| August 1, 2011 Setting the Record Straight Validus’ Superior Proposal and the Questionable Judgment of Transatlantic’s Response FILED BY VALIDUS HOLDINGS, LTD. PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF 1933 AND DEEMED FILED PURSUANT TO RULE 14a-12 UNDER THE SECURITIES EXCHANGE ACT OF 1934 SUBJECT COMPANY: TRANSATLANTIC HOLDINGS, INC. COMMISSION FILE NO. 001-10545 |

| Cautionary Note Regarding Forward-looking Statements This presentation may include forward-looking statements, both with respect to Validus and its industry, that reflect Validus' current views with respect to future events and financial performance. Statements that include the words "expect," "intend," "plan," "believe," "project," "anticipate," "will," "may," "would" and similar statements of a future or forward-looking nature are often used to identify forward-looking statements. All forward-looking statements address matters that involve risks and uncertainties, many of which are beyond Validus' control. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements. Validus believes that these factors include, but are not limited to, the following: 1) uncertainty as to whether Validus will be able to enter into or consummate the proposed transaction on the terms set forth in Validus' proposal; 2) uncertainty as to the actual premium that will be realized by Transatlantic stockholders in connection with the proposed transaction; 3) failure to realize the anticipated benefits (including combination synergies) of the proposed transaction, including as a result of delay in completing the transaction or integrating the businesses of Validus and Transatlantic; 4) uncertainty as to the long-term value of Validus voting common shares; 5) unpredictability and severity of catastrophic events; 6) rating agency actions; 7) adequacy of Validus' or Transatlantic's risk management and loss limitation methods; 8) cyclicality of demand and pricing in the insurance and reinsurance markets; 9) Validus' ability to implement its business strategy during "soft" as well as "hard" markets; 10) adequacy of Validus' or Transatlantic's loss reserves; 11) continued availability of capital and financing; 12) retention of key personnel; 13) competition in the insurance and reinsurance markets; 14) potential loss of business from one or more major reinsurance or insurance brokers; 15) the credit risk Validus assumes through its dealings with its reinsurance and insurance brokers; 16) Validus' or Transatlantic's ability to implement, successfully and on a timely basis, complex infrastructure, distribution capabilities, systems, procedures and internal controls, and to develop accurate actuarial data to support the business and regulatory and reporting requirements; 17) general economic and market conditions (including inflation, volatility in the credit and capital markets, interest rates and foreign currency exchange rates); 18) the integration of businesses Validus may acquire or new business ventures Validus may start; 19) the legal, regulatory and tax regimes under which Validus operates; 20) the effect on Validus' or Transatlantic's investment portfolios of changing financial market conditions, including inflation, interest rates, liquidity and other factors; 21) acts of terrorism or outbreak of war or hostilities; 22) availability of reinsurance and retrocessional coverage; and 23) the outcome of transaction related litigation, as well as management's response to any of the aforementioned factors. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the Risk Factors included in Validus' and Transatlantic's most recent reports on Form 10-K and Form 10-Q and other documents of Validus and Transatlantic on file with the Securities and Exchange Commission. Any forward-looking statements made in this presentation are qualified in their entirety by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by Validus will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Validus or its business, operations or financial condition. Except to the extent required by applicable law, Validus undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. No rating agency (A.M. Best, Moody's, or Standard & Poor's) has specifically approved or disapproved or otherwise taken definitive action on the potential transaction. The contents of any websites referenced in this presentation are not incorporated by reference into this presentation. 2 |

| Additional Information and Participants in the Solicitation Additional Information about the Proposed Transaction and Where to Find It: This presentation relates to the Exchange Offer by Validus to exchange each issued and outstanding share of common stock of Transatlantic for 1.5564 Validus voting common shares and $8.00 cash. This presentation does not constitute an offer to exchange, or a solicitation of an offer to exchange, shares of Transatlantic common stock, nor is it a substitute for the Tender Offer Statement on Schedule TO or the preliminary prospectus/offer to exchange included in the Registration Statement on Form S-4 (including the letter of transmittal and related documents and as amended and supplemented from time to time, the "Exchange Offer Documents") and the preliminary proxy statement that Validus has filed with the Securities and Exchange Commission. The Registration Statement has not yet become effective. The Exchange Offer will be made only through the Exchange Offer Documents. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE EXCHANGE OFFER DOCUMENTS AND ALL OTHER RELEVANT DOCUMENTS THAT VALIDUS HAS FILED OR MAY FILE WITH THE SECURITIES AND EXCHANGE COMMISSION IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. All such documents, if filed are or will be available free of charge at the Securities and Exchange Commission's website (http://www.sec.gov) or by directing a request to Innisfree M&A Incorporated at (877) 717-3929 (banks and brokers may call collect at (212) 750-5833). Participants in the Solicitation: Validus and certain of its directors and officers may be deemed to be participants in any solicitation of shareholders in connection with the proposed transaction. Information about the participants in the solicitation is available in the preliminary proxy statement that Validus filed with the SEC on July 20, 2011 in connection with the special meeting of stockholders of Transatlantic. Other information regarding the participants and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in relevant solicitation materials that Validus may file with the Securities and Exchange Commission in connection with the proposed transaction. Third Party-Sourced Information: Certain information included in this presentation has been sourced from third parties. Validus does not make any representations regarding the accuracy, completeness or timeliness of such third party information. Permission to quote third party sources neither sought nor obtained. 3 |

| Note on Non-GAAP Financial Measures In presenting Validus' results herein, management has included and discussed certain schedules containing diluted book and tangible book value per common share that are not calculated under standards or rules that comprise U.S. GAAP. Such measures are referred to as non-GAAP. Non-GAAP measures may be defined or calculated differently by other companies. We believe that these measures are important to investors and other interested parties. These measures should not be viewed as a substitute for those determined in accordance with U.S. GAAP. Diluted book value per share is calculated based on total shareholders’ equity plus the assumed proceeds from the exercise of outstanding stock options and warrants, divided by the sum of unvested restricted shares, stock options, warrants and share equivalents outstanding (assuming their exercise). Diluted tangible book value per share is calculated based on total tangible shareholders’ equity plus the assumed proceeds from the exercise of outstanding stock options and warrants, divided by the sum of unvested restricted shares, stock options, warrants and share equivalents outstanding (assuming their exercise). Reconciliations to the most comparable GAAP measure for both diluted and tangible diluted book value per share can be found in the appendix to this presentation. 4 |

| The Transatlantic Board is Failing its Stockholders Unwilling to Enter into Discussions with Validus |

| Validus is Fully Committed to a Transaction with Transatlantic On July 12, 2011, Validus announced its Superior Proposal for a combination with Transatlantic and sought to engage with Transatlantic’s board Creation of a global reinsurance leader Higher market value than Allied World’s (“AWAC”) inferior takeover offer On July 19, 2011, the Transatlantic board determined that Validus’ proposal was reasonably likely to lead to a Superior Proposal and that its failure to enter into discussions with Validus would result in a breach of the board’s fiduciary duties Transatlantic proposed a confidentiality agreement with a restrictive standstill as a precondition to discussions with Validus Validus provided Transatlantic with a mutual confidentiality agreement that Validus was, and still remains, prepared to execute immediately On July 28, 2011, the Transatlantic board recommended rejection of Validus’ higher market value exchange offer. Further, the Transatlantic board adopted a poison pill, commenced litigation that Validus believes is meritless and changed Transatlantic’s corporate by-laws giving the Transatlantic board more control over stockholder meetings Validus has a path to pursue a transaction without the Transatlantic board to bring the higher market value of its Superior Proposal directly to Transatlantic stockholders Commenced vote no campaign “AGAINST” AWAC’s inferior takeover offer Commenced a higher market value Exchange Offer for Transatlantic shares Validus will remain open to a consensual transaction 6 |

