Tollefsen Business Law p.c.

2825 Colby Avenue, Suite 304

Everett, Washington 98201

Telephone (425) 353-8883

October 21, 2010

Transmitted by EDGAR Submission

Division of Corporation Finance

Securities and Exchange Commission

100 F Street, N.E.

Mail Stop 3561

Washington, DC 20549

| Attention: | H. Christopher Owings, Assistant Director |

| | Mara Ransom, Legal Branch Chief |

| | David Orlic, Special Counsel, Office of Mergers and Acquisitions |

| | Robert Errett, Staff Attorney |

| Re: | ITEX Corporation |

| | Preliminary Proxy Statement on Schedule 14A |

| | Filed October 6, 2010 |

| | File No. 000-18275 |

Dear Ms. Ransom and Messrs. Owings, Orlic and Errett:

On behalf of our client, ITEX Corporation (“ITEX” or “Company”), we submit the following response to your comment letter dated October 15, 2010. Set forth below are the Staff’s comments followed by our responses. The numbered responses in this letter correspond to your numbered comments.

ITEX has filed a revised preliminary proxy statement which reflects the changes described below.

General

| 1. | Please tell us how you determined to define the affiliated shareholders as “the Pagidipati Group” in your proxy materials, given that Mr. Polonitza appears to be the focal point of the group, the Schedule 13D relating to the group's holdings is filed under his name, and in your prior proxy statement you referred to the group as the “Polonitza Group.” |

Response:

On behalf of the Company we submit that although the group was initially formed by Mr. Polonitza, and ITEX initially referred to it as the “Polonitza Group,” we believe the “Pagidipati Group” is a more accurate designation of the current group for several reasons:

| · | The addition of the Pagidipati family in September 2009 (as reported in the Schedule 13D filed on 9-23-09) more than doubled the previous share ownership of the group and triggered presumptive affiliate status for the group; |

| · | The Pagidipati family owns more shares than any other person or family within the group, representing the largest percentage of ownership of ITEX shares by a group member (4.37% based on the group’s latest Schedule 13D filing of 9-08-10 and subsequent Forms 4); |

Mr. H. Christopher Owings

October 21, 2010

Page 2

| · | The Pagidipati family has more cash invested than any other person or family within the group; 1 |

| · | The Pagidipati family has more individual members in the group (4) than any other; |

| · | The Pagidipati family is represented by a family member as a board nominee of the group (Sidd Pagidipati); |

| · | A member of the Pagidipati family serves as legal counsel for the group (Rahul Pagidipati); |

| · | Since the latest Schedule 13D filing of 9-08-10, the Pagidipati family has purchased 2,930 additional shares and Polonitza has purchased an additional 340 shares (as reported on Forms 4), which is consistent with the trend of the greater proportional and controlling influence of the Pagidipati family |

The Company has set forth its reasons for naming the group the “Pagidipati” Group in the section entitled “Background of the Solicitation” on pages 6 through 8. ITEX does not believe readers or stockholders will be confused as to the identity of the group.

| 2. | Please provide a brief background discussion regarding the contacts the company has had with the shareholder group and its members leading up to the current solicitation. You should describe in sufficient detail whether the Company's Board of Directors responded to contacts made by the shareholder group or its members and, if material, the specifics of any discussions between the parties. |

Response:

The Company has added a section entitled “Background of the Solicitation,” in which it has described contacts with the shareholder group and the specifics of discussions. See pages 6-8.

Notice of Annual Meeting of Stockholders

Information about the Meeting and Voting, page 1

What are our Board of Directors’ voting recommendations?, page 1

| 3. | In an appropriate place in your proxy materials, please explain why you are recommending that shareholders vote for your nominees instead of the shareholder group's nominees. |

Response:

The Company has added a section entitled “Pagidipati Group’s Alternative Director Nominees,” in which it set forth the reasons for the Board’s recommendations. See pages 8-10.

1 Based on the average cost per share of $3.465 for Mr. Polonitza as disclosed in the group’s latest Schedule 13D filing of 9-08-10. In this Schedule 13D, Mr. Polonitza does not report his share cost individually, but rather aggregates his cost with the cost of shares purchased by additional group members Anderson and Kim.

Mr. H. Christopher Owings

October 21, 2010

Page 3

How do I vote for the Board’s recommended nominees?, page 1

| 4. | We note your indication on page 2 that custodians may vote shares on routine matters and you state that Proposal 2 is a routine matter. Please revise to clarify, if true, that Proposal 1 is not routine and the implications of such status as it relates to a custodian’s ability to vote shares. |

Response:

The Company has revised the disclosure to clarify that Proposal 1 will be considered a non-routine matter, and thus, if a beneficial owner does not give the custodian specific instructions on Proposal 1, shares will be treated as “broker non-votes” and will not be voted on Proposal 1.

Ratify the Appointment of our Independent Auditors, page 4

| 5. | You state on page 2 that you believe that custodians may vote on the proposal to ratify the selection of auditors. However, in this section, you state that broker non-votes will count as shares not voted on this proposal. Please advise, or revise your disclosure. |

Response:

On behalf of the Company we submit that we do not believe there is any inconsistency. A “broker non-vote” occurs when a custodian does not vote on a particular proposal because it has not received voting instructions from the applicable beneficial owner and does not have discretionary voting power on the matter in question. It is our understanding that an exercise of custodian discretionary voting power, such as in favor of Proposal 2, would not be deemed a “broker non-vote.” Nevertheless, for greater clarity the Company has revised the disclosure to rather state that any shares not voted (whether by abstention, broker non-vote, or otherwise) would not be included in the vote totals and, as such, will have no effect on the outcome of the proposal.

Election of Directors Proposal 1, page 6

| 6. | Please update this section to reflect the two directors for whom the shareholder group is soliciting proxies. In addition, update to address the information provided in the shareholder group’s proxy materials filed on September 8, 2010. |

Response:

The Company has added substantive disclosure in the two sections entitled “Background of the Solicitation” on page 6, and “Pagidipati Group’s Alternative Director Nominees,” on page 8. In these sections it has identified the three Pagidipati Group nominees, identified in general terms the issues the group has raised, and explained why the Board believes election of the Pagidipati Group nominees is not in the best interest of ITEX stockholders.

The Company will further address various issues raised by the dissident stockholders in its proxy solicitation materials which will subsequently be filed with the Commission in connection with the annual meeting, as it formulates responsive proxy materials. On behalf of the Company we submit that we believe the issues raised by the dissident stockholders are derived from a very familiar and generic script for activist platforms, including raising selected governance issues, opportunistic criticisms of past performance, expenses and ineffective deployment of capital.

Mr. H. Christopher Owings

October 21, 2010

Page 4

Director Qualifications and Skills, page 6

| 7. | Please characterize consistently each statement or assertion of opinion or belief as such, and ensure that a reasonable basis for each opinion or belief exists. Also, refrain from making any insupportable statements. Support for opinions or beliefs should be self-evident, disclosed in the proxy statement or provided to the staff on a supplemental basis, with a view towards revised disclosure. For example, the statements regarding the performance of ITEX while Mr. White as served as Chief Executive Officer must be supported on a supplemental basis and, where not already categorized as such, must be stated as your belief. Where the bases are other documents, such as prior proxy statements, Forms 10-K and 10-Q, annual reports, analysts’ reports and newspaper articles, provide sufficient pages of information so that we can assess the context of the information upon which you rely. Mark any supporting documents provided to identify the specific information relied upon, such as quoted statements, financial statement line items, press releases, and mathematical computations, and identify the sources of all data utilized. |

Response:

On behalf of the Company, we submit that the Company has a reasonable basis for each of the statements expressed regarding the performance of ITEX while Mr. White served as Chief Executive Officer. The statements in Mr. White’s biographical section regarding the performance of ITEX have been revised, and now only refer to readily supportable facts. Identical factual statements have been made in the section entitled “Pagidipati Group’s Alternative Director Nominees.” Except for statement (6), all factual assertions are derived from ITEX’s previous filings on Form 10-K and Form 10-KSB as outlined below. Statement (6) is supported by OTC Bulletin Board Quarterly Trade and Quote Summary Reports, as published by the NASDAQ Stock Market, Inc.

