Table of Contents

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 10-K

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the Fiscal Year Ended December 31, 2007 |

or

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the Transition Period from to |

Commission File Number 1-6563

Safeco Corporation

State of Incorporation: Washington

I.R.S. Employer I.D. No.: 91-0742146

Address of Principal Executive Offices: Safeco Plaza, 1001 Fourth Avenue, Seattle, Washington 98154

Telephone: 206-545-5000

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, no par value | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES x NO ¨

Indicate by check mark if the registrant is not required to file reports, pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2007, was $6,300,000,000.

89,742,213 Shares of Common Stock were outstanding at February 15, 2008.

Documents Incorporated by Reference: Portions of the registrant’s definitive Proxy Statement for the 2008 annual shareholders meeting are incorporated by reference into Part III.

Table of Contents

Safeco Corporation and Subsidiaries

Index to Financial Statements, Schedules and Exhibits

2

Table of Contents

3

Table of Contents

Part I

(Dollar amounts in millions except for ratios, per-claim data and per-share data unless noted otherwise)

| Item 1: | OUR BUSINESS |

OVERVIEW

We have been in business serving the insurance needs of customers since 1923. Safeco Corporation is an insurance holding company incorporated in the state of Washington. We are licensed to provide property and casualty insurance along with related services to individuals and small- to mid-size businesses in all 50 states through our insurance subsidiaries and as of February 15, 2008, we had 7,057 employees located throughout the United States. We also sell surety bonds to contractors and businesses. Our revenues are generated from the premiums we earn on the insurance policies we write and the income we earn from our investment of premium dollars.

We sell our insurance products principally through independent agents. According to A.M. Best, an insurance rating agency, we are one of the 20 largest domestic insurance carriers, the 6th largest domestic property and casualty insurance carrier selling through independent agents and our surety business is the 4th largest in the United States, based on 2006 direct written premiums.

We deliver the majority of our products over our Safeco Now automated platform, which gives our agents a single point of entry to sell our core property and casualty products and select transactional surety bonds. Most of our pricing, underwriting and servicing processes are presented through this platform. Consumers can also purchase certain policies directly and online at www.Safeco.com. Today, over 95% of our personal lines and small commercial business lines are automated and priced using multi-variate and predictive models.

OUR VISION AND STRATEGY

Our vision is to be the indispensable carrier of choice for customers and their agents through excellence in the solutions we provide, ease of doing business with us and the competitiveness of our products.

Our strategy centers on developing long-term customers who value insurance products and proactively manage their risks. We focus on the personal and commercial insurance products that are purchased by the vast majority of U.S. households and small businesses.

2007 ACCOMPLISHMENTS

In 2007, we focused our efforts on maintaining disciplined underwriting, managing our expenses and capital, developing and introducing new products and improving our technology infrastructure.

| • | Underwriting Profitability – We took actions in 2007 to sustain our underwriting profitability through: |

| ¡ | Continued refinements in our underwriting discipline |

| ¡ | Catastrophe risk management |

| ¡ | Claims management |

| ¡ | Refinements in our producer review process |

• | Expense Management – We achieved expense savings of approximately $50 million for 2007, offset in part by reinvestment in our research and development unit – Open Seas™, increased advertising and marketing spend, and strategic technology investments. We increased productivity as of December 31, 2007 to 593 Policies in Force per Full Time Equivalent (PIF per FTE) from 557 as of December 31, 2006. |

| • | Capital Management – We increased our common stock dividend rate by 33%. We paid $545.9 of our high cost debt and repurchased $1.0 billion of our outstanding shares. |

4

Table of Contents

| • | Development and Introduction of New Products – We launched a new version of our multi-variate pricing segmentation model called Safeco True Pricing™. This product, which applies to our auto and property lines, evaluates customers at every renewal and re-underwrites them so that we can better match rate for risk. The evolution of our multi-variate segmented pricing model is designed to increase our pricing accuracy, improve our retention and competitively price new business. |

In 2007, we rolled out more coverage options for our agents and customers through our Safeco Optimum Package™ products which offer customers the choice of additional coverages for auto, homeowners and small commercial policies. We launched Teensurance™ in the second quarter of 2007, highlighting our drive to innovate. Teensurance is a product for parents and their teen drivers which features special pricing when a tracking device is installed in the vehicle. We have additional product innovations in pilot phase in various markets.

| • | Technology Infrastructure Investment – We evaluated key technologies that will support our business strategy. These included applications that pull together disparate legacy data to create a more holistic view of our customers, advanced data mining tools, and modernized workplace technologies. We established an IT governance structure for our technology investments. |

OUR FOCUS IN 2008

In 2008, our goals are as follows:

| • | Drive the Economics of our Business – Provide sustainable expense savings through improvements in business process; relentlessly address environmental factors, procedures and practices that impede performance and demonstrate momentum in achieving best-in-class in expense and loss-cost management. |

| • | Add Value through Innovative Thinking – Deliver accurate data, deep analytics and technology that will enable us to identify trends, design products and services, and improve risk management, combining these capabilities with a strong talent management initiative that leverages the full capacity of our people to deliver for the customer. |

| • | Enhance the Safeco Experience – Respect the time of agents and customers by providing an integrated approach to logistics, customer support and technology, and make our personal engagement in the business unmistakable to agents and customers. |

| • | Deliver Superior Performance – Perform for our owners by driving book value growth and maintaining ROE that is among the best in the Property and Casualty (P&C) industry, and deploy a combination of underwriting discipline, superior selection, investment performance, and active capital management to deliver stable results and demonstrate clear potential to outperform peers. |

We have various internal metrics by which we chart our progress in achieving these goals.

Insurance products blunt the economic effect of large financial losses on customers by pooling the risks of many individuals and businesses and transferring these risks to an insurance company in return for a premium. The type of risks that are pooled for insurance include risks that are definable, accidental in nature, and part of a group of similar risks large enough to make losses predictable. We offer a range of insurance products in our four business segments that address these risks.

Our four business segments include:

| • | Safeco Personal Insurance – offers auto, homeowners and other property and specialty insurance products for individuals |

| • | Safeco Business Insurance – offers businessowner policies, commercial auto, commercial multi-peril, workers’ compensation, commercial property and general liability policies for small- and mid-sized businesses |

| • | Surety – offers bonds that provide payment and performance guarantees for various businesses |

| • | P&C Other – run-off assumed reinsurance, large-commercial business accounts and commercial specialty programs in run-off, our own self-insurance, asbestos and environmental results, run-off religious institutions and other business and programs we have exited. |

5

Table of Contents

Safeco Now – our automated underwriting platform used to sell these products – allows agents and consumers to quote and sell or purchase policies faster, enabling us to streamline the sales process. Our agents can handle most auto policy changes and endorsements online. These endorsements include vehicle additions and deletions, vehicle replacements or updates and coverage and deductible changes. This automation also has facilitated the comparison of our products online and within software packages that offer the agent and the consumer the ability to compare product quotes.

The table below shows net earned premiums, which is equivalent to our premium revenues. We use “net” because some of our premiums are ceded to reinsurers.

