- CCEL Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Cryo-Cell International (CCEL) DEF 14ADefinitive proxy

Filed: 1 Oct 21, 5:01pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant: ☒ Filed by a Party other than the Registrant: ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement | |||

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

☒ | Definitive Proxy Statement | |||

☐ | Definitive Additional Materials | |||

☐

| Soliciting Material Pursuant under § 240.14a-12

| |||

CRYO-CELL INTERNATIONAL, INC. | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

☒ | No fee required. | |||

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies:

| |||

| ||||

(2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

(4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

(5) | Total fee paid: | |||

| ||||

☐ | Fee paid previously with preliminary materials. | |||

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid:

| |||

| ||||

(2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

(3) | Filing Party:

| |||

| ||||

(4) | Date Filed:

| |||

| ||||

PROXY STATEMENT

CRYO-CELL INTERNATIONAL, INC.

700 BROOKER CREEK BOULEVARD

SUITE 1800

OLDSMAR, FLORIDA 34677

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on October 20, 2021

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder meeting to be held October 20, 2021

The Proxy Statement and our 2020 Annual Report on Form 10-K are available on the Internet at

http://www.proxydocs.com/CCEL

To the Shareholders of Cryo-Cell International, Inc.:

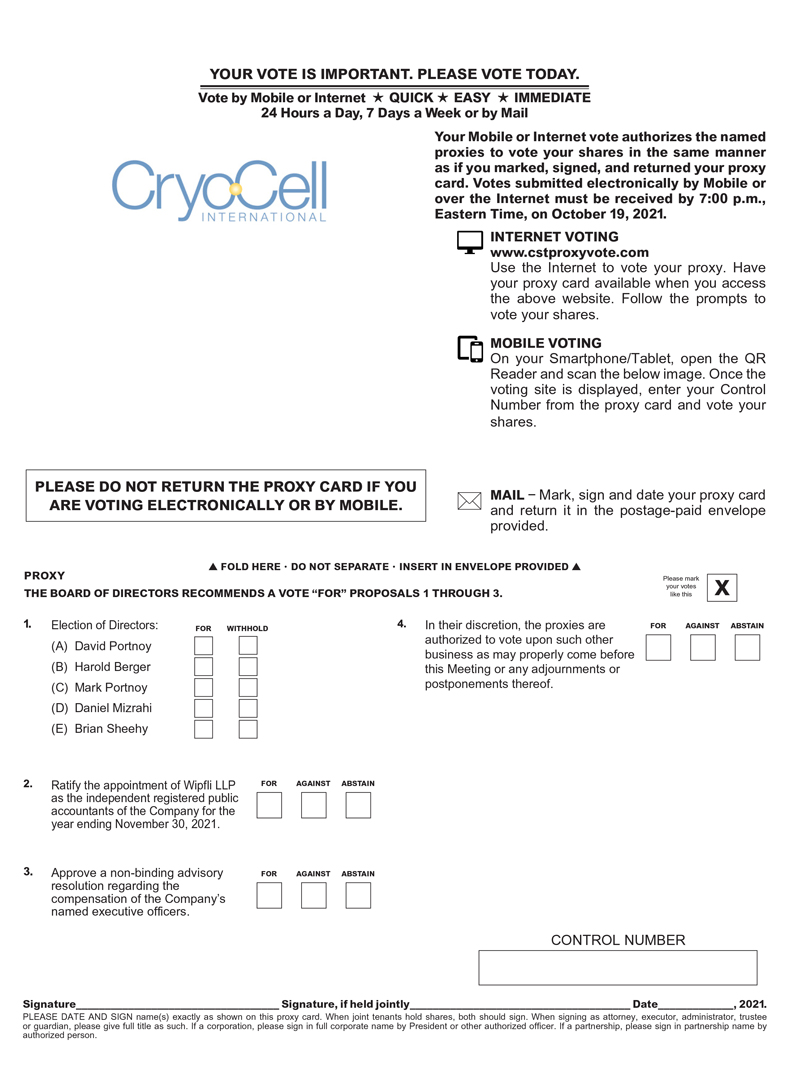

Notice is hereby given that the 2021 Annual Meeting of the Shareholders of Cryo-Cell International, Inc. (the “Company”) will be held on Wednesday, October 20, 2021 at 10:00 a.m., local time, at Cryo-Cell International, Inc., 700 Brooker Creek Blvd., Suite 1800, Oldsmar, Florida 34677. The meeting is called for the following purposes:

| 1 | To consider for election five individuals named in the attached proxy statement to the Company’s Board of Directors; |

| 2 | To ratify the appointment of Wipfli LLP as our independent registered public accountants for the fiscal year ending November 30, 2021; |

| 3 | To consider and approve a non-binding advisory resolution regarding the compensation of the Company’s named executive officers; |

| 4 | To consider and take action upon such other matters as may properly be brought before the meeting or any postponements or adjournments thereof by or at the direction of the Board of Directors. |

The close of business on September 20, 2021, has been fixed as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting.

A proxy for the meeting is enclosed with this Notice of Annual Meeting of Shareholders and the accompanying Proxy Statement. You are requested to complete and return the accompanying proxy card, which is solicited by the Company’s Board of Directors, in the enclosed envelope, or submit a proxy via the Internet or telephone, to be sure that your shares will be represented and voted at the Annual Meeting. The enclosed proxy card contains instructions on submitting a proxy via the Internet or telephone or, if your shares are registered in the name of a broker or bank, your broker or bank will provide instructions, including as to providing voting instructions over the Internet or by telephone.

It is important that your shares be represented at the Annual Meeting, regardless of the number of shares you hold or whether you plan to attend the meeting in person. I urge you to read the accompanying Proxy Statement and submit a proxy for your shares as soon as possible.

By Order of the Board of Directors, |

|

David Portnoy |

Chairman and Co-Chief Executive Officer |

Dated: October 1, 2021

PROXY STATEMENT

CRYO-CELL INTERNATIONAL, INC.

This Proxy Statement is furnished to the shareholders of Cryo-Cell International, Inc. (the “Company”) in connection with the Annual Meeting of Shareholders and any adjournments or postponements thereof. The meeting will be held at Cryo-Cell International, Inc., 700 Brooker Creek Blvd., Suite 1800, Oldsmar, Florida 34677, on October 20, 2021 at 10:00 a.m., local time.

This Proxy Statement and the Notice of Annual Meeting are being provided to shareholders beginning on or about October 1, 2021. A copy of the Company’s Annual Report on Form 10-K for the fiscal year ended November 30, 2020 accompanies this Proxy Statement. The Company, a Delaware corporation, has its principal executive offices at 700 Brooker Creek Boulevard, Suite 1800, Oldsmar, Florida 34677.

The Annual Meeting is being held for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders.

Shareholders Entitled to Vote

Only holders of record of our shares of common stock at the close of business on September 20, 2021 are entitled to notice of and to vote at the meeting and at any adjournments or postponements of the meeting. Each share entitles its holder to one vote on each matter presented at the meeting. The holders of one-third of the shares entitled to vote at the meeting must be present in person or represented by proxy in order to constitute a quorum for all matters to come before the meeting. On the record date, there were 8,529,647 shares outstanding.

Vote Required

As provided in the Company’s bylaws, directors are elected by a plurality of votes cast. This means that the five candidates receiving the highest number of “FOR” votes will be elected. In the election of directors, you may vote “FOR” or “WITHHOLD” with respect to each of the nominees. A properly executed proxy card marked “WITHHOLD” with respect to the election of a director nominee will be counted for purposes of determining if there is a quorum at the Annual Meeting but will not be considered to have been voted for or against the director nominee. Withhold votes will have no effect on the outcome of the election.

When voting on all other business matters, you may vote “FOR,” “AGAINST” or “ABSTAIN.”

Approval of each of Proposals 2 and 3 requires a majority of votes cast affirmatively or negatively at a meeting by the holders of shares entitled to vote thereon. Broker non-votes and abstentions will have no effect on the outcome of the vote on such Proposals because they do not count as a vote cast.

As to the advisory, non-binding resolution with respect to our executive compensation as described in this Proxy Statement, while this vote is required by law, it will neither be binding on the Company or the Board of Directors, nor will it create or imply any change in the fiduciary duties of, or impose any additional fiduciary duty on, the Company or the Board of Directors.