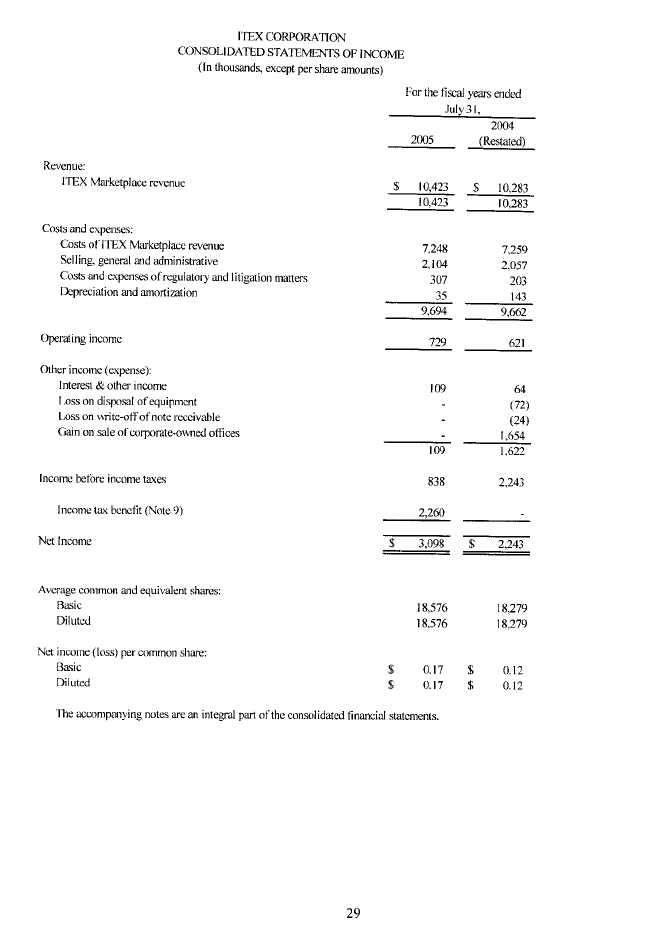

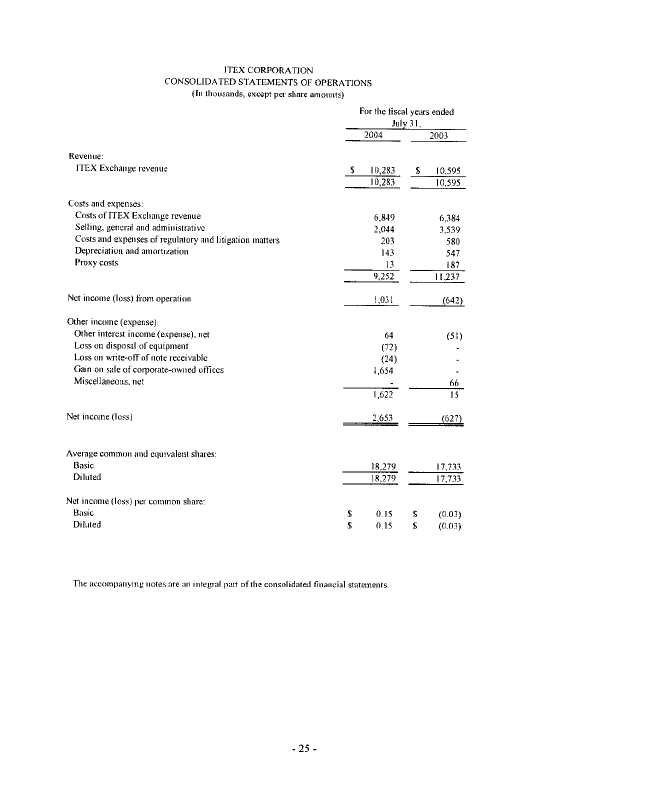

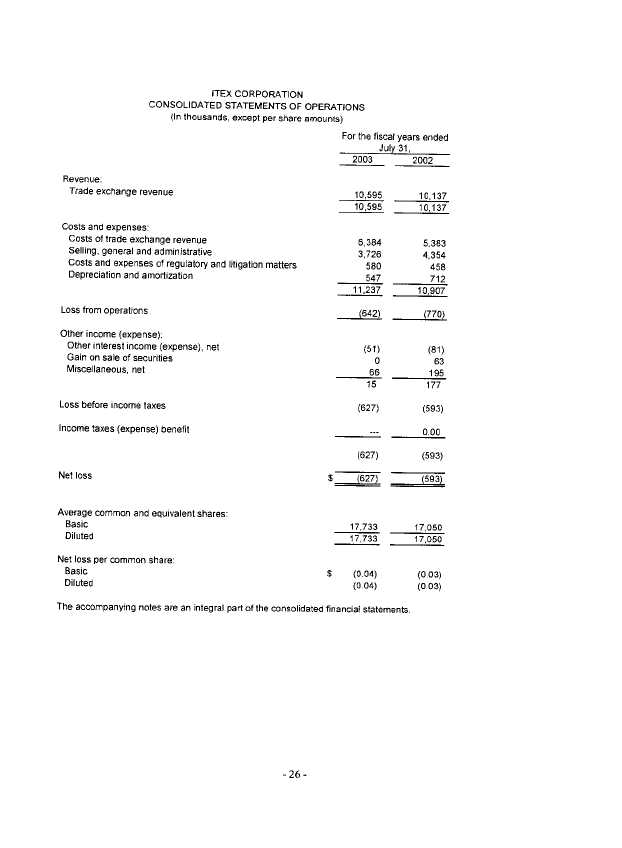

| (1) | Since 2003 ITEX has “achieved seven consecutive years of profitable operations (fiscal 2004 through 2010)”; |

