Economic, Strategic Program Review and Fiscal Update Third Quarter 2016–2017

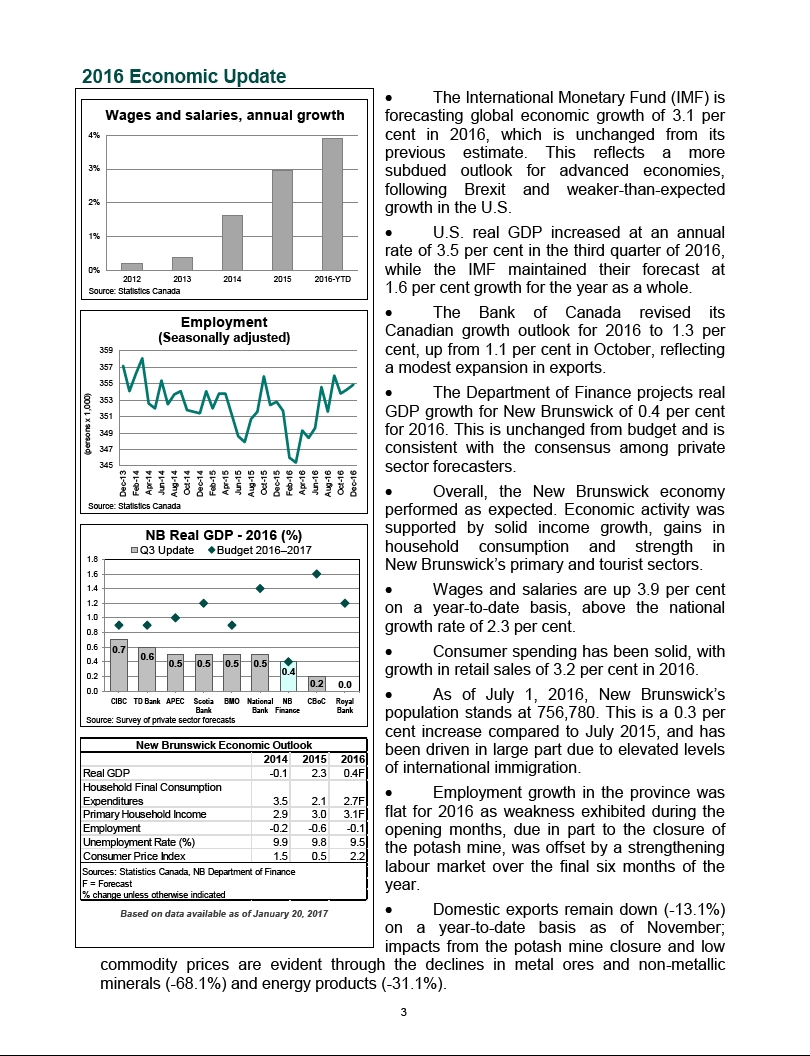

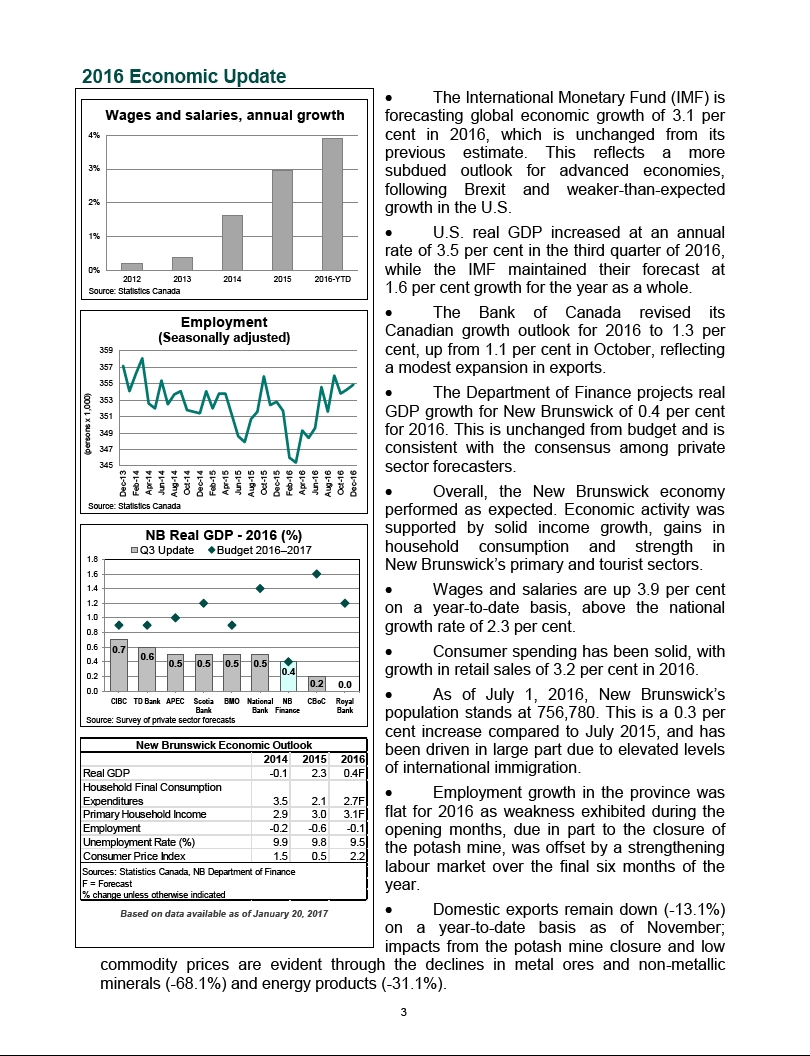

Published by:

Treasury Board and Department of Finance Government of New Brunswick P.O. Box 6000 Fredericton, New Brunswick E3B 5H1 Canada

Internet: www.gnb.ca/finance

January 2017

Translation:

Translation Bureau, Service New Brunswick

ISBN 978-1-4605-0526-7

Think Recycling!

Strategic Program Review Update

· Strategic Program Review (SPR) was an inclusive and transparent process with input sought from the public to help identify savings and revenues in order to eliminate the province’s deficit. The review began by looking internally to government first through efforts such as reducing the number of deputy ministers by 30 per cent; centralizing some government services; and reducing travel costs. Over $115 million in savings were found in the 2015–2016 Budget.

· In the 2016–2017 Budget, an additional $181 million in savings to be achieved over the next five years was announced. Based on the third quarter information, the projected savings for 2016–2017 will be approximately $52 million; additional savings identified through Strategic Program Review will be seen as projects are implemented.

· At third quarter, we are on track to deliver 99.5 per cent of the annual savings target of $52.6 million for fiscal 2016–2017.

· A complete accounting of the consulting fees paid for the planning, execution and delivery of the SPR has been completed. Government spent a total of $1 million on consultants from MC Business Solutions ($882,223) and Brigus Consulting ($125,045) to lever savings of $296 million, a return on investment of 296:1.

· Through the fourth quarter of 2016–2017 and into the first quarter of 2017–2018, implementation of one of the largest SPR initiatives will begin. Government announced in the spring of 2015 that an early SPR initiative would be outsourcing the management of environmental, portering and food services in hospitals. This project is a continuation of work begun by the previous government and after planning and negotiations, implementation will begin soon. This initiative will result in improved quality of service in hospitals, but will also see job losses in some hospitals as services are delivered differently.

· Through continued efforts in administrative efficiencies and centralization of services, additional savings of $7 million were found in the third quarter versus the second quarter of 2016–2017.

