Exhibit 99.3 Third Quarter 2020 Earnings November 2, 2020 Earnings Call Presentation – 3Q 2020

Preliminary Matters Cautionary Statements Regarding Forward-Looking Information This presentation may contain or incorporate by reference information that includes or is based on forward-looking statements within the meaning of the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give expectations or forecasts of future events and can be identified by the fact that they relate to future actions, performance or results rather than strictly to historical or current facts. Any or all forward-looking statements may turn out to be wrong, and, accordingly, readers are cautioned not to place undue reliance on such statements, which speak only as of the date of this presentation. Forward-looking statements involve a number of risks and uncertainties that are difficult to predict and are not guarantees of future performance. Among the general factors that could cause actual results and financial condition to differ materially from estimated results and financial condition are those factors listed in periodic reports filed by Kemper Corporation with the Securities and Exchange Commission (“SEC”). The COVID-19 outbreak and subsequent global pandemic (“Pandemic”) is an extraordinary event that creates unique uncertainties and risks. Kemper cannot provide any assurances as to the impacts of the Pandemic and related economic conditions on the Company’s operating and financial results. No assurances can be given that the results and financial condition contemplated in any forward-looking statements will be achieved or will be achieved in any particular timetable. Kemper assumes no obligation to publicly correct or update any forward-looking statements as a result of events or developments subsequent to the date of this presentation, including any such statements related to the Pandemic. The reader is advised, however, to consult any further disclosures Kemper makes on related subjects in its filings with the SEC. Non-GAAP Financial Measures This presentation contains non-GAAP financial measures that the company believes are meaningful to investors. Non-GAAP financial measures have been reconciled to the most comparable GAAP financial measure. Earnings Call Presentation – 3Q 2020 2

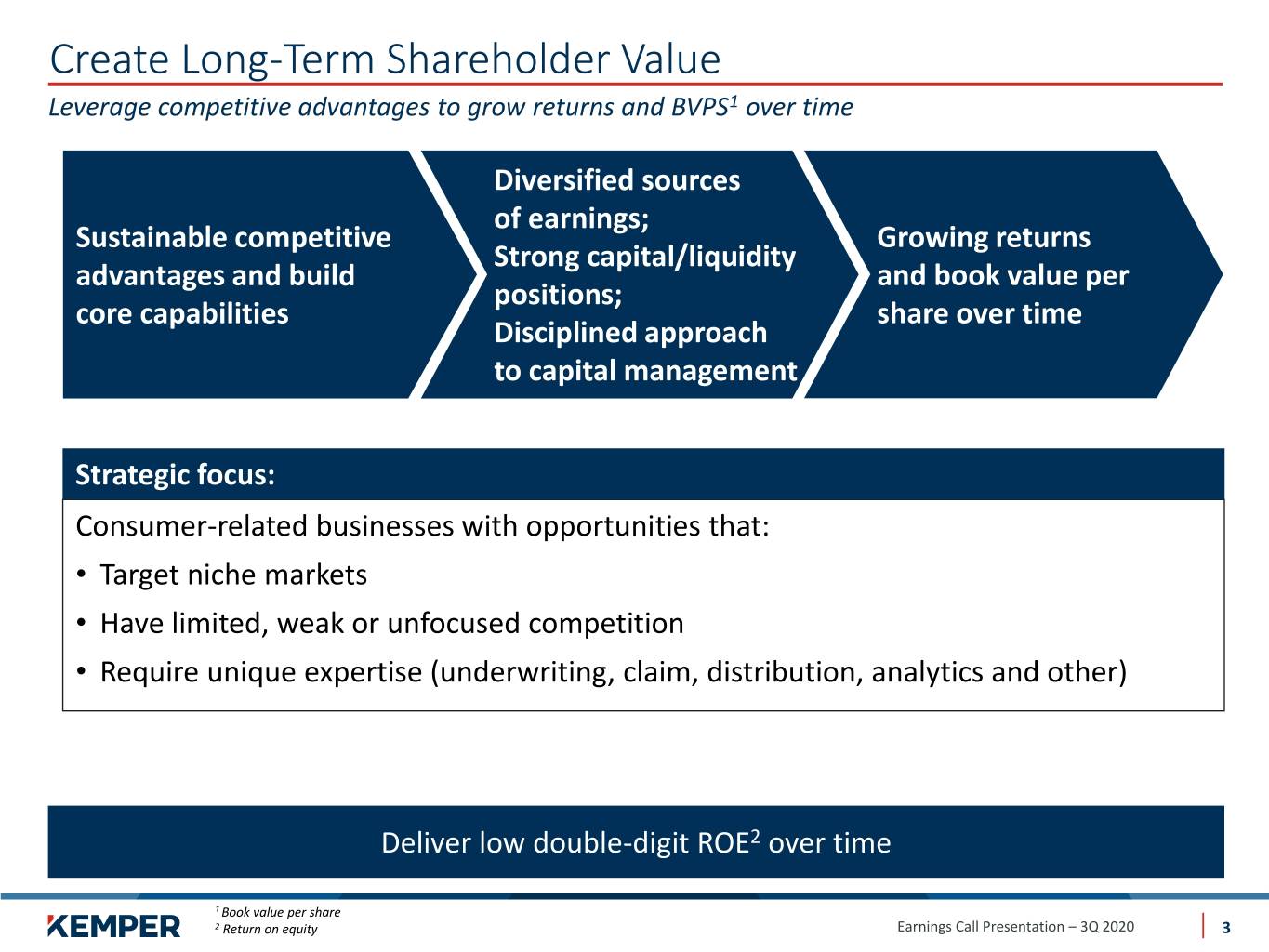

Create Long-Term Shareholder Value Leverage competitive advantages to grow returns and BVPS1 over time Diversified sources of earnings; Sustainable competitive Growing returns Strong capital/liquidity advantages and build and book value per positions; core capabilities share over time Disciplined approach to capital management Strategic focus: Consumer-related businesses with opportunities that: • Target niche markets • Have limited, weak or unfocused competition • Require unique expertise (underwriting, claim, distribution, analytics and other) Deliver low double-digit ROE2 over time ¹ Book value per share 2 Return on equity Earnings Call Presentation – 3Q 2020 3

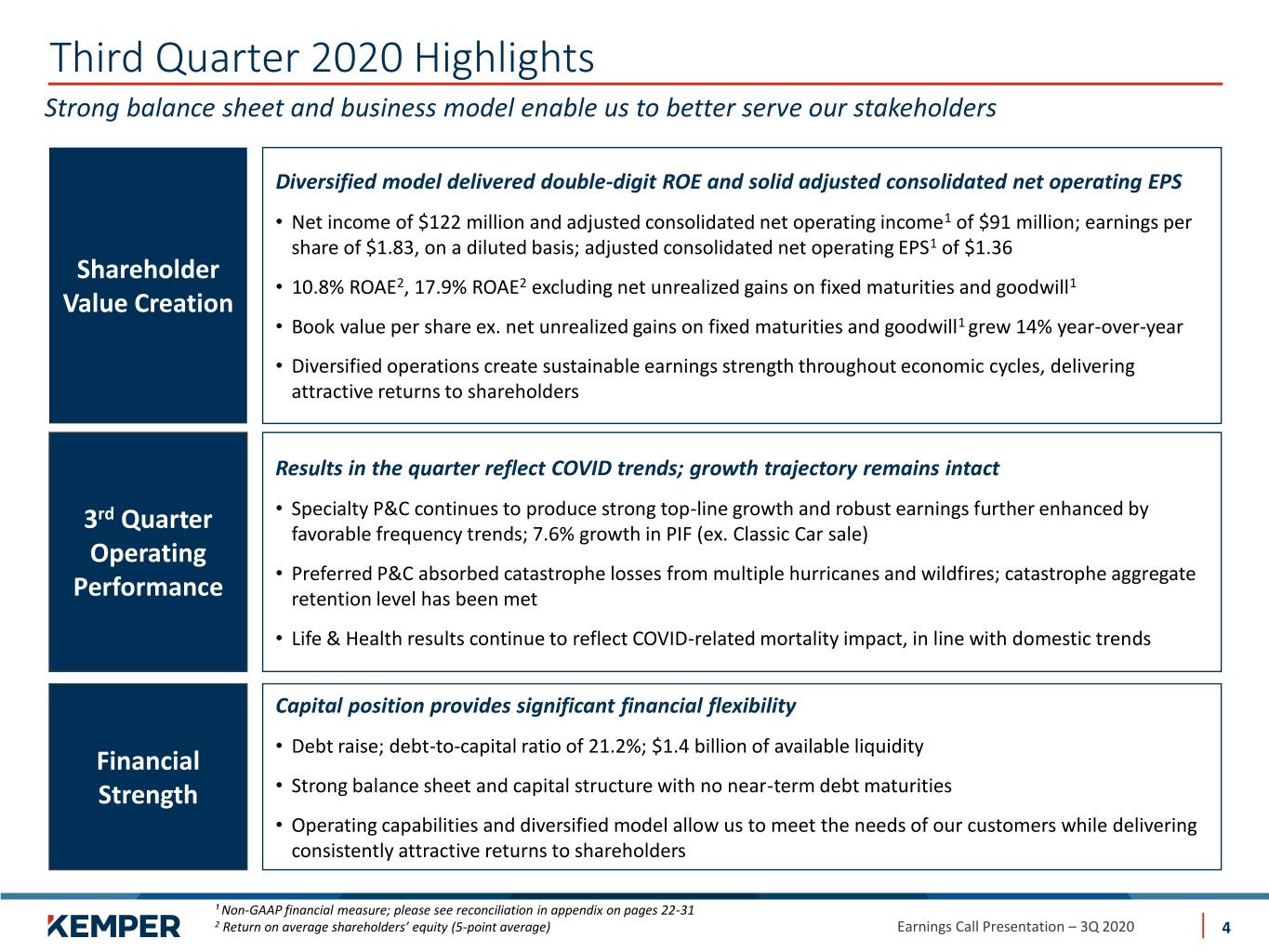

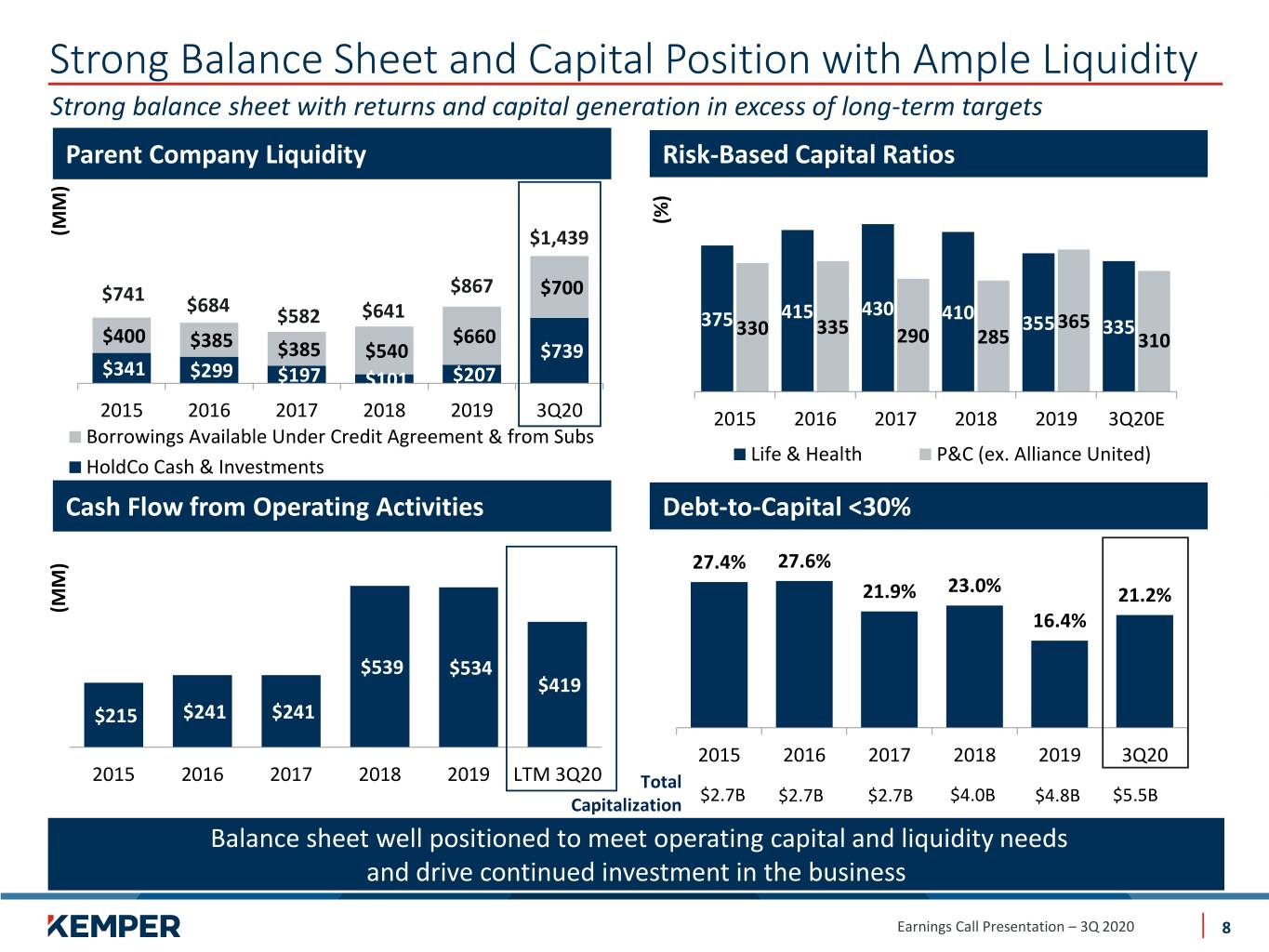

Third Quarter 2020 Highlights Strong balance sheet and business model enable us to better serve our stakeholders Diversified model delivered double-digit ROE and solid adjusted consolidated net operating EPS • Net income of $122 million and adjusted consolidated net operating income1 of $91 million; earnings per share of $1.83, on a diluted basis; adjusted consolidated net operating EPS1 of $1.36 Shareholder • 10.8% ROAE2, 17.9% ROAE2 excluding net unrealized gains on fixed maturities and goodwill1 Value Creation • Book value per share ex. net unrealized gains on fixed maturities and goodwill1 grew 14% year-over-year • Diversified operations create sustainable earnings strength throughout economic cycles, delivering attractive returns to shareholders Results in the quarter reflect COVID trends; growth trajectory remains intact 3rd Quarter • Specialty P&C continues to produce strong top-line growth and robust earnings further enhanced by favorable frequency trends; 7.6% growth in PIF (ex. Classic Car sale) Operating • Preferred P&C absorbed catastrophe losses from multiple hurricanes and wildfires; catastrophe aggregate Performance retention level has been met • Life & Health results continue to reflect COVID-related mortality impact, in line with domestic trends Capital position provides significant financial flexibility • Debt raise; debt-to-capital ratio of 21.2%; $1.4 billion of available liquidity Financial Strength • Strong balance sheet and capital structure with no near-term debt maturities • Operating capabilities and diversified model allow us to meet the needs of our customers while delivering consistently attractive returns to shareholders ¹ Non-GAAP financial measure; please see reconciliation in appendix on pages 22-31 2 Return on average shareholders’ equity (5-point average) Earnings Call Presentation – 3Q 2020 4

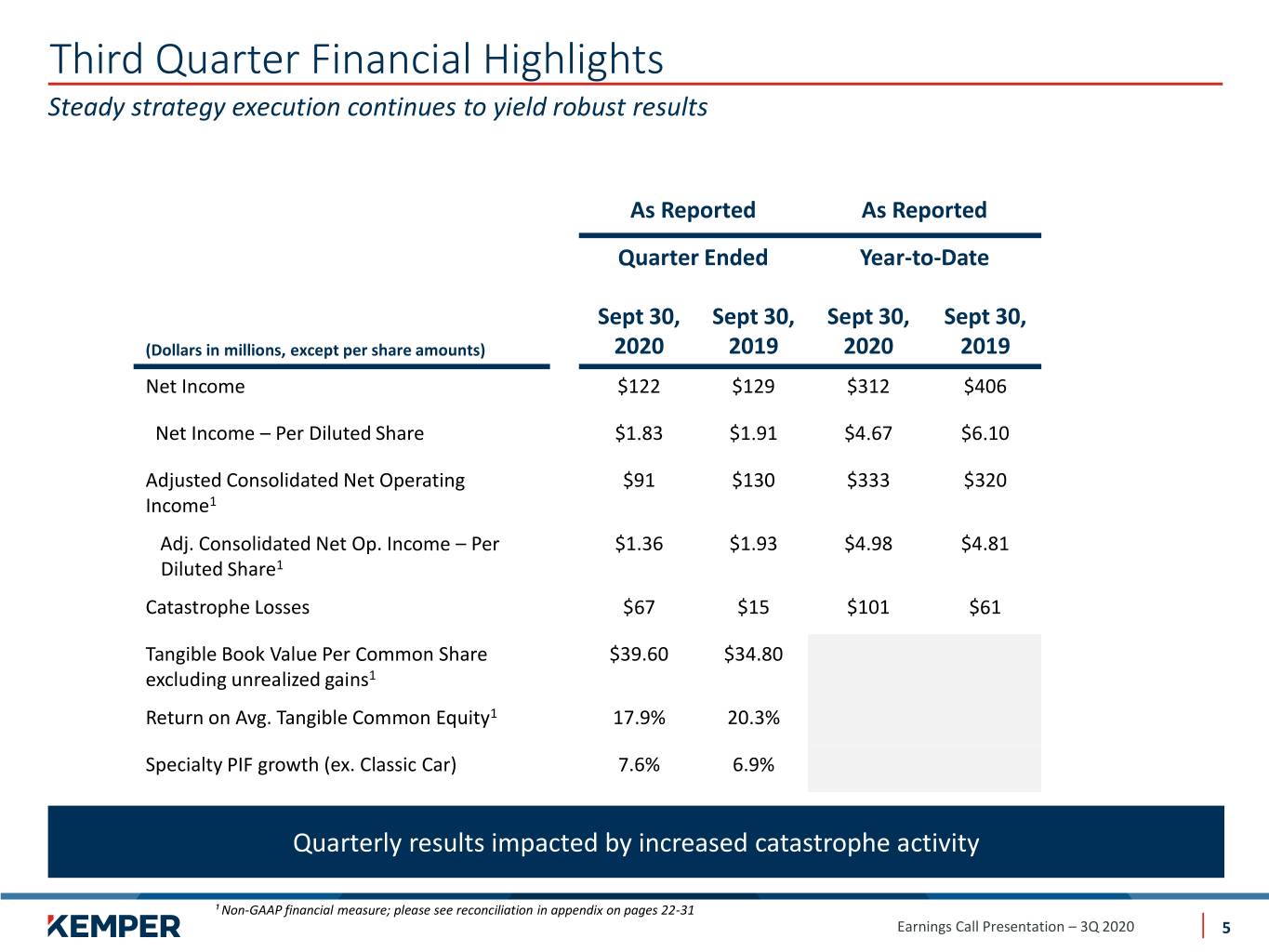

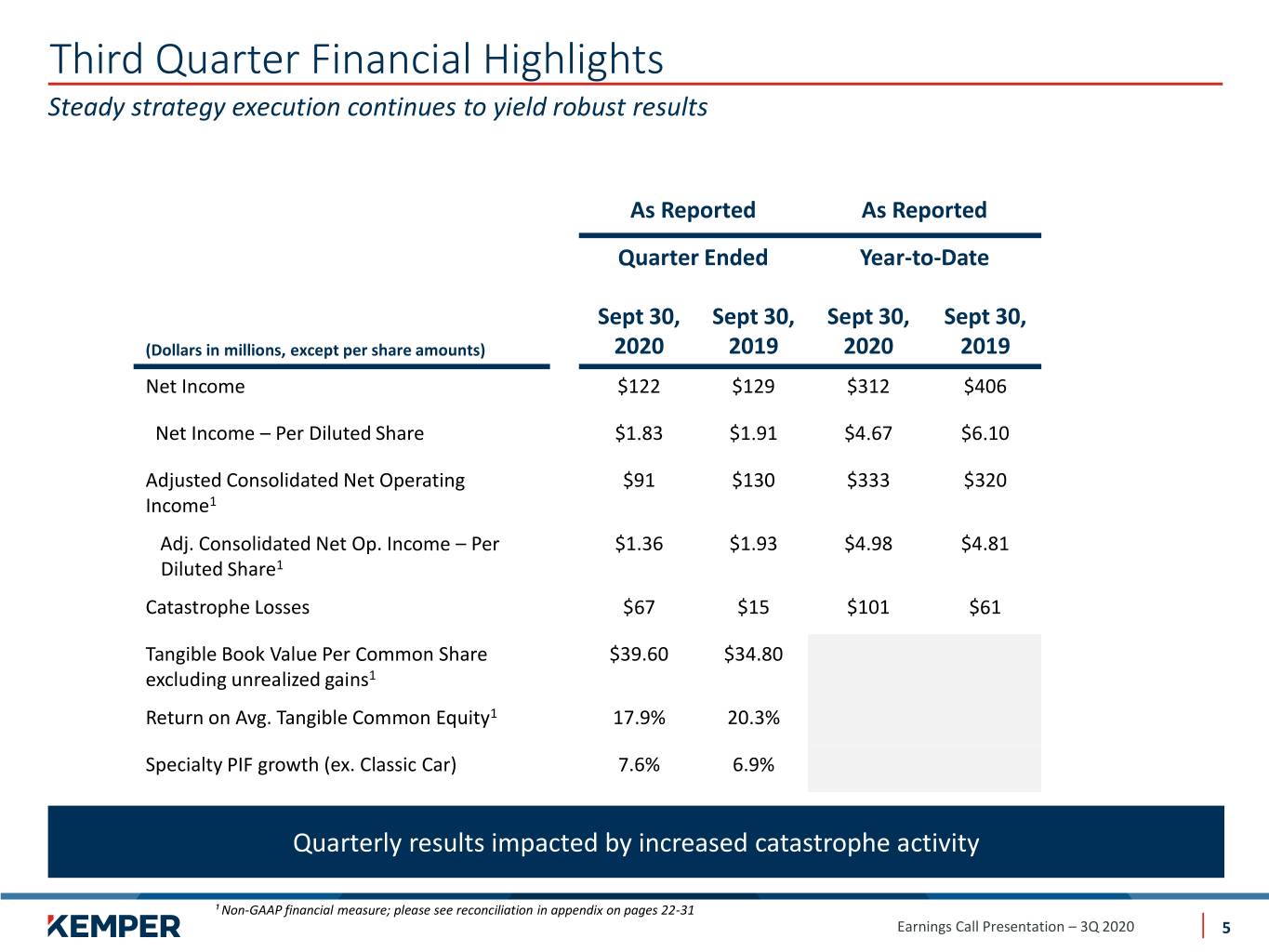

Third Quarter Financial Highlights Steady strategy execution continues to yield robust results As Reported As Reported Quarter Ended Year-to-Date Sept 30, Sept 30, Sept 30, Sept 30, (Dollars in millions, except per share amounts) 2020 2019 2020 2019 Net Income $122 $129 $312 $406 Net Income – Per Diluted Share $1.83 $1.91 $4.67 $6.10 Adjusted Consolidated Net Operating $91 $130 $333 $320 Income1 Adj. Consolidated Net Op. Income – Per $1.36 $1.93 $4.98 $4.81 a Diluted Share1 Catastrophe Losses $67 $15 $101 $61 Tangible Book Value Per Common Share $39.60 $34.80 excluding unrealized gains1 Return on Avg. Tangible Common Equity1 17.9% 20.3% Specialty PIF growth (ex. Classic Car) 7.6% 6.9% Quarterly results impacted by increased catastrophe activity ¹ Non-GAAP financial measure; please see reconciliation in appendix on pages 22-31 Earnings Call Presentation – 3Q 2020 5

