Exhibit 99.2

MANAGEMENT DISCUSSION AND ANALYSIS

For the THREE-MONTH PERIOD ENDED JANUARY 31, 2010

(Unaudited)

World Ventures Inc.

102 Piper Crescent

Nanaimo, British Columbia

Canada

V9T 3G3

| |

| Tel: | (250)756-0291 |

| Fax: | (250)756-0298 |

| E-Mail: | ir@worldventuresinc.com |

| Web: | www.worldventuresinc.com |

TO OUR SHAREHOLDERS

Gold is soaring in its price resurgence and continues to be the metal focus for many companies and investors. Exploration for both the precious metals, gold and silver continues at an increasing rate. The Company has had many investors expressing interest in both Lapon Canyon and Triton Properties.

The Company is evaluating and conducting preliminary planning for the Triton Property, located Southeast of Timmins, Ontario in the Shiningtree Belt. The Company continues entertaining Joint Venture business proposals to develop the Triton Property. Subject to the availability of financing the Company plans to initiate the clean- out of access portals order to conduct additional sampling on Lapon Canyon Property.

The Company continues to evaluate opportunities for acquiring attractive precious metals as time and funds permit. We look forward to the continuing search for gold.

Stewart A Jackson

President, Chief Executive Officer

World Ventures Inc.

| |

| 2010 First Quarter Report | Page2 |

| |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

| FOR THE THREE MONTH PERIOD ENDED JANUARY 31, 2010 |

INDEX

| | |

| | | Page |

| | |

| 1.1 | Date | 7 |

| | |

| 1.2 | Overall Performance | 7-25 |

| | |

| 1.3 | Selected Annual Information | 26 |

| | |

| 1.4 | Results of Operations | 26-28 |

| | |

| 1.5 | Summary of Quarterly Results | 28-29 |

| | |

| 1.6/1.7 | Liquidity and Capital Resources | 29-31 |

| | |

| 1.8 | Off –Balance Sheet Transactions | 31 |

| | |

| 1.9 | Transactions with Related Party | 31-32 |

| | |

| 1.10 | Fourth Quarter | 32 |

| | |

| 1.11 | Proposed Transactions | 32-33 |

| | |

| 1.12 | Critical Accounting Estimates | 33 |

| | |

| 1.13 | Changes in Accounting Policies | 33-35 |

| | |

| 1.14 | Financial Instruments | 35 |

| | |

| 1.15 | Other MD&A Requirement | 35-39 |

| | |

| 1.16 | Subsequent Events | 39 |

| | |

| 1.17 | Other Information | 40 |

| |

| 2010 First Quarter Report | Page3 |

| |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

| FOR THE THREE MONTH PERIOD ENDED JANUARY 31, 2010 |

GLOSSARY & ABBREVIATIONS

Certain terms and their usage used throughout this Form 6K are defined below.

| |

| Adit Level | The horizontal mine entry opening to allow mining activity to go underground, generally going into the side of a hill or mountain. |

| Assay or Fire Assay | A high-temperature process involving the melting of a rock to determine its precious and base metal content. |

| Assessment Work | Annual work requirement necessary to hold a mineral claim for the ensuing year. |

| Basement | The part of the Earth's crust that occurs beneath a cover of sedimentary rocks. |

| Company | World Ventures Inc, its predecessors and subsidiaries. |

| Consultants | Persons retained to advise other persons or companies in the field of their expertise. Consultants act independently and are not employees. |

| Diamond Kimberlite Pipes | Diamond bearing kimberlite pipes. |

| Downdip | Down the plane of a surface of structure at an angle perpendicular to strike. |

| Drill Testing | Sampling of a unit, zone, or bed by taking samples from subsurface by means of a drill. |

| Electromagnetic Survey | A method of measuring conductivity and resistivity variations of the |

| (E-M Survey) | Earth’s surface by passing electricity through the ground measuring changes of electric fields produced. |

| Exploration Program | Work conducted directed toward discovery of a mineral commodity including geological, geochemical and geophysical mapping surface sampling, drill sampling and determination of mineral content. |

| Extraction | A chemical or physical process by which a metal or mineral is separated and removed from a host rock. |

| Fault | A discrete surface separating two rock masses which have moved past one another. |

| Geological Mapping | Recording on paper of the real expression of rock types and their altitudes. |

| Geophysical Anomalies | Variations in physical parameters of the Earth that display differences from background or “normal” levels. |

| Geophysical Exploration | Exploration for mineral deposits utilizing instruments that measure variations in the Earths physical properties. |

| Gold-Bearing Structures | Features within rock units or layers that carry gold and are frequently planar or linear controlled by faults, shears or contacts. |

| Grade | The relative quantity of ore-mineral content in a mineralized body, e.g. grams of gold per t of rock or percent of copper. |

| Ground Magnetometer | An instrument used at ground or close to ground level to measure the intensity of the Earths’ magnetic field and variations of the field in time and space. |

| Kimberlite Pipes | “Carrot – shaped” pipes created when kimberlitic (iron-magnesium-rich) rocks are injected up through the Earths’ crust, occasionally contain economic concentrations of diamonds. |

| Magnetic Survey | A measure of the variations in the Earths magnetic field over a specific area. |

| Mineral Claims | Lands held by claiming or staking for mineral discovery and exploration under claiming regulations of the government unit (country, state, province), which holds the lands. |

| Mineral Lease –Saskatchewan | A metallic and industrial mineral lease issued by the Province of Saskatchewan or property owners’ that conveys the right to develop and produce metallic and industrial minerals. |

| Mineral | A naturally occurring homogeneous substance having fixed physical properties and chemical composition and a defined crystal form. |

| Mineral Reserve | That part of a mineral deposit, that could be economically and legally extracted or produced at the time of the reserve determination. |

| |

| 2010 First Quarter Report | Page4 |

| |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

| FOR THE THREE MONTH PERIOD ENDED JANUARY 31, 2010 |

GLOSSARY & ABBREVIATIONS(continued)

| |

| Mineralization | Generically refers to (i) the process of formation of minerals in a specific area or geological formation, or (ii) an occurrence of potentially valuable minerals. The term has no economic implications. |

| Mineralized Material | A mineralized body that may have been delineated by appropriately spaced drilling and/or underground sampling to support a tonnage and average grade of materials. Such a deposit does not qualify as a reserve until a comprehensive evaluation based upon unit cost, grade, recoveries and other material factors concludes legal and economic

feasibility. |

| Net Smelter Returns | The cash returns from shipments of ores sold to a smelter, which is the sales price of materials obtained minus certain transportation and smelting fees. |

| NI 43-101 | National Instrument 43-101 prepared by the Canadian Securities Regulators and which governs the public disclosure of mining information in Canada. |

| Paleozoic Rocks | Post-Precambrian rocks that lie on the older Precambrian basement rocks. Younger than 0.9 billion years. |

| Precambrian Basement Rocks | The oldest units of rocks that form the basement in much of the Earth, overlain by younger sedimentary and volcanic rock. Predates a time of 0.9 billion years. |

| Precious Metals | A group of metals generally resistant to oxidation of relatively high economic value; includes silver, gold, platinum and palladium, amongst others. |

| Production Royalties | Monies paid to an owner from the proceeds of sales materials derived from on the owner’s property. |

| Qualified Person | Conforms to the definition under National Instrument 43-101,Standards of Disclosure for Mineral Projectsand is an engineer or a geoscientist with at least five years of experience relevant to a particular project. National Instrument 43-101 was developed by the Canadian Securities Administrators, an umbrella group of Canada’s provincial and territorial securities regulators |

| Resource Property | Any form of title or right to explore and/or mine granted by a government/or property owner pursuant to one or more of: a claim, contract of work, special exploration permit, mineral lease or mineral permit. |

| Samplings | Materials removed for chemical, physical or other measurements. |

| Sedimentary Rock | A rock originating from the weathering of pre-existing rocks that is deposited in layers on the Earth's surface by air, water or ice. |

| Showings | Surface exposures of potentially economic mineralization. |

| Strike | The direction or orientation of a horizontal plane with the planar surface of a rock included from the horizontal. |

| Structure | The physical arrangement of rock related to its deformation by, for example, faulting. |

| Tailings | The material removed from the milling circuit after separation of the valuable metals, minerals or in the case of oil sands, bitumen. |

| Updip | Up the plane of a surface or structure of at an angle perpendicular to strike. |

| US | The United States of America. |

| | | |

| CONVERSION | 1 tonne | = | 1 t, 1.1023 short tons, 1,000 kilograms or 2,204.6 pounds |

| | 1 Hectare | = | 2.4711 Acres |

| | 1 Kilometre | = | 0.6214 Miles |

| SYMBOLS: | $ or Cdn$ | = | Canadian dollar |

| | T | = | Metric tonne |

| | Km | = | Kilometre |

| |

| 2010 First Quarter Report | Page5 |

| |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

| FOR THE THREE MONTH PERIOD ENDED JANUARY 31, 2010 |

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

The information presented in or incorporated by reference in this Form 6K includes both historical information and “forward-looking statements” (within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended) relating to the future results of the Company (including projections and business trends), which involve risks and uncertainties.

Except for statements of historical fact, certain information contained within constitutes forward-looking statements. Forward looking statements are usually identified by use of certain terminology, including “will”, “believes”, “may”, “expects”, “should”, “seeks”, “anticipates”, or “intends” or by discussions of strategy or intentions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results or achievements to be materially different for any future results or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts, and include but are not limited to, estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to the effectiveness of the Company’s business model; future operations, p roducts and services; the impact of regulatory initiatives on the Company’s operations; the size of and opportunities related to the markets for the Company’s products; general industry and macroeconomic growth rates; expectations related to possible joint and/or strategic ventures and statements regarding future performance.