· Once fully realized, the Strategic Program Review will yield $296 million in expenditure reductions and $293 million in revenue measures.

| | |

| Strategic Program Review – by the numbers: | |

| | |

| | Savings | Revenue |

| Announced in 2015–2016 Budget | $115 million | $57 million |

| Announced in 2016–2017 Budget | $181 million | $236 million |

| Total SPR savings/revenue achieved by 2020 | $296 million | $293 million |

| Grand Total – SPR | | $589 million |

4

· Administrative Efficiencies: Projects include but are not limited to administration of Municipal Tax Warrant ($2.0 million), elimination of Municipal Fine Revenue Sharing ($1.5 million), standardization of budget processes ($1.4 million), and Vacant Bed Days policy compliance ($800,000). General administrative efficiencies such as rationalization of phone lines, computers and subscriptions, as well as continuous process improvement efforts, have resulted in savings of $12.2 million.

· Reshaping the Civil Service: Projects include but are not limited to reforming Transportation and Infrastructure ($4.9 million) and rightsizing the civil service, including combining positions and eliminating unneeded positions ($2.4 million).

· Centralization of Services: Projects include but are not limited to centralization of common services at Service New Brunswick ($7.2 million), Land Registry centralization ($400,000), and Human Resources centralization ($300,000).

· Other: Projects include but are not limited to Visitor Information Centre closures ($195,000) and Off-Road Vehicle Enforcement ($150,000).

2016–2017 Fiscal Update

Based on third quarter information, there is a projected deficit of $331.1 million for 2016–2017. This is an improvement of $16.0 million compared to the budgeted deficit of $347.0 million. If the contingency reserve is not required, the deficit will be $231.1 million.

| | | | | |

| Third Quarter Fiscal Summary |

| |

| ($ Thousands) | 2016–2017 Budget | 2016–2017 3rd Quarter Projection | Variance from Budget |

| Revenue | 8,718,765 | 8,744,360 | 25,595 |

| Expense | 8,965,789 | 8,975,420 | 9,631 |

| Contingency Reserve | (100,000) | (100,000) | 0 |

| Surplus (Deficit) | (347,024) | (331,060) | 15,964 |

Net debt is projected to increase by $437.8 million, a decrease of $30.7 million from budget. Net debt is projected to reach $14,097 million by March 31, 2017. If the contingency reserve is not required, the net debt will be $13,997 million.

The 2017–2018 Budget will eliminate the contingency reserve and reflect the consolidation of nursing homes on the province’s financial statements. However, to maintain consistency and comparability with the 2016–2017 Budget, the revised 2016–2017 revenue and expense figures within this report do not reflect the consolidation of nursing homes. Once these changes are incorporated, the deficit projection for 2016–2017 will be $231.1 million, and a net debt projection of $13,997 million.

Revenue:

Revenue is $25.6 million higher than budget. The major variances include:

· Corporate Income Tax is up $54.0 million from budget due to higher in-year payments and an anticipated, significant, positive prior-year adjustment related to the 2015 taxation year.

· Conditional Grants are up $43.9 million due to higher recoveries for various federally funded programs, including the Disaster Financial Assistance program.

· Special Operating Agencies revenue is up $19.5 million because of new federal funding for the Post-Secondary Institutions Strategic Investment Fund and the Clean Water and Wastewater Fund.

· Miscellaneous revenue is up $15.1 million mainly due to the realignment of revenue from Sale of Goods and Services and various other accounts across departments.

· Royalties revenue is up $9.9 million due to higher estimates for timber royalty.

· The Special Purpose Account is up $7.5 million mainly due to higher school-raised funds and donations.

· Lottery and Gaming Revenues are up $7.0 million largely due to strong year-end results in 2015–2016 resulting in a higher forecast base for 2016–2017.

· Harmonized Sales Tax is down $86.2 million due to significant negative prior-year adjustments covering the 2011–2015 period, reflecting the lowering of national revenue pool estimates by the federal government on which payments are based, and a strong Ontario housing market, which has adverse implications on the share allocation for all other HST-receiving provinces.

· Return on Investment is down $37.5 million primarily as a result of lower projected net income for NB Power. This is mainly due to lower export sales, loss of in-province industrial load and additional preventative maintenance investments for the Point Lepreau Nuclear Generating Station.

