UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2006

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number 1-12911

Granite Construction Incorporated

(Exact name of registrant as specified in its charter)

Delaware | 77-0239383 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

| | |

585 West Beach Street | |

Watsonville, California | 95076 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (831) 724-1011

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

| Common Stock, $0.01 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer (as defined by Rule 12b-2 of the Exchange Act).

Large accelerated filer x Accelerated filer o Non-accelerated filer o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant was approximately $1.6 billion as of June 30, 2006, based upon the average of the bid and asked prices per share of the registrant’s Common Stock as reported on the New York Stock Exchange on such date. Shares of Common Stock held by each executive officer and director and by each person who owns 5% or more of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

At February 12, 2007, 41,825,917 shares of Common Stock, par value $0.01, of the registrant were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information called for by Part III is incorporated by reference to the definitive Proxy Statement for the Annual Meeting of Shareholders of Granite Construction Incorporated to be held on May 21, 2007, which will be filed with the Securities and Exchange Commission not later than 120 days after December 31, 2006.

FORWARD-LOOKING DISCLOSURE

From time to time, Granite makes certain comments and disclosures in reports and statements, including in this Annual Report on Form 10-K (“Report”), or statements made by its officers or directors that are not based on historical facts and which may be forward-looking in nature. Under the Private Securities Litigation Reform Act of 1995, a “safe harbor” may be provided to us for certain of these forward-looking statements. We wish to caution readers that forward-looking statements are subject to risks regarding future events and the future results of Granite that are based on current expectations, estimates, forecasts, and projections as well as the beliefs and assumptions of Granite’s management. Words such as “outlook,” “believes,” “expects,” “appears,” “may,” “will,” “should,” “anticipates” or the negative thereof or comparable terminology, are intended to identify such forward-looking statements. In addition, other written or oral statements which constitute forward-looking statements have been made and may in the future be made by or on behalf of Granite. These forward-looking statements are estimates reflecting the best judgment of senior management that rely on a number of assumptions concerning future events, many of which are outside of our control, and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those more specifically described in this Report under “Item 1A. Risk Factors.” Granite undertakes no obligation to publicly revise or update any forward-looking statements for any reason. As a result, the reader is cautioned not to rely on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K.

Introduction

We were originally incorporated in 1922 as Granite Construction Company. In 1990, Granite Construction Incorporated was incorporated in Delaware as the holding company for Granite Construction Company and its wholly owned subsidiaries. Unless otherwise indicated, the terms “we,” “us,” “our,” “Company” and “Granite” refer to Granite Construction Incorporated and its consolidated subsidiaries.

We are one of the largest heavy civil construction contractors in the United States. We operate nationwide, serving both public and private sector clients. Within the public sector, we primarily concentrate on infrastructure projects, including the construction of roads, highways, bridges, dams, tunnels, canals, mass transit facilities and airport infrastructure. Within the private sector, we perform site preparation and infrastructure services for residential development, commercial and industrial buildings, plants and other facilities. Our diversification in both the public and private sectors and our mix of project types and sizes have contributed to our profitability in various economic environments.

We own and lease substantial aggregate reserves and own a number of construction materials processing plants. We also have one of the largest contractor-owned heavy construction equipment fleets in the United States. We believe that the ownership of these assets enables us to compete more effectively by ensuring availability of these resources at a favorable cost.

Operating Structure

We are currently organized into two operating segments, the Branch Division and the Heavy Construction Division (“HCD”). The Branch Division is comprised of branch offices that serve local markets, while HCD is composed of regional offices and pursues major infrastructure projects throughout the nation. HCD focuses on building larger heavy civil projects with contract durations that are generally greater than two years, while Branch Division projects are typically smaller in size and shorter in duration.

As decentralized profit centers, the branches and HCD regional offices independently estimate, bid and complete contracts. Both divisions are supported by centralized functions, including finance, accounting, tax, human resources, labor relations, safety, legal, risk management, corporate development and information technology. We believe that centralized support for decentralized profit centers results in a more market-responsive business with effective controls and reduced overhead.

On February 14, 2007 we announced an organizational realignment of our business operations which is designed to accommodate growth of our vertically integrated Branch business in the West and improve profitability of our large, complex HCD projects. This realignment will involve realigning our operating divisions geographically into “Granite West” and “Granite East” and is expected to take approximately twelve months to complete.

Granite West will include the operations of our current Branch Division as well as the western portion of our large project business that is currently included in HCD. Granite West will retain our successful decentralized operating structure, with each of its branch locations aligning under one of three operating groups: Northwest, Northern California and Southwest. Each of these newly formed operating groups will report to a Granite West Group Vice President who will oversee three to six branches and will have the responsibility to stimulate strategic thinking and growth in their geographic territory. Among other key benefits, this structure will allow Granite West to utilize its resources and market knowledge to take advantage of the larger projects we expect to be let as a result of healthy funding in the West as well as the recently passed infrastructure funding propositions in California.

Granite East will include the eastern portion of our large project business that is currently included in HCD and will be aligned to focus on enhancing project management oversight and discipline from estimating through execution. Granite East will leverage its resources and core capabilities in areas where it has local knowledge, local relationships and local resources. It will be operated out of three regional offices: the Central Region, based in Dallas, Texas; the Southeast Region, based in Tampa, Florida; and the Northeast Region, based in Tarrytown, New York.

In addition to our two current operating segments, we purchase, develop and sell real estate through our Granite Land Company subsidiary (“GLC”) which also provides real estate services for other Granite operations. GLC’s portfolio of projects includes both commercial and residential development and is geographically diversified throughout the West and Texas. The amount invested by GLC in each project is typically less than $5.0 million and the revenues and operating income of Granite Land Company are not included in either the Branch Division or HCD operating segments.

Information about our business segments is incorporated in Note 16 of the “Notes to the Consolidated Financial Statements.”

Branch Division. In 2006, Branch Division contract revenue and sales of aggregate products was $1.8 billion (62.3% of our total revenue), compared with $1.6 billion (60.3% of our total revenue) in 2005. The Branch Division has both public and private sector clients. Public sector projects include both new construction and improvement of streets, roads, highways and bridges. Major private sector contracts include site preparation for housing and commercial development, including excavation, grading and street paving and installation of curbs, gutters, sidewalks and underground utilities.

The Branch Division currently has 12 branch offices in the western United States with additional satellite operations. Our eight branch offices in California are located in Bakersfield, Fresno (Central Valley), Indio (Southern California), Sacramento (Northern California), Santa Clara (Bay Area), Santa Barbara, Stockton and Watsonville (Monterey Bay Area). Our branch offices outside of California are located in Arizona, Nevada, Utah, and our majority-owned subsidiary Wilder Construction Company (“Wilder”), which has locations in Alaska, Oregon and Washington. Each branch effectively operates as a local or regional construction company and our branch management is encouraged to participate actively in the local community. While individual branch revenues vary from year to year, in 2006 these revenues ranged from $73.3 million to $248.1 million.

