| Greater Current and Long-Term Value for Transatlantic Stockholders August 2011 Building a Global Reinsurance Leader FILED BY VALIDUS HOLDINGS, LTD. PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF 1933 AND DEEMED FILED PURSUANT TO RULE 14a-6 UNDER THE SECURITIES EXCHANGE ACT OF 1934 SUBJECT COMPANY: TRANSATLANTIC HOLDINGS, INC. COMMISSION FILE NO. 001-10545 |

| Cautionary Note Regarding Forward-looking Statements This presentation may include forward-looking statements, both with respect to Validus and its industry, that reflect Validus' current views with respect to future events and financial performance. Statements that include the words "expect," "intend," "plan," "believe," "project," "anticipate," "will," "may," "would" and similar statements of a future or forward-looking nature are often used to identify forward-looking statements. All forward-looking statements address matters that involve risks and uncertainties, many of which are beyond Validus' control. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements. Validus believes that these factors include, but are not limited to, the following: 1) uncertainty as to whether Validus will be able to enter into or consummate the proposed transaction on the terms set forth in Validus' proposal; 2) uncertainty as to the actual premium that will be realized by Transatlantic stockholders in connection with the proposed transaction; 3) failure to realize the anticipated benefits (including combination synergies) of the proposed transaction, including as a result of delay in completing the transaction or integrating the businesses of Validus and Transatlantic; 4) uncertainty as to the long-term value of Validus voting common shares; 5) unpredictability and severity of catastrophic events; 6) rating agency actions; 7) adequacy of Validus' or Transatlantic's risk management and loss limitation methods; 8) cyclicality of demand and pricing in the insurance and reinsurance markets; 9) Validus' ability to implement its business strategy during "soft" as well as "hard" markets; 10) adequacy of Validus' or Transatlantic's loss reserves; 11) continued availability of capital and financing; 12) retention of key personnel; 13) competition in the insurance and reinsurance markets; 14) potential loss of business from one or more major reinsurance or insurance brokers; 15) the credit risk Validus assumes through its dealings with its reinsurance and insurance brokers; 16) Validus' or Transatlantic's ability to implement, successfully and on a timely basis, complex infrastructure, distribution capabilities, systems, procedures and internal controls, and to develop accurate actuarial data to support the business and regulatory and reporting requirements; 17) general economic and market conditions (including inflation, volatility in the credit and capital markets, interest rates and foreign currency exchange rates); 18) the integration of businesses Validus may acquire or new business ventures Validus may start; 19) the legal, regulatory and tax regimes under which Validus operates; 20) the effect on Validus’ or Transatlantic’s investment portfolios of changing financial market conditions, including inflation, interest rates, liquidity and the recent downgrade of U.S. securities by Standard & Poor’s and the possible effect on the value of securities in Validus’ and Transatlantic’s investment portfolios, as well as other factors; 21) acts of terrorism or outbreak of war or hostilities; 22) availability of reinsurance and retrocessional coverage; and 23) the outcome of transaction related litigation, as well as management's response to any of the aforementioned factors. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the Risk Factors included in Validus' and Transatlantic's most recent reports on Form 10-K and Form 10-Q and other documents of Validus and Transatlantic on file with the Securities and Exchange Commission. Any forward-looking statements made in this presentation are qualified in their entirety by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by Validus will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Validus or its business, operations or financial condition. Except to the extent required by applicable law, Validus undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. No rating agency (A.M. Best, Moody's, or Standard & Poor's) has specifically approved or disapproved or otherwise taken definitive action on the potential transaction. The contents of any websites referenced in this presentation are not incorporated by reference into this presentation. 2 |

| Additional Information and Participants in the Solicitation Additional Information about the Proposed Transaction and Where to Find It: Validus has commenced an exchange offer to acquire all of the outstanding shares of common stock of Transatlantic for 1.5564 Validus voting common shares and $8.00 cash per Transatlantic share. This presentation is for informational purposes only and does not constitute an offer to exchange, or a solicitation of an offer to exchange, shares of Transatlantic common stock, nor are they a substitute for the Tender Offer Statement on Schedule TO or the prospectus/offer to exchange included in the Registration Statement on Form S-4 (including the letter of transmittal and related documents and as amended and supplemented from time to time, the “Exchange Offer Documents”) filed by Validus with the Securities and Exchange Commission. The Registration Statement on Form S-4 has been declared effective by the Securities and Exchange Commission. The Exchange Offer will be made only through the Exchange Offer Documents. Investors and security holders are urged to read the Exchange Offer Documents and all other relevant documents that Validus has filed or may file with the Securities and Exchange Commission if and when they become available because they contain or will contain important information about the proposed transaction. All such documents, if filed will be available free of charge at the Securities and Exchange Commission’s website (www.sec.gov) or by directing a request to Innisfree M&A Incorporated at (877) 717-3929 (banks and brokers may call collect at (212) 750-5833). Third Party-Sourced Information: Certain information included in this presentation has been sourced from third parties. Validus does not make any representations regarding the accuracy, completeness or timeliness of such third party information. Permission to quote third party sources neither sought nor obtained. 3 |

| Note on Non-GAAP Financial Measures In presenting the Company’s results herein, management has included and discussed certain schedules containing underwriting income, net operating income (loss), annualized return on average equity and diluted book value per common share that are not calculated under standards or rules that comprise U.S. GAAP. Such measures are referred to as non-GAAP. Non-GAAP measures may be defined or calculated differently by other companies. We believe that these measures are important to investors and other interested parties. These measures should not be viewed as a substitute for those determined in accordance with U.S. GAAP. The underwriting results of an insurance or reinsurance company are often measured by reference to its underwriting income because underwriting income indicates the performance of the company’s core underwriting function. Underwriting income is reconciled to net income by the addition or subtraction of net investment income (loss), finance expenses, fair value of warrants issued, transaction expenses, net realized gains (losses) on investments, net unrealized gains (losses) on investments and foreign exchange gains (losses). Net operating income is calculated based on net income (loss) excluding net realized gains (losses), net unrealized gains (losses) on investments, gains (losses) arising from translation of non-US$ denominated balances and non-recurring items. Net income is the most directly comparable GAAP measure. Net operating income focuses on the underlying fundamentals of our operations without the influence of realized gains (losses) from the sale of investments, net unrealized gains on investments, translation of non-US$ currencies and non-recurring items. Realized gains (losses) from the sale of investments are driven by the timing of the disposition of investments, not by our operating performance. Gains (losses) arising from translation of non-US$ denominated balances are unrelated to our underlying business. Diluted book value per share is calculated based on total shareholders’ equity plus the assumed proceeds from the exercise of outstanding stock options and warrants, divided by the sum of unvested restricted shares, stock options, warrants and share equivalents outstanding (assuming their exercise). Reconciliations to the most comparable GAAP measure for both net operating income and diluted book value per share can be found in Appendix B to this presentation. 4 |

| Table of Contents 5 Executive Summary 6 Industry Overview 17 Building a Global Reinsurance Leader with a Clear Business Plan 22 Creating Long-Term Value Post-Acquisition 33 What Transatlantic Stockholders Would be Subject to with AWAC 39 Setting the Record Straight on AWAC’s and Transatlantic’s Misleading Statements 54 Conclusion 65 Appendices Validus, From Formation to Today 67 Reconciliation of Non-GAAP Measures 81 |

| Executive Summary Transatlantic Stockholders Should Reject the Inferior AWAC Takeover Offer |

| Validus, From Formation to Today: A Case Study in Value Creation Within five years of commencing operations, Validus has established leading global positions in Bermuda and at Lloyd’s Number two position in Bermuda reinsurance, the world’s most important property-catastrophe reinsurance market Top tier position at Lloyd’s, where Talbot is the 11th largest of 89 syndicates Size and scale to remain strong competitor Business plan since formation has been to focus on short-tail lines, which have been the best-priced classes of risk Underwriting acumen has been validated by ability to attract and manage third-party capital from sophisticated inventors Maintained a focus on underwriting profits in conjunction with a strong balance sheet Minimal exposure to interest rate risk History of favorable reserve development Delivered superior financial results since 2007 IPO, outperforming short-tail Bermuda peers Active capital management, returning $1.25 billion to investors through repurchases and dividends from IPO through Q2 20111 Attained a premium valuation 7 1 Excluding cash paid in IPC transaction Source: Moody’s |

| Superior Strategic Rationale and Business Combination for Transatlantic Stockholders Validus AWAC Business Mix and Business Plan Commitment to reinsurance Short-tail experience and focus – best priced part of market Complementary lines, leading to diversification Clear business plan Purposefully limited reinsurance business Growth into soft US casualty market Doubles down on casualty, questionable diversification benefit AWAC attempts to compete with most of Transatlantic’s largest customers Market Position and Performance Best-in-class financial performance Leader in property-cat reinsurance Top tier specialty insurance position at Lloyd’s Relied on reserve releases from AIG years, masking underlying performance Weak U.S. insurance franchise Non-U.S./Bermuda business lacks meaningful market share Capital Management Commitment to active capital management treating all shareholders equally Concentrated efforts on privately-negotiated repurchases from founding shareholders Governance & Management Board and management devoted to maximizing shareholder value, not premium volume Strategic intent appears to be growth into soft casualty markets Transaction Experience Successfully executed and integrated two value-creating transactions Acquisition record of destroying book value Validus Offers a Compelling Business and Value Proposition, versus AWAC’s Deeply Flawed Strategic Rationale 8 |

| Overview of Validus' Superior Proposal 9 1 With respect to Validus shares received in the merger; pre-closing cash dividend taxed as dividend 2 Based on Validus ($30.81), Transatlantic ($49.02) and AWAC ($56.72) closing prices on July 12, 2011 3 Based on Validus ($25.95) and AWAC ($53.99) closing prices on August 29, 2011 4 Based on Transatlantic ($44.01) closing price on June 10, 2011 and Validus ($30.81) closing price on July 12, 2011 5 Fully diluted shares calculated using treasury stock method 6 Validus has obtained HSR approval; Exchange Offer registration statement is effective; Validus filed its Form A with the New York Insurance Department on August 1, 2011 (3 weeks ahead of AWAC) Structure Stock-for-stock merger with pre-closing Transatlantic special cash dividend, or alternatively Exchange Offer with stock and cash consideration Structured to be tax-free for Transatlantic stockholders1 in consensual merger transaction Offer Price Total consideration of $55.952 per Transatlantic share based on July 12, 2011 closing price, $48.39 per Transatlantic share based on current price3 Fixed exchange ratio of 1.5564 Validus shares per Transatlantic share ($47.95 per share based on July 12, 2011 closing price2, $40.39 based on current price3) $8.00 cash per share Transatlantic (~$500 million in the aggregate) Premium 27.1% premium to June 10, 2011 unaffected Transatlantic share price4 14.1% premium to Transatlantic July 12, 2011 closing price2 12.1% premium to the proposed AWAC takeover based on July 12, 2011 closing price2 1.8% premium to the proposed AWAC takeover based on current prices3 Pro Forma Ownership (Fully Diluted)5 52% by Validus shareholders 48% by Transatlantic stockholders Key Conditions Termination of the AWAC / Transatlantic Merger Agreement Transatlantic stockholder approval and Validus shareholder approval Customary regulatory approvals6 Pro Forma Effect Modestly accretive to Validus diluted book value per share Accretive to Validus diluted tangible book value per share |

