UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2009

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number 1-12911

Granite Construction Incorporated

(Exact name of registrant as specified in its charter)

| Delaware | 77-0239383 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

| | |

| 585 West Beach Street | |

| Watsonville, California | 95076 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (831) 724-1011

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

| Common Stock, $0.01 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. Large accelerated filer x Accelerated filer o Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant was approximately $1.3 billion as of June 30, 2009, based upon the average of the bid and asked prices per share of the registrant’s Common Stock as reported on the New York Stock Exchange on such date. Shares of Common Stock held by each executive officer and director and by each person who owns 5% or more of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

At February 12, 2010, 38,629,378 shares of Common Stock, par value $0.01, of the registrant were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information called for by Part III is incorporated by reference to the definitive Proxy Statement for the Annual Meeting of Shareholders of Granite Construction Incorporated to be held on May 7, 2010, which will be filed with the Securities and Exchange Commission not later than 120 days after December 31, 2009.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains statements that are not based on historical facts and which may be forward-looking in nature. Under the Private Securities Litigation Reform Act of 1995, a “safe harbor” may be provided to us for certain of these forward-looking statements. Words such as “outlook,” “believes,” “expects,” “appears,” “may,” “will,” “should,” “anticipates” or the negative thereof or comparable terminology, are intended to identify these forward-looking statements. These forward-looking statements are estimates reflecting the best judgment of our senior management and are based on our current expectations and projections concerning future events, many of which are outside of our control, and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those risks described in this Report under “Item 1A. Risk Factors.” Except as required by law, we undertake no obligation to revise or update any forward-looking statements for any reason. As a result, the reader is cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report.

Introduction

Granite Construction Company was originally incorporated in 1922. In 1990, Granite Construction Incorporated was formed as the holding company for Granite Construction Company and its wholly owned subsidiaries and was incorporated in Delaware. Unless otherwise indicated, the terms “we,” “us,” “our,” “Company” and “Granite” refer to Granite Construction Incorporated and its consolidated subsidiaries.

We are one of the largest heavy civil construction contractors in the United States. We operate nationwide, serving both public and private sector clients. Within the public sector, we primarily concentrate on heavy-civil infrastructure projects, including the construction of roads, highways, mass transit facilities, airport infrastructure, bridges, dams and canals. Within the private sector, we perform site preparation and infrastructure services for residential development, commercial and industrial buildings, and other facilities.

We own and lease substantial aggregate reserves and own a number of construction materials processing plants. We also have one of the largest contractor-owned heavy construction equipment fleets in the United States. We believe that the ownership of these assets enables us to compete more effectively by ensuring availability of these resources at a favorable cost.

In 2000, we diversified into real estate investment and development, investing our own capital in carefully selected real estate projects throughout the western United States and Texas.

Operating Structure

Our construction business has been organized into two geographic segments, Granite West and Granite East. Included in our Granite West segment is our vertically integrated construction materials business. The Company also has a real estate investment and development business, Granite Land Company (“GLC”). Our results of operations discussed herein have been reported with the segment structure that was in place during 2009. See Note 20 of “Notes to the Consolidated Financial Statements” for additional information about our operating segments.

On August 31, 2009, we announced changes to our organizational structure designed to improve operating efficiencies and position the Company for long-term growth. In conjunction with the reorganization we are changing our reportable segments to reflect our business product lines. Beginning in fiscal 2010, the Company’s new reportable segments are: Construction, Large Project Construction, Construction Materials and Real Estate. The Real Estate segment will contain what was previously known as Granite Land Company. We will continue to provide geographic information within the new segment structure.

Granite West: In 2009 and 2008, Granite West contract revenue and sales of construction materials was $1.4 billion and $2.0 billion (71.9% and 73.7% of our total revenue), respectively. Granite West revenue is derived from both public and private sector clients. Typical public sector projects include both new construction and improvement of roads, highways, airport infrastructure and bridges. Major private sector contracts typically include site preparation for housing and commercial development, including excavation, grading and street paving and installation of curbs, gutters, sidewalks and underground utilities.

Granite West’s decentralized operating structure includes 14 branch offices in the western United States, several with additional satellite operations. In 2009, individual branch revenues ranged from $47.0 million to $210.1 million. Although most Granite West projects are started and completed within a year, the division also has the capability of constructing larger projects and, as of December 31, 2009, had four active large projects, each with total contract revenue greater than $50.0 million.

The Company mines aggregates and/or operates plants that process aggregates into construction materials for internal use and for sale to third parties. These activities are vertically integrated into Granite West and provide both a source of profits and a competitive advantage to our construction business through the readily available supply of materials. We have significant aggregate reserves that we have acquired by ownership in fee or through long-term leases.

Aggregate products used in our construction projects represented approximately 54.9% of our aggregate sales during 2009 and ranged from 42.3% to 54.9% over the last five years. The remainder is sold to third parties.

Granite East: In 2009, revenue from Granite East was $550.2 million (28.0% of our total revenue), compared with $695.0 million (26.0% of our total revenue) in 2008. Granite East’s focus is on large, complex infrastructure projects and included major highways, mass transit facilities, bridges, tunnels, waterway locks and dams, pipelines, canals, and airport infrastructure. It also performs activities such as demolition, clearing, large-scale earthwork and grading, dewatering, drainage improvements, structural concrete, rail signalization, and concrete and asphalt paving. Granite East also has the ability to process locally sourced aggregates into construction materials using owned or rented portable crushing, concrete and asphalt processing plants.

Granite East operates out of three regional offices that provide management and administrative support and are the primary hubs for estimating efforts. Granite East construction contracts are typically greater than two years in duration with contract values ranging from $12.0 million to $466.5 million at December 31, 2009.

Joint Ventures and Design/Build Projects: We participate in joint ventures with other construction companies. Joint ventures are used for large, technically complex projects, including design/build projects, where it is desirable to share risk and resources. Joint venture partners typically provide independently prepared estimates, shared financing and equipment and often bring local knowledge and expertise (see “Joint Ventures; Off-Balance-Sheet Arrangements” under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations”).

We also utilize the design/build method of project delivery. Unlike traditional projects where owners first hire a design firm or design a project themselves and then put the project out to bid for construction, design/build projects provide the owner with a single point of responsibility and a single contact for both final design and construction. Revenue from design/build projects represented 64.0% and 66.4% of Granite East revenue in 2009 and 2008, respectively, and 10.1% and 14.1% of Granite West revenue in 2009 and 2008, respectively. Although these projects carry additional risk as compared to traditional bid/build projects, the profit potential can also be higher.

Granite Land Company: GLC is an investor in a diversified portfolio of land assets and provides real estate services for other Granite operations. GLC’s current portfolio consists of residential, retail and office site development projects for sale to home and commercial property developers, or held for rental income. The range of our involvement in an individual project may vary from passive investment to management of land rights or entitlement (use of land authorized by government agency), development, construction, leasing and eventual sale of the project. GLC projects have long lead times affording us the flexibility to stage our land entitlement and construction activities to meet market demand. Our strategy is to remain flexible, and to evaluate opportunities to sell any of our investments at any stage of the development process.

Generally, we team with partners who have local knowledge and expertise in the development of each property. Each of these developments is affected by such factors as changes in general economic conditions, bank-lending practices, interest rate fluctuations, and demand for real estate. In addition, each project is subject to issues unique to that property such as environmental conditions, local entitlement policies and market conditions.

Our current investments are located in Washington, Oregon, California and Texas. In 2009, revenue from GLC was $2.3 million (0.1% of our total revenue), compared with $9.0 million (0.3% of our total revenue) in 2008.