As part of our strategy, our branches mine aggregates and operate plants that process aggregates into construction materials for internal use and for sale to others. These activities are integrated into the Branch Division construction business providing both a source of profits and a competitive advantage to our construction business through the readily available supply of materials. We have significant aggregate reserves that we have acquired by ownership in fee or through long-term leases. The amount of aggregate products produced that are used in our construction projects was approximately 42.0% during 2006 and has ranged from 37.0% to 48.0% over the last five years. The remainder is sold to unaffiliated parties and accounted for the following:

| | | | | | | | |

Years Ended December 31, | | 2006 | | 2005 | | 2004 | |

| (in thousands) | | | |

| Material sales to unaffiliated parties | | $ | 410,159 | | $ | | | $ | | |

| Percent of total revenue | | | 13.8 | % | | | % | | | % |

| Percent of Branch Division revenue | | | 22.2 | % | | | % | | | % |

Heavy Construction Division. In 2006, revenue from HCD was $1.1 billion (36.6% of our total revenue), compared with $1.0 billion (39.0% of our total revenue) in 2005. Like the Branch Division, HCD builds infrastructure projects for both public and private sector clients. Its projects have included major highways, large dams, mass transit facilities, bridges, pipelines, canals, tunnels, waterway locks and dams, and airport infrastructure. It also performs activities such as demolition, clearing, large-scale earthwork and grading, dewatering, drainage improvements, structural concrete, rail signalization, and concrete and asphalt paving. HCD projects are usually larger and more complex than those performed by the Branch Division. HCD is working on or has completed projects in 25 states from coast to coast.

HCD currently markets, estimates, bids and provides management oversight of its projects from our Watsonville, California headquarters and its five regional estimating offices in Davis, California; Tampa, Florida; Bloomington, Minnesota; Tarrytown, New York and Lewisville, Texas. HCD has the ability, if needed, to process locally sourced aggregates into construction materials using owned or rented portable crushing, concrete and asphalt processing plants.

HCD participates in joint ventures with other large construction companies. Joint ventures are used for large, technically complex projects, including design/build projects, where it is desirable to share risk and resources. Joint venture partners typically provide independently prepared estimates, shared financing and equipment and often also bring local knowledge and expertise (see “Joint Ventures; Off-Balance-Sheet Arrangements” under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation”).

Design/build is increasingly being used as a method of project delivery. Unlike traditional projects where owners first hire a design firm or design a project themselves and then put the project out to bid for construction, design/build projects provide the owner with a single point of responsibility and a single contact for both design and construction. HCD’s revenue from design/build projects has grown over the last several years and represented 65.3% of HCD revenue (25.1% of total company revenue) in 2006 and 49.1% of HCD revenue (20.3% of total company revenue) in 2005. Although these projects carry additional risk as compared to traditional bid/build projects, the profit potential can also be higher. We frequently bid design/build projects as a part of a joint venture team.

Business Strategy

Our fundamental objective is to increase long-term shareholder value by focusing on consistent profitability from controlled revenue growth. Shareholder value is measured by the appreciation of the value of our common stock over a period of years as well as a return from dividends. Further, it is a specific measure of our financial success to achieve a return on net assets greater than the cost of capital, creating “Granite Value Added.” We believe that the following are key factors in our ability to achieve this objective:

Employee Development - We believe that our employees are key to the successful implementation of our business strategies. Significant resources are employed to attract, nurture and retain extraordinary talent and fully develop each employee’s capabilities.

Infrastructure Construction Focus - We concentrate our core competencies on this segment of the construction industry, which includes the building of roads, highways, bridges, dams and tunnels, mass transit facilities, railroad infrastructure and underground utilities as well as site preparation. This focus allows us to most effectively utilize our specialized strengths, which include grading, paving and concrete structures.

Ownership of Aggregate Materials and Construction Equipment - We own and lease aggregate reserves and own processing plants that are vertically integrated into our construction operations and we own a large fleet of carefully maintained heavy construction equipment. By ensuring availability of these resources at favorable cost, we believe we have bidding advantages in many of our markets, as well as a reliable source of revenue and income from the sale of construction materials to unaffiliated parties.

Selective Bidding - We focus our resources to bid on jobs that meet our selective bidding criteria, which include analyzing the risk of a potential job in relation to available personnel to estimate and prepare the proposal, degree of competition, experience with the type of work, relationship with the owner, local resources and partnerships, equipment resources, and size and complexity of the job.

Diversification - To mitigate the risks inherent in construction and general economic factors, we pursue projects: (i) in both the public and private sectors; (ii) for a wide range of customers within each sector (from the federal government to small municipalities and from large corporations to individual homeowners); (iii) in diverse geographic markets; (iv) that are design/build, lump sum and fixed unit price; and (v) of various sizes, durations and complexities.

Decentralized Profit Centers - We approach each selected market with a local focus through our decentralized structure. Each of our branches and HCD regional offices are individual profit centers.

Profit-based Incentives - We compensate our profit center managers with base salaries below the median point of salaries for similar positions in the marketplace coupled with a substantial variable cash and restricted stock incentive element based on the annual profit performance of their respective profit centers.

Controlled Expansion - We intend to continue our expansion by selectively adding branches or branch satellite locations in the western United States, exploring opportunities to establish branch-like businesses in other areas of the country through acquisitions, and selectively pursuing major infrastructure projects throughout the nation where we have an established presence. Additionally, we intend to leverage our financial capacity by investing in a limited number of real estate development projects that we believe will provide an acceptable return on our investment.

Accident Prevention - We believe that the prevention of accidents is both a moral obligation and good business. By identifying and concentrating resources to address jobsite hazards, we continually strive to reduce our incident rates and the costs associated with accidents.

Environmental Responsibility - We believe it benefits everyone to maintain environmentally responsible operations. We are committed to effective measures to protect the environment and maintain good community relations. We continually monitor our performance in this area and take our responsibilities to the communities we work in and compliance with government agency requirements seriously.

Quality and High Ethical Standards - We emphasize the importance of performing high quality work and maintaining high ethical standards through an established code of conduct and an effective corporate compliance program.

Customers

We have customers in both the public and private sectors. The Branch Division’s largest volume customer is the California Department of Transportation (“Caltrans”). In 2006, contracts with Caltrans represented 8.3% of our revenue, and total public sector revenue generated in California represented 24.5% of our revenue. Other Branch Division customers include departments of transportation of other states, county and city public works departments, school districts and developers and owners of industrial, commercial and residential sites. HCD’s customers are predominantly in the public sector and currently include the state departments of transportation in a number of states as well as local transit authorities and federal agencies (see “Concentrations” in Note 1 of the “Notes to the Consolidated Financial Statements”).

Backlog

Our backlog includes the total value of awarded contracts that have not been completed, including our proportionate share of unconsolidated joint venture contracts. Our backlog was approximately $2.3 billion at both December 31, 2006 and 2005. Approximately $1.6 billion of the December 31, 2006 backlog is expected to be completed during 2007. With the exception of certain federal government contracts, we include a construction project in our backlog at such time as a contract is awarded and funding is in place. Certain federal government contracts that extend beyond one year are funded on a year-by-year basis. Backlog at December 31, 2006 includes approximately $21.0 million from one federal government project for which the funding has not yet been fully allocated. Substantially all of the contracts in our backlog may be canceled or modified at the election of the customer; however, we have not been materially adversely affected by contract cancellations or modifications in the past (see “Contract Provisions and Subcontracting”). A sizeable percentage of our anticipated contract revenue in any year is not reflected in our backlog at the start of the year due to the short duration of smaller Branch Division projects that are initiated and completed during each year (“turn business”). Backlog by segment is presented in “Backlog” under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation.”