| Validus Validus AWAC Merger Exchange Takeover Proposal Offer Offer Share Price (8/29/11) $25.95 $25.95 $53.99 x Exchange Ratio 1.5564 1.5564 0.8800 Equity Per Transatlantic Share $40.39 $40.39 $47.51 + Pre-Closing Transatlantic Cash Dividend $8.00 - - + Cash - $8.00 - Total Consideration per Transatlantic Share $48.39 $48.39 $47.51 Premium to AWAC Takeover Offer1: - 8/29/11 1.8% 1.8% n.a. - 7/12/11 12.1% 12.1% n.a. - 6/10/11 8.5% 8.5% n.a. Structured to be Tax-Free to Transatlantic Stockholders? Yes2 No No Superior Market Value for Transatlantic Stockholders 10 Validus is offering compelling value to Transatlantic stockholders, in excess of that offered by AWAC 1 Based on closing prices on respective dates for Validus and AWAC 2 With respect to Validus shares received in the merger |

| Superior Financial Proposal – Higher Quality Currency Validus AWAC Market Capitalization 1 $3.0 billion $2.2 billion Superior Liquidity Average Daily Trading Volumes 1 3 month - $27.6 million 6 month - $22.4 million Average Daily Trading Volumes 1 3 month - $14.6 million 6 month - $13.4 million Total Return to Shareholders (Including Dividends) Since Validus IPO Up 55% 2 Since Validus IPO Up 24% 2 Higher Multiples Price / As-Reported Diluted Book Value 3 Unaffected – 0.97x 7/12/11 – 0.98x Price / As-Reported Diluted Book Value 3 Unaffected – 0.78x 7/12/11 – 0.76x Dividend Yield 1 3.3% 4 2.6% 5 Analyst Recommendations 67% Buy / 33% Hold 33% Buy / 67% Hold 1 Measured as of 6/10/11, prior to 6/12/11 announcement of AWAC/Transatlantic takeover. Source: Bloomberg 2 Total shareholder return based on closing prices from 7/25/2007 to 6/10/2011 and assumes dividends are reinvested. Source: SNL 3 Unaffected price / as-reported diluted book value measured prior to 6/12/2011 announcement of AWAC/Transatlantic takeover. Current is as of 7/12/2011 closing prices and is based on March 31, 2011 as-reported diluted book value figures of $31.32/share for Validus and $74.23/share for AWAC. Source: SNL 4 Based on $0.25 per share quarterly dividend, announced May 5, 2011 5 Based on $0.375 per share quarterly dividend, as disclosed in AWAC Form 8-K dated June 15, 2011 The Validus proposal provides a premium to Transatlantic stockholders with a more liquid and better performing currency, plus a cash component 11 |

| Validus is Fully Committed to a Transaction with Transatlantic On July 12, 2011, Validus announced its Superior Proposal for a combination with Transatlantic and sought to engage with Transatlantic’s board Creation of a global reinsurance leader Higher market value than AWAC’s inferior takeover offer On July 19, 2011, the Transatlantic board determined that Validus’ proposal was reasonably likely to lead to a Superior Proposal and that its failure to enter into discussions with Validus would result in a breach of the board’s fiduciary duties On July 23, 2011, Transatlantic proposed a confidentiality agreement with a restrictive standstill as a precondition to discussions with Validus; in response: Validus provided Transatlantic with a mutual confidentiality agreement that does not restrict Validus from continuing to pursue its proposal that Validus was, and still remains, prepared to execute immediately On July 28, 2011, the Transatlantic board recommended rejection of Validus’ higher market value exchange offer; in response: Validus proposed as an alternative to enter into a confidentiality agreement with a standstill if Transatlantic would grant a waiver to allow Validus to continue pursuing its proposal Validus also proposed to unilaterally provide information to Transatlantic under a confidentiality agreement, which did not contain a standstill or prevent Transatlantic from disclosing information it became legally required to disclose Validus has a path to pursue a transaction without the Transatlantic board to bring the higher market value of its Superior Proposal directly to Transatlantic stockholders Commenced a higher market value Exchange Offer for Transatlantic shares on July 25, 2011 Commenced vote no campaign “AGAINST” AWAC’s inferior takeover offer on August 22, 2011 Validus will remain open to a consensual transaction On August 24, 2011, Davis Selected Advisers, the largest and a long-term Transatlantic stockholder, announced its intent to vote against the inferior AWAC takeover 12 |

| Board Tactics Have Not Served Transatlantic Stockholders’ Best Interests Determined not to pursue Validus’ approaches in early June (when it could have done so) that could have lead to a better deal for Transatlantic stockholders Accepted the AWAC takeover Embraced a self-induced no-talk constraint that the Transatlantic board now attempts to use as a shield against criticism of its unwillingness to engage with Validus without a restrictive standstill Crafted a definition of “Superior Proposal” that requires Transatlantic stockholders own less than 50% of any combined company -- despite the Transatlantic board’s now-stated view that such a transaction may disadvantage Transatlantic stockholders Gave up any right to terminate the AWAC acquisition agreement on a fiduciary duty basis to accept a superior proposal by agreeing to a “force the vote” provision Granted AWAC broad, unlimited “matching rights” and information rights that give AWAC a de facto seat at the negotiating table with third parties Agreed to a $115 million break-up fee, including following a change in board recommendation This was a fee of 4.2% of equity value at signing $70 million due upon a “naked no vote” by Transatlantic stockholders When it entered into the AWAC acquisition agreement, Transatlantic’s board: Validus believes that the Transatlantic board’s actions were inconsistent with an intent to obtain greater value for Transatlantic stockholders 13 |

| Board Tactics Have Not Served Transatlantic Stockholders’ Best Interests (cont’d) Despite acknowledging their fiduciary duty to enter into discussions with Validus, the Transatlantic board has not done so and instead has: Demanded a confidentiality agreement from Validus including a standstill that would prevent Validus from pursuing its higher market value exchange offer and soliciting against the inferior AWAC takeover Refused to consider concurrent grant of waiver coupled with entry of standstill Despite claims that the Transatlantic board lacks information to fully analyze Validus’ offer, refused Validus’ proposal to receive non-public information from Validus under the terms of a one-way confidentiality agreement When given an opportunity in Delaware Chancery Court to pursue an expedited ruling that could permit discussions with Validus without a standstill, instead closed ranks with AWAC to maintain its self-induced no-talk constraint Adopted a “poison pill” with a 10% threshold Amended Transatlantic’s corporate by-laws to give the Transatlantic board more control over stockholder meetings – including the stockholder vote on the proposed AWAC takeover Since July 12th, Transatlantic’s board has continued its misguided tactics: Based on the Transatlantic Board’s actions since July, Validus believes that the board’s tactics have been intended to frustrate Vaildus’ ability to provide its Superior Proposal to Transatlantic’s stockholders 14 |

| The Questionable Value of AWAC and its Weak Long-Term Prospects Struggled to establish itself as an independent entity Been growing into a soft U.S. casualty market to maintain volume Not created a leading U.S. franchise A stagnant non U.S./Bermuda business that is irrelevant in its markets Ballooning expenses Relied on ever-increasing, unsustainable reserve releases for earnings Revealed its weaker financial prospects in its merger projections Poor underwriting margins that create significant headwinds Significant exposure to a spike in interest rates An acquisition record of destroying book value Capital management that has not been open to all stockholders In our view, AWAC has: 15 |

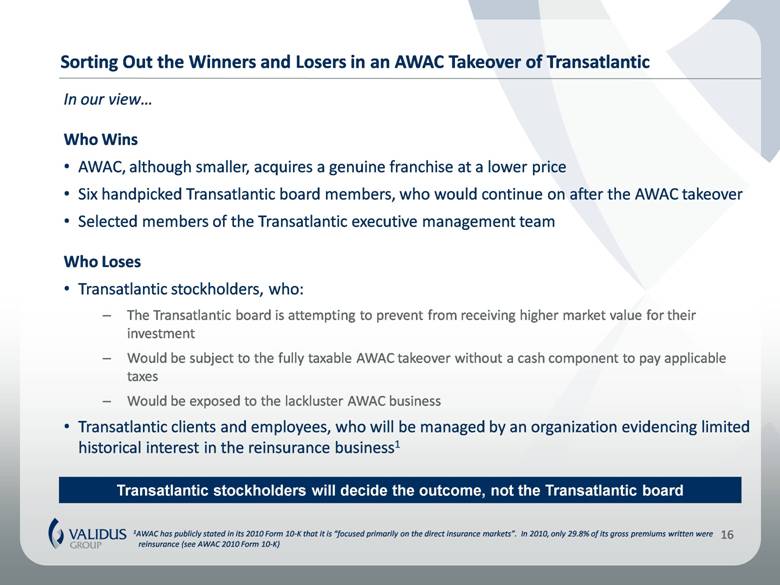

| Sorting Out the Winners and Losers in an AWAC Takeover of Transatlantic 16 Transatlantic stockholders will decide the outcome, not the Transatlantic board In our view... Who Wins AWAC, although smaller, acquires a genuine franchise at a lower price Six handpicked Transatlantic board members, who would continue on after the AWAC takeover Selected members of the Transatlantic executive management team Who Loses Transatlantic stockholders, who: The Transatlantic board is attempting to prevent from receiving higher market value for their investment Would be subject to the fully taxable AWAC takeover without a cash component to pay applicable taxes Would be exposed to the lackluster AWAC business Transatlantic clients and employees, who will be managed by an organization evidencing limited historical interest in the reinsurance business1 1AWAC has publicly stated in its 2010 Form 10-K that it is “focused primarily on the direct insurance markets”. In 2010, only 29.8% of its gross premiums written were reinsurance (see AWAC 2010 Form 10-K) |

