SCHEDULE 14A

(Rule 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||||

| ¨ | Definitive Additional Materials | |||||

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12. | |||||

Cathay General Bancorp

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Explanatory Note:

On March 16, 2004, Cathay General Bancorp (the “Company”) filed with the Securities and Exchange Commission a definitive proxy statement dated March 18, 2004 (the “Proxy Statement”) for the Annual Meeting of Stockholders to be held on April 19, 2004. After the filing of the Proxy Statement but prior to the mailing of the Proxy Statement to its stockholders, the Company discovered that the Proxy Statement did not include certain information. In order to provide the omitted information, the Company is amending and restating the Proxy Statement (as amended and restated, the “Amended and Restated Proxy Statement”) to include the following:

| • | The section of the Proxy Statement captioned ELECTION OF DIRECTORS—Security Ownership of Nominees, Continuing Directors, and Named Executive Officers—was supplemented by the following information: |

Thomas C.T. Chiu is a brother-in-law to Peter Wu.

| • | The section of the Proxy Statement captioned THE BOARD OF DIRECTORS was supplemented by adding the following: |

“Director Independence

The Board of Directors has determined that the following six of its thirteen members are “independent” as defined in the Nasdaq listing standards established by the National Association of Securities Dealers: Kelly L. Chan, Wing K. Fat, Patrick S.D. Lee, Ting Y. Liu, Joseph C.H. Poon, and Thomas G. Tartaglia. Bancorp has a staggered board. As such, pursuant to NASD Rule 4350(a)(5), with the exception of the Audit Committee requirements, Bancorp has until its annual meeting of stockholders in 2005 to implement all of the new Nasdaq listing requirements relating to board composition.”

| • | The section of the Proxy Statement captioned COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION was supplemented by the following information: |

Beginning on November 20, 2003, Thomas C.T. Chiu became a member of the Equity Incentive Plan Committee and a member of the Cathay Bank Compensation Committee. Mr. Chiu is not an “independent” director as defined in the Nasdaq listing standards because he is a brother-in-law to Peter Wu.

The Company will only mail the Amended and Restated Proxy Statement to its stockholders.

777 NORTH BROADWAY

LOS ANGELES, CALIFORNIA 90012

To Our Stockholders:

We are pleased to invite you to attend the annual meeting of stockholders of Cathay General Bancorp. The meeting will be held on Monday, April 19, 2004, at 5:00 p.m., local time, at 777 North Broadway, Los Angeles, California 90012.

At the meeting, you will be asked to elect four Class II directors to serve until 2007.

We look forward to seeing you at the meeting.

Sincerely yours, |

|

Michael M.Y. Chang Secretary |

March 18, 2004

Los Angeles, California

777 NORTH BROADWAY

LOS ANGELES, CALIFORNIA 90012

Notice of Annual Meeting of Stockholders

to be Held on April 19, 2004

Notice is hereby given that the annual meeting of stockholders of Cathay General Bancorp will be held on Monday, April 19, 2004, at 5:00 p.m., local time, at 777 North Broadway, Los Angeles, California 90012, for the following purposes:

| 1. | To elect four Class II directors to serve until the 2007 annual meeting of stockholders and their successors have been elected and qualified; and |

| 2. | To transact such other business as may properly come before the meeting or any adjournments or postponements of the meeting. |

The Board of Directors has fixed March 5, 2004, as the record date for the meeting. Only holders of record of common stock at the close of business on the record date are entitled to receive notice of and to vote at the meeting.

Please vote, sign, and date the enclosed proxy card and return it in the accompanying envelope. If you mail the envelope in the United States, it does not require postage.It is important that you return the proxy card promptly even if you plan to attend the meeting.

We invite you to attend the meeting in person. If you attend, you may choose to revoke your proxy and vote in person at the meeting. If you do so, your proxy card will be disregarded.

By Order of the Board of Directors |

|

Michael M.Y. Chang Secretary |

March 18, 2004

Los Angeles, California

777 NORTH BROADWAY

LOS ANGELES, CALIFORNIA 90012

Proxy Statement

Annual Meeting of Stockholders

April 19, 2004

The Board of Directors of Cathay General Bancorp is furnishing this proxy statement to the holders of record of Bancorp’s common stock to solicit proxies, including the proxy granted by the enclosed proxy card, for use at the 2004 annual meeting of stockholders of Bancorp and any adjournments or postponements of the meeting. In this proxy statement, “Bancorp,” “we,” “us,” and “our” refer to Cathay General Bancorp.

At the meeting, our stockholders will be asked to:

| • | Elect four Class II directors to serve until the 2007 annual meeting of stockholders and their successors have been elected and qualified; and |

| • | Transact such other business as may properly be brought before the meeting or any adjournments or postponements of the meeting. |

Please vote by completing the enclosed proxy card and returning it signed and dated in the enclosed postage-prepaid envelope. If you properly complete the proxy card and Bancorp receives it before the voting, the proxy holders named in the proxy card will vote your shares of common stock as you direct on the proxy card. If you give no direction on the proxy card, the proxy holders will vote your shares in favor of the election of Kelly L. Chan, Dunson K. Cheng, Thomas C.T. Chiu, and Joseph C.H. Poon as directors. Under Delaware law, the inspector of elections for the meeting may consider evidence deemed to be reliable to reconcile proxies and ballots submitted by banks, brokers, their nominees or similar persons that represent more votes than the holder of a proxy is authorized by the record holder to cast or more votes than the stockholder holds of record.

The Board of Directors knows of no other proposal to be presented for consideration at the meeting. The proxy holders named in the enclosed proxy card reserve the right to vote your shares in accordance with their best judgment on any proposal that does properly come before the meeting or to vote your shares for other persons if any nominee for director becomes unavailable to serve.

You may revoke your proxy at any time before it is exercised by filing a written notice of revocation with Bancorp’s Secretary or delivering to Bancorp’s Secretary a later signed and dated proxy card. You may also revoke your proxy if you are present at the meeting and vote in person. This proxy statement and the enclosed proxy card were first mailed to stockholders on or about March 18, 2004.

QUORUM AND VOTING

The Board of Directors has fixed March 5, 2004, as the record date for the meeting. Only holders of record of Bancorp’s common stock at the close of business on the record date are entitled to notice of and to vote at the meeting. On the record date, 24,857,133 shares of Bancorp’s common stock were outstanding. Each stockholder of record is entitled to one vote for each share of common stock registered in the stockholder’s name. Cumulative voting isnot available for the election of directors.

It is important that stockholders be represented in person or by proxy at the meeting. The presence in person or by proxy of the holders of a majority of the outstanding shares of our common stock is necessary to constitute a quorum for the transaction of business. If the shares represented at the meeting are not sufficient to constitute a quorum or to elect the nominees for director, we may adjourn or postpone the meeting to permit further solicitation of proxies.

Persons receiving a plurality of the votes cast at the meeting will be elected directors. Plurality means that the persons who receive the largest number of votes cast are elected as directors up to the maximum number of directors to be chosen at the meeting.

Abstentions and broker non-votes are counted for purposes of establishing a quorum. However, they are not counted and have no effect in determining whether a nominee or the nominees have been elected. The term “broker non-votes” refers to shares held by a broker in street name that are present by proxy but are not voted on the matter pursuant to rules prohibiting brokers from voting on non-routine matters without instructions from the beneficial owners.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Based on the contents of reports filed with the Securities and Exchange Commission pursuant to Sections 13(d) and 13(g) of the Securities Exchange Act of 1934, the entity listed below is the beneficial owner of more than five percent of our common stock as of December 31, 2003.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership of Common Stock | Percentage of Common Stock Beneficially Owned1/ | ||||

Capital Research and Management Company 333 South Hope Street, Los Angeles, CA 90071 | 1,271,400 | 2/ | 5.12 | % |

| 1/ | The ownership percentage is determined by dividing the number of shares shown in this table by 24,833,124, which is the number of shares of Bancorp common stock issued and outstanding as of February 18, 2004. |

| 2/ | The number of shares in this table and the information in this footnote is derived from the Schedule 13G dated as of February 10, 2004, filed with the Securities and Exchange Commission by Capital Research and Management Company. According to this Schedule 13G filing, Capital Research and Management Company, an investment adviser registered under Section 203 of the Investment Advisers Act of 1940, is deemed to be beneficial owner of 1,271,400 shares or 5.1% of the outstanding common stock of Bancorp as of December 31, 2003, as a result of acting as investment adviser to various investment companies registered under Section 8 of the Investment Company Act of 1940. |

As of February 18, 2004, our directors and executive officers named in this proxy statement, and their affiliates, including the Cathay Bank Employee Stock Ownership Trust (the ESOPT), were entitled to vote approximately 3,697,792 shares of our common stock. These shares represent approximately 14.89% of the outstanding shares of our common stock as of February 18, 2004. If shares held by the ESOPT that have been allocated to persons other than our directors and executive officers named in this proxy statement are excluded from this total, as of February 18, 2004, our directors and named executive officers were entitled to vote approximately 2,826,428 shares of our common stock. These shares represent approximately 11.38% of the outstanding shares of our common stock

2

as of February 18, 2004. The individual security ownership of our directors and executive officers can be found in the section of this proxy statement entitled Security Ownership of Nominees, Continuing Directors, and Named Executive Officers.Our directors and executive officers have informed us that they intend to vote for the election of Kelly L. Chan, Dunson K. Cheng, Joseph C.H. Poon, and Thomas C.T. Chiu.

