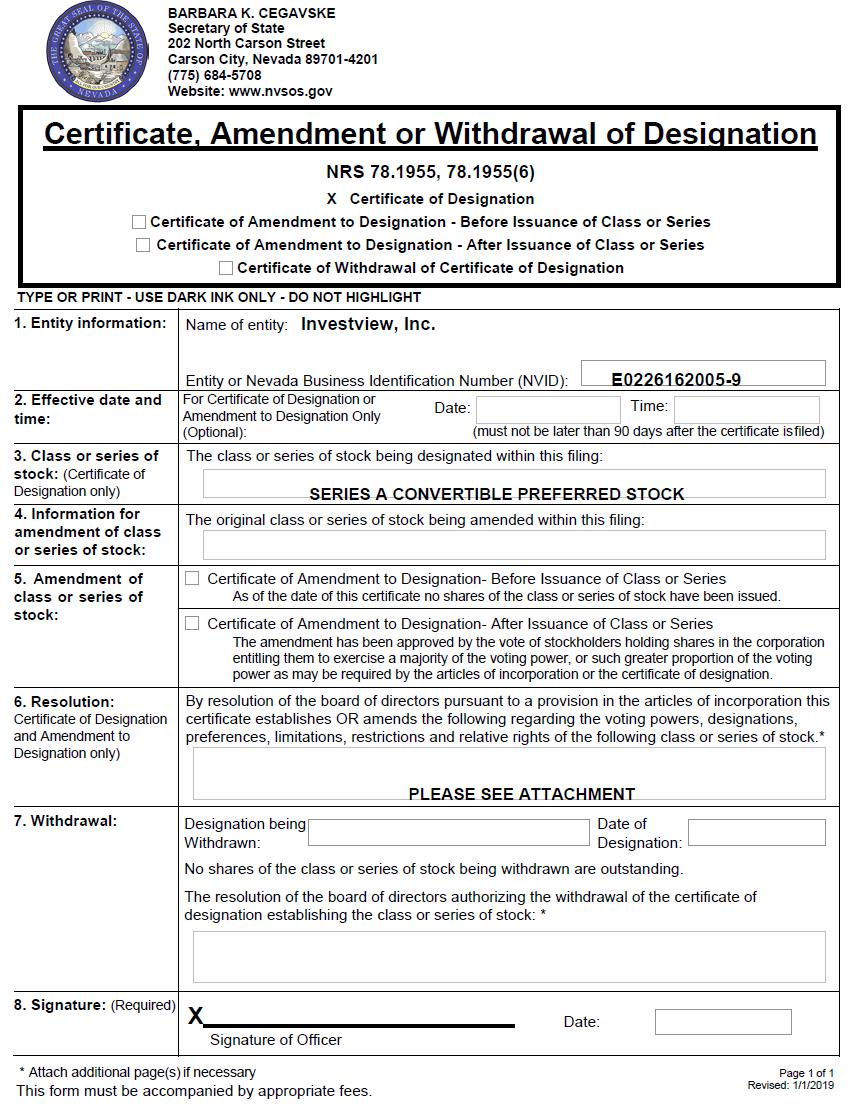

Exhibit (d)(1)

FORM OF CERTIFICATE OF DESIGNATION FOR

SERIES A CONVERTIBLE PREFERRED STOCK

OF INVESTVIEW, INC.

1.Designation, Number and Par Value. The shares of a series of Preferred Stock shall be designated as “Series A Convertible Preferred Stock” (“Series A Preferred”). The number of shares which shall constitute Series A Preferred shall be 6,000,000 shares. Shares of Series A Preferred shall have a par value of $0.001 per share.

2.Dividends.

