UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement. |

| ☐ | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| ☒ | Definitive Proxy Statement. |

| ☐ | Definitive Additional Materials. |

| ☐ | Soliciting Material Pursuant to § 240.14a-12. |

TORRAY FUND

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) Title of each class of securities to which transaction applies: |

| | (2) Aggregate number of securities to which transaction applies: |

| | (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) Proposed maximum aggregate value of transaction: |

| | (5) Total fee paid: |

| ☐ | Fee paid previously with preliminary materials: |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) Amount Previously Paid: |

| | (2) Form, Schedule or Registration Statement No.: |

| | (3) Filing Party: |

| | (4) Date Filed: |

Torray Fund

A Series of Torray Fund

7501 Wisconsin Ave., Ste. 750W

Bethesda, MD 20814

November 18, 2021

Dear Fellow Shareholder.

Thank you for your investment in the Torray Fund (the “Fund”) . We are grateful for your support and the confidence you have placed in us.

We are sending you this enclosed proxy statement because of a recent change in the ownership structure of Torray LLC (“Torray”), the investment manager for the Fund. This change will in no way affect your account or the management of the Fund. However, because it constituted a presumptive change in control of Torray, it will require a shareholder vote to approve a new management agreement between Torray and the Fund, as described in the materials provided.

A special meeting of Fund shareholders (the “Meeting”) to consider these matters will be held on December 15, 2021, at 7501 Wisconsin Ave., Ste. 750W, Bethesda, MD 20814 at 9:30 A.M. Eastern time. For the reasons described below, we are asking shareholders of the Fund to:

| (1) | Approve a new management agreement (the “New Management Agreement”) between the Fund, and Torray; and |

| (2) | Authorize the holder of proxies solicited under this proxy statement to vote the shares represented by the proxies in favor of the adjournment of the Meeting from time to time in order to allow more time to solicit additional proxies, as necessary, if there are insufficient votes at the time of the Meeting to constitute a quorum or to approve Proposal 1. |

Shareholders may also transact such other business as may properly come before the Meeting or any adjournments or postponements thereof.

Neither the events nor the transactions that gave rise to the presumptive change in control nor the implementation of the New Management Agreement will have any effect on the management of the Fund or your account with the Fund. The Fund will continue to be managed by Mr. Shawn M. Hendon and Mr. Jeffrey D. Lent, with no change to the Fund’s portfolio management, investment objective, principal investment strategies, principal investment risks, fundamental and non-fundamental investment restrictions and operations. You will still own the same number of shares in the Fund and the value of your investments will not change. Also, because there are no material differences between the Fund’s previous management agreement with Torray (“Prior Management Agreement”) and the New Management Agreement with respect to the services provided by Torray and the management fees paid to Torray, and because there are no material differences between the Fund’s previous operating expenses limitation agreement with Torray (“Prior OELA”) and the Fund’s new expense limitation agreement with Torray (“New OELA”), the fees and expense ratios of the Fund will not change.

At a meeting of the Fund’s Board of Trustees (the “Board”) held on September 22, 2021, the Board unanimously approved the New Management Agreement as in the best interest of the Fund and its shareholders.

The question-and-answer section that follows discusses the proposal, with the proxy statement itself providing additional details. The Board of Trustees requests that you read the enclosed materials carefully and unanimously recommends that you vote in favor of the proposal.

You may choose one of the following options to authorize a proxy to vote your shares (which is commonly known as proxy voting) or to vote in person at the Meeting:

| • | Mail: Complete and return the enclosed proxy card.

|

| • | Internet: Access the website shown on your proxy card and follow the online instructions.

|

| • | Telephone (automated service): Call the toll-free number shown on your proxy card and follow the recorded instructions.

|

| • | In person: Attend the special shareholder meeting on December 15, 2021 at 9:30 am. |

If you grant a proxy but wish to revoke it prior to its exercise, you may do so by mailing notice of such revocation to the Fund (addressed to the Secretary at the principal executive office of the Trust shown at the beginning of this proxy statement), or in person at the meeting by executing a superseding proxy or by submitting a notice of revocation to the Fund. In addition, although mere attendance at the Special Meeting will not revoke a proxy, if you are present at the Special Meeting you may withdraw a previously submitted proxy and vote in person. Thank you for your response and for your continued investment in the Fund.

Sincerely,

/s/ Shawn M. Hendon

Shawn M. Hendon

President of Torray Fund

Questions and Answers

While we encourage you to read the full text of the enclosed proxy statement, for your convenience, we have provided a brief overview of the proposals that require a shareholder vote.

| Q. | Why am I receiving this proxy statement? |

| A. | You are receiving these proxy materials — including the proxy statement and your proxy card — because you have the right to vote on an important proposal concerning the Torray Fund (the “Fund”), a series of Torray Fund (the “Trust”) at a special meeting of shareholders to be held on December 15, 2021 at the offices of Torray LLC, 7501 Wisconsin Ave., Ste. 750W, Bethesda, MD 20814 at 9:30 a.m. Eastern time (the “Meeting”). Shareholders of the Fund are being asked to vote on a proposal to approve a new management agreement (the “New Management Agreement”) between the Trust, on behalf of the Fund, and Torray, the investment manager of the Fund. At a meeting of the Trust’s Board of Trustees (the “Board”) held on September 22, 2021, the Board unanimously approved the New Management Agreement as in the best interest of the Fund and its shareholders. |

| Q. | Why am I being asked to approve the New Management Agreement? |

| A. | As described in more detail below and in the proxy statement, Mr. Nicholas Haffenreffer, who owned more than a 25% voting ownership interest in Torray prior to September 30, 2021 and therefore was deemed to be a control person of Torray under the Investment Company Act of 1940, left Torray on September 30, 2021 to join a large East Coast investment management firm, and sold the entirety of his ownership interests in Torray to current members and employees of Torray, effective as of September 30, 2021 (the “Sale Transactions”). None of the individuals to whom Mr. Haffenreffer sold his interests on September 30, 2021 owns a greater than 25% voting interest in Torray following the Sale Transactions, and no other individuals or entities currently own more than a 25% voting interest in Torray. Because the 1940 Act presumptively defines the owner of a greater than 25% voting interest in a company as a control person of that company, the Sale Transactions resulted in a change of control of Torray and the termination of Torray’s management agreement with the Fund (the “Prior Management Agreement”). To ensure continuation of the advisory services Torray has provided to the Fund, shareholders of the Fund are being asked to approve the New Management Agreement. Both the New Management Agreement and Prior Management Agreement contain identical fee structures. Both agreements provide that Torray shall receive a management fee from the Fund equal to 1.00% of the average daily net assets of the Fund. There are also no material differences between the New Management Agreement and the Prior Management Agreement in terms of the services that Torray is required to provide. |

| Q. | What actions did the Fund’s Board take during its September 22, 2021 Board Meeting relating to the anticipated Sale Transactions? |

| A. | In anticipation of the expected consummation of the Sale Transactions, at a meeting of the Board held on September 22, 2021, the Board, including a majority of the Trustees who are not “interested persons” (as defined in the 1940 Act) of the Fund (the “Independent Trustees”), took the actions described below to ensure that investment management services would continue to be provided to the Fund and its shareholders despite the changes in control that would result from the Sale Transactions. In particular, the Board considered and unanimously approved the following agreements as in the best and its shareholders: |

(1) a New Management Agreement between Torray and the Trust that has no material differences from the Prior Management Agreement; the New Management Agreement is subject to shareholder approval;

(2) a New Operating Expenses Limitation Agreement between Torray and the Trust (“New OELA”), that has no material differences from the operating expense limitation agreement in effect when the Sale Transactions occurred (“Prior OELA”); the New OELA will go into effect if and when the New Management Agreement is approved by shareholders;

(3) an Interim Management Agreement between Torray and the Trust that has no material differences from both the Prior Management Agreement and the New Management Agreement; the Interim Management Agreement would go into effect upon the consummation of the transactions associated with Mr. Haffenreffer’s departure from Torray (the “Sale Transactions”), with a maximum duration of 150 days from that date; and

(4) an Interim Operating Expenses Limitation Agreement (“Interim OELA”) that has no material differences from both the Prior OELA and the New OELA, with the same term as the Interim Management Agreement.

