Exhibit 99.3 First Quarter 2019 Earnings April 29, 2019 Earnings Call Presentation – 1Q 2019

Preliminary Matters Cautionary Statements Regarding Forward-Looking Information This presentation may contain or incorporate by reference information that includes or is based on forward-looking statements within the meaning of the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give expectations or forecasts of future events, and can be identified by the fact that they relate to future actions, performance or results rather than strictly to historical or current facts. Any or all forward-looking statements may turn out to be wrong, and, accordingly, readers are cautioned not to place undue reliance on such statements, which speak only as of the date of this presentation. Forward-looking statements involve a number of risks and uncertainties that are difficult to predict, and are not guarantees of future performance. Among the general factors that could cause actual results and financial condition to differ materially from estimated results and financial condition are the possibility that the anticipated benefits and synergies from an acquisition may not be fully realized to the extent or within the time frame previously expected and other factors listed in periodic reports filed by Kemper Corporation with the Securities and Exchange Commission (SEC). No assurances can be given that the results and financial condition contemplated in any forward-looking statements will be achieved or will be achieved in any particular timetable. Kemper assumes no obligation to publicly correct or update any forward-looking statements as a result of events or developments subsequent to the date of this presentation. The reader is advised, however, to consult any further disclosures Kemper makes on related subjects in its filings with the SEC. Non-GAAP Financial Measures This presentation contains non-GAAP financial measures that the company believes are meaningful to investors. Non-GAAP financial measures have been reconciled to the most comparable GAAP financial measure. Earnings Call Presentation – 1Q 2019 2

Create Long-Term Shareholder Value Leverage competitive advantages to grow returns and BVPS1 over time Diversified sources of earnings; Sustainable competitive Growing returns Strong capital/liquidity advantages and build and book value per positions; core capabilities share over time Disciplined approach to capital management Strategic focus: Consumer-related businesses with opportunities that: • Target niche markets • Have limited, weak or unfocused competition • Require unique expertise (underwriting, claim, distribution, analytics and other) Deliver low double-digit ROE2 over time ¹ Book value per share Earnings Call Presentation – 1Q 2019 2 Return on equity 3

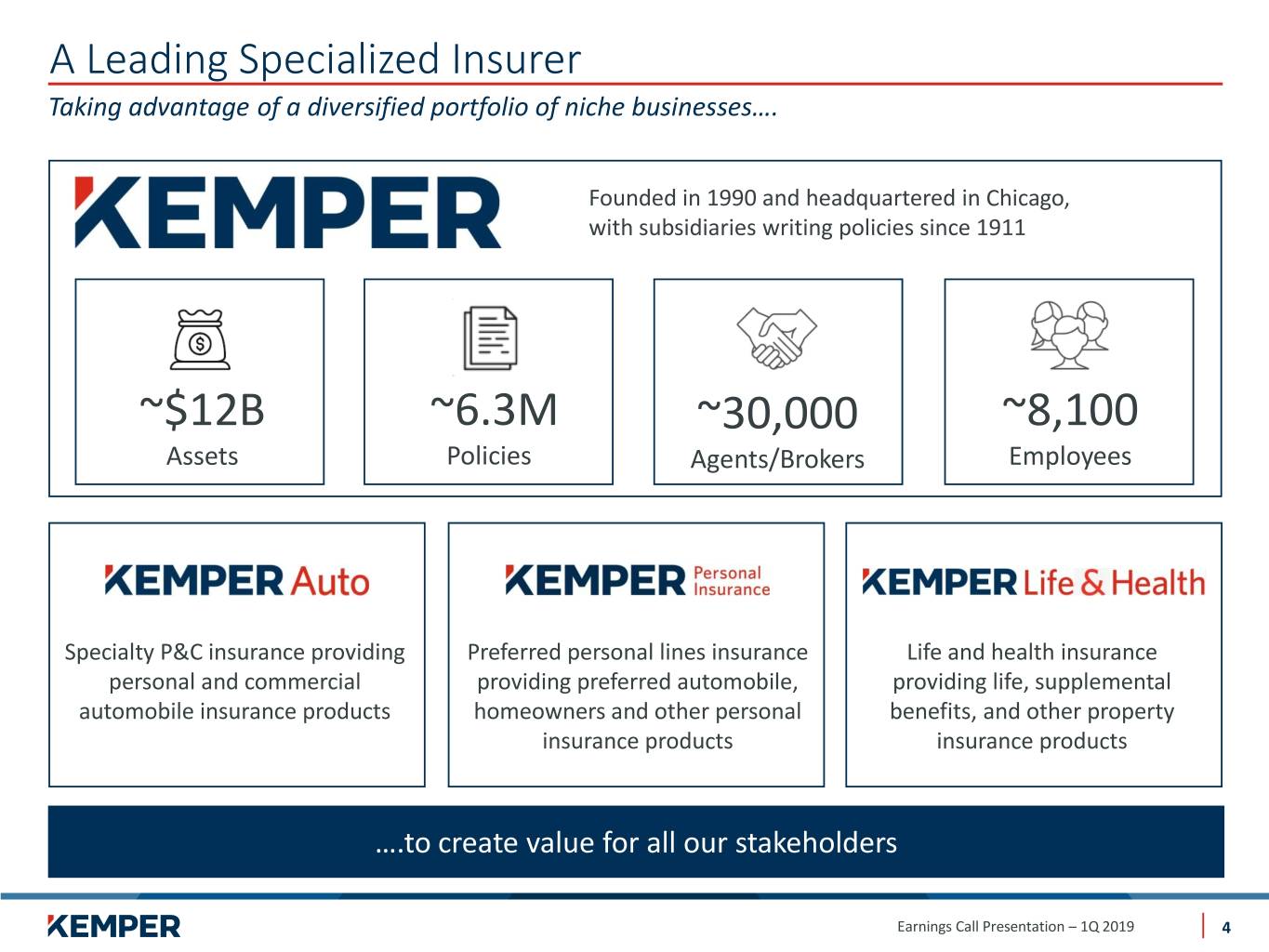

A Leading Specialized Insurer Taking advantage of a diversified portfolio of niche businesses…. Founded in 1990 and headquartered in Chicago, with subsidiaries writing policies since 1911 ~$12B ~6.3M ~30,000 ~8,100 Assets Policies Agents/Brokers Employees Specialty P&C insurance providing Preferred personal lines insurance Life and health insurance personal and commercial providing preferred automobile, providing life, supplemental automobile insurance products homeowners and other personal benefits, and other property insurance products insurance products ….to create value for all our stakeholders Earnings Call Presentation – 1Q 2019 4