Business Strategy

Our fundamental objective is to increase long-term shareholder value as measured by the appreciation of the value of our common stock over a period of time as well as dividend yields. A specific measure of our financial success is the achievement of a return on net assets greater than the cost of capital, creating “Granite Value Added.” The following are key factors in our ability to achieve these objectives:

Controlled Growth - We intend to grow our business by working on many types of infrastructure projects as well as by expanding into new geographic areas. In addition, we are focusing our efforts on larger projects wherein our financial strength and project experience provide us with a competitive advantage.

Decentralized Profit Centers - Each of our operating groups is established as an individual profit center which encourages entrepreneurial activity while allowing the offices to benefit from centralized administrative and support functions.

Diversification - To mitigate the risks inherent in the construction business as the result of general economic factors, we pursue projects: (i) in both the public and private sectors, (ii) for a wide range of customers within each sector (from the federal government to small municipalities and from large corporations to individual homeowners), (iii) in diverse geographic markets, (iv) that are design/build, lump sum and fixed unit price and (v) of various sizes, durations and complexity.

Employee Development - We believe that our employees are key to the successful implementation of our business strategies. Significant resources are employed to attract, develop and retain extraordinary talent and fully promote each employee’s capabilities.

Infrastructure Construction Focus - We concentrate our core competencies on this segment of the construction industry, which includes the building of roads, highways, bridges, dams, tunnels, mass transit facilities, railroad infrastructure and underground utilities as well as site preparation. This focus allows us to most effectively utilize our specialized strengths, which include grading, paving and concrete structures.

Aggregate Materials - We own and lease aggregate reserves and own processing plants that are vertically integrated into our construction operations. By ensuring availability of these resources and providing quality products, we believe we have a competitive advantage in many of our markets as well as a source of revenue and income from the sale of construction materials to third parties.

Ownership of Construction Equipment - We own a large fleet of well maintained heavy construction equipment. We believe that ownership of construction equipment enables us to compete more effectively by ensuring availability of the equipment at a favorable cost.

Profit-based Incentives - Profit center managers are incentivized with cash compensation and restricted stock, payable upon the attainment of pre-established annual financial and non-financial metrics.

Selective Bidding - We focus our resources on bidding jobs that meet our selective bidding criteria, which include analyzing the risk of a potential job relative to: (i) available personnel to estimate and prepare the proposal, (ii) available personnel to effectively manage and build the project, (iii) the competitive environment, (iv) our experience with the type of work, (v) our experience with the owner, (vi) local resources and partnerships, (vii) equipment resources, (viii) the size and complexity of the job and (ix) profitability.

Our operating principles include:

Accident Prevention - We believe accident prevention is a moral obligation as well as good business. By identifying and concentrating resources to address jobsite hazards, we continually strive to reduce our incident rates and the costs associated with accidents.

Environmental Responsibility - We believe in environmentally responsible operations. We are committed to protecting the environment, maintaining good community relations and ensuring compliance with government agency requirements.

Quality and High Ethical Standards - We believe in the importance of performing high quality work and maintaining high ethical standards through an established code of conduct and an effective corporate compliance program.

Raw Materials

We purchase raw materials consisting of aggregate products, cement, diesel fuel, liquid asphalt, natural gas, propane and steel from numerous sources. Our aggregate reserves supply a portion of the raw materials needed in our construction projects. The price and availability of raw materials may vary from year to year due to market conditions and production capacities. We do not foresee the lack of availability of any raw materials.

Seasonality

The first and fourth quarter of our fiscal year are typically affected by weather conditions, primarily in the West, which may alter our construction schedules and can create variability in our revenues, profitability and the required number of employees.

Customers

We have customers in both the public and private sectors. Our largest volume customer is the California Department of Transportation (“Caltrans”). Contracts with Caltrans represented 11.9% and 9.6% of our total revenue and 16.6% and 13.1% of our Granite West revenue in 2009 and 2008, respectively. Public sector revenue in California represented 28.1% and 27.7% of our total revenue in 2009 and 2008, respectively. Other Granite West customers include certain federal agencies, departments of transportation of other states, county and city public works departments, school districts and developers and owners of industrial, commercial and residential sites. Granite East’s customers are predominantly in the public sector and currently include various state departments of transportation, local transit authorities, and federal agencies.

Contract Backlog

Our contract backlog is comprised of the unearned portion of revenue on awarded contracts that have not been completed, including 100% of the unearned revenue of our consolidated joint ventures and our proportionate share of unconsolidated joint venture contracts. We include a construction project in our contract backlog at the time a contract is awarded and funding is in place, with the exception of certain federal government contracts for which funding is appropriated on a periodic basis. Substantially all of the contracts in our contract backlog may be canceled or modified at the election of the customer; however, we have not been materially adversely affected by contract cancellations or modifications in the past (see “Contract Provisions and Subcontracting”). Most Granite West projects are added and completed within each year and therefore are not reflected in our year-end contract backlog. Contract backlog by segment is presented in “Contract Backlog” under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our contract backlog was approximately $1.4 billion and $1.7 billion at December 31, 2009 and 2008, respectively. Approximately $931.2 million of the December 31, 2009 contract backlog is expected to be completed during 2010.

Equipment

At December 31, 2009 and 2008, we owned the following construction equipment and vehicles:

December 31, | | | 2009 | | | 2008 | | |

Heavy construction equipment | | | 2,362 | | | | | |

Trucks, truck-tractors, trailers and vehicles | | | 5,254 | | | | | |

Our portfolio of equipment includes loaders, bulldozers, excavators, rollers, motor graders, pavers, scrapers, cranes, trucks, backhoes and barges. We believe that ownership of equipment is generally preferable to leasing because it ensures the equipment is available as needed and normally results in lower costs. We pool certain equipment for use by both Granite West and Granite East to maximize utilization. On a short-term basis, we lease or rent equipment to supplement existing equipment in response to construction activity peaks. In 2009 and 2008, we spent approximately $17.6 million and $36.5 million, respectively, on purchases of construction equipment and vehicles.

Employees

On December 31, 2009, we employed approximately 1,800 salaried employees, who work in management, estimating and clerical capacities, plus approximately 600 hourly employees. The total number of hourly personnel we employ is subject to the volume of construction in progress and is seasonal. During 2009, the number of hourly employees ranged from approximately 600 to 3,600 and averaged approximately 2,700. Two of our wholly owned subsidiaries - Granite Construction Company and Granite Construction Northeast, Inc. - are parties to craft collective bargaining agreements in many areas in which they work.

We believe our employees are our most valuable resource and that our workforce possesses a strong dedication to and pride in our company. Among salaried and non-union hourly employees, this dedication is reinforced by a 14.6% equity ownership at December 31, 2009 through our Employee Stock Ownership Plan, our Profit Sharing and 401(k) Plan and performance-based incentive compensation arrangements. Our managerial and supervisory personnel have an average of approximately 11 years of service with us.

Competition

Granite West competitors range from small local construction companies to large regional, national and global construction companies. While the market areas of these competitors overlap with several of the markets served by our branches, few compete in all of our market areas. Many of our Granite West competitors have the ability to perform work in either the private or public sectors. When opportunities for work in one sector are reduced, competitors tend to look for opportunities in the other sector. This migration has the potential to reduce revenue growth and/or increase pressure on gross profit margins. In addition, we own and/or have long-term leases on aggregate resources that provide an extra measure of competitive advantage in certain markets. Granite East normally competes with large regional, national and global construction companies.