Net earned premiums for our business segments were as follows:

YEAR ENDED DECEMBER 31, | 2007 | 2006 | 2005 | |||||||||||||||

| Amount | % of Total | Amount | % of Total | Amount | % of Total | |||||||||||||

Safeco Personal Insurance | $ | 3,663.0 | 65.7 | % | $ | 3,727.6 | 66.5 | % | $ | 3,831.8 | 66.0 | % | ||||||

Safeco Business Insurance | 1,559.1 | 28.0 | 1,509.6 | 26.9 | 1,555.4 | 26.8 | ||||||||||||

Surety | 352.9 | 6.3 | 297.5 | 5.3 | 260.9 | 4.5 | ||||||||||||

P&C Other | 1.0 | — | 73.6 | 1.3 | 157.3 | 2.7 | ||||||||||||

Total | $ | 5,576.0 | 100.0 | % | $ | 5,608.3 | 100.0 | % | $ | 5,805.4 | 100.0 | % | ||||||

SAFECO PERSONAL INSURANCE

Net earned premiums for Safeco Personal Insurance by reportable segment were as follows:

YEAR ENDED DECEMBER 31 | 2007 | 2006 | 2005 | ||||||

Auto | $ | 2,604.8 | $ | 2,713.2 | $ | 2,820.4 | |||

Property | 942.3 | 909.0 | 913.3 | ||||||

Specialty | 115.9 | 105.4 | 98.1 | ||||||

Total | $ | 3,663.0 | $ | 3,727.6 | $ | 3,831.8 | |||

Auto– We sell insurance products that provide coverage for our customers’ liability to others after a collision for both bodily injury and property damage, for injuries sustained by our customers, and for physical damage to our customers’ vehicles from collision and other hazards.

Our tiered auto product uses multi-variate modeling to match rates to the risks we are willing to insure. This allows us to quote a spectrum of customers and is intended to reduce volatility in our underwriting results over time. Safeco True Pricing makes our pricing more accurate for existing customers, charging the right rate for the customer’s evolving risk profile and adjusting the premiums at every renewal period. It also seeks to create a more accurate and competitive rate for new business quotes.

Policyholders can purchase our Safeco Optimum Package as an endorsement to the personal auto policy. With the package, customers can make more coverage choices, be rewarded for good driving and elect extra protection.

Property – We provide solutions to insure dwellings, contents and liability exposures. We offer homeowners, renter, condo owners, dwelling fire and earthquake policies. Our policies protect our insureds against losses from hazards such as hurricanes, tornadoes, wildfires, earthquakes, hail and windstorms along with other exposures.

As in our other lines of business, we look for growth in property insurance that meets our profitability targets. We target new property business by offering competitive pricing on policies, while carefully managing our exposure to catastrophic events. Like auto, our tiered property product enables us to better match rates to the risks we insure.

Specialty – We offer umbrella, motorcycle, recreational vehicle, classic cars and boat owners insurance coverage for individuals. These specialty products serve to round out our personal lines portfolio so we can provide products to meet the majority of our policyholders’ personal insurance needs. The umbrella product provides cross-sell opportunities with auto.

6

Table of Contents

SAFECO BUSINESS INSURANCE

Net earned premiums for Safeco Business Insurance by reportable segment were as follows:

YEAR ENDED DECEMBER 31 | 2007 | 2006 | 2005 | ||||||

SBI Regular | $ | 1,297.8 | $ | 1,245.4 | $ | 1,272.2 | |||

SBI Special Accounts Facility | 261.3 | 264.2 | 283.2 | ||||||

Total | $ | 1,559.1 | $ | 1,509.6 | $ | 1,555.4 | |||

SBI Regular – We offer a variety of commercial insurance products designed for small- and mid-sized businesses. Our principal business insurance products include business owner policies (BOP), commercial auto, commercial multi-peril, workers’ compensation, commercial property and general liability insurance. Of the businesses we insure, 95% of our policies in force are from customers who pay annual premiums of $10,000 or less and have 99 or fewer employees.

Our lead product in this segment is BOP and it is fully automated on our Safeco Now platform. Our BOP product is designed for customers with up to $15 million in insured values and up to $15 million in annual sales. BOP policies can be issued over Safeco Now for more than 350 classes of business.

Safeco BOP Access™ is designed to target risks that do not fit a traditional businessowners’ policy, but do not require a complex package policy. Packed with enhanced coverages and customizable options, Safeco BOP Access makes policies for “in-between” customers easy to sell, write and maintain. It completes our entire suite of commercial products to cover the small-to-medium marketplace.

Our commercial auto product includes non-fleet and small fleet commercial auto business. We principally insure fleets that include up to 15 vehicles. Approximately 80% of this product is transacted on our automated platform.

Our commercial multi-peril product offers enhanced liability and property coverages that can be tailored to the customer’s needs. This packaged product allows the customer to obtain those coverages that are important to their specific situation.

Our workers’ compensation product targets small- to mid-sized manufacturing, retail and service companies similar to those who buy our BOP and commercial multi-peril product. We require the companies we insure to show a demonstrable concern for employee safety and have formalized loss-prevention plans. Approximately 95% of our workers’ compensation coverage is automated on our Safeco Now platform.

Other products within SBI Regular include farm risks, equipment breakdown, excess liability and umbrella coverage.

SBI Special Accounts Facility – Our Special Accounts Facility segment writes policies covering large-commercial accounts (customers who pay annual premiums of more than $250,000) for our key agents and brokers who deliver a strong flow of our small- to mid-sized commercial products. We also write three specialty commercial programs – agents’ errors and omissions insurance, property and liability insurance for mini-storage and warehouse properties, and property, auto, professional and general liability insurance for non-profit social service organizations. We limit our appetite in the large commercial account business because of our belief that this business is more susceptible to unprofitable price competition in soft market cycles resulting in earnings volatility.

SURETY

We provide surety bonds for construction, performance and legal matters such as appeals, probate and bankruptcies. Our business relies principally on the increasing needs of long-term customers. Surety differs from traditional insurance as it resembles a credit function. We charge a fee for lending our credit to customers who then indemnify us, whereas insurance pools the risks of many customers.

There are three parties to a surety contract – the principal (our customer), Safeco and the beneficiary. All three parties have an obligation under the contract. We are the party who guarantees fulfillment of the principal’s obligation to its beneficiary. In addition, we are generally entitled to recover from the principal any losses and expenses paid to third parties. We are responsible for evaluating the risk and determining if the principal meets the underlying requirements for the bond. We step in on behalf of our principals in the event of a default. We use outside attorneys and engineers to determine contract completion performance or recovery and salvage potential.

7

Table of Contents

We offer two broad types of surety products – contract surety and commercial surety. Contract surety bonds secure a contractor’s performance or payment obligation generally with respect to a construction project. Contract surety bonds are generally required by federal, state and local governments for public works projects. Commercial surety bonds include all surety bonds other than contract and cover obligations typically required by law or regulation. We also market transactional surety bond obligations to individuals and small business through our web-based Surety Online ™ product.

P&C OTHER

This segment includes run-off assumed reinsurance, large-commercial business accounts and commercial specialty programs in run-off, our own self-insurance asbestos and environmental results, run-off religious institutions and other business and programs we have exited, including Safeco Financial Institution Solutions (SFIS), which we sold in April 2006.

CORPORATE

In our Corporate segment, we include:

| • | Interest expense we pay on our debt |

| • | Miscellaneous corporate investment and other activities, real estate holdings, contributions to the Safeco Insurance Foundation and transactions and losses on debt repurchases |

| • | Our intercompany eliminations |

Additional financial information on our segments can be found in the Our P&C Operating Results section Our Corporate Results section in Item 7: Management’s Discussion and Analysis (MD&A) as well as in the Notes to our Consolidated Financial Statements.

