UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantý

Filed by a Party other than the Registranto

Check the appropriate box:

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

CIB MARINE BANCSHARES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| |

| | | | |

| | | | |

| |

| | (2) | | Aggregate number of securities to which transaction applies: |

| |

| | | | |

| | | | |

| |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| | | | |

| | | | |

| |

| | (4) | | Proposed maximum aggregate value of transaction: |

| |

| | | | |

| | | | |

| |

| | (5) | | Total fee paid: |

| |

| | | | |

| | | | |

| o | | Fee paid previously with preliminary materials. |

| |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| |

| | | | |

| | | | |

| |

| | (2) | | Form, Schedule or Registration Statement No.: |

| |

| | | | |

| | | | |

| |

| | (3) | | Filing Party: |

| |

| | | | |

| | | | |

| |

| | (4) | | Date Filed: |

| |

| | | | |

| | | | |

CIB Marine Bancshares, Inc.

N27 W24025 Paul Court

Pewaukee, Wisconsin 53072

April 4, 2008

Dear Shareholder:

You are cordially invited to attend the annual meeting of shareholders of CIB Marine Bancshares, Inc. to be held at 1:30 p.m., local time, on Thursday, May 29, 2008, at the Doubletree Hotel, 5000 West 127th Street, Alsip, Illinois.

All shareholders of record at the close of business on March 20, 2008 of our outstanding shares of common stock will be entitled to vote at the Annual Meeting.

The accompanying Notice of Annual Meeting of Shareholders and Proxy Statement discuss the business to be acted upon at the meeting. We have also enclosed a proxy card, and a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2007.

If you are unable to attend the annual meeting in person, you may listen to the meeting by teleconference. Please see the next page for more information and instructions on how to participate.

On behalf of the Board of Directors, and officers and employees of CIB Marine, we would like to thank you for your continued support, and your attention to this important matter.

| | | | | |

| | Sincerely,

CIB Marine Bancshares, Inc.

| |

| |  | |

| | John P. Hickey, Jr. | |

| | President and Chief Executive Officer | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 29, 2008

The Proxy Statement and 2007 Annual Report on Form 10-K are available atwww.cibmarine.com.

TELECONFERENCE INSTRUCTIONS

In order to access the teleconference of the meeting, please dial 1-800-894-5910 (domestic). Please provide conference ID “CIB Marine” and program title “CIB Marine” to the greeter in order to access the conference call. Please note that listening to the teleconference at the meeting will not constitute attendance at the meeting for purposes of determining a quorum. In addition, you will not be able to vote via teleconference. Accordingly, even if you intend to participate in the teleconference, it is important for you to return your completed proxy card to us in advance of the meeting in order for your attendance and vote to be counted.

-2-

CIB MARINE BANCSHARES, INC.

N27 W24025 Paul Court

Pewaukee, WI 53072

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 29, 2008

Dear Shareholder:

The 2008 annual meeting of shareholders CIB Marine Bancshares, Inc. (the “Company”) will be held at the Doubletree Hotel, 5000 West 127th Street, Alsip, Illinois on Thursday, May 29, 2008, at 1:30 p.m., local time. The meeting is being held for the following purposes:

| | 1. | | To elect nine directors to serve on the Board of Directors of the Company; and |

| |

| | 2. | | To transact any other business that may properly come before the annual meeting and any adjournment or postponement thereof. |

Our Board of Directors recommends that you voteFORthe election of the director nominees named on Proposal 1 of the enclosed Proxy Statement.

Only shareholders of record at the close of business on March 20, 2008 are entitled to notice of and to vote at the meeting and at any adjournment or postponement thereof. To gain admission to the annual meeting of shareholders, you will need to show that you are a shareholder of the Company. All shareholders will be required to show valid, government-issued, picture identification. If your shares are registered in your name, your name will be compared to the list of registered shareholders to verify your share ownership. If your shares are in the name of your broker or bank, you will need to bring evidence of your share ownership, such as your most recent brokerage account statement or a legal proxy from your broker. If you do not have valid picture identification and proof that you own Company shares, you will not be admitted to the annual meeting of shareholders. Please arrive in advance of the start of the meeting to allow time for identity verification.

Your vote is important. Whether or not you plan to attend the meeting, please act promptly to vote your shares. You may vote your shares by completing, signing and dating the enclosed proxy card and returning it in the accompanying postage paid envelope provided. You may also vote your shares by telephone or through the internet by following the instructions set forth on the proxy card. Your right to vote in person at the meeting is not affected by returning the proxy card, or voting by telephone or through the internet.Your prompt action will aid the Company in reducing the expense of proxy solicitation.

| | | | | |

| | BY ORDER OF THE BOARD OF DIRECTORS

| |

| |  | |

| | Daniel J. Rasmussen | |

| | Senior Vice President, General Counsel and Secretary | |

-3-

TABLE OF CONTENTS

| | | | | |

| | | 5 | |

| | | | | |

| | | 8 | |

| | | | | |

| | | 8 | |

| | | | | |

| | | 10 | |

| | | | | |

| | | 10 | |

| | �� | 10 | |

| | | 11 | |

| | | 11 | |

| | | 12 | |

| | | | | |

| | | 12 | |

| | | | | |

| | | 12 | |

| | | 13 | |

| | | 14 | |

| | | 14 | |

| | | | | |

| | | 15 | |

| | | | | |

| | | 16 | |

| | | | | |

| | | 17 | |

| | | | | |

| | | 17 | |

| | | | | |

| | | 18 | |

| | | | | |

| | | 18 | |

| | | | | |

| | | 18 | |

| | | 18 | |

| | | 18 | |

| | | | | |

| | | 19 | |

-4-

CIB MARINE BANCSHARES, INC.

N27 W24025 Paul Court

Pewaukee, WI 53072

Proxy Statement For Annual Meeting Of Shareholders

The Board of Directors of CIB Marine Bancshares, Inc. is soliciting your proxy to vote at the Annual Meeting of Shareholders to be held on Thursday, May 29, 2008, at 1:30 p.m., local time, and any adjournment or postponement of that meeting. The meeting will be held at the Doubletree Hotel, 5000 West 127th Street, Alsip, Illinois. This Proxy Statement and the accompanying proxy card, Notice of Meeting, and Annual Report on Form 10-K for the year ended December 31, 2007, was first mailed on or about April 4, 2008 to all shareholders of record as of March 20, 2008 (the “Record Date ”). The only voting securities of the Company are shares of the Company’s common stock, $1.00 par value per share (the “Common Stock ”), of which there were 18,346,442 shares outstanding as of the Record Date (excluding treasury stock). We need a majority of the shares of Common Stock outstanding on the record date present, in person or by proxy, to hold the annual meeting.

In this proxy statement, we refer to CIB Marine Bancshares, Inc. as the “Company,” “CIB Marine,” “we” or “us” and the Board of Directors as the “Board.”

Our Annual Report on Form 10-K, which contains consolidated and combined financial statements for fiscal 2007, accompanies this Proxy Statement. You also may obtain a copy of our Annual Report on Form 10-K for fiscal 2007, without charge, by writing to or telephoning our Investor Relations department at the above address. Our Annual Report on Form 10-K is also available in the “SEC Filings” section of www.cibmarine.com.

THE PROXY PROCESS AND SHAREHOLDER VOTING

Why am I receiving this Proxy Statement and proxy card?

