SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a-12 |

SAFECO CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

2004 PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

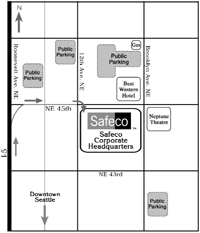

The Annual Meeting of Shareholders of Safeco Corporation will be held at:

Safeco Auditorium, Safeco Plaza

4333 Brooklyn Avenue N.E.

Seattle, Washington 98185

on May 5, 2004 at 11:00 a.m.

PROXY VOTING OPTIONS

Your Vote is Important!

Whether or not you expect to attend in person, we urge you to vote your shares by Internet, by phone or by signing, dating and returning the enclosed proxy card at your earliest convenience. This will ensure the presence of a quorum at the meeting. Promptly voting your shares will save Safeco the expense of additional solicitation. An addressed envelope, for which no postage is required if mailed in the United States, is enclosed if you wish to vote your shares by mail. Submitting your proxy now will not prevent you from voting your shares at the meeting if you desire to do so, as your vote by proxy is revocable at your option.

Voting by the Internet or telephone is fast, convenient and your vote is immediately confirmed and tabulated. Most importantly, by using the Internet or telephone, you help Safeco reduce postage and proxy tabulation costs.

Or, if you are a beneficial shareholder, you may return the enclosed voting instruction form in the envelope provided.

PLEASE DO NOT RETURN THE ENCLOSED PAPER BALLOT IF YOU ARE VOTING

OVER THE INTERNET OR BY TELEPHONE.

VOTE BY INTERNET

http://www.proxyvotenow.com/safc 24 hours a day / 7 days a week

INSTRUCTIONS:

Read the accompanying Proxy Statement.

Point your browser to:

http://www.proxyvotenow.com/safc

and follow the instructions to cast your vote. | VOTE BY TELEPHONE

1-866-252-6915 toll-free 24 hours a day / 7 days a week

INSTRUCTIONS:

Read the accompanying Proxy Statement.

Call toll-free 1-866-252-6915

You will be asked to enter your control number |

SAFECO CORPORATION

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

MAY 5, 2004

Seattle, Washington

March 29, 2004

To Our Shareholders:

The Annual Meeting of the Shareholders of Safeco Corporation, a Washington corporation, will be held on May 5, 2004 at 11:00 a.m. in the Safeco Auditorium, Safeco Plaza, 4333 Brooklyn Avenue N.E., Seattle, Washington 98185, for the following purposes:

| 1. | Election of four directors to serve a term of three years; |

| 2. | Ratification of the appointment of Ernst & Young as our independent auditors; |

| 3. | Voting on a shareholder proposal; and |

| 4. | Transaction of such other business as may properly come before the Annual Meeting. |

Only shareholders of record at the close of business on March 8, 2004 are entitled to notice of, and to vote at, this meeting.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, PLEASE MARK, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD PROMPTLY IN THE POSTAGE-PAID ENVELOPE PROVIDED, OR VOTE VIA THE INTERNET OR TELEPHONE BY FOLLOWING THE INSTRUCTIONS ON YOUR PROXY CARD.

By Order of the Board of Directors,

Michael S. McGavick

Chairman of the Board, President and

Chief Executive Officer

SAFECO CORPORATION

Safeco Plaza, Seattle, Washington 98185

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS—MAY 5, 2004

This Proxy Statement is furnished in connection with the Annual Meeting of Shareholders of Safeco Corporation, or Safeco, to be held on May 5, 2004. Shareholders of record at the close of business on March 8, 2004 are entitled to vote at the Annual Meeting either in person or by proxy.

The Board of Directors of Safeco solicits your proxy pursuant to the enclosed proxy card. You have one vote for each share of Safeco common stock you own. The shares represented by the enclosed proxy, if returned prior to the Annual Meeting, will be voted in accordance with your directions. The approximate date of the mailing of this Proxy Statement and the enclosed proxy card is March 29, 2004.

GENERAL INFORMATION

Outstanding Shares and Shareholders Entitled to Vote

On March 8, 2004, there were 139,057,607 shares of our common stock outstanding, all of which will be entitled to vote at the Annual Meeting to be held on May 5, 2004. Each shareholder is entitled to one vote for each share of common stock held of record in that person’s name on the record date.

Vote Required and Method of Counting Votes

Under Washington law, a quorum consisting of a majority of the outstanding shares entitled to vote must be represented in person or by proxy for the transaction of business at the Annual Meeting. Shareholders of record who are present at the Annual Meeting in person or by proxy and who abstain, including brokers holding customers’ shares of record who cause abstentions to be recorded at the Annual Meeting, are considered shareholders who are present and entitled to vote, and will count toward the quorum.

If a quorum exists at the Annual Meeting, for the election of directors, those nominees who receive the greatest number of votes cast for the election of directors will be elected directors. For the auditor ratification and shareholder proposals, if a quorum exists, such actions will be approved if the number of votes cast in favor of the proposed action exceeds the number of votes cast against. As a result, abstentions (votes withheld with respect to the election of directors) and broker non-votes (shares held by a broker or nominee who does not have the authority, either express or discretionary, to vote on the matter) will have no impact on the election of directors or the other two proposals set forth in the Notice of Annual Meeting of Shareholders.

Voting by Proxy

The Board of Directors selected Michael S. McGavick and Christine B. Mead to act as proxyholders for shareholders who wish to vote by proxy. The proxyholders are authorized to (i) vote shares as instructed by the shareholders who have properly completed and returned the proxy card, (ii) vote shares as recommended by the Board of Directors when shareholders have executed and returned the proxy card, but have given no

1

instructions, and (iii) vote shares at their discretion on any matter not identified on the proxy card that is properly brought before the Annual Meeting.

Revocation of Proxies

A registered shareholder may revoke a properly executed proxy at any time before its exercise by (i) delivering a written notice of revocation to the Secretary of Safeco at Safeco Plaza, Seattle, Washington 98185, (ii) delivering another proxy that is dated later than the original proxy, or (iii) attending the Annual Meeting and voting in person. Beneficial shareholders wishing to change their votes after returning voting instructions to their bank or broker should contact their bank or broker directly.

The Safeco Stock Ownership Fund

If you are a participant in The Safeco Stock Ownership Fund, you may direct the trustee or plan administrator how to vote the number of shares allocated to your account. The enclosed proxy indicates any common stock allocated to your account.

Electronic Access to Proxy Materials

Safeco’s 2003 Annual Report and 2004 Proxy Statement are available on Safeco’s website at www.safeco.com/ar. Registered shareholders may elect to receive future proxy materials electronically, instead of receiving paper copies in the mail. Shareholders who participate in this service will receive an email message providing Internet links to our Proxy Statement, Annual Report and electronic voting site. If you would like to enroll in the electronic proxy delivery service, please email your request to The Bank of New York at shareowners@bankofny.com. Shareholders who own their shares through a bank or broker should contact their bank or broker to enroll in electronic proxy delivery.

Paper copies of the Annual Report and Proxy Statement are available upon request for shareholders who have enrolled in the electronic delivery service. Registered shareholders may request paper copies by contacting our transfer agent, The Bank of New York at 1-800-524-4458 or our Investor Relations Department at 1-877-947-7232 and select option “5” to speak with a representative. Beneficial shareholders must contact their bank or broker to receive paper copies of the Annual Report and Proxy Statement.

Householding

If you and others who share your mailing address own our common stock or stock of other companies through bank or brokerage accounts, you may have received a notice that your household will receive only one annual report and proxy statement from each company whose stock is held in such accounts. This practice, known as “householding,” is designed to reduce the volume of duplicate information and reduce printing and postage costs. Unless you responded that you did not want to participate in householding, a single copy of this Proxy Statement and 2003 Annual Report have been sent to your address. Each shareholder will continue to receive a separate voting instruction form.

If you would like to receive an individual copy of this Proxy Statement and 2003 Annual Report, we will send a copy to you free of charge upon request by mail to Investor Relations, Safeco Corporation, Safeco Plaza, T-15, Seattle, Washington 98185, by calling 1-877-947-7232 and selecting option “5” or by email to ir@safeco.com.

