EXHIBIT 99.9

| Consolidated Financial Statements Volume 1 | |

|

| |

| | |

| Consolidated Financial Statements Volume 1 | |

| | |

| | |

| PUBLIC

ACCOUNTS for the fiscal year ended 31 March 2016 Printed by Authority of the Legislature Fredericton, N.B. ISSN 0382-1277 ISBN printed version: 978-1-4605-1090-2 ISBN PDF version: 978-1-4605-1091-9 | |

|

| |

| | |

ii | PROVINCE OF NEW BRUNSWICK | 2016 |

To Her Honour,

The Honourable Jocelyne Roy Vienneau

lieutenant-Governor of the Province of New Brunswick

The undersigned has the honour to submit the Public Accounts of the Province of New Brunswick for the fiscal year ended 31 March 2016.

| | I am, Your Honour, | |

| | |

|

| |

| | Cathy Rogers Minister of Finance | |

Fredericton, New Brunswick September 2016 | | |

The Honourable Cathy Rogers

Minister of Finance

Madam:

The undersigned has the honour to present to you the Public Accounts of the Province of New Brunswick for the fiscal year ended 31 March 2016.

| | Respectfully submitted, | |

| | |

|  | |

| | Paul Martin, FCPA, FCA Comptroller | |

Fredericton, New Brunswick September 2016 | | |

2016 | PROVINCE OF NEW BRUNSWICK | iii |

TABLE OF CONTENTS

Audited Consolidated Financial Statements

| | Page | |

| | | |

Introduction to Volume I | | | 1 | |

| | | | |

Statement of Responsibility | | | 2 | |

| | | | |

Results for the Year | | | 3 | |

| | | | |

Major Variance Analysis | | | 7 | |

| | | | |

Indicators of Financial Health | | | 13 | |

| | | | |

Independent Auditor's Report | | | 20 | |

| | | | |

Consolidated Statement of Financial Position | | | 21 | |

| | | | |

Consolidated Statement of Operations | | | 22 | |

| | | | |

Consolidated Statement of Cash Flow | | | 23 | |

| | | | |

Consolidated Statement of Change in Net Debt | | | 24 | |

| | | | |

Consolidated Statement of Change in Accumulated Deficit | | | 24 | |

| | | | |

Notes to the Consolidated Financial Statements | | | 25 | |

| | | | |

Schedules to the Consolidated Financial Statements | | | 63 | |

2016 | PROVINCE OF NEW BRUNSWICK | 1 |

INTRODUCTION

VOLUME I

The Public Accounts of the Province of New Brunswick are presented in two volumes.

This volume contains the audited consolidated financial statements of the Provincial Reporting Entity as described in Note 1 to the consolidated financial statements. They include a Consolidated Statement of Financial Position, a Consolidated Statement of Operations, a Consolidated Statement of Cash Flow, a Consolidated Statement of Change in Net Debt and a Consolidated Statement of Change in Accumulated Deficit. This volume also contains the Independent Auditor’s Report, Statement of Responsibility, management’s comments on the Results for the Year, Major Variance Analysis and a discussion of the Indicators of Financial Health of the Province.

Volume II contains unaudited supplementary information to the consolidated financial statements presented in Volume I. It presents summary statements for revenue and expenditure as well as five-year comparative statements. This volume also contains detailed information on Supplementary Appropriations, Funded Debt, statements of the General Sinking Fund and revenue and expenditure by government department.

In addition, the Government includes the following lists on the Office of the Comptroller web site at www.gnb.ca/finance:

| · | Salary information of government employees and employees of certain government organizations in excess of $60,000. Salary information is for the calendar year and is reported under the department where the employee worked at 31 December; |

| | |

| · | Travel and other employee expenses in excess of $12,000 paid during the year to government employees, separated by department; |

| | |

| · | Payments made to suppliers during the year in excess of $25,000 separated by department as well as a global listing including payments made by all departments; |

| | |

| · | Loans disbursed to recipients during the year in excess of $25,000 separated by department. |

2 | PROVINCE OF NEW BRUNSWICK | 2016 |

STATEMENT OF RESPONSIBILITY

The consolidated financial statements of the Province of New Brunswick are prepared each year by the Comptroller as required under section 14 of the Financial Administration Act. The Results for the Year, Major Variance Analysis and Indicators of Financial Health commentaries are prepared jointly by the Department of Finance and the Office of the Comptroller. The consolidated financial statements include a Consolidated Statement of Financial Position, a Consolidated Statement of Operations, a Consolidated Statement of Cash Flow, a Consolidated Statement of Change in Net Debt and a Consolidated Statement of Change in Accumulated Deficit.

Financial statement integrity and objectivity are the responsibility of the Government. To help fulfil this responsibility, systems of internal control have been established to provide reasonable assurance that transactions are properly authorized, executed and reported. The statements are prepared in accordance with the accounting policies described in Note 1 to the Consolidated Financial Statements.

On behalf of the Government:

Cathy Rogers

Minister of Finance

September 2016

2016 | PROVINCE OF NEW BRUNSWICK | 3 |

RESULTS FOR THE YEAR

General Comments

The Province budgeted a deficit of $476.8 million for the March 31, 2016 fiscal year. This included a $150.0 million contingency reserve, intended to protect the Province against potential revenue weakness. Given the numerous factors that impact the economy and revenues which are beyond the Province’s control, the government demonstrated prudence in introducing a contingency reserve in the budget in order to protect the Province from unforeseen circumstances. During the year, the reserve was not required and the budgeted deficit was reduced to $326.8 million.

The Province's summary financial statements, contained in this volume of Public Accounts, report a deficit for the fiscal year ended 31 March 2016 of $260.5 million. This represents a decrease of $66.3 million from the budgeted deficit of $326.8 million. The difference is the result of higher than budgeted revenues of $78.3 million, and higher than budgeted expenses of $12.0 million.

Revenues were $78.3 million higher than budget. Other Provincial Revenue increased $149.3 million due to the inclusion of nursing homes within the provincial reporting entity, the recording of school raised funds (which started in 2015), and higher than budgeted revenues from the New Brunswick Lottery and Gaming Corporation and the Regional Health Authorities. These increases were partially offset by lower than budgeted revenue of $73.3 million from the New Brunswick Power Corporation.

Expenses were $12.0 million higher than budget. The major over-expenditures were in Social Development, mainly due to the inclusion of nursing homes within the provincial reporting entity; in Health due to higher costs in the Regional Health Authorities and the Medicare program; and in Protection Services, mainly due to Disaster Financial Assistance funding associated with various storm events. These increases were offset by a number of under expenditures, particularly in Economic Development and Central Government.

A more detailed discussion of major variances can be found in the major variance section that follows.

Summary Financial Information

(millions)

Consolidated Statement of Financial Position |

| | 2016 | | | 2015 | |

Financial Assets | | $ | 8,584.2 | | | $ | 8,187.8 | |

Liabilities | | | (22,243.8) | | | | (21,306.0) | |

Net Debt | | | (13,659.6) | | | | (13,118.2) | |

Tangible Capital Assets | | | 8,738.5 | | | | 8,585.7 | |

Other Non Financial Assets | | | 219.0 | | | | 234.2 | |

Total Non Financial Assets | | | 8,957.5 | | | | 8,819.9 | |

Accumulated Deficit | | $ | (4,702.1) | | | $ | (4,298.3) | |

Consolidated Statement of Operations |

| | 2016 | | | 2015 | |

Revenue - Provincial Sources | | $ | 5,433.5 | | | $ | 5,429.4 | |

Revenue - Federal Sources | | | 2,952.7 | | | | 3,009.8 | |

Total Revenue | | | 8,386.2 | | | | 8,439.2 | |

Expenses | | | 8,646.7 | | | | 8,800.6 | |

Surplus / (Deficit) | | $ | (260.5) | | | $ | (361.4) | |

Consolidated Statement of Change in Net Debt |

| | 2016 | | | 2015 | |

Opening Net Debt | | $ | (13,118.2) | | | $ | (12,415.1) | |

Increase in Net Debt From Operations | | | (541.4) | | | | (703.1) | |

Ending Net Debt | | $ | (13,659.6) | | | $ | (13,118.2) | |

4 | PROVINCE OF NEW BRUNSWICK | 2016 |

Revenue

Revenues of the Province for the past ten years, as restated, are shown in the table below. The consolidation of nursing homes was accounted for retroactively to opening 2015 net debt and accumulated deficit balances. As such, the impact of the accounting change is only reflected in the

2015 and 2016 numbers below.

($ millions)

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

Provincial Sources | 4,221.5 | 4,467.1 | 4,462.0 | 4,178.7 | 4,609.8 | 4,928.8 | 4,784.6 | 4,896.2 | 5,429.4 | 5,433.5 |

Federal Sources | 2,530.9 | 2,720.6 | 2,763.6 | 2,940.8 | 2,930.3 | 2,874.2 | 3,000.5 | 2,877.9 | 3,009.8 | 2,952.7 |

Total Revenue | 6,752.4 | 7,187.7 | 7,225.6 | 7,119.5 | 7,540.1 | 7,803.0 | 7,785.1 | 7,774.1 | 8,439.2 | 8,386.2 |

Average annual revenue growth over the ten-year period is 2.8%. In 2016, year-over-year revenue decreased by 0.6%. Increased revenue from Taxes, Other Provincial Revenue and Unconditional Grants was more than offset by decreased revenue from the New Brunswick Power Corporation and lower Conditional Grants, due in part to one-time revenue received in 2015.

Expense

Expenses of the Province for the past ten years, as restated, are shown in the table below. The consolidation of nursing homes and the change in accounting policy for pensions were accounted for retroactively to opening 2015 net debt and accumulated deficit balances. As such, the impacts of the accounting changes are only reflected in the 2015 and 2016 numbers below.

($ millions)

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

Total Expense | 6,475.1 | 6,946.6 | 7,377.6 | 7,815.4 | 8,157.3 | 8,047.8 | 8,318.3 | 8,374.5 | 8,800.6 | 8,646.7 |

Average annual expense growth over the ten-year period is 3.5%. In 2016, expenses decreased by $153.9 million year-over-year, a 1.7% decrease. This was due in large part to a one-time expense associated with the reform of the Teachers’ Pension Plan in 2015, as well as decreased expenses in Economic Development, Transportation and Infrastructure, and Resources. These decreases were partially offset by increased expenses in other areas, including Health and Central Government.