No proposals other than those identified on the Notice of Annual Meeting were submitted to the Company pursuant to the advance notice provisions of the Company’s bylaws. Thus, any other proposals raised at the Annual Meeting, other than procedural matters raised by the Chairman of the Annual Meeting, will be ruled out of order.

On March 8, 2018, the Company entered into Stockholder Agreements with George Gaines, a former member of the Board of Directors of the Company, David Portnoy, Co-Chief Executive Officer of the Company

and Mark Portnoy, Co-Chief Executive Officer of the Company (“Restricted Stockholders”), copies of which were filed on March 13, 2018 with the Securities and Exchange Commission under cover of Form 8-K. Pursuant to the Stockholder Agreements, the Restricted Stockholders may vote their shares of Common Stock of the Company up to their respective Voting Percentage Limit in their discretion with regard to the election of directors and all other matters. For this purpose, “Voting Percentage Limit” means 14.35% of the Common Stock outstanding on the record date for Mr. David Portnoy, 9.5% of the Common Stock outstanding on the record date for Mr. Mark Portnoy, and 11.15% of the Common Stock outstanding on the record date for Mr. George Gaines. If a Restricted Stockholder owns shares of Common Stock in excess of his respective Voting Percentage Limit, such person must vote such shares:

| • | With respect to Proposal 1, in the same proportion as the Common Stock not beneficially owned by Mr. David Portnoy, Mr. Mark Portnoy or Mr. George Gaines are voted affirmatively “for” or to “withhold authority” with respect to, as applicable, the election of each person nominated to serve as a director. |

| • | With respect to all other Proposals, in the same proportion as the Common Stock not beneficially owned by any current officer or director are voted “for” or “against”, or “abstain” with respect to, each such Proposal. For this purpose, broker non-votes and all shares of Common Stock that are not present, in person or by proxy, at the Annual Meeting are not considered. |

Copies of the Stockholders Agreements are attached as Exhibits 10.3, 10.4 and 10.5, respectively, to the Current Report on Form 8-K filed with the SEC on March 13, 2018.

No proposals other than those identified on the Notice of Annual Meeting were submitted to the Company pursuant to the advance notice provisions of the Company’s bylaws. Thus, any other proposals raised at the Annual Meeting, other than procedural matters raised by the Chairman of the Annual Meeting, will be ruled out of order.

How to Vote

Your vote is very important to the Board no matter how many shares of Common Stock you own. Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares today.

If You Are a Record Holder of Common Stock

If you are a record holder of Common Stock (including unvested restricted stock), you may vote your shares either by submitting a proxy in advance of the Annual Meeting or by voting in person at the Annual Meeting. By submitting a proxy, you are legally authorizing another person to vote your shares on your behalf. We urge you to use the enclosed proxy card to vote FOR the Board’s nominees and FOR Proposals 2 and 3. If you submit the executed proxy card which accompanies this proxy statement, but you do not indicate how your shares are to be voted, then your shares will be voted in accordance with the Board’s recommendations set forth in this Proxy Statement. In addition, if any other matters are brought before the Annual Meeting (other than the Proposals contained in this Proxy Statement), then the individuals listed on the proxy card will have the authority to vote your shares on those other matters in accordance with their discretion and judgment.

Whether or not you plan to attend the Annual Meeting, we urge you to promptly submit a proxy by signing, dating and returning the enclosed proxy card in the postage-paid envelope provided. If you later decide to attend the Annual Meeting and vote in person, that vote will automatically revoke any previously submitted proxy.

If You Hold Your Shares in “Street Name”

If you hold your shares in “street name,” i.e., through a bank, broker or other holder of record (a “custodian”), your custodian is required to vote your shares on your behalf in accordance with your instructions.

2

Please note that if you intend to vote your street name shares in person at the Annual Meeting, you must provide a “legal proxy” from your custodian at the Annual Meeting.

Under applicable rules, brokers who hold shares in “street name” for customers (including securities like our Common Stock) have the authority to vote on “routine” proposals when they have not received instructions from beneficial owners. However, brokers are precluded from exercising their voting discretion with respect to matters deemed “non-routine,” including any director election, contested matter or other matter that may substantially affect the rights and privileges of stockholders. As a result, absent specific instructions from the beneficial owner of such shares, brokers are not empowered to vote those shares on “non-routine” matters, which are referred to generally as “broker non-votes.” Proposal 2, regarding the ratification of auditors, is considered routine, so that there will be no “broker non votes” on such Proposal. Broker non-votes will have no effect on the outcome of Proposals 1 and 3.

Proxy Revocability

Any proxy given pursuant to this solicitation is revocable at any time prior to the voting at the meeting by (1) delivering written notice to the Secretary of the Company, (2) submitting a later dated proxy, or (3) attending the Annual Meeting and voting in person.

PROPOSAL 1 – ELECTION OF DIRECTORS

The Board has five nominees for election at the Annual Meeting. Each of the nominees named below is currently a director of the Company. If elected, each of the five directors will hold office until the next annual meeting of shareholders and until his or her successor is elected and qualified, or as otherwise provided by the Company’s bylaws or by Delaware law. Each person nominated for election has consented to being named in this proxy statement and has agreed to serve if elected. The Board does not believe that any nominee will be unable to serve.

Nominees for Election of Director

The name, age, principal occupation and other information concerning each current nominee for election as a director are set forth below:

David I. Portnoy, age 58, Chairman and Co-Chief Executive Officer. Mr. Portnoy has served as Chairman of the Board and Co-Chief Executive Officer of the Company since August 2011. Since 2002, Mr. Portnoy has served as Chairman of the Board of Directors of Partner-Community, Inc., which provides software and hardware integration solutions to telecommunication companies and which was awarded the Verizon 2010 Supplier Recognition Award for Outstanding Performance. Mr. Portnoy provided the initial venture capital to Waves Audio Ltd, a leading audio technology company. Mr. Portnoy graduated Magna Cum Laude in 1984 from The Wharton School of Finance at the University of Pennsylvania where he earned a Bachelor of Science Degree in Economics with a joint major in finance and accounting. David I. Portnoy is the brother of Mark L. Portnoy, a director and Co-Chief Executive Officer of the Company. We believe that Mr. Portnoy’s knowledge of the Company having served as its Co-Chief Executive Officer assists the Board with its oversight of the strategic plan of the Company. Additionally, we believe that Mr. Portnoy’s financial and business experiences provide the Board with general business acumen.

Mark L. Portnoy, age 57, Co-Chief Executive Officer. Mr. Portnoy has served as Co-Chief Executive Officer since August 2011. Mr. Portnoy served as a director from August 2011 through September 2020. Additionally, since 2002 and 2007, Mr. Portnoy has served on the boards of directors of Partner-Community, Inc. and uTIPu Inc., a private Internet-based business, respectively. Mr. Portnoy has been engaged in managing his personal investments since April 1997. From January 1995 to April 1997, Mr. Portnoy was employed at Strome, Susskind

3

Investments as its Chief Fixed Income Trader. From March 1986 until November 1991, Mr. Portnoy was employed at Donaldson, Lufkin & Jenrette Securities Corp. as a Fixed Income Arbitrage Trader, with a trading portfolio ranging in size from $1 billion to $7 billion. In addition to the finance experience, Mr. Portnoy’s experience includes negotiating contracts for National Basketball Association (NBA) players totaling approximately $30 million. Mr. Portnoy graduated Phi Beta Kappa from the University of North Carolina at Chapel Hill with a degree in Economics in December 1985. Mark L. Portnoy is the brother of David I. Portnoy, Chairman of the Board and Co-Chief Executive Officer of the Company.

Harold D. Berger, age 57, has served as a director since August 2011. Mr. Berger is a certified public accountant. Prior to opening his own accounting practice in 2005, Mr. Berger was an equity partner with Habif, Arogeti & Wynne, LLP, an accounting firm based in Atlanta, Georgia. Over the past 25 years, Mr. Berger also has served on boards for a variety of charitable organizations. Mr. Berger currently serves as Treasurer and Executive Committee Member of the Holly Lane Foundation (f/k/a The Gatchell Home, Inc.), as Director and Finance committee member of the Jewish Educational Loan Fund, Inc., and as Director and financial adviser to The Atlanta Group Home Foundation, Inc. Mr. Berger graduated in December 1987 from the University of Texas at Austin with a Master’s Degree in Professional Accounting. Mr. Berger is a member of the American Institute of Certified Public Accountants (AICPA) and the Georgia Society of Certified Public Accountants (GSCPA). We believe that Mr. Berger’s years of experience as an auditor and accountant, including expertise in financial accounting, provides the Board and the Audit Committee of the Board with valuable financial and accounting experience.