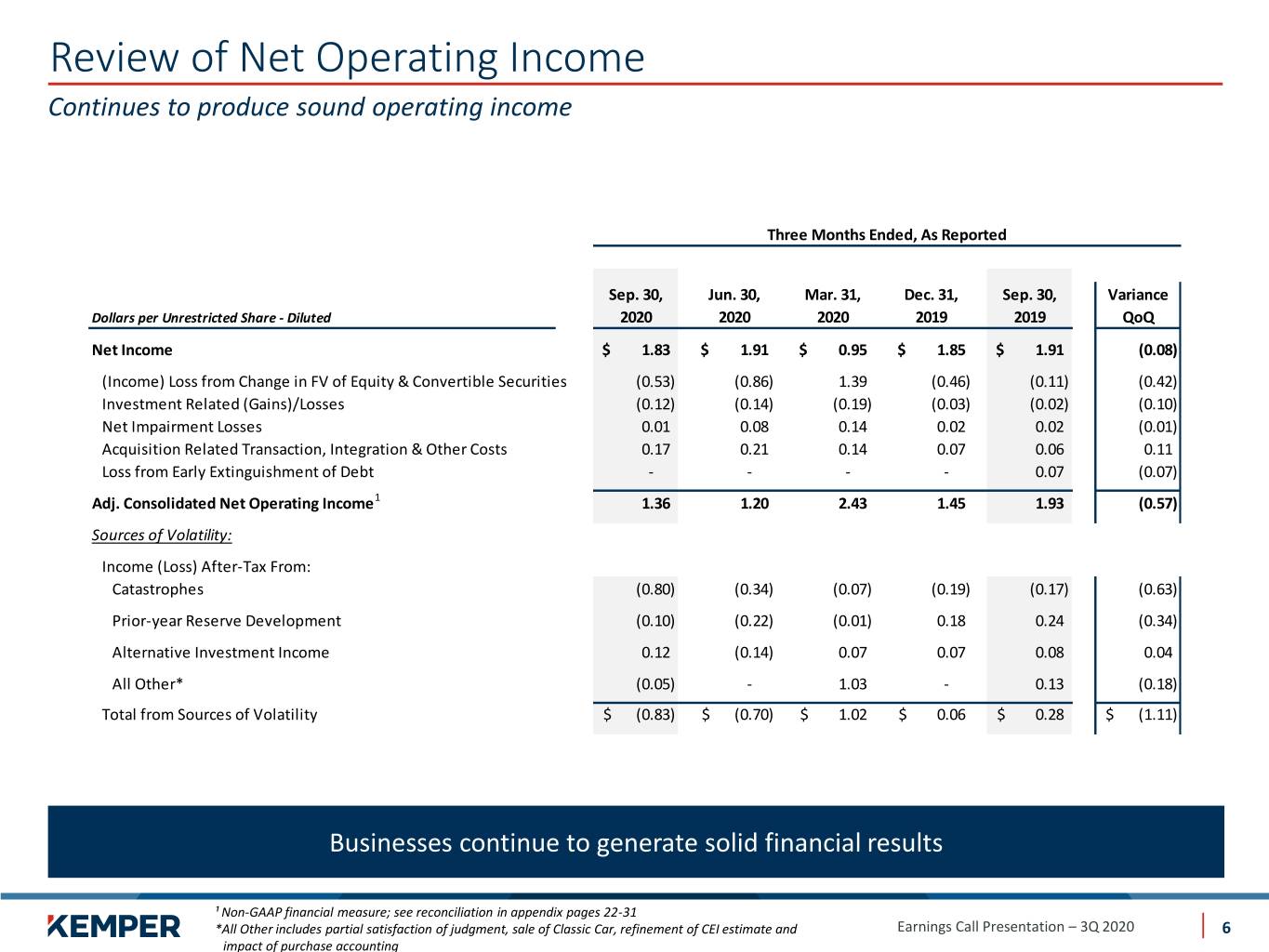

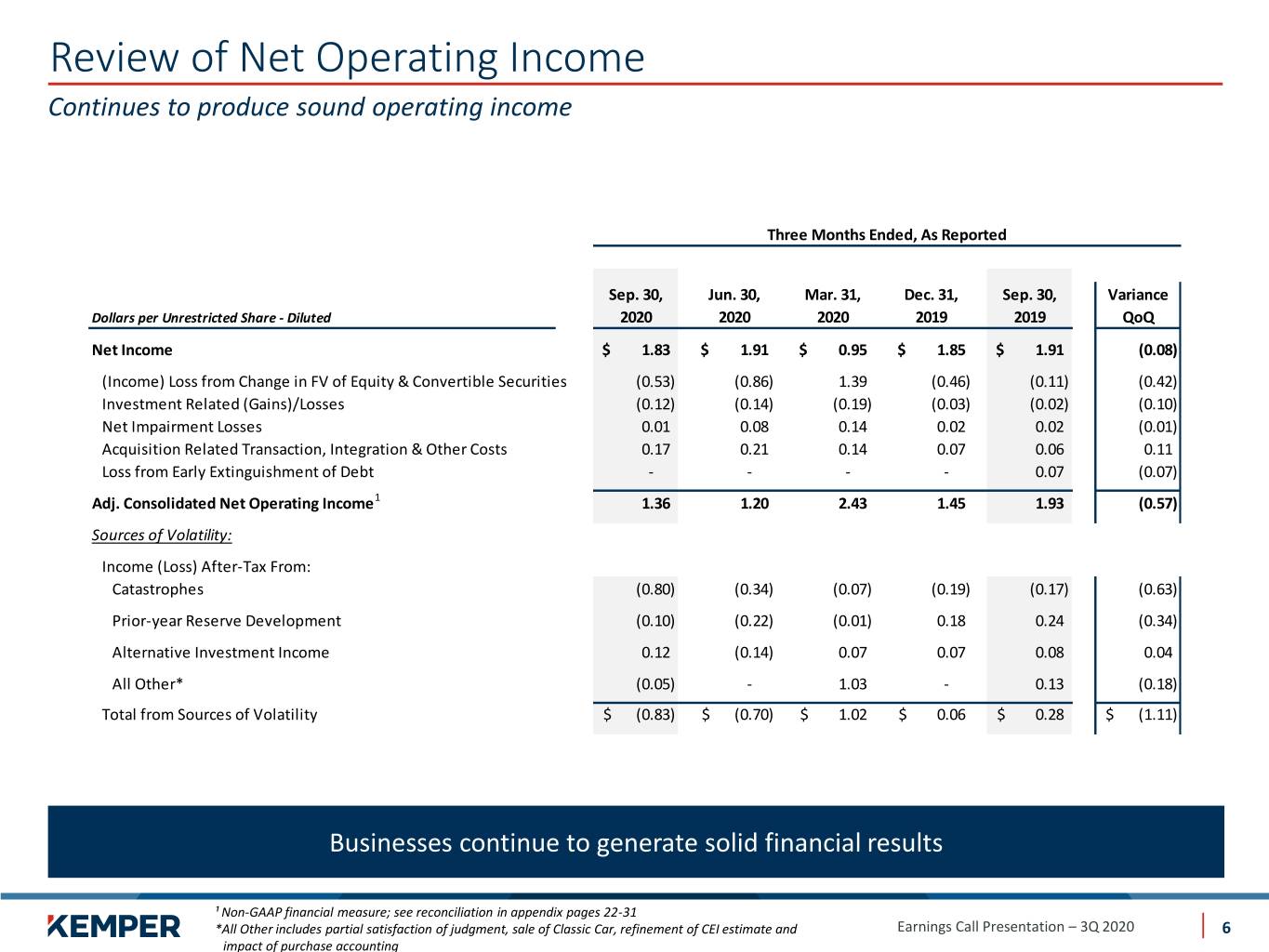

Review of Net Operating Income Continues to produce sound operating income Three Months Ended, As Reported Sep. 30, Jun. 30, Mar. 31, Dec. 31, Sep. 30, Variance Dollars per Unrestricted Share - Diluted 2020 2020 2020 2019 2019 QoQ Net Income $ 1.83 $ 1.91 $ 0.95 $ 1.85 $ 1.91 (0.08) (Income) Loss from Change in FV of Equity & Convertible Securities (0.53) (0.86) 1.39 (0.46) (0.11) (0.42) Investment Related (Gains)/Losses (0.12) (0.14) (0.19) (0.03) (0.02) (0.10) Net Impairment Losses 0.01 0.08 0.14 0.02 0.02 (0.01) Acquisition Related Transaction, Integration & Other Costs 0.17 0.21 0.14 0.07 0.06 0.11 Loss from Early Extinguishment of Debt - - - - 0.07 (0.07) Adj. Consolidated Net Operating Income1 1.36 1.20 2.43 1.45 1.93 (0.57) Sources of Volatility: Income (Loss) After-Tax From: Catastrophes (0.80) (0.34) (0.07) (0.19) (0.17) (0.63) - Prior-year Reserve Development (0.10) (0.22) (0.01) 0.18 0.24 (0.34) - Alternative Investment Income 0.12 (0.14) 0.07 0.07 0.08 0.04 - All Other* (0.05) - 1.03 - 0.13 (0.18) Total from Sources of Volatility $ (0.83) $ (0.70) $ 1.02 $ 0.06 $ 0.28 $ (1.11) Businesses continue to generate solid financial results ¹ Non-GAAP financial measure; see reconciliation in appendix pages 22-31 *All Other includes partial satisfaction of judgment, sale of Classic Car, refinement of CEI estimate and Earnings Call Presentation – 3Q 2020 6 impact of purchase accounting

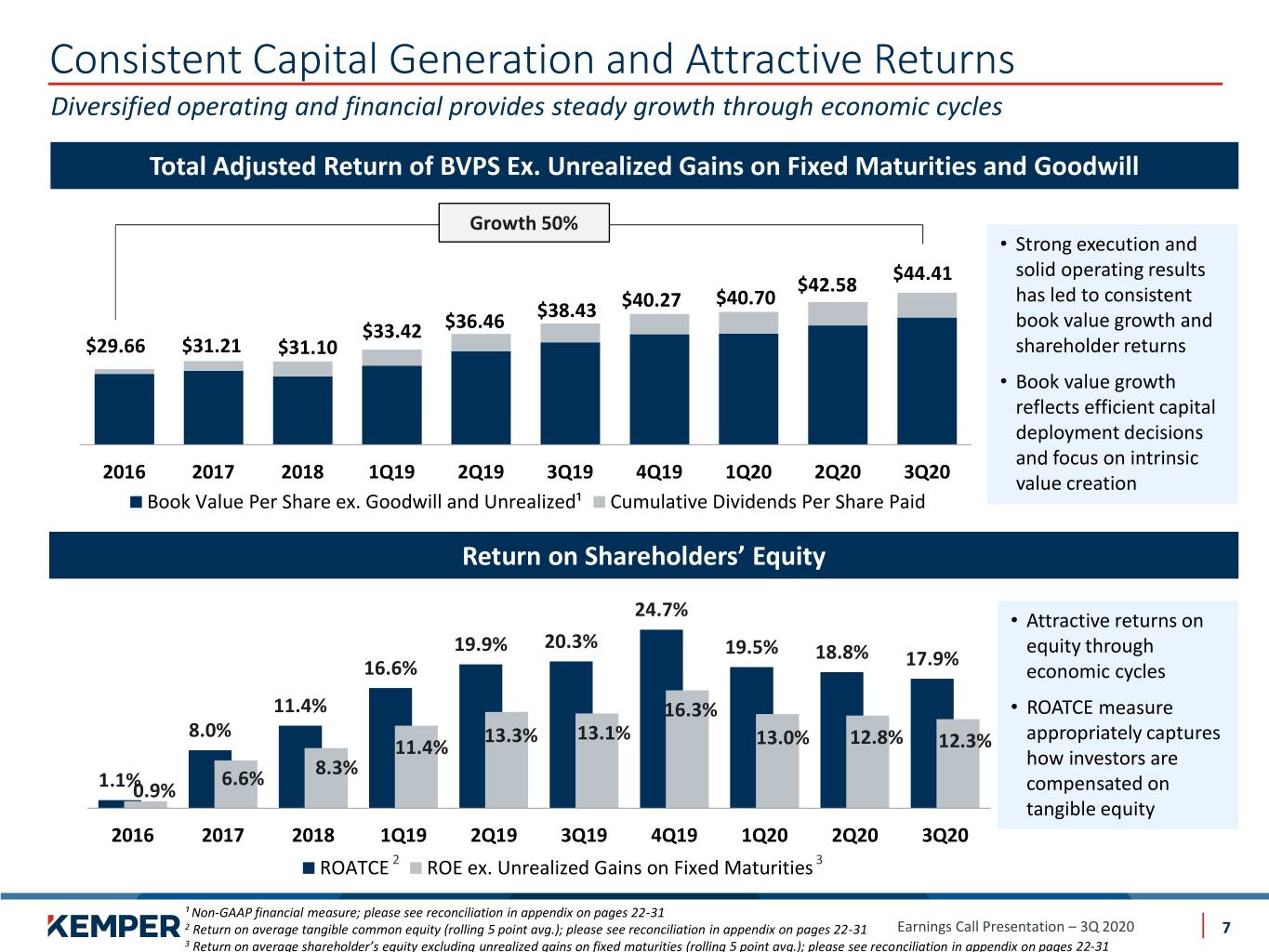

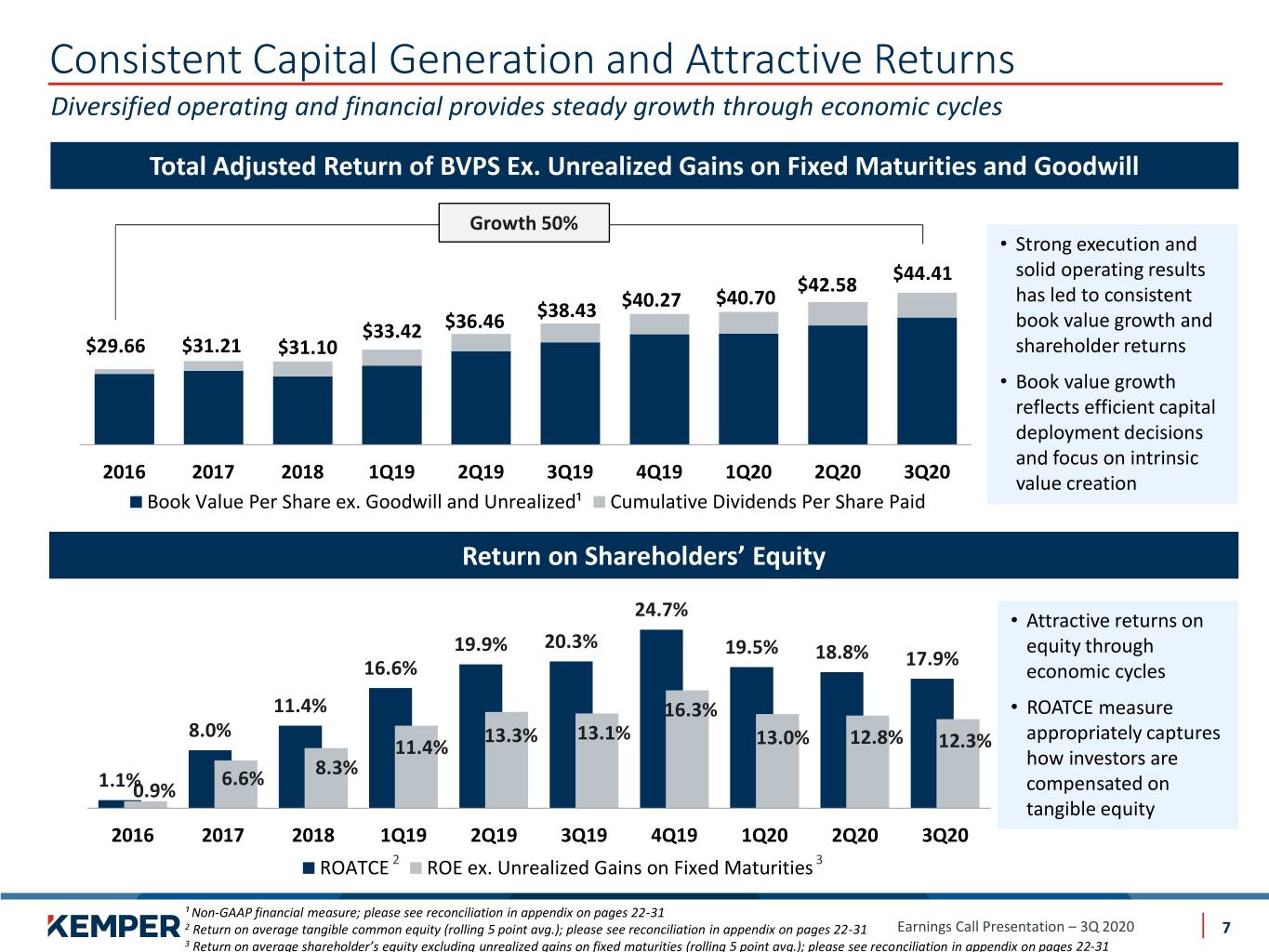

Consistent Capital Generation and Attractive Returns Diversified operating and financial provides steady growth through economic cycles Total Adjusted Return of BVPS Ex. Unrealized Gains on Fixed Maturities and Goodwill Growth 50% • Strong execution and $44.41 solid operating results $42.58 $40.27 $40.70 has led to consistent $38.43 book value growth and $33.42 $36.46 $29.66 $31.21 $31.10 shareholder returns • Book value growth reflects efficient capital deployment decisions and focus on intrinsic 2016 2017 2018 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 value creation Book Value Per Share ex. Goodwill and Unrealized¹ Cumulative Dividends Per Share Paid Return on Shareholders’ Equity 24.7% • Attractive returns on 19.9% 20.3% 19.5% equity through 18.8% 17.9% 16.6% economic cycles 11.4% 16.3% • ROATCE measure 8.0% 13.3% 13.1% appropriately captures 11.4% 13.0% 12.8% 12.3% 8.3% how investors are 6.6% 1.1%0.9% compensated on tangible equity 2016 2017 2018 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 ROATCE 2 ROE ex. Unrealized Gains on Fixed Maturities 3 ¹ Non-GAAP financial measure; please see reconciliation in appendix on pages 22-31 2 Return on average tangible common equity (rolling 5 point avg.); please see reconciliation in appendix on pages 22-31 Earnings Call Presentation – 3Q 2020 7 3 Return on average shareholder’s equity excluding unrealized gains on fixed maturities (rolling 5 point avg.); please see reconciliation in appendix on pages 22-31

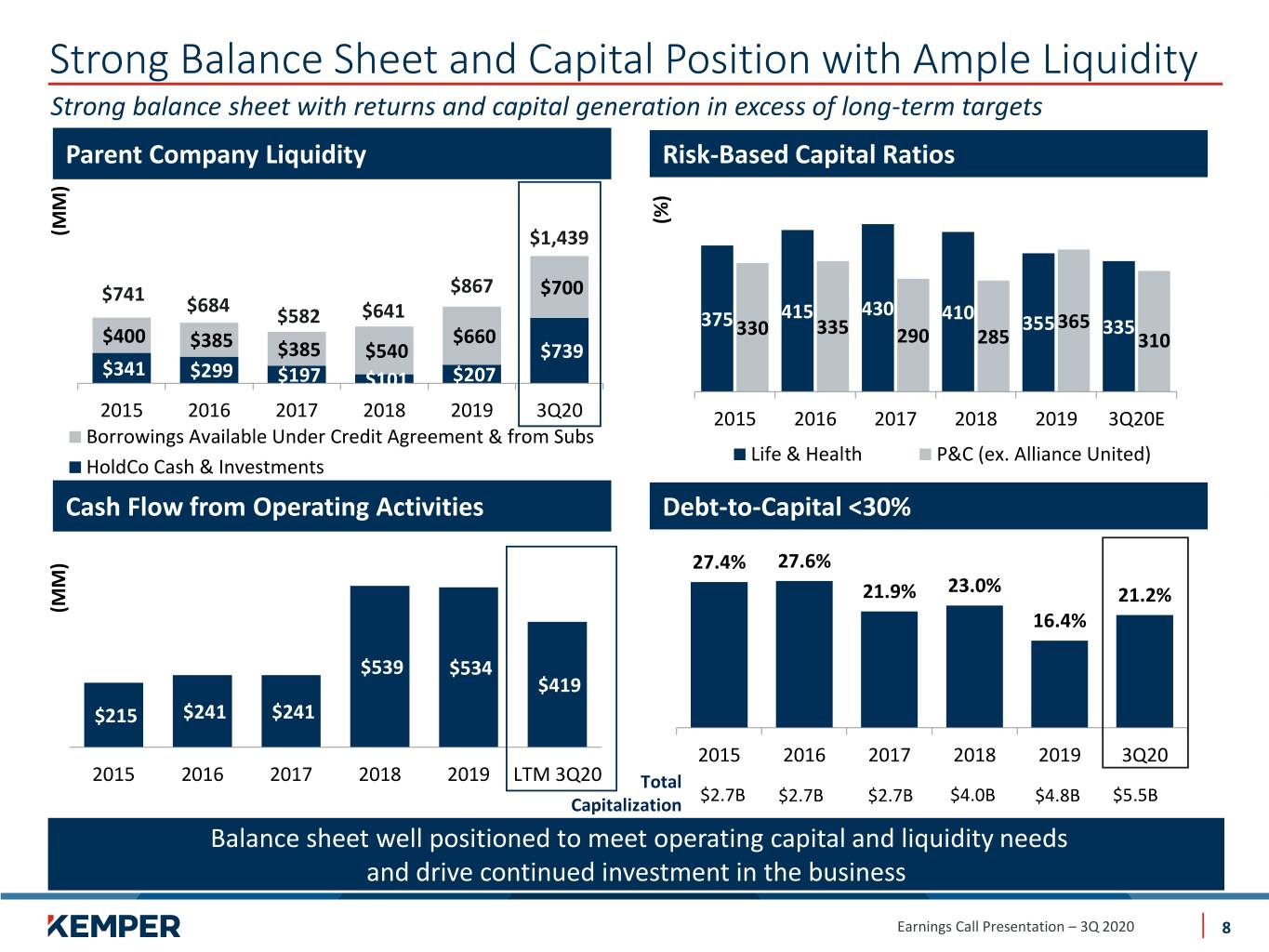

Strong Balance Sheet and Capital Position with Ample Liquidity Strong balance sheet with returns and capital generation in excess of long-term targets Parent Company Liquidity Risk-Based Capital Ratios (%) (MM) $1,439 $741 $867 $700 $684 $582 $641 415 430 410 375 330 335 355 365 335 $400 $385 $660 290 285 $385 $540 $739 310 $341 $299 $197 $101 $207 2015 2016 2017 2018 2019 3Q20 2015 2016 2017 2018 2019 3Q20E Borrowings Available Under Credit Agreement & from Subs Life & Health P&C (ex. Alliance United) HoldCo Cash & Investments Cash Flow from Operating Activities Debt-to-Capital <30% 27.4% 27.6% 21.9% 23.0% 21.2% (MM) 16.4% Debt $539 $534 $419 $215 $241 $241 2015 2016 2017 2018 2019 3Q20 2015 2016 2017 2018 2019 LTM 3Q20 Total $2.7B $4.0B $5.5B Capitalization $2.7B $2.7B $4.8B Balance sheet well positioned to meet operating capital and liquidity needs and drive continued investment in the business Earnings Call Presentation – 3Q 2020 8

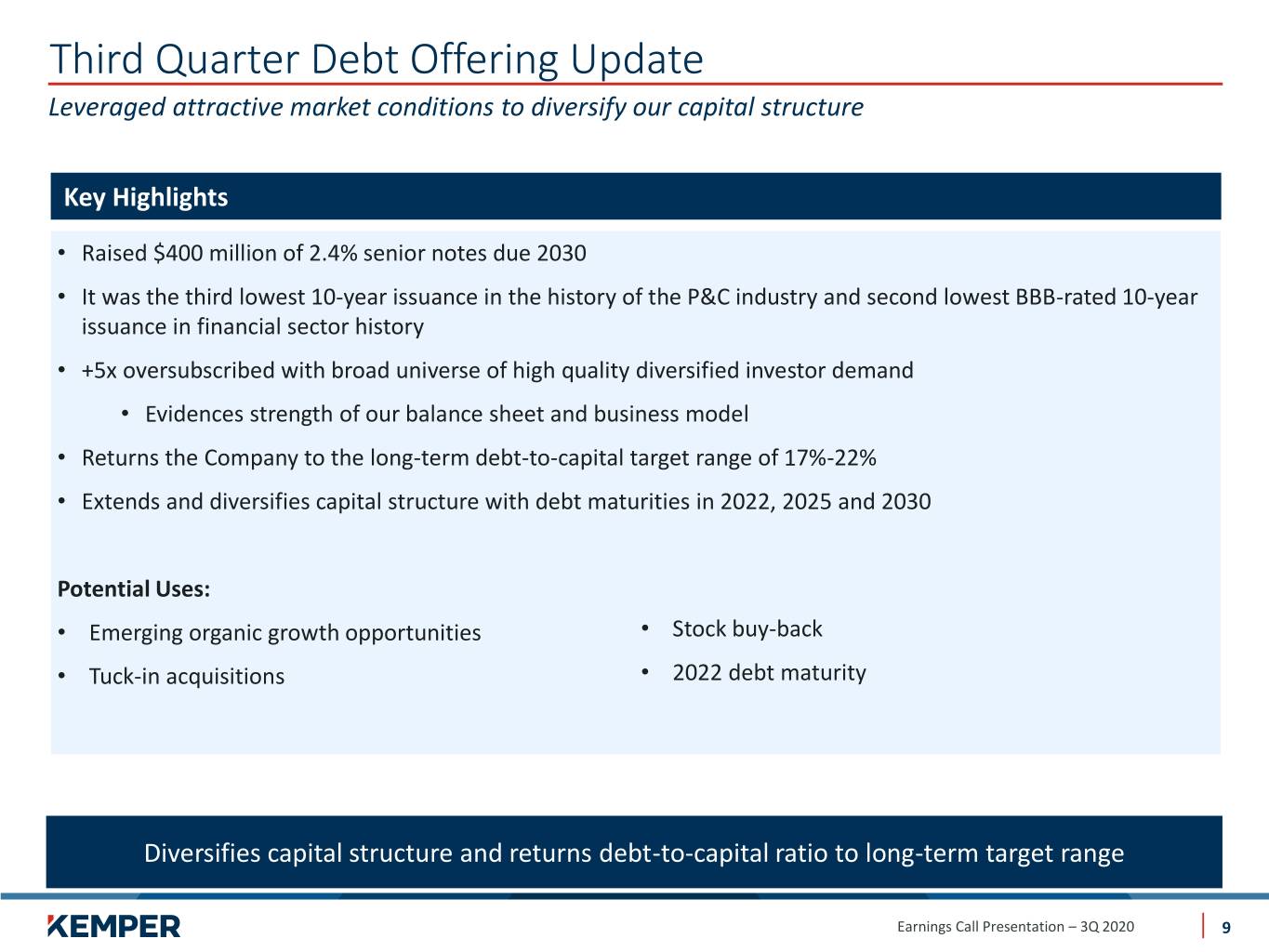

Third Quarter Debt Offering Update Leveraged attractive market conditions to diversify our capital structure Key Highlights • Raised $400 million of 2.4% senior notes due 2030 • It was the third lowest 10-year issuance in the history of the P&C industry and second lowest BBB-rated 10-year issuance in financial sector history • +5x oversubscribed with broad universe of high quality diversified investor demand • Evidences strength of our balance sheet and business model • Returns the Company to the long-term debt-to-capital target range of 17%-22% • Extends and diversifies capital structure with debt maturities in 2022, 2025 and 2030 Potential Uses: • Emerging organic growth opportunities • Stock buy-back • Tuck-in acquisitions • 2022 debt maturity Diversifies capital structure and returns debt-to-capital ratio to long-term target range Earnings Call Presentation – 3Q 2020 9

