Earnings Call Presentation – 2Q 2024 Second Quarter 2024 Earnings August 5, 2024

Earnings Call Presentation – 2Q 2024 Preliminary Matters 2 Cautionary Statements Regarding Forward-Looking Information This presentation may contain or incorporate by reference information that includes or is based on forward-looking statements within the meaning of the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. We caution investors that these forward-looking statements are not guarantees of future performance, and actual results may differ materially. Such statements involve known and unknown risks, uncertainties, and other factors, including but not limited to: • changes in the frequency and severity of insurance claims; • claim development and the process of estimating claim reserves; • the impacts of inflation; • changes in interest rate environment; • supply chain disruption; • product demand and pricing; • effects of governmental and regulatory actions; • litigation outcomes and trends; • investment risks; • cybersecurity risks or incidents; • impact of catastrophes; and • other risks and uncertainties detailed in Kemper’s Annual Report on Form 10-K and subsequent filings with the Securities and Exchange Commission (“SEC”). Kemper assumes no obligation to publicly correct or update any forward-looking statements as a result of events or developments subsequent to the date of this presentation. Non-GAAP Financial Measures This presentation contains non-GAAP financial measures that the company believes are meaningful to investors. Non-GAAP financial measures have been reconciled to the most comparable GAAP financial measure.

Earnings Call Presentation – 2Q 2024 Target top quartile value creation for customers, employees and shareholders Leading Insurer Empowering Specialty and Underserved Markets Enabled by a dynamic, diverse and innovative team who act like owners 3 Distribution Have Limited or Unfocused Competition Require Unique Expertise Sizable Market Delivering appropriate and affordable insurance and financial solutions Specialty auto insurance1 for underserved markets; Latino, Hispanic and urban areas Life insurance2 for low/moderate income customers Market Characteristics Differentiated Capabilities Product SophisticationEase of UseLow-Cost Management Enable Systematic, Sustainable Competitive Advantages (SSCAs) 1 Kemper Auto is equivalent to the Specialty Property & Casualty Insurance Segment 2 Kemper Life is equivalent to the Life Insurance Segment