Equipment and Plants

We own many pieces of equipment, including cranes, bulldozers, barges, backhoes, excavators, scrapers, motor graders, loaders, trucks, pavers and rollers as well as construction materials processing plants. In 2006 and 2005, we spent approximately $91.0 million and $90.6 million, respectively, for construction equipment, plants and vehicles. At December 31, 2006 and 2005, we owned the following construction equipment, plants and vehicles:

| | | | | | | | | |

| December 31, | | | 2006 | | | 2005 | | |

| Heavy construction equipment (units) | | | 2,641 | | | 2,467 | | |

| Trucks, truck-tractors and trailers and vehicles (units) | | | 5,338 | | | 4,958 | | |

| Aggregate crushing plants | | | 55 | | | 50 | | |

| Asphalt concrete plants | | | 53 | | | 56 | | |

| Portland cement concrete batch plants | | | 25 | | | | | |

| Asphalt rubber plants | | | 4 | | | | | |

| Lime slurry plants | | | 9 | | | | | |

We believe that ownership of equipment is generally preferable to leasing because ownership ensures the equipment is available as needed and normally results in lower equipment costs. We attempt to keep our equipment as fully utilized as possible by pooling equipment for use by both the Branch Division and HCD. We regularly lease or rent equipment on a short-term basis to supplement existing equipment and respond to construction activity peaks.

Employees

On December 31, 2006, we employed approximately 2,100 salaried employees, who work in management, estimating and clerical capacities, and 3,100 hourly employees. The total number of hourly personnel employed by us is subject to the volume of construction in progress. During 2006, the number of hourly employees ranged from 3,100 to 7,200 and averaged approximately 5,400. Our wholly owned subsidiaries, Granite Construction Company and Granite Construction Northeast, Inc. (formerly Granite Halmar Construction Company, Inc.) and our majority-owned subsidiary, Wilder Construction Company are parties to craft collective bargaining agreements in many areas in which they work.

We believe our employees are our most valuable resource and that our workforce possesses a strong dedication to and pride in our company. Among salaried and non-union hourly employees, this dedication is reinforced by 17.6% equity ownership through our Employee Stock Ownership Plan, our Profit Sharing and 401k Plan and performance-based incentive compensation arrangements at December 31, 2006. Our managerial and supervisory personnel have an average of approximately 10 years of service with us.

Competition

Factors influencing our competitiveness include price, reputation for quality, the availability of aggregate materials, machinery and equipment, financial strength, knowledge of local markets and conditions, and project management and estimating abilities. Although some of our competitors are larger than us and may possess greater resources, we believe that we compete favorably on the basis of the foregoing factors. Historically, the construction business has not usually required large amounts of capital, particularly for the smaller size construction work pursued by our Branch Division, which can result in relative ease of market entry for companies possessing acceptable qualifications. Branch Division competitors range from small local construction companies to large regional and national construction companies. While the market areas of these competitors overlap with several of the markets served by our branches, few compete in all of our market areas. In addition, most of our branches own and/or have long-term leases on aggregate resources that provide an extra measure of competitive advantage in certain markets. HCD normally competes with large regional and national construction companies, which may or may not be larger than Granite. Although the construction business is highly competitive, we believe we are well positioned to compete effectively in the markets in which we operate.

Contract Provisions and Subcontracting

Our contracts with our customers are primarily either “fixed unit price” or “fixed price.” Under fixed unit price contracts, we are committed to provide materials or services required by a project at fixed unit prices (for example, dollars per cubic yard of concrete poured or cubic yard of earth excavated). While the fixed unit price contract shifts the risk of estimating the quantity of units required for a particular project to the customer, any increase in our unit cost over the expected unit cost in the bid, whether due to inflation, inefficiency, faulty estimates or other factors, is borne by us unless otherwise provided in the contract. Fixed price contracts are priced on a lump-sum basis under which we bear the risk of performing all the work for the specified amount. The percentage of fixed price contracts in our backlog increased from approximately 63.0% at December 31, 2005 to approximately 67.7% at December 31, 2006. Our contracts are generally obtained through competitive bidding in response to advertisements by federal, state and local government agencies and private parties. Less frequently, contracts may be obtained through direct negotiations with private owners. Our contract risk mitigation process includes identifying risks and opportunities during the bidding process, review of bids fitting certain criteria by various levels of management and, in some cases, by the executive committee of our Board of Directors.

There are a number of factors that can create variability in contract performance and results as compared to a project’s original bid. The most significant of these include the completeness and accuracy of the original bid, costs associated with added scope changes, extended overhead due to owner and weather delays, subcontractor performance issues, changes in productivity expectations, site conditions that differ from those assumed in the original bid (to the extent contract remedies are unavailable), the availability and skill level of workers in the geographic location of the project and a change in the availability and proximity of equipment and materials. All of these factors can impose inefficiencies on contract performance, which can drive up costs and lower profits. Conversely, if any of these or other factors are more positive than the assumptions in our bid, project profitability can improve. The ability to realize improvements on project profitability is more limited than the risk of lower profitability. Design/build projects carry other risks such as the risk inherent in estimating quantities and prices before the project design is completed and design error risk, including additional construction costs due to any design errors, liability to the contract owner for the design of the project and right-of-way and permit acquisition costs. Although we manage this additional risk by adding contingencies to our bid amounts, obtaining errors and omissions insurance and obtaining indemnifications from our design consultants where possible, there is no guarantee that these risk management strategies will always be successful.

All state and federal government contracts and most of our other contracts provide for termination of the contract for the convenience of the contract owner, with provisions to pay us for work performed through the date of termination. We have not been materially adversely affected by these provisions in the past. Many of our contracts contain provisions that require us to pay liquidated damages if specified completion schedule requirements are not met and these amounts can be significant.

We act as prime contractor on most of the construction projects we undertake. We accomplish the majority of our projects with our own resources and subcontract specialized activities such as electrical and mechanical work. As prime contractor, we are responsible for the performance of the entire contract, including subcontract work. Thus, we may be subject to increased costs associated with the failure of one or more subcontractors to perform as anticipated. We manage this risk by reviewing the size of the subcontract, the financial stability of the subcontractor and other factors and, based on this review, determine whether to require that the subcontractor furnish a bond or other type of security that guarantees their performance. Disadvantaged business enterprise regulations require us to use our best efforts to subcontract a specified portion of contract work done for governmental agencies to certain types of disadvantaged subcontractors. As with all of our subcontractors, some may not be able to obtain surety bonds or other types of performance security.

Insurance and Bonding

We maintain general and excess liability, construction equipment and workers’ compensation insurance; all in amounts consistent with industry practices.

In connection with our business, we generally are required to provide various types of surety bonds that provide an additional measure of security for our performance under certain public and private sector contracts. Our ability to obtain surety bonds depends upon our capitalization, working capital, past performance, management expertise and external factors, including the capacity of the overall surety market. Surety companies consider such factors in light of the amount of our backlog that we have currently bonded and their current underwriting standards, which may change from time to time. The capacity of the surety market is subject to market-driven fluctuations driven primarily by the level of surety industry losses and the degree of surety market consolidation. When the surety market capacity shrinks it results in higher premiums and increased difficulty obtaining bonding, in particular for larger, more complex projects throughout the market. In order to help mitigate this risk, we employ a co-surety structure involving three sureties. Our majority owned subsidiary, Wilder Construction Company, continues to work with a single surety and obtains surety bonds on a stand alone basis. Although we do not believe that fluctuations in surety market capacity has significantly impacted our ability to grow our business, there is no assurance that it will not significantly impact our ability to obtain new contracts in the future (see “Item 1A. Risk Factors”).