| The Transatlantic Board is not Aligned with its Stockholders We believe the Transatlantic board: 7 Validus believes that the Transatlantic board's actions have not served Transatlantic stockholders’ best interests Has rushed into the inferior and ill-advised AWAC takeover with lower market value and scant strategic logic Has not addressed concerns publicly raised by major Transatlantic stockholders Despite acknowledging their fiduciary duty to enter into discussions with Validus, the Transatlantic board has not done so Has adopted misguided tactics in an attempt to prevent Transatlantic stockholders from obtaining the benefit of Validus’ Superior Proposal However, Transatlantic stockholders will determine the outcome, not the Transatlantic board Collectively do not have material holdings in Transatlantic, with non-executive directors owning 0.03%1 Bulk of this ownership comes from restricted stock grants and options rather than personal purchases Has made Transatlantic a target for class action lawsuits brought by the very stockholders that they have a duty to serve 1Holdings as disclosed in Transatlantic Schedule 14A dated 5/26/2011; includes options and restricted stock units Source: Company filings |

| Sorting Out the Winners and Losers in an AWAC Takeover of Transatlantic 8 Transatlantic stockholders will decide the outcome, not the Transatlantic board Who Wins AWAC, although smaller, acquires a genuine franchise at a lower price Six handpicked Transatlantic board members, who would continue on after the AWAC takeover Selected members of the Transatlantic executive management team Who Loses Transatlantic stockholders, who: The Transatlantic board is attempting to prevent from receiving the highest market value for their investment Would be subject to the fully taxable AWAC takeover Would be exposed to the lackluster AWAC business Transatlantic clients and employees, who will be managed by an organization evidencing limited historical interest in the reinsurance business1 1AWAC has publicly stated in its 2010 Form 10-K that it is “focused primarily on the direct insurance markets”. In 2010, only 29.8% of its gross premiums written were reinsurance (see AWAC 2010 Form 10-K) |

| What Transatlantic Stockholders Would be Subject to with AWAC The Questionable Value of AWAC and its Weak Long-Term Prospects |

| The Questionable Value of AWAC and its Weak Long-Term Prospects 10 Struggled to establish itself as an independent entity Been growing into a soft U.S. casualty market to maintain volume Not created a leading U.S. franchise A stagnant international business and is irrelevant in the global market Ballooning expenses Relied on ever-increasing, unsustainable reserve releases for earnings Revealed its weaker financial prospects in its projections Poor underwriting margins that create significant headwinds Significant exposure to a spike in interest rates An acquisition record of destroying book value Capital management that has not been open to all stockholders In our view, AWAC has: |

| AWAC’s Formative Years AWAC was formed in November 2001 by an AIG-led investor group, including Goldman Sachs, Chubb and Swiss Re In its initial years through 2005, AWAC’s function was to provide capacity for AIG like a “sidecar” “[AWAC distributed] products in the United States primarily through surplus lines program administrator agreements and a reinsurance agreement with subsidiaries of AIG” - AWAC Form S-1, March 17, 2006 AIG and AWAC shared information about, and coordinated responses to, bidding opportunities through AIG’s universal reservations system Distribution agreement with Lexington to assume AIG-produced surplus lines business Underwriting agency agreement with IPC Re, Ltd., an AIG affiliate From 2001 through December 31, 2005, AWAC had an administrative services agreement with various AIG entities, whereby AIG provided AWAC with administrative services for a fee based on gross premium written 11 Source: Company filings |

| AWAC Has Struggled to Establish Itself as an Independent Entity AWAC has struggled to manage its separation from AIG 2004 consolidated GPW was $1,708 million, and it has taken AWAC six years for consolidated GPW to return to that level The original business produced by AIG was far more profitable and has delivered significant run-off profits which benefit AWAC’s earnings, even today In contrast, AWAC is currently chasing premium growth in a weak casualty market AWAC’s Bermuda business never established an independent franchise and now has been effectively abandoned by executive management AWAC’s expense ratio has grown rapidly, far in excess of its premium growth Creates a significant competitive disadvantage Challenges AWAC’s future underwriting profitability in the current soft casualty market 12 Source: Company filings |

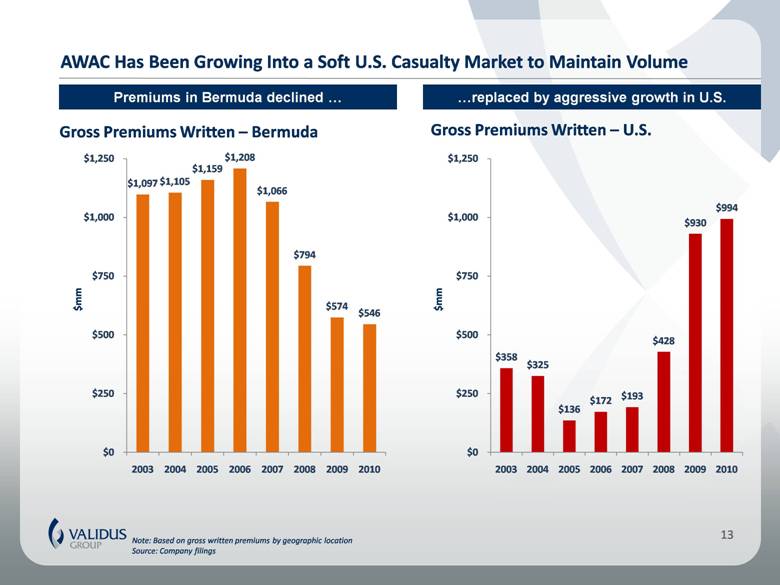

| AWAC Has Been Growing Into a Soft U.S. Casualty Market to Maintain Volume 13 Premiums in Bermuda declined ... replaced by aggressive growth in U.S. Note: Based on gross written premiums by geographic location Source: Company filings Gross Premiums Written – Bermuda Gross Premiums Written – U.S. $mm $mm |

