Earnings Call Presentation – 1Q 2022 First Quarter 2022 Earnings May 2, 2022

Earnings Call Presentation – 1Q 2022 Cautionary Statements Regarding Forward-Looking Information This presentation may contain or incorporate by reference information that includes or is based on forward-looking statements within the meaning of the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. We caution investors that these forward-looking statements are not guarantees of future performance, and actual results may differ materially. Such statements involve known and unknown risks, uncertainties, and other factors, including but not limited to: • changes in the frequency and severity of insurance claims; • claim development and the process of estimating claim reserves; • the impacts of inflation; • supply chain disruption; • product demand and pricing; • effects of governmental and regulatory actions; • litigation outcomes; • investment risks; • cybersecurity risks; • impact of catastrophes; and • other risks and uncertainties detailed in Kemper’s Annual Report on Form 10-K and subsequent filings with the Securities and Exchange Commission (“SEC”). The COVID-19 outbreak and subsequent global pandemic (“Pandemic”) is an extraordinary catastrophe that creates unique uncertainties and risks. Kemper cannot provide any assurances as to the impacts of the Pandemic and related economic conditions on Kemper’s operating and financial results. Kemper assumes no obligation to publicly correct or update any forward-looking statements as a result of events or developments subsequent to the date of this presentation, including any such statements related to the Pandemic. Non-GAAP Financial Measures This presentation contains non-GAAP financial measures that the company believes are meaningful to investors. Non-GAAP financial measures have been reconciled to the most comparable GAAP financial measure. Preliminary Matters 2

Earnings Call Presentation – 1Q 2022 Deliver low double-digit ROE2 over time Create Long-Term Shareholder Value Leverage competitive advantages to grow returns and BVPS1 over time ¹ Book value per share 2 Return on equity Sustainable competitive advantages and build core capabilities Grow returns and book value per share over time Diversified sources of earnings; Strong capital/liquidity positions; Disciplined approach to capital management Consumer-related businesses with opportunities that: • Target specialty markets • Have limited, weak or unfocused competition • Require unique expertise (underwriting, claim, distribution, analytics and other) Strategic focus: 3

Earnings Call Presentation – 1Q 2022 First Quarter 2022 Highlights ¹ Non-GAAP financial measure; please see reconciliation in appendix on pages 19-28 2 Return on average shareholders’ equity (5-point average) 3 As adjusted for acquisition; see reconciliation on Pages 25-28 4 Auto margins improved despite persistent environmental challenges Environmental challenges continued to impact segments of the insurance market • Broad market inflation due to supply chain issues and labor shortages continue to drive up loss costs • Geopolitical and inflationary concerns negatively impacted financial asset valuations Macroeconomic Environment Restoration actions taking hold; continue to aggressively pursue all improvement opportunities • Initiatives more than offset environmental headwinds; rate taking activity exceeded expectations • Specialty P&C Personal Auto rate actions: Filed an additional 8% rate increase on 59% of the book • Preferred P&C Personal Auto rate actions: Filed an additional 12% rate increase on 69% of the book, ongoing repositioning of the book to improve profitability Actions Taken Significant sequential improvement in results; auto underlying combined ratio improved 11pts, auto frequency below 2019 levels • Net loss of $95 million ($1.49) per share, as reported, or $91 million ($1.43) per share, as adjusted3 • Adjusted consolidated net operating loss1 of $60 million ($0.94) per share, as reported, or $57 million ($0.89) per share, as adjusted3 • (9)% ROAE2, (14)% ROAE2 excluding net unrealized (gain) loss on fixed maturities and goodwill1 1st Quarter Results Strong capital and liquidity enable us to navigate environmental challenges • Holding company remains a source of strength for subsidiaries, with more than $1.2B of liquidity • 1Q debt offerings at attractive rates provide additional flexibility and diversifies capital structure Balance Sheet Strength

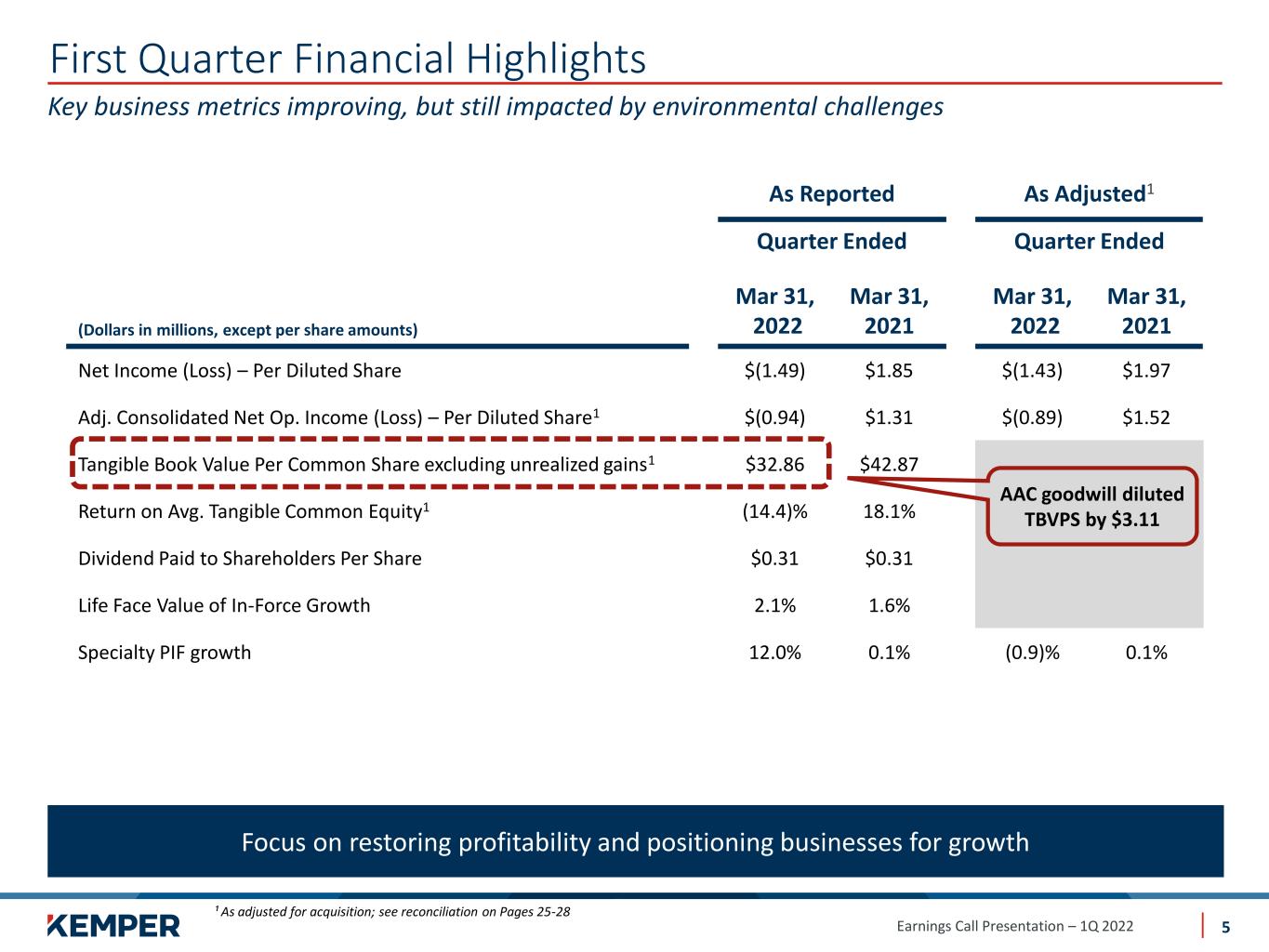

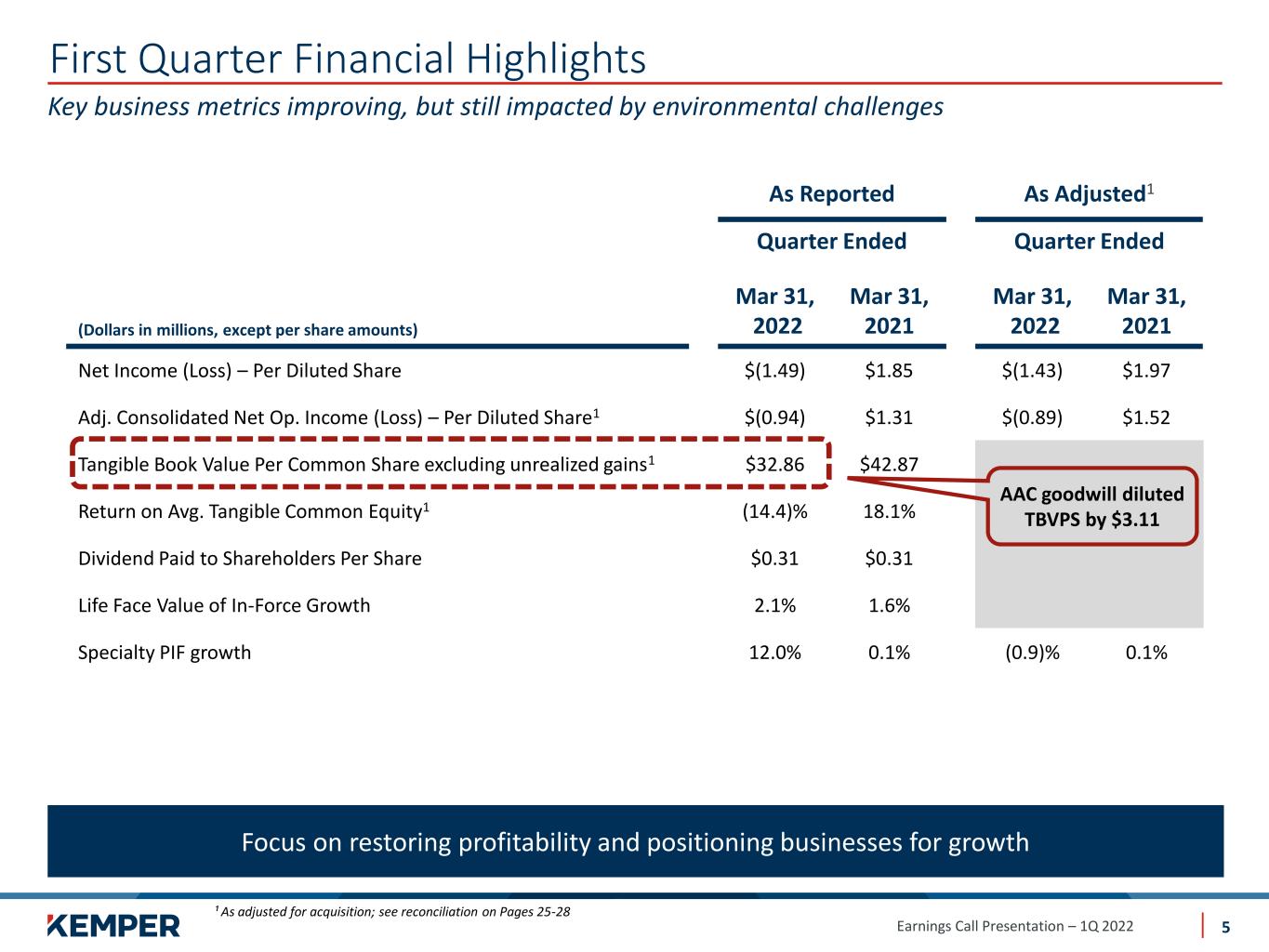

Earnings Call Presentation – 1Q 2022 Focus on restoring profitability and positioning businesses for growth First Quarter Financial Highlights As Reported As Adjusted1 Quarter Ended Quarter Ended (Dollars in millions, except per share amounts) Mar 31, 2022 Mar 31, 2021 Mar 31, 2022 Mar 31, 2021 Net Income (Loss) – Per Diluted Share $(1.49) $1.85 $(1.43) $1.97 Adj. Consolidated Net Op. Income (Loss) – Per Diluted Share1 $(0.94) $1.31 $(0.89) $1.52 Tangible Book Value Per Common Share excluding unrealized gains1 $32.86 $42.87 Return on Avg. Tangible Common Equity1 (14.4)% 18.1% Dividend Paid to Shareholders Per Share $0.31 $0.31 Life Face Value of In-Force Growth 2.1% 1.6% Specialty PIF growth 12.0% 0.1% (0.9)% 0.1% 5 AAC goodwill diluted TBVPS by $3.11 ¹ As adjusted for acquisition; see reconciliation on Pages 25-28 Key business metrics improving, but still impacted by environmental challenges

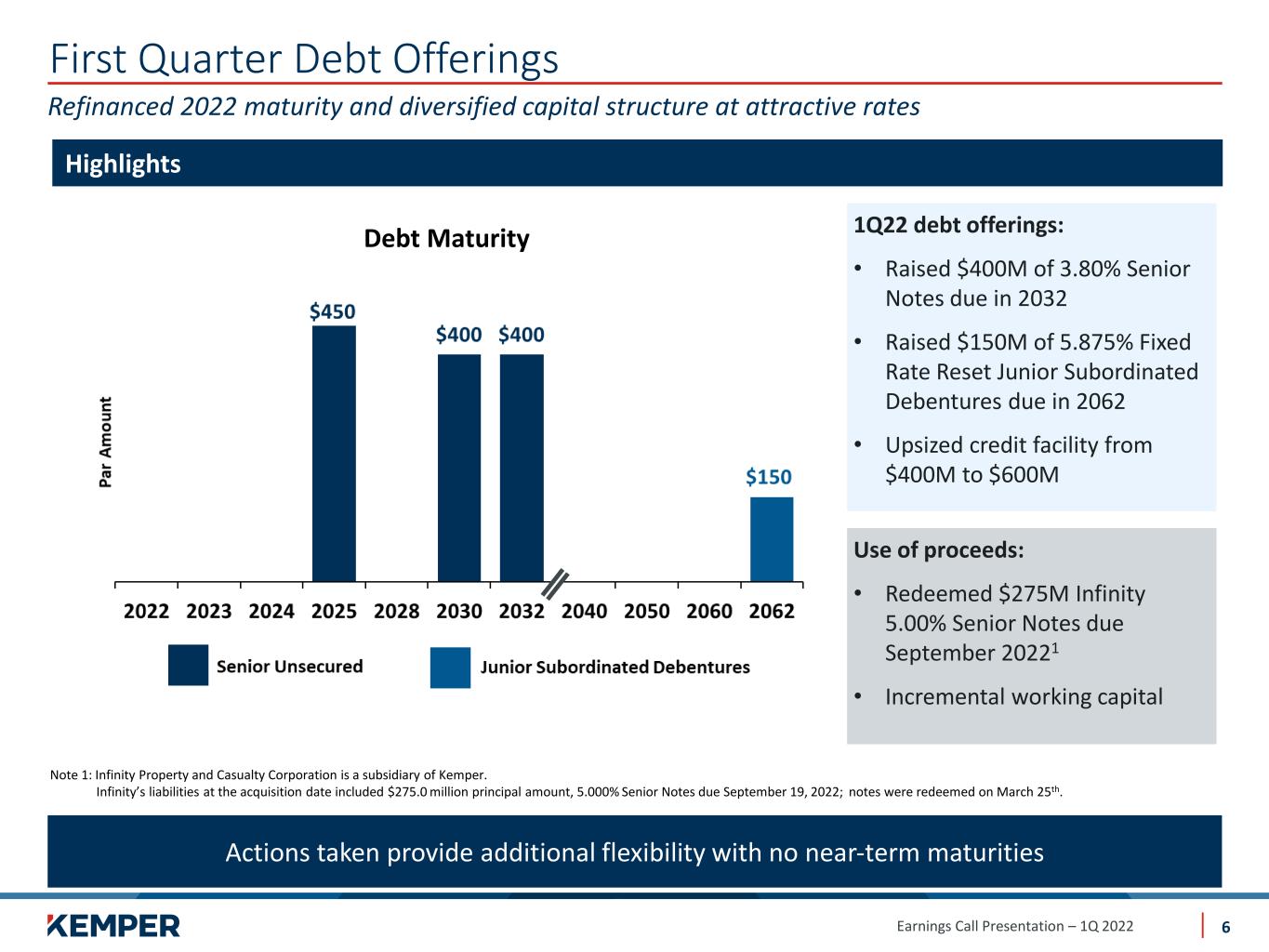

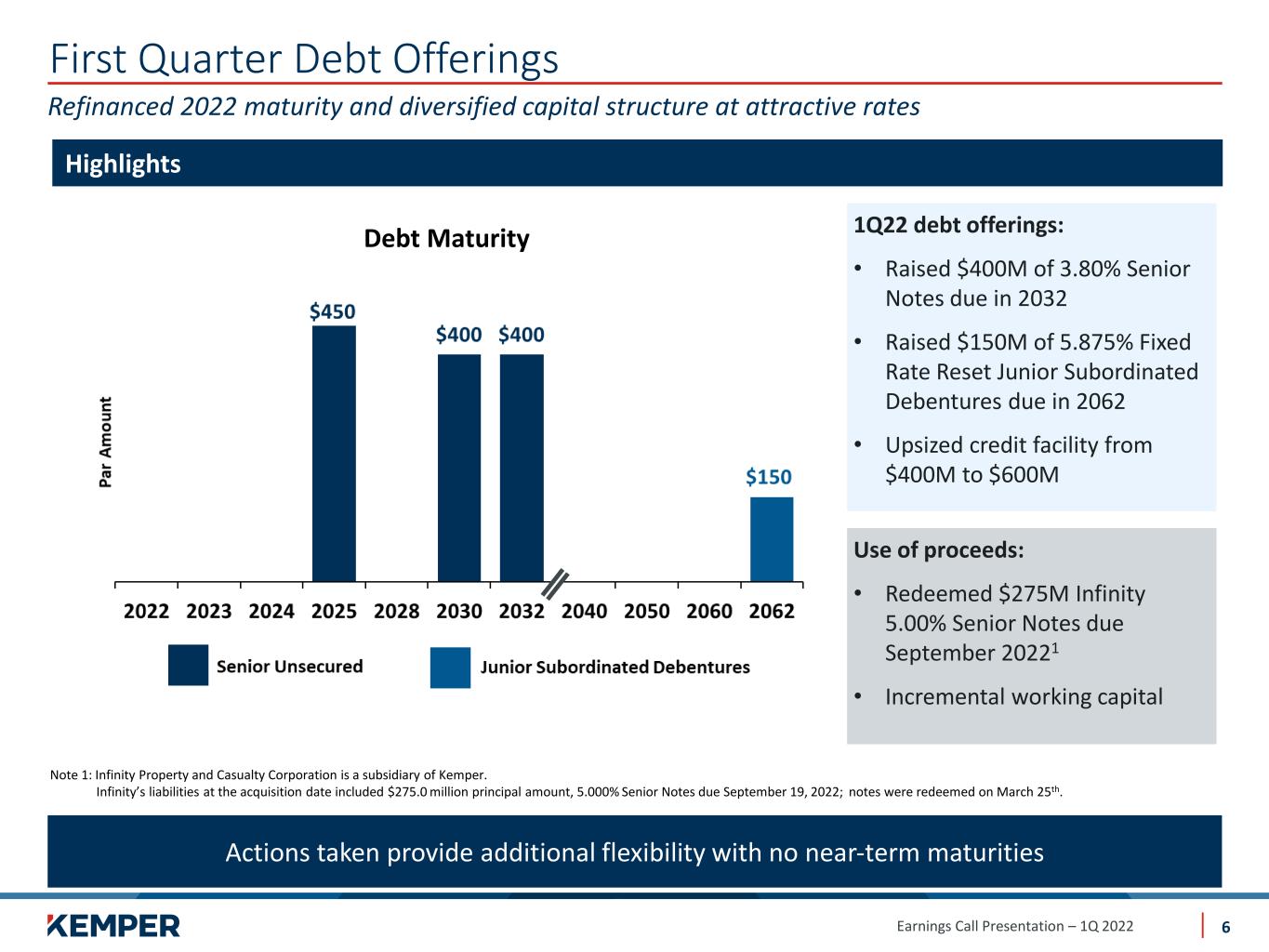

Earnings Call Presentation – 1Q 2022 Use of proceeds: • Redeemed $275M Infinity 5.00% Senior Notes due September 20221 • Incremental working capital First Quarter Debt Offerings 6 Actions taken provide additional flexibility with no near-term maturities Refinanced 2022 maturity and diversified capital structure at attractive rates 1Q22 debt offerings: • Raised $400M of 3.80% Senior Notes due in 2032 • Raised $150M of 5.875% Fixed Rate Reset Junior Subordinated Debentures due in 2062 • Upsized credit facility from $400M to $600M Highlights Note 1: Infinity Property and Casualty Corporation is a subsidiary of Kemper. Infinity’s liabilities at the acquisition date included $275.0 million principal amount, 5.000% Senior Notes due September 19, 2022; notes were redeemed on March 25th. Debt Maturity