| Industry Overview |

| Industry Overview Insurance underwriting involves the transfer of the risk of a loss, from one entity to another, in exchange for a fee (or premium) – through risk management and pooling insurers try to profit from underwriting Property insurance is used to protect against the loss of physical property, including the loss of the insured property’s income-producing capabilities - among other things, property insurance may cover physical damage to automobiles, dwellings, office buildings, and personal possessions Casualty insurance protects against legal liability for losses or damage to other people or property - among other things, casualty insurance covers negligent acts or omissions by people or businesses, injuries at the workplace (workers’ compensation), and liability for automobile owners or drivers After an insurer collects the premium from a policyholder, the funds (or “float”) are invested to generate investment income and/or capital gains. The length of time before the insurer needs to pay related claims is called the claims tail Long-tail lines of business – typically casualty lines such as workers’ compensation or medical malpractice, which may have claims that are not settled until many years after the claim is initially incurred – allows for investment in longer-duration instruments With short-tail lines – typically property lines such as homeowners or auto physical damage, that are usually settled quickly – investment focus is generally on shorter-duration, fixed income instruments 18 |

| Reinsurance Industry Overview Reinsurance is a mechanism used by insurance companies to spread the risks assumed from policyholders Reinsurance enlarges the primary carrier’s underwriting capacity Reinsurance contract is an insurance policy issued by one company – the reinsurer – to another company called the primary carrier or ceding company (the “cedant”) The cedant is the insurer that underwrites the policy initially, and then later shifts part or all of the liability for coverage to a reinsurer by purchasing insurance Reinsurance provides reimbursement to the cedant for claims payments covered by the agreement providing protection to the cedant against frequent or severe losses Underwriting capacity is the amount of business an insurer can underwrite and is limited by the level of capital of the business 19 Industry Structure Reinsurer Reinsurer Primary Carrier “Cedant” Risks Risks Risks Insurance Contracts Retrocession Reinsurance Contracts |

| Validus is Focused on Short-Tail Specialty Classes, Garnering a Premium Multiple 20 Short Tail (%) Long Tail (%) Note: Based on 2010 gross premium written, except TRH and ACGL based on net premium written Source: Company filings, SNL 6/10/11 P/DBVPS 0.61x 1.23x 0.97x 0.78x 0.85x 0.79x 0.72x 0.77x 0.89x 0.76x 0.85x 0.72x 0.68x 0.53x 1.08x 0.78x |

| Validus is Balanced Between Insurance and Reinsurance 21 Note: Based on 2010 gross premium written, except TRH and ACGL based on net premium written Source: Company filings, SNL Reinsurance (%) Insurance (%) |

| Building a Global Reinsurance Leader with a Clear Business Plan Greater Current and Long-Term Value for Transatlantic Stockholders |

| Compelling Post-Combination Business Plan, Driving Long-Term Value Combined company will be a global, committed leader in reinsurance1 Maximize underwriting profitability to achieve superior growth in book value per share Short-tail reinsurance lines are the core of Validus' current strategy Best priced segments of the reinsurance market Long-tail lines offer attractive opportunities at the right point of the underwriting cycle Current market conditions suggest to us a defensive posture toward casualty business Validus intends to fortify Transatlantic’s reserve position through a planned $500 million pretax reserve strengthening at closing Stay positioned for eventual upturn in casualty rates by preserving Transatlantic’s expertise in specialty casualty lines Rely on substantial short-tail earnings in the interim Validus' leadership in property-catastrophe will be further enhanced through the transaction Pro forma managed catastrophe premiums of more than $1 billion Catastrophe lines will be underwritten in Bermuda using Validus’ pricing and research expertise Pro forma ratio of 1:100 USWS PML to capital of 12.6% immediately after closing2 23 1 The Flaspöhler 2010 Broker Report ranked Transatlantic #3 and Validus #7 for “Best Overall” reinsurer and Validus #4 and Transatlantic #7 for “Best Overall – Property Catastrophe” 2 Ratio equals 15.0% if calculated on a pretax basis. Pro forma PML does not take into account possible differences in vendor models and aggregation methodologies between Validus and Transatlantic or potential diversification benefit across the two portfolios |

| Post-Combination Brand, Management and Governance Historically, Transatlantic did not develop operations in Bermuda or at Lloyd’s, which are natural extensions of Transatlantic’s worldwide reinsurance franchise Validus brings leading positions in each market, through our Validus Re and Talbot subsidiaries, as well as an EU passport through Validus Re Europe Limited Capital flexibility allows Validus to shift capital as needed to maximize returns Validus intends that each company’s brand will continue on in their respective markets after a merger Talbot continues to trade under its own established brand with its pre-acquisition management four years after combining with Validus Validus believes that retaining the Transatlantic brand will preserve the established brand equity to the benefit of shareholders Validus will seek to retain the Transatlantic management team In the Talbot transaction, where Validus sought to retain the existing management team (unlike with IPC), Validus was successful in doing so 24 |

| Post-Transaction, Validus would be in the Top Six Reinsurance Companies Worldwide, as well as a Market Leader in the U.S. and Bermuda Pro Forma Reinsurance Market Position – By 2009 Net Premiums U.S. Rankings Company 2009 Net Reinsurance Premiums Written ($mm) Berkshire Hathaway Life National Indemnity $4,253.0 Transatlantic 5 3,410.0 Swiss Reinsurance 6 3,331.0 2,338.0 Munich Re 2,217.8 Odyssey 1,660.9 Everest Re 1,646.6 Swiss Re Life & Health 1,336.9 Berkley 1,226.0 General Re 1,198.3 Top 10 Subtotal: 22,618.5 Total: $31,431.6 5 Bermuda Rankings Company 2009 Net Reinsurance Premiums Written ($mm) Everest Re $1,752.3 Validus 1,053.4 Arch Reinsurance 973.1 Platinum 897.8 XL 764.3 AXIS 635.8 Montpelier Re 2 602.2 Renaissance Re 503.7 Partner Re 476.1 Top 10 Subtotal: 8,696.5 Total: $11,971.3 ACE Tempest 1,037.8 Munich Re $33,704.6 Swiss Reinsurance 22,896.7 Hannover Rueckversicherung 13,639.0 Berkshire Hathaway 12,362.0 Lloyd’s $9,733.5 SCOR 8,314.7 Validus / Transatlantic 5,755.3 Reinsurance Group of America 5,725.2 Transatlantic 3,986.1 PartnerRe 4,964.9 Top 10 Subtotal: 111,000.6 Total (Including Lloyd’s): $160,109.7 World Rankings1 Everest Reinsurance 3,929.8 4 3 Company 2009 Net Reinsurance Premiums Written ($mm) 2 Korean Reinsurance 2,493.8 1 Excluding Lloyd’s 2 On July 8, 2009, Validus signed a definitive agreement to combine with IPC Holdings, Ltd. The data presented is combined pro forma for Validus and IPC Re 3 The group acquired Paris Re on October 2, 2009. The data presented is combined pro forma for Partner Re and Paris Re 4 Data presented is based on the published pro forma accounts for the Market, which represents an aggregation of all syndicates participating at Lloyd’s. As such, some premium included for Lloyd’s may also be included by other groups that consolidate their Lloyd’s operations 5 Significant change in NPW for 2009 reflects a reserve transfer arising from a co-insurance agreement between Swiss Re Life & Heath America and Berkshire Hathaway Life Insurance Co. of NE 6 Data presented includes intra group reinsurances Source: Standard & Poor’s Global Reinsurance Highlights 2010; company filings 25 |

| Bermuda and Reinsurance Peer Group – By Capitalization 26 $bn Q2 2011 Total Capitalization 1 HNR and SCR converted to USD at exchange rate of 1.439 USD/EUR 2 Pro forma book value, adjusted for $500mm debt-funded cash component, $115mm termination fee and $500mm pre-tax reserve charge ($325mm after tax at a 35.0% rate), plus outstanding debt and hybrids Source: Company filings and SNL |

| Validus' Leadership in Property Cat will be Further Enhanced... 27 3 $mm 2 2010 Property Catastrophe Premium1 4 1 Based on property catastrophe GPW for 2010, except ACGL which is NPW 2 Pro forma for Validus ($572mm), Transatlantic ($431mm) and AlphaCat Re 2011 ($43mm) 3 Includes RNR ($630mm), DaVinci ($364mm) and Top Layer ($48mm) 4 Converted to USD at 2010 average historical exchange rate of 1.325 USD/EUR Source: Company filings = Sidecars = Transatlantic |

| 28... But Will Remain Within Validus' Risk Tolerance 1:100 USWS Probable Maximum Loss Validus has significant experience integrating catastrophe portfolios - Potential to enhance profitability through optimization - Potential to enhance profitability through increased market penetration Note: Based on Validus 1:100 USWS PML as disclosed in Q2 2011 investor supplement and Transatlantic 1:100 USWS PML per 2010 Form 10-K. Gross 1:100 USWS PML not publicly available for Transatlantic. Pro forma PML does not take into account possible differences in vendor models and aggregation methodologies between Validus and Transatlantic or potential diversification benefit across the two portfolios 1 Ratio equals 15.0% if calculated on a pretax basis $mm Pro Forma Jun-11 |

| 29 Validus and Transatlantic – Diversification to Manage the Cycle1 Pro Forma Validus / Transatlantic2 1 Standalone based on 2010 GPW for Validus, NPW for Transatlantic 2 Pro forma Validus / Transatlantic based on 2010 GPW for Validus, NPW for Transatlantic Note: “Casualty short-tail” = A&H, Ocean Marine, Aviation, Auto Liability, Surety, Credit, Validus FI and Marine Liability; “Specialty Casualty” for Validus / Transatlantic = D&O, E&O, Med Mal Source: SNL, company filings |

| Validus Has a Track Record of Successfully Executing and Integrating Transactions Acquisition of Talbot (July 2007) In July 2007, Validus acquired Talbot, a leading Lloyd’s Syndicate for $382 million Talbot has contributed $277 million of net income since acquisition By moving first, Validus acquired the syndicate with the best business fit A large number of competitors followed Validus' entry into Lloyd’s E.g., AWAC, Arch, Ariel, Argo, Aspen, Flagstone, Montpelier, Max and RenaissanceRe None have reached the scale or profitability that Talbot brings to Validus 30 Amalgamation with IPC (Sept. 2009) In September 2009, Validus closed the combination with IPC Holdings for $1.67 billion Transaction yielded better value per IPC share than did proposed Max transaction Transaction consummated at below IPC book value Resulted in significant accretion to Validus book value per share Transaction was the culmination of an unsolicited offer by Validus Validus launched a multi-pronged campaign to overcome agreed IPC transaction with Max Solidified Validus position as leader in global short-tail reinsurance markets Strategically positioned Validus as a lead and quoting market Size and market presence created opportunity for differentiated price/terms on many programs |

| Potential Combination Synergies In addition to the aggregate earnings power resident in a combined Validus/Transatlantic, we believe there are significant opportunities to expand earnings and ROE through combination synergies Once Validus and Transatlantic have combined, we see potential synergies in: Eliminating Transatlantic’s public company costs Restructuring the combined company’s legal entity organization such that Transatlantic’s non-U.S. subsidiaries are no longer CFCs Optimizing the combined company’s catastrophe portfolio and harmonizing our respective risk appetites Taking steps to maximize the after-tax returns on our combined investment portfolios Validus does not expect material employee-based cost savings We estimate that the combination of a predominately short-tail business like Validus, where PML is the greatest capital constraint, with Transatlantic's large premium and reserve base, results in a better spread of risk and increases our excess capital by over $500 million1 31 1 Based on Validus’ internal capital modeling Source: Validus analysis |