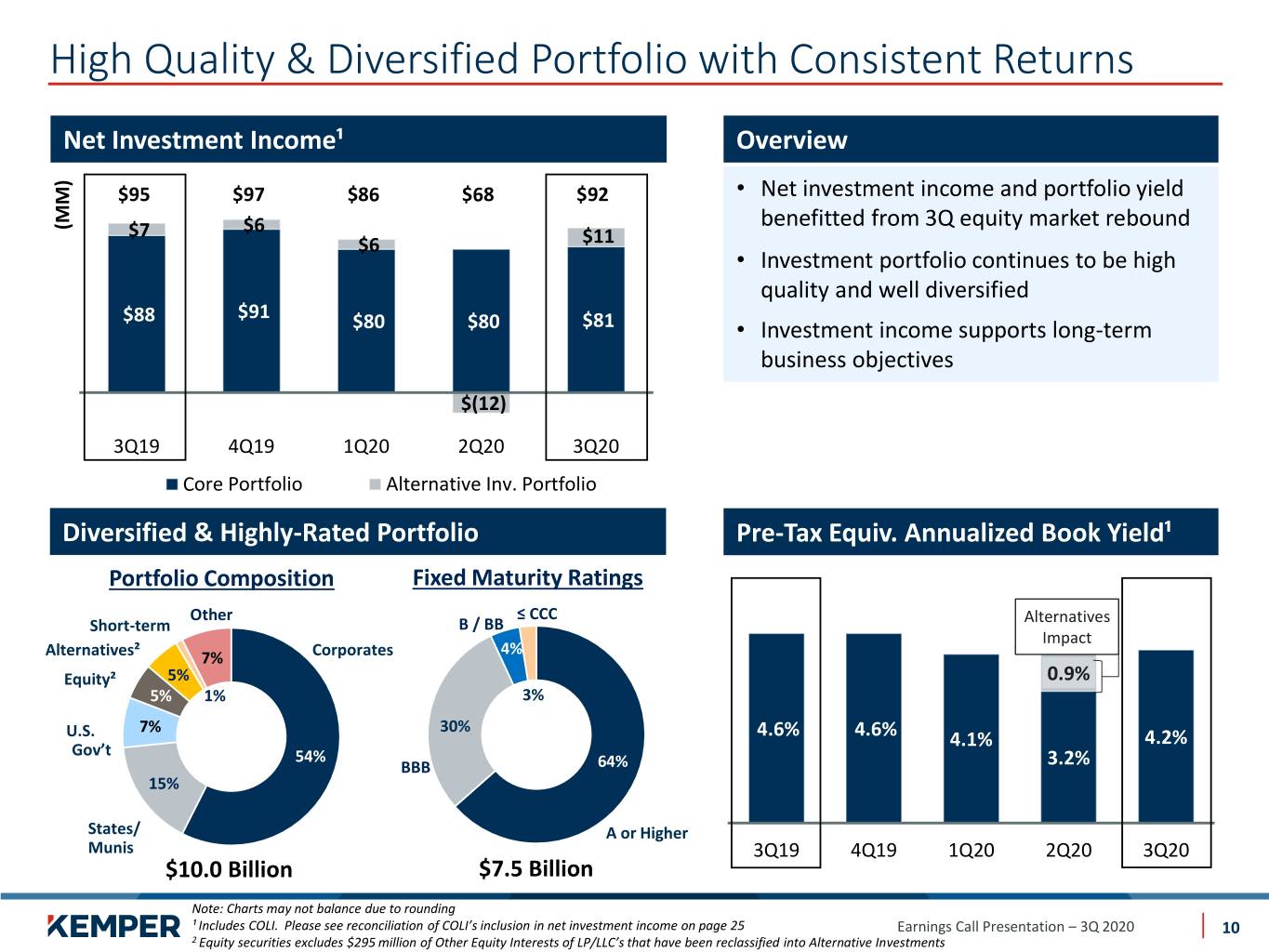

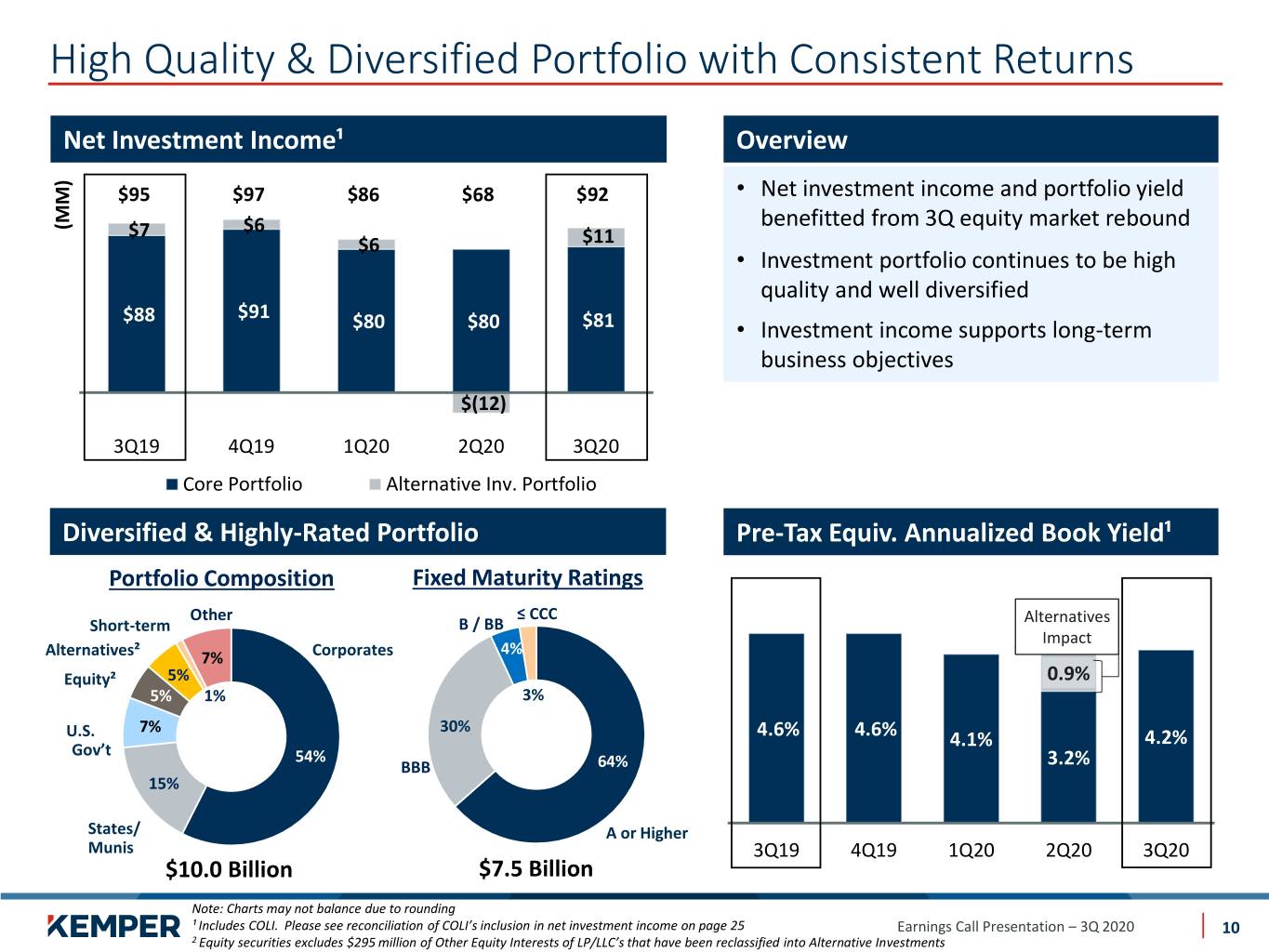

High Quality & Diversified Portfolio with Consistent Returns Net Investment Income¹ Overview $95 $97 $86 $68 $92 • Net investment income and portfolio yield (MM) $7 $6 benefitted from 3Q equity market rebound $6 $11 • Investment portfolio continues to be high quality and well diversified $88 $91 $80 $80 $81 • Investment income supports long-term business objectives $(12) 3Q19 4Q19 1Q20 2Q20 3Q20 Core Portfolio Alternative Inv. Portfolio Diversified & Highly-Rated Portfolio Pre-Tax Equiv. Annualized Book Yield¹ Portfolio Composition Fixed Maturity Ratings Other ≤ CCC Alternatives Short-term B / BB Impact 4% Alternatives² 7% Corporates Equity² 5% 0.9% 5% 1% 3% 7% 30% U.S. 4.6% 4.6% 4.1% 4.2% Gov’t 54% BBB 64% 3.2% 15% States/ A or Higher Munis 3Q19 4Q19 1Q20 2Q20 3Q20 $10.0 Billion $7.5 Billion Note: Charts may not balance due to rounding ¹ Includes COLI. Please see reconciliation of COLI’s inclusion in net investment income on page 25 Earnings Call Presentation – 3Q 2020 10 2 Equity securities excludes $295 million of Other Equity Interests of LP/LLC’s that have been reclassified into Alternative Investments

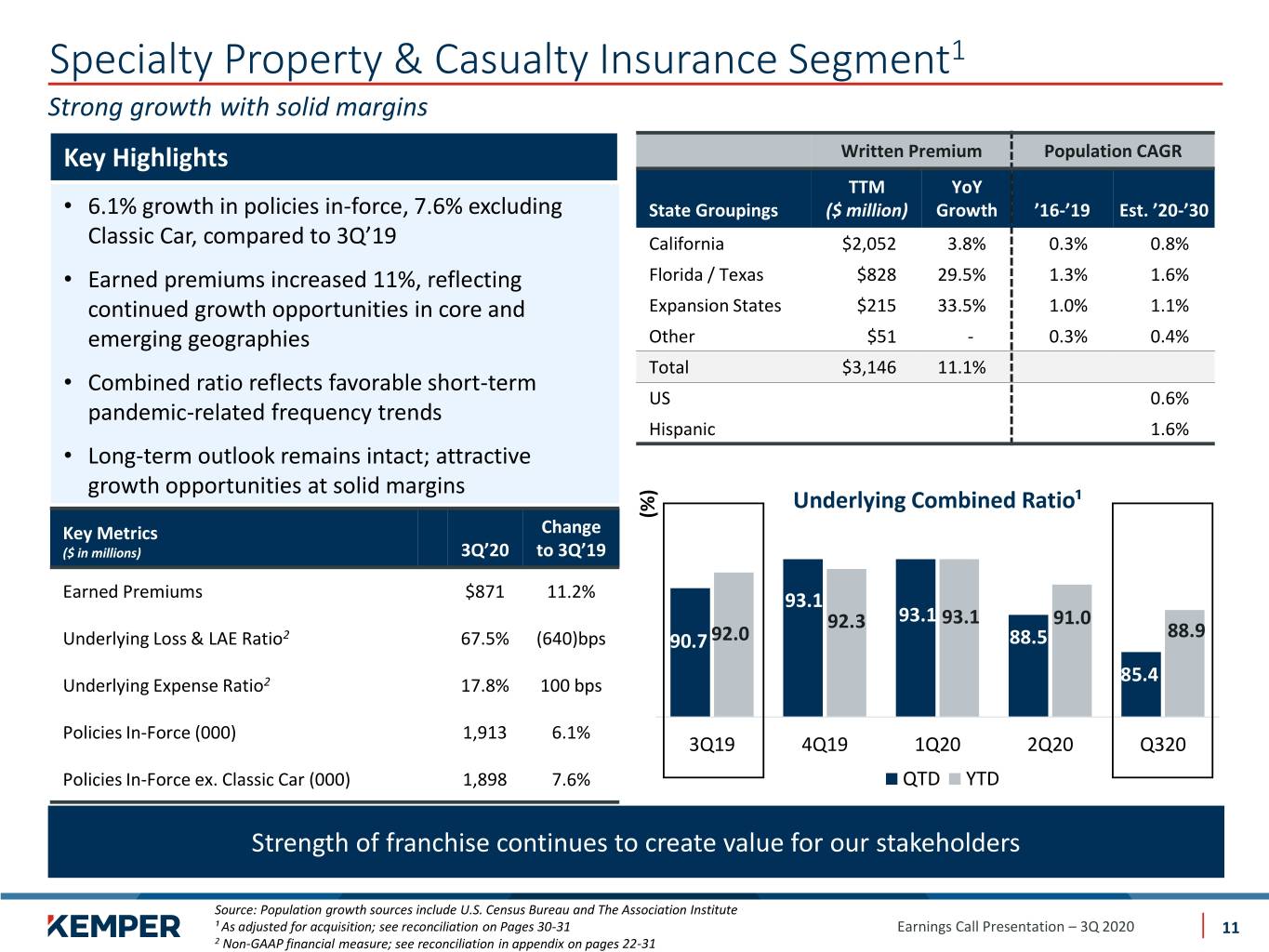

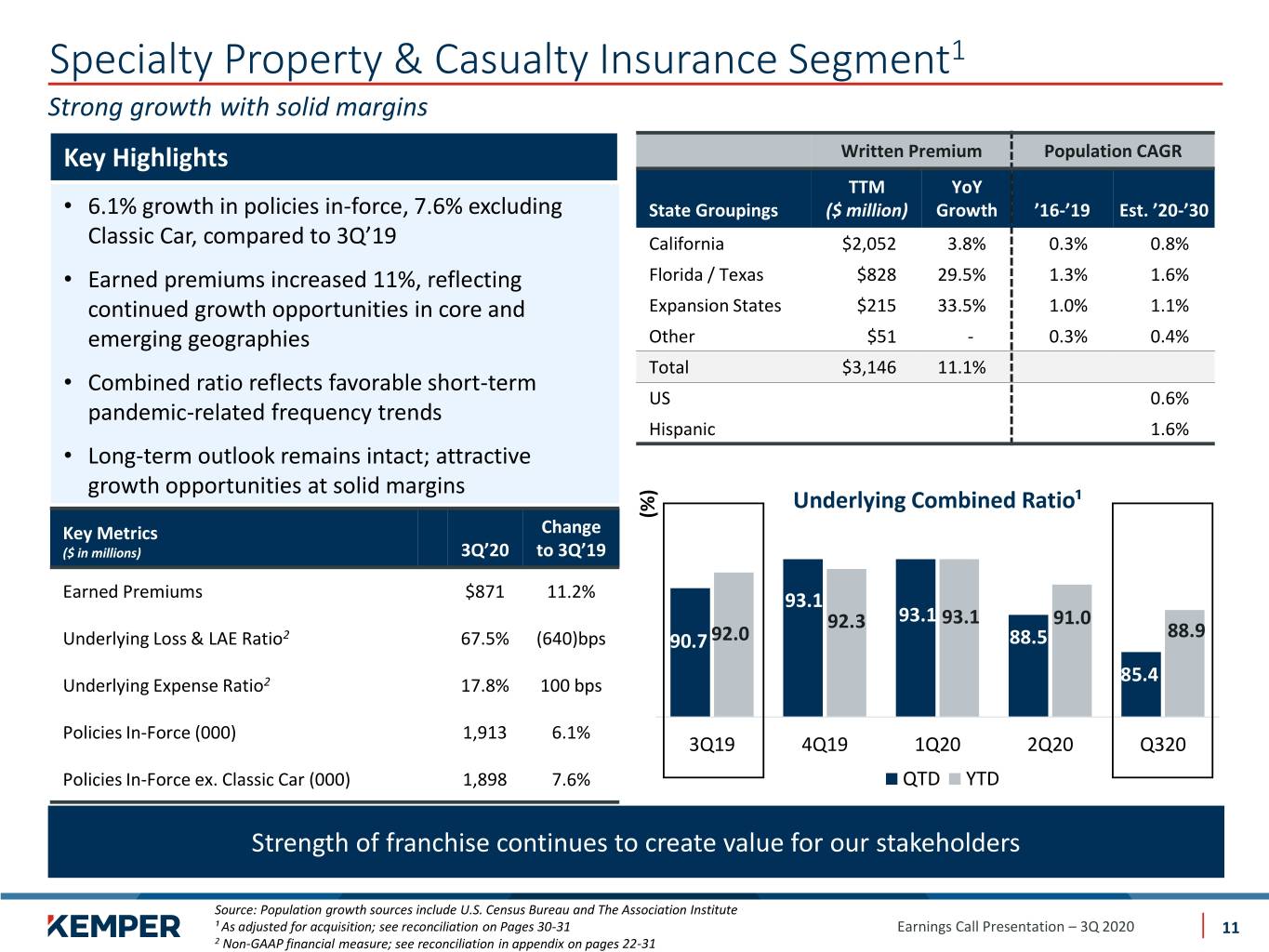

Specialty Property & Casualty Insurance Segment1 Strong growth with solid margins Key Highlights Written Premium Population CAGR TTM YoY • 6.1% growth in policies in-force, 7.6% excluding State Groupings ($ million) Growth ’16-’19 Est. ’20-’30 Classic Car, compared to 3Q’19 California $2,052 3.8% 0.3% 0.8% • Earned premiums increased 11%, reflecting Florida / Texas $828 29.5% 1.3% 1.6% continued growth opportunities in core and Expansion States $215 33.5% 1.0% 1.1% emerging geographies Other $51 - 0.3% 0.4% Total $3,146 11.1% • Combined ratio reflects favorable short-term US 0.6% pandemic-related frequency trends Hispanic 1.6% • Long-term outlook remains intact; attractive growth opportunities at solid margins Underlying Combined Ratio¹ (%) Key Metrics Change ($ in millions) 3Q’20 to 3Q’19 Earned Premiums $871 11.2% 93.1 92.3 93.1 93.1 91.0 2 88.9 Underlying Loss & LAE Ratio 67.5% (640)bps 90.7 92.0 88.5 85.4 Underlying Expense Ratio2 17.8% 100 bps Policies In-Force (000) 1,913 6.1% 3Q19 4Q19 1Q20 2Q20 Q320 Policies In-Force ex. Classic Car (000) 1,898 7.6% QTD YTD Strength of franchise continues to create value for our stakeholders Source: Population growth sources include U.S. Census Bureau and The Association Institute ¹ As adjusted for acquisition; see reconciliation on Pages 30-31 Earnings Call Presentation – 3Q 2020 11 2 Non-GAAP financial measure; see reconciliation in appendix on pages 22-31

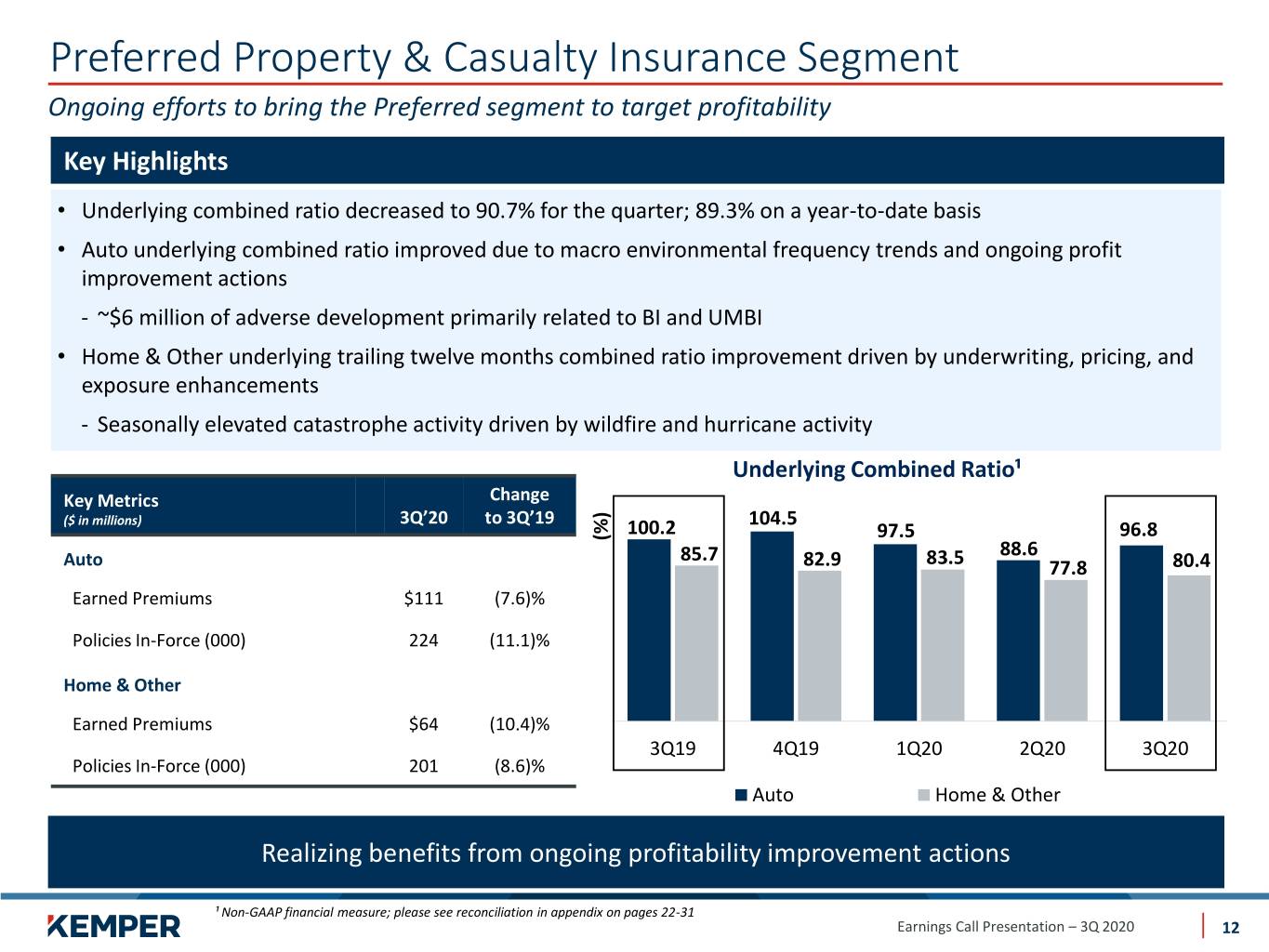

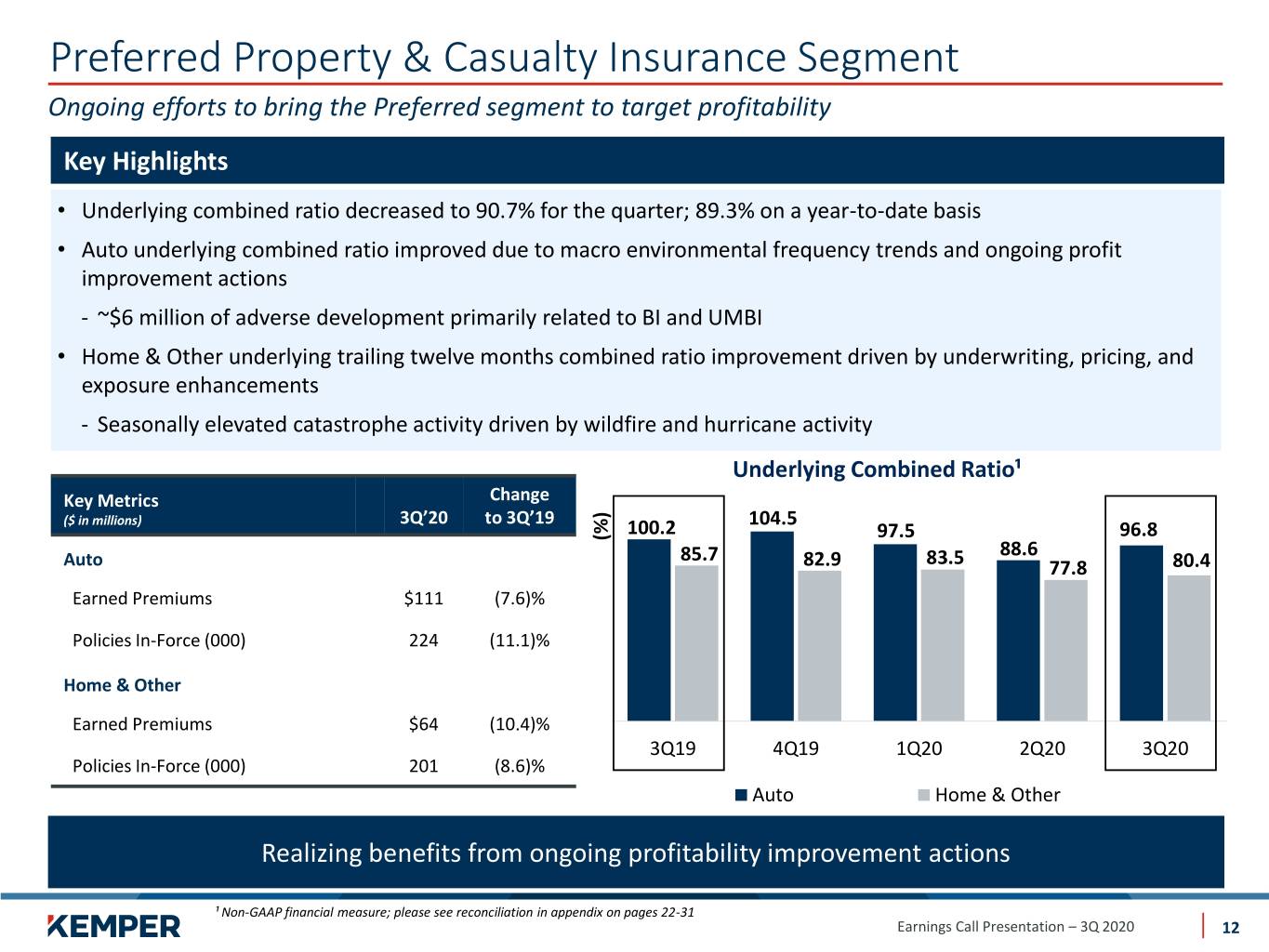

Preferred Property & Casualty Insurance Segment Ongoing efforts to bring the Preferred segment to target profitability Key Highlights • Underlying combined ratio decreased to 90.7% for the quarter; 89.3% on a year-to-date basis • Auto underlying combined ratio improved due to macro environmental frequency trends and ongoing profit improvement actions - ~$6 million of adverse development primarily related to BI and UMBI • Home & Other underlying trailing twelve months combined ratio improvement driven by underwriting, pricing, and exposure enhancements - Seasonally elevated catastrophe activity driven by wildfire and hurricane activity Underlying Combined Ratio¹ Key Metrics Change ($ in millions) 3Q’20 to 3Q’19 100.2 104.5 (%) 97.5 96.8 85.7 88.6 Auto 82.9 83.5 77.8 80.4 Earned Premiums $111 (7.6)% Policies In-Force (000) 224 (11.1)% Home & Other Earned Premiums $64 (10.4)% 3Q19 4Q19 1Q20 2Q20 3Q20 Policies In-Force (000) 201 (8.6)% Auto Home & Other Realizing benefits from ongoing profitability improvement actions ¹ Non-GAAP financial measure; please see reconciliation in appendix on pages 22-31 Earnings Call Presentation – 3Q 2020 12