The Interim Advisory Agreement and Interim OELA went into effect on September 30, 2021 and are scheduled to expire on the earlier of the following dates: (1) the date that shareholders approve the New Management Agreement, and such results are certified; or (2) on February 27, 2022, which is 150 days after the Sale Transactions were consummated. If shareholders do not approve the New Management Agreement before February 27, 2022, the Fund will not have an effective advisory agreement in place as of February 28, 2022, and Torray would not be authorized to continue to provide such services to the Fund. Your vote to approve the New Management Agreement is consequently extremely important.

| Q. | What will happen if shareholders do not approve the New Management Agreement before the Interim Management Agreement expires? |

| A. | At its September 22, 2021 Board meeting, the Board discussed the course of action it might take in the unlikely scenario that the New Management Agreement is not approved within 150 days of the change in control transactions that were to be consummated on September 30, 2021. Both the Board and the Registrant are fully aware that if the New Management Agreement is not approved by February 27, 2022, there will not be an advisory agreement in place that would permit Torray to continue to provide advisory serves to the Fund after that date. To address these concerns, the Registrant, with the Board’s approval, will take the following measures. As a first step, if the requisite approval is not obtained at the December 15, 2021 Shareholder Meeting, the Registrant will seek to adjourn the Shareholder Meeting by the requisite vote of shareholders present at the Meeting in person or by proxy until a later date or dates, and continue to solicit the necessary votes for passage of the Proposal. If shareholders have not approved the New Management Agreement by January 15, 2022, the Registrant will advise Commission staff of that fact and apprise the staff whether it intends to seek no-action relief, in a manner that is consistent with no-action relief that the staff has granted in similar circumstances, to allow the Registrant to continue to provide advisory services to the Fund after the expiration of the 150-day term of the Interim Management Agreement while also continuing to solicit votes on the proposal to approve the New Management Agreement. Registrant acknowledges that there is no guarantee such relief will be granted. If sufficient shareholder votes to approve the New Management Agreement are not obtained during the period of no-action relief, or if the staff does not issue the requested relief, the Fund’s Board will consider and determine what further actions it might take in the best interests of Fund shareholders, including potentially merging the Fund with another mutual fund or liquidating and deregistering the Fund. |

| Q. | What ownership changes resulted from the Sale Transactions? |

| A. | Before he left Torray and sold the entirety of his ownership interests in Torray to current members and employees of Torray effective as of September 30, 2021, Mr. Haffenreffer owned 38.31% of voting interests of Torray (24.9 units out of 65 units total), while the voting interest percentages of Torray’s five other owners ranged from 3.08% to 23.08%. Mr. Haffenreffer was the only owner with greater than a 25% interest in Torray, and therefore the only owner who was presumptively a control person of Torray under the 1940 Act. Mr. Haffenreffer sold his ownership in interest in Torray to current and new employee owners effective September 30, 2021. Following these transactions, the voting ownership interests of Torray’s owners now range from 5.0% to 23.0%, and no individual owner or entity is a presumptive control person of Torray. |

| Q. | Why did Mr. Haffenreffer leave Torray, and how will his departure affect the Management of the Fund and the management of Torray? |

A. Mr. Haffenreffer decided to leave Torray for a senior portfolio management position at a large East coast investment management firm. Mr. Haffenreffer’s departure will in no way affect the Management of the Fund or the quality of services that Torray provides to the Fund. He was not at all involved in managing the Fund or Torray’s value strategy. If shareholders approve the New Management Agreement, your investments will continue to be managed by the Fund’s dedicated and experienced co-portfolio managers, Messrs. Shawn Hendon and Jeffrey Lent. We also note that although Mr. Haffenreffer was nominated as an Interested Trustee and approved by Shareholders at the August 27, 2021 Special Meeting of Shareholders, he never became a member of the Board. This is because the proxy vote itself stated that Mr. Haffereffer’s term would commence only when William M Lane departs from the Board. Mr. Lane has never departed from the Torray Fund Board, and continues to serve as an Interested Trustee. In addition, Mr. Haffenreffer has written to Torray Fund Board Chair Wayne Shaner resigning from his position as a prospective member of the Torray Fund Board of Trustees because of his responsibilities at his current firm. Mr. Haffenreffer’s resignation from his contingent prospective membership on the Board has been accepted, and he will not assume the role of Interested Trustee when Mr. Lane departs from the Board. Finally, with respect to how Mr. Haffenreffer’s departure affects the management of Torray, we note that Torray will continue to be managed by a Board of Managers, now comprised of Mr. Hendon and Mr. William M Lane, who have been Members of the Board of Managers since its inception, and Mr. Lent, who has replaced Mr. Haffenreffer on the Board of Managers.

| Q. | How does this proxy vote to approve a New Management Agreement relate to the proxy vote to approve a new management agreement that occurred earlier this year? |

| A. | Although it follows closely in time to the prior proxy to approve a new management agreement for the Fund, the current proxy to approve a New Management Agreement is unrelated to the prior proxy, except for the fact that Mr. Haffenreffer became a presumptive control person of Torray when Mr. Robert Torray died -- part of the reason that the prior proxy was necessary. In the prior proxy, we initially solicited shareholder approval of a new management agreement between Torray and the Fund in April, 2021 because of certain planned transactions whereby Torray’s founder Robert Torray would transition from being Torray’s only presumptive control person (meaning that he owned more than 25% of Torray’s voting interests) to being a non-control person owning a less than 25% voting interest in Torray, and Mr. Haffenreffer would transition from being a non-control person owner of Torray to becoming Torray’s only presumptive control person. The need for approval of a new management agreement between Torray and the Fund subsequently accelerated when Robert Torray died unexpectedly on May 10, 2021, before the scheduled shareholder meeting to approve the new management agreement even occurred. Mr. Torray’s death by itself was an event that immediately caused a change in control of the Manager and an assignment and termination of the management agreement between the Trust and Torray that was then in effect. The control profile of Torray as a consequence of Mr. Torray’s death was the same as the control profile that would have resulted had the planned change in control transactions been consummated -- Mr. Torray was no longer a presumptive control person of Torray, and Mr. Haffenreffer became Torray’s only presumptive control person. Unlike the prior proxy, this proxy involves Mr. Haffenreffer transitioning from a presumptive control person of Torray to a person who has no relationship with Torray at all. |

| Q. | How will these events affect my account with the Fund? |

| A. | The Sale Transactions and the implementation of the New Management Agreement will not affect your account. You will still own the same number of shares in the Fund and the value of your investment will not change as a result of the change of control at Torray. In addition, the Fund’s co-portfolio managers, Messrs. Shawn M. Hendon and Jeffrey D. Lent, will continue managing the Fund without interruption. Except for the effective dates and the signatories, there are no material differences between the Prior Management Agreement and New Management Agreement, as discussed in more detail in the enclosed proxy statement. If approved by shareholders, the New Management Agreement would become effective immediately upon such shareholder approval. |

| Q. | How will my approval of the New Management Agreement affect the management and operation of the Fund? |

| A. | There will be no change to the Fund’s portfolio management, investment objective, principal investment strategies, principal investment risks, fundamental and non-fundamental investment restrictions and operations as a result of the New Management Agreement. |

| Q. | How will approval of the New Management Agreement affect the fees and expenses I pay as a shareholder of the Fund? |

| A. | The fees and expenses that you pay as a shareholder of the Fund will not increase as a result of the Sale Transactions. The approval of the New Management Agreement will not result in an increase in the Fund’s management fee, the New Operating Expense Limitation Agreement has no material differences from the Prior Operating Expense Limitation Agreement, and the Fund will not bear any portion of the costs associated with the Sale Transactions or any costs and expenses associated with this proxy. |