Forward-looking statements used in this discussion are subject to various risks and uncertainties, most of which are difficult to predict and generally beyond the control of the Company. If risks or uncertainties materialize, or if underlying assumptions prove incorrect, our actual results may vary materially from those expected, estimated, or projected. Forward-looking statements in this document are not a prediction of future events or circumstances, and those future events or circumstances may not occur. Given these uncertainties, users of the information included herein, including investors and prospective investors are cautioned not to place undue reliance on such forward-looking statements.

Investors are cautioned not to put undue reliance on forward-looking statements, and should not infer that there has been no change in the affairs of the Company since the date of this report that would warrant any modification of any forward-looking statement made in this document or other documents filed periodically with securities regulators. All subsequent written and oral forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by this notice. Except as required by law, the Company disclaims any intent or obligation to update publicly these forward-looking statements, whether as a result of new information, future events or otherwise

Disclaimer

The information in this document is not intended to be comprehensive review of all matters concerning the Company. The users of this information, including but not limited to investors and prospective investors, should read it in conjunction with all other disclosure documents provided including but not limited to all documents filed on SEDARwww.sedar.comandwww.sec.gov/edgar.shtml. No securities commission or regulatory has reviewed the accuracy or adequacy of the information presented herein.

REPORTING CURRENCY AND FINANCIAL INFORMATION

Currency and Exchange Rates

Financial information in this Form 6K is expressed in Canadian dollars; therefore, unless otherwise noted, references to “Cdn$” or “$” are to Canadian dollars. The following tables sets forth the period-end exchange rate, the average of the period, and the high and low exchange rates in the period, for the Canadian dollar in exchange for United States dollars, based upon the inverse of exchange rates reported by the Bank of Canada at the noon buying rates payable in Canadian dollars as certified for customs purposes. As of December 31, 2009, the noon rate of exchange, as reported by the Bank of Canada for the conversion of United States dollars into Canadian dollars was US $0.9555 (US $1.00 = CDN $1.0466). As of June 14, 2010 the noon rate of exchange, as reported by the Bank of Canada for the conversion of United States dollars into Canadian dollars was US $1.0253 (US $1.00 = CDN $0.9753).

| |

| 2010 First Quarter Report | Page6 |

| |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

| FOR THE THREE MONTH PERIOD ENDED JANUARY 31, 2010 |

This discussion date June 14, 2010 is intended to assist readers with a better understanding and evaluation World Ventures Inc.’s (“WVI” or the “Company”) history, business environment, strategies, performance and risk factors as well as the financial condition and operations for the first quarter ended JANUARY 31, 2010. The following Management Discussion and Analysis (“MD&A”) should be read in conjunction with the audited financial statements and related notes thereto for the Three Month Period ended January 31, 2010, the Director’s Report to Shareholders, and other management discussion included in the Company’s Annual Report. The information in this report includes information available to June 14, 2010. Except where otherwise noted, all dollar amounts are stated in Canadian dollars. The data included was prepared in accordance with Canadian Generally Accepted Accounting Principles (GAAP). Please also refer to the Company� 6;s financial statements and notes for further information. Further financial information regarding theWorld Ventures Inc.is available atwww.sedar.comand atwww.sec.gov/edgar.shtml

This MD&A contains forward-looking statements with respect to expected financial performance, strategy and business conditions. These statements involve risks and uncertainties, are based on assumptions and estimates, and therefore actual results may differ materially from those expressed or implied by World Ventures Inc. Factors which may cause such differences include, but are not limited to, general economic and market conditions including interest and foreign exchange rates, investment performance, global and domestic financial markets, the competitive industry environment, legislative and regulatory changes, technological developments, catastrophic events and other business risks. The reader is cautioned against undue reliance on these forward-looking statements. Certain totals, subtotals and percentages may not reconcile due to rounding.

Management is responsible for the preparation and integrity of the financial statements including, the maintenance of appropriate information systems, procedures and internal controls, and to ensure that the financial information used internally or disclosed externally, including financial statements and MD&A is complete and reliable.

| |

| A. | History and Development of World Ventures Inc. |

World Ventures Inc. (the “Company”) (formerly Nu-Dawn Resources Inc.) effected a name change on June 28th, 1999. World Ventures Inc. (formerly Nu-Dawn Resources Inc.) was incorporated on October 3rd, 1980 by registration of its Memorandum and Articles under theCompany Actof the Province of British Columbia.

World Ventures Inc.’s head office is located at 102 Piper Crescent, Nanaimo, British Columbia, Canada, V9T 3G3, Telephone: (250) 756-0291. The Company’s registered office is located at Suite 1600 – 609 Granville Street, Vancouver, British Columbia, Canada.

Since its formation, the Company has been engaged in the acquisition and exploration of mineral properties. In 1999, the Company changed its direction of business to pursue real estate and land development. In 2001, the Company ceased its pursuit of real estate and land development and resumed its historical business of acquisition and exploration of mineral properties. The Company presently operates the mineral exploration and development business in the United States, Canada, Panama and Costa Rica. The Company continues to maintain its mineral holdings with the intent to explore, develop and recruit buyers or joint venture partners for their projects. The Company will continue to pursue mining projects in North and Central America.

Principal Capital Expenditures

The Company has invested principally in its resource properties in the Lapon Canyon - Nevada Property, Crystal Springs - Saskatchewan Property, and Triton - Ontario Property over the last five years. Over the past five years, $576,659 has been invested in resource properties for legal fees, consulting fees, lease costs, and travel expenditures. The Company’s claims lapsed on the Triton – Ontario Property therefore the property was written down. There have been no significant divestitures or disposals over the past three years.

| |

| 2010 First Quarter Report | Page 7 |

| |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

| FOR THE THREE MONTH PERIOD ENDED JANUARY 31, 2010 |

| |

| 1.2 | Overall Performance (continued) |

World Ventures Inc. remains in the exploration stage. The Company is not presently engaged in extracting minerals from any of its properties and has not generated any revenues to date. Our focus for the last five years has been on their principal resource properties; Lapon Canyon Property, located in Mineral County Nevada, near Reno Nevada, United States; Triton Property located in the MacMurchy Township, Shining Tree Mining District, Ontario, Canada; and Crystal Springs Property, located in Central Saskatchewan, Canada.

The mining industry in which the Company is engaged is in general, highly competitive. Competitors include well-capitalized mining companies, independent mining companies and other companies having financial and other resources far greater than those of the Company. The Company encounters strong competition in attempting to acquire additional mineral properties and interest in commercially mineable ore reserves in the State of Nevada. In general, properties with a higher grade of recoverable mineral and/or which are more readily mineable afford the owners a competitive advantage in that the cost of production is lower. Thus, a degree of competition exists between those engaged in the mining industry to acquire the most valuable properties. The Company’s competitive position in the mining business in general, and in the State of Nevada in particular, is insignificant

There has been no public announcement of, nor has the Company otherwise made public information about, any new product or industry segment of the Company requiring the investment by the Company of a material amount of its total assets, or which is otherwise material to the Company’s operations. The Company has not engaged in any material research and development activities during its last three fiscal years except to the extent that it conducted mineral exploration activities However, should the Company determine to commence production of a resource property, this would require large expenditures and commitment of funds neither of which are presently available to the Company.

The sources and availability of raw materials essential to the Company’s business are limited in the context that mineral bearing ore of a high enough commercial grade to justify development must be discovered or otherwise acquired and explored before a production decision can be made and implemented. Mining projects are dependant on permitting, water supply, utilities and roads. The Company anticipates no lack of materials, supplies and services. The Company has no material patents, trademarks, licenses, franchises or concessions except insofar as mining claims or properties acquired from the Canadian, American, Panamian and Costa Rican governments. The Company believes it is in compliance with all applicable obligations regarding such titles. The Company’s business is seasonal only to the extent that severe winter conditions may limit the Company’s exploratory activities or future mill operating activities.

The Company is not dependent upon a single or few customers for revenues. The nature of the Company’s business precludes a backlog of orders. No portion of the Company’s business is subject to renegotiation of profits or termination of contracts or subcontracts at the election of the government. The Company does not foresee that there is any risk to the conduct of its business in the United States, Canada, Panama, and Costa Rica.

The Company, like any business involved in the extraction or processing of mineral properties, may be required to make extensive capital expenditures in the future to protect the environment and to comply with applicable environmental regulations in connection with any exploration, development, mining or milling activities. As of the end of 2007 fiscal year, the Company was engaged in no such activities. However, such capital expenditures or requirements could effect the Company’s competitive position in the business and, conceivably, could limit the Company’s availability to enter into some projects. No capital expenditures for environmental control facilities have been made and the Company does not expect to make any such expenditure during the current or coming fiscal year.

| |

| 2010 First Quarter Report | Page 8 |

| |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

| FOR THE THREE MONTH PERIOD ENDED JANUARY 31, 2010 |

| |

| 1.2 | Overall Performance(continued) |

| |

| B. | Business Overview (continued) |

World Ventures Inc. is an Exploration Stage Company

There are certain risk factors that could have material affects that are un-quantifiable at present due to the nature of the Company’s industry and other considerations including, without limitations as follows:

| |

| • | Exploration Development - mineral exploration involves a high degree of risk and few properties result in successful production. Even when a prospect is discovered and designated, the probability of an individual prospect ever having proven reserves is extremely remote. In all probability the properties described herein may not contain any reserves and funds spent on exploration may not find any reserves. Even if the Company completes anticipated exploration programs and is successful in identifying a mineral deposit, substantial additional funds will need to be expended on further drilling and engineering studies before it can be ascertained whether there is a commercially viable mineral deposit on the property; |

| |

| • | Operating Risk – all properties in which the Company has a direct or indirect interest will be subject to all the hazards and risks normally associated with exploration and development any of which could result in damage to property, and possible environmental damage; |

| |

| • | Commodity Prices – the price of the Company’s shares, its financial results, and exploration activities have been or may in the future be, adversely affected by declines in the price of mineral commodity prices; |

| |

| • | Foreign Operation Risk – properties in Costa Rica and Panama are affected by changes in regulation of shift in the political attitudes, which are beyond the control of the Company; |

| |

| • | Financing and Acquisition – exploration activities require substantial additional financing. Failure to obtain financing results in delayed or postponed exploration and/or acquisition of resource properties; |

| |

| • | Environmental – all phases of the Company’s exploration are subject to environmental regulation in the various jurisdictions of these resource properties. There are no assurances that future changes in environmental regulation will not adversely affect the Company; |

| |

| • | Competition – the mining industry is intensely competitive industry, and the Company competes with numerous companies that have greater financial resources and technical facilities available. |

World Ventures Inc. has a Lack of Cash Flows and Financing May Not Be Available to the Company

World Ventures Inc. is a developing Company and does not yet have sufficient revenues to meet its yearly operating and capital requirements. The Company has historically raised funds necessary to conduct its business primarily through issuance of equity or debt. There is no guarantee the Company will be able to continue to raise funds through additional equity issuances, project debt financing, joint ventures and /or partnering arrangements.