Shares of our common stock beneficially owned by the ESOPT have been allocated among the participants of the Cathay Bank Employee Stock Ownership Plan. Each participant has the power to direct the vote of his or her allocated shares. The ESOPT Committee has the sole power to vote and dispose of all unallocated shares of our common stock beneficially owned by the ESOPT. As of February 18, 2004, the ESOPT held approximately 978,262 shares of Bancorp common stock, of which approximately 2,545 shares are unallocated. Dunson K. Cheng, Peter Wu, Kelly L. Chan, George T.M. Ching, Joseph C.H. Poon, and Anthony M. Tang are members of the ESOPT Committee.

ELECTION OF DIRECTORS

Under our certificate of incorporation, the Board of Directors may consist of between 3 and 25 directors. Our Board currently consists of thirteen directors, each of whom is also a director of Cathay Bank, a California-chartered bank and wholly-owned subsidiary of Bancorp. Our Board has three classes of directors. The term of office of each class of directors is three years. The current term of the Class II directors will expire at the 2004 annual meeting of stockholders. The current term of the Class III directors will expire at the 2005 annual meeting of stockholders. The current term of the Class I directors will expire at the 2006 annual meeting of stockholders.

Stockholders are being asked to elect four Class II directors. The Class II directors will hold office until the 2007 annual meeting of stockholders and their successors have been elected and qualified. Our Board has nominated Kelly L. Chan, Dunson K. Cheng, Thomas C.T. Chiu, and Joseph C.H. Poon to serve as Class II directors. All of the nominees are currently directors of Bancorp and Cathay Bank, and have served continuously in these capacities since the dates indicated below. If any nominee named in this proxy statement becomes unavailable for any reason, or if any vacancy on the Board of Directors occurs before the election, the shares represented by any proxy voting for that nominee will be voted for the person that may be designated by the Board of Directors to replace that nominee or to fill that vacancy on the Board. However, the Board of Directors does not believe that any nominee will be unavailable or that any vacancy will occur.

The Board of Directors recommends a voteFORthe election of Kelly L. Chan, Dunson K. Cheng, Thomas C.T. Chiu, and Joseph C.H. Poon as Class II directors.

Security Ownership of Nominees, Continuing Directors, and Named Executive Officers

The following table sets forth:

| • | The periods each nominee and director have served as a director of Bancorp. |

| • | Information on the beneficial ownership, as that term is defined under Securities and Exchange Commission rules and regulations, of shares of our common stock held as of February 18, 2004, for the meeting by each nominee and director, by the chief executive and the other four highest paid executive officers, and all the directors and named executive officers as a group. |

3

Each nominee, director, and named executive officer has furnished the information on his or her own beneficial ownership set forth in the following table.

Name | Age | Director of Bancorp Since | Common Stock Beneficially Owned as of February 18, 2004 | Percentage Ownership as of February 18, 2004 | ||||||

Nominees for Election at the Meeting for the Term Ending in 2007 (Class II): | ||||||||||

Kelly L. Chan1/ | 57 | 1990 | 209,281 | 2/ | 0.84 | %2/ | ||||

Dunson K. Cheng | 59 | 1990 | 437,605 | 3/ | 1.76 | %3/ | ||||

Thomas C.T. Chiu4/ | 56 | 2003 | 123,392 | 5/ | 0.50 | %5/ | ||||

Joseph C.H. Poon | 57 | 1990 | 28,945 | 6/ | 0.12 | %6/ | ||||

Directors Currently Serving Term Ending in 2005 (Class III): | ||||||||||

George T.M. Ching | 89 | 1990 | 178,873 | 7/ | 0.72 | %7/ | ||||

Wing K. Fat1/ | 77 | 1990 | 263,116 | 8/ | 1.06 | %8/ | ||||

Ting Y. Liu | 67 | 2003 | 202,894 | 9/ | 0.82 | %9/ | ||||

Wilbur K. Woo | 88 | 1990 | 273,429 | 10/ | 1.10 | %10/ | ||||

Directors Currently Serving Term Ending in 2006 (Class I): | ||||||||||

Michael M.Y. Chang | 67 | 1990 | 292,216 | 11/ | 1.18 | %11/ | ||||

Patrick S.D. Lee | 69 | 1990 | 132,752 | 12/ | 0.53 | %12/ | ||||

Anthony M. Tang | 50 | 1990 | 420,633 | 13/ | 1.69 | %13/ | ||||

Thomas G. Tartaglia | 80 | 1990 | 40,321 | 14/ | 0.16 | %14/ | ||||

Peter Wu4/ | 55 | 2003 | 565,505 | 15/ | 2.28 | %15/ | ||||

Other Named Executive Officers: | ||||||||||

Heng W. Chen | 51 | — | 0 | 0.00 | % | |||||

Irwin Wong | 55 | — | 31,290 | 16/ | 0.13 | %16/ | ||||

James R. Brewer | 51 | — | 0 | 0.00 | % | |||||

All directors and named officers as a group (16 persons) | 3,200,252 | 17/ | 12.89 | %17/ | ||||||

| 1/ | Kelly L. Chan is the nephew, by marriage, of Wing K. Fat. |

| 2/ | Includes approximately 29,144 shares held by the Kelly and Barbara Chan Living Trust, 3,900 shares held by Mr. Chan’s spouse, approximately 9,830 shares held by Mr. Chan as custodian for his children, approximately 15,342 shares held by Chansons Properties, 100,000 shares held as Trustee of the WHFC Chan Grandchildren Sprinkling Trust, 3,180 shares issuable under options exercisable within 60 days of February 18, 2004, and approximately 2,545 shares held as unallocated shares by the ESOPT. Mr. Chan is a member of the ESOPT Committee and, as such, may be deemed to be a beneficial owner of unallocated ESOPT shares. |

| 3/ | Includes approximately 119,082 shares held by the Dunson Cheng and Cynthia Cheng Trust, approximately 46,476 shares held by the ESOPT which have been allocated to Mr. Cheng’s account, 117,746 shares issuable under options exercisable within 60 days of February 18, 2004, and approximately 2,545 shares held as unallocated shares by the ESOPT. Mr. Cheng is a member of the ESOPT Committee and, as such, may be deemed to be a beneficial owner of unallocated ESOPT shares. |

4

| 4/ | Thomas C.T. Chiu is a brother-in-law to Peter Wu. |

| 5/ | Includes approximately 60,570 shares held jointly by Dr. Chiu and his spouse, approximately 14,455 shares held by Dr. Chiu’s spouse, approximately 29,867 shares by Dr. Chiu’s Pension Plan, and 10,240 shares issuable under options exercisable within 60 days of February 18, 2004. |

| 6/ | Consists of 23,220 shares held by the Poon Family Trust, 3,180 shares issuable under options exercisable within 60 days of February 18, 2004, and approximately 2,545 shares held as unallocated shares by the ESOPT. Mr. Poon is a member of the ESOPT Committee and, as such, may be deemed to be a beneficial owner of unallocated ESOPT shares. |

| 7/ | Includes 155,186 shares held by the Ching Family Trust, approximately 6,814 shares held by Mr. Ching’s spouse, 1,180 shares issuable under options exercisable within 60 days of February 18, 2004, and approximately 2,545 shares held as unallocated shares by the ESOPT. Mr. Ching is a member of the ESOPT Committee and, as such, may be deemed to be a beneficial owner of unallocated ESOPT shares. |

| 8/ | Includes approximately 117,744 shares held by the Fat Family Trust, approximately 132,262 shares held by Frank Fat, Inc., approximately 10,030 shares held by Frank Fat Properties, and 1,680 shares issuable under options exercisable within 60 days of February 18, 2004. |

| 9/ | Includes 189,832 shares held by the Liu Family Inter Vivos Trust, and 10,240 shares issuable under options exercisable within 60 days of February 18, 2004. |