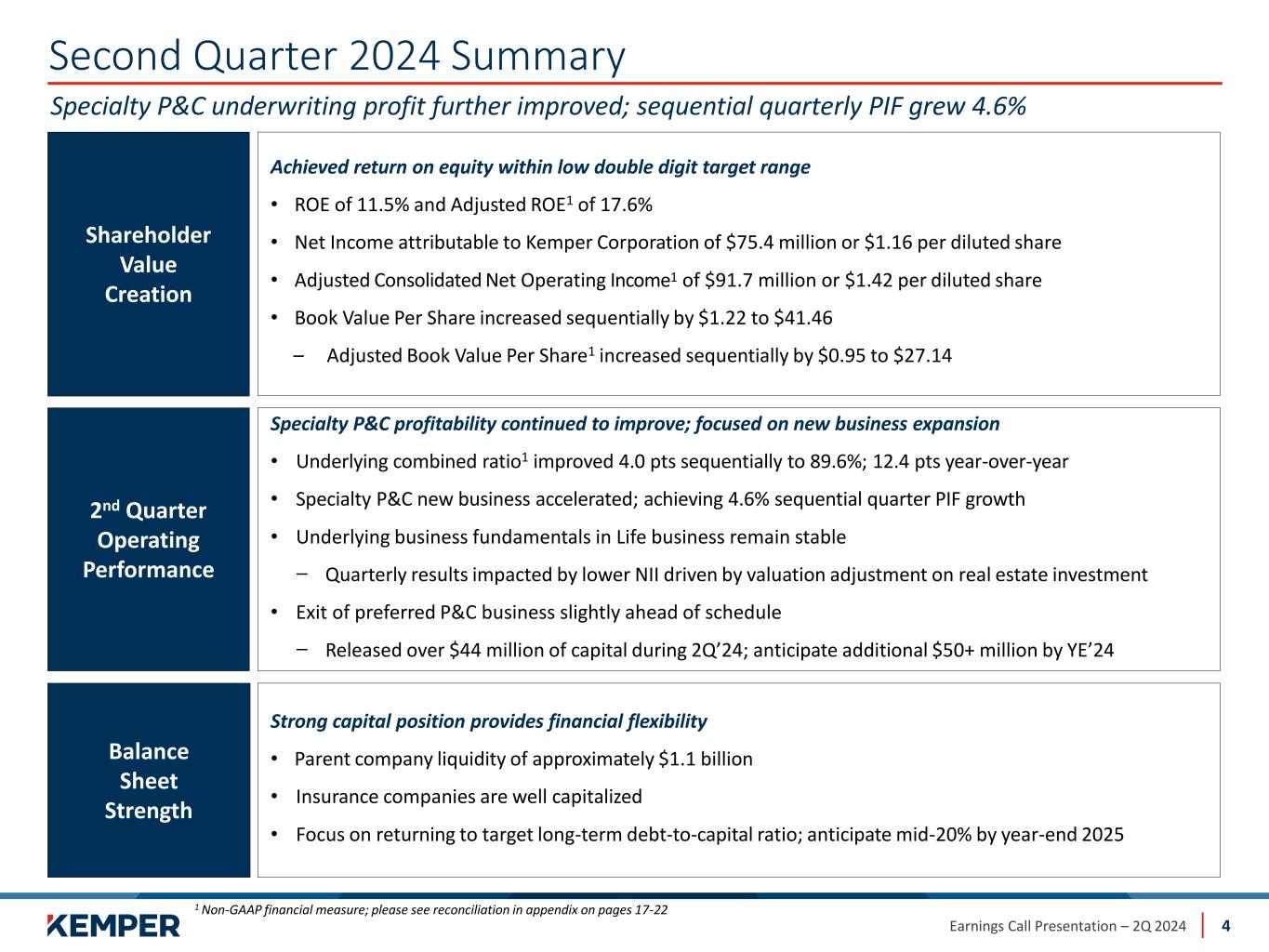

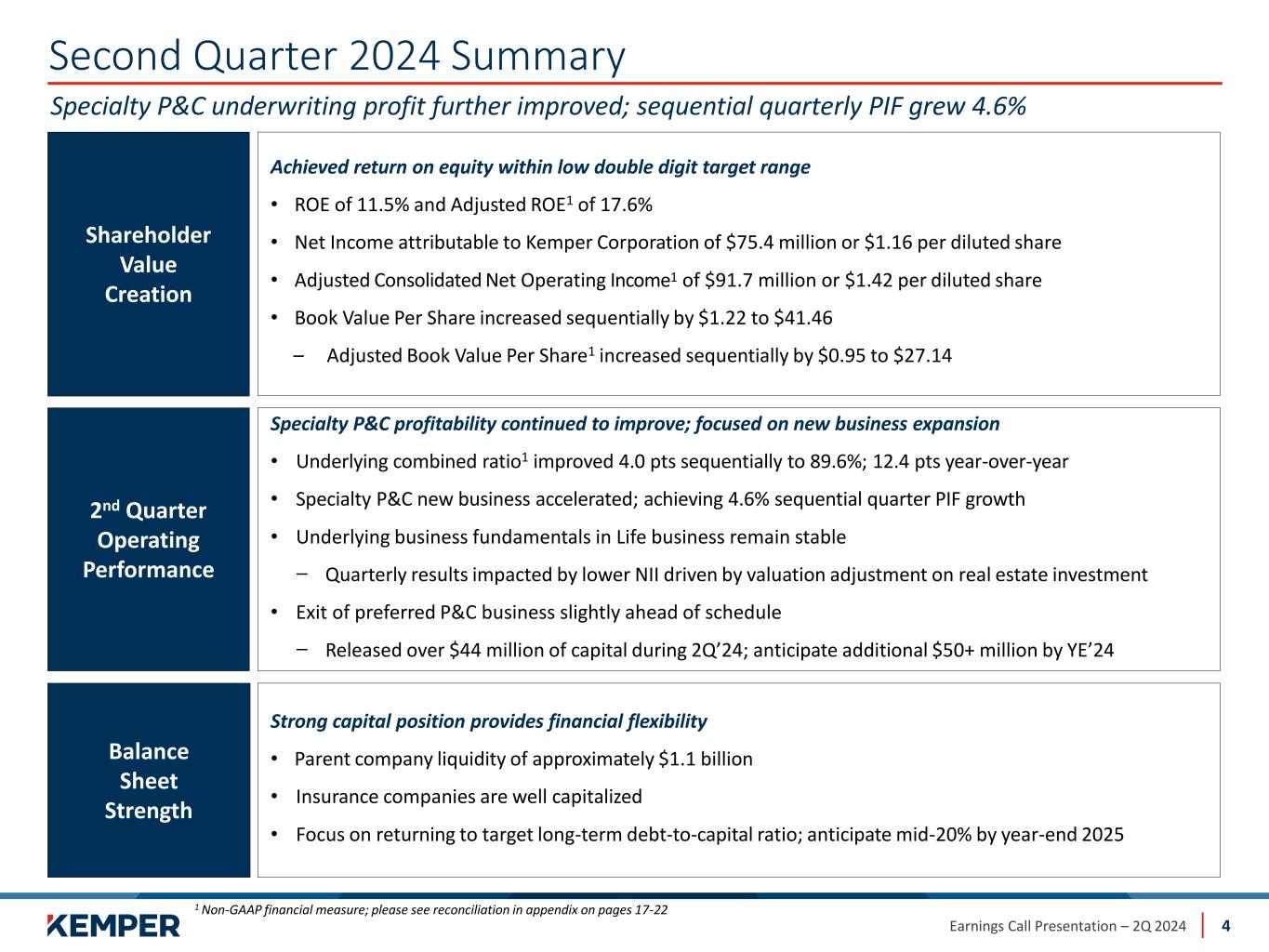

Earnings Call Presentation – 2Q 2024 Second Quarter 2024 Summary 4 Specialty P&C underwriting profit further improved; sequential quarterly PIF grew 4.6% Specialty P&C profitability continued to improve; focused on new business expansion • Underlying combined ratio1 improved 4.0 pts sequentially to 89.6%; 12.4 pts year-over-year • Specialty P&C new business accelerated; achieving 4.6% sequential quarter PIF growth • Underlying business fundamentals in Life business remain stable ̶ Quarterly results impacted by lower NII driven by valuation adjustment on real estate investment • Exit of preferred P&C business slightly ahead of schedule ̶ Released over $44 million of capital during 2Q’24; anticipate additional $50+ million by YE’24 2nd Quarter Operating Performance Achieved return on equity within low double digit target range • ROE of 11.5% and Adjusted ROE1 of 17.6% • Net Income attributable to Kemper Corporation of $75.4 million or $1.16 per diluted share • Adjusted Consolidated Net Operating Income1 of $91.7 million or $1.42 per diluted share • Book Value Per Share increased sequentially by $1.22 to $41.46 – Adjusted Book Value Per Share1 increased sequentially by $0.95 to $27.14 Shareholder Value Creation Strong capital position provides financial flexibility • Parent company liquidity of approximately $1.1 billion • Insurance companies are well capitalized • Focus on returning to target long-term debt-to-capital ratio; anticipate mid-20% by year-end 2025 Balance Sheet Strength 1 Non-GAAP financial measure; please see reconciliation in appendix on pages 17-22

Earnings Call Presentation – 2Q 2024 Jun 30, 2024 Mar 31, 2024 Specialty P&C PIF Sequential Quarterly Change 4.6% (5.5)% Quarter Ended ($ in millions, except per share amounts) Jun 30, 2024 Jun 30, 2023 Net Income (Loss) Per Diluted Share attributable to Kemper Corporation $1.16 $(1.52) Adj. Consolidated Net Operating Income (Loss) – Per Diluted Share1 $1.42 $(0.22) Book Value – Per Diluted Share $41.46 $39.22 Adjusted Book Value – Per Diluted Share1 $27.14 $26.66 Return on Shareholders’ Equity 11.5% (15.1)% Return on Adjusted Shareholders’ Equity1 17.6% (22.4)% Life Face Value of In-Force YoY Change (0.6)% (0.6)% Specialty P&C Earned Premium YoY Change (7.4)% (10.7)% Second Quarter 2024 Financial Summary 5 Delivered fifth consecutive quarter of underlying business improvement 1 Non-GAAP financial measure; please see reconciliation in appendix on pages 17-22 Specialty P&C PIF grew 4.6% sequentially; delivered an overall 11.5% ROE in 2Q’24