We operate in a highly competitive environment for the sale of property and casualty insurance. We compete with thousands of domestic and foreign insurance companies for placement with quality independent agents and brokers. Factors that influence carrier-distributor relationships include:

| • | Availability of capacity and coverage terms |

| • | Ease of doing business |

| • | Product price |

| • | Claims handling |

| • | Compensation structure |

| • | Financial strength and ratings |

| • | Reputation |

We also compete in the marketplace for the business of the retail consumer. There, the same issues regarding coverage, ease, price, service, claims handling, financial strength and reputation are all factors. In the retail market, not only do we compete against other insurance carriers that are represented by independent agents, but also carriers with captive agents and carriers that write directly without agents. Several competing carriers have brands that are more commonly known and spend significantly more on advertising than we do. Because we do not support our brand through extensive advertising, we are reliant on our ability to:

| • | Manage our costs to remain competitive |

| • | Provide coverage and service that will commend us to agents and customers |

| • | Maintain positive relationships with our agents |

| • | Invest in innovation in our products and services to differentiate Safeco |

We offer our products principally through independent agents. Our agency relationship is important to us and we provide our agents with a competitive compensation package and tools to enhance their business.

We have brought together our major auto, property, specialty and small- to mid-sized commercial products on our online Safeco Now sales-and-service platform. This agent workplace tool is Web-based and features a single point of entry for Safeco personal and commercial products, including certain surety bonds. Safeco Now allows agents and brokers to quote and sell these products in minutes and provides them with seamless cross-sell opportunities.

8

Table of Contents

Safeco Now is easy for our agents and brokers to use relative to manual underwriting, drives operating efficiencies in their offices, and gives us a competitive advantage over small regional carriers that have not made (or cannot afford) such investments in technology and larger carriers whose tools may not be as advanced.

Our sales force educates agents on our products and our overall value proposition. This enables us to achieve top-of-mind status with agents and help agents grow their businesses thereby growing ours. We strive to deepen our agency relationships by responding to survey feedback and engaging senior management in regular dialogues to understand agent needs.

We offer our agents on-demand training solutions – live, online virtual classrooms, recorded sessions, and robust user-assistance tools embedded in our systems and applications to maximize their efficiency for agents who prefer to handle service transactions on their own. This enables our agents and brokers to easily learn how to place new business, service existing business and check the status of bills and claims. We also offer phone support and expert troubleshooting if our agents need help placing or renewing business with Safeco.

We offer a “fee and service” option for agents who prefer not to handle their customers’ service transactions. This service, known as Gold Service™, offers licensed Safeco Customer Care professionals who handle all service-related issues directly with the policyholder. In turn, this allows agents to focus on growing their books of business while we focus on providing a consistent and high-value service experience. Participating agents also get the benefit of Safeco cross-selling their book of business to help drive new business and retention.

We sell a modest amount of our products directly through licensed agents who are Safeco employees and through our website, www.Safeco.com.

We have a team of more than 2,500 claims professionals across the country. They handled 97% of our claims in 2007; the remainder was handled by independent adjusters. We have specialized claims-handling functions to address complex claims such as surety, workers’ compensation, asbestos, environmental and construction defects.

Customers can receive repair estimates and claim checks by visiting one of our drive-in claims centers, or our new Safeco OneStop™ repair facilities. At Safeco OneStop repair facilities, customers simply drop off their drivable car, and the estimate, rental car and repair are taken care of at one convenient location. We have vendor partnerships and reward vendors who meet our customers’ satisfaction criteria.

CATASTROPHE MANAGEMENT

As a property and casualty insurer, our results can be affected by claims arising out of natural or man-made catastrophes. Depending on their severity, such catastrophic events can have a significant impact on our results of operations and financial condition. Catastrophes can be caused by various events, including severe weather, earthquakes, terrorism, fires and explosions. We actively attempt to limit our exposure to catastrophe risk through a combination of risk avoidance, risk mitigation and risk transfer strategies. We maintain proprietary data on selected risks to conduct our own analysis of exposures as well as using industry data.

Our underwriting strategy across all segments of our business is to target customers whose risk of loss provides us with the opportunity for profitable growth. When writing business in catastrophe-prone areas we attempt to limit our exposure by adhering to strict guidelines that include variables such as building age and condition, coastal proximity, standards for policy deductibles and wildfire mapping. Due to our conservative catastrophe management strategy, our catastrophe losses have been lower than would be predicted by our applicable market share for nearly all major catastrophes.

As part of our on-going catastrophe expense management efforts, we are evaluating whether to join the California Earthquake Authority (CEA). The CEA is a privately-financed, publicly managed state agency created to provide insurance coverage for earthquake damage in California. Insurers selling homeowners policies in California are required to offer earthquake insurance to their customers either through their company or through participation in the CEA. Participation in the CEA would limit our exposure to earthquake losses.

9

Table of Contents

LOSS AND LOSS ADJUSTMENT EXPENSE RESERVES

Our ability to accurately estimate our loss and loss adjustment expense (LAE) reserves affects the viability and financial strength of our operations. Loss and LAE reserves reflect our estimates of ultimate amounts for losses from claims and related settlement expenses that we have not yet paid to settle both reported and unreported claims.

We record two categories of loss and LAE reserves – case-basis reserves and incurred but not reported (IBNR) reserves.

We estimate case-basis reserves as the amount we will have to pay for losses that have already been reported to us but are not yet fully paid. These amounts include related legal expenses and other costs associated with resolving and settling a particular claim.

We establish IBNR reserves at the end of every reporting period to estimate the amount we will have to pay for:

| • | Losses that have occurred, but have not yet been reported to us |

| • | Losses that have been reported to us that may ultimately be paid out differently than expected in our case-basis reserves |

| • | Losses that have been paid and closed, but may reopen and require future payment |

| • | Expenses related to resolving and settling these losses |

We use actuarial methods combined with judgment to estimate IBNR reserves.

Additional information about loss and LAE reserves can be found in the Loss and Loss Adjustment Expense Reserves section of our MD&A.

Our policyholders buy insurance from us to reduce the financial impact of the losses they may suffer. In turn, we purchase reinsurance to limit the financial impact of policyholder losses and our exposure to catastrophic events.

We purchase reinsurance from several providers and are not dependent upon any single reinsurer. When we select reinsurers, we have requirements on minimum financial strength ratings, surplus level and the number of years a company has acted as a reinsurer. Reinsurance does not eliminate our liability to our policyholders, and we remain primarily liable to policyholders for the risks we insure.

We purchase reinsurance primarily to cover:

| • | Property catastrophes |

| • | Workers’ compensation |

| • | Commercial property |

| • | Commercial umbrella |

| • | Surety |

Additional information about reinsurance can be found in the Reinsurance section of our MD&A.

Insurance is a highly regulated industry in the United States. Our insurance subsidiaries do business in and operate under the regulations of all 50 states and the District of Columbia. States regulate the insurance industry primarily to protect the interest of policyholders and to ensure the financial viability of the insurance companies they regulate.

The nature and extent of such regulation and supervision vary from state to state, and regulation of the insurance industry is subject to change. In general, the current regulations under which we operate include:

| • | Licensing of insurers – Our insurance subsidiaries are licensed and supervised by departments of insurance in each of the states where we do business. |

| • | Regulation of agents – We may only sell insurance through properly licensed agents and brokers who have met the eligibility requirements of the applicable state. |

