UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-6001

Oppenheimer Global Opportunities Fund

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette

OFI Global Asset Management, Inc.

225 Liberty Street, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end: September 30

Date of reporting period: 3/31/2018

Item 1. Reports to Stockholders.

| | | | | | |

| Semiannual Report | | 3/31/2018 | | | | |

Table of Contents

Class A Shares

AVERAGE ANNUAL TOTAL RETURNS AT 3/31/18

| | | | | | | | | | | | |

| | | Class A Shares of the Fund | | |

| | | Without Sales Charge | | With Sales Charge | | MSCI All Country (AC) World Index |

6-Month | | | 25.02 | % | | | 17.82 | % | | | 4.71 | % |

1-Year | | | 40.85 | | | | 32.75 | | | | 14.85 | |

5-Year | | | 21.65 | | | | 20.21 | | | | 9.20 | |

10-Year | | | 13.83 | | | | 13.16 | | | | 5.57 | |

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns include changes in share price, reinvested distributions, and a 5.75% maximum applicable sales charge except where “without sales charge” is indicated. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. Returns for periods of less than one year are cumulative and not annualized. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800. CALL OPP (225.5677). See Fund prospectuses and summary prospectuses for more information on share classes and sales charges.

2 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

Fund Performance Discussion

The Fund’s Class A shares (without sales charge) generated a return of 25.02% during the reporting period, significantly outperforming the MSCI All Country World Index (the “Index”), which returned 4.71%. The Fund outperformed the Index in 10 out of 11 sectors of the Index this period. The Health Care sector drove the Fund’s outperformance versus the Index this period, due to strong stock selection. Other top contributors included stock selection in Telecommunication Services and Consumer Staples. The only underperforming sector versus the Index was Consumer Discretionary, where stock selection detracted from performance. Our results were gratifying given the market backdrop, as we had some good results in our equity positions. In addition, although our hedges on the S&P 500 Index and the NASDAQ 100 Index detracted from performance during the overall reporting period, they were additive once volatility reemerged after January 2018.

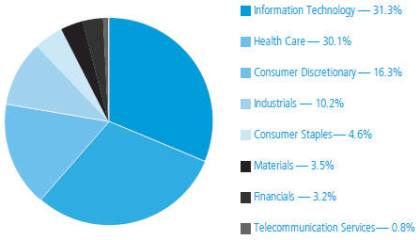

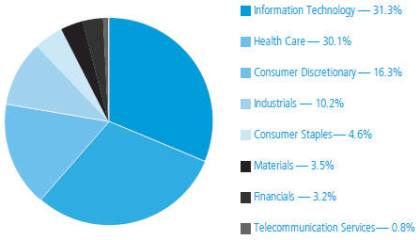

Our portfolio has some clear sector preferences, which reflect the sorts of ideas that we find appealing. We manage a forward-looking strategy, attuned to the long term technological, cultural and demographic trends of the 21st century. The big ideas of the 20th century are to be found elsewhere. In the Fund, you can see this quite vividly. We have substantial overweight positions to sectors where innovation is proliferating, such as Technology and Health Care.

MARKET OVERVIEW

After closing a strong 2017, markets went somewhat parabolic in January, making a correction of some sort likely, and we got one over the remainder of Q1. There has been a lot of noise in markets of late, and that certainly contributed to the ups and downs of the first quarter. Given the unrealistically low level of volatility we had in 2017, it appears to us that markets are returning more

to a state of normalcy than anything else. Valuations, though not necessarily high given the interest rate backdrop, are high relative to history and that makes them more vulnerable to a dose of bad news.

TOP INDIVIDUAL CONTRIBUTORS

The top three performing holdings of the Fund this reporting period were Nektar Therapeutics, Twitter, and CyberAgent.

Nektar Therapeutics Inc. has had a steady stream of good news over the last six months and its share price has more than tripled. During the first quarter of 2018, Nektar announced that they were entering into an agreement with Bristol Myers Squibb Inc. (BMY), to jointly develop NKTR-214 in combination with Opdivo, BMY’s immuno-oncology drug. The deal involves a $1 billion upfront cash payment to Nektar and the purchase of more than 8 million shares of

3 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

Nektar by BMY. Any profits from the venture will be split, with Nektar receiving 65% of the proceeds. The share price responded nicely, to say the least. We continue to find significant appeal in Nektar’s prospects.

Twitter was first purchased in the portfolio in February of 2017, after it had declined for over three years to interesting valuation levels. If nothing else, it could be a potential takeover target for a larger player. Twitter has a large platform of engaged users and a very specific market profile, with optionality potential for other services. The company reached profitability for the first time in late 2017. However user growth has slowed and the Twitter management has declared that they do not want to consider bids from any outside purchasers. The share price has risen substantially and we decided to take our profit on the company and exit the position.

CyberAgent, based in Japan, engages in the provision of internet media services and invests in other companies that do the same. The growth in demand for these services in Japan is strong, as it is in the rest of the world. The company reported better than expected earnings results over its fiscal first quarter and the share price reacted favorably.

TOP INDIVIDUAL DETRACTORS

Top detractors from performance this reporting period included Advanced Micro Devices, Iconix Brand Group, and a put option on the S&P 500 Index.

Advanced Micro Devices has been a long-term holding in the portfolio and has been a good performer over the last two years. The reasons are pretty straightforward, their products are becoming more competitive and semiconductor demand has been rising as the technology content of nearly everything deepens, which we expect will continue over the long term. However, late in 2017 the company announced quarterly results that were disappointing versus consensus and the share price has pulled back.

Iconix Brand Group is an owner of the rights to various well-known brands like London Fog, Danskin and Fieldcrest, among others. In October, Walmart announced they were ending their licensing agreement for the Danskin brand, which put Iconix close to violating some of their debt covenants. A sharp drop in its share price followed.

We have hedges on the S&P 500 Index and the NASDAQ 100 Index in place with an eye towards managing risk of heightened and extended volatility. Although these hedges detracted from performance during the overall reporting period, they were additive to performance when volatility picked up over the first quarter of 2018.

STRATEGY & OUTLOOK

We remain largely focused on investments in companies with sizable, transformational growth potential.

4 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

We have no crystal ball, but there are more than a few things which could stimulate a risk off period, including North Korea, trade wars, Syria, the Russia investigation, etc. We don’t believe these are likely to affect our companies 10 years hence. Tariffs are not likely to be applied to a company with a cure for a deadly form of cancer, but it can create some bumps along a path of ownership.

We remain largely focused on investments in companies with sizable, transformational growth potential.

| | |

| |  |

| | Frank V. Jennings, Ph. D. |

| | Portfolio Manager |

5 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

Top Holdings and Allocations

TOP TEN COMMON STOCK HOLDINGS

| | | | |

Nektar Therapeutics, Cl. A | | | 12.5 | % |

Advanced Micro Devices, Inc. | | | 3.3 | |

Nintendo Co. Ltd. | | | 2.0 | |

PeptiDream, Inc. | | | 1.8 | |

Coherent, Inc. | | | 1.4 | |

Genmab AS | | | 1.4 | |

IQE plc | | | 1.4 | |

H. Lundbeck AS | | | 1.2 | |

Applied Materials, Inc. | | | 1.2 | |

Eurofins Scientific SE | | | 1.2 | |

Portfolio holdings and allocations are subject to change. Percentages are as of March 31, 2018, and are based on net assets. For more current Fund holdings, please visit oppenheimerfunds.com.

TOP TEN GEOGRAPHICAL HOLDINGS

| | | | |

United States | | | 47.0 | % |

Japan | | | 12.5 | |

United Kingdom | | | 10.3 | |

Germany | | | 7.6 | |

Denmark | | | 5.0 | |

France | | | 3.1 | |

Italy | | | 2.6 | |

Spain | | | 2.3 | |

Sweden | | | 1.4 | |

Belgium | | | 1.4 | |

Portfolio holdings and allocation are subject to change. Percentages are as of March 31, 2018, and are based on total market value of investments.

SECTOR ALLOCATION

Portfolio holdings and allocations are subject to change. Percentages are as of March 31, 2018, and are based on the total market value of investments.

