- FISI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

FWP Filing

Financial Institutions (FISI) FWPFree writing prospectus

Filed: 11 Dec 24, 4:07pm

Filed Pursuant to Rule 433 Issuer Free Writing Prospectus dated December 11, 2024 Relating to Preliminary Prospectus Supplement dated December 11, 2024 and Prospectus dated December 4, 2024 Registration No. 333-283475

| ||

Investor Presentation Financial Institutions, Inc. (NASDAQ: FISI) Follow-On Offering Investor Presentation December 2024 | ||

Important Information & Disclosures Notice to and Undertaking by Recipients In this presentation, “we,” “our,” “us,” “Financial Institutions,” “FISI” or the “Company” refers to Financial Institutions, Inc., and our consolidated subsidiaries, including Five Star Bank, unless the context indicates that we refer only to the parent company, Financial Institutions, Inc. The Company has filed a shelf registration statement on Form S-3 (Registration Statement No. 333-283475), which was filed with the U.S. Securities and Exchange Commission (the “SEC”) on November 26, 2024, and declared effective by the SEC on December 4, 2024. A preliminary prospectus supplement and accompanying prospectus relating to the offering have been or will be filed with the SEC for the offering to which this presentation relates. Before you invest in any securities, you should read the preliminary prospectus supplement and accompanying prospectus, including the risk factors set forth therein, the registration statement and the documents incorporated by reference therein, and the other documents that the Company has filed with the SEC for more complete information about the Company and the offering. You may obtain the documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Company, the underwriter, or any dealer participating in the offering will arrange to send you the registration statement, preliminary prospectus supplement and accompanying prospectus if you request them by contacting Keefe, Bruyette & Woods, Inc., toll-free at (800)-966-1559 or by emailing USCapitalMarkets@kbw.com. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy securities of the Company, nor shall there be any sale of such securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. This presentation has been prepared by us solely for informational purposes based on our own information, as well as information from public and industry sources. Neither the SEC nor any regulatory agency has approved or disapproved of our securities or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense. Forward Looking Statements This presentation contains, and future oral and written statements by us and our management may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions, projections and statements of the Company’s beliefs concerning future events, business plans, objectives, expected operating results and the assumptions upon which those statements are based. Forward-looking statements include without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and are typically identified with words such as “may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “aim,” “intend,” “plan,” the negatives of such words or words or phases of similar meaning. The Company cautions that the forward-looking statements are based largely on the Company’s expectations and are subject to a number of known and unknown risks and uncertainties that are subject to change based on factors which are, in many instances, beyond the Company’s control. Such forward-looking statements are based on various assumptions (some of which may be beyond the Company’s control) and are subject to risks and uncertainties, which change over time, and other factors which could cause actual results to differ materially from those currently anticipated. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence or how they will affect the Company. If one or more of the factors affecting the Company’s forward-looking information and statements proves incorrect, then the Company’s actual results, performance or achievements could differ materially from those expressed in, or implied by, forward-looking information and statements contained in this presentation. Therefore, you should review this presentation completely and the Company cautions you not to place undue reliance on the Company’s forward-looking information and statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements are set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and in the preliminary prospectus supplement and accompanying prospectus, in the sections entitled “Forward-Looking Information,” “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors,” and other documents filed by the Company with the SEC from time to time. The Company disclaims any duty to revise or update the forward-looking statements, whether written or oral, to reflect actual results or changes in the factors affecting the forward-looking statements, except as specifically required by law. Industry Information This presentation includes statistical and other industry and market data that we obtained from government reports and other third-party sources. Our internal data, estimates, and forecasts are based on information obtained from government reports, trade, and business organizations and other contacts in the markets in which we operate and our management’s understanding of industry conditions. Although we believe that this information (including the industry publications and third-party research, surveys, and studies) is accurate and reliable, we have not independently verified such information and no representations or warranties are made by us or our affiliates as to the accuracy of any such statements or projections. In addition, estimates, forecasts, and assumptions are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements in this presentation. These and other factors could cause our results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties. Unaudited Financial Data Numbers contained in this presentation for the quarter ended September 30, 2024 and for other quarterly or interim monthly periods are unaudited. As a result, subsequent information may cause a change in certain accounting estimates and other financial information, including the Company’s allowance for credit losses, fair values, and income taxes. Non-GAAP Financial Measures The Company uses financial information in its analysis of the Company’s performance that is not in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Company believes that these non-GAAP financial measures provide useful information to management and investors that is supplementary to the Company’s financial condition, results of operations, and cash flows computed in accordance with GAAP. However, the Company acknowledges that its non-GAAP financial measures have a number of limitations. For example, the non-GAAP measures that we present may not be comparable to similar non-GAAP financial measures presented by other companies. Our presentation of such measures, which may include adjustments to exclude unusual or non-recurring items, should not be construed as an inference that our future results will be unaffected by other unusual or non-recurring items. See the appendix to this presentation for a reconciliation of these non-GAAP measures to the most directly comparable GAAP financial measures. 2

Introduction Common Stock Offering Summary Issuer Financial Institutions, Inc. Exchange / Ticker Nasdaq / FISI Base Offering Size $85 million (100% Primary) Overallotment 15% (100% Primary) Use of Proceeds General corporate purposes which may include a balance sheet restructuring through the repositioning of a substantial portion of our available-for-sale debt securities portfolio to support our continued growth as well as the repayment of indebtedness Lock-Up 90 days for the Company, Directors & Officers Sole Bookrunner Keefe, Bruyette & Woods, A Stifel Company Co-Manager Piper Sandler & Co. Expected Pricing Date December 11th, 2024 3

Introduction Today’s Presenters Martin K. Birmingham—President, CEO & Director • President and Chief Executive Officer of Financial Institutions, Inc. and Five Star Bank since 2013 • Joined Five Star in 2005 as President and CEO of National Bank of Geneva, which consolidated with three other subsidiary banks in December of 2005 to form Five Star Bank • Started his banking career in 1989 with Fleet Financial Group, where he held several progressive corporate banking roles until it was acquired by Bank of America and he was named President of the Rochester Market W. Jack Plants, II—Executive VP, CFO & Treasurer • Chief Financial Officer and Treasurer of Financial Institutions, Inc. and Five Star Bank since February 2021; joined Five Star Bank in 2019 as Senior Vice President and Corporate Treasurer • Served as Senior Vice President and Treasurer of United Bank where he progressed from Treasury Manager to Treasurer during his seven-year tenure • Prior to his tenure at United Bank, Mr. Plants served in various treasury and credit roles at GE Capital, GE Commercial Finance and Five Star Bank 4