· Sale of Goods and Services is down $12.5 million due to the cessation of the New Brunswick Investment Management Corporation, realignment of revenue to Miscellaneous revenue, and lower revenue for fees, tuition and training in the community colleges.

· Provincial Real Property Tax is down $11.2 million mainly due to the tax base being lower than forecasted.

Expense:

Total expenses are projected to be $9.6 million higher than budget. The major variances include the following:

· Education and Early Childhood Development ($3.3 million over): Mainly due to higher than budgeted expenses in school districts associated with Syrian students.

· General Government ($47.0 million under): Primarily due to lower than expected expenses in the Legislated Pension Plans, Benefit Accruals, Subsidies, and Supplementary Allowances Programs associated with retirement allowance benefits, as well as lower than expected centrally managed funds.

· Health ($21.1 million over): Mainly due to higher than expected expenses under the Medicare program.

· Justice and Public Safety ($3.0 million over): Mainly due to higher than budgeted expenses under the Disaster Financial Assistance program associated with storm and flood events. These expenses are partially offset by increased recoveries from the federal government.

· Other Agencies ($16.3 million under): Due to lower than budgeted expenses of various consolidated entities.

· Post-Secondary Education, Training and Labour ($4.7 million over): Mainly due to additional expenditures in employment programs related to increased federal funding and in the Maritime Provinces Higher Education Commission.

7

· Regional Development Corporation ($22.2 million over): Due to accelerated project funding for various initiatives.

· Service of the Public Debt ($5.0 million under): Due to lower than anticipated interest rates and the timing of debt issuance.

· Social Development ($4.0 million over): Mainly due to increased costs in the Housing Services program associated with the new federal-provincial Social Infrastructure Fund Agreement.

· Transportation and Infrastructure ($2.7 million over): Mainly due to higher than expected costs associated with the Radio Communications project, WorkSafe NB and Summer Maintenance.

· Capital Account ($9.8 million under): Due to lower than expected Capital Account expense in the Department of Transportation and Infrastructure and the Regional Development Corporation.

· Special Operating Agencies Account ($14.5 million over): Mainly due to costs associated with the federal-provincial Clean Water and Wastewater Fund and the Post-Secondary Institutions Strategic Investment Fund in the Regional Development Corporation, as well as increased costs under the Vehicle Management Agency of the Department of Transportation and Infrastructure.

8

PROVINCE OF NEW BRUNSWICK

FISCAL UPDATE

Thousands

$

| | | | | | | | |

| | | | 2016–2017 | | 2016–2017 | | Variance | |

| | 2016–2017 | | 2nd Quarter | | 3rd Quarter | | from | |

| | Budget | | Projection | | Projection | | Budget | |

| |

| Revenue | | | | | | | | |

| Ordinary Account | 8,354,502 | | 8,362,531 | | 8,347,461 | | (7,041) | |

| Capital Account | 32,680 | | 36,458 | | 36,193 | | 3,513 | |

| Special Purpose Account | 76,101 | | 76,031 | | 83,587 | | 7,486 | |

| Special Operating Agencies | 65,282 | | 79,403 | | 84,819 | | 19,537 | |

| Sinking Fund Earnings | 190,200 | | 190,200 | | 192,300 | | 2,100 | |

| Total Revenue | 8,718,765 | | 8,744,623 | | 8,744,360 | | 25,595 | |

| |

| Expense | | | | | | | | |

| Ordinary Account | 8,261,450 | | 8,263,372 | | 8,254,509 | | (6,941) | |

| Capital Account | 122,649 | | 109,089 | | 112,864 | | (9,785) | |

| Special Purpose Account | 87,265 | | 88,539 | | 95,993 | | 8,728 | |

| Special Operating Agencies | 59,239 | | 78,132 | | 73,698 | | 14,459 | |

| Amortization of Tangible Capital Assets | 435,186 | | 437,049 | | 438,356 | | 3,170 | |

| Total Expense | 8,965,789 | | 8,976,181 | | 8,975,420 | | 9,631 | |

| |

| Contingency Reserve | (100,000 | | (100,000 | | (100,000) | | 0 | |

| |

| Surplus (Deficit) | (347,024) | | (331,558) | | (331,060) | | 15,964 | |

If the contingency reserve is not required, the deficit based on third quarter projections will be $231.1 million.