World Ventures Inc. is Subject to Certain Mining Hazards

The business of mining is subject to certain types of risks and hazards, including environmental hazards, and industrial accidents. Such occurrences could result in damage to, or destruction of, mineral properties or production facilities, personal injury or death, environmental damages, delays in mining, monetary losses and possible legal liability. Any payments made with regards to such liabilities may have a material adverse effect on World Ventures Inc.'s financial position. The Company carries insurance to protect itself against certain risks of mining and processing to the extent that it is economically feasible but which may not be adequate. World Ventures Inc. currently does not have any active mining in progress.

| |

| 2010 First Quarter Report | Page 9 |

| |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

| FOR THE THREE MONTH PERIOD ENDED JANUARY 31, 2010 |

| |

| 1.2 | Overall Performance (continued) |

| |

| B. | Business Overview (continued) |

World Ventures Inc. will Require Regulatory Approvals and Operating Permits.

In the ordinary course of business, exploration companies are required to seek regulatory approvals, and operating permits for the federal, provincial and local governments for commencement of new operations. Obtaining the necessary regulatory approvals and operating permits is a complex and time-consuming process involving numerous agencies and often involving public hearings and costly undertaking by the Company. The duration and success of regulatory and permitting efforts are contingent upon many variables outside the Company’s control. Environment protection permitting, including the approval of reclamation plans, may increase costs and cause delays depending on the nature of the activity to be permitted and the interpretation of applicable requirements implemented by the permitting authority. There can be no assurance that all regulatory approvals and operating permits will be obtained and, if obtained, the costs involved will not exceed those previously estimated by the Company. It is impossible the costs and delays associated with the compliance with such standards and regulations could become such that he Company could not proceed with the development or operations of Resource Property.

Abandonment and Reclamation Costs and Regulations May Change

World Ventures Inc. is responsible for complying with terms and conditions of environmental and regulatory approvals and all laws and regulations regarding the abandonment of the site and reclamation of its lands at the end of its economic life, which abandonment and reclamation costs may be substantial. A breach of such legislation and/or regulations may result in the imposition of fines and penalties, including an order for cessation of operations at the site until satisfactory remedies are made. Abandonment and reclamation costs are estimates and since they will be a function of regulatory requirements at the time, costs of goods and services at the time and the value of the salvaged equipment may be more or less than the abandonment and reclamation costs. World Ventures Inc. currently does not have any active mining in progress.

Independent Reviews Provide No Assurance of Future Results

Although third parties have prepared reviews, reports and projections relating to the viability and expected performance of the resource properties, it cannot be assured that these reports, reviews and projections and the assumptions on which they are based will, over time, prove to be accurate.

Personnel Risks May Impact the Company’s Ability to Carry Out its Operational Plans

At January 31, 2010, the Company had 5 directors and one part-time employee. The Company is relies on the directors, contractors, and consultants to assist in executing operations and providing technical guidance. As the Company anticipating growth and expansion of its operations will be dependant on the ability to attract and hold knowledgeable, expert, experienced management and employees to explore and develop it’s mineral properties.

There is a Possibility of Dilution to Present and Prospective Shareholders

Any transaction involving the issuance of additional World Ventures Inc shares or securities may result in dilution, possibly substantial, to present and prospective holders of Common Shares.

Title Risks May Result in Title Claims or Disputes

The Company is satisfied that it has good and proper right, title and interest in and to the Resource Properties that are currently under exploration. Aboriginal peoples have claimed aboriginal title and rights to a substantial portion of western Canada. Certain aboriginal peoples have filed claims against the Government of Canada.

| |

| 2010 First Quarter Report | Page10 |

| |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

| FOR THE THREE MONTH PERIOD ENDED JANUARY 31, 2010 |

| |

| 1.2 | Overall Performance (continued) |

| |

| B. | Business Overview (continued) |

Enforcement of Civil Liabilities by Present and Prospective Shareholders May be Adversely Affected

The enforcement by investors of civil liabilities under the federal securities laws of the US may be affected adversely by the fact that the Company is incorporated under the laws of British Columbia, Canada, that the independent auditors who have audited the Company's financial statements and some or all of its directors and officers may be residents of Canada or elsewhere, and that all or a substantial portion of the Company's assets and said persons are located outside the US. As a result, it may be difficult for holders of the Common Shares to effect service of process within the US upon people who are not residents of the US or to realize in the US upon judgments of courts of the US predicated upon civil liabilities under the federal securities laws of the US.

The key determinants of the Company’s operating results are as follows:

| |

(a) | the state of capital markets, which affects the ability of the Company to finance its exploration activities; |

| (b) | the write-down and abandonment of mineral properties as exploration results provide further information relating to the underlying value of such properties; |

(c) | market prices for gold, copper, diamonds, silver, lead, molybdenum, tungsten, iron and zinc; |

| (d) | ability to attract and hold knowledgeable, expert, experienced management and employees; |

| (e) | continued regulatory standard changes which increase the complexity and length of processes and increased cost associated; |

(f) | foreign properties are at risk of changes in regulations or shifts in political attitudes within foreign countries; |

(g) | intense competition of the mining industry in all phases affects the acquisition of suitable properties for exploration in the future |

The Company reported financial results for the first quarter and the Three-Month Period Ended January 31, 2010 a net of loss of $34,762 and a net loss of $52,439 in January 31, 2009 reflective of the status quo activity of the Company. Comparatively the Company reported a net loss in January 31, 2008 of $27,649; a net loss of $ 20,144 for the first quarter and the Three-Month Period Ended January 31, 2007. As at January 31, 2010 the Company had a cash position of $3 and at January 31, 2009 cash position of $31. Compared to January 31, 2008 the Company had a cash position of $72,037; January 31, 2007 a cash position of $18,126; $9,219 as at January 31, 2006. As at January 31, 2010 the Company reported a working capital deficiency of $551,487 and as at January 31, 2009 a deficiency of $356,668 comparative to January 31, 2008 the Company reported a working capital deficiency of $189,565; January 31, 2007, the Company reported a working capital deficiency of $ $267,178; and a worki ng capital deficiency of $399,515 as at January 31, 2006. The net working capital is not sufficient for the Company’s present requirements. The Company has continued to provide capital through equity financing and proposes to meet any further working capital requirements through equity financings on acceptable terms in order to enable us to complete any plan of operation.

In the current period ended January 31, 2010 the Company continued to incur general and administrative expenses consistent with the previous 12 months. The Company incurred expenditures for the Lapon Canyon - Nevada Project consistent with the same 12-month period in the previous year. In additional the Company incurred expenditures for the Crystal Springs – Saskatchewan, the Triton – Ontario and Gladiator – Arizona properties. Total expenditures for all resource properties for the current three-month period total $42,296. Comparatively $18,399 for the three month period ended January 31, 2009; compared with the three-month period ended January 31, 2008 of $21,115; compared with the three-month period ended January 31, 2007 of $14,320. Total expenditures for all resource properties for the year ended October 31, 2009 $149,420 and for October 31, 2008 total $105,949. Compared with total resource expenditures in 2007 of $107,291, and for 2006 total resource expendi tures were $60,414.

| |

| 2010 First Quarter Report | Page11 |

| |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

| FOR THE THREE MONTH PERIOD ENDED JANUARY 31, 2010 |

| |

| 1.2 | Overall Performance (continued) |

| |

| B. | Business Overview (continued) |

Financial results for the year of 2008 reported a net loss of $393,223 which includes $60,156 of stock-based compensation and in 2007 reported a net loss of $320,473 included a recognized $171,470 of stock-based compensation. Financial results for the year of 2005 the Company reported a net loss of $467,969. A significant change was made in accounting policy effective November 1, 2003, per the recommendations of the Canadian Institute of Chartered Accountants (“CICA”) Handbook Section 3870, for Stock-based compensation and other stock-based payments. In accordance with the CICA policy the Company has accounted for stock options granted to directors, employees and consultants using the fair market value method. As a result of the preceding, the Company has recognized $289,341in stock-based compensation in the 2005 years net loss, and an additional $33,712, which was charged to the opening deficit in 2005.

