EXECUTION VERSION

STERICYCLE, INC.

FIRST AMENDMENT

This FIRST AMENDMENT, dated as of April 26, 2022 (this “Amendment”), is entered into by and among STERICYCLE, INC., a Delaware corporation (the “Company”), the Subsidiaries of the Company signatory hereto (collectively, together with the Company, the “Loan Parties” and, each a “Loan Party”), the Lenders (as defined below) signatory hereto, and BANK OF AMERICA, N.A., as administrative agent (in such capacity, the “Administrative Agent”) under that certain Amended and Restated Credit Agreement, dated as of September 30, 2021 (the “Existing Credit Agreement”; the Existing Credit Agreement as amended by this Amendment, the “Credit Agreement”), among the Company, the financial institutions from time to time party thereto as lenders (the “Lenders”) or as “L/C Issuers”, the Subsidiaries of the Company party thereto as “Designated Borrowers”, and the Administrative Agent. Capitalized terms used and not otherwise defined herein shall have the meanings ascribed to them in the Credit Agreement.

W I T N E S S E T H

WHEREAS, the Company has requested that the Lenders and the Administrative Agent amend the Existing Credit Agreement as set forth herein; and

WHEREAS, the Administrative Agent and the Lenders have agreed, on the terms and conditions set forth below, to so amend the Existing Credit Agreement.

NOW, THEREFORE, in consideration of the mutual covenants and agreements herein contained and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, each of the parties hereto hereby agrees as follows:

1. Amendments to Existing Credit Agreement. Subject to and in accordance with the terms and conditions set forth herein and in reliance upon the representations and warranties set forth herein, the parties hereto hereby agree that the Existing Credit Agreement is hereby amended as follows:

(a) Section 1.01 of the Existing Credit Agreement is amended by adding the following new defined terms in the appropriate alphabetical order:

“First Amendment Effective Date” means April 26, 2022.

“Settlement Agreements/Orders” mean, collectively, (a) that certain Deferred Prosecution Agreement between the U.S. Department of Justice and the Company, (b) that certain Order Instituting Cease and Desist Proceedings issued by SEC, (c) that certain Offer of Settlement between the SEC and the Company, and (d) any other settlement agreement between the Company or any of its Subsidiaries and Governmental Authorities in Brazil, in each case contemplated to be entered into on or about the First Amendment Effective Date in connection with the settlement of the anti-corruption investigation first publicly disclosed in the Company’s quarterly report on Form 10-Q for the quarter ended June 30, 2017.

“U.S. Settlement Agreements/Orders” mean, collectively, the Settlement Agreements/Orders referred to in clauses (a) through (c) of the definition thereof.

(b) Clause (a) of the definition of “Consolidated EBITDA” in Section 1.01 of the Existing Credit Agreement is hereby amended to: (i) replace the “and” before the beginning of subclause (viii) with “,”, and (ii) add a new subclause (ix) thereto immediately succeeding subclause (viii) thereof to read in its entirety as follows:

“, and (ix) charges accrued in accordance with GAAP in connection with the Company’s settlement of the government investigations by the U.S. Department of Justice, the SEC and Governmental

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 1

Authorities in Brazil arising from the anti-corruption investigation first publicly disclosed in the Company’s quarterly report on Form 10-Q for the quarter ended June 30, 2017 in an aggregate amount not to exceed (A) $61,000,000 for the fiscal quarter ended September 30, 2021, (B) $19,700,000 for the fiscal quarter ended December 31, 2021, and (C) $9,200,000 for the fiscal quarter ended March 31, 2022”.

(c) Section 6.02 of the Existing Credit Agreement is hereby amended to: (i) add a new clause

(g) thereto immediately succeeding subclause (f) thereof to read in its entirety as set forth below and (ii) re- letter existing clause (g) to clause (h):

“(g) promptly following the effectiveness of any Settlement Agreement/Order, copies of each such Settlement Agreement/Order”.