If you would like to revoke your consent to householding and in the future receive your own set of proxy materials, please contact your bank or broker. You may also have an opportunity to opt in or opt out of

2

householding by following the instructions on your voting instruction form. If your household is currently receiving multiple copies of the proxy materials and you would like in the future to receive only a single set of proxy materials at your address, please contact The Bank of New York by email to shareowners@bankofny.com or by mail to The Bank of New York, Receive & Deliver Department—11W, P.O. Box 11002, Church Street Station, New York, NY 10286.

Expenses of Solicitation

All expenses for soliciting proxies will be paid by Safeco. Georgeson Shareholder Communications Inc., New York, New York, has been retained to solicit proxies personally or by mail, telephone or Internet at a cost anticipated to be $6,500 plus reasonable out-of-pocket expenses. Banks and brokers will be reimbursed for their reasonable expenses in forwarding proxy solicitation materials to shareholders. Management does not expect to solicit proxies except through the mail; however, if proxies are not promptly received, employees of Safeco may solicit proxies personally, by telephone or fax.

3

ITEM 1. ELECTION OF DIRECTORS

The Board of Directors currently consists of 11 directors, who are divided into three classes. The Board of Directors increased the size of our Board and appointed G. Thompson Hutton to fill a vacancy on the Board effective January 1, 2004 until the 2004 Annual Meeting of Shareholders. At the 2004 Annual Meeting, four nominees will be elected to serve three-year terms until the 2007 Annual Meeting and until their successors are elected and qualified. Under our Restated Articles of Incorporation, a shareholder may vote each share held only once for each nominee for director.

NOMINEES FOR DIRECTOR

Class III—Term Expires at the 2007 Annual Meeting of Shareholders

Robert S. Cline, 66, has been one of our directors since 1992. Effective immediately following the 2004 Annual Meeting, Mr. Cline will serve as our lead director. Mr. Cline was Chairman of the Board of Directors and Chief Executive Officer of Airborne, Inc., an air freight carrier, from 1984 until his retirement in May 2002. He is also a director of Esterline Technologies Corp., an aerospace technology company.

G. Thompson Hutton, 49, has been one of our directors since January 2004. Mr. Hutton is a private equity and venture capital investor based in Palo Alto, California. Since 2003, Mr. Hutton has been Managing Director of Thompson Hutton LLC, providing management and investment advisory services to private equity and venture capital firms and their portfolio of operating companies. Immediately prior to forming Thompson Hutton LLC, he worked as a private investor in association with Trident Capital, Sutter Hill Ventures and Morgan Stanley Venture Partners. Mr. Hutton served as President and Chief Executive Officer of Risk Management Solutions, Inc. from 1990 to 2000. Prior to 1990, Mr. Hutton was a management consultant at McKinsey & Company, Inc. Mr. Hutton is currently a director of Montpelier Re Holdings Ltd., a reinsurance company.

William W. Krippaehne, Jr., 53, has been one of our directors since 1996. Mr. Krippaehne is President, Chief Executive Officer and a director of Fisher Communications, Inc., the primary subsidiaries of which are engaged in broadcasting, emerging media services and real estate ownership. He has been an executive officer of Fisher Communications since 1982.

Michael S. McGavick, 46, has been our President, Chief Executive Officer and a director since January 30, 2001 and Chairman of the Board since January 1, 2003. Mr. McGavick was President and Chief Operating Officer of CNA Agency Market Operations from October 1997 until January 2001, and President of CNA’s Commercial Lines group from January 1997 until October 1997, and held a series of executive positions with CNA’s commercial insurance operations from 1995 through October 1997. He was Director of the Superfund Improvement Project for the American Insurance Association from 1992 to 1995.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE DIRECTOR NOMINEES.

4

CONTINUING DIRECTORS

Class I—Term Expires at the 2005 Annual Meeting of Shareholders

Joseph W. Brown, 55, has been one of our directors since 2001. Mr. Brown has served as Chairman and Chief Executive Officer of MBIA Inc., a financial services company, since 1999. Prior to that, he was Chairman, President and Chief Executive Officer of Talegen Holdings, Inc., formerly the insurance holdings operation of Xerox Corporation, from 1992 through 1998. Prior to joining Talegen, Mr. Brown was President and Chief Executive Officer of Fireman’s Fund Insurance Company. He is also a director of Oxford Health Plans, Inc., a health care company.

Phyllis J. Campbell, 52, has been one of our directors since 1994. Ms. Campbell has served as President and Chief Executive Officer of The Seattle Foundation, a charitable organization, since 2003. Prior to that, she was Chair of the Community Board of U.S. Bank, Washington, a division of U.S. Bancorp. She also served as President of U.S. Bank, Washington from 1993 until her retirement in 2001. She is also a director of Puget Energy, Inc., a public utility holding company, and its wholly owned subsidiary, Puget Sound Energy, Inc., and Alaska Air Group, Inc., a commercial airline.

Kerry Killinger, 54, has been one of our directors since January 2003. He has served as Chairman, President and Chief Executive Officer of Washington Mutual, Inc., a financial services company, since 1991; he began serving as the President and as a director of that company in 1988, as its Chief Executive Officer in 1990, and as its Chairman of the Board of Directors in 1991.

Class II—Term Expires at the 2006 Annual Meeting of Shareholders

Joshua Green III, 67, has been one of our directors since 1981. Mr. Green is Chairman and Chief Executive Officer of the Joshua Green Corporation, a family investment firm, and Chairman of its wholly-owned subsidiary, Sage Manufacturing Corporation, a manufacturing company.

William G. Reed, Jr., 65, has been one of our directors since 1974 and has been our lead director from May 2000 until the 2004 Annual Meeting. Mr. Reed was Chairman of the Board of Directors of Safeco from January 30, 2001 until January 1, 2003, and served as our Acting Chairman and Acting Chief Executive Officer for an interim 30-day period from January 1, 2001 through January 30, 2001. Mr. Reed was the Chairman of Simpson Investment Company, a forest products holding company, until his retirement in 1996. He is also a director of Microsoft Corporation, a software company; PACCAR Inc, a truck manufacturing company; and Washington Mutual, Inc., a financial services company, and its subsidiary, Washington Mutual Bank.

Norman B. Rice, 60, has been one of our directors since 1999. Mr. Rice is President and Chief Executive Officer of the Federal Home Loan Bank of Seattle. He joined the Federal Home Loan Bank of Seattle in March 1998 as its Executive Vice President. Mr. Rice served two terms as the Mayor of the City of Seattle from 1990 through 1997 and served three terms as a member of the City of Seattle Council from 1979 until 1990.

Judith M. Runstad, 59, has been one of our directors since 1990. Mrs. Runstad has been of counsel to the Seattle law firm Foster Pepper & Shefelman PLLC since 1998 and a partner from 1978 to 1998. She is also a director of Wells Fargo & Company, a diversified financial services company; and Potlatch Corporation, a forest products company.

5

SECURITY OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The following table provides information as of February 9, 2004, with regard to the beneficial ownership of our common stock and of phantom stock units held pursuant to Safeco’s deferred compensation plans by directors, our chief executive officer and our four other most highly compensated executive officers, and all directors and executive officers as a group.