Annualized fiscal expenses for 2009, 2008, and 2007 are comparative across all categories. Noted changes are in Accounting and Administration with $51,826 in 2009, $54,783 in 2008 compare to $47,323 in 2007; an decrease in Travel and Promotion with $35,893 in 2009 and $68,380 in 2008 compared to $25,547 in 2007, and $45,252 in 2006. In 2009 Consulting fees paid were $66,00 and in 2008 Consulting fees paid are $67,451 compared with $4,500 in 2007, and $2,000 in 2006. No Corporate capital taxes were paid during 2009, 2008, and 2007. Revenues remained unchanged at $0 in 2009, 2008, and 2007, reflective of the nature of a mining exploration company.(Please review 1.3 Selected Annual Information and 1.5 Summary of Quarterly Results.)

RESOURCE PROPERTIES

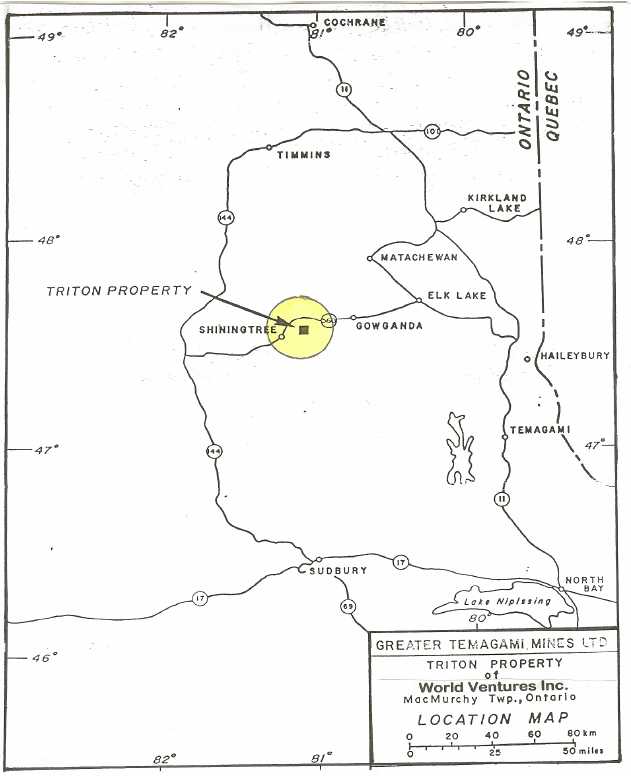

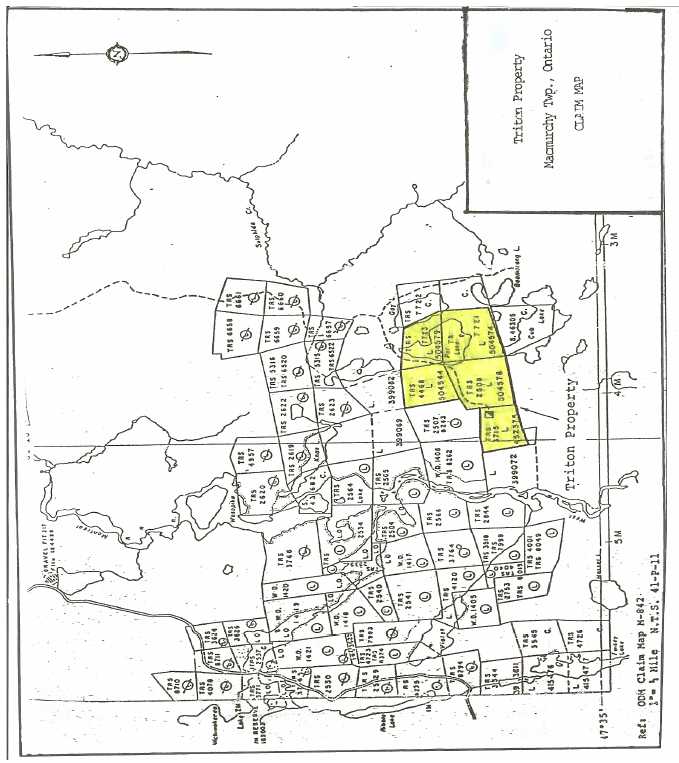

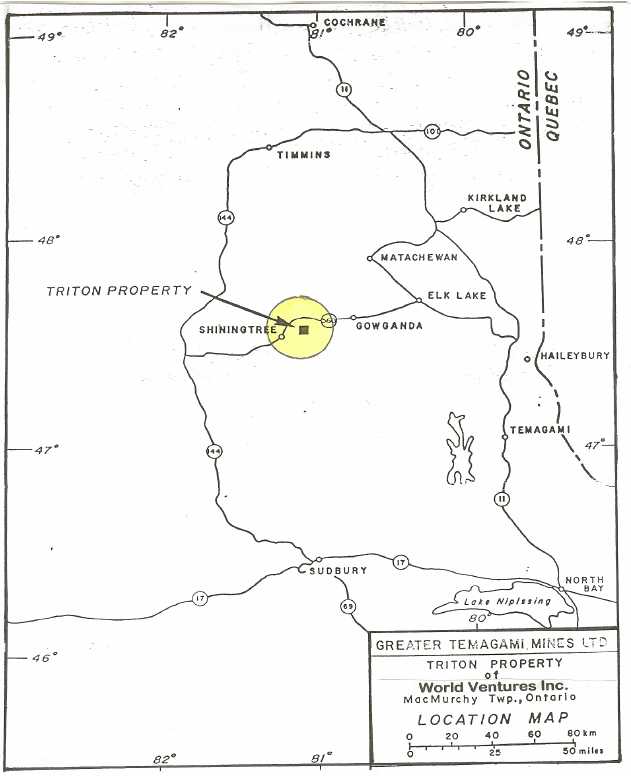

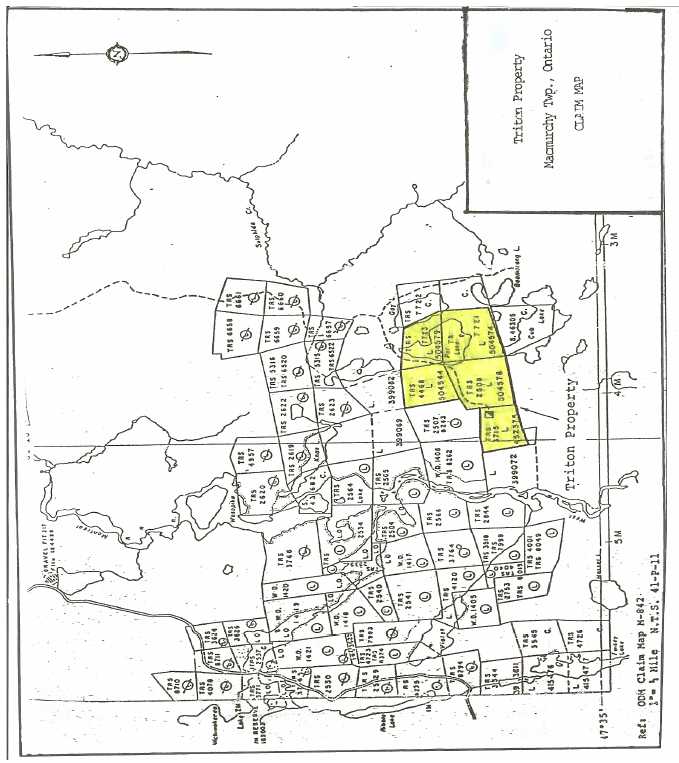

Triton Property, MacMurchy Township, Shining Tree Mining District, Ontario, Canada

Potential Mineral Commodity: Gold

On June 3, 2009, the Company entered into an agreement to purchase 100% right, title and interest in to the property with respect to Claims L-4247576 7 units; L-4247577 1 unit located in MacMurchy Twp. In consideration for the acquisition of the Property the Company has paid the vendors $10,000 cash upon execution of the agreement; and issuance of 250,000 common shares; and additional $20,000 cash and issuance of 250,000 common shares upon the anniversary date of the agreement and subject to a 1% NSR. The Company may re-purchase a ¾% NSR from the vendors in consideration of $500,000. This property is located in MacMurchy Township, Larder Lake, Mining District, Ontario, Canada as shown in Figure 1, 2, and 3.

The Property is in the exploration stage. There are no known mineral resources on the property. There are no immediate planned exploration programs for the Property. Work requirements of $200 per claim per year are required to maintain the Property in good standing. Anticipated work on the Property will be funded by either capital raised by equity funding or joint venture partnership funding. Access to the Property is by light-truck on unimproved logging roads. Water is available on the Property. Power for any operations would be provided by portable equipment as the Property is remote from power lines.

Historically the Company held a 50% interest in a joint-venture basis with Greater Temagami Mines Ltd. (“Temagami”), an unaffiliated corporation, in five unsurveyed mining claims in the Shiningtree area of the Larder Lake mining division, Ontario, Canada. In 2004, the Company acquired an additional 50% interest in the Triton property from Temagami Mines Ltd., subject to a 1% royalty payable to Teck-Cominco Limited (Temagami being a wholly-owned subsidiary).

| |

| 2010 First Quarter Report | Page12 |

| |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

| FOR THE THREE MONTH PERIOD ENDED JANUARY 31, 2010 |

| |

| 1.2 | Overall Performance (continued) |

RESOURCE PROPERTIES (continued)

Triton Property, MacMurchy Township, Shining Tree Mining District, Ontario, Canada

Potential Mineral Commodity: Gold (continued)

The Property is underlain by Precambrian-aged metavolcanic which contains occurrences of quartz veins containing gold values as reported in historical reports. A prospect shaft to 110 feet in depth with 145 feet of lateral workings is described in old Company reports. Gold assay values reported are historical in nature and cannot be relied upon. Drilling conducted by Teck-Cominco in 1985-1988 is reported to have intersected gold values but this information is historical in nature and cannot be relied upon. In March 2009, the Company claims lapsed, and the Company has written off its investment of $8,928 in the property.

| |

| 2010 First Quarter Report | Page13 |

FIGURE 1

LOCATION MAP – TRITON PROPERTY

Near Timmins, MacMurchy Township, Shinning Tree District, Ontario

Ontario

| |

| 2010 First Quarter Report | Page14 |

FIGURE 2

LOCATION MAP – TRITON PROPERTY

Shinning Tree District

| |

| 2010 First Quarter Report | Page15 |

FIGURE 3

CLAIMS MAP – TRITON PROPERTY

MacMurchy Township

| |

| 2010 First Quarter Report | Page16 |

| |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

| FOR THE THREE MONTH PERIOD ENDED JANUARY 31, 2010 |

| |

| 1.2 | Overall Performance (continued) |

RESOURCE PROPERTIES (continued)

Royalty Interest: Kootenay Property, near Salmo, British Columbia, Canada

Potential Mineral Commodities: Molybdenum, Tungsten, Lead, Zinc, Gold, Silver and Copper

The Jersey-EmeraId Property in the Nelson Mining Division, Kootenay Region of British Columbia, Canada is a former producer of lead-zinc and tungsten. The Company retained a 1.5% net smelter return royalty when it sold the property some years ago during a period of depressed metal prices. Since 1995 Sultan Minerals Inc. (“Sultan”) of Vancouver, British Columbia, Canada, the current owner of the property, has conducted exploration on the molybdenum, tungsten, lead and zinc potential of the property. The Company makes no expenditures for exploration on the Property but does pay taxes on two retained surface lots in the area totalling $237 per year.