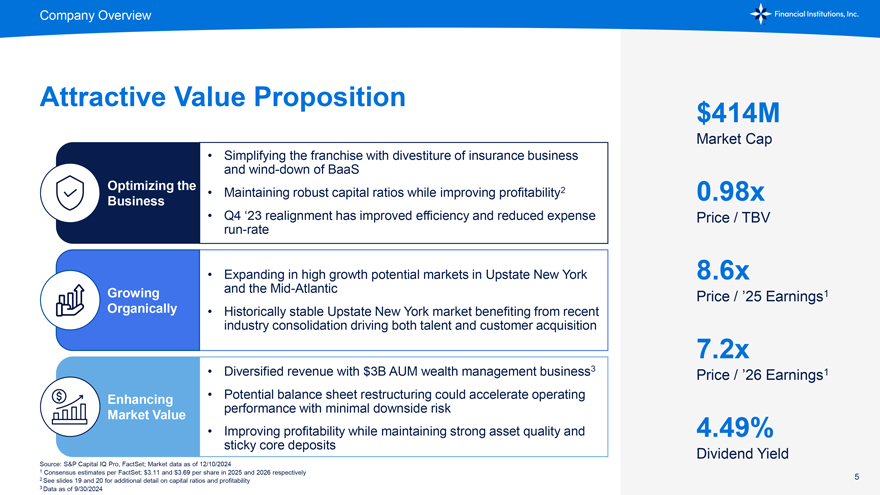

Company Overview Attractive Value Proposition $414M Market Cap • Simplifying the franchise with divestiture of insurance business and wind-down of BaaS Optimizing the • Maintaining robust capital ratios while improving profitability2 0.98x Business • Q4 ‘23 realignment has improved efficiency and reduced expense Price / TBV run-rate • Expanding in high growth potential markets in Upstate New York 8.6x Growing and the Mid-Atlantic Price / ’25 Earnings1 Organically • Historically stable Upstate New York market benefiting from recent industry consolidation driving both talent and customer acquisition 7.2x • Diversified revenue with $3B AUM wealth management business3 Price / ’26 Earnings1 Enhancing • Potential balance sheet restructuring could accelerate operating Market Value performance with minimal downside risk • Improving profitability while maintaining strong asset quality and 4.49% sticky core deposits Dividend Yield Source: S&P Capital IQ Pro, FactSet; Market data as of 12/10/2024 1 Consensus estimates per FactSet; $3.11 and $3.69 per share in 2025 and 2026 respectively 2 See slides 19 and 20 for additional detail on capital ratios and profitability 5 3 Data as of 9/30/2024

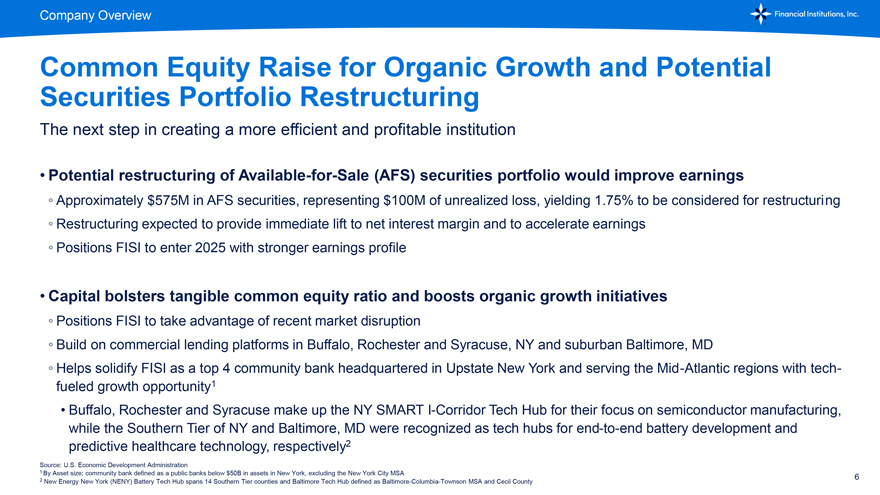

Company Overview Common Equity Raise for Organic Growth and Potential Securities Portfolio Restructuring The next step in creating a more efficient and profitable institution • Potential restructuring of Available-for-Sale (AFS) securities portfolio would improve earnings Approximately $575M in AFS securities, representing $100M of unrealized loss, yielding 1.75% to be considered for restructuring Restructuring expected to provide immediate lift to net interest margin and to accelerate earnings Positions FISI to enter 2025 with stronger earnings profile • Capital bolsters tangible common equity ratio and boosts organic growth initiatives Positions FISI to take advantage of recent market disruption Build on commercial lending platforms in Buffalo, Rochester and Syracuse, NY and suburban Baltimore, MD Helps solidify FISI as a top 4 community bank headquartered in Upstate New York and serving the Mid-Atlantic regions with tech-fueled growth opportunity1 • Buffalo, Rochester and Syracuse make up the NY SMART I-Corridor Tech Hub for their focus on semiconductor manufacturing, while the Southern Tier of NY and Baltimore, MD were recognized as tech hubs for end-to-end battery development and predictive healthcare technology, respectively2 Source: U.S. Economic Development Administration 1 By Asset size; community bank defined as a public banks below $50B in assets in New York, excluding the New York City MSA 6 2 New Energy New York (NENY) Battery Tech Hub spans 14 Southern Tier counties and Baltimore Tech Hub defined as Baltimore-Columbia-Townson MSA and Cecil County

Company Overview Overview of Financial Institutions, Inc. 1817 Founded NASDAQ: FISI (IPO in 1999) • Financial holding company headquartered in Western New York offering banking and wealth management services through its subsidiaries, Five Star Bank and Courier Capital, LLC $6.16B • Experienced management team with extensive market knowledge and industry experience Total Assets • 49 banking locations1 in 14 contiguous Upstate New York counties • History of generating consistent, strong operating results $4.40B Total Loans Diversified Business Lines Community Commercial and $5.31B Banking Services SMB Lending Wealth Total Deposits Management Source: Company Filings; Data as of 9/30/2024 7 1 48 branches and 1 motor branch in Olean, NY