Brian Sheehy, age 50, has served as a director since 2018. Mr. Sheehy received his B.A. in Biochemistry and Environmental Science from the University of California, Berkeley, his M.A. from University of Exeter and his M.D. from New York Medical College. Mr. Sheehy is the founder and managing partner, since 2010, of IsZo Capital. Mr. Sheehy was the cofounder in 2002 of Black Horse Capital and managing partner until 2008. He is also a Chartered Financial Analyst. We believe that Mr. Sheehy’s experience provides the Board with general business acumen and an increased ability to effectively oversee and assess management’s execution of the Company’s strategic business plan.

Daniel Mizrahi, age 47, has served as a director since September 2021. Since 2012, Mr. Mizrahi has served as CEO of Power Tech, S.A. an overseas company serving over 3,000 retail clients in the Central America region. From 2008-2012, Mr. Mizrahi was the Director of Purchasing for Cohesa, S.A. – Toolcraft, one of the largest tool companies in Mexico with a purchase budget of approximately $60 million per year. From 2003-2008, Mr. Mizrahi served as Property Manager for Maayan, LLC, which represented a group of foreign investors in the acquisition and management of real estate properties in Florida with over 500 residential units. Over the last 10 years, Mr. Mizrahi has, at times, provided consulting services to Cryo-Cell relating to its Central and South American affiliates and also with regard to the international outsourcing of medical products and marketing materials. We believe that Mr. Mizrahi’s experience provides the Board with general business acumen and an increased ability to effectively oversee and assess management’s execution of the Company’s strategic business plan.

OUR BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” EACH OF DAVID PORTNOY, MARK PORTNOY, HAROLD BERGER, BRIAN SHEEHY AND DANIEL MIZRAHI BY EXECUTING AND RETURNING THE ENCLOSED PROXY CARD OR VOTING BY ONE OF THE OTHER WAYS INDICATED THEREON. PROXIES SOLICITED BY THE BOARD WILL BE SO VOTED UNLESS SHAREHOLDERS SPECIFY OTHERWISE.

Other Executive Officers

Biographical information regarding the Company’s executive officers who are not or will not be directors of the Company after the Annual Meeting is set forth below:

Jill Taymans, age 52, is the Company’s Vice President, Finance and Chief Financial Officer. Ms. Taymans joined the Company in April 1997 serving initially as Controller and was appointed Chief Financial Officer in

4

May 1998. Ms. Taymans graduated from the University of Maryland in 1991 with a BS in Accounting. She has worked in the accounting industry for over 25 years in both the public and private sectors. Prior to joining the Company, she served for three years as Controller for a telecommunications company.

Oleg Mikulinsky, age 48, is the Company’s Chief Information Officer. Mr. Mikulinsky has served as Cryo-Cell’s Chief Information Officer since March 2012. Mr. Mikulinsky is a software technologist and serial entrepreneur. He has been a founding member of several software enterprises and most recently served as Chief Technology Officer of Partner-Community, Inc. and Chief Technology Officer at uTIPu Inc. from 2007 to 2009. Before that, Mr. Mikulinsky served as the Director of Enterprise Architecture at WebLayers, Inc., where he defined enterprise architecture best practices for companies like AT&T and Defense Information’s Systems Agency (DISA), as well as for many major banking institutions. He contributed to the development of international systems interoperability standards at OASIS-OPEN.ORG and WS-I.ORG. Prior to starting his professional career as a software engineer in United States, Mr. Mikulinsky studied radio electronics at the Bauman Moscow State Technical University (BMSTU), Russia.

THE BOARD OF DIRECTORS AND ITS COMMITTEES

The business and affairs of the Company are managed under the direction of the board of directors. Currently, the size of the board of directors is set at seven and, as of the date of the Annual Meeting, the size of the board of directors will be set at five members. Each director is elected to hold office for a period of one year or until his or her successor is elected. The Company does not have a policy regarding director attendance at annual meetings of shareholders, although directors are requested to attend these meetings absent unavoidable consequences. Each director of the Company then in office attended the 2020 Annual Meeting of Shareholders.

The board of directors held sixteen meetings during the fiscal year ended November 30, 2020, and each of the directors then in office, attended at least 75% of the regularly scheduled meetings of the board and the committees of the board of which the director was a member. The committees established by the board of directors include the following:

Audit Committee

The current members of the Audit Committee are Messrs. Berger (Chairman), and Mizrahi. The Audit Committee is comprised entirely of non-employee, independent members of the board of directors and operates under a written charter adopted by the board of directors, which is available on the Company’s website at www.cryo-cell.com. The charter sets out the responsibilities, authority and specific duties of the Audit Committee. In addition, the charter specifies the structure and membership requirements of the committee, as well as the relationship of the Audit Committee to the independent auditors and management of the Company.

The Audit Committee assists the board of directors in fulfilling its oversight responsibilities by reviewing the Company’s internal control systems, audit functions, financial reporting processes, the audit of the Company’s financial statements and methods of monitoring compliance with legal and regulatory matters. In performing these functions, the Audit Committee meets periodically with the independent auditors and management to review their work and confirm that they are properly discharging their respective responsibilities. In addition, the Audit Committee appoints and the full board of directors ratifies the Company’s independent auditors. The Audit Committee met four times during the last fiscal year. The members of the Audit Committee are deemed independent as defined in Rule 4200(a)(15) of the Nasdaq listing standards and Rule 10A-3 under the Securities Exchange Act of 1934.

The board of directors has determined that each of the Audit Committee members is able to read and understand fundamental financial statements. In addition, the board of directors has determined that Audit

5

Committee member Mr. Harold Berger is an “Audit Committee financial expert” as that term is defined in Item 407(d)(5) of Regulation S-K promulgated under the Securities Exchange Act of 1934. Mr. Berger’s relevant experience includes his current position as partner at his own accounting practice and his prior position as an equity partner with Habif, Arogeti & Wynne, LLP, an accounting firm based in Atlanta, Georgia. In addition, Mr. Berger has a Master’s Degree in Professional Accounting from the University of Texas at Austin.

Compensation Committee

The current members of the Compensation Committee are Messrs. Berger (Chairman), Mizrahi, and Sheehy. The primary function of the Compensation Committee is to establish and oversee the Company’s compensation policies and programs, which determines management and executive compensation benefits. The Compensation Committee is also responsible for the administration of the Company’s incentive and stock option plans and is the approving authority for management recommendations with respect to option grants. The Compensation Committee met five times during last fiscal year. The Compensation Committee is comprised entirely of non-employee, independent members of the board of directors and operates under a written charter adopted by the board of directors which is available on the Company’s website at www.cryo-cell.com. The charter sets out the responsibilities, authority and specific duties of the Compensation Committee.

Governance Committee

The current members of the Governance Committee are and Messrs. Berger (Chairman), and Mizrahi. The primary focus of the Governance Committee is on the broad range of issues surrounding the composition and operation of the Company’s board of directors. The committee provides assistance to the board of directors in the areas of membership selection, committee selection and rotation practices, evaluation of the overall effectiveness of the board of directors, and review and consideration of developments in corporate governance practices. The committee’s goal is to assure that the composition, practices and operation of the board of directors contribute to value creation and effective representation of the Company’s shareholders.

The Governance Committee has adopted a charter which is available on the Company’s website at www.cryo-cell.com. The charter does not, however, cover the procedures for director nominations made by our board of directors. During the last fiscal year, the Governance Committee met one time.

Nominating Committee

The current members of the Nominating Committee are Messrs. Berger and Mizrahi. The Nominating Committee evaluates the Company’s board of directors and examines the skills and characteristics required of board candidates.

Director Independence and Board Leadership Structure

The Board determined that the following existing directors are independent, as independence is defined in Rule 4200(a)(15) of the Nasdaq listing standards, which we choose to follow: Harold Berger, Brian Sheehy and Daniel Mizrahi.