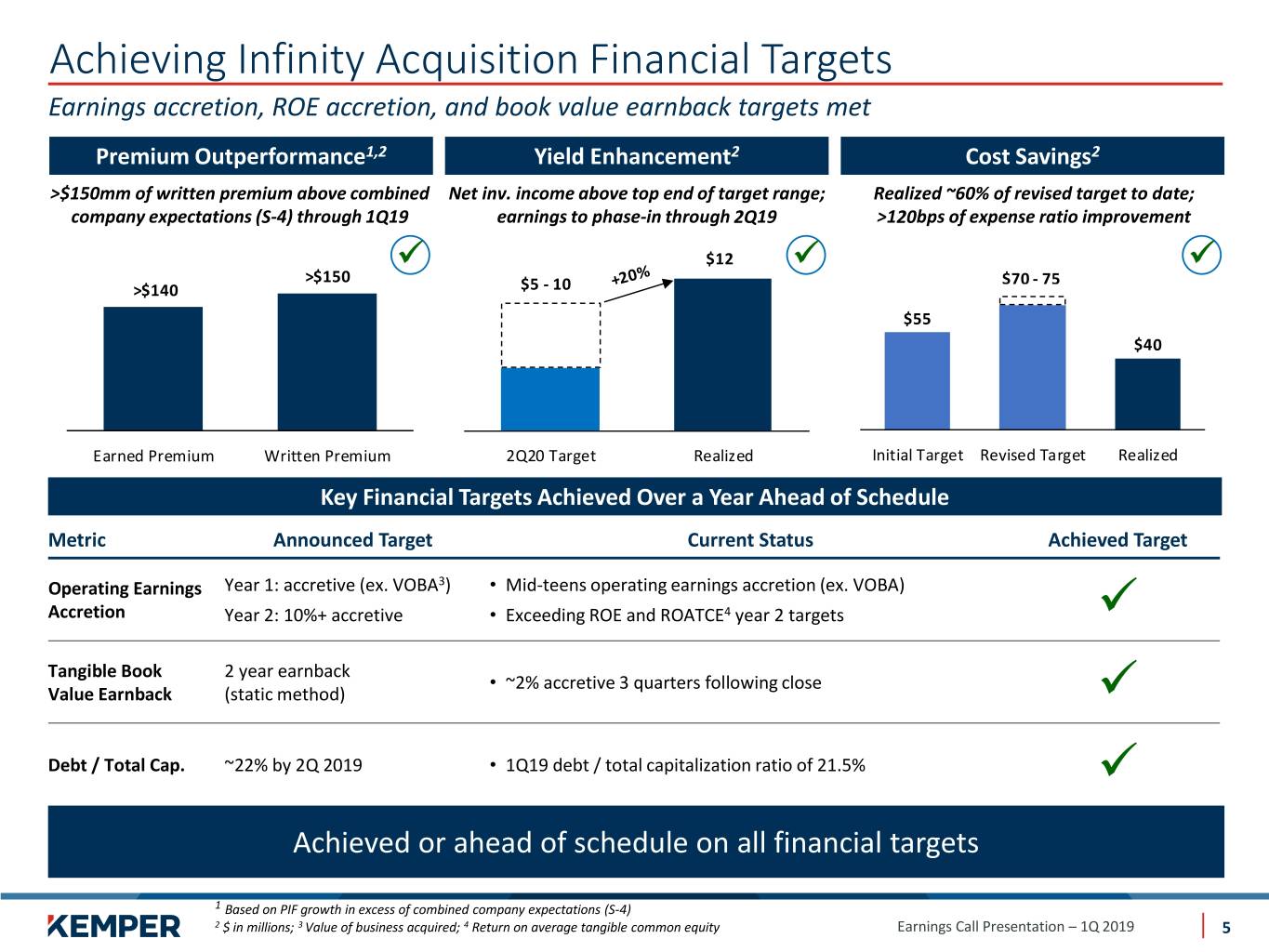

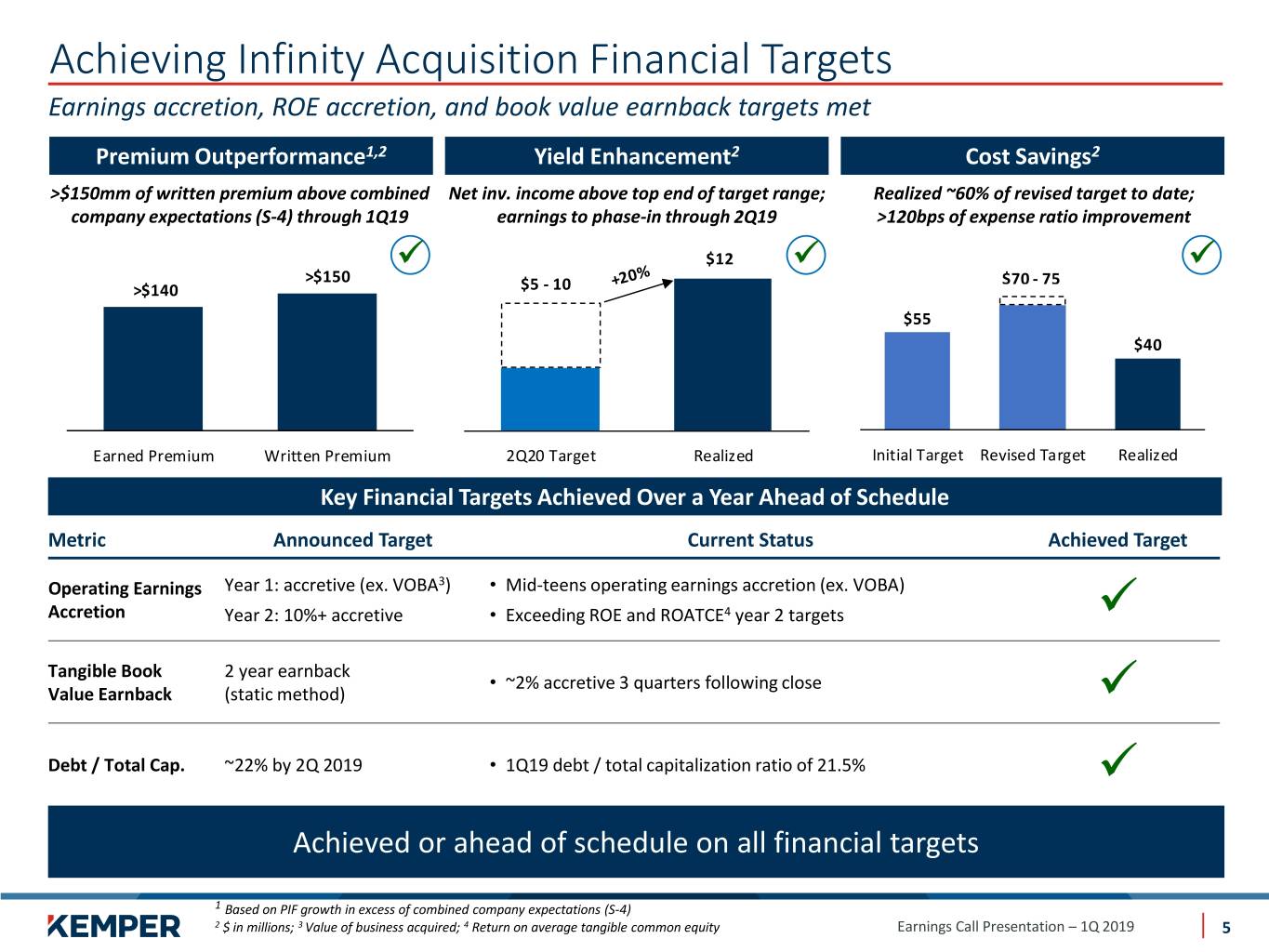

Achieving Infinity Acquisition Financial Targets Earnings accretion, ROE accretion, and book value earnback targets met Premium Outperformance1,2 Yield Enhancement2 Cost Savings2 >$150mm of written premium above combined Net inv. income above top end of target range; Realized ~60% of revised target to date; company expectations (S-4) through 1Q19 earnings to phase-in through 2Q19 >120bps of expense ratio improvement ✓ ✓ ✓ $12 >$150 $70 - 75 >$140 $5 - 10 $55 $40 Earned Premium Written Premium 2Q20 Target Realized Initial Target Revised Target Realized Key Financial Targets Achieved Over a Year Ahead of Schedule Metric Announced Target Current Status Achieved Target Operating Earnings Year 1: accretive (ex. VOBA3) • Mid-teens operating earnings accretion (ex. VOBA) ✓ Accretion Year 2: 10%+ accretive • Exceeding ROE and ROATCE4 year 2 targets Tangible Book 2 year earnback • ~2% accretive 3 quarters following close ✓ Value Earnback (static method) Debt / Total Cap. ~22% by 2Q 2019 • 1Q19 debt / total capitalization ratio of 21.5% ✓ Achieved or ahead of schedule on all financial targets 1 Based on PIF growth in excess of combined company expectations (S-4) 2 $ in millions; 3 Value of business acquired; 4 Return on average tangible common equity Earnings Call Presentation – 1Q 2019 5