(a) For so long as any shares of Series A Preferred shall be outstanding and until all shares of Series A Preferred are redeemed by the Corporation, the holders of shares of Series A Preferred shall be entitled to receive cumulative dividends at the annual rate of 12% per annum of the liquidation price, equal to $1.20 per share. Cumulative dividends on outstanding shares of Series A Preferred shall accrue from the date of the issuance of such shares (the “Issue Date”) through and including the date of redemption for all such shares. Such cumulative dividends shall be payable in cash, in kind or in shares of the Corporation’s common stock, par value $0.001 per share (the “Common Stock”) or Series A Preferred, at the option of the Corporation as set forth below, quarterly in arrears on the first day of the months of March, June, September and December or, in the event such date is not a Business Day, on the first Business Day immediately following such date. The dividend accrued for any period which is less than a quarter shall be computed on a pro rata basis for the actual number of days elapsed in the period for which payable, including the date of payment. Such dividends shall be paid to the holders of record of the Series A Preferred at the close of business on the date specified by the Board of Directors of the Corporation at the time such dividend is declared;provided,however, that such date shall not be more than 50 days nor less than ten days prior to the date on which such dividend is payable.

(b) At the option of the Corporation, dividends on Series A Preferred may be paid in that number of shares of Common Stock equal to the quotient of (A) the amount of dividends to be so paid divided by (B) the Current Market Price (as defined below) per share of Common Stock or Series A Preferred. “Current Market Price” means the ten-day average of the daily Closing Price per share of the Common Stock or Series A Preferred on each of the five consecutive Trading Days preceding and following the Dividend Payment Date. “Closing Price” means, with respect to the Common Stock or Series A Preferred on any date of determination, the closing sale price or, if no closing sale price is reported, the last reported sale price of the shares of the Common Stock or Series A Preferred as reported on an national securities exchange of the NASDAQ Stock Market or the New York Stock Exchange (an “Approved Market”) on such date. If the Common Stock or Series A Preferred is not traded on an Approved Market, the Closing Price of the Common Stock or Series A Preferred on such date of determination means the closing sale price as reported in the composite transactions for the principal U.S. national or regional securities exchange on which the Common Stock or Series A Preferred is so listed or quoted, or, if no closing sale price is reported, the last reported sale price on the principal U.S. national or regional securities exchange on which the Common Stock or Series A Preferred is so listed or quoted, or if the Common Stock or Series A Preferred is not so listed or quoted on a U.S. national or regional securities exchange, the last quoted bid price for the Common Stock or Series A Preferred in the over-the-counter market on a marketplace tier of the OTC Markets Group or, if that bid price is not available, the market price of the Common Stock or Series A Preferred on that date as determined in good faith by the Board of Directors. “Trading Day” means a day during which the trading of securities generally occurs on the Approved Market or other principal U.S. national or regional securities exchange on which the Common Stock is then listed or if the Common Stock is not then listed or quoted on an Approved Market or a U.S. national or regional securities exchange, on the over-the-counter market on which the Common Stock is then quoted.

(c) Unless all accrued dividends on the Series A Preferred shall have been paid or declared, and a sum sufficient for the payment thereof set apart, no dividend, whether in cash or property, shall be paid or declared, nor shall any distribution be made, on any other class or series of common stock or preferred stock of the Corporation (“Junior Stock”), nor shall any shares of any Junior Stock be purchased, redeemed or otherwise acquired for value by the Corporation or by any subsidiary of the Corporation, directly or indirectly, unless the holder(s) of a majority of the shares of Series A Preferred, voting as a class, shall approve such dividend, distribution, purchase, redemption or acquisition.

3.Priority of Ranking. Shares of Series A Preferred shall, with respect to distribution rights upon the liquidation, dissolution or winding-up of the affairs of the Corporation and dividend rights, rank senior to all classes or series of common stock and preferred stock of the Corporation, whether now existing or hereafter created.

4.Liquidation, Dissolution or Winding-Up.

(a) In the event of a voluntary or involuntary liquidation, dissolution or winding-up of the affairs of the Corporation, the holders of shares of Series A Preferred shall be entitled to receive a liquidation value of $10.00 per share, plus accrued dividends thereon payable in cash, before any payment to any holders of any Junior Stock.

(b) If such payments shall have been made in full to the holders of shares of Series A Preferred, the remaining assets and funds of the Corporation shall be distributed among the holders of outstanding shares of Junior Stock, according to their respective rights and preferences. If, upon any liquidation, dissolution or winding-up of the affairs of the Corporation, the amounts so payable are not paid in full to the holders of all outstanding shares of Series A Preferred, the holders of shares of Series A Preferred shall share ratably in any distribution of assets in proportion to the full amounts to which they would otherwise be respectively entitled. Neither the consolidation or merger of the Corporation, nor the sale, lease or conveyance of all or a part of its assets (a “Liquidation Transaction”), shall be deemed a liquidation, dissolution or winding-up of the affairs of the Corporation within the meaning of this Section 4(b).

