We developed a standard severance package for Mr. Marr, Mr. Moore, Mr. Miller, and Mr. Puckett because we believe it is necessary to attract and retain these qualified executive officers. We also believe these agreements are important to help minimize the distraction caused by a potential transaction and reduce the risk that any of these executive officers departs before an acquisition is consummated. We believe that a pre-existing plan allows these executive officers to focus on continuing normal business operations and the success of a potential business combination, rather than on seeking alternative employment. We further believe that our employment agreements ensure stability and will enable our executive officers to maintain a balanced perspective in making overall business decisions during a potentially uncertain period. The Compensation Committee applied its best judgment in developing the severance package after considering each executive’s overall compensation package, the rapidly changing environment for technology-based companies, the average time required to obtain employment for equivalent job duties, and the amount paid to executives in the event of termination without cause or upon a change in control.

Other Important Elements of Our Executive Compensation

Executive Compensation Recovery Policy; Clawbacks or Forfeitures

Accountability is one of our fundamental Company values. To reinforce this value through our executive compensation program, the Board of Directors adopted an Executive Compensation Recovery Policy in February 2010. The policy applies to our Named Executive Officers, group and division presidents, senior financial management, and other key financial employees, and is included in the compensation plans for each such individual. Under this policy, if, in the opinion of the independent directors of the Board, an executive engages in fraud or intentional misconduct that causes a material restatement of our financial statements, then the independent directors shall have the discretion to use their best efforts to remedy the misconduct and prevent its recurrence. Based upon the facts and circumstances surrounding the restatement, the independent directors may direct the Company to recover all or a portion of any bonus or incentive compensation paid, adjust the future compensation of the executive, and dismiss, or take legal action against, the executive, in each case as the independent directors determine is in the Company’s best interests. The remedies that may be sought by the independent directors are subject to a number of conditions, including that: (1) the bonus or incentive compensation to be recouped was calculated based upon the financial results that were restated; (2) the executive in question engaged in fraud or intentional misconduct; and (3) the bonus or incentive compensation calculated under the restated financial results is less than the amount actually paid or awarded.

The 2018 Stock Incentive Plan includes a “clawback/forfeiture” provision pursuant to which the Compensation Committee may provide in any equity incentive award agreement that (1) the Compensation Committee may in its discretion cancel the award if the holder of the award engages in certain defined detrimental activity, and/or (2) the holder of an award is required to repay any amount in excess of what the holder should have received, whether by reason of a financial restatement, mistake in calculations, administrative error, or otherwise. In addition, all awards would be subject to reduction, cancellation, forfeiture, or recoupment as required under applicable law.

Stock Ownership Requirements

Our Named Executive Officers and other senior Company executives are also subject to minimum stock ownership requirements. Please see “Stock Ownership Guidelines” above for more information.

Anti-Hedging and Pledging

We maintain a Stock Anti-Hedging and Pledging Policy, described in the “Corporate Governance Principles—Stock Anti-Hedging and Pledging Policy” section, to prohibit our executives from engaging in transactions that could reduce or limit their holdings, ownership or interest in Company securities and to discourage our executives from pledging Company securities or from holding Company securities in margin accounts.

Frequency of Say-on-Pay Vote

The Board of Directors has submitted an advisory vote on executive compensation to our shareholders since the 2017 annual meeting of shareholders. The annual proposal gives our shareholders the opportunity to vote to approve or not approve, on an advisory basis, the compensation of our Named Executive Officers. Please see Proposal Four for a discussion of our history and intent with respect to the frequency of the shareholder say-on-pay advisory vote.

Annual Assessment of Risks Associated with our Compensation Policies and Programs

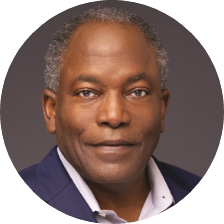

Our compensation program is designed not to incentivize excessive risk taking by allocating an appropriate balance between the three compensation elements. The base salary component of compensation is a fixed amount and is therefore not subject to or influenced by risk taking. Our annual incentive compensation is principally focused on short-term performance