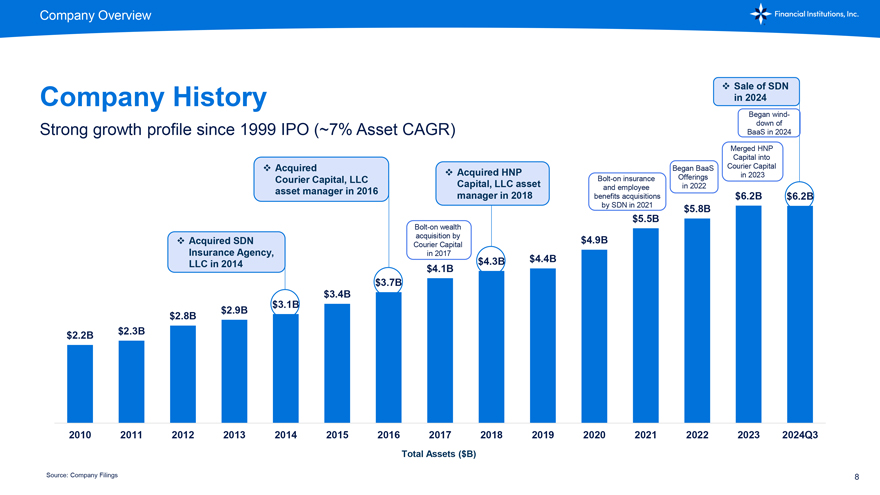

Company Overview Sale of SDN Company History in 2024 Began wind-down of Strong growth profile since 1999 IPO (~7% Asset CAGR) BaaS in 2024 Merged HNP Capital into Acquired Began BaaS Courier Capital Acquired HNP in 2023 Courier Capital, LLC Bolt-on insurance Offerings Capital, LLC asset and employee in 2022 asset manager in 2016 manager in 2018 benefits acquisitions $6.2B $6.2B by SDN in 2021 $5.8B $5.5B Bolt-on wealth acquisition by $4.9B Acquired SDN Courier Capital Insurance Agency, in 2017 $4.3B $4.4B LLC in 2014 $4.1B $3.7B $3.4B $3.1B $2.9B $2.8B $2.2B $2.3B 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024Q3 Total Assets ($B) Source: Company Filings 8

Company Overview Company Focus FISI’s vision is to be a high-performing community bank, offering a simple, connected and trusted banking experience in the markets we serve ✓ Scalable and efficient operating model has yielded consistent results over time ✓ Diversified revenue base with additive fee income while maintaining expense discipline Attractive long-term returns for shareholders ✓ Expansion in high growth markets with seasoned lending teams ✓ Longstanding commitment to dividend ✓ Depth and caliber of talent fuels relationship-based approach to financial services Meaningful customer experiences & relationships ✓ Value-added products & services designed for commercial, consumer, municipal and wealth clients ✓ Enhancing digital experiences with robust, usable data and tech ✓ Talented and empowered employees sharing collective focus on strong corporate citizenship Engaged & motivated associates ✓ Operating in sound risk and compliance environment ✓ Recognized as a top workplace locally and nationally ✓ Supports the local community with financial education and community service Positive contributions to our communities ✓ Recognized & trusted brand in Upstate New York, including along NY SMART I- Corridor and NENY Battery Tech Hubs ✓ Committed to proactive engagement with regulators to support strong execution of Effective engagement & communications with regulators strategy ✓ Continued focus on liquidity, capital and earnings Note: Information as of 9/30/2024 9

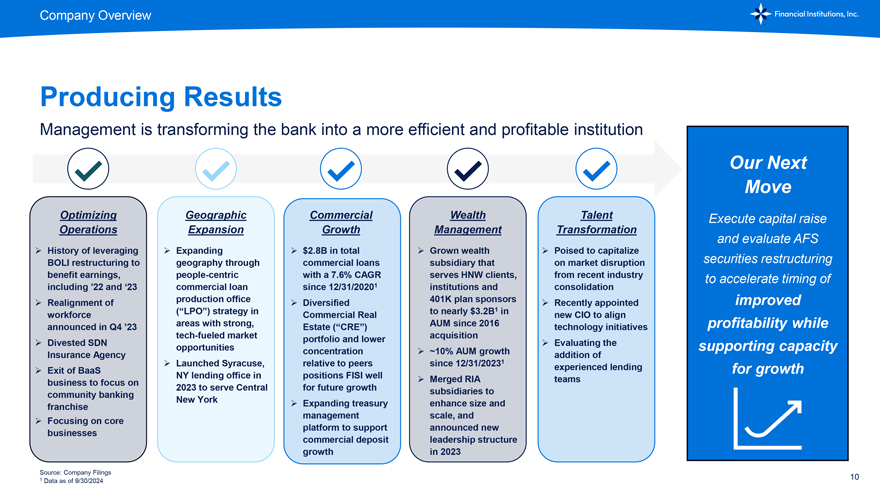

Company Overview Producing Results Management is transforming the bank into a more efficient and profitable institution Our Next Move Optimizing Geographic Commercial Wealth Talent Execute capital raise Operations Expansion Growth Management Transformation and evaluate AFS History of leveraging Expanding $2.8B in total Grown wealth Poised to capitalize BOLI restructuring to geography through commercial loans subsidiary that on market disruption securities restructuring benefit earnings, people-centric with a 7.6% CAGR serves HNW clients, from recent industry to accelerate timing of including ’22 and ‘23 commercial loan since 12/31/20201 institutions and consolidation Realignment of production office Diversified 401K plan sponsors Recently appointed improved workforce (“LPO”) strategy in Commercial Real to nearly $3.2B1 in new CIO to align announced in Q4 ’23 areas with strong, Estate (“CRE”) AUM since 2016 technology initiatives profitability while tech-fueled market portfolio and lower acquisition Divested SDN opportunities concentration ~10% AUM growth Evaluating the supporting capacity Insurance Agency addition of Exit of BaaS Launched Syracuse, relative to peers since 12/31/20231 experienced lending for growth NY lending office in positions FISI well Merged RIA teams business to focus on community banking 2023 to serve Central for future growth subsidiaries to New York Expanding treasury enhance size and franchise Focusing on core management scale, and businesses platform to support announced new commercial deposit leadership structure growth in 2023 Source: Company Filings 1 Data as of 9/30/2024 10