(d) Section 6.03 of the Existing Credit Agreement is hereby amended to: (i) delete the “and” at the end of clause (c), and (ii) add a new clause (e) thereto immediately succeeding subclause (d) thereof to read in its entirety as follows:

“; and (e) of any notice or other formal correspondence from a Governmental Authority concerning (i) any actual or potential breach or non-compliance with any Settlement Agreements/Orders, (ii) any actual or potential extension of the duration of the Settlement Agreements/Order or any monitorship in connection therewith, or (iii) any material change in the obligations of the Company or any of its Subsidiaries under any Settlement Agreement/Order.”

(e) Section 8.01(h) of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

“(h) Judgments. There is entered against the Company or any Subsidiary (i) a final judgment or order for the payment of money in an aggregate amount exceeding

$75,000,000 (to the extent not covered by independent third-party insurance as to which the insurer does not dispute coverage), other than any order for the payment of money pursuant to the Settlement Agreements/Orders, or (ii) any one or more non-monetary final judgments that have, or could reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect and, in either case, (A) enforcement proceedings are commenced by any creditor upon such judgment or order, or (B) there is a period of 30 consecutive days during which a stay of enforcement of such judgment, by reason of a pending appeal or otherwise, is not in effect; or”

(f) Section 8.01 of the Existing Credit Agreement is hereby amended to add a new clause (n) thereto immediately succeeding subclause (m) thereof to read in its entirety as follows:

“; or (n) Breach of U.S. Settlement Agreements/Orders. (i) Any written notice from the U.S. Department of Justice or the SEC that any such Governmental Authority intends to institute any prosecution of the Company on account of any material breach of any U.S. Settlement Agreements/Orders, unless the Company has taken action to remedy any such breach in its good faith determination within sixty (60) days after any such written notice and so long as the Governmental Authorities that provided the written notice of breach do not actually institute any prosecution action as a result of such breach, or (ii) institution of any prosecution action by the U.S. Department of Justice or the SEC following termination or breach of any U.S. Settlement Agreement/Order.”

2. Conditions to Effectiveness. The amendments set forth in Section 1 of this Amendment shall become effective as of the date hereof upon the satisfaction of the following conditions (such date, the “Amendment Effective Date”):

(a) the Administrative Agent’s receipt of counterparts of this Amendment, duly executed and delivered on behalf of each of the Company, each other Loan Party and the Required Lenders; and

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 2

(b) the Company shall have paid all fees (including the Amendment Fee (as defined below)) and, unless waived by the Administrative Agent, the Company shall have paid all expenses in connection with this Amendment (including charges and disbursements of counsel to the Administrative Agent, to the extent invoiced prior to the date hereof).

3. Amendment Fee. The Company will pay an amendment fee (the “Amendment Fee”) to the Administrative Agent on the Amendment Effective Date, for the account of each Lender (including Bank of America) that approves this Amendment on or before the date that signatures are requested by the Administrative Agent, in an amount equal to 0.025% multiplied by the sum of: (i) the then outstanding principal amount of the Term Loans then held by each such Lender on the Amendment Effective Date plus

(ii) the then existing Revolving Credit Commitment of each such Lender on the Amendment Effective Date. The Amendment Fee shall be fully earned and due and payable in full on the Amendment Effective Date.

4. Representations and Warranties. Each Loan Party hereby represents and warrants that:

(a) This Amendment has been duly executed and delivered by each Loan Party that is party hereto. This Amendment and the Credit Agreement constitutes a legal, valid and binding obligation of such Loan Party, enforceable against such Loan Party in accordance with its terms (except, in any case, as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization, examinership or similar laws affecting creditors’ rights generally and by principles of equity);

(b) Each Loan Party (i) is duly organized or formed, validly existing and in good standing (if applicable in such Loan Party’s jurisdiction of incorporation or organization) under the Laws of the jurisdiction of its incorporation or organization and (ii) has all requisite power and authority and all requisite governmental licenses, authorizations, consents and approvals to execute, deliver and perform its obligations under this Amendment and each other Loan Document;

