratio to average net assets: | |||||||||||||||||||||||

| Total expenses before custody credits** | 1.09 | % | 1.20 | % | 1.27 | % | 1.51 | % | 1.55 | % | |||||||||||||

| Net investment income (loss) | 1.08 | % | .78 | % | .81 | % | 1.00 | % | (.44 | )% | |||||||||||||

| Portfolio turnover | 31.86 | % | 30.16 | % | 45.29 | % | 43.88 | % | 57.77 | % | |||||||||||||

| Net assets at end of period (000's) | $ | 772,722 | $ | 431,975 | $ | 292,027 | $ | 177,766 | $ | 126,467 | |||||||||||||

† For U.S. tax purposes, total distributions consisted of:

| Ordinary income | $ | (.545 | ) | $ | (0.17 | ) | $ | (0.22 | ) | — | $ | (0.23 | ) | ||||||||||

| Long term capital gains | $ | (2.507 | ) | — | — | — | — | ||||||||||||||||

| $ | (3.052 | ) | $ | (0.17 | ) | $ | (0.22 | ) | — | $ | (0.23 | ) | |||||||||||

†† Total investment return based on market value is calculated assuming that shares of the Fund's common stock were purchased at the closing market price as of the beginning of the year, dividends, capital gains and other distributions were reinvested as provided for in the Fund's dividend reinvestment plan and then sold at the closing market price per share on the last day of the period. The computation does not reflect any sales commission investors may incur in purchasing or selling shares of the Fund. The total investment return based on the net asset value is similarly computed except that the Fund's net asset value is substituted for the closing market value.

* Return excludes the effect of the $2.15 and $3.25 respectively, for 2004 and 2006 per share dilution associated with the Fund's rights offering.

** The custody credits are attributable to interest earned on U.S. cash balances. The ratios of total expenses after custody credits to average net assets are 1.04%, 1.19%, 1.26%, 1.50% and 1.54% for 2006, 2005, 2004, 2003 and 2002, respectively.

23

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

The Central Europe and Russia Fund, Inc.

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of The Central Europe and Russia Fund, Inc. (the "Fund") at October 31, 2006, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial stat ements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2006 by correspondence with the custodian, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

New York, NY

December 22, 2006

24

VOLUNTARY CASH PURCHASE PROGRAM AND DIVIDEND REINVESTMENT PLAN

(unaudited)

The Fund offers shareholders a Voluntary Cash Purchase Program and Dividend Reinvestment Plan ("Plan") which provides for optional cash purchases and for the automatic reinvestment of dividends and distributions payable by the Fund in additional Fund shares. A more complete description of the Plan is provided in the Plan brochure available from Investors Bank & Trust Company, the plan agent (the "Plan Agent"), Shareholder Services, P. O. Box 9130, Boston, Massachusetts 02117 (telephone 1-800-437-6269). A shareholder should read the Plan brochure carefully before enrolling in the Plan.

Under the Plan, participating shareholders ("Plan Participants") appoint the Plan Agent to receive or invest Fund distributions as described below under "Reinvestment of Fund Shares." In addition, Plan Participants may make optional cash purchases through the Plan Agent as often as once a month as described below under "Voluntary Cash Purchases." There is no charge to Plan Participants for participating in the Plan, although when shares are purchased under the Plan by the Plan Agent on the New York Stock Exchange or otherwise on the open market, each Plan Participant will pay a pro rata share of brokerage commissions incurred in connection with such purchases, as described below under "Reinvestment of Fund Shares" and "Voluntary Cash Purchases."

Reinvestment of Fund Shares. Whenever the Fund declares a capital gains distribution, an income dividend or a return of capital distribution payable, at the election of shareholders, either in cash or in Fund shares, or payable only in cash, the Plan Agent shall automatically elect to receive Fund shares for the account of each Plan Participant.

Whenever the Fund declares a capital gains distribution, an income dividend or a return of capital distribution payable only in cash and the net asset value per share of the Fund's common stock equals or is less than the market price per share on the valuation date (the "Market Parity or Premium"), the Plan Agent shall apply the amount of such dividend or distribution payable to a Plan Participant to the purchase from the Fund of Fund Shares for a Plan Participant's account, except that if the Fund does not offer shares for such purpose because it concludes Securities Act registration would be required and such registration cannot be timely effected or is not otherwise a cost-effective alternative for the Fund, then the Plan Agent shall follow the procedure described in the next paragraph. The number of additional shares to be credited to a Plan Participant's account sha ll be determined by dividing the dollar amount of the distribution payable to a Plan Participant by the net asset value per share of the Fund's common stock on the valuation date, or if the net asset value per share is less than 95% of the market price per share on such date, then by 95% of the market price per share. The valuation date will be the payable date for such dividend or distribution.

Whenever the Fund declares a capital gains distribution, an income dividend or a return of capital distribution payable only in cash and the net asset value per share of the Fund's common stock exceeds the market price per share on the valuation date (the "Market Discount"), the Plan Agent shall apply the amount of such dividend or distribution payable to a Plan Participant (less a Plan Participant's pro rata share of brokerage commissions incurred with respect to open-market purchases in connection with the reinvestment of such dividend or distribution) to the purchase on the open market of Fund shares for a Plan Participant's account. The valuation date will be the payable date for such dividend or distribution. Such purchases will be made on or shortly after the valuation date and in no event more than 30 days after such date except where temporary curtailment or suspension of purchase is necessary to comply with applicable provisions of federal securities laws.

The Plan Agent may aggregate a Plan Participant's purchases with the purchases of other Plan Participants, and the average price (including brokerage commissions) of all shares purchased by the Plan Agent shall be the price per share allocable to each Plan Participant.

For all purposes of the Plan, the market price of the Fund's common stock on a payable date shall be the last sales price on the New York Stock Exchange on that date, or, if there is no sale on such Exchange (or, if different, the principal exchange for Fund shares) on that date, then the mean between the closing bid and asked quotations for such stock on such Exchange on such date. The net asset value per share of the Fund's common stock on a valuation date shall be as determined by or on behalf of the Fund.

25

VOLUNTARY CASH PURCHASE PROGRAM AND DIVIDEND REINVESTMENT PLAN