| 10/ | Consists of 266,179 shares held by Mr. Woo as trustee of a living trust established by Mr. Woo and his spouse, 4,070 shares held by Mr. Woo as custodian for his daughter, and 3,180 shares issuable under options exercisable within 60 days of February 18, 2004. |

| 11/ | Consists of approximately 50,158 shares held jointly by Mr. Chang and his spouse, approximately 66,472 shares held by Mr. Chang as custodian for his children, approximately 68,000 shares held by Mr. Chang’s spouse, as custodian for their children, 104,406 shares held by the Michael and Judy Chang Family Trust, and 3,180 shares issuable under options exercisable within 60 days of February 18, 2004. |

| 12/ | Consists of 129,572 shares held by Mr. Lee as trustee of the Lee Trust, and 3,180 shares issuable under options exercisable within 60 days of February 18, 2004. |

| 13/ | Includes 44,139 shares held by Mr. Tang as custodian for his children, approximately 120,431 shares held by Mr. Tang’s spouse, approximately 40,348 shares held by the ESOPT which have been allocated to Mr. Tang’s account, approximately 37,878 shares issuable under options exercisable within 60 days of February 18, 2004, and approximately 2,545 shares held as unallocated shares by the ESOPT. Mr. Tang is a member of the ESOPT Committee and, as such, may be deemed to be a beneficial owner of unallocated ESOPT shares. |

| 14/ | Consists of 30,682 shares held by the Thomas G. Tartaglia Trust, approximately 7,459 shares held by the ESOPT which have been allocated to Mr. Tartaglia’s account, and 2,180 shares issuable under options exercisable within 60 days of February 18, 2004. |

| 15/ | Includes 392,828 shares held by the Wu Trust, 25,063 shares held by Mr. Wu’s spouse as custodian for his children, 145,069 shares issuable under options exercisable within 60 days of February 18, 2004, and 2,545 shares held as unallocated shares by the ESOPT. |

| 16/ | Includes approximately 10,070 shares held by the ESOPT which have been allocated to Mr. Wong’s account, and 18,986 shares issuable under options exercisable within 60 days of February 18, 2004. |

| 17/ | Includes a total of 104,353 shares held by the ESOPT that have been allocated to the directors and named executive officers, 2,545 shares held as unallocated shares by the ESOPT and attributed to each of the six members of the ESOPT Committee (resulting in a total of 15,270 shares included in the 3,200,252 share total) and 361,099 shares issuable under options exercisable within 60 days of February 18, 2004. If the 2,545 unallocated ESOPT shares are counted once instead of being counted six times by being attributed to each ESOPT Committee member, the total shares of common stock beneficially owned by all directors and named officers as a group would be 3,187,527. |

5

Security Ownership in Subsidiary

In December 2003 and January 2004, Cathay Real Estate Investment Trust (“REIT”), a subsidiary of Cathay Bank, sold in a private placement 332,200 shares of its 7.0% Series A Non-Cumulative Preferred Shares (the “Series A Shares”) for $100 per share, of which Cathay Bank purchased 265,760 shares. The Series A Shares vote on a share for share basis with the common shares of REIT and are not convertible into common stock of the REIT or common stock of Cathay Bank or Bancorp. The REIT intends to continue to operate as a real estate investment trust under the Internal Revenue Code of 1986, as amended, by investing primarily in participation interests in a portion of Cathay Bank’s portfolio of loans secured, in whole or in part, by real estate and leasehold improvements which generate net income.

The information below sets forth the number of Series A Shares beneficially owned as of February 18, 2004, by each of the current directors, the nominees recommended by the Board of Directors for election as directors, each of the individuals included in the “Summary Compensation Table” below, and all current directors, nominees, and executive officers as a group. Except as otherwise noted in the footnotes below, each of these persons had sole voting and investment power with respect to the Series A Shares owned by him or her.

Name | Series A Shares Beneficially Owned | Series A Percent of Class | ||||

Michael M.Y. Chang | 2,500 | 1/ | 0.75 | % | ||

Heng W. Chen | 250 | 0.08 | % | |||

Dunson K. Cheng | 5,000 | 2/ | 1.51 | % | ||

George T.M. Ching | 2,500 | 3/ | 0.75 | % | ||

Wing K. Fat | 2,000 | 4/ | 0.60 | % | ||

Thomas G. Tartaglia | 1,000 | 5/ | 0.30 | % | ||

Wilbur K. Woo | 1,500 | 6/ | 0.45 | % | ||

All directors and named executive officers as a group (7 persons) | 14,750 | 4.44 | % | |||

| 1/ | The shares are jointly owned by Michael M.Y. Chang and Mr. Chang’s spouse. |

| 2/ | Includes 2,500 shares held by Mr. Cheng’s spouse. |

| 3/ | The shares are jointly owned by George T.M. Ching and Mr. Ching’s spouse. |

| 4/ | The shares are held by the Fat Family Trust. |

| 5/ | The shares are held by the Thomas G. Tartaglia Trust. |

| 6/ | The shares are held by the Beth & Wilbur Woo Family Foundation. |

Nominees, Continuing Directors, and Named Executive Officers

The principal occupations for at least the past five years of each nominee, director, and named executive officer is set forth as follows:

Nominees (Class II)

Kelly L. Chan, Director of Bancorp since 1990. Director of Cathay Bank since 1981. Certified Public Accountant. Owner of interest in and Vice President of Phoenix Bakery, Inc., a retail bakery in Los Angeles, California, since 1984.

6

Dunson K. Cheng, Director of Bancorp since 1990. Chairman of the Board of Directors of Bancorp, Cathay Bank, and Cathay Investment Company since 1994. President of Bancorp since 1990. President of Cathay Bank since 1985 and Director of Cathay Bank since 1982. President of Cathay Investment Company since 1999. Chief Executive Officer of Cathay Investment Company since 1995 and Director of Cathay Investment Company since 1984. Chairman of the Board of Directors and President of Cathay Securities Fund, Inc. from July, 2000 to January 2003. Trustee and President of Cathay Real Estate Investment Trust since February, 2003.

Thomas C.T. Chiu, Director of Bancorp and Cathay Bank since October 20, 2003. Medical doctor. Director of GBC Bancorp and General Bank from 1983 to October, 2003.

Joseph C.H. Poon, Director of Bancorp since 1990. Director of Cathay Bank since 1981. Director of Cathay Investment Company since 1984. Secretary and Chief Financial Officer of Cathay Investment Company from 1994 to 1998. President of Edward Properties since 1981 (real estate development).

Continuing Directors (Class III)

George T.M. Ching, Director of Bancorp since 1990. Vice Chairman of the Board of Directors of Bancorp since 1990. Director of Cathay Bank since 1962. Vice Chairman of the Board of Cathay Investment Company since May, 1999. President of Cathay Investment Company from 1985 until 1999 and Director of Cathay Investment Company since 1984.

Wing K. Fat, Director of Bancorp since 1990. Director of Cathay Bank since 1972. Owner of interest in and the President of Frank Fat Inc., a restaurant and real estate company, for over 40 years. Owner of interest in and Vice President of Fat City Inc., a restaurant company, since 1973. Director of River City Bank since 1973.

Ting Y. Liu, Director of Bancorp and Cathay Bank since October 20, 2003. Chairman of HITO Corporation since 1987. Director of GBC Bancorp and General Bank from 1981 to 2003.

Wilbur K. Woo, Director of Bancorp since 1990. Vice Chairman of the Board of Directors of Bancorp and Cathay Bank since November, 2001. Secretary of Bancorp from 1990 to November, 2001. Secretary of Cathay Bank from 1980 to November, 2001, and Director of Cathay Bank since 1978. Chief Financial Officer and Secretary of Cathay Investment Company since 1998 and Director of Cathay Investment Company since 1987.

Continuing Directors (Class I)

Michael M.Y. Chang, Director of Bancorp since 1990. Secretary of Bancorp and Cathay Bank since November, 2001. Director of Cathay Bank since 1983. Assistant Secretary of Bancorp and Cathay Bank from April, 2001 to November, 2001. Retired attorney at law.

Patrick S.D. Lee, Director of Bancorp since 1990. Director of Cathay Bank since 1983. Director of Cathay Investment Company since 1984; Vice President of T.C. Realty, Inc. (property management) until retirement in March, 2001. Trustee of Cathay Real Estate Investment Trust since February, 2003.

Anthony M. Tang, Director of Bancorp since 1990. Executive Vice President of Bancorp since 1994; Assistant Secretary of Bancorp from 1991 to April, 2001; and Chief Financial Officer and Treasurer of Bancorp from 1990 until June, 2003. Chief Lending Officer of Cathay Bank since 1985; Director of Cathay Bank since 1986; Assistant Secretary of Cathay Bank from 1994 to April, 2001; Senior Executive Vice President of Cathay Bank since December, 1998. Vice President, Chief Financial Officer, and Director of Cathay Securities Fund, Inc. from July, 2000 to January, 2003. Trustee and Vice President of Cathay Real Estate Investment Trust since February, 2003.