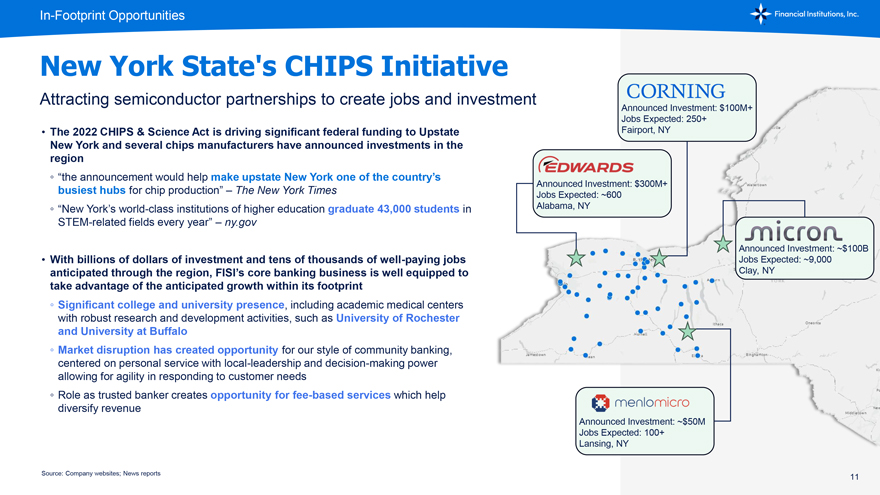

In-Footprint Opportunities New York State’s CHIPS Initiative Attracting semiconductor partnerships to create jobs and in Announced Investment: $100M+ Jobs Expected: 250+ The 2022 CHIPS & Science Act is driving significant federal funding to Upstate Fairport, NY New York and several chips manufacturers have announced investments in the region “the announcement would help make upstate New York one of the country’s Announced Investment: $300M+ busiest hubs for chip production” – The New York Times Jobs Expected: ~600 “New York’s world-class institutions of higher education graduate 43,000 students in Alabama, NY STEM-related fields every year” – ny.gov Announced Investment: ~$100B • With billions of dollars of investment and tens of thousands of well-paying jobs Jobs Expected: ~9,000 anticipated through the region, FISI’s core banking business is well equipped to Clay, NY take advantage of the anticipated growth within its footprint Significant college and university presence, including academic medical centers with robust research and development activities, such as University of Rochester and University at Buffalo Market disruption has created opportunity for our style of community banking, centered on personal service with local-leadership and decision-making power allowing for agility in responding to customer needs Role as trusted banker creates opportunity for fee-based services which help diversify revenue Announced Investment: ~$50M Jobs Expected: 100+ Lansing, NY Source: Company websites; News reports 11

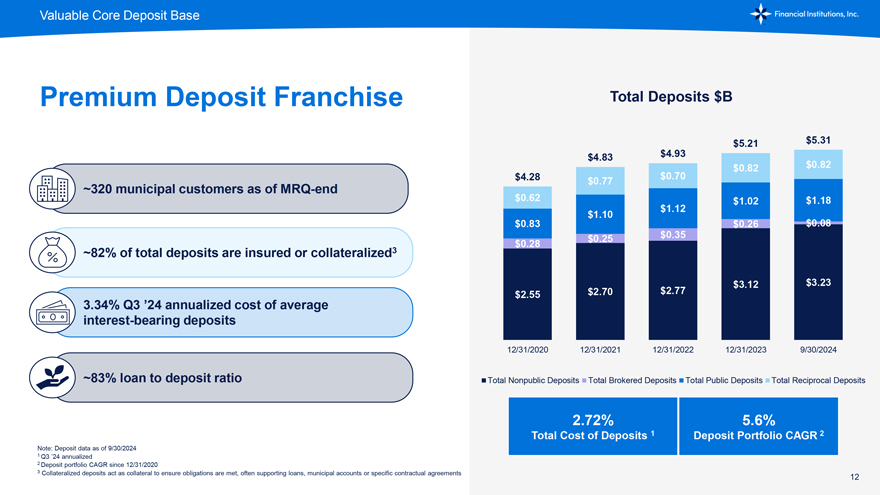

Valuable Core Deposit Base Premium Deposit Franchise Total Deposits $ B $ 5.21 $ 5.31 $ 4.83 $ 4.93 $ 0.82 $ 0.82 $ 4.28 $ 0.77 $ 0.70 ~320 municipal customers as of MRQ-end $ 0.62 $ 1.02 $ 1.18 $ 1.10 $ 1.12 $ 0.83 $ 0.26 $ 0.08 $ 0.25 $ 0.35 $ 0.28 ~82% of total deposits are insured or collateralized3 $ 3.12 $ 3.23 $ 2.55 $ 2.70 $ 2.77 3.34% Q3 ’24 annualized cost of average interest-bearing deposits 12/31/2020 12/31/2021 12/31/2022 12/31/2023 9/30/2024 ~83% loan to deposit ratio Total Nonpublic Deposits Total Brokered Deposits Total Public Deposits Total Reciprocal Deposits 2.72% 5.6% Total Cost of Deposits 1 Deposit Portfolio CAGR 2 Note: Deposit data as of 9/30/2024 1 Q3 ’24 annualized 2 Deposit portfolio CAGR since 12/31/2020 3 Collateralized deposits act as collateral to ensure obligations are met, often supporting loans, municipal accounts or specific contractual agreements 12

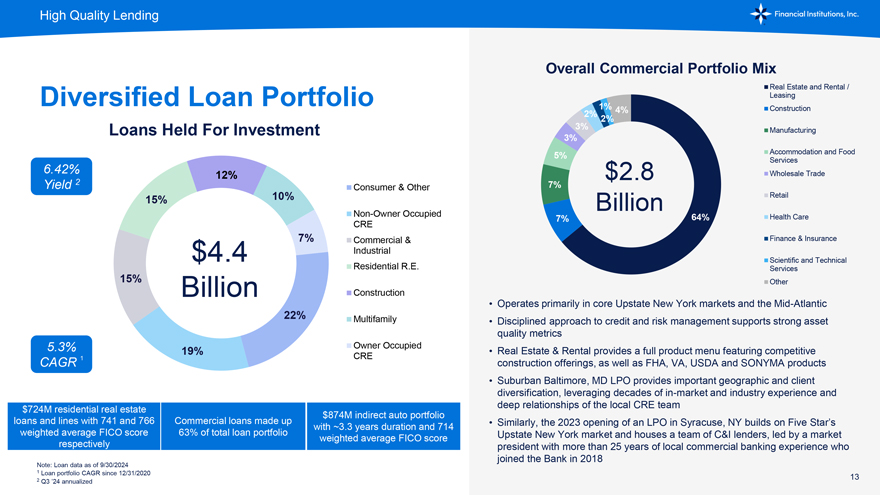

High Quality Lending Overall Commercial Portfolio Mix Real Estate and Rental / Diversified Loan Portfolio Leasing 1% 4% Construction 2% 2% Loans Held For Investment 3% Manufacturing 3% 5% Accommodation and Food Services 6.42% 12% $2.8 Wholesale Trade Yield 2 Consumer & Other 7% 15% 10% Billion Retail Non-Owner Occupied 7% 64% Health Care CRE 7% Commercial & Finance & Insurance $4.4 Industrial Scientific and Technical Residential R.E. Services 15% Other Billion Construction Operates primarily in core Upstate New York markets and the Mid-Atlantic 22% Multifamily Disciplined approach to credit and risk management supports strong asset quality metrics 5.3% 19% Owner Occupied Real Estate & Rental provides a full product menu featuring competitive CAGR 1 CRE construction offerings, as well as FHA, VA, USDA and SONYMA products Suburban Baltimore, MD LPO provides important geographic and client diversification, leveraging decades of in-market and industry experience and $724M residential real estate deep relationships of the local CRE team $874M indirect auto portfolio loans and lines with 741 and 766 Commercial loans made up with ~3.3 years duration and 714 Similarly, the 2023 opening of an LPO in Syracuse, NY builds on Five Star’s weighted average FICO score 63% of total loan portfolio weighted average FICO score Upstate New York market and houses a team of C&I lenders, led by a market respectively president with more than 25 years of local commercial banking experience who joined the Bank in 2018 Note: Loan data as of 9/30/2024 1 Loan portfolio CAGR since 12/31/2020 2 Q3 ’24 annualized 13