Sultan has released a series of updates on the status of the molybdenum, tungsten, and lead-zinc evaluation programs. An estimate for resources for each of molybdenum and tungsten has been prepared for the modest tonnage higher-grade portions of the deposits. Additional evaluation continues of the potential for much larger bulk tonnages of tungsten, molybdenum and gold. Sultan is also in the process of reviewing the resource potential of the lead and zinc mineralization remaining in and adjacent to the mine workings from previous production episodes. The Property is accessed by paved highway and improved roads. Power and water are available on site.

In a scoping study by Wardrop Engineering Inc. on May, 2007 the resources are as stated below and filed on SEDAR by Sultan Minerals Inc.

Table 1.1 Total WO3 Resource for Jersey Project

| | | | |

| Classification | Cutoff | Tons>Cutoff | WO3 % | Pounds of WO3 |

| Measured | 0.15 | 1,200,000 | 0.379 | 9,096,000 |

| Indicated | 0.15 | 1,310,000 | 0.365 | 9,563,000 |

| Measured Plus Indicated | 0.15 | 2,510,000 | 0.372 | 18,674,000 |

| Inferred | 0.15 | 1,210,000 | 0.397 | 9,607,000 |

Table 1.2 Total Mo Resources for Dodger for Dodger 4200 Zone

| | | |

| Mo Cutoff | Tons>Cutoff (tons) | Grade > Cutoff |

| Mo (%) | Pounds Mo |

| Indicated Resource |

| 0.05 | 28,000 | 0.098 | 54,880 |

| Inferred Resource |

| 0.05 | 481,000 | 0.103 | 990,860 |

The Company monitors the exploration activity on the Property to track the potential values of the retained royalty interest.

| |

| 2010 First Quarter Report | Page 17 |

| |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

| FOR THE THREE MONTH PERIOD ENDED JANUARY 31, 2010 |

| |

| 1.2 | Overall Performance (continued) |

RESOURCE PROPERTIES (continued)

Crystal Springs Property, Central Saskatchewan, Canada

Potential Mineral Commodities: Diamonds, Gold, Copper and Iron

The Company acquired mineral rights covering 540 acres, Section 21, Township 44, Range 20, West of the Second Meridian, near Crystal Springs area, near Fort a la Corne, Saskatchewan, Canada as shown in Figure 4. This tract of land is prospective for diamonds, gold, copper and iron, is held as private land mineral rights. The Company also held Saskatchewan Mineral Claims covering 57,000 acres (23,700 hectares) that were filed in July 2005, but they are no longer held.

This land holding lies to the south of a regional diamond exploration play in the vicinity of Fort a la Corne. Diamond exploration began in the late 1980’s and has accelerated recently. Numerous diamondiferous kimberlite pipes have been discovered with the Star Kimberlite being the most prominent, currently undergoing underground testing by Shore Gold, Inc.

The Company’s land position was acquired based on results of a preliminary investigation carried out in the area by the Company in 1995 and 1996. The exploration targets are of two conceptual types; one being the kimberlite pipes that may be present, cutting vertically across flat lying sedimentary rocks overlying an older Precambrian basement assemblage: the other being postulated gold-copper bearing iron formations in the underlying Precambrian basement, as suggested by an airborne magnetic survey conducted by the Company in 1995.

Approximately 640 acres are private minerals rights of Mrs. M. Lanctot and Mr. A Lanctot. The Company entered into a lease purchase agreement dated July 1, 2005 with Mrs. M. Lanctot and Mr. A. Lanctot ("Lanctots") to acquire the right to explore, develop and mine a property located in the vicinity of Fort a la Corne, Saskatchewan, Canada (“Crystal Springs Property”). The initial lease term is ten years with the first payment of $2,000 upon execution of the agreement on, March 31, 2006 and an annual sum of $4,000 for a total of $38,000.

The Company has an option to purchase the 640-acre Crystal Springs Property upon commercial development. Upon commencing mining operations on the Property, the Company will pay Lanctots a production royalty equal to 5% of net profits and $4,000 per annum. Expenditures for 2009 are $4,373 and in 2008 are $10,418, in 2007 $4,000 and in 2006 total $12,732. There were no expenditures for this property in 2005 or 2004. The Saskatchewan Mineral Claims require the expenditure of $12 per hectare for years starting 2-10 to maintain Mineral Claims in good standing. As no work was completed or filed on these claims they have lapsed. There are no known mineral resources on the property. There are no current plans to conduct exploration programs for the Property. Any work to be conducted on this Property will be subjected to the raising of funds by equity funding or joint venture partnership funding. The claims remain active and good standing, the Company has written off its investment of $ 27,150 at October 31, 2009. .

| |

| 2010 First Quarter Report | Page18 |

FIGURE 4

LOCATION MAP – CRYSTAL SPRINGS PROPERTY

Near Melfort, Section 21, Township 44 Range 20, West of the Second Meridian

SASKATCHEWAN

| |

| 2010 First Quarter Report | Page19 |

| |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

| FOR THE THREE MONTH PERIOD ENDED JANUARY 31, 2010 |

| |

| 1.2 | Overall Performance (continued) |

RESOURCE PROPERTIES (continued)

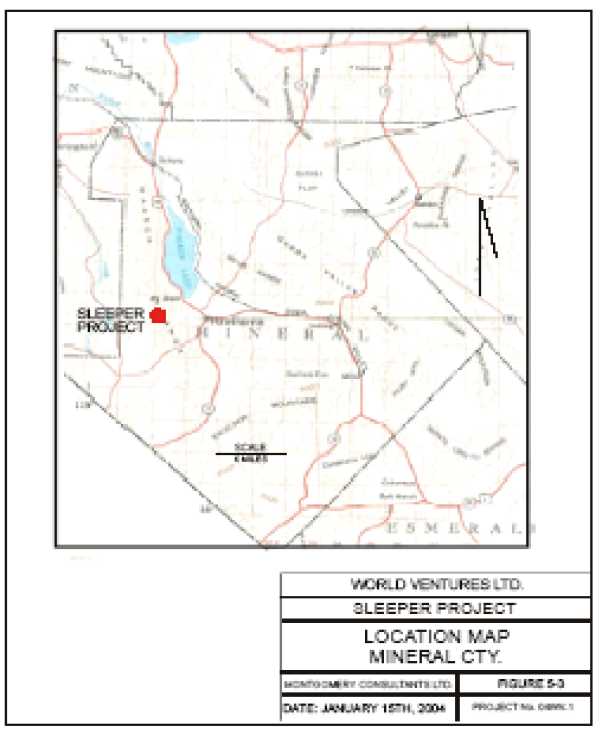

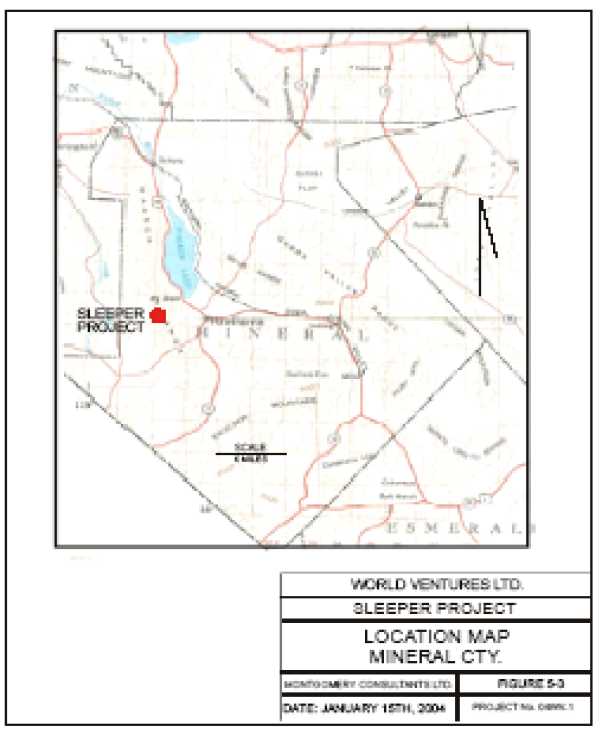

Lapon Canyon Property, Mineral County Nevada, near Reno Nevada, United States

Potential Mineral Commodities: Gold and Silver (continued)