6 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

Share Class Performance

AVERAGE ANNUAL TOTAL RETURNS WITHOUT SALES CHARGE AS OF 3/31/18

| | | | | | | | | | | | |

| | | Inception Date | | | 6-Month | | 1-Year | | 5-Year | | 10-Year |

Class A (OPGIX) | | | 10/22/90 | | | 25.02% | | 40.85% | | 21.65% | | 13.83% |

Class B (OGGIX) | | | 10/10/95 | | | 24.54 | | 39.75 | | 20.68 | | 13.24 |

Class C (OGICX) | | | 12/1/93 | | | 24.54 | | 39.79 | | 20.73 | | 12.98 |

Class I (OGIIX) | | | 1/27/12 | | | 25.28 | | 41.43 | | 22.17 | | 19.09* |

Class R (OGINX) | | | 3/1/01 | | | 24.86 | | 40.47 | | 21.32 | | 13.49 |

Class Y (OGIYX) | | | 2/1/01 | | | 25.17 | | 41.20 | | 21.94 | | 14.15 |

AVERAGE ANNUAL TOTAL RETURNS WITH SALES CHARGE AS OF 3/31/18

| | | | | | | | | | | | |

| | | Inception Date | | | 6-Month | | 1-Year | | 5-Year | | 10-Year |

Class A (OPGIX) | | | 10/22/90 | | | 17.82% | | 32.75% | | 20.21% | | 13.16% |

Class B (OGGIX) | | | 10/10/95 | | | 19.54 | | 34.75 | | 20.49 | | 13.24 |

Class C (OGICX) | | | 12/1/93 | | | 23.54 | | 38.79 | | 20.73 | | 12.98 |

Class I (OGIIX) | | | 1/27/12 | | | 25.28 | | 41.43 | | 22.17 | | 19.09* |

Class R (OGINX) | | | 3/1/01 | | | 24.86 | | 40.47 | | 21.32 | | 13.49 |

Class Y (OGIYX) | | | 2/1/01 | | | 25.17 | | 41.20 | | 21.94 | | 14.15 |

* Shows performance since inception.

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800. CALL OPP (225.5677). Fund returns include changes in share price, reinvested distributions, and the applicable sales charge: for Class A shares, the current maximum initial sales charge of 5.75%; for Class B shares, the contingent deferred sales charge of 5% (1-year) and 2% (5-year); and for Class C shares, the contingent deferred sales charge of 1% for the 1-year period. There is no sales charge for Class I, Class R and Class Y shares. Because Class B shares convert to Class A shares 72 months after purchase, the 10-year return for Class B shares uses Class A performance for the period after conversion. Returns for periods of less than one year are cumulative and not annualized. See Fund prospectuses and summary prospectuses for more information on share classes and sales charges.

The Fund’s performance is compared to the performance of the MSCI All Country (AC) World Index, a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The Index is unmanaged and cannot be purchased directly by investors. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the Index. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s

7 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

The views in the Fund Performance Discussion represent the opinions of this Fund’s portfolio managers and are not intended as investment advice or to predict or depict the performance of any investment. These views are as of the close of business on March 31, 2018, and are subject to change based on subsequent developments. The Fund’s portfolio and strategies are subject to change.

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds, and may be obtained by asking your financial advisor, visiting oppenheimerfunds.com, or calling 1.800. CALL OPP (225.5677). Read prospectuses and summary prospectuses carefully before investing.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

8 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

Fund Expenses

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments and/or contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended March 31, 2018.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During 6 Months Ended March 31, 2018” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or contingent deferred sales charges (loads). Therefore, the “hypothetical” section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

9 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

| | | | | | | | | | | | |

| Actual | | Beginning Account Value October 1, 2017 | | | Ending Account Value March 31, 2018 | | | Expenses Paid During 6 Months Ended March 31, 2018 | |

Class A | | | $ 1,000.00 | | | | $ 1,250.20 | | | | $ 6.30 | |

Class B | | | 1,000.00 | | | | 1,245.40 | | | | 10.68 | |

Class C | | | 1,000.00 | | | | 1,245.40 | | | | 10.51 | |

Class I | | | 1,000.00 | | | | 1,252.80 | | | | 3.99 | |

Class R | | | 1,000.00 | | | | 1,248.60 | | | | 7.70 | |

Class Y | | | 1,000.00 | | | | 1,251.70 | | | | 4.89 | |

| | | |

| Hypothetical | | | | | | | | | | | | |

(5% return before expenses) | | | | | | | | | | | | |

Class A | | | 1,000.00 | | | | 1,019.35 | | | | 5.65 | |

Class B | | | 1,000.00 | | | | 1,015.46 | | | | 9.59 | |

Class C | | | 1,000.00 | | | | 1,015.61 | | | | 9.44 | |

Class I | | | 1,000.00 | | | | 1,021.39 | | | | 3.58 | |

Class R | | | 1,000.00 | | | | 1,018.10 | | | | 6.92 | |

Class Y | | | 1,000.00 | | | | 1,020.59 | | | | 4.39 | |

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the 6-month period ended March 31, 2018 are as follows:

| | | | |

| Class | | Expense Ratios |

Class A | | | 1.12 | % |

Class B | | | 1.90 | |

Class C | | | 1.87 | |

Class I | | | 0.71 | |

Class R | | | 1.37 | |

Class Y | | | 0.87 | |

The expense ratios reflect voluntary and/or contractual waivers and/or reimbursements of expenses by the Fund’s Manager and Transfer Agent. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