Mr. David Portnoy serves as our Chairman of the Board. Mr. David Portnoy also serves as Co-Chief Executive Officer of the Company along with Mr. Mark Portnoy, who is the brother of David Portnoy. Messrs. Portnoy and Portnoy have served in these positions since August 2011.

The Board of Directors has an active role, as a whole and also at the committee level, in overseeing management of the Company’s risks. The Board of Directors reviews information regarding the Company’s

6

financial position, liquidity and operations, as well as the risks associated with each. The Compensation Committee is responsible for overseeing the management of risks relating to the Company’s executive compensation plans and arrangements. The Audit Committee oversees potential conflicts of interest. The Governance and Nominating Committees review the Board’s leadership structure to ensure that it is most appropriate for the Company. While each committee is responsible for evaluating certain tasks and overseeing the management of such risks, the entire Board of Directors is regularly informed about such risks.

Director Nomination Process

When a directorship becomes vacant, or the board otherwise determines that an individual should be recruited for possible nomination to the board, the Governance and Nominating Committees, in consultation with the Company’s Co-Chief Executive Officers, will prepare a profile of a candidate expected to provide the most meaningful contribution to the board as a whole. The Nominating Committee will generally consider all of the following: (a) the candidate’s skills, experience and other relevant biographical information, (b) the candidate’s general interest in serving a public corporation, (c) the candidate’s ability to attend board and committee meetings, and (d) any potential concerns regarding independence or conflicts of interest. Following the initial screening, if the Nominating Committee approves a candidate for further review, the Nominating Committee will establish an interview process for the candidate. It is expected that a majority of the members of the Nominating Committees, along with the Company’s Co-Chief Executive Officers, would interview each candidate. At the same time, the Nominating Committee, assisted by the Company’s legal counsel, will conduct a comprehensive conflicts-of-interest assessment for the candidate. The Nominating Committee will then consider reports of the interviews and the conflicts-of-interest assessment and determine whether to recommend the candidate to the full board of directors. Management representatives designated by the Nominating Committee or a search firm selected by the Nominating Committee may assist the process. Any nominee recommended by a shareholder would be subject to the same process.

The Governance and Nominating Committees will consider director-nominees submitted by shareholders. Any shareholder recommendation should be submitted in writing to the Company in care of the Corporate Secretary at 700 Brooker Creek Boulevard, Suite 1800, Oldsmar, Florida 34677, along with the written consent of such nominee to serve as a director if so elected. Any such recommendation by a shareholder shall be referred to the Nominating Committee, and the Nominating Committee, in consultation with the Company’s Co-Chief Executive Officers, will review the nomination in accordance with the Company’s certificate of incorporation, bylaws and applicable laws and regulations. The Nominating Committee considers general business experience, industry experience, experience as a director of other companies, probable tenure if elected and other factors as relevant in evaluating director-nominees.

According to the Company’s bylaws, only persons nominated in accordance with the following procedures shall be eligible for election as directors at an annual shareholders meeting. Nominations of persons for election as directors at an annual meeting of shareholders may be made by or at the direction of the board of directors or by any shareholder of record in the manner described below. For a nomination to be properly made by a shareholder, the shareholder must be a shareholder of record at the time of the giving of notice and must give written notice to the Company’s corporate Secretary so as to be received at the principal executive offices of the Company not more than 90 days and no less than 60 days before the first anniversary of the date on which the Company mailed its proxy materials for the preceding year’s annual meeting, except that if the date of the Annual Meeting has been changed by more than 30 days from the date of the anniversary of the proceeding year’s annual meeting, such notice must be so received no later than the later of the 90th day prior to such annual meeting or the 10th day after the date on which public disclosure of the date of such meeting is first made. The public disclosure of an adjournment of an annual meeting will not commence a new time period for the giving of a timely shareholder notice. Each such notice shall set forth:

| • | the name and address, as they appear on the Company’s books, of the shareholder giving the notice and of the beneficial owner, if any, on whose behalf the nomination is made; |

7

| • | a representation that the shareholder giving the notice is a holder of record of stock of the Company entitled to vote at such annual meeting; |

| • | the class and number of shares of stock of the Company owned beneficially and of record by the shareholder giving the notice and by the beneficial owner, if any, on whose behalf the nomination is made; |

| • | a description of all arrangements or understandings between or among any of (A) the shareholder giving the notice, (B) the beneficial owner on whose behalf the notice is given, (C) each nominee, and (D) any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the shareholder giving the notice; |

| • | such other information regarding each nominee proposed by the shareholder giving the notice as would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC had the nominee been nominated, or intended to be nominated, by the board of directors; |

| • | the signed consent of each nominee to serve as a director of the Company if so elected; |

| • | whether either such shareholder or beneficial owner intends to deliver a proxy statement and form of proxy to holders of at least a majority of shares of capital stock entitled to vote in the election of directors or to otherwise engage in a solicitation of proxies; and |

| • | a representation that such shareholder intends to appear in person or by proxy at the meeting to nominate the persons named in the notice. |

This description of the procedures that must be followed by a stockholder in order to nominate a person for election to the board of directors at an annual meeting of stockholders is not complete and is qualified in its entirety by Article II, Section 10 of the Company’s Bylaws, a copy of which, as amended, is attached as Exhibit 3.1 to the Current Report on Form 8-K filed with the SEC on December 11, 2018.

Composition of Board and Vacancies

According to the Company’s bylaws, the number of the directors of the Company is to be established by the Board of Directors from time to time, and, from time to time, the number of directors may be increased or decreased by a majority vote of the Board of Directors. Pursuant to the Company’s bylaws, any vacancy in the Board of Directors resulting from an increase in the number of directors shall be filled for the unexpired portion of the term by the majority vote of the remaining directors, though less than a quorum, at any regular meeting or special meeting of the Board called for that purpose. If at any time a vacancy would otherwise exist on the Board of Directors resulting from death, resignation or removal of a director, the number of directors shall be automatically decreased accordingly so that such vacancy no longer exists.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our officers, directors and persons who are the beneficial owners of more than 10% of our common stock to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock. Officers, directors and beneficial owners of more than 10% of our common stock are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. Based solely on a review of the copies of the Forms 3, 4 and 5 and amendments that we received with respect to transactions during the fiscal year ended November 30, 2020, we believe that all such forms were filed on a timely basis.

Ability of Shareholders to Communicate with the Board of Directors

The Company’s board of directors has established several means for our shareholders to communicate with the board of directors. If a shareholder has a concern regarding the Company’s financial statements, accounting

8

practices or internal controls, the concern should be submitted in writing to the Company’s Audit Committee, in care of the corporate Secretary, at the Company’s headquarters address. If the concern relates to the Company’s governance practices, business ethics or corporate conduct, the concern should be submitted in writing to the Chairman of the Board, in care of the corporate Secretary, at the Company’s headquarters address. All shareholder communications will be sent to the applicable director(s).

PROPOSAL 2 – RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

Wipfli LLP (“Wipfli”) served as our independent registered public accounting firm for the fiscal year ended November 30, 2020 and has been appointed to serve in that capacity in fiscal 2021. We anticipate that a representative of Wipfli will be available at the Annual Meeting to respond to questions and make a statement if they desire to do so.

At the Annual Meeting, our shareholders will be asked to ratify the selection of Wipfli as our independent registered public accountants for the fiscal year ending November 30, 2021. Although there is no requirement that we submit the appointment of independent registered public accountants to shareholders for ratification, we believe that it is good corporate practice to do so. Even if the appointment is ratified, however, the Audit Committee of our board of directors may, in its discretion, direct the appointment of different independent registered accountants during the year, if the Audit Committee determines such a change would be in our best interests.

Vote Required and Board Recommendation

Approval of this Proposal requires a majority of votes cast affirmatively or negatively at a meeting by the holders of shares entitled to vote thereon. Broker non-votes and abstentions will have no effect on the outcome of the vote on such Proposals because they do not count as a vote cast.

Our board of directors recommends you vote “FOR” ratification of the appointment of Wipfli as our independent registered public accountants. Unless otherwise instructed, validly executed proxies will be voted “FOR” this resolution.