5.Voting Rights.

(a) Holders of shares of Series A Preferred shall be entitled, in addition to the voting and other rights set forth in subsection (b) of this Section 5 or as mandated in the Nevada Revised Statutes in effect at such time, to five hundred (500) votes per share (as adjusted for subdivision, combinations and reclassifications of the Common Stock) and shall vote together with the holders of Common Stock and of any other class or series of stock which may similarly be entitled to vote with the holders of Common Stock as a single class upon all matters upon which stockholders are entitled to vote.

(b) So long as any shares of Series A Preferred are outstanding, the consent of the holders of at least a majority of shares of Series A Preferred at the time outstanding, given in person or by proxy, either in writing without a meeting or by vote at any meeting called for such purpose, shall be necessary for approving, adopting or ratifying any amendment, alteration or repeal of any of the provisions of the Articles of Incorporation or of the Bylaws of the Corporation which adversely affects the rights or preferences of the holders of the Series A Preferred or the authorization, creation or issuance of, or the increase in the authorized amount of, any stock or any security convertible into any stock;provided,however, that neither (x) the amendment of the provisions of the Corporation’s Articles of Incorporation or Bylaws so as to authorize, create or increase the authorized amount of any stock or any security convertible into any stock ranking junior in all rights and preferences to the Series A Preferred nor (y) the authorization, creation or issuance of, or the increase in the authorized amount of, any stock or any security convertible into any stock ranking junior in all rights and preferences to the Series A Preferred, shall be deemed to adversely affect the rights of the holders of the Series A Preferred.

6.Conversion Rights.

(a)Right of Holder to Convert.

(i)Optional Conversion. Each holder of Series A Preferred shall have the right to convert, at any time and from time to time, and without the payment of additional consideration by the holder thereof, any or all of such holder’s shares of Series A Preferred into such number of fully paid and nonassessable shares of Common Stock equal to the product of (A) the number of shares of Series A Preferred being so converted and (B) the quotient of the Liquidation Preference divided by the Conversion Price (as defined below) in effect at the time of conversion, with such adjustment for fractional shares as set forth pursuant to Section 6(f). The “Conversion Price” shall be $0.02, subject to adjustment as provided in Section 6(c). Each share of Series A Preferred shall thus at the Issue Date be convertible into 500 shares of Common Stock, subject to adjustment as set forth herein.

(ii)Mechanics of Conversion. Before any holder of Series A Preferred shall be entitled to convert the same into shares of Common Stock, such holder shall surrender the certificate or certificates therefor, duly endorsed (or a reasonably acceptable affidavit and indemnity undertaking in the case of a lost, stolen or destroyed certificate), at the office of the Corporation or of any transfer agent for such series of Series A Preferred, and shall provide the Corporation the name or names in which the certificate or certificates for shares of Common Stock are to be issued. The date on which a holder complies with the procedures in this clause (ii) is the “Optional Conversion Date.” The Corporation shall, as soon as practicable thereafter, issue and deliver to such holder of Series A Preferred, or to the nominee or nominees of such holder, a certificate or certificates for the number of shares of Common Stock to which such holder shall be entitled as aforesaid and a certificate for the remaining number of shares of Series A Preferred if less than all of the Series A Preferred evidenced by the certificate were surrendered. Such conversion shall be deemed to have been made immediately prior to the close of business on the Optional Conversion Date, and the person or persons entitled to receive the shares of Common Stock issuable upon the Optional Conversion Date shall be treated for all purposes as the record holder or holders of such shares of Common Stock as of such date.

(b)Right of Corporation to Convert.