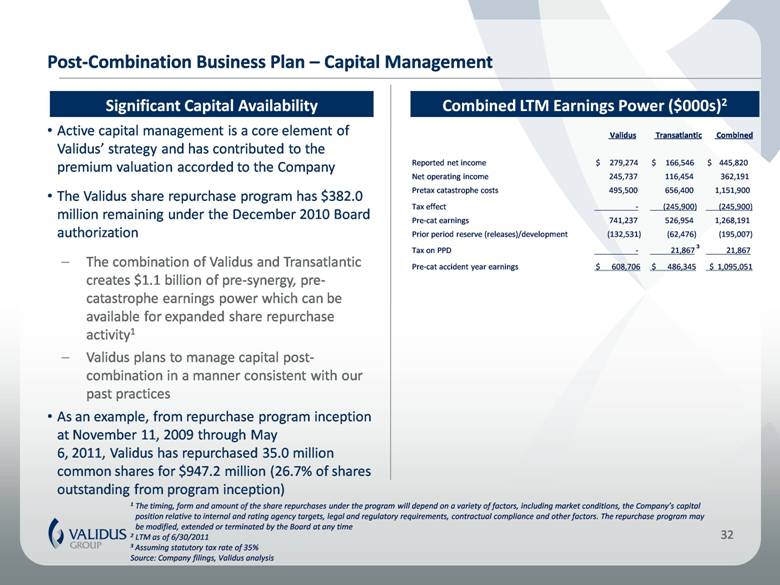

| Validus Transatlantic Combined Reported net income $ 279,274 $ 166,546 $ 445,820 Net operating income 245,737 116,454 362,191 Pretax catastrophe costs 495,500 656,400 1,151,900 Tax effect - (245,900) (245,900) Pre-cat earnings 741,237 526,954 1,268,191 Prior period reserve (releases)/development (132,531) (62,476) (195,007) Tax on PPD - 21,867 21,867 Pre-cat accident year earnings $ 608,706 $ 486,345 $ 1,095,051 32 Combined LTM Earnings Power ($000s)2 Significant Capital Availability Active capital management is a core element of Validus’ strategy and has contributed to the premium valuation accorded to the Company The Validus share repurchase program has $382.0 million remaining under the December 2010 Board authorization The combination of Validus and Transatlantic creates $1.1 billion of pre-synergy, pre- catastrophe earnings power which can be available for expanded share repurchase activity1 Validus plans to manage capital post- combination in a manner consistent with our past practices As an example, from repurchase program inception at November 11, 2009 through May 6, 2011, Validus has repurchased 35.0 million common shares for $947.2 million (26.7% of shares outstanding from program inception) 1 The timing, form and amount of the share repurchases under the program will depend on a variety of factors, including market conditions, the Company’s capital position relative to internal and rating agency targets, legal and regulatory requirements, contractual compliance and other factors. The repurchase program may be modified, extended or terminated by the Board at any time 2 LTM as of 6/30/2011 3 Assuming statutory tax rate of 35% Source: Company filings, Validus analysis Post-Combination Business Plan – Capital Management 3 |

| Creating Long-Term Value Post-Acquisition The Validus Track Record |

| Shareholder Value Creation Arising from the IPC Acquisition Validus announced the IPC offer on March 31, 2009 VR’s $24.91 share price represented a 1.05x multiple of $23.78 trailing December 31, 2008 diluted book value per share (and 1.01x not-yet reported $24.65 March 31, 2009 diluted book value per share) VR’s share price reached a low point of $20.93 on June 22, 2009 shortly after the Max/IPC amalgamation was rejected approximately 3:1 by IPC shareholders The 16.0% decline in VR’s share price resulted in a price/diluted book value per share multiple of 0.85x based on March 31, 2009 diluted book value per share (and 0.80x not-yet reported June 30, 2009 $26.08 diluted book value per share) From the June 22, 2009 low, VR’s share price increased 47.2% to $30.91 by July 12, 2011, restoring VR’s price/diluted book value per share multiple to 0.98x trailing March 31, 2011 diluted book value per share of $31.32 At VR’s peak share price of $34.51 on April 7, 2011, VR’s share price had increased 64.9% and its price/diluted book value per share multiple was a 1.05x multiple of $32.98 trailing December 31, 2010 diluted book value per share (and 1.10x not-yet reported March 31, 2011 $31.32 diluted book value per share) 34 Validus is confident in its ability to create value for all shareholders through acquisition in part due to its experience in past acquisitions |

| Validus Share Price Performance and Total Return to Shareholders 35 1 3/31/2009 through 7/12/2011 2 Including dividends, rebased to Validus share price as of 3/31/2009 Source: FactSet, SNL Validus Market Performance – IPC Announcement Through TRH Announcement1 6/12/2009 IPC shareholders vote down Max proposal 7/9/2009 Validus and IPC transaction 9/4/2009 IPC transaction closes 2 30% Increase in share price 40% Total return2 3/31/2009 Validus announces offer for IPC 17.50 22.50 27.50 32.50 37.50 3/31/2009 4/30/2009 5/31/2009 6/30/2009 7/31/2009 8/31/2009 9/30/2009 10/31/2009 11/30/2009 12/31/2009 1/31/2010 2/28/2010 3/31/2010 4/30/2010 5/31/2010 6/30/2010 7/31/2010 8/31/2010 9/30/2010 10/31/2010 11/30/2010 12/31/2010 1/31/2011 2/28/2011 3/31/2011 4/30/2011 5/31/2011 6/30/2011 Share Price $ / Total Return Share Price Total Return |

| Validus Has an Established Record of Trading at a Book Value Premium 36 Price / As-Reported Diluted Book Value1 Price / As-Reported Diluted Book Value 1 1 Quarterly Price / Diluted Book Value Per Share shown for 1/1/2009 through 7/12/2011 – point value based on share price on day immediately following release of relevant quarter’s earnings 1 Consist of ACGL, AGII, AHL, ALTE, AWH, AXS, ENH, FSR, MRH, PRE, PTP, RE, RNR, TRH and XL Source: Company filings and SNL 2 |

| Validus Delivers Superior Value to Transatlantic Stockholders 37 Note: Unaffected data as at 6/10/2011, immediately prior to AWAC/Transatlantic announcement 1 Value delivered based on relevant unaffected counterparty multiple multiplied by pro forma book value delivered per TRH share 2 Value delivered based on relevant unaffected multiple (weighted by market capitalization for TRH and counterparty) multiplied by pro forma book value delivered per TRH share Source: Company filings, SNL, FactSet, Capital IQ Applying Unaffected Counterparty Multiples1 Applying Unaffected Weighted Multiples2 Based on Pro Forma Book Value and Market Multiples $ per share, unless stated AWAC Validus Diluted BV Diluted TBV Diluted BV Diluted TBV TRH Multiple 0.69x 0.69x 0.69x 0.69x TRH Market Cap $bn 2.7 2.7 2.7 2.7 Counterparty Multiple 0.78x 0.88x 0.97x 1.02x Counterparty MC $bn 2.2 2.2 3.0 3.0 Weighted Multiple 0.73x 0.77x 0.84x 0.86x PF BV $72.78 $69.73 $32.44 $31.80 TRH Ex Ratio 0.8800x 0.8800x 1.5564x 1.5564x TRH Equivalent BV 64.05 61.36 50.49 49.49 Weighted Multiple 0.73x 0.77x 0.84x 0.86x Implied Value 46.75 47.52 42.21 42.67 Cash 0.00 0.00 8.00 8.00 Total $46.75 $47.52 $50.21 $50.67 Premium 7.4% 6.6% $ per share, unless stated AWAC Validus Diluted BV Diluted TBV Diluted BV Diluted TBV PF BV $72.78 $69.73 $32.44 $31.80 TRH Ex Ratio 0.8800x 0.8800x 1.5564x 1.5564x TRH Equivalent BV 64.05 61.36 50.49 49.49 Stated Multiple 0.78x 0.88x 0.97x 1.02x Implied Value 49.96 54.00 48.97 50.48 Cash 0.00 0.00 8.00 8.00 Total $49.96 $54.00 $56.97 $58.48 Premium 14.0% 8.3% |

| Validus has Outperformed AWAC on a Total Returns Basis since Validus IPO 38 1 Total shareholder return based on closing prices from 7/25/2007 to 6/10/2011 (last trading day prior to AWH / TRH announcement) and assumes dividends are reinvested Source: SNL +55% +24% % Total Shareholder Return Since Validus IPO1 |

| What Transatlantic Stockholders Would be Subject to with AWAC The Questionable Value of AWAC and its Weak Long-Term Prospects |

| The Questionable Value of AWAC and its Weak Long-Term Prospects 40 Struggled to establish itself as an independent entity Been growing into a soft U.S. casualty market to maintain volume Not created a leading U.S. franchise A stagnant non U.S./Bermuda business that is irrelevant in its markets Ballooning expenses Relied on ever-increasing, unsustainable reserve releases for earnings Revealed its weaker financial prospects in its merger projections Poor underwriting margins that create significant headwinds Significant exposure to a spike in interest rates An acquisition record of destroying book value Capital management that has not been open to all stockholders In our view, AWAC has: |