The property covers a gold-bearing complex vein structure that has had minor historical production from two mine adit levels with additional exploration on a third adit level. There are no known mineral resources on this Property. The Company entered into a Lease Purchase Agreement dated June 6, 2002 with Mr. Donald B. Potts ("Potts") to acquire the right to explore, develop and mine the property located in Mineral County, Nevada, USA (the "Property") as shown in Figure 5, 6, 7. The initial lease term is five years but can be extended for an additional five years, and for so long thereafter as minerals are mined and produced from the Property. Upon commencing production of valuable minerals from the property, the Company shall pay Potts a royalty on production equal to 4% of net smelter returns. Pursuant to a Letter Agreement with Potts dated May 2, 2002, the Company has paid to Potts the sum of $US 11,000 which included the royalty payment due on June 6, 2002. Subsequent to th e Company’s October 31, 2006 year-end, the Company and Potts amended the Lease Purchase Agreement with an Amendment Agreement Letter dated January 16, 2007. The Amendment Agreement Letter amended the Term of the Lease to automatically extend the lease for an additional 5 years to June 6, 2012 and a minor amendment to the Minimum Royalties Payments. The amended Minimum Royalty payment schedule is as follows:

| | | | |

| | Payment Period | Amount Monthly US$ |

| |

| (i) | July 6, 2002 through February 6, 2003(paid) | $ | 1,000 |

| (ii) | March 6, 2003 through November 6, 2003(paid) | $ | 1,500 |

| (iii) | December 6, 2003 through August 6, 2004(paid) | $ | 2,000 |

| (iv) | September 6, 2004 through May 4, 2005(paid) | $ | 2,500 |

| (v) | June 6, 2005 through February 6, 2006(paid) | $ | 3,000 |

| (vi) | March 6, 2006 through November 6, 2006(paid) | $ | 3,500 |

| (vii) | December 6, 2006 through August 6, 2007(paid) | $ | 4,000 |

| (viii) | September 6, 2007 through the 6th day of each month thereafter (paid to May 2010) | $ | 4,500 |

Potts granted the Company the exclusive right and option to purchase the Property for US$ 1,250,000 or 50% of the unpaid balance at any time during the initial or extended terms of the lease. Upon exercise of this option by the Company, Potts shall transfer the property to the Company with a reserved royalty on production equal to 0.5% of net smelter returns.

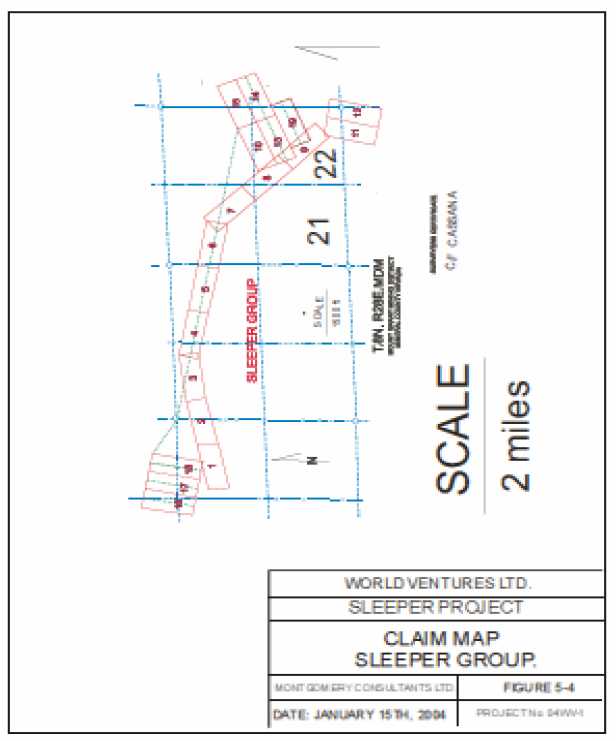

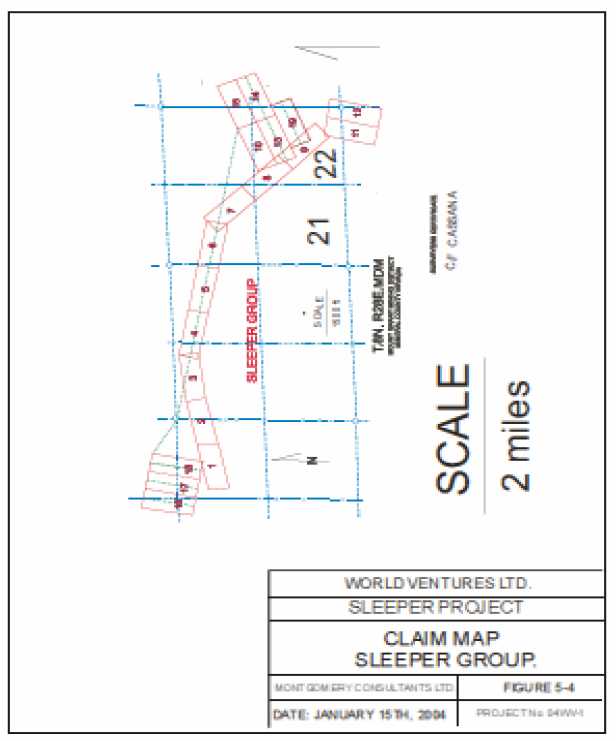

The Lapon Canyon Property located in Mineral County, Nevada, USA consists of the following claims totaling approximately 1,000 acres:

TABLE 1

SLEEPER CLAIM GROUP

| | |

| CLAIMS | BLM SERIAL No. | LOCATION DATE |

| Sleeper 1-3 | 699414– 416 | Feb 16, 1994 |

| Sleeper 4-10 | 699417– 423 | Feb. 26, 1994 |

| Sleeper 11-12 | 699424– 424 | Mar. 3, 1994 |

| Sleeper 13-14 | 708229– 230 | Sep. 9, 1994 |

| Sleeper 15 | 708231 | Sep. 14, 1994 |

| Sleeper 16-18 | 708232– 234 | Sep. 9, 1994 |

| Sleeper 19 | 708235 | Sep. 9, 1994 |

The Property is accessed by truck from an improved county road along two miles of unimproved access road. Water is available on site. Power is accessible within ten (10) miles.

| |

| 2010 First Quarter Report | Page20 |

| |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

| FOR THE THREE MONTH PERIOD ENDED JANUARY 31, 2010 |

| |

| 1.2 | Overall Performance (continued) |

RESOURCE PROPERTIES (continued)

Lapon Canyon Property, Mineral County Nevada, near Reno Nevada, United States Potential Mineral Commodities: Gold and Silver (continued)

J. H. Montgomery, Ph.D., P. Eng. and N. Barr, B. Sc., the Company’s Consultants recommend that a US$ 1 million dollar exploration program be carried out on the Company’s Lapon Canyon gold project. On July 31st, 2004 the Company applied to the Regional Office of The Bureau of Land Management for permits to carry out its exploration program and received approval for the permits on September 16th, 2004. The Company is required to post a reclamation bond in the amount of $2,500 US and will have to apply for renewal of the earlier permits.

Expenditures to date on the property total $572,195, (total expenditures of $78,248 in 2008, total expenditures of $92,490 for 2007 and $45,682 in 2006) including lease obligations, preliminary and on-going evaluation costs, and the costs of an independent NI 43-101report.

This Property is in the exploration stage. The Company signed a letter of intent date April 9, 2009 with Kelward Overseas Corp. under which the expenditures of the exploration of the property will be funded to the extent of $750,000 for a 50% interest in the property. The initial $100,000 of expenditures will earn Kelward Overseas Corp. 20% interest in the property. Kelward Overseas Corp can earn the additional 30% interest by making exploration expenditures of $650,000 within two years of the letter of intent within the context of the exploration program of the Company. The letter of intent did not progress to an agreement and this business arrangement is no longer in effect.

| |

| 2010 First Quarter Report | Page21 |

FIGURE 5

LOCATION MAP – LAPON CANYON PROPERTY

Near Reno, Mount Grant Mining District, Mineral County, Nevada

NEVADA

| |

| 2010 First Quarter Report | Page22 |

FIGURE 6

LOCATION MAP – LAPON CANYON PROPERTY

Mineral County, Nevada

| |

| 2010 First Quarter Report | Page23 |

FIGURE 7

CLAIMS MAP – LAPON CANYON PROPERTY

Mineral County, Nevada

| |

| 2010 First Quarter Report | Page24 |

Gladiator, Arizona, United States

The Company entered into an option agreement on January 14, 2000 with Curitiba S.A., a Costa Rican corporation, to acquire 100% of the issued and outstanding shares of Nor-Quest Arizona Inc., an Arizona corporation. Nor-Quest Arizona Inc. has title to 170 acres within the Prescott National Forest in the State of Arizona. The option expired January 14, 2002; however, as part of the original agreement, the Company agreed to pay any property tax balance outstanding during the option period. During 2004, the Company paid the outstanding arrears taxes of $5,549 relating to the option period. There were no expenditures by the Company for this property in 2006 or 2005. The Company entered into a letter of intent to purchase the outstanding and issued common shares of Nor-Quest Arizona Inc. on March 31, 2009, the letter of intent expired. The Company has written off its investment of $21,156.

Guanacaste, Costa Rica

Pursuant to an option agreement dated October 23, 1995 and amended February 27, 1996 between the Company and Minera Oceanica S.A., the Company acquired an option for the mineral and surface rights in Concession 6622 situated in the Juntas de Abangares, District of Guanacaste, Costa Rica, subject to a 10% royalty in favour of Minera Oceanica S.A. on operating profits derived from the property, or US $100,000 per year, whichever is greater. This royalty has been waived indefinitely until the commencement of production. Finder’s fees of $22,500 have been included in the cost of resource properties. The Company wrote down the property ($395,496) during 2003 and as at October 31, 2009 the Company is holding the rights for future use. There were no expenditures by the Company for this property in 2009, 2008, or 2007. The Company monitors mineral exploration in Costa Rica. There is no known mineral resource on this Property. The Company has no planned exploration for this propert y. The Property is not a material Property. The Company plans to review the climate for mineral exploration in Costa Rica and subject to financing may initiate activity there.