(c) The execution, delivery and performance by each Loan Party of this Amendment and each other Loan Document executed in connection herewith have been duly authorized by all necessary corporate or other organizational action, and do not and will not (i) contravene the terms of any of such Person’s Organization Documents; (ii) conflict with or result in any breach or contravention of, or the creation of any Lien under, or require any payment to be made under (A) any Contractual Obligation to which such Person is a party or affecting such Person or the properties of such Person or any of its Subsidiaries or (B) any order, injunction, writ or decree of any Governmental Authority or any arbitral award to which such Person or its property is subject; or (iii) violate any Law;

(d) No approval, consent, exemption, authorization, or other action by, or notice to, or filing with, any Governmental Authority or any other Person is necessary or required in connection with the execution, delivery or performance by, or enforcement against, any Loan Party of this Amendment or any other Loan Document executed in connection herewith;

(e) No Default has occurred and is continuing or would result from the consummation of the transactions contemplated by this Amendment; and

(f) The representations and warranties contained in Article V of the Credit Agreement and the other Loan Documents are true and correct in all material respects (except to the extent any such representation and warranty is qualified by materiality or reference to Material Adverse Effect, in which case, such representation and warranty shall be true and correct in all respects) on and as of the date hereof, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they are true and correct in all material respects (except to the extent any such representation and warranty is qualified by materiality or reference to Material Adverse Effect, in which case, such representation and warranty shall be true and correct in all respects) as of such earlier date and except that the representations and warranties contained in subsections (a) and (b) of

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 3

Section 5.05 thereof shall be deemed to refer to the most recent statements furnished pursuant to clauses (a) and (b), respectively, of Section 6.01 thereof.

5. Governing Law; Jurisdiction; Waiver of Jury Trial; Etc. THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE INTERNAL LAWS AND DECISIONS (AS OPPOSED TO CONFLICTS OF LAW PROVISIONS) OF THE STATE OF NEW YORK. This Amendment shall be further subject to the provisions of Sections 10.14 and 10.15 of the Credit Agreement.

6. Counterparts; Integration; Effectiveness. This Amendment may be executed in counterparts (and by different parties hereto in different counterparts), each of which shall constitute an original, but all of which when taken together shall constitute a single contract. This Amendment, together with the Credit Agreement and the other Loan Documents, constitutes the entire contract among the parties relating to the subject matter hereof and supersede any and all previous agreements and understandings, oral or written, relating to the subject matter hereof. Delivery of an executed counterpart of a signature page of this Amendment by telecopy or other electronic imaging means shall be effective as delivery of a manually executed counterpart of this Amendment.

7. Severability. If any provision of this Amendment is held to be illegal, invalid or unenforceable, (a) the legality, validity and enforceability of the remaining provisions of this Amendment shall not be affected or impaired thereby and (b) the parties shall endeavor in good faith negotiations to replace the illegal, invalid or unenforceable provisions with valid provisions the economic effect of which comes as close as possible to that of the illegal, invalid or unenforceable provisions. The invalidity of a provision in a particular jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction.

8. Effect. Upon the effectiveness of this Amendment, each reference in the Existing Credit Agreement to “this Agreement,” “hereunder,” “hereof” or words of like import shall mean and be a reference to the Existing Credit Agreement as modified hereby and each reference in the other Loan Documents to the “Credit Agreement”, “thereunder,” “thereof,” or words of like import shall mean and be a reference to the Existing Credit Agreement as modified hereby. This Amendment shall constitute a Loan Document for purposes of the Credit Agreement and the other Loan Documents.

9. Reaffirmation. Except as specifically modified by this Amendment, the Existing Credit Agreement shall remain in full force and effect in the form of the Credit Agreement and is hereby ratified and confirmed.