Fees to Independent Auditors

Effective October 1, 2019 Porter Keadle Moore, LLC (“PKM”) combined its practice (the “Practice Combination”) with Wipfli LLP (“Wipfli”). As a result of the Practice Combination, PKM effectively resigned as the Company’s independent registered public accounting firm and Wipfli, as the successor to PKM following the Practice Combination, was engaged as the Company’s independent registered public accounting firm. The Company’s Audit Committee was notified of the Practice Combination and the effective resignation of PKM and ratified and approved the engagement of Wipfli. On November 21, 2019 the appointment was ratified by the Company’s shareholders at the 2019 Annual Meeting of Shareholders.

The following table presents fees for professional audit services rendered by Wipfli for the audit of the Company’s financial statements for the fiscal year ended November 30, 2020, fees for professional audit services rendered by PKM and Wipfli for the audit of the Company’s financial statements for the fiscal year ended November 30, 2019, tax services rendered by Wipfli for fiscal year ended November 30, 2020 and tax services rendered by PKM and Wipfli for the fiscal year ended November 30, 2019.

| 2020 | 2019 | |||||||

Audit Fees | $ | 235,000 | $ | 238,665 | ||||

Audit Related Fees | 1,500 | 7,500 | ||||||

Tax Fees | 58,837 | 64,858 | ||||||

Other | — | — | ||||||

|

|

|

| |||||

Total | $ | 295,337 | $ | 311,023 | ||||

9

Audit Fees

Audit fees consisted of fees billed by our principal accountants for professional services rendered for the audit of the Company’s annual financial statements set forth in the Company’s Annual Report on Form 10-K for the fiscal years ended November 30, 2020 and November 30, 2019 as well as assistance with and review of documents filed with the SEC.

Audit Related Fees

Audit related fees consisted of fees billed for professional services by our principal accountants during the fiscal years ended November 30, 2020 and November 30, 2019 related primarily to the Cord:Use acquisition and accounting consultations.

Tax Fees

Tax fees consisted of the aggregate fees billed by our principal accountants for professional services rendered for tax compliance, tax advice and tax planning for the fiscal years ended November 30, 2020 and November 30, 2019.

Other Fees

The Company did not incur other fees by our principal accountants for the fiscal years ended November 30, 2020 and November 30, 2019.

The policy of the Company’s audit committee is to review and pre-approve both audit and non-audit services to be provided by the independent auditors (other than with de minimis exceptions permitted by the Sarbanes-Oxley Act of 2002). This duty may be delegated to one or more designated members of the audit committee with any such approval reported to the committee at its next regularly scheduled meeting. All of the fees described above under the captions “Audit-Related Fees,” “Tax Fees” and “Other Fees” and paid to Wipfli were pre-approved by the audit committee.

No services in connection with appraisal or valuation services, fairness opinions or contribution-in-kind reports were rendered by Wipfli. Furthermore, no work of with respect to its services rendered to the Company was performed by anyone other than Wipfli.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee reports to and acts on behalf of the board of directors by providing oversight of the financial management, independent auditors and financial reporting procedures of the Company. The Company’s management is responsible for preparing the Company’s financial statements and the independent auditors are responsible for auditing those financial statements. The Audit Committee is responsible for overseeing the conduct of these activities by the Company’s management and the independent auditors.

In this context, the committee has met and held discussions with management and Wipfli. Management represented to the committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the committee has reviewed and discussed the consolidated financial statements with management and the independent auditors.

The committee has discussed with the independent auditors matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees), as amended. In addition, the Audit Committee received the written disclosures and the letter from the independent auditors required by applicable

10

requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence, and the committee and the independent auditors have discussed the auditors’ independence from the Company and its management, including the matters in those written disclosures. The committee has discussed with the Company’s independent auditors, with and without management present, their evaluation of the Company’s internal accounting controls and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions with management and the independent auditors referred above, the Audit Committee recommended to the board of directors, and the board of directors approved, the inclusion of the audited financial statements in the Company’s Annual Report on Form 10-K for the fiscal year ended November 30, 2020, for filing with the Securities and Exchange Commission.

Harold Berger (Chairman) Daniel Mizrahi

11

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of our common stock as of September 20, 2021 by (i) each current director and executive officer of the Company, (ii) each director nominee of the Company, (iii) each person who is known by the Company to own beneficially more than 5% of the outstanding shares of our common stock and (iv) all current directors and executive officers of the Company as a group. Except as otherwise indicated below, each of the shareholders named in the table has sole voting and investment power with respect to their shares of common stock, except to the extent authority is shared by spouses under applicable law.

Name and Address of Beneficial Owner (1) | Number of Shares Beneficially Owned (2) | Percent of Class (1) | ||||||

Five Percent Shareholders: | ||||||||

Mary J. Nyberg Trustee of the CDMJ Nyberg Family Trust, U/A/D June 9, 2005 (3) | 600,000 | 7.03 | % | |||||

Adam Fleishman Trustee of the Adam Fleishman Trust dated April 13, 2001 (4) | 509,000 | 5.97 | % | |||||

IsZo Capital, Inc. (5) | 496,503 | 5.80 | ||||||

George Gaines (6) | 1,040,627 | 12.13 | % | |||||

Current directors, nominees and executive officers: | ||||||||

David Portnoy (7) | 1,661,418 | 19.17 | % | |||||

Mark Portnoy (8) | 990,823 | 11.46 | % | |||||

Harold Berger (9) | 76,001 | * | ||||||

Daniel Mizrahi | 30,634 | * | ||||||

Jill Taymans (10) | 55,229 | * | ||||||

Oleg Mikulinsky (11) | 114,348 | 1.33 | % | |||||

Brian Sheehy (12) | 520,436 | 6.08 | % | |||||

All current directors and executive officers as a group (7 persons) (13) | 3,448,889 | 38.65 | % | |||||

| * | Less than 1%. |

| (1) | Pursuant to applicable SEC rules, the percentage of voting stock for each shareholder is calculated by dividing (i) the number of shares deemed to be beneficially held by such shareholders as September 20, 2021 by (ii) the sum of (a) 8,529,647, which is the number of shares of common stock outstanding as September 20, 2021, plus (b) the number of shares issuable upon exercise of options held by such shareholder which were exercisable as of September 20, 2021 or will become exercisable within 60 days. Unless otherwise indicated, the address of each person in the table is 700 Brooker Creek Boulevard, Suite 1800, Oldsmar, Florida 34677. |

| (2) | In accordance with Rule 13d-3 under the Securities Exchange Act of 1934, a person is deemed to be the beneficial owner for purposes of this table of any shares of Common Stock if he or she has shared voting or investment power with respect to such security or has a right to acquire beneficial ownership at any time within 60 days from September 20, 2021. As used herein, “voting power” is the power to vote or direct the voting of shares, and “investment power” is the power to dispose or direct the disposition of shares. The shares set forth above for directors and executive officers include all shares held directly, as well as by spouses and minor children, in trust and other indirect ownership, over which shares the named individuals effectively exercise sole or shared voting and investment power. |

| (3) | Mary J. Nyberg as trustee of CDMJ Nyberg Family Trust, U/A/D June 9, 2005 filed a Schedule 13G/A on January 17, 2018 (“the Schedule 13G/A”) reporting the following beneficial ownership: (i) 600,000 shares of common stock held by CDMJ Nyberg Family Trust U/A/D June 9, 2005, as to which this trust has the sole power to vote and dispose or direct the disposition. Beneficial ownership information is supplied per |