Name | Number of Shares Beneficially Owned and Nature of Beneficial Ownership(1) | Number of Shares Acquirable Within 60 Days(2) | Number of Stock Units Held(3) | Percent of Class | |||||

Joseph W. Brown | 10,000 | 4,000 | 3,807 | * | |||||

Phyllis J. Campbell | 1,000 | 8,000 | 4,097 | * | |||||

Robert S. Cline | 7,000 | 8,000 | 37 | * | |||||

Joshua Green III | 2,547,432 | (4) | 8,000 | 3,149 | 1.8 | ||||

G. Thompson Hutton | 0 | 0 | 103 | * | |||||

Kerry Killinger | 0 | 0 | 1,729 | * | |||||

William W. Krippaehne, Jr. | 3,005,462 | (5) | 8,000 | 0 | 2.2 | ||||

Michael E. LaRocco | 8,046 | 29,495 | 733 | * | |||||

Michael S. McGavick | 60,535 | 150,348 | 0 | * | |||||

Christine B. Mead | 5,754 | 55,350 | 0 | * | |||||

William G. Reed, Jr. | 167,749 | (6) | 8,000 | 0 | * | ||||

Norman B. Rice | 0 | 8,000 | 474 | * | |||||

James W. Ruddy | 9,365 | 98,312 | 151 | * | |||||

Judith M. Runstad | 9,000 | 8,000 | 0 | * | |||||

Randall H. Talbot | 36,238 | 131,609 | 0 | * | |||||

All directors and executive officers as a group (18 persons) | 5,894,916 | 639,131 | 17,093 | 4.7 |

| * | Total beneficial ownership of our outstanding common stock (including shares subject to stock options which may be exercised within 60 days) is less than 1%. |

| (1) | These numbers include shares allocated to executives’ accounts under The Safeco Stock Ownership Fund. |

| (2) | Shares that may be purchased within 60 days by exercise of options granted under the Safeco Long-Term Incentive Plan of 1997 and the Safeco Incentive Plan of 1987. |

| (3) | These numbers represent phantom stock units acquired under Safeco’s Deferred Compensation Plan for Executives and Safeco’s Deferred Compensation Plan for Directors. All non-employee directors may choose to defer all or part of their cash compensation into a phantom stock fund, among other measurement funds. Our executive officers may choose to defer all or part of their cash compensation, gains on the exercise of non-qualified stock options and payments in settlement of rights granted under Safeco’s stock-based incentive plan into the phantom stock fund. |

| (4) | Represents 2,546,832 shares owned by the Joshua Green Corporation, a corporation in which Mr. Green has a substantial interest and with respect to which Mr. Green exercises voting and investment power, and 600 shares owned by his spouse. |

6

| (5) | Includes 3,002,376 shares owned by Fisher Communications, Inc., or Fisher, of which Mr. Krippaehne is an officer and a director and for which he thereby has shared voting and investment power, and 372 shares owned by Mr. Krippaehne’s spouse. Mr. Krippaehne disclaims any beneficial interest in any of the shares owned by Fisher, other than such indirect interest he may have as a shareholder of Fisher. On March 21, 2002, Fisher entered into a variable forward sale transaction, or the Forward Transaction, with Merrill Lynch International, or MLI, with respect to 3,000,000 shares of our common stock owned by Fisher. The Forward Transaction is in consideration of MLI committing to loan to Fisher approximately $70 million. Fisher continues to hold voting power over the shares, which serve as collateral for Fisher’s obligations under the Forward Transaction. However, MLI has the right to borrow the shares, subject to certain rights of Fisher, and any borrowed shares would no longer be voted by Fisher. The Forward Transaction, which is divided into different tranches, will terminate in five separate intervals beginning March 28, 2005 and ending April 9, 2007. The amount due at each termination date is determined based on the market value of our common stock on the termination date. Fisher may satisfy its obligation under the Forward Transaction either by paying cash or by delivering shares of our common stock. During the term of the Forward Transaction, Fisher will continue to receive dividends paid on the shares; however, MLI is entitled to any increase in the dividend amount above the rate paid at the time the Forward Transaction was entered. The Forward Transaction will terminate or be modified in the event of a merger, recapitalization or other similar transaction with respect to Safeco. |

| (6) | Includes 7,772 shares owned by Mr. Reed’s spouse and 5,000 shares owned by a charitable foundation for which Mr. Reed has sole voting and investment power. Mr. Reed disclaims any beneficial interest in the shares owned by the charitable foundation. |

SECURITY OWNERSHIP OF MORE THAN 5% SHAREHOLDERS

The following table provides information with regard to the beneficial ownership of the owners of more than 5% of our outstanding common stock as of December 31, 2003.

Name/Address | Number of Shares Beneficially Owned and Nature of Beneficial Ownership | Percent of Shares Outstanding | ||||

T. Rowe Price Associates, Inc. (“Price Associates”) 100 E. Pratt Street Baltimore, Maryland 21202 | 9,390,890 | (a) | 6.7 | % |

| (a) | Information is based on a Schedule 13G filed on February 11, 2004. Price Associates reports that at December 31, 2003, it had sole dispositive power with respect to 9,390,890 shares of our common stock, which are held for the benefit of its clients. It also reports that it had sole voting power with respect to 1,954,091 shares of our common stock. |

7

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under Section 16 of the Securities Exchange Act of 1934, as amended, directors and officers of Safeco are required to report their holdings of and transactions in our common stock to the Securities and Exchange Commission, or the SEC. To our knowledge, based solely on a review of the copies of such reports furnished to us and written representations that no other reports were required, during 2003 all persons subject to the Section 16 reporting requirements timely filed the required reports.

CORPORATE GOVERNANCE

In order to help our shareholders understand Safeco’s governance policies and practices, the following is a description of our corporate governance principles and current practices. The Nominating/Governance Committee reviews these practices and our Corporate Governance Guidelines, which are posted on our website at www.safeco.com/governance.

Size and Composition of the Board of Directors

Safeco’s Bylaws provide that our Board of Directors shall consist of no fewer than 10 and no more than 18 members. The Board of Directors currently has 11 members, all of whom, except Michael S. McGavick, our Chairman, President and CEO, qualify as independent directors as defined in the listing standards of the Nasdaq Stock Market, Inc. and pursuant to Safeco’s director independence policy. On February 4, 2004, the Board of Directors reviewed employment, business, charitable and other relationships of directors and affirmatively determined that there are no current material relationships between any non-employee director and Safeco that compromise the independence of any non-employee director. The Board of Directors annually appoints a non-management director to serve as its lead director. Presently, our lead director is William G. Reed, Jr., who has served in that capacity since May 2000. At its February 2004 meeting the Board of Directors appointed Robert S. Cline as our lead director effective immediately following the Annual Meeting.

Under its charter, the Nominating/Governance Committee is charged with annually reviewing the requisite skills and characteristics of new Board members as well as the composition of the Board as a whole. This assessment includes a review of members’ qualifications as independent, as well as a consideration of members’ diversity, age, skills and experience in the context of the make-up of the Board as a whole. Nominees for vacancies on the Board are selected by the Nominating/Governance Committee in accordance with its established policies and principles, and those nominees are recommended to the full Board for approval. More on the director nomination process can be found at page 27 under “Nominating/Governance Committee.”

Director Responsibilities

The basic responsibility of a director is to discharge the director’s duties in good faith, with the care an ordinary prudent person in a like position would exercise under similar circumstances, and in a manner that person reasonably believes to be in the best interests of Safeco.

Lead Director Responsibilities

Each year, the Nominating/Governance Committee appoints an independent director to serve as its lead director. The lead director helps set the Board’s agenda, presides over all executive sessions attended only by independent directors, serves as a liaison between the chairman and the independent directors and monitors our shareholder communications mechanisms.

8

Board Meetings and Agenda

A director is expected to attend Board meetings and meetings of committees on which the director serves, and to spend the time necessary to properly discharge the director’s responsibilities. Any director may suggest the inclusion of items on the meeting agenda and may raise meeting subjects not on the agenda for a regularly scheduled meeting. The Board reviews Safeco’s long-term strategic plans annually during at least one Board meeting.

Director Retirement

Safeco has not established Board term limits, and the normal retirement age for our directors is 72. When a director’s principal occupation or business association changes substantially during his or her tenure as a director, that director is expected to offer to resign from the Board. The Nominating/Governance Committee then recommends to the Board the action, if any, to be taken with respect to the offered resignation. It is not Safeco’s policy to accept an offered resignation in every instance when a director’s principal occupation or business association changes during his or her tenure as a director.

Director Compensation

The Nominating/Governance Committee annually reviews the compensation of directors. It is the policy of the Board of Directors that the level and type of director compensation be competitive with that paid to directors on boards of similarly sized and situated corporations.

Chief Executive Officer Compensation and Management Succession

The Compensation Committee conducts an annual review of the chief executive officer and oversees the evaluation process of the other executive officers. The evaluation of the chief executive officer is based on both qualitative and quantitative factors, including actual performance of the business and long-term business and financial goals. Further, the Compensation Committee oversees the succession planning process. To assist the Compensation Committee, the chief executive officer provides recommendations and evaluations of potential successors for his position as well as for the other executive officer positions.