10 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

STATEMENT OF INVESTMENTS March 31, 2018 Unaudited

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks—96.5% | | | | | | | | |

Consumer Discretionary—15.8% | | | | | | | | |

Auto Components—1.5% | | | | | | | | |

Brembo SpA | | | 2,000,000 | | | $ | 30,962,480 | |

Cie Plastic Omnium SA | | | 1,500,000 | | | | 71,911,631 | |

Continental AG | | | 100,000 | | | | 27,622,508 | |

| | | | | | | | 130,496,619 | |

Automobiles—0.4% | | | | | | | | |

Ferrari NV | | | 300,000 | | | | 36,156,000 | |

Diversified Consumer Services—1.0% | | | | | | | | |

Rentokil Initial plc | | | 15,000,000 | | | | 57,241,368 | |

Sotheby’s1 | | | 600,000 | | | | 30,786,000 | |

| | | | | | | | 88,027,368 | |

Hotels, Restaurants & Leisure—1.0% | | | | | | | | |

InterContinental Hotels Group plc | | | 797,872 | | | | 47,843,255 | |

Shake Shack, Inc., Cl. A1 | | | 1,000,000 | | | | 41,630,000 | |

| | | | | | | | 89,473,255 | |

Household Durables—3.5% | | | | | | | | |

Bang & Olufsen AS1 | | | 2,000,000 | | | | 50,764,423 | |

De’ Longhi SpA | | | 1,000,000 | | | | 29,760,485 | |

iRobot Corp.1 | | | 900,000 | | | | 57,771,000 | |

Nikon Corp. | | | 2,000,000 | | | | 36,100,578 | |

Rational AG | | | 80,000 | | | | 50,372,725 | |

SodaStream International Ltd.1 | | | 1,000,000 | | | | 91,830,000 | |

| | | | | | | | 316,599,211 | |

Internet & Catalog Retail—3.4% | | | | | | | | |

AO World plc1 | | | 20,000,000 | | | | 32,467,075 | |

ASKUL Corp. | | | 1,600,000 | | | | 53,488,643 | |

ASOS plc1 | | | 700,000 | | | | 68,489,022 | |

boohoo.com plc1 | | | 20,000,000 | | | | 41,682,877 | |

Boozt AB1,2,3 | | | 3,000,000 | | | | 26,720,746 | |

Rakuten, Inc. | | | 6,000,000 | | | | 49,579,043 | |

SRP Groupe SA1,2 | | | 500,000 | | | | 4,820,603 | |

Zalando SE1,2 | | | 600,000 | | | | 32,732,308 | |

| | | | | | | | 309,980,317 | |

Media—1.6% | | | | | | | | |

CyberAgent, Inc. | | | 1,600,000 | | | | 83,000,929 | |

Schibsted ASA, Cl. A | | | 900,000 | | | | 25,273,873 | |

Stroeer SE & Co. KGaA | | | 300,000 | | | | 20,985,657 | |

Technicolor SA | | | 10,000,000 | | | | 16,942,472 | |

| | | | | | | 146,202,931 | |

Specialty Retail—1.4% | | | | | | | | |

JINS, Inc. | | | 600,000 | | | | 33,136,535 | |

11 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

STATEMENT OF INVESTMENTS Unaudited / Continued

| | | | | | | | |

| | | Shares | | | Value | |

Specialty Retail (Continued) | | | | | | | | |

Superdry plc | | | 3,000,000 | | | $ | 65,920,490 | |

Urban Outfitters, Inc.1 | | | 800,000 | | | | 29,568,000 | |

| | | | | | | | 128,625,025 | |

Textiles, Apparel & Luxury Goods—2.0% | | | | | | | | |

Brunello Cucinelli SpA | | | 1,500,000 | | | | 47,150,041 | |

Iconix Brand Group, Inc.1,3 | | | 6,000,000 | | | | 6,660,000 | |

Moncler SpA | | | 1,000,000 | | | | 38,132,382 | |

Mulberry Group plc | | | 500,000 | | | | 5,435,121 | |

OVS SpA2 | | | 3,000,000 | | | | 18,436,170 | |

Pandora AS | | | 600,000 | | | | 65,038,517 | |

| | | | | | | | 180,852,231 | |

Consumer Staples—4.4% | | | | | | | | |

Food & Staples Retailing—0.9% | | | | | | | | |

Rite Aid Corp.1 | | | 50,000,000 | | | | 84,000,000 | |

| | | | | | | | |

Food Products—1.9% | | | | | | | | |

Ebro Foods SA | | | 2,000,000 | | | | 50,875,952 | |

First Derivatives plc | | | 800,000 | | | | 40,983,003 | |

Marine Harvest ASA | | | 4,000,000 | | | | 80,371,578 | |

| | | | | | | 172,230,533 | |

| | | | | | | | |

Personal Products—1.6% | | | | | | | | |

Ci:z Holdings Co. Ltd. | | | 1,800,000 | | | | 90,033,511 | |

Ontex Group NV | | | 2,000,000 | | | | 53,526,113 | |

| | | | | | | 143,559,624 | |

| | | | | | | | |

Financials—3.0% | | | | | | | | |

Capital Markets—1.1% | | | | | | | | |

Allied Minds plc1 | | | 10,000,000 | | | | 14,755,772 | |

IP Group plc1 | | | 20,785,545 | | | | 33,457,145 | |

Rothschild & Co. | | | 1,500,000 | | | | 55,248,704 | |

| | | | | | | 103,461,621 | |

| | | | | | | | |

Commercial Banks—0.4% | | | | | | | | |

Banco Comercial Portugues SA, Cl. R1 | | | 100,000,000 | | | | 33,540,959 | |

| | | | | | | | |

Diversified Financial Services—0.4% | | | | | | | | |

IG Group Holdings plc | | | 3,000,000 | | | | 33,618,970 | |

| | | | | | | | |

Real Estate Investment Trusts (REITs)—0.6% | | | | | | | | |

British Land Co. plc (The) | | | 4,000,000 | | | | 36,079,732 | |

Unibail-Rodamco SE | | | 100,000 | | | | 22,890,704 | |

| | | | | | | | 58,970,436 | |

Real Estate Management & Development—0.5% | | | | | | | | |

Fisher & Paykel Healthcare Corp. Ltd. | | | 3,000,000 | | | | 28,815,215 | |

12 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

| | | | | | | | |

| | | Shares | | | Value | |

Real Estate Management & Development (Continued) | | | | | | | | |

Purplebricks Group plc1 | | | 4,000,000 | | | $ | 17,639,947 | |

| | | | | | | | 46,455,162 | |

Health Care—29.1% | | | | | | | | |

Biotechnology—7.2% | | | | | | | | |

Abcam plc | | | 1,000,000 | | | | 17,402,308 | |

Arrowhead Pharmaceuticals, Inc.1,3 | | | 7,800,000 | | | | 56,238,000 | |

Bavarian Nordic AS1 | | | 800,000 | | | | 25,158,282 | |

Exact Sciences Corp.1 | | | 2,500,000 | | | | 100,825,000 | |

Genmab AS1 | | | 600,000 | | | | 129,170,817 | |

Halozyme Therapeutics, Inc.1 | | | 1,000,000 | | | | 19,590,000 | |

Hansa Medical AB1 | | | 1,000,000 | | | | 28,304,850 | |

Innate Pharma SA1 | | | 1,000,000 | | | | 7,071,351 | |

PeptiDream, Inc.1 | | | 3,000,000 | | | | 164,167,863 | |

Rigel Pharmaceuticals, Inc.1 | | | 5,000,000 | | | | 17,700,000 | |

Sarepta Therapeutics, Inc.1 | | | 500,000 | | | | 37,045,000 | |

Seattle Genetics, Inc.1 | | | 1,000,000 | | | | 52,340,000 | |

| | | | | | | | 655,013,471 | |

Health Care Equipment & Supplies—3.8% | | | | | | | | |

Align Technology, Inc.1 | | | 300,000 | | | | 75,339,000 | |

Biocartis NV1,2,3 | | | 2,600,000 | | | | 39,126,239 | |

Carl Zeiss Meditec AG | | | 1,000,000 | | | | 63,856,633 | |

Consort Medical plc3 | | | 2,856,109 | | | | 44,881,144 | |

Ion Beam Applications | | | 400,000 | | | | 8,090,046 | |

Jeol Ltd. | | | 3,660,000 | | | | 33,792,245 | |

Nevro Corp.1 | | | 900,000 | | | | 78,003,000 | |

| | | | | | | | 343,088,307 | |

Health Care Providers & Services—0.4% | | | | | | | | |

Amplifon SpA | | | 2,000,000 | | | | 35,668,675 | |

| | | | | | | | |

Health Care Technology—1.0% | | | | | | | | |

M3, Inc. | | | 2,000,000 | | | | 91,615,831 | |

| | | | | | | | |

Life Sciences Tools & Services—2.7% | | | | | | | | |

Bruker Corp. | | | 1,400,000 | | | | 41,888,000 | |

Eurofins Scientific SE | | | 200,000 | | | | 105,723,472 | |

MorphoSys AG1 | | | 900,000 | | | | 92,058,736 | |

| | | | | | | | 239,670,208 | |

Pharmaceuticals—14.0% | | | | | | | | |

GW Pharmaceuticals plc, ADR1 | | | 100,000 | | | | 11,267,000 | |

H. Lundbeck AS | | | 2,000,000 | | | | 111,794,817 | |

Merck KGaA | | | 200,000 | | | | 19,187,012 | |

Nektar Therapeutics, Cl. A1,3 | | | 10,594,680 | | | | 1,125,790,697 | |

| | | | | | | 1,268,039,526 | |

13 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

STATEMENT OF INVESTMENTS Unaudited / Continued

| | | | | | | | |

| | | Shares | | | Value | |

Industrials—9.9% | | | | | | | | |

Aerospace & Defense—2.1% | | | | | | | | |

Boeing Co. (The) | | | 300,000 | | | $ | 98,364,000 | |

Hexcel Corp. | | | 700,000 | | | | 45,213,000 | |

United Technologies Corp. | | | 400,000 | | | | 50,328,000 | |

| | | | | | | | 193,905,000 | |

Air Freight & Couriers—0.2% | | | | | | | | |

Expeditors International of Washington, Inc. | | | 250,000 | | | | 15,825,000 | |