| Q. | Are there any material differences between the Fund’s Prior Management Agreement with Torray, the Interim Management Agreement and the New Management Agreement? |

| A. | No. There are no material differences between the Fund’s Prior Management Agreement with Torray, the Interim Management Agreement, and the Fund’s New Management Agreement, other than their effective dates and signatories. The Prior Management Agreement, Interim Management Agreement and New Management Agreement contain identical fee structures and service requirements. All three agreements provide that Torray shall receive a management fee from the Fund equal to 1.00% of the average daily net assets of the Fund. A form of the New Management Agreement is attached as Exhibit A to the Proxy. |

| Q. | Are there any material differences between the Prior Operating Expense Limitation Agreement, the Interim Operating Expense Limitation Agreement, and the New Operating Expense Limitation Agreement? |

| A. | No. There are no material differences between the Fund’s Prior OELA, the Interim OELA, and the New OELA. All three of these Agreements cap the Fund’s operating expenses, as identically defined in each agreement, at 1.00%. Under all three agreements, Torray does not reserve the right to recoup any previously waived fees or reimbursed expenses. A form of the New Operating Expenses Limitation Agreement is attached as Exhibit B to the Proxy. |

| Q. | How does the Trust’s Board of Trustees recommend that I vote? |

| A. | After careful consideration, the Board, including its Independent Trustees voting separately, having determined that the proposal is in the best interest of the Fund and its shareholders, unanimously recommends that shareholders vote to APPROVE the new Management Agreement. |

| Q. | Who is eligible to vote? |

| A. | Any person who owns shares of the Fund on the “record date,” which is October 8, 2021 (even if that person subsequently redeems those shares), is eligible to vote on the Proposal. |

| Q. | Who is paying for this proxy mailing and for the other expenses and solicitation costs associated with this shareholder meeting? |

| A. | The expenses incurred in connection with preparing the proxy statement and its enclosures and all related legal and solicitation expenses will be paid by Torray. Torray will not seek reimbursement for the any costs associated with the proxy. |

| Q. | What vote is required to approve Proposal 1? |

| A. | Under the Trust’s Agreement and Declaration of Trust (“Trust Instrument’), except when a larger quorum is required by law, by the By-laws or by the Trust Instrument, 40% of the Fund’s shares entitled to vote shall constitute a quorum at a Shareholders' meeting. The proposal to approve the New Management Contract requires the vote of the “majority of the outstanding voting securities” of the Fund. Under the 1940 Act and the terms of the Management Agreement, a “majority of the outstanding voting securities” is defined as the lesser of: (1) 67% or more of the voting securities of the Fund entitled to vote present in person or by proxy at the Meeting, if the holders of more than 50% of the outstanding voting securities entitled to vote thereon are present in person or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Fund entitled to vote thereon. |

A majority of the votes cast at the Meeting, either in person or by proxy, is required to approve any adjournment(s) of the special meeting, even if the number of votes cast is fewer than the number required for a quorum.

| Q. | How can I cast my vote? |

| A. | You may vote in any of four ways: |

| • | By telephone, with a toll-free call to the phone number indicated on the proxy card.

|

| • | By internet, by accessing the website shown on your proxy card and following the online instructions.

|

| • | By mailing in your proxy card.

|

| • | In person at the meeting in Bethesda, Maryland on December 15, 2021. |

We encourage you to vote via telephone or over the internet using the control number on your proxy card and following the simple instructions because these methods result in the most efficient means of transmitting your vote and reduces the need for the Fund to conduct telephone solicitations and/or follow up mailings. If you would like to change your previous vote, you may vote again using any of the methods described above.

IMPORTANT INFORMATION FOR SHAREHOLDERS

Torray Fund

A series of Torray Fund

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held December 15, 2021

Notice is hereby given that Torray Fund (the “Trust”) will hold a special meeting of shareholders (the “Meeting”) of the Torray Fund (the “Fund”) on December 15, 2021, at the offices of the Fund’s Manager, Torray LLC, 7501 Wisconsin Avenue, Suite 750W, Bethesda, Maryland 20814 at 9:30 A.M. Eastern Time.

The purpose of the Meeting is to consider and act upon the following proposals and to transact such other business as may properly come before the Meeting or any adjournments thereof:

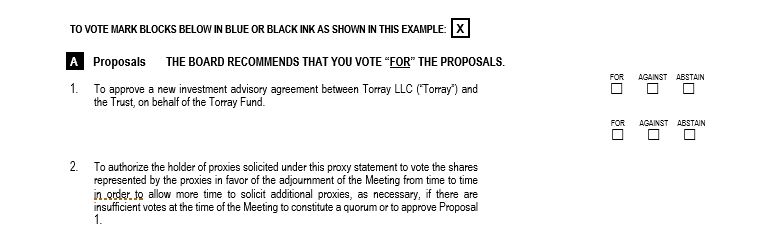

| Proposal | Description |

| 1 | To approve a New Management Agreement between Torray LLC (“Torray”) and the Trust, on behalf of the Torray Fund. |

| 2 | To authorize the holder of proxies solicited under this proxy statement to vote the shares represented by the proxies in favor of the adjournment of the Meeting from time to time in order to allow more time to solicit additional proxies, as necessary, if there are insufficient votes at the time of the Meeting to constitute a quorum or to approve Proposal 1. |

Shareholders may also transact such other business as may properly come before the Meeting or any adjournments or postponements thereof.

The Board of Trustees of the Trust unanimously recommends that you APPROVE these Proposals.

Shareholders of record of the Fund at the close of business on the record date, October 8, 2021, are entitled to notice of and to vote at the Meeting and any adjournment(s) or postponements thereof. The Notice of Special Meeting of Shareholders, proxy statement and proxy card are being mailed on or about November 22, 2021, to such shareholders of record.

By Order of the Board of Trustees,

/s/ William M Lane

William M Lane

Secretary of Torray Fund

Bethesda, Maryland

November 18, 2021

IMPORTANT – WE NEED YOUR PROXY VOTE IMMEDIATELY

Shareholders are invited to attend the Special Meeting in person. Any shareholder who does not expect to attend the Special Meeting is urged to vote using the touch-tone telephone voting and internet voting instructions found on the enclosed proxy card. Alternatively, you may cast your votes on the enclosed proxy card, date and sign it, and return it in the envelope provided, which needs no postage if mailed in the United States. To avoid unnecessary expense, we ask your cooperation in responding promptly, no matter how large or small your holdings may be.

Torray Fund

a Series of Torray Fund

PROXY STATEMENT

c/o Torray LLC

7501 Wisconsin Avenue, Suite 750W

Bethesda, Maryland 20814

SPECIAL MEETING OF SHAREHOLDERS

December 15, 2021

Introduction

This proxy statement is being provided to you on behalf of the Board of Trustees (the “Board”) of Torray Fund (the “Trust”) in connection with the solicitation of proxies to be used at the special meeting of shareholders of the Torray Fund (the “Fund”) to be held on December 15, 2021 (the “Meeting”). The purpose of the Meeting is (1) to seek shareholder approval of a new investment management agreement (“New Management Agreement”) between the Trust, on behalf of the Fund, and Torray LLC (“Torray”); and (2) to transact such other business as may be properly brought before the Special Meeting.

Shareholders of record at the close of business on the record date, established as October 8, 2021 (the “Record Date”), are entitled to notice of, and to vote at, the Special Meeting. We anticipate that the Notice of Special Meeting of Shareholders, this proxy statement and the proxy card (collectively, the “proxy materials”) will be mailed to shareholders beginning on or about November 22, 2021.

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be Held on December 15, 2021:

The Notice of Meeting, Proxy Statement and Proxy Card

are available at https://www.proxy-direct.com/USB-32428

Please read the proxy statement before voting on the proposal. If you need additional copies of this proxy statement or proxy card, please contact Computershare Fund Services at 1-888-456-7566. Representatives are available to answer your call Monday through Friday, 9:00 a.m. to 10:00 p.m. and Saturday 9:00 a.m. to 5:00 p.m. Eastern Time. Additional copies of this proxy statement will be delivered to you promptly upon request.