Surplus / (Deficit)

Surpluses (or Deficits) of the Province for the past ten years, as restated, are shown in the table below.

($ millions)

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

Surplus/(Deficit) | 277.3 | 241.1 | (152.0) | (695.9) | (617.2) | (244.8) | (533.2) | (600.4) | (361.4) | (260.5) |

The deficit for the year ended 31 March 2016 was $260.5 million, which is lower than the budgeted deficit of $326.8 million. The lower deficit was a result of higher than budgeted revenue of $78.3 million mainly due to the consolidation of nursing homes and higher personal income tax revenue, offset by lower than budgeted revenue from the New Brunswick Power Corporation. Expenses were higher than budgeted by just $12.0 million due to a number of factors, including the consolidation of nursing homes.

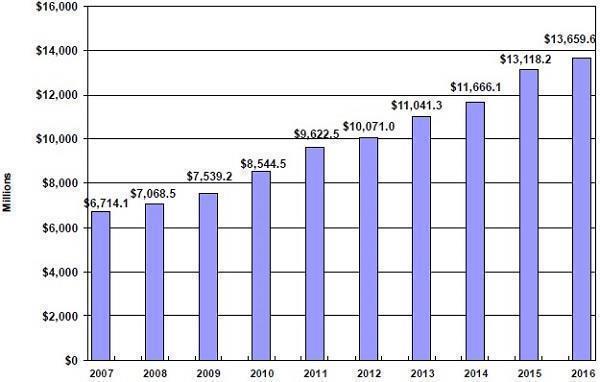

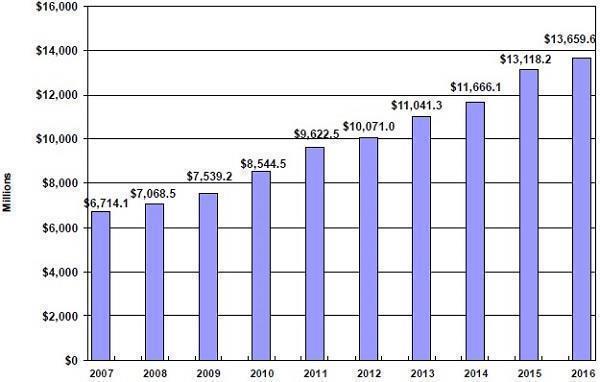

Net Debt

Net debt increased by $541.4 million during the year ended 31 March 2016, an increase of $105.9 million from the budgeted increase of $435.5 million. The increase in net debt is related to the operating deficit and net capital asset transactions of highways, hospitals, schools and other buildings.

2016 | PROVINCE OF NEW BRUNSWICK | 5 |

Net Debt

($ millions)

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

Net Debt | 6,714.1 | 7,068.5 | 7,539.2 | 8,544.5 | 9,622.5 | 10,071.0 | 11,041.3 | 11,666.1 | 13,118.2 | 13,659.6 |

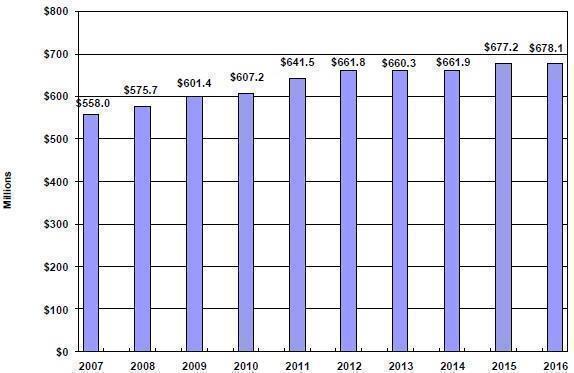

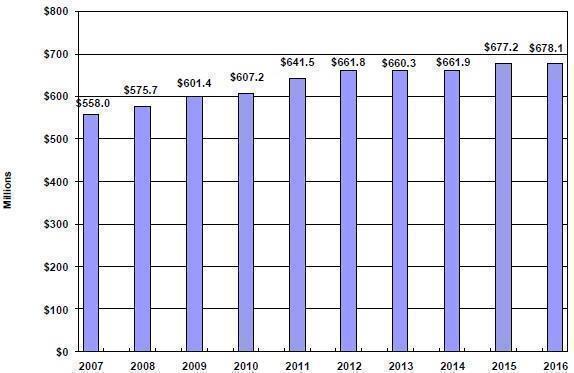

Cost of Servicing the Public Debt

The Province’s cost of servicing the Public Debt totaled $678.1 million for the year ended 31 March 2016. This represents a slight increase of $0.9 million from 2015, largely due to a higher level of debt which was partially offset by refinancing maturing debt at lower interest rates and the repayment of maturing debt from the sinking fund.

6 | PROVINCE OF NEW BRUNSWICK | 2016 |

Cost of Servicing the Public Debt

($ millions)

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

Cost of Servicing the Public Debt | 558.0 | 575.7 | 601.4 | 607.2 | 641.5 | 661.8 | 660.3 | 661.9 | 677.2 | 678.1 |

2016 | PROVINCE OF NEW BRUNSWICK | 7 |

MAJOR VARIANCE ANALYSIS

Explanations of major variances are described below. In this analysis, comparisons are made between the actual results for 2016 and either the 2016 budget or the actual results for 2015.

REVENUE

Budget 2016 to Actual 2016 Comparison

2016 Budget to Actual ($ millions) | |

Item | | Budget | | | Actual | | | Variance | | | % Variance | |

Provincial Sources | |

Taxes | | | 4,017.2 | | | | 4,029.7 | | | | 12.5 | | | | 0.3 | |

Licenses and Permits | | | 151.7 | | | | 153.8 | | | | 2.1 | | | | 1.4 | |

Royalties | | | 107.2 | | | | 89.3 | | | | (17.9 | ) | | | (16.7 | ) |

Income from Government Business Enterprises | | | 258.0 | | | | 189.1 | | | | (68.9 | ) | | | (26.7 | ) |

Other Provincial Revenue | | | 628.2 | | | | 777.5 | | | | 149.3 | | | | 23.8 | |

Sinking Fund Earnings | | | 193.7 | | | | 194.1 | | | | 0.4 | | | | 0.2 | |

Revenue from Provincial Sources | | | 5,356.0 | | | | 5,433.5 | | | | 77.5 | | | | 1.4 | |

Federal Sources |

Fiscal Equalization | | | 1,668.9 | | | | 1,668.0 | | | | (0.9 | ) | | | (0.1 | ) |

Unconditional Grants | | | 993.1 | | | | 994.7 | | | | 1.6 | | | | 0.2 | |

Conditional Grants | | | 289.9 | | | | 290.0 | | | | 0.1 | | | | - | |

Revenue from Federal Sources | | | 2,951.9 | | | | 2,952.7 | | | | 0.8 | | | | - | |

Total Revenues | | | 8,307.9 | | | | 8,386.2 | | | | 78.3 | | | | 0.9 | |

Taxes

Taxes are up $12.5 million from budget, primarily due to:

| · | Personal Income Tax is up $67.6 million due to an underpayment for the 2014 taxation year and an improved forecast base. |

| · | Gasoline and Motive Fuels Tax is up $16.0 million due to an increase in sales volume. |

| · | Tobacco Tax is up $12.9 million due to higher than anticipated sales volume. |

| · | Harmonized Sales Tax is down $47.4 million reflecting overpayments for the 2009-2015 taxation years. |

| · | Corporate Income Tax is down $32.2 million reflecting an overpayment for the 2014 taxation year and lower in-year payments. |

| · | Financial Corporation Capital Tax is down $5.7 million due to a reduction in capital held by financial institutions. |

Royalties

Royalties are down $17.9 million from budget due to lower than anticipated potash production and the subsequent shutdown of the Picadilly potash mine, and less forest timber being harvested than anticipated.

Income from Government Business Enterprises

Income from Government Business Enterprises is down $68.9 million primarily as a result of $73.3 million less revenue than budgeted from the New Brunswick Power Corporation. The net income of the New Brunswick Power Corporation was less than budgeted due to reduced output at the Point Lepreau Generating Station caused by unplanned outages, higher natural gas prices and reduced revenue due to mild winter weather.

8 | PROVINCE OF NEW BRUNSWICK | 2016 |

Other Provincial Revenue

Other Provincial Revenue is up $149.3 million from budget due to the inclusion of nursing homes within the provincial reporting entity ($84.0 million); higher than anticipated revenues from the New Brunswick Lotteries and Gaming Corporation of $20.8 million, due in part to extraordinary ticket lottery sales; the recording of school raised funds, which started in 2015 ($18.3 million) and higher than budgeted revenue from the Regional Health Authorities ($13.6 million). There were also other miscellaneous revenue increases across various departments and agencies.

Actual 2015 to Actual 2016 Comparison

2015 Actual to 2016 Actual ($ millions) | |

Item | | 2015 Actual | | | 2016

Actual | | | Change | | | %

Change | |

Provincial Sources | |

Taxes | | | 3,983.1 | | | | 4,029.7 | | | | 46.6 | | | | 1.2 | |

Licenses and Permits | | | 149.4 | | | | 153.8 | | | | 4.4 | | | | 2.9 | |

Royalties | | | 97.5 | | | | 89.3 | | | | (8.2 | ) | | | (8.4 | ) |

Income from Government Business Enterprises | | | 270.9 | | | | 189.1 | | | | (81.8 | ) | | | (30.2 | ) |

Other Provincial Revenue | | | 732.6 | | | | 777.5 | | | | 44.9 | | | | 6.1 | |

Sinking Fund Earnings | | | 195.9 | | | | 194.1 | | | | (1.8 | ) | | | (0.9 | ) |

Revenue from Provincial Sources | | | 5,429.4 | | | | 5,433.5 | | | | 4.1 | | | | 0.1 | |

Federal Sources |

Fiscal Equalization Payments | | | 1,666.0 | | | | 1,668.0 | | | | 2.0 | | | | 0.1 | |

Unconditional Grants | | | 955.8 | | | | 994.7 | | | | 38.9 | | | | 4.1 | |

Conditional Grants | | | 388.0 | | | | 290.0 | | | | (98.0 | ) | | | (25.3 | ) |

Revenue from Federal Sources | | | 3,009.8 | | | | 2,952.7 | | | | (57.1 | ) | | | (1.9 | ) |

Total Revenues | | | 8,439.2 | | | | 8,386.2 | | | | (53.0 | ) | | | (0.6 | ) |

Taxes

Taxes are up $46.6 million over the previous fiscal year, mainly due to:

| · | Personal Income Tax is up $130.9 million due to higher in-year payments from the federal government and prior year adjustments. |

| · | Gasoline and Motive Fuels Tax is up $41.4 million due to tax measures announced in the 2015-16 budget and increased sales volume. |

| · | Provincial Real Property Tax is up $13.6 million due to an increase in the assessment base. |

| · | Tobacco Tax is up $5.3 million due to an increase in sales volume. |

| · | Harmonized Sales Tax is down $104.1 million reflecting prior year adjustments offset by an improvement to in-year payments. |

| · | Metallic Minerals Tax is down $21.8 million due to an audit assessment in 2014-15 on past mining activities. |

| · | Corporate Income Tax is down $12.3 million reflecting a reduction in New Brunswick’s projected corporate taxable income upon which New Brunswick’s payments are based. |

| · | Financial Corporation Capital Tax is down $8.1 million due to a reduction in capital held by financial institutions. |

Royalties

Royalties are down $8.2 million to due lower than anticipated potash production and the subsequent shutdown of the Picadilly potash mine.