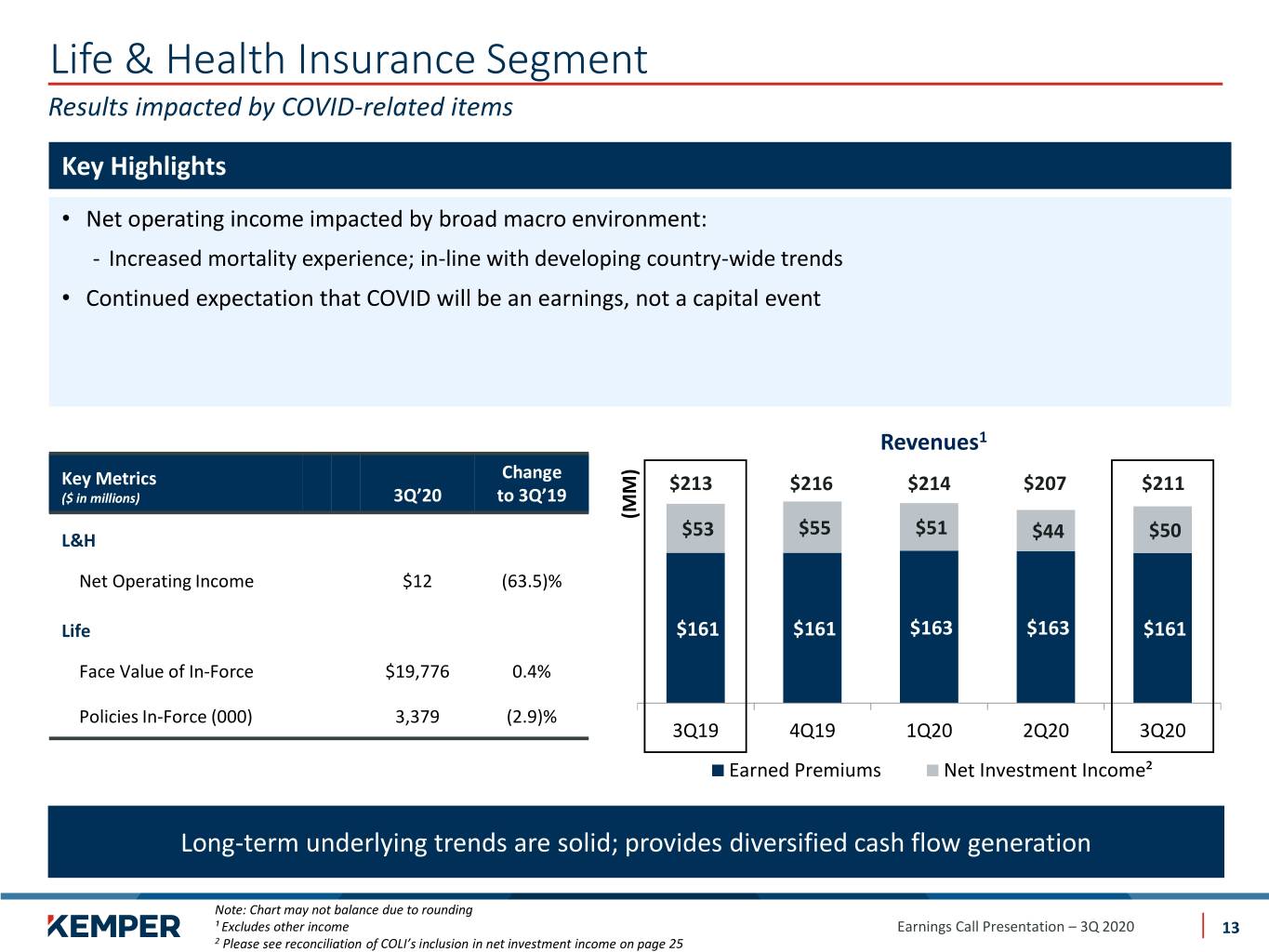

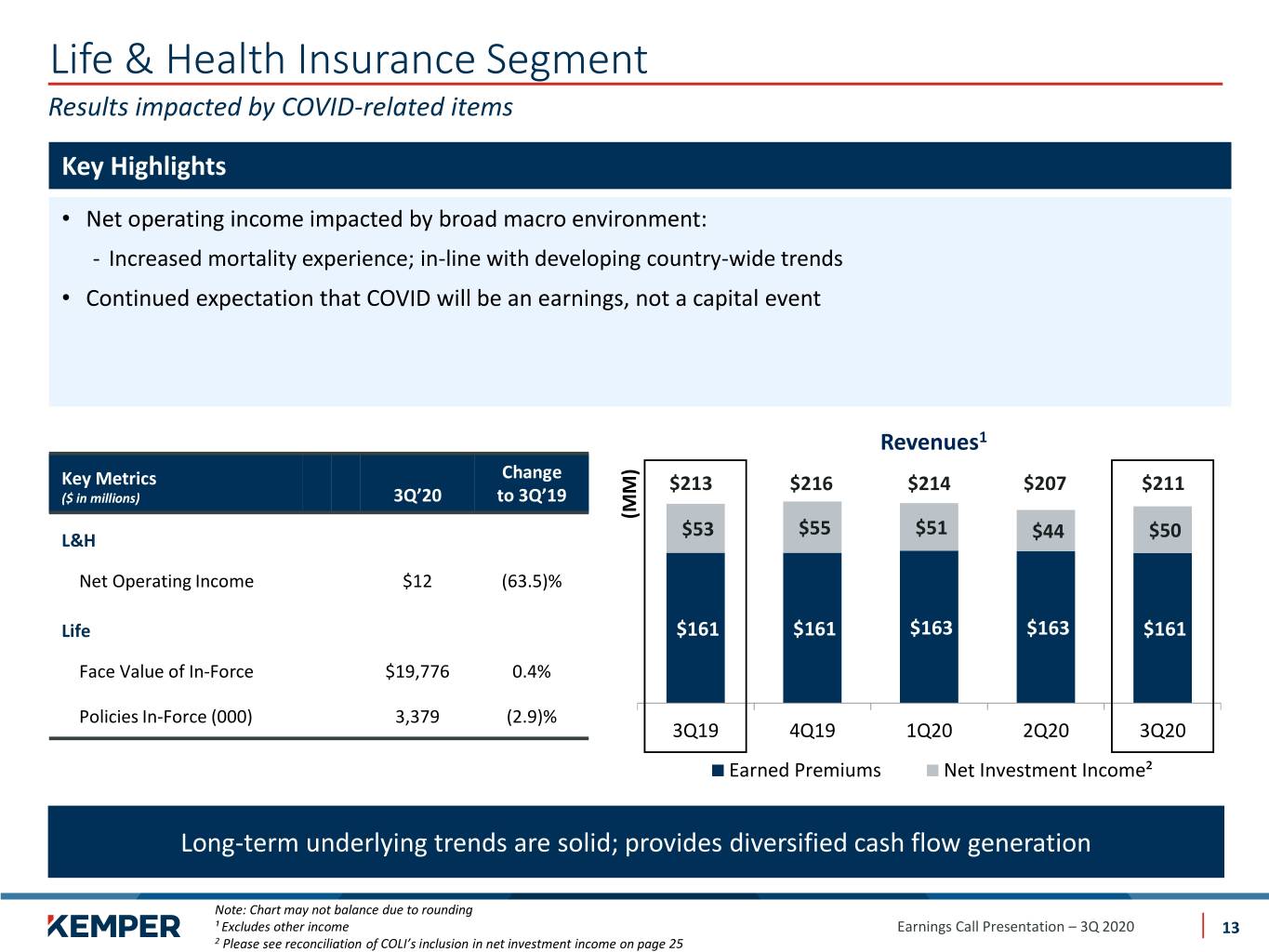

Life & Health Insurance Segment Results impacted by COVID-related items Key Highlights • Net operating income impacted by broad macro environment: - Increased mortality experience; in-line with developing country-wide trends • Continued expectation that COVID will be an earnings, not a capital event Revenues1 Change Key Metrics $213 $216 $214 $207 $211 ($ in millions) 3Q’20 to 3Q’19 (MM) $53 $55 $51 L&H $44 $50 Net Operating Income $12 (63.5)% Life $161 $161 $163 $163 $161 Face Value of In-Force $19,776 0.4% Policies In-Force (000) 3,379 (2.9)% 3Q19 4Q19 1Q20 2Q20 3Q20 Earned Premiums Net Investment Income² Long-term underlying trends are solid; provides diversified cash flow generation Note: Chart may not balance due to rounding ¹ Excludes other income Earnings Call Presentation – 3Q 2020 13 2 Please see reconciliation of COLI’s inclusion in net investment income on page 25

Appendix Earnings Call Presentation – 3Q 2020 14

A Leading Specialized Insurer Taking advantage of a diversified portfolio of niche businesses…. Founded in 1990 and headquartered in Chicago, with subsidiaries writing policies since 1911 ~$14B ~6.3M ~30,000 ~9,300 Assets Policies Agents/Brokers Employees Specialty P&C insurance providing Preferred personal lines insurance Life and health insurance personal and commercial providing preferred automobile, providing life, supplemental automobile insurance products homeowners and other personal benefits, and other property insurance products insurance products ….to create value for all our stakeholders Earnings Call Presentation – 3Q 2020 15

Capital Deployment Priorities Dedicated to being good stewards of capital 1. Investment in the business • Fund profitable organic growth at appropriate risk-adjusted returns • Strategic investments and acquisitions that enhance the business and meet or exceed our ROE targets over time 2. Return capital to shareholders • Repurchase shares opportunistically • Maintain competitive dividends Management and capital deployment priorities focused on maximizing shareholder value Earnings Call Presentation – 3Q 2020 16

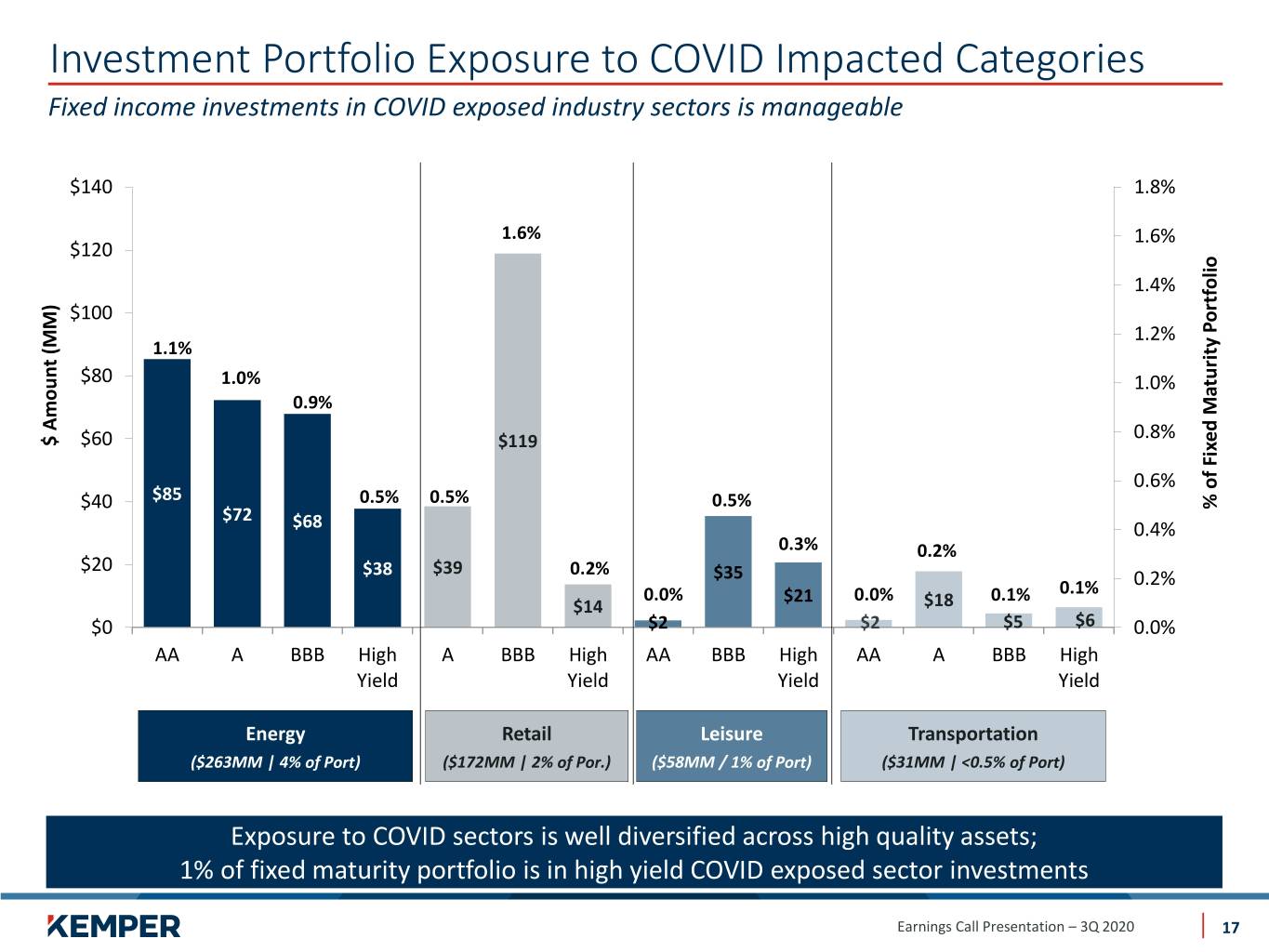

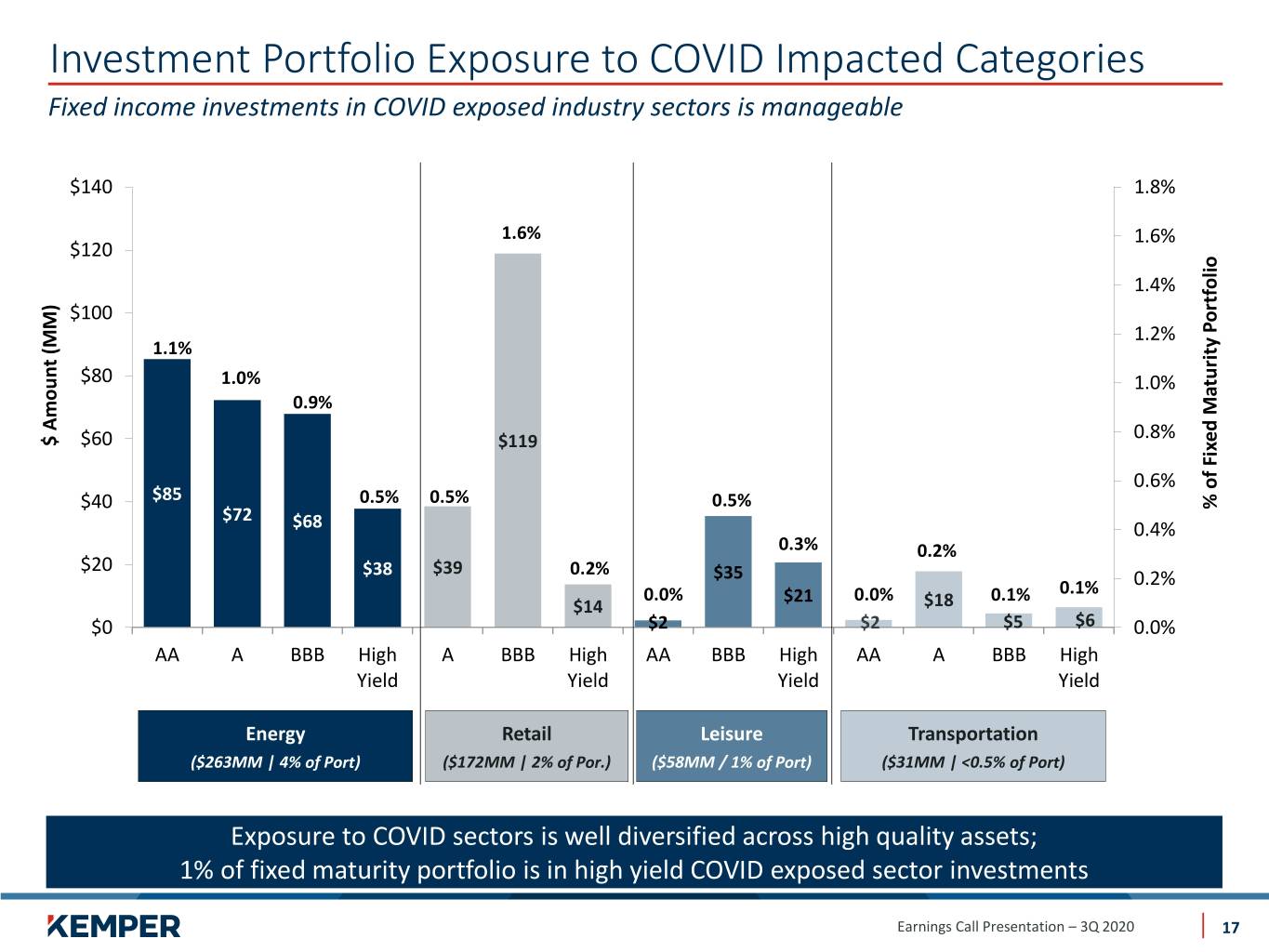

Investment Portfolio Exposure to COVID Impacted Categories Fixed income investments in COVID exposed industry sectors is manageable $140 1.8% 1.6% 1.6% $120 1.4% $100 1.2% 1.1% $80 1.0% 1.0% 0.9% 0.8% $ Amount (MM) $ Amount $60 $119 0.6% $85 0.5% 0.5% $40 0.5% Portfolio Maturity % Fixed of $72 $68 0.4% 0.3% 0.2% $20 $39 $38 0.2% $35 0.2% 0.0% $21 0.0% 0.1% 0.1% $14 $18 $0 $2 $2 $5 $6 0.0% AA A BBB High A BBB High AA BBB High AA A BBB High Yield Yield Yield Yield Energy Retail Leisure Transportation ($263MM | 4% of Port) ($172MM | 2% of Por.) ($58MM / 1% of Port) ($31MM | <0.5% of Port) Exposure to COVID sectors is well diversified across high quality assets; 1% of fixed maturity portfolio is in high yield COVID exposed sector investments Earnings Call Presentation – 3Q 2020 17