For a free copy of the Fund’s annual report for the fiscal year ended December 31, 2020, or the most recent semi-annual report, please contact the Trust at 1-800 626-9769 or write to the Fund, c/o Torray LLC, 7501 Wisconsin Avenue, Suite 750W, Bethesda, Maryland 20814.

DESCRIPTION OF PROPOSAL 1

APPROVAL OF NEW MANAGEMENT AGREEMENT

Background

Until September 30, 2021, Torray served as the investment manager to the Fund pursuant to a management agreement that was approved by the Board and by Fund shareholders. As required by section 15(b) of the Investment Company Act of 1940 (the “1940 Act”), the management agreement between the Trust and Torray automatically terminates if Torray experiences a direct or indirect change in control. In effect, this provision requires the Fund’s shareholders to vote on a new Management Agreement whenever the ownership control of the Fund’s Manager changes. The provision is designed to ensure that shareholders have a say in determining the company or persons that manage their fund.

The solicitation of shareholder votes on Proposal 1 to approve a New Management Agreement for the Fund is required because Nicholas Haffenreffer, who was the only person who owned more than a 25% voting ownership interest in Torray prior to September 30, 2021, and therefore was deemed to be the only presumptive control person of Torray under the Investment Company Act of 1940, left Torray on September 30, 2021 to join a large East Coast investment management firm, and sold the entirety of his ownership interests in Torray to current members and employees of Torray, effective as of September 30, 2021 (the “Sale Transactions”). None of the individuals to whom Mr. Haffenreffer sold his interests on September 30, 2021 owns greater than 25% voting interest in Torray following the Sale Transactions, and no other individuals or entities currently own more than a 25% voting interest in Torray. Because the 1940 Act presumptively defines the owner of a greater than 25% voting interest in a company as a control person of that company, and presumptively defines the owner of a 25% or less voting interest in a company as not a control person of that company, the Sale Transactions resulted in a change of control of Torray constituting an assignment of the Prior Management Agreement, resulting in its termination. To ensure continuation of the advisory services provided to the Fund, shareholders of the Fund are being asked to approve the New Management Agreement.

If the Proposal is approved by shareholders of the Fund, Torray will serve as the investment manager to the Fund for an initial two-year period from the effective date of the New Management Agreement. The change of control of Torray is not expected to have any material impact on Torray’s business or operations or the day-to-day portfolio management of the Fund.

Information About the Fund

The Fund is a series of the Trust. The Trust is an open-end management investment company organized as a Massachusetts Business Trust. Torray, located at 7501 Wisconsin Avenue, Suite 750W, Bethesda, Maryland 20814, is the Fund’s investment manager. Foreside Fund Distributors, LLC (“Foreside”) is the principal underwriter of the Fund’s shares. Foreside is located at 400 Berwyn Park, 899 Cassatt Road, Berwyn, PA 19312. The Fund’s administrator, transfer agent, and fund accountant is U.S. Bancorp Global Fund Services, LLC, located at 615 East Michigan Avenue, Milwaukee, Wisconsin, 53202.

Information About Torray

Torray is an investment adviser registered with the Securities and Exchange Commission (“SEC”) under the Investment Advisers Act of 1940, as amended. As of October 8, 2021, Torray had assets under management of approximately $690 million. Torray provides investment management and advisory services to investment companies, individuals, high net worth individuals, charitable organizations and companies. Torray is not currently controlled by any individual or entity.

The following table sets forth the name, position and principal occupation of each current principal officer of Torray, each of whom can be contacted through Torray’s principal office location, 7501 Wisconsin Avenue, Suite 750W, Bethesda, Maryland 20814.

| Name | Position/Principal Occupation

|

| Shawn M. Hendon | President |

| William M Lane | Executive Vice President |

| Suzanne E. Kellogg | Chief Compliance Officer |

Torray does not serve as investment manager to any other investment companies with an investment objective similar to the Fund.

Impact of the Sale Transactions on the Fund’s Management Agreement

Shareholders of the Fund are being asked to approve the New Management Agreement. Under the 1940 Act, the consummation of the Sale Transactions constituted an “assignment” (as defined in the 1940 Act) of the management agreement that was in effect such transactions occurred (the “Prior Management Agreement”). As required under the 1940 Act, the Prior Management Agreement provided for its automatic termination in the event of its assignment. Accordingly, the Prior Management Agreement terminated upon the consummation of the Sale Transactions.

If the shareholders of the Fund do not approve the New Management Agreement, the Board will take action as it deems necessary in the best interests of shareholders of the Fund. At its September 22, 2021 Board meeting, the Board discussed the course of action it might take in the unlikely scenario that the New Management Agreement is not approved within 150 daysof the change in control transactions that were consummated on September 30, 2021. Both the Board and the Registrant are fully aware that if the New Management Agreement is not approved by February 27, 2022, there will not be an advisory agreement in place that would permit Torray to continue to provide advisory serves to the Fund after that date. To address these concerns, the Registrant, with the Board’s approval, will take the following measures. As a first step, if the requisite approval is not obtained at the December 15, 2021 Shareholder Meeting, the Registrant will seek to adjourn the Shareholder Meeting by the requisite vote of shareholders present at the Meeting in person or by proxy until a later date or dates, and continue to solicit the necessary votes for passage of the Proposal. If shareholders have not approved the New Management Agreement by January 15, 2022, the Registrant will advise Commission staff of that fact and apprise the staff whether it intends to seek no-action relief, in a manner that is consistent with no-action relief that the staff has granted in similar circumstances, to allow the Registrant to continue to provide advisory services to the Fund after the expiration of the 150-day term of the Interim Management Agreement while also continuing to solicit votes on the proposal to approve the New Management Agreement. In that regard, Registrant represents that its counsel has reviewed and is familiar with the staff’s October 2013 Guidance on these matters and the no-action letter cited therein,1 as well as the Staff’s 2017 no-action relief in Nuveen Fund Advisors, LLC,2 and would intend to seek relief consistent with the representations and conditions of such authority. Registrant acknowledges that there is no guarantee such relief will be granted. If sufficient shareholder votes to approve the New Management Agreement are not obtained during the period of no-action relief, or if the staff does not issue the requested relief, the Fund’s Board will consider and determine what further actions it might take in the best interests of Fund shareholders, including potentially merging the Fund with another mutual fund or liquidating and deregistering the Fund.

1 See IM Guidance Update No. 2013-09 – Fund Advisors Serving “At Cost” Or “For No Compensation” (October 2013); Gartmore Global Partners (SEC Staff No-Action Letter, pub. avail. July 31, 2000); Claymore Advisors, LLC (SEC Staff No-Action Letter, pub. avail. Apr. 27, 2010) and Mellon Equity Associates, LLP (SEC Staff No-Action Letter, pub. avail. Apr. 1, 2005).

2 See Nuveen Fund Advisors, LLC, available at https://www.sec.gov/divisions/investment/noaction/2017/nuveen-fund-advisors-15a-062017.htm

Section 15(f) the 1940 Act

The Board has been advised that the Sale Transactions would be structured to comply with the safe harbor provisions of Section 15(f) of the 1940 Act in that Torray has agreed that, following the closing of the Sale Transactions, it will use reasonable best efforts to enable the requirement of Section 15(f) to be met. Section 15(f) provides a non-exclusive safe harbor whereby an owner of an investment adviser to an investment company (such as the Fund) may receive payment or benefit in connection with the sale of an interest in the investment adviser if two conditions are satisfied.

The first condition of Section 15(f) ) specifies that, during the three-year period immediately following consummation of the Transaction, at least 75% of a Fund’s Board of Trustees must not be interested persons of Torray or the Trust as defined in Section 2(a)(19) of the 1940 Act. Currently, the Board meets this 75% requirement and the Board anticipates that it will continue to meet this requirement for the required three-year period.