| | | | | | | | |

Commercial Services & Supplies—0.6% | | | | | | | | |

Rollins, Inc. | | | 1,000,000 | | | | 51,030,000 | |

| | | | | | | | |

Construction & Engineering—0.7% | | | | | | | | |

Ferrovial SA | | | 3,000,000 | | | | 62,727,833 | |

| | | | | | | | |

Electrical Equipment—2.2% | | | | | | | | |

Emerson Electric Co. | | | 653,224 | | | | 44,615,199 | |

Nidec Corp. | | | 300,000 | | | | 46,018,749 | |

OSRAM Licht AG | | | 500,000 | | | | 36,815,811 | |

Schneider Electric SE | | | 500,000 | | | | 43,980,433 | |

Sensata Technologies Holding plc1 | | | 600,000 | | | | 31,098,000 | |

| | | | | | | | 202,528,192 | |

Machinery—2.6% | | | | | | | | |

Albany International Corp., Cl. A | | | 400,000 | | | | 25,080,000 | |

FANUC Corp. | | | 200,000 | | | | 50,901,732 | |

SLM Solutions Group AG1,3 | | | 2,000,000 | | | | 79,201,324 | |

Spirax-Sarco Engineering plc | | | 464,285 | | | | 37,531,536 | |

THK Co. Ltd. | | | 1,000,000 | | | | 41,669,214 | |

| | | | | | | | 234,383,806 | |

Professional Services—0.9% | | | | | | | | |

Acacia Research Corp.1 | | | 2,500,000 | | | | 8,750,000 | |

Bureau Veritas SA | | | 450,000 | | | | 11,702,300 | |

Intrum Justitia AB | | | 500,000 | | | | 14,191,965 | |

Teleperformance | | | 300,000 | | | | 46,550,171 | |

| | | | | | | | 81,194,436 | |

Trading Companies & Distributors—0.6% | | | | | | | | |

Indutrade AB | | | 2,000,000 | | | | 51,792,587 | |

| | | | | | | | |

Information Technology—30.2% | | | | | | | | |

Communications Equipment—0.6% | | | | | | | | |

Nokia OYJ | | | 10,000,000 | | | | 55,276,513 | |

| | | | | | | | |

Electronic Equipment, Instruments, & Components—5.8% | | | | | | | | |

Basler AG3 | | | 200,000 | | | | 42,631,001 | |

Cognex Corp. | | | 1,200,000 | | | | 62,388,000 | |

Coherent, Inc.1 | | | 700,000 | | | | 131,180,000 | |

14 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

| | | | | | | | |

| | | Shares | | | Value | |

Electronic Equipment, Instruments, & Components (Continued) | | | | | | | | |

Corning, Inc. | | | 1,000,000 | | | $ | 27,880,000 | |

Dolby Laboratories, Inc., Cl. A | | | 800,000 | | | | 50,848,000 | |

Littelfuse, Inc. | | | 400,000 | | | | 83,272,000 | |

Next Biometrics Group AS1,3 | | | 987,583 | | | | 4,842,596 | |

Optex Group Co. Ltd. | | | 1,100,000 | | | | 27,957,000 | |

Yaskawa Electric Corp. | | | 2,000,000 | | | | 90,821,752 | |

| | | | | | | | 521,820,349 | |

Internet Software & Services—1.1% | | | | | | | | |

Alarm.com Holdings, Inc.1 | | | 400,000 | | | | 15,096,000 | |

Baozun, Inc., Sponsored ADR1 | | | 1,000,000 | | | | 45,880,000 | |

Hortonworks, Inc.1 | | | 2,000,000 | | | | 40,740,000 | |

| | | | | | | | 101,716,000 | |

IT Services—1.9% | | | | | | | | |

Amadeus IT Group SA | | | 400,000 | | | | 29,570,964 | |

BasWare OYJ1,3 | | | 1,000,000 | | | | 53,837,125 | |

FleetCor Technologies, Inc.1 | | | 200,000 | | | | 40,500,000 | |

Square, Inc., Cl. A1 | | | 1,000,000 | | | | 49,200,000 | |

| | | | | | | | 173,108,089 | |

Semiconductors & Semiconductor Equipment—11.2% | | | | | | | | |

Advanced Micro Devices, Inc.1 | | | 30,000,000 | | | | 301,500,000 | |

AIXTRON SE1 | | | 4,000,000 | | | | 77,324,651 | |

Applied Materials, Inc. | | | 2,000,000 | | | | 111,220,000 | |

Cree, Inc.1 | | | 1,000,000 | | | | 40,310,000 | |

Disco Corp. | | | 200,000 | | | | 43,148,280 | |

First Solar, Inc.1 | | | 1,000,000 | | | | 70,980,000 | |

Infineon Technologies AG | | | 1,000,000 | | | | 26,790,028 | |

IQE plc1,3 | | | 68,505,887 | | | | 123,808,456 | |

Nordic Semiconductor ASA1 | | | 3,000,000 | | | | 17,985,061 | |

ON Semiconductor Corp.1 | | | 2,000,000 | | | | 48,920,000 | |

PDF Solutions, Inc.1 | | | 1,000,000 | | | | 11,660,000 | |

PVA TePla AG1,3 | | | 1,723,811 | | | | 31,691,985 | |

STMicroelectronics NV | | | 1,000,000 | | | | 22,192,446 | |

Synaptics, Inc.1 | | | 500,000 | | | | 22,865,000 | |

Veeco Instruments, Inc.1,3 | | | 4,000,000 | | | | 68,000,000 | |

| | | | | | | | 1,018,395,907 | |

Software—8.2% | | | | | | | | |

BlackBerry Ltd.1 | | | 4,000,000 | | | | 46,000,000 | |

Blue Prism Group plc1 | | | 3,000,000 | | | | 58,923,158 | |

EVR Holdings plc1 | | | 37,500,000 | | | | 6,102,787 | |

FireEye, Inc.1 | | | 3,000,000 | | | | 50,790,000 | |

Frontier Developments plc1 | | | 1,000,000 | | | | 18,485,205 | |

Globant SA1 | | | 300,000 | | | | 15,462,000 | |

Manhattan Associates, Inc.1 | | | 1,000,000 | | | | 41,880,000 | |

Nintendo Co. Ltd. | | | 400,000 | | | | 178,366,834 | |

PTC, Inc.1 | | | 1,200,000 | | | | 93,612,000 | |

15 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

STATEMENT OF INVESTMENTS Unaudited / Continued

| | | | | | | | |

| | | Shares | | | Value | |

Software (Continued) | | | | | | | | |

Red Hat, Inc.1 | | | 600,000 | | | $ | 89,706,000 | |

Rovio Entertainment OYJ1,2 | | | 2,401,035 | | | | 14,354,332 | |

SDL plc | | | 2,000,000 | | | | 11,513,183 | |

Tableau Software, Inc., Cl. A1 | | | 200,000 | | | | 16,164,000 | |

WANdisco plc1,3 | | | 5,835,399 | | | | 68,860,336 | |

Zendesk, Inc.1 | | | 600,000 | | | | 28,722,000 | |

| | | | | | | | 738,941,835 | |

Technology Hardware, Storage & Peripherals—1.4% | | | | | | | | |

3D Systems Corp.1,3 | | | 8,000,000 | | | | 92,720,000 | |

Tobii AB1 | | | 3,000,000 | | | | 11,595,702 | |

Xaar plc3 | | | 4,000,000 | | | | 18,845,921 | |

| | | | | | | | 123,161,623 | |

Materials—3.4% | | | | | | | | |

Chemicals—2.3% | | | | | | | | |

Croda International plc | | | 482,758 | | | | 30,979,222 | |

Novozymes AS, Cl. B | | | 1,500,000 | | | | 77,677,647 | |

Symrise AG | | | 500,000 | | | | 40,260,163 | |

Toray Industries, Inc. | | | 3,000,000 | | | | 28,492,982 | |

Umicore SA | | | 600,000 | | | | 31,830,088 | |

| | | | | | | | 209,240,102 | |

Containers & Packaging—0.5% | | | | | | | | |

Sealed Air Corp. | | | 1,000,000 | | | | 42,790,000 | |

| | | | | | | | |

Metals & Mining—0.6% | | | | | | | | |

thyssenkrupp AG | | | 2,000,000 | | | | 52,160,185 | |

| | | | | | | | |

Telecommunication Services—0.7% | | | | | | | | |

Wireless Telecommunication Services—0.7% | | | | | | | | |

Masmovil Ibercom SA1 | | | 450,000 | | | | 66,558,118 | |

Total Common Stocks (Cost $5,587,934,292) | | | | | | | 8,731,901,855 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Exercise

Price | | | Expiration

Date | | | Notional

Amount (000’s) | | | Contracts (000’s) | | | | |

Exchange-Traded Options Purchased—1.6% | | | | | | | | | |

PowerShares QQQ Trust, Series 1 Exchange Traded Fund Put1 | | | USD | | | | 155.000 | | | | 1/18/19 | | | | USD 1,120,910 | | | | USD 70 | | | | 65,800,000 | |

PowerShares QQQ Trust, Series 1 Exchange Traded Fund Put1 | | | USD | | | | 135.000 | | | | 1/18/19 | | | | USD 1,120,910 | | | | USD 70 | | | | 35,700,000 | |

S&P 500 Index Put1 | | | USD | | | | 2,275.000 | | | | 12/21/18 | | | | USD 2,112,696 | | | | USD 8 | | | | 47,640,000 | |

Total Exchange-Traded Options Purchased (Cost $210,459,711) | | | | | | | | 149,140,000 | |

16 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

| | | | | | | | |

| | | Shares | | | Value | |

Investment Company—3.1% | | | | | | | | |

Oppenheimer Institutional Government Money Market Fund, Cl. E, 1.58%3,4 (Cost $277,791,247) | | | 277,791,247 | | | $ | 277,791,247 | |

Total Investments, at Value (Cost $6,076,185,250) | | | 101.2% | | | | 9,158,833,102 | |

Net Other Assets (Liabilities) | | | (1.2) | | | | (105,773,468 | ) |

Net Assets | | | 100.0% | | | $ | 9,053,059,634 | |

| | | | |

Footnotes to Statement of Investments

1. Non-income producing security.

2. Represents securities sold under Rule 144A, which are exempt from registration under the Securities Act of 1933, as amended. These securities have been determined to be liquid under guidelines established by the Board of Trustees. These securities amount to $136,190,398 or 1.50% of the Fund’s net assets at period end.

3. Is or was an affiliate, as defined in the Investment Company Act of 1940, as amended, at or during the reporting period, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the reporting period in which the issuer was an affiliate are as follows:

| | | | | | | | | | | | | | | | |

| | | Shares September 30, 2017 | | | Gross Additions | | | Gross Reductions | | | Shares March 31, 2018 | |

3D Systems Corp. | | | 2,000,000 | | | | 6,000,000 | | | | — | | | | 8,000,000 | |

Arrowhead Pharmaceuticals, Inc. | | | 3,000,000 | | | | 4,800,000 | | | | — | | | | 7,800,000 | |

Basler AG | | | — | | | | 200,000 | | | | — | | | | 200,000 | |

BasWare OYJ | | | 500,000 | | | | 500,000 | | | | — | | | | 1,000,000 | |

Biocartis NV | | | — | | | | 2,600,000 | | | | — | | | | 2,600,000 | |

Boozt AB | | | — | | | | 3,000,000 | | | | — | | | | 3,000,000 | |

Consort Medical plc | | | 2,856,109 | | | | — | | | | — | | | | 2,856,109 | |

Iconix Brand Group, Inc. | | | 6,000,000 | | | | — | | | | — | | | | 6,000,000 | |

IQE plc | | | — | | | | 68,505,887 | | | | — | | | | 68,505,887 | |

Nektar Therapeutics, Cl. A | | | 24,225,000 | | | | — | | | | 13,630,320 | | | | 10,594,680 | |

