Exhibit 99.2

Idera Pharmaceuticals + Aceragen A Business Combination to Create a Public Rare Disease Pulmonary & Rheumatology Company September 2022

© 2022 Idera Important Information expectations include, but are not limited to: whether the Company will be able to successfully integrate the Aceragen operations and realize the anticipated benefits of the acquisition of Aceragen ; whether the Company is able to resolve the clinical hold affecting the ACG - 801 program; whether the Company’s stockholders approve the conversion of the Series Z Preferred Stock; whether the Company’s cash resources will be sufficient to fund the Company’s continuing operations and the newly acquired Aceragen operations, including the liabilities of Aceragen incurred in connection with the completion of the Merger; whether the Company’s products will advance into or through the clinical trial process when anticipated or at all or warrant submission for regulatory approval; whether such products will receive approval from the U.S. Food and Drug Administration or equivalent foreign regulatory agencies; whether, if the Company's products receive approval, they will be successfully distributed and marketed; whether the Company's collaborations will be successful; and whether the Company will be able to comply with the continued listing requirements of the Nasdaq Capital Market. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. All forward - looking statements included in this presentation are made as of the date hereof and are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in the Company’s Annual Report on Form 10 - K for the year ended December 31, 2021, and otherwise in the Company’s filings and reports filed with the Securities and Exchange Commission (“SEC”). Readers are cautioned that this list of factors should not be construed as exhaustive. The forward - looking statements contained in this presentation are expressly qualified by this cautionary statement. Except as required by law, we undertake no obligation to update or revise publicly any forward - looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Readers are cautioned not to place undue reliance on forward - looking statements. Important Additional Information and Where to Find It Idera Pharmaceuticals, Inc., its directors and certain of its executive officers are deemed to be participants in the solicitation of proxies from Idera Pharmaceuticals’ stockholders in connection with the matters to be considered at Idera Pharmaceuticals 2022 Special Meeting of Stockholders. Information regarding the names of Idera Pharmaceuticals’ directors and executive officers and their respective interests in Idera Pharmaceuticals by security holdings or otherwise can be found in Idera Pharmaceuticals’ proxy statement for its 2022 Annual Meeting of Stockholders, filed with the SEC on April 29, 2022. To the extent holdings of Idera Pharmaceuticals’ securities have changed since the amounts set forth in Idera Pharmaceuticals’ proxy statement for the 2022 Annual Meeting of Stockholders, such changes have been reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC. These documents are available free of charge at the SEC’s website at www.sec.gov . Idera Pharmaceuticals intends to file a proxy statement and accompanying proxy card with the SEC in connection with the solicitation of proxies from Idera Pharmaceuticals stockholders in connection with the matters to be considered at Idera Pharmaceuticals’ 2022 Special Meeting of Stockholders. Additional information regarding the identity of participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in Idera Pharmaceuticals’ proxy statement for its 2022 Special Meeting, including the schedules and appendices thereto. INVESTORS AND STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ ANY SUCH PROXY STATEMENT AND THE ACCOMPANYING PROXY CARD AND ANY AMENDMENTS AND SUPPLEMENTS THERETO AS WELL AS ANY OTHER DOCUMENTS FILED BY IDERA PHARMACEUTICALS WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders will be able to obtain copies of the proxy statement, any amendments or supplements to the proxy statement, the accompanying proxy card, and other documents filed by Idera Pharmaceuticals with the SEC for no charge at the SEC’s website at www.sec.gov . Copies will also be available at no charge at the Investor Relations section of Idera Pharmaceuticals’ corporate website at https:// ir.iderapharma.com / or by contacting Idera Pharmaceuticals’ Investor Relations at Idera Pharmaceuticals, Inc., 505 Eagleview Blvd., Suite 212 Exton, Pennsylvania 19341 or by calling Idera Pharmaceuticals’ Investor Relations at (877) 888 - 6550. The information provided in this presentation pertaining to the business combination (the “Business Combination”) between Idera Pharmaceutical, Inc. (“Idera”) and Aceragen, Inc. (“Aceragen”) is for informational purposes only to assist interested parties in making their own evaluation and is not a solicitation of a proxy, consent or authorization related to o r in respect of the Business Combination in any jurisdiction. Information contained in this presentation should not be relied upon as advice to buy or sell such securities. You should not construe the contents of this presentation as legal, tax, accounting or investment advice or a recommendation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein. No legally binding obligations will be created, implied, or inferred from this presentation or the information contained herein. The products outlined in this presentation are still under development. The features of the final product may be different, and nothing should be construed as a commitment by Idera. Important Information While the information in this presentation is believed to be accurate, Idera, Aceragen and their respective agents, advisors, directors, officers, employees and stockholders make no representation or warranties, expressed or implied, as to the accuracy, completeness or reliability of such information. Neither Idera, Aceragen, nor any of their respective affiliates, agents, advisors, directors, officers, employees and stockholders shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this presentation by yo u or any of your representatives or for omissions from the information in this presentation. We reserve the right to amend or replace the information contained herein, in part or entirely, at any time, and undertakes no obligation to provide you with access to the amended information or to notify you thereof. The distribution of this presentation may also be restricted by law and persons into whose possession this presentation comes should inform themselves about and observe any such restrictions. The presentation is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of the presentation is prohibited. Persons in respect of whom such prohibitions apply must not access the presentation. Forward - Looking Statements Certain information in this presentation and oral statements made in any meeting are forward - looking and relate to the Company and its anticipated financial position, business strategy, events and courses of action. The use of words such as, but not limited to, “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” and similar words expressions are intended to ident ify forward - looking statements. Forward - looking statements are based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward - looking statements. Although we believe that the expectations reflected in the forward - looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, level of activity, performance or achievements and there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in th e forward - looking statements. By their nature, forward - looking statements involve numerous assumptions, known and unknown risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts and other forward - looking information will not occur, which may cause the Company’s actual performance and financial results in future periods to differ materially from any estimates of future performance, illustrations of performance results or results expressed or implied by such forward - looking statements. Important factors that could cause actual results to differ materially from 2

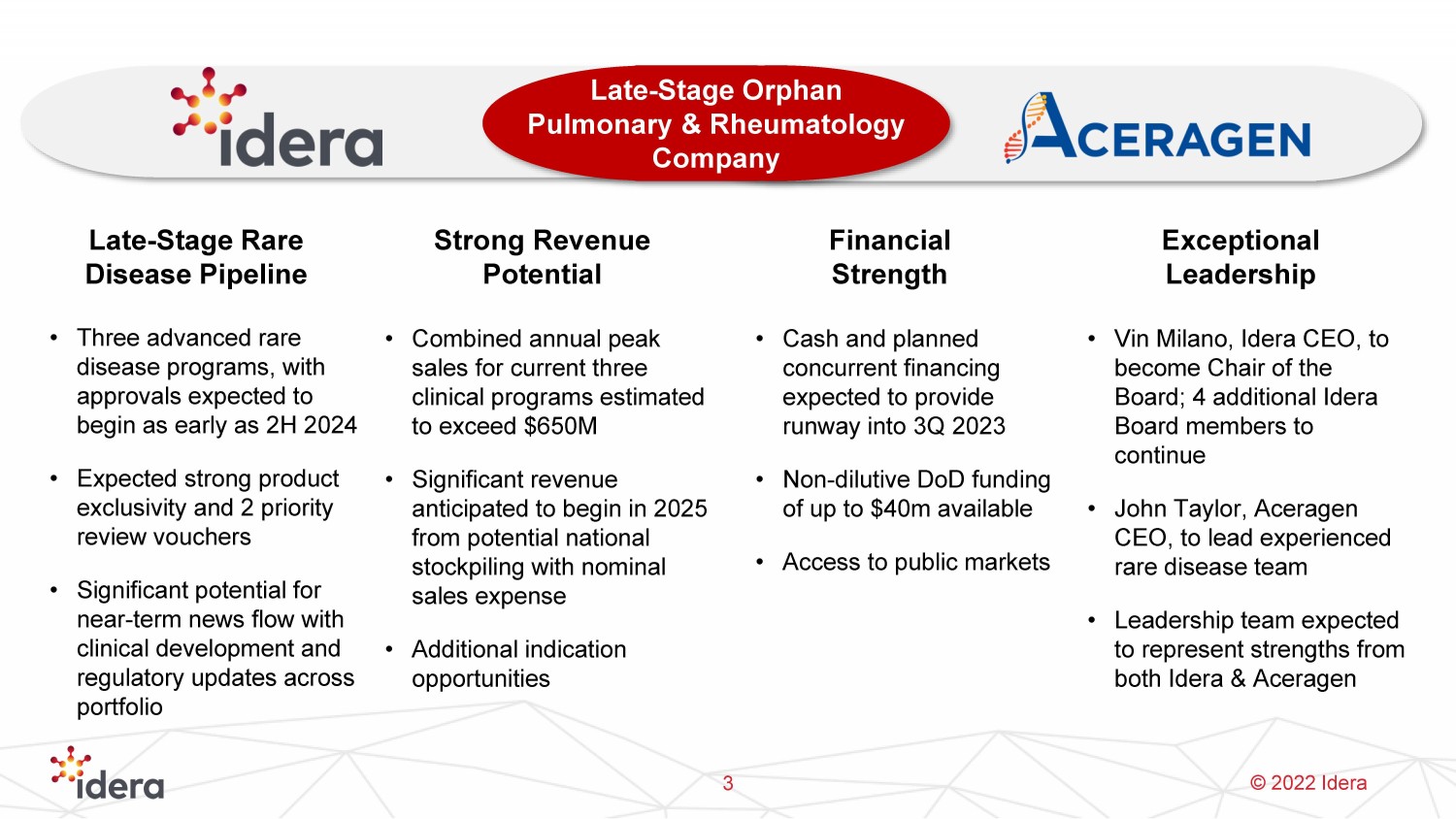

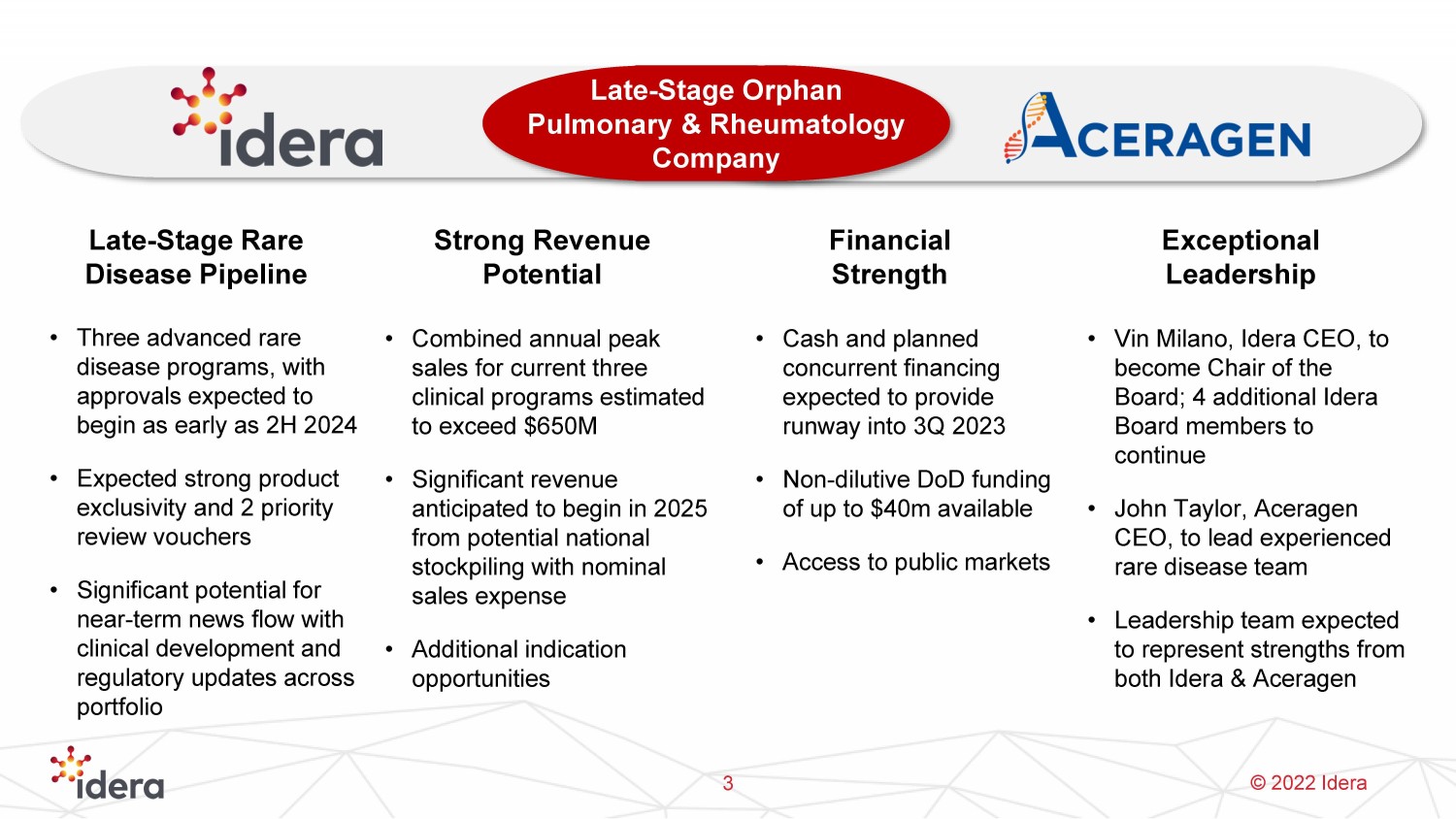

© 2022 Idera 3 Late - Stage Rare Disease Pipeline Strong Revenue Potential • Combined annual peak sales for current three clinical programs estimated to exceed $650M • Significant revenue anticipated to begin in 2025 from potential national stockpiling with nominal sales expense • Additional indication opportunities • Cash and planned concurrent financing expected to provide runway into 3Q 2023 • Non - dilutive DoD funding of up to $40m available • Access to public markets • Vin Milano, Idera CEO, to become Chair of the Board; 4 additional Idera Board members to continue • John Taylor, Aceragen CEO, to lead experienced rare disease team • Leadership team expected to represent strengths from both Idera & Aceragen Exceptional Leadership Financial Strength • Three advanced rare disease programs, with approvals expected to begin as early as 2H 2024 • Expected strong product exclusivity and 2 priority review vouchers • Significant potential for near - term news flow with clinical development and regulatory updates across portfolio Late - Stage Orphan Pulmonary & Rheumatology Company

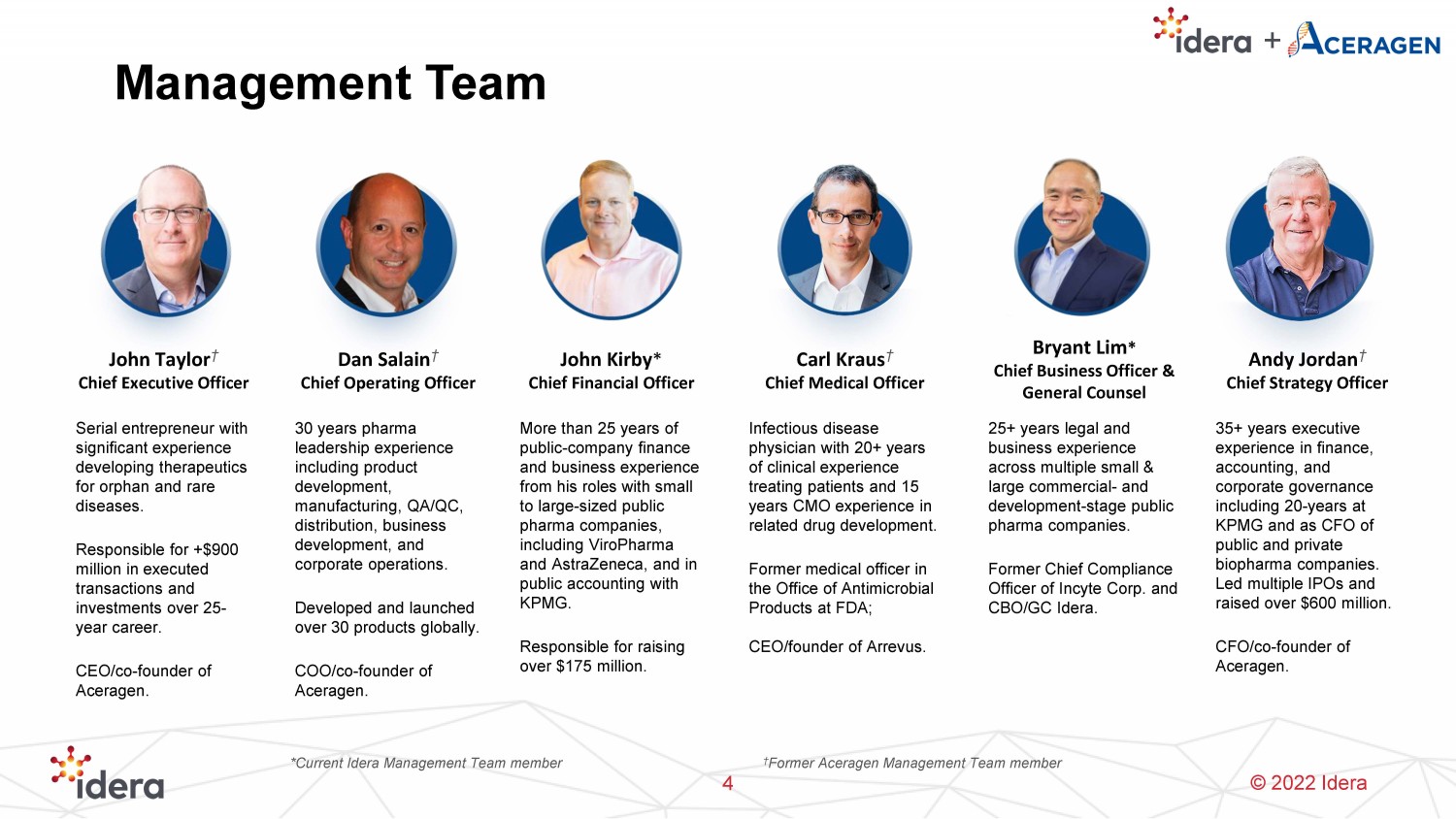

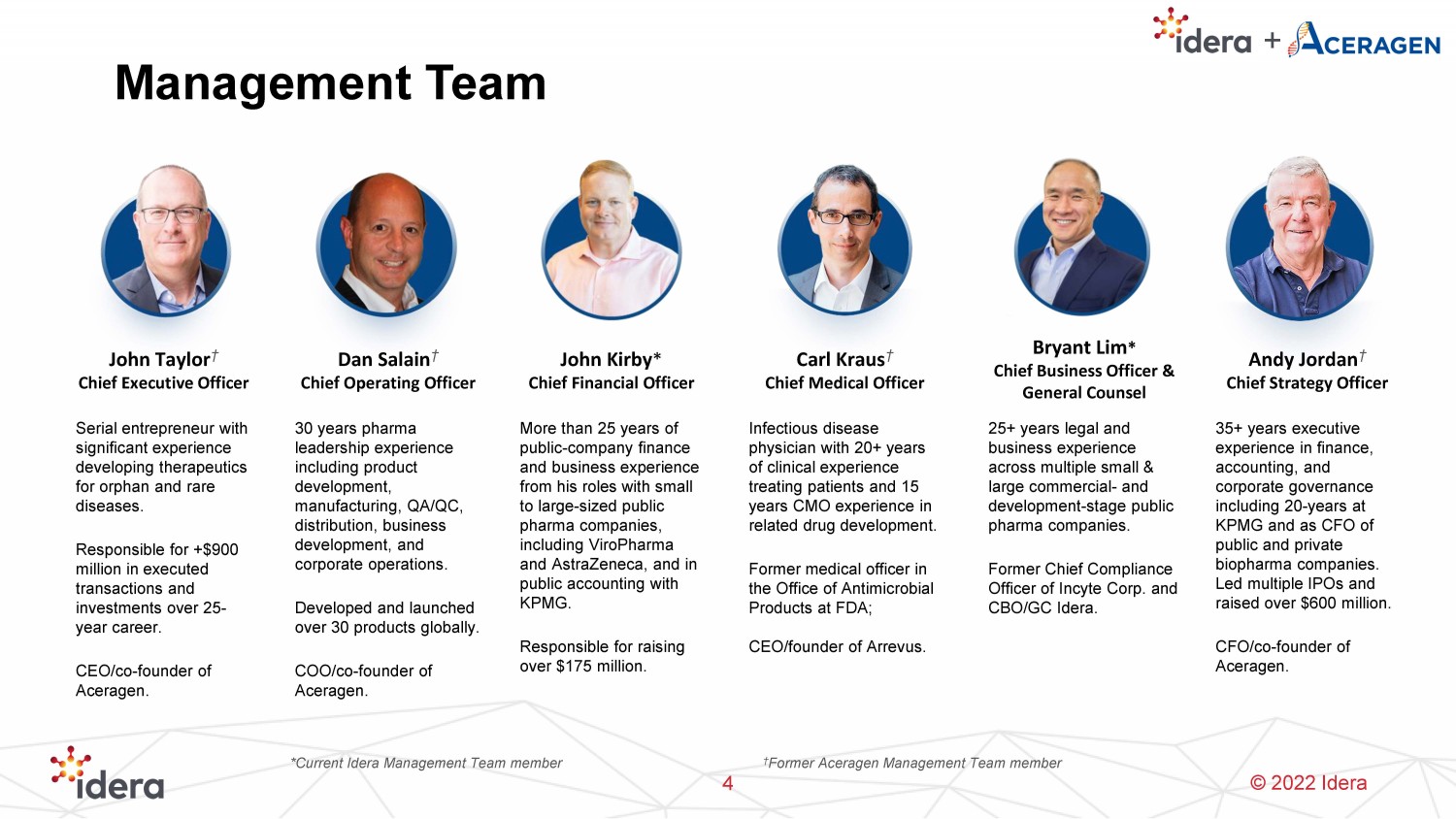

© 2022 Idera Management Team John Taylor † Chief Executive Officer Dan Salain † Chief Operating Officer Carl Kraus † Chief Medical Officer Andy Jordan † Chief Strategy Officer Serial entrepreneur with significant experience developing therapeutics for orphan and rare diseases. Responsible for +$900 million in executed transactions and investments over 25 - year career. CEO/co - founder of Aceragen. 30 years pharma leadership experience including product development, manufacturing, QA/QC, distribution, business development, and corporate operations. Developed and launched over 30 products globally. COO/co - founder of Aceragen. Infectious disease physician with 20+ years of clinical experience treating patients and 15 years CMO experience in related drug development. Former medical officer in the Office of Antimicrobial Products at FDA; CEO/founder of Arrevus. 35+ years executive experience in finance, accounting, and corporate governance including 20 - years at KPMG and as CFO of public and private biopharma companies. Led multiple IPOs and raised over $600 million. CFO/co - founder of Aceragen . Bryant Lim * Chief Business Officer & General Counsel 25+ years legal and business experience across multiple small & large commercial - and development - stage public pharma companies. Former Chief Compliance Officer of Incyte Corp. and CBO/GC Idera. † Former Aceragen Management Team member *Current Idera Management Team member John Kirby * Chief Financial Officer More than 25 years of public - company finance and business experience from his roles with small to large - sized public pharma companies, including ViroPharma and AstraZeneca, and in public accounting with KPMG. Responsible for raising over $175 million.