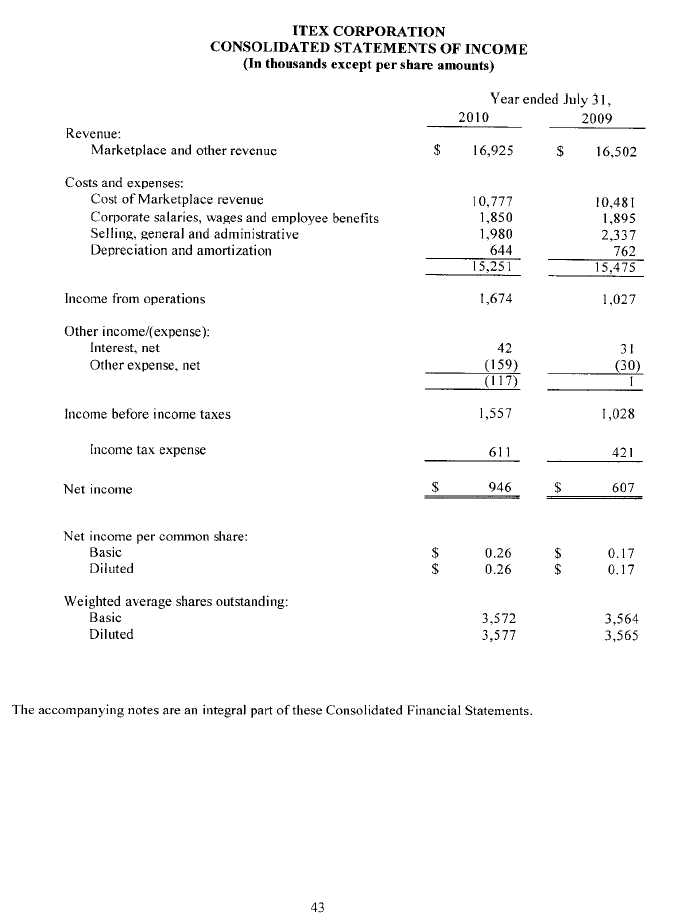

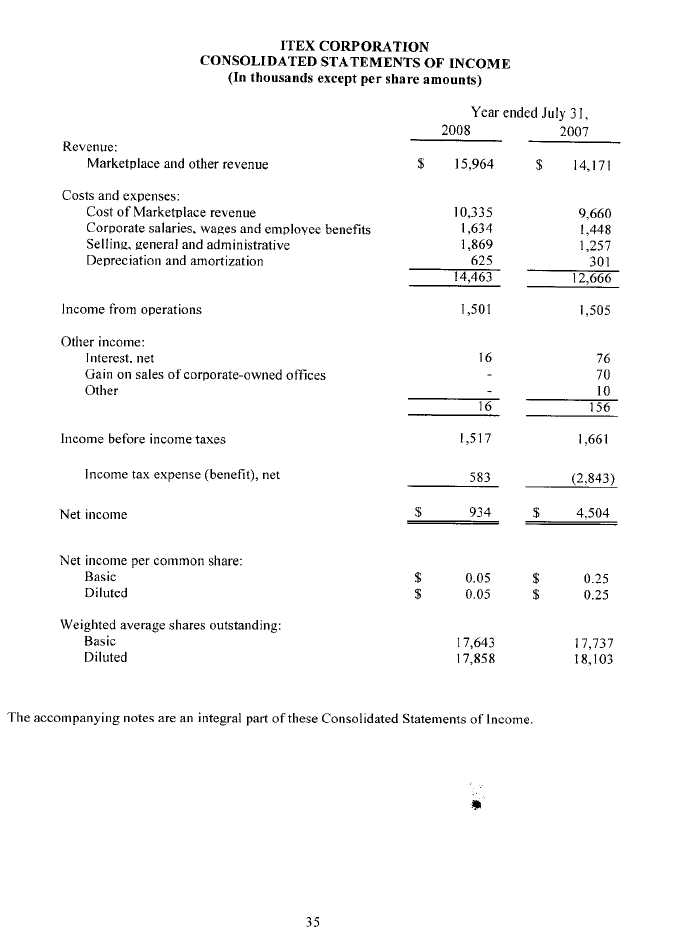

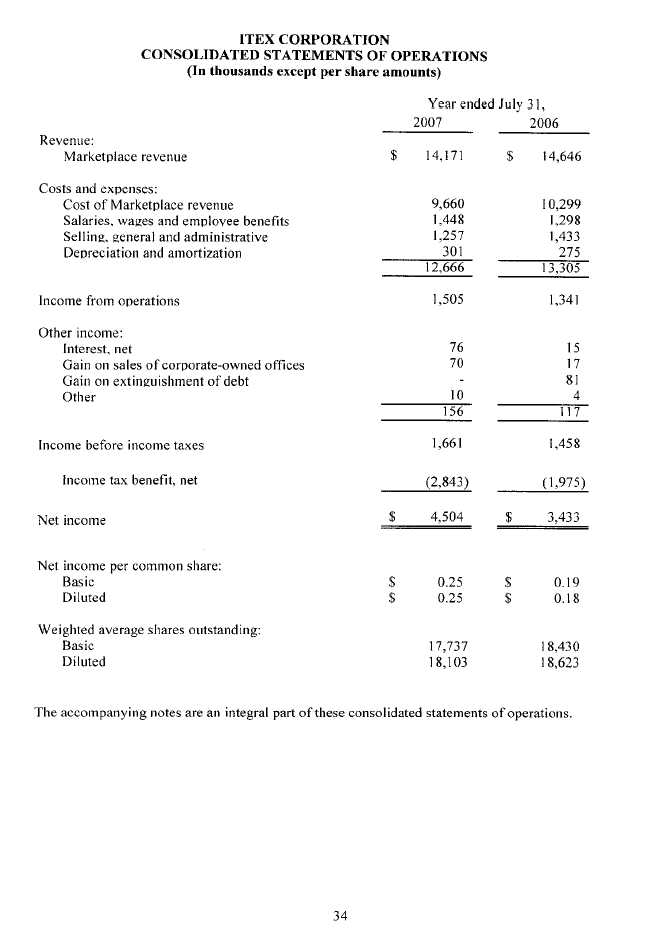

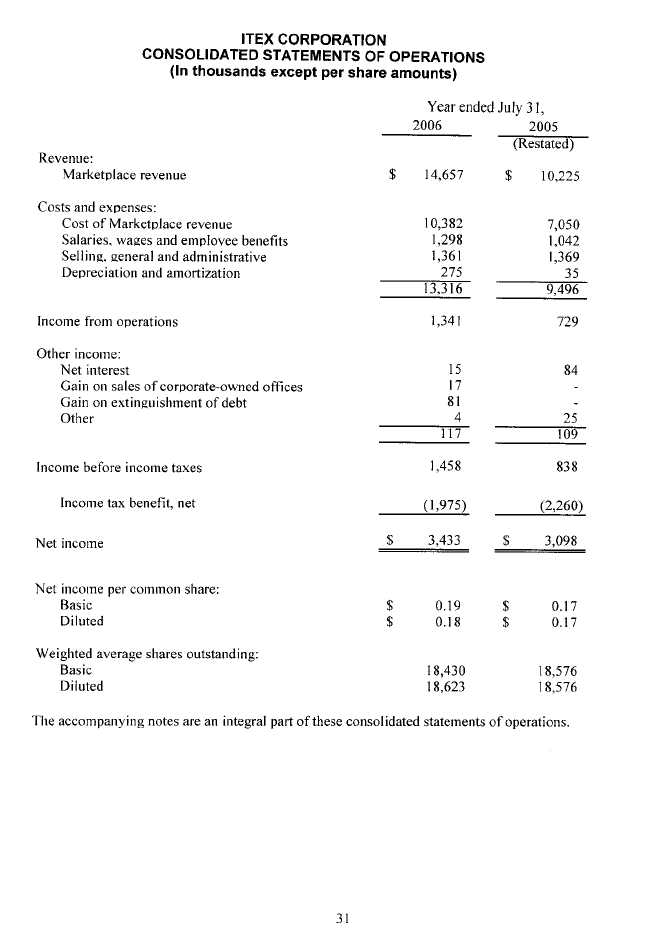

| | Fiscal year ended July 31, | From Forms 10-K and 10-KSB Consolidated Statements of Income (In thousands) “Net Income (Loss)” ** |

| | | |

| | 2003 | $ (627) |

| | 2004 | $ 2,243 (Restated) |

| | 2005 | $ 3,098 |

| | 2006 | $ 3,433 |

| | 2007 | $ 4,504 |

| | 2008 | $ 934 |

| | 2009 | $ 607 |

| | 2010 | $ 946 |

| | ** | Consolidated Statements of Income, as filed with the Commission on Forms 10-K and 10-KSB for each of the years 2003 through 2010 are attached. |

Mr. H. Christopher Owings

October 21, 2010

Page 5

| (2) | Since 2003 ITEX has “increased revenue by 60%”; |

Fiscal year ended July 31, | | From Forms 10-K and 10-KSB Consolidated Statements of Income (In thousands) “Revenue” ** | | | Percentage Increase | |

| | | | | | | |

| 2003 | | $ | 10.595 | | | | |

| 2010 | | $ | 16,925 | | | | 59.75 | % |

| | ** Consolidated Statements of Income, as filed with the Commission on Forms 10-K and 10-KSB for each of the years 2003 through 2010 are attached. |