9

CHANGE IN NET DEBT

Thousands

$

| | | | | | | | |

| | | | 2016–2017 | | 2016–2017 | | Variance | |

| | 2016–2017 | | 2nd Quarter | | 3rd Quarter | | from | |

| | Budget | | Projection | | Projection | | Budget | |

| | | | | | | | | |

| Net Debt - Beginning of Year | (12,989,898) | | (13,659,580) | | (13,659,580) | | (669,682) | |

| | | | | | | | | |

| Changes in Year | | | | | | | | |

| Surplus (Deficit) | (347,024) | | (331,558) | | (331,060) | | 15,964 | |

| Investments in Tangible Capital Assets | (556,661) | | (551,292) | | (545,122) | | 11,539 | |

| Amortization of Tangible Capital Assets | 435,186 | | 437,049 | | 438,356 | | 3,170 | |

| (Increase) Decrease in Net Debt | (468,499) | | (445,801) | | (437,826) | | 30,673 | |

| | | | | | | | | |

| Net Debt - End of Year | (13,458,397) | | (14,105,381) | | (14,097,406) | | (639,009) | |

If the contingency reserve is not required, the net debt based on third quarter projections will be $13,997 million.

At second quarter, Net Debt - Beginning of Year was updated to reflect the ending net debt that was published in the

2015–2016 Consolidated Financial Statements (Public Accounts Volume I).

10

APPENDIX A

ORDINARY ACCOUNT REVENUE BY SOURCE

Thousands

$

| | | | | | | | |

| | | | 2016–2017 | | 2016–2017 | | Variance | |

| | 2016–2017 | | 2nd Quarter | | 3rd Quarter | | from | |

| | Budget | | Projection | | Projection | | Budget | |

| |

| Taxes | | | | | | | | |

| Personal Income Tax | 1,632,000 | | 1,627,000 | | 1,636,000 | | 4,000 | |

| Corporate Income Tax | 276,200 | | 279,600 | | 330,200 | | 54,000 | |

| Metallic Minerals Tax | 0 | | 200 | | 700 | | 700 | |

| Provincial Real Property Tax | 514,688 | | 506,000 | | 503,500 | | (11,188) | |

| Harmonized Sales Tax: Net of Credit | 1,335,600 | | 1,335,600 | | 1,249,400 | | (86,200) | |

| Gasoline and Motive Fuels Tax | 288,000 | | 288,000 | | 288,000 | | 0 | |

| Tobacco Tax | 153,500 | | 158,500 | | 158,000 | | 4,500 | |

| Pari-Mutuel Tax | 420 | | 420 | | 420 | | 0 | |

| Insurance Premium Tax | 54,000 | | 54,000 | | 54,100 | | 100 | |

| Real Property Transfer Tax | 23,000 | | 23,000 | | 23,000 | | 0 | |

| Financial Corporation Capital Tax | 27,000 | | 27,000 | | 27,000 | | 0 | |

| Penalties and Interest | 13,000 | | 11,000 | | 13,000 | | 0 | |

| Subtotal - Taxes | 4,317,408 | | 4,310,320 | | 4,283,320 | | (34,088) | |

| |

| Return on Investment | 303,686 | | 254,481 | | 266,190 | | (37,496) | |

| Licences and Permits | 150,604 | | 150,306 | | 151,139 | | 535 | |

| Sale of Goods and Services | 334,610 | | 330,914 | | 322,066 | | (12,544) | |

| Lottery and Gaming Revenues | 144,800 | | 150,800 | | 151,800 | | 7,000 | |

| Royalties | 70,430 | | 70,035 | | 80,352 | | 9,922 | |

| Fines and Penalties | 10,724 | | 10,740 | | 8,256 | | (2,468) | |

| Miscellaneous | 72,362 | | 85,495 | | 87,473 | | 15,111 | |

| Total - Own Source Revenue | 5,404,624 | | 5,363,091 | | 5,350,596 | | (54,028) | |