Executive Sessions of Independent Directors

Independent directors meet in executive sessions on a regular basis with the lead director, who presides over each meeting.

Shareholder Communications with Independent Directors

Our chief executive officer, together with other senior management, is responsible for establishing effective communications with our constituents, including our shareholders. As a result, the following shareholder communication mechanisms have been established so that shareholders may communicate with our independent directors as a whole or our lead director individually.

| • | Email. Shareholders may send communications to Safeco’s shareholder communications email box at: shacom@safeco.com. |

| • | Post Office Address. Shareholders may write to: |

Shareholder Communications with

Independent Directors or Lead Director

c/o Safeco Corporation

Safeco Plaza, T-18

Seattle, Washington 98185

9

The lead director monitors these shareholder communications mechanisms, forwards communications to the appropriate committee(s) or non-management director(s) and facilitates an appropriate response. Shareholders and other interested parties may communicate with the lead director or any group or committee of directors at Safeco’s Annual Meeting of Shareholders. Directors are encouraged to attend Annual Shareholder Meetings and all of our directors attended the 2003 Annual Meeting of Shareholders. None of our shareholder communications required board action in 2003.

Audit, Compensation and Nominating/Governance Committees

The Audit, Compensation and Nominating/Governance committees consist solely of non-management directors, none of whom has been or is an employee of Safeco and all of whom qualify as independent directors under the listing standards of the Nasdaq Stock Market, Inc. Committee members are appointed by the Board upon the recommendation of the Nominating/Governance Committee. It is the policy of the Board that the chair of each committee rotate at least every five years. Each of these committees operates under its own charter, which can be found on our website at www.safeco.com/governance. The chair of each committee determines the frequency, length and agenda of meetings. The notice, agenda and materials for each of these committees is furnished to each director and each director is invited to observe all committee meetings.

Other Board Memberships

The Nominating/Governance Committee will assess whether a potential new Board member or an existing director has sufficient time to devote to the substantial duties and responsibilities required of a member of the Board. Generally, directors should not serve on more than three other public company boards. Audit Committee members may not serve on more than two other public company audit committees. Further, directors must advise the chairman of the Board, the lead director and the chair of the Nominating/Governance Committee in advance of accepting an invitation to serve on another public company board.

Board Performance Evaluation and Continuing Education

With the goal of increasing the effectiveness of the Board of Directors and its relationship with management, the Board of Directors has implemented an annual self-evaluation process to determine the effectiveness of both the Board and its committees. New directors attend Safeco’s director orientation program and incumbent directors attend continuing education programs to stay current regarding emerging trends and governance matters.

10

COMMITTEES OF THE BOARD

Safeco’s Board of Directors presently has the following standing committees: Audit, Compensation, Finance and Nominating/Governance. The Board of Directors met five times during the last fiscal year. All of our directors during fiscal year 2003 attended 75% or more of the Board meetings and meetings of the committees on which they served. Mr. Hutton joined the Board on January 1, 2004. Below is a table that provides membership and meeting information for each Board committee:

Name | Audit | Compensation | Finance | Nominating/ Governance | ||||||||

Joseph W. Brown | X | X | * | |||||||||

Phyllis J. Campbell | X | * | X | |||||||||

Robert S. Cline | X | * | X | X | ||||||||

Joshua Green III | X | X | X | |||||||||

G. Thompson Hutton | X | |||||||||||

Kerry Killinger | X | |||||||||||

William W. Krippaehne, Jr. | X | X | ||||||||||

Michael S. McGavick | X | |||||||||||

William G. Reed, Jr. | X | X | ||||||||||

Norman B. Rice | X | X | ||||||||||

Judith M. Runstad | X | * | ||||||||||

Total meetings in fiscal year 2003 | 9 | 8 | 9 | 4 |

| * | Committee Chair |

AUDIT COMMITTEE REPORT

The Audit Committee assists the Board in fulfilling its responsibility to (i) monitor the integrity of our financial reporting process and systems of internal controls regarding accounting and financial reporting; (ii) monitor the independence and performance of our independent auditors and internal auditors; (iii) provide an avenue of free and open communication among the independent auditors, internal auditors, management and the Board; (iv) review any conflict-of-interest situation brought to its attention and approve related party transactions; and (v) review Safeco’s approach to business ethics and compliance with the law.

Management is responsible for the preparation, presentation and integrity of Safeco’s financial statements, accounting and financial reporting principles, internal controls and procedures designed to assure compliance with accounting standards, applicable laws and regulations. Ernst & Young, Safeco’s independent auditor, is responsible for performing an independent audit of the consolidated financial statements in accordance with generally accepted auditing standards and perform such other functions as the Audit Committee may deem appropriate.

Safeco’s Audit Committee has five members, each of whom, in the judgment of the Board, is an “independent director” as defined in the listing standards of the Nasdaq Stock Market, Inc. and the SEC rules. The Audit Committee operates under a written charter adopted by the Board, a copy of which can be found on our website at www.safeco.com/governance and is attached as Appendix A. The Audit Committee reviews and assesses the adequacy of its charter annually and reports its conclusions to the Board. Audit Committee members may serve on no more than two other public company audit committees.

The Audit Committee met nine times during 2003. Audit Committee membership changed during 2003 as a result of Mr. Paul W. Skinner’s retirement from the Board in June 2003 and Mrs. Judith M. Runstad’s

11

decision to rotate off the Audit Committee in August 2003. The present members of the Audit Committee are Robert S. Cline (Chair), Joshua Green III, G. Thompson Hutton, William W. Krippaehne, Jr. and Norman B. Rice. Each member is required to have the requisite expertise and experience required by the SEC and Nasdaq. The Board has designated Robert S. Cline, G. Thompson Hutton and William W. Krippaehne, Jr. each as an audit committee financial expert.

The Audit Committee generally oversees Safeco’s internal compliance programs. Under its charter and in accordance with the law, the Audit Committee has established a procedure for the receipt, retention and treatment of complaints received by Safeco regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters.

Safeco has a full-time internal audit department that is responsible for reviewing and evaluating the adequacy, effectiveness and quality of Safeco’s systems of internal controls relating to the reliability and integrity of our financial information. The head of internal audit reports regularly to and receives guidance from the Audit Committee.

The Audit Committee has an annual agenda of meeting topics that includes, among other items, reviewing Safeco’s financial statements, earnings releases, internal controls and auditing matters. In addition, the Audit Committee has the authority to engage its own outside advisors as necessary to perform the duties required under its charter.

While the Audit Committee has the responsibility and the powers set forth in its charter, it is not the duty of the Audit Committee to plan or conduct the audits or to determine that Safeco’s financial statements are complete and accurate and are in accordance with GAAP. The Audit Committee serves a Board-level oversight role in which it provides advice, counsel and direction to management and the independent auditors on the basis of the information it receives, discussions with the independent auditors, discussions with the internal auditors and the experience of the Audit Committee members in business, financial and accounting matters.

In connection with Safeco’s financial statements for the year ended December 31, 2003, the Audit Committee has:

| • | Reviewed and discussed Safeco’s audit and the audited financial statements for 2003 with management and the independent auditors, including a report by the auditors regarding (i) the critical accounting policies and practices used by Safeco, (ii) alternative accounting treatments within generally accepted accounting principles, including the ramifications of the use of alternative treatments and the treatment preferred by our auditors, and (iii) other material written communications between our independent auditors and management, including any management letter provided by our auditors and our response to that letter and a review of any difficulties the auditors encountered in the course of their audit work and management’s response; |

| • | Discussed with the independent auditors, who are responsible for expressing an opinion on the conformity of the audited financial statements with accounting principles generally accepted in the United States, their judgments as to the quality, not just the acceptability, of Safeco’s accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards (including Statement on Auditing Standards Nos. 61 and 90, and other professional standards); |

| • | Received written disclosures and a letter from the independent auditors as required by Independence Standards Board Standard No. 1 and discussed with Ernst & Young their independence; and |

12

| • | Based on the reviews and discussions described above, recommended to the Board of Directors that Safeco include our audited financial statements for the year ended December 31, 2003 in our Annual Report on Form 10-K. |

Audit Committee:

Robert S. Cline, Chair

Joshua Green III

G. Thompson Hutton

William W. Krippaehne, Jr.