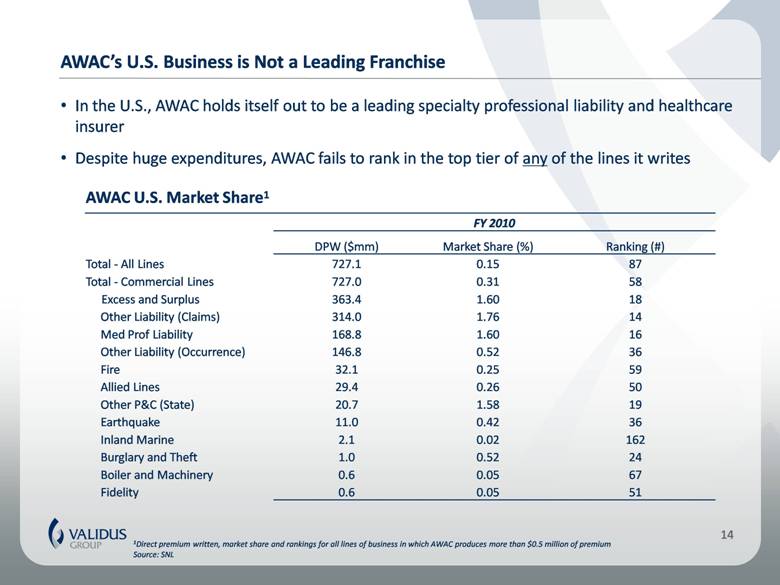

| AWAC’s U.S. Business is Not a Leading Franchise In the U.S., AWAC holds itself out to be a leading specialty professional liability and healthcare insurer Despite huge expenditures, AWAC fails to rank in the top tier of any of the lines it writes 14 AWAC U.S. Market Share1 FY 2010 DPW ($mm) Market Share (%) Ranking (#) Total - All Lines 727.1 0.15 87 Total - Commercial Lines 727.0 0.31 58 Excess and Surplus 363.4 1.60 18 Other Liability (Claims) 314.0 1.76 14 Med Prof Liability 168.8 1.60 16 Other Liability (Occurrence) 146.8 0.52 36 Fire 32.1 0.25 59 Allied Lines 29.4 0.26 50 Other P&C (State) 20.7 1.58 19 Earthquake 11.0 0.42 36 Inland Marine 2.1 0.02 162 Burglary and Theft 1.0 0.52 24 Boiler and Machinery 0.6 0.05 67 Fidelity 0.6 0.05 51 1Direct premium written, market share and rankings for all lines of business in which AWAC produces more than $0.5 million of premium Source: SNL |

| AWAC’s Non-U.S./Bermuda Premiums1 have Stagnated and Lack Meaningful Market Share 15 15 Gross Premiums Written1 2010 AWAC Market Share2 Singapore 0.24% Hong Kong 0.30% Europe 0.03% 1Based on gross written premiums by geographic location as disclosed by AWAC 2AWAC 2010 gross premium written divided by 2010 non-life direct premium written by market, per Swiss Re Sigma 2010 Source: Company filings $mm |

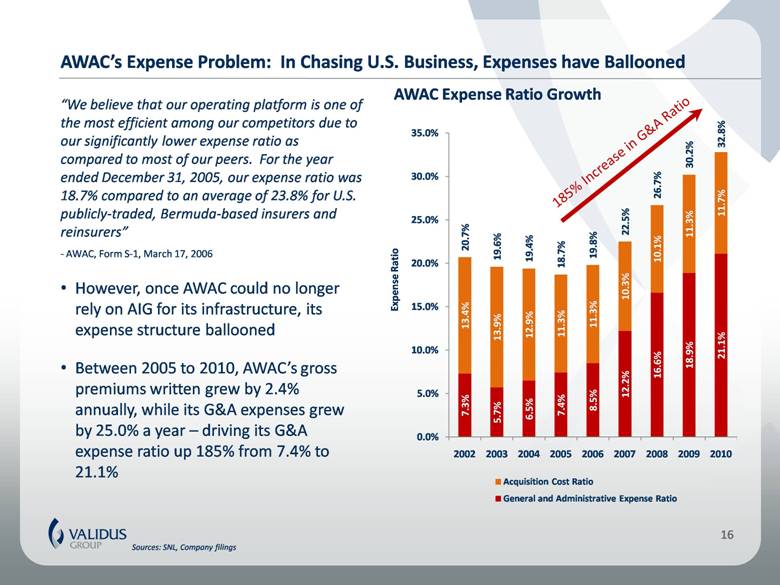

| AWAC’s Expense Problem: In Chasing U.S. Business, Expenses have Ballooned Sources: SNL, Company filings 16 AWAC Expense Ratio Growth Expense Ratio “We believe that our operating platform is one of the most efficient among our competitors due to our significantly lower expense ratio as compared to most of our peers. For the year ended December 31, 2005, our expense ratio was 18.7% compared to an average of 23.8% for U.S. publicly-traded, Bermuda-based insurers and reinsurers” - AWAC, Form S-1, March 17, 2006 However, once AWAC could no longer rely on AIG for its infrastructure, its expense structure ballooned Between 2005 to 2010, AWAC’s gross premiums written grew by 2.4% annually, while its G&A expenses grew by 25.0% a year – driving its G&A expense ratio up 185% from 7.4% to 21.1% 185% Increase in G&A Ratio |

| AWAC Has Relied on Ever-Increasing Reserve Releases for Earnings ... Sources: SNL, Company filings 17 $mm Reserve Development as % of Net Income Before Taxes 0% 0% 19% 41% N.M. 25% 26% 159% 39% 44% Prior Period Reserve Releases |

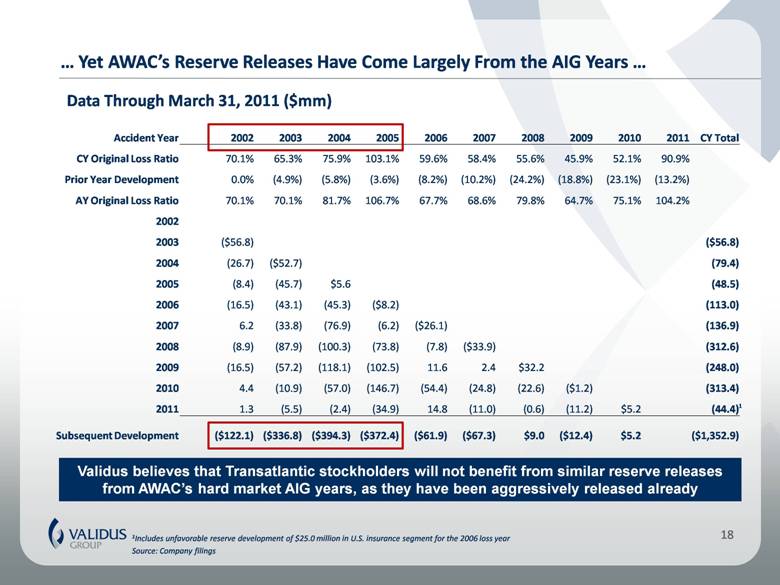

| ... Yet AWAC’s Reserve Releases Have Come Largely From the AIG Years ... 1Includes unfavorable reserve development of $25.0 million in U.S. insurance segment for the 2006 loss year Source: Company filings 18 Accident Year 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 CY Total CY Original Loss Ratio 70.1% 65.3% 75.9% 103.1% 59.6% 58.4% 55.6% 45.9% 52.1% 90.9% Prior Year Development 0.0% (4.9%) (5.8%) (3.6%) (8.2%) (10.2%) (24.2%) (18.8%) (23.1%) (13.2%) AY Original Loss Ratio 70.1% 70.1% 81.7% 106.7% 67.7% 68.6% 79.8% 64.7% 75.1% 104.2% 2002 2003 ($56.8) ($56.8) 2004 (26.7) ($52.7) (79.4) 2005 (8.4) (45.7) $5.6 (48.5) 2006 (16.5) (43.1) (45.3) ($8.2) (113.0) 2007 6.2 (33.8) (76.9) (6.2) ($26.1) (136.9) 2008 (8.9) (87.9) (100.3) (73.8) (7.8) ($33.9) (312.6) 2009 (16.5) (57.2) (118.1) (102.5) 11.6 2.4 $32.2 (248.0) 2010 4.4 (10.9) (57.0) (146.7) (54.4) (24.8) (22.6) ($1.2) (313.4) 2011 1.3 (5.5) (2.4) (34.9) 14.8 (11.0) (0.6) (11.2) $5.2 (44.4) Subsequent Development ($122.1) ($336.8) ($394.3) ($372.4) ($61.9) ($67.3) $9.0 ($12.4) $5.2 ($1,352.9) Data Through March 31, 2011 ($mm) Validus believes that Transatlantic stockholders will not benefit from similar reserve releases from AWAC’s hard market AIG years, as they have been aggressively released already 1 |

