TollefsenBusinessLaw P.C.

2825 Colby Avenue, Suite 304

Everett, Washington 98201

Telephone (425) 353-8883

Fax (425) 353-9415

March 10, 2012

Transmitted by EDGAR Submission

Daniel F. Duchovny

Special Counsel

Office of Mergers and Acquisitions

Division of Corporation Finance

Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549-3628

| | Preliminary Proxy Statement on Schedule 14A |

Dear Mr. Duchovny:

On behalf of our client, ITEX Corporation (“ITEX” or “Company”), we submit the following response to your comment letter dated March 9, 2012. Set forth below are the Staff’s comments followed by our responses. The numbered responses in this letter correspond to your numbered comments.

ITEX plans to file a definitive proxy statement which reflects the changes set forth below when the Staff has no further comments. In addition to setting forth the revised disclosure in response to Staff comments within the body of this letter, we have also attached separate pages of the proxy statement showing the revised disclosure that will be incorporated into the definitive proxy statement.

Preliminary Schedule 14A

The Polonitza Nominees are a Bad Fit for the Company, page 14

| 1. | Each statement or assertion of opinion or belief must be clearly characterized as such, and a reasonable factual basis must exist for each such opinion or belief. Support for opinions or beliefs should be self-evident, disclosed in the proxy statement or provided to the staff on a supplemental basis. Please provide us the support for your disclosure that (i) Mr. Polonitza “has initiated a protracted conflict thathas already harmed the financial performance of ITEX” (emphasis added), and (ii) you believe “a change in control of ITEX could be potentially destabilizing for ITEX’s business” and that you “believe there is value in the continuity of our key personnel, and our long-term relationship building with franchisees will be jeopardized by a complete lack of continuity.” |

Response:

| (1) | “has already harmed the financial performance of ITEX “ |

Mr. Daniel F. Duchovny

March 10, 2012

Page 2

The statement above was meant to refer to operating income and cash flow from operations as a measure of financial performance. Each is adversely affected (diminished) by an increase in expenses. We believe as a general statement it is self-evident that material costs of litigation and a proxy contest are detrimental, particularly to a smaller reporting company of ITEX’s relative size.

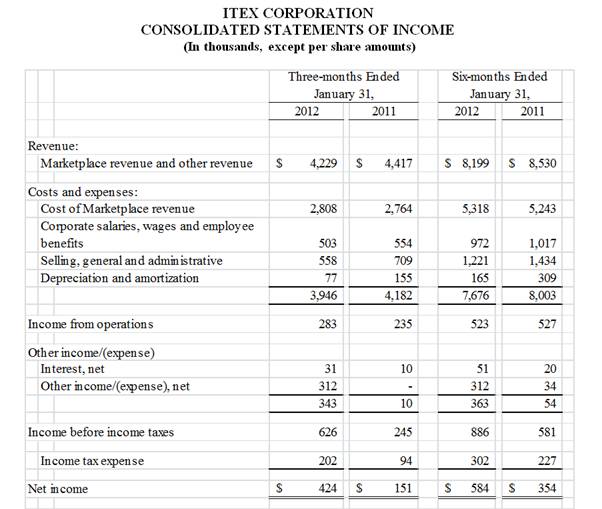

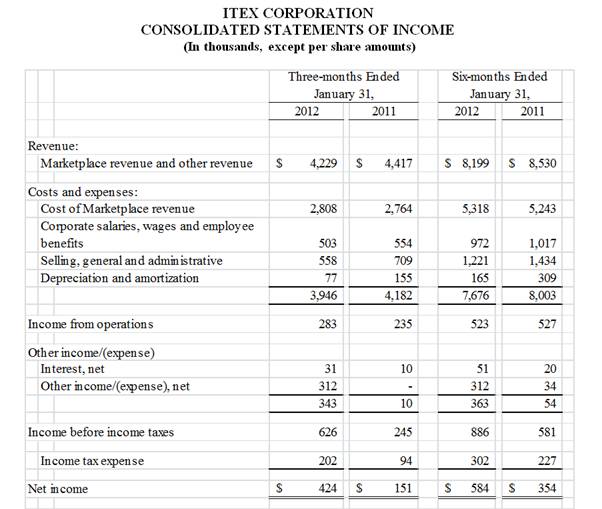

In the litigation matter, ITEX is advancing defense costs of directors under its indemnity obligations, and has expended an additional $155,000 in Polonitza litigation defense costs during the six-month period ended January 31, 2012, as disclosed in ITEX’s Form 10-Q for the quarter ended January 31, 2012 (See MD&A─ Results of Operations, pages 23 and 28). ITEX’s income from operations for the six-months ended January 31, 2012, was approximately $523,000 (see Form 10-Q excerpt below). But for the Polonitza litigation matter, operational income would have been $678,000 over the same six-month period. This represents a 23% reduction in the Company’s operational income, without taking in consideration any additional proxy contest costs.

Source: ITEX Form 10-Q for the quarter ended January 31, 2012, as filed with the Commission on March 8, 2012, page 2.

Mr. Daniel F. Duchovny

March 10, 2012

Page 3

The Company has revised its disclosure as follows:

“We believe Mr. Polonitza has been confrontational rather than genuinely engaging the Board to determine whether a proxy fight could be averted. He has initiated a protracted conflict that has already harmed the financial performance of ITEXas a result of increased litigation and proxy contest costs. It is difficult to envision how he could be expected to constructively contribute to the collective functioning of the Board. We believe that Mr. Polonitza by his actions has made it very clear that he refuses to consider anything short of a change in control in the Board and total control of ITEX.”

| (2) | “a change in control of ITEX could be potentially destabilizing for ITEX’s business “ |

“there is value in the continuity of our key personnel, and our long-term relationship building with franchisees will be jeopardized by a complete lack of continuity.”