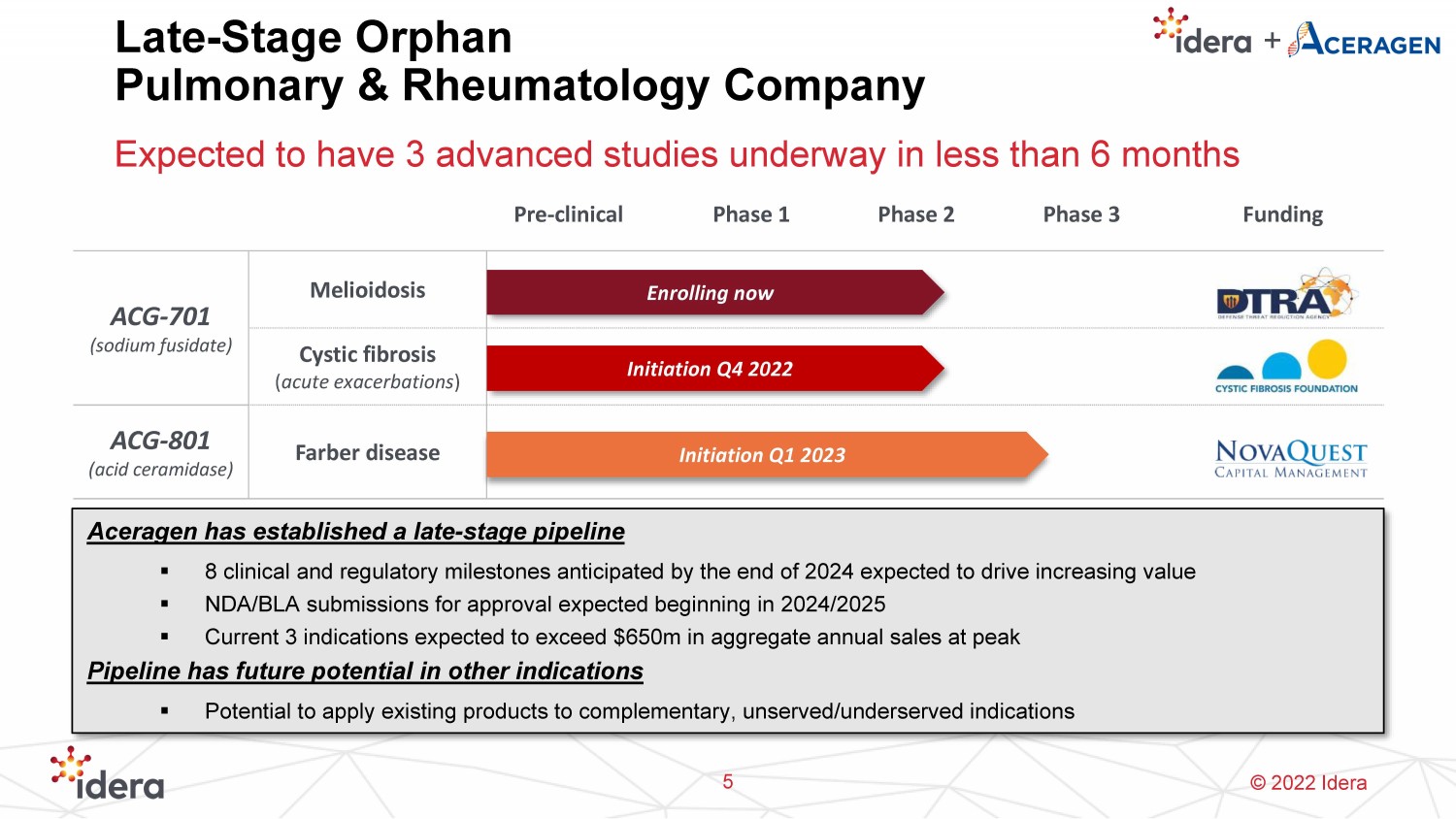

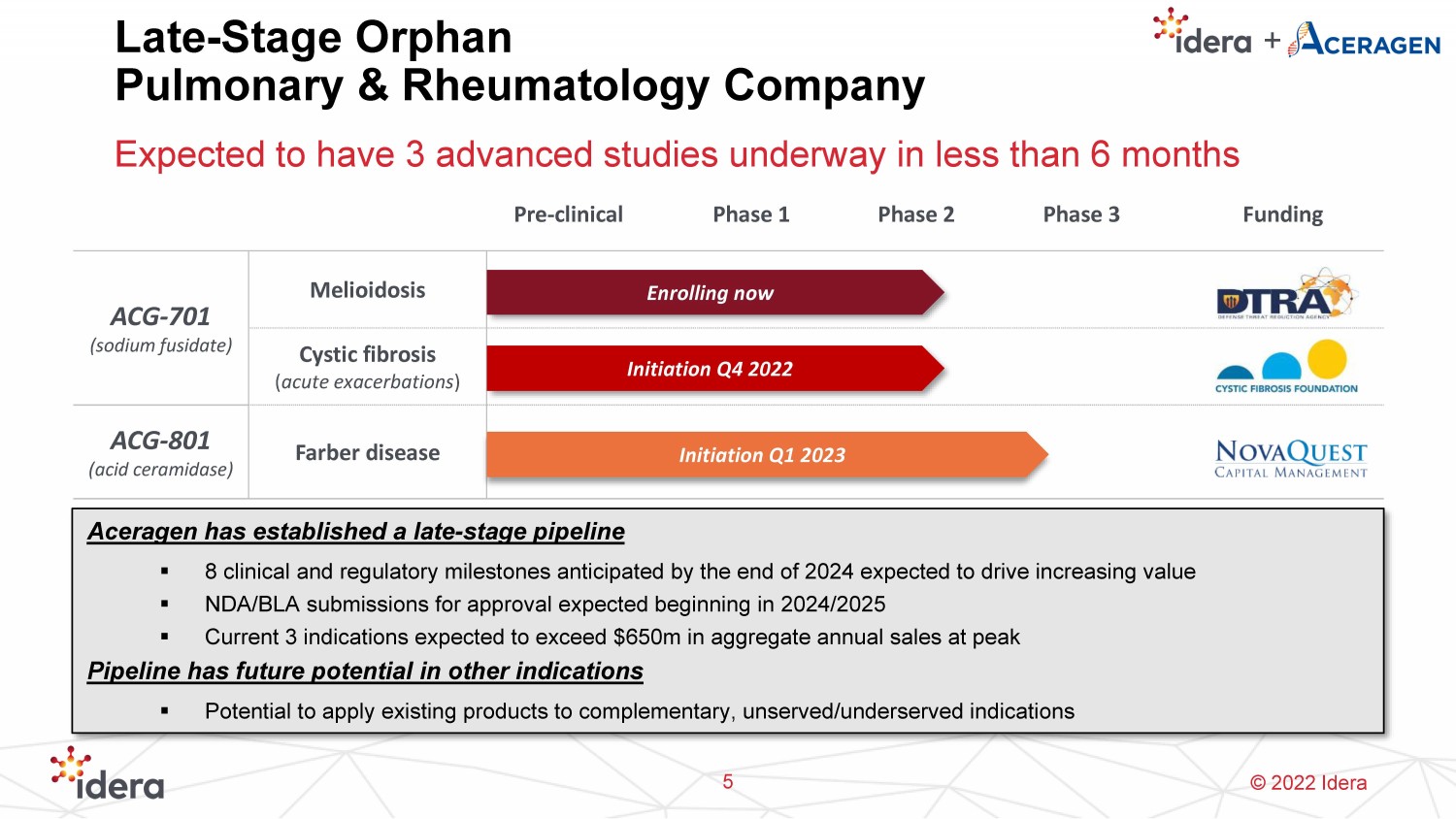

© 2022 Idera Late - Stage Orphan Pulmonary & Rheumatology Company Expected to have 3 advanced studies underway in less than 6 months 5 Aceragen has established a late - stage pipeline ▪ 8 clinical and regulatory milestones anticipated by the end of 2024 expected to drive increasing value ▪ NDA/BLA submissions for approval expected beginning in 2024/2025 ▪ Current 3 indications expected to exceed $650m in aggregate annual sales at peak Pipeline has future potential in other indications ▪ Potential to apply existing products to complementary, unserved/underserved indications Pre - clinical Phase 1 Phase 2 Phase 3 Funding ACG - 701 (sodium fusidate ) Melioidosis Cystic fibrosis ( acute exacerbations ) ACG - 801 (acid ceramidase) Farber disease Initiation Q4 2022 Enrolling now Initiation Q1 2023

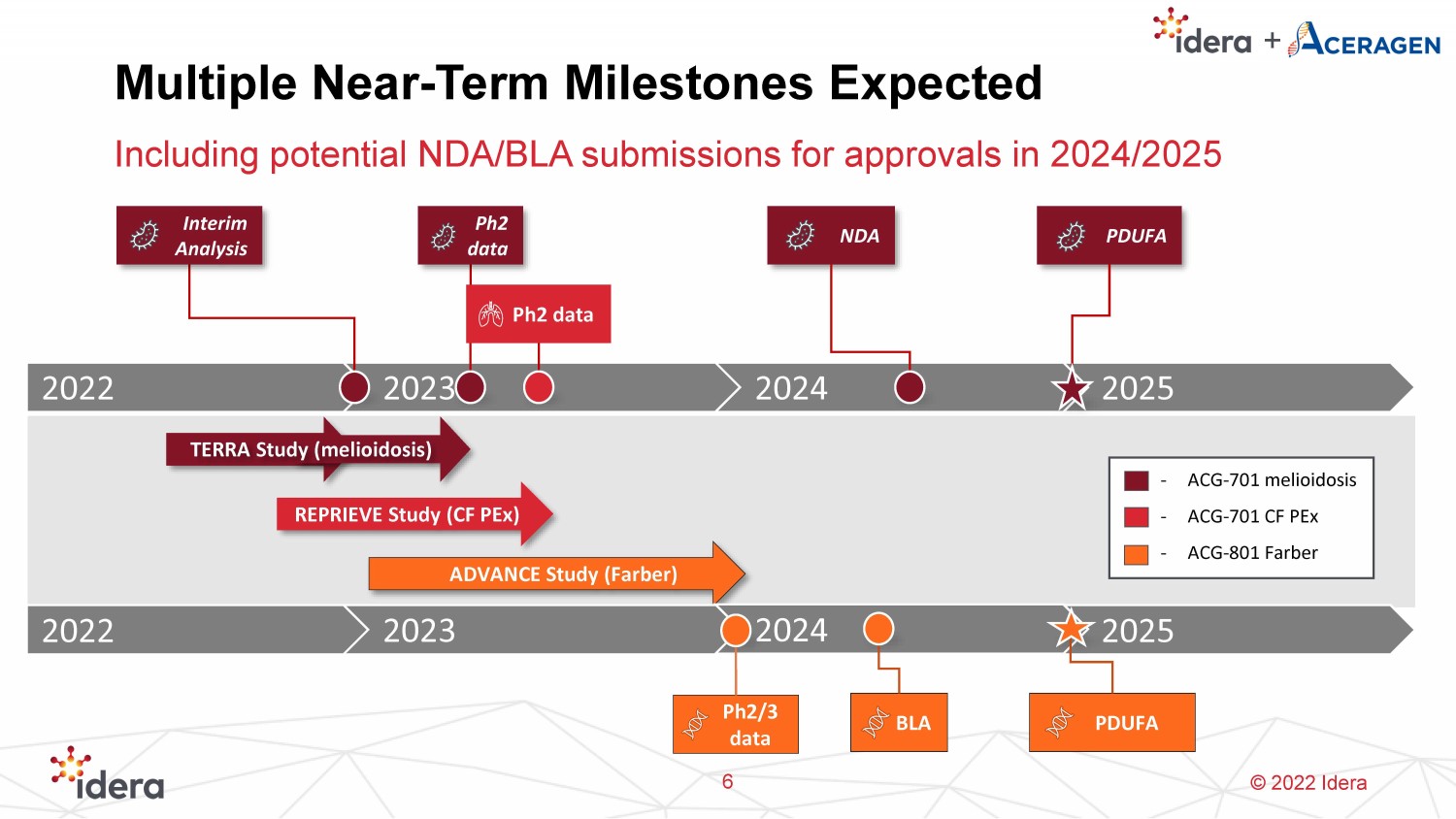

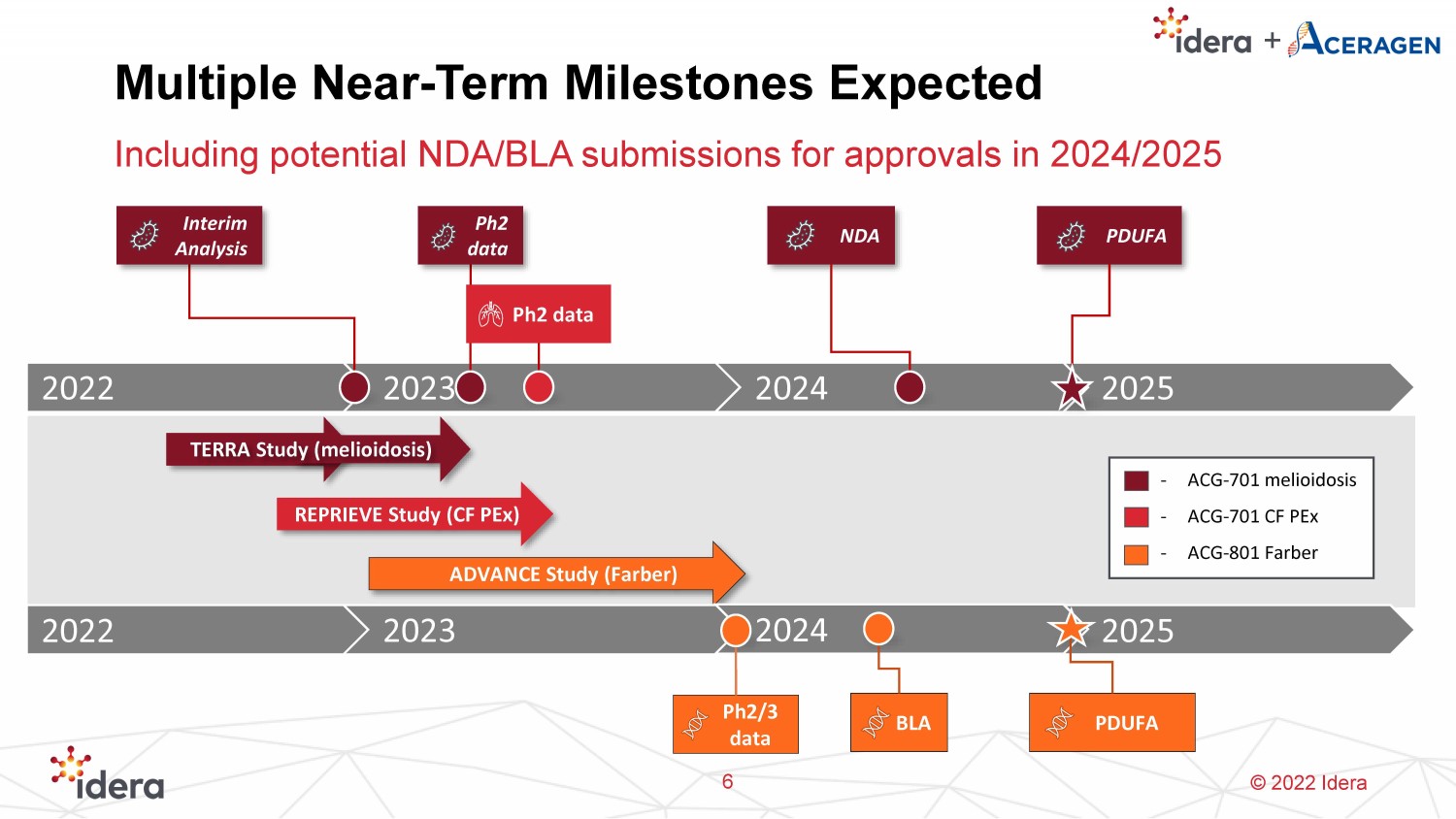

© 2022 Idera Multiple Near - Term Milestones Expected Including potential NDA/BLA submissions for approvals in 2024/2025 6 REPRIEVE Study (CF PEx ) ADVANCE Study (Farber) 2022 2023 2025 - ACG - 701 melioidosis - ACG - 701 CF PEx - ACG - 801 Farber Ph2 data 2024 NDA PDUFA TERRA Study (melioidosis) 2022 2023 2025 2024 Ph2 data Interim Analysis PDUFA BLA Ph2/3 data