Thomas G. Tartaglia, Director of Bancorp since 1990. Director of Cathay Bank since 1986. Formerly Executive Vice President of Cathay Bank from 1984 until 1990.

7

Peter Wu, Director, Executive Vice Chairman, and Chief Operating Officer of Bancorp and Cathay Bank since October 20, 2003. Director of GBC Bancorp and General Bank from 1981 to October, 2003. Chairman of the Board of GBC Bancorp and General Bank from January, 2003 to October, 2003. President and Chief Executive Officer of GBC Bancorp and General Bank from January, 2001 to October, 2003. President and Chief Operating Officer of GBC Bancorp and General Bank from 1998 to December, 2000. Secretary of GBC Bancorp and General Bank from 1979 to January, 2001. Executive Vice President of GBC Bancorp from 1981 to March, 1998. Executive Vice President and Chief Operating Officer of General Bank from January, 1995 to March, 1998.

Other Named Executive Officers

Heng W. Chen, Executive Vice President of Bancorp and Cathay Bank since June, 2003. Chief Financial Officer, and Treasurer of Bancorp since June, 2003. Vice President and Chief Financial Officer of Cathay Real Estate Investment Trust since December, 2003. Chief Financial Officer of Cathay Bank since January 1, 2004. Assistant Chief Financial Officer and Assistant Treasurer at City National Corporation from 1998 to June, 2003, Executive Vice President-Finance at City National Bank from 1984 to June, 2003.

Irwin Wong, Executive Vice President-Branch Administration for Cathay Bank since 1999. Senior Vice President-Branch Administration of Cathay Bank from 1989 until 1999. Treasurer of Cathay Real Estate Investment Trust from February, 2003 until December, 2003.

James R. Brewer, Executive Vice President-Credit Administration for Cathay Bank since August, 2003. Senior Vice President-Credit Administration for Cathay Bank from February, 2002 to August, 2003. President and Chief Executive Officer for First Charter Bank from September, 1996 to October, 2001. Consultant for First Charter Bank from October, 2001 to February, 2002.

THE BOARD OF DIRECTORS

The Bancorp Board of Directors generally holds regular meetings on a monthly basis. Special meetings are called when necessary. During 2003, the Bancorp Board of Directors held 13 meetings and each director attended at least 75% of these meetings. The Bancorp Board of Directors has six standing committees: the Executive Committee, the ESOPT Committee, the Equity Incentive Plan Committee, the Audit Committee, the Nomination Committee, and the Investment Committee. It is the policy of Bancorp to invite and encourage all members of the Board of Directors to attend Bancorp’s annual meeting of stockholders. In 2003, all but one of Bancorp’s Directors attended the annual meeting.

Peter Wu, Thomas C.T. Chiu, and Ting Y. Liu joined the Board of Directors on October 20, 2003, upon completion of Bancorp’s merger with GBC Bancorp. Effective as of November 18, 2003, Ralph Roy Buon-Cristiani resigned as a director due to personal health reasons.

Director Independence

The Board of Directors has determined that the following six of its thirteen members are “independent” as defined in the Nasdaq listing standards established by the National Association of Securities Dealers: Kelly L. Chan, Wing K. Fat, Patrick S.D. Lee, Ting Y. Liu, Joseph C.H. Poon, and Thomas G. Tartaglia. Bancorp has a staggered board. As such, pursuant to NASD Rule 4350(a)(5), with the exception of the Audit Committee requirements, Bancorp has until its annual meeting of stockholders in 2005 to implement all of the new Nasdaq listing requirements relating to board composition.

8

Executive Committee

During 2003, the Executive Committee consisted of Dunson K. Cheng (Chairman), Peter Wu (beginning November 20, 2003), George T.M. Ching, Anthony M. Tang, and Thomas G. Tartaglia. This committee exercises all powers of the Bancorp Board of Directors in the intervals between Board meetings, except for those powers that the Board has delegated to other committees or that are reserved to the full Board of Directors by statute, charter, or bylaws. The Executive Committee met 13 times during 2003, and each committee member attended all meetings of this committee while he was a member.

ESOPT Committee

During 2003, the ESOPT Committee consisted of Dunson K. Cheng (Chairman), Peter Wu (beginning November 20, 2003), Kelly L. Chan, George T.M. Ching, Joseph C.H. Poon, and Anthony M. Tang. This committee administers the ESOPT according to plan provisions and applicable governmental regulations. It is responsible for, among other things, the investment and management of the ESOPT’s assets. The ESOPT Committee met two times during 2003. Each committee member attended all of the meetings of this committee that were held while he was a member.

Equity Incentive Plan Committee

During 2003, the Equity Incentive Plan Committee consisted of Joseph C.H. Poon (Chairman), Thomas C.T. Chiu (beginning November 20, 2003), Ralph Roy Buon-Cristiani (until November 18, 2003), Michael M.Y. Chang, and Wing K. Fat. This committee selects participants, including executive officers and directors, of Bancorp and its subsidiary Cathay Bank to receive awards under Bancorp’s Equity Incentive Plan. It has broad discretion to determine the amount and types of awards, and the terms and conditions of individual awards. The Equity Incentive Plan Committee met two times during 2003, and each committee member attended all meetings of this committee that were held while he was a member.

Audit Committee

During 2003, the Audit Committee consisted of Kelly L. Chan (Chairman), Ralph Roy Buon-Cristiani (until November 18, 2003), Ting Y. Liu (beginning November 20, 2003), and Thomas G. Tartaglia. This committee oversees Bancorp’s financial reporting on behalf of its Board of Directors. It recommends to the Board and evaluates Bancorp’s independent auditors, and reviews with the independent auditors the proposed scope of, fees for, and results of the annual audit. It reviews the system of internal accounting controls and the scope and results of internal audits with the independent auditors, the internal auditors, and Bancorp management. It considers the audit and non-audit services provided by the independent auditors, the proposed fees to be charged for each type of service, and the effect of non-audit services on the independence of the independent auditors. It also performs any other tasks assigned to it by the Board of Directors. The Audit Committee met 14 times during 2003. Each committee member attended all of the meetings of this committee that were held while he was a member.

The Board of Directors has adopted a written charter for the Audit Committee, which was revised and restated to reflect changes determined necessary and appropriate in response to the Sarbanes-Oxley Act and its related regulations and to amendments to the Nasdaq listing standards established by the National Association of Securities Dealers. A copy of that revised Audit Committee charter is attached to this proxy statement as Appendix A.

The Audit Committee does not have a policy for pre-approving services to be provided by the Bancorp’s independent auditor without review by the Audit Committee. All services to be provided to Bancorp by its independent auditor are subject to review and approval by the Audit Committee in advance of the performance of the services, provided that the Audit Committee will not approve any non-audit services proscribed by Section 10A(g) of the Exchange Act in the absence of an applicable exemption. The Audit Committee may delegate to a designated member or members of the Audit Committee the authority to approve such services so long as any such approval is reported to the full Audit Committee at its next scheduled meeting.

9

The Board of Directors conducted a review regarding whether each member of the Audit Committee qualifies as independent and determined that, during 2003, Messrs. Buon-Cristiani, Chan, Liu, and Tartaglia were each “independent” as defined in the Nasdaq listing standards of the National Association of Securities Dealers in effect during their membership on the Audit Committee. Bancorp’s Board of Directors also conducted a review regarding whether any members of the Audit Committee meet the criteria to be considered an “audit committee financial expert” and determined that at least one of the three members of the Audit Committee, Kelly L. Chan, its Chairman, qualifies as an “audit committee finanical expert” as defined in Item 401(h) of Regulation S-K of the Securities Exchange Act of 1934, as amended.

Nomination Committee

During 2003, the Nomination Committee consisted of George T.M. Ching (Chairman), Kelly L. Chan, and Joseph C.H. Poon. All members of the committee are independent except Mr. Ching, because he holds the title of Vice Chairman of Bancorp and Cathay Bank and is an officer of Cathay Investment Company. The Board believes it has been in the best interest of Bancorp and its stockholders to include Mr. Ching as a member of the Nomination Committee because, as one of the founders of Cathay Bank, his experience and wisdom accumulated from over 40 years with Cathay Bank and the community that it serves is of value to the Bancorp. Nevertheless, Mr. Ching will be replaced on this committee with an independent director. This committee identifies and evaluates candidates qualified to serve as members of the Board and makes recommendations to the Board regarding such candidates. Nominees for this 2004 annual meeting of stockholders were made and approved by a majority of the independent directors of the Board, with the nominees abstaining. The Nomination Committee met four times during 2003. Each committee member attended all of the meetings of this committee. The Nomination Committee has a charter, a current copy of which is attached to this proxy statement as Appendix B.