12

the Schedule 13G. The address for the CDMJ Nyberg Family Trust is 4555 E. Mayo Blvd., Phoenix, AZ 85050. |

| (4) | Adam Fleishman as trustee of Adam Fleishman Trust April 13,2001 filed a Schedule 13G on January 5, 2015 (“the Schedule 13G”) reporting the following beneficial ownership: (i) 279,000 shares of common stock held by Adam Fleishman Trust dated April 13, 2001, as to which this trust has the sole power to vote and dispose or direct the disposition, and (ii) 230,000 shares of common stock held by Adam Fleishman. Beneficial ownership information is supplied per the Schedule 13G. The address for Adam Fleishman is 775 Summit Drive, Deerfield, Illinois 60015. |

| (5) | Based upon information provided by IsZo Capital, Inc. (“IsZo”), in its Amendment No. 3 to its Schedule 13G filing with the SEC on February 16, 2021, includes 496,503 shares of Common Stock held by IsZo Capital L.P. (the “Fund”), IsZo Capital GP LLC (“IsZo GP”), IsZo Capital Management LP (“ICM”) and Brian Sheehy. |

| (6) | Includes 48,100 shares subject to stock options that are currently exercisable or exercisable within 60 days of September 20, 2021. |

| (7) | Includes 98,162 shares of Common Stock held directly through a 401(k) plan account, 199,080 shares of Common Stock held directly through IRA accounts of David Portnoy, 790,472 shares he owns individually, 152,882 shares of Common Stock held by Partner-Community, Inc., as to which David Portnoy may be deemed the beneficial owner as Chairman of the Board and Secretary, 55,219 shares of Common Stock held by uTIPu, as to which David Portnoy may be deemed the beneficial owner as Chairman of the Board, 59,027 shares of Common Stock held by Mayim Investment Limited Partnership, as to which David Portnoy may be deemed the beneficial owner as the managing member and owner of Mayim Management, LLC, which is the general partner of Mayim Management Limited Partnership, which is the general partner of Mayim Investment Limited Partnership; 102,586 shares of Common Stock held by David Portnoy’s spouse, 9,974 shares held by David Portnoy as custodian for his minor son, 9,122 shares held by David Portnoy as custodian for his minor daughter, 15,611 shares held by David Portnoy as custodian for his minor daughter, 10,783 shares held by David Portnoy as custodian for his minor son, 11,242 shares held by David Portnoy as custodian for his minor son and 11,352 shares held by David Portnoy as custodian for his minor son. Includes 135,906 shares subject to stock options that are currently exercisable or exercisable within 60 days of September 20, 2021. |

| (8) | Includes 42,266 shares held through a 401(k)-plan account; 487,514 shares that Mark Portnoy owns individually; and 71,529 shares held by Capital Asset Fund #1 Limited Partnership, as to which Mark Portnoy may be deemed beneficial owner as its general partner. Also, includes 115,014 shares subject to stock options that are currently exercisable or exercisable within 60 days of September 20, 2021. |

| (9) | Includes 48,100 shares subject to stock options that are currently exercisable or exercisable within 60 days of September 20, 2021. |

| (10) | Includes 9,833 shares subject to stock options that are currently exercisable or exercisable within 60 days of September 20, 2021. |

| (11) | Includes 59,999 shares subject to stock options that are currently exercisable or exercisable within 60 days of September 20, 2021. |

| (12) | Includes 23,933 shares subject to stock options that are currently exercisable or exercisable within 60 days of September 20, 2021. |

| (13) | Includes 392,787 shares subject to stock options that are currently exercisable or exercisable within 60 days of September 20, 2021. |

13

EXECUTIVE AND DIRECTOR COMPENSATION

Summary Compensation Table

The table below summarizes the total compensation during the fiscal year ended November 30, 2020, November 30, 2019 and November 30, 2018, paid to or earned by (i) the Company’s Co-Chief Executive Officers and (ii) the two other most highly compensated individuals that served as executive officers of the Company as of November 30, 2020, November 30, 2019 and November 30, 2018, whose total compensation received from the Company during such fiscal year exceeded $100,000 (collectively, the “named executive officers”).

Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) (1) | Option Awards ($) | Total ($) | ||||||||||||||||||

David Portnoy | 2020 | $ | 602,085 | $ | 0 | $ | 0 | $ | 151,472 | $ | 753,557 | |||||||||||||

Co-Chief Executive Officer | 2019 | $ | 602,085 | $ | 50,000 | $ | 0 | $ | 34,978 | $ | 687,063 | |||||||||||||

| 2018 | $ | 547,350 | $ | 304,083 | $ | 43,432 | $ | 86,711 | $ | 981,576 | ||||||||||||||

Mark Portnoy | 2020 | $ | 478,995 | $ | 0 | $ | 0 | $ | 128,243 | $ | 607,238 | |||||||||||||

Co-Chief Executive Officer | 2019 | $ | 478,995 | $ | 40,000 | $ | 0 | $ | 32,512 | $ | 551,507 | |||||||||||||

| 2018 | $ | 435,450 | $ | 241,916 | $ | 8,811 | $ | 70,474 | $ | 756,651 | ||||||||||||||

Jill Taymans | 2020 | $ | 190,000 | $ | 11,500 | $ | 0 | $ | 1,012 | $ | 202,512 | |||||||||||||

Vice President Finance, Chief | 2019 | $ | 190,000 | $ | 11,500 | $ | 0 | $ | 0 | $ | 201,500 | |||||||||||||

Financial Officer | 2018 | $ | 187,197 | $ | 11,500 | $ | 0 | $ | 0 | $ | 198,697 | |||||||||||||

Oleg Mikulinsky | 2019 | $ | 250,000 | $ | 8,333 | $ | $ | 19,084 | $ | 277,417 | ||||||||||||||

Chief Information Officer | 2019 | $ | 250,000 | $ | 8,333 | $ | 16,611 | $ | 0 | $ | 274,944 | |||||||||||||

| 2018 | $ | 250,114 | $ | 27,775 | $ | 59,689 | $ | 0 | $ | 337,578 | ||||||||||||||

| (1) | Represents the dollar amount recognized for financial reporting purposes in fiscal 2020, 2019 and 2018. The fair value was estimated using the Black-Scholes option-pricing model. The amount reported has been adjusted to eliminate service-based forfeiture assumptions used for financial reporting purposes. See Note 10, Shareholders’ Equity, to our consolidated financial statements contained in our annual report for a discussion of our accounting for stock options and the assumptions used. |

| (2) | Represents perquisites and other benefits, valued on the basis of aggregate incremental cost to the Company. |

Narrative Disclosure Regarding Summary Compensation Table

Compensation Philosophy

Our executive compensation policies are designed to provide competitive levels of compensation that integrate pay with our annual objectives and long-term goals, align the long-term interests of management with those of our shareholders, reward for achieving performance objectives, recognize individual initiative and achievements, and assist us in attracting and retaining highly qualified and experienced executives. The Compensation Committee of our board of directors is primarily responsible for acting on our philosophical approach to executive compensation. There are three primary elements in our executive compensation program: base salary compensation, cash bonus and stock options.

Base salary compensation is based on the potential impact the individual may have on the Company, the skills and experience required by the job, comparisons with comparable companies and the performance and potential of the incumbent in the job.

In fiscal 2019, a cash bonus pool along with Company performance targets and individual performance objectives were established at the beginning of the fiscal year by the Compensation Committee. At the end of the fiscal year each performance target was measured and bonuses were paid based on the attainment of the set performance targets established at the beginning of the fiscal year. A percentage of the pre-determined cash

14

bonus pool was paid to the named executive officer depending on the performance targets met by the Company and the individual. In fiscal 2019, pursuant to their Employment Agreements, the Company’s Co-CEOs were entitled to a cash bonus equal to the sum of (x) 11.11% of base salary times the number of the six performance targets achieved (based on threshold, target and stretch performance standards for each of the Company’s annual net revenue and weighted average stock price), plus (y) 11.11% times the number of three subjective performance criteria achieved (as determined in the sole discretion of the Compensation Committee of the Board of Directors after consultation with Co-CEOs, respectively). There were no cash bonuses paid to the Co-CEOs for fiscal 2020.

In fiscal 2020 and 2019, pursuant to his Employment Agreement, the Company’s Chief Information Officer was entitled to a cash bonus equal to a percentage of 20% of his Base Salary equal to the sum of (x) 11.11% of base salary times the number of the six performance targets achieved (based on threshold, target and stretch performance standards for each of the Company’s annual net revenue and weighted average stock price), plus (y) up to 33.33% times the number of three subjective performance criteria achieved (as subjectively determined by the Co-CEOs in their sole discretion). In fiscal 2020 and 2019, the Company’s Chief Financial Officer was entitled to a discretion cash bonus, pursuant to her Employment Agreement.

With respect to the subjective performance reviews, in addition to evaluating the Company’s overall financial performance, the Compensation Committee considers the performance of each named executive officer’s business line or area of responsibility. Several key management competencies and behaviors are assessed, including the named executive officer’s effectiveness as a leader and his or her role in building a cohesive executive team, as well as other strategic core competencies such as accountability, analytical ability and decision making, communication, cooperation and teamwork, creativity and problem-solving, and integrity. The named executive officer’s performance relating to these competencies forms the basis of a performance review discussion with the named executive officer that reinforces his or her role in achieving the Company’s business plan and short- and long-term strategies.