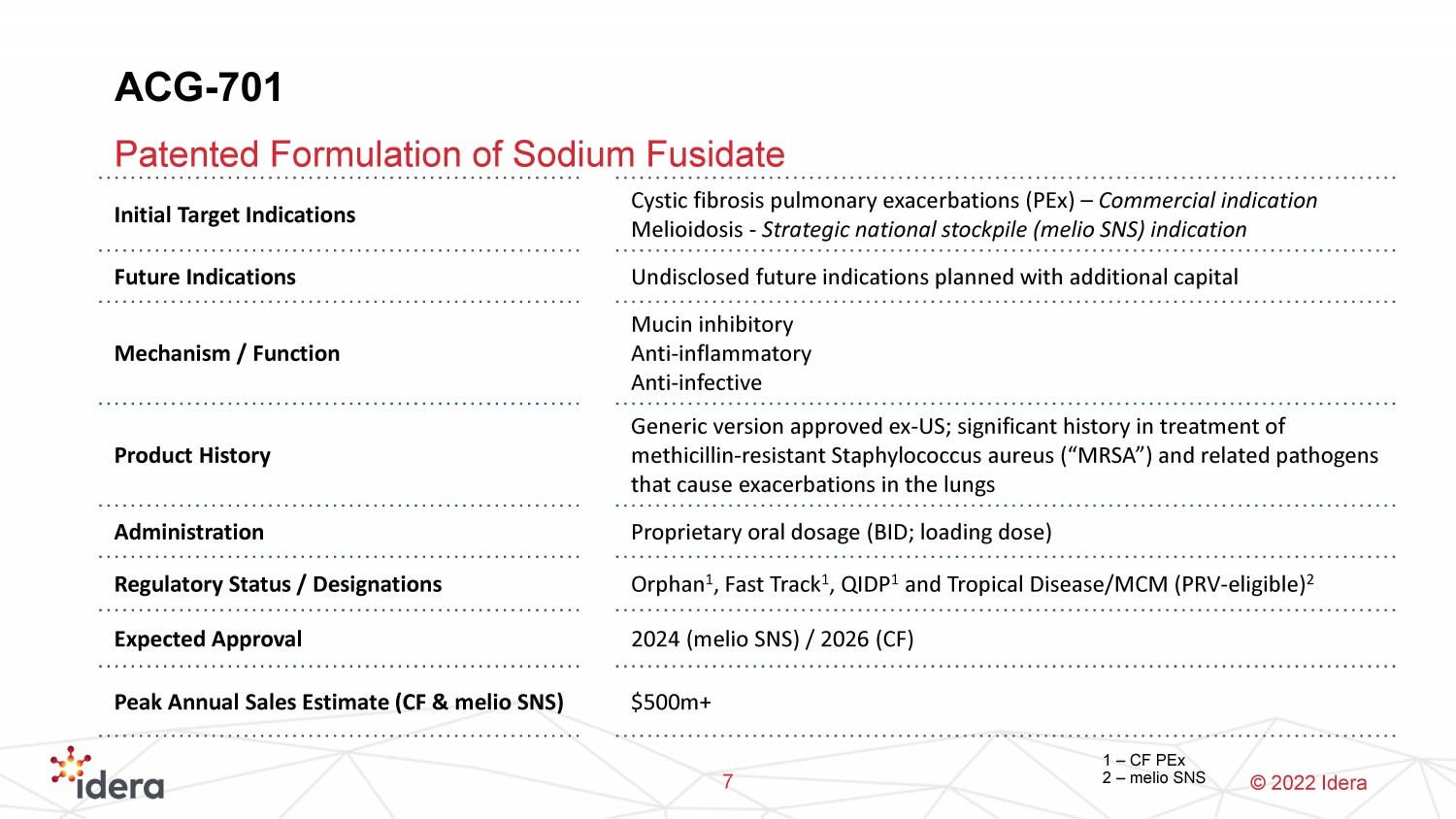

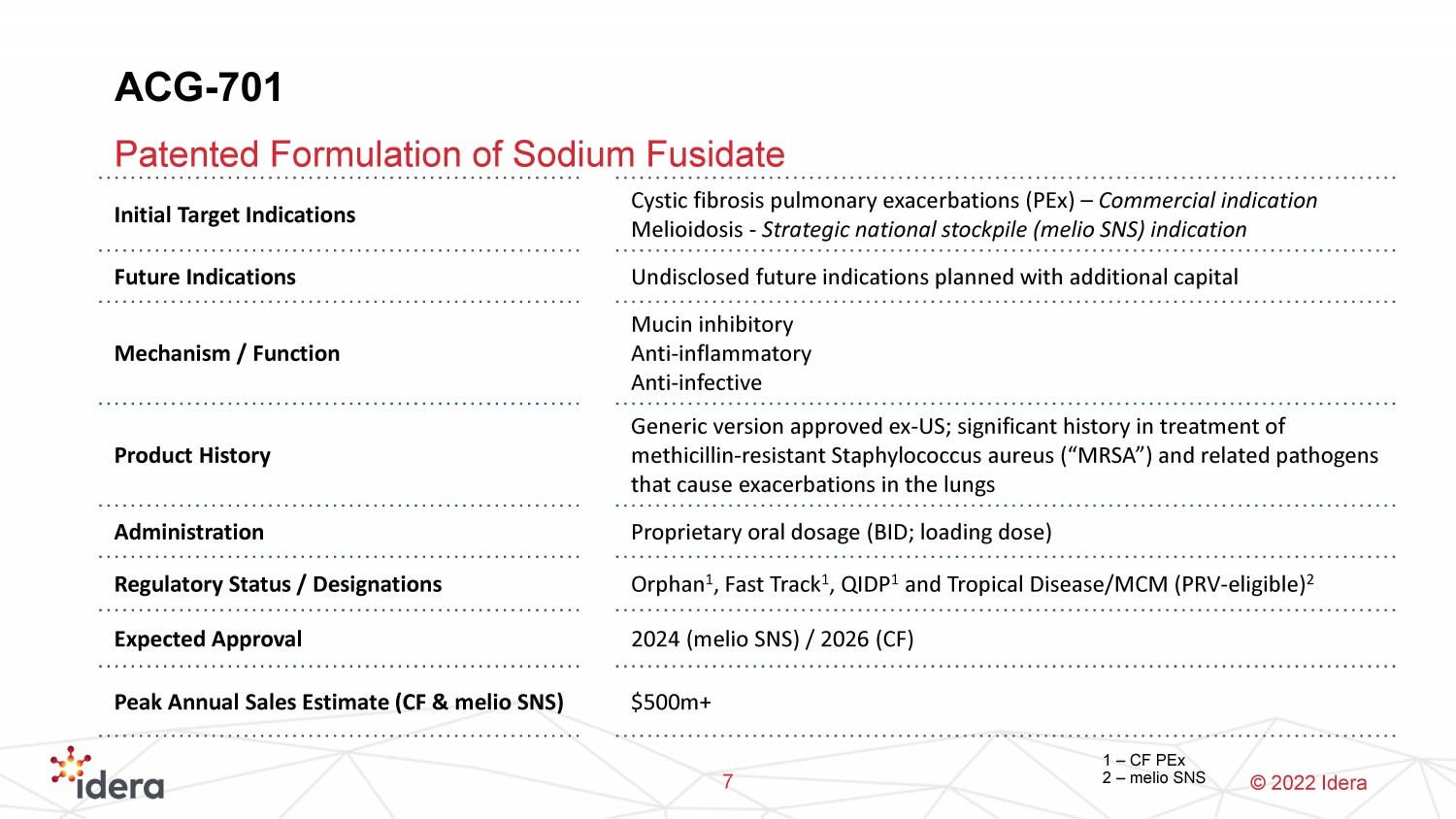

© 2022 Idera ACG - 701 Patented Formulation of Sodium Fusidate 7 Initial Target Indications Cystic fibrosis pulmonary exacerbations ( PEx ) – Commercial indication Melioidosis - Strategic national stockpile ( melio SNS) indication Future Indications Undisclosed future indications planned with additional capital Mechanism / Function Mucin inhibitory Anti - inflammatory Anti - infective Product History Generic version approved ex - US; significant history in treatment of methicillin - resistant Staphylococcus aureus (“MRSA”) and related pathogens that cause exacerbations in the lungs Administration Proprietary oral dosage (BID; loading dose) Regulatory Status / Designations Orphan 1 , Fast Track 1 , QIDP 1 and Tropical Disease/MCM (PRV - eligible) 2 Expected Approval 2024 ( melio SNS) / 2026 (CF) Peak Annual Sales Estimate (CF & melio SNS) $500m+ 1 – CF PEx 2 – melio SNS

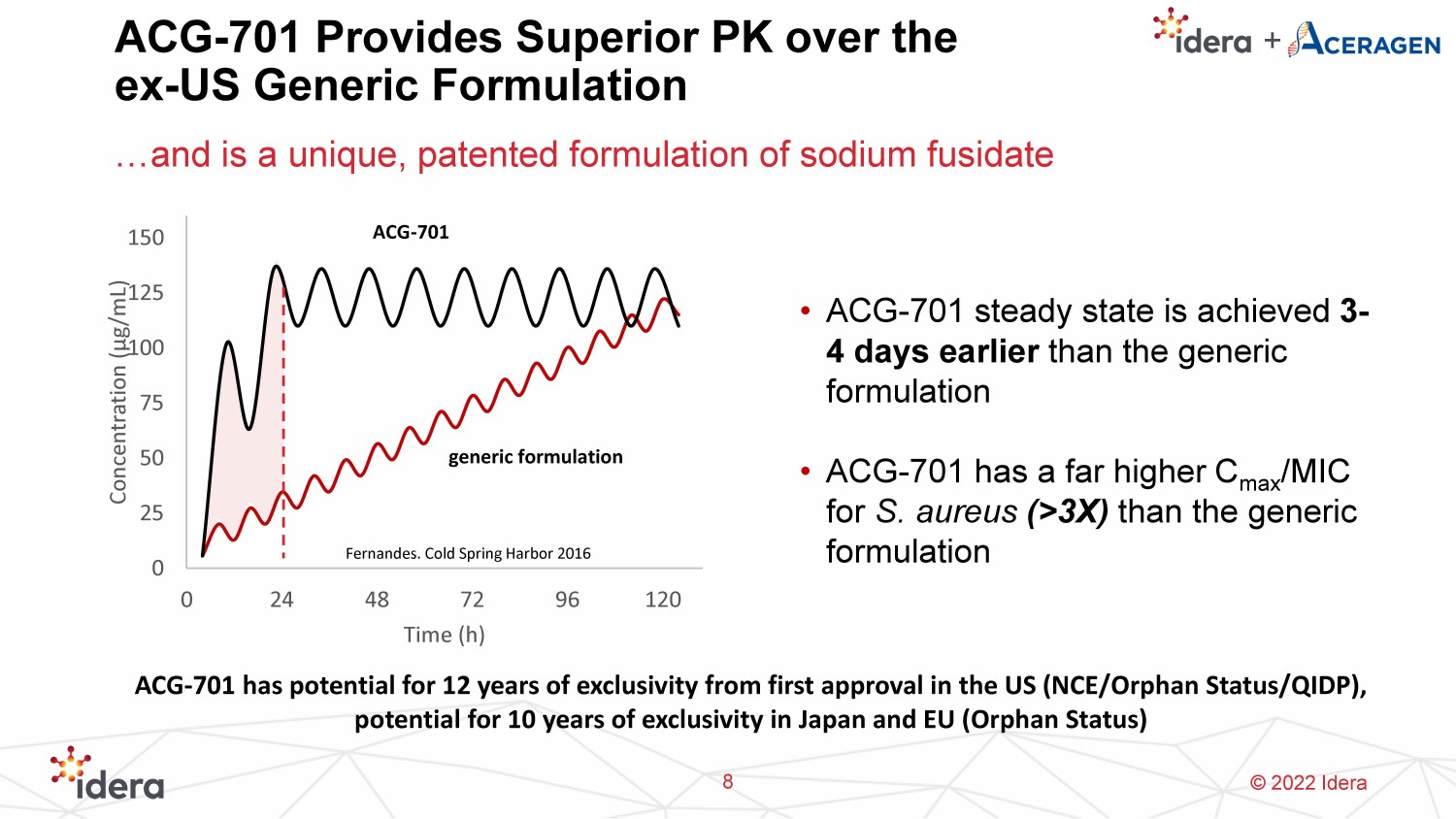

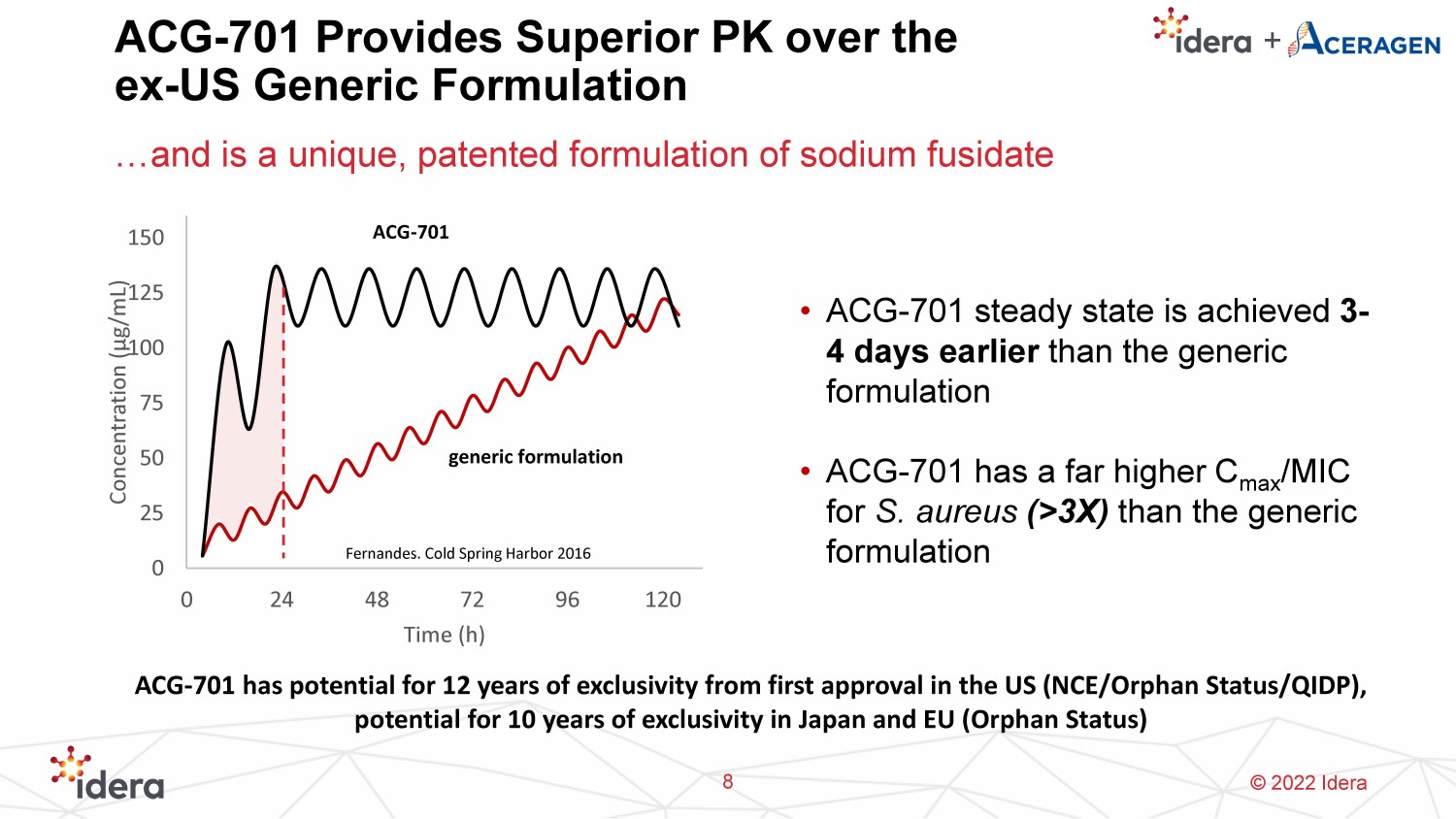

© 2022 Idera ACG - 701 Provides Superior PK over the ex - US Generic Formulation …and is a unique, patented formulation of sodium fusidate 8 • ACG - 701 steady state is achieved 3 - 4 days earlier than the generic formulation • ACG - 701 has a far higher C max /MIC for S. aureus (>3X) than the generic formulation 0 25 50 75 100 125 150 0 24 48 72 96 120 Concentration ( μ g/mL) Time (h) generic formulation ACG - 701 Fernandes. Cold Spring Harbor 2016 ACG - 701 has potential for 12 years of exclusivity from first approval in the US (NCE/Orphan Status/QIDP), potential for 10 years of exclusivity in Japan and EU (Orphan Status)