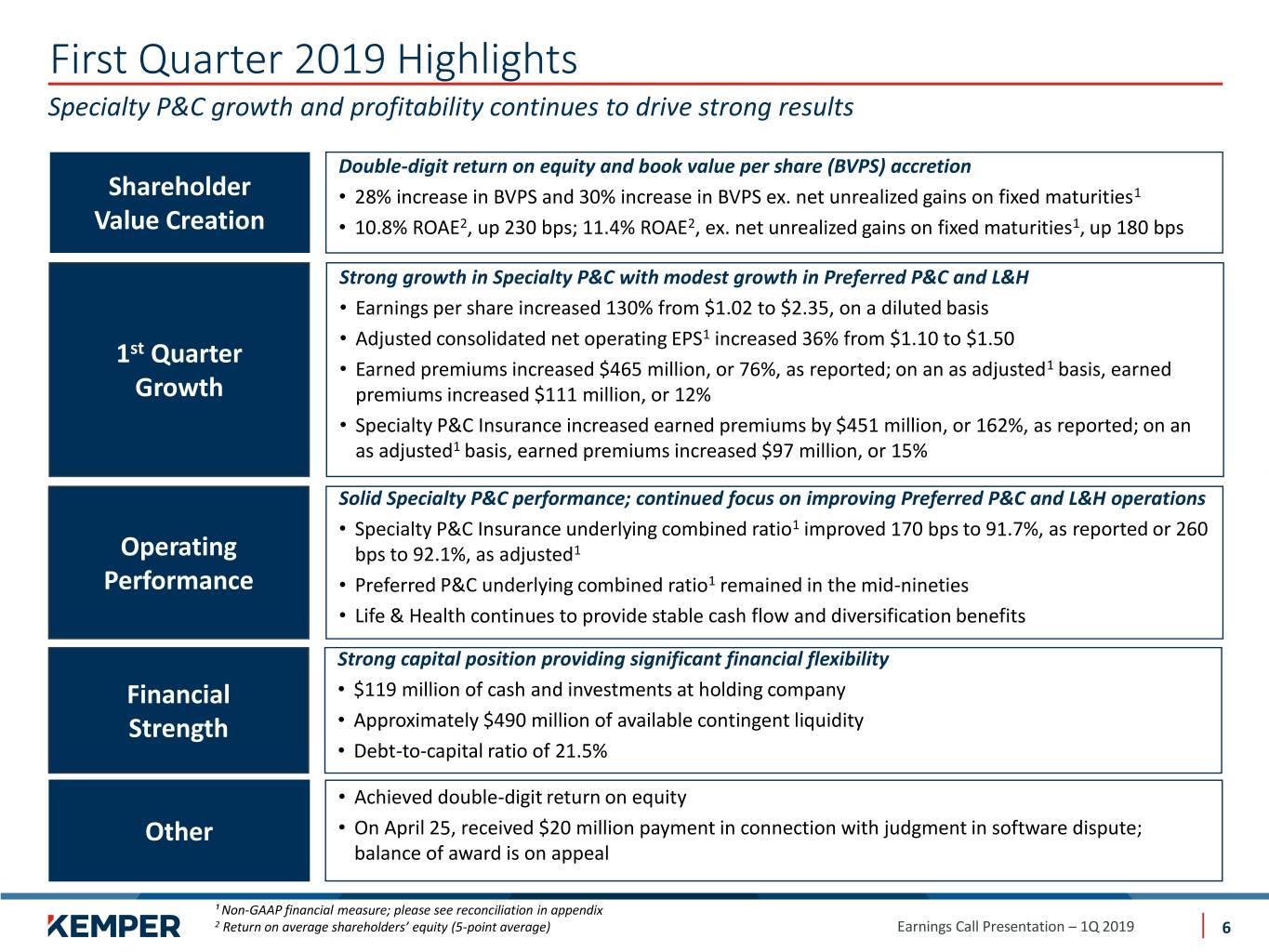

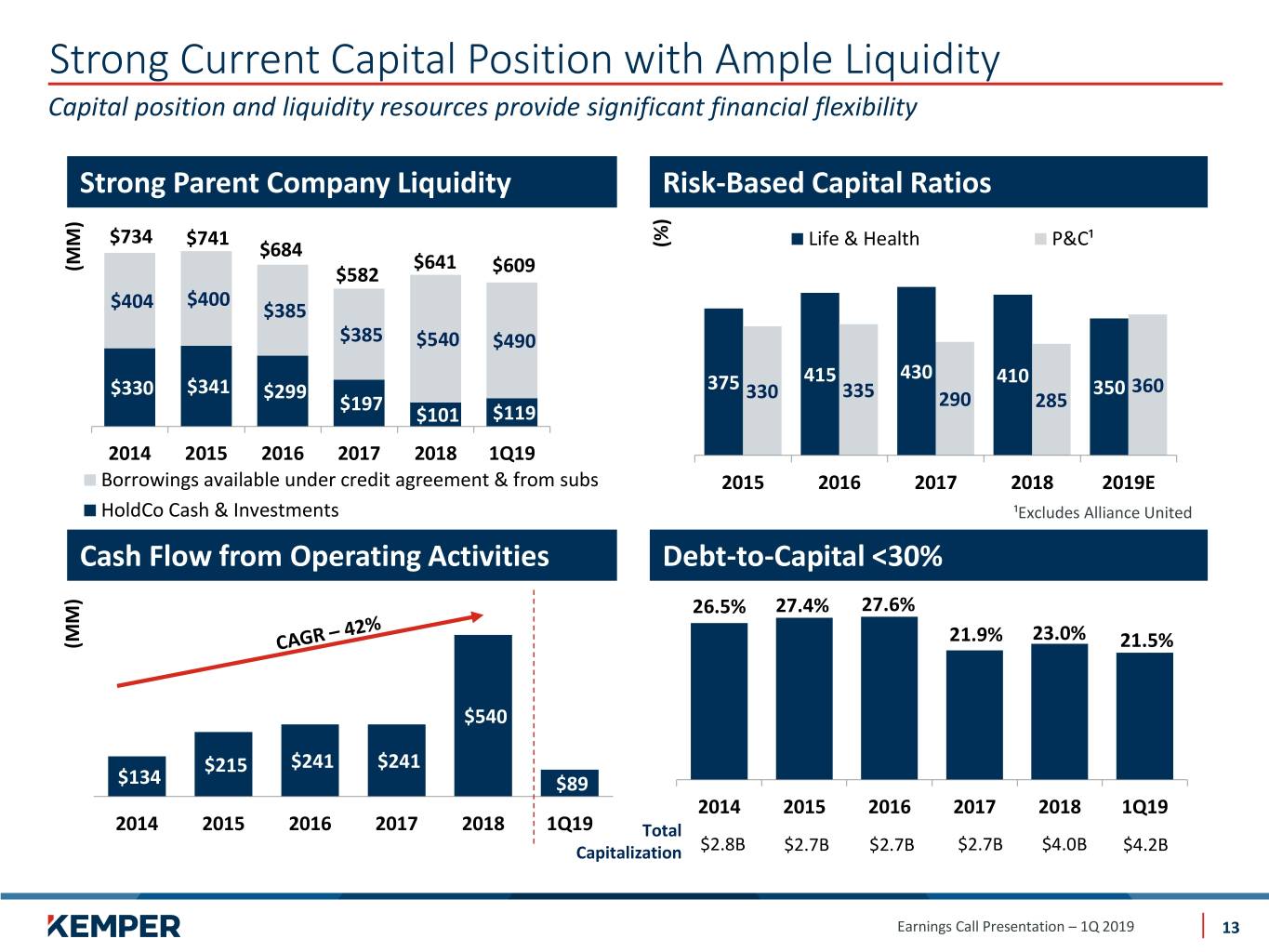

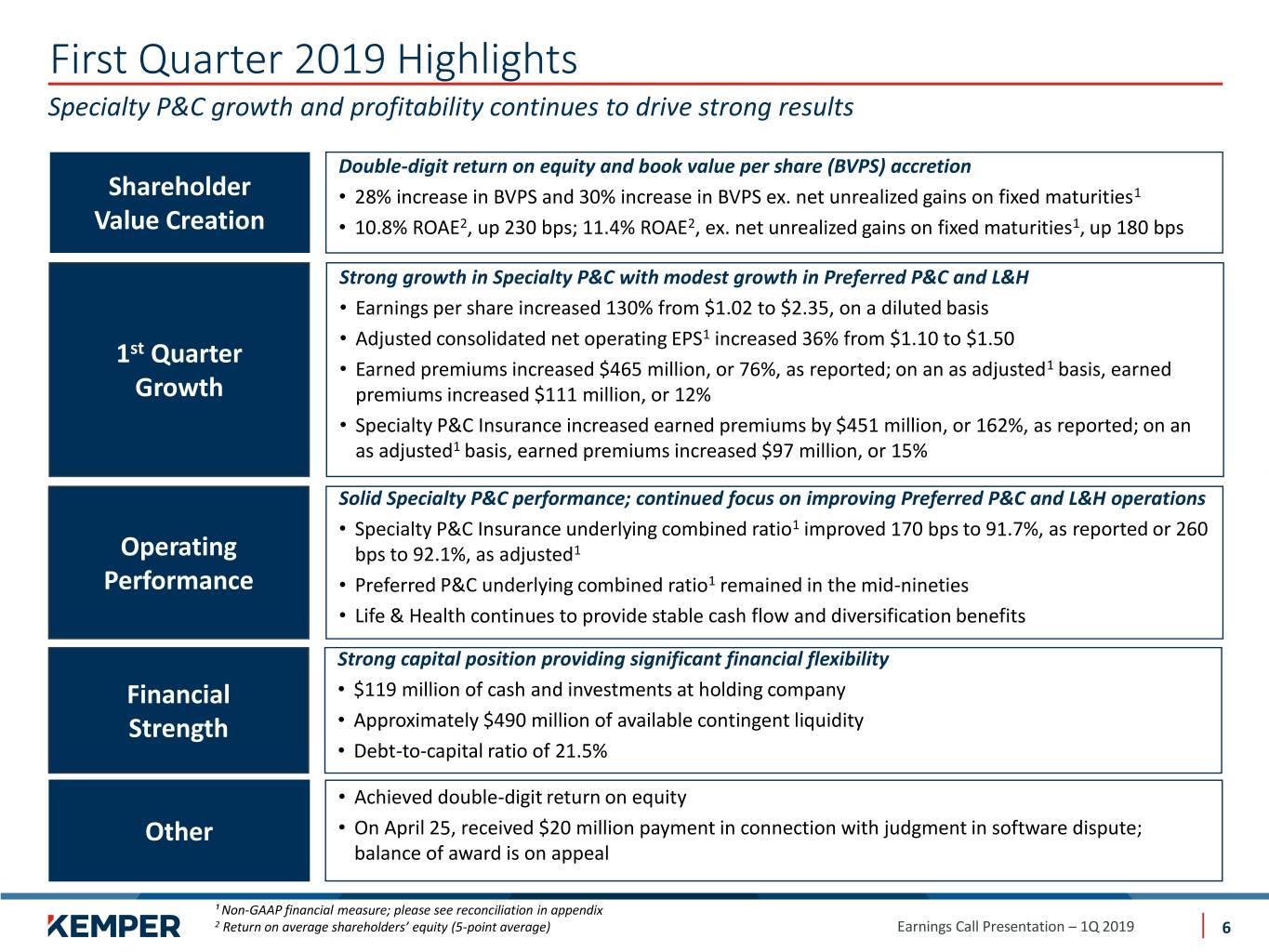

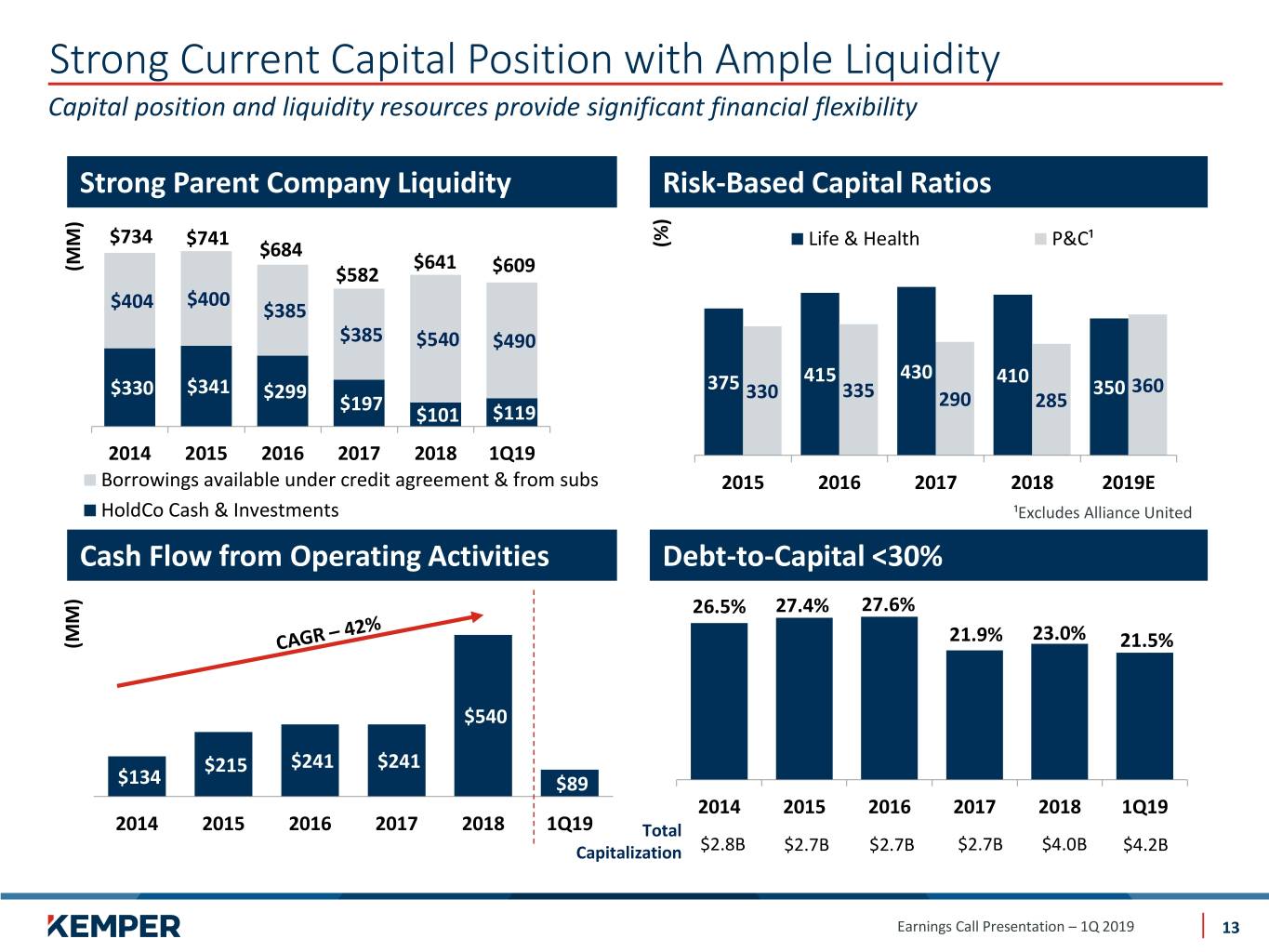

First Quarter 2019 Highlights Specialty P&C growth and profitability continues to drive strong results Double-digit return on equity and book value per share (BVPS) accretion Shareholder • 28% increase in BVPS and 30% increase in BVPS ex. net unrealized gains on fixed maturities1 Value Creation • 10.8% ROAE2, up 230 bps; 11.4% ROAE2, ex. net unrealized gains on fixed maturities1, up 180 bps Strong growth in Specialty P&C with modest growth in Preferred P&C and L&H • Earnings per share increased 130% from $1.02 to $2.35, on a diluted basis • Adjusted consolidated net operating EPS1 increased 36% from $1.10 to $1.50 1st Quarter • Earned premiums increased $465 million, or 76%, as reported; on an as adjusted1 basis, earned Growth premiums increased $111 million, or 12% • Specialty P&C Insurance increased earned premiums by $451 million, or 162%, as reported; on an as adjusted1 basis, earned premiums increased $97 million, or 15% Solid Specialty P&C performance; continued focus on improving Preferred P&C and L&H operations • Specialty P&C Insurance underlying combined ratio1 improved 170 bps to 91.7%, as reported or 260 Operating bps to 92.1%, as adjusted1 Performance • Preferred P&C underlying combined ratio1 remained in the mid-nineties • Life & Health continues to provide stable cash flow and diversification benefits Strong capital position providing significant financial flexibility Financial • $119 million of cash and investments at holding company Strength • Approximately $490 million of available contingent liquidity • Debt-to-capital ratio of 21.5% • Achieved double-digit return on equity Other • On April 25, received $20 million payment in connection with judgment in software dispute; balance of award is on appeal ¹ Non-GAAP financial measure; please see reconciliation in appendix 2 Return on average shareholders’ equity (5-point average) Earnings Call Presentation – 1Q 2019 6

First Quarter Highlights Continued execution of strategy yielding strong results As Adjusted As Reported for Acquisition (1) Quarter Ended Quarter Ended (Dollars in millions, except per share amounts) Change Change Mar 31, from 1Q’18 Mar 31, from 1Q’18 2019 (%) 2019 (%) Earned Premiums $1,075 76.3% $1,075 11.5% Net Investment Income $83 4.4% $83 (7.1%) Net Income $155 188.7% $153 107.3% Adjusted Consolidated Net Operating Income (1) $99 72.0% $97 19.1% Per Share Net Income - Diluted $2.35 130.4% $2.32 105.3% Adj. Consolidated Net Operating Income - Diluted (1) $1.50 36.4% $1.46 17.7% Book Value Per Share (BVPS) $51.13 27.7% BVPS Ex. Unrealized Gains on Fixed Maturities(1) $47.41 30.4% 72% increase in adjusted consolidated net operating income, as reported; 19%, as adjusted1, leading to 30% accretion in BVPS ex. unrealized gains on fixed maturities 1 Non-GAAP financial measure; see reconciliation in appendix Earnings Call Presentation – 1Q 2019 7

Operating Performance Continued strong operating income coupled with market recovery of equity & convertible securities Three Months Ended, As Reported Dollars per Unrestricted Share - Diluted Mar. 31, Dec. 31, Sep. 30, Jun. 30, Mar. 31, Variance 2019 2018 2018 2018 2018 QoQ Income from Continuing Operations $ 2.35 $ 0.08 $ 1.40 $ 0.73 $ 1.02 1.33 (Income) Loss from Change in FV of Equity & Convertible Securities (0.77) 0.92 (0.13) (0.01) (0.01) (0.76) Investment Related (Gains)/Losses1 (0.19) (0.20) (0.04) (0.06) (0.04) (0.15) Net Impairment Losses 0.04 0.02 0.02 - 0.01 0.03 Acquisition Related Transaction, Integration & Other Costs 0.07 0.09 0.34 0.04 0.12 (0.05) Adj. Consolidated Net Operating Income2 1.50 0.91 1.59 0.70 1.10 0.40 Sources of Volatility: Income (Loss) After-Tax From: Catastrophes (0.21) (0.30) (0.24) (0.66) (0.12) (0.09) - Prior-year Reserve Development 0.22 0.05 0.04 (0.05) 0.02 0.20 - Alternative Investment Income (0.01) 0.08 0.16 0.10 0.17 (0.18) - Tax Reform - - 0.40 - - - Partial Satisfaction of Judgment - - 0.43 - - - Impact of Purchase Accounting 0.03 (0.31) (0.61) - - 0.03 Total from Sources of Volatility $ 0.03 $ (0.48) $ 0.18 $ (0.61) $ 0.07 $ (0.04) 36% increase in adjusted consolidated net operating income per diluted share2 ¹ Includes net realized gains on sales of investments and net impairment losses recognized in earnings 2 Non-GAAP financial measure; see reconciliation in appendix Earnings Call Presentation – 1Q 2019 8