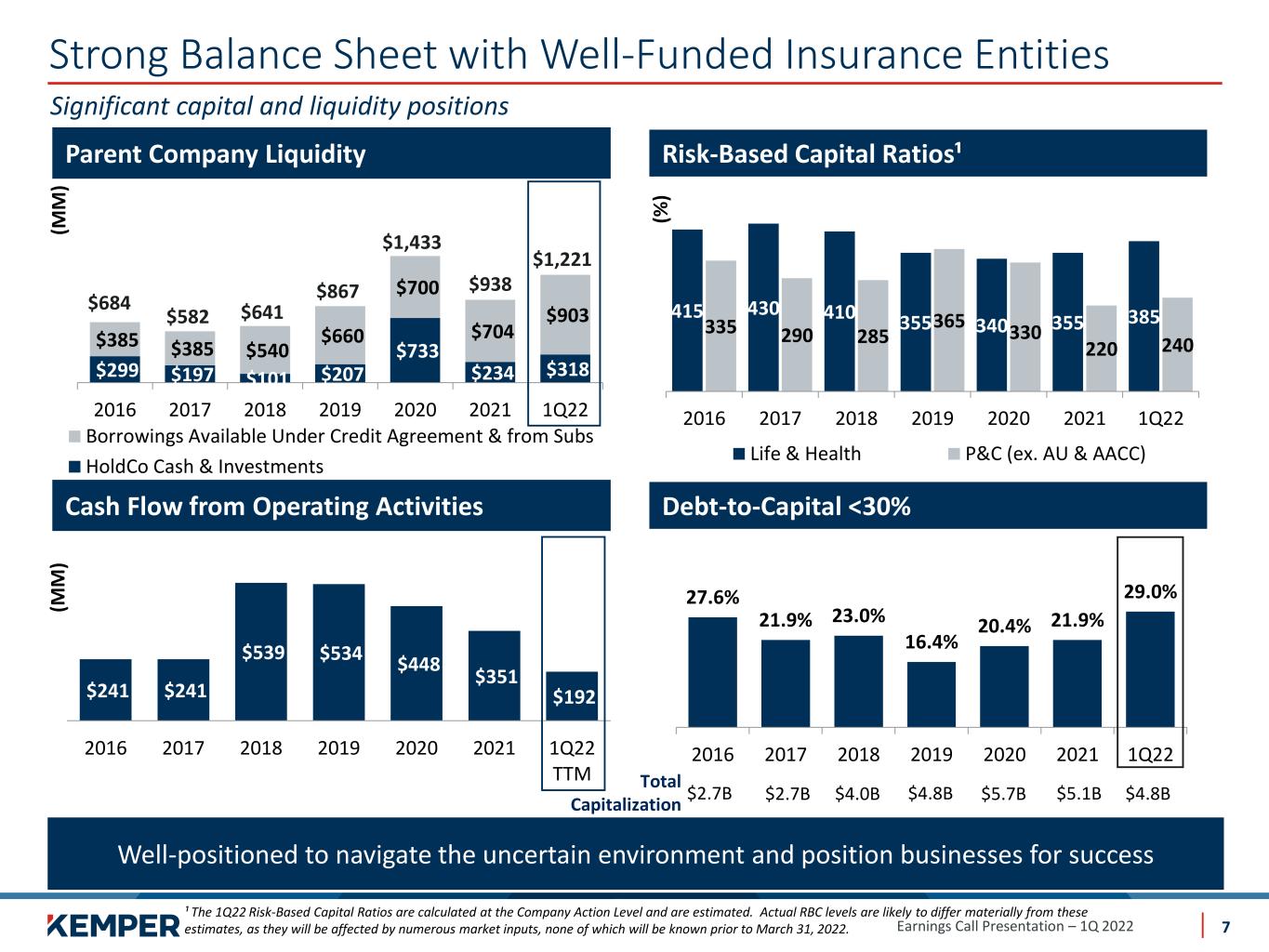

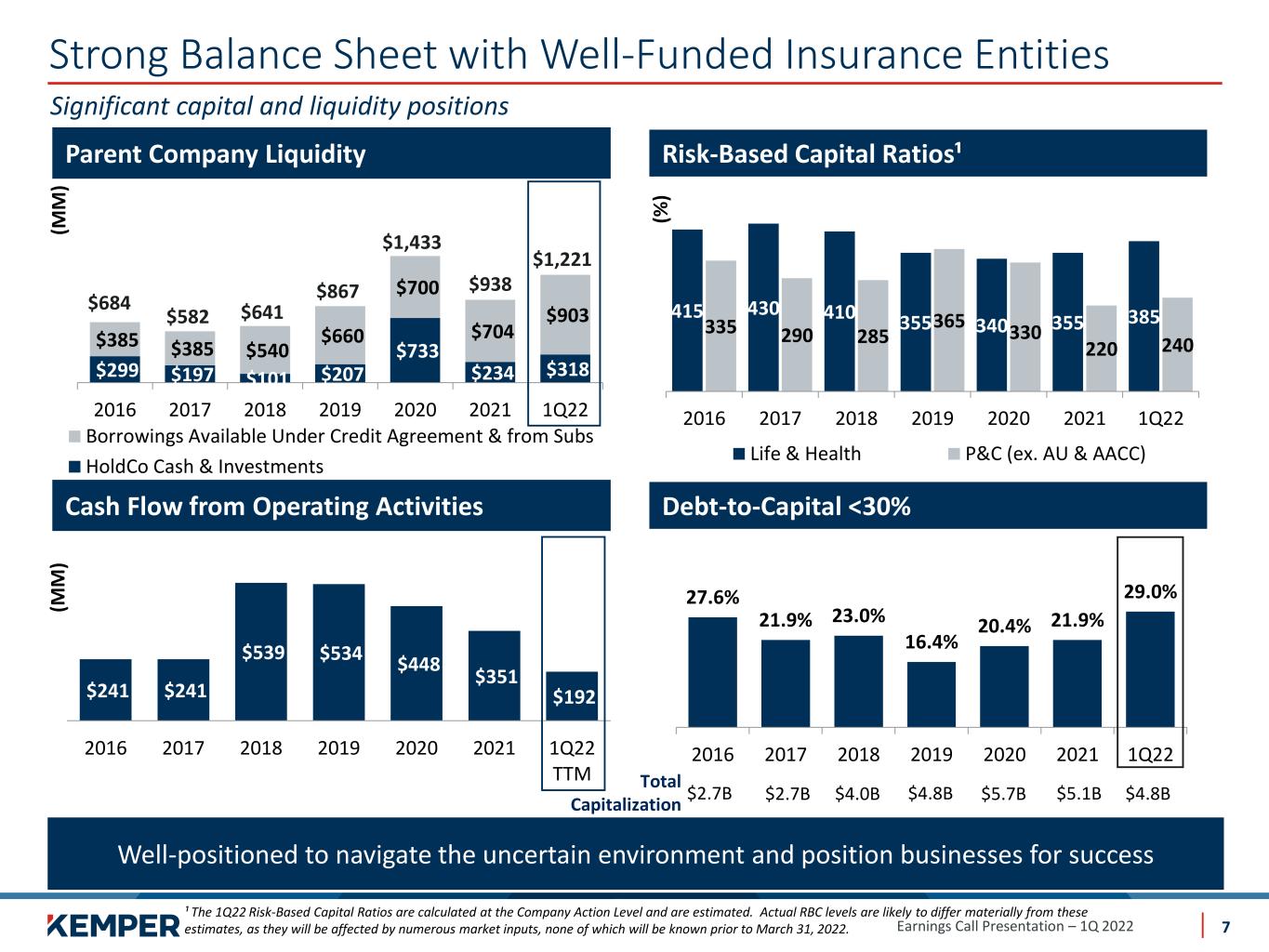

Earnings Call Presentation – 1Q 2022 27.6% 21.9% 23.0% 16.4% 20.4% 21.9% 29.0% 2016 2017 2018 2019 2020 2021 1Q22 Debt-to-Capital <30% Strong Balance Sheet with Well-Funded Insurance Entities Significant capital and liquidity positions Debt Cash Flow from Operating Activities $2.7B $4.8B$4.0B$2.7B Total Capitalization Parent Company Liquidity Risk-Based Capital Ratios¹ $299 $197 $101 $207 $733 $234 $318 $385 $385 $540 $660 $700 $704 $903 2016 2017 2018 2019 2020 2021 1Q22 Borrowings Available Under Credit Agreement & from Subs HoldCo Cash & Investments (M M ) 415 430 410 355 340 355 385335 290 285 365 330 220 240 2016 2017 2018 2019 2020 2021 1Q22 Life & Health P&C (ex. AU & AACC) (% ) $684 $867 $641$582 (M M ) $241 $241 $539 $534 $448 $351 $192 2016 2017 2018 2019 2020 2021 1Q22 TTM $1,433 $5.7B Well-positioned to navigate the uncertain environment and position businesses for success $5.1B 7 $938 ¹ The 1Q22 Risk-Based Capital Ratios are calculated at the Company Action Level and are estimated. Actual RBC levels are likely to differ materially from these estimates, as they will be affected by numerous market inputs, none of which will be known prior to March 31, 2022. $4.8B $1,221

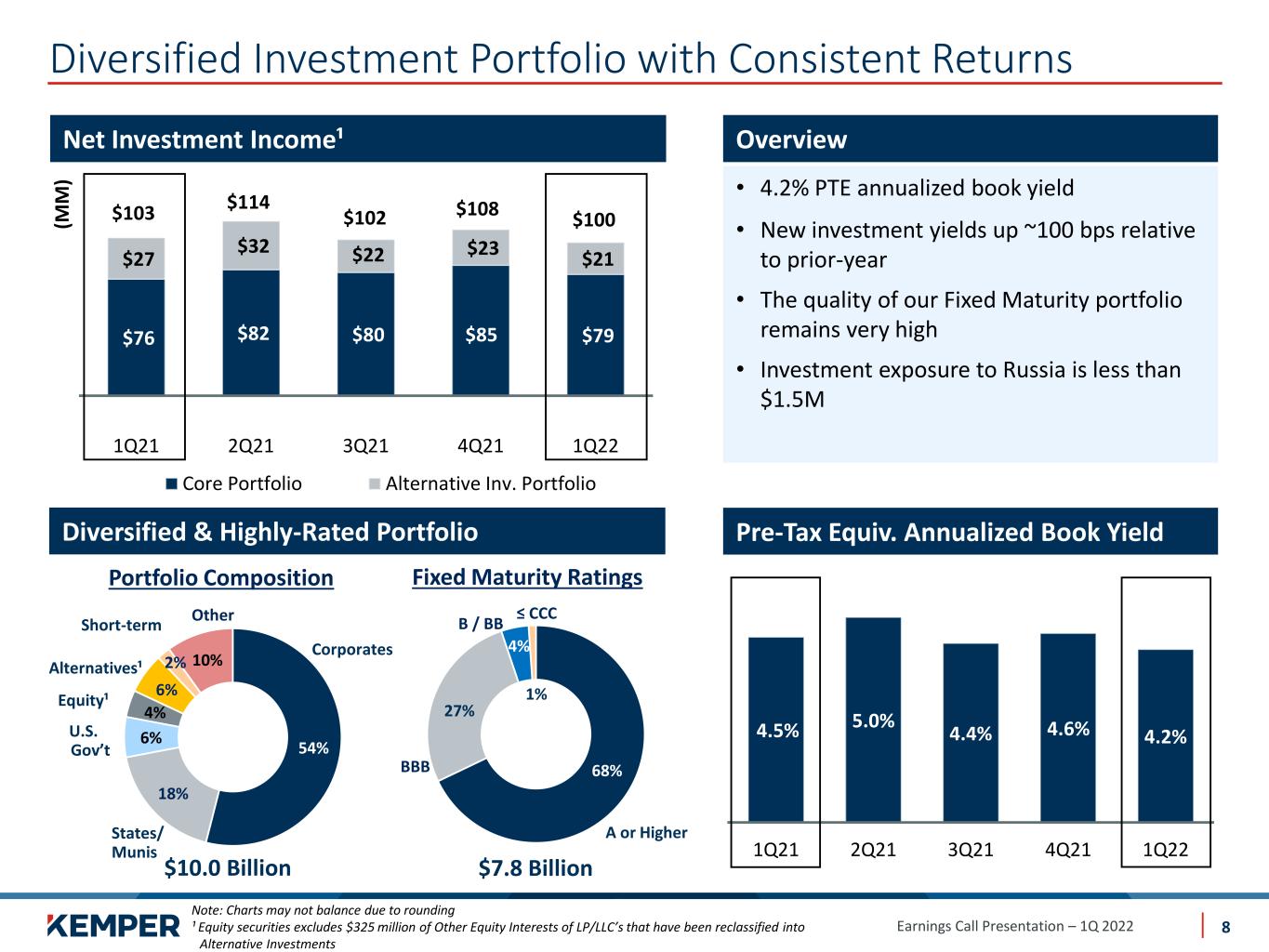

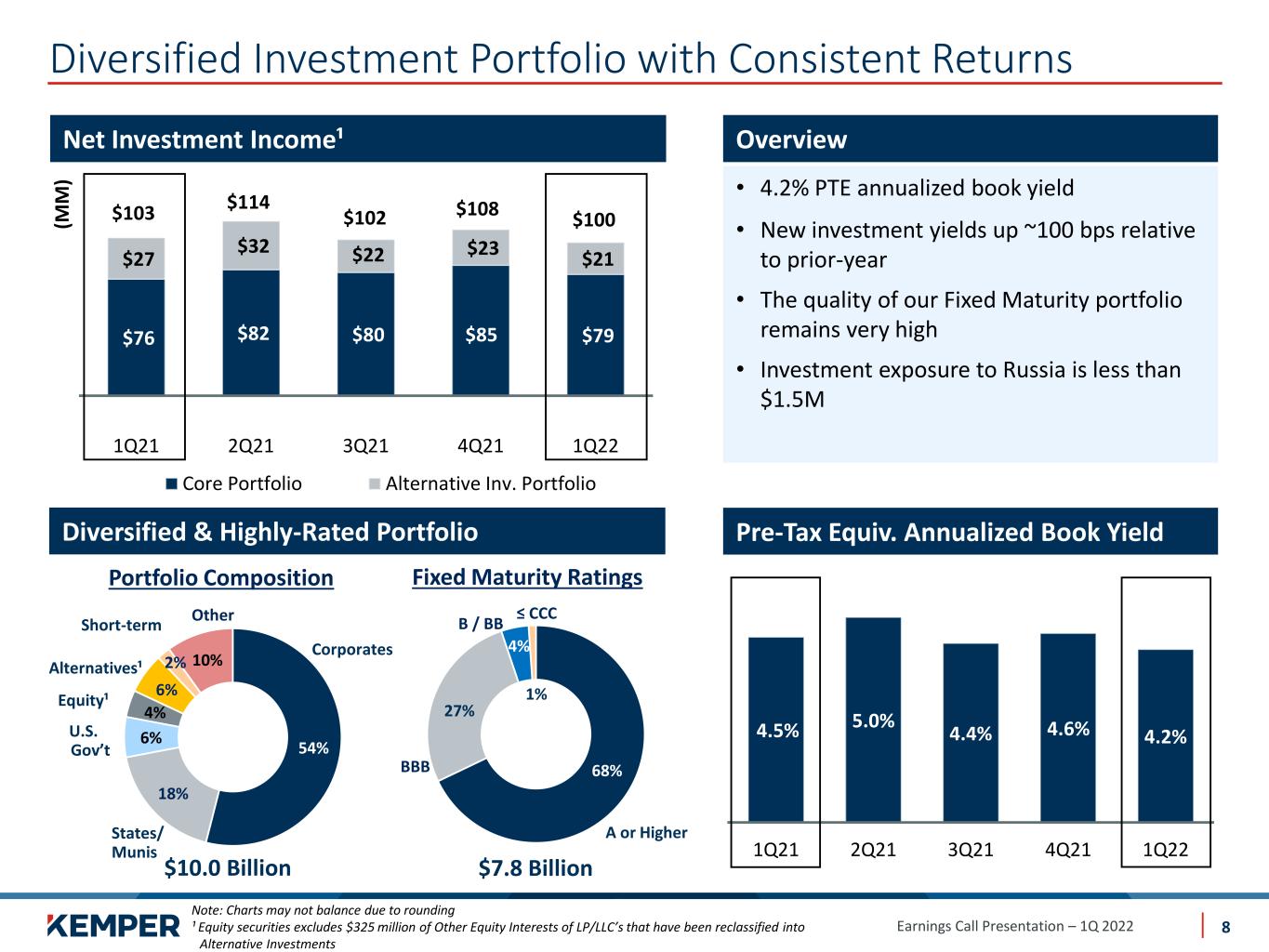

Earnings Call Presentation – 1Q 2022 4.5% 5.0% 4.4% 4.6% 4.2% 1Q21 2Q21 3Q21 4Q21 1Q22 54% 18% 6% 4% 6% 2% 10% Other States/ Munis 68% 27% 4% 1% Diversified & Highly-Rated Portfolio Fixed Maturity Ratings $7.8 Billion A or Higher ≤ CCC B / BB BBB Diversified Investment Portfolio with Consistent Returns Note: Charts may not balance due to rounding ¹ Equity securities excludes $325 million of Other Equity Interests of LP/LLC’s that have been reclassified into Alternative Investments • 4.2% PTE annualized book yield • New investment yields up ~100 bps relative to prior-year • The quality of our Fixed Maturity portfolio remains very high • Investment exposure to Russia is less than $1.5M $76 $82 $80 $85 $79 $27 $32 $22 $23 $21 1Q21 2Q21 3Q21 4Q21 1Q22 Core Portfolio Alternative Inv. Portfolio Net Investment Income¹ (M M ) $103 $100 $108$102 $114 Overview Corporates Short-term Alternatives¹ U.S. Gov’t Portfolio Composition Pre-Tax Equiv. Annualized Book Yield $10.0 Billion 8 Equity¹