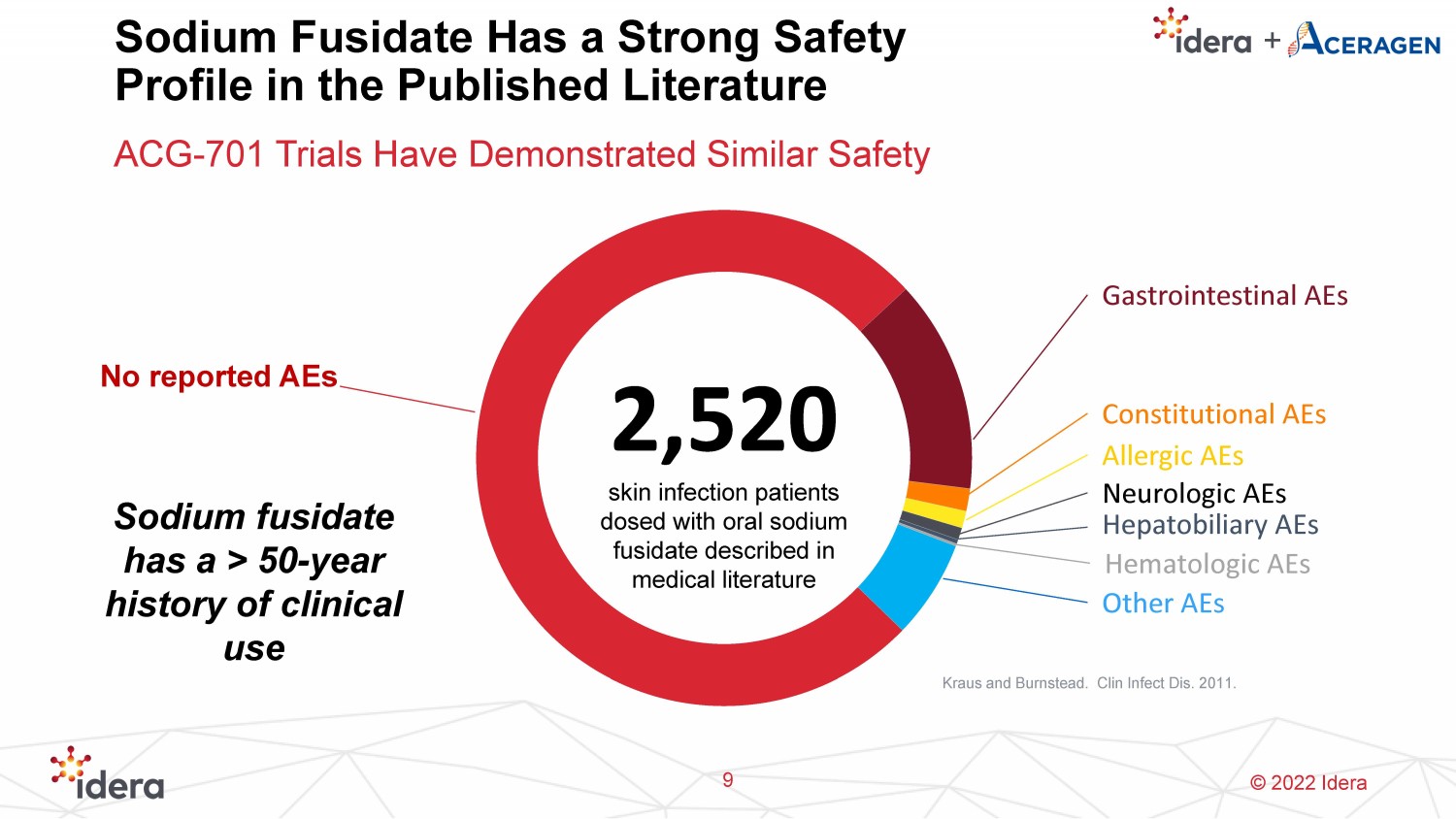

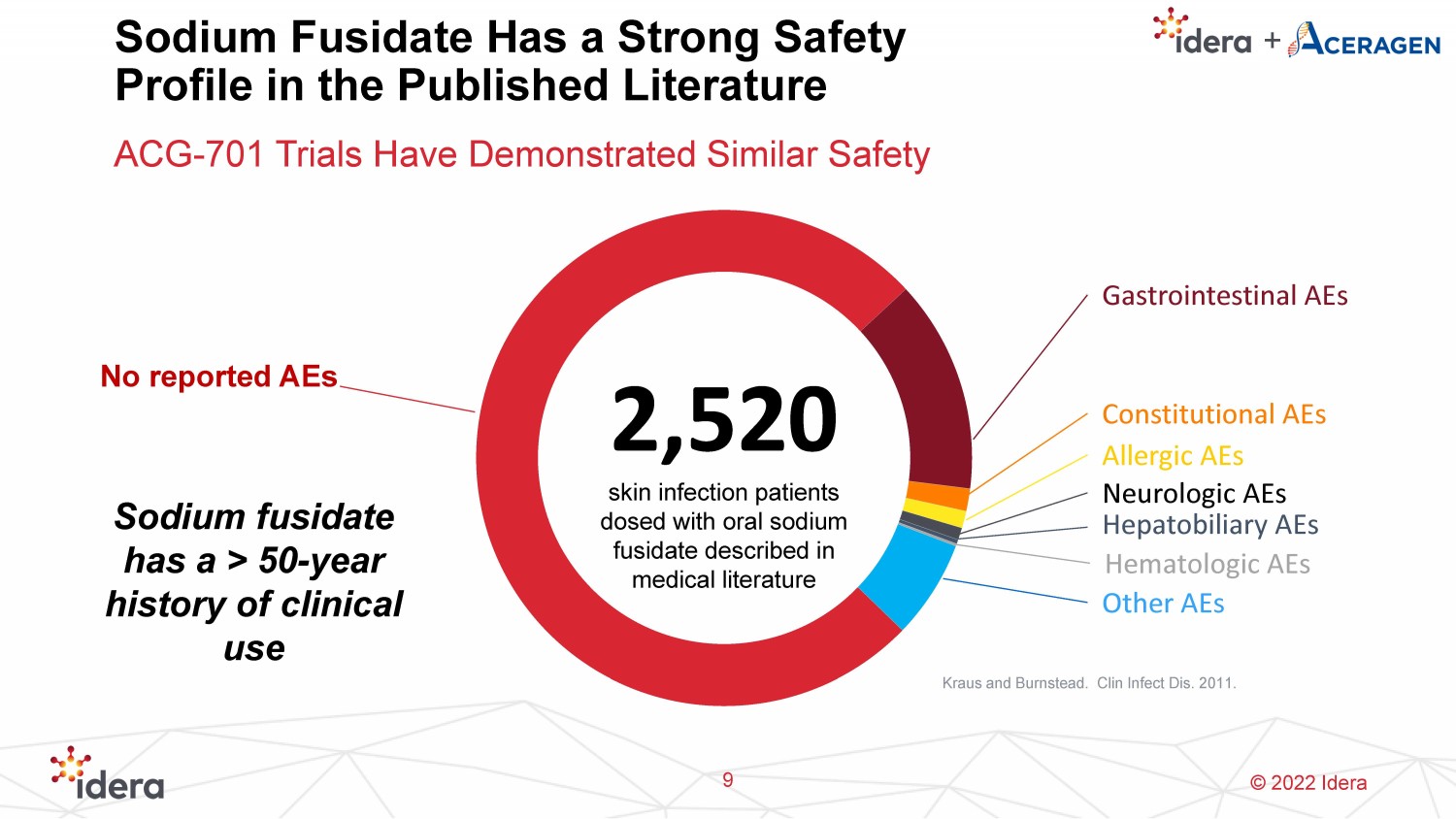

© 2022 Idera Sodium Fusidate Has a Strong Safety Profile in the Published Literature ACG - 701 Trials Have Demonstrated Similar Safety Sodium fusidate has a > 50 - year history of clinical use 2,520 skin infection patients dosed with oral sodium fusidate described in medical literature No reported AEs Gastrointestinal AEs Constitutional AEs Allergic AEs Neurologic AEs Hepatobiliary AEs Hematologic AEs Other AEs Kraus and Burnstead . Clin Infect Dis. 2011. 9

© 2022 Idera ACG - 701 is Well - Suited to Directly Address the Vicious Cycle of Respiratory Disease 10 DECREASES MUCIN PRODUCTION POWERFUL ANTI - INFECTIVE BIOFILM PENETRATING ACCUMULATES INTRACELLULARLY HIGH POTENCY AT LOW PH ANTI - INFLAMMATORY ACG - 701 PROPERTIES

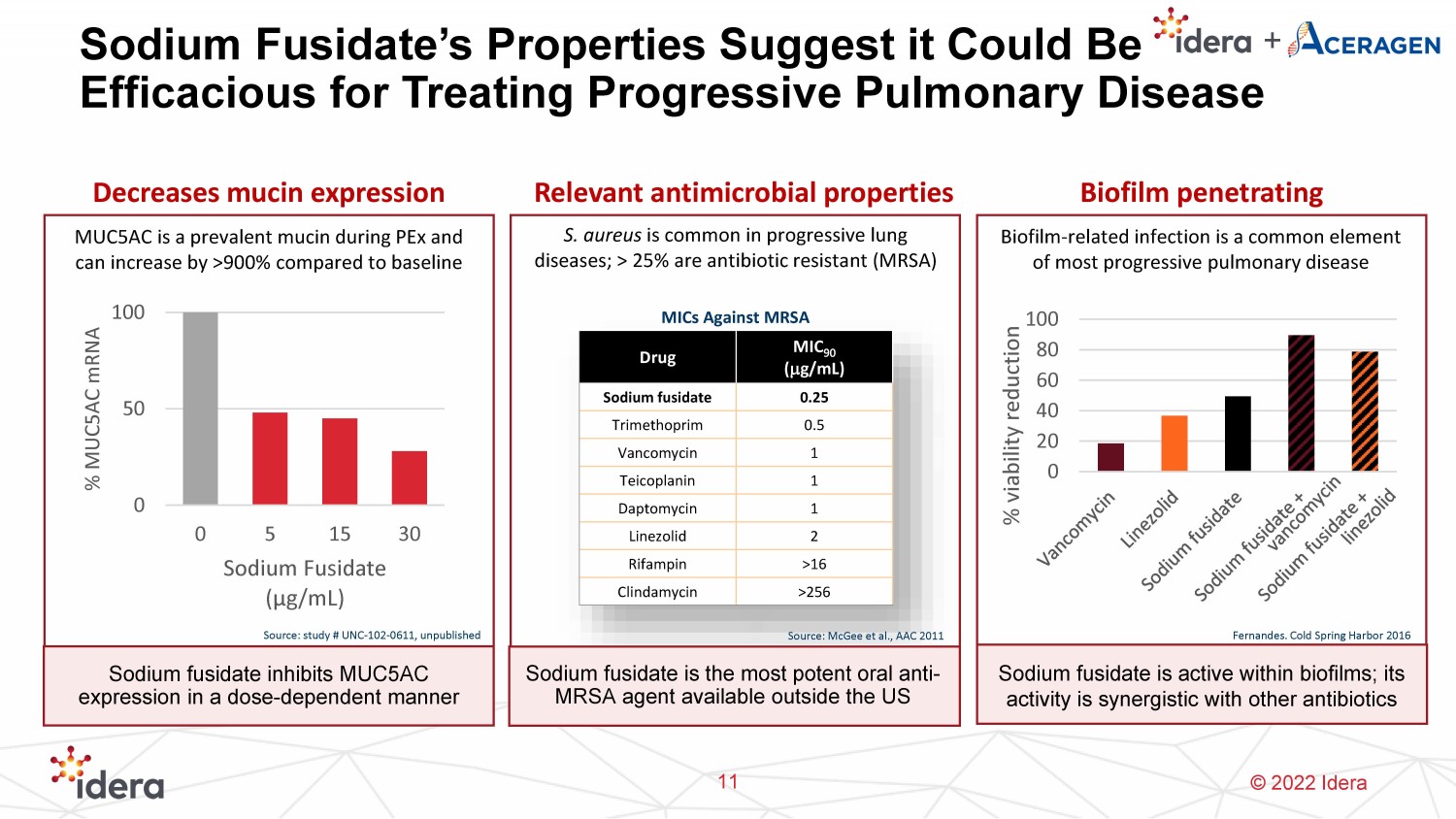

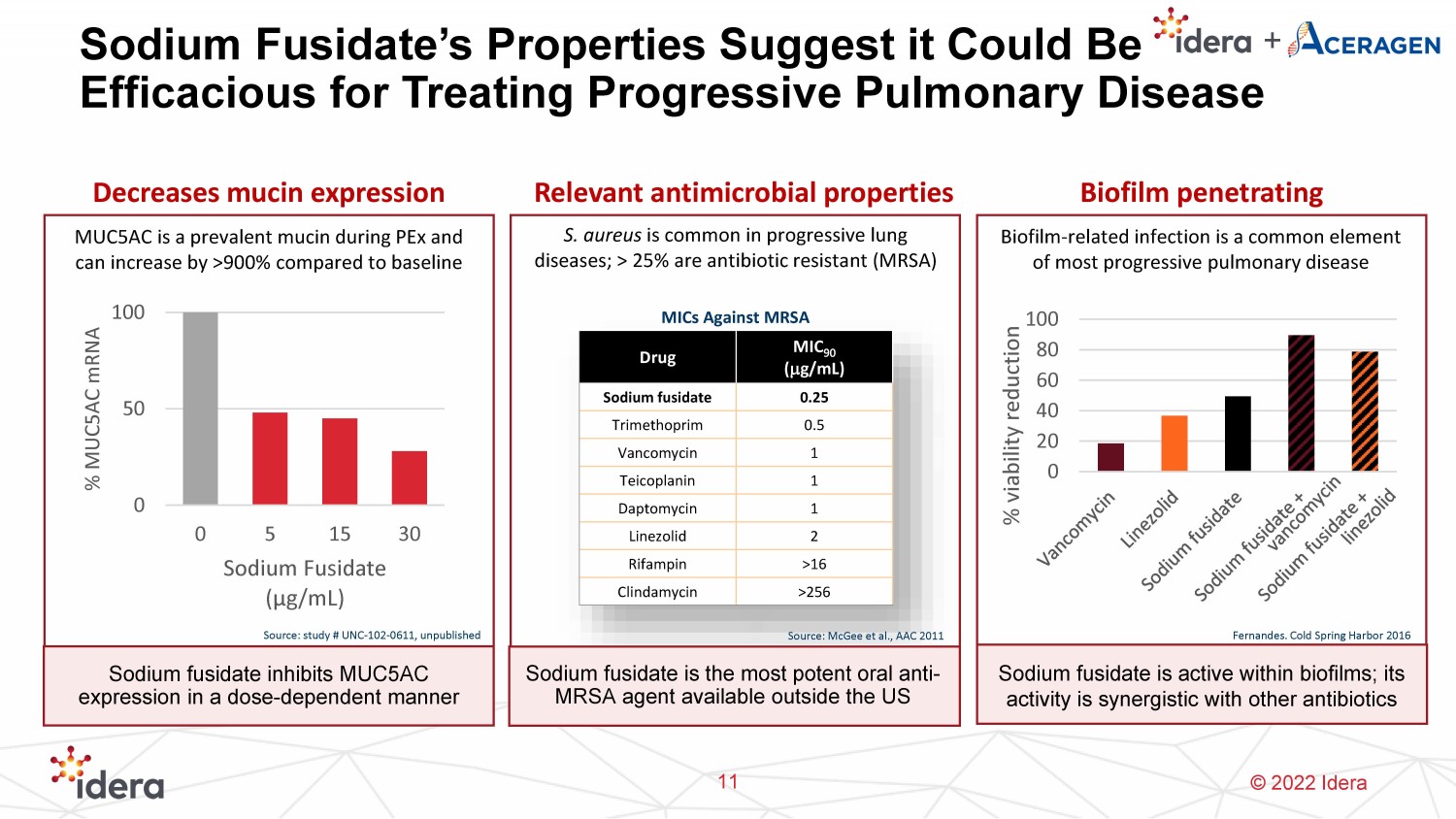

© 2022 Idera Sodium Fusidate’s Properties Suggest it Could Be Efficacious for Treating Progressive Pulmonary Disease 11 Decreases mucin expression Relevant antimicrobial properties 0 50 100 0 5 15 30 % MUC5AC mRNA Sodium Fusidate ( μg /mL) Source: study # UNC - 102 - 0611, unpublished MUC5AC is a prevalent mucin during PEx and can increase by >900% compared to baseline Drug MIC 90 ( m g/mL) Sodium fusidate 0.25 Trimethoprim 0.5 Vancomycin 1 Teicoplanin 1 Daptomycin 1 Linezolid 2 Rifampin >16 Clindamycin >256 S. aureus is common in progressive lung diseases; > 25% are antibiotic resistant (MRSA) MICs Against MRSA Sodium fusidate inhibits MUC5AC expression in a dose - dependent manner Sodium fusidate is the most potent oral anti - MRSA agent available outside the US Biofilm penetrating Biofilm - related infection is a common element of most progressive pulmonary disease 0 20 40 60 80 100 % viability reduction Sodium fusidate is active within biofilms; its activity is synergistic with other antibiotics Fernandes. Cold Spring Harbor 2016 Source: McGee et al., AAC 2011

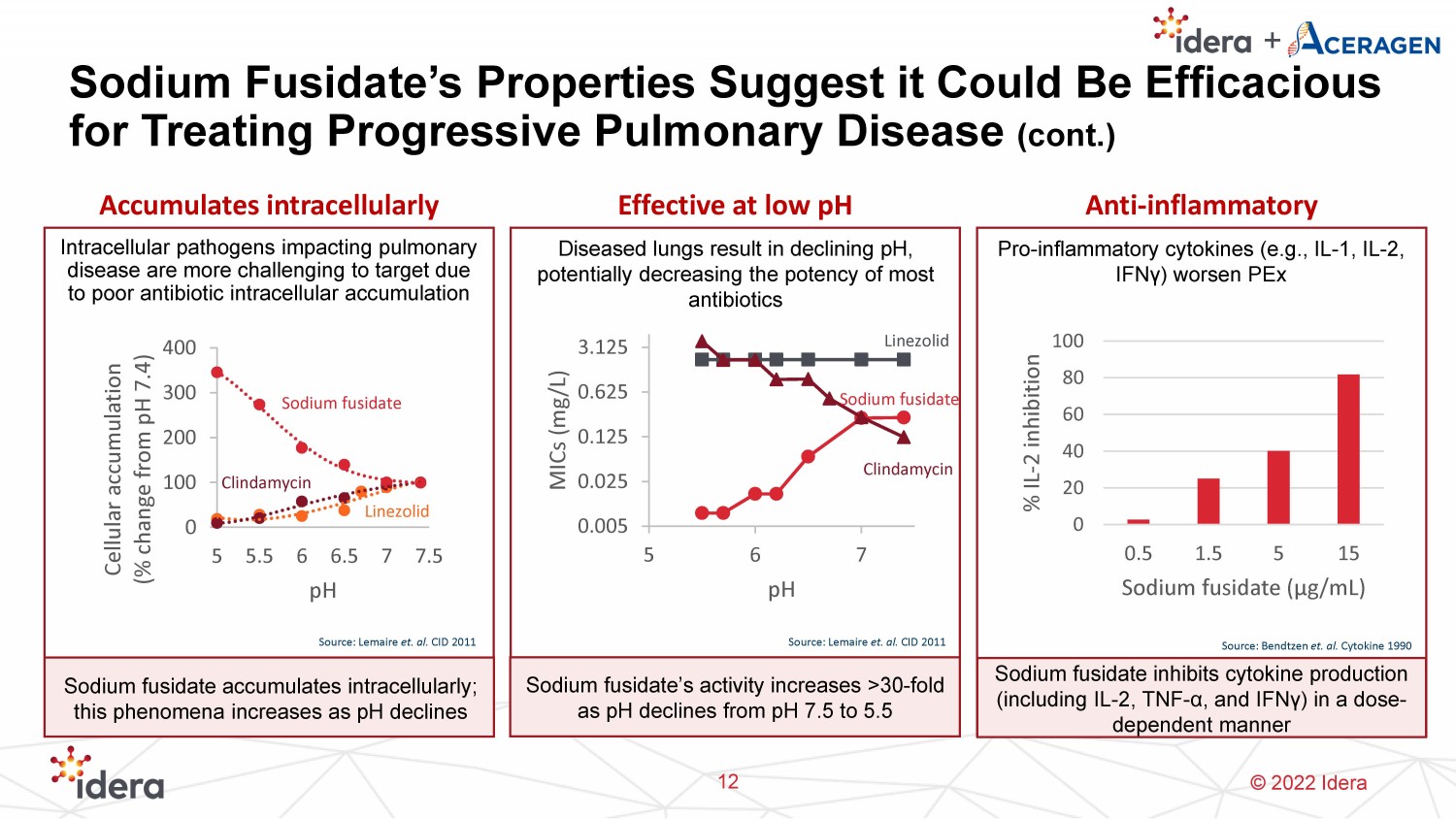

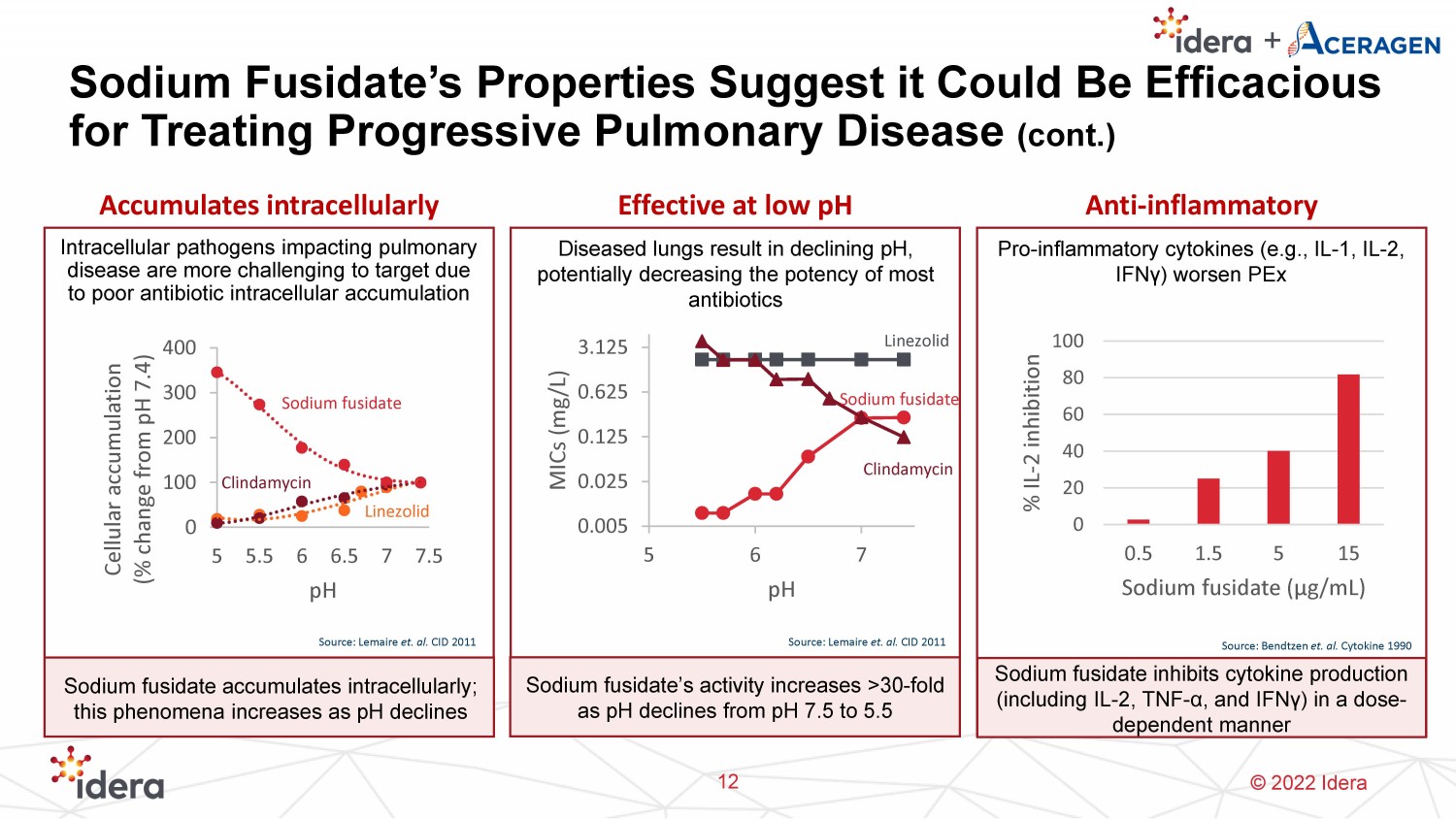

© 2022 Idera Sodium Fusidate’s Properties Suggest it Could Be Efficacious for Treating Progressive Pulmonary Disease (cont.) 12 Accumulates intracellularly Effective at low pH Anti - inflammatory Intracellular pathogens impacting pulmonary disease are more challenging to target due to poor antibiotic intracellular accumulation Source: Lemaire et. al. CID 2011 0 100 200 300 400 5 5.5 6 6.5 7 7.5 Cellular accumulation (% change from pH 7.4) pH Sodium fusidate Clindamycin Linezolid Sodium fusidate accumulates intracellularly; this phenomena increases as pH declines Sodium fusidate’s activity increases >30 - fold as pH declines from pH 7.5 to 5.5 Diseased lungs result in declining pH, potentially decreasing the potency of most antibiotics 0.005 0.025 0.125 0.625 3.125 5 6 7 MICs (mg/L) pH Pro - inflammatory cytokines (e.g., IL - 1, IL - 2, IFN γ ) worsen PEx 0 20 40 60 80 100 0.5 1.5 5 15 % IL - 2 inhibition Sodium fusidate ( μ g/mL) Sodium fusidate inhibits cytokine production (including IL - 2, TNF - α , and IFN γ ) in a dose - dependent manner Source: Bendtzen et. al. Cytokine 1990 Sodium fusidate Clindamycin Linezolid Source: Lemaire et. al. CID 2011