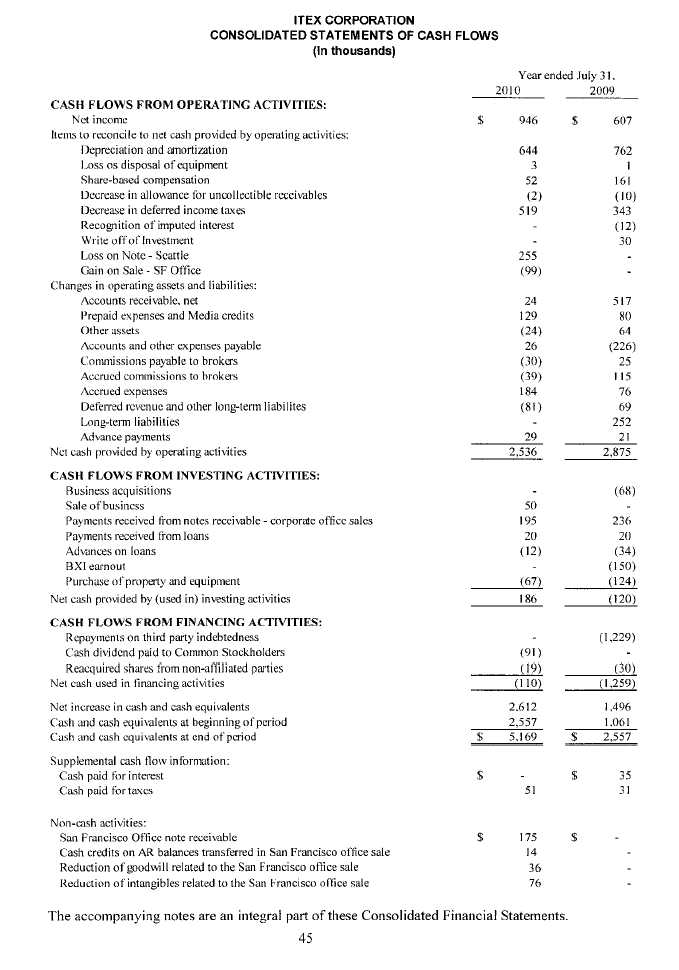

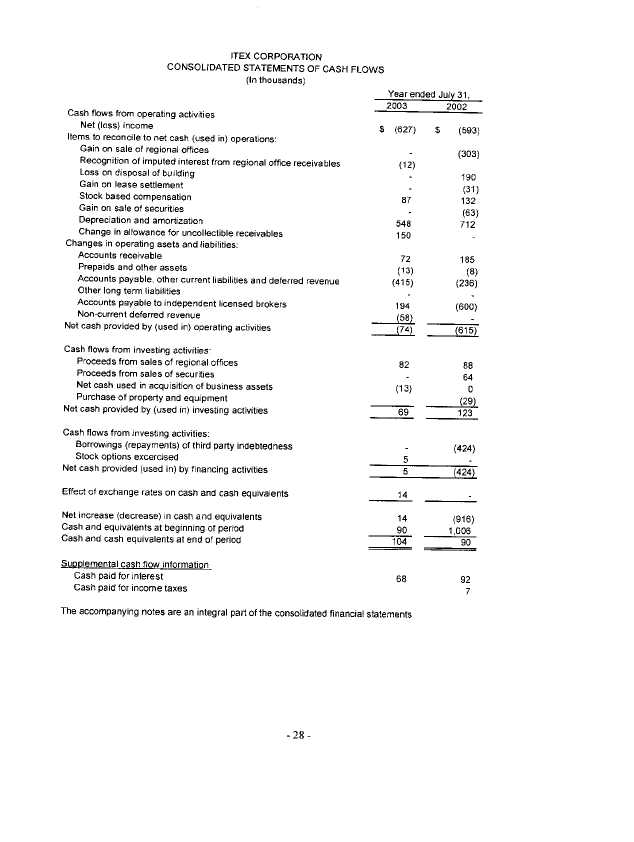

| (3) | Since 2003 ITEX has “increased annual operational cash flow from a net loss in 2003 to $2.5 million in 2010”; |