Norman B. Rice

INDEPENDENT AUDITOR’S FEES AND SERVICES

In early 2003, the SEC adopted final rules relating to auditor independence that, among other things, call for the disclosure of the aggregate fees billed by our independent auditors in four categories for the two most recent fiscal years: Audit Fees, Audit-Related Fees, Tax Fess and All Other Fees. The following table shows the fees that Safeco paid or accrued for audit and other services provided by Ernst & Young for the fiscal years 2003 and 2002 on a comparative basis by category in accordance with the new SEC rules.

| 2003 | 2002 | |||||

Audit Fees | $ | 3,475,000 | $ | 3,900,400 | ||

Audit-Related Fees | 478,500 | 246,500 | ||||

Tax Fees | 111,839 | 273,044 | ||||

All Other Fees | 0 | 0 | ||||

Total | $ | 4,065,339 | $ | 4,419,944 | ||

| • | Audit Fees for 2002 and 2003 consist of the fees paid to Ernst & Young for professional services for the audit of Safeco’s annual consolidated financial statements, review of quarterly consolidated financial statements, audit of annual statutory statements, and services that are normally provided by the independent auditors in connection with statutory and regulatory filings or engagements. |

| • | Audit-Related Fees for 2002 consist of fees paid to Ernst & Young for professional services for the audit of our employee benefit plans and SAS 70 examinations. In 2003, fees were paid for employee benefit plan audits, SAS 70 examinations, consultation regarding processes and procedures for compliance with The Sarbanes Oxley Act of 2002 and research and consultation in connection with the sale of our life and investments operations. |

| • | Tax Fees for 2002 and 2003 consist of certain tax compliance services and advice. |

| • | Ernst & Young did not provide any professional services, including services with respect to IT consulting, in the “All Other Fees” category for either year. |

The Audit Committee concluded that the provision of the services listed above was compatible with maintaining the independence of Ernst & Young. Ernst & Young has been retained by the Audit Committee to perform the 2004 audit.

13

AUDITOR INDEPENDENCE POLICY

The Audit Committee has direct responsibility for the appointment, compensation, retention and oversight of the work of our independent auditors and has sole authority to appoint and terminate the independent auditor. The Audit Committee believes that maintaining Safeco’s independence from our independent auditors is critical to the integrity of Safeco’s financial statements and has adopted a policy on auditor independence requiring the pre-approval of all audit and permitted non-audit services performed by the independent auditors. This policy also requires the regular rotation of the lead and concurring audit partner and limits the hiring of audit firm employees. In addition, the Audit Committee annually considers a rotation of the audit firm in order to evaluate the firm’s performance and assure continuing auditor independence. The Audit Committee may delegate the administration of the pre-approval process to one or more of its members, but not to management. To the extent a non-audit or audit-related service is pre-approved by a member of the Audit Committee under this delegation of authority, such service must be ratified by the full Audit Committee at its next quarterly committee meeting.

COMPENSATION OF DIRECTORS

Compensation of Directors

Our non-employee directors receive compensation for their services as directors as set forth in the table below.

Annual Board Retainer | $ | 36,000 | |

Annual Lead Director Retainer | $ | 50,000 | |

Annual Committee Chair Retainer | $ | 4,000 | |

Meeting Fees | |||

• Board Meeting | $ | 1,500 | |

• Committee Meeting | $ | 1,000 | |

Restricted Stock Rights | 2,500 |

| • | Non-employee directors are reimbursed for reasonable travel expenses and expenses incurred in connection with attending continuing education programs. No additional fees, other than those described in the table above, are paid for attending Board or committee meetings. Mr. McGavick, who is also an employee, receives no compensation for his services as a director. |

| • | Under a program adopted in 2003 under the Safeco Long-Term Incentive Plan of 1997, non-employee directors are granted restricted stock rights, or RSRs, for 2,500 shares immediately following each year’s annual meeting of shareholders. These rights vest on the date of the next annual meeting after the grant but are not settled (in common stock or an equivalent value of cash) until the director has ceased to serve on the Board. Holders of RSRs receive dividends in amounts equivalent to the dividends that would be paid on the same number of shares of common stock. |

| • | Under our Deferred Compensation Plan for Directors, non-employee directors may elect to defer their annual retainers and meeting fees, settlements of RSRs, and dividends accrued on RSRs, together with any gain realized on exercise of stock options. Amounts deferred under this plan are credited with earnings tied to the performance of designated measurement funds. |

| • | Within five years of joining the Board, directors are expected to own at least 10,000 shares of common stock or vested RSRs. |

| • | After the Annual Meeting, the Annual Audit Committee Chair Retainer will be increased from $4,000 to $8,000. |

14

COMPENSATION COMMITTEE REPORT

ON EXECUTIVE COMPENSATION

Overview

The Compensation Committee of the Board of Directors is composed solely of independent directors, none of whom has been or is an employee of Safeco. All of us, as members of the Compensation Committee, are “outside directors” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended, or the Code, and “non-employee directors” within the meaning of Section 16b-3 of the Exchange Act. We operate under a written charter, which can be found on our website at www.safeco.com/governance. We are responsible for preparing this report, reviewing Safeco’s compensation and benefits programs for employees as well as executives, approving salaries of $200,000 or greater, administering our stock-based incentive plan, approving and recommending to the Board for approval material changes to the employee benefit plans and overseeing the senior management evaluation and succession planning process.

Approach to Compensation

This report discusses the compensation policies applicable to our executive officers, including our chief executive officer and four other most highly compensated executives, or the Named Executive Officers. Our employees generally participate in the same retirement plans as our executive officers. Our compensation policies and plans are intended to:

| • | attract and retain highly qualified officers who will contribute to Safeco’s long-term success; |

| • | motivate those officers to achieve and maintain superior performance levels; |

| • | reward officers and employees who achieve short- and long-term goals; |

| • | encourage the creation of long-term shareholder value; |

| • | link compensation to our performance and shareholder returns over time; and |

| • | maintain an appropriate balance between base salary and short- and long-term incentive opportunities. |

Salary

We structure executive officer salaries, including those of the Named Executive Officers, based on market data for similar positions and the establishment of salary ranges based on position and responsibilities. We generally target cash compensation (base salary and bonus) at the median of our peers, including most companies in the S&P Property & Casualty Insurance Index (described under “Comparison of Five-Year Cumulative Total Return Among Safeco Corporation, S&P 500 Index and S&P 500 Property & Casualty Insurance Index” on page 24), and we target long-term compensation at the 50th percentile of our peers with an opportunity to receive long-term incentive awards at or above the 75th percentile for superior results.

Bonus

Under our Leadership Performance Plan, or the LPP, a leadership group of employees, including the Named Executive Officers other than Mr. McGavick, earn cash bonuses based on company performance, business unit performance and individual performance. For 2003, the company and business unit performance goals were based on operating earnings per share, operating return on equity, operating income and/or combined ratio. Participants had an opportunity to earn incentive pay at target levels between 10% and 70% of base salary. In addition, we decided in 2003 to incorporate the net present value of the workers compensation reserve charge taken in the third quarter of 2003 into the potential bonus award calculations for Safeco’s

15

leadership group of employees (the charge was excluded from the potential bonus award calculations for all other employees). For the leadership group of employees, which includes Safeco’s executive officers, the impact of the workers compensation reserve charge on bonuses depended on the employee’s level of responsibility (i.e., the higher the level of responsibility, the greater the potential effect on bonus), and the business unit. For Mr. McGavick 100% of the workers compensation reserve charge was included and for the Named Executive Officers 90% of the workers compensation reserve charge was included.

Stock-Based Incentive Program

A shareholder-approved stock-based incentive program has been an element of our compensation since the early 1960s. The purpose of the program is to encourage selected, key employees of Safeco and its subsidiaries to remain employed, participate in our ownership, advance the interests of our shareholders and increase the value of our common stock. All of our executive officers participate in our stock-based incentive program.

Under our shareholder-approved Long-Term Incentive Plan of 1997, or the Plan, we may grant stock options, restricted stock rights, or RSRs, and performance stock rights, or PSRs, in amounts and on terms consistent with the Plan.