Pan-Oro, Panama

During 1995, the Company entered into a letter of agreement with Grande Portage Resources Ltd. to enter into a joint venture agreement to develop mineral concessions in Panama. The agreement has not yet been concluded and regulatory approval remains outstanding. During 2001, the Company decided to write-down its investment in this property to a nominal carrying value. The Company retained the right to resume exploration on this property. The Company has a 90% ownership interest in Pan-Oro S.A., an inactive Panamanian corporation. As at October 31, 2009, the Company is not actively conducting exploration in Panama. There were no expenditures by the Company for this property in 2009, 2008 or 2007. The Company abandoned its rights in Panama during the fiscal year and has written off the carrying value of the investment. This Property is not a material Property, however the Company monitors activity in Panama and may renew activity in that area.

| |

| 2010 First Quarter Report | Page25 |

| |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

| FOR THE THREE MONTH PERIOD ENDED JANUARY 31, 2010 |

| |

| 1.3 | Selected Annual Information |

The following selected financial information is derived from the audited financial statements for the years ended October 31, 2009, 2008, 2007, and three month period ended January 31, 2010, of the Company as prepared in accordance with Canadian Generally Accepted Accounting Principles (GAAP). The Company has included in the consolidated financial statements reconciliation between Canadian Generally Accepted Accounting Principles and United States Generally Accepted Accounting Principles. The reconciliation and explanation of the differences are in Note 13 for the Company’s consolidate financial statements, pages 24 through 28. For more detailed information, refer to the Company’s audited Financial Statements.

| | | | |

| | January 31,2010 | October 31,2009 | October 31,2008 | October 31,2007 |

| Net sales or total revenues | $Nil | $Nil | $Nil | $Nil |

| Income (loss) before discontinued items orextraordinary items | $(34,762) | $(197,204) | $(351,082) | $(320,473) |

Income (loss) before discontinued items orextraordinary items:

- per share undiluted

- per share diluted | (0.01)

(0.01) | (0.01)

(0.01) | (0.02)

(0.02) | (0.02)

(0.02) |

|

| Net Income (loss) | $(34,762) | $(197,204) | $(393,223) | $(320,473) |

Net Income (loss) before discontinued itemsor extraordinary items:

- per share undiluted

- per share diluted | (0.00)

(0.00) | (0.01)

(0.01 | (0.02)

(0.02) | (0.02)

(0.02) |

|

| Total Assets | $690,197 | $648,761 | $500,569 | $564,608 |

| Total Long-term Debt | $Nil | $Nil | $Nil | $Nil |

| Cash dividends declared: $ per share | $Nil | $Nil | $Nil | $Nil |

The growth in total assets for the Three Month period ended January 31, 2010 is primarily the result of capitalized exploration expenditures incurred during the Three Month period ended January 31, 2010 and a decrease in cash and cash equivalents primarily due to decrease in private placements during the current year. Financial results for the year of 2005 the Company reported a net loss of $467,969 including a significant change in accounting policy effective November 1, 2003, per the recommendations of the Canadian Institute of Chartered Accountants (“CICA”) Handbook Section 3870, for Stock-based compensation and other stock-based payments. In accordance with the CICA policy the Company has accounted for stock options granted to directors, employees and consultants using the fair market value method. As a result the preceding the Company has recognized in 2008 $60,156 in stock based compensation, in 2007 $171,470 stock-based compensation and in 2005 $289,341 stock-b ased compensation and an additional $33,712, which was charged to the opening deficit in the previous year in 2004.

| |

| 1.4 | Results of Operations |

The Company’s consolidated financial statements for the Three Month period ended January 31, 2010 with comparatives have been prepared in accordance with Canadian Generally Accepted accounting principles. The Company’s financial reporting is in Canadian dollars. The Company has included in the consolidated financial statements reconciliation between Canadian Generally Accepted Accounting Principles and United States Generally Accepted Accounting Principles. The reconciliation and explanation of the differences are in Note 13, pages 24 through 28.

Differences in income (losses) by the Company in the various periods are caused entirely by variations in the amounts that the Company incurred in its day-to-day operations and, primarily in raising funds or conducting exploration work on its Lapon Canyon-Nevada Property, Triton-Ontario Property, and Crystal Springs-Saskatchewan Property.

The Lapon Canyon, Nevada Property is a gold-bearing vein structure with historical exploration and minor production on three levels Proposed exploration consisting of opening, re-examining, sampling, and drilling of extensions has not been started to date.

| |

| 2010 First Quarter Report | Page26 |

| |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

| FOR THE THREE MONTH PERIOD ENDED JANUARY 31, 2010 |

| |

| 1.4 | Results of Operations (continued) |

The Crystal Springs, Saskatchewan diamond gold exploration target was acquired during the 2006 year. The required airborne geophysical surveys, drill testing for possible diamond pipes, and drill testing for potential gold-copper-iron targets in the basement rock have not yet been imitated. Monitoring of diamond exploration activity within the kimberlite field to the north continually evaluates the region for exploration potential.

The Kootenay (Jersey-Emerald) Property royalty interest covers production from the several potential targets. An extensive program by Sultan Minerals Inc., the current owner of property is ongoing and is monitored on continued basis.

As the Company is in the exploration stage of investigating, evaluating its minerals properties, revenues remained unchanged at $0 in 2009, 2008, 2007, and 2006, reflective of the nature of a mining exploration company.

The Company reported financial results for the first quarter and the Three-Month Period Ended January 31, 2010 a net of loss of $34,762 and a net loss of $52,439 in January 31, 2009 reflective of the status quo activity of the Company. Comparatively the Company reported a net loss in January 31, 2008 of $27,649; a net loss of $ 20,144 for the first quarter and the Three-Month Period Ended January 31, 2007. As at January 31, 2010 the Company had a cash position of $3 and at January 31, 2009 cash position of $31. Compared to January 31, 2008 the Company had a cash position of $72,037; January 31, 2007 a cash position of $18,126; $9,219 as at January 31, 2006. As at January 31, 2010 the Company reported a working capital deficiency of $551,487 and as at January 31, 2009 a deficiency of $356,668 comparative to January 31, 2008 the Company reported a working capital deficiency of $189,565; January 31, 2007, the Company reported a working capital deficiency of $ $267,178; and a worki ng capital deficiency of $399,515 as at January 31, 2006. The net working capital is not sufficient for the Company’s present requirements. The Company has continued to provide capital through equity financing and proposes to meet any further working capital requirements through equity financings on acceptable terms in order to enable us to complete any plan of operation.

In the current period ended January 31, 2009 the Company continued to incur general and administrative expenses consistent with the previous 12 months. The Company incurred expenditures for the Lapon Canyon - Nevada Project consistent with the same 12-month period in the previous year. In additional the Company incurred expenditures for the Crystal Springs – Saskatchewan, the Triton – Ontario and Gladiator – Arizona properties. Total expenditures for all resource properties for the current three-month period total $42,296. Comparatively $18,399 for the three month period ended January 31, 2009; compared with the three-month period ended January 31, 2008 of $21,115; compared with the three-month period ended January 31, 2007 of $14,320. Total expenditures for all resource properties for the year ended October 31, 2009 $149,420 and for October 31, 2008 total $105,949. Compared with total resource expenditures in 2007 of $107,291, and for 2006 total resource expendi tures were $60,414.

Expenses for 2010, 2009, 2008, 2007, 2006, and 2005, are comparative across all categories. Specific expenses of note during the 2010, 2009, 2008, 2007, 2006, and 2005 are as follows:

| |

| • | Professional fees with $8,750 in 2010, $8,750 in 2009, $8,089 for 2008 and $13,346 in 2007, $37,436 in 2006 compared to $15,768 in 2005 as result of increase costs of auditing fees; |

| • | Travel and Promotion with $4,090 in 2010, $11,810 in 2009, $623 for 2008 and $676 in 2007, $45,252 in 2006 compared to $97,587 in 2005 expenditures vary depending public relations expenditures; |

| • | Interest and Bank Charges with $386 in 2010, $281 in 2009, $278 in 2008 and for 2007 of $946 which increased to $8,025 in 2006, compared to $6,505 in 2005. |

| • | Office and sundry with $516, $573 in 2009, $1,097 in 2008, $1,259 in 2007, $7,021 in 2006 compared to $11,148 in 2005. |

| • | Consulting fees paid for 2010 are $16,500, and 2009 are $16,500, 2008 and 2007 were $0 and for 2006 was $44,182 compared to $54,772 in 2005. |

| • | No Corporate capital taxes were paid during 2009, 2008, 2007, 2006, and 2005 years. |

| • | Included expenditures for services paid to an individual related to a director of the Company for the 2009, 2008 2007, 2006 and 2005 periods were $3,000. |

| |

| 2010 First Quarter Report | Page27 |

| |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

| FOR THE THREE MONTH PERIOD ENDED JANUARY 31, 2010 |

| |

| 1.4 | Results of Operations (continued) |

There are no trends, commitments, events or uncertainties presently known or identifiable to management that are reasonably expected to have a material affect on the Company’s business, financial position, or results of operations. The nature of the Company’s business is the demanding of capital for property acquisition costs, exploration commitments and holding costs. The Company intends to utilize cash on hand to meet these obligations and will continue to raise funds by equity financings as necessary to augment this cash position, as it does not have sufficient operating cash flow.