2016 | PROVINCE OF NEW BRUNSWICK | 9 |

Income From Government Business Enterprises

Income from Government Business Enterprises is down $81.8 million year-over-year largely as a result of lower revenue from the New Brunswick Power Corporation. The Corporation’s net income decreased due to unplanned outages and improvement initiatives at the Point Lepreau Generating Station, reduced revenue due to mild winter weather and lower nuclear investment fund earnings.

Other Provincial Revenue

Other Provincial Revenue is up $44.9 million mainly due to higher overall revenue from the New Brunswick Lotteries and Gaming Corporation of $17.2 million, particularly from extraordinary ticket lottery sales. The Regional Health Authorities had higher revenue of $6.4 million; school districts had increased revenue of $5.3 million, and increased funding of $3.6 million for First Nations education. In addition, there are other miscellaneous revenue increases across various departments and agencies.

Unconditional Grants

Unconditional Grants are up $38.9 million due to legislated growth for the Canada Health Transfer and the Canada Social Transfer.

Conditional Grants

Conditional Grants are down $98.0 million mainly due to one-time funding in 2014-15 related to New Brunswick joining the Cooperative Capital Markets Regulatory System, lower federal recoveries for Disaster Financial Assistance, and lower federal capital recoveries.

EXPENSES

Budget 2016 to Actual 2016 Comparison

2016 Budget to Actual ($ millions) |

Item | | Budget | | | Actual | | | Variance | | | % Variance | |

Education and Training | | | 1,840.2 | | | | 1,846.3 | | | | 6.1 | | | | 0.3 | |

Health | | | 2,864.9 | | | | 2,899.0 | | | | 34.1 | | | | 1.2 | |

Social Development | | | 1,130.3 | | | | 1,196.4 | | | | 66.1 | | | | 5.8 | |

Protection Services | | | 258.0 | | | | 281.3 | | | | 23.3 | | | | 9.0 | |

Economic Development | | | 266.7 | | | | 204.0 | | | | (62.7 | ) | | | (23.5 | ) |

Labour and Employment | | | 133.1 | | | | 135.0 | | | | 1.9 | | | | 1.4 | |

Resources | | | 194.2 | | | | 185.3 | | | | (8.9 | ) | | | (4.6 | ) |

Transportation and Infrastructure | | | 624.1 | | | | 636.0 | | | | 11.9 | | | | 1.9 | |

Central Government | | | 638.2 | | | | 585.3 | | | | (52.9 | ) | | | (8.3 | ) |

Service of the Public Debt | | | 685.0 | | | | 678.1 | | | | (6.9 | ) | | | (1.0 | ) |

Total Expenses | | | 8,634.7 | | | | 8,646.7 | | | | 12.0 | | | | 0.1 | |

Items in the table are reported by functional area. See the related schedule in the consolidated financial statements for additional details.

Education and Training

Education and Training expenses were $6.1 million higher than budget mainly due to increased expenses in the School District Projects Special Purpose Account offset by lower than budgeted expenses in General Government related to the accrual for teachers’ summer pay.

Health

Health expenses were $34.1 million higher than budget mainly due to over-expenditures in the Department of Health, including expenses related to the Regional Health Authorities as well as the Medicare program. These over expenditures were partially offset by lower than anticipated costs in corporate and pharmaceutical programs.

10 | PROVINCE OF NEW BRUNSWICK | 2016 |

Social Development

Social Development expenses were $66.1 million higher than budget mainly due to the inclusion of nursing homes within the provincial reporting entity.

Protection Services

Protection Services were $23.3 million higher than budget due to higher expenses in the Department of Public Safety resulting from Disaster Financial Assistance funding associated with various storm and flood events.

Economic Development

Economic Development expenses were $62.7 million lower than budget mainly due to lower than expected financial assistance in Opportunities New Brunswick. This was mainly due to lower than expected Strategic Assistance expenses, lower than expected expenses in the Regional Development Corporation due to project timing changes, and decreased provision expense.

Labour and Employment

Labour and Employment expenses were $1.9 million higher than budget primarily due to increased demand under the Employment Services, Workforce Expansion, and Training and Skills Development programs.

Resources

Resources expenses were $8.9 million less than budget mainly due to lower than anticipated demand under the Agristability Program, as well as increased investments in tangible capital assets in the Department of Natural Resources.

Transportation and Infrastructure

Transportation expenses were $11.9 million higher than budget mainly due to higher Transportation and Infrastructure expenses related to the Winter Maintenance program, as well as increased provision expense.

Central Government

Central Government expenses were $52.9 million lower than budget mainly due to lower than anticipated expenses in General Government associated with the Retirement Allowance benefit.

2016 | PROVINCE OF NEW BRUNSWICK | 11 |

Actual 2015 to Actual 2016 Comparison

2015 Actual to 2016 Actual ($ millions) |

Item | | 2015 Actual | | | 2016 Actual | | | Change | | | % Change | |

Education and Training | | | 2,083.7 | | | | 1,846.3 | | | | (237.4 | ) | | | (11.4 | ) |

Health | | | 2,830.9 | | | | 2,899.0 | | | | 68.1 | | | | 2.4 | |

Social Development | | | 1,182.3 | | | | 1,196.4 | | | | 14.1 | | | | 1.2 | |

Protection Services | | | 268.7 | | | | 281.3 | | | | 12.6 | | | | 4.7 | |

Economic Development | | | 247.6 | | | | 204.0 | | | | (43.6 | ) | | | (17.6 | ) |

Labour and Employment | | | 122.6 | | | | 135.0 | | | | 12.4 | | | | 10.1 | |

Resources | | | 197.3 | | | | 185.3 | | | | (12.0 | ) | | | (6.1 | ) |

Transportation and Infrastructure | | | 649.7 | | | | 636.0 | | | | (13.7 | ) | | | (2.1 | ) |

Central Government | | | 540.6 | | | | 585.3 | | | | 44.7 | | | | 8.3 | |

Service of the Public Debt | | | 677.2 | | | | 678.1 | | | | 0.9 | | | | 0.1 | |

Total Expenses | | | 8,800.6 | | | | 8,646.7 | | | | (153.9 | ) | | | (1.7 | ) |

Items in the table are reported by functional area. See the related schedule in the consolidated financial statements for additional details.

Education and Training

Education and Training expenses were $237.4 million lower than the previous fiscal year. This was mainly due to a one-time expense associated with the reform of the Teachers’ Pension Plan in 2015.

Health

Health expenses were $68.1 million higher than the previous fiscal year mainly due to an increase in expenses in the Regional Health Authorities associated with wages and inflation, as well as an increase in payments under the Medicare and Drug programs.

Social Development

Social Development expenses were $14.1 million higher than the previous fiscal year mainly due to the opening of new nursing homes and higher service delivery costs, specifically related to Youth Engagement Services and Disability Support Services.

Protection Services

Protection Services were $12.6 million higher than the previous fiscal year due to higher expenses in the Department of Public Safety resulting from Disaster Financial Assistance funding associated with various storm and flood events. This increase was partially offset by a decrease in provision expense.

Economic Development

Economic Development expenses were $43.6 million lower than the previous fiscal year primarily due to decreased expenses in the Regional Development Corporation related to the acceleration of project funding in 2015, as well as lower provision expense.

Labour and Employment

Labour and Employment expenses were $12.4 million higher than the previous fiscal year due to increased clients served under employment programs, as well as the expansion of Advocate Services and setup of the Workers' Compensation Appeals Tribunal.

Resources

Resources expenses were $12.0 million lower than the previous fiscal year mainly due to expenses associated with the Energy Efficiency and Conservation Agency of New Brunswick in 2015.

12 | PROVINCE OF NEW BRUNSWICK | 2016 |

Transportation and Infrastructure

Transportation and Infrastructure expenses were $13.7 million lower than the previous year mainly due to lower winter maintenance costs and provision expense. This was partially offset by increased amortization expense.

Central Government

Central Government expenses were $44.7 million higher than the previous year. This was mainly due to increased expense in Service New Brunswick, General Government, and provision expense.

2016 | PROVINCE OF NEW BRUNSWICK | 13 |

INDICATORS OF FINANCIAL HEALTH

This section provides indicators of progress in the Province’s financial condition using information provided in the Province’s consolidated financial statements as well as other standard socio-economic indicators such as nominal Gross Domestic Product (GDP) data from Statistics Canada.

The analysis of financial indicators is a reporting practice recommended by the Public Sector Accounting Board, and provides results in a manner that improves transparency and provides a clearer understanding of recent trends in the Province’s financial health. Trends over the last ten years (2007 to

2016) are evaluated using the criteria of sustainability, flexibility and vulnerability. Though many potential indicators are available, those found to be the most relevant, measurable and transparent to users of government financial information are included. Similar data series are also widely used by banks and other financial institutions, investors and credit-rating agencies.