Next Biometrics Group AS | | | 660,000 | | | | 327,583 | | | | — | | | | 987,583 | |

Oppenheimer Institutional | | | | | | | | | | | | | | | | |

Government Money Market Fund, Cl. E | | | 16,324,804 | | | | 1,291,832,861 | | | | 1,030,366,418 | | | | 277,791,247 | |

PVA TePla AG | | | — | | | | 1,723,811 | | | | — | | | | 1,723,811 | |

SLM Solutions Group AG | | | 1,200,000 | | | | 800,000 | | | | — | | | | 2,000,000 | |

Veeco Instruments, Inc. | | | — | | | | 4,000,000 | | | | — | | | | 4,000,000 | |

WANdisco plc | | | 5,276,000 | | | | 559,399 | | | | — | | | | 5,835,399 | |

Xaar plc | | | 4,000,000 | | | | — | | | | — | | | | 4,000,000 | |

| | | | |

| | | Value | | | Income | | | Realized Gain (Loss) | | | Change in Unrealized Gain (Loss) | |

3D Systems Corp. | | $ | 92,720,000 | | | $ | — | | | $ | — | | | $ | 1,469,159 | |

Arrowhead Pharmaceuticals, Inc. | | | 56,238,000 | | | | — | | | | — | | | | 23,361,262 | |

Basler AG | | | 42,631,001 | | | | — | | | | — | | | | (3,246,721 | ) |

BasWare OYJ | | | 53,837,125 | | | | — | | | | — | | | | 3,235,968 | |

Biocartis NV | | | 39,126,239 | | | | — | | | | — | | | | 1,020,954 | |

Boozt AB | | | 26,720,746 | | | | — | | | | — | | | | (187,506 | ) |

Consort Medical plc | | | 44,881,144 | | | | 295,049 | | | | — | | | | 3,276,969 | |

Iconix Brand Group, Inc. | | | 6,660,000 | | | | — | | | | — | | | | (27,480,000 | ) |

IQE plc | | | 123,808,456 | | | | — | | | | — | | | | 6,046,986 | |

Nektar Therapeutics, Cl. A | | | 1,125,790,697 | | | | — | | | | 515,164,830 | | | | 736,036,405 | |

17 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

STATEMENT OF INVESTMENTS Unaudited / Continued

Footnotes to Statement of Investments (Continued)

| | | | | | | | | | | | | | |

| | | Value | | | Income | | | Realized Gain (Loss) | | | Change in Unrealized Gain (Loss) |

Next Biometrics Group AS | | $ | 4,842,596 | | | $ | — | | | $ | — | | | $ (934,848) |

Oppenheimer Institutional Government Money Market Fund, Cl. E | | | 277,791,247 | | | | 850,459 | | | | — | | | — |

PVA TePla AG | | | 31,691,985 | | | | — | | | | — | | | 11,141,442 |

SLM Solutions Group AG | | | 79,201,324 | | | | — | | | | — | | | (12,421,837) |

Veeco Instruments, Inc. | | | 68,000,000 | | | | — | | | | — | | | 1,681,752 |

WANdisco plc | | | 68,860,336 | | | | — | | | | — | | | 7,790,144 |

Xaar plc | | | 18,845,921 | | | | — | | | | — | | | (5,035,623) |

| | | |

Total | | $ | 2,161,646,817 | | | $ | 1,145,508 | | | $ | 515,164,830 | | | $ 745,754,506 |

| | | |

4. Rate shown is the 7-day yield at period end.

Distribution of investments representing geographic holdings, as a percentage of total investments at value, is as follows:

| | | | | | | | | | | | |

| Geographic Holdings | | Value | | | Percent | | | | |

United States | | $ | 4,300,813,143 | | | | 47.0% | | | | | |

Japan | | | 1,142,291,722 | | | | 12.5 | | | | | |

United Kingdom | | | 944,214,032 | | | | 10.3 | | | | | |

Germany | | | 693,690,726 | | | | 7.6 | | | | | |

Denmark | | | 459,604,503 | | | | 5.0 | | | | | |

France | | | 281,118,369 | | | | 3.1 | | | | | |

Italy | | | 236,266,234 | | | | 2.6 | | | | | |

Spain | | | 209,732,868 | | | | 2.3 | | | | | |

Sweden | | | 132,605,850 | | | | 1.4 | | | | | |

Belgium | | | 132,572,485 | | | | 1.4 | | | | | |

Norway | | | 128,473,108 | | | | 1.4 | | | | | |

Finland | | | 123,467,970 | | | | 1.3 | | | | | |

Luxembourg | | | 105,723,472 | | | | 1.2 | | | | | |

Israel | | | 91,830,000 | | | | 1.0 | | | | | |

Canada | | | 46,000,000 | | | | 0.5 | | | | | |

China | | | 45,880,000 | | | | 0.5 | | | | | |

Portugal | | | 33,540,959 | | | | 0.4 | | | | | |

New Zealand | | | 28,815,215 | | | | 0.3 | | | | | |

Switzerland | | | 22,192,446 | | | | 0.2 | | | | | |

Total | | $ | 9,158,833,102 | | | | 100.0 | % | | | | |

| | | | |

See accompanying Notes to Financial Statements.

18 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

STATEMENT OF ASSETS AND LIABILITIES March 31, 2018 Unaudited

| | | | |

Assets | | | | |

Investments, at value—see accompanying statement of investments: | | | | |

Unaffiliated companies (cost $4,970,431,186) | | $ | 6,997,186,285 | |

Affiliated companies (cost $1,105,754,064) | | | 2,161,646,817 | |

| | | 9,158,833,102 | |

Cash | | | 52,039,325 | |

Cash—foreign currencies (cost $8,497,829) | | | 8,482,577 | |

Receivables and other assets: | | | | |

Shares of beneficial interest sold | | | 32,897,736 | |

Dividends | | | 6,705,474 | |

Other | | | 381,624 | |

Total assets | | | 9,259,339,838 | |

Liabilities | | | | |

| |

Payables and other liabilities: | | | | |

| |

Investments purchased | | | 190,582,011 | |

| |

Shares of beneficial interest redeemed | | | 13,753,625 | |

| |

Distribution and service plan fees | | | 1,162,978 | |

| |

Trustees’ compensation | | | 538,913 | |

| |

Shareholder communications | | | 15,674 | |

| |

Other | | | 227,003 | |

| |

Total liabilities | | | 206,280,204 | |

Net Assets | | $ | 9,053,059,634 | |

| | | | |

| | | | |

Composition of Net Assets | | | | |

| |

Par value of shares of beneficial interest | | $ | 121,879 | |

| |

Additional paid-in capital | | | 5,441,816,233 | |

| |

Accumulated net investment loss | | | (49,331,753 | ) |

| |

Accumulated net realized gain on investments and foreign currency transactions | | | 577,572,464 | |

| |

Net unrealized appreciation on investments and translation of assets and liabilities denominated in foreign currencies | | | 3,082,880,811 | |

| |

Net Assets | | $ | 9,053,059,634 | |

| | | | |

19 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

STATEMENT OF ASSETS AND LIABILITIES Unaudited / Continued

| | |

Net Asset Value Per Share | | |

Class A Shares: | | |

| |

| Net asset value and redemption price per share (based on net assets of $4,294,149,937 and 57,275,707 shares of beneficial interest outstanding) | | $74.97 |

| |

Maximum offering price per share (net asset value plus sales charge of 5.75% of offering price) | | $79.54 |

| |

| Class B Shares: | | |

| |

Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $4,999,277 and 75,648 shares of beneficial interest outstanding) | | $66.09 |

| |

| Class C Shares: | | |

| |

Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $913,775,865 and 13,806,413 shares of beneficial interest outstanding) | | $66.18 |

| |

| Class I Shares: | | |

| |

Net asset value, redemption price and offering price per share (based on net assets of $ 1,144,601,338 and 15,018,124 shares of beneficial interest outstanding) | | $76.21 |

| |

| Class R Shares: | | |

| |

Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $263,649,202 and 3,656,181 shares of beneficial interest outstanding) | | $72.11 |

| |

| Class Y Shares: | | |

| |

| Net asset value, redemption price and offering price per share (based on net assets of $ 2,431,884,015 and 32,046,885 shares of beneficial interest outstanding) | | $75.89 |

See accompanying Notes to Financial Statements.