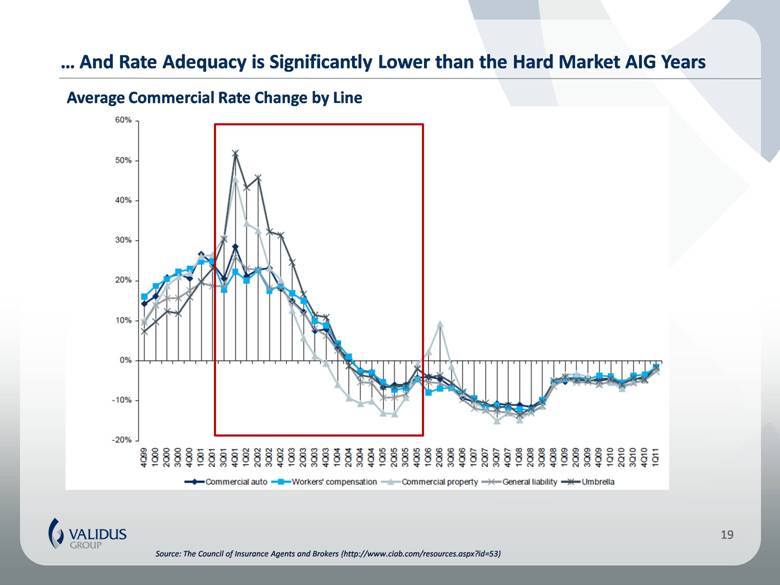

| ... And Rate Adequacy is Significantly Lower than the Hard Market AIG Years Source: The Council of Insurance Agents and Brokers (http://www.ciab.com/resources.aspx?id=53) 19 Average Commercial Rate Change by Line |

| AWAC Revealed its Weaker Financial Prospects in its Projections 1 Diluted tangible book value per share from 12/31/2005 through 12/31/2010. Validus believes dividends are an important source of shareholder value 2 See page 64 of AWAC’s merger proxy statement for AWAC’s internal financial forecasts for 2011 - 2015 Sources: SNL, Company filings 20 Comparative Return Profile AWAC has acknowledged its diminished growth in operating return and book value over the next five years 1 1 While AWAC advertises high five-year historical growth rate in TBVPS, it has achieved this through reserve releases stemming from business written during the AIG years The underlying growth in AWAC’s TBVPS is consistent with the 9.0% return on average equity projected by AWAC in its merger proxy statement 2 2 |

| 21 1 See page 61 of AWAC’s merger proxy statement 2 Q1 2011 AY ex cat underwriting profit of $12mm, annualized and divided by average equity of $3.0bn – underwriting leverage of 44.5% of average equity 3 Q1 2011 investment income of $50mm, annualized and divided by average equity of $3.0bn – investment leverage of 239.4% of average equity 4 Q1 2011 interest expense of $14mm and intangible amortization of $1mm, annualized and divided by average equity of $3.0bn – debt to equity of 26.5% 5 Q1 2011 operating tax expense of $1mm divided by average equity of $3.0bn Sources: Company filings AWAC’s high expense ratio, its high accident year loss ratio and the low interest rate environment make it extremely challenging to attain even its stated goal of a 5-year average 9.0% ROAE AWAC’s results are affected by reserve releases, catastrophe losses and investment gains/(losses) – analyzing AWAC’s Q1 2011 results and “normalizing” for these items reveals an underlying ROAE of 6.2% In order to generate a 9.0% ROAE, AWAC would need a 58.7% loss ratio based on current expense and investment performance This is 7.2 percentage points better than the 65.9% that AWAC has achieved on average over the last 5-years (AY loss ratio, ex cats) AWAC's underlying ROAE is currently below the estimated cost of equity (8.5% - 10.5%) used by its financial advisor in AWAC’s merger proxy statement AWAC Q1 2011 Underlying ROAE Composition Accident Year Ex Cat Operating Performance 96.3% CR 64.7% LR +1.6% +6.7% -1.9% -0.2% 6.2% AWAC ROAE Goal: 9.0% AWAC Cost of Equity: 8.5% to 10.5% 2 3 4 5 Poor Underwriting Margins are a Significant Headwind to AWAC’s Weak Prospects |

| ...And AWAC’s Investment Leverage Exposes its Equity to a Spike in Interest Rates 1 The changes in market values as a result of changes in interest rates is determined by calculating hypothetical March 31, 2011 ending prices based on yields adjusted to reflect the hypothetical changes in interest rates, comparing such hypothetical ending prices to actual ending prices, and multiplying the difference by the principal amount of the security. The sensitivity analysis is based on estimates contained in AWAC’s Q1 2011 10-Q Sources: Company filings 22 Interest Rate Shift in Basis Points ($ in 000s) 0 +50 +100 +200 Total Market Value 3/31/2011 7,251 7,150 7,048 6,845 Change From Base 0 (101) (203) (406) % of Base Value 0.0% -1.4% -2.8% -5.6% % of Shareholders Equity 0.0% -3.4% -6.9% -13.7% AWAC’s disclosure about market risk highlights its significant exposure to an increase in the yield curve As of March 31, 2011, a 100 basis point rise in interest rates would have reduced AWAC’s shareholder equity by 6.9% – nearly a whole year’s worth of operating income AWAC’s Exposure to Interest Rate Increases1 |

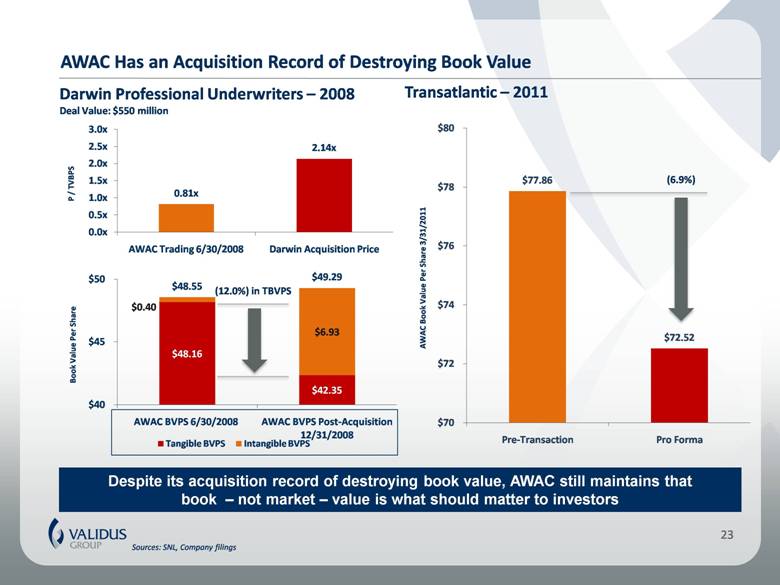

| AWAC Has an Acquisition Record of Destroying Book Value Sources: SNL, Company filings 23 Despite its acquisition record of destroying book value, AWAC still maintains that book – not market – value is what should matter to investors P / TVBPS (12.0%) in TBVPS Book Value Per Share Darwin Professional Underwriters – 2008 Deal Value: $550 million Transatlantic – 2011 AWAC Book Value Per Share 3/31/2011 (6.9%) |