Government and Environmental Regulations

Our operations are subject to compliance with regulatory requirements of federal, state and local government agencies and authorities, including regulations concerning workplace safety, labor relations and disadvantaged businesses. Additionally, all of our operations are subject to various federal, state and local laws and regulations relating to the environment, including those relating to discharges to air, water and land, the handling and disposal of solid and hazardous waste, the handling of underground storage tanks and the cleanup of properties affected by hazardous substances. Certain environmental laws impose substantial penalties for non-compliance and others, such as the federal Comprehensive Environmental Response, Compensation and Liability Act, impose strict, retroactive, joint and several liability upon persons responsible for releases of hazardous substances. We continually evaluate whether we must take additional steps at our locations to ensure compliance with environmental laws. While compliance with applicable regulatory requirements has not materially adversely affected our operations in the past, there can be no assurance that these requirements will not change and that compliance will not adversely affect our operations in the future. In addition, our aggregate materials operations require operating permits granted by governmental agencies. We believe that tighter regulations for the protection of the environment and other factors will make it increasingly difficult to obtain new permits and renewal of existing permits may be subject to more restrictive conditions than currently exist.

The California Air Resources Board has proposed regulations that will require equipment owners to reduce diesel particulate emissions from in-use off-road diesel equipment to meet emission targets proposed for each year from 2009 to 2020. A regulation is anticipated to be approved in 2007. The emission targets that are currently proposed will require California off-road diesel equipment owners to retrofit equipment with diesel particulate filters or replace equipment with new engine technology as it becomes available. This regulation is still in the rule-making process and changes to the regulation may be made prior to its final approval.

As is the case with other companies in the same industry, some of our aggregate products contain varying amounts of crystalline silica, a common mineral. Also, some of our construction and material processing operations release as dust crystalline silica that is in the materials being handled. Excessive, prolonged inhalation of very small-sized particles of crystalline silica has allegedly been associated with respiratory disease (including silicosis). The Mine Safety and Health Administration and the Occupational Safety and Health Administration have established occupational thresholds for crystalline silica exposure as respirable dust. We monitor to verify that our dust control procedures are keeping occupational exposures at or below the requisite thresholds and to verify that respiratory protective equipment is made available when required. We also communicate, through safety information sheets and other means, what we believe to be appropriate warnings and cautions to employees and customers about the risks associated with excessive, prolonged inhalation of mineral dust in general and crystalline silica in particular.

Website Access

Our website address is www.graniteconstruction.com. On our website we make available, free of charge, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (“SEC”). The information on our website is not incorporated into, and is not part of, this report. These reports, and any amendments to them, are also available at the website of the SEC, www.sec.gov.

Set forth below and elsewhere in this Report and in other documents we file with the SEC are various risks and uncertainties that could cause our actual results to differ materially from the results contemplated by the forward-looking statements contained in the Report or otherwise adversely affect our business.

| · | Our success depends on attracting and retaining qualified personnel in a competitive environment. The single largest factor in our ability to profitably execute our work is our ability to attract, develop and retain qualified personnel. Our success in attracting qualified people is dependent on the resources available in individual geographic areas and the impact on the labor supply due to general economic conditions as well as our ability to provide a competitive compensation package and work environment. |

| · | Economic downturns and reductions in government funding could have a negative impact on our business. Significant portions of our revenues are derived from contracts that are funded by federal, state and local government agencies. Our ability to obtain future public sector work at reasonable margins is highly dependent on the amount of work that is available to bid, which is largely a function of the level of government funding available. We also perform commercial and residential site development and other work for customers in the private sector. The availability of this private sector work can be significantly adversely affected by general economic downturns. |

| · | Our fixed price and fixed unit price contracts subject us to the risk of increased project cost. As more fully described under “Contract Provisions and Subcontracting” above, the profitability of our fixed price and fixed unit price contracts can be adversely affected by a number of factors that can cause our actual costs to materially exceed the costs estimated at the time of our original bid. |

| · | Accounting for our revenues and costs involves significant estimates. As further described in “Critical Accounting Estimates” under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation,” accounting for our contract related revenues and costs, as well as other cost items, requires management to make a variety of significant estimates and assumptions. Although we believe we have sufficient experience and processes to enable us to formulate appropriate assumptions and produce reasonably dependable estimates, these assumptions and estimates may change significantly in the future, and these changes could result in the reversal of previously recognized revenue and profit and have a material adverse effect on our financial position and the results of our operations. |

| · | Many of our contracts have penalties for late completion. In some instances, including many of our fixed price contracts, we guarantee that we will complete a project by a scheduled date. If we subsequently fail to complete the project as scheduled we may be held responsible for cost impacts resulting from any delay, generally in the form of contractually agreed-upon liquidated damages. To the extent that these events occur, the total costs of the project could exceed our original estimates and we could experience reduced profits or, in some cases, a loss for that project. |

| · | Weather can significantly impact our quarterly revenues and profitability. Our ability to perform work is significantly impacted by weather conditions such as precipitation and temperature. Changes in weather conditions can create significant variability in our quarterly revenues and profitability, particularly in the first and fourth quarters of the year. Additionally, delays and other weather impacts may increase a project’s cost and decrease its profitability. |

| · | We work in a highly competitive marketplace. As more fully described under “Competition” above, we have multiple competitors in all of the areas in which we work. During economic down cycles or times of lower government funding for public works projects, competition for the fewer available projects intensifies and this increased competition may result in a decrease in our ability to be competitive at acceptable margins. |

| · | An inability to secure and permit aggregate reserves could negatively impact our future operations and results. Tighter regulations for the protection of the environment and the finite nature of property containing suitable aggregate reserves are making it increasingly challenging and costly to secure and permit aggregate reserves. Although we have thus far been able to secure and permit reserves to support our business, it is likely to become increasingly difficult to do so and there is no assurance that we will be able to secure and permit reserves in the future. |

| · | We are subject to environmental and other regulation. As more fully described under “Government and Environmental Regulations” above, we are subject to a number of federal, state and local laws and regulations relating to the environment, workplace safety and a variety of socioeconomic requirements, the noncompliance of which can result in substantial penalties, termination or suspension of government contracts as well as civil and criminal liability. While compliance with these laws and regulations has not materially adversely affected our operations in the past, there can be no assurance that these requirements will not change and that compliance will not adversely affect our operations in the future. |

| · | Strikes or work stoppages could have a negative impact on our operations and results. We are party to collective bargaining agreements covering a portion of our craft workforce. Although our results and operations have not been significantly impacted by strikes or work stoppages in the past, such labor actions could have a significant impact on our operations if they occur in the future. |

| · | Unavailability of insurance coverage could have a negative impact on our operations and results. We maintain insurance coverage as part of our overall risk management strategy and pursuant to requirements to maintain specific coverage that are contained in our financing agreements and in most of our construction contracts. Although we have been able to obtain insurance coverage to meet our requirements in the past, there is no assurance that such insurance coverage will be available in the future. |

| · | An inability to obtain bonding would have a negative impact on our operations and results. As more fully described in “Insurance and Bonding” above, we generally are required to provide surety bonds securing our performance under the majority of our public and private sector contracts. Our inability to obtain surety bonds in the future would significantly impact our ability to obtain new contracts, which would have a material adverse effect on our business. |

| · | Our joint venture contracts with project owners subject us to joint and several liability. If a joint venture partner fails to perform we could be liable for completion of the entire contract and, if the contract were unprofitable, this could result in a material adverse effect on our financial position, results of operations and cash flows. |

| · | We use certain commodity products that are subject to significant price fluctuations. Diesel fuel, liquid asphalt and other petroleum-based products are used to fuel and lubricate our equipment and fire our asphalt concrete processing plants and also constitute a significant part of the asphalt paving materials that are used in many of our construction projects and sold to outside parties. Although we are partially protected by asphalt or fuel price escalation clauses in some of our contracts, many contracts provide no such protection. We also use cement, steel and other commodities in our construction projects that can be subject to significant price fluctuations. We have not been significantly adversely affected by price fluctuations in the past; however, there is no guarantee that we will not be in the future. |