20 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

STATEMENT OF

OPERATIONS For the Six Months Ended March 31, 2018 Unaudited

| | | | |

Investment Income | | | | |

Dividends: | | | | |

| |

Unaffiliated companies (net of foreign withholding taxes of $2,924,171) | | $ | 21,515,671 | |

| |

Affiliated companies | | | 1,145,508 | |

| |

Interest | | | 362,983 | |

| |

Total investment income | | | 23,024,162 | |

Expenses | | | | |

Management fees | | | 24,721,606 | |

| |

Distribution and service plan fees: | | | | |

| |

Class A | | | 4,509,688 | |

| |

Class B | | | 42,689 | |

| |

Class C | | | 3,911,633 | |

| |

Class R | | | 575,252 | |

| |

Transfer and shareholder servicing agent fees: | | | | |

| |

Class A | | | 3,830,483 | |

| |

Class B | | | 9,010 | |

| |

Class C | | | 809,045 | |

| |

Class I | | | 133,136 | |

| |

Class R | | | 238,597 | |

| |

Class Y | | | 1,784,206 | |

| |

Shareholder communications: | | | | |

| |

Class A | | | 21,134 | |

| |

Class B | | | 541 | |

| |

Class C | | | 3,439 | |

| |

Class I | | | 4,701 | |

| |

Class R | | | 538 | |

| |

Class Y | | | 5,703 | |

| |

Borrowing fees | | | 109,853 | |

| |

Custodian fees and expenses | | | 87,413 | |

| |

Trustees’ compensation | | | 51,471 | |

| |

Other | | | 89,761 | |

| |

Total expenses | | | 40,939,899 | |

| |

Less waivers and reimbursements of expenses | | | (281,684 | ) |

| |

Net expenses | | | 40,658,215 | |

Net Investment Loss | | | (17,634,053 | ) |

21 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

STATEMENT OF

OPERATIONS Unaudited / Continued

| | | | |

Realized and Unrealized Gain (Loss) | | | | |

| |

Net realized gain (loss) on: | | | | |

| |

Investment transactions in: | | | | |

| |

Unaffiliated companies | | $ | 51,993,416 | |

| |

Affiliated companies | | | 515,164,830 | |

| |

Foreign currency transactions | | | (120,052 | ) |

| |

Net realized gain | | | 567,038,194 | |

| |

Net change in unrealized appreciation/depreciation on: | | | | |

| |

Investment transactions in: | | | | |

| |

Unaffiliated companies | | | 244,699,285 | |

| |

Affiliated companies | | | 745,754,506 | |

| |

Translation of assets and liabilities denominated in foreign currencies | | | 165,369 | |

| |

Net change in unrealized appreciation/depreciation | | | 990,619,160 | |

Net Increase in Net Assets Resulting from Operations | | $ | 1,540,023,301 | |

| | | | |

| |

See accompanying Notes to Financial Statements. | | | | |

22 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Six Months Ended

March 31, 2018

(Unaudited) | | | Year Ended September 30, 2017 |

Operations | | | | |

| | |

Net investment loss | | $ | (17,634,053 | ) | | $ | (20,632,359 | ) |

| | |

Net realized gain | | | 567,038,194 | | | | 238,030,156 | |

| | |

Net change in unrealized appreciation/depreciation | | | 990,619,160 | | | | 1,018,479,306 | |

| | |

Net increase in net assets resulting from operations | | | 1,540,023,301 | | | | 1,235,877,103 | |

Dividends and/or Distributions to Shareholders | | | | |

| |

Dividends from net investment income: | | | | |

| | |

Class A | | | — | | | | (6,341,952 | ) |

| | |

Class B | | | — | | | | — | |

| | |

Class C | | | — | | | | — | |

| | |

Class I | | | — | | | | (869,379 | ) |

| | |

Class R | | | — | | | | (153,977 | ) |

| | |

Class Y | | | — | | | | (3,223,850 | ) |

| | | — | | | | (10,589,158 | ) |

| | |

Distributions from net realized gain: | | | | |

| | |

Class A | | | (81,359,710 | ) | | | (171,785,186 | ) |

| | |

Class B | | | (242,438 | ) | | | (1,513,021 | ) |

| | |

Class C | | | (19,404,043 | ) | | | (36,239,637 | ) |

| | |

Class I | | | (18,407,270 | ) | | | (9,011,793 | ) |

| | |

Class R | | | (5,250,874 | ) | | | (9,337,663 | ) |

| | |

Class Y | | | (35,315,115 | ) | | | (42,595,721 | ) |

| | | (159,979,450 | ) | | | (270,483,021 | ) |

Beneficial Interest Transactions | | | | |

| |

Net increase (decrease) in net assets resulting from beneficial interest transactions: | | | | |

| | |

Class A | | | 501,393,984 | | | | 9,385,732 | |

| | |

Class B | | | (8,894,992 | ) | | | (14,284,268 | ) |

| | |

Class C | | | 120,568,716 | | | | 67,479,218 | |

| | |

Class I | | | 316,337,488 | | | | 470,463,581 | |

| | |

Class R | | | 19,701,674 | | | | 42,236,538 | |

| | |

Class Y | | | 875,318,334 | | | | 494,405,602 | |

| | |

| | | 1,824,425,204 | | | | 1,069,686,403 | |

Net Assets | | | | |

| | |

Total increase | | | 3,204,469,055 | | | | 2,024,491,327 | |

| | |

Beginning of period | | | 5,848,590,579 | | | | 3,824,099,252 | |

| | |

End of period (including accumulated net investment loss of $49,331,753 and $31,697,700, respectively) | | $ | 9,053,059,634 | | | | $ 5,848,590,579 | |

| | | | | | | | |

See accompanying Notes to Financial Statements.

23 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | Six Months Ended March 31, 2018 (Unaudited) | | | Year Ended September 30, 2017 | | | Year Ended September 30, 2016 | | | Year Ended September 30, 2015 | | | Year Ended September 30, 2014 | | | Year Ended September 30, 2013 | |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $61.40 | | | | $50.76 | | | | $39.42 | | | | $38.67 | | | | $38.11 | | | | $29.80 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss1 | | | (0.18) | | | | (0.23) | | | | (0.17) | | | | (0.27) | | | | (0.07) | | | | (0.07) | |

| Net realized and unrealized gain | | | 15.34 | | | | 14.49 | | | | 11.81 | | | | 1.13 | | | | 0.63 | | | | 8.71 | |

| Total from investment operations | | | 15.16 | | | | 14.26 | | | | 11.64 | | | | 0.86 | | | | 0.56 | | | | 8.64 | |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | 0.00 | | | | (0.13) | | | | (0.05) | | | | (0.11) | | | | 0.00 | | | | (0.33) | |

| Distributions from net realized gain | | | (1.59) | | | | (3.49) | | | | (0.25) | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Total dividends and/or distributions to shareholders | | | (1.59) | | | | (3.62) | | | | (0.30) | | | | (0.11) | | | | 0.00 | | | | (0.33) | |

| Net asset value, end of period | | | $74.97 | | | | $61.40 | | | | $50.76 | | | | $39.42 | | | | $38.67 | | | | $38.11 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Return, at Net Asset Value2 | | | 25.02% | | | | 30.48% | | | | 29.66% | | | | 2.22% | | | | 1.47% | | | | 29.36% | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $4,294,150 | | | | $3,085,024 | | | | $2,529,288 | | | | $2,118,295 | | | | $2,293,999 | | | | $2,192,080 | |

| Average net assets (in thousands) | | | $3,735,053 | | | | $2,689,282 | | | | $2,281,847 | | | | $2,299,089 | | | | $2,422,818 | | | | $1,896,481 | |

| Ratios to average net assets:3 | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.50)% | | | | (0.43)% | | | | (0.39)% | | | | (0.66)% | | | | (0.17)% | | | | (0.23)% | |

| Expenses excluding specific expenses listed below | | | 1.13% | | | | 1.17% | | | | 1.18% | | | | 1.18% | | | | 1.17% | | | | 1.21% | |

| Interest and fees from borrowings | | | 0.00%4 | | | | 0.00%4 | | | | 0.00%4 | | | | 0.00%4 | | | | 0.00% | | | | 0.00% | |

| Total expenses5 | | | 1.13% | | | | 1.17% | | | | 1.18% | | | | 1.18% | | | | 1.17% | | | | 1.21% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.12% | | | | 1.15% | | | | 1.18%6 | | | | 1.18%6 | | | | 1.17%6 | | | | 1.21%6 | |

| Portfolio turnover rate | | | 13% | | | | 18% | | | | 26% | | | | 16% | | | | 16% | | | | 27% | |

24 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

1. Per share amounts calculated based on the average shares outstanding during the period.

2. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

3. Annualized for periods less than one full year.

4. Less than 0.005%.

5. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | |

Six Months Ended March 31, 2018 | | 1.13% | | |

Year Ended September 30, 2017 | | 1.17% | | |

Year Ended September 30, 2016 | | 1.18% | | |

Year Ended September 30, 2015 | | 1.18% | | |

Year Ended September 30, 2014 | | 1.17% | | |

Year Ended September 30, 2013 | | 1.21% | | |

6. Waiver was less than 0.005%.

See accompanying Notes to Financial Statements.