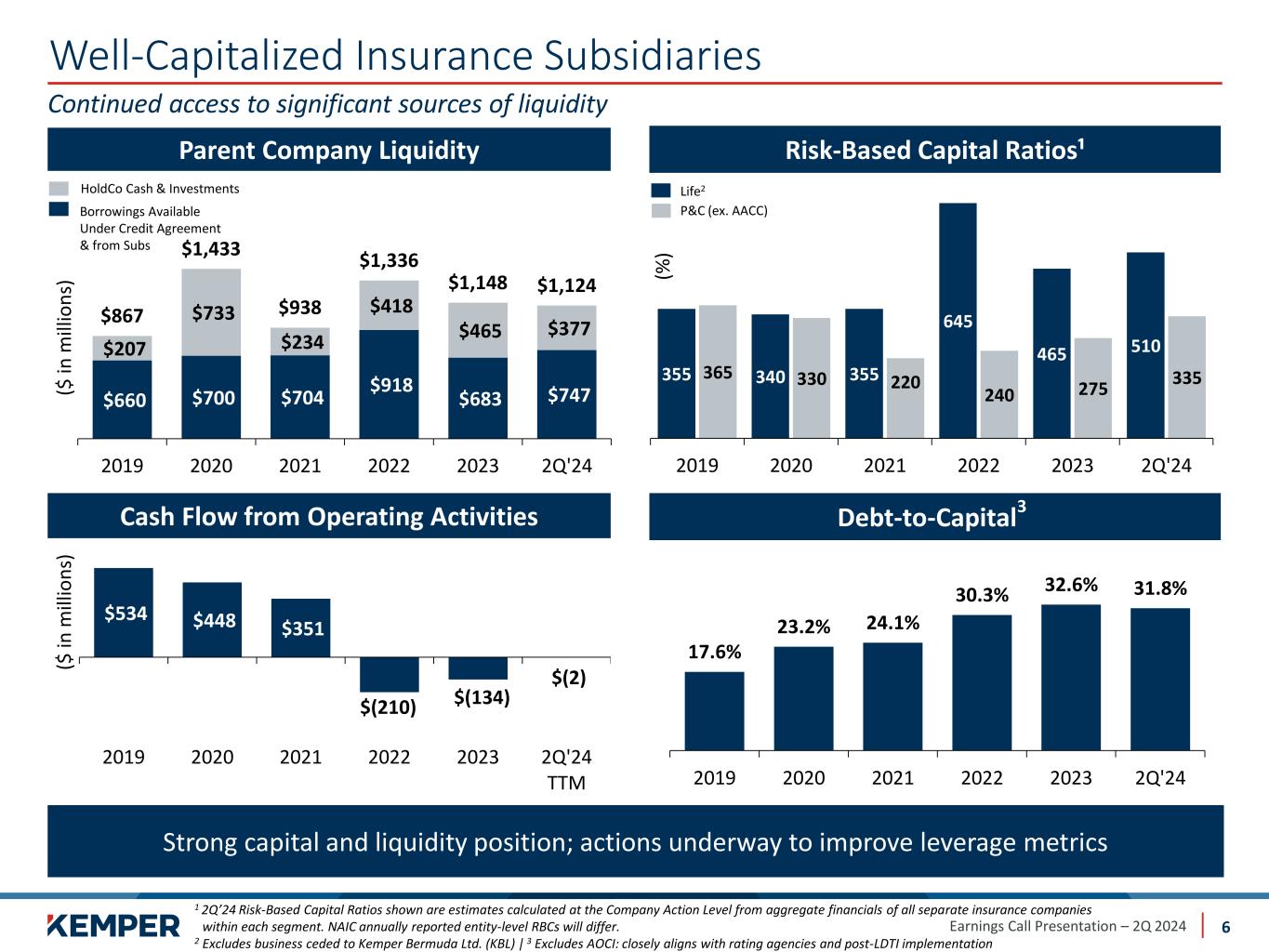

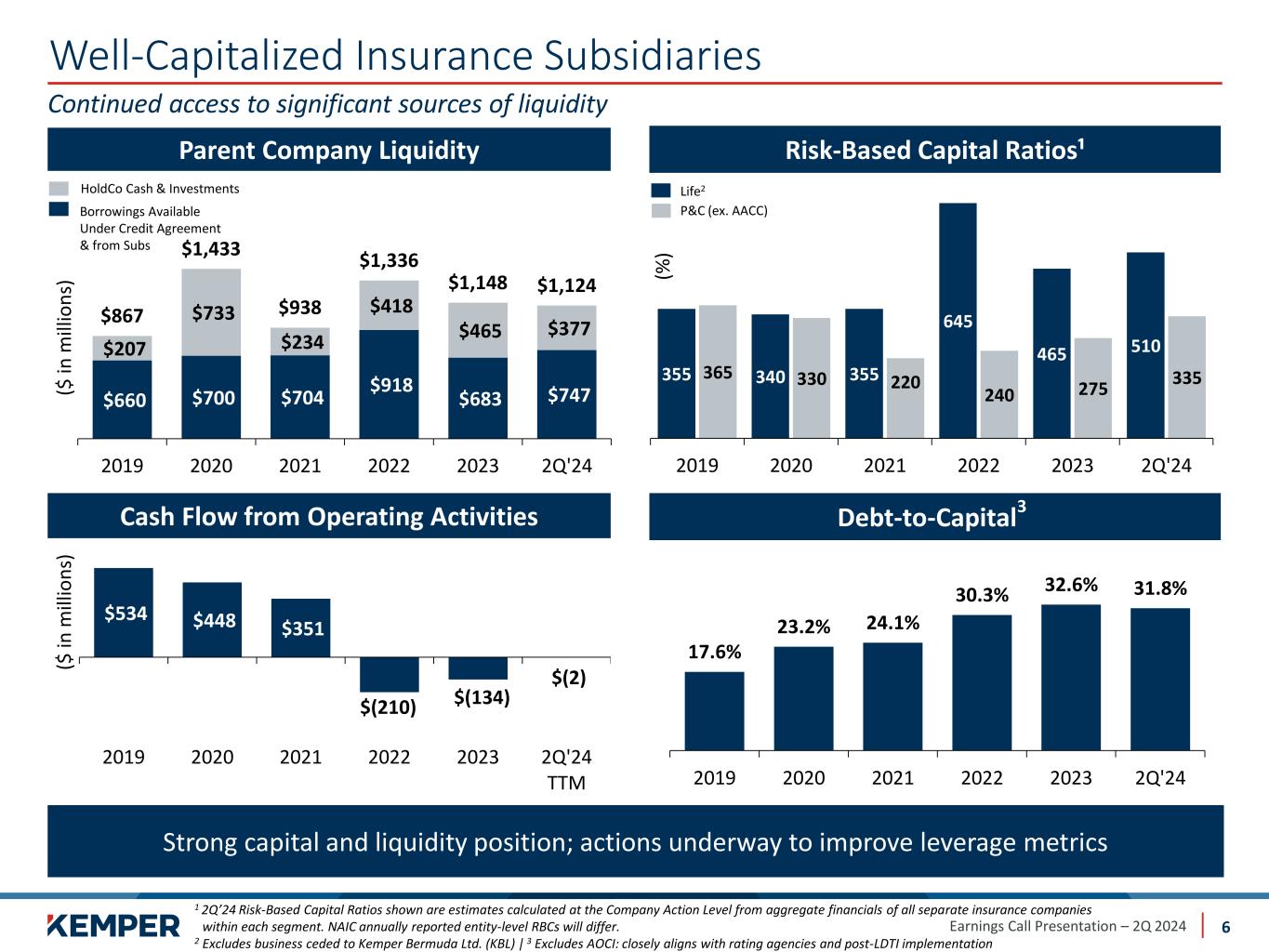

Earnings Call Presentation – 2Q 2024 Well-Capitalized Insurance Subsidiaries 6 Continued access to significant sources of liquidity Strong capital and liquidity position; actions underway to improve leverage metrics 17.6% 23.2% 24.1% 30.3% 32.6% 31.8% 2019 2020 2021 2022 2023 2Q'24 Debt-to-Capital 3 Parent Company Liquidity Risk-Based Capital Ratios¹ $660 $700 $704 $918 $683 $747 $207 $733 $234 $418 $465 $377 $867 $1,433 $938 $1,336 $1,148 $1,124 2019 2020 2021 2022 2023 2Q'24 (% ) Debt Cash Flow from Operating Activities ($ in m ill io n s) $534 $448 $351 $(210) $(134) $(2) 2019 2020 2021 2022 2023 2Q'24 TTM HoldCo Cash & Investments Borrowings Available Under Credit Agreement & from Subs P&C (ex. AACC) Life2 1 2Q’24 Risk-Based Capital Ratios shown are estimates calculated at the Company Action Level from aggregate financials of all separate insurance companies within each segment. NAIC annually reported entity-level RBCs will differ. 2 Excludes business ceded to Kemper Bermuda Ltd. (KBL) | 3 Excludes AOCI: closely aligns with rating agencies and post-LDTI implementation ($ in m ill io n s) 355 340 355 645 465 510 365 330 220 240 275 335 2019 2020 2021 2022 2023 2Q'24

Earnings Call Presentation – 2Q 2024 Diversified Investment Portfolio with Consistent Returns 7 56% 15% 6% 6% 5% 6% 6% Other States/ Munis COLI 71% 24% 4% 1% Diversified and Highly-Rated Portfolio Fixed Maturity Ratings $6.7 Billion A or Higher ≤ CCCB / BB BBB • High-quality portfolio provides consistent net investment income; 71% of fixed income portfolio rated A or higher • 4.6% pre-tax equivalent (PTE) annualized book yield on core portfolio • Average investment grade new money yields approximately 6.5% for the quarter • Lower net investment income driven by valuation adjustment on real estate investment $97 $97 $98 $99 $102 $9 $10 $7 $1 $(9) $106 $107 $105 $100 $93 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24 Core Portfolio Alternative Inv. Portfolio Net Investment Income1 Highlights Corporates Alternatives U.S Gov’t Portfolio Composition2 PTE Annualized Book Yield Contribution $8.7 Billion Short Term ($ in m ill io n s) 1 Non-Core Operations reflects $13, $13, $13, $12, and $13 million related to Preferred P&C in 2Q’23, 3Q’23, 4Q’23, 1Q’24, and 2Q’24, respectively | 2 Other category includes Equity Securities, which excludes $194 million of Other Equity Interests of LPs/LLCs that have been reclassified into Alternative Investments; COLI represents Company Owned Life Insurance 4.1% 4.2% 4.2% 4.2% 4.4% 0.4% 0.4% 0.3% 0.1% (0.4)% 4.5% 4.6% 4.5% 4.3% 4.0% 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24 Core Portfolio Alt. Inv. Portfolio (ex. Solar)