| · | As a part of our growth strategy we expect to make future acquisitions and acquisitions involve many risks. These risks include difficulties integrating the operations and personnel of the acquired companies, diversion of management’s attention from our ongoing operations, potential difficulties and increased costs associated with completion of any assumed construction projects, insufficient revenues to offset increased expenses associated with acquisitions and the potential loss of key employees or customers of the acquired companies. Acquisitions may also cause us to increase our liabilities, record goodwill or other non-amortizable intangible assets that will be subject to subsequent impairment testing and potential impairment charges and incur amortization expenses related to certain other intangible assets. Failure to manage and successfully integrate acquisitions could harm our business and operating results significantly. |

| | |

| · | Our goodwill may be impaired and result in a charge to income. We have accounted for our past acquisitions using the “purchase” method of accounting. Under the purchase method, we recorded, at fair value, assets acquired and liabilities assumed, and we recorded as goodwill the difference between the cost of acquisitions and the sum of the fair value of tangible and identifiable intangible assets acquired, less liabilities assumed. At December 31, 2006, our goodwill balance was $9.9 million. In accordance with Statement of Financial Accounting Standards No. 142, “Goodwill and Other Intangible Assets,” our recorded goodwill is not amortized but instead is subject to an impairment review on at least an annual basis. In the future, if our goodwill is determined to be impaired, the impairment would result in a charge to income from operations in the year of the impairment with a resulting decrease in our recorded net worth. |

| · | Failure of our subcontractors to perform as anticipated could have a negative impact on our results. As further described under “Contract Provisions and Subcontracting” above, we subcontract a portion of many of our contracts to specialty subcontractors and we are ultimately responsible for the successful completion of their work. Although we seek to require bonding or other forms of guarantees, we are not always successful in obtaining those bonds or guarantees from our higher risk subcontractors, and there is no guarantee that we will not incur a material loss due to subcontractor performance issues. |

| · | We may be unable to identify qualified Disadvantaged Business Enterprise (“DBE”) contractors to perform as subcontractors. Certain of our government agency projects contain minimum DBE participation clauses. If we subsequently fail to complete these projects with the minimum DBE participation we may be held responsible for damages due to breach of contract including restrictions on our ability to bid on future projects and monetary damages. To the extent that these events occur, the total costs of the project could exceed our original estimates and we could experience reduced profits or, in some cases, a loss for that project. |

| · | A significant portion of our revenue is from government funded contracts. Approximately 68% of our consolidated revenue in 2006 was derived from performing contracts funded by federal, state and local government agencies and authorities. These government contracts are subject to specific procurement regulations, contract provisions and a variety of socioeconomic requirements relating to their formation, administration, performance and accounting. Many of these contracts include express or implied certifications of compliance with applicable laws and contract provisions. As a result of our government contracting, claims for civil or criminal fraud may be brought by the government for violations of these regulations, requirements or statutes. We may also be subject to qui tam litigation brought by private individuals on behalf of the government under the Federal Civil False Claims Act, which could include claims for up to treble damages. Further, if we fail to comply with any of these regulations, requirements or statutes, our existing government contracts could be terminated, we could be suspended from government contracting or subcontracting, including federally funded projects at the state level. If our government contracts are terminated for any reason, or if we are suspended from government work, we could suffer a significant reduction in expected revenue. |

| · | Our long-term debt and credit arrangements contain restrictive covenants and failure to meet these covenants could significantly harm our financial condition. Our long-term debt and credit arrangements and related restrictive covenants are more fully described in Note 10 of the “Notes to the Consolidated Financial Statements” included in this report. In most cases, failure to meet the restrictive covenants would result in an immediate repayment of all amounts due and cancellation of open lines of credit. Additionally, failure to meet restrictive covenants related to our debt and credit agreements would trigger cross-default provisions that would cause us to also be in default of our surety agreements. Although we have not had difficulty meeting these covenants in the past, failure to do so in the future could have material adverse effects on our business and financial condition. |

| |

| · | Our backlog is subject to unexpected adjustments and cancellations and could be an uncertain indicator of our future earnings. We cannot guarantee that the revenues projected in our backlog will be realized or, if realized, will result in profits. Projects may remain in our backlog for an extended period of time. In addition, project cancellations or scope adjustments may occur, from time to time, with respect to contracts reflected in our backlog. Backlog reductions can adversely affect the revenue and profit we actually receive from contracts reflected in our backlog. Future project cancellations and scope adjustments could further reduce the dollar amount of our backlog and the revenues and profits that we actually receive. |

The foregoing list is not exhaustive. There can be no assurance that we have correctly identified and appropriately assessed all factors affecting our business or that the publicly available and other information with respect to these matters is complete and correct. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial also may adversely impact us. These developments could have material adverse effects on our business, financial condition and results of operations. For these reasons, the reader is cautioned not to place undue reliance on our forward-looking statements.

Not applicable.

The following table provides our estimate of certain information about our properties as of December 31, 2006:

| | | | | |

| | Land Area (acres) | Building Square Feet | Permitted Aggregate Reserves (tons) | Unpermitted Aggregate Reserves (tons) |

| Office and shop space (owned and leased) | 1,400 | 1,050,000 | N/A | N/A |

| Owned quarry property | N/A | N/A | 430.0 million | 125.0 million |

| Leased quarry property | N/A | N/A | 355.0 million | 645.0 million |

| Real estate held for sale | 2,800 | 60,000 | N/A | N/A |

Approximately 80% of the office and shop space is used by the Branch Division at their various locations throughout the western United States and the remainder is primarily used by HCD. The quarry property is located at Branch Division locations throughout the western United States. We consider our available and future aggregate reserves adequate to meet our expected operating needs. We pursue a plan of acquiring new sources of aggregate reserves to replenish those depleted and to support future growth with a goal of maintaining approximately thirty years of aggregate reserves at most of our Branch locations.

Eldredge

A $9.3 million judgment was entered in June 2005 against our wholly owned subsidiary Granite Construction Company (“GCCO”) by the District Court Clark County; Nevada, in an action entitled Eldredge vs. Las Vegas Valley Water District, GCCO, et al. The civil lawsuit was initially brought by a former employee of GCCO against the Las Vegas Water District in June 2000. The plaintiff subsequently filed an amended complaint on June 10, 2003, bringing GCCO into the action and seeking compensation in addition to the worker’s compensation payments the employee previously accepted for injuries sustained when a trench collapsed. The jury issued a verdict finding against GCCO on two causes of action, assault and battery and intentional infliction of emotional distress. The judgment awarded damages for past and future lost wages, medical expenses and pain and suffering. After the verdict was issued, the plaintiff filed a motion seeking monetary sanctions against GCCO in the amount of $26.8 million (a multiple of the jury verdict) based on allegations that GCCO and/or its trial counsel improperly withheld and/or attempted to influence testimony in respect to the case.

Pursuant to the parties written agreement to resolve this dispute, on January 11, 2007 the $9.3 million judgment was dismissed with prejudice making the judgment against GCCO null and void and plaintiff’s motion seeking monetary sanctions against GCCO in the amount of $26.8 million (a multiple of the jury verdict) deemed withdrawn with prejudice.