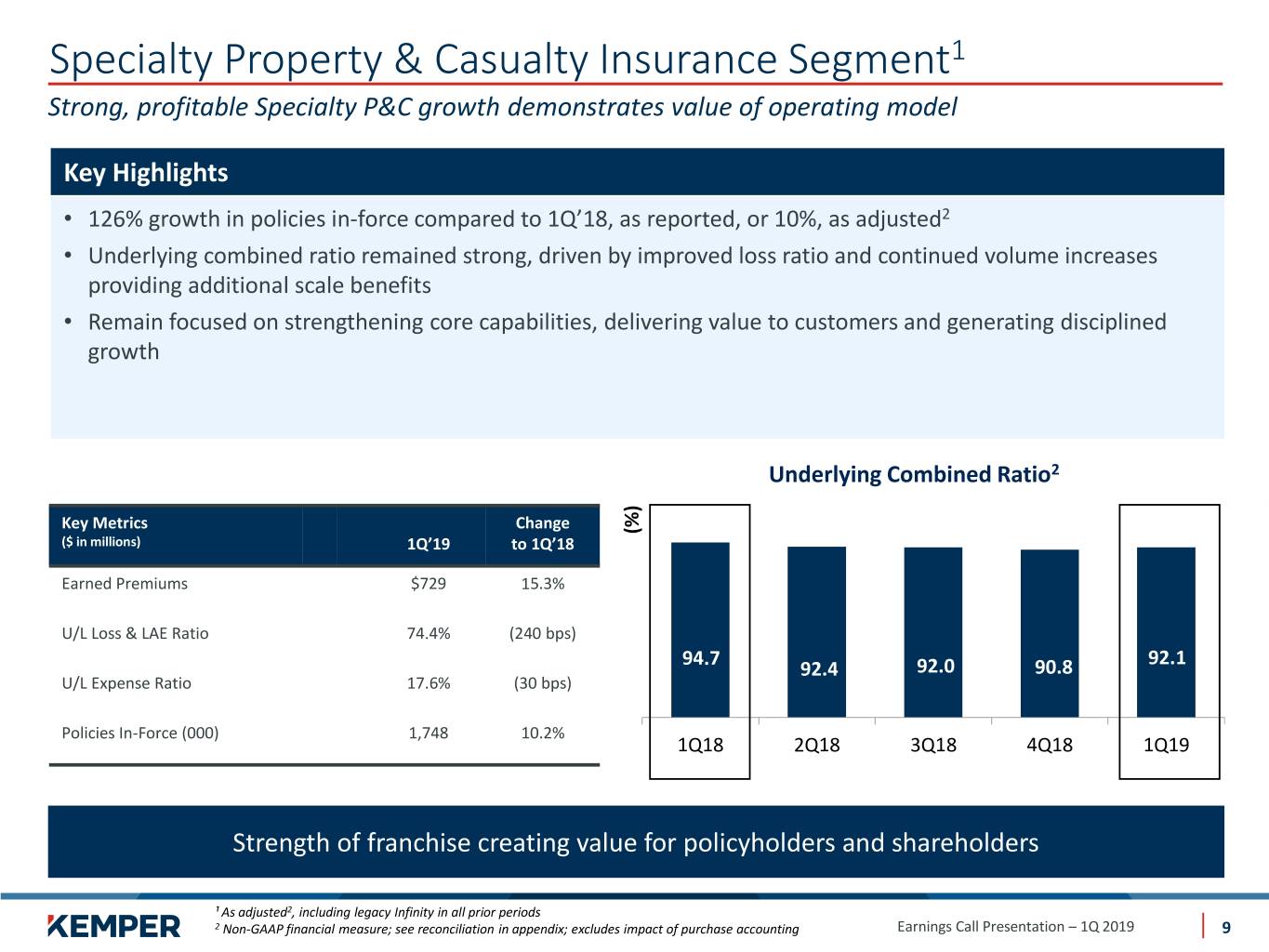

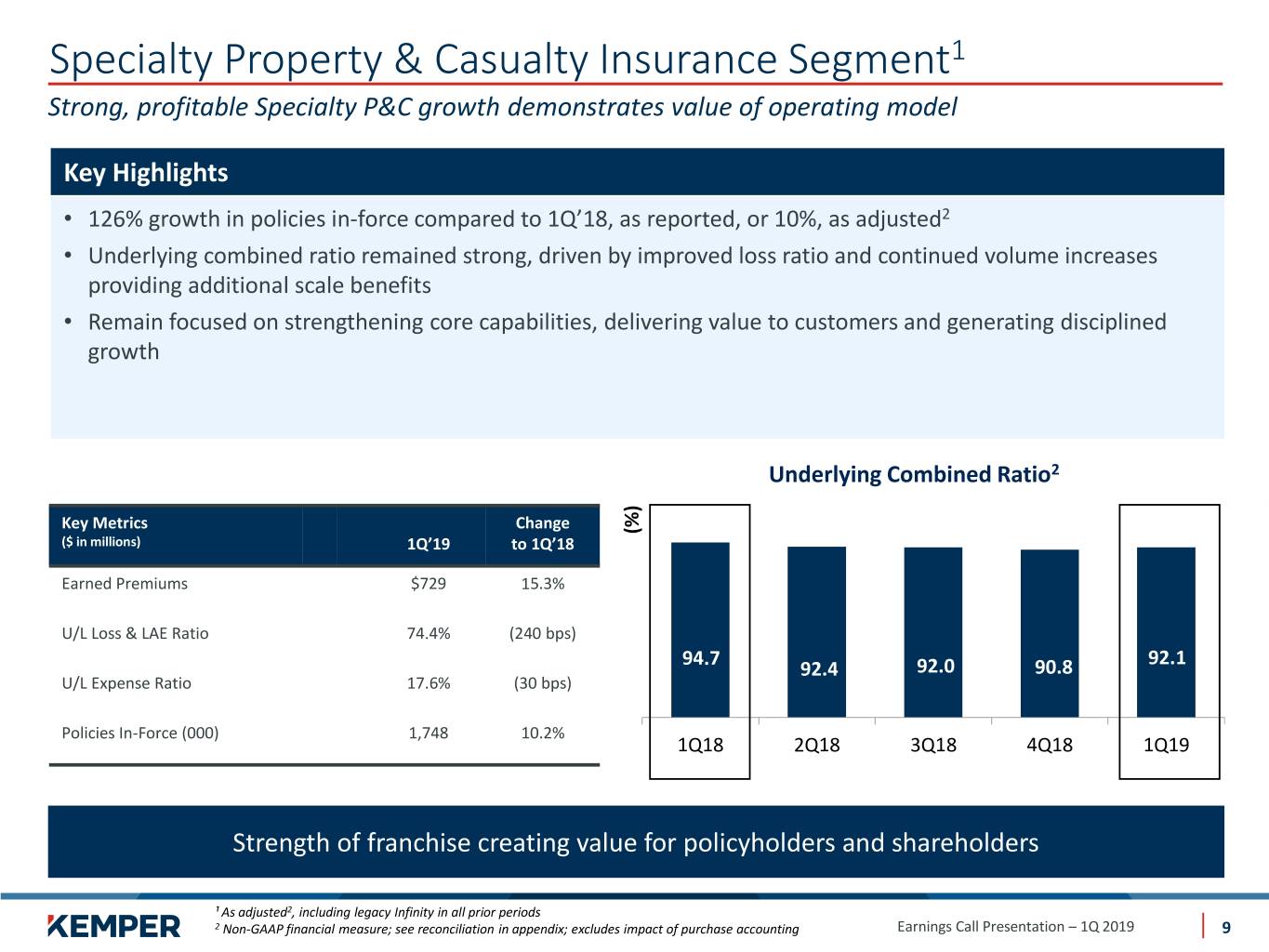

Specialty Property & Casualty Insurance Segment1 Strong, profitable Specialty P&C growth demonstrates value of operating model Key Highlights • 126% growth in policies in-force compared to 1Q’18, as reported, or 10%, as adjusted2 • Underlying combined ratio remained strong, driven by improved loss ratio and continued volume increases providing additional scale benefits • Remain focused on strengthening core capabilities, delivering value to customers and generating disciplined growth Underlying Combined Ratio2 Key Metrics Change (%) ($ in millions) 1Q’19 to 1Q’18 Earned Premiums $729 15.3% U/L Loss & LAE Ratio 74.4% (240 bps) 94.7 92.1 92.4 92.0 90.8 U/L Expense Ratio 17.6% (30 bps) Policies In-Force (000) 1,748 10.2% 1Q18 2Q18 3Q18 4Q18 1Q19 Strength of franchise creating value for policyholders and shareholders ¹ As adjusted2, including legacy Infinity in all prior periods 2 Non-GAAP financial measure; see reconciliation in appendix; excludes impact of purchase accounting Earnings Call Presentation – 1Q 2019 9

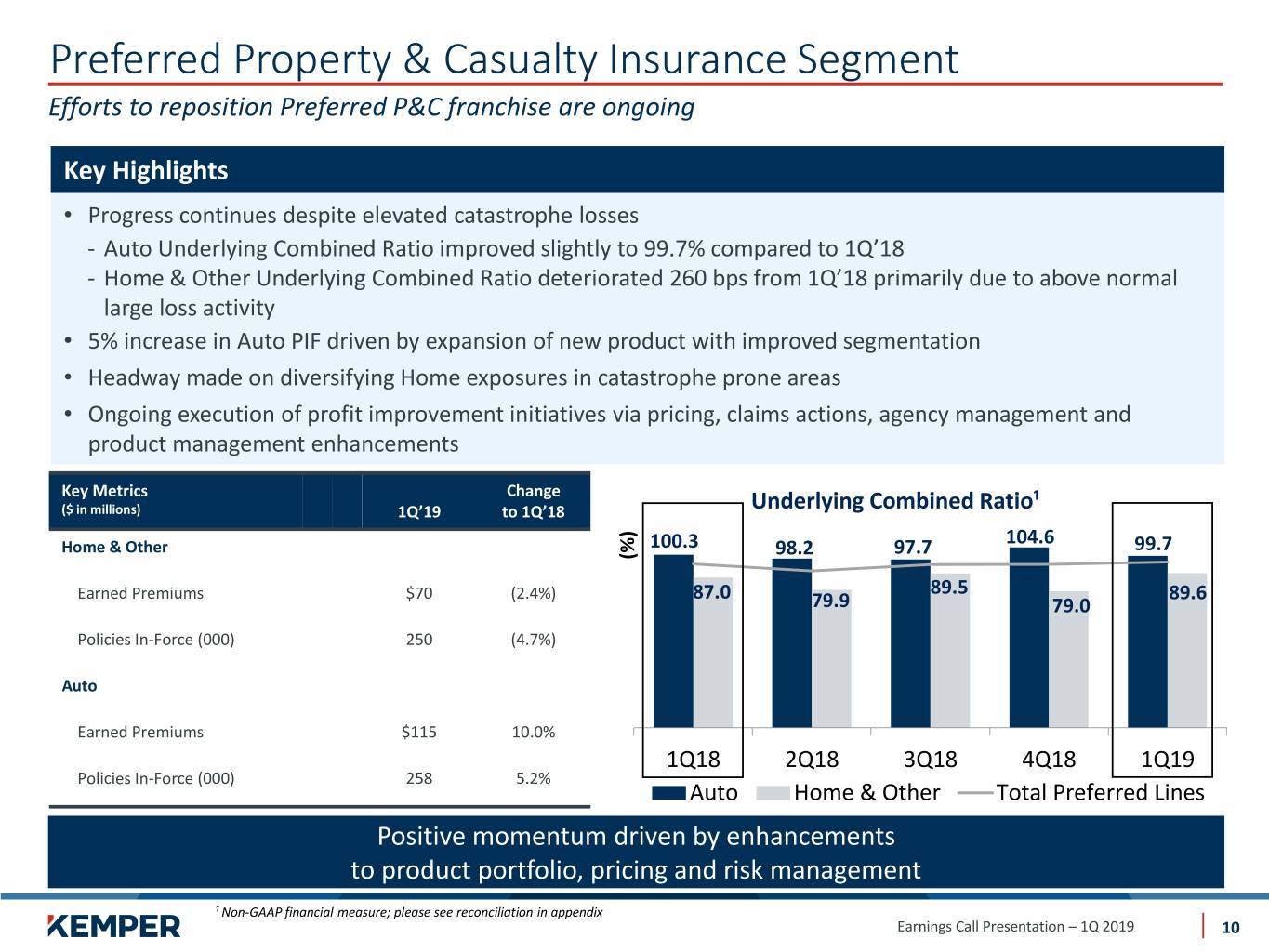

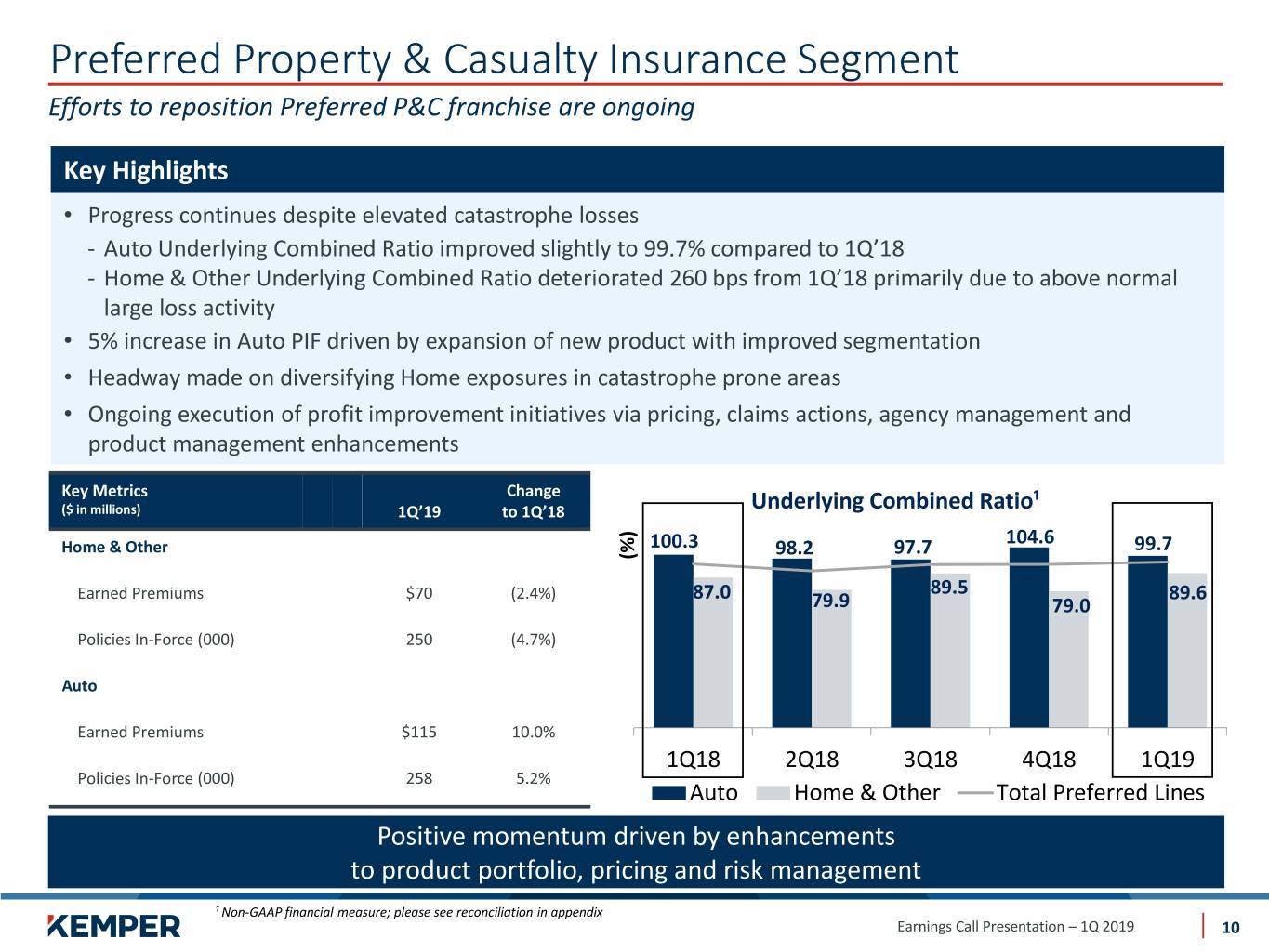

Preferred Property & Casualty Insurance Segment Efforts to reposition Preferred P&C franchise are ongoing Key Highlights • Progress continues despite elevated catastrophe losses - Auto Underlying Combined Ratio improved slightly to 99.7% compared to 1Q’18 - Home & Other Underlying Combined Ratio deteriorated 260 bps from 1Q’18 primarily due to above normal large loss activity • 5% increase in Auto PIF driven by expansion of new product with improved segmentation • Headway made on diversifying Home exposures in catastrophe prone areas • Ongoing execution of profit improvement initiatives via pricing, claims actions, agency management and product management enhancements Key Metrics Change ($ in millions) 1Q’19 to 1Q’18 Underlying Combined Ratio¹ 104.6 Home & Other 100.3 97.7 99.7 (%) 98.2 Earned Premiums $70 (2.4%) 87.0 89.5 89.6 79.9 79.0 Policies In-Force (000) 250 (4.7%) Auto Earned Premiums $115 10.0% 1Q18 2Q18 3Q18 4Q18 1Q19 Policies In-Force (000) 258 5.2% Auto Home & Other Total Preferred Lines Positive momentum driven by enhancements to product portfolio, pricing and risk management ¹ Non-GAAP financial measure; please see reconciliation in appendix Earnings Call Presentation – 1Q 2019 10