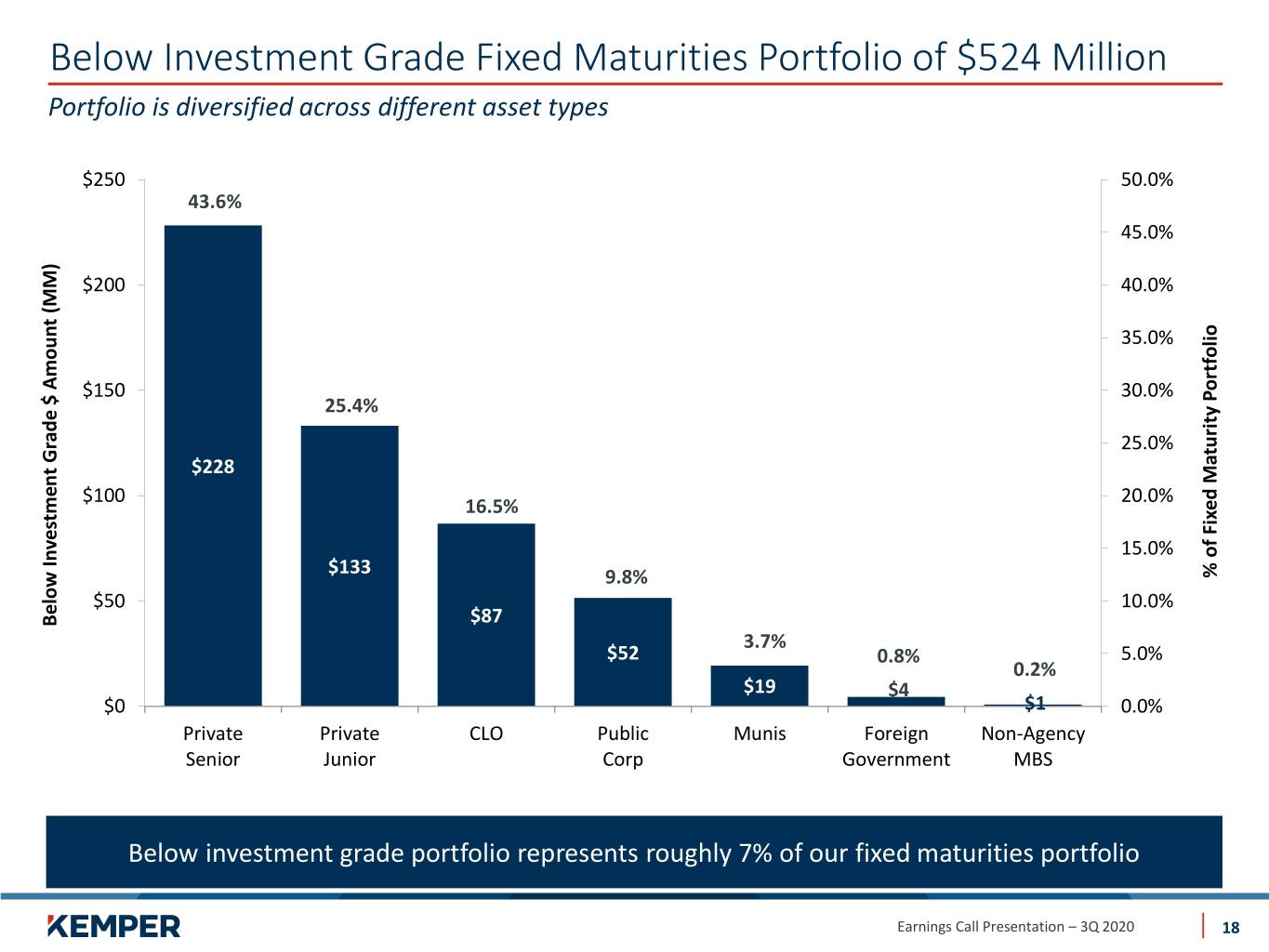

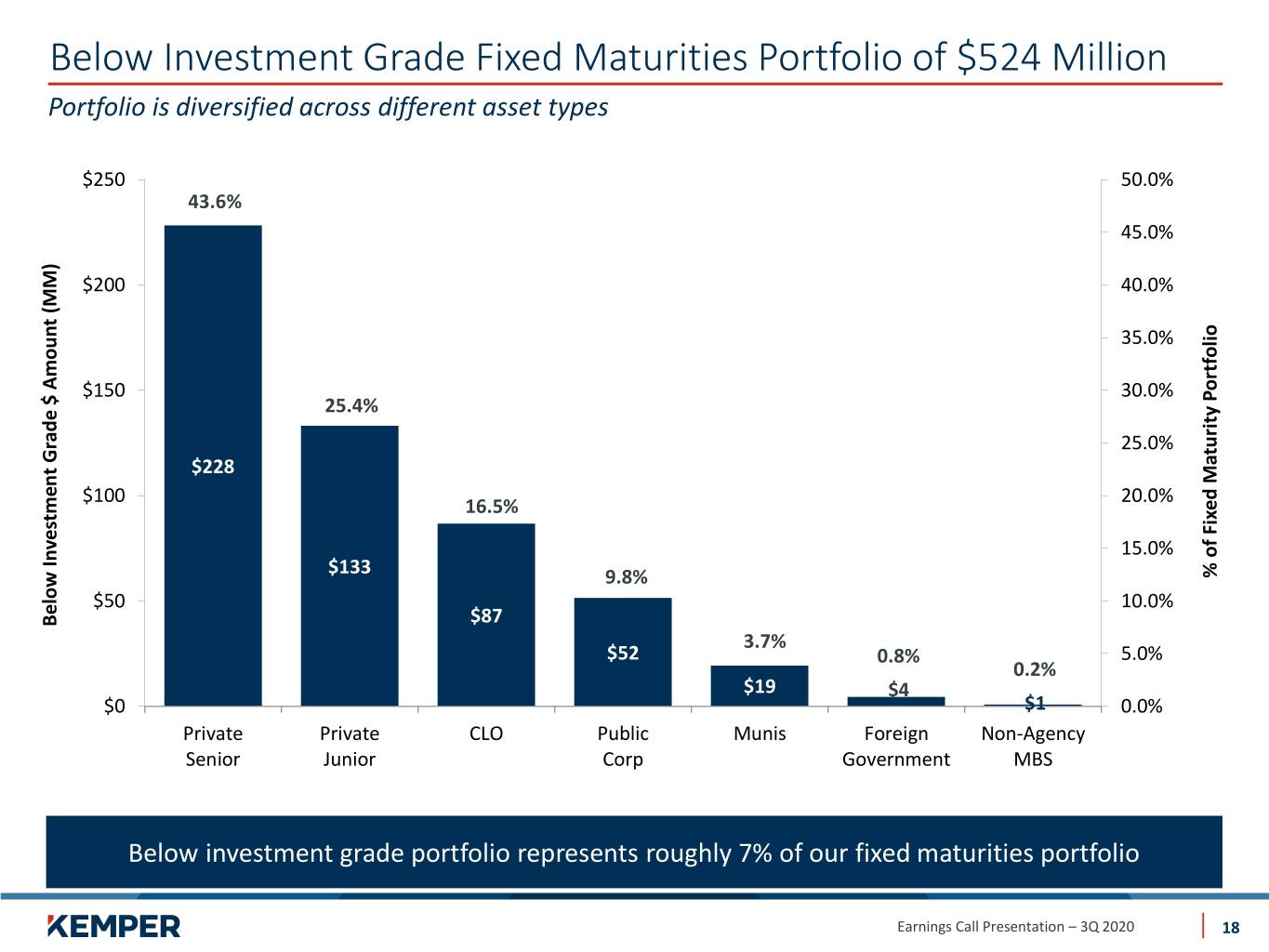

Below Investment Grade Fixed Maturities Portfolio of $524 Million Portfolio is diversified across different asset types $250 50.0% 43.6% 45.0% $200 40.0% 35.0% $150 30.0% 25.4% 25.0% $228 $100 20.0% 16.5% 15.0% $133 9.8% Portfolio Maturity % Fixed of $50 10.0% Below Investment Grade $ $ Amount (MM) Grade Below Investment $87 3.7% $52 0.8% 5.0% 0.2% $19 $4 $0 $1 0.0% Private Private CLO Public Munis Foreign Non-Agency Senior Junior Corp Government MBS Below investment grade portfolio represents roughly 7% of our fixed maturities portfolio Earnings Call Presentation – 3Q 2020 18

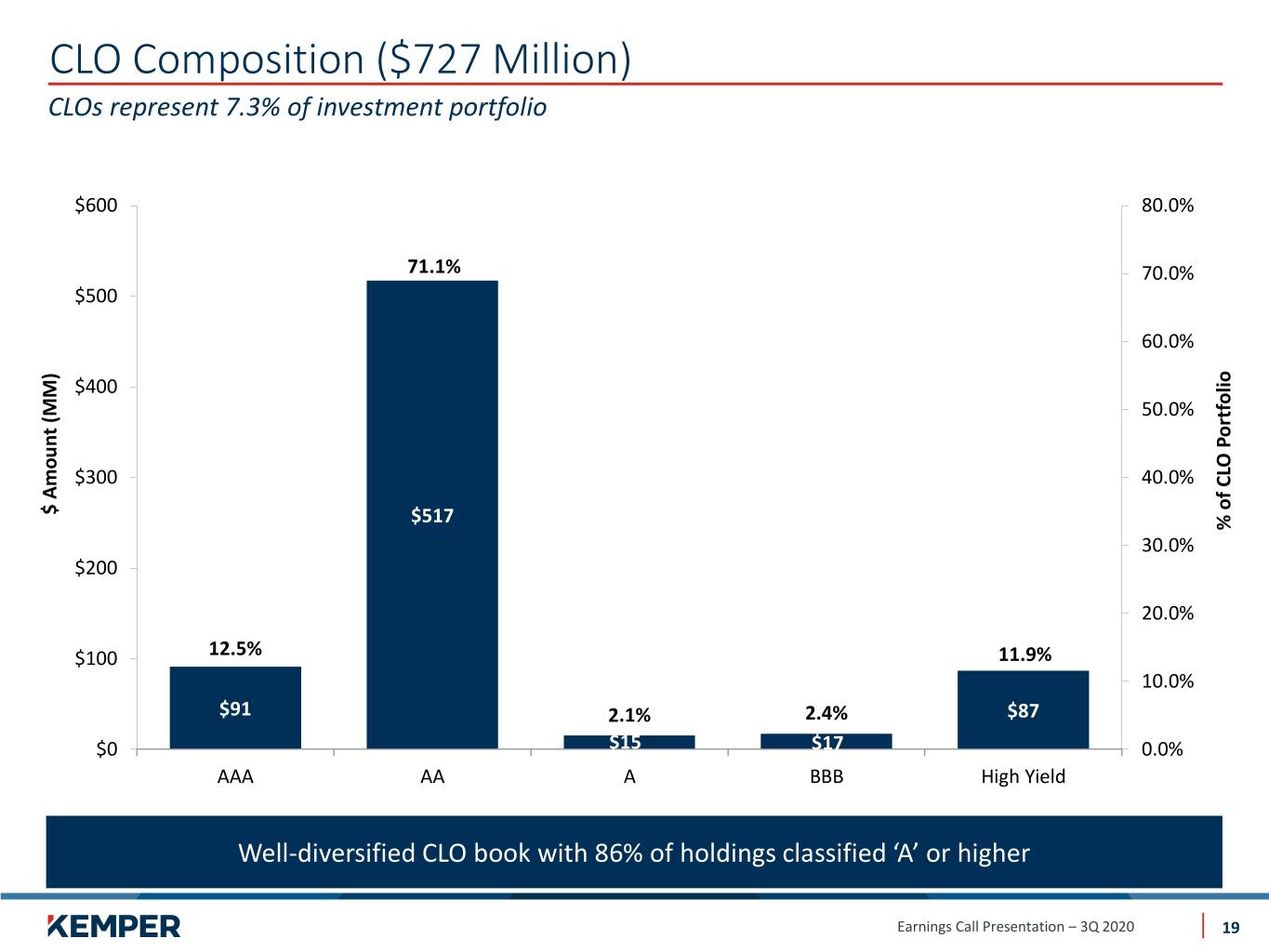

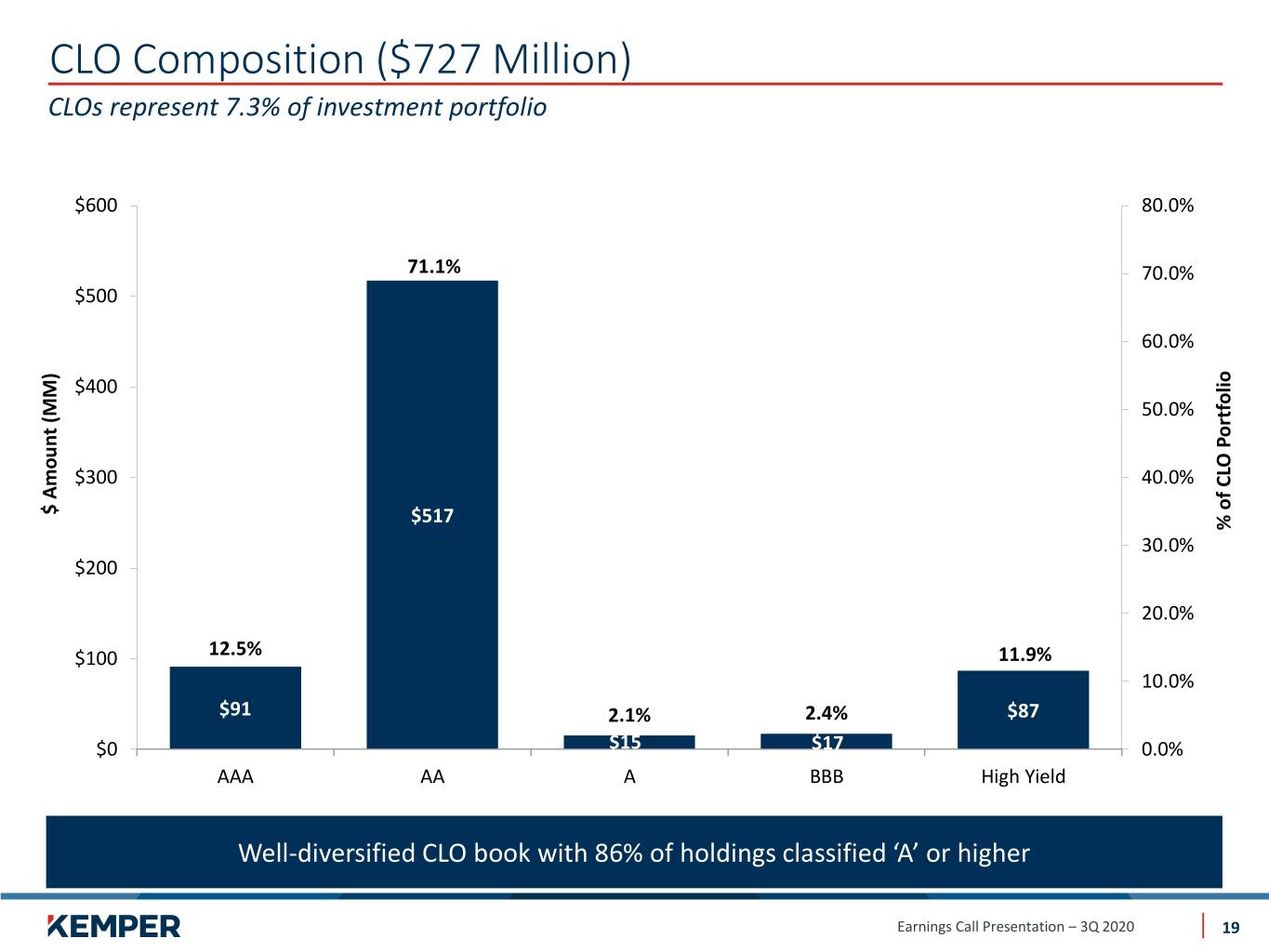

CLO Composition ($727 Million) CLOs represent 7.3% of investment portfolio $600 80.0% 71.1% 70.0% $500 60.0% $400 50.0% $300 40.0% $ Amount (MM) $ Amount $517 % of CLO %Portfolio CLO of 30.0% $200 20.0% $100 12.5% 11.9% 10.0% $91 2.1% 2.4% $87 $0 $15 $17 0.0% AAA AA A BBB High Yield Well-diversified CLO book with 86% of holdings classified ‘A’ or higher Earnings Call Presentation – 3Q 2020 19

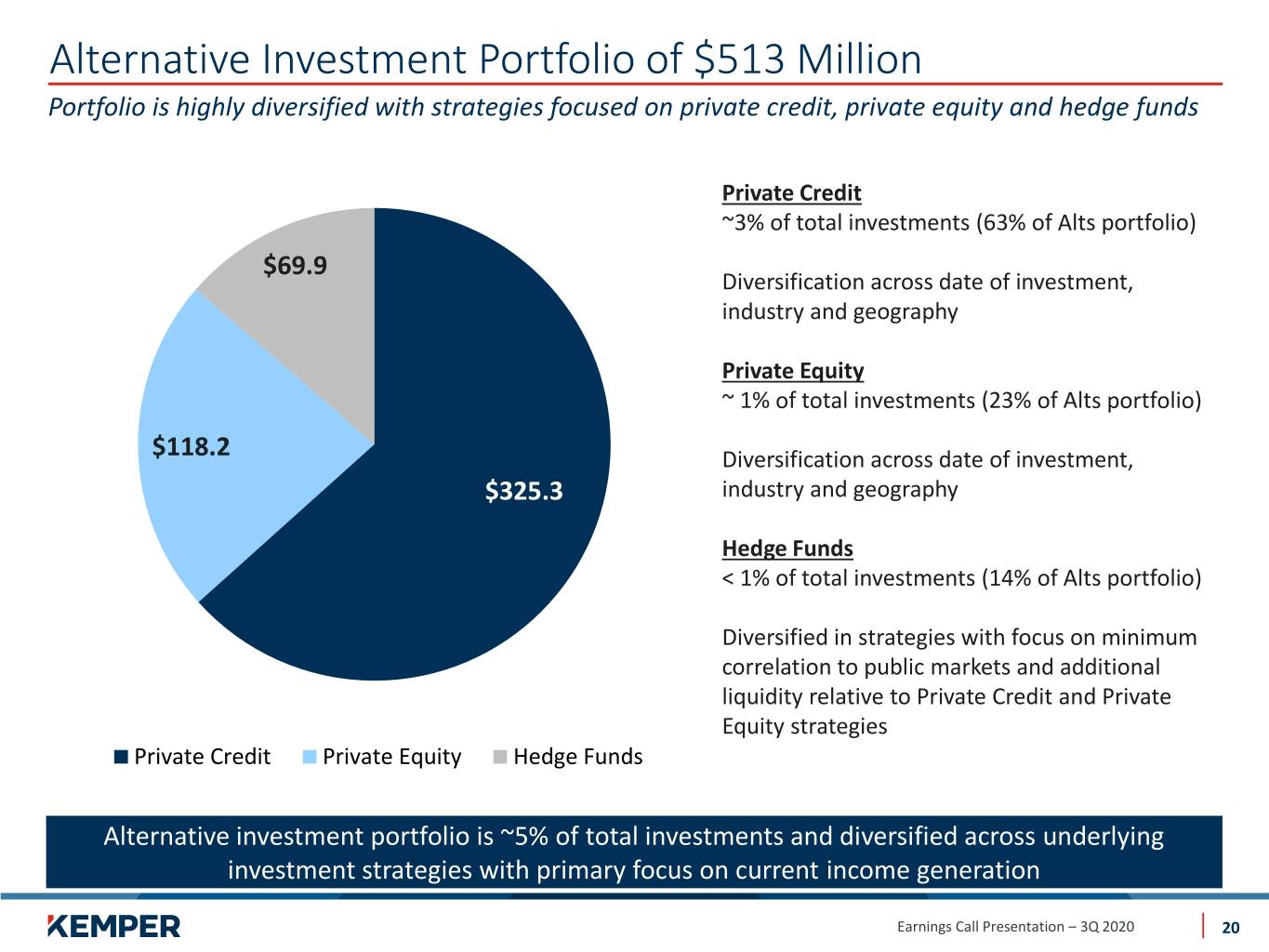

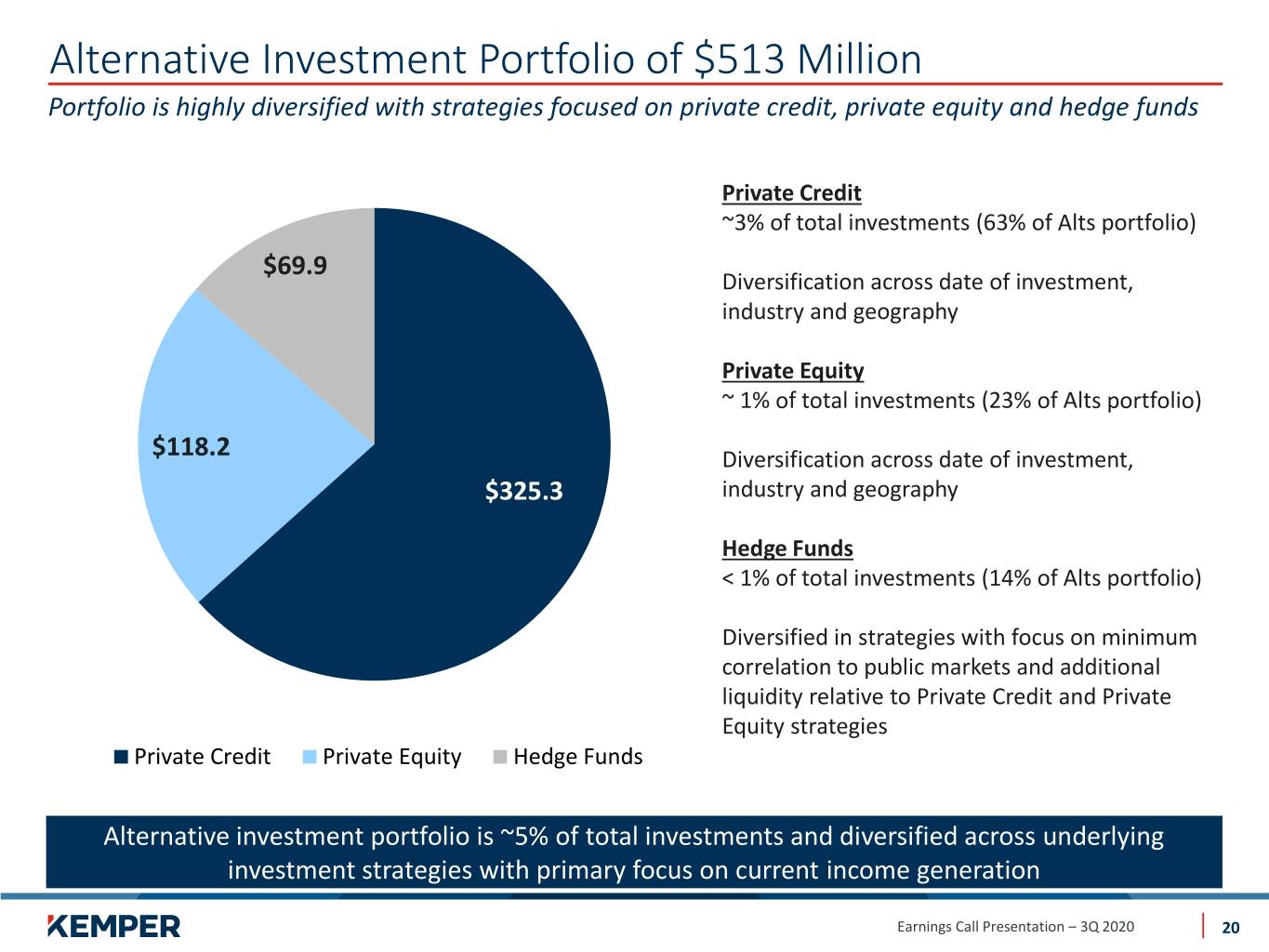

Alternative Investment Portfolio of $513 Million Portfolio is highly diversified with strategies focused on private credit, private equity and hedge funds Private Credit ~3% of total investments (63% of Alts portfolio) $69.9 Diversification across date of investment, industry and geography Private Equity ~ 1% of total investments (23% of Alts portfolio) $118.2 Diversification across date of investment, $325.3 industry and geography Hedge Funds < 1% of total investments (14% of Alts portfolio) Diversified in strategies with focus on minimum correlation to public markets and additional liquidity relative to Private Credit and Private Equity strategies Private Credit Private Equity Hedge Funds Alternative investment portfolio is ~5% of total investments and diversified across underlying investment strategies with primary focus on current income generation Earnings Call Presentation – 3Q 2020 20