There are certain risk factors that could have material affects that are un-quantifiable at present due to the nature of the Company’s industry and other considerations as follows:

| |

| • | Exploration Development and Operating Risk – mineral exploration involves many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Properties in the Company has direct of indirect interest will be subject to all the hazards and risks normally associated with exploration and development any of which could result in damage to property, and possible environmental damage. Mineral exploration involves a high degree of risk and few properties result in successful production; |

| • | Commodity Prices – the price of the Company’s shares, its financial results, and exploration activities have been or may in the future be, adversely affected by declines in the price of mineral commodity prices; |

| • | Foreign Operation Risk – properties in Costa Rica and Panama are affected by changes in regulation of shift in the political attitudes, which are beyond the control of the Company; |

| • | Financing and Acquisition – exploration activities require substantial additional financing. Failure to obtain financing results in delayed or postponed exploration and/or acquisition of resource properties; |

| • | Environmental – all phases of the Company’s exploration are subject to environmental regulation in the various jurisdictions of these resource properties. There are no assurances that future changes in environmental regulation will not adversely affect the Company; |

| • | Competition – the mining industry is intensely competitive industry, and the Company competes with numerous companies that have greater financial resources and technical facilities available; |

| |

| 1.5 | Summary of Quarterly Results |

The following information is provided for each of the eight (8) most recently completed quarters of the Company. This financial information was prepared in accordance with Canadian Generally Accepted Accounting Principles (“GAAP”) and reported in Canadian dollars.

| | | | | | | | |

| | Q1Jan 31,2010 | Q4Oct 31,2009 | Q3Jul 31,2009 | Q2Apr 30,2009 | Q1Jan 31,2009 | Q4Oct 31,2008 | Q3Jul 31,2008 | Q2Apr 30,2008 |

| Net sales or total revenues | $Nil | $Nil | $Nil | $Nil | $Nil | $Nil | $Nil | $Nil |

| Income (loss) beforediscontinued items orextraordinary items | (34,762) | (4,572) | (58,141) | (82,052) | (52,439) | (47,514) | (217,391) | (58,528) |

Income (loss) beforediscontinued items orextraordinary items:

- per share undiluted

- per share diluted | (0.00)

(0.00) | (0.01)

(0.012) | (0.00)

(0.00) | (0.00)

(0.00) | (0.00)

(0.00) | (0.01)

(0.01) | (0.00)

(0.00) | (0.00)

(0.00) |

|

| Net Income (loss) | (34.762) | (4,572) | (58,141) | (82,052) | (52,439) | (89,655) | (217,391) | (58,528) |

Net Income (loss) beforediscontinued items orextraordinary items:

- per share undiluted

- per share diluted | (0.00)

(0.00) | (0.04)

(0.04) | (0.00)

(0.00) | (0.00)

(0.00) | (0.00)

(0.00) | (0.01)

(0.01) | (0.00)

(0.00) | (0.00)

(0.00) |

|

| Total Assets | 690,197 | 648,761 | 617,842 | 568,523 | 518,797 | 500,569 | 521,214 | 539,662 |

| Total Long-term Debt | Nil | Nil | Nil | Nil | Nil | Nil | Nil | Nil |

Cash dividends declared:

$ per share | Nil | Nil | Nil | Nil | Nil | Nil | Nil | Nil |

| |

| 2010 First Quarter Report | Page28 |

| 1.5 | Summary of Quarterly Results (continued) |

The net loss for the fourth quarter of the fiscal 2009 is $4,572, loss for the fourth quarter of the fiscal 2008 is $89,655, the net loss for the fourth quarter of the fiscal 2007 was $252,828 compared to fourth quarter 2006 net loss of $28,779. The increase in the net loss for the fourth quarter in 2008, 2007 and 2005 was primarily due to stock-based compensation expenses of $60,156 for 2008, $171,470 for 2007 and $323,053 for 2005. Compensation expenses are based on the fair value over their vesting periods using the Black Scholes option-pricing model.

| |

| 1.6 | Liquidity and Capital Resources |

As at January 31, 2010 the Company had cash position of $3, and as at January 31, 2009 the Company had cash position of $31, compare to January 31, 2008 the Company had a cash position of $72,037; January 31, 2007cash position of $18,126 compared to $9,219 as at January 31, 2006. As at January 31, 2009 the Company reported a working capital deficiency of $356,668 and January 31, 2008 the Company reported a working capital deficiency of $189,565; January 31, 2007, the Company reported a working capital deficiency of $ $267,178 compared with working capital deficiency of $399,515 as at January 31, 2006. The net working capital is not sufficient for the Company’s present requirements. The Company has continued to provide capital through equity financing and proposes to meet any further working capital requirements through equity financings on acceptable terms in order to enable us to complete any plan of operation.

The financial statements have been prepared on a going concern basis which assumes that the Company will continue to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. The Company has no revenue generating properties at this time, and has generally incurred losses since inception.

The net working capital is not sufficient for the Company’s present requirements. The Company has continued to provide capital through equity financing and proposes to meet any further working capital requirements through equity financings on acceptable terms in order to enable us to complete any plan of operations. Please review “Subsequent Events” – Page 39.

In April 2010, the Company completed non-brokered private placements to issue 1,500,000 units at $0.02 per unit for proceeds of $30,000. Each unit is comprised of one common share and one share purchase warrant, each warrant entitling the holder to purchase one additional common share at a price of $0.03 per share in the first year and at price of $0.04 in the second year from the date of issue.

In November 2009, the Company agreed to issue 250,000 shares pursuant to a option to purchase agreement for Triton Property. The vendors agreed upon an assigned value of $0.02 per share.

On March 18, 2009, the Company completed a non-brokered private placement of 6,750,000 units at a purchase price of $0.02 per unit for proceeds of $135,000. Each unit is comprised of one common share and one share purchase warrant exercisable for 24 months from closing. Each warrant entitles the holder to purchase one additional common share at a price of $0.04 per share for a period of two years from the date of issue. The net proceeds of $135,000 were allocated $87,902 to common shares and $47,098 to the warrants on a relative fair value basis. The company issued 441,000 common shares as finder’s fees.

On August 20,2009, the Company extended the expiry date on 825,000 warrants to July 10, 2010.On August 20, 2009, the Company extended the expiry date on 1,000,000 warrants to November 19, 2010. The Company has granted a total of 1,150,000 stock options to its directors and officers. All options are exercisable at a price of $0.05 per share and an expiry date of August 14, 2014

On February 3, 2009, the Company extended the expiry date on the 1,250,000 warrants issued on March 1, 2006 to February 28, 2010, and extended the expiry date on the 700,000 warrants issued on February 15, 2007 to February 14, 2010. On February 18, 2009, the Company completed a non–brokered private placement of 516,768 units at a purchase price of $0.02 per unit for settlement of debt of $10,335. Each unit is comprised of one common share and one share purchase warrant exercisable for 24 months from closing. Each warrant entitles the holder to purchase one additional common share at a price of $0.04 per share for a period of two years from the date of issue. The Company issued the units on February 18, 2009.

| |

| 2010 First Quarter Report | Page29 |

| |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

| FOR THE THREE MONTH PERIOD ENDED JANUARY 31, 2010 |

| |

| 1.6 | Liquidity and Capital Resources (continued |

In October 2008, the Company completed a non-brokered private placement of 546,065 units at $0.10 per unit. Each unit is comprised of one common share and one common share purchase warrant exercisable for 24 months. The warrants are exercisable at $0.10 per share in the first year and at $0.10 in the second year. The Company issued the units on October 30, 2008

In September 2008, the Company completed a non-brokered private placement of 812,293 units at $0.10 per unit. Each unit is comprised of one common share and one common share purchase warrant exercisable for 24 months. The warrants are exercisable at $0.10 per share in the first year and at $0.15 in the second year. Of the 812,293 units issued, 706,142 units were issued to settle a $70,614 of the Company’s debts. 335,075 units were issued to Company directors to settle $33,508 of debt. The Company issued the units on September 9, 2008

In August 2008, the Company agreed to issue 706,142 shares to certain creditors to extinguish accounts payable totalling $70,614. The Company and the creditors agreed upon an assigned value of $0.10 per share. Of the 706,142 shares issued 317,990 shares were issued to directors of the Company to settle debts of $31,799. In June 2008, the Company completed non-brokered private placements to issue 333,333 units at $0.15 per unit for proceeds of $15,000. Each unit is comprised of one common share and one share purchase warrant, each warrant entitling the holder to purchase one additional common share at a price of $0.30 per share for a period of two years from the date of issue. The Company issued the units 100,000 on June 12, 2008 and the remainder of 233,333 units on September 9, 2008. Finders Fee of 8% for a total of 8,000 common shares was paid.

In February 2008, the Company completed non-brokered private placements to issue 561,733 units at $0.09 per unit for proceeds of $50,556. Each unit is comprised of one common share and one share purchase warrant, each warrant entitling the holder to purchase one additional common share at a price of $0.15 per share for a period of two years from the date of issue. The Company issued the units on February 27, 2008.

In November 2007, the Company issued 100,000 common shares as security for accounts payable pursuant to a court settlement. The Company was required to make monthly payments of $1,000 for 14 months and issued shares as security over the period the debt was to be repaid. Once the Company has extinguished the debt, the Company will cancel the shares. The shares of the Company are currently being held in trust with the lawyer of their creditor.

In respect to the above private placements totalling 10,780,584 units, if the Company’s shares trade on the OTC B:B at a price greater than or equal to $0.50 per share at any time during the trading day for a period of ten consecutive trading days (the Premium Trading Days) the exercise period shall be shortened to a period of 14 calendar days commencing on that day that is the tenth Premium Trading Day.

The funding raised as noted and any additional funds raised will be used for the Company’s exploration programs located in Nevada, and Saskatchewan, if warranted, to pursue other business opportunities and for general working capital.