(i)Mandatory Conversion. The Corporation shall have the right, in its sole discretion, to cause the Series A Preferred, in whole but not in part, to be automatically converted into that number of fully paid and nonassessable shares of Common Stock for each share of Series A Preferred Stock equal to the quotient of (A) the Liquidation Preference divided by (B) the Conversion Price in effect at the time of conversion, with such adjustment or cash payment for fractional shares as set forth pursuant to Section 6(f). The Corporation may exercise its right to cause a mandatory conversion pursuant to this Section 6(b)(i) at any time after the earlier of (A) such date when the Common Stock commences trading on an Approved Market or other national securities exchange or (B) December 31, 2022 (the “Mandatory Conversion Notice Date”).

(ii)Notice. To exercise the mandatory conversion right described in Section 6(b)(i), a written notice (the “Mandatory Conversion Notice”) shall be sent by or on behalf of the Corporation, by first class mail, postage prepaid, to the holders of record of Series A Preferred as they appear on the stock register of the Corporation up to 10 days and no more than 30 days prior to the Mandatory Conversion Notice Date (A) notifying such holders of the Corporation’s intent to exercise its mandatory conversion right and of the date of the mandatory conversion, which date shall not be less than 5 days nor be more than 30 days after the Mandatory Conversion Notice Date (the “Mandatory Conversion Date”), and (ii) stating the office of the Corporation or of any transfer agent for such series of Series A Preferred Stock at which the shares of Series A Preferred called for conversion shall, upon presentation and surrender of the certificate(s) (or a reasonably acceptable affidavit and indemnity undertaking in the case of a lost, stolen or destroyed certificate) evidencing such shares, be converted, and the Conversion Price to be applied thereto. The Corporation shall also issue a press release containing such information and publish such information on its website; provided that, failure to issue such press release or publish such information on the Corporation’s website shall not act to prevent or delay conversion pursuant to this Section 6(b).

(iii)Mandatory Conversion Mechanics. The Corporation shall deliver to the transfer agent for such series of Series A Preferred irrevocable written instructions authorizing the transfer agent, on behalf and at the expense of the Corporation, to cause the Mandatory Conversion Notice to be duly mailed as soon as practicable after receipt of such irrevocable instructions from the Corporation and in accordance with the above provisions. The shares of Common Stock to be issued upon conversion of the Series A Preferred pursuant to this Section 6(b) and cash with respect to any accrued and unpaid dividends as provided in Section 6(b)(iv) and cash in an amount sufficient to cover payment for fractional shares as contemplated by Section 6(h) shall be deposited with the transfer agent in trust at least one Business Day prior to the Mandatory Conversion Date, for the pro rata benefit of the holders of record as they appear on the stock register of the Corporation, so as to be and continue to be available therefor. Neither failure to mail such Mandatory Conversion Notice to one or more such holders nor any defect in such Mandatory Conversion Notice shall affect the sufficiency of the proceedings for conversion as to other holders.

(iv)Accumulated Dividends. The Corporation may not authorize the mandatory conversion pursuant to Section 6(b) unless, prior to giving the Mandatory Conversion Notice, all accrued and unpaid dividends on the Series A Preferred Stock for periods ended prior to the date of such Mandatory Conversion Notice shall have been declared and paid.

(c)Conversion Price Adjustments of Series A Preferred. The Conversion Price shall be subject to adjustment from time to time as follows:

(i)Adjustment for Stock Splits, Subdivisions, Reclassifications or Combinations. If the Corporation, at any time after the Issue Date, (A) pays a dividend or otherwise distributes to holders of its Common Stock, as such, shares of its capital stock (whether Common Stock or capital stock of any other class), (B) subdivides its outstanding shares of Common Stock into a greater number of shares of Common Stock, (C) combines its outstanding shares of Common Stock into a smaller number of shares of Common Stock, or (D) issues any shares of its capital stock in a reclassification of its outstanding shares of Common Stock (including any such reclassification in connection with a consolidation, merger or other business combination transaction in which the Corporation is the continuing or surviving corporation), the Conversion Price in effect at the time of the record date for such dividend or distribution or the effective date of such subdivision, combination or reclassification shall be adjusted to the number obtained by multiplying such Conversion Price by a fraction, the numerator of which shall be the number of shares of Common Stock outstanding immediately prior to such action and the denominator of which shall be the number of shares of Common Stock outstanding immediately following such action. For the purposes of this Section 6(c)(i), the number of shares of Common Stock at any time outstanding shall not include shares held in the treasury of the Corporation.