The policy of our Nomination Committee is to consider candidates properly recommended by our stockholders. In evaluating any such candidates, our Nomination Committee will consider the criteria described below. Any such recommendations should include the nominee’s name and qualifications for membership on our Board of Directors and should be directed to our Secretary, Cathay General Bancorp, 777 North Broadway, Los Angeles, California 90012. In addition, our bylaws permit stockholders to nominate directors for election at stockholder meetings. To nominate a director, stockholders must give timely notice to our Secretary in accordance with our bylaws, which require that the notice be received by our Secretary within the time periods described under “Stockholder Proposals” on page 25.

The Board and Nomination Committee consider potential nominees based on such criteria as depth and breadth of relevant experience, intelligence, personal character, integrity, commitment to the community and to Bancorp, knowledge of the business of banking, compatibility with the current Board culture, and prominence — all in the context of the perceived needs of the Board at the point in time of the consideration. Nominees must also be acceptable to banking regulators. Bancorp seeks to insure that at least a majority of the directors are independent under the NASDAQ listing rules and that members of Bancorp’s audit committee meet NASDAQ and the Federal Deposit Insurance Corporation requirements and that at least one of them qualifies as an “audit committee financial expert” under the rules of the Securities and Exchange Commission.

The process for identifying and evaluating candidates is commenced by the Board upon its determination of a need to fill a new position or vacancy. At the request of the Board, the Nomination Committee then seeks to identify potential candidates who meet the specific criteria given by the Board at the time of the request based on input from members of the Board and, if the Board deems appropriate, a third-party search firm. The process begins with conducting inquiries into the backgrounds and qualifications of such candidates. If the Nomination Committee determines that a candidate is qualified to serve as a director and that he or she should be recommended to the Board, the Board will then review the recommendation and the accompanying information. If the Board is interested in a proposed candidate, it will designate a member to contact the candidate to discuss the proposed nomination, and determine if the candidate is interested in the nomination and if there is any reason why the Board should not proceed with the nomination. Depending on the outcome, the next step in the process is for the candidate to meet with all members of the Board. Following these meetings, and using the input from such interviews and the

10

information obtained by the Nomination Committee, the Nomination Committee will evaluate whether the candidate meets the requisite qualifications and criteria and should be recommended to the Board. Candidates recommended by the Nomination Committee are then presented to the Board for selection as nominees for election by the stockholders or by the Board to fill a vacancy. The Nomination Committee expects that a similar process will be used to evaluate nominees recommended by stockholders.

Investment Committee

During 2003, the Investment Committee consisted of Dunson K. Cheng (Chairman), Peter Wu (beginning November 20, 2003), Joseph C.H. Poon, George T.M. Ching, and Kelly L. Chan. This committee oversees Bancorp’s investment and funds management policies at the holding company level. This committee exists along side the Investment Committee at Bancorp’s subsidiary, Cathay Bank. The Bancorp Investment Committee met three times during 2003. Each committee member attended all of the meetings of this committee while he was a member except for Mr. Chan, who was absent for one meeting.

Compensation of Directors

The current directors of Bancorp are also the current directors of Cathay Bank. As a result, the current policy for compensation of directors is that Cathay Bank pays each Cathay Bank director who is not also a full-time officer of Bancorp, Cathay Bank, or Cathay Investment Company a monthly fee of $1,500 plus $300 for each Cathay Bank Board committee meeting (other than loan committee meetings) and $350 for each Cathay Bank Board loan committee meeting attended by the director. In 2003, Cathay Bank also paid each Cathay Bank non-employee director $8,400 as a bonus. Cathay Investment Company currently pays each of its directors who is not a full-time officer of Bancorp, Cathay Bank, or Cathay Investment Company a fee of $200 for each of its Board of Directors meetings attended. Bancorp, Cathay Bank, and Cathay Investment Company reimburse directors for out-of-pocket expenses incurred in attending meetings of the Boards of Directors and Board committees and in traveling on company business. Cathay Bank pays Mr. Chang $1,500 per month for his services as Secretary of Bancorp and Cathay Bank. In addition to director fees paid to such persons, in 2003, Cathay Bank paid $22,425 to Mr. Woo for his service as an officer, and Cathay Investment Company paid $33,635 to Mr. Ching for his service as an officer.

Directors are also eligible to receive stock option grants and restricted stock awards under the Bancorp’s Equity Incentive Plan. On January 16, 2003, each non-employee director was granted nonqualified stock options to purchase 1,900 shares of our common stock at an exercise price of $39.85 per share (which was the closing price of our common stock on the date of grant). In addition, on November 20, 2003, each non-employee director was granted nonqualified stock options to purchase an additional 5,500 shares of our common stock at an exercise price of $49.60 per share (which was the closing price of our common stock on the date of grant). Both sets of option grants become exercisable in 20% increments over a five-year period. They terminate ten years from the date of grant, subject to early termination in the event of termination of directorship, disability, or death.

11

AUDIT COMMITTEE REPORT

As part of its ongoing activities, the Audit Committee has:

| • | Reviewed and discussed with management and Bancorp’s independent auditors Bancorp’s audited consolidated financial statements for the year ended December 31, 2003; |

| • | Discussed with Bancorp’s independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Codification of Statements on Auditing Standards, AU § 380), as may be modified or supplemented; and |

| • | Received the written disclosures and the letter from Bancorp’s independent auditors required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and has discussed with such independent auditors their independence. |

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited annual consolidated financial statements be included in Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2003.

| The Audit Committee: |

Kelly L. Chan Ting Y. Liu Thomas G. Tartaglia |

Professional Services Provided by Independent Auditors

KPMG LLP was Bancorp’s independent auditor during 2003. The following table presents fees for professional audit services rendered by KPMG LLP for the audits of Bancorp’s annual financial statements for 2003 and 2002, and fees billed or to be billed for other services rendered by KPMG LLP.

| 2003 | 2002 | ||||||

Audit fees | $ | 361,500 | 1/ | $ | 186,000 | ||

Audit related fees | 140,155 | 2/ | 20,000 | ||||

Tax fees | 240,445 | 3/ | 205,000 | ||||

All other fees | 0 | 0 | |||||

Total fees | $ | 742,100 | $ | 411,000 | |||

| 1/ | Audit fees consist of the aggregate fees billed by KPMG LLP in connection with the audit of Bancorp’s annual consolidated financial statements for the year ended December 31, 2003, and for the required review of Bancorp’s financial information included in its Quarterly Reports on Form 10-Q for 2003 and in its registration statements filed with the Securities and Exchange Commission during 2003. |

| 2/ | Audit related fees consisted of fees for audits of financial statements of certain employee benefit plans and due diligence services. After considering the matter, the Audit Committee does not believe the rendering of these services by KPMG LLP to be incompatible with maintaining the independence of KPMG LLP as Bancorp’s external auditor. |

| 3/ | Tax fees consisted of fees for tax consultation and tax compliance services. After considering the matter, the Audit Committee does not believe the rendering of these services by KPMG LLP to be incompatible with maintaining the independence of KPMG LLP as Bancorp’s external auditor. |

12

EXECUTIVE COMPENSATION

Remuneration of Executive Officers

The following table sets forth information regarding the compensation for services in all capacities paid or accrued for 2003 by Bancorp or Cathay Bank to the Chief Executive Officer and Chief Operating Officer of Bancorp and the four most highly compensated executive officers of either Bancorp or Cathay Bank.