| AWAC’s Formative Years AWAC was formed in November 2001 by an AIG-led investor group, including Goldman Sachs, Chubb and Swiss Re In its initial years through 2005, AWAC’s function was to provide capacity for AIG like a “sidecar” “[AWAC distributed] products in the United States primarily through surplus lines program administrator agreements and a reinsurance agreement with subsidiaries of AIG” - AWAC Form S-1, March 17, 2006 AIG and AWAC shared information about, and coordinated responses to, bidding opportunities through AIG’s universal reservations system Distribution agreement with Lexington to assume AIG-produced surplus lines business Underwriting agency agreement with IPC Re, Ltd., an AIG affiliate From 2001 through December 31, 2005, AWAC had an administrative services agreement with various AIG entities, whereby AIG provided AWAC with administrative services for a fee based on gross premium written 41 Source: Company filings |

| AWAC Has Struggled to Establish Itself as an Independent Entity AWAC has struggled to manage its separation from AIG 2004 consolidated GPW was $1,708 million, and it has taken AWAC six years for consolidated GPW to return to that level The original business produced by AIG was far more profitable and has delivered significant run-off profits which benefit AWAC’s earnings, even today In contrast, AWAC is currently chasing premium growth in a weak casualty market AWAC’s Bermuda business never established an independent franchise and now has been effectively abandoned by executive management AWAC’s expense ratio has grown rapidly, far in excess of its premium growth Creates a significant competitive disadvantage Challenges AWAC’s future underwriting profitability in the current soft casualty market 42 Source: Company filings |

| AWAC Has Been Growing Into a Soft U.S. Casualty Market to Maintain Volume 43 Premiums in Bermuda declined replaced by aggressive growth in U.S. Note: Based on gross written premiums by geographic location Source: Company filings Gross Premiums Written – Bermuda Gross Premiums Written – U.S. $mm $mm |

| AWAC’s U.S. Business is Not a Leading Franchise In the U.S., AWAC holds itself out to be a leading specialty professional liability and healthcare insurer Despite huge expenditures, AWAC fails to rank in the top tier of any of the lines it writes 44 AWAC U.S. Market Share1 FY 2010 DPW ($mm) Market Share (%) Ranking (#) Total - All Lines 727.1 0.15 87 Total - Commercial Lines 727.0 0.31 58 Excess and Surplus 363.4 1.60 18 Other Liability (Claims) 314.0 1.76 14 Med Prof Liability 168.8 1.60 16 Other Liability (Occurrence) 146.8 0.52 36 Fire 32.1 0.25 59 Allied Lines 29.4 0.26 50 Other P&C (State) 20.7 1.58 19 Earthquake 11.0 0.42 36 Inland Marine 2.1 0.02 162 Burglary and Theft 1.0 0.52 24 Boiler and Machinery 0.6 0.05 67 Fidelity 0.6 0.05 51 1Direct premium written, market share and rankings for all lines of business in which AWAC produces more than $0.5 million of premium Source: SNL |

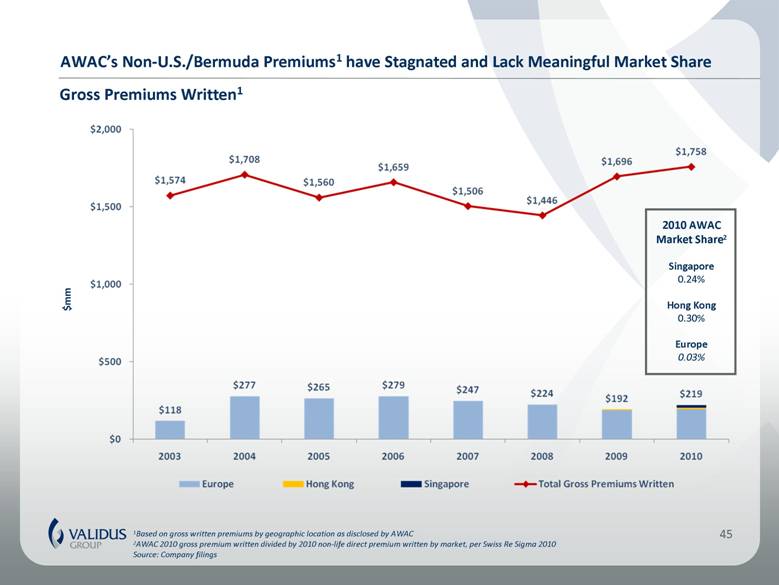

| AWAC’s Non-U.S./Bermuda Premiums1 have Stagnated and Lack Meaningful Market Share 45 Gross Premiums Written1 2010 AWAC Market Share2 Singapore 0.24% Hong Kong 0.30% Europe 0.03% 1Based on gross written premiums by geographic location as disclosed by AWAC 2AWAC 2010 gross premium written divided by 2010 non-life direct premium written by market, per Swiss Re Sigma 2010 Source: Company filings $mm |

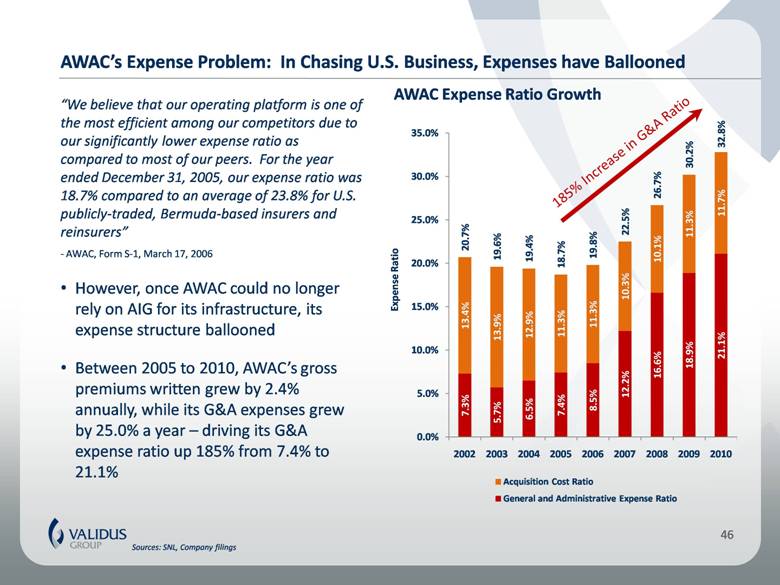

| AWAC’s Expense Problem: In Chasing U.S. Business, Expenses have Ballooned Sources: SNL, Company filings 46 AWAC Expense Ratio Growth Expense Ratio “We believe that our operating platform is one of the most efficient among our competitors due to our significantly lower expense ratio as compared to most of our peers. For the year ended December 31, 2005, our expense ratio was 18.7% compared to an average of 23.8% for U.S. publicly-traded, Bermuda-based insurers and reinsurers” - AWAC, Form S-1, March 17, 2006 However, once AWAC could no longer rely on AIG for its infrastructure, its expense structure ballooned Between 2005 to 2010, AWAC’s gross premiums written grew by 2.4% annually, while its G&A expenses grew by 25.0% a year – driving its G&A expense ratio up 185% from 7.4% to 21.1% 185% Increase in G&A Ratio |

| AWAC Has Relied on Ever-Increasing Reserve Releases for Earnings Sources: SNL, Company filings 47 $mm Reserve Development as % of Net Income Before Taxes 0% 19% 41% N.M. 25% 26% 159% 39% 44% Prior Period Reserve Releases |

| Yet AWAC’s Reserve Releases Have Come Largely From the AIG Years 1Includes unfavorable reserve development of $25.0 million in U.S. insurance segment for the 2006 loss year Source: Company filings 48 Accident Year 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 CY Total CY Original Loss Ratio 70.1% 65.3% 75.9% 103.1% 59.6% 58.4% 55.6% 45.9% 52.1% 90.9% Prior Year Development 0.0% (4.9%) (5.8%) (3.6%) (8.2%) (10.2%) (24.2%) (18.8%) (23.1%) (13.2%) AY Original Loss Ratio 70.1% 70.1% 81.7% 106.7% 67.7% 68.6% 79.8% 64.7% 75.1% 104.2% 2002 2003 ($56.8) ($56.8) 2004 (26.7) ($52.7) (79.4) 2005 (8.4) (45.7) $5.6 (48.5) 2006 (16.5) (43.1) (45.3) ($8.2) (113.0) 2007 6.2 (33.8) (76.9) (6.2) ($26.1) (136.9) 2008 (8.9) (87.9) (100.3) (73.8) (7.8) ($33.9) (312.6) 2009 (16.5) (57.2) (118.1) (102.5) 11.6 2.4 $32.2 (248.0) 2010 4.4 (10.9) (57.0) (146.7) (54.4) (24.8) (22.6) ($1.2) (313.4) 2011 1.3 (5.5) (2.4) (34.9) 14.8 (11.0) (0.6) (11.2) $5.2 (44.4) Subsequent Development ($122.1) ($336.8) ($394.3) ($372.4) ($61.9) ($67.3) $9.0 ($12.4) $5.2 ($1,352.9) Data Through March 31, 2011 ($mm) Validus believes that Transatlantic stockholders will not benefit from similar reserve releases from AWAC’s hard market AIG years, as they have been aggressively released already 1 |

| And Rate Adequacy is Significantly Lower than the Hard Market AIG Years Source: The Council of Insurance Agents and Brokers (http://www.ciab.com/resources.aspx?id=53) 49 Average Commercial Rate Change by Line |

| AWAC Revealed its Weaker Financial Prospects in its Merger Projections 1 Diluted tangible book value per share from 12/31/2005 through 12/31/2010. Validus believes dividends are an important source of shareholder value 2 See page 76 of AWAC’s merger proxy statement for AWAC’s internal financial forecasts for 2011 - 2015 Sources: SNL, Company filings 50 Comparative Return Profile AWAC has acknowledged its diminished growth in operating return and book value over the next five years 1 1 While AWAC advertises high five-year historical growth rate in TBVPS, it has achieved this through reserve releases stemming from business written during the AIG years The underlying growth in AWAC’s TBVPS is consistent with the 9.0% return on average equity projected by AWAC in its merger proxy statement 2 2 |