In fiscal 2019, the Company’s threshold, target and stretch performance standards required to earn cash bonuses were based on an increase of net revenue as of November 30, 2019, of 12%, 14% and 16%, respectively, and the Company’s weighted average stock price as of November 30, 2019 of $9.50, $10.50 and $11.50, respectively. In fiscal 2019, Cash bonuses were earned and are payable to the Co-CEO’s, Chief Information Officer and Chief Financial Officer in amounts totaling $50,000, $40,000, $8,333 and $11,500, respectively.

In fiscal 2019, pursuant to their Employment Agreements, David Portnoy and Mark Portnoy, the Company’s Co-CEOs, were granted 23,636 and 20,000 stock options, respectively. One-third of each grant vested upon grant, one-third will vest on December 1, 2020 and one-third will vest on November 30, 2021. In addition, the Employment Agreements for David Portnoy and Mark Portnoy provide that they are entitled to receive up to an additional 47,273 and 40,000 stock options, respectively, based on performance, with award being equal to the sum of (x) 11.11% times the number of the six performance targets achieved (based on threshold, target and stretch performance standards for each of the Company’s annual net revenue and weighted average stock price), plus (y) 11.11% times the number of three subjective performance criteria achieved (as determined in the sole discretion of the Compensation Committee of the Board of Directors after consultation with Co-CEOs, respectively). In 2020 and 2019, neither of the Co-CEOs received any performance-based stock options.

In fiscal 2019, pursuant to his Employment Agreement, the Company’s Chief Information Officer was granted 8,000 stock options. One-third vested upon grant, one-third will vest on December 1, 2020 and one-third will vest on November 30, 2021. In addition, pursuant to his Employment Agreement, the Company’s CIO, Oleg Mikulinsky, is entitled to up to 8,000 stock options based on performance, with the award being equal to the sum of (x) the product of 11.11% and the number of the net revenue and weighted average stock price performance goals achieved at the “threshold”, “target” and “stretch” levels and (y) up to 33.33% at the discretion of the Co-CEOs based on his subjective performance. In fiscal 2020, the Company granted Oleg Mikulinsky 1,333 of qualified stock options of the Company’s common stock based upon certain performance criteria met by the end

15

of the fiscal 2019 service period and per the Amendment Agreement. There were no performance-based stock options issued to the CIO for fiscal 2020.

Stock options are granted to our executive officers in order to maintain competitive pay packages and to align management’s long-term interests with those of our stockholders. The compensation committee approves stock option grants to our executives and key personnel. Awards vest and options become exercisable based upon criteria established by the Compensation Committee. During fiscal 2020, 17,000 stock options were awarded to executive officers.

Overall, the compensation committee attempts to establish levels of executive compensation that it believes to be competitive with those offered by employers of comparable size, growth and profitability in the Company’s industry and in general industry. In establishing the levels of the various compensation elements, the compensation committee has from time to time used the services of compensation consultants.

Employment Agreements and Change in Control Arrangements

David Portnoy and Mark Portnoy Employment Agreements. On June 24, 2021, the Company entered into new two-year employment agreements, effective December 1, 2020, with David Portnoy, Co-Chief Executive Officer of the Company, and Mark Portnoy, Co-Chief Executive Officer of the Company. The agreements superseded and replaced prior employment agreements with each of the executives.

The agreements provided for an annual base salary of $620,150 for David Portnoy and $493,400 for Mark Portnoy. In addition to base salary, the agreements also provided for reimbursement for all business expenses, including reasonable commuting expenses for David Portnoy between his home in Miami, Florida to the Company’s headquarters in Tampa, Florida, including lodging and rental car expenses for when he is working in the Company’s offices in Tampa. David Portnoy’s principal place of employment shall be at the Company’s offices in Miami, Florida, provided he shall travel to the Company’s headquarters as necessary to fulfill his responsibilities under the agreement. The Company shall pay reasonable legal and financial consulting fees and costs incurred in negotiating the agreements and shall pay each executive up to $75,000 in legal fees related to any dispute or question of interpretation regarding the agreements. The executives will also participate in the employee benefit plans that the Company generally makes available to Company employees from time to time, including retirement and health plans.

Upon the occurrence of (i) an involuntary termination of employment; (ii) a voluntary termination of employment for “Good Reason” (as defined in the Agreements); or (iii) an involuntary termination of employment or voluntary termination of employment for “Good Reason” at any time following a change in control (as defined in the Agreements), the Agreements provide for severance pay equal to two times the Executive’s then-current annual base salary, paid within 90 days after the occurrence of the triggering event. In addition, the Company shall provide, at no cost to the Executives, continued life insurance coverage and nontaxable medical, dental and disability insurance coverage substantially similar to the coverage maintained by the Company for the executives prior to such termination for 24 months after the termination. If the termination of employment is due to disability (as defined in the Agreements), the Company shall pay the executive two times their then-current base salary in equal installments over three years no later than 30 days after such disability, reduced by any amount paid to them from any disability insurance, Social Security, workman’s compensation or other disability program. In addition, all unvested shares and options held by the Executives shall become fully vested upon their disability. If the termination of employment is due to death, the Company shall pay the Executives two times their then-current base salary as a cash lump sum within 30 days after their date of death, and the Company will continue to provide medical and dental coverage for the Executives family for two years after their death. The Agreements include a one-year non-competition restriction and an 18-month restriction on solicitation of employees or customers.

Taymans Employment Agreement. On November 1, 2005, the Company entered into a one-year employment agreement with Jill M. Taymans, the Company’s Chief Financial Officer and Vice President (the

16

“Taymans Employment Agreement”). Under the Taymans Employment Agreement, the one-year term is automatically extended for an additional one-year period unless, at least 60 days prior to the end of the then-current term, either party notifies the other in writing of its intent not to renew the agreement. The Taymans Employment Agreement was amended in July 2008 to provide that the then-current term would expire on November 30, 2008. The ending date of the current term of the Taymans Employment Agreement is November 30, 2021. The Executive’s current base salary is $215,000.

At all times during the term of the Taymans Employment Agreement (as the same may be extended), Ms. Taymans will be eligible for discretionary merit increases and adjustments in base salary, in addition to discretionary annual bonuses awarded at the discretion of the compensation committee of the Company’s board of directors. The Taymans Employment Agreement provides that she will be eligible to receive long-term incentive awards provided to the Company’s senior executives generally, on terms finally determined by the compensation committee of the Company’s board of directors.

In the event of a termination of employment of Ms. Taymans upon or within one year of a Change in Control (as defined in the Taymans Employment Agreement), or prior to the Change in Control if the termination was related to the Change in Control, if the termination was by the Company without cause or was by Ms. Taymans due to being requested to accept without cause a demotion or relocation, Ms. Taymans will be entitled to receive the following: (i) all earned compensation through the date of termination (or, if greater, on the date immediately preceding a Change in Control); and (ii) 12 months of base salary as in effect on the termination date (or, if greater, base salary in effect immediately prior to the Change in Control).

Under the Taymans Employment Agreement, the Company will also provide Ms. Taymans with certain other benefits, including continued participation in all applicable Company benefit plans and payment of reasonable business expenses.

In the Taymans Employment Agreement, Ms. Taymans agreed not to compete with the Company or solicit its customers, clients or employees during the term of her Employment Agreement and for a 12-month period following her termination of employment under the agreement.

Mikulinsky Employment Agreement. On July 29, 2021, the Company entered into a new two-year employment agreement (the “Mikulinsky Employment Agreement”) with Oleg Mikulinsky, as the Company’s Chief Information Officer effective August 1, 2021. Under the Mikulinksy Employment Agreement, the two-year term will automatically extended for additional one-year periods unless, at least 30 days prior to the end of the then-current term, either party notifies the other in writing of its intent not to renew the agreement.

Pursuant to the new two-year agreement, the Executive’s base salary is $300,000 (the “Base Salary”). In addition to base salary, for the fiscal years ending November 30, 2021 and November 30, 2022, the Executive’s and Company’s performance will be evaluated for consideration of a subjective cash bonus of an amount not to exceed 25% of the Executive’s base salary.