In evaluating a government’s financial health, it should be acknowledged that governments have exposure to a number of variables that are beyond their direct scope of control, but still can exert major influences on financial results and indicators. These include but are not limited to:

| · | Changing global economic conditions such as energy prices, commodity prices, investment valuation and inflation; |

| · | Changes to international financial conditions that impact interest rates, currency fluctuations or availability of credit; |

| · | Changes to federal transfers or programs; |

| · | Emergencies such as floods, forest fires and pandemics; |

| · | Developments affecting agencies such as the New Brunswick Power Corporation that are reflected in the Province’s financial statements and; |

| · | Changes in public sector accounting standards. |

Sustainability

Sustainability is the degree to which a government can maintain its existing financial obligations both in respect of its service commitments to the public and financial commitments to creditors, employees and others without increasing the debt or tax burden relative to the economy within which it operates. It is measured in this analysis by:

| · | Net debt as a proportion of GDP; |

| · | Net debt per capita. |

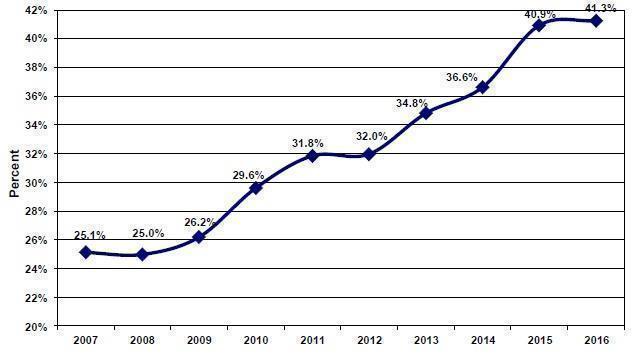

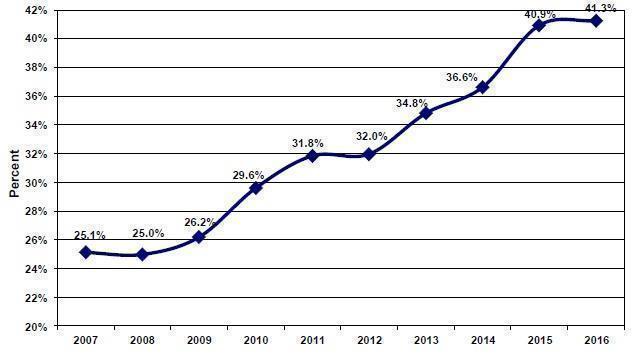

Net Debt as a Proportion of GDP:

Net debt is an indication of the extent to which Provincial government liabilities exceed financial assets. The net debt-to-GDP ratio shows the relationship between net debt and the economy. If the ratio is declining, growth in the economy is exceeding growth in net debt, resulting in improved sustainability. Conversely, an increasing net debt-to-GDP ratio indicates net debt is increasing faster than growth in the economy and serving to reduce the provincial government’s financial sustainability.

Over the last ten years the Province’s ratio of net debt-to-GDP increased from 25.1% to 41.3%. Beginning in 2008, the ratio has trended upwards related to weakened economic circumstances, operating deficits, capital spending, and other factors. In 2012, the ratio stabilized but has increased since due to the above noted factors. The inclusion of nursing homes within the provincial reporting entity and a change in accounting policy related to pensions were both implemented retroactively to the opening 2015 net debt balance. As such, only the 2015 and 2016 net debt numbers were restated, having a major impact on the ratio for those years.

14 | PROVINCE OF NEW BRUNSWICK | 2016 |

Net Debt-to-GDP Ratio

Net Debt-to-GDP Ratio |

Fiscal Year Ending | Net Debt | GDP | Net Debt/GDP |

| ($ millions) | ($ millions) | (%) |

2007 | 6,714.1 | 26,718 | 25.1 |

2008 | 7,068.5 | 28,287 | 25.0 |

2009 | 7,539.2 | 28,779 | 26.2 |

2010 | 8,544.5 | 28,857 | 29.6 |

2011 | 9,622.5 | 30,213 | 31.8 |

2012 | 10,071.0 | 31,500 | 32.0 |

2013 | 11,041.3 | 31,723 | 34.8 |

2014 | 11,666.1 | 31,857 | 36.6 |

2015 | 13,118.2 | 32,056 | 40.9 |

2016 | 13,659.6 | 33,114 | 41.3 |

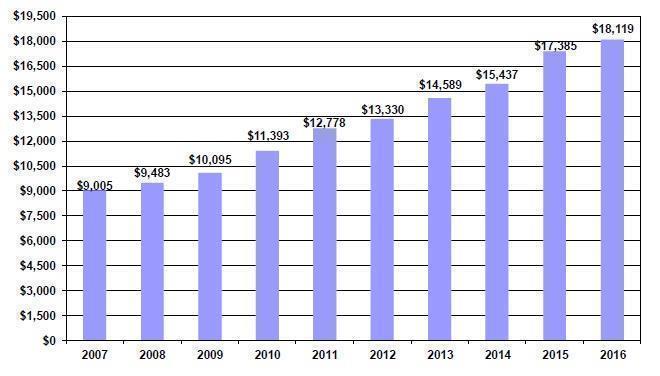

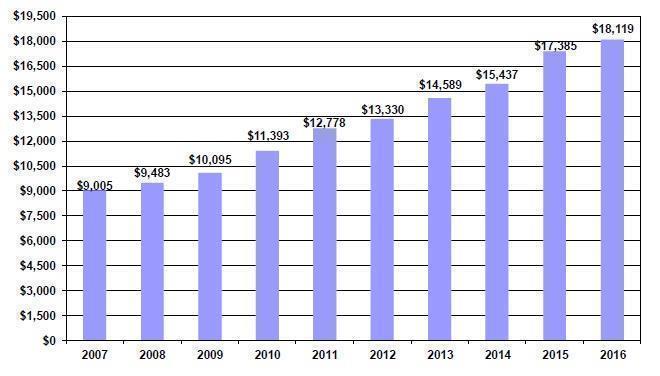

Net Debt per Capita:

Net debt per capita is a statement of the net debt attributable to each New Brunswick resident. A decrease in net debt per capita suggests the debt burden has improved while an increase implies the debt burden has increased. Over the past ten years the net debt per capita has been trending upwards reflecting weakened economic circumstances, operating deficits, capital spending and other factors including population declines in recent years. The inclusion of nursing homes within the provincial reporting entity and a change in accounting policy related to pensions were both implemented retroactively to the opening 2015 net debt balance. As such, only the 2015 and 2016 net debt numbers were restated, having a major impact on net debt per capita in those years.

2016 | PROVINCE OF NEW BRUNSWICK | 15 |

Net Debt per Capita

Net Debt per Capita |

Fiscal Year Ending | Net Debt | Population | Net Debt per Capita |

| ($ millions) | (July 1) | ($) |

2007 | 6,714.1 | 745,609 | 9,005 |

2008 | 7,068.5 | 745,407 | 9,483 |

2009 | 7,539.2 | 746,855 | 10,095 |

2010 | 8,544.5 | 749,954 | 11,393 |

2011 | 9,622.5 | 753,044 | 12,778 |

2012 | 10,071.0 | 755,530 | 13,330 |

2013 | 11,041.3 | 756,836 | 14,589 |

2014 | 11,666.1 | 755,718 | 15,437 |

2015 | 13,118.2 | 754,578 | 17,385 |

2016 | 13,659.6 | 753,871 | 18,119 |

Flexibility

Flexibility is the degree to which a government can change its debt or tax burden on the economy within which it operates to meet its existing financial obligations both in respect of its service commitments to the public and financial commitments to creditors, employees and others. It is measured in this analysis by:

| · | Own-source revenue as a proportion of GDP; |

| · | Cost of servicing the public debt as a proportion of total revenue. |

16 | PROVINCE OF NEW BRUNSWICK | 2016 |

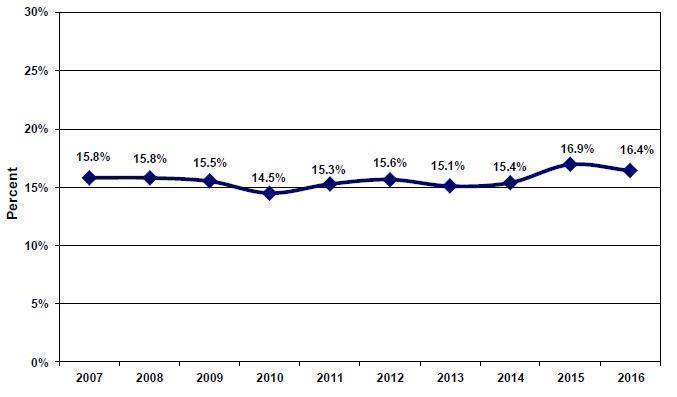

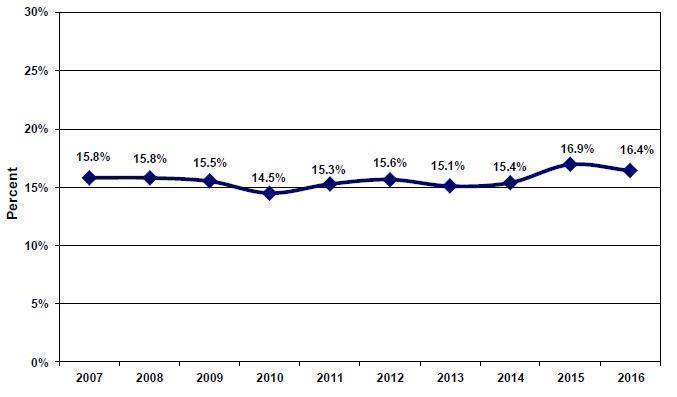

Own-source Revenue as a Proportion of GDP:

This ratio measures own-source revenues of the Provincial government as a percentage of the economy, as measured by nominal GDP. An increase in this ratio indicates that government own-source revenues are growing faster than the economy as a whole, reducing government’s flexibility to increase revenues without slowing growth in the economy. A decrease in the ratio is indicative of the government taking less revenue out of the economy on a relative basis, which increases its flexibility.