For 2003, we awarded stock options, RSRs and PSRs based on then current guidelines applicable to individuals in several salary bands. We considered the different nature of stock options, RSRs and PSRs in developing these guidelines. For executives other than the chief executive officer, senior management recommended award levels within the prescribed guidelines to us based on individual responsibilities, individual performance, potential for advancement, current salary, previous grants, the current price of our common stock and the performance of our common stock over time. In addition, we received the recommendation of the chief executive officer regarding award levels for senior management.

Beginning in 2004, we modified our methodology for determining the economic value of awards to the chief executive officer and the Named Executive Officers. We made changes to further link equity awards to executives with Safeco’s short- and long-term performance goals. We decided to make future equity grants only in the form of RSRs where the number of RSRs granted in 2005 and in subsequent years will be determined by performance measures, or PM-RSRs. For example, the number of PM-RSRs granted in 2005 will be based on company results measured against stated performance goals including operating return on equity, premium growth and combined ratio as well as individual performance. Fiscal year 2004 will be a transition year for determining the number of RSRs granted. Both RSR and PM-RSR grants will be subject to time-based vesting and settle in 25% increments as discussed below. At the request of the chief executive officer and senior management, the maximum economic value of long-term incentive awards (based on the net present value determined at the time of grant) will be reduced by 20% in 2004.

Stock options were awarded with an exercise price equal to the closing market price of our common stock on the grant date and typically vest in 25% increments on the first, second, third and fourth anniversaries of the grant date. Each of the Named Executive Officers received a stock option grant in 2003. We have never repriced stock options and cannot do so in the future without shareholder approval. We have not awarded stock options in 2004 and instead plan to grant RSRs in 2004 and PM-RSRs in 2005 and going-forward.

RSRs and PM-RSRs entitle the holder to receive a specified number of shares of common stock or cash equal to the closing market price of the shares on the vesting date. These awards typically vest and are settled in 25% increments on the first, second, third and fourth anniversaries of the grant date. Prior to vesting, holders of RSRs and PM-RSRs receive dividends in amounts equivalent to the dividends that would be paid on the same number of shares of common stock. The dollar values of the RSR awards made in 2003 to the Named Executive Officers are stated in the column “Restricted Stock Awards” in the Summary Compensation Table.

16

PSRs entitle the holder to receive a specific number of shares of common stock on the settlement date, or cash equal to the closing market price of the shares. PSRs are settled if specified performance goals have been met at the end of a three-year performance period. In 2003, PSRs were awarded to the Named Executive Officers, with performance goals customized for each officer. Performance goals included, as appropriate, the operating return on equity for Safeco, our property and casualty or life and investments operations; the change in our common stock price compared to the average change in the price of the common stock of the companies that are in the S&P Property & Casualty Insurance Index, or the SP Insurance Index (“Stock Price Comparison”); our operating earnings per share; the combined ratio of our property and casualty operations, the average annual growth in premiums for our property and casualty operations; and the pretax operating income for our life and investments operations. We have not awarded PSRs in 2004 and instead plan to grant RSRs in 2004 and PM-RSRs in 2005 and going-forward.

Retirement Program

Our retirement program is available on the same basis to all our employees and is comprised of a combined 401(k)/profit-sharing plan and cash balance plan. In addition, we maintain a non-qualified supplemental retirement plan to restore benefits that cannot be included in the tax-qualified retirement plans for certain highly compensated individuals.

Deferred Compensation Plan for Executives

Under Safeco’s Deferred Compensation Plan for Executives, eligible executives may elect to defer salary, bonus and incentives, settlements of RSRs, dividends accrued on RSRs, settlements of PSRs, qualifying gains realized on stock-for-stock exercises of non-qualified stock options and employee contributions and employer contributions in excess of the limitations of the Code. Amounts deferred under this plan are credited with earnings tied to the performance of designated measurement funds, including a Safeco phantom stock fund and an interest accruing fund based on the federal long-term rate for purposes of 1274 of the Code.

Chief Executive Officer Compensation

With respect to Mr. McGavick’s 2003 compensation, his employment agreement provides for the payment of base annual salary, a discretionary bonus of up to 200% of base salary (which was increased to 240% effective in 2004) and other benefits. See “Employment Contracts, Termination of Employment and Change in Control Arrangements.” We generally took into account the following factors when considering Mr. McGavick’s compensation for 2003: (i) the cumulative total return to our shareholders, (ii) customary financial measures (e.g., the compounded annual return to shareholders, our common stock price and the common stock prices of comparable companies); (iii) the combined ratio of Safeco’s property and casualty subsidiaries and the combined ratios of competitors; (iv) the revenue and premium growth of our operating subsidiaries; (v) our financial strength and asset management; and (vi) the ratings assigned to us and our subsidiaries or securities by A.M. Best Insurance Services, Standard & Poor’s Ratings Group, Moody’s Investors Service, Inc. and Fitch, Inc. Based on Mr. McGavick’s accomplishments in 2002 and a review of compensation paid to the chief executive officers of our peers, we approved an increase in his salary to $1,000,000 effective January 1, 2003 and continued his salary at this same level for 2004. We granted stock options, RSRs and PSRs to Mr. McGavick as described in the Summary Compensation Table. For his 2003 PSR grant, the three applicable performance goals we used were Safeco’s operating return on equity, operating earnings per share and the Stock Price Comparison. For the three-year performance cycle ended December 31, 2003 under the 2001 PSR grant, we concluded that he earned 13,675 shares. Based on Safeco surpassing the return on equity and operating earnings targets set for 2003, the achievement of several qualitative goals and incorporating 100% of the net present value of the workers compensation reserve

17

charge, we approved a bonus of 185% of base salary. We concluded, and the Board agreed, that Mr. McGavick’s performance in 2003 fully supported the total compensation awarded. Mr. McGavick will be eligible for annual grants of RSRs in 2004 and PM-RSRs thereafter.

Stock Ownership Guidelines

We established stock ownership guidelines for our executive officers in 2002. “Stock ownership” is defined as (i) stock owned by the executive officer directly, (ii) stock owned through The Safeco Stock Ownership Fund in the 401(k)/profit-sharing plan, (iii) shares acquired under Safeco’s Long-Term Incentive Plan of 1997, or (iv) a deemed investment made in the phantom stock fund through Safeco’s Deferred Compensation Plan for Executives. Under the guidelines we established, the chief executive officer must own common stock equal in value to at least five times his projected average base salary over a five year period, or Projected Average Salary. The guidelines also cover the Named Executive Officers and other members of our senior leadership team, each of whom must own common stock equal in value to at least two and a half times the officer’s Projected Average Salary. All other executive officers above a certain salary band must own common stock with a value equivalent to at least half their Projected Average Salaries. All officers have five years to attain ownership of the specified number of Safeco shares. Until the share ownership thresholds have been met, RSRs and PSRs, which were awarded in May 2002 or later, must be settled in shares. Notwithstanding this limitation, a portion of RSRs and PSRs may be settled in cash to satisfy tax withholding requirements incurred at settlement.

Considerations in Connection with Compensation Levels

In connection with compensation for individual executive officers other than the chief executive officer, we consulted with the chief executive officer and exercised our subjective judgment in evaluating each individual’s leadership and managerial abilities, achievement of business unit and corporate objectives, achievement of individual objectives under the LPP, potential for advancement or promotion and the relative value of the individual’s performance in the overall achievement of Safeco’s objectives.

In connection with our consideration of compensation for our executive officers, including the chief executive officer, we reviewed information regarding compensation practices and salary levels of our competitors (including most of the companies that are in the SP Insurance Index as well as non-competing companies of a similar size to us or our operating subsidiaries). In addition, with respect to compensation paid to executive officers, we reviewed information concerning compensation practices and compensation levels obtained from (i) the proxy statements of publicly held companies, (ii) two independent consulting firms, and (iii) our human resources department.