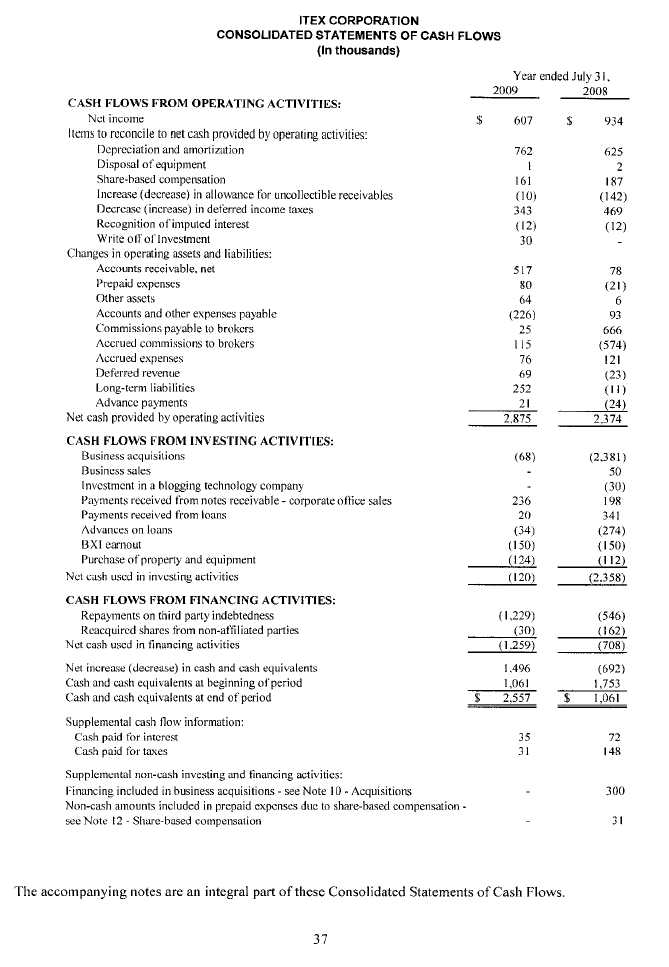

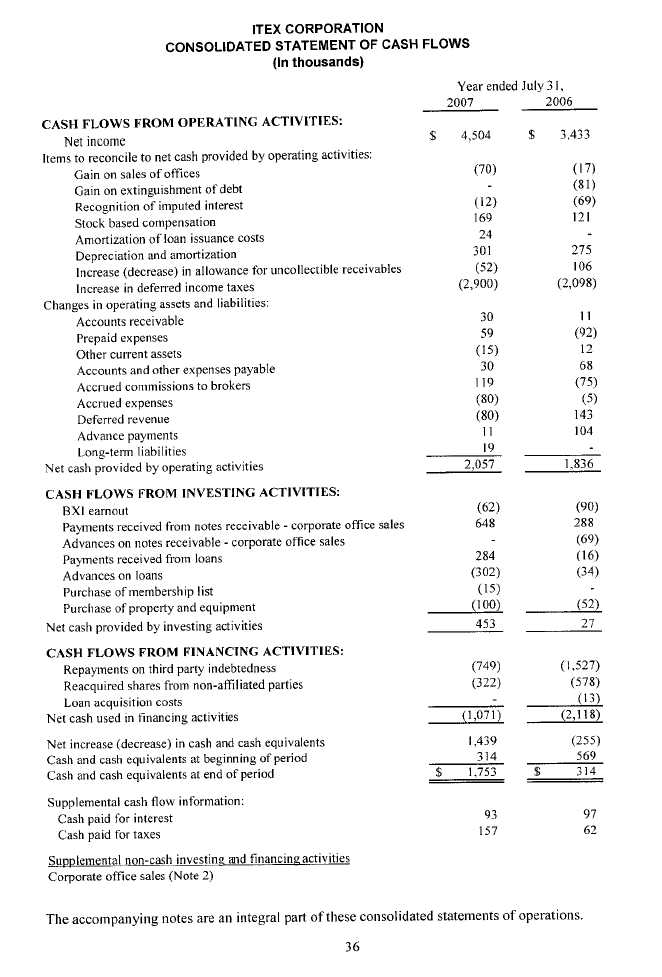

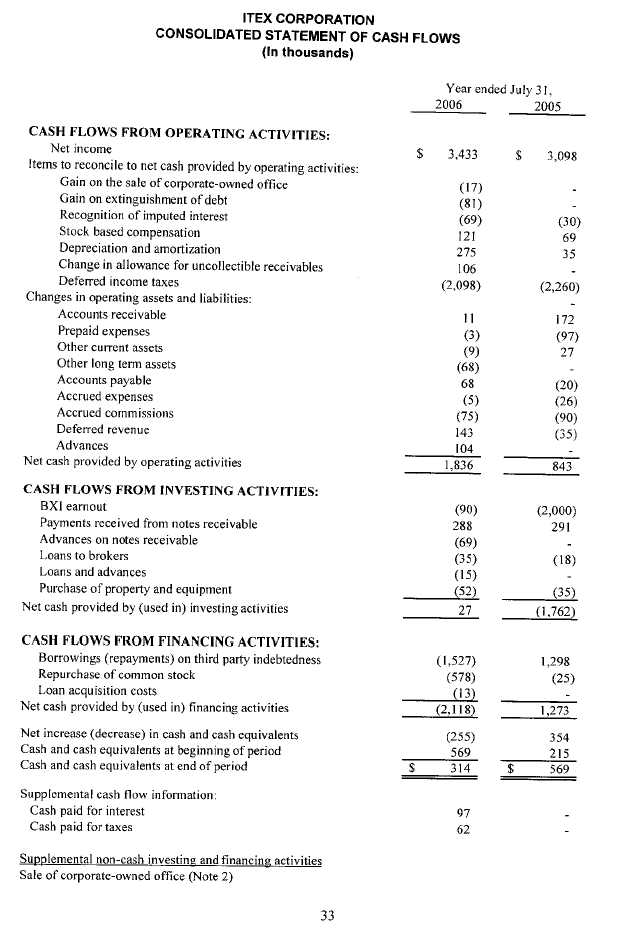

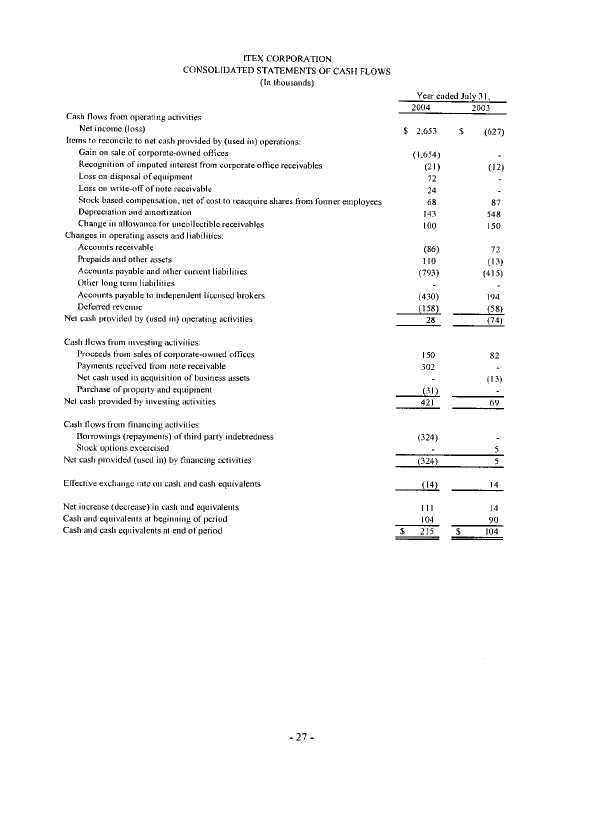

| | Fiscal year ended July 31, | From Forms 10-K and 10-KSB Consolidated Statements of Cash Flows (In thousands) “Net cash provided by (used in) operating activities” ** | | | | | |

| | | | | | | | |

| | 2003 | $ (74) | | | | | |

| | 2004 | $ 28 | | | | | |

| | 2005 | $ 843 | | | | | |

| | 2006 | $ 1,836 | | | | | |

| | 2007 | $ 2,057 | | | | | |

| | 2008 | $ 2,374 | | | | | |

| | 2009 | $ 2,875 | | | | | |

| | 2010 | $ 2,536 | | | | | |

| | ** | Consolidated Statements of Cash Flows, as filed with the Commission on Forms 10-K and 10-KSB for each of the years 2003 through 2010 are attached. |