Own-source revenue includes revenues from taxation, natural resources, fees, return on investment, lotteries, fines and penalties, etc., and is essentially all revenue minus federal transfers. While more controllable than federal transfers, as the Province can influence revenues through its own tax rates and fiscal policy, own-source revenue is vulnerable to, among other factors:

| · | Net income or revenue of outside agencies whose revenue can fluctuate significantly due to price, volume, accounting changes, weather, etc. (e.g. the New Brunswick Power Corporation) |

| · | Variability in provincial revenues that are collected or estimated by the federal government such as personal and corporate income taxes and the Harmonized Sales Tax; |

| · | Commodity tax revenues such as Metallic Minerals Tax that are vulnerable to world prices. |

Own-source revenue as a proportion of GDP has been relatively stable, with an increase in this ratio the past few years.

Own-source Revenue as a Proportion of GDP

2016 | PROVINCE OF NEW BRUNSWICK | 17 |

Own-source Revenue as a Proportion of GDP |

Fiscal Year Ending | Own-source Revenue | GDP | Own-source Revenue as a Proportion of GDP |

| ($ millions) | ($ millions) | (%) |

2007 | 4,221.5 | 26,718 | 15.8 |

2008 | 4,467.1 | 28,287 | 15.8 |

2009 | 4,462.0 | 28,779 | 15.5 |

2010 | 4,178.7 | 28,857 | 14.5 |

2011 | 4,609.8 | 30,213 | 15.3 |

2012 | 4,928.8 | 31,500 | 15.6 |

2013 | 4,784.6 | 31,723 | 15.1 |

2014 | 4,896.2 | 31,857 | 15.4 |

2015 | 5,429.4 | 32,056 | 16.9 |

2016 | 5,433.5 | 33,114 | 16.4 |

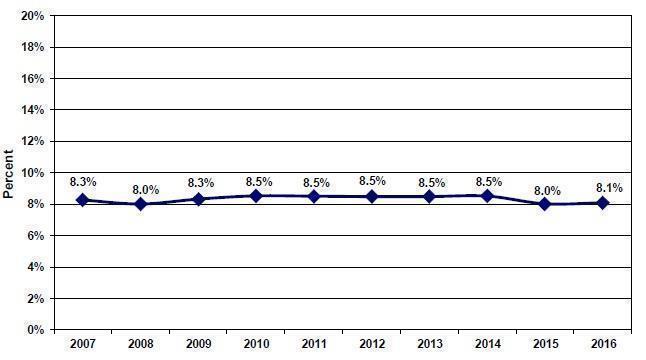

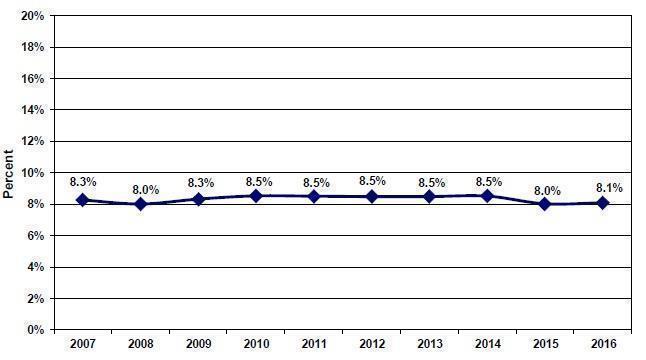

Cost of Servicing the Public Debt as a Proportion of Total Revenue:

Debt service costs as a proportion of total revenue is an indicator of the Province’s ability to satisfy existing credit requirements in the context of the government’s overall revenue. Debt service costs can be impacted by variables outside the direct control of government, such as credit ratings, interest rates, financial markets and currency fluctuations. Investment in public infrastructure resulting in a change in the stock of debt can also influence borrowing requirements.

The Province’s proportion of debt service costs to revenue has been relatively stable. In 2015 and 2016 the ratio has dropped to a lower level signifying that debt service costs are a smaller proportion of Provincial revenues overall, allowing the Province more financial resources to provide essential programs and services.

Cost of Servicing the Public Debt as a Proportion of Total Revenue

18 | PROVINCE OF NEW BRUNSWICK | 2016 |

Cost of Servicing the Public Debt as a Proportion of Total Revenue |

Fiscal Year Ending | Cost of Servicing the Public Debt | Total Revenue | Cost of Servicing the

Public Debt as a

Proportion of Total Revenue |

| ($ millions) | ($ millions) | (%) |

2007 | 558.0 | 6,752.4 | 8.3 |

2008 | 575.7 | 7,187.7 | 8.0 |

2009 | 601.4 | 7,225.6 | 8.3 |

2010 | 607.2 | 7,119.5 | 8.5 |

2011 | 641.5 | 7,540.1 | 8.5 |

2012 | 661.8 | 7,803.0 | 8.5 |

2013 | 660.3 | 7,785.1 | 8.5 |

2014 | 661.9 | 7,774.1 | 8.5 |

2015 | 677.2 | 8,439.2 | 8.0 |

2016 | 678.1 | 8,386.2 | 8.1 |

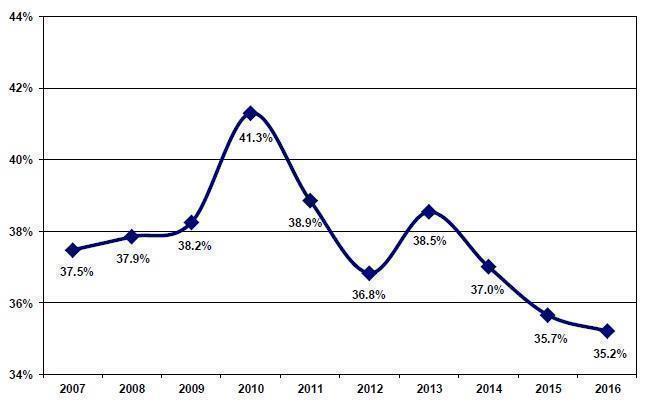

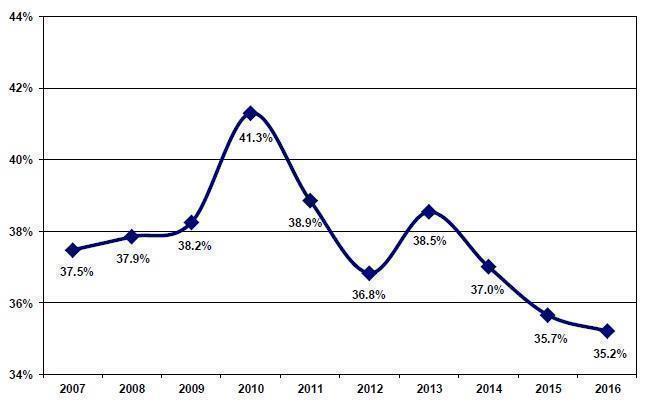

Vulnerability

Vulnerability is the degree to which a government is dependent on sources of funding outside its control or influence or is exposed to risks that could impair its ability to meet its existing financial obligations both in respect of its service commitments to the public and financial commitments to creditors, employees and others. A common measurement of vulnerability is federal government transfers as a proportion of revenue.

Federal Government Transfers as a Proportion of Total Revenue:

Revenue from federal sources is comprised of conditional and unconditional grants from the federal government, including:

| · | Fiscal Equalization Program payments; |

| · | The Canada Health Transfer and the Canada Social Transfer; |

| · | Conditional grants or capital revenue in support of economic development, infrastructure, education and labour training and other areas. |

Federal transfer payments can be affected by federal fiscal policy decisions, the normal annual estimate process that guides federal payments under the Equalization Program and Canada Health and Social Transfers, as well as timing and conditions related to conditional grants.

Comparing the level of federal transfers to total revenue provides an indication of the vulnerability of the Province. Generally, if the ratio is increasing, the Province is increasingly reliant on federal transfers, resulting in increased vulnerability. If the ratio is declining, vulnerability is diminished.

Federal government transfers as a proportion of total revenue reached a high of 41.3% in 2010. In that year, provincial-source revenues contracted as the effects of the economic slowdown hampered revenues and the NBEFC experienced a significant net loss. At the same time, federal stimulus funding supported federal-source revenue growth. Since then the ratio has declined to the current rate of 35.2%, its lowest level in the past decade.

2016 | PROVINCE OF NEW BRUNSWICK | 19 |

Federal Government Transfers as a Proportion of Total Revenue

Federal Government Transfers as a Proportion of Total Revenue |

Fiscal Year Ending | Federal Government Transfers | Total Revenue | Federal Government

Transfers as a

Proportion of Total

Revenue |

| ($ millions) | ($ millions) | (%) |

2007 | 2,530.9 | 6,752.4 | 37.5 |

2008 | 2,720.6 | 7,187.7 | 37.9 |

2009 | 2,763.6 | 7,225.6 | 38.2 |

2010 | 2,940.8 | 7,119.5 | 41.3 |

2011 | 2,930.3 | 7,540.1 | 38.9 |

2012 | 2,874.2 | 7,803.0 | 36.8 |

2013 | 3,000.5 | 7,785.1 | 38.5 |

2014 | 2,877.9 | 7,774.1 | 37.0 |

2015 | 3,009.8 | 8,439.2 | 35.7 |

2016 | 2,952.7 | 8,386.2 | 35.2 |

AUDITOR GENERAL OF NEW BRUNSWICK | |

| | VERIFICATEUR GENERAL DU NOUVEAU-BRUNSWICK |

INDEPENDENT AUDITOR'S REPORT

To the Legislative Assembly

Province of New Brunswick

Report on the consolidated financial statements

I have audited the accompanying consolidated financial statements of the Province of New Brunswick, which comprise the consolidated statement of financial position as at March 31, 2016, and the consolidated statements of operations, cash flow, change in net debt and change in accumulated deficit for the year then ended, and a summary of significant accounting policies and other explanatory information.

Management's Responsibility for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with Canadian public sector accounting standards, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

Auditor's Responsibility

My responsibility is to express an opinion on these consolidated financial statements based on my audit. I conducted my audit in accordance with Canadian generally accepted auditing standards. Those standards require that I comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity's preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

I believe that the audit evidence I have obtained is sufficient and appropriate to provide a basis for my audit opinion.