© 2022 Idera CF Pulmonary Exacerbations (CF PEx ) • Exacerbations and related complications account for nearly two - thirds of CF patient deaths • Despite treatment advances, current rates are still approximately 1 - 2x/year • No therapies currently approved to treat CF PEx • Polypharmacy approach typically used to address increased mucin production, inflammation and bacteria that often “hide” intracellularly Principal Driver of Declining Lung function Image source: https://emedicine.medscape.com/article/1001602 - overview ; updated Sept. 28, 2020 13

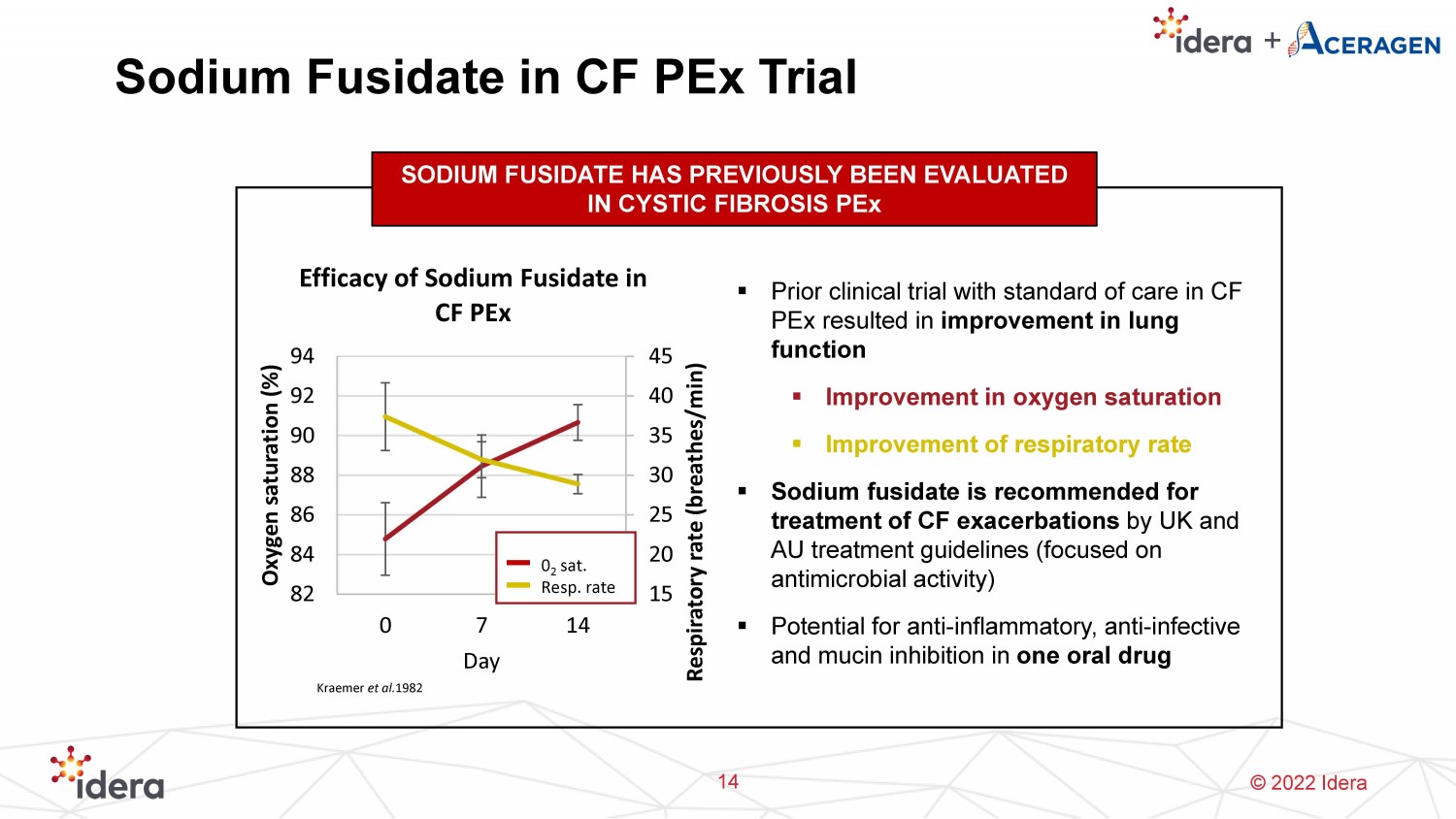

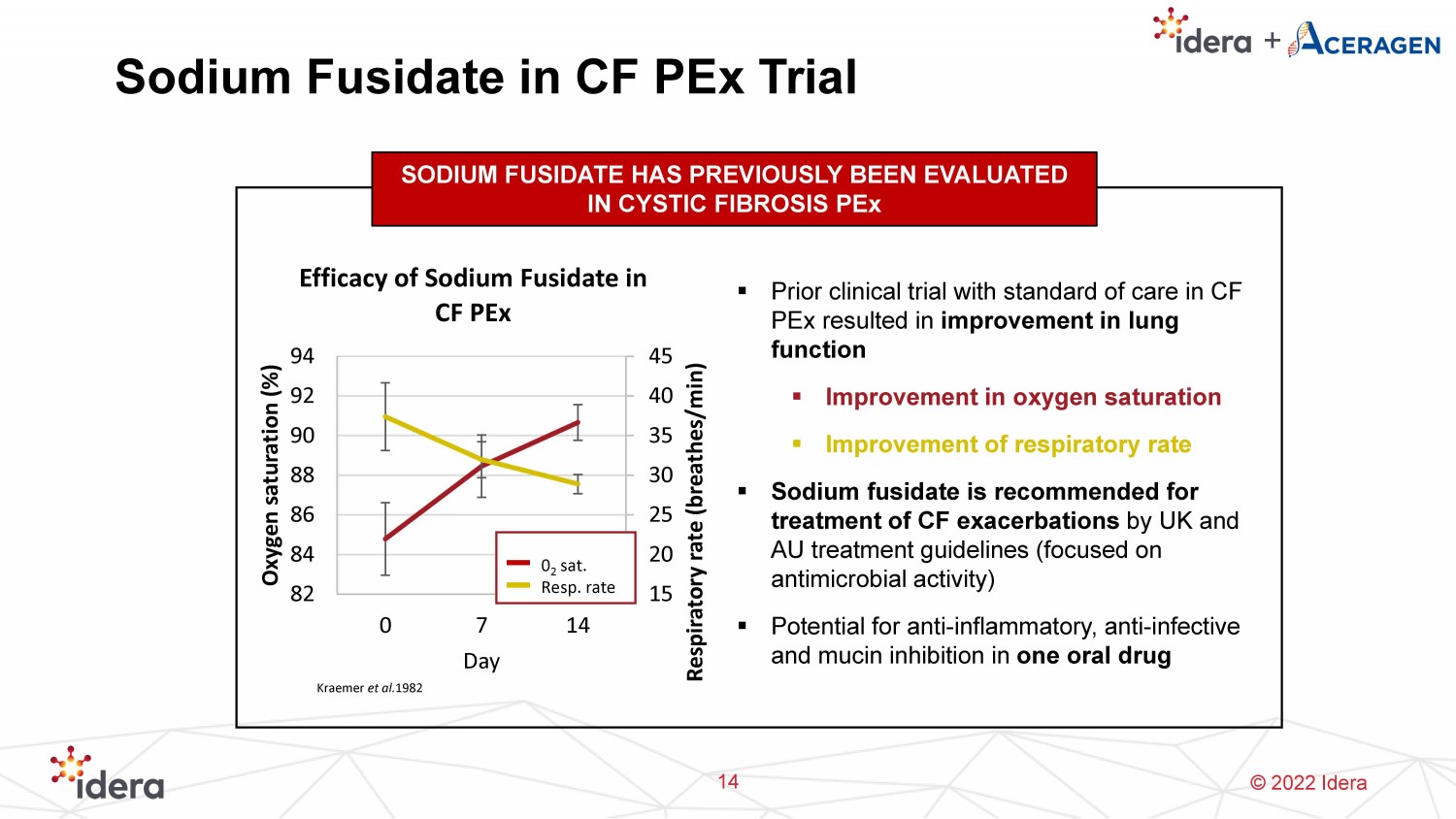

© 2022 Idera 15 20 25 30 35 40 45 82 84 86 88 90 92 94 0 7 14 Respiratory rate (breathes/min) Oxygen saturation (%) Day Efficacy of Sodium Fusidate in CF PEx 0 2 sat. Resp. rate Sodium Fusidate in CF PEx Trial 14 SODIUM FUSIDATE HAS PREVIOUSLY BEEN EVALUATED IN CYSTIC FIBROSIS PEx ▪ Prior clinical trial with standard of care in CF PEx resulted in improvement in lung function ▪ Improvement in oxygen saturation ▪ Improvement of respiratory rate ▪ Sodium fusidate is recommended for treatment of CF exacerbations by UK and AU treatment guidelines (focused on antimicrobial activity) ▪ Potential for anti - inflammatory, anti - infective and mucin inhibition in one oral drug Kraemer et al. 1982

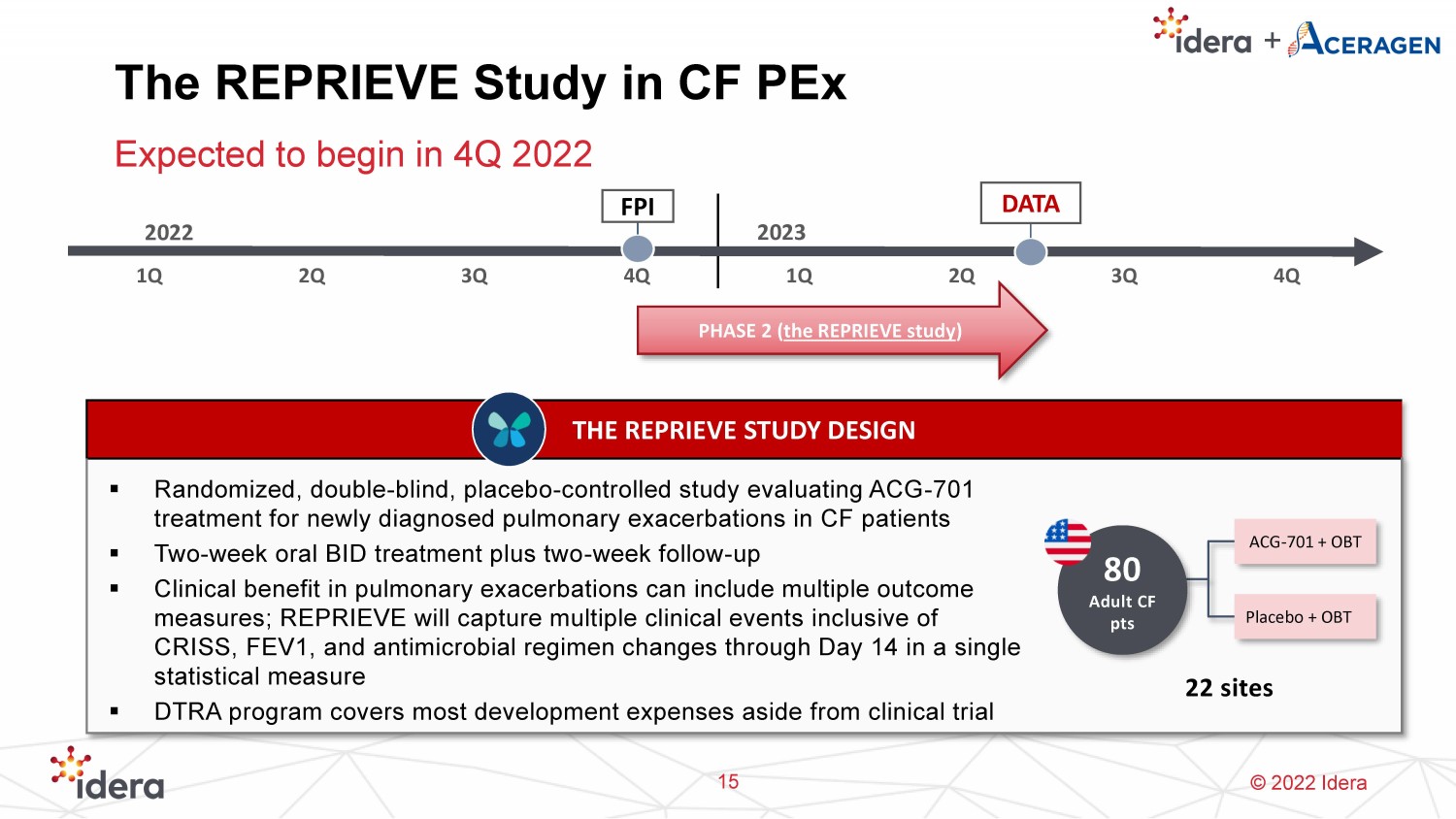

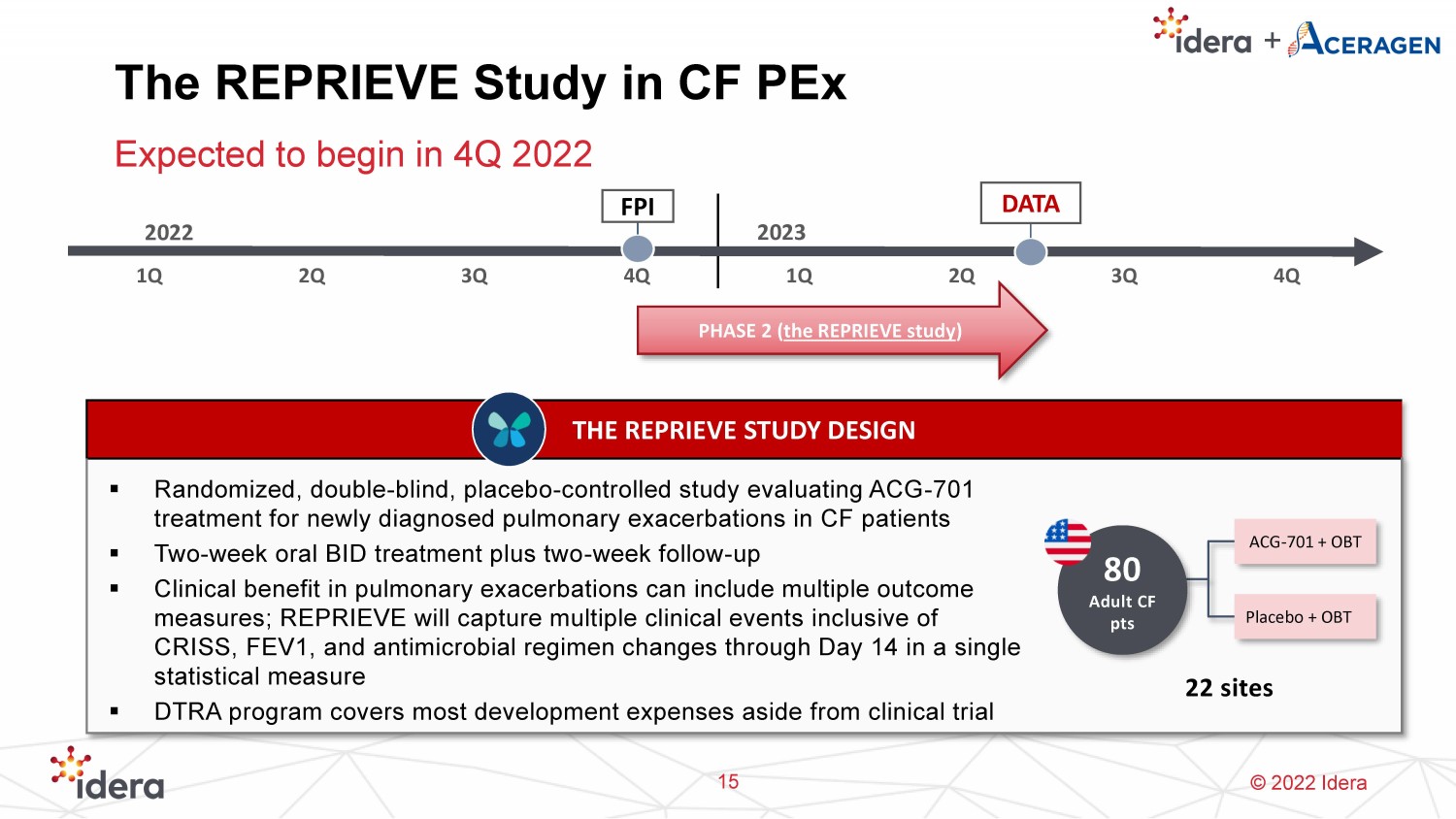

© 2022 Idera The REPRIEVE Study in CF PEx Expected to begin in 4Q 2022 15 THE REPRIEVE STUDY DESIGN ▪ Randomized, double - blind, placebo - controlled study evaluating ACG - 701 treatment for newly diagnosed pulmonary exacerbations in CF patients ▪ Two - week oral BID treatment plus two - week follow - up ▪ Clinical benefit in pulmonary exacerbations can include multiple outcome measures; REPRIEVE will capture multiple clinical events inclusive of CRISS, FEV1, and antimicrobial regimen changes through Day 14 in a single statistical measure ▪ DTRA program covers most development expenses aside from clinical trial 2022 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q FPI PHASE 2 ( the REPRIEVE study ) DATA 80 Adult CF pts ACG - 701 + OBT 22 sites Placebo + OBT 2023