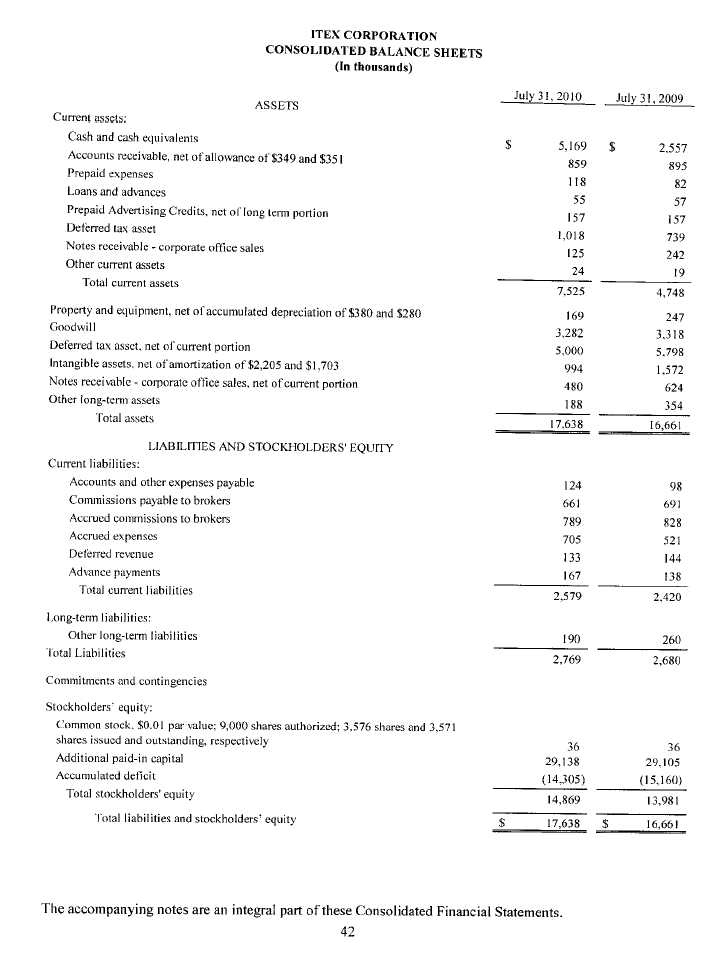

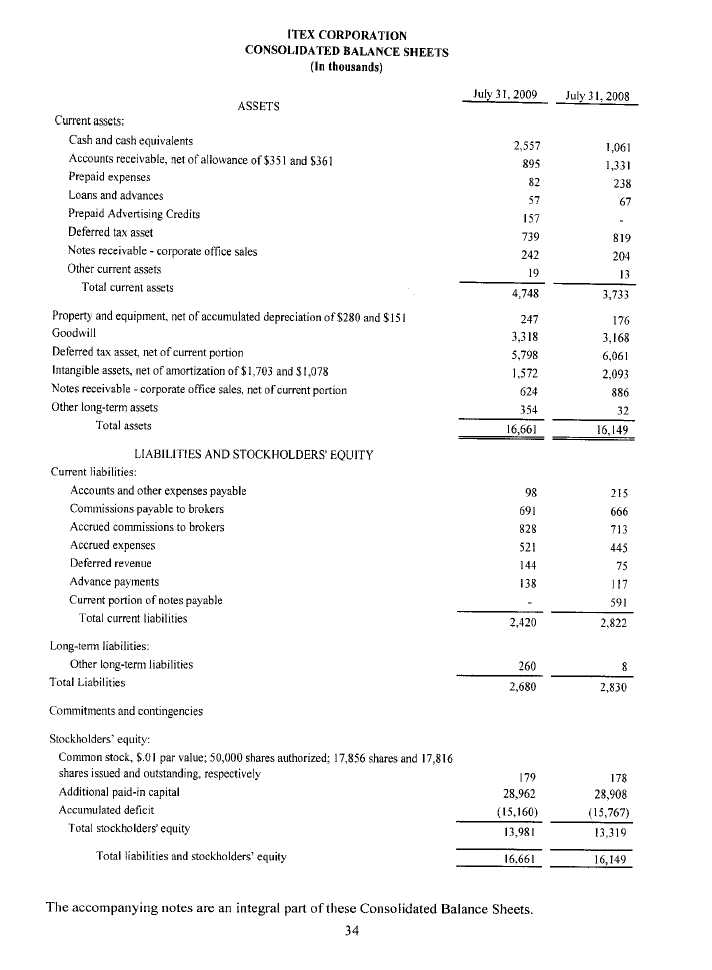

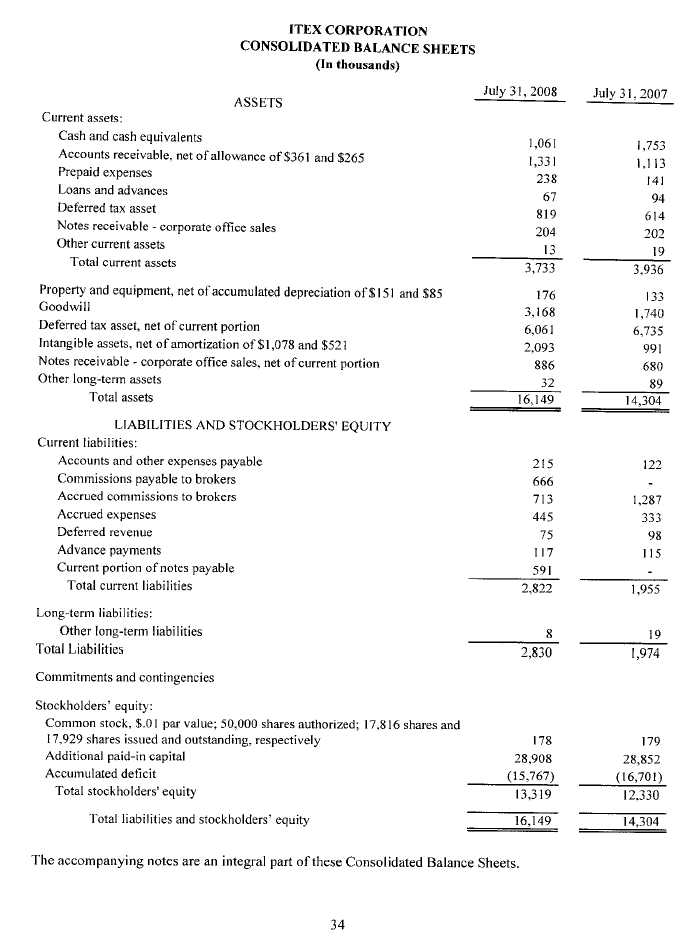

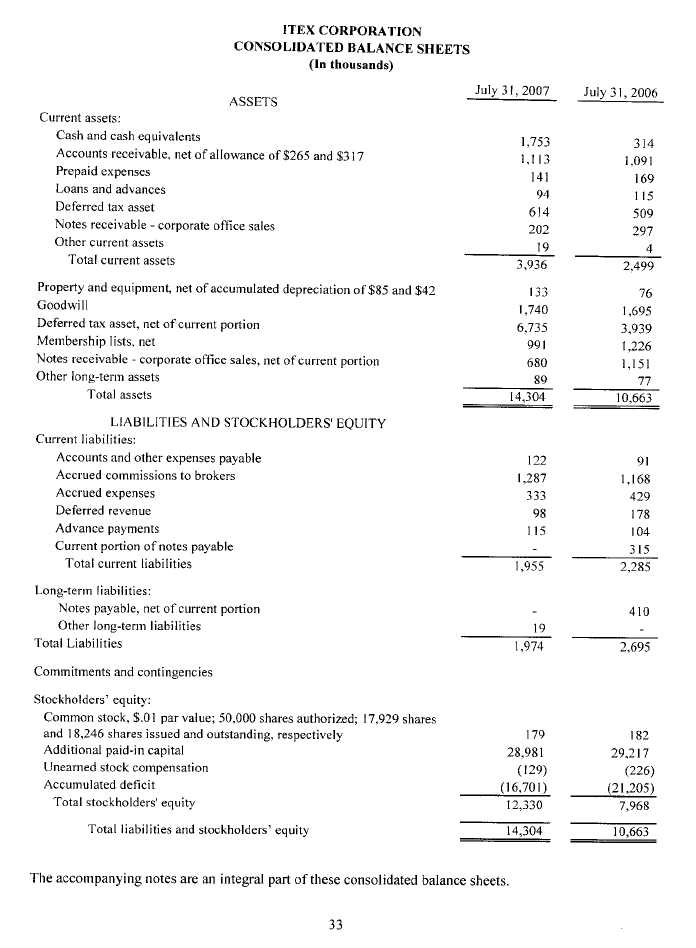

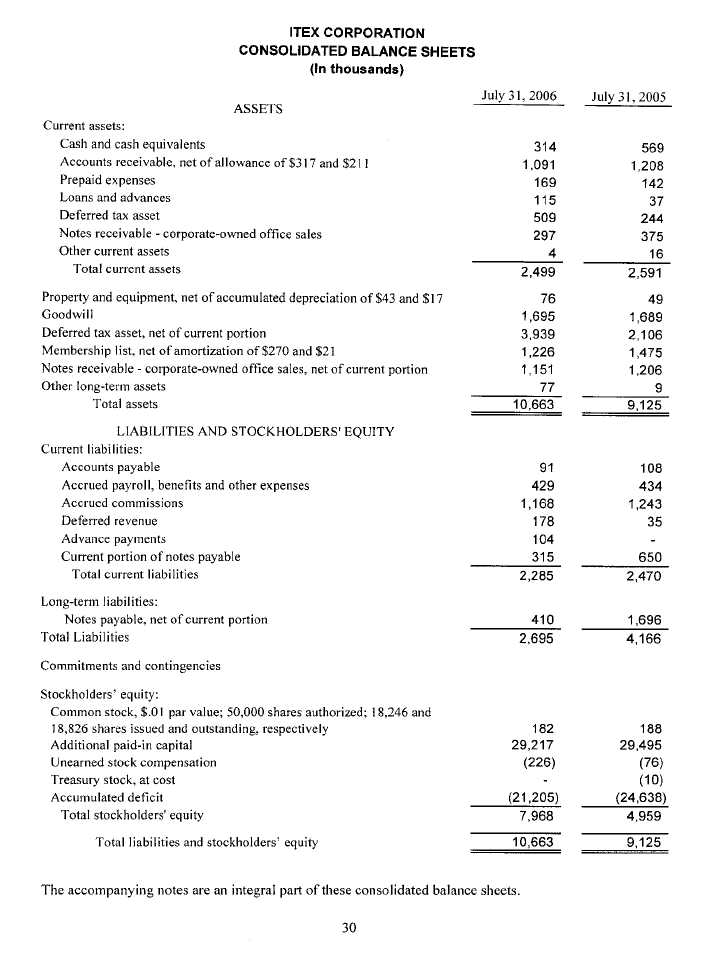

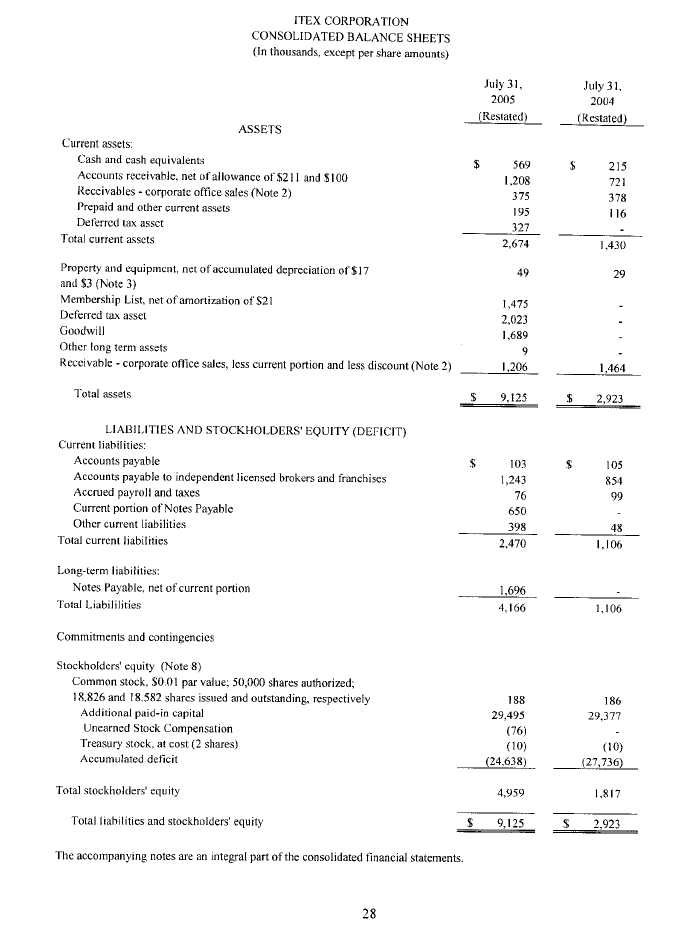

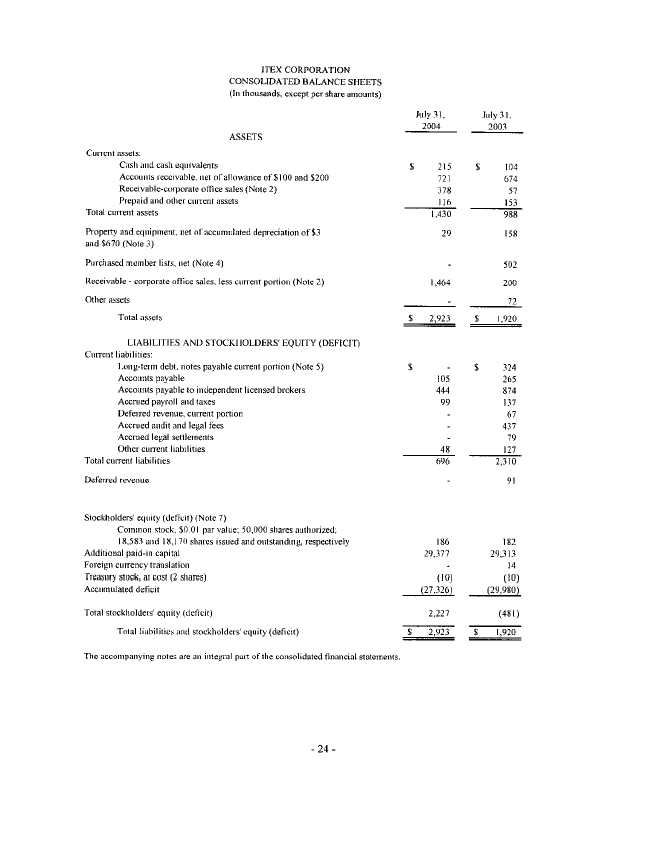

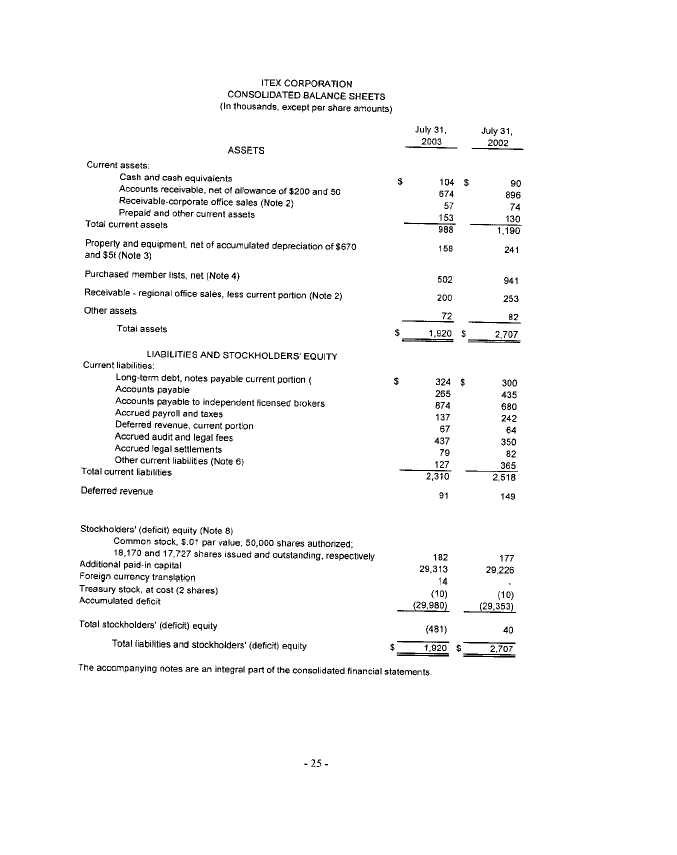

| (4) | Since 2003 ITEX has “increased stockholder equity from a negative ($481,000) in 2003 to $14.9 million in 2010”; |

| | July 31, | From Forms 10-K and 10-KSB Consolidated Balance Sheets (In thousands) “Total stockholders’ (deficit) equity” ** | | | | | |

| | | | | | | | |

| | 2003 | $ (481) | | | | | |

| | 2010 | $ 14,869 | | | | | |

| ** | Consolidated Balance Sheets, as filed with the Commission on Forms 10-K and 10-KSB for each of the years 2003 through 2010 are attached. |

Mr. H. Christopher Owings

October 21, 2010

Page 6

| (5) | Since 2003 ITEX has “increased cash from $104,000 at July 31, 2003, to $5.169 million at July 31, 2010”; |

| | July 31, | From Forms 10-K and 10-KSB Consolidated Balance Sheets (In thousands) “Cash and cash equivalents” ** | | | | | |

| | | | | | | | |

| | 2003 | $ 104 | | | | | |

| | 2010 | $ 5,169 | | | | | |

| ** | Consolidated Balance Sheets, as filed with the Commission on Forms 10-K and 10-KSB for each of the years 2003 through 2010 are attached. |