Factors influencing our competitiveness include price, estimating abilities, knowledge of local markets and conditions, project management, financial strength, reputation for quality, the availability of aggregate materials, and machinery and equipment. Although some of our competitors are larger than us and may possess greater resources, we believe that we compete favorably on the basis of the foregoing factors. Historically, the construction business has not required large amounts of capital, particularly for the smaller size construction work pursued by Granite West, which can result in relative ease of market entry for companies possessing acceptable qualifications. Although the construction business is highly competitive, we believe we are well positioned to compete effectively in the markets in which we operate.

Contract Provisions and Subcontracting

Our contracts with our customers are primarily “fixed unit price” or “fixed price.” Under fixed unit price contracts, we are committed to providing materials or services at fixed unit prices (for example, dollars per cubic yard of concrete poured or cubic yard of earth excavated). While the fixed unit price contract shifts the risk of estimating the quantity of units required for a particular project to the customer, any increase in our unit cost over the expected unit cost in the bid, whether due to inflation, inefficiency, errors in our estimates or other factors, is borne by us unless otherwise provided in the contract. Fixed price contracts are priced on a lump-sum basis under which we bear the risk of performing all the work for the specified amount. The percentage of fixed price contracts in our contract backlog increased to approximately 75.1% at December 31, 2009 compared with approximately 68.7% at December 31, 2008.

Our contracts are generally obtained through competitive bidding in response to advertisements by federal, state and local government agencies and private parties. Less frequently, contracts may be obtained through direct negotiations with private owners. Our contract review process includes identifying risks and opportunities during the bidding process and managing these risks through mitigation efforts such as insurance and pricing. Contracts fitting certain criteria of size and complexity are reviewed by various levels of management and, in some cases, by the Executive Committee of our Board of Directors.

There are a number of factors that can create variability in contract performance and results as compared to a project’s original bid. The most significant of these include the completeness and accuracy of the original bid, costs associated with added scope changes, extended overhead due to owner, weather and other delays, subcontractor performance issues, changes in productivity expectations, site conditions that differ from those assumed in the original bid (to the extent contract remedies are unavailable), the availability and skill level of workers in the geographic location of the project and a change in the availability and proximity of equipment or materials. All of these factors can impose inefficiencies on contract performance, which can increase costs and lower profits. Conversely, positive variations in any of these or other factors can decrease costs and improve profitability. However, the ability to realize improvements on project profitability is often more limited than the risk of lower profitability. Design/build projects typically incur additional costs such as right-of-way and permit acquisition costs and carry additional risks such as design error risk and the risk associated with estimating quantities and prices before the project design is completed. These unknown factors may cause higher than anticipated construction costs and additional liability to the contract owner. We manage this additional risk by adding contingencies to our bid amounts, obtaining errors and omissions insurance and obtaining indemnifications from our design consultants where possible. However, there is no guarantee that these risk management strategies will always be successful.

Most of our contracts, including those with the government, provide for termination at the convenience of the contract owner, with provisions to pay us for work performed through the date of termination. We have not been materially adversely affected by these provisions in the past. Many of our contracts contain provisions that require us to pay liquidated damages if specified completion schedule requirements are not met and these amounts could be significant.

We act as prime contractor on most of our construction projects. We complete the majority of our projects with our own resources and subcontract specialized activities such as electrical and mechanical work. As prime contractor, we are responsible for the performance of the entire contract, including subcontract work. Thus, we may be subject to increased costs associated with the failure of one or more subcontractors to perform as anticipated. Based on our analysis of their construction and financial capabilities, among other criteria, we determine whether to require the subcontractor to furnish a bond or other type of security to guarantee their performance. Disadvantaged business enterprise regulations require us to use our best efforts to subcontract a specified portion of contract work done for governmental agencies to certain types of disadvantaged subcontractors. As with all of our subcontractors, some may not be able to obtain surety bonds or other types of performance security.

Insurance and Bonding

We maintain general and excess liability, construction equipment and workers’ compensation insurance; all in amounts consistent with industry practices.

In connection with our business, we generally are required to provide various types of surety bonds that provide an additional measure of security for our performance under certain public and private sector contracts. Our ability to obtain surety bonds depends upon our capitalization, working capital, past performance, management expertise and external factors, including the capacity of the overall surety market. Surety companies consider such factors in light of the amount of our contract backlog that we have currently bonded and their current underwriting standards, which may change from time to time. The capacity of the surety market is subject to market-based fluctuations driven primarily by the level of surety industry losses and the degree of surety market consolidation. When the surety market capacity shrinks it results in higher premiums and increased difficulty obtaining bonding, in particular for larger, more complex projects throughout the market. In order to help mitigate this risk, we employ a co-surety structure involving three sureties. Although we do not believe that fluctuations in surety market capacity have significantly affected our ability to grow our business, there is no assurance that it will not significantly affect our ability to obtain new contracts in the future (see “Item 1A. Risk Factors”).

Environmental Regulations

Our operations are subject to various federal, state and local laws and regulations relating to the environment, including those relating to discharges to air, water and land, the handling and disposal of solid and hazardous waste, the handling of underground storage tanks and the cleanup of properties affected by hazardous substances. Certain environmental laws impose substantial penalties for non-compliance and others, such as the federal Comprehensive Environmental Response, Compensation and Liability Act, impose strict, retroactive, joint and several liability upon persons responsible for releases of hazardous substances. We continually evaluate whether we must take additional steps at our locations to ensure compliance with environmental laws. While compliance with applicable regulatory requirements has not materially adversely affected our operations in the past, there can be no assurance that these requirements will not change and that compliance will not adversely affect our operations in the future. In addition, our aggregate materials operations require operating permits granted by governmental agencies. We believe that tighter regulations for the protection of the environment and other factors will make it increasingly difficult to obtain new permits and renewal of existing permits may be subject to more restrictive conditions than currently exist.

In July 2007, the California Air Resources Board (“CARB”) approved a regulation that will require California equipment owners/operators to reduce diesel particulate and nitrogen oxide emissions from in-use off-road diesel equipment and to meet progressively more restrictive emission targets proposed for each year from 2010 to 2020. In December 2008, CARB approved a similar regulation for in-use on-road diesel equipment that includes more restrictive emission targets from 2010 to 2022. The emission targets will require California off-road and on-road diesel equipment owners to retrofit equipment with diesel emission control devices or replace equipment with new engine technology as it becomes available, which will result in higher equipment related expenses. To date, costs to prepare the Company for compliance have been minimal. However, it is too early to determine what the full cost of compliance will be.

As is the case with other companies in our industry, some of our aggregate products contain varying amounts of crystalline silica, a common mineral. Also, some of our construction and material processing operations release, as dust, crystalline silica that is in the materials being handled. Excessive, prolonged inhalation of very small-sized particles of crystalline silica has allegedly been associated with respiratory disease (including silicosis). The Mine Safety and Health Administration and the Occupational Safety and Health Administration have established occupational thresholds for crystalline silica exposure as respirable dust. We have implemented dust control procedures to measure compliance with requisite thresholds and to verify that respiratory protective equipment is made available as necessary. We also communicate, through safety information sheets and other means, what we believe to be appropriate warnings and cautions to employees and customers about the risks associated with excessive, prolonged inhalation of mineral dust in general and crystalline silica in particular.

Website Access

Our website address is www.graniteconstruction.com. On our website we make available, free of charge, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (“SEC”). The information on our website is not incorporated into, and is not part of, this report. These reports, and any amendments to them, are also available at the website of the SEC, www.sec.gov.