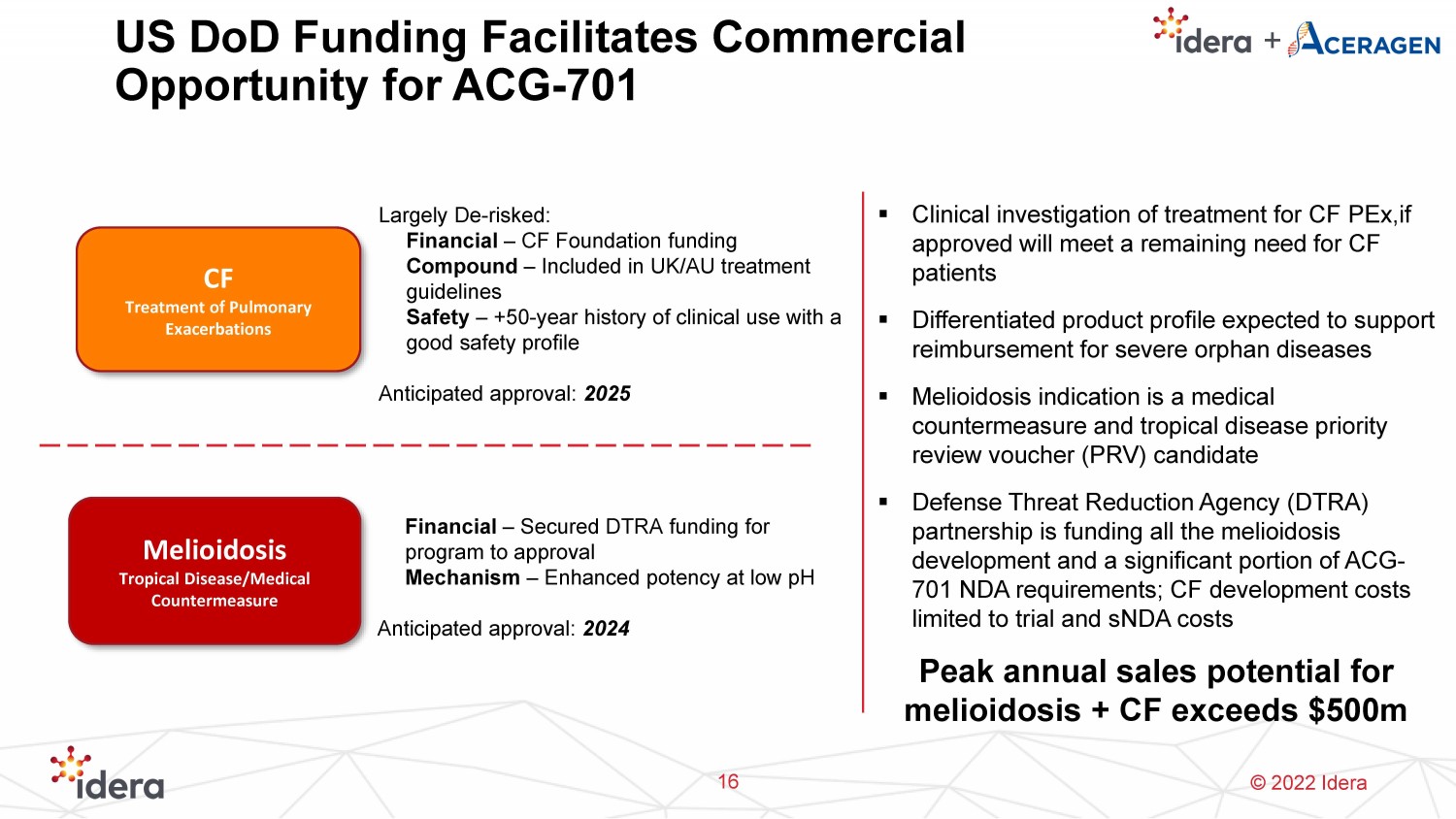

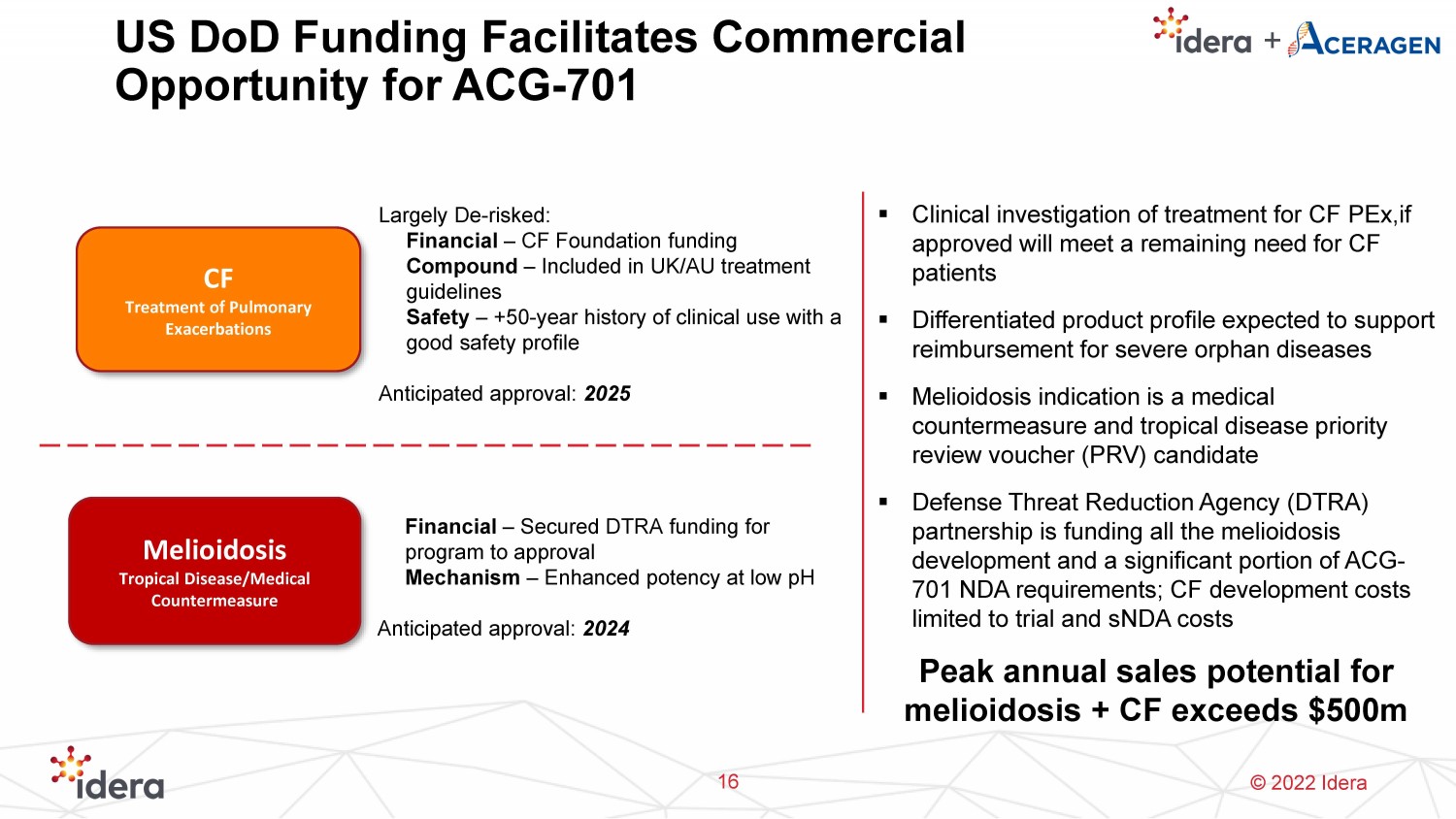

© 2022 Idera Melioidosis Tropical Disease/Medical Countermeasure US DoD Funding Facilitates Commercial Opportunity for ACG - 701 16 ▪ Clinical investigation of treatment for CF PEx,if approved will meet a remaining need for CF patients ▪ Differentiated product profile expected to support reimbursement for severe orphan diseases ▪ Melioidosis indication is a medical countermeasure and tropical disease priority review voucher (PRV) candidate ▪ Defense Threat Reduction Agency (DTRA) partnership is funding all the melioidosis development and a significant portion of ACG - 701 NDA requirements; CF development costs limited to trial and sNDA costs Peak annual sales potential for melioidosis + CF exceeds $500m Largely De - risked: Financial – CF Foundation funding Compound – Included in UK/AU treatment guidelines Safety – +50 - year history of clinical use with a good safety profile Anticipated approval: 2025 CF Treatment of Pulmonary Exacerbations Financial – Secured DTRA funding for program to approval Mechanism – Enhanced potency at low pH Anticipated approval: 2024

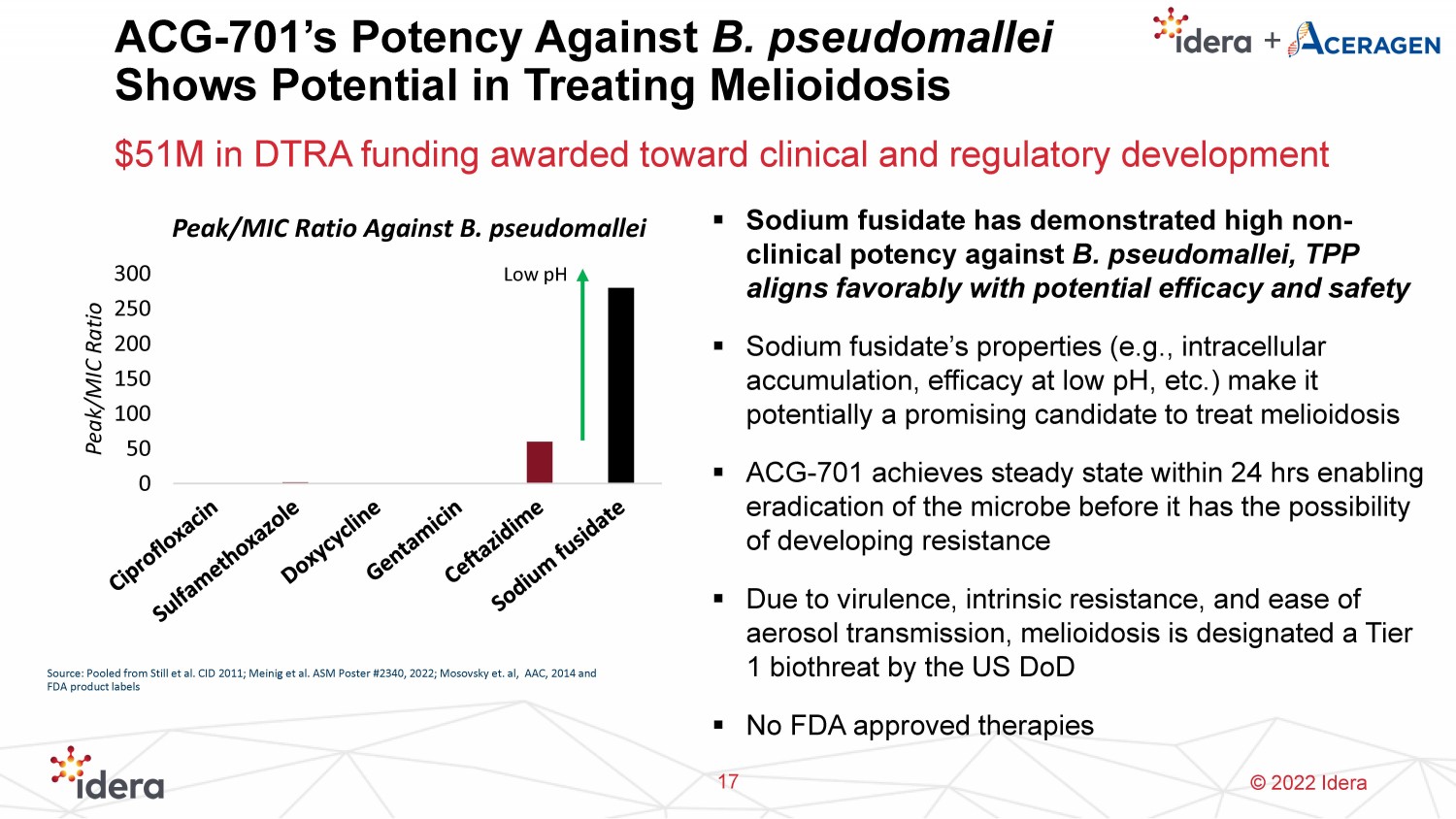

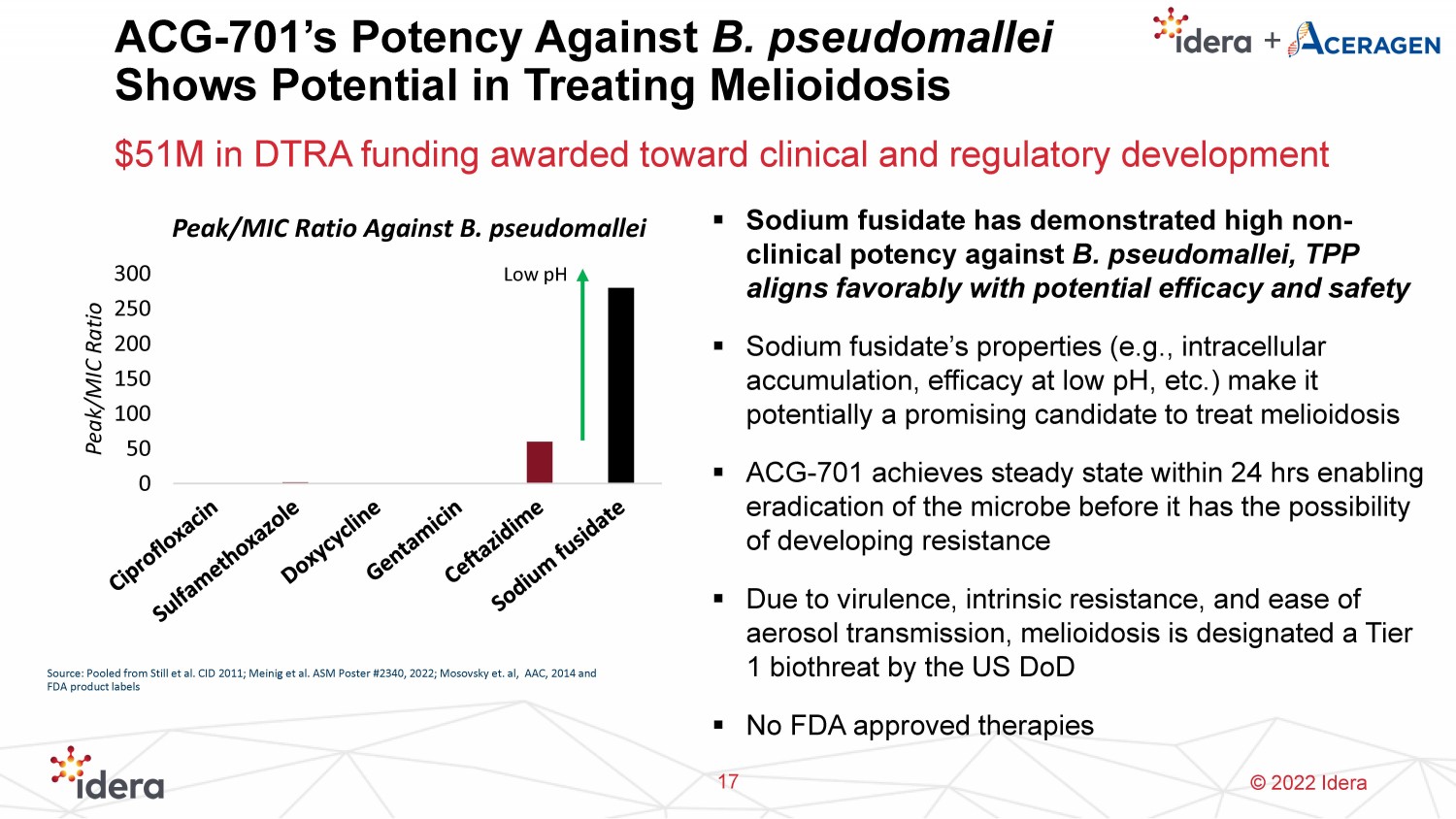

© 2022 Idera ACG - 701’s Potency Against B. pseudomallei Shows Potential in Treating Melioidosis 17 ▪ Sodium fusidate has demonstrated high non - clinical potency against B. pseudomallei , TPP aligns favorably with potential efficacy and safety ▪ Sodium fusidate’s properties (e.g., intracellular accumulation, efficacy at low pH , etc.) make it potentially a promising candidate to treat melioidosis ▪ ACG - 701 achieves steady state within 24 hrs enabling eradication of the microbe before it has the possibility of developing resistance ▪ Due to virulence, intrinsic resistance, and ease of aerosol transmission, melioidosis is designated a Tier 1 biothreat by the US DoD ▪ No FDA approved therapies 0 50 100 150 200 250 300 Peak/MIC Ratio Peak/MIC Ratio Against B. pseudomallei Low pH Source: Pooled from Still et al. CID 2011; Meinig et al. ASM Poster #2340, 2022; Mosovsky et. al, AAC, 2014 and FDA product labels $51M in DTRA funding awarded toward clinical and regulatory development

© 2022 Idera The TERRA Study of ACG - 701 in Melioidosis is Underway 18 2022 2023 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q FPI DATA INTERIM DATA ▪ Randomized, double - blind, placebo - controlled study in hospitalized melioidosis patients; two - week BID dosing with two - week follow - up ▪ Melioidosis has a non - homogenous clinical presentation; TERRA will capture multiple clinical events inclusive of mortality, organ failure, sepsis and treatment modifications through Day 14 in a single statistical measure. ▪ Interim analysis included to allow power re - estimation for sample expansion ▪ Study could be expanded into a Ph 3 study 125 Adult melioidosis pts ACG - 701 + SOC 12 sites Placebo + SOC THE TERRA PHASE 2 STUDY Interim Analysis N=~30 Potential Outcome N=130 - 140

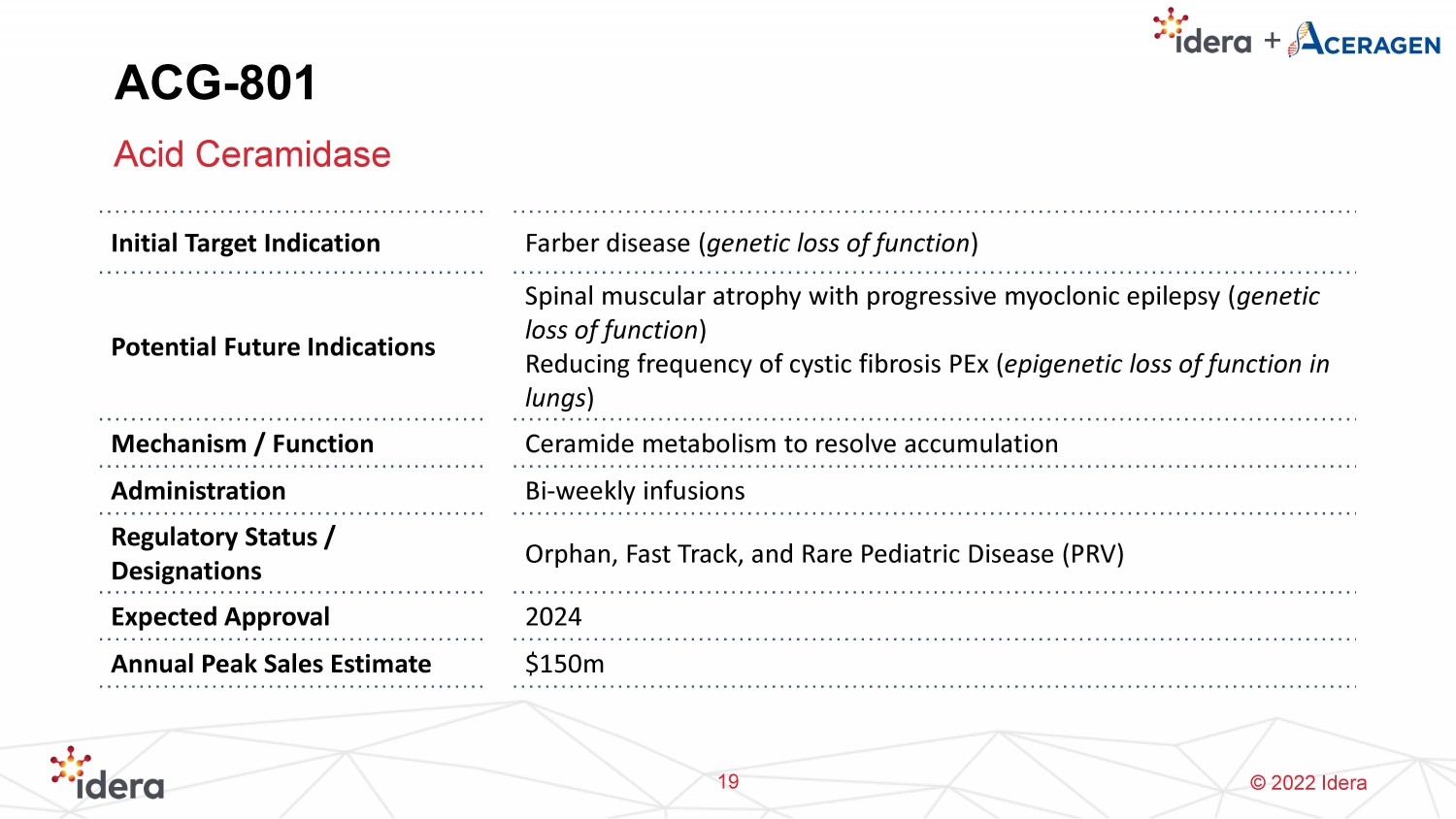

© 2022 Idera ACG - 801 Acid Ceramidase 19 Initial Target Indication Farber disease ( genetic loss of function ) Potential Future Indications Spinal muscular atrophy with progressive myoclonic epilepsy ( genetic loss of function ) Reducing frequency of cystic fibrosis PEx ( epigenetic loss of function in lungs ) Mechanism / Function Ceramide metabolism to resolve accumulation Administration Bi - weekly infusions Regulatory Status / Designations Orphan, Fast Track, and Rare Pediatric Disease (PRV) Expected Approval 2024 Annual Peak Sales Estimate $150m