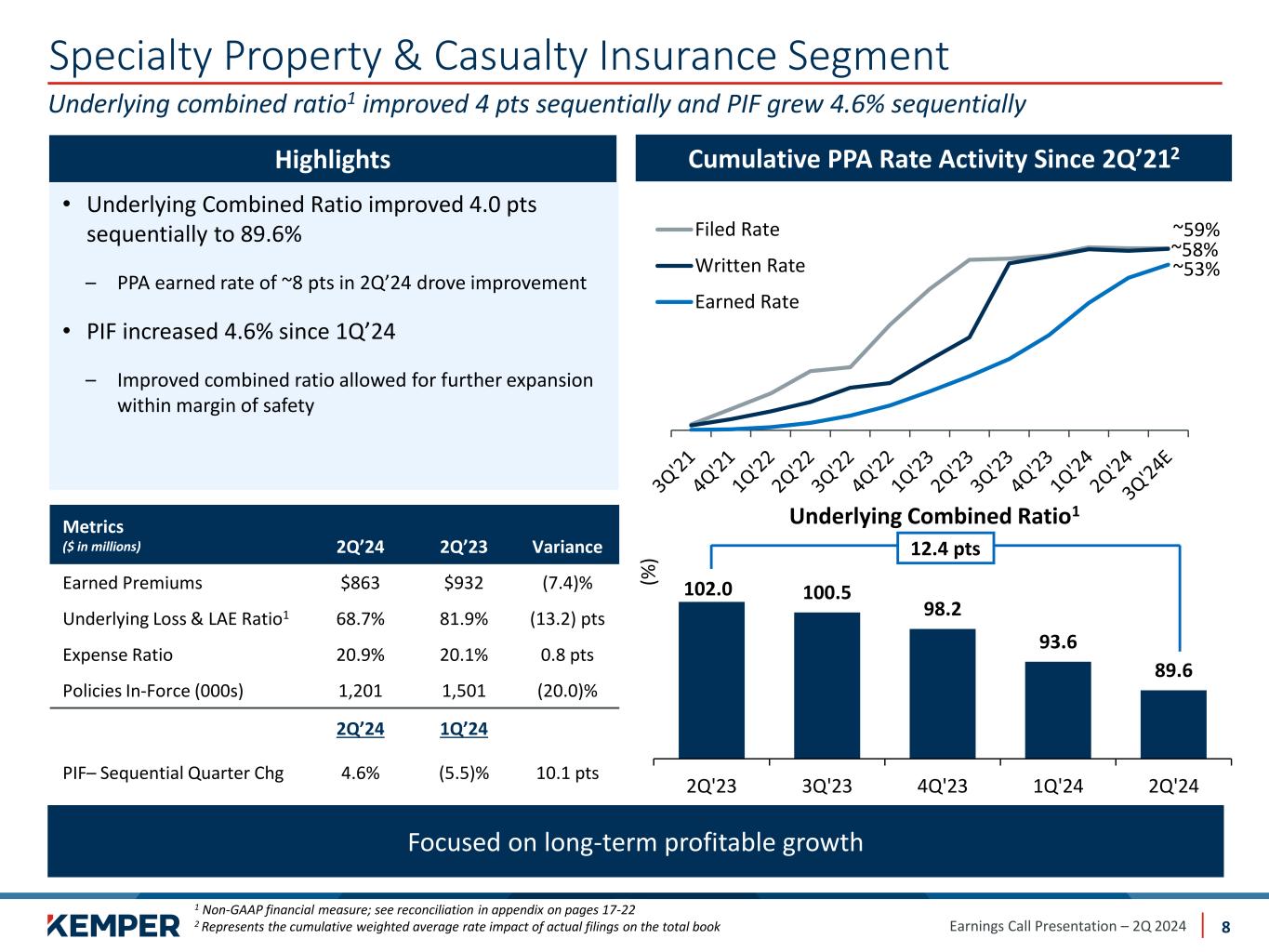

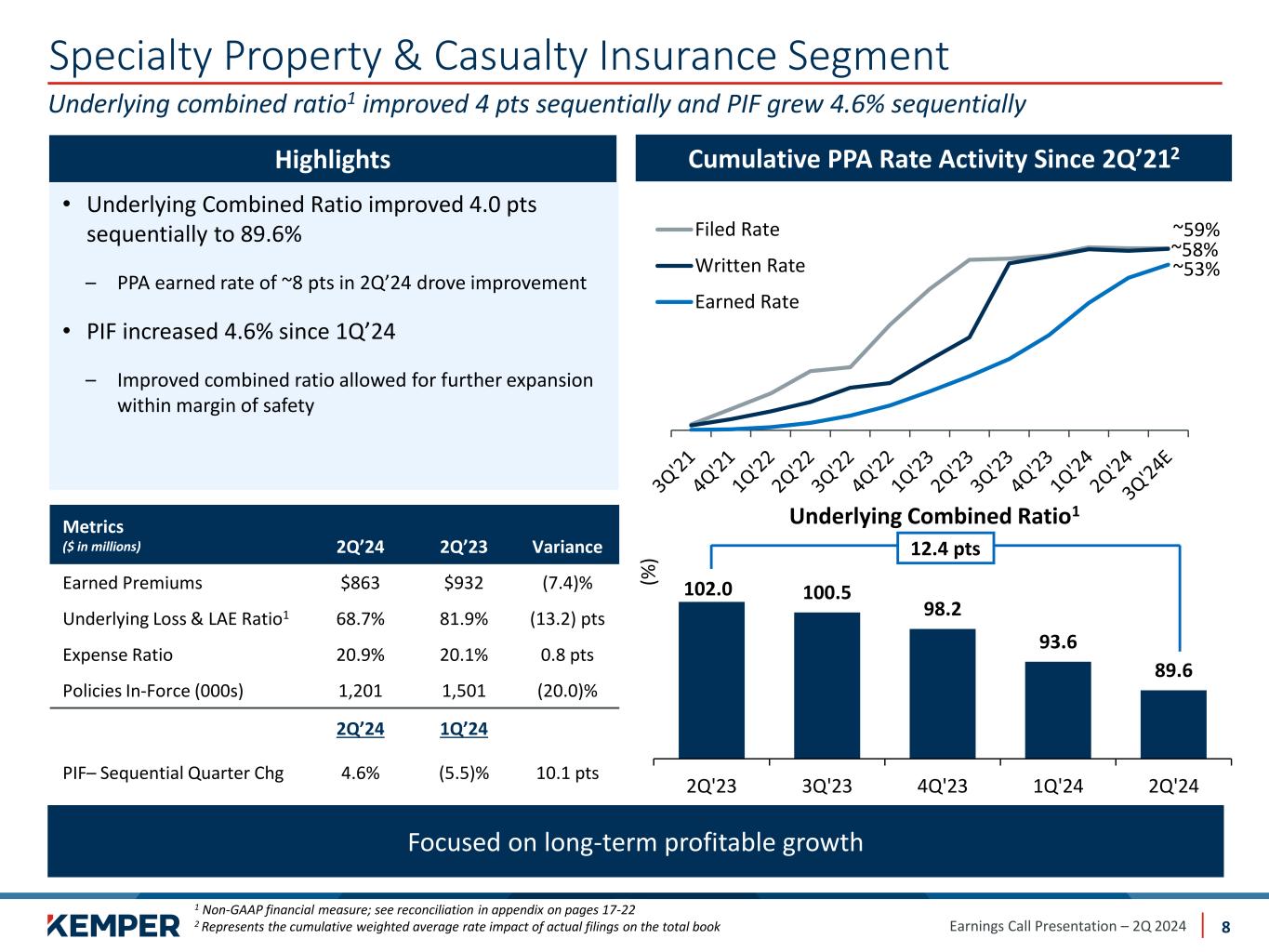

Earnings Call Presentation – 2Q 2024 Specialty Property & Casualty Insurance Segment 8 Underlying combined ratio1 improved 4 pts sequentially and PIF grew 4.6% sequentially 102.0 100.5 98.2 93.6 89.6 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24 Underlying Combined Ratio1 (% ) Highlights • Underlying Combined Ratio improved 4.0 pts sequentially to 89.6% – PPA earned rate of ~8 pts in 2Q’24 drove improvement • PIF increased 4.6% since 1Q’24 – Improved combined ratio allowed for further expansion within margin of safety Metrics ($ in millions) 2Q’24 2Q’23 Variance Earned Premiums $863 $932 (7.4)% Underlying Loss & LAE Ratio1 68.7% 81.9% (13.2) pts Expense Ratio 20.9% 20.1% 0.8 pts Policies In-Force (000s) 1,201 1,501 (20.0)% 2Q’24 1Q’24 PIF– Sequential Quarter Chg 4.6% (5.5)% 10.1 pts Cumulative PPA Rate Activity Since 2Q’212 Focused on long-term profitable growth ~59% ~58% ~53% Filed Rate Written Rate Earned Rate 1 Non-GAAP financial measure; see reconciliation in appendix on pages 17-22 2 Represents the cumulative weighted average rate impact of actual filings on the total book 12.4 pts

Earnings Call Presentation – 2Q 2024 Specialty Auto – Policies In Force Metrics Continue to Improve 9 New business expansion led to sequential quarter PIF increase Commentary Year-Over-Year PIF Change • During periods of significant change, sequential quarter PIF variance provides more insight into new business trends • Sequential quarter PIF – Metric represents more responsive measure – Increased 4.6% vs. down 5.5% in 1Q’24; improved by 10.1 points – Annualized rate of 19.8% vs. (20.3)% for prior quarter • YoY PIF – Rolling four-quarter nature of YoY metric represents trailing indicator – Declined ~20% in 2Q’24 vs. ~32% in 1Q’24 and 4Q’23 • Sequential quarter 2H’24 PIF outlook – Consumer shopping typically lower in 2H; results in moderating 2H’24 PIF growth Anticipate low single digit sequential quarterly PIF growth for remainder of 2024 Sequential Quarter PIF Change