Silica

GCCO is one of approximately 100 to 300 defendants in ten active California Superior Court lawsuits. Of the ten lawsuits, five were filed against GCCO in 2005 and five were filed against GCCO in 2006, in Alameda County (Riley vs. A-1 Aggregates, et al.; Molina vs. A-1 Aggregates, et al.; Dominguez vs. A-1 Aggregates, et al.; Cleveland vs. A. Teichert & Son.; Guido vs. A. Teichert & Son, Inc.; Williams vs. A. Teichert & Son, Inc.; Horne vs. Teichert & Son, Inc.; Harris vs. A-1 Aggregates, et al.; Kammer vs.A-1 Aggregates, et al.; and Solis vs. The 3M Company et al.). Each lawsuit was brought by a single plaintiff who is seeking money damages by way of various causes of action, including strict product and market share liability, and alleges personal injuries caused by exposure to silica products and related materials during the plaintiffs’ use or association with sand blasting or grinding concrete. The plaintiff in each lawsuit has categorized the defendants as equipment defendants, respirator defendants, premises defendants and sand defendants. We have been identified as a sand defendant, meaning a party that manufactured, supplied or distributed silica-containing products. Our preliminary investigation revealed that we have not knowingly sold or distributed abrasive silica sand for sandblasting, and therefore, we believe the probability of these lawsuits resulting in an incurrence of a material liability is remote. We have been dismissed from fourteen other similar lawsuits. In addition, we have been apprised of three complaints that are based on similar allegations of exposure to silica containing products being filed, but not served, against GCCO and more than 100 other defendants in California Superior Court.

Hiawatha Project DBE Issues

The Hiawatha Light Rail Transit (“HLRT”) project was performed by Minnesota Transit Constructors (“MnTC”), a joint venture that consisted of GCCO, and other unrelated companies. GCCO was the managing partner of the joint venture, with a 56.5% interest. The Minnesota Department of Transportation (“MnDOT”) is the contracting agency for this federally funded project. The MnDOT and the U.S. Department of Transportation Office of Inspector General (“OIG”) each conducted a review of the Disadvantaged Business Enterprise (“DBE”) program maintained by MnTC for the HLRT project. In addition, the U.S. Department of Justice (“USDOJ”), is conducting an investigation into compliance issues with respect to MnTC’s DBE Program for the HLRT project. The MnDOT and the OIG (collectively the “Agencies”) have initially identified certain compliance issues in connection with MnTC’s DBE program, and as a result, have determined that MnTC failed to meet the DBE utilization as represented by MnTC. There has been no formal administrative subpoena issued, nor has a civil complaint been filed in connection with the administrative reviews or the investigation. The MnTC is fully cooperating with all of the agencies involved and will be provided an opportunity to informally present its response to the initial determinations of the Agencies as well as the investigation of the USDOJ.

Other

We are a party to a number of other legal proceedings arising in the normal course of business which, from time to time, includes inquiries from public agencies seeking information concerning our compliance with government construction contracting requirements and related laws and regulations. We believe that the nature and number of these proceedings are typical for a construction firm of our size and scope. Our litigation typically involves claims regarding public liability or contract related issues. While management currently believes, after consultation with counsel, that the ultimate outcome of these proceedings, individually and in the aggregate, will not have a material adverse effect on our financial position or overall trends in results of operations or cash flows, litigation is subject to inherent uncertainties. Were an unfavorable ruling to occur, there exists the possibility of a material adverse impact on the results of operations, cash flows and/or financial position for the period in which the ruling occurs. While any one of our pending legal proceedings is subject to early resolution as a result of our ongoing efforts to settle, whether or when any legal proceeding will resolve through settlement is neither predictable nor guaranteed.

We did not submit any matters to a vote of security holders during the fourth quarter of the year ended December 31, 2006.

Executive Officers of the Registrant

Our executive officers are as follows:

| | | |

Name | Age | Position |

| William G. Dorey | 62 | President, Chief Executive Officer and Director |

| Mark E. Boitano | 58 | Executive Vice President and Chief Operating Officer |

| William E. Barton | 62 | Senior Vice President and Chief Financial Officer |

| Michael F. Donnino | 52 | Senior Vice President and Heavy Construction Division Manager |

| James H. Roberts | 50 | Senior Vice President and Branch Division Manager |

Granite Construction Incorporated was incorporated in Delaware in January 1990 as the holding company for Granite Construction Company, which was incorporated in California in 1922. All dates of service for our executive officers include the periods in which they served for Granite Construction Company.

Mr. Dorey has been an employee of Granite since 1968 and has served in various capacities, including President and Chief Executive Officer since January 2004, President and Chief Operating Officer from February 2003 to December 2003, Executive Vice President and Chief Operating Officer from 1998 to February 2003, Senior Vice President and Manager, Branch Division from 1987 to 1998, and Vice President and Assistant Manager, Branch Division from 1983 to 1987. Mr. Dorey has also served as a member of our Board of Directors since January 2004. Mr. Dorey also served as a director of TIC Holdings, Inc. from 1997 to 2002. He received a B.S. degree in Construction Engineering from Arizona State University in 1967.

Mr. Boitano has been an employee of the Company since 1977 and has served in various capacities, including Chief Operating Officer since January 2004 and Executive Vice President since February 2003. He also served as Branch Division Manager from 1998 to January 2004, and Senior Vice President from 1998 to February 2003. In 2001, he became a director of Wilder Construction Company. Mr. Boitano received a B.S. degree in Civil Engineering from Santa Clara University in 1971 and an M.B.A. degree from California State University, Fresno in 1977.

Mr. Barton has been an employee of the Company since 1980 and has served as Senior Vice President and Chief Financial Officer since 1999 and as Vice President and Chief Financial Officer from 1990 to 1999. In 1997, Mr. Barton became a director of TIC Holdings, Inc., and in January 2000 he also became a director of Wilder Construction Company. He received a B.S. degree in Accounting and Finance from San Jose State University in 1967 and an M.B.A. degree from Santa Clara University in 1973.

Mr. Donnino joined Granite in 1977 and has served as Senior Vice President and Heavy Construction Division Manager since January 2005. He served as Vice President and Heavy Construction Division Assistant Manager during 2004, Texas Regional Manager from 2000 to 2003 and Dallas Estimating Office Area Manager from 1991 to 2000. Mr. Donnino received a B.S.C.E. in Structural, Water and Soils Engineering from the University of Minnesota in 1976.

Mr. Roberts joined Granite in 1981 and has served in various capacities, including Senior Vice President and Branch Division Manager since May 2004, Vice President and Assistant Branch Division Manager from 1999 to 2004, Regional Manager of Nevada and Utah Operations from 1995 to 1999 and became a Director of Wilder Construction Company in 2006. He received a B.S.C.E. in 1979 and an M.S.C.E. in 1980 from the University of California, Berkeley, and an M.B.A. from the University of Southern California in 1981.

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock trades on the New York Stock Exchange under the ticker symbol GVA. See “Quarterly Results” under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation” for a two-year summary of quarterly dividends and high and low sales prices of our stock.

We have paid quarterly cash dividends since the second quarter of 1990, and we expect to continue to pay quarterly cash dividends. However, declaration and payment of dividends is within the sole discretion of our Board of Directors, subject to limitations imposed by Delaware law and compliance with our credit agreements, and will depend on our earnings, capital requirements, financial condition and such other factors as the Board of Directors deems relevant.

As of February 12, 2007, there were 41,825,917 shares of our common stock outstanding held by 986 shareholders of record.