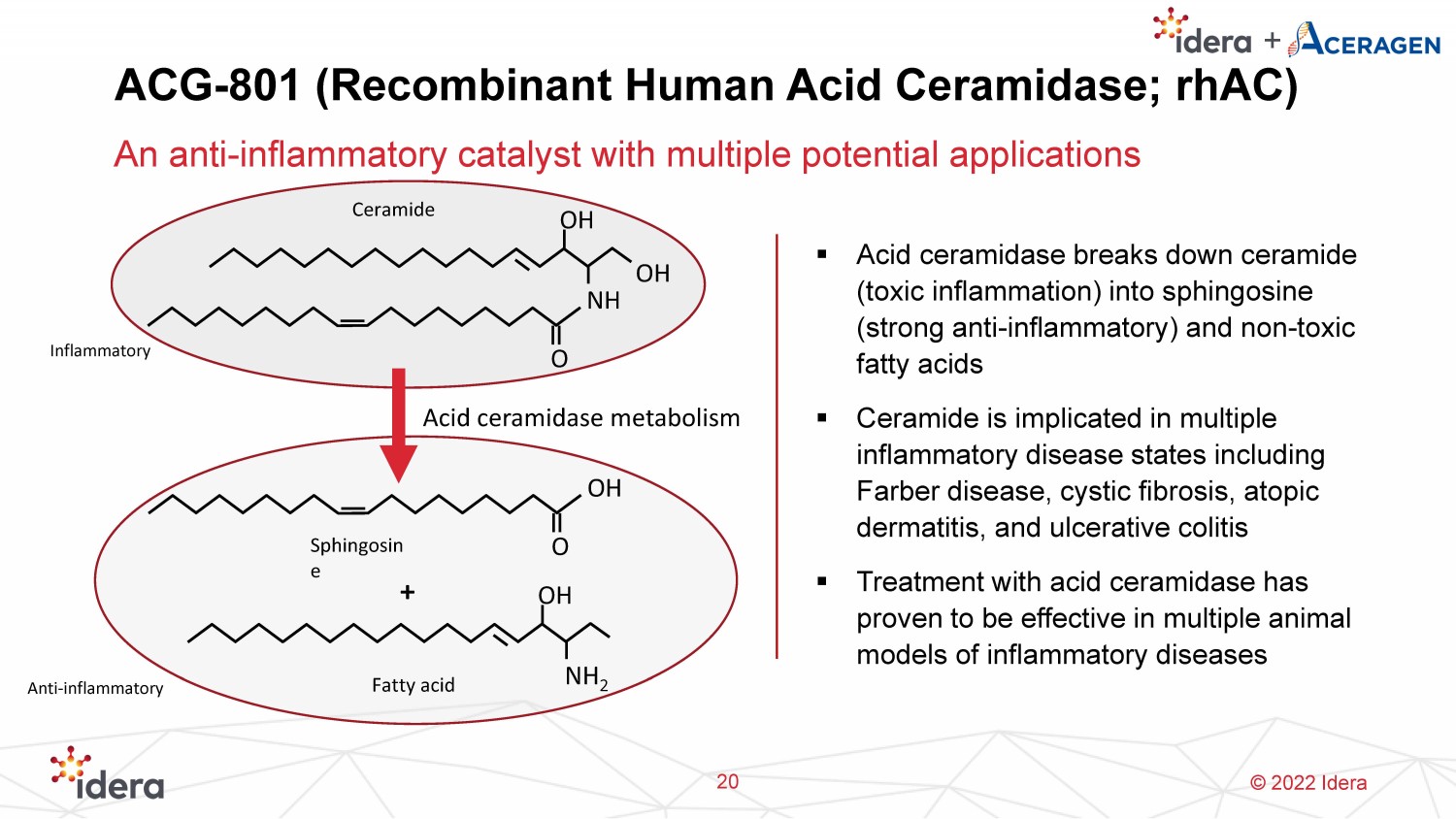

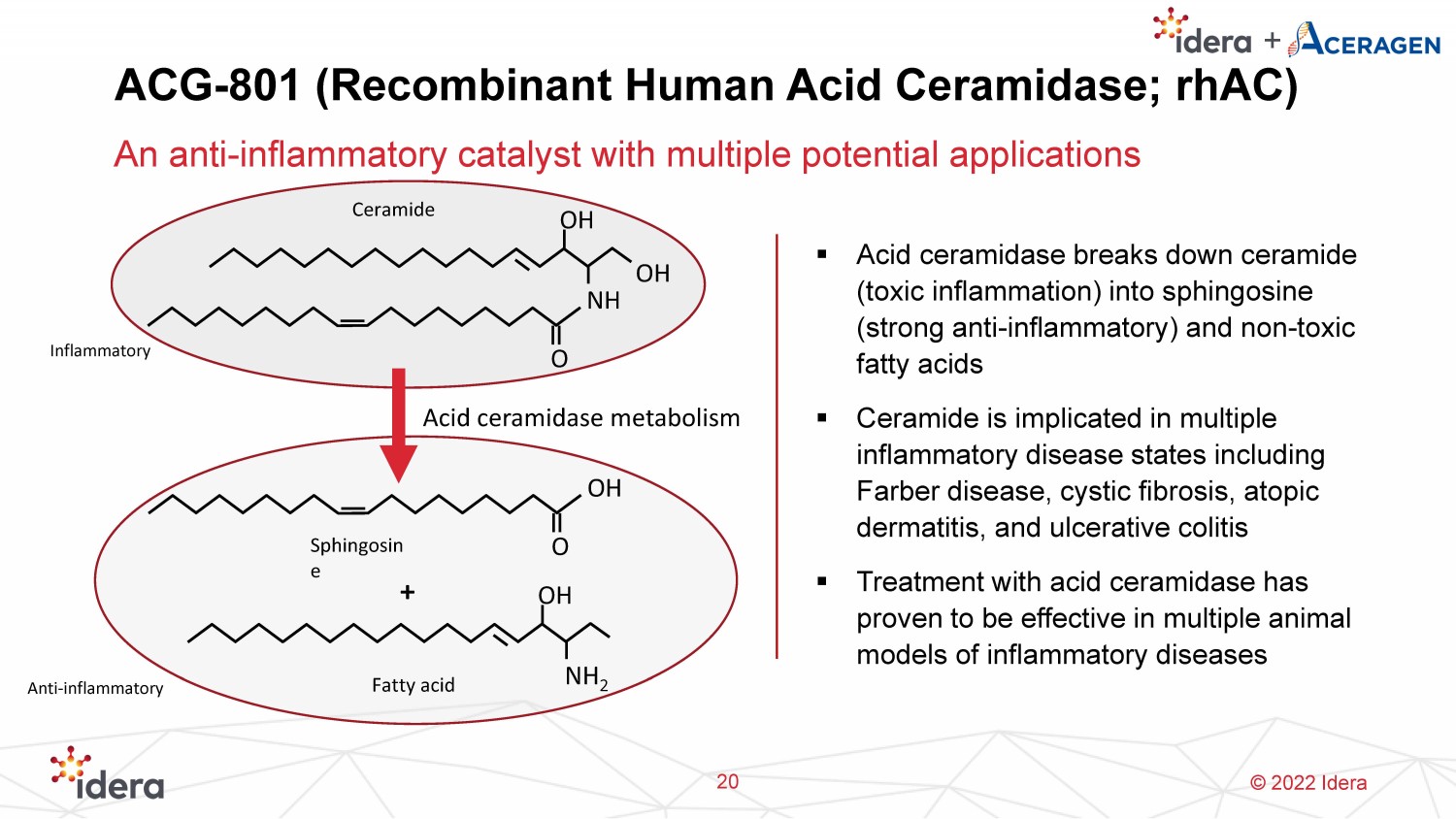

© 2022 Idera ACG - 801 (Recombinant Human Acid Ceramidase; rhAC ) An anti - inflammatory catalyst with multiple potential applications 20 ▪ Acid ceramidase breaks down ceramide (toxic inflammation) into sphingosine (strong anti - inflammatory) and non - toxic fatty acids ▪ Ceramide is implicated in multiple inflammatory disease states including Farber disease, cystic fibrosis, atopic dermatitis, and ulcerative colitis ▪ Treatment with acid ceramidase has proven to be effective in multiple animal models of inflammatory diseases O NH OH OH Ceramide O OH NH 2 OH Fatty acid Sphingosin e Acid ceramidase metabolism + Inflammatory Anti - inflammatory

© 2022 Idera Farber Disease • Mutations in the acid ceramidase gene lead to toxic levels of ceramide accumulation • Patients with the most severe phenotype die by age two, most commonly of respiratory failure • Worldwide prevalence is expected to be similar to MPS VI (1000+ patients) A progressive monogenic lysosomal storage disorder (LSD) Jarisch et al. Eur J Pediatr . 2014. $150M in worldwide annual peak sales estimated for ACG - 801 treatment of Farber 21

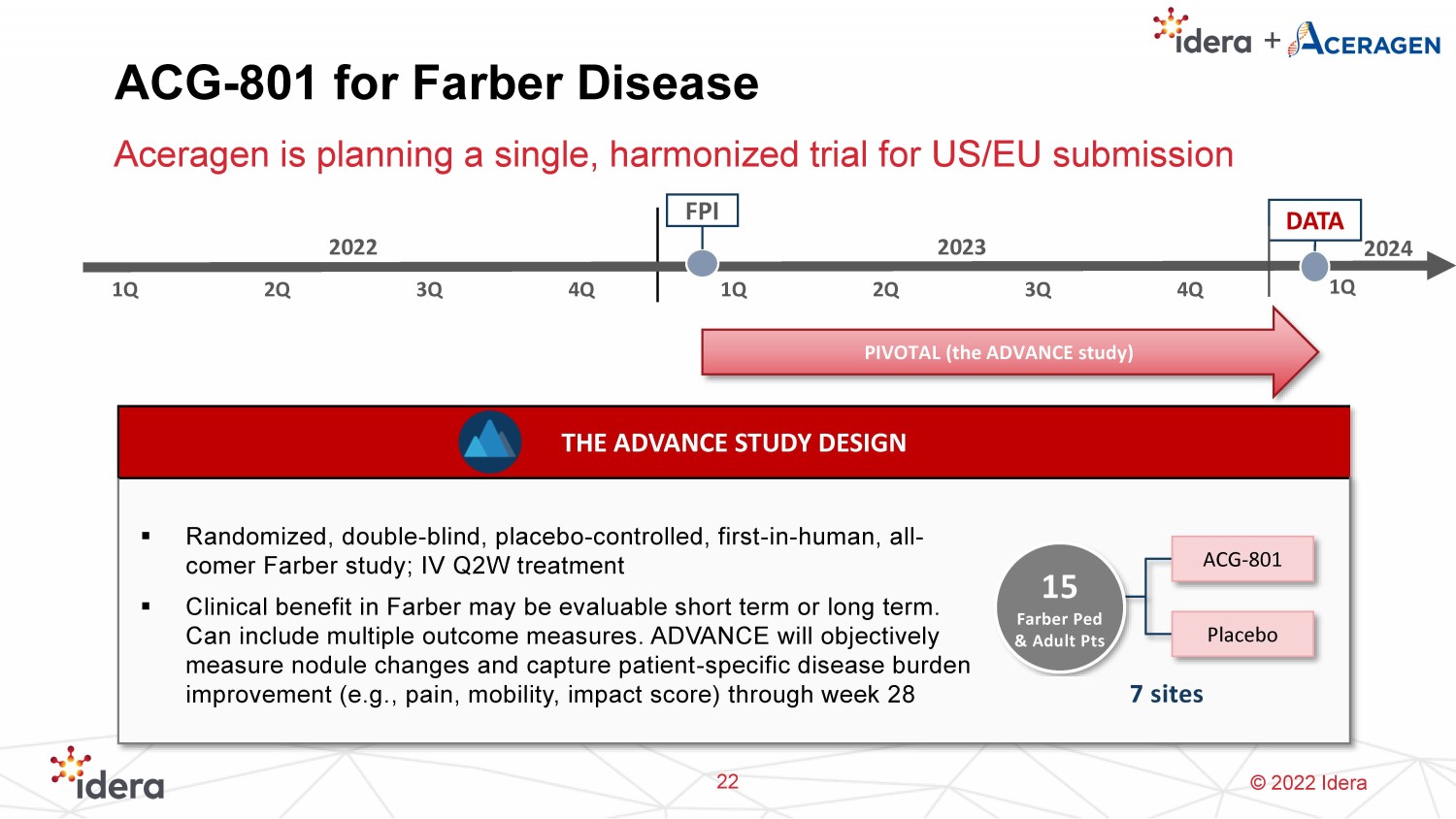

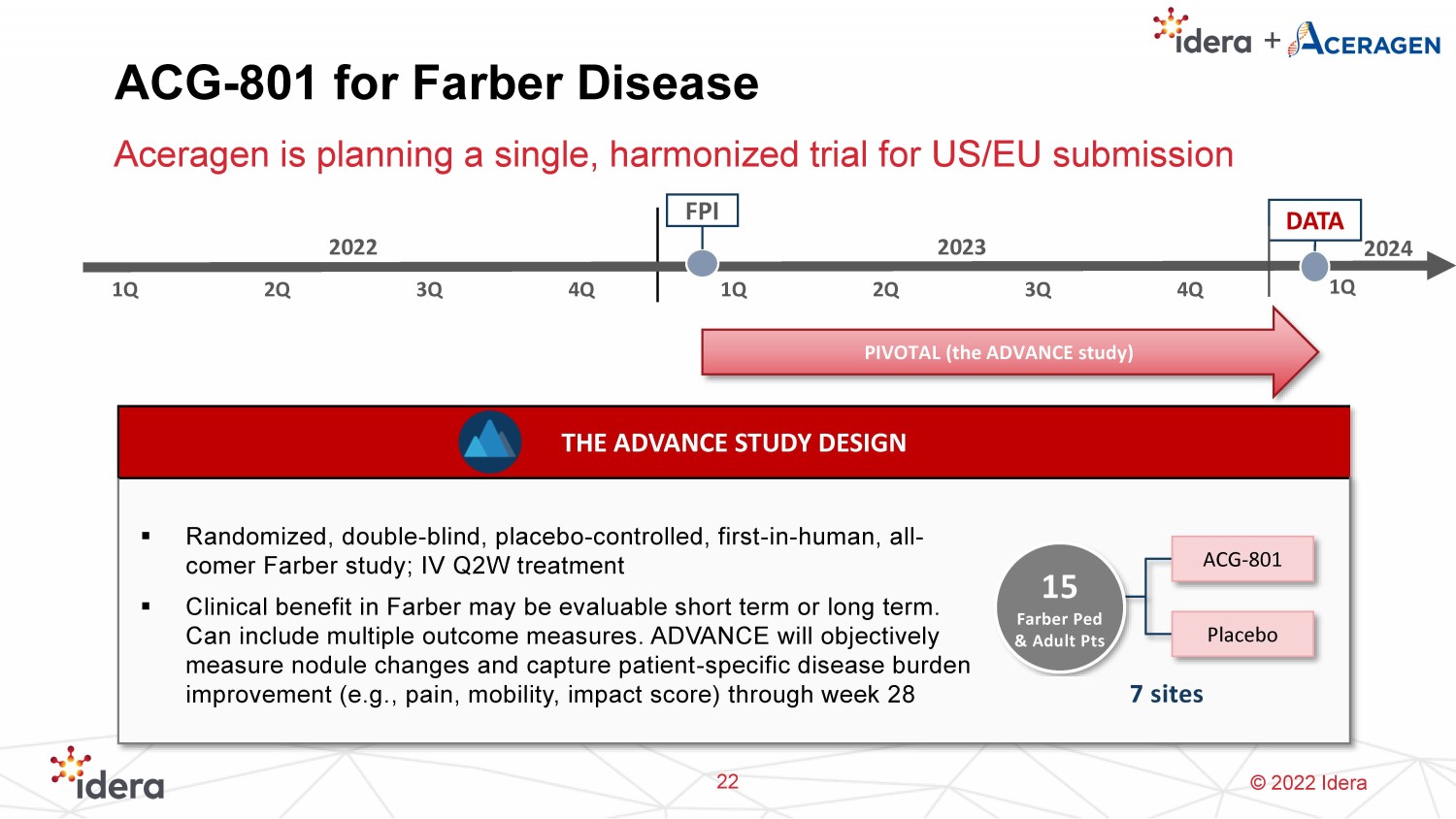

© 2022 Idera ACG - 801 for Farber Disease Aceragen is planning a single, harmonized trial for US/EU submission THE ADVANCE STUDY DESIGN ▪ Randomized, double - blind, placebo - controlled, first - in - human, all - comer Farber study; IV Q2W treatment ▪ Clinical benefit in Farber may be evaluable short term or long term. Can include multiple outcome measures. ADVANCE will objectively measure nodule changes and capture patient - specific disease burden improvement (e.g., pain, mobility, impact score) through week 28 2022 2023 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q FPI PIVOTAL (the ADVANCE study) DATA 15 Farber Ped & Adult Pts ACG - 801 7 sites Placebo 22 1Q 2024