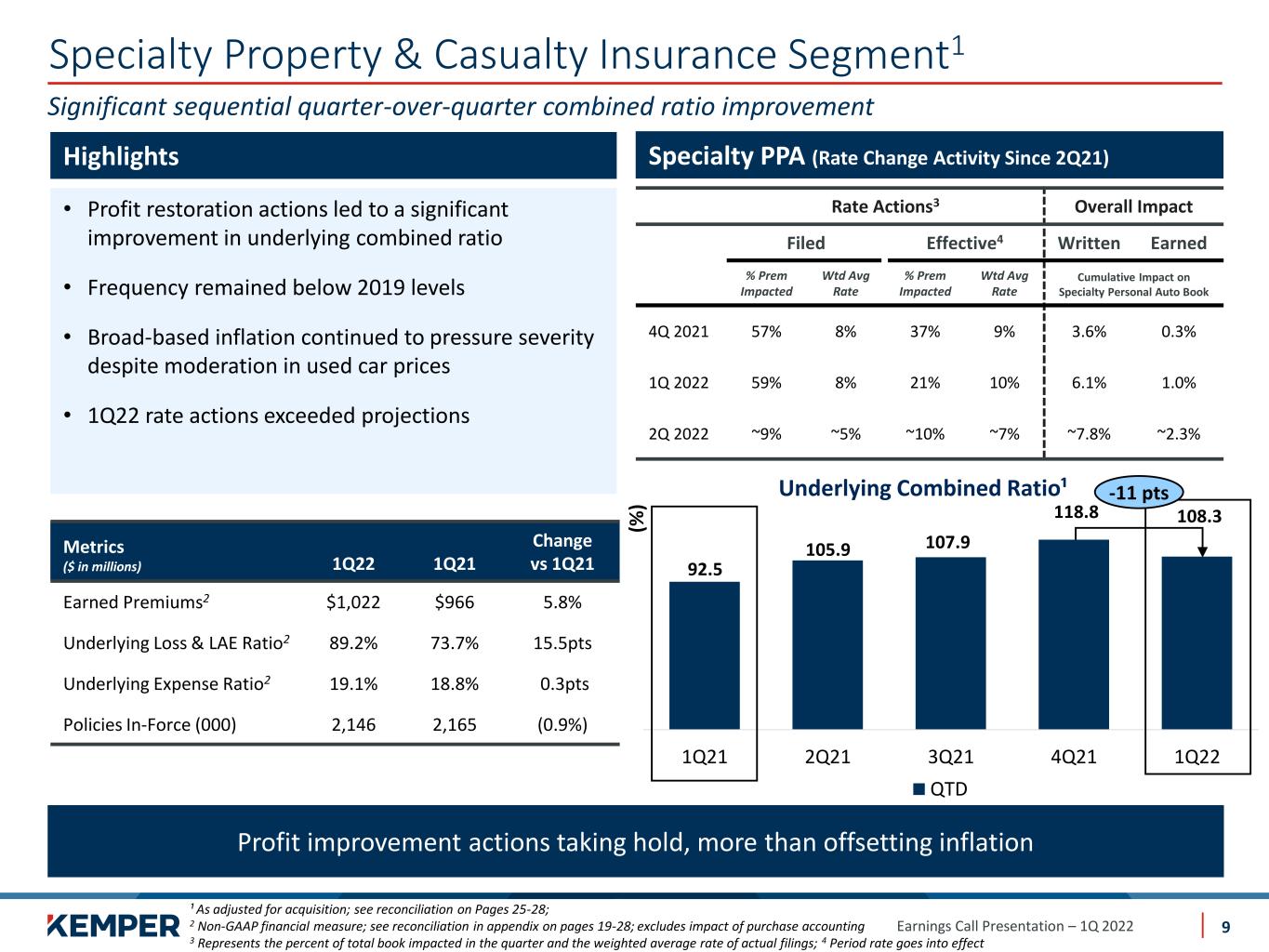

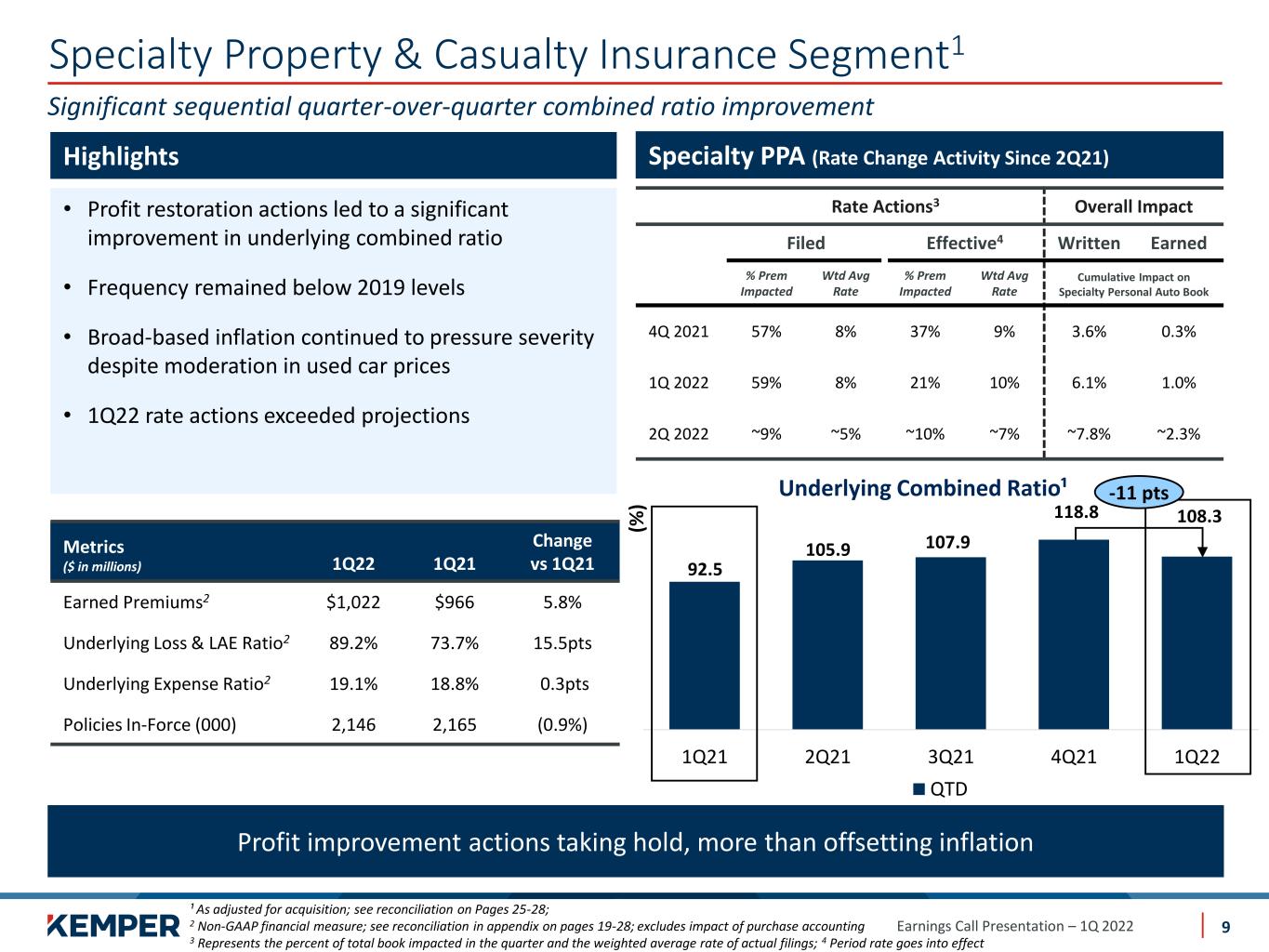

Earnings Call Presentation – 1Q 2022 92.5 105.9 107.9 118.8 108.3 1Q21 2Q21 3Q21 4Q21 1Q22 Underlying Combined Ratio¹ QTD Specialty Property & Casualty Insurance Segment1 Significant sequential quarter-over-quarter combined ratio improvement ¹ As adjusted for acquisition; see reconciliation on Pages 25-28; 2 Non-GAAP financial measure; see reconciliation in appendix on pages 19-28; excludes impact of purchase accounting 3 Represents the percent of total book impacted in the quarter and the weighted average rate of actual filings; 4 Period rate goes into effect (% ) Highlights Profit improvement actions taking hold, more than offsetting inflation Rate Actions3 Overall Impact Filed Effective4 Written Earned % Prem Impacted Wtd Avg Rate % Prem Impacted Wtd Avg Rate Cumulative Impact on Specialty Personal Auto Book 4Q 2021 57% 8% 37% 9% 3.6% 0.3% 1Q 2022 59% 8% 21% 10% 6.1% 1.0% 2Q 2022 ~9% ~5% ~10% ~7% ~7.8% ~2.3% 9 • Profit restoration actions led to a significant improvement in underlying combined ratio • Frequency remained below 2019 levels • Broad-based inflation continued to pressure severity despite moderation in used car prices • 1Q22 rate actions exceeded projections Metrics ($ in millions) 1Q22 1Q21 Change vs 1Q21 Earned Premiums2 $1,022 $966 5.8% Underlying Loss & LAE Ratio2 89.2% 73.7% 15.5pts Underlying Expense Ratio2 19.1% 18.8% 0.3pts Policies In-Force (000) 2,146 2,165 (0.9%) Specialty PPA (Rate Change Activity Since 2Q21) -11 pts

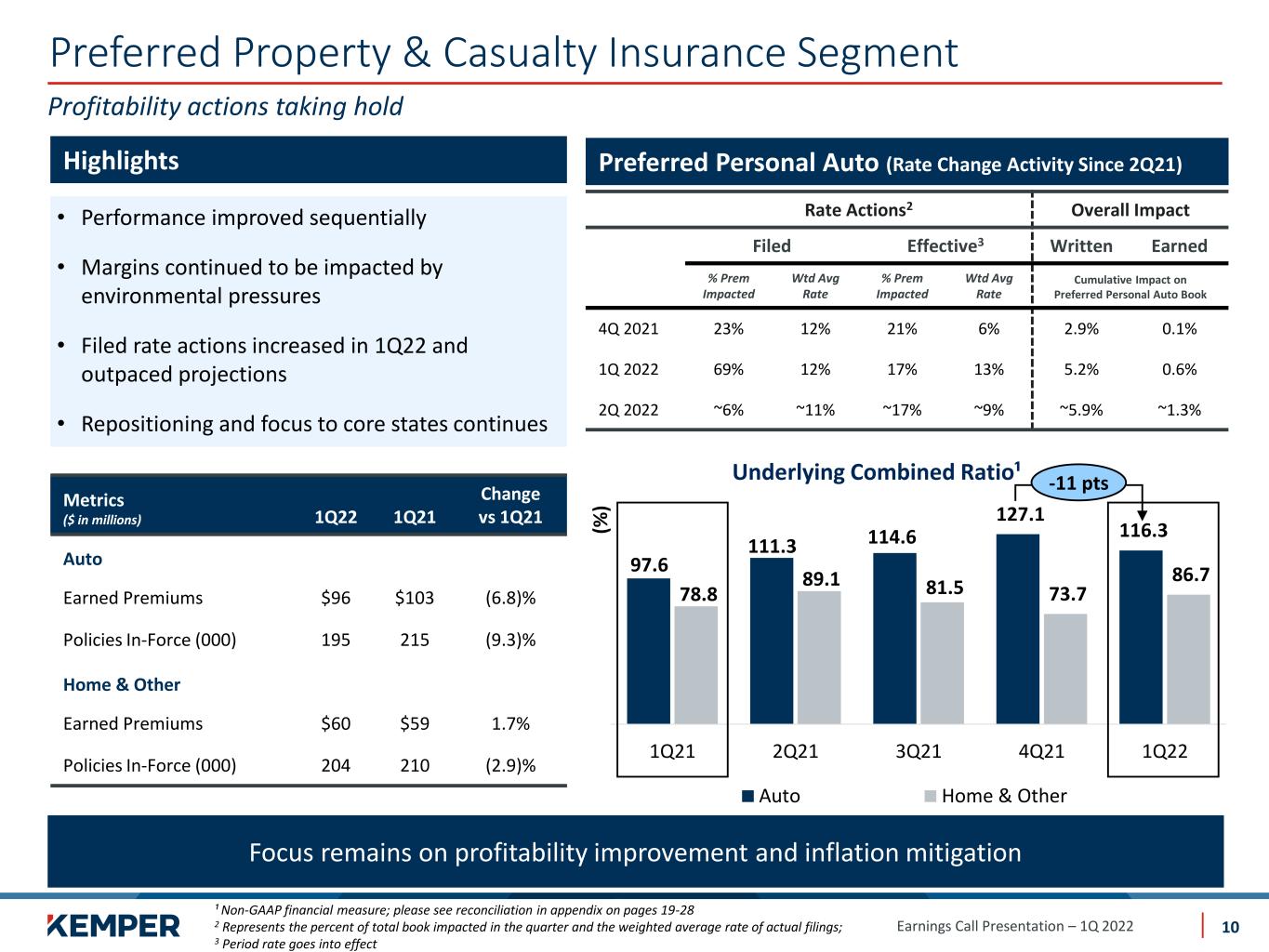

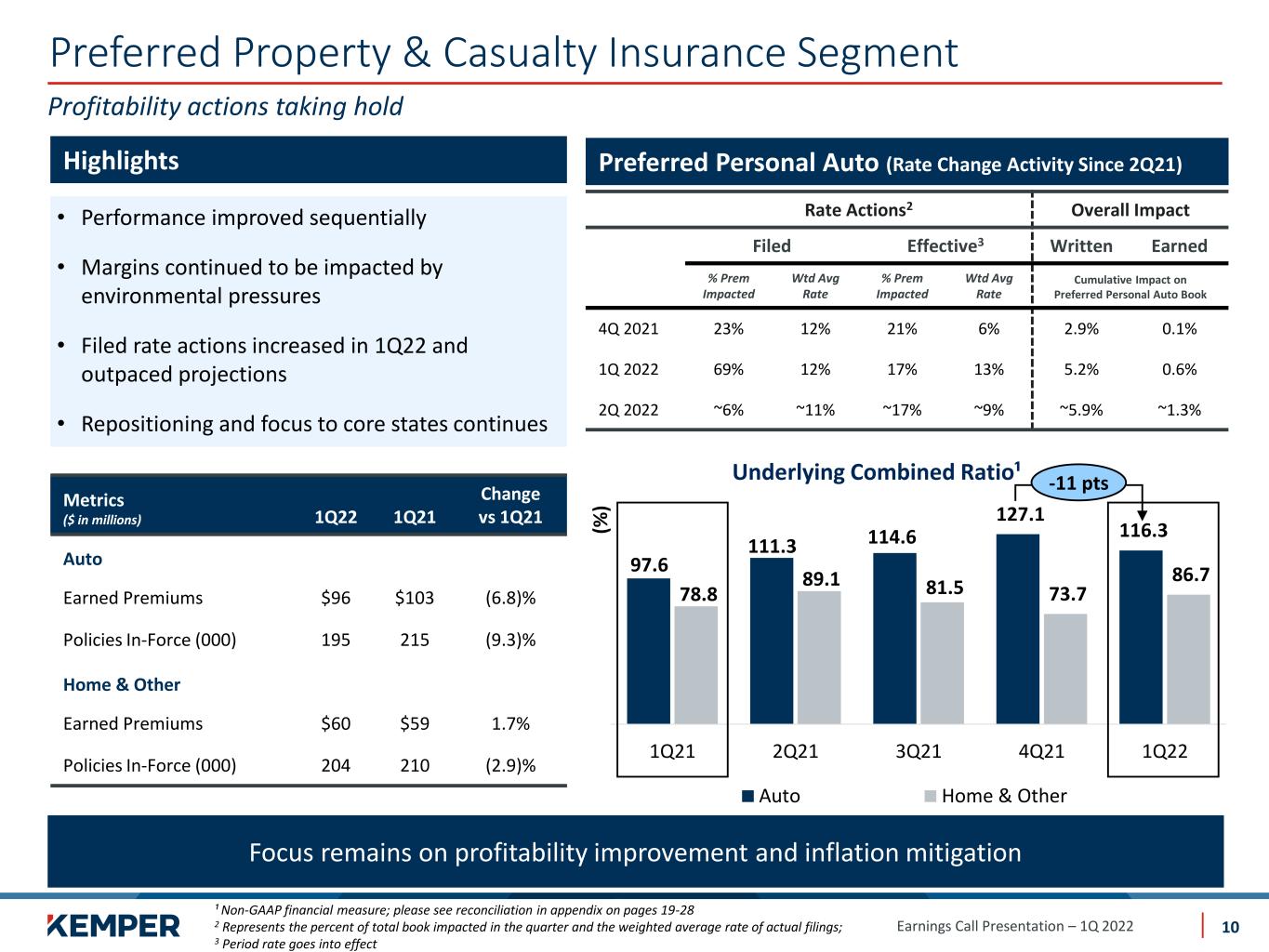

Earnings Call Presentation – 1Q 2022 Preferred Property & Casualty Insurance Segment Profitability actions taking hold Highlights 97.6 111.3 114.6 127.1 116.3 78.8 89.1 81.5 73.7 86.7 1Q21 2Q21 3Q21 4Q21 1Q22 Underlying Combined Ratio¹ Auto Home & Other Focus remains on profitability improvement and inflation mitigation ¹ Non-GAAP financial measure; please see reconciliation in appendix on pages 19-28 2 Represents the percent of total book impacted in the quarter and the weighted average rate of actual filings; 3 Period rate goes into effect • Performance improved sequentially • Margins continued to be impacted by environmental pressures • Filed rate actions increased in 1Q22 and outpaced projections • Repositioning and focus to core states continues (% ) 10 Metrics ($ in millions) 1Q22 1Q21 Change vs 1Q21 Auto Earned Premiums $96 $103 (6.8)% Policies In-Force (000) 195 215 (9.3)% Home & Other Earned Premiums $60 $59 1.7% Policies In-Force (000) 204 210 (2.9)% Rate Actions2 Overall Impact Filed Effective3 Written Earned % Prem Impacted Wtd Avg Rate % Prem Impacted Wtd Avg Rate Cumulative Impact on Preferred Personal Auto Book 4Q 2021 23% 12% 21% 6% 2.9% 0.1% 1Q 2022 69% 12% 17% 13% 5.2% 0.6% 2Q 2022 ~6% ~11% ~17% ~9% ~5.9% ~1.3% Preferred Personal Auto (Rate Change Activity Since 2Q21) -11 pts