The second condition of Section 15(f) specifies that no “unfair burden” may be imposed on the investment company as a result of the transaction relating to the change of control, or any express or implied terms, conditions or understandings. An “unfair burden” includes: any arrangement after the sale of the interest in the investment adviser where the investment adviser (or predecessor or successor adviser), or any of its “interested persons” (as defined in the 1940 Act), receive or is entitled to receive any compensation, directly or indirectly, (i) from any person in connection with the purchase or sale of securities or other property to, from or on behalf of the investment company (other than bona fide ordinary compensation as principal underwriter for the investment company), or (ii) from the investment company or its shareholders (other than fees for bona fide investment advisory or other services). Relevant to this second condition, in connection with the Sale Transactions, Torray has agreed to contractually enter into both an interim operating expense limitation agreement (“Interim OELA”) and a new operating expense limitation agreement with the Trust, on behalf of the Fund (the “New OELA”), the terms of which are both identical to the prior operating expense limitation agreement between Torray and the Trust (“ Prior OELA”) Each of these Agreements requires Torray to waive its management fees and reimburse expenses of the Fund to the extent necessary to ensure that the Fund’s total annual operating expenses do not exceed 1.00% of the Fund’s average daily net assets. Under each of these Agreements, the term “Operating Expenses” with respect to the Fund, includes all expenses necessary or appropriate for the operation of the Fund, including the Adviser’s management fee as detailed in the Management Agreement, but does not include any front-end or contingent deferred loads, taxes, leverage, interest, brokerage commissions, acquired fund fees and expenses, trustee fees and expenses, auditor fees and expenses, legal fees and expenses, insurance costs, registration and filing fees, printing postage and mailing expenses, expenses incurred in connection with any merger or reorganization, or extraordinary expenses such as litigation. Also, under each of these Agreements, Torray is not entitled to seek recoupment of any management fees waived or expenses reimbursed. The Interim OELA is in effect through the earlier of February 27, 2022 or the date that shareholders approve the New Management Agreement, while the New OELA will go into effect when shareholders approve the New Management Agreement and will remain in effect at least through April 30, 2023. Based on information provided to the Board, the Board anticipates that no “unfair burden” will be imposed upon the Fund for the relevant two-year period.

Terms of the New Management Agreement, Interim Management Agreement and Prior Management Agreement

A form of the New Management Agreement is attached as Exhibit A. The following description is a summary that discusses all relevant and material terms of that agreement. However, you should refer to Exhibit A for the full text of the New Management Agreement. There are no differences between the terms of the New Management Agreement, the Interim Management Agreement, and the Prior Management Agreement with respect to services provided by Torray, and the three Agreements are identical with respect to the Management fees paid to Torray.

The Trust’s Management Agreement with Torray with respect to the Fund was originally approved by Fund shareholders on November 16, 2005, and was again approved by shareholders at a reconvened shareholder meeting on August 27, 2021 in connection with the prior proxy. The Management Agreement approved by shareholders on August 27, 2021 was not subject to renewal by the Board prior to the initiation of this proxy. For the fiscal year ended December 31, 2020 and year-to-date in the fiscal year ending December 31, 2021, Torray has received management fees subject to the application of the Prior OELA or Interim OELA.

Services Rendered by the Manager to the Fund. Each of the New Management Agreement, the Interim Management Agreement, and the Prior Management Agreement require Torray to provide identical services to the Trust. In particular, Torray is required to (i) furnish continuously an investment program for the Fund and to make investment decisions on behalf of the Fund and place all orders for the purchase and sale of portfolio securities and (ii) manage, supervise and conduct all of the affairs and business of the Fund and bear the expenses of all service providers to the Fund, furnish office space and equipment, and pay all salaries, fees and expenses of officers and Trustees of the Trust who are affiliated with the Manager.

Management Fee. The New Management Agreement, the Interim Management Agreement, and the Prior Management Agreement contain identical fee structures. All three agreements provide that Torray shall receive a management fee from the Fund equal to 1.00% of the average daily net assets of the Fund.

Duration and Termination. Subject to requisite Board and/or shareholder approvals required by the 1940 Act, both the New Management Agreement and the Prior Management Agreement provide that they will become effective upon their execution. Both agreements provide that they shall remain in effect for the Fund for two years from the effective date and thereafter for successive periods of one year, subject to annual Board approval as required by the 1940 Act. Both the New Management Agreement and the Prior Management Agreement provide for the termination of the agreement by either party at any time by written notice of at least 60 days to the other party. Action by the Trust to terminate the Agreement may be taken either (i) by vote of a majority of its Trustees, or (ii) by the affirmative vote of a majority of the outstanding shares of the Trust. Under both the New Management Agreement and the Prior Management Agreement, termination of the Agreement by either party pursuant to these contractual provisions is not subject to the payment of any penalty. The Interim Management Agreement became effective on September 30, 2021, the date that the Sale Transactions resulted in a presumptive change in control of Torray, terminating the Prior Management Agreement. The Interim Advisory Agreement and Interim OELA are scheduled to expire on the earlier of the following dates: (1) the date that shareholders approve the New Management Agreement, and such results are certified; or (2) on February 27, 2022, which is 150 days after the Sale Transactions were consummated. If shareholders do not approve the New Management Agreement before February 27, 2022, the Fund will not have an effective advisory agreement in place as of February 28, 2022 and Torray would not be authorized to continue to provide such services to the Fund.

Payment of Expenses. Under each of the New Management Agreement, the Interim Management Agreement and the Prior Management Agreement, Torray is responsible at its own expense for (i) furnishing continuously an investment program for the Fund, making investment decisions on behalf of the Fund and placing all orders for the purchase and sale of portfolio securities and (ii) managing, supervising and conducting all of the affairs and business of the Fund and bearing the expenses of all service providers to the Fund, furnishing office space and equipment, and paying all salaries, fees and expenses of officers and Trustees of the Trust who are affiliated with the Manager. Under each of the New Management Agreement, the Interim Management Agreement and the Prior Management Agreement Management Agreement, the Manager is not obligated to pay any expenses of or for the Trust that not expressly assumed by the Manager under the Management Agreement. The Manager will also be responsible on a monthly basis for any operating expenses that exceed the agreed upon expense limit of the New OELA. The New OELA has no material differences from the Interim OELA and the Prior OELA. Torray does not reserve the right to recoup any previously waived fees or reimbursed expenses under any of the OELAs.

Subject to the New OELA, as applicable, the Fund is responsible for all of its own expenses, except for those specifically assigned to Torray under New Management Agreement. The Fund will be responsible for the same expenses under the New Management Agreement as it is under Interim Management Agreement and was under the Prior Management Agreement.

Brokerage. The New Management Agreement, like the Interim Management Agreement and the Prior Management Agreement, provides that Torray is responsible for selecting brokers or dealers and the placing orders for the purchase and sale of portfolio investments for the Fund. In performing these functions the Manager must seek to obtain for the Fund the most favorable price and execution available, except to the extent it may be permitted to pay higher brokerage commissions for brokerage and research services under certain circumstances described below. Under each of these agreements, in using its best efforts to obtain for the Trust the most favorable price and execution available, the Manager, bearing in mind the Trust's best interests at all times, is required to consider all factors it deems relevant, including by way of illustration, price, the size of the transaction, the nature of the market for the security, the amount of the commission, the timing of the transaction taking into account market prices and trends, the reputation, experience and financial stability of the broker and dealer involved and the quality of service rendered by the broker or dealer in other transactions. Also, under each to these agreements, subject to such policies as the Trustees may determine, the Manager will not be deemed to have acted unlawfully or to have breached any duty created by the Management Agreement or otherwise solely by reason of its having caused the Fund to pay a broker or dealer that provides brokerage and research services to the Manager an amount of commission for effecting a securities transaction for the Fund in excess of the commission another broker or dealer would have charged for effecting that transaction, provided the Manager determines in good faith that such amount of commission was reasonable in relation to the value of the brokerage and research services provided by such broker or dealer, viewed in terms of either that particular transaction or the Manager's overall responsibilities with respect to the Fund and to other clients of the Manager as to which the Manager exercises investment discretion.