Opinion

In my opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Province of New Brunswick as at March 31, 2016, and the results of its operations, its cash flows, changes in its net debt and changes in its accumulated deficit for the year then ended in accordance with Canadian public sector accounting standards.

| | |  | |

| | | |

Fredericton, New Brunswick | | Kim MacPherson, CPA, CA | |

September 27, 2016 | | Auditor General | |

P.O. Box 758

Fredericton, New Brunswick E3B 5B4

2016 | PROVINCE OF NEW BRUNSWICK | 21 |

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 31 March

| | | | (millions) | |

Schedule | | | 2016 | | | | 2015 | |

| FINANCIAL ASSETS | | | | | | | | |

1 | Cash and Short Term Investments | | $ | 2,141.1 | | | $ | 1,682.2 | |

2 | Receivables and Advances | | | 303.2 | | | | 339.2 | |

3 | Taxes Receivable | | | 1,168.3 | | | | 1,238.1 | |

4 | Inventories for Resale | | | 0.3 | | | | 1.7 | |

5 | Loans | | | 623.2 | | | | 629.3 | |

6 | Equity in Government Business Enterprises (Note 6) | | | 97.7 | | | | 214.5 | |

| Sinking Fund Equity (Note 9) | | | 4,201.3 | | | | 4,049.6 | |

6 | Other Investments | | | 49.1 | | | | 33.2 | |

| Total Financial Assets | | | 8,584.2 | | | | 8,187.8 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Short Term Borrowing (Note 4) | | | 1,680.1 | | | | 1,268.1 | |

7 | Accounts Payable and Accrued Expenses | | | 2,726.0 | | | | 2,694.7 | |

8 | Allowance for Losses | | | 25.3 | | | | 38.8 | |

9 | Deferred Revenue | | | 506.3 | | | | 490.1 | |

10 | Deposits Held in Trust | | | 362.0 | | | | 375.7 | |

11 | Obligations under Capital Leases (Note 5) | | | 733.9 | | | | 767.6 | |

| Net Pension Liability (Note 11) | | | 641.8 | | | | 628.5 | |

| | | | 6,675.4 | | | | 6,263.5 | |

| | | | | | | | | |

| Funded Debt (Note 9) | | | 20,107.1 | | | | 19,711.1 | |

| Borrowing for New Brunswick Power Corporation | | | (4,514.3 | ) | | | (4,607.1 | ) |

| Funded Debt for Provincial Purposes | | | 15,592.8 | | | | 15,104.0 | |

| Unamortized Premiums and Discounts | | | (40.8 | ) | | | (80.9 | ) |

| Unrealized Foreign Exchange Gains | | | 16.4 | | | | 19.4 | |

| | | | 15,568.4 | | | | 15,042.5 | |

| Total Liabilities | | | 22,243.8 | | | | 21,306.0 | |

| NET DEBT | | | (13,659.6 | ) | | | (13,118.2 | ) |

| NON-FINANCIAL ASSETS | | | | | | | | |

| Tangible Capital Assets (Note 7) | | | 8,738.5 | | | | 8,585.7 | |

12 | Inventories of Supplies | | | 49.4 | | | | 51.5 | |

13 | Prepaid and Deferred Charges | | | 169.6 | | | | 182.7 | |

| Total Non-Financial Assets | | | 8,957.5 | | | | 8,819.9 | |

| ACCUMULATED DEFICIT | | $ | (4,702.1 | ) | | $ | (4,298.3 | ) |

| | | | | | | | | |

| Contingent Liabilities - Note 13 | | | | | | | | |

| Commitments - Note 14 | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

Paul Martin, FCPA, FCA

Comptroller

22 | PROVINCE OF NEW BRUNSWICK | 2016 |

CONSOLIDATED STATEMENT OF OPERATIONS

for the fiscal year ended 31 March

| | | (millions) | |

Schedule | | 2016

Budget | | | 2016

Actual | | | 2015

Actual | |

| REVENUE | | | | | | | | | |

| | | | | | | | | | |

| Provincial Sources | | | | | | | | | |

14 | Taxes | | $ | 4,017.2 | | | $ | 4,029.7 | | | $ | 3,983.1 | |

15 | Licenses and Permits | | | 151.7 | | | | 153.8 | | | | 149.4 | |

16 | Royalties | | | 107.2 | | | | 89.3 | | | | 97.5 | |

17 | Income from Government Business Enterprises | | | 258.0 | | | | 189.1 | | | | 270.9 | |

18 | Other Provincial Revenue | | | 628.2 | | | | 777.5 | | | | 732.6 | |

| Sinking Fund Earnings | | | 193.7 | | | | 194.1 | | | | 195.9 | |

| | | | 5,356.0 | | | | 5,433.5 | | | | 5,429.4 | |

| Federal Sources | | | | | | | | | | | | |

| Fiscal Equalization Payments | | | 1,668.9 | | | | 1,668.0 | | | | 1,666.0 | |

19 | Unconditional Grants | | | 993.1 | | | | 994.7 | | | | 955.8 | |

20 | Conditional Grants | | | 289.9 | | | | 290.0 | | | | 388.0 | |

| | | | 2,951.9 | | | | 2,952.7 | | | | 3,009.8 | |

| | | | 8,307.9 | | | | 8,386.2 | | | | 8,439.2 | |

| EXPENSE | | | | | | | | | | | | |

21 | Education and Training | | | 1,840.2 | | | | 1,846.3 | | | | 2,083.7 | |

22 | Health | | | 2,864.9 | | | | 2,899.0 | | | | 2,830.9 | |

23 | Social Development | | | 1,130.3 | | | | 1,196.4 | | | | 1,182.3 | |

24 | Protection Services | | | 258.0 | | | | 281.3 | | | | 268.7 | |

25 | Economic Development | | | 266.7 | | | | 204.0 | | | | 247.6 | |

26 | Labour and Employment | | | 133.1 | | | | 135.0 | | | | 122.6 | |

27 | Resources | | | 194.2 | | | | 185.3 | | | | 197.3 | |

28 | Transportation and Infrastructure | | | 624.1 | | | | 636.0 | | | | 649.7 | |

29 | Central Government | | | 638.2 | | | | 585.3 | | | | 540.6 | |

| Service of the Public Debt (Note 10) | | | 685.0 | | | | 678.1 | | | | 677.2 | |

| | | | 8,634.7 | | | | 8,646.7 | | | | 8,800.6 | |

| | | | | | | | | | | | | |

| ANNUAL DEFICIT (Note 2) | | $ | (326.8 | ) | | $ | (260.5 | ) | | $ | (361.4 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

2016 | PROVINCE OF NEW BRUNSWICK | 23 |

CONSOLIDATED STATEMENT OF CASH FLOW

for the fiscal year ended 31 March

| | (millions) | |

| | 2016 | | | 2015 | |

OPERATING ACTIVITIES | | | | | | |

| | | | | | |

Deficit | | $ | (260.5 | ) | | $ | (361.4 | ) |

Non Cash Items | | | | | | | | |

Amortization of Premiums, Discounts and Issue Expenses | | | 7.1 | | | | 10.1 | |

Foreign Exchange Expense | | | (5.8 | ) | | | (5.8 | ) |

(Decrease) Increase in Provision for Losses | | | (3.0 | ) | | | 48.5 | |

Amortization of Tangible Capital Assets | | | 426.8 | | | | 406.0 | |

Loss on Disposal or Impairment of Tangible Capital Assets | | | 6.5 | | | | 15.1 | |

Sinking Fund Earnings | | | (194.1 | ) | | | (195.9 | ) |

Losses on Foreign Exchange Settlements | | | 2.7 | | | | 2.5 | |

Increase in Net Pension Liability (Note 11) | | | 13.3 | | | | 272.8 | |

Increase (Decrease) in Deferred Revenue | | | 16.2 | | | | (18.0 | ) |

Changes in Working Capital | | | | | | | | |

Decrease in Accounts Receivable | | | 29.1 | | | | 13.6 | |

Decrease (Increase) in Taxes Receivable | | | 66.8 | | | | (125.9 | ) |

Decrease (Increase) in Inventories | | | 3.5 | | | | (0.2 | ) |

Decrease (Increase) in Prepaid and Deferred Charges | | | 13.1 | | | | (7.3 | ) |

Increase in Accounts Payable and Accrued Expenses | | | 31.3 | | | | 59.9 | |

(Decrease) Increase in Deposits Held in Trust | | | (13.7 | ) | | | 42.1 | |

Net Cash From Operating Activities | | | 139.3 | | | | 156.1 | |

| | | | | | | | |

INVESTING ACTIVITIES | | | | | | | | |

| | | | | | | | |

Increase in Investments, Loans and Advances | | | 106.2 | | | | 42.1 | |

Other Comprehensive Loss | | | (143.3 | ) | | | (162.6 | ) |

Net Cash Used in Investing Activities | | | (37.1 | ) | | | (120.5 | ) |

| | | | | | | | |

CAPITAL TRANSACTIONS | | | | | | | | |

| | | | | | | | |

Acquisition of Capital Assets (Note 7) | | | (586.1 | ) | | | (591.0 | ) |

| | | | | | | | |

FINANCING ACTIVITIES | | | | | | | | |

| | | | | | | | |

Proceeds from Issuance of Funded Debt | | | 1,653.9 | | | | 1,644.5 | |

Purchase of NB Power Debentures | | | (494.4 | ) | | | --- | |

Elimination of Debentures held by NB Immigrant Investor Fund | | | (0.2 | ) | | | (17.0 | ) |

Received from Sinking Fund for Redemption of Debentures and Payment of Exchange | | | 196.1 | | | | 173.1 | |

(Decrease) Increase in Obligations under Capital Leases | | | (33.7 | ) | | | 51.5 | |

Sinking Fund Installments | | | (153.7 | ) | | | (142.9 | ) |

Increase (Decrease) in Short Term Borrowing | | | 412.0 | | | | (153.6 | ) |

Funded Debt Matured | | | (637.2 | ) | | | (852.4 | ) |

Net Cash from Financing Activities | | | 942.8 | | | | 703.2 | |

| | | | | | | | |

INCREASE IN CASH DURING YEAR | | | 458.9 | | | | 147.8 | |

CASH AND SHORT TERM INVESTMENTS - BEGINNING OF YEAR | | | 1,682.2 | | | | 1,534.4 | |

CASH AND SHORT TERM INVESTMENTS - END OF YEAR | | $ | 2,141.1 | | | $ | 1,682.2 | |

The accompanying notes are an integral part of these consolidated financial statements.