You are receiving a Proxy Statement and proxy card from us because you own shares of our Common Stock. This Proxy Statement describes issues on which we would like you, as a shareholder, to vote. It also gives you information on these issues so that you can make an informed decision.

When you sign the enclosed proxy card, you appoint the proxy holder as your representative at the meeting. The proxy holder will vote your shares as you have instructed in the proxy card, thereby ensuring that your shares will be voted whether or not you attend the meeting. Even if you plan to attend the meeting, you should complete, sign and return your proxy card in advance of the meeting just in case your plans change.

If you have signed and returned the proxy card and an issue comes up for a vote at the meeting that is not identified on the card, the proxy holder will vote your shares, under your proxy, in accordance with his or her best judgment.

What matters will be voted on at the meeting?

You are being asked to vote on the election of nine directors of CIB Marine. This matter is more fully described in this Proxy Statement.

-5-

How do I vote?

You may vote your shares by proxy by any of the following methods: by mail, by telephone, or by internet. To vote by mail, complete and sign the enclosed proxy card and mail it in the enclosed pre-addressed envelope. No postage is required if mailed in the United States. If you mark your proxy card to indicate how you want your shares voted, your shares will be voted as you instruct. If you sign and return your proxy card but do not mark the card to provide voting instructions, the shares represented by your proxy card will be voted “for” all nine nominees for director named in this Proxy Statement. To vote your shares by telephone, please call the toll-free number located on the proxy card. To vote your shares by internet, use the internet site provided on the proxy card.

If you want to vote in person, please come to the meeting. We will distribute written ballots to anyone who wants to vote at the meeting. Please note, however, that if your shares are held in the name of your broker (or in what is usually referred to as “street name”), you will need to arrange to obtain a proxy from your broker in order to vote in person at the meeting.

What does it mean if I receive more than one proxy card?

It means that you have multiple holdings reflected in our stock transfer records and/or in accounts with stockbrokers. Please sign and return ALL proxy cards to ensure that all your shares are voted.

If I hold shares in the name of a broker, who votes my shares?

If you received this Proxy Statement from your broker, your broker should have given you instructions to direct it how to vote your shares. It will then be your broker’s responsibility to vote your shares for you in the manner you direct.

Under the rules of various national and regional securities exchanges, brokers may generally vote on routine matters, such as the election of directors. Nevertheless, we encourage you to provide directions to your broker as to how you want your shares voted on the matters to be brought before the meeting. You should do this by carefully following the instructions your broker gives you concerning its procedures. This ensures that your shares will be voted at the meeting.

What if I change my mind after I return my proxy?

If you hold your shares in your own name, you may revoke your proxy and change your vote at any time before the polls close at the meeting. You may do this by:

| | • | | signing another proxy with a later date and returning that proxy to us; |

| |

| | • | | voting by telephone or through the internet on a later date; |

| |

| | • | | sending notice to us that you are revoking your proxy; or |

| |

| | • | | voting in person at the meeting. |

You should send any later dated proxy or notice of revocation to: CIB Marine Bancshares, Inc., N27 W24025 Paul Court, Pewaukee, Wisconsin 53072, Attention: Daniel J. Rasmussen, Secretary.

If you hold your shares in the name of your broker and desire to revoke your proxy, you will need to contact your broker to revoke your proxy.

-6-

How many votes do we need to hold the annual meeting?

A majority of the shares that were outstanding and entitled to vote as of the record date must be present in person or by proxy at the meeting in order to hold the meeting and conduct business. Shares are counted as present at the meeting if the shareholder either is present and votes in person at the meeting, or has properly submitted a signed proxy card or telephone or internet proxy. The inspectors of election appointed for the annual meeting will determine whether or not a quorum is present. The inspectors of election will treat abstentions and broker non-votes as present and entitled to vote for purposes of determining the presence of a quorum. A broker non-vote occurs when a broker holding shares for a beneficial owner does not have authority to vote the shares and has not received instructions from the beneficial owner as to how the beneficial owner would like the shares to be voted. It is not anticipated there will be any broker non-votes, as brokers have discretion to vote for directors.

How many votes are required to approve the proposal?

The nine individuals receiving the highest number of votes cast “for” their election will be elected as our directors.

What options do I have for voting on the proposal?

You may vote “for” or “withhold” for each nominee for director. You may vote “for,” “against” or “abstain” on any other proposal that may properly be brought before the meeting.

How are votes counted?

Voting results will be tabulated and certified by our transfer agent, Computershare Investor Services, LLC.

Where do I find the voting results of the meeting?

We will announce voting results at the meeting. The voting results will also be disclosed in our Form 10-Q for the quarter ended June 30, 2008.

Who bears the cost of soliciting proxies?

We will bear the cost of soliciting proxies. In addition to solicitation of proxies by mail, our directors, officers or employees or directors, officers or employees of our subsidiaries may solicit proxies in person, by electronic mail, or by telephone. These persons will not receive any special or additional compensation for soliciting proxies. To aid in the solicitation of proxies, we have retained Georgeson, Inc., an affiliate of our transfer agent, for a fee of $7,500 plus expenses. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to shareholders.

-7-

PROPOSAL 1 — ELECTION OF DIRECTORS

Our Board is constituted of nine directors who serve staggered terms. This is accomplished as follows:

| | • | | the directors are divided into three classes of three directors each; |

| |

| | • | | each director serves a three-year term; and |

| |

| | • | | the term of each class of directors expires in different successive years. |

Since we have not had an annual meeting of shareholders since 2003, the terms of each director class have expired and each of these directors has continued to serve, since their successors have not been elected under Wisconsin law. Accordingly, in order for the staggered board to be properly constituted, at the 2008 annual meeting, three directors will be elected to serve for a one-year term expiring at the annual meeting in 2009, three directors will be elected to serve for a two-year term expiring at the annual meeting in 2010, and three directors will be elected to serve for a three-year term expiring at the annual meeting in 2011. At each subsequent annual meeting, only one class of directors will be elected to serve for a three-year term until such directors’ successors have been duly elected and qualified or until such directors’ earlier resignation, death or removal.

The Board has nominated Charles E. Baker, Norman E. Baker, W. Scott Blake, Stanley J. Calderon, John P. Hickey, Jr., Steven C. Hillard, Gary L. Longman, Donald M. Trilling and Howard E. Zimmerman to serve as directors. Each nominee is currently serving as a director and has consented to serve for a new term. We do not anticipate that any nominee will be unable or unwilling to stand for election, but if that happens, your proxy will be voted for another person nominated by the Board.

The Board of Directors recommends that you vote “FOR” the election of each of the nominees named above. Proxies solicited by our Board will be voted “FOR” these nominees unless otherwise instructed.