Limitation on Liability and Indemnification. The New Management Agreement, like the Interim Management Agreement and the Prior Management Agreement provide that, in the absence of willful misfeasance, bad faith, or gross negligence on the part of the Manager, or reckless disregard of the duties and obligation imposed on the Manager by such Agreements, Torray will not be subject to any liability to the Trust or the Fund, or to any shareholder of the Fund, for any act or omission in the course of, or connected with, rendering services under the Management Agreement.

Board Approval and Recommendation

The Board approved the New Management Agreement at a meeting called specifically for that purpose held on September 22, 2021 (the “September Meeting”). Prior to the September Meeting, the Board received and considered information from Torray and the Trust’s administrator designed to provide the Board with the information necessary to evaluate the approval of the New Management Agreement (“Support Materials”). In addition, at the September Meeting, representatives of Torray met with the Board and Counsel to the Independent Trustees telephonically to discuss the Sale Transactions. Before voting to approve the New Management Agreement as in the best interest of the Fund and its shareholders, the Board reviewed the Support Materials with Trust management and with counsel to the Independent Trustees, and discussed a memorandum from such counsel discussing the legal standards for the Board’s consideration of the New Management Agreement. In determining whether to approve the New Management Agreement, the Trustees considered all factors they believed relevant, including the following with respect to the Fund: (1) the nature, extent, and quality of the services to be provided by Torray with respect to the Fund; (2) the Fund’s historical performance as managed by Torray under the Current Management Agreement; (3) the costs of the services to be provided by Torray and the profits to be realized by Torray from services rendered to the Fund; (4) comparative fee and expense data for the Fund and other investment companies with similar investment objectives; (5) the extent to which economies of scale may be realized as the Fund grows, and whether the advisory fee for the Fund reflects such economies of scale for the Fund’s benefit; and (6) other benefits to Torray resulting from its relationship with the Fund. In their deliberations, the Trustees weighed to varying degrees the importance of the information provided to them, and did not identify any particular information that was all-important or controlling.

In unanimously approving the New Management Agreement as in the best interests of the Fund and its shareholders, the Board considered the following factors and made the following conclusions with respect to the Fund:

Nature, Extent and Quality of Services. With respect to the nature, extent and quality of services that the Manager renders, the Trustees considered the scope of services provided under the Agreement, which includes, but are not limited to, the following: (1) investing the Fund’s assets consistent with the Fund’s investment objective, policies and restrictions; (2) making investment decisions and placing all orders for the purchase and sale of portfolio securities and cash instruments; (3) pursuant to its Operating Expense Limitation Agreement with the Trust, covering the costs of the administration, fund accounting, custody, transfer agency and distribution services that are provided to the Fund; (4) monitoring the compliance of the Fund’s investment portfolio with applicable Federal securities laws and regulations and Internal Revenue standards; and (5) providing the interested Trustee, Chief Financial Officer and Chief Compliance Officer of the Fund and paying the salaries, fees and expenses of such persons. The Trustees also considered the long-term investment philosophy and the significant industry experience of the Manager’s personnel involved in servicing the Fund, noting their high quality. In addition, the Trustees reviewed the Manager's brokerage and best-execution procedures and observed that they were reasonable and consistent with standard industry practice. The Trustees also noted that while the Manager is permitted to use soft dollars to acquire proprietary and third-party research, it receives only proprietary research and does not currently “pay-up” above execution cost to obtain such research. Finally, the Trustees discussed the state of the Manager’s compliance program. They noted the significant resources that the Manager had expended to enhance the compliance program, implement and maintain the Liquidity Risk Management Program, and increase cybersecurity measures. They also noted that in response to the global outbreak of COVID-19, the Manager had successfully activated and continues to use its Disaster Recovery Plan. The Trustees concluded that they were satisfied with the nature, extent and quality of services provided by the Manager pursuant to the Agreement.

Performance of the Fund. The Board next reviewed the Fund’s performance as reported in the Meeting Materials for the period ending July 31, 2021. The Trustees discussed the Manager’s focus on long-term investing and risk management, as well as the fact that the Fund historically underperforms in strong markets and outperforms in down markets. The Trustees noted the Fund’s positive return for the year-to-date, one-year, three-year, five-year, and ten-year periods, all as of July 31, 2021. The Trustees further noted that the Fund’s performance was comparable to the S&P 500 for year-to-date performance and exceeded the S&P 500 for one year performance, while trailing the S&P for the 3-year, 5 year, 10 year and since inception periods. The Trustees also noted that the Fund’s performance was comparable to the Russell 1000 Value Index, the Morningstar Large Value Funds Average, and Peer Group Median for year-to-date and one year performance, while lagging for each of the 3-year, 5-year, and 10-year periods. Mr. Hendon reviewed with the Trustees the steps which had been taken over the past year to focus on good businesses, while maintaining a value orientation. He noted that market volatility had provided opportunities to invest in companies which management thought improved both the quality and financial strength of the portfolio. He also indicated management has become more selective with companies facing secular challenges. He noted that this focus had been successful in improving the Fund’s relative performance.

After further discussion, the Trustees concluded that they were satisfied with the Fund’s performance and management’s discussion of its investment strategy and portfolio activity.

Cost of Advisory Services and Profitability. The Trustees considered and discussed with the Manager the profitability to the Manager of its relationship with the Fund (as reflected in a profitability analysis provided by the Manager), the overall profitability of the Manager (as reflected in the unaudited P&L statement of the Manager as of June 30, 2021 and the audited P&L statement of the Manager as of December 31, 2020), and the Manager’s unaudited and audited balance sheet as of the same dates. They noted that the Manager compensates Foreside Distributors, LLC for the distribution/underwriting services it provides, pays intermediary and platform fees on behalf of the Fund, and also covers the costs of the services that U.S. Bancorp Global Fund Services and its affiliates provide to the Fund. He also noted the Manager will be taking on more responsibility for marketing and distribution internally. After further discussion, the Trustees concluded that the Manager’s profitability with respect to the Fund is reasonable, that its assets and revenues were sufficient to provide the services called for by the Agreement, and that the Manager’s assets, coupled with its insurance coverage, were sufficient to cover potential liabilities incurred under the Agreement.

Comparative Fee and Expense Data; Economies of Scale. The Trustees discussed the Fund’s management fee of 1.00% and its current net expense ratio of 1.06%. The Trustees noted that the management fee payable to the Manager is in the form of a partial "unified fee," an arrangement wherein the Manager pays certain expenses of the Fund from its management fee. The Trustees noted that comparative fee data for such partial “unified fee,” arrangements is not readily available from data sources such as Morningstar because there are so few funds that operate in this structure. They also noted that the Manager would be entering into a New Operating Expense Limitation Agreement (“OELA”) with the Fund, identical to the Prior Operating Expense Limitation Agreement, if both the Board, the Independent Trustees and Fund shareholders approve the New Management Agreement. The Trustees then discussed that the Manager receives a net management fee of approximately 89 basis points after payment of fees to Fund Services and other required waivers and reimbursements made pursuant to the current OELA. They also considered that because the Fund has no rule 12b-l or shareholder service fees, the Manager pays certain distribution and platform expenses exclusively from its own profits, and noted that that expense amounted to approximately five basis points. The Trustees then focused their attention on the gross and net expense ratios of comparable funds, noting that the Fund’s expense ratios are slightly higher when compared to those funds within the Morningstar U.S. Large Value Funds category, the Fund’s designated Morningstar category. The Trustees discussed economies of scale with the Manager and considered the Manager’s representation that the Fund’s asset level is not high enough to warrant breakpoints in the management fee. The Trustees also noted that the Manager advises two separate accounts in a similar investment style to that of the Fund, and that with respect to one of these accounts, the Manager charged its standard separate account fee schedule, which is 1% at the current asset level of the account, the same as the management fee charged to the Fund. The second account (whose purpose is to maintain a composite of this investment style) is charged no management fee. The Trustees further noted however, that management of the Fund entails many additional regulatory and compliance responsibilities and higher costs, and therefore would be expected to have a higher fee. After further discussion, the Trustees concluded that the fees paid to the Manager under the Agreement and the Fund’s overall expenses were reasonable and were not inflated to cover distribution-related expenses.