10. Guarantors. Each Guarantor hereby consents to this Amendment and reaffirms its Guaranty and the terms and conditions of each Guaranty and each other Loan Document executed by it and acknowledges and agrees that each and every such Guaranty and other Loan Document executed by such Guarantor in connection with the Credit Agreement remains in full force and effect and is hereby reaffirmed, ratified and confirmed.

[Remainder of this page intentionally left blank; signature pages follow]

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 4

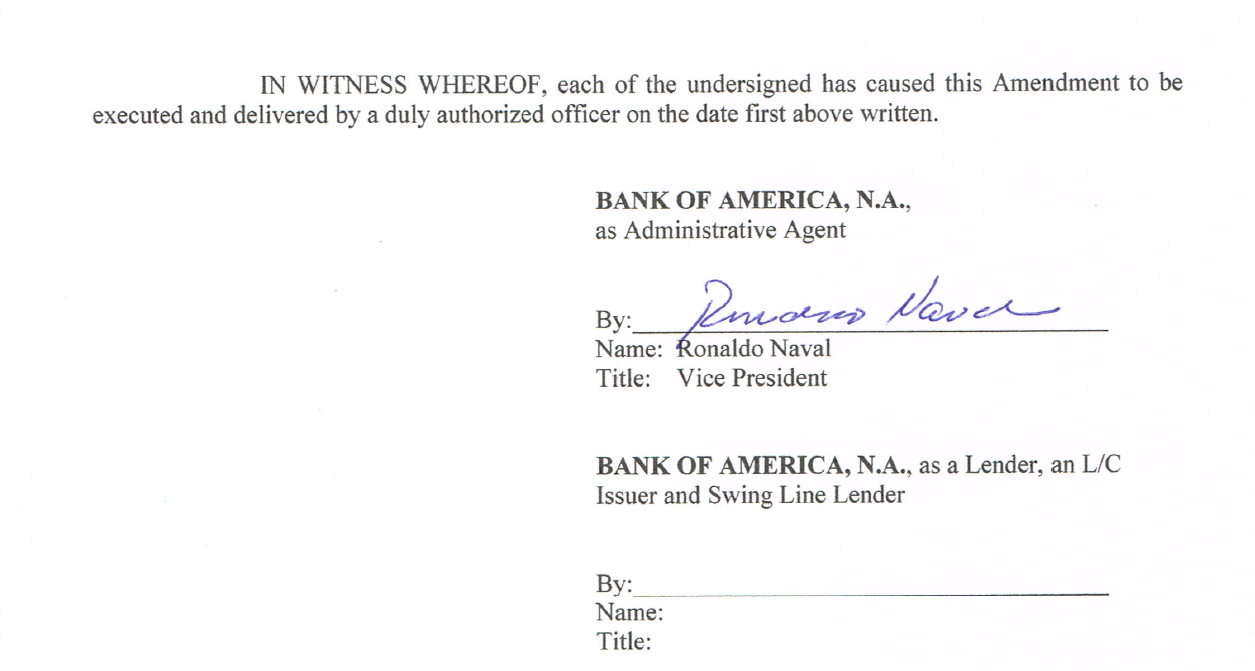

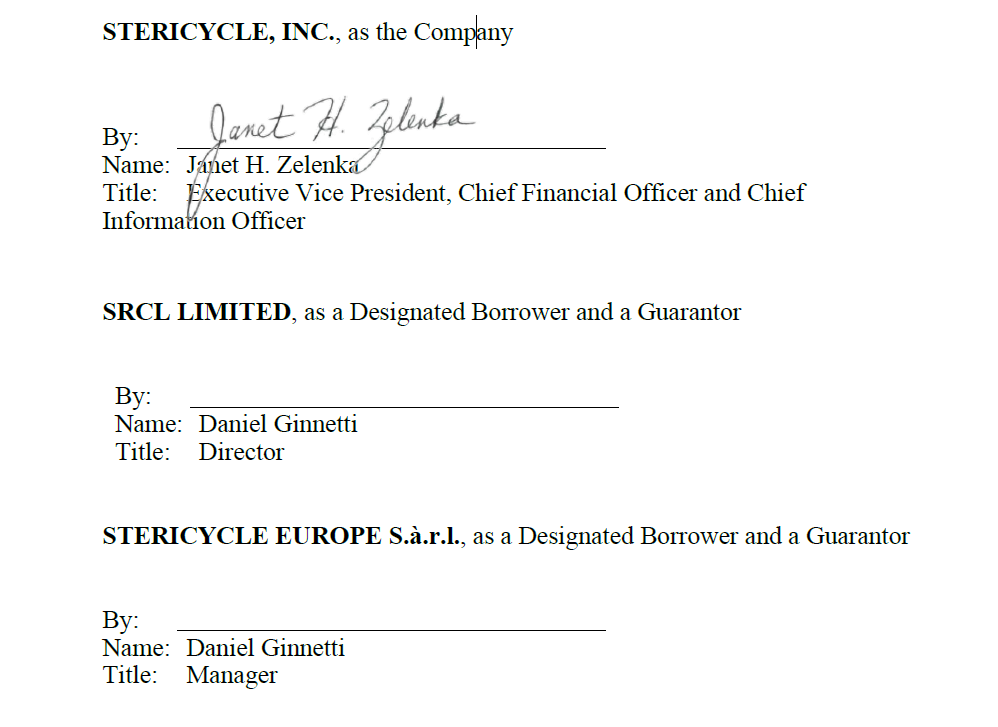

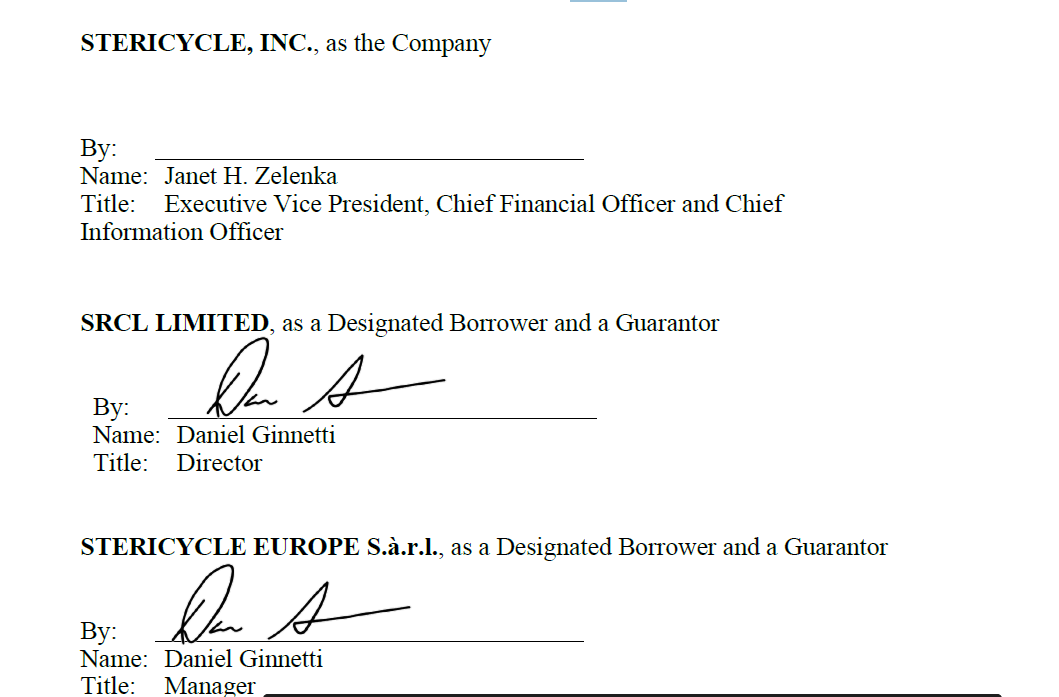

IN WITNESS WHEREOF, each of the undersigned has caused this Amendment to be executed and delivered by a duly authorized officer on the date first above written.