Information Regarding Nominees and Directors

Nominees for Election at the Annual Meeting to Serve Until 2009:

| | | | | | | |

| Name and Age | | Serving

Since | | Position with CIB Marine or Other Principal Occupation and Other Directorships |

| | | | | | | |

| Norman E. Baker (61) | | | 1988 | | | Chairman of Central Illinois Bank from February 2004 to March 2006; Director of Central Illinois Bank from 1988 to December 2007; Director of CIB Bank-Indiana from 1998 until its merger into Marine Bank in August 2006; Director of Marine Bank from August 2006 to December 2007; Chairman of Marine Bank FSB from February 2004 to June 2005; and Director of Marine Bank from October 1999 until its merger into Marine Bank in March 2006. President and Chief Executive Officer of Estoy Pronto, Inc., a consulting and investment company, since July 1994. |

| | | | | | | |

| W. Scott Blake (47) | | | 1987 | | | Chairman of CIB Marine from February 2004 to March 2007; Chairman of Marine Bank since March 2006; Director of Marine Bank since December 2002; Manager |

-8-

| | | | | |

| | | | | of CIB Marine Capital LLC since 2001; and Director of MICR, Inc. since 2000. President of Blake Capital Corp., a real estate development, investment and property management company, since July 1998.(1) (2) |

| | | | | | | |

| Donald M. Trilling (77) | | | 1987 | | | Chairman of the Board of CIB Marine from September 1987 to February 2004; Director of Central Illinois Bank from 1987 to April 2004. Sales Representative at TTT, a phone service company, since January 2005; Secretary of Illini Tile Distributors Inc., an importer and distributor of ceramic tiles, from 1983 to 2002.(3) |

| | |

| (1) | | Mr. Blake resigned as Chairman of CIB Marine in the first quarter of 2007. Mr. Blake remains a director of CIB Marine. |

| |

| (2) | | In November 2005, CIB Marine sold substantially all of the assets of MICR and changed the company’s name to Everett Tech Inc. Everett Tech, Inc. was dissolved in January 2008. |

| |

| (3) | | In September 2003, Illini Tile Distributors, Inc. entered into liquidation through an assignment for the benefit of creditors under Illinois law. |

Nominees for Election at the Annual Meeting to Serve Until 2010:

| | | | | | | |

| Name and Age | | Serving

Since | | Position with CIB Marine or Other Principal Occupation and Other Directorships |

| | | | | | | |

| John P. Hickey, Jr. (60) | | | 2007 | | | Director of CIB Marine since May 2007; President and Chief Executive Officer of CIB Marine since March 2007; Director, President and Chief Executive Officer of Marine Bank since April 2006. Prior to joining CIB Marine, Mr. Hickey was Senior Vice President of Business Banking at Guaranty Bank in 2006; and from 2001 to 2005 held senior management positions with Marsh McLennan, first as Managing Director of the Western region, then as the Managing Director of a substantial business segment of the company.(1) |

| | | | | | | |

| Charles E. Baker (62) | | | 2008 | | | Senior Technical Advisor at Clifton Gunderson LLP, an accounting, tax and consulting services firm, since January 2006; Partner at Ernst & Young LLP, an accounting, tax and advisory services firm, from 1969 to 2005; Director of Marine Bank since July 2006.(2) |

| | | | | | | |

| Howard E. Zimmerman (78) | | | 1987 | | | Retired; Chairman of the Board of Zimmerman Real Estate Group, a real estate appraisal and consulting company since 1986. |

| | |

| (1) | | Mr. Hickey was appointed President and Chief Executive Officer of CIB Marine in March 2007, and was appointed to the Board of CIB Marine in April 2007. |

| |

| (2) | | Mr. Baker was appointed to the Board of CIB Marine in January 2008. |

-9-

Nominees for Election at the Annual Meeting to Serve Until 2011:

| | | | | | | |

| Name and Age | | Serving

Since | | Position with CIB Marine or Other Principal Occupation and Other Directorships |

| | | | | | | |

| Stanley J. Calderon (62) | | | 2004 | | | Chairman of CIB Marine since March 2007; President and Chief Executive Officer of CIB Marine from April 2004 to March 2007; Director of Central Illinois Bank since December 2004, Marine Bank since February 2005, Citrus Bank since February 2005, and CIB Marine Information Services, Inc. since March 2005. Prior to joining CIB Marine, Mr. Calderon was Executive Vice President and Manager of Middle Market Banking for the Midwest Region of Bank One from 1999 to 2003.(1) |

| | | | | | | |

| Steven C. Hillard (45) | | | 2004 | | | Director of CIB Marine from 1991 to 2002 and since September 2004; Director of MICR, Inc. since December 2004. President of HILMUN Holdings, Inc., a diversified holding company with interests in manufacturing and financial investments, since September 1991; Chief Executive Officer and Chairman of the Board of Pinnacle Door Company, a distributor and installer of garage doors from 1992 to 2007; and Chairman, President and Chief Executive Officer of Strategic Capital Bancorp, Inc. from November 2002 to September 2004.(2) |

| | | | | | | |

| Gary L. Longman (59) | | | 2004 | | | President and CEO of Sunny Ridge Family Center Inc., an adoption agency, since June 2003; President of G.L. Longman Consulting, a consulting business, since January 2001; Partner at KPMG, LLP, an accounting, tax and advisory services firm from 1980 to 2000. |

| | |

| (1) | | On March 2, 2007, Mr. Calderon resigned from his positions as President and Chief Executive Officer of CIB Marine and was succeeded by Mr. John P. Hickey, Jr. Mr. Calderon was appointed Chairman of the Board of Directors of CIB Marine on March 8, 2007. |

| |

| (2) | | In November 2005, CIB Marine sold substantially all of the assets of MICR and changed the company’s name to Everett Tech Inc. Everett Tech, Inc. was dissolved in January 2008. |

CORPORATE GOVERNANCE AND BOARD COMMITTEES

Director Independence

The Board has determined that each of the following directors is an “independent director” as such term is defined in Nasdaq Marketplace Rule 4200(a)(15): Charles E. Baker, Norman E. Baker, W. Scott Blake, Steven C. Hillard, Gary L. Longman, Donald M. Trilling and Howard E. Zimmerman. Stanley J. Calderon and John P. Hickey, Jr. are not independent under the Nasdaq rule since both are or were officers of CIB Marine during the past three years. Jose Araujo, who was a director until his death in March 2007, was not an independent director due to his employment at Citrus Bank.

Board Meetings and Committees

The Board of Directors held twelve meetings during 2007. During 2007, each of our directors attended at least 75% of the aggregate number of meetings of our Board of Directors and meetings of any committee on which such director served. Our Board of Directors has an established Audit Committee and a Compensation and Stock Option Committee. The membership and function of the committee and the number of meetings held by each committee is described below.

-10-

| | | | | | | |

| | | | | | | # of |

| | | | | | | Meetings |

| Committee | | Members | | Primary Responsibilities | | in 2007 |

| | | | | | | |

| Audit | | Mr. Hillard

Mr. Longman (Chair)

Mr. Trilling

Mr. Zimmerman | | Assist the Board in its general oversight of CIB Marine’s financial reporting, internal controls and audit functions. | | 4 |

| | | | | | | |

| Compensation and Stock Option | | Mr. N. Baker

Mr. Blake

Mr. Calderon

Mr. Hillard

Mr. Longman

Mr. Trilling

Mr. Zimmerman (Chair) | | Establish policies relating to executive compensation, determine the salary and bonus of the named executive officers, recommend to the Board of Directors the adoption of, or any substantive amendments to, any employee benefit or long-term executive compensation plan or program in which named executive officers participate, and administer the stock-based plan of CIB Marine. | | 3 |

Our Board has adopted a written charter for both the Audit Committee and Compensation and Stock Option Committees setting forth the specific duties, responsibilities and authorities of the committees. The charters are available in the “Corporate Governance” section of our website atwww.cibmarine.com.

The Board of Directors has determined that all of the members of the Audit Committee and all of the members of the Compensation and Stock Option Committee, except Mr. Calderon, satisfy the independence requirements of Nasdaq. In addition, the Board has determined that Mr. Longman is an “audit committee financial expert” as such term is defined by the SEC rules.