Other Benefits. The Trustees considered the Manager’s representation that it does not derive any other benefits from its relationship with the Fund and concluded that Manager does not receive any additional financial or other benefits from its relationship with the Fund.

Prior to voting on the proposed New Management Agreement, the Independent Trustees convened in executive session with Counsel to discuss matters relating to the Board’s consideration of the New Management. After the completion of the executive session, the Board reconvened to consider the approval of the New Agreement. Based upon the Manager’s presentation at the meeting and the information contained in the Manager’s Section 15(c) Response, as well as other information gleaned from the Trust’s quarterly Board meetings throughout the year, the Board concluded that the overall arrangements between the Fund and the Manager as set forth in the New Agreement are fair and reasonable in light of the services performed, fees paid and such other matters as the Trustees considered relevant in the exercise of their reasonable judgment. In their deliberations, the Trustees did not identify any particular factor that was all-important or controlling.

Based on all of the information presented to and considered by the Board and the conclusions that it reached, the Board and the Independent Trustees voting separately unanimously approved the New Management Agreement for the Fund on the basis that its terms and conditions are fair and reasonable and in the best interests of the Fund and its shareholders.

For the reasons set forth above, the Board unanimously recommends that shareholders of the Fund vote in favor of Proposal 1 to approve the New Management Agreement with Torray.

DESCRIPTION OF PROPOSAL 2

AUTHORIZATION OF PROXIES TO VOTE THE SHARES IN FAVOR OF THE ADJOURNMENT OF THE MEETING

The purpose of this Proposal 2 is to authorize the holder of proxies solicited under this proxy statement to vote the shares represented by the proxies in favor of the adjournment of the Meeting from time to time in order to allow more time to solicit additional proxies, as necessary, if there are insufficient votes at the time of the Meeting to constitute a quorum or to approve Proposal 1.

One or more adjournments may be made without notice other than an announcement at the Meeting, to the extent permitted by applicable law and the Fund’s governing documents. Any adjournment of the Meeting for the purpose of soliciting additional proxies will allow the Fund’s shareholders who have already sent in their proxies to revoke them at any time before their use at the Meeting, as adjourned.

The proxy holders have no current intention to bring any matter before the Meeting other than those specifically referred to above or matters in connection with or for the purpose of effecting such matters. Neither the proxy holders nor the Board of Trustees are aware of any matters which may be presented by others. If any business shall properly come before the Meeting, the proxy holders intend to vote thereon in accordance with their best business judgment.

INFORMATION ABOUT OWNERSHIP OF SHARES OF THE FUND

Outstanding Shares

Only shareholders of record at the close of business on October 8, 2021, the record date (the “Record Date”), will be entitled to notice of, and to vote at, the Special Meeting. On the Record Date, the Fund had 6,788,867.911 shares outstanding.

Security Ownership of Management, Trustees and Principal Shareholders

As of the Record Date, to the best of the knowledge of the Trust, Trustees, officers, and affiliated persons of the Fund, as a group, owned 20.84% of the outstanding shares of the Fund. As of the Record Date, no shareholder owned more than 25% of the Fund and therefore no shareholder may be deemed to control the Fund. The Board is aware of no arrangements, the operation of which at a subsequent date may result in a change in control of the Fund. As of the Record Date, the Independent Trustees, and their respective immediate family members, did not own any securities beneficially or of record in Torray or Foreside Distributors, LLC. As of the Record Date, the following entities owned beneficially or of record, for their own account or the accounts of their customers, more than 5% of the outstanding shares of the Fund:

Shareholder | # of Shares | % of Fund |

JP Morgan Securities LLC Brooklyn, NY 11201-3873 | 1,093,471 | 16% |

Charles Schwab & Co. Inc. FBO Schwab Customers San Francisco, CA 94105-1905 | 498,530 | 7% |

National Financial Services LLC Jersey City, NJ 07310-1995 | 402,469 | 6% |

VOTING INFORMATION

Who is Eligible to Vote?

Shareholders of record of the Fund as of the close of business on the Record Date, October 8, 2021, are entitled to vote on the proposal or proposals that relate to the Fund at the Special Meeting and any adjournments thereof. Each whole share is entitled to one vote on each matter on which it is entitled to vote, and each fractional share is entitled to a proportionate fractional vote.

Quorum

In order for a vote on each Proposal to occur at the Special Meeting, there must exist a quorum of shareholders of the Fund to which the Proposal relates. With respect to the Fund, the presence at the Special Meeting, in person or by proxy, of shareholders representing forty percent of the Fund’s shares outstanding and entitled to vote as of the Record Date constitutes a quorum for the Special Meeting. It is the Fund’s understanding that because Proposal 1 presented for approval at the Special Meeting is a “non-routine” matter, broker-dealers and other intermediaries will not have discretionary authority to vote on that proposal in the absence of specific authorization from their customers. In the absence of such specific authorization, such broker-dealers and intermediaries also will not be counted as present for purposes of establishing a quorum. In the event the necessary quorum to transact business or the vote required to approve Proposal 1 is not obtained at the Special Meeting, the persons named as proxies may propose one or more adjournments of the Special Meeting with respect to the Proposal in accordance with applicable law to permit further solicitation of proxies. Any adjournment of the Special Meeting will require the affirmative vote of the holders of a simple majority of the Fund’s shares cast at the Special Meeting, even if the number of votes cast is fewer than the number required for a quorum, and any adjournment with respect to the Proposals will require the affirmative vote of the holders of a simple majority of the Fund’s shares entitled to vote on the Proposal cast at the Special Meeting. The persons named as proxies will vote for or against any adjournment in their discretion.

Vote Required to Pass Proposal 1

As provided under the 1940 Act and required by the Prior Management Agreement, approval of Proposal 1 related to the New Management Agreement will require the vote of a majority of the outstanding voting securities of the Fund. In accordance with the 1940 Act, a “majority of the outstanding voting securities” of the Fund means the lesser of (a) 67% or more of the shares of the Fund present at a shareholder meeting if the owners of more than 50% of the shares of the Fund then outstanding are present in person or by proxy, or (b) more than 50% of the outstanding shares of the Fund entitled to vote at the meeting. Abstentions and broker “non-votes”, if any, will have the effect of a “no” vote for purposes of obtaining the requisite approval of the proposal.

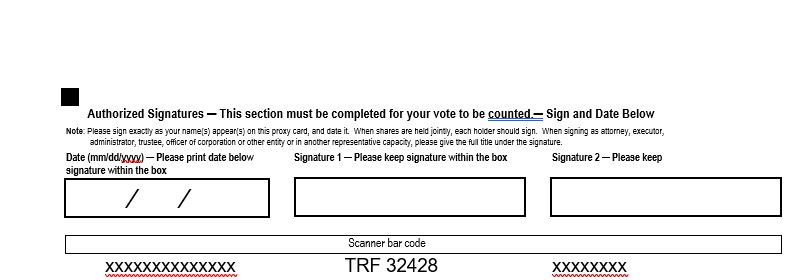

Proxies and Voting at the Special Meeting

Shareholders may use the proxy card provided if they are unable to attend the meeting in person or wish to have their shares voted by a proxy even if they do attend the meeting. Any shareholder of the Fund giving a proxy has the power to revoke it prior to its exercise by mail (addressed to the Secretary at the principal executive office of the Trust shown at the beginning of this proxy statement), or in person at the meeting, by executing a superseding proxy or by submitting a notice of revocation to the Fund. In addition, although mere attendance at the Special Meeting will not revoke a proxy, a shareholder present at the Special Meeting may withdraw a previously submitted proxy and vote in person. To obtain directions on how to attend the Special Meeting and vote in person, please call 1- 888-456-7566.