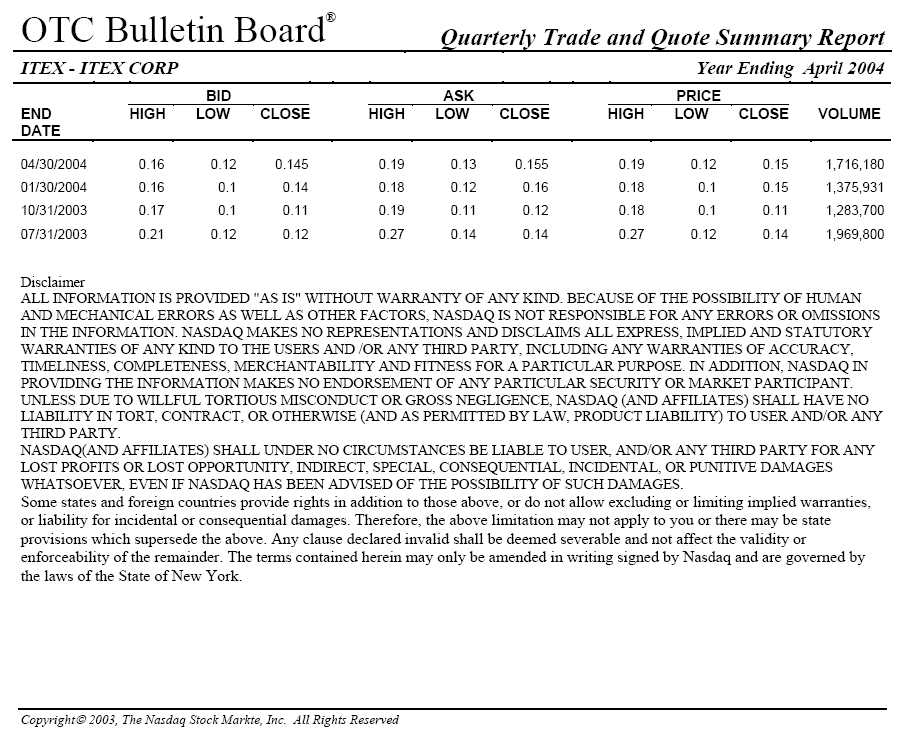

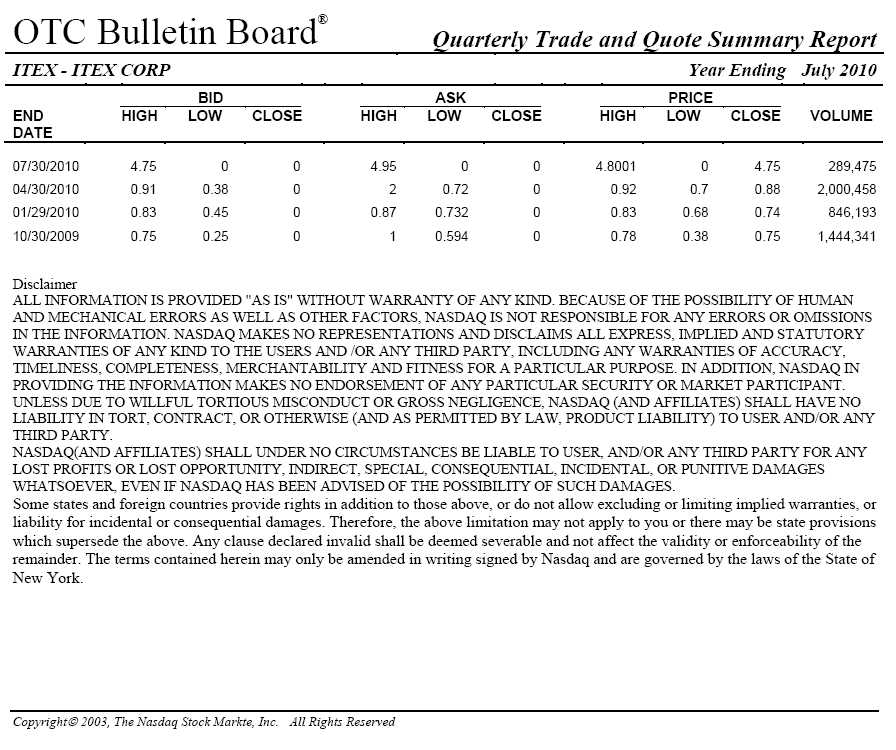

| (6) | Since 2003 ITEX has “seen its stock price increase by approximately 700%” |

| | Closing bid price on July 31, | From OTC Bulletin Board Reports** | Percentage Increase | | | | |

| | | | | | | | |

| | 2003 | $ .60 | | | | | |

| | 2010 | $ 4.75 | 692% | | | | |

** OTC Bulletin Board Quarterly Trade and Quote Summary Reports, as published by the NASDAQ Stock Market, Inc. for each of the relevant periods are attached. Stock prices are adjusted to give retroactive effect to the Company’s 1:5 reverse stock split on May 3, 2010.

Corporate Governance, page 8

| 8. | Please identify each director and director nominee that is independent under the independence standards applicable to the registrant under paragraph (a)(1) of Item 407 of Regulation S-K. We note your discussion regarding Mr. Wade's lack of independence on page 9, however, it does not appear that you affirmatively state who is independent pursuant to Item 407 of Regulation S-K. |

Response:

The Company has added a paragraph to make the affirmative statement as to the two independent outside directors. See page 13.

Audit Committee, page 9

| 9. | Please describe the contributions that the Board of Directors believes that Mr. Wade makes to the Audit Committee that leads them to conclude that the contributions that Mr. Wade makes to the Audit Committee outweighs any concerns that he is not independent as defined by NASDAQ Marketplace Rules. Also, please disclose who constituted the Board of Directors for purposes of determining whether Mr. Wade is an independent member of the Audit Committee. |

Mr. H. Christopher Owings

October 21, 2010

Page 7

Response:

The Company has modified the sentence to read as follows, “The Board believes that by virtue of his substantial financial and accounting knowledge, former experience as a CFO of a public company, ability to implement internal controls and procedures, and qualifications as an ‘audit committee financial expert,’ Mr. Wade makes a valuable contribution to the Audit Committee, notwithstanding the fact that the audit committee is not composed solely of directors who satisfy the independence requirements of the NASDAQ Marketplace Rules for audit committee members.” See page 13.

It is disclosed that independence determinations are made by the full board, without counting the vote of the interested director. See page 13.

Executive Compensation, page 13

Summary Compensation Table, page 14

| 10. | You state that the disclosure in this section includes summary information about compensation received by your chief executive officer and "the two other highest paid executive officers." However, you only include information regarding Steven White which we assume is because the other officers do not receive total compensation in excess of $100,000. Please advise. If you have no other executive officers that receive total direct compensation in excess of $100,000 please revise your filing to remove this statement. Please refer to Item 402(m)(1) of Regulation S-K. |

Response:

On behalf of the Company, we confirm that there is presently only one (1) executive officer. The reference to the two other highest paid executive officers has been deleted. See page 18.

Narrative to Summary Compensation Table, page 14

Employment and Change-in-Control Agreements, page 14

| 11. | We note your disclosure that during 2009 you entered into a change of control agreement with Mr. White. Please disclose the date on which such agreement was entered into. |

Response:

The reference to 2009 has been corrected. The Company has disclosed the correct agreement date of February 28, 2008. See page 18. This agreement was filed on March 3, 2008, as exhibit 10.15 to its Form 10-Q.

Mr. H. Christopher Owings

October 21, 2010

Page 8

| 12. | Please revise the disclosure to quantify the change of control payment, if any that would be due to Mr. White if the shareholder group’s nominees were elected to the board. |

Response:

The Company has added disclosures indicating that in the event the Pagidipati Group nominees were elected to the board, Mr. White would receive a payment of $250,000, and upon termination of his employment as CEO an additional payment of $500,000. See page 19.

Other Matters, page 19

Other Matters Brought Before the Meeting, page 19

| 13. | Please advise how the standard for discretionary voting set forth in this section is consistent with Rule 14a-4(c), or revise your disclosure. Similar disclosure appears on your form of proxy. |

Response:

On behalf of the Company we confirm that the discretionary voting referred to on page 22 of the preliminary proxy statement and the form of proxy is intended to address only situations within the authority created by Rule 14a-4(c). The Company has revised its disclosure to clarify the issue, as follows:

“However if any business matters other than those referred to in this proxy statement should properly come before the meeting, the persons named in the proxy will, to the extent permitted by applicable rules of the Securities and Exchange Commission, use their discretion to determine how to vote your shares.”

Proxy Solicitation, page 19

| 14. | We note that proxies may be solicited by mail, personally, by telephone, fax, email or other electronic means and by press releases and public statements. Please be advised that all written soliciting materials, including any scripts to be used in soliciting proxies by personal interview or telephone must be filed under the cover of Schedule 14A. Please confirm your understanding in this regard. See Rule 14a-6(c) of Regulation 14A. |

Response:

On behalf of the Company, we hereby confirm that under Rule 14a-6(b) and (c), all written soliciting materials, including any e-mails or scripts to be used in soliciting proxies by personal interview or telephone, must be filed under the cover of Schedule 14A on the date of first use.

In connection with this response, on behalf of ITEX, we hereby acknowledge that:

| o | ITEX is responsible for the adequacy and accuracy of the disclosure in the filing; |

| o | staff comments or changes to its disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

Mr. H. Christopher Owings

October 21, 2010

Page 9

| o | ITEX may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States; |

Should you have any questions regarding the foregoing, please do not hesitate to contact me at (425) 353-8883.

| | Sincerely, | |

| | TOLLEFSEN BUSINESS LAW P.C. | |

| | | |

| | /s/ Stephen Tollefsen | |

| | Stephen Tollefsen | |

| | | |

Enclosures