| AWAC’s Investment Leverage Exposes its Equity to a Spike in Interest Rates 1 The changes in market values as a result of changes in interest rates is determined by calculating hypothetical June 30, 2011 ending prices based on yields adjusted to reflect the hypothetical changes in interest rates, comparing such hypothetical ending prices to actual ending prices, and multiplying the difference by the principal amount of the security. The sensitivity analysis is based on estimates contained in AWAC’s Q2 2011 10-Q Sources: Company filings 51 Interest Rate Shift in Basis Points ($ in 000s) 0 +50 +100 +200 Total Market Value 6/30/2011 7,354 7,275 7,196 7,040 Change From Base 0 (79) (158) (315) % of Base Value 0.0% -1.1% -2.1% -4.3% % of Shareholders Equity 0.0% -2.6% -5.2% -10.3% AWAC’s disclosure about market risk highlights its significant exposure to an increase in the yield curve As of June 30, 2011, a 100 basis point rise in interest rates would have reduced AWAC’s shareholder equity by 5.2% AWAC’s Exposure to Interest Rate Increases1 |

| AWAC Has an Acquisition Record of Destroying Book Value 1 Reduction in diluted book value per share; reduction in basic book value per share would be 6.4% (from $80.23 to $75.11) Sources: SNL, Company filings 52 Despite its acquisition record of destroying book value, AWAC still maintains that book – not market – value is what should matter to investors P / TVBPS (12.0%) in TBVPS Book Value Per Share Darwin Professional Underwriters – 2008 Deal Value: $550 million Transatlantic – 20111 AWAC Diluted Book Value Per Share 6/30/2011 (5.1%) |

| AWAC’s Capital Management has Not been Open to All Shareholders 1 Aggregate capital returns from IPO through 2Q 2011, including stock and warrant repurchases and dividends Source: SNL, company filings 53 AWAC has concentrated its capital management efforts on privately-negotiated repurchases from its founding shareholders rather than treating all shareholders equally Capital Return Detail Since IPO $1,589 million1 Amount ($mm) Year Event Founding All Shareholders YTD Common stock buyback 60 Warrant repurchase from AIG 54 2010 Common stock buyback 239 Common stock repurchases - Goldman Sachs 435 Warrant Repurchase - Goldman Sachs 37 Warrant Repurchase - Chubb 33 Dividends 48 2009 Dividends 37 2008 Dividends 35 2007 Common stock repurchase from AIG 563 Dividends 38 2006 Dividends 9 Total: $1,123 $466 Less than 30% of Money Returned was Shared Pro Rata with All Stockholders |

| Setting the Record Straight on AWAC’s and Transatlantic’s Misleading Statements |

| Casualty-on-Casualty – A Deeply Flawed Strategic Rationale Illogical Business Case A casualty-on-casualty combination does not bring diversification benefits2; rather it magnifies the risks inherent in the casualty pricing cycle and potential for claims inflation AWAC attempts to compete with most of Transatlantic’s largest customers, which could result in customer losses to the detriment of the combined company 55 Pro Forma AWAC / Transatlantic 1 Standalone based on 2010 GPW for AWAC, NPW for Transatlantic 2 “Diversification benefits” refers to the diversity of premiums, earnings and reserves by different lines of business, as noted by various ratings agencies Source: SNL, company filings AWAC ? Casualty intensified How much business could be lost? Total Casualty: $2,743 million Total Casualty: $1,278 million 1 1 |

| AWAC is Attempting to Compete with Most of Transatlantic’s Customers Sources: SNL 56 Transatlantic’s 2010 Reinsurance Premiums Assumed – Top 20 Relationships Validus believes AWAC’s strategic rationale for the takeover of Transatlantic is flawed and could lead to diminishment of Transatlantic’s franchise Premiums Cedent Assumed ($mm) American International Group 389 Lloyd's of London 216 ACE Ltd. 133 Liberty MHC 131 Zurich Financial Services 113 Travelers 81 AXIS Capital 76 ISMIE Mutual Insurance Co. 75 Hawaii Management Alliance 70 Ironshore Inc 69 HCC Insurance Holdings 68 Nederlandsche 58 Chubb Corp 58 Fenelon Ventures 53 Arch Capital 48 MS&AD 47 Haftpflichtverband der 46 Qualitas Cia de Seguros 45 Fairfax Financial Holdings 41 W.R. Berkley 40 |

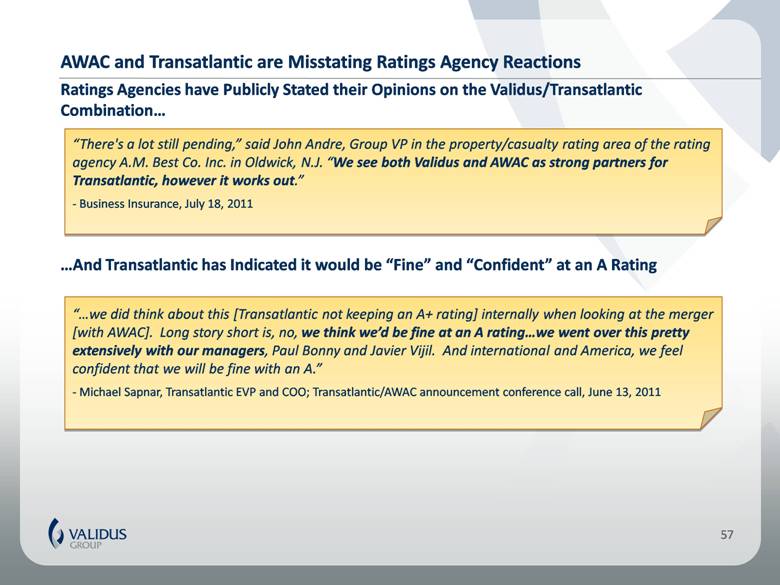

| AWAC and Transatlantic are Misstating Ratings Agency Reactions “There's a lot still pending,” said John Andre, Group VP in the property/casualty rating area of the rating agency A.M. Best Co. Inc. in Oldwick, N.J. “We see both Validus and AWAC as strong partners for Transatlantic, however it works out.” - Business Insurance, July 18, 2011 Ratings Agencies have Publicly Stated their Opinions on the Validus/Transatlantic Combination “we did think about this [Transatlantic not keeping an A+ rating] internally when looking at the merger [with AWAC]. Long story short is, no, we think we’d be fine at an A ratingwe went over this pretty extensively with our managers, Paul Bonny and Javier Vijil. And international and America, we feel confident that we will be fine with an A.” - Michael Sapnar, Transatlantic EVP and COO; Transatlantic/AWAC announcement conference call, June 13, 2011 And Transatlantic has Indicated it would be “Fine” and “Confident” at an A Rating 57 |

| Despite AWAC’s Empty Assertions, Lower Risk Appetite Doesn’t Mean Lower Losses 58 Validus’ leadership in the global cat market is based on superior analytics and risk management What AWAC Claims 1:250 PML as % of Equity 1 Q1 2011 Japan cat net loss ($365mm) adjusted for 35% tax rate divided by Transatlantic 1:250 PML ($690mm post-tax, per Transatlantic 2010 10-K) 2 Q1 2011 Japan cat net loss ($89.5mm) divided by implied AWAC 1:250 “actual” PML (15% of 3/31/11 equity) 3 Q1 2011 Japan cat net loss ($169mm, including $20mm IBNR allocation) divided by $1,064 1:250 PML Sources: Company filings Versus Actual Risk Management Experience Q1 2011 Japan Cat Loss as % of 1:250 PML Actual Actual 1 2 3 ...... |

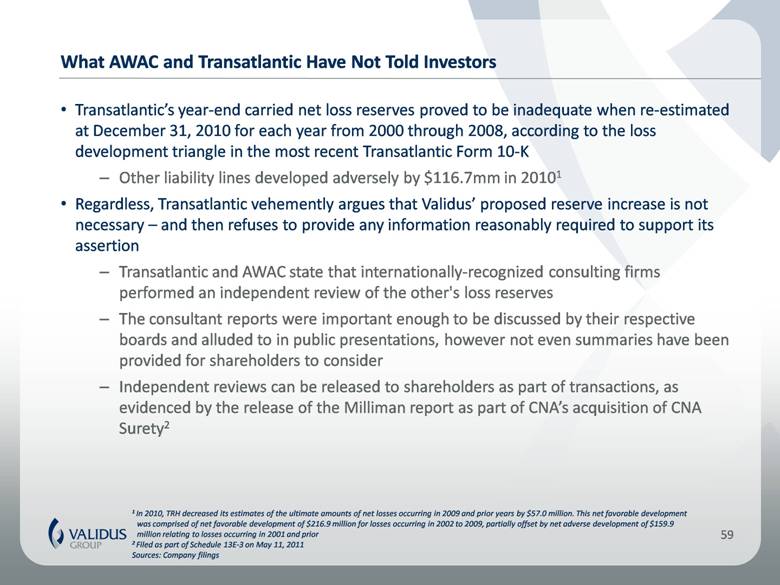

| What AWAC and Transatlantic Have Not Told Investors Transatlantic’s year-end carried net loss reserves proved to be inadequate when re-estimated at December 31, 2010 for each year from 2000 through 2008, according to the loss development triangle in the most recent Transatlantic Form 10-K Other liability lines developed adversely by $116.7mm in 20101 Regardless, Transatlantic vehemently argues that Validus’ proposed reserve increase is not necessary – and then refuses to provide any information reasonably required to support its assertion Transatlantic and AWAC state that internationally-recognized consulting firms performed an independent review of the other's loss reserves The consultant reports were important enough to be discussed by their respective boards and alluded to in public presentations, however not even summaries have been provided for shareholders to consider Independent reviews can be released to shareholders as part of transactions, as evidenced by the release of the Milliman report as part of CNA’s acquisition of CNA Surety2 59 1 In 2010, TRH decreased its estimates of the ultimate amounts of net losses occurring in 2009 and prior years by $57.0 million. This net favorable development was comprised of net favorable development of $216.9 million for losses occurring in 2002 to 2009, partially offset by net adverse development of $159.9 million relating to losses occurring in 2001 and prior 2 Filed as part of Schedule 13E-3 on May 11, 2011 Sources: Company filings |