10

Table of Contents

| • | Capital and surplus requirements – The amount of premiums we can write is limited in relation to our total policyholders’ surplus. The limit is dependent on factors such as the type of insurance we write, the reasonableness of our reserves, and the quality of our assets. |

| • | Investment and dividend limitations – As an insurance holding company, we rely on dividends from our insurance subsidiaries to pay shareholder dividends and to pay principal and interest on our debt. State regulations limit the amount of dividends our insurance subsidiaries can pay to us without regulatory approval. |

| • | Authority to discontinue business or exit a market – Most states regulate our ability to discontinue business or exit a market, and limit our ability to cancel or refuse to renew policies. Some states prohibit us from withdrawing from one or more lines of business within the state unless a plan is approved by the state department of insurance. |

| • | Insurance premium rates and policy forms – All states prohibit insurance premiums from being excessive, inadequate or unfairly discriminatory. Most states require that we file price schedules, policy forms and supporting information for review by the insurance department. The filing and approval process can affect our ability to adjust pricing in a timely manner, and states may deny proposed price changes altogether. |

| • | Reasonableness of reserves for losses – States require that we analyze the reasonableness of our reserves annually and report this information to their departments of insurance. |

| • | Transactions with affiliates – We are required to provide notice to the state before entering into certain material transactions with our insurance subsidiaries. Some transactions require state approval as well. |

| • | Changes in control – Any acquisition or “change of control” of an insurer requires prior approval by the domiciled state insurance regulator. |

| • | Guaranty funds and other non-voluntary participations – Some states require that we contribute to state guaranty funds to cover policyholder losses resulting from the impairment or insolvency of other insurers. As a condition of writing policies in certain states, we also are required to participate in assigned risk plans, reinsurance facilities and joint underwriting associations that provide insurance to individuals or entities who otherwise would be unable to purchase such coverage. |

| • | Market conduct and financial examination – State laws govern and state insurance departments periodically examine our financial condition and many aspects of our conduct in the market. They also require that we file financial and other reports on an annual and quarterly basis. |

STATUTORY ACCOUNTING

The accounting standards required by the state regulatory authorities are called statutory accounting principles, or SAP. These principles differ in some respects from U.S. generally accepted accounting principles (GAAP). For example, in reporting loss and LAE reserves on our Consolidated Balance Sheets:

| • | SAP requires us to reduce our loss and LAE reserves for reinsurance recoverables |

| • | GAAP requires us to report our loss and LAE reserves without reduction for our reinsurance recoverables, which are reported separately as an asset |

As a result, our loss and LAE reserves at December 31, 2007, were:

| • | $4,730.0 in our annual financial statements filed with state regulatory authorities, in accordance with SAP, net of reinsurance |

| • | $5,185.0 in our Consolidated GAAP Financial Statements |

More information about our loss and LAE reserves and our reinsurance recoverables can be found in the Notes to our Consolidated Financial Statements.

11

Table of Contents

EXECUTIVE OFFICERS OF THE REGISTRANT

Here are our executive officers as of February 26, 2008. No family relationships exist among our executive officers.

Officer Name | Age | Positions with Safeco and Business Experience | ||

Paula Rosput Reynolds | 51 | President and Chief Executive Officer, Safeco Corporation, since January 2006. Before joining Safeco, Ms. Reynolds was employed at AGL Resources, an Atlanta-based energy services holding company, where she served as Chairman (beginning in 2002) and President and Chief Executive Officer from 2000 to 2005. Previously, Ms. Reynolds served as President of Atlanta Gas Light Company, a subsidiary of AGL. In addition to serving on Safeco’s board of directors, Ms. Reynolds serves as a director for Delta Air Lines and Anadarko Petroleum Corporation. | ||

Ross J. Kari | 49 | Executive Vice President, and Chief Financial Officer, Safeco Corporation, since June 2006. Before joining Safeco, Mr. Kari was the Chief Operating Officer and Chief Financial Officer for Federal Home Loan Bank of San Francisco from 2002 to May 2006. | ||

Arthur Chong | 54 | Executive Vice President and Chief Legal Officer, Safeco Corporation, since November 2005. Prior to joining Safeco, Mr. Chong served as Deputy General Counsel of McKesson Corporation, a healthcare services company, from 1999 to October 2005. | ||

Michael H. Hughes | 53 | Executive Vice President, Insurance Operations, Safeco Corporation, since July 2006 and Senior Vice President, Safeco Business Insurance, Safeco Corporation, since April 2002. Prior to joining Safeco, Mr. Hughes spent more than 20 years in commercial underwriting at The Hartford Financial Services, most recently as Executive Vice President, Affinity Personal Lines from 1996 to 2002. | ||

Robert Ingram | 49 | Executive Vice President and Chief Information Officer, Safeco Corporation since February 11, 2008. Prior to joining Safeco, Mr. Ingram served as Chief Information Officer for Argonaut Group from 2006 to 2008. Mr. Ingram held a number of leadership positions at Andersen Consulting, IBM and USAA, where from 1998 to 2006, he served as senior vice president in Information Technology, supporting USAA’s property and casualty business. | ||

R. Eric Martinez | 39 | Executive Vice President, Claims, Customer Care and Fulfillment, Safeco Corporation, since June 2007. Prior to joining Safeco, Mr. Martinez held a number of leadership positions from 1989 to 2006 at AGL Resources, most recently, Executive Vice President, Utility Operations. | ||

Rauline Gonzales Ochs | 49 | Executive Vice President, Sales & Marketing, Safeco Corporation since January 22, 2008. Prior to joining Safeco, Ms. Ochs was senior vice president for North American Alliances and Channels at Oracle Corporation from 2003 to 2008 and senior vice president of Worldwide Alliances for BEA Systems from 2000 to 2002. | ||

Kris L. Hill | 41 | Vice President and Controller, Safeco Corporation, since November 2006 and Principal Accounting Officer since February 2007. Assistant Vice President and Assistant Controller, Safeco Corporation, from December 2002 to November 2006. Before joining Safeco, Ms. Hill was Vice President of Finance at Northstar Communications Group, Inc., from 1998 to 2002. | ||

12

Table of Contents

CORPORATE INFORMATION

Safeco Corporation was formed as a Washington corporation in 1923.

We make our periodic and current financial reports and related amendments available on our Web site at www.safeco.com/ir at the same time as they are electronically filed with the Securities and Exchange Commission (SEC). They are also available at the SEC’s website,www.sec.gov. The information found on our Web site is not part of this or any other report we file with or furnish to the SEC.

We submitted the certification of our Chief Executive Officer required by Section 303A.12(a) of the New York Exchange (NYSE) List Company Manual, relating to our compliance with the NYSE’s corporate governance listing standards, to the NYSE with no qualifications. The Company has filed the Chief Executive Officer and Chief Financial Officer certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 required to be filed with the SEC.

13

Table of Contents

| Item 1A: | RISK FACTORS |

Our business involves various risks and uncertainties. Additional risks and uncertainties that are presently unknown to us or that we currently believe to be immaterial may also adversely affect our business. If any such risks or uncertainties, or any of the following risks or uncertainties, develop into actual events, this could have a materially adverse effect on our business, financial condition or results of operations. In that case, the market price of our common stock could decline materially.

This information should be considered carefully together with the other information contained in this report and in the other reports and materials filed by us with the SEC, as well as news releases and other information publicly disseminated by us from time to time.