Summary Compensation Table

| Annual Compensation | Long Term Compensation | ||||||||||||||||||||||||

Name and Principal Position | Year | Salary1/ ($) | Bonus ($) | Other Annual Compen- sation2/ ($) | Restricted ($) | Securities Underlying Options (#) | LTIP ($) | All Other ($) | |||||||||||||||||

| Dunson K. Cheng, Chairman of the Board of Directors, President, and Chief Executive Officer of Bancorp and Cathay Bank | 2003 2002 2001 | $ | 700,000 660,540 606,000 | | $ $ | 700,000 600,000 530,000 | | $ | 4,852 4,868 5,768 | | N/A N/A N/A | 395,865 39,660 37,080 | | N/A N/A N/A | $ | 21,372 19,120 16,905 | 4/ | ||||||||

| Peter Wu, Executive Vice Chairman, and Chief Operating Officer of Bancorp and Cathay Bank | 2003 2002 2001 | $ | 72,425 * * | 5/ | $ | 74,554 * * | 6/ | | 2,222 * * | 7/ | N/A * * | 0 * * | 8/ | N/A * * | $ | 730 * * | 9/ | ||||||||

| Anthony M. Tang, Executive Vice President of Bancorp and Senior Executive Vice President and Chief Lending Officer of Cathay Bank | 2003 2002 2001 | $ | 243,918 235,670 227,700 | | $ | 225,000 234,771 227,850 | | | 0 0 0 | | N/A N/A N/A | 76,320 13,000 13,180 | | N/A N/A N/A | $ | 20,402 18,057 16,463 | 10/ | ||||||||

| Heng W. Chen, Executive Vice President and Chief Financial Officer of Bancorp and Cathay Bank | 2003 2002 2001 | $ | 118,793 * * | 11/ | $ | 165,000 * * | | | 0 * * | | N/A * * | 24,870 * * | | N/A * * | $ | 2,398 * * | 12/ | ||||||||

| Irwin Wong, Executive Vice President for Branch Administration of Cathay Bank | 2003 2002 2001 | $ | 185,536 175,536 165,600 | | $ | 178,000 150,000 154,375 | | $ | 570 487 763 | | N/A N/A N/A | 90,310 9,240 8,060 | | N/A N/A N/A | $ | 19,302 17,788 16,147 | 13/ | ||||||||

| James R. Brewer, Executive Vice President for Credit Administration | 2003 2002 2001 | $ | 155,000 103,672 * | 15/ | | 85,000 43,200 * | | | 0 0 * | | N/A N/A * | 25,480 0 * | | N/A N/A * | $ | 5,075 2,392 * | 14/ | ||||||||

| * | Was not employed by Cathay General Bancorp or Cathay Bank during this period of time. |

| 1/ | Includes amounts deferred by the named officers under Bancorp’s 401(k) Profit Sharing Plan. |

| 2/ | The amounts reported in this column reflect the incremental cost to Bancorp of automobiles provided to the named officers. The amounts exclude other perquisites and personal benefits paid to each named officer as such |

13

other perquisites and personal benefits, in each instance, were less than the lesser of $50,000 or 10% of the total annual salary and bonus set forth above. |

| 3/ | The amounts in this column consist of group life insurance premiums, health insurance premiums, employer contributions to the ESOPT and employer contributions under the 401(k) Plan. |

| 4/ | This amount consists of $468 in group life insurance premiums, $3,245 in health insurance premiums, approximately $10,659 in employer contribution to the ESOPT and $7,000 in employer contribution under the 401(k) Plan. |

| 5/ | The amount shown represents salary paid for 2003 by Cathay Bank to Mr. Wu following the merger of GBC Bancorp and General Bank (collectively “GBC”) with and into Bancorp and Cathay Bank on October 20, 2003, and does not include salary paid by GBC to Mr. Wu for the 2003 service rendered prior to the merger, i.e., $246,358. Effective October 21, 2003, Mr. Wu’s annual salary from Cathay Bank is $350,000. |

| 6/ | The amount shown represents bonus accrued for 2003 by Cathay Bank to Mr. Wu, and does not include the profit sharing award and the gross-up payment related thereto, in a total sum of $214,099, received by Mr. Wu for his services rendered to GBC in 2003 prior to the merger. |

| 7/ | Does not include other annual compensation received by Mr. Wu for services rendered to GBC in 2003 prior to the merger or as benefits received from the merger, including $26,400 in director fees paid by GBC, $506 incremental cost of automobile, $13,462 accrued vacation, $140,178 termination fee received by Mr. Wu under his employment agreement with GBC, $383,580 in income associated with the pre-closing exercise of the stock options held by Mr. Wu under the GBC 1988 stock option plan, and $3,013,162 in income associated with the pre-closing exercise of the contingency options held by Mr. Wu. |

| 8/ | Bancorp did not make any option grants to Mr. Wu during 2003; however, as part of the GBC merger, Bancorp assumed Mr. Wu’s options to purchase shares of GBC common stock held under the GBC 1999 employee stock incentive plan that were converted into options to purchase 230,403 shares of Bancorp common stock. |

| 9/ | This amount consists of $78 in group life insurance premiums and $652 in health insurance premiums. Does not include $360 in group life insurance premiums, $3,559 in health insurance premiums, and $10,000 in employer contributions under the General Bank 401(k) Plan contributed by General Bank prior to the merger. |

| 10/ | This amount consists of $468 in group life insurance premiums, $4,530 in health insurance premiums, $10,685 in employer contribution to the ESOPT and $4,719 in employer contribution under the 401(k) Plan. |

| 11/ | Prorated amount actually paid (based on annual salary of $235,000) because employment commenced effective June 30, 2003. |

| 12/ | This amount consists of $117 in group life insurance premiums, $1,106 in health insurance premiums, and $1,175 in employer contribution under the 401(k) Plan. |

| 13/ | This amount consists of $468 in group life insurance premiums, $4,530 in health insurance premiums, $10,643 in employer contribution to the ESOPT and $3,661 in employer contribution under the 401(k) Plan. |

| 14/ | This amount consists of $468 in group life insurance premiums, $3,245 in health insurance premiums, and $1,362 in employer contribution under the 401(k) Plan. |

| 15/ | Prorated amount actually paid (based on annual salary of $120,000) because employment commenced effective February 14, 2002. |

Options and Stock Appreciation Rights

In 2003, the following individuals named in the above Summary Compensation Table were granted options to purchase shares of our common stock under the Equity Incentive Plan. In 2003, Bancorp did not have any outstanding stock appreciation rights.

14

Option Grants in Last Fiscal Year

| Individual Grants | Grant Date Present Value ($) | |||||||||||||

Name | Number of Securities Granted(#)1/ | % of Total Options Granted to Employees | Exercise or Base Price ($/Sh) | Expiration Date | ||||||||||

Dunson K. Cheng | 76,530 319,335 | 7.63 31.84 | % % | $ | 39.85 49.60 | 01/16/2013 11/20/2013 | $ | 689,535 3,733,026 | 3/ 4/ | |||||

Peter Wu | 0 | 0.00 | % | N/A | N/A | 0 | ||||||||

Anthony M. Tang | 23,750 52,570 | 2.37 5.24 | % % | $ | 39.85 49.60 | 01/16/2013 11/20/2013 | | 213,988 614,543 | 3/ 4/ | |||||

Heng W. Chen | 24,870 | 2.48 | % | 49.60 | 11/20/2013 | 290,730 | 4/ | |||||||

Irwin Wong | 18,790 71,520 | 1.87 7.13 | % % | $ | 39.85 49.60 | 01/16/2013 11/20/2013 | | 169,298 836,069 | 3/ 4/ | |||||

James R. Brewer | 25,480 | 2.54 | % | $ | 49.60 | 11/20/2013 | 297,861 | 4/ | ||||||

| 1/ | The options become exercisable in 20% increments over a five-year period, subject to early termination in the event of termination of employment, disability, or death. |

| 2/ | Based on total options to purchase 1,003,000 shares of Bancorp common stock granted in 2003 under Bancorp’s Equity Incentive Plan, including options granted to non-employee directors to purchase 61,100 shares. |

| 3/ | The grant date present values are estimated using the Black-Scholes option-pricing model assuming (a) a four-year expected life of the option; (b) a stock price volatility of 28.55%, based on daily market prices for the preceding four-year period; (c) an expected dividend yield of 1.41% per share per annum; and (d) a risk-free interest rate of 2.33%. The grant date present values are provided in accordance with the rules of the Securities and Exchange Commission and do not represent Bancorp’s estimate or projection of the future value or market price of Bancorp common stock. Actual gains, if any, on stock option exercises are dependent, among other things, on Bancorp’s future financial performance, overall market conditions, and the option holder’s continued employment through the vesting period. |

| 4/ | The grant date present values are estimated using the Black-Scholes option-pricing model assuming (a) a four-year expected life of the option; (b) a stock price volatility of 28.06%, based on daily market prices for the preceding four-year period; (c) an expected dividend yield of 1.13% per share per annum; and (d) a risk-free interest rate of 2.76%. The grant date present values are provided in accordance with the rules of the Securities and Exchange Commission and do not represent Bancorp’s estimate or projection of the future value or market price of Bancorp common stock. Actual gains, if any, on stock option exercises are dependent, among other things, on Bancorp’s future financial performance, overall market conditions, and the option holder’s continued employment through the vesting period. |

The following table summarizes options exercises during 2003, and the number of all options and the value of all in-the-money options held at the end of 2003, by the individuals named in the above Summary Compensation Table.