The purposes of this review were to compare our approach to and level of compensation with that of our peers, including most of those companies in the SP Insurance Index, to target cash compensation (base salary and bonus) for the Named Executive Officers at the median of peers, to target long-term compensation at the 50th percentile of peers, to confirm that our approach to compensation continues to be appropriate given our lines of business, size and culture and the geographic location of our executive officers and to suggest changes to management regarding the overall approach to compensation of employees. For 2003, we confirmed that our approach to compensation, including our administration of base salary, variable pay and equity-based awards under the Plan, was suitable to the achievement of the general purposes of our compensation policies and plans. To more effectively align executive compensation with the long-term interests of shareholders, we made changes to the long-term incentive award guidelines in 2004.

The directors annually review a graph that compares the cumulative total return to our shareholders with the S&P 500 Index. The graph also compares these returns with the returns of companies in the same general

18

lines of business. Set forth on page 24 is a graph that compares the cumulative total return to our shareholders with the S&P 500 Index and the SP Insurance Index, with the returns of the companies in the SP Insurance Index each weighted according to each component company’s respective market capitalization. The graph reflects our historical performance and does not indicate future performance.

Tax Deductibility of Compensation

Under Section 162(m) of the Code, the federal income tax deduction for certain types of compensation paid to the chief executive officer and four other most highly-paid officers of publicly-held companies is subject to an annual limit of $1 million per employee, unless that compensation is deferred or is considered performance-based. Our policy generally is to structure executive officer compensation to achieve deductibility under Section 162(m) with minimal sacrifices in flexibility and corporate objectives. We paid cash compensation that exceeded this limit in 2003.

Succession Planning

We discussed the succession plan for the chief executive officer as well as for the other members of the senior leadership team during the course of our regular quarterly meetings. We reported on these discussions to the full Board during its executive sessions both with and without the chief executive officer present.

Executive Sessions

We regularly met in executive sessions without any member of management present both with and without our independent compensation consultant.

Compensation Committee Membership

Our membership changed in 2003 as a result of Mr. Paul W. Skinner’s retirement from the Board in June 2003. The members of the Compensation Committee, which met eight times during 2003, are Phyllis J. Campbell (Chair), Joseph W. Brown, Robert S. Cline and William G. Reed, Jr.

Compensation Committee:

Phyllis J. Campbell (Chair)

Joseph W. Brown

Robert S. Cline

William G. Reed, Jr.

19

COMPENSATION OF NAMED EXECUTIVE OFFICERS

Summary Compensation Table

The following table sets forth all compensation paid to the Named Executive Officers during the past three years. Annual compensation includes amounts deferred at the officer’s election.

Summary Compensation Table

| Annual Compensation | Long-Term Compensation | ||||||||||||||||

| Awards | Payouts | ||||||||||||||||

Name and Principal Position | Year | Salary ($) | Bonus(4) ($) | Other sation(5) | Restricted Stock Awards(6) ($) | Securities (#) | LTIP Payouts(7) ($) | All Other Compensation ($) | |||||||||

M. McGavick(1) Chairman of the Board, President and Chief Executive Officer | 2003 2002 2001 | 1,000,000 950,000 790,972 | 1,850,000 1,805,000 2,039,235 | 143,855 162,357 254,537 | 638,537 618,047 1,577,124 | 420,800 420,392 390,500 | 602,521 450,727 0 | 124,150 102,375 0 | (8) | ||||||||

R. Talbot President, Life & Investments | 2003 2002 2001 | 525,000 525,000 477,500 | 735,000 500,000 599,034 | 15,884 13,833 0 | 181,479 184,977 256,250 | 119,600 118,436 33,000 | 246,472 194,056 78,213 | 48,750 49,520 33,456 | (9) | ||||||||

C. Mead(2) Senior Vice President, Chief Financial Officer and Secretary | 2003 2002 | 450,000 421,875 | 660,614 727,685 | 62,498 68,824 | 155,662 321,278 | 102,500 165,700 | 0 0 | 24,524 0 | (10) | ||||||||

M. LaRocco(3) President and Chief Operating Officer, Safeco Personal Insurance | 2003 2002 2001 | 420,000 395,000 178,750 | 588,000 250,000 187,688 | 51,685 58,333 0 | 145,275 137,423 145,300 | 95,700 87,980 15,000 | 0 0 0 | 35,400 12,375 0 | (11) | ||||||||

J. Ruddy Senior Vice President and General Counsel | 2003 2002 2001 | 380,000 380,000 368,333 | 532,000 207,000 114,308 | 8,342 9,488 0 | 131,374 133,889 153,750 | 86,600 80,000 20,000 | 255,151 259,308 0 | 31,568 28,578 25,803 | (12) | ||||||||

| (1) | Mr. McGavick became an employee of Safeco on January 26, 2001 and was appointed President and Chief Executive Officer on January 30, 2001. On January 1, 2003, Mr. McGavick became Chairman of the Board. |

| (2) | Ms. Mead was appointed Senior Vice President, Chief Financial Officer and Secretary on January 24, 2002. |

| (3) | Mr. LaRocco was appointed President and Chief Operating Officer, Safeco Personal Insurance on July 16, 2001. |

| (4) | The dollar amounts in this column include (i) the value of bonus taken as cash or deferred, (ii) a portion of 2002 LPP bonuses paid in the form of RSR grants, (iii) any hiring bonus and (iv) settlement of PSRs awarded in 2001 for the one-year performance cycle ended December 31, 2001. Under his employment agreement, Mr. McGavick had the opportunity to earn a discretionary cash bonus of up to 200% of base salary, which has been increased to 240% effective in 2004. He was paid a cash bonus of $1,850,000 in 2003. The LPP provides that upon meeting certain business and individual objectives, participants have the opportunity to earn target awards between 10% and 70% of base salary. For 2003 the following amounts were awarded under the LPP: for Mr. Talbot, $735,000; for Ms. Mead, $630,000; for Mr. LaRocco, $588,000; and for Mr. Ruddy, $532,000. Ms. Mead was also paid a special bonus of $30,614 as provided under the terms of her hire letter. |

| (5) | Included in this column for Mr. McGavick for 2003 are $88,995 of interest benefit for a below market rate residential loan made as an inducement to relocate to the Seattle area and $48,590 for air transport |

20

services. Also included in this column are the following amounts of interest benefit of below market rate residential loans made as inducements to relocate to the Seattle area: $61,740 for Ms. Mead; and $50,700 for Mr. LaRocco. |

| (6) | This column shows the dollar value of RSRs granted in each year, excluding the portion of 2002 LPP bonuses paid in the form of RSR grants. RSRs entitle an employee who remains continuously employed by Safeco or our subsidiaries for a stated number of years to receive a specified number of shares of common stock or cash equal to the fair market value of the shares on the settlement date. Holders of unvested RSRs are entitled to receive an amount equivalent to the dividends that would be paid on the same number of shares of common stock. The dollar amounts in this column are determined by multiplying the number of shares covered by an RSR by the closing market price of our common stock on the grant date. |

| In 2003, we awarded RSRs for 16,720 shares to Mr. McGavick; 4,752 shares to Mr. Talbot; 4,076 shares to Ms. Mead; 3,804 shares to Mr. LaRocco; and 3,440 shares to Mr. Ruddy. The RSRs settle in four equal installments in 2004, 2005, 2006 and 2007. |

| The total number of RSRs held by the Named Executive Officers and the total value of such holdings at December 31, 2003, based on the closing market price of our common stock on that date, was: for Mr. McGavick, 63,717 RSRs with a value of $2,480,503; for Mr. Talbot, 13,823 RSRs with a value of $538,129; for Ms. Mead, 15,125 RSRs with a value of $588,816; for Mr. LaRocco, 10,052 RSRs with a value of $391,324; and for Mr. Ruddy, 7,857 RSRs with a value of $305,873. |

| (7) | Represents pay-out for PSRs pursuant to which annual payments of a portion of the total award may be made based on achievement of specified performance goals at the end of the performance period. Performance goals are established at the time of grant. For the three-year performance cycle ended December 31, 2003 under the 2001 PSR grant, Mr. McGavick earned 13,675 shares valued at $602,521, Mr. Talbot earned 5,594 shares valued at $246,472 and Mr. Ruddy earned 5,791 shares valued at $255,151. |

| (8) | Includes net contributions by Safeco of $14,000 to the 401(k)/profit-sharing plan and allocations to non-qualified plans of $110,150 for amounts that may not be contributed to the qualified plan because of limitations imposed by the Code (“Non-Qualified Allocations”). |

| (9) | Includes net contributions of $14,000 to the 401(k)/profit sharing plan and Non-Qualified Allocations of $34,750 |

| (10) | Includes net contributions of $6,000 to the 401(k)/profit-sharing plan and Non-Qualified Allocations of $18,524. |

| (11) | Includes net contributions of $14,000 to the 401(k)/profit-sharing plan and Non-Qualified Allocations of $21,400. |

| (12) | Includes net contributions of $12,967 to the 401(k)/profit sharing plan and a Non-Qualified Allocation of $18,601. |