At all times during the term of the Mikulinsky Employment Agreement (as the same may be extended), Mr. Mikulinsky will be eligible for discretionary merit increases and base salary adjustments, in addition to cash and equity annual bonuses discussed above. The Mikulinsky Employment Agreement provides he will also be eligible for long-term incentive awards provided to the Company’s senior executives generally, on terms finally determined by the compensation commttee of the Company’s board of directors.

Upon the occurrence of (i) an involuntary termination of employment; (ii) a voluntary termination of employment for “Good Reason” (as defined in the Agreement); or (iii) an involuntary termination of employment or voluntary termination of employment for “Good Reason” at any time following a change in control (as defined in the Agreement), the Agreement provides for severance pay equal to one times the Executive’s then-current annual base salary, paid within 90 days after the occurrence of the triggering event. In

17

addition, the Company shall provide, at no cost to the Executive, continued life insurance coverage and nontaxable medical, dental and disability insurance coverage substantially similar to the coverage maintained by the Company for the executive prior to such termination for 24 months after the termination. If the termination of employment is due to disability (as defined in the Agreement), the Company shall pay the executive a sum equal to six months of the executive’s their then-current base salary in equal installments over three years no later than 30 days after such disability, reduced by any amount paid to them from any disability insurance, Social Security, workman’s compensation or other disability program. In addition, all unvested shares and options held by the Executives shall become fully vested upon their disability. If the termination of employment is due to death, the Company shall pay the Executive one times the Executive’s then-current base salary as a cash lump sum within 30 days after their date of death, and the Company will continue to provide medical and dental coverage for the Executives family for two years after their death. The Agreement includes a one-year non-competition restriction and an 18-month restriction on solicitation of employees or customers.

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth information concerning stock options held by the named executive officers at November 30, 2020:

Name | Grant Date | Number of Securities Underlying Unexercised Options (#) Exercisable | Option Exercise Price ($) | Option Expiration Date | ||||||||

David Portnoy | April 15, 2016 March 8, 2018 August 30,2019 (1) December 20, 2019 (1) | | 70,270 23,636 26,243 23,636 |

| $ $ $ $ | 3.14 7.92 7.53 7.28 |

| April 15, 2026 March 8, 2023 August 30, 2029 December 20, 2029 | ||||

Mark Portnoy | April 15, 2016 March 8, 2018 August 30, 2019 (1) December 20, 2019 (1) | | 59,459 20,000 22,222 20,000 |

| $ $ $ $ | 3.14 7.92 7.53 7.28 |

| April 15, 2026 March 8, 2023 August 30, 2029 December 20, 2029 | ||||

Jill Taymans | June 2, 2016 September 23, 2020 (2) | | 7,500 7,000 |

| $

| 3.10 7,000 |

| June 3, 2023 September 23, 2027 | ||||

Oleg Mikulinsky | April 18, 2016 May 21, 2018 September 4, 2019 (1) February 27, 2020 (1) September 23, 2020 (2) | | 40,000 8,000 4,444 1,333 10,000 |

| $ $ $ $ $ | 3.20 7.49 7.13 6.55 8.00 |

| April 18, 2026 May 21, 2028 September 4, 2029 February 27, 2030 Sptember 23, 2027 | ||||

| (1) | 1/3 of the options vest immediately on the date of grant, 1/3 of the options vest one-year from the date of grant and 1/3 of the options vest two-years from the date of grant. |

| (2) | 1/3 of options vest one-year from the date of grant, 1/3 of the options vest two-years from the date of grant and 1/3 of the options vest three years from the date of grant. |

Director Compensation

Directors who are employees of the Company receive no compensation for their services as directors or as members of board committees. Effective November 25, 2019, non-employee directors are paid an annual retainer in the amount of $25,500. Each non-employee director receives an annual stock option grant in the amount of 5,300 shares on the date of the annual stockholders meeting in each year with an exercise equal to the fair market value of the common stock on the date of grant.

18

The table below summarizes the compensation paid by the Company to its non-employee directors for the fiscal year ended November 30, 2020:

Name | Fees Earned or Paid in Cash ($) | Option Awards ($) (1) | Total ($) | |||||||||

Harold Berger | $ | 19,125 | $ | 54,963 | $ | 74,088 | ||||||

George Gaines (2) | $ | 19,125 | $ | 54,963 | $ | 74,088 | ||||||

Jonathan Wheeler (2) | $ | 19,125 | $ | 54,963 | $ | 74,088 | ||||||

Arthur Ellis (2) | $ | 19,125 | $ | 90,891 | $ | 110,016 | ||||||

Brian Sheehy | $ | 19,125 | $ | 60,615 | $ | 79,740 | ||||||

| (1) | Represents the dollar amount recognized for financial reporting purposes in fiscal 2020 with respect to stock options. The fair value was estimated using the Black-Scholes option-pricing model. The amount reported has been adjusted to eliminate service-based forfeiture assumptions used for financial reporting purposes. See Note 10, Stockholders’ Equity, to our consolidated financial statements for a discussion of our accounting for stock options and the assumptions used. |

| (2) | Former Board of Directors. |

RELATED PARTY TRANSACTIONS

David Portnoy, the Company’s Chairman and Co-Chief Executive officer, is the brother of the Company’s Co-Chief Executive Officer, Mark Portnoy. The Company’s Audit Committee Chairman, Harold Berger, provides accounting services to the Company’s Co-Chief Executive Officer, Mark Portnoy.

On August 2, 2019, the Company entered into mutual releases with each of the Co-CEOs and certain directors and officers of the Company who received incentive awards that were submitted for ratification at the 2019 Annual Meeting or forfeited in connection therewith. The Company and each counterparty to a mutual release agreed, among other things, not to pursue certain claims relating to such ratification and surrenders.

PROPOSAL 3 – ADVISORY VOTE ON EXECUTIVE COMPENSATION

The compensation of our Co-Chief Executive Officers and our two other most highly compensated named executive officers (“named executive officers”) is described in “EXECUTIVE AND DIRECTOR COMPENSATION.” Shareholders are urged to read the Executive Compensation section of this Proxy Statement, which discusses our compensation policies and procedures with respect to our named executive officers.

In accordance with Section 951 of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Section 14A of the Securities Exchange Act of 1934, we are providing the Company’s shareholders the opportunity to vote on a non-binding, advisory resolution to approve the compensation of our named executive officers, which is described in the section titled “EXECUTIVE AND DIRECTOR COMPENSATION” in this Proxy Statement. Accordingly, the following resolution will be submitted for a shareholder vote at the Annual Meeting:

“RESOLVED, that the shareholders of Cryo-Cell International, Inc. (the “Company”) approve, on an advisory basis, the overall compensation of the Company’s named executive officers, as described in the “EXECUTIVE AND DIRECTOR COMPENSATION” section set forth in the Proxy Statement for this Annual Meeting.”

19

This advisory vote, commonly referred to as a “say-on-pay” advisory vote, is non-binding on the Company and the Board. However, the Board values constructive dialogue on executive compensation and other important governance topics with the Company’s shareholders and encourages all shareholders to vote their shares on this matter.

Vote Required and Recommendation of the Board of Directors

Approval of this resolution requires the affirmative vote of a majority of the votes cast affirmatively or negatively at the Annual Meeting by the holders of shares entitled to vote thereon. Broker non-votes and abstentions will have no effect on the outcome of the vote. While this vote is required by law, it will neither be binding on the Company or the Board, nor will it create or imply any change in the fiduciary duties of, or impose any additional fiduciary duty on, the Company or the Board. However, the Compensation Committee will take into account the outcome of the vote when considering future executive compensation decisions.

The Board of Directors unanimously recommends that you vote “FOR” the resolution set forth in Proposal 3. Unless otherwise instructed, validly executed proxies will be voted “FOR” this resolution.

OTHER BUSINESS

The Board does not know of any business, other than the proposals set forth in the attached Notice of Annual Meeting of Shareholders, to be acted upon at the Annual Meeting, and, as far as is known to management, no matters are to be brought before the meeting except as specified in the notice of the meeting. However, if any other business properly should come before the meeting, it is intended that the proxies will vote on any such matters in accordance with the judgment of the persons voting such proxies.

ANNUAL REPORT TO SHAREHOLDERS