During the three months ended December 31, 2006, we did not sell any of our equity securities that were not registered under the Securities Act of 1933, as amended. The following table sets forth information regarding the repurchase of shares of our common stock during the three months ended December 31, 2006:

| | | | | | | | | | |

Period | | Total number of shares purchased1 | | Average price paid per share | | Total number of shares purchased as part of publicly announced plans or programs2 | | Approximate dollar value of shares that may yet be purchased under the plans or programs2 | |

| October 1, 2006 through October 31, 2006 | | | - | | | - | | | - | | $ | 22,787,537 | |

| November 1, 2006 through November 30, 2006 | | | - | | | - | | | - | | $ | 22,787,537 | |

| December 1, 2006 through December 31, 2006 | | | 19,512 | | $ | 51.08 | | | - | | $ | 22,787,537 | |

| | | | 19,512 | | $ | 51.08 | | | - | | | | |

1The total number of shares purchased represents shares purchased in connection with employee tax withholding for shares granted under our Amended and Restated 1999 Equity Incentive Plan.

2On October 16, 2002, we publicly announced that our Board of Directors had authorized us to repurchase up to $25.0 million worth of shares of our common stock at management’s discretion on the open market or in privately negotiated block purchases, exclusive of repurchases related to employee benefit plans.

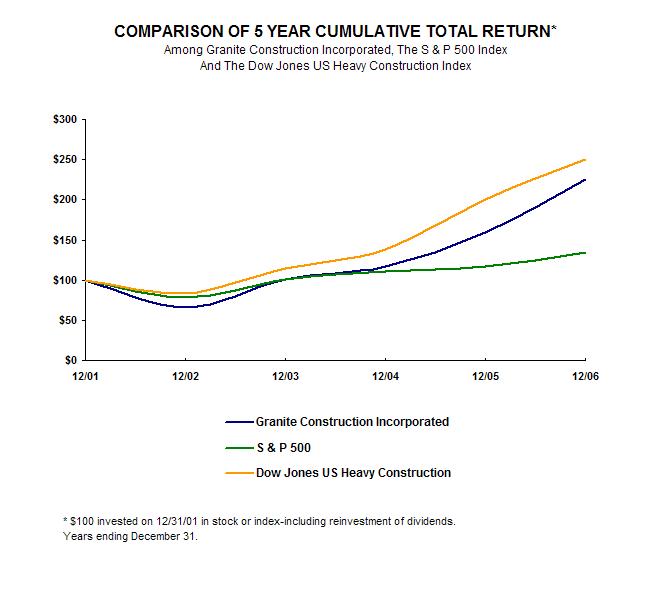

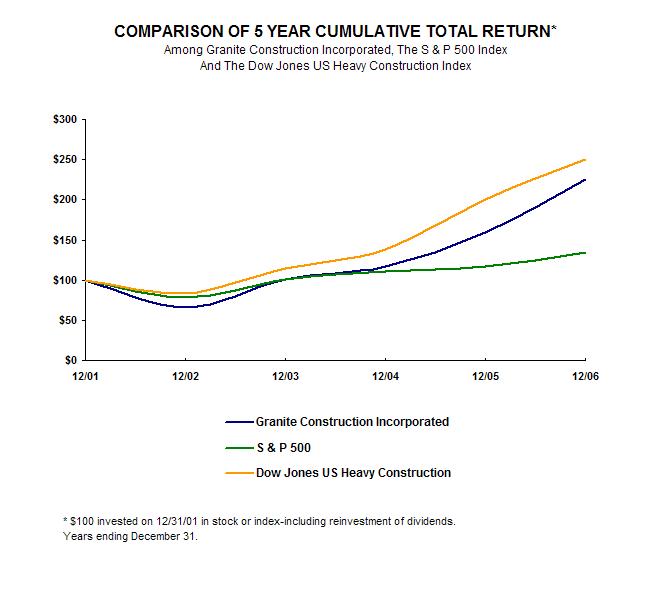

Performance Graph

The following graph compares the cumulative 5-year cumulative total return to shareholders on Granite Construction Incorporated’s common stock relative to the cumulative total returns of the S&P 500 index and the Dow Jones US Heavy Construction index. The Dow Jones US Heavy Construction index includes the following companies: EMCOR Group Inc., Fluor Corp., Granite Construction Inc., Insituform Technologies Inc., Jacobs Engineering Group Inc., McDermott International Inc., Quanta Services Inc. and Shaw Group Inc. An investment of $100 (with reinvestment of all dividends) is assumed to have been made in our common stock and in each of the indexes on December 31, 2001 and its relative performance is tracked through December 31, 2006.

The comparisons in the graph below are based on historical data and are not intended to forecast the possible future performance of our common stock.

| | | | | | | | | | | | | | |

| | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | |

| Granite Construction Incorporated | | $ | 100 | | $ | 65.43 | | $ | 101.27 | | $ | 116.72 | | $ | 159.63 | | $ | 225.54 | |

| S & P 500 | | | 100 | | | 77.90 | | | 100.24 | | | 111.15 | | | 116.61 | | | 135.03 | |

| Dow Jones US Heavy Construction | | | 100 | | | 83.87 | | | 114.41 | | | 138.74 | | | 200.48 | | | 250.08 | |

The selected consolidated operations data for 2006, 2005 and 2004 and consolidated balance sheet data as of December 31, 2006 and 2005 set forth below have been derived from our audited consolidated financial statements included herein, and are qualified by reference to those consolidated financial statements. The selected consolidated operations data for 2002 and 2003 and the consolidated balance sheet data as of December 31, 2002, 2003 and 2004 have been derived from our audited consolidated financial statements not included herein. These historical results are not necessarily indicative of the results of operations to be expected for any future period.

| | |

Selected Consolidated Financial Data | |

Years Ended December 31, | | 2006 | | 2005 | | 2004* | | 2003 | | 2002 | |

Operating Summary | | (In Thousands, Except Per Share Data) | |

| Revenue | | $ | 2,969,604 | | $ | 2,641,352 | | $ | 2,136,212 | | $ | 1,844,491 | | $ | 1,764,742 | |

| Gross profit | | | 295,720 | | | 319,372 | | | 222,021 | | | 226,450 | | | 224,584 | |

| As a percent of revenue | | | 10.0 | | | 12.1 | | | 10.4 | | | 12.3 | | | 12.7 | |

| General and administrative expenses | | | 204,281 | | | 183,392 | | | 157,035 | | | 151,879 | | | 146,467 | |

| As a percent of revenue | | | 6.9 | | | 6.9 | | | 7.4 | | | 8.2 | | | 8.3 | |

| Provision for (reversal of) legal judgment | | | (4,800 | ) | | 9,300 | | | - | | | - | | | - | |

| Goodwill impairment charge** | | | 18,011 | | | - | | | - | | | - | | | - | |

| Net income | | | 80,509 | | | 83,150 | | | 57,007 | | | 60,504 | | | 49,279 | |

| As a percent of revenue | | | 2.7 | | | 3.1 | | | 2.7 | | | 3.3 | | | 2.8 | |

| Net income per share: | | | | | | | | | | | | | | | | |

| Basic | | $ | 1.97 | | $ | 2.05 | | $ | 1.41 | | $ | 1.51 | | $ | 1.23 | |

| Diluted | | | 1.94 | | | 2.02 | | | 1.39 | | | 1.48 | | | 1.21 | |

| Weighted average shares of common stock: | | | | | | | | | | | | | | | | |

| Basic | | | 40,874 | | | 40,614 | | | 40,390 | | | 40,175 | | | 40,016 | |

| Diluted | | | 41,471 | | | 41,249 | | | 41,031 | | | 40,808 | | | 40,723 | |

Balance Sheet | | | | | | | | | | | | | | | | |

| Total assets | | $ | 1,632,838 | | $ | 1,472,230 | | $ | 1,277,954 | | $ | 1,060,410 | | $ | 983,819 | |