Set forth below and elsewhere in this Report and in other documents we file with the SEC are various risks and uncertainties that could cause our actual results to differ materially from the results contemplated by the forward-looking statements contained in this Report or otherwise adversely affect our business.

| · | Reductions in governmental infrastructure spending could have a negative impact on our business. A significant portion of our revenue is generated from infrastructure work funded by various government entities, including state departments of transportation such as Caltrans. Infrastructure spending by government entities could be negatively affected by the overall condition of the economy and declining tax revenues. Our ability to obtain future public sector work at reasonable margins is highly dependent on the amount of work that is available to bid. It may also affect our customer base, subcontractors and suppliers and could materially affect our contract backlog, operating results, cash flows and our ability to implement our strategic plan. |

| We work in a highly competitive marketplace. We have multiple competitors in all of the areas in which we work. During economic down cycles or times of lower government funding for public works projects, competition for the fewer available public projects intensifies and this increased competition may result in a decrease in new awards at acceptable profit margins. In addition, downturns in residential and commercial construction activity increases the competition for available public sector work, further impacting our revenue, contract backlog and profit margins. |

| Accounting for our revenues and costs involves significant estimates. As further described in “Critical Accounting Estimates” under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” accounting for our contract related revenues and costs, as well as other expenses, requires management to make a variety of significant estimates and assumptions. Although we believe we have sufficient experience and processes to enable us to formulate appropriate assumptions and produce reasonably dependable estimates, these assumptions and estimates may change significantly in the future and could result in the reversal of previously recognized revenue and profit. Such changes could have a material adverse effect on our financial position, results of operations, and cash flows. |

| · | Our success depends on attracting and retaining qualified personnel in a competitive environment. The single largest factor affecting our ability to profitably execute our work is our ability to attract, develop and retain qualified personnel. Our success in attracting qualified people is dependent on the resources available in individual geographic areas and changes in the labor supply as a result of general economic conditions, as well as our ability to provide compensation packages and a work environment that are competitive. |

| Fixed price and fixed unit price contracts subject us to the risk of increased project cost. As more fully described under “Contract Provisions and Subcontracting” above, the profitability of our fixed price and fixed unit price contracts can be adversely affected by a number of factors that can cause our actual costs to materially exceed the costs estimated at the time of our original bid. |

| Many of our contracts have penalties for late completion. In some instances, including many of our fixed price contracts, we guarantee that we will complete a project by a certain date. If we subsequently fail to complete the project as scheduled we may be held responsible for costs resulting from the delay, generally in the form of contractually agreed-upon liquidated damages. To the extent these events occur, the total cost of the project could exceed our original estimate and we could experience reduced profits or, in some cases, a loss on that project. |

| Weather can significantly affect our quarterly revenues and profitability. Our ability to perform work is significantly affected by weather conditions such as precipitation and temperature. Changes in weather conditions can cause delays and otherwise significantly affect our project costs. The impact of weather conditions can result in variability in our quarterly revenues and profitability, particularly in the first and fourth quarters of the year. |

| Design/build contracts subject us to the risk of design errors and omissions. Design/build is increasingly being used as a method of project delivery as it provides the owner with a single point of responsibility for both design and construction. We generally subcontract design responsibility to architectural and engineering firms. However, in the event of a design error or omission causing damages, there is risk that the subcontractor or their errors and omissions insurance would not be able to absorb the liability. In this case we may be responsible, resulting in a potentially material adverse effect on our financial position, results of operations and cash flows. |

| Failure of our subcontractors to perform as anticipated could have a negative effect on our results. As further described under “Contract Provisions and Subcontracting” above, we subcontract portions of many of our contracts to specialty subcontractors, but we are ultimately responsible for the successful completion of their work. Although we seek to require bonding or other forms of guarantees, we are not always successful in obtaining those bonds or guarantees from our higher risk subcontractors. In this case we may be responsible, resulting in a potentially adverse effect on our financial position, results of operations and cash flows. |

| We may be unable to identify qualified Disadvantaged Business Enterprise (“DBE”) contractors to perform as subcontractors. Certain of our government agency projects contain minimum DBE participation clauses. If we subsequently fail to complete these projects with the minimum DBE participation, we may be held responsible for breach of contract damages which may include restrictions on our ability to bid on future projects as well as monetary damages. To the extent we are responsible for monetary damages, the total costs of the project could exceed our original estimates and we could experience reduced profits or, in some cases, a loss for that project. |

| Government contracts generally have strict regulatory requirements. Approximately 86.0% of our consolidated revenue in 2009 was derived from contracts funded by federal, state and local government agencies and authorities. Government contracts are subject to specific procurement regulations, contract provisions and a variety of socioeconomic requirements relating to their formation, administration, performance and accounting and often include express or implied certifications of compliance. Claims for civil or criminal fraud may be brought for violations of regulations, requirements or statutes. We may also be subject to qui tam (“Whistle Blower”) litigation brought by private individuals on behalf of the government under the Federal Civil False Claims Act, which could include claims for up to treble damages. Further, if we fail to comply with any of the regulations, requirements or statutes, our existing government contracts could be terminated and we could be suspended from government contracting or subcontracting, including federally funded projects at the state level. Should one of these events occur, it could have a material adverse effect on our financial position, results of operations, and cash flows. |

| We are subject to environmental and other regulation. As more fully described under “Environmental Regulations” above, we are subject to a number of federal, state and local laws and regulations relating to the environment, workplace safety and a variety of socioeconomic requirements, the noncompliance with which can result in substantial penalties, termination or suspension of government contracts as well as civil and criminal liability. While compliance with these laws and regulations has not materially adversely affected our operations in the past, there can be no assurance that these requirements will not change and that compliance will not adversely affect our operations in the future. |

| Strikes or work stoppages could have a negative effect on our operations and results. We are party to collective bargaining agreements covering a portion of our craft workforce. Although our results and operations have not been significantly affected by strikes or work stoppages in the past, such labor actions could have a significant effect on our operations if they occur in the future. |

| Unavailability of insurance coverage could have a negative effect on our operations and results. We maintain insurance coverage as part of our overall risk management strategy and pursuant to requirements to maintain specific coverage that are contained in our financing agreements and in most of our construction contracts. Although we have been able to obtain reasonably priced insurance coverage to meet our requirements in the past, there is no assurance that we will be able to do so in the future, and our inability to obtain such coverage could materially affect our financial position, results of operations and cash flows. |

| An inability to obtain bonding would have a negative effect on our operations and results. As more fully described in “Insurance and Bonding” above, we generally are required to provide surety bonds securing our performance under the majority of our public and private sector contracts. Our inability to obtain reasonably priced surety bonds in the future could significantly affect our ability to be awarded new contracts, which would have a material adverse effect on our financial position, results of operations and cash flows. |

| Our joint venture contracts with project owners subject us to joint and several liability. As further described in “Joint Ventures; Off-Balance Sheet Arrangements” under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” if a joint venture partner fails to perform we could be liable for completion of the entire contract. If the contract were unprofitable, this could result in a material adverse effect on our financial position, results of operations and cash flows. |

| Our contract backlog is subject to unexpected adjustments and cancellations and could be an uncertain indicator of our future earnings. We cannot guarantee that the revenues projected in our contract backlog will be realized or, if realized, will be profitable. Projects reflected in our contract backlog may be affected by project cancellations, scope adjustments, time extensions or other changes. Such changes may adversely affect the revenue and profit we ultimately realize on these projects. |