Board Attendance at Annual Shareholder Meeting

We expect our directors to attend our annual meetings of shareholders, subject to any scheduling or other conflicts.

Nomination of Directors

We do not have a nominating committee or charter. The Board performs the functions of a nominating committee, and considers and acts on all matters relating to the nomination of individuals for election as directors. The Board does not believe that a separate nominating committee is necessary because the Board has the ability to perform the function of selecting and evaluating director nominees, and does so on behalf of our interests and in accordance with our Restated Bylaws.

Nominations for director by shareholders should be sent to us on a timely basis, either in person or by certified mail, to the attention of the Secretary. Any recommendations submitted to the Secretary should be in writing and should include whatever supporting material the shareholder considers appropriate in support of that recommendation, but must include the information that would be required to be disclosed under the SEC’s rules in a proxy statement soliciting proxies for the election of such candidate and a signed consent of the candidate to serve as our director if elected. Nominations must be delivered to or mailed to and received by our Secretary not fewer than 60 days or more than 90 days prior to the anniversary date of the annual meeting of the shareholders in the immediately preceding year.

-11-

In the consideration of director nominees, including any nominee that a shareholder may submit, the Board of Directors considers, at a minimum, the following factors: (1) the ability of the prospective nominee to represent the interests of our shareholders; (2) the prospective nominee’s standards of integrity, commitment and independence of thought and judgment; (3) the freedom of the prospective nominee from any conflict of interest which would violate any applicable law or regulation or interfere with the proper performance of the responsibilities of the director; (4) the prospective nominee’s ability to dedicate sufficient time to the performance of his or her duties; and (5) the extent to which the prospective nominee contributes to the range of talent, skill and expertise appropriate for the Board. The Board will evaluate all potential candidates in the same manner, regardless of the source of the recommendation. Based on the information provided to the Board, it will make an initial determination whether to conduct a full evaluation of a candidate. As part of the full evaluation process, the Board may conduct interviews, obtain additional background information, and conduct reference checks of the candidate.

Communications with Directors

Shareholders and other interested parties may communicate with any director by sending written correspondence addressed to such director in care of our Secretary at CIB Marine Bancshares, Inc., N27 W24025 Paul Court, Pewaukee, WI 53072. Our Secretary or his designee will forward such correspondence to the relevant director.

EXECUTIVE AND DIRECTOR COMPENSATION

2007 SUMMARY COMPENSATION TABLE

The following table sets forth the cash and non-cash compensation for the last two fiscal years, where applicable, awarded to or earned by our Named Executive Officers.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| SUMMARY COMPENSATION TABLE | |

| | | | | | | | | | | | | | | | | | | All Other | | | | |

| | | | | | | | | | | | | | | Option | | | Compensation | | | | |

| Name and Principal Position | | Year | | | | Salary ($) | | | Bonus ($) | | | Awards ($)(1) | | | ($)(2) | | | Total ($) | |

John P. Hickey, Jr.(3)

| | | 2007 | | | $ | 249,846 | | | $ | 45,000 | (4)(5) | | $ | 4,783 | | | $ | 12,046 | | | $ | 311,675 | |

| President and CEO | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Stanley J. Calderon(3) | | | 2007 | | | $ | 162,923 | | | $ | 78 | | | $ | — | | | $ | 9,123 | | | $ | 172,124 | |

| Former President and CEO | | | 2006 | | | | 278,000 | | | | — | | | | — | | | | 15,264 | | | | 293,264 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Steven T. Klitzing | | | 2007 | | | $ | 178,882 | (6) | | $ | 15,000 | | | $ | — | | | $ | 11,780 | | | $ | 205,662 | |

| Executive Vice President, Chief | | | 2006 | | | | 195,000 | | | | — | | | | 8,820 | | | | 27,888 | | | | 231,708 | |

| Financial Officer and Treasurer | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Michael L. Rechkemmer | | | 2007 | | | $ | 180,000 | | | $ | 15,000 | | | $ | — | | | $ | 9,616 | | | $ | 204,616 | |

| Executive Vice President and | | | 2006 | | | | 180,000 | | | | — | | | | 5,880 | | | | 11,503 | | | | 197,383 | |

| Chief Operations Officer | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Daniel J. Rasmussen | | | 2007 | | | $ | 159,385 | | | $ | 22,500 | | | $ | — | | | $ | 7,600 | | | $ | 189,485 | |

| Senior Vice President, General | | | 2006 | | | | 151,000 | | | | — | | | | 5,880 | | | | 7,915 | | | | 164,795 | |

| Counsel and Secretary | | | | | | | | | | | | | | | | | | | | | | | | |

-12-

| | |

| (1) | | Represents grants of options to purchase our Common Stock made pursuant to our stock option plan. This column shows the dollar amount of expense recognized by us for financial reporting purposes in 2007 in accordance with Financial Accounting Standards No. 123R (“SFAS No. 123R), disregarding adjustments for potential forfeitures, for all outstanding stock options granted to each Named Executive Officer. See Item 8, Note 1 — Summary of Significant Accounting Policies Stock-Based Compensation contained in Part II of our 2007 Form 10-K for a discussion of the assumptions made by us in the valuation of these option awards. Under SFAS No. 123R, the fair value of option awards is recognized as expense over the vesting period of the award. |

| |

| (2) | | The table below provides the details of amounts included in the “All Other Compensation” table for each Named Executive Officer. The perquisites are valued for disclosure purposes at their incremental cost to us in accordance with SEC regulations. |

| |

| (3) | | On March 2, 2007, Mr. Calderon resigned from his positions as our President and Chief Executive Officer and was succeeded by Mr. John P. Hickey, Jr. Mr. Calderon was appointed Chairman of our Board of Directors on March 8, 2007. Prior to being named our President and CEO, Mr. Hickey was an employee of Marine Bank. |

| |

| (4) | | This amount includes a $30,000 signing bonus paid by Marine Bank to Mr. Hickey pursuant to the terms of his employment agreement with Marine Bank in connection with his position as President and CEO of the bank. |

| |

| (5) | | During 2006, Messrs. Hickey, Klitzing, Rasmussen and Rechkemmer were provided with company-owned automobiles for their use. In 2007, CIB Marine terminated this perquisite, and Messrs. Hickey, Klitzing, Rasmussen and Rechkemmer were each paid a one-time payment of $15,000 in lieu of the continued program. |

| |

| (6) | | On November 14, 2007, Mr. Klitzing resigned from all positions with us, including Chief Financial Officer. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Life | | | | | | | | | | | | | | | | | |

| | | | | | | Insurance | | | 401(k) | | | Car | | | | | | | Parking/ | | | | |

| Name and Position | | Year | | | Premiums | | | Match | | | Allowance | | | Club Dues | | | Transit | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| John P. Hickey, Jr. | | | 2007 | | | $ | 1,866 | | | $ | 6,750 | | | $ | 3,430 | | | $ | — | | | $ | — | | | $ | 12,046 | |

| President and CEO | | | 2006 | | | | 669 | | | | 3,000 | | | | 10,020 | | | | | | | | | | | | 13,689 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stanley J. Calderon | | | 2007 | | | $ | 1,866 | | | $ | 4,888 | | | $ | — | | | $ | 468 | | | $ | 1,901 | | | $ | 9,123 | |