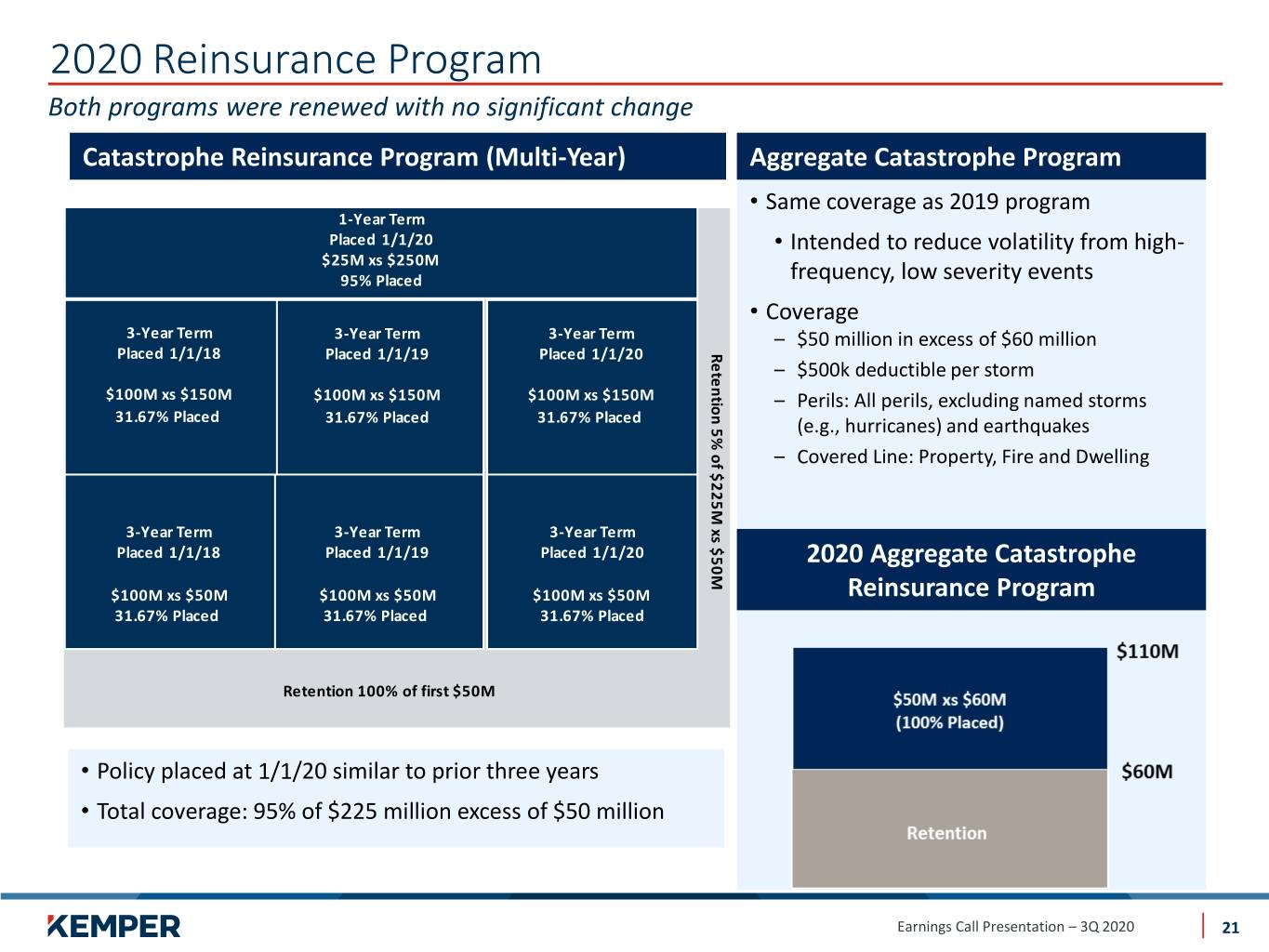

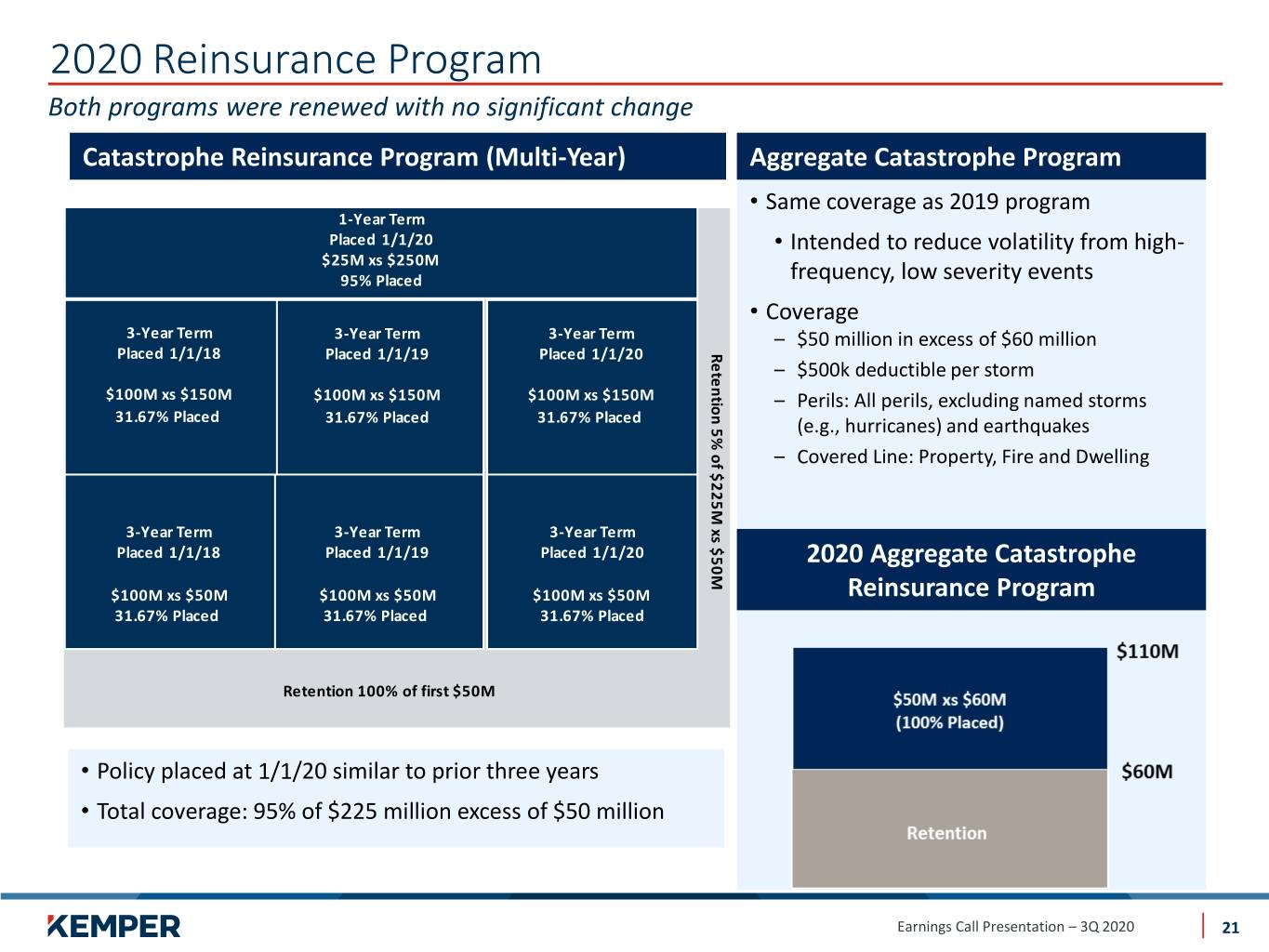

2020 Reinsurance Program Both programs were renewed with no significant change Catastrophe Reinsurance Program (Multi-Year) Aggregate Catastrophe Program • Same coverage as 2019 program 1-Year Term Placed 1/1/20 • Intended to reduce volatility from high- $25M xs $250M 95% Placed frequency, low severity events • Coverage 3-Year Term 3-Year Term 3-Year Term – $50 million in excess of $60 million Placed 1/1/18 Placed 1/1/19 Placed 1/1/20 5% Retention – $500k deductible per storm $100M xs $150M $100M xs $150M $100M xs $150M – Perils: All perils, excluding named storms 31.67% Placed 31.67% Placed 31.67% Placed (e.g., hurricanes) and earthquakes of $225M $225M of – Covered Line: Property, Fire and Dwelling Retention 3-Year Term 3-Year Term 3-Year Term xs Placed 1/1/18 Placed 1/1/19 Placed 1/1/20 $50M 2020 Aggregate Catastrophe $100M xs $50M $100M xs $50M $100M xs $50M Reinsurance Program 31.67% Placed 31.67% Placed 31.67% Placed Retention 100% of first $50M • Policy placed at 1/1/20 similar to prior three years • Total coverage: 95% of $225 million excess of $50 million Earnings Call Presentation – 3Q 2020 21

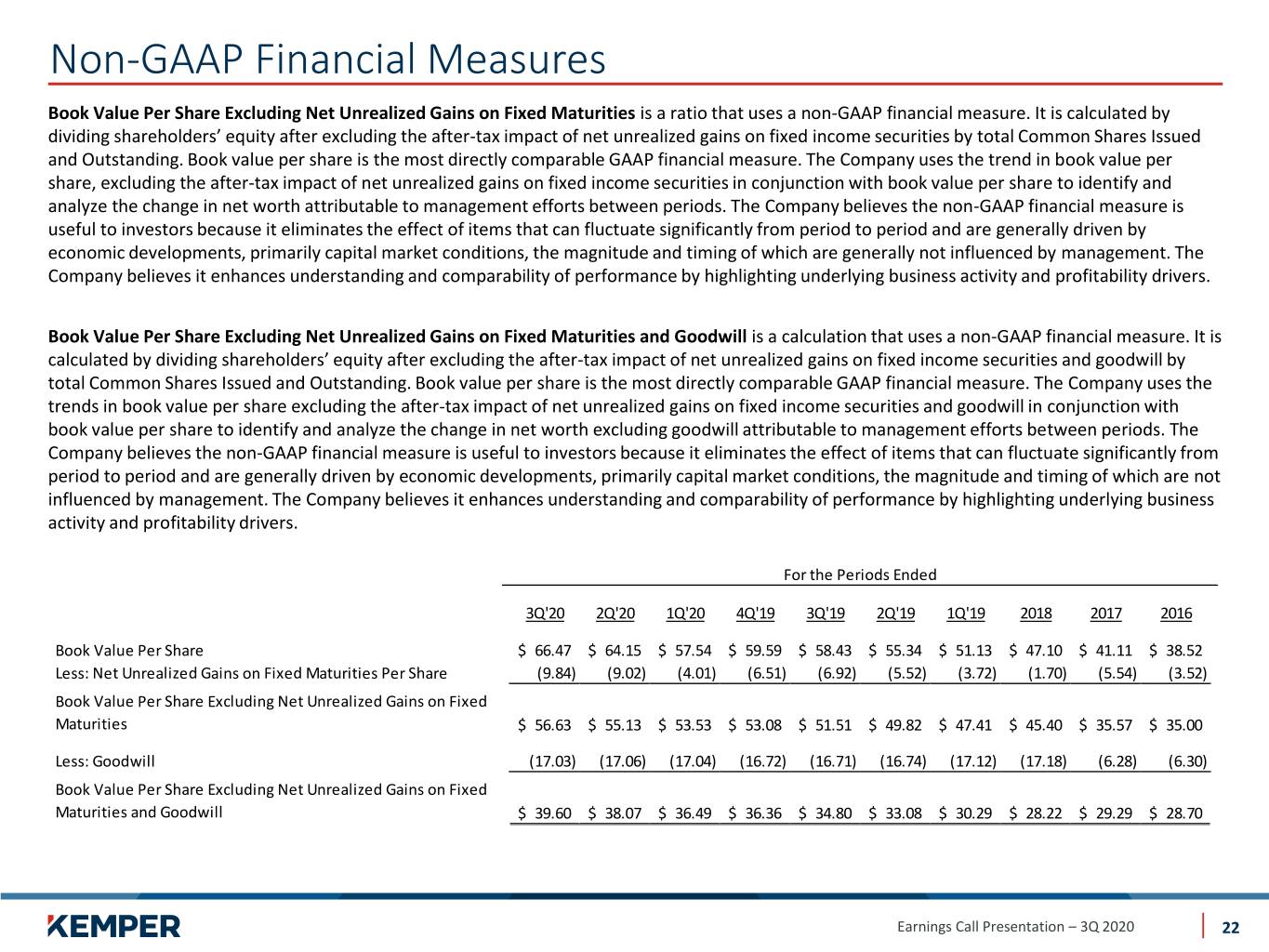

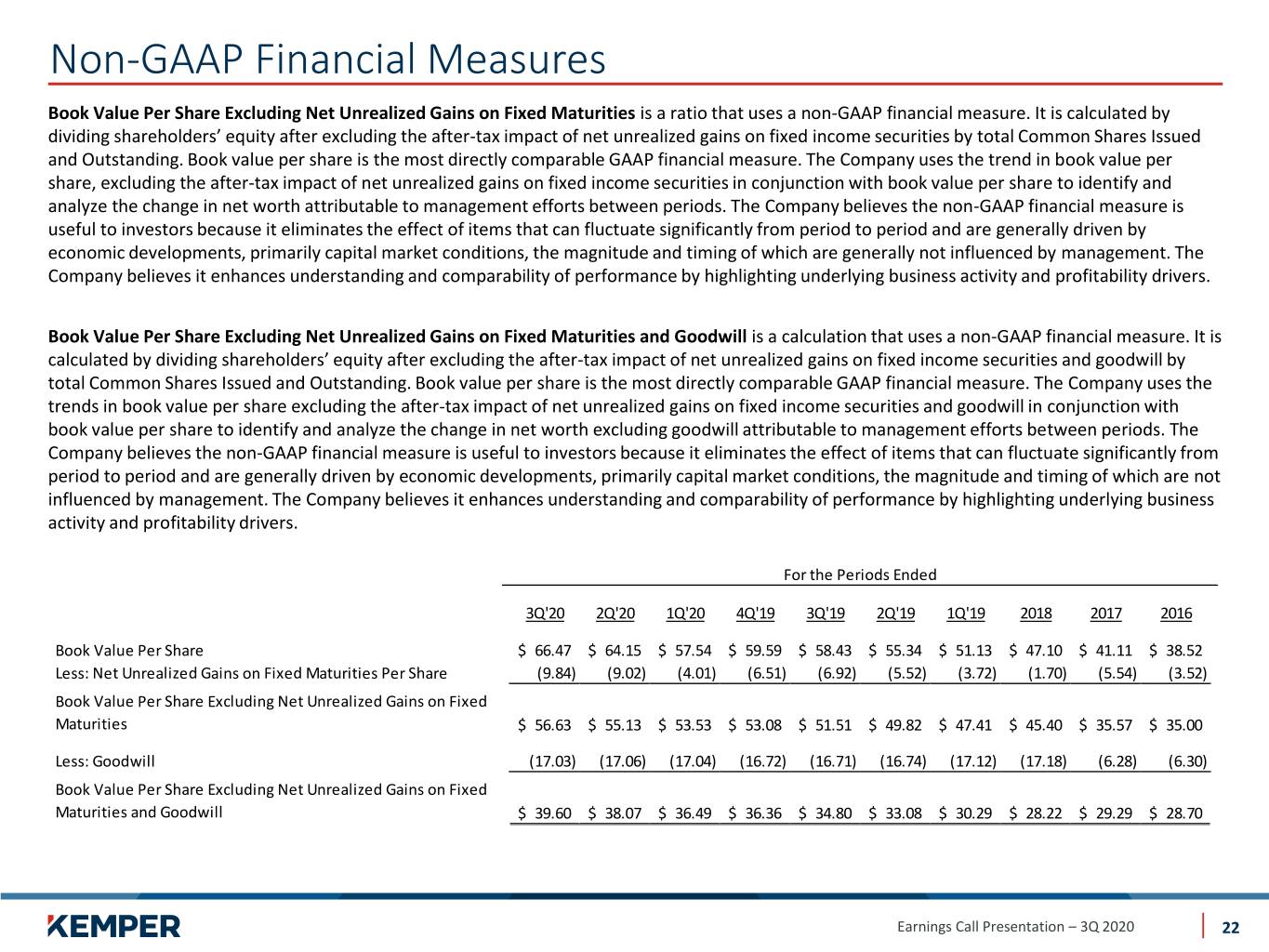

Non-GAAP Financial Measures Book Value Per Share Excluding Net Unrealized Gains on Fixed Maturities is a ratio that uses a non-GAAP financial measure. It is calculated by dividing shareholders’ equity after excluding the after-tax impact of net unrealized gains on fixed income securities by total Common Shares Issued and Outstanding. Book value per share is the most directly comparable GAAP financial measure. The Company uses the trend in book value per share, excluding the after-tax impact of net unrealized gains on fixed income securities in conjunction with book value per share to identify and analyze the change in net worth attributable to management efforts between periods. The Company believes the non-GAAP financial measure is useful to investors because it eliminates the effect of items that can fluctuate significantly from period to period and are generally driven by economic developments, primarily capital market conditions, the magnitude and timing of which are generally not influenced by management. The Company believes it enhances understanding and comparability of performance by highlighting underlying business activity and profitability drivers. Book Value Per Share Excluding Net Unrealized Gains on Fixed Maturities and Goodwill is a calculation that uses a non-GAAP financial measure. It is calculated by dividing shareholders’ equity after excluding the after-tax impact of net unrealized gains on fixed income securities and goodwill by total Common Shares Issued and Outstanding. Book value per share is the most directly comparable GAAP financial measure. The Company uses the trends in book value per share excluding the after-tax impact of net unrealized gains on fixed income securities and goodwill in conjunction with book value per share to identify and analyze the change in net worth excluding goodwill attributable to management efforts between periods. The Company believes the non-GAAP financial measure is useful to investors because it eliminates the effect of items that can fluctuate significantly from period to period and are generally driven by economic developments, primarily capital market conditions, the magnitude and timing of which are not influenced by management. The Company believes it enhances understanding and comparability of performance by highlighting underlying business activity and profitability drivers. For the Periods Ended 3Q'20 2Q'20 1Q'20 4Q'19 3Q'19 2Q'19 1Q'19 2018 2017 2016 Book Value Per Share $ 66.47 $ 64.15 $ 57.54 $ 59.59 $ 58.43 $ 55.34 $ 51.13 $ 47.10 $ 41.11 $ 38.52 Less: Net Unrealized Gains on Fixed Maturities Per Share (9.84) (9.02) (4.01) (6.51) (6.92) (5.52) (3.72) (1.70) (5.54) (3.52) Book Value Per Share Excluding Net Unrealized Gains on Fixed Maturities $ 56.63 $ 55.13 $ 53.53 $ 53.08 $ 51.51 $ 49.82 $ 47.41 $ 45.40 $ 35.57 $ 35.00 Less: Goodwill (17.03) (17.06) (17.04) (16.72) (16.71) (16.74) (17.12) (17.18) (6.28) (6.30) Book Value Per Share Excluding Net Unrealized Gains on Fixed Maturities and Goodwill $ 39.60 $ 38.07 $ 36.49 $ 36.36 $ 34.80 $ 33.08 $ 30.29 $ 28.22 $ 29.29 $ 28.70 Earnings Call Presentation – 3Q 2020 22

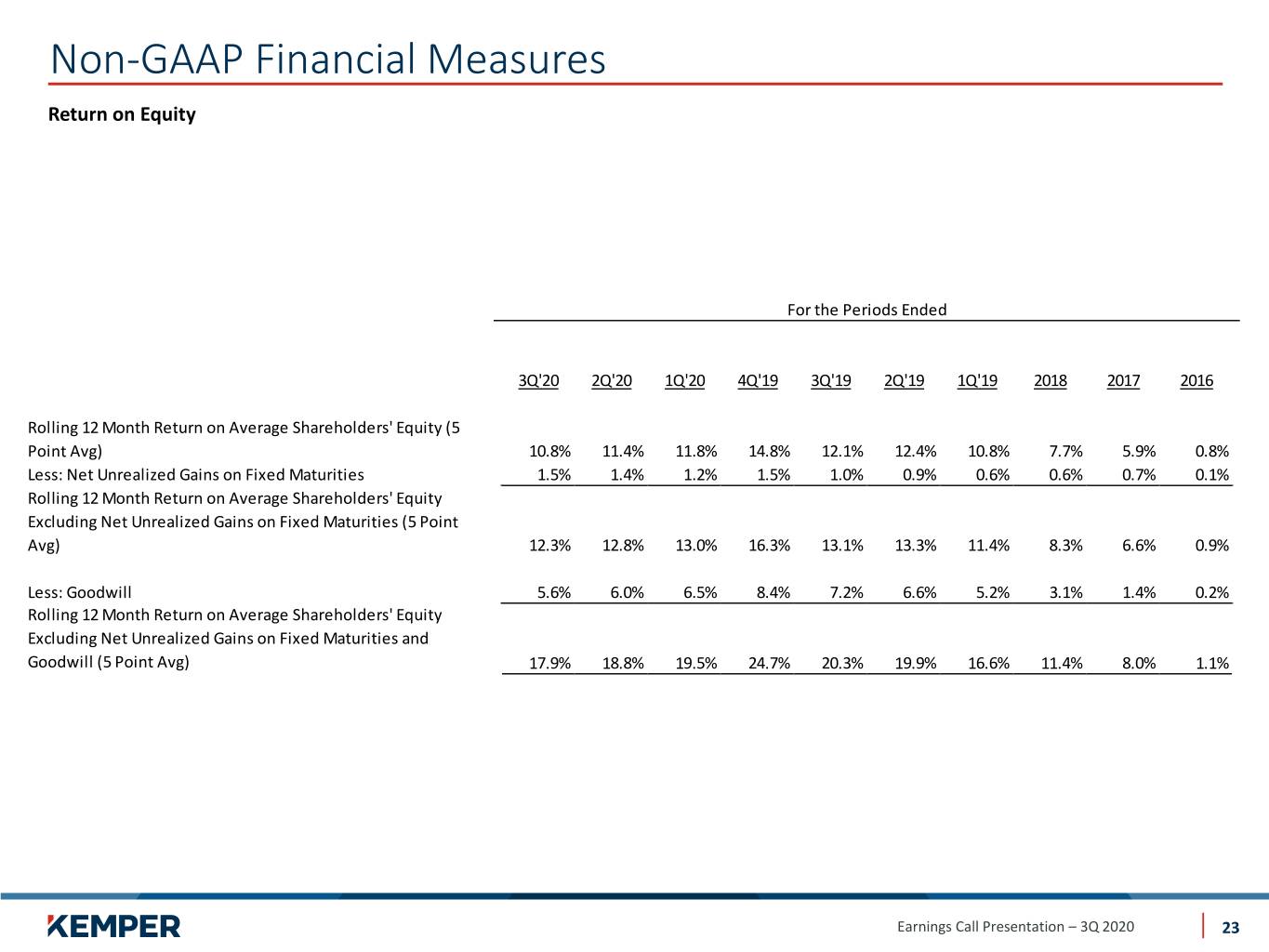

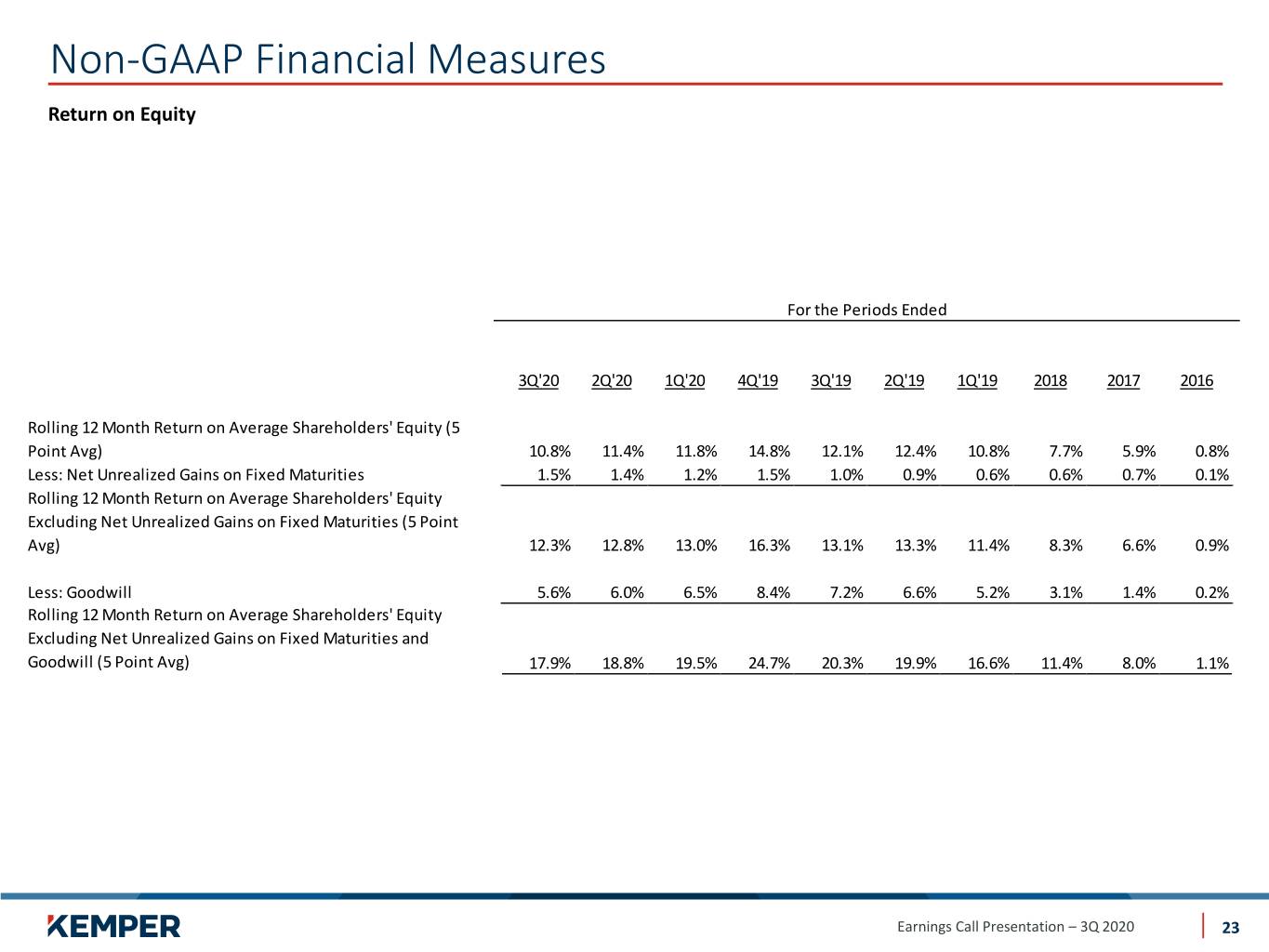

Non-GAAP Financial Measures Return on Equity For the Periods Ended 3Q'20 2Q'20 1Q'20 4Q'19 3Q'19 2Q'19 1Q'19 2018 2017 2016 Rolling 12 Month Return on Average Shareholders' Equity (5 Point Avg) 10.8% 11.4% 11.8% 14.8% 12.1% 12.4% 10.8% 7.7% 5.9% 0.8% Less: Net Unrealized Gains on Fixed Maturities 1.5% 1.4% 1.2% 1.5% 1.0% 0.9% 0.6% 0.6% 0.7% 0.1% Rolling 12 Month Return on Average Shareholders' Equity Excluding Net Unrealized Gains on Fixed Maturities (5 Point Avg) 12.3% 12.8% 13.0% 16.3% 13.1% 13.3% 11.4% 8.3% 6.6% 0.9% Less: Goodwill 5.6% 6.0% 6.5% 8.4% 7.2% 6.6% 5.2% 3.1% 1.4% 0.2% Rolling 12 Month Return on Average Shareholders' Equity Excluding Net Unrealized Gains on Fixed Maturities and Goodwill (5 Point Avg) 17.9% 18.8% 19.5% 24.7% 20.3% 19.9% 16.6% 11.4% 8.0% 1.1% Earnings Call Presentation – 3Q 2020 23