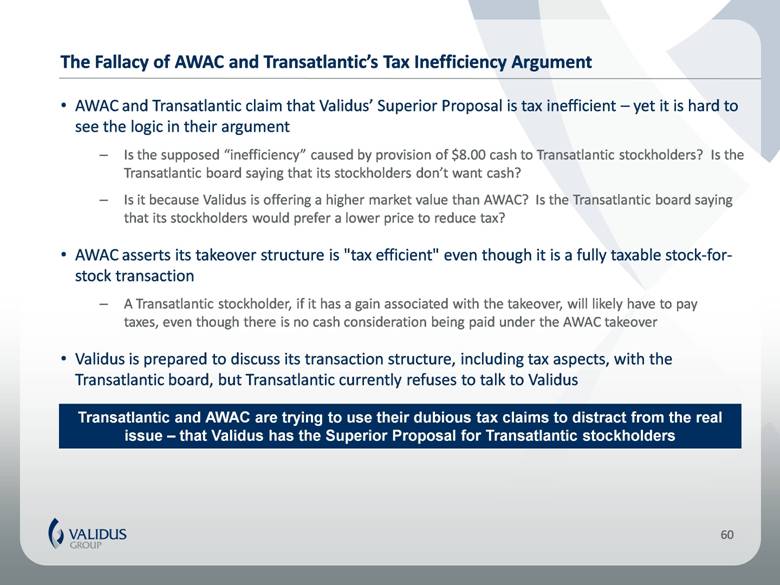

| The Fallacy of AWAC and Transatlantic’s Tax Inefficiency Argument AWAC and Transatlantic claim that Validus’ Superior Proposal is tax inefficient – yet it is hard to see the logic in their argument Is the supposed “inefficiency” caused by provision of $8.00 cash to Transatlantic stockholders? Is the Transatlantic board saying that its stockholders don’t want cash? Is it because Validus is offering a higher market value than AWAC? Is the Transatlantic board saying that its stockholders would prefer a lower price to reduce tax? AWAC asserts its takeover structure is "tax efficient" even though it is a fully taxable stock-for-stock transaction A Transatlantic stockholder, if it has a gain associated with the takeover, will likely have to pay taxes, even though there is no cash consideration being paid under the AWAC takeover Validus is prepared to discuss its transaction structure, including tax aspects, with the Transatlantic board, but Transatlantic currently refuses to talk to Validus 60 Transatlantic and AWAC are trying to use their dubious tax claims to distract from the real issue – that Validus has the Superior Proposal for Transatlantic stockholders |

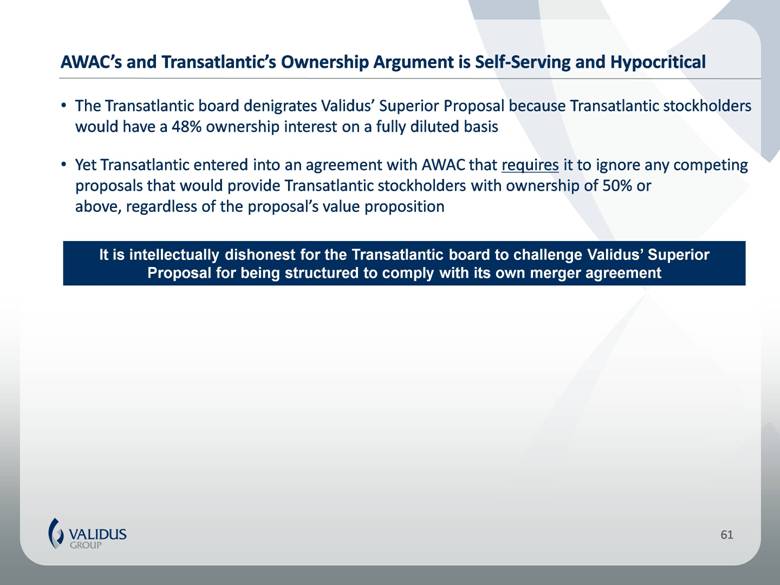

| AWAC’s and Transatlantic’s Ownership Argument is Self-Serving and Hypocritical The Transatlantic board denigrates Validus’ Superior Proposal because Transatlantic stockholders would have a 48% ownership interest on a fully diluted basis Yet Transatlantic entered into an agreement with AWAC that requires it to ignore any competing proposals that would provide Transatlantic stockholders with ownership of 50% or above, regardless of the proposal’s value proposition 61 It is intellectually dishonest for the Transatlantic board to challenge Validus’ Superior Proposal for being structured to comply with its own merger agreement |

| Validus’ Superior Proposal is Effectively No More Conditional than AWAC’s Takeover 62 1 Not intended to be exhaustive list of conditions 2 Validus filed its Form A with the New York Insurance Department on August 1, 2011 (3 weeks ahead of AWAC) 3 Validus has obtained HSR approval; based on publicly available information, AWAC has obtained HSR approval 4 Each of Validus and AWAC has satisfied this condition 5 Pre-closing dividend relates to Validus’ merger offer 6 Although not an express condition in the merger agreement, it is a covenant; AWAC has indicated in disclosure that if required to terminate its syndicated credit facilities, it would seek to transfer letters of credit outstanding to its existing European syndicated unsecured credit facility, but has not disclosed affirmative arrangements to do so 7 Validus has satisfied this condition 8 Based on publicly available information, AWAC has satisfied this condition Sources: Company filings Closing Conditions1 AWAC Takeover Validus Proposal Transatlantic Stockholder Approval X X Acquiror Stockholder Approvals X X Insurance Regulatory Approvals2 X X Antitrust Approvals3 X X Effectiveness of Registration Statement4 X X NYSE Listing X X No MAE X X Termination of Merger Agreement / Poison Pill / DGCL 203 X Pre-Closing Dividend X5 Credit Facility Amendments ?6 X7 Swiss Commercial Register Ruling X8 The key condition for Validus and AWAC is securing Transatlantic stockholder support Given Validus’ Superior Proposal, AWAC appears to face the most challenging hurdle |

| AWAC and Transatlantic Mischaracterize the Reason Validus is Willing to Increase its Leverage On a standalone basis, Validus has lower leverage than both Transatlantic and AWAC1,2 The incremental leverage in Validus’ Superior Proposal only arises through Transatlantic stockholders receiving $8.00 per share in cash 63 Comparative Debt-to-Capital2 – 6/30/2011 1 Standalone debt-to-capital 6/30/11: Validus 6.1%. AWAC 20.8%, Transatlantic 19.2% 2 Excluding Validus’ Junior Subordinated Deferrable Debentures from numerator, which are hybrid securities treated as equity by the rating agencies – included in capital (denominator) 3 Excluding $500mm incremental debt raised to pay $8.00 per share cash to Transatlantic stockholders Source: Company filings 3 |

| What Investors Should Ask AWAC and Transatlantic AWAC and Transatlantic seem fixated on book value. When was the last time AWAC shareholders have been able to sell their shares at or above book value? Given that a critical component of AWAC’s growth in book value per share has come from reserve releases over the past several years, how does it plan to support any possible future growth in book value? Is AWAC satisfied with its projected 5 year average 9% ROAE (per its merger proxy statement) in light of its cost of equity as estimated by AWAC’s financial adviser? How can AWAC assert (contrary to quotes from A.M. Best and Transatlantic’s own management) that ratings agencies view an AWAC/Transatlantic combination as more favorable than a Validus/Transatlantic combination? How can the Transatlantic board purport to represent stockholders, but refuse to discuss Validus’ Superior Proposal despite opposition to the AWAC takeover by major Transatlantic stockholders? Why does Transatlantic's largest stockholder oppose the AWAC transaction? 64 |

| Conclusion What You Get With Validus |

| What Transatlantic Stockholders Get With Validus Greater market value than AWAC offer Better currency, with superior stock price performance Strong, long-term upside potential Board and management devoted to maximizing shareholder value, not premium volume Leading franchise positions in Bermuda and at Lloyd’s Deeply experienced reinsurance management team Proven expertise in integrating two transformational business combinations A commitment to active capital management treating all shareholders equally 66 |

| Appendix A Validus, From Formation to Today |

| Validus, From Formation to Today: A Case Study in Value Creation Within five years of commencing operations, Validus has established leading global positions in Bermuda and at Lloyd’s Number two position in Bermuda reinsurance, the world’s most important property-catastrophe reinsurance market Top tier position at Lloyd’s, where Talbot is the 11th largest of 89 syndicates Size and scale to remain strong competitor Business plan since formation has been to focus on short-tail lines, which have been the best-priced classes of risk Underwriting acumen has been validated by ability to attract and manage third-party capital from sophisticated inventors Maintained a focus on underwriting profits in conjunction with a strong balance sheet Minimal exposure to interest rate risk History of favorable reserve development Delivered superior financial results since 2007 IPO, outperforming short-tail Bermuda peers Active capital management, returning $1.25 billion to investors through repurchases and dividends from IPO through Q2 20111 Attained a premium valuation 68 1 Excluding cash paid in IPC transaction Source: Moody’s |

| Bermuda and Lloyd’s Each Generate $1bn in Short-Tail Business for Validus 69 Last Twelve Months GPW through June 30, 2011 of $2.1 billion Balanced by Class: 51% Property, 27% Marine, 22% Specialty Validus Re Gross Premiums Written Last Twelve Months: $1.130 billion Talbot Gross Premiums Written Last Twelve Months: $996.8 million Note: $2.1 billion consolidated gross premiums written reflects $68.2 million of intersegment eliminations. Validus Re gross premiums written and Talbot gross premiums written do not Property Cat XOL, 57% Other Property, 15% Marine, 20% Specialty, 8% |

| Each of Validus’ Operating Segments is a Leader in its Markets 70 Bermuda Rankings1 Company 2009 Net Reinsurance Premiums Written ($mm) Everest Re $1,752.3 Validus 1,053.4 Arch Reinsurance 973.1 Platinum 897.8 XL 764.3 AXIS 635.8 Montpelier Re 2 602.2 Renaissance Re 503.7 Partner Re 476.1 Market Total: $11,971.3 ACE Tempest 1,037.8 1 Sourced from Standard & Poor’s Global Reinsurance Highlights 2010 and company filings 2 On September 4, 2009, Validus consummated the acquisition of IPC Holdings, Ltd. The data presented is combined pro forma for Validus and IPC Re 3 As of 8/2/11; sourced from Moody’s – ranked by aggregated syndicate totals of each managing agent (56 managing agents in total) 4 Based on combined ratio, as reported by CityPlace Analysis Lloyd’s Rankings3 Managing Agent 2011 Indicative Aggregate Syndicate Capacity (£mm) R J Kiln £1,503.5 Catlin 1,430.4 QBE 1,295.0 Hiscox 1,187.3 Amlin 1,078.0 Chaucer 1,046.7 Liberty 910.0 Brit 760.0 Canopius 619.9 Beazley Furlonge 1,319.5 Ascot 600.0 Novae 575.0 Validus (Talbot) 560.0 Market Total (89 syndicates): £23,170.2 Validus Re is one of the two leading markets for property cat in Bermuda Talbot is a consistent top-quartile performer in the Lloyd’s market4 |