| Cash, cash equivalents and marketable securities | | | 394,878 | | | 301,381 | | | 277,692 | | | 201,985 | | | 182,694 | |

| Working capital | | | 319,762 | | | 367,801 | | | 355,927 | | | 274,947 | | | 220,396 | |

| Current maturities of long-term debt | | | 28,660 | | | 26,888 | | | 15,861 | | | 8,182 | | | 8,640 | |

| Long-term debt | | | 78,576 | | | 124,415 | | | 148,503 | | | 126,708 | | | 132,380 | |

| Other long-term liabilities | | | 58,419 | | | 46,556 | | | 40,641 | | | 29,938 | | | 13,742 | |

| Shareholders’ equity | | | 694,544 | | | 621,560 | | | 550,474 | | | 504,891 | | | 454,869 | |

| Book value per share | | | 16.60 | | | 14.91 | | | 13.23 | | | 12.16 | | | 11.03 | |

| Dividends per share | | | 0.40 | | | 0.40 | | | 0.40 | | | 0.40 | | | 0.32 | |

| Common shares outstanding | | | 41,834 | | | 41,682 | | | 41,612 | | | 41,528 | | | 41,257 | |

| Backlog | | $ | 2,256,587 | | $ | 2,331,540 | | $ | 2,437,994 | | $ | 1,985,788 | | $ | 1,856,451 | |

* Effective January 1, 2004, we adopted Financial Accounting Standards Board Interpretation No. 46 (revised December 2003) “Consolidation of Variable Interest Entities” (see Note 5 of the “Notes to the Consolidated Financial Statements”).

**During the year ended December 31, 2006 we recorded a goodwill impairment charge of approximately $18.0 million related to our Granite Northeast operation in New York (see Note 8 of the “Notes to the Consolidated Financial Statements”).

General

We are one of the largest heavy civil contractors in the United States as well as one of the largest construction materials production companies in the Western United States. We are engaged in the construction of highways, dams, airport infrastructure, mass transit facilities and other infrastructure-related projects. We have offices in Alaska, Arizona, California, Florida, Minnesota, Nevada, New York, Oregon, Texas, Utah and Washington. Our business involves two operating segments: the Branch Division and the Heavy Construction Division.

Our contracts are obtained primarily through competitive bidding in response to advertisements by federal, state and local agencies and private parties and to a lesser extent through negotiation with private parties. Our bidding activity is affected by such factors as backlog, current utilization of equipment and other resources, ability to obtain necessary surety bonds and competitive considerations. Bidding activity, backlog and revenue resulting from the award of new contracts may vary significantly from period to period.

The two primary economic drivers of our business are (1) federal, state and local public funding levels and (2) the overall health of the economy, both nationally and locally. The level of demand for our services will have a direct correlation to these drivers. For example, a weak economy will generally result in a reduced demand for construction in the private sector. This reduced demand increases competition for fewer private sector projects and will ultimately also increase competition in the public sector as companies migrate from bidding on scarce private sector work to projects in the public sector. Greater competition can reduce revenue growth and/or increase pressure on gross profit margins. A weak economy also tends to produce less tax revenue, thereby decreasing the funds available for spending on public infrastructure improvements. There are funding sources that have been specifically earmarked for infrastructure spending, such as gasoline taxes, which are not necessarily directly impacted by a weak economy. However, even these funds can be temporarily at risk as state and local governments struggle to balance their budgets. Conversely, higher public funding and/or a robust economy will increase demand for our services and provide opportunities for revenue growth and margin improvement.

Our general and administrative costs include salaries and related expenses, incentive compensation, discretionary profit sharing and other variable compensation, as well as other overhead costs to support our overall business. In general, these costs will increase in response to the growth and the related increased complexity of our business. These costs may also vary depending on the number of projects in process in a particular area and the corresponding level of estimating activity. For example, as large projects are completed or if the level of work slows down in a particular area, we will often re-assign project employees to estimating and bidding activities until another project gets underway, temporarily moving their salaries and related costs from cost of revenue to general and administrative expense. Additionally, our compensation strategy for selected management personnel is to rely heavily on a variable cash and restricted stock performance-based incentive element. The cash portion of these incentives is expensed when earned while the restricted stock portion is expensed over the vesting period of the stock (generally five years). Depending on the mix of cash and restricted stock, these incentives can have the effect of increasing general and administrative expenses in very profitable years and decreasing expenses in less profitable years.

Current Year Overview

| | | | |

| Comparative Financial Summary | | | | | | | |

Years ended December 31, | | 2006 | | 2005 | | 2004 | |

| (in thousands) | | | |

| Total revenue | | $ | 2,969,604 | | $ | 2,641,352 | | $ | | |

| Gross profit | | | 295,720 | | | | | | | |

| General and administrative expenses | | | 204,281 | | | | | | | |

| Provision for (reversal of) legal judgment | | | (4,800 | ) | | | | | - | |

| Goodwill impairment charge | | | 18,011 | | | - | | | - | |

| Gain on sale of property and equipment | | | 10,408 | | | | | | | |

| Operating income | | | 88,636 | | | | | | | |

| Net income | | | 80,509 | | | | | | | |

Our results of operations for the year ended December 31, 2006 reflect increased operating income from our Branch Division compared with the corresponding period in 2005, which was primarily driven by the strong economy in the West and the ability to work well into the fourth quarter due to mild weather conditions. The Branch Division’s 2006 operating results also include the results of the fourth quarter settlement and partial reversal of a provision related to an unfavorable legal judgment previously recorded in 2005. These improved results were offset by an operating loss in our Heavy Construction Division due primarily to additional costs recorded as a result of changes in the estimates of the cost to complete certain projects and a goodwill impairment charge of approximately $18.0 million related to our Granite Northeast operation in New York. Operating income for the year ended December 31, 2006 includes approximately $17.9 million related to sales of certain real estate development assets by our Granite Land Company subsidiary (approximately $10.2 million net of our minority partners’ share). Additionally, our net income for the year ended December 31, 2006 reflects an increase in non-operating income of approximately $17.0 million due primarily to higher interest income in 2006.

Critical Accounting Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Our estimates, judgments and assumptions are continually evaluated based on available information and experience; however, actual amounts could differ from those estimates.

Certain of our accounting policies and estimates require higher degrees of judgment than others in their application. These include the recognition of revenue and earnings from construction contracts, the valuation of long-lived assets and insurance estimates. We evaluate all of our estimates and judgments on an on-going basis.

Revenue Recognition for Construction Contracts: Our contracts with our customers are primarily either “fixed unit price” or “fixed price.” Under fixed unit price contracts, we are committed to provide materials or services required by a project at fixed unit prices (for example, dollars per cubic yard of concrete poured or cubic yards of earth excavated). While the fixed unit price contract shifts the risk of estimating the quantity of units required for a particular project to the customer, any increase in our unit cost over the expected unit cost in the bid, whether due to inflation, inefficiency, faulty estimates or other factors, is borne by us unless otherwise provided in the contract. Fixed price contracts are priced on a lump-sum basis under which we bear the risk that we may not be able to perform all the work profitably for the specified contract amount. The percentage of fixed price contracts in our backlog increased from approximately 63.0% at December 31, 2005 to approximately 67.7% at December 31, 2006. All state and federal government contracts and many of our other contracts provide for termination of the contract for the convenience of the party contracting with us, with provisions to pay us for work performed through the date of termination.