Earnings Call Presentation – 1Q 2022 Life & Health Insurance Segment In line with national mortality trends, Pandemic continued to impact operating income Note: Chart may not balance due to rounding ¹ Excludes other income and solar credit impairment (M M ) • Life Earned Premium increased by $3.2 million or 3.3% in Q122 to $101.3 million • Persistency increased over pre-Pandemic levels (2017-2019) • Annualized Life new business sales remain above historical levels • Business to benefit from improved interest rate environment Highlights $161 $164 $164 $164 $161 $51 $52 $48 $51 $49 1Q21 2Q21 3Q21 4Q21 1Q22 Revenues1 Earned Premiums Net Investment Income $210$213$217$212 $215 Profitability expected to materially improve as mortality normalizes 11 Metrics ($ in millions except per policy amounts) 1Q22 1Q21 Change vs 1Q21 L&H Net Operating Income $3 $7 (57.1)% Life Face Value of In-Force $20,473 $20,046 2.1% Avg. Face per Policy $6,238 $5,998 4.0% Avg. Premium per Policy Issued $559 $494 13.2%

Earnings Call Presentation – 1Q 2022 Appendix 12

Earnings Call Presentation – 1Q 2022 ….to create value for all our stakeholders A Leading Specialized Insurer Taking advantage of a diversified portfolio of niche businesses…. Founded in 1990 and headquartered in Chicago, with subsidiaries writing policies since 1911 ~6.4M Policies ~35,500 Agents/Brokers ~10,400 Employees Preferred personal lines insurance providing preferred automobile, homeowners and other personal insurance products ~$15B Assets Specialty P&C insurance providing personal and commercial automobile insurance products Life and health insurance providing life, supplemental benefits, and other property insurance products 13

Earnings Call Presentation – 1Q 2022 14 Inflationary Pressures Remain Persistent • Insurers continue to face increased auto body work prices due to labor shortage and supply chain issues • Auto body work prices rose by 3.4% from last quarter; up 12.4% YoY • Used car and truck prices rose 35% over the past year; pace of increase slowed compared to last quarter • Medical care costs increased 1.8% from last quarter; up 2.9% YoY Source: U.S. Bureau of Labor Statistics. Inflation trends continue to be dynamic and trending upward Subcomponents of inflation continue to disproportionately impact insurers, driving up loss costs 90 100 110 120 130 140 150 160 J F M A M J J A S O N D J F M A M J J A S O N D J F M 2020 2021 2022 Motor Vehicle Body Work Used Car & Truck Medical Care Core CPI 152 109 106 117 Price Indices (Indexed to Q418) Slowdown of used car prices Continued increases to Motor Vehicle Body Work Steady increase in medical care inflation

Earnings Call Presentation – 1Q 2022 Capital Deployment Priorities Dedicated to being good stewards of capital Management and capital deployment priorities focused on maximizing shareholder value 1. Investment in the business • Fund profitable organic growth at appropriate risk-adjusted returns • Strategic investments and acquisitions that enhance the business and meet or exceed our ROE targets over time 2. Return capital to shareholders • Repurchase shares opportunistically • Maintain competitive dividends 15

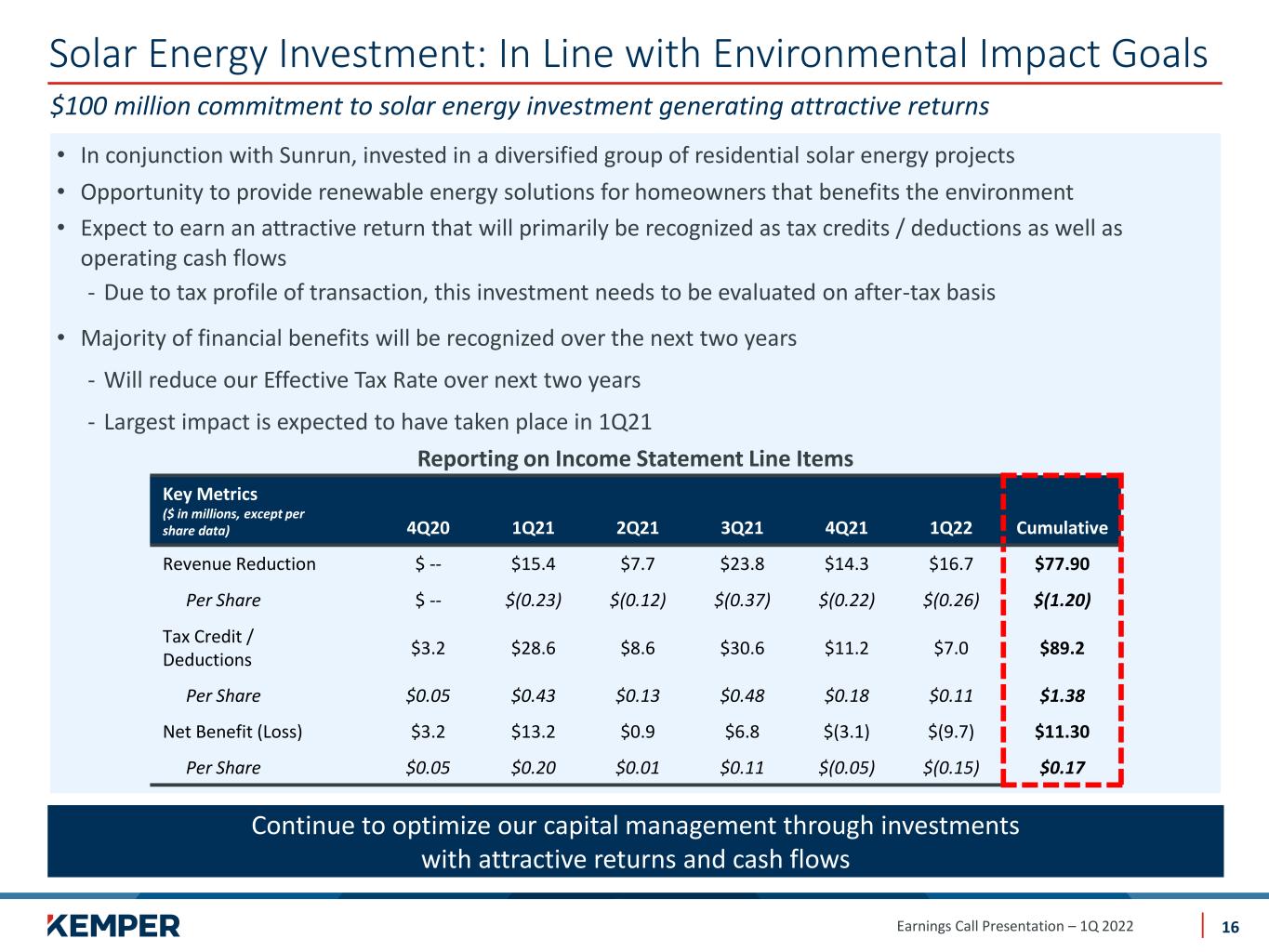

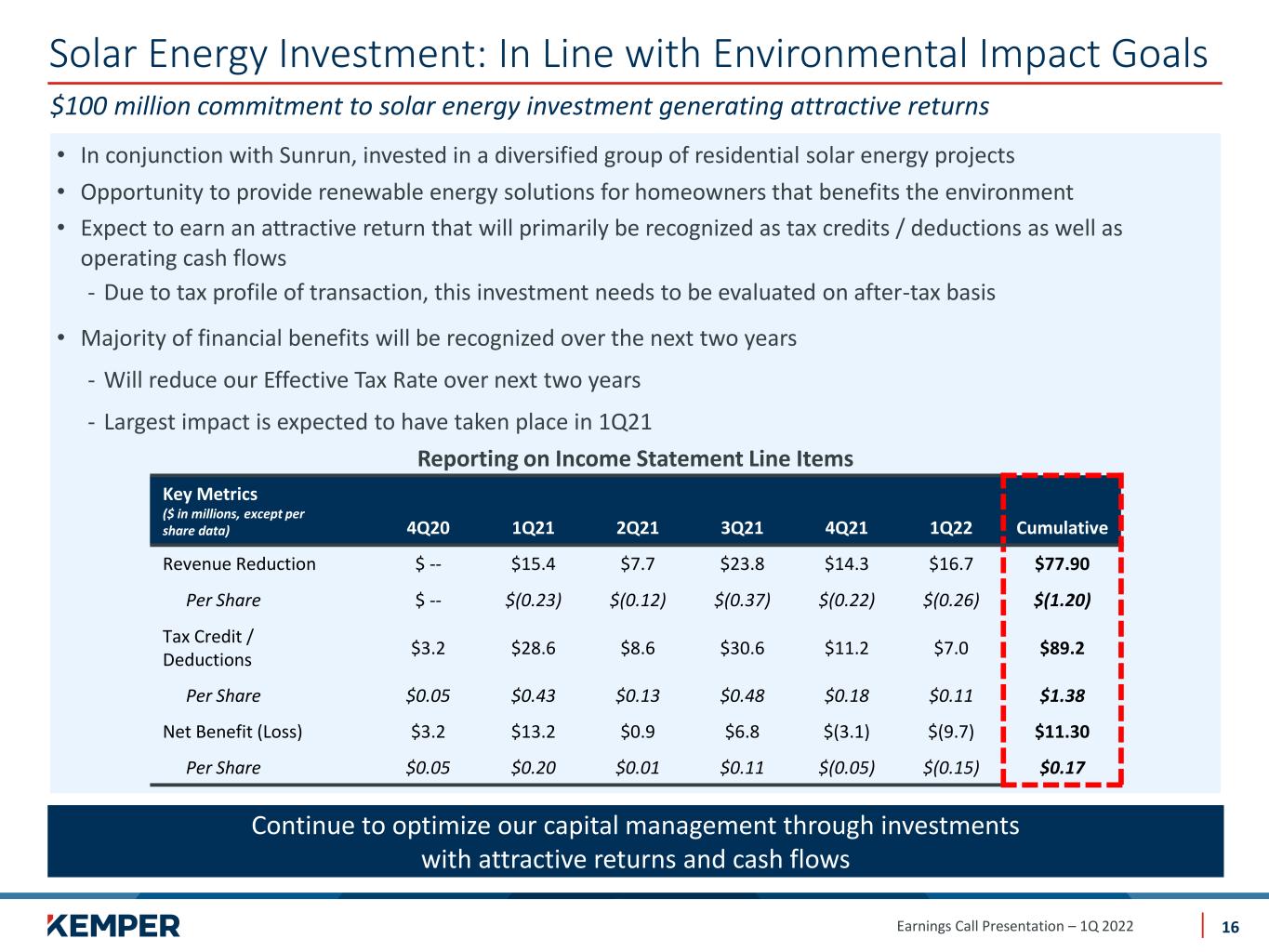

Earnings Call Presentation – 1Q 2022 Solar Energy Investment: In Line with Environmental Impact Goals $100 million commitment to solar energy investment generating attractive returns 16 • In conjunction with Sunrun, invested in a diversified group of residential solar energy projects • Opportunity to provide renewable energy solutions for homeowners that benefits the environment • Expect to earn an attractive return that will primarily be recognized as tax credits / deductions as well as operating cash flows - Due to tax profile of transaction, this investment needs to be evaluated on after-tax basis • Majority of financial benefits will be recognized over the next two years - Will reduce our Effective Tax Rate over next two years - Largest impact is expected to have taken place in 1Q21 Reporting on Income Statement Line Items Continue to optimize our capital management through investments with attractive returns and cash flows Key Metrics ($ in millions, except per share data) 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 Cumulative Revenue Reduction $ -- $15.4 $7.7 $23.8 $14.3 $16.7 $77.90 Per Share $ -- $(0.23) $(0.12) $(0.37) $(0.22) $(0.26) $(1.20) Tax Credit / Deductions $3.2 $28.6 $8.6 $30.6 $11.2 $7.0 $89.2 Per Share $0.05 $0.43 $0.13 $0.48 $0.18 $0.11 $1.38 Net Benefit (Loss) $3.2 $13.2 $0.9 $6.8 $(3.1) $(9.7) $11.30 Per Share $0.05 $0.20 $0.01 $0.11 $(0.05) $(0.15) $0.17

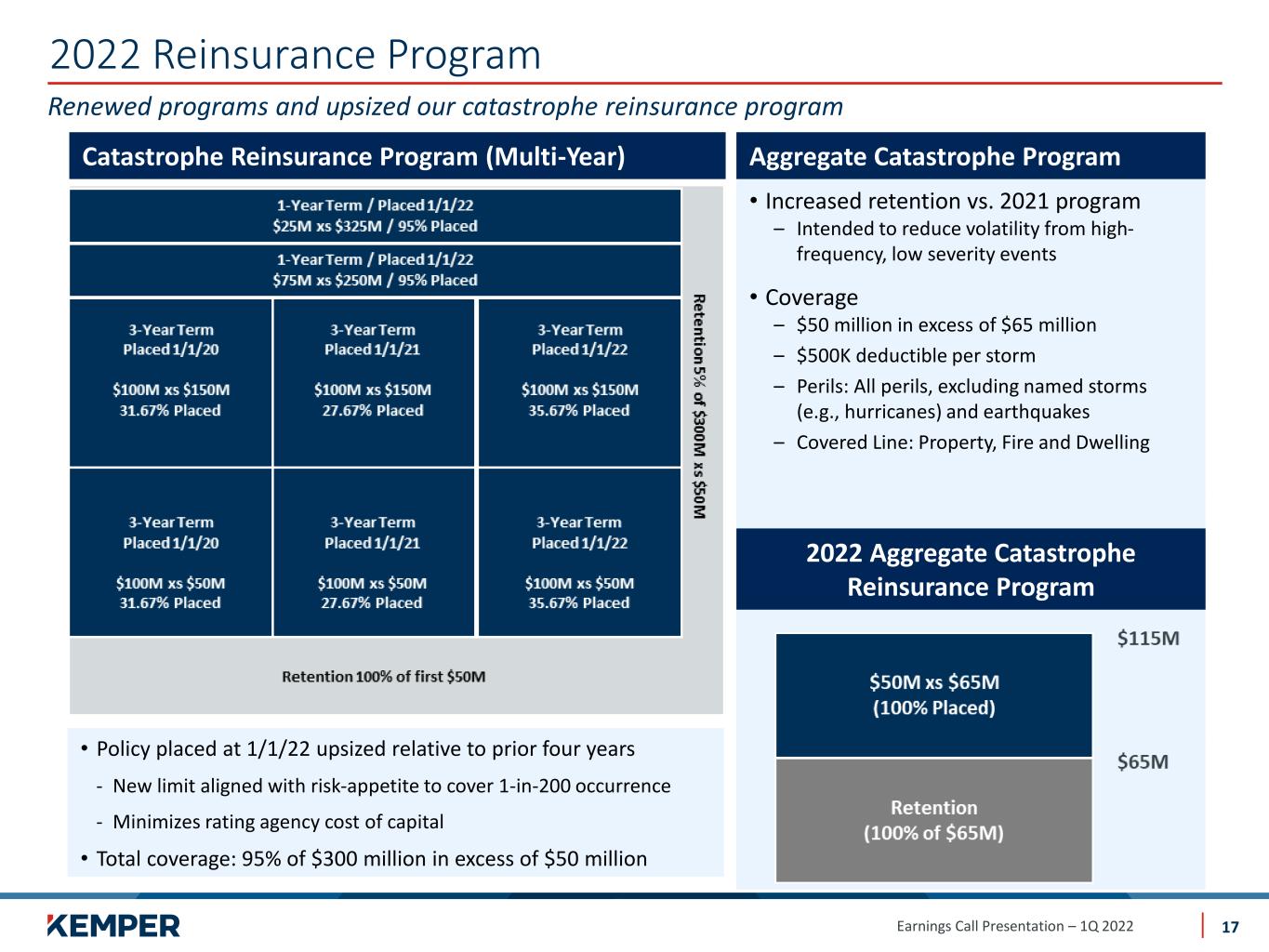

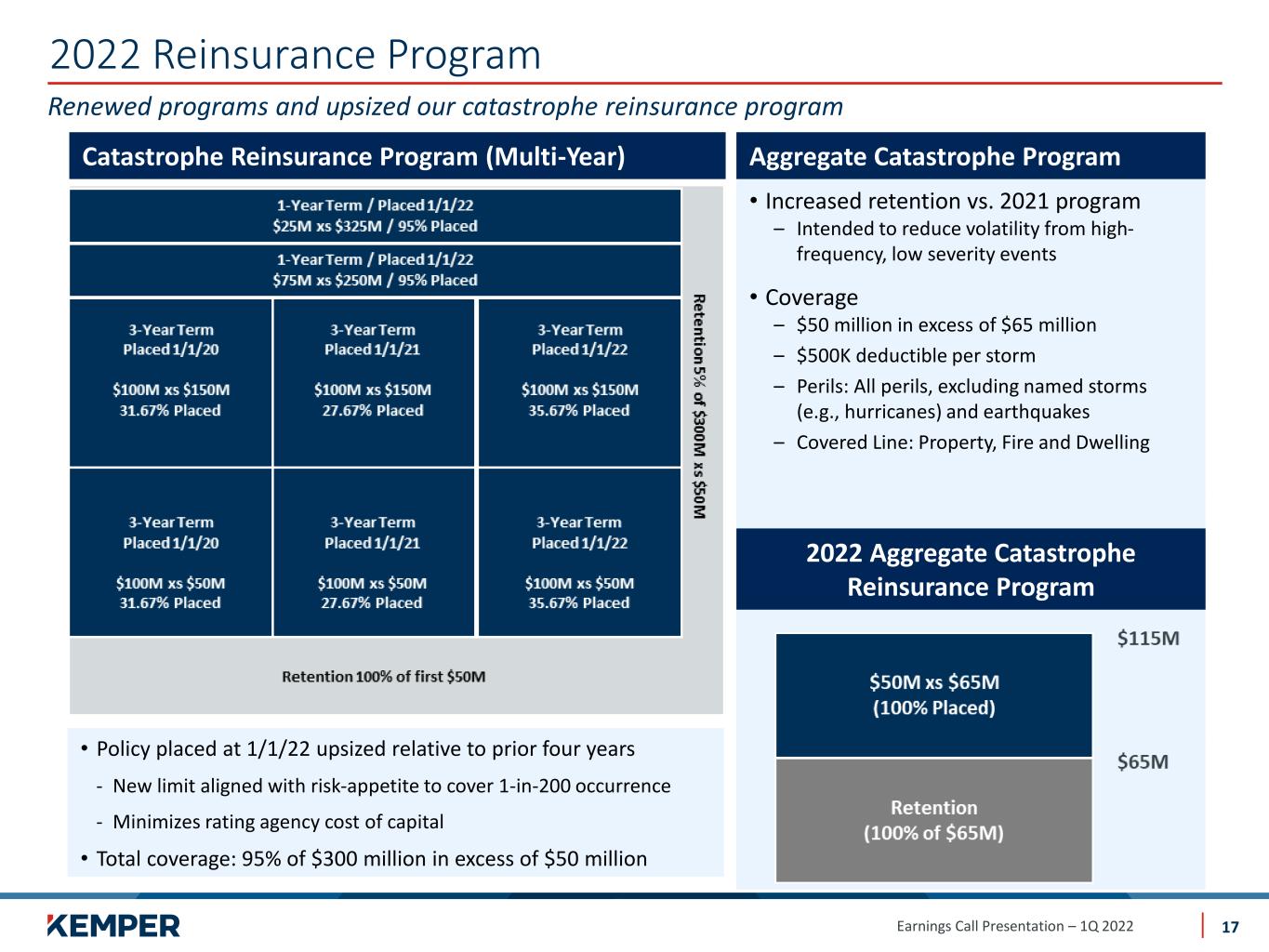

Earnings Call Presentation – 1Q 2022 2022 Reinsurance Program Renewed programs and upsized our catastrophe reinsurance program • Policy placed at 1/1/22 upsized relative to prior four years - New limit aligned with risk-appetite to cover 1-in-200 occurrence - Minimizes rating agency cost of capital • Total coverage: 95% of $300 million in excess of $50 million Catastrophe Reinsurance Program (Multi-Year) • Increased retention vs. 2021 program – Intended to reduce volatility from high- frequency, low severity events • Coverage – $50 million in excess of $65 million – $500K deductible per storm – Perils: All perils, excluding named storms (e.g., hurricanes) and earthquakes – Covered Line: Property, Fire and Dwelling Aggregate Catastrophe Program 2022 Aggregate Catastrophe Reinsurance Program 17