| Former President and CEO | | | 2006 | | | | 1,841 | | | | 8,267 | | | | — | | | | 2,484 | | | | 2,672 | | | | 15,264 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Steven T. Klitzing | | | 2007 | | | $ | 144 | | | $ | 419 | | | $ | 11,217 | | | $ | — | | | $ | — | | | $ | 11,780 | |

| Executive Vice President, | | | 2006 | | | | 156 | | | | 5,376 | | | | 22,356 | | | | — | | | | — | | | | 27,888 | |

| Chief Financial Officer and Treasurer | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Michael L. Rechkemmer | | | 2007 | | | $ | 1,176 | | | $ | 5,882 | | | $ | 1,077 | | | $ | — | | | $ | 1,481 | | | $ | 9,616 | |

| Executive Vice President and | | | 2006 | | | | 1,151 | | | | 5,491 | | | | 3,033 | | | | — | | | | 1,828 | | | | 11,503 | |

| Chief Operations Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Daniel J. Rasmussen | | | 2007 | | | $ | 186 | | | $ | 5,419 | | | $ | 1,995 | | | $ | — | | | $ | — | | | $ | 7,600 | |

| Senior Vice President, General | | | 2006 | | | | 161 | | | | 4,249 | | | | 3,505 | | | | — | | | | — | | | | 7,915 | |

| Counsel and Secretary | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Employment Agreements

In October 2007, we entered into an employment agreement with Mr. Hickey, our President and CEO, which continues until June 1, 2010 and provides for a minimum base salary of $260,000 per year, and 50,000 stock options pursuant to our stock option plan which were granted on May 31, 2007. The agreement also provides for severance equal to continued salary for the remainder of the term of the agreement if Mr. Hickey’s employment is terminated by us for other than cause or he terminates his employment with us for good reason (as defined in the agreement), including a change in control of CIB Marine.

-13-

In addition, we had an employment agreement with Mr. Calderon, our President and CEO, that terminated March 2, 2007 as a result of his resignation as CEO. It provided for a minimum base salary of $450,000 per year, a year-end bonus subject to the sole discretion of the Board of Directors, and 150,000 stock options pursuant to our stock option plan, which were granted to Mr. Calderon on September 29, 2005. In 2005, 2006 and 2007, Mr. Calderon voluntarily agreed to salary reductions. In addition, the agreement provided for a severance payment to Mr. Calderon if Mr. Calderon’s employment was terminated by us without cause, or Mr. Calderon terminated his employment due to good reason (as defined in the agreement), including a change in control of CIB Marine. As a result of his resignation, Mr. Calderon received no severance benefits under the agreement.

401(k) Plan

Our 401(k) plan is a tax-qualified retirement plan the covers all eligible employees generally, including the Named Executive Officers. An employee can elect to defer a percentage of his or her compensation on a pre-tax basis, up to a maximum in 2007 of $15,500, or $20,500 if age 50 or over, and we contribute a matching contribution of 50% up to 6% of the employee’s deferral contributions. Our contributions under the plan on behalf of each Named Executive Officer are included in the “All Other Compensation” column of the Summary Compensation Table of this Proxy Statement. We provide no other retirement benefits for our executives, including the Named Executive Officers.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

This table sets forth the information for each Named Executive Officer with respect to each grant of stock options outstanding as of March 31, 2008.

| | | | | | | | | | | | | | | | | |

| | | Option Awards |

| | | Number of | | Number of | | | | |

| | | Securities | | Securities | | | | |

| | | Underlying | | Underlying | | | | |

| | | Unexercised | | Unexercised | | Option | | Option |

| | | Options (#) | | Options(#) | | Exercise | | Expiration |

| Name | | Exercisable | | Unexercisable | | Price ($) | | Date |

| | | | | | | | | | | | | | | | | |

| John P. Hickey, Jr. | | | 0 | | | | 50,000 | (1) | | $ | 4.10 | | | | 05/31/2017 | |

| | | | 5,000 | | | | 20,000 | (2) | | | 4.10 | | | | 11/16/2016 | |

| | | | 10,000 | | | | 15,000 | (3) | | | 4.10 | | | | 03/30/2016 | |

| | | | | | | | | | | | | | | | | |

| Stanley J. Calderon | | | 60,000 | | | | 90,000 | (4) | | $ | 4.10 | | | | 09/29/2015 | |

| | | | | | | | | | | | | | | | | |

| Steven T. Klitzing | | | 0 | (5) | | | 0 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | |

| Michael L. Rechkemmer | | | 5,700 | | | | 0 | | | $ | 13.07 | | | | 02/25/2008 | |

| | | | 7,050 | | | | 0 | | | | 16.23 | | | | 07/29/2009 | |

| | | | 10,190 | | | | 0 | | | | 18.40 | | | | 07/27/2010 | |

| | | | 9,830 | | | | 0 | | | | 22.89 | | | | 11/29/2011 | |

| | | | 8,000 | | | | 12,000 | (4) | | | 4.10 | | | | 09/29/2015 | |

| | | | 4,000 | | | | 16,000 | (2) | | | 4.10 | | | | 11/16/2016 | |

| | | | | | | | | | | | | | | | | |

| Daniel J. Rasmussen | | | 1,350 | | | | 0 | | | $ | 16.23 | | | | 07/29/2009 | |

| | | | 1,332 | | | | 0 | | | | 18.40 | | | | 07/27/2010 | |

| | | | 1,365 | | | | 0 | | | | 22.89 | | | | 11/29/2011 | |

| | | | 8,000 | | | | 12,000 | (4) | | | 4.10 | | | | 09/29/2015 | |

| | | | 4,000 | | | | 16,000 | (2) | | | 4.10 | | | | 11/16/2016 | |

| | |

| (1) | | One-fifth of these options become fully exercisable on May 31, 2008, one-fifth become fully exercisable on May 31, 2009, one-fifth become fully exercisable on May 31, 2010, one-fifth become fully exercisable on May 31, 2011, and one-fifth become fully exercisable on May 31, 2012. |

-14-

| | |

| (2) | | One-fifth of these options became fully exercisable on November 16, 2007, one-fifth become fully exercisable on November 16, 2008, one-fifth become fully exercisable on November 16, 2009, one-fifth become fully exercisable on November 16, 2010, and one-fifth become fully exercisable on November 16, 2011. |

| |

| (3) | | One-fifth of these options became fully exercisable on March 30, 2007, one-fifth of these options became fully exercisable on March 30, 2008, one-fifth of these options become fully exercisable on March 30, 2009, one-fifth of these options become fully exercisable on March 30, 2010, and one-fifth of these options become fully exercisable on March 30, 2011. |

| |

| (4) | | One-fifth of these options became fully exercisable on September 29, 2006, one-fifth became fully exercisable on September 29, 2007, one-fifth become fully exercisable on September 29, 2008, one-fifth become fully exercisable on September 29, 2009, and one-fifth become fully exercisable on September 29, 2010. |

| |

| (5) | | On November 14, 2007, Mr. Klitzing resigned from all positions with CIB Marine, including Chief Financial Officer, and all outstanding options expired. |

If a Named Executive Officer’s employment terminates by reason of death or disability, all of the Named Executive Officer’s outstanding options vest and may be exercised within twelve months after the date of such termination, but in no event later than the expiration date of such options.