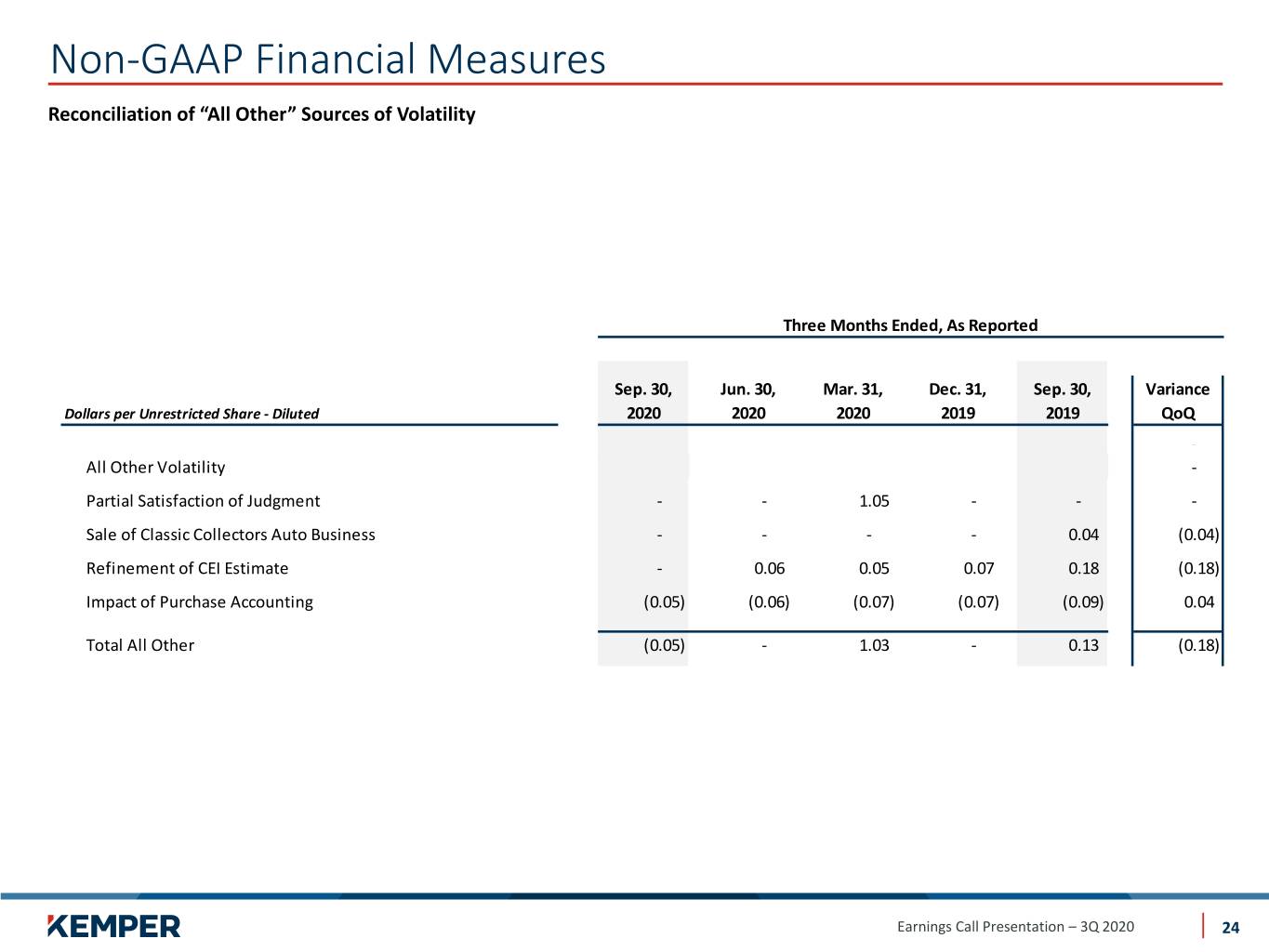

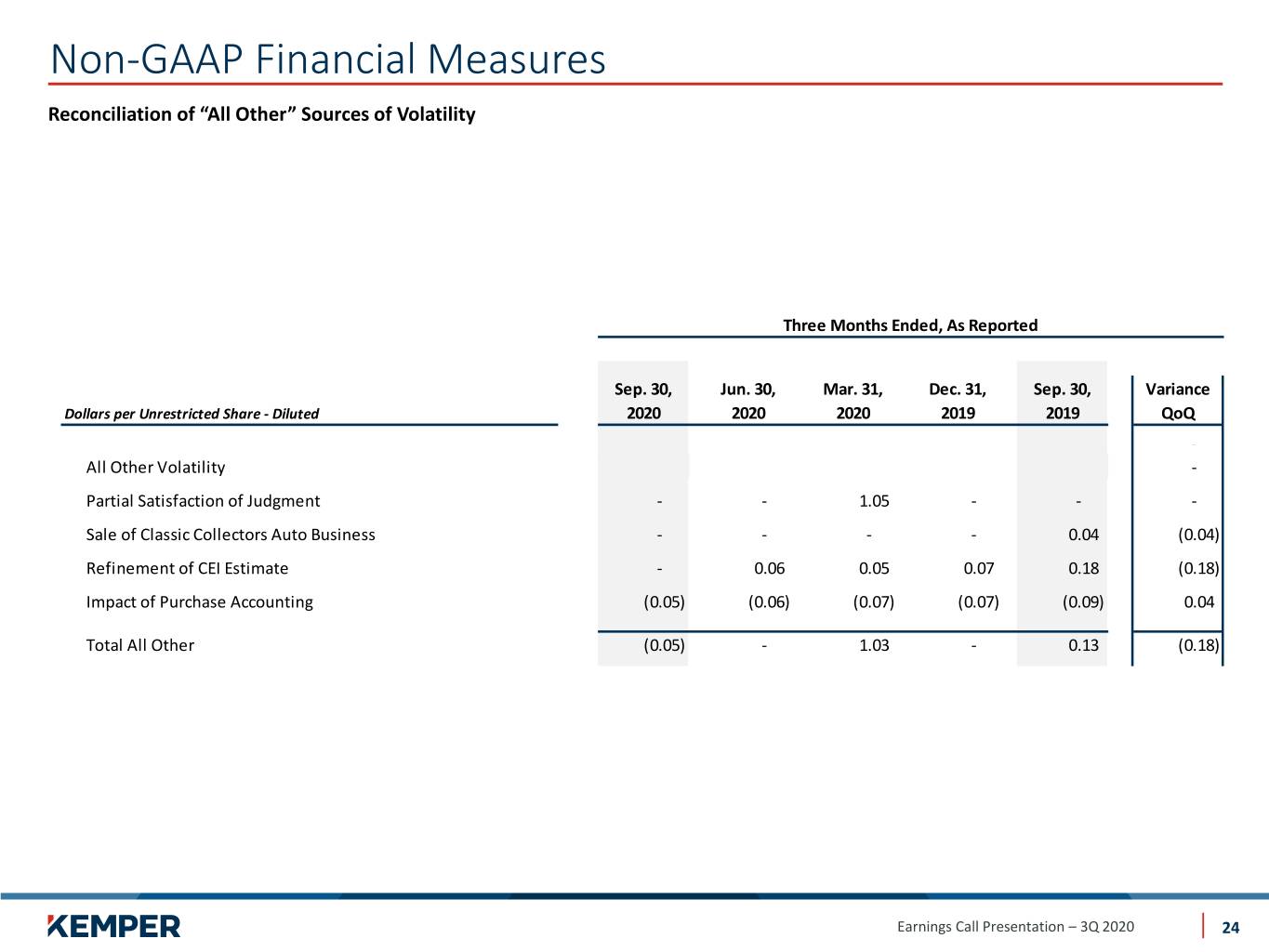

Non-GAAP Financial Measures Reconciliation of “All Other” Sources of Volatility Three Months Ended, As Reported Sep. 30, Jun. 30, Mar. 31, Dec. 31, Sep. 30, Variance Dollars per Unrestricted Share - Diluted 2020 2020 2020 2019 2019 QoQ - - All Other Volatility - Partial Satisfaction of Judgment - - 1.05 - - - Sale of Classic Collectors Auto Business - - - - 0.04 (0.04) Refinement of CEI Estimate - 0.06 0.05 0.07 0.18 (0.18) Impact of Purchase Accounting (0.05) (0.06) (0.07) (0.07) (0.09) 0.04 Total All Other (0.05) - 1.03 - 0.13 (0.18) Earnings Call Presentation – 3Q 2020 24

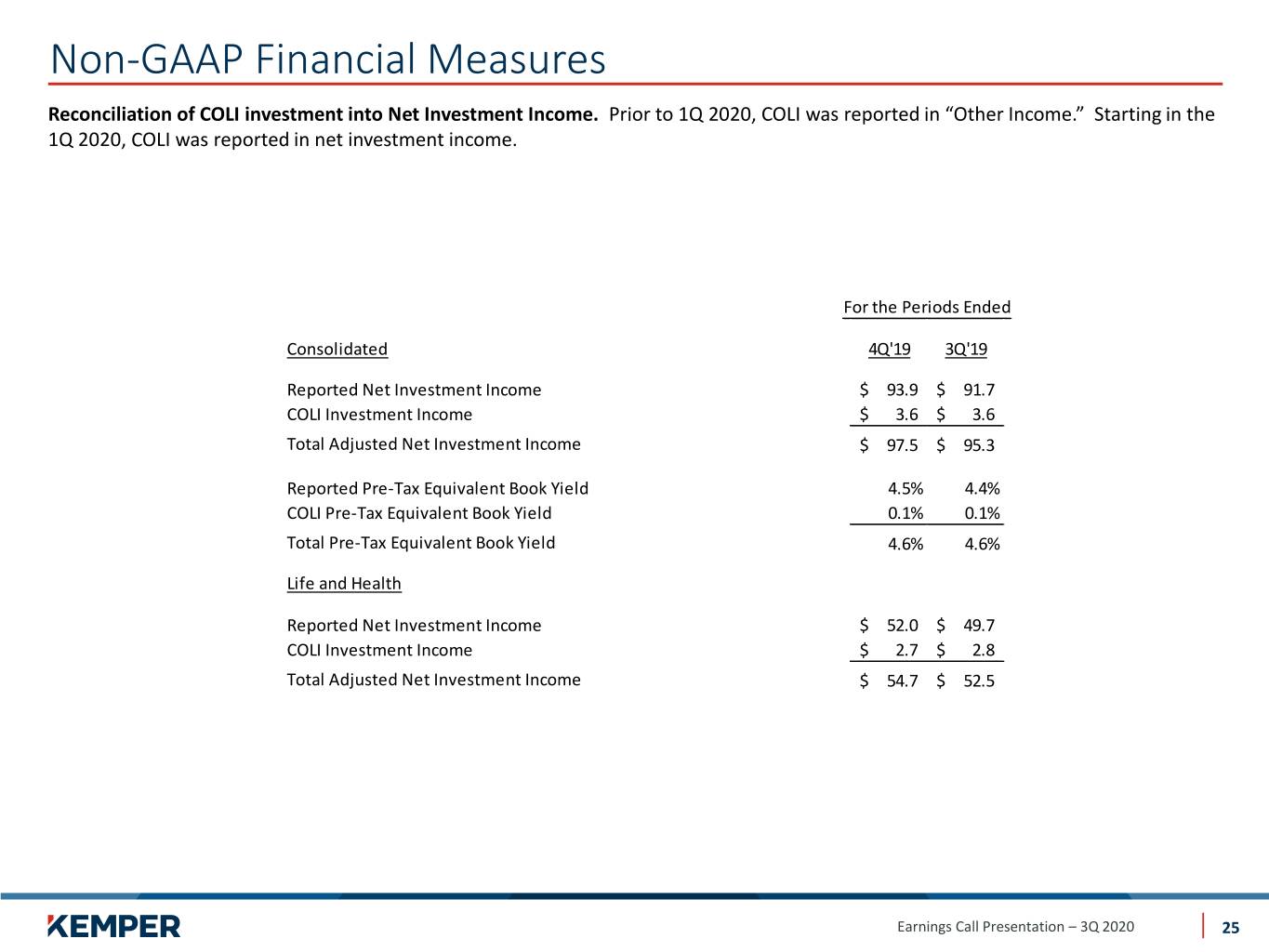

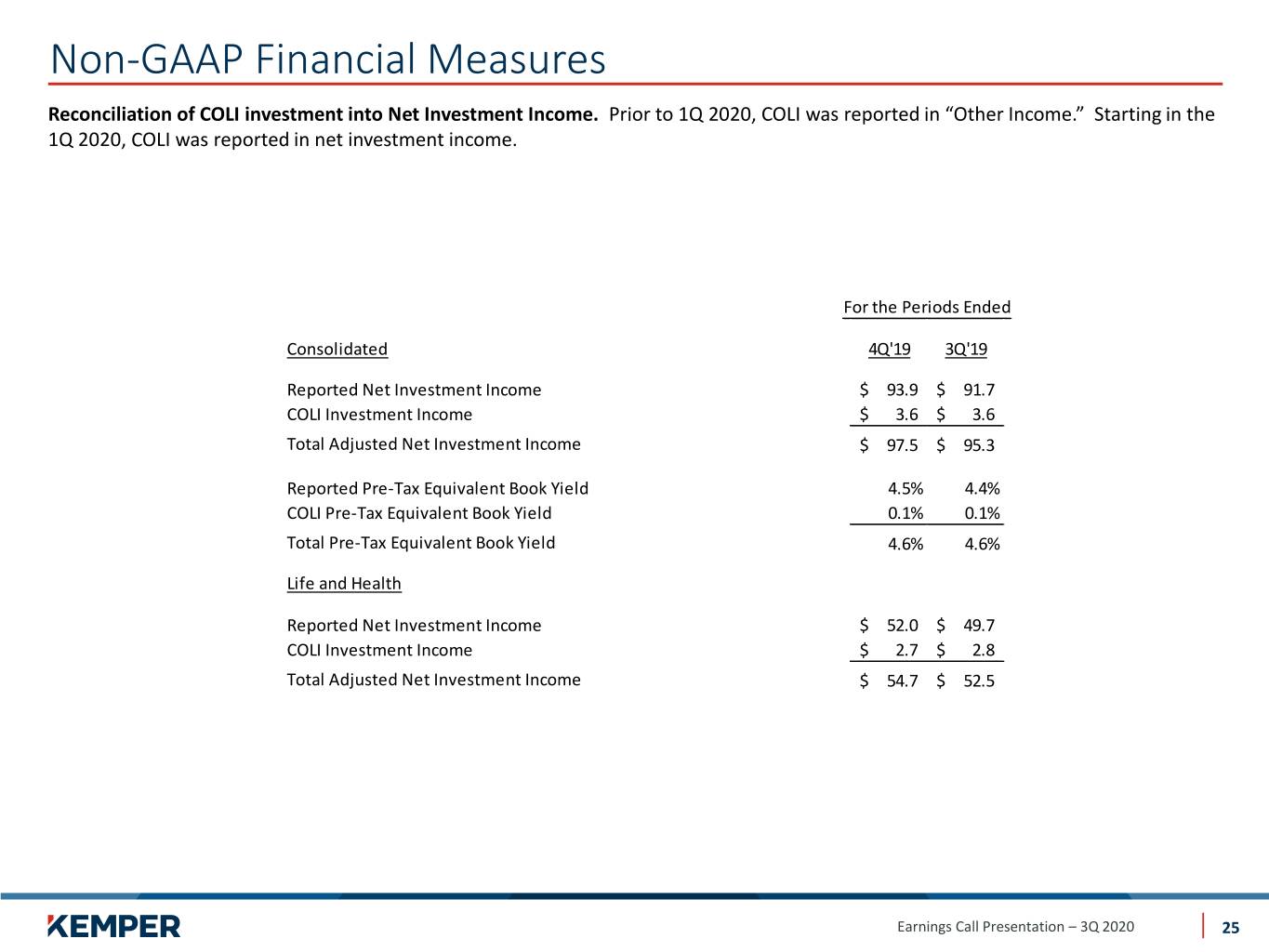

Non-GAAP Financial Measures Reconciliation of COLI investment into Net Investment Income. Prior to 1Q 2020, COLI was reported in “Other Income.” Starting in the 1Q 2020, COLI was reported in net investment income. For the Periods Ended Consolidated 4Q'19 3Q'19 Reported Net Investment Income $ 93.9 $ 91.7 COLI Investment Income $ 3.6 $ 3.6 Total Adjusted Net Investment Income $ 97.5 $ 95.3 Reported Pre-Tax Equivalent Book Yield 4.5% 4.4% COLI Pre-Tax Equivalent Book Yield 0.1% 0.1% Total Pre-Tax Equivalent Book Yield 4.6% 4.6% Life and Health Reported Net Investment Income $ 52.0 $ 49.7 COLI Investment Income $ 2.7 $ 2.8 Total Adjusted Net Investment Income $ 54.7 $ 52.5 Earnings Call Presentation – 3Q 2020 25

Non-GAAP Financial Measures Adjusted Consolidated Net Operating Income is an after-tax, non-GAAP financial measure computed by excluding from Net Income the after-tax impact of 1) income (loss) from change in fair value of equity and convertible securities, 2) net realized gains on sales of investments, 3) impairment losses related to investments, 4) acquisition related transaction, integration and other costs, 5) loss from early extinguishment of debt and 6) significant non-recurring or infrequent items that may not be indicative of ongoing operations. Significant non-recurring items are excluded when (a) the nature of the charge or gain is such that it is reasonably unlikely to recur within two years and (b) there has been no similar charge or gain within the prior two years. The most directly comparable GAAP financial measure is Net Income. Kemper believes that Adjusted Consolidated Net Operating Income (Loss) provides investors with a valuable measure of its ongoing performance because it reveals underlying operational performance trends that otherwise might be less apparent if the items were not excluded. Income (loss) from change in fair value of equity and convertible securities, net realized gains on sales of investments and impairment losses recognized in earnings related to investments included in the Company’s results may vary significantly between periods and are generally driven by business decisions and external economic developments such as capital market conditions that impact the values of the Company’s investments, the timing of which is unrelated to the insurance underwriting process. Loss from early extinguishment of debt is driven by the Company’s financing and refinancing decisions and capital needs, as well as external economic developments such as debt market conditions, the timing of which is unrelated to the insurance underwriting process. Acquisition related transaction, integration and other costs may vary significantly between periods and are generally driven by the timing of acquisitions and business decisions which are unrelated to the insurance underwriting process. Significant non-recurring items are excluded because, by their nature, they are not indicative of the Company’s business or economic trends. Earnings Call Presentation – 3Q 2020 26

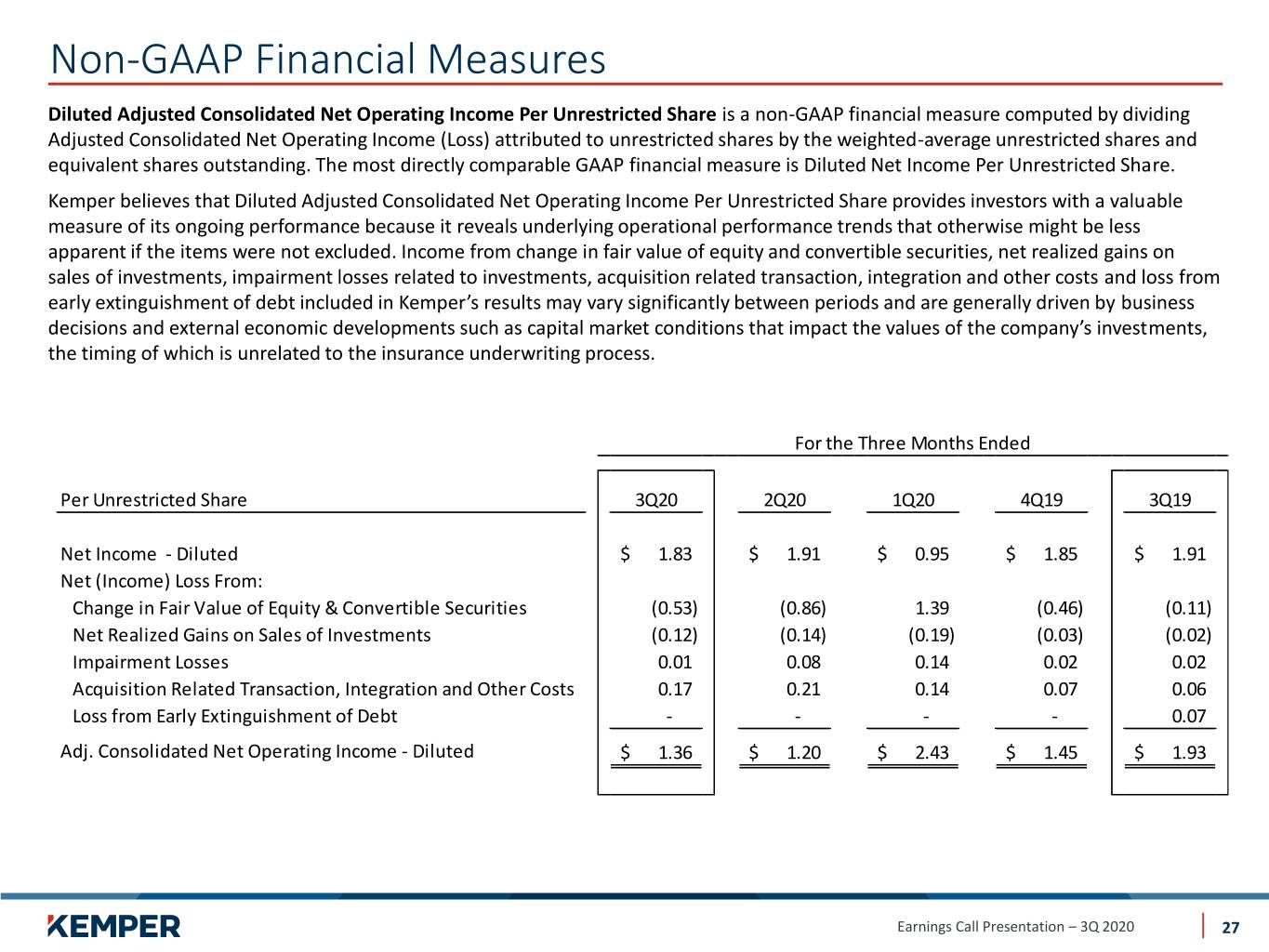

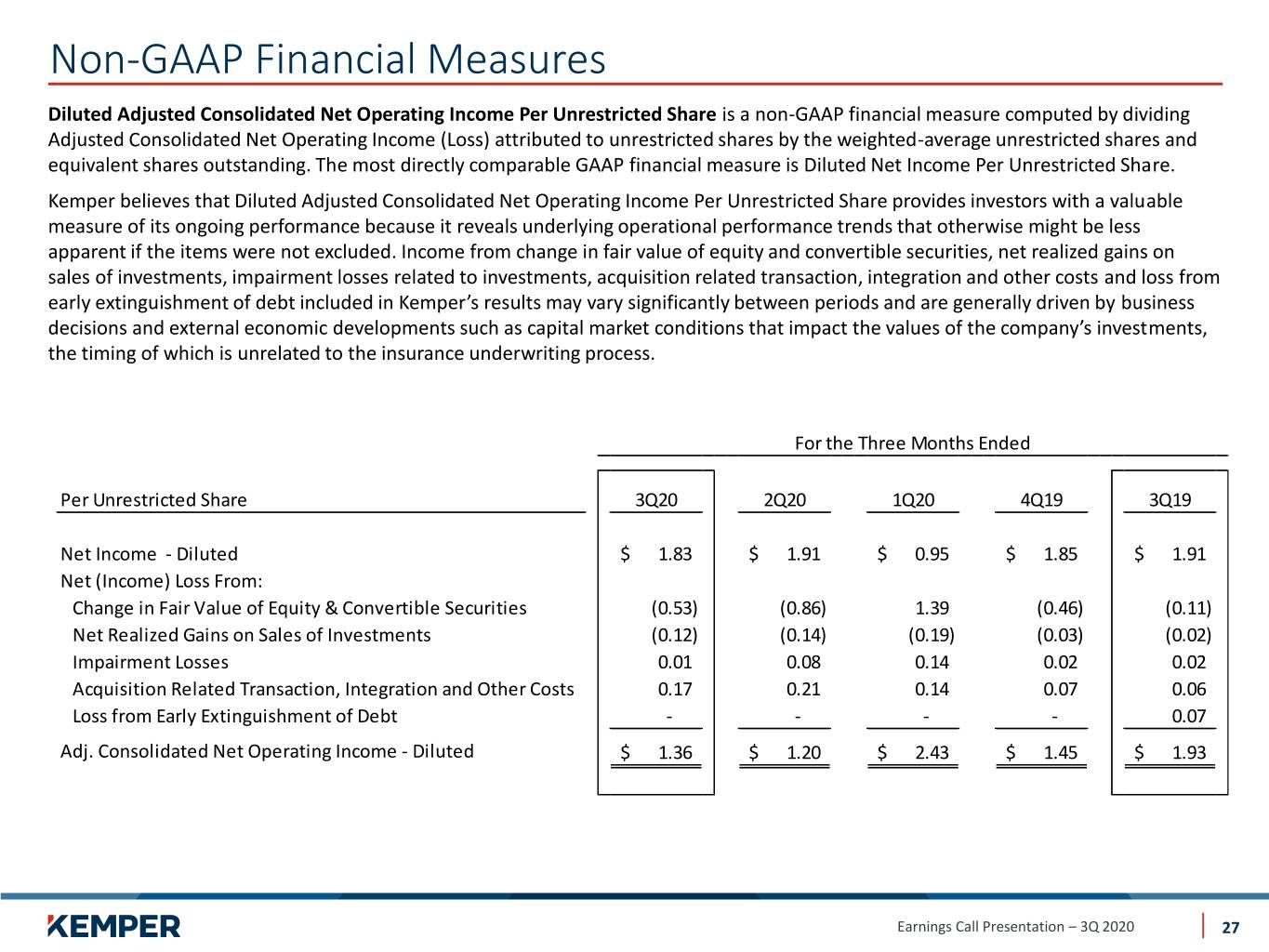

Non-GAAP Financial Measures Diluted Adjusted Consolidated Net Operating Income Per Unrestricted Share is a non-GAAP financial measure computed by dividing Adjusted Consolidated Net Operating Income (Loss) attributed to unrestricted shares by the weighted-average unrestricted shares and equivalent shares outstanding. The most directly comparable GAAP financial measure is Diluted Net Income Per Unrestricted Share. Kemper believes that Diluted Adjusted Consolidated Net Operating Income Per Unrestricted Share provides investors with a valuable measure of its ongoing performance because it reveals underlying operational performance trends that otherwise might be less apparent if the items were not excluded. Income from change in fair value of equity and convertible securities, net realized gains on sales of investments, impairment losses related to investments, acquisition related transaction, integration and other costs and loss from early extinguishment of debt included in Kemper’s results may vary significantly between periods and are generally driven by business decisions and external economic developments such as capital market conditions that impact the values of the company’s investments, the timing of which is unrelated to the insurance underwriting process. For the Three Months Ended Per Unrestricted Share 3Q20 2Q20 1Q20 4Q19 3Q19 Net Income - Diluted $ 1.83 $ 1.91 $ 0.95 $ 1.85 $ 1.91 Net (Income) Loss From: Change in Fair Value of Equity & Convertible Securities (0.53) (0.86) 1.39 (0.46) (0.11) Net Realized Gains on Sales of Investments (0.12) (0.14) (0.19) (0.03) (0.02) Impairment Losses 0.01 0.08 0.14 0.02 0.02 Acquisition Related Transaction, Integration and Other Costs 0.17 0.21 0.14 0.07 0.06 Loss from Early Extinguishment of Debt - - - - 0.07 Adj. Consolidated Net Operating Income - Diluted $ 1.36 $ 1.20 $ 2.43 $ 1.45 $ 1.93 Earnings Call Presentation – 3Q 2020 27