15

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

Shares Acquired on Exercise (#) | Value Realized($)1/ | Number of Securities Underlying Unexercised Options at End of Fiscal | Value of Unexercised In- End of Fiscal 2003 ($)2/ | |||||||

Name | Exercisable/Unexercisable | Exercisable/Unexercisable | ||||||||

Dunson K. Cheng | 0 | 0 | 79,760 / 464,505 | $ | 2,717,887 / 5,114,279 | |||||

Peter Wu | 0 | 0 | 98,986 / 131,417 | 3/ | 1,477,267 / 1,648,865 | |||||

Anthony M. Tang | 0 | 0 | 25,592 / 99,228 | 864,962 / 1,329,590 | ||||||

Heng W. Chen | 0 | 0 | 0 / 24,870 | 0 / 159,417 | ||||||

Irwin Wong | 0 | 0 | 9,980 / 106,114 | 312,326 / 1,185,133 | ||||||

James R. Brewer | 0 | 0 | 0 / 25,480 | 0 / 163,327 | ||||||

| 1/ | Based on the closing price of the underlying securities at the exercise date, less the exercise price. |

| 2/ | Based on the closing price of the underlying securities at year-end, less the exercise price. |

| 3/ | Bancorp did not make any option grants to Mr. Wu during the year 2003; however, as part of the GBC Bancorp merger, Bancorp assumed Mr. Wu’s options to purchase shares of GBC Bancorp common stock held under the GBC Bancorp 1999 Employee Stock Incentive Plan. Pursuant to the terms of the GBC Bancorp plan, the unexercisable options become exercisable if Mr. Wu’s employment is terminated for any reason, or for no reason (other than as the result of malfeasance or gross misfeasance in the performance of duties, or conviction of illegal activity in connection therewith or conviction of a felony) within one year after October 20, 2003. |

Profit Sharing Plan

Salaried employees of Bancorp’s subsidiary, Cathay Bank, who have completed three months of service and have attained the age of 21 are eligible to participate in Bancorp’s 401(k) Profit Sharing Plan. Enrollment dates are on January 1st, April 1st, July 1st, and October 1st of each year. In 2003, participants were allowed to contribute up to 75% of their compensation for the year, not to exceed the dollar limit set by the Internal Revenue Code. Participants may change their contribution election on the enrollment dates. In 2003, after a participant has completed one year of service, Cathay Bank matched 50% of the participants’ contribution up to 4% of their compensation. Commencing in 2004, Cathay Bank will match 100% of a participants’ contribution up to 5% of their compensation. The vesting schedule for the matching contribution is 0% for less than two years of service, 25% after two years of service and from then on, at an increment of 25% each year until 100% is vested after five years of service. In 2003, Cathay Bank’s contribution amounted to approximately $287,529. The 401(k) Plan allows participants to withdraw all or part of their vested amount due to certain financial hardships set forth in the Internal Revenue Code and Treasury Regulations. Participants may also borrow up to 50% of the vested amount, up to a maximum of $50,000. The minimum loan amount is $1,000.

Employee Stock Ownership Plan

Bancorp’s Amended and Restated Cathay Bank Employee Stock Ownership Plan (“ESOP”) provides that Bancorp can make annual contributions to a trust in the form of either cash or common stock of Bancorp for the benefit of eligible employees and to pay administration expenses for this plan and trust. Employees of Cathay Bank are eligible to participate in the ESOP after completing two years of service for salaried full-time employees or 1,000 hours for each of two consecutive years for salaried part-time employees.

The amount of the annual contribution is discretionary except that it must be sufficient to enable the trust to meet its current obligations. Each participant’s share of the annual contribution to the trust, including the share of each participating executive officer, is calculated by dividing the participant’s total “units” by the total “units” of all ESOP participants for that year. Each ESOP participant is granted one “unit” for each year of service and one “unit” for each one hundred dollars of eligible compensation.

16

Bancorp does not plan to make any contributions to the trust in 2004. In prior years, the Board of Directors determined the amount of the annual contribution to the trust in light of Bancorp’s earnings in the prior plan year. To date, such contributions have been made in cash. The cash contributed to the trust is invested by its trustees in shares of Bancorp’s common stock. Each participant’s benefits under the ESOP consist of the cash (or cash equivalents) and shares of Bancorp’s common stock allocated to the participant’s ESOP account in accordance with the above-described formula. Under the ESOP, each participant’s benefits are fully vested and without risk of forfeiture. Benefits under the ESOP are distributed to the participant in accordance with the rules of the ESOP and generally begin when the participant attains the age of 65 (or upon death or disability) or after the lapse of three years following termination of employment.

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth certain information as of December 31, 2003, with respect to compensation plans under which equity securities of Bancorp are authorized for issuance.

Plan Category | (a) Number of Securities to | (b) Weighted-average | (c) Number of Securities Remaining Available For Future Issuance Under Reflected in Column (a)] | |||||

Equity Compensation Plans Approved by Security Holders | 2,011,540 | 1/ | $ | 40.07 | 2,156,972 | |||

Equity Compensation Plans Not Approved by Security Holders | 0 | 0 | 0 | |||||

Total | 2,011,540 | 1/ | $ | 40.07 | 2,156,972 | |||

| 1/ | Includes options granted under the GBC Bancorp 1999 Employee Stock Incentive Plan. On October 20, 2003, pursuant to the terms of its merger with GBC Bancorp, Bancorp assumed an obligation to issue up to 708,260 shares of Bancorp’s common stock for outstanding options under the GBC Bancorp 1999 Employee Stock Incentive Plan. No further grants will be made under this GBC Bancorp plan. |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Bancorp Board of Directors has a committee administering the Equity Incentive Plan, but did not have a compensation committee in 2003. No executive officer is separately compensated for services rendered to Bancorp. Messrs. Cheng, Wu, Tang, and Chen hold positions with both Bancorp and Cathay Bank. Accordingly, in 2003, recommendations regarding the compensation of certain executive officers, including the President and Chief Executive Officer, other than the grant of awards under the Equity Incentive Plan, were made by the Compensation Committee of the Cathay Bank Board of Directors, subject to the review and approval of the Cathay Bank Board of Directors. Beginning in 2004, the compensation of the Chief Executive Officer and all other executive officers will be recommended to the Board of Directors for determination by a newly created Bancorp Executive Compensation Committee comprised solely of independent directors.

The Bancorp Equity Incentive Plan Committee makes decisions regarding the grant of awards under the Equity Incentive Plan to executive officers, including the President and Chief Executive Officer. In 2003, the members of the Equity Incentive Plan Committee were Joseph C.H. Poon (Chairman), Ralph Roy Buon-Cristiani (until November 18, 2003), Michael M.Y. Chang, Wing K. Fat, and Thomas C.T. Chiu (beginning November 20, 2003). Each of these individuals is also a director of Bancorp.

17

The members of the Cathay Bank Compensation Committee were Dunson K. Cheng (Chairman), George T.M. Ching, Joseph C.H. Poon, Thomas G. Tartaglia, Kelly L. Chan, and Thomas C.T. Chiu (beginning November 20, 2003). Each of these individuals is also a Director of Bancorp. Mr. Cheng does not participate in, and excuses himself from, those portions of any meeting of the Cathay Bank Board of Directors or Compensation Committee in which his compensation is discussed or established. All members of the committee are independent except Mr. Cheng, who is the Chairman of the Board, President, and Chief Executive Officer of Cathay Bank and Bancorp, Mr. Ching, who holds the title of Vice Chairman of Bancorp and Cathay Bank and is a paid officer of Cathay Investment Company, and Mr. Chiu, who is a brother-in-law to Peter Wu. Beginning in 2004, the compensation of the Chief Executive Officer and all other executive officers will be recommended to the Board of Directors for determination by a newly created Bancorp Executive Compensation Committee comprised solely of independent directors.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

In 2003, the Cathay Bank Compensation Committee established general policies on executive compensation as well as the actual salary, bonus, and discretionary benefits of the President and Chief Executive Officer of Bancorp and Cathay Bank and all other executive officers of the Bancorp including the executive officers named in this proxy statement. Decisions of the Cathay Bank Compensation Committee are subject to the review and approval of the entire Cathay Bank Board of Directors. Beginning in 2004, the compensation of the Chief Executive Officer and all other executive officers will be recommended to the Board of Directors for determination by a newly created Bancorp Executive Compensation Committee comprised solely of independent directors.

The Bancorp Equity Incentive Plan Committee selects participants, including the executive officers, of Bancorp and its subsidiary, Cathay Bank, to receive awards under the Equity Incentive Plan and has broad discretion to determine the amounts and types of awards and the terms and conditions of individual awards.

The compensation program for executive officers, including the President and Chief Executive Officer, currently consists of base salary, annual cash bonus, participation in Bancorp’s ESOP, certain matching contributions under the 401(k) Plan, life insurance in an amount equal to three times base salary (with a $300,000 cap), and the same medical, dental, and disability benefits as provided to other Cathay Bank employees. Such officers are also eligible to participate in the Equity Incentive Plan.