| We use certain commodity products that are subject to significant price fluctuations. Diesel fuel, liquid asphalt and other petroleum-based products are used to fuel and lubricate our equipment and fire our asphalt concrete processing plants. In addition, they constitute a significant part of the asphalt paving materials that are used in many of our construction projects and are sold to third parties. Although we are partially protected by asphalt or fuel price escalation clauses in some of our contracts, many contracts provide no such protection. We also use steel and other commodities in our construction projects that can be subject to significant price fluctuations. We enter into supply agreements or pre-purchase commodities to secure pricing. We have not been significantly adversely affected by price fluctuations in the past; however, there is no guarantee that we will not be in the future. |

| An inability to secure and permit aggregate reserves could negatively affect our future operations and results. Tighter regulations for the protection of the environment and the finite nature of property containing suitable aggregate reserves are making it increasingly challenging and costly to secure and permit aggregate reserves. Although we have thus far been able to secure and permit reserves to support our business, our operating results and financial conditions may be adversely affected by an increasingly difficult permitting process. |

| Private sector work can be affected by economic downturns. The availability of private sector work can be adversely affected by economic downturns in the residential housing market, demand for commercial property or the availability of credit. To the extent these events occur, our operating results will be adversely affected. |

| Granite Land Company is greatly affected by the strength of the real estate industry. Our real estate development activities are subject to numerous factors beyond our control including local real estate market conditions; substantial existing and potential competition; general national, regional and local economic conditions; fluctuations in interest rates and mortgage availability and changes in demographic conditions. If our outlook for a project’s forecasted profitability deteriorates, we may find it necessary to curtail our development activities and evaluate our real estate assets for possible impairment. Our evaluation includes a variety of estimates and assumptions and future changes in these estimates and assumptions could affect future impairment analyses. If our real estate assets are determined to be impaired, the impairment would result in a charge to income from operations in the year of the impairment. |

| Our real estate investments may require additional funding. Granite Land Company’s real estate investments generally utilize short-term debt financing for their development activities. Due to the tightening of the credit markets, banks have required lower loan-to-value ratios often resulting in the need to pay a portion of the debt when short-term financing is renegotiated. If our real estate investment partners are unable to make their proportional share of a required repayment, GLC may be required to provide the additional funding which could materially affect our financial position and cash flows. Also, if we assume full financial management responsibility, additional real estate investments may need to be consolidated in our financial statements. |

| Our long-term debt and credit arrangements contain restrictive covenants, and failure to meet these covenants could significantly harm our financial condition. Our long-term debt and credit arrangements and related restrictive covenants are more fully described in Note 11 of “Notes to the Consolidated Financial Statements” included in this report. In most cases, failure to meet the restrictive covenants would result in the acceleration of outstanding indebtedness requiring immediate repayment of all amounts due and cancellation of open lines of credit. Additionally, failure to meet restrictive covenants related to our debt and credit agreements could trigger cross-default provisions that would cause us to also be in default of our surety agreements. Although we have not had difficulty meeting these covenants in the past, failure to do so in the future could have a material adverse effect on our business and financial condition. |

| As a part of our growth strategy we may make future acquisitions and acquisitions involve many risks. These risks include difficulties integrating the operations and personnel of the acquired companies, diversion of management’s attention from ongoing operations, potential difficulties and increased costs associated with completion of any assumed construction projects, insufficient revenues to offset increased expenses associated with acquisitions and the potential loss of key employees or customers of the acquired companies. Acquisitions may also cause us to increase our liabilities, record goodwill or other non-amortizable intangible assets that will be subject to subsequent impairment testing and potential impairment charges, as well as amortization expenses related to certain other intangible assets. Failure to manage and successfully integrate acquisitions could harm our financial position, results of operations and cash flows. |

The foregoing list is not all-inclusive. There can be no assurance that we have correctly identified and appropriately assessed all factors affecting our business or that the publicly available and other information with respect to these matters is complete and correct. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial also may adversely affect us. These developments could have material adverse effects on our business, financial condition and results of operations. For these reasons, the reader is cautioned not to place undue reliance on our forward-looking statements.

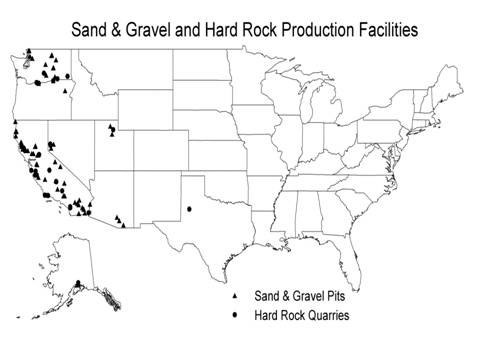

We have 53 active and 37 inactive quarry properties available for the extraction of sand and gravel and hard rock, all of which are located in the western United States. All of our quarries are open-pit and are primarily accessible by road. We process aggregates into construction materials for internal use and for sale to third parties. The following map shows the approximate locations of our permitted quarry properties as of December 31, 2009.

We estimate our permitted proven1 and probable2 aggregate reserves to be 752 million tons with an average permitted life of approximately 38 years at present operating levels. Present operating levels are determined based on a three-year annual average aggregate production rate of 15.9 million tons. Reserve estimates were made by our geologists and engineers based primarily on drilling studies. Our plant equipment is powered mostly by electricity provided by local utility companies.

1Proven reserves are determined through the testing of samples obtained from closely spaced subsurface drilling and/or exposed pit faces. Proven reserves are sufficiently understood so that quantity, quality, and engineering conditions are known with sufficient accuracy to be mined without the need for any further subsurface work. Actual required spacing is based on geologic judgment about the predictability and continuity of each deposit.

2Probable reserves are determined through the testing of samples obtained from subsurface drilling but the sample points are too widely spaced to allow detailed prediction of quantity, quality, and engineering conditions. Additional subsurface work may be needed prior to mining the reserve.

The following tables present information about our quarry properties as of December 31, 2009:

| | Type | | Permitted | | Unpermitted | | Three-Year

Annual Average | | | |

| Quarry Properties | Sand & Gravel | Hard Rock | | Aggregate Reserves (tons) | | Aggregate Reserves (tons) | | Production Rate (tons) | | Average Reserve Life | |

| Owned quarry properties | 31 | 8 | | 416.0 million | | 540.0 million | | 8.0 million | | 47 years | |

Leased quarry properties1 | 35 | 16 | | 336.3 million | | 644.0 million | | 7.9 million | | 33 years | |

1 Our leases have expiration dates which range from 5 to 50 years with most including an option to renew.

| | | | | | Permitted Reserves for Each Product Type (tons) | | | Percentage of Permitted Reserves Owned and Leased | |

| State | | Number of Properties | | | Sand & Gravel | | | Hard Rock | | | Owned | | | Leased | |

| California | | | | | | | | | | | | | | | | % | | | | % |

| Non-California | | | | | | | | | | | | | | | | % | | | | % |

Plant Properties

We operate plants at our quarry sites to process aggregates into construction materials. Some of our quarry sites may have more than one crushing, concrete or asphalt processing plant. At December 31, 2009 and 2008, we owned the following plants:

December 31, | | | 2009 | | | 2008 | | |

Aggregate crushing plants | | | 52 | | | | | |

| | | 69 | | | | | |

Portland cement concrete batch plants | | | 22 | | | | | |

| | | 5 | | | | | |

| | | 9 | | | | | |

Other Properties

The following table provides our estimate of certain information about other properties as of December 31, 2009:

| | Land Area (acres) | Building Square Feet |

Office and shop space (owned and leased) | | |

Real estate held for development and sale and use | | |

Granite West uses approximately 86% of our office and shop space with the remainder being primarily utilized by Granite East.