DIRECTORS’ COMPENSATION

For fiscal year 2007, the Board agreed to forego the payment of the normal retainer for all Board members except as noted below for Messrs. Blake and Calderon. The Board agreed to compensate Mr. Blake $120,000 annually, due to his continued increased responsibilities and in lieu of Board and committee meeting fees for both us and any of our subsidiaries’ committees. Upon Mr. Calderon’s resignation as President and CEO and appointment as Chairman in March 2007, the Board agreed to compensate Mr. Calderon $180,000 annually, due to his continuing responsibilities as Chairman and in lieu of Board and committee meeting fees for both us and any of our subsidiaries’ committees. In July 2007, Messrs. Blake and Calderon voluntarily agreed to a reduction of their annual compensation from $120,000 to $80,000, and $180,000 to $120,000, respectively. With the exception of Messrs. Blake and Calderon, non-employee Directors received a fee of $1,000 for each Board meeting attended. Non-employee Directors serving on the Audit, Executive, Litigation, Investment, and Executive Loan Committees received a fee of $1,000, $1,000, $300, $300 and $300, respectively per meeting attended, except that the Chairman of the Audit Committee was paid $2,000 per Audit Committee meeting attended. In addition, the Chairman of the Audit Committee was paid an annual retainer of $10,000.

The following table sets forth all compensation paid to each of our non-employee Directors in 2007:

| | | | | | | | | | | | | |

| | | Fees Earned or | | | Option | | | | |

| Name | | Paid in Cash ($) | | | Awards ($)(1) | | | Total ($) | |

| | | | | | | | | | | | | |

Charles E. Baker(2) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | |

| Norman E. Baker | | | 35,700 | | | | — | | | | 35,700 | |

| | | | | | | | | | | | | |

| W. Scott Blake | | | 100,000 | | | | — | | | | 100,000 | |

| | | | | | | | | | | | | |

| Steven C. Hillard | | | 15,000 | | | | — | | | | 15,000 | |

| | | | | | | | | | | | | |

| Gary L. Longman | | | 29,900 | | | | — | | | | 29,900 | |

| | | | | | | | | | | | | |

| Donald M. Trilling | | | 16,000 | | | | — | | | | 16,000 | |

| | | | | | | | | | | | | |

| Howard Zimmerman | | | 16,000 | | | | — | | | | 16,000 | |

| | |

| (1) | | There were no options granted to directors during 2007. As of December 31, 2007, the Directors had the following amounts of outstanding options: Charles E. Baker – 0; Norman E. Baker – 33,050; W. Scott Blake – 108,050; Stanley Calderon – 150,000; Steven C. Hillard – 0; Donald M. Trilling – 33,050; and Howard E. Zimmerman – 33,050. |

| |

| (2) | | Mr. Baker was appointed to the Board in January 2008. |

-15-

Mr. Hickey is not included in this table since he is a Named Executive Officer and received no additional compensation for service as a director. Mr. Calderon is also not included in this table since he was a Named Executive Officer during 2007. The compensation paid to Mr. Calderon is set forth in the Summary Compensation Table.

Directors are reimbursed for any out-of-pocket expenses they incur. Our Directors who are also directors of our subsidiaries receive compensation from such subsidiaries in varying amounts based on the director compensation schedules of such subsidiaries. The only director in 2007 to be paid such compensation was Norman E. Baker, whose fees totaled $11,600.

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 31, 2008, unless otherwise indicated, the number of shares of our Common Stock beneficially owned by (1) each shareholder who is known by us to be a beneficial owner of more than five percent of our outstanding Common Stock, (2) each of our directors, (3) each of our Named Executive Officers named in the Summary Compensation Table on page 12, and (4) all of our directors and executive officers as a group.

| | | | | | | | | |

| | | Beneficial Ownership of | |

| | | Common Stock | |

| | | | | | | Percentage of | |

| | | Amount and Nature of | | | Common Stock | |

| Beneficial Owner | | Beneficial Ownership(1) | | | Outstanding |

5% Stockholders | | | | | | | | |

| Bradford M. Johnson | | | | | | | | |

| P.O. Box 8208 | | | | | | | | |

| Shawnee Mission, KS 66208-8208 | | | 1,116,378 | (2) | | | 6.09 | % |

| | | | | | | | | |

Director Nominees, Directors, and Named Executive Officers | | | | | | | | |

| | | | | | | | | |

| Charles E. Baker | | | — | | | | * | |

| Norman E. Baker | | | 402,500 | (3) | | | 2.20 | %(4) |

| W. Scott Blake | | | 248,750 | (5) | | | 1.36 | %(4) |

| Stanley J. Calderon | | | 60,108 | (6) | | | * | |

| John P. Hickey, Jr. | | | 10,002 | (7) | | | * | |

| Steven C. Hillard | | | 165,030 | | | | * | |

| Steven T. Klitzing | | | 26,850 | | | | * | |

| Gary L. Longman | | | — | | | | * | |

| Daniel J. Rasmussen | | | 16,445 | (8) | | | * | |

| Michael L. Rechkemmer | | | 55,825 | (9) | | | * | |

| Donald M. Trilling | | | 230,532 | (10) | | | 1.26 | %(4) |

| Howard E. Zimmerman | | | 140,650 | (11) | | | * | |

All Directors and Executive Officers as a group (14 persons) | | | 1,414,818 | | | | 7.71 | %(12) |

| | |

| * | | Less than one percent |

| |

| (1) | | Unless otherwise indicated, the nature of beneficial ownership for shares shown in this column is sole voting and investment power. |

| |

| (2) | | Based solely on information provided in Schedule 13-G filed with the Securities & Exchange Commission by the beneficial owner. |

| |

| (3) | | Includes 33,050 shares Mr. Baker has the right to acquire within 60 days upon the exercise of stock options. |

| |

| (4) | | Percentage is calculated on a partially diluted basis, assuming only the exercise of stock options by such individual which are exercisable within 60 days. |

| |

| (5) | | Includes 48,050 shares that Mr. Blake has the right to acquire within 60 days upon the exercise of stock options, and 67,500 shares held in three trusts for the benefit of Mr. Blake’s mother, for which Mr. Blake shares voting and investment powers, and for which Mr. Blake disclaims beneficial ownership. |

| |

| (6) | | Includes 60,000 shares that Mr. Calderon has the right to acquire within 60 days upon the exercise of stock options. |

-16-

| | |

| (7) | | Includes 15,000 shares that Mr. Hickey has the right to acquire within 60 days upon the exercise of stock options. |

| |

| (8) | | Includes 16,047 shares that Mr. Rasmussen has the right to acquire within 60 days upon the exercise of stock options. |

| |

| (9) | | Includes 44,770 shares that Mr. Rechkemmer has the right to acquire within 60 days upon the exercise of stock options. |

| |

| (10) | | Includes 68,705 shares held in a trust for the benefit of Mr. Trilling’s wife and 33,050 shares that Mr. Trilling has the right to acquire within 60 days upon the exercise of stock options. |

| |

| (11) | | Includes 33,050 shares Mr. Zimmerman has the right to acquire within 60 days upon the exercise of stock options. |

| |

| (12) | | Percentage is calculated on a partially diluted basis, assuming the exercise of all stock options which are exercisable within 60 days by all directors and executive officers. |

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The audit committee reviewed and discussed with management CIB Marine’s audited financial statements as and for the fiscal year ended December 31, 2007.