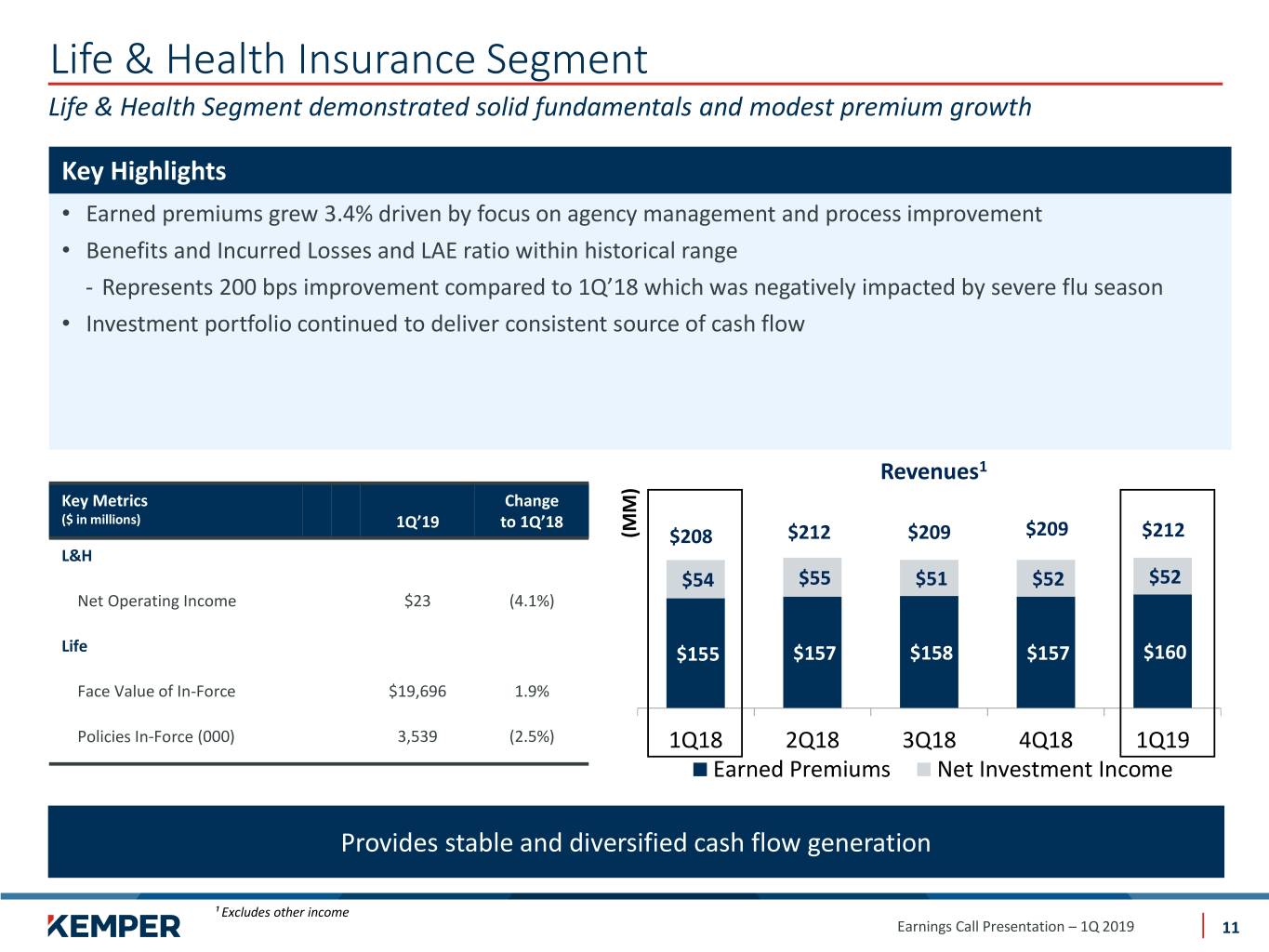

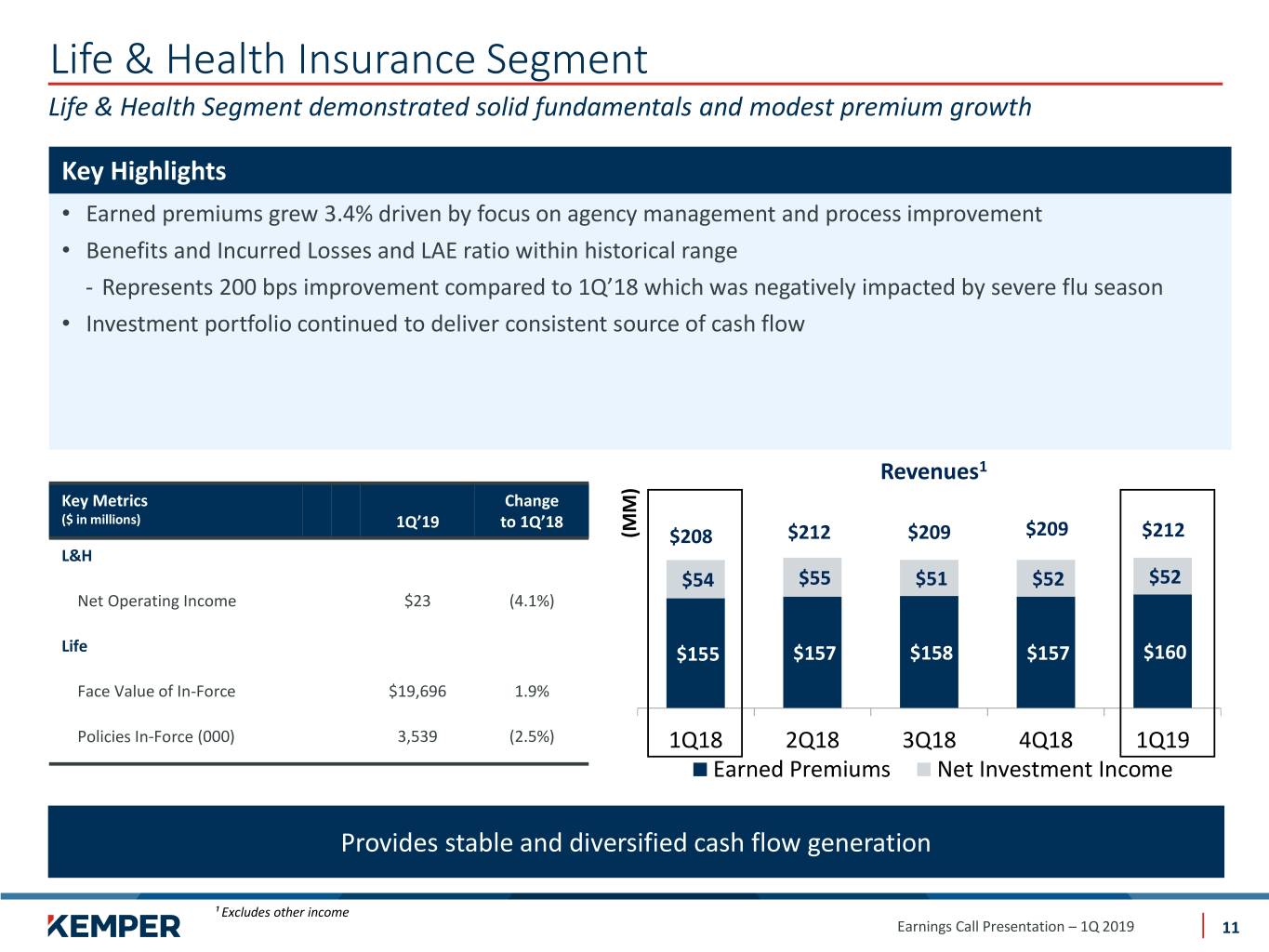

Life & Health Insurance Segment Life & Health Segment demonstrated solid fundamentals and modest premium growth Key Highlights • Earned premiums grew 3.4% driven by focus on agency management and process improvement • Benefits and Incurred Losses and LAE ratio within historical range - Represents 200 bps improvement compared to 1Q’18 which was negatively impacted by severe flu season • Investment portfolio continued to deliver consistent source of cash flow Revenues1 Key Metrics Change ($ in millions) 1Q’19 to 1Q’18 (MM) $208 $212 $209 $209 $212 L&H $54 $55 $51 $52 $52 Net Operating Income $23 (4.1%) Life $155 $157 $158 $157 $160 Face Value of In-Force $19,696 1.9% Policies In-Force (000) 3,539 (2.5%) 1Q18 2Q18 3Q18 4Q18 1Q19 Earned Premiums Net Investment Income Provides stable and diversified cash flow generation ¹ Excludes other income Earnings Call Presentation – 1Q 2019 11

Consistent Portfolio Returns: High Quality & Diversified Stable Net Investment Income Overview • Increase in core portfolio investment $79 $78 $92 $91 $83 income primarily from the addition of (MM) $13 $7 Infinity’s portfolio and organic growth $11 $7 $85 $84 • Alternative investment income produced a $72 $79 $68 loss of $1 million primarily due to underperformance of three funds 1Q18 2Q18 3Q18 4Q18 1Q19 Alternative Investment Portfolio Core Portfolio Diversified & Highly-Rated Portfolio Pre-Tax Equiv. Annualized Book Yield Portfolio Composition Fixed Maturity Ratings Other ≤ CCC Short-term B / BB 1 Alternatives¹ 5% Corporates 4% 5.0% 5.0% 5.2% Equity¹ 5% 4.6% 4.2% 6% 6% 3% 27% 10% 50% U.S. BBB 1Q18 2Q18 3Q18 4Q18 1Q19 Gov’t 65% • Lower yield primarily due to decrease in 20% A or Higher States/ alternative performance and mix shift from Munis addition of Infinity portfolio $8.5 Billion $6.6 Billion ¹ Equity Securities excludes $211 million of Other Equity Interests of LP/LLC’s that have been reclassified into Alternative Investments and excludes $230 million Bond ETF that has been reclassified into Corporates Earnings Call Presentation – 1Q 2019 12

Strong Current Capital Position with Ample Liquidity Capital position and liquidity resources provide significant financial flexibility Strong Parent Company Liquidity Risk-Based Capital Ratios $734 $741 (%) Life & Health P&C¹ $684 (MM) $641 $582 $609 $400 $404 $385 $385 $540 $490 415 430 410 $330 $341 $299 375 330 335 350 360 $197 290 285 $101 $119 2014 2015 2016 2017 2018 1Q19 Borrowings available under credit agreement & from subs 2015 2016 2017 2018 2019E HoldCo Cash & Investments ¹Excludes Alliance United Cash Flow from Operating Activities Debt-to-Capital <30% 26.5% 27.4% 27.6% 21.9% 23.0% (MM) 21.5% Debt $540 $215 $241 $241 $134 $89 2014 2015 2016 2017 2018 1Q19 2014 2015 2016 2017 2018 1Q19 Total Capitalization $2.8B $2.7B $2.7B $2.7B $4.0B $4.2B Earnings Call Presentation – 1Q 2019 13

Initiated Operating Leverage Program Capital-efficient avenue to increase earnings and enhance shareholder value Operating Leverage Program • Access collateralized advances to invest in high-quality assets • Generate stable, risk-adjusted net investment income • Program is designed to provide enhanced ability and flexibility to deploy float • Enables Company the ability to take advantage of inefficient market pricing • Common tool utilized by Life and P&C insurance companies Financial & Capital Impacts • 1Q’19 Advances: - $187.7 million • Financial Impact: - Increases net investment income • Capital Treatment: - GAAP: excluded from short- and long-term debt - GAAP: no impact to capital ratios - No impact to bank debt covenants - Favorable rating agency capital treatment Further evidence of management’s operational focus to drive long-term shareholder value Earnings Call Presentation – 1Q 2019 14

Appendix Earnings Call Presentation – 1Q 2019 15

Capital Deployment Priorities Dedicated to being good stewards of capital 1. Investment in the business • Fund profitable organic growth at appropriate risk-adjusted returns • Strategic investments and acquisitions that enhance our business and meet or exceed our ROE targets over time 2. Return capital to shareholders • Repurchase shares opportunistically • Maintain competitive dividends Capital deployment and management focused on maximizing shareholder value Earnings Call Presentation – 1Q 2019 16

2019 Reinsurance Program Aggregate stop-loss program intended to reduce volatility from high-frequency, low-severity events Catastrophe Reinsurance Program (Multi-Year) Aggregate Catastrophe Program • Same coverage as 2018 program • Coverage – $50 million in excess of $60 million – $500k deductible per storm – Perils: All perils, excluding named storms (e.g., hurricanes) and earthquakes – Covered Line: Preferred homeowners (excludes dwelling fire) 2019 Aggregate Catastrophe Reinsurance Program • Policy placed at 1/1/19 similar to prior two years – Added $25 million excess of $250 million layer for 1-year term • Total coverage: 95% of $225 million excess of $50 million Earnings Call Presentation – 1Q 2019 17

Non-GAAP Financial Measures Book Value Per Share Excluding Net Unrealized Gains on Fixed Maturities is a ratio that uses a non-GAAP financial measure. It is calculated by dividing shareholders’ equity after excluding the after-tax impact of net unrealized gains on fixed income securities by total Common Shares Issued and Outstanding. Book value per share is the most directly comparable GAAP financial measure. The Company uses the trend in book value per share, excluding the after-tax impact of net unrealized gains on fixed income securities in conjunction with book value per share to identify and analyze the change in net worth attributable to management efforts between periods. The Company believes the non-GAAP financial measure is useful to investors because it eliminates the effect of items that can fluctuate significantly from period to period and are generally driven by economic developments, primarily capital market conditions, the magnitude and timing of which are generally not influenced by management. The Company believes it enhances understanding and comparability of performance by highlighting underlying business activity and profitability drivers. For the Periods Ended Mar. 31, 2019 Mar. 31, 2018 Book Value Per Share $ 51.13 $ 40.05 Less: Net Unrealized Gains on Fixed Maturities Per Share (3.72) (3.70) Book Value Per Share Excluding Net Unrealized Gains on Fixed Maturities $ 47.41 $ 36.35 Earnings Call Presentation – 1Q 2019 18