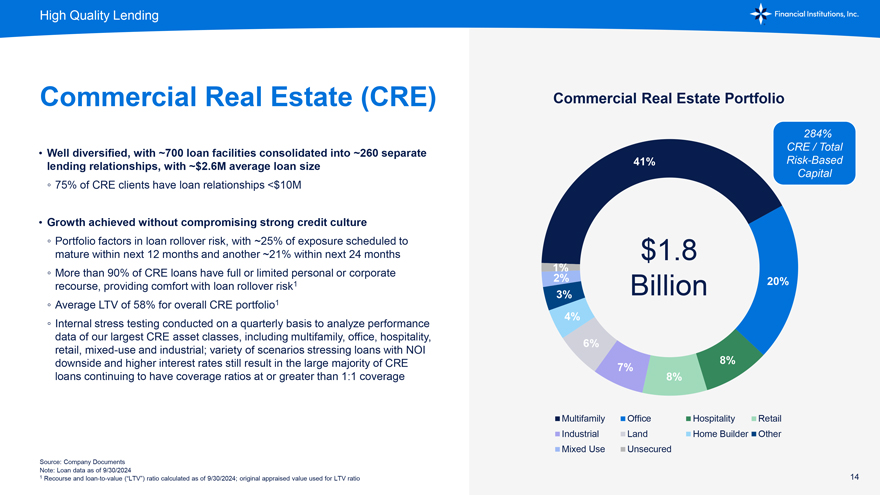

High Quality Lending Commercial Real Estate (CRE) Commercial Real Estate Portfolio 284% Well diversified, with ~700 loan facilities consolidated into ~260 separate CRE / Total lending relationships, with ~$2.6M average loan size 41% Risk-Based Capital 75% of CRE clients have loan relationships <$10M • Growth achieved without compromising strong credit culture Portfolio factors in loan rollover risk, with ~25% of exposure scheduled to mature within next 12 months and another ~21% within next 24 months $1.8 1% recourse, More than providing 90% of CRE comfort loans with have loan full rollover or limited risk personal 1 or corporate 2% Billion 20% 3% Average LTV of 58% for overall CRE portfolio1 Internal stress testing conducted on a quarterly basis to analyze performance 4% data of our largest CRE asset classes, including multifamily, office, hospitality, 6% retail, mixed-use and industrial; variety of scenarios stressing loans with NOI downside and higher interest rates still result in the large majority of CRE 7% 8% loans continuing to have coverage ratios at or greater than 1:1 coverage 8% Multifamily Office Hospitality Retail Industrial Land Home Builder Other Mixed Use Unsecured Source: Company Documents Note: Loan data as of 9/30/2024 1 Recourse and loan-to-value (“LTV”) ratio calculated as of 9/30/2024; original appraised value used for LTV ratio 14

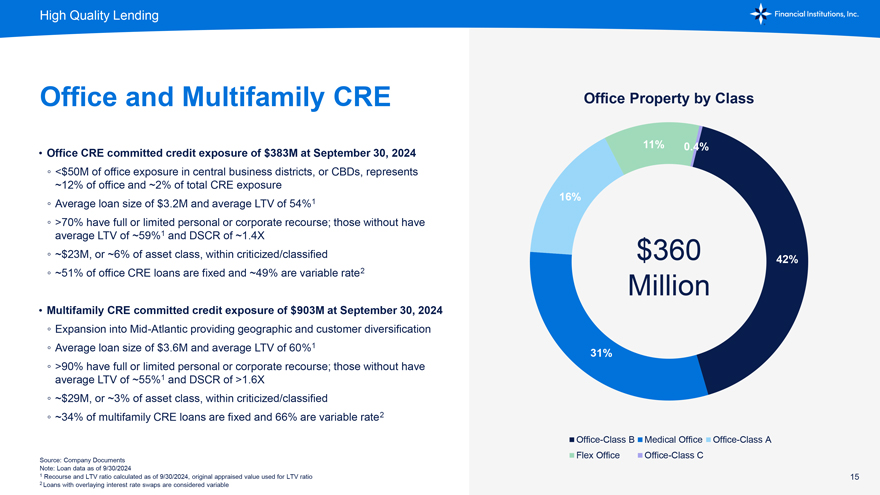

High Quality Lending Office and Multifamily CRE Office Property by Class • Office CRE committed credit exposure of $383M at September 30, 2024 11% 0.4% <$50M of office exposure in central business districts, or CBDs, represents ~12% of office and ~2% of total CRE exposure Average loan size of $3.2M and average LTV of 54%1 16% >70% have full or limited personal or corporate recourse; those without have average LTV of ~59%1 and DSCR of ~1.4X ~$23M, or ~6% of asset class, within criticized/classified $360 42% ~51% of office CRE loans are fixed and ~49% are variable rate2 Million Multifamily CRE committed credit exposure of $903M at September 30, 2024 Expansion into Mid-Atlantic providing geographic and customer diversification Average loan size of $3.6M and average LTV of 60%1 31% >90% have full or limited personal or corporate recourse; those without have average LTV of ~55%1 and DSCR of >1.6X ~$29M, or ~3% of asset class, within criticized/classified ~34% of multifamily CRE loans are fixed and 66% are variable rate2 Office-Class B Medical Office Office-Class A Source: Company Documents Flex Office Office-Class C Note: Loan data as of 9/30/2024 1 Recourse and LTV ratio calculated as of 9/30/2024, original appraised value used for LTV ratio 15 2 Loans with overlaying interest rate swaps are considered variable