(ii)Adjustment for Consolidation, Merger or Sale. If at any time or from time to time on or after the Issue Date, any Liquidation Transaction shall be effected, then, as a condition of such Liquidation Transaction, lawful and adequate provision shall be made whereby each holder of Series A Preferred shall then have the right to convert the Series A Preferred into the kind and amount of stock and other securities and property receivable upon such Liquidation Transaction by holders of the maximum number of shares of Common Stock into which such shares of Series A Preferred could have been converted immediately prior to such Liquidation Transaction, all subject to further adjustment as provided herein or with respect to such other securities or property by the terms thereof.

(d)Other Distributions. In the event the Corporation shall declare a distribution (other than a subdivision, combination or merger or sale of assets transaction provided for elsewhere in this Section 6 or in Section 4) payable in securities of other persons, evidences of indebtedness issued by the Corporation or other persons, assets (excluding cash dividends) or options or rights not referred to in Section 6(c)(i), then, in each such case for the purpose of this Section 6(d), the holders of Series A Preferred shall be entitled to a proportionate share of any such distribution as though they were the holders of the number of shares of Common Stock of the Corporation into which their shares of Series A Preferred are convertible as of the record date fixed for the determination of the holders of Common Stock of the Corporation entitled to receive such distribution.

(e)Termination of Conversion Rights. In the event of a notice of redemption of any shares of Series A Preferred pursuant to Section 7, the conversion rights of the shares designated for redemption shall terminate at the close of business on the last full day preceding the date fixed for redemption, unless the redemption price is not paid on such redemption date, in which case the conversion rights for such shares shall continue until such price is paid in full. In the event of a liquidation, dissolution or winding-up of the Corporation or a Liquidation Transaction, the conversion rights shall terminate at the close of business on the last full day preceding the date fixed for the payment of any such amounts distributable on such event to the holders of Series A Preferred.

(f)No Fractional Shares. No fractional shares shall be issued upon the conversion of any share or shares of the Series A Preferred, and the number of shares of Common Stock to be issued shall be rounded down to the nearest whole share. The number of shares issuable upon such conversion shall be determined on the basis of the total number of shares of Series A Preferred the holder is at the time converting (or are being automatically converted) into Common Stock and the number of shares of Common Stock issuable upon such aggregate conversion. If the conversion would result in any fractional share, the Corporation may, in lieu of issuing any such fractional share, pay the holder thereof an amount in cash equal to the fair market value of such fractional share of Common Stock on the date of conversion.

(g)Certificate as to Adjustments. Upon the occurrence of each adjustment or readjustment of the Conversion Price pursuant to this Section 6, the Corporation, at its expense, shall promptly compute such adjustment or readjustment in accordance with the terms hereof and prepare and furnish to each holder of such Series A Preferred a certificate setting forth such adjustment or readjustment and showing in detail the facts upon which such adjustment or readjustment is based. The Corporation shall, upon the written request at any time of any holder of Series A Preferred, furnish or cause to be furnished to such holder a like certificate setting forth (i) such adjustment and readjustment, (ii) the Conversion Price at the time in effect, and (iii) the number of shares of Common Stock and the amount, if any, of other property which at the time would be received upon the conversion of a share of Series A Preferred.

(h)Notices of Record Date. In the event of any taking by the Corporation of a record of the holders of any class of securities for the purpose of determining the holders thereof who are entitled to receive any dividend (other than a cash dividend) or other distribution, any right to subscribe for, purchase or otherwise acquire any shares of stock of any class or any other securities or property, or to receive any other right, the Corporation shall mail to each holder of Series A Preferred, at least ten days prior to the date specified therein, a notice specifying the date on which any such record is to be taken for the purpose of such dividend, distribution or right, and the amount and character of such dividend, distribution or right.