| AWAC’s Capital Management has Not been Open to All Shareholders 24 1 Aggregate capital returns from IPO through 1Q 2011, including stock and warrant repurchases and dividends Source: SNL, company filings AWAC has concentrated its capital management efforts on privately-negotiated repurchases from its founding shareholders rather than treating all shareholders equally Capital Return Detail Since IPO $1,589 million1 Amount ($mm) Year Event Founding All Shareholders YTD Common stock buyback 60 Warrant repurchase from AIG 54 2010 Common stock buyback 239 Common stock repurchases - Goldman Sachs 435 Warrant Repurchase - Goldman Sachs 37 Warrant Repurchase - Chubb 33 Dividends 48 2009 Dividends 37 2008 Dividends 35 2007 Common stock repurchase from AIG 563 Dividends 38 2006 Dividends 9 Total: $1,123 $466 Less than 30% of Money Returned was Shared Pro Rata with All Stockholders |

| Setting the Record Straight on AWAC and Transatlantic’s Misleading Statements |

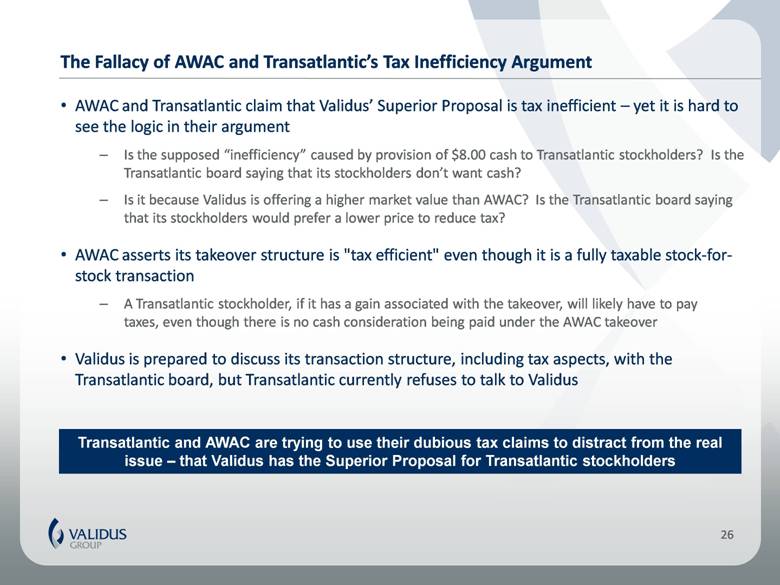

| The Fallacy of AWAC and Transatlantic’s Tax Inefficiency Argument AWAC and Transatlantic claim that Validus’ Superior Proposal is tax inefficient – yet it is hard to see the logic in their argument Is the supposed “inefficiency” caused by provision of $8.00 cash to Transatlantic stockholders? Is the Transatlantic board saying that its stockholders don’t want cash? Is it because Validus is offering a higher market value than AWAC? Is the Transatlantic board saying that its stockholders would prefer a lower price to reduce tax? AWAC asserts its takeover structure is "tax efficient" even though it is a fully taxable stock-for-stock transaction A Transatlantic stockholder, if it has a gain associated with the takeover, will likely have to pay taxes, even though there is no cash consideration being paid under the AWAC takeover Validus is prepared to discuss its transaction structure, including tax aspects, with the Transatlantic board, but Transatlantic currently refuses to talk to Validus 26 Transatlantic and AWAC are trying to use their dubious tax claims to distract from the real issue – that Validus has the Superior Proposal for Transatlantic stockholders |

| AWAC and Transatlantic Mischaracterize the Reason Validus is Willing to Increase its Leverage On a standalone basis, Validus has lower leverage than both Transatlantic and AWAC1,2 The incremental leverage in Validus’ Superior Proposal only arises through Transatlantic stockholders receiving $8.00 per share in cash 27 Comparative Debt-to-Capital2 – 3/31/2011 1 Standalone debt-to-capital 3/31/11: Validus 6.4%. AWAC 21.3%, Transatlantic 19.9% 2 Excluding Validus’ Junior Subordinated Deferrable Debentures, which are hybrid securities treated as equity 3 Excluding $500mm incremental debt raised to pay $8.00 per share cash to Transatlantic stockholders Source: Company filings 3 |

| AWAC’s and Transatlantic’s Ownership Argument is Self-Serving and Hypocritical The Transatlantic board denigrates Validus’ Superior Proposal because Transatlantic stockholders would have a 48% ownership interest on a fully diluted basis Yet Transatlantic entered into an agreement with AWAC that requires it to ignore any competing proposals that would provide Transatlantic stockholders with ownership of 50% or above, regardless of the proposal’s value proposition 28 It is intellectually dishonest for the Transatlantic board to challenge Validus’ Superior Proposal for being structured to comply with its own merger agreement |

| AWAC and Transatlantic are Misstating Ratings Agency Reactions 29 “There's a lot still pending,” said John Andre, Group VP in the property/casualty rating area of the rating agency A.M. Best Co. Inc. in Oldwick, N.J. “We see both Validus and AWAC as strong partners for Transatlantic, however it works out.” - Business Insurance, July 18, 2011 Ratings Agencies have Publicly Stated their Opinions on the Validus/Transatlantic Combination... “...we did think about this [Transatlantic not keeping an A+ rating] internally when looking at the merger [with AWAC]. Long story short is, no, we think we’d be fine at an A rating...we went over this pretty extensively with our managers, Paul Bonny and Javier Vijil. And international and America, we feel confident that we will be fine with an A.” - Michael Sapnar, Transatlantic EVP and COO; Transatlantic/AWAC announcement conference call, June 13, 2011 ...And Transatlantic has Indicated it would be “Fine” and “Confident” at an A Rating |