Silica Litigation

Our wholly-owned subsidiary Granite Construction Company (“GCCO”) is one of approximately 100 to 300 defendants in six active California Superior Court lawsuits. Of the six lawsuits, four were filed against GCCO in 2005 and two were filed against GCCO in 2006, in Alameda County (Dominguez vs. A-1 Aggregates, et al.; Guido vs. A. Teichert & Son, Inc.; Williams vs. A. Teichert & Son, Inc.; Horne vs. Teichert & Son, Inc.; Kammer vs. A-1 Aggregates, et al.; and Solis vs. The 3M Company et al.). Each lawsuit was brought by a single plaintiff who is seeking money damages by way of various causes of action, including strict product and market share liability, and alleges personal injuries caused by exposure to silica products and related materials during the plaintiffs’ use or association with sand blasting or grinding concrete. The plaintiff in each lawsuit has categorized the defendants as equipment defendants, respirator defendants, premises defendants and sand defendants. We have been identified as a sand defendant, meaning a party that manufactured, supplied or distributed silica-containing products. Our investigation revealed that we have not knowingly sold or distributed abrasive silica sand for sandblasting, and therefore, we believe the probability of these lawsuits resulting in an incurrence of a material liability is remote. We have been dismissed from eighteen other similar lawsuits.

Hiawatha Project DBE Issues

The Hiawatha Light Rail Transit (“HLRT”) project was performed by Minnesota Transit Constructors (“MnTC”), a joint venture that consisted of GCCO and other unrelated companies. GCCO was the managing partner of the joint venture, with a 56.5% interest. The Minnesota Department of Transportation (“MnDOT”) is the contracting agency for this federally funded project. The Metropolitan Council is the local agency conduit for providing federal funds to MnDOT for the HLRT project. MnDOT and the U.S. Department of Transportation Office of Inspector General (“OIG”) each conducted a review of the Disadvantaged Business Enterprise (“DBE”) program maintained by MnTC for the HLRT project. In addition, the U.S. Department of Justice (“USDOJ”) is conducting an investigation into compliance issues with respect to MnTC’s DBE Program for the HLRT project. MnDOT and the OIG (collectively, the “Agencies”) have initially identified certain compliance issues in connection with MnTC’s DBE Program and, as a result, have determined that MnTC failed to meet the DBE utilization criteria as represented by MnTC. Although there has been no formal administrative subpoena issued, nor has a civil complaint been filed in connection with the administrative reviews or the investigation, MnDOT has proposed a monetary sanction of $4.3 million against MnTC and specified DBE training for personnel from the members of the MnTC joint venture as a condition of awarding future projects to joint venture members of MnTC on MnDOT and Metropolitan Council work. MnTC is fully cooperating with the Agencies and the USDOJ and has presented its detailed written responses to the initial determinations of the Agencies as well as the investigation by the USDOJ. On September 17, 2009, the USDOJ replied to MnTC’s responses. MnTC and the USDOJ are continuing to engage in informal discussions in an attempt to resolve this matter. Such discussions, if successful, are expected to include resolution of issues with the USDOT and with the state agencies. We cannot, however, rule out the possibility of civil or criminal actions being brought against MnTC or one or more of its members which could result in civil and criminal penalties.

US Highway 20 Project

GCCO and our wholly-owned subsidiary, Granite Northwest, Inc. are the members of a joint venture known as Yaquina River Constructors (“YRC”) which is currently constructing a new road alignment of US Highway 20 near Eddyville, Oregon under contract with the Oregon Department of Transportation (“ODOT”). The project involves constructing seven miles of new road through steep and forested terrain in the Coast Range Mountains. During the fall and winter of 2006, extraordinary rain events produced runoff that overwhelmed erosion control measures installed at the project and resulted in discharges to surface water in alleged violations of YRC’s stormwater permit. In June 2009, YRC was informed that the USDOJ had assumed the criminal investigation that the Oregon Department of Justice had previously been conducting in connection with stormwater runoff from the project. YRC and its members are fully cooperating in the investigation. We do not know whether any criminal charges or civil lawsuits will be brought or against whom, as a result of the investigation. Therefore, we cannot estimate what, if any, criminal or civil penalty or conditional assessment may result from this investigation.

City of San Diego Fire Debris Cleanup

In the aftermath of the 2007 San Diego County wildfires, GCCO bid for and was awarded a fixed unit price, variable quantity contract with the City of San Diego (the “City”) to perform specified debris cleanup work. GCCO began work in November 2007 and completed the work in April 2008. In August 2008, the City announced that it would conduct an independent audit of the project. In December 2008, the City’s audit report was released with findings that, while some GCCO billings contained mistakes, rates paid to GCCO appear to be generally reasonable. GCCO has reimbursed the City for the undisputed overbilled amount of less than $3,000. The former San Diego City Attorney, after conducting a separate investigation of GCCO’s work on the project, filed a civil lawsuit in California Superior Court, County of San Diego on October 17, 2008 against GCCO and another contractor that had been awarded a similar cleanup contract with the City. In the complaint, the City alleges that both contractors knowingly presented to the City false claims for payment in violation of the California False Claims Act. The City seeks trebled damages in an amount to be determined, and a civil penalty in the amount of $10,000 for each false claim made. After the November 2008 election in which a new City Attorney was elected, GCCO and the City Attorney agreed to stay the lawsuit in order to allow the City Attorney time to complete its investigation. The stay expired in January 2010, and the parties have agreed to jointly request a further stay. GCCO believes the allegations in the City’s complaint to be without factual or legal basis and, therefore, the City’s entitlement to relief sought under the California False Claims Act is remote.

Grand Avenue Project DBE Issues

On March 6, 2009, the U.S. Department of Transportation, Office of Inspector General (“OIG”) served upon our wholly-owned subsidiary, Granite Construction Northeast, Inc. (“Granite Northeast”), a United States District Court Eastern District of New York subpoena to testify before a grand jury by producing documents. The subpoena seeks all documents pertaining to a Granite Northeast Disadvantaged Business Enterprise (“DBE”) subcontractor (the “Subcontractor”), and the Subcontractor’s non-DBE lower tier subcontractor/consultant, relating to the Subcontractor’s work on the Grand Avenue Bus Depot and Central Maintenance Facility for the Borough of Queens Project (the “Grand Avenue Project”). The subpoena also seeks all documents regarding Granite Northeast’s use of the Subcontractor as a DBE on the Grand Avenue Project and all documents related to the Subcontractor as a DBE on any other contract including other public works construction projects. We have complied with the subpoena and are fully cooperating with the OIG’s investigation. To date, Granite Northeast has not been notified that it is either a subject or target of the OIG’s investigation. As a result, we do not know whether any criminal charges or civil lawsuits will be brought or against whom, as a result of the investigation. Therefore, we cannot estimate what, if any, criminal or civil penalty or conditional assessment may result from this investigation.

Other Legal Proceedings/Government Inquiries

We are a party to a number of other legal proceedings arising in the normal course of business. From time to time, we also receive inquiries from public agencies seeking information concerning our compliance with government construction contracting requirements and related laws and regulations. We believe that the nature and number of these proceedings and compliance inquiries are typical for a construction firm of our size and scope. Our litigation typically involves claims regarding public liability or contract related issues. While management currently believes, after consultation with counsel, that the ultimate outcome of pending proceedings and compliance inquiries, individually and in the aggregate, will not have a material adverse affect on our financial position or overall trends in results of operations or cash flows, litigation is subject to inherent uncertainties. Were an unfavorable ruling to occur, there exists the possibility of a material adverse affect on our results of operations, cash flows and/or financial position for the period in which the ruling occurs. While any one of our pending legal proceedings is subject to early resolution as a result of our ongoing efforts to settle, whether or when any legal proceeding will be resolved through settlement is neither predictable nor guaranteed.