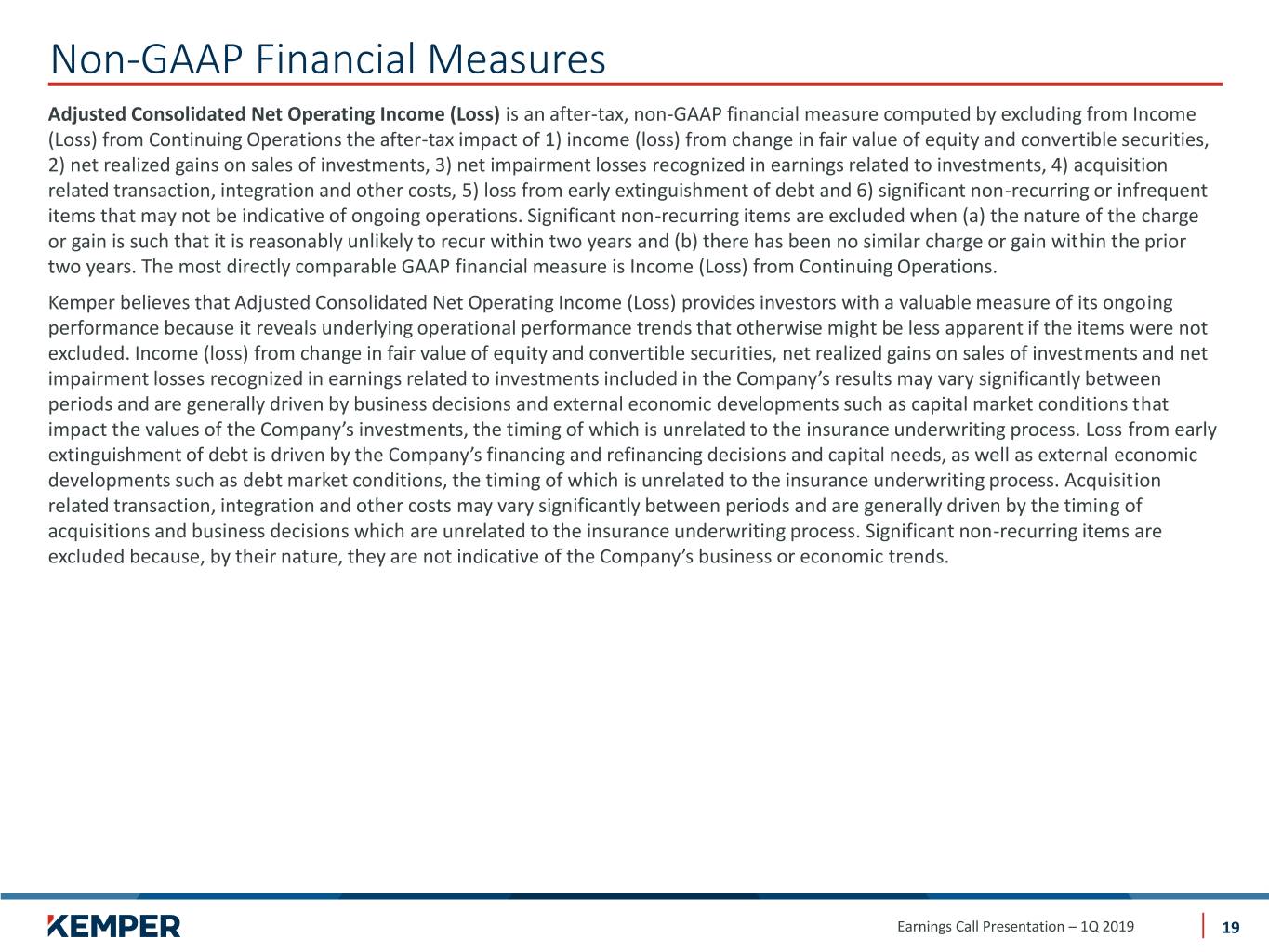

Non-GAAP Financial Measures Adjusted Consolidated Net Operating Income (Loss) is an after-tax, non-GAAP financial measure computed by excluding from Income (Loss) from Continuing Operations the after-tax impact of 1) income (loss) from change in fair value of equity and convertible securities, 2) net realized gains on sales of investments, 3) net impairment losses recognized in earnings related to investments, 4) acquisition related transaction, integration and other costs, 5) loss from early extinguishment of debt and 6) significant non-recurring or infrequent items that may not be indicative of ongoing operations. Significant non-recurring items are excluded when (a) the nature of the charge or gain is such that it is reasonably unlikely to recur within two years and (b) there has been no similar charge or gain within the prior two years. The most directly comparable GAAP financial measure is Income (Loss) from Continuing Operations. Kemper believes that Adjusted Consolidated Net Operating Income (Loss) provides investors with a valuable measure of its ongoing performance because it reveals underlying operational performance trends that otherwise might be less apparent if the items were not excluded. Income (loss) from change in fair value of equity and convertible securities, net realized gains on sales of investments and net impairment losses recognized in earnings related to investments included in the Company’s results may vary significantly between periods and are generally driven by business decisions and external economic developments such as capital market conditions that impact the values of the Company’s investments, the timing of which is unrelated to the insurance underwriting process. Loss from early extinguishment of debt is driven by the Company’s financing and refinancing decisions and capital needs, as well as external economic developments such as debt market conditions, the timing of which is unrelated to the insurance underwriting process. Acquisition related transaction, integration and other costs may vary significantly between periods and are generally driven by the timing of acquisitions and business decisions which are unrelated to the insurance underwriting process. Significant non-recurring items are excluded because, by their nature, they are not indicative of the Company’s business or economic trends. Earnings Call Presentation – 1Q 2019 19

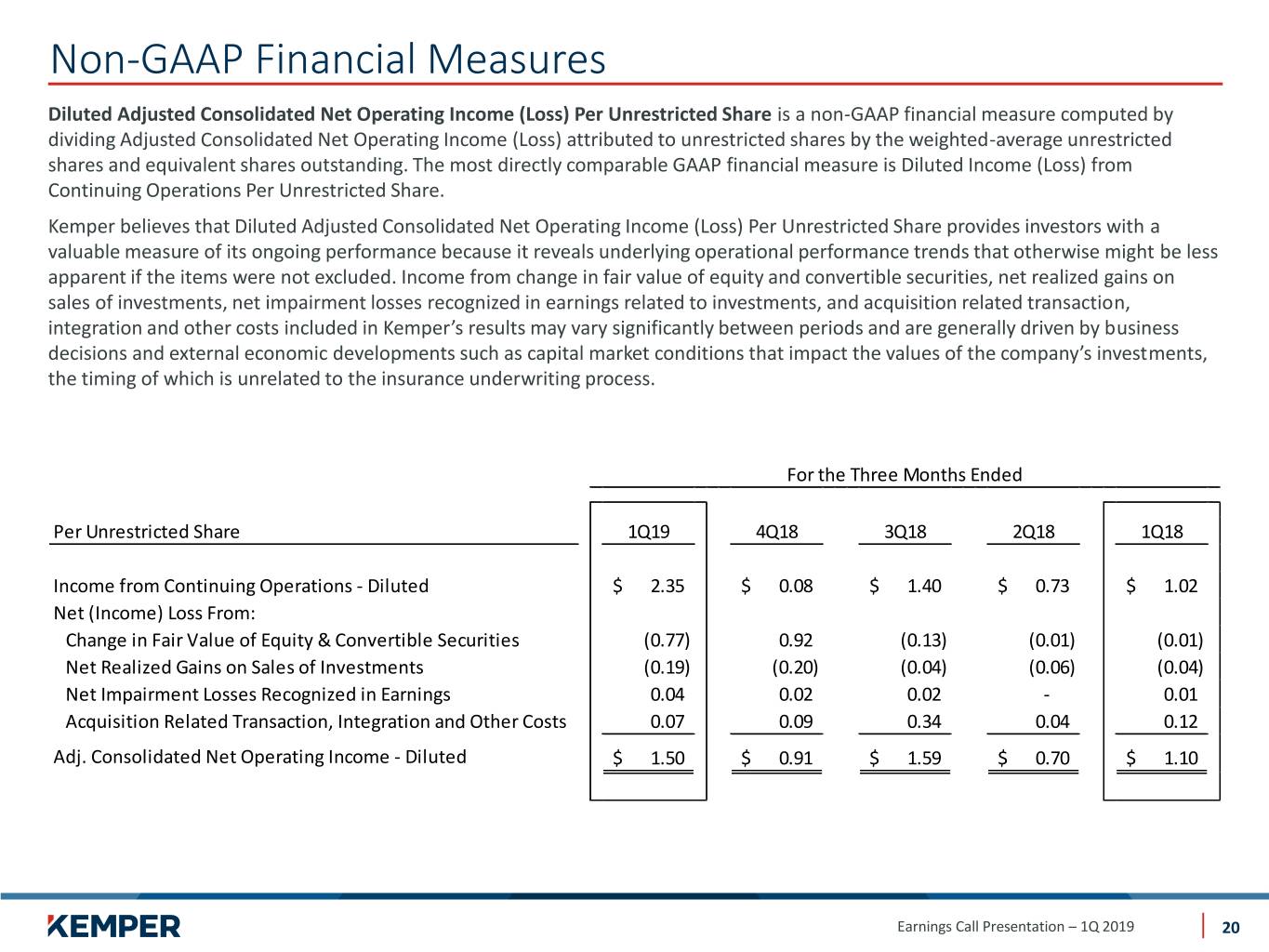

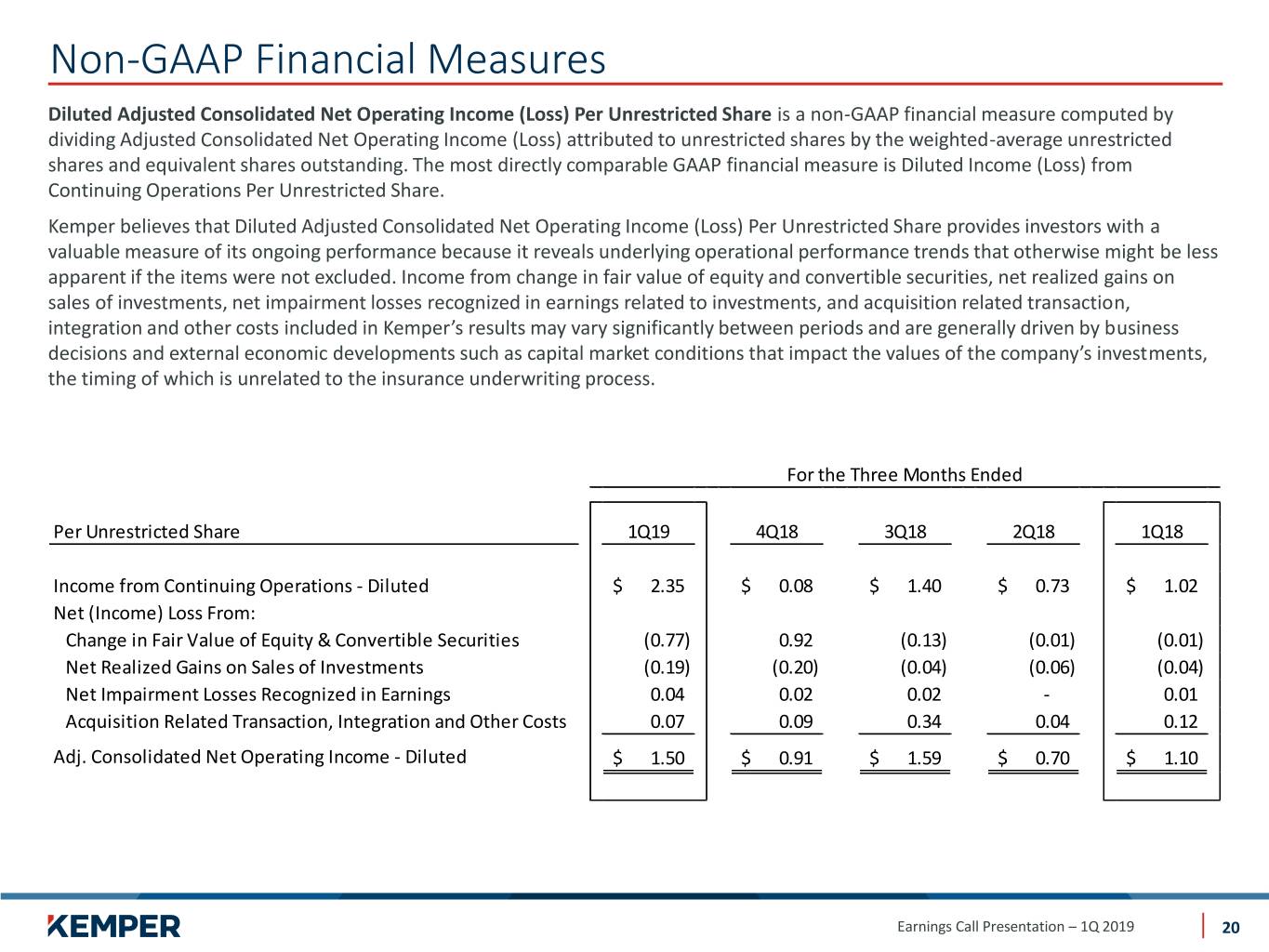

Non-GAAP Financial Measures Diluted Adjusted Consolidated Net Operating Income (Loss) Per Unrestricted Share is a non-GAAP financial measure computed by dividing Adjusted Consolidated Net Operating Income (Loss) attributed to unrestricted shares by the weighted-average unrestricted shares and equivalent shares outstanding. The most directly comparable GAAP financial measure is Diluted Income (Loss) from Continuing Operations Per Unrestricted Share. Kemper believes that Diluted Adjusted Consolidated Net Operating Income (Loss) Per Unrestricted Share provides investors with a valuable measure of its ongoing performance because it reveals underlying operational performance trends that otherwise might be less apparent if the items were not excluded. Income from change in fair value of equity and convertible securities, net realized gains on sales of investments, net impairment losses recognized in earnings related to investments, and acquisition related transaction, integration and other costs included in Kemper’s results may vary significantly between periods and are generally driven by business decisions and external economic developments such as capital market conditions that impact the values of the company’s investments, the timing of which is unrelated to the insurance underwriting process. For the Three Months Ended Per Unrestricted Share 1Q19 4Q18 3Q18 2Q18 1Q18 Income from Continuing Operations - Diluted $ 2.35 $ 0.08 $ 1.40 $ 0.73 $ 1.02 Net (Income) Loss From: Change in Fair Value of Equity & Convertible Securities (0.77) 0.92 (0.13) (0.01) (0.01) Net Realized Gains on Sales of Investments (0.19) (0.20) (0.04) (0.06) (0.04) Net Impairment Losses Recognized in Earnings 0.04 0.02 0.02 - 0.01 Acquisition Related Transaction, Integration and Other Costs 0.07 0.09 0.34 0.04 0.12 Adj. Consolidated Net Operating Income - Diluted $ 1.50 $ 0.91 $ 1.59 $ 0.70 $ 1.10 Earnings Call Presentation – 1Q 2019 20