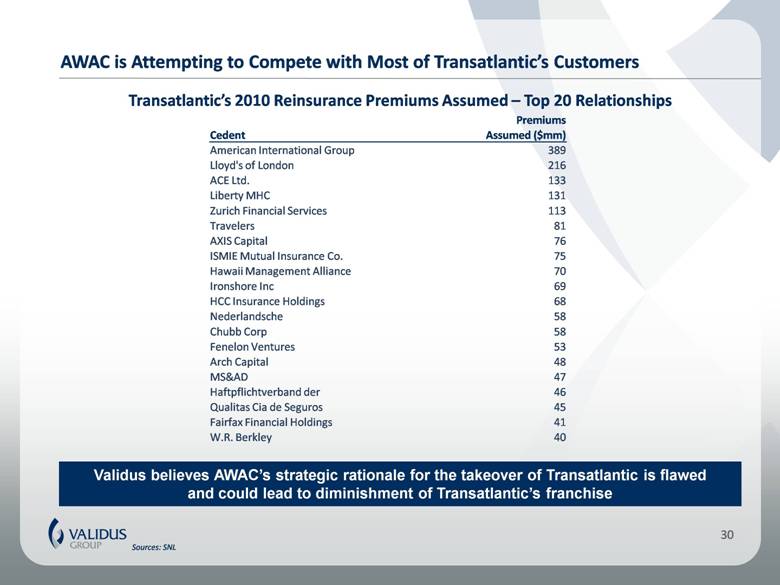

| AWAC is Attempting to Compete with Most of Transatlantic’s Customers Sources: SNL 30 Transatlantic’s 2010 Reinsurance Premiums Assumed – Top 20 Relationships Validus believes AWAC’s strategic rationale for the takeover of Transatlantic is flawed and could lead to diminishment of Transatlantic’s franchise Premiums Cedent Assumed ($mm) American International Group 389 Lloyd's of London 216 ACE Ltd. 133 Liberty MHC 131 Zurich Financial Services 113 Travelers 81 AXIS Capital 76 ISMIE Mutual Insurance Co. 75 Hawaii Management Alliance 70 Ironshore Inc 69 HCC Insurance Holdings 68 Nederlandsche 58 Chubb Corp 58 Fenelon Ventures 53 Arch Capital 48 MS&AD 47 Haftpflichtverband der 46 Qualitas Cia de Seguros 45 Fairfax Financial Holdings 41 W.R. Berkley 40 |

| Casualty-on-Casualty – A Deeply Flawed Strategic Rationale Illogical Business Case A casualty-on-casualty combination does not bring diversification benefits2; rather it magnifies the risks inherent in the casualty pricing cycle and potential for claims inflation AWAC attempts to compete with most of Transatlantic’s largest customers, which could result in customer losses to the detriment of the combined company 31 Pro Forma AWAC / Transatlantic 1 Standalone based on 2010 GPW for AWAC, NPW for Transatlantic 2 “Diversification benefits” refers to the diversity of premiums, earnings and reserves by different lines of business, as noted by various ratings agencies Source: SNL, company filings AWAC ? Casualty intensified How much business could be lost? Total Casualty: $2,743 million Total Casualty: $1,278 million 1 1 Transatlantic Re |

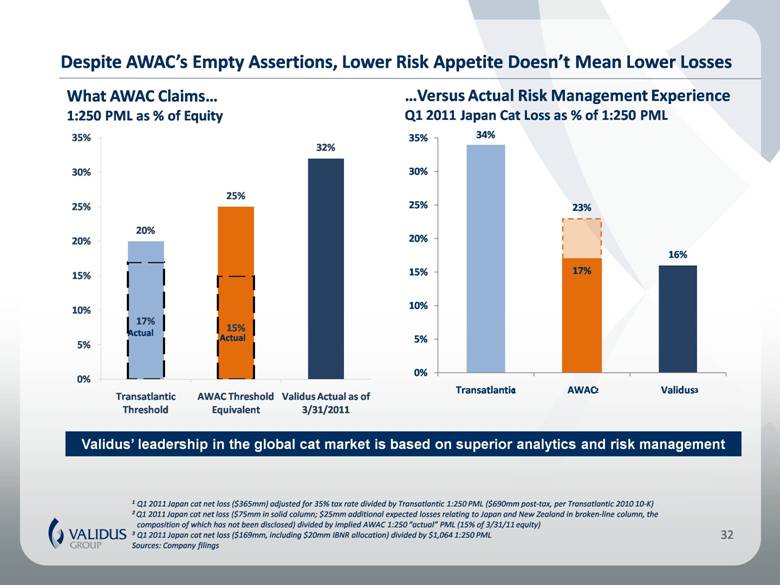

| Despite AWAC’s Empty Assertions, Lower Risk Appetite Doesn’t Mean Lower Losses 32 Validus’ leadership in the global cat market is based on superior analytics and risk management What AWAC Claims... 1:250 PML as % of Equity 1 Q1 2011 Japan cat net loss ($365mm) adjusted for 35% tax rate divided by Transatlantic 1:250 PML ($690mm post-tax, per Transatlantic 2010 10-K) 2 Q1 2011 Japan cat net loss ($75mm in solid column; $25mm additional expected losses relating to Japan and New Zealand in broken-line column, the composition of which has not been disclosed) divided by implied AWAC 1:250 “actual” PML (15% of 3/31/11 equity) 3 Q1 2011 Japan cat net loss ($169mm, including $20mm IBNR allocation) divided by $1,064 1:250 PML Sources: Company filings ...Versus Actual Risk Management Experience Q1 2011 Japan Cat Loss as % of 1:250 PML |

| Validus’ Superior Proposal is Effectively No More Conditional than AWAC’s Takeover 33 1 Not intended to be exhaustive list of conditions 2 Pre-closing dividend relates to merger 3 Although not an express condition in the merger agreement, it is a covenant, and AWAC has not disclosed how it would close the transaction and operate the combined business should it not receive necessary amendments 4 Validus has satisfied this condition 5 Based on publicly available information, AWAC has satisfied this condition Sources: Company filings Closing Conditions1 AWAC Takeover Validus Proposal Transatlantic Stockholder Approval X X Acquiror Stockholder Approvals X X Insurance Regulatory Approval X X Antitrust Approval X X Effectiveness of Registration Statement X X NYSE Listing X X No MAE X X Termination of Merger Agreement / Poison Pill / DGCL 203 X Pre-Closing Dividend X2 Credit Facility Amendments ?3 X4 Swiss Commercial Register Ruling X5 The key condition for both Validus and AWAC is securing Transatlantic stockholder support Given Validus’ Superior Proposal, AWAC appears to face the most challenging hurdle |

| What AWAC and Transatlantic Have Not Told Investors Transatlantic’s year-end carried net loss reserves proved to be inadequate when re-estimated at December 31, 2010 for each year from 2000 through 2008, according to the loss development triangle in the most recent Transatlantic Form 10-K Regardless, Transatlantic vehemently argues that Validus’ proposed reserve increase is not necessary – and then refuses to provide any information reasonably required to support its assertion Transatlantic and AWAC state that internationally-recognized consulting firms performed an independent review of the other's loss reserves The consultant reports were important enough to be discussed by their respective boards and alluded to in public presentations, however not even summaries have been provided for shareholders to consider Independent reviews can be released to shareholders as part of transactions, as evidenced by the release of the Milliman report as part of CNA’s acquisition of CNA Surety1 34 1 Filed as part of Schedule 13E-3 on May 11, 2011 Sources: Company filings |