During the fourth quarter of 2009, no matter was submitted to a vote of security holders through the solicitation of proxies or otherwise.

Executive Officers of the Registrant

Our current executive officers are as follows:

| Name | Age | Position |

| | President, Chief Executive Officer and Director |

| James H. Roberts | 53 | Executive Vice President and Chief Operating Officer |

| LeAnne M. Stewart | 45 | Senior Vice President and Chief Financial Officer |

| Michael F. Donnino | 55 | Senior Vice President and Group Manager |

| John A. Franich | 53 | Vice President and Group Manager |

| Thomas S. Case | 47 | Vice President and Group Manager |

Granite Construction Incorporated was incorporated in Delaware in January 1990 as the holding company for Granite Construction Company, which was incorporated in California in 1922. All dates of service for our executive officers include the periods in which they served for Granite Construction Company.

Mr. Dorey has been an employee of Granite since 1968 and has served in various capacities, including Chief Executive Officer since January 2004 and President since February 2003. He also served as Chief Operating Officer from May 1998 to January 2004, Executive Vice President from November 1998 to February 2003, Senior Vice President from 1990 to 1998, Branch Division Manager from 1987 to 1998, and Vice President and Branch Division Assistant Manager from 1983 to 1987. Mr. Dorey has also served as a member of our Board of Directors since January 2004. He received a B.S. degree in Construction Engineering from Arizona State University in 1967.

Mr. Roberts joined Granite in 1981 and has served in various capacities, including Executive Vice President and Chief Operating Officer since September 2009, Senior Vice President from May 2004 to September 2009, Granite West Manager from February 2007 to September 2009, Branch Division Manager from May 2004 to February 2007, Vice President and Assistant Branch Division Manager from 1999 to 2004, and Regional Manager of Nevada and Utah Operations from 1995 to 1999. He received a B.S.C.E. in 1979 and an M.S.C.E. in 1980 from the University of California, Berkeley, and an M.B.A. from the University of Southern California in 1981. He also completed the Stanford Executive Program in 2009.

Ms. Stewart has been a Senior Vice President of Granite since February 2008. In June 2008, she was appointed Chief Financial Officer. Prior to joining Granite, Ms. Stewart was employed by Nash Finch Company as Senior Vice President and Chief Financial Officer from October 2004 to January 2007 and as Vice President and Corporate Controller from April 2000 to October 2004. She has served on the Board of Trustees of the College of St. Benedict since 1995. Ms. Stewart became a Certified Public Accountant in 1987, received a B.A. in Accounting from the College of St. Benedict in 1987 and an M.B.A. from the Wharton School at the University of Pennsylvania in 1997.

Mr. Donnino joined Granite in 1977 and has served as Senior Vice President and Group Manager since January 2010, Senior Vice President since January 2005, Manager of Granite East since February 2007, and Heavy Construction Division Manager from January 2005 to February 2007. He served as Vice President and Heavy Construction Division Assistant Manager during 2004, Texas Regional Manager from 2000 to 2003 and Dallas Estimating Office Area Manager from 1991 to 2000. Mr. Donnino received a B.S.C.E. in Structural, Water and Soils Engineering from the University of Minnesota in 1976.

Mr. Franich joined Granite in 2005 and has served as Vice President and Group Manager since January 2010, Vice President and Granite West Manager of Construction from February 2007 to December 2009, and Vice President, Branch Division Construction Manager from January 2005 through January 2007. Prior to joining Granite in 2005, Mr. Franich has held various positions in the construction industry since 1979 and was formerly the President of Associated General Contractors of California. Mr. Franich received a B.S. in Business Administration (Finance) from California State University, Chico in 1979.

Mr. Case has been an employee of Granite since 1987 and has been Vice President and Group Manager since January 2010. He also served as Southwest Operating Group Manager from March 2007 to December 2009, Utah Operations Branch Manager from August 2001 through March 2007, Utah Operations Construction Manager during 2001, Utah Operations Materials Manager between 1996 and 2000, and in various positions at Granite’s Nevada and Santa Barbara, California operations between 1986 and 1996. Mr. Case received a B.S. degree in Construction Management from California Polytechnic State University in 1986.

Our common stock trades on the New York Stock Exchange under the ticker symbol GVA.

As of February 12, 2010, there were 38,629,378 shares of our common stock outstanding held by 1,529 shareholders of record.

We have paid quarterly cash dividends since the second quarter of 1990, and we expect to continue to do so. However, declaration and payment of dividends is within the sole discretion of our Board of Directors, subject to limitations imposed by Delaware law and compliance with our credit agreements, and will depend on our earnings, capital requirements, financial condition and such other factors as the Board of Directors deems relevant.

| Market Price and Dividends of Common Stock | | | | | | |

| | December 31, | | | September 30, | | | June 30, | | | March 31, | |

| High | | $ | 34.58 | | | $ | 36.39 | | | $ | 45.94 | | | $ | 45.82 | |

| Low | | $ | 27.14 | | | $ | 29.41 | | | $ | 32.29 | | | $ | 30.14 | |

| Dividends per share | | $ | 0.13 | | | $ | 0.13 | | | $ | 0.13 | | | $ | 0.13 | |

| | | | | | | | | | | | | | | | | |

| 2008 Quarters Ended | | December 31, | | September 30, | | | | June 30, | | | | March 31, | |

| High | | $ | 50.00 | | | $ | 42.24 | | | $ | 37.79 | | | $ | 39.84 | |

| Low | | $ | 21.20 | | | $ | 30.22 | | | $ | 29.19 | | | $ | 26.64 | |

| Dividends per share | | $ | 0.13 | | | $ | 0.13 | | | $ | 0.13 | | | $ | 0.13 | |

During the three months ended December 31, 2009, we did not sell any of our equity securities that were not registered under the Securities Act of 1933, as amended. The following table sets forth information regarding the repurchase of shares of our common stock during the three months ended December 31, 2009:

| Period | | Total Number of Shares Purchased1 | | | Average Price Paid per Share | | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | | Approximate Dollar Value of Shares that May yet be Purchased Under the Plans or Programs2 | |

October 1 through October 31, 2009 | | | 479 | | | $ | 29.52 | | | | | | | $ | | |

November 1 through November 30, 2009 | | | 89 | | | $ | 31.35 | | | | - | | | $ | | |

December 1 through December 31, 2009 | | | | | | $ | 29.97 | | | | - | | | $ | | |

| | | | | | $ | 29.97 | | | | - | | | | | |

1The number of shares purchased is in connection with employee tax withholding for shares granted under our Amended and Restated 1999 Equity Incentive Plan.

2In October 2007, our Board of Directors authorized us to repurchase, at management’s discretion, up to $200.0 million of our common stock. Under this repurchase program, the Company may repurchase shares from time to time on the open market or in private transactions. The specific timing and amount of repurchases will vary based on market conditions, securities law limitations and other factors. The share repurchase program may be suspended or discontinued at any time without prior notice.