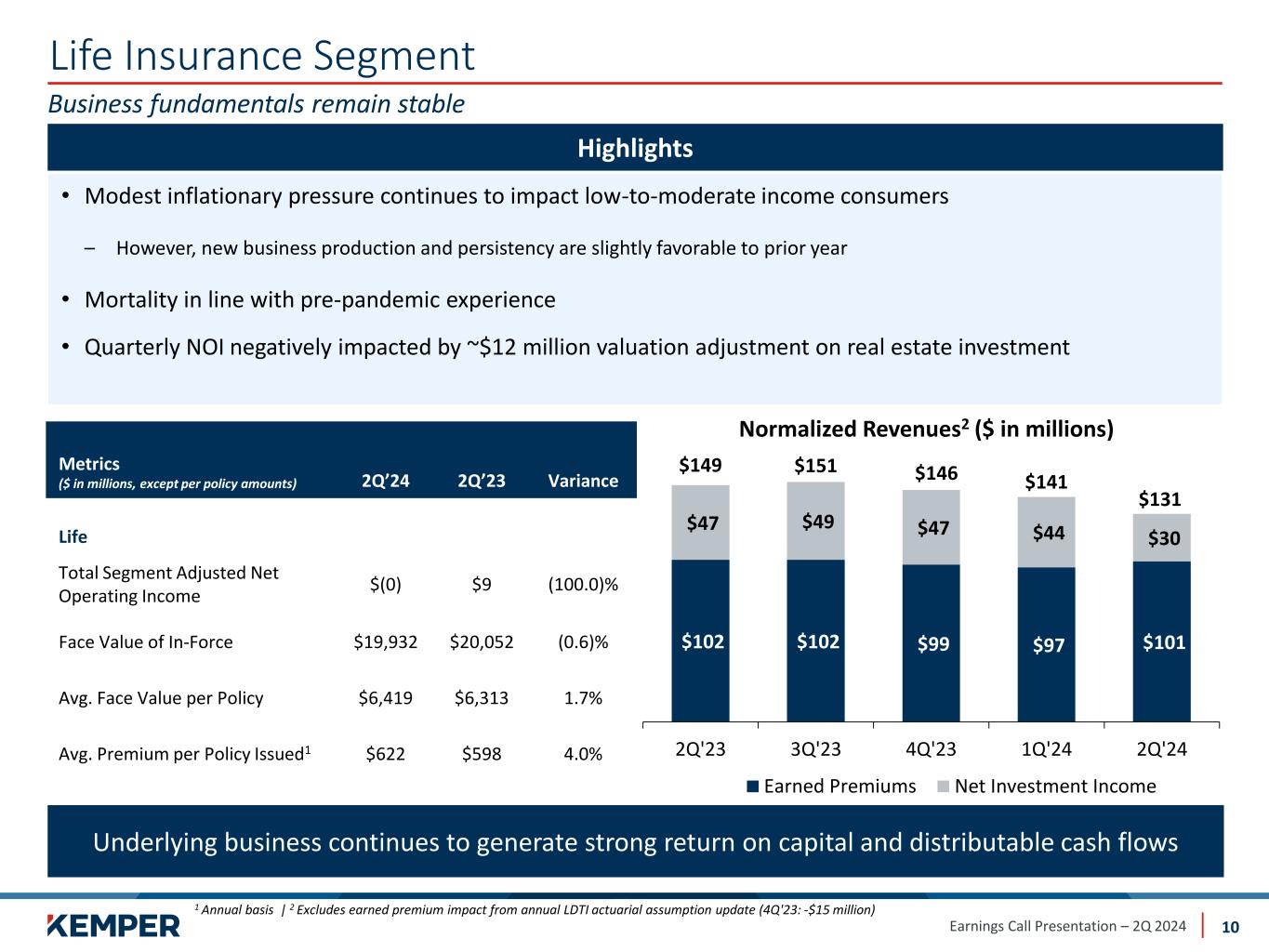

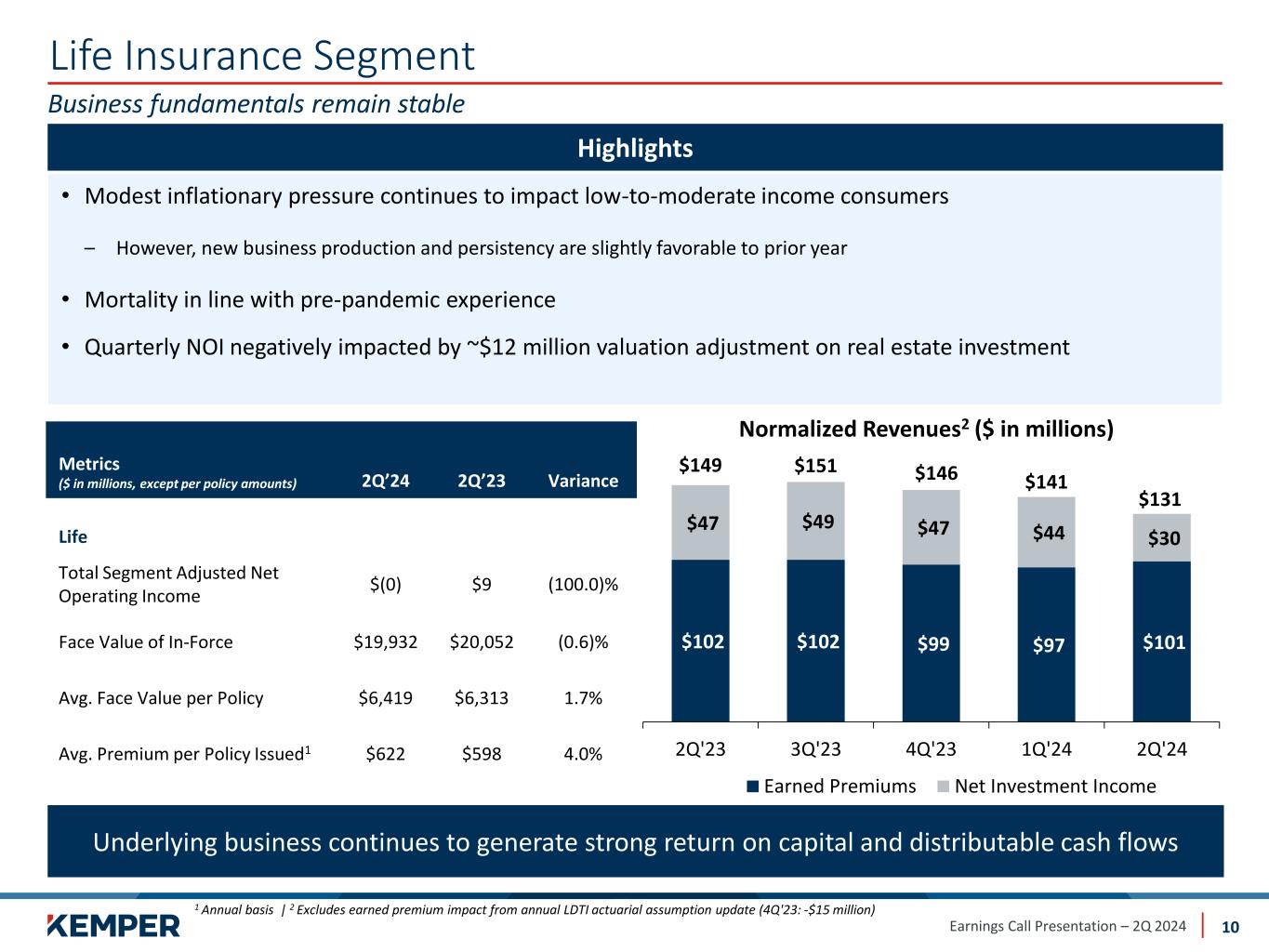

Earnings Call Presentation – 2Q 2024 Life Insurance Segment 10 Business fundamentals remain stable Underlying business continues to generate strong return on capital and distributable cash flows $102 $102 $99 $97 $101 $47 $49 $47 $44 $30 $149 $151 $146 $141 $131 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24 Normalized Revenues2 ($ in millions) Earned Premiums Net Investment Income • Modest inflationary pressure continues to impact low-to-moderate income consumers – However, new business production and persistency are slightly favorable to prior year • Mortality in line with pre-pandemic experience • Quarterly NOI negatively impacted by ~$12 million valuation adjustment on real estate investment Highlights Metrics ($ in millions, except per policy amounts) 2Q’24 2Q’23 Variance Life Total Segment Adjusted Net Operating Income $(0) $9 (100.0)% Face Value of In-Force $19,932 $20,052 (0.6)% Avg. Face Value per Policy $6,419 $6,313 1.7% Avg. Premium per Policy Issued1 $622 $598 4.0% 1 Annual basis | 2 Excludes earned premium impact from annual LDTI actuarial assumption update (4Q'23: -$15 million)

Earnings Call Presentation – 2Q 2024 Key Takeaways 11 Returning focus to long-term profitable growth Specialty P&C • Sequential underlying results improved for the fifth consecutive quarter • Strong 2Q’24 underwriting profit with underlying combined ratio of 89.6% • PIF increased 4.6% from 1Q’24 • Expect low single digit sequential quarter PIF growth for remainder of 2024 Life • Underlying business fundamentals remain stable Investment Portfolio • High quality and well diversified; no change to long-term philosophy or execution • Anticipate quarterly net investment income to revert to normal levels