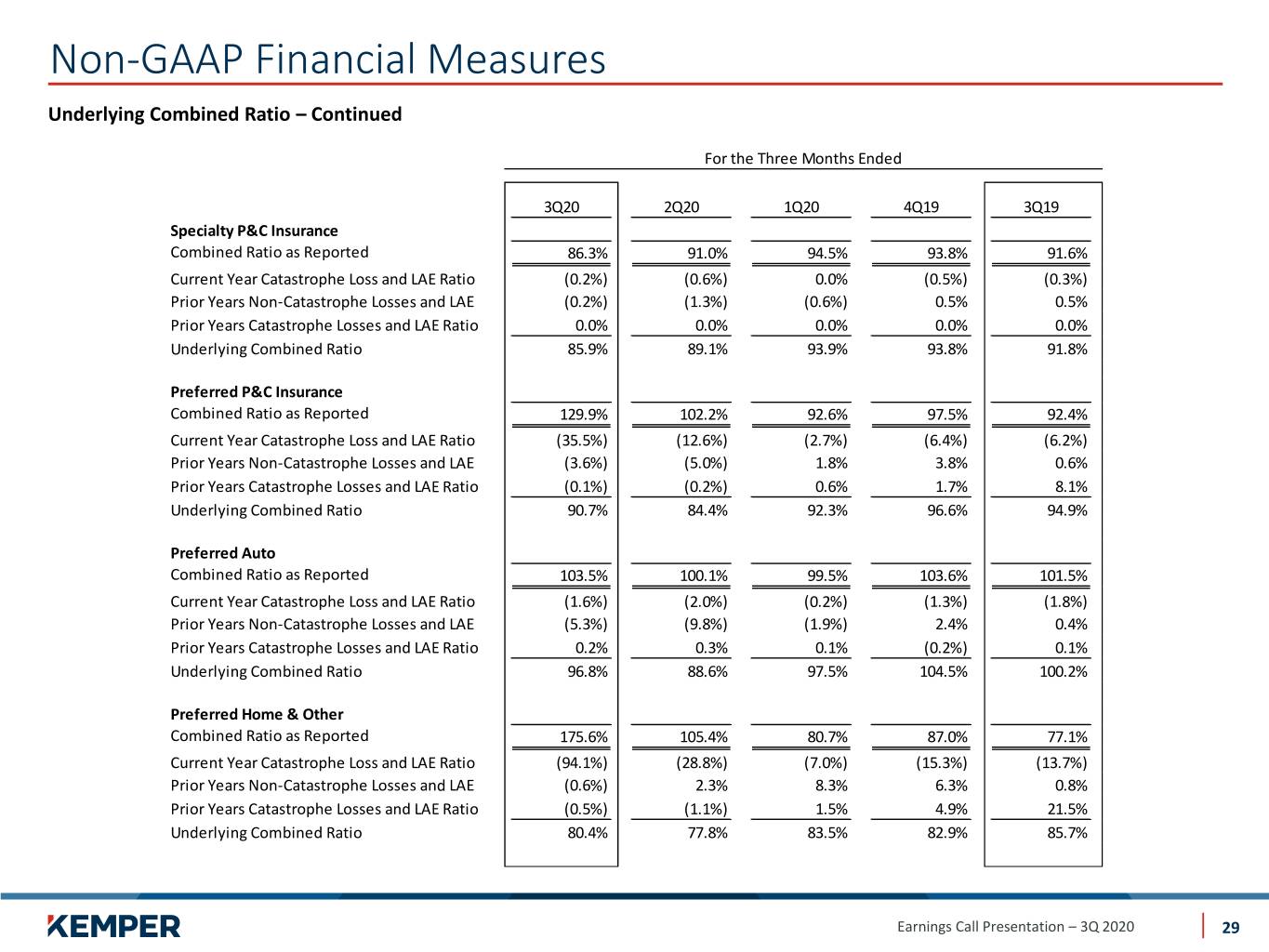

Non-GAAP Financial Measures Underlying Combined Ratio is a non-GAAP financial measure. It is computed by adding the Current Year Non-catastrophe Losses and LAE Ratio with the Insurance Expense Ratio. The most directly comparable GAAP financial measure is the Combined Ratio, which is computed by adding total incurred losses and LAE, including the impact of catastrophe losses and loss and LAE reserve development from prior years, with the Insurance Expense Ratio. The Company believes the underlying combined ratio is useful to investors and is used by management to reveal the trends in the Company’s property and casualty insurance businesses that may be obscured by catastrophe losses and prior-year reserve development. These catastrophe losses cause loss trends to vary significantly between periods as a result of their incidence of occurrence and magnitude, and can have a significant impact on the combined ratio. Prior-year reserve developments are caused by unexpected loss development on historical reserves. Because reserve development relates to the re-estimation of losses from earlier periods, it has no bearing on the performance of our insurance products in the current period. The Company believes it is useful for investors to evaluate these components separately and in the aggregate when reviewing the Company’s underwriting performance. The underlying combined ratio should not be considered a substitute for the combined ratio and does not reflect the overall underwriting profitability of our business. Earnings Call Presentation – 3Q 2020 28

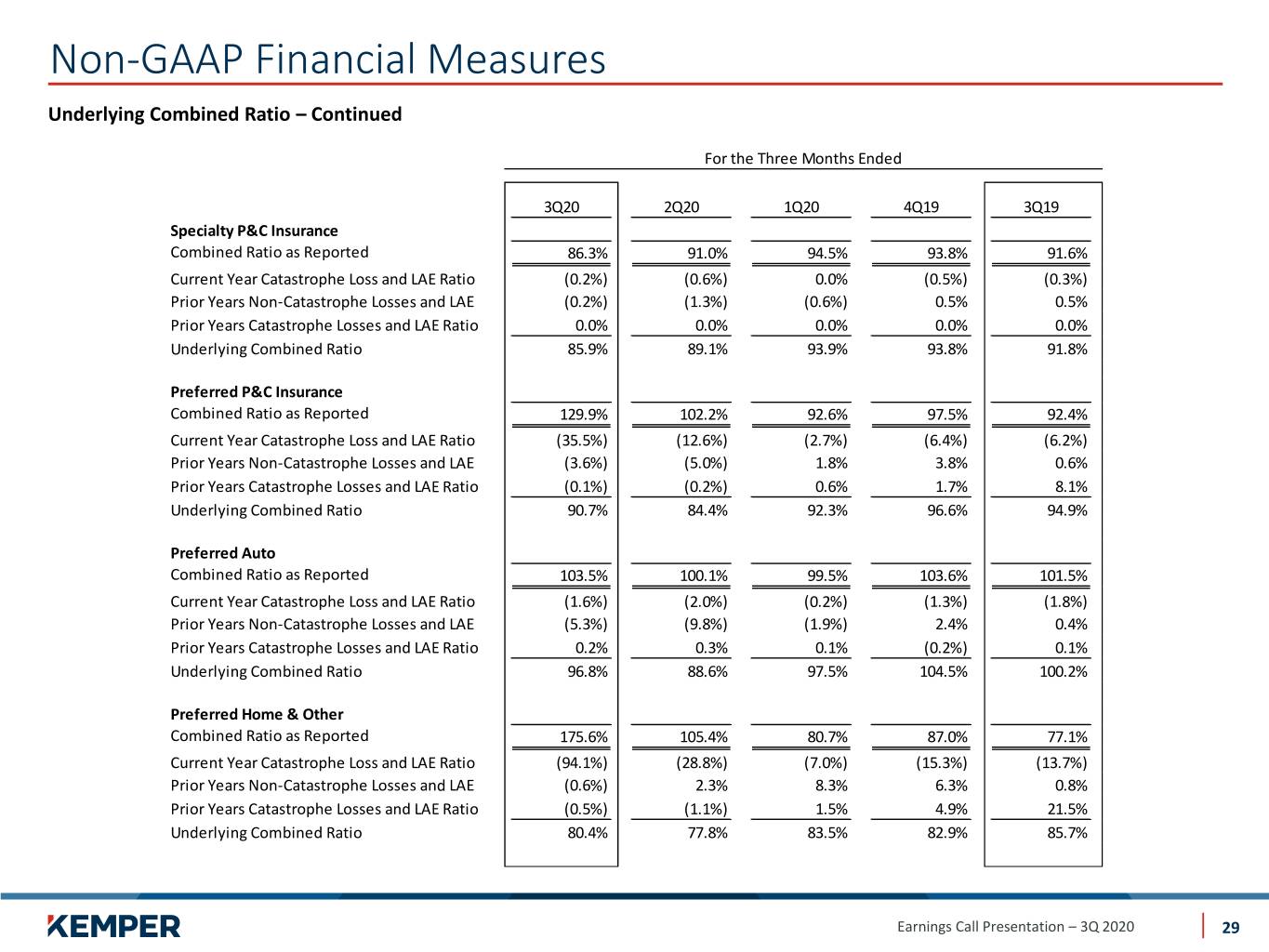

Non-GAAP Financial Measures Underlying Combined Ratio – Continued For the Three Months Ended 3Q20 2Q20 1Q20 4Q19 3Q19 Specialty P&C Insurance Combined Ratio as Reported 86.3% 91.0% 94.5% 93.8% 91.6% Current Year Catastrophe Loss and LAE Ratio (0.2%) (0.6%) 0.0% (0.5%) (0.3%) Prior Years Non-Catastrophe Losses and LAE (0.2%) (1.3%) (0.6%) 0.5% 0.5% Prior Years Catastrophe Losses and LAE Ratio 0.0% 0.0% 0.0% 0.0% 0.0% Underlying Combined Ratio 85.9% 89.1% 93.9% 93.8% 91.8% Preferred P&C Insurance Combined Ratio as Reported 129.9% 102.2% 92.6% 97.5% 92.4% Current Year Catastrophe Loss and LAE Ratio (35.5%) (12.6%) (2.7%) (6.4%) (6.2%) Prior Years Non-Catastrophe Losses and LAE (3.6%) (5.0%) 1.8% 3.8% 0.6% Prior Years Catastrophe Losses and LAE Ratio (0.1%) (0.2%) 0.6% 1.7% 8.1% Underlying Combined Ratio 90.7% 84.4% 92.3% 96.6% 94.9% Preferred Auto Combined Ratio as Reported 103.5% 100.1% 99.5% 103.6% 101.5% Current Year Catastrophe Loss and LAE Ratio (1.6%) (2.0%) (0.2%) (1.3%) (1.8%) Prior Years Non-Catastrophe Losses and LAE (5.3%) (9.8%) (1.9%) 2.4% 0.4% Prior Years Catastrophe Losses and LAE Ratio 0.2% 0.3% 0.1% (0.2%) 0.1% Underlying Combined Ratio 96.8% 88.6% 97.5% 104.5% 100.2% Preferred Home & Other Combined Ratio as Reported 175.6% 105.4% 80.7% 87.0% 77.1% Current Year Catastrophe Loss and LAE Ratio (94.1%) (28.8%) (7.0%) (15.3%) (13.7%) Prior Years Non-Catastrophe Losses and LAE (0.6%) 2.3% 8.3% 6.3% 0.8% Prior Years Catastrophe Losses and LAE Ratio (0.5%) (1.1%) 1.5% 4.9% 21.5% Underlying Combined Ratio 80.4% 77.8% 83.5% 82.9% 85.7% Earnings Call Presentation – 3Q 2020 29

Non-GAAP Financial Measures As Adjusted for Acquisition – Continued Specialty P&C Insurance Segment Three Months Ended 30-Sep-20 30-Jun-20 31-Mar-20 31-Dec-19 30-Sep-19 Earned Premiums Kemper Specialty P&C - GAAP As Reported $ 871.4 $ 759.0 $ 822.5 $ 799.7 $ 783.4 Current Year Non-CAT Losses and LAE Kemper Specialty P&C - GAAP As Reported $ 589.0 $ 515.8 $ 619.8 $ 599.5 $ 579.4 Less: Impact of Purchase Accounting Amortization of Fair Value Adjustment to Infinity's Unpaid Loss and LAE 0.3 0.8 0.7 0.8 0.8 As Adjusted 1 $ 588.7 $ 515.0 $ 619.1 $ 598.7 $ 578.6 Insurance Expenses Kemper Specialty P&C - GAAP As Reported $ 159.5 $ 161.2 $ 152.1 $ 150.7 $ 139.2 Less: Impact of Purchase Accounting 4.2 4.5 5.2 5.2 7.3 As Adjusted 1 $ 155.3 $ 156.7 $ 146.9 $ 145.5 $ 131.9 As Adjusted 1 Underlying Combined Ratio As Adjusted 1 Underlying Loss & LAE Ratio 67.6% 67.8% 75.3% 74.9% 73.9% As Adjusted 1 Expense Ratio 17.8% 20.6% 17.9% 18.2% 16.8% As Adjusted 1 Underlying Combined Ratio 85.4% 88.5% 93.1% 93.1% 90.7% ¹ As Adjusted is a non-GAAP measure, which is comprised by excluding impact of purchase accounting in 2018 and including historical results of Kemper and Infinity in periods prior to acquisition date of July 2, 2018. Earnings Call Presentation – 3Q 2020 30

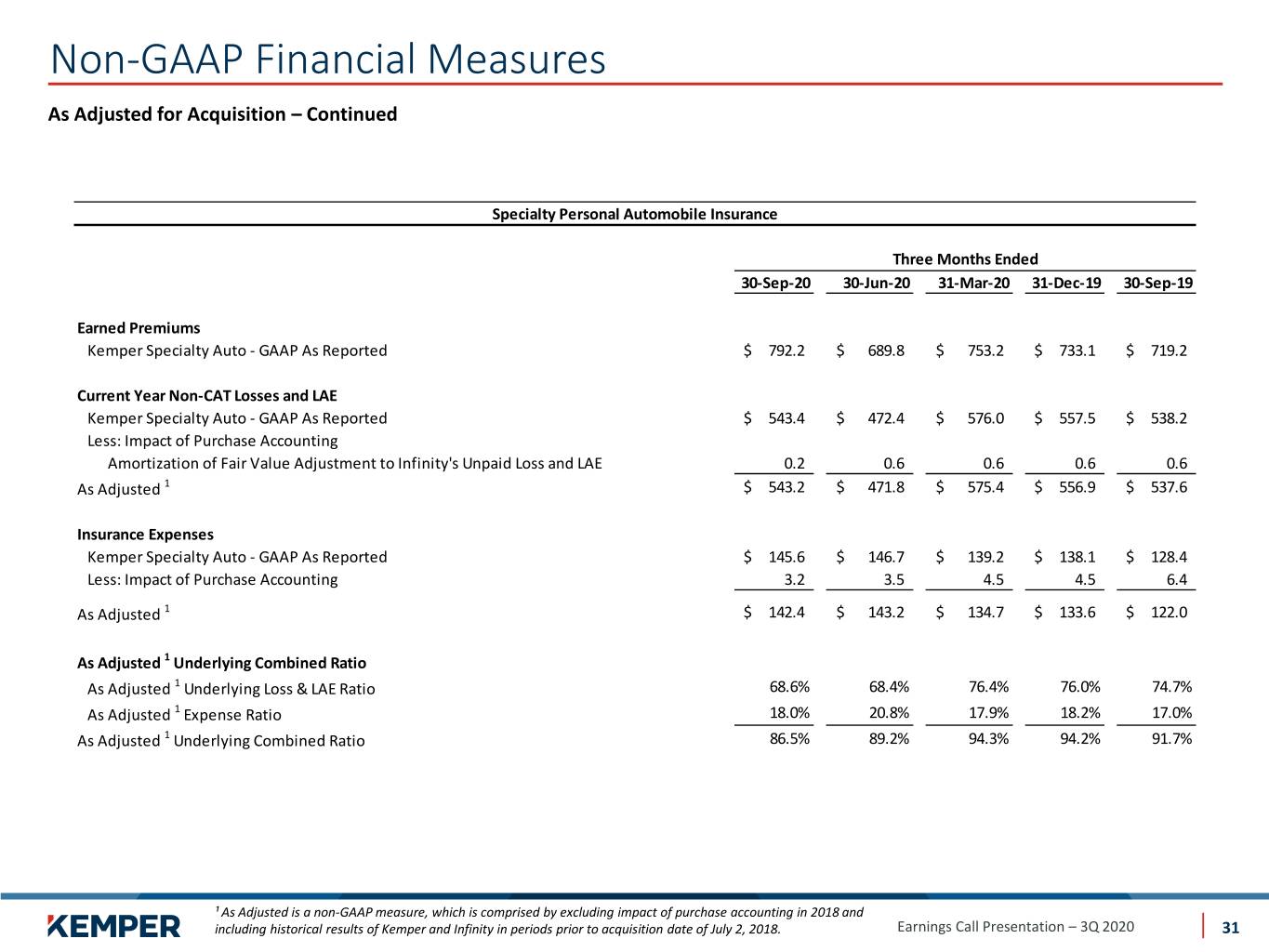

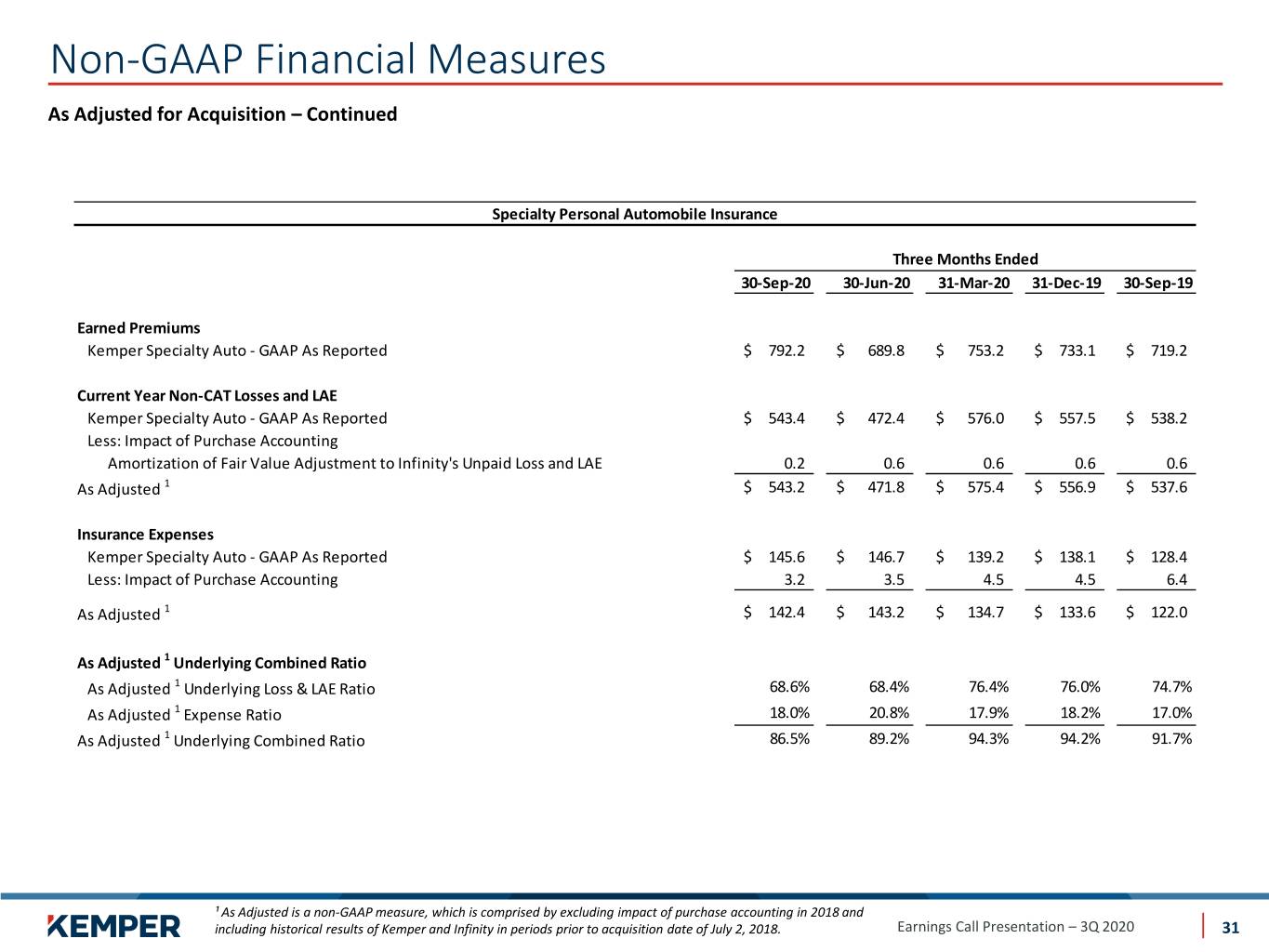

Non-GAAP Financial Measures As Adjusted for Acquisition – Continued Specialty Personal Automobile Insurance Three Months Ended 30-Sep-20 30-Jun-20 31-Mar-20 31-Dec-19 30-Sep-19 Earned Premiums Kemper Specialty Auto - GAAP As Reported $ 792.2 $ 689.8 $ 753.2 $ 733.1 $ 719.2 Current Year Non-CAT Losses and LAE Kemper Specialty Auto - GAAP As Reported $ 543.4 $ 472.4 $ 576.0 $ 557.5 $ 538.2 Less: Impact of Purchase Accounting Amortization of Fair Value Adjustment to Infinity's Unpaid Loss and LAE 0.2 0.6 0.6 0.6 0.6 As Adjusted 1 $ 543.2 $ 471.8 $ 575.4 $ 556.9 $ 537.6 Insurance Expenses Kemper Specialty Auto - GAAP As Reported $ 145.6 $ 146.7 $ 139.2 $ 138.1 $ 128.4 Less: Impact of Purchase Accounting 3.2 3.5 4.5 4.5 6.4 As Adjusted 1 $ 142.4 $ 143.2 $ 134.7 $ 133.6 $ 122.0 As Adjusted 1 Underlying Combined Ratio As Adjusted 1 Underlying Loss & LAE Ratio 68.6% 68.4% 76.4% 76.0% 74.7% As Adjusted 1 Expense Ratio 18.0% 20.8% 17.9% 18.2% 17.0% As Adjusted 1 Underlying Combined Ratio 86.5% 89.2% 94.3% 94.2% 91.7% ¹ As Adjusted is a non-GAAP measure, which is comprised by excluding impact of purchase accounting in 2018 and including historical results of Kemper and Infinity in periods prior to acquisition date of July 2, 2018. Earnings Call Presentation – 3Q 2020 31