21

Stock Option Grants in 2003

The table below sets forth information on stock option grants in 2003 to the Named Executive Officers.

| Individual Grants | ||||||||||

Name | Number of (#) | Percent of Year | Exercise Price(2) ($/Sh) | Expiration Date | Grant Date Present Value(3) ($) | |||||

M. McGavick | 420,800 | 17.37 | 38.19 | 05/07/2013 | 4,439,440 | |||||

R. Talbot | 119,600 | 4.94 | 38.19 | 05/07/2013 | 1,261,780 | |||||

C. Mead | 102,500 | 4.23 | 38.19 | 05/07/2013 | 1,081,375 | |||||

M. LaRocco | 95,700 | 3.95 | 38.19 | 05/07/2013 | 1,009,635 | |||||

J. Ruddy | 86,600 | 3.57 | 38.19 | 05/07/2013 | 913,630 | |||||

| (1) | These options to purchase common stock were granted on May 7, 2003 and generally 25% of the shares subject to each option become exercisable on the first, second, third and fourth anniversary dates of the option grant. Vesting is accelerated upon a change in control. |

| (2) | The exercise price, which is the fair market value of our common stock on the date of grant, may be paid in cash, in shares of common stock valued at fair market value on the date of exercise, or in part cash and part stock. |

| (3) | The fair value is based on the Black-Scholes option valuation model. Black-Scholes is a mathematical model used to estimate the theoretical price an individual would pay for a traded option. The actual value an executive may realize will depend on the excess of the stock price over the exercise price. There is no assurance the value realized will be at or near the value estimated by Black-Scholes. The fair value of each option estimated by the Black-Scholes option valuation model is $10.55 based on the following assumptions: (i) an exercise price of $38.19; (ii) an option term of five years; (iii) a future dividend yield of 2.5%; (iv) a risk-free interest rate of 3%; and (v) an estimated stock price volatility of .35. |

Aggregated Option Exercises in 2003 and Year-End Option Values

The table below sets forth information on the exercise of stock options in 2003 by each of the Named Executive Officers and the value of unexercised options at December 31, 2003.

Shares (#) | Value ($) | Number of Securities (#) | Value of Unexercised in-the-Money Options at ($) | |||||||||

Name | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||

M. McGavick | 0 | 0 | 150,348 | 1,081,344 | 1,116,310 | 7,010,901 | ||||||

R. Talbot | 12,500 | 233,875 | 116,609 | 259,927 | 534,581 | 1,192,133 | ||||||

C. Mead | 0 | 0 | 41,425 | 226,775 | 290,322 | 946,817 | ||||||

M. LaRocco | 0 | 0 | 29,495 | 169,185 | 197,417 | 515,019 | ||||||

J. Ruddy | 8,938 | 38,880 | 86,312 | 184,350 | 404,000 | 842,952 | ||||||

| (1) | Based on $38.93, the last sale price of our common stock on December 31, 2003. |

22

Long-Term Incentive Plan Awards in 2003

The table below sets forth information with respect to awards of performance stock rights, or PSRs, granted to Named Executive Officers in 2003.

Number of (#) | Performance or Other Period Until Maturation or Payout | Estimated Future Payouts under Non-Stock-Price-Based Plans (1) | ||||||||

Name | Threshold (#) | Target (#) | Maximum (#) | |||||||

M. McGavick | 18,209 | 2003-2005 | 0 | 18,209 | 27,314 | |||||

R. Talbot | 5,178 | 2003-2005 | 0 | 5,178 | 7,767 | |||||

C. Mead | 4,438 | 2003-2005 | 0 | 4,438 | 6,657 | |||||

M. LaRocco | 4,142 | 2003-2005 | 0 | 4,142 | 6,213 | |||||

J. Ruddy | 3,748 | 2003-2005 | 0 | 3,748 | 5,622 | |||||

| (1) | PSRs will vest and shares will become payable only if specified performance goals (e.g., return on equity; operating earnings, income and stock price; expense levels; and premium growth) are achieved over a three-year performance period. |

23

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURN

AMONG SAFECO CORPORATION, S&P 500 INDEX AND

S&P 500 PROPERTY & CASUALTY INSURANCE INDEX

Total Return To Shareholders

| ANNUAL RETURN PERCENTAGE | ||||||||||||

| Years Ending | ||||||||||||

Company / Index | Dec 99 | Dec 00 | Dec 01 | Dec 02 | Dec 03 | |||||||

Safeco Corporation | -39.66 | 40.71 | -2.03 | 13.84 | 14.55 | |||||||

S&P 500 Index | 21.04 | -9.10 | -11.89 | -22.10 | 28.68 | |||||||

S&P 500 Property & Casualty Insurance Index | -25.49 | 55.85 | -8.02 | -11.02 | 26.41 | |||||||

| INDEXED RETURNS | ||||||||||||

| Base Period Dec 98 | Years Ending | |||||||||||

Company / Index | Dec 99 | Dec 00 | Dec 01 | Dec 02 | Dec 03 | |||||||

Safeco Corporation | 100 | 60.34 | 84.91 | 83.19 | 94.70 | 108.47 | ||||||

S&P 500 Index | 100 | 121.04 | 110.02 | 96.95 | 75.52 | 97.18 | ||||||

S&P 500 Property & Casualty Insurance Index | 100 | 74.51 | 116.11 | 106.80 | 95.03 | 120.13 | ||||||

Assumes $100 invested on December 31, 1998 in Safeco common stock, the S&P 500 Index and the S&P 500 Property & Casualty Insurance Index, or SP Insurance Index.

| • | Total return assumes reinvestment of dividends. |

| • | Measurement dates are the last trading day of the calendar year shown. |

| • | SP Insurance Index: Safeco Corporation, ACE Limited, Allstate Corporation, AMBAC Financial Group, Inc., The Chubb Corporation, Cincinnati Financial Corporation, MBIA Inc., Progressive Corp.–Ohio, The St. Paul Companies, Travelers Property Casualty Corp. and XL Capital, Ltd. |

24

The Safeco Employees’ Cash Balance Plan

The Safeco Employees’ Cash Balance Plan, or the Cash Balance Plan, is credited with an amount equal to 3% of the annual compensation (base salary and bonus) of participating employees plus 5% interest on the cumulative amount credited for prior years, together, the Accrued Benefit. The portion of the Accrued Benefit in excess of limitations imposed under Section 401(a)(17) of the Code is accrued under the Deferred Compensation Plan for Executives, or the DCP. There are no employee contributions to the Cash Balance Plan. In general, all employees become eligible to participate in the Cash Balance Plan following one year of service with Safeco during which they work a minimum of 1,000 hours. An employee’s balance in the Cash Balance Plan becomes vested at a graduated rate commencing at two years of service, with full vesting after five years of service. Participants may elect to receive, after termination, a lump-sum distribution of their vested balances or an annuitized payment from the Cash Balance Plan’s trust fund. The Cash Balance Plan complies with the Employment Retirement Income Security Act of 1974, as amended.

The following is an estimate of annual benefits payable upon normal retirement age to the Named Executive Officers from the Cash Balance Plan plus the portion of the accrued benefit in the DCP. These projections are based on an annual 2% increase to compensation.

Name | Estimated Annual Benefits at 65 Years of Age | ||

M. McGavick | $ | 149,982 | |

R. Talbot | 48,479 | ||

C. Mead | 44,615 | ||

M. LaRocco | 48,716 | ||

J. Ruddy | 30,706 | ||

EMPLOYMENT CONTRACTS, TERMINATION OF EMPLOYMENT

AND CHANGE IN CONTROL ARRANGEMENTS