| |

| Unconditional Grants – Canada | | | | | | | | |

| Fiscal Equalization Payments | 1,708,400 | | 1,708,400 | | 1,708,400 | | 0 | |

| Canada Health Transfer | 753,900 | | 753,500 | | 753,500 | | (400) | |

| Canada Social Transfer | 279,000 | | 278,700 | | 278,700 | | (300) | |

| Other | 1,866 | | 1,866 | | 1,866 | | 0 | |

| Subtotal - Unconditional Grants – Canada | 2,743,166 | | 2,742,466 | | 2,742,466 | | (700 | |

| |

| Conditional Grants – Canada | 216,936 | | 266,695 | | 260,823 | | 43,887 | |

| |

| Total – Grants from Canada | 2,960,102 | | 3,009,161 | | 3,003,289 | | 43,187 | |

| |

| Subtotal | 8,364,726 | | 8,372,252 | | 8,353,885 | | (10,841) | |

| |

| Inter-account Transactions | (10,224) | | (9,721) | | (6,424) | | 3,800 | |

| |

| Ordinary Account Revenue | 8,354,502 | | 8,362,531 | | 8,347,461 | | (7,041 | |

11

APPENDIX B

ORDINARY ACCOUNT EXPENSE

Thousands

$

| | | | | | | | | | |

| | | | 2016–2017 | | 2016–2017 | | Variance | | | |

| | 2016–2017 | | 2nd Quarter | | 3rd Quarter | | from | | | |

| | Budget* | | Projection | | Projection | | Budget | | % | |

| DEPARTMENT | | | | | | | | | | |

| Agriculture, Aquaculture and Fisheries | 37,209 | | 36,970 | | 36,970 | | (239) | | -0.6% | |

| Education and Early Childhood Development | 1,137,886 | | 1,137,886 | | 1,141,146 | | 3,260 | | 0.3% | |

| Energy and Resource Development | 100,016 | | 99,676 | | 99,676 | | (340) | | -0.3% | |

| Environment and Local Government | 138,481 | | 138,861 | | 138,879 | | 398 | | 0.3% | |

| Executive Council Office | 11,950 | | 11,900 | | 11,950 | | 0 | | 0.0% | |

| Finance | 12,503 | | 12,503 | | 12,503 | | 0 | | 0.0% | |

| General Government | 782,018 | | 761,664 | | 734,993 | | (47,025) | | -6.0% | |

| Health | 2,580,772 | | 2,590,754 | | 2,601,840 | | 21,068 | | 0.8% | |

| Justice and Public Safety | 224,141 | | 226,800 | | 227,112 | | 2,971 | | 1.3% | |

| Legislative Assembly | 26,030 | | 26,456 | | 26,516 | | 486 | | 1.9% | |

| Office of the Attorney General | 17,641 | | 17,991 | | 17,641 | | 0 | | 0.0% | |

| Office of the Premier | 1,598 | | 1,598 | | 1,598 | | 0 | | 0.0% | |

| Opportunities New Brunswick | 46,492 | | 48,482 | | 45,865 | | (627) | | -1.3% | |

| Other Agencies | 263,594 | | 260,836 | | 247,334 | | (16,260) | | -6.2% | |

| Post-Secondary Education, Training and Labour | 609,985 | | 612,985 | | 614,671 | | 4,686 | | 0.8% | |

| Regional Development Corporation | 79,922 | | 79,922 | | 102,147 | | 22,225 | | 27.8% | |

| Service of the Public Debt | 700,000 | | 700,000 | | 695,000 | | (5,000) | | -0.7% | |

| Social Development | 1,164,423 | | 1,171,794 | | 1,168,414 | | 3,991 | | 0.3% | |