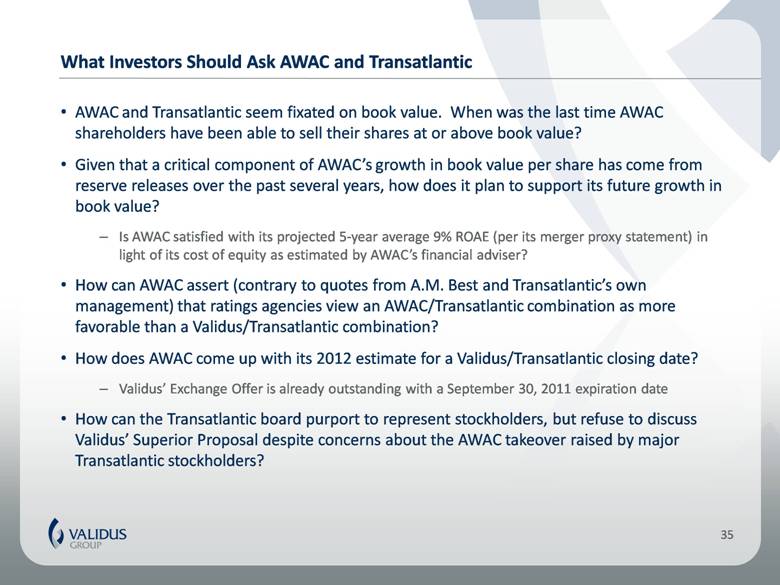

| What Investors Should Ask AWAC and Transatlantic AWAC and Transatlantic seem fixated on book value. When was the last time AWAC shareholders have been able to sell their shares at or above book value? Given that a critical component of AWAC’s growth in book value per share has come from reserve releases over the past several years, how does it plan to support its future growth in book value? Is AWAC satisfied with its projected 5-year average 9% ROAE (per its merger proxy statement) in light of its cost of equity as estimated by AWAC’s financial adviser? How can AWAC assert (contrary to quotes from A.M. Best and Transatlantic’s own management) that ratings agencies view an AWAC/Transatlantic combination as more favorable than a Validus/Transatlantic combination? How does AWAC come up with its 2012 estimate for a Validus/Transatlantic closing date? Validus’ Exchange Offer is already outstanding with a September 30, 2011 expiration date How can the Transatlantic board purport to represent stockholders, but refuse to discuss Validus’ Superior Proposal despite concerns about the AWAC takeover raised by major Transatlantic stockholders? 35 |

| Validus' Superior Proposal to Create a Global Reinsurance Leader Superior Current Value and Future Upside Potential |

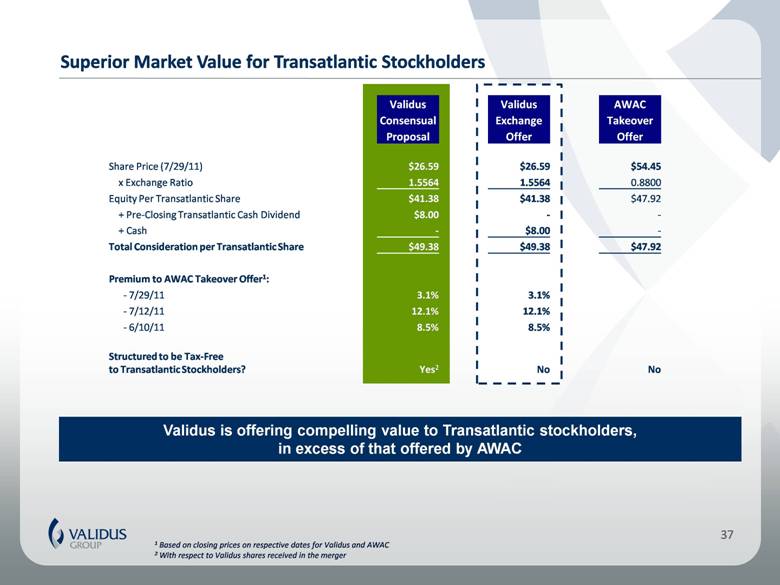

| Validus Validus AWAC Consensual Exchange Takeover Proposal Offer Offer Share Price (7/29/11) $26.59 $26.59 $54.45 x Exchange Ratio 1.5564 1.5564 0.8800 Equity Per Transatlantic Share $41.38 $41.38 $47.92 + Pre-Closing Transatlantic Cash Dividend $8.00 - - + Cash - $8.00 - Total Consideration per Transatlantic Share $49.38 $49.38 $47.92 Premium to AWAC Takeover Offer1: - 7/29/11 3.1% 3.1% - 7/12/11 12.1% 12.1% - 6/10/11 8.5% 8.5% Structured to be Tax-Free to Transatlantic Stockholders? Yes2 No No Superior Market Value for Transatlantic Stockholders 37 Validus is offering compelling value to Transatlantic stockholders, in excess of that offered by AWAC 1 Based on closing prices on respective dates for Validus and AWAC 2 With respect to Validus shares received in the merger |

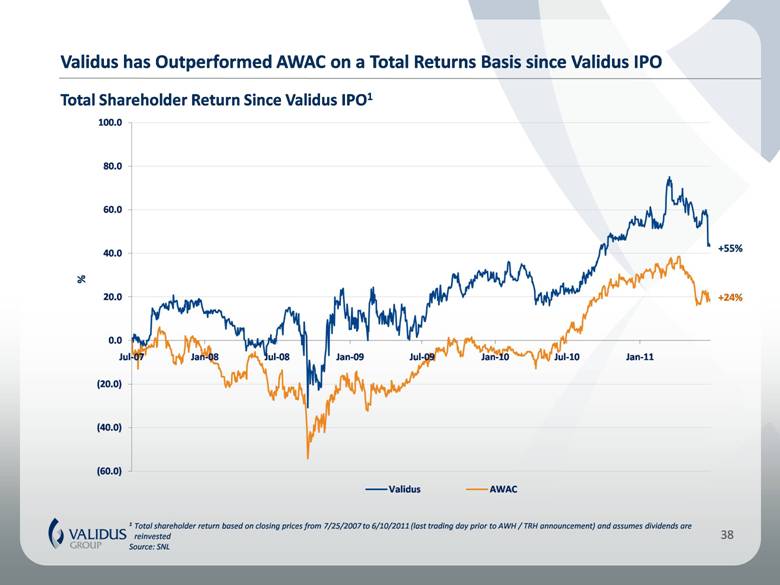

| Validus has Outperformed AWAC on a Total Returns Basis since Validus IPO 38 1 Total shareholder return based on closing prices from 7/25/2007 to 6/10/2011 (last trading day prior to AWH / TRH announcement) and assumes dividends are reinvested Source: SNL +55% +24% % Total Shareholder Return Since Validus IPO1 |

| Validus Has an Established Record of Trading at a Book Value Premium to AWAC 1 Quarterly Price / Diluted Book Value Per Share shown for 1/1/2009 through 7/12/2011 – point value based on share price on day immediately following release of relevant quarter’s earnings Source: Company filings and SNL 39 Price / As-Reported Diluted Book Value1 7/12/2011 Price / As-Reported Diluted Book Value 1 |