| The Property Catastrophe Rate Environment Continues to be Favorable... 71 1 Index value of 100 in 1990 Source: Guy Carpenter ...And is Recognized as an Attractive Growth Opportunity “Using RMS version 9 as a stable baseline to calculate the amount of risk in both this year's and last year's programs, and measuring the price change by unit of exposure to mitigate the impact of exposure changes, pricing shifted on average up 5 percent to up 10 percent, with a wide range of outcomes for individual programs.” - Guy Carpenter, 6/1/11 US Catastrophe Rate on Line Index1 “US property catastrophe rates have experienced a directional shift since January 2011, with increases due primarily to global losses and new versions of the catastrophe models.” - Guy Carpenter, 7/1/11 “While our competitors reportedly placed business at increased rates of as high as 15 percent, we drove flat to reduced pricing through to completion for U.S. property catastrophe program renewals... Our outlook for the pricing of U.S. property catastrophe renewals for the remainder of the year is flat assuming no additional occurrences of substantial insured and reinsured catastrophe losses. Clearly, however, the reinsurance market for renewals for the remainder of the year is more sensitive to additional losses this year than last given reinsured loss experience to date this year.” - Aon, July 2011 Rate increases at mid-year “New capacity was scarce and more expensive than renewal capacity, in particular for peak wind placements on nationwide accounts ... Percentage rate changes varied by layer with existing top layers in peak zones most heavily impacted; this was driven by increased cost of capital pressures due to international catastrophe losses, more expensive retrocessional costs and most noticeably, from increases in modeled losses for U.S. wind ... Property rates: US Florida catastrophe loss free change -5% to +15%; US Nationwide catastrophe loss free change +5% to +15% / catastrophe loss hit change +10% to +20%” - Willis, 7/1/11 |

| Strength of Validus’ Underwriting Franchise Validated by Sophisticated Third Parties 2006: Petrel Re Formed in May 2006 $200 million facility for marine and energy risks 75% quota share of certain marine and offshore energy reinsurance contracts underwritten by Validus Re for 2006 and 2007 underwriting years Underwrote $87.5 million in premium income in 2006-2007 Sponsored by First Reserve Corporation Leading private equity firm specializing in the energy sector First Reserve subsequently founded Torus Insurance Holdings Ltd. in 2008 72 2011: AlphaCat Re 2011 Formed in May 2011 $185 million of capital, including $135 million of third-party capital Provides collateralized reinsurance and retrocessional reinsurance for the 2011 and 2012 underwriting years Achieved $42.6 million gross premiums written in Q2 2011 Serengeti Asset Management was the lead equity investor |

| Validus has been Able to Grow into the Improving Pricing Environment Peer Comparison – Q2 2011 YoY Growth1 73 Q2 2011 YoY Growth in GPW Note: ALTE excluded because of non-comparability due to impact of Max / Harbor Point transaction 1 Growth versus Q2 2010 Source: SNL, company filings Peer Comparison – Q2 2011 Operating ROAE Q2 2011 Operating ROAE |

| While Managing its Exposures Within its Risk Appetite 74 1:100 USWS Probable Maximum Loss 22.1% 21.2% 19.2% 22.4% 20.5% 19.0% 21.4% 20.8% 20.7% 21.1% 18.0% 0 200 400 600 800 1,000 1,200 1,400 Dec-08 Mar-09 Jun-09 Sep-09 Dec-09 Mar-10 Jun-10 Sep-10 Dec-10 Mar-11 Jun-11 PML/Capital Gross PML Net PML |

| Best in Class Financial Performance Short-Tail Specialist Comparison – Key Metrics LTM through June 30, 2011 75 Source: SNL, company filings Statistic ($mm) Validus Renaissance Montpelier Flagstone Gross premiums written $2,058 $1,410 $717 $1,097 Net premiums earned 1,721 1,022 637 825 Underwriting income $177 $(151) $(45) $(185) + (Favorable)/Unfavorable reserve development (133) (199) (99) 7 + Catastrophe losses 496 588 278 430 Accident year ex-Cat underwriting income 502 239 134 251 Operating income $246 $27 $1 $(149) Net income 279 104 49 (129) Accident year ex-Cat loss ratio % 39.1 47.8 45.3 33.9 Cat loss ratio % 26.6 57.5 43.6 52.1 Prior year development % (7.7) (19.4) (15.6) 0.8 Calendar year loss ratio % 58.0 85.9 73.4 86.8 Expense ratio % 31.7 28.8 33.7 37.5 Combined ratio % 89.7 114.7 107.1 124.3 Average common shareholders’ equity $3,519 $3,160 $1,572 $1,094 Accident year ROAE ex-Cats % 17.3 13.2 11.5 26.2 Operating ROAE % 7.0 0.9 0.1 (13.7) Net income ROAE % 7.9 3.3 3.1 (11.8) Cat losses, % of beginning common equity 13.8 18.7 17.1 35.9 |

| Short-Tail Specialist Comparison – Growth in Book Value and Market Valuation 76 1 Since Validus IPO; 14.1% CAGR for Validus since December 2005 2 Price / most recently reported book value as of 7/12/11 Source: SNL, Company filings Compound Annual Growth in Diluted Book Value Including Dividends1 Price / As-Reported Diluted Book Value2 Best in Class Financial Performance (cont’d) |

| Liquid and Short Duration Investment Portfolio Total cash and invested assets of $6.16 billion Conservative investment strategy Emphasis on the preservation of invested assets Provision of sufficient liquidity for prompt payment of claims Minimal exposure to equity and alternative asset classes Comprehensive portfolio disclosure Average portfolio rating of AA Minimum average credit quality of AA- Duration of 1.57 years Quarterly average investment yield: 1.76% 77 Note: Figures as of 6/30/11 25.0% 22.8% 13.7% 10.2% 7.7% 7.6% 6.3% 4.5% 0.8% 0.5% 0.5% 0.3% 0.1% Short term and cash U.S. corporate U.S. Govt. and Agency Non-U.S. corporate Non-U.S. Govt. and Agency Agency RMBS Bank Loans ABS Non-Agency RMBS Cat bonds State and local Other CMBS 0% 10% 20% 30% |

| Investment Leverage – (Cash and Investments) / Equity1 78 Liquid and Short Duration Investment Portfolio vs. Peers 1 Q2 2011 2 Duration in years Source: SNL, company filings Average Duration 2 |

| Loss Reserves at June 30, 2011 Validus Net Reserve Mix Observations Net reserves for losses and loss expenses of $2.18 billion: $2.62 billion gross IBNR represents 51.5% of net reserves Talbot has a history of favorable reserve development: $269.0 million since acquisition Favorable reserve development in Q2 2011 of $25.7 million: Talbot favorable development of $13.4 million Validus Re favorable development of $12.3 million 79 |

| Active Capital Management - Rationalizing Capacity and Returning Capital Combined proforma shareholders’ equity of $4.17 billion at June 30, 2009 Cash consideration to IPC shareholders of $420.8 million Post-closing share repurchases of $947.2 million through June 30, 20111 Post-closing dividends of $208.6 million Shareholders’ equity available to Validus of $3.41 billion at June 30, 2011 80 In total, Validus has reduced underwriting capital by $1.58 billion since the IPC acquisition, or 78% of IPC’s pre-transaction equity 1 Includes $300 million in June 2010 Dutch auction tender offer and $300 million in December 2010 fixed price tender offer and private repurchase. Note: Total dividends to shareholders paid by VR from IPO to June 30, 2011 equal $306.1 million. $2,152 $2,014 $421 $947 $209 $819 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 Pre-Merger (1) Cash paid (2) Repurchases (3) Dividends (4) Other (5) VR Shareholders' Equity $3.41 billion at 06/30/2011 |

| Appendix B Reconciliation of Non-GAAP Measures |

| Net Operating Income Reconciliation 82 Validus Holdings, Ltd. Non-GAAP Financial Measure Reconciliation Net Operating Income, Net Operating Income per share and Annualized Net Operating Return on Average Equity (Expressed in thousands of U.S. Dollars, except share and per share information) June 30, 2011 June 30, 2010 June 30, 2011 June 30, 2010 Net income (loss) available (attributable) to Validus 109,884 $ 179,782 $ (62,480) $ 61,404 $ Adjustments for: Net realized (gains) on investments (11,552) (12,441) (17,931) (23,839) Net unrealized (gains) on investments (18,526) (41,640) (5,698) (57,053) Foreign exchange losses 1,991 4,099 2,458 12,863 Net operating income (loss) available (attributable) to Validus 81,797 129,800 (83,651) (6,625) less: Dividends and distributions declared on outstanding warrants (1,966) (1,749) (3,950) (3,498) Net operating income (loss) available (attributable) to Validus, adjusted 79,831 $ 128,051 $ (87,601) $ (10,123) $ Net income (loss) per share available (attributable) to Validus - diluted 1.05 $ 1.44 $ (0.68) $ 0.46 $ Adjustments for: Net realized (gains) on investments (0.11) (0.10) (0.18) (0.19) Net unrealized (gains) on investments (0.18) (0.33) (0.06) (0.45) Foreign exchange losses 0.02 0.03 0.03 0.10 Net operating income (loss) per share available (attributable) to Validus - diluted 0.78 $ 1.04 $ (0.89) $ (0.08) $ Weighted average number of common shares and common share equivalents 104,562,450 125,152,300 98,165,132 128,182,164 Average shareholders’ equity 3,361,819 3,681,246 3,409,490 3,797,870 Annualized net operating return on average equity 9.7% 14.1% -4.9% -0.3% Three months ended Six months ended |

| Diluted Book Value Per Share Reconciliation 83 (a) Weighted average exercise price for those warrants and stock options that have an exercise price lower than book value per shares. (b) Using the “as-if-converted” method, assuming all proceeds received upon exercise of warrants and stock options will be retained by the Company and the resulting common shares from exercise remain outstanding. Validus Holdings, Ltd. (Expressed in thousands of U.S. Dollars, except share and per share information) Equity amount Shares Exercise Price (a) Book value per share Book value per common share, reported Book value per common share Total shareholders’ equity available to Validus 3,408,317 $ 98,763,928 34.51 $ Diluted book value per common share Total shareholders’ equity available to Validus 3,408,317 $ 98,763,928 Assumed exercise of outstanding warrants (b) 137,992 7,862,262 17.55 $ Assumed exercise of outstanding stock options (b) 45,604 2,266,801 20.12 $ Unvested restricted shares - 3,670,942 Diluted book value per common share 3,591,913 $ 112,563,933 31.91 $ At June 30, 2011 |