24 | PROVINCE OF NEW BRUNSWICK | 2016 |

CONSOLIDATED STATEMENT OF CHANGE IN NET DEBT

for the fiscal year ended 31 March

| | (millions) | |

| | 2016 Budget | | | 2016 Actual | | | 2015 Actual | |

RESTATED NET DEBT - BEGINNING OF YEAR (NOTE 17) | | | | | | | | | |

| | $ | (12,421.9 | ) | | $ | (13,118.2 | ) | | $ | (12,415.1 | ) |

CHANGES IN YEAR | | | | | | | | | | | | |

Annual Deficit | | | (326.8 | ) | | | (260.5 | ) | | | (361.4 | ) |

Other Comprehensive Loss | | | --- | | | | (143.3 | ) | | | (162.6 | ) |

Acquisition of Tangible Capital Assets (Note 7) | | | (525.9 | ) | | | (586.1 | ) | | | (591.0 | ) |

Amortization of Tangible Capital Assets (Note 7) | | | 417.2 | | | | 426.8 | | | | 406.0 | |

Loss on Disposal or Impairment of Tangible Capital Assets | | | --- | | | | 6.5 | | | | 15.1 | |

Net Change in Supplies Inventories | | | --- | | | | 2.1 | | | | (1.9 | ) |

Net Change in Prepaid Expenses | | | --- | | | | 13.1 | | | | (7.3 | ) |

INCREASE IN NET DEBT | | | (435.5 | ) | | | (541.4 | ) | | | (703.1 | ) |

NET DEBT - END OF YEAR | | $ | (12,857.4 | ) | | $ | (13,659.6 | ) | | $ | (13,118.2 | ) |

CONSOLIDATED STATEMENT OF CHANGE IN ACCUMULATED DEFICIT

for the fiscal year ended 31 March

| | (millions) | |

| | 2016 Budget | | | 2016 Actual | | | 2015 Actual | |

RESTATED ACCUMULATED DEFICIT - BEGINNING OF YEAR (NOTE 17) | | $ | (3,961.3 | ) | | $ | (4,298.3 | ) | | | (3,774.3 | ) |

| | | | | | | | | | | | |

Annual Deficit | | | (326.8 | ) | | | (260.5 | ) | | | (361.4 | ) |

Other Comprehensive Loss | | | --- | | | | (143.3 | ) | | | (162.6 | ) |

| | | | | | | | | | | | |

ACCUMULATED DEFICIT - END OF YEAR | | $ | (4,288.1 | ) | | $ | (4,702.1 | ) | | $ | (4,298.3 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

2016 | PROVINCE OF NEW BRUNSWICK | 25 |

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

31 March 2016

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

a) Basis of Accounting

These consolidated financial statements are prepared in accordance with Canadian public sector accounting standards.

b) Provincial Reporting Entity

These consolidated financial statements include the accounts of organizations that are controlled by the Province. A complete listing of the organizations within the Province’s government reporting entity is provided in Schedule 30.

Legally established trust funds which the Province administers but does not control are not included as Provincial assets or liabilities. These consolidated financial statements disclose the equity balances of the trust funds administered by the Province in Note 16.

c) Principles of Consolidation

The accounts of organizations within the Province’s government reporting entity are included in these consolidated financial statements through one of the following accounting methods:

Consolidation Method

This method combines the accounts of distinct organizations. It requires uniform accounting policies for the organizations. The Province does not adjust the tangible capital asset policies of organizations that are consolidated using this method to those of the Province in cases where the adjustment would be immaterial. Inter- organizational balances and transactions are eliminated under this method. This method reports the organizations as if they were one organization.

Modified Equity Method

This method is used for government business enterprises (GBEs). GBEs are defined in Note 6 to these consolidated financial statements. The modified equity method reports a GBE’s net assets as an investment on the Province’s Consolidated Statement of Financial Position. The net income of the GBE is reported as income from government business enterprises on the Province’s Consolidated Statement of Operations. Inter-organizational transactions and balances are not eliminated. All gains or losses arising from inter-organizational transactions between GBEs and other government organizations are eliminated. The accounting policies of GBEs are not adjusted to conform with those of other government organizations.

Transaction Method

This method records only transactions between the Province and the other organizations. The transaction method is used when the appropriate methods would not produce a materially different result.

d) Changes in Accounting Policy

Nursing Homes Consolidation

Effective 1 April 2015, the Province retroactively changed its accounting policy to include within the Provincial Reporting Entity not-for-profit nursing homes operating in New Brunswick. As a result of this change, the financial results of Province’s not-for-profit nursing homes are now included in the Province’s consolidated financial statements using the full consolidation method. Note 17 discloses the impact of the change in accounting policy on prior periods. A complete listing of the organizations within the Province’s government reporting entity is provided in Schedule 30.

26 | PROVINCE OF NEW BRUNSWICK | 2016 |

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

31 March 2016

Target Benefit Pension Plans

Effective 1 April 2015, the Province retroactively changed its accounting policy for Target Benefit Pension Plans. The Province previously accounted for these plans as defined contribution plans, and is now applying defined benefit and joint defined benefit accounting treatment to these plans. Further detail can be found in Note 11(b). Note 17 discloses the impact of the change in accounting policy on prior periods.

e) Future Changes in Accounting Policy

New Standards

The Public Sector Accounting Board issued sections PS 2200 - Related Party Disclosures, PS 3210 – Assets, PS3320 - Contingent Assets, PS 3380 - Contractual Rights and PS 3420 – Inter-entity Transactions with effective dates of 1 April 2017. The Board also issued section PS 3430 - Restructuring Transactions with an effective date of 1 April 2018.

The Province plans to adopt these new and amended standards on the effective date and is currently analyzing the impact of the standards on its consolidated financial statements.

PS 3450 - Financial Instruments and PS 2601 - Foreign Currency Translation

The Public Sector Accounting Board issued section PS 3450 - Financial Instruments with an effective date of 1 April 2019. Under this new standard, financial instruments will be assigned a measurement category of either fair value, cost or amortized cost. Until a financial instrument is derecognized, any gains or losses that arise due to fair value remeasurement will be reported on the Statement of Remeasurement Gains and Losses. Adoption of this standard requires the adoption of PS 2601 - Foreign Currency Translation, PS 1201 - Financial Statement Presentation and PS 3041 - Portfolio Investments in the same fiscal year.

f) Specific Accounting Policies

Asset Classification

Assets are classified as either financial or non-financial. Financial assets are assets that could be used to discharge existing liabilities or finance future operations and are not to be consumed in the normal course of operations. Non- financial assets are acquired, constructed or developed assets that do not provide resources to discharge existing liabilities but are employed to deliver government services, may be consumed in normal operations and are not for resale. Non-financial assets include tangible capital assets, prepaid and deferred charges and inventories of supplies.

Financial Assets

Cash and Short Term Investments

Cash and short term investments are recorded at cost, which approximates market value. Short term investments include highly liquid investments that are readily convertible to known amounts of cash, with maturity dates of six months or less. Cash and short term investments include $855.0 million ($784.3 million 2015) in short term investments issued by the New Brunswick Power Corporation.

Inventories for Resale

Inventories for resale are recorded at the lower of cost or net realizable value. Properties held for resale are reported as a financial asset and include land and fixtures acquired or constructed for the purpose of sale. Properties held for resale also include properties acquired through foreclosure.

2016 | PROVINCE OF NEW BRUNSWICK | 27 |

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

31 March 2016

Loans

Loans are initially recorded at cost, and reported at the lower of cost and net recoverable value through a valuation allowance. Changes in the valuation allowance are recognized in expense. Interest revenue is recognized on a loan when earned, and ceases to be accrued when the collectability of either the principal or interest is not reasonably assured.

Loans issued under the Opportunities New Brunswick Act, Agricultural Development Act, and Fisheries and Aquaculture Development Act facilitate the establishment, development, or maintenance of industry in a variety of areas. As such, the nature and terms of the loans under these Acts vary. Loans to students are interest free while the student is in full-time studies and becomes repayable with interest six months after the student leaves post-secondary studies. The maximum repayment term is fifteen years. Loans issued under the New Brunswick Housing Act may offer concessionary interest rates, and are repayable over a period not to exceed twenty-five years.

Other Investments

Investments are recorded at cost, which approximates market value. Where there has been a loss in the value of an investment that is other than a temporary decline, the investment is written down to recognize this loss.

Sinking Funds

The General Sinking Fund is maintained by the Minister of Finance under the authority of section 12 of the Provincial Loans Act (“Act”). This Act provides that the Minister shall maintain one or more sinking funds for the payment of funded debt either at maturity or upon redemption in advance of maturity. Typically, redemptions are only made after the related Provincial purpose portion of the debt has been outstanding a minimum of twenty years.

Sinking fund installments are paid into the General Sinking Fund on or before the anniversary date of each issue of funded debt, at the prescribed rate of a minimum of 1% of the outstanding principal.

Sinking fund investments in bonds and debentures are reported at par value less unamortized discounts less premiums and the unamortized balance of unrealized foreign exchange gains or losses. Short-term deposits are reported at cost. The Province’s sinking fund is invested in eligible securities as defined in the Act.

New Brunswick Power Corporation (NB Power) is contractually obligated to pay to the Province the amount of the sinking fund installment required each year in respect of the debentures issued by the Province on behalf of the New Brunswick Power Corporation.

The following table shows the components of the Sinking Fund:

| | | (millions) | |

| | | Consolidated Fund | | | | NB Power | | | | Total | |

| | | | | | | | | | | | |

Fund Equity, beginning of year | | $ | 4,049.6 | | | $ | 471.3 | | | $ | 4,520.9 | |

Sinking Fund Earnings | | | 194.1 | | | | 27.6 | | | | 221.7 | |

Installments | | | 153.7 | | | | 44.6 | | | | 198.3 | |

Paid for Debt Retirement | | | (196.1 | ) | | | (79.8 | ) | | | (275.9 | ) |

| | | | | | | | | | | | |

Fund Equity, end of year | | $ | 4,201.3 | | | $ | 463.7 | | | $ | 4,665.0 | |

28 | PROVINCE OF NEW BRUNSWICK | 2016 |

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

31 March 2016

Liabilities

Allowances

Allowances have been established for loans and accounts receivable, loan guarantees and other possible losses. These allowances are disclosed in the schedules to the consolidated financial statements.

Obligations resulting from guaranteed loans are recorded as liabilities when management determines that a loss is probable with changes in this allowance recorded annually.