The following list describes the most significant risks facing our company:

| • | Our ability to respond to the competitive initiatives of other property and casualty insurers could affect our growth and pressure our pricing –We compete within the property and casualty insurance industry not only for personal and commercial insurance customers, but also for employees and agents and brokers, particularly within our personal auto and small-business segments. We compete most notably on types of product, price, quality and depth of coverage, customer service, claims handling, and in the case of agents and brokers, compensation. With respect to employees, we not only compete with other carriers for a specialized and well educated workforce but we also compete with other large employers in our region. |

Competition for customers and agents has led to increased marketing and advertising by our competitors, varied agent compensation structures, as well as the introduction of new insurance products and aggressive pricing. If we cannot effectively respond to increased competition for the business of our current and prospective customers, we may not be able to grow our business or we may lose market share.

| • | Our underwriting results are dependent on our ability to match rate to risk. If our pricing models fail to price risks accurately, our profitability may be adversely affected –The profitability of our business substantially depends on the extent to which our actual claims experience is consistent with the assumptions we use in pricing our policies. We use automated underwriting tools for the preponderance of our products, as well as tiered pricing structures to match our premium rates to the risks we insure. As we expand our appetite into different markets and products, we will write more policies in markets and geographical areas where we have less data specific to these new markets, and accordingly may be more susceptible to error in our models or claims adjustment. If we fail to appropriately price the risks we insure, change our pricing model to reflect our current experience, or our claims experience is more frequent or severe than our underlying risk assumptions, our profit margins may be negatively affected. To the extent we have overpriced risks, new-business growth and retention of our existing business may be adversely affected. |

| • | If we are unable to maintain the availability of our information technology systems and safeguard the security of our data, our ability to conduct our business may be compromised or our reputation may be harmed– We use computer systems, including our automated underwriting platform, to store, retrieve, evaluate and utilize customer and company data and information. Our information technology and telecommunications systems, in turn, interface with and rely upon third-party systems. Our business is highly dependent on our ability, and the ability of our employees, agents and brokers, to access these systems to perform necessary business functions, such as providing new-business quotes, processing new and renewal business, making changes to existing policies, filing and paying claims, and providing customer support. Systems failures or outages and an inability to recover from these failures and outages could compromise our ability to perform these functions on a timely basis, which could hurt our business and our relationships with our agents and policyholders. In addition, systems failures (either our own or those of third parties) could jeopardize the confidentiality of our policyholders’ personal data, which could harm our reputation and expose us to possible liability. We rely on encryption and authentication technology licensed from third parties to provide security and authentication capabilities. But there can be no guarantee that advances in computer capabilities, new computer viruses, programming or human errors, or other events or developments would not result in a breach of our security measures, misappropriation of our proprietary information or an interruption of our business operations. |

| • | Our financial results may be adversely affected by the cyclical nature of the property and casualty business in which we participate– The property and casualty insurance market is traditionally cyclical, experiencing periods characterized by relatively high levels of price competition, less restrictive underwriting standards and relatively low premium rates, followed by periods of relatively low levels of competition, more selective underwriting standards and relatively high premium rates. We are currently operating in a period characterized by significant price competition. While both types of periods pose challenges to us, if we were to relax our underwriting standards or pricing in response to the competitive market, the associated claims activity could adversely affect our financial condition and results of operations. |

14

Table of Contents

| • | Increased claims activity resulting from catastrophic events, whether natural or man-made, may result in significant losses –We experience increased claims activity when catastrophic events affect areas where our policyholders live or do business. Catastrophes can be caused by natural events, such as hurricanes, tornadoes, wildfires, earthquakes, snow, hail and windstorms, or other factors, such as terrorism, riots, hazardous material releases or utility outages. The extent of our losses in connection with catastrophic events is a function of the severity of the event and the total amount of policyholder exposure in the affected area. Where we have geographic concentrations of policyholders, a single catastrophe (such as an earthquake) or destructive weather trend affecting a region may have a significant impact on our financial condition and results of operations. We cannot accurately predict catastrophes, or the number and type of catastrophic events that will affect us. As a result, our operating and financial results may vary significantly from one period to the next. It is possible that changing climate conditions have added to the unpredictability and frequency of natural disasters and created additional uncertainty as to future trends and exposures. In particular, the increased severity and frequency of storms experienced in 2005 although not necessarily evident over the past two years, may continue in the foreseeable future. While we anticipate and plan for catastrophe losses, there can be no assurance that our financial results will not be adversely affected by our exposure to losses arising from catastrophic events in the future that exceed our previous experience and assumptions. |

| • | We may not be able to manage expenses effectively, which could adversely affect our profitability and our ability to compete in the property and casualty insurance markets– Ongoing expense management is important to maintaining and increasing our growth and profitability. If we are unable to execute effectively on our process improvement and outsourcing efforts to realize expense efficiencies, it could affect our ability to maintain competitive pricing and could have a negative effect on our new-business growth and retention of existing business. |

| • | We may not be able to attract and retain distributors for our products or our distributors may be unable to sell our policies, which may adversely affect our market share and our business –We rely principally on independent agents and brokers to sell our insurance policies. The number of traditional independent agency distributors has decreased due to consolidation from mergers and acquisitions, and independent distributors have increasing leverage with insurers seeking their business. Many insurers offer products similar to ours. In choosing an insurance carrier, an agent may consider ease-of-doing business, reputation, price of product, customer service, claims handling and the insurer’s compensation structure. We may be unable to compete with insurers that adopt more aggressive pricing policies or more generous compensation structures; insurers that offer a broader array of products; and insurers that have extensive promotional and advertising campaigns. |

Because we depend principally on our independent agents and brokers to make the ultimate sale to our policyholders, we also face competition from insurers that employ other distribution methods through captive agents or direct sales, including the Internet. While we are expanding our means of distribution, we must continue to maintain an independent distribution network. If we are unable to maintain a strong network of independent agents and brokers, or our agents and brokers are unable to compete effectively with other distribution models, it will adversely affect our ability to write new business and retain existing policyholders, which may have a negative impact on our results of operations and prospects.

| • | Claims payments could exceed our reserves and adversely affect the viability and financial strength of our operations– The profitability and viability of our business depend on our ability to estimate our loss and loss adjustment expense (LAE) reserves accurately. For each of our product lines, we maintain loss and LAE reserves, reflecting our best estimates of losses insured by us and related settlement expenses we may be required to pay in connection with both reported and unreported claims. |

We establish reserves at levels we expect to be sufficient to meet our insurance policy obligations. The ultimate cost of losses and the impact of unforeseen events may vary materially from recorded reserves, and variances may adversely affect our operating results and financial condition.

| • | Inflationary pressures on medical care costs, auto parts and repair, construction costs and other economic factors may increase the amount we pay for claims and negatively affect our underwriting results –Inflationary pressures may require us to increase our reserves. If we are unable to adjust pricing for our products to account for cost increases or find other offsetting supply chain and business efficiencies, these inflationary trends may negatively affect our underwriting profit and financial results. Rising medical costs require us to make higher payouts in connection with bodily injury claims under our policies. Likewise, increases in costs for auto parts and repair services, construction costs and other commodities result in higher loss costs for property damage claims. |

| • | Other adverse economic factors including recession, inflation, periods of high unemployment or lower economic activity could result in fewer policies sold and/or an increase in premium defaults which, in turn, could affect our policy growth and retention – Negative economic factors may also affect our ability to receive the appropriate rate for the risk we insure with our policyholders and may impact our policy flow. In an economic downturn, the degree to which prospective policyholders apply for insurance and fail to pay all balances owed may increase. Existing policyholders may exaggerate or even falsify claims to obtain higher claims payments. These outcomes would reduce our underwriting profit to the extent these effects are not reflected in our rates. |