| Tourism, Heritage and Culture | 51,514 | | 52,504 | | 52,504 | | 990 | | 1.9% | |

| Transportation and Infrastructure | 292,900 | | 295,250 | | 295,550 | | 2,650 | | 0.9% | |

| Treasury Board | 15,809 | | 15,718 | | 15,489 | | (320) | | -2.0% | |

| |

| Subtotal | 8,294,884 | | 8,300,550 | | 8,287,798 | | (7,086) | | -0.1% | |

| |

| Investment in Tangible Capital Assets | (23,210) | | (27,457) | | (26,865) | | (3,655) | | 15.7% | |

| Inter-account Transactions | (10,224) | | (9,721) | | (6,424) | | 3,800 | | -37.2% | |

| |

| Ordinary Account Expense | 8,261,450 | | 8,263,372 | | 8,254,509 | | (6,941 | | -0.1% | |

| |

| *The 2016–2017 Budget has been restated to reflect government reorganization. |

12

APPENDIX C

CAPITAL EXPENDITURES

Thousands

$

| | | | | | | | |

| | | | 2016–2017 | | 2016–2017 | | Variance | |

| | 2016–2017 | | 2nd Quarter | | 3rd Quarter | | from | |

| | Budget* | | Projection | | Projection | | Budget | |

| |

| Regular Capital Investments | | | | | | | | |

| Agriculture, Aquaculture and Fisheries | 500 | | 531 | | 531 | | 31 | |

| Education and Early Childhood Development | 65,022 | | 57,234 | | 57,131 | | (7,891) | |

| Environment and Local Government | 1,000 | | 1,000 | | 1,000 | | 0 | |

| Health | 70,100 | | 61,582 | | 61,689 | | (8,411) | |

| Justice and Public Safety | 0 | | 33 | | (1,146) | | (1,146) | |

| Legislative Assembly | 450 | | 321 | | 321 | | (129) | |

| Post-Secondary Education, Training and Labour | 5,895 | | 5,895 | | 5,830 | | (65) | |

| Regional Development Corporation | 2,707 | | 2,707 | | 2,707 | | 0 | |

| Service New Brunswick | 3,411 | | 3,411 | | 3,411 | | 0 | |

| Tourism, Heritage and Culture | 1,000 | | 1,000 | | 1,000 | | 0 | |

| Transportation and Infrastructure | 367,250 | | 372,953 | | 370,046 | | 2,796 | |

| Regular Capital Investments | 517,335 | | 506,667 | | 502,520 | | (14,815 | |

| |

| Strategic Infrastructure Initiative | | | | | | | | |

| Agriculture, Aquaculture and Fisheries | 1,000 | | 1,000 | | 1,000 | | 0 | |

| Education and Early Childhood Development | 41,085 | | 39,135 | | 41,016 | | (69) | |

| Health | 2,000 | | 528 | | 511 | | (1,489) | |

| Legislative Assembly | 335 | | 464 | | 464 | | 129 | |

| Regional Development Corporation | 44,500 | | 37,479 | | 37,986 | | (6,514) | |

| Tourism, Heritage and Culture | 1,295 | | 1,295 | | 1,295 | | 0 | |

| Transportation and Infrastructure | 35,210 | | 33,016 | | 32,989 | | (2,221) | |

| Energy Retrofit and Renewable Energy | 13,340 | | 13,340 | | 13,340 | | 0 | |

| Strategic Infrastructure Initiative | 138,765 | | 126,257 | | 128,601 | | (10,164) | |

| |

| Total - Capital Expenditures | 656,100 | | 632,924 | | 631,121 | | (24,979) | |

| |

| Investments in Tangible Capital Assets | (533,451) | | (523,835) | | (518,257) | | 15,194 | |

| |

| Capital Account Expense | 122,649 | | 109,089 | | 112,864 | | (9,785) | |

| |

| *The 2016–2017 Budget has been restated to reflect government reorganization. |

13