The Cathay Bank Compensation Committee and the Bancorp Equity Incentive Plan Committee believe that to reward, provide incentives to, and retain capable management, each of the executive officers should receive compensation that is both competitive and reflective of Cathay Bank’s and Bancorp’s performance. In addition, the Compensation Committee and the Equity Incentive Plan Committee believe that individual compensation should reflect the experience, performance, and responsibility level of that individual.

Publicly held corporations generally are not permitted a Federal income tax deduction for compensation paid to certain officers to the extent that such an officer’s compensation exceeds $1 million in a taxable year. An exception may apply to performance-based compensation that meets certain requirements, including approval of the material terms by the stockholders in advance of payment. The newly created Bancorp Executive Compensation Committee will review the application of the Internal Revenue Code Section 162(m) limitation on tax deductions and intends to structure Bancorp’s compensation programs to qualify certain compensation payments for tax deduction to the extent possible while reserving the discretion to make payments which are not tax deductible as circumstances warrant.

Base Compensation

As part of the process of establishing base salaries, the Compensation Committee reviews the performance of each executive officer in relation to the overall performance of Cathay Bank, and considers factors such as the experience and responsibility of each individual, including performance of special projects and assignments. Because the Committee believes that the evaluation of performance should not be reduced to a formula, the Committee considers a wide range of performance criteria. These criteria include objective factors, such as earnings and profits, and subjective factors, such as individual performance.

18

In establishing each executive officer’s base salary, the Compensation Committee generally gives the most weight to the subjective evaluation of the performance of the individual in relation to the performance of Cathay Bank, followed by a consideration of the officer’s level of responsibility and experience, and then an evaluation of objective performance factors, without any particular magnitude being assigned to these factors. The size of the base salary for each executive officer is determined by the above-mentioned subjective evaluation of the individual’s performance, a comparison of the compensation levels paid to the individual in past years in relation to the individual’s performance in those years, and Bancorp’s and Cathay Bank’s general financial condition, profitability, and results of operations. Consideration is also given to changes in the cost of living.

In 2002, Bancorp’s total assets increased by approximately 12% over 2001 levels, deposits increased by approximately 9%, stockholders’ equity increased by approximately 17% over 2001 levels, return on average assets increased from 1.82% in 2001 to 1.88% in 2002, net income increased approximately 14%, from $42.6 million in 2001 to $48.7 million in 2002, and earnings per diluted share increased from $2.35 in 2001 to $2.69 in 2002. The Compensation Committee considered this financial performance data and each executive officer’s level of responsibilities in giving executive officers an increase in base salaries of approximately 3.5% to 29% in 2003. The Compensation Committee further notes the substantial growth of the Bancorp, and the increased responsibilities of its executive officers, as a result of the merger with GBC Bancorp. At year-end 2003, due in part to Bancorp’s merger with GBC Bancorp, total assets increased by 101.2%, deposits at Cathay Bank increased by approximately 91% and gross loans increased by 76%, and stockholders’ equity increased by approximately 115% over 2002 levels. In addition, return on average stockholders’ equity, at 15.13%, and return on average assets, at 1.58%, continue to be strong while net income increased approximately 14%, from $48.7 million in 2002 to $55.6 million in 2003, and earnings per diluted share increased from $2.69 in 2002 to $2.85 in 2003.

The Compensation Committee reviews objective data on the financial condition, profitability, and results from operations of Bancorp and Cathay Bank in light of the financial performance of other similar banks, Bancorp’s and Cathay Bank’s relative advantages and disadvantages in the banking industry, and the obstacles and challenges presented to the particular executive in attempting to achieve the goals of Bancorp and Cathay Bank. The Compensation Committee also reviews the base compensation of executive officers in equivalent positions paid by banks considered competitive with Cathay Bank and by other banks of similar size across the United States.

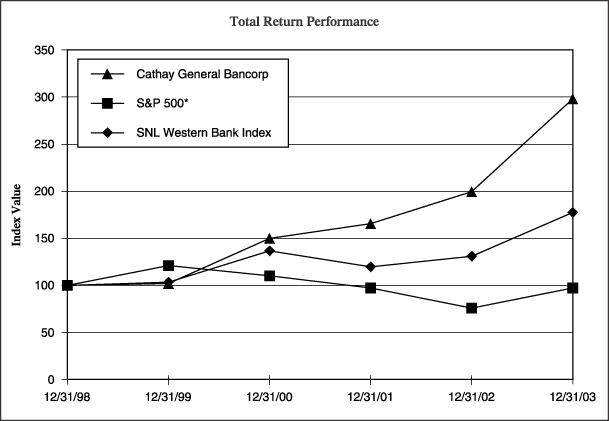

In addition to these surveys, the Compensation Committee considers data comparing the percentage change in cumulative total stockholder return on Bancorp’s common stock with the percentage change in cumulative total stockholder return on the Standard & Poor’s 500 and the SNL Western Bank Index. See “Comparative Stock Performance” below for a graph comparing cumulative stockholder return data for Bancorp, the Standard & Poor’s 500 Index, and the SNL Western Bank Index. The SNL Western Bank Index is a market-weighted index including every publicly traded bank located in Alaska, California, Hawaii, Montana, Oregon, and Washington.

Annual Cash Bonus

The annual cash bonus paid to each executive officer, including the Chairman, President and Chief Executive Officer, is determined, in the discretion of the Compensation Committee, on the basis of the overall performance and profitability of Cathay Bank and Bancorp in the fiscal year then ending, and the Committee’s subjective evaluation of the individual officer’s performance and responsibility in relation to company performance. Overall performance and profitability is determined with reference to the following factors listed in order of importance: net income, return on average assets, return on stockholders’ equity, and percentage increase or decrease in total assets, loans, and deposits.

The size of the annual bonus for each officer is determined by the above-mentioned evaluation of the performance of Bancorp and Cathay Bank in relation to the contributions, as perceived by the Compensation Committee, made by the officer to achieve the overall level of financial performance of Bancorp and Cathay Bank, and by a comparison of the size of annual bonuses paid to the officer in past years with respect to the individual’s performance in those years, the base salaries of the executives and the length of employment with Bancorp and Cathay Bank, and the overall performance and profitability of Bancorp and Cathay Bank in those years. Based on these factors, the Compensation Committee increased the bonuses paid to three named executive officers by between 18.7% to 96.8% and reduced the bonus of one by approximately 4.2%. Two of the named officers joined

19

Bancorp in 2003 and as such a year-over-year comparisons are not available for these officers. See also “CEO Compensation” below.

The Equity Incentive Plan

Bancorp’s Equity Incentive Plan authorizes the issuance of up to 3,500,000 shares of Bancorp’s common stock under awards granted under the Equity Incentive Plan. Awards may be granted in the form of stock options or restricted stock. The Equity Incentive Plan is intended to strengthen Bancorp by providing selected employees and directors of Bancorp and its subsidiaries, including Cathay Bank, an opportunity to participate in Bancorp’s future by offering them an opportunity to acquire common stock in Bancorp so as to retain, attract, and motivate them.

As of February 18, 2004, there are 45 participants in the Equity Incentive Plan. The Equity Incentive Plan Committee has the discretion to determine the number and type of awards granted, and awards generally increase as a function of higher positions of responsibility in Bancorp or its subsidiaries. Awards are generally based on a subjective analysis of the individual’s performance, the general performance of Bancorp and Cathay Bank, and a review of option grants made at other banks of comparable size and complexity. Consideration is also given to the estimated dilutive effect of such awards on Bancorp’s stockholders.

In 2003, the Equity Incentive Plan Committee granted nonqualified options to purchase 1,003,000 shares of our common stock under the Equity Incentive Plan. Of these options, it granted options to purchase 395,865 shares of our common stock to the Chairman, President, and Chief Executive Officer. Options granted to the other officers named in this proxy statement for the same period ranged from options to purchase 24,870 shares to 90,310 shares. The options granted in January have an exercise price of $39.85 per share. The options granted in November have an exercise price of $49.60. The exercise prices for both sets of options were based on the closing price of a share of our common stock on the date of grant. Options become exercisable in 20% increments over a five-year period, and they terminate ten years from the date of the grant, subject to early termination in the event of termination of employment, disability, or death.

On October 20, 2003, pursuant to the terms of its merger with GBC Bancorp, Bancorp assumed an obligation to issue up to 708,260 shares of Bancorp’s common stock for outstanding options under the GBC Bancorp 1999 Employee Stock Incentive Plan. No further grants will be made under this GBC Bancorp plan.

CEO Compensation