Filed Pursuant to Rule 424(b)(5)

Registration No. 333-271537

PROSPECTUS SUPPLEMENT

(To Prospectus dated May 1, 2023)

HCA Inc.

$5,250,000,000 Senior Notes Consisting of:

$700,000,000 5.000% Senior Notes due 2028

$300,000,000 Floating Rate Senior Notes due 2028

$750,000,000 5.250% Senior Notes due 2030

$750,000,000 5.500% Senior Notes due 2032

$1,500,000,000 5.750% Senior Notes due 2035

$1,250,000,000 6.200% Senior Notes due 2055

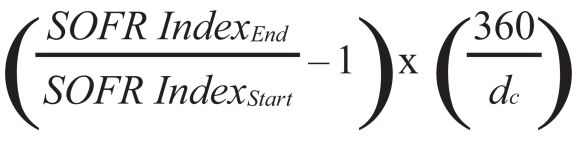

HCA Inc. is offering $700,000,000 aggregate principal amount of 5.000% Senior Notes due 2028, which we refer to as the “2028 notes,” $300,000,000 aggregate principal amount of Floating Rate Senior Notes due 2028, which we refer to as the “floating rate notes,” $750,000,000 aggregate principal amount of 5.250% Senior Notes due 2030, which we refer to as the “2030 notes,” $750,000,000 aggregate principal amount of 5.500% Senior Notes due 2032, which we refer to as the “2032 notes,” $1,500,000,000 aggregate principal amount of 5.750% Senior Notes due 2035, which we refer to as the “2035 notes,” and $1,250,000,000 aggregate principal amount of 6.200% Senior Notes due 2055, which we refer to as the “2055 notes.” The 2028 notes, the 2030 notes, the 2032 notes, the 2035 notes and the 2055 notes are collectively referred to herein as the “fixed rate notes” and the fixed rate notes and the floating rate notes are collectively referred to herein as the “notes,” unless context otherwise requires. The 2028 notes will bear interest at a rate of 5.000% per annum, the floating rate notes will bear interest at a rate per annum equal to Compounded SOFR (as defined in “Description of the Notes—Interest—Floating Rate Notes—Information about the SOFR and the SOFR Index”) plus 0.870%, the 2030 notes will bear interest at a rate of 5.250% per annum, the 2032 notes will bear interest at a rate of 5.500% per annum, the 2035 notes will bear interest at a rate of 5.750% per annum and the 2055 notes will bear interest at a rate of 6.200% per annum. HCA Inc. will pay interest on the fixed rate notes semi-annually, in cash in arrears, on March 1 and September 1 of each year, beginning on September 1, 2025. HCA Inc. will pay interest on the floating rate notes quarterly, in cash in arrears, on March 1, June 1, September 1 and December 1 of each year, beginning on June 1, 2025. The 2028 notes will mature on March 1, 2028, the floating rate notes will mature on March 1, 2028, the 2030 notes will mature on March 1, 2030, the 2032 notes will mature on March 1, 2032, the 2035 notes will mature on March 1, 2035 and the 2055 notes will mature on March 1, 2055.

We may redeem each series of fixed rate notes, at any time in whole or from time to time in part, in each case at the redemption prices described in this prospectus supplement. We may not redeem the floating rate notes prior to their maturity. In addition, if a Change of Control Triggering Event (as defined in “Description of the Notes—Repurchase at the Option of Holders—Change of Control Triggering Event”) occurs, we will be required to repurchase the notes of each series from holders on the terms described in this prospectus supplement.

The notes will be HCA Inc.’s senior obligations and will rank equally and ratably with all of its existing and future senior indebtedness and senior to any of its existing and future subordinated indebtedness. The obligations under the notes will be fully and unconditionally guaranteed by HCA Healthcare, Inc., the direct parent company of HCA Inc., on a senior unsecured basis and will rank equally and ratably with HCA Healthcare, Inc.’s existing and future senior indebtedness and senior to any of its existing and future subordinated indebtedness. The obligations under the notes will be structurally subordinated in right of payment to all obligations of HCA Inc.’s subsidiaries and will be effectively subordinated to any of HCA Inc.’s existing and future secured indebtedness to the extent of the value of the collateral securing such indebtedness.

HCA Inc. intends to use the net proceeds of this offering for general corporate purposes, which may include the repayment of expected borrowings under our proposed senior unsecured credit facility (as defined in “Summary—Recent Developments”) in connection with the Proposed Refinancing Transaction (as defined in “Summary—Recent Developments”). If the Proposed Refinancing Transaction is not consummated, these general corporate purposes may instead include the repayment of borrowings outstanding under our ABL credit facility (as defined in “Summary—Recent Developments”). See “Use of Proceeds.”

Investing in the notes involves risks. See “Risk Factors” beginning on page S-8.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission or other regulatory body has approved or disapproved of these securities or determined if this prospectus supplement or the attached prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Public offering price(1) | | | Underwriting

discount | | | Proceeds to

HCA Inc.(1)

(before expenses) | |

| | | Per

note | | | Total | | | Per

note | | | Total | | | Per

note | | | Total | |

5.000% Senior Notes due 2028 | | | 99.932 | % | | $ | 699,524,000 | | | | 0.450 | % | | $ | 3,150,000 | | | | 99.482 | % | | $ | 696,374,000 | |

Floating Rate Senior Notes due 2028 | | | 100.000 | % | | $ | 300,000,000 | | | | 0.450 | % | | $ | 1,350,000 | | | | 99.550 | % | | $ | 298,650,000 | |

5.250% Senior Notes due 2030 | | | 99.780 | % | | $ | 748,350,000 | | | | 0.600 | % | | $ | 4,500,000 | | | | 99.180 | % | | $ | 743,850,000 | |

5.500% Senior Notes due 2032 | | | 99.923 | % | | $ | 749,422,500 | | | | 0.625 | % | | $ | 4,687,500 | | | | 99.298 | % | | $ | 744,735,000 | |

5.750% Senior Notes due 2035 | | | 99.757 | % | | $ | 1,496,355,000 | | | | 0.650 | % | | $ | 9,750,000 | | | | 99.107 | % | | $ | 1,486,605,000 | |

6.200% Senior Notes due 2055 | | | 99.176 | % | | $ | 1,239,700,000 | | | | 0.875 | % | | $ | 10,937,500 | | | | 98.301 | % | | $ | 1,228,762,500 | |

| (1) | Plus accrued interest, if any, from February 21, 2025. |

We expect to deliver the notes to investors on or about February 21, 2025 in book-entry form only through the facilities of The Depository Trust Company (“DTC”). See “Underwriting (Conflicts of Interest)—Settlement.”

Joint Book-Running Managers

| | | | | | |

| BofA Securities | | Barclays | | Citigroup | | J.P. Morgan |

| | | |

| Mizuho | | Wells Fargo Securities | | BNP PARIBAS | | Capital One Securities |

| | | |

| Credit Agricole CIB | | Fifth Third Securities | | Goldman Sachs & Co. LLC | | Morgan Stanley |

| | | |

| PNC Capital Markets LLC | | RBC Capital Markets | | SMBC Nikko | | Truist Securities |

Co-Managers

| | | | | | |

| BBVA | | CIBC Capital Markets | | DNB Markets | | Huntington Capital Markets |

| | | |

| NatWest | | Regions Securities LLC | | Scotiabank | | TD Securities |

Prospectus Supplement dated February 18, 2025