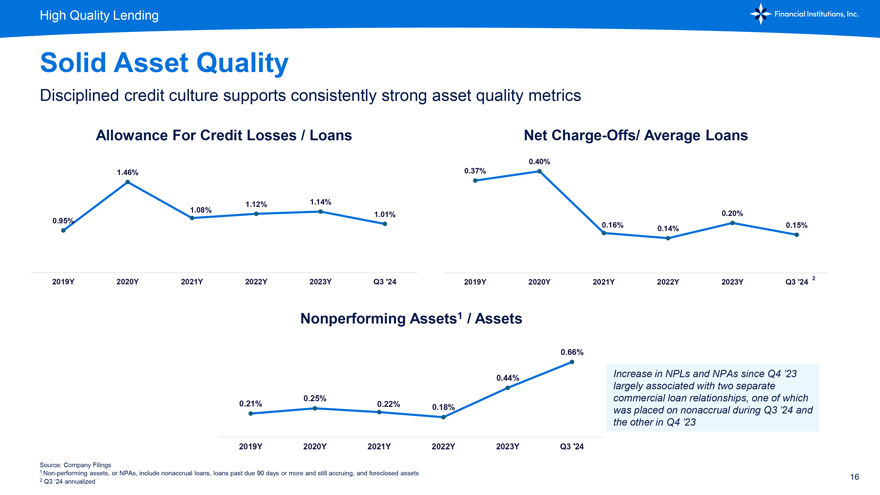

High Quality Lending Solid Asset Quality Disciplined credit culture supports consistently strong asset quality metrics Allowance For Credit Losses / Loans Net Charge-Offs/ Average Loans 0.40% 1.46% 0.37% 1.12% 1.14% 1.08% 1.01% 0.20% 0.95% 0.16% 0.15% 0.14% 2019Y 2020Y 2021Y 2022Y 2023Y Q3 ‘24 2019Y 2020Y 2021Y 2022Y 2023Y Q3 ‘24 2 Nonperforming Assets1 / Assets 0.66% 0.44% Increase in NPLs and NPAs since Q4 ’23 largely associated with two separate 0.25% commercial loan relationships, one of which 0.21% 0.22% 0.18% was placed on nonaccrual during Q3 ’24 and the other in Q4 ’23 2019Y 2020Y 2021Y 2022Y 2023Y Q3 ‘24 Source: Company Filings 1 Non-performing assets, or NPAs, include nonaccrual loans, loans past due 90 days or more and still accruing, and foreclosed assets 2 Q3 ‘24 annualized 16

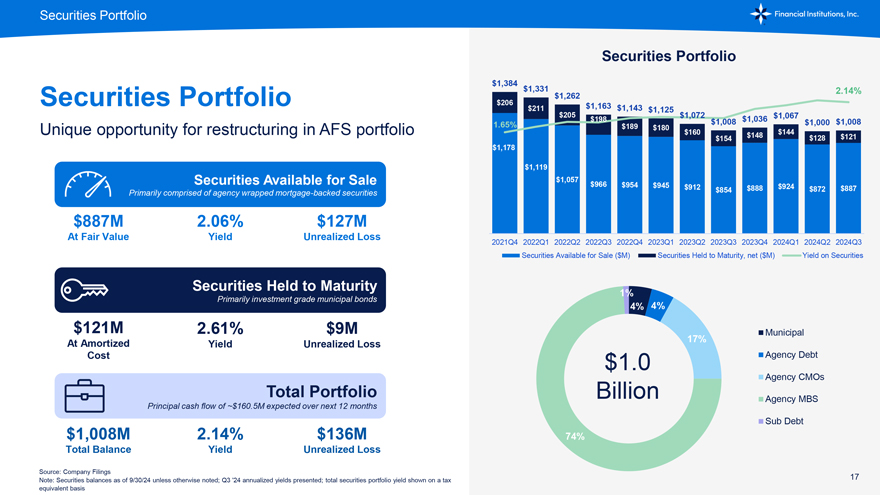

Securities Portfolio Securities Portfolio $1,384 $1,331 2.14% $1,262 Securities Portfolio $206 $1,163 $211 $1,143 $1,125 $205 $198 $1,072 $1,036 $1,067 65% $189 $180 $1,008 $1,000 $1,008 Unique opportunity for restructuring in AFS portfolio 1. $160 $148 $144 $154 $128 $121 $1,178 $1,119 Securities Available for Sale $1,057 $966 $954 $945 $912 $888 $924 $872 $887 Primarily comprised of agency wrapped mortgage-backed securities $854 $887M 2.06% $127M At Fair Value Yield Unrealized Loss 2021Q4 2022Q1 2022Q2 2022Q3 2022Q4 2023Q1 2023Q2 2023Q3 2023Q4 2024Q1 2024Q2 2024Q3 Securities Available for Sale ($M) Securities Held to Maturity, net ($M) Yield on Securities Securities Held to Maturity 1% Primarily investment grade municipal bonds 4% 4% $121M 2.61% $9M Municipal At Amortized Yield Unrealized Loss 17% Cost $1.0 Agency Debt Agency CMOs Total Portfolio Billion Agency MBS Principal cash flow of ~$160.5M expected over next 12 months Sub Debt $1,008M 2.14% $136M 74% Total Balance Yield Unrealized Loss Source: Company Filings Note: Securities balances as of 9/30/24 unless otherwise noted; Q3 ‘24 annualized yields presented; total securities portfolio yield shown on a tax 17 equivalent basis

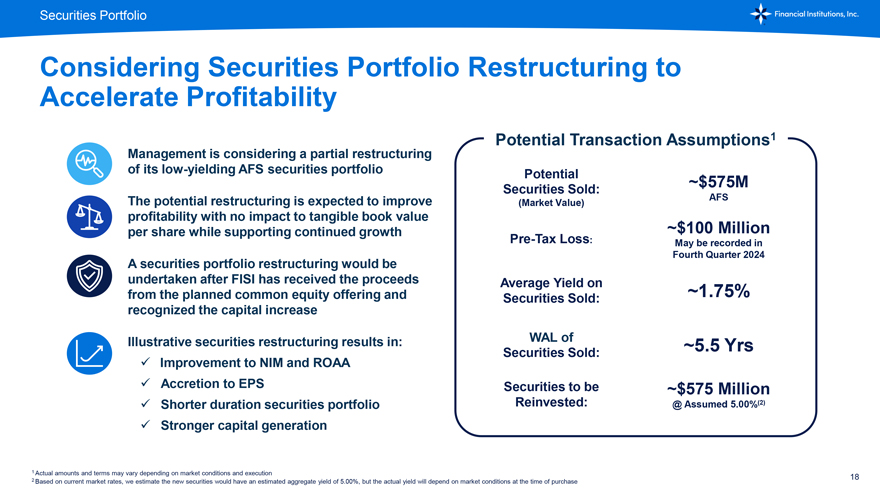

Securities Portfolio Considering Securities Portfolio Restructuring to Accelerate Profitability Potential Transaction Assumptions1 Management is considering a partial restructuring of its low-yielding AFS securities portfolio Potential Securities Sold: ~$575M The potential restructuring is expected to improve (Market Value) AFS profitability with no impact to tangible book value per share while supporting continued growth ~$100 Million Pre-Tax Loss: May be recorded in Fourth Quarter 2024 A securities portfolio restructuring would be undertaken after FISI has received the proceeds Average Yield on from the planned common equity offering and Securities Sold: ~1.75% recognized the capital increase Illustrative securities restructuring results in: WAL of ~5.5 Yrs Securities Sold: ✓ Improvement to NIM and ROAA ✓ Accretion to EPS Securities to be ~$575 Million ✓ Shorter duration securities portfolio Reinvested: @ Assumed 5.00%(2) ✓ Stronger capital generation 1 Actual amounts and terms may vary depending on market conditions and execution 2 Based on current market rates, we estimate the new securities would have an estimated aggregate yield of 5.00%, but the actual yield will depend on market conditions at the time of purchase 18