Earnings Call Presentation – 2Q 2024 Appendix 12

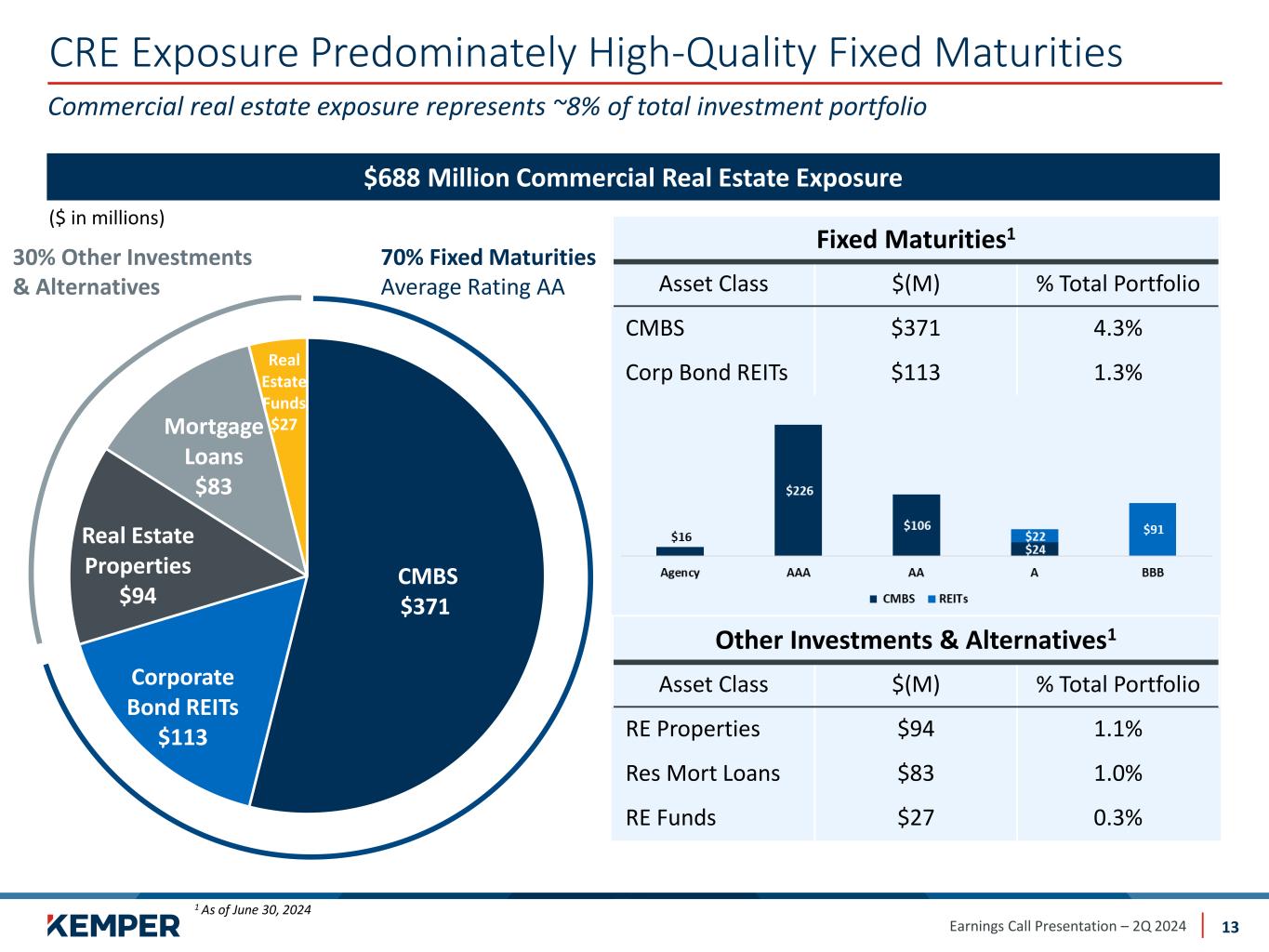

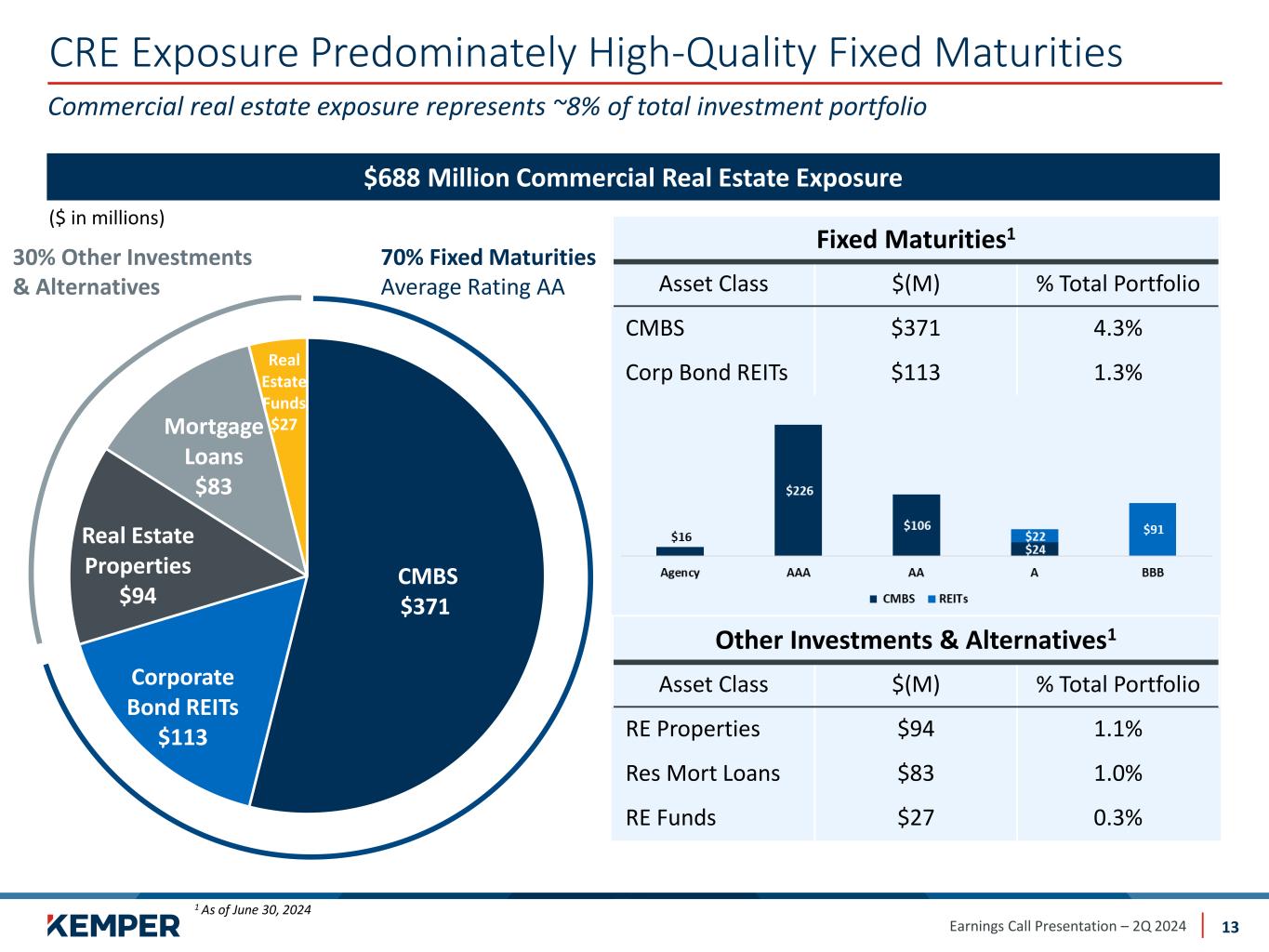

Earnings Call Presentation – 2Q 2024 CRE Exposure Predominately High-Quality Fixed Maturities 13 Commercial real estate exposure represents ~8% of total investment portfolio CMBS $371 Corporate Bond REITs $113 Real Estate Properties $94 Mortgage Loans $83 Real Estate Funds $27 70% Fixed Maturities Average Rating AA 30% Other Investments & Alternatives Other Investments & Alternatives1 Asset Class $(M) % Total Portfolio RE Properties $94 1.1% Res Mort Loans $83 1.0% RE Funds $27 0.3% $688 Million Commercial Real Estate Exposure 1 As of June 30, 2024 Fixed Maturities1 Asset Class $(M) % Total Portfolio CMBS $371 4.3% Corp Bond REITs $113 1.3% ($ in millions)

Earnings Call Presentation – 2Q 2024 CRE Portfolio Consists of Diversified Underlying Property Types 14 Office exposure represents ~2% of total investment portfolio $688 Million Commercial Real Estate Exposure Breakdown 1 As of June 30, 2024 Diverse Property Type Mix1 Type $(M) % CRE % Total Portfolio Multifamily $245 36% 2.8% Office $188 27% 2.2% Retail $63 9% 0.7% Mixed Use $49 7% 0.6% Single Fam Rental $40 6% 0.5% Hotel $29 4% 0.3% Warehouse $25 4% 0.3% Healthcare $15 2% 0.2% Industrial $14 2% 0.2% Self Storage $12 2% 0.1% Other $8 1% 0.1%

Earnings Call Presentation – 2Q 2024 2024 Reinsurance Program 15 Renewed Catastrophe XoL Reinsurance • New policy effective January 1, 2024: ̶ New limit aligned with risk-appetite ̶ New structure improves overall cost of capital for Kemper Catastrophe Excess of Loss Program (XOL): • Program consists of two towers: – 3-year term placed in 2022: $200 million excess $50 million – 1-year term placed in 2024: $190 million excess $50 million – Co-participation: o Layer 1: 15% o Layer 2: 5% • Updated 2024 purchase limit reflects exposure changes, inclusive of the Preferred P&C exit, and model enhancements HighlightsCatastrophe Reinsurance Program 3-Year Term Placed 1/1/22 $100M xs $150M 31.67% Placed 1-Year Term Placed 1/1/24 $90M xs $150M 63.33% Placed Laye r 2 : 5 % co -p articip atio n 3-Year Term Placed 1/1/22 $100M xs $50M 31.67% Placed 1-Year Term Placed 1/1/24 $100M xs $50M 53.33% Placed Laye r 1 : 1 5 % co -p articip atio n Retention 100% of first $50M

Earnings Call Presentation – 2Q 2024 16 Auto Inflation Pressures Remain Elevated Price Indices (Indexed to Q4’18) Source: U.S. Bureau of Labor Statistics Pace of increase continues to moderate 90 100 110 120 130 140 150 160 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 2019 2020 2021 2022 2023 2024 Bodywork Used Car & Truck Medical Care Core CPI 136 132 116 123