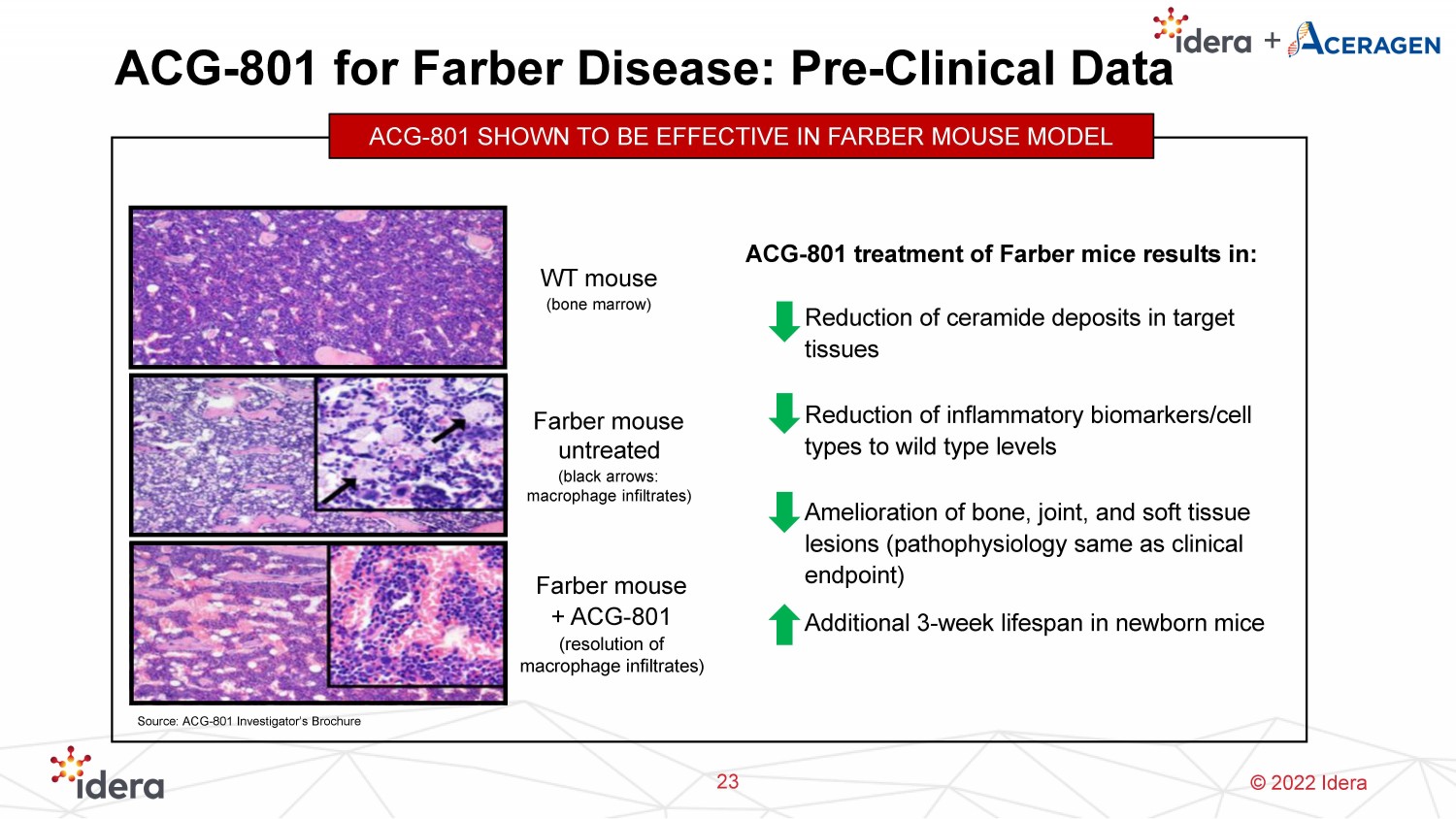

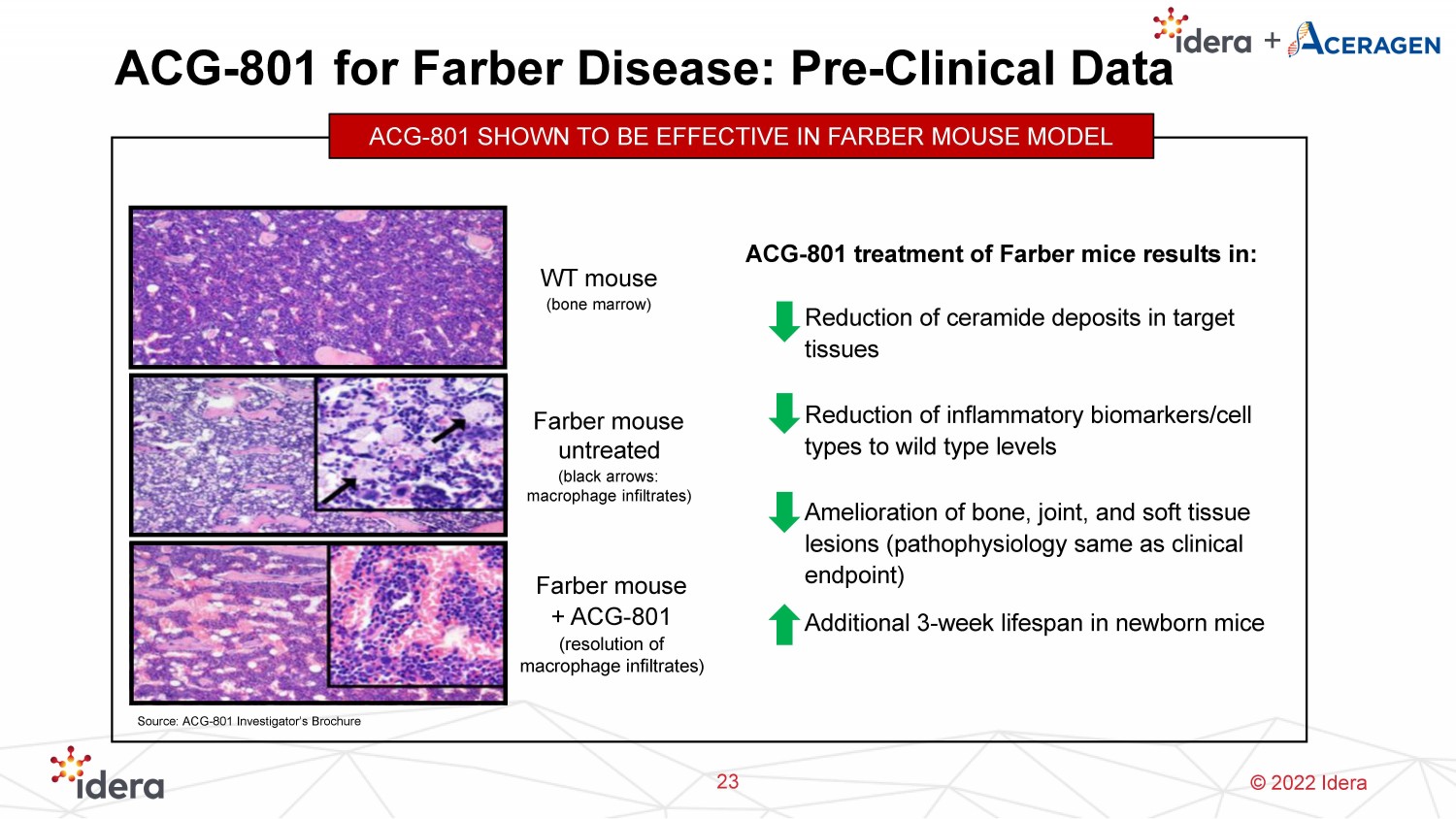

© 2022 Idera ACG - 801 for Farber Disease: Pre - Clinical Data 23 ACG - 801 SHOWN TO BE EFFECTIVE IN FARBER MOUSE MODEL Farber mouse + ACG - 801 (resolution of macrophage infiltrates) Farber mouse untreated (black arrows: macrophage infiltrates) WT mouse (bone marrow) ACG - 801 treatment of Farber mice results in: ▪ Reduction of ceramide deposits in target tissues ▪ Reduction of inflammatory biomarkers/cell types to wild type levels ▪ Amelioration of bone, joint, and soft tissue lesions (pathophysiology same as clinical endpoint) ▪ Additional 3 - week lifespan in newborn mice Source: ACG - 801 Investigator’s Brochure

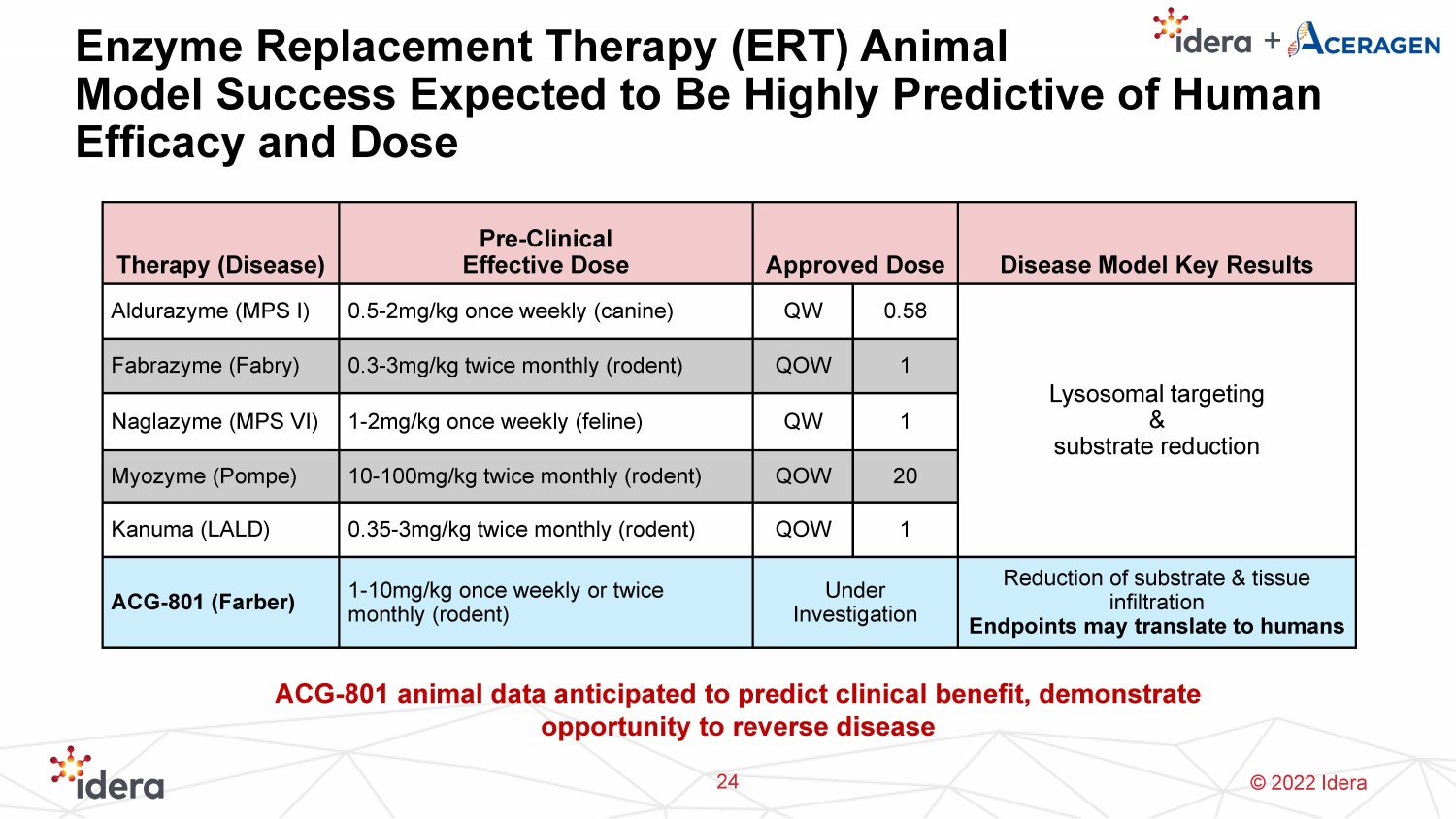

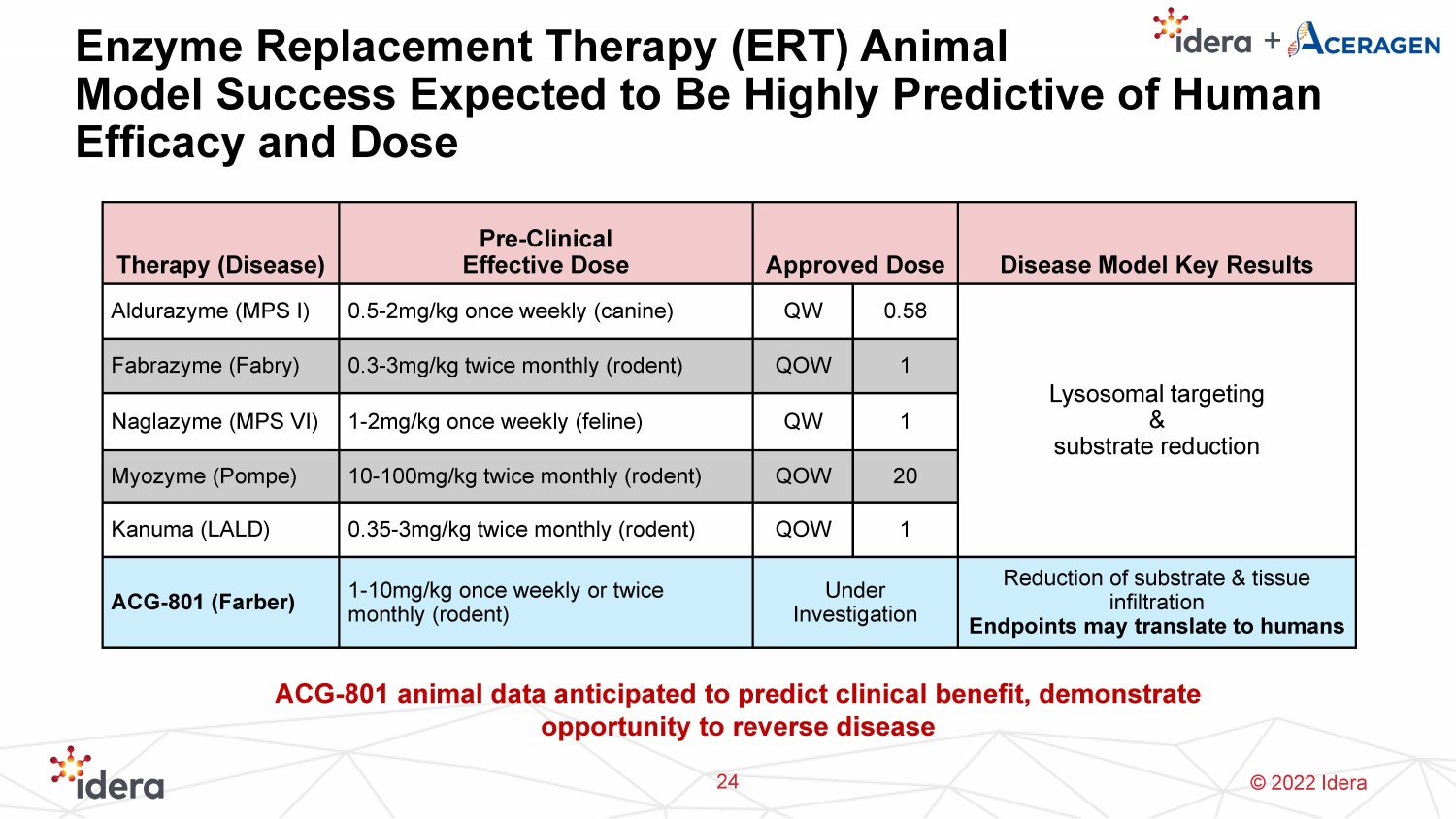

© 2022 Idera Enzyme Replacement Therapy (ERT) Animal Model Success Expected to Be Highly Predictive of Human Efficacy and Dose 24 Therapy (Disease) Pre - Clinical Effective Dose Approved Dose Disease Model Key Results Aldurazyme (MPS I) 0.5 - 2mg/kg once weekly (canine) QW 0.58 Lysosomal targeting & substrate reduction Fabrazyme (Fabry) 0.3 - 3mg/kg twice monthly (rodent) QOW 1 Naglazyme (MPS VI) 1 - 2mg/kg once weekly (feline) QW 1 Myozyme ( Pompe ) 10 - 100mg/kg twice monthly (rodent) QOW 20 Kanuma (LALD) 0.35 - 3mg/kg twice monthly (rodent) QOW 1 ACG - 801 (Farber) 1 - 10mg/kg once weekly or twice monthly (rodent) Under Investigation Reduction of substrate & tissue infiltration E ndpoints may translate to humans ACG - 801 animal data anticipated to predict clinical benefit, demonstrate opportunity to reverse disease

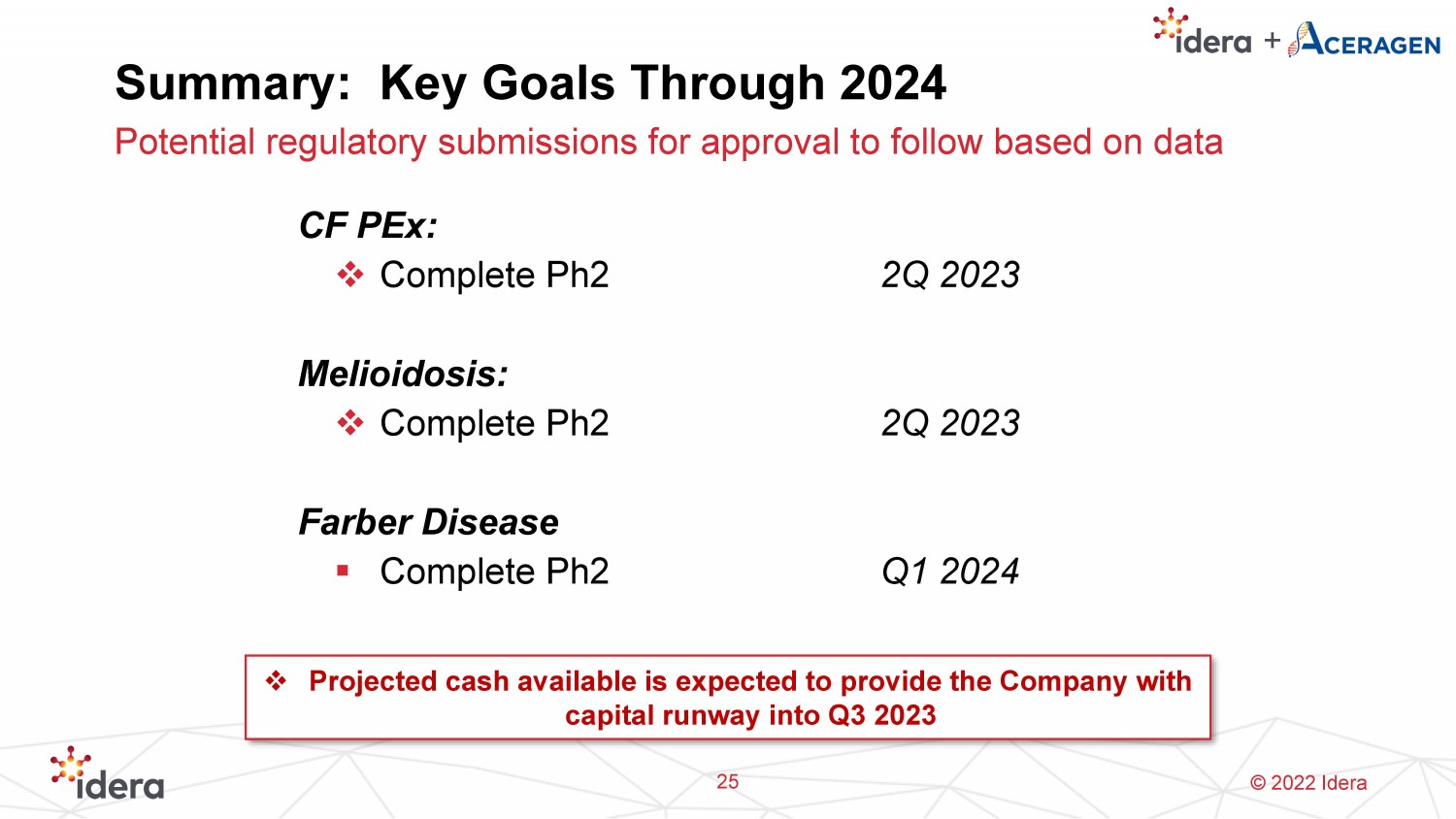

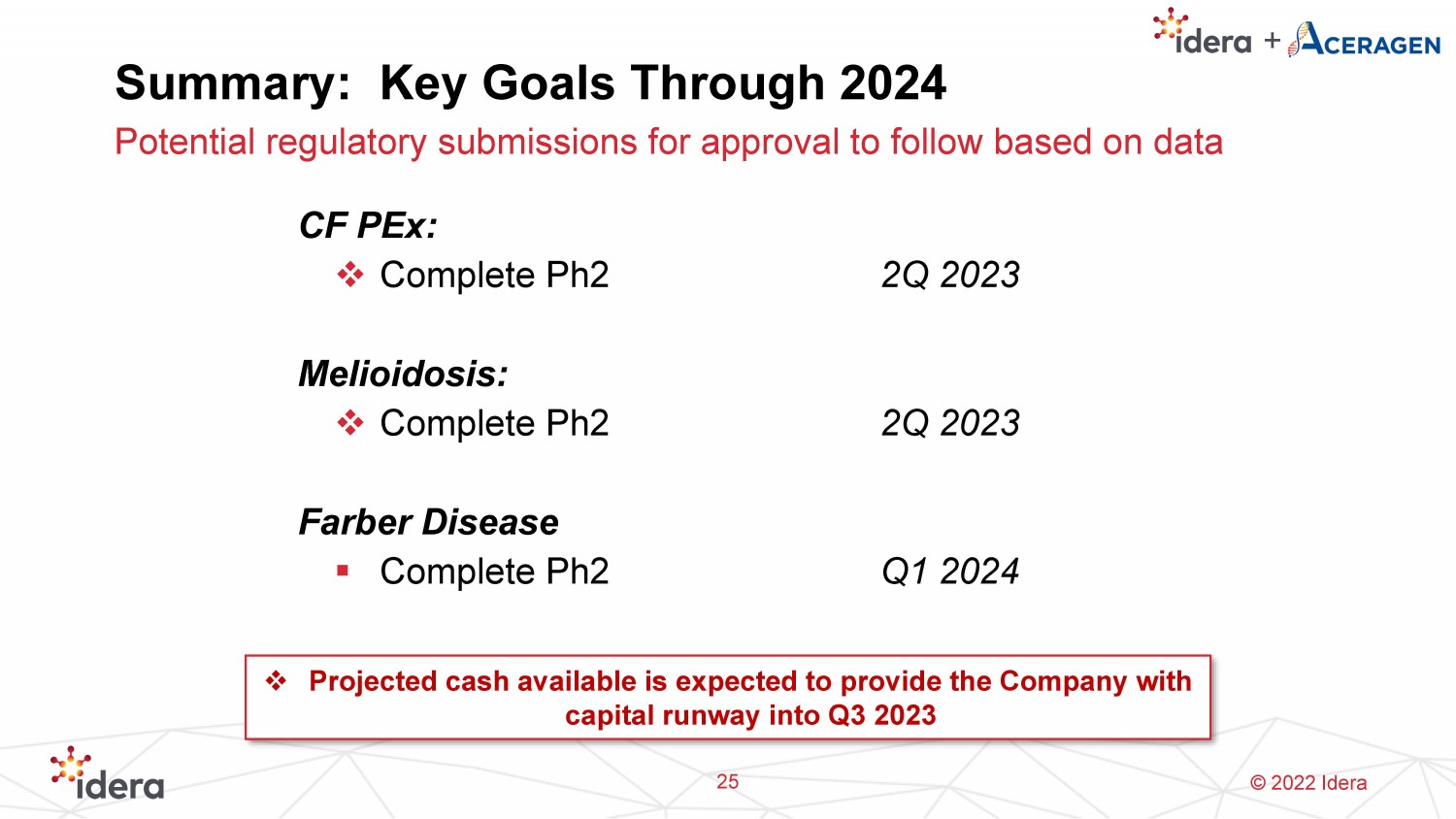

© 2022 Idera Summary: Key Goals Through 2024 CF PEx : □ Complete Ph2 2Q 2023 Melioidosis: □ Complete Ph2 2Q 2023 Farber Disease ▪ Complete Ph2 Q1 2024 Potential regulatory submissions for approval to follow based on data 25 □ Projected cash available is expected to provide the Company with capital runway into Q3 2023