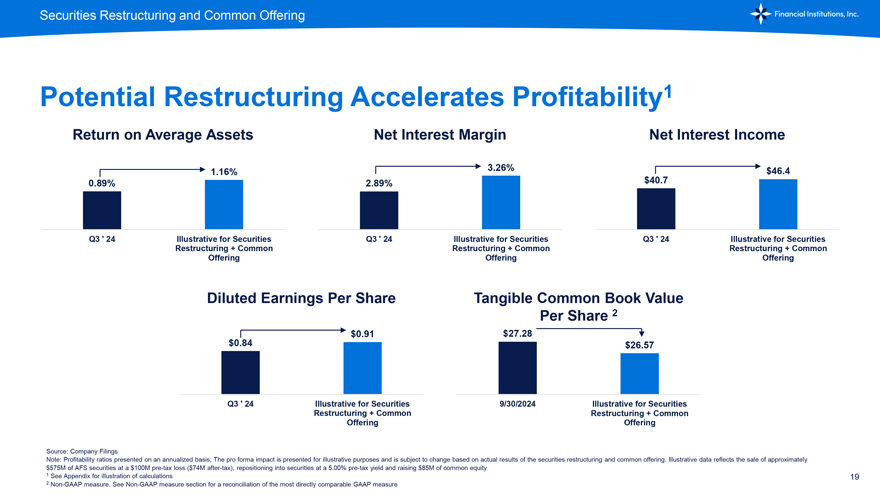

Securities Restructuring and Common Offering Potential Restructuring Accelerates Profitability1 Return on Average Assets Net Interest Margin Net Interest Income 1.16% 3.26% $46.4 0.89% 2.89% $40.7 Q3 ‘ 24 Illustrative for Securities Q3 ‘ 24 Illustrative for Securities Q3 ‘ 24 Illustrative for Securities Restructuring + Common Restructuring + Common Restructuring + Common Offering Offering Offering Diluted Earnings Per Share Tangible Common Book Value Per Share 2 $0.91 $27.28 $0.84 $26.57 Q3 ‘ 24 Illustrative for Securities 9/30/2024 Illustrative for Securities Restructuring + Common Restructuring + Common Offering Offering Source: Company Filings Note: Profitability ratios presented on an annualized basis; The pro forma impact is presented for illustrative purposes and is subject to change based on actual results of the securities restructuring and common offering. Illustrative data reflects the sale of approximately $575M of AFS securities at a $100M pre-tax loss ($74M after-tax), repositioning into securities at a 5.00% pre-tax yield and raising $85M of common equity 1 See Appendix for illustration of calculations 19 2 Non-GAAP measure. See Non-GAAP measure section for a reconciliation of the most directly comparable GAAP measure

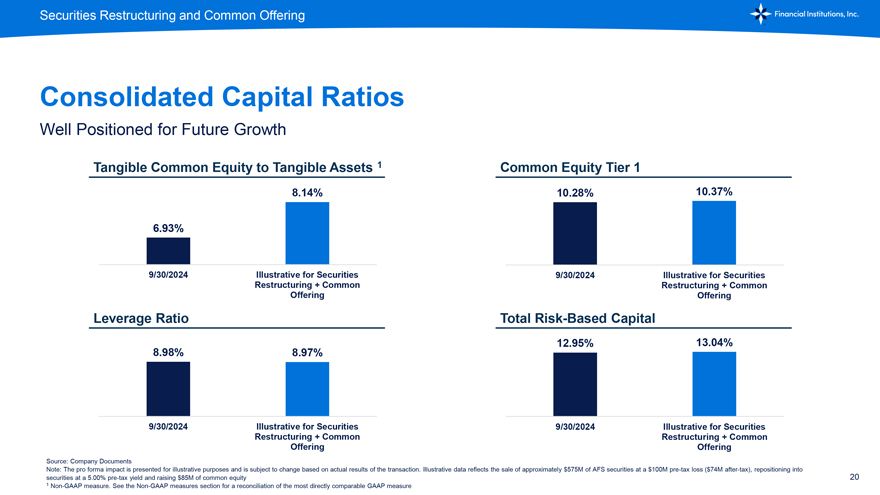

Securities Restructuring and Common Offering Consolidated Capital Ratios Well Positioned for Future Growth Tangible Common Equity to Tangible Assets 1 Common Equity Tier 1 8.14% 10.28% 10.37% 6.93% 9/30/2024 Illustrative for Securities 9/30/2024 Illustrative for Securities Restructuring + Common Restructuring + Common Offering Offering Leverage Ratio Total Risk-Based Capital 12.95% 13.04% 8.98% 8.97% 9/30/2024 Illustrative for Securities 9/30/2024 Illustrative for Securities Restructuring + Common Restructuring + Common Offering Offering Source: Company Documents Note: The pro forma impact is presented for illustrative purposes and is subject to change based on actual results of the transaction. Illustrative data reflects the sale of approximately $575M of AFS securities at a $100M pre-tax loss ($74M after-tax), repositioning into securities at a 5.00% pre-tax yield and raising $85M of common equity 20 1 Non-GAAP measure. See the Non-GAAP measures section for a reconciliation of the most directly comparable GAAP measure

Investment Thesis Investment Thesis Positioned well for profitable, organic growth Results-driven community bank with strong retail and commercial franchise Wealth management business diversifies revenue and complements core banking franchise Disciplined credit culture with strong credit quality Experienced management team committed to rewarding shareholders Attractive valuation 21

Appendix Thank you for your interest in Financial Institutions, Inc. NASDAQ: FISI Investor Relations Contacts Kate Croft Director of Investor and External Relations Jack Plants Chief Financial Officer & Corporate Treasurer FISI-Investors@five-starbank.com Learn more at www.FISI-Investors.com 22

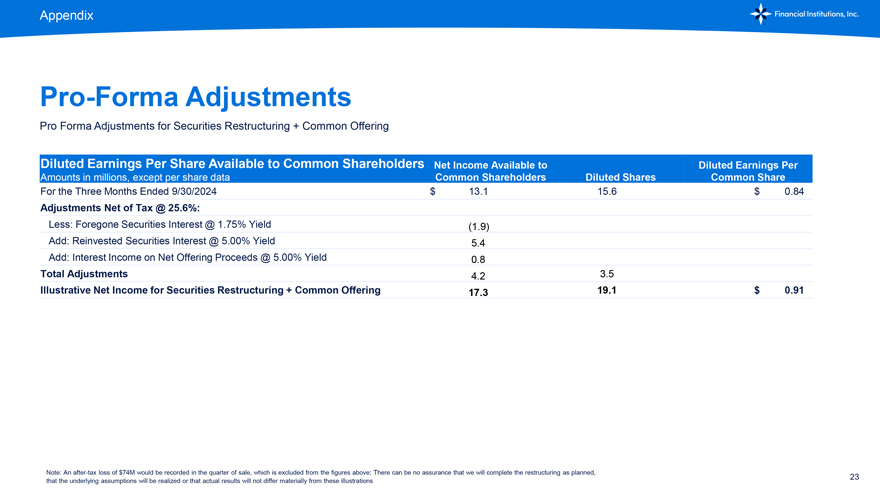

Appendix Pro-Forma Adjustments Pro Forma Adjustments for Securities Restructuring + Common Offering Diluted Earnings Per Share Available to Common Shareholders Net Income Available to Diluted Earnings Per Amounts in millions, except per share data Common Shareholders Diluted Shares Common Share For the Three Months Ended 9/30/2024 $ 13.1 15.6 $ 0.84 Adjustments Net of Tax @ 25.6%: Less: Foregone Securities Interest @ 1.75% Yield (1.9) Add: Reinvested Securities Interest @ 5.00% Yield 5.4 Add: Interest Income on Net Offering Proceeds @ 5.00% Yield 0.8 Total Adjustments 4.2 3.5 Illustrative Net Income for Securities Restructuring + Common Offering 17.3 19.1 $ 0.91 Note: An after-tax loss of $74M would be recorded in the quarter of sale, which is excluded from the figures above; There can be no assurance that we will complete the restructuring as planned, that the underlying assumptions will be realized or that actual results will not differ materially from these illustrations 23

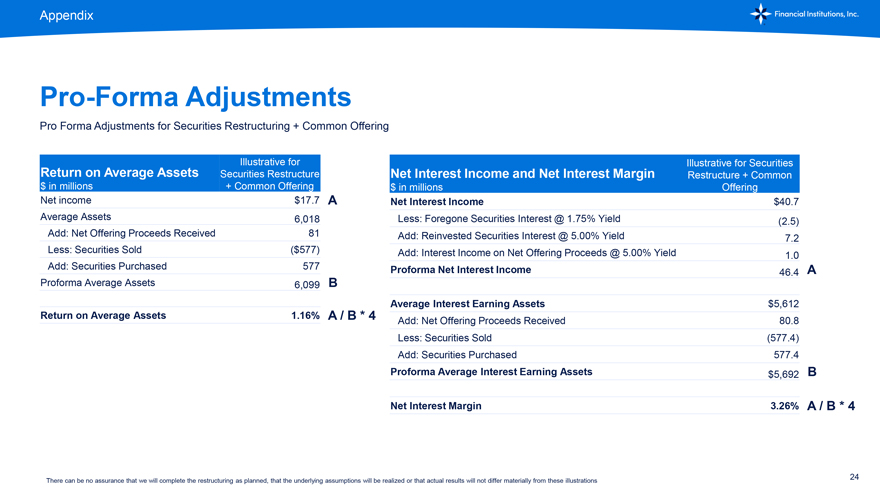

Appendix Pro-Forma Adjustments Pro Forma Adjustments for Securities Restructuring + Common Offering Illustrative for Return on Average Assets Securities Restructure $ in millions + Common Offering Net income $17.7 A Average Assets 6,018 Add: Net Offering Proceeds Received 81 Less: Securities Sold ($577) Add: Securities Purchased 577 Proforma Average Assets 6,099 B Return on Average Assets 1.16% A / B * 4 Illustrative for Securities Net Interest Income and Net Interest Margin Restructure + Common $ in millions Offering Net Interest Income $40.7 Less: Foregone Securities Interest @ 1.75% Yield (2.5) Add: Reinvested Securities Interest @ 5.00% Yield 7.2 Add: Interest Income on Net Offering Proceeds @ 5.00% Yield 1.0 Proforma Net Interest Income 46.4 A Average Interest Earning Assets $5,612 Add: Net Offering Proceeds Received 80.8 Less: Securities Sold (577.4) Add: Securities Purchased 577.4 Proforma Average Interest Earning Assets $5,692 B Net Interest Margin 3.26% A / B * 4 There can be no assurance that we will complete the restructuring as planned, that the underlying assumptions will be realized or that actual results will not differ materially from these illustrations 24

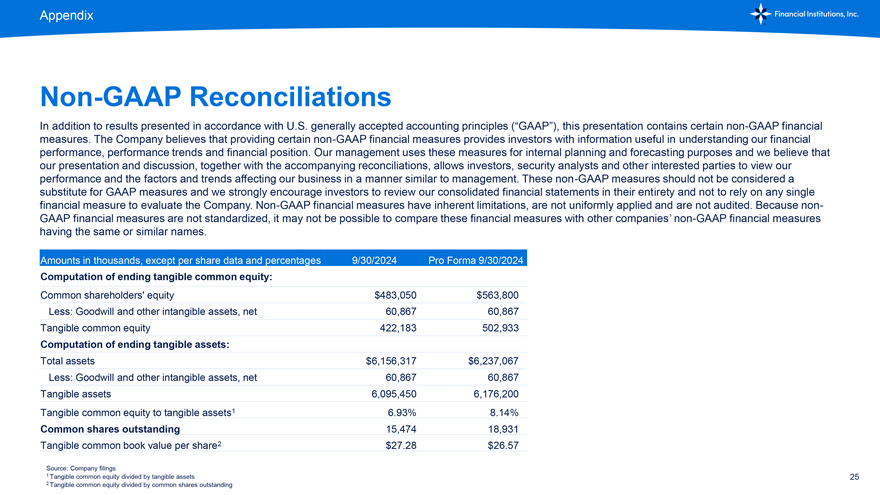

Appendix Non-GAAP Reconciliations In addition to results presented in accordance with U.S. generally accepted accounting principles (“GAAP”), this presentation contains certain non-GAAP financial measures. The Company believes that providing certain non-GAAP financial measures provides investors with information useful in understanding our financial performance, performance trends and financial position. Our management uses these measures for internal planning and forecasting purposes and we believe that our presentation and discussion, together with the accompanying reconciliations, allows investors, security analysts and other interested parties to view our performance and the factors and trends affecting our business in a manner similar to management. These non-GAAP measures should not be considered a substitute for GAAP measures and we strongly encourage investors to review our consolidated financial statements in their entirety and not to rely on any single financial measure to evaluate the Company. Non-GAAP financial measures have inherent limitations, are not uniformly applied and are not audited. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures having the same or similar names. Amounts in thousands, except per share data and percentages 9/30/2024 Pro Forma 9/30/2024 Computation of ending tangible common equity: Common shareholders’ equity $483,050 $563,800 Less: Goodwill and other intangible assets, net 60,867 60,867 Tangible common equity 422,183 502,933 Computation of ending tangible assets: Total assets $6,156,317 $6,237,067 Less: Goodwill and other intangible assets, net 60,867 60,867 Tangible assets 6,095,450 6,176,200 Tangible common equity to tangible assets1 6.93% 8.14% Common shares outstanding 15,474 18,931 Tangible common book value per share2 $27.28 $26.57 Source: Company filings 1 Tangible common equity divided by tangible assets 25 2 Tangible common equity divided by common shares outstanding