15

Table of Contents

| • | Emerging claim and coverage issues could negatively impact our business –As industry practices and legal, judicial, social and other conditions outside of our control change, unexpected and unintended issues related to claims and coverage may emerge. These issues may adversely affect our business by extending coverage beyond our underwriting intent or increasing the type, number or size of claims. Such emerging claims and coverage issues include: (i) increases in the number and size of claims relating to construction defects that can present complex coverage and damage valuation questions; (ii) evolving theories of liability and judicial decisions expanding the interpretation of our policy provisions and thereby increasing the amount of damages for which we are liable; and (iii) a growing trend of plaintiffs targeting property and casualty insurers in purported class action litigation relating to claim handling, consumer notification and other practices. The effects of these and other related, unforeseen emerging issues are extremely hard to predict and could harm our business and adversely affect our operating results and financial condition. |

| • | Our investment portfolio includes fixed-maturities and marketable equity securities, and fluctuations in the fixed-maturities or equity markets could adversely affect the valuation of our investment portfolio, our net investment income and our overall profitability –Our investment portfolio is subject to market risks, primarily risks associated with changes in interest rates, as well as deterioration in the credit of companies and public entities in which we have invested. When interest rates rise, the value of our investment portfolio may decline due to decreases in the fair value of our fixed-maturities securities that comprise a substantial majority of our investment portfolio. In a declining interest-rate environment, prepayments and redemptions affecting our securities may increase as issuers seek to refinance at lower rates. Such a decline in market rates could reduce our investment income as new funds are invested at lower yields. Our general intent with respect to all of our fixed-maturities investments is to hold them to maturity, including investments that have declined in value. This intent can change, however, due to financial market fluctuations, changes in our investment strategy or changes in our evaluation of the issuer’s financial condition and prospects. Investment returns are an important part of our overall profitability, and fluctuations in the fixed-maturities or equity markets could negatively affect the timing and amount of our net investment income and cause our financial condition to fluctuate. Volatile conditions in certain credit markets such as the well-publicized mortgage-backed securities market situation result in less liquidity, widening of credit spreads, and lack of price transparency. A decline in the quality of our investment portfolio due to adverse market conditions, the effectiveness of our investment strategy and oversight of our outsourcing relationships could cause additional realized losses on our securities. |

| • | The insurance industry is subject to extensive regulation, and changes within this regulatory environment could adversely affect our operating costs and limit the growth of our business –We conduct our business in a highly regulated environment. State insurance regulators are charged with protecting policyholders, not shareholders, and have broad supervisory powers over our business practices. For example, state departments of insurance regulate and approve underwriting practices and rate changes, which can delay the implementation of premium rate changes or prevent us from making changes we believe are necessary to match rate to risk. |

Because the laws and regulations under which we operate are administered and enforced by a diverse group of governmental authorities, there is always the risk that compliance with one regulator’s interpretation of a matter may conflict with another authority’s interpretation of the same issue. In addition, there is a risk that a regulator’s interpretation of an issue will change over time to our detriment. While the U.S. federal government does not directly regulate the insurance industry, federal legislation and administrative policies can affect us, and Congress and various federal agencies periodically discuss proposals that would provide for a federal charter for insurance companies. We cannot predict whether any such laws will be enacted or what effect they would have on our business. For an overview of regulations affecting Safeco, see the Regulation section of Item 1: Our Business.

Changes in the overall legal and regulatory environment also may expand our liability in connection with existing policies or require us to reassess the actions we need to take to comply with evolving perceptions of law. We believe we are in substantial compliance with applicable laws, rules and regulations; however, they are subject to regular modification and change. There can be no assurance that changes will not be made to current laws, rules and regulations, or that any other laws, rules or regulations will not be adopted in the future that could adversely affect our business and financial condition.

16

Table of Contents

| • | Our exposure to individual risks and catastrophic losses may increase if we are unable to purchase sufficient reinsurance at acceptable rates or our reinsurers are unable to pay –We purchase reinsurance to reduce our exposure to catastrophe losses and limit our financial losses on large individual risks. This allows us to stabilize our loss experience and increases our capacity to write policies. The availability and cost of reinsurance are determined by market conditions outside our control. No assurance can be made that we will be able to obtain and maintain reinsurance at the same levels and on the same terms as we do today. |

If we are not able to obtain or maintain reinsurance in amounts we consider appropriate for our business, or if the cost of obtaining such reinsurance increases materially, we may choose to retain a larger portion of the potential loss associated with our policies. If we are unable to collect reinsurance proceeds because a reinsurer is unable or unwilling to pay, we may incur greater losses. If we are unable to mitigate our exposure to large losses through reinsurance for any reason, our financial condition could be adversely affected in the event of a significant catastrophe.

| • | Judicial decisions affecting the interpretation of insurance policy provisions and coverage, together with changing theories of liability, may cause us to incur increased losses and damages –We are involved in numerous threatened or filed legal actions in the ordinary course of our operations. As a liability insurer, our involvement in legal actions typically relates to our defense of third-party claims brought against our policyholders, or our principals in the case of surety bonds. We also are commonly a defendant in policy coverage claims brought against us. For a description of our current legal proceedings, see Item 3: Legal Proceedings. |

While we do not expect any of these actions to have a material adverse impact on our financial condition or operating results, evolving theories of liability and judicial decisions expanding the interpretation of our policy provisions could increase the amount of damages for which we are liable, and increase our costs associated with defending and settling such lawsuits. Such a scenario could require us to set higher reserves for claims.

| • | Our business operations depend on our ability to appropriately execute and administer our policies and claims –Our primary business is writing and servicing property and casualty insurance policies for individuals, families and small- to mid-sized commercial businesses. Because we deal with large numbers of similar policies, any problems or discrepancies that arise in our pricing, underwriting, billing, processing, claims handling or other practices, whether as a result of employee or outsourced vendor error or technological problems, could have negative repercussions on our financial results and our reputation if such problems or discrepancies are replicated through multiple policies or claims. |

| • | Our access to capital markets, our financing arrangements and our business operations are dependent on favorable evaluations and ratings by credit and other rating agencies – Our credit strength and financial strength of our insurance subsidiaries are evaluated and rated by various rating agencies, such as Standard and Poor’s, Moody’s Investor Services, Fitch Ratings, and A.M. Best. Downgrades in our credit ratings could adversely affect both our ability to sell new business in our surety line and our ability to access the capital markets which may increase our borrowing costs in the future. Downgrades in the ratings of our insurance subsidiaries could have a negative impact on perceptions of our company by investors, producers, other businesses and consumers which may result in lower or negative premium growth. Such downgrades could have a material adverse impact on our financial performance and results of operations. |

| • | If we experience difficulties with outsourcing relationships our ability to conduct our business might be negatively impacted –We outsource certain functions to third parties and plan to do so increasingly in the future. If we do not effectively develop and implement our outsourcing strategy and as a result we experience technological or other problems with an outsourcing transition, we may not realize productivity improvements or cost efficiencies. In addition, we may experience operational difficulties, increased costs and a loss of business if third party providers do not perform as anticipated. Our ability to receive services from third party providers outside of the United States on an on-going basis could be impacted by cultural differences, political instability and unanticipated regulatory requirements or policies inside or outside of the United States. As a result, our ability to conduct our business might be adversely affected. |

17

Table of Contents

| Item 1B: | UNRESOLVED STAFF COMMENTS |

We have no written comments from the SEC staff regarding our periodic or current reports that are unresolved as of the date of this filing.

| Item 2: | PROPERTIES |

We lease our current headquarters of 305,000 square feet in Seattle, Washington. We own data centers of 97,000 square feet in Washington and Colorado and lease an additional 1.8 million square feet of space throughout the United States.

| Item 3: | LEGAL PROCEEDINGS |

In common with the insurance and financial service industries in general, we are subject to legal actions filed or threatened, including claims for punitive damages, in the ordinary course of our operations. Generally, our involvement in legal actions involves defending third-party claims brought against our insureds (in our role as liability insurer) or principals of surety bonds and defending policy coverage claims brought against us.

Litigation arising from claims settlement activities is generally considered in the establishment of our reserve for Loss and LAE. However, in certain circumstances, we may deem it necessary to provide disclosure due to the size or nature of the potential liability to us.

Based on information currently known to us, we believe that the ultimate outcome of any pending matters is not likely to have a material adverse effect on our financial position or results of operations.

| Item 4: | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

There were no matters submitted to a vote of security holders, through the solicitation of proxies or otherwise, during the fourth quarter of 2007.