The audit committee discussed with CIB Marine’s independent auditors, KPMG LLP, the matters required to be discussed by the statement on Auditing Standards No. 61, as amended (AICPA,Professional StandardsVol. 1, AU 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T. The audit committee has received the written disclosures and letter from KPMG LLP, required by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees), as adopted by the Public Company Accounting Oversight Board in Rule 3600T, and discussed with KPMG LLP, the independence of that firm.

Based on the review and discussions referred to above, the audit committee recommended to the Board of Directors that the audited financial statements be included in CIB Marine’s annual report on Form 10-K for the fiscal year ended December 31, 2007.

| | | |

| Respectfully Submitted, | | |

| | | |

The Audit Committee | | |

| | | |

| Steven C. Hillard | | Donald M. Trilling |

| Gary L. Longman (Chairman) | | Howard E. Zimmerman |

FEES OF INDEPENDENT AUDITORS

The following table presents fees for professional audit services rendered by KPMG LLP for the audit of our annual financial statements for 2007 and 2006, and fees billed for other services rendered by KPMG LLP.

| | | | | | | | | |

| | | 2007 | | | 2006 | |

| Audit fees | | $ | 466,500 | | | $ | 440,000 | |

Audit related fees(1) | | | 48,175 | | | | 39,000 | |

Tax fees (2) | | | 151,500 | | | | 99,000 | |

| | | | | | |

| Total fees | | $ | 666,175 | | | $ | 578,000 | |

| | | | | | | |

| | |

| (1) | | The audit related fees were actually incurred and paid by our ESOP and 401(k) Plans. |

| |

| (2) | | Tax fees consisted of fees for tax consultation and tax compliance services. |

-17-

The audit committee pre-approves all auditing services and permitted non-audit services provided by the independent auditors. These services may include audit services, audit-related services, tax services, and other services. The audit committee pre-approved all services performed by the independent auditors in 2007.

INDEPENDENT PUBLIC ACCOUNTANTS

Our independent public accounting firm for the fiscal year ended December 31, 2007 was KPMG LLP. Our Audit Committee has not yet appointed auditors for the fiscal year ending December 31, 2008 because it is in the process of evaluating the proposed terms of KPMG LLP’s engagement, and expect to make such appointment in the second quarter 2008. Representatives of KPMG LLP are expected to attend the 2008 shareholder meeting. They will be given the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions from shareholders present at the meeting.

OTHER MATTERS

Section 16 — Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires executive officers and directors, and persons who own more than ten percent of a registered class of our stock, to file reports of ownership and changes in ownership with the SEC. Executive officers, Directors and greater than ten percent shareholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file.

Based solely on our review of the copies of such forms received by us, and written representations from reporting persons that no Annual Statement of Changes In Beneficial Ownership of Securities on Form 5 were required for those persons, we believe that, for the period from January 1, 2007 through December 31, 2007, our executive officers and directors complied with all filing requirements applicable to them.

Code of Ethics

We have adopted a Code of Ethics (the “Code”) which applies to all of our directors, officers and employees, including its chief executive officer and senior financial officers. A copy of the Code may be accessed on our website at www.cibmarine.com by clicking on the “Code of Ethics Policy” link in “Corporate Governance.”

Certain Relationships and Related Transactions

Transactions with Related Persons

During 2007, our directors and executive officers, as well as members of their immediate families and various corporations and other entities associated with our directors, were clients of and had transactions with our subsidiaries in the ordinary course of business. These transactions included loans and deposits. Similar transactions may occur in the ordinary course of business in the future. All loans were made on a non-preferential basis and did not involve more than the normal risk of collectibility or present other unfavorable terms.

Review, Approval or Ratification of Related Party Transactions

We have various policies and procedures, including our Code of Ethics policy, annual questionnaires completed by all directors and executive officers, and regulatory compliance requirements (including Regulation O, which restricts loans by the banks to directors, executive officers, principle shareholders

-18-

and their affiliates and requires approval by the board of directors of the banks for certain such loans), all of which are designed to identify transactions or relationships that may constitute conflicts of interest or otherwise require disclosure under applicable SEC rules. When such a transaction or relationship is identified, our Board of Directors evaluates the transaction or relationship and determines if the transaction is permissible or a prohibited conflict of interest.

SHAREHOLDER PROPOSALS FOR THE 2009 MEETING

To be considered for inclusion in our proxy statement in connection with next year’s annual shareholder meeting, a shareholder proposal to take action at such meeting must be in writing and received by our Secretary, at the address set forth on the first page of this Proxy Statement, no later than December 5, 2008. Any shareholder proposal submitted to us for inclusion in the Proxy Statement will be subject to Rule 14a-8 under the Securities Exchange Act of 1934. Also, under our Restated Bylaws, other proposals that are not included in the Proxy Statement will be considered timely and may be presented at next year’s annual shareholder meeting if the requirements described below are satisfied.

Our Restated Bylaws provide an advance notice procedure for nominations to the Board of Directors and certain business to be brought before an annual meeting. Generally, in order for a shareholder to make a nomination or bring business before an annual meeting, the shareholder must give notice thereof in writing to our Secretary no later than the close of business on the 60th day, nor earlier than the close of business on the 90th day, prior to the first anniversary of the preceding year’s annual meeting. The shareholder must also comply with certain other provisions set forth in our Restated Bylaws. For a copy of our Restated Bylaws, which include the provisions relating to advance notice for nominations and proposals, an interested shareholder should contact our Secretary at N27 W24025 Paul Court, Pewaukee, Wisconsin 53072.

Our Board of Directors is not aware of any business or matter, which will be presented for consideration at the meeting other than as stated in the Notice of Annual Meeting of Shareholders. If, however, any other matter properly comes before the meeting, it is the intention of the persons named in the accompanying proxy card to vote the shares represented thereby on such matters in accordance with their best judgment.

This Proxy Statement is provided to you at the direction of our Board of Directors.