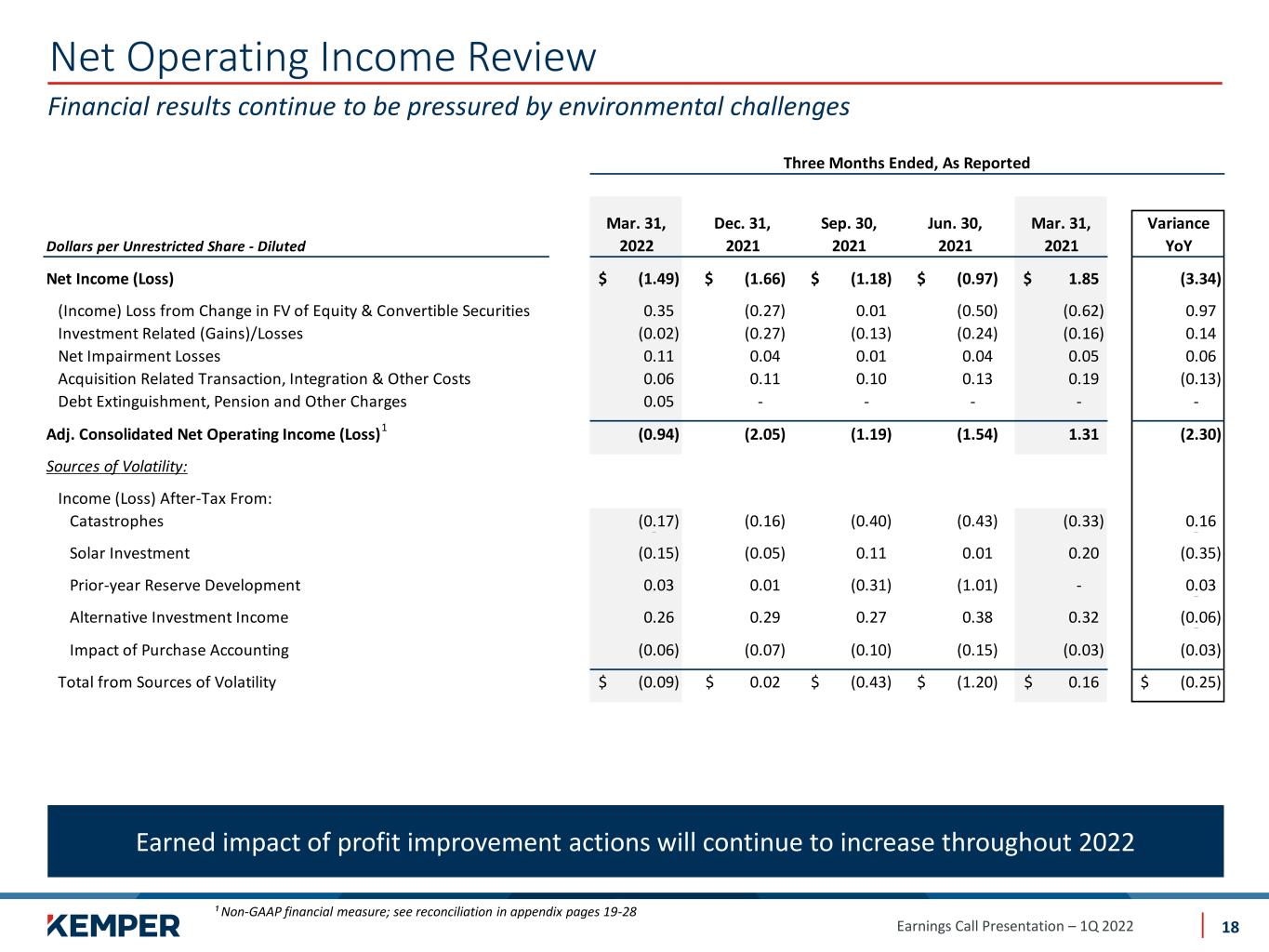

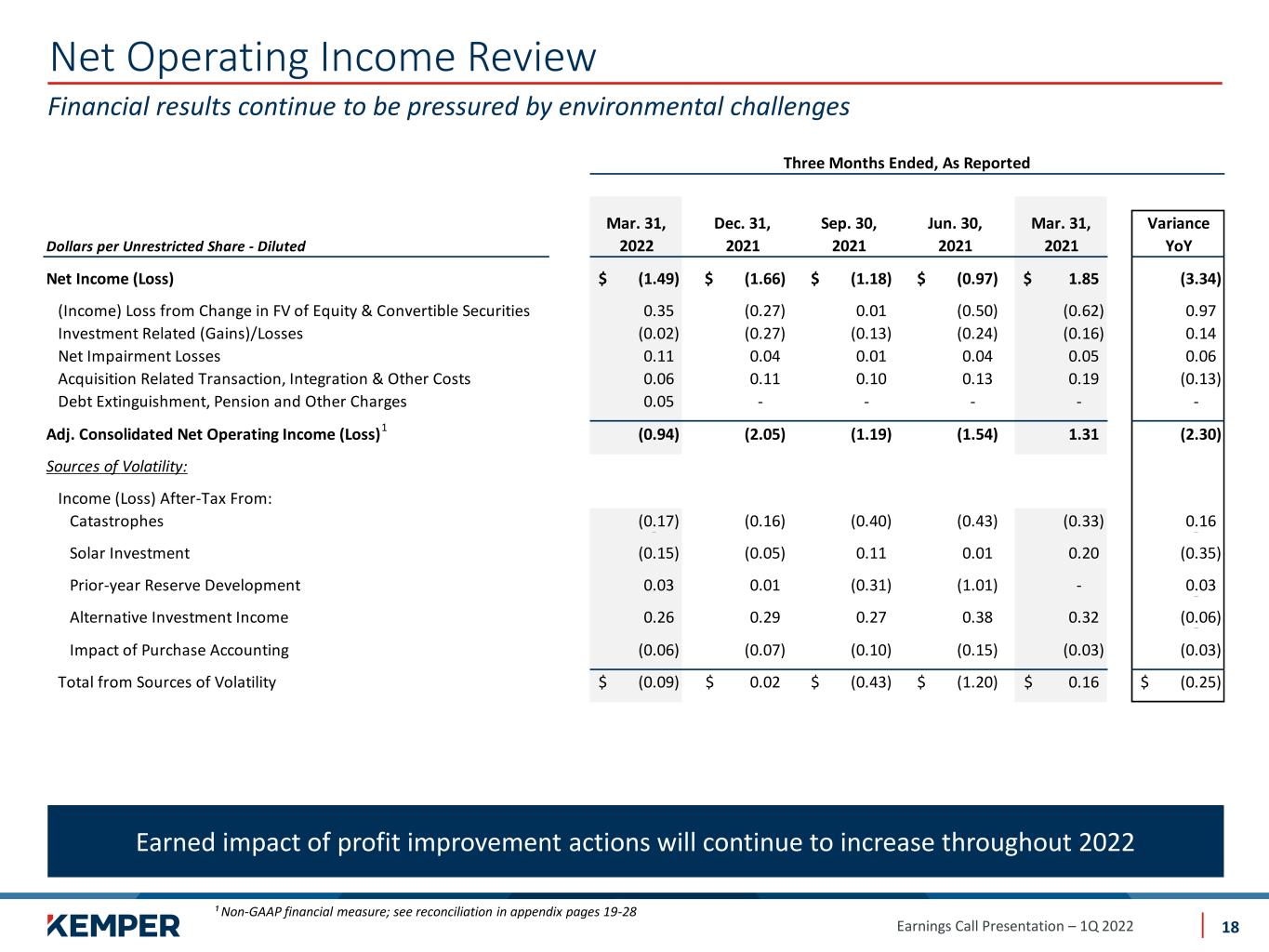

Earnings Call Presentation – 1Q 2022 Earned impact of profit improvement actions will continue to increase throughout 2022 Net Operating Income Review ¹ Non-GAAP financial measure; see reconciliation in appendix pages 19-28 Financial results continue to be pressured by environmental challenges 18 Three Months Ended, As Reported Mar. 31, Dec. 31, Sep. 30, Jun. 30, Mar. 31, Variance Dollars per Unrestricted Share - Diluted 2022 2021 2021 2021 2021 YoY Net Income (Loss) (1.49)$ (1.66)$ (1.18)$ (0.97)$ 1.85$ (3.34) (Income) Loss from Change in FV of Equity & Convertible Securities 0.35 (0.27) 0.01 (0.50) (0.62) 0.97 Investment Related (Gains)/Losses (0.02) (0.27) (0.13) (0.24) (0.16) 0.14 Net Impairment Losses 0.11 0.04 0.01 0.04 0.05 0.06 Acquisition Related Transaction, Integration & Other Costs 0.06 0.11 0.10 0.13 0.19 (0.13) Debt Extinguishment, Pension and Other Charges 0.05 - - - - - Adj. Consolidated Net Operating Income (Loss)1 (0.94) (2.05) (1.19) (1.54) 1.31 (2.30) Sources of Volatility: Income (Loss) After-Tax From: Catastrophes (0.17) (0.16) (0.40) (0.43) (0.33) 0.16 - - Solar Investment (0.15) (0.05) 0.11 0.01 0.20 (0.35) Prior-year Reserve Development 0.03 0.01 (0.31) (1.01) - 0.03 - Alternative Investment Income 0.26 0.29 0.27 0.38 0.32 (0.06) - Impact of Purchase Accounting (0.06) (0.07) (0.10) (0.15) (0.03) (0.03) Total from Sources of Volatility (0.09)$ 0.02$ (0.43)$ (1.20)$ 0.16$ (0.25)$