Non-GAAP Financial Measures Underlying Combined Ratio is a non-GAAP financial measure. It is computed by adding the Current Year Non-catastrophe Losses and LAE Ratio with the Insurance Expense Ratio. The most directly comparable GAAP financial measure is the Combined Ratio, which is computed by adding total incurred losses and LAE, including the impact of catastrophe losses and loss and LAE reserve development from prior years, with the Insurance Expense Ratio. Kemper believes the underlying combined ratio is useful to investors and is used by management to reveal the trends in the Company’s property and casualty insurance businesses that may be obscured by catastrophe losses and prior-year reserve development. These catastrophe losses cause loss trends to vary significantly between periods as a result of their incidence of occurrence and magnitude, and can have a significant impact on the combined ratio. Prior-year reserve developments are caused by unexpected loss development on historical reserves. Because reserve development relates to the re-estimation of losses from earlier periods, it has no bearing on the performance of our insurance products in the current period. The Company believes it is useful for investors to evaluate these components separately and in the aggregate when reviewing the Company’s underwriting performance. The underlying combined ratio should not be considered a substitute for the combined ratio and does not reflect the overall underwriting profitability of our business. Earnings Call Presentation – 1Q 2019 21

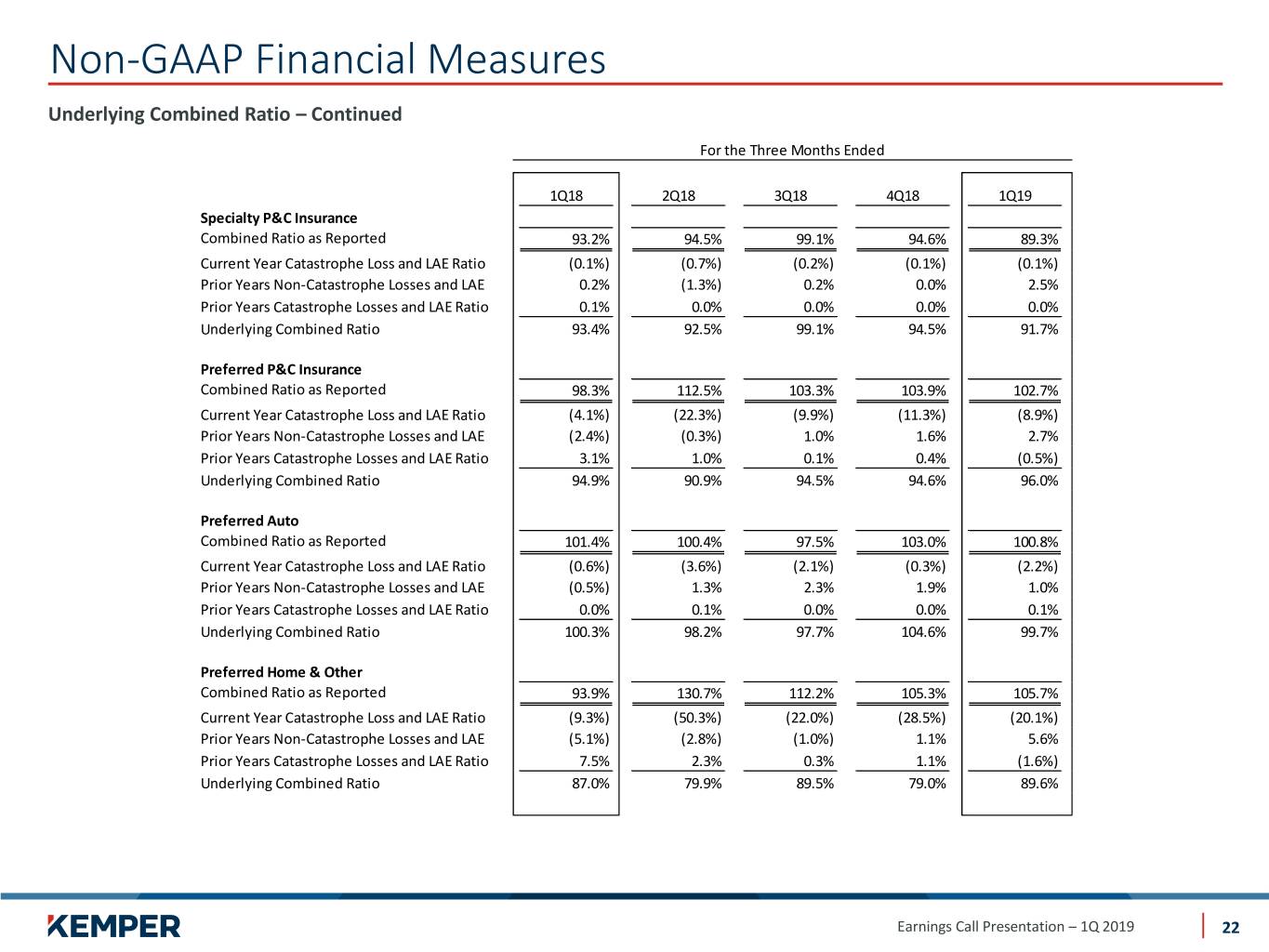

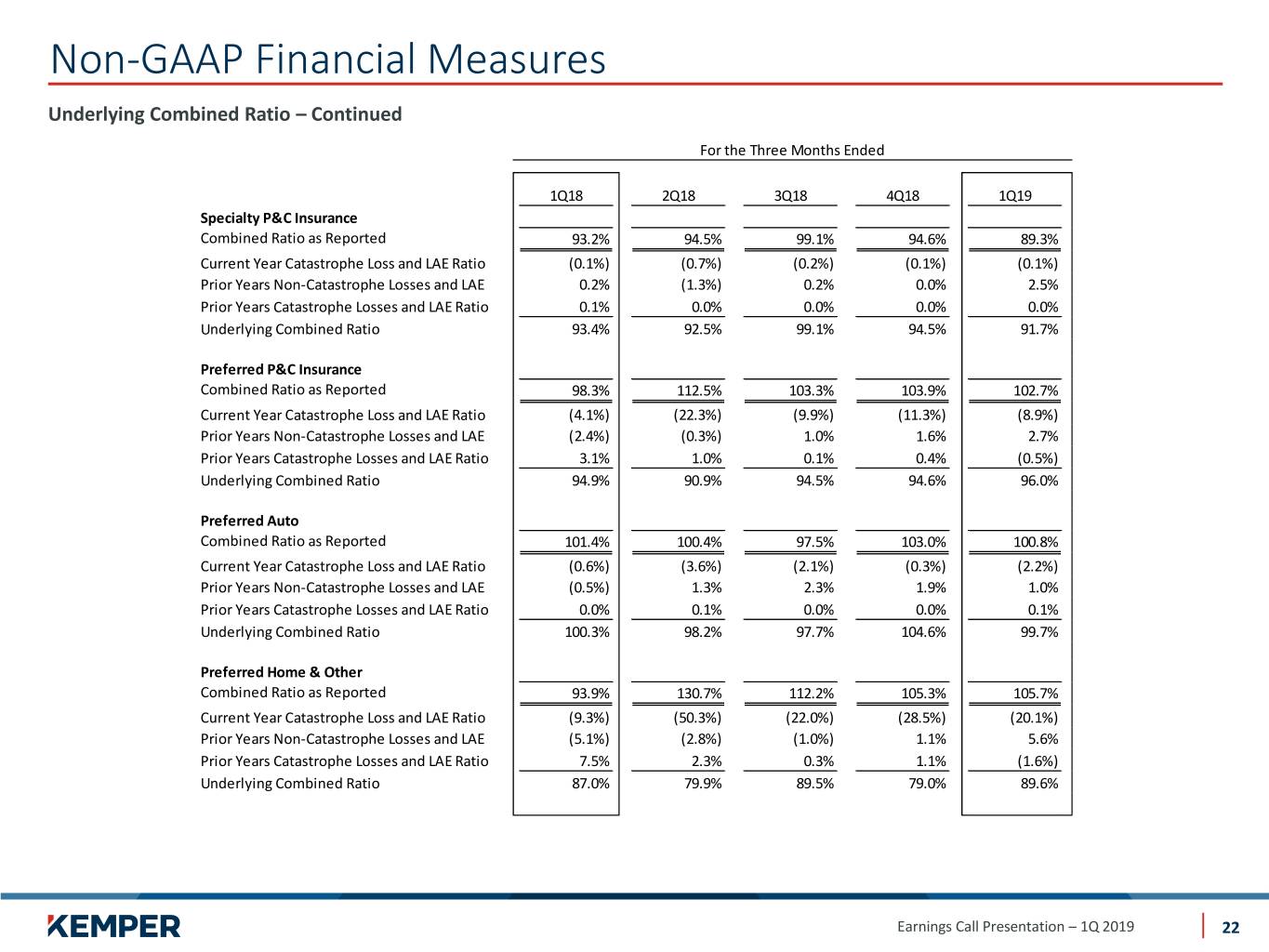

Non-GAAP Financial Measures Underlying Combined Ratio – Continued For the Three Months Ended 1Q18 2Q18 3Q18 4Q18 1Q19 Specialty P&C Insurance Combined Ratio as Reported 93.2% 94.5% 99.1% 94.6% 89.3% Current Year Catastrophe Loss and LAE Ratio (0.1%) (0.7%) (0.2%) (0.1%) (0.1%) Prior Years Non-Catastrophe Losses and LAE 0.2% (1.3%) 0.2% 0.0% 2.5% Prior Years Catastrophe Losses and LAE Ratio 0.1% 0.0% 0.0% 0.0% 0.0% Underlying Combined Ratio 93.4% 92.5% 99.1% 94.5% 91.7% Preferred P&C Insurance Combined Ratio as Reported 98.3% 112.5% 103.3% 103.9% 102.7% Current Year Catastrophe Loss and LAE Ratio (4.1%) (22.3%) (9.9%) (11.3%) (8.9%) Prior Years Non-Catastrophe Losses and LAE (2.4%) (0.3%) 1.0% 1.6% 2.7% Prior Years Catastrophe Losses and LAE Ratio 3.1% 1.0% 0.1% 0.4% (0.5%) Underlying Combined Ratio 94.9% 90.9% 94.5% 94.6% 96.0% Preferred Auto Combined Ratio as Reported 101.4% 100.4% 97.5% 103.0% 100.8% Current Year Catastrophe Loss and LAE Ratio (0.6%) (3.6%) (2.1%) (0.3%) (2.2%) Prior Years Non-Catastrophe Losses and LAE (0.5%) 1.3% 2.3% 1.9% 1.0% Prior Years Catastrophe Losses and LAE Ratio 0.0% 0.1% 0.0% 0.0% 0.1% Underlying Combined Ratio 100.3% 98.2% 97.7% 104.6% 99.7% Preferred Home & Other Combined Ratio as Reported 93.9% 130.7% 112.2% 105.3% 105.7% Current Year Catastrophe Loss and LAE Ratio (9.3%) (50.3%) (22.0%) (28.5%) (20.1%) Prior Years Non-Catastrophe Losses and LAE (5.1%) (2.8%) (1.0%) 1.1% 5.6% Prior Years Catastrophe Losses and LAE Ratio 7.5% 2.3% 0.3% 1.1% (1.6%) Underlying Combined Ratio 87.0% 79.9% 89.5% 79.0% 89.6% Earnings Call Presentation – 1Q 2019 22