BANK OF AMERICA, N.A.,

as Administrative Agent

By:_____________________________________

Name:

Title:

BANK OF AMERICA, N.A., as a Lender, an L/C

Issuer and Swing Line Lender

By:_____________________________________

Name:

Title:

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 5

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 6

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 7

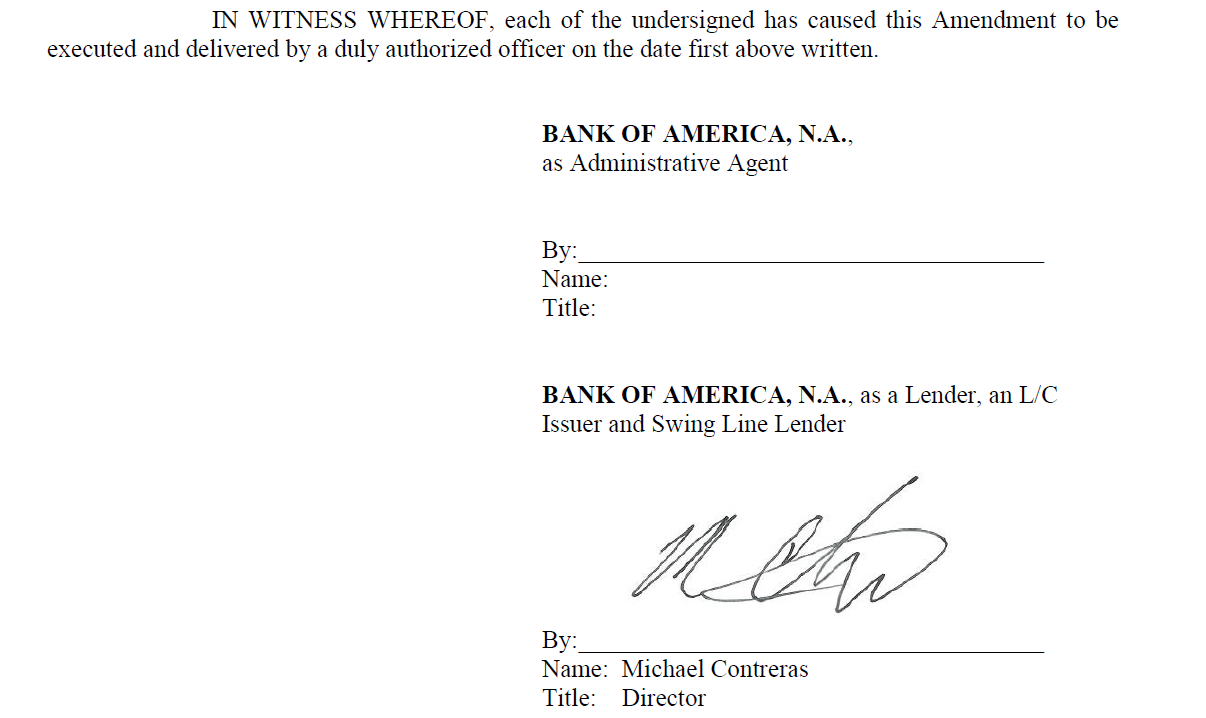

IN WITNESS WHEREOF, each of the undersigned has caused this Amendment to be executed and delivered by a duly authorized officer on the date first above written.

BANK OF AMERICA, N.A.,

as Administrative Agent

By:_____________________________________

Name:

Title:

BANK OF AMERICA, N.A., as a Lender, an L/C

Issuer and Swing Line Lender

By:_____________________________________

Name:

Title:

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 8

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 9

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 10

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 11

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 12

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 13

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 14

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 15

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 16

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 17

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 18

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 19

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 20

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 21

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 22

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 23

Stericycle, Inc.

First Amendment to Amended and Restated Credit Agreement

Signature Page Page 24