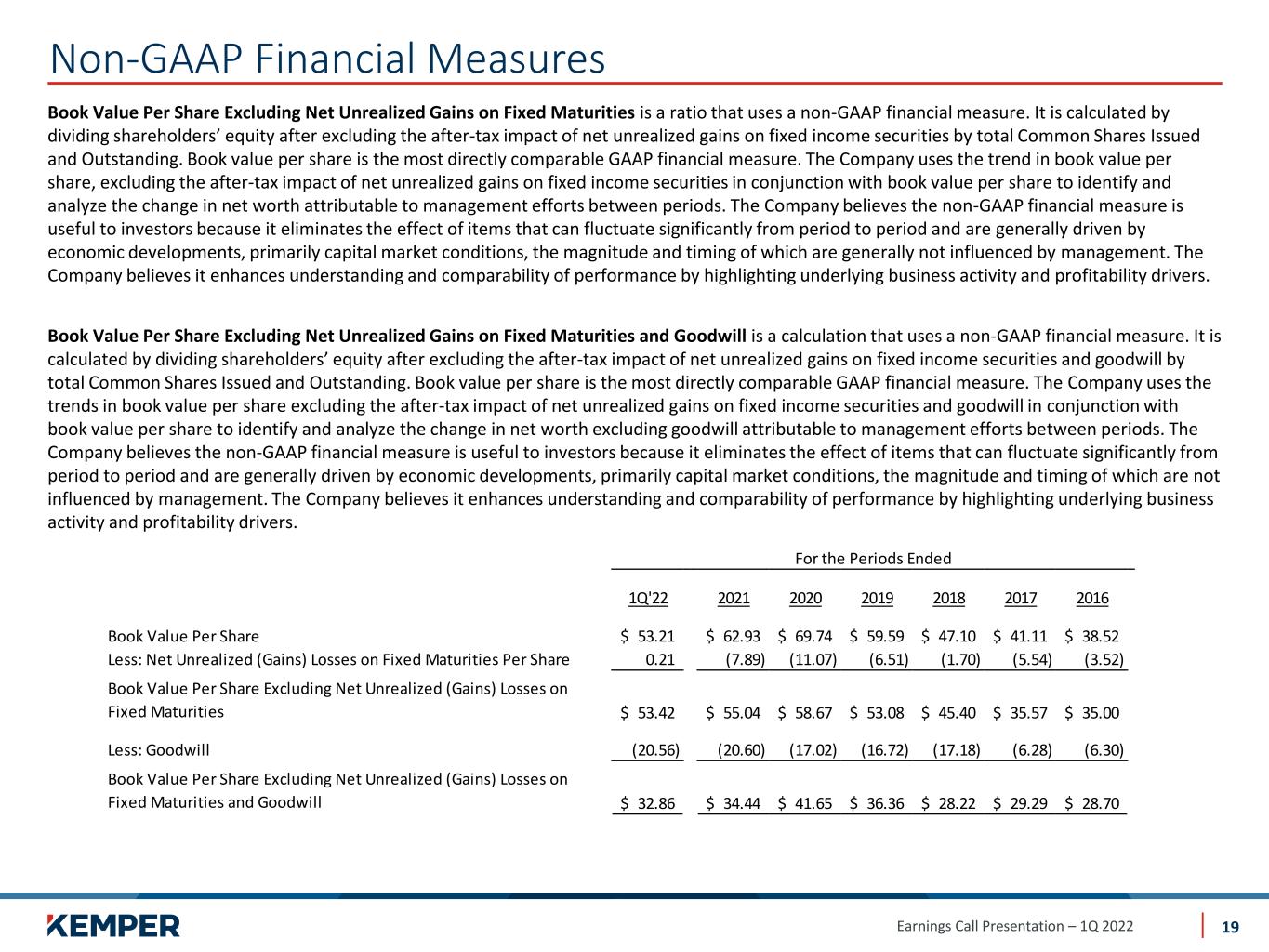

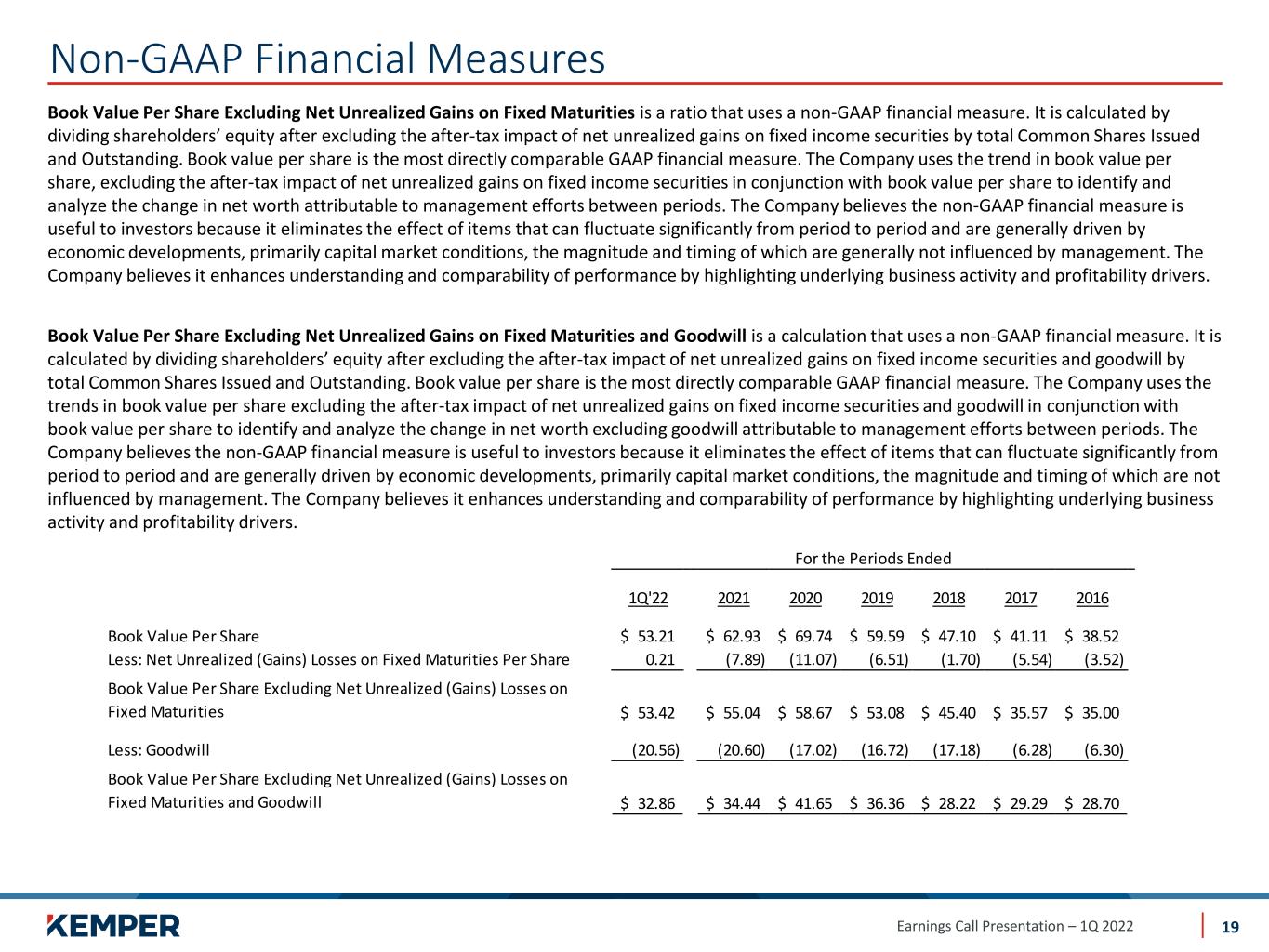

Earnings Call Presentation – 1Q 2022 Book Value Per Share Excluding Net Unrealized Gains on Fixed Maturities is a ratio that uses a non-GAAP financial measure. It is calculated by dividing shareholders’ equity after excluding the after-tax impact of net unrealized gains on fixed income securities by total Common Shares Issued and Outstanding. Book value per share is the most directly comparable GAAP financial measure. The Company uses the trend in book value per share, excluding the after-tax impact of net unrealized gains on fixed income securities in conjunction with book value per share to identify and analyze the change in net worth attributable to management efforts between periods. The Company believes the non-GAAP financial measure is useful to investors because it eliminates the effect of items that can fluctuate significantly from period to period and are generally driven by economic developments, primarily capital market conditions, the magnitude and timing of which are generally not influenced by management. The Company believes it enhances understanding and comparability of performance by highlighting underlying business activity and profitability drivers. Book Value Per Share Excluding Net Unrealized Gains on Fixed Maturities and Goodwill is a calculation that uses a non-GAAP financial measure. It is calculated by dividing shareholders’ equity after excluding the after-tax impact of net unrealized gains on fixed income securities and goodwill by total Common Shares Issued and Outstanding. Book value per share is the most directly comparable GAAP financial measure. The Company uses the trends in book value per share excluding the after-tax impact of net unrealized gains on fixed income securities and goodwill in conjunction with book value per share to identify and analyze the change in net worth excluding goodwill attributable to management efforts between periods. The Company believes the non-GAAP financial measure is useful to investors because it eliminates the effect of items that can fluctuate significantly from period to period and are generally driven by economic developments, primarily capital market conditions, the magnitude and timing of which are not influenced by management. The Company believes it enhances understanding and comparability of performance by highlighting underlying business activity and profitability drivers. Non-GAAP Financial Measures 19 1Q'22 2021 2020 2019 2018 2017 2016 Book Value Per Share 53.21$ 62.93$ 69.74$ 59.59$ 47.10$ 41.11$ 38.52$ Less: Net Unrealized (Gains) Losses on Fixed Maturities Per Share 0.21 (7.89) (11.07) (6.51) (1.70) (5.54) (3.52) Book Value Per Share Excluding Net Unrealized (Gains) Losses on Fixed Maturities 53.42$ 55.04$ 58.67$ 53.08$ 45.40$ 35.57$ 35.00$ Less: Goodwill (20.56) (20.60) (17.02) (16.72) (17.18) (6.28) (6.30) Book Value Per Share Excluding Net Unrealized (Gains) Losses on Fixed Maturities and Goodwill 32.86$ 34.44$ 41.65$ 36.36$ 28.22$ 29.29$ 28.70$ For the Periods Ended

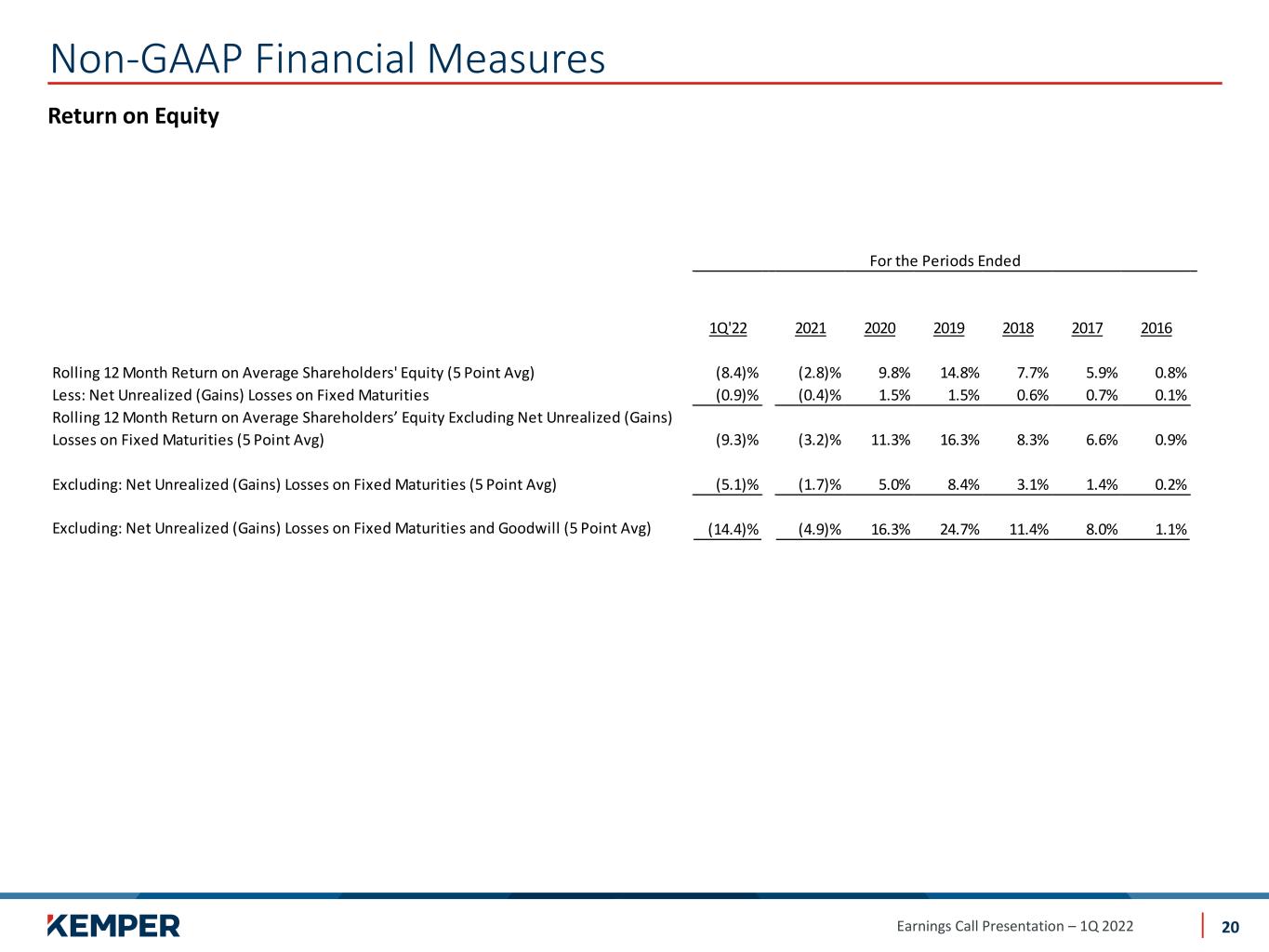

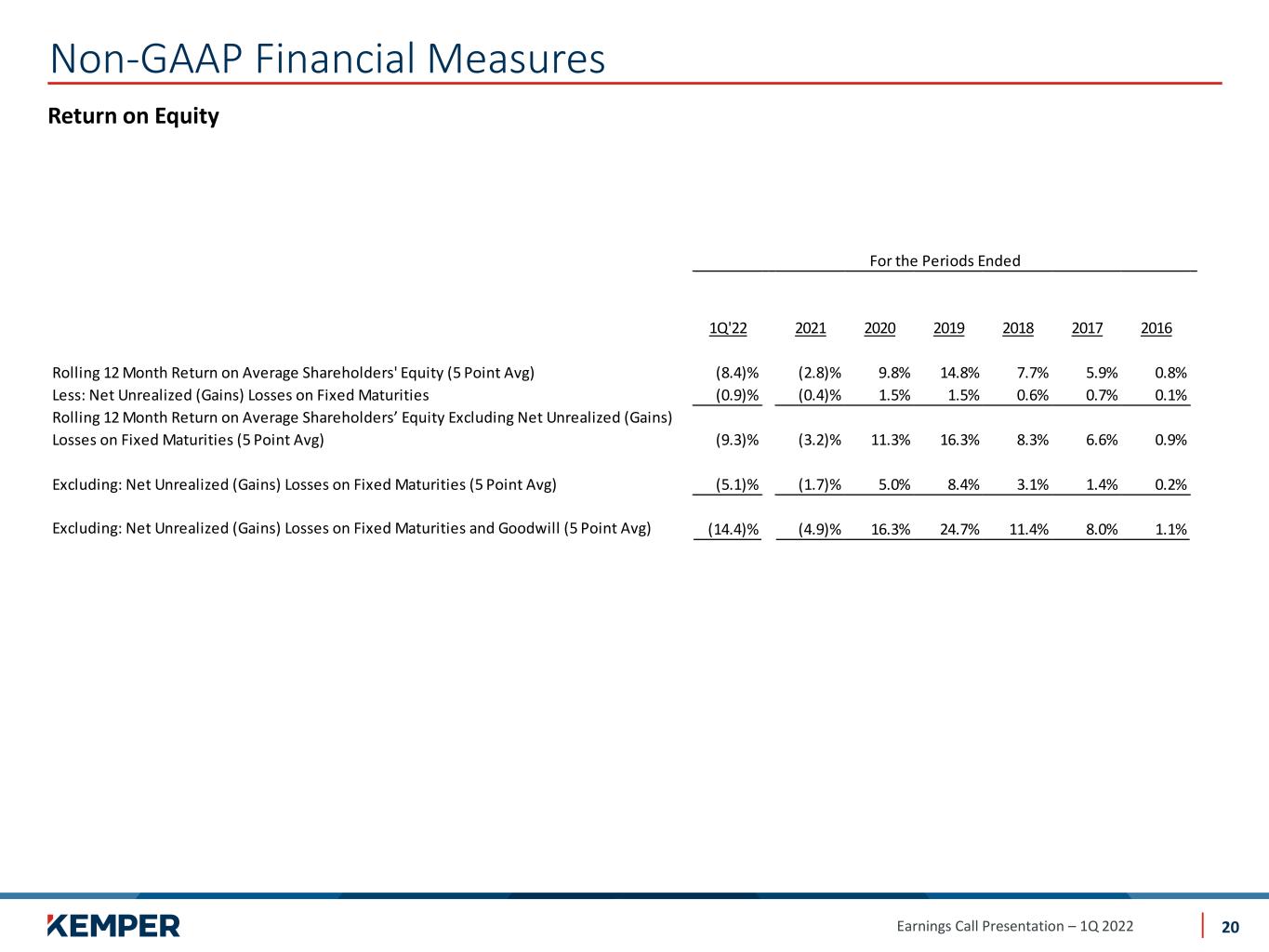

Earnings Call Presentation – 1Q 2022 Return on Equity Non-GAAP Financial Measures 20 1Q'22 2021 2020 2019 2018 2017 2016 Rolling 12 Month Return on Average Shareholders' Equity (5 Point Avg) (8.4)% (2.8)% 9.8% 14.8% 7.7% 5.9% 0.8% Less: Net Unrealized (Gains) Losses on Fixed Maturities (0.9)% (0.4)% 1.5% 1.5% 0.6% 0.7% 0.1% Rolling 12 Month Return on Average Shareholders’ Equity Excluding Net Unrealized (Gains) Losses on Fixed Maturities (5 Point Avg) (9.3)% (3.2)% 11.3% 16.3% 8.3% 6.6% 0.9% Excluding: Net Unrealized (Gains) Losses on Fixed Maturities (5 Point Avg) (5.1)% (1.7)% 5.0% 8.4% 3.1% 1.4% 0.2% Excluding: Net Unrealized (Gains) Losses on Fixed Maturities and Goodwill (5 Point Avg) (14.4)% (4.9)% 16.3% 24.7% 11.4% 8.0% 1.1% For the Periods Ended

Earnings Call Presentation – 1Q 2022 Kemper believes that Adjusted Consolidated Net Operating Income (Loss) provides investors with a valuable measure of its ongoing performance because it reveals underlying operational performance trends that otherwise might be less apparent if the items were not excluded. Income (Loss) from Change in Fair Value of Equity and Convertible Securities, Net Realized Gains on Sales of Investments and Impairment Losses related to investments included in the Company’s results may vary significantly between periods and are generally driven by business decisions and external economic developments such as capital market conditions that impact the values of the Company’s investments, the timing of which is unrelated to the insurance underwriting process. Acquisition Related Transaction and Integration Costs may vary significantly between periods and are generally driven by the timing of acquisitions and business decisions which are unrelated to the insurance underwriting process. Debt Extinguishment, Pension and Other Charges relate to (i) loss from early extinguishment of debt, which is driven by the Company’s financing and refinancing decisions and capital needs, as well as external economic developments such as debt market conditions, the timing of which is unrelated to the insurance underwriting process; (ii) settlement of pension plan obligations which are business decisions are made by the Company, the timing of which is unrelated to the underwriting process; and (iii) other charges that are non-standard, not part of the ordinary course of business, and unrelated to the insurance underwriting process. Significant non-recurring items are excluded because, by their nature, they are not indicative of the Company’s business or economic trends. Non-GAAP Financial Measures 21