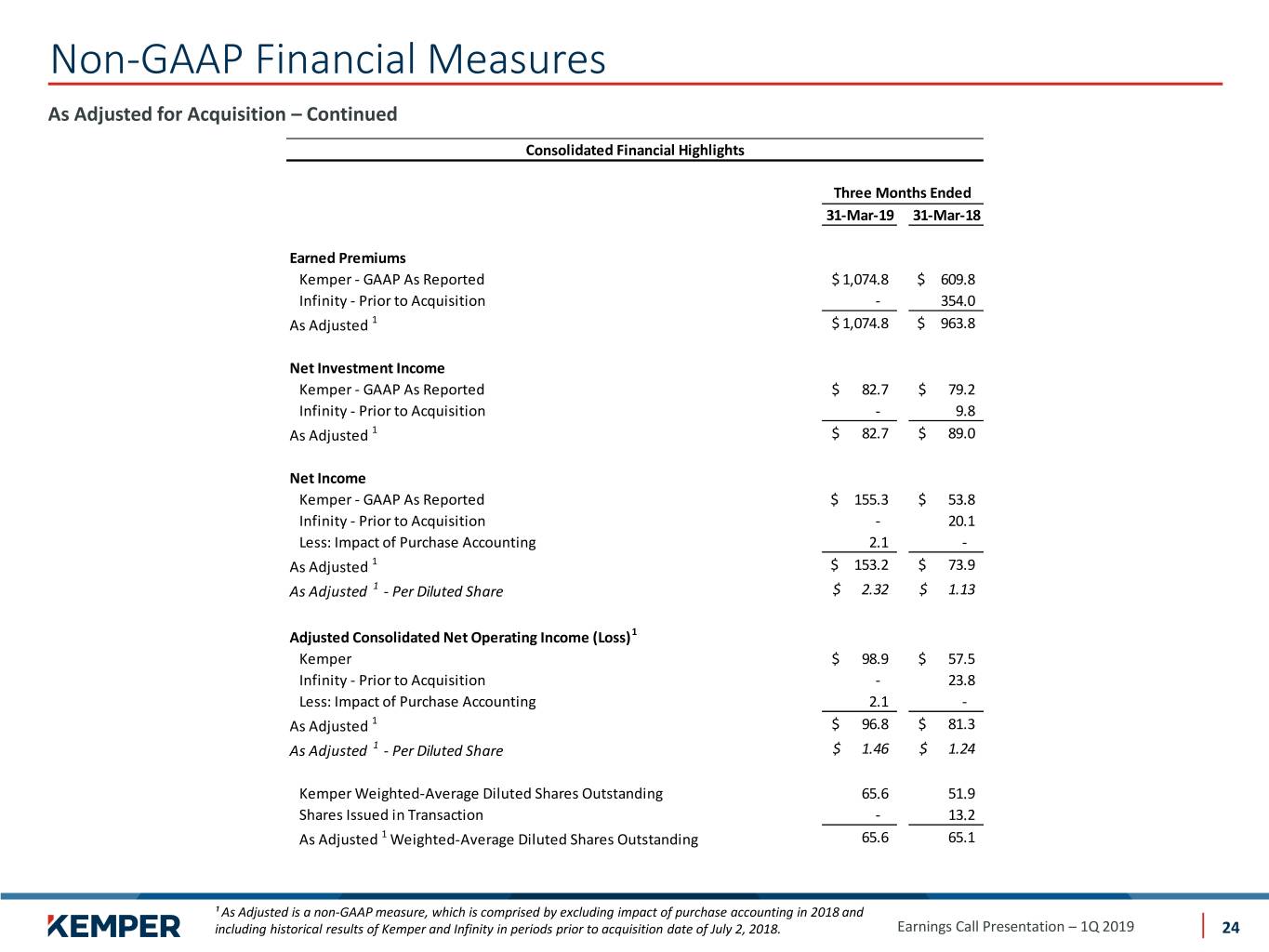

Non-GAAP Financial Measures As Adjusted for Acquisition amounts are non-GAAP financial measures. For the three months ended March 31, 2019, as adjusted amounts are computed by subtracting the impact of purchase accounting adjustments from the comparable consolidated GAAP financial measure reported by Kemper. For the three months ended March 31, 2018, as adjusted amounts are computed by adding the historical results of Infinity reported on a GAAP basis to the comparable consolidated GAAP financial measure reported by Kemper. The Company believes computing and presenting results on an adjusted basis are useful to investors and are used by management to provide meaningful and comparable year-over-year comparisons. Earnings Call Presentation – 1Q 2019 23

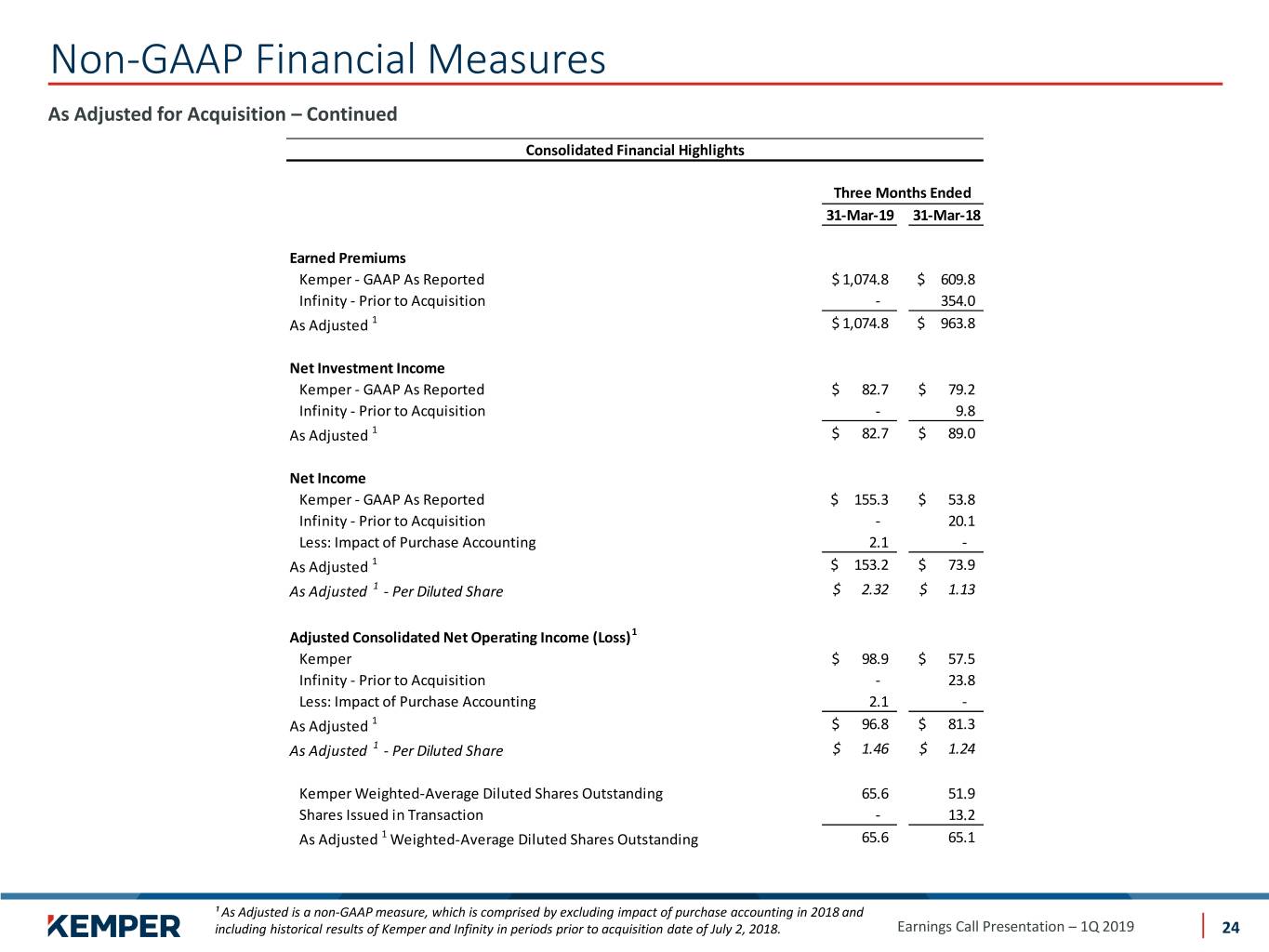

Non-GAAP Financial Measures As Adjusted for Acquisition – Continued Consolidated Financial Highlights Three Months Ended 31-Mar-19 31-Mar-18 Earned Premiums Kemper - GAAP As Reported $ 1,074.8 $ 609.8 Infinity - Prior to Acquisition - 354.0 As Adjusted 1 $ 1,074.8 $ 963.8 Net Investment Income Kemper - GAAP As Reported $ 82.7 $ 79.2 Infinity - Prior to Acquisition - 9.8 As Adjusted 1 $ 82.7 $ 89.0 Net Income Kemper - GAAP As Reported $ 155.3 $ 53.8 Infinity - Prior to Acquisition - 20.1 Less: Impact of Purchase Accounting 2.1 - As Adjusted 1 $ 153.2 $ 73.9 As Adjusted 1 - Per Diluted Share $ 2.32 $ 1.13 Adjusted Consolidated Net Operating Income (Loss)1 Kemper $ 98.9 $ 57.5 Infinity - Prior to Acquisition - 23.8 Less: Impact of Purchase Accounting 2.1 - As Adjusted 1 $ 96.8 $ 81.3 As Adjusted 1 - Per Diluted Share $ 1.46 $ 1.24 Kemper Weighted-Average Diluted Shares Outstanding 65.6 51.9 Shares Issued in Transaction - 13.2 As Adjusted 1 Weighted-Average Diluted Shares Outstanding 65.6 65.1 ¹ As Adjusted is a non-GAAP measure, which is comprised by excluding impact of purchase accounting in 2018 and including historical results of Kemper and Infinity in periods prior to acquisition date of July 2, 2018. Earnings Call Presentation – 1Q 2019 24

Non-GAAP Financial Measures As Adjusted for Acquisition – Continued Specialty P&C Insurance Segment Three Months Ended 31-Mar-19 31-Dec-18 30-Sep-18 30-Jun-18 31-Mar-18 Earned Premiums Kemper Specialty P&C - GAAP As Reported $ 729.3 $ 717.8 $ 711.2 $ 320.0 $ 278.4 Infinity - Prior to Acquisition - - - 374.3 354.0 As Adjusted 1 $ 729.3 $ 717.8 $ 711.2 $ 694.3 $ 632.4 Current Year Non-CAT Losses and LAE Kemper Specialty P&C - GAAP As Reported $ 544.3 $ 530.3 $ 527.6 $ 247.2 $ 212.3 Infinity - Prior to Acquisition - - - 277.4 273.3 Less: Impact of Purchase Accounting Amortization of Fair Value Adjustment to Infinity's Unpaid Loss and LAE 1.5 1.9 2.5 - - As Adjusted 1 $ 542.8 $ 528.4 $ 525.1 $ 524.6 $ 485.6 Insurance Expenses Kemper Specialty P&C - GAAP As Reported $ 124.8 $ 148.0 $ 176.8 $ 49.0 $ 47.9 Infinity - Prior to Acquisition - - - 68.1 65.4 Less: Impact of Purchase Accounting (3.9) 24.5 47.8 - - As Adjusted 1 $ 128.7 $ 123.5 $ 129.0 $ 117.1 $ 113.3 As Adjusted 1 Underlying Combined Ratio As Adjusted 1 Underlying Loss & LAE Ratio 74.4% 73.6% 73.8% 75.6% 76.8% As Adjusted 1 Expense Ratio 17.6% 17.2% 18.1% 16.9% 17.9% As Adjusted 1 Underlying Combined Ratio 92.1% 90.8% 92.0% 92.4% 94.7% ¹ As Adjusted is a non-GAAP measure, which is comprised by excluding impact of purchase accounting in 2018 and including historical results of Kemper and Infinity in periods prior to acquisition date of July 2, 2018. Earnings Call Presentation – 1Q 2019 25

Non-GAAP Financial Measures As Adjusted for Acquisition – Continued Specialty Personal Automobile Insurance Three Months Ended 31-Mar-19 31-Dec-18 30-Sep-18 30-Jun-18 31-Mar-18 Earned Premiums Kemper Specialty P&C - GAAP As Reported $ 669.6 $ 660.5 $ 655.3 $ 307.5 $ 266.2 Infinity - Prior to Acquisition - - - 332.6 314.2 As Adjusted 1 $ 669.6 $ 660.5 $ 655.3 $ 640.1 $ 580.4 Current Year Non-CAT Losses and LAE Kemper Specialty P&C - GAAP As Reported $ 498.8 $ 492.0 $ 485.6 $ 237.8 $ 202.8 Infinity - Prior to Acquisition - - - 244.5 242.3 Less: Impact of Purchase Accounting Amortization of Fair Value Adjustment to Infinity's Unpaid Loss and LAE 1.3 1.5 2.0 - - As Adjusted 1 $ 497.5 $ 490.5 $ 483.6 $ 482.3 $ 445.1 Insurance Expenses Kemper Specialty P&C - GAAP As Reported $ 114.7 $ 132.5 $ 160.8 $ 46.7 $ 45.2 Infinity - Prior to Acquisition - - - 60.8 58.5 Less: Impact of Purchase Accounting (2.5) 21.8 45.1 - - As Adjusted 1 $ 117.2 $ 110.7 $ 115.7 $ 107.5 $ 103.7 As Adjusted 1 Underlying Combined Ratio As Adjusted 1 Underlying Loss & LAE Ratio 74.3% 74.3% 73.8% 75.3% 76.7% As Adjusted 1 Expense Ratio 17.5% 16.8% 17.7% 16.8% 17.9% As Adjusted 1 Underlying Combined Ratio 91.8% 91.0% 91.5% 92.1% 94.6% ¹ As Adjusted is a non-GAAP measure, which is comprised by excluding impact of purchase accounting in 2018 and including historical results of Kemper and Infinity in periods prior to acquisition date of July 2, 2018. Earnings Call Presentation – 1Q 2019 26