Each outstanding loan guarantee under the Opportunities New Brunswick Act is reviewed on a quarterly basis. An allowance for loss on loan guarantees is established when management determines that a loss is probable. A loss is considered probable when one or more of the following factors is present:

| · | a decline in the financial position of the borrower; |

| · | economic conditions in which the borrower operates indicate the borrower’s inability to repay the loan; |

| · | collection experience for the loan. |

Losses on guaranteed loans under the Agriculture Development Act and the Fisheries and Aquaculture Development Act for classes that have similar standards are calculated using an average rate based on past experience and trends.

Amounts due to the Province but deemed uncollectible are written off from the accounts of the Province once the write-off has been approved by either the Board of Management or Secretary to the Board of Management depending on the dollar value involved.

Retirement benefits

Retirement benefits include various retirement benefit plans and other employee future benefit plans where the province has an obligation to provide benefits to employees. Liabilities for these plans are calculated using the projected benefit method prorated on service, using various assumptions based on management’s best estimate. Pension fund assets are valued at marked-related values. The cost of benefits earned is attributed to the period that the employee provides service. Changes in the liability resulting from experience gains or losses and changes in actuarial assumptions are amortized over the expected average remaining service life of the related plan. Gains and losses arising from plan amendments are recognized in the period of the plan amendment. The plans accounted for using this method are the Provincial Court Act and the Provincial Court Judges’ Pension Act, the Members’ Superannuation Act and the Members’ Pension Act, the Pension Plan for Management Employees of New Brunswick School Districts, the Pension Plan for General Labour, Trades and Services Employees of New Brunswick School Districts, the Pension Plan for Full-Time CUPE 2745 Employees of New Brunswick School Districts, the Pension Plan for Management Employees’ of New Brunswick Nursing Homes, the Pension Plan for General and Service Employees’ of New Brunswick Nursing Homes, the Pension Plan for Nursing and Paramedical Employees’ of New Brunswick Nursing Homes, the Supplementary Retirement Plan, and the Retirement Allowance program.

Target Benefit Pension Plans are accounted for similar to the above plans except they are governed by an Agreement and Declaration of Trust which restricts access to the plan assets. On this basis, the Province records the value of the plan net assets as nil when these plans are in a net asset position. When these plans are in a net obligation position, the Province records a liability for its share. The plans accounted for using this method are: the Public Service Shared Risk Pension Plan, the New Brunswick Teachers’ Pension Plan, the Shared Risk Plan for CUPE Employees of New Brunswick Hospitals, and the Shared Risk Plan for Certain Bargaining Employees of New Brunswick Hospitals.

The Province also contributes to the Pension Plan for Part-Time and Seasonal Employees. For this plan, the Board of Trustees has the obligation to provide benefits to its members. As such, no liability is recorded by the Province. The cost recorded by the Province for this plan equals the amount of the Province’s required contribution for the period.

2016 | PROVINCE OF NEW BRUNSWICK | 29 |

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

31 March 2016

Sick Leave

The cost of accumulating, non-vesting sick leave benefits are determined by an actuarial valuation, using management’s best estimate of salary escalation, accumulated sick days at retirement, long term inflation rates and discount rates.

Liability for Injured Workers

The Province provides workers’ compensation benefits on a self-insured basis. Work Safe New Brunswick administers the claims on the Province’s behalf and charges a fee for this service. The liability for injured workers is determined using a number of methods to estimate future payments including: the annuity method, the loss development method, and the aggregate claims method. Future payments are then discounted to determine the present value. Annual claim payments are expensed by each department and are reported in the functional expense area related to the program in which the employee worked. The net change in the liability, excluding actual claims costs, is reported under central government.

Borrowing on Behalf of New Brunswick Power Corporation

The Province, as represented by the Consolidated Fund, has issued long term debt securities on behalf of the New Brunswick Power Corporation in exchange for debentures with like terms and conditions. This financing arrangement was used to obtain more favourable debt servicing costs.

The New Brunswick Power Corporation debentures received by the Province are reported in the Statement of Financial Position of these consolidated financial statements as a reduction of Funded Debt. The transactions involving these securities, including the debt servicing costs, are not part of the budget plan of the Province’s Consolidated Fund.

Non-Financial Assets

Tangible Capital Assets

Tangible capital assets are assets of the Province which have useful lives greater than one year. Certain dollar thresholds for capitalization have been established for practical purposes.

Tangible capital asset policies of government entities which are consolidated in these consolidated financial statements are not adjusted to conform to Provincial policies in cases where the differences are not material. The areas in which tangible capital asset policies could differ include amortization rate, estimated useful life and capitalization threshold.

Capital Leases

Long term leases, under which the Province, as lessee, assumes substantially all the benefits and risks of ownership of leased property, are classified as capital leases although certain minimum dollar thresholds are in place for practical reasons. The present value of a capital lease is accounted for as a tangible capital asset and an obligation at the inception of the lease.

Inventories of Supplies

Inventories of supplies for use are recorded at the lower of cost or net realizable value. Inventories of supplies are reported as a non-financial asset.

30 | PROVINCE OF NEW BRUNSWICK | 2016 |

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

31 March 2016

Revenues

Tax Revenue

Official estimates received from the federal government are used as the basis for determining federal tax revenue. Federal tax revenue amounts for the current year reflect prior year adjustments based on returns or more recent economic data.

Provincial real property tax is recognized based on the calculation of applying the relevant provincial and local service district tax rates to the assessed property value. Adjustments are made to current year revenue for future assessments and allowance for doubtful accounts.

Other provincial tax revenue is recognized based on the self-assessed returns of tax payers and tax collectors (e.g. retailers and wholesalers). This revenue is subsequently adjusted for future tax assessments and allowance for doubtful accounts. Other provincial tax revenue is also recognized from direct payments made by tax payers in completing certain types of transactions.

Grant Revenue

Government transfers are recognized as grant revenue in the period during which the transfer is authorized and all eligibility criteria have been met, except when and to the extent that the transfer gives rise to an obligation that meets the definition of a liability. Transfers meeting the definition of a liability are recorded as deferred revenue and are recognized as revenue when transfer stipulations are met. Capital projects for which the stipulation of project completion had not been met as at 31 March 2016 have been recorded as deferred capital contributions in Schedule 9. Major transfers recognized during the period include fiscal equalization payments and other transfers disclosed in Schedule 19.

Expenses

Grant Expense

Grants, entitlements and other government transfers are recognized as expense in the period during which the event giving rise to the transfer has occurred, provided that the transfer has been authorized and all eligibility criteria have been met by the recipient. Major government transfers during the period include: grants to universities, grants to municipalities, and funding provided through social and employment programs.

Debt Charges

Interest and other debt service charges are reported in the Consolidated Statement of Operations as Service of the Public Debt except as described below:

As government business enterprises are included in the Provincial Reporting Entity through modified equity accounting, the cost of servicing their debt is not included in the Service of the Public Debt expense. The cost of servicing the debt of government business enterprises is an expense included in the calculation of their net profit or loss for the year.

Interest costs imputed on the Province’s Net Pension Liability are recorded as part of pension expense, which is included in various expense functions.

Interest on debt to finance the Student Loan Portfolio is recorded as part of the Education and Training expense function.

Interest on CMHC debentures and Nursing Home debt is recorded as part of the Social Development expense function.

2016 | PROVINCE OF NEW BRUNSWICK | 31 |

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

31 March 2016

Interest earned on the assets of the General Sinking Fund and on other provincial assets is reported as revenue.

Note 10 to these consolidated financial statements reports the components of the Service of the Public Debt Expense function and total debt charges.

Operating Leases

All leases under which the Province does not assume substantially all the benefits and risks of ownership related to the leased property are classified as operating leases. Each rental payment required by an operating lease is recorded as an expense when it is due.

Concessionary Loans

There are two situations in which the Province charges loan disbursements entirely as expenses. These are:

| · | Loan agreements which commit the Province to provide future grants to the debtor to be used to repay the loan. |

| | |

| · | Loan agreements which include forgiveness provisions if the forgiveness is considered likely. |

In both these situations, the loan is charged to expense when it is disbursed.

Loans that are significantly concessionary because they earn a low rate of return are originally recorded as assets at the net present value of the expected future cash flows. The net present value is calculated using the Province’s borrowing rate at the time the loan was issued. The difference between the nominal value of the loan and its net present value is recorded as an expense.

g) Foreign Currency Translation and Risk Management

The Province's assets, liabilities and contingent liabilities denominated in foreign currencies are translated to Canadian dollars at the year-end rates of exchange, except where such items have been hedged or are subject to interest rate and currency swap agreements. In such cases, the rates established by the hedge or the agreements are used in the translation. Exchange gains and losses are included in the Consolidated Statement of Operations except for the unrealized exchange gains and losses arising on the translation of long term items, which are deferred and amortized on a straight line basis over the remaining life of the related assets or liabilities. Revenue and expense items are translated at the rates of exchange in effect at the respective transaction dates.

The Province borrows funds in both domestic and foreign capital markets and manages its existing debt portfolio to achieve the lowest debt costs within specified risk parameters. As a result, the Province may be exposed to foreign exchange risk. Foreign exchange or currency risk is the risk that the principal and interest payments on foreign debt will fluctuate in Canadian dollar terms due to fluctuations in foreign exchange rates.

In accordance with risk management policy guidelines, the Province uses various financial instruments and techniques to manage exposure to foreign currency risk. These financial instruments include currency forwards, cross-currency swaps and purchases of foreign denominated assets into the Province’s sinking fund.

As at 31 March 2016, the full amount of the Province’s outstanding foreign denominated debt (1,400 million US$) has been hedged by entering into cross-currency swaps, which convert the interest and principal payable from the original currency to Canadian dollars. As the entire foreign denominated debt portfolio has been hedged, the Province has no foreign currency exposure.

h) Measurement Uncertainty

Measurement uncertainty exists when there is uncertainty in the determination of the amount at which an item is recorded in the financial statements. Such uncertainty exists when there is a variance between the recognized or disclosed amount and another reasonably possible amount. Many items are measured using management’s best estimate, based on assumptions that reflect the most probable set of economic conditions and planned courses of action at the time of financial statement preparation. Estimates are updated to reflect new information as it becomes available. Actual results could differ from these estimates.

32 | PROVINCE OF NEW BRUNSWICK | 2016 |

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

31 March 2016

Significant estimates used in these consolidated financial statements include: