Exhibit 99.1

| May 8, 2013 |

| John E. Benjamin Chairman |

| Introductions Call Meeting to Order Director Nominations & Election Ratify the Appointment of KPMG, LLP as independent registered public accounting firm Non-Binding Vote on Executive Compensation Management Presentation Voting Results Closing Remarks Agenda |

| Call Meeting to Order Formal Meeting |

| Call Meeting to Order Director Nominations & Election Formal Meeting |

| Call Meeting to Order Director Nominations & Election Ratify the appointment of KPMG, LLP as independent registered public accounting firm Formal Meeting |

| Call Meeting to Order Director Nominations & Election Ratify the appointment of KPMG, LLP as independent registered public accounting firm Non-Binding Vote on Executive Compensation Formal Meeting |

| Call Meeting to Order Director Nominations & Election Ratify the appointment of KPMG, LLP as independent registered public accounting firm Non-Binding Vote on Executive Compensation Formal Meeting |

| Management Transition Peter Humphrey retired on August 28, 2012 35 years of loyal and dedicated service 18 years President & CEO Management Depth Martin Birmingham Named President & CEO in March 2013 Rick Harrison Named Chief Operating Officer in August 2012 Kevin Klotzbach Named Chief Financial Officer in April 2013 Mike Grover Named Chief Accounting Officer in April 2013 |

| Martin K. Birmingham President and Chief Executive Officer Management Presentation |

| Statements contained in this presentation which are not historical facts and which pertain to future operating results of Financial Institutions, Inc. and its subsidiaries constitute "forward looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward looking statements involve significant risks and uncertainties. We refer you to the documents the Company files from time to time with the Securities and Exchange Commission, specifically the Company's last filed Form 10-K and Form 10-Q. These documents contain and identify important factors that could cause actual results to differ materially from those contained in our projections or forward looking statements. The Company assumes no obligation to update any information presented herein. |

| Our Promise Enhance Shareholder Value Customer Experience Employee Experience All strategic initiatives are focused on delivering on this promise Board & Management Accountability Measurement and Monitoring tools in place |

| Our Approach Sound Risk Management Disciplined Lending Organic growth Balance between volume and credit risk Operational Efficiency Responsible expense management Focus on revenue growth Opportunistic Acquisitions Building Management Depth Attract and retain talent Promote from within - Create career opportunities |

| Successful Branch Acquisitions |

| Successful Branch Acquisitions Acquired 4 former First Niagara Offices on June 22, 2012 $129.6 Million in Deposits Entered Orleans County Strengthened presence in Genesee and Seneca Counties Acquired 4 former HSBC Offices on August 17, 2012 $157.2 Million in Deposits Gained Significant Market Share in Chemung County |

| Successful Branch Acquisitions Solid Execution Detailed planning Seamless integration Extended customer service hours Satisfied Customers Deposit Retention Levels Higher than Projected |

| Employee Development Created the Five Star Bank Experience Core Beliefs "We work as a team in an environment of trust, integrity and mutual respect where successes are recognized" "Every interaction is an opportunity to deliver a friendly, professional, relationship building experience" Developed Recognition System Incorporated into hiring, evaluation and incentive processes |

| Employee Development Regular Employee & Customer Assessments Correlation between Employee Satisfaction and Customer Satisfaction Satisfied Employees = Satisfied Customers = Shareholder Value |

| Customer Experience New Service Offerings Mobile Banking Enhanced Web Presence Online Account Opening Updated Online Banking & Bill Payor New Product Offerings Enhanced Retail Checking Products |

| Customer Experience "Made For You" Philosophy Give the Customer the Power of Choice Robust Products State of the Art Technology Convenient Locations Outstanding Service |

| Growth Opportunities $ 29.8 Billion $ 10.9 Billion $ 1.0 Billion * Source - SNL Financial |

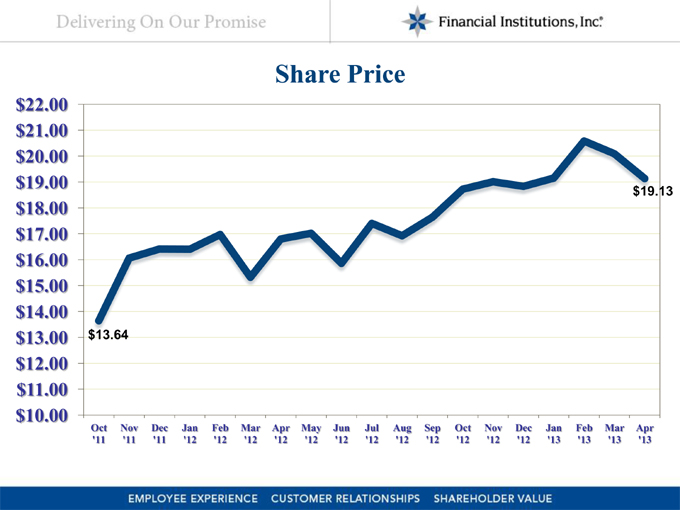

| 4/30/12 4/30/13 Market capitalization $233.7 mil. $263.9 mil. Shares outstanding 13.8 mil. 13.8 mil. Price $16.92 $19.13 52-week range $12.18 - $15.71 - $17.99 $20.83 Annualized Dividend Rate $ 0.52 $ 0.72 Dividend yield 3.07% 3.76% Shareholder Value |

| Share Price (CHART) $13.64 $19.13 |

| Total Shareholder Return (CHART) |

| Financial Overview Kevin B. Klotzbach EVP and Chief Financial Officer/Treasurer |

| FINANCIAL Highlights 2012 %Change vs. 2011 BALANCE SHEET BALANCE SHEET BALANCE SHEET Loans $ 1,706,000 14.9% Deposits $ 2,262,000 17.1% INCOME STATEMENT INCOME STATEMENT INCOME STATEMENT Net Interest Income $ 88,500 8.1% Non-Interest Income $ 24,800 3.6% Net Income $ 23,400 2.9% GAAP EPS $ 1.60 7.4% Key Statistics Dollars in thousands except Earnings per Share data |

| Net Interest incomE anD noninterest INCOME (CHART) CAGR ('09-'12) 6.3% * All years exclude OTTI & Securities Gains |

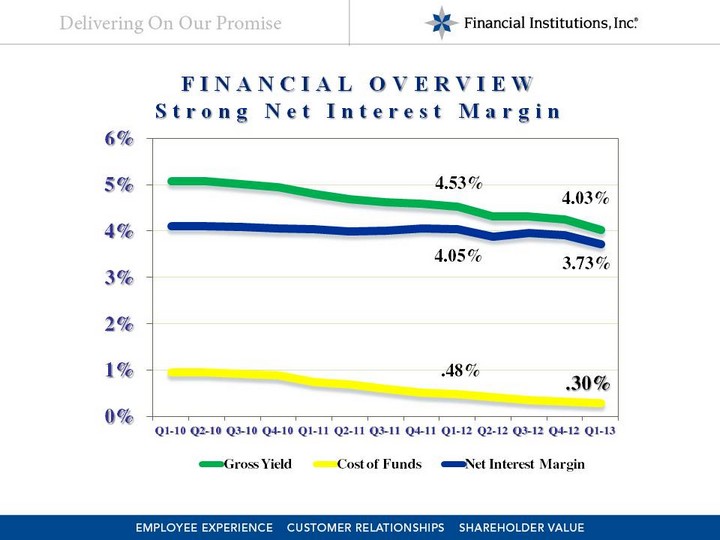

| FINANCIAL overview Strong Net Interest Margin (CHART) |

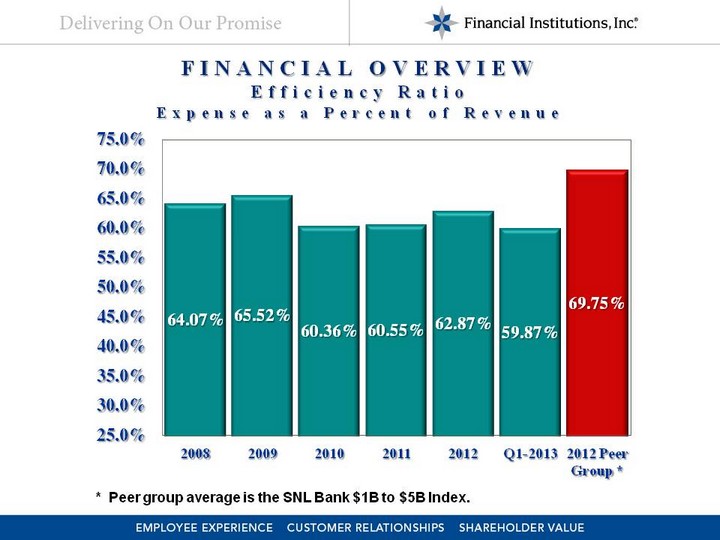

| (CHART) Financial overview Efficiency Ratio Expense as a Percent of Revenue * Peer group average is the SNL Bank $1B to $5B Index. |

| (CHART) CAGR ('4Q, 09- 4Q, 12) 10.5% |

| $ Millions 2011 2012 Q1 - 2013 2012 Peer Group* Non-Performing Loans Non-Performing Loans Non-Performing Loans Non-Performing Loans Non-Performing Loans Balances $7.1 $9.1 $11.8 Percent 0.48% 0.53% 0.69% 2.41% Net Loan Charge Offs Net Loan Charge Offs Net Loan Charge Offs Net Loan Charge Offs Net Loan Charge Offs Balances $5.0 $5.7 $1.6 Percent 0.36% 0.36% 0.38% 0.81% Allowance for Loan Losses Allowance for Loan Losses Allowance for Loan Losses Allowance for Loan Losses Allowance for Loan Losses Balances $23.3 $24.7 $25.8 Percent 1.57% 1.45% 1.50% 1.90% financial overview CREDIT Quality * Peer group average is the SNL Bank $1B to $5B Index. |

| financial overview Low Risk Investment Portfolio (CHART) |

| (CHART) (CHART) Financial OVERVIEW 1,883 1,932 2,262 2,409 |

| 2011 2012 Q1 '13 Leverage Ratio 8.63% 7.71% 7.46% Tier 1 Risk-Based Capital 12.20% 10.73% 10.84% Total Risk-Based Capital 13.45% 11.98% 12.09% Common Dividend Payout Ratio 31.33% 35.63% 42.86% Return on Average Tangible Common Equity 11.55% 11.74% 12.47% FINANCIAL OVERVIEW capital Management * Peer group average is the SNL Bank $1B to $5B Index. Well Capitalized 38.27% 2012 Peer Group* 9.37% |

| Voting Results |

| Closing Remarks |