(i)Reservation of Stock Issuable Upon Conversion. The Corporation shall at all times reserve and keep available out of its authorized but unissued shares of Common Stock, solely for the purpose of effecting the conversion of the shares of Series A Preferred, such number of its shares of Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding shares of Series A Preferred; and if at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all then outstanding shares of such series of Series A Preferred, in addition to such other remedies as shall be available to the holders of such Series A Preferred, the Corporation will take such corporate action as may, in the opinion of its counsel, be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purposes, including, without limitation, engaging in best efforts to obtain the requisite stockholder approval of any necessary amendment to the Articles of Incorporation.

7.Optional Redemption.

(a) (i) At any time, and from time to time, commencing one year after the Issue Date, the Corporation may, at its option (subject to the other provisions of this Section 7), subject to restrictions on payment of dividends, redemption payments and other distributions contained in any material agreement pursuant to which the Corporation is subject, redeem all or part of the outstanding shares of Series A Preferred at a price equal to 125% of the liquidation value per share, or $12.50 per share (as adjusted for stock splits, recapitalizations, reclassifications and similar events), together with accrued dividends to the redemption date.

(ii) The right of the Corporation to redeem shares of Series A Preferred pursuant to this Section 7(a) shall be conditioned upon its giving notice of redemption, signed by its President or a Vice President and by its Treasurer or an Assistant Treasurer, to each holder of Series A Preferred, not less than 20 Business Days prior to the date upon which the redemption is to be made specifying (A) the total number of shares of the Series A Preferred to be redeemed, (B) the shares of Series A Preferred held by such holder which are to be redeemed, (C) the date of such redemption (which must be a Business Day), (D) the accumulated and unpaid dividends (up to but not including the date upon which the redemption is to be made) and (E) that the redemption is being made pursuant to this Section 7(b). Notice of redemption having been so given, the total price for the number of shares of the Series A Preferred so specified in such notice, together with all accrued dividends thereon, shall become due and payable on the specified redemption date.

(iii) In the event that a redemption under this Section 7 does not redeem all outstanding shares of the Series A Preferred, the shares of Series A Preferred to be redeemed shall be selected among all Series A Preferred at the time outstanding, in proportion, as nearly as practicable, to the respective number of shares of Series A Preferred held by each holder of Series A Preferred.

(b)Payment in Federal Funds. (i) On any date set for redemption under this Section 7, the Corporation shall redeem the shares of Series A Preferred at the redemption price set therefor by payment in federal or other immediately available funds by bank check or, if requested by the holder of such shares, by wire transfer to the account (as designated to the Corporation) of such holder or nominee at any bank or trust corporation in the United States of America.

(ii) On the date fixed for redemption, the holders of shares of Series A Preferred to be redeemed shall surrender the certificates for such shares to be redeemed to the Corporation at its principal office (or such other office or agency as may be designated by the Corporation by notice in writing to the holders of Series A Preferred);provided,however, that if, on the date fixed for redemption, funds necessary for the redemption shall be available therefor and shall have been irrevocably deposited or set aside, then, notwithstanding that the certificates evidencing any shares so called for redemption shall not have been surrendered, no dividends with respect to such shares shall accrue after the date fixed for redemption, such shares shall no longer be deemed outstanding, the holders thereof shall cease to be stockholders, and all rights whatsoever with respect to such shares so called for redemption (except the right of the holders to receive the redemption price set therefor in accordance with this Section 7 without interest upon their surrender of the certificates therefor) shall terminate. Any monies deposited by the Corporation pursuant to the foregoing provision and unclaimed at the end of one year from the date fixed for redemption shall, to the extent permitted by law, be returned to the Corporation, after which return the holders of shares of Series A Preferred so called for redemption shall look only to the Corporation for the payment thereof. Shares of Series A Preferred redeemed by the Corporation shall be restored to the status of authorized but unissued shares of Preferred Stock of the Corporation, undesignated as to series, and may thereafter be reissued, but not as shares of Series A Preferred.

8.Right of Participation.