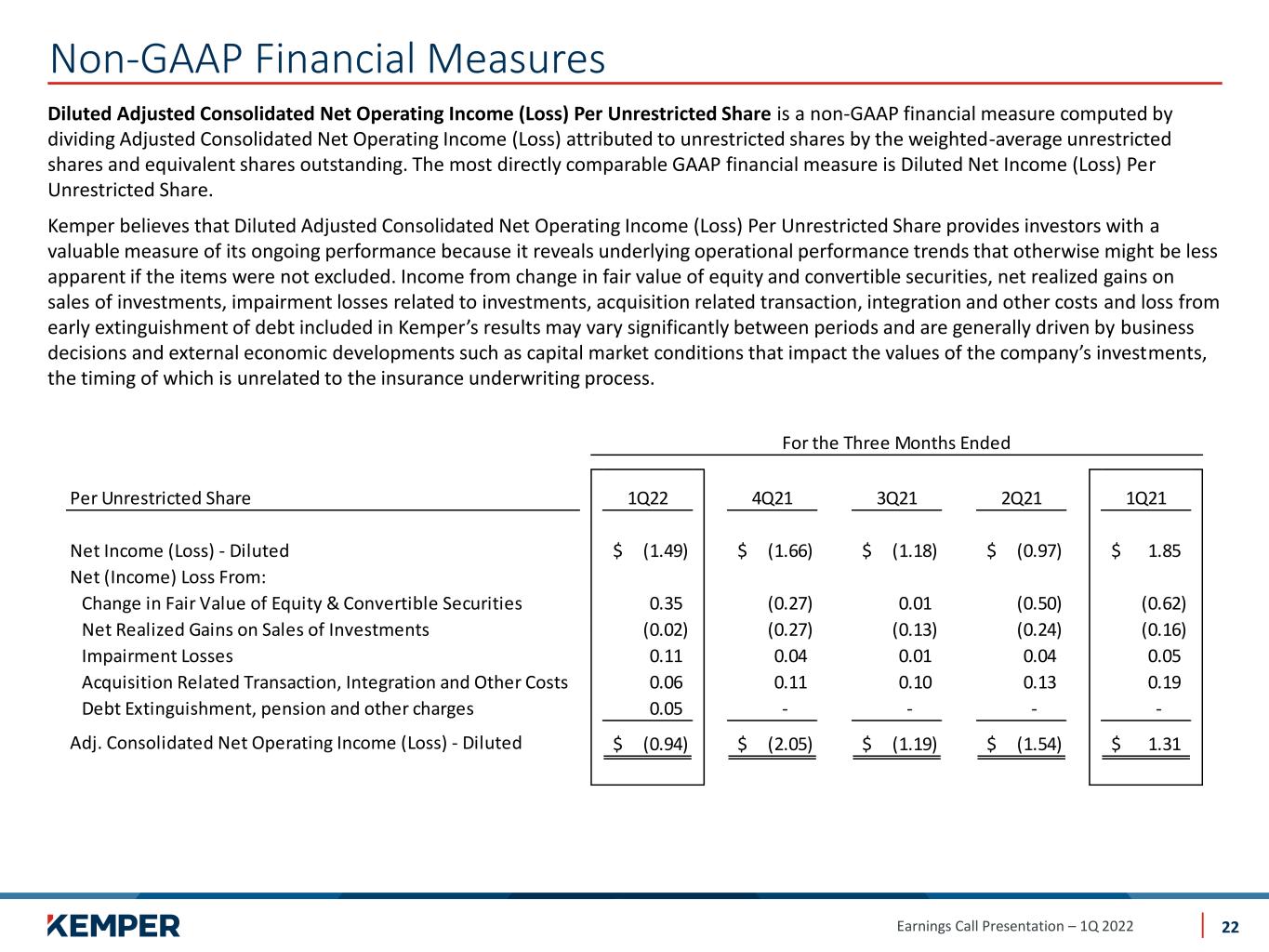

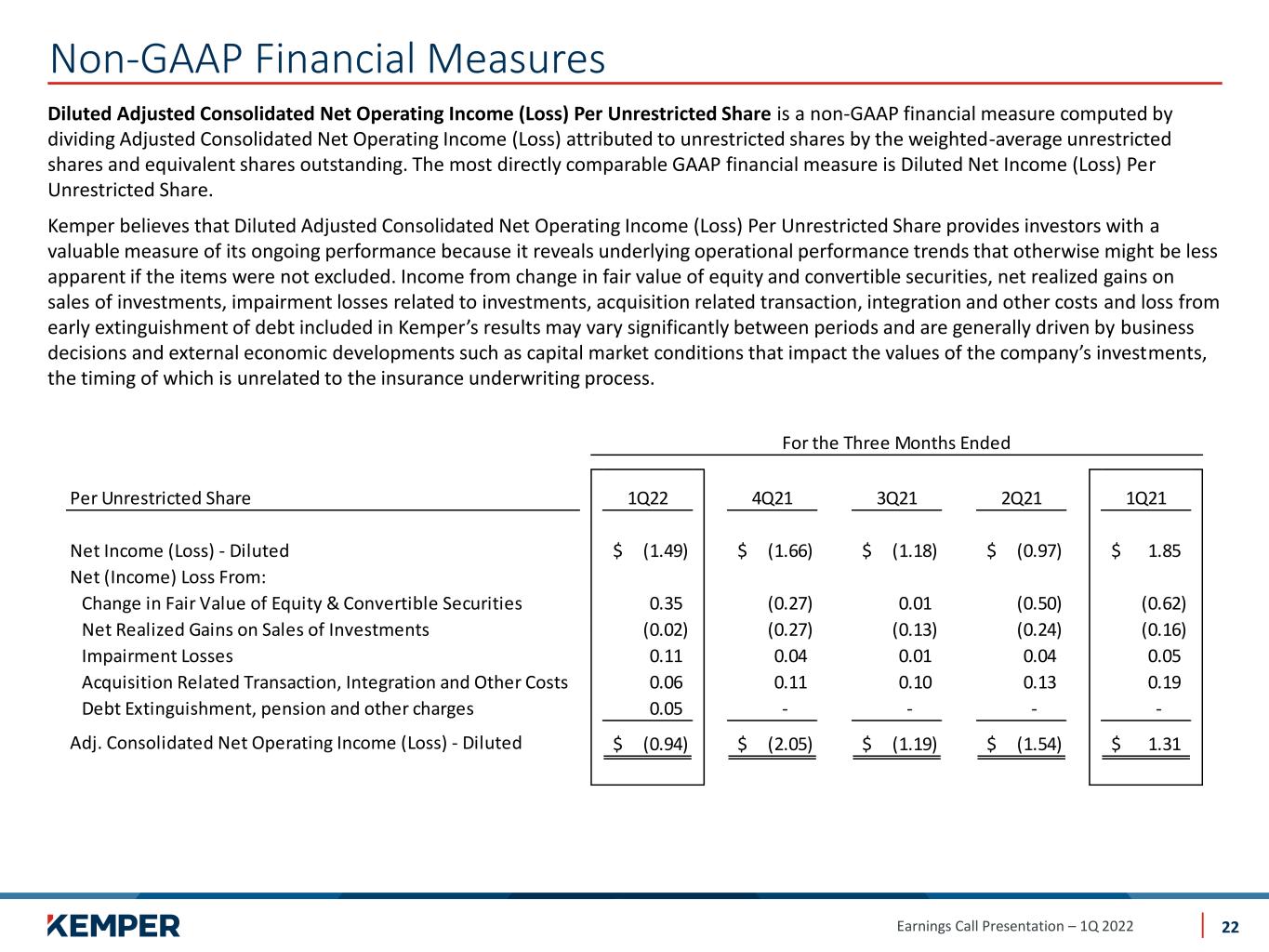

Earnings Call Presentation – 1Q 2022 Diluted Adjusted Consolidated Net Operating Income (Loss) Per Unrestricted Share is a non-GAAP financial measure computed by dividing Adjusted Consolidated Net Operating Income (Loss) attributed to unrestricted shares by the weighted-average unrestricted shares and equivalent shares outstanding. The most directly comparable GAAP financial measure is Diluted Net Income (Loss) Per Unrestricted Share. Kemper believes that Diluted Adjusted Consolidated Net Operating Income (Loss) Per Unrestricted Share provides investors with a valuable measure of its ongoing performance because it reveals underlying operational performance trends that otherwise might be less apparent if the items were not excluded. Income from change in fair value of equity and convertible securities, net realized gains on sales of investments, impairment losses related to investments, acquisition related transaction, integration and other costs and loss from early extinguishment of debt included in Kemper’s results may vary significantly between periods and are generally driven by business decisions and external economic developments such as capital market conditions that impact the values of the company’s investments, the timing of which is unrelated to the insurance underwriting process. Non-GAAP Financial Measures 22 Per Unrestricted Share 1Q22 4Q21 3Q21 2Q21 1Q21 Net Income (Loss) - Diluted (1.49)$ (1.66)$ (1.18)$ (0.97)$ 1.85$ Net (Income) Loss From: Change in Fair Value of Equity & Convertible Securities 0.35 (0.27) 0.01 (0.50) (0.62) Net Realized Gains on Sales of Investments (0.02) (0.27) (0.13) (0.24) (0.16) Impairment Losses 0.11 0.04 0.01 0.04 0.05 Acquisition Related Transaction, Integration and Other Costs 0.06 0.11 0.10 0.13 0.19 Debt Extinguishment, pension and other charges 0.05 - - - - Adj. Consolidated Net Operating Income (Loss) - Diluted (0.94)$ (2.05)$ (1.19)$ (1.54)$ 1.31$ For the Three Months Ended

Earnings Call Presentation – 1Q 2022 Underlying Combined Ratio is a non-GAAP financial measure. It is computed by adding the Current Year Non-catastrophe Losses and LAE Ratio with the Insurance Expense Ratio. The most directly comparable GAAP financial measure is the Combined Ratio, which is computed by adding total incurred losses and LAE, including the impact of catastrophe losses and loss and LAE reserve development from prior years, with the Insurance Expense Ratio. The Company believes the underlying combined ratio is useful to investors and is used by management to reveal the trends in the Company’s property and casualty insurance businesses that may be obscured by catastrophe losses and prior-year reserve development. These catastrophe losses cause loss trends to vary significantly between periods as a result of their incidence of occurrence and magnitude, and can have a significant impact on the combined ratio. Prior-year reserve developments are caused by unexpected loss development on historical reserves. Because reserve development relates to the re-estimation of losses from earlier periods, it has no bearing on the performance of our insurance products in the current period. The Company believes it is useful for investors to evaluate these components separately and in the aggregate when reviewing the Company’s underwriting performance. The underlying combined ratio should not be considered a substitute for the combined ratio and does not reflect the overall underwriting profitability of our business. Non-GAAP Financial Measures 23

Earnings Call Presentation – 1Q 2022 Underlying Combined Ratio – Continued Non-GAAP Financial Measures 24 1Q22 4Q21 3Q21 2Q21 1Q21 Specialty P&C Insurance Combined Ratio as Reported 108.6% 118.9% 111.6% 116.1% 93.5% Current Year Catastrophe Loss and LAE Ratio (0.2)% (0.2)% (0.3)% (0.8)% (0.2)% Prior Years Non-Catastrophe Losses and LAE 0.4% 0.7% (2.4)% (8.0)% 0.2% Prior Years Catastrophe Losses and LAE Ratio (0.1)% 0.0% 0.0% 0.0% 0.0% Underlying Combined Ratio 108.7% 119.4% 108.9% 107.3% 93.5% Preferred P&C Insurance Combined Ratio as Reported 111.6% 115.5% 116.6% 118.9% 105.4% Current Year Catastrophe Loss and LAE Ratio (7.3)% (4.6)% (14.3)% (14.8)% (14.8)% Prior Years Non-Catastrophe Losses and LAE (1.3)% (5.2)% 0.0% (3.1)% (0.1)% Prior Years Catastrophe Losses and LAE Ratio 2.1% 1.2% (0.1)% 2.1% 0.2% Underlying Combined Ratio 105.1% 106.9% 102.2% 103.1% 90.7% Preferred Auto Combined Ratio as Reported 118.5% 135.5% 117.4% 117.3% 99.5% Current Year Catastrophe Loss and LAE Ratio (0.5)% (1.3)% (2.6)% (2.7)% (0.6)% Prior Years Non-Catastrophe Losses and LAE (1.6)% (7.2)% (0.1)% (3.5)% (1.2)% Prior Years Catastrophe Losses and LAE Ratio (0.1)% 0.1% (0.1)% 0.2% (0.1)% Underlying Combined Ratio 116.3% 127.1% 114.6% 111.3% 97.6% Preferred Home & Other Combined Ratio as Reported 100.5% 82.5% 115.2% 121.8% 115.7% Current Year Catastrophe Loss and LAE Ratio (18.3)% (10.1)% (33.9)% (35.8)% (39.5)% Prior Years Non-Catastrophe Losses and LAE (1.0)% (1.8)% 0.2% (2.3)% 1.9% Prior Years Catastrophe Losses and LAE Ratio 5.5% 3.1% 0.0% 5.4% 0.7% Underlying Combined Ratio 86.7% 73.7% 81.5% 89.1% 78.8%

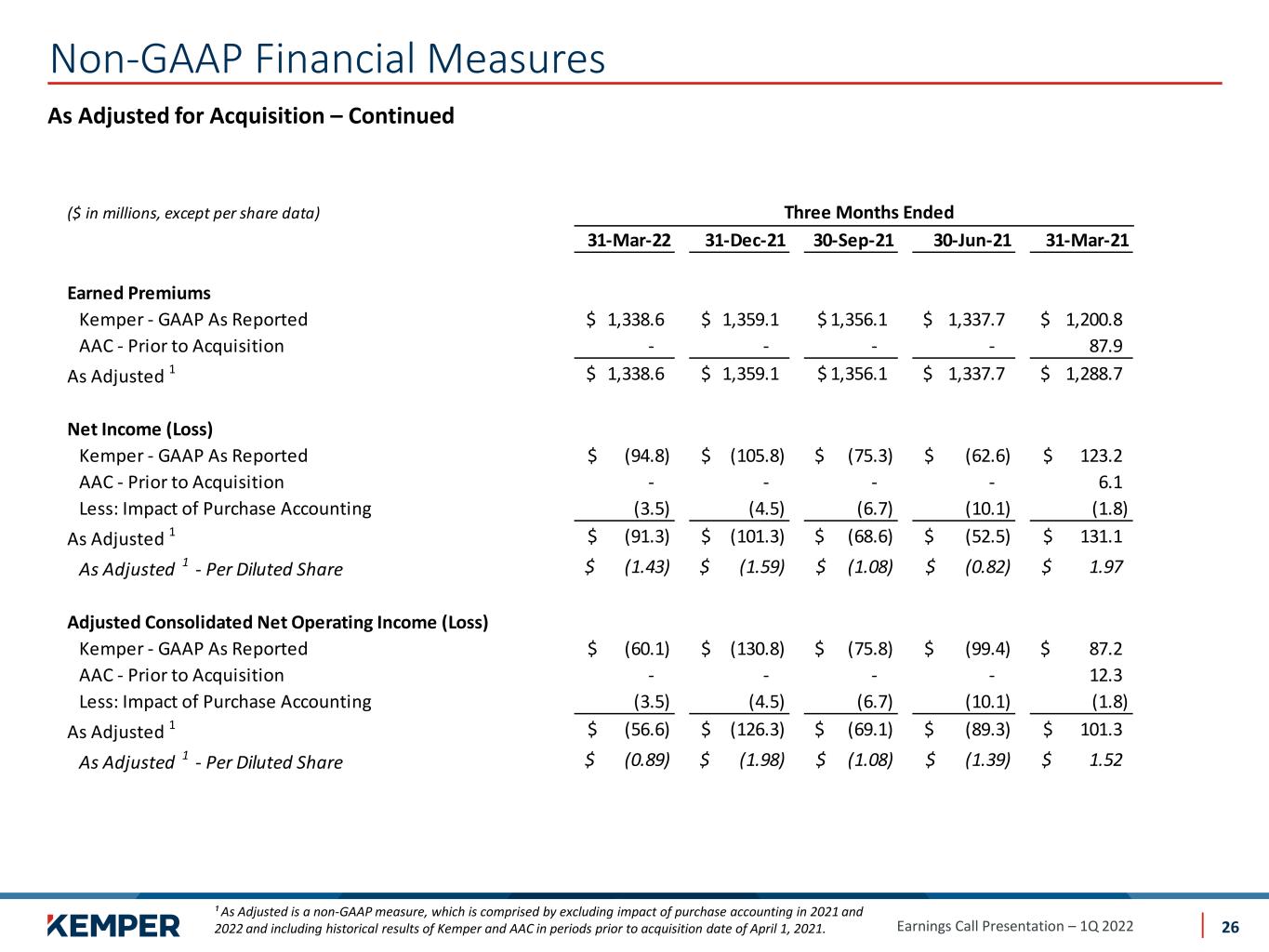

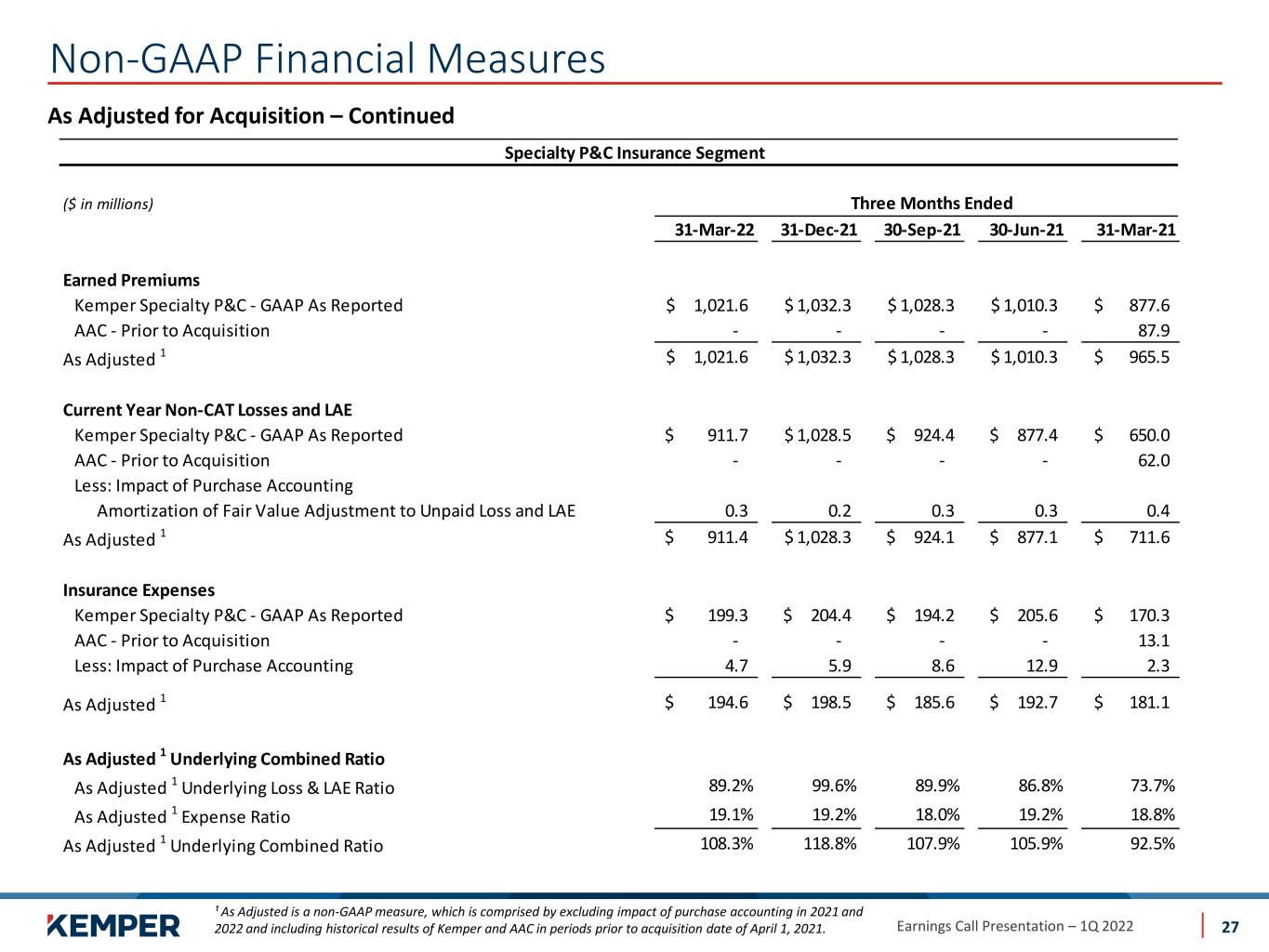

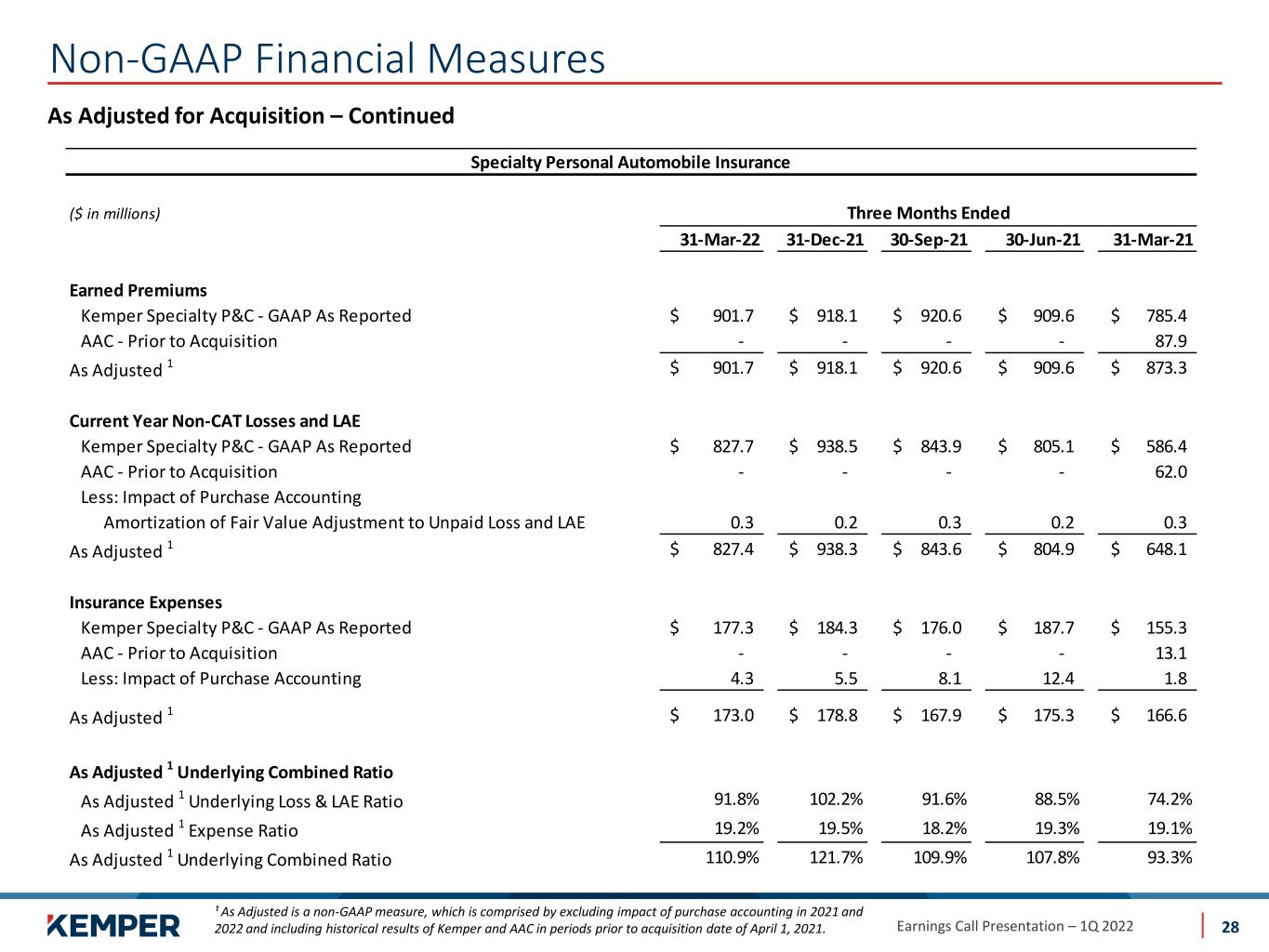

Earnings Call Presentation – 1Q 2022 As Adjusted for Acquisition amounts are non-GAAP financial measures. Subsequent to the applicable acquisitions, the As Adjusted for Acquisitions amounts are computed by subtracting the impact of purchase accounting adjustments from the comparable consolidated GAAP financial measure reported by Kemper. The Company believes computing and presenting results on an adjusted basis are useful to investors and are used by management to provide meaningful and comparable year-over-year comparisons. Non-GAAP Financial Measures 25