We have deleted the reference to key personnel to focus on franchisees. Although franchisees are independent contractors with respect to the Company, strong, cooperative relationships with them are an important element of ITEX’s business strategy. ITEX services its member businesses primarily through its franchise network, and its financial success primarily depends on its franchisees and the manner in which they operate and develop their offices. ITEX depends on the ability of its franchisees to enroll new members, train them in the use of the ITEX Marketplace, grow its transactional volume by facilitating business among members, manage member relationships, provide members with information about ITEX products and services, and assure the payment of fees.

As part of its strategic plan noted in its preliminary proxy materials, the Polonitza Group has also acknowledged the important of franchisees by stating its intention to “focus on franchising” and its plans for “the core franchise business” (page 12 of Revised Preliminary Proxy Materials on Form PRRN14A, filed March 7, 2012).

Including the current election contest for control of the Company, ITEX has been subject to three takeover attempts since 2007. In management’s view, the last Polonitza Group proxy contest in late 2010 created noticeable disruption, uncertainty and damaged morale within the organization and the franchisee network. During the last Polonitza Group election contest, Mr. Polonitza made personal contact with several ITEX franchisees. The anecdotal feedback ITEX received from franchisees about their experience with Mr. Polonitza was overwhelmingly negative. However, the Polonitza Group’s characterization of its interactions in its 2010 proxy materials was that it had “spoken to over 10% of the existing franchise base, who have expressed interest in working with a new leadership team.”

On November 7, 2010, ITEX published a letter it received from the ITEX Broker Association Board of Directors (“IBABD”), which represents 92% of the franchisees and independent licensed brokers in the ITEX broker network. In addition to seeking to refute the above statement made by the Polonitza Group, among other things, IBABD stated, “We are very concerned that a change of the board and management would be potentially destabilizing to ITEX and the franchise network and will undermine years of progress.” (See Form DEFA14A filed with the Commission on November 18, 2011).

Mr. Daniel F. Duchovny

March 10, 2012

Page 4

After the completion of the election contest in 2010, the ITEX Board of Directors was informed that several franchisees were considering terminating their franchise contracts with ITEX if the Polonitza Group had won the election contest.

The Company has revised its disclosure as follows:

“We believe a change in control of ITEX could be potentially destabilizing for ITEX’s business,We believe there is value in the continuity of our key personnel,because our financial success depends on our franchiseesandour long-term relationship building with franchiseeswillwould be jeopardized by a complete lack of continuity. Furthermore, election of the Polonitza Group nominees would cause a “change in control” under our change in control agreements, which would result in additional costs and accounting charges for ITEX, and which may raise additional questions about key employee retention. See “Employment and Change-in-Control Agreements” on page 23 for a description of these charges.”

Other Matters – Proxy Solicitation, page 29

| 2. | We note that you may employ various methods to solicit proxies, including mail, personally, telephone, fax, email, or other electronic means. Be advised that all written soliciting materials, including any e-mails or scripts to be used in soliciting proxies over the telephone or any other medium, must be filed under the cover of Schedule 14A on the date of first use. Refer to Rule 14a-6(b) and (c). Please confirm your understanding. |

Response:

On behalf of the Company, we hereby confirm that all written soliciting materials, including any emails or scripts to be used in soliciting proxies over the telephone or any other medium, must be filed under the cover of Schedule 14A on the date of first use as required by Rule 14a-6(b) and (c).

| 3. | Please describe what other methods of soliciting proxies will be used rather than state “other electronic means.” If this refers to the solicitation of proxies via the internet, tell us whether it will include solicitations via internet chat rooms and tell us which websites you plan to utilize. |

Response:

The Company does not intend to solicit proxies via Internet chat rooms. The Company may post material that may be considered soliciting material on the investor relations portion of its website, at http://www.itex.com. The Company understands that website soliciting materials must be filed with the Commission under the cover of Schedule 14A on the date of first use.

The Company has revised its disclosure to clarify as follows:

“In addition to soliciting proxies by mail, solicitations may be madeby press release or throughthe investor relations portion of our website at www.itex.com, or personally, by telephone, fax,or emailor other electronic means by our directors and officers and regular employees, who will not be additionally compensated for any such services.”

Mr. Daniel F. Duchovny

March 10, 2012

Page 5

As requested by the Staff in the comment letter, attached hereto as Annex A is a written acknowledgement by the Company of certain matters.

Should you have any questions regarding the foregoing, please do not hesitate to contact me at (425) 353-8883.

Sincerely, | |

| TOLLEFSEN BUSINESS LAW P.C. | |

| | |

| /s/ Stephen Tollefsen | |

| Stephen Tollefsen | |

| | |

Enclosures

ANNEX A

As requested by the Staff in the comment letter, in connection with the proxy solicitation materials filed by the Company with the Commission on March 6, 2012, as amended and supplemented, ITEX hereby acknowledges that:

| o | ITEX is responsible for the adequacy and accuracy of the disclosure in the filing; |

| o | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| o | ITEX may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

| | | |

| ITEX Corporation |

| | |

| by | | |

| | | /s/ Steven White |

| | | Name: Steven White |

| | | Title: Chief Executive Officer |