(a) From and after the Issue Date and to and through December 31, 2021 (when the rights set forth in this Section 8 shall terminate), at any time the Corporation makes any nonpublic offering or sale of any capital stock, warrants, rights, calls, options, debt or other securities exchangeable or exercisable for or convertible into Common Stock of the Corporation (“Equity Securities”), the holders of shares of Series A Preferred shall be afforded the opportunity to acquire from the Corporation at a 25% discount to the price as such securities are proposed to be offered to others, Equity Securities of the same type in the aggregate amount required to enable it to maintain its proportionate Common Stock-equivalent interest in the Corporation and/or its subsidiaries immediately prior to any such issuance of Equity Securities. Notwithstanding the foregoing, the term “Equity Securities” shall not include any issuances made: (a) to employees, officers, directors, consultants and advisors of the Corporation pursuant to any incentive plan, stock purchase plan, agreement or other arrangement duly adopted by the Corporation and approved by the compensation committee of the Board; (b) upon exercise of warrants; (c) upon issuance or conversion of the Series A Preferred; (c) in connection with a merger, acquisition, asset acquisition, lease, joint venture or similar acquisitive transaction approved by the Board; and (d) for services to financial institutions in connection with investment banking, commercial credit transactions, equipment financing or similar transactions approved by the Board. The amount of Equity Securities that a holder shall be entitled to purchase in the aggregate shall be determined by multiplying (i) the total number or principal amount of such offered Equity Securities by (ii) a fraction, (x) the numerator of which is the number of shares of Common Stock held by the holder (determined on an as-converted basis), and (y) the denominator of which is the number of shares of Common Stock then outstanding (determined on an as-converted basis with respect to the holder’s holdings).

(b) In the event the Corporation proposes to offer or sell Equity Securities, it shall give holders of shares of Series A Preferred written notice of its intention, describing the price (or range of prices), anticipated type and amount of securities, timing and other terms upon which the Corporation proposes to offer the same, no later than ten Business Days after the Corporation proposes to pursue any other offering. Holders shall have ten Business Days from the date such a notice is given to notify the Corporation in writing that it intends to exercise its rights provided in this Section 8 and as to the amount of Equity Securities the holder desires to purchase, up to the maximum amount calculated pursuant to Section 8(a).

(c)Purchase Mechanism. If a holder of shares of Series A Preferred exercises its rights provided in this Section 8, the closing of the purchase of the Equity Securities with respect to which such right has been exercised shall take place within 30 days after the giving of notice of such exercise, which period of time shall be extended for a maximum of one month at the election of the holder in order to comply with applicable laws and regulations (including receipt of any applicable regulatory or stockholder approvals). The Corporation agrees to use its reasonable commercial efforts to secure any regulatory or stockholder approvals or other consents, and to comply with any law or regulation necessary in connection with the offer, sale and purchase of, such Equity Securities.

(d)Failure of Purchase. In the event a holder of shares of Series A Preferred does not exercise the rights provided in this Section 8 within the ten Business Day period or, if so exercised, the holder is unable to consummate such purchase within the time period specified in Section 8(c), the Corporation shall thereafter be entitled (during the period of 90 days following the conclusion of the applicable period) to sell or enter into an agreement (pursuant to which the sale of the Equity Securities covered thereby shall be consummated, if at all, within 90 days from the date of said agreement) to sell the Equity Securities not elected to be purchased pursuant to this Section 8(d), at a price and upon terms, taken together in the aggregate, no more favorable to the purchasers of such securities than were specified in the Corporation’s notice to holders. In the event the Corporation has not sold the Equity Securities or entered into an agreement to sell the Equity Securities within such 90-day period (or sold and issued Equity Securities in accordance with the foregoing within 90 days from the date of said agreement), the Corporation shall not thereafter offer, issue or sell such Equity Securities without first offering such securities to Investor in the manner provided above.

9.No Other Rights. The shares of Series A Preferred shall not have any relative powers, preferences or rights, nor any qualifications, limitations or restrictions thereof, other than as set forth herein, in the Articles of Incorporation or pursuant to the Nevada Revised Statutes in effect at such time.

10.Business Day. The term “Business Day” shall mean any day other than a Saturday, Sunday or other day on which banks in the State of Nevada are required or authorized to be closed.

11.Notices. All notices and other correspondence to be delivered to the holders of Series A Preferred shall be given, unless otherwise indicated, by first-class mail, postage prepaid, to each holder of record as its address appears in the stock register of the Corporation.