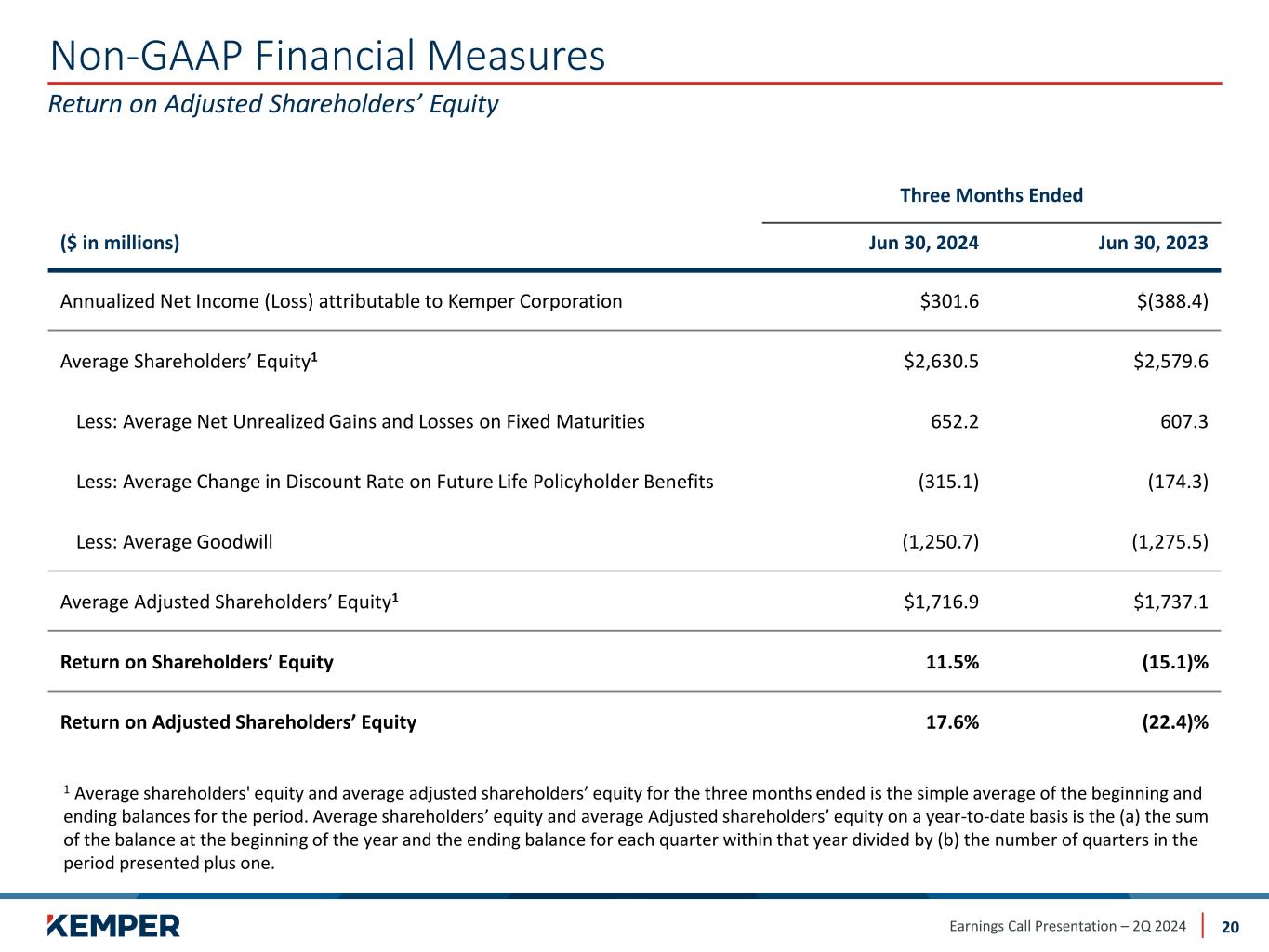

Earnings Call Presentation – 2Q 2024 Non-GAAP Financial Measures 17 Adjusted Consolidated Net Operating Income (Loss) is an after-tax, non-GAAP financial measure and is computed by excluding from Net Income (Loss) attributable to Kemper Corporation the after-tax impact of: (i) Change in Fair Value of Equity and Convertible Securities; (ii) Net Realized Investment Gains (Losses); (iii) Impairment Losses; (iv) Acquisition and Disposition Related Transaction, Integration, Restructuring and Other Costs; (v) Debt Extinguishment, Pension Settlement and Other Charges; (vi) Goodwill Impairment Charges; (vii) Non-Core Operations; and (viii) Significant non-recurring or infrequent items that may not be indicative of ongoing operations. Significant non-recurring items are excluded when (a) the nature of the charge or gain is such that it is reasonably unlikely to recur within two years, and (b) there has been no similar charge or gain within the prior two years. The most directly comparable GAAP financial measure is Net Income (Loss) attributable to Kemper Corporation. There were no applicable significant non-recurring items that the Company excluded from the calculation of Adjusted Consolidated Net Operating Income (Loss) for the three months ended June 30, 2024 or 2023. The Company believes that Adjusted Consolidated Net Operating Income (Loss) provides investors with a valuable measure of its ongoing performance because it reveals underlying operational performance trends that otherwise might be less apparent if the items were not excluded. Change in Fair Value of Equity and Convertible Securities, Net Realized Investment Gains (Losses) and Impairment Losses related to investments included in the Company’s results may vary significantly between periods and are generally driven by business decisions and external economic developments such as capital market conditions that impact the values of the Company’s investments, the timing of which is unrelated to the insurance underwriting process. Acquisition and Disposition Related Transaction, Integration, Restructuring and Other Costs may vary significantly between periods and are generally driven by the timing of acquisitions and business decisions which are unrelated to the insurance underwriting process. Debt Extinguishment, Pension Settlement and Other Charges relate to (i) loss from early extinguishment of debt, which is driven by the Company’s financing and refinancing decisions and capital needs, as well as external economic developments such as debt market conditions, the timing of which is unrelated to the insurance underwriting process; (ii) settlement of pension plan obligations which are business decisions made by the Company, the timing of which is unrelated to the underwriting process; and (iii) other charges that are non-standard, not part of the ordinary course of business, and unrelated to the insurance underwriting process. Goodwill Impairment Charges are excluded because they are infrequent and non-recurring charges. Non-Core Operations includes the results of our Preferred Insurance business which we expect to fully exit. These results are excluded because they are irrelevant to our ongoing operations and do not qualify for Discontinued Operations under Generally Accepted Accounting Principles ("GAAP"). Significant non-recurring items are excluded because, by their nature, they are not indicative of the Company’s business or economic trends. The preceding non-GAAP financial measures should not be considered a substitute for the comparable GAAP financial measures, as they do not fully recognize the profitability of the Company’s businesses. Adjusted Consolidated Net Operating Income (Loss) Per Unrestricted Share is a non-GAAP financial measure. It is computed by dividing Adjusted Consolidated Net Operating Income (Loss) by the weighted average unrestricted shares outstanding. The most directly comparable GAAP financial measure is Net Income (Loss) attributable to Kemper Corporation per Unrestricted Share - basic. The Company believes that Adjusted Consolidated Net Operating Income (Loss) Per Unrestricted Share provides investors with a valuable measure of its ongoing performance because it reveals underlying operational performance trends that otherwise might be less apparent if the items were not excluded. Income from change in fair value of equity and convertible securities, net realized investment gains (losses), impairment gains (losses) related to investments, acquisition related transaction, integration and other costs, loss from early extinguishment of debt, and goodwill impairment charges included in the Company’s results may vary significantly between periods and are generally driven by business decisions and external economic developments such as capital market conditions that impact the values of the company’s investments, the timing of which is unrelated to the insurance underwriting process.