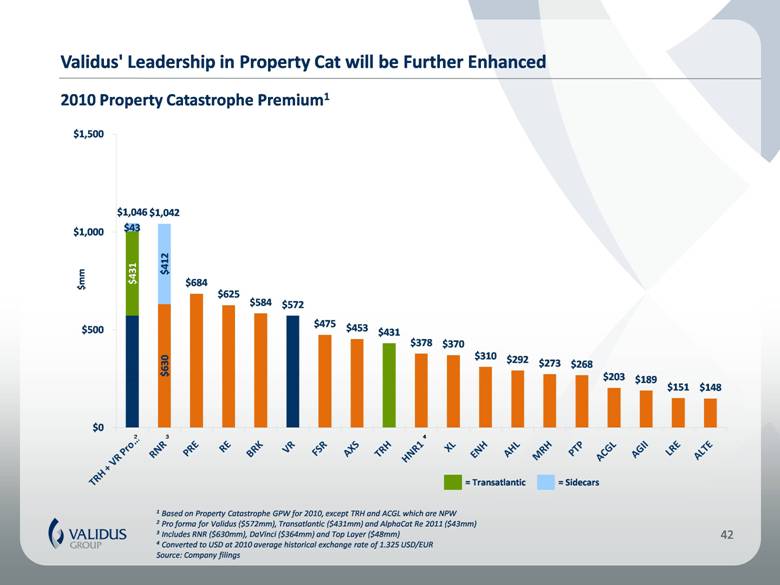

| Post-Combination Business Plan Combined company will be a global, committed leader in reinsurance1 Maximize underwriting profitability to achieve superior growth Short-tail reinsurance lines are the core of Validus' current strategy Best priced segments of the reinsurance market Long-tail lines offer attractive opportunities at the right point of the underwriting cycle Current market conditions suggest a defensive posture toward casualty business Validus intends to fortify Transatlantic’s reserve position through a planned $500 million pretax reserve strengthening at closing Stay positioned for eventual upturn in casualty rates Rely on substantial short-tail earnings in the interim Validus' leadership in property-catastrophe will be further solidified through the transaction Pro forma managed catastrophe premiums of more than $1 billion Catastrophe lines will be underwritten in Bermuda using Validus’ pricing and research expertise Pro forma ratio of 1:100 USWS PML to capital of 14.3% immediately after closing2 40 1 The Flaspöhler 2010 Broker Report ranked Transatlantic #3 and Validus #7 for “Best Overall” reinsurer and Validus #4 and Transatlantic #7 for “Best Overall – Property Catastrophe” 2 Ratio equals 16.7% if calculated on a pretax basis. Pro forma PML does not take into account possible differences in vendor models and aggregation methodologies between Validus and Transatlantic or potential diversification benefit across the two portfolios |

| Post-Transaction, Validus would be in the Top Six Reinsurance Companies Worldwide, as well as a Market Leader in the U.S. and Bermuda Pro Forma Reinsurance Market Position – By 2009 Net Premiums U.S. Rankings Company 2009 Net Reinsurance Premiums Written ($mm) Berkshire Hathaway Life National Indemnity $4,253.0 Transatlantic 5 3,410.0 Swiss Reinsurance 6 3,331.0 2,338.0 Munich Re 2,217.8 Odyssey 1,660.9 Everest Re 1,646.6 Swiss Re Life & Health 1,336.9 Berkley 1,226.0 General Re 1,198.3 Top 10 Subtotal: $22,618.5 Total: 31,431.6 5 Bermuda Rankings Company 2009 Net Reinsurance Premiums Written ($mm) Everest Re $1,752.3 Validus 1,053.4 Arch Reinsurance 973.1 Platinum 897.8 XL 764.3 AXIS 635.8 Montpelier Re 2 602.2 Renaissance Re 503.7 Partner Re 476.1 Top 10 Subtotal: $8,696.5 Total: 11,971.3 ACE Tempest 1,037.8 Munich Re $33,704.6 Swiss Reinsurance 22,896.7 Hannover Rueckversicherung 13,639.0 Berkshire Hathaway 12,362.0 Lloyd’s $9,733.5 SCOR 8,314.7 Validus / Transatlantic 5,755.3 Reinsurance Group of America 5,725.2 Transatlantic 3,986.1 PartnerRe 4,964.9 Top 10 Subtotal: $111,000.6 Total (Including Lloyd’s): $160,109.7 World Rankings1 Everest Reinsurance 3,929.8 4 3 Company 2009 Net Reinsurance Premiums Written ($mm) 2 Korean Reinsurance 2,493.8 1 Excluding Lloyd’s 2 On July 8, 2009, Validus signed a definitive agreement to combine with IPC Holdings, Ltd. The data presented is combined pro forma for Validus and IPC Re 3 The group acquired Paris Re on October 2, 2009. The data presented is combined pro forma for Partner Re and Paris Re 4 Data presented is based on the published pro forma accounts for the Market, which represents an aggregation of all syndicates participating at Lloyd’s. As such, some premium included for Lloyd’s may also be included by other groups that consolidate their Lloyd’s operations 5 Significant change in NPW for 2009 reflects a reserve transfer arising from a co-insurance agreement between Swiss Re Life & Heath America and Berkshire Hathaway Life Insurance Co. of NE 6 Data presented includes intra group reinsurances Source: Standard & Poor’s Global Reinsurance Highlights 2010; company filings 41 |

| Validus' Leadership in Property Cat will be Further Enhanced 42 3 $mm 2 2010 Property Catastrophe Premium1 4 1 Based on Property Catastrophe GPW for 2010, except TRH and ACGL which are NPW 2 Pro forma for Validus ($572mm), Transatlantic ($431mm) and AlphaCat Re 2011 ($43mm) 3 Includes RNR ($630mm), DaVinci ($364mm) and Top Layer ($48mm) 4 Converted to USD at 2010 average historical exchange rate of 1.325 USD/EUR Source: Company filings = Sidecars = Transatlantic |

| What You Get With Validus Higher market value for your Transatlantic stock today, superior long term prospects Board and management devoted to maximizing shareholder value, not premium volume Leading franchise positions in Bermuda and at Lloyd’s Deeply experienced reinsurance management team Proven expertise in integrating two transformational business combinations A commitment to active capital management treating all shareholders equally 43 |

| Appendix Reconciliation of Non-GAAP Financial Measures |

| Book Value & Tangible Book Per Share Reconciliation 45 Validus Holdings, Ltd. Non-GAAP Financial Measure Reconciliation Book Value & Tangible Book Value Per Share (Expressed in thousands of US Dollars, except share and per share information) At March 31, 2011 Equity amount Shares Exercise Price (a) Value per share Book value per common share, reported Book value per common share Total shareholders' equity $ 3,315,321 98,288,177 $ 33.73 Diluted book value per common share Total shareholders' equity $ 3,315,321 98,288,177 Assumed exercise of outstanding warrants (b) 139,272 7,934,860 $ 17.55 Assumed exercise of outstanding stock options (b) 50,571 2,521,975 $ 20.05 Unvested restricted shares - 3,177,751 Diluted book value per common share $ 3,505,164 111,922,763 $ 31.32 Tangible value per common share Tangible Book value per common share Total shareholders' equity $ 3,315,321 Total Intangible Assets (138,246) Total tangible shareholders' equity $ 3,177,075 98,288,177 $ 32.32 Assumed exercise of outstanding warrants (b) 139,272 7,934,860 $ 17.55 Assumed exercise of outstanding stock options (b) 50,571 2,521,975 $ 20.05 Unvested restricted shares - 3,177,751 Diluted tangible book value per common share $ 3,366,918 111,922,763 $ 30.08 Notes: (a) Weighted average exercise price for those warrants and stock options that have an exercise price lower than book value per shares. (b) Using the "as-if-converted" method, assuming all proceeds received upon exercise of warrants and stock options will be retained by the Company and the resulting common shares from exercise remain outstanding. |