Daniel J. Rasmussen

Senior Vice President

General Counsel and Secretary

-19-

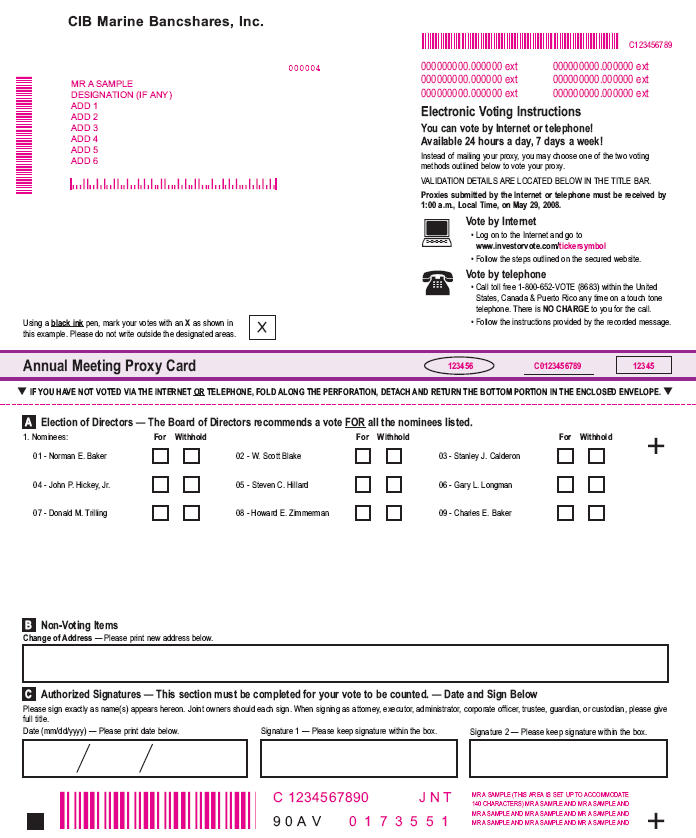

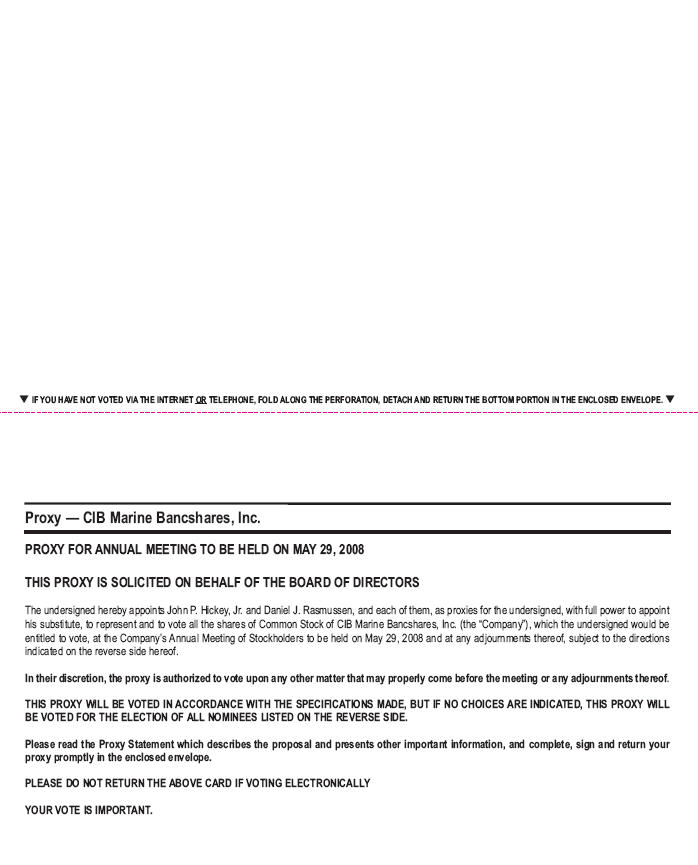

| . NNNNNNNNNNNN CIB Marine Bancshares, Inc. NNNNNNNNN MR A SAMPLE DESIGNATION (IF ANY) ADD 1 ADD 2 ADD 3 ADD 4 ADD 5 ADD 6 Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas. X 000004 NNNNNNNNNNNNNNN C123456789 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext Electronic Voting Instructions You can vote by Internet or telephone! Available 24 hours a day, 7 days a week! Instead of mailing your proxy, you may choose one of the two voting methods outlined below to vote your proxy. VALIDATION DETAILS ARE LOCATED BELOW IN THE TITLE BAR. Proxies submitted by the Internet or telephone must be received by 1:00 a.m., Local Time, on May 29, 2008. Vote by Internet• Log on to the Internet and go to www.investorvote.com/tickersymbol• Follow the steps outlined on the secured website. Vote by telephone Call toll free 1-800-652-VOTE (8683) within the United States, Canada & Puerto Rico any time on a touch tone telephone. There is NO CHARGE to you for the call. Follow the instructions provided by the recorded message. ? IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. ? Election of Directors — The Board of Directors recommends a vote FOR all the nominees listed. 1. Nominees: For Withhold For Withhold For Withhold 01 — Norman E. Baker + 02 — W. Scott Blake 03 — Stanley J. Calderon 04 — John P. Hickey, Jr. 05 — Steven C. Hillard 06 — Gary L. Longman 07 — Donald M. Trilling 08 — Howard E. Zimmerman 09 — Charles E. Baker Non-Voting Items Change of Address — Please print new address below. Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below Please sign exactly as name(s) appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, corporate officer, trustee, guardian, or custodian, please give full title. Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box. MR A SAMPLE (THIS AREA IS SET UP TO ACCOMMODATE C 1234567890 J N T 140 CHARACTERS) MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND 90AV 0173551 MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND NNNNNNN + <STOCK#> 00VAOB . |

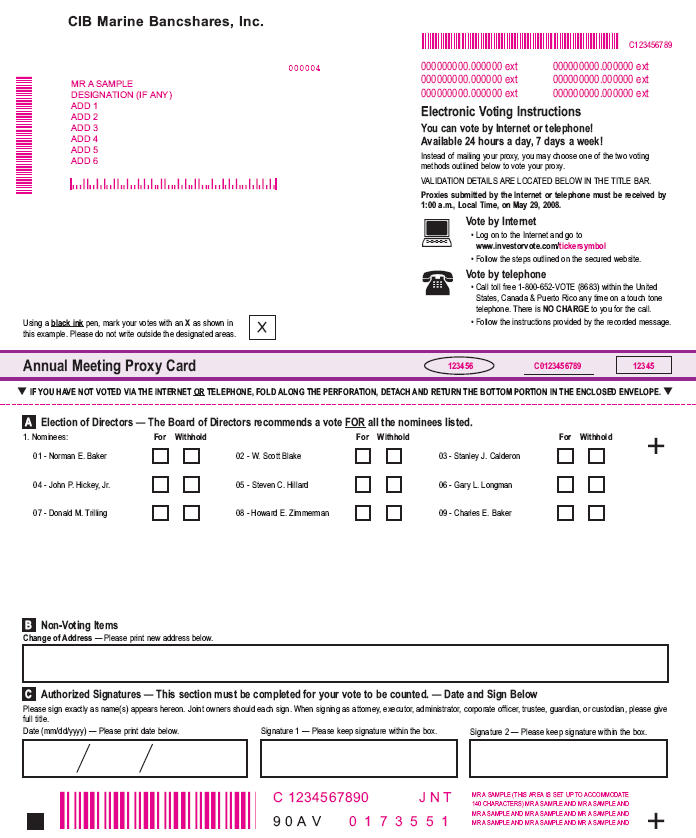

| ? IF YOU HAVE NOT VOTED VIA THE INTERNET OR TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. ? Proxy — CIB Marine Bancshares, Inc. PROXY FOR ANNUAL MEETING TO BE HELD ON MAY 29, 2008 THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS The undersigned hereby appoints John P. Hickey, Jr. and Daniel J. Rasmussen, and each of them, as proxies for the undersigned, with full power to appoint his substitute, to represent and to vote all the shares of Common Stock of CIB Marine Bancshares, Inc. (the “Company”), which the undersigned would be entitled to vote, at the Company’s Annual Meeting of Stockholders to be held on May 29, 2008 and at any adjournments thereof, subject to the directions indicated on the reverse side hereof. In their discretion, the proxy is authorized to vote upon any other matter that may properly come before the meeting or any adjournments thereof. THIS PROXY WILL BE VOTED IN ACCORDANCE WITH THE SPECIFICATIONS MADE, BUT IF NO CHOICES ARE INDICATED, THIS PROXY WILL BE VOTED FOR THE ELECTION OF ALL NOMINEES LISTED ON THE REVERSE SIDE. Please read the Proxy Statement which describes the proposal and presents other important information, and complete, sign and return your proxy promptly in the enclosed envelope. PLEASE DO NOT RETURN THE ABOVE CARD IF VOTING ELECTRONICALLY YOUR VOTE IS IMPORTANT. |