25 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

FINANCIAL HIGHLIGHTS Continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class B | | Six Months Ended March 31, 2018 (Unaudited) | | | Year Ended September 30, 2017 | | | Year Ended September 30, 2016 | | | Year Ended September 30, 2015 | | | Year Ended September 30, 2014 | | | Year Ended September 30, 2013 | |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $54.50 | | | | $45.66 | | | | $35.71 | | | | $35.21 | | | | $34.98 | | | | $27.32 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss1 | | | (0.41) | | | | (0.57) | | | | (0.47) | | | | (0.53) | | | | (0.38) | | | | (0.33) | |

| Net realized and unrealized gain | | | 13.59 | | | | 12.90 | | | | 10.67 | | | | 1.03 | | | | 0.61 | | | | 8.02 | |

| Total from investment operations | | | 13.18 | | | | 12.33 | | | | 10.20 | | | | 0.50 | | | | 0.23 | | | | 7.69 | |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.03) | |

| Distributions from net realized gain | | | (1.59) | | | | (3.49) | | | | (0.25) | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Total dividends and/or distributions to shareholders | | | (1.59) | | | | (3.49) | | | | (0.25) | | | | 0.00 | | | | 0.00 | | | | (0.03) | |

| Net asset value, end of period | | | $66.09 | | | | $54.50 | | | | $45.66 | | | | $35.71 | | | | $35.21 | | | | $34.98 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Return, at Net Asset Value2 | | | 24.54% | | | | 29.47% | | | | 28.68% | | | | 1.42% | | | | 0.66% | | | | 28.17% | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $4,999 | | | | $12,079 | | | | $23,917 | | | | $34,617 | | | | $57,192 | | | | $79,296 | |

| Average net assets (in thousands) | | | $8,533 | | | | $16,688 | | | | $28,303 | | | | $45,754 | | | | $71,794 | | | | $76,488 | |

| Ratios to average net assets:3 | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (1.35)% | | | | (1.22)% | | | | (1.19)% | | | | (1.43)% | | | | (1.04)% | | | | (1.14)% | |

| Expenses excluding specific expenses listed below | | | 1.91% | | | | 1.93% | | | | 1.94% | | | | 1.94% | | | | 2.01% | | | | 2.27% | |

| Interest and fees from borrowings | | | 0.00%4 | | | | 0.00%4 | | | | 0.00%4 | | | | 0.00%4 | | | | 0.00% | | | | 0.00% | |

| Total expenses5 | | | 1.91% | | | | 1.93% | | | | 1.94% | | | | 1.94% | | | | 2.01% | | | | 2.27% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.90% | | | | 1.91% | | | | 1.94%6 | | | | 1.94%6 | | | | 1.99% | | | | 2.14% | |

| Portfolio turnover rate | | | 13% | | | | 18% | | | | 26% | | | | 16% | | | | 16% | | | | 27% | |

26 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

1. Per share amounts calculated based on the average shares outstanding during the period.

2. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

3. Annualized for periods less than one full year.

4. Less than 0.005%.

5. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | |

Six Months Ended March 31, 2018 | | 1.91% | | |

Year Ended September 30, 2017 | | 1.93% | | |

Year Ended September 30, 2016 | | 1.94% | | |

Year Ended September 30, 2015 | | 1.94% | | |

Year Ended September 30, 2014 | | 2.01% | | |

Year Ended September 30, 2013 | | 2.27% | | |

6. Waiver was less than 0.005%.

See accompanying Notes to Financial Statements.

27 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

FINANCIAL HIGHLIGHTS Continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class C | | Six Months Ended March 31, 2018 (Unaudited) | | | Year Ended September 30, 2017 | | | Year Ended September 30, 2016 | | | Year Ended

September 30, 2015 | | | Year Ended

September 30, 2014 | | | Year Ended

September 30, 2013 | |

| Per Share Operating Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $54.57 | | | | $45.72 | | | | $35.75 | | | | $35.24 | | | | $34.99 | | | | $27.39 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss1 | | | (0.39) | | | | (0.56) | | | | (0.45) | | | | (0.52) | | | | (0.34) | | | | (0.29) | |

| Net realized and unrealized gain | | | 13.59 | | | | 12.90 | | | | 10.67 | | | | 1.03 | | | | 0.59 | | | | 8.02 | |

| Total from investment operations | | | 13.20 | | | | 12.34 | | | | 10.22 | | | | 0.51 | | | | 0.25 | | | | 7.73 | |

Dividends and/or distributions to shareholders: Dividends from net investment income | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.13) | |

| Distributions from net realized gain | | | (1.59) | | | | (3.49) | | | | (0.25) | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Total dividends and/or distributions to shareholders | | | (1.59) | | | | (3.49) | | | | (0.25) | | | | 0.00 | | | | 0.00 | | | | (0.13) | |

| Net asset value, end of period | | | $66.18 | | | | $54.57 | | | | $45.72 | | | | $35.75 | | | | $35.24 | | | | $34.99 | |

| | | | |

| | | | | | | | | | | | | | | | | | | |

| Total Return, at Net Asset Value2 | | | 24.54% | | | | 29.47% | | | | 28.71% | | | | 1.45% | | | | 0.72% | | | | 28.35% | |

| | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $913,776 | | | | $648,270 | | | | $475,199 | | | | $385,550 | | | | $420,778 | | | | $392,294 | |

| Average net assets (in thousands) | | | $789,005 | | | | $533,915 | | | | $421,487 | | | | $416,534 | | | | $438,648 | | | | $342,250 | |

Ratios to average net assets:3 | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (1.26)% | | | | (1.18)% | | | | (1.14)% | | | | (1.41)% | | | | (0.93)% | | | | (0.98)% | |

| Expenses excluding specific expenses listed below | | | 1.88% | | | | 1.92% | | | | 1.94% | | | | 1.94% | | | | 1.92% | | | | 1.97% | |

| Interest and fees from borrowings | | | 0.00%4 | | | | 0.00%4 | | | | 0.00%4 | | | | 0.00%4 | | | | 0.00% | | | | 0.00% | |

| Total expenses5 | | | 1.88% | | | | 1.92% | | | | 1.94% | | | | 1.94% | | | | 1.92% | | | | 1.97% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.87% | | | | 1.91% | | | | 1.94%6 | | | | 1.94%6 | | | | 1.92%6 | | | | 1.97%6 | |

| Portfolio turnover rate | | | 13% | | | | 18% | | | | 26% | | | | 16% | | | | 16% | | | | 27% | |

28 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

1. Per share amounts calculated based on the average shares outstanding during the period.

2. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

3. Annualized for periods less than one full year.

4. Less than 0.005%.

5. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| | Six Months Ended March 31, 2018 | | 1.88% | | |

| | Year Ended September 30, 2017 | | 1.92% | | |

| | Year Ended September 30, 2016 | | 1.94% | | |

| | Year Ended September 30, 2015 | | 1.94% | | |

| | Year Ended September 30, 2014 | | 1.92% | | |

| | Year Ended September 30, 2013 | | 1.97% | | |

6. Waiver was less than 0.005%.

See accompanying Notes to Financial Statements.

29 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

FINANCIAL HIGHLIGHTS Continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class I | | Six Months Ended March 31, 2018

(Unaudited) | | | Year Ended September 30, 2017 | | | Year Ended September 30, 2016 | | | Year Ended September 30, 2015 | | | Year Ended September 30, 2014 | | | Year Ended September 30, 2013 | |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $62.26 | | | | $51.43 | | | | $39.93 | | | | $39.18 | | | | $38.45 | | | | $30.07 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)1 | | | (0.03) | | | | 0.002 | | | | 0.02 | | | | (0.09) | | | | 0.13 | | | | 0.03 | |

| Net realized and unrealized gain | | | 15.57 | | | | 14.66 | | | | 11.97 | | | | 1.13 | | | | 0.60 | | | | 8.82 | |

| Total from investment operations | | | 15.54 | | | | 14.66 | | | | 11.99 | | | | 1.04 | | | | 0.73 | | | | 8.85 | |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | 0.00 | | | | (0.34) | | | | (0.24) | | | | (0.29) | | | | 0.00 | | | | (0.47) | |

| Distributions from net realized gain | | | (1.59) | | | | (3.49) | | | | (0.25) | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Total dividends and/or distributions to shareholders | | | (1.59) | | | | (3.83) | | | | (0.49) | | | | (0.29) | | | | 0.00 | | | | (0.47) | |

| Net asset value, end of period | | | $76.21 | | | | $62.26 | | | | $51.43 | | | | $39.93 | | | | $39.18 | | | | $38.45 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Total Return, at Net Asset Value3 | | | 25.28% | | | | 31.01% | | | | 30.21% | | | | 2.67% | | | | 1.90% | | | | 29.97% | |

| | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $1,144,602 | | | | $662,176 | | | | $127,643 | | | | $69,700 | | | | $55,279 | | | | $32,235 | |

| Average net assets (in thousands) | | | $894,534 | | | | $225,454 | | | | $89,556 | | | | $67,065 | | | | $48,088 | | | | $20,251 | |

| Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.08)% | | | | 0.01% | | | | 0.04% | | | | (0.21)% | | | | 0.32% | | | | 0.10% | |

| Expenses excluding specific expenses listed below | | | 0.71% | | | | 0.73% | | | | 0.75% | | | | 0.75% | | | | 0.74% | | | | 0.76% | |

| Interest and fees from borrowings | | | 0.00%5 | | | | 0.00%5 | | | | 0.00%5 | | | | 0.00%5 | | | | 0.00% | | | | 0.00% | |

| Total expenses6 | | | 0.71% | | | | 0.73% | | | | 0.75% | | | | 0.75% | | | | 0.74% | | | | 0.76% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.71%7 | | | | 0.73%7 | | | | 0.75%7 | | | | 0.75%7 | | | | 0.74%7 | | | | 0.76%7 | |

| Portfolio turnover rate | | | 13% | | | | 18% | | | | 26% | | | | 16% | | | | 16% | | | | 27% | |

30 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

1. Per share amounts calculated based on the average shares outstanding during the period.

2. Less than $0.005 per share.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| | Six Months Ended March 31, 2018 | | 0.71% | | |

| | Year Ended September 30, 2017 | | 0.73% | | |

| | Year Ended September 30, 2016 | | 0.75% | | |

| | Year Ended September 30, 2015 | | 0.75% | | |

| | Year Ended September 30, 2014 | | 0.74% | | |

| | Year Ended September 30, 2013 | | 0.76% | | |

7. Waiver was less than 0.005%.

See accompanying Notes to Financial Statements.