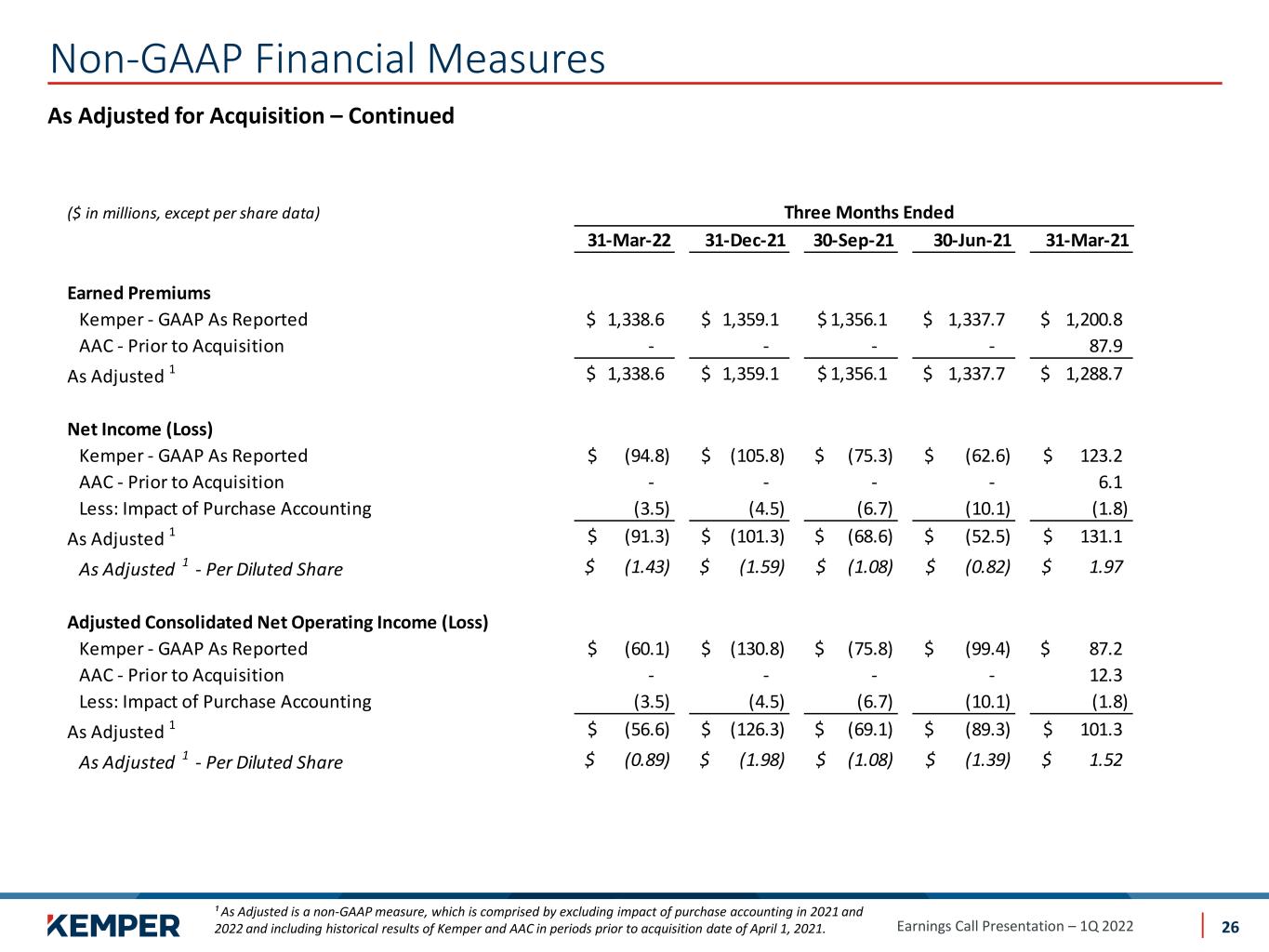

Earnings Call Presentation – 1Q 2022 As Adjusted for Acquisition – Continued Non-GAAP Financial Measures ¹ As Adjusted is a non-GAAP measure, which is comprised by excluding impact of purchase accounting in 2021 and 2022 and including historical results of Kemper and AAC in periods prior to acquisition date of April 1, 2021. 26 ($ in millions, except per share data) 31-Mar-22 31-Dec-21 30-Sep-21 30-Jun-21 31-Mar-21 Earned Premiums Kemper - GAAP As Reported 1,338.6$ 1,359.1$ 1,356.1$ 1,337.7$ 1,200.8$ AAC - Prior to Acquisition - - - - 87.9 As Adjusted 1 1,338.6$ 1,359.1$ 1,356.1$ 1,337.7$ 1,288.7$ Net Income (Loss) Kemper - GAAP As Reported (94.8)$ (105.8)$ (75.3)$ (62.6)$ 123.2$ AAC - Prior to Acquisition - - - - 6.1 Less: Impact of Purchase Accounting (3.5) (4.5) (6.7) (10.1) (1.8) As Adjusted 1 (91.3)$ (101.3)$ (68.6)$ (52.5)$ 131.1$ As Adjusted 1 - Per Diluted Share (1.43)$ (1.59)$ (1.08)$ (0.82)$ 1.97$ Adjusted Consolidated Net Operating Income (Loss) Kemper - GAAP As Reported (60.1)$ (130.8)$ (75.8)$ (99.4)$ 87.2$ AAC - Prior to Acquisition - - - - 12.3 Less: Impact of Purchase Accounting (3.5) (4.5) (6.7) (10.1) (1.8) As Adjusted 1 (56.6)$ (126.3)$ (69.1)$ (89.3)$ 101.3$ As Adjusted 1 - Per Diluted Share (0.89)$ (1.98)$ (1.08)$ (1.39)$ 1.52$ Three Months Ended

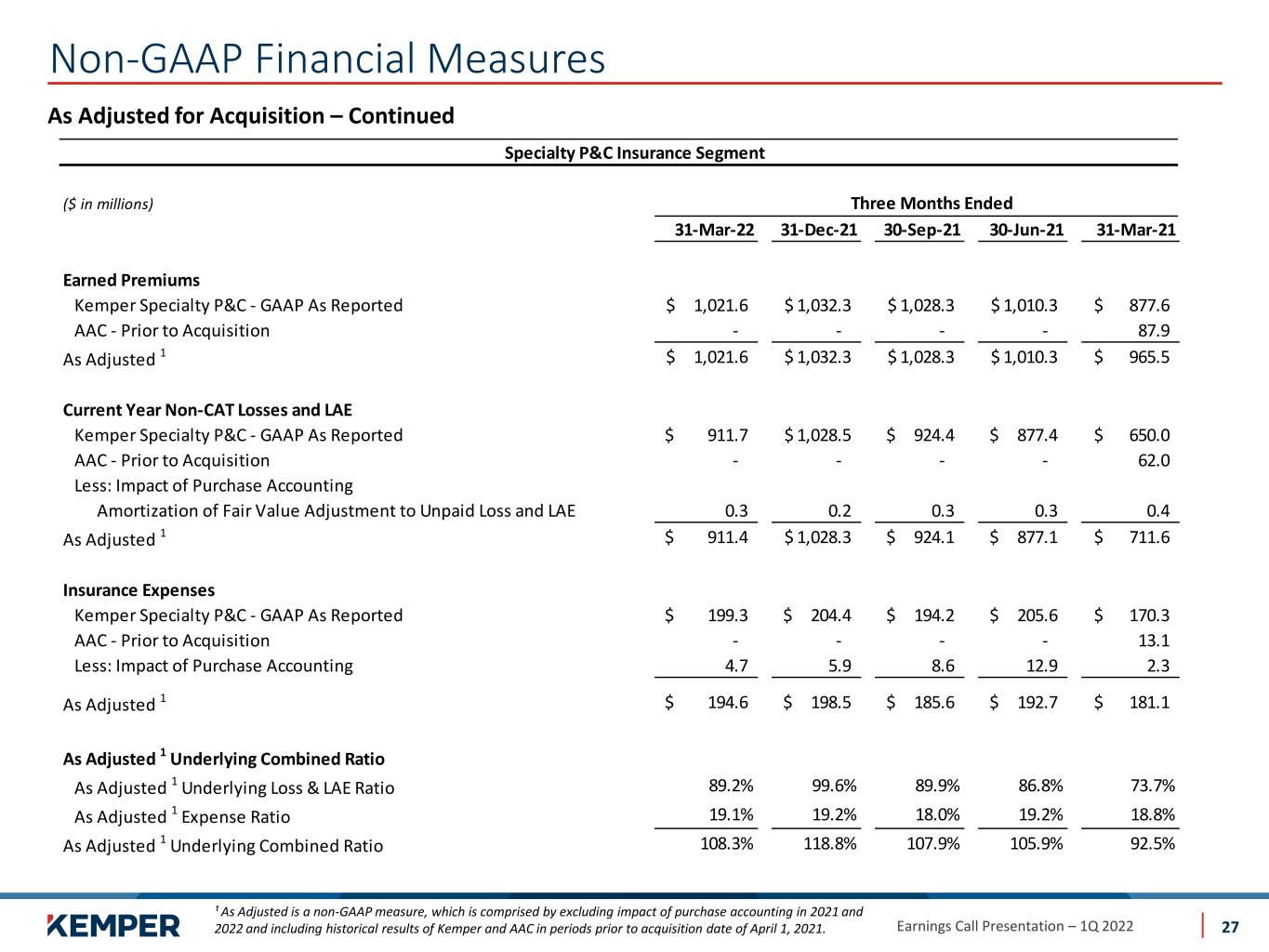

Earnings Call Presentation – 1Q 2022 As Adjusted for Acquisition – Continued Non-GAAP Financial Measures ¹ As Adjusted is a non-GAAP measure, which is comprised by excluding impact of purchase accounting in 2021 and 2022 and including historical results of Kemper and AAC in periods prior to acquisition date of April 1, 2021. 27 Specialty P&C Insurance Segment ($ in millions) 31-Mar-22 31-Dec-21 30-Sep-21 30-Jun-21 31-Mar-21 Earned Premiums Kemper Specialty P&C - GAAP As Reported 1,021.6$ 1,032.3$ 1,028.3$ 1,010.3$ 877.6$ AAC - Prior to Acquisition - - - - 87.9 As Adjusted 1 1,021.6$ 1,032.3$ 1,028.3$ 1,010.3$ 965.5$ Current Year Non-CAT Losses and LAE Kemper Specialty P&C - GAAP As Reported 911.7$ 1,028.5$ 924.4$ 877.4$ 650.0$ AAC - Prior to Acquisition - - - - 62.0 Less: Impact of Purchase Accounting Amortization of Fair Value Adjustment to Unpaid Loss and LAE 0.3 0.2 0.3 0.3 0.4 As Adjusted 1 911.4$ 1,028.3$ 924.1$ 877.1$ 711.6$ Insurance Expenses Kemper Specialty P&C - GAAP As Reported 199.3$ 204.4$ 194.2$ 205.6$ 170.3$ AAC - Prior to Acquisition - - - - 13.1 Less: Impact of Purchase Accounting 4.7 5.9 8.6 12.9 2.3 As Adjusted 1 194.6$ 198.5$ 185.6$ 192.7$ 181.1$ As Adjusted 1 Underlying Combined Ratio As Adjusted 1 Underlying Loss & LAE Ratio 89.2% 99.6% 89.9% 86.8% 73.7% As Adjusted 1 Expense Ratio 19.1% 19.2% 18.0% 19.2% 18.8% As Adjusted 1 Underlying Combined Ratio 108.3% 118.8% 107.9% 105.9% 92.5% Three Months Ended

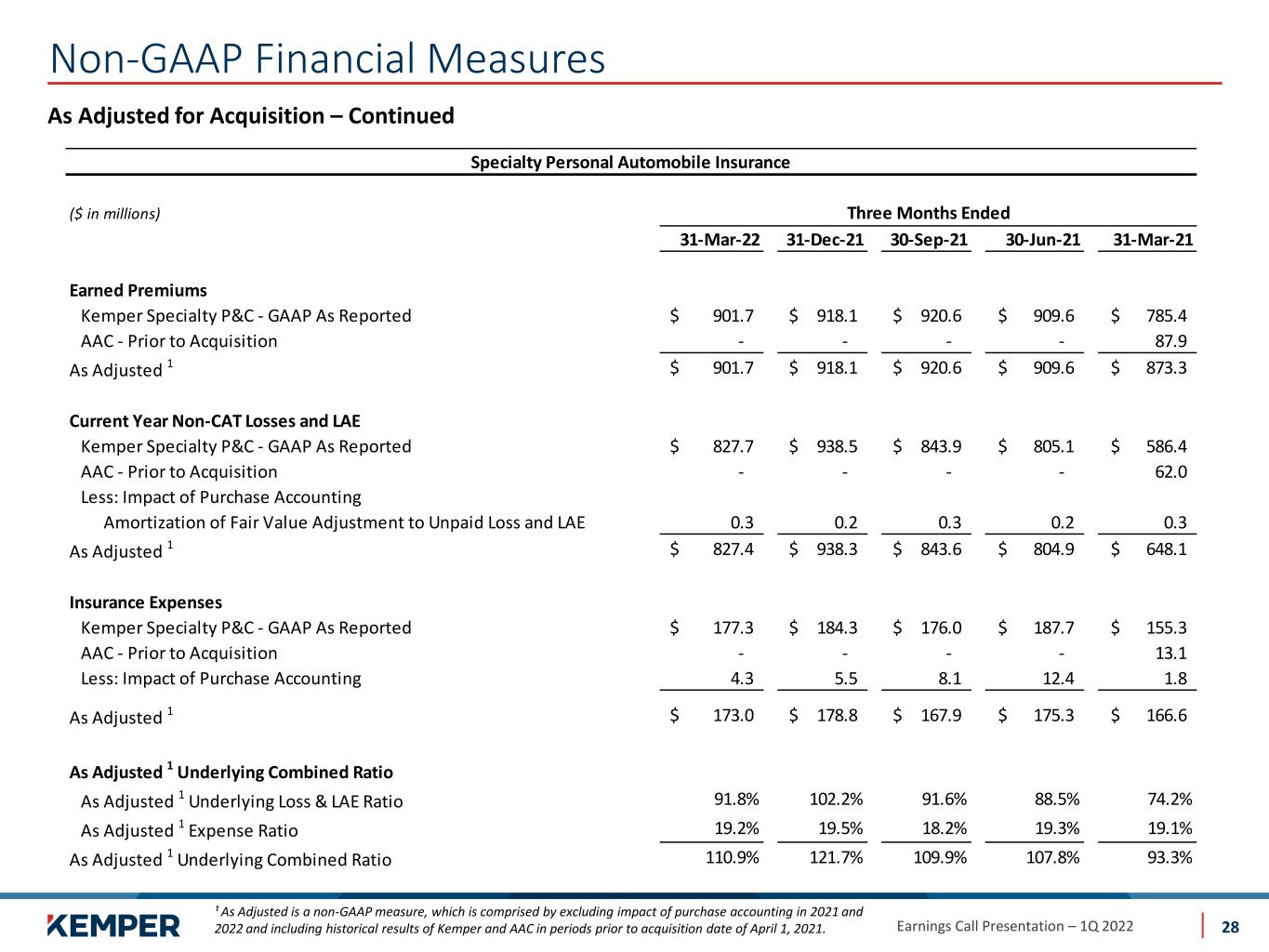

Earnings Call Presentation – 1Q 2022 As Adjusted for Acquisition – Continued Non-GAAP Financial Measures ¹ As Adjusted is a non-GAAP measure, which is comprised by excluding impact of purchase accounting in 2021 and 2022 and including historical results of Kemper and AAC in periods prior to acquisition date of April 1, 2021. 28 Specialty Personal Automobile Insurance ($ in millions) 31-Mar-22 31-Dec-21 30-Sep-21 30-Jun-21 31-Mar-21 Earned Premiums Kemper Specialty P&C - GAAP As Reported 901.7$ 918.1$ 920.6$ 909.6$ 785.4$ AAC - Prior to Acquisition - - - - 87.9 As Adjusted 1 901.7$ 918.1$ 920.6$ 909.6$ 873.3$ Current Year Non-CAT Losses and LAE Kemper Specialty P&C - GAAP As Reported 827.7$ 938.5$ 843.9$ 805.1$ 586.4$ AAC - Prior to Acquisition - - - - 62.0 Less: Impact of Purchase Accounting Amortization of Fair Value Adjustment to Unpaid Loss and LAE 0.3 0.2 0.3 0.2 0.3 As Adjusted 1 827.4$ 938.3$ 843.6$ 804.9$ 648.1$ Insurance Expenses Kemper Specialty P&C - GAAP As Reported 177.3$ 184.3$ 176.0$ 187.7$ 155.3$ AAC - Prior to Acquisition - - - - 13.1 Less: Impact of Purchase Accounting 4.3 5.5 8.1 12.4 1.8 As Adjusted 1 173.0$ 178.8$ 167.9$ 175.3$ 166.6$ As Adjusted 1 Underlying Combined Ratio As Adjusted 1 Underlying Loss & LAE Ratio 91.8% 102.2% 91.6% 88.5% 74.2% As Adjusted 1 Expense Ratio 19.2% 19.5% 18.2% 19.3% 19.1% As Adjusted 1 Underlying Combined Ratio 110.9% 121.7% 109.9% 107.8% 93.3% Three Months Ended