18

Table of Contents

Part II

| Item 5: | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

MARKET INFORMATION

Our common stock is quoted and traded on the New York Stock Exchange (NYSE) under the symbol SAF. Our common shares were quoted and traded on the Nasdaq Stock Market under the symbol SAFC until November 30, 2006 when Safeco commenced trading on the NYSE. The quarterly high and low prices for Safeco common shares for the last two years were:

MARKET PRICE RANGES | FIRST QUARTER | SECOND QUARTER | THIRD QUARTER | FOURTH QUARTER | ANNUAL | ||||||||||

2007 –High | $ | 69.15 | $ | 67.32 | $ | 64.26 | $ | 62.40 | $ | 69.15 | |||||

–Low | 57.43 | 60.68 | 54.46 | 53.18 | 53.18 | ||||||||||

2006 –High | 58.86 | 57.44 | 59.15 | 64.85 | 64.85 | ||||||||||

–Low | $ | 50.14 | $ | 49.09 | $ | 51.75 | $ | 57.88 | $ | 49.09 | |||||

There were approximately 2,400 holders of record of our common stock at February 15, 2008. This number excludes the beneficial owners of shares (approximately 50,000) held by brokers and other institutions on behalf of shareholders.

DIVIDENDS

We have paid cash dividends each year since 1933.

We fund dividends paid to shareholders with dividends paid to us by our operating subsidiaries. Our dividends declared for the last two years were:

DIVIDENDS DECLARED | FIRST QUARTER | SECOND QUARTER | THIRD QUARTER | FOURTH QUARTER | ANNUAL | ||||||||||

2007 | $ | 0.30 | $ | 0.40 | $ | 0.40 | $ | 0.40 | $ | 1.50 | |||||

2006 | $ | 0.25 | $ | 0.30 | $ | 0.30 | $ | 0.30 | $ | 1.15 | |||||

We expect to continue paying dividends in the foreseeable future. However, payment of future dividends depends on the discretion of our board of directors and compliance with regulatory constraints discussed in our business section and the Notes to our Financial Statements.

ISSUER PURCHASES OF EQUITY SECURITIES

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (1) | Approximate Dollar Value of Shares that may yet be Purchased under the Plans or Programs | ||||||

October 1-31 | 2,664,513 | $ | 59.39 | 2,664,513 | $ | 218.6 | ||||

November 1-30 | 3,190,856 | 56.06 | 3,190,856 | 39.7 | ||||||

December 1-31 | 685,429 | 57.91 | 685,429 | $ | 500.0 | |||||

Total | 6,540,798 | $ | 57.61 | 6,540,798 | ||||||

| (1) | In May 2007, we implemented a Rule 10b5-1 trading plan to repurchase up to $250.0 of our outstanding common stock. We completed this plan on July 24, 2007. In August 2007, we received approval from the Board to purchase up to $750.0 of our outstanding common stock. We completed this plan on December 6, 2007. In December 2007, we received approval from our Board to repurchase up to $500.0 of our outstanding common stock. No repurchases have been made under this plan as of December 31, 2007. |

19

Table of Contents

MARKET PRICE OF OUR DIVIDENDS ON COMMON EQUITY AND RELATED SHAREHOLDER MATTERS

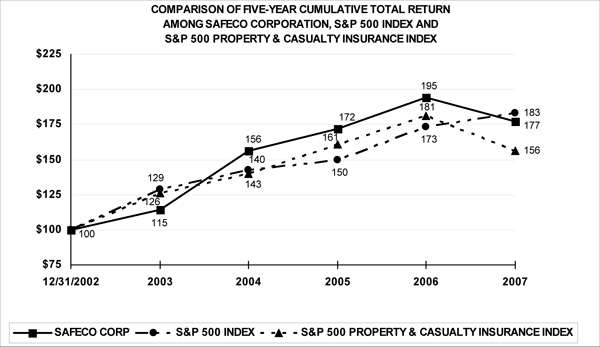

Our performance graph below provides a graphical comparison of our stock performance to comparable industry indices over five years.

20

Table of Contents

| Item 6: | SELECTED FINANCIAL DATA |

This selected consolidated financial data comes from our Consolidated Financial Statements. It should be read in conjunction with the Consolidated Financial Statements and accompanying notes:

YEAR ENDED DECEMBER 31, | 2007 | 2006 | 2005 | 2004 | 2003 | |||||||||||||||

(In millions except per share values and ratios) | ||||||||||||||||||||

REVENUES | ||||||||||||||||||||

Net Earned Premiums | $ | 5,576.0 | $ | 5,608.3 | $ | 5,805.4 | $ | 5,529.1 | $ | 4,901.8 | ||||||||||

Net Investment Income | 486.7 | 509.1 | 485.1 | 464.6 | 468.4 | |||||||||||||||

Net Realized Investment Gains | 146.1 | 3.8 | 60.4 | 200.8 | 70.1 | |||||||||||||||

Gains on Sales of Real Estate | — | 168.7 | — | — | — | |||||||||||||||

Total Revenues | 6,208.8 | 6,289.9 | 6,350.9 | 6,194.5 | 5,440.3 | |||||||||||||||

INCOME SUMMARY | ||||||||||||||||||||

Income from Continuing Operations | 707.8 | 880.0 | 691.1 | 620.2 | 285.5 | |||||||||||||||

Net Income (1) | $ | 707.8 | $ | 880.0 | $ | 691.1 | $ | 562.4 | $ | 339.2 | ||||||||||

INCOME PER DILUTED SHARE OF COMMON STOCK | ||||||||||||||||||||

Income from Continuing Operations | $ | 6.97 | $ | 7.51 | $ | 5.43 | $ | 4.59 | $ | 2.06 | ||||||||||

Net Income (1) | 6.97 | 7.51 | 5.43 | 4.16 | 2.44 | |||||||||||||||

Dividends Declared | $ | 1.50 | $ | 1.15 | $ | 0.97 | $ | 0.81 | $ | 0.74 | ||||||||||

Average Number of Diluted Shares (2, 3, 4,5) | 101.6 | 117.1 | 127.2 | 135.2 | 138.9 | |||||||||||||||

UNDERWRITING RATIOS | ||||||||||||||||||||

Loss Ratio | 53.5 | % | 47.2 | % | 50.1 | % | 51.0 | % | 55.6 | % | ||||||||||

LAE Ratio | 9.6 | 11.3 | 12.6 | 12.3 | 14.8 | |||||||||||||||

Expense Ratio | 28.3 | 28.8 | 28.4 | 28.2 | 29.7 | |||||||||||||||

Combined Ratio (6) | 91.4 | % | 87.3 | % | 91.1 | % | 91.5 | % | 100.1 | % | ||||||||||

AT DECEMBER 31, | 2007 | 2006 | 2005 | 2004 | 2003 | |||||||||||||||

TOTAL ASSETS | $ | 12,640.4 | $ | 14,213.0 | $ | 14,887.0 | $ | 14,587.2 | $ | 36,141.6 | ||||||||||

DEBT | ||||||||||||||||||||

Current | $ | 200.0 | $ | 197.3 | $ | — | $ | — | $ | — | ||||||||||

Long-Term | 504.0 | 1,052.7 | 1,307.0 | 1,332.9 | 1,951.3 | |||||||||||||||

Total | $ | 704.0 | $ | 1,250.0 | $ | 1,307.0 | $ | 1,332.9 | $ | 1,951.3 | ||||||||||