31 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

FINANCIAL HIGHLIGHTS Continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class R | | Six Months Ended March 31, 2018 (Unaudited) | | | Year Ended September 30, 2017 | | | Year Ended September 30, 2016 | | | Year Ended September 30, 2015 | | | Year Ended September 30, 2014 | | | Year Ended September 30, 2013 | |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $59.18 | | | | $49.10 | | | | $38.19 | | | | $37.46 | | | | $37.02 | | | | $28.96 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss1 | | | (0.26) | | | | (0.35) | | | | (0.27) | | | | (0.36) | | | | (0.18) | | | | (0.18) | |

| Net realized and unrealized gain | | | 14.78 | | | | 13.98 | | | | 11.43 | | | | 1.09 | | | | 0.62 | | | | 8.47 | |

Total from investment operations | | | 14.52 | | | | 13.63 | | | | 11.16 | | | | 0.73 | | | | 0.44 | | | | 8.29 | |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | 0.00 | | | | (0.06) | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.23) | |

| Distributions from net realized gain | | | (1.59) | | | | (3.49) | | | | (0.25) | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Total dividends and/or distributions to shareholders | | | (1.59) | | | | (3.55) | | | | (0.25) | | | | 0.00 | | | | 0.00 | | | | (0.23) | |

| Net asset value, end of period | | | $72.11 | | | | $59.18 | | | | $49.10 | | | | $38.19 | | | | $37.46 | | | | $37.02 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Total Return, at Net Asset Value2 | | | 24.86% | | | | 30.15% | | | | 29.34% | | | | 1.95% | | | | 1.19% | | | | 28.88% | |

| | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $263,649 | | | | $199,696 | | | | $123,310 | | | | $85,548 | | | | $91,043 | | | | $99,915 | |

| Average net assets (in thousands) | | | $232,413 | | | | $156,671 | | | | $100,670 | | | | $91,765 | | | | $101,911 | | | | $90,808 | |

| Ratios to average net assets:3 | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.76)% | | | | (0.67)% | | | | (0.64)% | | | | (0.91)% | | | | (0.46)% | | | | (0.57)% | |

| Expenses excluding specific expenses listed below | | | 1.38% | | | | 1.42% | | | | 1.44% | | | | 1.43% | | | | 1.45% | | | | 1.56% | |

| Interest and fees from borrowings | | | 0.00%4 | | | | 0.00%4 | | | | 0.00%4 | | | | 0.00%4 | | | | 0.00% | | | | 0.00% | |

| Total expenses5 | | | 1.38% | | | | 1.42% | | | | 1.44% | | | | 1.43% | | | | 1.45% | | | | 1.56% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.37% | | | | 1.41% | | | | 1.44%6 | | | | 1.43%6 | | | | 1.45%6 | | | | 1.56%6 | |

| Portfolio turnover rate | | | 13% | | | | 18% | | | | 26% | | | | 16% | | | | 16% | | | | 27% | |

32 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

1. Per share amounts calculated based on the average shares outstanding during the period.

2. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

3. Annualized for periods less than one full year.

4. Less than 0.005%.

5. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| | Six Months Ended March 31, 2018 | | 1.38% | | |

| | Year Ended September 30, 2017 | | 1.42% | | |

| | Year Ended September 30, 2016 | | 1.44% | | |

| | Year Ended September 30, 2015 | | 1.43% | | |

| | Year Ended September 30, 2014 | | 1.45% | | |

| | Year Ended September 30, 2013 | | 1.56% | | |

6. Waiver was less than 0.005%.

See accompanying Notes to Financial Statements.

33 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

FINANCIAL HIGHLIGHTS Continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class Y | | Six Months Ended March 31, 2018 (Unaudited) | | | Year Ended September 30, 2017 | | | Year Ended September 30, 2016 | | | Year Ended September 30, 2015 | | | Year Ended September 30, 2014 | | | Year Ended September 30, 2013 | |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $62.05 | | | | $51.28 | | | | $39.82 | | | | $39.07 | | | | $38.40 | | | | $30.04 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)1 | | | (0.08) | | | | (0.09) | | | | (0.06) | | | | (0.17) | | | | 0.04 | | | | 0.01 | |

| Net realized and unrealized gain | | | 15.51 | | | | 14.61 | | | | 11.92 | | | | 1.13 | | | | 0.63 | | | | 8.77 | |

| Total from investment operations | | | 15.43 | | | | 14.52 | | | | 11.86 | | | | 0.96 | | | | 0.67 | | | | 8.78 | |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | 0.00 | | | | (0.26) | | | | (0.15) | | | | (0.21) | | | | 0.00 | | | | (0.42) | |

| Distributions from net realized gain | | | (1.59) | | | | (3.49) | | | | (0.25) | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Total dividends and/or distributions to shareholders | | | (1.59) | | | | (3.75) | | | | (0.40) | | | | (0.21) | | | | 0.00 | | | | (0.42) | |

| Net asset value, end of period | | | $75.89 | | | | $62.05 | | | | $51.28 | | | | $39.82 | | | | $39.07 | | | | $38.40 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return, at Net Asset Value2 | | | 25.17% | | | | 30.79% | | | | 29.98% | | | | 2.46% | | | | 1.75% | | | | 29.69% | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $2,431,884 | | | | $1,241,346 | | | | $544,742 | | | | $360,040 | | | | $409,448 | | | | $308,513 | |

| Average net assets (in thousands) | | | $1,753,774 | | | | $919,307 | | | | $422,088 | | | | $399,477 | | | | $405,921 | | | | $252,615 | |

| Ratios to average net assets:3 | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.23)% | | | | (0.16)% | | | | (0.14)% | | | | (0.41)% | | | | 0.10% | | | | 0.04% | |

| Expenses excluding specific expenses listed below | | | 0.88% | | | | 0.92% | | | | 0.94% | | | | 0.94% | | | | 0.92% | | | | 0.95% | |

| Interest and fees from borrowings | | | 0.00%4 | | | | 0.00%4 | | | | 0.00%4 | | | | 0.00%4 | | | | 0.00% | | | | 0.00% | |

| Total expenses5 | | | 0.88% | | | | 0.92% | | | | 0.94% | | | | 0.94% | | | | 0.92% | | | | 0.95% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.87% | | | | 0.91% | | | | 0.94%6 | | | | 0.94%6 | | | | 0.92%6 | | | | 0.95%6 | |

| Portfolio turnover rate | | | 13% | | | | 18% | | | | 26% | | | | 16% | | | | 16% | | | | 27% | |

34 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

1. Per share amounts calculated based on the average shares outstanding during the period.

2. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

3. Annualized for periods less than one full year.

4. Less than 0.005%.

5. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| | Six Months Ended March 31, 2018 | | 0.88% | | |

| | Year Ended September 30, 2017 | | 0.92% | | |

| | Year Ended September 30, 2016 | | 0.94% | | |

| | Year Ended September 30, 2015 | | 0.94% | | |

| | Year Ended September 30, 2014 | | 0.92% | | |

| | Year Ended September 30, 2013 | | 0.95% | | |

6. Waiver was less than 0.005%.

See accompanying Notes to Financial Statements.

35 OPPENHEIMER GLOBAL OPPORTUNITIES FUND

NOTES TO FINANCIAL STATEMENTS March 31, 2018 Unaudited

1. Organization

Oppenheimer Global Opportunities Fund (the “Fund”) is a diversified open-end management investment company registered under the Investment Company Act of 1940 (“1940 Act”), as amended. The Fund’s investment objective is to seek capital appreciation. The Fund’s investment adviser is OFI Global Asset Management, Inc. (“OFI Global” or the “Manager”), a wholly-owned subsidiary of OppenheimerFunds, Inc. (“OFI” or the “Sub-Adviser”). The Manager has entered into a sub-advisory agreement with OFI.