Performance Graph

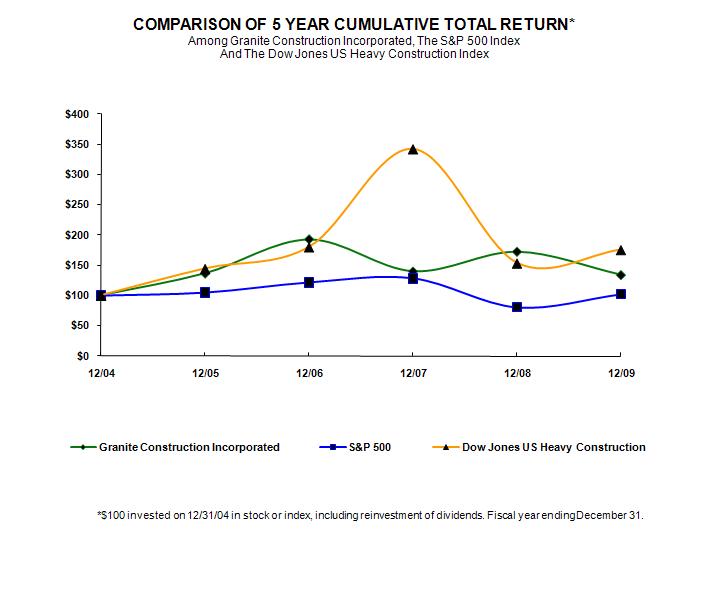

The graph below compares Granite Construction Incorporated’s cumulative 5-year total shareholder return on common stock with the cumulative total returns of the S&P 500 index and the Dow Jones U.S. Heavy Construction index. The Dow Jones U.S. Heavy Construction index includes the following companies: EMCOR Group Inc., Fluor Corp., Foster Wheeler Ltd., Granite Construction Inc., Insituform Technologies Inc., Jacobs Engineering Group Inc., KBR Inc., McDermott International Inc., Quanta Services Inc. and Shaw Group Inc. The graph tracks the performance of a $100 investment in our common stock and in each of the indexes (with reinvestment of all dividends) from December 31, 2004 to December 31, 2009.

| | | 2004 | | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | |

| Granite Construction Incorporated | | $ | 100.00 | | | $ | 136.76 | | | $ | 193.23 | | | $ | 140.14 | | | $ | 172.69 | | | $ | 134.32 | |

| S&P 500 | | | 100.00 | | | | 104.91 | | | | 121.48 | | | | 128.16 | | | | 80.74 | | | | 102.11 | |

| Dow Jones U.S. Heavy Construction | | | 100.00 | | | | 144.50 | | | | 180.25 | | | | 342.40 | | | | 153.66 | | | | 175.65 | |

The selected consolidated operations data for 2009, 2008 and 2007 and consolidated balance sheet data as of December 31, 2009 and 2008 set forth below have been derived from our audited consolidated financial statements included herein, and are qualified by reference to those consolidated financial statements. The selected consolidated operations data for 2006 and 2005 and the consolidated balance sheet data as of December 31, 2007, 2006 and 2005 have been derived from our audited consolidated financial statements not included herein. These historical results are not necessarily indicative of the results of operations to be expected for any future period.

| Selected Consolidated Financial Data | | |

| Years Ended December 31, | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | | 2005 | | |

| Operating Summary | (Dollars In Thousands, Except Per Share Data) | | |

| | $ | 1,963,479 | | | $ | 2,674,244 | | | $ | 2,737,914 | | | $ | 2,969,604 | | | $ | 2,641,352 | | |

| | | 346,373 | | | | 468,720 | | | | 410,744 | | | | 295,720 | | | | 319,372 | | |

| | | 17.6 | % | | | 17.5 | % | | | 15.0 | % | | | 10.0 | % | | | 12.1 | % | |

General and administrative expenses | | | 224,910 | | | | 257,532 | | | | 246,202 | | | | 199,481 | | | | 192,692 | | |

| | | 11.5 | % | | | 9.6 | % | | | 9.0 | % | | | 6.7 | % | | | 7.3 | % | |

| Restructuring charges1 | | | 9,453 | | | | - | | | | - | | | | - | | | | - | | |

Goodwill impairment charge2 | | | - | | | | - | | | | - | | | | 18,011 | | | | - | | |

| Net income | | | 100,201 | | | | 165,738 | | | | 132,924 | | | | 74,339 | | | | 100,898 | | |

Amount attributable to noncontrolling interests3 | | | (26,701 | ) | | | (43,334 | ) | | | (20,859 | ) | | | 6,170 | | | | (17,748 | ) | |

Net income attributable to Granite | | | 73,500 | | | | 122,404 | | | | 112,065 | | | | 80,509 | | | | 83,150 | | |

| | | 3.7 | % | | | 4.6 | % | | | 4.1 | % | | | 2.7 | % | | | 3.1 | % | |

Net income per share attributable to common shareholders4: | | | | | | | | | | | | | | | | | | | | | |

| | $ | 1.91 | | | $ | 3.19 | | | $ | 2.69 | | | $ | 1.93 | | | $ | 2.00 | | |

| | | 1.90 | | | | 3.18 | | | | 2.68 | | | | 1.92 | | | | 1.99 | | |

Weighted average shares of common stock: | | | | | | | | | | | | | | | | | | | | | |

| | | 37,566 | | | | 37,606 | | | | 40,866 | | | | 40,874 | | | | 40,614 | | |

| | | 37,683 | | | | 37,709 | | | | 40,909 | | | | 40,920 | | | | 40,684 | | |

Consolidated Balance Sheet | | | | | | | | | | | | | | | | | | | | | |

| | $ | 1,709,575 | | | $ | 1,743,455 | | | $ | 1,786,418 | | | $ | 1,632,838 | | | $ | 1,472,230 | | |

Cash, cash equivalents and marketable securities | | | 458,341 | | | | 520,402 | | | | 485,348 | | | | 394,878 | | | | 301,381 | | |

| | | 500,605 | | | | 475,942 | | | | 397,568 | | | | 319,762 | | | | 367,801 | | |

Current maturities of long-term debt | | | 58,978 | | | | 39,692 | | | | 28,696 | | | | 28,660 | | | | 26,888 | | |

| | | 244,688 | | | | 250,687 | | | | 268,417 | | | | 78,576 | | | | 124,415 | | |

Other long-term liabilities | | | 48,998 | | | | 43,604 | | | | 46,441 | | | | 58,419 | | | | 46,556 | | |

Granite shareholders’ equity | | | 830,651 | | | | 767,509 | | | | 700,199 | | | | 694,544 | | | | 621,560 | | |

| | | 21.50 | | | | 20.06 | | | | 17.75 | | | | 16.60 | | | | 14.91 | | |

| | | 0.52 | | | | 0.52 | | | | 0.43 | | | | 0.40 | | | | 0.40 | | |

Common shares outstanding | | | 38,635 | | | | 38,267 | | | | 39,451 | | | | 41,834 | | | | 41,682 | | |

| | $ | 1,401,988 | | | $ | 1,699,396 | | | $ | 2,084,545 | | | $ | 2,256,587 | | | $ | 2,331,540 | | |

1 During 2009, we recorded restructuring charges of approximately $9.5 million as part of our reorganization.

2 In 2006, we recorded a goodwill impairment charge of approximately $18.0 million related to our Granite Northeast operation in New York.

3 Effective January 1, 2009, we adopted a new accounting standard requiring net income attributable to both the parent and noncontrolling interests to be disclosed separately as well as the components of equity attributable to the parent and noncontrolling interests. Prior years have been adjusted to conform to this new standard.

4 Computed using the two-class method required by accounting standards adopted January 1, 2009, which requires prior period per share data to be restated retrospectively for comparability.

General