All properly executed proxies received in time for the Special Meeting will be voted as specified in the proxy or, if no specification is made, FOR the Proposal referred to in the proxy statement and in the discretion of the persons named as proxies on such procedural matters that may properly come before the Special Meeting. If any other business comes before the Special Meeting, your shares will be voted at the discretion of the persons named as proxies.

Telephonic Voting. Shareholders may call the toll-free phone number indicated on their proxy card to vote their shares. Shareholders will need to enter the control number set forth on their proxy card and then will be prompted to answer a series of simple questions. The telephonic procedures are designed to authenticate a shareholder’s identity, to allow shareholders to vote their shares and to confirm that their instructions have been properly recorded.

Method of Solicitation and Expenses

Computershare has been retained as proxy solicitor and tabulator. Torray will assist in the solicitation of proxies under a contract with Computershare Fund Services. The solicitation of proxies may occur principally by mail, but proxies may also be solicited by telephone, e-mail or other electronic means, facsimile or personal interview. If instructions are recorded by telephone, the person soliciting the proxies will use procedures designed to authenticate shareholders’ identities to allow shareholders to authorize the voting of their shares in accordance with their instructions, and to confirm that a shareholder’s instructions have been properly recorded.

The cost of preparing, printing and mailing the enclosed proxy card and this proxy statement, and all other costs incurred in connection with the solicitation of proxies, including any additional solicitation made by letter, telephone, facsimile or telegraph is estimated to be $20,000. The cost of solicitation will be borne by Torray. In addition to the solicitation by mail, officers and employees of Torray, who will receive no extra compensation for their services, may solicit proxies by telephone, e-mail or other electronic means, letter or facsimile.

The Fund will not bear any expenses in connection with the Sale Transactions, including any costs of soliciting shareholder approval. Torray will not seek reimbursement from the Fund for any costs associated with the proxy.

Shareholder Proposals for Subsequent Meetings

The Fund does not hold annual shareholder meetings except to the extent that such meetings may be required under the 1940 Act or state law. Shareholders who wish to submit proposals for inclusion in the proxy statement for a subsequent shareholder meeting should send their written proposals to the Trust’s Secretary at its principal office within a reasonable time before such meeting. The timely submission of a proposal does not guarantee its inclusion.

Householding

If possible, depending on shareholder registration and address information, and unless you have otherwise opted out, only one copy of this Proxy Statement will be sent to shareholders at the same address. However, each shareholder will receive separate proxy cards. If you would like to receive a separate copy of the Proxy Statement, please call --888-456-7566. If you currently receive multiple copies of Proxy Statements or shareholder reports and would like to request to receive a single copy of documents in the future, please call 1-800-626-9769 or write to the Fund at 615 East Michigan Street, Milwaukee, Wisconsin 53202.

Other Matters to Come Before the Meeting

No business other than the matters described above is expected to come before the Special Meeting, but should any other matter requiring a vote of shareholders arise the persons named as proxies will vote thereon in their discretion according to their best judgment in the interests of the Fund and its shareholders.

EXHIBIT A

FORM OF NEW MANAGMENT CONRACT

THE TORRAY FUND

MANAGEMENT CONTRACT

Management Contract executed as of _______ __, 2021, between THE TORRAY FUND, a Massachusetts business trust (the “Trust”), on behalf of its separate investment series THE TORRAY FUND (the “Fund”) and TORRAY LLC, a Delaware limited liability company (the “Manager”).

Witnesseth:

That in consideration of the mutual covenants herein contained, it is agreed as follows:

1. SERVICES TO BE RENDERED BY MANAGER TO THE FUND

(a) Subject always to the control of the Trustees of the Trust and to such policies as the Trustees may determine, the Manager will, entirely at its own expense, (i) furnish continuously an investment program for the Fund and will make investment decisions on behalf of the Fund and place all orders for the purchase and sale of portfolio securities and (ii) manage, supervise and conduct all of the affairs and business of the Fund and bear the expenses of all service providers to the Fund, furnish office space and equipment, and pay all salaries, fees and expenses of officers and Trustees of the Trust who are affiliated with the Manager. In the performance of its duties, the Manager will be subject to the control of the Trustees and to the policies determined by the Trustees, as well as to the provisions of the Trust's Agreement and Declaration of Trust, its By-laws as in effect from time to time, and the investment objectives, policies and restrictions stated in the Fund's prospectus.

(b) In the selection of brokers or dealers and the placing of orders for the purchase and sale of portfolio investments for the Fund, the Manager shall seek to obtain for the Fund the most favorable price and execution available, except to the extent it may be permitted to pay higher brokerage commissions for brokerage and research services as described below. In using its best efforts to obtain for the Trust the most favorable price and execution available, the Manager, bearing in mind the Trust's best interests at all times, shall consider all factors it deems relevant, including by way of illustration, price, the size of the transaction, the nature of the market for the security, the amount of the commission, the timing of the transaction taking into account market prices and trends, the reputation, experience and financial stability of the broker and dealer involved and the quality of service rendered by the broker or dealer in other transactions. Subject to such policies as the Trustees may determine, the Manager shall not be deemed to have acted unlawfully or to have breached any duty created by this Contract or otherwise solely by reason of its having caused the Fund to pay a broker or dealer that provides brokerage and research services to the Manager an amount of commission for effecting a securities transaction for the Fund in excess of the commission another broker or dealer would have charged for effecting that transaction, if the Manager determines in good faith that such amount of commission was reasonable in relation to the value of the brokerage and research services provided by such broker or dealer, viewed in terms of either that particular transaction or the Manager's overall responsibilities with respect to the Fund and to other clients of the Manager as to which the Manager exercises investment discretion.

(c) The Manager shall not be obligated to pay any expenses of or for the Trust not expressly assumed by the Manager pursuant to this Section 1.

2. OTHER AGREEMENTS, ETC

It is understood that any of the shareholders, Trustees, officers, and employees of the Trust may be a shareholder, director, officer, or employee of, or be otherwise interested in, the Manager, and in any person controlled by or under common control with the Manager, and that the Manager and any person controlled by or under common control with the Manager may have an interest in the Trust. It is also understood that the Manager and persons controlled by or under common control with the Manager have and may have advisory, management service, distribution or other contracts with other organizations and persons, and may have other interests and businesses.

3. COMPENSATION TO BE PAID BY THE FUND TO THE MANAGER.

The Fund will pay to the Manager as compensation for the Manager’s services. rendered, for the facilities furnished and for the expenses borne by the Manager pursuant to Section 1, a fee, computed daily and paid monthly, at the annual rate of 1.00% of the daily net asset value of the Fund. The fee shall be paid from the assets of the Trust. Such fee shall be payable within five (5) business days after the end of such month. If the Manager shall serve for less than the whole of a month, the foregoing compensation shall be prorated.

4. ASSIGNMENT TERMINATES THIS CONTRACT; AMENDMENTS OF THIS CONTRACT.

This Contract shall automatically terminate, without the payment of any penalty, in the event of its assignment; and this Contract shall not be amended unless such amendment is approved at a meeting by the affirmative vote of a majority of the outstanding shares of the Fund, and by the vote, cast in person at a meeting called for the purpose of voting on such approval, of a majority of the Trustees of the Trust who are not interested persons of the Trust or of the Manager.

5. EFFECTIVE PERIOD AND TERMINATION OF THIS CONTRACT.

This Contract shall become effective upon its execution, and shall remain in full force and effect continuously thereafter (unless terminated automatically as set forth in Section 4) until terminated as follows:

(a) Either party hereto may at any time terminate this Contract by not more than sixty days’ written notice delivered or mailed by registered mail, postage prepaid, to the other party, or