SHAREHOLDERS’ EQUITY | $ | 3,392.6 | $ | 3,927.9 | $ | 4,124.6 | $ | 3,920.9 | $ | 5,023.3 | ||||||||||

BOOK VALUE PER SHARE | $ | 37.81 | $ | 37.29 | $ | 33.38 | $ | 30.88 | $ | 36.24 | ||||||||||

| (1) | Discontinued Operations reflect our Life & Investments (L&I) businesses that were sold in 2004. |

| (2) | Our 2004 average diluted shares reflect the repurchase of 13.2 million shares pursuant to an accelerated share repurchase program. |

| (3) | Our 2005 average diluted shares reflect the repurchase of 2.8 million shares pursuant to an accelerated share repurchase program and 1.7 million shares pursuant to a Rule 10b5-1 trading plan. |

| (4) | Our 2006 average diluted shares reflect the repurchase of 10.2 million shares pursuant to an accelerated share repurchase program and 10.0 million shares pursuant to Rule 10b5-1 trading plans. |

| (5) | Our 2007 average diluted shares reflect the repurchase of 13.6 million shares pursuant to a Rule 10b5-1 trading plan and 3.4 million shares as a result of open market purchases. 2007 also includes (0.9) million shares issued to settle an accelerated share repurchase settlement. |

| (6) | Combined ratios are calculated on a GAAP basis. Expressed as a percentage, combined ratios equal losses and expenses divided by net earned premiums. |

21

Table of Contents

| Item 7: | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

(Dollar amounts in millions except for ratios, per-claim data and per-share data, unless noted otherwise)

This discussion should be read with the Consolidated Financial Statements and Notes to the Consolidated Financial Statements included elsewhere in this report. Certain reclassifications have been made to prior-year financial information for consistency with the current-year presentation.

Forward-Looking Information

Forward-looking information contained in this report is subject to risk and uncertainty.

We have made statements under the captions “Our Business,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in this Form 10-K that are forward-looking statements. We have tried, whenever possible, to identify such statements by using words such as “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other words and terms of similar meaning in connection with any discussion of future operating or financial performance or business plans and prospects.

We believe it is important to communicate our expectations to investors. However, there may be events in the future that we are not able to predict accurately or that we do not fully control, which could cause actual results to differ materially from those expressed or implied by our forward-looking statements, including changes in general economic and business conditions, changes in the insurance industry and changes in our business strategies. Investors should bear this in mind as they consider forward-looking statements. Additional information on factors that may impact our forward-looking statements are included under “Risk Factors” and elsewhere in this Form 10-K.

Overview

We have been in business serving the insurance needs of our customers since 1923. Safeco Corporation is an insurance holding company. We are licensed to provide property and casualty insurance along with related services to individuals and small to mid-size businesses in all 50 states through our insurance subsidiaries. We also sell surety bonds to contractors and businesses. Our revenues come primarily from the premiums we earn on the insurance policies we write and the income we earn from our investment of premium dollars.

We sell our insurance products principally through independent agents and deliver the majority of our products over our Safeco Now® automated platform. Safeco Now gives our agents a single point of entry to sell our core property and casualty products and select transactional surety bonds in a matter of minutes. Most of our pricing, underwriting and servicing processes are presented through this platform. Consumers can also purchase certain policies online at www.Safeco.com. Today, over 95% of our personal lines and small commercial business lines are automated and priced based on predictive models.

We manage our business through four segments, Safeco Personal Insurance, Safeco Business Insurance, Surety and P&C Other.

In 2007, we focused on achieving a balance between growth and profitability. We:

| • | Improved our pricing models in our Homeowners and Auto lines using Safeco True Pricing |

| • | Introduced new products including Safeco Optimum Package and Teensurance |

| • | Generated Return on Equity (ROE) of 18.5% that is competitive relative to our peers |

| • | Achieved overall underwriting profitability for the year of $479.8, with a total combined ratio of 91.4% |

| • | Exercised careful stewardship of our invested assets, generating net investment income of $486.7, with no subprime exposure; and |

| • | Managed our capital actively for the benefit of our shareholders, as we increased our dividend rate by 33%, repurchased $1.0 billion of our common stock and repaid of $545.9 of our higher cost debt |

22

Table of Contents

Our long-term focus remains to pursue growth only where we see opportunities to maintain overall underwriting profitability. Net written premiums overall remained essentially flat in 2007 compared with the prior year as growth in Property, SBI Regular and Surety were offset by a decline in Auto. This reflects a combination of softness in rates and our unwillingness to write risks at prices we believe to be uneconomic. We expect the rate environment for each of our business segments in 2008 to be similar to that of 2007, with some opportunity for selective rate increases. As a result, we do not expect overall significant net written premium growth in 2008 compared with 2007.

Our Auto combined ratio increased to 98.8% in 2007 and exceeded 100% for the 4th quarter, as loss costs, principally related to bodily injury, increased faster than our ability to increase rates. We plan to maintain our underwriting discipline and not compete for business that we do not believe will meet our long-term target margins. In 2008, we will focus on lowering our combined ratio to our target of 96.0% in Auto, rather than pursuing growth opportunities. Our ability to achieve this will depend in part on the effectiveness of current efforts to reduce loss costs through improved training and logistics management and our ability to obtain rate increases necessary to properly match rate to risk. As our loss costs have risen, we have taken steps to offset with rate increases. In 2007, we increased our Auto premium rates an average of 4%, most of which will be earned into premium in 2008. Rates are subject to regulatory approval on a state-by state basis and increases may take time to implement.

The strong growth in premiums in our Property segment was due in part to rate changes throughout 2006 and 2007, increased commissions and improved cross-selling with our Auto product. We have filed additional rate changes in Property across the country. While we are expecting increased rate competition in non-coastal states, our new business trends in Property remain favorable. Our ability to maintain strong underwriting results in our property line will be dependent on the effectiveness of our multi-variate tiered pricing model and continued catastrophe management. As part of our ongoing catastrophe expense management efforts, we are evaluating whether to join the CEA. If we decide to join the CEA and our application for membership is approved, we estimate that our cost of entry to the CEA will be an up-front payment in the range of $40 to $50 million. This amount would be recognized as an expense in our personal property line in the period when we begin issuing policies under the CEA. We would also be subject to additional assessments in the event that the initial capitalization and retained earnings of the CEA are exhausted by claim payments.

The premium growth in our SBI Regular segment was due in part to automating several products on the Safeco Now platform as well as the mix of the coverages our customers chose and the nature of the risk. We do not intend to write business when pricing or risk factors indicate we will be putting our target returns at risk, which could limit our growth opportunities.

In our commercial surety business, we continued to focus on Fortune 1000 and other large companies with high credit quality to drive that business at a solid pace and we increased capacity on our highest rated accounts. We have grown our Surety business in 2007 by focusing on our highest credit quality accounts and new account growth. We achieved record underwriting profits in our Surety segment in 2007. We do not expect to be able to maintain that level of profitability in 2008 as we do not expect historically low loss levels to recur.

In 2008, we must realize benefits from our business process improvement effort that is examining all aspects of our operations for potential cost savings. The goal is to achieve greater efficiency by streamlining or eliminating processes, outsourcing processes where appropriate, and building our infrastructure and technological capability. We met our targeted annualized expense savings in 2007 offset in part by increased spending associated with strategic technology and claims initiatives and increased advertising. In 2008, we expect to achieve $25 to $50 million in expense savings. Some of these savings will benefit the bottom line directly, and we may choose to reinvest a portion in various strategic initiatives. We expect the savings will be derived from a number of projects, including for example, further outsourcing of administrative functions to lower-cost markets and continued review of in-house operations to create efficiencies using Lean Six Sigma methodologies.

We are committed to further reducing our expenses, which will allow us flexibility to enhance our competitive position while still achieving our target margins. We plan to continue to retain customers and maintain opportunities to quote new business through enhancements to our Safeco Now Sales-and-Service platform, our focus on agency relationships, customer retention efforts and distinctive customer service.

Overall Results

We measure our success by tracking our operating and financial performance according to the following indicators:

| • | Combined ratio |

| • | Earnings per share |

23

Table of Contents

| • | Return on equity |