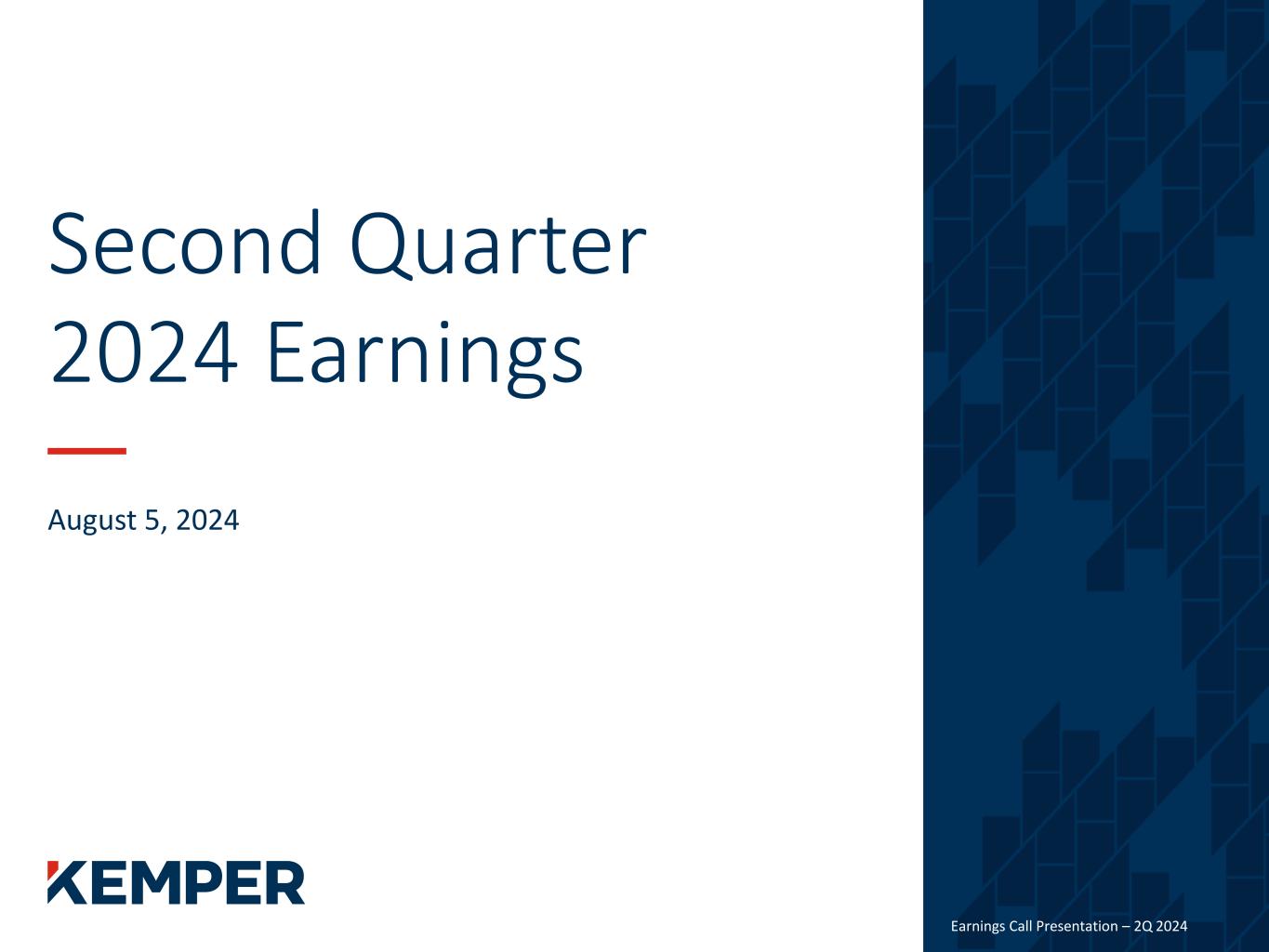

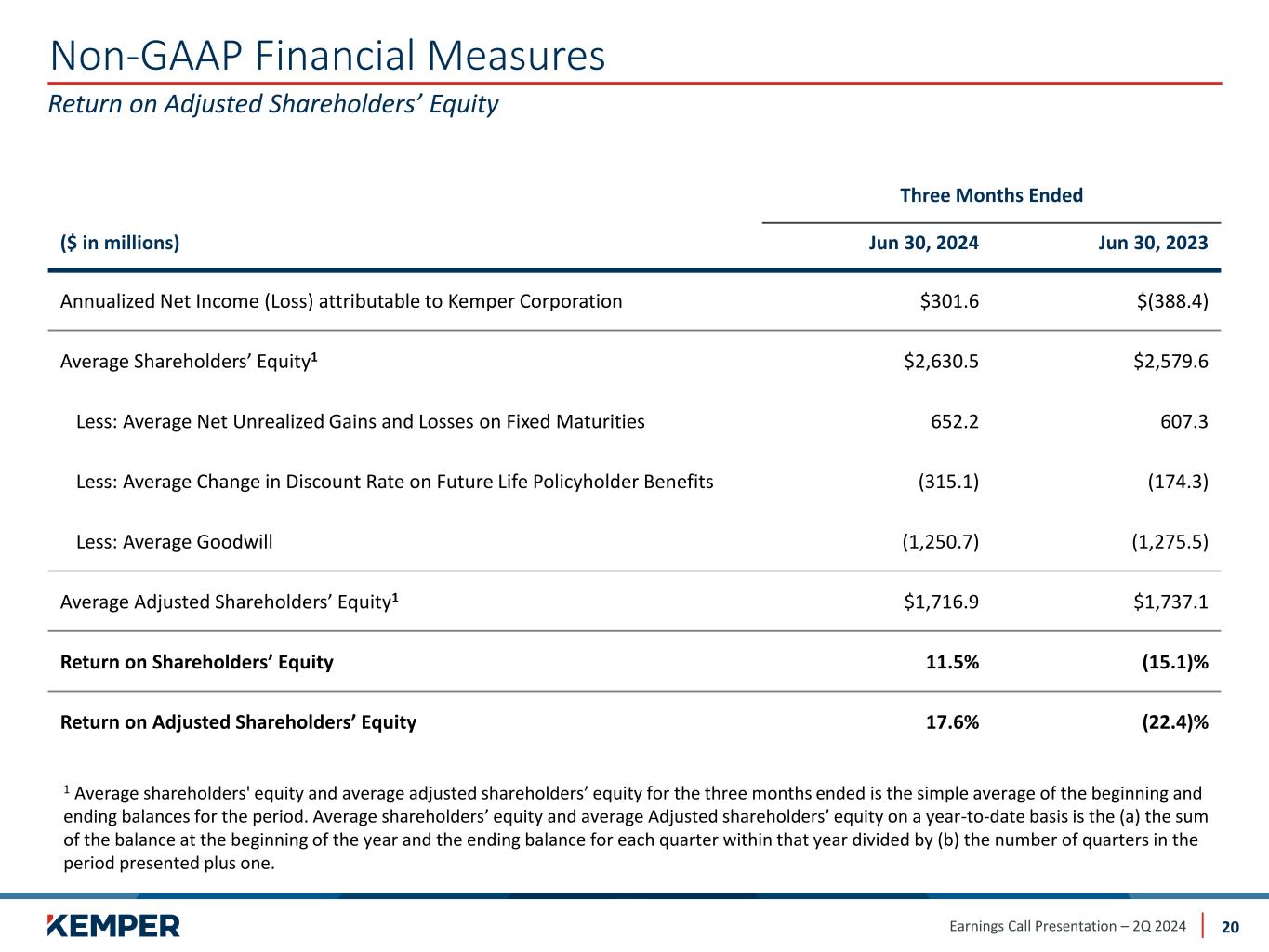

Earnings Call Presentation – 2Q 2024 Non-GAAP Financial Measures 18 Return on Adjusted Shareholders’ Equity is a calculation that uses a non-GAAP financial measure. It is calculated by dividing the period’s net income attributable to Kemper Corporation by the average shareholders’ equity excluding net unrealized gains and losses on fixed maturities, the change in discount rate on future life policyholder benefits and goodwill. Return on Shareholders’ Equity is the most directly comparable GAAP measure. We use this non-GAAP measure to identify and analyze the change in performance attributable to management efforts between periods. The Company believes this non-GAAP financial measure is useful to investors because it eliminates the effect of items that can fluctuate significantly from period to period and are generally driven by economic developments, primarily capital market conditions, the magnitude and timing of which are not influenced by management. The Company believes it enhances understanding and comparability of performance by highlighting underlying business activity and profitability drivers. The “Return on Adjusted Shareholders’ Equity” metric was referred to as “Return on Tangible Shareholders’ Equity” in prior periods. Adjusted Book Value Per Share is a calculation that uses a non-GAAP financial measure. It is calculated by dividing shareholders’ equity after excluding the after-tax impact of net unrealized gains and losses on fixed income securities, the change in discount rate on future life policyholder benefits and goodwill by total Common Shares Issued and Outstanding. Book value per share is the most directly comparable GAAP financial measure. The Company uses the trends in book value per share excluding the after-tax impact of net unrealized gains and losses on fixed income securities, the change in discount rate on future life policyholder benefits and goodwill in conjunction with book value per share to identify and analyze the change in net worth excluding goodwill attributable to management efforts between periods. The Company believes the non-GAAP financial measure is useful to investors because it eliminates the effect of items that can fluctuate significantly from period to period and are generally driven by economic developments, primarily capital market conditions, the magnitude and timing of which are not influenced by management. The Company believes it enhances understanding and comparability of performance by highlighting underlying business activity and profitability drivers. The “Adjusted Book Value Per Share” metric was referred to as “Tangible Book Value Per Share” in prior periods. Underlying Combined Ratio is a non-GAAP financial measure. It is computed by adding the Current Year Non-catastrophe Losses and LAE Ratio with the Insurance Expense Ratio. The most directly comparable GAAP financial measure is the Combined Ratio, which is computed by adding Total Incurred Losses and LAE Ratio, including the impact of catastrophe losses and loss and LAE reserve development from prior years, with the Insurance Expense Ratio. The Company believes Underlying Losses and LAE and the Underlying Combined Ratio are useful to investors and uses these financial measures to reveal the trends in the Company’s Property & Casualty Insurance segment that may be obscured by catastrophe losses and prior-year reserve development. These catastrophe losses may cause the Company’s loss trends to vary significantly between periods as a result of their incidence of occurrence and magnitude and can have a significant impact on incurred losses and LAE and the Combined Ratio. Prior-year reserve developments are caused by unexpected loss development on historical reserves. Because reserve development relates to the re-estimation of losses from earlier periods, it has no bearing on the performance of the Company’s insurance products in the current period. The Company believes it is useful for investors to evaluate these components separately and in the aggregate when reviewing the Company’s underwriting performance.

Earnings Call Presentation – 2Q 2024 Non-GAAP Financial Measures 19 Three Months Ended ($ per share) Jun 30, 2024 Jun 30, 2023 Net Income (Loss) attributable to Kemper Corporation Per Unrestricted Share $1.17 $(1.52) Less Net (Loss) Income Per Unrestricted Share From: Change in Fair Value of Equity and Convertible Securities (0.02) 0.03 Net Realized Investment Gains (Losses) 0.02 (0.20) Impairment Losses - (0.02) Acquisition and Disposition Related Transaction, Integration, Restructuring and Other Costs (0.08) (0.36) Debt Extinguishment, Pension Settlement and Other Charges 0.03 - Goodwill Impairment Charge - (0.71) Non-Core Operations (0.21) (0.04) Adjusted Consolidated Net Operating Income (Loss) Per Unrestricted Share $1.43 $(0.22) Adjusted Consolidated Net Operating Income (Loss) attributable to Kemper Corporation Three Months Ended ($ in millions) Jun 30, 2024 Jun 30, 2023 Net Income (Loss) attributable to Kemper Corporation $75.4 $(97.1) Less Net (Loss) Income From: Change in Fair Value of Equity and Convertible Securities (1.0) 1.9 Net Realized Investment Gains (Losses) 1.2 (12.5) Impairment Losses (0.1) (0.8) Acquisition and Disposition Related Transaction, Integration, Restructuring and Other Costs (5.1) (23.3) Debt Extinguishment, Pension Settlement and Other Charges 2.1 - Goodwill Impairment Charge - (45.5) Non-Core Operations (13.4) (2.7) Adjusted Consolidated Net Operating Income (Loss) $91.7 $(14.2)

Earnings Call Presentation – 2Q 2024 Non-GAAP Financial Measures 20 Return on Adjusted Shareholders’ Equity Three Months Ended ($ in millions) Jun 30, 2024 Jun 30, 2023 Annualized Net Income (Loss) attributable to Kemper Corporation $301.6 $(388.4) Average Shareholders’ Equity1 $2,630.5 $2,579.6 Less: Average Net Unrealized Gains and Losses on Fixed Maturities 652.2 607.3 Less: Average Change in Discount Rate on Future Life Policyholder Benefits (315.1) (174.3) Less: Average Goodwill (1,250.7) (1,275.5) Average Adjusted Shareholders’ Equity1 $1,716.9 $1,737.1 Return on Shareholders’ Equity 11.5% (15.1)% Return on Adjusted Shareholders’ Equity 17.6% (22.4)% 1 Average shareholders' equity and average adjusted shareholders’ equity for the three months ended is the simple average of the beginning and ending balances for the period. Average shareholders’ equity and average Adjusted shareholders’ equity on a year-to-date basis is the (a) the sum of the balance at the beginning of the year and the ending balance for each quarter within that year divided by (b) the number of quarters in the period presented plus one.

Earnings Call Presentation – 2Q 2024 Non-GAAP Financial Measures 21 Adjusted Book Value Per Share As of ($ and shares in millions except per share amounts) Jun 30, 2024 Jun 30, 2023 Kemper Corporation Shareholders’ Equity $2,671.2 $2,512.2 Less: Net Unrealized Gains and Losses on Fixed Maturities 685.9 640.5 Less: Change in Discount Rate on Future Life Policyholder Benefits (358.0) (194.4) Less: Goodwill (1,250.7) (1,250.7) Adjusted Shareholders’ Equity $1,748.4 $1,707.6 Common Shares Issued and Outstanding 64.427 64.054 Book Value Per Share $41.46 $39.22 Less: Net Unrealized Gains and Losses on Fixed Maturities 10.65 10.00 Less: Change in Discount Rate on Future Life Policyholder Benefits (5.56) (3.03) Less: Goodwill (19.41) (19.53) Adjusted Book Value Per Share $27.14 $26.66

Earnings Call Presentation – 2Q 2024 Three Months Ended 2Q’24 1Q’24 4Q'23 3Q'23 2Q'23 Specialty P&C Insurance Combined Ratio as Reported 90.7% 94.8% 98.5% 109.9% 106.5% Current Year Catastrophe Losses and LAE Ratio (1.2) (0.5) (0.3) (0.7) (1.9) Prior Years Non-Catastrophe Losses and LAE Ratio 0.1 (0.6) - (8.8) (2.7) Prior Years Catastrophe Losses and LAE Ratio - (0.1) - 0.1 0.1 Underlying Combined Ratio 89.6% 93.6% 98.2% 100.5% 102.0% Personal Auto Insurance Combined Ratio as Reported 90.8% 95.1% 99.5% 112.6% 108.0% Current Year Catastrophe Losses and LAE Ratio (1.1) (0.5) (0.3) (0.7) (2.0) Prior Years Non-Catastrophe Losses and LAE Ratio (0.1) (1.0) 0.3 (9.9) (2.3) Prior Years Catastrophe Losses and LAE Ratio - (0.1) - 0.1 0.1 Underlying Combined Ratio 89.6% 93.5% 99.5% 102.1% 103.8% Commercial Auto Insurance Combined Ratio as Reported 90.5% 93.6% 94.9% 98.4% 99.5% Current Year Catastrophe Losses and LAE Ratio (1.4) (0.4) (0.4) (0.7) (1.4) Prior Years Non-Catastrophe Losses and LAE Ratio 0.8 0.7 (1.2) (4.2) (4.2) Prior Years Catastrophe Losses and LAE Ratio 0.1 (0.1) (0.1) 0.1 - Underlying Combined Ratio 90.0% 93.8% 93.2% 93.6% 93.9% Non-GAAP Financial Measures 22 Underlying Combined Ratio